P260 Huddoc?id=10 18ml

User Manual: P260

Open the PDF directly: View PDF ![]() .

.

Page Count: 16

U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

WASHINGTON, DC 20410-8000

OFFICE OF HOUSING

www hud.gov espanol.hud.gov

May 13, 2010 MORTGAGEE LETTER 2010-18

TO: ALL APPROVED MORTGAGEES

ATTENTION: Single Family Servicing Managers

SUBJECT: Update of Property and Preservation (P&P) Requirements

and Cost Reimbursement Procedures

This Mortgagee Letter provides updated consolidated property and preservation (P&P)

guidance for foreclosed properties that had been secured by FHA-insured mortgages, and provides

cross-references to the compliance requirements within HUD handbooks, regulations and current

P&P guidelines. This Mortgagee Letter:

Changes the process requirements for over-allowable expenses, including;

o Setting a per property allowable cost limit; and

o Mandating submission of all documents to the Mortgagee Compliance

Manager (MCM) through HUD‟s P260 system;

Emphasizes FHA‟s current conveyance condition standards; and also,

o Re-introduces requirements for removal of interior debris and maintain

the property in broom-swept condition; and

Reminds servicers of FHA‟s inspection requirements.

This Mortgagee Letter and its attachment (Exhibits A and B) supersede Mortgagee Letter

2008-31 (and its attachment) in its entirety.

Effective Date of Mortgagee Letter

The requirements presented herein are effective on July 13, 2010.

Changes to Over-allowable Requests

Pursuant to the guidance issued herein, a mortgagee may request over-allowable approval

from HUD only if its property and preservation costs exceed $2,500 per property. This $2,500

property and preservation amount does not include one time major repair items – e.g. roof

replacement and demolition. Exhibit B to this Mortgagee Letter lists the new maximum property

preservation allowable cost schedule, which also includes a per item cost maximum. Property and

preservation charges that exceed $2,500 per property must be pre-approved by HUD‟s MCM

through the web-based P260 internet portal. The process for over-allowable approval is described

2

in Exhibit A, Section 1, page 5.

Mortgagee Compliance Manager

The MCM is the single point of contact designated by HUD to administer all mortgagee

compliance functions, including property preservation activities. For additional information

regarding the MCM, please see Mortgagee Letter 2010-16. The MCM will also audit all Single

Family Applications for Insurance Benefits, form HUD 27011, parts B-D to evaluate the claimed

amounts against the allowable charges in Exhibit B of this Mortgagee Letter to ensure that the

Department is not overcharged.

HUD’s P260 Web-based Internet Portal

P260 is the Department‟s new web-based internet portal. P260 provides mortgagees and

HUD real-time access to requests, notifications, approvals and document submissions for pre- and

post-conveyance activities. For additional information on P260, refer to Mortgagee Letter 2010-16.

Conveyance Condition Standards

At the time of conveyance to HUD, a property must be undamaged by fire, earthquake,

flood, hurricane, tornado, boiler explosions (for condominiums that were secured by mortgages

insured under §234 of the National Housing Act), or mortgagee neglect. In addition, any debris

must be removed from the interior of the property and maintained in broom-swept condition. These

standards are fully described in Exhibit A, Section 2 “Acceptable Conveyance Condition.”

Inspections

Generally, the mortgagee is responsible for three types of inspections:

Occupancy Inspections;

Initial Vacant Property Inspections; and

Vacant Property Inspections.

These inspection types are fully described in Exhibit A, Section 6 (A) “Inspections.”

Information Collection Requirements

The information collection requirements contained in this document have been approved by

the Office of Management and Budget (OMB) under the Paperwork Reduction Act of 1995 (44

U.S.C. 3501-3520) and assigned OMB control numbers 2502-0429 and 2502-0523. In accordance

with the Paperwork Reduction Act, HUD may not conduct or sponsor, and a person is not required

to respond to, a collection of information unless the collections request displays a currently valid

OMB Control Number.

3

If you have any questions concerning this Mortgagee Letter, please contact HUD‟s National

Servicing Center at (888) 297-8685. Persons with hearing or speech impairments may call via

TDD/TTY on 1-877-TDD-2HUD (1-877-833-2483).

