Form RP 5217 INS 1170 Rp5217pdfins

User Manual: RP 1170

Open the PDF directly: View PDF ![]() .

.

Page Count: 8

***** For use in approved counties only *****

This bar-coded RP-5217 form is NOT intended for use as a handwritten or typewriter-entry document and will NOT

be accepted with a Deed by the County Clerk as such.

The RP-5217-PDF Real Property Transfer Report (RPL Article 9, Section 333) is a one-part, downloadable,

barcoded, pdf form used to document the information associated with real property transfers for approved counties

within New York State. (For counties where RP-5217-PDF is yet to be approved, the RP-5217 4-part form must be

used. For transfers within the 5 boroughs of New York City, the RP-5217-NYC must be used.) An original RP-5217-

PDF form must accompany all deeds and correction deeds upon filing with the Recording Officer. A filing fee

is also required. Pursuant to Section 8017 of Civil Practice Law and Rules, the state and counties, and agencies and

officers thereof are exempt from this fee.

The barcode is used to capture all information entered and saved on the form. Therefore, it is

imperative that the transfer information be complete and accurate. The document must also be saved after

entry or when any changes are made in order to populate the barcode. Any questions that cannot be answered

using these instructions should be addressed to NYS Department of Taxation and Finance - Office of Real Property

Tax Services, Data Management Unit at the number above. Please review and follow the instructions provided

below. Also see the RP-5217 FAQs and the RP-5217 Answer/Fact Sheet for more detailed information.

Section 1: County Use (Items C1-C4)

This section of the form is to be filled out ONLY by County personnel. Items C1 – C4 are found on the

deed after the deed is recorded. SWIS Code, Book and Page are used by the NYS Department of Taxation and

Finance - Office of Real Property Tax Services as a means for uniquely identifying each property transfer and also for

matching state and local files. If the recording system is being changed to something other than a book/page filing

system for documents in the County Clerk's office, please let NYSORPS know promptly by calling (518) 474-1170.

C1: SWIS Code (Statewide Information System Code) - Each County, City, Town-Outside Village (TOV) area and

Village in New York State has a six digit SWIS Code associated with it. The SWIS Code is formatted as follows:

"CCCTVT" where CC = County Code; CT = City/Town Code; VT = Village/TOV Code.

C2: Date Deed Recorded - The date the deed for the transfer was recorded by the County Clerk.

C3: Book - The numbered book in which the deed was recorded by the County Clerk. This much match the entry on

the deed exactly.

C4: Page - The page number of the book in which the sale deed was recorded by the County Clerk. This much match

the entry on the deed exactly.

RP-5217-PDF Real Property Transfer Report

Instructions

Data Management Unit – (518) 474-1170

Tax and Finance website: www.tax.ny.gov

RP-5217-PDF-INS (Rev. 06/13)

