Publication 3319 (Rev. 4 2017) P3319

User Manual: 3319

Open the PDF directly: View PDF ![]() .

.

Page Count: 172 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- 2018 Grant Application Package and Guidelines

- RESOURCES

- TABLE OF CONTENTS

- I. LITC PROGRAM OVERVIEW

- II. Grant Recipient Eligibility

- III. How to Apply for an LITC Grant

- IV. Standards for Operating a Low Income Taxpayer Clinic

- V. Standards for Providing Taxpayer Services

- VI. Compliance Requirements

- VII. Post-Award Requirements of Grantees

- VIII. LITC Program Office Responsibilities

- Appendix A Information Forms for LITC Grant Applications and Continuation Requests

- Appendix B Budget Forms for LITC Grant Applications and Continuation Requests

- Appendix C FORMS FOR REPORTING LITC GRANTEE ACTIVITIES

- COMMONLY USED ACRONYMS

- GLOSSARY

- Index

LITC

LOW INCOME

TAXPAYER CLINICS

Representation • Education • Advocacy

2018 Grant Application Package and Guidelines

i

LOW INCOME TAXPAYER CLINIC

TABLE OF CONTENTS

MAY 2017

DEAR PROSPECTIVE LOW INCOME TAXPAYER CLINIC GRANT APPLICANT:

I am pleased to announce the opening of the 2018 Low Income Taxpayer Clinic (LITC) grant application

period, which runs from May 1 through June 20, 2017.

The LITC program provides matching grants of up to $100,000 per year to qualifying organizations to

represent low income taxpayers in disputes with the IRS and to educate persons who speak English

as a second language (ESL) about their rights and responsibilities as U.S. taxpayers. LITC services

must be provided for free or for no more than a nominal fee. If you would like to know more about the

activities and accomplishments of organizations that have been awarded LITC funding in prior years, see

Publication 5066, LITC Program Report.

This publication outlines eligibility requirements for Low Income Taxpayer Clinic matching grants

authorized under Internal Revenue Code (IRC) § 7526 and instructions about how to apply for a matching

grant. This publication contains information about:

Basic eligibility requirements;

Standards of operation;

Compliance requirements;

Application and selection process;

Post-award requirements;

LITC Program Office responsibilities;

Application forms and instructions; and

Reporting forms and instructions.

This publication, including the Appendix section, should be

retained for future reference by all LITC grant recipients.

The IRS remains committed to achieving maximum access to representation for low income taxpayers

under the terms of this grant program. Thus, in awarding 2018 LITC grants, we will continue to work

toward the following program goals:

Ensuring that each state (plus the District of Columbia and Puerto Rico) has at least one clinic;

Expanding coverage in areas identified as underserved; and

Ensuring that grant recipients demonstrate that they are serving geographic areas that have sizable

populations eligible for and requiring LITC services.

The IRS may award grants to qualifying organizations to fund one-year to three-year project periods.

Low Income Taxpayer Clinics (LITCs) ensure

the fairness and integrity of the tax system

for taxpayers who are low income or speak

English as a second language (ESL) by:

Providing pro bono representation on their

behalf in tax disputes with the IRS;

Educating them about their rights and

responsibilities as taxpayers; and

Identifying and advocating for issues that

impact low income taxpayers.

To be considered for 2018 LITC Program grant funding, all applications and continuation requests must

be submitted electronically by June 20, 2017, via www.grants.gov or www.grantsolutions.gov, respectively.

The cost of preparing and submitting an application or continuation request is the responsibility of each

applicant.

The LITC Program Office will notify each applicant in November 2017 about whether it was selected to

receive a matching grant for 2018.

If you have questions about the LITC Program or grant application process, please contact the LITC

Program Office at 202-317-4700 (not a toll-free call) or by email at LITCProgramOffice@irs.gov.

I appreciate your interest in the LITC Program and look forward to working with the 2018 Low Income

Taxpayer Clinic grantees to ensure the fairness and integrity of federal tax administration.

Sincerely,

Nina E. Olson

National Taxpayer Advocate

Paperwork Reduction Act Notice:

This application package is provided for awards under the Low Income Taxpayer Clinic Grant Program. The

information is requested from the applicants in order to determine their eligibility for an LITC grant and

evaluate their grant proposals. Applicants are not required to respond to this collection of information unless

it displays a currently valid OMB number. The estimated average burden associated with this collection

of information is 60 hours per respondent for program sponsors and 2 hours for student and program

participants. Comments concerning the accuracy of this burden estimate and suggestions for reducing

this burden should be directed to the IRS, Tax Forms and Publication Division, 1111 Constitution Ave. NW,

Room, Washington, DC 20224. Do not send grant application forms to this address. Grant applications

must be submitted through www.grants.gov and continuation requests must be submitted through

www.grantsolutions.gov. Comments about this application package should be sent to: Internal Revenue

Service, Taxpayer Advocate Service, LITC Program Office, TA: LITC, Room 1034, 1111 Constitution Ave., NW,

Washington, DC 20224.

Catalog of Federal Domestic Assistance Number: 21.008 OMB Approval No.1545-1648

iii

LOW INCOME TAXPAYER CLINIC

TABLE OF CONTENTS

RESOURCES

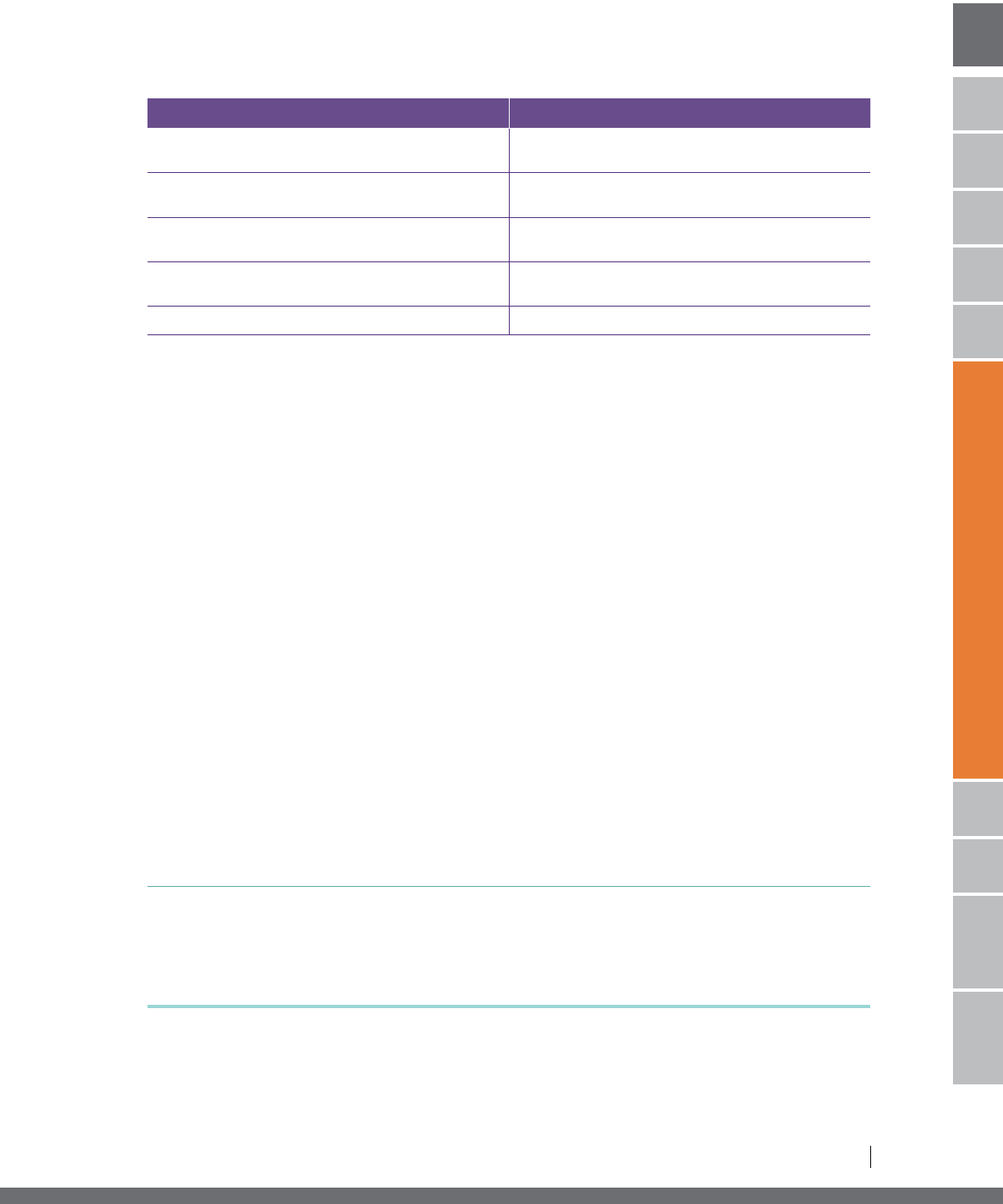

IMPORTANT DATES FOR 2018 LITC GRANTEES

Application period May 1 – June 20, 2017

Program Office review and evaluation June – October 2017

Notification of selection/non-selection November 2017

LITC Grantee Conference Early December 2017

Grant year January 1, 2018 – December 31, 2018

Interim report due July 30, 2018

Year-End report due April 1, 2019

CONTACTING THE PROGRAM OFFICE

Potential applicants may direct questions concerning the LITC Program or the application process to the LITC

Program Office. Organizations that have been awarded an LITC grant should contact their assigned Advocacy

Analyst directly with any questions regarding reporting or program requirements.

Hours of Operation: 8:00 a.m. – 4:30 p.m. (EST), Monday – Friday

Phone: 202-317-4700

Fax: 877-477-3520

Email: LITCProgramOffice@irs.gov

Address: Internal Revenue Service

LITC Program Office

Attention: TA: LITC, Room 1034

1111 Constitution Ave., NW

Washington, DC 20224

GENERAL INFORMATION

www.taxpayeradvocate.irs.gov/Tax-Professionals/Low-Income-Taxpayer-Clinics

INCOME GUIDELINES TO DETERMINE ELIGIBILITY FOR LITC SERVICES

www.irs.gov/Advocate/Low-Income-Taxpayer-Clinics/Low-Income-Taxpayer-Clinic-Income-Eligibility-Guidelines

LITC TOOLKIT

www.litctoolkit.com (Access restricted to current LITC grantees)

QUESTIONS RELATING TO SPECIAL APPEARANCE AUTHORIZATION FOR

STUDENT AND LAW GRADUATE PRACTICE

Phone: 212-298-2295

Fax: 212-298-2079

LITC PROGRAM PUBLICATIONS

Publication 3319, Low Income Taxpayer Clinic (LITC) Grant Application Package and Guidelines

https://www.irs.gov/pub/irs-pdf/p3319.pdf

Publication 4134, Low Income Taxpayer Clinic List

http://core.publish.no.irs.gov/pubs/pdf/p4134--2017-01-00.pdf

Publication 5066, Low Income Taxpayer Clinic (LITC) Program Report

http://core.publish.no.irs.gov/pubs/pdf/p5066--2017-01-00.pdf

OTHER USEFUL RESOURCES

Dun and Bradstreet Data Universal Numbering System (DUNS)

Website: fedgov.dnb.com/webform

Support: 866-705-5711

Email: govt@dnb.com

System for Award Management (SAM)

Website: www.sam.gov

Support: 866-606-8220

Submission of a Grant Application via Grants.gov

Website: www.grants.gov

Support: 800-518-4726

Email: Support@grants.gov

Submission of a Continuation Request and Interim/Year-End Reports via Grantsolutions.gov

Website: www.grantsolutions.gov

Email: Beard.William@irs.gov

Department of Health and Human Services (HHS) Payment Management System

Website: www.dpm.psc.gov

Support: 877-614-5533

Email: PMSSupport@psc.gov

Civil Rights Protection

Website: https://www.irs.gov/uac/your-civil-rights-are-protected

2 CFR Part 200 (OMB Guidance) and 2 CFR Part 1000 (Treasury Department Adoption of OMB Guidance)

Website: www.ecfr.gov

Taxpayer Advocate Service Taxpayer Toolkit

Website: www.TaxpayerAdvocate.irs.gov

United States Tax Court

Website: www.ustaxcourt.gov

v

LOW INCOME TAXPAYER CLINIC

TABLE OF CONTENTS

TABLE OF CONTENTS

The organization of this publication represents a progression of the LITC grant process and administration

including the following information:

I. LITC PROGRAM OVERVIEW ...................................................1

A. History of the LITC Program .................................................1

B. Types of Grants Awarded by the LITC Program Office ...............................3

C. Core Terms and Definitions .................................................4

II. GRANT RECIPIENT ELIGIBILITY ...............................................7

A. Subgrants are Prohibited ...................................................8

B. Requirements for Providing LITC Services .......................................8

C. Start-Up Expenses may be Paid Using LITC Grant Funds.............................9

D. Compliance with Federal Tax and Federal Nontax Obligations .........................9

E. Civil Rights Reviews......................................................10

F. Other Assurances and Certifications ..........................................11

III. HOW TO APPLY FOR AN LITC GRANT ..........................................15

A. Application Process ......................................................15

B. Completion and Submission of the LITC Grant Application Package....................17

C. Completion and Submission of a Non-Compete Continuation Request ..................18

D. Eligible LITC Grant Applications .............................................19

E. Notice of Award.........................................................23

IV. STANDARDS FOR OPERATING A LOW INCOME TAXPAYER CLINIC .................24

A. Staffing ..............................................................24

B. Infrastructure and Resources ...............................................24

C. Developing a Community Plan ..............................................26

D. Publicizing LITC Services ..................................................26

E. Building Community Partnerships ............................................28

F. Networking With Other Clinics ..............................................28

G. Mentoring and Technical Assistance ..........................................29

H. Maintaining Client Confidentiality ............................................29

I. Volunteers ............................................................31

J. Recordkeeping and File Management .........................................32

V. STANDARDS FOR PROVIDING TAXPAYER SERVICES .............................35

A. Representation .........................................................35

B. Education .............................................................45

C. Advocacy .............................................................47

D. Preparing Tax Returns and ITIN Applications ....................................47

VI. COMPLIANCE REQUIREMENTS ...............................................49

A. Uniform Administrative Requirements .........................................49

B. Civil Rights Protection Responsibilities ........................................49

C. Lobbying Restrictions.....................................................50

D. Spending LITC Grant Funds and Matching Funds .................................53

E. Meeting the Matching Funds Requirement......................................56

VII. POST-AWARD REQUIREMENTS OF GRANTEES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .61

A. Events Requiring Notification to the LITC Program Office............................62

B. Managing Grant Funds....................................................64

C. Reporting Responsibilities ................................................65

VIII. LITC PROGRAM OFFICE RESPONSIBILITIES ....................................68

A. Structure .............................................................68

B. Administration..........................................................69

C. Assistance ............................................................69

D. Oversight .............................................................70

E. Sight Assistance Visits ...................................................70

F. Suspension or Termination of a Grant .........................................71

G. Grant Close Out ........................................................73

APPENDIX A: INFORMATION FORMS FOR LITC GRANT APPLICATIONS AND

CONTINUATION REQUESTS ........................................... 75

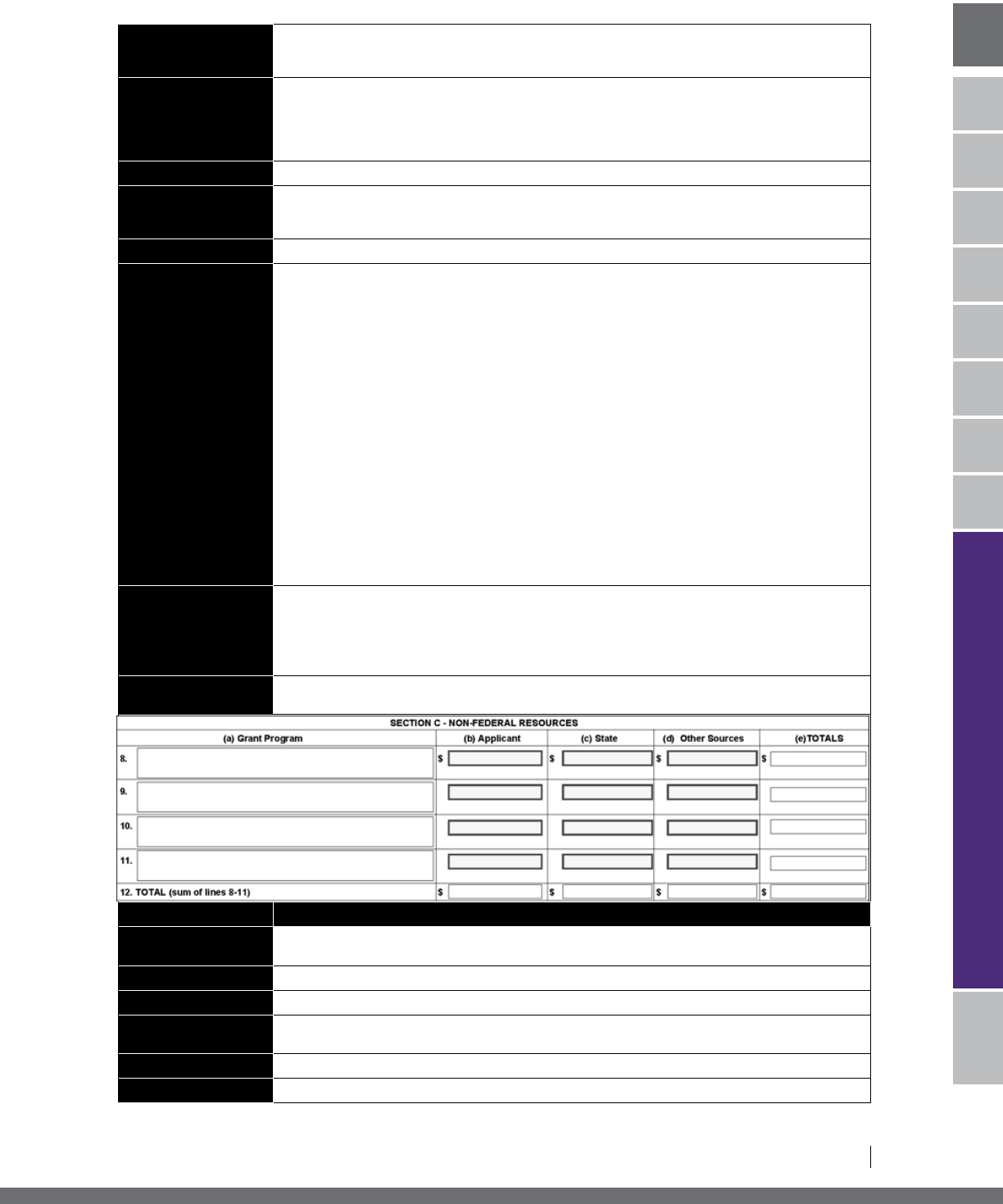

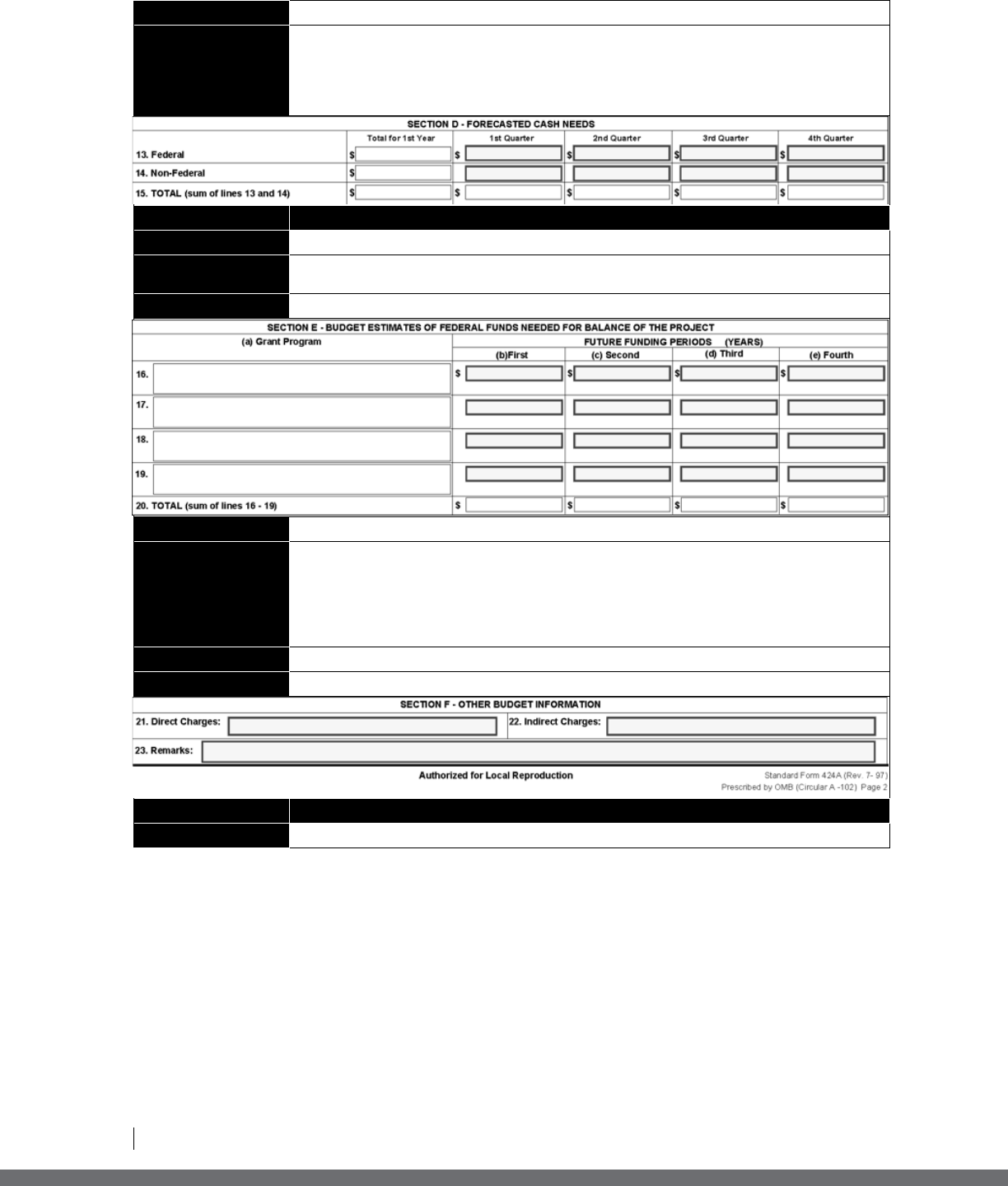

APPENDIX B: BUDGET FORMS FOR LITC GRANT APPLICATIONS AND

CONTINUATION REQUESTS ........................................... 97

APPENDIX C: FORMS FOR REPORTING LITC GRANTEE ACTIVITIES ............... 111

COMMONLY USED ACRONYMS .......................................... 145

GLOSSARY.......................................................... 149

INDEX ............................................................. 161

1

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

I. LITC PROGRAM OVERVIEW

A. HISTORY OF THE LITC PROGRAM

As part of the Internal Revenue Service Restructuring and Reform Act of 1998 (RRA 98), Congress enacted

IRC § 7526 to authorize funding for the LITC grant program. Subject to the availability of appropriated funds,

the IRS may award grants of up to $100,000 per year to qualifying organizations for the development, expansion,

or continuation of an LITC.

The program is designed to protect taxpayers’ rights by providing access to representation for low income

taxpayers, so that achieving a correct outcome in an IRS dispute does not depend on the taxpayer’s ability to pay

for representation. Many low income taxpayers are also individuals for whom English is a second language (ESL

taxpayers). Consequently, Congress authorized funding for organizations to provide outreach and education

about taxpayer rights and responsibilities to ESL taxpayers in addition to representing low income taxpayers in

controversies with the IRS.

In June 2014, the IRS adopted the Taxpayer Bill of Rights — a set of ten fundamental rights that taxpayers

should be aware of when dealing with the IRS.1 One of those ten rights is the right to retain representation,

which gives taxpayers the right to retain an authorized representative of their choice to represent them in their

interactions with the IRS. In addition, taxpayers have the right to be informed that if they cannot afford to

hire a representative, they may be eligible for assistance from an LITC. In December 2015, Congress enacted

IRC § 7803(a)(3), which requires the Commissioner to ensure that employees of the IRS are familiar with and act

in accord with taxpayer rights, including the right to retain representation.2

The IRS created the LITC Program Office in 1999 to provide guidance, assistance, and oversight to LITC

grantees and prospective applicants. The LITC Program Office is part of the Office of the Taxpayer Advocate

(commonly referred to as the Taxpayer Advocate Service (TAS)).