Sincerely,

David H. Stevens

Assistant Secretary for Housing –

Federal Housing Commissioner

Attachment

4

HUD/FHA Property and Preservation Guidelines

Document Page

Exhibit A General Requirements 5-14

No. Title

Mortgagee Responsibility 5

Damage Due to Failure to Preserve and Protect (Mortgagee Neglect) 5

1. Maximum Property Preservation Allowance and Over-Allowable Expense Request 5

2. Acceptable Conveyance Condition 6

3. Conveyance of Properties 6

4. Local Requirements 7

5. Photographs 7

6. Specific Preservation Requirements 7

A. Inspections 7

B. Securing 8

C. Roof Repair 9

D. Pools, Hot Tubs and Spas 9

E. Boarding 9

F. Yard Maintenance and Snow Removal 10

G. Winterization Requirements 11

H. Demolition 12

7. Claim Submission and Documentation 12

8. Requests to Exceed Timeframes 13

9 Appeal of a Demand for Reimbursement 13

10. Record Retention 14

11. Enforcement 14

Exhibit B Maximum Property Preservation Allowances 15-16

5

Exhibit A: GENERAL REQUIREMENTS FOR PROPERTY AND PRESERVATION

OF PROPERTIES SECURED BY FHA INSURED MORTGAGES

Mortgagee Responsibility

Mortgagees shall preserve and protect foreclosed properties that were secured by FHA-insured

mortgages as required by 24 CFR § 203.377 through § 203.381 and 24 CFR § 234.270. The

decision as to what action to take to preserve and protect the property is the mortgagee‟s

responsibility and is independent of the amount that HUD reimburses. If a property that was

secured by an FHA-insured mortgage is conveyed with damage to the Secretary without prior

approval, the Department may reconvey the property or require a reduction to the claim for

insurance benefits, for the greater of the hazard insurance recovery or HUD‟s estimate of the cost of

repairing the damage.

Damage Due to Failure to Preserve and Protect (Mortgagee Neglect)

HUD will hold the mortgagee liable for property damage or destruction to vacant or abandoned

property resulting from the mortgagee‟s failure to take action to preserve and protect the property.

This failure to preserve and protect is considered mortgagee neglect. Examples of mortgagee

neglect include, but are not limited to, the mortgagee‟s failure to:

a. Adequately verify the occupancy status of a property;

b. Initiate foreclosure within the required timeframe;

c. Obtain timely and accurate property inspections;

d. Promptly secure and continue to protect all vacant properties; or

e. Promptly notify the MCM of receipt of code violations, demolition notices and/or

take appropriate action.

Mortgagees may use any qualified individual or firm to perform P&P services on properties that

were secured by FHA-insured mortgages; however, the mortgagee remains fully responsible to

HUD for its actions and the actions of its agents, individuals and firms that performed such services.

1. Maximum Property Preservation Allowance and Over-Allowable Expense Request

The maximum property preservation allowance is the maximum reimbursement for all P&P

expenses on an individual property without MCM approval. Maximum amounts for individual

items are set forth in Exhibit B- “Maximum Property Preservation Allowance”. All reimbursements

are subject to the maximum allowable amounts.

If the total P&P expense exceeds the $2,500 maximum cost limit in Exhibit B, the mortgagee may

submit an over-allowable request in the „Conveyance Overallowables Screen‟ (an electronic version

of Form HUD-50002, Request to Exceed Cost Limits), via the web-based P260 portal. The

mortgagee must upload all supporting documentation into P260, including a detailed description of

what actions were taken, along with verifiable, auditable documentation which includes an itemized

list of the repairs, materials used, room dimensions, receipts, and photographs. The MCM will

6

review the requests and supporting documentation and approve, deny or adjust the requested P&P

allowance utilizing an industry standard cost estimator. The mortgagee must obtain the MCM‟s

decision, which is recorded in P260. Requests must be submitted at least five (5) business days

prior to the conveyance due date or will be rejected. However, the mortgagee may request an

extension of the conveyance due date. For a one time major repair item, the mortgagee must enter

the request and its supporting documentation into the P260 internet based web portal for review

and approval or denial by the Mortgage Compliance Manager. The cost of the one time major

repair item does not count toward the maximum allowable cost of $2,500 per property for

property and preservation expenses.

