Publication 5066 (Rev. 2 2018) P5066

User Manual: 5066

Open the PDF directly: View PDF ![]() .

.

Page Count: 28

February 2018

Program Report

Representation • Education • Advocacy

Assisting Taxpayers Face-to-Face with

An Increasingly Automated Tax System

LITC

LOW INCOME

TAXPAYER CLINICS

Representation • Education • Advocacy

PROGR A M

The Low Income Taxpayer Clinic (LITC) Program unites a nationwide network of

independent organizations under a shared mission to protect taxpayer rights.

OUR MISSION

Low Income Taxpayer Clinics ensure the fairness and integrity of the tax system

for taxpayers who are low income or speak English as a second language (ESL) by:

§ Providing pro bono representation on their behalf in tax disputes with the IRS;

§ Educating about taxpayer rights and responsibilities; and

§ Identifying and advocating for issues that impact low income taxpayers.

FUNDING

The LITC Program is a matching federal grant program that provides up to

$100,000 per year to organizations that represent low income taxpayers in

controversies with the IRS and provide education and outreach to ESL taxpayers.

Table of Contents

A Letter from the National Taxpayer Advocate ...................... 1

What Does an LITC Do? .......................................... 2

Representation ................................................... 5

Education ....................................................... 11

Advocacy ....................................................... 12

Spending Transparency ........................................... 14

Program Ofce Activities ........................................ 16

List of LITCs .................................................... 18

1

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

A Letter from

the National Taxpayer Advocate

Dear Readers,

As the National Taxpayer Advocate, it is my honor to oversee the LITC Grant Program. LITC grants use federal

dollars and because I am accountable to the public and their representatives, I am issuing this report to provide an

update on the Program’s progress.

This report provides an overview of the LITC Program and discusses challenges of the people that need assistance

from an LITC, and highlights some of the Program’s accomplishments over the past year. The successes detailed in

this report reect the combined efforts of independent organizations across the country. Although the grants that

support LITCs come from the IRS, each organization operating an LITC is wholly independent of the IRS. The

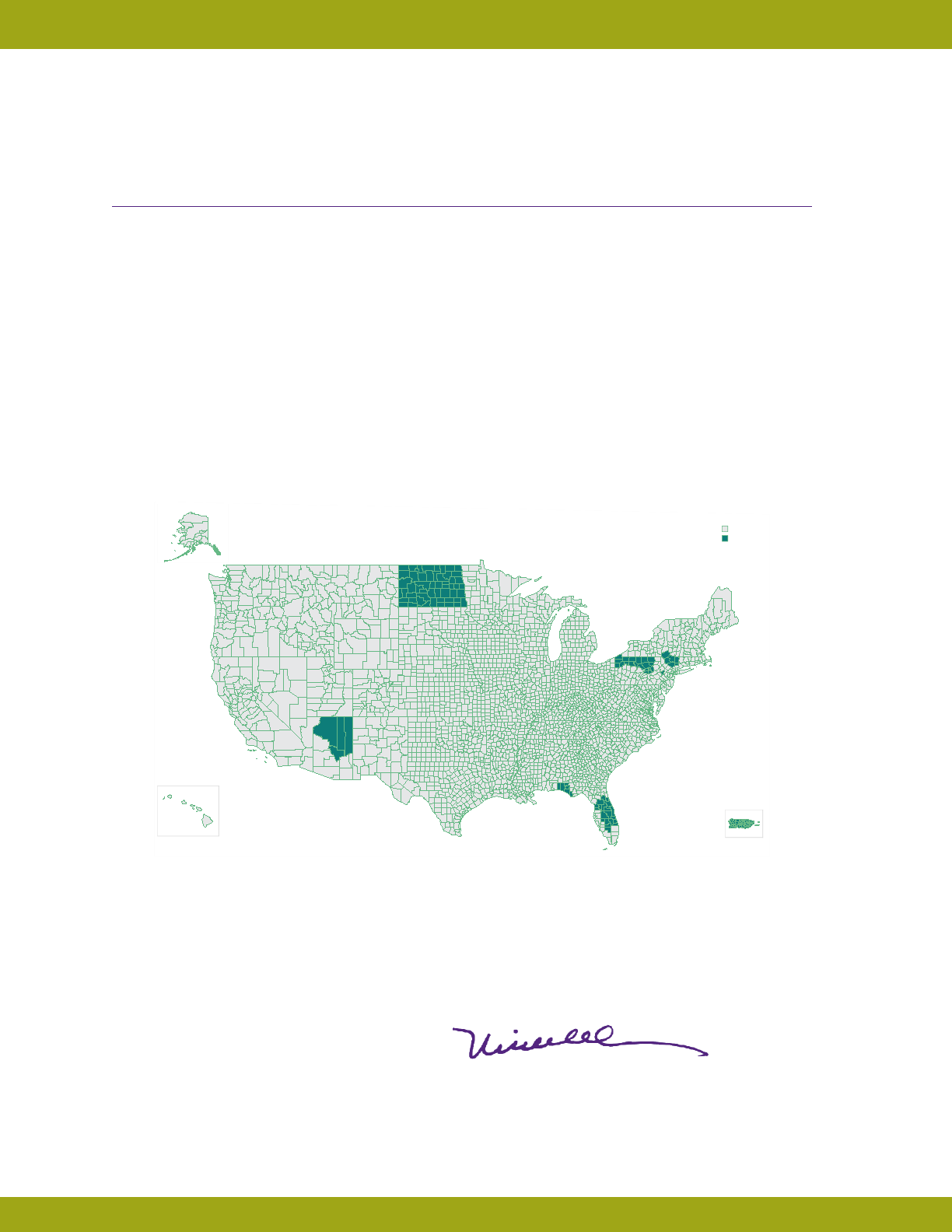

map in Figure 1 shows how widespread availability of LITC assistance is in most of the country.

Figure 1: LITC COVERAGE BY COUNTY

WA

WY

WV

MO

NM

MN

MA

MD

CO

OR

GA

OK

OH

MS

ME

AR

CA

NH

ND

NC

MT

KS

KY

PA

NE

NV

NY

SC

SD

VA

DE

CT

TN

AL

AZ

LA

UT

NJ

TX

VT

FL

WI

MI

ID

IA

INIL

WA

WY

WV

MO

NM

MN

MA

MD

CO

OR

GA

OK

OH

MS

ME

AR

CA

NH

ND

NC

MT

KS

KY

PA

NE

NV

NY

SC

SD

VA

DE

CT

TN

AL

AZ

LA

UT

NJ

TX

VT

FL

WI

MI

ID

IA

INIL

2017 LITC Counties Coverage

LITC Service

Covered

Not Covered

AKAK

HI PR

The Ofce of the Taxpayer Advocate (TAS) has been delegated the authority to administer the LITC grant

program, which involves selecting grant recipients, providing training and support, and monitoring the grant

recipients to ensure compliance with federal rules and the terms of the grant. Like TAS, LITCs work to protect

America’s taxpayers by providing representation,edcation, and advocacy.

Sincerely,

Nina E. Olson

National Taxpayer Advocate

2OFFICE OF THE TAXPAYER ADVOCATE

What Does an LITC Do?

Background

For a low income individual or family, or for those

experiencing nancial hardship, the potential monetary

impact of a tax controversy can be devastating. For

instance, a tax controversy can arise from the IRS

denying a claim for an anti-poverty credit, or imposing

a penalty for failing to follow the requirements of the

Affordable Care Act. LITCs exist to assist taxpayers

who may be unable to afford to hire a representative

to advocate on their behalf to the IRS, and taxpayers

who do not speak English as a rst language and may

need assistance to understand how to remain tax

compliant.

LITCs are required to provide outreach and education

about taxpayer rights and responsibilities to English

as a second language (ESL)

taxpayers, in addition to

representing low income

taxpayers in controversies

with the IRS. This

education informs taxpayers

about critical information,

such as the Taxpayer

Bill of Rights (TBOR), including their right to retain

representation.1 Empowering taxpayers to exercise

their rights begins with helping them to understand

those rights. The TBOR informs taxpayers about

the types of information a taxpayer has a right to

know when interacting with the IRS, and actions the

taxpayer has the right to do or refrain from doing

regarding those interactions. Providing representation

and education offers a safety net for taxpayers who

require assistance to protect and preserve their rights

under the TBOR.

1 See IRC § 7803(a)(3)(I) and https://www.irs.gov/taxpayer-bill-of-rights.

Achieving a correct outcome in a controversy with the

IRS should not depend on the taxpayer’s ability to pay

for representation. Thus, all LITC services must be

provided for no more than a nominal fee.

