!! Fy14 Fy15 Rtp Manual

Preview ! fy14_ fy15_rtp_manual Grant Lawn Mower Manuals - Lawn Mower Manuals – The Best Lawn Mower Manuals Collection

User Manual: !! Grant Lawn Mower Manuals - Lawn Mower Manuals – The Best Lawn Mower Manuals Collection

Open the PDF directly: View PDF ![]() .

.

Page Count: 72

1

North Dakota Parks and Recreation Department

Recreation Division – 701-328-5357 – parkrec@nd.gov

Recreational Trail Program (RTP)

Program Manual

http://www.parkrec.nd.gov/recreation/grants/rtp/rtpoverview.html

Moving Ahead for Progress in the 21st Century (MAP-21)

Effective October 1, 2012 through September 30, 2014.

Revised 11/29/2013

2

Table of Contents

Introduction 3

General Information 3

Program Overview 3

Title VI 4

RTP Funding 4

Eligibility 4

“40-30-30” Requirement 5

Project Timeline 6

Eligible Projects/Expenses 6

Ineligible Projects/Expenses 7

Land Acquisitions and Easements 7

Control and Tenure 8

Application Process and Review 9

Technical Review 9

Recreational Trail Program Advisory Committee (RTPAC) 9

Pair-Based Scoring Process and Example 9

Environmental and Historical Requirements and Project Clearance 10

State Historic Preservation Office (SHPO) Requirements 11

Other Environmental Considerations 12

Project Expenditure and Reimbursement Process 12

Contributions and Expenses 12

Local Share 12

Federal Matching Share 13

Procurement 13

Reimbursement 15

Progress Reports 17

Amendments 17

Project Termination 18

Project Site Retention & Future Responsibilities 18

Signage Requirement 19

Attachments

A- Sample Online Application 20

B- FHWA 1273 Synopsis 33

C- FHWA Form 1273 34

D- Federal Register Rules and Regulations, 58

Vol. 75, No. 177, dated September 14, 2010, pages 55663-55676

E- Title VI Sub-recipient Assurances and Non-discrimination Provisions 67

3

North Dakota Parks and Recreation Department

Recreation Division – 701-328-5357 – parkrec@nd.gov

RECREATIONAL TRAIL PROGRAM

Program Manual

***NEW PROGRAM ITEMS IN THE MANUAL ARE HIGHLIGHTED IN YELLOW***

Introduction

The North Dakota Parks and Recreation Department (NDPRD) in cooperation with the North

Dakota Division Office of the Federal Highway Administration (FHWA) has prepared this manual

to answer questions relating to project application and management.

General Information

Program Overview

The Recreational Trails Program (RTP) is a federal-aid assistance program to help states provide

and maintain recreational trails for both motorized and non-motorized trail use. The program

provides funds for all kinds of recreational trail uses, such as pedestrian uses (hiking, running,

and wheelchair use), bicycling, in-line skating, equestrian use, cross-country skiing,

snowmobiling, canoe/kayak trails, off-road motorcycling, all-terrain vehicle riding, four-wheel

driving, or using other off-road motorized vehicles.

The Moving Ahead for Progress in the 21st Century Act (MAP-21) reauthorized the Recreational

Trails Program (RTP) through Federal fiscal years 2013 and 2014 as a set aside from the new

Transportation Alternatives Program. The RTP funds come from the Federal Highway Trust Fund,

and represent a portion of the motor fuel excise tax collected from non-highway recreational fuel

use: fuel used for off-highway recreation by snowmobiles, all-terrain vehicles, off-highway

motorcycles, and off-highway light trucks.

The U.S. Department of Transportation, Federal Highway Administration (USDOT/FHWA)

administers the RTP program. The Governor of the state of North Dakota has designated the

North Dakota Parks and Recreation Department (NDPRD) as the agency responsible for

administering apportionments made to the state. RTP funds represent a portion of the federal

gasoline tax attributed to recreation on non-gasoline tax supported roads. The federal

government prescribes many of the regulations governing this program.

NDPRD, along with the Recreational Trail Program Advisory Committee (RTPAC), intends that

RTP grant funding be used to enhance trail opportunities by achieving results that would not

otherwise be possible. RTP grants are for projects that are primarily recreational in nature,

rather than serving a more utilitarian transportation function. The following is a list of eligible

projects:

4

New construction (first priority for RTP funding)

Maintenance of existing trails (re-routes)

Trail amenities

Purchase and lease of recreational trail construction and maintenance equipment

Land or easement acquisition

Trail accessibility assessment

Title VI

Title VI

Sponsors who are Title VI compliant may coordinate bidding and procurement on their own.

Sponsors must follow the original procurement process for reimbursement. All bidding,

procurement and construction must adhere to Title VI requirements. Additional information on

the Title VI Program is available on the North Dakota Parks and Recreation Department website

at: http://www.parkrec.nd.gov/information/department/attachments/title_6_program.pdf.

Sponsors who are not Title VI compliant will work with NDPRD during the bidding and

procurement process. Project reimbursement in this manner will require project

reimbursement (20%) from sponsor to NDPRD.

RTP Funding

The Recreation Trails Program funds up to 80% of eligible costs for trail projects. At the time of

application the project sponsor must have at least 20% of the total project cost available. The

local share may include tax sources (appropriations), bond issues or force account contributions.

The donated value of land, cash, labor, equipment and materials may also be used.

Individual grant awards are limited to a minimum of $10,000 and a maximum of $200,000.

NDPRD and the RTPAC reserve the right to change the minimum/maximum dollar amounts in

order to ensure the complete expenditure of RTP funds. A second cycle may be offered to

ensure total expenditure of funds.

Eligibility

(Please note equipment projects, only federal, state and municipal agencies qualify for funding;

a use agreement will need to be signed by the project sponsor). Grants may be awarded to any

of the following:

Non-profit organizations - A qualified non-profit organization is one that meets the

following criteria:

o Registered with the State of North Dakota as a non-profit for a minimum of 5

years.

o Will name a successor at the time of any change in organizational status (for

example, dissolution). A qualified successor is any party that meets the eligibility

criteria to apply for RTP funds and is capable of complying with all RTP

responsibilities. NDPRD recommends, whenever possible, a government agency

5

be sought as a successor. A successor organization must agree, in writing, to

complete all RTP project responsibilities should the original organization’s status

change.

Title VI of the Civil Rights Act of 1964 ensures that no person in the United States shall,

on the grounds of race, color, or national origin, be excluded from participation in, be

denied the benefits of, or be otherwise subjected to discrimination, including sex, age,

disability, low-income, or LEP discrimination, under any program or activity for which

the Recipient receives Federal financial assistance. The Civil Rights Restoration Act of

1987 clarified the original intent of Congress, with respect to Title VI and other Non-

discrimination requirements (The Age Discrimination Act of 1975, and Section 504 of the

Rehabilitation Act of 1973) by restoring the broad, institutional-wide scope and

coverage of these non-discrimination statutes and requirements to include all programs

and activities of the Recipient, so long as any portion of the program is Federally-

assisted.

Municipal agencies (cities, towns, counties, school districts, etc.)

State agencies (North Dakota Parks and Recreation Department, North Dakota Forest

Service, North Dakota Game and Fish).

Federal government agencies (Bureau of Land Management, U.S. Forest Service, National

Park Service, etc.)

Other government entities (regional governments, etc.)

Potential project sponsors with active or previously awarded grants through NDPRD must be in

full compliance with federal and state programs to be eligible for funding.

“40-30-30” Requirement

RTP Legislation (23 U.S.C. 206) requires that States use 40 percent of their funds in a fiscal year

for diverse recreational trail use; 30 percent for motorized recreation; and 30 percent for non-

motorized recreation. The diverse, motorized, and non-motorized percentages are minimum

requirements that must be met. A project for diverse motorized use (such as snowmobile and

off-road motorcycle use) may satisfy the 40 percent diverse use requirement and the 30 percent

motorized use requirement simultaneously. A project for diverse non-motorized use (such as

pedestrian and bicycle use) may satisfy the 40 percent diverse use requirement and the 30

percent non-motorized use requirement simultaneously.

To provide more flexibility in RTP project selection, FHWA established five categories to account

for the 40-30-30 requirements:

6

1) Non-motorized project for a single use: A project primarily intended to benefit only one

mode of non-motorized recreational trail use, such as pedestrian use only, water trails

(canoe/kayak), or equestrian use only. RTP projects serving various pedestrian uses (such

as walking, hiking, wheelchair use, running, bird-watching, nature interpretation,

backpacking, etc.) constitute a single use for the purposes of this category. A project

serving various non-motorized human-powered snow uses (such as skiing, snowshoeing,

etc.) constitutes single use for this category.

2) Non-motorized diverse use project: A project primarily intended to benefit more than one

mode of non-motorized recreational use such as: walking, bicycling, and skating; both

pedestrian and equestrian use; and pedestrian use in summer and cross-country ski use

in winter.

3) Diverse use project including both motorized and non-motorized uses: A project intended

to benefit both non-motorized recreational trail use and motorized recreational trail use.

This category includes projects where motorized use is permitted, but is not the

predominant beneficiary. This category includes RTP projects where motorized and non-

motorized uses are separated by season, such as equestrian use in summer and

snowmobile use in winter.

4) Motorized single use project: A project primarily intended to benefit only one mode of

motorized recreational use, such as snowmobile trail grooming. A project may be

classified in this category if the project also benefits some non-motorized uses (it is not

necessary to exclude non-motorized uses), but the primary intent must be for the benefit

of motorized use.