HUD is not prescribing the amounts that mortgagees may pay for the services performed, but is

standardizing a reasonable maximum allowance that HUD reimburses for such services.

2. Acceptable Conveyance Condition

At the time of conveyance to HUD, a property must be undamaged by fire, flood, earthquake,

hurricane, tornado, or mortgagee neglect, as set forth in and required by 24 CFR §203.378. For

condominiums that were secured by mortgages insured under §234 of the National Housing Act, the

property must also be undamaged by boiler explosion, as required by 24 CFR § 234.270. In

addition, the property must be secured, the lawn maintained, winterized (as applicable), and interior

and exterior debris must be removed with the property‟s interior maintained in broom-swept

condition. This includes the removal of any vehicles and removal of any personal property in

accordance with local and state requirements. Mortgagees are responsible for the damage to, or

destruction of, properties due to their failure to take reasonable action to secure, inspect, preserve

and protect such properties.

If a property is damaged due to mold resulting from the mortgagee‟s failure to protect and preserve,

the mortgagee must remediate the cause of the mold and complete any other required P&P actions

to minimize further mold and/or water damage prior to conveyance of the property.

3. Conveyance of Properties

Mortgagees may convey damaged properties without prior written approval if there is damage

resulting from Mortgagor neglect and the damage was discovered and documented at the initial

inspection. The mortgagee must include a description of the damage in the “Mortgagee‟s

Comments” section of Form HUD-27011, Part A, and mark Item 24. “Is the property conveyed

damaged?” “no”. (Note: marking “yes” in item 24, triggers HUD‟s claim system to look in item 26

for the date of HUD‟s approval to convey the property damaged and to item 27 for the amount that

the claim is to be reduced.)

For properties that were damaged while under the control of the mortgagee or as a result of

mortgagee neglect, the mortgagee must obtain approval from the MCM to convey the damaged

property to HUD. However, as a matter of administrative practice, HUD generally will not deny

conveyance of properties if the Government‟s estimate of the cost to repair the damage attributable

to the mortgagee is equal to or less than $2,500. The claim is generally reduced by that amount.

7

The mortgagee must include documentation supporting the P&P work performed on the property.

At a minimum, this documentation shall include evidence of the date of vacancy, validation of the

property condition at vacancy, inspection reports, and a chronology of actions performed by the

mortgagee to preserve and protect the property. If no documentation or inadequate documentation

is received from the mortgagee, all the damage will be considered attributable to the mortgagee and

HUD may either re-convey the property to the mortgagee or seek reimbursement from the

mortgagee for HUD‟s estimate of the cost of the repairs.

4. Local Requirements

If at any time local codes require more extensive protection than stated in this guidance, mortgagees

shall contact the MCM.

5. Photographs

P&P actions must be documented to include before and after pictures using digital photography.

The photographic fee is included in the lock change/securing maximum allowable cost per property.

Photographs are required to document property condition and all P&P claimed expenses. All

photographs shall be dated and labeled. If photographs are not included at the time of the claim

review, the expenses will be disallowed.

6. Specific Preservation Requirements

A. Inspections:

For specific details about HUD Inspection Requirements see 24 CFR § 203.377 and HUD

Handbook 4330.1, Rev- 5, Chapter 9-9, as it provides complete details on inspection requirements

and types of inspections.

There are three types of inspections:

Occupancy Inspections;

Initial Vacant Property Inspections; and

Vacant Property Inspections.

Inspection reports and photographs shall be submitted in P260 in support of the 27011 parts B - D

claim request.

Occupancy Inspection (Inspection at Initial Default)

When a mortgage is in default because a payment was not received within 45 calendar days of the

due date of the missed payment, and efforts to reach the mortgagor by telephone or correspondence

have proven unsuccessful, the mortgagee must make an inspection to determine if the property is

vacant or abandoned.

8

Initial Vacant Property Inspection

An Initial Vacant Property Inspection is performed on the date the mortgagee takes physical

possession of a vacant or abandoned property. The initial inspection is when the mortgagee

ascertains the condition of the property, and may be of critical importance in distinguishing between

mortgagor and mortgagee neglect following conveyance. If the occupancy inspection and initial

vacant property inspection are performed on the same date, only one inspection fee will be

reimbursed.