To provide the most current information available,

the LITC Program Report contains both 2016 and

2017 data. Any information pertaining to clinic

work, including case work, educational activities,

and outreach is from 2016, the most recent year

with complete data. Award amounts and related

information is current through 2017, because we

release that information prior to the start of the

calendar year. In 2017, the LITC Program awarded

approximately $11.8 million in grants to 138

organizations across the United States, including

seven that received an award for the rst time. Our

matching grants helped fund LITCs that provide face-

to-face assistance to taxpayers seeking to comply with

the law and understand their rights and responsibilities

as taxpayers. The maximum amount of an LITC

grant is $100,000 per year, and many of our recipients

receive much smaller sums. Despite the modest size

of the grants, each clinic maintains a staff that includes

an attorney, certied public accountant (CPA), or

enrolled agent who can represent taxpayers before

the IRS. In addition, LITCs must have a staff member

or a volunteer available to provide pro bono assistance

who is admitted to practice before the United States

Tax Court to handle litigation matters. Students

and recent law graduates working at an LITC may be

authorized to represent taxpayers before the IRS.

Moreover, LITCs are supported by the work of many

volunteers. Over 1,800 volunteers provided 47,480

hours to LITCs in 2016. More than two-thirds of the

volunteers were attorneys, CPAs, or enrolled agents.

$11.8M

in grants to

138

organizatons

3

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

Representation

The combined efforts of clinic staff and volunteers

brought over 4,200 taxpayers facing an IRS collection

action back into compliance. In each case, a licensed

tax professional represented each of them for free or

for a nominal fee.

Resolving tax problems can have a meaningful

impact in the lives of those assisted. Access

to a representative

who understands the

complexities of the tax

code empowers low income

taxpayers to exercise their

rights, such as the right to

pay no more than the correct

amount of tax.

For example, during 2016, an LITC represented a

single father and helped him to obtain years of tax

credits the IRS had improperly denied him. The

taxpayer’s former wife was deceased, and no one else

had claimed any credits for his son, yet the IRS audited

his claims for a dependency credit, Child Tax Credit

(CTC), and Earned Income Tax Credit (EITC). The

taxpayer was not uent in English, and had difculty

explaining his circumstances to the IRS. During the

examination, the taxpayer moved over 1,000 miles

away. He asked the IRS to transfer his case to a

closer ofce. The IRS refused. A relative drove the

taxpayer more than 1,000 miles back to speak with

the examiner. The relative was more skilled in English

and was hoping to help the taxpayer explain the

situation to the examiner. Because the taxpayer did

not have an appointment, the examiner refused to

speak with the taxpayer. The IRS denied the credits,

assessed a liability of over $17,000, and placed a ban

on the taxpayer’s account that prohibited him from

claiming the EITC for an additional two years, nding

that the taxpayer had acted with reckless disregard in

making his EITC claim. The LITC requested the IRS

conduct an audit reconsideration of the taxpayer’s

case. After 18 months without an IRS response to

the request, the LITC requested TAS assistance. TAS

assisted the LITC in resolving one year. Because the

IRS had by now disallowed dependency exemptions

and credits for two subsequent years, the LITC led a

petition with the U.S. Tax Court. Ultimately, the LITC

persuaded the IRS to reverse its position, eliminate

the liability, refund approximately $13,000 to the

taxpayer, and remove the EITC ban. This taxpayer’s

perseverance along with the LITC’s dedication to

obtaining justice ultimately secured the right to pay no

more than the correct amount of tax for this taxpayer.

See IRC § 7803(a)(3)(C).

4,200

taxpayers

into compliance

4OFFICE OF THE TAXPAYER ADVOCATE

Education

Taxpayers living in the United States and for whom

English is a second language (ESL) may have a hard

time nding reliable tax information about their rights

and responsibilities as taxpayers. ESL taxpayers

who immigrate to the United States may come from

countries where the tax systems operate in a much

different fashion, and those arriving from countries

with pervasive corruption may bring with them a

mistrust of government

institutions. They may

be completely unfamiliar

with the process of

ling a tax return or

even maintaining a bank

account. When seeking

to comply with the tax

laws, they are exposed

to risks like identity theft

from unscrupulous tax

return preparers who may steal or divert refunds and

disappear long before their acts are discovered.2

2 For more information about tax-related identity theft, see National

Taxpayer Advocate 2011 Annual Report to Congress 48-73 (Most

Serious Problem: Tax-Related Identity Theft Continues to Impose Signicant

Burdens on Taxpayers and the IRS).

Advocacy

The third prong of the LITC mission is to identify and

advocate for issues that impact low income and ESL

taxpayers. LITCs may achieve this goal through a

variety of methods, including but not limited to:

§Participating in advocacy projects with professional

organizations;

§Commenting on proposed IRS regulations and

guidance;

§Preparing and ling an amicus brief to alert a

court about the concerns of low income or ESL

taxpayers;

§Authoring articles in scholarly journals or general

interest publications;

§Appearing on television or radio to raise awareness

about tax issues that affect low income or ESL

taxpayers;

§Producing public service announcements; or

§Submitting issues to the Systemic Advocacy

Management System (SAMS), available through the

IRS website at www.irs.gov/Advocate/Systemic-

Advocacy-Management-System-SAMS.

Each year in December, recipients of an LITC award

for the upcoming calendar year gather in Washington,

D.C., to attend training on

advocating for low income and

ESL taxpayers. In December

2016, over 150 organizations

represented by 252 tax

professionals from across the

country met for three days in

preparation for the 2017 grant

year.

Through years of hard work, one LITC successfully

resolved tax controversies for more than 30 victims

of a mass identity theft scheme that claimed roughly

$4.8 million in false refunds, and this year saw the

perpetrator brought to justice.

60,500

more

than

In 2016, LITCs held

over 2,100 events

to educate

low income and

ESL taxpayers

Justice for

30

victims of

tax fraud

5

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

Representation

America’s taxpayers have the right to retain

representation, and studies have found that a

represented taxpayer is nearly twice as likely to receive

a positive outcome as an unrepresented taxpayer

in a dispute with the IRS, both in administrative

proceedings3 and in the United States Tax Court.4

Despite having the right to hire an attorney, CPA, or

enrolled agent for representation and advice, the cost

of professional tax services limits access for low income

taxpayers. For no more than a nominal fee, LITCs

provide assistance to thousands of taxpayers who

otherwise could not obtain representation.

In 2016, LITCs represented 19,479 taxpayers dealing

with an IRS tax controversy. Depending on the

circumstances of each case, some taxpayers are

seeking assistance with obtaining a refund, while

others are seeking to resolve

a tax liability. Refund cases

represented eight percent of

the overall caseload worked

in 2016, and LITCs succeeded

in securing over $4.3 million

dollars in cash refunds for low

income taxpayers. Refundable

3 See National Taxpayer Advocate 2007 Annual Report to Congress vol.

2 93-116 (Research Studies and Reports: The IRS EIC Audit Process – A

Challenge for Taxpayers).

4 Janene R. Finley & Allan Karnes, An Empirical Study of the Effectiveness of

Counsel in United States Tax Court Cases, 16 J. Am. AcAd. Bus. 1-10 (Sept.

2010).

credits such as the EITC and CTC provide a signicant

portion of the annual budget for many low income

families. Thus, a denial or delay of a refund can create

an economic hardship for these taxpayers.

Some taxpayers who owe the IRS may be unable

to pay because of economic hardship. Yet other

taxpayers who have a tax liability or are facing a

potential assessment may not owe the tax at all, or

owe less than the IRS says they do. LITCs have the

skills and expertise to determine what remedies can

help achieve the right result for the taxpayer. One such

remedy is Audit Reconsideration. This administrative

remedy is used to reopen the results of a prior

audit and is available where the taxpayer has new

information to present that the IRS did not previously

consider. In addition, the IRS needs to have either

assessed additional tax that remains unpaid, or a tax

LITC Assists Victim of Human Trafcking

A social service organization afliated with an

LITC referred a survivor of human trafcking to

an LITC for assistance with her tax controversy.

The IRS was sending her notices stating that

she owed nearly $4,000 in income and self-

employment taxes for underreported wages in

2014. The trafcker had reported to the IRS

that she had been paid wages, and that triggered

the IRS liability. The LITC called the IRS and

explained that the taxpayer

had been trafcked as a

domestic worker during

2014. She endured physical

and emotional abuse,

working more than 100

hours per week. The IRS

corrected the tax liability

and refunded her close to $950. The taxpayer

was elated that she received a refund instead of

having to pay tax liabilities.

