ITC250 Ingenico Ict250 Quick Reference Guide

User Manual: ITC250

Open the PDF directly: View PDF ![]() .

.

Page Count: 18

QUICK REFERENCE GUIDE

Ingenico

Review this Quick Reference Guide to learn how to run a sale,

settle your batch and troubleshoot terminal responses.

INGENICO iCT 250

INGENICO iWL 250

INDUSTRY

Retail and Restaurant

APPLICATION

CPCU02A

TERMINALS

Ingenico iCT250

and iWL250

SOFTWARE

SECURITY

The software on this

terminal has been

secured. This will protect

it from both inadvertent

overwriting and malicious

tampering. If you need

help with changes or

updates, please contact

a representative at our

service desk.

QUICK REFERENCE GUIDE | INGENICO | 3

CONTENTS

GETTING STARTED

Key Functions .................................................................. 4

Navigating Your Terminal .................................................. 5

Settling the Batch............................................................. 6

Integrated Contactless and Chip Technology......................... 7

Available Transaction Types ............................................... 8

Clerk/Server Management ............................................... 10

Available Reports ........................................................... 11

Gift Card Transaction Types (Optional) ................................ 12

REFERENCE

Prompt Q&A ................................................................... 13

AVS Response Codes .......................................................14

Common Error Codes ...................................................... 15

Chip Technology Q&A ......................................................16

Chip Technology Quick Tips .............................................. 17

4 | INGENICO | QUICK REFERENCE GUIDE

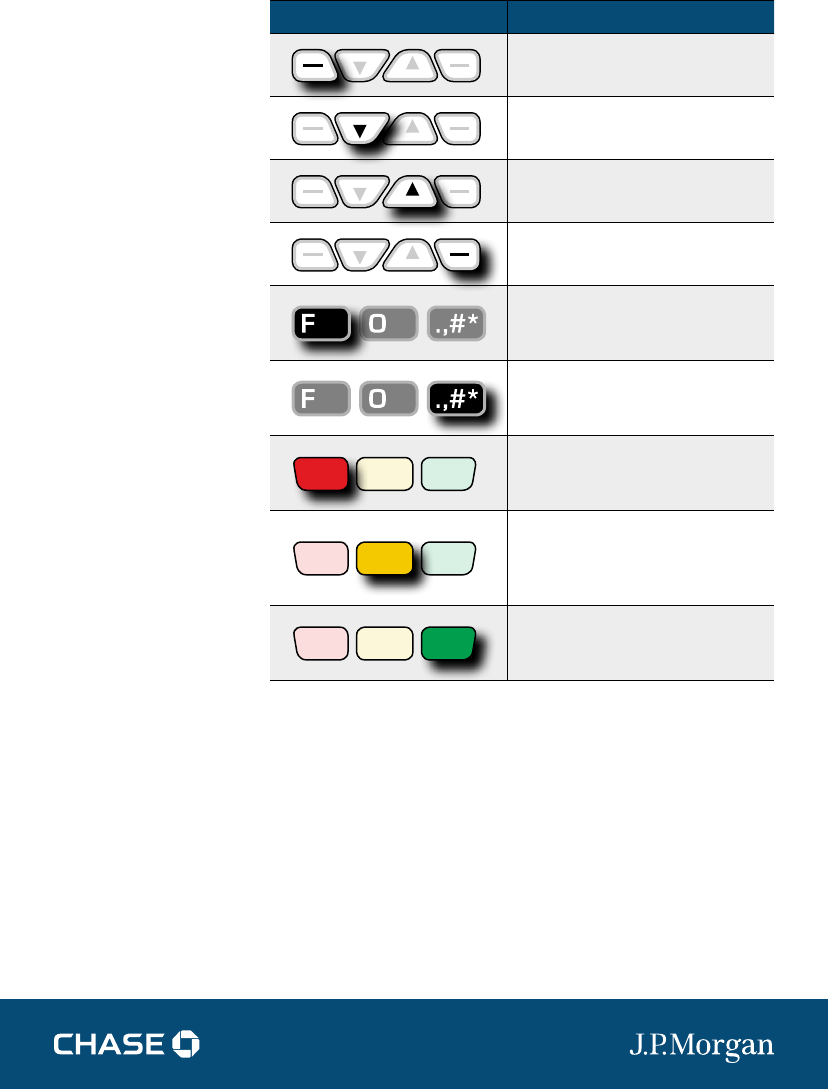

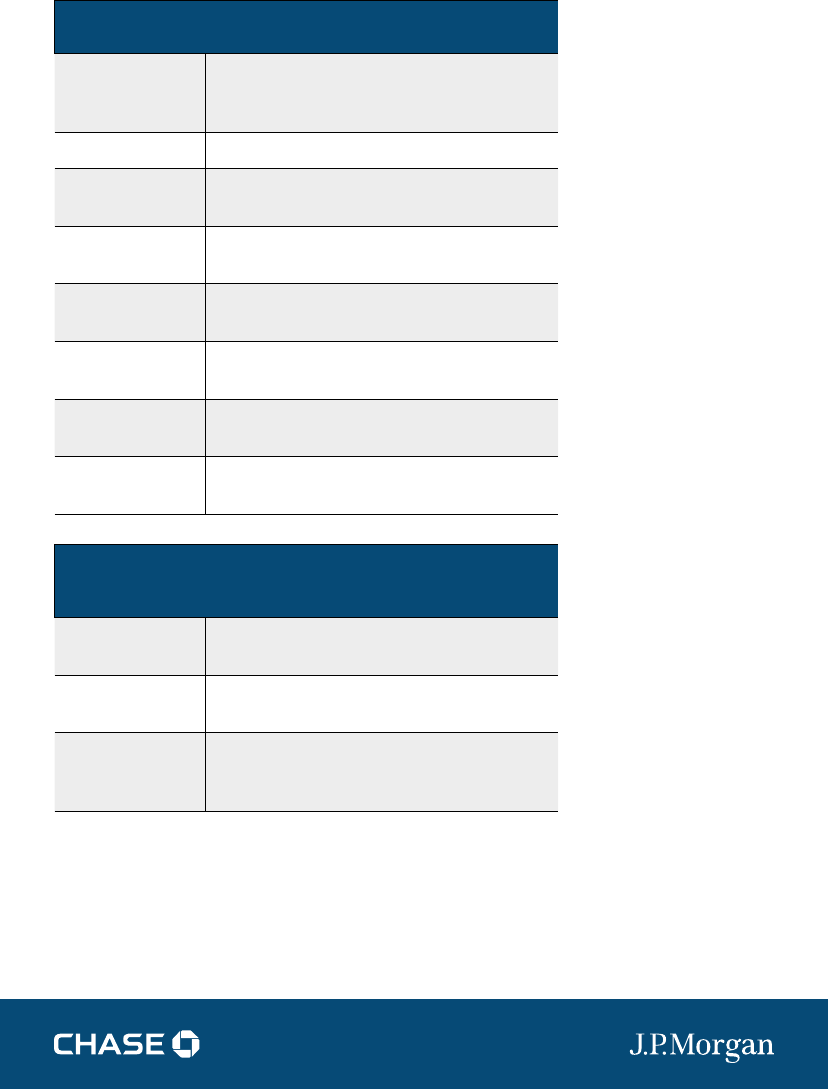

KEY FUNCTIONS

Press the keys beneath

the display to navigate

your terminal’s menus.

ICON/IMAGE FUNCTION

F1 — this is a variable key.

F2 — press to scroll down.

