Hp 10Bii Financial Calculator Users Manual 10bII+_User Guide_English_EN_NW239 90001_Edition 1

HP 10bII+ Financial Calculator - User Manual c03066677

HP 10bII+ Financial Calculator - User Manual c02989763

10BII c02989763

2015-01-05

: Hp Hp-10Bii-Financial-Calculator-Users-Manual-152986 hp-10bii-financial-calculator-users-manual-152986 hp pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 187 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- Legal Notice

- HP 10bII+ Financial Calculator

- Keyboard Map Legend

- Table of Contents

- At a Glance...

- Getting Started

- Power On and Off

- Manual Conventions and Examples

- Basics of Key Functions

- Shift Keys

- Boxed Key Functions

- Simple Arithmetic Calculations

- Understanding the Display and Keyboard

- Cursor

- Clearing the Calculator

- Annunciators

- Input Key

- Swap Key

- Statistics Keys

- Time Value of Money (TVM), Cash Flows, Bond, and Break-even Keys

- Math Functions

- Trigonometric and Hyperbolic Functions and Modes

- Pi

- Hyperbolic Functions

- Two-Number Functions

- In-line Functions

- Arithmetic with One-and Two-number Functions

- Last Answer

- Display Format of Numbers

- Scientific Notation

- Interchanging the Period and Comma

- Rounding Numbers

- Messages

- Business Percentages

- Number Storage and Storage Register Arithmetic

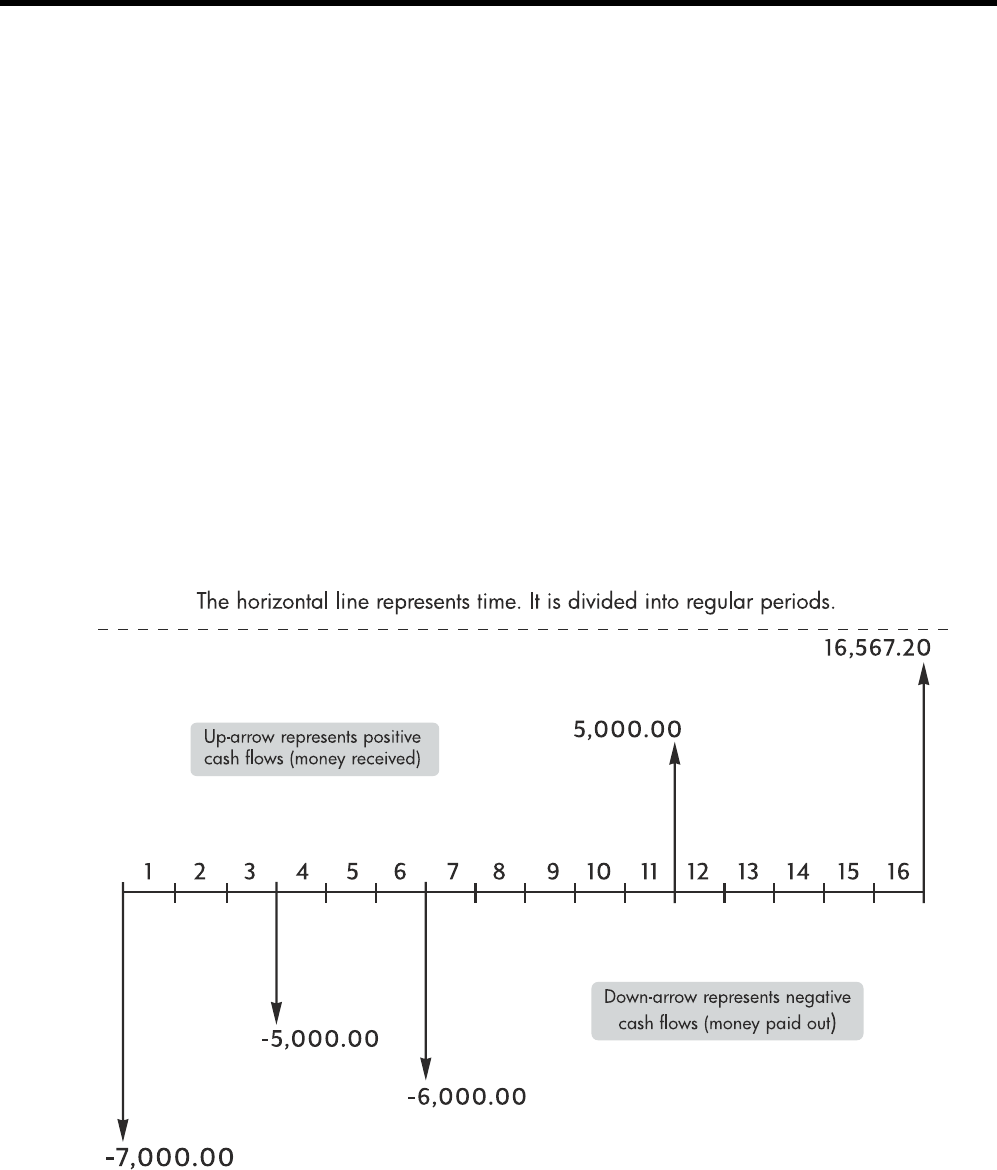

- Picturing Financial Problems

- Time Value of Money Calculations

- Depreciation

- Cash Flow Calculations

- Calendar Formats and Date Calculations

- Bonds

- Break-even

- Statistical Calculations

- Clearing Statistical Data

- Entering Statistical Data

- Viewing and Editing Statistical Data

- Summary of Statistical Calculations

- Mean, Standard Deviations, and Summation Statistics

- Linear Regression, Estimation, and Regression Modes

- Weighted Mean

- Regression Models and Variables

- Probability Calculations

- Factorial

- Permutations

- Combinations

- Random Number and Seed

- Advanced Probability Distributions

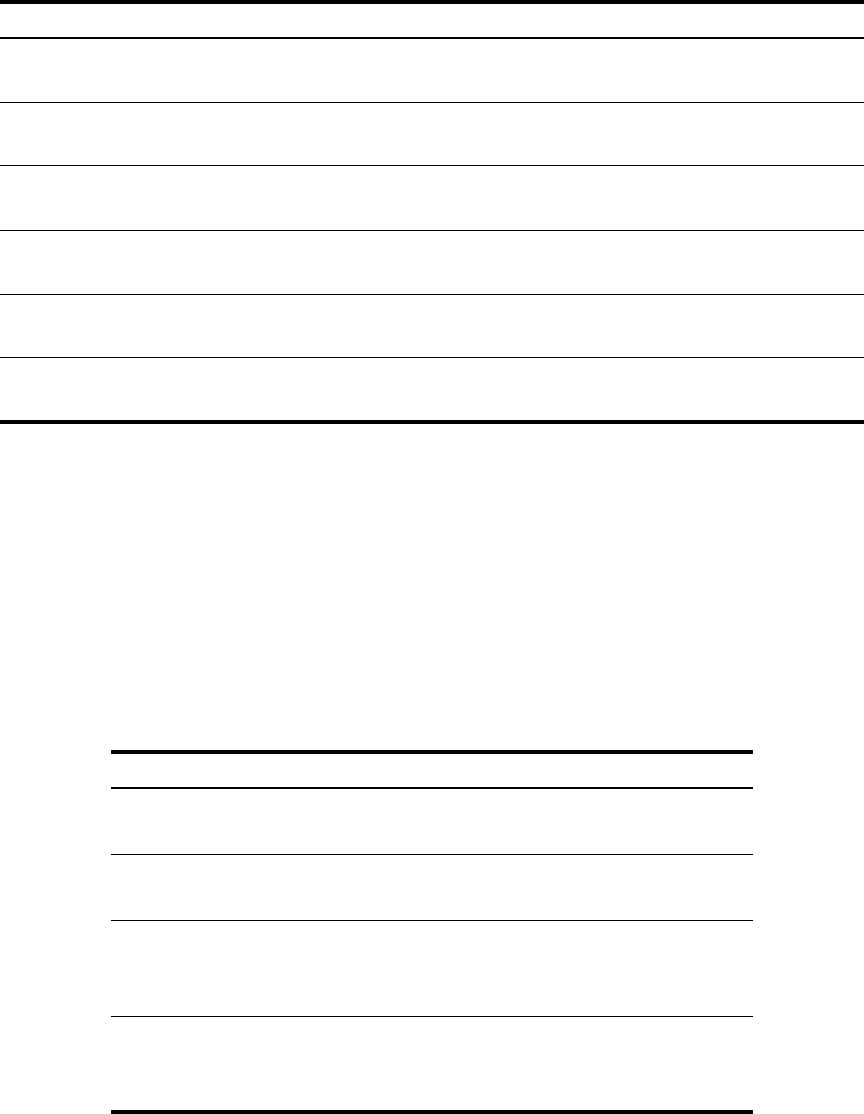

- Normal Lower Tail Probability

- Inverse of Normal Lower Tail Probability

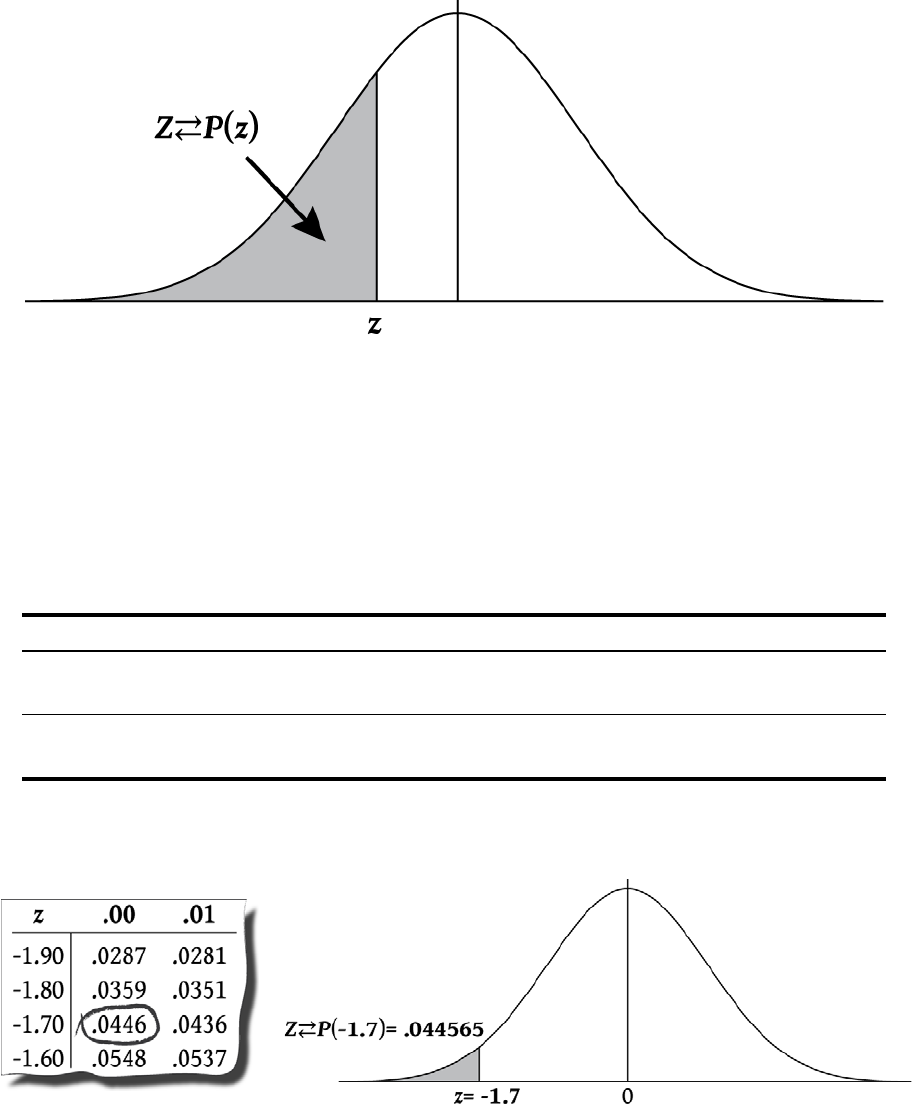

- Student's T Probability Lower Tail

- Inverse of Student’s t Probability Lower Tail

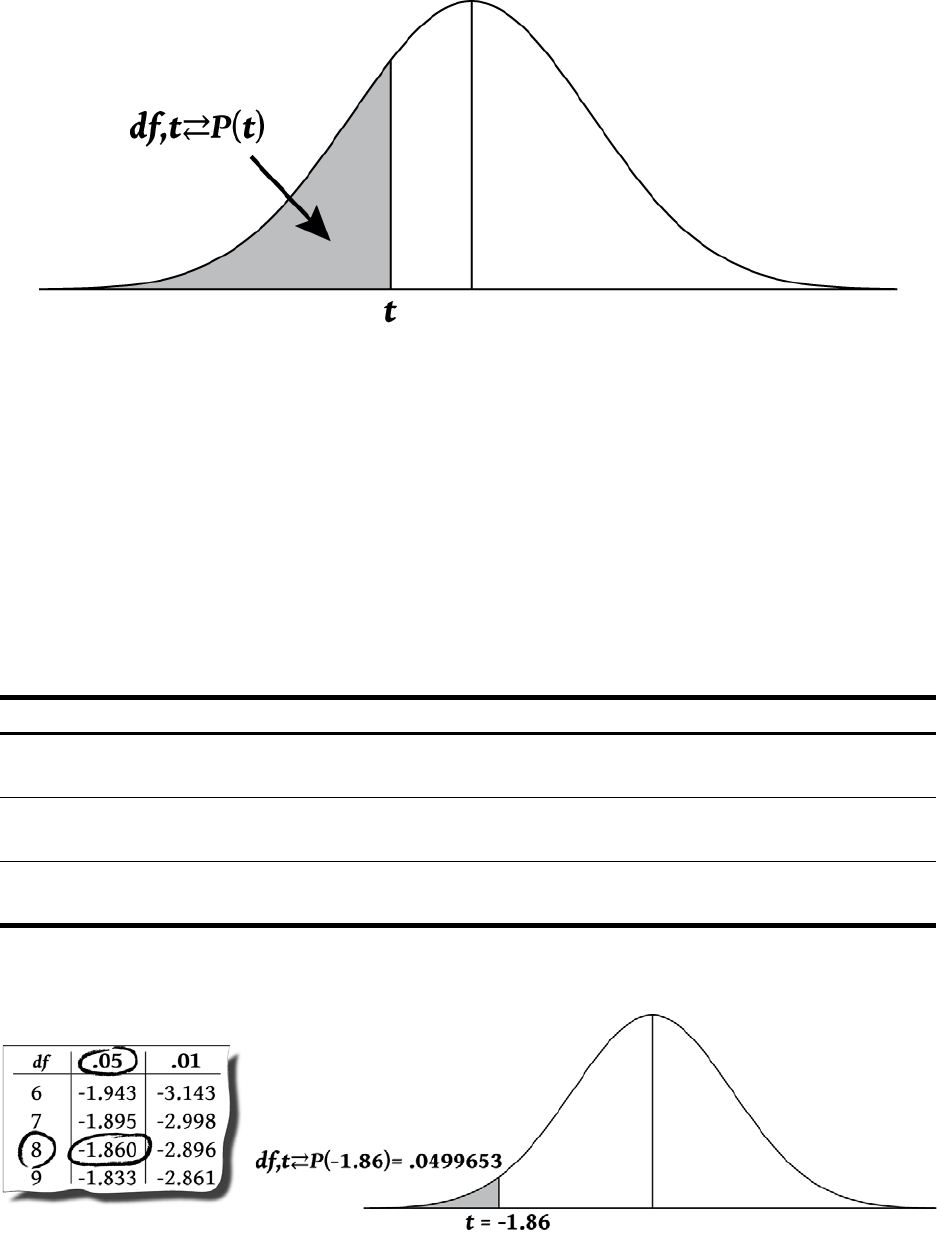

- Conversions from Lower Tail

- Additional Examples

- Appendix A: Batteries and Answers to Common Questions

- Appendix B: More About Calculations

- Appendix C: Messages

- Warranty, Regulatory, and Contact Information

- Replacing the Batteries

- HP Limited Hardware Warranty and Customer Care

- Limited Hardware Warranty Period

- General Terms

- Exclusions

- Regulatory Information

- Federal Communications Commission Notice

- Modifications

- Declaration of Conformity for Products Marked with FCC Logo, United States Only

- Canadian Notice

- Avis Canadien

- European Union Regulatory Notice

- Japanese Notice

- Disposal of Waste Equipment by Users in Private Household in the European Union

- Perchlorate Material - special handling may apply

- Customer Care

- Contact Information

- Index

i

HP 10bII+ Financial Calculator

User’s Guide

HP Part Number: NW239-90001

Edition 1, May 2010

ii

Legal Notice

This manual and any examples contained herein are provided “as is” and are subject to

change without notice. Hewlett-Packard Company makes no warranty of any kind with

regard to this manual, including, but not limited to, the implied warranties of merchantability,

non-infringement and fitness for a particular purpose. In this regard, HP shall not be liable

for technical or editorial errors or omissions contained in the manual.

Hewlett-Packard Company shall not be liable for any errors or for incidental or consequential

damages in connection with the furnishing, performance, or use of this manual or the exam-

ples contained herein.

Copyright © 2010 Hewlett-Packard Development Company, L.P.

Reproduction, adaptation, or translation of this manual is prohibited without prior written

permission of Hewlett-Packard Company, except as allowed under the copyright laws.

