182490 Pw E182490

User Manual: 182490

Open the PDF directly: View PDF ![]() .

.

Page Count: 11

NV ABF HSA1 RX1 (01-2014) NV ABF HSA $1500_90% (10_30_50_30% Rx).s0114

1

Summary of Benefits for

Anthem Balanced Funding HSA 1

$1500-90% 10/30/50/30%

This is a general benefit summary for this health plan. A complete listing and description of benefits, limitations, and

exclusions are found in the benefit booklet. Copayment options reflect the amount the member will pay, coinsurance

options reflect the amount that this plan will pay.

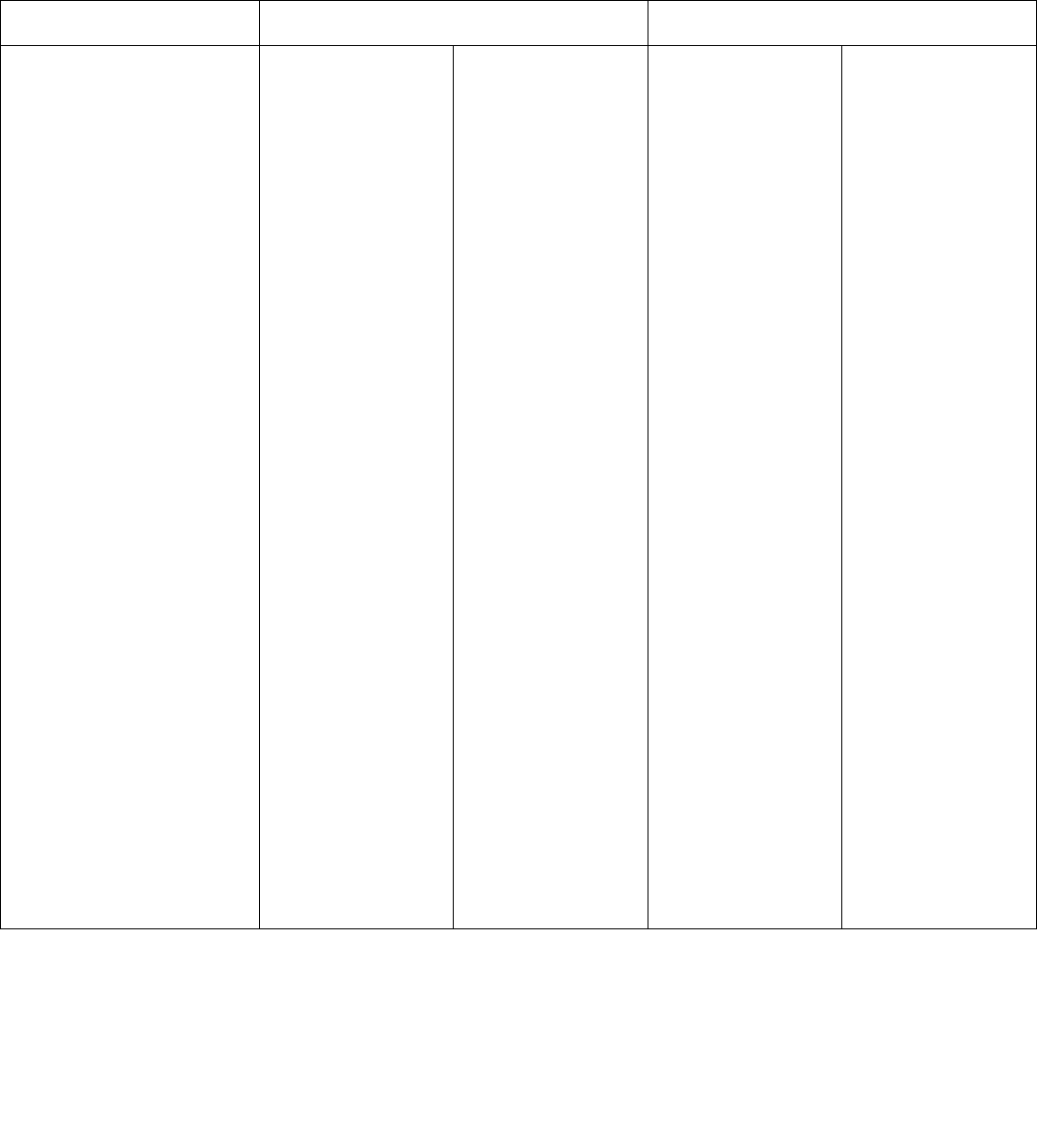

In-Network

(Participating Provider)

Out-of-Network

(Non-Participating Provider)

Annual Deductible

Deductibles are per

calendar year.