5) Motorized diverse use project: A project primarily intended to benefit more than one

mode of motorized recreational use, such as: motorcycle and ATV use; or ATV use in

summer and snowmobile use in winter. A project may be classified in this category if the

project also benefits some non-motorized uses (it is not necessary to exclude non-

motorized uses), but the primary intent must be for the benefit of motorized use.

Projects in categories 1 and 2 apply towards the 30 percent non-motorized use requirement.

Projects in categories 2, 3, and 5 apply towards the 40 percent diverse trail use requirement.

Projects in categories 4 and 5 apply towards the 30 percent motorized use requirement.

Project Timeline

When applying for project funding, the project sponsor must be ready to begin construction upon

grant approval. This requirement includes having all local match available and all project planning

complete. Once the project sponsors are notified of their project approval and funding level, they

have 18 months to complete the project.

Eligible Projects/Expenses

Projects will be ranked based on the categories below with construction of new recreation trails

being given the highest priority.

1. Construction of new recreation trails: For projects on federal land, the most important

requirement is that the federal agency land manager must approve of the project in

7

accordance with other applicable federal laws and regulations. This category may include

construction of new trail bridges, or providing appropriate signage along a trail.

2. Restoration of existing trails: Restoration may be interpreted broadly to include any kind

of non-deferred trail maintenance, restoration, rehabilitation, or relocation. This category

may include maintenance and restoration of trail bridges, or providing appropriate

signage along a trail.

3. Development and rehabilitation of trailside and trailhead facilities and trail linkages: This

may be interpreted broadly to include development or rehabilitation of any trailside and

trailhead facility. The definition of “rehabilitation” means extensive trail repair needed to

bring a facility up to standards suitable for public use due to natural disasters or acts of

nature. Trailside and trailhead facilities must have a direct relationship with a

recreational trail.

4. Purchase and lease of recreational trail construction and maintenance equipment:

Purchase and lease of any trail construction and maintenance equipment, provided the

equipment is used primarily to construct and maintain recreational trails. This provision

does not include purchase of equipment which may be used for purposes unrelated to

recreational trails. For example, a lawn mower purchased under this program must be

used primarily for trail and trailside maintenance, not to maintain open lawn areas or

sport fields. (Please note equipment projects, only federal, state and municipal agencies

qualify for funding; a use agreement will need to be signed by the project sponsor).

5. Acquisition: See the Land Acquisitions and Easements section below; please note, RTP

legislation prohibits condemnation of any kind of interest in property. Therefore,

acquisition of any kind of interest in property must be from a willing landowner or seller.

Ineligible Projects/Expenses

Condemned Land as Matching Value: RTP legislation prohibits using RTP funds for

condemnation of any kind of interest in property. An RTP project may be located on land

condemned with funds from other sources. However, it is not permissible to use the value

of condemned land toward the match requirement for an RTP project.

Feasibility Studies: Trail feasibility studies are not a use permitted in the RTP legislation.

The permissible uses relate to actual on-the- ground trail projects.

Environmental Evaluation and Documentation: Projects intended solely for the purpose

of covering environmental evaluation and documentation costs are not permissible.

However, reasonable environmental evaluation and documentation costs, including costs

associated with environmental permits and approvals, may be included as part of an

approved project’s engineering costs. Costs incurred developing the environmental

evaluation, necessary permits, as well as engineering costs may not exceed 20% of the

total funded project cost.

Law Enforcement: Routine law enforcement is not a use permitted in the RTP

legislation.

Planning: Trail planning is not a permissible use of RTP funds.

8

Sidewalks: RTP funds will not normally be used to provide paths or sidewalks along or

adjacent to public roads or streets, unless the path or sidewalk is needed to complete a

missing link between other recreational trails.

Roads: RTP funds may not be used to improve roads for general passenger vehicle use.

Overhead: The regular operating expenses such as rent, building upkeep, utilities and all

fixed costs associated with a business, agency or group.

Indirect Costs: Only direct costs that can be identified specifically with a particular final

cost objective directly related to the trail project are eligible.

Land Acquisitions and Easements

Acquisition Costs: The following land acquisition costs are allowable and eligible for

reimbursement under the Recreational Trails Program:

o The appraised fair market value of fee simple title or an easement for the use of

real property acquired by negotiated purchase.

o The purchase price for an easement or fee title to real property acquired below

appraised value.

o The donated land value (the difference between the purchase price and appraised

value) may be used as a match for federal funds to purchase that parcel of land,

purchase other pieces of property, or develop facilities.

o Similarly, lands for which 100% of the value is donated may only be used as the

organization’s share of a project to purchase other land or build facilities.

o Appraisal fees.

o Boundary surveys, title search, legal filling fees.

Ineligible Costs: Costs ineligible for reimbursement in an acquisition project include:

o The purchase of real property to which the project sponsor became committed

prior to federal approval.

o Legal fees other than for filling and fines and penalties paid by the project sponsor.

o Incidental costs relating to real property acquisition and interests in real property

unless allowable under the Uniform Relocation Assistance and Real Property

Acquisition Policies Act.

o Taxes for which the local sponsor would not have been liable to pay.

o Damage judgments arising out of acquisition whether determined by judicial

decision, arbitration or otherwise.

Easements: In some instances, the applicant will not be able to purchase the property

but can acquire an easement. An easement must be for a period of at least 25 years.

During the time period, the easement cannot be revoked at will by the landowner

unless the applicant or state is guilty of an infraction of the easement. The land must

still be retained in public trail use for the duration of the easement period even though

the easement has been revoked. Provisions stated in the easement cannot be

detrimental to the proposed recreational development.

9

A draft copy of the easement must accompany the application for acquisition and

development projects. If an easement has been or is to be executed prior to the

submission of a development project application, a draft copy of the easement should

be sent to the NDPRD for review. Advance approval of such agreements may help

ensure the eligibility of the site for funding. Negotiations for easements must follow

general negotiated land purchase regulations including the requirements of the

Uniform Relocation Assistance and Real Property Acquisition Policies Act.

Control and Tenure

Adequate control must be established by an applicant over any land (public or private) to be

improved/ developed with RTP grant funds, including documentation of the fee title, lease,

easement, or use agreement. Lease, easement and use agreement terms must be for a term no

less than 25 years.

The application must identify all outstanding rights or interests held by others on land upon which

the project is proposed. A signed letter explaining control and tenure must be submitted for all

projects not located on Federal Lands. The applicant will be required to submit a signed approval

from the official responsible for management of the project property.

Application Process and Review

The following information outlines the review process for each submitted application. A sample

application can be found at the end of this document (see Attachment A on page 20).

Metropolitan Planning Organizations

Project sponsors that fall into one of the Metropolitan Planning Organizations’ jurisdictions must

provide evidence that their project is in compliance with the MPO Long Range Transportation

Plan. These areas include Bismarck-Mandan, Grand Forks, and Fargo.

Technical Review

Once a potential sponsor submits an application, NDPRD staff will review the application for

completeness, eligibility, the sponsor’s current grant status, match, property ownership,

local/regional/federal approval, etc. Staff will forward eligible applications to the Recreational

Trails Program Advisory Committee (RTPAC) for further consideration.

Recreational Trail Program Advisory Committee (RTPAC)

RTPAC membership represents a broad range of motorized and non-motorized trail users and

associations. A total of nine committee members are appointed by the Director of the North

Dakota Parks and Recreation Department and must be recreational trail users and represent trail

interests (hiking, biking, horseback riding, paddling, OHV and snowmobile). Committee members

are appointed for 3-year terms. Upon completion of a 3-year term, NDPRD will advertise for

replacement of the committee member. If no eligible candidates are received, the existing

committee member will be given the option to renew their term. In North Dakota the committee

serves as the evaluation committee that reviews and prioritizes grant applications and

recommends projects for funding.

10

The project evaluation allows committee members to bring their knowledge of statewide and

local recreation patterns, resources, and needs into consideration. Reviewers may rank a project

based upon their evaluation of site suitability, fiscal consideration, commitment to long-term

operation and maintenance, superior design, superior leverage of funding and partnership, ADA

compliance, and project presentation, heritage and legacy context, regional issues, and the basic

intent of MAP-21.

For a current committee list, please visit:

http://www.parkrec.nd.gov/recreation/grants/rtp/attachments/rtpac_member_list.pdf.