ACCESS TO REPRESENTATION

HELPS PROTECT TAXPAYER

RIGHTS by assisting low

income and ESL taxpayers to:

• Achieve better outcomes in cases;

• Access benefits administered

through the tax code; and

• Resolve tax debts, liens, and levies.

SUCCESS STORY

$950

refunded

represented

19,479

taxpayers

in 2016

LITCs

6OFFICE OF THE TAXPAYER ADVOCATE

credit was disallowed. Audit Reconsideration may

result in elimination or reduction of the amount owed.

The IRS has a variety of powerful tools at its disposal

to collect unpaid liabilities, such as the ability to impose

liens and levies. However, taxpayers are afforded

important due process protections against IRS

collection actions.

Choosing the appropriate avenue for seeking relief

and communicating with the IRS can be overwhelming

for an unsophisticated taxpayer who cannot pay the

amount shown on an IRS notice or may not even be

able to understand what the notice says. More than

half of the taxpayer cases worked in 2016 involved

collection matters. The combined efforts of clinic staff

and volunteers provided relief to over 4,200 taxpayers

facing an IRS collection action and allowed these

taxpayers to become tax compliant.

Economically vulnerable taxpayers are at risk of falling

into an economic hardship if the IRS takes a collection

action that is more intrusive than necessary. Some

taxpayers are not able to communicate effectively with

the IRS to negotiate a collection alternative. The IRS

does not have the resources to provide every taxpayer

with face-to-face assistance; however, some vulnerable

groups of taxpayers, for example those suffering

from a physical or mental impairment, may require

individualized assistance.

Figure 2: LITC ASSISTANCE TO LOW INCOME

TAXPAYERS BY ISSUE

Percentage of 2016 cases that involved:

Collection Due Process Hearing

Innocent Spouse Relief

Audit Reconsideration

Identity Theft

Lien Withdrawal

Levy Release

Tax Court Litigation

Installment Agreement

EITC Examination

Offer-in-Compromise

15%

14%

10%

10%

9%

6%

5%

3%

2%

3%

The IRS can temporarily suspend collection efforts

against taxpayers experiencing economic hardship by

placing such taxpayers in a “Currently Not Collectible”

(CNC) status. The IRS will cease collection efforts

and follow-up annually when the taxpayer les an

income tax return.5 LITC representatives provide

5 Internal Revenue Manual (IRM) 5.16.1.6, Currently Not Collectible

Procedures (Dec. 8, 2014).

LITC Helps Taxpayer Avoid Foreclosure

A taxpayer facing a potential IRS lien foreclosure

on her home approached an LITC for help.

The taxpayer was retired and living on a xed

income. She carried two mortgages on the

property and the amount of her tax liability was

nearly triple the amount of equity she had in her

home. If the IRS foreclosed on her property, she

would lose her home and would still carry the

burden of the tax debt remaining unpaid. The

LITC advocated successfully for the IRS to release

the lien so the taxpayer could sell her home

and avoid foreclosure. The LITC persuaded the

IRS to accept an offer-in-compromise for $500

in full satisfaction of her liability. To ensure the

taxpayer could get her life on track and remain

compliant with her

taxes going forward, the

LITC stood by her while

she sold her home and

moved to her daughter’s

property where she could

receive ongoing care from

her family, free of debt she was unable to pay.

SUCCESS STORY

LITC helped

save taxpayer’s

home

7

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

expertise that helps taxpayers make an informed

decision about whether seeking CNC status or

another collection alternative is right for them.

The IRS offers streamlined installment agreements

that are guaranteed for taxpayers who owe under a

certain amount of tax and indicate they can pay that

tax in installments in six years or less. A taxpayer

who enters into an agreement that ultimately is

unaffordable and results in a default creates a drain

on IRS resources by creating back-end rework.

Helping the taxpayer nd a solution that ts individual

circumstances benets the IRS by reducing that

rework.

For taxpayers with little chance of a change in

economic status, resolving their controversy with an

offer-in-compromise (OIC) provides a better long-

term solution for all parties. The IRS saves resources

that would be wasted on attempting collection against

someone unable to pay, and vulnerable taxpayers are

provided an opportunity to resolve past debts. It

encourages the taxpayer to become compliant and

remain compliant by requiring the taxpayer to le and

pay tax obligations timely for ve years after the OIC

is accepted.

More than 200 of the cases LITCs worked in 2016

involved a taxpayer who was compensated as an

independent contractor, but should have been

paid as an employee, or vice versa. In terms of

the amount of tax, that distinction can potentially

make a big difference. Independent contractors

may be responsible for a larger portion of tax than

an employer would otherwise have to pay. The

IRS has procedures for reviewing the nature of the

employment relationship if taxpayers believe they have

been misclassied. The factual and legal issues can

be complex and the process can take several months.

It’s easy to imagine the systemic impact of employers

misclassifying groups of employees as independent

contractors to avoid paying the additional expenses of

treating them as employees.

LITC Helps Taxpayer Victimized by

Employer

An auto shop worker who worked on a schedule

set by the employer, using the employer’s tools,

was wrongly classied by the employer as an

independent contractor. The taxpayer and his

wife had medical issues, and he made roughly

$15,000 a year, which represented the entire

household income aside from his wife’s disability

payments. The taxpayer

was unaware that his

independent contractor

status triggered a ling

requirement, and

approached an LITC for

assistance after receiving

IRS notices. Not only did

the LITC resolve his tax controversy, they were

able to prove to the IRS that he was improperly

classied as an independent contractor instead of

an employee, saving him thousands in liabilities.

LITC Gives Retired Taxpayer Relief from

30-Year-Old Tax Debt

After losing his home to an IRS seizure, a

taxpayer agreed to extend the collection period

on a debt from tax year 1981. The loss of the

home had a devastating effect on the taxpayer’s

family. Each year that followed, the IRS applied

his tax refund to the debt, but the amount

continued to grow, and by the time he came to

the LITC for assistance,

penalties and interest had

caused the 1981 tax debt

to grow to more than ten

times the amount it was

when he agreed to extend

the collection period. It

was unlikely the retired

taxpayer suffering from multiple health issues

could afford to pay off the debt. The LITC

submitted an OIC of $300 to resolve the debt,

which the IRS accepted.

SUCCESS STORY

OIC of $300

clears 30-year-

old tax debt

SUCCESS STORY

LITC saves

misclassified

employee thousands

8OFFICE OF THE TAXPAYER ADVOCATE

Protecting the Right to be

Heard and to Appeal the IRS’s

Decision in an Independent

Forum

When taxpayers are unable to resolve tax

controversies using IRS administrative channels, some

cases proceed to litigation in the courts. The United

States Tax Court is the only pre-payment forum for

taxpayers challenging an IRS examination decision or

collection action. LITCs are strongly encouraged to

provide representation to unrepresented taxpayers

who have petitioned the Tax Court. Nearly 10

percent of all LITC cases in 2016 were in litigation, with

the majority before the U.S. Tax Court.

According to a 2015 study, the number of self-

represented petitioners ling Tax Court petitions

is increasing, accounting for over 70 percent of all

Tax Court petitions.6 The Tax Court is committed

to ensuring access to justice for all petitioners, and

in recent years has given a high level of attention to

facilitating the participation of practitioners from LITCs

at the Tax Court’s “calendar calls.” The Tax Court’s

website contains the following statement: “Tax clinics

and Bar sponsored calendar call programs provide

important advice and assistance to many low income,

self-represented taxpayers who have disputes with the

Internal Revenue Service.”7

For many taxpayers, the day of their Tax Court

calendar call will be the rst time they speak to an

IRS employee face-to-face. Some may want a chance

to explain their circumstances, regardless of their

understanding of how the law applies to the facts of

their case. LITC representatives who attend calendar

calls provide expert counsel, independent of IRS

interests.

The Tax Court has taken signicant steps in providing

information to self-represented petitioners via printed

information and the Tax Court’s website; however, the

complexity of the process can overwhelm taxpayers.

In addition, the Tax Court’s Clinical Program requires

participating LITCs to submit a “stuffer notice” to the

Tax Court, including information about how taxpayers

can contact the LITC. The Tax Court will then include

the “stuffer notice” in its mailings to petitioners in an

LITC’s geographic area who indicated they did not

have representation. These “stuffer notices” are a

valuable way to get word to taxpayers that assistance

from an LITC is available.