Click here

for important notice to home buyers

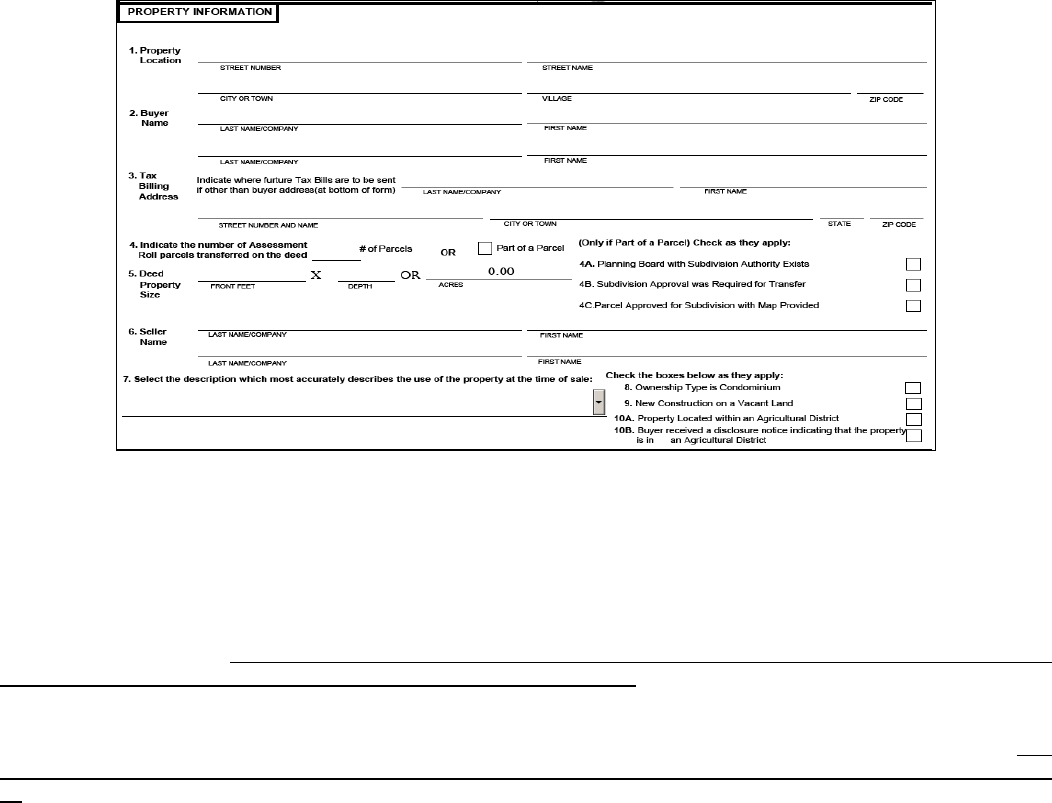

Section 2: Property Information (Items 1-10)

1. Property Location - Enter the actual physical location of property being transferred. This includes street address,

city/town and/or village name and zip code. The city/town and/or village are not necessarily the mailing address but the

actual municipality in which the parcel is located.

2. Buyer Name (Grantee/Transferee) - Enter the name or names of the buyer(s) of the property being transferred.

Enter last name or company name first. Attach additional sheet if necessary.

3. Tax Billing Address - If future tax bills are to be sent to an address that is different from the buyer address located

on the bottom of the form (certification area), enter that address here. If the real property tax billing address is the

same as the buyer's address after the sale, no entry is required.

4. Number of Parcels - Enter the number of assessment roll parcels transferred on the deed (i.e. 1, 2, 3, etc.). The

number of parcels entered in item 4 should equal the number of “Tax Map Identifiers/Roll Identifiers” entered in item

20.

Part of Parcel - If part of a parcel is included in the transfer, check the box and include part of parcel in the count for

number of parcels.

Examples:

2 parcels and part of a 3rd parcel sold. The number 3 should be entered for the number of parcels and the part of parcel

box should be checked.

Part of 1 parcel sold. The number 1 should be entered for the number of parcels and the part of parcel box should also be

checked.

4A - 4C Subdivision Questions - Only applies if Part of a Parcel box is checked. Check as they apply:

4A. Planning Board with Subdivision Authority Exists

4B. Subdivision Approval was Required for Transfer

4C. Parcel Approved for Subdivision with Map Provided

5. Deed Property Size - This refers to the size of the property conveyed in the deed. This reflects only the size of the

parcel(s) or part of a parcel being transferred. For multiple parcels, the size represents the combined size. The

property size may be found in the text of the deed or on the tax bill. (The tax bill may reflect the size of the whole

parcel when only part of a parcel or parcels is being transferred.) When completing this section enter only front feet

and depth, or acres, but not both.

6. Seller Name (Grantor/Transferor) - Enter the name or names of the seller(s) of the property being transferred.

Enter the last name or company name first. Attach additional sheet if necessary.

7. Property Use - The following define uses for the property at the time of sale or describes the buyer's intended use

of the property after the sale. Please select the description that best applies. If multiple uses are included in the

transfer, select the code that represents the primary use.