Hewlett-Packard Company

Palo Alto, CA

94304

USA

iii

HP 10bII+ Financial Calculator

iv

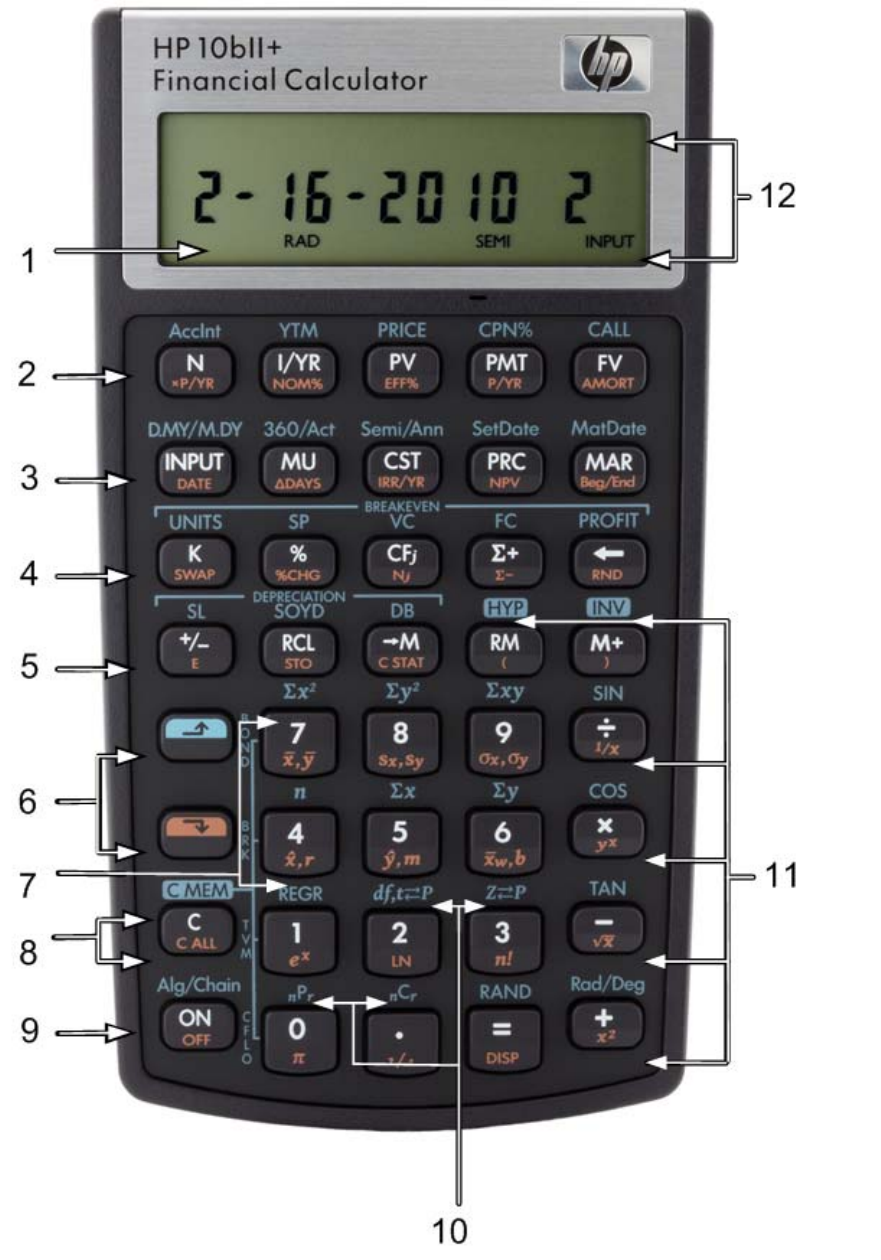

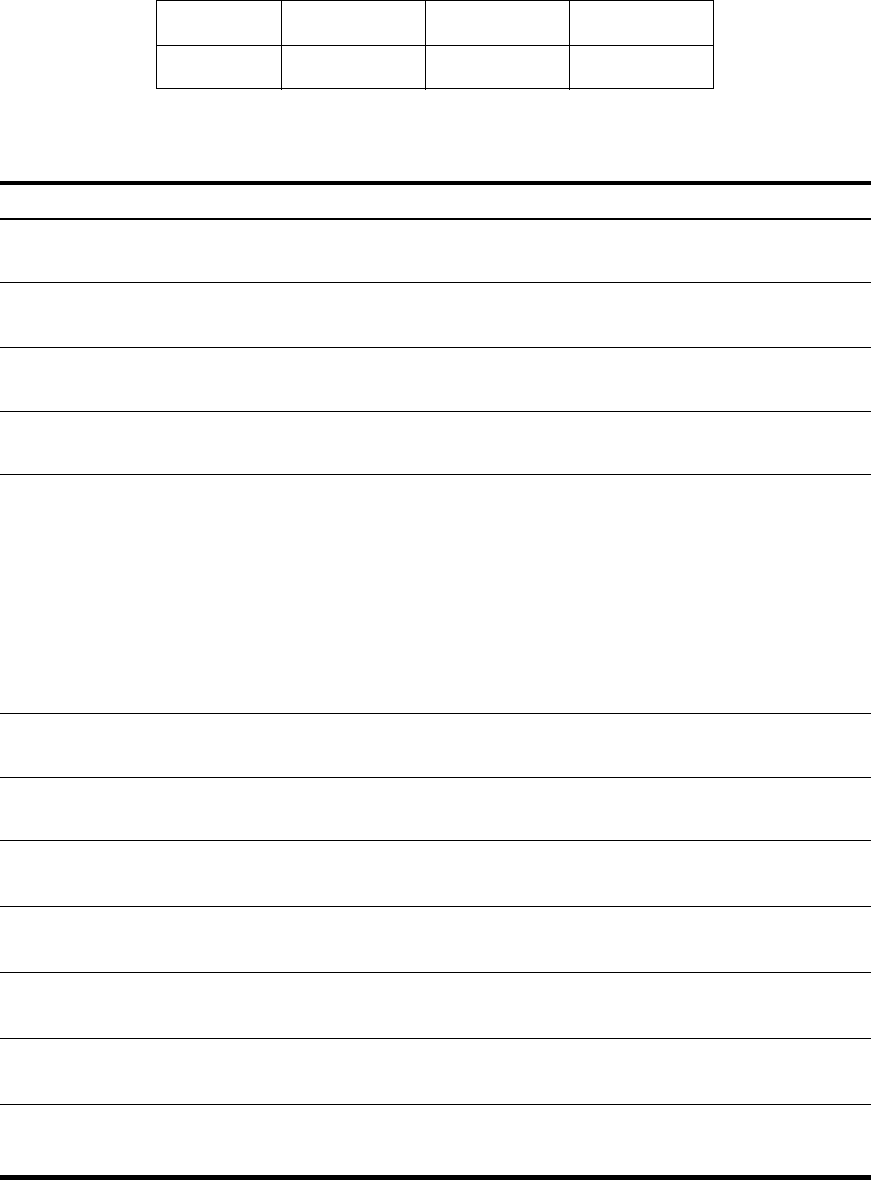

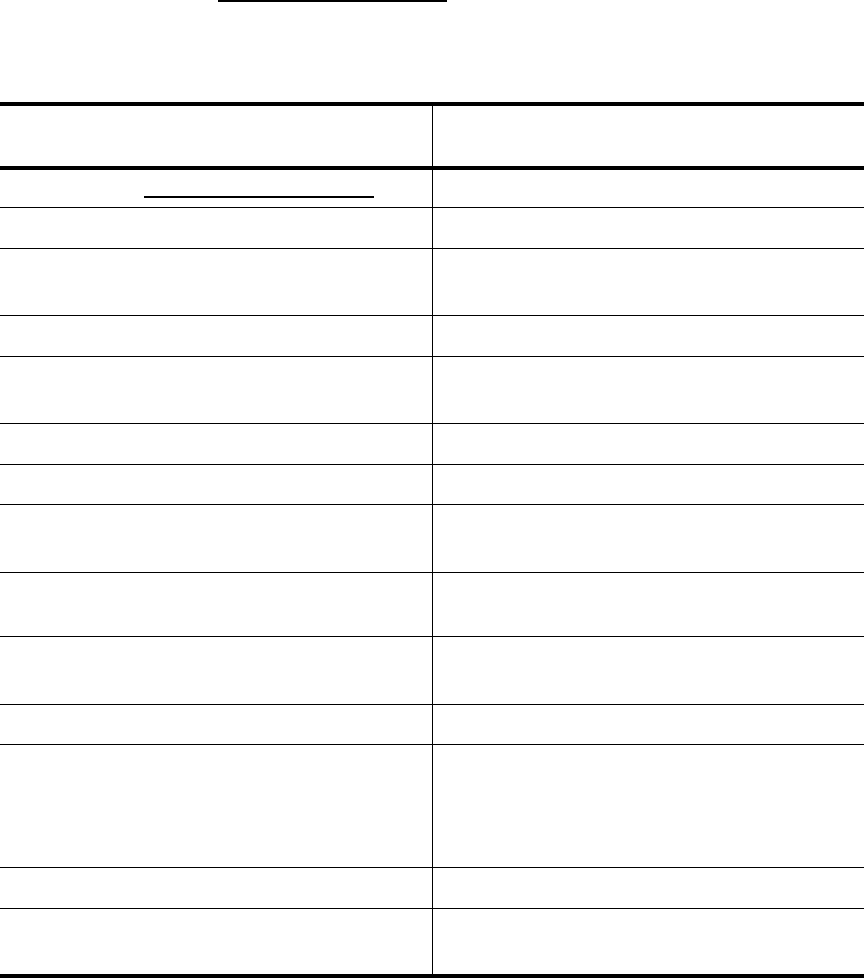

Keyboard Map Legend

Number

(row of keys)

Primary Functions

(white)

SHIFT Down \

(orange functions on

key bevel)

SHIFT Up ]

(blue functions above

keys)

1 12 character, seven-

segment screen display

2 Time Value of Money

(TVM) Payments per year,

interest conversion,

amortization,

Bond calculations

3 Input key, markup, cost,

price and margin Date and change of

days, IRR per year, NPV,

beginning/end of

payment period

Calendar and coupon

payment schedules,

settlement and maturity

dates (bonds)

4 K memory register,

percent, cash flow

amount, statistics entry,

backspace

Swap, percent change,

cash flow count, delete

statistics, round

Break-even calculation

5 Change sign, recall

and memory Scientific notation, store,

clear statistics,

parentheses

Depreciation,

hyperbolic and

trigonometric functions

6 Shift (blue, up)

Shift (orange, down)

7 Numbered keys: 1, and

4-9 Statistics, weighted

mean and estimation Statistical functions and

regression modes

8 Clearing functions Clearing functions Clearing functions

9On Off Operating modes

10 Numbered keys: 0 and

2-3, decimal Common mathematical

functions Probability functions

11 Mathematical functions Common mathematical

functions, parentheses Trigonometric functions

12 Annun ciators

1

Table of Contents

Legal Notice...............................................................................................................ii

HP 10bII+ Financial Calculator....................................................................................iii

Keyboard Map Legend............................................................................................... iv

1 At a Glance........................................................................................................................ 1

Basics of Key Functions................................................................................................1

Shift Keys...................................................................................................................2

Boxed Key Functions ...................................................................................................2

Percentages ...............................................................................................................3

Memory Keys .............................................................................................................4

Time Value of Money (TVM) .........................................................................................6

TVM What if... ...........................................................................................................7

Amortization ..............................................................................................................8

Depreciation ..............................................................................................................9

Interest Rate Conversion.............................................................................................10

Cash Flows, IRR/YR, NPV, and NFV ...........................................................................11

Date and Calendar ...................................................................................................13

Bonds......................................................................................................................14

Break-even ...............................................................................................................16

Statistical Calculations...............................................................................................17

Probability ...............................................................................................................19

Trigonometric Functions .............................................................................................20

2 Getting Started................................................................................................................. 23

Power On and Off ....................................................................................................23

Manual Conventions and Examples.............................................................................23

Basics of Key Functions..............................................................................................24

Shift Keys.................................................................................................................25

Boxed Key Functions .................................................................................................25

Simple Arithmetic Calculations....................................................................................26

Understanding the Display and Keyboard....................................................................29

Cursor .....................................................................................................................29

Clearing the Calculator..............................................................................................29

Annunciators ............................................................................................................30

Input Key .................................................................................................................32

Swap Key ................................................................................................................32

Statistics Keys...........................................................................................................32

Time Value of Money (TVM), Cash Flows, Bond, and Break-even Keys ............................33

Math Functions .........................................................................................................33

Trigonometric and Hyperbolic Functions and Modes .....................................................35

Pi............................................................................................................................36

Hyperbolic Functions .................................................................................................36

Two-Number Functions ..............................................................................................37

In-line Functions ........................................................................................................37

2

Arithmetic with One-and Two-number Functions............................................................ 39

Last Answer ............................................................................................................. 41

Display Format of Numbers ....................................................................................... 41

Scientific Notation.................................................................................................... 43

Interchanging the Period and Comma ......................................................................... 43

Rounding Numbers................................................................................................... 43

Messages................................................................................................................ 44

3 Business Percentages.........................................................................................................45

The Business Percentage Keys .................................................................................... 45

Percent key.............................................................................................................. 45

Margin and Markup Calculations............................................................................... 47

4 Number Storage and Storage Register Arithmetic ...............................................................49

Using Stored Numbers in Calculations ........................................................................ 49

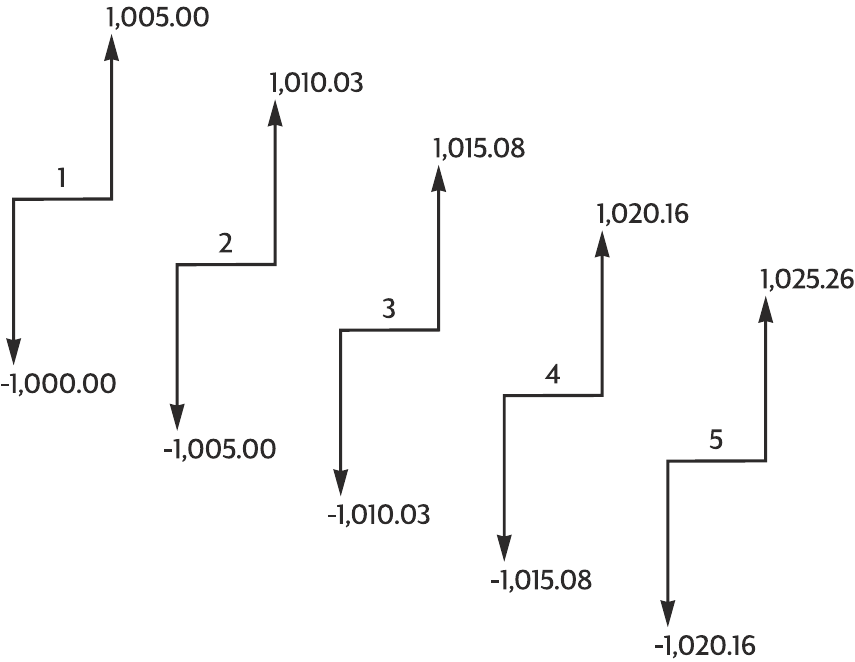

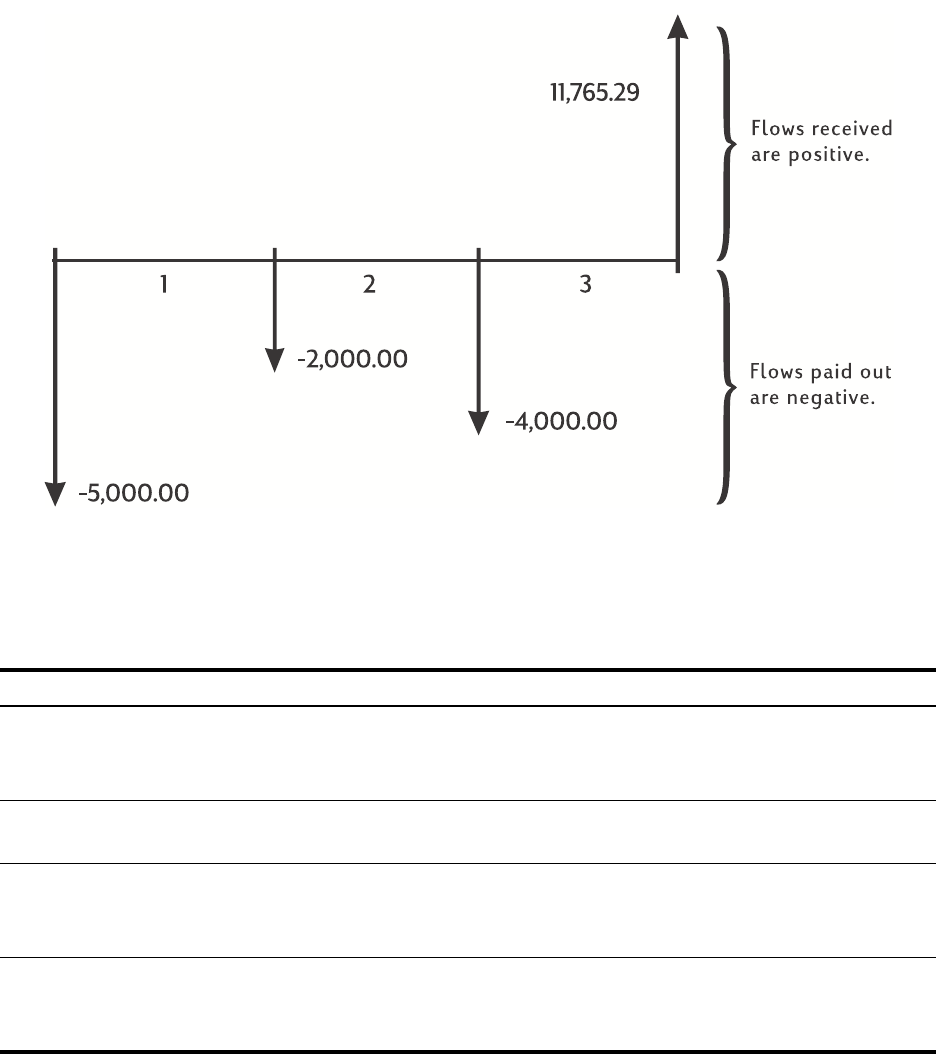

5 Picturing Financial Problems ..............................................................................................55

How to approach a Financial Problem ........................................................................ 55

Signs of Cash Flows ................................................................................................. 56

Periods and Cash Flows............................................................................................ 56

Simple and Compound Interest................................................................................... 56

Interest Rates............................................................................................................ 57

Two Types of Financial Problems................................................................................ 58

Recognizing a Cash Flow Problem ............................................................................. 59

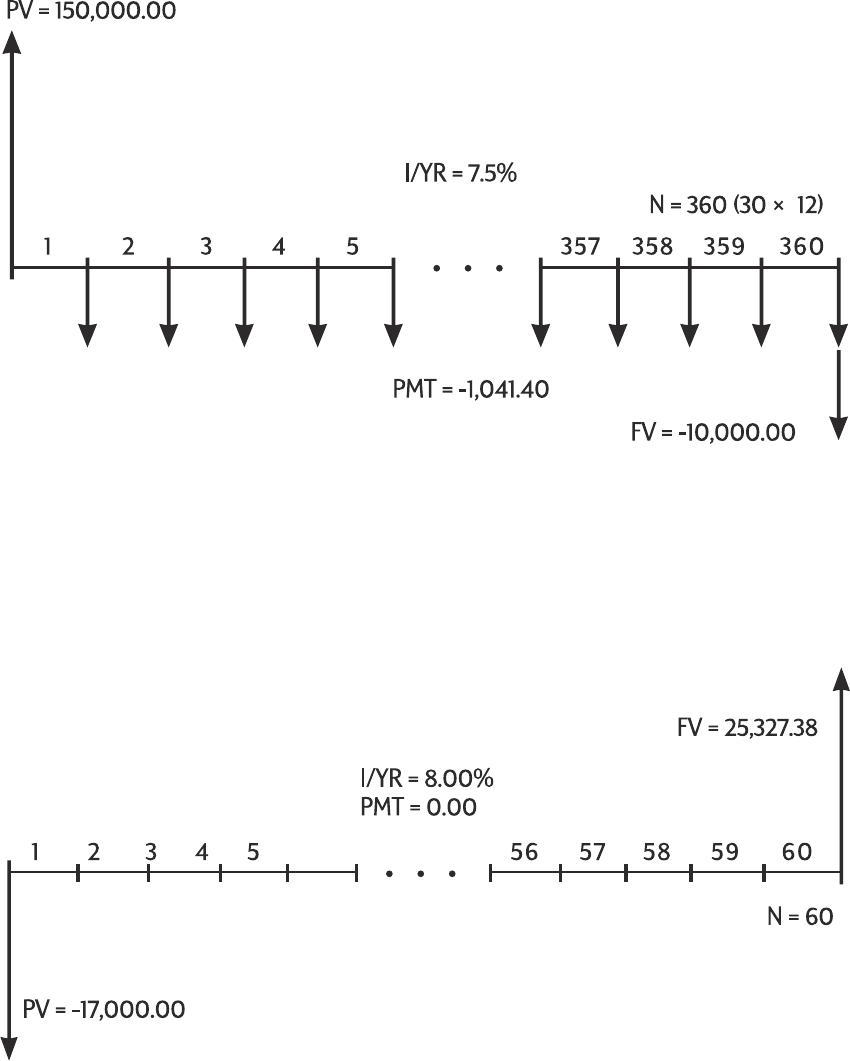

6 Time Value of Money Calculations .....................................................................................61

Using the TVM Application ........................................................................................ 61

The TVM Keys.......................................................................................................... 61

Begin and End Modes............................................................................................... 62

