Paypal Gateway 2013 Developers Guide Payflow Developer And Reference

Gateway - 2013 - Developer Guide and Reference payflowgateway_2013_ug Free User Guide for PayPal Software, Manual

2015-07-27

: Paypal Paypal-Gateway-2013-Developers-Guide-777945 paypal-gateway-2013-developers-guide-777945 paypal pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 256 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- Content

- Preface

- Introducing the Gateway Checkout Solutions

- Secure Token

- Configuring Hosted Checkout Pages

- Payflow SDK

- Sending a Simple Transaction to the Server

- Submitting Credit Card Transactions

- Obtaining an Internet Merchant Account

- About Credit Card Processing

- Credit Card Features

- Planning Your Gateway Integration

- Core Credit Card Parameters

- Submitting Account Verifications

- Submitting Authorization/Delayed Capture Transactions

- Submitting Balance Inquiry Transactions

- Submitting Card Present (SWIPE) Transactions

- Submitting Credit Transactions

- Submitting Inquiry Transactions

- When To Use an Inquiry Transaction

- Required Parameters When Using the PNREF

- Inquiry Transaction Parameter String Using the PNREF

- Required Parameters When Using the CUSTREF

- Inquiry Transaction Parameter String Using the CUSTREF

- Required Parameters When Using the Secure Token

- Inquiry Parameter String Using the Secure Token

- Submitting Partial Authorizations

- Submitting Purchasing Card Transactions

- Submitting Reference Transactions (Tokenization)

- Submitting Sale Transactions

- Submitting Soft Merchant Information

- Submitting Voice Authorization Transactions

- Submitting Void Transactions

- Using Address Verification Service

- Using Card Security Code

- Testing Transactions

- Transaction Responses

- Processors Requiring Additional Transaction Parameters

- American Express Additional Credit Card Parameters

- Elavon Additional Credit Card Parameters

- First Data Merchant Services Nashville, Additional Credit Card Parameters

- First Data Merchant Services North, Additional Credit Card Parameters

- Heartland, Additional Credit Card Parameters

- Litle Additional Credit Card Parameters

- Merchant e-Solutions, Additional Credit Card Parameters

- Paymentech Salem (New Hampshire) Additional Credit Card Parameters for American Express

- PayPal Credit Card Transaction Request Parameters

- SecureNet Additional Credit Card Parameters for American Express

- Vantiv Additional Credit Card Parameters

- WorldPay Additional Credit Card Parameters

- TeleCheck Electronic Check Processing

- Submitting Purchasing Card Level 2 and 3 Transactions

- About Purchasing Cards

- About Program Levels

- About American Express Purchasing Card Transactions

- American Express Purchasing Card Transaction Processing

- Elavon (Formerly Nova) Purchasing Card Transaction Processing

- First Data Merchant Services (FDMS) Nashville Purchasing Card Transaction Processing

- First Data Merchant Services (FDMS) North Purchasing Card Transaction Processing

- First Data Merchant Services South (FDMS) Purchasing Card Transaction Processing

- Global Payments - Central Purchasing Card Transaction Processing

- Global Payments - East Purchasing Card Transaction Processing

- Heartland Purchasing Card Transaction Processing

- Litle Purchasing Card Transaction Processing

- Merchant e-Solutions Purchasing Card Transaction Processing

- Paymentech Salem (New Hampshire) Purchasing Card Transaction Processing

- Paymentech Tampa Level 2 Purchasing Card Transaction Processing

- SecureNet Purchasing Card Transaction Processing

- TSYS Acquiring Solutions Purchasing Card Transaction Processing

- Vantiv Purchasing Card Transaction Processing

- WorldPay Purchasing Cards Transaction Processing

- Payflow Header Parameters

- VERBOSITY: Processor-Specific Transaction Results

- ISO Country Codes

- Codes Used by FDMS South Only

- PayPal Acquirer

- Additional Processor Information

- Payflow Link Migration

- Payflow Gateway MagTek Parameters

Gateway Developer

Guide and Reference

PayPal Payments Advanced

PayPal Payments Pro

Payflow Pro

Payflow Link

Last updated: 07 February 2013

Gateway Developer Guide and Reference

Document Number: 200045.en_US-201302

© 2013 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal (Europe) S.à r.l. et Cie., S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard

Royal, L-2449, Luxembourg, R.C.S. Luxembourg B 118 349.

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information in this document to you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information contained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Gateway Developer Guide and Reference 07 February 2013 3

Content

Chapter Preface . . . . . . . . . . . . . . . . . . . . . . . . . . .13

Scope . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Related Documentation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Who Should Use This Document . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Chapter 1 Introducing the Gateway Checkout Solutions . . . . . . . .23

About the Gateway Checkout Solutions . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Summary of the Gateway Checkout Solutions . . . . . . . . . . . . . . . . . . . . . 23

Gateway Product Details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

About the Gateway Transaction Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

About Security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Secure Token . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Hosted Checkout Pages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

PCI Compliance Without Hosted Pages: Transparent Redirect . . . . . . . . . . . . . 27

Processing Platforms Supporting Card-Present Transactions . . . . . . . . . . . . . . . . 28

Supported Payment Types . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Supported Languages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Recurring Billing Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Fraud Protection Service. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Chapter 2 Secure Token . . . . . . . . . . . . . . . . . . . . . . . .31

About the Secure Token . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Integrating the Secure Token With the Hosted Checkout Pages . . . . . . . . . . . . . . 31

Integrating the Secure Token Without the Hosted Checkout Pages: Transparent Redirect . 32

Secure Token Errors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Posting To the Hosted Checkout Page . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Chapter 3 Configuring Hosted Checkout Pages . . . . . . . . . . . .37

Configuring Hosted Checkout Pages . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Content

407 February 2013 Gateway Developer Guide and Reference

Configuring Hosted Pages Using PayPal Manager . . . . . . . . . . . . . . . . . . . . . 37

Setup. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Customize . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Integrate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Using a Secure Token to Pass Hosted Pages Customization Parameters . . . . . . . . . 41

Using the PARMLIST Parameter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

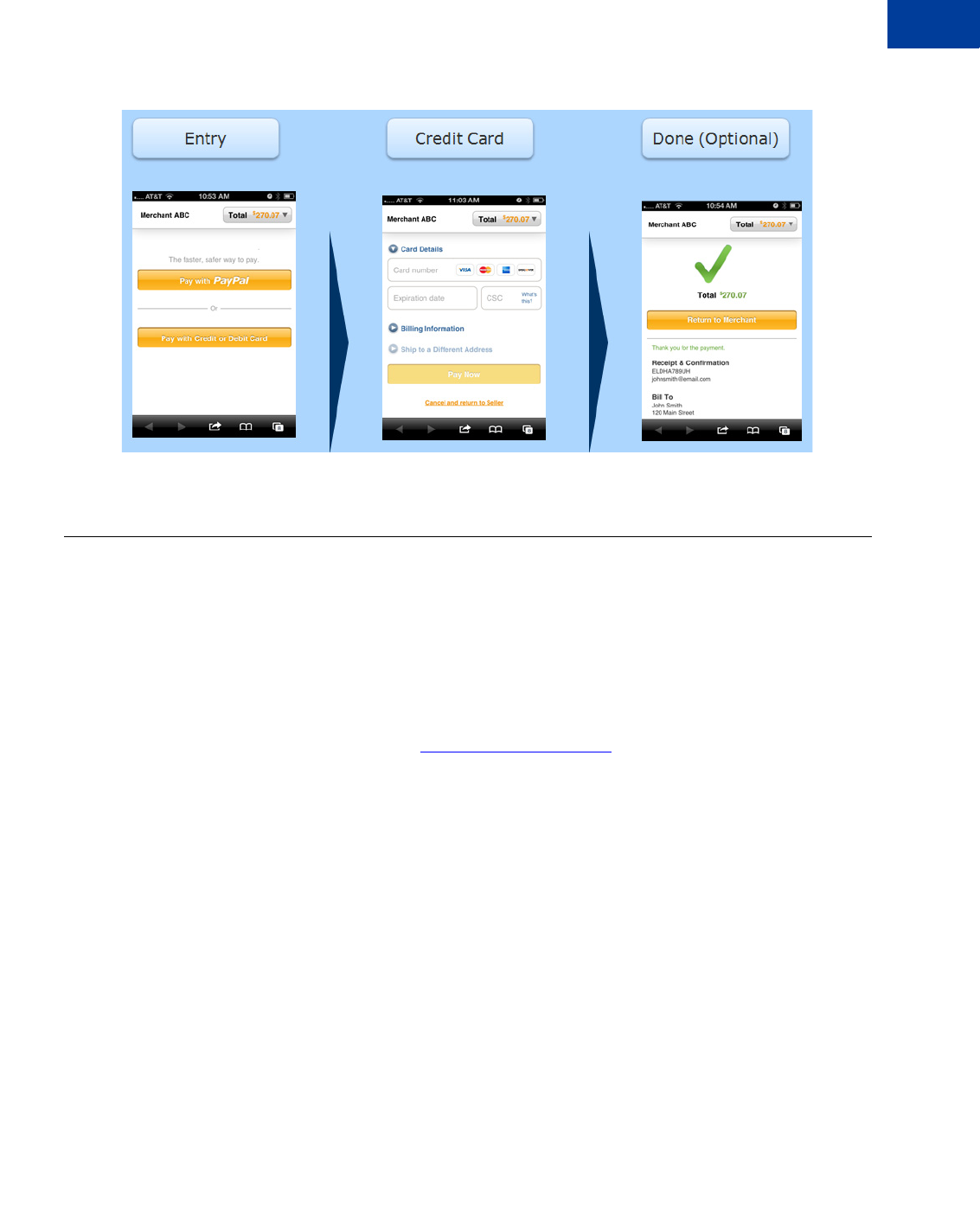

Hosted Pages and Mobile Browsers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Mobile Optimized Checkout Pages . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Silent Posts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Force Silent Post Confirmation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Data Returned by the Silent Post Features . . . . . . . . . . . . . . . . . . . . . . . 48

Passing Other Data to Your Server Using Post or Silent Post . . . . . . . . . . . . . . . . 48

Chapter 4 Payflow SDK . . . . . . . . . . . . . . . . . . . . . . . . .49

Preparing the Payflow Gateway Client Application . . . . . . . . . . . . . . . . . . . . . 49

Activating Your Payflow Gateway Account. . . . . . . . . . . . . . . . . . . . . . . . . . 50

Host URL Addresses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Chapter 5 Sending a Simple Transaction to the Server . . . . . . . .51

About Name-Value Pairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Using Special Characters In Values . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Name-Value Parameter Syntax Guidelines . . . . . . . . . . . . . . . . . . . . . . . 52

Do Not URL Encode Name-Value Parameter Data . . . . . . . . . . . . . . . . . . . 52

Payflow Connection Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

User Parameter Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Sale Transaction Example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Typical Sale Transaction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Formatting Payflow Gateway Transactions . . . . . . . . . . . . . . . . . . . . . . . . . 54

Chapter 6 Submitting Credit Card Transactions . . . . . . . . . . . .55

Obtaining an Internet Merchant Account . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

About Credit Card Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

Credit Card Features. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Planning Your Gateway Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Complying With E-commerce Indicator . . . . . . . . . . . . . . . . . . . . . . . . . 58

Handling Credit Card Type Information . . . . . . . . . . . . . . . . . . . . . . . . . 58

Gateway Developer Guide and Reference 07 February 2013 5

Content

Core Credit Card Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

Submitting Account Verifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

When To Use Account Verifications . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

Required Account Verification Parameters . . . . . . . . . . . . . . . . . . . . . . . 62

Example Account Verification String . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

