Form 8802 (Rev. April 2012) F8802

User Manual: 8802

Open the PDF directly: View PDF ![]() .

.

Page Count: 3

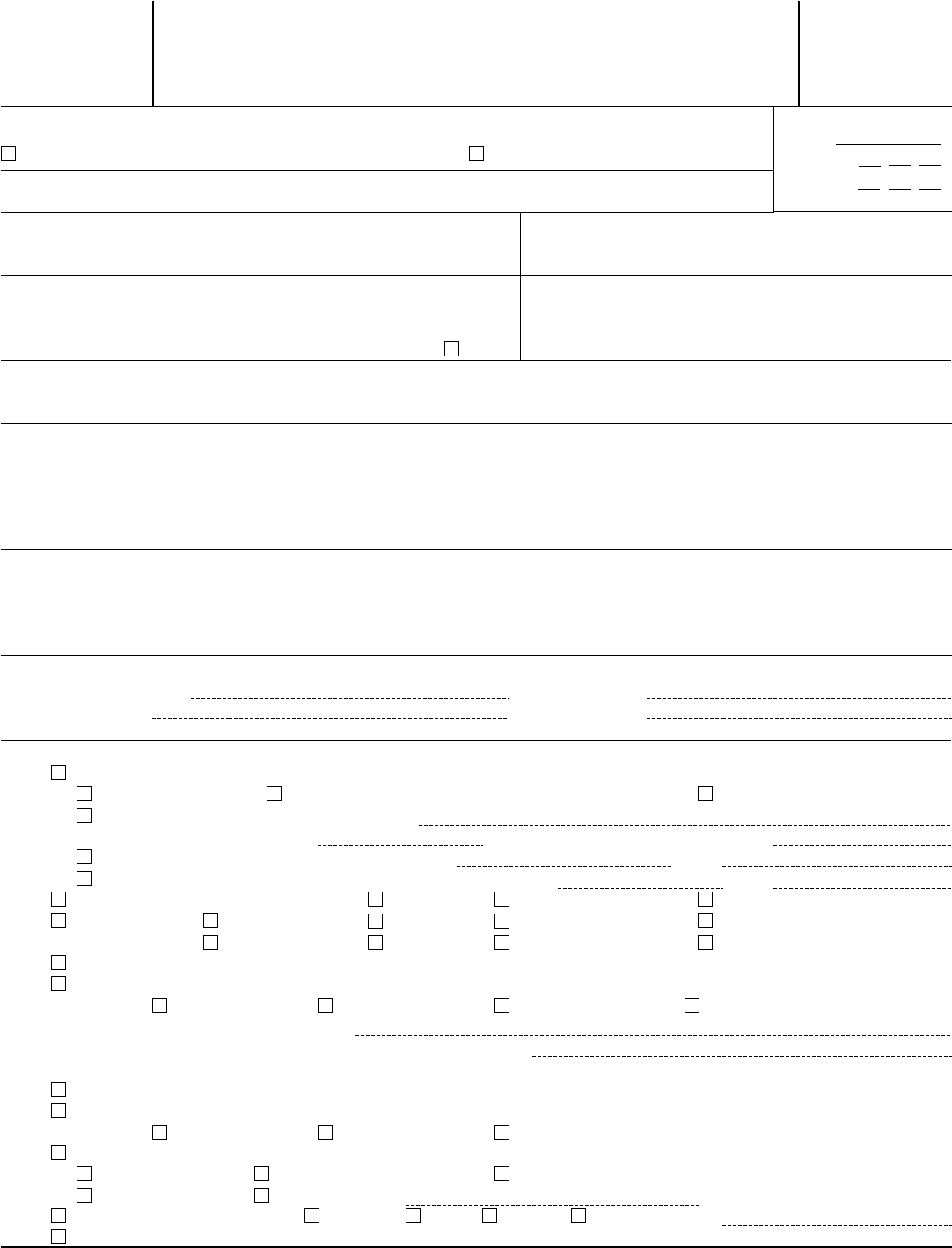

Form 8802

(Rev. April 2012)

Department of the Treasury

Internal Revenue Service

Application for United States

Residency Certification

▶ See separate instructions.

OMB No. 1545-1817

Important. For applications filed after March 31, 2012, the user fee is $85 per application.

For IRS use only:

Additional request (see instructions) Foreign claim form attached

Pmt Amt $ .

Deposit Date: / /

Date Pmt Vrfd: / /

Electronic payment confirmation no. ▶

Applicant’s name Applicant’s U.S. taxpayer identification number

If a joint return was filed, spouse’s name (see instructions)

If a separate certification is needed for spouse, check here ▶

If a joint return was filed, spouse’s U.S. taxpayer

identification number

1Applicant’s name and taxpayer identification number as it should appear on the certification if different from above

2Applicant’s address during the calendar year for which certification is requested, including country and ZIP or postal code. If a P.O.

box, see instructions.

