Publication 3823 (Rev. 9 2014) P3823

User Manual: 3823

Open the PDF directly: View PDF ![]() .

.

Page Count: 188 [warning: Documents this large are best viewed by clicking the View PDF Link!]

2014

For

Authorized

IRS e-file

Providers

Publication 3823 (Rev. 9-2014) Catalog number 32077F Department of the Treasury Internal Revenue Service www.irs.gov

Employment Tax

e-file

System

Implementation and User Guide

2014

Publication 3823

INTERNAL REVENUE SERVICE

ELECTRONIC TAX ADMINISTRATION

i

THE IRS MISSION

Provide America’s taxpayers top quality service by helping them understand and meet

their tax responsibilities, and by applying the tax law with integrity and fairness to all.

ii

TABLE OF CONTENTS

THE IRS MISSION ......................................................................................................................... I

TABLE OF CONTENTS ................................................................................................................ II

LIST OF FIGURES ...................................................................................................................... IV

LIST OF TABLES .......................................................................................................................... V

1.0 INTRODUCTION TO 94X EMPLOYMENT TAX E-FILE SYSTEM .........................1

1.1 Publication Upgrades ...............................................................................................2

1.2 Communications ......................................................................................................2

1.3 Transition Operations ...............................................................................................3

2.0 94X E-FILE PROGRAM ADMINISTRATION ..................................................................4

2.1 Legal and Administrative Guidelines ....................................................................4

2.2 Participation in 94x e-file and OnLine e-Filer Programs .....................................4

2.2.1 94x e-file Program Method ........................................................................4

2.2.2 94x OnLine e-Filer Program Method.........................................................5

2.3 Who Can Participate in 94x Programs .......................................................................5

2.3.1 94x Aggregate Return e-Filer Participants ..................................................5

2.3.2 94x OnLine e-Filer Participants ................................................................6

2.3.3 Authorized Signer of the Business Entity .................................................6

2.3.4 Acceptable Contact(s) for 94x as IRS Authorized Signer ........................7

2.3.5 PIN Registration Processing Rules ..........................................................10

2.3.6 Rules for 94x OnLine e-Filers ..................................................................10

2.4 94x e-file and 94x OnLine e-Filer Program Customer Roles ........................... 11

2.4.1 Software Developers .................................................................................. 11

2.4.2 Transmitters .............................................................................................. 11

2.4.3 Reporting Agents ....................................................................................... 11

2.4.4 Electronic Return Originators (EROs) ................................................... 11

2.4.5 94x OnLine Filing Provider .....................................................................12

2.4.6 94x OnLine e-Filer ....................................................................................12

2.5 Responsibilities of 94x Electronic Filers .................................................................13

2.5.1 General .......................................................................................................13

2.5.2 Requirements for Electronic Filing of Forms 940/941/944 .................13

2.5.3 Penalty for Failure to Timely File a Return ................................................15

2.5.4 Authorized Signer and Userid/Password Responsibilities ............................15

3.0 IRS E-FILE APPLICATION AND 94X PIN REGISTRATION .........................................16

3.1 E-File Application for Participation in the IRS e-file Program .............................17

3.1.2 Reporting Agent IRS e-file Application Process Requirements ...........17

3.1.3 Revising the Agent’s List ...........................................................................18

3.1.4 Software Developer IRS e-file Applications ..............................................18

3.1.5 Due Dates for Software Developer IRS e-file Applications .....................18

3.1.6 Transmitter IRS e-file Application ............................................................18

iii

3.2 94x OnLine e-Filer PIN Registration Process (Authorized Signer) ............................19

3.2.1 Compromised 94x OnLine e-Filer PIN and Other Issues ...................20

3.2.2 Authorized Signer Changes ....................................................................20

3.3 Communications Testing Procedures ....................................................................21

3.4 Assurance Testing Procedures ...............................................................................21

3.4.1 Assurance Testing Requirements .............................................................21

3.4.2 Pre-Validation of XML Data ......................................................................22

3.4.3 Test Transmissions .....................................................................................22

4.0 IRS E-FILE APPLICATION AND 94X PIN REGISTRATION ...........................................22

4.1 Acceptance into IRS e-file .......................................................................................23

4.2 IRS e-file Application and 94x PIN Registration – Rejection .................................24

5.0 XML SCHEMA AND VERSION CONTROL ....................................................................25

5.1 Schema Conventions ..................................................................................................25

5.2 Schema Location ........................................................................................................25

5.3 Version Control ..........................................................................................................25

6.0 BUILDING XML TRANSMISSION FILES .....................................................................26

6.1 A Guide to Creating PIN Registration Transmission Files ....................................49

7.0 VALIDATION CRITERIA – BUSINESS RULES & ERROR CONDITIONS ......................65

7.1 Business Rule & Error Condition Matrix ..............................................................65

8.0 ACKNOWLEDGEMENT FILES .......................................................................................79

8.1 A Guide to Creating 94x Acknowledgement Files ................................................79

8.2 Acknowledgement File Construction ....................................................................79

APPENDIX A FORMS & SCHEDULES ACCEPTED ELECTRONICALLY ..........................92

APPENDIX B NAME CONTROL CONVENTIONS ...........................................................95

APPENDIX C STREET ABBREVIATIONS .........................................................................106

APPENDIX D POSTAL SERVICE STATE ABBREVIATIONS & ZIP CODE

RANGES .........................................................................................................................109

APPENDIX E GLOSSARY OF TERMS ............................................................................... 113

APPENDIX F 94X XML SCHEMA SAMPLES .................................................................. 115

iv

LIST OF FIGURES

Figure 6-1 Open xsd schema and Generate Sample File ...............................................................28

Figure 6-2 Open xsd schema and Generate Sample File ...............................................................29

Figure 6-3 Select a Root Element – Origin Headers ......................................................................31

Figure 6-4 Select a Root Element – Return Data ...........................................................................35

Figure 6-5 Open Message/efile Message – DTD/Schema – Generate Sample XML file .............50

Figure 6-6 Select a Root Element–Origin Header .........................................................................51

Figure 6-7 Select a Root Element – Origin Headers ......................................................................53

Figure 6-8 Select a Root Element – Find Data ..............................................................................57

Figure 8-1 Open Message/efile Message – DTD/Schema – Generate Sample XML File .......80

Figure 8-2 Select a Root Element – Acknowledgement Action ................................................81

Figure 8-3 Generate Sample XML File – Attributes and Elements ........................................81

v

LIST OF TABLES

Table 3-1. Reference Revenue Procedures for Other Applications .........................................16

Table 3-2. Due Dates for Software Developer Applications .........................................................18

Table 3-3 Test File Due Date for Each Filing Quarter ..............................................................21

Table 4.1 Identification Items by Type ..........................................................................................23

Table 7-2 Business Rule and Error Condition Matrix ...................................................................65

1.0 INTRODUCTION TO 94X EMPLOYMENT TAX E-FILE SYSTEM

The Employment Tax e-file System is used to receive and process 94x (944, 941 and 940)

Family of Tax Returns electronically. Participants must apply to participate.

All approved 94x

e-file

participants must comply with the provisions of this publication and all

other applicable revenue procedures, publications and notices governing IRS

e-file

.

Employers are responsible to ensure that their tax returns are filed timely and deposits and

payments are made when due, even if the employer contracts with a third party. The employer

remains liable if the third party fails to perform a required action.

Publication 3823 provides the 94x

e-file

Program Criteria, and Legal and Administrative

Guidelines for filing 94x

e-file

returns.

Publication 3823 contains the Form 94x electronic filing instructions, procedural guidelines

and validation criteria for the Employment Tax

e-file

System. Form 94x returns received

through this system must be transmitted in an eXtensible Mark-up Language (XML) format.

Publication 3823 is available electronically at www.irs.gov on the 94x XML Developers’

Forum web page. Simply search under the 94x XML Developer’ Forum – Employment Tax

e-file System.

2014 Accepted Forms, Schedules, and Attachments

Form 941

Form 941PR

Form 941SS

Form 940

Form 940PR

Form 944

Form 941 Schedule B

Form 941PR Anexo B

Schedule D (Form 941)

Schedule R (Form 941) and (Form 940)

Schedule A (Form 940)

PIN Registration

Payment Record

Formatted 94x XML return files will be transmitted electronically via the IRS Electronic

Management System (EMS), located at the Enterprise Computing Center in Memphis, Tennessee

(ECC-MEM).

Formatted 94x PIN Registration files will be transmitted electronically via EMS at ECC-MEM .

2

NOTE: Amended Returns (Forms 940, 941-X and 944-X) are not accepted electronically.

2014 Payment Options

The Employment Tax

e-file

System provides convenient, safe, and secure methods for paying

taxes for IRS

e-file

participants as follows:

Authorize an Electronic Funds Withdrawal (EFW),

Authorize use of a credit or debit card

Enroll in the U.S. Treasury’s Electronic Federal Tax Payment System (EFTPS)®.

The EFW and EFTPS options are free!

For additional information research under e-file payment options on the IRS web site at

www.irs.gov

1.1 Publication Upgrades

If information in this publication changes between its’ annual revision, change page(s) will be

issued. Any information that is changed, added, or deleted in this publication will be posted to

the IRS Web Site, under the 94x XML Developers’ Forum – Employment Tax e-file System,

and will be communicated to current and potential partners via the communications method

outlined below.

1.2 Communications

The following communication vehicle will be used to distribute information and updates to

Employment Tax

e-file

System Partners:

QuickAlerts – The Quick Alerts system allows IRS

e-file

Software Developers, Reporting

Agents, Electronic Return Originators (EROs) and Transmitters to receive important news

and information about the IRS

e-file

programs, urgent messages and information from the

IRS

e-file

Submission Processing and Computing Centers, and notices of upcoming seminars

and conferences. Quick Alerts lets you decide how you want to receive your messages (e.g.,

fax, e-mail, phone, cell phone). You must sign up to gain access through the IRS Web Site at

www.irs.gov Search for Subscribe to Quick Alerts.

3

1.3 Transition Operations

The Employment Tax e-file System was designed to replace all previous electronic filing options

available for returns in the 940, 941 and 944 programs.

Employment Tax Returns can now be filed through the Modernized e-File (MeF) System. MeF

will accept Forms 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, and 945.

The following MeF publications are available for the 94x MeF program and are found on the

MeF User Guides and Publications page on IRS.gov: Publication 4163, MeF Information for

Authorized e-Filed Providers for Business Returns, Publication 4164, MeF Guide for Software

Developers and Transmitter, Publication 5078, MeF Test Package and the MeF Submission

Composition Guide.

4

2.0 94X E-FILE PROGRAM ADMINISTRATION

2.1 Legal and Administrative Guidelines

All Employment Tax e-file System participants must adhere to all rules and regulations as set

forth in the following documents, as applicable:

Publication 3823, Employment Tax

e-file

System Implementation and User Guide

Publication 15 (Circular E),

Employer’s Tax Guide

Revenue Procedure 2007-40, Authorized IRS e-file Provider Responsibilities (This

Revenue Procedure combines the rules governing IRS

e-file

)

Publication 3112,

IRS e-file Application and Participation

Revenue Procedure 2012-32,

Requirements for Completing and Submitting Form

8655, Reporting Agent Authorization

Publication 1474,

Technical Specification Guide for Reporting Agent Authorization

and Federal Tax Depositors

These revenue procedures and publications provide legal and administrative guidelines for

participation in the 94x

e-file and 94x OnLine

e-Filer Programs. Additional responsibilities

and guidelines may be provided in postings to the IRS web site at www.irs.gov . Click on

Businesses then click the Employment Taxes link.

When the guidance provided in this Publication 3823 differs from procedures outlined in the

above referenced revenue procedures follow this publication as your guide.

2.2 Participation in 94x e-file and OnLine e-Filer Programs

Two Methods of e-Filing 94x Returns

There are only two methods to electronically file 94x Family of Tax Returns. All employers

with a 94x filing requirement who choose to file electronic 94x returns must apply. To

participate in either the 94x

e-file

Program or the 94x OnLine e-Filer Program, follow one of the

two methods below:

2.2.1 94x e-file Program Method

Become a Reporting Agent, and receive a 5 digit PIN to sign 94x e-file returns transmitted via

the Employment Tax e-file System. Potential e-file participants that use the 94x e-file Program

5

select the Reporting Agent provider option on their IRS e-file Application. Applications can be

completed on-line after first registering for e-Services.

Authorized Reporting Agents prepare, sign and e-file all 94x Family of Returns for

his/her clients. For complete guidelines refer to Publication 3112 and Revenue Procedure 2007-

40.

2.2.2 94x OnLine e-Filer Program Method

Become a 94x OnLine e-Filer, also known as the IRS Authorized Signer and sign using a 10

digit PIN to e-file your own 94x Family of Returns.

2.3 Who Can Participate in 94x Programs

Businesses and organizations that have employees and a liability to file employment and

unemployment tax returns and a desire to file returns electronically, can apply to participate in

IRS e-file.

NOTE:

94x Legacy will no longer accept testing for new software developers to e-file

returns. This will not affect current software developers for 94x Legacy testing.

New software developers are to use Modernized e-File (MeF) when testing.

2.3.1 94x Aggregate Return e-Filer Participants

Agents approved by the Internal Revenue Service to file Schedule R (Form 941 and 940),

Allocation Schedule for Aggregate Form 941/940 filers are defined by Section 3504 of the

Internal Revenue Code. The general procedures for designating an agent and reporting and

filing as an agent are set forth in Rev. Proc 70-6, 1970-1C.B. 420.

The Schedule R (Form 941 and 940) is filed electronically via the Employment Tax e-file

System. To be eligible to file the Schedule R (Form 941 and 940) the Form 2678,

Employer/Payer Appointment of Agent, is required to be mailed to the applicable address listed

on the instructions for approval before the Schedule R (Form 941 and 940) can be filed.

Once the application for Form 2678 has been approved the agent must file one 941 and 940

return for each tax period, using the agent’s own Employer Identification Number (EIN)

regardless of the number of employers for whom the agent acts. The agent must maintain

records that will disclose the full wages paid for each of his clients, as reported on the Schedule

R.

An Agent may:

Elect to perform all of the agent tasks himself, or

6

Enter a contract with a third party, such as a Reporting Agent or certified public

accountant.

All agents, employers, and payers are liable for filing all returns and making all tax deposits and

payments while the Form 2678 appointment is in effect.

To file the Schedule R (Form 941 and 940) Aggregate return electronically, the approved agent

must decide which of the following Customer Roles to use to sign and transmit the return:

Apply to become a Reporting Agent and use the 5-digit PIN to sign e-file returns for your

clients

Apply for a 94x On-line 10 digit PIN, used to sign your own returns.

The agent can choose from the Authorized IRS e-File Provider options listed in Section 2.4,

Customer Roles and Responsibilities.

2.3.2 94x OnLine e-Filer Participants

Employers that want to sign and file their own 94x family of returns electronically must

complete the 94x PIN Registration Process to become a participant in the 94x OnLine e-Filer

Program

.

Use IRS Approved Commercial-Off-the-Shelf (COTS) software to complete the 94x On-Line

PIN Registration Process. IRS Approved (COTS) software is made available through an

Authorized IRS Online Filing Provider who provides software that can be downloaded from

an Internet site and prepared Off-line, or through an Online Internet site.

Once the PIN Registration is completed and approved, the applicant will become a 94x OnLine

e-Filer Participant also referred to as the IRS Authorized Signer.

The IRS Authorized Signer will receive a 10 digit PIN used to sign electronically filed 94x

returns through the IRS Approved COTS software through a designated Transmitter that will

batch, bundle, and transmit files to the IRS.

The designated Third Party Transmitter sends the returns to the Service for processing via

Employment Tax

e-file

System.

Complete guidelines are referenced in Publication 3823, under Section 2.4, 94x e-file and 94x

OnLine e-Filer Customer Roles.

2.3.3 Authorized Signer of the Business Entity

The signature provisions for electronically filed Forms 94x (944, 941 and 940) are defined in this

section. Employers with a 94x filing requirement must decide how to file electronic returns and

7

who will be the authorized signer of the return. Only a Principal for the business or organization

can apply to become the IRS Authorized Signer and participate in the 94x OnLine e-Filer

Program.

This method is not acceptable for tax professionals. Form 8655 Reporting Agent Authorization,

gives the tax professional authority to sign the client’s return with their Reporting Agent’s 5 digit

PIN, NOT the OnLine e-filer’s assigned 10 digit PIN. The OnLine e-filer’s 10 digit PIN is not to

be shared; therefore, if the tax professional enters the client’s 10 digit PIN on their behalf, they

are doing so without a signed authorization.

The Authorized Signer acts for the entity in legal and/or tax matters and is held liable for filing

all 94x returns and making all 94x tax deposits and payments, adhering to all rules and

regulations as set forth in this Publication 3823, Publication 15 (Circular E), Employer’s Tax

Guide and Revenue Procedures 2007-40.

An Authorized signer of the Business Entity must complete the 94x OnLine PIN Registration

Process 45 days in advance of the return due date, to allow time to timely file returns as required.

2.3.4 Acceptable Contact(s) for 94x as IRS Authorized Signer

The IRS Authorized Signer for Forms 94x (944, 941, 944) should be a Principal for the

business or organization represented, as follows:

If 94x Filing Requirement and Type of Return is:

Then Acceptable

Contact(s) as IRS

Authorized

Signer for 94x e-

file returns is:

Form 1065/Form 1065B (Partnership Returns)

Partner with 5% or more interest in a partnership or person authorized to act in legal and or

tax matters (Forms 1065/1065B)

Partner LLC

Member Limited

Partner General

Partner Member

President

Manager

Managing Member

Owner (See Form

1065 instructions)

Tax Matter Partner

(TMP) (See Form

1065 instructions)

8

Form 1120 ( Family of Returns)

(Corporate Returns)

President

Vice President

Treasurer

Assistant Treasurer

Tax Officer

Chief Accounting

Officer (CAO)

Chief Executive

Officer (CEO)

Chief Financial

Officer (CFO)

Chief Operating

Officer

Corporate

Treasurer

Corporate

Secretary/Secretary

Secretary

Treasurer

Member

* Any Corporate

Officer

Form 990 (Family of Returns)

(Exempt Organization Returns)

Chief Executive

Officer (CEO)

President

Vice President

Treasurer

Assistant Treasurer

Tax Officer

Chief Accounting

Officer

Receiver

Chief Operating

Officer

Trustee

9

Chief Financial

Officer

Executive

Director/Director

Chairman

Executive

Administrator/

Administrator

*Any Corporate

Officer

Leader of a

religious

organization

(Pastor, assistant

to religious

leader, Reverend,

Priest, Minister,

Rabbi, etc.)