A. One Family Residential - a one family dwelling constructed for year-round occupancy.

B. 2 or 3 Family Residential - a two or three dwelling unit within one structure constructed for year-round

occupancy.

C. Residential Vacant Land - a vacant lot or acreage that is located in a residential area or which is suitable for

residential development. This could include waterfront or any rural land available for residential development.

D. Non-Residential Vacant Land - any vacant lot or acreage excluding land suitable for residential development,

agricultural purposes and forest land. For these uses check boxes C, E, or L respectively.

E. Agricultural - used for production of crops or livestock.

F. Commercial - used for the sale of goods or services, e.g., restaurants, banks, offices, car washes, car repairs,

car dealerships, all retail, hotels, warehouses and storage/distribution.

G. Apartments - a dwelling unit comprised of one or more rooms designed to provide complete living facilities for

a family or individual(s). Examples of this are walk-up, converted, garden, townhouse, high-rise, row and

external apartments.

H. Entertainment/Amusement - used for the gathering of groups, e.g., theatres, sports stadiums/arenas,

auditoriums/studios, marinas, beaches, campgrounds, amusement parks, golf courses, health and fitness

centers.

I. Community Service - used for the well being of the community, e.g., hospital, school, cultural center, social

organizations and homes for the aged.

J. Industrial - used for the production of goods, e.g., manufacturing and processing, mining/quarrying and wells.

K. Public Service - used to provide public services such as water, gas or electric, waste disposal,

communications and telecommunications.

L. Forest - tracts of forested land.

8. Ownership Type is Condominium - Check this box if the sale is for individual ownership of a condominium unit in

a multi-unit structure or property.

9. New Construction on Vacant Land - Check this box if the property sold is new construction.

10A. Property Located within an Agricultural District - Check this box if the property sold is located within a

designated agricultural district. Information on whether a parcel is located within an agricultural district is available at

the office of the County Director of Real Property Tax Services. This designation should not be confused with zoning.

Buyers should be aware that the property lies partially or wholly within an agricultural district and that farming activities

occur within the district. Farming activities may include but are not limited to activities that cause noise, dust, and

odors.

10B. Buyer received a disclosure notice indicating that the property is in an Agricultural District - Check this

box if the buyer received a disclosure notice indicating that the property is located in an agricultural district.