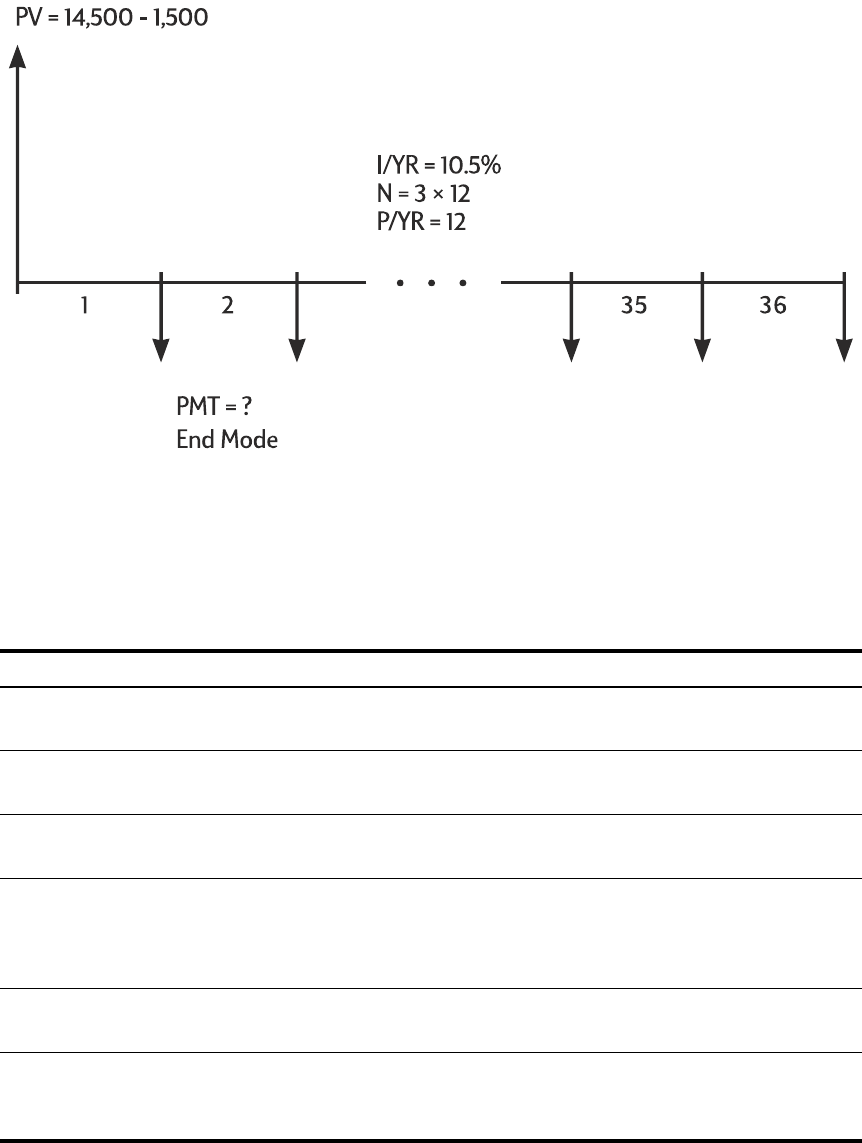

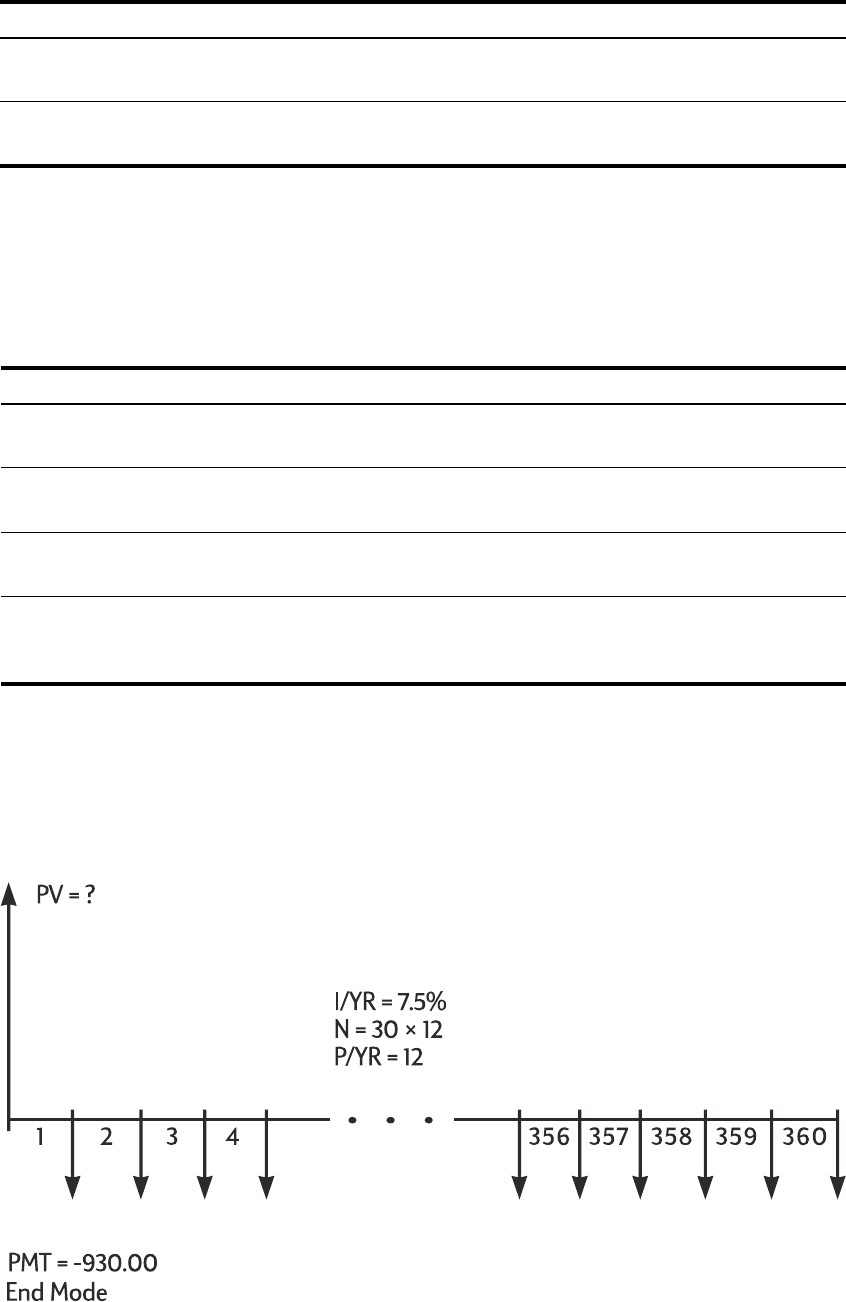

Loan Calculations..................................................................................................... 62

Savings Calculations................................................................................................. 67

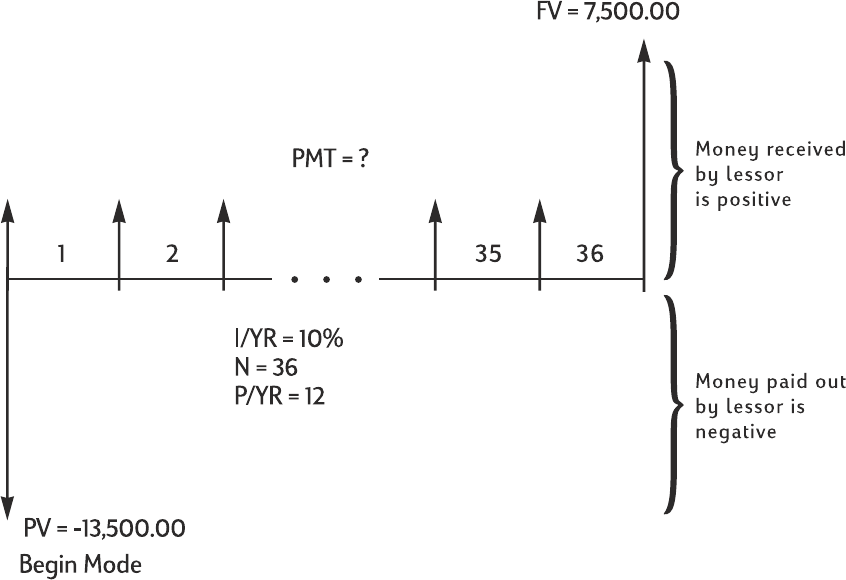

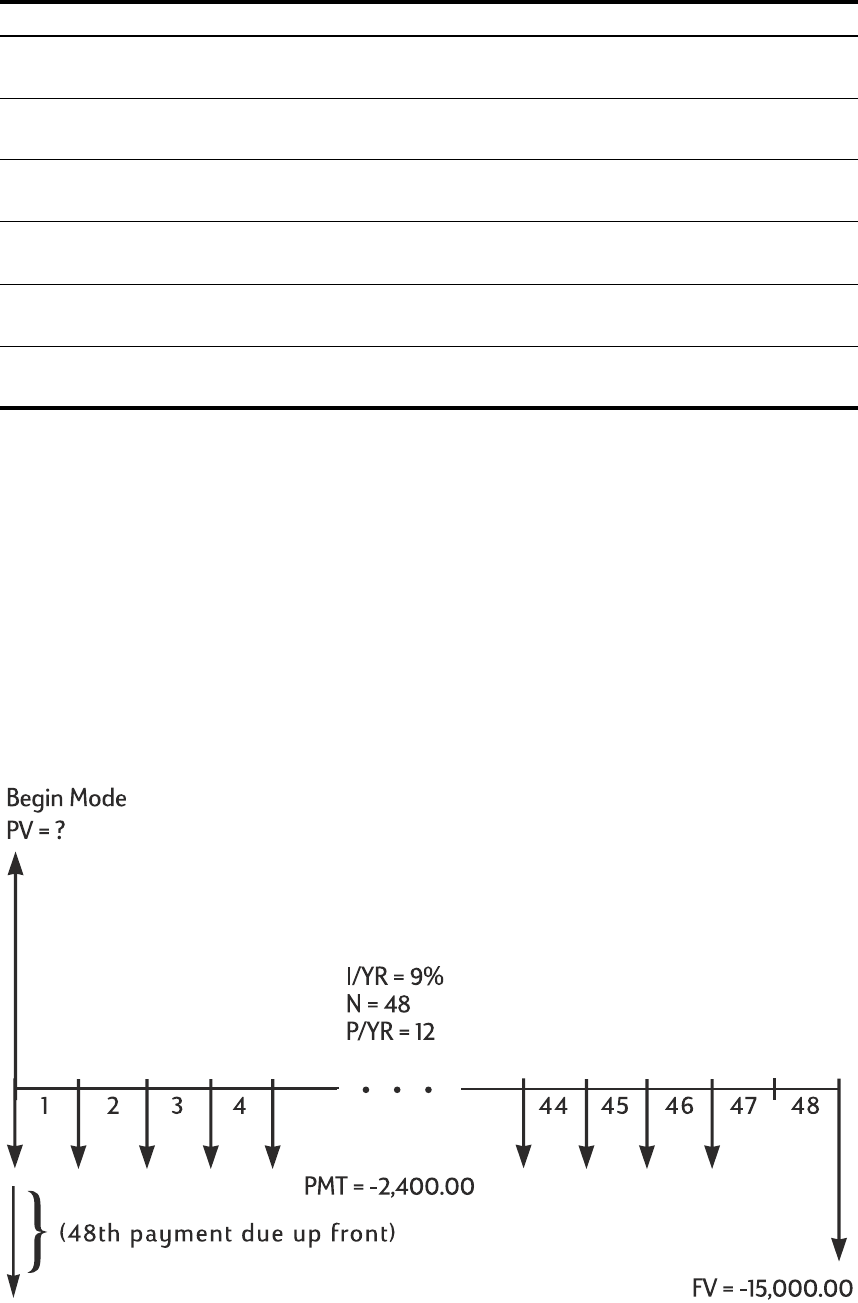

Lease Calculations.................................................................................................... 71

Amortization............................................................................................................ 74

Interest Rate Conversions........................................................................................... 79

Resetting the TVM Keys ............................................................................................. 82

7 Depreciation .....................................................................................................................83

The Depreciation Keys .............................................................................................. 83

Resetting the TVM Keys ............................................................................................. 86

3

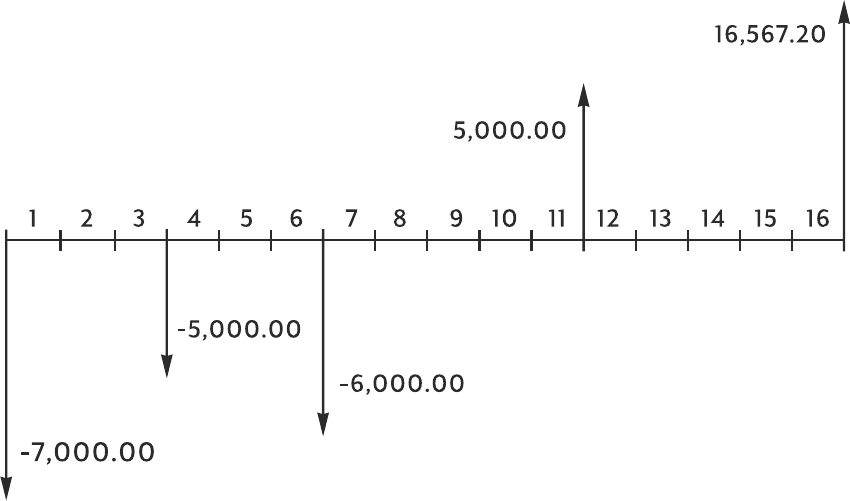

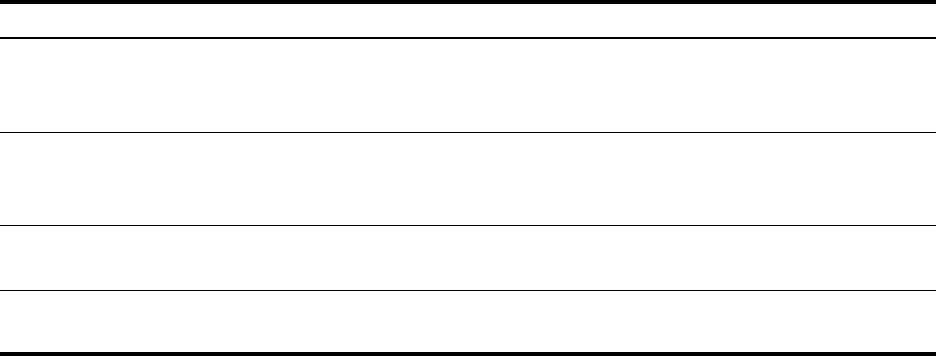

8 Cash Flow Calculations..................................................................................................... 87

How to Use the Cash Flow Application........................................................................87

Clearing the Cash Flow Memory.................................................................................88

Calculating Internal Rate of Return...............................................................................90

NPV and IRR/YR: Discounting Cash Flows ...................................................................91

Organizing Cash Flows.............................................................................................91

Viewing and Editing Cash Flows.................................................................................93

Calculating Net Present Value and Net Future Value .....................................................95

Automatic Storage of IRR/YR and NPV........................................................................98

9 Calendar Formats and Date Calculations ........................................................................... 99

Calendar Format.......................................................................................................99

Date Format .............................................................................................................99

Date Calculations and Number of Days.....................................................................101

Number of Days .....................................................................................................102

10 Bonds .......................................................................................................................... 105

The Bond Keys........................................................................................................105

Resetting the bond keys ...........................................................................................108

11 Break-even .................................................................................................................. 109

The Break-even Keys................................................................................................109

Resetting the Break-even keys ...................................................................................112

12 Statistical Calculations .................................................................................................. 113

Clearing Statistical Data ..........................................................................................114

Entering Statistical Data ...........................................................................................114

Viewing and Editing Statistical Data..........................................................................116

Summary of Statistical Calculations ...........................................................................119

Mean, Standard Deviations, and Summation Statistics.................................................120

Linear Regression, Estimation, and Regression Modes..................................................121

Weighted Mean .....................................................................................................124

Regression Models and Variables .............................................................................125

Probability Calculations ...........................................................................................126

Factorial ................................................................................................................126

Permutations...........................................................................................................126

Combinations.........................................................................................................127

Random Number and Seed......................................................................................127

Advanced Probability Distributions ............................................................................128

Normal Lower Tail Probability ..................................................................................129

Inverse of Normal Lower Tail Probability....................................................................130

Student's T Probability Lower Tail ..............................................................................131

4

Inverse of Student’s t Probability Lower Tail................................................................ 132

Conversions from Lower Tail .................................................................................... 133

13 Additional Examples .....................................................................................................137

Business Applications.............................................................................................. 137

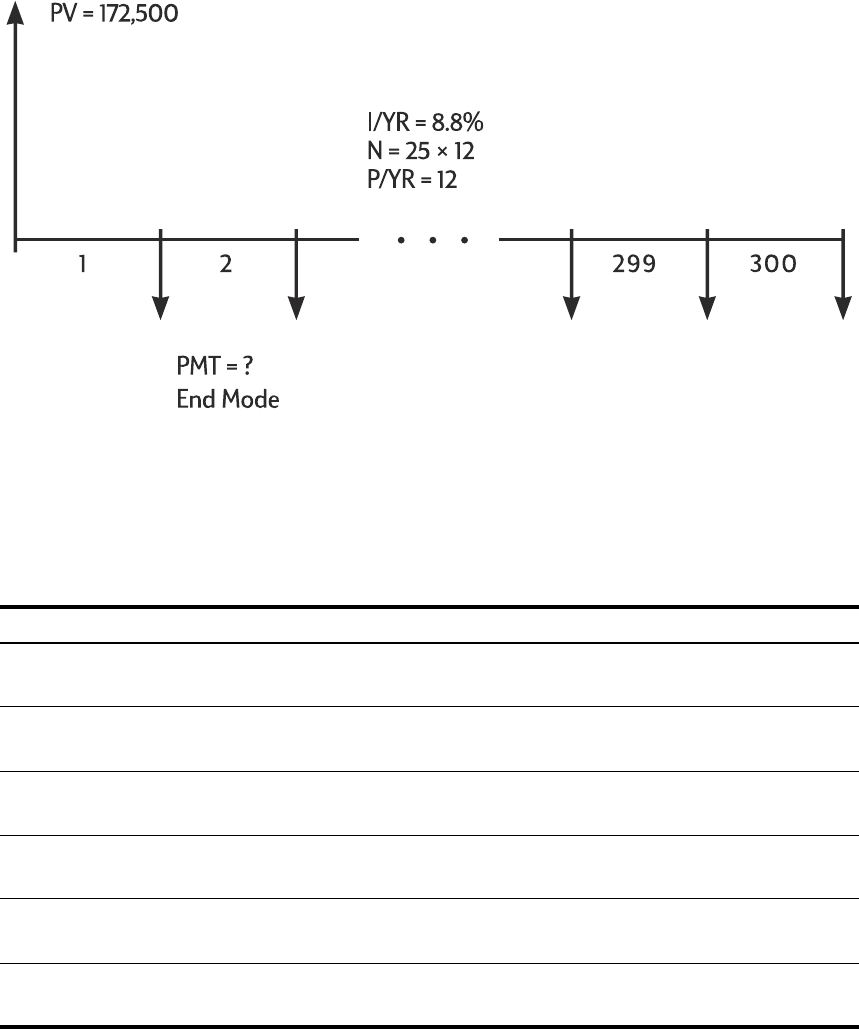

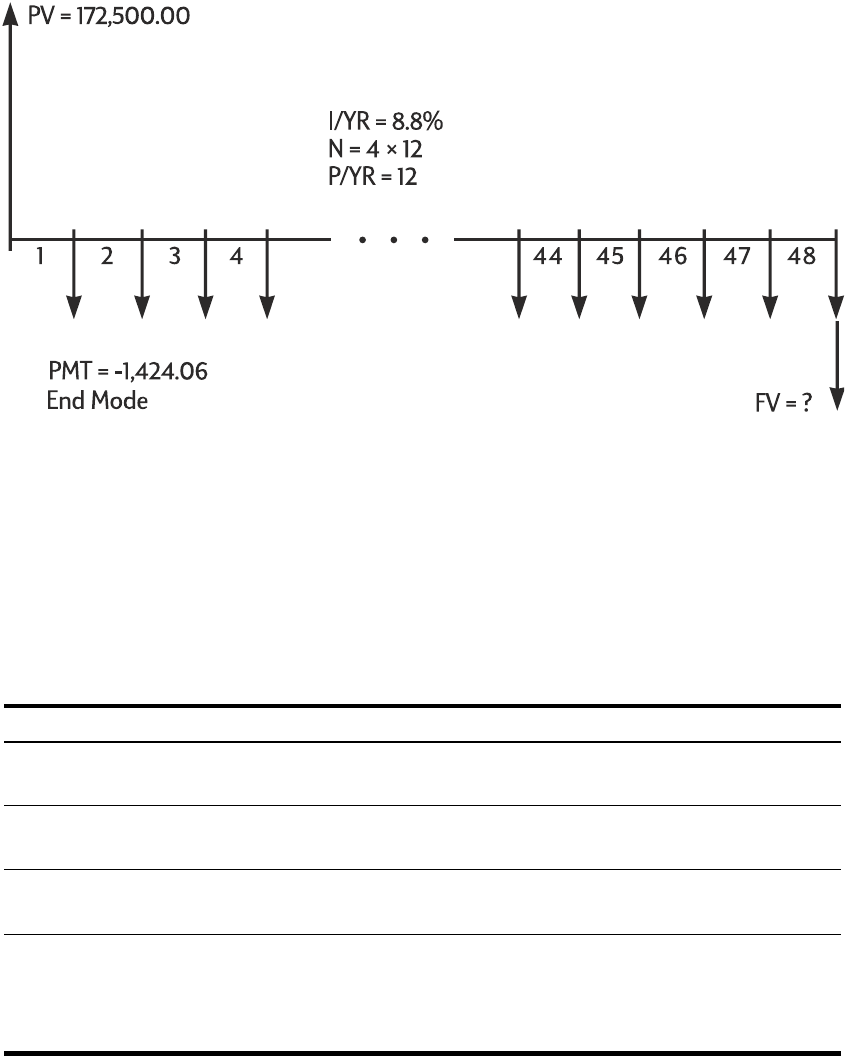

Loans and Mortgages ............................................................................................. 139