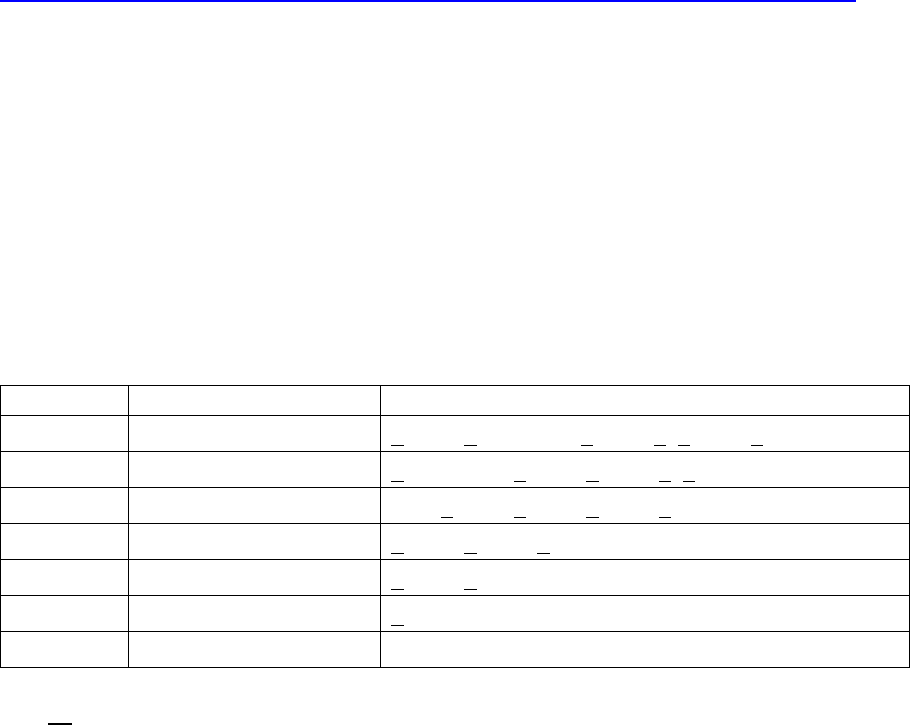

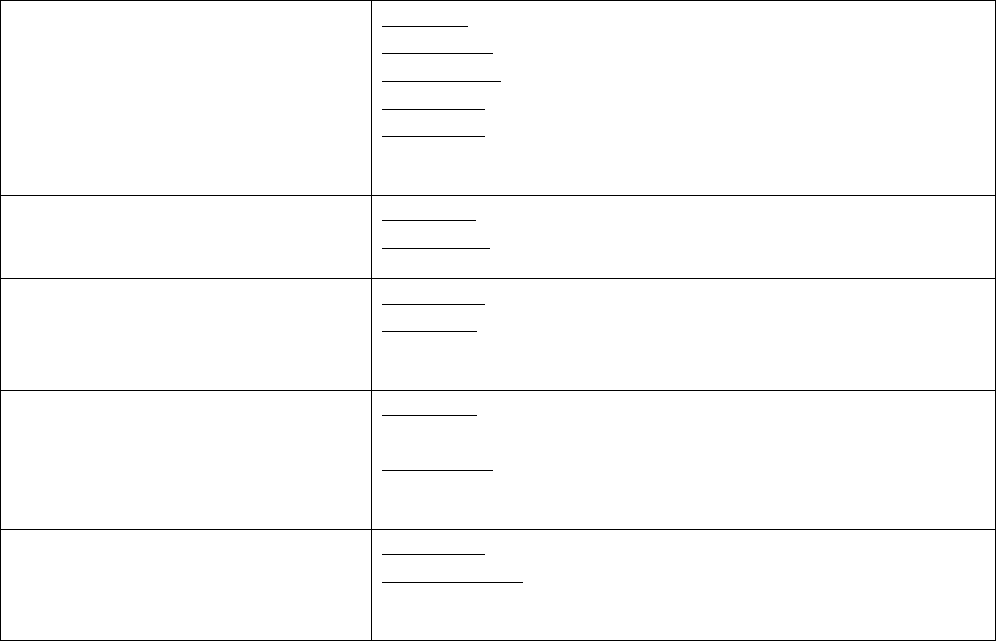

Pair-Based Scoring Process and Example

Pair-based scoring is a ranking methodology in which each project is individually ranked against

each other project, one project at a time. In the example below, 7 applications were received

and ranked. The numbers 1-7 correspond with the assigned application numbers. Projects are

then compared starting with project number 1 vs. project number 2. The better of the two

projects is then marked on the score sheet. Then project 1 is compared to project 3 and again

the better project is marked on the score sheet. This process is repeated until project 1 has

been compared to all other applications. Project 2 is then compared against all other projects

excluding project 1, then project 3 against all others excluding 1 and 2, etc., until each has been

compared to all other projects and project preference has been established. Points are assigned

based on the number of times a project is chosen.

Project #

Total Times Chosen

Pair Ranking

1

4

1 vs. 2, 1 vs.3, 1 vs. 4, 1 vs. 5, 1 vs. 6, 1 vs. 7

2

2

2 vs. 3, 2 vs. 4, 2 vs. 5, 2 vs. 6, 2 vs. 7

3

0

3 vs. 4, 3 vs. 5, 3 vs. 6, 3 vs. 7

4

6

4 vs. 5, 4 vs. 6, 4 vs. 7

5

5

5 vs. 6, 5 vs. 7

6

3

6 vs. 7

7

1

____21_____ Total Points - The sum of all points should be 21.

In this example project number 4 was selected the most times and is ranked #1, followed by

project 5 and so on. Once the projects have been ranked by all committee members, the scores

will be averaged and the highest ranking projects will be submitted for environmental and

historical review and clearance.

Environmental and Historical Requirements and Project Clearance

Documentation of compliance with the National Environmental Policy Act (NEPA) and other

Federal environmental laws, regulations, and Executive Orders must be provided as part of an

11

authorized project under the RTP. FHWA procedures in 23 CFR 771 apply to the RTP. Each project

must be evaluated to determine the environmental impacts; however, most RTP projects will

qualify as Categorical Exclusions (CE) under NEPA (23 CFR 771.117) if they meet the following

requirements:

Does not have significant impacts to planned growth or land use for the area;

Does not require the relocation of a significant number of people;

Do not have a significant impact on any natural, cultural, recreational, historic or other

resource;

Does not involve significant air, noise, or water quality impacts;

Does not have significant impacts on travel patterns;

Does not otherwise have any significant environmental impacts.

The following project types are CE by definition and do not require further review:

Rehabilitation contained within the footprints of existing trails and trailhead facilities;

Re-grading within the footprints of existing trails or trail parking areas;

Striping and/or re-striping of existing facilities;

Replacement, renovation, or rehabilitation of existing signs, kiosks, or markers;

Alterations to existing facilities in order to make them accessible to the elderly and

handicapped persons;

Repair or replacement of existing fencing, guardrails, retaining walls, or berms within

existing facilities, including areas needed for construction and staging.

After the Recreational Trails Program Advisory Committee (RTPAC) reviews and ranks the

applications, the selected projects will be sent to the following agencies to meet the

environmental review requirements:

North Dakota Department of Health

North Dakota Department of Transportation

North Dakota Game and Fish

North Dakota Parks and Recreation Department

North Dakota State Historical Society

North Dakota Water Commission

US Army Corps of Engineers

US Department of Agriculture

US Fish and Wildlife Service

All projects must be approved by these agencies before funding can be awarded.

State Historic Preservation Office (SHPO) Requirements

The SHPO will be contacted to assure that the project proposal complies with State laws

regarding archaeology on lands or historic properties.

12

Any project element calling for alteration, rehabilitation, renovation, or demolition of a

historically, culturally, or architecturally significant property or property contributing to

the integrity of a cohesive older neighborhood or historic district needs to be cleared by

the SHPO on a case-by-case basis.

Photographs of impacted properties 45 years of age or older need to be submitted along

with a narrative describing the project, including plans and specifications, as appropriate.

Any available historical information on the property should also be submitted.

It is illegal to disturb an archaeological site or to remove an archaeological site or to

remove an archaeological object from public or private lands unless that activity is

authorized under a permit.

If human remains are found during an excavation, the local law enforcement office must

be contacted to determine if they are Native American or are evidence of a crime scene.

If other archaeological materials are found during a ground disturbing activity, contact the SHPO

at 701-328-2666. The SHPO can check to see if your project area has been surveyed and can give

you a current list of archaeological consultants. Only professional archaeologists or persons

working for recognized scientific organizations may apply for an archaeological permit.

Other Environmental Considerations

Wetlands: Impacts to wetlands must be considered and may result in trail route or

structure changes. All applications will be reviewed by NDPRD Grant staff for wetland

impacts using the U.S. Fish and Wildlife’s Wetland Mapper available at

http://www.fws.gov/wetlands/data/.

Threatened and Endangered Species: The occurrence of a protected species could be an

important issue to consider during the development of an RTP project. Projects will be

reviewed by the U.S. Fish and Wildlife Service and the North Dakota National Heritage

Inventory Program.

Hazardous Wastes and Contaminated Properties: Contaminated sites may be

encountered during the development of RTP projects. Abandoned railroad lines being

converted into trails are of particular concern. Site assessments and appropriate steps for

remediation may be necessary.

Noxious Weeds: Project sponsors are responsible for the spread of noxious weeds in

conjunction with the trail project.

Project Expenditure and Reimbursement Process

Contributions and Expenses

To be eligible for reimbursement funds, project costs must be incurred after the federal project

approval date. Donations of equipment, labor, and materials must be contributed after federal

grant approval. Cash contributions may be received at any time.

The bidding and procurement process must also begin after the federal project approval date,

which will be indicated on your final award letter. Please note a pre-approval award letter will be

sent out to all projects that are ranked high enough to be funded; final approval will be contingent

13

upon Solicitation of View (SOV) letters and responses. Upon successful completion of reviews, a

final award letter, to include the project start/completion date, will be provided to the sponsor.

Local Share

Local match may include donated/volunteer labor, donated equipment and materials, and force

account.

Donated Labor: The time of a person donating services will be valued at a rate paid as a

general laborer (per North Dakota Job Service’s General Laborer Rate for the project area

location, documented and provided by sponsor to NDPRD) unless the person is

professionally skilled in the work being performed on the project (i.e. mason doing work

on a retaining wall). When this is the case, the wage rate this individual is normally paid

for performing this service may be charged to the project. The rates for labor should not

include payroll additives or overhead costs. Evidence of the skilled labor rates must

accompany the reimbursement request. Volunteer labor may be used as match only and

is never a reimbursable item.

Donated Equipment and Materials: Donated equipment and materials may be used as

match only and are never reimbursable items. The value of the donated materials and

equipment rental rates must be documented through an invoice or official letter from the

donor/vendor.

Force Account: Force account is different than volunteer labor or donated equipment and

supplies. Force account refers to the use of a project sponsor’s staff, equipment, and/or

materials. All or part of the project sponsor’s share may be provided through force

account, but force account is never a reimbursable item. Documentation must be

verifiable from the project sponsor’s records, and must be reasonable and necessary for

efficient completion of the project.