(Church Only)

Chairman

Secretary

Director of

Taxation

Director of

Personnel

Form 1041 (Estates and Trusts Tax Returns)

Administrator

Executor

Trustee

Fiduciary (See

Form 1041

instructions)

Form 941

o

Owner

Sole Proprietor

Fiduciary (Form

10

941 instructions)

*

Forms 1040 Schedule C and Schedule SE

(Sole Proprietor for a Sole proprietorship)

Sole

Proprietor/Owner

Sole Member

Member

* Anyone that is legally authorized to act for or bind the organization.

NOTE:

If dual titles are present and one of them appears on the above matrix, the

application should be accepted.

2.3.5 PIN Registration Processing Rules

The IRS will send the PIN to the IRS Authorized Signer via U.S. Mail within 7 – 10 days, after

the PIN Registration Process is completed. Allow 45 days for the PIN Registration Process to

complete.

IRS can not activate the PIN until the signed Statement of Receipt has been returned back,

acknowledging that the PIN was received by the signer of the PIN Registration. The statement of

Receipt should be returned within 10 days.

The Service has prescribed in Publication 3823 (94x electronic filing instructions) that an

electronically filed Form 94x is signed by the entry of the IRS Authorized Signer’s PIN. The

IRS Authorized Signer is allowed to electronically file the 94x Family of Returns designated on

the 94x PIN Registration Record, through a designated Transmitter that will batch, bundle, and

transmit files to the IRS.

2.3.6 Rules for 94x OnLine e-Filers

Adhere to IRS provided host of information on the services of Authorized IRS e-file Providers

and IRS e-file products available to assist in making e-file decisions.

IRS Approved COTS software should only be used by the IRS Authorized Signer referenced on

the PIN Registration, as the business signer.

94x OnLine e-Filers cannot send returns directly to the Service therefore must determine what

types of services are needed by their business.

Review the 94x e-file Program Customer Roles referenced below in Section 2.4., for information

on the services of other Authorized IRS e-file Providers that may be needed, when ready to file

returns electronically.

11

Approved 94x OnLine e-Filers are only allowed submission of 5 returns a year, using the IRS

Approved COTS software.

Approved 94x OnLine e-Filers can not file bulk returns or e-file returns for other businesses.

Review the additional governing rules and regulations for information you need to know,

regarding the roles and responsibilities of Authorized IRS e-file Providers:

Revenue Procedure 2007-40,

Authorized IRS e-file Provider Responsibilities

Publication 3112, IRS e-file Application and Participation

2.4 94x e-file and 94x OnLine e-Filer Program Customer Roles

2.4.1 Software Developers

A Software Developer develops software for the purposes of formatting electronic return

information according to publications issued by the IRS that set forth electronic return

specifications and record layouts or tax returns.

2.4.2 Transmitters

A Transmitter is a firm, organization, or individual that receives returns and 94x PIN

Registrations electronically, from clients, reformats the data (if necessary), batches them with

returns or electronic 94x PIN Registrations from other clients, and then transmits the data to the

IRS. A Transmitter does not have signature authority for the taxpayers that it services.

Transmitters are identified with an Electronic Transmitter Identification Number (ETIN).

2.4.3 Reporting Agents

A Reporting Agent is an accounting service, franchiser, bank, or other entity that complies with

Rev. Proc. 2012-32, IRB 2012-34, and is authorized to prepare and electronically file Forms 940,

941, and 944 for a taxpayer. Reporting Agents sign all of the electronic returns they file with a 5-

digit PIN signature. The Reporting Agent PIN is issued through the IRS

e-file

Application

Process as a result of selecting Reporting Agent as a provider option on the application.

Reporting Agents may transmit their own returns, or may use the services of a third party

transmitter.

2.4.4 Electronic Return Originators (EROs)

An Electronic Return Originator (ERO) is any entity that "originates" the electronic submission

of tax returns to the IRS. The ERO is identified by an Electronic Filing Identification Number

(EFIN). An ERO does not originate its own employment tax returns (Form 94x family); a third

party provider must be used for this purpose.

12

An ERO does not have signature authority and should not be issued a PIN to sign an OnLine

Employment Tax Return as the signer for the employer. If the ERO applied for multiple roles,

indicating on his IRS e-File Application that he wants to be a Reporting Agent then and only

then will he be granted signature authority for the client and tax periods referenced on his Form

8655 submitted to IRS for processing.

2.4.5 94x OnLine Filing Provider

A 94x OnLine Filing Provider allows taxpayers to self-prepare returns by entering return data

directly into commercially available IRS approved software. This software can be downloaded

from an Internet site and prepared Off-line, or through an On-line Internet site.

2.4.6 94x OnLine e-Filer

The employer’s authorized signer must apply to become a 94x OnLine e-Filer. Once approved,

he must sign the returns using the 10 digit PIN received from the Service. The PIN should not be

disclosed to anyone. PINs are confidential.

The 94x OnLine e-Filer is an Authorized Signer that electronically files Forms 94x for his

business through a designated Transmitter that will batch, bundle, and transmit files to the IRS,

using IRS Approved Commercial Off-the-Shelf (COTS) software.

13

2.5 Responsibilities of 94x Electronic Filers

All IRS e-file participants must adhere to the electronic filing requirements set forth in Revenue

Procedure 2007-40, Authorized IRS e-file Provider Responsibilities, as applicable. Additionally,

adhering to the guidelines referenced in this Publication 3823 and other published resources

referenced in Section 2.1, Legal and Administrative Guidelines, are required. This section

provides specific responsibilities of the 94x electronic filers.

2.5.1 General

94x OnLine e-Filers and Reporting Agents, as applicable, must retain the following material

for four years after the due date of the return, unless otherwise notified by the IRS:

a complete copy of the electronically filed Forms 940/941/944

a copy of the Service’s acknowledgement of receipt of the return

a copy of each Form 8655, Reporting Agent Authorization

An Authorized IRS

e-file

Provider that is a Reporting Agent or Transmitter, as applicable,

must:

Provide the taxpayer a copy of the taxpayer’s electronically filed Forms 940/941/944 (this

information may be provided on a replica of an official form or in any other format that

provides all of the return information and references the line numbers of the official form);

Advise the taxpayer to retain a copy of the return and any supporting material;

Inform the taxpayer of the Submission Processing Campus that processes the taxpayer’s

returns;

Provide the taxpayer, upon request, with the date the return was transmitted to the Service

and the date the Service acknowledged receipt of the taxpayer’s return.

2.5.2 Requirements for Electronic Filing of Forms 940/941/944

94x OnLine e-Filers and Reporting Agents must ensure that current electronic Forms

940/941/944 are filed on or before the due date of the return.

An electronic filer that is a Transmitter must ensure that electronic Forms 940/941/944 are

transmitted to the Service by the later of:

Three days after receipt of the return

Or, the due date of the return without regard to extensions

14

The due dates prescribed for filing paper Forms 940/941/944 with the Service also apply to

returns filed under the Form 940/941/944 e-file Programs, as follows:

Forms 940/944 are due on January 31st

following the year for which the return is

made.

Form 940/944 for which all tax deposits were

made when due for the period may be filed by

the 10th day of the month following the due

date.

Note: When filing Forms 940 and 944

electronically, you may only file a current

year return.

Forms 941 are due on or before the last day of

the first calendar month following the period

for which the return is made.

Form 941 for which all tax deposits were made

when due for the quarter may be filed by the

10th day of the month following the due date.

Note: When filing Form 941 electronically,

you may only file the current quarter and

the previous four quarters.

An Accepted Return

An electronically filed return is not considered filed until it has been acknowledged as accepted

for processing by the Service. If an electronically filed return is transmitted to the Service on or

before the due date, the return will be deemed timely.

A Rejected Return

An electronic transmission that causes a processing interruption may not be accepted. A

Reporting Agent will be asked to resubmit the return(s). If the transmission is acknowledged as

rejected by the Service, the Reporting Agent should correct the error(s) and retransmit the

return(s) on the same calendar day. If the Reporting Agent chooses not to have the previously

rejected returns retransmitted, or if the return still cannot be accepted for processing, a paper

return must be filed by the later of: (1) the due date of the return; or (2) within five calendar days

of the rejection or notice that the return cannot be retransmitted, with an explanation of why the

return is being filed after the due date.

If a processing interruption occurs due to an electronic transmission, and the Transmitter cannot

promptly correct any transmission error that cause the electronic transmission to reject, then the

Transmitter must take reasonable steps within 24 hours of receiving the rejection to inform the

94x OnLine e-Filer that the return has not been filed. When the Transmitter advises the 94x

OnLine e-Filer that the return has not been filed, the Transmitter must provide the 94x OnLine e-

Filer with the reject code(s), and the sequence number of each reject code(s).

If the 94x OnLine e-Filer chooses not to have the electronic portion of the return corrected and

transmitted to the Service, or if the electronic portion of the return cannot be accepted for

15

processing by the Service, the 94x On-Line e-Filer must file a paper return by the later of: (1) the

due date of the return; or (2) within five calendar days of the rejection or notice that the return

cannot be retransmitted, with an explanation of why the return is being filed after the due date.

Acknowledgement File

Within two days of the transmission, a Transmitter must retrieve the acknowledgement file in

which the Service states whether it accepts or rejects the returns; match the acknowledgement

file to the original transmission file and send the 94x OnLine e-Filer either an acceptance notice

or a rejection notice. If the Transmitter does not receive an acknowledgement of acceptance

within two work days of the transmission or receives an acknowledgement for a return that was

not transmitted on the designated transmission, the Transmitter should immediately contact the

IRS e-help Desk at 1 (866) 255-0654.

Software Developer

A Software Developer must promptly correct any software errors that may cause, or causes, an

electronic return to be rejected; promptly distribute any such software correction(s); and, ensure

any software package that will be used to transmit returns from multiple Electronic Filers that are

Reporting Agents has the capability of combining these returns into one Service transmission

file.

2.5.3 Penalty for Failure to Timely File a Return

Section 6651(a)(1) of the Internal Revenue Code provides that for each month (or part thereof) a

return is not filed when required, there is a penalty of 5 percent of the unpaid tax not to exceed

25 percent, absent reasonable cause. A taxpayer does not establish reasonable cause simply by

engaging a competent Electronic Filer to file the taxpayer’s return. However, if the Electronic

Filer has reasonable cause under Section 6651(a) for failing to file the taxpayer’s return, the

taxpayer will also have reasonable cause for that failure, and the failure-to-file penalty will be

abated.

2.5.4 Authorized Signer and Userid/Password Responsibilities

2.5.4.1 94x Signature Requirements

This publication provides complete guidelines and program criteria for employers who are

allowed to file his returns through the Employment Tax

e-file

System. All 94x returns must be

signed electronically.

There are two Authorized Signer options available to Employment Tax

e-file

System

participants, as follows:

Option 1 - Reporting Agent PIN

16

Reporting Agents are issued a 5 Digit PIN to sign 94x returns for their clients. Reporting Agents

sign all of the electronic returns they file with a single 5-digit PIN signature. Reporting Agents

are issued their 5-digit PIN through the Third Party Data Store (TPDS) during the

e-file

application process, as a result of selecting Reporting Agent as a provider option.

*Note Special Option for Electronic Return Originator (ERO):

If the ERO applied for multiple roles, indicating on his IRS

e-file

Application that he

wants to be a Reporting Agent then and only then will he be granted signature authority

for the client and tax periods referenced on his Form 8655, submitted for processing.

An ERO that applied, using Form 8655, to become a Reporting Agent, will receive an

IRS issued Reporting Agent 5-digit PIN, once the application is processed. This PIN is

used by the ERO/RA to sign returns for his clients.

Option 2 - 94x OnLine e-Filer PIN

94x OnLine e-Filer (Authorized Signer) is issued a 10 Digit PIN to sign his/her own 94x

returns On-Line. The Authorized Signer must sign their own returns via the approved software

and should not disclose the PIN to anyone. PINs are confidential.

Employers who want to sign and file their own Forms 94x, electronically, must complete the 94x

PIN Registration Process, as an Authorized Signer for their business or organization. For

details, see Section 2.3 under

Authorized Signer should be a Principal for the business or

organization

.

The 10-digit PIN is issued by the Electronic Management System (EMS) Customer Data Base

(CDB) to the IRS Authorized Signer to sign the 94x returns, once the approval process is

completed.

3.0 IRS E-FILE APPLICATION AND 94X PIN REGISTRATION

Application Issue

An IRS

e-file

Application may not be used to include a request to make FTD payments and

submit FTD information to the Service electronically. Instead, an Applicant interested in

participating in these programs should submit the appropriate Application in accordance with the

following revenue procedure:

Table 3-1. Reference Revenue Procedures for Other Applications

Rev. Proc.

Subject

97-33

Electronic transmission of FTDs

17

3.1 E-File Application for Participation in the IRS e-file Program

Prospective participants must complete and submit an IRS e-file application to participate in the

IRS e-file Program. Complete the IRS

e-file

application on-line after registering for e-Services

on the IRS web site at www.irs.gov. Additional guidance can be found in Publication 3112,

IRS e-file Application and Participation

which can also be downloaded on the IRS web site.

Follow the instructions provided in Publication 3112 to complete your application.

NOTE:

94x Legacy will no longer accept testing for new software developers to e-file

returns. This will not affect current software developers for 94x Legacy testing.

3.1.2 Reporting Agent IRS e-file Application Process Requirements

Special Note:

Reporting Agents must adhere to the following:

Revenue Procedure 2012-32

, Requirements for Completing and Submitting Form

8655, Reporting Agent Authorization

Publication 1474

, Technical Specification Guide for Reporting Agent Authorization

and Federal Tax Depositors

Reporting Agents must:

Submit an Agent’s List containing the names, EINs, and addresses of the taxpayers for whom

they will file returns. Publication 1474 page 13 Exhibit 2 shows how to create an agent list.

Submit an authorization made on Form 8655,

Reporting Agent Authorization

with a

revision date of May 2005 or later (or its equivalent), for each taxpayer included on the

Agent’s List. For instructions on preparing Form 8655, see Rev. Proc. 2012-32.

NOTE: A revised Authorization is not required to replace an Authorization that was

previously submitted to the Service, provided that the Authorization in place gives the

Reporting Agent authority to file the return on behalf of the client and places no

restrictions on the medium for filing Forms 940/941/944, and the Reporting Agent.

Advise his or her client that their Forms 940/941/944 may be filed electronically, and

provides the client with the option of rejecting electronic filing as the medium for filing its

Forms 940/941/944. An Agent may use the most efficient and timely method of clearly

providing this notification to a client. A client’s rejection of electronic filing for its Forms

940/941/944 must be submitted in writing to the Agent.

Remove immediately any client that objects to having the Forms 940/941/944 filed

electronically from the Reporting Agent’s electronic filing client base.

18

3.1.3 Revising the Agent’s List

After a Reporting Agent is notified that the application for electronic filing has been approved,

the Agent may want to add and delete taxpayers from the Agent’s List.

To add taxpayers, the Agent must submit the added names and EINs (Add List) and

authorization for each taxpayer added. The Service must validate the Add List and return it to the

Agent before the Agent can electronically file returns for these taxpayers. The Service will

generally validate and mail the Add List to the Agent within 10 business days of receiving the

Add List.

To delete taxpayers, the Agent must submit a list of those taxpayers to be deleted (Delete List)

and, if known, a short statement indicating which taxpayers will not remain in business.

NOTE: See Publication 1774 Technical Specification Guide for Reporting Agent Authorization

and Federal Tax Depositors for complete instructions on submitting additions and deletions.

3.1.4 Software Developer IRS e-file Applications

An IRS e-file Application for a Software Developer must also contain the following:

The brand name of the software translation package, or the development name if no brand

name exists

Whether the software is stand-alone or interfaces with a named payroll package

3.1.5 Due Dates for Software Developer IRS e-file Applications

Applications must be received by the following dates in order to be eligible to file for the

specified quarter:

Table 3-2. Due Dates for Software Developer Applications

Application Due Date

Quarter Ending

December 15

March 31

March 15

June 30

June 15

September 30

September 15

December 31

3.1.6 Transmitter IRS e-file Application

Transmitters must complete the IRS e-file Application to participate in IRS e-file, by first

registering for e-Services on-line.

19

3.2 94x OnLine e-Filer PIN Registration Process (Authorized Signer)

Special Note:

Employers who want to file for themselves using the 94x On-Line e-file Program must adhere to

the applicable business rules provided in this Publication 3823 and must follow the guidelines

provided in Publication 15

, (Circular E) Employer’s Tax Guide.

To become a 94x OnLine e-Filer participant, the applicant must first complete the electronic

94x PIN Registration Process. The 94x PIN Registration Process is used to request an IRS

issued 10-digit PIN, used by the Authorized Signer to sign the 94x Family of OnLine e-filed

returns.

The Authorized Signer must register for the 94x OnLine e-Filer PIN through an approved

software provider who offers this service to their clients, by completing the 94x PIN Registration

via the Internet, using a personal computer, modem, and IRS Approved Commercial Off-the-

Shelf (COTS) software. The IRS Approved software must be downloaded from an Internet site

and prepared off-line or the software can be used on-line. Prospective 94x OnLine e-Filers must

submit the 94x Registration at least 45 days in advance of the due date of the 94x return to

ensure timely filing of 94x

e-file

returns.

