Mc 105

User Manual: MC 105

Open the PDF directly: View PDF ![]() .

.

Page Count: 385 [warning: Documents this large are best viewed by clicking the View PDF Link!]

1

MANAGEMENT ACCOUNTING: NATURE AND SCOPE

Objective: The present lesson explains the meaning, nature, scope and limitations

of accounting. Further, it discusses the activities covered under

management accounting and its difference with financial accounting.

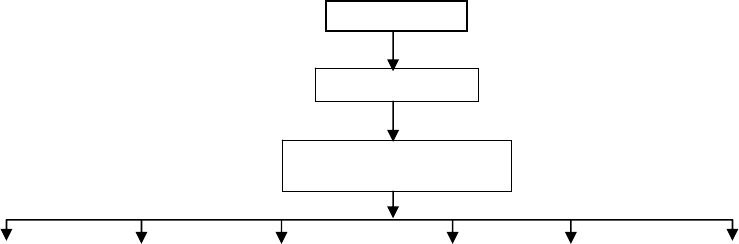

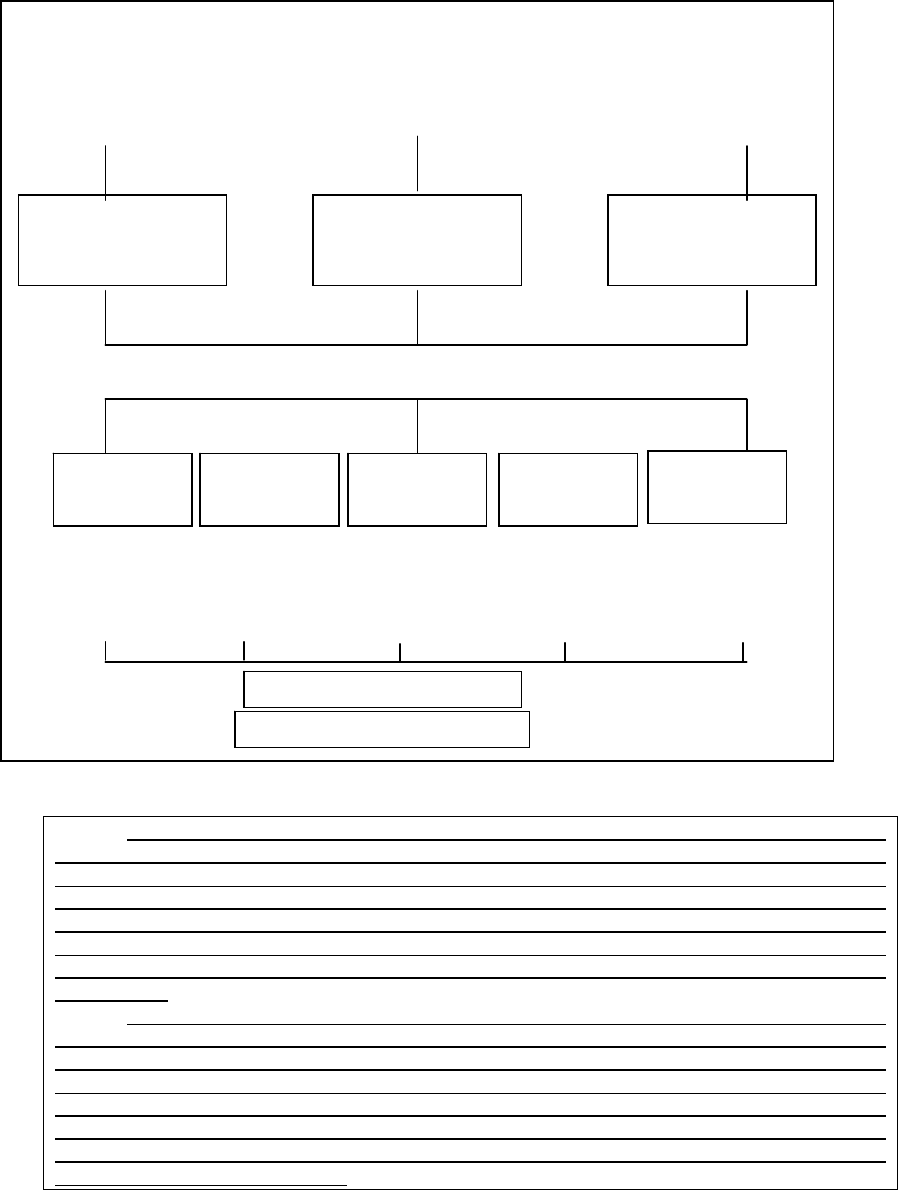

LESSON STRUCTURE

1.1 Introduction

1.2 Definitions of Management Accounting

1.3 Nature of Management Accounting

1.4 Functions of Management Accounting

1.5 Scope of Management Accounting

1.6 The Management Accountant

1.7 Management Accounting and Financial Accounting

1.8 Cost Accounting and Management Accounting

1.9 Limitations of Management Accounting

1.10 Self-Test Questions

1.11 Suggested Readings

1.1 INTRODUCTION

Management accounting can be viewed as Management-oriented Accounting.

Basically it is the study of managerial aspect of financial accounting,

"accounting in relation to management function". It shows how the accounting

function can be re-oriented so as to fit it within the framework of management

activity. The primary task of management accounting is, therefore, to

redesign the entire accounting system so that it may serve the operational

COURSE: MANAGEMENT ACCOUNTING

COURSE CODE: MC-105 AUTHOR: Dr. N. S. MALIK

LESSON: 01

V

ETTER: Prof. M S Turan

2

needs of the firm. If furnishes definite accounting information, past, present or

future, which may be used as a basis for management action. The financial

data are so devised and systematically development that they become a

unique tool for management decision.

1.2 DEFINITIONS OF MANAGEMENT ACCOUNTING

The term “Management Accounting”, observe, Broad and Carmichael, covers

all those services by which the accounting department can assist the top

management and other departments in the formation of policy, control of

execution and appreciation of effectiveness. This definition points out that

management is entrusted with the primary task of planning, execution and

control of the operating activities of an enterprise. It constantly needs

accounting information on which to base its decision. A decision based on

data is usually correct and the risk of erring is minimized. The position of the

management in respect of its functions can be compared to that of an army

general who wants to wage a successful battle. A general can hardly fight

successfully unless he gets full information about the surrounding situation

and the extent of effectiveness of each of his battalions and, to the extend

possible, even the enemy's intentions. Like a general a successful

management too strives to outstrip other competitors in the field by

streamlining its operating efficiency. It needs a thorough knowledge of the

situation and the circumstances in which the firm operates. Such knowledge

can only be gained through the processed financial data rendered by the

accounting department on the basis of which it can take policy decision

regarding execution, control, etc. It is here that the role of management

accounting comes in. It supplies all sorts of accounting information in the

3

form of such statements as may be needed by the management. Therefore,

management accounting is concerned with the accumulation, classification

and interpretation of information that assists individual executives to fulfill

organizational objectives.

The Report of the Anglo-American Council of Productivity (1950) has also

given a definition of management accounting, which has been widely

accepted. According to it, "Management accounting is the presentation of

accounting information in such a way as to assist the management in creation

of policy and the day to day operation of an undertaking". The reasoning

added to this statement was, "the technique of accounting is of extreme

importance because it works in the most nearly universal medium available

for the expression of facts, so that facts of great diversity can be represented

in the same picture. It is not the production of these pictures that is a function

of management but the use of them." An analysis of the above definition

shows that management needs information for better decision-making and

effectiveness. The collection and presentation of such information come

within the area of management accounting. Thus, accounting information

should be recorded and presented in the form of reports at such frequent

intervals, as the management may want. These reports present a systematic

review of past events as well as an analytical survey of current economic

trends. Such reports are mainly suggestive in approach and the data

contained in them are quite up to date. The accounting data so supplied thus

provide the informational basis of action. The quality of information so

supplied depends upon its usefulness to management in decision-making.

The usual approach is that, first of all, a thorough analysis of the whole

4

managerial process is made, then the information required for each area is

explored, and finally, all the information, after analysis in terms of alternatives,

is taken into consideration before arriving at a management decision. It is to

be understood here that the accounting information has no end in itself; it is a

means to an end. As its basic idea is to serve the management, its form and

frequency are all decided by managerial needs. Therefore, accounting aids

the management by providing quantitative information on the economic well

being of the enterprise. It would be appropriate if we called management

accounting an Enterprise Economics. Its scope extends to the use of certain

modern sophisticated managerial techniques in analyzing and interpreting

operative data and to the establishment of a communication network for

financial reporting at all managerial levels of an organization.

1.3 NATURE OF MANAGEMENT ACCOUNTING

The term management accounting is composed of 'management' and

'accounting'. The word 'management' here does not signify only the top

management but the entire personnel charged with the authority and

responsibility of operating an enterprise. The task of management accounting

involves furnishing accounting information to the management, which may

base its decisions on it. It is through management accounting that the

management gets the tools for an analysis of its administrative action and can

lay suitable stress on the possible alternatives in terms of costs, prices and

profits, etc. but it should be understood that the accounting information

supplied to management is not the sole basis for managerial decisions. Along

with the accounting information, management takes into consideration or

weighs other factors concerning actual execution. For reaching a final

5

decision, management has to apply its common sense, foresight, knowledge

and experience of operating an enterprise, in addition to the information that is

already has.

The word 'accounting' used in this phrase should not lead us to believe that it

is restricted to a mere record of business transactions i.e., book keeping only.

It has indeed a 'macro-economic approach'. As it draws its raw material from

several other disciplines like costing, statistics, mathematics, financial

accounting, etc., it can be called an interdisciplinary subject, the scope of

which is not clearly demarcated. Other fields of study, which can be covered

by management accounting, are political science, sociology, psychology,

management, economics, statistics, law, etc. A knowledge of political science

helps to understand authority relationship and responsibility identification in an

organization. A study of sociology helps to understand the behaviour of man

in groups. Psychology enables us to know the mental make-up of employers

and employees. A knowledge of these subjects helps to increase motivation,

and to control the actions of the people who are ultimately responsible for

costs. This builds a better employer-employee relationship and a sound

morale. The subject of management reveals the processes involved in the art

of managing, a knowledge of economics assists in the determination of

optimum output in the forecasting of sales and production, etc., and also

makes it possible to analyze management action in terms of cost revenues,

profits, growth, etc. It is with the help of statistics that this information is

presented to the management in a form that can be assimilated. The subject

of management accounting also encompasses the subject of law, knowledge

6

of which is necessary to find out if the management action is ultra-vires or not.

It is, therefore, a wide and diverse subject.

Management accounting has no set principles such as the double entry

system of bookkeeping. In place of generally accepted accounting principles,

the philosophy of cost benefit analysis is the core guide of this discipline. It

says that no accounting system is good or bad but is can be considered

desirable so long as it brings incremental benefits in excess of its incremental

costs. Applying management accounting principles to financial matters can

arrive at no single perfect solution. It is, therefore, an inexact science, which

uses its own conventions rather than standardized principles. The facts to be

studied here can be interpreted in different ways and the precision of the

inferences depends upon the skill, judgement and common sense of different

management accountants. It occupies a middle position between a fully

matured and an infant subject.

Since management accounting is managerially oriented, its data is selective in

nature. It focuses on potential opportunities rather than opportunities lost.

The data is operative in nature catering to the operational needs of a firm. It

details events, monetary and non-monetary. The nature of data, the form of

presentation and its duration are mainly determined by managerial needs. It

is quite frequently reported as it is meant for internal uses and managerial

control. An accountant should look at his enterprise from the management's

point of view. Whenever he fails to do that he ceases to be a management

accountant.

Management accounting is highly sensitive to management needs. However,

it assists the management and does not replace it. It represents a service

7

phase of management rather than a service to management from

management accountant. It is rather highly personalized service. Finally, it

can be said that the management accounting serves as a management

information system and so enables the management to manage better.

1.4 FUNCTIONS OF MANAGEMENT ACCOUNTING

The basic function of management accounting is to assist the management in

performing its functions effectively. The functions of the management are

planning, organizing, directing and controlling. Management accounting helps

in the performance of each of these functions in the following ways:

(i) Provides data: Management accounting serves as a vital source of

data for management planning. The accounts and documents are a

repository of a vast quantity of data about the past progress of the

enterprise, which are a must for making forecasts for the future.

(ii) Modifies data: The accounting data required for managerial decisions

is properly compiled and classified. For example, purchase figures for

different months may be classified to know total purchases made

during each period product-wise, supplier-wise and territory-wise.

(iii) Analyses and interprets data: The accounting data is analyzed

meaningfully for effective planning and decision-making. For this

purpose the data is presented in a comparative form. Ratios are

calculated and likely trends are projected.

(iv) Serves as a means of communicating: Management accounting

provides a means of communicating management plans upward,

downward and outward through the organization. Initially, it means

identifying the feasibility and consistency of the various segments of

8

the plan. At later stages it keeps all parties informed about the plans

that have been agreed upon and their roles in these plans.

(v) Facilitates control: Management accounting helps in translating

given objectives and strategy into specified goals for attainment by a

specified time and secures effective accomplishment of these goals in

an efficient manner. All this is made possible through budgetary

control and standard costing which is an integral part of management

accounting.

(vi) Uses also qualitative information: Management accounting does

not restrict itself to financial data for helping the management in

decision making but also uses such information which may not be

capable of being measured in monetary terms. Such information may

be collected form special surveys, statistical compilations, engineering

records, etc.

1.5 SCOPE OF MANAGEMENT ACCOUNTING

Management accounting is concerned with presentation of accounting

information in the most useful way for the management. Its scope is,

therefore, quite vast and includes within its fold almost all aspects of business

operations. However, the following areas can rightly be identified as falling

within the ambit of management accounting:

(i) Financial Accounting: Management accounting is mainly concerned

with the rearrangement of the information provided by financial

accounting. Hence, management cannot obtain full control and

coordination of operations without a properly designed financial

accounting system.

9

(ii) Cost Accounting: Standard costing, marginal costing, opportunity

cost analysis, differential costing and other cost techniques play a

useful role in operation and control of the business undertaking.

(iii) Revaluation Accounting: This is concerned with ensuring that capital

is maintained intact in real terms and profit is calculated with this fact in

mind.

(iv) Budgetary Control: This includes framing of budgets, comparison of

actual performance with the budgeted performance, computation of

variances, finding of their causes, etc.

(v) Inventory Control: It includes control over inventory from the time it is

acquired till its final disposal.

(vi) Statistical Methods: Graphs, charts, pictorial presentation, index

numbers and other statistical methods make the information more

impressive and intelligible.

(vii) Interim Reporting: This includes preparation of monthly, quarterly,

half-yearly income statements and the related reports, cash flow and

funds flow statements, scrap reports, etc.

(viii) Taxation: This includes computation of income in accordance with the

tax laws, filing of returns and making tax payments.

(ix) Office Services: This includes maintenance of proper data processing

and other office management services, reporting on best use of

mechanical and electronic devices.

(x) Internal Audit: Development of a suitable internal audit system for

internal control.

(xi)

10

1.6 THE MANAGEMENT ACCOUNTANT

Management Accounting provides significant economic and financial data to

the management and the Management Accountant is the channel through

which this information efficiently and effectively flows to the management. The

Management Accountant has a very significant role to perform in the

installation, development and functioning of an efficient and effective

management information system. He designs the framework of the financial

and cost control reports that provide each management level with the most

useful data at the most appropriate time. He educates executives in the need

for control information and ways of using it. This is because his position is

unique with respect to information about the organization. Apart from top

management no one in the organization perhaps knows more about the

various functions of the organization than him. He is, therefore, sometimes

described as the Chief Intelligence Officer of the top management. He

gathers information, breaks it down, sifts it out and organizes it into

meaningful categories. He separates relevant and irrelevant information and

then ranks relevant information in an intelligible form to the management and

sometimes also to those who are interested in the information in the

information outside the company. He also compares the actual performance

with the planned one and reports and interprets the results of operations to all

levels of management and to the owners of the business. Thus, in brief,

management accountant or controller is the person who designs the

management information system for the organization, operates it by means of

interlocked budgets, computes variances and exhorts others to institute

11

corrective measures. Mr. P.L. Tandon has explained beautifully the position

of the management accountant in the following words.

"The management accountant is exactly like the spokes in a wheel,

connecting the rim of the wheel and the hub receiving the information. He

processes the information and then returns the processed information back to

where it came from"1.

Dr. Don barker2 sees a very bright future for the management accountants.

According to him, "Management Accountants will be presented with many

opportunities for innovative actions in the global economic environment. In

addition to their role of providing accurate, timely and relevant information,

management accountants will be expected to participate as business

consultants and partners with management in the strategic planning process".

Thus, there are tremendous possibilities for management accountants to

shine as a professional group in the years to come. To fit in this role, it is

necessary that the management accountants develop effective

communication abilities, adopt a structured approach, a flexible

accommodation and keep themselves aware with the latest evolving

technologies in the profession.

FUNCTIONS OF MANAGEMENT ACCOUNTANT

It is the duty of the management accountant to keep all levels of management

informed of their real position. He has, therefore, varied functions to perform.

His important functions can be summarized as follows:

1 Tandon, P.L.: "The Role of Management Accountants in General Management”. 4th All India

Seminar on Management Accounting, Lucknow, Feb. 1963.

2. President (1991-92), The Institute of Management Accountants, USA.

12

(i) Planning: He has to establish, coordinate and administer as an

integral part of management, an adequate plan for the control of the

operations. Such a plan would include profit planning, programmes of

capital investment and financing, sales forecasts, expenses budgets

and cost standards.

(ii) Controlling: He has to compare actual performance with operating

plans and standards and to report and interpret the results of

operations to all levels of management and the owners of the business.

This id done through the compilation of appropriate accounting and

statistical records and reports.

(iii) Coordinating: He consults all segments of management responsible

for policy or action. Such consultation might concern any phase of the

operation of the business having to do with attainment of objectives

and the effectiveness of the organizational structures and policies.

(iv) Other functions:

¾ He administers tax policies and procedures.

¾ He supervises and coordinated the preparation of reports to

governmental agencies.

¾ He ensures fiscal protection for the assets of the business through

adequate internal control and proper insurance coverage.

¾ He carries out continuous appraisal economic and social forces and

the government influences, and interprets their effect on the

business.

It should be noted that the functions of a Management Accountant are

more of those of a 'staff official'. He, in addition to processing historical

13

data, supplies a good deal of information concerning the future

operations in line with the management's needs. Besides serving top

management with information concerning the company as a whole, he

supplies detailed information to the line officers regarding alternative

plans and their profitability, which help them in decision-making. As a

matter of fact the Management Accountant should not bother himself

regarding the decision taken by the line officials after tendering advice

unless he has reasonable grounds to believe that such a decision is

going to affect the interests of corporation adversely. In such an event

also he should report it to the concerned level of management with

tact, firmness combined with politeness.

1.7 MANAGEMENT ACCOUNTING AND FINANCIAL ACCOUNTING

Financial accounting and management accounting are closely interrelated

since management accounting is to a large extent rearrangement of the data

provided by financial accounting. Moreover, all accounting is financial in the

sense that all accounting systems are in monetary terms and management is

responsible for the contents of the financial accounting statements. In spite of

such a close relationship between the two, there are certain fundamental

differences. These differences can be laid down as follows:

(i) Objectives: Financial accounting is designed to supply information in

the form of profit and loss account and balance sheet to external

parties like shareholders, creditors, banks, investors and Government.

Information is supplied periodically and is usually of such type in which

management is not much interested. Management Accounting is

designed principally for providing accounting information for internal

14

use of the management. Thus, financial accounting is primarily an

external reporting process while management accounting is primarily

an internal reporting process.

(ii) Analyzing performance: Financial accounting portrays the position of

business as a whole. The financial statements like income statement

and balance sheet report on overall performance or statues of the

business. On the other hand, management accounting directs its

attention to the various divisions, departments of the business and

reports about the profitability, performance, etc., of each of them.

Financial accounting deals with the aggregates and, therefore, cannot

reveal what part of the management action is going wrong and why.

Management accounting provides detailed analytical data for these

purposes.

(iii) Data used: Financial accounting is concerned with the monetary

record of past events. It is a post-mortem analysis of past activity and,

therefore, out the date for management action. Management

accounting is accounting for future and, therefore, it supplies data both

for present and future duly analyzed in detail in the 'management

language' so that it becomes a base for management action.