Federal Matching Share

The federal share through the RTP for projects is limited to 80 percent except under the following

circumstances:

A Federal agency project sponsor may provide its own funds toward RTP projects as

additional Federal share up to 95 percent of the project cost. The limitation is intended

to ensure commitment to the project from State, local, or private co-sponsors. Under this

provision, a Federal agency project sponsor may provide any amount of funds, provided

the total Federal share does not exceed 95 percent.

Funds from Federal Programs: RTP funds may be matched with funds available under

other Federal funding programs, if the project also is eligible for funding under the other

Federal program. Federal funds received by any project sponsor from another Federal

program may be credited as if they were the non-Federal share, and may be used to

match RTP project funds up to 100 percent of the project cost.

Procurement

Please note this section is only applicable to project sponsors that are Title VI compliant. If the

sponsor is not Title VI compliant, the NDPRD will be coordinating the bidding and procurement

process.

14

Grant recipients are required to follow the State of North Dakota’s procurement guidelines

when purchasing goods or services needed to complete a project.

Purchases $2,500 and below: Use adequate procedures to ensure commodities and

services are obtained at a fair and reasonable price, which may include the soliciting only

one informal bid or proposal. Rotate vendors solicited on an equitable basis (ref. N.D.A.C.

§ 4-12-08-02). “Fair and reasonable” price can be based on previous purchases, market

research, a published price list, or by simply soliciting more than one vendor. Remember,

“When in doubt, bid it out.”

Purchases $2,500.01 to $25,000: Solicit no fewer than three vendors, insofar as practical,

to submit oral or written informal bids or proposals. If you do not receive three bids or

proposals, provide a written justification (e.g., “only two known vendors” or “contacted

three vendors, only two responded”).

Purchases over $25,000: Solicit formal sealed bids or proposals with notice to approved

bidders on the State Bidders List (ref. N.D.C.C. § 54-44.4-14, N.D.A.C. Chapter 4-12-08).

Notice of bid opportunities must be placed weekly in a newspaper for a period of no less

than three weeks to ensure notice of a bid opportunity.

Limited Competitive and Noncompetitive Procurements: Occasionally, circumstances

arise under which a fully competitive procurement process may be difficult or impossible.

Procurement is noncompetitive when there is no bidding process. Limited competition

occurs when competition is possible, but the requirements of the solicitation restrict

competition to particular bidders. (Ref. N.D.C.C. § 54-44.4-05, N.D.A.C. § 4-12-09). Project

sponsors must use the State’s Alternate Procurement Request form, SFN 51403 to

document this process and submit to NDPRD prior to entering into a contract or incurring

an expense which is classified as a limited competitive or noncompetitive purchase. In

accordance with federal regulations, NDPRD will then forward to FHWA for approval.

NDPRD will notify the project sponsor of FHWA’s decision within 10 business days of the

forms submittal along with a reason, if denied.

Documentation Requirements: Each procurement transaction must be adequately

documented for audit and public record purposes. If the purchase is over $2,500, the

procurement file must have evidence that three vendors were solicited or document the

reason three bids were not obtained using the guidelines and forms listed above. Include

any required approvals, solicitation documents used, list of bidders solicited and

responses received. In addition a bid tab or summary must be included which includes

the name, address and phone number of the all bidders along with evaluation

worksheets, reasons for rejecting a particular bid, and method of award (e.g. purchasing

card or purchase order).

Exemptions by Statute: Please note, certain commodities and services are not subject to

state procurement laws. The following commodities and services are exempted from

state procurement practices by N.D.C.C. § 54-44.4-02 And N.D.A.C. § 4-12-01-04, as

follows:

15

o Land, building, space, or the rental thereof, however before making a

commitment to obtain land for a RTP project, an appraisal must be submitted to

the Parks and Recreation Department for approval. The land is required to be

appraised by a certified general appraiser with federal experience according to the

Uniform Appraisal Standards for Federal Land Acquisitions (located on the web at

http://www.justice.gov/enrd/land-ack/Uniform-Appraisal-Standards.pdf).

No more than the appraised value can be paid.

o Telephone and telegraph service, electrical light, and power services.

o Department of Transportation materials, equipment, and supplies in accordance

with N.D.C.C. § 24-02-16.

o Specific commodities and services as determined by written directive by the

Director of OMB in N.D.A.C § 4-12-01-04 such as: A. contracts for public buildings

and public improvement contract bids, pursuant to N.D.C.C. Title 48. B. Contracts

for architect, engineer, and land surveying services pursuant to N.D.C.C. Chapter

54-44.7.

Required Contract Language: Attached to this manual is FHWA Form 1273 and Title VI

nondiscrimination assurances, which are required to be included in its entirety in every

RTP contract between a project sponsor and any organization, group, agency or individual

they do business with (see attachments B and C). Failure to include this form will result in

forfeiture of RTP funds for the project portion covered by of the contract in question.

While including this form is a federal requirement, only certain portions may apply

depending on the contracted dollar amount or the location of the project (federal road

right of way). Please direct any questions relating to this form to NDPRD grant staff.

Disadvantaged Business Enterprise Program: Project sponsors are encouraged to work

with disadvantaged businesses, including those owned by minorities, women, and socially

and economically disadvantaged individuals, when practical and applicable to the State’s

procurement guidelines. For more information on the ND Department of Transportation’s

Disadvantaged Business Enterprise Program, please visit

http://www.dot.nd.gov/divisions/civilrights/dbeprogram.htm.

Reimbursement

The project sponsor will not receive upfront funding at the time of project approval. Instead, the

sponsor must pay the bills and be reimbursed for a maximum of 80% of the expenses incurred

for the project. To avoid the risk of losing funding, reimbursement requests must be made every

6 months during the project period. Land donations will be credited towards the match of the

sponsor’s share of the project.

As in any program where a reimbursement is requested for a portion of the project costs,

adequate documentation and records are essential. There must be definite supporting

documentation (i.e. invoices and canceled checks) for each item of cost claimed- estimates are

not sufficient. NDPRD may request additional support documentation in order to process a

billing.

16

Reimbursement Requests: The following is a list of documentation NDPRD will need to

process reimbursement requests:

o Grant Programs Reimbursement Request Form.

o Grant Programs Progress Report Form.

o Affidavit of publication, supplied by the newspaper when you advertise for bids.

o For purchases over $2,500, include any required approvals, solicitation

documents used, list of bidders solicited and responses received. In addition a

bid tab or summary must be included which includes the name, address and

phone number of the all bidders along with evaluation worksheets, reasons for

rejecting a particular bid, and method of award (e.g. purchasing card or purchase

order). Forms should be dated and signed by responsible official.

o Contractor invoices (or final progress payment, if countersigned by contractor

acknowledging payment of all prior charges, and if the cost of each major work

item is shown) and cancelled checks to contractor (copy of both sides).

o All other cancelled checks (copy of both sides).

o Copies of invoices. Not monthly statements.

o Individual earnings records for the calendar year or payroll journals. Should

show gross wages, withholdings and net pay for each pay period – See Force

Account Form.

o Equipment rental time records.

o Detailed schedule showing how you computed owned-equipment rental rates.

For donated equipment time, you must use hourly rates via a quote from a local

rent all or a published equipment billing chart for a municipality. See Equipment

Value Form.

All required forms are available at

http://www.parkrec.nd.gov/recreation/grants/rtp/reimbursementforms.html

Partial Billings: A partial billing along with supporting documentation may be submitted

to NDPRD after portions of the work have been completed. Submit the completed

"Reimbursement Request Form." The state will retain 5% of the grant amount until the

project is complete and a final inspection completed. Supporting documentation needed

includes the following:

o Progress Report – Grant Programs Progress Report Form

o Expenditure Records indicated above

o Volunteer Logs

Final Billings: In order for a project to be considered completed and ready for final billing,

it should be submitted within thirty days of the completion of the project or grant

expiration date, whichever comes first. Final project billings must be submitted to NDPRD

utilizing the process outlined above. Once a final billing is received NDPRD staff will

contact the project sponsor to discuss the completed RTP project and arrange for a final

inspection. Final project billing and grant closeout will not be completed until NDPRD has

17

conducted the final inspection and certified the project is indeed complete, meeting the

project description outlined in the grant application and/or project amendment.

Reimbursement Request Form: A separate file should be established and maintained for

each RTP project. The project sponsor is responsible to track costs according to the

categories on the Grant Programs Reimbursement Request Form and must maintain an

auditable record for a period of not less than 3 years from the date of the final

reimbursement. A GRANT REIMBURSEMENT FORM MUST BE SUBMITTED FOR ALL

PAYMENT REQUESTS AND REIMBURSEMENTS. ONLY THE FORM PROVIDED BY NDPRD

WILL BE ACCEPTED.

Progress Reports

Project sponsors are required to submit progress reports with each reimbursement request or

at a minimum every six months to ensure that NDPRD is aware of the project’s progress. Please

use the “Grant Programs Progress Report” form located at:

http://www.parkrec.nd.gov/recreation/grants/rtp/attachments/grantprogramprogressreport.pdf.

Projects that have not shown progress for six months risk potential termination of RTP funding.

If no progress reports are received, NDPRD will assume no progress has been made.

Amendments

During the project period, various situations may result in changes or deviations from the Project

description. An amendment is necessary to add to, or alter the approved project. Changes that

may necessitate an amendment are increases or decreases in the grant amount, project scope

changes, or an extension of the project period.

