4155 2_12_secBx 703i/203 Huddoc?id=4155 2 12 Sec B

User Manual: 703i/203

Open the PDF directly: View PDF ![]() .

.

Page Count: 19

HUD 4155.2 Chapter 12, Section B

12-B-1

Section B. System Code and Error Exhibits

Overview

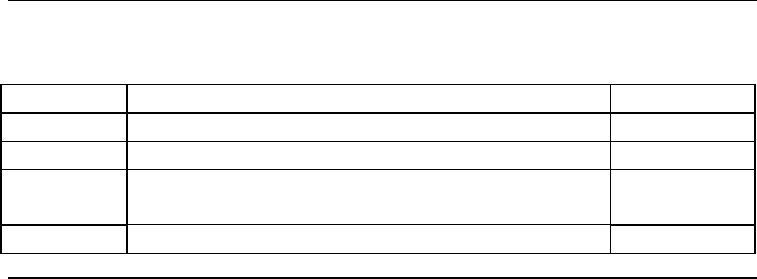

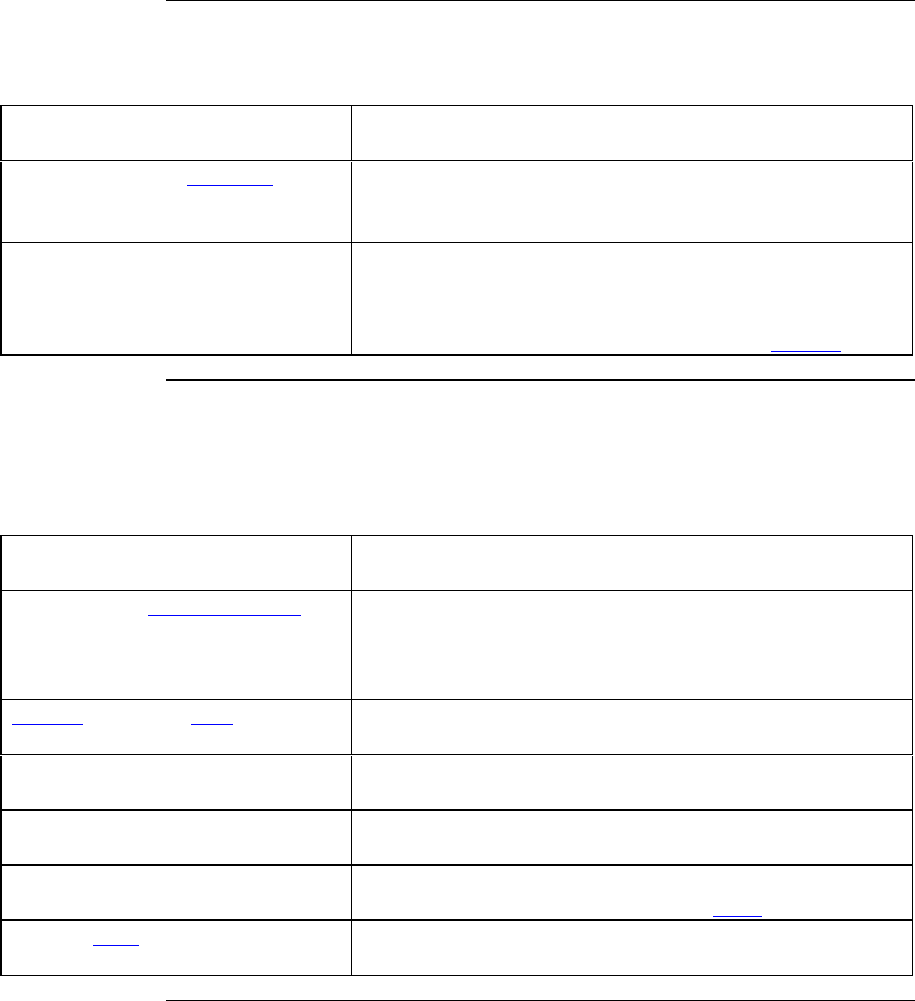

In This Section This section contains the topics listed in the table below.