F3 — press to scroll up.

F4 — this is a variable key.

F Key — press to access the System

Menu. When entering text, press to

specify letters and characters.

# Key — press to access the

Admin menu for reports and

management.

Cancel — press to immediately

stop the current activity and return

to the idle screen.

Clear/Back — press to stop the

current activity and restart the

current activity, such as entering

a password.

Enter — press to confirm and

continue with the activity in

progress.

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 5

NAVIGATING YOUR TERMINAL

BEGIN A SALE

Press [0] and enter the amount of the transaction. Pass the device to

the customer.

▪ For magnetic stripe payments, the customer should swipe their card,

and then specify credit or debit. (Note: Debit cards must be swiped.)

▪ For smart chip card payments, the customer should insert their card

and leave it inserted for the entire transaction. If the chip card is

swiped, then the terminal may prompt the customer to insert the

card in the chip reader slot.

▪ For contactless payments, the customer should tap/wave their card

on or in close proximity to the terminal’s screen.

BEGIN OTHER TRANSACTIONS

Press [Enter] and then use the hot keys to navigate to the type of

transaction you wish to perform.

CLERK/SERVER MENU

Press [#] and then select Clerk/Server menu.

BATCH REVIEW

Press [#] and then select Reports. Choose whether you would like a

detail or summary report, and then specify whether you would like the

report printed or simply displayed on the terminal.

TIP ADJUSTMENTS

Press [Enter] and select Tip, if tip processing is enabled.

Refer to this section

to find and begin the

transaction or function

you wish to use.

To reprint a receipt,

press [9] from the

main menu.

ç Back | Forward è

6 | INGENICO | QUICK REFERENCE GUIDE

TRANSACTION TYPES

ABOUT SETTLEMENT

A Settlement operation is used to close the current batch and open a

new batch for logging and accumulating transactions.