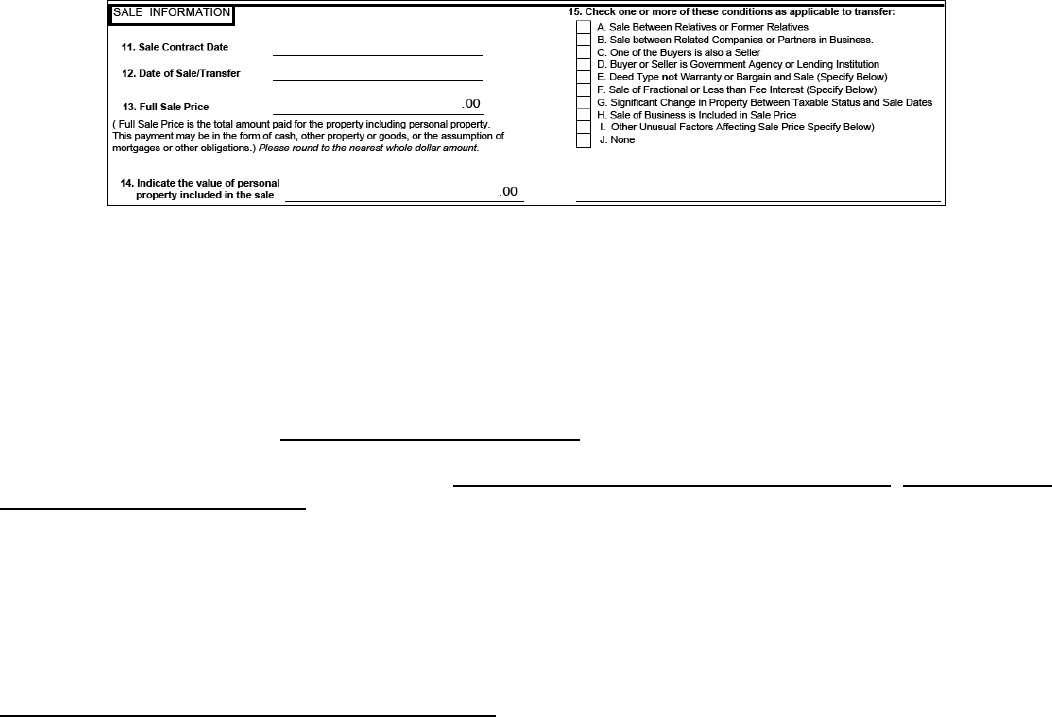

Section 3: Sale Information (Items 11-15)

11. Sale Contract Date - Enter the date that the contract for sale was signed. In case of a verbal contract enter the

date that the full sale price was established. This date also represents the date a contract was signed for any land

contract sales. This date would always precede the Date of Sale / Transfer. It can also be blank when transfers

involve only name changes on a deed.

12. Date of Sale / Transfer - Enter the date on which the seller conveyed the title of the real property to the buyer.

Generally, this will be the date of the closing or, if there is no formal closing, the date within the text of the deed.

13. Full Sale Price - enter the total amount paid for the property. This includes money/cash, other property, personal

property, goods or any other thing of value; the cancellation of indebtedness or the assumption of an encumbrance,

mortgage or other obligations on the real property. Please round to the nearest whole dollar amount. If there is no Full

Sale Price for the transfer enter $0.

Please note that typical components of the Full Sale Price would include:

Cash Consideration - include the total amount of cash transferred from the buyer to the seller. This includes

any standard purchase money mortgages and second or third mortgages.

Assumed mortgages and other liens or obligations - include the principal amount of any existing mortgages,

liens, or encumbrances on the property assumed or taken subject to by the buyer and the amount of any other

indebtedness or obligation assumed, cancelled or discharged by the buyer as part of the consideration.

Property received by the seller - include the fair market value of any other property or thing of value received

by the seller as part of the full sale price.

Do NOT include seller concessions in the full sale price (i.e., the buyer and seller have agreed on a price of $100,000

for the purchase of the property. As part of the agreement, the seller will pay $4000 of the buyer’s closing costs.

Therefore, the actual full sale price paid by the buyer (or received by the seller) is $96,000 ($100,000 - $4000)).

14. Personal Property - Indicate the value of personal property included in the sale - If property other than real estate

was included in the transfer and in the Full Sale Price, enter the amount of such personal property on the line provided.

Examples of this would be the furnishings and boat included in the sale of a seasonal home, or a business included in

the sale of a commercial property.

15. Conditions of Sale - Check one or more of these conditions as applicable to the transfer. Review the conditions

listed below and check all that apply to this sale, otherwise check the box labeled "None". Unusual conditions

sometimes affect whether or not the fair market value of the property is reflected in the sale price. Conditions of sale

are explained below for use in filling out item 15 in the sale information section of the RP-5217 Real Property Transfer

Report.

A. Sale Between Relatives or Former Relatives - Buyer and seller are or were related by blood or marriage.

B. Sale Between Related Companies or Partners in Business - Buyer and seller hold interest in the same

business or are controlled by the same person or corporation.

C. One of the Buyers is also a Seller - Any of the buyers is also a seller involved in the property transfer.

D. Buyer or Seller is a Government Agency or Lending Institution - Local, State, or Federal government or a

lending institution is a party to the property transfer. Foreclosure sales may fall within this category.