Currently, 124 LITCs participate in the Tax Court’s

Clinic Program. In this program unrepresented

taxpayers receive a yer notifying the taxpayer of

the existence and availability of assistance by a LITC

to eligible taxpayers. Many participating in the clinic

program also attend calendar calls to consult and

advise self-represented taxpayers, and, in some cases,

enter an appearance before the Tax Court to act as

a taxpayer’s representative. In 2016, LITCs consulted

6 The United States Tax Court and Calendar Call Programs, Panuthos, Hon.

Peter J., 68 Tax Law. 439, 440 (Spring 2015).

7 http://www.ustaxcourt.gov/clinics.htm.

LITC Assists Victim of Employee

Misclassication

The clinic assisted an ESL taxpayer who owed tax

after his employer overreported his income to

the IRS. The taxpayer worked for a construction

company, and after sustaining an injury on the

job, the employer terminated his employment.

He led claims against his former employer

for worker’s compensation and unpaid wages.

At the end of the year, the taxpayer’s former

employer issued a 1099-Misc which incorrectly

classied the taxpayer as an independent

contractor instead of an

employee. The employer

reported triple the amount

of the taxpayer’s actual

compensation. With LITC

assistance, he brought his

case to the Tax Court

and proved that the amount the employer

reported on the 1099 was incorrect and that

the amount reported on his return was correct.

The Tax Court ruled in the taxpayer’s favor and

eliminated the entire tax liability.

SUCCESS STORY

Entire tax

liability

eliminated

9

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

with more than 600 self-represented taxpayers at Tax

Court calendar calls.

Through the Tax Court’s Clinical Program, the Tax

Court and the LITCs work together to identify

taxpayers who may benet from LITC representation,

thereby protecting taxpayers’ access to justice and the

right to appeal an IRS decision in an independent forum.

For LITCs, the lion’s share of their litigation work

occurs in the United States Tax Court, because it is

the only pre-payment forum for taxpayers challenging

an IRS examination decision or collection action.

However, depending on the circumstances, a taxpayer

may need to seek relief by litigating in a different court.

LITCs can also represent taxpayers before the United

States district courts, Courts of Appeals, Court of

Federal Claims, and the United States Supreme Court.

Not every taxpayer is able to obtain his or her

desired outcome, but the taxpayer is equipped with

information about how the tax law applies to the facts

of his or her case before speaking to the judge and is

able to exercise the right to challenge the IRS’s position

and be heard.

LITC Prevents Taxpayer from Conceding to

a Tax Liability She Did Not Owe

An ESL taxpayer facing an IRS controversy

brought her case to Tax Court. The controversy

arose from taxes on earnings paid to another

person using her social security number. By the

time the taxpayer sought LITC assistance, she

had already signed

decision documents

conceding her case in

full. She would have

owed the IRS taxes,

penalties, and interest.

She was also subject to

a ban that would have

prevented her from claiming the EITC for two

years. The LITC disputed the legitimacy of the

decision documents, then convinced the IRS to

eliminate the entire liability.

SUCCESS STORY

Entire liability

eliminated for

ESL taxpayer

The United States Tax

Court Calendar Call

The Tax Court operates on a strict schedule, only

holding court for a limited number of dates per

year in each city, and it may hear many cases in a

single day. When the Tax Court grants a taxpayer’s

petition for a hearing, the Tax Court sends a notice

of trial to the IRS and to each of the petitioners

scheduled for that day, approximately ve months in

advance of the scheduled trial. Each court session

begins with each party called before the judge to set

hearings and trials and schedule the court’s calendar.

Thus, the proceeding is known as a calendar call.

10 OFFICE OF THE TAXPAYER ADVOCATE

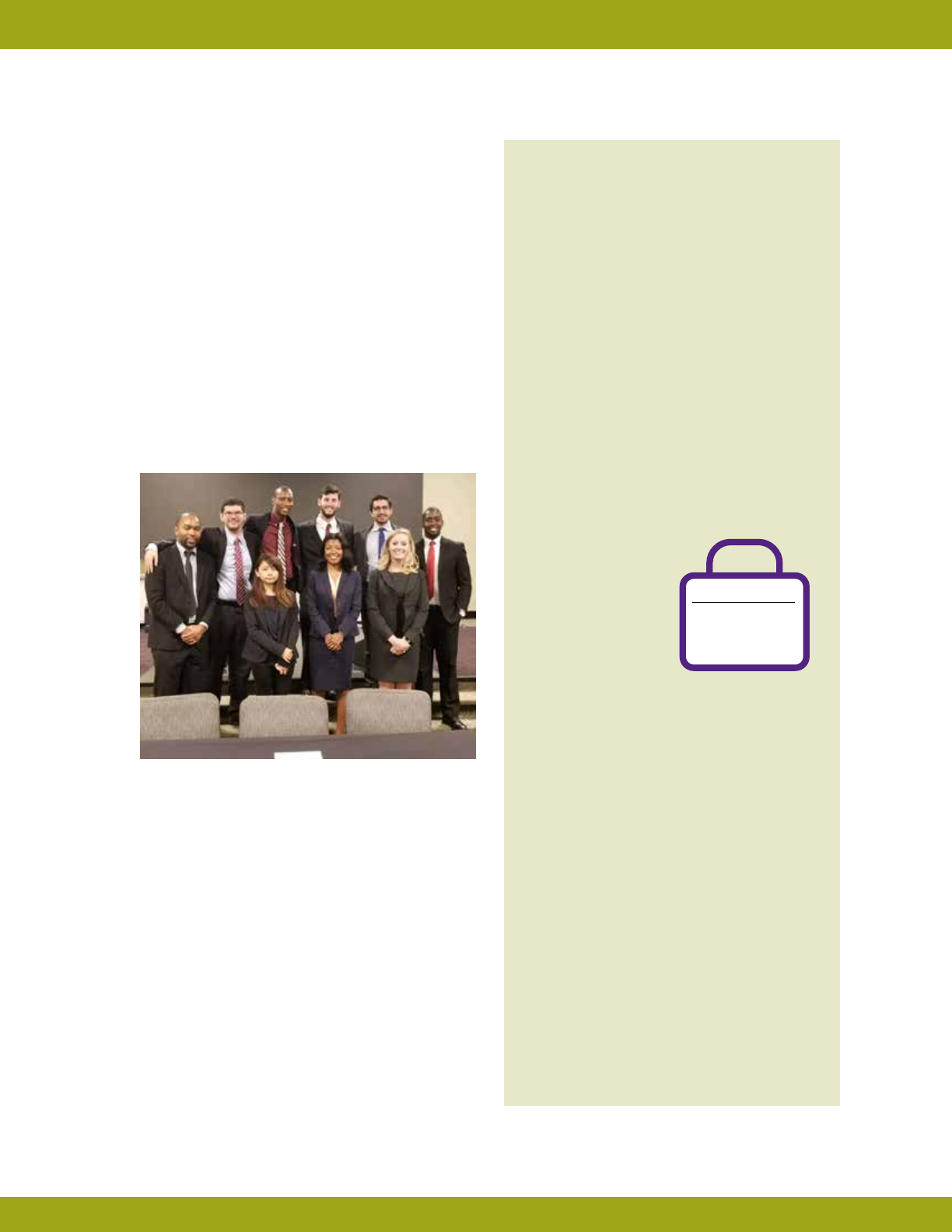

Student R epresentation

LITCs are operated by a variety of nonprot

organizations, including academic institutions. For

instance, a law school may operate a clinic where a

professor supervises a group of students who provide

representation, education, and advocacy to low

income and ESL taxpayers.8 Creating an environment

where students work directly with taxpayers to

resolve disputes with the IRS enables LITCs to assist

more taxpayers and allows the students to develop

their advocacy skills. Moreover, participating in

an LITC fosters a pro bono tradition, helping keep

taxpayer-funded overhead costs at a minimum.9

8 The LITC Program Ofce may grant students and recent law graduates

working at an LITC temporary authority to represent taxpayers before

the IRS. Delegation Order 25-18 (Rev. 2), IRM 1.2.52.19 (Sept. 9, 2015).

For more information, see Publication 3319, LITC Grant Application

Package and Guidelines.

9 Students face challenges during their clinic work, which they can examine,

resolve, internalize, and then carry with them in their subsequent profes-

sional endeavors. See Christian A. Johnson & Mary Grossman, The Tax

Law Clinic: Loyola Chicago’s Decade of Experience, 50 J. Legal Educ. 376, 390

(Sept. 2000).