Changes in Project Scope: Only those items approved for the project are eligible for

federal assistance. Similarly, facilities must be constructed in the same location as

designated on the plans submitted with the application. Due to unforeseen changes in

project costs or revisions in the plans for the facility, certain items may have to be added

or deleted from the project after it is approved. These changes may require submission

to the Federal Government for approval. In the case of adding an item to the project,

construction on that item cannot begin until the amendment is approved.

The amount of federal assistance specified on the award letter is the maximum amount

reserved for that particular project. Costs over this amount have to be paid by the

applicant. All changes in project scope should be in accordance with the intent of the

original application, and must be justifiable. The need for the change must be

documented by a letter to the NDPRD, accompanied by revised cost estimates,

construction plans and maps.

Project Period Extensions: All acquisition and development must take place within the

project period, which is identified in the award letter. The award letter is sent to the

18

project sponsor after the project has received Federal approval. For most projects, the

target date for project completion will be based on an 18 month project period. The

project sponsor is encouraged to complete the project as soon as possible as inflation can

add a 5% cost increase each year.

If the project cannot be completed during the period identified on the project letter, a

request must be submitted for a time extension. The request must justify why the project

cannot be completed before the expiration date. This justification should include a time

schedule for completing the remaining items. Typically no more than one six month

extension can be granted and then only under unforeseen circumstances. Work

performed after the project has expired will not be eligible for federal assistance. Final

payments for work done during the project period can be made after the project has

expired. These payments should specify the work had been completed before the project

expired.

Submission of an Amendment Request: The sponsoring agency initiates the amendment

by submitting a request for the changes to NDPRD. This request should include all project

revisions desired, including cost estimates, maps or design plans, and justification of the

need for the changes. It is recommended the NDPRD be contacted prior to the submission

of the amendment request. Department staff will be able to provide advice on the

feasibility of an amendment approval. An amendment for a change in project scope can

be requested any time prior to the construction of the added item or acquisition of the

added tract. An amendment for an extension of time should be submitted forty-five days

before the project is scheduled to expire.

It is essential that amendment requests be kept to a minimum. Amendments are used to

cover items that could not be anticipated in the original project. Major deviations from

the original project will not be accepted. It is the responsibility of the project sponsor to

thoroughly determine the type of project prior to submission and, upon approval, carry

through with that project.

Project Termination

A project sponsor may request withdrawal of the project at any time prior to the first payment

or expenditure of grant funds. After the initial payment, the project may be rescinded, modified

or amended only by written mutual agreement between the project sponsor and NDPRD.

NDPRD may terminate the project in whole or in part, at any time before the date of completion,

if it is determined the project sponsor has failed to comply with the terms of the project proposal

or the intent of the program. Failure by the project sponsor to comply with the terms of the grant

may cause suspension of all obligations by and a return of any monies received. If a project is

terminated the project sponsor will be notified in writing of the determination and the reasons

for the termination, together with the effective date. Payments made to the project sponsor or

recovery of funds by the NDPRD under projects terminated for cause shall be in accord with the

legal rights and liabilities of the parties.

19

NDPRD may terminate the grants in whole, or in part at any time before the date of completion,

when all parties agree that the continuation of the project would not produce beneficial results

commensurate with the further expenditure of funds. The parties shall agree upon the

termination conditions, including the effective date and, in the case of partial termination, the

portion to be terminated. The project sponsor shall not incur new obligations for the terminated

portion after the effective date, and shall cancel as many outstanding obligations as possible.

Termination either for cause or for convenience requires the project in question be brought to a

state of recreational usefulness agreed upon by the project sponsor and NDPRD or all funds must

be returned.

Project Site Retention & Future Responsibilities

At the time of project approval, the project sponsor through the acceptance of funds, commits

that the facilities developed with federal assistance must remain open for general public use and

will be operated and maintained. If RTP monies are used for land acquisition the land must

remain in public trail use for perpetuity. If RTP monies are used for development, the site and

facility must remain in public trail use for 25 years or until the facilities become obsolete or are

at the end of their useable life.

Signage Requirement

Project sites funded through the Recreational Trails Program are required to display a sign stating

that the funding assistance for the site came through a partnership between the FHWA and

NDPRD.

20

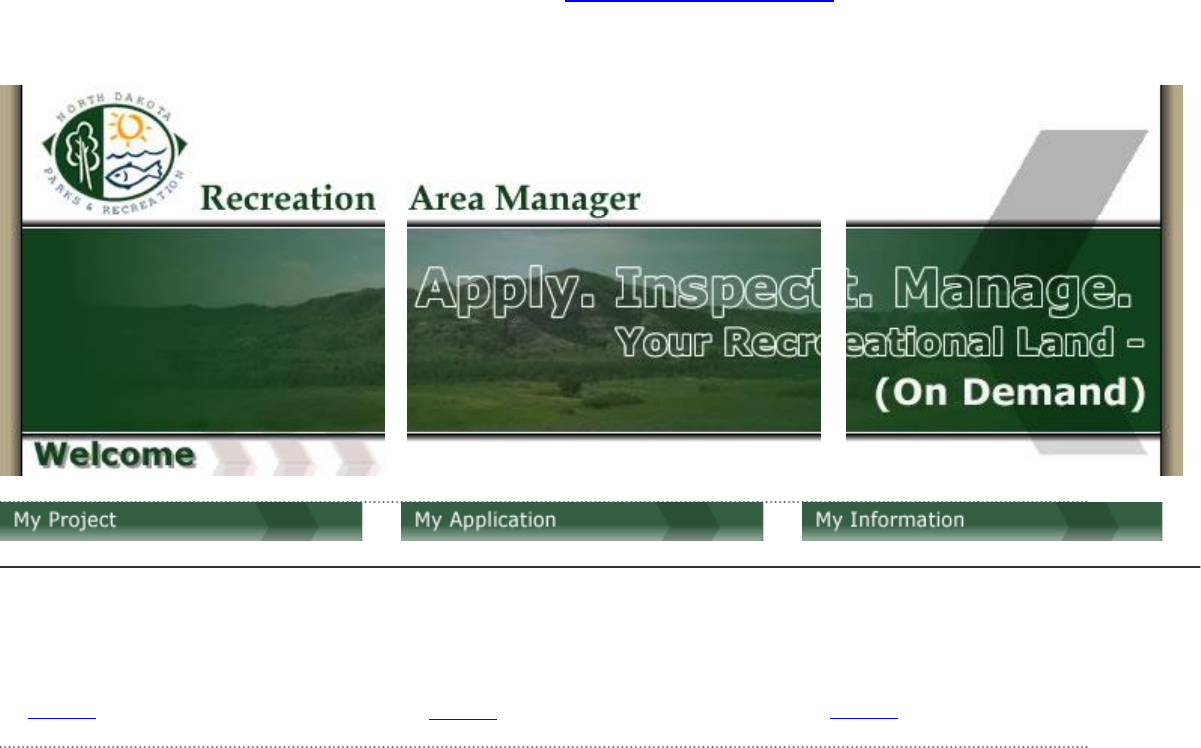

Attachment A: Sample Online Application

All instructions are indicated by the use of italics.

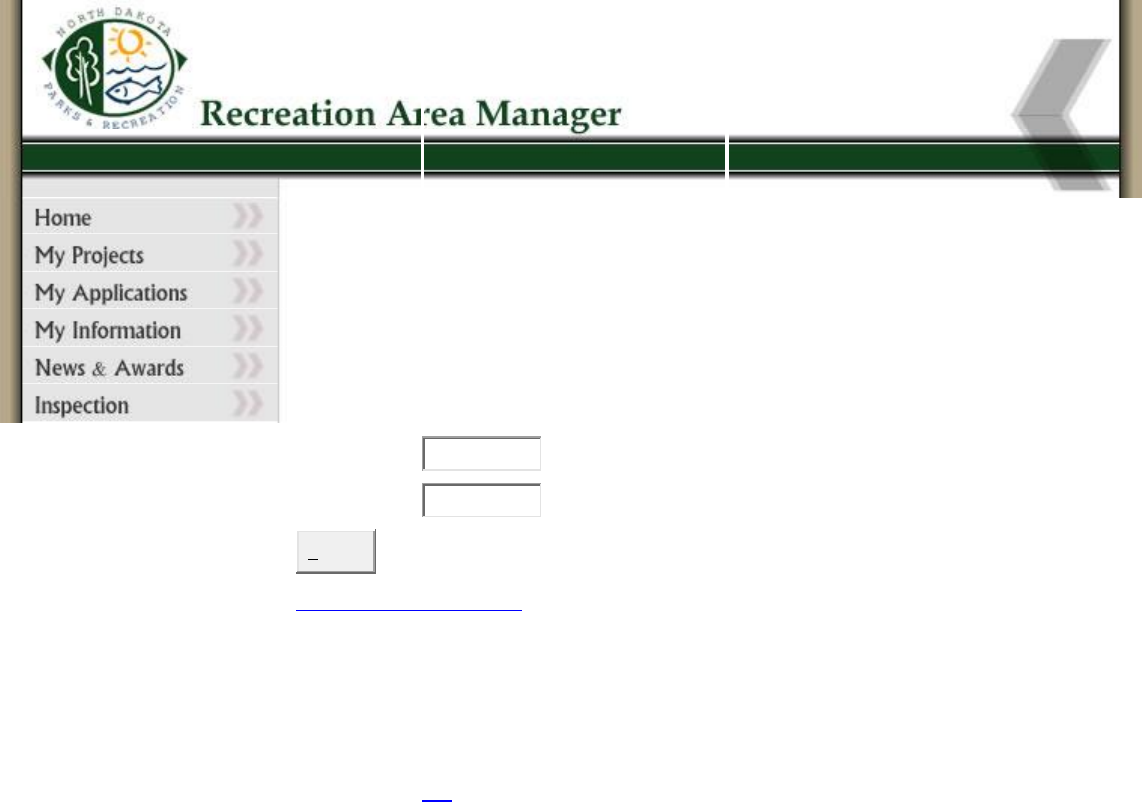

Go to online application at the following location: http://idctech.net/NDRAM/ and the following screen will

appear.

