Form SS 4 (Rev. December 2017) SS4 Fss4

User Manual: SS4

Open the PDF directly: View PDF ![]() .

.

Page Count: 2

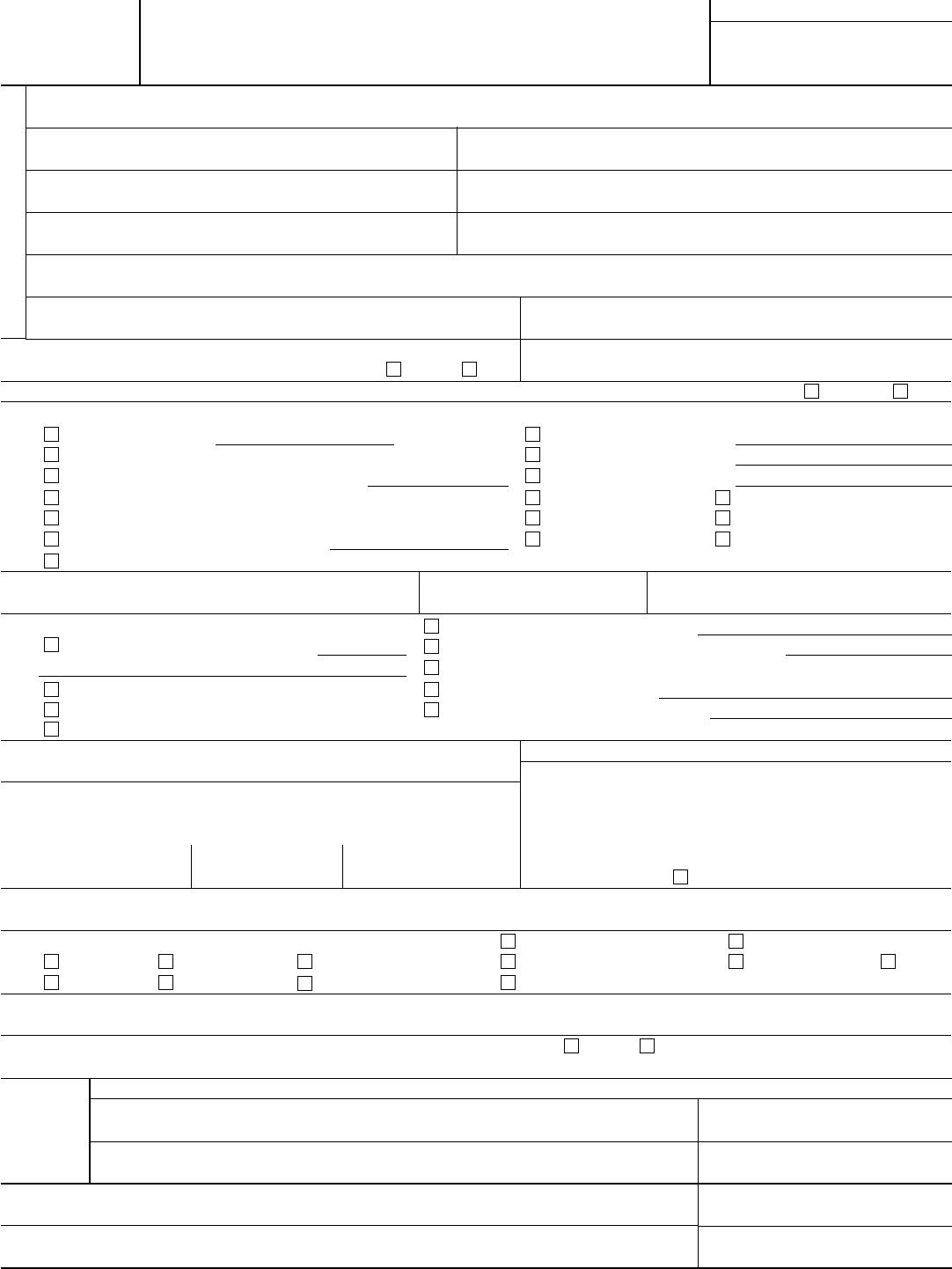

Form SS-4

(Rev. December 2017)

Department of the Treasury

Internal Revenue Service

Application for Employer Identification Number

(For use by employers, corporations, partnerships, trusts, estates, churches,

government agencies, Indian tribal entities, certain individuals, and others.)