Vacant Property Inspections (On-Going Delinquency Inspection)

Vacant Property Inspections are performed after the initial inspection and physical possession by the

mortgagee have occurred. The mortgagee shall inspect a vacant or abandoned property every 25-35

days following an initial inspection, or more frequently, as authorized by HUD.

Generally, not more than 13 inspections per calendar year may be claimed. Where there is a

property in an area requiring more frequent inspections due to high vandalism or local ordinances,

police reports and/or a letter from a local law enforcement agency requesting additional protective

measures may be submitted to support the additional inspection(s).

B. Securing:

Properties must be secured to prevent unauthorized entry and protect against weather-related

damage. All exterior doors shall be secured. The mortgagee is also responsible for the following

securing activities:

Replacing a broken window-pane (re-glazing), unless the opening is to be boarded;

Securing in-ground swimming pools;

Securing above-ground pools;

Securing hot-tubs and spas; and

Maintaining pools, hot tubs and spas.

Minimum Securing Requirements

1. All windows and doors must be secured.

2. Broken glass shall be removed from interior and exterior areas and replaced, unless the opening

is to be boarded.

3. Locks on the front and rear entry doors shall be rekeyed to random identical key codes.

4. If there is a deadbolt lock on the main entry door replace the handle set. Key the deadbolt the

same as the handle set.

5. Other entryways that provide immediate access to a living area, attached garage or basement

shall be secured with a knob-lock, keyed the same as the front and rear entry doors. Or, if the

secondary entryway has an existing deadbolt lock, re-key the deadbolt to the specifications of

the front and rear entry doors.

6. Document key-codes to the existing or replacement lock in the Mortgagee‟s Comments section

of form HUD-27011 Part A, which must be provided to the MCM.

9

7. Doors and windows must not be braced or nailed shut or the mortgagee will be held accountable

for resulting damage. Replace locking mechanism on windows or doors, if inoperable or

missing.

8. Sliding glass doors should be double locked.

9. Detached or attached garage doors and outbuildings shall be secured with a padlock and hasp if

no other locking mechanism exists.

10. Unplug automatic garage door openers, when applicable. Garage doors should be left in such a

condition as to allow for opening and closing without the use of the automatic garage door

opener. Leave the remote key(s)/transmitter(s) in a kitchen counter drawer.

11. Display 24-hour emergency contact information including a toll free telephone number in a

front window. This contact information shall clearly advise any person of interest, or someone

who wants access to the property whom to contact.

C. Roof Repair:

The mortgagee is responsible for roof repairs (e.g., patching or replacing loose shingles). The

maximum allowance for roof repairs is $600. Please refer to Exhibit A, Item I, “Maximum Property

Preservation Allowance and Over-Allowable Expense Request” when the cost of roof repair

exceeds $600.

D. Pools, Hot Tubs and Spas:

In-ground pools (including hot tubs or spas that share the same filtering system as the pool) must be

secured but not drained. Pools (including hot tubs or spas that share the same filtering system),

must be secured with a cover that prevents entry, either deliberate or accidental. Fences must be

secured to restrict access, if applicable.

Above Ground Pools: If the above ground pool is in good condition (i.e., built-up with decking or

other infrastructure that provides value and will support a pool cover), secure it with a cover that

prevents entry, either deliberate or accidental. Above ground pools in poor condition or those that

cannot be secured shall be removed. When an above ground pool is removed, remediate any

depression in the ground that might constitute a hazard.

Securing Hot Tubs or Spas: The Mortgagee shall drain and secure portable hot tubs and spas. If a

hot tub or spa is outdoors, the mortgagee shall secure it with a cover that prevents entry, either

deliberate or accidental.

Maintenance of Pools, Hot Tubs or Spas: The Mortgagee must perform monthly maintenance and

chemical treatments to operational pools, hot tubs or spas when attached to a pool filtering system.

E. Boarding:

Reimbursement for boarding is provided on a “per opening” basis, up to the maximum allowance

per property. The Mortgagee shall be reimbursed for boarding when the following conditions are

met:

The property has been secured for safety reasons; and

10

The property is in a high vandalism area and boarding is the only reasonable means

to protect the property.