E. Deed Type is Not Warranty or Bargain and Sale (Specify Below) - If the deed conveying the property is

other than a Warranty Deed or Bargain and Sale Deed, check this box and indicate the deed type on the lines

provided. A foreclosure deed or quitclaim deed would fall into this category.

F. Sale of Fractional or Less than Fee Interest (Specify Below) - An interest in part of a whole property. If less

han 100% interest or fee interest (e.g. remainder) is being conveyed check the box and indicate the interest

conveyed on the lines provided.

G. Significant Change in Property Between Taxable Status and Sale Dates - If the property has experienced

a significant change in inventory, condition, etc., between the taxable status date and the sale date check the

box provided. An example of this would be a fire or an addition to the property. Taxable status date information

is available from the County Director of Real Property Tax Services. For most towns in the state Taxable

Status Date is March 1.

H. Sale of Business is Included in Sale Price - If the sale price includes the sale of a business the box

provided should be checked.

I. Other Unusual Factors Affecting Sale Price (Specify Below) - Check the box and describe on the lines

provided any unusual facts or circumstances that relate to the transfer that might affect the market value of the

property. Do not include seller concessions in this category.

Examples include: a divorce settlement, bankruptcy settlement, sale at auction, foreclosure, estate

sale, transfer to a trust, sale involving charitable, religious or educational institutions, sale between

neighbors or of contiguous property, sale price is above or below market value.

