Maxis 73315 V Users Manual

73315-V to the manual 0fdaba2e-8581-4a0b-a99b-e56a505a5db9

2015-02-09

: Maxis Maxis-73315-V-Users-Manual-554036 maxis-73315-v-users-manual-554036 maxis pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 32

Maxis FastTap

User Guide

Maxis Mobile Services Sdn. Bhd. (73315-V)

1. Introduction 2

1.1. Welcome to Maxis FastTap............................................................................................................................................. 2

1.1.1. FastTap to enjoy Maxis services - Tags, Posters & Accessories........................................................................................... 3

1.2. What is NFC technology?............................................................................................................................................... 4

1.3. Getting Started............................................................................................................................................................... 4

1.3.1. Activate 3G.................................................................................................................................................................... 4

1.3.2. Nokia 6212 classic mobile phone settings for Maxis FastTap........................................................................................... 5

1.4. Preloaded Mobile Applications....................................................................................................................................... 8

2. Maybankard Visa payWave on your mobile with Maxis FastTap 10

2.1. Overview........................................................................................................................................................................ 10

2.2. Benefits of Maybankard Visa payWave on your mobile.................................................................................................. 11

2.3. How to download Maybankard Visa payWave to your mobile........................................................................................ 12

2.3.1. Downloading Maybankard Visa payWave to your mobile................................................................................................ 13

2.3.2. Credit Card Application Process & Eligibility Criteria....................................................................................................... 15

2.4. How to access the Maybankard Visa payWave mobile application ................................................................................ 16

2.5. How to use the Nokia 6212 classic mobile phone for credit card payments at Visa

payWave retail outlets.................................................................................................................................................... 17

3. Touch ‘n Go with Maxis FastTap 18

3.1. Overview........................................................................................................................................................................ 18

3.2. Where to use Touch ‘n Go on the Nokia 6212 classic mobile phone............................................................................... 18

3.3. How to access the Touch ‘n Go mobile application.......................................................................................................... 19

3.4 How to use the Nokia 6212 classic mobile phone at Touch ‘n Go points........................................................................ 20

3.4.1. Useful Tips when using Touch ‘n Go.............................................................................................................................. 20

3.5 Where to reload Touch ‘n Go balance on the Nokia 6212 classic mobile phone.............................................................. 21

3.6 How to reload Touch ‘n Go on the Nokia 6212 classic mobile phone.............................................................................. 24

4. Maxis FastTap Frequently Asked Questions 25

5. Terms and Conditions 26

Contents

1

1.1. Welcome to Maxis FastTap.

Maxis FastTap encompasses the following services which you can enjoy with your NFC* enabled Nokia

6212 classic mobile phone :-

1. Introduction

Touch ‘n Go

Use your mobile at all existing Touch ‘n Go points

Reload at all existing Touch ‘n Go reload points

View your Touch ‘n Go status and balance via the

Touch ‘n Go mobile application

Reload your Touch ‘n Go from your mobile

anywhere, anytime – coming soon

Maybankard Visa payWave on your mobile

Download Maybankard Visa payWave directly to

your phone

Use Maybankard Visa payWave on your mobile to

pay at any Visa payWave retail outlets nationwide

* For more details on NFC, refer to Section 1.2

2

1.1.1. FastTap to enjoy Maxis services - Tags, Posters & Accessories

NFC* tags can be used to store useful information and make it easy for you to find out more

about Maxis services, download mobile content or even activate Maxis services via a simple tap

on the tag (see diagram below). There are several NFC Tags included in the Nokia 6212 classic

mobile phone box for you to try out.

You can also use the same tap action on Maxis FastTap posters to find out more about Maxis

services or other information such as special offers. Please look out for Maxis FastTap posters

and follow the instructions on the poster.

NFC enabled accessories are also made available at the Maxis Retail outlets.

* For more details on NFC, refer to Section 1.2

3

1.2. What is NFC technology?

Near Field Communications (NFC) is a new, short-range wireless connectivity technology that

simplifies the way consumer devices interact with one another, making it easy to receive and

share information and even make fast and secure payments.

Mobile phones with NFC capabilities can be used in the same way as physical contactless cards

with existing payment services such as Visa payWave and Touch ‘n Go.

The NFC enabled Nokia 6212 classic mobile phone has a built-in NFC antenna to communicate

with other contactless devices and contactless readers, and also contains an embedded secure

computer chip, which stores payment applications such as Visa payWave and Touch ‘n Go.

An introduction to NFC is also available in the Nokia 6212 classic mobile phone user guide.

1.3. Getting Started

1.3.1. Activate 3G

The Maxis FastTap service requires applications to be downloaded to your Nokia 6212 classic

mobile phone via the Maxis network. If you have not already activated Maxis 3G, type *136#

and click “Send” to activate now.