Individual coverage,

the insured pays a

$1,500 deductible

per member’s

benefit year

Family coverage,

the family pays a

$3,000 deductible

per member’s

benefit year

If you select family

membership (2 or

more members

enrolled), no

individual deductible

applies and the

family deductible

must be met before

this plan provides

benefits to any

family member. The

family deductible

amount is met as

follows: (1) When

one individual has

satisfied the family

deductible, that

family member and

all other family

members are

eligible for benefits,

or (2) When no

family member

meets the family

deductible on their

own, but the family

members

collectively meet the

entire family

deductible, then all

family members will

be eligib

le for

benefits

Individual coverage,

the insured pays a

$3,000 deductible

per member’s

benefit year

Family coverage,

the family pays a

$6,000 deductible

per member’s

benefit year

If you select family

membership (2 or

more members

e

nrolled), no

individual deductible

applies and the

family deductible

must be met before

this plan provides

benefits to any

family member. The

family deductible

amount is met as

follows: (1) When

one individual has

satisfied the family

deductible, that

family member and

all other family

members are

eligible for benefits,

or (2) When no

family member

meets the family

deductible on their

own, but the family

members

collectively meet the

entire family

deductible, then all

family members will

be eligible for

benefits

The benefits described in this summary of benefits are funded by the Employer who is responsible for their payment. Anthem provides administr

ative claims payment services

only and does not assume any financial risk or obligation with respect to claims.

Anthem Blue Cross and Blue Shield is the trade name of Rocky Mountain Hospital and Medical Service, Inc. HMO products underwritten by HMO Colo

rado, Inc. dba HMO Nevada. Independent licensees of the Blue

Cross and Blue Shield Association. ® ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross a

nd Blue

Shield Association.

Si usted necesita ayuda en español para entender éste documento, puede solicitarla gratis llamando al número de servicio al c

liente que aparece en su tarjeta de identificación o

en su folleto de inscripción.