LITC Volunteer Works Tirelessly to Assist

Victim of Preparer Fraud

After an unscrupulous tax return preparer

diverted her expected refund of over $5,000

in 2009, the victim sought TAS assistance. TAS

was unable to gather sufcient documentation

to persuade the IRS that she was the victim

of preparer fraud and to issue her a refund,

and referred her to an LITC for further legal

assistance. An attorney volunteering at the LITC

agreed to represent the taxpayer and spent the

next year helping the taxpayer with her case.

The attorney learned that the tax return

preparer had been arrested for another crime

(unrelated to the tax fraud), and used creative

thinking and good research to prove her client’s

case. Using a FOIA

request, the volunteer

attorney obtained

copies of several

hundred documents

seized from the tax

return preparer’s

vehicle pursuant to

the tax return preparer’s arrest. The attorney

was unable to locate evidence of her client’s

defrauding among the documents, however she

discovered evidence of other tax fraud and used

those documents to prove to the IRS that the

tax return preparer had defrauded many other

clients. Within days of receiving the documents,

the IRS conceded the taxpayer’s case and less

than one month later the taxpayer received a

$5,000 refund plus six years of interest. The

volunteer attorney described her experience,

stating “I felt like Columbo.” Had she been

working for a fee, the amount required to

compensate her for her services would have

exceeded the $5,000 refund her client received,

making it unlikely the taxpayer could have

obtained the same kind of assistance outside of a

pro bono context.

SUCCESS STORY

$5,000

plus 6 years

interest refunded

11

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

Education

Helping a taxpayer to avoid a controversy in the rst

place through education and outreach is another

essential function of LITCs. LITCs educate low

income and ESL taxpayers about their rights and

responsibilities under the tax code. Over the last 19

years, the taxpayers who received LITC assistance

shared a common trait — a desire to comply with

their tax responsibilities — yet many of them simply

needed help to do that. They may need information

about their ling requirements or eligibility for tax

credits. The IRS favors online self-help resources and

has taken cost-cutting measures that make it harder to

receive one-on-one assistance from the IRS.10 LITCs

help to ll the service gap for low income and ESL

taxpayers who require personal assistance.

Tailoring education about taxpayer rights and

responsibilities to the needs of specic communities

and offering the presentations in a taxpayer’s native

language provide an avenue for reaching taxpayers

who may otherwise be unable to overcome

communication barriers with the IRS. LITCs provided

more than 2,500 free educational activities for

10 See National Taxpayer Advocate 2016 Annual Report to Congress 1-41

(Special Focus: IRS Future State: The National Taxpayer Advocate’s Vision for

a Taxpayer-Centric 21st Century Tax Administration).

more than 70,000 attendees during the 2016 grant

year. LITCs generally direct their education and

outreach activities to specic groups of taxpayers,

many of whom speak little or no English and are new

residents of the United States. These efforts provide

information and education to help ESL individuals

understand their federal tax responsibilities.

LITCs address a wide range of substantive tax issues

in their educational programs and materials (e.g., ling

requirements, tax recordkeeping, family status issues,

refundable credits, the Affordable Care Act, worker

classication, identity theft, information about the

audit and appeals process, and collection alternatives).

LITCs prepare and distribute materials in languages

appropriate for the ESL communities they assist.

America’s taxpayers speak many languages, and while

the IRS offers publications and online resources in six

languages on its website,11 LITCs go further by offering

assistance to taxpayers in a wide variety of languages.12

To expand their reach, LITCs work with existing

community groups and agencies to educate staff about

the basics, help staffers identify when clients have tax

issues and refer taxpayers who need help to LITCs for

assistance.

LITCs provide a valuable

community-based resource

for taxpayers. LITCs provide

an environment where

taxpayers can listen and pose

questions to a person who

can break down complex

tax topics, and can address

the needs of taxpayers who

need information in a language other than English.

11 See IR-2015-94, IRS Spotlights Year-Round Tax Help in 6 Languages (July 1,

2015). IRS.gov features online resources in Chinese, Korean, Russian, and

Vietnamese, as well as English and Spanish.

12 For a complete list of LITC names, geographic locations, and languages

in which services are available in addition to English, see IRS Publication

4134.

EDUCATE English as a second

language taxpayers about

their taxpayer rights and

responsibilities and help them:

• Understand the U.S. tax system;

• Exercise their rights as taxpayers;

and

• Comply with their tax

responsibilities.

variety

in a

wide

LITCs offer

assistance

of languages

12 OFFICE OF THE TAXPAYER ADVOCATE

Advocacy

LITCs are uniquely positioned to recognize

emerging issues or trends in tax administration. As

representatives, counselors, and advocates for low

income and ESL taxpayers, clinicians see rsthand

how IRS policies and procedures affect their clients.

LITCs also network with one another, which permits

clinicians to gain a broader perspective on the extent

to which taxpayers in other locales experience

problems faced by their own clients.

When LITCs identify problems that affect multiple

taxpayers, they can work with the IRS and the TAS

Ofce of Systemic Advocacy to nd solutions on a

systemic level. Clinics are encouraged to utilize the

Systemic Advocacy Management System (SAMS) on

the TAS website13 to report potential systemic issues.

TAS analysts follow up on every SAMS submission,

conducting research to determine the extent of

impact of the reported issue, ascertaining whether

there is already a similar or related project underway,

and formulating the next steps to take to correct a

problem. TAS works with various IRS business units

to propose and implement solutions. If TAS and the

IRS cannot reach a resolution, the National Taxpayer

Advocate can include systemic issues in her Annual

Report to Congress and propose administrative and

legislative recommendations to resolve those issues.14

13 www.irs.gov/Advocate/Systemic-Advocacy-Management-System-SAMS.

14 See IRC § 7803(c)(2)(B)(ii).

ADVOCATE about issues that

impact low income taxpayers and

help the IRS:

• Identify and fix systemic

tax problems; and

• Ensure the fairness and integrity of

the tax system for all taxpayers.

LITC Helps Identify Local Tax Scam and

Assists More Than 30 Victims

Through years of hard work, one LITC

successfully resolved tax controversies for

more than 30 victims of a mass identity theft

scheme, and this year saw the perpetrator

brought to justice. A local minister swindled his

congregants into divulging their social security

numbers and other personal information by

offering false promises of government stimulus

payments. Instead, he led tax returns using the

ill-gotten information, claimed excess refunds,

and then diverted the refunds to bank accounts

he controlled. The IRS attempted to collect the

excess refunds, which led one of the victims to

seek assistance from an LITC. After speaking

with the victim, a representative at the LITC

determined what had occurred, and brought the

matter to the attention

of the Local Taxpayer

Advocate (LTA). The

Department of Justice

investigated, charged, and

convicted the minister

for his participation in

a scheme that claimed

roughly $4.8 million in false refunds. After more

victims were identied, the LITC aided more

than 30 people and helped them to resolve the

effects of the theft on their tax accounts.

SUCCESS STORY

LITC helped

victims of

identity theft

13

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

LITCs have successfully advocated for resolution of

systemic issues affecting taxpayers they represent

using a variety of avenues

ranging from elevating issues

through SAMS, to contesting

issues administratively within

the IRS, and litigating cases

in the United States Tax

Court, other federal courts,

and federal appellate courts.

When public comment is sought on IRS administrative

rule making, LITCs often offer feedback. They

advocate to ensure IRS rules and procedures are fair

and equitable to populations of taxpayers who may

not have the resources to advocate for their own

interests. Opting to take the additional steps required

has a systemic impact and protects other taxpayers’

right to pay no more than the correct amount of tax.

LITC Protects Deductibility of Graduate

Education Expenses

The successful advocacy of one LITC made

it easier for a full-time Master of Business

Administration (MBA) student to deduct the

cost of his graduate education. The taxpayer

came to an LITC for assistance after the IRS

denied deductions he claimed as unreimbursed

employee expenses for obtaining an Executive

Master of Business Administration (EMBA)

graduate degree. The IRS argued that obtaining

the EMBA degree qualied the taxpayer for

a new trade or business, and the degree was

unrelated to an ongoing trade or business, since

his employer terminated

his employment while

pursuing his degree.

The LITC represented

the taxpayer and

persuaded the Tax

Court that he continued

to perform essentially

the same tasks after obtaining the EMBA,

although the knowledge he obtained through his

studies allowed him to address more complex

issues. The LITC also proved that the EMBA did

not qualify him for a new trade or business, and

temporary unemployment while pursuing the

EMBA did not render the educational expenses

nondeductible. See Kopaigora v. Comm’r, T.C.

Summ. Op. 2016-35.