Your Ingenico terminal uses a Terminal Capture System (TCS), meaning

it stores transactions throughout the day and sends batch totals

of sales and refunds to the host (Chase) after the close of business.

THERE ARE TWO SETTLEMENT OPTIONS

1. Manual Settlement

If your terminal is set to manually settle, press [Enter] and select

Settlement from the main menu, then follow the prompts displayed.

2. Auto Settlement

If your terminal is set to automatically settle, it will automatically settle

transactions in the current batch at a specific, predetermined time,

within a 24-hour period. When configured, auto settlement begins any

time after the set time occurs if there are transactions in the batch.

For example, if auto settlement time is set to 22:30:00 (10:30 p.m.)

then auto settlement occurs any time after 22:30:00. If the terminal is

turned o before the set time, and turned on again (usually the next

morning), auto settlement occurs at that time.

Your transactions must

be “settled” daily. Read

this section to ensure

the settlement process

operates smoothly.

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 7

CONTACTLESS PAYMENTS

Your Ingenico terminal automatically accepts contactless

payments. Your customers can tap or wave their contactless

form factors (cards, fobs, mobile phones, etc.) on or near the

device to submit account information to the terminal, removing the

need to swipe, insert or manually key.

During a sale transaction, the terminal will display the “Insert/Swipe/

Tap/Key Card” prompt and the contactless symbol. At this time,

customers with contactless-enabled form factors should touch or “tap”

them on the terminal’s screen. Your terminal will process contactless

payment transactions as if a card were swiped or inserted.

As an added security measure, transaction amounts over a pre-set

threshold may require a card swipe or insert.

SMART CHIP CARD TECHNOLOGY

Your Ingenico device also supports smart chip card technology. A chip

payment card looks just like a magnetic stripe card with a chip in

addition to the standard magnetic stripe on the back of the card. What

you see on the card is not the actual microchip, but a protective

overlay. The microchip provides an additional level of authenticity for

the transaction.

When a customer presents a chip card, you should initiate a sale and

then pass the terminal to the customer. The customer inserts their

card into the chip reader at the bottom of the terminal, where it

should remain until the transaction completes. This ensures that the

card never leaves the customer’s possession and that your business

does not accept counterfeit plastics.

Refer to page 16 for answers to your chip technology questions.

TRANSACTION TYPES

Our goal is to provide

you with the latest

technology to help you

make the most of your

payment processing

services.

For added conve nience

and security for both

you and your customers,

your Ingenico device

supports both contact-

less and smart chip

payments.

Note: Smart chip

acceptance at the

individual merchant

level may depend

on setup variables.

ç Back | Forward è

8 | INGENICO | QUICK REFERENCE GUIDE

AVAILABLE TRANSACTION TYPES

Your terminal supports

various transaction

types.

Refer to this section

for information on

what transactions are

available, when to use

them, and how to

begin the transaction.

CREDIT TRANSACTIONS TO INITIATE

Credit Sale* — A sale transaction using a credit

card; the card may or may not be present.

Swipe the card

and then select

Credit.

Or, press [0] and

then select Credit.

Pre-Auth* — An authorization-only transaction

provides an approval, but does not charge the

consumer until the transaction has been added

to the batch by way of a force transaction.

Press [Enter]

and then select

Pre-Auth.

Force* — Perform a force sale when the terminal

cannot reach the host (Chase Paymentech) to

authorize a transaction, or to finalize a pre-auth

transaction. Contact your Voice Authorization

Center for an authorization code, and then

force the transaction.

Press [Enter]

and then select

Force.

Return* — Perform a return to refund money

to a cardholder’s account from a credit sale

completed in a closed batch (in other words,

previous day). May also be used to adjust a

previous transaction.

Press [1] and then

select Credit.

Void* — Perform a void to reverse a credit sale,

force, or return transaction and prevent any

funds from transferring from the cardholder’s

account. Only available for transactions in the

current batch (in other words, same day).

Press [Enter] and

then select Void.

Open/Close Tab (restaurant only) — A

transaction for a specific, predetermined

dollar amount.

Press [Enter] and

then select Tab.

* Purchase and Commercial cards are supported for this transaction type.

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 9

AVAILABLE TRANSACTION TYPES

Your terminal supports

various transaction

types.

Refer to this section

for information on

what transactions are

available and when to

use them.

DEBIT TRANSACTIONS TO INITIATE

Debit Sale — A sale transaction using a debit

card and PIN; the card must be present.

Swipe the card

and select Debit.

Or, press [0] and

select Debit.

Debit Return — Perform a debit return to refund

money to a cardholder’s account from a debit

sale completed in a previous batch; the card

must be present.