The following specifications shall be followed:

Windows: Secured with ½” plywood or equivalent

Doors: Secured with 5/8” plywood or equivalent

Other Openings: French doors and sliding door openings should be secured with ¾”

plywood or equivalent.

All openings shall be boarded. If security bars are located on windows/doors, boarding is not

required. Small openings, such as pet openings in doors, should be secured but not boarded.

Eliminate any health and safety hazard caused by any protruding bolts used to secure boarding

and/or any broken glass.

If local codes differ from HUD requirements above, contact the MCM for direction.

F. Yard Maintenance and Snow Removal:

Grass cuts (initial and subsequent cuts) include mowing, weeding, edge trimming, sweeping of all

paved areas, and removal of all lawn clippings, related cuttings, and incidental debris (newspapers,

flyers, bottles, etc.) removal. The disposal of all clippings and incidental debris should comply

with jurisdictional requirements.

Mortgagees should not order yard maintenance if a homeowners‟ association for such property

covers this service.

Frequency of Grass Cuts:

An initial grass cut is permitted at the beginning of each grass-growing season. Initial grass cuts

may be completed when needed, during any month of the year, in the following states/territories:

Alabama, Arizona, California, Florida, Georgia, Guam, Hawaii, Louisiana, Mississippi, Nevada,

New Mexico, Puerto Rico, South Carolina, Virgin Islands and Texas.

Initial grass cuts are allowed from June 1 to September 30 in the state of Alaska. In all other states,

initial grass cuts are allowed between April 1 and October 31. If conveyance occurs during the

growing season, a final grass cut should be completed within two weeks of conveyance. After the

initial cut, grass should typically be re-cut twice a month during the periods listed above. Shrubs are

to be trimmed and cuttings removed once in a growing season, between April 1 and October 31.

Grass should be cut to a maximum of two inches in length. Grass and weeds are to be cut to the

edge of the property line, trimmed around foundations, bushes, trees, and planting beds. Grass and

weeds should also be trimmed flush with fences and other construction that would normally require

trimming.

11

Snow Removal:

The mortgagee shall maintain a safe and accessible property throughout the winter season. Snow

shall be removed from the entire entryway, walkways, porch and driveway following a minimum

three-inch (3”) accumulation. Mortgagees must comply with local codes and ordinances governing

the removal of snow and ice.

G. Winterization Requirements:

Properties are to be winterized between October 1 and March 31, unless, climatic conditions require

earlier and extended winterization treatment periods. Properties should only be winterized once.

However, a property should be re-winterized if the initial winterization is no longer effective. The

winterization process must include cleaning toilets and a complete draining of all plumbing and

heating systems. The mortgagee is responsible for any damage to plumbing and heating systems,

including sump pumps and wells, caused by untimely, inadequate, or improper maintenance or

winterization.

Utilities:

Utilities are to be turned off unless required to protect the property, such as in states where heat is to

remain on. For units that are attached to other units or dwellings, water services and utilities should

remain on only if those systems are shared with other units. In some cases, it may be cost-effective

to maintain utility service rather than disconnect the service. For example, in some rural areas, large

fees may be charged to re-connect water service. Mortgagees should use proper judgment to

determine the most cost-effective method of managing utilities when re-connection fees exist.

Condominiums and Attached Dwellings

At condominiums and attached dwellings in Planned Unit Developments (PUDs), water services

and utilities should remain on if the systems are shared with other units.

Sump Pumps

Where there is an existing sump pump, the mortgagee shall check to make sure the sump pump is

operating. The mortgagee shall leave the electricity on, regardless of whether the property is

located in a state where utilities are required to be off.

Utility Accounts

Utility accounts including electricity, gas, home heating oil and water, should be in the mortgagee's

name until conveyance of the property to HUD.

In states where utilities should remain on, if there is any reason to believe that a mortgagor may

abandon a property, the mortgagee shall contact the utility company to request that the mortgagee

be notified of non-payment of utilities so that utilities can be transferred to the mortgagee‟s name

and the heat remain on if the mortgagor vacates.

12

Propane and Oil Systems

If the property has a propane or oil heating system, put a "KEEP FULL" work order on with a local

supplier in those jurisdictions, where the heat should remain “ON.”

