Publication 4163 (Rev. 12 2017) P4163

User Manual: 4163

Open the PDF directly: View PDF ![]() .

.

Page Count: 123 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- Table of Contents

- List of Tables

- List of Figures

- 1 Introduction and General Information

- 1.1 What is Modernized e-File (MeF)?

- 1.2 Using Publication 4163

- 1.3 General Information

- 1.4 Authorized IRS e-File Providers

- 1.4.1 Electronic Filing Identification Numbers (EFINs), Electronic Transmitter Identification Numbers (ETINs), and Passwords

- 1.4.2 Electronic Return Originator (ERO)

- 1.4.3 Transmitter

- 1.4.4 Software Developer

- 1.4.5 Online Provider

- 1.4.6 Intermediate Service Provider (ISP)

- 1.4.7 Reporting Agent

- 1.4.8 Large Taxpayer

- 1.5 Communicating with IRS

- 1.6 Overview and Benefits of Modernized e-File (MeF)

- 1.7 New for Processing Year 2018

- 1.8 Forms for Processing Year 2018

- 1.9 Preparer Tax Identification Number (PTIN) Procedures

- 1.10 Tax Relief in Disaster Situations

- 1.11 The Requirement to e-File

- 2 MeF Rules and Requirements

- 2.1 Participating in the IRS e-File Program

- 2.2 Maintaining Your IRS e-File Application

- 2.3 Adherence to MeF Rules

- 2.4 Protecting Taxpayer Information: Gramm-Leach-Bliley Act of 1999 and Federal Trade Commission Rules

- 2.5 Safeguarding MeF Data from Fraud and Abuse

- 2.6 Disclosure of Tax Return Information

- 2.7 Submitting a Timely-Filed Electronic Tax Return

- 2.8 Preparer Penalties

- 2.9 Paperwork Reduction Act Notice

- 2.10 Provider Responsibilities in Obtaining, Handling, and Processing Return Information

- 3 MeF Information Applicable to All Form Types

- 3.1 Preparing Your Return

- 3.2 Validating Your Return

- 3.3 Return/Extension Due Date Tables

- 3.4 Short Period Returns for Corporate, Partnership and Estate and Trust Tax Returns

- 3.4.1 Current Year Software is Available

- 3.4.2 Current Year Software is Not Available

- 3.4.3 Valid Reasons for Forms 1041 Short Period Returns

- 3.4.4 Valid Reasons for Forms 1120 or 1120-F Short Period Returns

- 3.4.5 Valid Reasons for Form 1120S Short Period Returns

- 3.4.6 Forms 1065 and 1065-B Technical Termination Returns

- 3.5 Superseding and Amended Returns

- 3.6 Signing an Electronic Return

- 3.6.1 Practitioner Personal Identification Number (PIN) Signature Method—Form 8879

- 3.6.2 Form 1041 Multiple Tax Return Listing (MTRL)

- 3.6.3 Scanned Form 8453 Signature Method

- 3.6.4 Reporting Agents Personal Identification Number (PIN) Signature Method—Form 8655

- 3.6.5 94x On-Line e-Filer Signature Method (IRS Authorized Signer)

- 3.7 Applications for Extension of Time to File—Forms 7004 and 8868

- 3.8 Other Forms and Elections Requiring Signatures

- 3.9 Attaching Portable Document Format (.pdf) Files

- 3.10 Special Instructions for Supporting Data Required by Form 8865

- 3.11 Name Controls

- 3.12 Addresses

- 3.13 North American Industry Classification System (NAICS) Codes

- 3.14 Refunds

- 3.15 Payments

- 3.16 Special Instructions When Copies of Original Forms are Required

- 3.17 Submitting the Electronic Return to the IRS

- 3.18 Record Keeping and Documentation Requirements

- 3.19 Acknowledgements of Transmitted Return Data

- 3.20 Transmission Perfection Period

- 3.21 Rejected e-Filed Returns

- 3.22 Integrating Data/Elections into Your Return

- 3.23 Preparing Supporting Data Required by IRS Forms or Form Instructions

- 3.24 General Dependency

- 3.25 Creating Elections Required by Forms or Form Instructions

- 3.26 Creating Elections/Disclosure Statements Required by Regulations or Publications

- 3.27 Preparing Elections and/or Disclosure Statements That Require Supporting Data

- 3.28 Electronic Postmark

- 3.29 MeF Routine Maintenance

- 3.30 Ensuring Taxpayer Data Integrity

- 3.31 MeF Fed/State Program

- 4 MeF Information for Specific Forms

- 4.1 Employment Tax Returns

- 4.2 Tax-Exempt Organization Returns

- 4.3 Estate and Trusts

- 4.4 Partnership Returns

- 4.5 Corporate Returns

- 4.5.1 1120 Family Forms that cannot be e-filed as a Stand-Alone Return at the Parent Level

- 4.5.2 Special Instructions for Form 1120 Section 847, Special Estimated Tax Payments

- 4.5.3 Special Instructions for Form 8838 When Filed With Form 1120

- 4.5.4 Special Instructions for Form 1120-F when Foreign Investment in Real Property Tax is Claimed

- 4.6 Application for Automatic Extension of Time to File Certain Business Income Tax, Information and Other Returns—Form 7004

- 4.7 Application for Extension of Time to File an Exempt Organization Return—Form 8868

- 4.8 Excise Tax e-File and Compliance (ETEC)

- 4.9 Return Due Dates

- 4.10 Accepted Forms and Schedules

- 5 IRS e-File for Large Taxpayers Filing Their Own Corporate Income Tax Return

- 5.1 Purpose of Section 5

- 5.2 Why Certain Large Taxpayers are Required to e-File

- 5.3 How to Meet the Requirement to e-File

- 5.4 How to Register and Apply to e-file as a Large Taxpayer

- 5.5 What is Different in Preparing Returns to e-File

- 5.5.1 Traditional Paper Filing Process

- 5.5.2 MeF Filing Process

- 5.5.3 Consolidated Returns

- 5.5.4 Aggregation of Data from Different Sources

- 5.5.5 Attaching Data Not Defined in XML Schemas

- 5.5.6 Attaching Data in PDF Format

- 5.5.7 Treasury Decision (T.D.) 9300 - Eliminating Signature Requirements for Certain Forms

- 5.5.8 Return Address and Name Control

- 5.5.9 Signing the Electronic Return

- 5.6 How to Transmit Electronic Returns to the IRS

- 5.7 Timely Filed Electronic Returns

- 5.8 Additional Resources

- 6 Exhibits

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Publication 4163

Modernized e-File (MeF)

Information for Authorized

IRS e-File Providers for

Business Returns

Tax Returns

Processed in 2018

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

The Internal Revenue Service Mission

Provide America’s taxpayers top quality service by helping them

understand and meet their tax responsibilities and by applying the tax

law with integrity and fairness to all.

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Table of Contents

Table of Contents ....................................................................................................................................... iii

List of Tables ............................................................................................................................................... x

List of Figures ............................................................................................................................................ xi

Processing Year 2018 Nature of Substantive Changes ........................................................................ xii

1 Introduction and General Information .............................................................................................. 1

1.1 What is Modernized e-File (MeF)? ................................................................................................... 1

1.2 Using Publication 4163 .................................................................................................................... 1

1.3 General Information ......................................................................................................................... 1

1.4 Authorized IRS e-File Providers ....................................................................................................... 1

1.4.1 Electronic Filing Identification Numbers (EFINs), Electronic Transmitter Identification

Numbers (ETINs), and Passwords ....................................................................................................... 2

1.4.2 Electronic Return Originator (ERO) ......................................................................................... 2

1.4.3 Transmitter .............................................................................................................................. 3

1.4.4 Software Developer ................................................................................................................. 4

1.4.5 Online Provider ........................................................................................................................ 5

1.4.6 Intermediate Service Provider (ISP) ........................................................................................ 6

1.4.7 Reporting Agent ....................................................................................................................... 6

1.4.8 Large Taxpayer ....................................................................................................................... 6

1.5 Communicating with IRS .................................................................................................................. 7

1.5.1 Modernized e-File (MeF) Status Page .................................................................................... 7

1.5.2 Helpful Publications and Information ....................................................................................... 8

1.6 Overview and Benefits of Modernized e-File (MeF) ...................................................................... 11

1.7 New for Processing Year 2018 ...................................................................................................... 12

1.7.1 Forms..................................................................................................................................... 12

1.7.2 Processes and Procedures ................................................................................................... 12

1.8 Forms for Processing Year 2018 ................................................................................................... 13

1.8.1 Corporation Returns .............................................................................................................. 13

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

1.8.2 Employment Tax Returns ...................................................................................................... 13

1.8.3 Estate and Trust Returns....................................................................................................... 14

1.8.4 Excise Tax and e-filing Compliance Returns (ETEC) ........................................................... 14

1.8.5 Extension Applications .......................................................................................................... 14

1.8.6 Partnership Returns ............................................................................................................... 14

1.8.7 Tax Exempt/Government Entity (TEGE) Returns ................................................................. 14

1.9 Preparer Tax Identification Number (PTIN) Procedures ................................................................ 14

1.10 Tax Relief in Disaster Situations .................................................................................................... 15

1.11 The Requirement to e-File ............................................................................................................. 15

1.11.1 Large Business and International (LB&I) Corporations ......................................................... 15

1.11.2 Employment Tax Returns ...................................................................................................... 15

1.11.3 Estates and Trusts ................................................................................................................. 15

1.11.4 Excise Tax Returns ............................................................................................................... 16

1.11.5 Partnerships .......................................................................................................................... 16

1.11.6 Tax Exempt/Government Entities (TEGE) ............................................................................ 16

2 MeF Rules and Requirements ......................................................................................................... 17

2.1 Participating in the IRS e-File Program .......................................................................................... 17

2.2 Maintaining Your IRS e-File Application ........................................................................................ 18

2.3 Adherence to MeF Rules ............................................................................................................... 18

2.4 Protecting Taxpayer Information: Gramm-Leach-Bliley Act of 1999 and Federal Trade

Commission Rules .................................................................................................................................. 19

2.5 Safeguarding MeF Data from Fraud and Abuse ............................................................................ 20

2.5.1 Safeguarding Taxpayer Information ...................................................................................... 20

2.5.2 Safeguarding Against Fraud and Abuse ............................................................................... 20

2.6 Disclosure of Tax Return Information ............................................................................................ 20

2.7 Submitting a Timely-Filed Electronic Tax Return ........................................................................... 21

2.8 Preparer Penalties ......................................................................................................................... 21

2.9 Paperwork Reduction Act Notice ................................................................................................... 22

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

2.10 Provider Responsibilities in Obtaining, Handling, and Processing Return Information ................ 22

2.10.1 Making Substantive Changes to the Return .......................................................................... 22

2.10.2 Providing a Copy of the Return to the Taxpayer ................................................................... 23

3 MeF Information Applicable to All Form Types ............................................................................. 23

3.1 Preparing Your Return ................................................................................................................... 23

3.2 Validating Your Return ................................................................................................................... 24

3.3 Return/Extension Due Date Tables ............................................................................................... 24

3.4 Short Period Returns for Corporate, Partnership and Estate and Trust Tax Returns ................... 24

3.4.1 Current Year Software is Available ....................................................................................... 24

3.4.2 Current Year Software is Not Available ................................................................................. 25

3.4.3 Valid Reasons for Forms 1041 Short Period Returns ........................................................... 26

3.4.4 Valid Reasons for Forms 1120 or 1120-F Short Period Returns .......................................... 26

3.4.5 Valid Reasons for Form 1120S Short Period Returns .......................................................... 27

3.4.6 Forms 1065 and 1065-B Technical Termination Returns ..................................................... 27

3.5 Superseding and Amended Returns .............................................................................................. 27

3.5.1 Superseding Returns ............................................................................................................. 28

3.5.2 Amended Returns .................................................................................................................. 29

3.5.3 Form 2290 VIN Correction .................................................................................................... 30

3.6 Signing an Electronic Return ......................................................................................................... 31

3.6.1 Practitioner Personal Identification Number (PIN) Signature Method—Form 8879 .............. 31

3.6.2 Form 1041 Multiple Tax Return Listing (MTRL) .................................................................... 33

3.6.3 Scanned Form 8453 Signature Method ................................................................................ 33

3.6.4 Reporting Agents Personal Identification Number (PIN) Signature Method—Form 8655 .... 35

3.6.5 94x On-Line e-Filer Signature Method (IRS Authorized Signer) ........................................... 36

3.7 Applications for Extension of Time to File—Forms 7004 and 8868 ............................................... 37

3.8 Other Forms and Elections Requiring Signatures ......................................................................... 38

3.8.1 Signature Requirements for Elections ................................................................................... 38

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

3.9 Attaching Portable Document Format (.pdf) Files .......................................................................... 38

3.10 Special Instructions for Supporting Data Required by Form 8865 ................................................ 39

3.11 Name Controls ............................................................................................................................... 39

3.11.1 Form 1041 Name Control Information ................................................................................... 43

3.12 Addresses ...................................................................................................................................... 46

3.12.1 Domestic Address Changes .................................................................................................. 46

3.12.2 Foreign Addresses ................................................................................................................ 47

3.12.3 Address Format ..................................................................................................................... 48

3.12.4 Foreign Country Codes for Forms 8858 and 926 .................................................................. 49

3.13 North American Industry Classification System (NAICS) Codes ................................................... 50

3.14 Refunds .......................................................................................................................................... 50

3.15 Payments ....................................................................................................................................... 51

3.15.1 General Payment Information ............................................................................................... 51

3.15.2 Electronic Funds Withdrawal (EFW) ..................................................................................... 51

3.15.3 Electronic Federal Tax Payment System (EFTPS) ............................................................... 54

3.15.4 Check or Money Order .......................................................................................................... 54

3.16 Special Instructions When Copies of Original Forms are Required .............................................. 54

3.17 Submitting the Electronic Return to the IRS .................................................................................. 55

3.18 Record Keeping and Documentation Requirements ..................................................................... 55

3.19 Acknowledgements of Transmitted Return Data ........................................................................... 56

3.19.1 Acknowledgement Alerts for Form 1120-F ............................................................................ 57

3.20 Transmission Perfection Period ..................................................................................................... 57

3.20.1 How to Determine IRS Received Date .................................................................................. 58

3.21 Rejected e-Filed Returns ............................................................................................................... 59

3.21.1 Resubmission of Rejected Applications for Filing Extensions............................................... 61

3.22 Integrating Data/Elections into Your Return................................................................................... 61

3.22.1 Special Instructions for Consolidated Returns ...................................................................... 61