Topic Topic Name See Page

1 Exhibit 1: Home Mortgage ADP Codes 12-B-2

2 Exhibit 2: Program Identification Codes 12-B-8

3 Exhibit 3: FHA Common System Errors and

Documentation Problems 12-B-12

4 Exhibit 4: PETR Deficiency Codes 12-B-15

Chapter 12, Section B HUD 4155.2

12-B-2

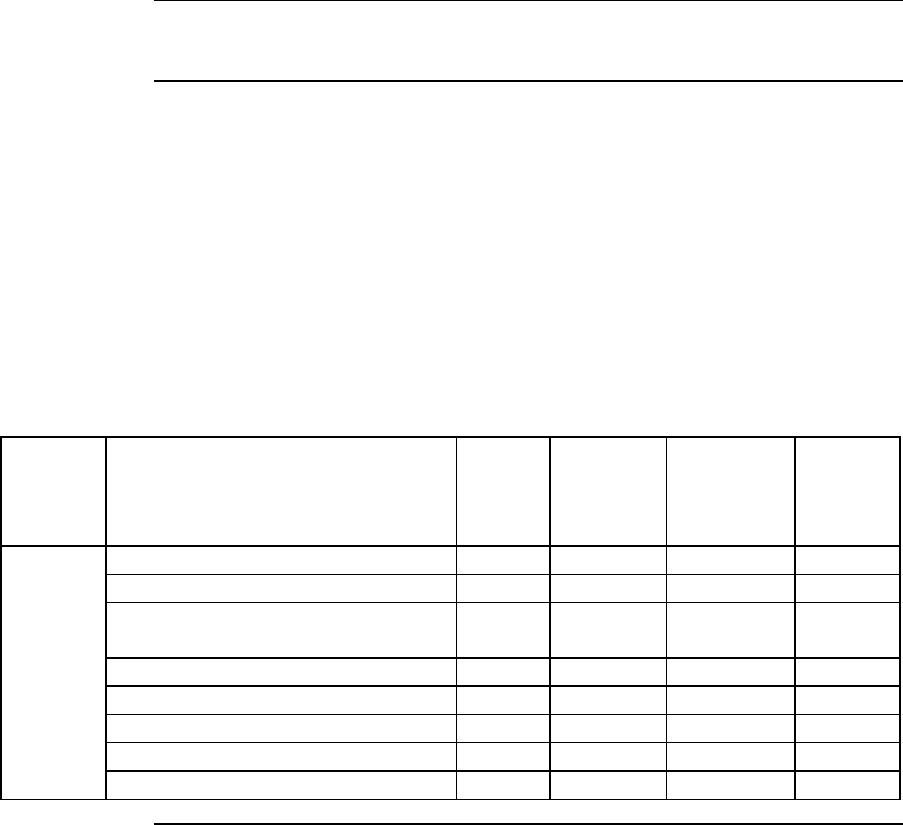

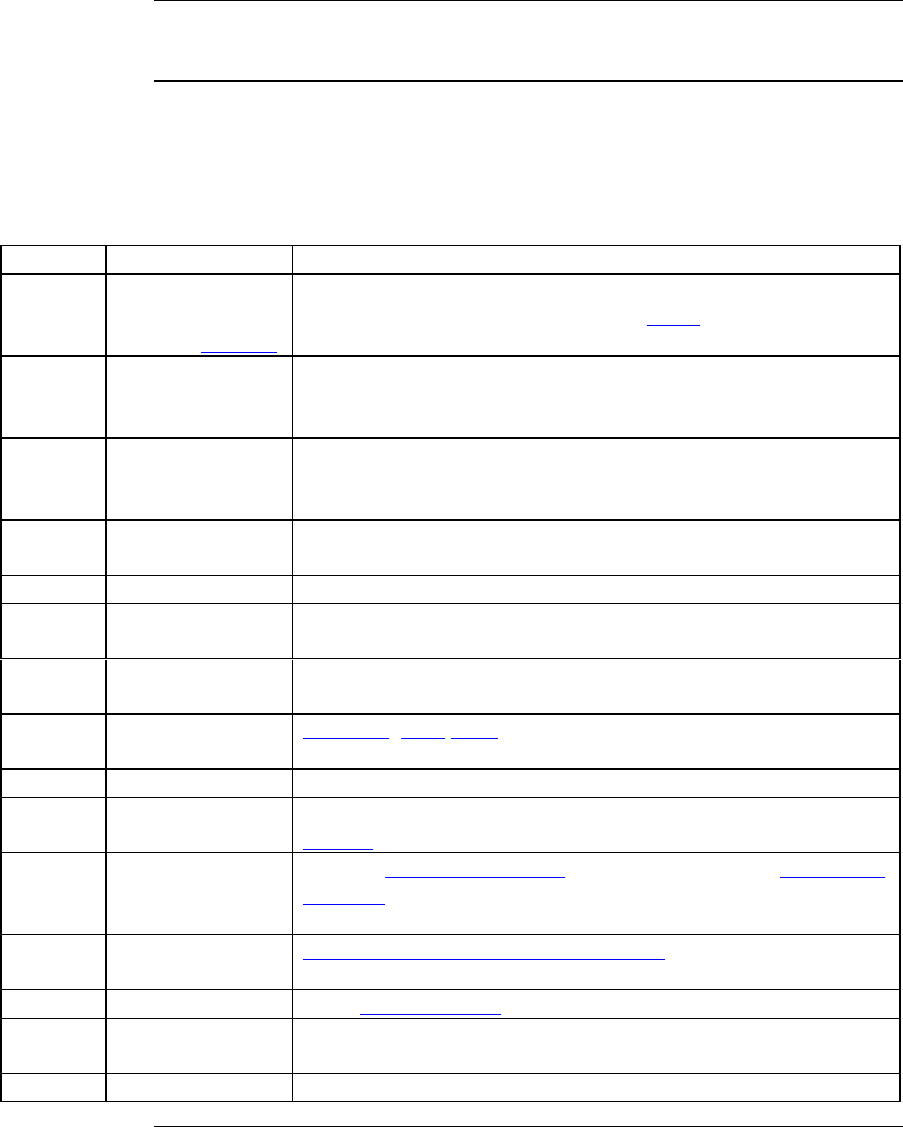

1. Exhibit 1: Home Mortgage ADP Codes

Change Date March 1, 2011

4155.2 12.B.1.a

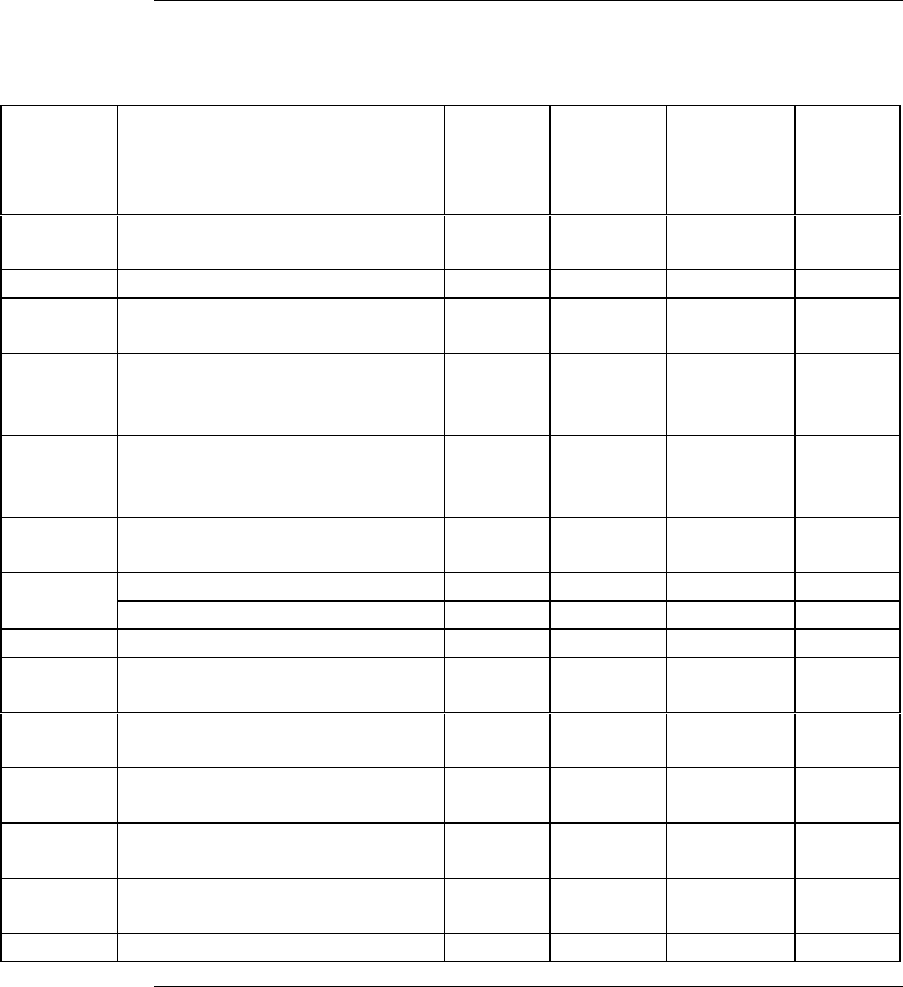

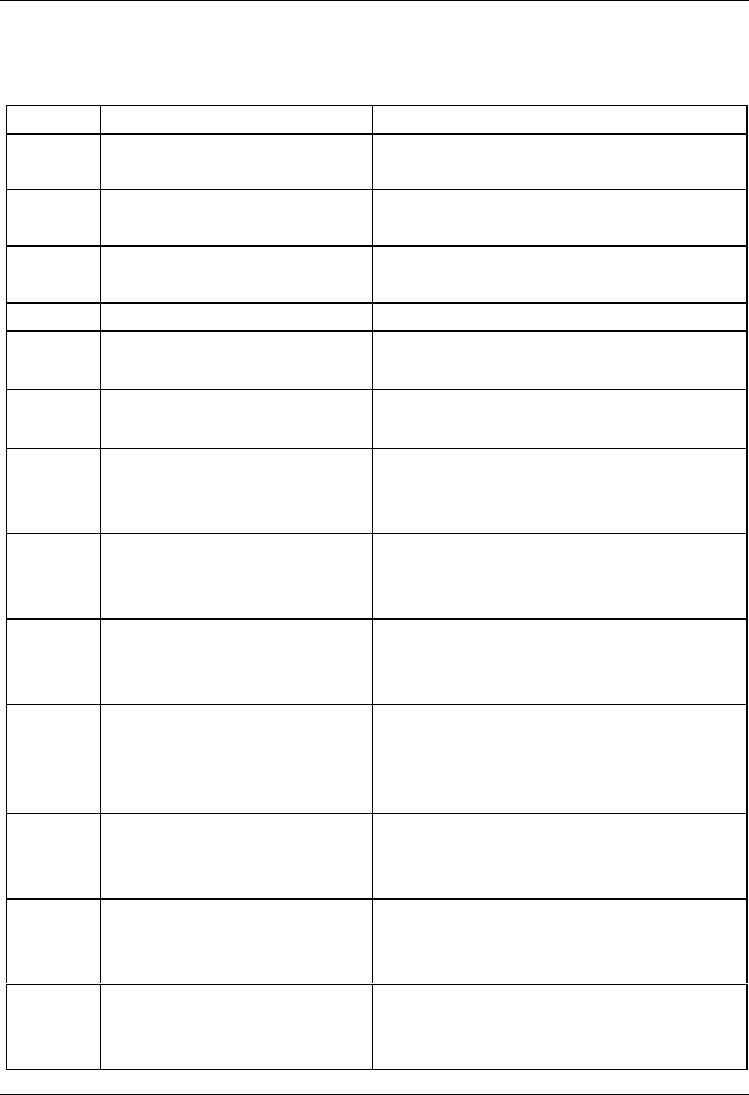

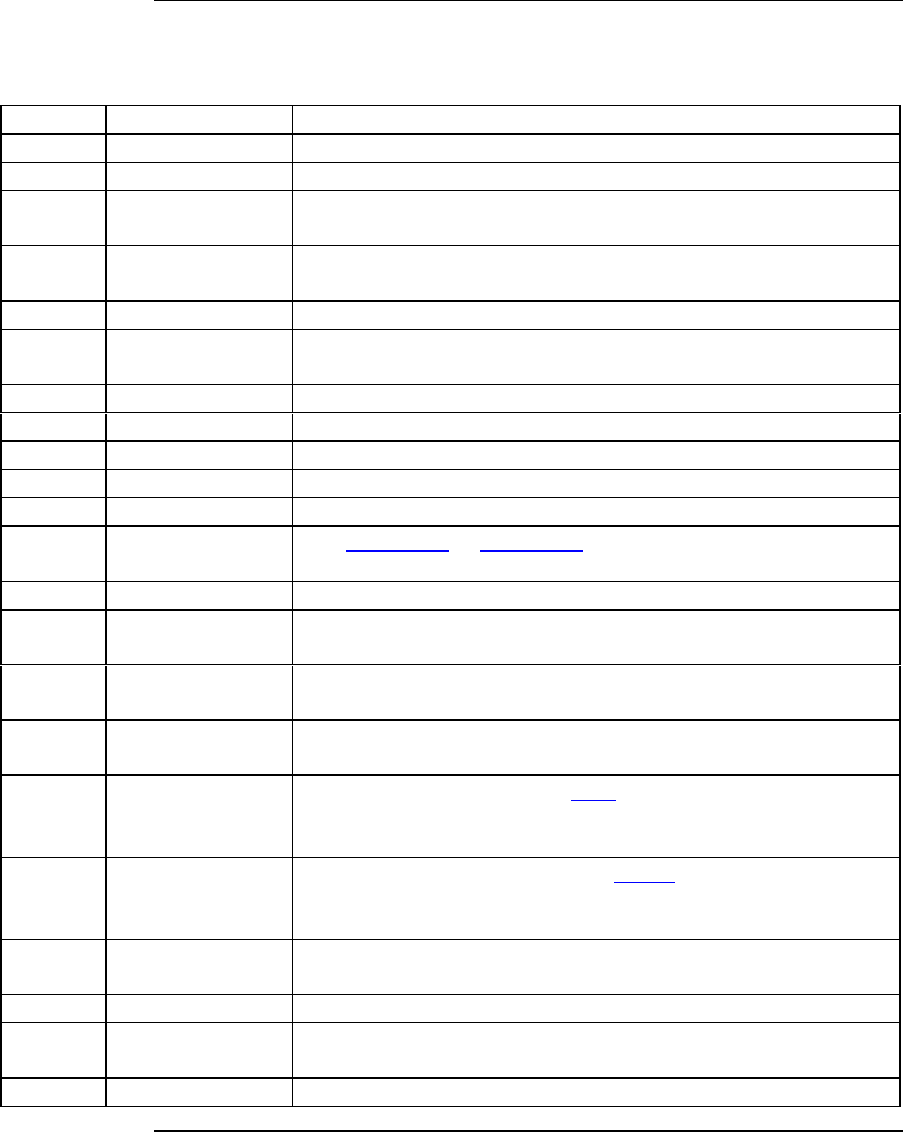

ADP Codes The table below lists the Automated Data Processing (ADP) codes commonly

used in processing FHA-insured home mortgages, presented according to the

Section of the National Housing Act under which the loans are insured.