Water:

Domestic Water

If the water supply source is a public system, the utility company shall be contacted to turn off the

water supply at the curb. The mortgagee shall not cut water lines or remove water meters. The

water department or provider shall be notified when water is turned off so that a final meter reading

is completed.

Wells

If the water supply is a private well, the mortgagee shall turn off the well at the breaker panel and

tape off the breaker, disconnect the water supply line between the property and pressure tank and

install a hose bib on the pressure tank side of the breaker. The hose bib shall be tagged “For Water

Testing". All pressure tanks shall be drained. If pump is surface mounted, drain pump housing. If

submersible, then disconnect the check valve and drain all pump, suction, and discharge pipes. All

fixtures shall be winterized.

H. Demolition:

The cost of demolition is not included in the maximum cost limit per property. In such cases, where

a local jurisdiction has determined a property to be uninhabitable and mandates demolition of a

property, the mortgagee must obtain approval from the MCM. Requests received less than five (5)

business days of the conveyance timeframe where no extension has been requested and approved,

will be rejected, unless notification by the local jurisdiction has not been received within that period.

The mortgagee must provide to the MCM documentation to include the notice of demolition by the

local jurisdiction along with inspection reports and photographic documentation that establishes the

condition of the property when the mortgagee first entered or took possession of the property.

7. Claim Submission and Documentation

HUD will reimburse mortgagees for P&P actions in accordance with the provisions of this

Mortgagee Letter, upon receipt of Form HUD-27011 Parts A & B. For instructions on claim

processing and document submission, see HUD Handbook 4330.4, REV-1, “FHA Single Family

Insurance Claims” (http://www.hud.gov/offices/adm/hudclips/handbooks/hsgh/4330.4/index.cfm).

Documentation including photographs to support each P &P claimed expense shall be provided to

the MCM through the web-based P260 portal, upon submission of the claim for insurance benefits

request. The documentation must support the expenditures and provide a verifiable timeline that

13

demonstrates the mortgagee took prudent actions to preserve and protect the property until its

conveyance. The MCM will audit all claims filed under HUD Form 27011 parts B-D to evaluate

the charges against Exhibit B of this Mortgagee Letter and ensure that the Department was not

overcharged. The MCM will evaluate the cost of the preservation and protection work performed

using an industry standard cost estimator.

HUD will require the repayment of reimbursements if it determines that:

Amounts paid for reimbursement were unnecessary or excessive; or

Services claimed were not performed or not performed properly

To claim reimbursement, all P&P actions shall meet the guidelines as provided in 24

CFR § 203.377 through 24 CFR § 203.381, the guidance provided in this Mortgagee

Letter and any subsequent guidance as directed by HUD.

Mortgagees are prohibited from performing or claiming P&P services after the deed has

been recorded. However, payment of certain utility bills may be considered an

exception to this guideline. Reimbursable costs are outlined on the attached Exhibit B,

“Maximum Property Preservation Allowance” chart.

8. Requests to Exceed Timeframes

The mortgagee shall submit a separate request for each extension of time to the MCM. All requests

for extensions shall be submitted on form HUD-50012, Mortgagee’s Request for an Extension of

Time (now PDF fill-able) through HUD‟s web-based P260 portal. Upon receipt, the MCM will

have five (5) business days to approve the request, reject the request as lacking adequate

documentation or deny the request.

If the MCM rejects or denies the request for an extension of time, the MCM will specify, in writing,

the reason for the rejection or denial on form HUD-50012 and post this information in HUD‟s P260

portal. Verbal requests for extensions will not be accepted. Requests received less than five (5)

business days of the conveyance timeframe will be rejected. For guidance on extension of time

requirements, see HUD Handbook 4330.4, “FHA Single Family Insurance Claims,” Section 1-6,

Extension of Time Requirements.

9. Appeal of a Demand for Reimbursement

If a mortgagee has improperly conveyed a property or billed HUD for P&P services that were either

not performed or were not performed properly, or in cases of mortgagee neglect, HUD will

authorize its MCM to issue a Demand Letter in accordance with 24 CFR § 203.363.