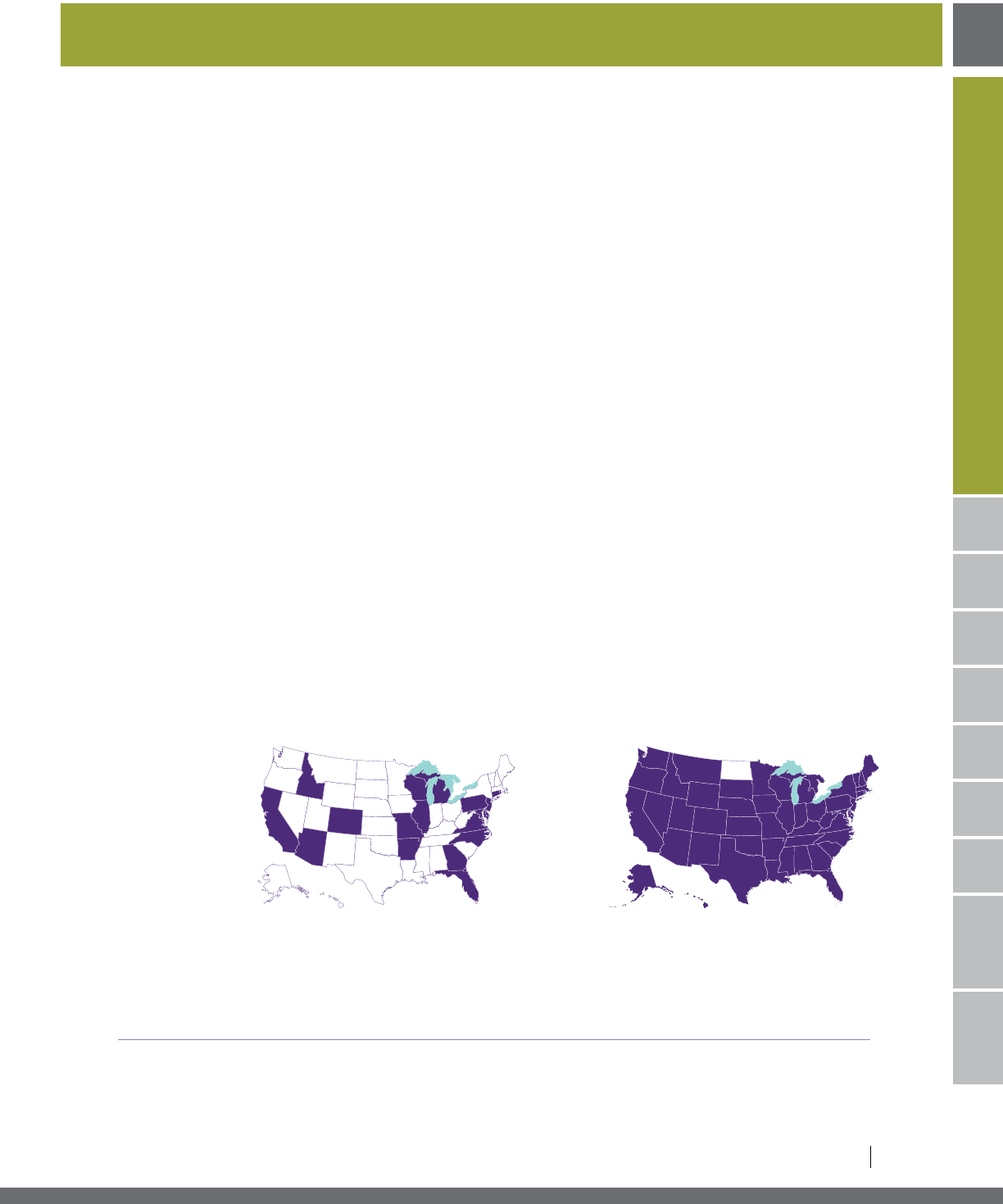

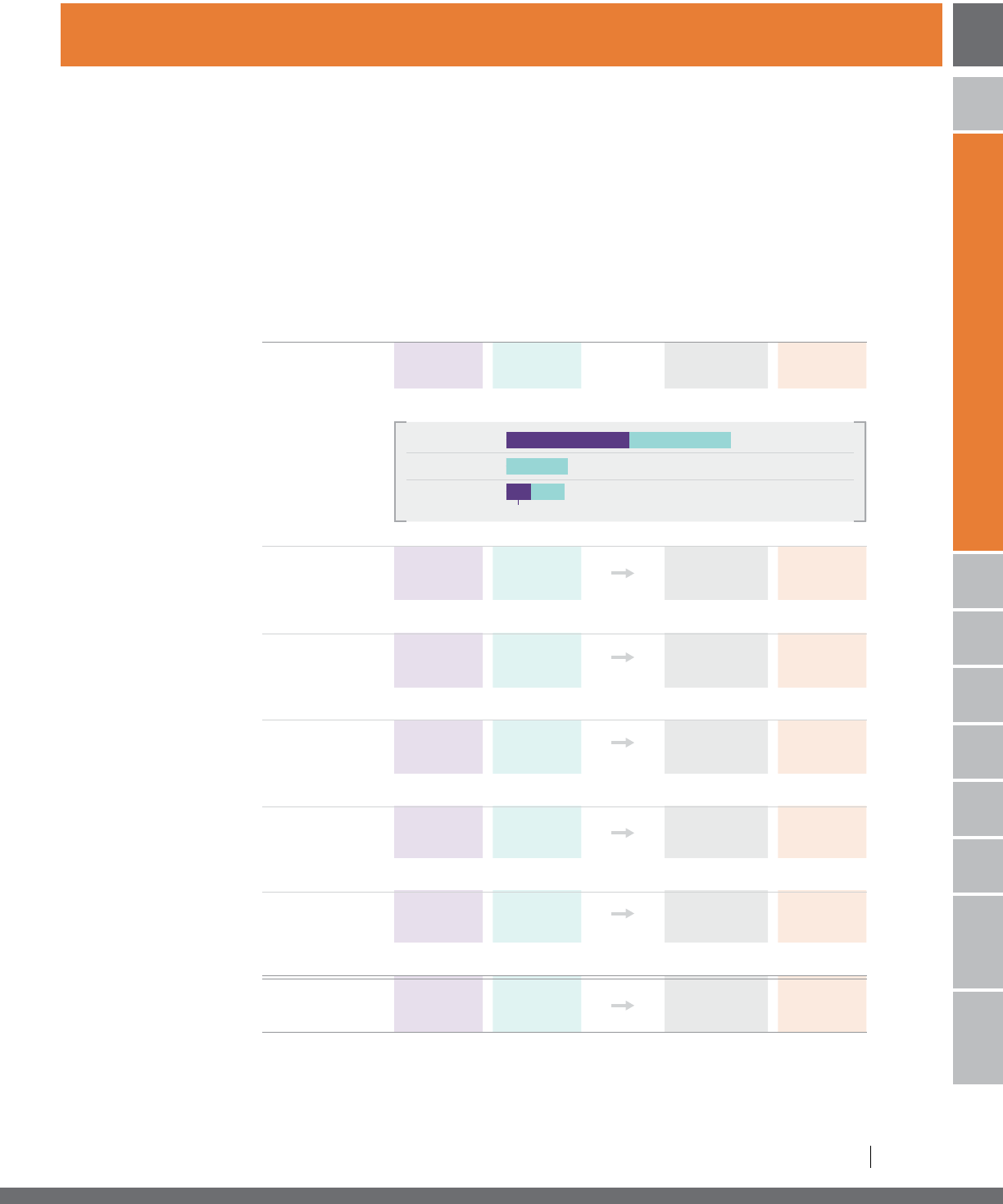

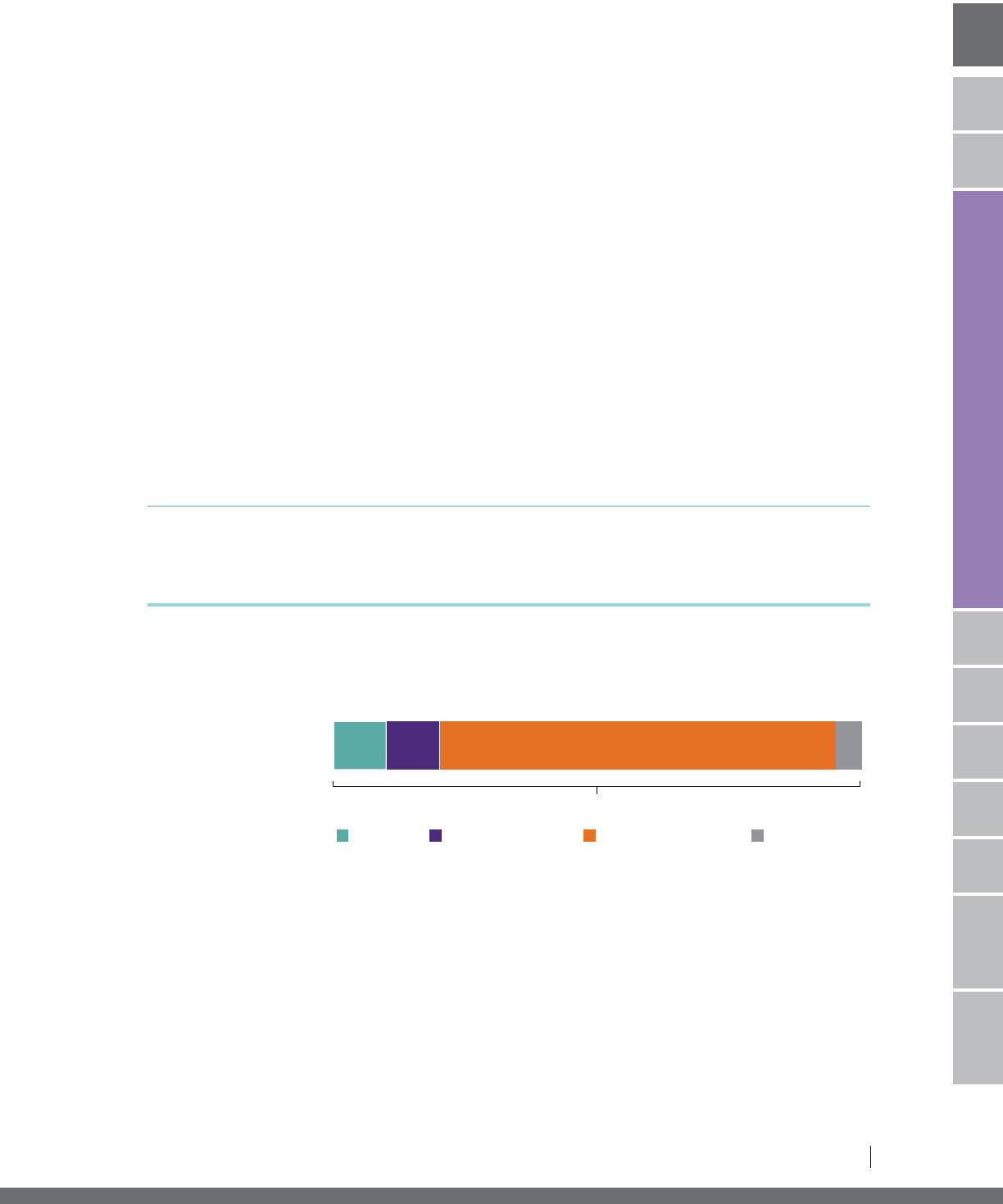

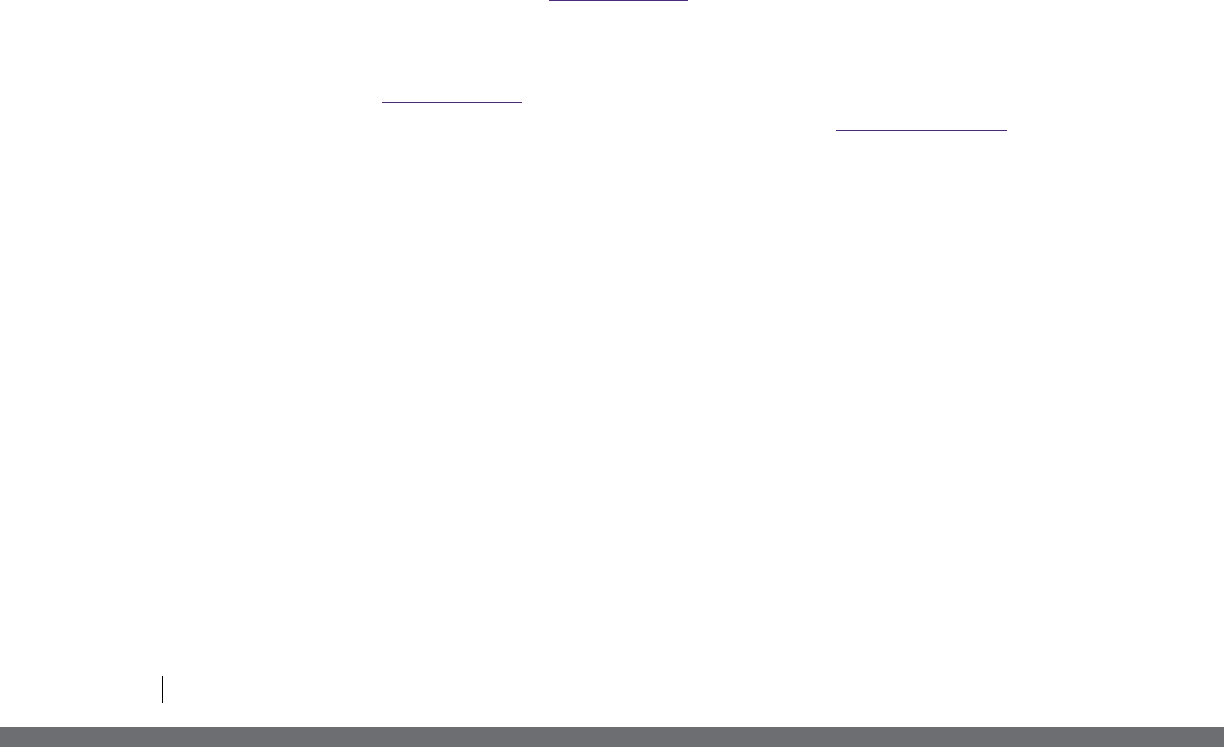

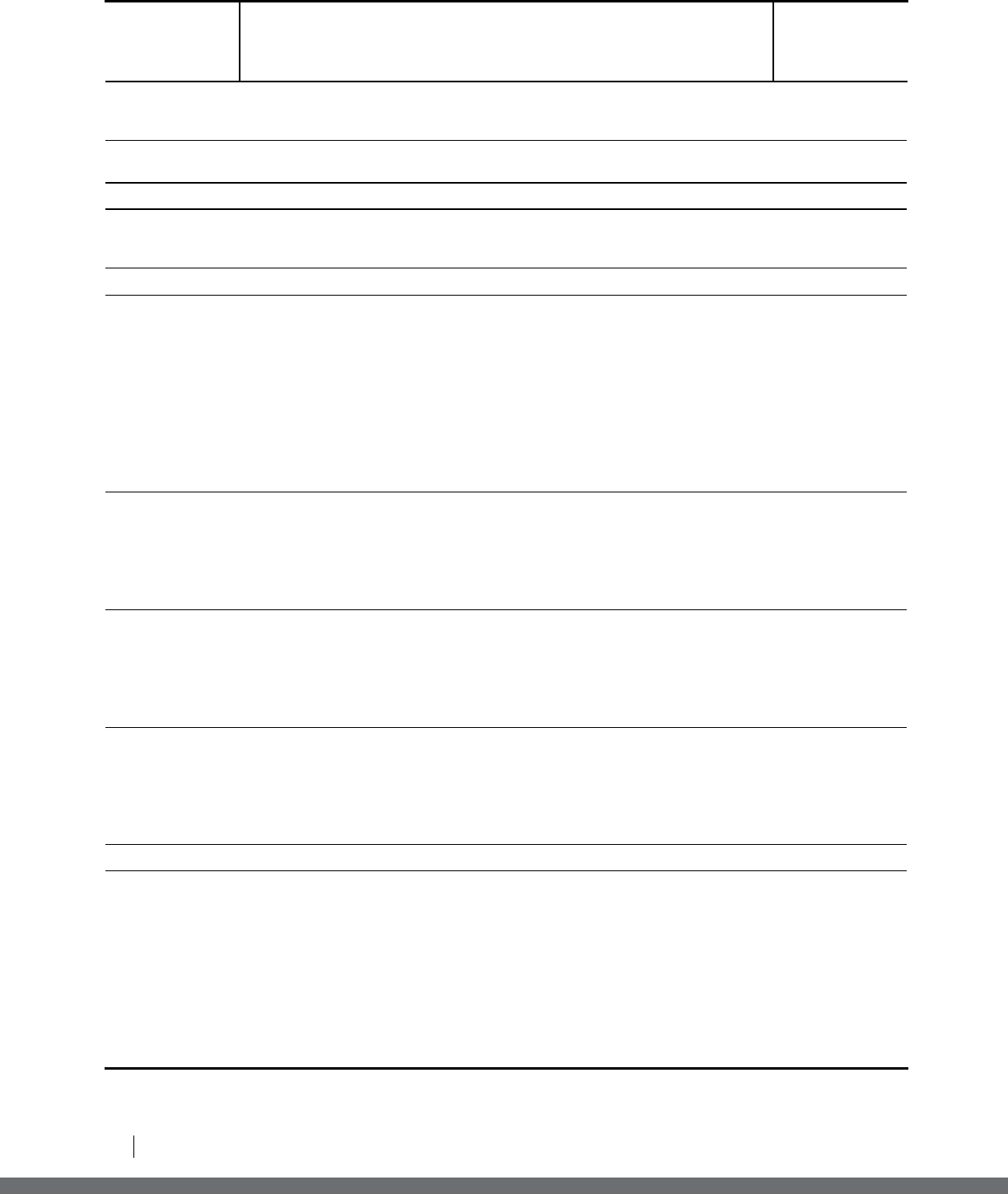

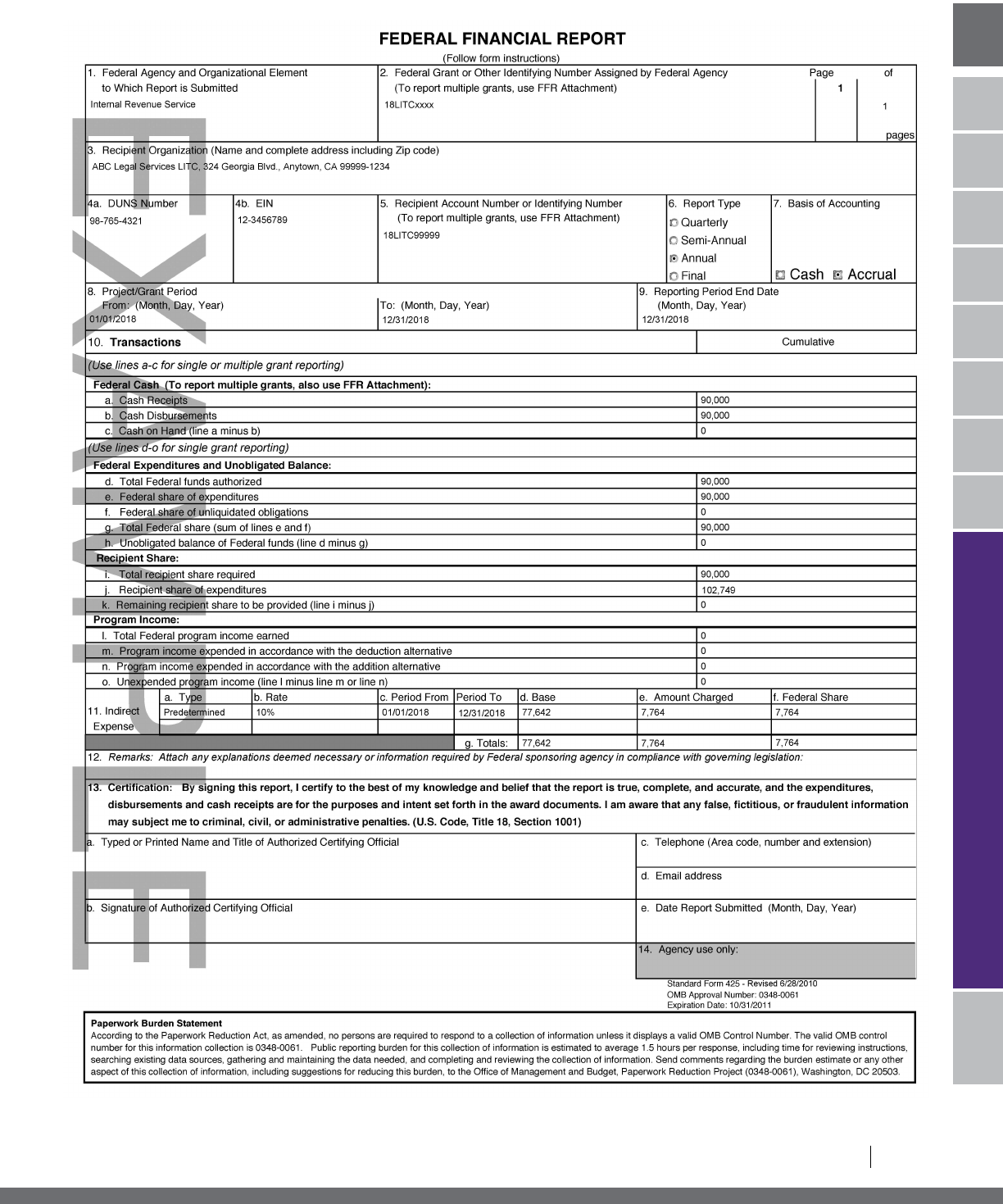

Figure 1, States With at Least One LITC Grantee, 1999 and 2016

States with at Least One LITC Grantee – 1999 States with at Least One LITC Grantee – 2016

1 See IR-2014-72 (June 10, 2014).

2 See Consolidated Appropriations Act, 2016, Public Law 114-113, Division Q, § 401, 129 Stat. 2242, 3117 (Dec. 18, 2015).

2

LOW INCOME TAXPAYER CLINIC

In 1999, the IRS awarded grants totaling less than $1.5 million to 34 entities located in 18 states and the District

of Columbia. In 2016, the IRS awarded over $11.4 million in grants to 138 entities located in 49 states and the

District of Columbia.

Representation, Education, and Advocacy Are the Primary Functions of LITCs

The text of IRC § 7526 is reprinted in full below:

Section 7526. Low-income taxpayer clinics.

(a) In general. The Secretary may, subject to the availability of appropriated funds, make grants to provide

matching funds for the development, expansion, or continuation of qualified low-income taxpayer clinics.

(b) Definitions. For purposes of this section—

(1) Qualified low-income taxpayer clinic.

(A) In general. The term “qualified low-income taxpayer clinic” means a clinic that—

(i) does not charge more than a nominal fee for its services (except for reimbursement of actual costs

incurred); and

(ii) (I) represents low-income taxpayers in controversies with the Internal Revenue Service; or

(II) operates programs to inform individuals for whom English is a second language about their

rights and responsibilities under this title.

(B) Representation of low-income taxpayers. A clinic meets the requirements of subparagraph (A)(ii)(I)

if—

(i) at least 90 percent of the taxpayers represented by the clinic have incomes which do not exceed 250

percent of the poverty level, as determined in accordance with criteria established by the Director of

the Office of Management and Budget; and

(ii) the amount in controversy for any taxable year generally does not exceed the amount specified in

section 7463.

(2) Clinic. The term “clinic” includes—

(A) a clinical program at an accredited law, business, or accounting school in which students represent

low-income taxpayers in controversies arising under this title; and

(B) an organization described in section 501(c) and exempt from tax under section 501(a) which satisfies

the requirements of paragraph (1) through representation of taxpayers or referral of taxpayers to

qualified representatives.

(3) Qualified representative. The term “qualified representative” means any individual (whether or not an

attorney) who is authorized to practice before the Internal Revenue Service or the applicable court.

(c) Special rules and limitations.

(1) Aggregate limitation. Unless otherwise provided by specific appropriation, the Secretary shall not allocate

more than $6,000,000 per year (exclusive of costs of administering the program) to grants under this section.

3

LOW INCOME TAXPAYER CLINIC

LITC PROGRAM OVERVIEW

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

(2) Limitation on annual grants to a clinic. The aggregate amount of grants which may be made under this

section to a clinic for a year shall not exceed $100,000.

(3) Multi-year grants. Upon application of a qualified low-income taxpayer clinic, the Secretary is authorized

to award a multi-year grant not to exceed 3 years.

(4) Criteria for awards. In determining whether to make a grant under this section, the Secretary shall

consider—

(A) the numbers of taxpayers who will be served by the clinic, including the number of taxpayers in the

geographical area for whom English is a second language;

(B) the existence of other low-income taxpayer clinics serving the same population;

(C) the quality of the program offered by the low-income taxpayer clinic, including the qualifications of its

administrators and qualified representatives, and its record, if any, in providing service to low-income

taxpayers; and

(D) alternative funding sources available to the clinic, including amounts received from other grants and

contributions, and the endowment and resources of the institution sponsoring the clinic.

(5) Requirement of matching funds. A low-income taxpayer clinic must provide matching funds on a dollar-

for-dollar basis for all grants provided under this section. Matching funds may include—

(A) the salary (including fringe benefits) of individuals performing services for the clinic; and

(B) the cost of equipment used in the clinic.

Indirect expenses, including general overhead of the institution sponsoring the clinic, shall not be counted as

matching funds.

B. TYPES OF GRANTS AWARDED BY THE LITC PROGRAM OFFICE

A grant may be awarded for up to a three-year period. However, funding is provided for one-year periods

(January 1 – December 31), subject to the availability of annually appropriated funds. First-time applicants may

request a one year grant. Multi-year grants will only be awarded to applicants that have successfully completed at

least one year under the terms of the LITC grant.

New applicants and current grantees whose single year or multi-year grant period will end on December 31, 2017,

must submit an application. A recipient of an LITC grant entering the second or third year of a multi-year grant

in 2018 must submit a Non-Compete Continuation (NCC) request, in lieu of an application. See Section III,

How to Apply for an LITC Grant.

With respect to multi-year grant awards, the second and third years will be funded subject to satisfactory

performance, compliance with the conditions outlined in the notice of award, and availability of appropriated

funds. All grant funds awarded must be used for the program specifically authorized in the notice of award.