NV ABF HSA1 RX1 (01-2014) NV ABF HSA $1500_90% (10_30_50_30% Rx).s0114

2

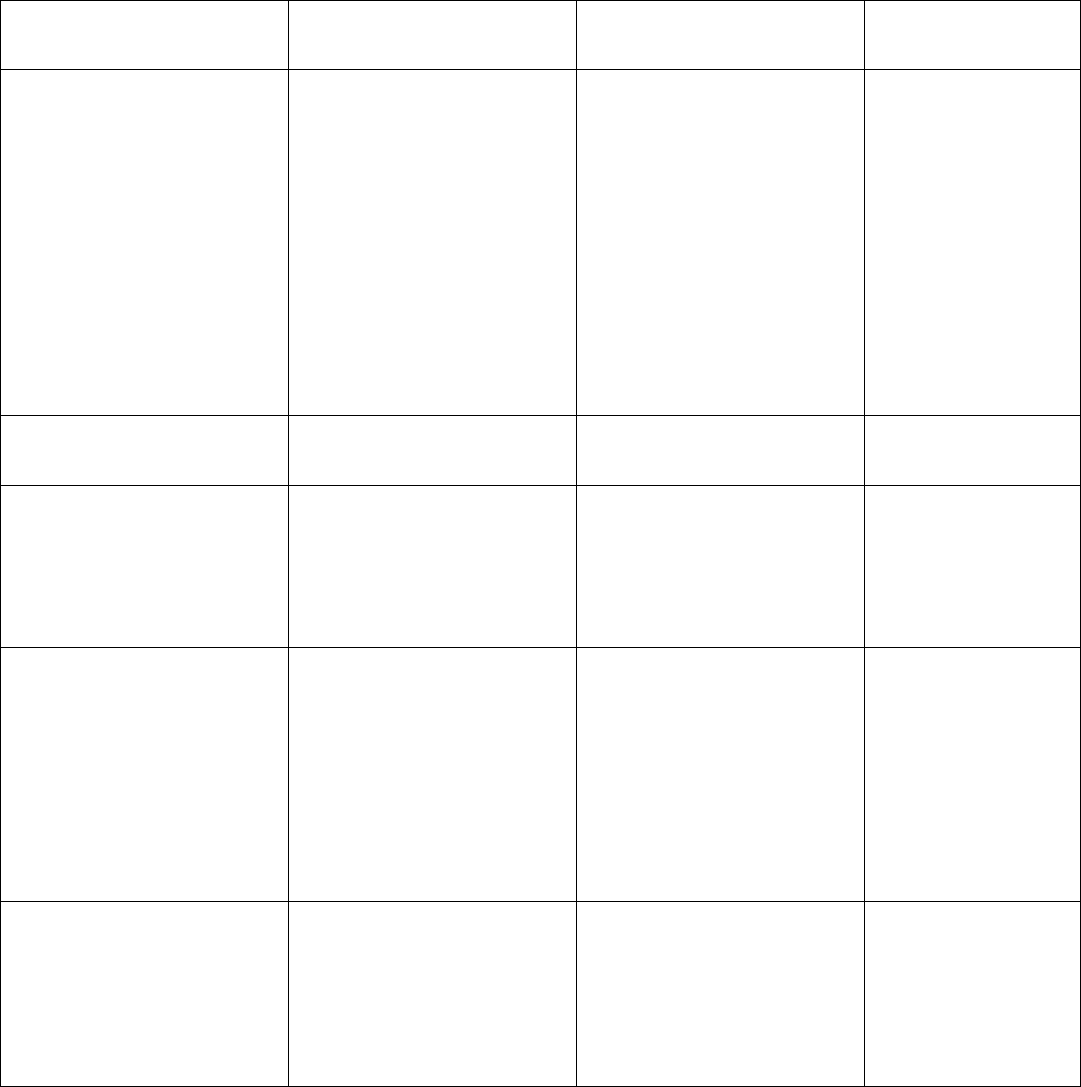

In-Network

(Participating Provider)

Out-of-Network

(Non-Participating Provider)

Out-of-Pocket Annual

Maximum

All coinsurance and

deductible contributes

towards the out-of-pocket

annual maximum.

Some covered services

have a maximum number of

days, visits or dollar

amounts. These maximums

apply even if the applicable

out-of-pocket annual

maximum is satisfied.

Individual:

$3,000

Family:

$6,000

If you select family

membership (2 or

more members

enrolled), no

individual out-of-

pocket maximum

applies and the

family out-of-pocket

maximum must be

met. The family out-

of-pocket maximum

amount is met as

follows: (1) When

one individual has

satisfied the family

out-of-pocket

maximum, each

family member has

satisfied the family

out-of-pocket

maximum amount,

or (2) When no

family member

meets the family

out-of-pocket

annual maximum,

but the family

members

collectively meet the

entire family out-of-

pocket annual

maximum, then

each family member

has satisfied the

family out-of-pocket

maximum amount.

Individual:

$9,000

Family:

$18,000

If you select family

membership (2 or

more members

enrolled), no

individual out-of-

pocket maximum

applies and the

family out-of-pocket

maximum must be

met. The family out-

of-pocket maximum

amo

unt is met as

follows: (1) When

one individual has

satisfied the family

out-of-pocket

maximum, each

family member has

satisfied the family

out-of-pocket

maximum amount,

or (2) When no

family member

meets the family

out-of-pocket

annual maximum,

but the family

members

collectively meet the

entire family out-of-

pocket annual

maximum, then

each family member

has satisfied the

family out-of-pocket

maximum amount.