If a mortgagee believes that the demand decision is not supported by regulation or circumstance,

the mortgagee may request a review of the indebtedness determination or inspect departmental

records related to the debt by submitting a request to the MCM through HUD‟s P260 portal within

20 days of receipt of the Secretary‟s notification (24 CFR § 17.104-105).

14

10. Record Retention

Mortgagees are reminded that pursuant to HUD Handbook 4330.4, paragraph 1-12, all claim

files must be maintained for a period of three years after the date of the last check received by

the mortgagee in payment of a claim. The submission of documents to P260 does not abrogate

this requirement.

11. Enforcement

As a cautionary note, the Department reminds mortgagees that in addition to the surcharges

discussed in this Mortgagee Letter, HUD may pursue enforcement action, including debarment,

civil money penalties and actions under the Program Fraud Civil Remedies Act.

15

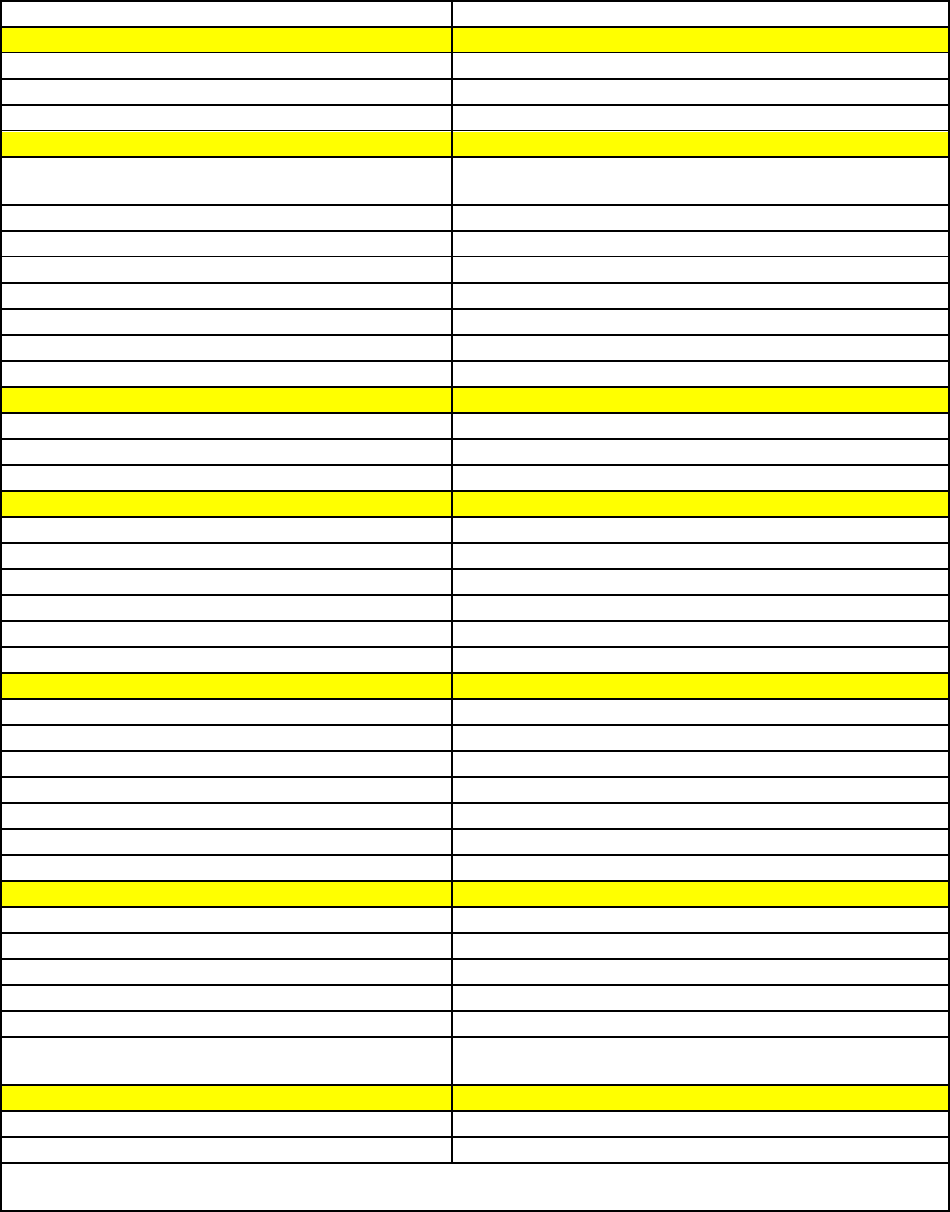

EXHIBIT B: Maximum Property Preservation Allowances

DESCRIPTION OF SERVICE

MAXIMUM ALLOWANCE

Property Inspections

Property Inspections

$30 per unit; $15 additional unit

Subsequent inspection (as reqd.)