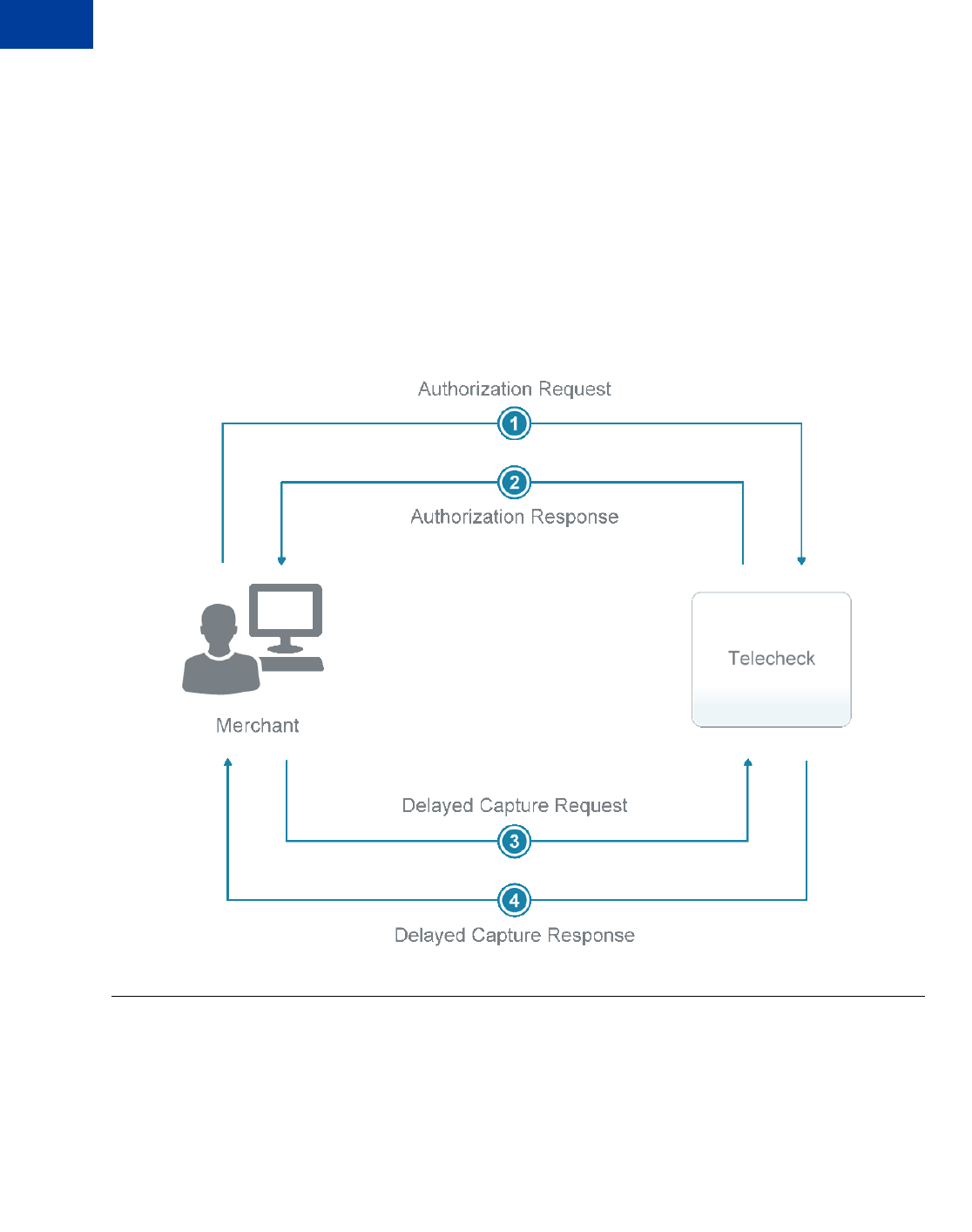

Submitting Authorization/Delayed Capture Transactions . . . . . . . . . . . . . . . . . . 63

When to Use Authorization/Delayed Capture Transactions . . . . . . . . . . . . . . . 63

Required Authorization Transaction Parameters . . . . . . . . . . . . . . . . . . . . 64

Typical Authorization Transaction Parameter String . . . . . . . . . . . . . . . . . . . 64

Submitting Balance Inquiry Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Processing Platforms Supporting Balance Inquiry Transactions . . . . . . . . . . . . 65

Required Balance Inquiry Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Example Balance Inquiry Transaction String . . . . . . . . . . . . . . . . . . . . . . 65

Submitting Card Present (SWIPE) Transactions. . . . . . . . . . . . . . . . . . . . . . . 65

Processing Platforms Supporting Card-Present Transactions. . . . . . . . . . . . . . 66

Card Present Transaction Syntax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Submitting Credit Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Required Credit Transaction Parameters . . . . . . . . . . . . . . . . . . . . . . . . 67

Submitting Inquiry Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

When To Use an Inquiry Transaction . . . . . . . . . . . . . . . . . . . . . . . . . . 70

Required Parameters When Using the PNREF . . . . . . . . . . . . . . . . . . . . . 70

Inquiry Transaction Parameter String Using the PNREF . . . . . . . . . . . . . . . . 70

Required Parameters When Using the CUSTREF . . . . . . . . . . . . . . . . . . . 70

Inquiry Transaction Parameter String Using the CUSTREF . . . . . . . . . . . . . . . 71

Required Parameters When Using the Secure Token . . . . . . . . . . . . . . . . . . 71

Inquiry Parameter String Using the Secure Token . . . . . . . . . . . . . . . . . . . . 72

Submitting Partial Authorizations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

When To Use Partial Authorizations . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

Required Partial Authorization Parameters . . . . . . . . . . . . . . . . . . . . . . . 72

Example Partial Authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Submitting Purchasing Card Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Submitting Reference Transactions (Tokenization) . . . . . . . . . . . . . . . . . . . . . 74

When To Use a Reference Transaction . . . . . . . . . . . . . . . . . . . . . . . . . 74

Transaction Types That Can Be Used As the Original Transaction . . . . . . . . . . . 75

Fields Copied From Reference Transactions . . . . . . . . . . . . . . . . . . . . . . 75

Example Reference Transaction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Data Upload - Storing Credit Card Data on the Gateway Server . . . . . . . . . . . . 76

Submitting Sale Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

When To Use a Sale Transaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Content

607 February 2013 Gateway Developer Guide and Reference

Additional Parameters For Sale Transactions . . . . . . . . . . . . . . . . . . . . . . 77

Typical Sale Transaction Parameter String . . . . . . . . . . . . . . . . . . . . . . . 78

Submitting Soft Merchant Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

About Soft Merchant Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Ways to Send Soft Merchant Information . . . . . . . . . . . . . . . . . . . . . . . . 79

Submitting Voice Authorization Transactions . . . . . . . . . . . . . . . . . . . . . . . . 80

When To Use a Voice Authorization Transaction . . . . . . . . . . . . . . . . . . . . 80

Required Voice Authorization Transaction Parameters . . . . . . . . . . . . . . . . . 80

Submitting Void Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

When To Use a Void Transaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

Required Void Transaction Parameters . . . . . . . . . . . . . . . . . . . . . . . . . 81

Fields Copied From the Original Transaction Into the Void Transaction. . . . . . . . . 81

Example Void Transaction Parameter String . . . . . . . . . . . . . . . . . . . . . . 82

Using Address Verification Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

Example Address Verification Service Parameter String . . . . . . . . . . . . . . . . 82

Using Card Security Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

Chapter 7 Testing Transactions . . . . . . . . . . . . . . . . . . . .85

Setting Up The Payflow Gateway Testing Environment . . . . . . . . . . . . . . . . . . . 85

Testing Guidelines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Processors Other Than PayPal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Credit Card Numbers for Testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Testing Address Verification Service. . . . . . . . . . . . . . . . . . . . . . . . . . . 89

Testing Card Security Code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

PayPal Processor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

Credit Card Numbers for Testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

Result Values Based On Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Chapter 8 Transaction Responses . . . . . . . . . . . . . . . . . . .95

Credit Card Transaction Responses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

Address Verification Service Responses From PayPal . . . . . . . . . . . . . . . . . . . 98

Card Security Code Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .100

Normalized Card Security Code Results . . . . . . . . . . . . . . . . . . . . . . . .100

PayPal Card Security Code Results . . . . . . . . . . . . . . . . . . . . . . . . . . .100

BALAMT Response and Stored Value Cards . . . . . . . . . . . . . . . . . . . . . . . .101

American Express Stored Value Card Example . . . . . . . . . . . . . . . . . . . . .101

PNREF . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .101

Gateway Developer Guide and Reference 07 February 2013 7

Content

RESULT Values and RESPMSG Text . . . . . . . . . . . . . . . . . . . . . . . . . . . .102

RESULT Values For Communications Errors . . . . . . . . . . . . . . . . . . . . . .108

Chapter A Processors Requiring Additional Transaction Parameters 111

American Express Additional Credit Card Parameters . . . . . . . . . . . . . . . . . . . 111

Retail Transaction Advice Addendum (for SWIPE transactions) . . . . . . . . . . . . 111

Internet Transaction Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .112

Address Verification Service Parameters . . . . . . . . . . . . . . . . . . . . . . . . 113

Location Transaction Advice Addendum Parameters . . . . . . . . . . . . . . . . . . 113

Transaction Advice Detail Parameters. . . . . . . . . . . . . . . . . . . . . . . . . .115

Airline Passenger Data Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . .115

American Express Other Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . 116

Elavon Additional Credit Card Parameters. . . . . . . . . . . . . . . . . . . . . . . . . . 117

First Data Merchant Services Nashville, Additional Credit Card Parameters . . . . . . . . 118

First Data Merchant Services North, Additional Credit Card Parameters . . . . . . . . . .118

Heartland, Additional Credit Card Parameters . . . . . . . . . . . . . . . . . . . . . . . . 119

Litle Additional Credit Card Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . 119

Merchant e-Solutions, Additional Credit Card Parameters. . . . . . . . . . . . . . . . . .121

Paymentech Salem (New Hampshire) Additional Credit Card Parameters for American

Express . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .121

Internet Transaction Data Parameters . . . . . . . . . . . . . . . . . . . . . . . . . .121

AVS Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .122

Additional Credit Card Parameters for M Record . . . . . . . . . . . . . . . . . . . .123

PayPal Credit Card Transaction Request Parameters . . . . . . . . . . . . . . . . . . . .123

SecureNet Additional Credit Card Parameters for American Express . . . . . . . . . . . .128

Retail Transaction Advice Addendum (for SWIPE transactions) . . . . . . . . . . . .128

Internet Transaction Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .129

AVS Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .129

Location Transaction Advice Addendum Parameters . . . . . . . . . . . . . . . . . .130

Transaction Advice Detail Parameters. . . . . . . . . . . . . . . . . . . . . . . . . .131

Airline Passenger Data Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . .131

Other Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .133

Vantiv Additional Credit Card Parameters . . . . . . . . . . . . . . . . . . . . . . . . . .133

Additional Credit Card Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . .133

Soft Merchant Descriptor Parameters . . . . . . . . . . . . . . . . . . . . . . . . . .134

WorldPay Additional Credit Card Parameters . . . . . . . . . . . . . . . . . . . . . . . .135

Chapter B TeleCheck Electronic Check Processing . . . . . . . . . 137

Content

807 February 2013 Gateway Developer Guide and Reference

TeleCheck NFTF Overview of Services . . . . . . . . . . . . . . . . . . . . . . . . . . .137

TeleCheck NFTF Processing Overview . . . . . . . . . . . . . . . . . . . . . . . . . . .137

NFTF Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .137

NFTF Processing Considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . .139

NFTF Guidelines. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .139

TeleCheck Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .140

Required TeleCheck Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . .141

Testing TeleCheck Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .143

Example Test Transaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .143

Preparing for TeleCheck Production Transactions . . . . . . . . . . . . . . . . . . . . . .144

Responses to TeleCheck Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . .144

Transaction Responses Common to All Tender Types . . . . . . . . . . . . . . . . .144

Response Code Values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .145

Sale Response Code Values . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .145

Adjustment Code Values. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .146

Response Codes For Status Response Packets . . . . . . . . . . . . . . . . . . . .146

TeleCheck Authorization Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . .147

Authorization – Sales Consent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .147

Authorization – Sales Decline/Error . . . . . . . . . . . . . . . . . . . . . . . . . . .150

Chapter C Submitting Purchasing Card Level 2 and 3 Transactions . 151

About Purchasing Cards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .151

About Program Levels . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .151

Accepted BIN Ranges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .152

About American Express Purchasing Card Transactions . . . . . . . . . . . . . . . . . .152

Supported Transaction Types . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .152

Avoiding Downgrade. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .153

Submitting Successful Level 3 Transactions . . . . . . . . . . . . . . . . . . . . . .153