The 94x PIN Registration Process requires the applicant to provide information about the

company and the authorized signer of the 94x family of e-filed returns for IRS records. This

information is used to validate that the signer and PIN used to sign the e-filed return is the same

signer and PIN found in IRS records, provided during the 94x PIN Registration Process. A

prospective 94x OnLine e-Filer will receive an acceptance or rejection status letter regarding

their 94x PIN Registration within 45 days of the Service’s receipt of their completed 94x PIN

Registration.

Once the applicant’s 94x PIN Registration record is completed the Authorized IRS

e-file

Provider will transmit the registration to the IRS to request the 94x OnLine e-Filer PIN. After

the 94x PIN Registration Process has been completed and information has been successfully

processed and approved, the IRS will send the Authorized Signer a 10-digit PIN via U.S. Mail

within 7 – 10 days.

Once the 94x OnLine e-Filer PIN is received by the Authorized Signer, named in the 94x PIN

Registration record, he/she must return the Acknowledgment Receipt. Returning the signed

acknowledgment indicates possession of, and responsibility for the proper use of the 94x OnLine

e-Filer PIN used for signing tax returns (pursuant to § 301.6061-1) filed through the 94x

e-file

Program.

When the Authorized Signer is ready to

e-file

the returns, he/she must manually enter the 94x

OnLine e-Filer PIN signature for each transmission of electronically filed Forms 94x via an

Authorized IRS

e-file

Provider, as referenced in this publication.

20

3.2.1 Compromised 94x OnLine e-Filer PIN and Other Issues

The Authorized Signer identified on the registration record is responsible for safeguarding the

94x OnLine e-Filer PIN. If the Authorized Signer suspects that the confidentiality of the PIN has

been compromised, the electronic filer must contact the IRS e-help Desk at 1(866) 255-0654

within 24 hours for instructions on how to proceed. The 94x OnLine e-Filer PIN will be

deactivated, and a new 94x OnLine e-Filer PIN will be issued.

The 94x OnLine e-Filer PIN is valid for filing all returns through the Employment Tax

e-file

System. In addition, if the taxpayer decides to use the services of another Authorized IRS

e-file

Provider after they have received their PIN, they DO NOT need to re-register. The PIN

identifies the IRS Authorized Signer, and is not linked to the provider that transmitted the

original registration.

NOTE: At this time, only one 94x OnLine e-Filer PIN can be issued for an Employer

Identification Number.

3.2.2 Authorized Signer Changes

If the Authorized Signer changes, the Electronic Filer or OnLine e-Filer must notify the Service

of the name and title of the new Authorized Signer and request a new 94x OnLine e-Filer PIN no

later than 15 days before the filing of another return.

Notification of the change must be faxed or mailed to the Cincinnati e-help Desk on company

letterhead and signed by the owner, partner or officer of the business. The letter must include the

following:

EIN for the business

Business name and address

The name and title of the person signing the letter must be printed on the letter

The name of the previous Authorized Signer and the name, title and phone number of the

new Authorized Signer.

After this notification is received, the Service will deactivate the current 94x OnLine e-Filer PIN

and issue a new 94x OnLine e-Filer PIN to the new Authorized Signer.

Fax number for Cincinnati - 1-877-477-0569

Mailing Address for the Cincinnati e-help Desk:

Internal Revenue Service

Mail Stop 2701G

Cincinnati, OH 45999

21

3.3 Communications Testing Procedures

Transmitters must complete Communications Testing with the

e-file

system prior to filing live

tax returns, as part of their IRS e-file Application process. Transmitters send information

directly to the Service. IRS will be provided with a telephone number in order to arrange for a

test transmission.

3.4 Assurance Testing Procedures

Note: For complete Assurance Testing Procedures, please search the 94x XML Developers

Forum – Employment Tax

e-file

System web site at www.irs.gov

3.4.1 Assurance Testing Requirements

All Software Developers will be required to complete the Assurance Testing process for each

Software package that they will use with the Employment Tax

e-file

Program. In addition,

Transmitters are required to complete a communications test with the

e-file

system prior to filing

live tax returns through the system.

Transmitters and Software Developers will be provided with a telephone number in order to

arrange for a test transmission.

To electronically file tax returns for a specific quarter, an applicant must complete Assurance

Testing prior to the due date for that quarter’s returns, but no later than the dates shown below in

Table 3-3.

To transmit subsequent test files, contact the e- help Desk. Transmission of a test file does not

constitute the filing of a tax return.

If an Applicant’s test file fails to meet the evaluation criteria, the Applicant must, within 15 days

of the Service’s notification of the failure, transmit a new test file or contact the e-help Desk to

make other arrangements.

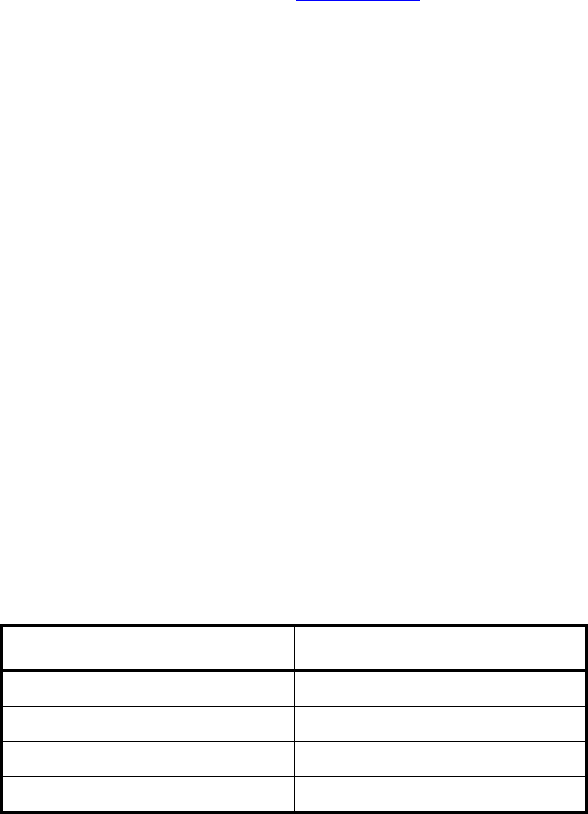

Table 3-3 Test File Due Date for Each Filing Quarter

Quarter Ending Date

Test File Due Date

March 31

April 10

June 30

July 10

September 30

October 10

December 31

January 10

22

3.4.2 Pre-Validation of XML Data

Each developer should develop their own test data. Once the XML Data has been developed, the

developer should use a validating XML parser to determine if their records are valid XML files.

This pre-validation is intended to identify the majority of potential error conditions, and

minimize the chance of receiving error conditions on their test transmission.

3.4.3 Test Transmissions

Once the data has been validated against the 94x XML schemas you are ready to submit a test

transmission. Transmitters and Software Developers should call the e-help Deck at 1-866-255-

0654 in order to arranage a test transmision.

Once the test transmission has been submitted, the file will be processed through the

Employment Tax

e-file

System, and an Acknowledgement will be prepared for each test return

submitted. If errors are identified during processing, an error message will be returned for each

of the conditions identified during validation.

For example:

Improperly formatted test transmission

Failure to submit a successful test transmission within one year of the issuance of the test

identification codes.

If a return has no errors, an acceptance Acknowledgement will be received for that return.

4.0 IRS E-FILE APPLICATION AND 94X PIN REGISTRATION

All applicants will be notified of their acceptance or rejection into the Employment Tax e-file

System within 45 days of the receipt of their e-file Application or 94x OnLine PIN Registration.

23

4.1 Acceptance into IRS e-file

Once accepted, participants will receive the identification items indicated below in Table 4.1.

IRS will issue a software developer questionnaire that must be completed and returned before

approving software. When all of the returns in a test transmission have been accepted and the

transmission has "passed", the e-help Desk will advise the developer that their software has been

approved. The developer may then begin to market their software. IRS will issue software IDs if

the software is being sold to other companies.

The IRS e-help Desk examiner will change the status for the return type that they are testing

from “Testing” to “Production”. Once in production status, an acceptance letter is issued to the

software developer.

If the software developer wants to continue testing with their own test data, they may continue to

test using their software developer ETIN.

Acceptance of a Software Developer establishes only that the test transmission was formatted

properly and could be processed by the Service. It is not an endorsement of the software or of the

quality of the developer’s service. A Software Developer is not entitled to electronically file

Forms 940/941/944 unless a separate application approval as an Authorized IRS

e-file

Provider

has been granted via an IRS

e-file

Application.

NOTE: Software Developers are never moved to production status: If the

e-file

participant is a

Software Developer and Transmitter, they will be assigned two ETIN numbers; one for testing

their software and the other for transmitting live data.

If the Applicant is a Reporting Agent, the Applicant will receive a Validated Agent’s List within

45 days of the Service receiving the Agent’s Application. Failure to use the names and EINs

provided on the Validated Agent’s List might delay processing.