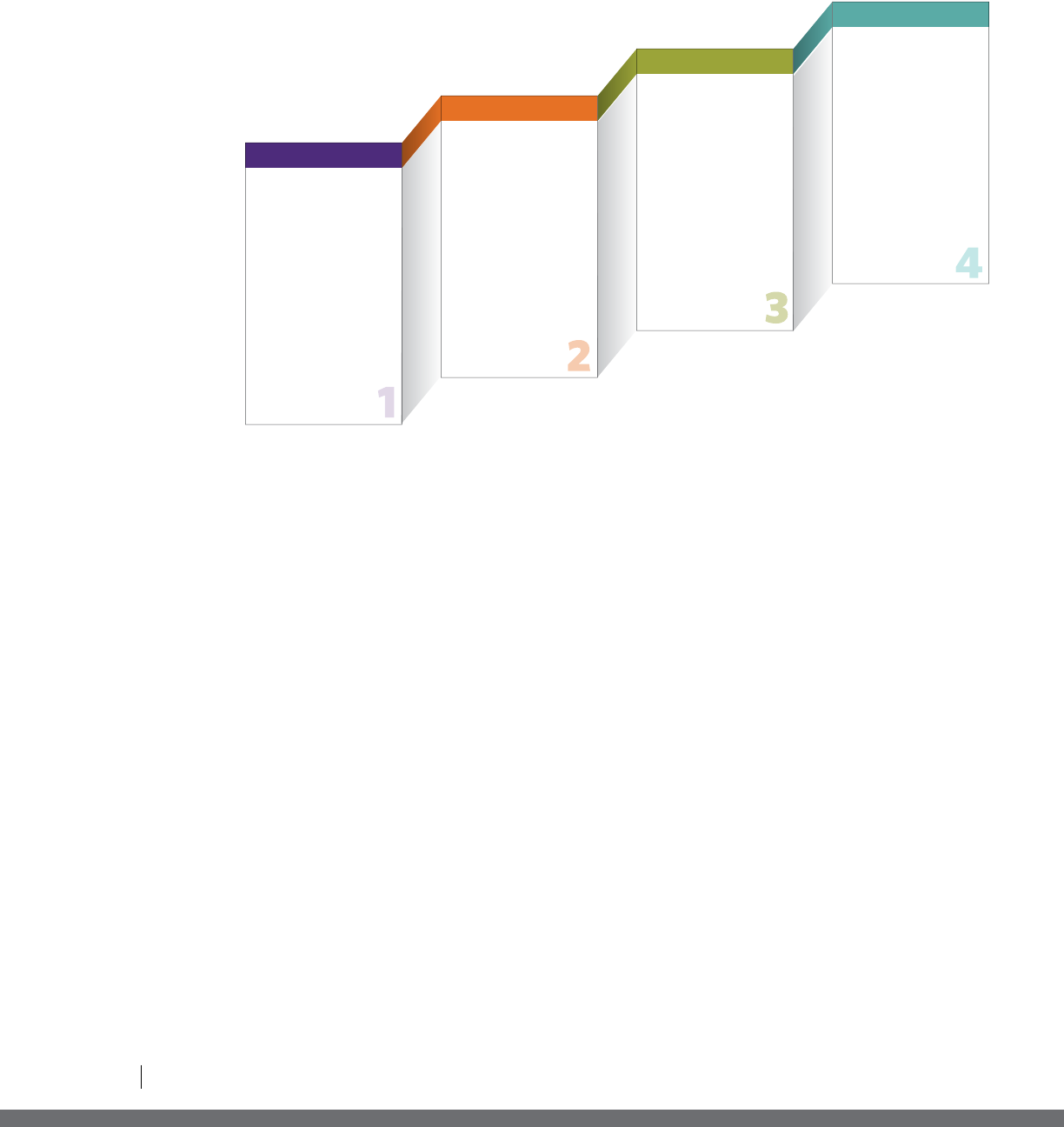

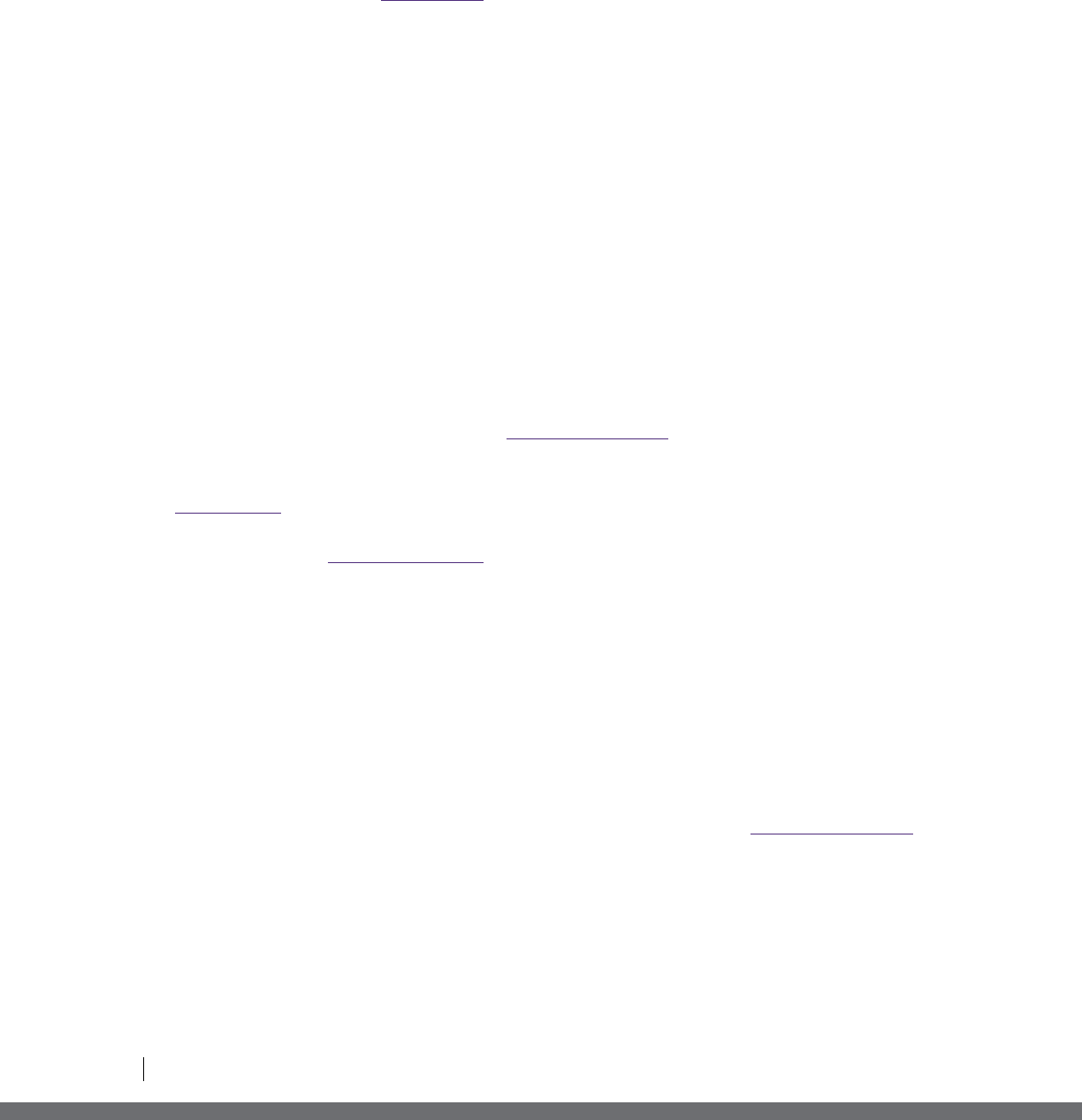

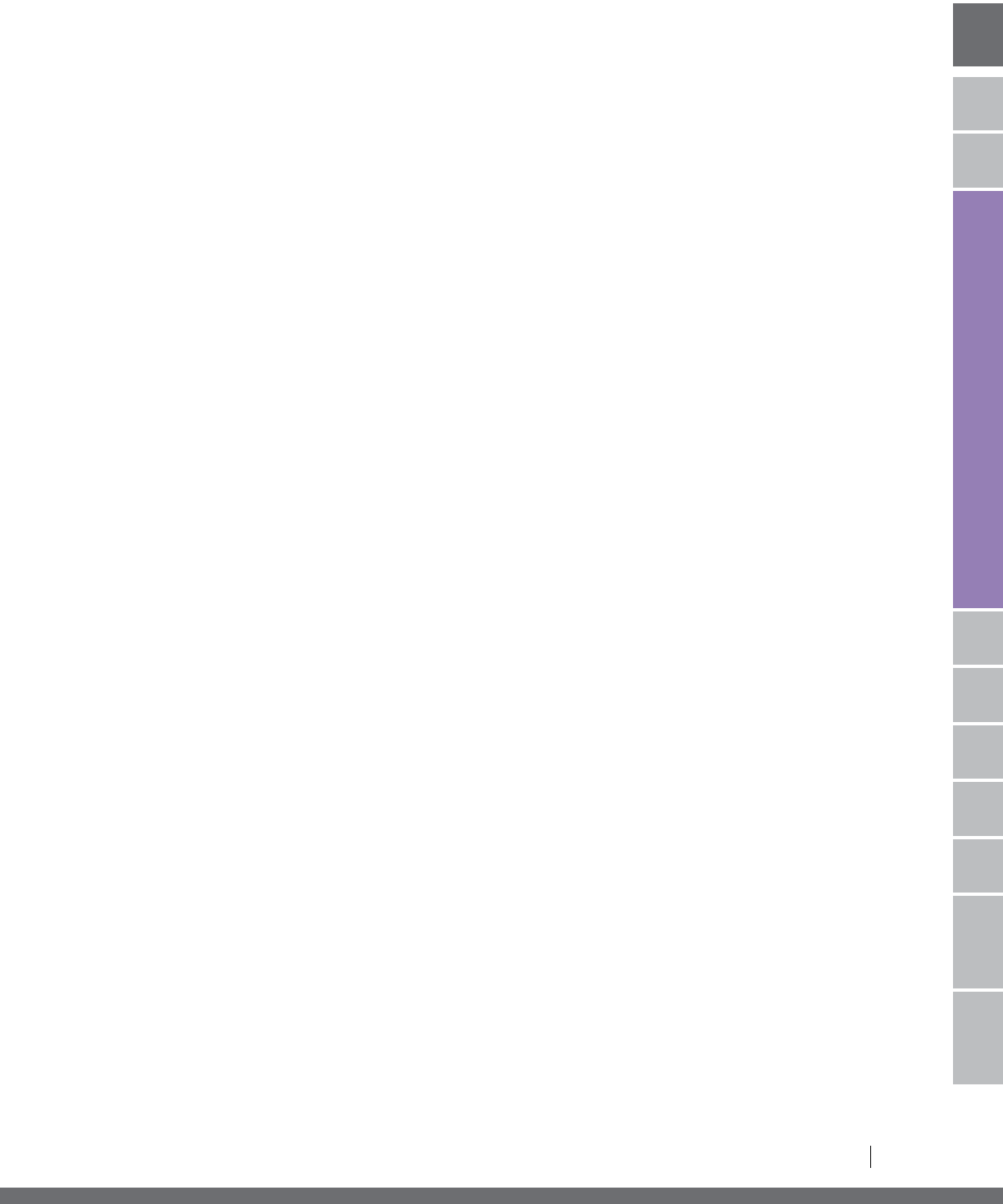

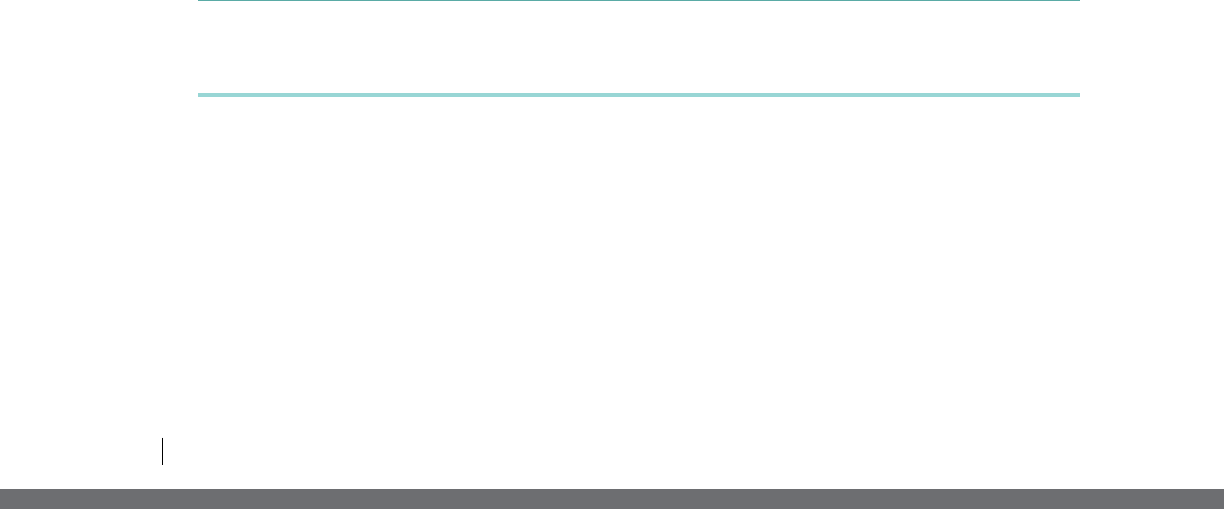

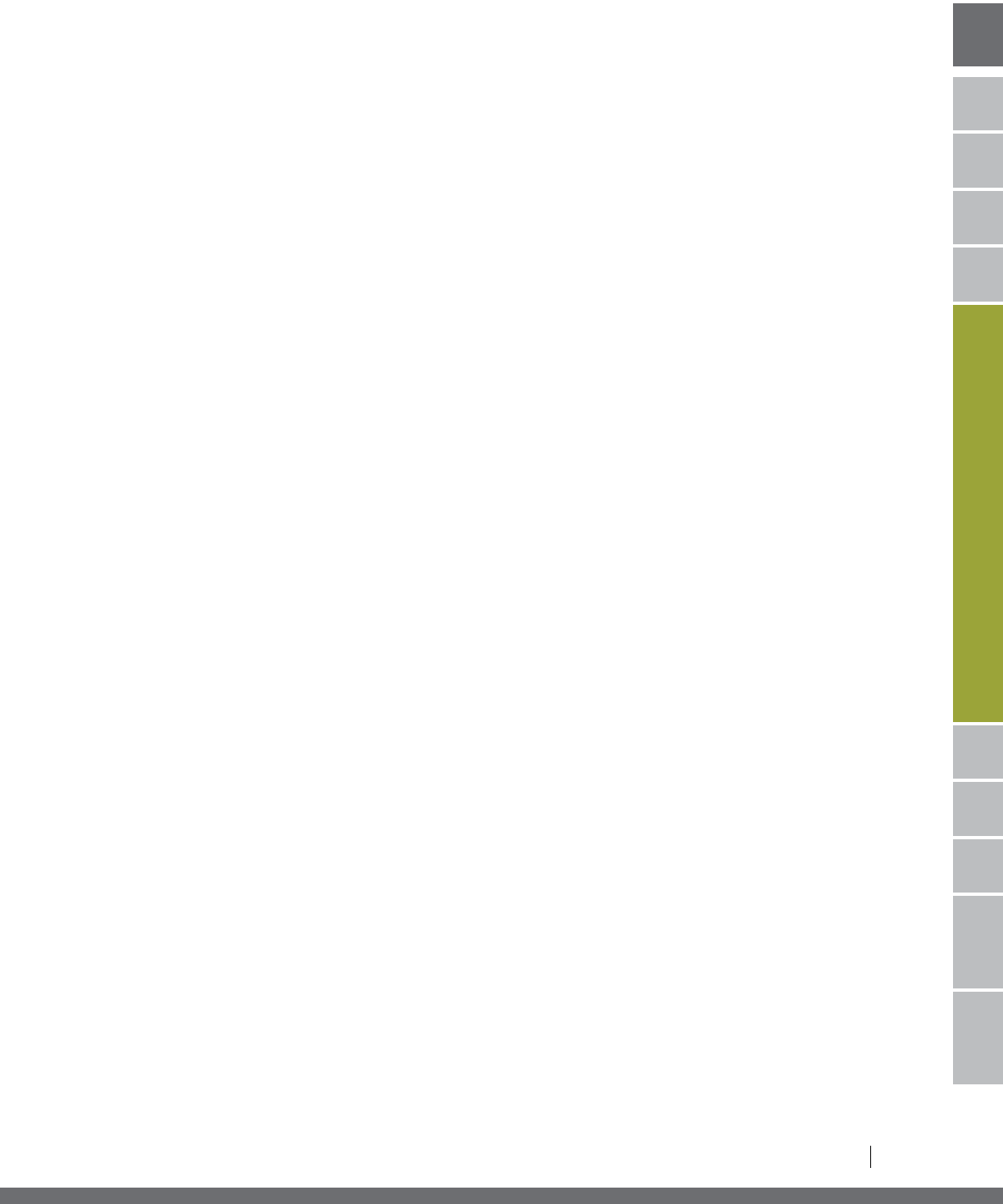

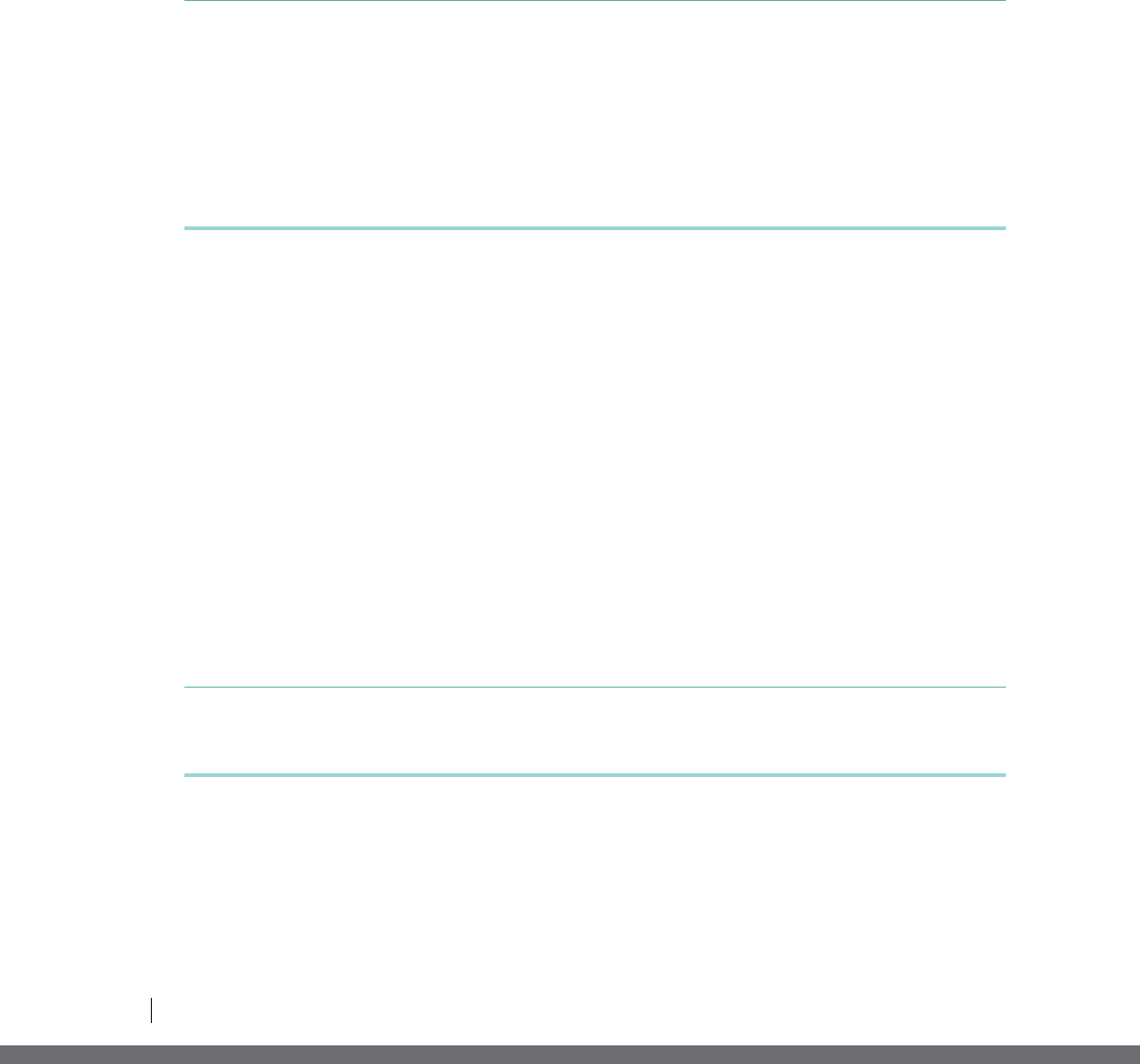

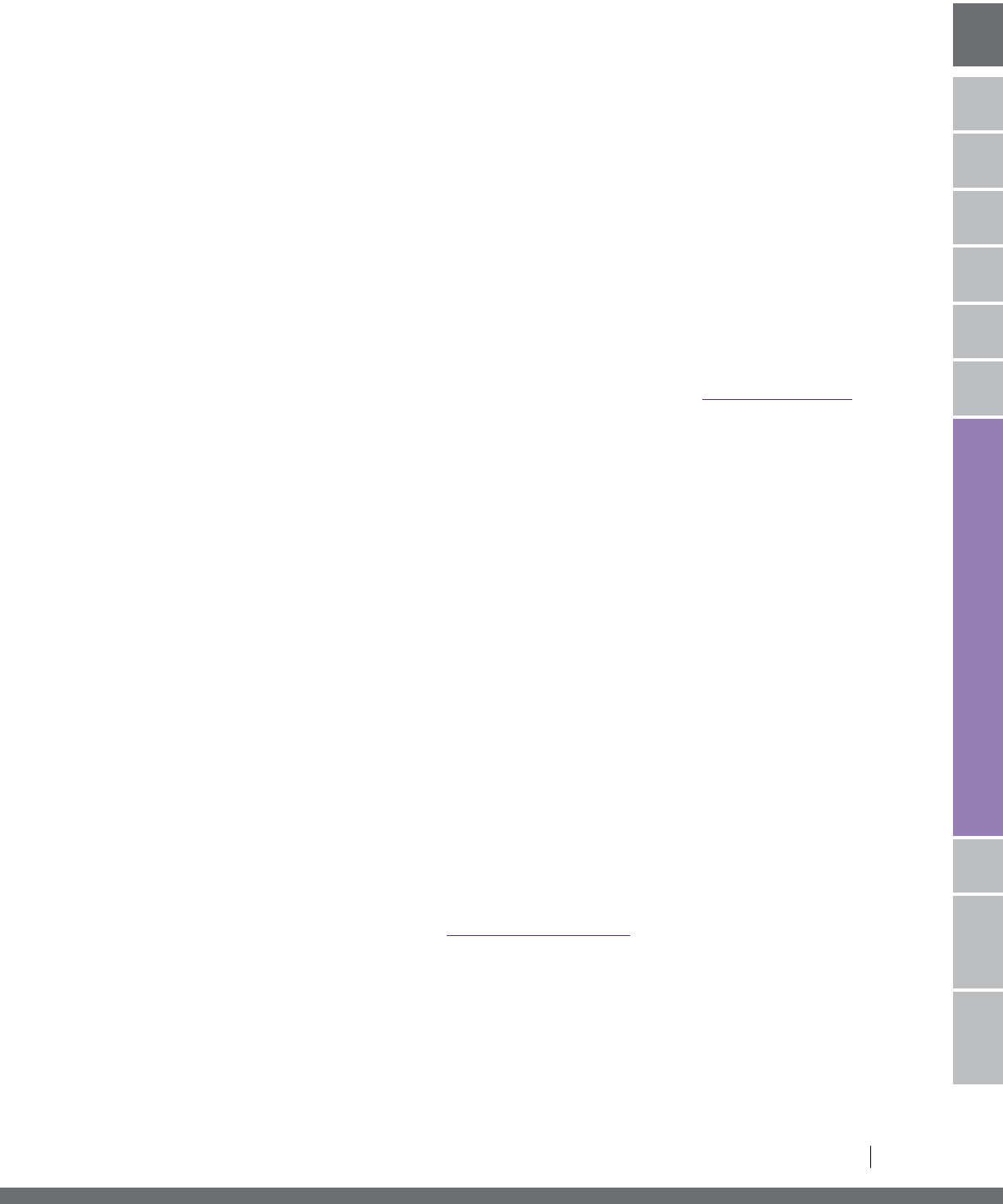

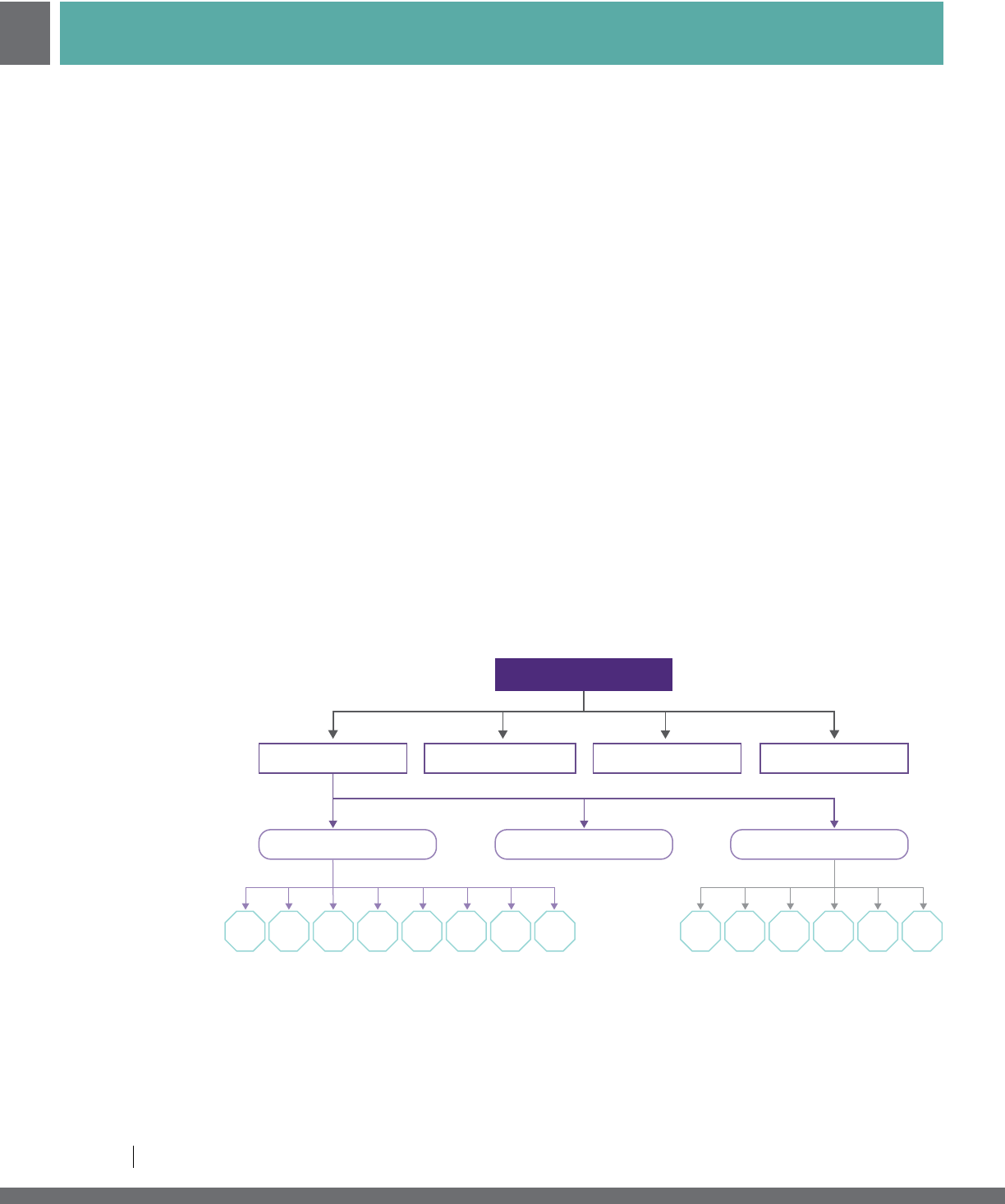

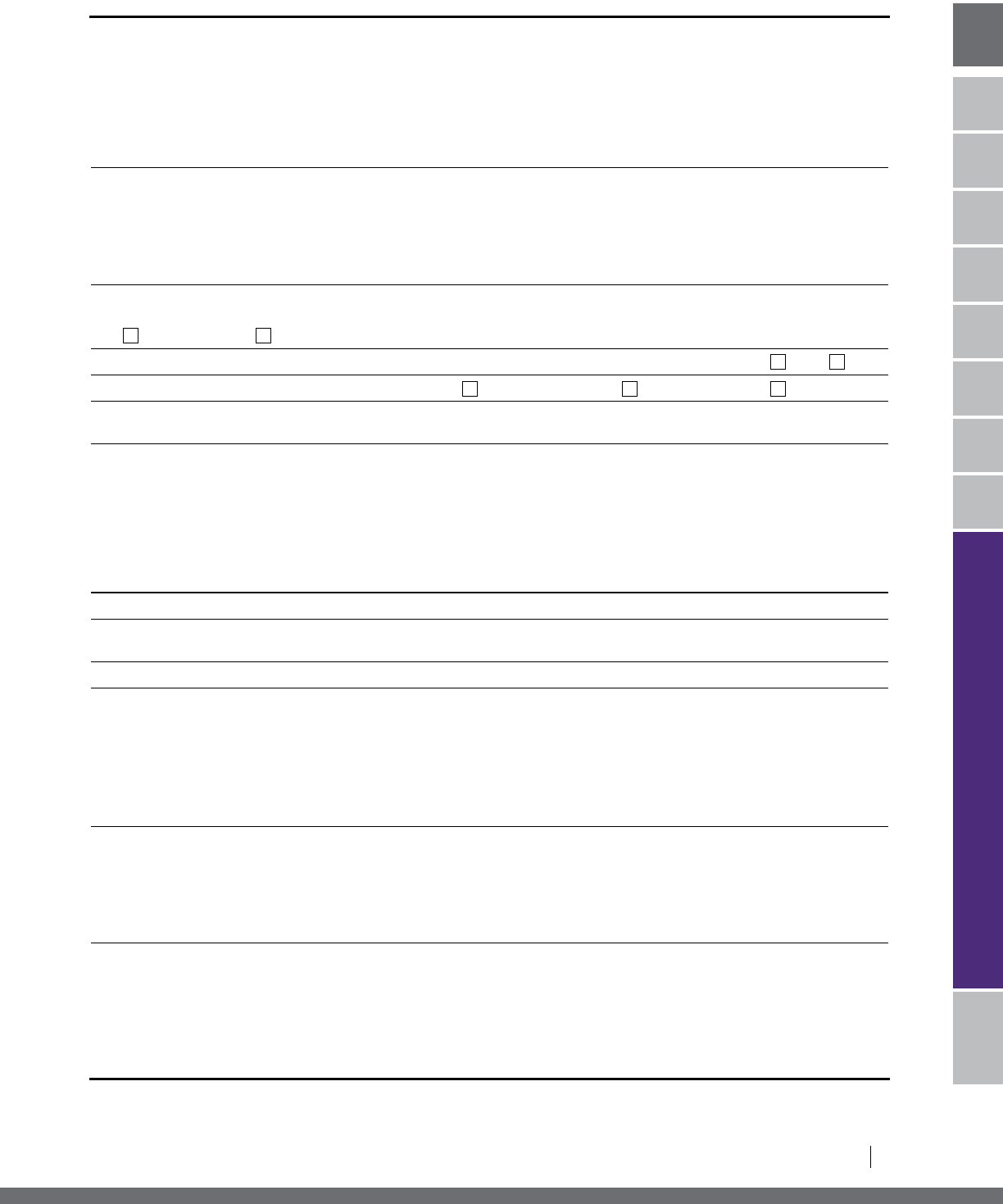

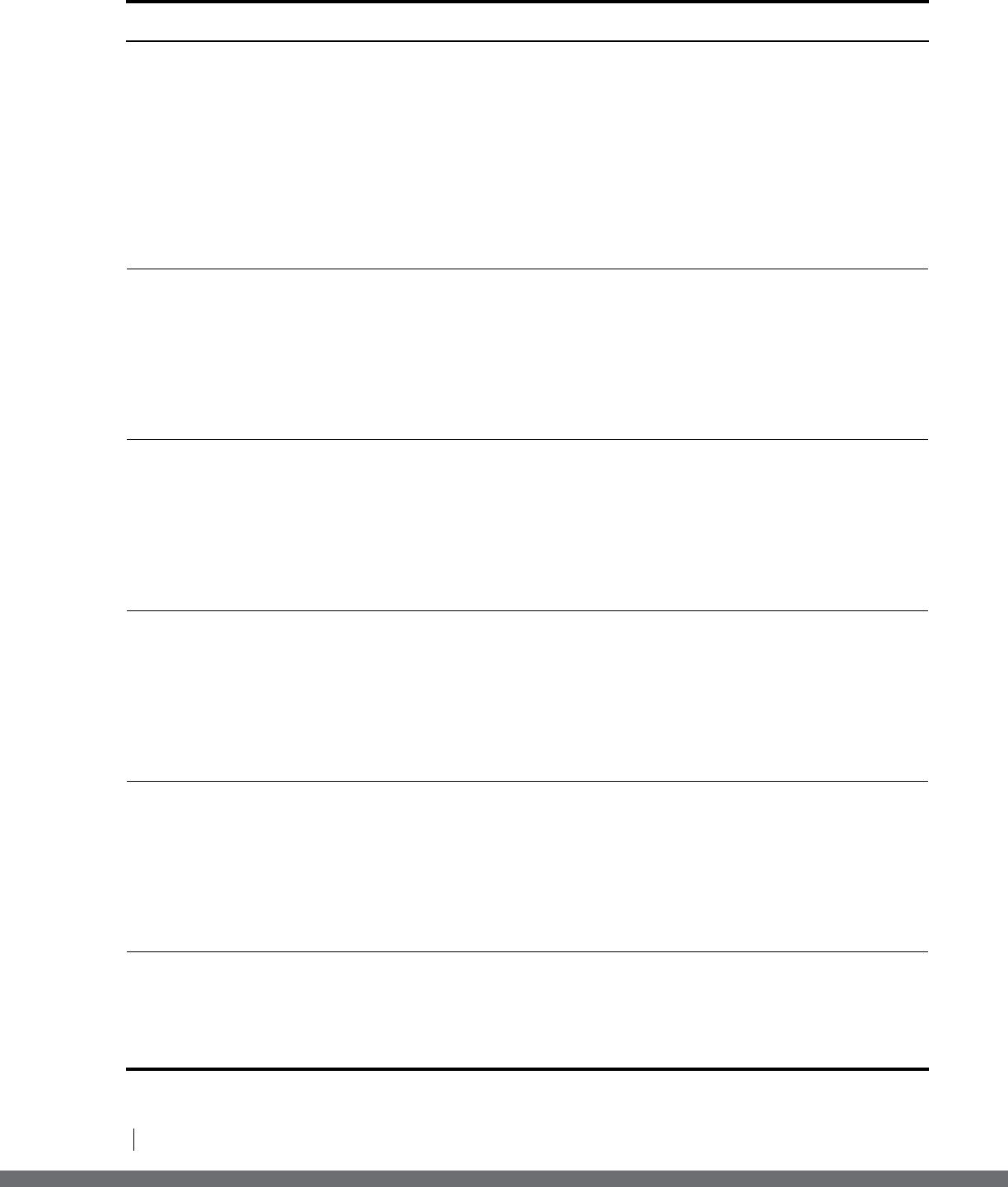

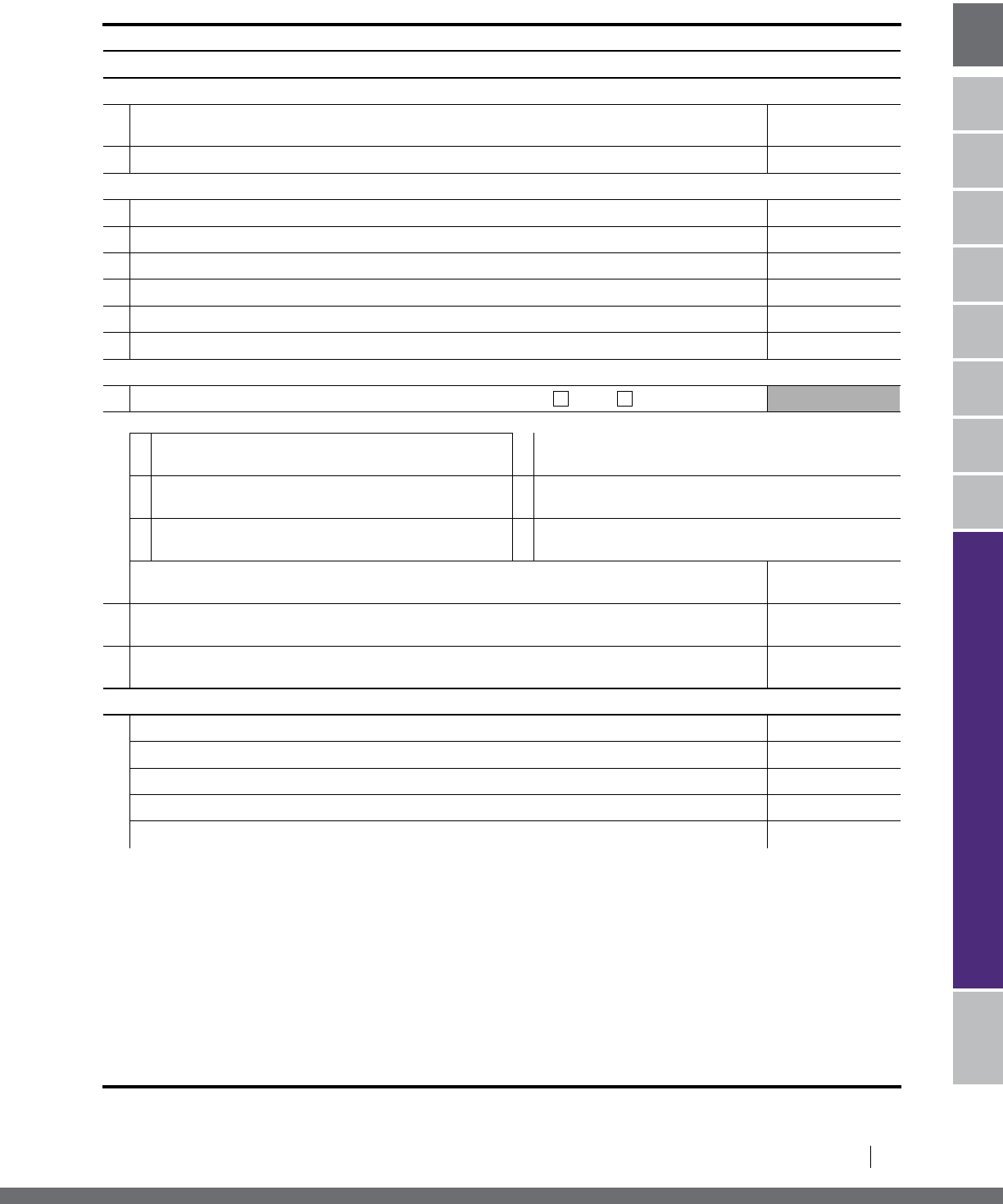

Figure 2 explains how the LITC Grant Program receives its funding.

4

LOW INCOME TAXPAYER CLINIC

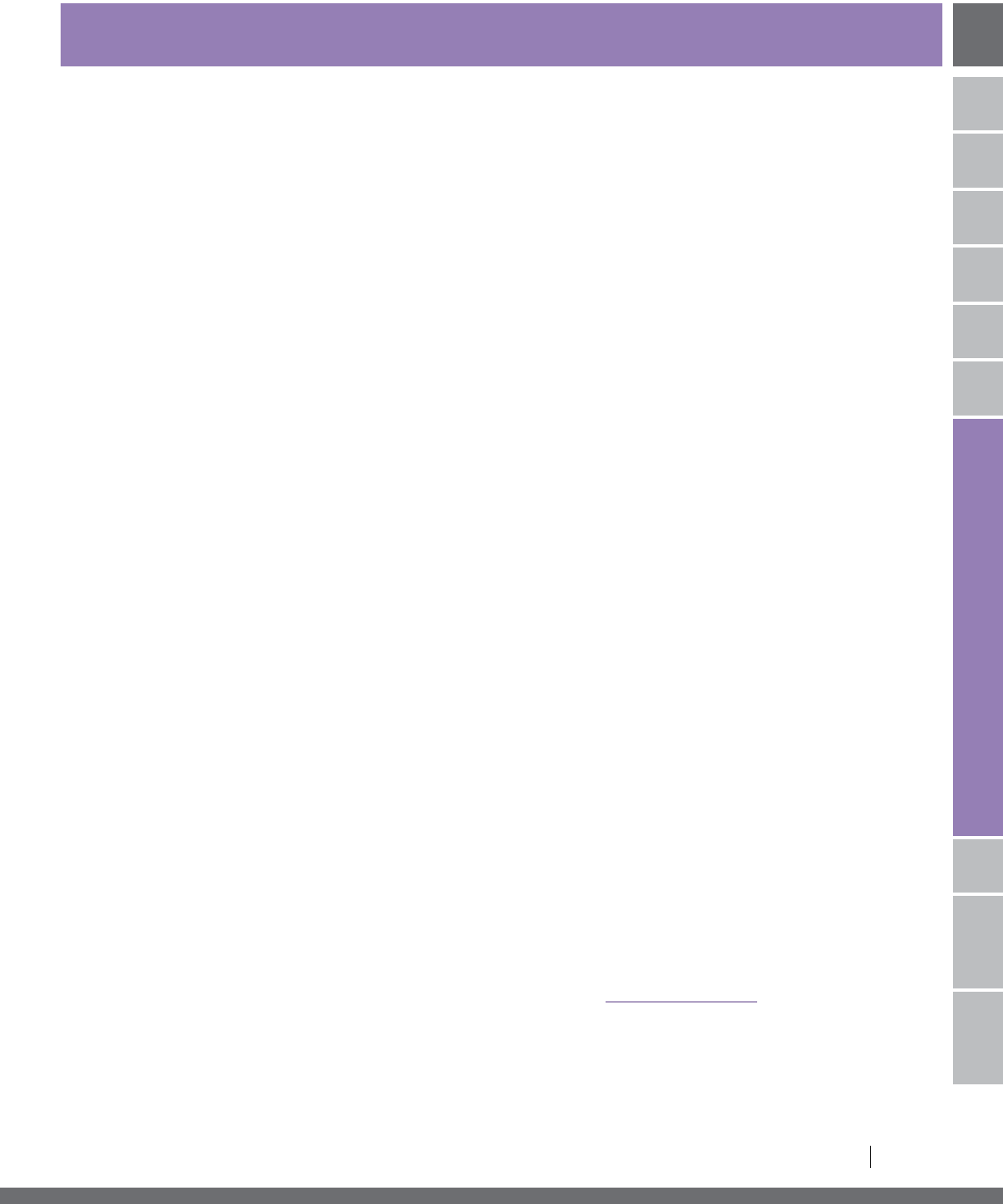

Figure 2, How the LITC Program Receives Its Funding

How the LITC Program Receives Its Funding

Step One

Step Two

Step Three

Step Four

OMB coordinates with

federal agencies to

formulate the President’s

Budget, which covers all

federal agencies,

including the IRS, and

reflects the President’s

priorities and vision for

the country. Federal law

requires that the

President submit a budget

proposal to Congress

every February, which

serves as a starting point

for negotiations in

Congress.

Congressional

appropriations

committees consider the

President’s Budget as

they prepare

appropriations legislation

for the upcoming fiscal

year, which begins on

October 1.

The appropriations

committees submit

legislative proposals

which are brought to the

floor for consideration by

the House of

Representatives and the

Senate. Once the House

and the Senate consider

the proposals and

reconcile them, Congress

passes a unified

omnibus budget and

sends the legislation to

the President to be

signed into law.

The President signs the

appropriations bill into

law, making funds

available to executive

agencies, including the

IRS.

C. CORE TERMS AND DEFINITIONS

Amount in controversy means the amount in dispute for each tax year for which the LITC is representing the

taxpayer. Often the amount in controversy is the amount owed or the refund requested that is in dispute. In

some disputes with the IRS, however, the amount in controversy is the amount associated with an action taken

by the IRS. The amount includes the tax liability in dispute for a tax year, plus any related penalties imposed.

Whether interest is included in the amount in controversy will depend on the nature of the controversy. Further,

the amount in controversy is limited to the amount in dispute, which may be less than the amount specified in a

statutory notice of deficiency. If the taxpayer is disputing the amount due in more than one tax year or period,

the amount in controversy is the amount in dispute for a single tax year. For additional rules with regard to

calculating the amount in controversy, see Section V. A, Representation.

Clinic means an organization receiving a grant pursuant to IRC § 7526 that represents low income taxpayers

in controversies with the IRS and that operates a program to educate individuals for whom English is a second

language about their rights and responsibilities under the Internal Revenue Code. Examples of a clinic include:

A clinical program at an accredited law, business or accounting school in which students represent low

income taxpayers in controversies arising under the Internal Revenue Code; and

An organization described in IRC § 501(c) and exempt from tax under IRC § 501(a) in which employees

and volunteers represent low income taxpayers in controversies with the IRS.

5

LOW INCOME TAXPAYER CLINIC

LITC PROGRAM OVERVIEW

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

Consultation means a discussion with a taxpayer designed to provide advice or counsel about a specific tax matter

that does not result in representation of the taxpayer.

Controversy means a dispute arising under the Internal Revenue Code between an individual and the IRS

concerning the determination, collection, or refund of any tax, penalties, or interest under the Internal Revenue

Code, and includes any proceeding brought by the taxpayer under Title 26. A controversy includes a dispute

related to the tax provisions of the Affordable Care Act and certain civil actions arising under the Internal Revenue

Code, for example those arising under IRC §§ 7431–7435. While representing a taxpayer in a controversy

with the IRS, an LITC may also need to represent the taxpayer in a controversy with a state or local tax agency

concerning the same or related tax matter. A controversy does not include a federal criminal tax matter, but may

include a state criminal matter. For example, in some instances, the controversy may be considered a civil matter

in the federal context, but a criminal matter under state or local law. If the LITC is already representing the

taxpayer in the federal civil matter, it may be appropriate for the LITC to continue the representation to resolve

the state or local matter.

Educational activities are programs designed to inform ESL or low income taxpayers about their rights and

responsibilities as taxpayers, as well as tax issues of particular significance to the intended audience. Educational

activities may also be conducted for other organizations that assist low income or ESL taxpayers. In order to

be considered an educational activity, information about a specific tax topic or topics must be conveyed to the

audience. Examples of educational activities include a presentation about tax collection issues made to ESL

taxpayers, a workshop for low income workers about how to properly complete a Form W-4 for withholding, or a

free training session at a local social services organization to educate case workers about earned income tax credit

(EITC) eligibility rules to so they can better assist their clients.

Low income taxpayer means an individual whose income does not exceed 250 percent of the Federal Poverty

Guidelines, as determined in accordance with official guidance published by the federal government. A business

or other entity is not a low income taxpayer eligible for LITC representation. An individual trying to resolve the

individual’s tax liability arising from involvement with a business can be a low income taxpayer. For example, an

individual who is personally liable for taxes owed from a business (e.g., a responsible person within the meaning of

IRC § 6672) may be a low income taxpayer, provided the individual otherwise meets the definition. Low income

status is determined by reference to the Federal Poverty Guidelines, which are updated annually (usually in late

January) by the Department of Health and Human Services (HHS). The current LITC Income Guidelines can

be found in Section V. A, Representation, of this publication.

Nominal fee means a fee that is insignificantly small or minimal. A nominal fee is a trivial payment, bearing no

relation to the value of the representation provided, taking into account all the facts and circumstances. A fee

does not include reimbursement for actual costs incurred (e.g., photocopies, court costs, and expert witness fees).

A nominal fee must be a flat fee; the fee cannot fluctuate based on an hourly rate, the type of services the LITC is

providing, and if being charged, must be paid by every taxpayer receiving representation from the LITC.

Pro bono panel means a group of qualified representatives who have agreed to accept taxpayer referrals from an

LITC and provide representation or consultation free of charge to low income or ESL taxpayers.

6

LOW INCOME TAXPAYER CLINIC

Program to educate means the conduct of an activity intended to educate both low-income taxpayers and

individuals for those for whom English is a second language (ESL) about their rights and responsibilities under

the Internal Revenue Code. For additional information, see Educational Activities.

Program plan means an outline of a clinic’s planned operations, including a description of the particular services

to be offered, how the services will be delivered, the intended recipients of the services, and numerical goals.

Qualified representative means an attorney, certified public accountant, or enrolled agent who is authorized to

practice before the IRS. The term qualified representative also means an individual authorized to practice before

the IRS pursuant to 31 CFR § 10.7(d) (e.g., a student, law graduate, tribal court advocate, or other individual for

whom the IRS has issued a special appearance authorization). Thus, a student or law graduate working under the

supervision of a qualified representative is a qualified representative if the Director of the LITC Program Office

has authorized that student or law graduate to practice before the IRS. See Delegation Order 25-18 (Rev. 2),

IRM 1.2.52.19 (Sept. 9, 2015). In addition, the term qualified representative means an individual authorized

to appear before the applicable court where the controversy with the IRS will be adjudicated. An unenrolled

return preparer who can practice before the IRS based upon return preparation is not a qualified representative for

purposes of the LITC program, because the authority of the unenrolled return preparer to act as a representative is

limited to only certain taxpayers and select functions of the IRS.

Note: For more information on student representation of taxpayers, see Section V. A, Representation.

Referral activities for which grant funds may be spent are the referral of low income taxpayers to a pro bono panel

for representation or consultation.

Representing a taxpayer in a controversy means acting as an agent of the taxpayer in an advocacy capacity in a

matter before the IRS, the United States Tax Court, another federal court, or before a state or local tax authority

when the clinic is representing the taxpayer in a related federal controversy. Fact finding or advice alone is not

representation.

7

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

II. GRANT RECIPIENT ELIGIBILITY III IV VVI VIIIIII IV VVI VII VIII

II. GRANT RECIPIENT ELIGIBILITY

To receive an LITC grant, an organization must represent low income individual taxpayers in controversies with the

IRS and educate low income and ESL taxpayers about their rights and responsibilities as U.S. taxpayers. Additionally,

organizations must offer LITC services for free or for no more than a nominal fee (except for reimbursements of actual