(iv) Monetary measurement: In financial accounting only such economic

events find place, which can be described in money. However, the

management is equally interested in non-monetary economic events,

viz., technical innovations, personnel in the organization, changes in

the value of money, etc. These events affect management's decision

and, therefore, management accounting cannot afford to ignore them.

15

For example, change in the value of money may not find a place in

financial accounting on account of "going concern concept". But while

affecting an insurance policy on an asset or providing for replacement

of an asset, the management will have to take into account this factor.

(v) Periodicity of reporting: The period of reporting is much longer in

financial accounting as compared to management accounting. The

Income Statement and the Balance Sheet are usually prepared yearly

or in some cases half-yearly. Management requires information at

frequent intervals and, therefore, financial accounting fails to cater to

the needs of the management. In management accounting there is

more emphasis on furnishing information quickly and at comparatively

short intervals as per the requirements of the management.

(vi) Precision: There is less emphasis on precision in case of

management accounting as compared to financial accounting since the

information is meant for internal consumption.

(vii) Nature: Financial accounting is more objective while management

accounting is more subjective. This is because management

accounting is fundamentally based on judgement rather than on

measurement.

(viii) Legal compulsion: Financial accounting has more or less become

compulsory for every business on account of the legal provisions of

one or the other Act. However, a business is free to install or not to

install system of management accounting.

The above points of difference between Financial Accounting and

Management Accounting prove that Management Accounting has flexible

16

approach as compared to rigid approach in the case of Financial Accounting.

In brief, financial accounting simply shows how the business has moved in the

past while management accounting shows how the business has to move in

the future.