3a Mail Form 6166 to the following address:

bAppointee Information (see instructions):

Appointee Name ▶CAF No. ▶

Phone No. ▶( ) Fax No. ▶( )

4Applicant is (check appropriate box(es)):

aIndividual. Check all applicable boxes.

U.S. citizen U.S. lawful permanent resident (green card holder) Sole proprietor

Other U.S. resident alien. Type of entry visa ▶

Current nonimmigrant status ▶and date of change (see instructions) ▶

Dual-status U.S. resident (see instructions). From ▶to ▶

Partial-year Form 2555 filer (see instructions). U.S. resident from ▶to ▶

bPartnership. Check all applicable boxes. U.S. Foreign LLC

cTrust. Check if: Grantor (U.S.) Simple Rev. Rul. 81-100 Trust IRA (for Individual)

Grantor (foreign) Complex Section 584 IRA (for Financial Institution)

dEstate

eCorporation. If incorporated in the United States only, go to line 5. Otherwise, continue.

Check if: Section 269B Section 943(e)(1) Section 953(d) Section 1504(d)

Country or countries of incorporation ▶

If a dual-resident corporation, specify other country of residence ▶

If included on a consolidated return, attach page 1 of Form 1120 and Form 851.

fS corporation

gEmployee benefit plan/trust. Plan number, if applicable ▶

Check if: Section 401(a) Section 403(b) Section 457(b)

hExempt organization. If organized in the United States, check all applicable boxes.

Section 501(c) Section 501(c)(3) Governmental entity

Indian tribe Other (specify) ▶

iDisregarded entity. Check if: LLC LP LLP Other (specify) ▶

jNominee applicant (must specify the type of entity/individual for whom the nominee is acting) ▶

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 10003D Form 8802 (Rev. 4-2012)