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

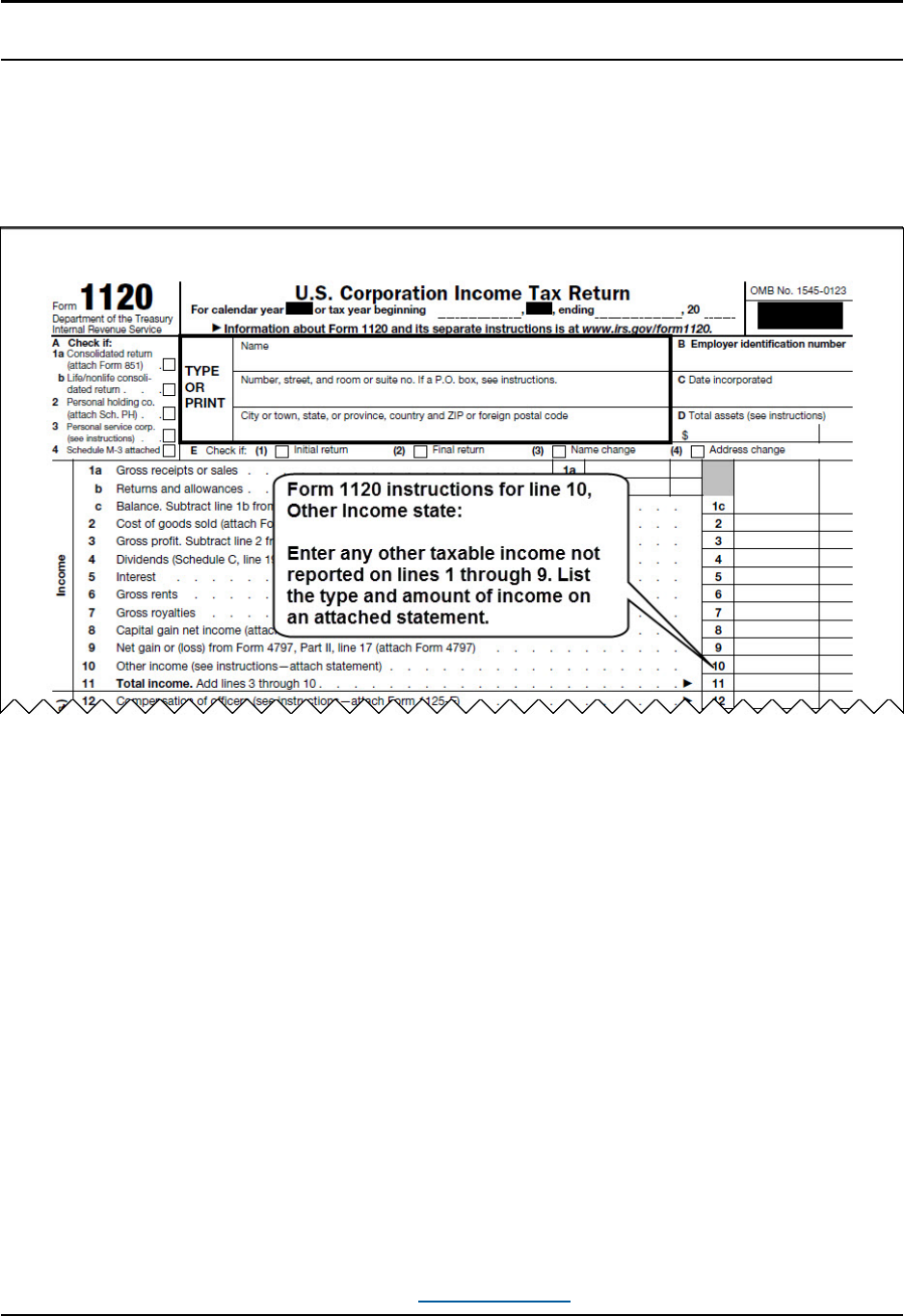

3.23 Preparing Supporting Data Required by IRS Forms or Form Instructions .................................... 66

3.23.1 Example 1—Supporting data required by IRS forms ............................................................ 67

3.23.2 Example 2—Supporting data required by IRS form instructions. .......................................... 68

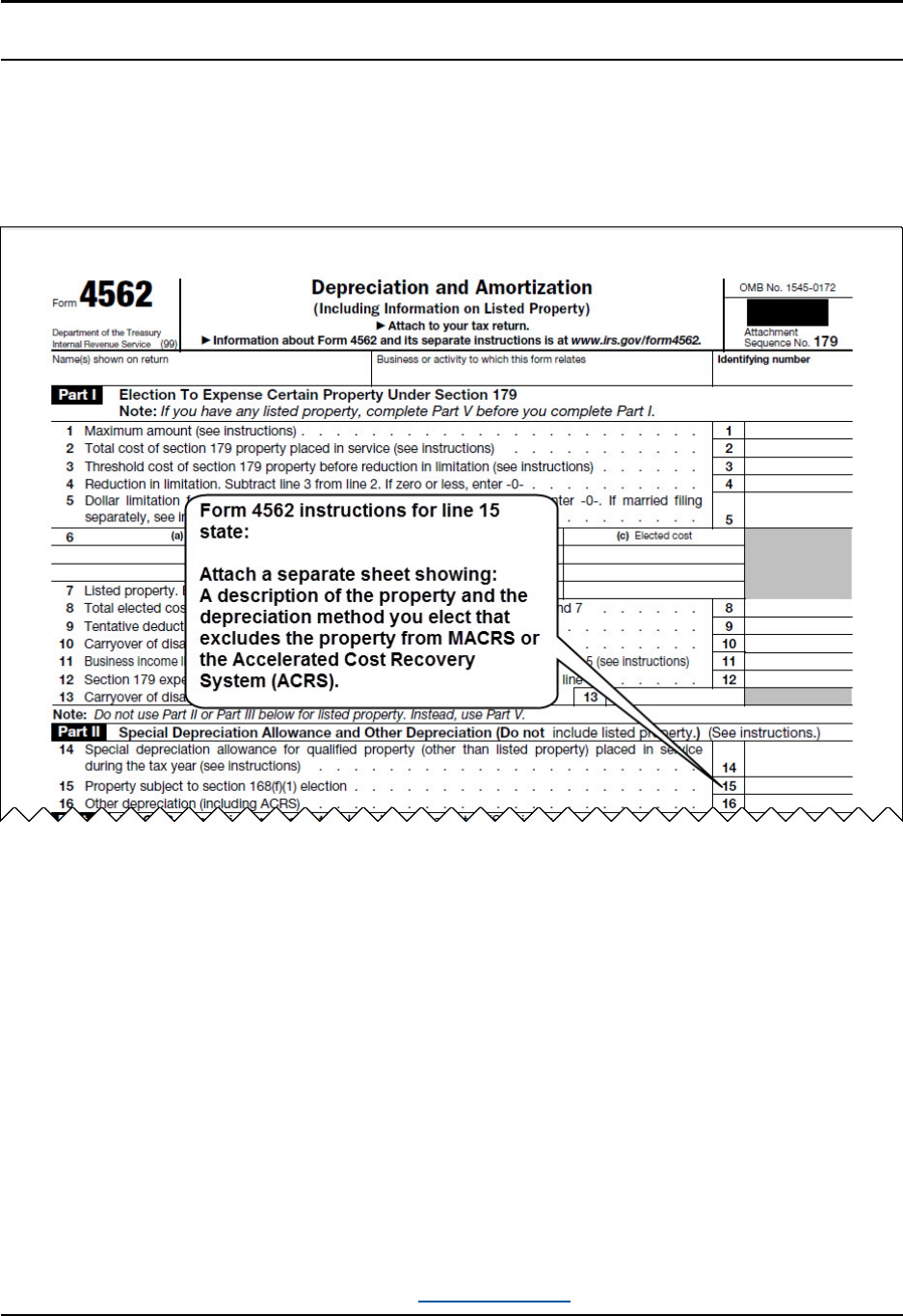

3.23.3 Example 3—Supporting data required as another IRS form ................................................. 69

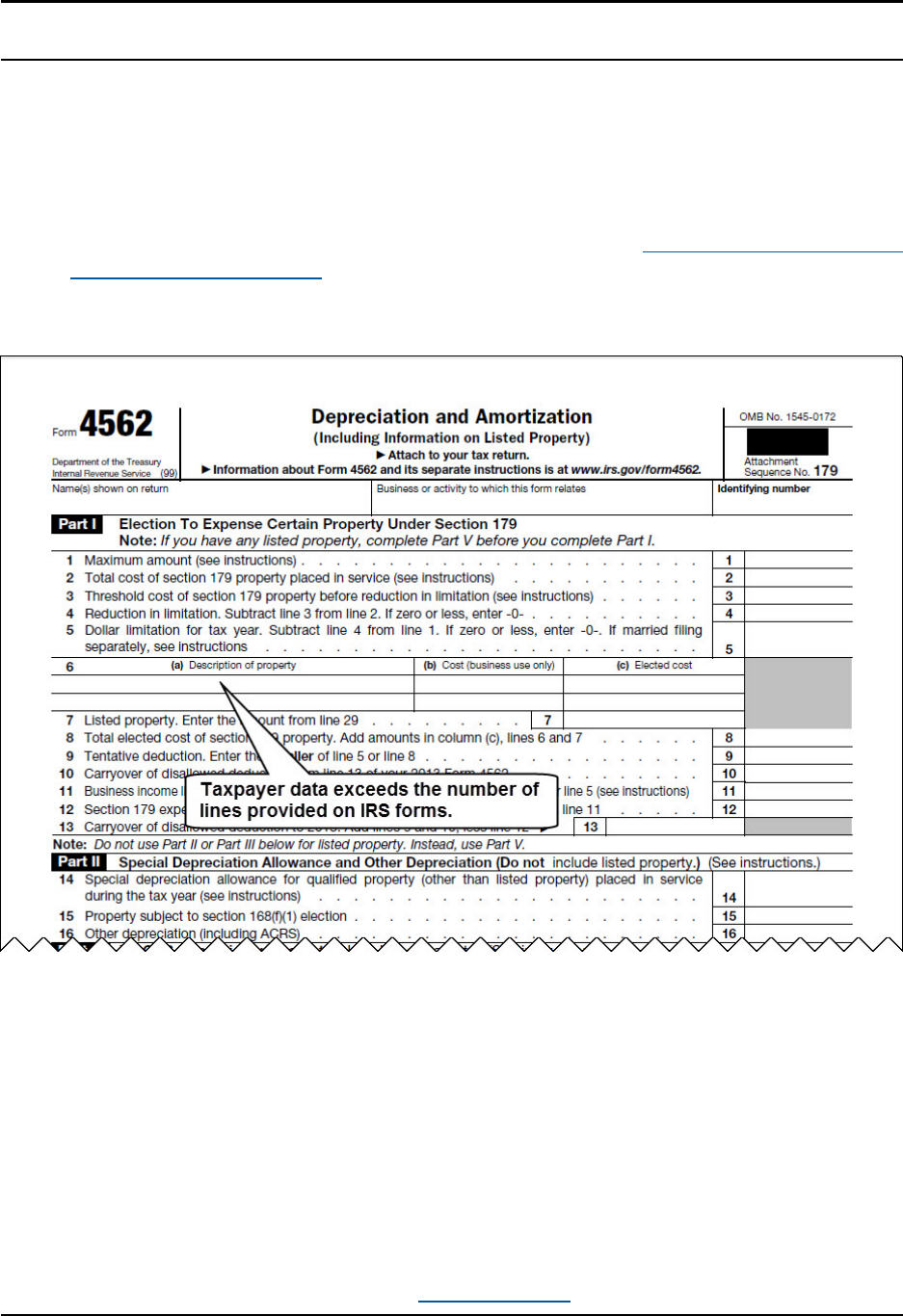

3.23.4 Example 4—Supporting data required for tables on IRS forms ............................................ 70

3.24 General Dependency ..................................................................................................................... 71

3.24.1 The Element “SpecialConditionDesc” ................................................................................... 72

3.25 Creating Elections Required by Forms or Form Instructions ......................................................... 72

3.26 Creating Elections/Disclosure Statements Required by Regulations or Publications ................... 72

3.26.1 Example 1—Creating Elections and/or Disclosure Statements With No Columnar Data ..... 73

3.26.2 Example 2—Creating Elections and/or Disclosure Statements That Apply to Multiple

Subsidiaries ........................................................................................................................................ 74

3.26.3 Example 3—Creating Elections and/or Disclosure Statements With Columnar Data........... 74

3.27 Preparing Elections and/or Disclosure Statements That Require Supporting Data ...................... 75

3.28 Electronic Postmark ....................................................................................................................... 75

3.29 MeF Routine Maintenance ............................................................................................................. 76

3.30 Ensuring Taxpayer Data Integrity .................................................................................................. 77

3.31 MeF Fed/State Program................................................................................................................. 77

4 MeF Information for Specific Forms ............................................................................................... 79

4.1 Employment Tax Returns............................................................................................................... 79

4.2 Tax-Exempt Organization Returns ................................................................................................. 79

4.2.1 TY 2017, 2016, 2015 Form 990-N (e-Postcard) .................................................................... 81

4.3 Estate and Trusts ........................................................................................................................... 81

4.4 Partnership Returns ....................................................................................................................... 82

4.5 Corporate Returns .......................................................................................................................... 82

4.5.1 1120 Family Forms that cannot be e-filed as a Stand-Alone Return at the Parent Level ..... 82

4.5.2 Special Instructions for Form 1120 Section 847, Special Estimated Tax Payments ............ 83

4.5.3 Special Instructions for Form 8838 When Filed With Form 1120 ......................................... 83

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

4.5.4 Special Instructions for Form 1120-F when Foreign Investment in Real Property Tax is

Claimed............................................................................................................................................... 84

4.6 Application for Automatic Extension of Time to File Certain Business Income Tax, Information and

Other Returns—Form 7004 .................................................................................................................... 84

4.7 Application for Extension of Time to File an Exempt Organization Return—Form 8868 ............... 85

4.8 Excise Tax e-File and Compliance (ETEC) ................................................................................... 86

4.8.1 ETEC Extension Requests: ................................................................................................... 86

4.9 Return Due Dates .......................................................................................................................... 86

4.10 Accepted Forms and Schedules .................................................................................................... 87

5 IRS e-File for Large Taxpayers Filing Their Own Corporate Income Tax Return ...................... 88

5.1 Purpose of Section 5 ...................................................................................................................... 88

5.2 Why Certain Large Taxpayers are Required to e-File ................................................................... 89

5.3 How to Meet the Requirement to e-File ......................................................................................... 90

5.4 How to Register and Apply to e-file as a Large Taxpayer ............................................................. 94

5.4.1 Register with E-Services ....................................................................................................... 94

5.4.2 Apply to e-File ........................................................................................................................ 94

5.5 What is Different in Preparing Returns to e-File ............................................................................ 97

5.5.1 Traditional Paper Filing Process ........................................................................................... 97

5.5.2 MeF Filing Process ................................................................................................................ 97

5.5.3 Consolidated Returns ............................................................................................................ 98

5.5.4 Aggregation of Data from Different Sources ......................................................................... 98

5.5.5 Attaching Data Not Defined in XML Schemas ...................................................................... 98

5.5.6 Attaching Data in PDF Format .............................................................................................. 99

5.5.7 Treasury Decision (T.D.) 9300 - Eliminating Signature Requirements for Certain Forms .. 100

5.5.8 Return Address and Name Control ..................................................................................... 100

5.5.9 Signing the Electronic Return .............................................................................................. 101

5.6 How to Transmit Electronic Returns to the IRS ........................................................................... 102

5.6.1 Transmission Channels ....................................................................................................... 102

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

5.6.2 Methods of Transmission .................................................................................................... 104

5.6.3 Retrieving an Acknowledgement ......................................................................................... 104

5.7 Timely Filed Electronic Returns ................................................................................................... 107

5.8 Additional Resources ................................................................................................................... 109

5.8.1 Publication 5078 .................................................................................................................. 109

5.8.2 Publication 4164 .................................................................................................................. 110

5.8.3 Frequently Asked Questions for Large and Mid-Size Corporations .................................... 110

5.8.4 Telephone Assistance Contacts for Business Customers .................................................. 110

5.8.5 E-Services – Online Tools for Tax Professionals ................................................................ 110

6 Exhibits ............................................................................................................................................ 110

Exhibit 1 Standard U.S. Postal Service State Abbreviations and ZIP Codes ................................ 110

Exhibit 2 Foreign Country Codes ................................................................................................... 110

Exhibit 3 Schemas and Business Rules ........................................................................................ 110

Exhibit 4 Recommended Names and Descriptions for PDF Files ................................................. 111