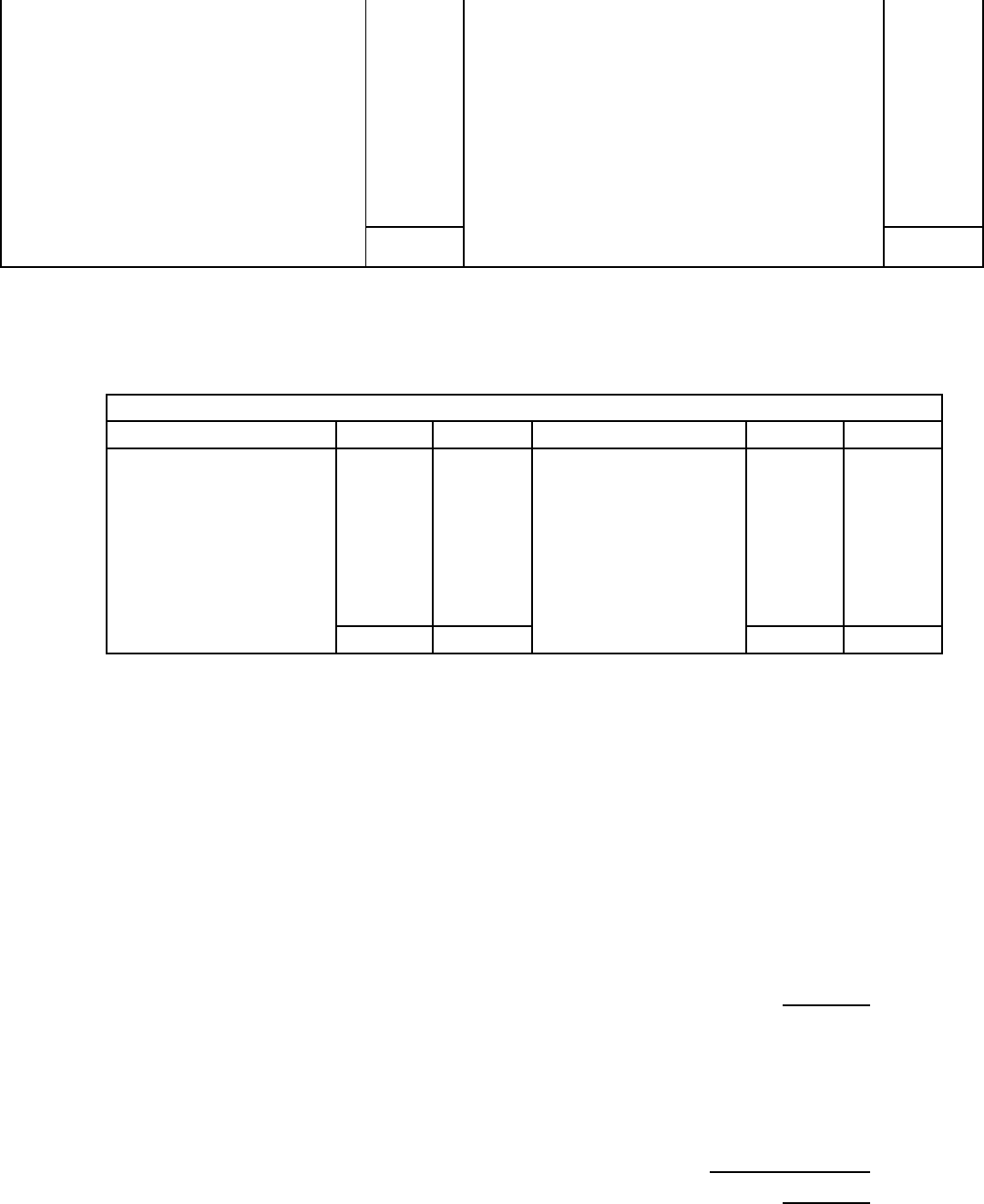

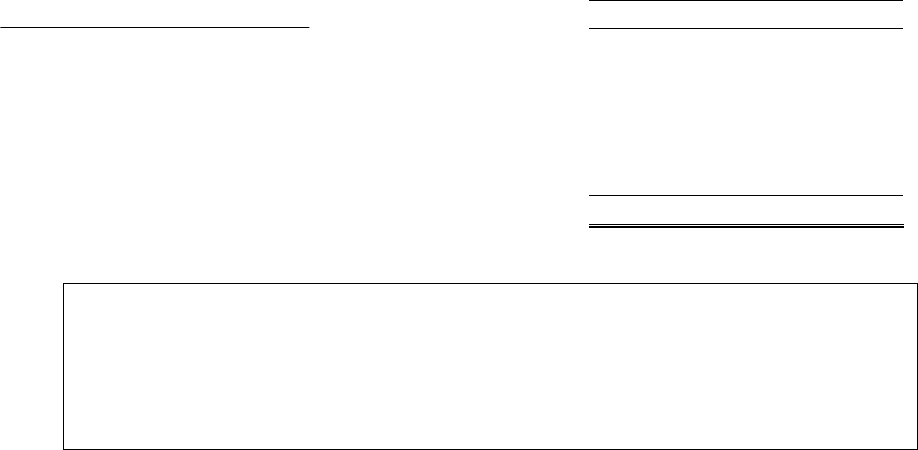

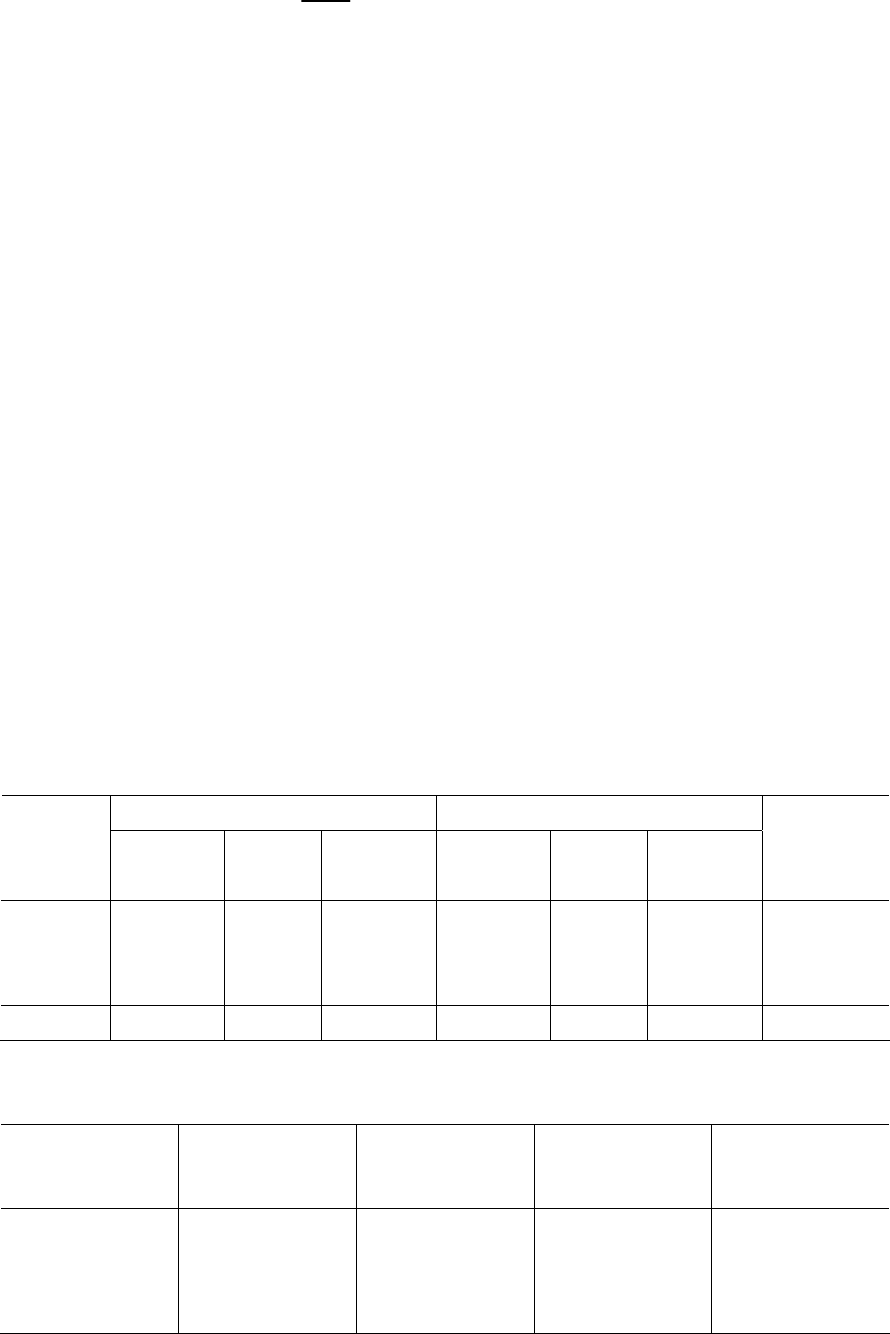

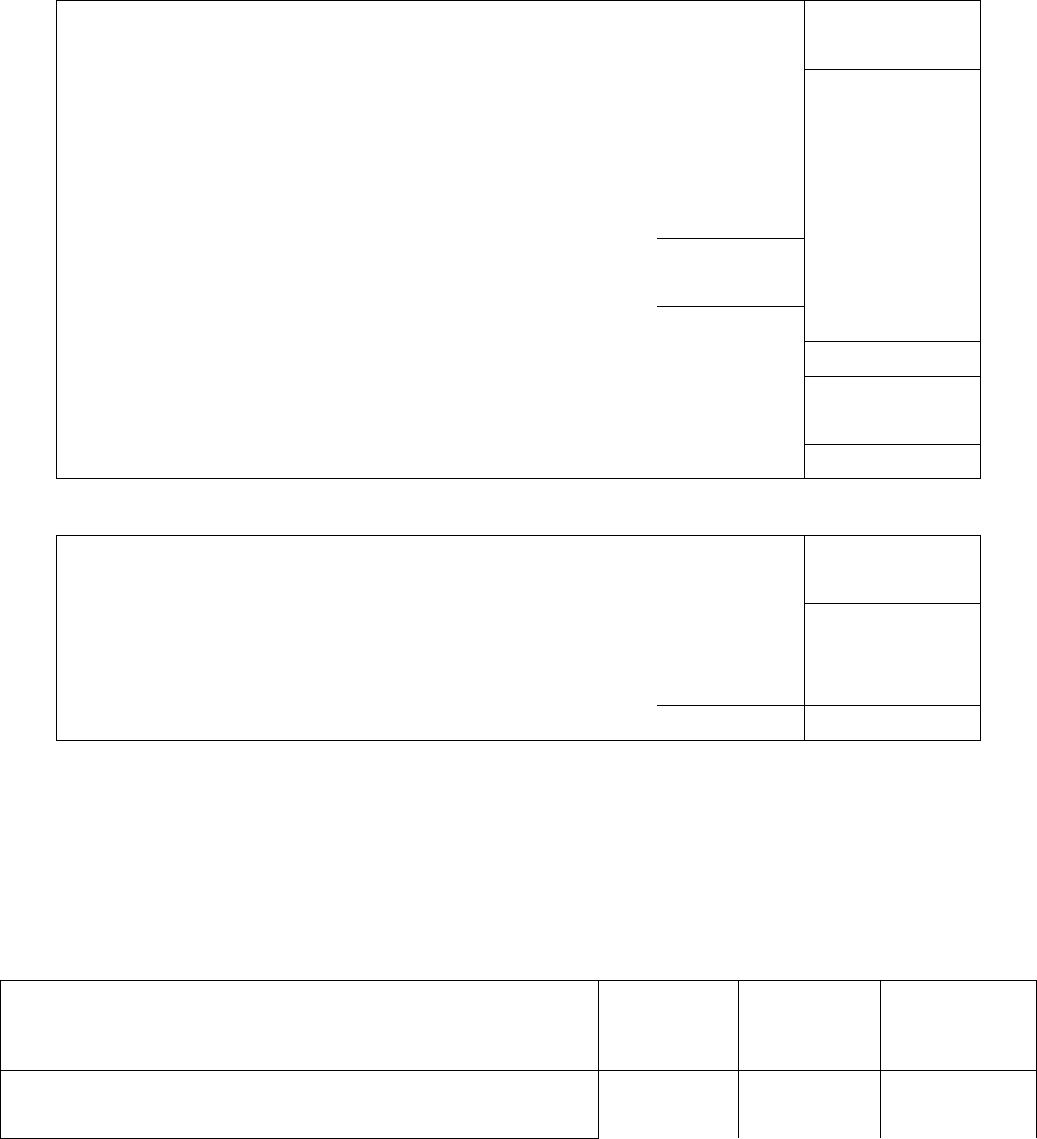

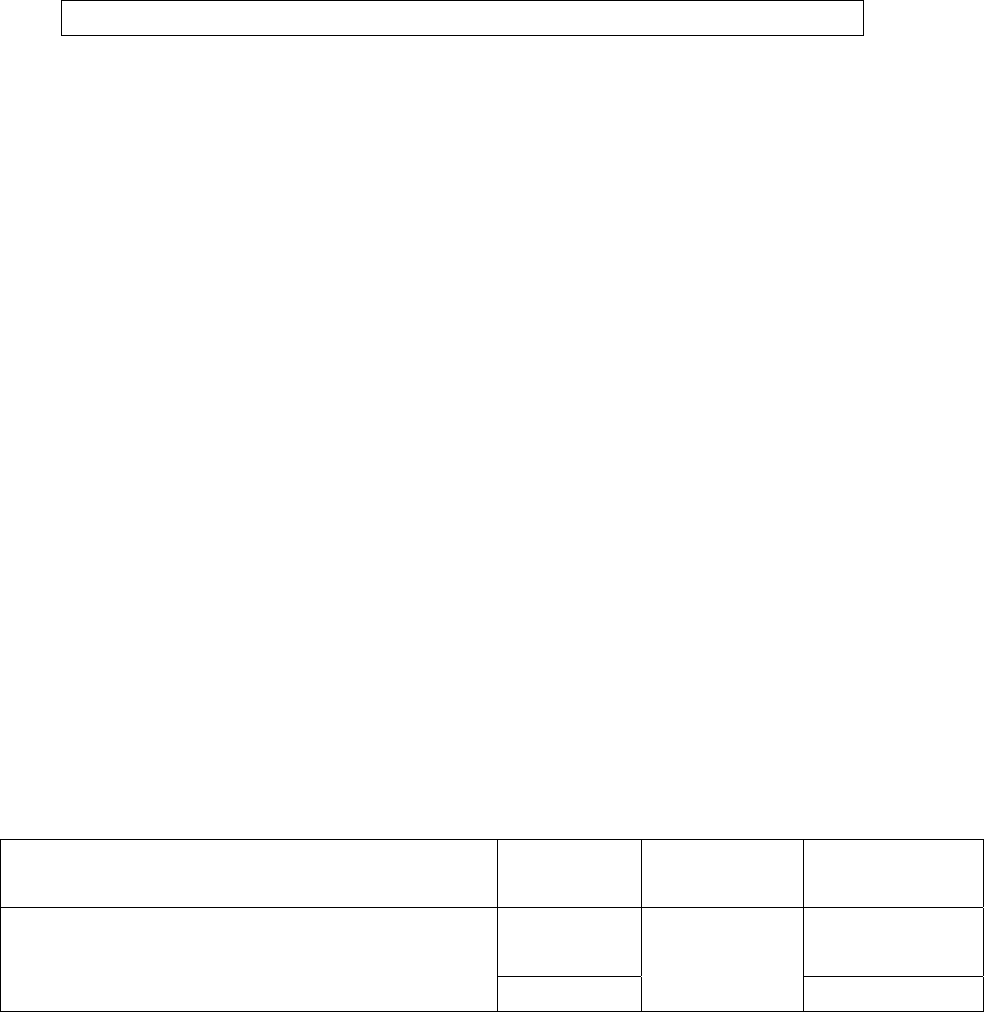

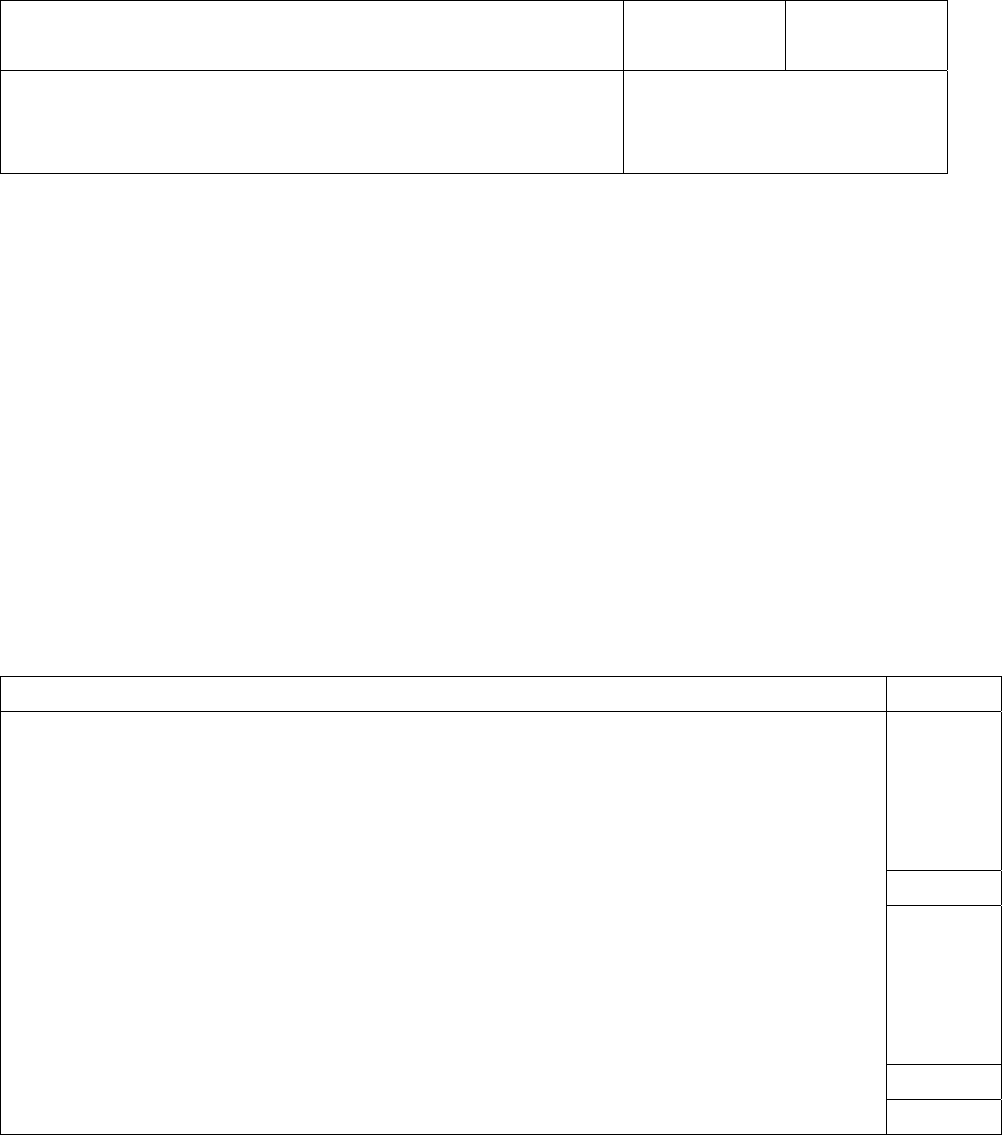

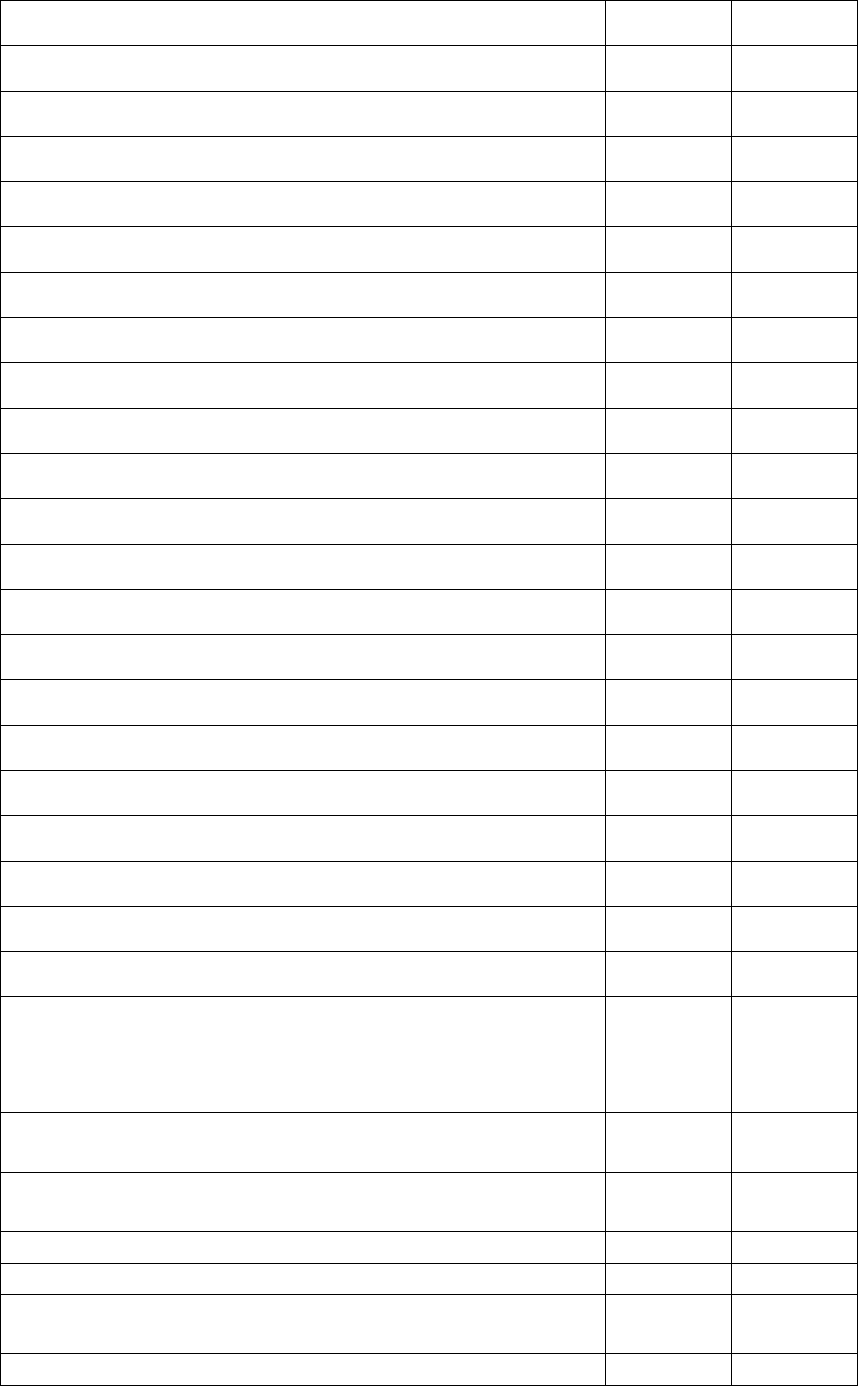

An attempt may now be made to compare and study the two types of

accounting on basis of the characteristics of the data used. It is presented

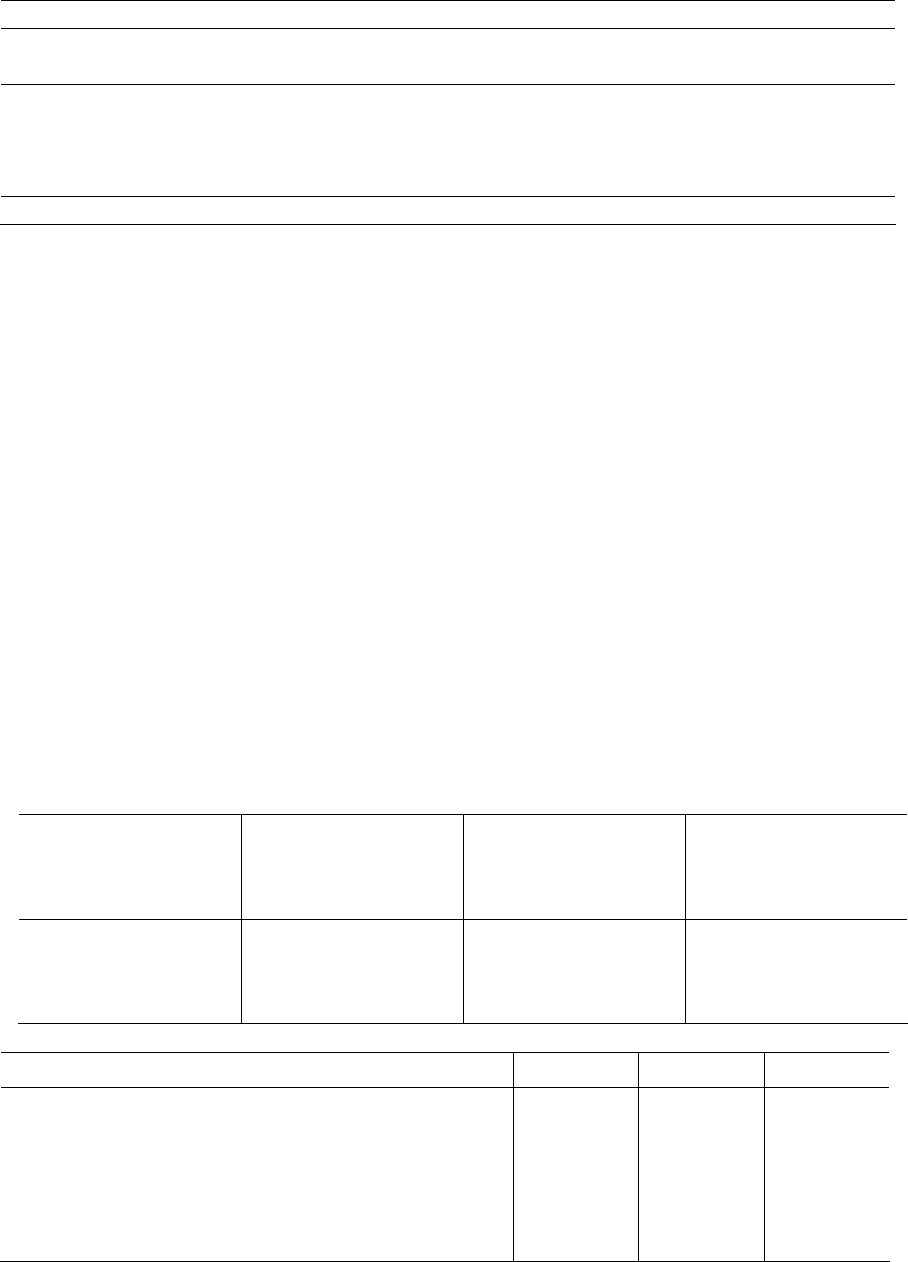

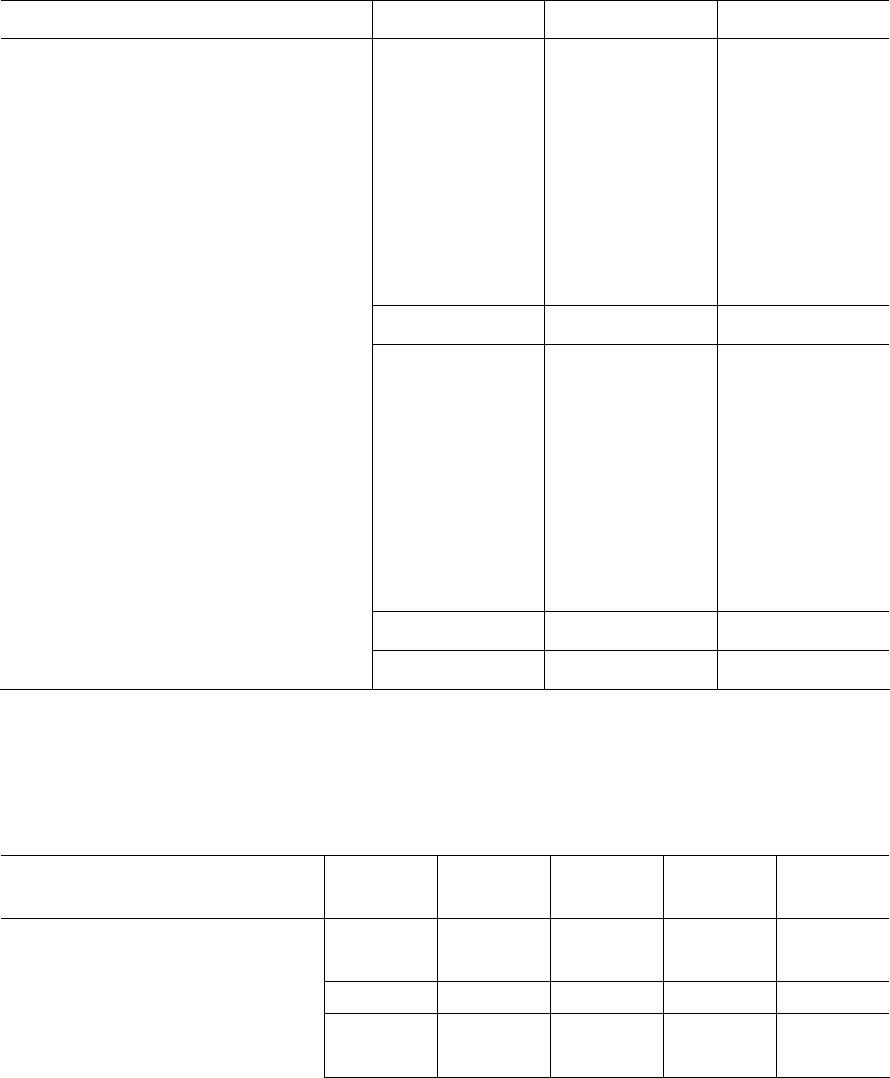

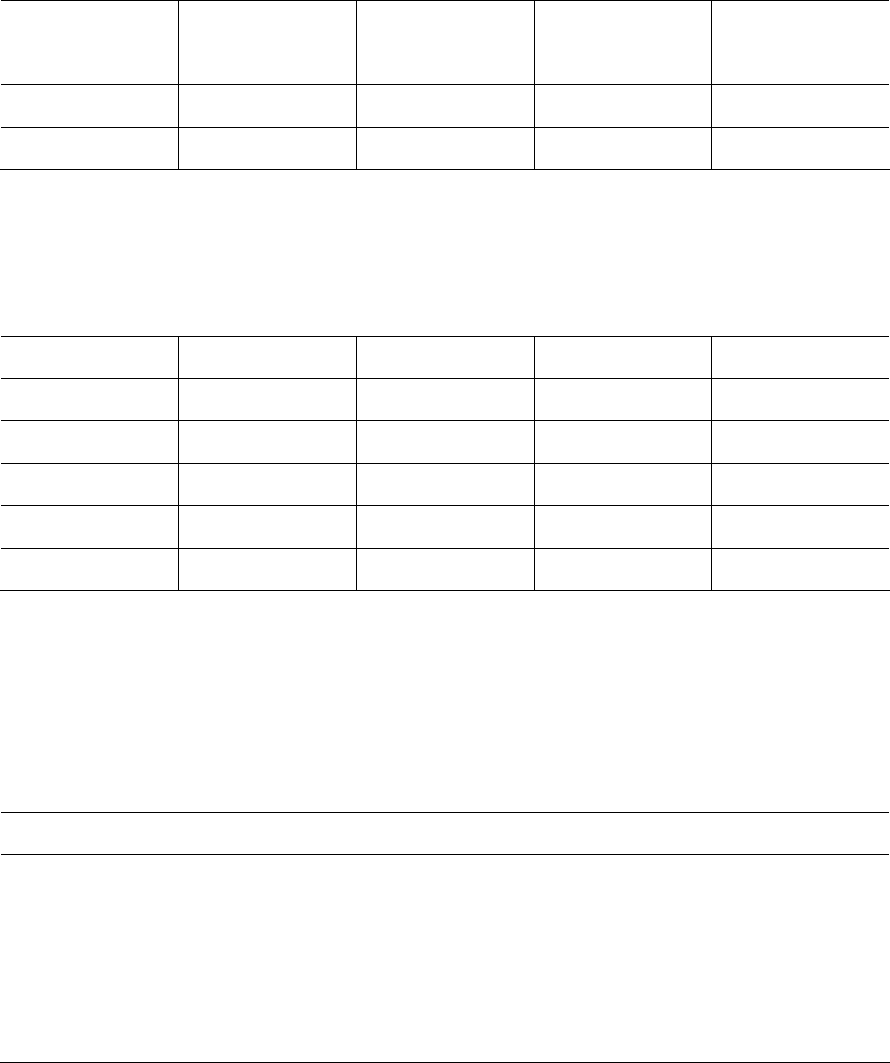

through the box- 1.1, given below.

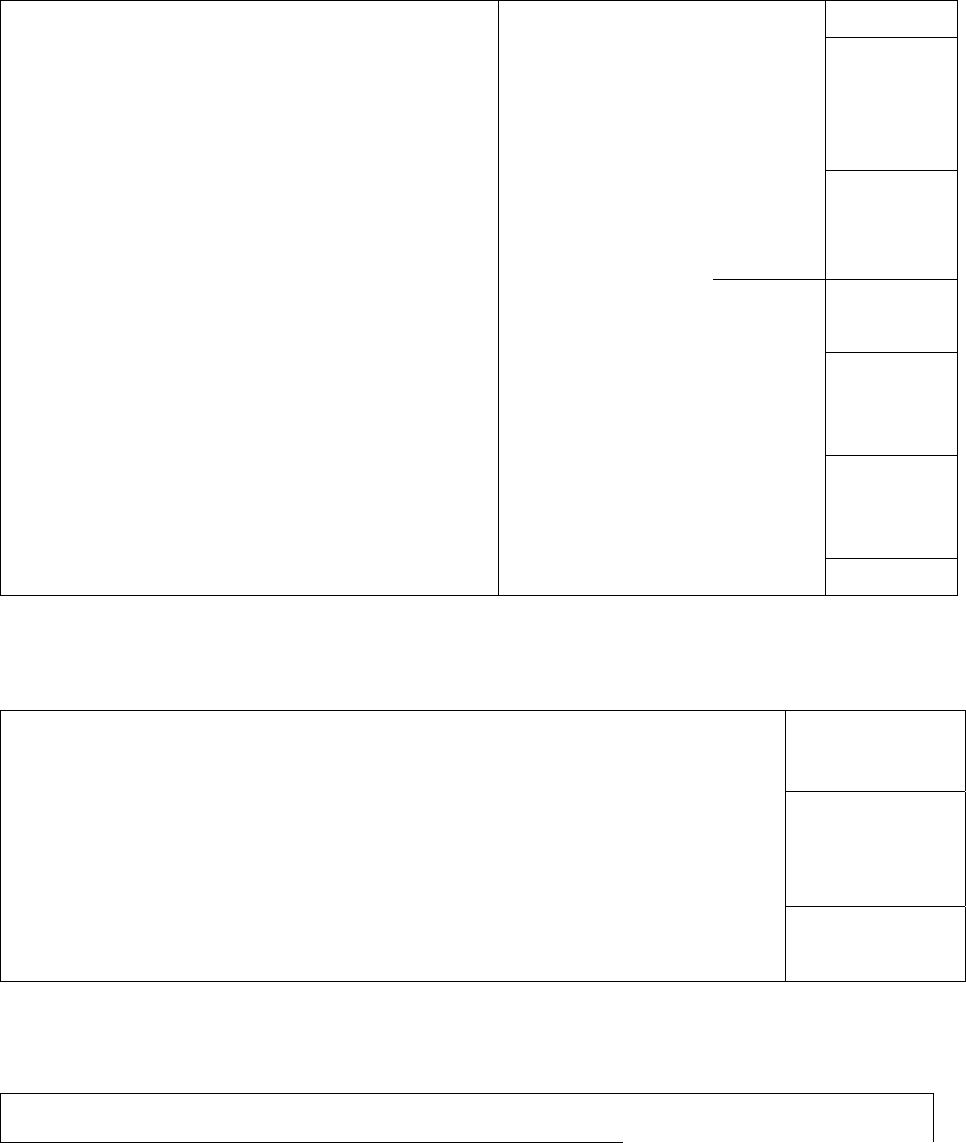

Box 1.1

Features of data Provided by Financial Provided by

Accounting Management accounting

1. Period After a stated period At frequent intervals

2. Time Historical data Current and future data

3. Unit of expression Money only Any statistical unit

4. Nature Actual data Projected data

5. Specificity Aggregates Detailed analysis

6. Description Money consequences Events

7. Reality Objective Subjective

8. Precision Pie to Pie accuracy May be guess-work

9. Principles Double entry system Cost benefit analysis

10. Legality Obligatory Optional

11. Purpose Overview of entire Analytical details of such

Business activity activities as call for decisions

1.8 COST ACCOUNTING AND MANAGEMENT ACCOUNTING

Cost accounting is the process of accounting for costs. It embraces the

accounting procedures relating to recording of all income and expenditure and

the preparation of periodical statements and reports with the object of

ascertaining and controlling costs. It is, thus, the formal mechanism by

means of which the costs of products or services are ascertained and

controlled. On the other hand, management accounting involves collecting,

analyzing, interpreting and presenting all accounting information, which is

useful to the management. It is closely associated with management control,

which comprises planning, executing, measuring and evaluating the

17

performance of an organization. Thus, management accounting draws

heavily on cost data and other information derived from cost accounting.

Today cost accounting is generally indistinguishable from the so-called

management accounting or internal accounting because it serves multiple

purposes. However, management accounting can be distinguished from cost

accounting in one important respect. Management accounting has a wider

scope as compared to cost accounting. Cost accounting deals primarily with

cost data while management accounting involves the considerations of both

cost and revenue. Management accounting is an all inclusive accounting

information system, which covers financial accounting, cost accounting, and

all aspects of financial management. But it is not a substitute for other

accounting functions. It involves a continuous process of reporting cost,

financial and other relevant data in an analytical and informative way to

management. We should not be very much concerned with boundaries of cost

accounting and management accounting since they are complementary in

nature. In the absence of a suitable system of cost accounting, management

accountant will not be in a position to have detailed cost information and his

function is bound to lose significance. On the other hand, the management

accountant cannot effectively use the cost data unless it has been reported to

him in a meaningful and informative form.

1.9 LIMITATIONS OF MANAGEMENT ACCOUNTING

Management accounting, being comparatively a new discipline, suffers from

certain limitations, which limit its effectiveness. These limitations are as

follows:

18

1. Limitations of basic records: Management accounting derives its

information from financial accounting, cost accounting and other

records. The strength and weakness of the management accounting,

therefore, depends upon the strength and weakness of these basic

records. In other words, their limitations are also the limitations of

management accounting.