54

1.3.2. Nokia 6212 classic mobile phone settings for Maxis FastTap

To optimise your Maxis FastTap service, please ensure that your Nokia 6212 classic mobile phone

is configured as follows:-

Date & Time Settings

Go to Menu > Settings > Date and time

o Configure the mobile phone date to today’s date

Mobile Data Settings

Your Nokia 6212 classic mobile phone has pre-configured Mobile Data settings, however if you

are experiencing difficulties in downloading, please check that the settings are configured as

per below. If the settings differ, you can request your settings again via

www.maxis.com.my

Go to Menu > Settings > Configuration

1. Check “Maxis 3G” for Default configuration setting

2. Check “Maxis 3G WAP” for Preferred access point

Note: If you are experiencing application download errors, Date & Time settings and/or Mobile Data Settings may

not have been configured correctly.

54

NFC Settings (Optional)

Go to Menu > NFC > NFC Settings

There are several NFC settings in the Nokia 6212 classic mobile phone as described below:

1. NFC On/Off This option allows you to control the NFC antenna embedded

within your Nokia 6212 classic mobile phone.

o If you select “On”, your mobile phone will detect and

communicate with any other NFC device or reader in close

proximity (e.g. Touch ‘n Go or Visa payWave touch points).

o If you select “Off”, the NFC functionality will be switched

off and you will need to set it to “On” manually each time

you want to use any Maxis FastTap services.

Tip: Select “On” to make sure your phone is always ready to use Maxis

FastTap.

2. Content Sharing This option allows you to control settings between your Nokia

6212 classic mobile phone and other NFC devices in the event

you want to share information such as contacts etc.

o If you select “Quick” you can instantly share content with

other NFC devices without asking for confirmation.

76

o If you select “By confirmation”, you will be prompted for

confirmation each time you want to share content with

other NFC devices.

o If you select “Not available”, the function will be turned off

and you will need to go to this menu to manually configure

each time you want to share content.

Tip: Select “On” to make sure your phone is always ready to use Maxis

FastTap.

3. Cards Availability This option allows you to control the Maxis FastTap payment

services on your Nokia 6212 classic mobile phone, such as

Touch ‘n Go and/or Maybankard Visa payWave on your mobile.

o If you select “Always” - your Maxis FastTap services such as

Maybankard Visa payWave on your mobile or Touch’n Go

will always be “available”. This means each time you tap

an NFC reader to pay, it will instantly be processed by the

appropriate payment application.

o If you select “By confirmation”, you will be prompted to

confirm each time you tap on an NFC reader before your

transaction can be processed.

76

o If you select “With password”, you can secure your Maxis

FastTap service with a 4-digit password and you will be

prompted to enter your password each time you tap your

phone on an NFC reader before your transaction can be

processed.

Tip: Select “Always” if you want your phone to be instantly ready when you

want to pay using Touch ‘n Go or Maybankard Visa payWave on your

mobile.

1.4. Preloaded Mobile Applications

Your Nokia 6212 classic mobile phone comes with preloaded applications and mobile content

ready for you to use:-

1. myMAXIS Application

o Single interface for purchasing mobile content downloads

- Music, Games, Maxis TV, Traffic Check and links to other

hot external websites.

o Access to details on your Maxis postpaid account

o Free mobile downloads - 7 Free Wallpapers and

2 Free Full Songs

98

2. Maybankard Visa payWave Mobile Application

For customers who have downloaded their Maybankard Visa

payWave credit card on to their mobile phone, this application

allows you to manage how the payment feature is accessed.

3. Touch ‘n Go Mobile Application

This application allows you to check the balance of your Touch

‘n Go on your mobile phone.

98

2. Maybankard Visa payWave on your mobile with

Maxis FastTap

2.1. Overview

You can now download a Maybankard Visa payWave credit card into your Nokia 6212 classic mobile

phone. Your phone can then become a supplementary device to your physical Maybankard Visa

payWave credit card. If you have not yet applied for Maybankard Visa payWave on your mobile,

please refer to Section 2.2 below.

To use your Maybankard Visa payWave on

your mobile to make a payment, simply

tap your mobile phone against any Visa

payWave contactless reader. Visa payWave

on your mobile works exactly the same way

as a Visa payWave credit card. No signature

is required on the receipt and you can make

payments up to RM150 per transaction.

1110

Annual Fee Waiver –

“Free For life”

Make contactless payments

using Visa payWave on your

mobile

Maybankard Auto Paybills

Earn TreatsPoints

TreatsPoints HotSpot

Visa payWave Monthly

Promotions

o No annual fee will be charged for your Maybankard

Visa payWave credit card on your mobile.

o Make speedier purchases at participating Visa payWave

retail outlets.

o Bills can be automatically charged to your Maybankard

Visa payWave on your mobile account, giving you the

convenience of paying your bills on time.

o Earn 1 TreatsPoints for every RM1 spent.

o During promotional period (May - August 2009)

earn: 5X TreatsPoints for every RM1 spent.

o Use your TreatsPoints to redeem gifts on-the-spot at over

500 HotSpot locations nationwide.

o Look out for special monthly offers at selected Visa

payWave retail outlets.