May not be available for all card issuers

Press [1] and

select Debit.

EBT TRANSACTIONS (RETAIL ONLY) TO INITIATE

EBT Sale — An Electronic Benefits Transfer

(EBT) card is a government-issued card tied to

a specific government-assistance account. EBT

transactions require PIN entry, as well as a

trace number and balance amount printed on

receipts. An EBT sale transaction may be a food

stamp sale, or a cash benefit sale. The card

must be present.

Press [0] and

select EBT.

EBT Force — A sale transaction performed when

the terminal cannot reach the host to authorize

the transaction. Contact your Voice Authorization

Center for an authorization code, then perform

a force transaction with the EBT card.

Press [Enter]

and select Force.

EBT Return — Perform a return to refund money

to a cardholder’s account from an EBT sale

completed in a closed batch (in other words,

previous day). May also be used to adjust a

previous transaction. Available only for food

stamp transactions.

Press [1] and

select EBT.

EBT Balance Inquiry — Obtain a customer’s

remaining EBT account balance. Available for

both food stamp and cash benefit.

Press [0], select

EBT and then

select Balance

Inquiry.

ç Back | Forward è

10 | INGENICO | QUICK REFERENCE GUIDE

CLERK/SERVER MANAGEMENT

Accessible through the

Admin menu, clerk/

server manage ment

allows you to manage

IDs and passwords.

Press [#] to access

the Admin menu.

ADD ID

Adds new clerks or servers to your terminal. You will be prompted to

create an ID and a password, if enabled, for each new clerk/server.

EDIT IDs

Allows you to revise existing clerks/servers.

DELETE IDs

Removes all or a single clerk/server from the terminal.

PRINT ID LIST

Prints a report of clerks/servers currently signed on.

AUTO ADD CLERK

This feature allows you to automatically add new clerks/servers during

a transaction. If you toggle the feature o, then the terminal will not

allow a transaction unless a valid clerk/server ID is entered.

CLERK PROMPT

Enable this feature to have the terminal prompt for a clerk/server ID

during each transaction.

CLERK WORDING

This feature allows you to alternate the terminal’s verbiage from

“clerk,” “server” or “cashier.”

DISPLAY PARAMETERS

Displays the current clerk/server parameter settings.

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 11

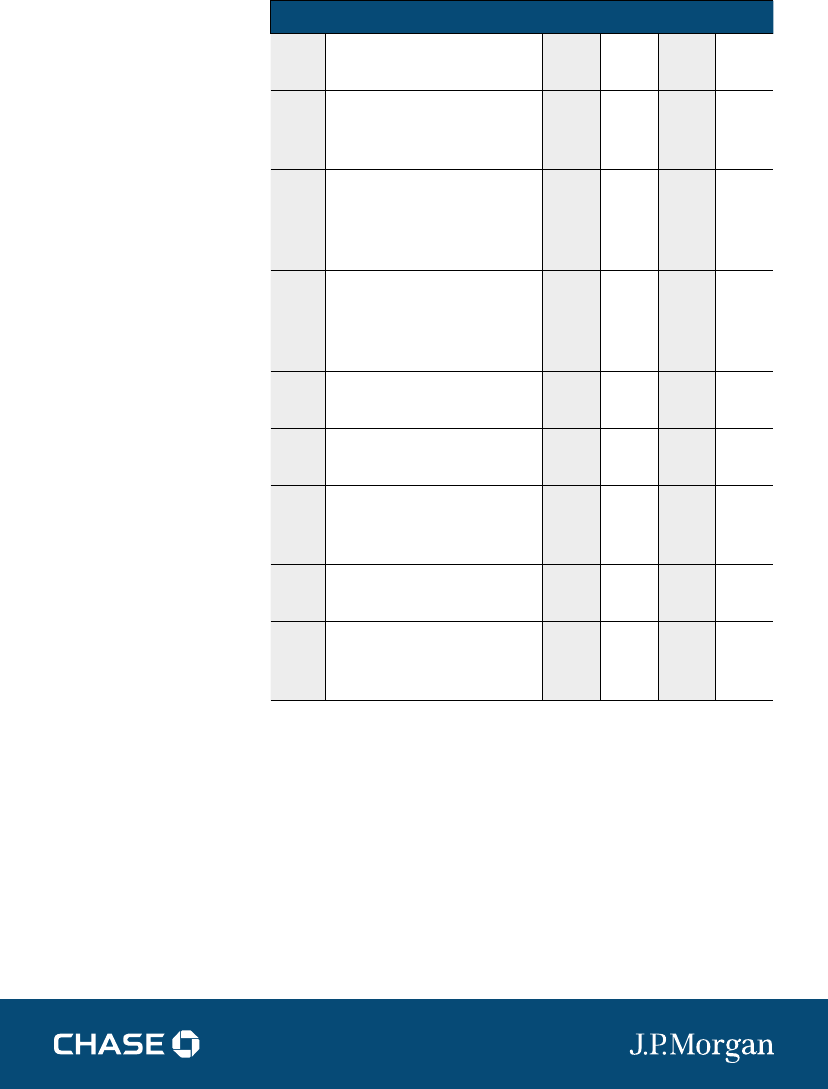

AVAILABLE REPORTS

Your terminal includes

a variety of transaction

and batch reports. Use

this data to help you

make crucial business

decisions.