2. Persistent efforts. The conclusions draws by the management

accountant are not executed automatically. He has to convince people

at all levels. In other words, he must be an efficient salesman in selling

his ideas.

3. Management accounting is only a tool: Management accounting

cannot replace the management. Management accountant is only an

adviser to the management. The decision regarding implementing his

advice is to be taken by the management. There is always a

temptation to take an easy course of arriving at decision by intuition

rather than going by the advice of the management accountant.

4. Wide scope: Management accounting has a very wide scope

incorporating many disciplines. It considers both monetary as well as

non-monetary factors. This all brings inexactness and subjectivity in

the conclusions obtained through it.

5. Top-heavy structure: The installation of management accounting

system requires heavy costs on account of an elaborate organization

and numerous rules and regulations. It can, therefore, be adopted only

by big concerns.

19

6. Opposition to change: Management accounting demands a break

away from traditional accounting practices. It calls for a rearrangement

of the personnel and their activities, which is generally not like by the

people involved.

7. Evolutionary stage: Management accounting is still in its initial stage.

It has, therefore, the same impediments as a new discipline will have,

e.g., fluidity of concepts, raw techniques and imperfect analytical tools.

This all creates doubt about the very utility of management accounting.

1.10 SELF-TEST QUESTIONS

1. What do you mean by management accounting? Explain giving examples.

2. What are the functions of a management accountant? Elaborate each one

of them.

3. Explain the benefits of management accounting in the business sector and

service sector.

4. Distinguish management accounting from financial accounting and cost

accounting.

5. Explain the limitations of management accounting.

1.11 SUGGESTED READINGS

1. Ashish K. Bhattacharya, Principles and Practices of Cost Accounting

(3rd.), New Delhi: Prentice Hall of India Private Limited, 2004.

2. Charles T. Horngren, Cost Accounting, A Managerial Emphasis,

Prentice Hall Inc., 1973.

3. D. T. Decoster and E. L. Schafer, Management Accounting, New York:

John Willey and Sons, 1979.

4. John G. Blocker and Wettmer W. Keith, Cost Accounting, New Delhi:

Tata Mc Grw Publishing Co. Ltd., 1976.

5. R. K. Sharma and Shashi K. Gupta, Management Accounting-

Principles and Practice (7th.), New Delhi: Kalyani Publishers, 1996.

20

FINANCIAL STATEMENT ANALYSIS

Objective: The present lesson explains the discrepancy between accounting

income and economic income; identify the devices used in practice to

exploit the use of the bottom line; the use of a firm's financial

statements to calculate standard financial ratios; decompose the return

on equity into its key determinants; carry out comparative analysis; and

highlights the uses of financial statement analysis for different

purposes.

LESSON STRUCTURE

2.1 Introduction

2.2 Financial Statements

2.3 Financial Statement Analysis

2.4 Methodical Presentation of Financial Statement Analysis

2.5 Techniques /Tools of Financial Statement Analysis

2.6 Self-Test Questions

2.7 Suggested Readings

2.1 INTRODUCTION

Financial statements are an important source of information for evaluating the

performance and prospects of a firm. If properly analyzed and interpreted,

financial statements can provide valuable insights into a firm's performance.

Analysis of financial statements is of interest to lenders (short term as well as

long term), investors, security analysts, managers, and others. Financial

statement analysis may be done for a variety of purposes, which may range

COURSE: MANAGEMENT ACCOUNTING

COURSE CODE: MC-105 AUTHOR: DR. N. S. MALIK

LESSON: 02

V

ETTER: Dr. Karam Pal

21

from a simple analysis of the short-term liquidity position of the firm to a

comprehensive assessment of the strengths and weaknesses of the firm in

various areas. It is helpful in assessing corporate excellence, judging

creditworthiness, forecasting bond ratings, evaluating intrinsic value of equity

shares, predicting bankruptcy, and assessing market risk.

2.2 FINANCIAL STATEMENTS

Managers, shareholders, creditors and other interested groups seek answers

to the following questions about a firm: What is the financial position of firm at

a given point of time? How has the firm performed financially over a given

period of time? What have been the sources and uses of cash over a given

period? To answer these questions, the accountant prepares two principal

statements, the balance sheet and the profit and loss account, and an

ancillary statement, the cash flow statement.

2.2.1 BALANCE SHEET

The balance sheet shows the financial condition of a business at a given point

of time. As per the Companies Act, the balance sheet of a company shall be

in either the account (horizontal) form or the report (vertical) form. Exhibit 2.1

shows the balance sheet of Horizon Limited as on March 31, 2005 cast in the

account as well as the report form. While the report form is most commonly

used by companies, it is more convenient to explain the contents of the

balance sheet of Horizon Limited, cast in the account form, as given Exhibit

2.2.

Structure of Balance Sheet as per the Companies Act

Exhibit 2.1 Account Form

22

Liabilities Assets

Share capital Fixed assets

Reserves and surplus Investments

Unsecured loans Current assets, loans and

advances

Current liabilities and provisions Current assets

Current liabilities Loans and advances

Provisions Miscellaneous expenditure

and losses

Exhibit 2.2 Report Form

I Sources of Funds

(1) Shareholders funds

(a) Share capital

(b) Reserves & surplus

(2) Loan funds

(a) Secured loans

(b) Unsecured loans

II Application of Funds

(1) Fixed assets

(2) Investments

(3) Current assets, loans and advances

Less: Current liabilities and provisions

Net current assets

(4) Miscellaneous expenditure and losses.

Liabilities. Liabilities defined very broadly represent what the business entity

owes others. The Companies Act classifies them as share capital, reserves

and surplus, secured loans, unsecured loans, current liabilities and provisions

Share Capital: This is divided into two types: equity capital and preference

capital. The first represents the contribution of equity shareholders who are

the owners to the firm. Equity capital, being risk capital, carries no fixed rate

of dividend. Preference capital represents the contribution of preference

shareholders and the dividend rate payable on it is fixed.

23

Reserves and Surplus: Reserves and surplus are profits, which have been

retained in the firm. There are two types of reserves: revenue reserves and

capital reserves. Revenue reserves represent accumulated retained earning

from the profits of normal business operations. These are held in various

forms: general reserve, investment allowance reserve, capital redemption

reserves, dividend equalization reserve, and so on. Capital reserves arise out

gains, which are not related to normal business operations. Examples of such

gains are the premium on issue of shares or gain on revaluation of assets.

Surplus is the balance in the profit and loss account, which has not been

appropriated to any particular reserve account. Note that reserves and

surplus along with equity capital represent owners' equity or net worth.

Secured Loans: These are the borrowings of the firm against which specific

collateral have been provided. The important components of secured loans

are: debentures, loans from financial institutions, and loans from commercial

banks.

Unsecured Loans. These are the borrowing of the firm against which no

specific security has been provided. The major components of unsecured

loans are: fixed deposits, loans and advances from promoters, inter-corporate

borrowings, and unsecured loans from banks.

Current liabilities and Provisions: Current liabilities and provisions, as per

the classification under the companies Act, consist of the amounts due to the

suppliers of goods and services bought on credit, advance payments

received, accrued expenses, unclaimed dividend, provisions for taxes,

dividends, and so on. Current liabilities for managerial purposes (as distinct

from their definition in the Companies Act) are obligations, which are expected

24

to mature in the next twelve months. So defined, they include current

liabilities and provisions as per the classification under the Companies Act

plus loans (secured and unsecured) which are repayable within one year from

the date of the balance sheet.

Assets: Broadly speaking, assets represent resources, which are of some

value to the firm. They have been acquired at a specific monetary cost by the

firm for the conduct of its operations. Assets are classified under the

Companies Act as fixed assets, investments, current assets, loans and

advances, miscellaneous expenditure and losses.

Fixed Assets: These assets have two characteristics: they are acquired for

use over relatively long periods for carrying on the operations of the firm and

they are ordinarily not meant for resale. Examples of fixed assets are land,

buildings, plant, machinery, patents, and copyrights.

Investments: These are financial securities owned by the firm. Some

investments represent long-term commitment of funds (usually these are the

equity shares of other firms held for income and control purposes). Other

investments are likely to be short term in nature such as holdings of units in

mutual fund schemes and may rightly be classified under current assets for

managerial purposes. (Under the requirements of the Companies Act,

however, short term holding of financial securities also has to be shown under

investments and not under current assets.)

Current Assets, Loans and Advances: This category consists of cash and

other assets, which get converted into cash during the operating cycle of the

fir. Current assets are held for a short period of time as against fixed assets,

which are held for relatively longer periods. The major components of current

25

assets are: cash, sundry debtors, inventories, loans and advances, and pre-

paid expenses. Cash denotes funds readily disbursable by the firm. The bulk

of it is usually in the form of bank balances and the rest is currency held by

the fir. Sundry debtors (also called accounts receivable) represent the

amounts owned to the firm by its customers who have bought goods and

services on credit. Sundry debtors are shown in the balance sheet at the

amount owed, less an allowance for bad debts. Inventories (also called

stocks) consist of raw materials, work-in-process, finished goods, and stores

and spares. They are usually reported at the lower of the cost or market

value. Loans and advances are the amounts loaned to employees, advances

given to suppliers and contractors, advance tax paid, and deposits made with

governmental and other agencies. They are shown at the actual amount.

Pre-paid expenses are expenditures incurred for services to be rendered in

the future. These are shown at the cost unexpired service.

Miscellaneous Expenditures and Losses: This category consists of two

items: (i) miscellaneous expenditures and (ii) losses. Miscellaneous

expenditures represent certain outlays such as preliminary expenses and

developmental expenses, which have not been written off. From the

accounting point of view, a loss represents a decrease in owners' equity.

Hence, when a loss occurs, the owners' equity should be reduced by that

amount. However, as per company law requirements, the share capital

(representing owners' equity) cannot be reduced when a loss occurs. So the

share capital is kept intact on the left hand side (the liabilities side) of the

balance sheet and the loss is shown on the right hand side (the assets side)

of the balance sheet.

26

2.2.2 PROFIT AND LOSS ACCOUNT

The Companies Act has prescribed a standard form for the balance sheet, but

none for the profit and loss account. However, the Companies Act does

require that the information provided should be adequate to reflect a true and

fair picture of the operations of the company for the accounting period. The

Companies Act has also specified that the profit and loss account must show

specific information as required by Schedule IV. The profit and loss account,

like the balance sheet, may be presented in the account form or the report

form. Typically, companies employ the report form. The report form

statement may be a single-step statement or a multi-step statement. In a

single step statement, all revenue items are recorded first, then the expense

items are show and finally the net profit is given. While a single step profit and

loss account aggregates all revenues and expenses, a multi-step profit and

loss account provides disaggregated information. Further, instead of showing

only the final profit measure, viz., the profit after tax figure, it presents profit

measures at intermediate stages as well.

¾ Net sales

¾ Cost of goods sold

¾ Gross profit

¾ Operating expenses

¾ Operating profit

¾ Non-operating surplus/deficit

¾ Profit before interest and tax

¾ Interest

¾ Profit before tax

¾ Tax

¾ Profit after tax.

2.3 FINANCIAL STATEMENTS ANALYSIS

27

Financial Statements Analysis (FSA) refers to the process of the critical

examination of the financial information contained in the financial statements in order

to understand and make decisions regarding the operations of the firm. The FSA is

basically a study of the relationship among various financial facts and figures is given

in a set of financial statements. The basic financial statements i.e. the Balance Sheet

and the Income Statement, already discussed in the preceding lesson contain a whole

lot of historical data. The complex figures as given in these financial statements are

dissected/broken up into simple and valuables elements and significant relationships

are established between the elements of the same statement or different financial

statements. This process of dissection, establishing relationships and interpretation

thereof to understand the working and financial position of a firm is called the FSA.

Thus, FSA is the process of establishing and identifying the financial weaknesses and

strength of the firm. It is indicative of two aspects of a firm i.e. the profitability and the

financial position and it is what is known as the objectives of the FSA.

2.3.1 Objectives of the FSA: Broadly, the objective of the FSA is to

understand the information contained in financial statements with a view to

know the weaknesses and strength of the firm and to make a forecast about

the future prospects of the firm and thereby enabling the financial analyst to

take different decisions regarding the operations of the firm. The objectives of

the FSA can be identified as:

¾ To assess the present profitability and operating efficiency of the firm

as a whole as well as for its different departments and segments.

¾ To find out the relative importance of different components of the

financial position of the firm.

¾ To identify the reasons for change in the profitability/financial position

of the firm, and

¾ To assess the short term as well as the long term liquidity position of

the firm.

2.3.2 Types of Financial Analysis

Financial analysis can be classified into different categories depending upon

(1) the material used, and (2) the modus operandi of analysis.

1. On the Basis of Material Used: Under this category the financial

analysis can be of two types: a) External Analysis; b) Internal Analysis

28

a. External Analysis: The outsiders to the business carry out this

kind of analysis, which includes investors, credit agencies,

government agencies and other creditors who have no access

to the internal records of the company. In the recent times this

analysis has gathered momentum towards better corporate

governance and government regulations for more detailed

disclosure of information by the companies in their financial

statements.

b. Internal Analysis: In contrary to the above this analysis is done

by those who have access to the books of accounts and other

information related to the business. The analysis is done

depending upon the objective to be achieved through this

analysis.

2. On the basis of Modus Operandi: In this case too, the financial

analysis can be of two types: a) Horizontal Analysis; b) Vertical

Analysis

a Horizontal Analysis: Under this financial statements for a

number of years are reviewed and analyzed. The current year’s

figures are compared with standard or base year.

b Vertical Analysis: Under this type of analysis a study is made

of the quantitative relationship of the various items in financial

statements on a particular date. For example, the ratios of

different items of costs for a particular period may be calculated

with the sales for that period. These types of financial analysis

are useful in comparing the performance of several companies

29

in the same group, or divisions or departments in the same

company.

In addition to above, the FSA for a firm can be undertaken in different ways.

There is 'the best' technique of the FSA, which can be applied to all the firms

under all the situations. The type of the FSA undertaken depends upon the

person doing the FSA and the purpose of which the FSA has been

undertaken. Different person/parties may undertake the FSA for different

purposes. The persons/parties, who are usually interested in the FSA, may

be the shareholders, the creditors, the financial institutions, the investors and

the management itself. The FSA can be classified into different categories as

follows: a) Internal and External FSA; b) Dynamic and Static FSA

a) Internal and External FSA: The FSA is said to be internal when it is

done by a person who has access to the books of the account and

other related information of the firm. This type of FSA is conducted for

measuring the operational and managerial efficiency at different

hierarchy levels of the firm. This type of analysis is quite

comprehensive and reliable. In order to undertake internal FSA, either

an employee of the same firm or an outside agency may be entrusted

the responsibility. External FSA, on the other hand, is one, which is

conducted by an outsider without having any access to the basic

accounting record of the firm. These outsiders may be the creditors,

the investors, the shareholders, the credit rating agencies etc. The

external FSA is dependent on the published financial data of the firm

and consequently can serve only limited purpose.

30

b) Dynamic and Static FSA: The FSA is said to be dynamic if it covers a

period of several years. Financial data/information for different years is

incorporated in the FSA to assess the progress of the firm. This type of

FSA is also called the horizontal analysis. The dynamic FSA is useful

for long-term trend analysis and planning. In dynamic FSA, the

figures/data for a year are placed and compared with the figures/data

for several other years and changes from 1 year to another are

identified. Since, the dynamic analysis covers a period of more than 1

year (may be up to 5 years or 10 years), is given a considerable insight

into areas of financial weaknesses and strength of the firm. On the

other hand, the static FSA covers a period of 1 year only and the

analysis is made on the basis of only one set of financial statements.

So, it is study in terms of information at a particular date only. It is also

called vertical FSA. Impliedly, the static FSA fails to incorporate the

periodic changes and therefore, may not be very conducive to a proper

understanding of the financial position of the firm. It may be noted that

both the dynamic and static FSA should be conducted simultaneously

as both are indispensable for understanding the profitability and

financial position of the firm.

On the basis of the above discussion, it can be said that FSA

investigative and thought provoking process in nature. The basic

objective of FSA is financial planning and forecasting on the basis of

meaningful interpretation of the financial information. It is forward

looking exercise. Since, decisions are going to be taken on the basis

31

of the FSA, the analyst must be careful, precise, analytical, objective

and intelligent enough to undertake the FSA in a systematic way.