▶ Go to www.irs.gov/FormSS4 for instructions and the latest information.

▶ See separate instructions for each line. ▶ Keep a copy for your records.

OMB No. 1545-0003

EIN

Type or print clearly.

1 Legal name of entity (or individual) for whom the EIN is being requested

2 Trade name of business (if different from name on line 1) 3 Executor, administrator, trustee, “care of” name

4a Mailing address (room, apt., suite no. and street, or P.O. box) 5a Street address (if different) (Do not enter a P.O. box.)

4b City, state, and ZIP code (if foreign, see instructions) 5b City, state, and ZIP code (if foreign, see instructions)

6 County and state where principal business is located

7a Name of responsible party 7b SSN, ITIN, or EIN

8a

Is this application for a limited liability company (LLC)

(or a foreign equivalent)? . . . . . . . . Yes No

8b If 8a is “Yes,” enter the number of

LLC members . . . . . . ▶

8c If 8a is “Yes,” was the LLC organized in the United States? . . . . . . . . . . . . . . . . . . Yes No

9a Type of entity (check only one box). Caution. If 8a is “Yes,” see the instructions for the correct box to check.

Sole proprietor (SSN) Estate (SSN of decedent)

Partnership Plan administrator (TIN)

Corporation (enter form number to be filed) ▶Trust (TIN of grantor)

Personal service corporation Military/National Guard State/local government

Church or church-controlled organization

Farmers’ cooperative

Federal government

Other nonprofit organization (specify) ▶REMIC

Indian tribal governments/enterprises

Other (specify) ▶Group Exemption Number (GEN) if any ▶

9b

If a corporation, name the state or foreign country (if

applicable) where incorporated

State Foreign country

10 Reason for applying (check only one box) Banking purpose (specify purpose) ▶

Started new business (specify type) ▶Changed type of organization (specify new type) ▶

Purchased going business

Hired employees (Check the box and see line 13.) Created a trust (specify type) ▶

Compliance with IRS withholding regulations Created a pension plan (specify type) ▶

Other (specify) ▶

11 Date business started or acquired (month, day, year). See instructions. 12 Closing month of accounting year

13

Highest number of employees expected in the next 12 months (enter -0- if none).

If no employees expected, skip line 14.

Agricultural Household Other

14

If you expect your employment tax liability to be $1,000 or

less in a full calendar year and want to file Form 944

annually instead of Forms 941 quarterly, check here.

(Your employment tax liability generally will be $1,000

or less if you expect to pay $4,000 or less in total wages.)

If you do not check this box, you must file Form 941 for

every quarter.

15 First date wages or annuities were paid (month, day, year). Note: If applicant is a withholding agent, enter date income will first be paid to

nonresident alien (month, day, year) . . . . . . . . . . . . . . . . . ▶

16

Check one box that best describes the principal activity of your business. Health care & social assistance

Wholesale-agent/broker

Construction

Rental & leasing

Transportation & warehousing

Accommodation & food service

Wholesale-other Retail

Real estate Manufacturing Finance & insurance Other (specify) ▶

17 Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided.

18 Has the applicant entity shown on line 1 ever applied for and received an EIN? Yes No

If “Yes,” write previous EIN here ▶

Third

Party

Designee

Complete this section only if you want to authorize the named individual to receive the entity’s EIN and answer questions about the completion of this form.

Designee’s name

Designee’s telephone number (include area code)

Address and ZIP code Designee’s fax number (include area code)

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete.

Name and title (type or print clearly) ▶

Applicant’s telephone number (include area code)

Signature ▶Date ▶

Applicant’s fax number (include area code)

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 16055N Form SS-4 (Rev. 12-2017)