REPORTS: MAIN MENU

To access, press [#] and select Reports Menu.

Detail Report

Prints detail information for each transaction

and a totals summary for each card type and

issuer.

Summary Report Prints totals by card type and card issuer.

Clerk/Server

Summary

Prints a summary report by all or one clerk/

server.

Open Pre-Auth

Report

Prints a list of all open pre-auth transactions

stored in the terminal.

Unadjusted Tip

Report

Prints a list of unadjusted transactions by

clerk/server, if enabled.

EMV Report Prints reports related to EMV chip transactions,

parameters, statistics and key settings.

Recent Error

Report

Displays a log of recent terminal and/or

transaction errors.

Open Tab Report

(Restaurant only)

Prints a list of all open tabs by all or one

clerk/server, if enabled.

REPORTS: GIFT CARD

To access, press [Enter] and select Gift.

Press [4] to open the Gift Reports menu.

Gift Card

Detail Report

Prints detailed information for each transaction

and a summary report of transaction types.

Gift Card

Summary Report Prints totals by transaction type

Clerk/Server Gift

Card Report

Prints a gift card detail report by clerk/server

that includes transaction type, amount and

total.

ç Back | Forward è

12 | INGENICO | QUICK REFERENCE GUIDE

GIFT CARD TRANSACTION TYPES (OPTIONAL)

If you are partici pating

in Chase’s proprietary

Gift Card program,

your terminal supports

various stored value

card transaction types.

Refer to this section for

information on what gift

card transactions are

available and when to

use them.

To begin a Gift Card

transaction, press

[Enter] and select Gift

(does not apply to a

void).

GIFT CARD TRANSACTIONS (OPTIONAL)

To begin, press [Enter] and select Gift.

TO INITIATE

Issuance — Adds value to the gift card account.

This transaction can be used to issue and

activate a new card, or to reload an active card

with incremental value.

Press [0].

Activation/Block Activation — Create a

consumer’s gift card account by assigning

value to a card. One or more gift cards can

be activated at one time. Activations can only

be performed on cards that have not been

previously activated.

Press [7] to

select Activation

Redemption — Decreases the value stored

on the consumer’s gift card account. This

transaction is performed when a consumer

uses the card to purchase goods or services.

Press [1].

Void — Remove a gift card transaction from

the terminal’s open batch. The void will

communicate to the gift card host that the

transaction is being reversed.

Without entering

the Gift menu,

press [Enter] and

select Void.

Balance Inquiry — Print a receipt that displays

the customer’s available gift card balance

(without changing it).

Press [2].

Force — Perform a force redemption, activation

or issuance when the terminal cannot reach

the gift card host with a valid approval code

from the Voice Authorization Center.

Press [5] to select

Issuance or press

[6] to select

Redemption.

Add Tip — A gift card redemption transaction

for the amount of the tip, if tip processing is

enabled.

Press [3].

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 13

PROMPT Q&A

While navigating

through transactions,

you’ll find that some

prompts aren’t as clear

as others. This section

clarifies those prompts.

PROMPT DESCRIPTION/ACTION

Enter Last 4 Digits

of Card Number

Key the last 4 digits of the card number and

press [Enter].

Enter Clerk/

Server ID

Key the server/clerk ID (up to 6 digits in

length) and press [Enter].

Enter Invoice

Number

Key the invoice number (up to 6 digits in

length) and press [Enter].

Duplicate

Transaction

Accept Cancel

Press the hot key under the desired option to

accept or cancel the duplicate transaction.

Enter Customer

Number

Key the customer reference number (up to

30 characters in length) and press [Enter].

Enter Card

Validation Number

Key the Card Verification Code from the card

and press [Enter].

1. Unreadable

2. Not Present

3. Bypass

Press the number of the appropriate option

to indicate why the Card Verification Code is

not available.

Enter Expiration

Date MMYY

Key the card’s expiration date in MMYY

format and press [Enter].

Enter Approval

Code

Key in the 6 character approval code and

press [Enter].