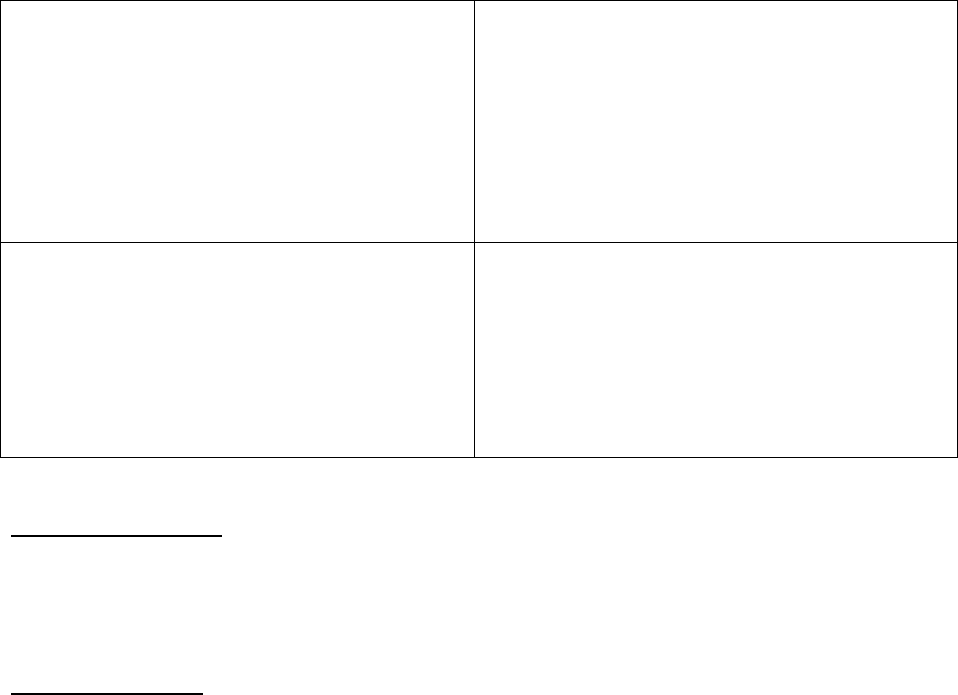

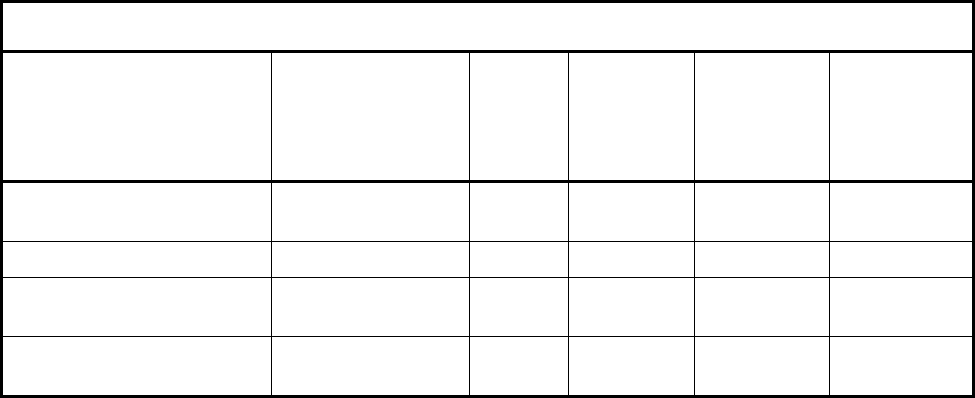

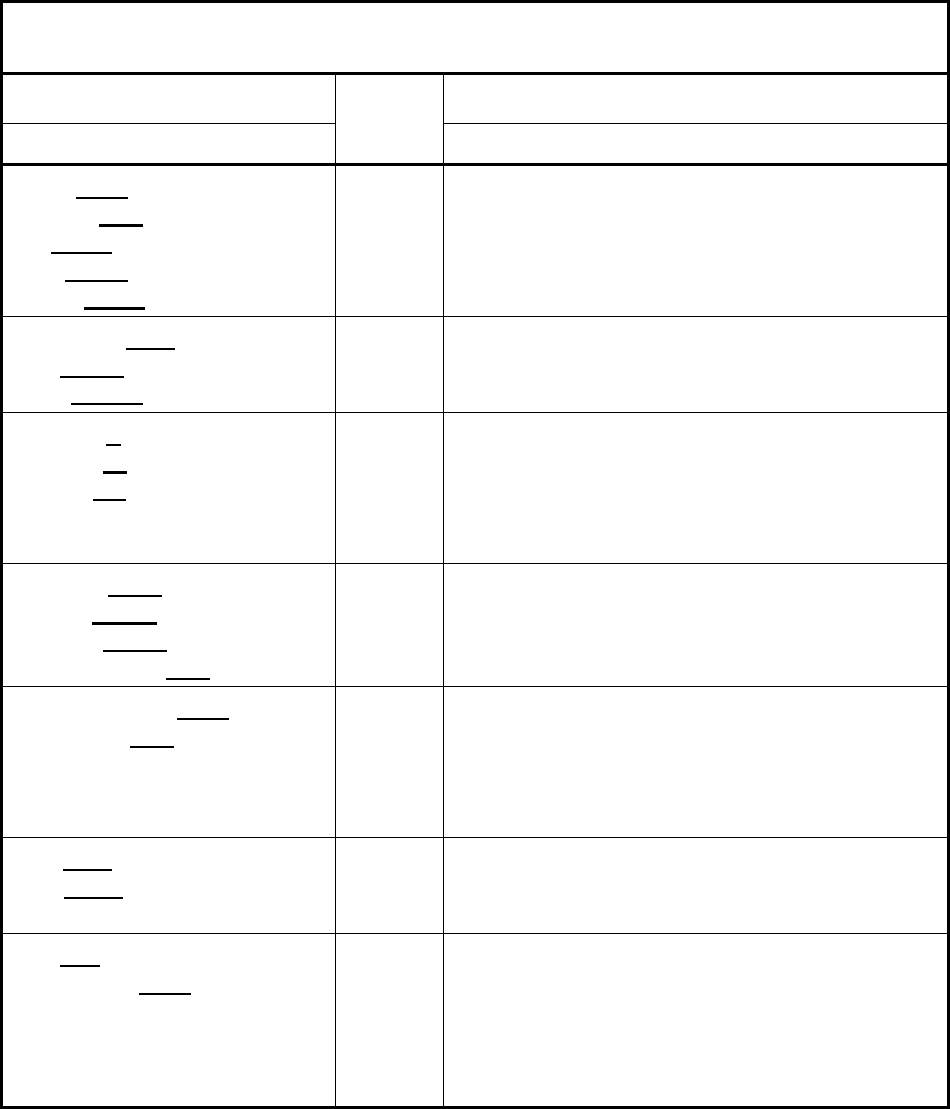

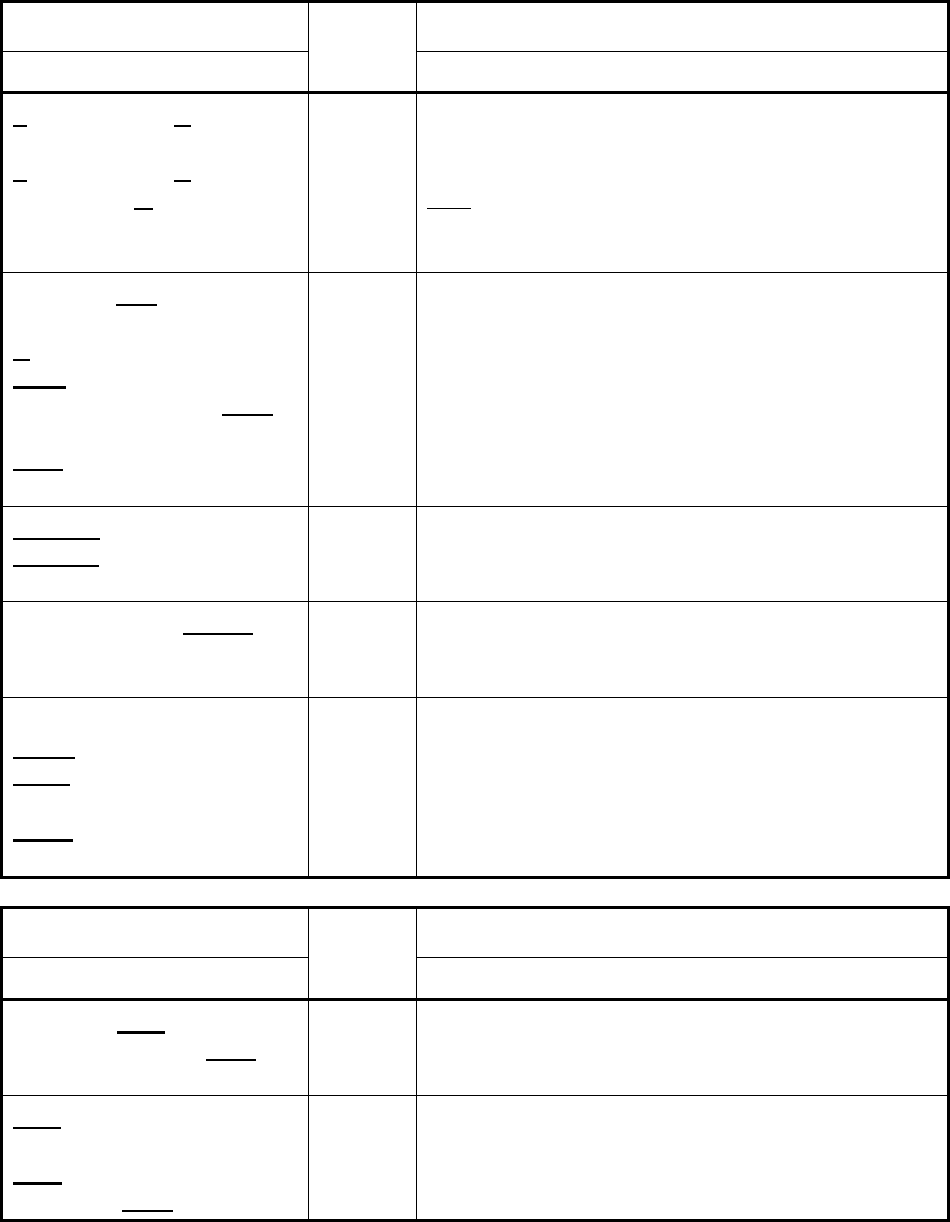

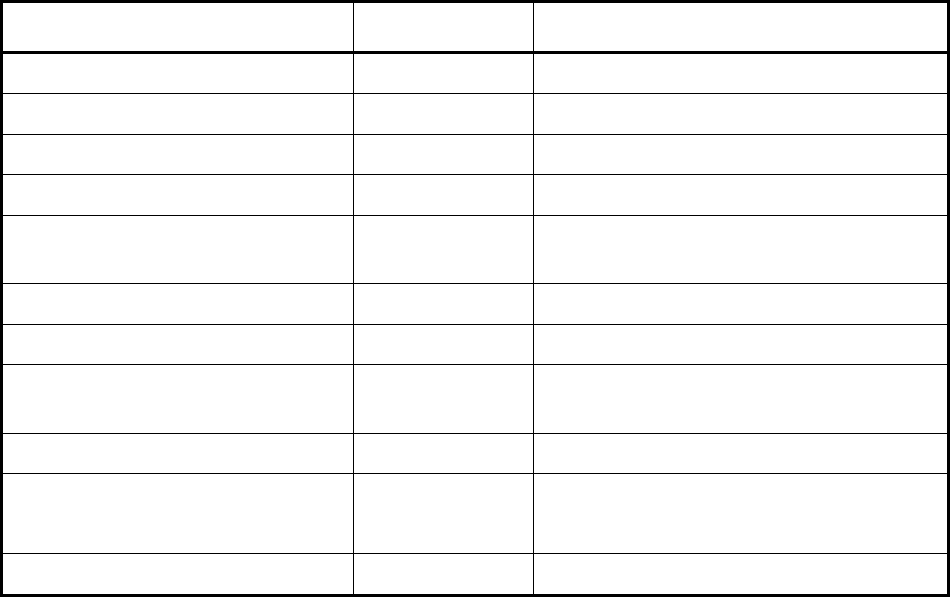

Table 4.1 Identification Items by Type

Identification Item

94x OnLine e-Filer

*(10 digit PIN)

ERO

Reporting

Agent

*(5 digit

PIN)

Transmitter

Software

Developer

Electronic Transmitter

Identification Number (ETIN)

X

X

Password

X

X

Electronic Filing

Identification Number (EFIN)

X

X

X

X

*Personal Identification

Number (PIN)

X

X

24

4.2 IRS e-file Application and 94x PIN Registration – Rejection

An IRS

e-file

application and/or 94x PIN Registration may be rejected for any of the following

reasons, as applicable:

Required information not included on e-file Application or 94x PIN Registration contact

information is invalid. See 2.3.3.1 for Acceptable Contact(s)

Required attachments missing from e-file Application

Previous Suspension from an Electronic Filing Program

Use of an invalid or inactive EIN

25

5.0 XML SCHEMA AND VERSION CONTROL

5.1 Schema Conventions

The 94x XML Schemas were designed following the format of each of the paper returns they are

designed to replace. XML tag names are closely aligned with the text from those returns, and the

format and content of each of the data elements is defined in the schema. Common data types

have been identified and defined in the schema efiletypes.xsd.

Please refer to guidelines in Section 5.0 for instructions on how to construct a transmission file,

and Section 7.0 for the construction of an acknowledgement file. In addition, Appendix A

provides guidance on valid attachments to each return type.

5.2 Schema Location

The current 94x XML Schemas are posted to the 94x XML Developers’ Forum on the IRS Web

Site, www.irs.gov

Subsequent changes or updates to the schemas will be posted to the Forum, and communicated to

Employment Tax

e-file

Partners.

5.3 Version Control

The current version and future version releases of the 94x XML schemas will be posted to the

94x XML Developers’ Forum. A formal change control process governs changes to the schema,

and any changes will result in a revised version release with an appropriate version number.

26

6.0 BUILDING XML TRANSMISSION FILES

The current 94x XML Schema Mapping Matrix is posted to the 94x XML Developers’ Forums

at the IRS Web Site, www.irs.gov

NOTE: Amended Returns (Forms 940-X, 941-X and 944-X) are not accepted electronically.

This section describes the procedure to create a “sample” 94x return transmission file with

dummy return data.

Assumptions:

The 94x XML Schemas Final Release is used as the base schemas for creating the XML data

instances.

Altova XMLSpy 2010 is used as the tool for creating and validating XML data instances

generated from the aforementioned base schemas.

All optional fields will be created to illustrate the widest spectrum of data combinations. The

actual definitions of required vs. optional fields can be found in the base schemas.

All XML data instances generated are kept in the instances subdirectory directly under the

root of the 94x XML schemas package. If placed elsewhere, the xsi:schemaLocation

attributes in all data instances generated need to be modified to reflect the location of the

XML instance relative to other schemas.

Create the transmission file according to the structure outlined below. Please note the following:

Required MIME content headers are highlighted.

Line spacing is important. There is a blank line between the end of the MIME content

headers and the beginning of the MIME part content itself. Also, there is a blank line

between the end of the MIME part content and the beginning of the next MIME part

boundary.

"MIME-Version: 1.0" must appear as the first line of the MIME message header.

The parameters on the “Content-Type: “line in each MIME part is required and must be in

the order as shown below.

The sample below uses “MIME94xBoundary” as the value for the MIME boundary but an

actual transmission file can have any transmitter-defined string as the boundary. The same

applies to the Content-Location MIME content header.

The Content-Location: line must match one of the contentLocation attributes referenced in the

OriginManifest of a ReturnOriginHeader, and the corresponding element ContentLocation in

the ReturnData.

27

MIME-Version: 1.0

Content-Type: Multipart/Related; boundary=MIME94xBoundary; type=text/xml;

X-eFileRoutingCode: 94x

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: Envelope94x

Transmission Envelope

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: MyUniqueOrigID001

First ReturnData

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: MyUniqueOrigID002

Second ReturnData

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: MyUniqueOrigID003

Third ReturnData

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: MyUniqueOrigID004

Fourth ReturnData

--MIME94xBoundary—

Step 1 – Create 94x Return Transmission Envelope

Step 1.1 – Create Transmission Envelope Skeleton

Here is the transmission envelope skeleton template. After filling in the placeholders, it becomes

the SOAP Envelope in the transmission file.

<?xml version="1.0" encoding="UTF-8"?>

<SOAP:Envelope xmlns="http://www.irs.gov/efile"

xmlns:xsi="http://www.w3.org/2009/XMLSchema-instance"

xmlns:SOAP="http://schemas.xmlsoap.org/soap/envelope/"

xmlns:efile="http://www.irs.gov/efile"

xsi:schemaLocation="http://schemas.xmlsoap.org/soap/envelope/ ../message/SOAP.xsd