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

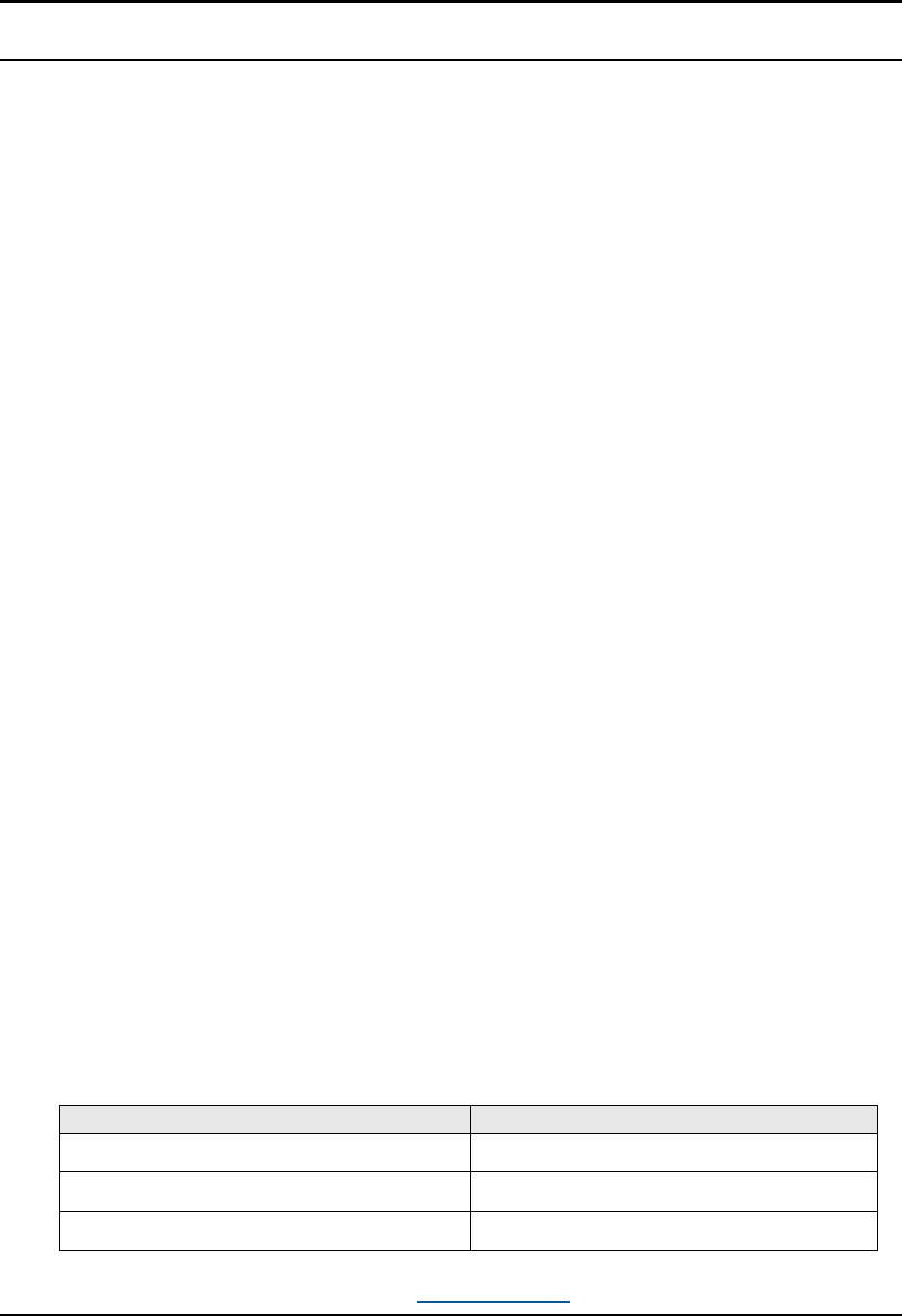

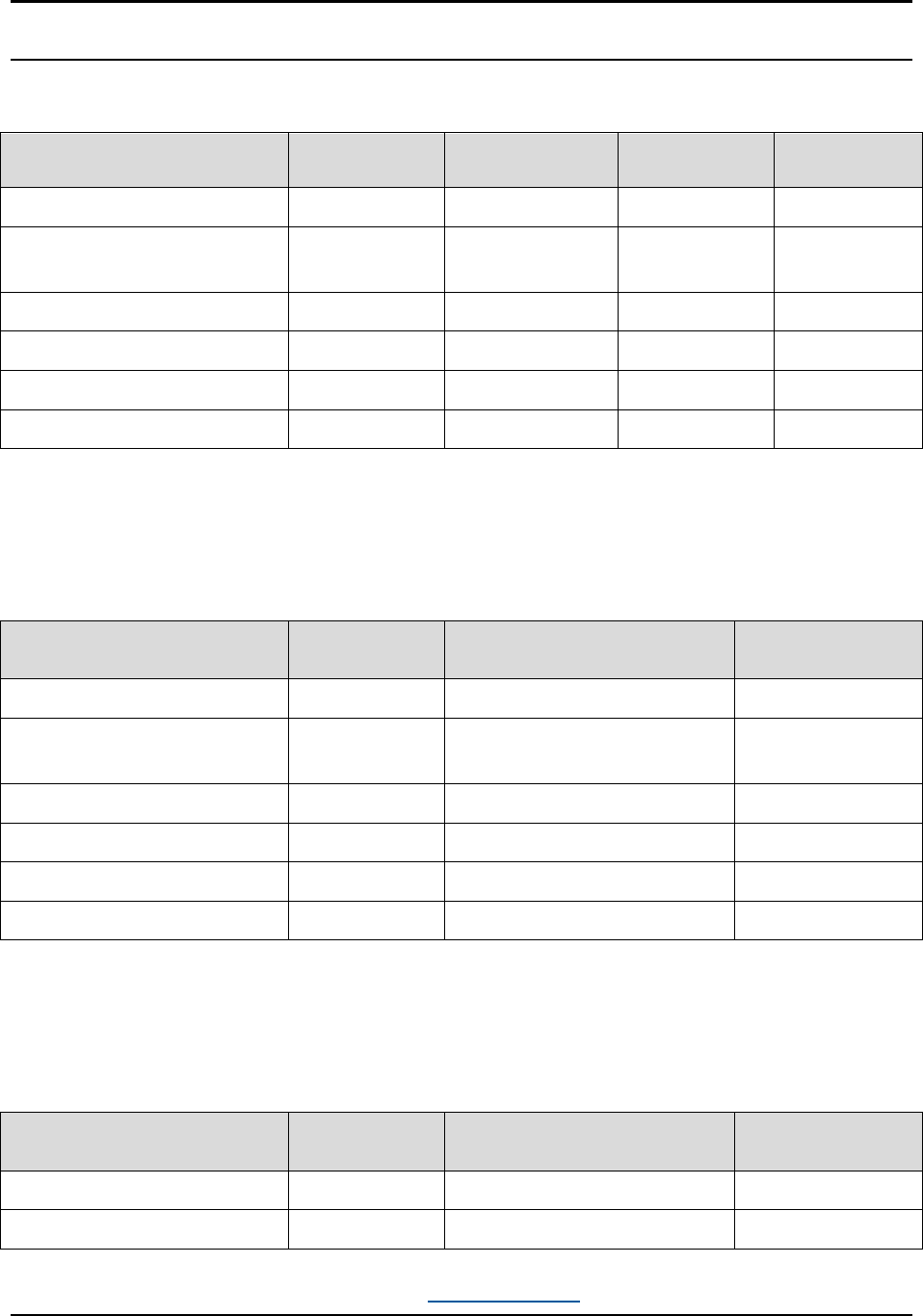

List of Tables

Table 1–1: MeF Information...................................................................................................................... 8

Table 1–2: Helpful Publications and Information ...................................................................................... 9

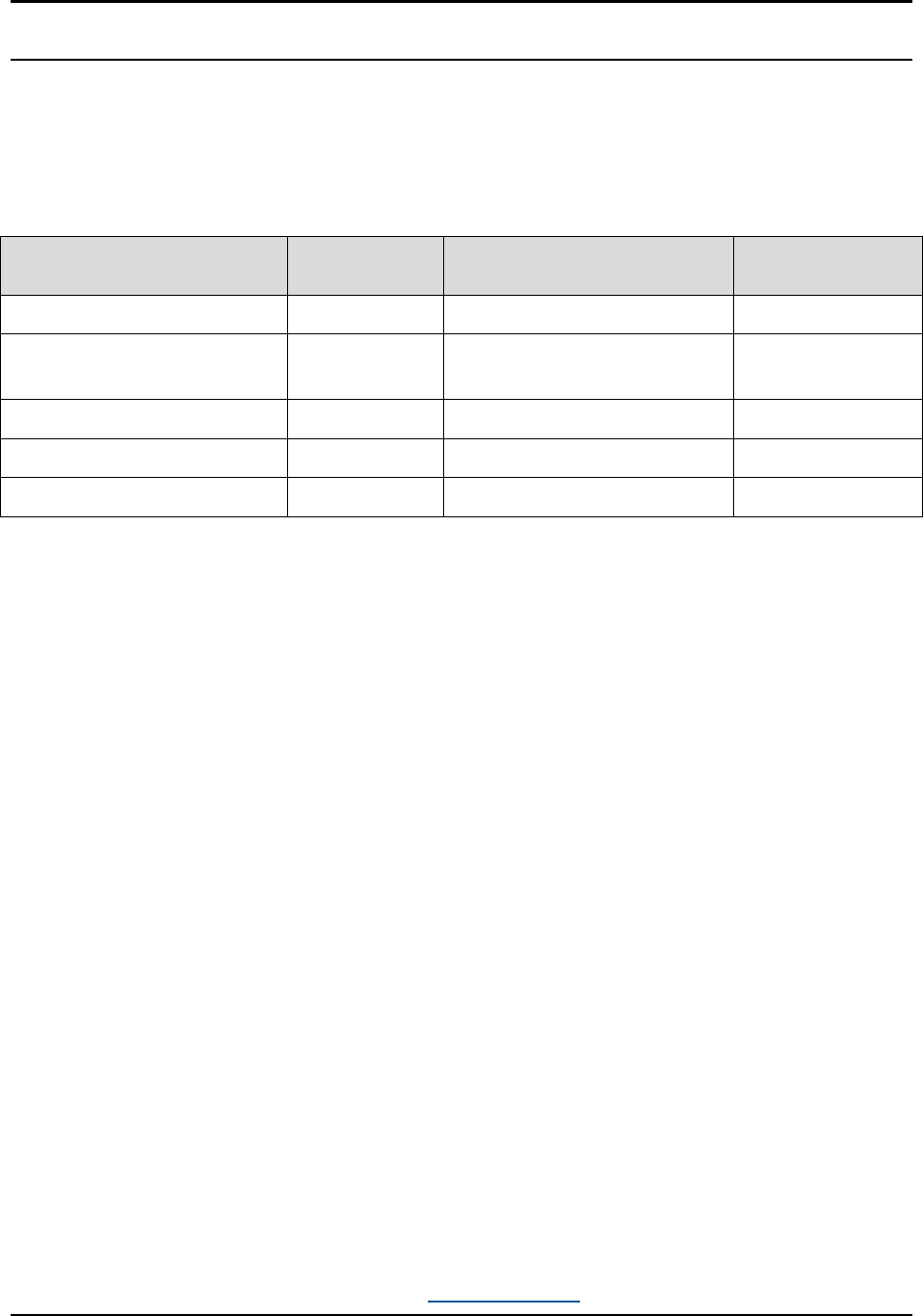

Table 3–1: Short Period Return Indicators ............................................................................................. 25

Table 3–2: Processed Superseding and Amended Returns .................................................................. 28

Table 3–3: PIN Signature Method Authorization Form ........................................................................... 33

Table 3–4: Scanned Form 8453 Method Authorization Form ................................................................ 35

Table 3–5: General Name Control Rules ............................................................................................... 40

Table 3–6: Name Control Rules for Partnerships ................................................................................... 42

Table 3–7: Additional Name Control Rules for Other Organizations ...................................................... 43

Table 3–8: Estate Name Controls .......................................................................................................... 44

Table 3–9: Trust Name Controls ............................................................................................................ 45

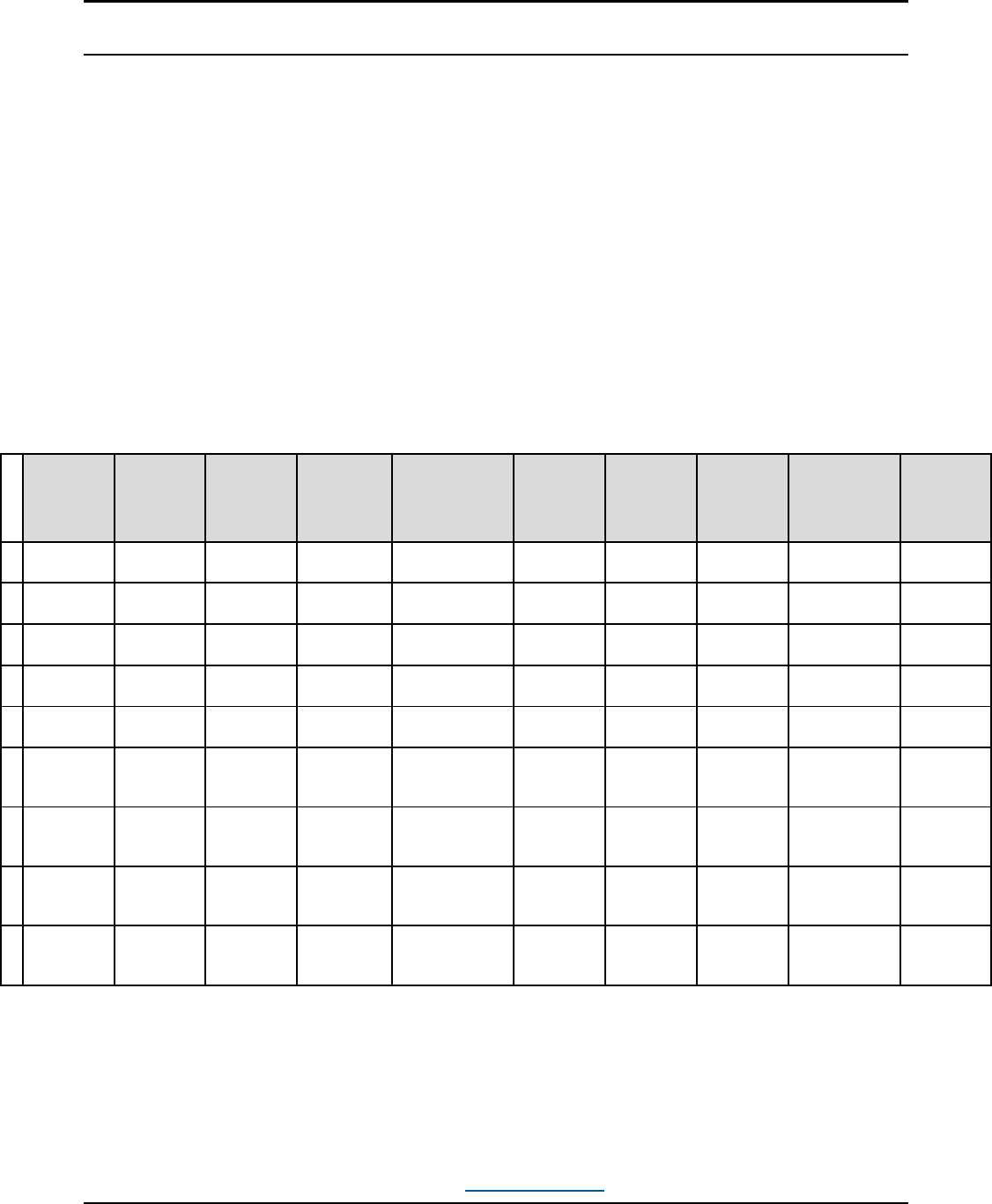

Table 3–10: Received Date Determination Chart ................................................................................... 58