J. None - If none of the above conditions apply please check this box.

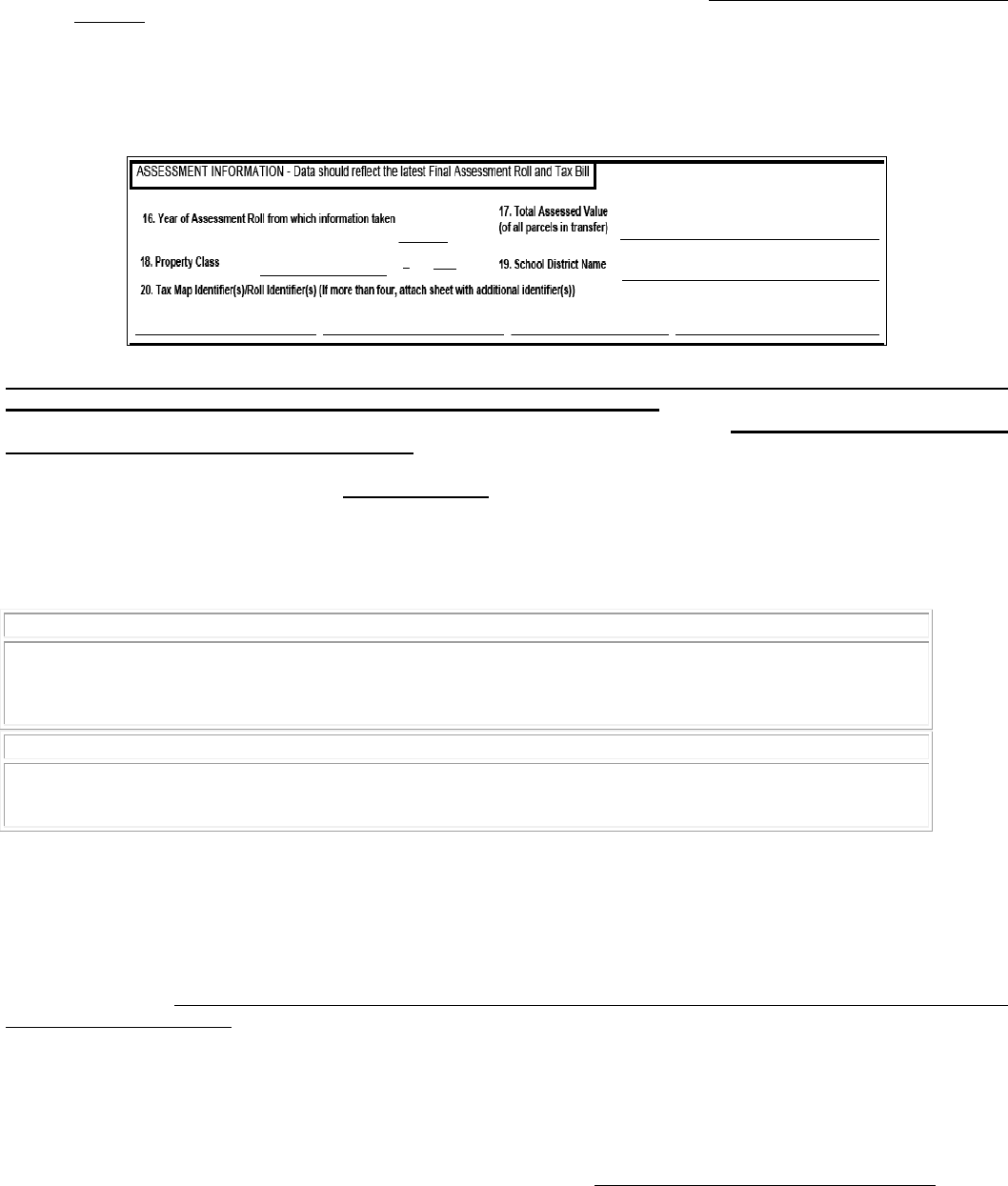

Section 4: Assessment Information (Items 16-20)

The “Assessment Information” must be taken from the latest final city or town assessment roll or latest tax

bill at the time of sale. In Nassau County the county roll should be used. The seller may have this information on

his/her latest tax bill. For any information that may not be printed on the tax bill, the office of the local Assessor or

County Director of Real Property Tax Service can be of assistance in obtaining this data.

16. Assessment Roll Year - Enter the last two numbers of the year from the latest final assessment roll (i.e. the year

of the assessment), at the time of sale. The table below provides the entries for all towns in the state for sales

occurring during these specified time periods. If the property transferred is within a city, roll year information may be

obtained by contacting the office of the local Assessor, County Director of Real Property Tax Services or the NYS

Department of Taxation and Finance - Office of Real Property Tax Services, Data Management Unit.

Westchester County Towns

Roll year entry is based upon the filing of the final assessment roll. For Westchester county towns the final roll is filed on

September 15.

Sales between January 1 and September 14 - enter last two digits of prior year

Sales between September 15 and December 31 - enter last two digits of current year.

All Other Towns

Roll year entry is based upon the filing of the final assessment roll. For all other towns, the final roll is filed on July 1.

Sales between January 1 and June 30 - enter last two digits of prior year

Sales between July 1 and December 31 - enter last two digits of current year

17. Total Assessed Value - Enter the total assessed value (before deduction for any exemptions) for all parcels from

the latest final assessment roll at the time of sale. If more than one parcel is included in the transfer, it is the total of all

the parcels. If only part of a parcel is being transferred, enter the assessed value of the whole assessment roll parcel.

18. Property Class Code - Enter the three digit numeric code that reflects the property type as it appears on the latest

final assessment roll at the time of sale. This code may be different than the use of the property at the time of sale

entered in item 7. If multiple uses are included in the transfer, use the code that represents the primary use of the

property at the time of sale.

Ownership Code - The space following the dash has been provided to describe the type of ownership for parcels as

defined below. Enter an A, B, C, D, T, U or W if they apply. If the property does not fall within any of these

descriptions, leave the last position of this code blank.

Association: The parcel is individually owned and, in addition, the owner of the parcel shares ownership with

other members of the association in the ownership of common areas (i.e., land, lakefront, docks, pools, tennis

courts, etc.). The common areas should also have this code. This code is not used for condominiums.

A = Association without waterfront.

B = Association with waterfront.

Condominium: The property is held in condominium form of ownership. Typically a unit is individually owned,

and an interest is owned in the land and in common improvements. Use this code if a condominium unit is

also part of a Homeowners Association.