Notes:

The column entitled “ADP Code If Pursuant to 223(e)” refers to the code

for mortgages insured pursuant to Section 223(e), which are all obligations

of the Special Risk Insurance (SRI) Fund.

The column entitled “ADP Code for HUD” refers to the code for FHA-

processed cases.

Section

of the

Act

Description ADP

Code

for DE

ADP

Code for

VA-CRV

ADP Code

If

Pursuant

to 223(e)

ADP

Code

for

HUD

203(b) Basic Home Mortgage Insurance 703 503 303 203

ARM 729 529 --- 229

Fannie Mae (FNMA) Direct

Financing --- 550 --- 250

HHL 759 --- --- 259

Alternate GPM 761 561 261

HHL/ARM 780 --- --- 280

Site Condominium (ARM) 731 --- --- 203

Site Condominium 734 --- --- 203

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-3

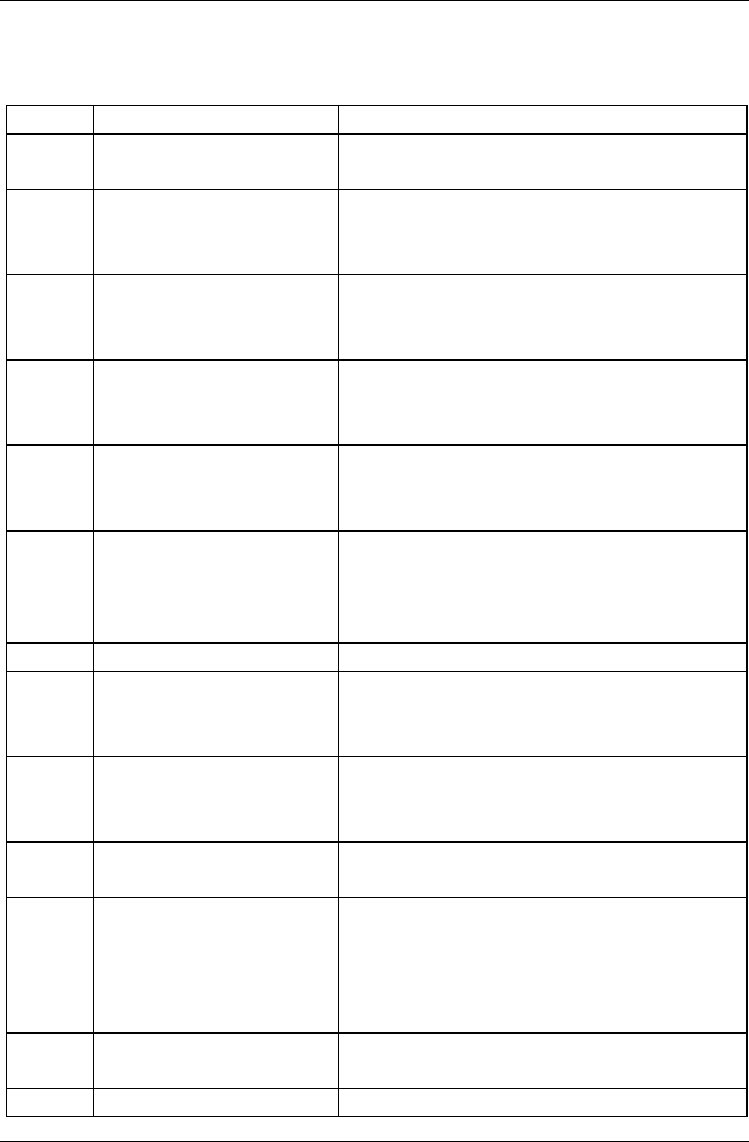

1. Exhibit 1: Home Mortgage ADP Codes, Continued

4155.2 12.B.1.a

ADP Codes

(continued)

Section

of the

Act

Description ADP

Code

for DE

ADP

Code for

VA-CRV

ADP Code

If

Pursuant

to 223(e)

ADP

Code

for

HUD

203(b) VA-CRV 223(e) Mortgage 792 --- 392

IL 783 583 --- 283

IL/ARM 788 588 --- 288

HHL/Interest Buy-Down (IBD) 811 --- --- 411

223(e) ARM 829 --- --- ---

IL (Salamanca, NY) --- 591 --- 291

Refinance of Borrower in

Negative Equity Position 821 --- --- ---

Refinance of Borrower in

Negative Equity Position (ARM) 822 --- --- ---

203(b)/

283(c) MIA/Alternate GPM --- 568 --- 268

MIA 774 574 374 274

203(b)/

283(c)

245(a)

MIA/GPM 776 576 --- 276

Continued on next page

Chapter 12, Section B HUD 4155.2

12-B-4

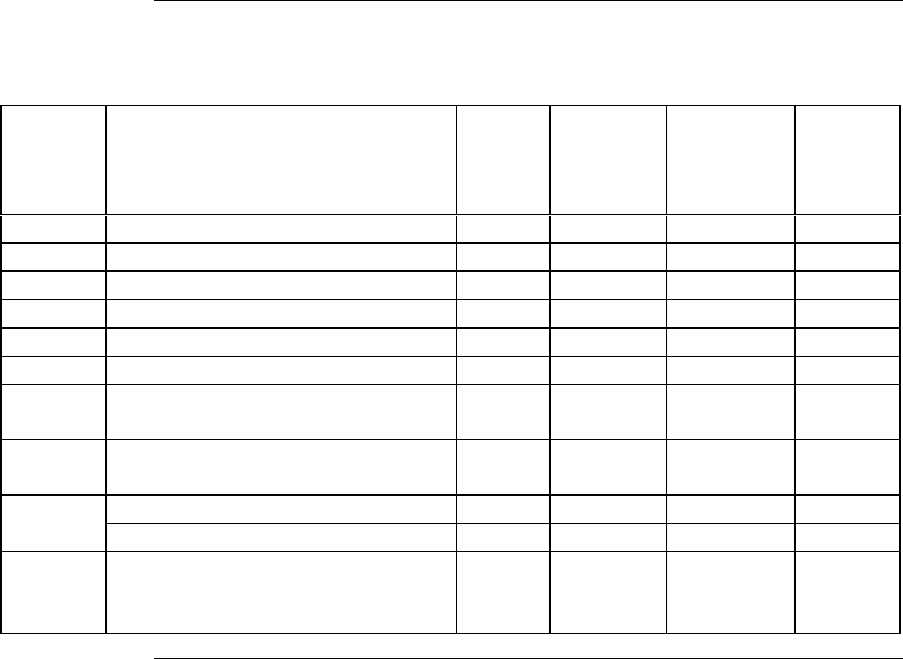

1. Exhibit 1: Home Mortgage ADP Codes, Continued

4155.2 12.B.1.

a

ADP Codes

(continued)

Section

of the

Act

Description ADP

Code

for DE

ADP

Code for

VA-CRV

ADP Code

If

Pursuant

to 223(e)