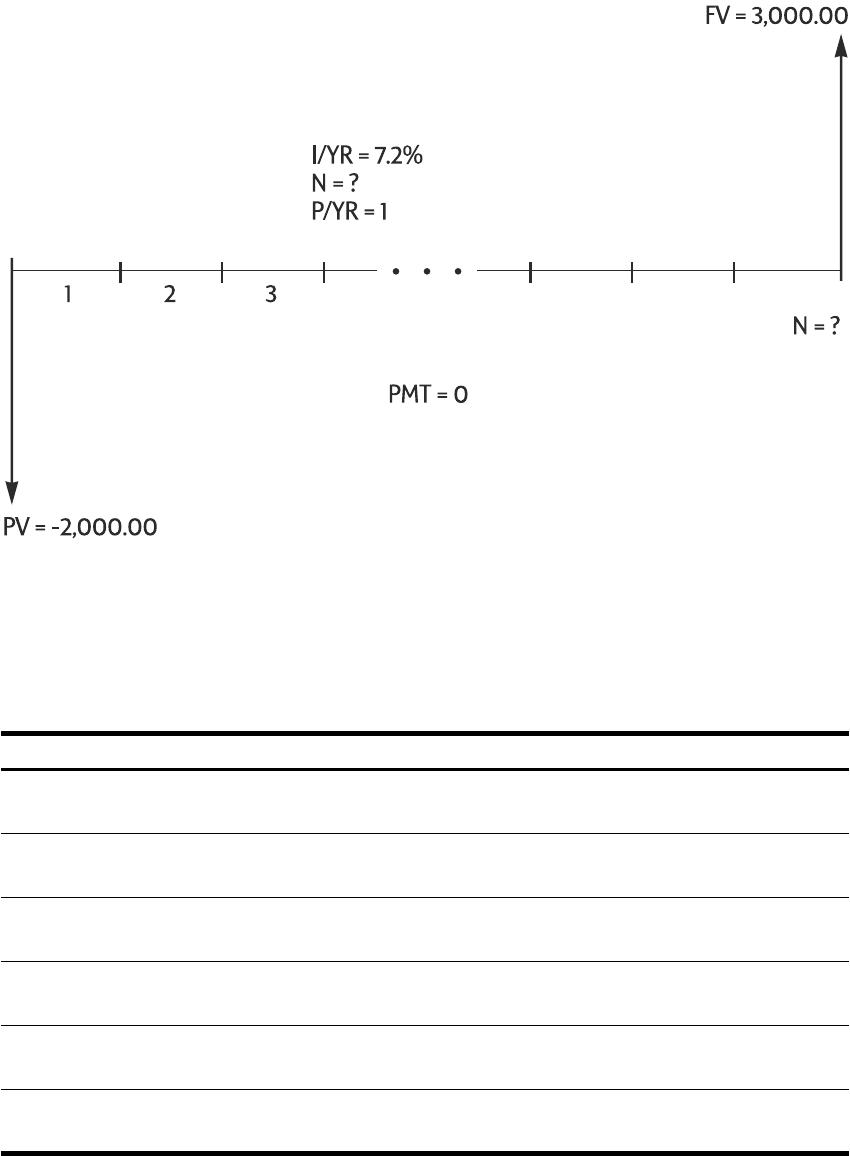

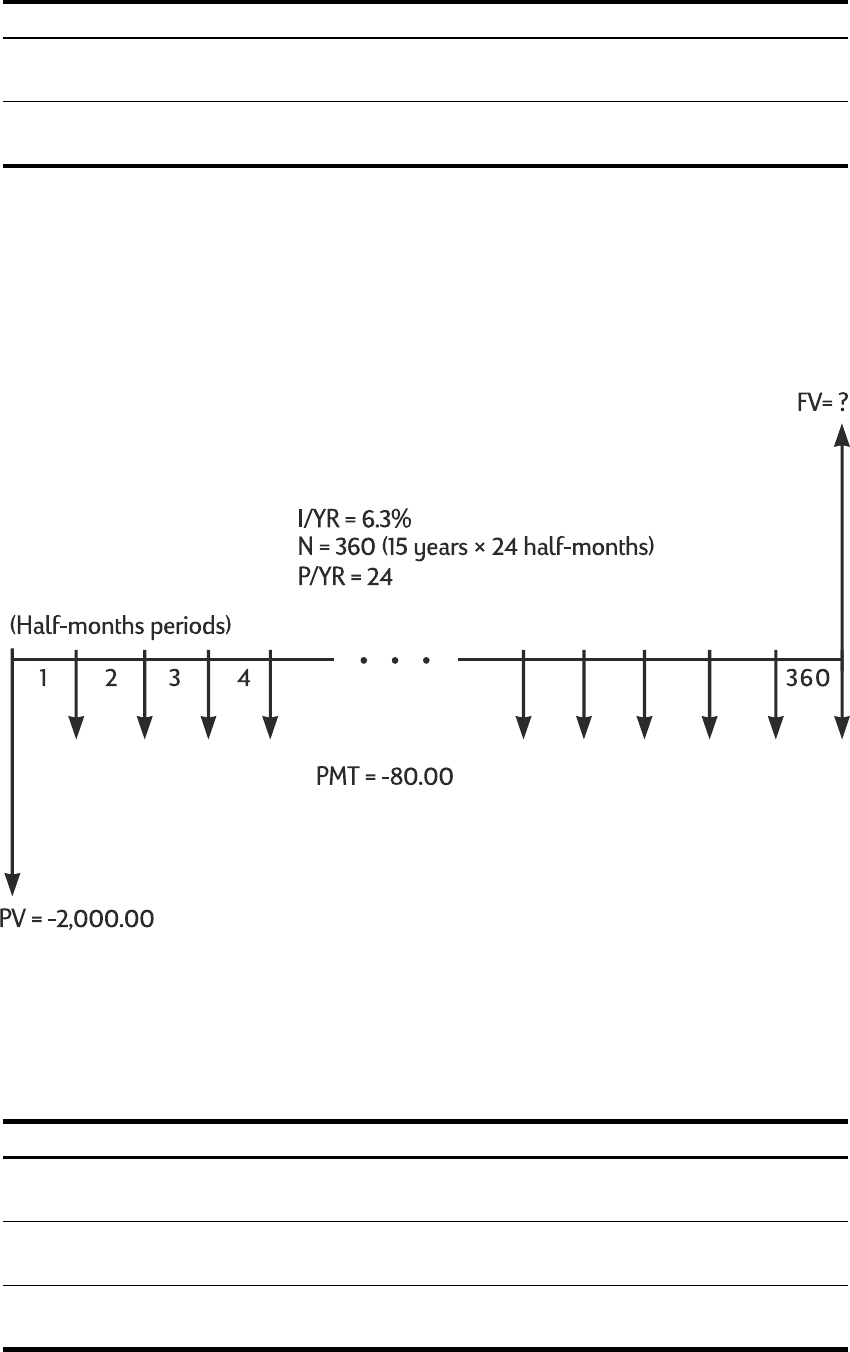

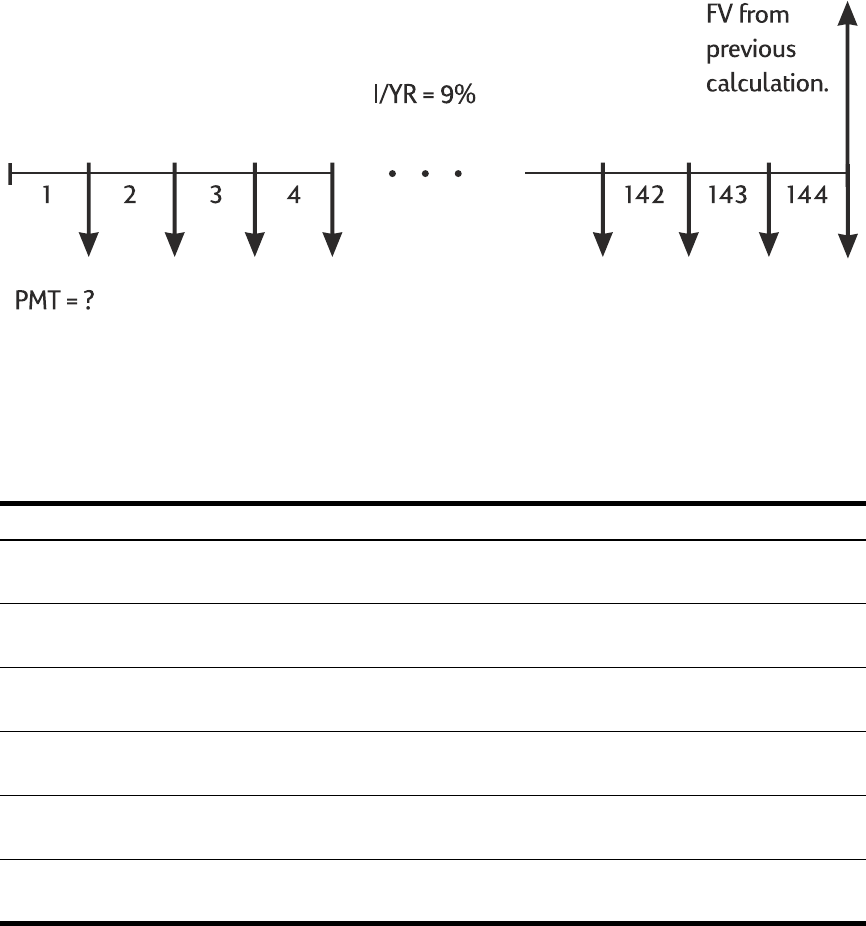

Savings................................................................................................................. 148

Cash Flow Examples............................................................................................... 152

14 Appendix A: Batteries and Answers to Common Questions ..................................................I

Power and Batteries..................................................................................................... I

Low Power Annunciator................................................................................................ I

Installing Batteries........................................................................................................ I

Determining if the Calculator Requires Service ................................................................II

Answers to Common Questions....................................................................................III

Environmental Limits................................................................................................... IV

15 Appendix B: More About Calculations.................................................................................I

IRR/YR Calculations..................................................................................................... I

Equations ................................................................................................................... I

16 Appendix C: Messages.......................................................................................................I

17 Warranty, Regulatory, and Contact Information .................................................................1

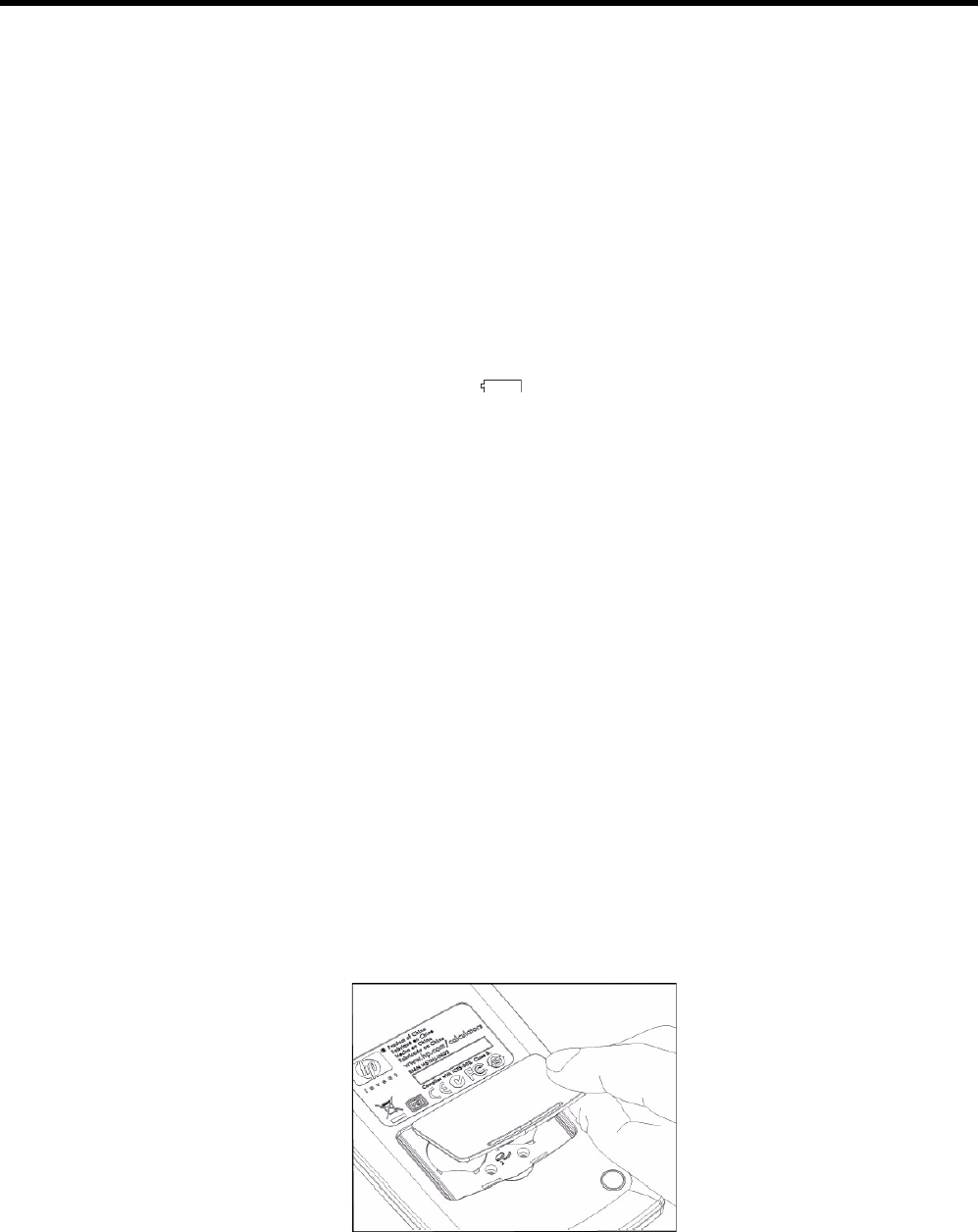

Replacing the Batteries................................................................................................ 1

HP Limited Hardware Warranty and Customer Care....................................................... 1

Limited Hardware Warranty Period .............................................................................. 1

General Terms ........................................................................................................... 2

Exclusions.................................................................................................................. 2

Regulatory Information ................................................................................................ 3

Federal Communications Commission Notice................................................................. 3

Modifications............................................................................................................. 3

Declaration of Conformity for Products Marked with FCC Logo, United States Only ............ 4

Canadian Notice ....................................................................................................... 4

Avis Canadien ........................................................................................................... 4

European Union Regulatory Notice............................................................................... 4

Japanese Notice ........................................................................................................ 5

Disposal of Waste Equipment by Users in Private Household in the European Union........... 5

Perchlorate Material - special handling may apply.......................................................... 6

Customer Care........................................................................................................... 6

Contact Information .................................................................................................... 6

At a Glance... 1

1 At a Glance...

This section is designed for you if you’re already familiar with calculator operation or financial

concepts. You can use it for quick reference. The rest of the manual is filled with explanations

and examples of the concepts presented in this section.

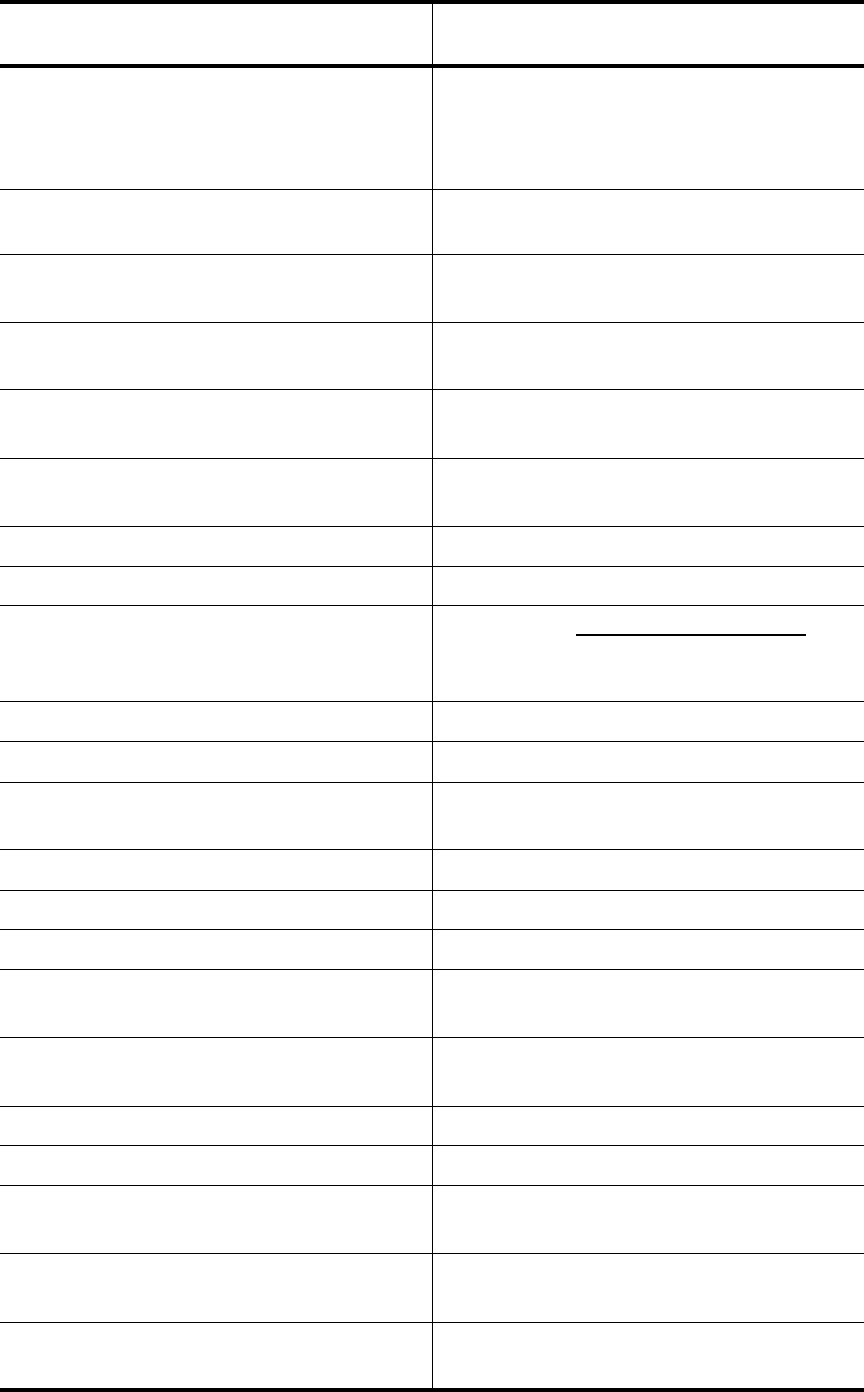

Basics of Key Functions

Table 1-1 Basics of key functions

Keys Display Description

=0.00 Turns calculator on.

] [blue]

0.00 Displays shift

annunciator .

\ [orange]

0.00 Displays shift

annunciator .

JGD| 12_ Erases last character.

M0.00 Clears display.

\t 0.00 Clears statistics

memory.

\N 12 P_ Y r (message flashes, then

disappears)

Clears all memory.

]Oj BOND CLR (message flashes,

then disappears)

Clears bond memory.

]OY BR EV CLR (message flashes,

then disappears)

Clears break-even

memory.

]OJ TVM CLR (message flashes, then

disappears)

Clears tvm registers.

]O: CFLO CLR (message flashes, then

disappears)

Clears cash flow

memory.

\> Turns calculator off.