Edit Check . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .153

Accepted BIN Ranges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .154

American Express Purchasing Card Transaction Processing . . . . . . . . . . . . . . . .154

American Express Level 2 Parameters for American Express . . . . . . . . . . . . .154

Example American Express Level 2 Transaction Parameter String . . . . . . . . . . .157

American Express Level 3 Parameters . . . . . . . . . . . . . . . . . . . . . . . . .157

Example American Express Level 3 Transaction Parameter String . . . . . . . . . . .159

Elavon (Formerly Nova) Purchasing Card Transaction Processing . . . . . . . . . . . . .160

Elavon Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .160

Elavon Additional Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .160

Gateway Developer Guide and Reference 07 February 2013 9

Content

Example Elavon Level 2 Transaction Parameter String . . . . . . . . . . . . . . . . .161

First Data Merchant Services (FDMS) Nashville Purchasing Card Transaction Processing.161

FDMS Nashville Commercial Card Parameters . . . . . . . . . . . . . . . . . . . . .161

First Data Merchant Services (FDMS) North Purchasing Card Transaction Processing . .162

FDMS North Purchasing Parameters . . . . . . . . . . . . . . . . . . . . . . . . . .162

FDMS North Purchasing Card Line Item Parameters . . . . . . . . . . . . . . . . . .163

First Data Merchant Services South (FDMS) Purchasing Card Transaction Processing . .163

FDMS South Level 2 and Level 3 Purchasing Card Parameters . . . . . . . . . . . .164

FDMS South Line Item Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . .165

Example FDMS South Purchasing Card Level 2 and 3 Parameter String . . . . . . . .166

Example FDMS South Line Item Parameter String . . . . . . . . . . . . . . . . . . .166

Global Payments - Central Purchasing Card Transaction Processing . . . . . . . . . . . .167

Global Payments - Central Level 2 Parameters . . . . . . . . . . . . . . . . . . . . .167

Global Payments - East Purchasing Card Transaction Processing . . . . . . . . . . . . .167

Global Payments - East Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . .167

Example Global Payments - East Level 2 Visa or MasterCard Transaction Parameter String

168

Heartland Purchasing Card Transaction Processing. . . . . . . . . . . . . . . . . . . . .168

Heartland Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .168

Heartland Level 3 MasterCard Parameters . . . . . . . . . . . . . . . . . . . . . . .169

Heartland Level 3 Visa Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . .171

Litle Purchasing Card Transaction Processing. . . . . . . . . . . . . . . . . . . . . . . .174

Litle Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .174

Litle Level 3 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .175

Merchant e-Solutions Purchasing Card Transaction Processing . . . . . . . . . . . . . .177

Merchant e-Solutions Level 2 Parameters. . . . . . . . . . . . . . . . . . . . . . . .177

Merchant e-Solutions Level 3 MasterCard Parameters . . . . . . . . . . . . . . . . .177

Merchant e-Solutions Level 3 Visa Parameters . . . . . . . . . . . . . . . . . . . . .180

Paymentech Salem (New Hampshire) Purchasing Card Transaction Processing . . . . . .182

Paymentech Salem (New Hampshire) Level 2 Parameters for American Express . . .182

Paymentech Salem (New Hampshire) Level 3 Purchasing Card Parameters. . . . . .185

Paymentech Tampa Level 2 Purchasing Card Transaction Processing . . . . . . . . . . .188

Paymentech Tampa Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . . . .189

Example Paymentech Tampa Level 2 Visa and MasterCard Transaction Parameter String

189

SecureNet Purchasing Card Transaction Processing . . . . . . . . . . . . . . . . . . . .189

SecureNet Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . .189

SecureNet Level 3 MasterCard Parameters . . . . . . . . . . . . . . . . . . . . . . .190

SecureNet Acquiring Solutions Level 3 Visa Parameters . . . . . . . . . . . . . . . .192

Content

10 07 February 2013 Gateway Developer Guide and Reference

TSYS Acquiring Solutions Purchasing Card Transaction Processing . . . . . . . . . . . .195

TSYS Acquiring Solutions Level 2 Parameters . . . . . . . . . . . . . . . . . . . . .195

TSYS Acquiring Solutions Level 3 MasterCard Parameters. . . . . . . . . . . . . . .196

TSYS Acquiring Solutions Level 3 Visa Parameters. . . . . . . . . . . . . . . . . . .198

Vantiv Purchasing Card Transaction Processing . . . . . . . . . . . . . . . . . . . . . .201

Vantiv Purchasing Parameters. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .201

Vantiv Purchasing Card Line Item Parameters . . . . . . . . . . . . . . . . . . . . .201

WorldPay Purchasing Cards Transaction Processing . . . . . . . . . . . . . . . . . . . .202

WorldPay Level 2 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .202

WorldPay Level 3 Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .204

Chapter D Payflow Header Parameters . . . . . . . . . . . . . . . . 207

Sending Requests Directly to PayPal Bypassing Payflow . . . . . . . . . . . . . . . . . .207

Posting Transactions Directly Without the Payflow SDK. . . . . . . . . . . . . . . . . . .208

The Payflow Message Protocol . . . . . . . . . . . . . . . . . . . . . . . . . . . . .208

Payflow Message Protocol Headers . . . . . . . . . . . . . . . . . . . . . . . . . . .209

Transaction Message . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .211

Integrator-Provided Data. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .212

Chapter E VERBOSITY: Processor-Specific Transaction Results . . 215

Chapter F ISO Country Codes . . . . . . . . . . . . . . . . . . . . 217

Chapter G Codes Used by FDMS South Only . . . . . . . . . . . . . 219

MasterCard Country Codes for FDMS South Only . . . . . . . . . . . . . . . . . . . . .219

Visa Country Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .226

Units of Measure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .233

Chapter H PayPal Acquirer . . . . . . . . . . . . . . . . . . . . . . 241

Countries and Regions Supported by PayPal . . . . . . . . . . . . . . . . . . . . . . . .241

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .241

PayPal Currency Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .241

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .241

Appendix I Additional Processor Information . . . . . . . . . . . . . 243

Moneris Solutions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .243

Gateway Developer Guide and Reference 07 February 2013 11

Content

Chapter J Payflow Link Migration . . . . . . . . . . . . . . . . . . 245

Migrating from a legacy Payflow Link Integration . . . . . . . . . . . . . . . . . . . . . .245

Chapter K Payflow Gateway MagTek Parameters . . . . . . . . . . . 247

MagTek MagneSafe Secure Card Readers and Qwick Codes . . . . . . . . . . . . . . .247

MagneSafe Secure Card Reader Authenticators . . . . . . . . . . . . . . . . . . . .247

MagTek Qwick Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .248

Passing Encrypted Card Swipe Data and Qwick Codes to the Payflow Gateway . . . . . .248

Encrypted Card Swipe Payflow Example . . . . . . . . . . . . . . . . . . . . . . . .249

Qwick Code (PCode) Payflow Example . . . . . . . . . . . . . . . . . . . . . . . . .249

Parameters for Encrypted Card Swipe Transactions . . . . . . . . . . . . . . . . . . . .250

Parameters for MagTek Qwick Code (PCode) Transactions. . . . . . . . . . . . . . . . .253

MagTek Error Codes and Messages . . . . . . . . . . . . . . . . . . . . . . . . . . . . .254

Content

12 07 February 2013 Gateway Developer Guide and Reference

Gateway Developer Guide and Reference 07 February 2013 13

Preface

This guide describes the data parameters for the Gateway payments solutions.

Scope

This guide is a reference to the payment card data parameters available for submitting in

transaction requests over the Gateway to multiple supported processors. It also covers the

resulting response data parameters and errors.

The guide describes the requirements of an ever growing list of processing platforms. It

organizes parameters into a core set of request parameters supported by all processors,

additional parameters unique to individual processors, and purchasing card parameters

specialized to monitor credit card use in businesses. It also provides a section on response

parameters and error codes (PNREF values that are not 0).

Although this guide provides guidance on getting started with the SDK, setting up credit card

processing, and testing your integration, its broad scope does not lend to use as a tutorial on

integration. Refer to the PayPal Developer website and the Payflow Gateway SDK for detailed

working examples and use cases.

Related Documentation

For additional information on the Gateway payments solutions:

-See PayPal Manager at:

https://manager.paypal.com/

-For more information on Payflow documentation, examples, and very current information,

see the PayPal developer site at the following URL:

https://www.x.com/developers/paypal

Intended Audience

This guide provides Gateway payments solutions to readers who:

-Are web or application developers

-Have a background in payments services

Preface

Intended Audience

14 07 February 2013 Gateway Developer Guide and Reference

Who Should Use This Document

This comprehensive developer guide includes integration information for multiple Gateway

solutions. Legacy Payflow Link features are not included in this guide. For legacy Payflow

Link features refer to the Payflow Link User’s Guide. Additionally, all the Gateway features

explained in this guide are not necessarily available to every Gateway customer. This section

will help you determine whether you should use this document and which sections of the

document are relevant to you.

To view the Gateway solutions available to you, login to PayPal Manager at

https://manager.paypal.com/. PayPal Manager displays your Gateway Services in the Service

Summary box.

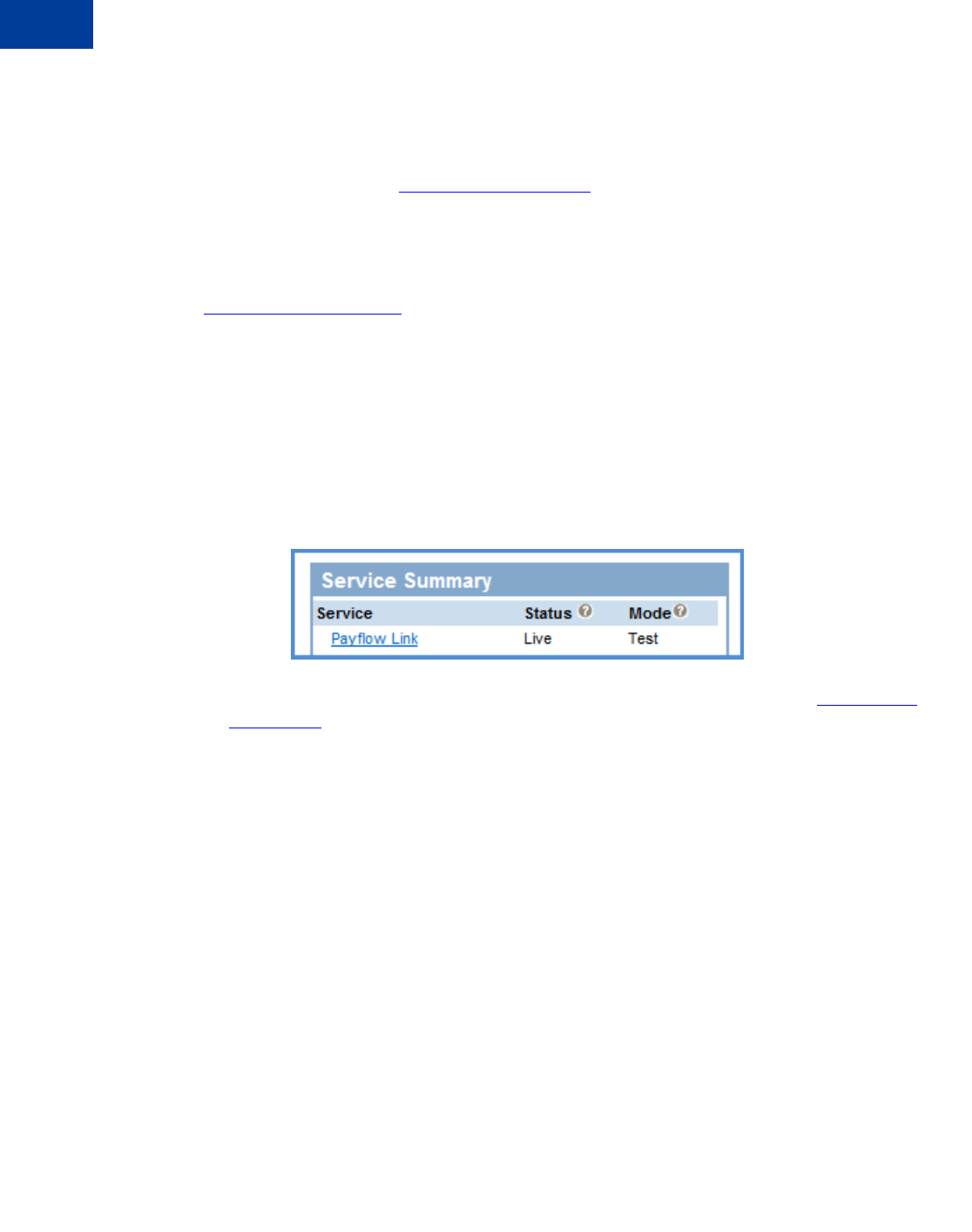

-Payflow Link

Payflow Link customers can choose PayPal or another merchant bank to process their

transactions via the Payflow Gateway.