This section allows you to signup and track your

project details. Once you login to your account your

information about your properties & trails will be

displayed to you.

>>Sign In

The My Application section allows you to fill out an

application for a new Land & Water Grant or

Recreational Trails Grant. Once the application is

filled out, you will receive updates via this system

from your state's administrator.

>>Sign In

The My Information section will allows you to

modify and change the information you provided

when you signed up to use the RAM system. If you

have any question just ask our staff.

>>Sign In

News & Awards

The Complete Inspection

The complete inspection section allows you enter inspection information

for the properties that you manage. This software will take information that use to be stored

non-conforming filing cabinets and place into highly efficient, state-of-the-art software program.

Click on Sign in, then you will be taken to the following screen.

21

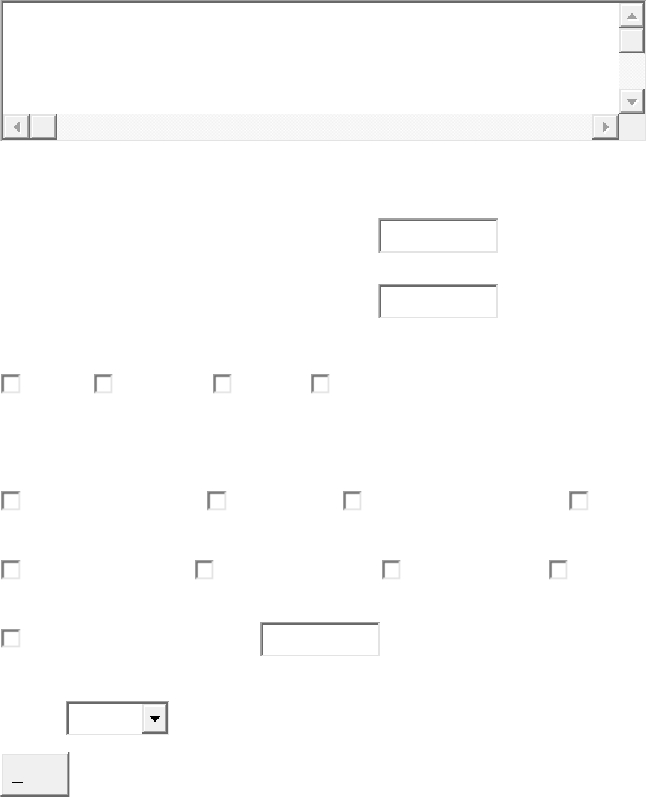

Log in with your user name and password, then click sign-in. If you do not have a user name and password call

701-328-5364 to request one.

Login

Sponsors who do not know their login information, or who are unsure about their status should contact the grant administrator by phone at

701.328.5364.

Sponsors who have never received a grant from the Land and Water Conservation Fund or the Recreational Trails Fund must register (by

clicking the REGISTER button) as a new sponsor in order to apply for a grant.

EXISTING LOGIN

User Name:

Password:

SIGN-IN

Forget Your Password?

NEW LOGIN

New Users may click here to register and use the system.

22

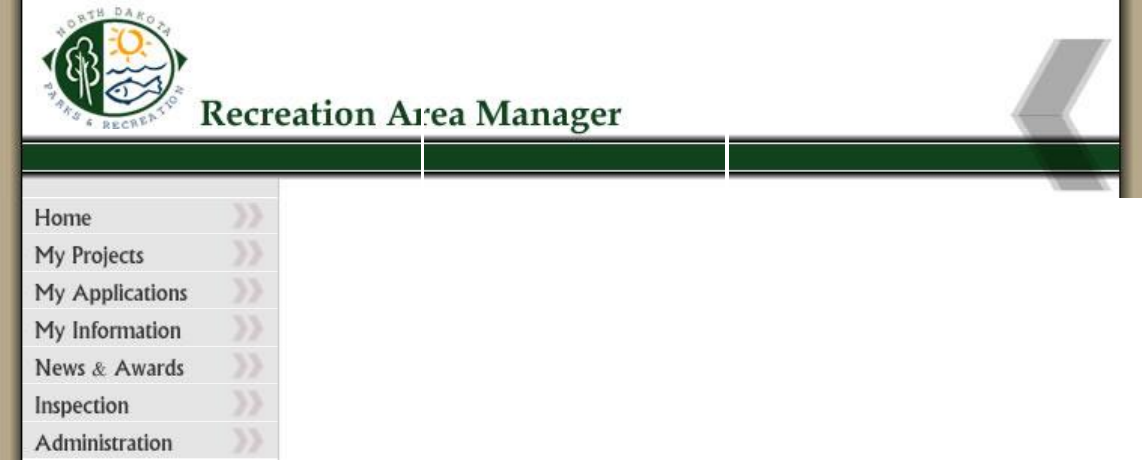

After successful login the following screen will be displayed.

Welcome

Welcome to the RAM System. To proceed, you may select from the menu options on the left side of your web browser. You currently have

57 Recreational Properties that are ready for inspection. You can see which properties these are by clicking on the "My Projects" menu

item.

Click on 'My Projects' to view the Recreational Properties that you help manage.

Click on 'My Applications' to view your current Applications, and to create new

Applications.

Click on 'My Information' to view and edit your Personal Contact Information

as well as your User Name and Password.

Click on 'News & Awards' to read the current News, and to see what awards

have been handed out, and to whom they went.

Click on 'Inspections' to review old Recreational Property Inspections.

Click on My Applications to create a new RTP application.

23

My Applications

Welcome to the application section. On this screen, the managing entity can view all of the applications you or the managing entity you

are associated with have submitted, track the status of those applications, and drill deeper into the application information. If you do not

see the ability to add a new application, then you need to be associated with a managing entity, please contact the grant

administrator by phone at 701.328.5364.

CREATE NEW LWCF APPLICATION

CREATE NEW RTP APPLICATION

LWCF

Property Name

Last Updated

RTP Project Name

Click Create New RTP Application then fill out application and upload required documents.

24

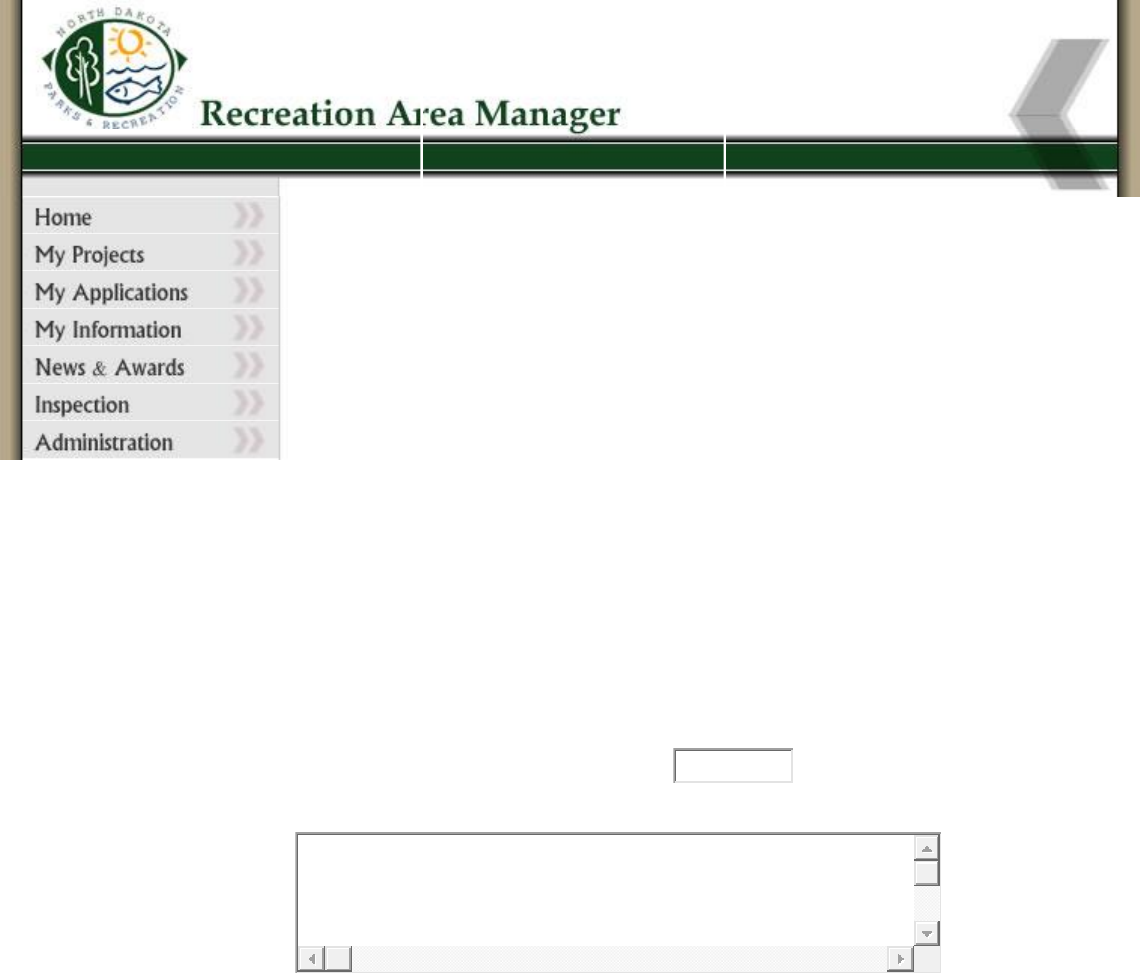

Fill in project name and click save then a new icon will appear that says “Upload Documents.” Click on this

button to upload all required and support documentation.