Obtaining an MBA degree is an expensive and

time-consuming process. While the Tax Court’s

decision in Kopaigora is not precedential (see

IRC § 7463(b)), nonetheless the facts and analysis

relied upon by the Tax Court will be helpful for

other taxpayers faced with questions about a

deduction for expenses incurred in pursuing an

EMBA degree.

LITCs

successfully

advocate tax

resolutions

SUCCESS STORY

Analysis

will be

helpful for

other taxpayers

14 OFFICE OF THE TAXPAYER ADVOCATE

Spending Tr ansparency

The LITC Program Ofce’s history of recruiting efforts

coupled with sound judgment in selecting federal grant

recipients has fostered the growth of a nationwide

network of independent organizations working

towards a common purpose in their local communities.

The program’s success led Congress to appropriate

$12 million for 2017 awards, a six-fold increase from

the amount Congress appropriated in 1999.15

Our average award grew from about $81,000 in

2016 to more than $86,000 in 2017, with only the

strongest programs receiving the maximum award of

$100,000. The LITC Program requires a dollar-for-

dollar match in funding from the recipient,16 yet many

programs provide matching funds in the form of cash

or third party in-kind contributions (e.g., time worked

by volunteers) far in excess of the minimum. For

example, if every award recipient in 2016 provided

only the minimum amount of match, the average

total program resources (grant award plus match

funding) available to each LITC would have been

about $162,000. Yet, in 2016 the average award of

about $81,000 saw an average match valued at over

$112,000. In other words, the additional contributions

of our award recipients increased the average total

program resources to over $193,000 in 2016.

The matching funds requirement ensures that each

LITC grant represents a nancial partnership between

the grantee and the federal government for the benet

of low income and ESL taxpayers. The commitment

of matching funds by the grantee leverages the federal

funding investment so that an LITC can assist more

taxpayers in need. Although LITCs receive funding

from the federal government, clinics, their employees

and volunteers are completely independent of the

federal government and the IRS.

15 IR-1999-63, IRS Encourages Growth of Low-Income Taxpayer Clinics with $1.5

Million in Grants (July 14, 1999). Consolidated Appropriations Act, 2016,

Pub. L. No. 114-113, Division E (2016).

16 IRC § 7526(c)(5).

We must also recognize the maximum award the law

allows for an LITC grant has stayed constant since the

creation of our program, yet we continue to ask more

of our grantees and they have continued to deliver

tremendous results. More than two-thirds of the 34

organizations that received an award in the rst year of

the LITC program are still with the program today.

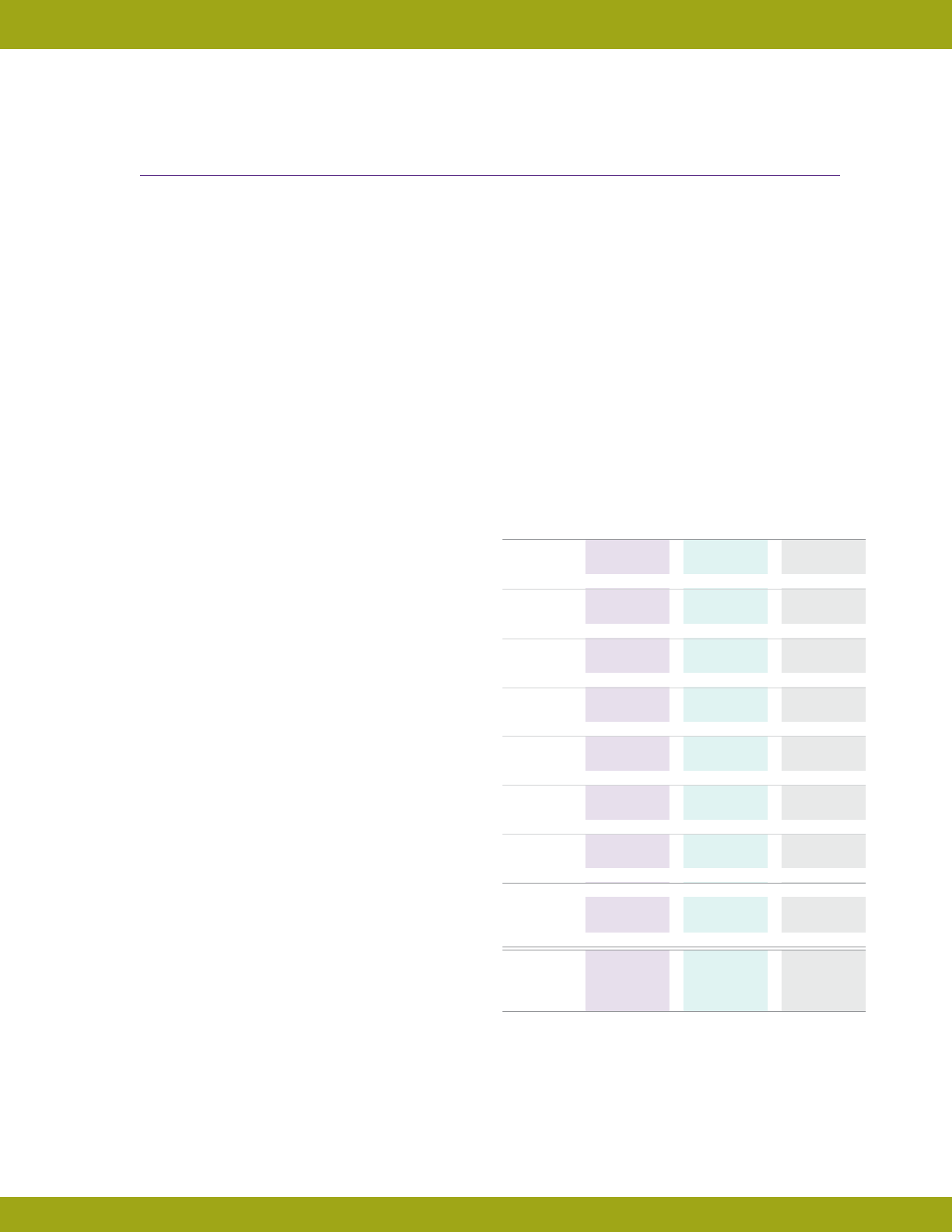

Figure 3 details how LITCs spent federal and matching

funds during grant year 2016.

Figure 3: LITC GRANT FUNDS EXPENDED:

GRANT YEAR 2016 (as of 10/6/2017)

Federal Funds Matching Funds Total*

PERSONNEL

FRINGE

BENEFITS

TRAVEL

EQUIPMENT

Expenditures

SUPPLIES

CONTRACTUAL

OTHER

EXPENSES

INDIRECT

CHARGES

TOTALS*

* Numbers may not total due to rounding.

† LITCs that include the value of volunteer services as part of the required matching funds include

the amount in the “Other Expenses” category.

†

$ 7,977,909 $ 6,496,907 $ 14,474,816

$ 1,581,418 $ 2,249,097 $ 3,830,515

$ 240,445 $ 252,734 $ 493,178

$ 1,074 $ 16,019 $ 17,093

$ 146,518 $ 242,094 $ 388,611

$ 262,964 $ 766,455 $ 1,029,420

$ 191,714 $ 5,490,511 $ 5,682,226

$ 812,115 $ — $ 812,115

$ 11,214,157 $ 15,513,817 $ 26,727,975

=

+

=

+

=

+

=

+

=

+

=

+

=

+

=

+

=

+

Figure 3: LITC GRANT FUNDS EXPENDED:

GRANT YEAR 2016 (as of October 6, 2017)

15

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

The major expenditures incurred by LITCs are

personnel costs and fringe benets paid to provide

direct representation, education, and advocacy

services to low income and ESL taxpayers. Personnel

costs and fringe benets total more than $18.3 million.

Grantees are prohibited from using matching funds

to pay indirect expenses, including general overhead

of the grantee.17 This ensures more program funds

are spent on taxpayer representation, education, and

advocacy rather than administrative costs.

LITCs are strongly encouraged to maintain a pro

bono panel to whom the clinic may refer taxpayers in

need of representation. Pro bono panel members are

volunteers who are qualied to practice before the

IRS. In 2016, 59 percent of the over 1,800 volunteers

at LITCs were attorneys. Clinics also use volunteers

to provide clerical assistance, develop or maintain

the clinic’s website, conduct community outreach

and education, or provide interpreter and translation

services. In total, volunteers contributed over 47,000

hours of service to LITCs in 2016.18 Figure 4 shows

the types of volunteers who provided services in 2016.

17 IRC § 7526(c)(5).

18 LITCs that include the value of volunteer services as part of the required

matching funds include the amount in the “Other Expenses” category.