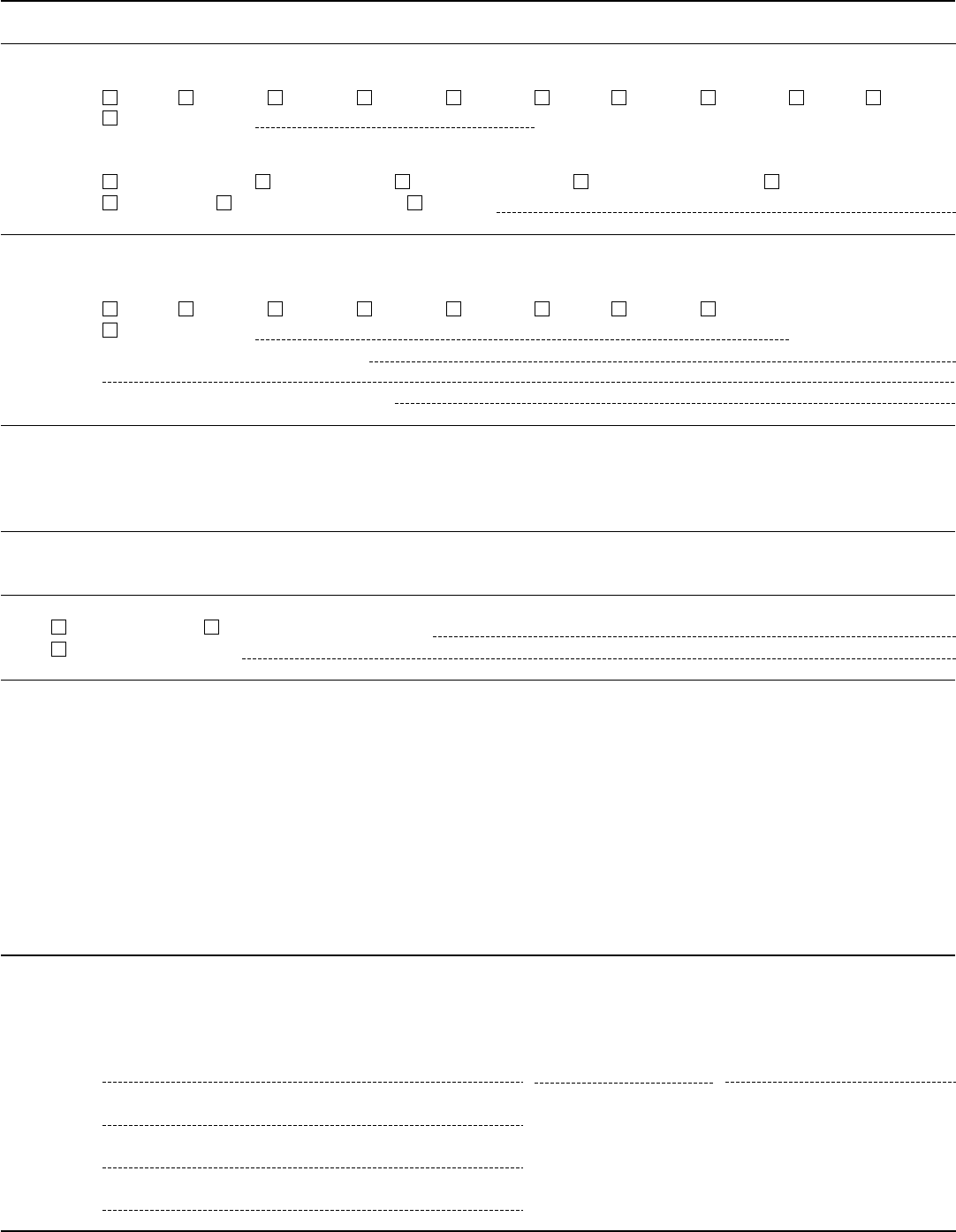

Form 8802 (Rev. 4-2012) Page 2

Applicant name:

5Was the applicant required to file a U.S. tax form for the tax period(s) on which certification will be based?

Yes. Check the appropriate box for the form filed and go to line 7.

990 990-T 1040 1041 1065 1120 1120S 3520-A 5227 5500

Other (specify) ▶

No. Attach explanation (see instructions). Check applicable box and go to line 6.

Minor child QSub U.S. DRE Foreign DRE Section 761(a) election

FASIT Foreign partnership Other ▶

6Was the applicant’s parent, parent organization or owner required to file a U.S. tax form? (Complete this line only if you checked

“No” on line 5.)

Yes. Check the appropriate box for the form filed by the parent.

990 990-T 1040 1041 1065 1120 1120S 5500

Other (specify) ▶

Parent’s/owner’s name and address ▶

and U.S. taxpayer identification number ▶

No. Attach explanation (see instructions).

7Calendar year(s) for which certification is requested.

Note. If certification is for the current calendar year or a year for which a tax return is not yet required to be filed, a penalties

of perjury statement from Table 2 of the instructions must be entered on line 10 or attached to Form 8802 (see instructions).

8Tax period(s) on which certification will be based (see instructions).

9Purpose of certification. Must check applicable box (see instructions).

Income tax VAT (specify NAICS codes) ▶

Other (must specify) ▶

10 Enter penalties of perjury statements and any additional required information here (see instructions).

Sign

here

Under penalties of perjury, I declare that I have examined this application and accompanying attachments, and to the best of my knowledge and belief,

they are true, correct, and complete. If I have designated a third party to receive the residency certification(s), I declare that the certification(s) will be used

only for obtaining information or assistance from that person relating to matters designated on line 9.

Keep a

copy for

your

records.

▶

Applicant’s signature (or individual authorized to sign for the applicant)

Signature Date

Applicant’s daytime phone no.:

Name and title (print or type)

Spouse’s signature. If a joint application, both must sign.

Name (print or type)

Form 8802 (Rev. 4-2012)