Application Page

Recreational Trail Program (RTP) grant awards are available to the State of North Dakota, political subdivisions and nonprofit

organizations in order to assist in the development, maintenance or rehabilitation of recreational trails. The RTP is an assistance program

of the U.S. Department of Transportation's Federal Highway Administration (FHWA). The program is administered by the Recreation

Division of the North Dakota Parks and Recreation Department.

Project proposals must be approved at the state and federal levels. A Recreation Trails Committee of private, state and federal

individuals evaluates and ranks the projects. Projects selected at the state level are submitted to the FHWA for federal review and

approval.

RTP grants reimburse up to 80 percent of the cost for development, maintenance or rehabilitation of recreational trails. The maximum

federal grant award is determined annually. Engineering fees exceeding more that 20% of total project cost are not eligible for

reimbursement. Project sponsors cannot be reimbursed for funds that are incurred before an application is approved and a local grant

agreement is signed.

A application deadline is established each year. Applications must be submitted on or before that date. Late or incomplete applications

will not be considered.

You may press SAVE at any time, as long as you have filled out a bare minimum of the application. A Red * will appear next to those

fields that are required. Once you have successfully saved your application, you will be able to add federal and local funding sources by

pressing the newly visible ADD FEDERAL FUNDING SOURCE and ADD LOCAL FUNDING SOURCE buttons located at both the top

and bottom of the page. At this time you will also be able to upload documents to this application.

Trail Project Name:

Description of Proposed Project:

25

Property Location Information

Urban or Rural Development:

Urban

Address Line 1:

Address Line 2:

Either Choose a City or Select 'Other' and Type one in the Box Provided:

Abercrombie

If Other:

County:

Adams

State:

ND

Either Choose a Zip Code or Select 'Other' and Type one in the Box

Provided:

58001

If Other:

Township: N

Range: W

Township Section:

Township, Range & Section

Length of New Trail: (in miles)

Length of Total Trail (in miles) if

Project is an Extension:

General Funding and Property Information

Total Cost:

Fund Amount:

Is this Project an Extension to an Existing Trail Project?

Yes

Who Holds the Title to the Project Land?

26

Projects must be completed within 18 months of grant award to meet

Federal Highway Administration Guidelines.

Estimated Start Date:

(mm/dd/yyyy)

Estimated End Date: (mm/dd/yyyy)

Classification of Land:

State Federal Local Private

Check all of the uses the Project impacts:

Walking/Hiking Bicycling Horseback Riding Cross-

Country Skiing

In-line Skating Snowmobiling ATV Riding Off-road

Motorcycling

4x4 Trucking Other:

Does the Project fall substantially within a federal highway right-of-

way?

Yes

SAVE

Federal Funding Sources __________________

Local Funding Sources ____________________

Adding sources to this section certifies that the sponsor has their share of money available and has earmarked these

funds for use on this project. It is necessary to have 20% of the total project cost available.

**All RTP projects must meet accessibility guidelines in compliance with the Americans with Disabilities Act of 1990,

Section 504 of the Rehabilitation Act of 1973 and the Architectural Barriers Act. For more information refer to the U.S.

Access Board at www.access-board.gov. Look for the Reg Neg Committee 1999 Report: Accessibility Guidelines for

Outdoor Developed Areas.

Requirement-

Each application must address each of the following requirements in the order they appear below:

1. A project description sufficient to understand the project. Indicate

prominently whether this is primarily a maintenance request, an

enhancement to an existing trail, new development, acquisition, length

27

of trail etc. Please explain if the application is for one or more phases

of a multi-phase project.

2. Clearly defined goals for the project (with a delineation of which user

groups would benefit from the project).

3. Costs associated with the project (with estimates of the following

components: material/service purchases including hardware, paint,

lumber, sand/gravel concrete, landscape materials, signs,

design/engineering services and contractor services).

4. Evidence of local/area support (e.g., council resolutions, minutes of

public meetings, letters of support, etc.). Evidence of MPO support

must be included if applicable.

5. Availability/access to 20% match for eligible elements of the project

proposal. Matching funds must not be from other federal sources such

as Transportation Enhancement through the Department of

Transportation. A resolution from the sponsor of the project regarding

the availability of funds will be required prior to any award of a grant.

6. Identification of the sponsor of the project: This organization or unit

of government will be legally responsible for the project.

7. Evidence of applicant capability (e.g., ability to carry out project, and

for development projects, to operate, maintain, and protect trail and

facilities when completed).

8. Written Assurances (if applicable). Produce leases or written

assurances that the project will be open for public use.

Evaluation Criterion-

All applications must address the following criteria in the order that they appear. Failure to provide this information may

result in the disqualification of this application.

1. Site and project quality: consideration of the needs of the intended

trail user group(s); aesthetic quality of the trail location;

appropriateness of the trail for the intended or existing uses; clarity,

detail, and quality of project plan/design; quality of existing

development (if any) on site or in corridor; attention to safety,

accessibility and health considerations.

2. Public need for and benefit of project: safety concerns, urgency of

action, potential to lose the opportunity, number of people who would

benefit from the project when compared to cost. Why should this

project be funded? How many people could be expected to use the

trail over the course of the year as a result of funding the project?

3. Context of the project in a wider plan: demonstrated compatibility

with local/region/area trail plans and the Statewide Comprehensive

Outdoor Recreation Plan. For proposed facilities, what relationship

does the proposed development/acquisition have to other outdoor

recreation facilities and trails?

4. Attention to the potential environmental impact of the project and

efforts to mitigate adverse effects: Possible areas of consideration

include but are not limited to: noise, odors, dust, surface erosion, fish

and wildlife populations, damage to wetlands, or other ecologically

sensitive natural resources or historical/archeological remains. A

28

cultural review letter or document should be included with the

application. All applications are subject to review by the State

Historical Society.

5. Impact on adjoining landowners in the vicinity of the project:

Identify adverse impacts that might be realized as a result of

completing the project, and how the projects design attempts to

mitigate adverse impacts. How might the project improve conditions

for adjacent landowners?

Certifications Regarding Debarment, Suspension and Other Responsibility Matters, Drug-Free Workplace

Requirements and Lobbying

Persons submitting this form should refer to the regulations referenced below for complete instructions:

Certification Regarding Debarment, Suspension, and Other Responsibility Matters – Primary Covered Transactions – The

prospective primary participant further agrees by submitting this proposal that it will include the clause titles, “Certification

Regarding Debarment, Suspension, Ineligibility and voluntary Exclusion – Lower Tier Covered Transaction,” provided by

the department or agency entering into this covered transaction, without modification, in all lower tier covered

transactions and in all solicitations for lower tier covered transactions. See below for language to be used; use this form

for certification and sign; Certification Regarding Drug- Free Workplace Requirements-Alternate I. (Grantees Other Than

Individuals) and Alternate II. (Grantees Who are Individuals) – (See Appendix C of Subpart D of 43 CFR Part 12)

Checking the boxes on this form and submitting it provides for compliance with certification requirements under 43 CFR

Parts 12 and 18. The certifications shall be treated as a material representation of fact upon which reliance will be placed

when the funding agency determines to award the covered transaction, grant, cooperative agreement or loan.

PART A: Certification Regarding Debarment, Suspension, and Other Responsibility Matters – Primary Covered

Transactions

CHECK IF THIS CERTIFICATION IS FOR A PRIMARY COVERED TRANSACTION AND IS APPLICABLE.

1. The prospective primary participant certifies to the best of its

knowledge and belief, that it and its principals:

1. Are not presently debarred, suspended, proposed for

debarment, declared ineligible, or voluntarily excluded from

covered transactions by any Federal department or agency;

2. Have not within a three-year period preceding this proposal

been convicted of or had a civil judgment rendered against

them for commission of fraud or a criminal offense in

connection with obtaining, attempting to obtain, or performing

a public (Federal, State or local) transaction or contract under a

public transaction; violation of Federal or State antitrust

statutes or commission of embezzlement, theft, forgery,

bribery, falsification or destruction of records, making false

statements, or receiving stolen property;

3. Are not presently indicted for or otherwise criminally or civilly

charged by a governmental entity (Federal, State or local) with

commission of any of the offenses enumerated in paragraph

(1)(b) of this certification; and

4. Have not within a three-year period preceding this

application/proposal had one or more public transactions

(Federal, State or local) terminated for cause or default

2. Where the prospective primary participant is unable to certify to any

of the statements in this certification, such prospective participant

shall attach an explanation to this proposal.

29

Part B: Certification Regarding Debarment, Suspension, Ineligibility and Voluntary Exclusion – Lower Tier

Covered Transactions

CHECK IF THIS CERTIFICATION IS FOR A LOWER TIER COVERED TRANSACTION AND IS APPLICABLE.

1. The prospective lower tier participant certifies, by submission of this

proposal, that neither it nor its principals is presently debarred,

suspended, proposed for debarment, declared ineligible, or voluntarily

excluded from participation in this transaction by any Federal

department or agency.

2. Where the prospective lower tier participant is unable to certify to any

of the statements in this certification, such prospective participant

shall attach an explanation to this proposal.