2.2. Benefits of Maybankard Visa payWave on your mobile

1110

Top Maybankard Visa payWave retail outlets:-

Note: Maybankard Visa payWave on your mobile can be used at all Visa payWave retail outlets in Malaysia.

2.3. How to download Maybankard Visa payWave to your mobile

To download Maybankard Visa payWave to your mobile, you first need to complete the credit

card approval process described on the next page.

If you have already completed the application process, your Maybankard Visa payWave on your

mobile account will be downloaded to your Nokia 6212 classic mobile phone as described on

the next page.

Carrefour

Parkson

Watsons

Baskin Robbins

Hush Puppies

KLIA Express Rail Link

Nando’s

Toy City

The Body Shop

Jusco (selected outlets only)

O’Briens (all outlets except 1Utama)

Focus Point

1312

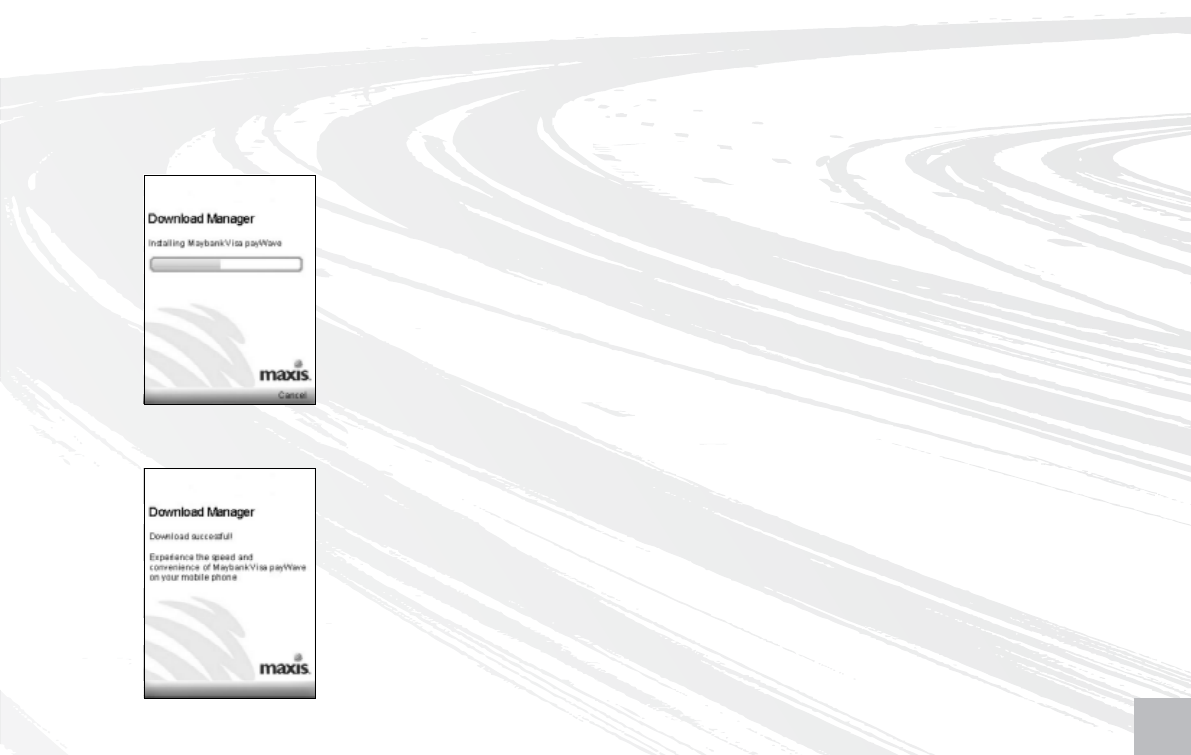

2.3.1. Downloading Maybankard Visa payWave on your mobile

Upon credit card application approval from Maybank, your Maybankard Visa payWave account

details will be automatically delivered over the Maxis data network and stored in your Nokia

6212 classic mobile phone.

Upon completion of the download process, you will be

prompted to configure settings for your Maybankard Visa

payWave mobile application to determine how the application

manages access to payment feature.

Note: You can change these settings at a later time by selecting

“Preferences” from the main menu of the Maybankard Visa

payWave mobile application.

During the download process, you will see the following on

your Nokia 6212 classic mobile phone.

Note: You must ensure that you do not interrupt the download process

until it is complete.

1312

You will be required to confirm the following settings :

Password o Choose “Yes” or “No”.

o If you select “Yes”, you will be asked to create a 6 digit

password. You will then be asked to re-enter your chosen

password to reconfirm. This password will then be required

each time you access your Maybankard Visa payWave

mobile application.

o If you select “No”, your Maybankard Visa payWave mobile

application can be run without requiring a password.