Lifetime Maximum Benefit

No lifetime maximum

NV ABF HSA1 RX1 (01-2014) NV ABF HSA $1500_90% (10_30_50_30% Rx).s0114

3

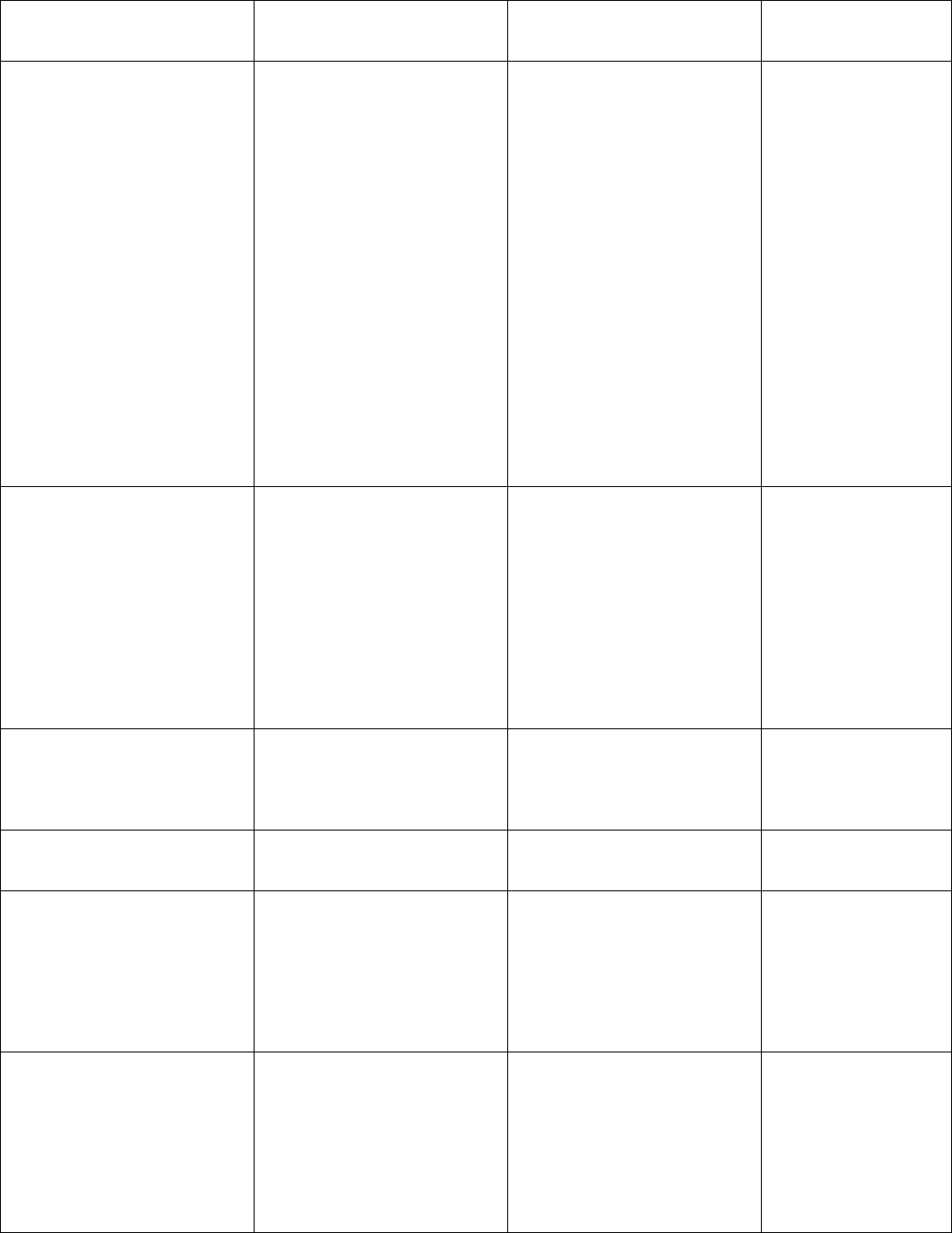

Services

In Network

(Participating Provider)

Out-of-Network

(Non-Participating

Provider)

Additional

Information

1. Physician Visits

a) Physician office visits and

physician consultations

b) Services related to

physician office visit

including but not limited

to, allergy testing, allergy

injections, or office

surgeries

c) Inpatient physician visits

90% coinsurance after

deductible

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

Physician visits

include diabetic

management and

limited family

planning services

(see benefit booklet

for additional details).

2. Retail Health Clinic

90% coinsurance after

deductible

70% coinsurance after

deductible

3. Preventive Care

Preventive care services that

meet the requirements of

federal law including

screenings, immunizations

and office visits.

No charge

70% coinsurance after

deductible

4. Diagnostic Services,

Laboratory, Pathology,

and X-ray

a) Laboratory, Pathology,

and X-ray

b) MRI/MRA, PET, CT

scans, nuclear medicine

and other high tech

services

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

Services billed by a

hospital are included

in the hospital

inpatient/outpatient

benefits.

5.

Maternity Care

a) Prenatal care

b) Delivery & inpatient baby

care

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

NV ABF HSA1 RX1 (01-2014) NV ABF HSA $1500_90% (10_30_50_30% Rx).s0114

4

Services

In Network

(Participating Provider)

Out-of-Network

(Non-Participating

Provider)