At a Glance...2

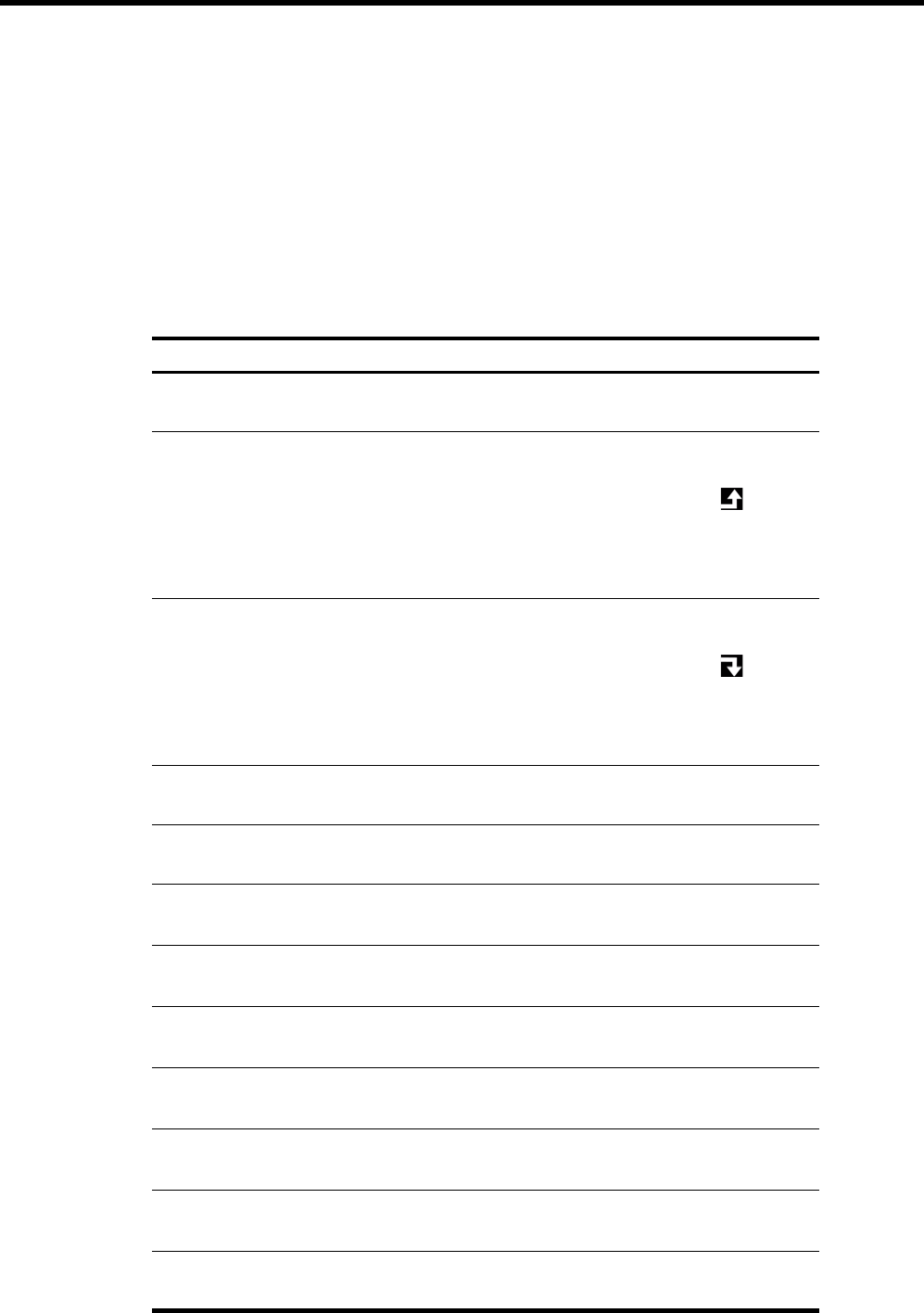

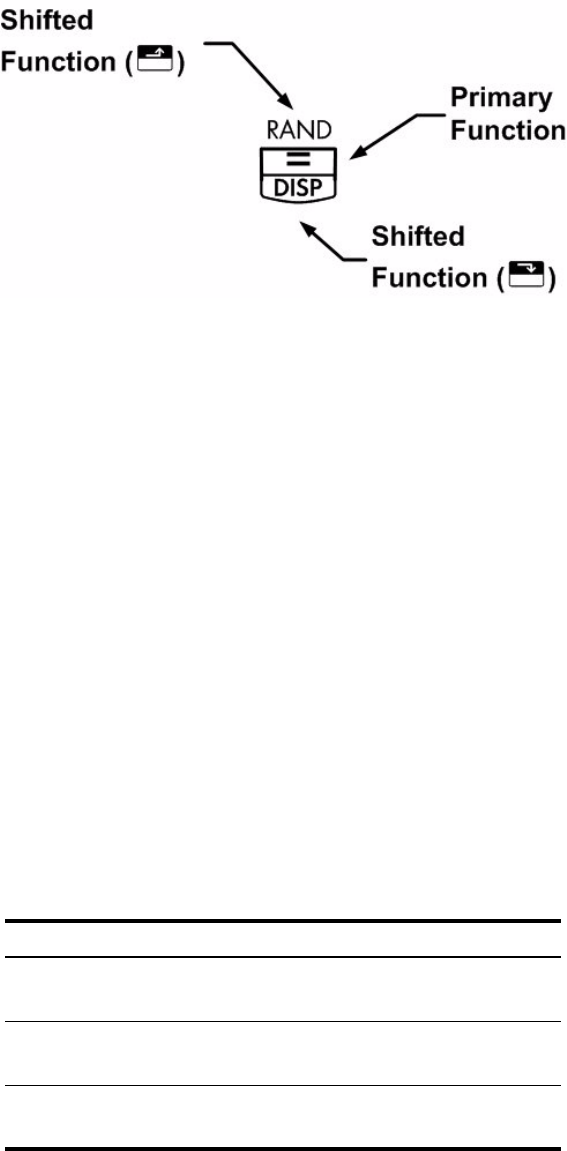

Shift Keys

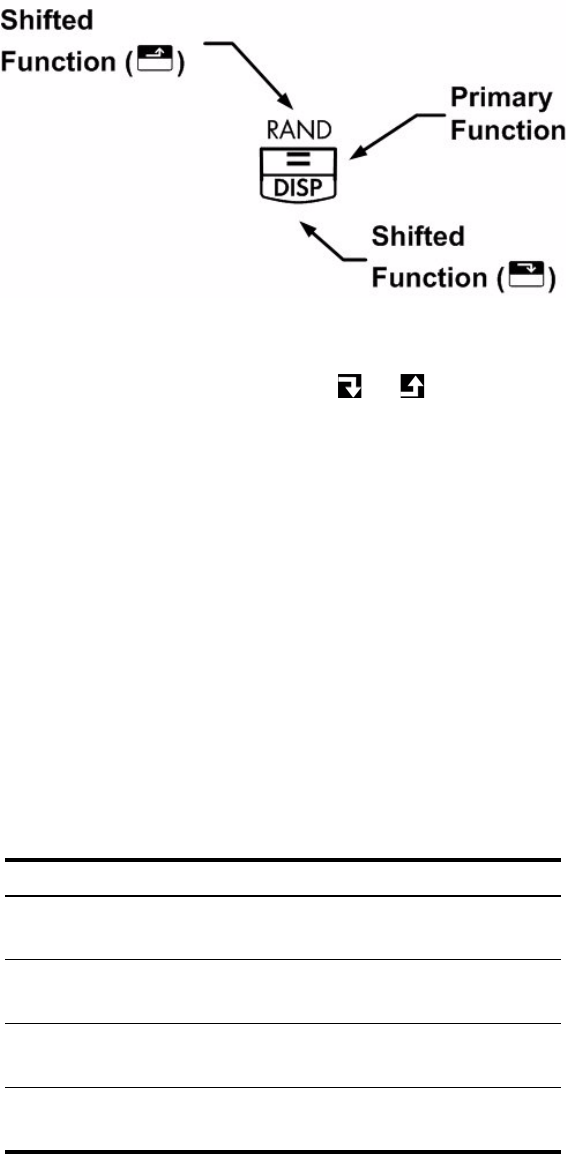

Most keys on the HP 10bII+ have three functions:

• a primary function printed in white on the key.

• a secondary function printed in orange on the bevel of the key.

• a tertiary function printed in blue above the key on the keyboard (see Figure 1).

Figure 1

As an example, the functions associated with the equals key, 4, are illustrated in the text

as follows:

• primary function (equals): 4

• secondary function (display): \5

• tertiary function (random): ]6

Boxed Key Functions

These special functions require subsequent key presses to operate. For example, the functions

associated with the clear key, M, include:

Table 1-2 Clearing functions

Keys Associated Function

MClear display.

\N Clear all memory.

]Oj Clears bond memory.

At a Glance... 3

For more information on the calculator’s keys and basic functions, refer to chapter 2, Getting

Started.

Percentages

Add 15% to 17.50.

Find the margin if the cost is 15.00 and selling price is 22.00.

]OY Clears break-even memory.

]OJ Clears TVM memory.

]O: Clears cash flow memory.

\t Clears statistics memory.

Table 1-2 Clearing functions

Keys Associated Function

Table 1-3 Keys for percentage calculations

Keys Description

§Percent

\¨ Percent change

ÀCost

¼Price

®Margin

ÃMarkup

Table 1-4 Calculating the price

Keys Display Description

Jj7V:1 17.50 Enters number.

JV§4 20.13 Adds 15%.

At a Glance...4

If the cost is 20.00 and the markup is 33%, what is the selling price?

For more information on percentages, refer to chapter 3, Business Percentages.

Memory Keys

Table 1-5 Finding the margin

Keys Display Description

JVÀ 15.0 0 E n te rs c o s t.

GG¼ 22.00 Enters price.

®31. 82 C a l cu l a t e s m a rg i n.

Table 1-6 Calculating the price

Keys Display Description

G:À 20.00 Enters cost.

DDÃ 33.00 Enters markup.

¼26.60 Calculates price.

Table 1-7 Memory keys

Keys Description

ªStores a constant operation.

sStores a value in the M register (memory location).

pRecalls a value from the M register.

mAdds a value to the number stored in the M register.

\w When followed by a number key, : to d, or 7 and : to d, stores a number in the

display into a numbered data storage register. There are 20 storage registers, designated 0-

19. Press \w7 followed by : through d to access registers 10-19.

vWhen followed by a number key, : to d, or 7 and : to d, recalls a number from

a storage register. Pressv7 followed by : through d to access registers 10-19.

At a Glance... 5

Multiply 17, 22, and 25 by 7, storing ‘× 7’ as a constant operation.

Store 519 in register 2, then recall it.

Store 1.25 into register 15, then add 3, and store the result in register 15.

For more information on number storage and storage register arithmetic, refer to chapter 4,

Number Storage and Storage Register Arithmetic.

Table 1-8 Storing ‘x 7’ as a constant

Keys Display Description

JjPjª 7.0 0 St ores ‘ × 7’ as a

constant operation.

4119.00 Multiplies 17 × 7.

GG4 154.00 Multiplies 22 × 7.

GV4 175.00 Multiplies 25 × 7.

Table 1-9 Storing and recalling

Keys Display Description

VJd\wG 519.00 Stores 519 in register 2.

M0.00 Clears display.

vG 519.0 0 Re c a l l s re g i s t e r 2.

Table 1-10 Storage register arithmetic

Keys Display Description

J7GV 1.25 I n p u t s 1. 25 i n t o t h e

display.

\w7V Stores 1.25 in register

15.

D\w17V 3.00 Adds 3 to 1.25 in

register 15 stores the

result in register 15.

M0.00 Clears the display.

v7V 4.25 Recalls register 15.

At a Glance...6

Time Value of Money (TVM)

Enter any four of the five values and solve for the fifth.

A negative sign in the display represents money paid out, and money received is positive.

If you borrow 14,000 (PV) for 360 months (N) at 10% interest (I/YR), what is the monthly

repayment?

Set to End mode. Press \¯ if BEGIN annunciator is displayed.

Table 1-11 Keys for TVM calculations

Keys Description

]OJ Clears TVM memory and the current P_YR is

displayed.

ÙNumber of payments.

\Ú Multiplies a value by the number of payments

per year and stores as N.

ÒInterest per year.

ÏPresent value.

ÌPayment.

ÉFuture value.

\¯ Begin or End mode.

\Í Number of payments per year mode.

Table 1-12 Calculating the monthly payment

Keys Display Description

]OJ TVM CLR (message flashes, then

disappears)

Clears TVM memory and

displays the current P_YR.

JG\Í 12.00 Sets payments per year.

DS:Ù 360.00 Enters number of payments.

J:Ò 10.00 Enters interest per year.

JY:::Ï 14,000.00 Enters present value.

At a Glance... 7

TVM What if...

It is not necessary to reenter TVM values for each example. Using the values you just entered,

how much can you borrow if you want a payment of 100.00?

...how much can you borrow at a 9.5% interest rate?

For more information on TVM concepts and problems, refer to chapter 5, Picturing Financial

Problems, and chapter 6, Time Value of Money Calculations.

:É 0.00 Enters future value.

Ì-122.86 Calculates payment if paid

at end of period.

Table 1-12 Calculating the monthly payment

Keys Display Description

Table 1-13 Calculating a new payment

Keys Display Description

J::yÌ -100.00 Enters new payment

amount. (Money paid out is

negative).

Ï11,395.08 Calculates amount you can

borrow.

Table 1-14 Calculating a new interest rate

Keys Display Description

d7VÒ 9.50 Enters new interest rate.

Ï11,892.67 Calculates new present

value for 100.00 payment

and 9.5% interest.

J:Ò 10.00 Reenters original interest

rate.

JY:::Ï 14,000.00 Reenters original present

value.

Ì-122.86 Calculates original payment.

At a Glance...8

Amortization

After calculating a payment using Time Value of Money (TVM), input the periods to amortize

and press \Ê. Press \Ê once for periods 1-12, and once again for payments 13-

24. Press 4 to continually cycle through the principal, interest, and balance values (indicated

by the PRIN, INT, and BAL annunciators respectively). Using the previous TVM example,

amortize a single payment and then a range of payments.

Amortize the 20th payment of the loan.

Amortize the 1st through 24th loan payments.

Table 1-15 Amortizing the 20th payment of the loan

Keys Display Description

G:Æ 20.00 Enters period to amortize.

\Ê 20 – 20 Displays period to amortize.

4-7.25 Displays principal.

4-115.61 Displays interest. (Money

paid out is negative).

413,865.83 Displays the balance

amount.

Table 1-16 Amortization example

Keys Display Description

JÆJG 12_ Enters range of periods to

amortize.

\Ê 1 – 12 Displays range of periods

(payments).

4-77.82 Displays principal.

4-1,396.50 Displays interest. (Money

paid out is negative).

413,922.18 Displays the balance

amount.

\Ê 13 – 24 Displays range of periods.

4-85.96 Displays principal.

At a Glance... 9

For more information on amortization, refer to the section titled, Amortization in chapter 6,

Time Value of Money Calculations.

Depreciation

A metalworking machine, purchased for 10,000.00, is to be depreciated over five years. Its

salvage value is estimated at 500.00. Using the straight-line method, find the depreciation

and remaining depreciable value for each of the first two years of the machine's life.

4-1,388.36 Displays interest.

413,836.22 Displays the balance

amount.

Table 1-16 Amortization example

Keys Display Description

Table 1-17 Depreciation keys

Keys Description

ÙExpected useful life of the asset.

ÒDeclining balance factor entered as a

percentage.

ÏDepreciable cost of the asset at acquisition.

ÉSalvage value of the asset.

]{ Straight-line depreciation.

]x Sum-of-the-years’-digits depreciation.

]u Declining Balance depreciation.

Table 1-18 Calculating the depreciation

Keys Display Description

J::::Ï 10,000.00 Inputs cost of the item.

V::É 500.00 Inputs the salvage value of the

item.

VÙ 5.00 Inputs the useful life of the asset.

J]{ 1,900.00 Depreciation of the asset in year

one.

At a Glance...10

For more information on depreciation, refer to chapter 7, Depreciation.

Interest Rate Conversion

To convert between nominal and effective interest rates, enter the known rate and the number

of periods per year, then solve for the unknown rate.

Find the annual effective interest rate of 10% nominal interest compounded monthly.

For more information on interest rate conversions, refer to the section titled, Interest Rate

Conversions in chapter 6, Time Value of Money Calculations.

\« 7,600.00 Remaining depreciable value

after year one.

G]{ 1,900.00 Depreciation of the asset in year

two.

\« 5,700.00 Remaining depreciable value

after year two.

Table 1-18 Calculating the depreciation

Keys Display Description

Table 1-19 Keys for interest rate conversion

Keys Description

\Ó Nominal interest percent.

\Ð Effective interest percent.

\Í Periods per year.

Table 1-20 Calculating the interest rate

Keys Display Description

J:\Ó 10.00 Enters nominal rate.

JG\Í 12.00 Enters payments per year.

\Ð 10.47 Calculates annual effective

interest.