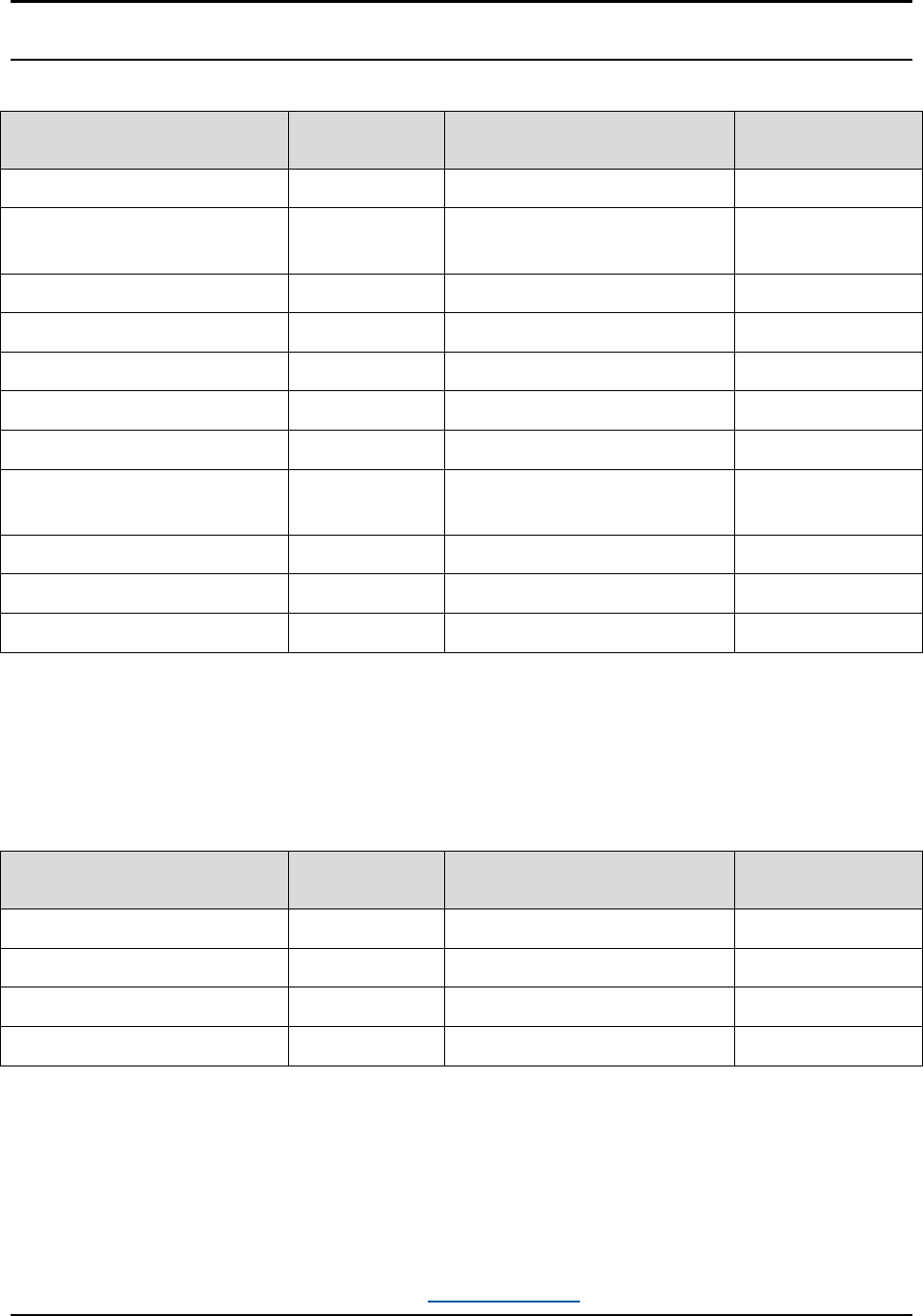

Table 3–11: Consolidated Return Example - Attachment 1, F1120, line 10, Other Income

(ItemizedOtherIncomeSchedule) ............................................................................................................ 63

Table 3–12: Consolidated Return Example - Subsidiary 1, Hide 'N Seek Foods, Inc. ........................... 63

Table 3–13: Consolidated Return Example - Subsidiary 2, The Greek Playhouse ............................... 63

Table 3–14: Consolidated Return Example - Subsidiary 3, Acme Food Corp. ...................................... 64

Table 3–15: Consolidated Return Example - Data Format 1 ................................................................. 65

Table 3–16: Consolidated Return Example - Data Format 2 ................................................................. 65

Table 3–17: Consolidated Return Example - Data Format 3 ................................................................. 66

Table 3–18: Examples of Elections Required by Form Instructions ....................................................... 72

Table 3–19: Example 1—Creating Elections and/or Disclosure Statements With No Columnar Data .. 73

Table 3–20: Example 2—Creating Elections and/or Disclosure Statements That Apply to Multiple

Subsidiaries ............................................................................................................................................ 74

Table 3–21: Example 3—Creating Elections and/or Disclosure Statements With Columnar Data........ 74

Table 4–1: Forms 8288-A and 8805 Special Instructions (FIRPTA Claims) .......................................... 84

Table 4–2: Return Due Dates ................................................................................................................. 87

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Table 4–3: Accepted Forms and Schedules........................................................................................... 87

Table 5–1: How to Meet the Requirements to E-File ............................................................................. 91

List of Figures

Figure 3–1: Supporting Data Required by IRS Forms ............................................................................ 67

Figure 3–2: Supporting Data Required by IRS Form Instructions .......................................................... 68

Figure 3–3: Supporting Data Required as Another IRS Form ................................................................ 69

Figure 3–4: Supporting Data Required for Tables on IRS Forms .......................................................... 70

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

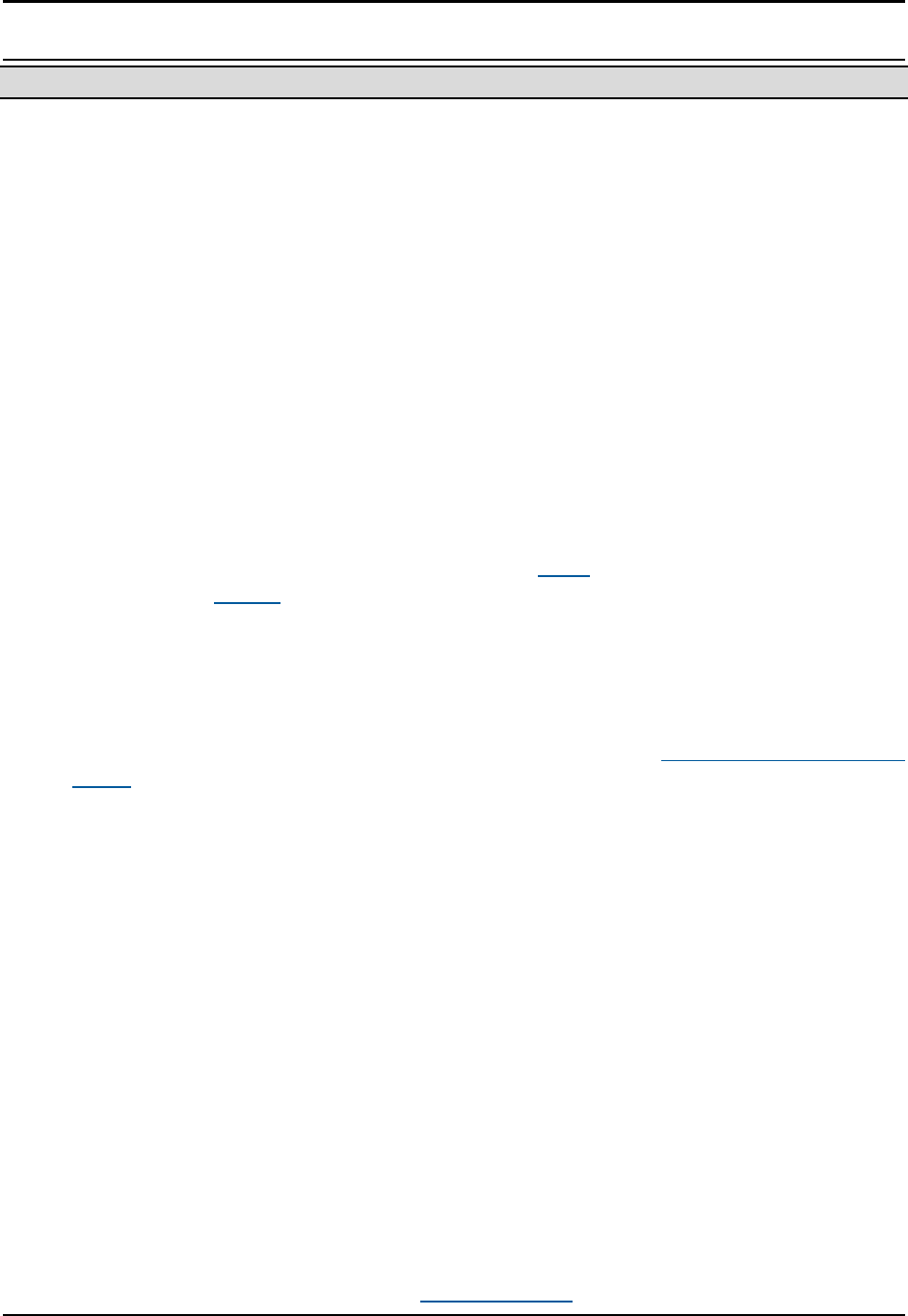

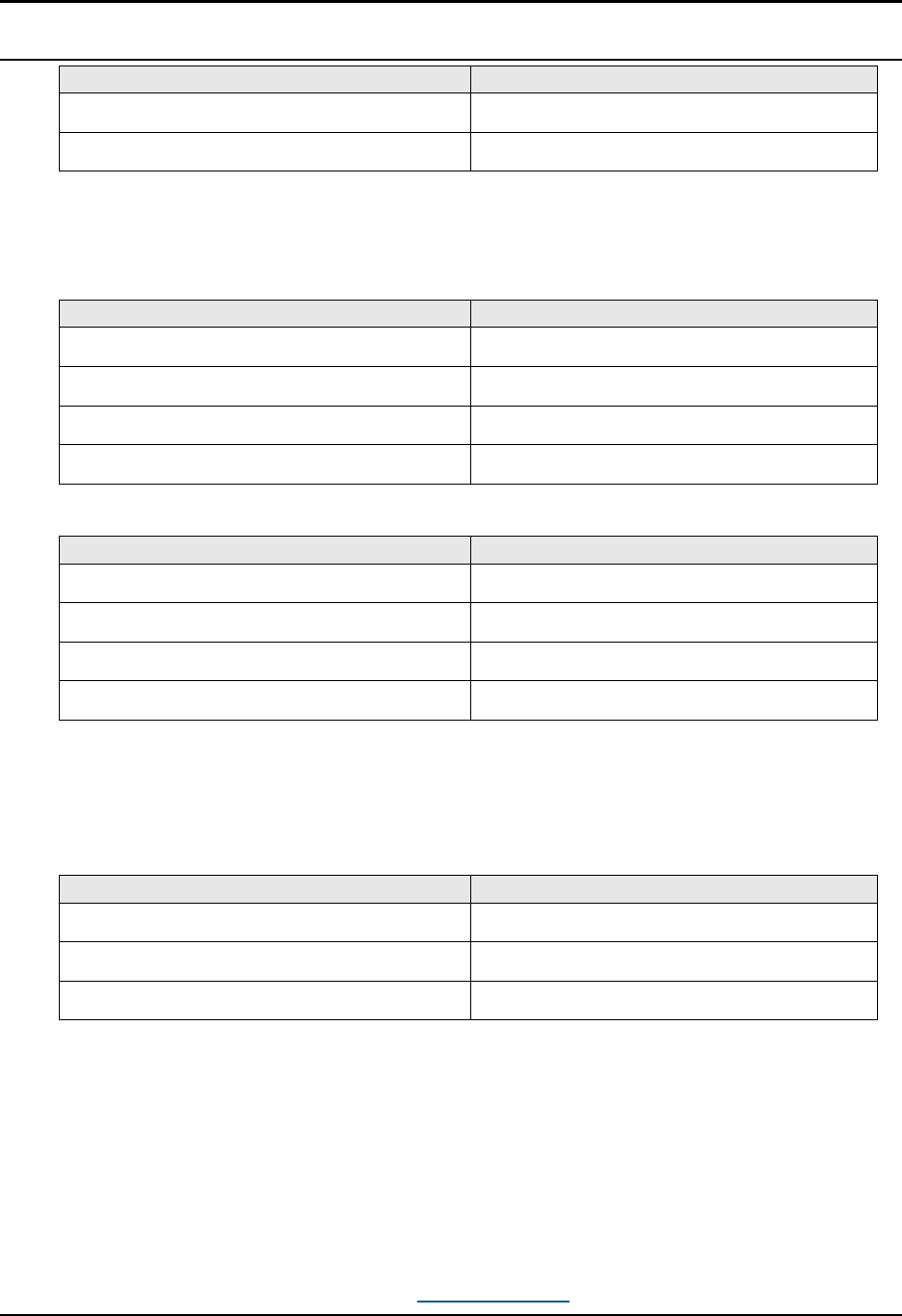

Processing Year 2018

Nature of Substantive Changes

Page

Change

All

This publication was updated to reflect tax returns processed in 2018; this

includes 2015, 2016 and 2017 tax returns, and a few 2018 tax year returns.

All

2014 tax year products were removed.

All

2017 and 2018 tax year products were added.

12

Added New forms for Processing Year 2018

12

Added information regarding filing requirements for Forms 8975 and 8975

Schedule A

12

Added information regarding Summer/Fall 2017 updates to e-Services affecting

e-Services users

Note: When reading this Publication “We” refers to the IRS, while “You” refers to the

reader.

Publication 4163 page 1

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

1 Introduction and General Information

1.1 What is Modernized e-File (MeF)?

Modernized e-File (MeF) is an important component of IRS re-engineering efforts to

improve service, enhance enforcement, and modernize technology and work processes.

It is an Internet-based system that uses standardized Extensible Mark-Up Language

(XML) constructs, which provide certain businesses the capability to electronically file.

MeF processes the following business forms: 720, 940, 940-PR, 941, 941-PR, 941-SS,

943, 943-PR, 944, 945, 94x On-Line Signature PIN Registration, 990, 990-EZ, 990-N,

990-PF, 1041, 1065, 1065-B, 1120, 1120-F, 1120-POL, 1120S, 2290, 7004, 8849, and

8868. Additional forms supported by MeF can be found at Modernized e-File (MeF)

Forms on IRS.gov.

1.2 Using Publication 4163

This document addresses Tax Years 2015, 2016, 2017 and some Tax Year 2018

business returns filed during 2018. Publication 4163 provides authorized IRS e-file

Providers and Large Taxpayers with specific requirements and procedures for electronic

filing through the MeF system. E-file instructions for Large Taxpayers filing their own

corporate income tax returns are included in Section 5 of this publication. The

procedures in this publication apply to all MeF business e-file programs. All publications

referenced in this document are available at Forms and Publications on IRS.gov. Be

sure to check the web page frequently for updated information on e-filing through

Modernized e-File (MeF) Program Information.

1.3 General Information

When a new tax form is added to the MeF platform, that form may only be filed

electronically during the current processing year (for example, PY 2018) and future

processing years. Furthermore, for any given processing year, MeF will accept returns

for the most recent tax year and two prior tax years. For example, during processing

year 2018 Form(s) 1120/1120S/1120-F can only be e-filed for TY 2017, TY 2016 and

TY 2015.

1.4 Authorized IRS e-File Providers

Authorized IRS e-file Providers are firms and organizations that develop software,

originate and/or transmit electronic returns to the IRS, and provide services to a

multitude of taxpayer clients. The roles and responsibilities of providers vary according

to the e-file activities that firms conduct. A firm identifies its e-file activity by selecting the

appropriate Provider Option in the IRS e-file application. Each Provider Option entails a

different role and may have different responsibilities that relate specifically to the e-file

activity of the firm. Some providers may have more than one e-file business activity. For

example, an Electronic Return Originator (ERO) may also be a Transmitter. Providers

must adhere to all IRS e-file rules and requirements applicable to their multiple e-file

roles. The following details the roles and responsibilities of each provider option.