C = Condominium without waterfront.

D = Condominium with waterfront.

Time Share: There are multiple owners of the property, each with the right to use a specific unit for a specific

time period annually.

T = Time Share without waterfront.

U = Time Share with waterfront.

Waterfront: Property NOT held in any of the above forms of ownership, but having water frontage requires an

entry of “W” to indicate the presence of waterfront (i.e., vacant land suited for residential purposes with

significant waterfront would be classified as 311-W for Item 18).

W = Waterfront associated with any property class where ownership is NOT an Association,

Condominium or Time Share.

19. School District Name - Enter the legal name of the school district in which the property transferred is located. This

is not necessarily the popular name by which the local school is known.

20. Tax Map Identifier(s) / Roll Identifier(s) - Enter the tax map number(s) or roll identifier(s) for the parcel(s)

involved in the transfer. Tax Map ID consists of a unique section, block and lot, which distinguish a parcel from all

other parcels in a municipality. A Roll ID consists of a unique number that distinguishes a parcel from all other parcels

in a municipality. The appropriate identifier can be found on the tax bill or assessment roll. This number should be

transcribed exactly as it appears. It is very important to include the dots and dashes found in the identifier (i.e.,

087.77-1-22). The 6 digit SWIS code is not part of the tax map identifier, therefore do not include it.

Note: When the transfer consists of more than one parcel, enter the identifiers for all parcels. Space has

been provided for up to 4 identifiers. If more than 4 identifiers are being provided, attach a separate sheet

referencing the tax map number(s). The number of identifiers entered in item 20 should equal the “Number of

Parcels” entered in item 4.