At a Glance... 11

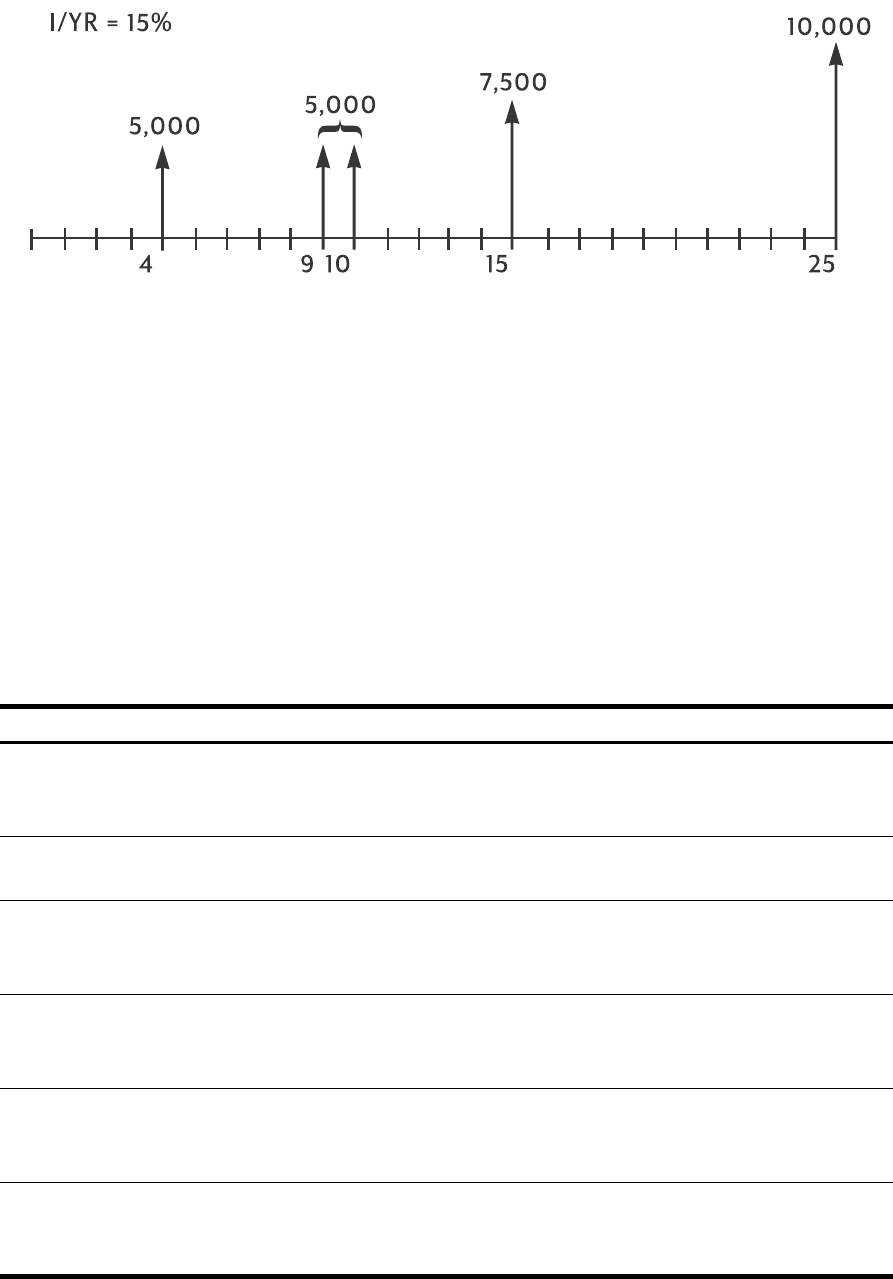

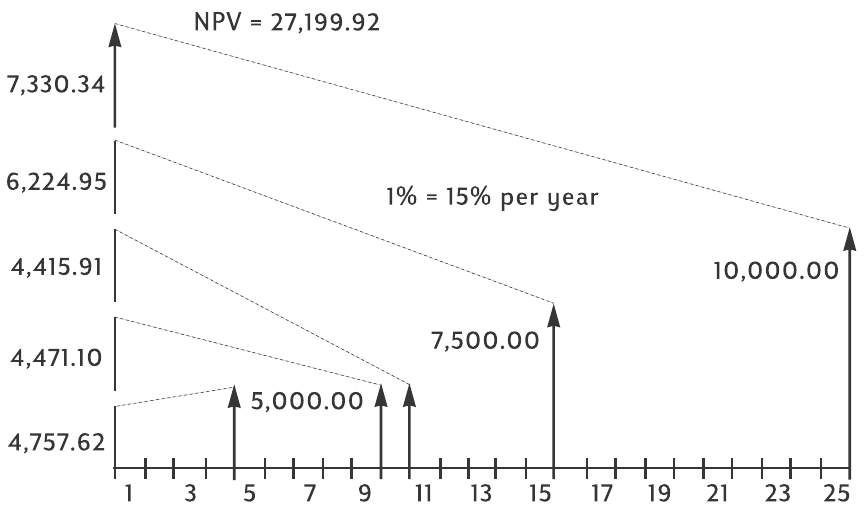

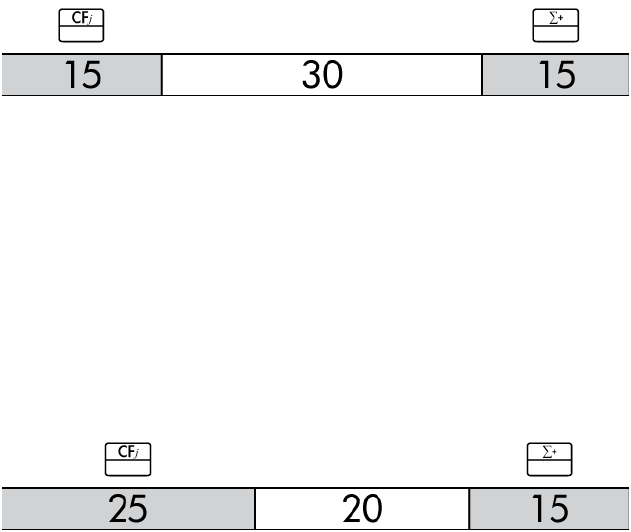

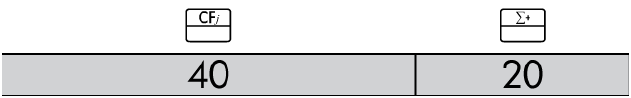

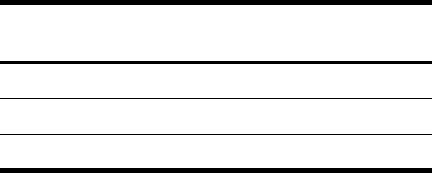

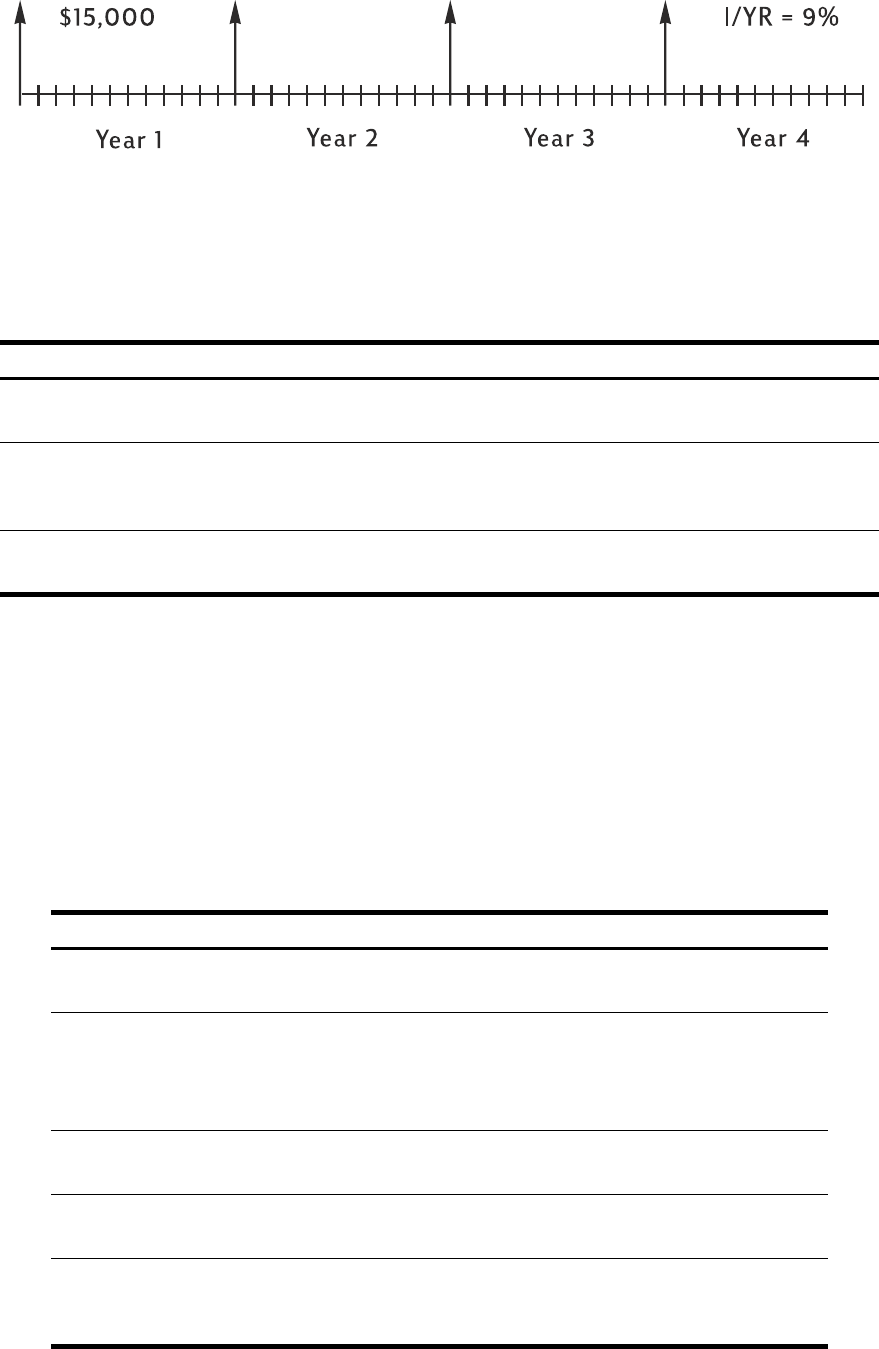

Cash Flows, IRR/YR, NPV, and NFV

Table 1-21 Cash flows, IRR, NPV, and NFV keys

Keys Description

]O: Clears cash flow memory.

\Í Number of periods per year (default is

12). For annual cash flows, P/YR should

be set to 1; for monthly cash flows, use

the default setting, 12.

¤Cash flows, up to 45. “J” identifies the

cash flow number. When preceded by a

number, pressing ¤ enters a cash flow

amount.

number1 Æ number 2 ¤Enter a cash flow amount, followed by

Æ. Enter a number for the cash flow

count followed by ¤ to enter cash

flow amount and count simultaneously.

v¤ Opens editor for reviewing/editing

entered cash flows. Press 1 or A to

scroll through the cash flows.

\¥ Number of consecutive times cash flow

“J” occurs.

\Á Internal rate of return per year.

\½ Net present value.

\½\« Net future value.

At a Glance...12

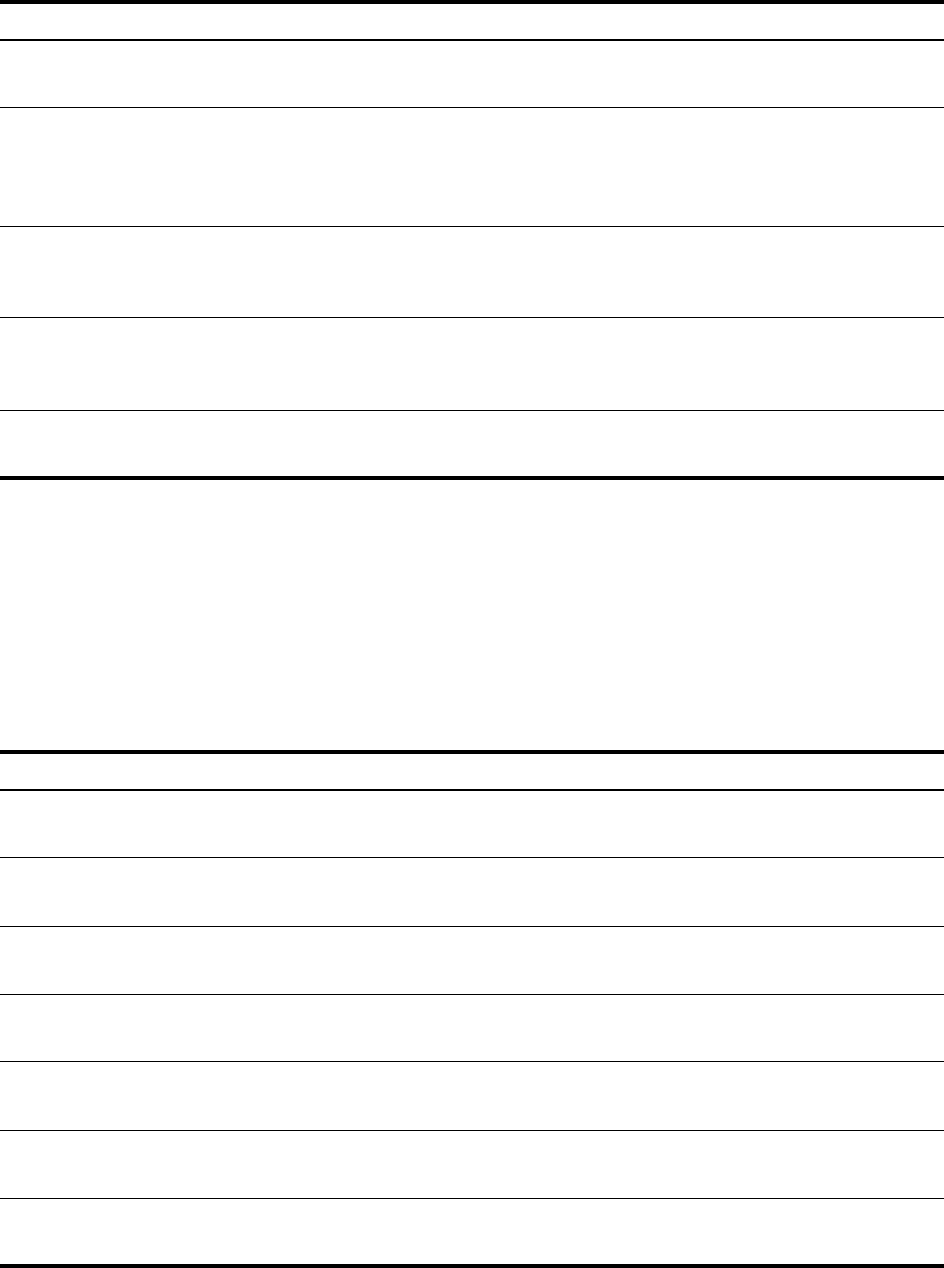

If you have an initial cash outflow of 40,000, followed by monthly cash inflows of 4,700,

7,000, 7,000, and 23,000, what is the IRR/YR? What is the IRR per month?

What is the NPV and NFV if the discount rate is 10%?

Table 1-22 Calculating the IRR/YR and IRR per month

Keys Display Description

]O: CFLO CLR

(message flashes, then

disappears)

Clears cash flow memory.

JG\Í 12.00 Sets payments per year.

Y::::y¤ -40,000.00

(CF 0 flashes, then disappears)

Enters initial outflow.

Yj::¤ 4,700.00

(CF 1 flashes, then disappears)

Enters first cash flow.

j:::ÆG¤ 2.00

(CFn 2 flashes, then disappears)

Enters both the cash flow

amount (7000.00) and count

(2.00) simultaneously for second

cash flow.

GD:::¤ 23,000.00

(CF 3 flashes, then disappears)

Enters third cash flow.

v¤ 0 -40,000.00 Reviews entered cash flows

starting with the initial cash flow.

Press 1 to scroll through the

cash flow list to verify the cash

flow number, the amounts, and

count for each entry. Press M

to exit.

\Á 15 . 96 C a l c u l a t e s IRR/YR.

aJG4 1. 33 C a l c u l a t e s IRR per month.

Table 1-23 Calculating NPV and NFV

Keys Display Description

J:Ò 10.00 Enters I/YR.

\½ 622.85 Calculates NPV.

At a Glance... 13

For more information on cash flows, refer to chapter 8, Cash Flow Calculations in the HP

10bII+ Financial Calculator User’s Guide.

Date and Calendar

If the current date is February 28 2010, what is the date 52 days from now? Calculate the

date using the 365-day calendar (actual) and the M.DY settings.

If 360 is displayed, press ]Å. If D.MY is displayed, press ]È.

For more information on date and calendar functions, refer to chapter 9, Calendar Formats

and Date Calculations.

\½\« 643.88 Calculates NFV.

Table 1-23 Calculating NPV and NFV

Keys Display Description

Table 1-24 Keys used for dates and calendar functions

Keys Description

]È Enters dates in DD.MMYYYY or MM.DDYYYY formats. D.MY is the default.

Numbers at the far right of a calculated date indicate days of the week. 1

is for Monday; 7 is for Sunday.

]Å Toggles between 360-and 365-day (Actual) calendars.

\Ç Calculates the date and day, past or future, that is a given number of days

from a given date. Based on your current setting, returned result is

calculated using either 360-day or 365-day (Actual).

\Ä Calculates the number of days between two dates. Returned result is

always calculated based on the 365-day calendar (Actual).

Table 1-25 Calculating the date

Keys Display Description

G7GgG:J:

\Ç

2.28 Inputs the date in the

selected format.

VG4 4-21-2010 3 Inputs the number of days

and calculates the date

along with the day of the

week.

At a Glance...14

Bonds

Bond calculations, primarily calculating bond price and yield, are performed by two keys,

]Ñ and ]Ô. These keys permit you to input data or return results. Pressing ]Û

only calculates a result. The other keys used in bond calculations only permit you to input the

data required for the calculations.

What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on

June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual

coupon payment on an actual/actual basis.

If SEMI is not displayed, press ]Â to select the semiannual coupon payment.

If D.MY is displayed, press ]È to select M.DY format.

Table 1-26 Bond calculation keys

Keys Description

]Oj Clears bond memory.

]Û Calculates accrued interest only.

]Ô Yield% to maturity or yield% to call date for

given price.

]Ñ Price per 100.00 face value for a given yield.

]Î Coupon rate stored as an annual %.

]Ë Call value. Default is set for a call price per

100.00 face value. A bond at maturity has a

call value of 100% of its face value.

]È Date format. Toggle between day-month-year

(dd.mmyyyy) or month-day-year (mm.ddyyyy).

]Å Day count calendar. Toggle between Actual

(365-day calendar) or 360 (30-day month/

360-day year calendar).

]Â Bond coupon (payment). Toggle between

semiannual and annual payment schedules.

]¾ Settlement date. Displays the current settlement

date.

]° Maturity date or call date. The call date must

coincide with a coupon date. Displays the

current maturity.

At a Glance... 15

For more information on bond calculations, refer to chapter 10, Bonds.

Table 1-27 Bond calculation

Keys Display Description

]Oj BOND CLR (message

flashes, then disappears)

Clears bond memory.

Y7GgG:J:

]¾

4-28-2010 3 Inputs the settlement date

(mm.ddyyyy format).

S7:YG:G:

]°

6-4-2020 4 Inputs the maturity date.

S7jV]Î 6.75 Inputs CPN%.

J::]Ë 100.00 Inputs call value. Optional,

as default is 100.

Y7jV]Ô 4.75 Inputs Yield%.

]Ñ 115.89 Calculates the price.

1]Û 2.69 Displays the current value

for accrued interest.

4118.59 Returns the result for total

price (value of price + value

of accrued interest). The net

price you should pay for the

bond is 118 . 5 9.

At a Glance...16

Break-even

The sale price of an item is 300.00, the cost 250.00, and fixed cost 150,000.00. For a profit

of 10,000.00, how many units would have to be sold?

For more information on break-even calculations, refer to chapter 11, Break-even.

Table 1-28 Break-even keys

Keys Description

]OY Clears break-even memory.

]¬ Stores the quantity of units required for a given

profit or calculates it.

]© Stores the sales price per unit or calculates it.

]¦ Stores variable cost per unit for manufacturing

or calculates it.

]£ Stores the fixed cost to develop and market or

calculates it.

]~ Stores the expected profit or calculates it.

Table 1-29 Calculating break-even

Keys Display Description

]OY BR EV CLR (message flashes,

then disappears)

Clears break-even memory.

JV::::]

£

150,000.00 Inputs fixed cost.

GV:]¦ 250.00 Inputs variable cost per unit.

D::]© 300.00 Inputs price.

J::::]~ 10,000.00 Inputs profit.

]¬ 3,200.00 Calculates the current value

for the unknown item,

UNITS.

At a Glance... 17

Statistical Calculations

Table 1-30 Statistics keys

Keys Description

\t Clear statistical registers.

x-data ¡

Enter one-variable statistical

data.

x-data \¢

Delete one-variable statistical

data.

x-data Æ y-data ¡

Enter two-variable statistical

data.

x-data Æ y-data \¢

Delete two-variable statistical

data.

v¡ Opens editor for reviewing/

editing entered statistical data.

\k \« Means of x and y.

\T \« Mean of x weighted by y. Also

calculates b, intercept.

\h \« Sample standard deviations of

x and y.

\e \« Population standard deviations

of x and y.

y-data \Z \«

Estimate of x and correlation

coefficient.

x-data \W \«

Estimate of y and slope.

]L Permits selection of six

regression models; linear is

default.

At a Glance...18

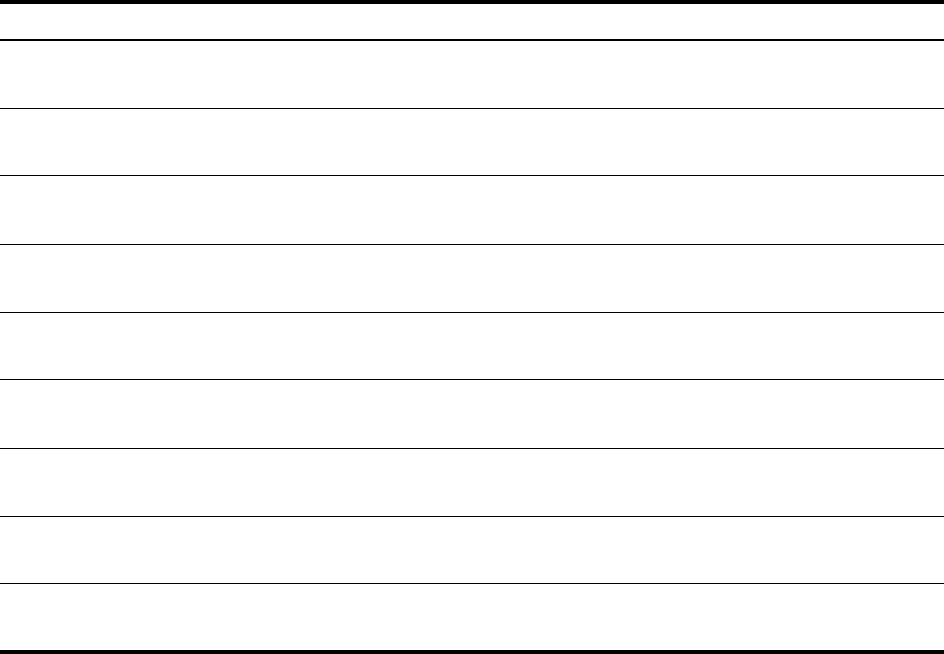

Using the following data, find the means of x and y, the sample standard deviations of x and

y, and the y-intercept and the slope of the linear regression forecast line. Then, use summation

statistics to find xy.