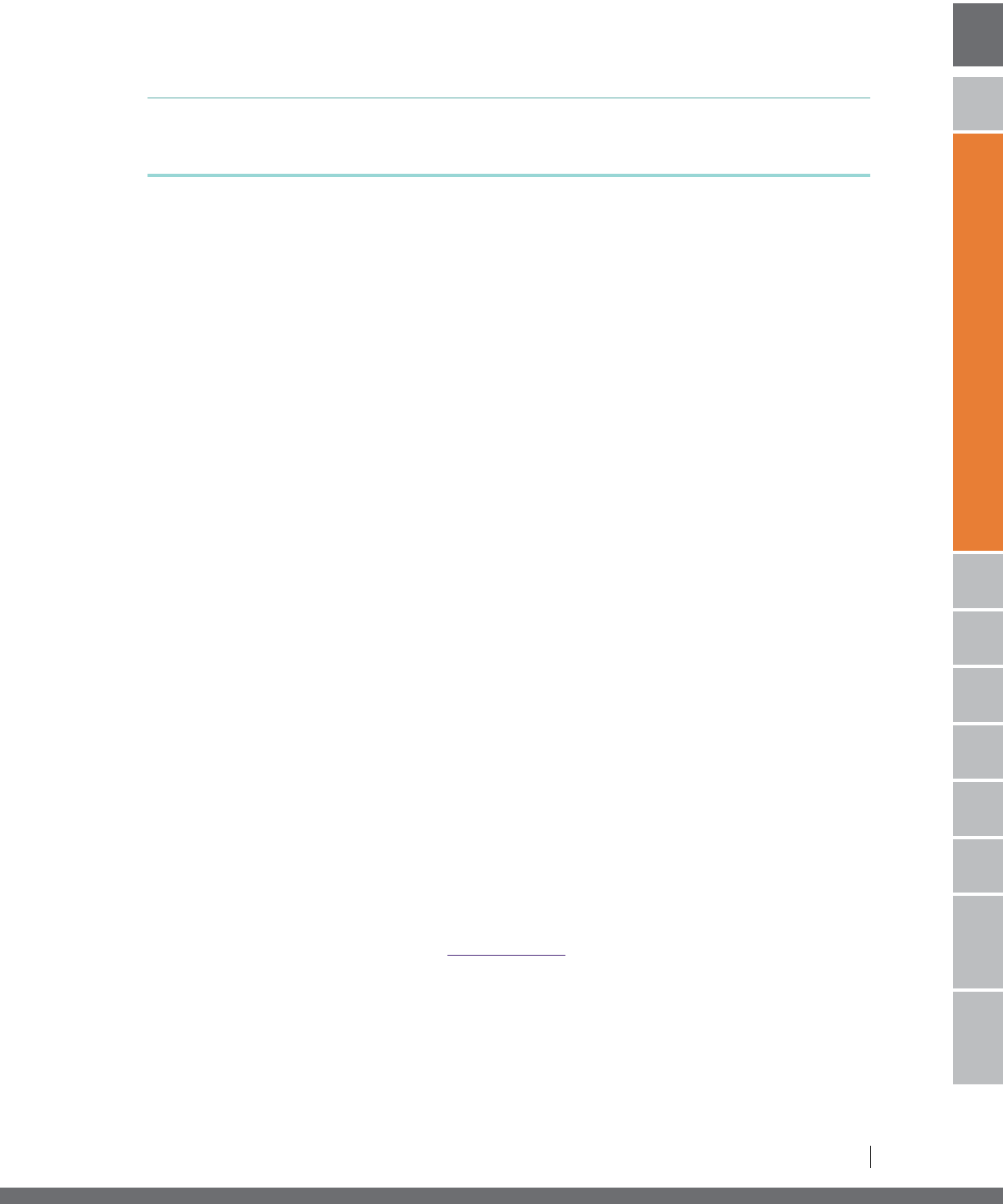

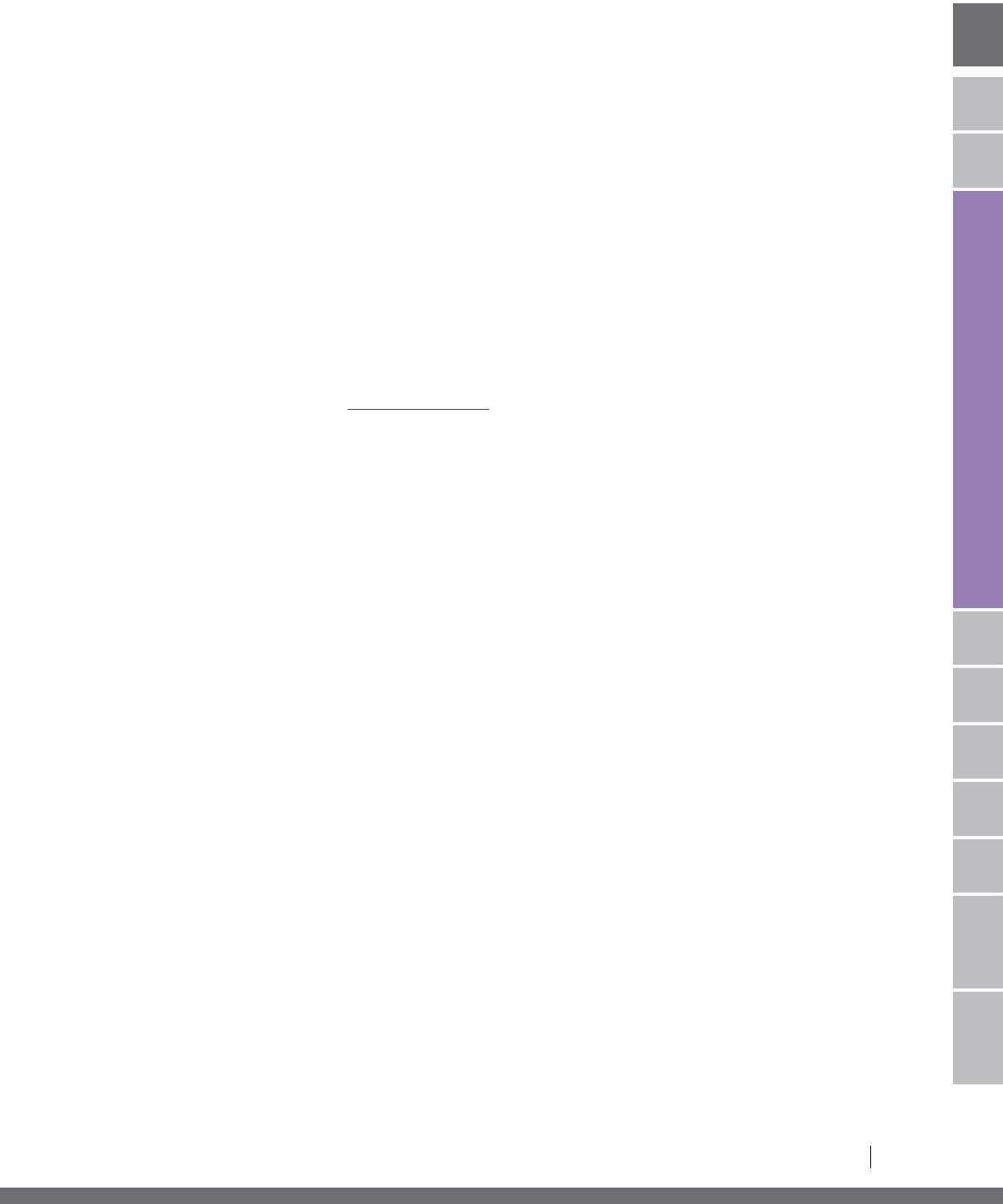

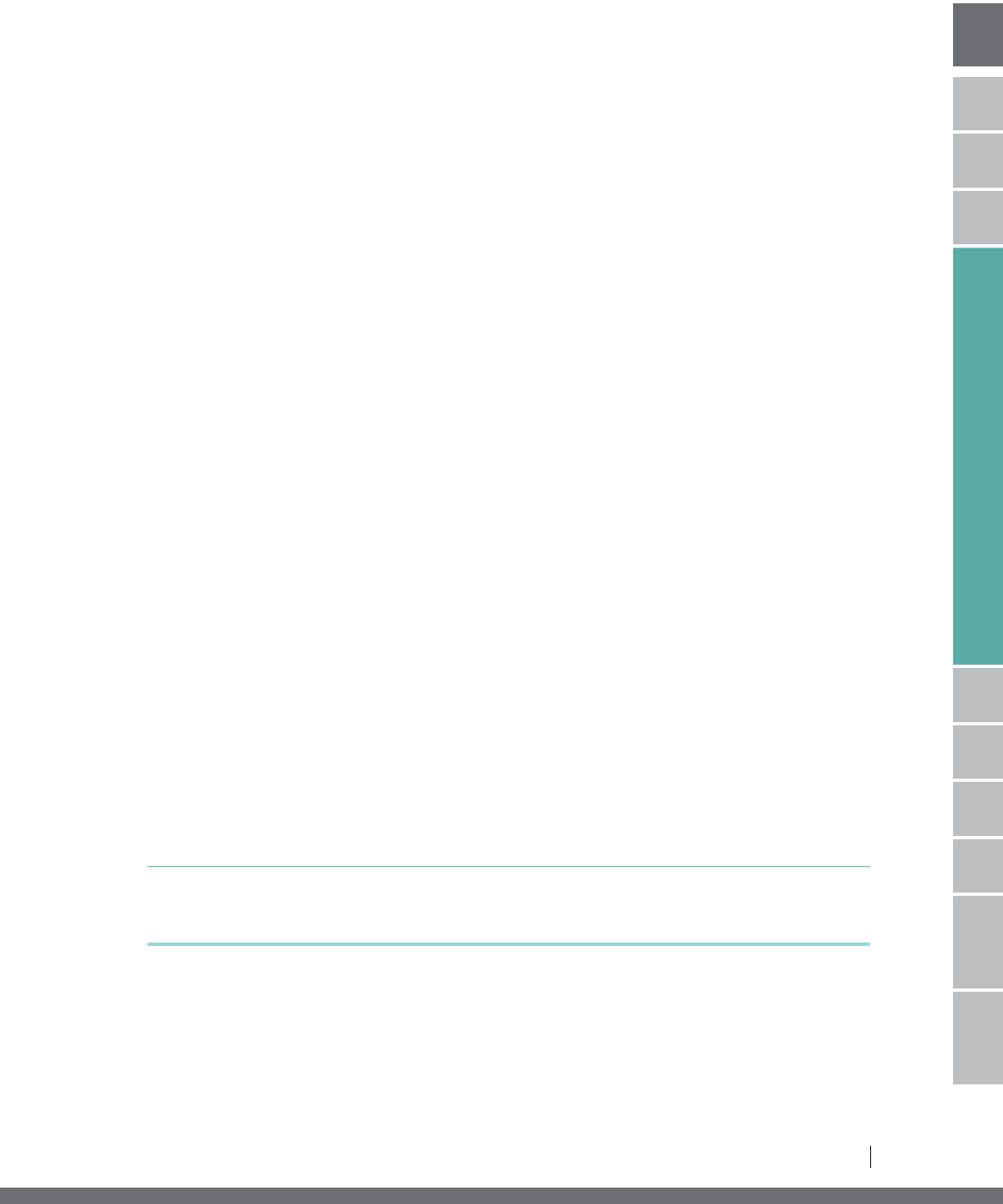

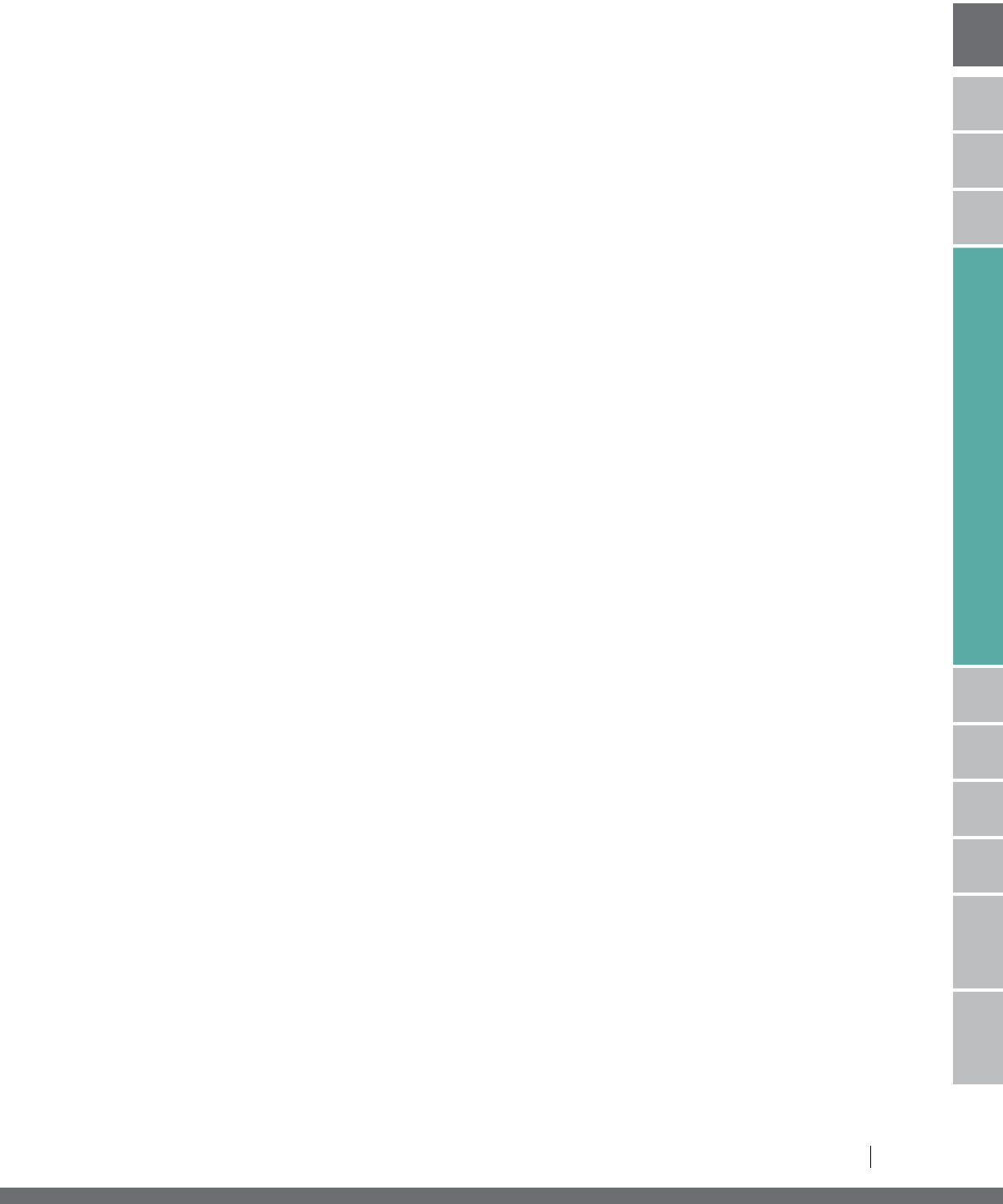

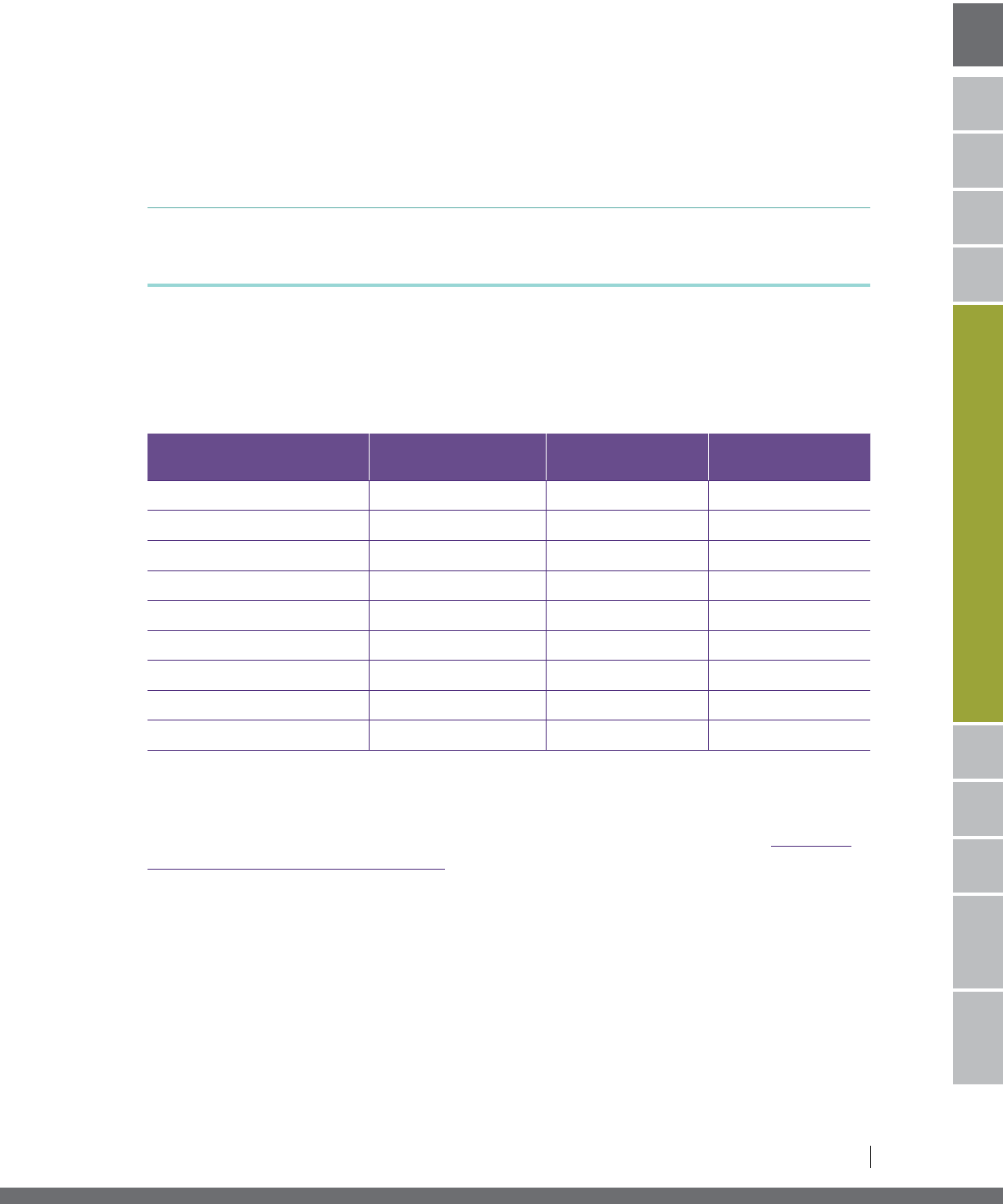

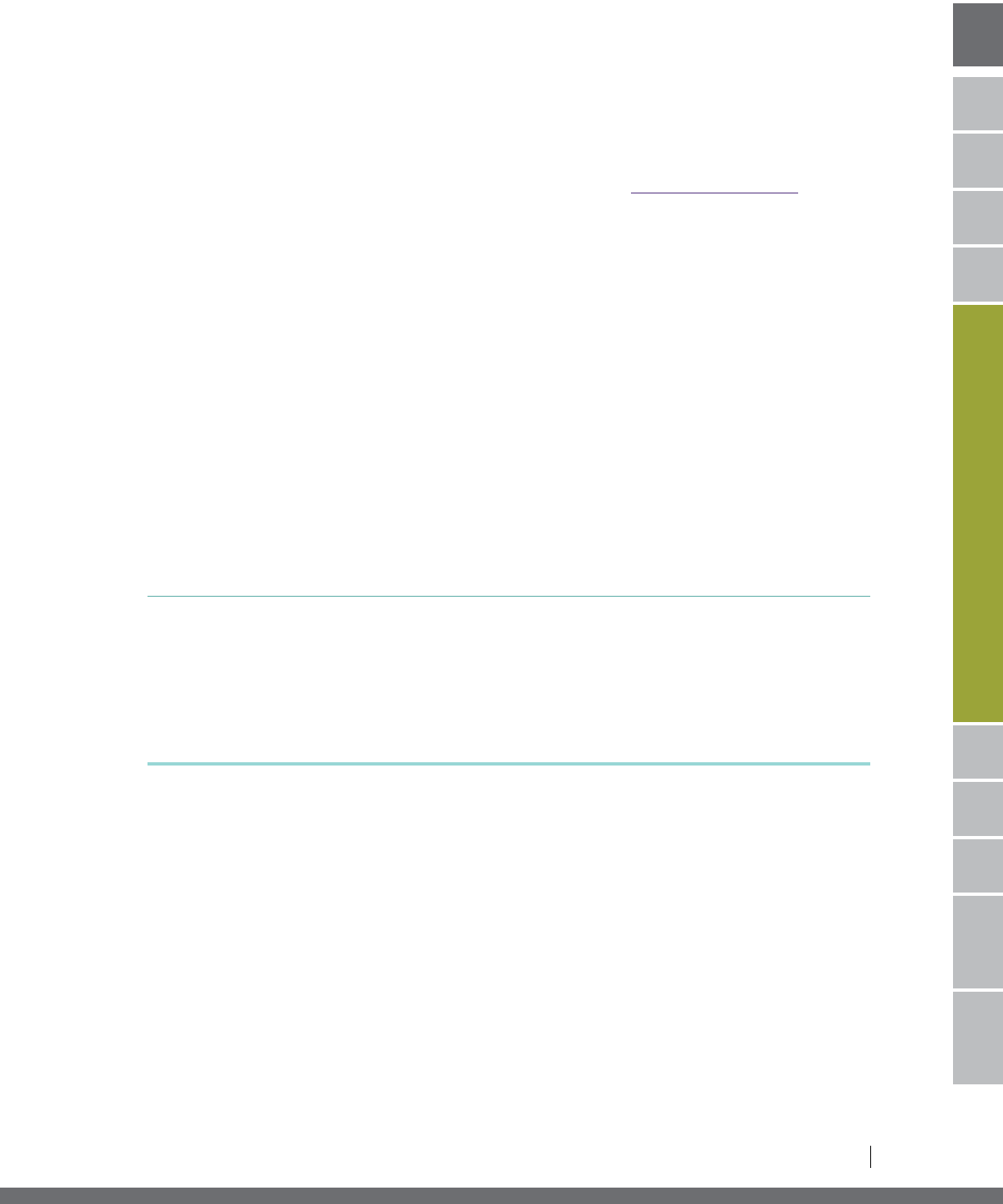

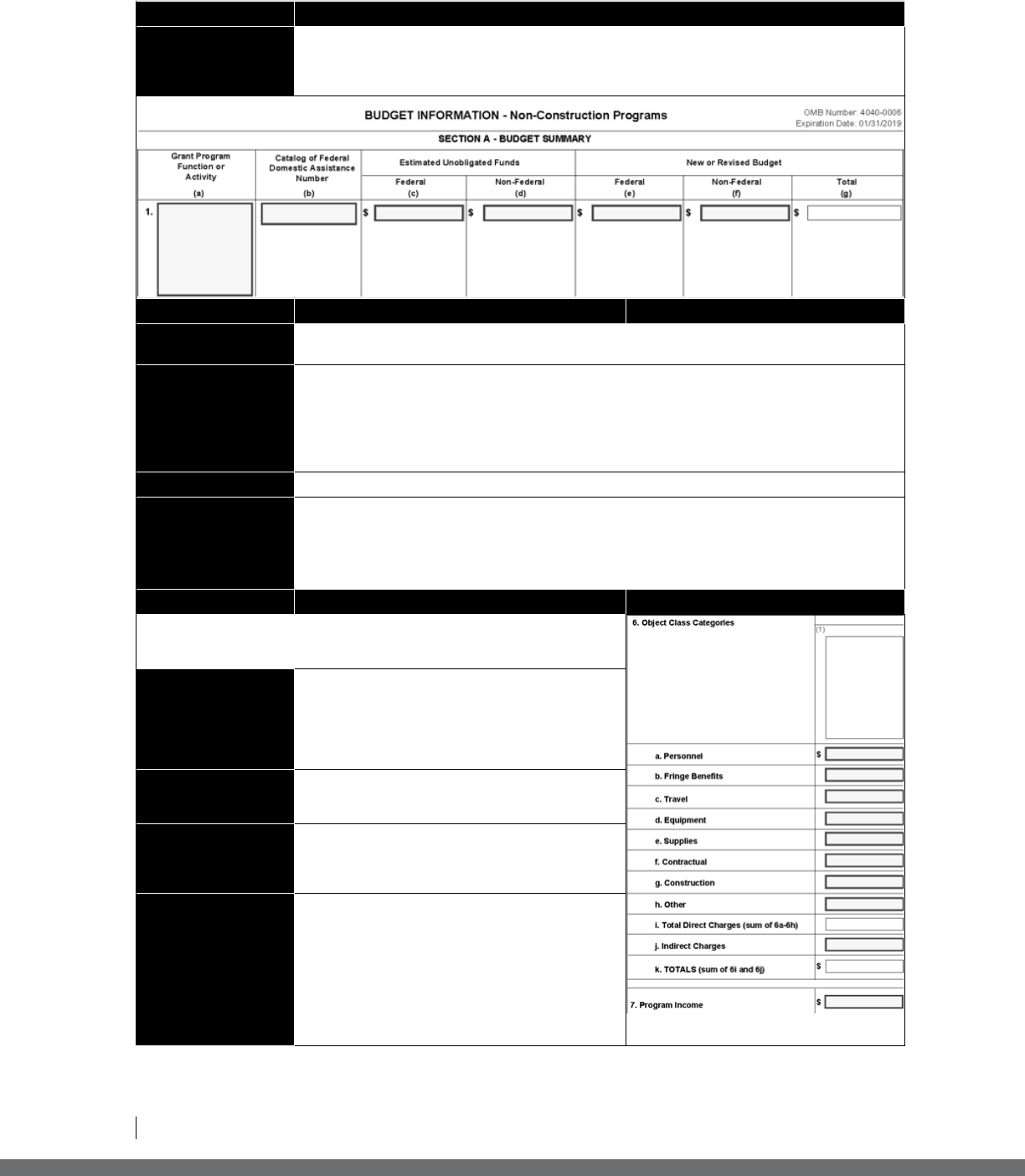

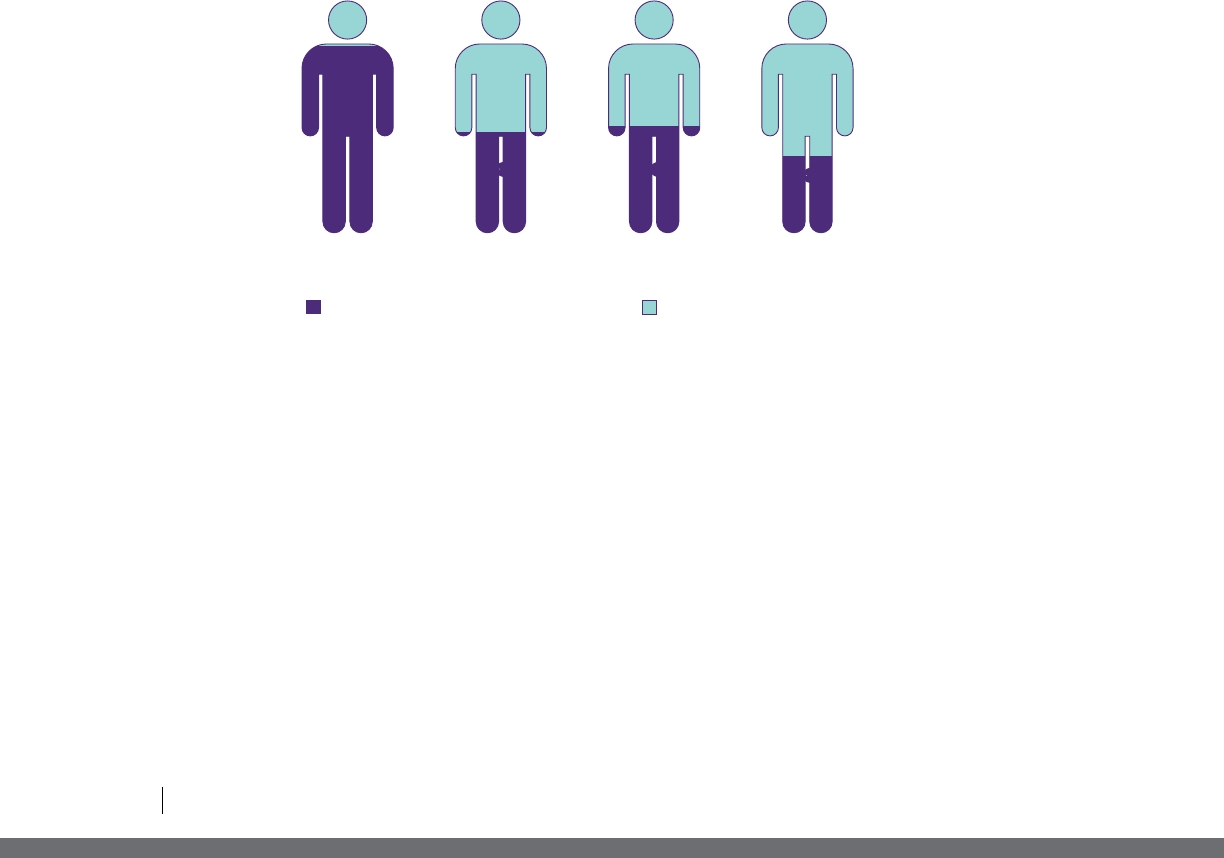

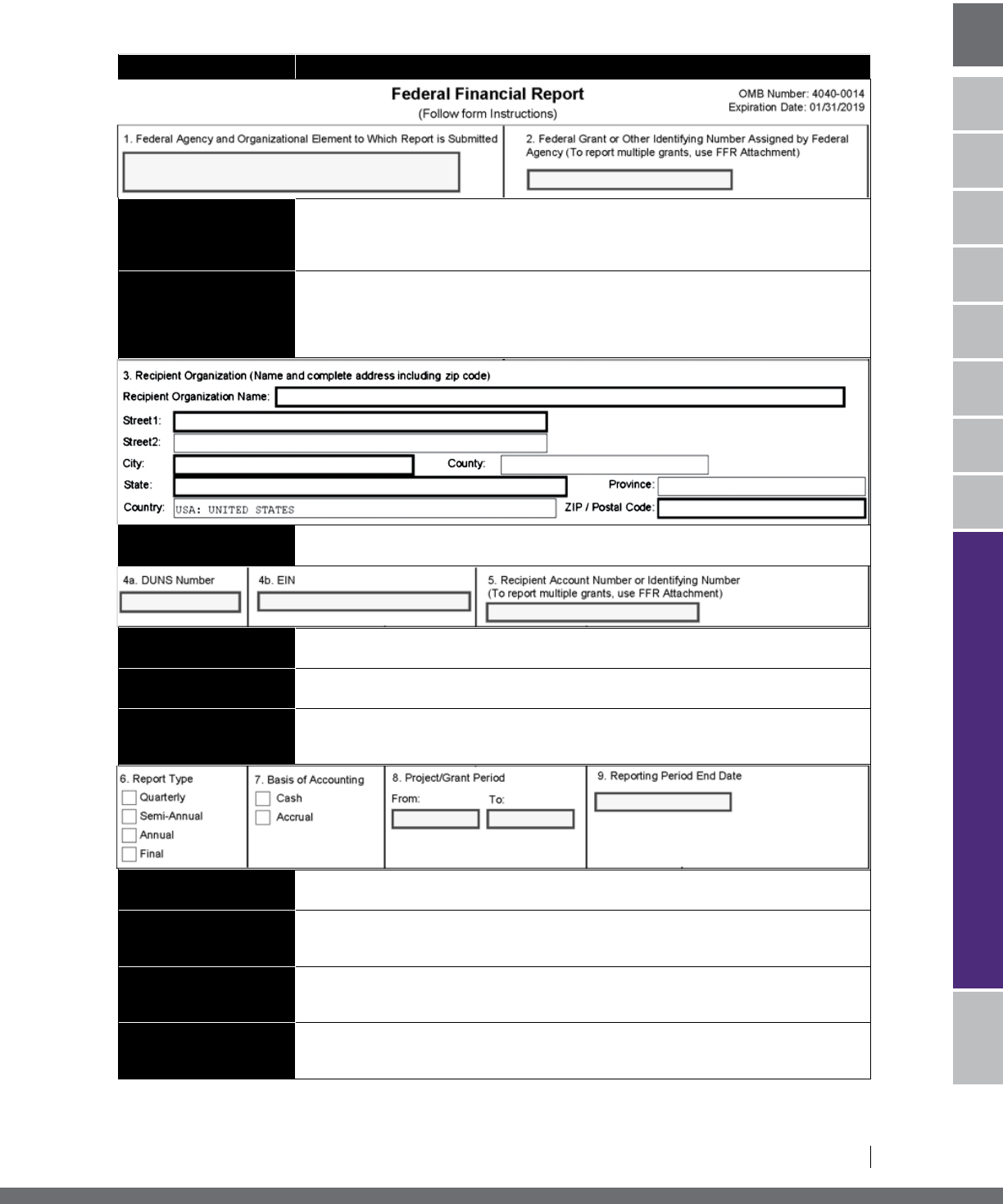

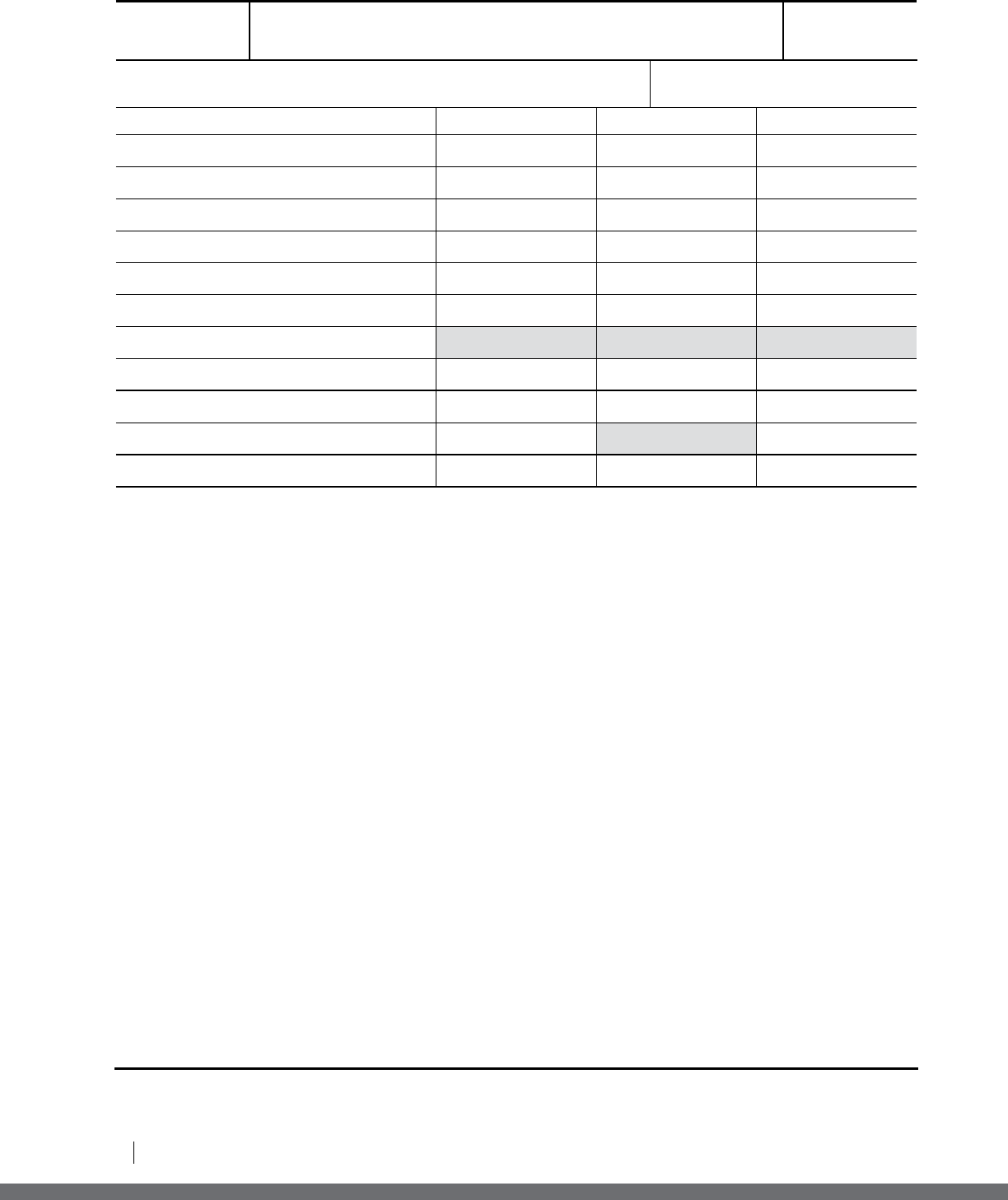

costs incurred). LITCs are encouraged to devote a significant portion of their budget to staffing. Figure 3 displays a

sample budget breakdown for a clinic receiving a $100,000 LITC grant.

