Publication 1494 (rev. 2018) ER 1383 P1494

User Manual: ER 1383

Open the PDF directly: View PDF ![]() .

.

Page Count: 1

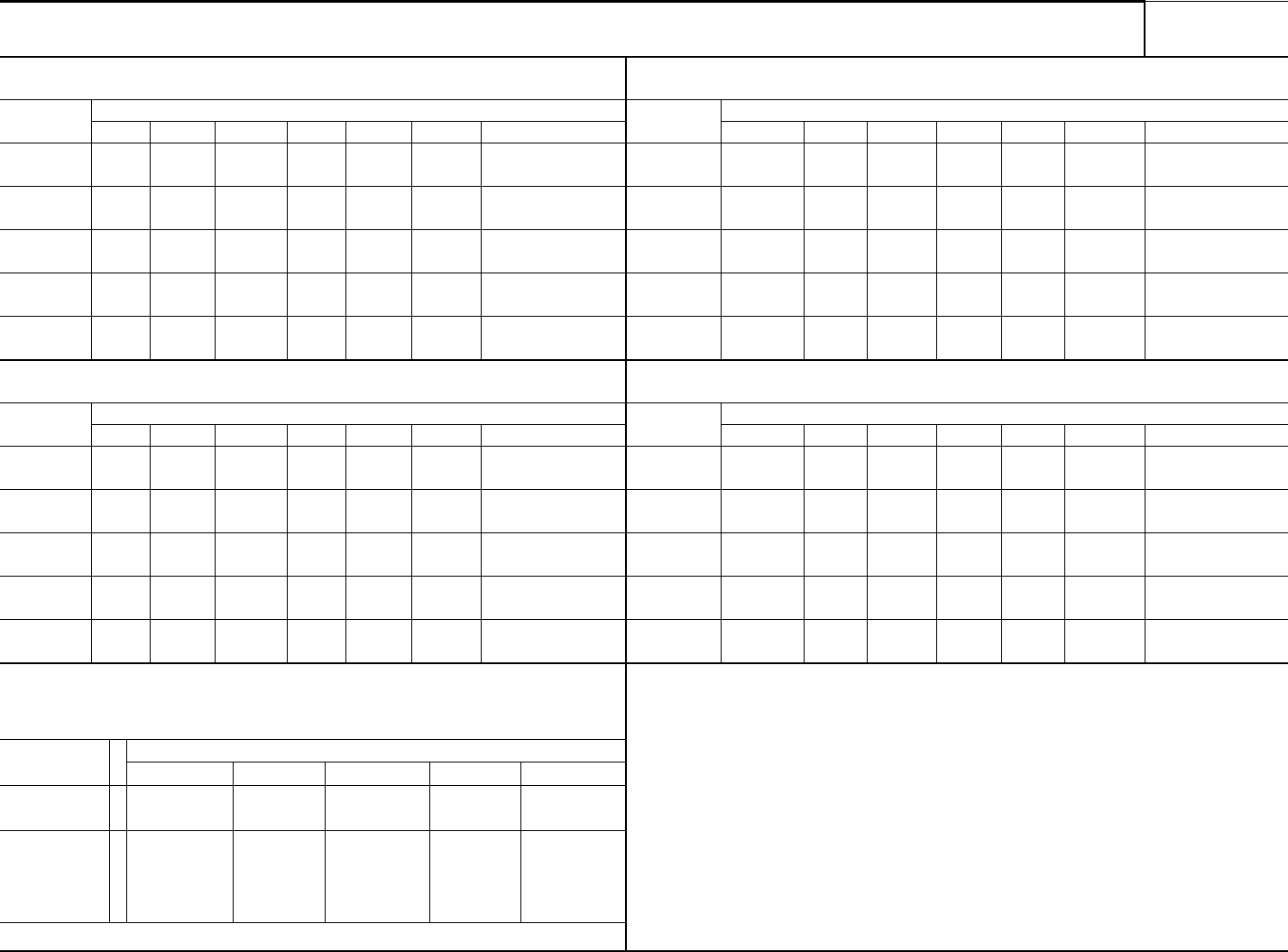

1. Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income (Forms 668-W(ACS), 668-W(c)(DO) and 668-W(ICS))

25 1 2 3 4 5 6 More Than 6

25 1 2 3 4 5 6 More Than 6

Monthly

1 133.33

2 266.67

1 108.33

2 216.67

3 325.00

4 433.33

Publication 1494 (2018)

Daily

Weekly

443.75

887.50 1579.17 1925.00

616.67

1233.33

Semimonthly

Monthly

1141.67

84.62

2179.17

1089.58

1005.77

502.88

100.58

263.46

686.54

743.75

Additional Exempt Amount

Daily Weekly Biweekly Semi-monthly

* ADDITIONAL STANDARD DEDUCTION claimed on Parts 3,4, and 5 of levy.