Additional

Information

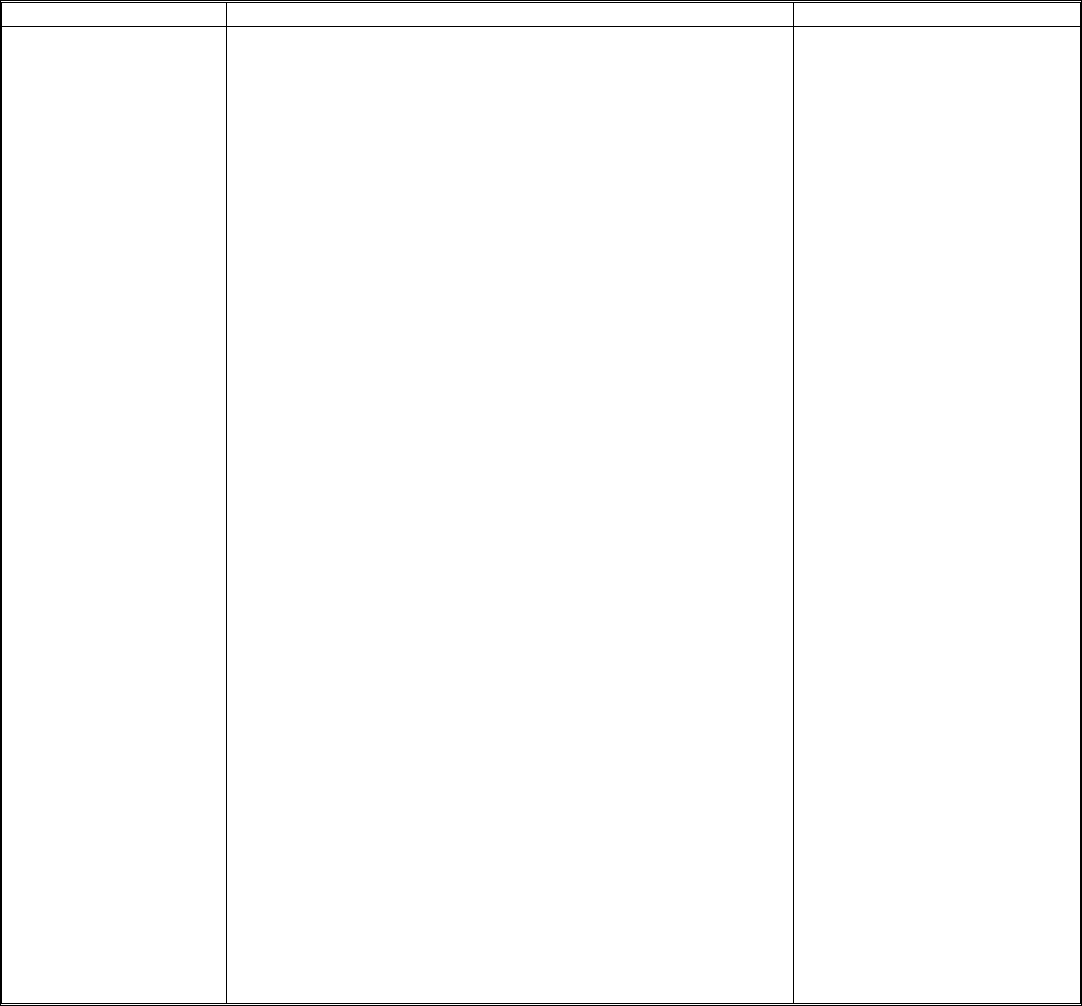

6. Outpatient Therapies:

Physical therapy,

occupational therapy,

speech therapy, cardiac

rehabilitation and spinal

manipulations/

acupuncture

a) Outpatient physical

therapy, occupational

therapy, speech therapy

and cardiac rehabilitation

b) Outpatient spinal

manipulations and

acupuncture

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

Limited to 20 visits

each of physical,

occupational and

speech therapy per

member per year.

Benefits are paid up

to 36 visits for cardiac

rehabilitation.

Limited to 12 visits

per member per year

7. Hospital Care/Other

Facility Services

a) Inpatient

b) Inpatient - acute

rehabilitation therapy

c) Outpatient Surgery

90% coinsurance after

deductible

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

Limited to 30

inpatient days per

member per year.

8. Emergency Care

90% coinsurance after

deductible

90% coinsurance after

deductible

Member cost share

responsibility for Out-

of-Network services

will be the same as

In-Network services.

9. Urgent Care

90% coinsurance after

deductible

70% coinsurance after

deductible

10.

Ambulance Services

a) Ground Services

b) Air Services

90% coinsurance after

deductible

90% coinsurance after

deductible

90% coinsurance after

deductible

90% coinsurance after

deductible

Benefits are paid for

medically necessary

ground or air

ambulance

transportation.

11. Mental Health and

Substance Abuse Care

a) Inpatient

b) Outpatient

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

NV ABF HSA1 RX1 (01-2014) NV ABF HSA $1500_90% (10_30_50_30% Rx).s0114

5

Services

In Network

(Participating Provider)

Out-of-Network

(Non-Participating

Provider)

Additional

Information

12. Medical Supplies and

Equipment

90% coinsurance after

deductible

70% coinsurance after

deductible

Includes diabetic

supplies and

equipment, medical

supplies, durable

medical equipment,

oxygen and

equipment,

orthopedic

appliances, prosthetic

devices and other

appliances.

Wigs for alopecia

resulting from

chemotherapy and

radiation therapy are

limited to a maximum

benefit of $500 per

member per year.

13. Home Health Care

90% coinsurance after

deductible

70% coinsurance after

deductible

Limited to 100 visits

per member per year.

14. Chemotherapy,

Hemodialysis, and

Radiation Therapy

a) Inpatient

b) Outpatient

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

15.

Skilled Nursing Facility

90% coinsurance after

deductible

70% coinsurance after

deductible

Limited to 100

inpatient days per

member per year.

16. Hospice Care

90% coinsurance after

deductible

70% coinsurance after

deductible

17. Human Organ and

Tissue Transplants

a) Inpatient

b) Outpatient

90% coinsurance after

deductible

90% coinsurance after

deductible

70% coinsurance after

deductible

70% coinsurance after

deductible

See the benefit

booklet for details on

covered transplants.

Transportation and

lodging services are

limited to a maximum

benefit of $10,000

per transplant;

unrelated donor

searches are limited

to a maximum benefit

of $30,000 per

transplant.

18. Enteral Formula and

Special Foods

90% coinsurance after

deductible

70% coinsurance after

deductible

Special food products

that are prescribed or

ordered by a

physician as

medically necessary

is allowed.