Publication 4163 page 2

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

1.4.1 Electronic Filing Identification Numbers (EFINs), Electronic Transmitter

Identification Numbers (ETINs), and Passwords

All providers must protect their EFINs, ETINs, and passwords from unauthorized use.

Providers must never share the numbers and passwords with others, including the

transferring of EFINs or ETINs to another entity when transferring the business by sale,

gift, or other disposition. If the IRS learns that a Provider’s EFIN or ETIN is

compromised, the IRS changes the number and notifies the Provider by mailing a new

acceptance letter to the Provider. Refer to Publication 3112, IRS e-file Application and

Participation for additional information.

1.4.2 Electronic Return Originator (ERO)

The ERO is the Authorized IRS e-file Provider who originates the electronic submission

of a return to the IRS. The ERO is usually the first point of contact for most taxpayers

filing a return using IRS e-file. Please refer to Publication 3112 and Revenue Procedure

(Rev. Proc.) 2007-40, Internal Revenue Bulletin (IRB): 2007-26 for additional

information. Revenue Procedure 2007-40 informs authorized IRS e-file providers of their

obligations to the Internal Revenue Service, taxpayers, and other participants in the IRS

e-file Program, and combines the rules governing IRS e-file.

1.4.2.1 ERO Responsibilities

Origination of an Electronic Return: Although an ERO may also engage in return

preparation, that activity is separate and distinct from the origination of the electronic

submission of the return to the IRS. An ERO originates the electronic submission of a

return after the taxpayer authorizes the filing of the return via IRS e-file. An ERO must

originate the electronic submission of only returns that the ERO either prepared or

collected from a taxpayer. An ERO originates the electronic submission by any one of

the following:

• Electronically sending the return to a Transmitter that will transmit the return to

the IRS (most taxpayers use this method); or

• Directly transmitting the return to the IRS (rarely used); or

• Providing a return to an ISP for processing, prior to transmission to the IRS

(rarely used).

Publication 4163 page 3

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

In originating the electronic submission of a return, the ERO has a variety of

responsibilities including, but not limited to:

• Timely originating the electronic submission of returns;

• Submitting required supporting paper documents to the IRS;

• Providing copies to taxpayers;

• Retaining records and making records available to the IRS;

• Accepting returns only from taxpayers and authorized IRS e-file Providers; and

• Working with the taxpayer and/or the Transmitter to correct rejected returns.

If the taxpayer chooses not to have the electronic portion of a return corrected and re-

transmitted to the IRS or if the electronic portion of a return cannot be accepted for

processing by the IRS, the taxpayer must file a paper return. See 3.20, Transmission

Perfection Period, for detailed instructions about filing a paper return.

Taxpayers required to e

-file their return under Treasury Decision (T.D.) 9363

or Section 1224

of the Taxpayer Relief Act of 1997 must contact the e-help

Desk for authorization to file their paper return

.

1.4.3 Transmitter

A Transmitter sends the electronic return data directly to the IRS. EROs may apply to

be Transmitters and transmit return data themselves, or they may contract with an

accepted third-party Transmitter to transmit the data.

1.4.3.1 Transmitter Responsibilities

A Provider participating in MeF as a Transmitter has a variety of responsibilities that

include, but are not limited to:

• Conducting a one-time communication test: no further testing is required as

additional forms are added to MeF. This applies to MeF Transmitters using

Software Developers’ software to prepare and transmit returns;

• Transmitting all electronic portions of returns to the IRS within three calendar

days of receipt;

• Retrieving the acknowledgement file within two business days of transmission;

• Matching the acknowledgement file to the original transmission file and sending,

or making available, the acknowledgement file to the ERO, ISP or Large

Publication 4163 page 4

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Taxpayer for all rejected and accepted returns, within two business days of

retrieval;

• Retaining an acknowledgement file received from the IRS until the end of the

calendar year in which the electronic return was filed, or, for fiscal year filers, for

nine (9) months after the transmission date, whichever is later;

• Immediately contacting the IRS e-help Desk toll-free number 1-866-255-0654 for

further instructions if an acknowledgement has not been received within 24 hours

of transmission;

• Working with the ERO or Large Taxpayer to promptly correct any transmission

error that caused an electronic transmission to be rejected;

• Contacting the IRS e-help Desk toll-free number 1-866-255-0654 for assistance if

the electronic portion of the return has been rejected after three transmission

attempts;

• Ensuring the security of all transmitted data; and

• Ensuring against the unauthorized use of its EFIN or ETIN. A Transmitter must

not transfer its EFIN or ETIN by sale, merger, loan, gift, or any other transaction

to another entity.

The Transmitter must notify the ERO, ISP or taxpayer of the following:

Accepted Returns

• Date the return was accepted

Rejected Returns

• Date the return was rejected;

• Business Rule(s) explaining why the return rejected;

• Steps the ERO or taxpayer need to take to correct any errors that caused the

reject.

1.4.4 Software Developer

A Software Developer creates software that formats electronic return information

according to IRS e-file specifications and/or transmits electronic return information

directly to the IRS. IRS e-file specifications are found in Publication 4164, Modernized

e-File (MeF) Guide for Software Developers and Transmitters. Additional resources,

such as the Automated Enrollment (AE) External User Guide, MeF Submission

Publication 4163 page 5

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Composition Guide and MeF State and Trading Partners Reference Guide can be found

on the Modernized e-File (MeF) User Guides and Publications page.

Software Developers must pass the Assurance Testing System (ATS). If an Authorized

IRS e-file Provider is a Software Developer whose only role in IRS e-file is software

development, the Principals and Responsible Officials need not pass a suitability check

during the application process. However, if a Software Developer performs the function

of any provider options, in addition to software development, then suitability checks will

apply.

Software Developers are not required to retest when new Schemas, either major or

minor, are released. However, retesting using the ATS system is strongly recommended

when updating software with Schema changes.

1.4.4.1 Software Developer Responsibilities

A Software Developer has a variety of responsibilities that include, but are not limited to:

• Adhering to specifications provided in official IRS publications;

• Ensuring its software creates accurate electronic returns;

• Promptly correcting all software errors that cause tax returns to reject; and

• Distributing the corrections to all affected parties.

1.4.5 Online Provider

An Online Provider transmits business income tax return information prepared by a

taxpayer using commercially purchased software or software provided by an Internet

site.

1.4.5.1 Online Provider Responsibilities

An Online Provider has a variety of responsibilities that include, but are not limited to:

• Ensuring the use of an EFIN or ETIN obtained for online filing;

• Ensuring the EFIN of the ISP is included in the electronic return data when

applicable;

• Transmitting online returns electronically to the IRS;

Publication 4163 page 6

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

• Notifying the taxpayer of the status of a return by:

o Sending an electronic transmission to the taxpayer or the ISP, when

applicable, within two business days of retrieving the acknowledgment file

from the IRS, or

o Mailing a written notification to the taxpayer within one business day of

retrieving the acknowledgment file;

• Providing the Internet Protocol (IP) information, which consists of the IP Address,

IP Date, IP Time and IP Time Zone;

• Entering into agreements with companies to allow access to online filing only if

the company correctly captures the IP Address of the computer submitting the

return and the date, time, and time zone of the computer receiving it; and

• Including the Originator Type “Online Filer” in the Return Header.

1.4.6 Intermediate Service Provider (ISP)

An ISP assists with processing return information between an ERO, or the taxpayer in

the case of Online Filer, and a Transmitter.

1.4.6.1 ISP Responsibilities

An ISP has a variety of responsibilities that include, but are not limited to:

• Including its EFIN and the ERO’s EFIN with all return information forwarded to a

Transmitter;

• Serving as a contact point between its client ERO and the IRS, if requested;

• Providing the IRS with a list of each client ERO, if requested; and

• Adhering to all applicable rules that apply to Transmitters.

1.4.7 Reporting Agent

A Reporting Agent originates the electronic submission of certain returns for its clients,

and/or transmits the returns to the IRS. A Reporting Agent must be an accounting

service, franchiser, bank, or other entity that complies with Rev. Proc. 2012-32, IRB

2012-34, and is authorized to perform one or more of the acts listed in Rev. Proc. 2012-

32 on behalf of a taxpayer. Reporting Agents must submit Form 8655 Reporting Agent

Authorization to the IRS prior to updating or submitting an IRS e-file application.

1.4.8 Large Taxpayer

A Large Taxpayer is also a Provider Option on the IRS e-file Application but it is not an

Authorized IRS e-file Provider. The creation of an IRS e-file Application for Large

Publication 4163 page 7

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Taxpayers is different from the Authorized IRS e-file Providers Application. Therefore,

large corporations should carefully read Section 5 of this publication for specific

information.

For purposes of electronic filing, the IRS defines a Large Taxpayer as a

business or other entity

(excluding partnerships)

with assets of $10 million or

more, or

a partnership with more than 100 partners

(asset criteria does not

apply to partnerships), which originates the electronic submission of its own

return(s).

1.5 Communicating with IRS

The following IRS e-file information resources are available to providers.

The IRS e-help Desk provides assistance in support of MeF software and

communication testing for corporate, partnership, estates and trusts, employment,

excise, and tax exempt returns throughout the filing season. The e-help Desk also

provides assistance with e-Services registration and the IRS e-file application

processes. Contact the e-help Desk at 1-866-255-0654 or if outside the U.S. and U.S.

Territories 1-512-416-7750. You may also contact the e-help Desk with comments or

suggestions regarding Publication 4163 or if you have technical questions regarding the

e-filing of Forms 720, 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, 94x On-

Line Signature PIN Registration, 945, 990, 990-EZ, 990-N, 990-PF, 1041, 1065, 1065-

B, 1120, 1120-F, 1120-POL, 1120S, 2290, 7004, 8849 and/or the 8868.

1.5.1 Modernized e-File (MeF) Status Page

The MeF Status page provides information on:

• Current system status

• System maintenance

• Unplanned system interruptions and processing delays

MeF uses QuickAlerts, an IRS email service, to disseminate information quickly

regarding MeF issues to subscribers. This service keeps tax professionals up to date on

MeF issues throughout the year.

After subscribing, authorized IRS e-file Providers receive round-the-clock

communications about issues such as processing delays, program updates, and early

notification of seminars and conferences. New subscribers may sign up through the

subscription page link located on the QuickAlerts “More” e-file Benefits for Tax

Professionals page.

Publication 4163 page 8

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

The subject line of a QuickAlert will usually identify targeted providers such as Software

Developers and Transmitters, and/or electronic return originators as well as the targeted

taxpayer type, either individual or business e-file.

For additional information and assistance on MeF and forms and publications, refer to

Table 1–1.