Always On o Choose “Yes” or “No”.

o If you select “Yes”, you can just tap your Nokia 6212

classic mobile phone on a Visa payWave reader and your

transaction will be processed without requiring confirmation.

o If you select “No”, you will need to open your Maybankard

Visa payWave mobile application and select the option

“pay” each time you want to use your phone to pay at a

Visa payWave reader.

Tip: For added security, select “Yes” for Password and “No” for Always On.

Then each time you need to make a payment, you should open the

Maybankard Visa payWave mobile application, key in your password and

select “Pay” before tapping your phone on the Visa payWave reader.

1514

2.3.2. Credit Card Application Process & Eligibility Criteria

For existing Maybankard credit card holders, it’s really simple - just complete a copy of the

Maybankard Visa payWave application form at participating Maxis Centres and our customer

service consultants will help facilitate your submission to Maybank.

For non-Maybankard credit card holders – Please complete the Maybankard Visa payWave

application form and provide the required supporting documentation outlined below:-

o Copy of NRIC (both sides) or Passport, including that of supplementary applicant’s

o Latest Income Tax Return (J Form)

o Latest 2 months’ salary slips

o Latest 3 months’ savings account activity/current account statements

If you are self-employed: o Copies of Business Registration

o Latest 3 months’ Bank Statements

If you are an expatriate: o Letter from employer confirming duration of

employment contract in Malaysia

Note: You must be an existing Maybank bank account holder

1514

Note: Application for this service is restricted to any Malaysian

or expatriate with a minimum annual income of RM30,000,

above the age of 21 years old.

If you are an existing credit card

holder from another bank

o Copy of NRIC (both sides) or Passport, including that

of supplementary applicant’s

o Copy of Credit/Charge card (both sides)

o Copy of latest card statement

2.4. How to access the Maybankard Visa payWave mobile application

To access the application please follow the steps below:

1. Go to Menu > Apps > Collection

2. Select the Maybankard Visa payWave mobile

application by clicking on the Maybank icon.

1716

2.5. How to use the Nokia 6212 classic mobile phone for credit

card payments at Visa payWave retail outlets

Using Maybankard Visa payWave on your mobile to pay at a Visa payWave retail outlet is

simple.

1. Firstly, inform the cashier that you wish to pay with Visa payWave.

2. After the Visa payWave reader displays “Present Card”, tap your phone on the reader.

3. After the Visa payWave reader displays “Remove Card”, remove your phone from the reader.

4. The transaction is complete after the Visa payWave reader displays “Transaction Completed”.

The cashier will hand you a receipt which you do not need to sign.

Note: If you have configured your Nokia 6212 classic mobile phone NFC settings to “Off” and/or Maybankard Visa

payWave mobile application settings on your mobile to prompt for confirmation before payment, you will

need to complete the confirmation steps prior to your payment transaction being processed.

(Refer to section 1.3)

1716

3. Touch ‘n Go on Maxis FastTap

3.1. Overview

You can now use the Nokia 6212 classic mobile phone in the same way as a Touch ‘n Go card at any

Touch ‘n Go points nationwide.

All Nokia 6212 classic mobile phones purchased from Maxis are ready with the Touch ‘n Go service. You

can also reload your Touch ‘n Go on your mobile phone at any existing Touch ‘n Go reload points.

Note: Maxis will provide Touch ‘n Go Sdn Bhd with registration details required for customer registration purposes

and facilitate any future card management requests.

3.2. Where to use Touch ‘n Go on the Nokia 6212 classic mobile phone

You can use your Touch ‘n Go on your mobile phone at any Touch ‘n Go points nationwide.

Touch ‘n Go can be used at the following locations:

o Tolls nationwide

o RapidKL LRT – Ampang Line & Kelana Jaya Lines

o RapidKL Buses

o KTM Komuter

o KL Monorail

o Selected parking lots

o Selected retail outlets

1918

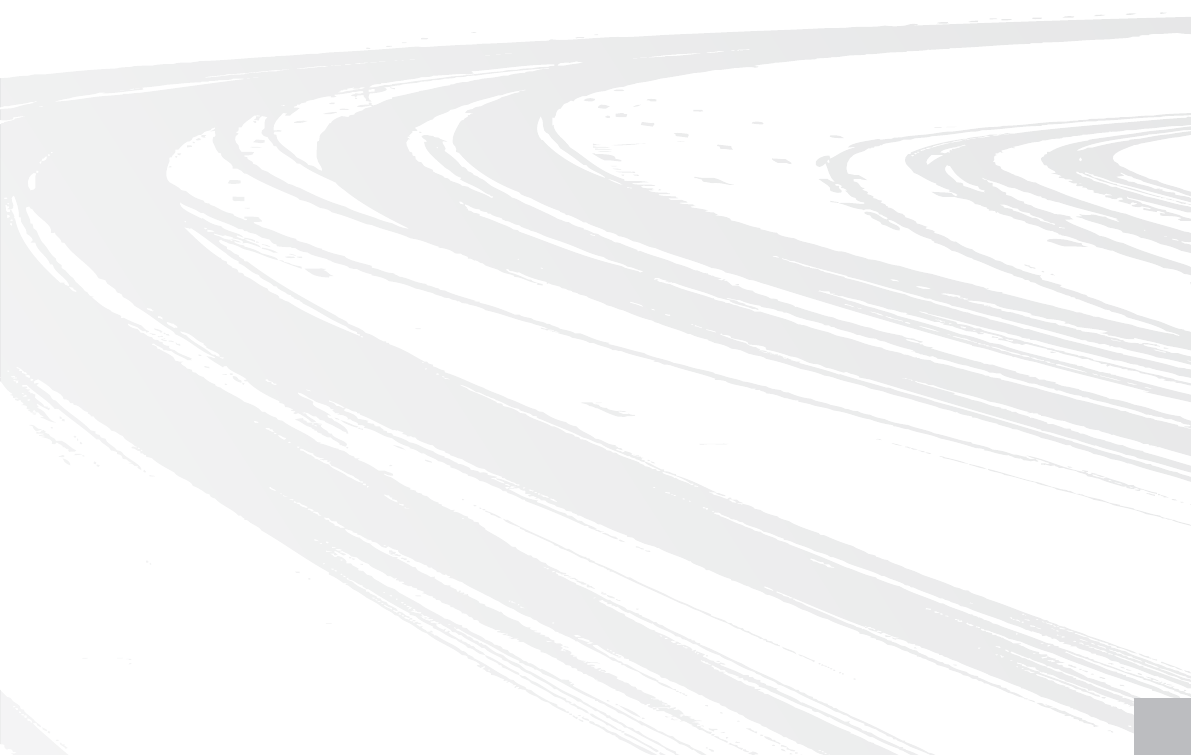

3.3. How to access the Touch ‘n Go mobile application

To access the application please follow the steps below:

1. Go to Menu > Apps > Collection

2. Select the Touch ‘n Go application by clicking

on the Touch ‘n Go icon

The following picture shows the Touch ‘n Go application menu

options:-

1. Select “Card Details” to view your Touch ‘n Go balance,

expiry date, status, and serial number.

2. Select “Last Reload Details” to view your last reload date,

reload amount and balance after reload.

3. Select “Help” to contact Touch ‘n Go Careline Centre for any

Touch ‘n Go related enquiries.

1918

3.4. How to use the Nokia 6212 classic mobile phone at

Touch ‘n Go points

3.4.1. Useful Tips when using Touch ‘n Go

o Please ensure that you have sufficient balance on the Touch ‘n Go in your Nokia 6212 classic

mobile phone at all times.

o Touch ‘n Go fees (e.g. LRT ticket fare; parking fees; toll fees etc.) will be deducted from your

Touch ‘n Go and your balance will be displayed at the Fare Indicator.

o For every Touch ‘n Go transaction, you need to ‘touch in’ by tapping your mobile phone on

a Touch ‘n Go reader upon entry (e.g. toll lane, parking lot, LRT). You will subsequently need

to ‘touch out’ by tapping the same mobile phone on a Touch ‘n Go reader again to exit (e.g.

toll lane, parking lot, LRT). There will usually be a ‘beep’ sound to notify you when you can

proceed. A maximum fare and / or surcharge will be imposed if you do not ‘touch in’ and ‘touch

out’ using the same mobile phone.

Note for toll lanes: If you take a transit ticket upon entry and use Touch ‘n Go on your Nokia 6212 classic

mobile phone to pay upon exit, a maximum fare will be imposed by Touch ‘n Go.

2120

All you need to do is tap your mobile phone at any Touch ‘n Go reader.

The display on the terminal will state your Touch ‘n Go balance.

3.5. Where to reload Touch ‘n Go balance on the Nokia 6212 classic

mobile phone

You can reload Touch ‘n Go on the Nokia 6212 classic mobile phone at all existing Touch ‘n Go reload

points nationwide listed below.

Note: Touch ‘n Go Reload Fees may vary according to the reload points.

Touch ‘n Go reload points nationwide:

1. Touch ‘n Go Hubs

2. Highway Sales & Customer Service Counters

PLUS Expressways (PLUS) Jitra, Alor Setar Utara, Pendang, Sg Petani Selatan, Sg Dua, Juru, Bukit Tambun Selatan,

Jawi, Taiping Utara, Kuala Kangsar, Jelapang, Ipoh Selatan, Tapah, Bidor, Jalan Duta,

Sg Besi, Batu Tiga, Sg Rasau, Damansara, Subang, Kota Damansara, Setia Alam, Kajang,

Bandar Baru Nilai, Senawang, Ayer Keroh, Yong Peng Utara, Ayer Itam, Skudai, Kempas

Central Link Expressway (ELITE) USJ, Seafield, KLIA

Seremban Port Dickson Highway, Mambau

Metramac Highways KL East-West Link (Cheras Bound)