Attorneys 58.9%

CPAs 5.6%

Enrolled Agents 4.2%

Interpreters 4.6%

Students 16.0%

Other Volunteers 10.6%

Figure 4: TYPES OF VOLUNTEERS IN 2016

Total Volunteers 1,807

Figure 4: TYPES OF VOLUNTEERS IN 2016

16 OFFICE OF THE TAXPAYER ADVOCATE

Progr am Office Activities

The LITC Program Ofce is responsible for managing

and administering the LITC grant program in a manner

so as to ensure that federal funding is expended and

funded programs are implemented in full accordance

with U.S. statutory and public policy requirements.

The LITC Program Ofce fullls its responsibilities by:

§Administering the award and payment of grant

funds;

§Providing assistance and guidance to grantees; and

§Monitoring the performance of grantees.

The LITC Program Ofce is part of TAS. The Director

of the LITC Program reports directly to the National

Taxpayer Advocate.

The LITC Program Ofce staff consists of the

following:

§Headquarters staff who report to the Director of

the LITC Program, including a Deputy Director,

two managers (Clinic Advocacy and Grant

Operations), and program analysts;

§Grant Operations staff who report to the Grant

Operations Manager and are responsible for

processing grant applications, awards, payments,

and reports; and

§Advocacy staff who report to the Advocacy

Manager and are responsible for reviewing and

analyzing budgets and reports, conducting site

assistance visits, and serving as the primary liaison

between grantees and the LITC Program Ofce.

Administr ation

The LITC Program Ofce administers the grant by:

§Processing LITC grant applications and making

awards to successful applicants;

§Revising and issuing annually Publication 3319, LITC

Grant Application Package and Guidelines;

§Maintaining the LITC Toolkit, a website used to

disseminate program guidance to grantees and

provide resources to clinics assisting low income

and ESL taxpayers;

§Maintaining Publication 4134, Low Income Taxpayer

Clinic List, a list of all federally funded LITCs,

and ensuring that the publication is included

in appropriate IRS mailings and referenced in

appropriate IRS publications and notices;

§Publishing annually Publication 5066, LITC Program

Report, which reports the activities of the LITCs to

internal and external stakeholders;

§Reviewing and analyzing data from reports

submitted by grantees to identify trends and

recognize best practices; and

§Submitting grant award information for posting on

USASpending.gov.

Assistance

The LITC Program Ofce assists grantees and

applicants by:

§Providing technical assistance and guidance to

grantees and potential applicants, including pairing

new LITCs with mentors and LITC networks;

§Informing the public about the availability of LITCs,

as appropriate and to the extent permitted by

law, including references on the IRS website at

www.irs.gov;

17

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

§Sponsoring and organizing the Annual LITC

Grantee Conference that delivers instruction and

continuing education to all grantees and provides

an opportunity for attendees to meet face-to-face

with colleagues from clinics throughout the country

to share ideas and strategies to better assist low

income and ESL taxpayers;

§Conducting orientation visits to familiarize new

grantees with LITC Program requirements and to

identify potential areas where the clinic may need

to create systems or improve processes;

§Fostering the working relationship between

grantees and LTA ofces by facilitating annual LTA

site assistance visits;

§Issuing special appearance authorizations to

LITCs that permit students and law graduates

working under the supervision of a practitioner to

represent taxpayers before the IRS; and

§Coordinating access for LITCs to e-services

products offered by the IRS.

Oversight

The LITC Program conducts oversight of grantees by:

§Processing Interim and Year-End reports to

assess progress in meeting program goals, identify

emerging issues, and collect, review, and validate

performance data submitted by grantees;

§Reviewing budgets and nancial reports submitted

by grantees to ensure that federal funds are

properly expended and that matching funds are

properly sourced, spent, and valued;

§Conducting operational site assistance visits to

interview clinic personnel, observe facilities, review

procedures and internal controls, corroborate

report information, and evaluate operations;

§Coordinating Civil Rights Pre-Award Compliance

reviews for all grant applicants with the IRS Ofce

of Equity, Diversity and Inclusion; and

§Coordinating or conducting other required

compliance reviews, such as for compliance with

federal tax obligations.

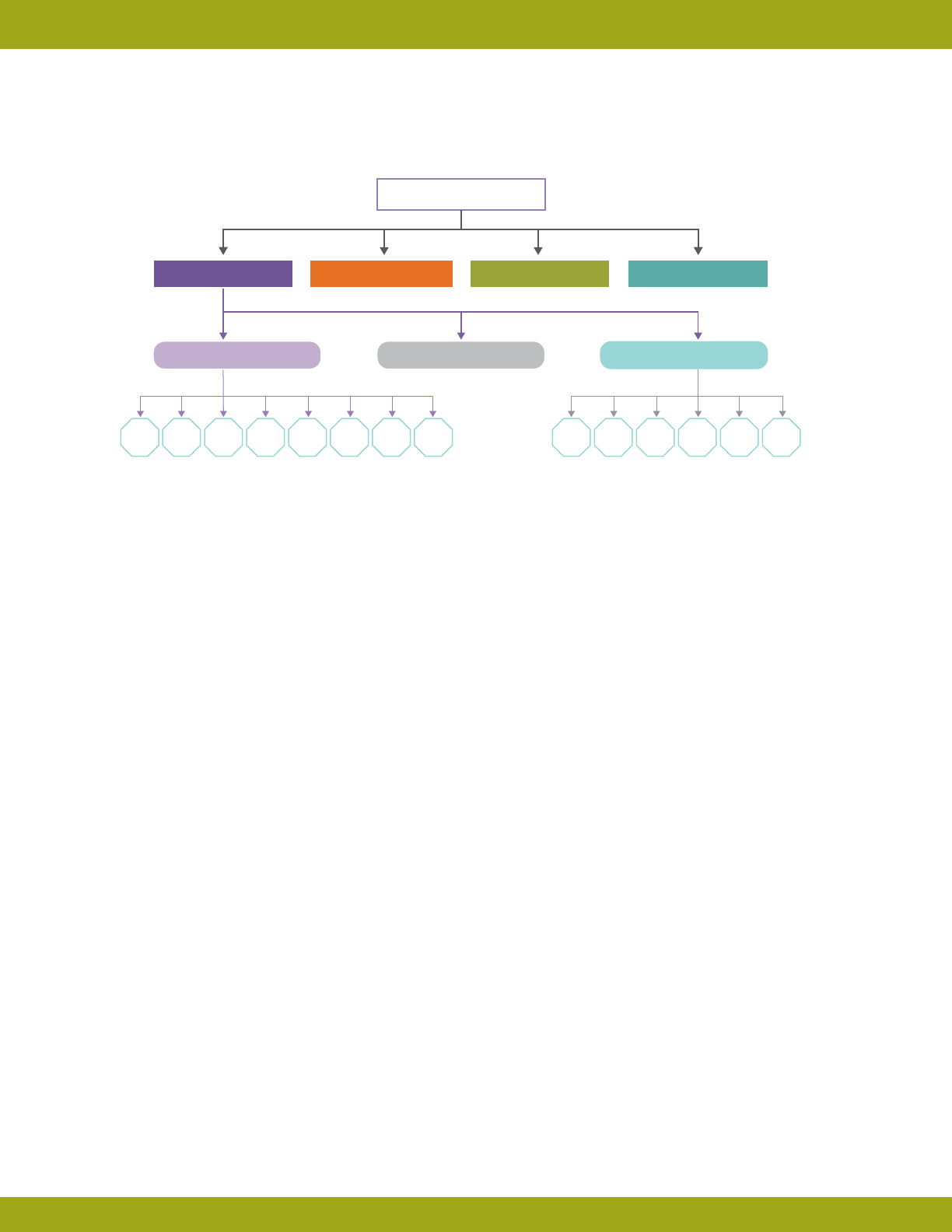

Figure 5: LITC PROGRAM OFFICE STAFFING CHART

Deputy Director

Clinical Advocacy Manager Secretary Grant Operations Manager

Senior Analyst Analyst Secretary

Director’s Office

Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst Analyst

Figure 5: LITC PROGRAM OFFICE STAFFING CHART

18 OFFICE OF THE TAXPAYER ADVOCATE

List of LITCs

Below is a list of LITCs in each state as of January 2017.

IRS Publication 4134, Low Income Taxpayer Clinic List,

which includes contact information and language

information for each clinic, is updated annually and

is available at www.irs.gov. Contact information

for clinics is subject to change. Up-to-date contact

information is available on the IRS and TAS websites.

For general questions about the LITC Program,

contact the LITC Program Ofce at 202-317-4700 (not

a toll-free call) or by email at LITCProgramOfce@

irs.gov.