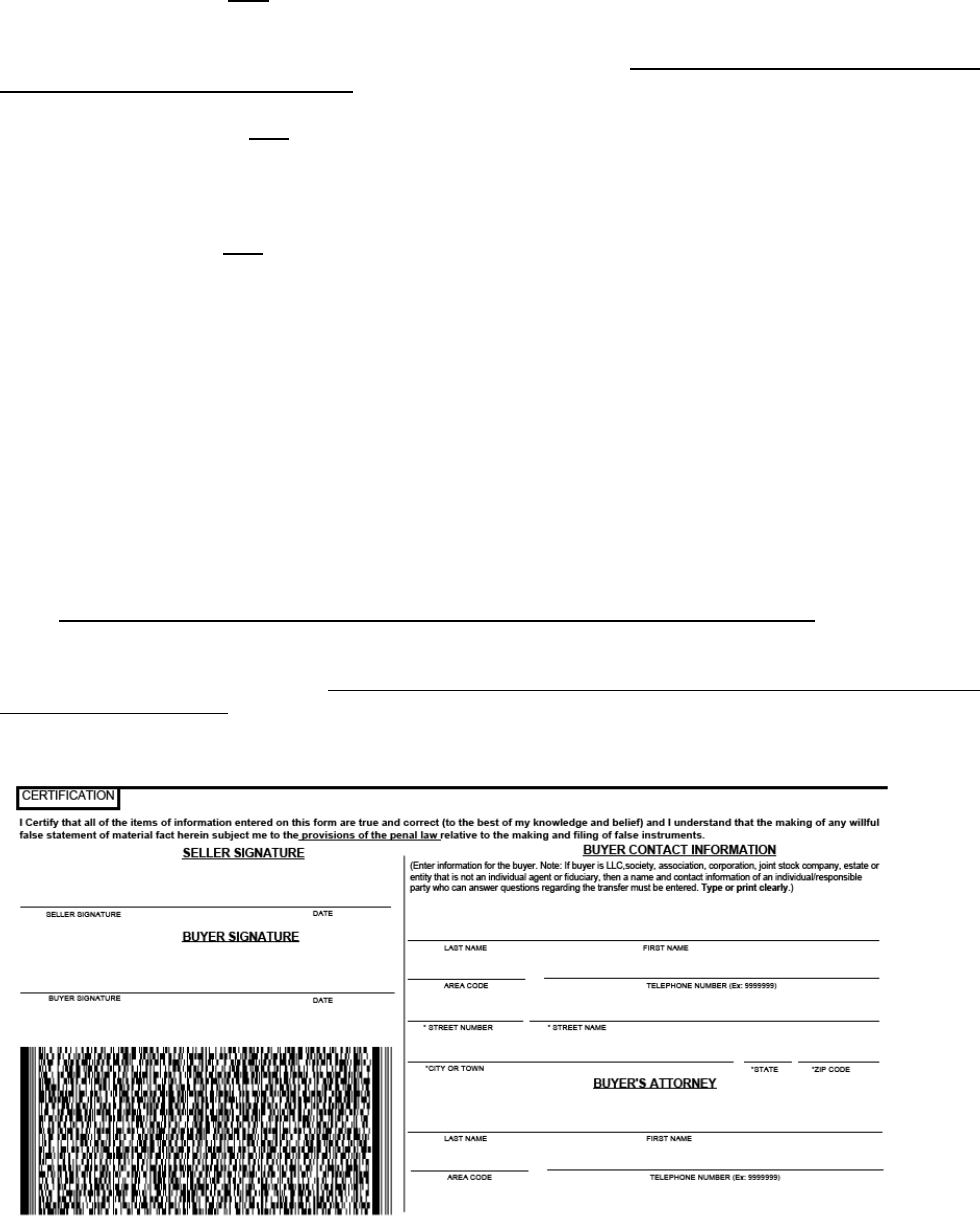

Section 5: Certification

By signing the RP-5217 form, the buyer is certifying that all of the items of information entered on the form are

true and correct and that any willful false statement of material fact will subject them to the provisions of the

penal law relative to the making and filing of false instruments.

The Law requires the signature of BOTH the buyer and the seller and NOT agents to the transfer. Exceptions

include:

If transfer occurs as a result of eminent domain (condemnation), tax foreclosure or other involuntary proceeding, then the signature of the buyer

(condemner, tax district, other party to whom the property is conveyed, or that party’s attorney) is only needed.

If the buyer or seller is unable to sign the form, the signature of a person who has been granted a “Power of Attorney” is acceptable. A copy

should be presented with the RP-5217NYC form at the time the deed is filed.

If multiple buyers and/or sellers are involved in the transfer, only one of each is required to sign. However, all names should appear at the top

of the form.

A signature stamp is an acceptable signature from the County for County Tax Sales.

Seller - The seller must sign and date this portion of the sale form.

Buyer - The buyer must sign and date this portion of the sale form.

Buyer's Contact Information – The buyer is required to identify the name, address and phone number of a person

that can answer questions regarding the property transfer.

If Buyer is an individual or group of individuals - the name, address and phone number should be for the

individual identified in Item # 2 on the form.

If Buyer is a limited liability company (LLC), society, association, joint stock company, corporation,

estate or any other entity that is NOT an individual - the buyer must enter the name, address and phone

number of an individual that can answer questions regarding the property transfer. In the case of an LLC, the

address MUST be a street address for the LLC and NOT a P.O. box.

Buyer's Attorney - Enter the name and telephone number of the attorney representing the buyer. If the buyer does

not have an attorney, enter "NONE".

Department of Taxation and Finance

Important Notice to Home Buyers TP-41

(6/16)

If you are buying residential property and you plan to

make it your primary residence, you may be entitled

to school tax relief through the New York State STAR

credit. To receive this credit, you must register with

the Tax Department after you have taken title to the

property. To register or to get more information, visit

our website at www.tax.ny.gov or call 518-457-2036.

Do not le an application for the STAR “exemption”

with your assessor, since new STAR exemptions

will no longer be granted. School tax relief is now

provided to new applicants through the STAR credit.