Insert Card in

Chip Reader

The customer’s card is a smart chip card and

should not be swiped. Start the transaction

from the menu and insert the card when

prompted. Leave the card in the slot until

the transaction is completed.

Pass Terminal to

Customer

The clerk should hand the terminal to the

customer. The customer can then complete

the transaction based on any card entry

method they choose.

Approved:

$XX.XX

Amount Due:

$XX.XX

Press Enter

The customer’s card approved for a portion

of the total. Press [Enter] to begin a

transaction for the remaining amount due.

ç Back | Forward è

14 | INGENICO | QUICK REFERENCE GUIDE

The Address Verifi cation

System (AVS) is a feature

that helps reduce fraud

on card-not-present

transactions. The

numeric portion of

the customer’s street

address and the ZIP

code are compared

against the infor mation

on file with the

card-issuing bank.

Use this chart to interpret

domestic AVS Response

Codes by card type.

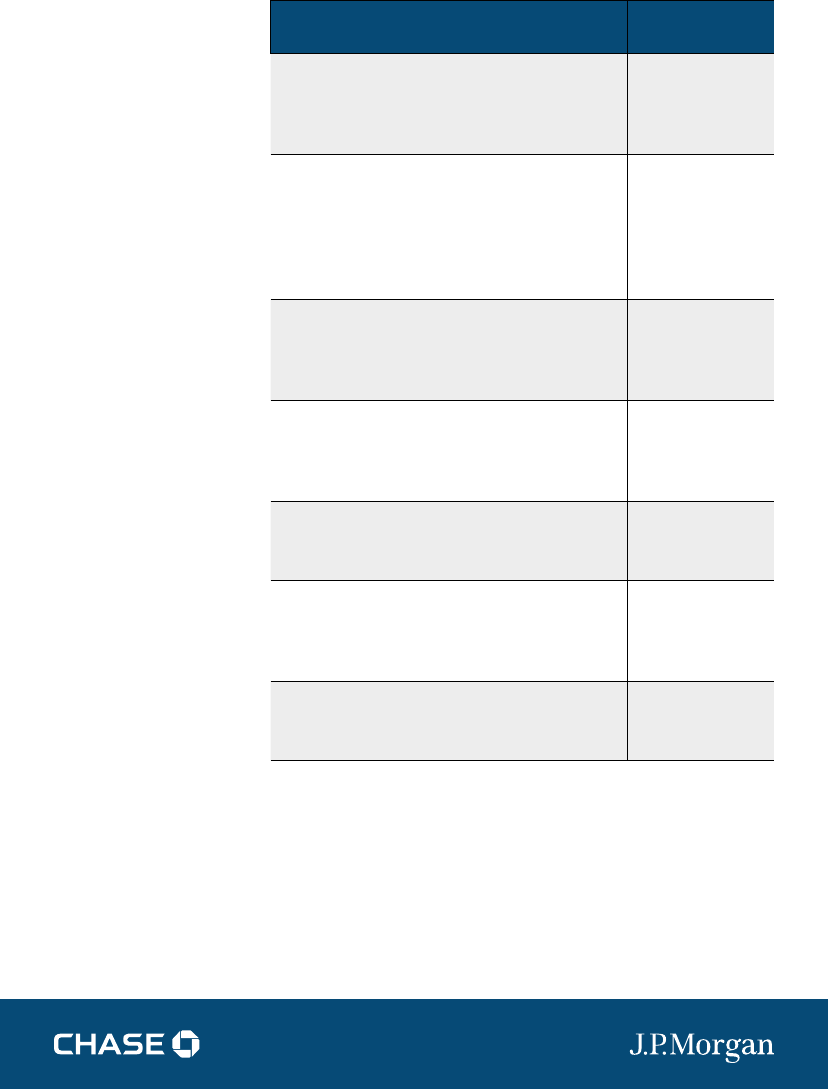

AVS RESPONSE CODES

CODE DESCRIPTION VISA MC AMEX DISC

XMatch — Address and

9-digit ZIP code

Y

Match — Address and ZIP

code (for Discover, address

only matches)

A

Partial — Address matches,

ZIP code does not (for

Discover, both address

and ZIP match)

W

Partial — 9-digit ZIP code

matches, address does not

(for Discover, no data from

issuer)