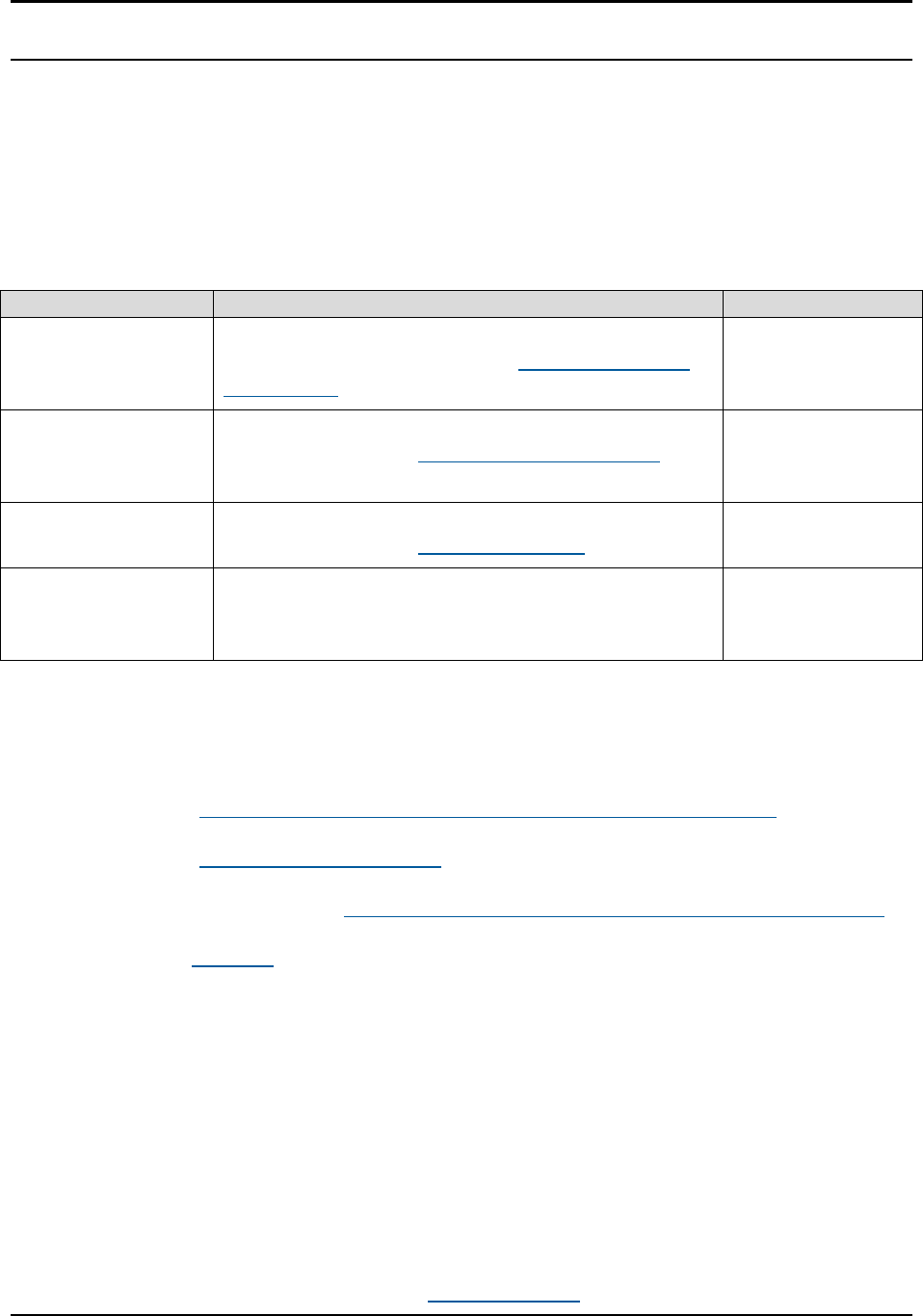

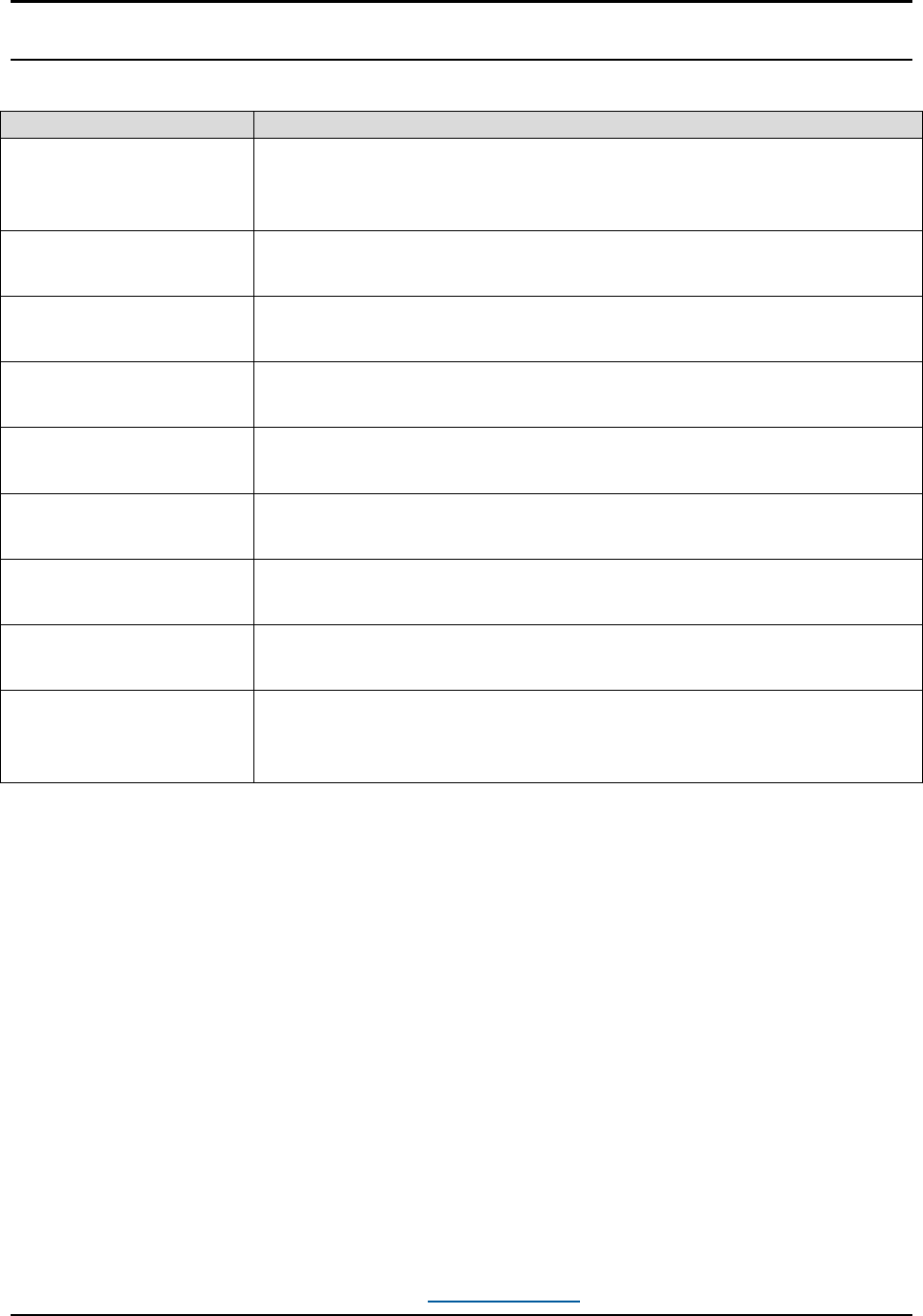

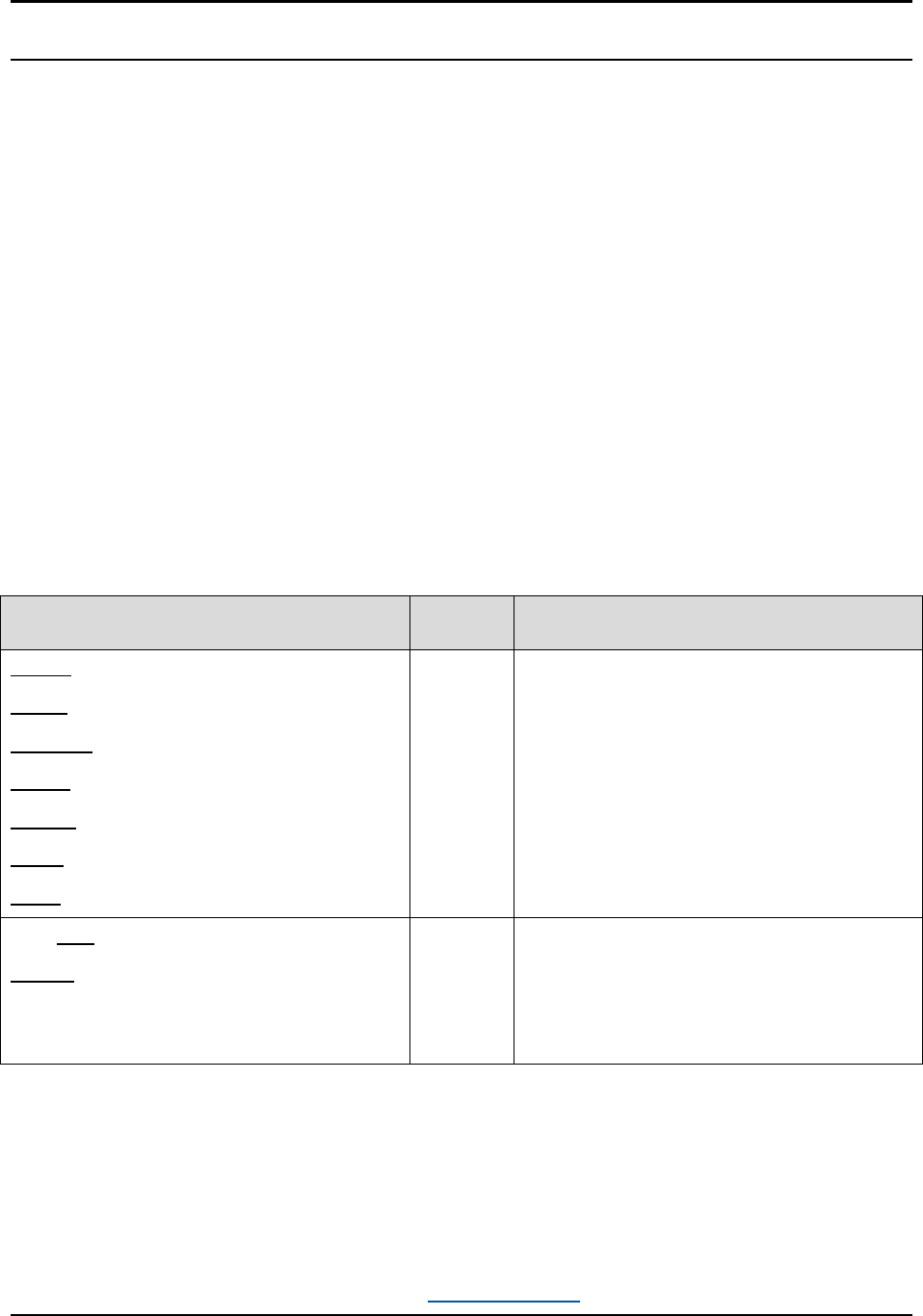

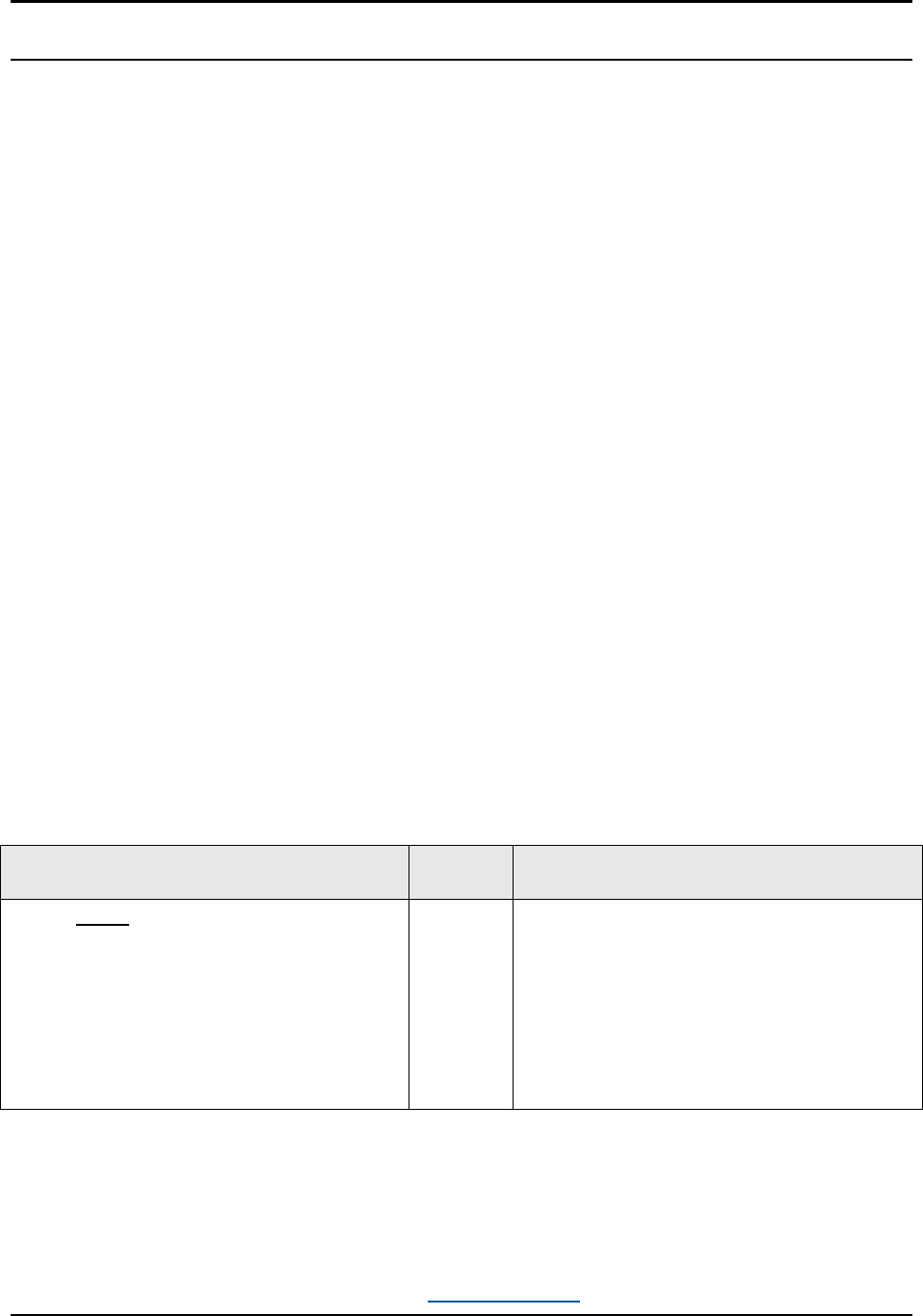

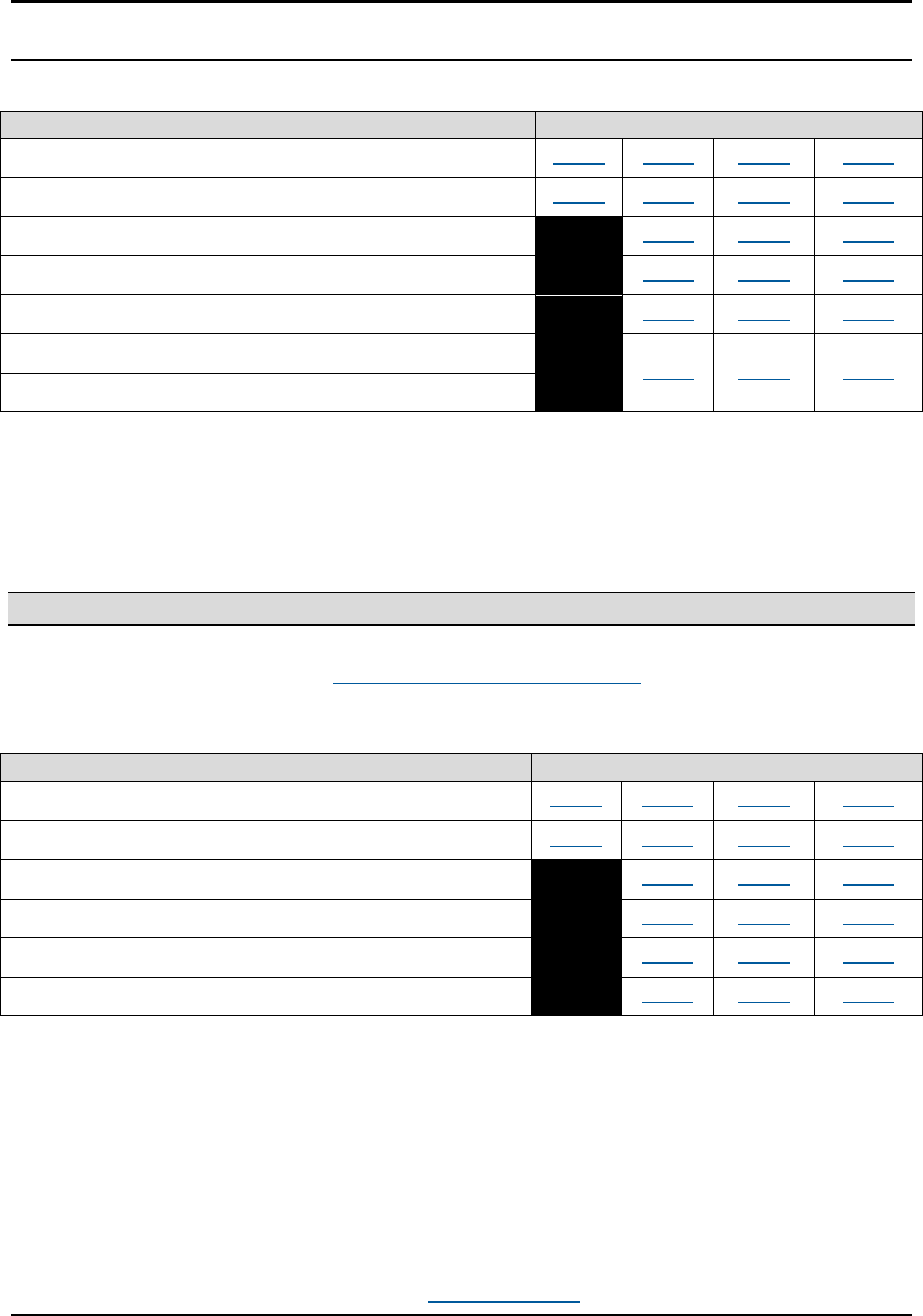

Table 1–1: MeF Information

Topic

Service

Phone Number

Electronic Funds

Withdrawal (Direct

Debit) Payments

Check the status of payments or cancelled

deferred payments. Visit the Electronic Funds

Withdrawal page for more information.

1-888-353-4537

Publications and

Tax Forms

Obtain IRS publications and tax forms by

phone or go to the Forms and Publications

page

1-800-829-3676

Draft Tax Forms

and Instructions

Obtain draft versions of IRS tax forms and

instructions on the Draft Tax Forms page.

1-800-829-4933

Business and

Specialty Tax

Help

Request IRS Tax Assistance for corporate,

partnership, tax exempt, employment or excise

returns.