ADP

Code

for

HUD

203(b)/

245(a) GPM/GEM 741 541 341 241

GPM/IBD 763 563 --- 263

GPM 770 570 --- 270

GPM/IL/GEM 782 582 --- 282

GPM/IL 787 587 --- 287

GPM/HHL 793 --- --- 293

203(k) Rehabilitation Home

Mortgage Insurance 702 502 302 202

Escrow Commitment 707 --- --- 207

ARM 730 530 --- 230

Second Lien 753 553 353 253

IL 801 --- --- 401

223(e)/DE 802 --- --- ---

Condominium 804 --- --- 404

203(k) HHL/IBD 805 --- --- 405

Energy Efficiency Mortgage

(EEM) 807 507 307 ---

HHL 808 --- --- 408

Condominium/IBD 812 --- --- 412

IBD 813 --- --- 413

Condominium/ARM 815 --- --- 415

203(k)/

245(a) GPM/GEM 754 554 --- 254

203(n) Cooperative – Individual Unit --- 560 360 260

203(n)/

245(a) GPM/GEM --- 547 --- 247

213 Cooperative – Sales – Type

Releases --- 513 313 213

220(d)(3) Urban Renewal 720 520 320 220

220(h) Improvements 719 519 --- 219

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-5

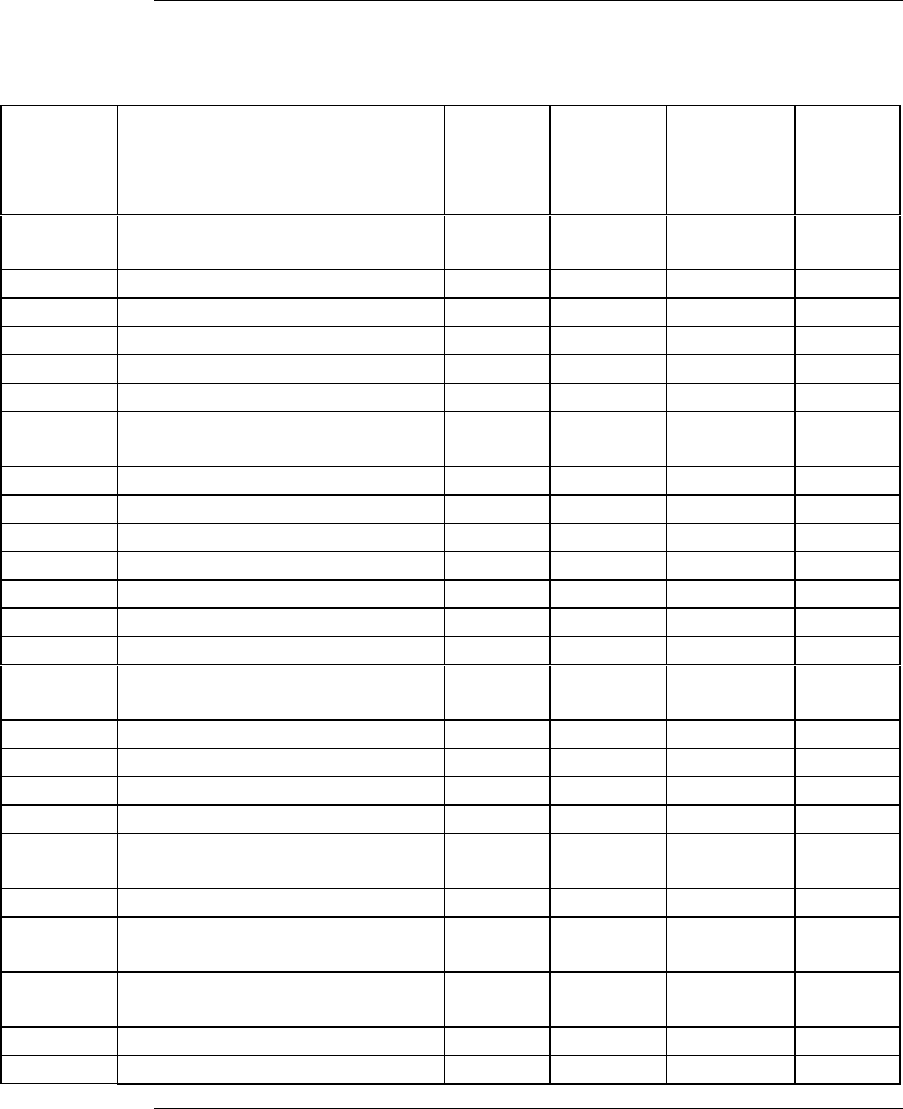

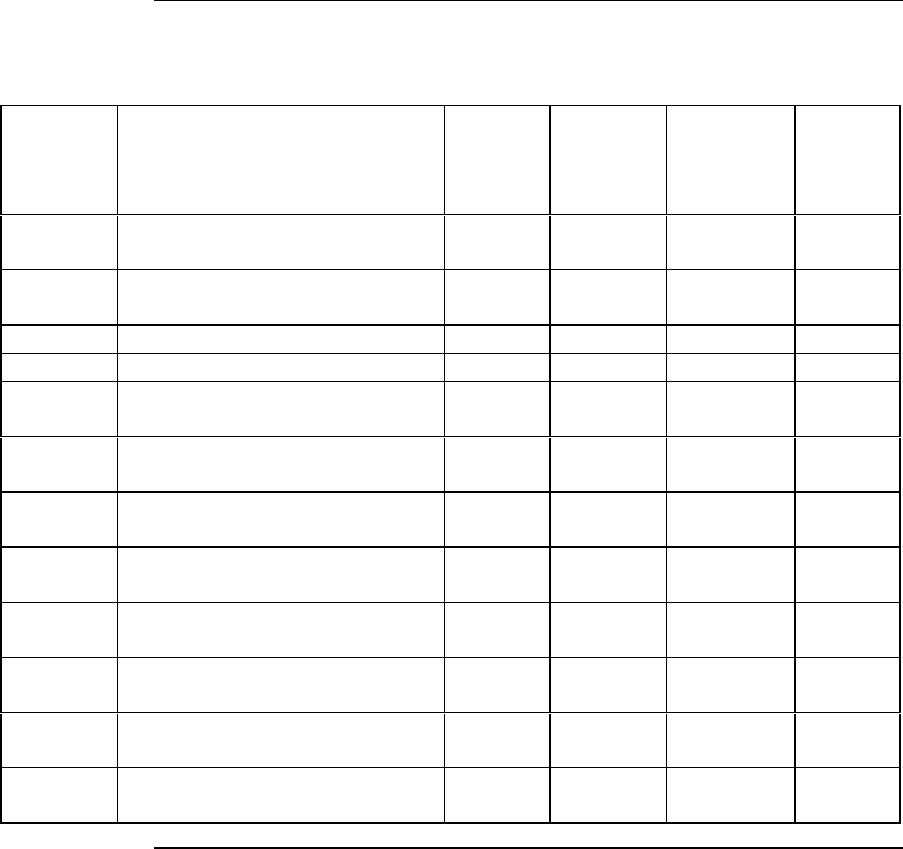

1. Exhibit 1: Home Mortgage ADP Codes, Continued

4155.2 12.B.1.

a

ADP Codes

(continued)

Section

of the

Act

Description ADP

Code

for DE

ADP

Code for

VA-CRV

ADP Code

If

Pursuant

to 223(e)

ADP

Code

for

HUD

234(c) Condominium 734 534 334 234

ARM 731 531 --- 231

Refinance of Borrower in

Negative Equity Position 831 --- --- ---

Refinance of Borrower in

Negative Equity Position

(ARM)

832 --- --- ---

234(c)/

238(c)/

245(a)

MIA/GPM 777 577 --- 277

234(c)/

238(c) MIA/Alternate GPM --- 569 --- 269

234(c)/

245(a) GPM/GEM 742 542 342 242

GPM 771 571 --- 271

234(c) Alternate GPM 762 562 --- 262

235(r)

REV Homeownership

Assistance/Refinance 765 --- --- 165

Refinance of Ten-Year Subsidy

Mortgage 746 --- --- 146

Refinance (Special Allocation

No. 1) 755 --- --- 155

Refinance (Recap/Special

Allocation No. 1) 756 --- --- 156

Refinance (Recap/Other than

Special Allocation No. 1) 766 --- --- 166

240 Fee Simple Title 740 540 --- 240

Continued on next page

Chapter 12, Section B HUD 4155.2

12-B-6

1. Exhibit 1: Home Mortgage ADP Codes, Continued

4155.2 12.B.1.a

ADP Codes

(continued)

Section

of the

Act

Description ADP

Code

for DE

ADP

Code for

VA-CRV

ADP Code

If

Pursuant

to 223(e)

ADP

Code

for

HUD

255 HECM Assignment/Fixed

(HECM Standard) 951 --- --- 911

HECM Assignment/ARM

(HECM Standard) 952 --- --- 912

HECM Shared Premium/Fixed 953 --- --- 913

HECM Shared Premium/ARM 954 --- --- 914

HECM Shared

Appreciation/Fixed 955 --- --- 915

HECM Shared

Appreciation/ARM 956 --- --- 916

HECM Condominium/Fixed

(HECM Standard) 957 --- --- 917

HECM Condominium/ARM

(HECM Standard) 958 --- --- 918

HECM Assignment/Fixed

(HECM Saver) 971 --- ---

HECM Assignment/ARM

(HECM Saver) 972 --- ---

HECM Condominium/Fixed

(HECM Saver) 977 --- ---

HECM Condominium/ARM

(HECM Saver) 978 --- ---

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-7

1. Exhibit 1: Home Mortgage ADP Codes, Continued

4155.2 12.B.1.

a

ADP Codes

(continued)

Section

of the

Act

Description ADP

Code

for DE

ADP

Code for

VA-CRV

ADP Code

If

Pursuant

to 223(e)