A) Legacy Payflow Link users will see the following in the Service Summary box in PayPal

Manager:

Payflow Link

If you are a legacy Payflow Link user, do not use this guide; instead, use the Payflow Link

User’s Guide.

B) New Payflow Link users will see the following in the Service Summary box in PayPal

Manager:

Hosted Checkout Pages & Payflow SDK/API (Limited Access). (If PayPal Payments

Advanced is also listed, then you are not a Payflow Link customer).

Gateway Developer Guide and Reference 07 February 2013 15

Preface

Intended Audience

New Payflow Link users who are using the Secure Token or the API should use this guide.

However, new Payflow Link users who are using the legacy Payflow Link input tag

integration should use the Payflow Link User’s Guide instead.

Limited API Access means you can perform all API functions except for Sales and

Authorization transactions. For Sales and Authorization type transactions you must use the

Hosted Checkout Pages.

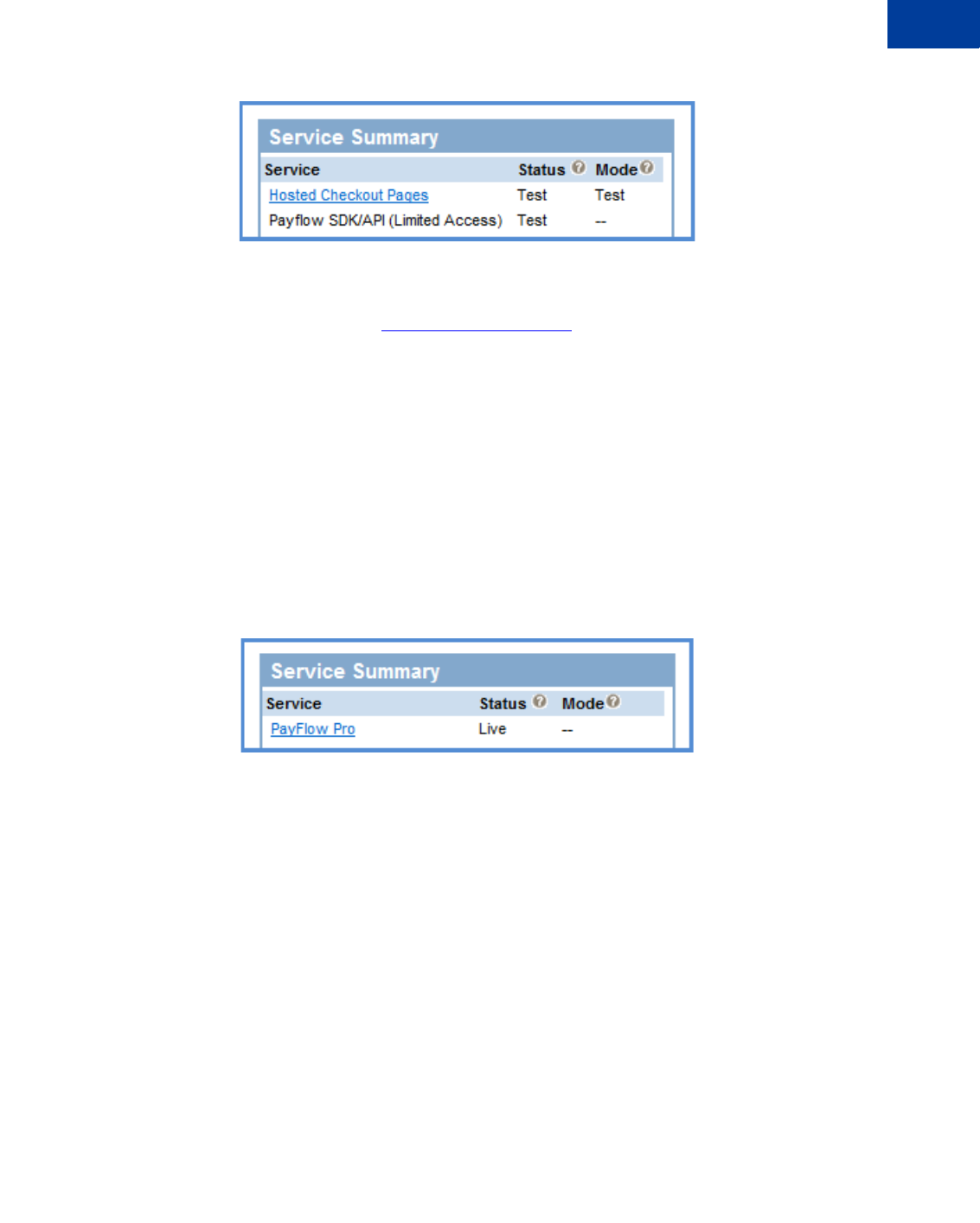

-Payflow Pro

Payflow Pro customers can choose PayPal or another merchant bank to process their

transactions via the Gateway.

A) Legacy Payflow Pro users will see the following in the Service Summary box in PayPal

Manager:

Payflow Pro

Legacy Payflow Pro users should use this guide; however, these users can only use the API

integration and do not have the Hosted Checkout Pages service. If you are a legacy

Payflow Pro user, you should skip the chapter on Hosted Checkout Pages - “Configuring

Hosted Checkout Pages” on page 37.

B) New Payflow Pro users can take advantage of all of the Gateway features including

Hosted Checkout Pages. These users will see the following in the Service Summary box in

PayPal Manager:

Hosted Checkout Pages & Payflow SDK/API (Full Access)

Preface

Intended Audience

16 07 February 2013 Gateway Developer Guide and Reference

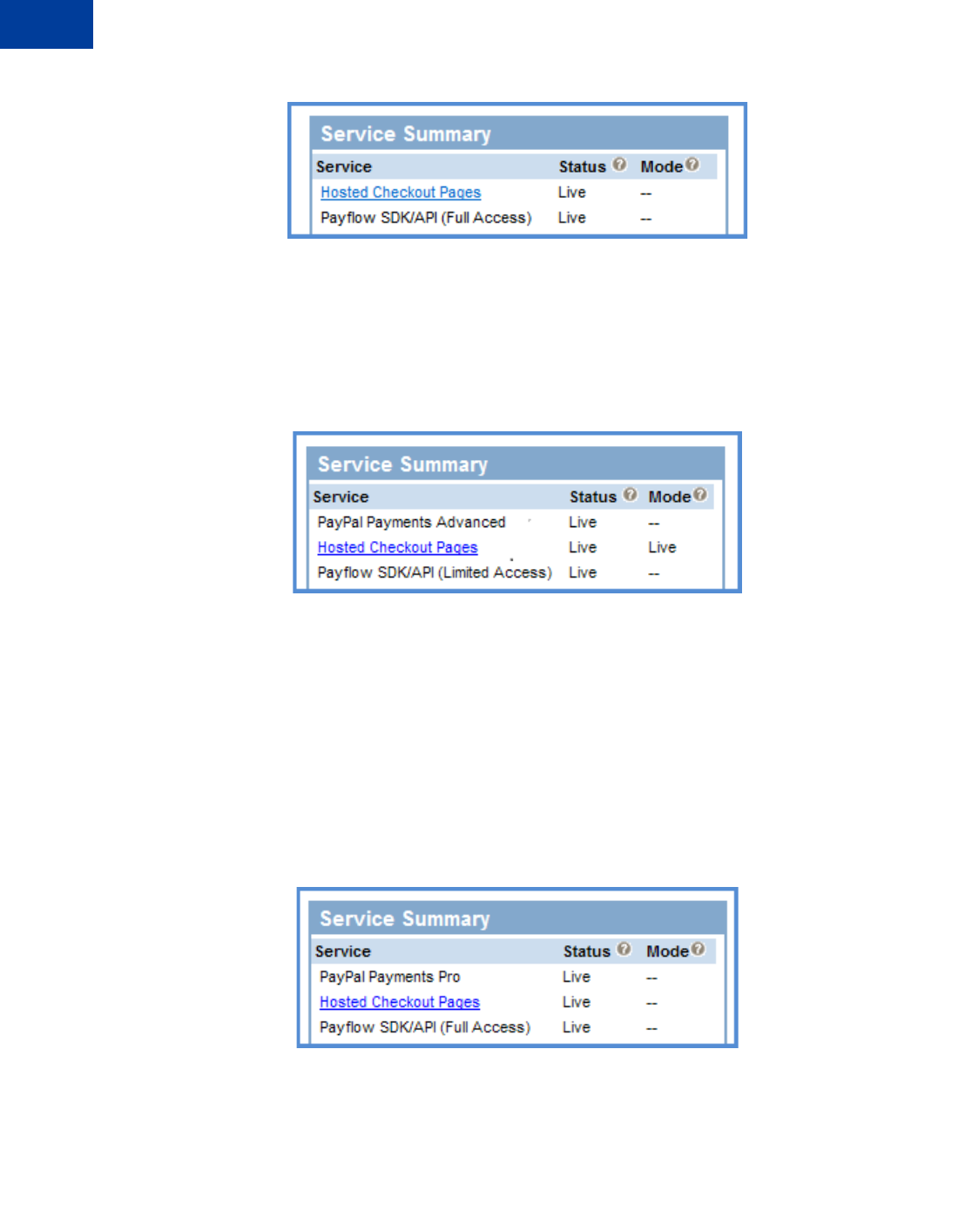

-PayPal Payments Advanced

Transactions submitted by PayPal Payments Advanced customers are processed through

the Gateway with PayPal acting as the merchant bank. PayPal Payments Advanced users

will see the following in the Service Summary box in PayPal Manager:

PayPal Payments Advanced with Hosted Checkout Pages & Payflow SDK/API (Limited

Access)

Limited API Access means you can perform all API functions except for Sales and

Authorization transactions. For Sales and Authorization type transactions you must use

Hosted Checkout Pages.

-PayPal Payments Pro

Transactions submitted by PayPal Payments Pro customers are processed through the

Gateway with PayPal acting as the merchant bank. PayPal Payments Pro users can use all

of the Gateway features supported by PayPal. These users will see the following in the

Service Summary box in PayPal Manager:

PayPal Payments Pro with Hosted Checkout Pages & Payflow SDK/API (Full Access)

Gateway Developer Guide and Reference 07 February 2013 17

Preface

Revision History

Revision History

Revision History for the Gateway Developer Guide and Reference:

Date Description

28 Jan 2013 Added a new Appendix on Payflow Header Parameters.

Added information about duplicate parameters in the

Name-Value Parameter Syntax Guidelines.

In the Hosted Pages Chapter, added the Passing Other

Data to Your Server Using Post or Silent Post section,

and clarified that Silent Posts are returned for both

approved and declined transactions.

Updated the Payflow Link legacy parameters and the

equivalent Payflow parameters parameter table.

Removed legacy Payflow Link parameters with

identical Payflow equivalents.

Updated the description of the BILLTOSTATE and

SHIPTOSTATE parameters in the Core Credit Card

Parameters table.

Added a note to the introduction of the Submitting

Credit Card Transactions chapter.

Revised the introduction to the Payflow SDK chapter.

Updated some of the external links in the guide.

Corrected the format of the ORDERDATE parameter in

TSYS Acquiring Solutions Level 3 Visa Extended Data.

28 Dec 2012 Updated the description of the Driver’s Licencse - DL

field in Required TeleCheck Parameters.

11 Dec 2012 Added info on forcing the Cancel URL with layout

template C to Configuring Hosted Pages Using PayPal

Manager.

Added Secure Token error codes to Secure Token Errors

and to RESULT Values and RESPMSG Text.