2.4 METHODICAL PRESENTATION TO FSA

The financial statements usually present the financial data in a traditional

form. However, in order to make meaningful and convenient analysis, the

presentation of data may be modified and suitably rearranged. In the

modified form, the items of a statement are presented in a vertical form and in

a particular sequence only. However, it must be noted that this modified form

of the financial statements is only a matter of convenience and not a

compulsory requirement and therefore, there is no standard form of

methodical presentation. The FSA can be undertaken even without such

modification but not so conveniently. In methodical presentation, the financial

information can be presented even side by side for inter-firm comparison or

for dynamic FSA. A set of methodical presentation of the Income Statement

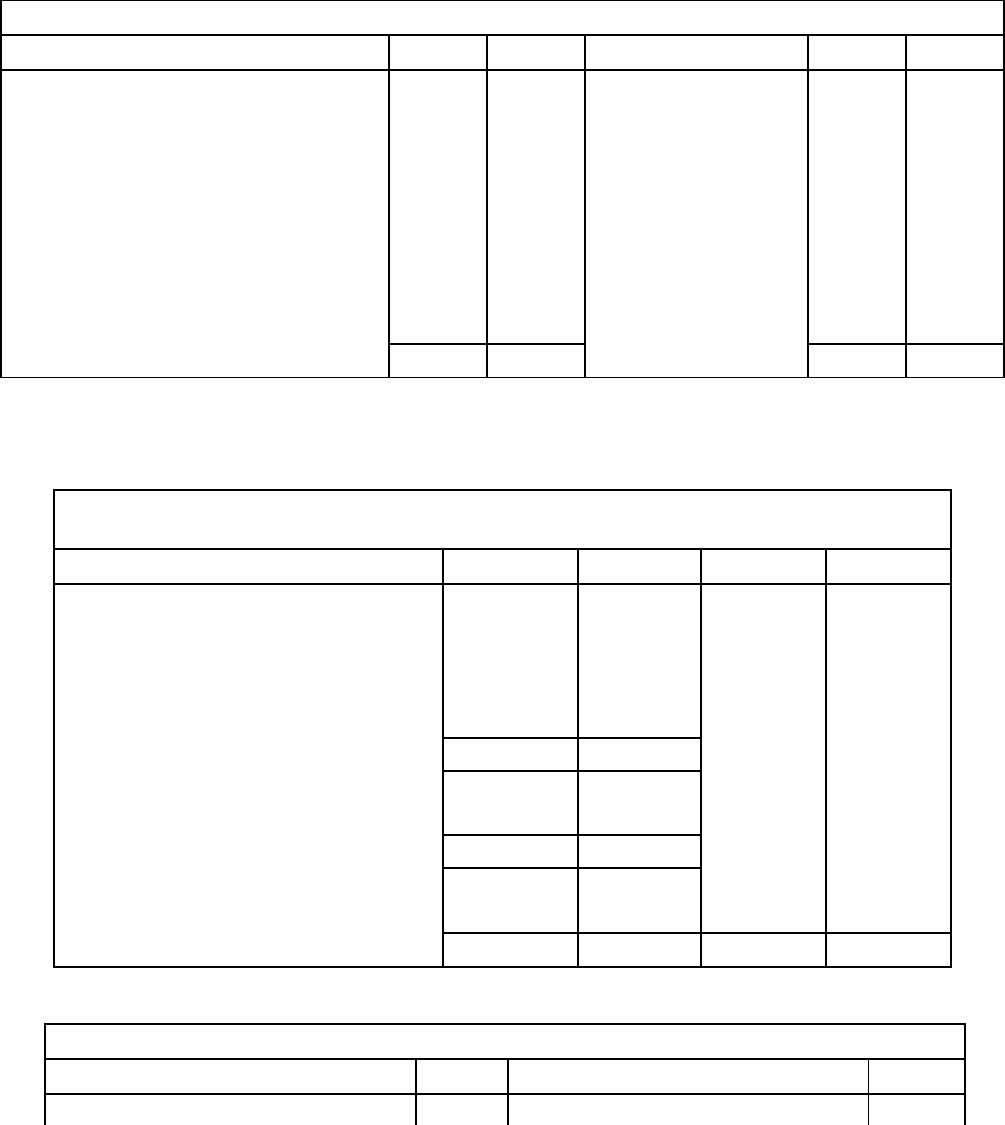

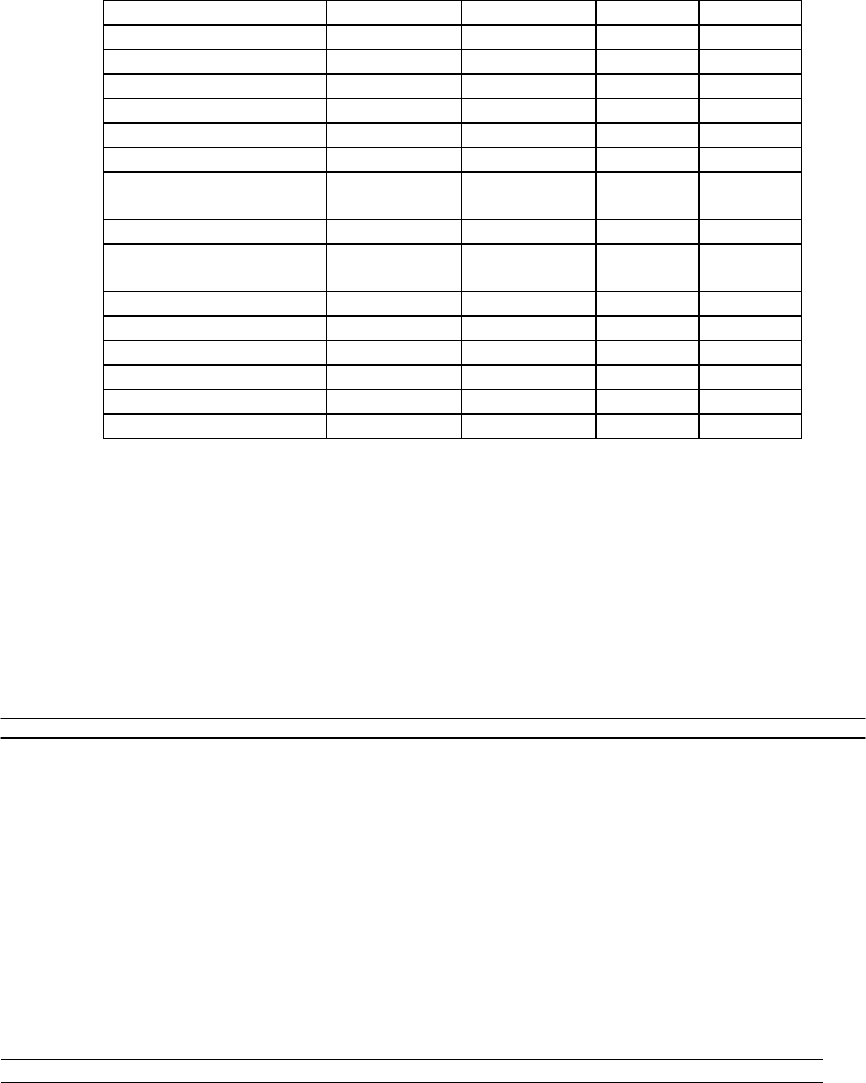

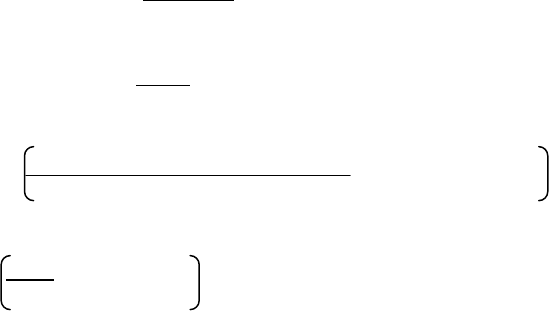

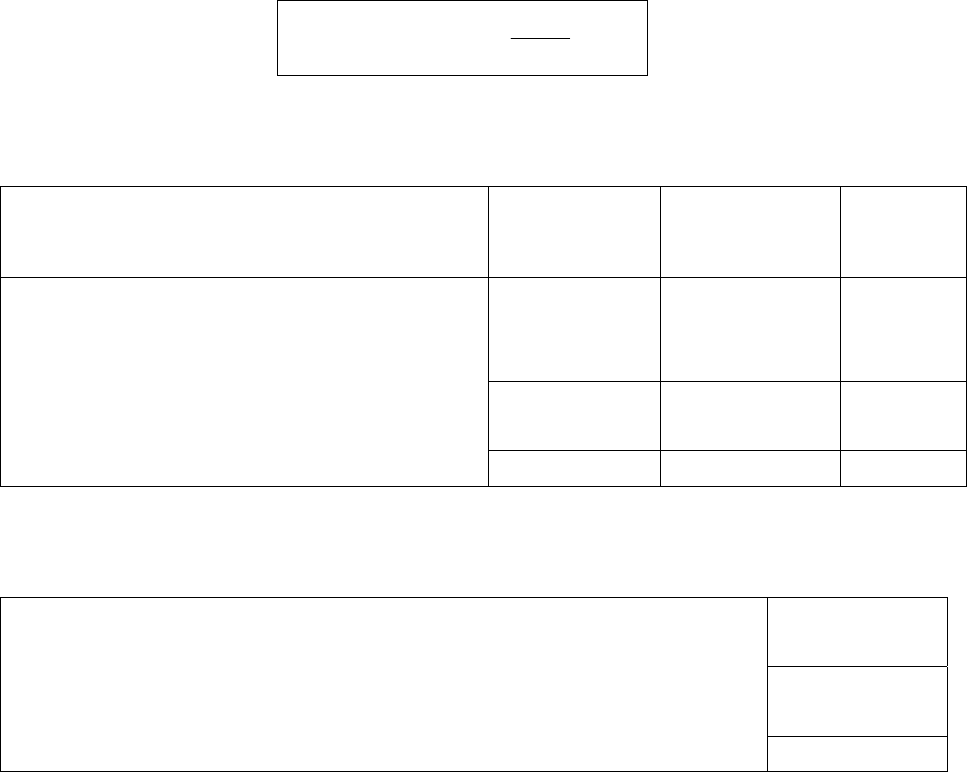

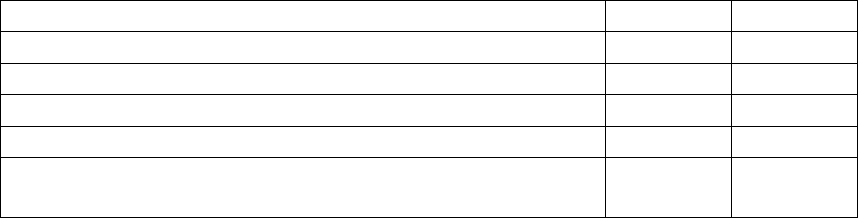

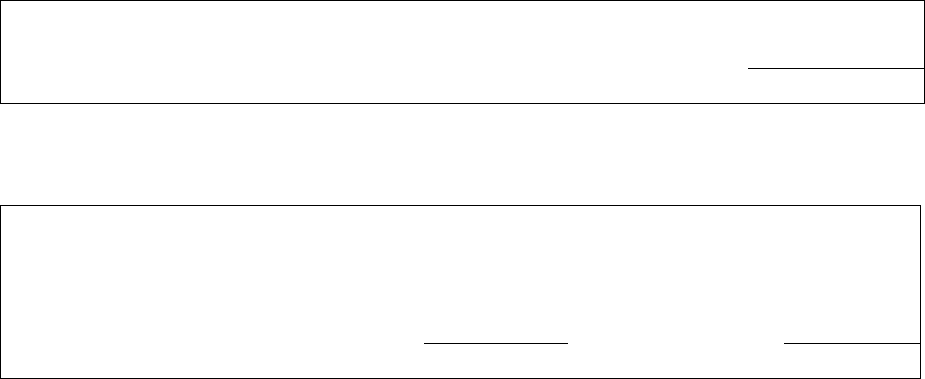

and the B/S are given in the Table 2.1 and 2.2 respectively.