NV ABF HSA1 RX1 (01-2014) NV ABF HSA $1500_90% (10_30_50_30% Rx).s0114

6

Services

Additional Information

19. Prescription

Drugs

a) Outpatient Retail

Pharmacy Drugs

b) Mail Order

Pharmacy Drugs

c) Specialty

Pharmacy Drugs

After deductible is satisfied you pay a tier 1 $10 copayment

per prescription, tier 2 $30 copayment per prescription, tier 3

$50 copayment per prescription, tier 4 30% copayment per

prescription when received from a contracted pharmacy or

30% copayment after deductible when received from a non-

contracted pharmacy

After deductible is satisfied you pay a tier 1 $10 copayment

per prescription, tier 2 $60 copayment per prescription, tier 3

$100 copayment per prescription, tier 4 30% copayment per

prescription for a 90-day supply.

After deductible is satisfied you pay a tier 1 $10 copayment

per prescription, tier 2 $30 copayment per prescription, tier 3

$50 copayment per prescription, tier 4 30% copayment per

prescription. Specialty pharmacy drugs are not available via

mail order.

The following applies to a), b) and c) above:

For the tier 4 outpatient retail pharmacy drugs or specialty

pharmacy dr

ugs, the maximum member copayment per

prescription is $250 per 30-

day supply at a contracted

pharmacy or a maximum member copayment per

prescription of $500 per 90-day supply for mail order.

Prescription drugs will always be dispensed as ordered by

your provider and by applicable state pharmacy regulations,

however you may have higher out-of-pocket expenses. You

may request, or your provider may order, the brand-name

drug. However, if a generic drug is available, you will be

responsible for the cost difference between the generic and

brand-name drug, in addition to your tier 1 copayment. By

law, generic and brand-name drugs must meet the same

standards for safety, strength, and effectiveness. This plan

reserves the right, at our discretion, to remove certain higher

cost generic drugs. For drugs on our approved list, call

customer service at (866) 837-4596.

Available up to a 30-day

supply.

Available only through a

contracted Pharmacy

Benefits Manager (PBM) mail

order service up to a 90-day

supply.

Not available at a

non-contracted PBM.

Available up to a 30-day

supply. Specialty pharmacy

drugs are high-cost,

injectable, infuse

d, oral or

inhaled medications that

generally require close

supervision and monitoring of

their effect on the patient by a

medical professional. They

are often unavailable at an

outpatient retail pharmacy or

mail order pharmacy since

these drugs may require

special handling such as

temperature controlled

packaging and overnight

delivery. These specialty

pharmacy drugs are available

only on an in-network basis

from

the PBM. Specialty

pharmacy drugs are not

available at non-contracted

pharmacies.

CDHP Disclosure (01-2014)

1

Benefit Summary Disclosure Information

This disclosure statement provides only a brief description of some important features and limitations of your plan. The

benefit booklet itself sets forth in the detail the rights and obligations of both you and the insurance company. It is

important that you review the benefit booklet once you are enrolled.

Coverage for treatment as part of a clinical trial:

Includes coverage for medical treatment provided in a Phase I, Phase II, Phase III or Phase IV clinical trial for the

treatment of cancer or in a Phase II, Phase III or Phase IV study or clinical trial for the treatment of chronic fatigue

syndrome conducted in the state of Nevada.

Coverage for medical treatment is limited to:

• Any drug or device approved for sale by the Food and Drug Administration.

• The cost of any reasonably necessary health care services required from the medical treatment or complications

thereof arising out of the medical treatment provided in the clinical trial.

• The initial consultation to determine whether the person is eligible to participate in a clinical trial.

• Health care services required for the clinically appropriate monitoring of the person during the clinical trial.

Coverage for the management and treatment of diabetes

Includes coverage for medication, equipment, supplies, and appliances that are medically necessary for the treatment of

diabetes type I, type II, and gestational diabetes.

Coverage for self-management of diabetes, including:

• The training and education provided to a person covered under the contract after initial diagnosis of diabetes which is

medically necessary for the care and management of diabetes, including, without limitation, counseling in nutrition and

the proper use of equipment and supplies for the treatment of diabetes.

• Training and education which is medically necessary as a result of a subsequent diagnosis that indicates a significant

change in the symptoms or condition of the program of self-management of diabetes.

• Training and education which is medically necessary because of the development of new techniques and treatment

for diabetes.

Medically Necessary

An intervention that is or will be provided for the diagnosis, evaluation and treatment of a condition, illness, disease or

injury and that this plan, subject to a member’s right to appeal, solely determines to be:

• Medically appropriate for and consistent with the symptoms and proper diagnosis or treatment of the condition, illness,

disease or injury.

• Obtained from a physician and/or licensed, certified or registered provider.