04 Oct 2012 Added a new section on Hosted Pages and Mobile

Browsers and updated the Configuring Hosted

Checkout Pages chapter.

Added a new section: Supported Languages.

Added a new section: Using the PARMLIST Parameter.

Added information to the Host URL Addresses section.

29 Aug 2012 Added the Payflow Gateway MagTek Parameters

Appendix.

31 July 2012 Added a list of Setup Params and Customize Params.

These parameters override PayPal Manager settings for

Hosted Pages.

Preface

Revision History

18 07 February 2013 Gateway Developer Guide and Reference

Briefly explained the differences between Submitting

Credit Transactions and Submitting Void Transactions.

Updated the parameters in the Payflow Link legacy

parameters and the equivalent Payflow parameters

table.

Added DATE_TO_SETTLE to Credit Card Transaction

Responses parameters table.

Added a note to the About Credit Card Processing

section.

23 July 2012 Added the Bill Me Later feature to the Gateway Product

Details section.

16 July 2012 Updated required value for BILLTOCITY,

BILLTOSTATE & BILLTOCOUNTRY in PayPal Credit

Card Transaction Request Parameters table.

June 2012 Who Should Use This Document section added to the

Preface.

Integrating the Secure Token Without the Hosted

Checkout Pages: Transparent Redirect section:

corrected value of SILENTTRAN to “True”

Silent Posts section added to Hosted Checkout Pages

chapter.

ISO Country Codes: removed the legacy paramater

CORPCOUNTRY

May 2012 Added new sections to the Testing Transactions

chapter:

Testing Address Verification ServiceTesting Card

Security Code

Added PayPal Acquirer chapter:

Contains links to PayPal API Ref country and currency

codes

May 2012 (cont.) Document maintenance: Added cross-references and

external links; reorganized content; removed no longer

applicable content.

April 2012 Added new transaction type:

Balance Inquiry(TRXTYPE=B) can be used to obtain

the balance of a pre-paid card.

Date Description

Gateway Developer Guide and Reference 07 February 2013 19

Preface

Revision History

Updated TeleCheck chapter:

Updated MICR values in Testing TeleCheck

Transactions section

Added TeleCheck Adjustment Response Code Values

table

Updated parameters and examples:

Added a description for response parameters

HOSTCODE, RESPTEXT, PROCCARDSECURE,

ADDLMSGS and an explanation on how to use these

parameters to obtain the processor’s raw response codes

and response messages.

Changed Litle parameters from STREET2,STREET3 to

BILLTOSTREET2, BILLTOSTREET3

Corrected description of MERCHSVC parameter for

FDMS North, Heartland, Litle, Merchant e-Solutions,

Paymentech Salem

Updated examples and removed legacy parameters to

include:FIRSTNAME, LASTNAME, STREET, CITY,

STATE, ZIP, COUNTRY

Updated processor and entity names:

Vantiv, previously known as Fifth Third Processing

Solutions

PayPal Australia, previously known as First Data

Australia

January 2012 Added new processors:

First Third International

Heartland Payment Systems

Planet Payment

SecureNet

TeleCheck

WorldPay

Added new transaction types:

TRXTYPE=L can be used to upload credit card data,

easing PCI compliance. You can store the resulting

PNREF locally for use in performing reference

transactions.

Date Description

Preface

Revision History

20 07 February 2013 Gateway Developer Guide and Reference

January 2012 (cont.) Added request NVPs:

ADDLAMTn

ADDLAMTTYPEn

AUTHDATE

CATTYPE

CONTACTLESS

CUSTDATA

CUSTOMERID

CUSTOMERNUMBER

DISCOUNT

DUTYAMT

DLNAME

DLNUM

DOB

L_ALTTAXAMTn

L_ALTTAXIDn

L_ALTTAXRATEn

L_CARRIERSERVICELEVELCODEn

L_COMMCODEn

L_EXTAMTn

L_PRODCODEn

L_TAXTYPEn

ORDERID

MERCHANTDESCR

MERCHANTINVNUM

MERCHANTNAME

MERCHANTURL

MERCHANTVATNUM

MERCHANTZIP

MISCDATA

REPORTGROUP

SILENTTRAN

STREET3

VATINVNUM

VATTAXAMT

VATTAXRATE

Added response NVPs:

DUPLICATE (response)

EXTRMSG (response)

Date Description

Gateway Developer Guide and Reference 07 February 2013 21

Preface

Revision History

January 2012 (cont.) Added concepts:

Gateway Product Solutions - PayPal Payments

Advanced, PayPal Payments Pro, Payflow Pro, Payflow

Link

Transaction Flow

Transparent Redirect

February 2011 First publication.

Date Description

Preface

Revision History

22 07 February 2013 Gateway Developer Guide and Reference

Gateway Developer Guide and Reference 07 February 2013 23

1Introducing the Gateway

Checkout Solutions

The Gateway provides checkout solutions for novice and advanced use. It provides merchants

with a rich set of options to handle payment transactions.

-“About the Gateway Checkout Solutions” on page 23

-“About the Gateway Transaction Flow” on page 25

-“About Security” on page 26

-“Processing Platforms Supporting Card-Present Transactions” on page 28

-“Supported Payment Types” on page 29

-“Recurring Billing Service” on page 30

About the Gateway Checkout Solutions

Gateway checkout consists of the following four solutions:

-Payflow Link

-Payflow Pro

-PayPal Payments Advanced

-PayPal Payments Pro

Summary of the Gateway Checkout Solutions

Below is a basic comparison of the Gateway checkout solutions:

-Payflow Link uses hosted checkout pages to send transactions to a supported processor.

Merchants can use the Payflow SDK APIs to perform all transactions except authorization

and sale transactions. By using hosted pages with a secure token, the merchant adheres to

compliance rules for handling customer data in a secure way: data is stored on PayPal so

that it is not exposed to compromise.

-Payflow Pro can send transactions to a number of different supported processors,

requirements for which are described in this documentation. Merchants select a supported

processor and obtain an acquiring bank. Typically merchants integrate with, and have full

access to, the Payflow SDK or use HTTPS to send transactions to the processor. Using

hosted pages is an option.

-PayPal Payments Advanced uses web pages hosted by PayPal (also known as hosted

checkout pages) to send transactions to the PayPal processor. With PayPal Payments

Advanced, PayPal is the acquiring bank. By using hosted checkout pages with a secure

Introducing the Gateway Checkout Solutions

About the Gateway Checkout Solutions

1

24 07 February 2013 Gateway Developer Guide and Reference

token, the merchant adheres to compliance rules for handling customer data in a secure

way: data is stored on PayPal so that it is not exposed to compromise.

-Like PayPal Payments Advanced, PayPal Payments Pro sends transactions to the PayPal

processor and PayPal is the acquiring bank. Using hosted checkout pages is an option.

Typically merchants integrate with the Payflow SDK or use HTTPS to send transactions to

the PayPal processor.

NOTE:PayPal strongly recommends that all users of Gateway checkout solutions take

advantage of the secure token and the hosted checkout pages. Doing so provides

automatic compliance with processing card industry (PCI) standards for protecting

cardholder data.

Gateway Product Details

The table below compares how the Gateway checkout solutions support payment processing

features.

Feature

PayPal Payments Advanced

Payflow Link

PayPal Payments Pro

Payflow Pro

Hosted checkout page (including an

iFrame version)

Yes Yes

PayPal payments Included Optional

Bill Me Later payments

(Available to US merchants only on

Hosted checkout pages.)

Included Optional

PayPal branding on full page templates Yes Optional

Transparent Redirect No Yes

Supports PayPal as a processor and an

acquirer

Yes Yes

Credit and debit cards Yes Yes

Level 2 and Level 3 purchase cards Yes Yes

TeleCheck (guaranteed electronic

checks)

No Yes

ACH (electronic checks) No Yes

Virtual Terminal support, including

card-present data passage

Yes Yes

Virtual Terminal Payflow Link only Yes

API Limited access (no authorization

or sale)

Full access

Gateway Developer Guide and Reference 07 February 2013 25

Introducing the Gateway Checkout Solutions

About the Gateway Transaction Flow 1

About the Gateway Transaction Flow

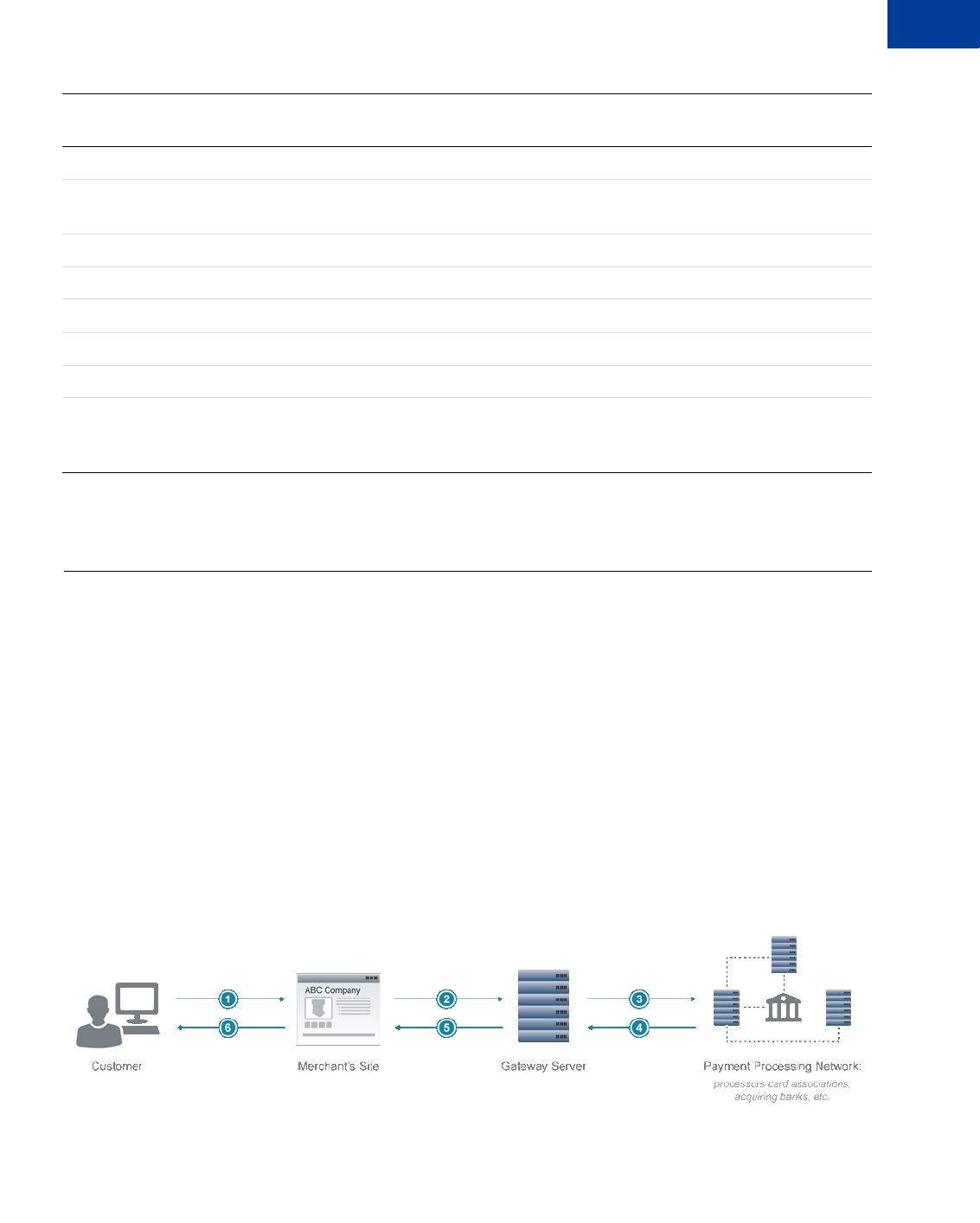

The traditional transaction flow is as follows. Numbers correspond to numbers in the figure.

1. At your website, the customer clicks Buy to purchase merchandise.

2. You send the transaction request to the Gateway server.

3. The Gateway sends the transaction to the payment processing network.

4. Your processor sends the response back to the Gateway server and processes the

transaction (obtains the payment from the customer bank and deposits it in the merchant

bank).