32

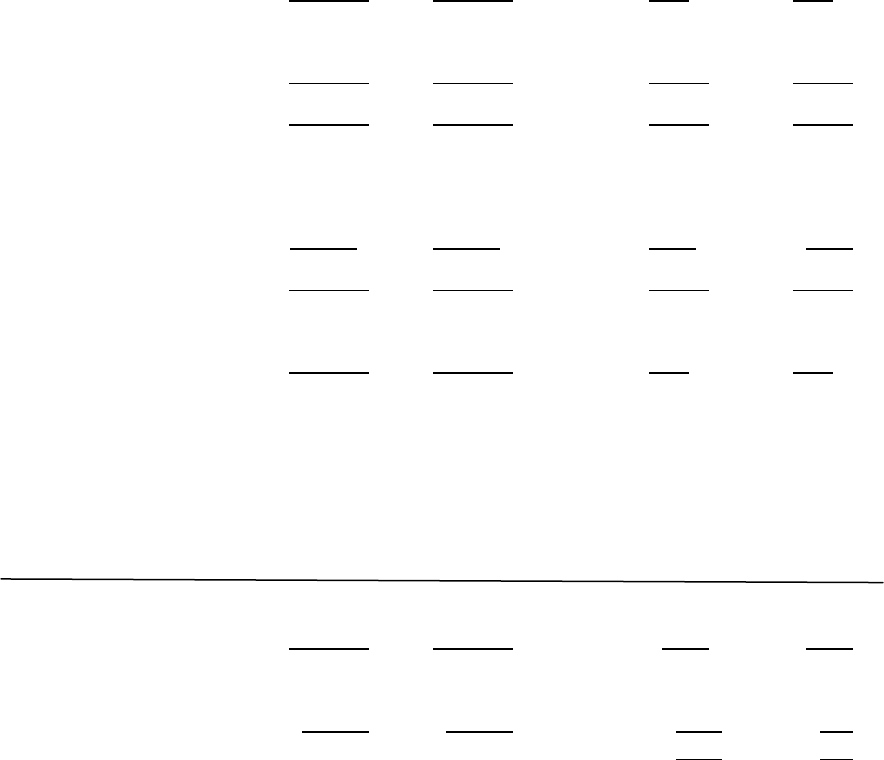

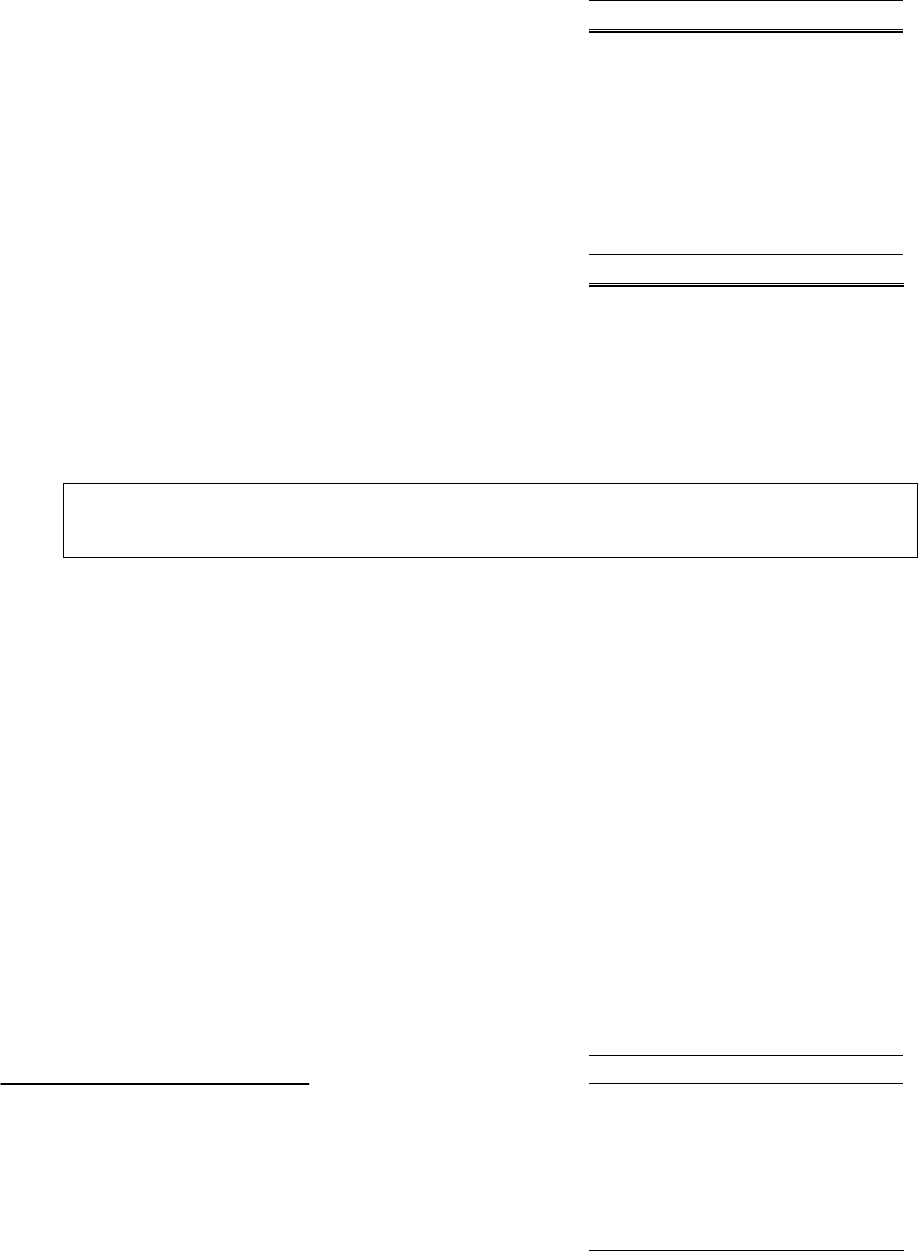

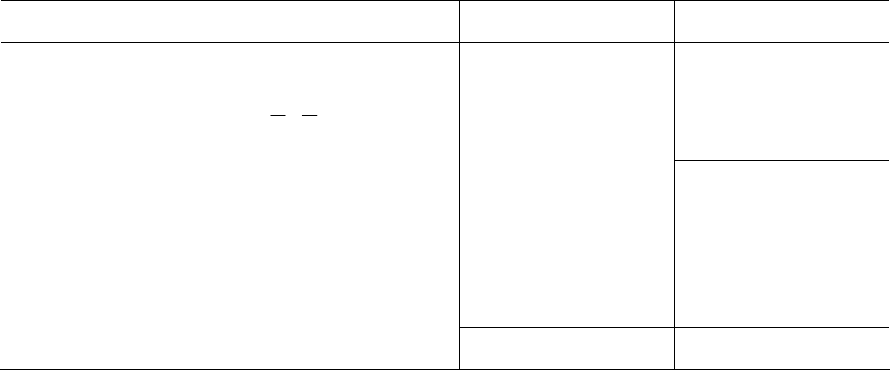

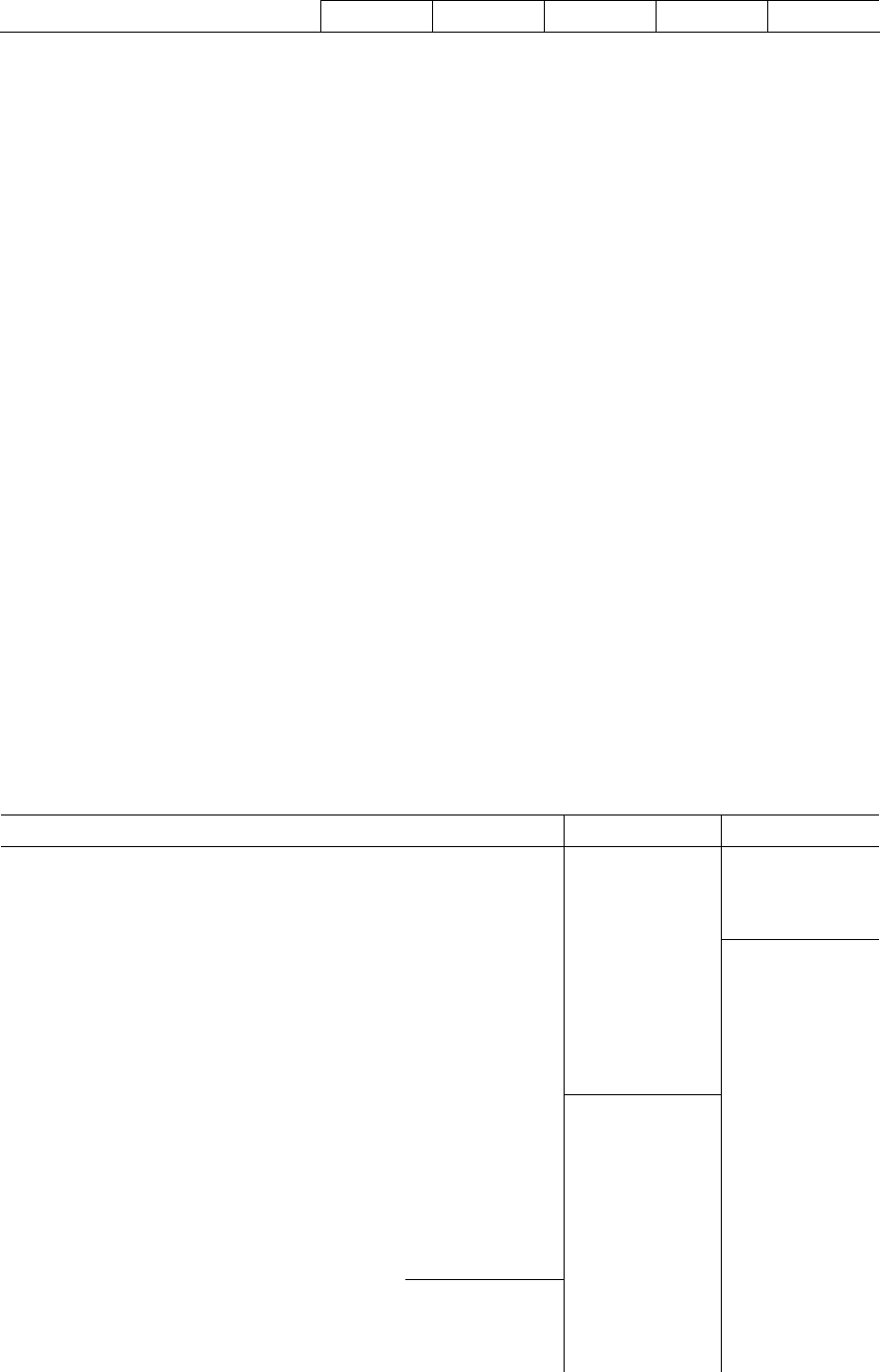

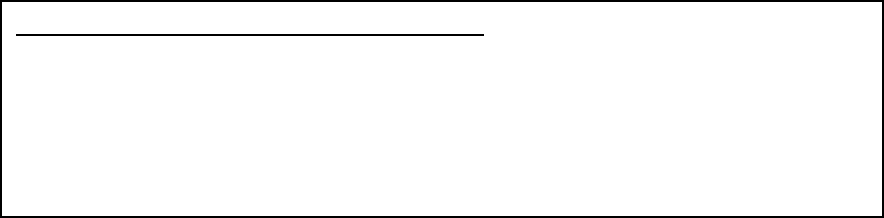

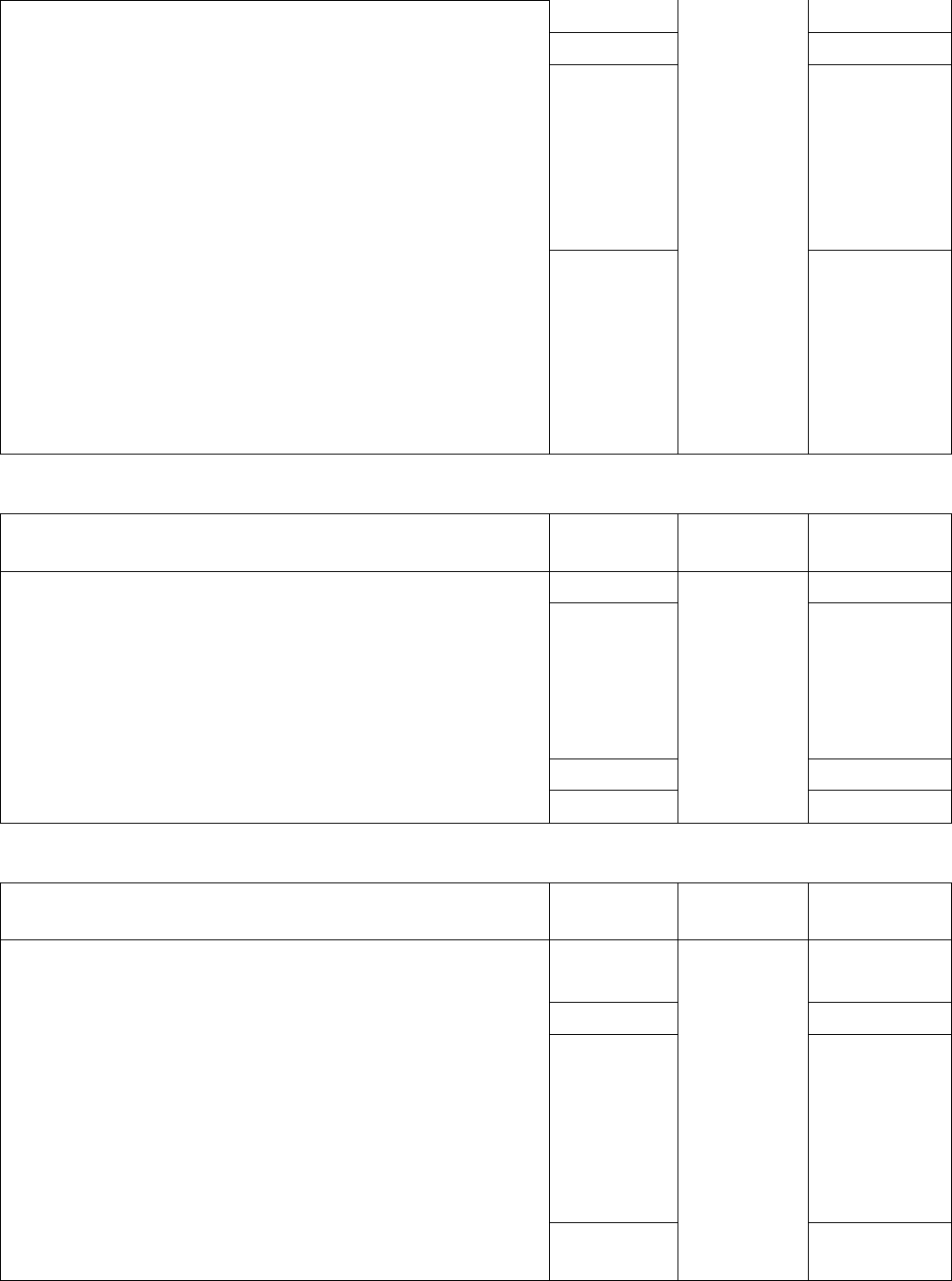

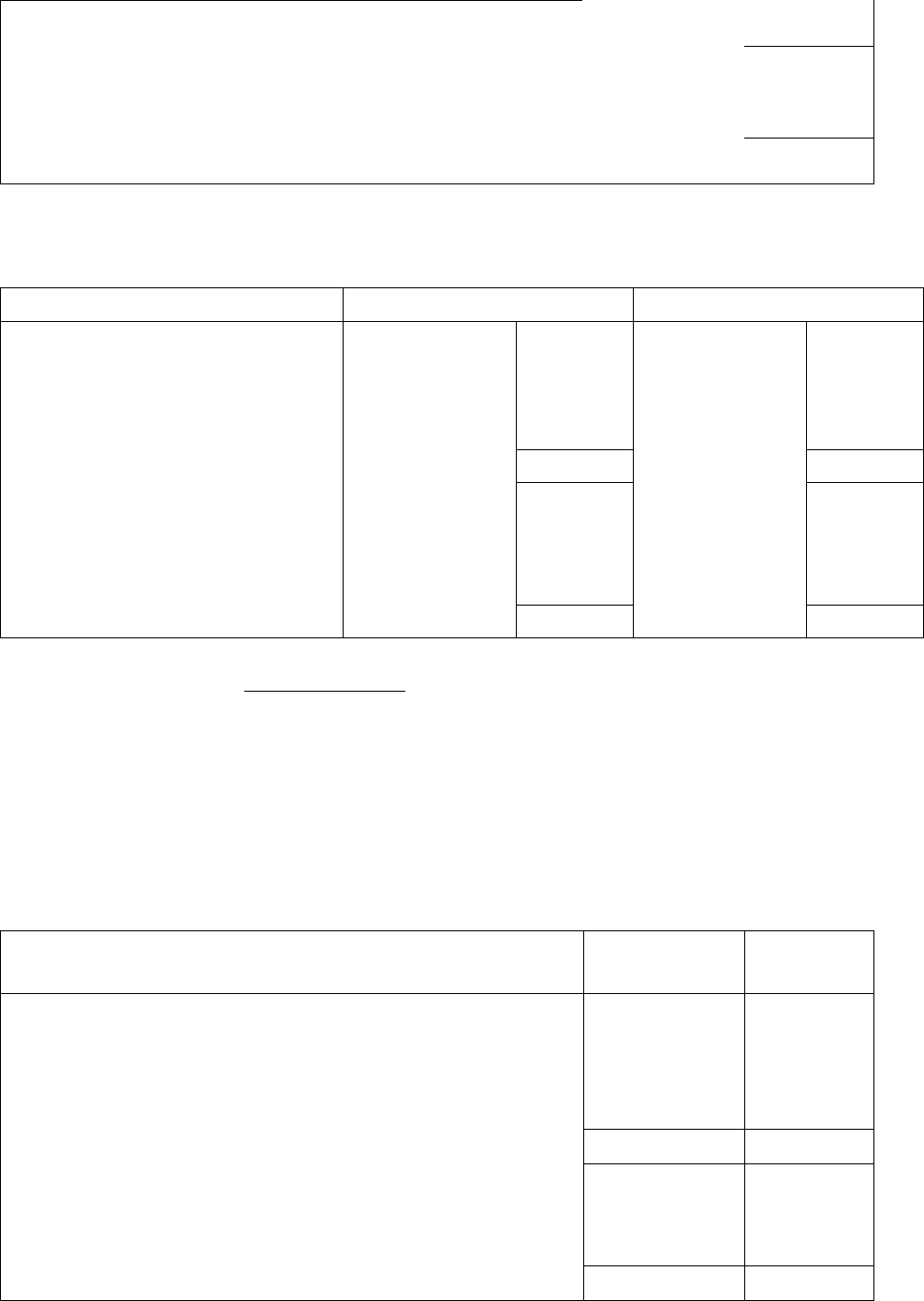

Table 2.1 : Income Statement (Methodical presentation).

INCOME STATEMENT FOR THE YEAR ENDING......

Amount Amount

Sales

Cash sales *****

Credit sales *****

Less: Sales return *****

Net sales (1) *****

Less: Cost of good sold:

Opening stock *****

+ Purchases *****

+Manufacturing expenses *****

+ Direct expenses *****

- Closing stock *****

Total cost of goods sold (2) ***** *****

Gross Profit (3) *****

Less: Operating expenses : (4)

Selling expenses *****

Administrative expenses *****

Depreciation ***** *****

Operating profit (5) *****

Add: Non Operating Income *****

Less: Non Operating Expenses *****

Profit before Interest & Taxes (6) *****

Less : Interest Charges: (7)