For more information on statistical calculations, refer to chapter 12, Statistical Calculations.

x-data 2 4 6

y-data 50 90 160

Table 1-31 Statistics example

Keys Display Description

\t 0.00 Clears statistics registers.

GÆV:¡ 1.00 Enters first x,y pair.

YÆd:¡ 2.00 Enters second x,y pair.

SÆJS:¡ 3.00 Enters third x,y pair.

v¡ 1 2.00 Reviews entered statistical

data, starting with the initial

x-value. Press 1 to scroll

through and verify the

entered statistical data.

Press M to exit.

\k 4.00 Displays mean of x.

\« 100.00 Displays mean of y.

\h 2.00 Displays sample standard

deviation of x.

\« 55.68 Displays sample standard

deviation of y.

\T\« -10.00 D isplays y-intercept of

regression line.

\W\« 27.50 Displays slope of regression

line.

]f 1,420.00 Displays xy, sum of the

products of x- and y-values.

Σ

Σ

At a Glance... 19

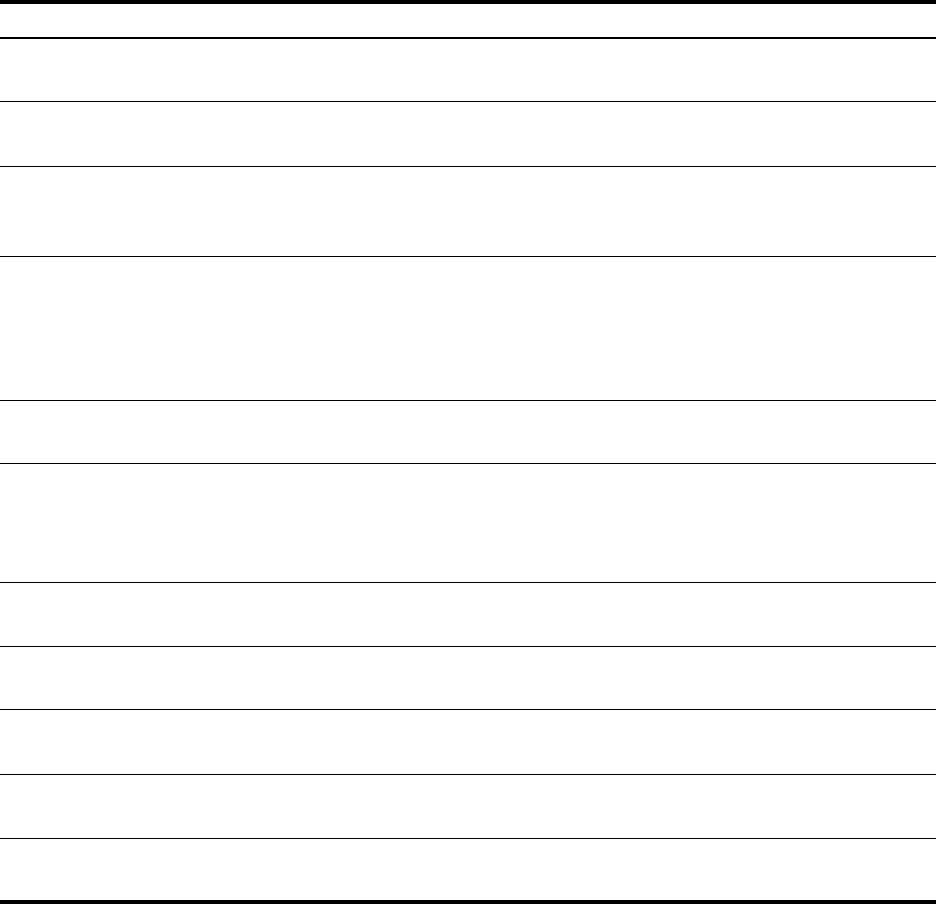

Probability

Enter .5 as a Z-value and calculate the cumulative probability of the Z-value and the Z-value

from a given cumulative probability.

For more information on probability, refer to the section titled, Probability in chapter 12,

Statistical Calculations.

Table 1-32 Probability keys

Keys Description

]F Calculates a cumulative normal probability

given a Z-value.

]o

F

Calculates a Z-value given a cumulative

normal probability.

]I Calculates the cumulative Student’s T

probability given degrees of freedom and a

T-value.

]o

I

Calculates a T-value given degrees of

freedom and the cumulative Student’s T

probability.

]< Calculates number of permutations of n items

taken r at a time.

]9 Calculates number of combinations of n taken

r at a time.

]E Calculates factorial of n (where -253 < n <

253).

Table 1-33 Calculating the probability

Keys Display Description

\5V 0.00000 Sets number display to five

digits to the right of the

decimal.

7V]F .69146 Calculates the cumulative

probability of the Z-value.

17GV4 .94146 Adds .25.

]oF 1.56717 Calculates the Z-value from

the cumulative probability.

At a Glance...20

Trigonometric Functions

Table 1-34 Trigonometry keys

Find Sin =.62 in degrees. If RAD is displayed, press ]3.

Keys Description

] c, R, or CCalculates sine, cosine, and tangent.

]o

c, R, or C

Calculates inverse sine, inverse cosine,

and inverse tangent.

]r

c, R, or C

Calculates hyperbolic sine, cosine and

tangent.

]ro

c, R, or C

Calculates inverse hyperbolic sine,

cosine, and tangent.

]3 Toggles between radians and degrees

modes. Degrees is the default setting.

Table 1-35 Trigonometry example

Keys Display Description

7SG .62 Enters value of sine for .

]oc 38.32 Calculates .

θ

θ

θ

At a Glance... 21

Convert the results to radians using Pi.

For more information on trigonometric functions, refer to chapter 2, Getting Started.

Table 1-36 Converting to radians

Keys Display Description

P\;aJg

:4

.67 Converts degrees to radians.

At a Glance...22

Getting Started 23

2 Getting Started

Power On and Off

To turn on your HP 10bII+, press =. To turn the calculator off, press the orange shift key,

\, then >. To change the brightness of the display, hold down = and then

simultaneously press 1 or A.

Since the calculator has continuous memory, turning it off does not affect the information you

have stored. To conserve energy, the calculator turns itself off after five minutes of inactivity.

The calculator uses two CR2032 coin batteries. If you see the low-battery symbol ( ) in

the display, replace the batteries. For more information, refer to the section titled, Installing

Batteries in Appendix A.

Manual Conventions and Examples

In this manual, key symbols are used to indicate the key presses used in the example prob-

lems. These symbols vary in appearance according to whether they indicate the primary,

secondary, or tertiary functions required for the problem. For example, the functions associ-

ated with the equals key, 4, are illustrated in the text as follows:

•primary function (equals): 4

•secondary function (display): \5

•tertiary function (random): ]6

Note the symbol for the primary function of the key, in this case, =, appears on each of the

key symbols depicted above. This repetition is intended to serve as a visual aid. By looking

for the symbol of the primary function on the key, you can quickly locate the keys used for the

secondary and tertiary functions on the calculator.

Displayed text

Text that appears in the display screen of the calculator is presented in BOLD CAPITAL letters

throughout the manual.

Examples

Example problems appear throughout the manual to help illustrate concepts and demonstrate

how applications work. Unless otherwise noted, these examples are calculated with CHAIN

set as the active operating mode. To view the current mode, press v]?. The

current mode, CHAIN or ALGEBRAIC, will flash, then disappear. To change the mode, press

] followed by ?.

Getting Started24

Basics of Key Functions

Table 2-1 Basics of key functions

Keys Display Description

= 0.00 Turns calculator on.

][blue]

0.00

Displays shift annunciator .

\[orange]

0.00

Displays shift annunciator .

JGD| 12_ Erases last character.

]3 RAD

(at the bottom of the display)

Toggles between radians and degrees.

The item before the / is the alternate; the

item after the / is the default setting.

Except for the operating mode,

annunciators in the display indicate

alternate settings are active.

M 0.00 Clears display.

\t 0.00 Clears statistics memory.

\N 12 P _ Y r (message flashes, then

disappears)

Clears all memory.

]Oj BOND CLR (message flashes,

then disappears)

Clears bond memory.

]OY BR EV CLR (message flashes,

then disappears)

Clears break-even memory.

]OJ TVM CLR (message flashes, then

disappears)

Clears tvm memory.

]O: CFLO CLR (message flashes, then

disappears)

Clears cash flow memory.

\> Turns calculator off.

Getting Started 25

Shift Keys

Most keys on the HP 10bII+ have three functions:

• a primary function printed in white on the key.

• a secondary function printed in orange on the bevel of the key.

• a tertiary function printed in blue above the key on the keyboard (see Figure 1).

Figure 1

When you press \ or ], a shift annunciator or is displayed to indicate that the

shifted functions are active. For example, press \ followed by 2 to multiply a num-

ber in the display by itself. To turn the shift annunciators off, press \ or ] again.

Boxed Key Functions

There are three shifted key functions on the calculator that are used to change the operation

of another key's function. These three tertiary functions, ]O, ]o and

]r, are bound by blue boxes to show that they operate differently. These special

functions require subsequent key presses to operate. For example, the functions associated

with the clear key, M, include:

Table 2-2 Clearing functions

Keys Associated Function

M Clear display.

\N Clear all memory.

\t Clear statistics memory.

]Oj Clears bond memory.

Getting Started26

Simple Arithmetic Calculations

Operating Modes

To change the operating mode, press the blue shift key, ] followed by ? to toggle

between Algebraic and Chain modes. A brief message is displayed indicating the selected

operating mode.

To view the current mode, press v]?. The current mode will flash, then disappear.

Arithmetic Operators

The following examples demonstrate using the arithmetic operators 1, A, P, and

a.

If you press more than one operator consecutively, for example 1, A, 1, P

1, all are ignored except the last one.

If you make a typing mistake while entering a number, press | to erase the incorrect digits.

When a calculation has been completed (by pressing 4), pressing a number key starts a

new calculation.

]OY Clears break-even memory.

]OJ Clears TVM memory.

]O: Clears cash flow memory.

Table 2-2 Clearing functions

Keys Associated Function

Table 2-3 Example displaying calculations using arithmetic operators

Keys Display Description

GY7jJ1SG7Yj4 87.18 Adds 24.71 and

62.47.

Table 2-4 Completing a calculation

Keys Display Description

JdPJG7Sg4 240.92 Calculates 19 × 12.68.

Getting Started 27

If you press an operator key after completing a calculation, the calculation is continued.

Calculations in Chain Mode

Calculations in Chain mode are interpreted in the order in which they are entered. For

example, entering the following numbers and operations as written from left to right,

J1GPD4, returns 9. If you press an operator key, 1,A,P, or

a, after 4, the calculation is continued using the currently displayed value.

You can do chain calculations without using 4 after each step.

Without clearing, now calculate 4 + 9 × 3.

In Chain mode, if you wish to override the left to right order of entry, use parentheses

\q and \n to prioritize operations.

Table 2-5 Continuing a calculation

Keys Display Description

1JJV7V4 356.42 Completes calculation of

240.92 + 115.5.

Table 2-6 Chain calculations

Keys Display Description

S7dPV7DVa 36.92 Pressing a displays

intermediate result (6.9 × 5.35).

7dJ4 40.57 Completes calculation.

Table 2-7 Chain calculations

Keys Display

Y1dP 13.00 Adds 4 and 9.

D4 39.00 Completes calculation.

Getting Started28

For example, to calculate 1 + (2 x 3), you may enter the problem as written from left to right,

with parentheses to prioritize the multiplication operation. When entered with parentheses,

this expression returns a result of 7.

Calculations in Algebraic Mode

In Algebraic mode, multiplication and division have a higher priority than addition and

subtraction. For example, in Algebraic mode, pressing J1GPD4 returns a

result of 7.00. In Chain mode, the same key presses return a result of 9.00.

In Algebraic mode, operations between two numbers have the following priority:

• Highest priority: combinations and permutations, T probability calculations, % change, and

date calculations

• Second priority: the power function ( )

• Third priority: multiplication and division

• Forth priority: addition and subtraction.

The calculator is limited to 12 pending operations. An operation is pending when it is waiting

for the input of a number or the result of an operation of higher priority.

Using Parentheses in Calculations

Use parentheses to postpone calculating an intermediate result until you’ve entered more

numbers. You can enter up to four open parentheses in each calculation. For example,

suppose you want to calculate:

If you enter D:agVA, the calculator displays the intermediate result, 0.35.

This is because calculations without parentheses are performed from left to right as you enter

them.

To delay the division until you’ve subtracted 12 from 85, use parentheses. Closing parentheses

at the end of the expression can be omitted. For example, entering 25 ÷ (3 × (9 + 12 = is

equivalent to 25 ÷ (3 × (9 + 12)) =.

If you type in a number, for example, 53, followed by the parenthesis symbol, the calculator

considers this implicit multiplication.

Example

yx

Table 2-8 Using parentheses in calculations

Keys Display Description

D:a\qgVA 85.00 No calculation yet.

JG\n 73.00 Calculates 85 - 12.

30

85 12–()

---------------------- 9×

Getting Started 29

Negative Numbers

Enter the number and press y to change the sign.

Calculate -75 ÷ 3.

Understanding the Display and Keyboard

Cursor

The blinking cursor ( _ ) is visible when you are entering a number.

Clearing the Calculator

Backspace

When the cursor is on, | erases the last digit you entered. Otherwise, | clears the

display and cancels the calculation.

Clear

M clears the current item on the display and replaces it with 0. If entry is in progress,

pressing M clears the current entry and replaces it with 0, but the current calculation

continues. Otherwise, M clears the display of its current contents and cancels the current

calculation.

Clear Memory

]O followed by j,Y,J,: clears a selected memory type (register). Other

memory is left intact.

P 0.41 Calculates 30 ÷ 73.

d4 3.70 Multiplies the result by 9.

Table 2-8 Using parentheses in calculations

Keys Display Description

Table 2-9 Changing the sign of numbers

Keys Display Description

jVy -75_ Changes the sign of 75.

aD4 –25.00 Calculates result.

Getting Started30

Clear All

\N all clears all memory in the calculator, with the exception of the payments per

year (P/Yr) setting. To clear all memory and reset calculator modes, press and hold down

=, then press and hold down both Ù and Ï. When you release all three, all

memory is cleared. The All Clear message is displayed.

Clearing Messages

When the HP 10bII+ is displaying an error message, |or M clears the message and

restores the original contents of the display.

Annunciators

Annunciators are symbols in the display that indicate the status of the calculator. For functions

that toggle between settings, annunciators indicate alternate settings are active. For the

defaults, no annunciators appear in the display. For example, when selecting a date format,

the default setting is month-day-year (M.DY). When day-month-year (D.MY) is active, the D.MY

in the display indicates it is the active setting. Table 2-11 lists all the annunciators that appear

in the display screen.

Table 2-10 Clear memory keys

Keys Description

]Oj Clears bond memory.

]OY Clears break-even memory.

]OJ Clears TVM memory.

]O: Clears cash flow memory.

\t Clears statistics memory.

Getting Started 31

Table 2-11 Annunciators and status

Annunciator Status

, A shift key has been pressed. When another key is pressed, the

functions labeled in orange or blue are executed.

INV Inverse mode is active for trigonometric or probability functions.

RAD Radians mode is active.

BEG Begin mode is active; payments are at the beginning of a

period.

D.MY Day-month-year date format (DD.MMYYYY) is active.

360 360-day calendar is active.

SEMI Semi-annual coupon payment schedule (bonds) is active.

PEND An operation is waiting for another operand.

INPUT The Æ key has been pressed and a number stored.

Battery power is low.

AMORT The amortization annunciator is lit, together with one of the

following four annunciators:

PER The range of periods for an amortization is displayed.

PRIN The principal of an amortization is displayed.

INT The interest of an amortization is displayed.

BAL The balance of an amortization is displayed.

CFLO The cash flow annunciator is lit, together with one of the

following two annunciators:

CF The cash flow number appears briefly, then the cash flow is

shown.

N The cash flow number appears briefly, then the number of

times the cash flow is repeated is shown.

STAT The statistics annunciator is lit, together with one of the following

two annunciators:

X The number of the data point, n, followed by an x-value is

shown, or, if STAT is not lit, indicates that the first of two

results is displayed.

Y The number of the data point, n, followed by a y-value is

shown, or, if STAT is not lit, indicates that the second of two

results is displayed.

ERROR The error annunciator is lit, together with one of the following

four annunciators:

TVM There is a TVM error (such as an invalid P/Yr), or, when

ERROR is not lit, a TVM calculation returned a second result.

FULL Available memory for cash flows or statistics is full, or the

pending operator memory is full.

STAT Incorrect data used in a statistics calculation or, when

ERROR is not lit, a statistical calculation has been performed.

Getting Started32

Input Key

The Æ key is used to separate two numbers when using two-number functions or two-

variable statistics. The Æ key can also be used to enter cash flows and cash flow counts,

ordered pairs, and evaluate any pending arithmetic operations, in which case the result is the

same as pressing 4.

Swap Key

Pressing \« exchanges the following:

• The last two numbers that you entered; for instance, to change the order of division or subtraction.

• The results of functions that return two values.

The « key toggles the item in the Æ register, or swaps the top two items in the

mathematical stack. This function is used to retrieve a secondary value returned during a

calculation, as well as to swap two items during a calculation.

Statistics Keys

The statistics keys are used to access summary statistics from the statistics memory registers.

When you press ] followed by a statistics key, you can recall one of six summary statistics

with the next keystroke.

For example, press ] followed by the X key to recall the sum of the x-values entered.

FUNC A math error has occurred (for example, division by zero).

Table 2-11 Annunciators and status

Annunciator Status

Table 2-12 Statistics keys

Keys Description

]l Sum of the squares of the x-

values.

]i Sum of the squares of the y-

values.

]f Sum of the products of the x- and

y-values.

][ Number of data points entered.

Getting Started 33

Time Value of Money (TVM), Cash Flows, Bond, and Break-even Keys

When entering data for TVM, cash flows, bond, depreciation and break-even calculations,

results are calculated based on data entered into specific memory registers. When pressed,

the keys used for these operations:

• store data.

• enter data for a variable that is used during calculations (input only).

• calculate unknown variables based on stored data.

For more information on how these keys function, refer to the specific chapters which cover

TVM problems, cash flows, and bond and break-even calculations.

Math Functions

One-Number Functions

Math functions involving one number use the number in the display. To execute one-number

functions, with a number displayed, press the key or key combination corresponding to the

operation you wish to execute. The result is displayed. See Table 2-14 for a list of one-number

functions.

Before doing any trigonometric calculations, check whether the angle mode is set for degrees

or radians (Rad). Degrees is the default setting. The RAD annunciator in the display indicates

radians is active. Press ]3 to toggle between the settings. You will need to change

the setting if the active mode is not what your problem requires.

Table 2-14 lists the one-number functions of the calculator.

]U Sum of the y-values.

]X Sum of the x-values.

Table 2-12 Statistics keys

Keys Description

Table 2-13 Example displaying one number functions

Keys Display Description

gd7GV\B 9.45 Calculates square root.

D7Vj1G7DS\b 0.42 1/2.36 is calculated

first.

4 3.99 Adds 3.57 and 1/2.36.

Getting Started34

The random function]6, and Pi \; are special operators. They insert values

for Pi, or a random number in the range 0 < x <1, into calculations.

Table 2-14 One-number functions

Keys Description

§ Divide a number by 100.