5. The Gateway server returns the response to your website.

6. Your website displays the result to the customer.

You can use the core transaction parameters supported by all Gateway processors described in

this dcumentation to send transaction data to your processor. In addition:

Reference transactions (Tokenization) Yes Yes

Secure token to preset hosted checkout

page

Yes Yes

Reporting APIs Yes Yes

Desktop integration Yes Yes

Recurring billing Yes Yes

Basic fraud protection Yes Yes

Advanced fraud protection Yes Yes

Partner/channel distribution support

(Partner Manager, registration, XML

registration) resale and referral

Yes Yes

Feature

PayPal Payments Advanced

Payflow Link

PayPal Payments Pro

Payflow Pro

Introducing the Gateway Checkout Solutions

About Security

1

26 07 February 2013 Gateway Developer Guide and Reference

-Each Gateway processor may support various additional parameters beyond the core set

that you can send in transaction requests.

-Your processor may also support purchasing cards (credit cards employers issue for

business-related charges). Purchasing card Level 2 and Level 3 parameters provide

specialized reporting so an employer can monitor card use. The parameter information may

appear on the customer’s statement or describe line items in greater detail. Be sure to check

for your processor’s Level 2 and 3 parameters in this documentation.

The sections in this documentation describing the above parameters alphabetically organize

parameters by processor name.

About Security

It is your responsibility to adhere to PCI compliance standards to protect personal information

and implement security safeguards on your website when processing payment card

transactions.

Gateway solutions make available a secure token and hosted checkout pages to help you meet

PCI compliance. Hosted pages are optional to PayPal Payments Pro and Payflow Pro users. If

you do not use a secure token or hosted pages, you must provide your own means of meeting

compliance requirements.

NOTE:PayPal Payments Advanced and Payflow Link merchants are required to use hosted

pages.

Secure Token

The secure token stores request transaction data on the Gateway server. It eliminates the need

to resend the parameter data for display in a hosted checkout page where the data might be

subject to compromise.

Hosted Checkout Pages

The Gateway enables the use of hosted checkout pages, which help you achieve PCI

compliance. The hosted checkout pages enable you to pass transaction data securely to the

server and to collect credit card acceptance data.

NOTE:You are required to use hosted pages with PayPal Payments Advanced and Payflow

Link.

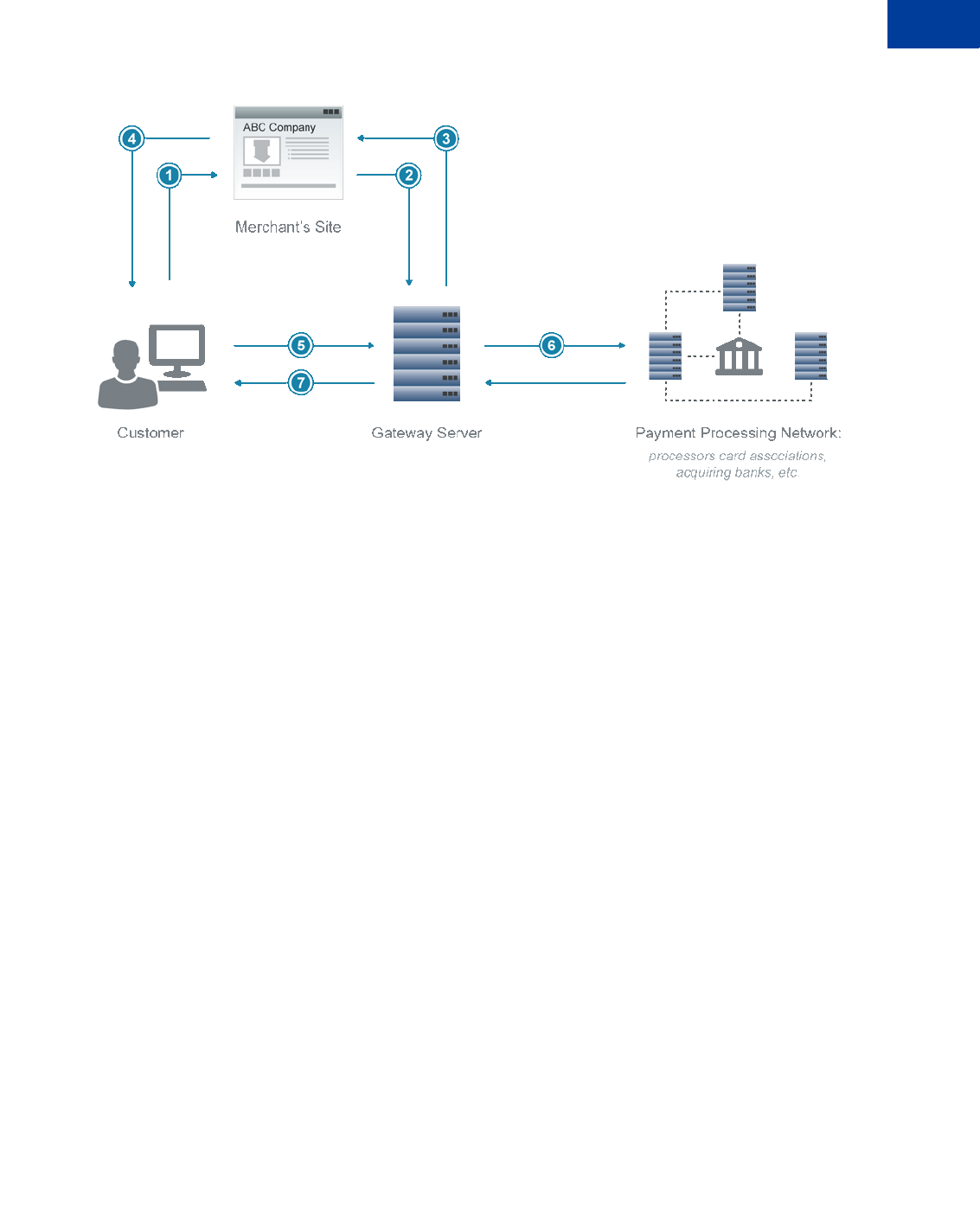

The following figure shows the transaction flow when using hosted pages and a secure token.

Gateway Developer Guide and Reference 07 February 2013 27

Introducing the Gateway Checkout Solutions

About Security 1

Numbers in the figure correspond to the numbered comments below:

1. The customer clicks Buy to purchase merchandise on your website.

2. You request a secure token by passing a token ID to the Gateway server.

3. The Gateway server returns the secure token and your token ID to your website.

4. You submit the secure token and token ID in an HTTP post to pages hosted on the Gateway

server and redirect the customer’s browser to the hosted pages.

5. The Gateway server uses the secure token to retrieve the amount and other transaction data.

The customer submits their credit card number, expiration date, and other sensitive data

directly to the host pages rather than to your website, easing your PCI compliance

requirements.

6. The Gateway processes the payment through the payment processing network.

7. The Gateway server transparently returns the customer to the location on your website that

you specified in the request to obtain a secure token. You display the results to the

customer on your website.

NOTE:If you do not get a response from the Gateway server, submit an Inquiry transaction,

passing in the secure token to see if the transaction has completed. For details, see

“Submitting Inquiry Transactions” on page 69.

PCI Compliance Without Hosted Pages: Transparent Redirect

PayPal Payments Pro and Payflow Pro merchants who want PCI compliance while

maintaining full control over designing and hosting checkout pages on their website can use

Transparent Redirect. Transparent Redirect posts payment details silently to the Gateway

server, so this sensitive information never goes through the merchant’s website.

Introducing the Gateway Checkout Solutions

Processing Platforms Supporting Card-Present Transactions

1

28 07 February 2013 Gateway Developer Guide and Reference

Implementing Transparent Redirect is very similar to implementing hosted pages. It differs

only in the steps shown in boldface below:

1. The customer clicks Buy to purchase merchandise on your website.

2. You request a secure token by passing a secure token ID to the Gateway server. In the

request, you pass the name-value pair, SILENTTRAN=TRUE. This name-value pair

prevents the hosted pages from displaying.

3. The Gateway server returns the secure token and your token ID to your website.

4. You display the credit card fields to the customer in a checkout page on your website.

5. The customer enters their credit card number, expiration date, and other sensitive

data into the credit card fields and clicks Submit. The browser posts the payment data

directly to the Gateway server, avoiding your website and easing your PCI

compliance requirements.

NOTE:To ensure that the post goes from the browser directly to PayPal and not back to

your website, you should add scripting.

6. The Gateway processes the payment through the payment processing network.

7. The Gateway server transparently sends the customer to the location on your website that

you specified in the request to obtain a secure token. You display the results to the

customer on your website.

Processing Platforms Supporting Card-Present Transactions

The following processing platforms support card-present transactions.

American Express

American Express APAC

Elavon

First Data Merchant Services (FDMS) Nashville

First Data Merchant Services (FDMS) North

First Data Merchant Services (FDMS) South

Global Payments Central

Global Payments East

Heartland Payment Systems

Litle

Merchant e-Solutions

Gateway Developer Guide and Reference 07 February 2013 29

Introducing the Gateway Checkout Solutions

Supported Payment Types 1

Supported Payment Types

Supported Languages

The Payflow Gateway only supports customer input and API parameter values that are in

regular ASCII (English language) characters. Payflow does not support extended ASCII

characters or any other character sets other than regular ASCII at this time. Additionally, the

Payflow hosted checkout pages and PayPal manager account settings pages are available in

English only. For information on a similar PayPal product that offers multi-lingual support, see

Website Payments Pro Hosted Solution.

Moneris Solutions

Paymentech Salem

Paymentech Tampa

PayPal

SecureNet

TeleCheck

TSYS Acquiring Solutions

Van t iv

WorldPay

Credit cards

PayPal (supported by PayPal’s Express Checkout product)

Pinless debit cards

Electronic checks

Check cards

Purchasing cards (also referred to as commercial cards, corporate cards, procurement cards, or business cards)

Level 2 and Level 3

Automated Clearing House (ACH). For information on performing ACH transactions, contact your PayPal Sales

Representative.

Introducing the Gateway Checkout Solutions

Recurring Billing Service

1

30 07 February 2013 Gateway Developer Guide and Reference

Recurring Billing Service

The Recurring Billing Service is a scheduled payment solution that enables you to

automatically bill your customers at regular intervals—for example, you can bill your

customers a monthly fee of $42 for 36 months with an initial fee of $129.

You enroll separately for the Recurring Billing Service. You can learn about the Recurring

Billing Service in the Payflow Pro – Recurring Billing Service User’s Guide. If you already have

this service, this user guide will show you how to define and manage recurring transactions

programmatically. You can also manage Recurring Billing tasks in PayPal Manager.

Fraud Protection Service

Fraud Protection Services can help you significantly reduce the cost of fraud and the resulting

damage to your business. This service uses Fraud Protection filters to help protect you from

fraudsters using stolen or false credit card information. These filters identify potentially

fraudulent activity and let you decide whether to accept or reject the suspicious transaction.

Fraud Protection Service can also minimize the risk of hacking your customer database by

enabling you to place powerful constraints on access to and use of your PayPal Manager and

Payflow Gateway accounts.

You enroll separately for the Fraud Protection Service. You can learn more about Fraud

Protection Service in the Payflow Pro Fraud Protection Services User’s Guide. If you already have

this service, this user guide will show you how to setup Fraud Protection filters. You can also

manage some aspects of your Fraud Protection Service in PayPal Manager.

Gateway Developer Guide and Reference 07 February 2013 31

2Secure Token

This section describes the secure token.

-“Secure Token” on page 31

-“Integrating the Secure Token With the Hosted Checkout Pages” on page 31

-“Integrating the Secure Token Without the Hosted Checkout Pages: Transparent Redirect”

on page 32

-“Posting To the Hosted Checkout Page” on page 34

-“Using the PARMLIST Parameter” on page 44

About the Secure Token

Use a secure token to send non-credit card transaction data to the Gateway server for safer

storage. The secure token prevents anyone from intercepting or manipulating the data. You

must use a secure token if you use hosted checkout pages. The token is good for a one-time

transaction and is valid for 30 minutes.