Interest on Loans *****

Interest on Debenture ***** *****

Profit before tax (6-7) (8) *****

Less: Provision for tax (9) *****

Net Profit (10) *****

33

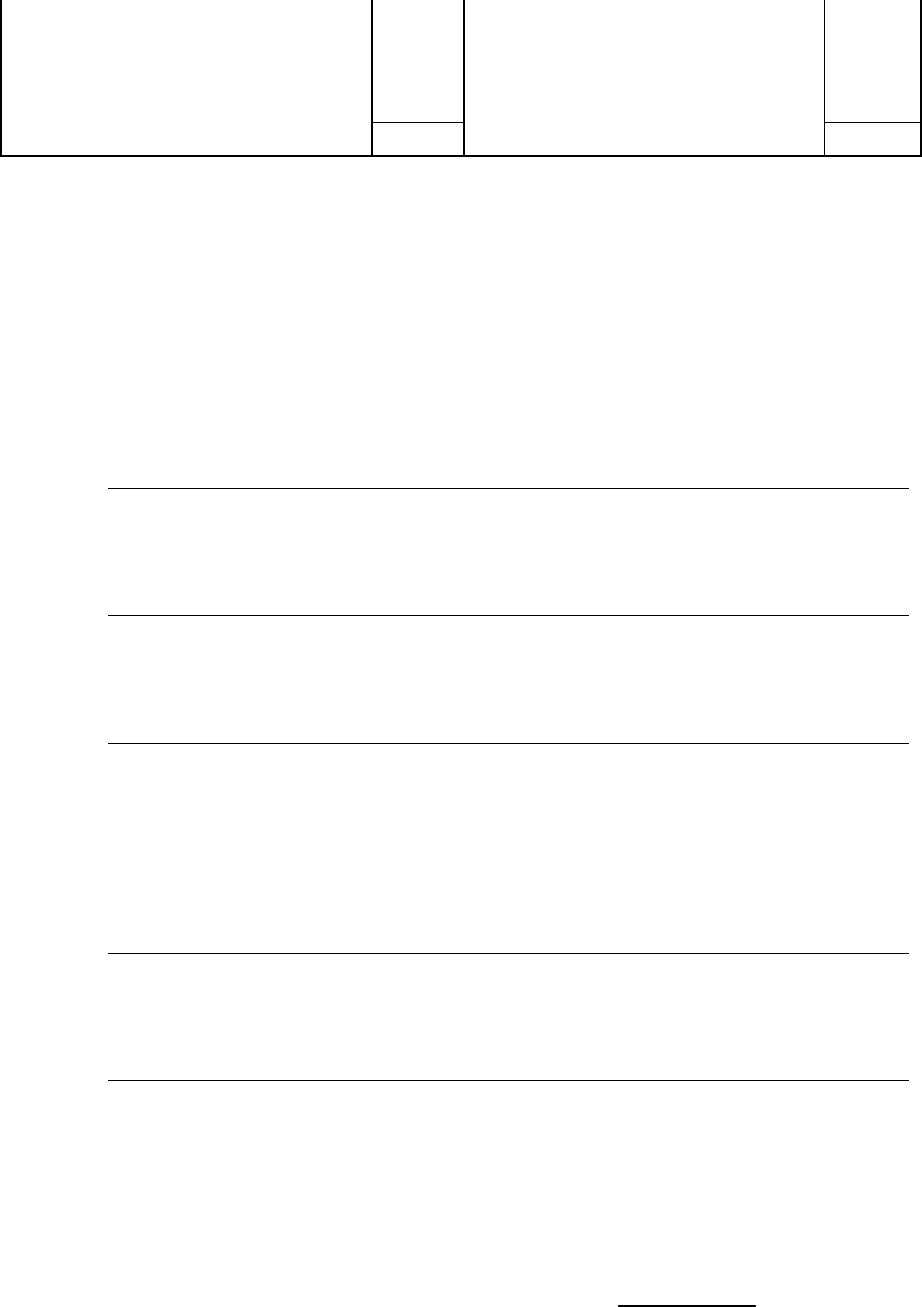

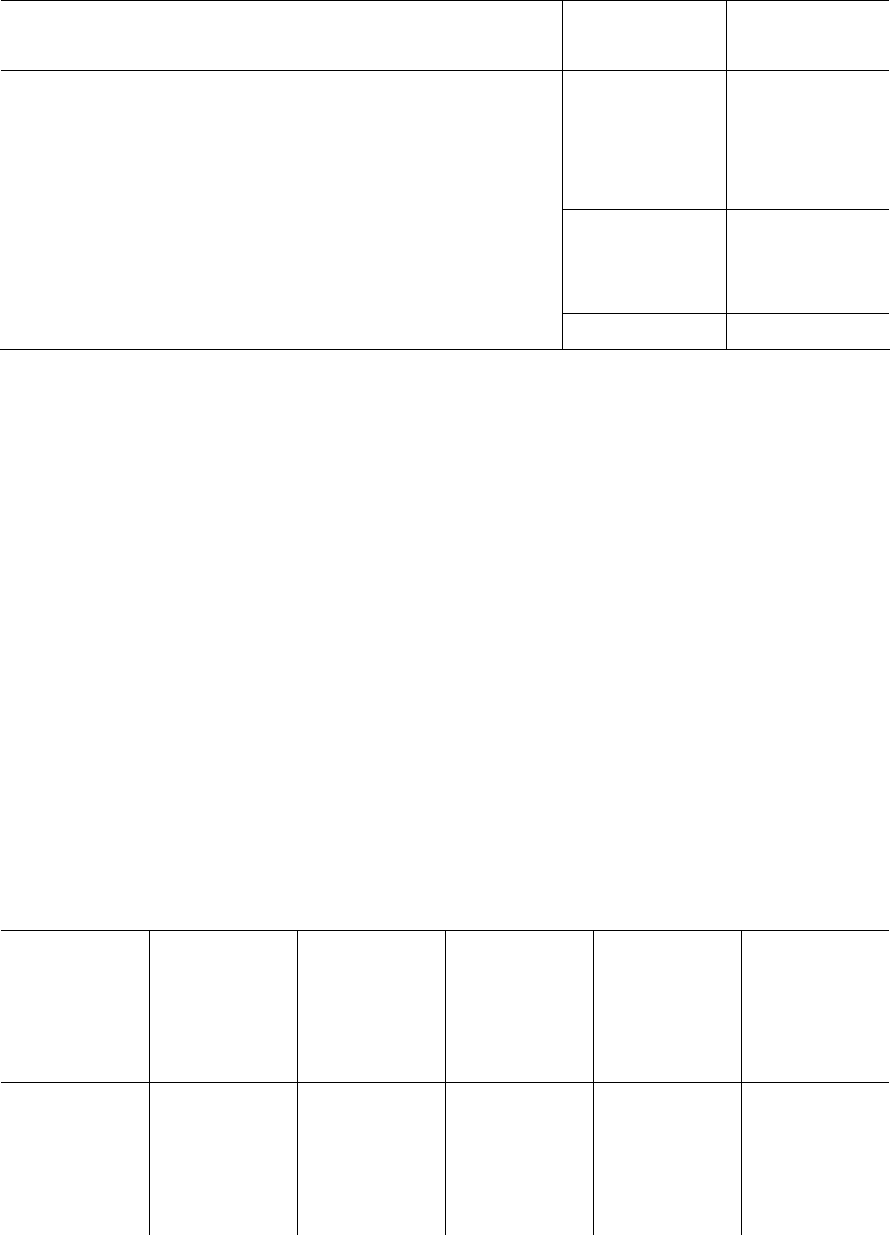

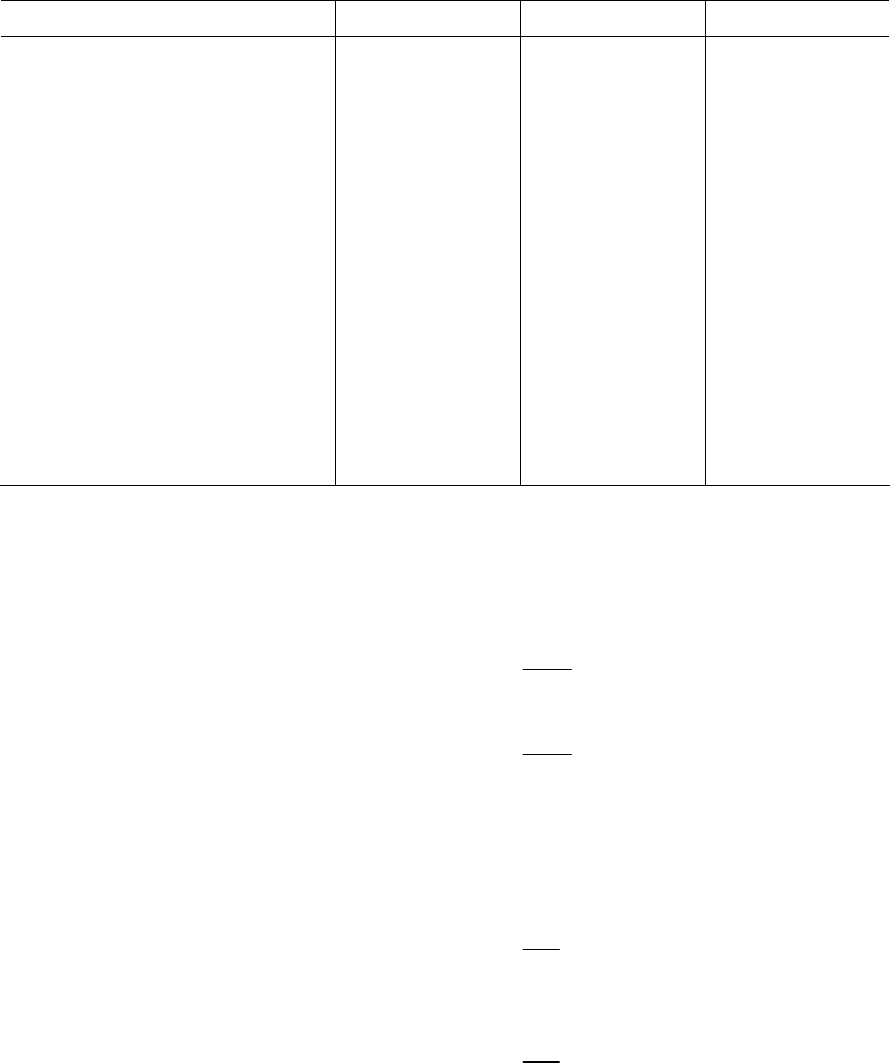

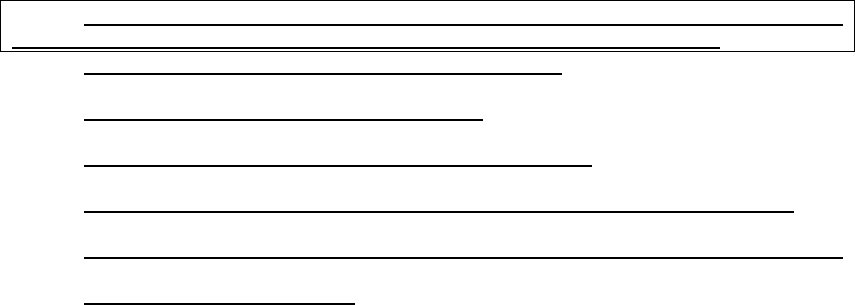

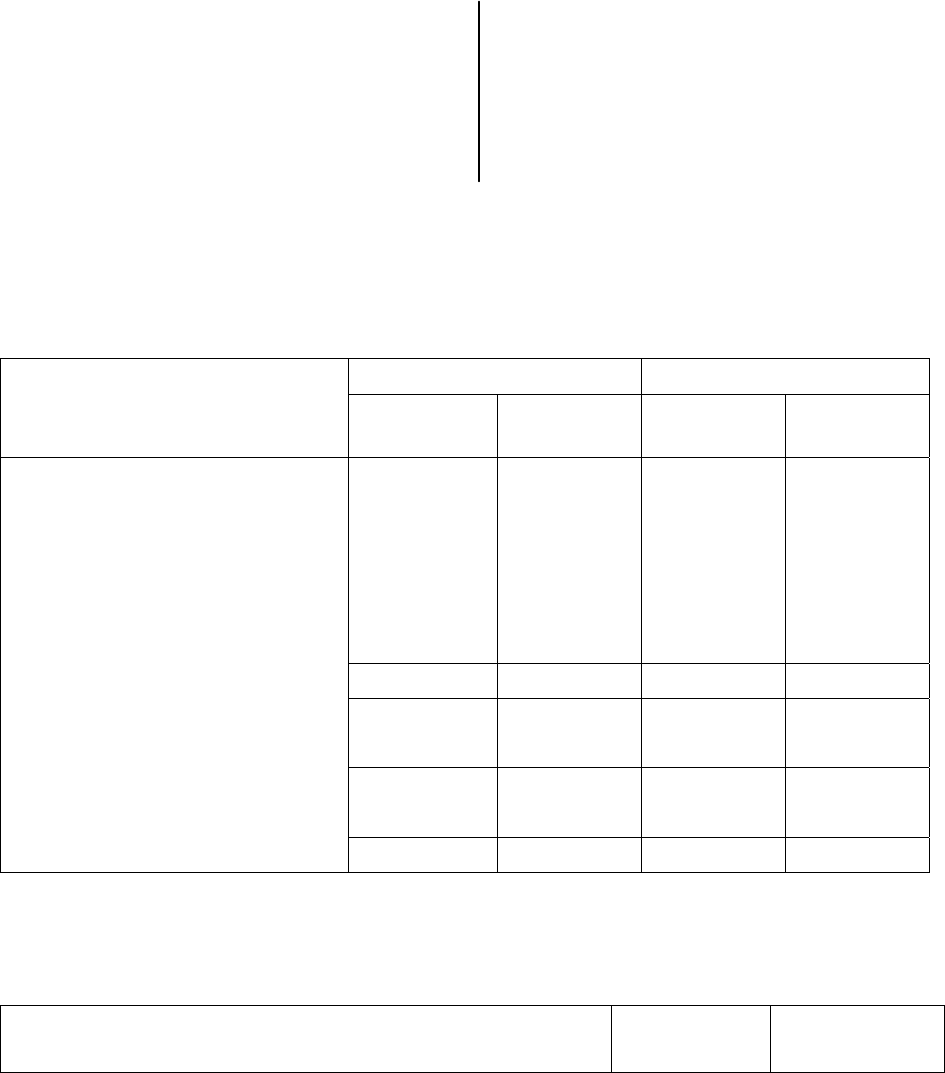

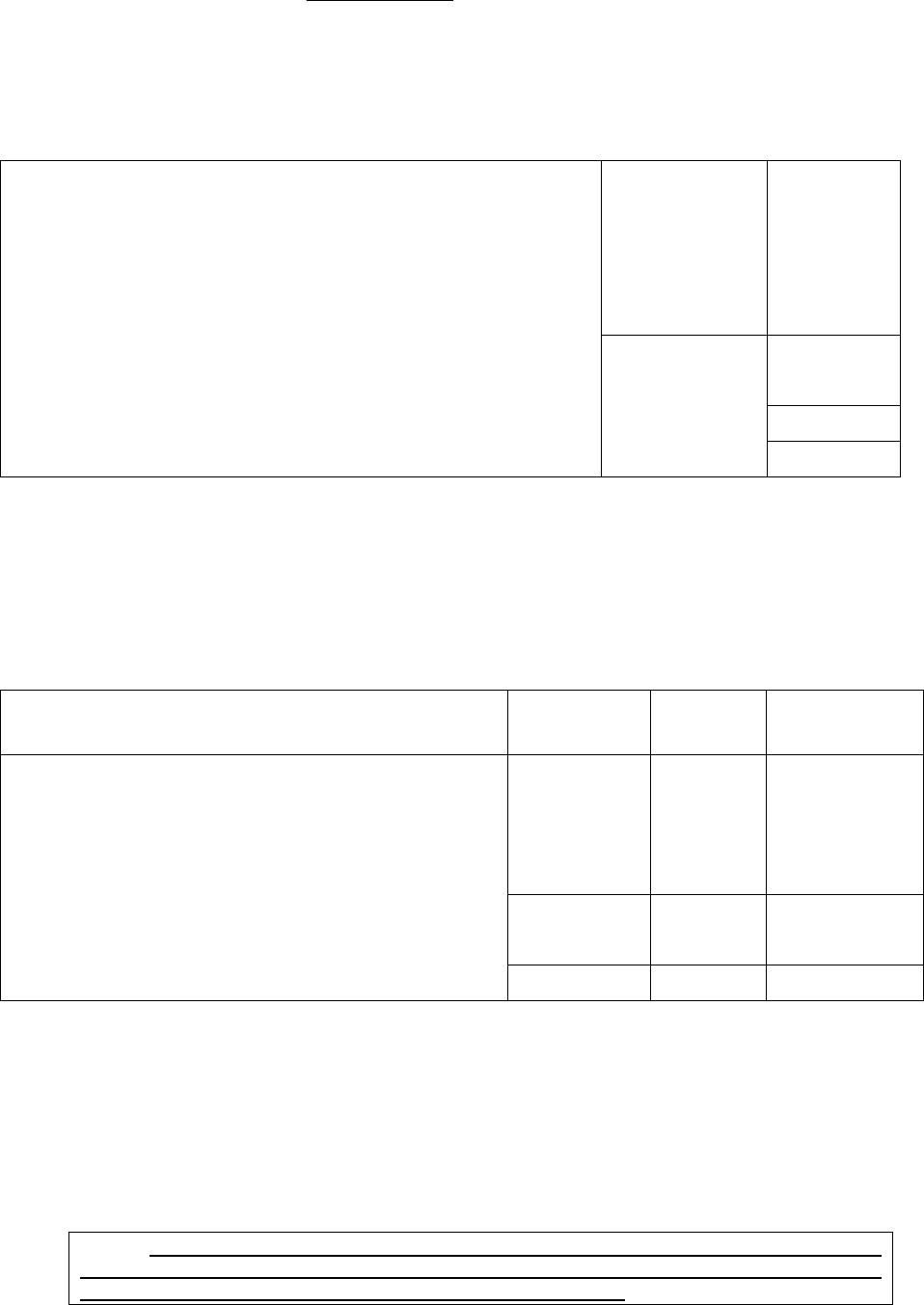

Table 2.2: The balance Sheet (Methodical presentation).

BALANCE SHEET AS ON.........

Amount Amount

Preference Share Capital *****

Equity Share Capital *****

Total Share Capital (1) ***** *****

Add: Capital Reserve *****

General Reserve *****

Share Premium A/c *****

Capital Redemption Reserve A/c *****

Profit & Loss A/c ***** *****

Less: Preliminary Expenses *****

Accumulated Losses ***** *****

Shareholders Fund (2) *****

Add: Long Term Loans *****

Debentures ***** *****

Capital Employed (3) *****

Represented by:

Fixed Assets

Land & Building *****

Plant & Machinery *****

Furniture & Fixture *****

Gross Block *****

Less : Depreciation *****

Fixed Assets (Net) (4) *****

Working Capital

Cash and Bank *****

Receivable *****

Marketable Securities *****

Liquid Assets (5) *****

+ Inventories *****

Total Current Assets (6) *****

34

Trade Creditors *****

Bills Payable *****

Expenses Outstanding *****

Provision for Tax *****

Quick Liabilities (7) *****

+ Bank Overdraft *****

Total Current Liabilities (8) *****

Net Working Capital (6-8) (9) *****

Total Assets (4+9) (10) *****

2.5 TECHNIQUES/TOOLS OF THE FSA

As already discussed, that the FSA can be undertaken by different persons

and for different purposes, therefore, the methodology adopted for the FSA

may be varying from the one situation to another. However, the following are

some of the common techniques of the FSA: a) Comparative financial

statements. (b) Common-size financial statements, (c) Trend percentages

analysis, and (d) Ration Analysis. The last techniques i.e. the ration analysis

is the most common, comprehensive and powerful tool of the FSA. For the

sake of proper understanding, all these techniques have been discussed in

detail as follows:

2.5.1 COMPARATIVE FINANCIAL STATEMENTS (CFS)

In CFS, two or more BS and/or the IS of a firm are presented simultaneously

in columnar form. The financial data for two or more years are placed and

presented in adjacent columns and thereby the financial data is provided a

times perspective in order to facilitate periodic comparison. In CFS, the BS

and the IS for number of years are presented in condensed form for year-to-

year comparison and to exhibit the magnitude and direction of changes.

35

The preparation of the CFS is based on the premise that a statement covering

a period of a number of years is more meaningful and significant than for a

single year only, and that the financial statements for one period represent

only 1 phase of the long and continuous history of the firm. Nowadays, most

of the published Annual Reports of the companies provide important statistical

information about the company in condensed from for the last so many years.

The presentation of such data enhances the usefulness of these reports and

brings out more clearly the nature and trends of changes affecting the

profitability and financial position of the firm.

So, the CFS helps a financial analyst in horizontal analysis of the firm and in

establishing operating and positional trend of the firm. The CFS may be

prepared to show the absolute amount of different items in monetary terms,

the amount of periodic changes in monetary terms and the percentages of

periodic changes to reveal the proportionate changes. The CFS can be

prepared for both the BS and IS.

Comparative Income Statement (CIS): A CIS shows the figures of different

items of the ISs of the firm in absolute terms, the absolute changes from one

period to another and if desired, the changes in percentage form. The CIS is

helpful in deriving meaningful conclusions regarding changes in sales volume,

cost of goods sold, different expense items etc. From the CIS a financial

analyst can quickly ascertain whether sales are increasing or decreasing and

by how much amount or by how much percentage. Similarly, analysis can be

made for other items also.

Comparative Balance Sheet (CBS): The CBS shows the different assets

and liabilities of the firm on different dates to make comparisons of absolute

36

balances and also of changes if any, from one date to another. The CBS may

be helpful in analyzing and evaluating the financial position of the firm over a

period of number of years. The preparation of CFS can be explained with the

help of Example 2.1.