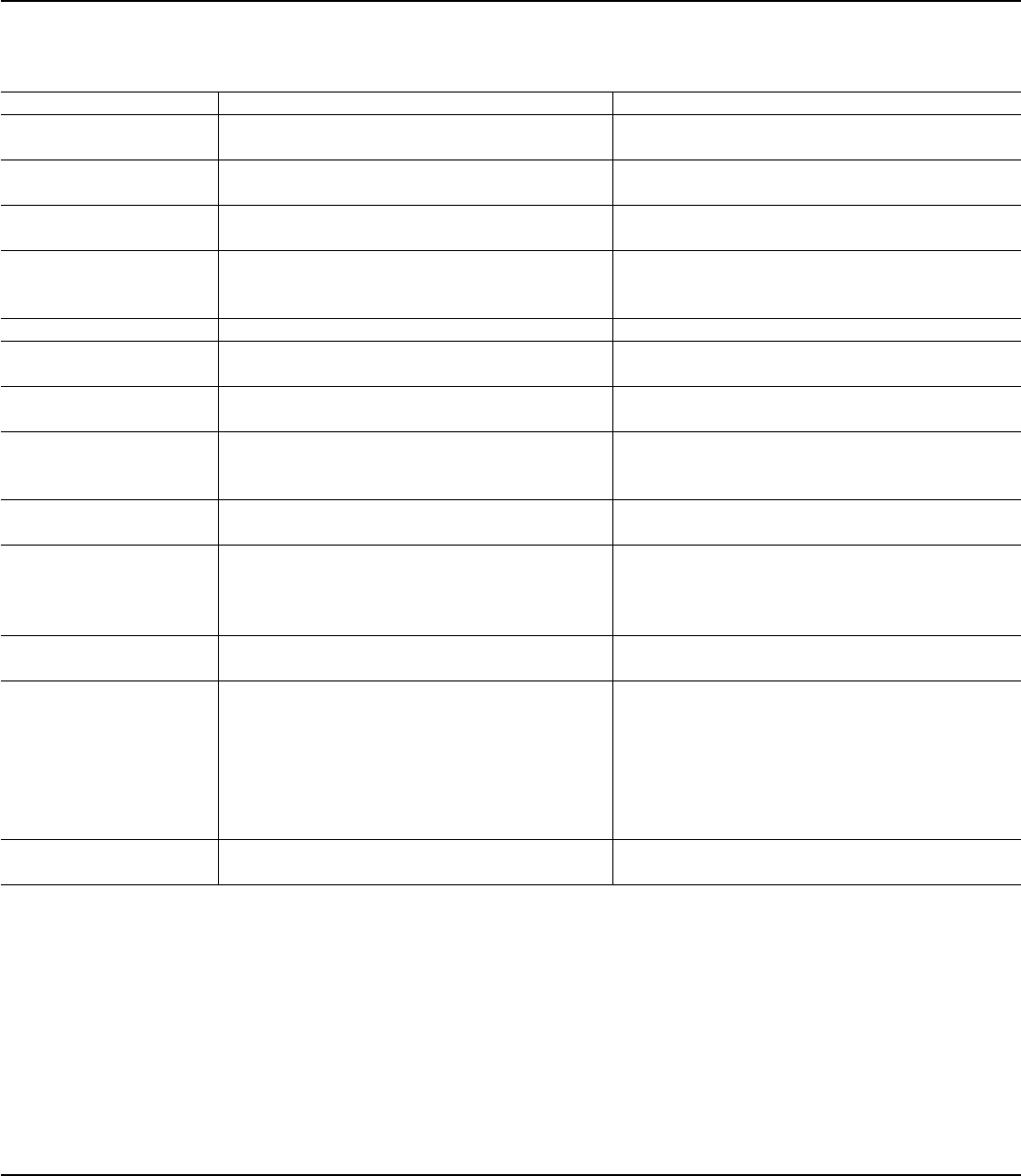

Form SS-4 (Rev. 12-2017) Page 2

Do I Need an EIN?

File Form SS-4 if the applicant entity does not already have an EIN but is required to show an EIN on any return, statement,

or other document.1 See also the separate instructions for each line on Form SS-4.

IF the applicant... AND... THEN...

Started a new business Does not currently have (nor expect to have)

employees

Complete lines 1, 2, 4a–8a, 8b–c (if applicable), 9a,

9b (if applicable), and 10–14 and 16–18.

Hired (or will hire) employees,

including household employees

Does not already have an EIN Complete lines 1, 2, 4a–6, 7a–b (if applicable), 8a,

8b–c (if applicable), 9a, 9b (if applicable), 10–18.