28

http://www.irs.gov/efile ../message/efileMessage.xsd">

<SOAP:Header>

Placeholder for TransmissionHeader

</SOAP:Header>

<SOAP:Body>

Placeholder for OriginHeaders

</SOAP:Body>

</SOAP:Envelope>

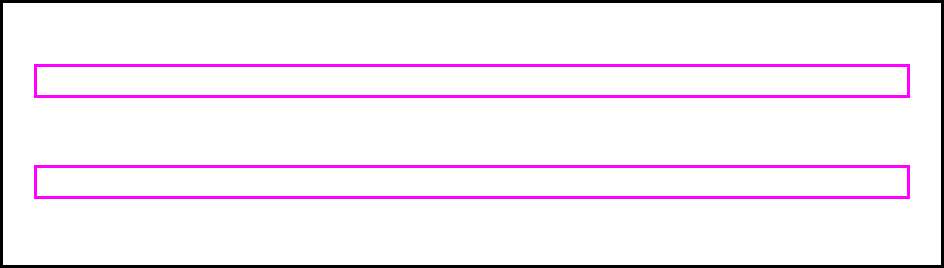

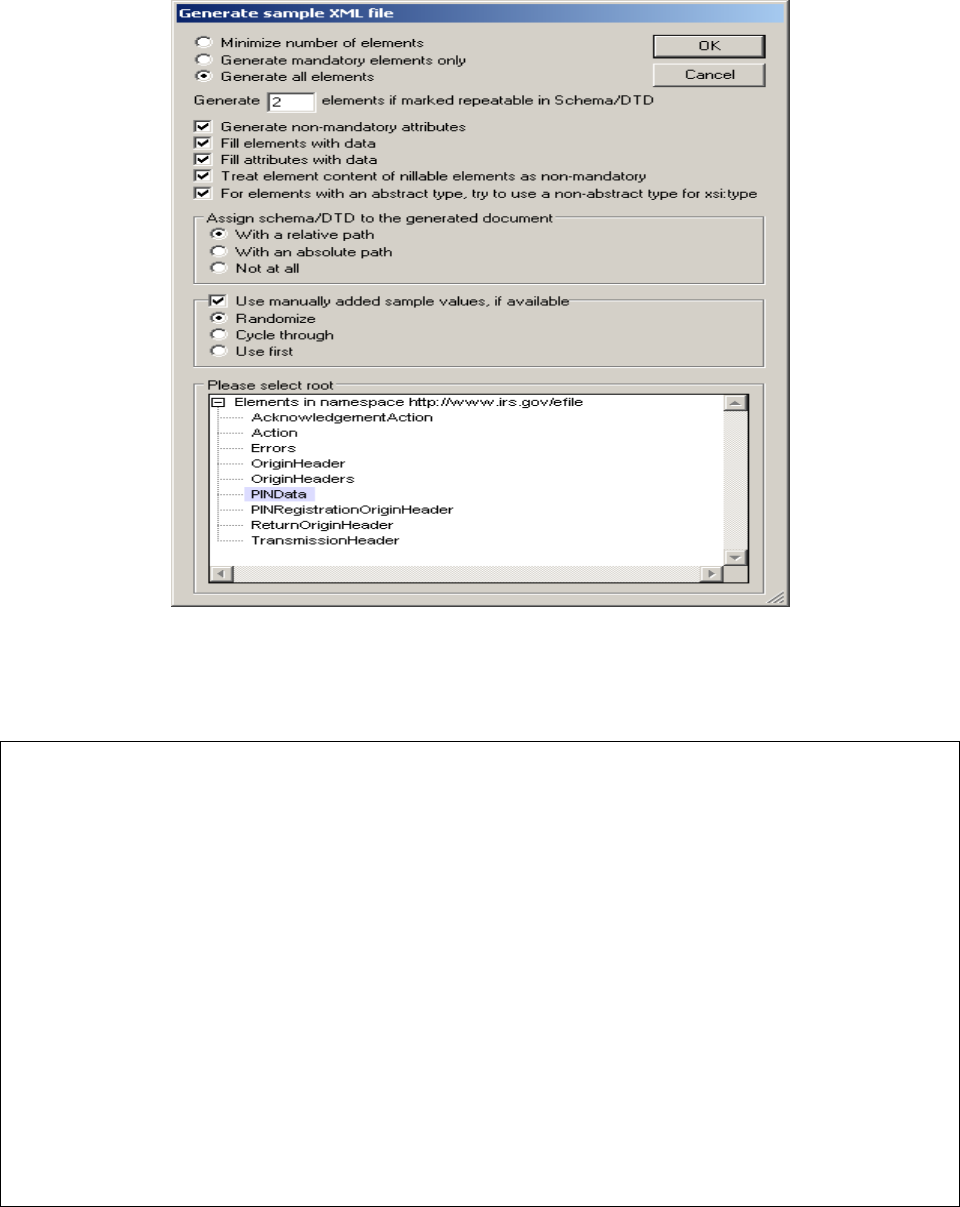

Step 1.2 – Create Transmission Header

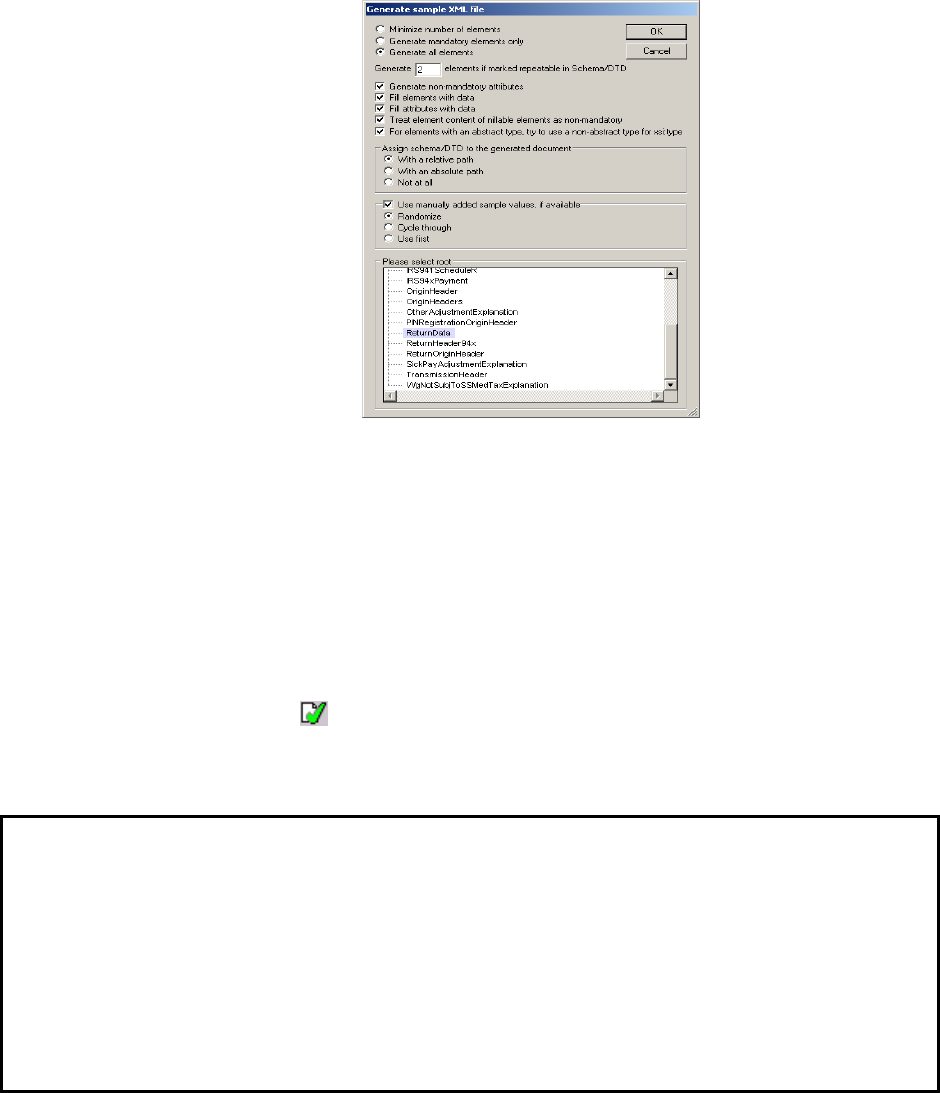

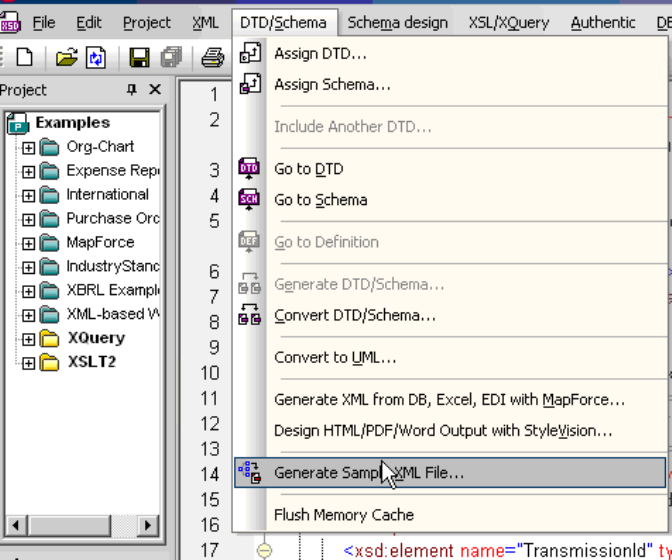

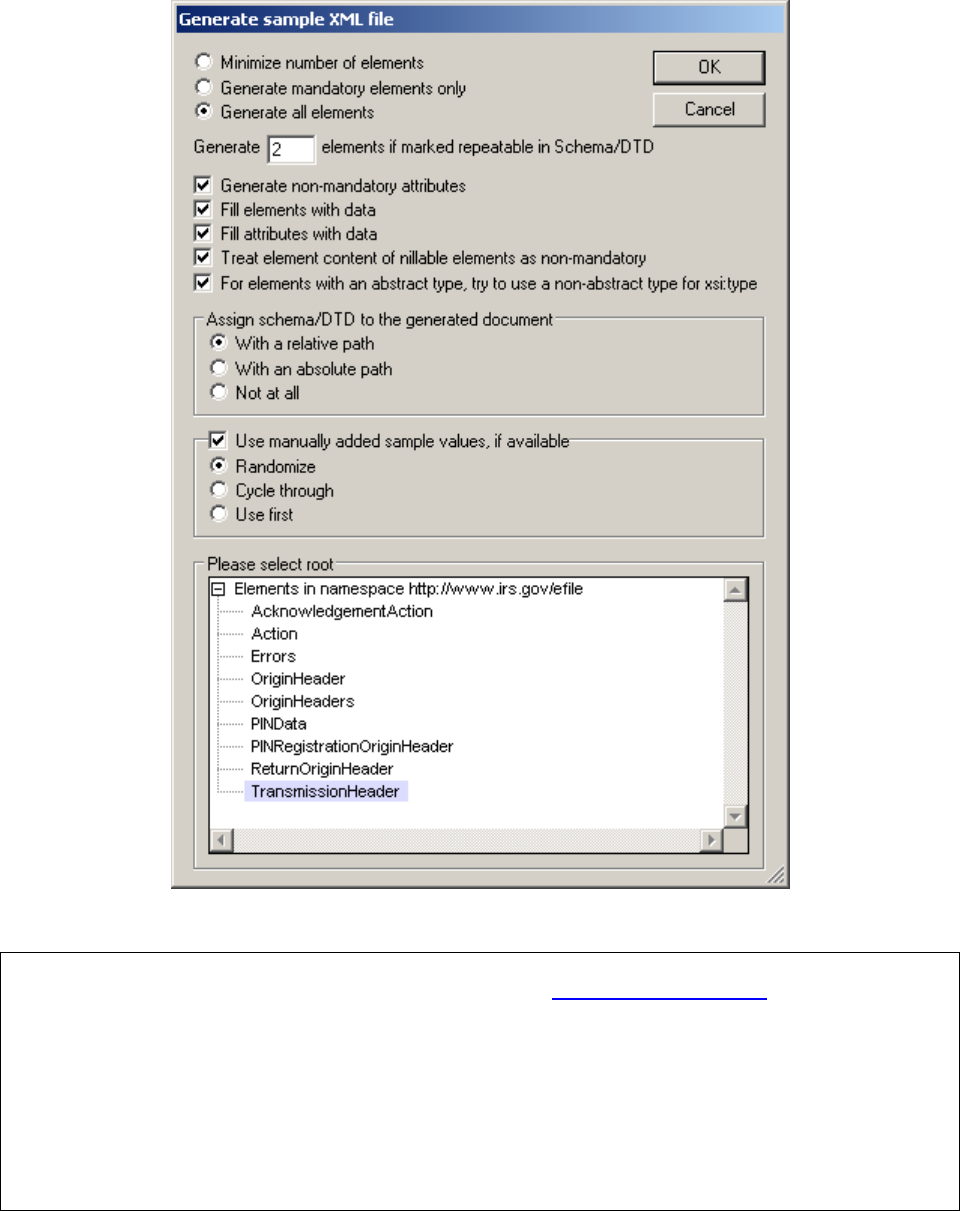

1. Open message/efileMessage.xsd in XML Spy

2. Select DTD/Schema from the main menu.

3. Select Generate sample XML file…

4. Select Generate all elements

5. Specify 2 (or more) repeatable elements

6. Check all options in the following pop-up menu

7. Select with a relative path option

8. Select Use Manually added sample values if available

9. Select TransmissionHeader as root

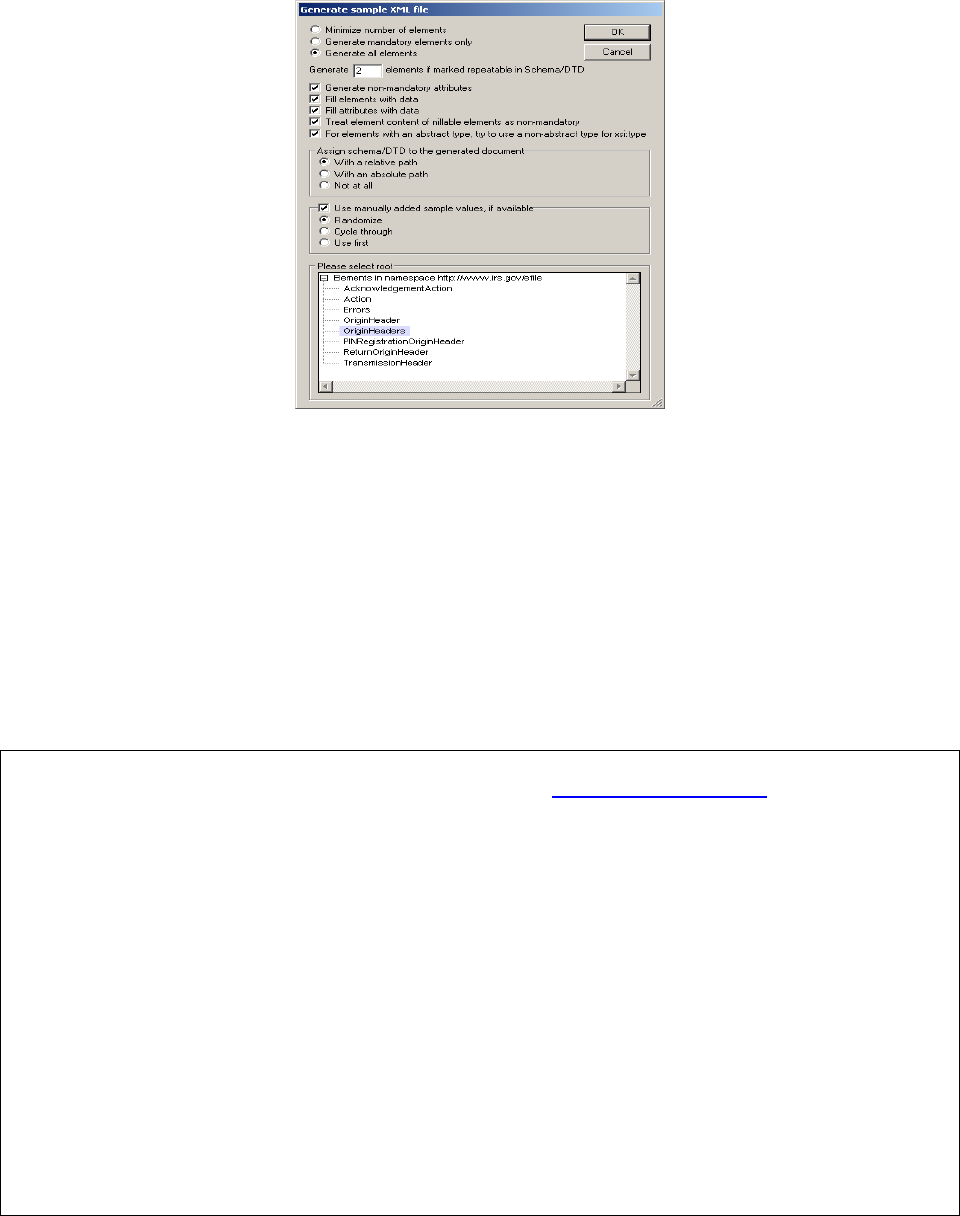

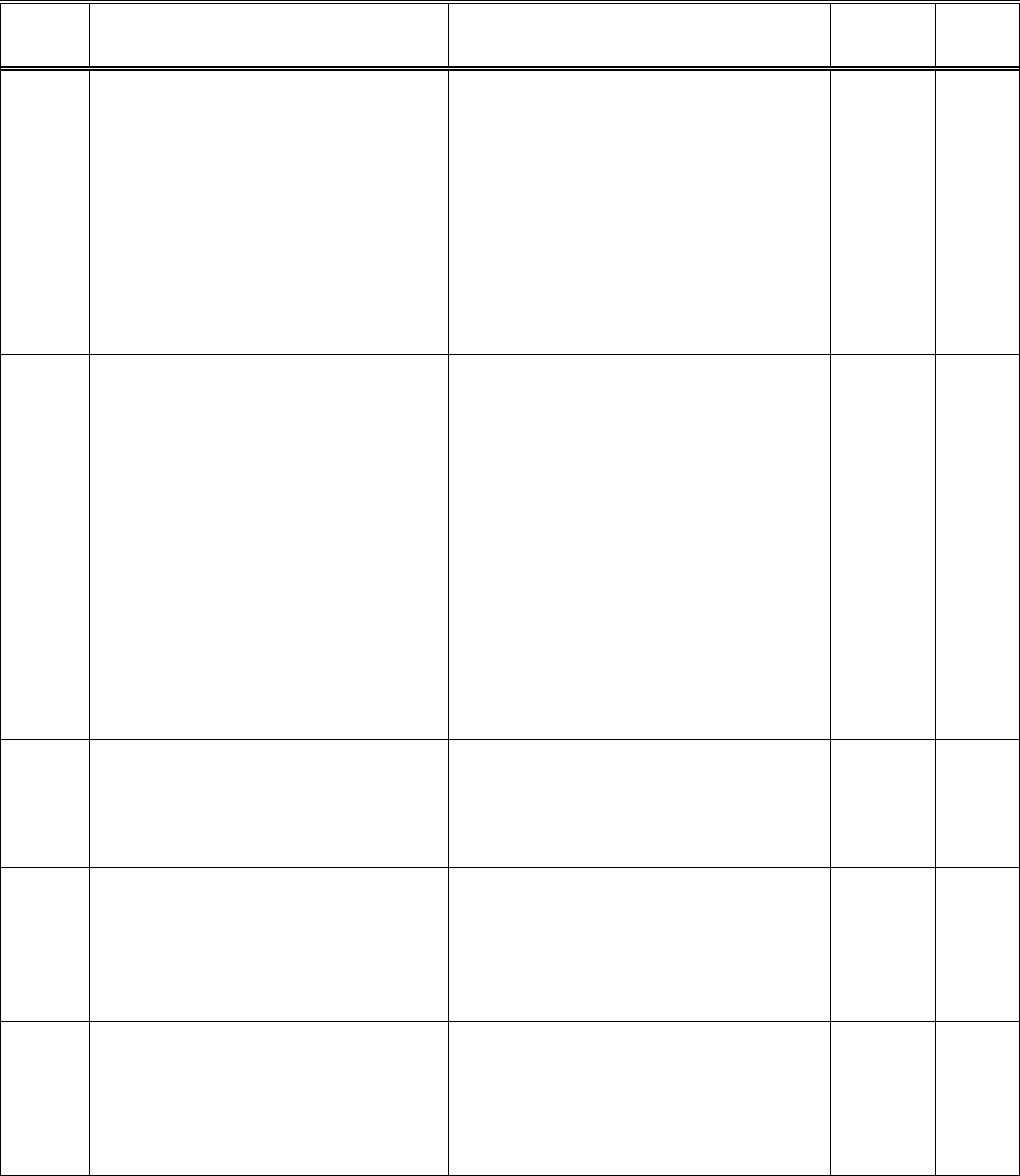

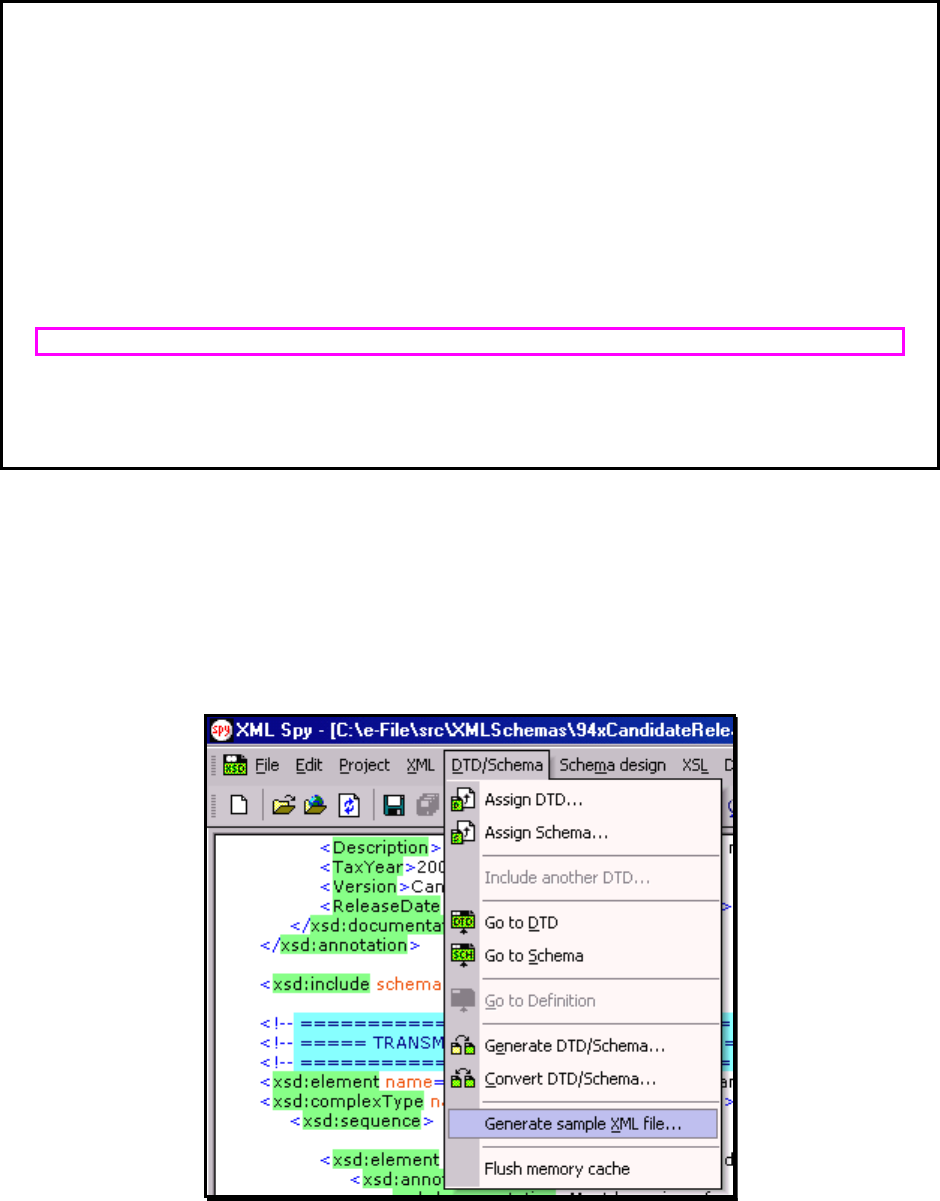

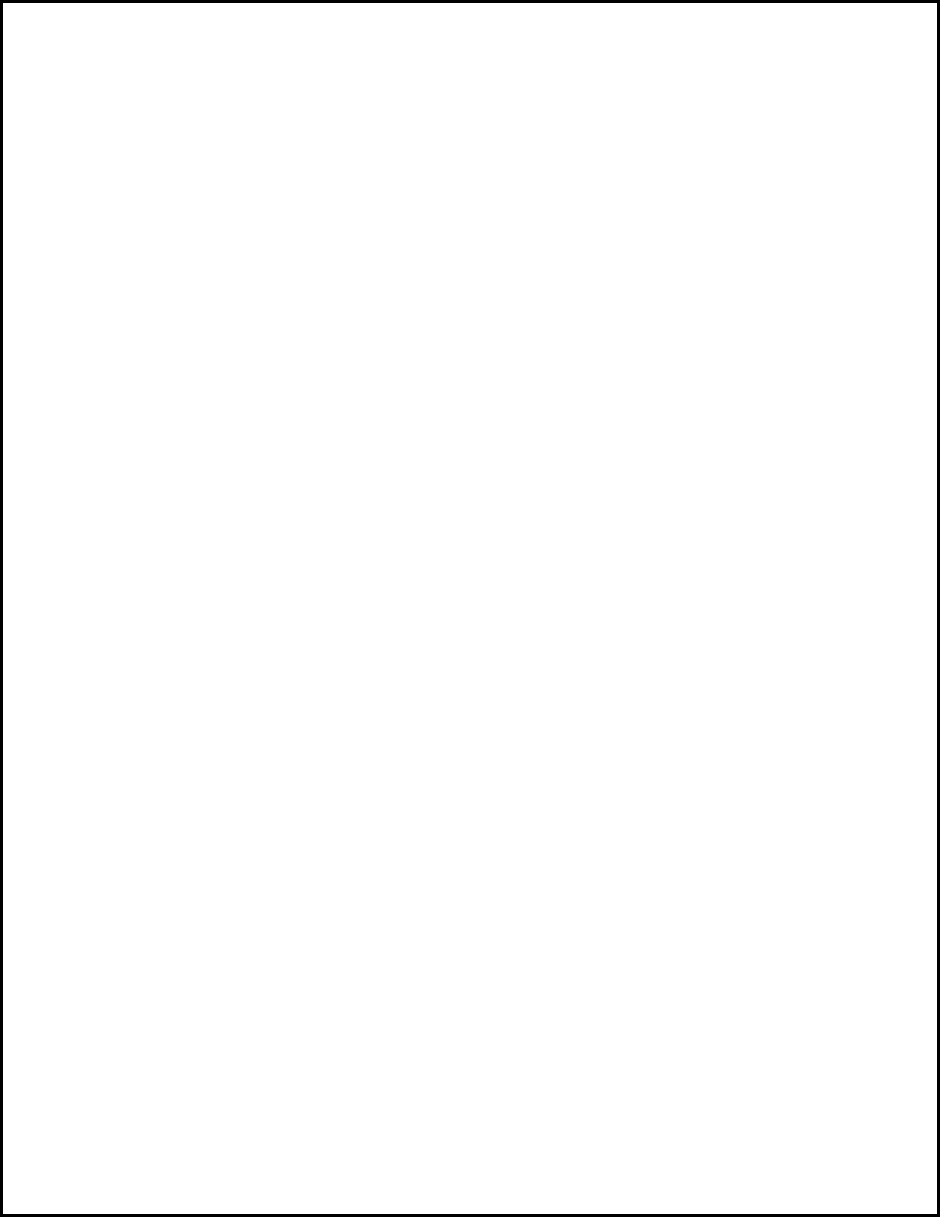

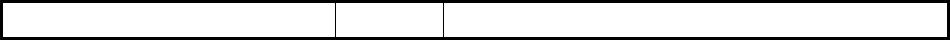

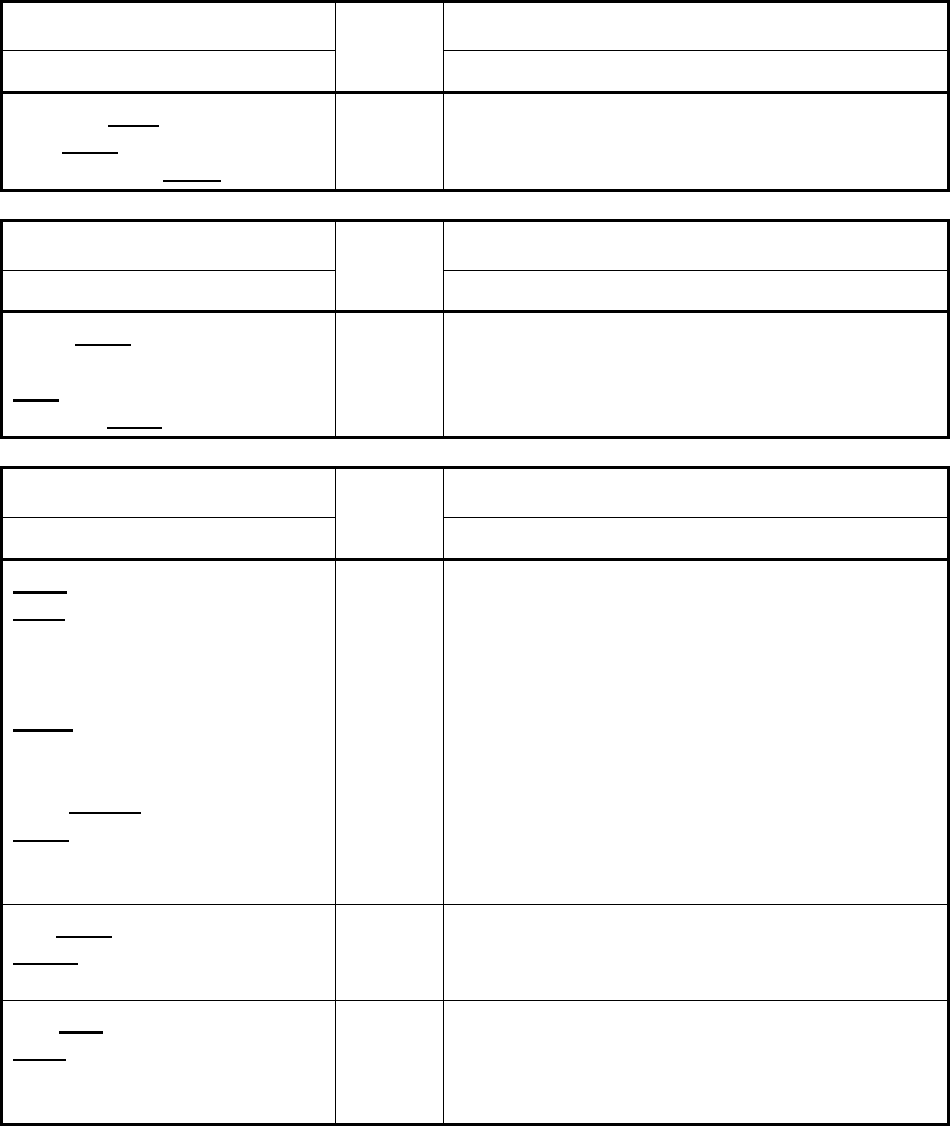

Figure 6-1 Open xsd schema and Generate Sample File

29