Penang Bridge Sdn Bhd (PBSB) Penang Bridge

Malaysia-Singapore Taman Perling

Second Crossing (LINKEDUA)

Faber Towers, Taman Desa, KL Sentral City Air Terminal, Plaza Tol Tambak Johor (CIQ)

2120

KL-Ampang Elevated Highway Dato’ Keramat

(PROLINTAS)

New Pantai Expressway (NPE) Pantai Dalam, PJS 2, PJS 5

SILK Highway Sg. Balak

East Coast Expressway (ECE) Kuantan, Temerloh (reload only), Karak (reload only)

Lingkaran Luar Butterworth Bagan Ajam

(BORR)

Butterworth Kulim Expressway Kubang Semang

Lebuhraya Kajang-Seremban Kajang Selatan

PUTRA Light Rail Transit Kelana Jaya, Terminal Putra-Gombak, Masjid Jamek, KL Sentral, KLCC, Wangsa Maju,

Taman Jaya, Kerinchi, Bangsar, Dang Wangi, Ampang Park, Setiawangsa

STAR Light Rail Transit Bandar Tasik Selatan, Masjid Jamek, Ampang, Sri Petaling

KTM Komuter KL Sentral

Car Park KLIA, LCCT (Sepang)

PLUS Expressways (PLUS) Sg Dua (entry), Juru (entry), Ipoh Selatan (entry), Rawang (exit), Sg Buloh OBR

(south bound), Jalan Duta (entry), Damansara (entry), Subang (exit), Bukit Raja (entry),

Batu Tiga (Klang bound), Sg Rasau (Klang bound), Sg Besi (entry), UPM (exit), Kajang

(entry), Port Dickson Selatan (exit), Simpang Ampat (entry), Senai Utara (entry), Skudai

(entry), Kempas

Central Link Expressway (ELITE) Seafield, Shah Alam

Penang Bridge Sdn Bhd (PBSB) Penang Bridge

3. Public Transport Sales & Customer Service Counters

4. Touch ‘n Go Reload Lanes – On Highways

2322

Malaysia-Singapore Tanjung Kupang (Malaysia Bound), Lima Kedai (Singapore Bound)

Second Crossing (LINKEDUA)

KL-Ampang Elevated Highway Dato’ Keramat

(PROLINTAS)

Guthrie Corridor Expressway Bukit Jelutong

(GCE)

PETRONAS Stations At participating outlets only

TMPoint At participating outlets only

E-Print Kiosk Deromp Media (M) Sdn Bhd,

Lot G30, Giant Kinrara, Lot 449, Jalan BK 5A/1,

Bandar Kinrara, 47100 Puchong, Selangor

Deromp Media (M) Sdn Bhd,

Bangsar Village, Lower Ground West Wing, No. 1, Jalan Telawi 1,

Bangsar Baru, 59100 Kuala Lumpur

Bukit Merah Laketown Resort Jalan Bukit Merah, Semanggol, Perak

Express Shop Restoran Jejantas / Overhead Bridges (OBR) Ayer Keroh

ATM Reload Maybank Malaysia (more than 1,000 ATMs nationwide), CIMB (more than 300 ATMs

nationwide), Bank Muamalat (16 ATMs at major cities), RHB (100 ATMs nationwide),

PBB (more than 40 ATMs nationwide), AmBank (more than 50 ATMs nationwide)

Cash Deposit Machine (CDM) AmBank (more than 50 CDMs at major cities)

5. Other Reload Outlets

6. Bank Reload Outlets

2322

3.6. How to reload Touch ‘n Go on the Nokia 6212 classic

mobile phone

At Touch ‘n Go Sales Counters / Reload lanes, please follow these steps:

o Bring your Nokia 6212 classic mobile phone to any Touch ‘n Go Sales Counter or designated

reload lane.

o Inform the Customer Service Assistant the required reload value e.g. RM20, RM35, RM50, RM100,

RM150, RM200 or RM500. Note: Only cash is accepted except at selected counters.

o Your Touch ‘n Go on your Nokia 6212 classic mobile phone will be reloaded and returned

immediately.

o Please keep the reload receipt for future reference.

At ATMs, please follow these steps:

o Bring your Nokia 6212 classic mobile phone and ATM card.

o Follow the instructions displayed on the ATM screen.

o Please keep the reload receipt for future reference.

Note: Touch ‘n Go Reload Fees may vary according to the reload points.

2524

4. Maxis FastTap Frequently Asked Questions

Q1 I do not have a Maybankard Visa payWave credit card,

can I still use the Maxis FastTap service?

Yes – Plus when you buy the Nokia 6212 classic mobile phone,

Touch’n Go is also available. You can also use Maxis FastTap to

communicate with Maxis FastTap posters available at selected Maxis

Centres or NFC tags or use NFC to share content with other NFC

devices.

Q2 How secure is this service?