• Provided in accordance with applicable medical and/or professional standards.

• Known to be effective, as proven by scientific evidence, in materially improving health outcomes.

• The most appropriate supply, setting or level of service that can safely be provided to the member and which cannot

be omitted consistent with recognized professional standards of care (which, in the case of hospitalization, also

means that safe and adequate care could not be obtained as an outpatient).

• Cost-effective compared to alternative interventions, including no intervention (“cost effective” does not mean lowest

cost).

• Not experimental/investigational.

• Not primarily for the convenience of the member, the member’s family or the provider.

• Not otherwise subject to an exclusion under the benefit booklet.

CDHP Disclosure (01-2014)

2

The fact that a physician and/or provider may prescribe, order, recommend or approve care, treatment, services or

supplies does not, of itself, make such care, treatment, services or supplies medically necessary.

Maximum allowed amount

Reimbursement for services rendered by participating and non-participating providers is based on this health benefits plan

maximum allowed amount for the covered service that the member receives.

NOTE: This plan will apply the in network level of benefits and the member will not be required to pay more for

the services than if the services had been received from a participating provider in the following circumstances:

• Emergency care (where rendered either within or outside the State of Nevada)

• Where in-patient hospital care at a non-participating hospital is necessary due to the nature of the treatment

• Where in-patient hospital care at a non-participating hospital is necessary due to participating provider hospital

capacity

• When a member has received a preauthorized network exception

Emergency

Emergency means a sudden onset of a medical condition manifesting itself by acute symptoms of sufficient severity that a

prudent person would believe that the absence of immediate medical attention could result in:

• Serious jeopardy to the health of the member, or

• Serious jeopardy to the health of an unborn child, or

• Serious impairment to bodily functions, or

• Serious and permanent dysfunction of any bodily organ or part.

Maximum Benefits

Some services or supplies may have an annual or lifetime maximum benefit, be sure to review you summary of benefits

for further details on what services may have a maximum benefit.

Limitations and Exclusions

This plan does not cover some services. The plan includes limitations and exclusions to protect against duplicate or

unnecessary services that could unfairly offset the cost of health care coverage for the entire plan. Following are

examples of the plan’s limitations and exclusions (please consult your benefit booklet for an exhaustive listing of

exclusions and limitations):

• Benefits provided under any local, state, or federal laws, including Workers’ Compensation and Medicare

• Cosmetic surgery

• Services by a family member

• Weight-reduction services and medications

• Complications from non-covered services

• Our payment allowance will be reduced or denied from what would have been paid if pre-certification is not obtained

prior to receiving inpatient hospital services and outpatient surgeries.

• Most services, such as non-emergency hospital admissions or surgical procedures require prior authorization.

• Alternative or complementary medicine. Services in this category include, but are not limited to, holistic medicine,

homeopathy, hypnosis, aromatherapy, massage therapy, reike therapy, herbal medicine, vitamin or dietary products

or therapies, naturopathy, thermography, orthomolecular therapy, contact reflex analysis, bioenergial synchronization

technique (BEST), clonics or iridology.

• Artificial conception

• Services received before the effective date of coverage.

• Biofeedback.

CDHP Disclosure (01-2014)

3

• Chelating agents except for providing treatment for heavy metal poisoning.

• Services or supplies provided as part of clinical research, except where required by law or allowed by Anthem.

• Convalescent care

• Convenience, luxury, deluxe services or equipment. Such services and supplies include but are not limited to, guest

trays, beauty or barber shop services, gift shop purchases, telephone charges, television, admission kits, personal

laundry services, and hot and/or cold packs, equipment or appliances, which include comfort, luxury, or convenience

items (e.g. wheelchair sidecars, fashion eyeglass frames, or cryocuff unit). Equipment or appliances the member

requests that include more features than needed for the medical condition are considered luxury, deluxe and

convenience items (e.g., motorized equipment when manually operated equipment can be used such as electric

wheelchairs or electric scooters).

• Court ordered services unless those services are otherwise covered under the certificate.

• Custodial care.

• Dental services, including accident related dental services, dental anesthesia for children, temporomandibular joint

therapy or surgery.

• Inpatient care received after the date Anthem, using managed care guidelines, determines discharge is appropriate.

• Hospital care if the member leaves a hospital against the medical advice of the physician, charges which are a direct

result of the member’s knowing and voluntary non-compliance of medically necessary care with prescribed medical

treatment are not eligible for coverage.

• Domiciliary care such as care provided in residential, non-treatment institution, halfway house or school.

• Services and supplies already covered by other valid coverage.

• Experimental/Investigative procedures.

• Genetic counseling.

• Government operated facility such as a military medical facility or veterans administration facility unless authorized by

Anthem.

• Hair loss, drugs, wigs, hairpieces, artificial hairpieces, hair or cranial prosthesis, hair transplants or implants even if

there is a physician prescription, and a medical reason for the hair loss.