ADP

Code

for

HUD

Other

Sections -

MIA

All MMI Sections-3%

Downpayment Program (3%

DPMT)

748 548 348 248

All GI Section-3% DPMT 749 549 349 249

Other Sections-MIA 779 579 379 279

All MMI Sections-IBD

excluding 245(a) 796 596 --- 296

All GI Sections-IBD 797 597 --- 297

All SRI Sections-IBD 798 598 398 298

Chapter 12, Section B HUD 4155.2

12-B-8

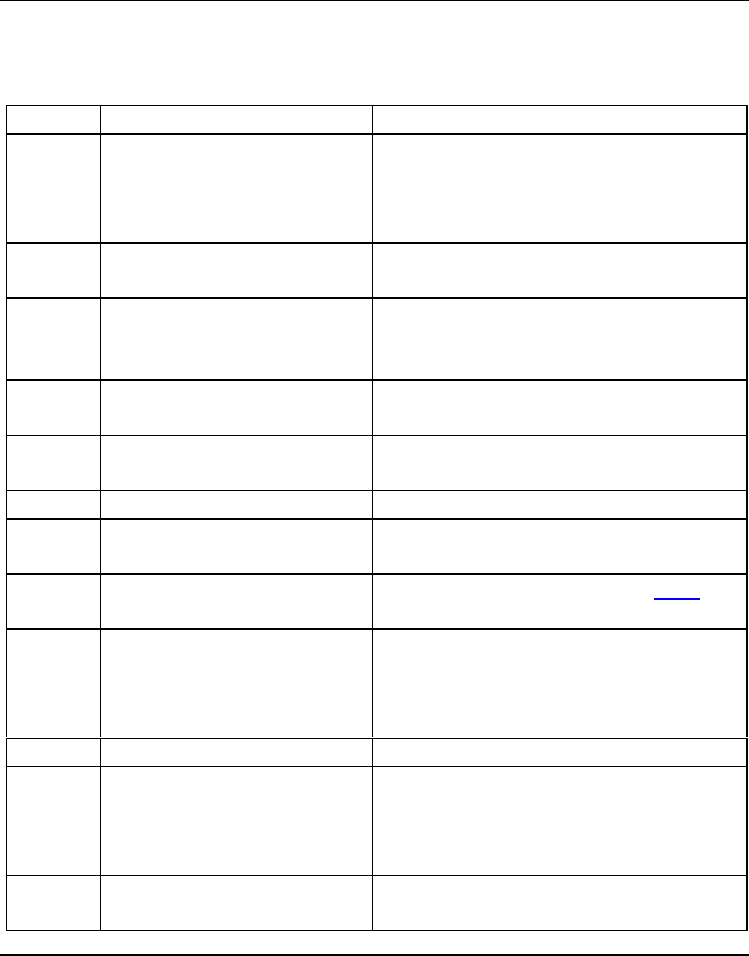

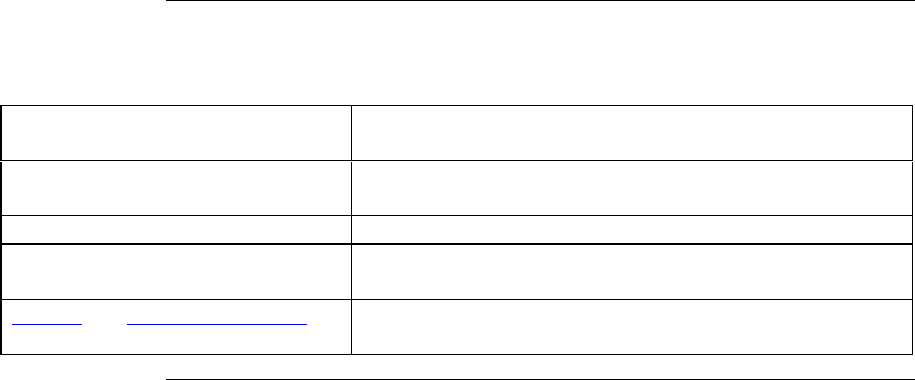

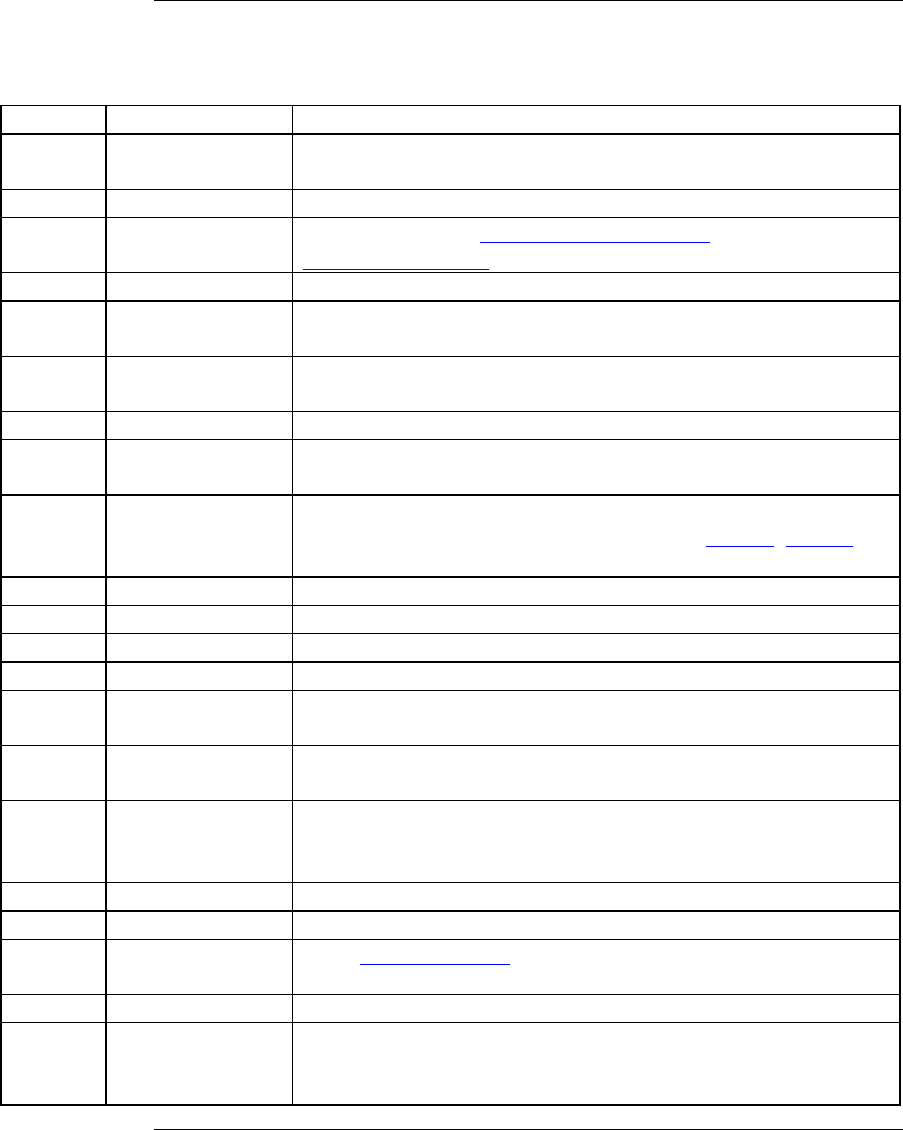

2. Exhibit 2: Program Identification Codes

Change Date December 23, 2010

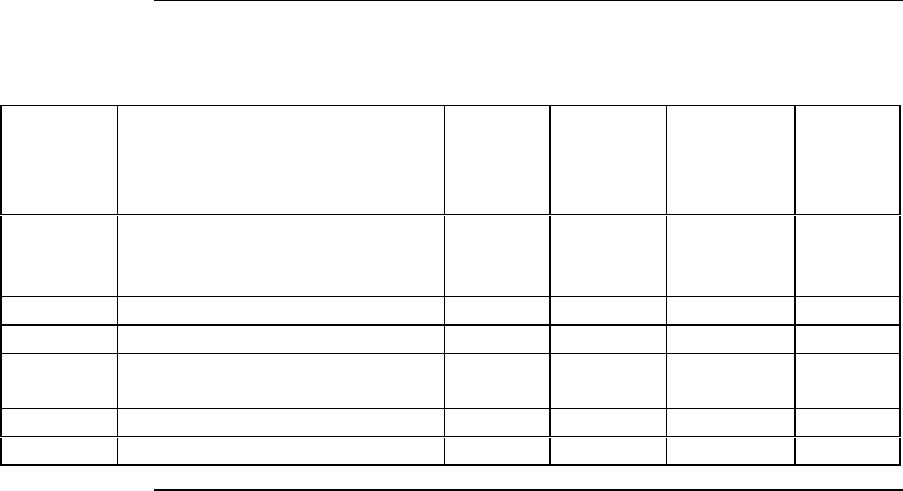

4155.2 12.B.2.a

Program

Identification

Codes

The table below describes the Program Identification Codes used to identify

special programs. These codes also apply when insurance is pursuant to

Section 223(e), Department of Veterans Affairs Certificates of Reasonable

Value (VA-CRV), and Direct Endorsement (DE) cases.