12.31 61.54 123.08 133.33

61.54 66.67

Any Other

Filing Status

5.00 25.00 50.00

15.00 75.00

526.92

570.83

162.50

20.00 100.00 200.00 216.67

54.17

10.00

6.15

Department of Treasury -- Internal Revenue Service

Filing Status: Married Filing Joint Return (and Qualifying Widow(er)s) Filing Status: Single

1

1833.33

916.67

846.15

423.08

52.69

150.00

www.irs.gov Catalog Number 11439T

100.00 108.33

2. Table for Figuring Additional Exempt Amount for Taxpayers

Single or Head of

Household

Filing Status *

50.00

30.77

2870.83

36.73 plus 15.96 for

each exemption

183.65 plus 79.81 for

each exemption

367.30 plus 159.62 for

each exemption

397.91 plus 172.92 for

each exemption

795.84 plus 345.83 for

each exemption

132.50

662.50

1325.00

1435.42

Examples

1487.50

6

116.54

582.69

1165.38

1262.50

2525.00

68.65

343.27

Pay

Period

Pay

Period

40.96

204.81

409.62

Filing Status: Married Filing Separate Return

34

72.88

364.42

Pay

Period

Pay

Period

2270.83

120.77

603.85

1207.69

1308.33

88.85

1

56.92

284.62

569.23 728.85

789.58

2616.67

34 6

104.81

524.04444.23

888.46

962.50

Number of Exemptions Claimed on Statement

Filing Status: Head of Household

Number of Exemptions Claimed on Statement

More Than 6

Daily

Weekly

Biweekly

25 plus 15.96 for

each exemption

Monthly

Daily

Weekly

Biweekly

Semimonthly

Monthly

Daily

Weekly

541.67 plus 345.83 for

each exemption

125 plus 79.81 for

each exemption

129.81

1457.69

1579.17

659.62

Biweekly

728.85

978.85

714.58

1048.08

Semimonthly

250 plus 159.62 for

each exemption

270.83 plus 172.92 for

each exemption

1048.08

1135.42

649.04

887.50 1060.42

Biweekly

Semimonthly

Number of Exemptions Claimed on Statement

Number of Exemptions Claimed on Statement

65.96 81.92 97.88 113.85

1233.33

1138.46

2466.67

819.23

Monthly

145.77

329.81 409.62 489.42 569.23

1298.08

1429.17 1775.00 2120.83

1135.42

50 plus 15.96 for

each exemption

250 plus 79.81 for

each exemption

500 plus 159.62 for

each exemption

541.67 plus 172.92 for

each exemption

1083.33 plus 345.83

for each exemption

2812.50 3158.33

1406.25

887.50

56.92

284.62

569.23

616.67

1233.33

40.96

204.81

409.62

443.75

1579.17

88.85

444.23

888.46

962.50

1925.00

72.88

364.42

728.85

789.58

These tables show the amount of take home pay that is exempt each pay period from a levy on wages, salary,

and other income.

1. A single taxpayer who is paid weekly and claims three exemptions (including one for the taxpayer)

25 plus 15.96 for

each exemption

125 plus 79.81 for

each exemption

250 plus 159.62 for

each examption

270.83 plus 172.92 for

each exemption

2270.83

120.77

603.85

1207.69

for the taxpayer) has $819.23 exempt from levy.

4. if the taxpayer in number 3 is over 65 and has a spouse who is blind, this taxpayer should write

2 in the ADDITIONAL STANDARD DEDUCTION space on Parts 3,4, and 5 of the levy. If so,

$919.23 is exempt from this levy ($819.23 plus $100).

has $364.42 exempt from levy.

2. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD DEDUCTION

space on Parts 3, 4, & 5 of the levy, $395.19 is exempt from this levy ($364.42 plus $30.77).

3. A taxpayer who is married, files jointly, is paid bi-weekly, and claims two exemptions (including one

The tables below show the amount of an individual's income

(

take home pa

y)

that is exempt from a notice of lev

y

used to collect delinquent tax in 201

8

2018

at Least 65 Years Old and/or Blind

541.67 plus 345.83 for

each exemption

More Than 6

1308.33

2616.67

104.81

524.04