ZPartial — ZIP code matches,

address does not

NNo match — Neither

address nor ZIP code match

U

Unavailable — AVS system

unavailable or issuer does

not support AVS

RRetry — Issuer’s system

unavailable or timed out

S

Not supported — AVS not

sup ported by issuer at this

time

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 15

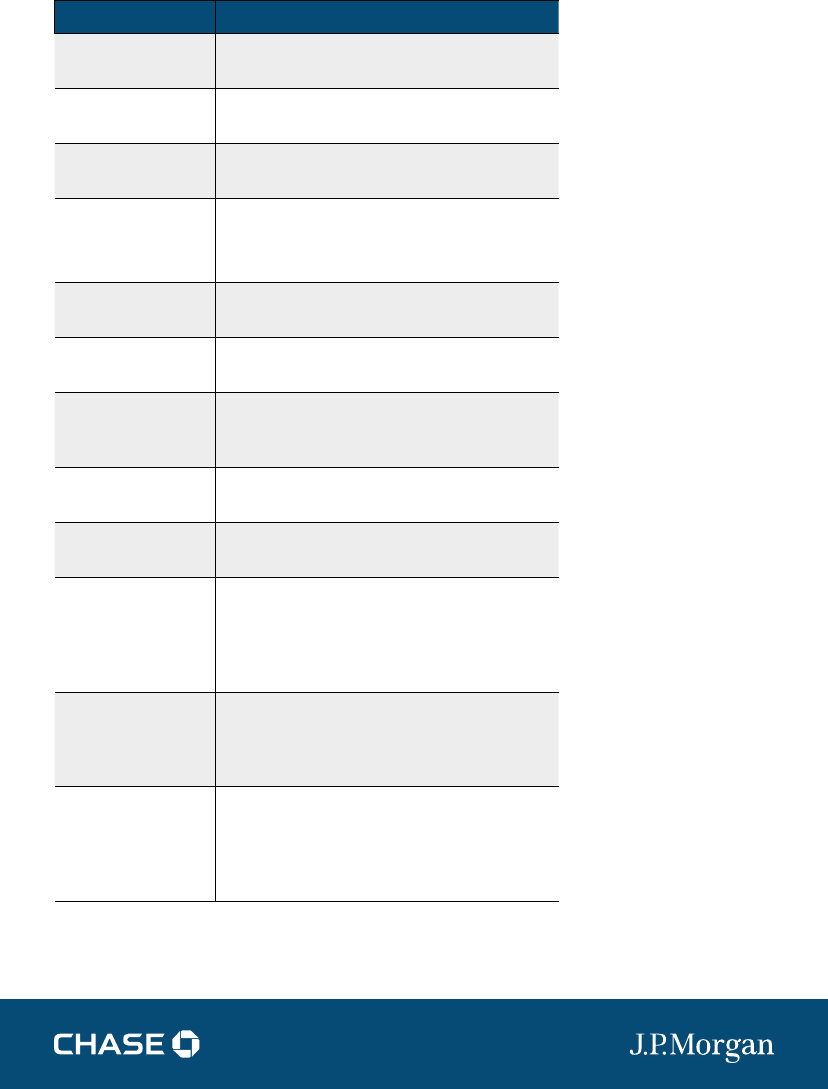

COMMON ERROR CODES

In the event that

your terminal displays

an error, refer to

hese error codes to

troubleshoot your

terminal.

If the code you are

experiencing is not

shown, retry the

transaction, or if

possible, manually

enter the account

number.

If the error persists,

contact your Help

Desk for support.

ERROR CODE DESCRIPTION ACTION

BATCH NEAR

MAX

SETTLE BATCH

The batch capacity of the

terminal is nearly full.

Complete the transaction

and settle as soon as

possible.

PINPAD OUT OF

ORDER

The terminal is configured

for an external PIN pad,

but one is not detected.

Verify that the PIN pad is

connected and receiving

power.

FAULTY CARD The terminal was unable

to read the card.

Re-swipe the card and try

again.

LINE BUSY The phone line is in use

or there may be

problems with the line.

The terminal will retry

automatically.

If the error persists, check

the terminal’s connection

and verify that no other

devices are using the line.

Connect an analog

telephone to listen for

a dial tone. Contact the

service provider if there

is no dial tone.

INVALID

AMOUNT

An amount greater than

the cash back limit, or

the ceiling limit for sale

or oine transactions,

will generate this error.

Retry the transaction with

an amount within the

limit.

CAN’T READ

CHIP

SWIPE ALLOWED

REMOVE CARD

A chip card was inserted

in the chip reader, but

could not be read.

The card can now be

swiped on the terminal.

TAP FAILED

PLEASE INSERT

OR SWIPE

CARD

A contactless card was

tapped on the terminal,

but the card was not

read properly.

Swipe, insert or key the

card on the terminal.

PASSWORD

LOCKED OUT

PRESS ENTER

More than four invalid

attempts have been

made to enter the admin

password.

The admin account will be

locked out for 30 minutes

or another admin account

may reset the locked

account.