Code Program Description

01 Section 203(b) (9) Housing for the elderly

02 Section 203(h) Disaster housing

03 Sections 203(i) &222 Low-cost housing in suburban area

(Obsolete)

04 Section 203(i) Farm homes on 5 or more acres

(Obsolete)

05 Reserved for inactive program

06 Reserved for inactive program

07 For all home mortgage

transactions pursuant to

Section 223(a) involving

public housing properties

sold by Federal, State, or

local governments, or

agencies thereof.

Inactive

08 For all home mortgage

and home improvement

loan transactions

involving properties

located in redevelopment

or urban renewal areas.

---

09 Section 809

Case not guaranteed by the military

Inactive

Note: Code 00 will be applicable for

guaranteed cases.

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-9

2. Exhibit 2: Program Identification Codes, Continued

4155.2 12.B.2.

a

Program Identification Codes

(continued)

Code Program Description

10 Sections 203(b) (2) &

234(c) Housing for veterans

11 Section 809

Special veteran provision,

guaranteed Inactive

12

Special veteran provision, not

guaranteed Inactive

13 Sections 220(d)(3) Special veteran provision

14 Sections 203, 220, & 809

Veteran in urban renewal area

Inactive

15

Veteran in model city area

Inactive

16

Veteran in model city area in urban

renewal area

Inactive

17

Veteran in periphery of model city

area

Inactive

18

Veteran in periphery of model city

area in urban renewal area

Inactive

19 All home mortgage, home

improvement, and fee

simple title loan

transactions

Located in model city area

Inactive

20

Veteran in periphery of model city

area in urban renewal area

Inactive

21

Veteran in periphery of model city

area

Inactive

22

Veteran in periphery of model city

area in urban renewal area

Inactive

Continued on next page

Chapter 12, Section B HUD 4155.2

12-B-10

2. Exhibit 2: Program Identification Codes, Continued

4155.2

12.B.2.

a

Program Identification Codes

(continued)

Code Program Description

23 Sections 235(i) &

235(i) REV Family unit in condominium

24

Family unit in condominium in urban

renewal area

Inactive

25

Family unit in condominium in model

city area

Inactive

26

Family unit in condominium in model

city area in urban renewal area

Inactive

27

Family unit in condominium in

periphery of model city area

Inactive

28

Family unit in condominium in

periphery of model city area in urban

renewal area

Inactive

29 Section 235(i) REV Family unit in a cooperative project

30 Section 234(c)

Resale of a conventionally financed

unit – veteran

Inactive

31

Resale of a conventionally financed

unit – non-veteran

Inactive

35 Sections 235(i) &

235(i) REV Cases originated by Department of

Agriculture

36 All home mortgage

transactions involving

construction/perm

properties including

manufactured homes

40 All home mortgage

sections Secretary-held sale - substantial

rehabilitation

46 Indian claims area

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-11

2. Exhibit 2: Program Identification Codes, Continued

4155.2 12.B.2.

a

Program Identification Codes

(continued)

Code Program Description

48 Sections 203(b), 203(b)-

ARM, 203(b)/245(a),

203(k), 203(k) – ARM, &

203(k)/245(a)

Indian Reservations

Note: Obsolete; Section of the Act

ADP Codes now apply.

50 Sections 203(b), 203(k)

203(n), 233, 244, & 245 Solar Energy dwellings for veterans

51 Sections 203(b), 203(k),

203(n), 233, 244, 245, &

809

Solar Energy dwellings for non-

veterans

52 All home mortgage

sections IBD provision

53 State-purchase property mortgages -

formerly Secretary-held (Inactive)