Mobile Visa payWave payments benefit from the same underlying

security because the underlying technology is the same as regular

Visa payments made with a card. For Touch ‘n Go, the same

standards as the existing Touch ‘n Go transit e-purse contactless card

service apply.

Q3 Where can I use this service?

Once you have configured your phone with Maybankard Visa

payWave and Touch’n Go card, you can use it at existing Visa

payWave retail outlets and Touch’n Go touch points in Malaysia.

Q4 Where can I reload my Touch ‘n Go?

You can reload your Touch’n Go at all existing Touch’n Go reload

points. For example LRT stations, petrol kiosks, convenience stores,

ATM machines. (Refer to Section 3.5 for complete list)

Q5 Will my credit card transactions be charged to my Maxis bill?

No, all Visa payWave transactions will appear in your Maybankard

monthly credit card statement as per all transactions with your

physical credit cards. All credit limits etc. associated with your

Maybankard Visa payWave credit card account will also apply.

Q6 Can the mobile phone perform normal mobile phone

functions?

Yes, the Nokia 6212 classic mobile phone supports 3G and is able to

carry out functions such as phone calls, SMS, MMS, GPRS/3G, etc.

Please refer to the Nokia 6212 classic User Guide for more information.

Q7 I am having difficulty downloading NFC applications onto my

mobile phone.

Please ensure that your phone settings are properly configured. For

recommended phone settings configurations, please refer to Section 1.3

(Getting Started)

Q8 I have lost my phone, what do I need to do?

Please call Maxis Customer Services at 1 800 821 123 to deactivate your

Maxis mobile service and also the Maxis FastTap service. You will also

need to contact Maybank and Touch ‘n Go immediately to deactivate or

cancel Maybankard mobile and Touch ‘n Go respectively.

Note: You only need to deactivate your Touch ‘n Go if you wish to claim any

remaining balance.

Q9 I have found some discrepancies in my credit card statement,

who should I call?

You should call Maybank for all Maybankard Visa payWave credit card

related enquiries at 1300 88 66 88.

Q10 What will happen if I unsubscribe for the Maxis FastTap service

or terminate my Maxis line?

If you terminate the Maxis FastTap service or your Maxis mobile line,

all existing Maxis FastTap services that you may have activated on your

Nokia 6212 classic mobile phone will also be terminated (ie. Touch ‘n Go

and/or Maybankard Visa payWave on your mobile).

Q11 Will my balance in Touch ‘n Go be refunded if I cancel the Maxis

FastTap service? How do I claim it back?

Yes it is possible to claim any remaining balance by contacting Touch ‘n

Go at 03 76285115 and following their claim process.

Q12 How should I configure my phone settings to ensure I experience

the fastest NFC transaction process?

Refer to Section 1.3.2. for a detailed explanation on configuration

options for NFC settings.

2524

Maxis Mobile Services Sdn Bhd for Maxis FastTap Service

1. Purchase of the Nokia 6212 classic mobile phone from Maxis Centres does not guarantee approval of Participant’s application for

Maybankard Visa payWave credit cards. Maxis Centre consultants will facilitate Participant’s application for Maybankard Visa payWave

on their mobile, in respect of which Maxis shall not be responsible for the application status results. Maxis may add to, vary, its FastTap

Services partner (i.e. Maybank and Touch ‘n Go) (“Partner”) as and when deemed necessary by Maxis. Partner shall refer to any such

additional or varying of Partner.

2. If a mobile phone is lost or stolen, customers are required to contact Maxis Customer Services immediately to suspend their line,

and are responsible for contacting the Partner directly (whichever is applicable) to suspend the Participant’s accounts with the said

respective parties.

3. In addition to Personal Information provision in the Principal Term and Conditions, the Participant hereby acknowledges that the

Participant’s personal details such as name, mobile number, NRIC will be provided to the Partner for user registration purposes.

The Participant expressly consents that Maxis may use such details which are necessary or related to Maxis’ provision of the FastTap

Services to the Participant.

4. Deactivation of the FastTap Services, Service and/or Participant’s Maxis postpaid account will result in deactivation of all the

applications residing in the Mobile phone. Customers are responsible for informing Maybank and/or Touch’N Go for the purpose of

deactivating respective services with Maybank and/or Touch ‘n Go, as the case may be, upon deactivation of the FastTap Services,

Service and/ or Participant’s Maxis postpaid account with Maxis.

5. FastTap Services transactions conducted with the Mobile phone (i.e. Maybankard Visa payWave contactless payments on your mobile,

Touch ‘n Go transactions and reloads etc) are the responsibility of the Participant and Maxis shall not be held liable for any loss and/or

damage suffered by the Participant as a result of using the mobile phone and/or the FastTap Services.

6. Maxis reserves the right, without any liability, to change, vary, add, amend any of these terms and conditions without prior notice.