• Hearing aids or routine hearing tests.

• Hypnosis, whether for medical or anesthesia purposes.

• This coverage does not cover any loss to which a contributing cause was the member’s commission of or attempt to

commit a felony which they are convicted of.

• Therapies for learning deficiencies and/or behavioral problems.

• Maintenance therapy.

• Services and supplies that are not medically necessary.

• Charges for failure to keep a scheduled appointment.

• Neuropsychiatric testing.

• Non-covered providers who include but are not limited to:

o Health spa or health fitness centers (whether or not services are provided by a licensed or registered provider).

o School infirmary.

o Halfway house.

o Massage therapist.

o Nursing home.

CDHP Disclosure (01-2014)

4

o Dental or medical services sponsored by or for an employer, mutual benefit association, labor union, trustee, or

any similar person or group.

• Non-medical expenses, including but not limited to:

o Adoption expenses.

o Educational classes and supplies not provided by the member’s provider unless specifically allowed as a benefit

under this benefit booklet.

o Vocational training services and supplies.

o Mailing and/or shipping and handling expenses.

o Interest expenses and delinquent payment fees.

o Modifications to home, vehicle, or workplace regardless of medical condition or disability.

o Membership fees for spas, health clubs, personal trainers, or other such facilities even if medically

recommended, regardless of any therapeutic value.

o Personal convenience items such as air conditioners, humidifiers, or exercise equipment.

o Personal services such as haircuts, shampoos, guest meals, and radio or televisions.

o Voice synthesizers or other communication devices, except as specifically allowed by Anthem’s medical policy.

• Upper or lower jaw augmentation or reductions (orthognathic surgery) even if the condition is due to a genetic

congenital imperfection or acquired characteristic.

• Any items available without a prescription such as over the counter items and items usually stocked in the home for

general use including but not limited to bandages, gauze, tape, cotton swabs, dressing, thermometers, heating pads,

and petroleum jelly. This coverage does not cover laboratory test kits for home use. These include but are not limited

to, home pregnancy tests and home HIV tests.

• Benefits are not provided for care received after coverage is terminated.

• Private duty nursing services.

• Private rooms are not covered.

• Charges for services and supplies when the member has received a professional or courtesy discount from a provider

or where the member’s portion of the payment is waived due or professional courtesy or discount.

• Peripheral bone density testing. This coverage does not cover whole body CT scan or routine screening except as

described by medical policy or as provided in the benefit booklet.

• Charges for the preparation of medical reports or itemized bills or charges for duplication of medical records from the

provider when requested by the member.

• Services or supplies necessitated by injuries which a member intentionally self-inflicted, except where the law

prohibits such an exclusion.

• Services or supplies related to sex change operations, reversals of such procedures, complications of such

procedures, services, supplies or medications related to a sex change operation.

• Treatment of sexual dysfunction or impotence including all services, supplies or prescription drugs used for the

treatment.

• Services and supplies which may be reimbursed by a third party

• Travel or lodging expenses for the member, member’s family or the physician except as travel or lodging expenses

related to human organ and tissue transplants.

• Routine eye examinations, routine refractive examinations, eyeglasses, contact lenses (even if there is a medical

diagnosis which requires the use of contact lenses), or prescriptions for such services and supplies. Surgical, medical,

or hospital service and/or supply rendered in connection with any procedure designed to correct farsightedness,

nearsightedness, or astigmatism. Vision therapy, including but not limited to, treatment such as vision training,

orthoptics, eye training or training for eye exercises.

CDHP Disclosure (01-2014)

5

• Services or supplies necessary to treat disease or injury resulting from war, civil war, insurrection, rebellion, or

revolution.

• Acupuncture except for pain management and chiropractic services except for spinal manipulation. Limited to a

combined maximum of 12 visits per calendar year.

• Whole blood, blood plasma and blood derivatives received from community sources or replaced through donor credit.

• Bariatric surgery services.

• Treatment of varicose veins or telangiectatic dermal veins (spider veins) by any method (including sclerotherapy or

other surgeries) when services are rendered for cosmetic purposes.

• Treatment for autism spectrum disorder.

• Hospice care is covered, but supportive care and services to the family after the death of the patient are not covered.

• Off-label use of FDA-approved prescription drugs.

Rate determinations

Rates are calculated based on allowable case characteristics of member age, geographic rating area, dependent

enrollment, and tobacco use.

Provider Directories

Copies of provider directories may be obtained by calling the customer service department or accessing the information

on our Internet site at www.Anthem.com.

Provider Network

Under this plan, members choose physicians, hospitals and other health care providers from the Anthem preferred

provider organization (PPO) network. Using the PPO network can mean substantial savings. If care is received outside

the PPO network, the member will pay a higher deductible and coinsurance and charges over the Maximum Allowed

Amount.