1-800-829-4933

1.5.2 Helpful Publications and Information

Use any of the following methods to access publications and information in the

subsequent table:

1. Access the Telephone Assistance Contacts for Business Customers page

2. Access the Forms and Publications page

3. Access the following link: Modernized e-File (MeF) User Guides & Publications

4. Search on IRS.gov “Keyword/Search Terms” box

5. Access the links in Table 1–2:

Publication 4163 page 9

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

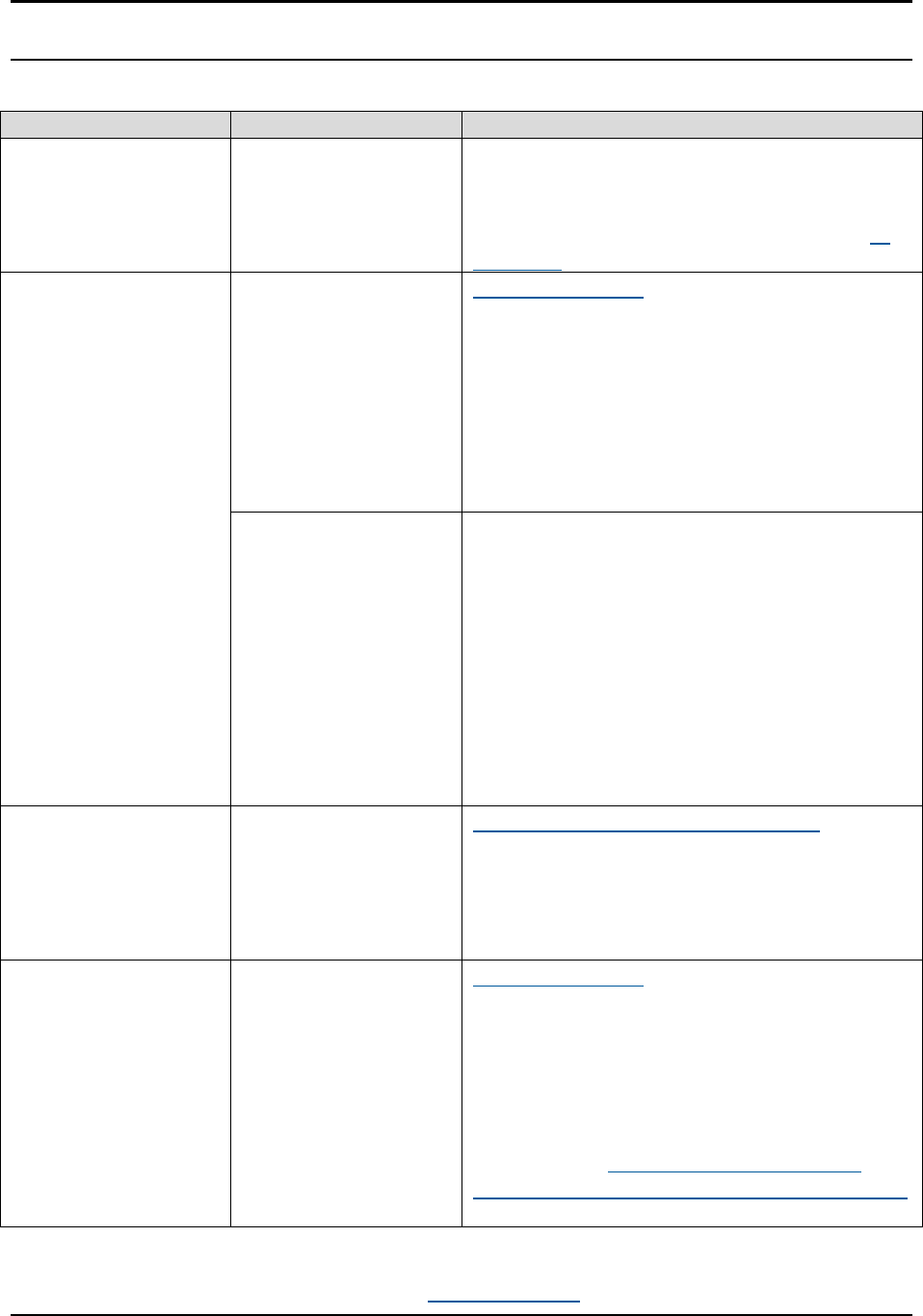

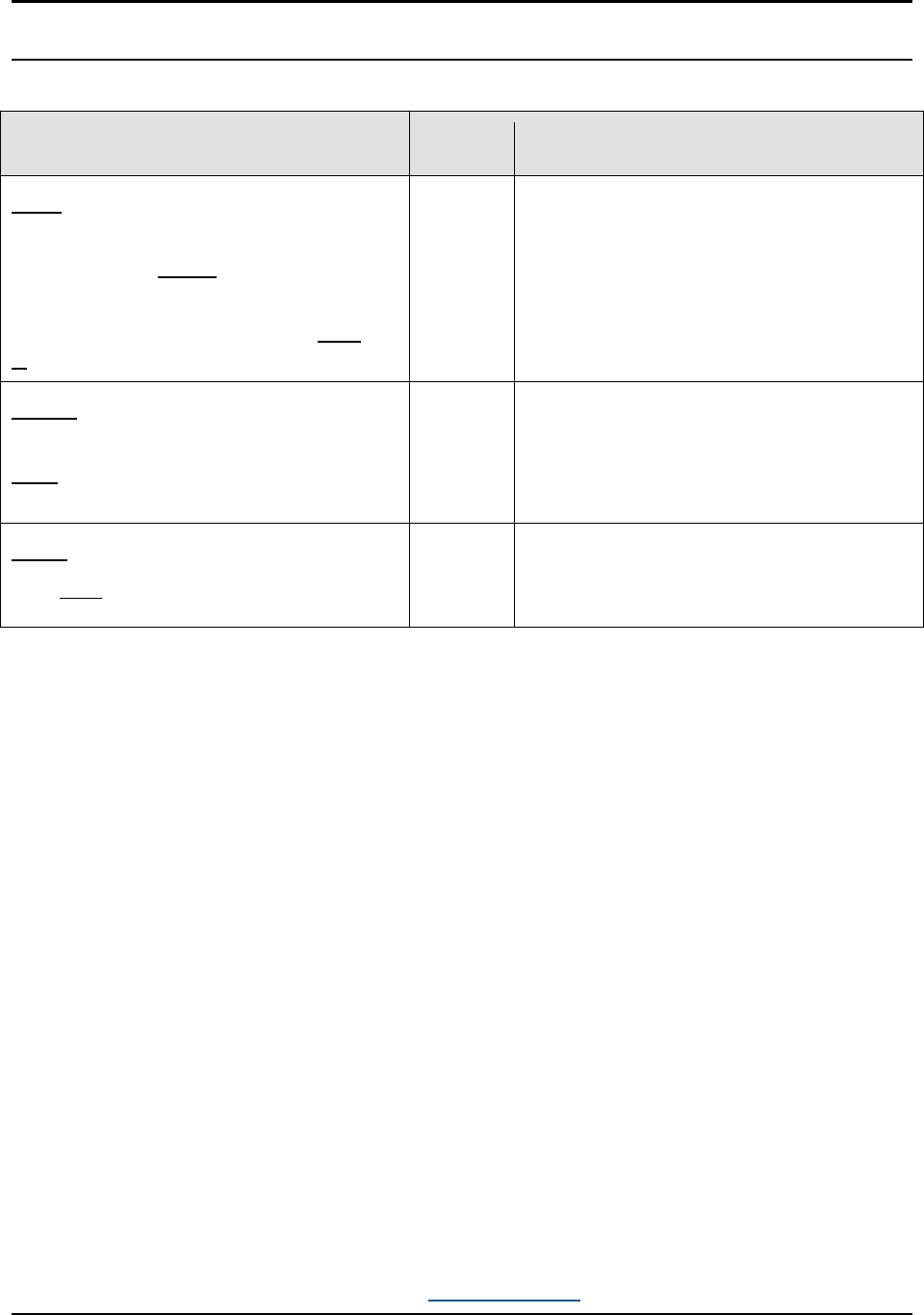

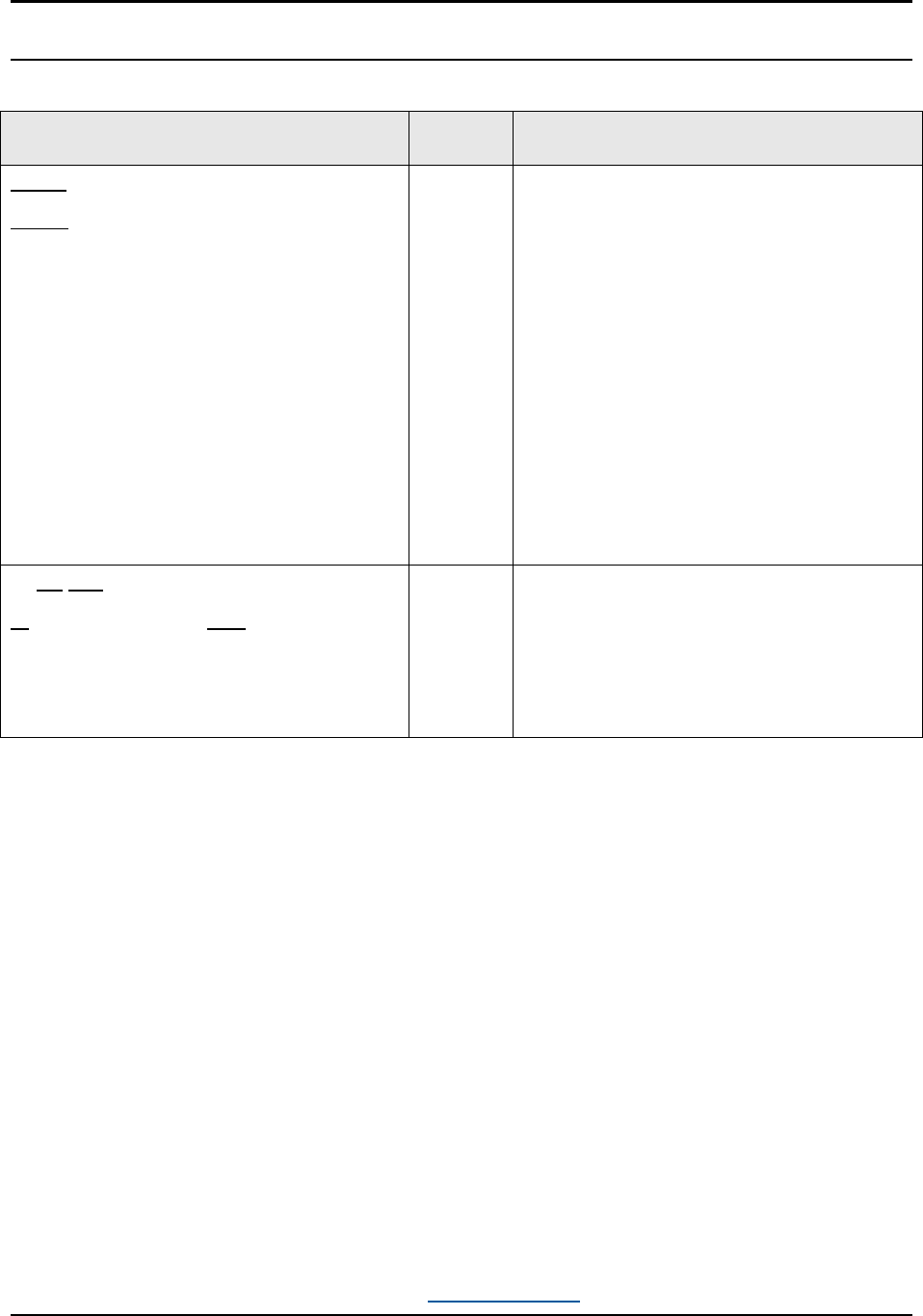

Table 1–2: Helpful Publications and Information

Process

Provider Option

Publication Description and/or Link

E-Services

Registration

All

Registration for e-Services allows

individuals to conduct business

electronically with the IRS. To register for

e-Services, follow the guidance on the e-

Services page on IRS.gov.

Creating an IRS

e-file Application

EROs, Transmitters,

Software

Developers, Online

Providers, ISPs and

Reporting Agents

Publication 3112, IRS e-file Application

and Participation: Provides information on

how to create an IRS e-file application.

Successful completion of the IRS e-file

application provides an Electronic Filing

Identification Number (EFIN) and

Electronic Transmitter Identification

Number (ETIN) necessary to originate and

transmit returns to IRS.

Large Taxpayers

Section 5 of Publication 4163, IRS e-File

for Large Taxpayers Filing Their Own

Corporate Income Tax Return: Provides

information on how to create an IRS e-file

application specific to Large Taxpayers.

Successful completion of the IRS e-file

application provides an Electronic Filing

Identification Number (EFIN) and

Electronic Transmitter Identification

Number (ETIN) necessary to originate and

transmit returns to IRS.

Current Schema

Known e-file Issues

and Solutions

Software

Developers and

Transmitters

Known e-file Issues and Solutions:

Contains temporary workaround solutions

for known issues within active Schema

versions. The issues are posted, by form

and tax year.

Assurance Test

System (ATS)

Testing

All

Publication 5078, Modernized e-File

(MeF)Test Package Business

Submissions:

Contains testing information for

Corporations, Partnerships, Estates and

Trusts, Employment, Excise and Tax

Exempt returns. Test Scenarios can be

found on the Modernized e-File (MeF)

Assurance Testing System (ATS) Updates

page.

Publication 4163 page 10

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

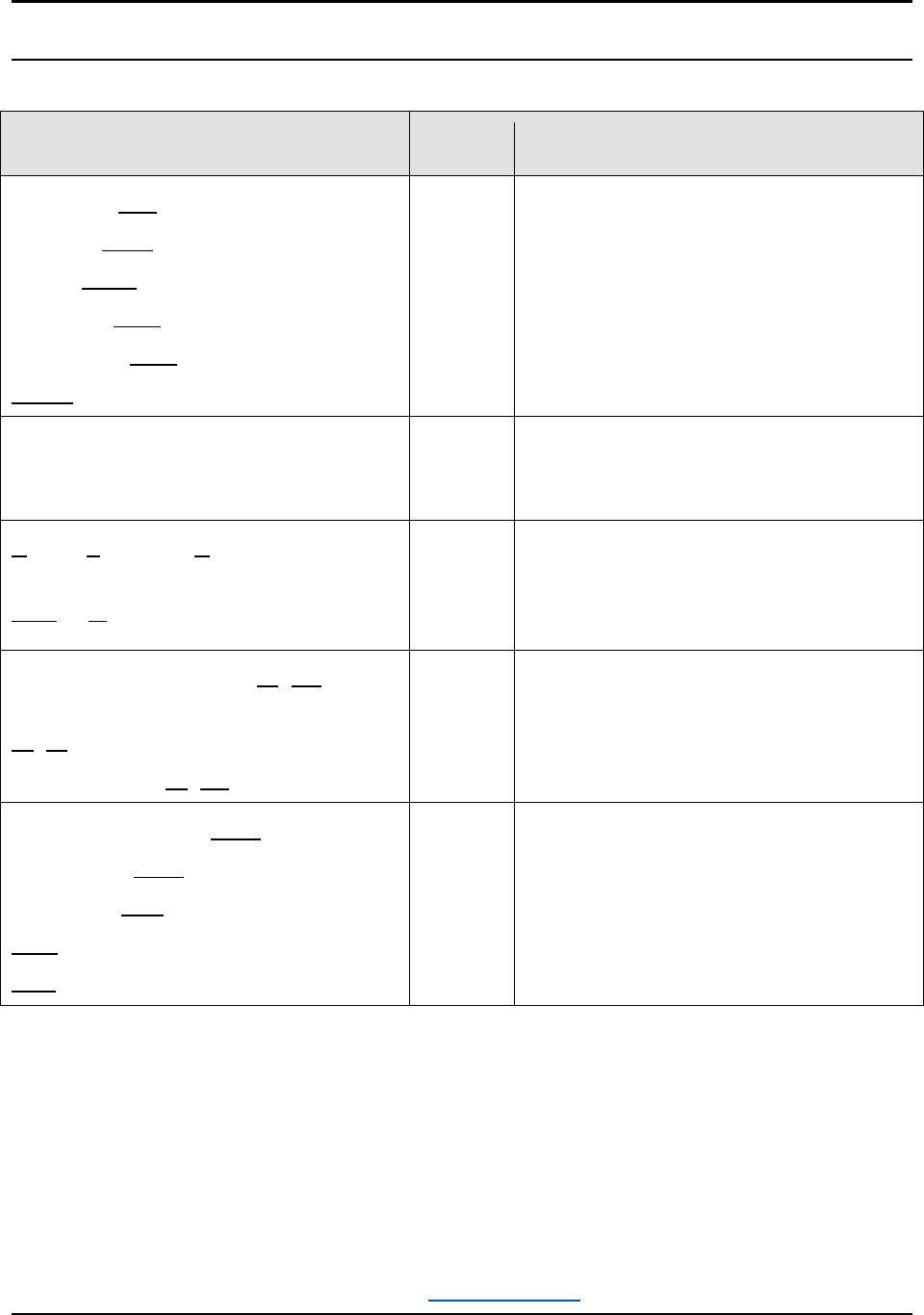

Process

Provider Option

Publication Description and/or Link

Technical

Information

Software

Developers and

Transmitters

Publication 4164, Modernized e-File (MeF)

Guide for Software Developers and

Transmitters: Contains communications

procedures, transmission formats,

Business Rules and validation procedures

for returns e-filed through MeF.