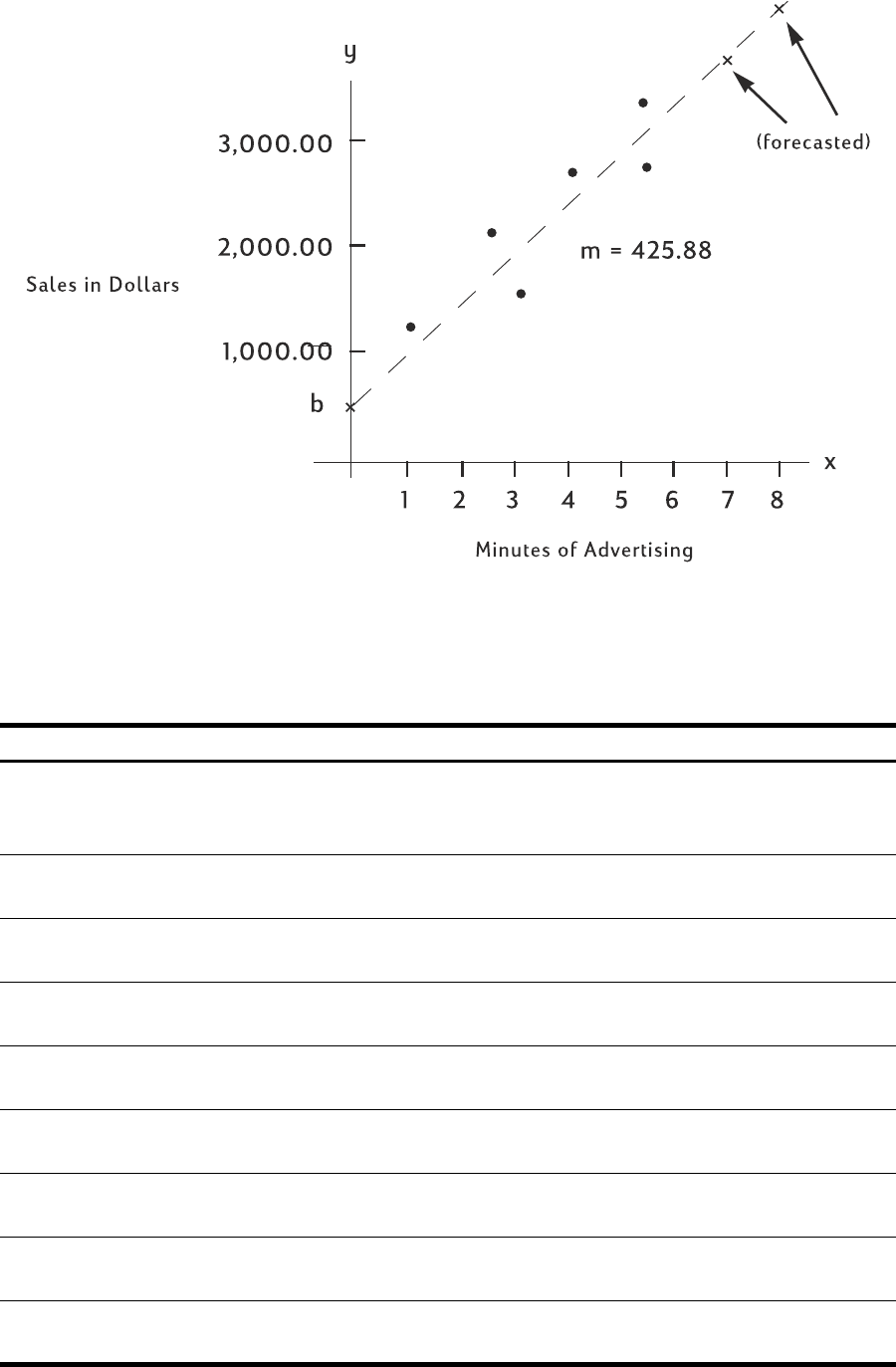

\} Rounds x to the number specified by the display format.

\b Calculates 1/x.

\B Calculates the square root of x.

\2 Calculates the square of x.

\K Calculates natural exponent to the power of x.

\H Calculates natural log.

\E Calculates factorial of n (where -253 < n < 253). The Gamma function is

used to calculate n! for non-integers or negative numbers.

]

c, R, or C

Calculates sine, cosine, or tangent.

]o

c, R, or C

Calculates inverse sine, cosine, or tangent.

]r

c, R, or C

Calculates hyperbolic sine, cosine, or tangent.

]ro

c, R, or C

Calculates inverse hyperbolic sine, cosine, or tangent.

]F Calculates a cumulative normal probability given a Z-value.

]oF Calculates a Z-value given a cumulative normal probability.

Getting Started 35

Trigonometric and Hyperbolic Functions and Modes

Selecting Angle Format

The trigonometric angle format determines how numbers are interpreted when using

trigonometry functions. The default format for angles on the 10bII+ is degrees. To change to

radians mode, press ]3. When radians mode is active, the RAD annunciator is

displayed.

Trigonometric Functions

Example

Perform the following trigonometric calculations. If RAD is lit in the display, press ]3.

Table 2-15 Trigonometric functions

Keys Description

]c Calculates sine, written as sin.

]R Calculates cosine, written as

cos.

]C Calculates tangent, written as

tan.

]oc Calculates inverse sine, also

written, arcsin, asin, or sin-1.

]oR Calculates inverse cosine, also

written, arccos, acos, or cos-1.

]oC Calculates inverse tangent, also

written, arctan, atan, or tan-1.

Table 2-16 Example using various trigonometric calculations

Keys Display Description

\5Y 0.0000 Set display to four decimal places.

JV]c 0.2588 Displays sine of 15o.

J1S:]C 1. 7321 Displays tangent of 60o.

4 2.7321 Calculates 1 + tangent of 60o.

7DV]oR 69.5127 Displays inverse cosine of 0.35.

Getting Started36

Pi

Pressing \; displays the value of . Although the displayed value is appears in the

current display format, the 12 digit value is actually used for calculations. is often used

during calculations in radians mode, as there are 2 radians in a circle.

Example

Find the surface area of a sphere with a radius of 4.5 centimeters. Use the formula:

Hyperbolic Functions

A7SG]oR 51.6839 D i sp l a ys i nve rse c o s in e o f 0 . 62.

4 17.8288 Calculates arccos 0.35 - arccos 0.62.

\5G 17.83 Return display to default format.

Table 2-16 Example using various trigonometric calculations

Keys Display Description

Table 2-17 Example using Pi

Keys Display Description

YP\; 3.14 Displays .

PY7V\2 20.25 Displays 4.52.

4 254.47 Calculates sphere surface area

in square centimeters.

π

π

π

A4πr2

=

π

Table 2-18 Hyperbolic and inverse hyperbolic functions

Keys Description

]rc Calculates hyperbolic sine, written as,

sinh.

]rR Calculates hyperbolic cosine, written

as, cosh.

]rC Calculates hyperbolic tangent, written

as, tanh.

]roc Calculates inverse hyperbolic sine,

written as, arcsinh, asinh, or, sinh-1.

]roR Calculates inverse hyperbolic sine, also

written, arccosh, acosh, or cosh-1.

]roC Calculates inverse hyperbolic tangent,

also written, arctanh, atanh, or tanh-1.

Getting Started 37

Example

Perform the following hyperbolic calculations.

Two-Number Functions

When a function requires two numbers, other than for addition, subtraction, multiplication,

division, and the power function, ( ), you may key in the numbers as follows: number1 Æ

number 2 followed by the operation. Pressing Æ evaluates the current expression and

displays the INPUT annunciator.

In-line Functions

For calculations involving \¨, \Ä, \Ç, ]9,

]<,]I, and ]oI, which require two numbers, you may also

key in the first number followed by the function keys, and then key in the second number

followed by 4 to return results. Throughout the manual, when examples are entered in this

manner without using Æ, they are referred to as in-line functions. For example, the

following keystrokes calculate the percent change between 17 and 29 using the \¨

keys as an in-line function:

Table 2-19 Example performing various hyperbolic calculations

Keys Display Description

\5Y 0.0000 Sets display to four decimal places.

J7GV]rc 1.6019 Display sinh 1.25.

17Vd]rC 0.5299 Displays tanh 0.59.

4 2.1318 Calculates sinh 1.25 + tanh 0.59.

]roR 1.3899 Ca l cu l a t e s a c os h 2.1318 .

\5G 1.39 Returns display to default format.

yx

Getting Started38

Press M, and now calculate the same example using the Æ key to store the first number,

then key in the second number and perform the operation.

Although the in-line function has fewer key strokes, performing this example using the Æ

key permits you to store a value and then perform other calculations following Æwithout

using parentheses.

Table 2-20 Example calculating percent change as an in-line function

Keys Display Description

Jj\¨ 17.00 E nt er s number1, displays the

PEND annunciator indicating the

calculator is awaiting

instructions.

Gd 29_ Enters number 2.

4 70.59 Calculates the percent change.

Table 2-21 Example calculating percent change using ‘INPUT’

Keys Display Description

JjÆ 17.00 E nt ers number1, and displays

the INPUT annunciator

indicating the number has been

stored.

Gd\¨ 70.59 Enters number 2 and calculates

the percent change.

Table 2-22 Example displaying two-number functions with chain calculation

Keys Display Description

JjÆ 17.0 0 E nt ers number1, and displays

the INPUT annunciator.

Gd1DD

1VYAgj

87_ Enters and performs the chain

calculation. Results are stored

and used in the next operation.

The PEND annunciator and the

blinking cursor indicate an

operation is pending as the

calculator awaits instructions.

\¨ 70.59 Calculates the percent change

between 17 and the result of the

chain operation (29).

Getting Started 39

The Table 2-23 below lists the two-number functions of the calculator.

Two-number functions may be performed in either CHAIN or ALGEBRAIC mode.

Arithmetic with One-and Two-number Functions

Math functions operate on the number in the display.

Example 1

Calculate 1/

4, then calculate + 47.2 + 1.12.

Table 2-23 Two-number functions

Keys Description

1APa Addition, subtraction,

multiplication, division.

\Q The power function.

\¨ % Change.

]9 Combinations.

]< Permutations.

\Ç The date and day, past or

future, that is a given number of

days from a given date.

\Ä The number of days between

two dates.

]I Calculates the cumulative

Student’s t probability given

degrees of freedom and a t-

value.

]oI Calculates a t-value given

degrees of freedom and the

cumulative Student’s t

probability.

Table 2-24 Calculating the expression

Keys Display Description

Y\b 0.25 Calculates the reciprocal of 4.

G:\B 4.47 Calculates .

20

20

Getting Started40

Example 2

Calculate natural logarithm (e2.5). Then calculate 790 + 4!

Example 3

The power operator, , raises the preceding number (y-value) to the power of the following

number (x-value).

Calculate 1253, then find the cube root of 125.

1Yj7G1 51. 67 Calculates + 47.20.

J7J\2 1. 21 Calculates 1.12.

4 52.88 Completes the calculation.

Table 2-25 Calculating the logarithm value

Keys Display Description

G7V\K 12.18 Calculates e2.5.

\H 2.50 Calculates natural logarithm of

the result.

jd:1Y\E 24.00 Calculates 4 factorial.

4 814.00 Completes calculation.

Table 2-26 Calculating the cube root

Keys Display Description

JGV\QD4 1,953,125.00 Calculates 1253.

JGV\QD\b4 5.00 Calculates the cube root of

125, or 1251/3

.

Table 2-24 Calculating the expression

Keys Display Description

20

yx

Getting Started 41

Last Answer

When a calculation is completed by pressing 4, or a calculation is completed during

another operation, the result is stored in a memory location that contains the last calculated

result. This enables the last result of a calculation to be used during the next calculation.

To access the last calculated answer, press v4. Unlike the other stored memory

registers however, this register is automatically updated when you complete a calculation.

Example 1

Example 2

Display Format of Numbers

When you turn on the HP 10bII+ for the first time, numbers are displayed with two decimal

places and a period as the decimal point. The display format controls how many digits

appear in the display.

If the result of a calculation is a number containing more significant digits than can be

displayed in the current display format, the number is rounded to fit the current display setting.

Table 2-27 Using last answer

Keys Display Description

VAJ7GV4 3.75 Calculate 5-1.25

D\Qv4 3.75 Recall last answer.

4 61.55 Calculate 33.75.

Table 2-28 Using last answer with ‘INPUT’

Keys Display Description

V:Æ 50.00 Store 50 in the INPUT register.

GG1JY\¨ -28.00 Calculate percent change.

S:Æ 60.00 Store 60 in the INPUT register.

v4 36.00 Recalls last calculation, 22+14.

\¨ -40.00 Calculate percent change.

Getting Started42

Regardless of the current display format, each number is stored internally as a signed, 12-digit

number with a signed, three-digit exponent.

Specifying Displayed Decimal Places

To specify the number of displayed decimal places:

1. P r e s s \5 followed by :–d for the desired decimal setting.

2. \5 followed by 7, v, or s changes the display mode. Pressing

\7 provides the best estimate and displays as many digits as required. v is

the value for 10, and s for 11.

When a number is too large or too small to be displayed in DISP format, it automatically

displays in scientific notation.

Displaying the Full Precision of Numbers

To set your calculator to display numbers as precisely as possible, press \57

(trailing zeros are not displayed.) To temporarily view all 12 digits of the number in the display

(regardless of the current display format setting), press \5 and hold 4. The number

is displayed as long as you continue holding 4. The decimal point is not shown.

Start with two decimal places \5G.

Table 2-29 Example displaying the number of decimal places

Keys Display Description

\M 0.00 Clears display.

\5D 0.000 Displays three decimal places.

YV7SP

7JGVS4

5.727

\5d 5.727360000 Displays nine decimal places.

\5G 5.73 Restores two decimal places.

Getting Started 43

Scientific Notation

Scientific notation is used to represent numbers that are too large or too small to fit in the

display. For example, if you enter the number 10,000,000 x 10,000,000 =, the result is

1.00E14, which means one times ten to the fourteenth power, or 1.00 with the decimal point

moved fourteen places to the right. You can enter this number by pressing J\

zJY. The E stands for exponent of ten.

Exponents can also be negative for very small numbers. The number 0.000000000004 is

displayed as 4.00E–12, which means four times ten to the negative twelfth power, or 4.0 with

the decimal point moved 12 places to the left. You can enter this number by pressing

Y\zyJG.

Interchanging the Period and Comma

To switch between the period and comma (United States and International display) used as

the decimal point and digit separator, press \8.

For example, one million can be displayed as 1,000,000.00 or 1.000.000,00.

Pressing \8, toggles between these options.

Rounding Numbers

The calculator stores and calculates using 12-digit numbers. When 12 digit accuracy is not

desirable, use \} to round the number to the displayed format before using it in a

calculation. Rounding numbers is useful when you want the actual (dollars and cents) monthly

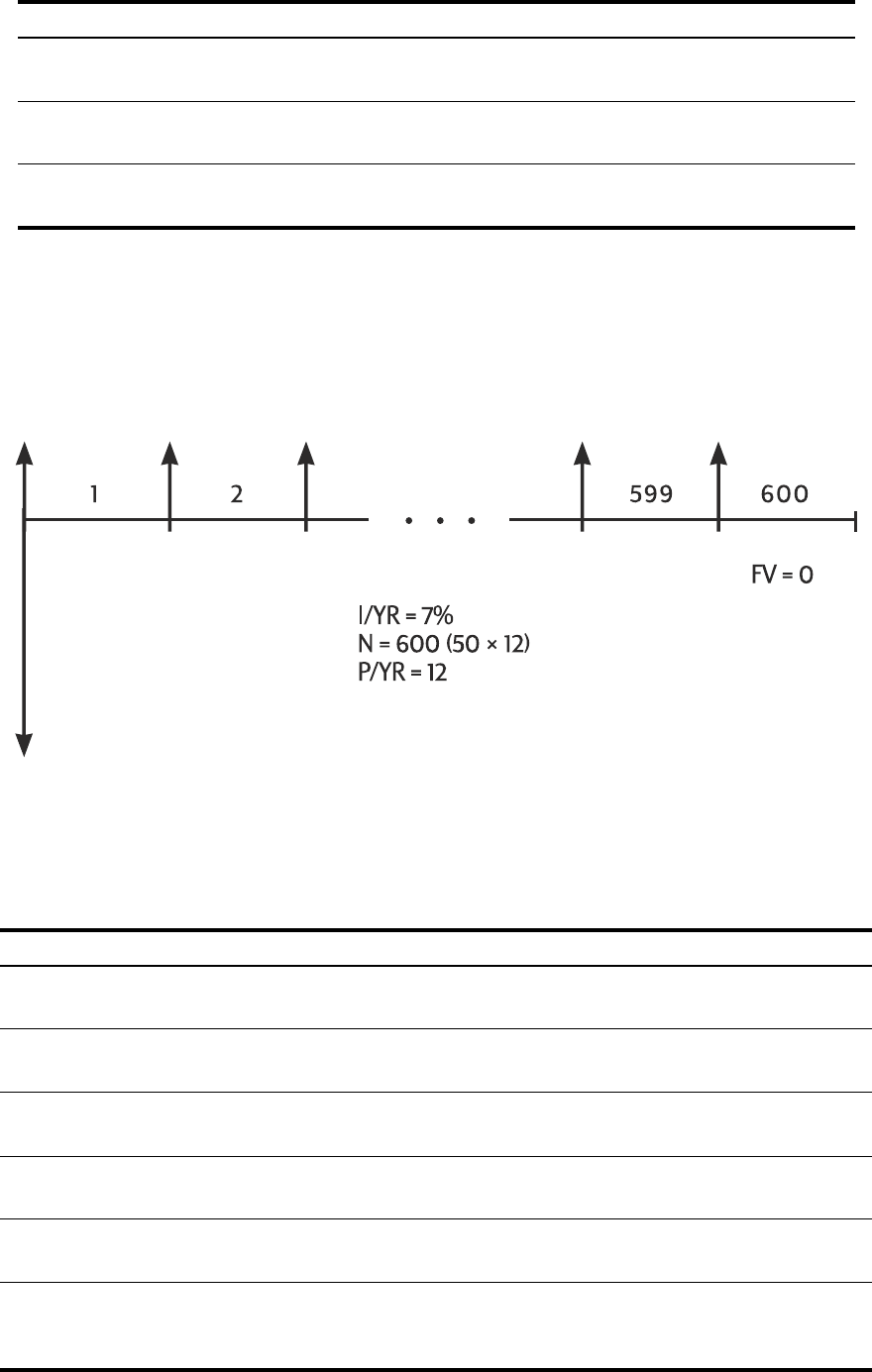

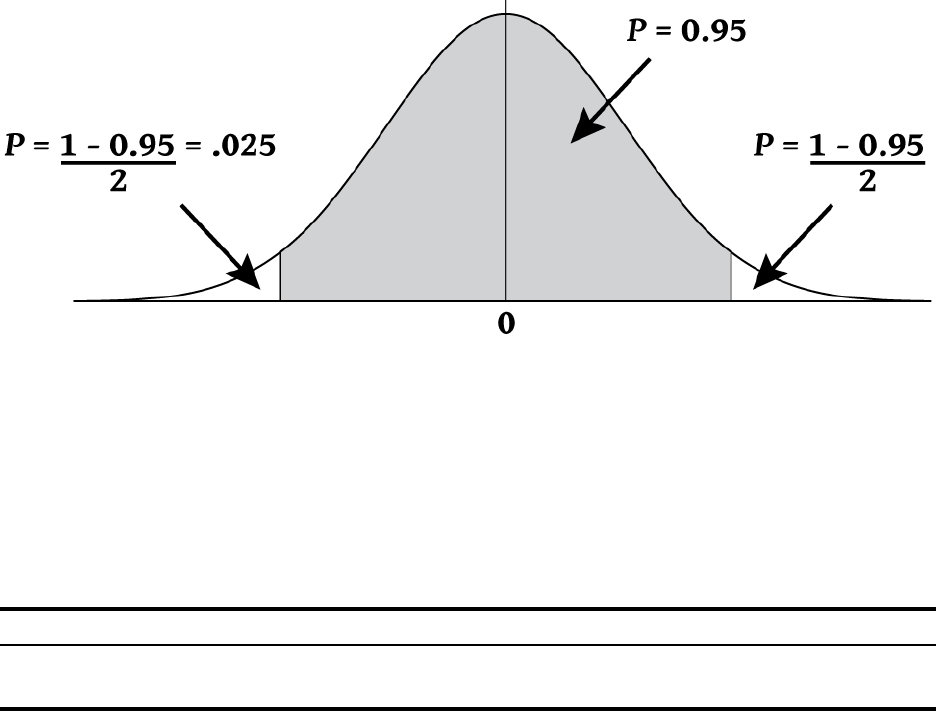

payment.