NOTE:PayPal Payments Pro and Payflow Pro merchants who do not use a secure token must

host their own payment pages. When hosting your own pages, you are responsible for

meeting PCI requirements by handling data securely. PayPal Payments Advanced and

Payflow Link merchants must use a secure token with hosted checkout pages.

To obtain a secure token, pass a unique, 36-character secure token ID and set

CREATESECURETOKEN=Y in a request to the Gateway server. The Gateway server associates

your ID with a secure token and returns the token as a string of up to 32 alphanumeric

characters.

To pass the transaction data to the hosted checkout page, you pass the secure token and secure

token ID in an HTTP form post. The token and ID trigger the Gateway server to retrieve your

data and display it for customer approval.

NOTE:You cannot modify the data sent with a secure token, with one exception. You can

configure PayPal Manager to allow you to modify billing and shipping information.

Integrating the Secure Token With the Hosted Checkout Pages

To create a secure token, pass all parameters that you need to process the transaction except

for payment details parameters such as the credit card number, expiration date, and check

number. For details on transaction parameters, see “Submitting Credit Card Transactions” on

page 55. In addition, pass the following Payflow parameters to create the secure token.

Secure Token

Integrating the Secure Token Without the Hosted Checkout Pages: Transparent Redirect

2

32 07 February 2013 Gateway Developer Guide and Reference

NOTE:The secure token is valid for 30 minutes, and you can only use it one time. If you

attempt to use the token after the time limit has expired, your transaction will fail with

Result value 7, “Secure Token Expired.” If you attempt to reuse the token, you receive

an error.

1. Set SECURETOKENID to a unique alphanumeric value up to 36 characters in length.

SECURETOKENID=9a9ea8208de1413abc3d60c86cb1f4c5

2. Set CREATESECURETOKEN to the value Y to request that Payflow gateway return a token.

CREATESECURETOKEN=Y

Secure Token Example

The following is an example of a request parameter string that creates a secure token.

TRXTYPE=A&BILLTOSTREET=123 Main St.&BILLTOZIP=95131&AMT=23.45&CURRENCY=USD&

INVNUM=INV12345&PONUM=PO9876&CREATESECURETOKEN=Y&SECURETOKENID=9a9ea8208de1

413abc3d60c86cb1f4c5

The Gateway server returns SECURETOKEN and SECURETOKENID in the response. A tag

follows the SECURETOKEN to indicate the length of the token value returned.

RESULT=0&RESPMSG=Approved&SECURETOKEN[25]=Fj+1AFUWft0+I0CUFOKh5WA==&SECURET

OKENID=9a9ea8208de1413abc3d60c86cb1f4c5

Integrating the Secure Token Without the Hosted Checkout

Pages: Transparent Redirect

To use your own checkout pages while complying with PCI guidelines (sending the

customer’s sensitive data directly to the Gateway server), pass all parameters that you need to

process the transaction except for sensitive payment details such as the credit card number,

expiration date, and check number. For details on sending transactions, see “Submitting Credit

Card Transactions” on page 55.

In addition, pass the following 3 Payflow parameters in your request. The first 2 parameters

obtain a secure token. The third parameter implements Transparent Redirect, which

suppresses hosted pages.

NOTE:The secure token is valid for 30 minutes, and you can only use it one time. If you

attempt to use the token after the time limit has expired, your transaction will fail with

Result value 7, “Secure Token Expired.” If you attempt to reuse the token, you receive

an error.

1. Set SECURETOKENID to a unique alphanumeric value up to 36 characters in length.

SECURETOKENID=9a9ea8208de1413abc3d60c86cb1f4c5

Gateway Developer Guide and Reference 07 February 2013 33

Secure Token

Secure Token Errors 2

2. Set CREATESECURETOKEN to the value Y to request that the Gateway server return a token.

CREATESECURETOKEN=Y

3. Set SILENTTRAN to the value TRUE to suppress the display of hosted pages.

SILENTTRAN=TRUE

Transparent Redirect Example

The following is an example of an authorization parameter string that suppresses hosted pages.

TRXTYPE=A&BILLTOSTREET=123 Main St.&BILLTOZIP=95131&AMT=24.35&INVNUM=INV123

45&PONUM=PO12345&CURRENCY=USD&CREATESECURETOKEN=Y&SECURETOKENID=9a9ea8208de

1413abc3d60c86cb1f4c5&SILENTTRAN=TRUE

The Gateway server returns a SECURETOKEN and SECURETOKENID in the response. A tag

follows the SECURETOKEN to indicate the length of the token value returned.

RESULT=0&RESPMSG=Approved&SECURETOKEN[25]=Fj+1AFUWft0+I0CUFOKh5WA==&SECURET

OKENID=9a9ea8208de1413abc3d60c86cb1f4c5

When the customer enters their sensitive data into the credit card fields on your website and

clicks Submit, the browser posts the data to the Gateway server rather than to your website.

NOTE:It is highly recommended that you add scripting to ensure the the browser posts the

sensitive data directly to the PayPal Gateway server rather than to your website.

If you are using the PARMLIST parameter with the Transparent Redirect, see “Using the

PARMLIST Parameter” on page 44 for more information.

Secure Token Errors

A successful Payflow transaction will return RESULT=0 in the response. If your Secure Token

transaction is unsuccessful, you can pass the token 2 more times to Payflow before the token

expires.

A Payflow Secure Token will expire:

-If the same Secure Token is passed to Payflow a total of 3 times.

-20 minutes after the Secure Token was generated.

-When the token is used in a successful transaction.

If you receive one of the following error codes in the RESULT response parameter, then your

Secure Token has expired.

Secure Token

Posting To the Hosted Checkout Page

2

34 07 February 2013 Gateway Developer Guide and Reference

If you see a different error code in the RESULT parameter, refer to the RESULT Values and

RESPMSG Text section for more information.

Posting To the Hosted Checkout Page

To display the transaction information to the Gateway hosted checkout page, you perform an

HTTP form post.

1. Direct the HTTP post to the Gateway applications server at the following URL.

https://payflowlink.paypal.com

2. Send the following parameter data:

–SECURETOKEN returned in the transaction response

–SECURETOKENID

HTTP Form Post Examples

The following is an example request string that displays the transaction information to the

hosted checkout page.

<html>

<head>

<title>PageTitle</title>

</head>

<body>

<form method="post" action="https://payflowlink.paypal.com">

<input type=hidden value="Fj+1AFUWft0+I0CUFOKh5WA=="

name=SECURETOKEN/>

<input type=hidden value="9a9ea8208de1413abc3d60c86cb1f4c5"

name=SECURETOKENID/>

</form>

</body>

</html>

160 Secure Token already been used. Indicates that the secure token has expired due to

either a successful transaction or the token has been used three times while trying to

successfully process a transaction. You must generate a new secure token.

161 Transaction using secure token is already in progress. This could occur if a

customer hits the submit button two or more times before the transaction completed.

162 Secure Token Expired. The time limit of 20 minutes has expired and the token can no

longer be used.

Gateway Developer Guide and Reference 07 February 2013 35

Secure Token

Posting To the Hosted Checkout Page 2

For more information on the Payflow parameters that are used to pass information to the

Gateway hosted checkout pages, see “Using a Secure Token to Pass Hosted Pages

Customization Parameters” on page 41

The following example uses Payflow name-value pairs to pass values in a form post to the

hosted checkout pages. For details on the name-value pair strings used in this example, see

“Sending a Simple Transaction to the Server” on page 51.

<html>

<head>

<title>PageTitle</title>

</head>

<body>

<form method="post" action="https://payflowlink.paypal.com">

<input type="text" name = "SECURETOKEN" value =

"FvwEnHTYRNUSVsZRlhFpudA=="/>

<input type="text" name = "SECURETOKENID" value =

"9a9ea8208de1413abc3d60c86cb1f4c5"/>

<input type="hidden" name="PARMLIST"

value="INVNUM[8]=INV12345&AMT[5]=25.50&CURRENCY[3]=

USD&PONUM[7]=PO12345"/>

<input type="submit"/>

</form>

</center>

</body></html>

Secure Token

Posting To the Hosted Checkout Page

2

36 07 February 2013 Gateway Developer Guide and Reference

Gateway Developer Guide and Reference 07 February 2013 37

3Configuring Hosted Checkout

Pages

This chapter describes the following:

-“Configuring Hosted Checkout Pages” on page 37

-“Configuring Hosted Pages Using PayPal Manager” on page 37

-“Using a Secure Token to Pass Hosted Pages Customization Parameters” on page 41

-“Hosted Pages and Mobile Browsers” on page 45

-“Silent Posts” on page 47

-“Passing Other Data to Your Server Using Post or Silent Post” on page 48

Configuring Hosted Checkout Pages

PayPal enables you to customize the hosted checkout pages so that they reflect the look and

feel of your website. In doing so, the buyer seamlessly transitions from your website to the

PayPal hosted checkout pages to make the payment and complete the transaction. Since the

pages are hosted on PayPal servers, you do not have to capture or store credit card information

on your website, thereby helping towards achieving PCI compliance. PayPal’s hosted

checkout pages are optimized for supported desktop and mobile browsers.

NOTE:The Payflow Gateway implementation helps to achieve PCI compliance but does not

necessarily guarantee it.

There are two ways to configure hosted checkout pages:

-Logging in to PayPal Manager and making selections

-Using a secure token and passing configuration parameters in a form post

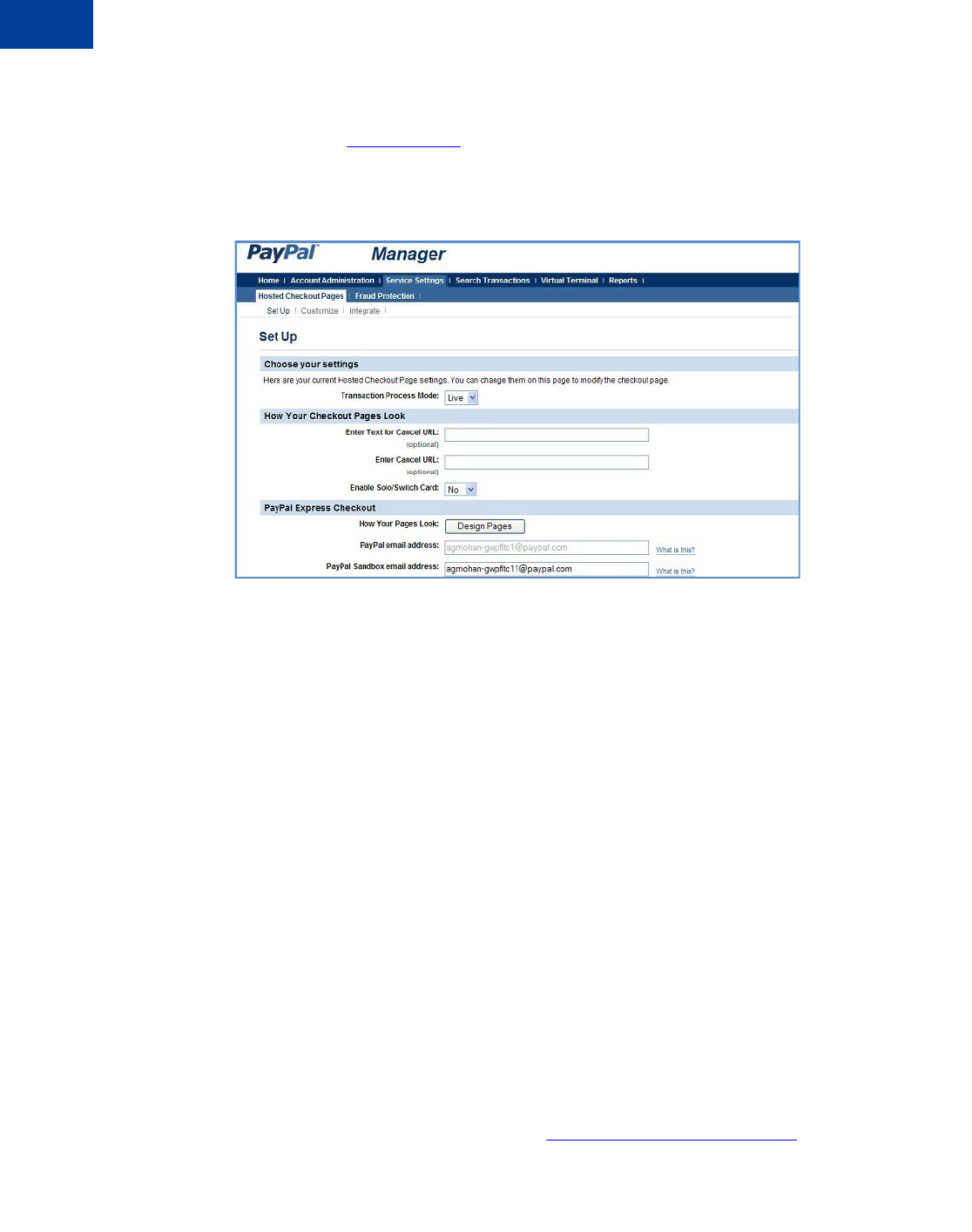

Configuring Hosted Pages Using PayPal Manager

You can specify the content of your hosted checkout pages and configure their appearance to

reflect the look and feel of your website. To do so, log into PayPal Manager and click on the