Opened a bank account Needs an EIN for banking purposes only Complete lines 1–5b, 7a–b (if applicable), 8a, 8b–c

(if applicable), 9a, 9b (if applicable), 10, and 18.

Changed type of organization Either the legal character of the organization or its

ownership changed (for example, you incorporate a

sole proprietorship or form a partnership)2

Complete lines 1–18 (as applicable).

Purchased a going business3Does not already have an EIN Complete lines 1–18 (as applicable).

Created a trust The trust is other than a grantor trust or an IRA

trust4

Complete lines 1–18 (as applicable).

Created a pension plan as a

plan administrator5

Needs an EIN for reporting purposes Complete lines 1, 3, 4a–5b, 9a, 10, and 18.

Is a foreign person needing an

EIN to comply with IRS

withholding regulations

Needs an EIN to complete a Form W-8 (other than

Form W-8ECI), avoid withholding on portfolio assets,

or claim tax treaty benefits6

Complete lines 1–5b, 7a–b (SSN or ITIN optional),

8a, 8b–c (if applicable), 9a, 9b (if applicable), 10,

and 18.

Is administering an estate Needs an EIN to report estate income on Form 1041 Complete lines 1–6, 9a, 10–12, 13–17 (if applicable),

and 18.

Is a withholding agent for

taxes on non-wage income

paid to an alien (i.e.,

individual, corporation, or

partnership, etc.)

Is an agent, broker, fiduciary, manager, tenant, or

spouse who is required to file Form 1042, Annual

Withholding Tax Return for U.S. Source Income of

Foreign Persons

Complete lines 1, 2, 3 (if applicable), 4a–5b, 7a–b (if

applicable), 8a, 8b–c (if applicable), 9a, 9b (if

applicable), 10, and 18.

Is a state or local agency Serves as a tax reporting agent for public assistance

recipients under Rev. Proc. 80-4, 1980-1 C.B. 5817

Complete lines 1, 2, 4a–5b, 9a, 10, and 18.

Is a single-member LLC (or

similar single-member entity)

Needs an EIN to file Form 8832, Classification

Election, for filing employment tax returns and

excise tax returns, or for state reporting purposes8, or

is a foreign-owned U.S. disregarded entity and needs

an EIN to file Form 5472, Information Return of a 25%

Foreign-Owned U.S. Corporation or a Foreign

Corporation Engaged in a U.S. Trade or Business

(Under Sections 6038A and 6038C of the Internal

Revenue Code)

Complete lines 1–18 (as applicable).

Is an S corporation Needs an EIN to file Form 2553, Election by a Small

Business Corporation9

Complete lines 1–18 (as applicable).

1 For example, a sole proprietorship or self-employed farmer who establishes a qualified retirement plan, or is required to file excise, employment, alcohol, tobacco, or

firearms returns, must have an EIN. A partnership, corporation, REMIC (real estate mortgage investment conduit), nonprofit organization (church, club, etc.), or farmers’

cooperative must use an EIN for any tax-related purpose even if the entity does not have employees.

2 However, do not apply for a new EIN if the existing entity only (a) changed its business name, (b) elected on Form 8832 to change the way it is taxed (or is covered by the

default rules), or (c) terminated its partnership status because at least 50% of the total interests in partnership capital and profits were sold or exchanged within a 12-

month period. The EIN of the terminated partnership should continue to be used. See Regulations section 301.6109-1(d)(2)(iii).

3 Do not use the EIN of the prior business unless you became the “owner” of a corporation by acquiring its stock.

4 However, grantor trusts that do not file using Optional Method 1 and IRA trusts that are required to file Form 990-T, Exempt Organization Business Income Tax Return,

must have an EIN. For more information on grantor trusts, see the Instructions for Form 1041.

5 A plan administrator is the person or group of persons specified as the administrator by the instrument under which the plan is operated.

6 Entities applying to be a Qualified Intermediary (QI) need a QI-EIN even if they already have an EIN. See Rev. Proc. 2000-12.

7 See also Household employer on page 4 of the instructions. Note: State or local agencies may need an EIN for other reasons, for example, hired employees.

8 See Disregarded entities on page 4 of the instructions for details on completing Form SS-4 for an LLC.

9 An existing corporation that is electing or revoking S corporation status should use its previously-assigned EIN.