Attachments to:

• Unique Tax

Returns: Forms

720/2290/8849

• Exempt

Organization

returns: Forms

990/990-EZ/990-

PF/1120-POL

• Estate and Trust

Tax Returns:

Form 1041

• Partnership Tax

Returns: Form

1065/1065-B

• Corporate Tax

Returns: Form

1120/1120S/

1120-F

EROs, Software

Developers, and

Transmitters

Each form family’s Schemas and Business

Rules page on IRS.gov contains a list of all

attachments, forms and schedules that

can be filed for each tax year. Also refer to

Section 4.10 of this publication.

Attachments to

Employment Tax

returns: Forms 940,

940-PR, 941, 941-

PR, 941-SS, 943,

943-PR, 944, and

945.

EROs, Reporting

Agents, Software

Developers, and

Transmitters

Publication 4163 page 11

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

1.6 Overview and Benefits of Modernized e-File (MeF)

The Modernized e-File (MeF) system was developed to provide a standardized format

using the widely accepted Extensible Markup Language (XML) format and standardized

transmission methods for e-filed returns. IRS works regularly with stakeholders,

including accounting firms, practitioners, Software Developers and the states, to identify

and resolve issues relative to MeF return and downstream processing. MeF also

provides:

• More explicit error conditions—Plain English explanations in the

Acknowledgement File pinpoint the location of the error(s) in the return and

provide complete information.

• Faster acknowledgements—Transmissions are processed upon receipt and

acknowledgments are returned in near real-time.

• Integrated refund and payment options—Refunds can be electronically

deposited in bank accounts or balance due payments can be electronically

withdrawn from bank accounts. Payments are subject to limitations of the Federal

Tax Deposit Rules found in Publications 3151, The ABCs of Federal Tax

Deposits and 3151A, The ABC's of Federal Tax Deposits (Resource Guide).

• The capability to attach supporting forms and schedules—Forms 720, 940,

940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, 94x On-Line Signature PIN

Registration, 945, 990, 990-EZ, 990-N, 990-PF, 1041, 1065, 1065-B, 1120, 1120-

F, 1120S, 1120-POL, 2290, 7004, 8868, 8849 and their supporting forms and

schedules can be e-filed in MeF. See each form family’s Schemas and Business

Rules page at IRS.gov for tax year accepted forms and schedules. Also refer to

Section 4.10 of this publication.

• 24/7 transmissions—MeF allows Transmitters to send transmissions to the IRS

year round, except for a short cutover period at the end of the calendar year.

• A completely paperless process—Taxpayers using a third-party practitioner

can use the Practitioner Personal Identification Number (PIN) option; see Section

3.6, Signing an Electronic Return. Forms 8453-C, 8453-S, 8453-I, 8453-PE,

8453-B, 8453-EX, 8453-EO, 8453-EMP and 8453-FE can be printed, signed by

the Corporate Officer, Principal or Fiduciary and when applicable, the ERO

and/or Paid Preparer, and then scanned and attached to the return as a Portable

Document Format (.pdf) file. Form 8655 is used by reporting agents to sign and

file certain returns electronically. All other attachments for which XML Schemas

have not been developed can be attached as PDF files.

• Support for filing prior-year returns—MeF can process the current and two

previous years of returns. For Processing Year 2018, taxpayers can e-file returns

for TY 2017, TY 2016, TY 2015, and for some TY 2018 returns.

Publication 4163 page 12

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

1.7 New for Processing Year 2018

1.7.1 Forms

Beginning Processing Year 2018, new forms include:

• Form 8838P

• Form 8974

• Form 8975 (available for production since July 30, 2017)

• Form 8975 Schedule A (available for production since July 30, 2017)

• Form 9100 (PDF)

• Form 943 (Schedule R)

1.7.2 Processes and Procedures

1.7.2.1 Schema and Business Rules Posting

For Tax Years 2016 and subsequent, Schemas and Business Rules are distributed

through your e-Services mailbox. In order to access these files you must have an active

e-Services account and be listed on an e-File application with the provider option of

Software Developer or State. Your role must be Principal, Responsible Official, or

Delegated User with MeF authorities. These mailbox messages are purged after 30

days so please make sure to download them as soon as possible. Instructions for

accessing the Secure Object Repository (SOR) Mailbox were created for your use.

1.7.2.2 Form 8975 and Form 8975 Schedule A

Treasury Decision 9773 contains final regulations that require annual country-by-

country reporting by certain United States persons that are the ultimate parent entity of

a multinational enterprise group. The final regulations affect United States persons that

are the ultimate parent entity of a multinational enterprise group that has annual

revenue for the preceding annual accounting period of $850,000,000 or more.

Form 8975 and Form 8975 Schedule A schemas were made available in package

version 2016v4.2. Voluntary TY2016 ATS testing started June 18, 2017. Software

developers were strongly encouraged to participate in the voluntary ATS testing for

TY2016 but are mandated to test for TY2017. Returns with Form 8975 were accepted

into production starting July 30, 2017.

1.7.2.3 Updates to E-Services

In Summer and Fall 2017, we began implementing a series of actions to improve e-

Services usability and security, including:

Publication 4163 page 13

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

• Launching a new e-Services platform and landing page;

• Establishing a new e-Services agreement;

• Protecting e-Services accounts with our Secure Access authentication process.

All registered users must accept the revised terms of the new e-Services User

Agreement to have access to e-Services and its products.

Further information is available on the e-Services page.

1.8 Forms for Processing Year 2018

MeF can process all the following parent forms in XML. Check IRS.gov for the exact

date MeF will begin processing. A complete listing of forms, including new forms, that

MeF accepts can be found on the IRS.gov website at each form family’s Schemas and

Business Rules page and in Section 4.10 of this publication.

1.8.1 Corporation Returns

• Form 1120, U.S. Corporation Income Tax Return

• Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

• Form 1120S, U.S. Income Tax Return for an S Corporation

1.8.2 Employment Tax Returns

• Form 94x On-Line Signature PIN Registration

• Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return

• Form 940-PR, Planilla para la Declaración Federal Anual del Patrono de la

Contribución Federal para el Desempleo (FUTA)

• Form 941, Employer's QUARTERLY Federal Tax Return

• Form 941-PR, Planilla para la Declaración Federal TRIMESTRAL del Patrono

• Form 941-SS, Employer's QUARTERLY Federal Tax Return (American Samoa,

Guam, the Commonwealth of Northern Mariana Islands, and the U.S. Virgin

Islands)

• Form 943, Employer's Annual Federal Tax Return for Agricultural Employees

• Form 943-PR, Planilla para la Declaración Anual de la Contribución Federal del

Patrono de Empleados Agrícolas

Publication 4163 page 14

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

• Form 944, Employer's ANNUAL Federal Tax Return

• Form 945, Annual Return of Withheld Federal Income Tax

1.8.3 Estate and Trust Returns

• Form 1041, U.S. Income Tax Return for Estates and Trusts

1.8.4 Excise Tax and e-filing Compliance Returns (ETEC)

• Form 2290, Heavy Highway Vehicle Use Tax Return

• Form 720, Quarterly Federal Excise Tax Return

• Form 8849, Claim for Refund of Excise Taxes (All Schedules available)

1.8.5 Extension Applications

• Form 7004, Application for Automatic Extension of Time To File Certain

Business Income Tax, Information, and Other Returns

• Form 8868, Application for Extension of Time To File an Exempt Organization

Return

1.8.6 Partnership Returns

• Form 1065, U.S. Return of Partnership Income

• Form 1065-B, U.S. Return of Income for Electing Large Partnerships

1.8.7 Tax Exempt/Government Entity (TEGE) Returns

• Form 990, Return of Organization Exempt From Income Tax

• Form 990-EZ, Short Form Return of Organization Exempt From Income Tax

• Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not

Required To File Form 990 or 990-EZ

• Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Trust Treated

as Private Foundation

• Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

1.9 Preparer Tax Identification Number (PTIN) Procedures

Beginning January 1, 2011, all paid preparers must have a Preparer Tax Identification

Number (PTIN) before preparing returns. Also, all enrolled agents are required to have

a PTIN.

Publication 4163 page 15

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

All PTINs expire on December 31 of each year. PTIN renewal open season begins

approximately October 16 each year for the following year.

The fees for processing a new or renewed PTIN application are no longer applicable.

Additional information on the PTIN process can be found on IRS.gov.

1.10 Tax Relief in Disaster Situations

Special tax provisions may help businesses recover financially from the impact of

disasters. For additional information, please access Disaster Assistance.

1.11 The Requirement to e-File

While millions of taxpayers e-file voluntarily, certain corporations, partnerships,

employment tax and tax exempt organizations are required to e-file. In the past several

years, the Department of the Treasury issued regulations requiring certain entities to e-

file. Complete regulations and the history of the requirement to e-file can be found on

the IRS.gov website at the following links.

1.11.1 Large Business and International (LB&I) Corporations

1.11.1.1 Form 1120-F Foreign Corporations

Treasury Decision (T.D.) 9363 provides authorization to extend the requirement to e-file

for certain corporations, including Form 1120-F. For tax years ending on or after

December 31, 2008, foreign corporations who file Form 1120-F and meet the T.D.

9363 criteria are required to e-file their return(s). Be sure to check the IRS.gov

website for the latest information on the requirement to e-file this form.

1.11.2 Employment Tax Returns

1.11.2.1 Forms 941/941-PR/941-SS filers

Beginning 2017, Treasury Decision (T.D.) 9768 requires approved certified professional

employer organizations (CPEOs) to file Schedule R (Form 941) and all other required

schedules with Form 941 electronically, unless granted a waiver by the IRS

Commissioner. The 1st quarter 2017 Form 941 will first be filed in April 2017. The IRS

began accepting applications for CPEO certification on July 1, 2016. The CPEO

program is a voluntary program; a person that does not wish to file Form 941, on

magnetic media (electronically as prescribed by the IRS Commissioner) is not obligated

to apply for or obtain certification as a CPEO. Although, this is a voluntary program,

once certification is obtained as a CPEO the consequence of any failure to file these

forms and associated schedules on magnetic media is the potential suspension or

revocation of certification as a CPEO.

1.11.3 Estates and Trusts

Any tax preparer who anticipates preparing and filing 11 or more Forms 1040, 1040A,

1040EZ and 1041 during a calendar year must use IRS e-file. Section 6011(e)(3) of the

Publication 4163 page 16

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

Internal Revenue Code requires specified tax return preparers to electronically file

certain federal income tax returns that they prepare and file for individuals, trusts or

estates. Final Regulations provide further guidance on this requirement. See T.D. 9518.

See also Most Tax Return Users Must Use IRS e-File on IRS.gov.

1.11.4 Excise Tax Returns

The American Jobs Creation Act statutorily requires that any taxpayer who files a Form

2290 with respect to 25 or more vehicles for any taxable period shall file such returns

electronically.

Note: Corporations, partnerships or tax exempt organizations not meeting the criteria

set out for their particular form in Treasury Decision (T.D.) 9363 and the

Taxpayer Relief Act of 1997, Section 1224 (December 31, 2000), and American

Jobs Creation Act (October 2004) are excluded from the requirement to e-file.

However, these entities are encouraged to e-file voluntarily.

1.11.5 Partnerships

Treasury Regulations Section 301.6011-3(a) provides that if a partnership with more

than 100 partners is required to file a partnership return, the information required by the

applicable forms and schedules must be filed electronically, unless a waiver from the

electronic filing requirement has been granted. Returns filed electronically must be

prepared in accordance with applicable revenue procedures or publications.

Announcement 2002-3 excludes Fiscal Year filers for Tax Year 2001 only.

1.11.6 Tax Exempt/Government Entities (TEGE)

Required e-filing of Forms 990 and 990-PF for certain large tax-exempt

organizations—For tax years ending on or after December 31, 2006, exempt

organizations with $10 million or more in total assets may be required to e-file if the

organization files at least 250 returns in a calendar year, including income, excise,

employment tax and information returns. Private foundations and non-exempt charitable

trusts are required to file Forms 990-PF electronically regardless of their asset size, if

they file at least 250 returns annually. The electronic filing requirement does not apply to

Form 8868. Form 8868, Application for Extension of Time To File an Exempt

Organization Return, can be filed electronically or in paper format.

Annual Electronic Filing Requirement for Small Exempt Organizations, Form 990-

N (e-Postcard)—Most small tax-exempt organizations whose annual gross receipts are

normally $50,000 or less ($25,000 for tax years ending after December 31, 2007 and

before December 31, 2010) are required to electronically submit Form 990-N, also

known as the e-Postcard, unless they choose to file a complete Form 990 or Form 990-

EZ instead.

There is no requirement to file Forms 990-EZ or 1120-POL electronically (e-file).

Publication 4163 page 17

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

2 MeF Rules and Requirements

2.1 Participating in the IRS e-File Program

To begin e-filing tax returns or developing tax preparation software for the submission of

returns to the IRS, you must apply and be accepted as an authorized IRS e-file

Provider.

To apply for IRS e-file, you must first register with e-Services. Registration for e-

services allows individuals to conduct business electronically with the IRS. To register

for e-Services, follow the guidance on the e-Services page on IRS.gov.

Effective Oct. 1, 2012, applications to become an IRS e-file Provider must be submitted

online. The IRS will no longer accept paper e-file applications.

Once you have successfully registered, you will need to complete an online IRS e-file

application for your business location. Section 1.4 of this publication and Publication

3112, IRS e-file Application and Participation, explain the different types of provider

options as well as the roles and responsibilities of being an Authorized IRS e-file

Provider. They also include information on passing suitability and other requirements.

Note: Software Developers with no other provider options (ERO, Transmitter, and so

on) are not required to undergo suitability.

W

e recommend you complete the e-Services registration and IRS e-file

Application process at least 45 days before you plan to e

-file any returns. IRS

als

o recommends that you have at least two Responsible Officials for back-up

purposes.

In order to transmit returns directly to IRS, all providers must designate one or more

representatives on the IRS e-file application as their MeF Internet Transmitter (IFA)

and/or MeF System Enroller (A2A).

Section 5 of this publication provides details for Large Taxpayers who electronically file

their own income tax return. For purposes of electronic filing, the IRS defines a Large

Taxpayer as a business or other entity (excluding partnerships) with assets of $10

million or more, or a partnership with more than 100 partners (asset criteria does not

apply to partnerships), which originates the electronic submission of its own return(s).

Revenue Procedure 2007-40 informs Authorized IRS e-file Providers of their obligations

to the IRS, taxpayers, and other participants in the IRS e-file program. Revenue

Procedure 2007-40, IRB 2007-26, which was published on June 25, 2007, supersedes

Revenue Procedure 2005-60 (2005-35 IRB 449).

Publication 4163 page 18

Return to Table of Contents

Publication 4163 (Rev. 12-2017) Catalog Number 36165C Department of the Treasury Internal Revenue Service www.irs.gov

2.2 Maintaining Your IRS e-File Application

Important information on maintaining your IRS e-file Application:

1. Form Types – IRS e-file applications must be current and must list all the form

types (1120, 1065, 990, etc.) that you plan to originate and transmit to the IRS

throughout the year. To avoid having returns reject because of an incorrect form

type, IRS e-file Applications must be kept up to date. Please be aware of all the

forms that each family includes, e.g., the 1120 family includes 1120, 1120S, and

1120-F; the 1065 family includes 1065 and 1065-B. In your e-file application,

check the appropriate box for each of the forms you plan to file.