Part C: Certification Regarding Drug-Free Workplace Requirements

CHECK IF THIS CERTIFICATION IS FOR AN APPLICANT WHO IS NOT AN INDIVIDUAL

Alternate I. (Grantees Other Than Individuals)

1. The grantee certifies that it will or continue to provide a drug-free

workplace by:

1. (a) Publishing a statement notifying employees that the

unlawful manufacture, distribution, dispensing, possession, or

use of a controlled substance is prohibited in the grantee’s

workplace and specifying the actions that will be taken against

employees for violation of such prohibition;

2. (b) Establishing an ongoing drug-free awareness program to

inform employees about-

1. The dangers of drug abuse in the workplace;

2. The grantee’s policy of maintaining a drug-free

workplace;

3. Any available drug counseling, rehabilitation, and

employee assistance programs; and

4. The penalties that may be imposed upon employees for

drug abuse violations occurring in the workplace;

3. (c) Making it a requirement that each employee to be engaged

in the performance of the grant be given a copy of the

statement required by paragraph (a);

4. (d) Notifying the employee in the statement required by

paragraph (a) that, as a condition of employment under the

grant, the employee will –

1. Abide by the terms of the statement; and

2. Notify the employer in writing of his or her conviction

for a violation of a criminal drug statue occurring in the

workplace no later than five calendar days after such

conviction;

5. (e) Notifying the agency in writing, within 10 calendar days

after receiving notice under subparagraph (d)(2) from an

employee or otherwise receiving actual notice of such

conviction. Employers of convicted employees must provide

notice, including position title, to every grant officer on whose

grant activity the convicted employee was working, unless the

30

Federal agency has designated a central point for the receipt of

such notices. Notice shall include the identification numbers

(s) of each affected grant;

6. (f) Taking one of the following actions, within 30 calendar

days of receiving notice under subparagraph (d)(2), with

respect to any employee who is so convicted—

1. Taking appropriate personnel action against such an

employee, up to and including termination, consistent

with the requirements of the Rehabilitation Act of

1973, as amended; or

2. Requiring such employee to participate satisfactorily in

a drug abuse assistance or rehabilitation program

approved for such purposes by a Federal, State, or local

health, law enforcement, or other appropriate agency;

7. (g) Making a good faith effort to continue to maintain a drug-

free workplace through implementation of paragraphs

(a),(b),(c),(d),(e) and (f).

2. The grantee may insert in the space provided below the site(s) for the

performance of work done in connection with the specific grant: Place

of Performance (Street address, city, county, state, zip code)

Address Line 1:

Address Line 2:

City:

State:

Zip:

Check if there are workplaces on file that are not identified here

Part D: Certification Regarding Drug-Free Workplace Requirements

CHECK IF THIS CERTIFICATION IS FOR AN APPLICANT WHO IS AN INDIVIDUAL

Alternate II. (Grantees Who Are Individuals)

1. The grantee certifies that, as a condition of the grant, he or she will not

engage in the unlawful manufacture, distribution, dispensing,

possession, or use of a controlled substance in conducting any activity

with the grant;

2. If convicted of a criminal drug offense resulting from a violation

occurring during the conduct of any grant activity, he or she will

report the conviction, in writing, within 10 calendar days of the

conviction, to the grant officer or other designee, unless the Federal

agency designates a central point for the receipt of such notices. When

notice is made to such a central point, it shall include the identification

number (s) of each affected grant.

Part E: Certification Regarding Lobbying

Certification for Contracts, Grants, Loans, and Cooperative

31

CHECK IF CERTIFICATION IS FOR THE AWARD OF ANY OF THE FOLLOWING AND THE AMOUNT

EXCEEDS $100,000: A FEDERAL GRANT OR COOPERATIVE AGREEMENT; SUBCONTRACT, OR SUBGRANT

UNDER THE GRANT OR COOPERATIVE AGREEMENT.

CHECK IF CERTIFICATION IS FOR THE AWARD OF A FEDERAL LOAN EXCEEDING THE AMOUNT OF

$150,000, OR A SUBGRANT OR SUBCONTRACT EXCEEDING $100,000, UNDER THE LOAN

The undersigned certifies, to the best of his or her knowledge and belief, that:

1. No federal appropriated funds have been paid or will be paid, by or on

behalf of the undersigned, to any person for influencing or attempting

to influence an agency, a Member of Congress, and officer or

employee of Congress, or an employee of a Member of Congress in

connection with the awarding of any cooperative agreement, and the

extension, continuation, renewal, amendment, or modification of any

Federal contract, grant, load, or cooperative agreement.

2. If any funds other than Federal appropriated funds have been paid or

will be paid to any person for influencing or attempting to influence

an officer or employee of any agency, a Member of Congress, an

officer or employee of Congress, or an employee of a Member of

Congress in connection with this Federal contract, grant, loan, or

cooperative agreement, the undersigned shall complete and submit

Standard Form-LL, “Disclosure Form to Report Lobbying,” in

accordance with its instructions.

3. The undersigned shall require that the language of this certification be

included in the award documents for all subawards at all tiers

(including subcontracts, subgrants, and contracts under grants, loans,

and cooperative agreements) and that all subrecipients shall certify

accordingly.

This certification is a material representation of fact upon which reliance was placed when this transaction was made or

entered unto. Submission of this certification is a prerequisite for making or entering into this transaction imposed by

Section 1352, title 31, U.S. Code. Any person who fails to tile the required certification shall be subject to a civil penalty of

not less than $10,000 and not more than $100,000 for each such failure.

As the authorized certifying official, I hereby certify that the above specified certifications are true.

SAVE

SUBMIT FOR REVIEW

Once all required and support documentation has been uploaded and you are satisfied with the information

entered in the application, click submit for review and final submission.

32

33

Attachment B: FHWA 1273 Synopsis

REQUIRED CONTRACT PROVISIONS FEDERAL-AID

CONSTRUCTION CONTRACTS (FHWA 1273)

APPLIES TO CONTRACTS AND RELATED SUBCONTRACTS:

ALL

Section I – General

Section VII - Subletting or Assigning the Contract

Section VIII - Safety: Accident Prevention

Section IX - False Statements Concerning Highway Projects

Section XI – Certification regarding Debarment, Suspension,

Ineligibility and Voluntary Exclusion

$10,000 or MORE

Section II - Nondiscrimination

Section III – Nonsegregated Facilities

> $2K and within the RIGHT-OF-

WAY of a FEDERAL-AID

HIGHWAY (*)

Section IV - Payment of Predetermined Minimum Wage

Section V - Statements and Payrolls

$100K or MORE

Section X – Implementation of Clean Air Act and Federal

Water Pollution Control Act

Section XII – Certification Regarding Use of Contract Funds

for Lobbying

N/A

Section VI - Record of Materials, Supplies, and Labor

Attachment A – Employment Preference for Appalachian

Contracts

*CONTACT FHWA FOR CLASSIFICATION DETERMINATIONS

34

Attachment C: FHWA Form 1273

FHWA-1273 -- Revised May 1, 2012

REQUIRED CONTRACT PROVISIONS

FEDERAL-AID CONSTRUCTION CONTRACTS

I. General

II. Nondiscrimination

III. Nonsegregated Facilities

IV. Davis-Bacon and Related Act Provisions

V. Contract Work Hours and Safety Standards Act Provisions

VI. Subletting or Assigning the Contract

VII. Safety: Accident Prevention

VIII. False Statements Concerning Highway Projects

IX. Implementation of Clean Air Act and Federal Water Pollution Control Act

X. Compliance with Governmentwide Suspension and Debarment Requirements

XI. Certification Regarding Use of Contract Funds for Lobbying

ATTACHMENTS

A. Employment and Materials Preference for Appalachian Development Highway System or

Appalachian Local Access Road Contracts (included in Appalachian contracts only)

I. GENERAL

1. Form FHWA-1273 must be physically incorporated in each construction contract funded

under Title 23 (excluding emergency contracts solely intended for debris removal). The

contractor (or subcontractor) must insert this form in each subcontract and further require its

inclusion in all lower tier subcontracts (excluding purchase orders, rental agreements and other

agreements for supplies or services).

The applicable requirements of Form FHWA-1273 are incorporated by reference for work done

under any purchase order, rental agreement or agreement for other services. The prime

contractor shall be responsible for compliance by any subcontractor, lower-tier subcontractor or

service provider.

Form FHWA-1273 must be included in all Federal-aid design-build contracts, in all subcontracts

and in lower tier subcontracts (excluding subcontracts for design services, purchase orders, rental

agreements and other agreements for supplies or services). The design-builder shall be

responsible for compliance by any subcontractor, lower-tier subcontractor or service provider.

Contracting agencies may reference Form FHWA-1273 in bid proposal or request for proposal

documents, however, the Form FHWA-1273 must be physically incorporated (not referenced) in

35

all contracts, subcontracts and lower-tier subcontracts (excluding purchase orders, rental

agreements and other agreements for supplies or services related to a construction contract).

2. Subject to the applicability criteria noted in the following sections, these contract provisions

shall apply to all work performed on the contract by the contractor's own organization and with

the assistance of workers under the contractor's immediate superintendence and to all work

performed on the contract by piecework, station work, or by subcontract.

3. A breach of any of the stipulations contained in these Required Contract Provisions may be

sufficient grounds for withholding of progress payments, withholding of final payment,

termination of the contract, suspension / debarment or any other action determined to be

appropriate by the contracting agency and FHWA.

4. Selection of Labor: During the performance of this contract, the contractor shall not use

convict labor for any purpose within the limits of a construction project on a Federal-aid

highway unless it is labor performed by convicts who are on parole, supervised release, or

probation. The term Federal-aid highway does not include roadways functionally classified as

local roads or rural minor collectors.

II. NONDISCRIMINATION