Figure 6-2 Open xsd schema and Generate Sample File

The TransmissionHeader data structure generate by XMLSpy

<?xml version="1.0" encoding="UTF-8"?>

<!--Sample XML file generated by XMLSpy v2010 rel. 3 sp1 (http://www.altova.com)-->

<TransmissionHeader xsi:schemaLocation="http://www.irs.gov/efile efileMessage.xsd"

xmlns="http://www.irs.gov/efile" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<TransmissionId>-</TransmissionId>

<Timestamp>2001-12-17T09:30:47Z</Timestamp>

<Transmitter>

30

<ETIN>00000</ETIN>

</Transmitter>

<ProcessType>T</ProcessType>

<TransmissionManifest originHeaderCount="2">

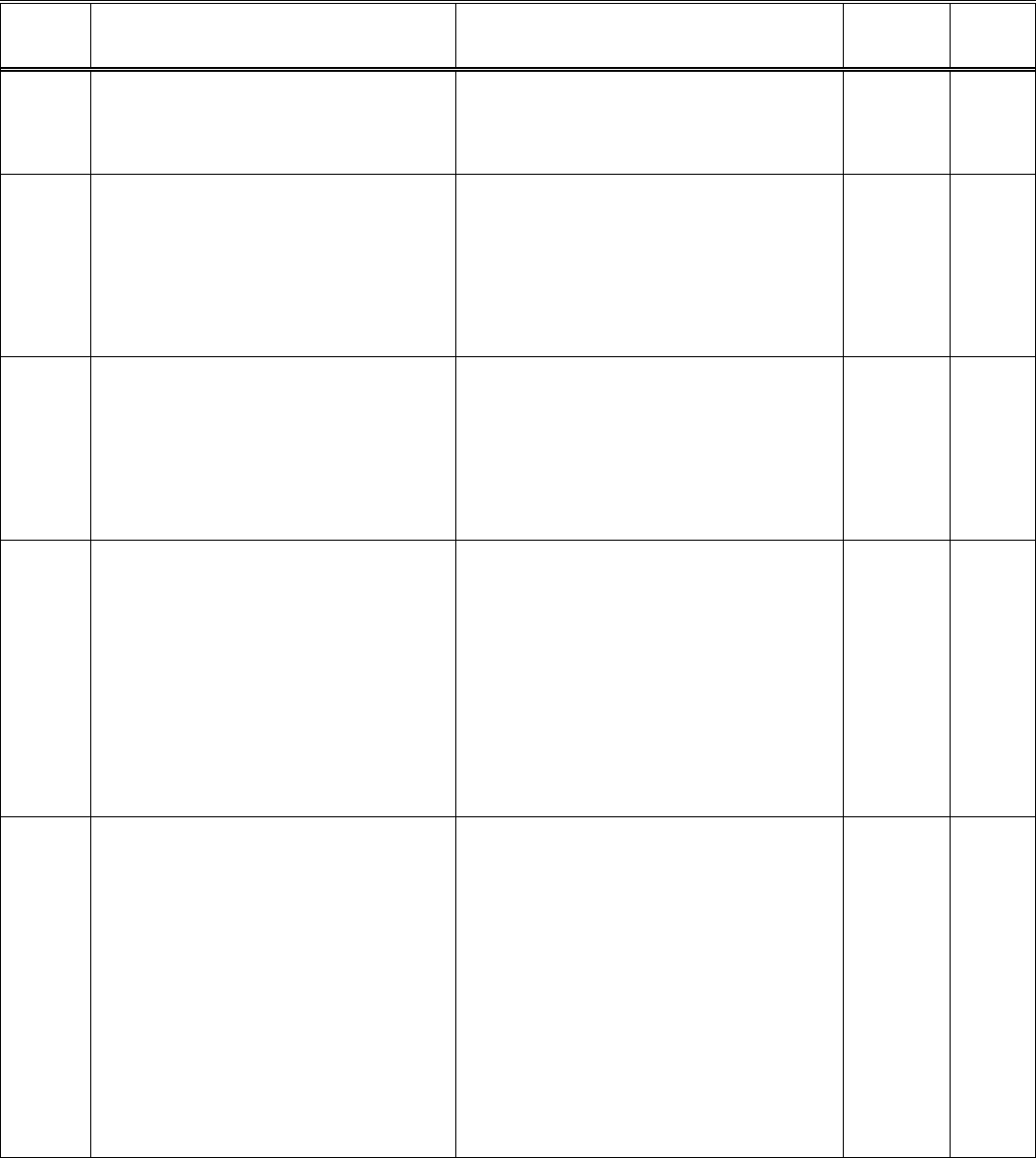

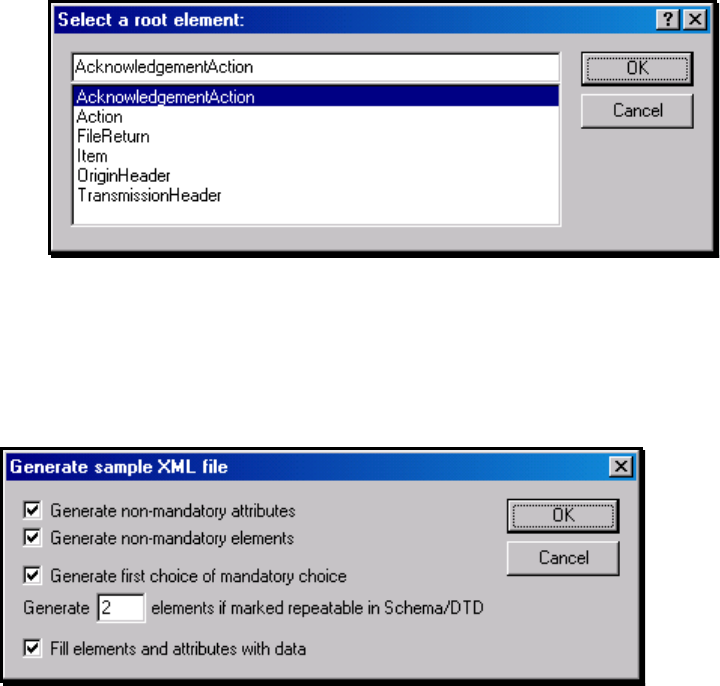

<OriginHeaderReference originId="-"/>

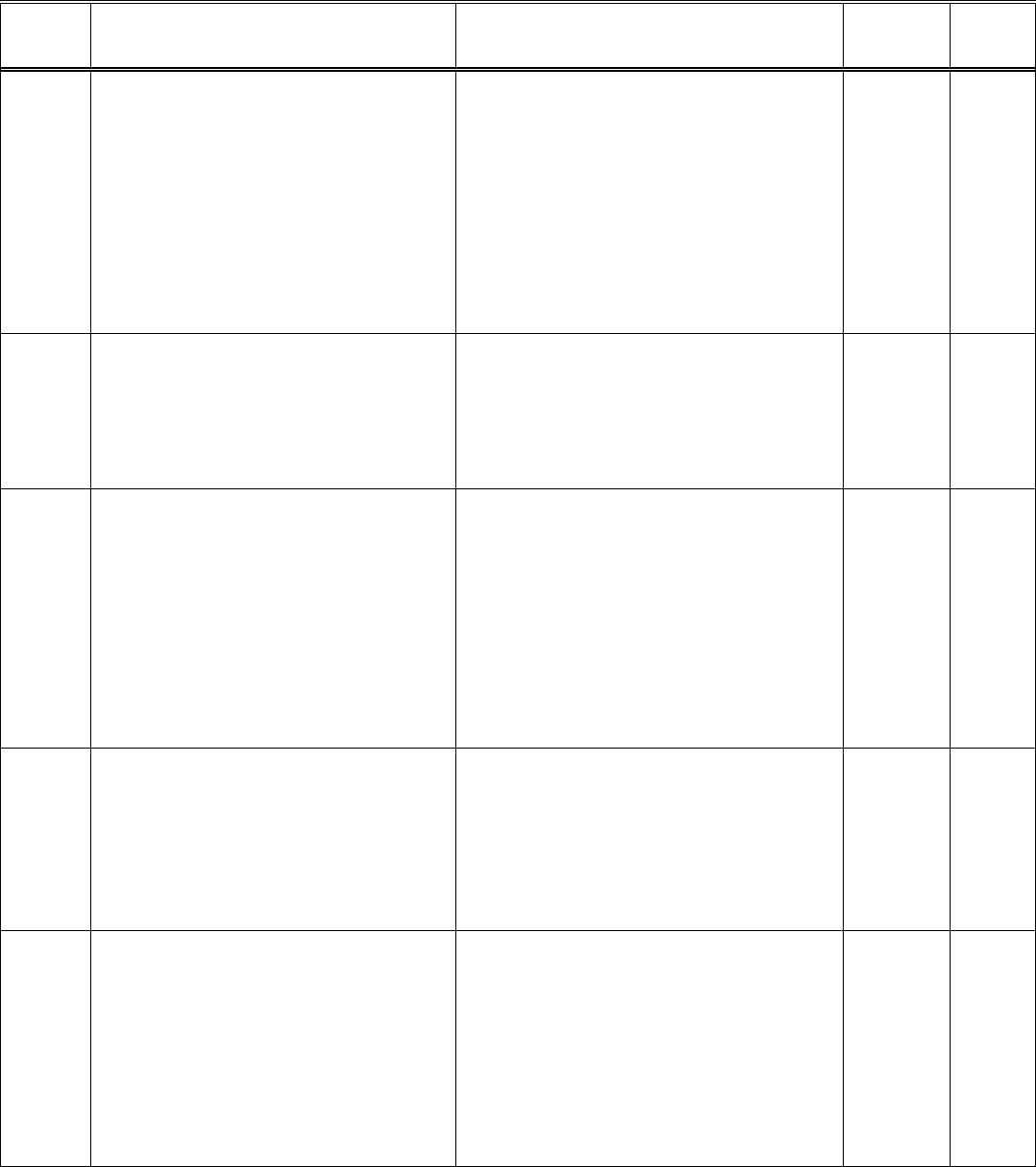

<OriginHeaderReference originId="-"/>

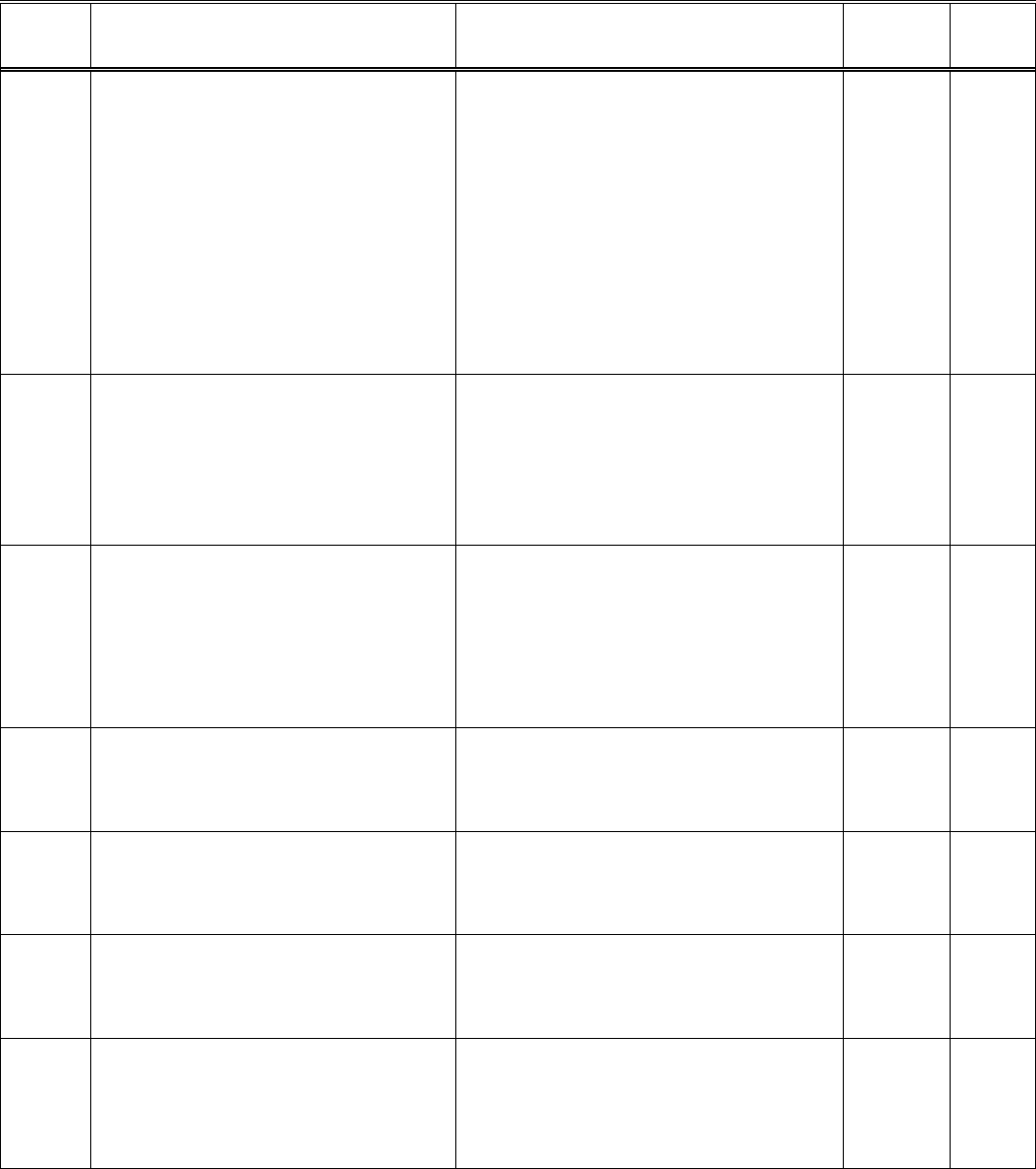

</TransmissionManifest>

</TransmissionHeader>

Step 1.3 – Modify TransmissionHeader data structure

In the TransmissionHeader data structure:

Remove all attributes in the TransmissionHeader element

Add efile: in front element name TransmissionHeader

Edit the data as you see fit.