Maxis has the right to make changes and remove the FastTap Services offers at any point in time and Maxis shall not be liable to the

Participant and/ or any party for any loss and/or damage of whatsoever nature suffered in relation to acceptance or non-acceptance

of the FastTap Services offers.

7. Maxis shall not be liable in the event that any Partner modifies, suspends or withdraws their service to the Participant under this

FastTap Services or for any loss and/or damages suffered by the Participant or any other party as a result thereof. Any disputes the

Participant may have concerning a Partner must be addressed directly with the Partner.

5. Terms and Conditions

26

Touch ‘n Go Sdn Bhd (TNGSB) for Touch ‘n Go on the Nokia 6212 classic

Mobile Phone

NFC General

1. TNGSB shall maintain your personal details provided as private and confidential unless such information is necessary to be disclosed if

required so for the purpose of provisions of services to you.

2. TNGSB is under no obligation to replace or compensate you for your lost, stolen, damaged, faulty, cloned and/or any unauthorised Reload.

3. TNGSB and/or the Service Providers shall not honour any unauthorised use of the Touch ‘n Go application and it shall be invalidated

by TNGSB.

4. TNGSB shall not refund the Deposit (if any) and the remaining Credit Value on cloned and invalidated transactions.

5. You are entitled to use the Touch ‘n Go application for Services at any of the authorized Service Providers and Point-of-Sales based on

the remaining Credit Value of your Touch ‘n Go.

6. TNGSB shall not be liable for any act, refusal and/ or omission by Service Providers to accept the Touch ‘n Go transactions nor shall

TNGSB be liable for any defect or deficiency in any of the Services provided by the Service Providers.

Lost and Stolen

1. For lost or stolen mobile phone, the Touch ‘n Go application can be invalidated when you notify TNGSB by telephone, followed by letter

(mail/ fax/email), provided that the last transaction occurred on or within three (3) months prior to the report of lost Nokia 6212 classic

mobile phone.

2. TNGSB will proceed with refunding the Credit Value (less any applicable fees) within thirty (30) days after receiving a written

notification from you.

3. TNGSB has the right to charge RM10.00 for refund of the lost Touch ‘n Go application in Nokia 6212 classic mobile phone by

deducting the amount (and any other fees applicable) from the Credit Value of the lost or stolen Card.

4. TNGSB has the right not to entertain any claims of lost or stolen Nokia 6212 classic mobile phone if the information given by you is

deemed incomplete.

27

Inactive Touch ‘n Go

1. If there is no Touch ‘n Go transaction for a period of twelve (12) consecutive months, the Touch ‘n Go application shall be deactivated

by TNGSB. The facility can no longer be used unless it is reactivated.

2. TNGSB shall levy an administrative Deactivation Fee of Ringgit Malaysia Five only (RM5) upon deactivation. This Deactivation Fee shall

be deducted from the Credit Value of your Touch ‘n Go in NFC mobile phone

3. TNGSB shall levy a Maintenance Fee of Ringgit Malaysia Five only (RM5) at every six (6) monthly intervals from the date your Touch ‘n Go

application deemed as Inactive by TNGSB. This Maintenance Fee shall be deducted from the Credit Value of your Inactive Touch ‘n Go.

4. TNGSB will invalidate the Touch ‘n Go application within twenty four (24) hours upon receiving the notification and you will remain

liable for all loss and damage incurred by TNGSB in relation to the Touch ‘n Go application including all costs associated with its

unauthorised use.

5. TNGSB will proceed with refunding the Credit Value (less any applicable fees) within thirty (30) days after receiving a written

notification from you.

Termination

1. You may at any time request to terminate the service and TNGSB will discontinue the use of the Services. TNGSB shall at its sole

discretion determine the condition of the Service Termination and will refund the Deposit (if applicable) and any remaining Credit Value

to you within thirty (30) days upon termination less a Processing Fee of Ringgit Malaysia Five only (RM5.00).

2. TNGSB reserves the right, at its sole and absolute discretion, without incurring any liability in whatsoever form and manner, not to

prompt or remind you before the Touch ‘n Go expiry to invalidate, cancel and/or terminate the Service or to suspend and/or restrict the

usage of the Service at any given time, without having to give notice or assign any reason whatsoever to you.

Terms

1. TNGSB reserves the right at its absolute discretion, from time to time, to vary, add to or otherwise amend these Terms and Conditions

or any part thereof including without limitation the Services. Your continued use of the Services after the effective date of any variation,

addition or amendments to the Terms and Conditions shall constitute unconditional acceptance of such variations, additions or

amendments by you and you will be bound by the same. If you do not accept such variation, addition or amendment, you shall be

entitled to terminate the use of the Services. TNGSB shall not be liable for any loss or inconvenience to you resulting therefrom.

2. These terms and conditions shall be read in addition to the terms and conditions of the Touch ‘n Go (‘Principal Terms & Conditions’).

These terms and conditions shall be supplemental to Touch ‘n Go “Principal Terms & Conditions.”

28