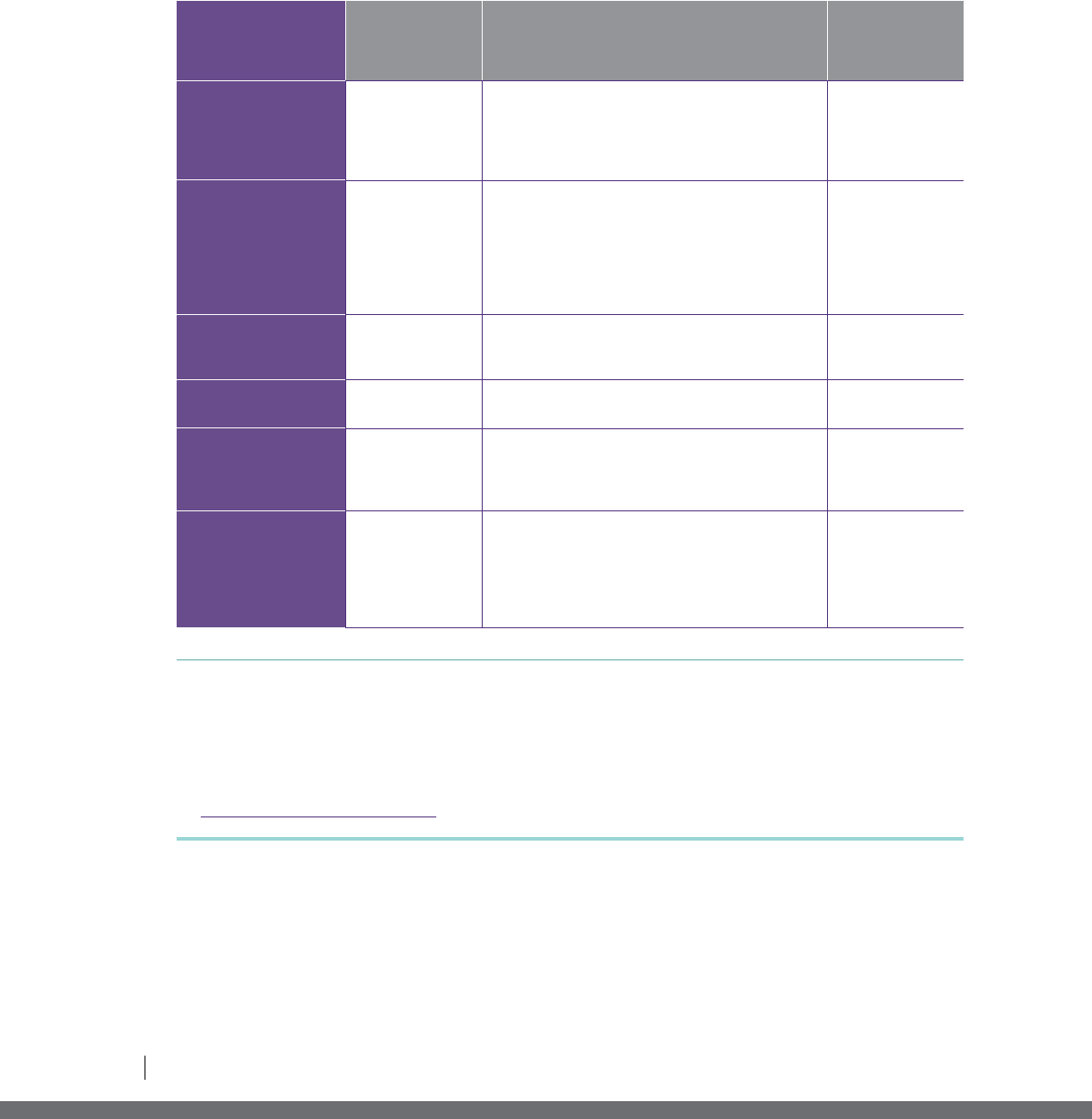

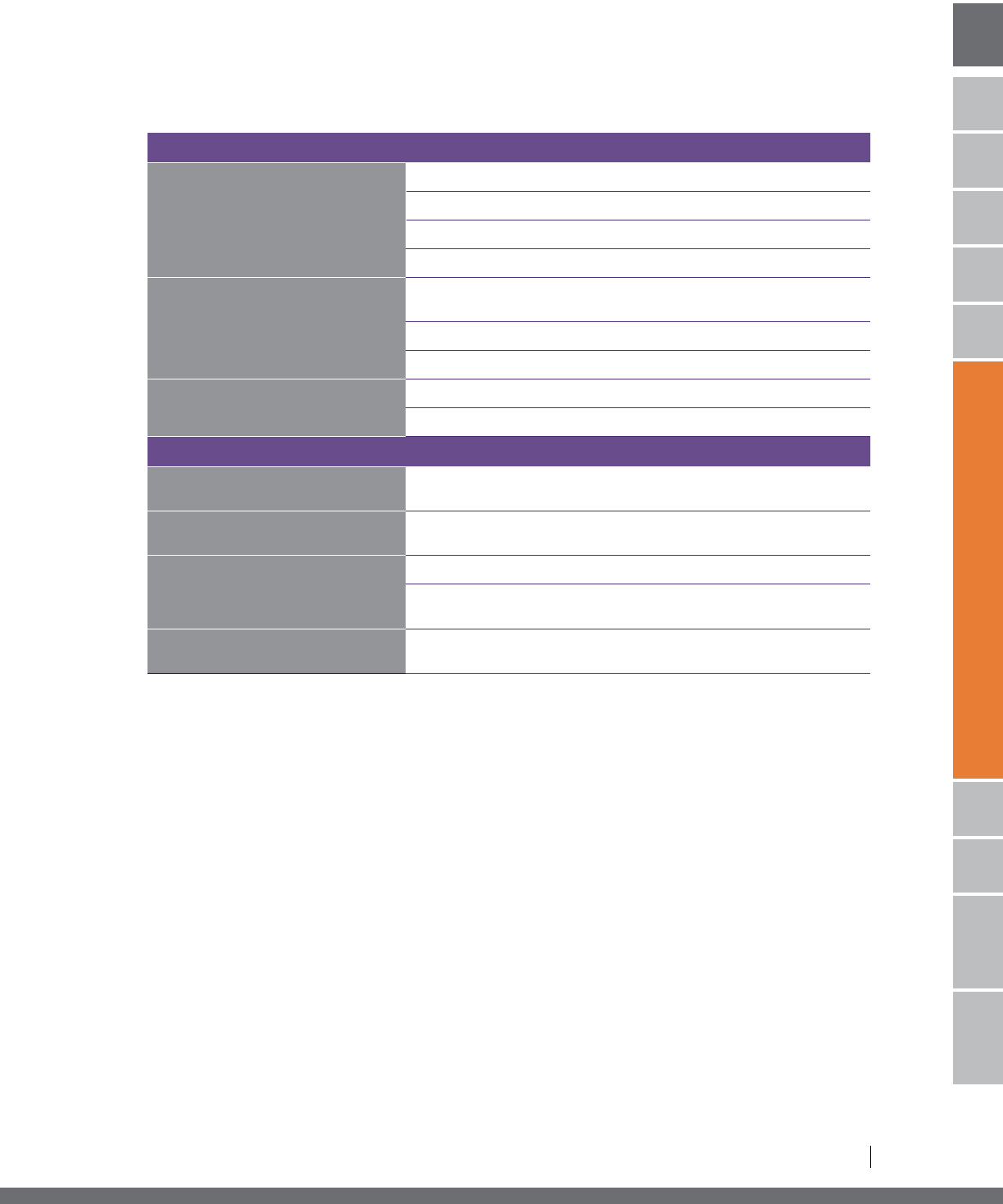

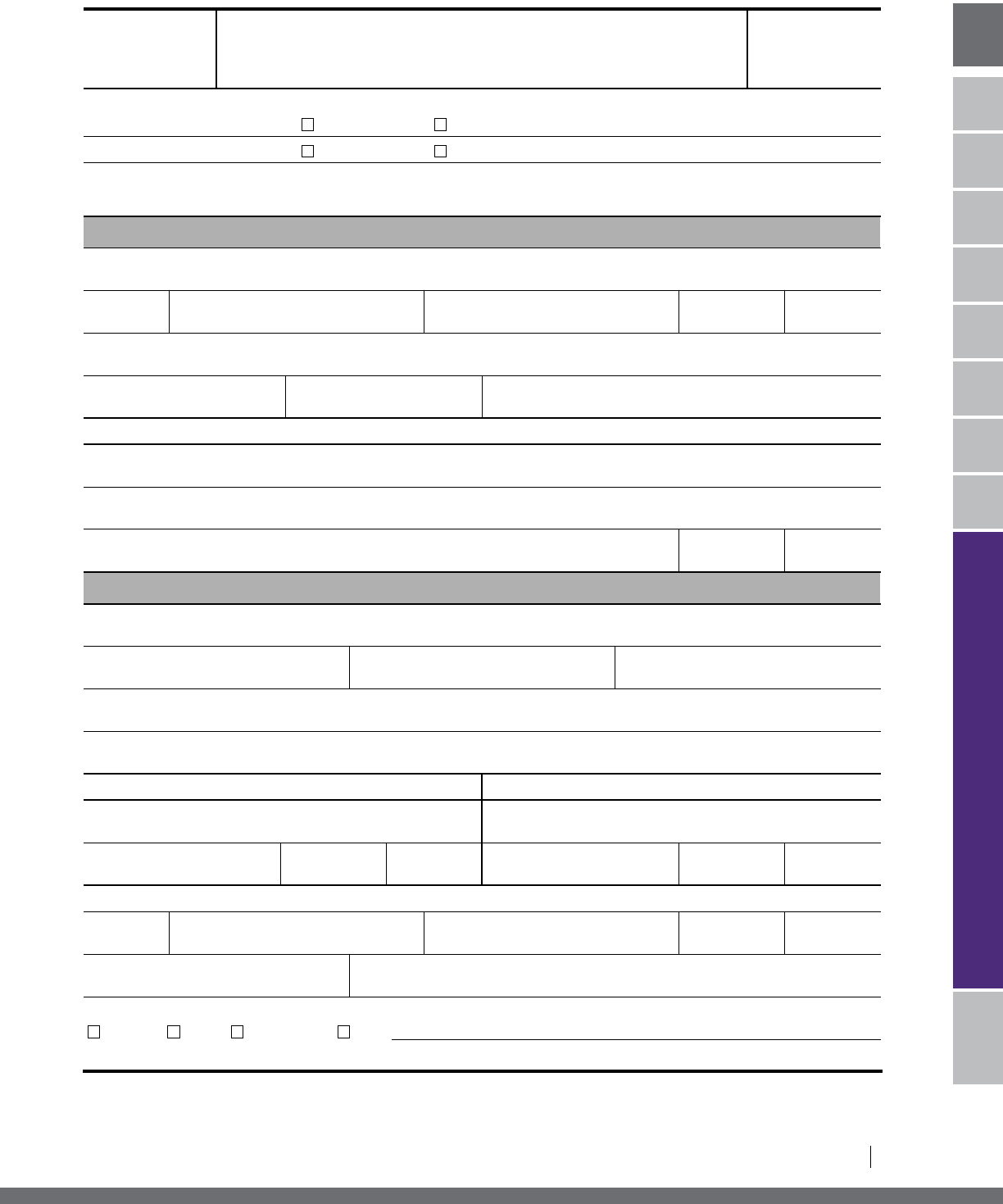

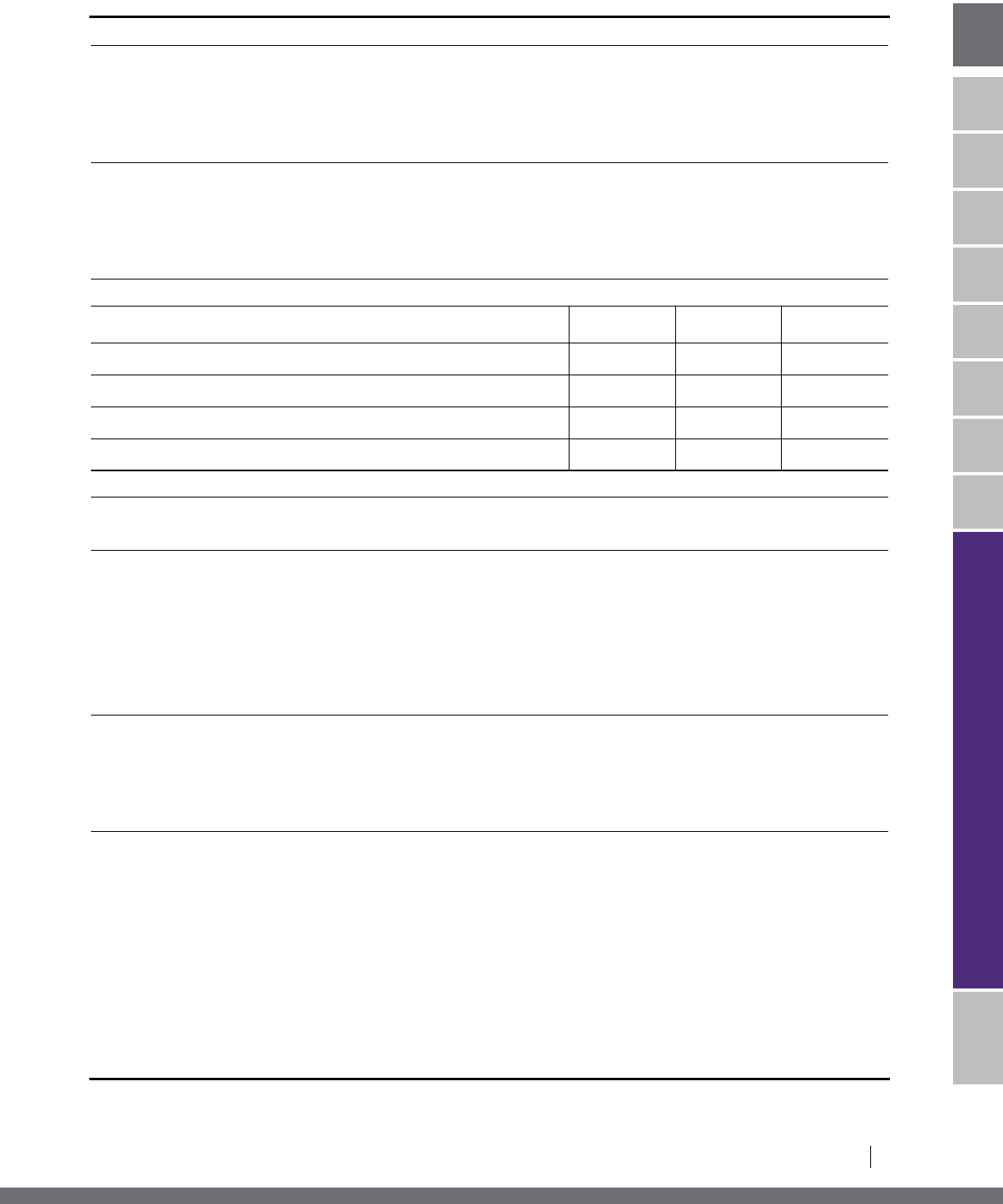

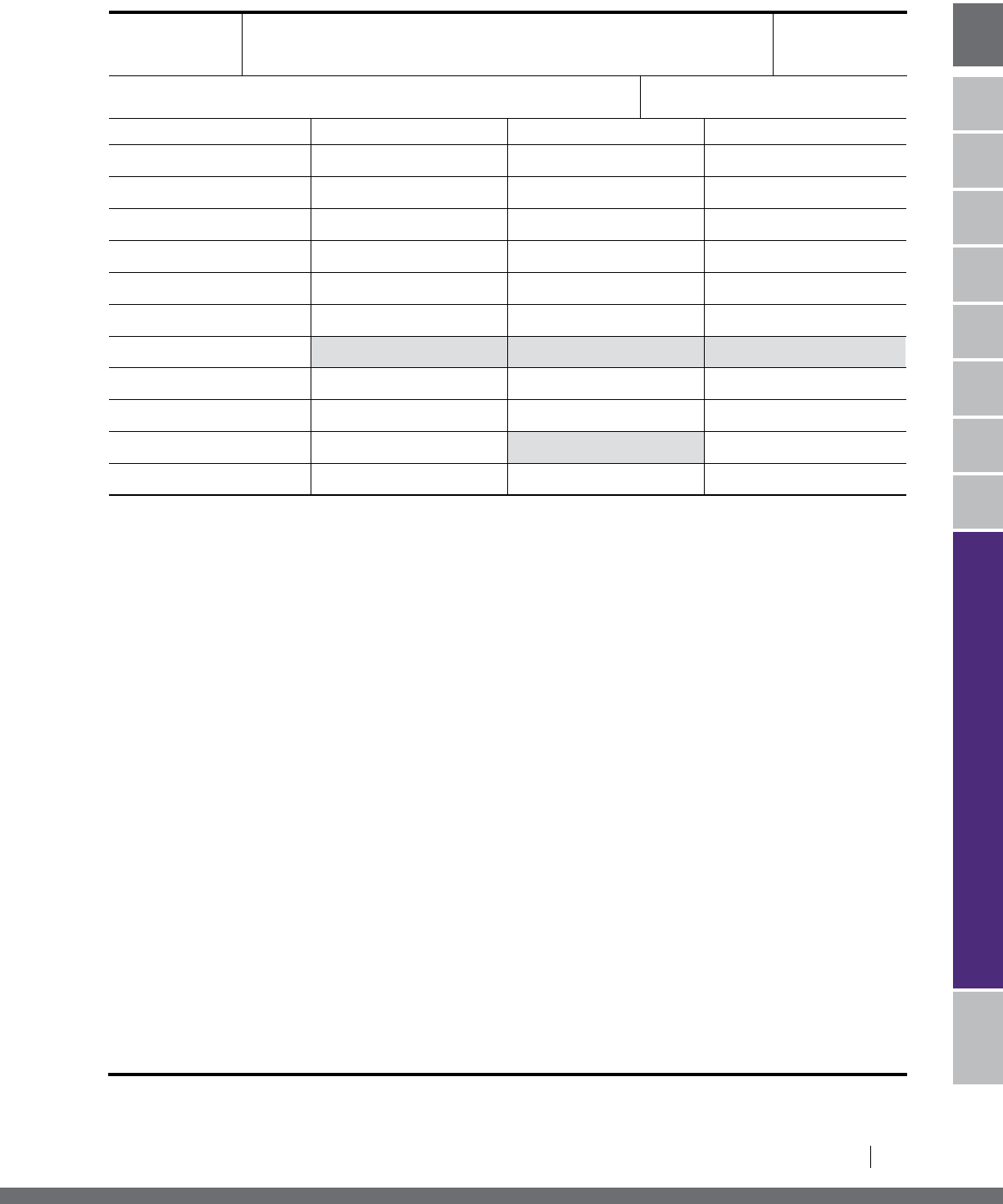

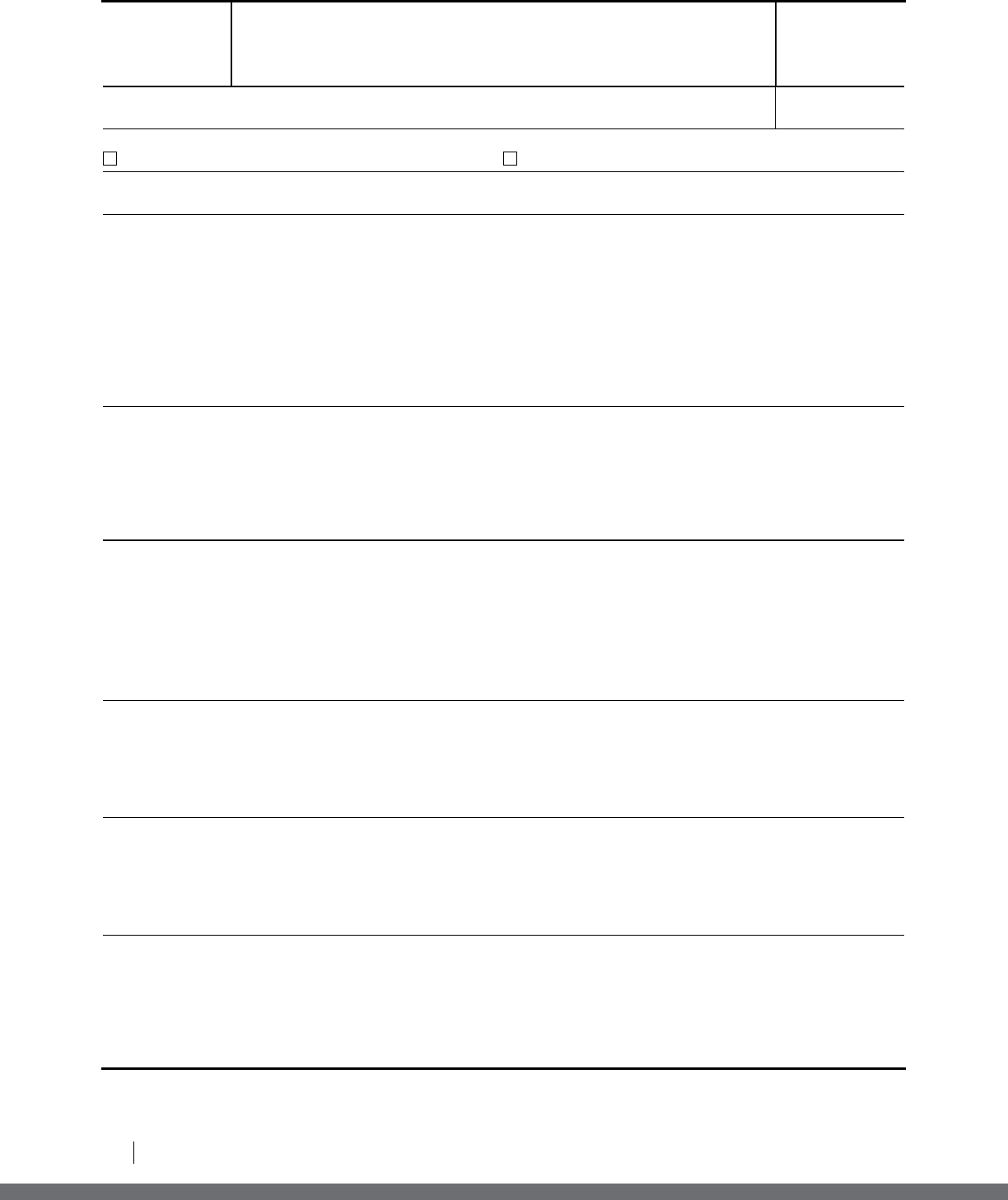

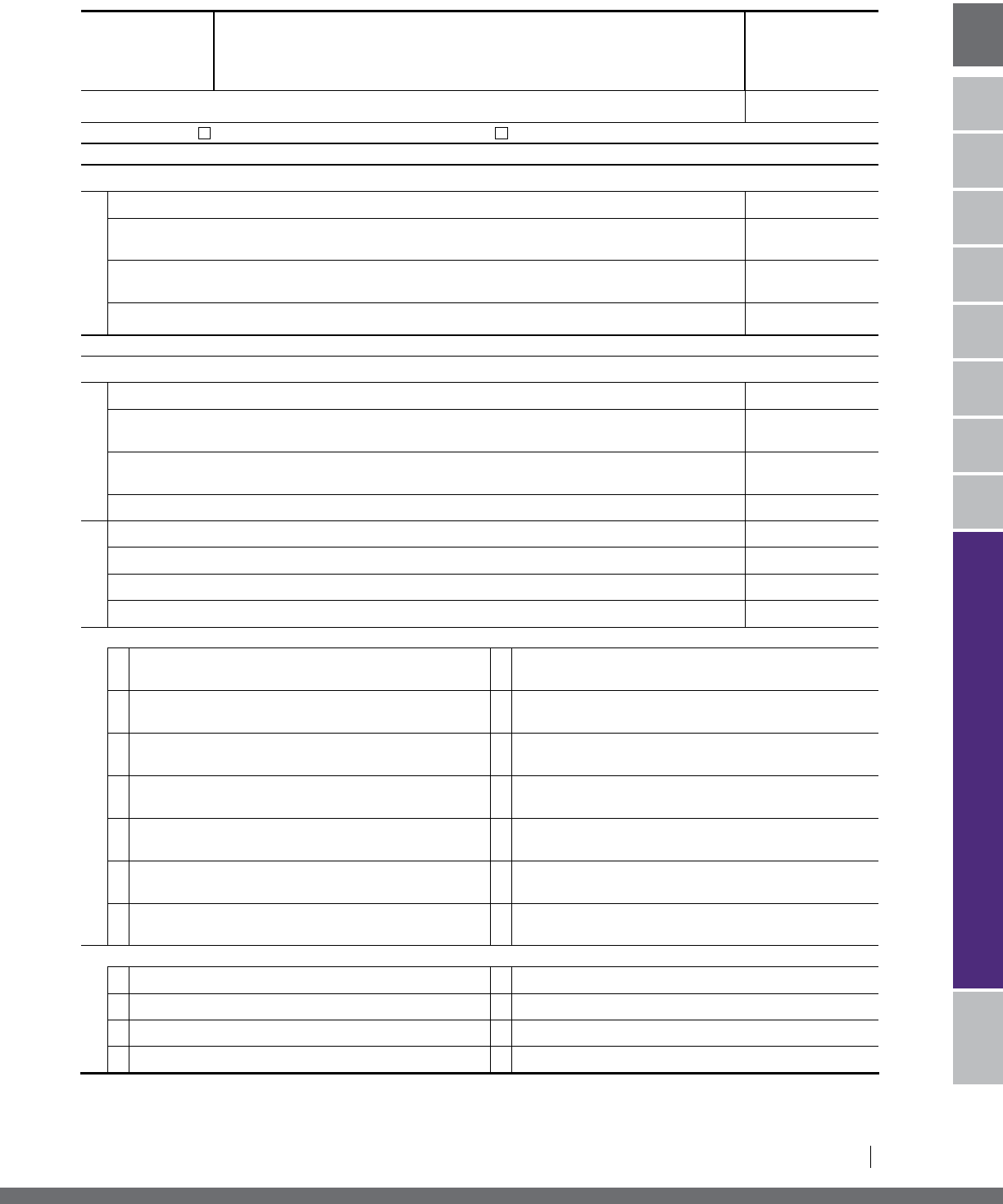

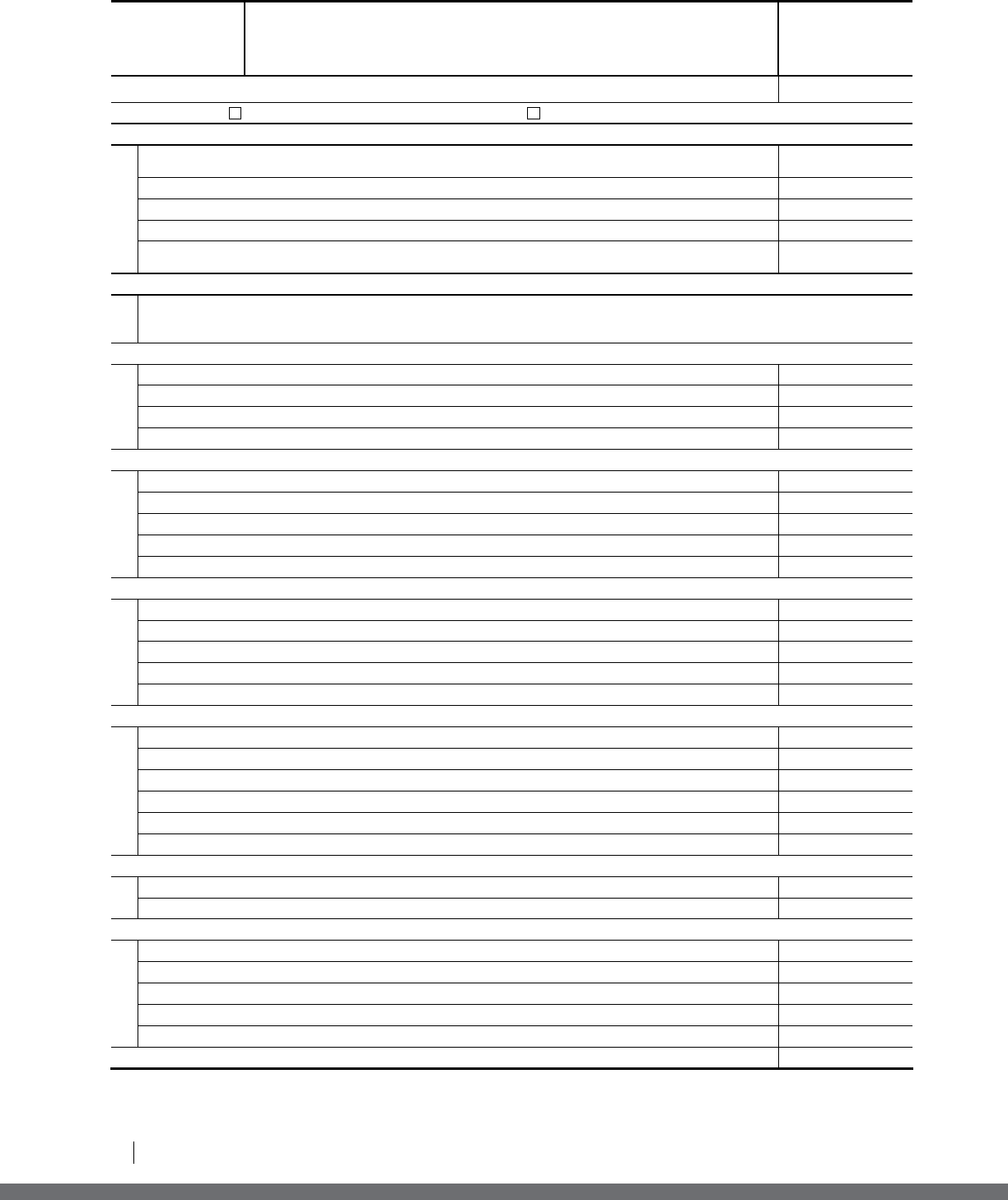

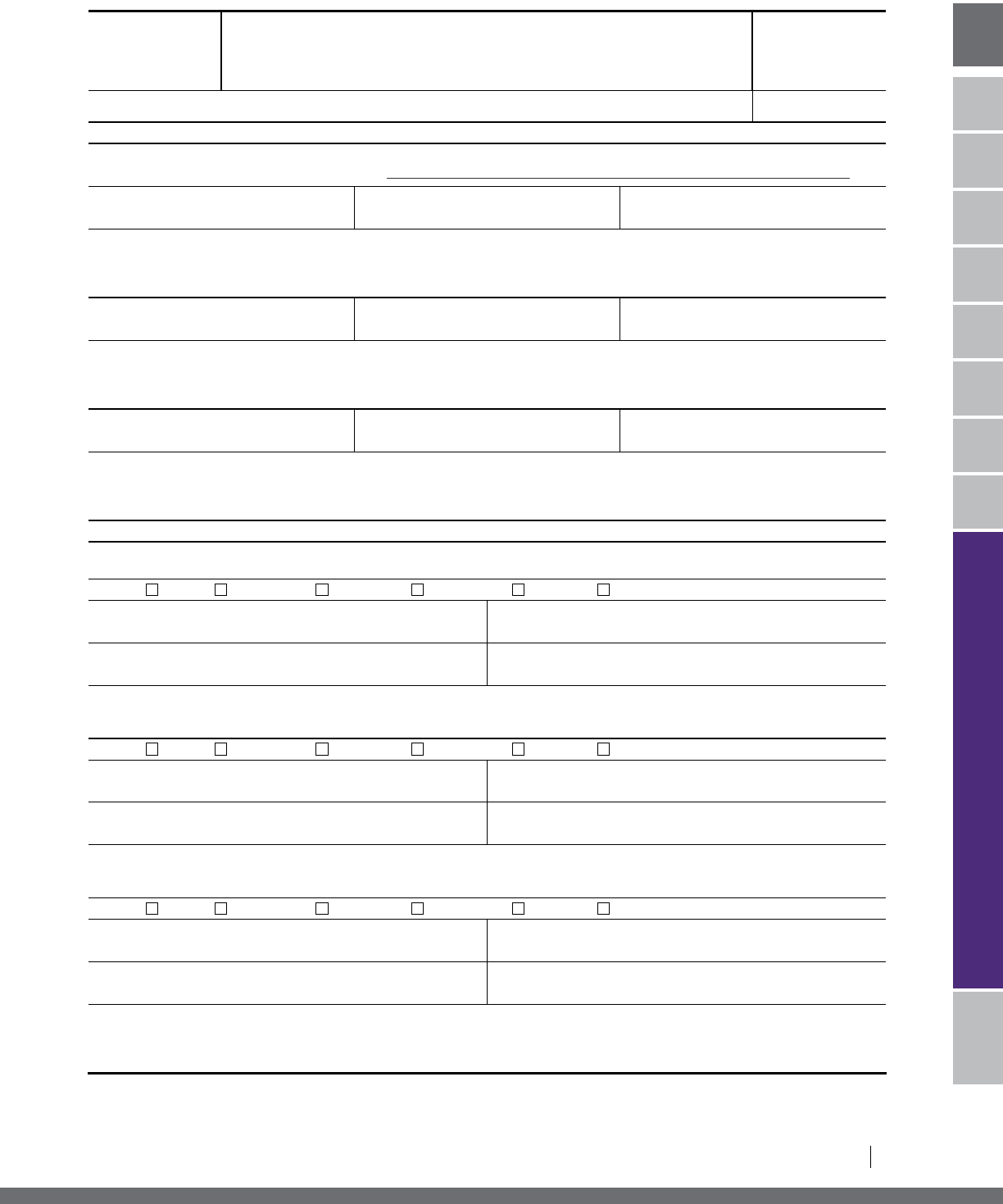

Figure 3, Sample Budget Broken Down by IRS Grant and Matching Funds

Sample Budget Broken Down by IRS Grant and Matching Funds

Federal Funds

Percent of

Budget AllocationMatching Funds Total Budget

STAFFING

Personnel

Volunteer Services

Fringe Benefits

$130,788

|

55.7%

CONTRACTUAL

(i.e., Rent, Utilities)

TRAVEL

EQUIPMENT

OTHER

EXPENSES

INDIRECT

EXPENSES

TOTAL

EXPENDITURE

$36,086

|

16.3%

$34,213

|

14.6%

$ 85,734 $ 115,353 $ 201,087 86.5%

$ 2,201 $ 6,849 $ 9,050

3.9%

$ 1,995 $ 2,166 $ 4,161

1.8%

$ 87 $ 222 $ 309 0.1%

$ 2,710 $ 7,881 $ 10,591

4.6%

$ 7,273 $ 0 $ 7,273

3.1%

$ 100,000 $ 132,471 $ 232,471

100%

$71,405 $59,383

$36,086

$19,884

$14,329

=

+

8

LOW INCOME TAXPAYER CLINIC

A. SUBGRANTS ARE PROHIBITED

A grantee may not make a subgrant of LITC grant funds to another organization or individual. A subgrant

is a payment to another organization or contractor to provide controversy representation or ESL education as

compared to a payment for providing goods and services to the grantee. For example, a grantee may not pay

another organization to prepare and conduct its ESL educational activities, although the clinic could pay a firm to

translate its educational materials into another language.

B. REQUIREMENTS FOR PROVIDING LITC SERVICES

At least 90 percent of the taxpayers represented must have incomes that do not exceed 250 percent of the Federal

Poverty Guidelines and the amount in controversy for any taxable year generally must not exceed the amount

specified in IRC § 7463 for eligibility for special small case procedures in Tax Court (currently $50,000) (see

Section V. A, Representation).

A grantee may provide qualifying LITC services within a broader spectrum of activity. A grantee may provide

representation in nontax matters as well as representation in tax matters as long as LITC grant funds are used

only to support the representation of eligible taxpayers in a controversy with the IRS or a related state or local tax

authority.

Matching Funds Are Required on a Dollar-for-Dollar Basis

IRC § 7526(c)(5) requires grantees to provide matching funds on a dollar-for-dollar basis for all federal funds

awarded by the IRS. Only funds that are used in direct support of the LITC Program qualify as matching funds.

What Contributions Qualify as Matching Funds?

Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards,

2 CFR § 200.306 provides that all contributions, including cash and third-party in-kind, shall be accepted as part

of the grantee’s cost sharing or matching when such contributions:

Are verifiable from the grantee’s records;

Are not included as contributions for any other federally assisted project or program;

Are necessary and reasonable for proper and efficient accomplishment of project or program objectives;

Are allowable under the applicable cost principles;

Are not paid by the federal government under another award, except where authorized by the federal statute

to be used for cost sharing or matching;

Are provided for in the approved budget when required by the federal awarding agency; and

Conform to other provisions of 2 CFR Part 200, when applicable.

9

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

GRANT RECIPIENT ELIGIBILITY

II. GRANT RECIPIENT ELIGIBILITY III IV VVI VIIIIII IV VVI VII VIII

Grant funds received from the Legal Services Corporation are not considered federal funds and

therefore can be used as a source of matching funds.

For more detailed information regarding the matching funds requirement, see Section VI. E, Meeting the Matching

Funds Requirement.

Charging More Than a Nominal Fee for Services Is Prohibited

An LITC may not charge more than a nominal fee for its services, although reimbursement of actual costs

incurred (e.g., photocopying, court costs, and expert witness fees) is permitted. If a clinic charges a fee, it must

charge that same fee to all taxpayers, regardless of the services being sought. The goal of the LITC Program is to

enhance access to representation, education, and advocacy services for low income taxpayers. If the amount that a

clinic charges results in fewer taxpayers assisted, the goal of the Program is not being achieved and that amount is

not nominal. A clinic may not charge a separate or additional fee (even if it is nominal) to prepare a tax return or

a claim for refund.

C. START-UP EXPENSES MAY BE PAID USING LITC GRANT FUNDS

An applicant may be awarded an LITC grant for the full grant year although it anticipates that it will not begin

representing taxpayers until after the start of the grant year. An applicant may also be awarded a grant although it

anticipates that it will not begin representing taxpayers until after the close of the grant year for which the grant is

awarded. All grant recipients must satisfy the statutory matching funds requirement during the period covered by

the grant and must meet all reporting requirements, regardless of when operations begin. Reports should provide

information on the status of the start-up. In addition, LITC grants to these applicants will be conditioned on

the conduct of qualifying activities during the immediately succeeding grant year; however, grant funds for the

immediately succeeding grant year are not guaranteed to be awarded.

D. COMPLIANCE WITH FEDERAL TAX AND FEDERAL NONTAX OBLIGATIONS

An applicant must be in full compliance with its federal tax responsibilities when applying for an LITC grant