Validate the TransmissionHeader data structure

Click the button on the tool bar or F8

A final for the TransmissionHeader data structure:

<efile:TransmissionHeader>

<TransmissionId>MyUniqueTransHeaderID001</TransmissionId>

<Timestamp>2001-12-17T09:30:47Z</Timestamp>

<Transmitter>

<ETIN>00000</ETIN>

</Transmitter>

<ProcessType>T</ProcessType>

<TransmissionManifest originHeaderCount="2">

<OriginHeaderReference originId="MyUniqueOrigHeaderID001"/>

<OriginHeaderReference originId="MyUniqueOrigHeaderID002"/>

</TransmissionManifest>

</efile:TransmissionHeader>

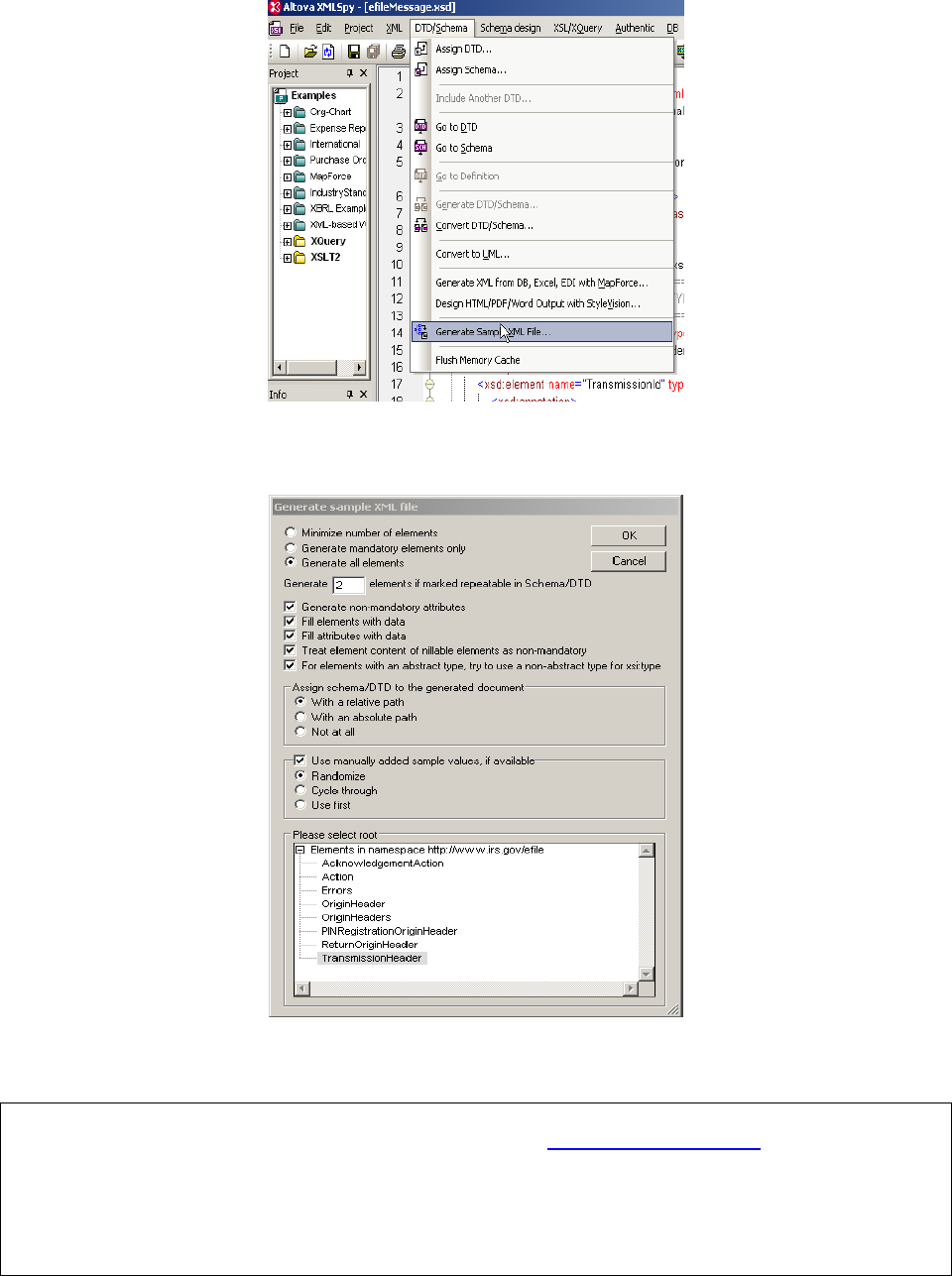

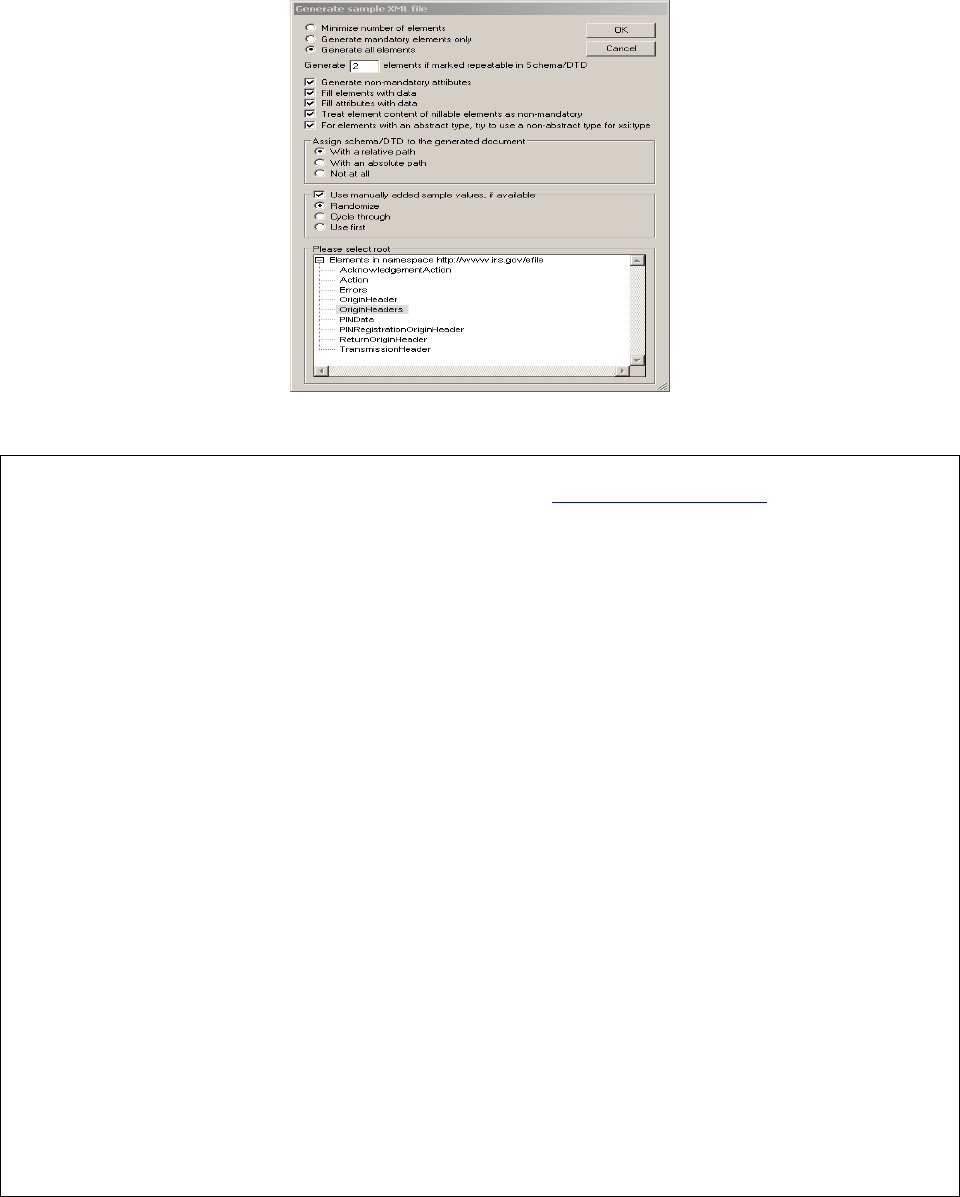

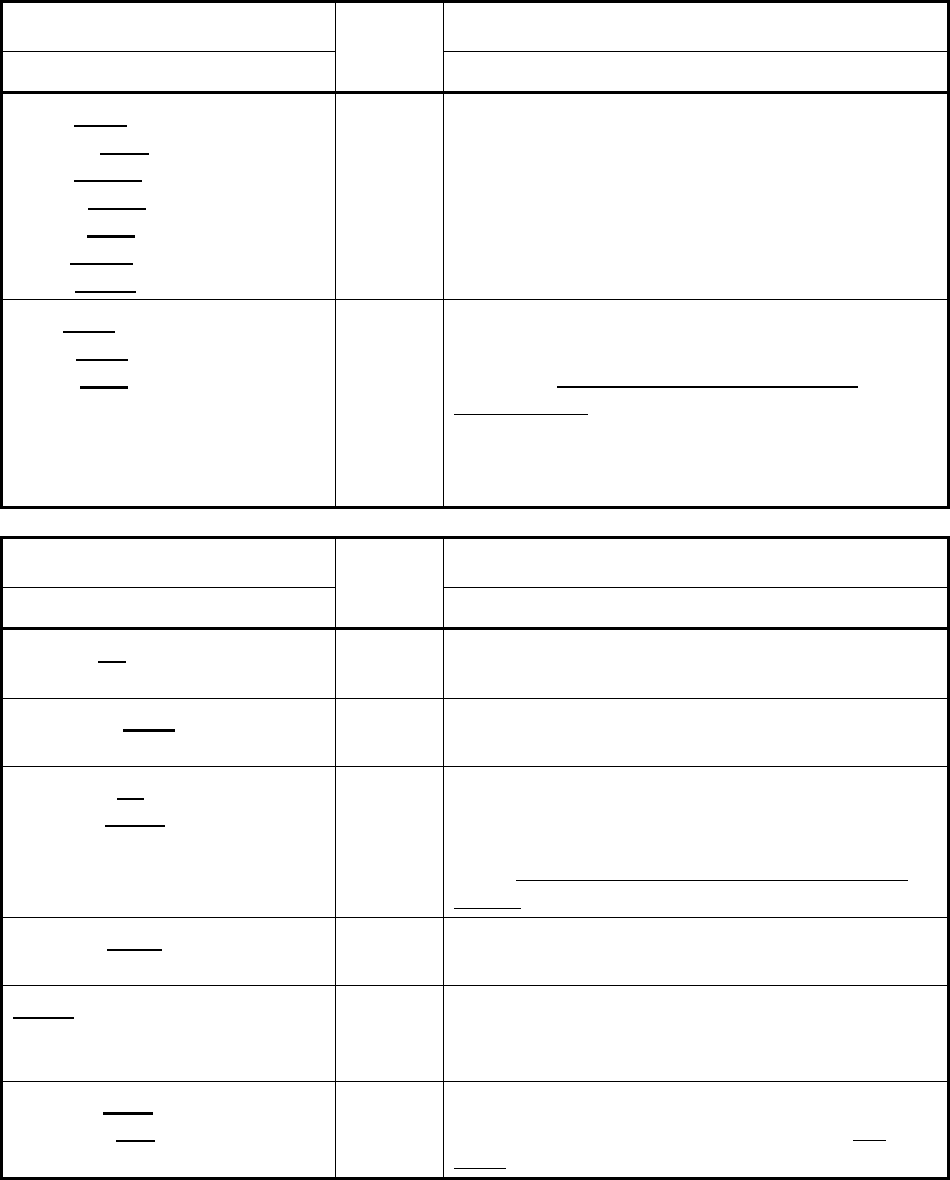

Step 1.4 – Generate OriginHeaders

Repeat Step 1.2 but select OriginHeaders as the root element:

31

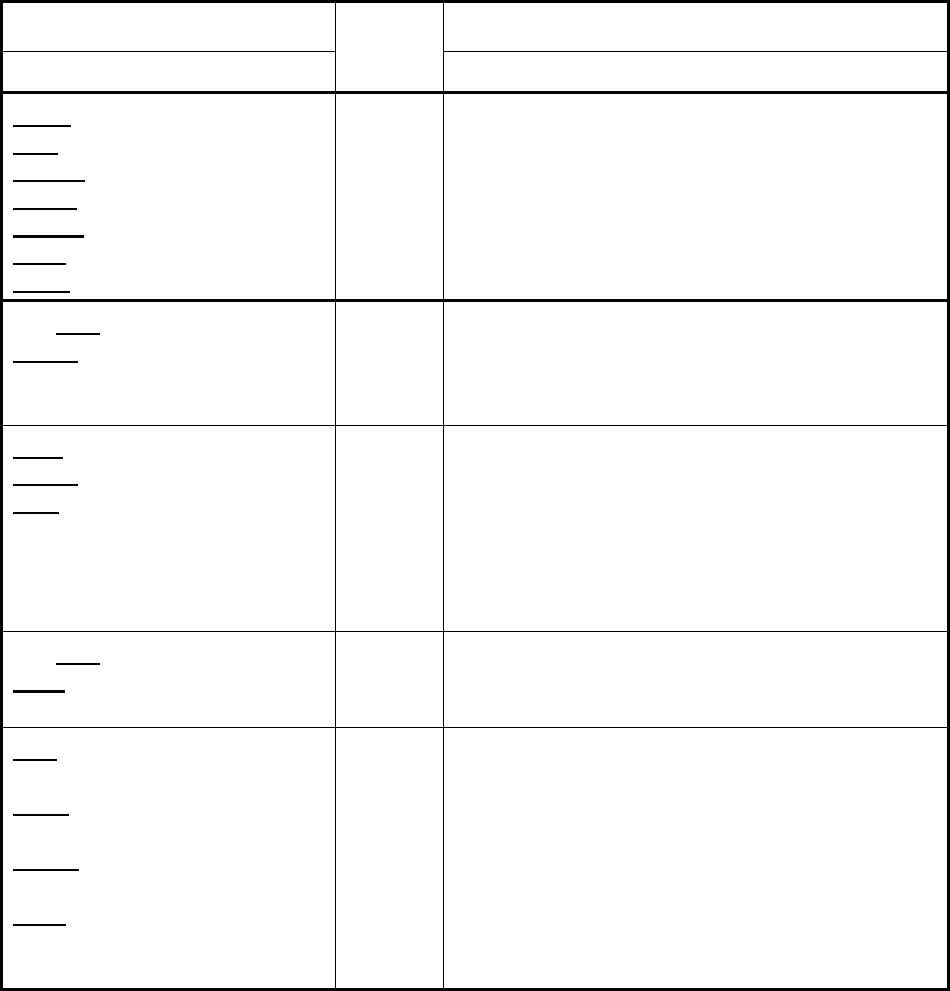

Figure 6-3 Select a Root Element – Origin Headers

The OriginHeaders data structure generate by XMLSpy

<?xml version="1.0" encoding="UTF-8"?>

<!--Sample XML file generated by XMLSpy v2010 rel. 3 sp1 (http://www.altova.com)-->

<OriginHeaders xsi:schemaLocation="http://www.irs.gov/efile efileMessage.xsd"

xmlns="http://www.irs.gov/efile" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<ReturnOriginHeader>

<OriginId>-</OriginId>

<Timestamp>2001-12-17T09:30:47Z</Timestamp>

<OriginManifest itemCount="2">

<ItemReference contentLocation="-"/>

<ItemReference contentLocation="-"/>

</OriginManifest>

<Originator>

<EFIN>aaaaaa</EFIN>

<Type>ReportingAgent</Type>

</Originator>

<ReportingAgentSignature>

<PIN>00000</PIN>

<ETIN>00000</ETIN>

</ReportingAgentSignature>

<ISPNumber>000000</ISPNumber>

32

</ReturnOriginHeader>

<ReturnOriginHeader>

<OriginId>-</OriginId>

<Timestamp>2001-12-17T09:30:47Z</Timestamp>

<OriginManifest itemCount="2">

<ItemReference contentLocation="-"/>

<ItemReference contentLocation="-"/>

</OriginManifest>

<Originator>

<EFIN>aaaaaa</EFIN>

<Type>LargeTaxPayer</Type>

</Originator>

<ReportingAgentSignature>

<PIN>00000</PIN>

<ETIN>00000</ETIN>

</ReportingAgentSignature>

<ISPNumber>000000</ISPNumber>

</ReturnOriginHeader>

</OriginHeaders>

Step 1.5 – Modify OriginHeaders data structure

In the OriginHeaders data structure:

1. Remove all attributes in the OriginHeaders elements.

2. Add efile: in front of element tag name OriginHeaders

3. Edit the data as you see fit

4. Validate the TransmissionHeader data structure

a. Click the button on the tool bar or F8

The final of OriginHeaders data structure:

<efile:OriginHeaders>

<ReturnOriginHeader>

<OriginId>MyUniqueOrigHeaderID001</OriginId>

<Timestamp>2001-12-17T09:30:47Z</Timestamp>

<OriginManifest itemCount="2">

<ItemReference contentLocation=”MyUniqueOrigItemID001"/>

<ItemReference contentLocation="MyUniqueOrigItemID002"/>

</OriginManifest>

<Originator>

<EFIN>XXXXXX</EFIN>

<Type>ReportingAgent</Type>

</Originator>

<ReportingAgentSignature>

<PIN>XXXXX</PIN>

<ETIN>XXXXX</ETIN>

</ReportingAgentSignature>

33

<ISPNumber>XXXXXX</ISPNumber>

</ReturnOriginHeader>

<ReturnOriginHeader>

<OriginId>MyUniqueOrigHeaderID002</OriginId>

<Timestamp>2001-12-17T09:30:47Z</Timestamp>

<OriginManifest itemCount="2">

<ItemReference contentLocation=”MyUniqueOrigItemID003"/>

<ItemReference contentLocation="MyUniqueOrigItemID004"/>

<ItemReference contentLocation="MyUniqueOrigItemID005"/>

</OriginManifest>

<Originator>

<EFIN>XXXXXX</EFIN>

<Type>ReportingAgent</Type>

</Originator>

<ReportingAgentSignature>

<PIN>XXXXX</PIN>

<ETIN>XXXXX</ETIN>

</ReportingAgentSignature>

<ISPNumber>XXXXXX</ISPNumber>

</ReturnOriginHeader>

</OriginHeaders>

Step 1.4 – Complete the Transmission Envelope

Complete the Transmission Envelope:

Plug the TransmissionHeader created in Step 1.3 into the Placeholder for

TransmissionHeader defined in Step 1.1

Plug the OriginHeaders structure created in Step 1.6 into the Placeholder for

OriginHeaders defined in Step 1.1

Validate the complete transmission Envelope if necessary

The complete transmission Envelope is shown below:

<?xml version="1.0" encoding="UTF-8"?>

<SOAP:Envelope xmlns="http://www.irs.gov/efile"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns:SOAP="http://schemas.xmlsoap.org/soap/envelope/"

xmlns:efile="http://www.irs.gov/efile"

xsi:schemaLocation="http://schemas.xmlsoap.org/soap/envelope/

../message/SOAP.xsd

http://www.irs.gov/efile ../message/efileMessage.xsd">

<SOAP:Header>

<efile:TransmissionHeader>

<TransmissionId>MyUniqueTransHeaderID001</TransmissionId>

<Timestamp>2012-08-16T23:56:44-04:00</Timestamp>

<Transmitter>

34

<ETIN>XXXXX</ETIN>

</Transmitter>

<ProcessType>P</ProcessType>

<TransmissionManifest originHeaderCount="2">

<OriginHeaderReference originId="MyUniqueOrigItemID001"/>

<OriginHeaderReference originId="MyUniqueOrigItemID002"/>

</TransmissionManifest>

</efile:TransmissionHeader>

</SOAP:Header>

<SOAP:Body>

<efile:OriginHeaders>

<ReturnOriginHeader>

<OriginId>MyUniqueOrigItemID001</OriginId>

<Timestamp>2012-08-16T23:56:44-04:00</Timestamp>

<OriginManifest itemCount="2">

<ItemReference contentLocation="MyUniqueOrigItemID001"/>

<ItemReference contentLocation="MyUniqueOrigItemID002"/>

</OriginManifest>

<Originator>

<EFIN>XXXXXX</EFIN>

<Type>Originator Type</Type>

</Originator>

<ReportingAgentSignature>

<PIN>XXXXX</PIN>

<ETIN>XXXXX</ETIN>

</ReportingAgentSignature>

<ISPNumber>XXXXX</ISPNumber>

</ReturnOriginHeader>

<ReturnOriginHeader>

<OriginId>MyUniqueOrigItemID002</OriginId>

<Timestamp>2012-08-16T23:56:44-04:00</Timestamp>

<OriginManifest itemCount="3">

<ItemReference contentLocation="MyUniqueOrigItemID003"/>

<ItemReference contentLocation="MyUniqueOrigItemID004"/>

<ItemReference contentLocation="MyUniqueOrigItemID005"/>

</OriginManifest>

<Originator>

<EFIN>XXXXXX</EFIN>

<Type>Originator Type</Type>

</Originator>

<ReportingAgentSignature>

<PIN>XXXXX</PIN>

<ETIN>XXXXX</ETIN>

</ReportingAgentSignature>

<ISPNumber>XXXXX</ISPNumber>

</ReturnOriginHeader>

</efile:OriginHeaders>

</SOAP:Body>

</SOAP:Envelope>

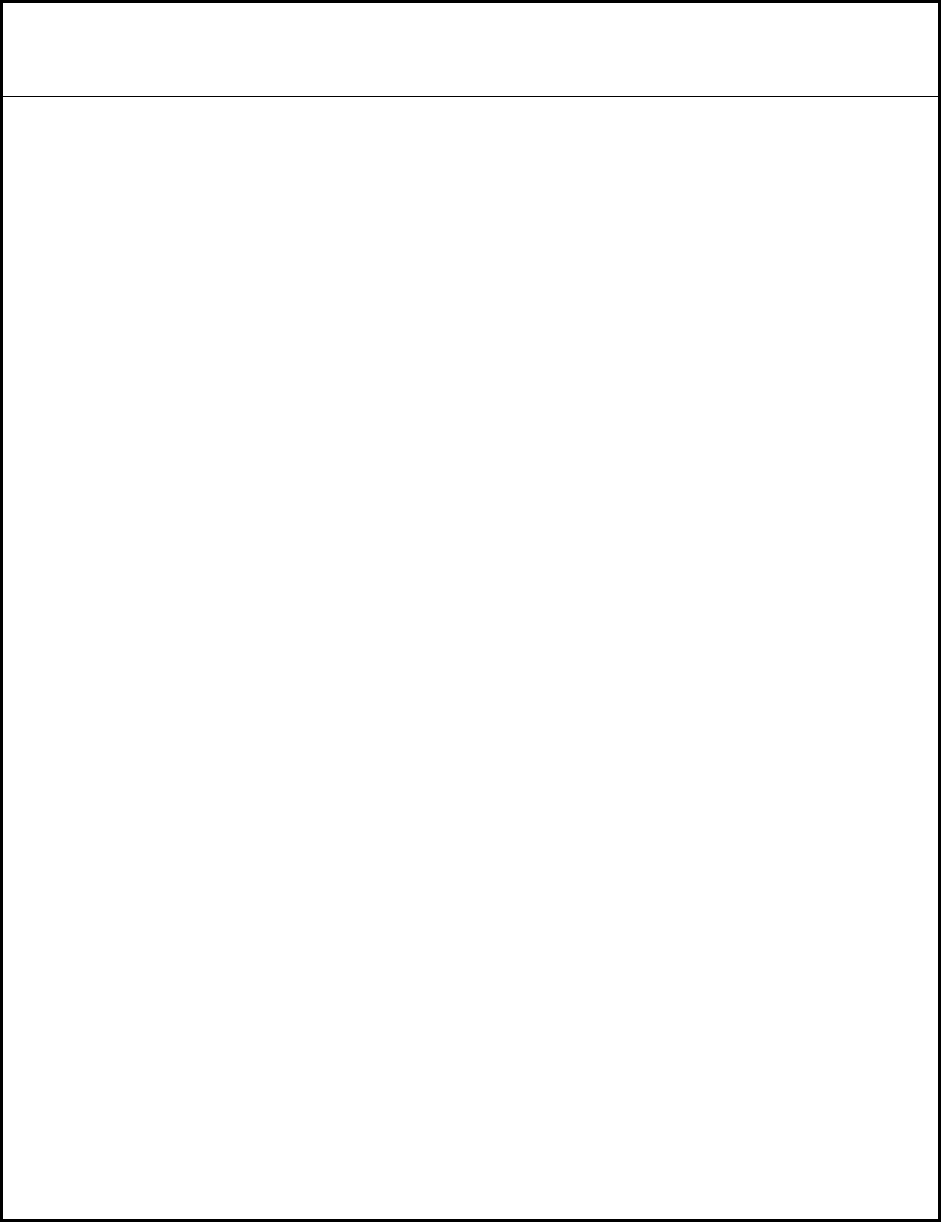

Step 2 – Create ReturnData MIME Parts

35

Step 2.1 – Create ReturnData

Repeat Step 1.2 with the efile/94x/ReturnData941PR.xsd schema file (or other

ReturnData94x.xsd for other return types). This time select ReturnData as the root element.

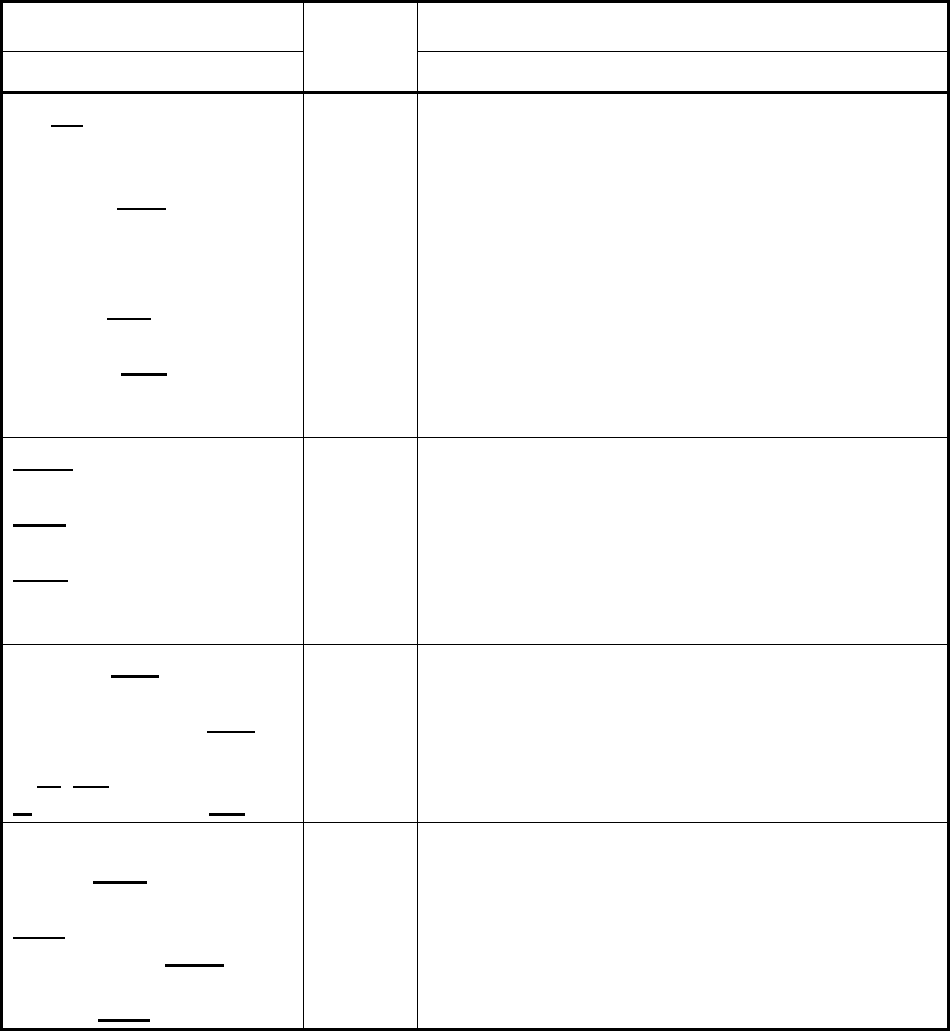

Figure 6-4 Select a Root Element – Return Data

You now have an XMLSpy generated XML data structure for ReturnData with all potential

parts in a return.

Step 2.2 – Validate ReturnData

1. Edit the data in ReturnData as you see fit

2. Validate the ReturnData if necessary

a. Clicking on the button on the tool bar or F8

Here is the final OriginHeaders data structure

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: MyUniqueOrigItemID001

<?xml version="1.0" encoding="UTF-8"?>

<ReturnData xmlns="http://www.irs.gov/efile"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xsi:schemaLocation="http://www.irs.gov/efile

..\94x\ReturnData940PR.xsd" documentCount="3">

<ContentLocation> MyUniqueOrigItemID001</ContentLocation>

36

<ReturnHeader94x documentId="1">

<ElectronicPostmark>2001-12-17T09:30:47Z</ElectronicPostmark>

<TaxPeriodEndDate>1967-08-13</TaxPeriodEndDate>

<DisasterRelief>!</DisasterRelief>

<ISPNumber>000000</ISPNumber>

<PreparerFirm>

<EIN>000000000</EIN>

<BusinessName1>Business Name 1</BusinessName1>

<BusinessName2>Business Name 1</BusinessName2>

<Address1>Address Name 1</Address1>

<Address2>Address Name 2</Address2>

<City>City Name</City>

<State>State Name</State>

<ZIPCode>00000</ZIPCode>

</PreparerFirm>

<SoftwareId>00000000</SoftwareId>

<ReturnType>940PR</ReturnType>

<Business>

<EIN>000000000</EIN>

<BusinessName1>Business Name 1</BusinessName1>

<BusinessName2>Business Name 1</BusinessName2>

<BusinessNameControl>Business Name Control</BusinessNameControl>

<InCareOfNameLine>% In Care Of Name Line</InCareOfNameLine>

<USAddress>

<AddressLine>Address Line</AddressLine>

<City>City Name</City>

<State>State Name</State>

<ZIPCode>00000</ZIPCode>

</USAddress>

<AddressChange>X</AddressChange>

</Business>

<Preparer>

<Name>Preparer Name</Name>

<PTIN>P00000000</PTIN>

<Phone>0000000000</Phone>

<EmailAddress>EmailName@hostname</EmailAddress>

<SelfEmployed>X</SelfEmployed>

</Preparer>

<ReturnSigner>

<Name>Return Signer Name</Name>

<Title>Title</Title>

<Phone>0000000000</Phone>

<EmailAddress>EmailName@hostName</EmailAddress>

<Signature>0000000000</Signature>

<DateSigned>1967-08-13</DateSigned>

</ReturnSigner>

<ThirdPartyAuthorization>

<AuthorizeThirdParty>X</AuthorizeThirdParty>

<DesigneeName>Designee Name</DesigneeName>

<DesigneePhone>0000000000</DesigneePhone>

<DPIN>00000</DPIN>

</ThirdPartyAuthorization>

</ReturnHeader94x>

<IRS940PR documentId="2">

<SuccessorEmployer>X</SuccessorEmployer>

37

<MultiStateContribution>X</MultiStateContribution>

<CreditReduction>X</CreditReduction>

<TotalWages>0.00</TotalWages>

<ExemptWages>

<ExemptWagesAmt>0.00</ExemptWagesAmt>

<ExemptionCategory>

<FringeBenefits>X</FringeBenefits>

<GroupTermLifeIns>X</GroupTermLifeIns>

<RetirementPension>X</RetirementPension>

<DependentCare>X</DependentCare>

<OtherExemption>X</OtherExemption>

</ExemptionCategory>

</ExemptWages>

<WagesOverLimitAmt>0.00</WagesOverLimitAmt>

<TotalExemptWagesAmt>0.00</TotalExemptWagesAmt>

<TotalTaxableWagesAmt>0.00</TotalTaxableWagesAmt>

<FUTATaxBeforeAdjustmentsAmt>0.00</FUTATaxBeforeAdjustmentsAmt>

<AdjustmentsToFUTATax>

<FUTAAdjustmentAmt>0.0</FUTAAdjustmentAmt>

<CreditReductionAmt>0.0</CreditReductionAmt>

</AdjustmentsToFUTATax>

<FUTATaxAfterAdjustments>0.00</FUTATaxAfterAdjustments>

<TotalTaxDepositedAmt>0.00</TotalTaxDepositedAmt>

<BalanceDue>0.00</BalanceDue>

<Quarter1LiabilityAmt>0.00</Quarter1LiabilityAmt>

<Quarter2LiabilityAmt>0.00</Quarter2LiabilityAmt>

<Quarter3LiabilityAmt>0.00</Quarter3LiabilityAmt>

<Quarter4LiabilityAmt>0.00</Quarter4LiabilityAmt>

<TotalYearLiabilityAmt>0.00</TotalYearLiabilityAmt>

</IRS940PR>

<IRS940ScheduleA documentId="3">

<MultiStateCode>XX</MultiStateCode>

<MultiStateCode>XX</MultiStateCode>

<CreditReductionGroup>

<StateCreditReductionGroup>

<CreditReductionStateCode>XX</CreditReductionStateCode>

<CreditReductionWagesAmt>0.0</CreditReductionWagesAmt>

<CreditReductionAmt>0.0</CreditReductionAmt>

</StateCreditReductionGroup>

<StateCreditReductionGroup>

<CreditReductionStateCode>XX</CreditReductionStateCode>

<CreditReductionWagesAmt>0.0</CreditReductionWagesAmt>

<CreditReductionAmt>0.0</CreditReductionAmt>

</StateCreditReductionGroup>

<StateCreditReductionGroup>

<CreditReductionStateCode>XX</CreditReductionStateCode>

<CreditReductionWagesAmt>0.0</CreditReductionWagesAmt>

<CreditReductionAmt>0.0</CreditReductionAmt>

</StateCreditReductionGroup>

<StateCreditReductionGroup>

<CreditReductionStateCode>XX</CreditReductionStateCode>

<CreditReductionWagesAmt>0.0</CreditReductionWagesAmt>

<CreditReductionAmt>0.0</CreditReductionAmt>

</StateCreditReductionGroup>

<TotalCreditReductionWages>0.0</TotalCreditReductionWages>

38

<TotalCreditReductionAmt>0.0</TotalCreditReductionAmt>

</CreditReductionGroup>

</IRS940ScheduleA>

</ReturnData>

Step 2.3 – Duplicate ReturnData

Duplicate the ReturnData structure 3 times to create a sequence of 4 separate ReturnData

structures.

Edit the data in ReturnData as you see fit.

Make sure all instances of the attribute contentLocation in the OriginManifest of the

ReturnOriginHeader match one referenced element ContentLocation in each

ReturnData. The ContentLocation must be unique within the transmission file.

Edit the documentId attribute for each return document in ReturnData. The documentId

must be unique within the return.

Step 3 – Create 94x Return Transmission File

Now that you have the validated Transmission Envelope and the ReturnData MIME parts, you

are ready to put it all together.

The complete 94x return transmission file is shown below in its entirety:

MIME-Version: 1.0

Content-Type: Multipart/Related; boundary=MIME94xBoundary; type=text/xml;

X-eFileRoutingCode: 94x

--MIME94xBoundary

Content-Type: text/xml; charset=UTF-8

Content-Transfer-Encoding: 8bit

Content-Location: Envelope94x

<?xml version="1.0" encoding="UTF-8"?>

<SOAP:Envelope xmlns="http://www.irs.gov/efile"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xmlns:SOAP="http://schemas.xmlsoap.org/soap/envelope/"

xmlns:efile="http://www.irs.gov/efile"