60 Subject to Section Trust

65 All home mortgage

sections except 222 & 235 Shared Equity mortgages

70 Section 245(a) Obsolete: Section of the Act ADP

Codes now apply

77 All home mortgage

sections Manufactured Housing

NOT

processed as construction-permanent

loans

88 Section 8 Section 8 Homeownership Programs

90 Sections 203(b), 203(b)-

ARM, 203(b)/245(a) -

GPM, & 203(b)/245(a) –

GPM/GEM

Operative Builder Firm Commitment

00 All cases not in program

codes shown above ---

Chapter 12, Section B HUD 4155.2

12-B-12

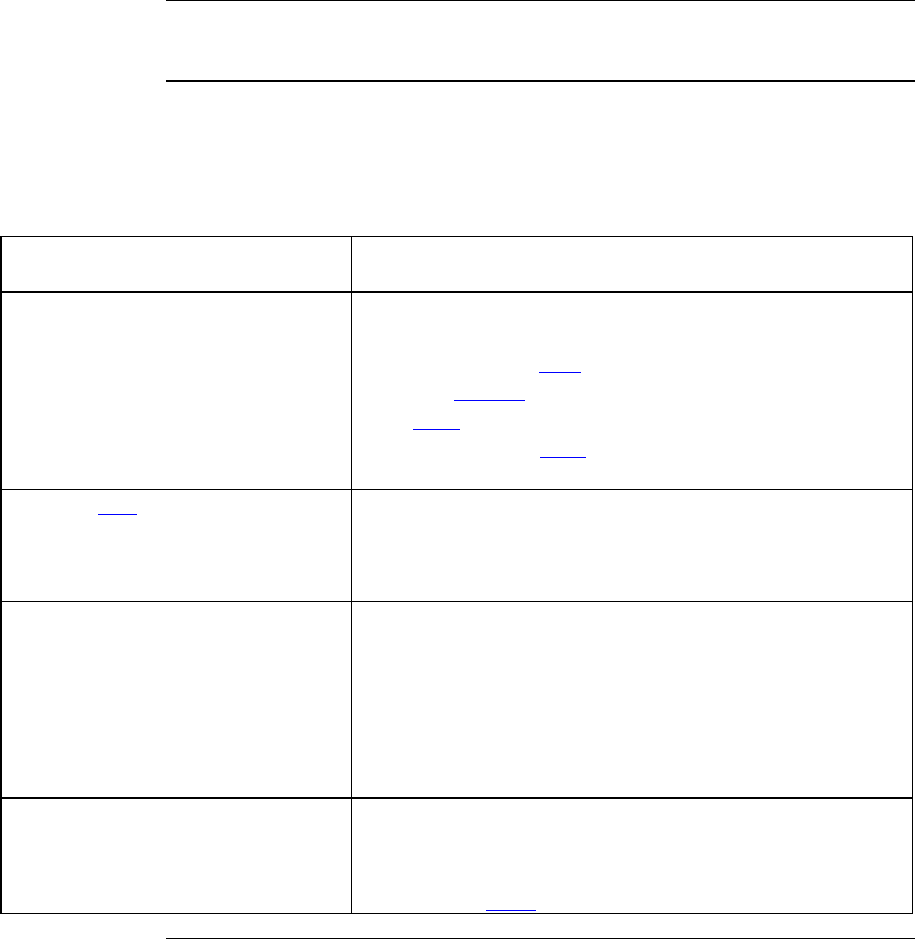

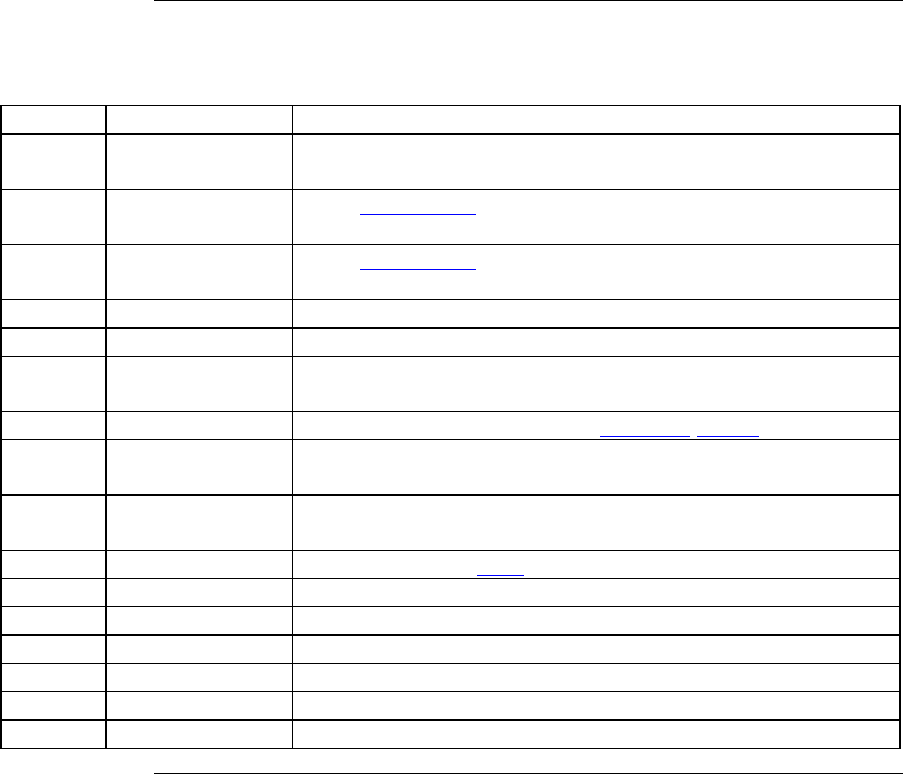

3. Exhibit 3: FHA Common System Errors and

Documentation Problems

Change Date

December 23, 2010

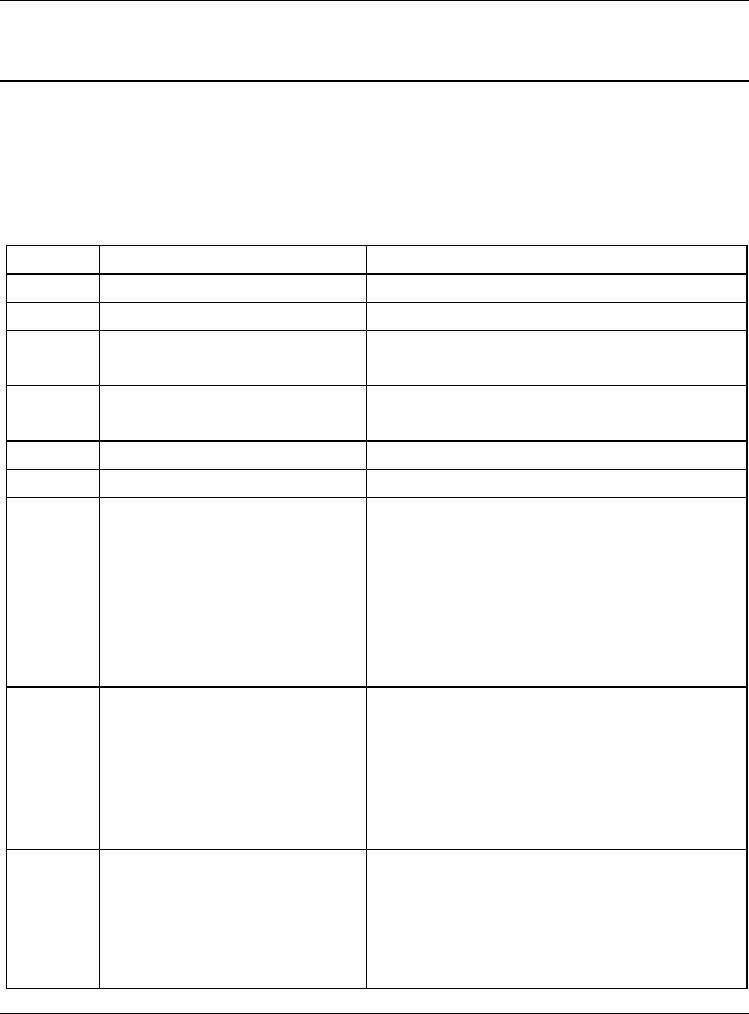

4155.2 12.B.3.a

Common

System

Problems

The table below describes common FHA system errors, and provides

information for their resolution.

When the Problem Error

Message is ... Then ...

Mortgage Amount cannot exceed

$XXXX for a value of $YYYYY verify

that the question MIP Financed? is correctly answered

that the UFMIP amount is paid in the case

the ADP code

that the previous REO case is correct, and

the mortgage amount and value entries.

Monthly P&I not within

acceptable range of $XXX.XX to

$YYY.YY

verify the

mortgage term, and

mortgage amount and interest rate entries.

Mortgage Amount exceeds

statutory limit verify

the number of units

the county code

that the question MIP Financed? is correctly answered,

and

if it is an Emergency Efficient Mortgage.

Address mismatch (refinance)

verify

the address with the one on the payoff statement, and

that the old case number is the borrower’s, and

contact the HOC for instructions if the error persists.

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-13

3. Exhibit 3: FHA Common System Errors and

Documentation Problems, Continued

4155.2 12.B.3.

a

Common System Problems

(continued)

When the Problem Error

Message is ... Then ...

Borrower cited on CAIVRS

Multiple Loans submit a print-out of a clear CAIVRS screen, if obtained

at case number assignment and the borrower is cited

later.

Borrower cited on Multiple Loans

research all case numbers cited, and

provide updated status of each case in the binder.

Note: If the property was sold, provide the HUD-1.

4155.2 12.B.3.b

Common

Documentation

Problems

The table below describes common documentation problems and provides

information for their resolution.

When the documentation

problem message is ... Then ...

Appraisal and HUD-92900-LT,

FHA Loan Underwriting and

Transmittal Summary information

not entered in FHA Connection

prior to shipment, verify that the information in the

system is for the correct case number.

UFMIP and netted MIP incorrectly

submitted verify that the transmission references the correct

numbers.

UFMIP and netted MIP submitted

late verify ten (10) days of closing.

Second copy of appraisal not

provided loose in binder ensure that one appraisal is fastened, and one is loose.

Late letter and payment history not

provided this means that the late letter and history are required as

of the 60th day, if not received by the HOC.

Missing ADP codes on appropriate

documents and allonges verify that the case numbers have the appropriate codes

included.

Continued on next page

Chapter 12, Section B HUD 4155.2

12-B-14

3. Exhibit 3: FHA Common System Errors and

Documentation Problems, Continued

4155.2 12.B.3.

b

Common Documentation Problems

(continued)

When the documentation

problem message is ... Then ...

203(k) cases not closed out in

system prior to refinance follow the close-out procedures prescribed by the HOC.

Case number not in binder verify the case number.

92900a not completed and

appropriately signed review the form for proper signatures.

HUD-1 and HUD-1 Addendum

not signed and dated by all parties review the forms for proper signatures, particularly the

seller and settlement agent.

HUD 4155.2 Chapter 12, Section B

12-B-15

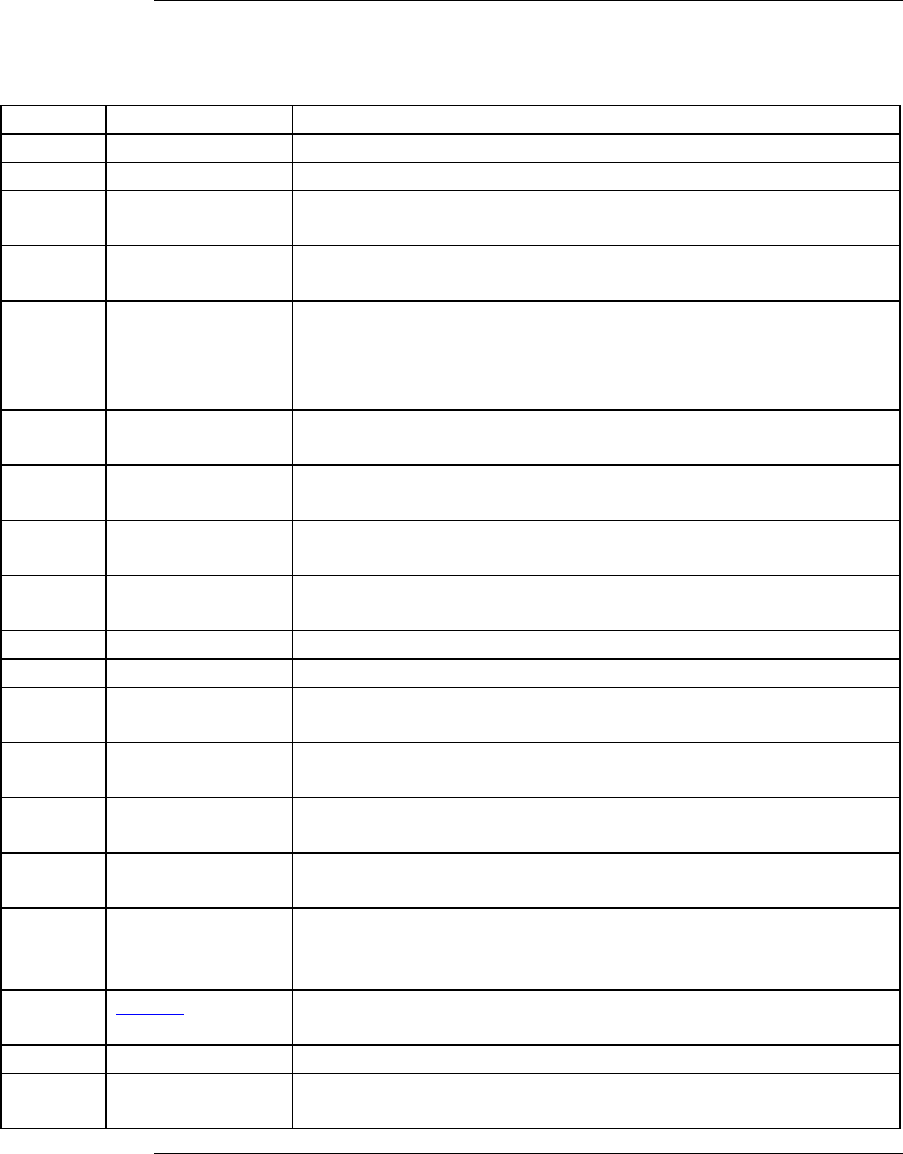

4. PETR Deficiency Codes

Change Date December 23, 2010

4155.2 12.B.4.a

PETR

Deficiency

Codes

When conducting the Post Endorsement Technical Review (PETR), the FHA

reviewer assigns one or more technical review reason deficiency codes from

the table below to identify the risk element, documentation deficiency or

processing error present in the loan.