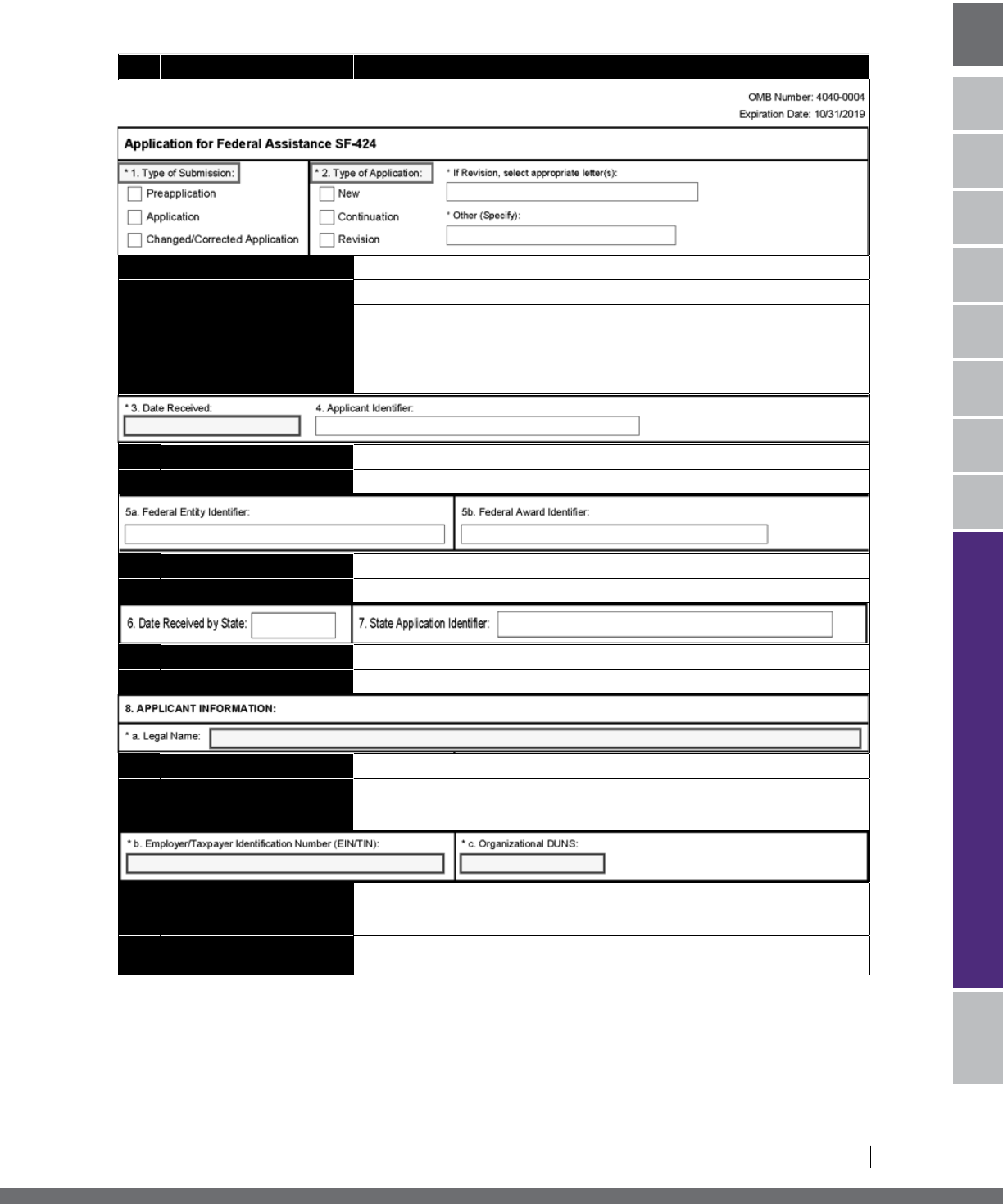

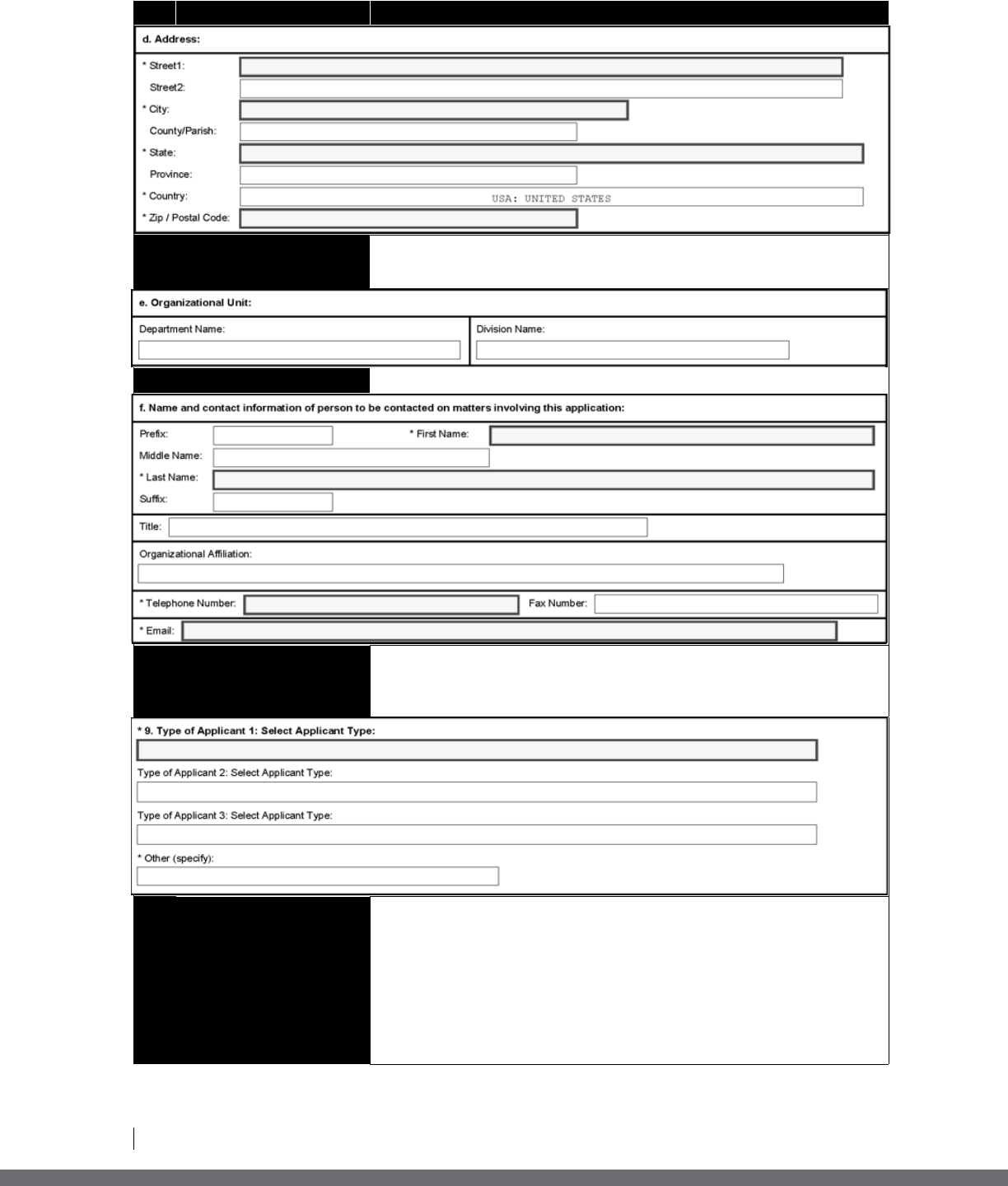

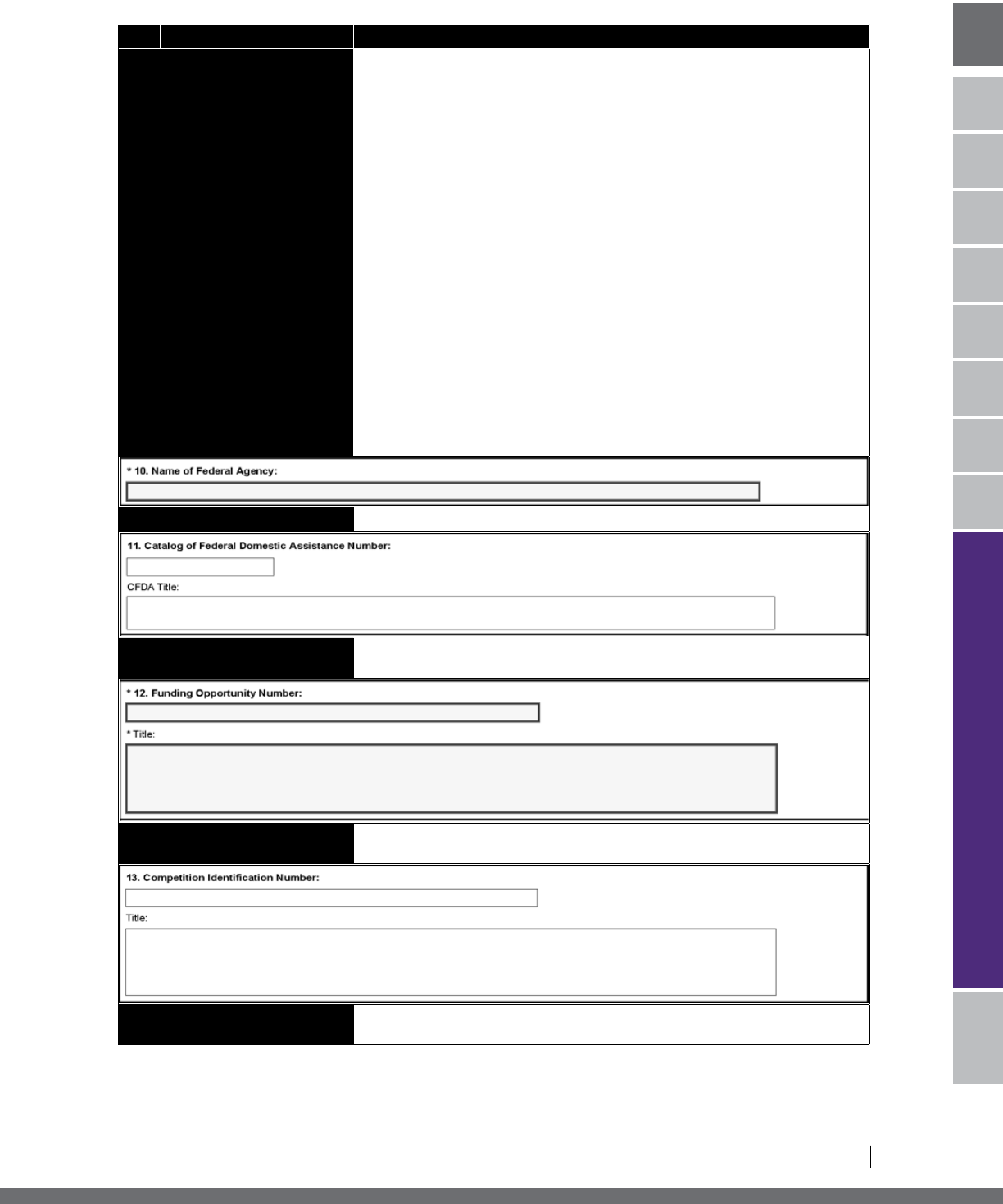

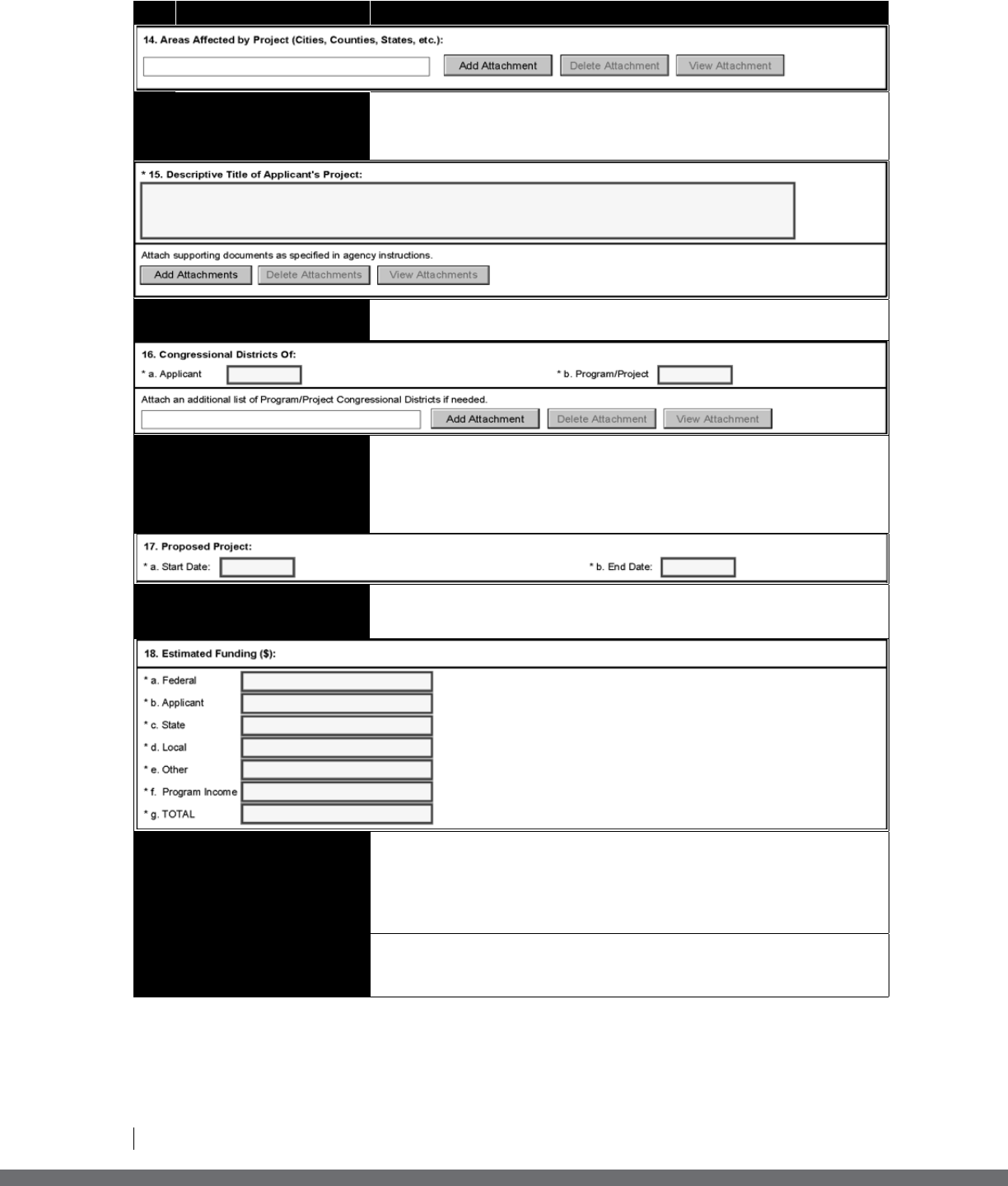

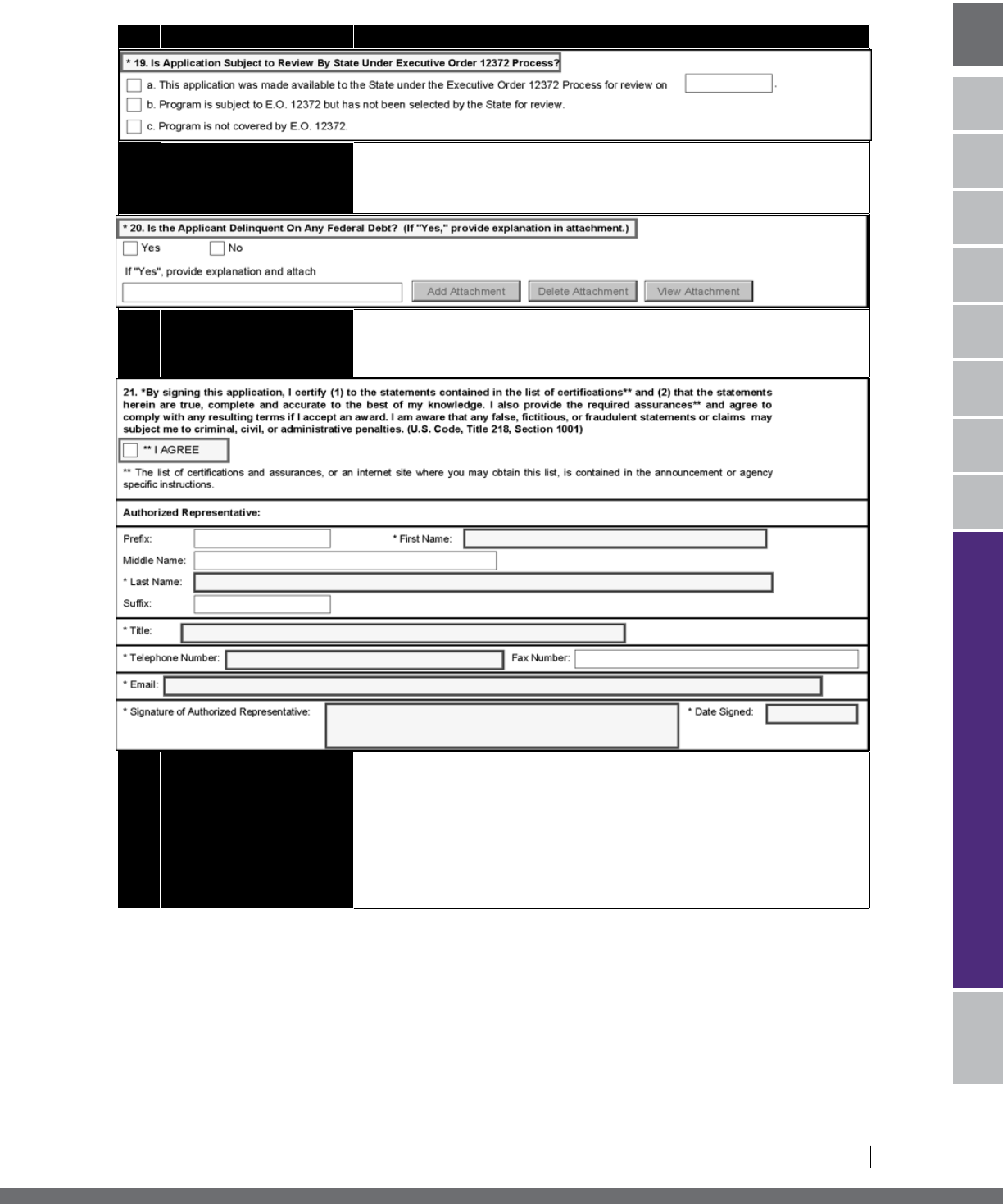

and also throughout the grant year. Standard Form 424 (Appendix, 81–85) asks whether the applicant

is delinquent on any federal debt. In general, funds will not be awarded to an applicant with any outstanding

federal nontax debt. The LITC Program Office utilizes the Do Not Pay List to determine ineligible grant

recipients and prevent improper payments. See donotpay.treas.gov for more information.

To facilitate the resolution of any potential tax compliance issues, Standard Form 424, Application for Federal

Assistance (specifically the Applicant Federal Debt Delinquency Explanation), and Form 13424, Low Income

Taxpayer Clinic (LITC) Application Information, require applicants to provide contact information for the

individual responsible for handling the organization’s federal tax matters. Failure to provide an appropriate

contact could delay application processing or the receipt of grant funds.

10

LOW INCOME TAXPAYER CLINIC

An outstanding federal tax debt is any unpaid federal tax liability (including penalties and interest) that has been

assessed, is not disputed, and for which all judicial and administrative remedies have been exhausted or have

lapsed. An applicant or grant funded organization that has entered into and remains current with an installment

agreement or other payment arrangement with the federal government will be considered in compliance with any

federal tax or nontax obligation and will be eligible for funding.

E. CIVIL RIGHTS REVIEWS

To the extent necessary to make a Civil Rights Compliance determination, the Civil Rights Division (CRD) of

the IRS may request additional data only to the extent that it is readily available or can be compiled within a

reasonable manner. Examples of such data and information include, but are not limited to:

The manner in which services are or will be provided by the program and related data necessary

for determining whether any persons are or will be denied such services on the basis of prohibited

discrimination;

The population eligible to be assisted by race, color, national origin, age, sex, or disability;

Data regarding covered employment, including use or planned use of bilingual public contact employees

serving beneficiaries of the program, where necessary to permit effective participation by beneficiaries with

limited English proficiency;

The location of existing or proposed facilities connected with the program and related information adequate

for determining whether the location has or will have the effect of unnecessarily denying access to any

persons on the basis of prohibited discrimination;

The present or proposed membership, by race, color, national origin, sex, age, or disability, in any planning

or advisory body that is an integral part of the program; and

Data, such as demographic maps of the racial composition of affected neighborhoods or census data.

A CRD staff member will review each grant application and continuation request for compliance with civil rights

reporting requirements. Upon completion, the CRD will forward a preliminary civil rights determination based

on the information in the grant application or continuation request to the LITC Program Office. No LITC

grant funding may be awarded until the CRD has made a preliminary determination of probable or conditional

compliance. Department of Justice regulations state that all federal agency staff determinations of Title VI

compliance shall be made by or be subject to review by the agency’s civil rights office.

The CRD annually conducts selected post-award reviews to ensure civil rights requirements are in place and to

provide technical assistance. The following are examples of civil rights compliance items addressed during site

reviews:

External building accessibility (e.g., accessible entrances, curb cuts, sufficient parking spaces for persons with

disabilities);

Interior accessibility (e.g., signage for emergency routes, routes to and within the service area, sufficient

seating in the service area, restrooms, water fountains and elevators);

Non-discrimination policies (e.g., Publication 4053, Your Civil Rights are Protected, displayed in service areas,

the organization’s non-discrimination policy posted and disseminated in marketing);

11

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

GRANT RECIPIENT ELIGIBILITY

II. GRANT RECIPIENT ELIGIBILITY III IV VVI VIIIIII IV VVI VII VIII

Accommodations for persons with disabilities (e.g., sign language interpreters, Braille/large print

documents); and

Accommodations for persons with limited English proficiency (e.g., bilingual volunteers, language

interpreters/language line, community resources).

The results from the selected site reviews are compiled into a report and provided to the Office of the Taxpayer

Advocate.

Contacting the Civil Rights Division

For additional information on civil rights requirements, see Publication 4454, Your Civil Rights are Protected, or

contact the Operations Director, Civil Rights Division at edi.civil.rights.division@irs.gov. If you believe you’ve

been discriminated against, send a written complaint to:

Director, Civil Rights Unit

Office of Equity, Diversity and Inclusion

Internal Revenue Service, Room 2413

1111 Constitution Avenue NW

Washington, DC 20224

F. OTHER ASSURANCES AND CERTIFICATIONS

Trafficking Victims Protection Act of 2000

The Trafficking Victims Protection Act (TVPA) of 2000, as amended (22 U.S.C. § 7104), requires any agency

that awards grants to include a condition authorizing the agency to terminate the grant if the grantee engages

in certain activities related to trafficking in persons. As part of the implementation of the Act, the Office of

Federal Financial Management has established terms that must be included in every grant agreement. See

2 CFR § 175.15.

The IRS may terminate the award, without penalty, if the grantee engages in, or uses labor recruiters, brokers, or

other agents in violation of the TVPA of 2000. The terms applicable to a grantee are as follows:

You as the recipient, and your employees, may not:

a. Engage in severe forms of trafficking in persons during the period of time that the award is in effect;

b. Procure a commercial sex act during the period of time that the award is in effect;

c. Use forced labor in the performance of the award; or

d. Engage in acts that directly support or advance trafficking in persons, including the following acts:

i. Destroying, concealing, removing, confiscating, or otherwise denying an employee access to that

employee’s identity or immigration documents.

12

LOW INCOME TAXPAYER CLINIC

ii. Failing to provide return transportation or pay for return transportation costs to an employee from a

country outside the United States to the country from which the employee was recruited upon the end

of employment if requested by the employee, unless:

exempted from the requirement to provide or pay for such return transportation by the Federal

department or agency providing or entering into the grant, contract, or cooperative agreement; or

the employee is a victim of human trafficking seeking victim services or legal redress in the country

of employment or a witness in a human trafficking enforcement action.

iii. Soliciting a person for the purpose of employment, or offering employment, by means of materially false

or fraudulent pretenses, representations, or promises regarding that employment.

iv. Charging recruited employees unreasonable placement or recruitment fees, such as fees equal to or

greater than the employee’s monthly salary, or recruitment fees that violate the laws of the country from

which an employee is recruited.

The IRS may unilaterally terminate the award, without penalty, if it determines that the grantee has violated one

of the provisions in a, b, c, or d above, or if the IRS official authorized to terminate the award determines that an

employee of the grantee violated a prohibition in items a, b, c, or d above through conduct that is either:

associated with performance under the award; or

imputed to the grantee using the standards and due process for imputing the conduct of an individual

to an organization that are provided in 2 CFR Part 180, OMB Guidelines to Agencies on Governmentwide

Debarment and Suspension (Non-Procurement), as implemented by the Department of the Treasury at

31 CFR Part 19.

Federal Funding Accountability and Transparency Act

The Federal Funding Accountability and Transparency Act (FFATA) of 2006, as amended, is intended to

empower Americans with the ability to hold the government accountable for each spending decision. Each

applicant must ensure it has the necessary processes and systems in place to comply with the FFATA reporting

requirements should it receive funding. Office of Management and Budget (OMB) has issued guidance to

establish requirements for grantees to report information about executive compensation in certain circumstances.

See 2 CFR Part 170.

Preparing for and Responding to a Breach of Personally Identifiable

Information

OMB requires that when a grant recipient creates, collects, uses, processes, stores, maintains, disseminates,

discloses, or disposes of personally identifiable information within the scope of a Federal award, the IRS shall

ensure that the grant recipient has procedures in place to respond to a breach. In addition, a grant recipient

must notify the IRS in the event of a breach. Because LITCs have access to their clients’ and prospective clients

personally identifiable information, LITCs must have procedures in place to respond to a breach, and must

notify the LITC Program Office in the event of a breach. See OMB Memorandum M-17-12, Preparing for and

Responding to a Breach of Personally Identifiable Information (Jan. 3, 2017).

13

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

GRANT RECIPIENT ELIGIBILITY

II. GRANT RECIPIENT ELIGIBILITY III IV VVI VIIIIII IV VVI VII VIII

Certain Criminal Law Violations

Federal law currently prohibits the award of grant funds to any corporation that was convicted of a felony criminal

violation under any Federal law within the preceding 24 months, where the IRS is aware of the conviction,

unless a federal agency has considered suspension or disbarment of the corporation, and made a determination

that denial of the grant is not necessary to protect the interests of the government. See Public Law 114-113,

Division E, Title VII, § 746 (2015); Public Law 114-223, Division C, § 101(a)(5) (2016), as extended by

Pub Law 114-254, § 101 (2016). If necessary, the LITC Program Office will advise grantees of any changes in

this prohibition for fiscal year 2018.

In addition, all applicants must disclose all violations of Federal criminal law involving fraud, bribery, or gratuity

violations potentially affecting the grant award. Failure to make required disclosures can result in any of the

remedies described in 2 CFR § 200.338, including suspension or debarment. See 2 CFR § 200.113.

Conflict of Interest Policy

Applicants and grantees must have a written conflict of interest policy which contains the terms as listed in this

section. LITCs must disclose in writing to the LITC Program Office any potential conflict of interest situation

and how the conflict was resolved.

At a minimum, an LITC grantee’s Conflicts of Interest Policy (“Policy”) must:

Apply to at least the grantee’s employees, officers, members of its board of directors (including non-director

members of committees), and pro bono panel members (“Covered Individuals”).

Apply to at least all grantee matters involving the use of LITC grant funds and matching funds, in whole

or in part, including, but not limited to, grants, contracts, procurements, leases, investments, other

commitments of grantee resources, and personnel matters.

Cover at least situations when an outside interest, activity, or relationship influences or appears to influence

the ability of a Covered Individual to exercise objectivity, or impairs or appears to impair his or her ability to

perform his or her responsibilities impartially and in the best interests of the grantee (“Conflict of Interest”

or “Conflict”).

Cover at least situations when an outside interest, activity, or relationship influences or appears to influence

the Covered Individual’s impartiality or duty of loyalty to a client.

The Policy must require Covered Individuals to avoid legal, financial, personal, or other Conflicts and potential

Conflicts involving the grantee, and to promptly disclose any such Conflicts and potential Conflicts that arise.

Covered Individuals must recuse themselves from a position of decision-making authority or influence on

decisions or actions with respect to any such Conflicts and potential Conflicts until resolved.

Covered Individuals must report on any situations that they know, or reasonably should know will present a

Conflict or a potential Conflict. The Policy must specify to whom Conflicts must be reported and how Conflicts

14

LOW INCOME TAXPAYER CLINIC

will be addressed and resolved. Covered Individuals may not participate in any situation involving a Conflict or

potential Conflict, unless the grantee determines, through these procedures that the:

Conflict or potential Conflict is not substantial; and

Covered Individual’s participation is in the best interest of the LITC and the LITC’s clients.

Association of Community Organizations for Reform Now

At this time, Federal law prohibits the IRS from providing funding to the Association of Community

Organizations for Reform Now (ACORN) or any of its affiliates, subsidiaries, allied organizations, or successors.

See Public Law 114-113, Division H, Title V, § 522; Public Law 114-223, Division C, § 101(a)(5) (2016), as

extended by Public Law 114-254, § 101 (2016). This prohibition may be lifted by next fiscal year. Contact the

LITC Program Office for up-to-date information about this prohibition.

Other Applicable Law and Regulations

Programs involving use of federal funds are governed by a wide variety of federal laws and regulations. These

include:

Restrictions on political activities at 18 U.S.C. §§ 595, 598, 600-603;

The national preservation program requirements (54 U.S.C. § 300101 et seq.);

Whistleblower protections at 41 U.S.C. § 4712;

Rules governing allowable costs at 41 U.S.C. §§ 4304, and 4310;

Environmental requirements of the Clean Air Act (42 U.S.C. § 7401 et seq.); and

The non-pollution requirement of the Federal Water Pollution Control Provisions (33 U.S.C. § 1251

et seq.).

Assurances of compliance are required for LITC funding, according to the “common rule” on non-procurement,

debarment, and suspension adopted by Department of Treasury at 31 CFR Part 19, Subpart C. An applicant

must certify that its organization and Clinic Director are not presently debarred or suspended from covered

transactions by any federal agency. In addition, an applicant must indicate that within the three-year period

before applying for a grant, its organization and Clinic Director have not been convicted of or had a civil

judgment rendered against them for fraud, theft or certain other offenses, and have not had one or more public

transactions terminated for cause or default. An applicant must also indicate that its organization and Clinic

Director are not presently criminally or civilly charged with certain offenses.

Additional assurances are required according to the governmentwide requirements for a drug-free workplace

(41 U.S.C. §§ 8101-06), adopted by the Department of the Treasury at 31 CFR Part 20, Subpart B and C, and

assurance of civil rights compliance, as specified above.

When an applicant submits Standard Form 424 and checks the box on line 21 marked “I agree,” the

applicant is agreeing to each of the assurance and certification provisions that accompany Standard

Form 424. The list of assurances and certifications is included in the Appendix on page 86.

15

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

III. HOW TO APPLY FOR AN LITC GRANT IV

II IV IV VVI VIIIIV VVI VII VIII

III. HOW TO APPLY FOR AN LITC GRANT

A. APPLICATION PROCESS

An overriding goal of the LITC Program is to provide services to low income and ESL taxpayers in every state,

the District of Columbia and Puerto Rico. In making grant award decisions, the IRS seeks to fund qualified

organizations, including academic institutions and nonprofit organizations throughout the United States, to

provide representation, education, and advocacy on behalf of low income and ESL taxpayers. The IRS awards

grant funds to achieve the goals of the LITC Program.

Preparing and submitting your grant application is a major undertaking. Take time to understand and review the

process well in advance of submitting an application. Prepare and start as early as possible.

Get Registered

Submitting an application for an LITC grant requires that the applicant organization be registered with

https://www.grants.gov/ and the System for Award Management (SAM). In order to register with SAM, the

organization will also need an Employer Identification Number (EIN) and a Data Universal Numbering System

(DUNS) number. Register early, as first-time registration with these groups is a multi-step process that can take

more than eight weeks and MUST be completed before the application submission deadline.

System for Award Management

Applicants are required to register with the System for Award Management (SAM) prior to submitting a grant

application and are required to maintain an active SAM registration with current information at all times

during which they have an active federal award or an application under consideration. SAM is a web-enabled

governmentwide application that collects, validates, stores, and disseminates business information about the

federal government’s trading partners in support of the contract award, grants, and electronic payment processes.

To remain active in the SAM database after registration, the applicant is required to review and update its

information in the SAM database at least once every 365 days. More information about the registration and

renewal process is available at www.sam.gov.

Employer Identification Number (EIN)

If the applicant does not have an EIN, it should submit a request to the IRS to be assigned one. See Form SS-4,

Application for Employer Identification Number. The fastest way to get an EIN is online at www.irs.gov/ein. The

hours of operation are Monday to Friday, 7 a.m. to 10 p.m. Eastern Time.

Data Universal Numbering System

Applicants are required to provide a Data Universal Numbering System (DUNS) number with each application.

A DUNS number is a nine-digit unique entity identifier provided by Dun & Bradstreet, Inc. The federal

government requires that all applicants for federal grants and cooperative agreements with the exception of

individuals other than sole proprietors have a DUNS number. The federal government will use the DUNS

number to better identify related organizations that are receiving funding under grants and cooperative

agreements, and to provide consistent name and address data for electronic grant application systems. A DUNS

16

LOW INCOME TAXPAYER CLINIC

number may be obtained by calling 866-705-5711 or applying online at fedgov.dnb.com/webform. For more

information on the requirement, see 2 CFR Part 25.

Here is some of the basic information you need to know as you begin learning about or navigating this important

process.

If you are seeking an LITC grant award for the first time, or if a multi-year LITC grant that you’ve already

received ends on December 31, 2017, you must submit an LITC Grant Application in order to receive

2018 funding. See Section III. B, Completion and Submission of the LITC Grant Application Package.

If you are already funded with a multi-year LITC grant that ends after December 31, 2017, you must

submit a Non-Compete Continuation Request. See Section III. C, Completion and Submission of a Non-

Compete Continuation Request.

All grant application and continuation requests must be submitted by June 20, 2017.

APPLICATIONS SUBJECT TO FOIA REQUESTS

Grant applications may be released in response to Freedom of Information Act (FOIA) requests after

appropriate redactions have been made. Do not include any individual taxpayer information in the grant

application.