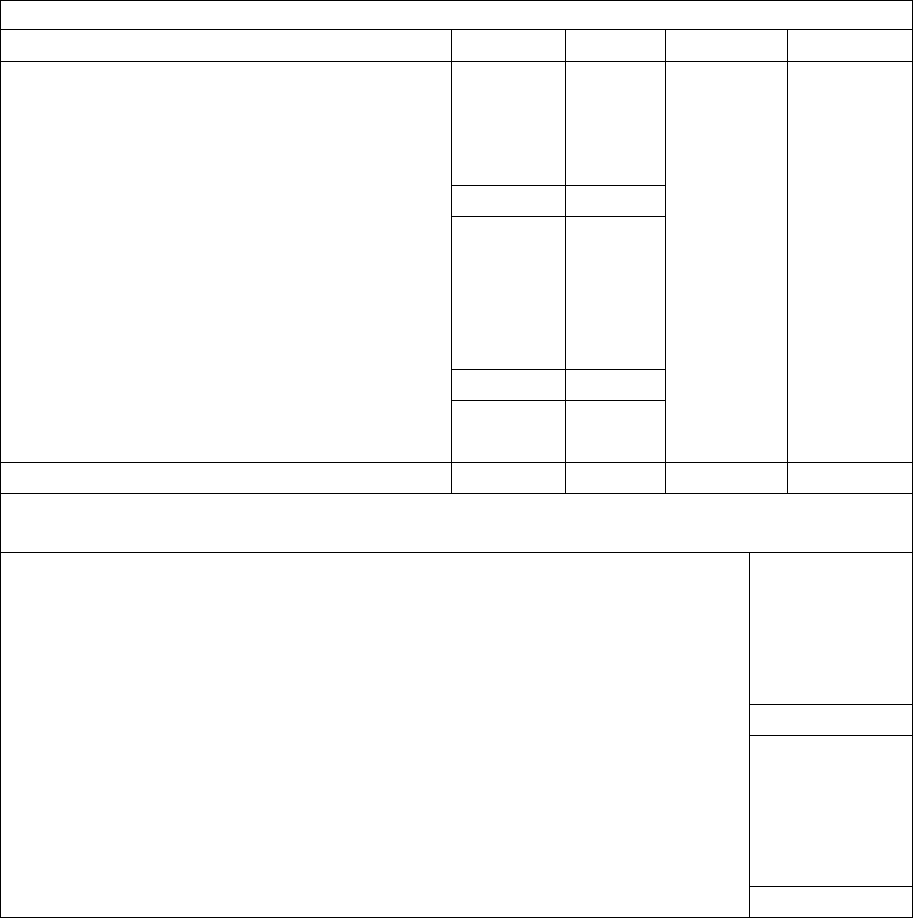

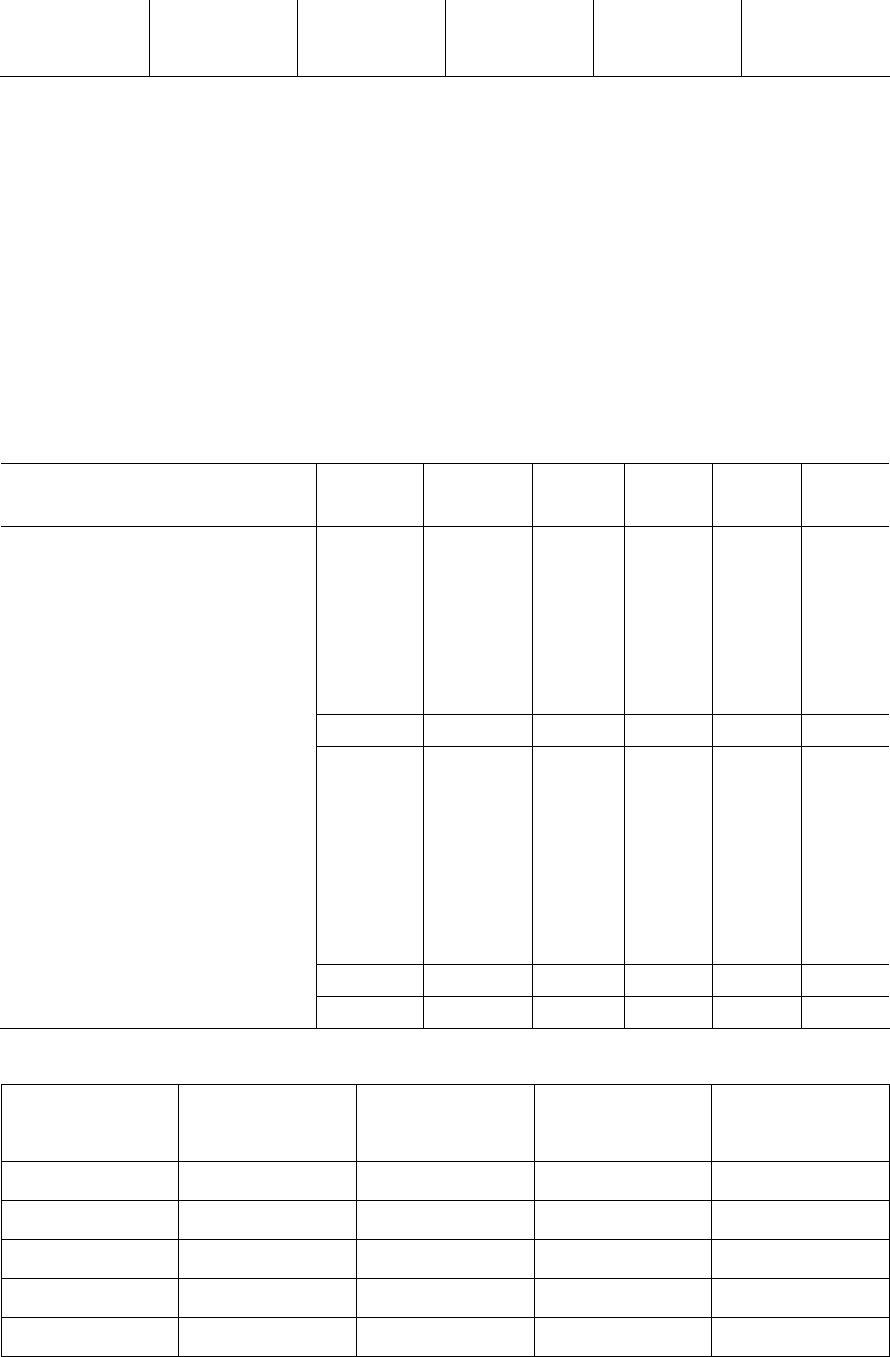

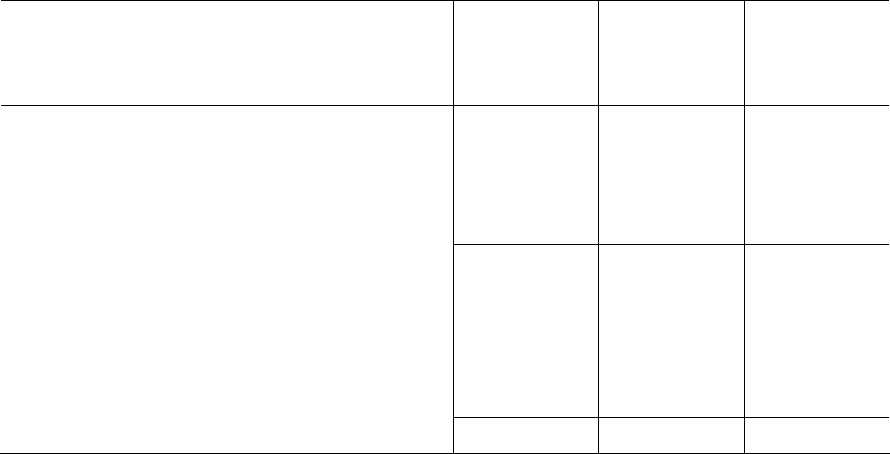

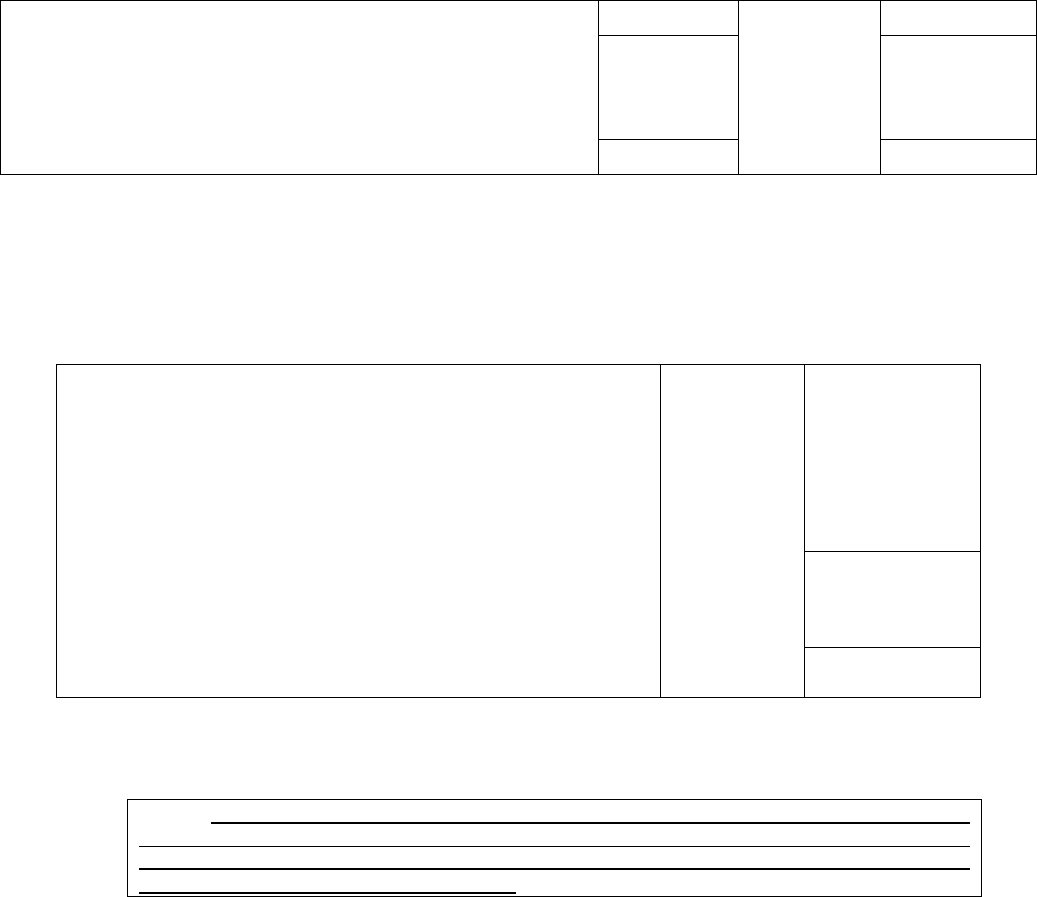

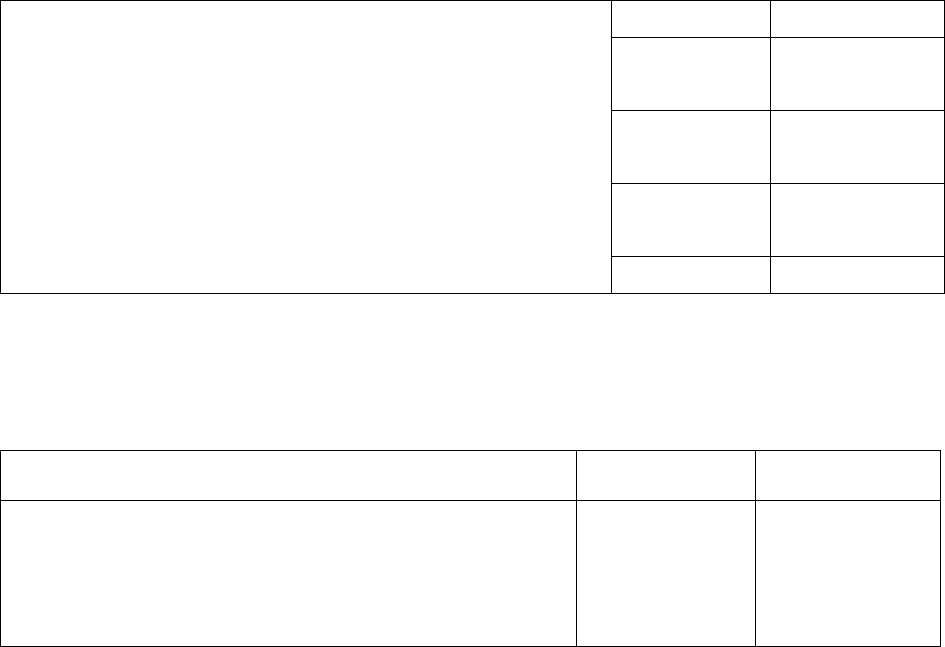

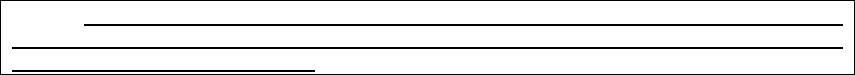

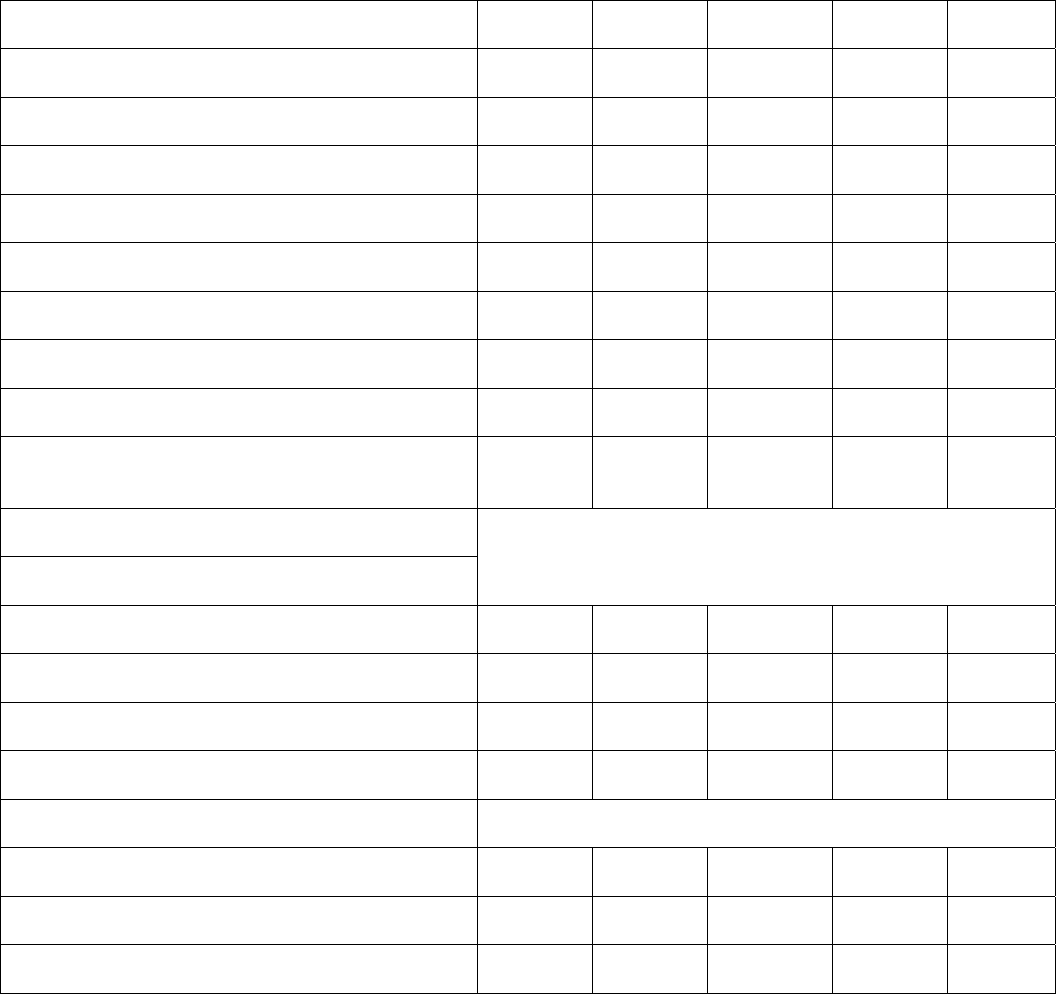

Example 2.1: Following are the IS and BS of ABC & Co. for the year 2003

and 2004, Prepare the CBS and CIS for these two years.

Income Statements for the year 2003 and 2004

(Figures in Rs.)

To Cost of good sold 300000 375000 By Net Sales 400000 500000

To General Expenses 10000 10000

To Selling Expenses 15000 20000

To Net Profit 75000 95000

400000 500000 400000 500000

_________________________________________________________________

Balance Sheets as on December 31

(Figures in Rs.)

__________________________________________________________________

Liabilities 2003 2004 Assets 2003 2004

Capital 350000 350000 Land 50000 50000

Reserves 100000 122500 Building 150000 135000

Secured Loans 50000 75000 Plant 150000 135000

Creditors 100000 137000 Furniture 50000 70000

Outstanding 50000 75000 Cash 50000 70000

Expenses

Debtors 100000 150000

Stores 100000 150000

Particulars 2003 2004 Particulars 2003 2004

37

650000 760000 650000 760000

Solution:

COMPARATIVE INCOME STATEMENT

FOR THE YEARS ENDING 2003 AND 2004

(Figures in Rs.)

__________________________________________________________________

Liabilities 2003 2004 Change in % change in

2004 2004

Net Sales 400000 500000 100000 + 25

Less cost of goods 300000 375000 75000 + 25

Soled

Gross Profit (1) 100000 125000 25000 + 25

Less General 10000 10000 ---- -----

Selling Expenses 15000 20000 5000 + 33.3

Total Expenses (2) 15000 30000 5000 + 20

Net Profit (1-2) 75000 95000 20000 + 26.7

__________________________________________________________________

COMPARATIVE BALANCE SHEET AS ON DEC. 31

__________________________________________________________________

Liabilities 2003 2004 Change in % change in

2004 2004

Land 50000 50000 ---- ----

Building 150000 135000 - 15000 - 10

Plant 150000 135000 -15000 - 10

Furniture 50000 70000 20000 + 40

Total F. assets (1) 400000 390000 -10000 - 2.5

Cash 50000 70000 20000 40

38

Debtors 100000 150000 50000 50

Stock 100000 150000 50000 50

Total C. Assets (2) 250000 370000 120000 48

Creditors 100000 137500 37500 37.5

O/s Expenses 50000 75000 25000 50

Total Liabilities (3) 150000 212500 62500 41.7

Net Working 100000 157500 57500 57.5

Capital (2 - 3)

Total Assets (1+2) 650000 760000 110000 16.9

Capital 350000 350000 ------- ------

Reserves 100000 122500 22500 22.5

Proprietor's Fund (4) 450000 472500 22500 5

Secured Loans (5) 50000 75000 25000 50

Capital Employed 500000 547500 47500 9.5

(4+5)

Total Assets (1+2) 650000 760000 110000 16.9

Cap.+ Total

Liabilities (3+4+5) 650000 760000 110000 16.9

Interpretation: On the basis of CIS it can be said that Gross Profit for the

year 2004 has increased by 25% over the profit for the year 2003. The Net

Sales during the same period has increased by 25%, which was coupled with

increase in the cost of goods sold which also increased by same 25%. This

means that Input/Output ratio or the production efficiency level has been

maintained during 2004. the same increase of 25% in Net Sales and the Cost

of goods sold has resulted in increase in Gross Profit by 25%. The increase

in Net Profit is more pronounced i.e. by 26.7%. The reason for a higher

increase in Net Profit is the comparatively less increase in total expenses

(only 20%). The General Expenses during 2003 and 2004 were same but the

increase in Selling Expenses by 33 1/3% has resulted increase of total

39

expenses by 20%. The CBS also reveals many facts about the composition of

assets and the financial structure of the firm. The Fixed Assets have

decreased over the period by 2.5%, though this decrease has primarily

resulted by the amount of depreciation @ 10% on Buildings and Plant.

However, the Current Assets have increased by 48%, this increase of 48% is

too much in view of increase in Net Sales by 25% only. Moreover, the

Current Liabilities have increased by 41.7%. Since the increase in Current

Assets is more than increase is Current Liabilities, therefore the Net Working

Capital has increased by 57.5%. The clearly indicates that the Working

Capital of the firm is not properly managed. Had the increase in current

assets restricted to 25% or the increase in current liabilities was also achieved

at 48% or so, then the situation would not have been so alarming. However,

the decrease in fixed assets has been offset by increase in Net Working

Capital and consequently the total assets have increased by 16.9%. The firm

has not raised any capital during the period and the increase in proprietor's

funds has resulted because of increase in retained profits by Rs. 22,500. The

Secured Loans have also increased by 50%. The funds provided by the

retained earnings and the secured loans seem to have been utilized in

financing the current assets. This has, on one hand increased the short term

paying capacity of the firm and on the other hand, will affect the earning

capacity of the firm as the current assets are less or non productive. The

increase in total assets by 16.9% is matched with the increase in total

liabilities (proprietor's fund plus the secured loans)) by 16.9%. So, the CFS

explains about the changes in different items of the financial statements.

However, despite this revelation, the CFS fails to highlight the component

40

changes in relation to total assets or total liabilities. The CFS does not throw

light on the variations in each asset as a percentage of total assets for a

particular period or changes in different liabilities in relation to total liabilities

for that period etc. This drawback of CFS is taken care of by the Common

Size Statement.

2.5.2 COMMON SIZE STATEMENT (CSS)

The CSS represents the relationship of different items of a financial statement

with some Common item by expressing each item as a percentage of the Common

item. In Common size Balance Sheet, each item of the Balance Sheet is stated as a

percentage of the total of the Balance Sheet. Similarly in Common size Income

Statement, each item is stated as percentage of the Net Sales. The percentages for

different items are computed by dividing the absolute amount of that item by the

Common base (i.e. the Balance Sheet Total or the Net Sales as the case may be) and

then multiplying by 100. The percentage so calculated can be easily compared with

the corresponding percentages in some other period. Thus, the CSS is useful not only

in intra-firm comparisons over a series of different year but also in making inter-firm

comparisons for the same year or for several years. The procedure and the technique

of preparation of the CSS can be explained with the help of Example 2.2.

Example 2.2.

With the use of data given in the Example 2.1 prepare the Common Size BS and

Common Size IS for the years 2003 & 2004.

Solution:

COMMON SIZE BALANCE SHEET

Amount (Rs.) Percentages

__________________________________________________________________

Liabilities 2003 2004 2003 2004

Land 50000 50000 7.70 6.59

Building 150000 135000 23.07 17.76

Plant 150000 135000 23.07 17.76

Furniture 50000 70000 7.70 9.21

Total Fixed Assets (1) 400000 390000 61.54 51.32

Cash 50000 70000 7.70 9.20

Debtors 100000 150000 15.38 19.74

Stock 100000 150000 15.38 19.74

Total C. Assets (2) 250000 370000 38.46 48.68

41

Total Assets (1+2) 650000 760000 100 100

Capital 350000 350000 53.85 46.05

Reserves 100000 122500 15.38 16.12

Proprietor's Fund (3) 450000 472500 69.23 62.17

Secured Loan 50000 75000 7.70 9.87

Creditor 100000 137500 15.37 18.09

O/s Expenses 50000 75000 7.70 9.87

Total Liabilities (4) 200000 287500 30.77 37.83

Total Capital +

Liabilities (3+4) 650000 760000 100 100

_________________________________________________________________

COMMON SIZE INCOME STATEMENT

Amount (Rs.) Percentages

__________________________________________________________________

2003 2004 2003 2004

Net Sales 400000 500000 100.0 100.0

Less : Cost of goods sold 300000 375000 75.0 75.0

Gross Profit (1) 100000 125000 25.0 25.0

Less : General Expenses 10000 10000 2.5 2.0

Selling Expenses 15000 20000 3.75 4.0

Total Op. Expenses(2) 25000 30000 6.25 6.0

Net Profit (1-2) 75000 95000 18.75 19.00

Interpretation: The Common size BS and the Common Size IS reveal that

proportion of fixed assets out of total assets has reduced from 61.54% to

51.32% whereas the proportion of reliance of the firm on the current assets.

Similarly, out the total liabilities the proportion of the proprietor's funds has

reduced from 69.23% to 62.17% and the proportion of external liabilities has

increased from 30.77% to 37.83%. Since, no new capital has been issued

and the other liabilities have increased, the proportion of capital in the total

financing of the firm has gone down from 53.85% to 46.05%.

Further, the Cost of goods sold as well as the Gross Profit has remained

pegged at 75% and 25% of Net Sales. However, the Net Profit has increased

42

from 18.75% to 19% of Net Sales. This is due to decrease in operating

expenses from 6.25% to 6% of the Net Sales.

It can be observed that the CSS can be used for analyzing and comparing the

financial position of a firm for two different periods or between two firms for

the same year. This comparability was not available in the CFS because of

difference in firms’ sizes or in different years. Of course, in order to make the

CSS more meaningful, the analyst should ensure that accounting policies of

different firms being compared or for different year are unchanged or not

significantly different.

The CSS can be easily used for analyzing and for some real insight into

operational and financial position of the firm over a period of different years.

However, it may become difficult and cumbersome if the period to be covered

is more than two years. The CSS does not show the variations in different

items from one period to another. In horizontal analysis, the CSS may not

provide sufficient information about the changing pattern or trend of different

items over years. In such a situation, the Trend Percentage Analysis can be

of immense help.

2.5.3 TREND PERCENTAGE ANALYSIS (TPA)

The TPA is a technique of studying several financial statements over a series

of years. In TPA, the trend percentages are calculated for each item by taking

the figure of that item for some base year as 100. So, the trend percentage is

the percentage relationship, which each item of different years bears to the

same item in the base year. Any year may be taken as the base year. Any

year may be taken as the base year, but generally the starting/initial year is

taken s the base year. So, each item for base year is taken as 100 and then

43

the same item for other years is expressed as a percentage of the base year.

The TPA which can be used both for the BS as well as the IS has been

explained with the help of the Example 3.3.

Example 2.3: From the following data relating to the ABC & Co. for the year

2001 to 2004, calculate the trend percentages (taking 2001 as base year).

(Figure in Rs.)

__________________________________________________________________

2001 2002 2003 2004

Net Sales 200000 190000 240000 260000

Less: Cost of goods sold 120000 117800 139200 145600

Gross Profit 80000 72200 100800 114400

Less: Expenses 20000 19400 22000 24000

Net Profit 60000 52800 78800 90400

__________________________________________________________________

Trend percentages

__________________________________________________________________

2001 2002 2003 2004

Net Sales 100 95.0 120.0 130.0

Less: Cost of goods sold 100 9.2 115.8 121.3

Gross GXX Profit 100 90.3 126.0 143.0

Less: Expenses 100 97.0 110.0 120.0

Net Profit 100 88.0 131.3 150.6

__________________________________________________________________

Interpretation: On the whole, the 2002 was a bad year but the recovery was

made during 2003 with increase in volume as well as profits. The figures of

2002 when compared with 2001 reveal that the Sales have reduced by 5%,

but the cost of goods sold and the Expenses have decreased only by 1.8%

and 3% respectively. This resulted in decrease in Net Profit by 12%. The

44

position was recovered in 2003 and not only the decline was arrested but the

positive growth was also visible both in 2003 and 2004. Again, the increase in

Net Profit by 31.3% (2003) and 50.6% (2004) is much more than the

increased in sales by 20% and 30% respectively. This again testifies that a

substantial portion of the cost of goods sold and expenses is of fixed nature.

So, the TPA is an important tool of historical analysis. It can be of immense

help in making a comparative analysis over a series of years. The TPA

provides brevity and easy readability to several financial statements as the

percentages figures disclose more than the absolute figures. However, some

precautions must be taken while using the TPA as a technique of the AFS as

follows:

There should not be a significant and material change in accounting policies

over the years. This consistency is necessary to ensure meaningful

comparability.

i. Proper care must be taken while selecting the base year. It must be a

normal and a representative year. Generally the initial year is taken as

base year, but intervening year can also be taken as the base year, if the

initial year is not found to be normal year.

ii. The trend percentages should be analyzed vis-à-vis the absolute figure to

avoid any misleading conclusions.

iii. If possible, the figures for different year should be adjusted for variations in

price level also. For example, increase in Net Sales by 30% (from 100 in

2001 to 130 in 2004) over 3 years might have resulted primarily because

of increase in selling price and not because of increase in volume.

45

Quite often, it may be difficult to interpret the increase or decrease in any item

(in absolute terms or in percentages terms) as a desirable change or an

undesirable change. For example, decrease in cash may be discouraging if it

is going to affect the liquidity but may be encouraging if it has resulted out of

better cash management. Similarly, increase in inventory may result because

of decrease in sales or because of necessity to maintain a minimum level of

stock. In such cases, therefore, the techniques of CFS, CSS and the TPA

may not be of much help. Financial analysts have developed another

technique called the Ratio Analysis, which is presumably the most common

and widely used technique of the FSA.

2.5.4 RATIO ANALYSIS (RA)

The RA has emerged as the principal technique of the FSA. A ratio is a

relationship expressed in mathematical terms between two individual or groups of

figures connected with each other in some logical manner. The RA is based on the

premise that a single accounting figure by itself may not communicate any meaningful

information but when expressed as a relative to some other figure, it may definitely

give some significant information. The relationship between two or more accounting

figures/groups is called a financial ratio. A financial ratio helps to summarize a large

mass of financial data into a concise form and to make meaningful interpretations and

conclusions about the performance and positions of a firm. For example, a firm having

Net Sales of Rs.5, 00,000 is making a gross profit of Rs.1, 00,000. It means that the

ratio of the Gross Profit to Net Sales is 20% i.e.

(Rs.1, 00,000/Rs.5, 00,000) x 100.

Steps in Ratio Analysis: The RA requires two steps as follows:

i. Calculation of a ratio (as discussed later), and

ii. Comparing the ratio with some predetermined standard. The standard

ratio may be the past ratio of the same firm or industry's average ratio or

a projected ratio or the ratio of the most successful firm in the industry.

In interpreting the ratio is compared with some predetermined standard.

The importance of a correct standard is obvious as the conclusion is

going to be based on the standard itself.

46

Types of comparisons: As already stated that the RA comprised of two

steps i.e. the calculation and thereafter the comparison with some standard.

The calculation part (as discussed later) of a ratio merely involves the

application of a formula to the given financial data to establish the

mathematical relationship. The comparison is the next steps. The ratio can

be compared in three different ways.

Cross-Section Analysis: One way of comparing the ratio or ratios of a firm

is to compare them with the ratio or ratios of some other selected firm in the

same industry at the same point of time. So, it involves the comparison of two

or more firm's financial ratios at the same point of time. The Cross-Section

Analysis helps the analyst to find out as to how a particular firm has

performed in relation to it competitors. The firm’s performance may be

compared with the performance of the leader in the industry in order to

uncover the major operational inefficiencies. In this type of an analysis, the

comparison with a standard helps to find out the quantum as well as direction

of deviation from the standard. It is necessary to look for the large deviations

on either side of the standard could mean a major concern for attention. The

Cross-Section Analysis is easy to be undertaken as most of the data required

for this may be available in financial statements of the firm.

2.5.5 Time-Series Analysis

The analysis is called Time-Series Analysis when the performance of a firm is

evaluated over a period of time. By comparing the present performance of a

firm with the performance of the same firm over last few years, an

assessment can be made about the trend in progress of the firm, about the

direction of progress of the fir. The information generated by the Time-Series