Code Category Deficiency

AU01 Automated

Underwriting

Systems/TOTAL

Data integrity deficiencies. File documentation does not

support Accept/Approve decision in AUS.

AU02 Automated

Underwriting

Systems/TOTAL

Documentation does not support credit waivers of AUS.

AU05 Automated

Underwriting

Systems/TOTAL

AUS invalid or missing.

CH03 Credit History Mortgage verification missing, mortgage not current, or

mortgage history not satisfactory.

CH10 Credit History Credit report unacceptable source or format.

CH21 Credit History Concerns related to bankruptcies, judgments, liens and/or

foreclosures.

CH40 Credit History Concerns related to poor credit pattern, major derogatory

credit and/or recent material inquiries.

CH41 Credit History CAIVRS,LDP/GSA authorization and/or delinquent federal

debt issued not properly documented or satisfied.

CH42 Credit History Credit report or non-traditional credit not obtained or illegible.

CL32 Closing Unallowable, excessive costs/credit to borrower, or other

HUD-1 inaccuracies.

CL37 Closing HUD-1, HUD-1 Addendum (if applicable), and/or Good Faith

Estimate (GFE) missing, not the final copy, incomplete or

illegible.

DC10 Documentation Uniform Residential Loan Application (URLA) not properly

completed or missing.

DC11 Documentation Form HUD-92900-A not properly completed or missing.

DC12 Documentation Quality of imaged documentation insufficient to permit

review.

DC13 Documentation Questionable documentation.

Continued on next page

Chapter 12, Section B HUD 4155.2

12-B-16

4. PETR Deficiency Codes, Continued

4155.2 12.B.4.a

PETR Deficiency Codes

(continued)

Code Category Deficiency

DC14 Documentation Concerns related to electronic documents.

DC15 Documentation Case binder indexing errors/deficiencies.

EQ01 Eligibility &

Qualification Invalid Social Security number (SSN) or Tax Identification

number (TIN).

EQ02 Eligibility &

Qualification Legal residency for non-US citizens not adequately

documented.

EQ03 Eligibility &

Qualification Borrower not owner-occupant, property not principal

residence, possible investor issues and/or eligibility

requirement for principal residence not met (including identity

of interest concerns).

EQ04 Eligibility &

Qualification Qualifying ratios exceeded without acceptable compensating

factors for manually-approved loans.

EQ05 Eligibility &

Qualification Borrower deleted on streamline refinance loan without credit

qualifying.

EQ07 Eligibility &

Qualification Payoff demand missing for refinance transaction.

EQ08 Eligibility &

Qualification Streamline refinance eligibility criteria not met.

FD10 Funds Unacceptable, unsupported or insufficient source of funds.

FD20 Funds Concerns related to assets derived from gift(s).

FD30 Funds Secondary financing: source or terms unacceptable, not

documented or inadequately documented.

FD60 Funds Borrower did not make the required minimum cash

investment (downpayment).

FP01 Flipping Sales contract dated fewer than 91 days from acquisition date

by seller.

FP02 Flipping Requirements for properties sold within 91-180 days not

documented.

FP03 Flipping Waiver requirements not met to permit a property sales

contract date less than 91 days with a sales price increase of

20% or greater above the seller’s acquisition cost.

HM01 HECM Borrower not eligible or eligibility not

established/documented.

HM04 HECM Counseling requirement not satisfied/acceptably documented.

HM05 HECM Anti-Churning Disclosure and/or supporting calculation

missing or inaccurate.

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-17

4. PETR Deficiency Codes, Continued

4155.2 12.B.4.a

PETR Deficiency Codes

(continued)

Code Category Deficiency

HM06 HECM Loan Agreement missing, incorrect or illegible.

HM07 HECM Maximum Claim Amount incorrect.

HM08 HECM Acceptable title insurance commitment not

provided/documented.

HM10 HECM Average Expected Mortgage Interest Rate (Expected Rate)

incorrect.

HM11 HECM Principal limit incorrect.

HM12 HECM Payment Plant incorrectly calculated and/or disagrees with

HUD-1.

HM13 HECM Excess servicing set-aside.

HM25 HECM Concerns related to repair set-aside.

HM26 HECM HECM for Purchase – no third party contributions exist.

IC02 Income Income improperly calculated or from an unacceptable source.

IC20 Income Income improperly documented.

IC22 Income IRS Form 4506 or Form 8821 required, but missing,

inaccurate or incomplete.

IC30 Income Stability of income insufficient and/or unsupported.

LA04 Liabilities Obligations of borrower(s) (non-purchasing spouses included)

omitted, inaccurate, unsupported, undisclosed and/or illegible.

LI01 LI Loans Lender Insured (LI) data integrity concerns: insured loan data

entered in FHA Connection not supported by file documents.

LI02 LI Loans Documentation and/or compliance errors/concerns for LI case

which were not resolved prior to insurance.

MA04 Maximum

Mortgage

Amount

Mortgage amount incorrect, LTV limit and/or statutory limit

exceeded.

MA05 Maximum

Mortgage

Amount

Secondary Financing: maximum CLTV and/or statutory limit

of combined mortgages exceeded.

PG10 Program Concerns related to Hawaiian Homelands financing

transactions.

PG20 Program Concerns related to 203(k) mortgages.

PG30 Program Concerns related to construction-to-permanent financing

transactions.

PG40 Program Concerns related to Energy Efficient mortgages.

Continued on next page

Chapter 12, Section B HUD 4155.2

12-B-18

4. PETR Deficiency Codes, Continued

PETR Deficiency Codes

(continued)

Code Category Deficiency

RH11 Rehab/

Construction Inadequate description of improvements/costs.

UW16 Underwriting Excess cash back on No Cash-Out refinance.

UW20 Underwriting Purchase contract, Real Estate Certification and/or

Amendatory Clause missing, illegible or incorrect.

UW22 Underwriting Concerns related to short sales and/or short payoffs.

UW23 Underwriting Concerns related to Help for Homeowners or other loan

modification program.

VA01 Valuation Concerns related to the Neighborhood, Site, and/or

Improvements sections of the appraisal report.

VA02 Valuation Illegal zoning.

VA03 Valuation Existing construction in Special Flood Hazard Area (A or V

Zone) without evidence of flood insurance.

VA04 Valuation New Construction and/or Manufactured Home in Special

Flood Hazard Area (A or V Zone) without LOMA,LOMR, or

an elevation certificate with evidence of flood insurance.

VA06 Valuation Property does not meet Minimum Property Requirements.

VA07 Valuation Appraisal expired.

VA08 Valuation Allowable commercial space in mixed-use property exceeded.

VA13 Valuation Concerns related to Cost Approach of the appraisal report.

VA14 Valuation Concerns related to Sales Comparison Approach section of

the appraisal report.

VA15 Valuation Concerns related to Income Approach section of the appraisal

report.

VA17 Valuation Concerns related to the Market Conditions Addendum to the

appraisal report, including: missing, incomplete, incorrect

and/or illegible.

VA18 Valuation Owner of record not documented.

VA20 Valuation Sales are not sufficiently comparable to the subject property.

VA22 Valuation Form HUD-92800.5B substantially incomplete, incorrect or

missing.

VA23 Valuation Repairs not acceptably addressed.

VA24 Valuation The Wood Destroying Insect Inspection report is missing or

incomplete, or inadequate documentation exists to reflect that

infestation was acceptably treated.

Continued on next page

HUD 4155.2 Chapter 12, Section B

12-B-19

4. PETR Deficiency Codes, Continued

4155.2 12.B.4.a

PETR Deficiency Codes

(continued)

Code Category Deficiency

VA25 Valuation Compliance inspections, certifications, or local government

approvals are missing or incomplete.

VA26 Valuation Form HUD-92051 or its equivalent is substantially incomplete

or incorrect.

VA27 Valuation Form HUD-92300,Mortgagee Assurance of Completion, is

missing, incomplete and/or incorrect.

VA29 Valuation Manufactured home does not meet eligibility guidelines.

VA30 Valuation Value not supported.

VA34 Valuation Newly-constructed or newly-rehabilitated home, does not

meet requirements.

VA36 Valuation Condo project not approved by DELRAP/HRAP.

VA41 Valuation Concerns related to photos, map and/or sketch missing or

illegible.

VA42 Valuation Concerns related to the subject and contract section of the

appraisal report.

VA43 Valuation Responsibility for MPS repairs not detailed.

VA44 Valuation Incorrect appraisal form used for property type.

V25A Valuation Manufactured home does not meet guidelines.

V26A Valuation Condo project, spot condo not approved.

V26B Valuation Condo 51% owner-occupancy not met.

V26C Valuation Condo – other deficiencies.

V27A Valuation Newly-constructed home does not meet requirements.