$20 per unit; $15 additional unit

Permit & Vacant property registration

$250

Securing

Initial securing of property

$60 per lock-set & $40 per pad lock;

Re-glazing window (replacing a window pane)

$30

Re-securing/re-keying of property

$0

Roof repair

$600 (FHA does not tarp )

Securing in-ground swimming pools

$1,050

Securing above-ground swimming pools

$400

Securing hot-tubs & spas

$50

Maintenance of pools, spas & hot tubs

$100 monthly

Boarding

Windows with 1/2" plywood or equivalent

$80 per window; $550 max for all windows

Doors with 5/8" plywood or equivalent

$150 per opening; $300

Other openings with 3/4" plywood or equivalent

$125 per opening maximum

Debris/Trash Removal/Dumping fees

Amount per cubic yard of trash

$50

Maximum allowable for 1 unit

$600 (Minimum load of 12 cu. yds of waste)

Maximum allowable for 2 units

$750 (Minimum load of 15 cu yds of waste)

Maximum allowable for 3 units

$900 (Minimum load of 18 cu yds of waste)

Maximum allowable for 4 units

$1,050 (Minimum load of 21 cu yds of waste)

Vehicle removal

$210 per vehicle

Yard Maintenance

Initial cut up to 5,000 sf.

$50

Initial cut 5,001 - 10,000 sf.

$75

Initial cut 10,000 -15,000 sf.

$100

Re-cut up to 5,000 sf.

$40

Re-cut 5,001 - 10,000 sf.

$65

Re-cut 10,000 - 15,000 sf.

$85

Shrub Trimming

$30 per site

Hazard abatement

Snow/ice removal

$50

Sump Pump repair

$50

Sump Pump installation

$300

Water Heater/Well/ Septic/ HVAC repair

$300

Pumping water from basement

$1,000

Demolition (excluded from the max allowable per

property)

Up to $10,000 (single story)

Up to $12,500 (multi-story)

Winterization

Dry Heat - 1 unit

$100

Dry Heat - additional unit

$50

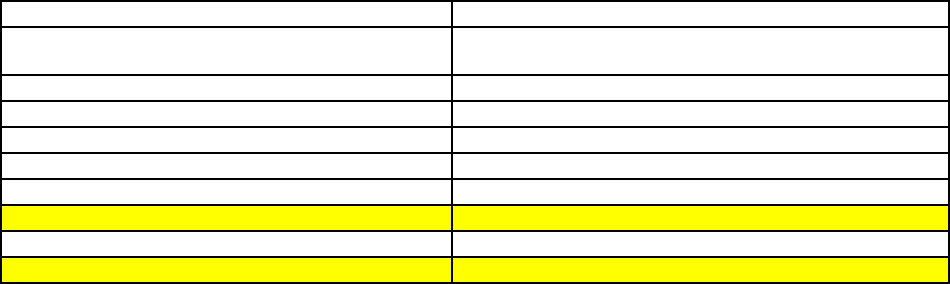

MAXIMUM PROPERTY PRESERVATION ALLOWANCES

16

DESCRIPTION OF SERVICE

MAXIMUM ALLOWANCE

Wet (steam) Heat - 1 unit

$150

Wet (steam) Heat – additional unit

$90

Wet (radiant) Heat - 1 unit

$250

Wet (radiant) Heat - additional unit

$125

Reduced Pressure Zone (RPZ) valves

$150 (if State or locally req‟d.)

Pools, Spas, and Hot-tubs

$200 (if State or locally req‟d.)

Utilities

Electricity, Gas, Oil, Propane, Water & Sewer

$75 (For one-time shut off/transfer fee.)

Maximum Allowance Per Property

$2,500