Alabama

Montgomery Legal Services Alabama LITC

Alaska

Anchorage Alaska Business Development

Center

Arizona

Phoenix Community Legal Services LITC

Tucson Taxpayer Clinic of Southern

Arizona

Arkansas

Little Rock UALR Bowen School of Law

LITC

Springdale LITC at Legal Aid of Arkansas

California

Fresno Central California Legal Services

LITC

Los Angeles Bet Tzedek Legal Services Tax

Clinic

Los Angeles KYCC Low Income Taxpayer

Clinic

Los Angeles Pepperdine University LITC

Northridge Bookstein Low Income Taxpayer

Clinic

Orange Chapman University Tax Law

Clinic

Riverside Inland Counties Legal Services

LITC

San Diego Legal Aid Society of San Diego

LITC

San Diego University of San Diego LITC

San Francisco Chinese Newcomers Service

Center

San Francisco Justice and Diversity Center

of the Bar Association of San

Francisco

San Luis Obispo Cal Poly Low Income Taxpayer

Clinic

Santa Ana Legal Aid Society of Orange

County LITC

Colorado

Denver Colorado Legal Services LITC

Denver University of Denver Graduate

Tax Program LITC

Connecticut

Hamden Quinnipiac University School of

Law LITC

Hartford University of Connecticut Law

School Tax Clinic

Delaware

Wilmington Delaware Community

Reinvestment Action Council

LITC

District of Columbia

Washington The Catholic University LITC

Washington The Janet R. Spragens Federal

Tax Clinic

Washington University of the District of

Columbia David A. Clarke School

of Law LITC

19

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

Florida

Gainesville Three Rivers Legal Services LITC

Miami Legal Services of Greater Miami

Community Tax Clinic

Orlando Community Legal Services of

Mid-Florida LITC

Plant City Bay Area Legal Services, Inc. LITC

Plantation Legal Aid Service of Broward &

Collier Counties LITC

St. Petersburg Gulfcoast Legal Services LITC

Tallahassee Legal Services of North Florida

LITC

West Palm Beach Legal Aid Society of Palm Beach

County LITC

Georgia

Atlanta The Philip C. Cook Low-Income

Taxpayer Clinic

Hinesville JCVision and Associates, Inc.

LITC

Hawaii

Honolulu Legal Aid Society of Hawaii LITC

Idaho

Boise University of Idaho College of

Law LITC

Twin Falls La Posada Tax Clinic

Illinois

Chicago Center for Economic Progress

Tax Clinic

Chicago Loyola University Chicago School

of Law LITC

Elgin Administer Justice

Wheaton Prairie State Legal Services LITC

Indiana

Bloomington Indiana Legal Services LITC

Indianapolis Neighborhood Christian Legal

Clinic

South Bend Notre Dame Tax Clinic

Valparaiso Valparaiso University Law Clinic

Iowa

Des Moines Iowa Legal Aid LITC

Kansas

Kansas City Kansas Legal Services, Inc. LITC

Kentucky

Covington Center for Great Neighborhoods

LITC

Louisville LITC at the Legal Aid Society, Inc.

Richmond AppalRed Legal Aid Low Income

Tax Clinic

Louisiana

New Orleans Southeast Louisiana Legal

Services LITC

Maine

Bangor Pine Tree Legal Assistance LITC

Maryland

Baltimore Maryland Volunteer Lawyers

Service LITC

Baltimore University of Baltimore School of

Law LITC

Baltimore University of Maryland Carey

School of Law LITC

Massachusetts

Boston Greater Boston Legal Services

LITC

Jamaica Plain Legal Services Center of Harvard

Law School LITC

Springeld Springeld Partners LITC

Waltham Bentley University Low Income

Taxpayer Clinic

Michigan

Ann Arbor University of Michigan LITC

Detroit Accounting Aid Society LITC

East Lansing Alvin L. Storrs Low Income

Taxpayer Clinic

Grand Rapids West Michigan Low Income

Taxpayer Clinic

Minnesota

Minneapolis Mid-Minnesota Legal Aid Tax

Law Project

Minneapolis University of Minnesota Ronald

M. Mankoff Tax Clinic

20 OFFICE OF THE TAXPAYER ADVOCATE

Mississippi

Oxford Mississippi Taxpayer Assistance

Project

Missouri

Kansas City Legal Aid of Western Missouri

LITC

Kansas City UMKC Kansas City Tax Clinic

St. Louis Washington University School of

Law LITC

Montana

Helena Montana Legal Services

Association LITC

Nebraska

Omaha Legal Aid of Nebraska LITC

Nevada

Las Vegas Nevada Legal Services LITC

New Hampshire

Concord NH Pro Bono Low-Income

Taxpayer Project

New Jersey

Camden South Jersey Legal Services LITC

Edison Legal Services of New Jersey Tax

Legal Assistance Project

Jersey City Northeast New Jersey Legal

Services LITC

Newark Rutgers Federal Tax Law Clinic

New Mexico

Albuquerque New Mexico Legal Aid Taxpayer

Clinic

Albuquerque University of New Mexico School

of Law LITC

New York

Albany Legal Aid Society of

Northeastern New York LITC

Bronx Legal Services NYC-Bronx LITC

Brooklyn Brooklyn Legal Services Corp A

LITC

Brooklyn Brooklyn Low-Income Taxpayer

Clinic

Buffalo Erie County Bar Association

Volunteer Lawyers Project LITC

Central Islip Touro Law Center LITC

Hempstead Hofstra Law School Federal Tax

Clinic

Jamaica Queens Legal Services LITC

New York Fordham Law School Tax

Litigation Clinic

New York The Legal Aid Society LITC

New York MFY Legal Services LITC

Syracuse Syracuse University College of

Law LITC

North Carolina

Charlotte Western North Carolina LITC

Durham North Carolina Central

University School of Law LITC

Ohio

Akron Community Legal Aid Service

LITC

Cincinnati Legal Aid of Greater Cincinnati

LITC

Cleveland The Legal Aid Society of

Cleveland LITC

Columbus The LITC of the Legal Aid Society

of Columbus LITC

Columbus Southeastern Ohio Legal

Services LITC

Toledo Legal Aid of Western Ohio LITC

Oklahoma

Oklahoma City Oklahoma Indian Legal Services

LITC

Tulsa Legal Aid Services of Oklahoma

LITC

Oregon

Gresham El Programa Hispano Catolico

LITC

Portland Legal Aid Services of Oregon

LITC

Portland Lewis & Clark Low Income

Taxpayer Clinic

21

LOW INCOME TAXPAYER CLINICS PROGRAM REPORT ¡ February 2018

Pennsylvania

Harrisburg The LITC of MidPenn Legal

Services

Philadelphia PLA’s Pennsylvania Farmworker

Project LITC

Pittsburgh University of Pittsburgh School of

Law Taxpayer Clinic

Villanova Villanova Federal Tax Clinic

Washington Southwestern Pennsylvania Legal

Services LITC

Rhode Island

Providence Rhode Island Legal Services LITC

South Carolina

Greenville South Carolina Legal Services

LITC

South Dakota

Vermillion University of South Dakota LITC

Tennessee

Memphis Memphis Area Legal Services

LITC

Oak Ridge Tennessee Taxpayer Project

Texas

Fort Worth Legal Aid of Northwest Texas

LITC

Fort Worth Texas A&M University School of

Law LITC

Houston Houston Volunteer Lawyers LITC

Houston Lone Star Legal Aid LITC

Houston South Texas College of Law

Lubbock Texas Tech University School of

Law LITC

San Antonio Texas Taxpayer Assistance

Project

Utah

Provo Centro Hispano LITC

Salt Lake City University of Utah College of

Law LITC

Salt Lake City Westminster Low Income

Taxpayer Clinic

Vermont

Burlington Vermont Low Income Taxpayer

Clinic

Virginia

Fairfax Legal Services of Northern

Virginia LITC

Lexington Washington and Lee University

School of Law Tax Clinic

Richmond The Community Tax Law Project

Washington

Seattle University of Washington Federal

Tax Clinic

Spokane Gonzaga University School of

Law Federal Tax Clinic

West Virginia

Charleston Legal Aid of West Virginia LITC

Wisconsin

Milwaukee Legal Action of Wisconsin LITC

Milwaukee LITC of The Legal Aid Society of

Milwaukee, Inc.

Wausau Wisconsin Judicare Northwoods

Tax Projec t

Wyoming

Cheyenne Wyoming Low Income Taxpayer

Clinic