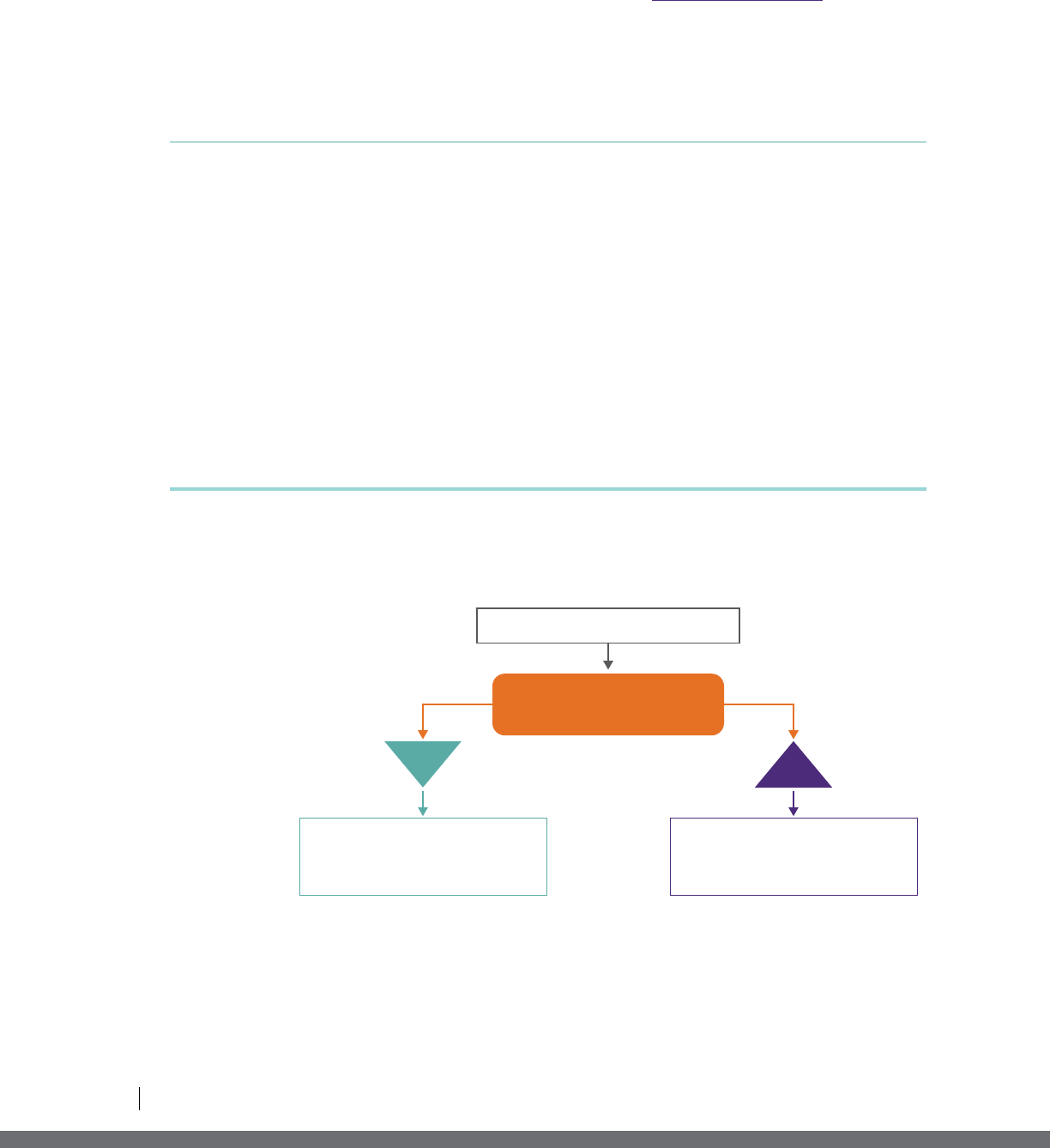

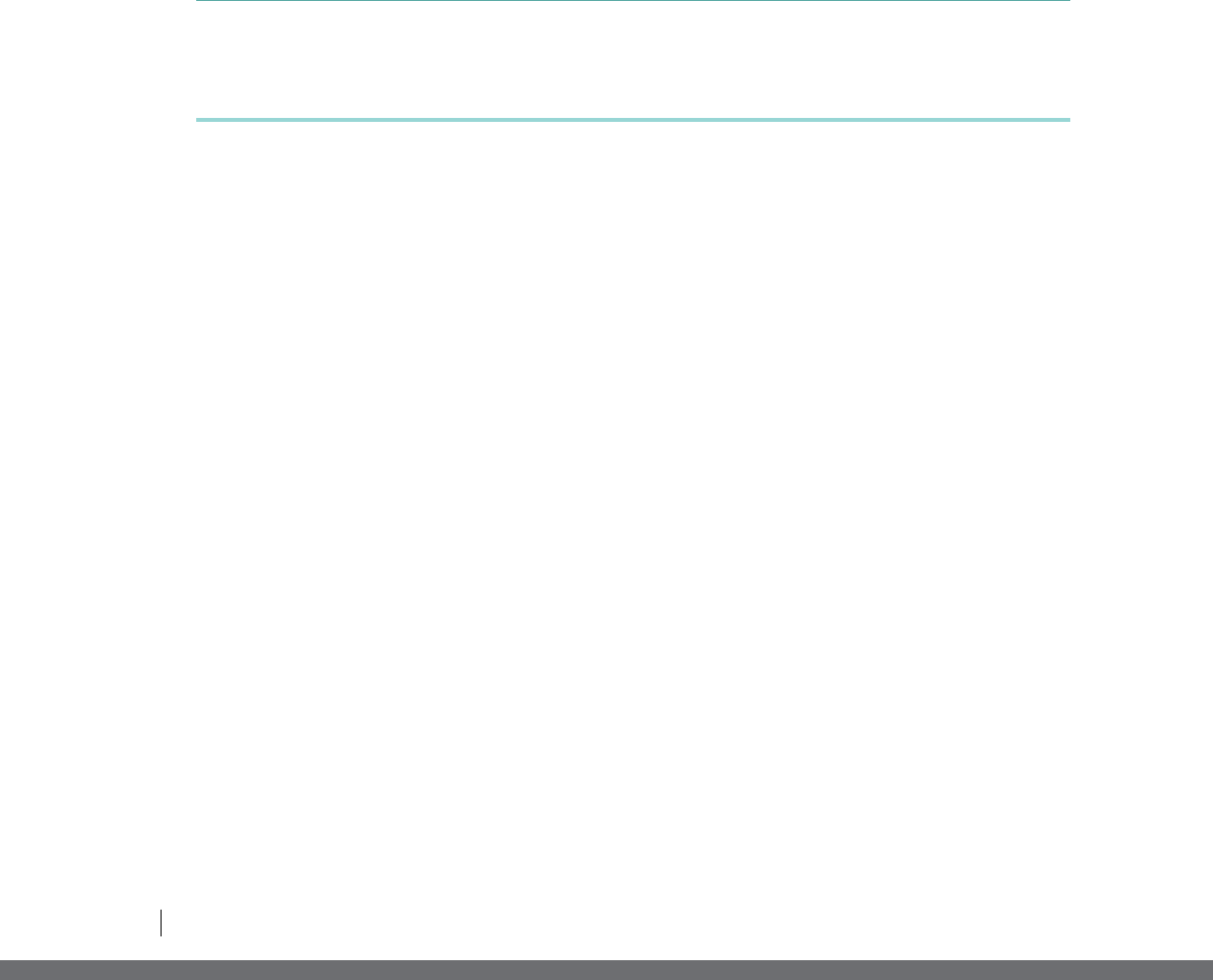

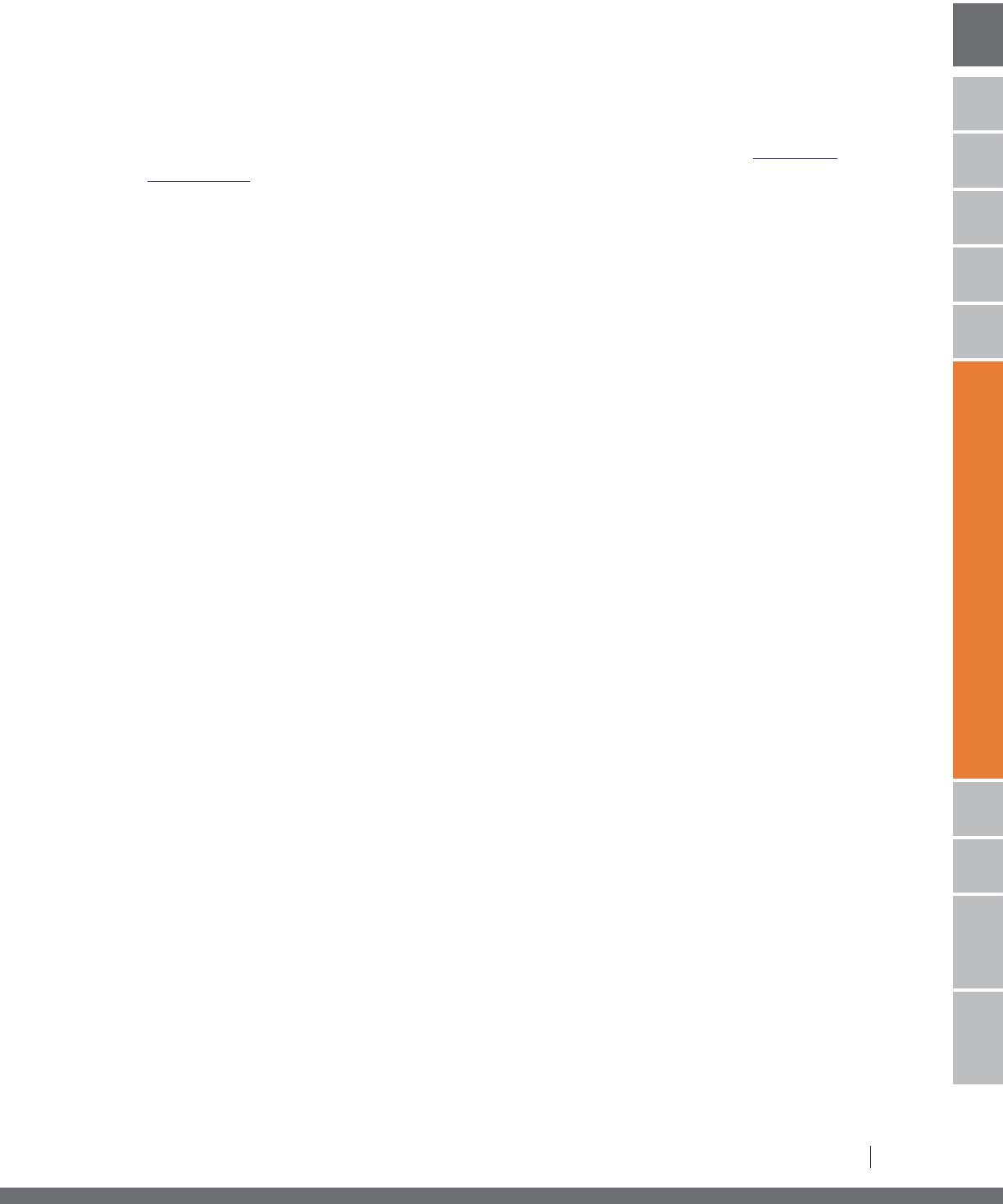

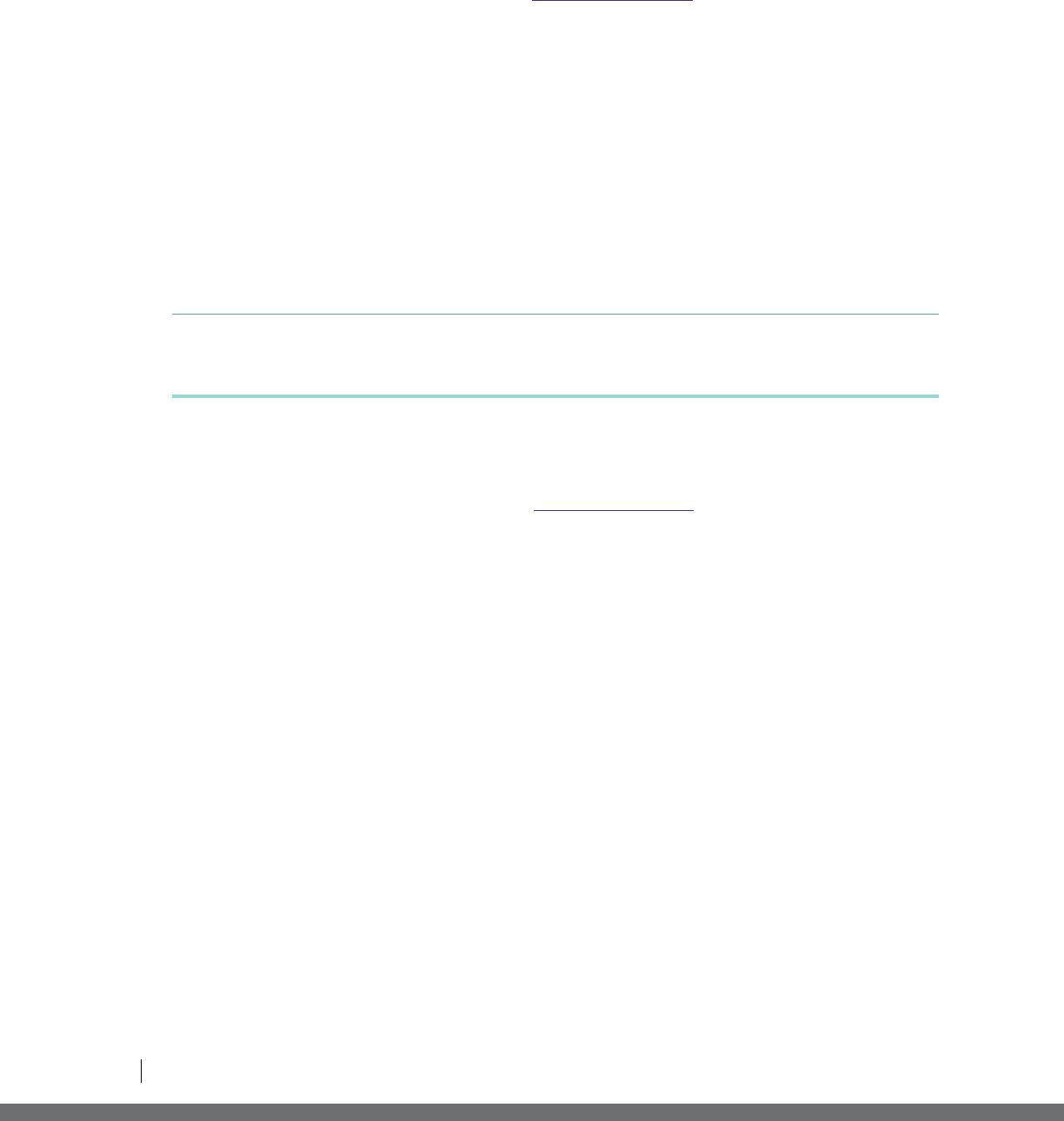

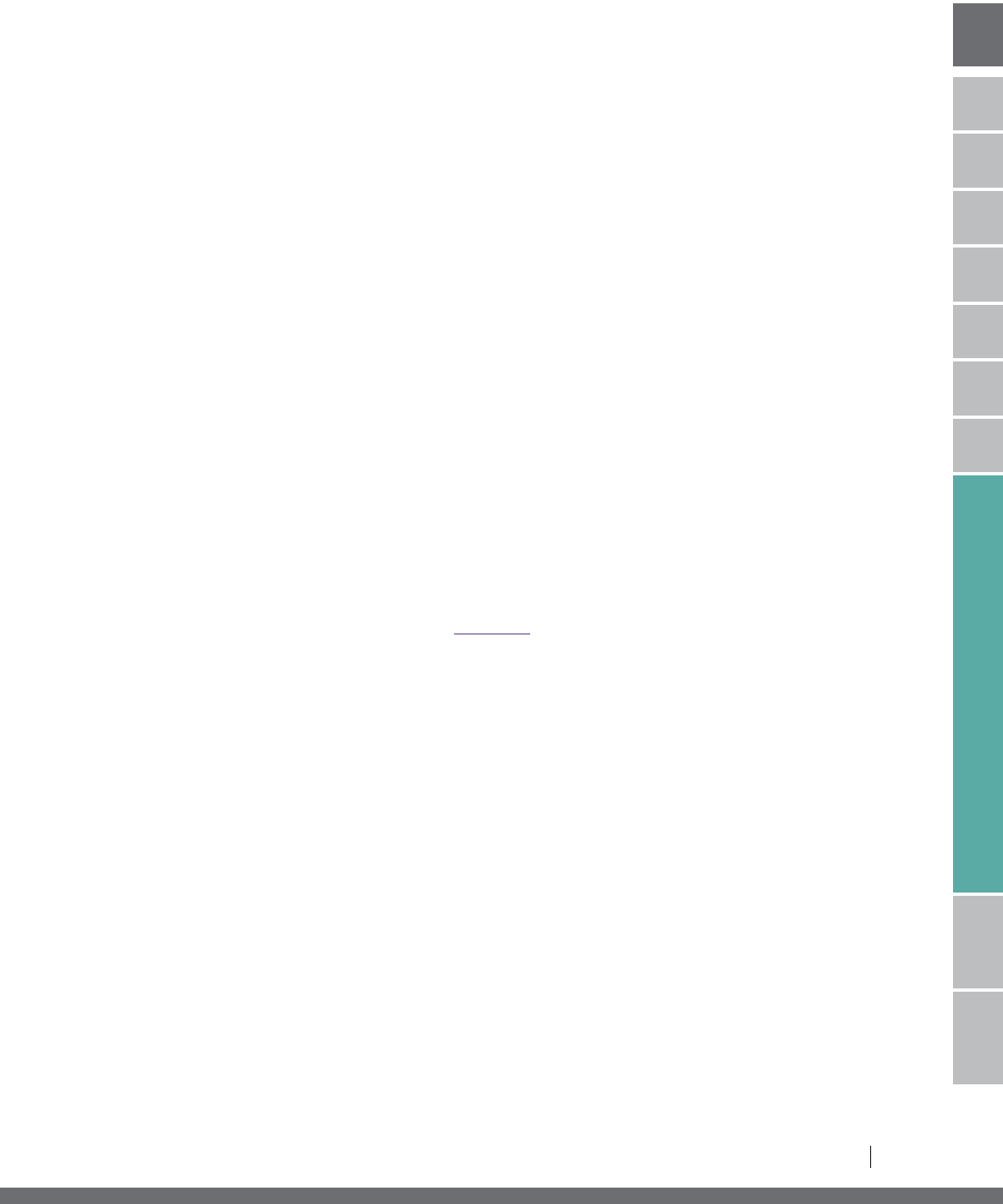

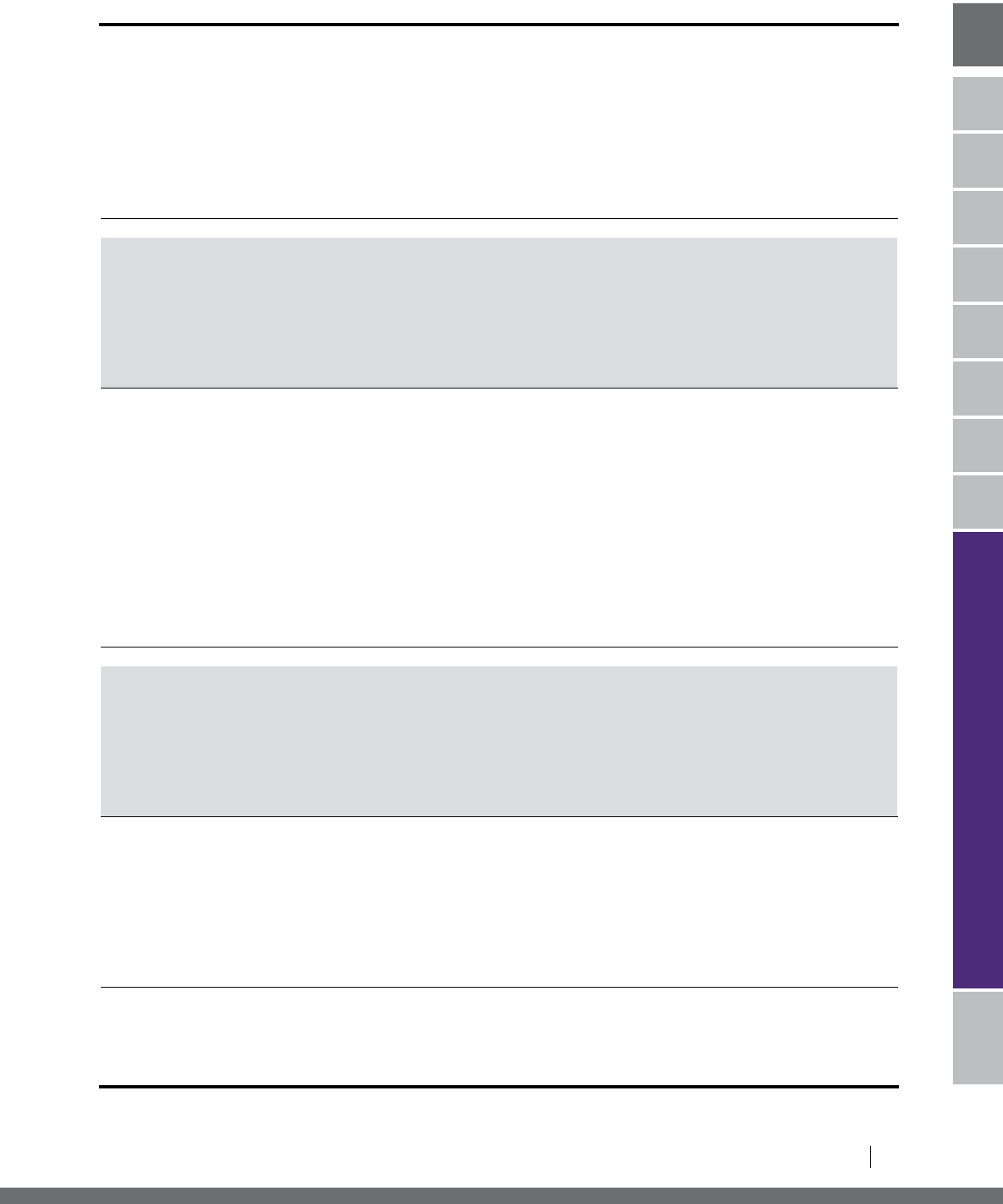

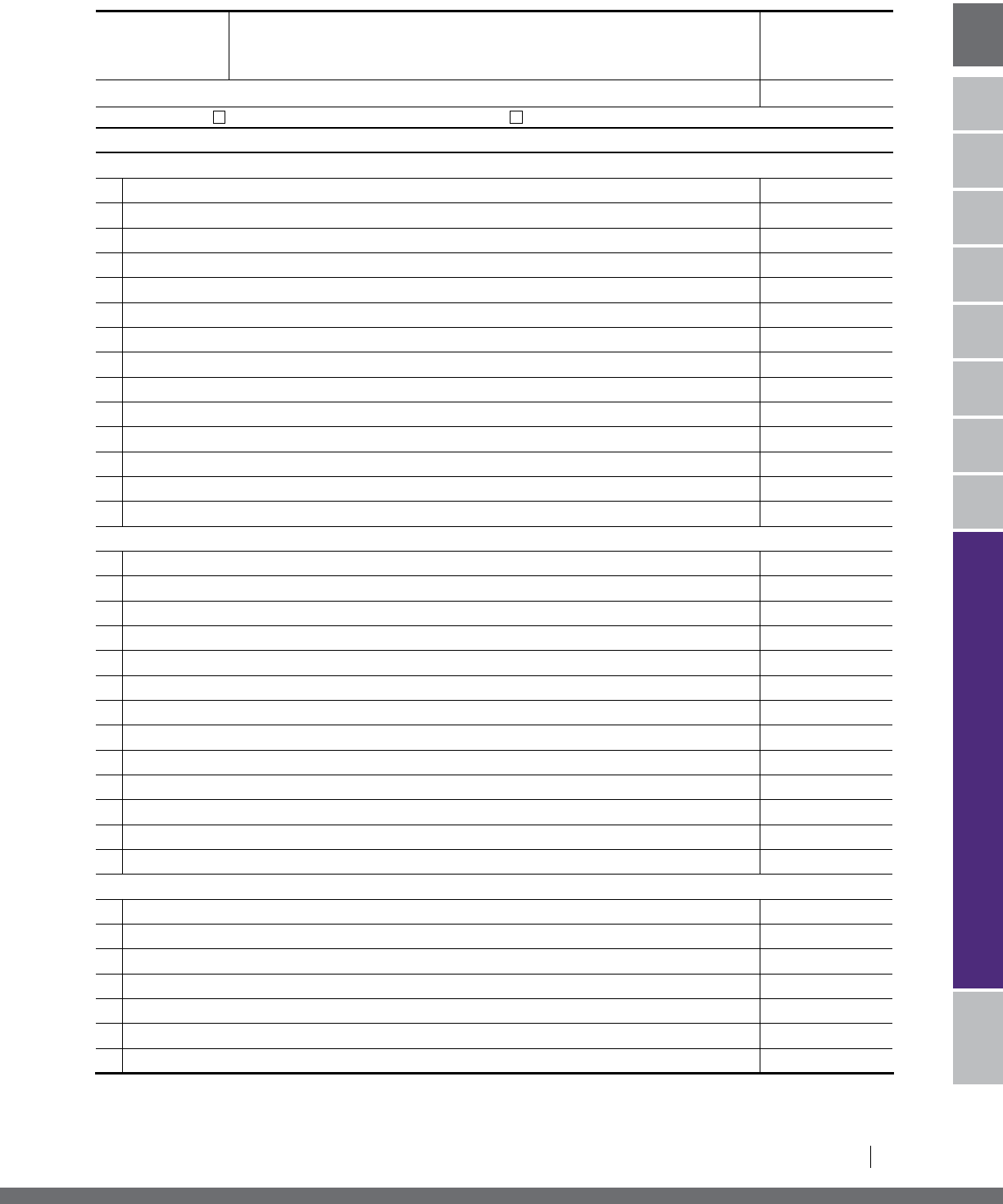

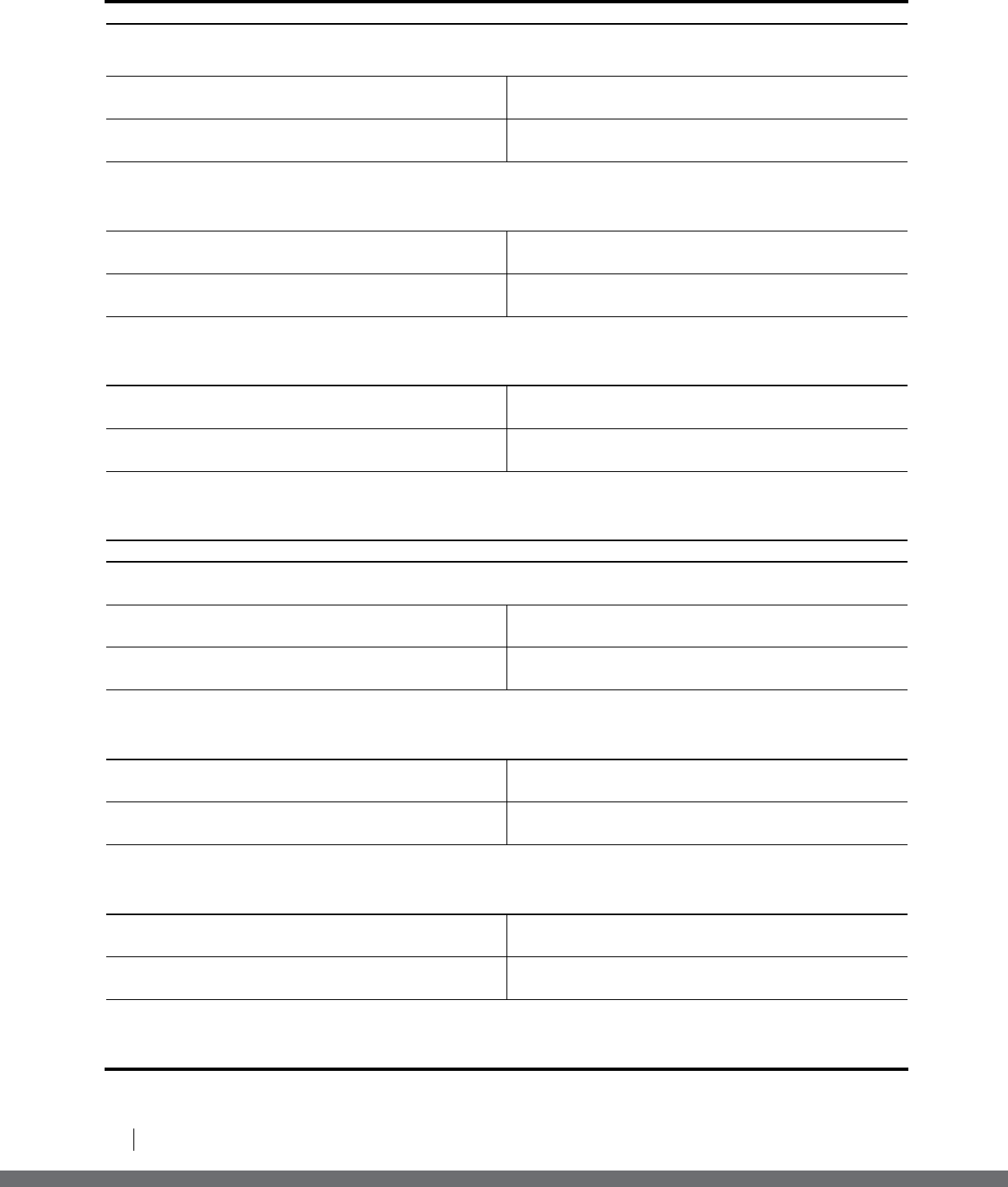

Figure 4, Overview of the Grants Process

Are you seeking continuation

of a multi-year award?

How to Apply for an LITC Grant

NO YES

Submit Grant Application

Package on Grants.gov for a

single-year or multi-year grant

Submit a Continuation Request

on GrantSolutions.gov

17

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

HOW TO APPLY FOR AN LITC GRANT

III. HOW TO APPLY FOR AN LITC GRANT IV

II IV IV VVI VIIIIV VVI VII VIII

B. COMPLETION AND SUBMISSION OF THE LITC GRANT APPLICATION

PACKAGE

If you are seeking an LITC grant award for the first time, or if a multi-year LITC grant that you’ve already

received ends on December 31, 2017, you must submit an LITC Grant application. To be considered for 2018

LITC Program grant funding, all continuation requests must be submitted by June 20, 2017.

Submit Applications on Grants.gov

The application must be submitted electronically via www.grants.gov. Use of grants.gov provides assurance

that required entries are not left blank on the standard forms and provides receipt acknowledgement when the

application is received by the LITC Program Office. The grants.gov website includes a narrated tutorial and

Frequently Asked Questions to help you use the system. The Funding Opportunity Number for the 2018 LITC

grant application is TREAS-GRANTS-052018-001.

Can I Withdraw My Application After Submission?

An LITC Grant Application may be withdrawn at any time during the application process or prior to the time

grant money is awarded by notifying the LITC Program Office in writing. Application withdrawals cannot be

completed through www.grants.gov. All withdrawals must be made in writing and faxed to 877-477-3520.

Sample Application Forms

Copies of all required application forms and certifications, as well as instructions, are included in the Appendix

section of this publication for your review. General information and budget forms, including examples, can be

found in the Appendix. See Appendix A and B.

A complete LITC Grant Application consists of the following items, submitted through www.grants.gov and

prepared in accordance with the relevant instructions:

a. IRS Form 13424, Low Income Taxpayer Clinic (LITC) Application Information (see Appendix);

b. Standard Form 424, Application for Federal Assistance (see Appendix);

c. IRS Form 13424-M, Low Income Taxpayer Clinic (LITC) Application Narrative (see Appendix);

d. Standard Form 424A, Budget Information – Non-Construction Programs (see Appendix);

e. IRS Form 13424-J, Detailed Budget Worksheet and Narrative (see Appendix);

f. Attachments Form (used to attach items g-j);

g. Tax exemption determination letter, if applicable;*

h. Proof of academic accreditation, if applicable;*

i. Most recent audited financial statement (if the applicant expends $750,000 or more in federal funds during

the applicant’s fiscal year, this must be a single audit or program-specific audit as defined in 2 CFR § 200.501;

an applicant that does not have audited financial statements must submit unaudited statements for its most

recent fiscal year and a statement as to why audited financial statements are not available);* and

18

LOW INCOME TAXPAYER CLINIC

j. Indirect cost rate agreement, if applicable.*

* Items marked with an * must be submitted via the Attachments Form (which is incorporated into the

downloadable pdf from www.grants.gov).

Incomplete Submissions

An LITC grant application is considered incomplete if it fails to follow the instructions provided on the

appropriate application form or if the application is submitted after the receipt deadline — except in very rare

cases. Incomplete applications do not proceed further in the process and will not be reviewed.

C. COMPLETION AND SUBMISSION OF A NON-COMPETE CONTINUATION

REQUEST

If you are already funded with a multi-year LITC grant that ends after December 31, 2017, you must submit a

Non-Compete Continuation request. To be considered for 2018 LITC Program grant funding, all continuation

requests must be submitted by June 20, 2017.

Submit Continuation Requests on Grantsolutions.gov

All continuation requests must be submitted via www.grantsolutions.gov. Use of grantsolutions.gov provides

assurance that required entries are not left blank on the standard forms and provides receipt acknowledgement

when the entry is received by the LITC Program Office. Do not submit continuation requests via

www.grants.gov. The LITC Program Office will provide annual training on how to use the grantsolutions.gov

website to submit reports and continuation requests. Additional questions regarding use may be directed to

the Program Office at Beard.William@irs.gov. The Funding Opportunity Number for the 2018 LITC grant is

TREASGRANTS-052018-001.

Sample Forms

Copies of all required forms and certifications, as well as instructions, are included in the Appendix section of this

publication for your review. General information forms and budget forms, including examples can be found in

the Appendix.

Copies of all required forms and certifications, as well as instructions, for the submission of an NCC are included

in the Appendix section of this publication for your review.

A complete continuation request consists of the following items, submitted through www.grantsolutions.gov and

prepared in accordance with the relevant instructions (see Appendix A and B):

a. IRS Form 13424, Low Income Taxpayer Clinic (LITC) Application Information (see Appendix);

b. Standard Form 424, Application for Federal Assistance (see Appendix);

c. Standard Form 424A, Budget Information – Non-Construction Programs (see Appendix);

d. IRS Form 13424-J, Detailed Budget Worksheet and Narrative (see Appendix);

19

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

HOW TO APPLY FOR AN LITC GRANT

III. HOW TO APPLY FOR AN LITC GRANT IV

II IV IV VVI VIIIIV VVI VII VIII

e. Project Abstract, which includes the following information (see Appendix A, pages 94–95):

i. Numerical goals;

ii. Changes to the Program Plan; and

iii. Civil Rights Statement;

f. Most recent audited or unaudited financial statement (if the applicant expends $750,000 or more in federal

funds during the applicant’s fiscal year, this must be a single audit or program-specific audit as defined in

2 CFR § 200.501; an applicant that does not have audited financial statements must submit unaudited

statements for its most recent fiscal year and a statement as to why audited financial statements are not

available);* and

g. Indirect cost rate agreement, if applicable.*

* Items marked with an * must be submitted via an attachment. The LITC Program Office provides training

to grantees on how to use www.grantsolutions.gov.

D. ELIGIBLE LITC GRANT APPLICATIONS

Grant Period

The LITC Program may award grants for up to a three-year period to applicants evaluated under the award

process. Applicants that have never been awarded an LITC grant are not eligible for a multi-year award and may

only apply for a single-year grant award; experienced LITC grantees are eligible to apply for a multi-year grant.

Determination of the grant period is at the discretion of the LITC Program Office. Thus, the Program Office

may elect to award a single-year grant to applicants that requested a multi-year grant.

Organizations awarded a multi-year grant based on the selection and award process for the 2018 grant year

will not undergo formal evaluation of their program plans during the second or third year selection and award

process. However, multi-year recipients will be reviewed annually for satisfactory performance and progress in

meeting goals and objectives as well as compliance with grant terms. The funding level for subsequent years

will be reviewed annually and may be increased or decreased at the discretion of the IRS, based on performance,

compliance with grant terms, and the availability of annually appropriated funds. Awarding of multi-year grants

is at the discretion of the IRS.

Eligibility Screening

All LITC grant applications will undergo a preliminary eligibility screening. Applications will be reviewed to

determine that the application package is complete and satisfies the following criteria:

Requests a single year grant or a multi-year grant of up to 3 years;

Requests no more than $100,000 in grant funding;

Budget provides for dollar-for-dollar matching funds; and

Applicant has an active SAM registration.

20

LOW INCOME TAXPAYER CLINIC

All applications undergo a civil rights review by the Civil Rights Division of the IRS. The LITC Program Office

will also conduct a review to verify that the applicant is:

In compliance with all federal tax obligations;

In general compliance with all federal nontax obligations; and

Not disbarred or suspended (2 CFR Part 180), or otherwise excluded from or ineligible for a federal grant

award.

Applicants that fail to satisfy the eligibility screening criteria will be notified and provided an opportunity to

correct the problem. Applications that are not corrected in a timely manner will be eliminated from the award

process. Applications that pass the eligibility screening will then undergo a technical evaluation. For additional

information, see Section III.E, Application Evaluation Process.

For purposes of this grant program, entering into and remaining current with respect to an installment

agreement or other payment arrangement with the federal government to satisfy any outstanding

federal obligations constitutes being in compliance.

Application Evaluation Process

Applications that pass the eligibility screening process will undergo a two-tiered evaluation process. Applications

will be subject to both a technical evaluation and a Program Office evaluation.

Technical Evaluation

During the technical evaluation, each application will be reviewed using the criteria listed below and awarded

points based on the information provided in the application. Applicants can receive a maximum of 100 points.

In scoring applications, the IRS will evaluate each program plan based on how it will assist in accomplishment of

the LITC Program goals as stated elsewhere in this Publication.

Points will be assigned as follows:

Experience (Maximum 10 points)

Experience in operating a low income taxpayer clinic or delivering representation and education services to low

income and ESL taxpayers.

Financial Responsibility (Maximum 10 points)

Quality of grant administration and internal accounting procedures.

21

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

HOW TO APPLY FOR AN LITC GRANT

III. HOW TO APPLY FOR AN LITC GRANT IV

II IV IV VVI VIIIIV VVI VII VIII

Program Performance Plan (Maximum 75 points)

Quality of the program plan offered to assist low income taxpayers and ESL taxpayers. Evaluation criteria include

the:

Qualifications, training, and supervision of the clinic staff, students, and volunteers;

Amount of time devoted to the program by clinic staff;

Comprehensiveness of services to be provided;

Procedures for ensuring the confidentiality of taxpayer information;

Procedures for monitoring and evaluating program results;

Publicity and outreach plans; and

Dates and hours of clinic operation.

Program Coverage (Maximum 5 points)

Number of low income and ESL taxpayers in geographic area(s), proposed efforts to reach these taxpayers, and the

number of taxpayers to be assisted.

Only information contained in the application will be considered during the technical evaluation process.

Therefore, it is extremely important that a submission contain all required information in order to

achieve the maximum score.