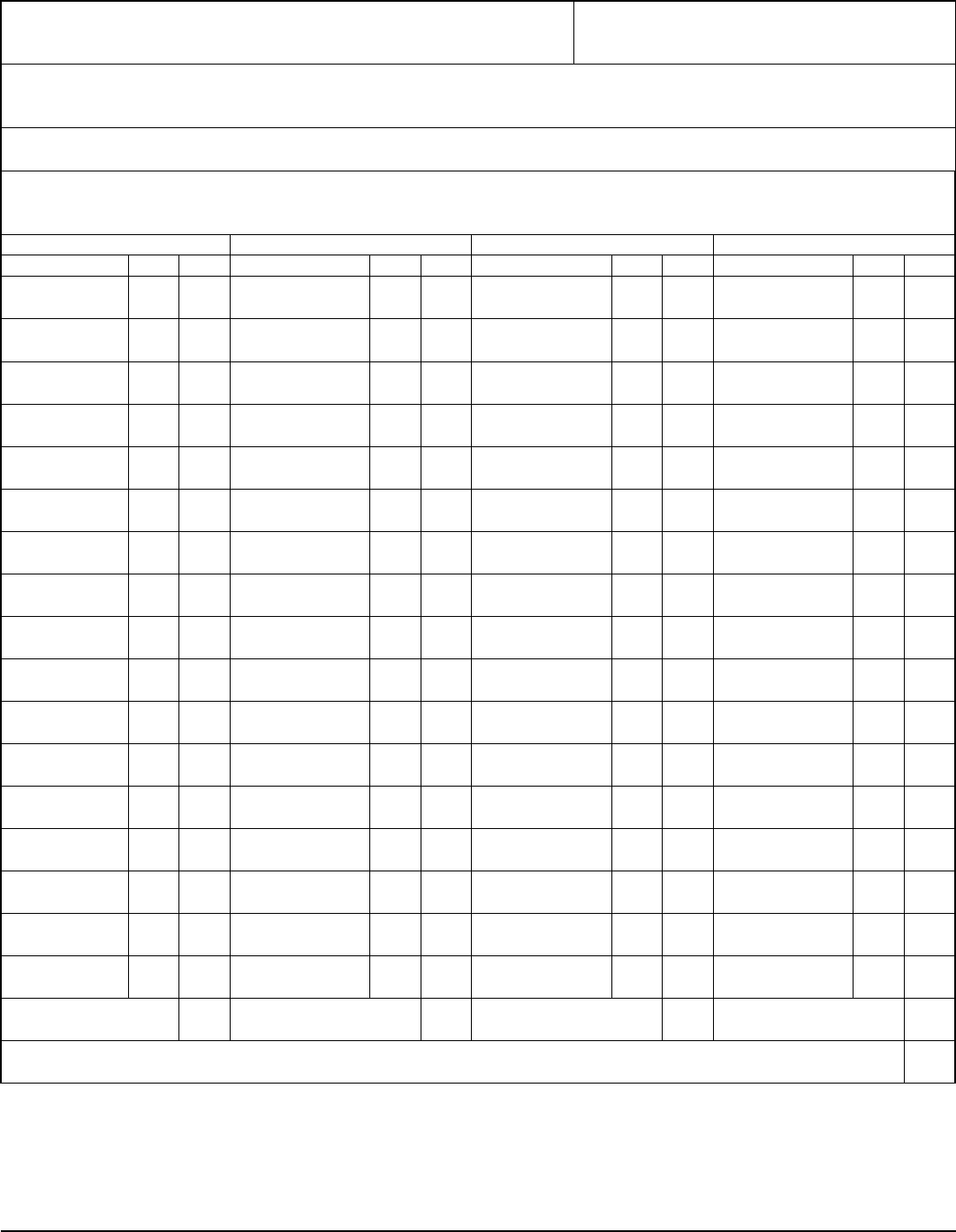

Form 8802 (Rev. 4-2012) Worksheet for U.S. Residency Certification Application Page 3

Applicant Name Applicant TIN

Appointee Name (If Applicable)

Calendar year(s) for which certification is requested (must be the same year(s) indicated on line 7)

11 Enter the number of certifications needed in the column to the right of each country for which certification is requested.

Note. If you are requesting certifications for more than one calendar year per country, enter the total number of certifications for all years for

each country (see instructions).

Column A

Country CC #

Armenia AM

Australia AS

Austria AU

Azerbaijan AJ

Bangladesh BG

Barbados BB

Belarus BO

Belgium BE

Bermuda BD

Bulgaria BU

Canada CA

China CH

Cyprus CY

Czech Republic EZ

Denmark DA

Egypt EG

Estonia EN

Column A - Total

Column B

Country CC #

Finland FI

France FR

Georgia GG

Germany GM

Greece GR

Hungary HU

Iceland IC

India IN

Indonesia ID

Ireland EI

Israel IS

Italy IT

Jamaica JM

Japan JA

Kazakhstan KZ

Korea, South KS

Kyrgyzstan KG

Column B - Total

Column C

Country CC #

Latvia LG

Lithuania LH

Luxembourg LU

Mexico MX

Moldova MD

Morocco MO

Netherlands NL

New Zealand NZ

Norway NO

Pakistan PK

Philippines RP

Poland PL

Portugal PO

Romania RO

Russia RS

Slovak Republic LO

Slovenia SI

Column C - Total

Column D

Country CC #

South Africa SF

Spain SP

Sri Lanka CE

Sweden SW

Switzerland SZ

Tajikistan TI

Thailand TH

Trinidad and Tobago TD

Tunisia TS

Turkey TU

Turkmenistan TX

Ukraine UP

United Kingdom UK

Uzbekistan UZ

Venezuela VE

Column D - Total

12 Enter the total number of certifications requested (add columns A, B, C, and D of line 11) . . . . . . . . . . ▶

Form 8802 (Rev. 4-2012)