PIN TRIES

EXCEEDED

The chip card has

recorded too many

invalid PIN entry attempts.

Request another form of

payment.

ç Back | Forward è

16 | INGENICO | QUICK REFERENCE GUIDE

CHIP TECHNOLOGY Q&A

WHAT IS CHIP TECHNOLOGY?

Chip technology is an evolution in our payment system that will help

increase security, reduce fraud and enable the use of future value-

added applications. Chip cards are embedded with a micro computer

chip. Some may require a PIN instead of a signature to complete the

transaction process.

WHAT ABOUT MAGNETIC STRIPE CARDS?

Your terminal will still have the capability to process magnetic stripe

cards. Chip cards will still have a magnetic stripe in order to be

compatible with other international and regional standards so that

customers will be able to use their cards on your terminal.

WHAT ARE THE TRANSACTION PROCESS AND NEW PROMPTS?

Your terminal can process EMV transactions for chip cards that have

been issued in the U.S. or from other countries. In addition, your

terminal will continue accepting all non-chip payment cards. Simply

use the magnetic stripe for those transactions.

To process a chip card transaction, follow these five steps:

1. Initiate the transaction on your terminal by pressing [0] or [Enter],

and following any additional prompts.

2. Ensure the customer has access to the payment device by passing it

to them if necessary.

3. The customer inserts the chip card into the chip card reader (slot

on the bottom-front of the terminal) and leaves it there until the

transaction completes.

4. Follow the prompts displayed on the terminal.

5. Let the customer complete the transaction by keying in a PIN or

signing the receipt.

WHAT ARE THE BENEFITS FOR MY BUSINESS?

Fraud Protection — Chip technology is virtually impossible to copy,

and combining its use with a PIN helps reduce fraud due to lost, stolen

or counterfeit cards.

Reduced Chargeback Risks — As fraud decreases, so will the amount

of customers who dispute transactions.

Peace of Mind — The acceptance of chip cards will become a payment

brand and PCI compliance mandate, and the adoption of the EMV

process means the card never has to leave the customer’s hand.

EMV chip technology is

the global standard for

credit and debit card

payments. Named after

its original developers

(Europay, MasterCard

and Visa), this smart

chip technology features

payment form factors

(cards, mobile phones,

etc.) with embedded

microprocessor chips

that store and protect

encrypted account user

data.

This enhances the

authentication of both

the card and cardholder,

eectively reducing

fraudulent activity in

the regions that have

adopted this technology.

Chase has been

supporting chip

technology in Canada

for several years and

is playing an active

role in ensuring our

merch ants are ready

when the U.S. payments

industry mandates it.

ç | Table of Contents

QUICK REFERENCE GUIDE | INGENICO | 17

CHIP TECHNOLOGY QUICK TIPS

Smart chip card tech-

nology and the EMV

standard are so new in

the U.S. that your sta

and customers may not

be familiar with how to

accept and successfully

process chip cards.

As you become familiar

with chip technology,

remem-ber that you

can call for technical

support if you have any

questions.

CUSTOMERS USING THEIR CHIP CARD FOR THE FIRST TIME —

Make sure the card stays in the terminal’s chip reader slot for the

duration of the transaction, which ends when the receipt is being

printed. If the card is removed before the end of a transaction, the

payment will not be processed.

INSERTING THE CARD — The card can be inserted into the terminal’s

chip reader slot. Make sure the card is inserted face up, with the

chip first.

FOLLOW THE TERMINAL PROMPTS — When processing any type

of card, follow the prompts on the terminal display. The terminal will

tell you what to do.

CUSTOMER VERIFICATION METHODS — Some customers will

carry a chip card that requires a PIN for identity verification, while

others may require only a signature. Your terminal will recognize the

card and prompt you to follow the required verification process.

FORGOTTEN OR UNKNOWN PINS — If a customer can’t remember

their PIN, they should contact their bank or card issuer to reset the

PIN. Ask for another payment method.

DEALING WITH A LOCKED PIN — If a PIN is locked, then the wrong

PIN has been entered too many times in a row, rendering the card

temporarily unusable. The terminal prompt will tell you whether

payment on this card will be accepted using a signature, or whether

the customer needs to provide a dierent method of payment. The

customer needs to contact their bank or card company to unlock the

PIN. Customer service contact telephone numbers are on the back

of most payment cards and on account statements.

DECLINED TRANSACTIONS — There is no change to procedures for

declined transactions.

REFUNDS — To process a refund, simply insert the card and proceed

with the refund.

ç Back | Forward è

POS-0512 6/17 IC1617 0617 ©2017, Paymentech, LLC (“Chase”). All rights reserved.

FOR MORE INFORMATION

www.chase.com/merchantservices