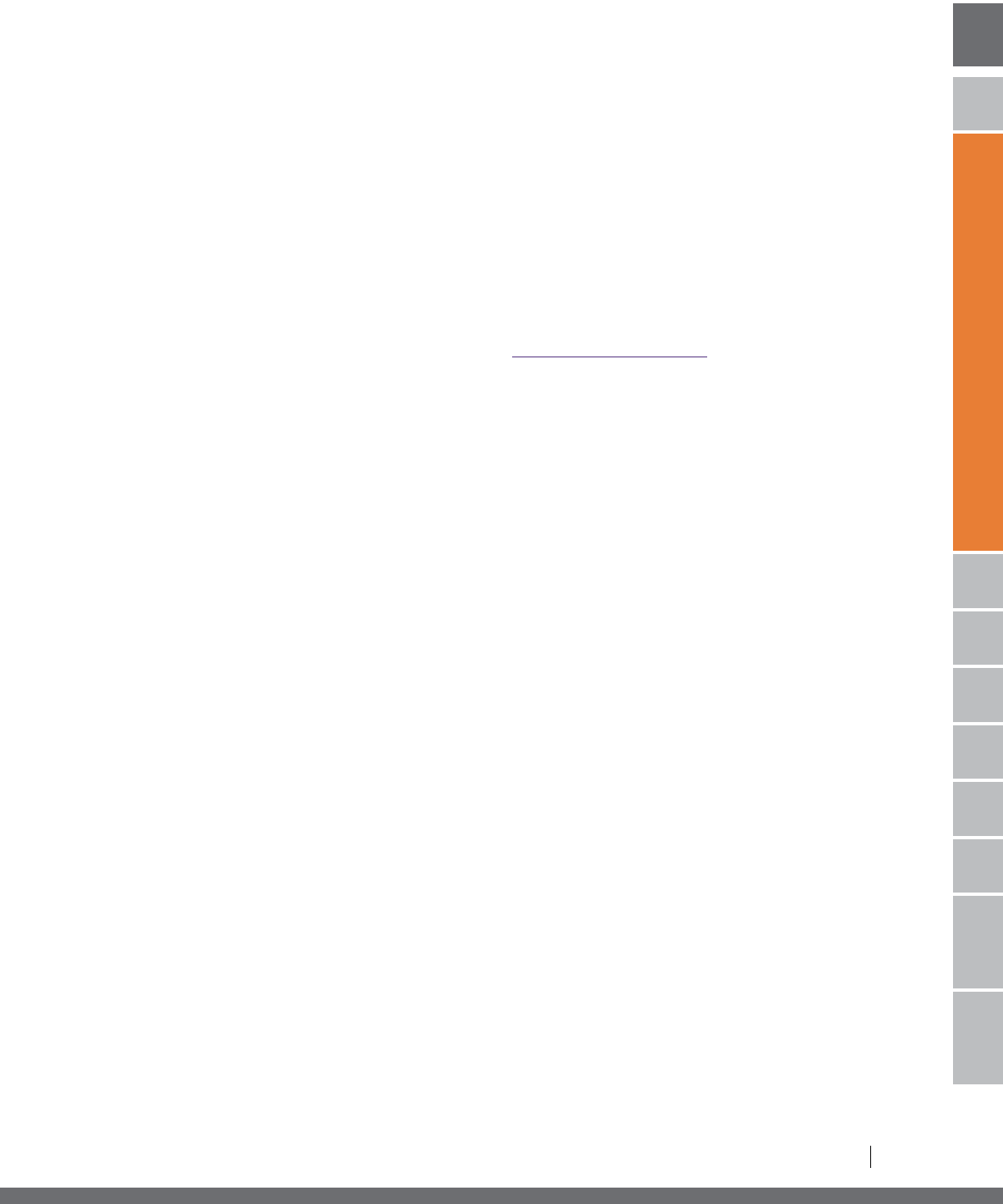

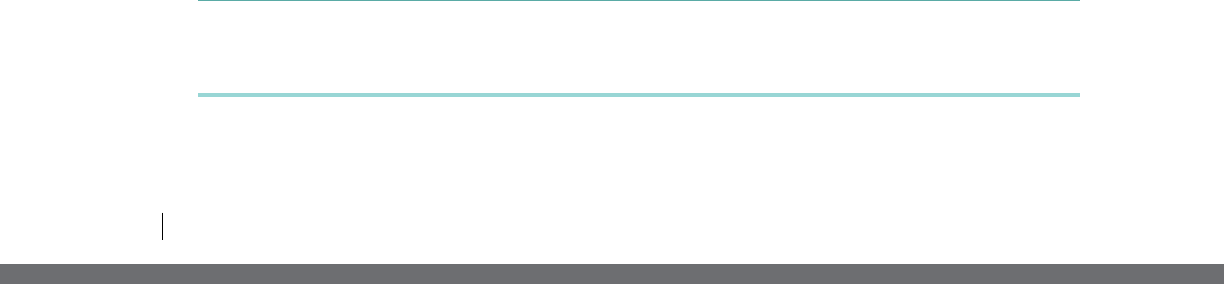

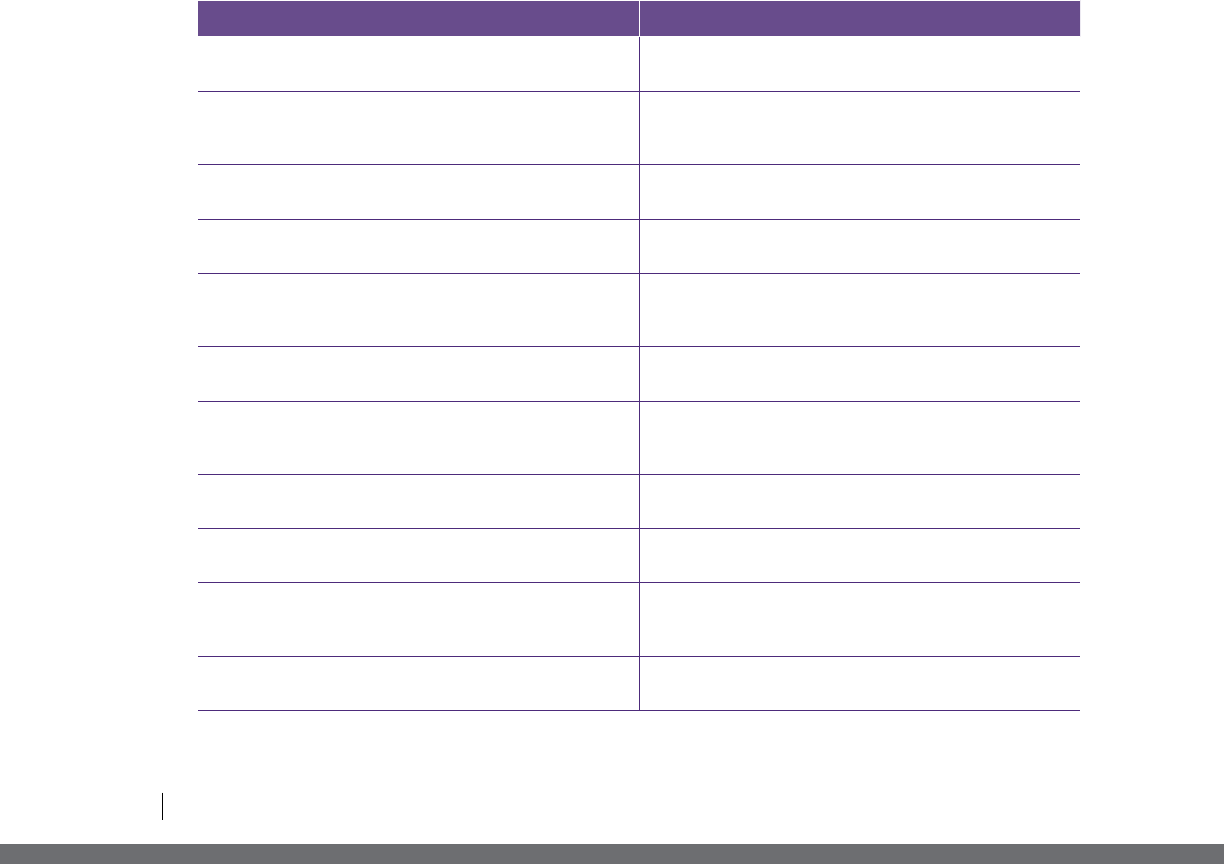

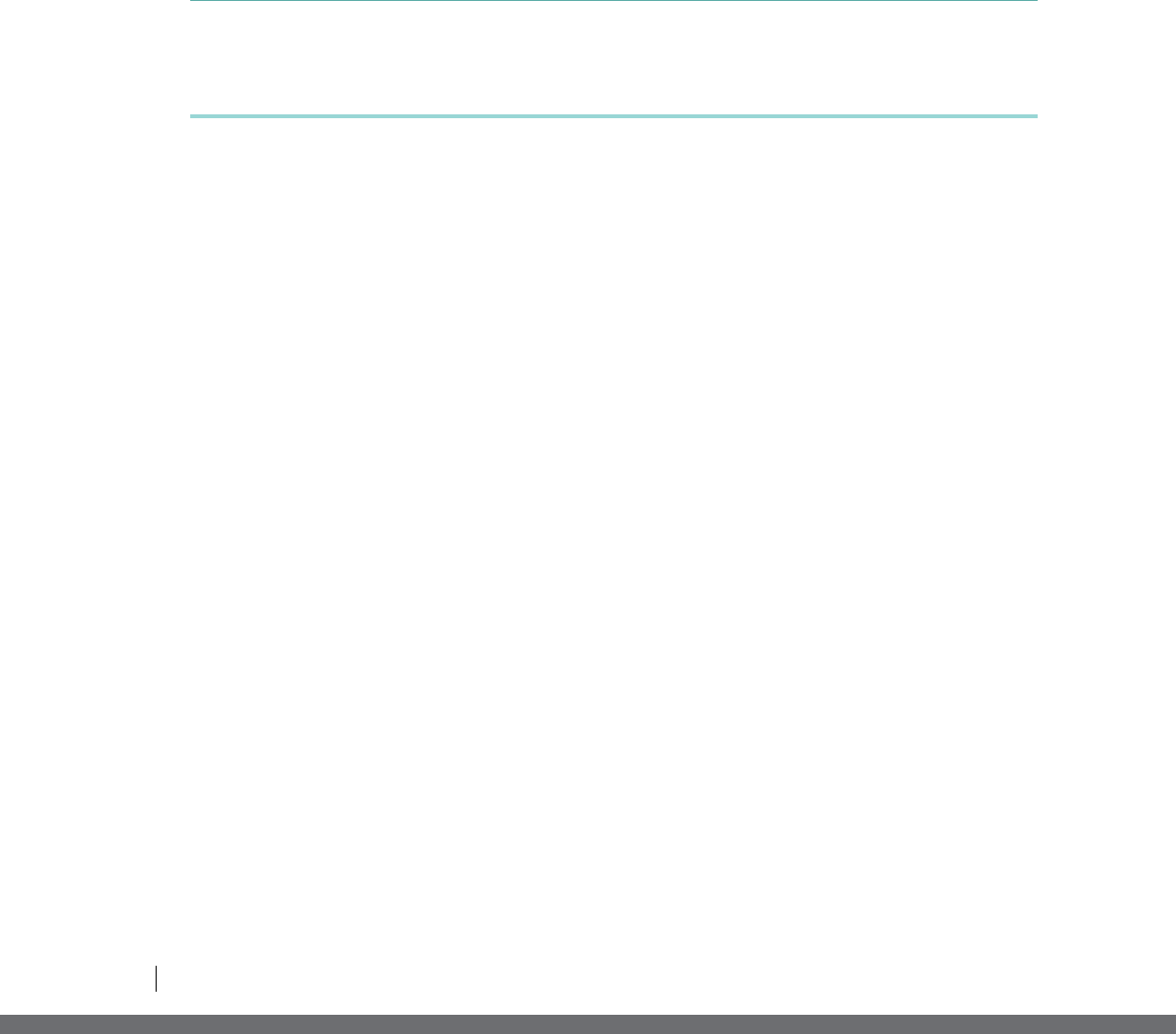

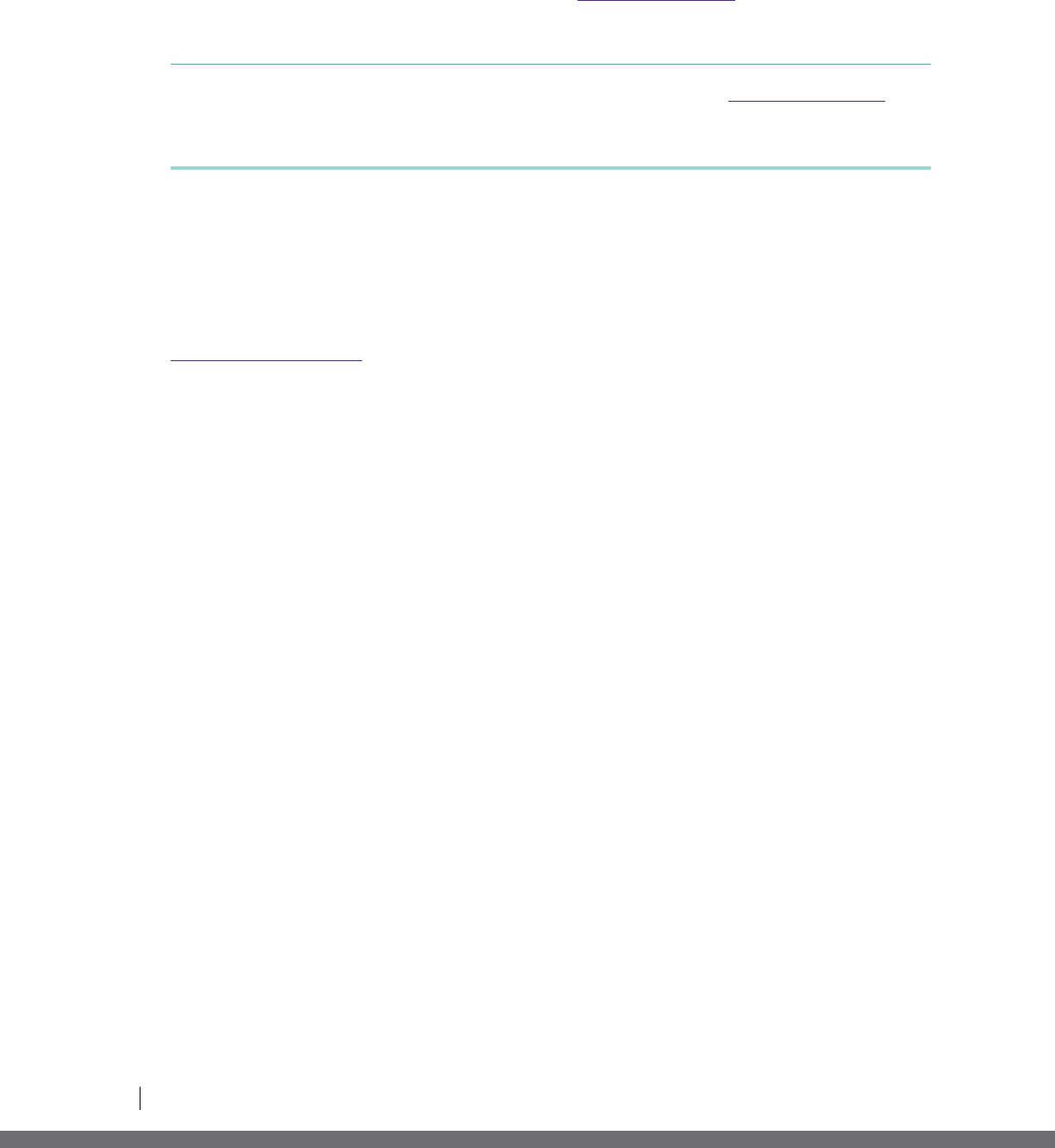

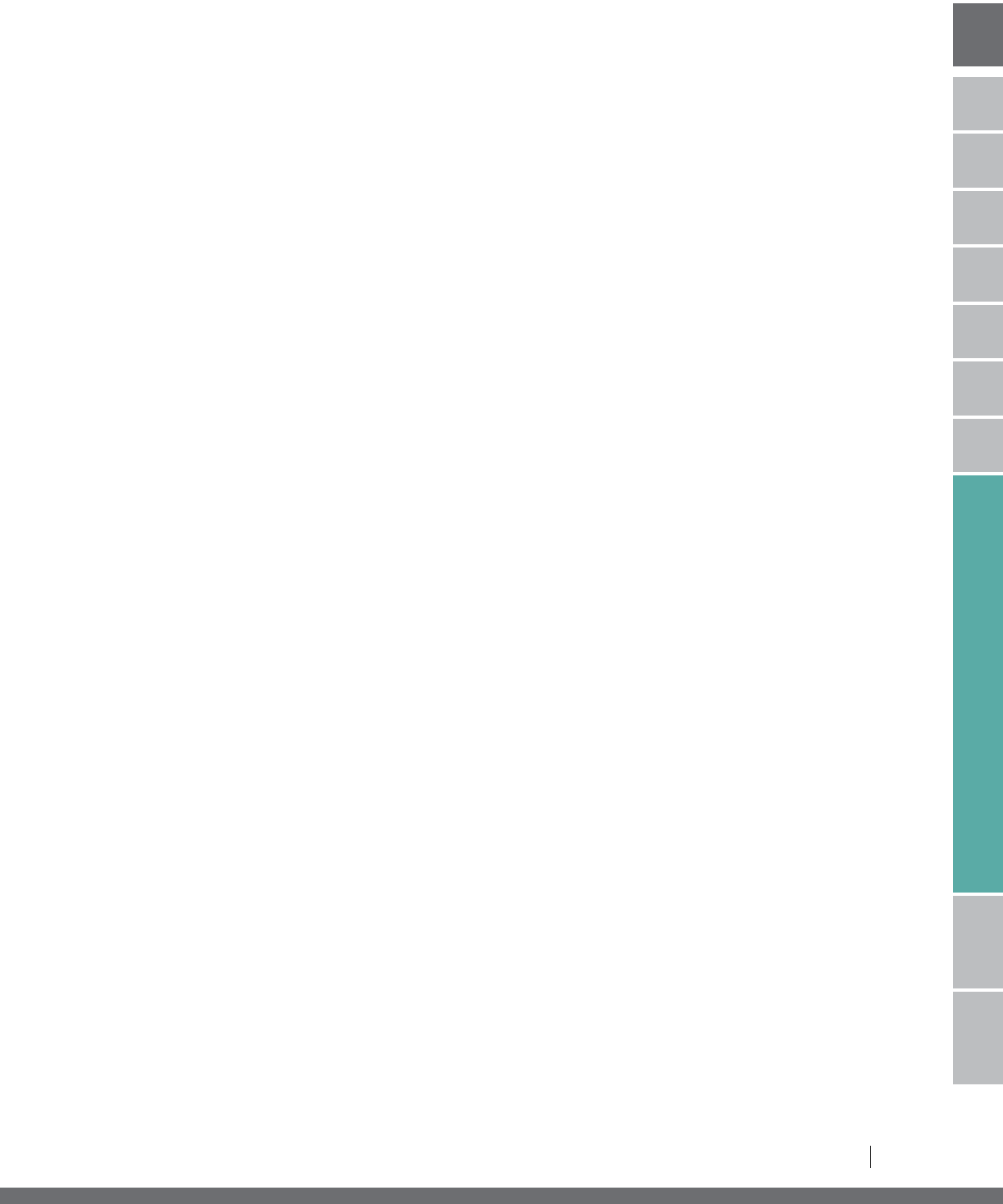

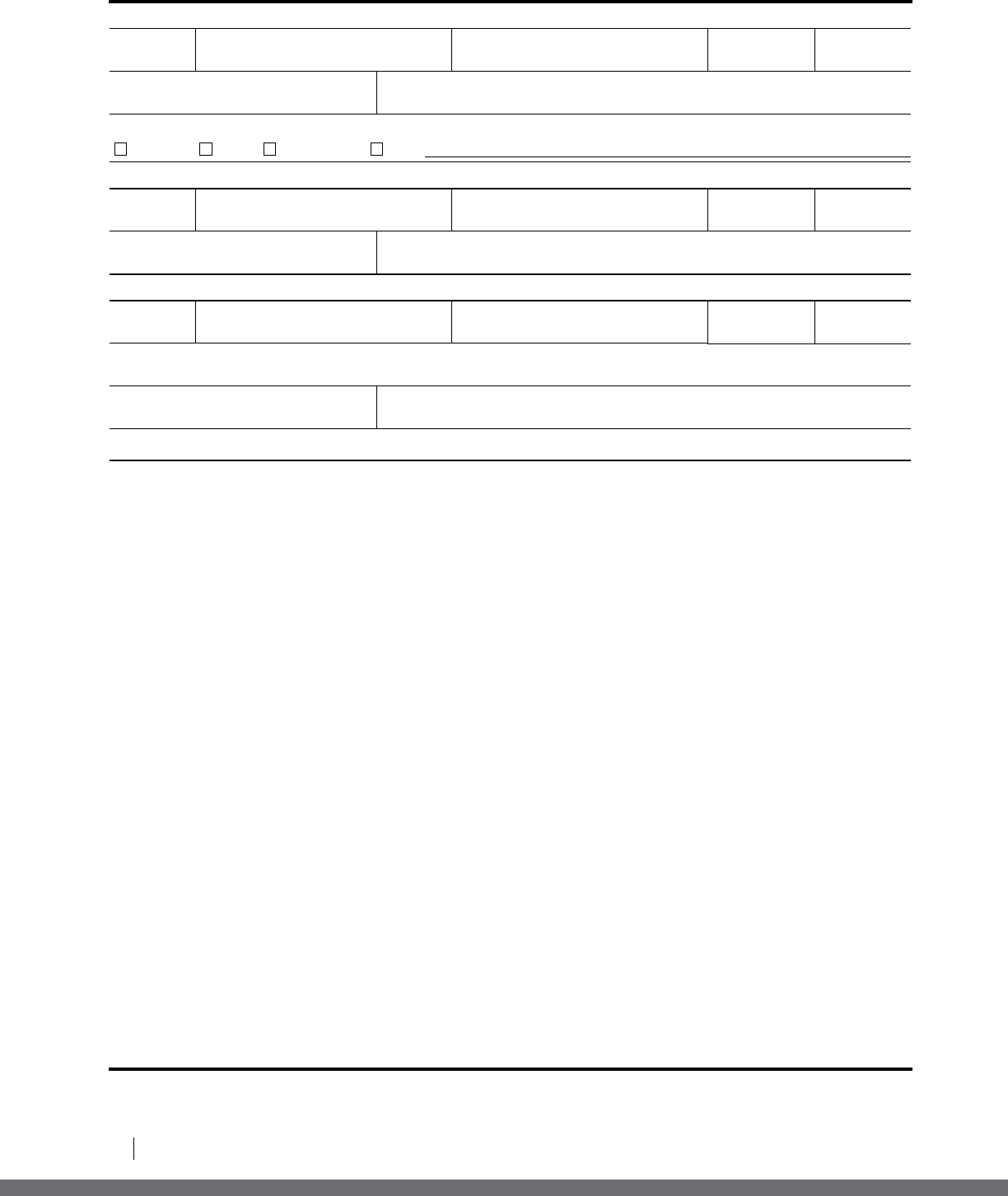

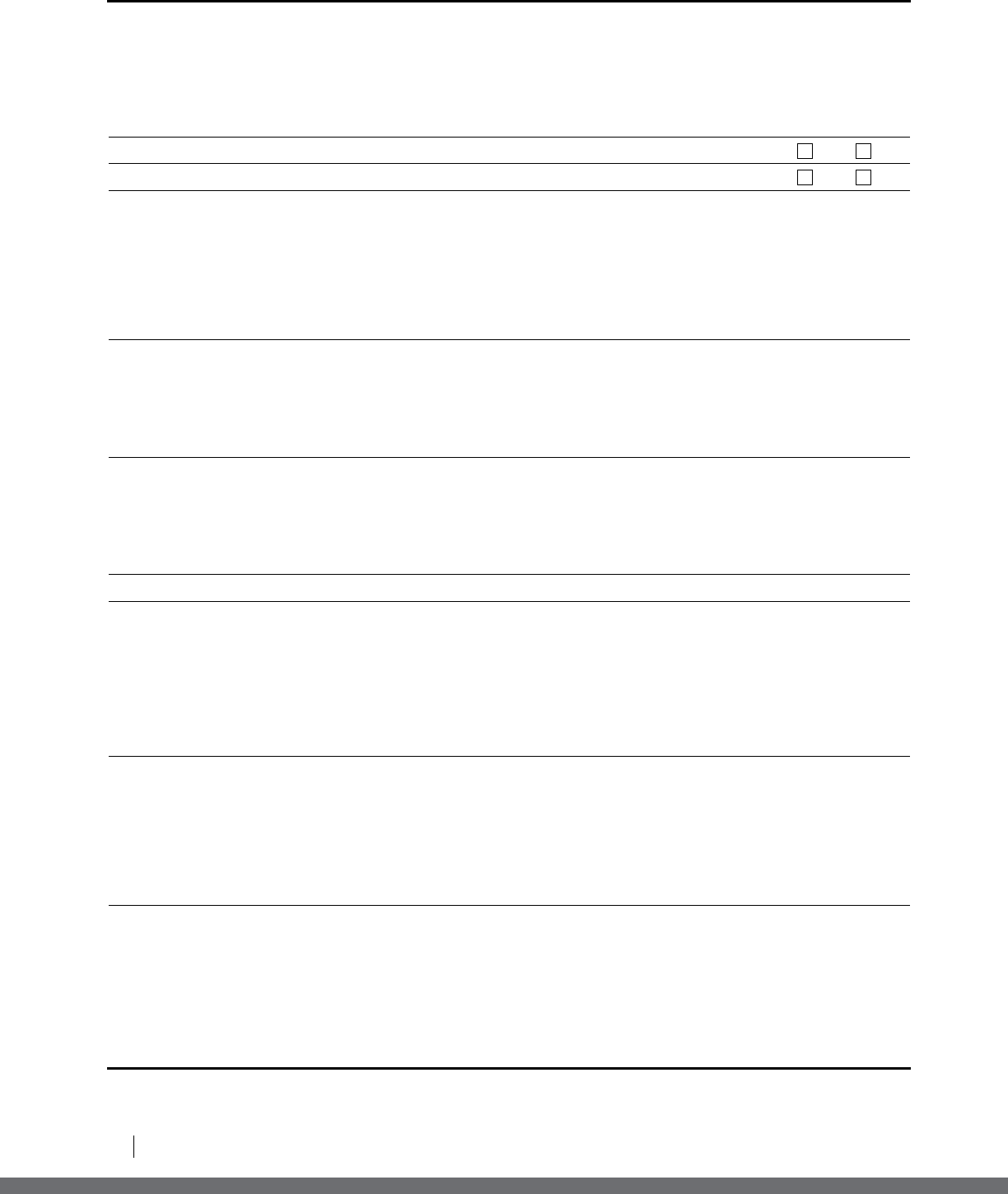

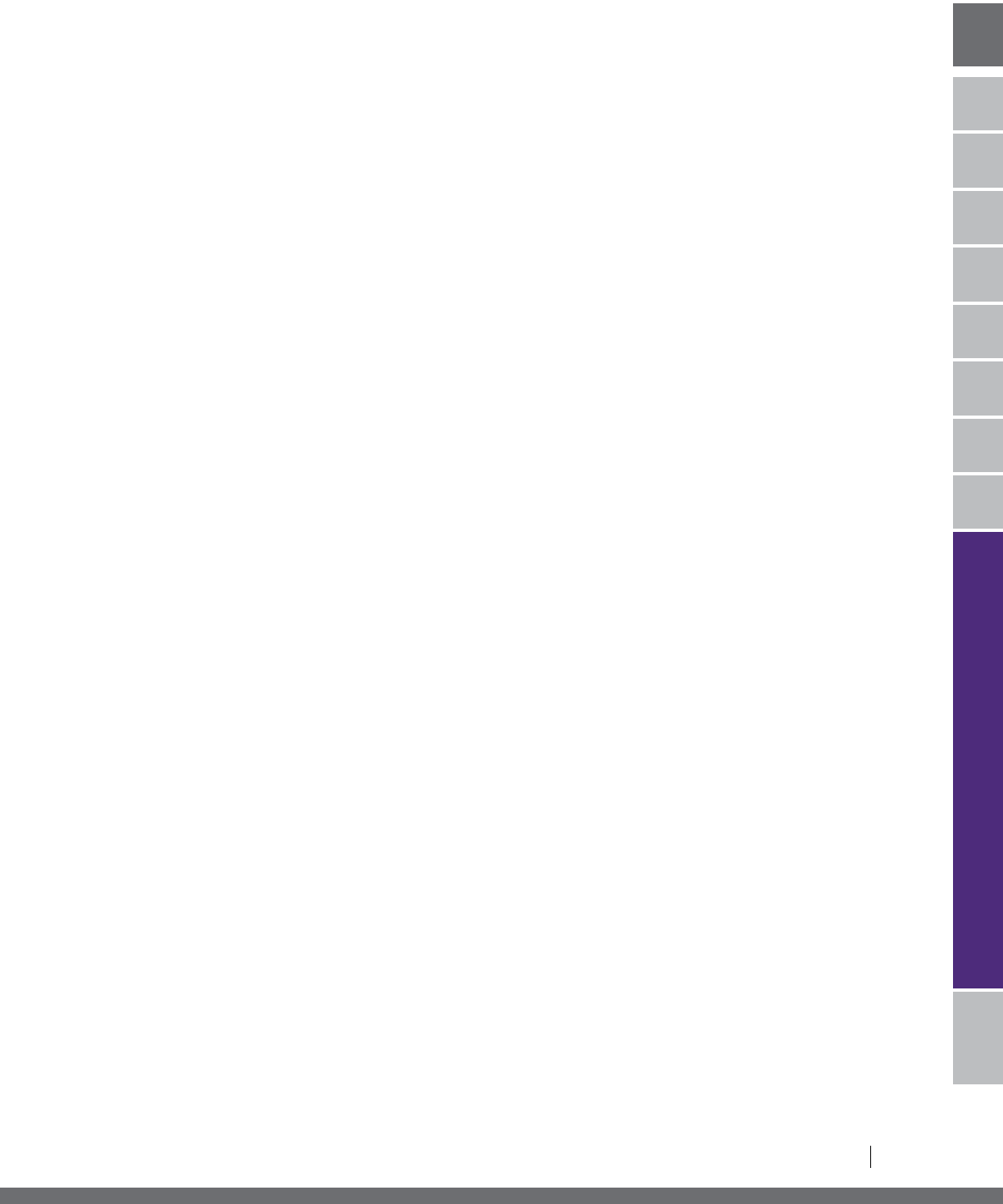

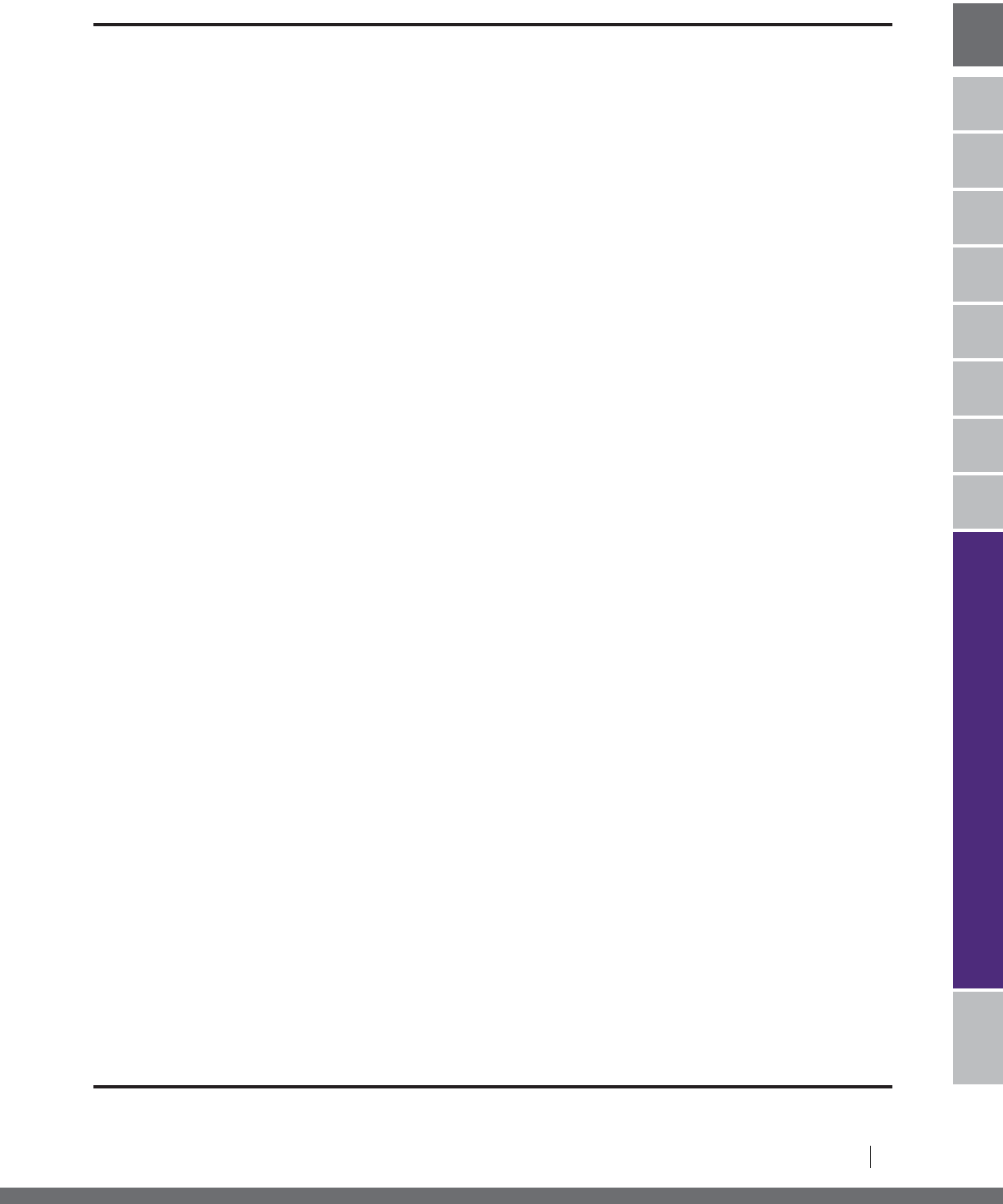

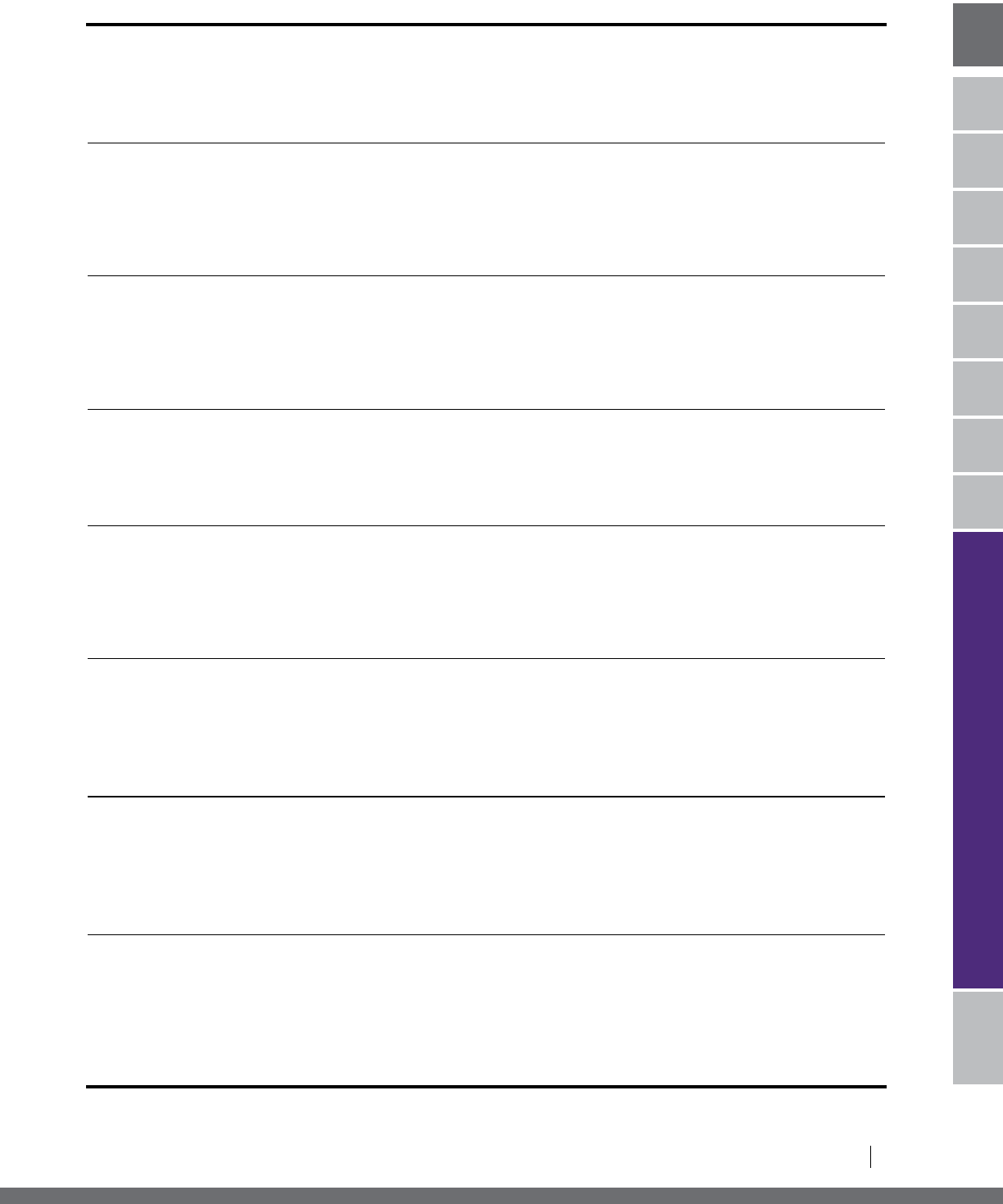

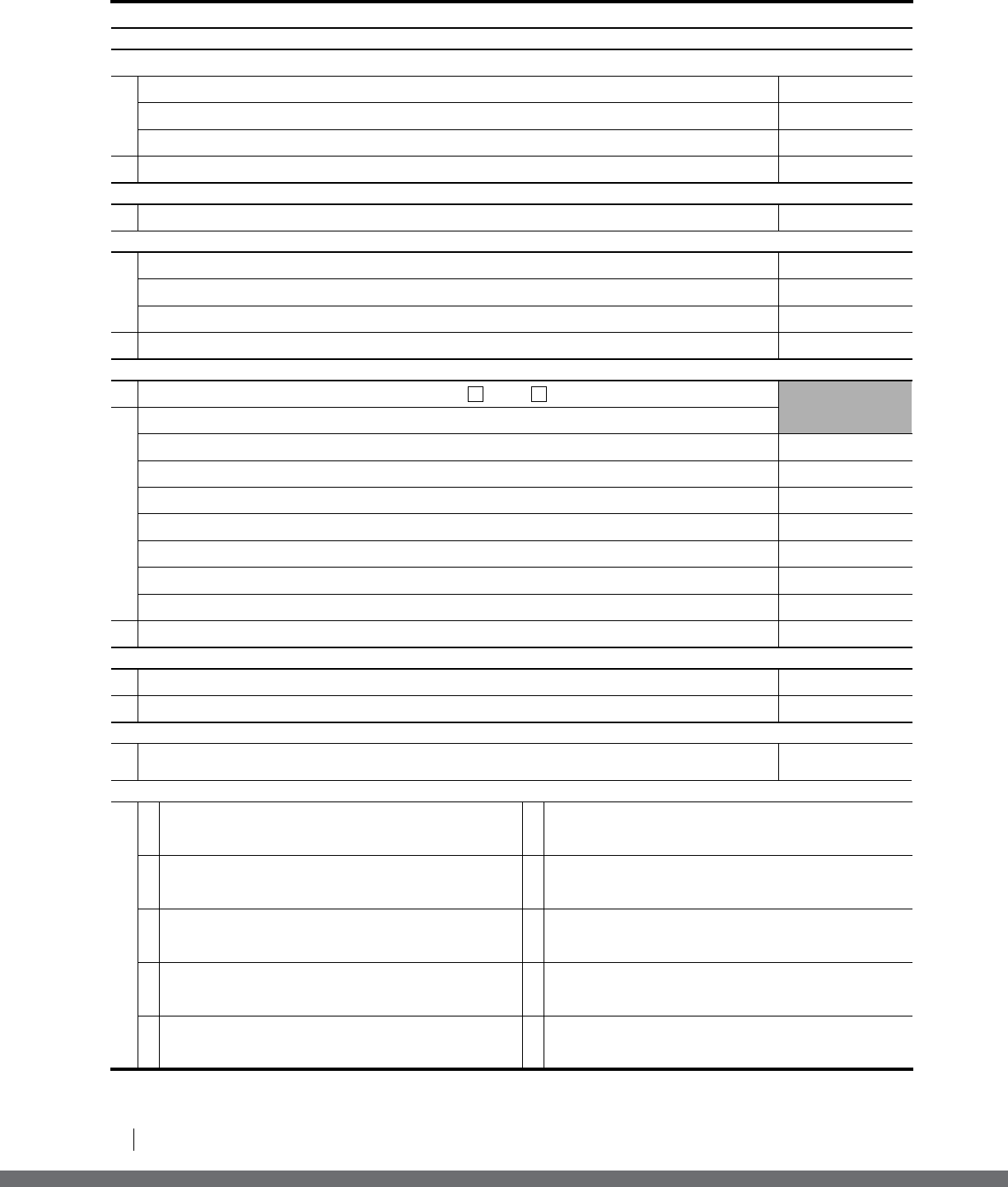

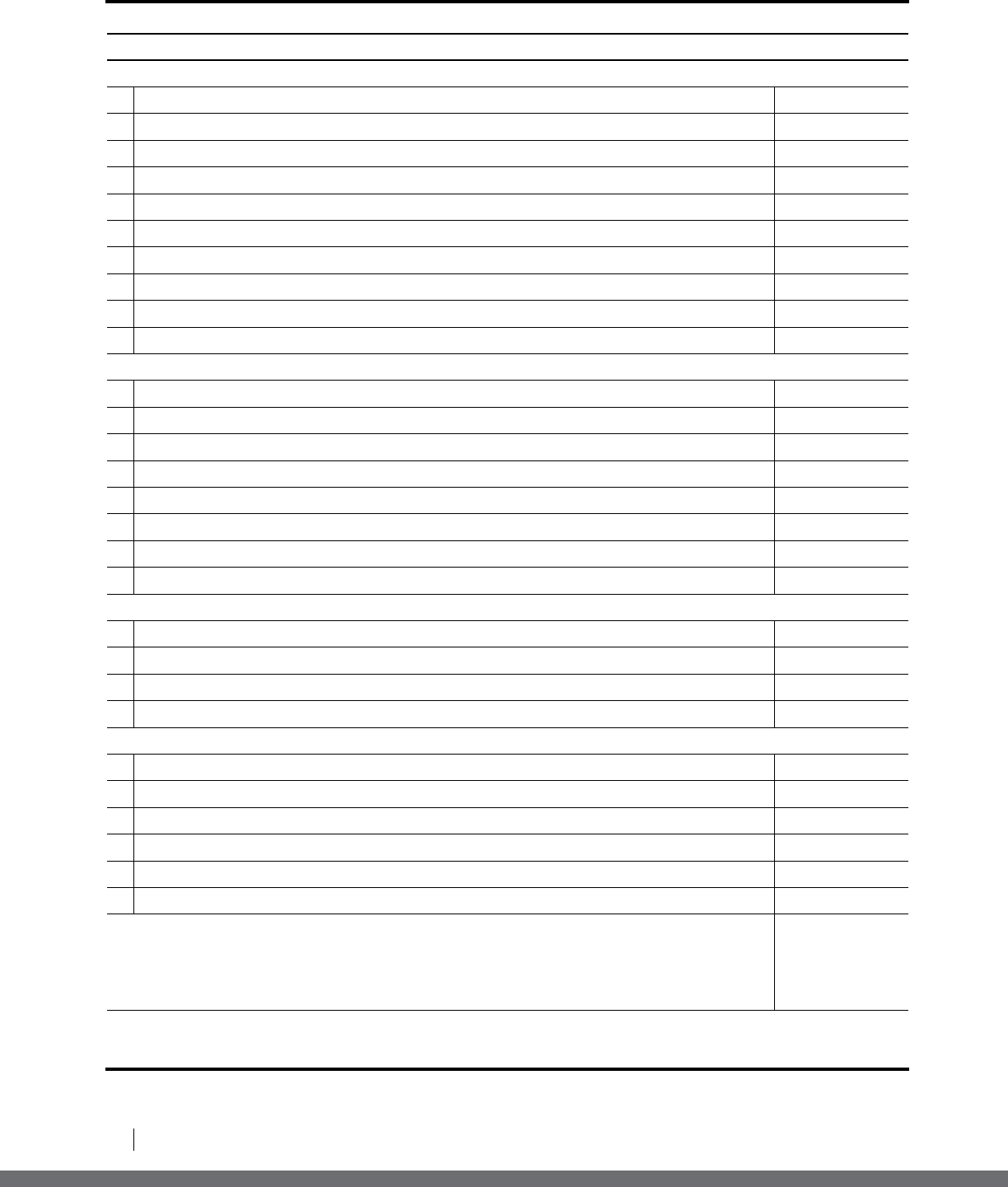

Figure 5, Grants Evaluation and Scoring Process

Grants Evaluation and Scoring Process

Financial Responsibility Program Performance Plan Program Coverage

Technical

Evaluation

Experience

10 10 75

100 points

5

22

LOW INCOME TAXPAYER CLINIC

Program Office Evaluation

After the completion of the technical evaluation, applications will undergo a secondary review by the LITC

Program Office. This evaluation will be based on the information contained in the program plan, as well as the

applicant’s performance history in the LITC Program, if applicable.

Review of New Applicants

The LITC Program Office will perform a general review of the application and proposed program plan. The

review will consider the quality of the proposed program, the soundness of the proposed budget, and any

significant concerns identified during the technical evaluation.

Review of Funded Grantees Submitting a Continuation Request

The LITC Program Office will perform a general review of the application, proposed budget, and program plan,

as well as a more detailed review of the grantee’s performance history in the LITC Program. The review will

consider:

Timeliness, accuracy, and completeness of Interim and Year-End reports;

Any significant concerns identified by site assistance visits and how the grantee addressed those concerns;

Whether the grantee’s activities match its program plan;

Grantee’s involvement with other tax clinics, community groups, the Taxpayer Advocate Service (TAS), and

the LITC Program Office;

Whether the grantee has a history of not drawing down funds in a timely manner; and

Whether the grantee has failed to use all funds awarded in prior years.

Additional Considerations

Grant funds may be withheld or denied based on an applicant’s failure to be in full compliance with all civil rights

requirements or federal obligations, or a determination that the applicant is currently suspended or disbarred from

receiving a federal grant award.

To foster parity regarding clinic availability and accessibility for low income and ESL taxpayers nationwide, the

LITC Program Office will consider an applicant’s geographic coverage area, the number of low income and ESL

taxpayers assisted, and the languages in which assistance will be provided to taxpayers.

If applications are submitted by more than one clinic sponsored by the same institution or organization, the LITC

Program Office will consider all factors surrounding the operation of the clinics, including the geographic area(s)

served by the clinics and the comprehensiveness of the services to be provided, in determining whether and in

what amount grants will be made to one or more such clinics.

For academic clinics, which may assist fewer taxpayers than non-academic clinics because of the time involved

in teaching and mentoring students, the LITC Program Office will consider additional ways in which academic

clinics can accomplish LITC Program goals (e.g., providing technical assistance, training, and mentoring to other

LITCs, publishing articles about the LITC Program, commenting on proposed Treasury regulations that affect

low income or ESL taxpayers, and monitoring graduates to determine whether they perform pro bono work on

behalf of or otherwise assist low income taxpayers).

23

LOW INCOME TAXPAYER CLINIC

I. LITC PROGRAM OVERVIEW II III IV VVI VII VIII APPENDICES GLOSSARY

INDEX

HOW TO APPLY FOR AN LITC GRANT

III. HOW TO APPLY FOR AN LITC GRANT IV

II IV IV VVI VIIIIV VVI VII VIII

The decision of whether or not to award grant funds will be based on the technical evaluation, Program Office

evaluation, and the following additional considerations:

The existence of other clinics representing the same population of low income taxpayers;

Reasonableness of funds sought for the quantity and quality of services to be offered; and

Other sources of funding available to the clinic.

Final funding decisions are made by the National Taxpayer Advocate, unless recused. In recusal situations, final

funding decisions are made by the Deputy National Taxpayer Advocate.

E. NOTICE OF AWARD

When Will I Know If I Have Been Selected to Receive an Award?

The LITC Program Office will notify all applicants no later than November 2017 whether or not they have been

selected to receive a 2018 grant award. However, no specific award amount information will be available until

after Congress appropriates funding for fiscal year 2018.

The LITC Program Office will issue a notice of award to each applicant selected to receive funding for the grant

year. The notice of award states the amount of funding awarded for the grant year, the grant period, and the terms