Service Settings tab. In the Hosted Checkout Pages section, you have the following options:

-Setup

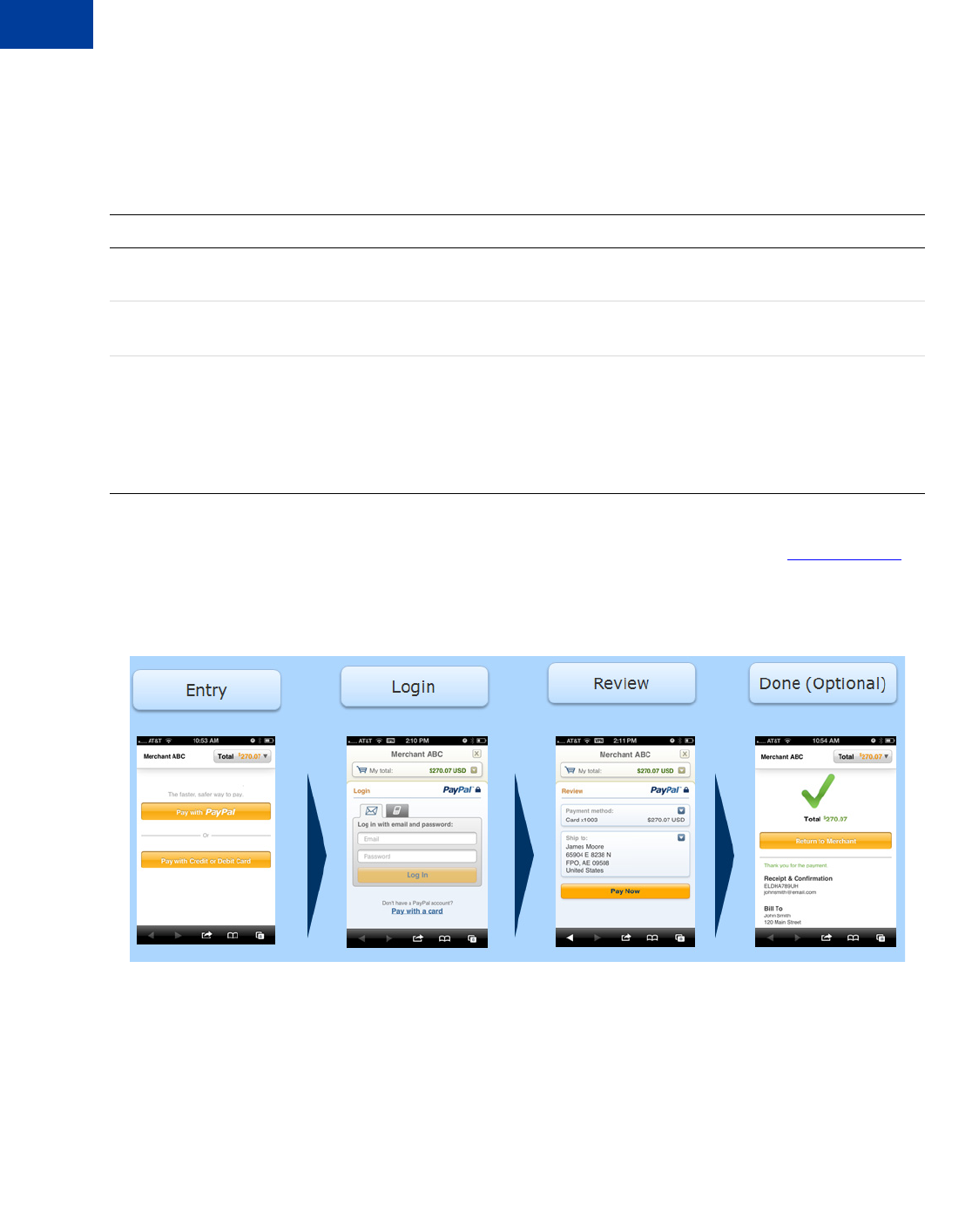

-Customize

-Integrate

Configuring Hosted Checkout Pages

Configuring Hosted Pages Using PayPal Manager

3

38 07 February 2013 Gateway Developer Guide and Reference

Setup

The Setup page in PayPal Manager enables you to select the information you want to collect

from buyers and what you want displayed on your hosted checkout pages. This includes

selecting the billing and the shipping information information fields, the payment

confirmation page settings, the confirmation email details, security options and other settings.

You can perform tasks such as:

-Configure your PayPal Express Checkout display and specify email addresses for live and

test transactions.

-Determine the cancel URL and the text of the link the buyer clicks on to cancel the

payment on your website. The cancel URL is the page to which PayPal redirects your

buyer’s browser if the buyer does not approve the payment.

NOTE:Payflow will ignore the cancel URL field that you entered in PayPal Manager if you

select layout template C. To force Payflow to use the cancel URL field with layout

template C, in PayPal Manager, add DISPLAY_URL | before your cancel URL.

Example: DISPLAY_URL | http://www.yoursite.com/home.php

-Select the billing and shipping information fields the buyer will be required to complete

during checkout.

-Choose to display a PayPal hosted payment confirmation page or host your own

confirmation page on your website. You can also specify the paypal hosted confirmation

page header and footer text and the URL and text for the return link. Additionally, you can

choose to enable the silent post feature.

-Opt to send email receipts to the buyer for each successful transaction.

For complete details on these settings, click the Help button on the Setup page. To quickly get

get started with your hosted pages, go to the Hosted Pages Getting Started Guide on the PayPal

Gateway Developer Guide and Reference 07 February 2013 39

Configuring Hosted Checkout Pages

Configuring Hosted Pages Using PayPal Manager 3

developer portal. For more information on the Silent Post feature, go to “Silent Posts” on

page 47

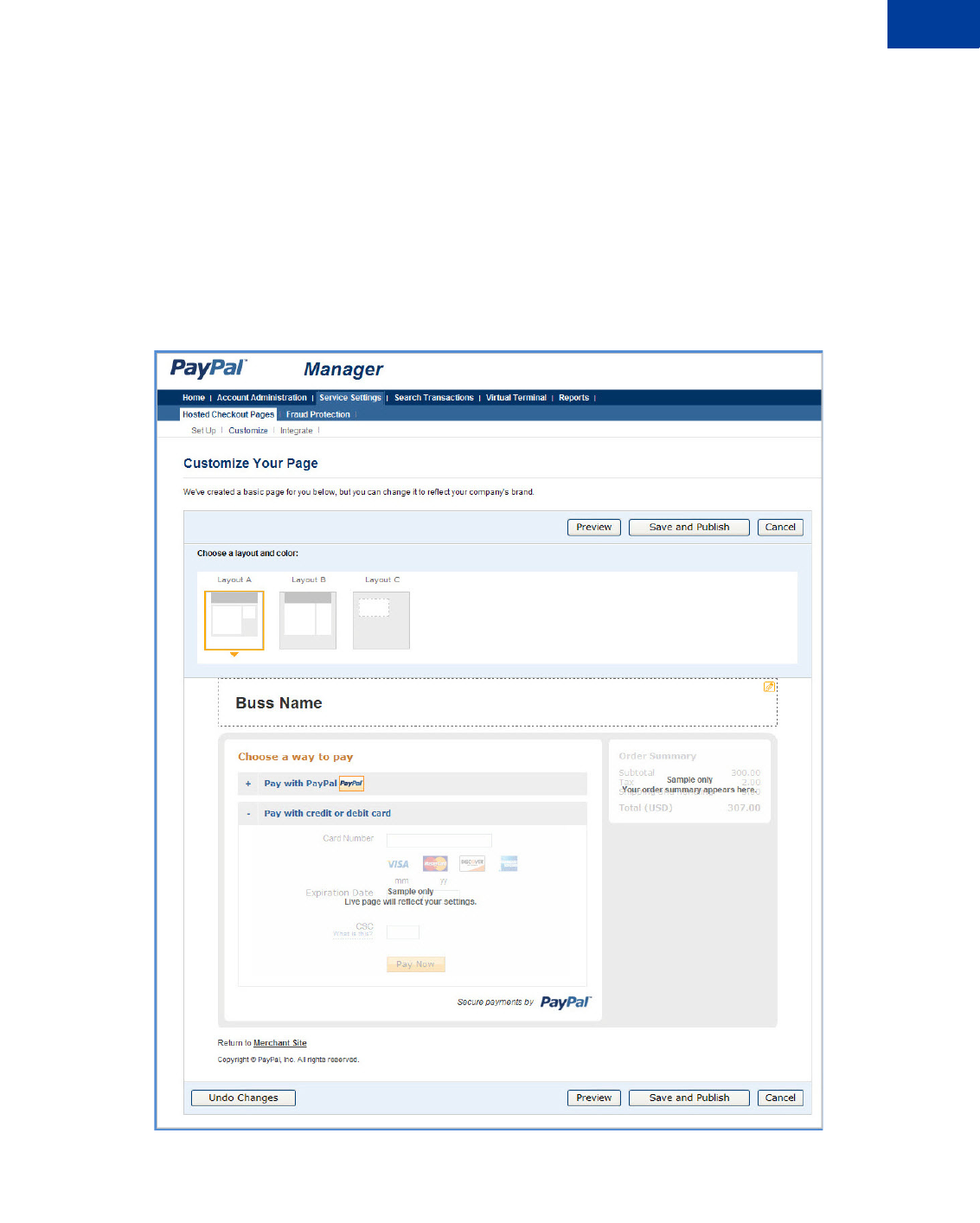

Customize

The Customize page allows you to customize the layout and appearance of your hosted

checkout page. You can customize the header, background, payment method section and the

order summary column of your payment page. PayPal offers three design layouts for you to

choose from. Layout A is the default layout but you can choose any of the three layouts

offered (Layouts A, B and C).

Configuring Hosted Checkout Pages

Configuring Hosted Pages Using PayPal Manager

3

40 07 February 2013 Gateway Developer Guide and Reference

On the Customize page, you can either change the design of your existing layout, or select and

customize a different layout. To make changes, double-click on the section of the template you

are trying to modify or the corresponding Click to Edit button for that section. In the pop-up

that appears, click the color selector to change the color, or enter the appropriate URL. The

customization options vary for the different Layouts. These options are described in greater

detail in the next section: Customizing Your Layout.

After making the changes, click one of the following buttons:

-Preview - Preview the changes you have made to your layout before saving and publishing

it

-Save and Publish - Save all the changes you have made and publish the updated layout.

Your buyers will see the updated payment page.

-Cancel - Discard all the changes you have made in this session.

-Undo Changes - Discard all changes you have made since the last time you saved the

layout. Your buyers will see the last saved layout.

NOTE:You must make all modifications (including changing layouts) within the same

session, otherwise all changes will be lost and you will have to redo your changes. If

the session times out, the design of the layout will remain at the version that was last

published.

NOTE:Payflow will ignore the cancel URL field that you entered in PayPal Manager if you

select layout template C. To force Payflow to use the cancel URL field with layout

template C, in PayPal Manager, add DISPLAY_URL | before your cancel URL.

Example: DISPLAY_URL | http://www.yoursite.com/home.php

Customizing Your Layout

You can customize the appearance of the Layout template that you selected on the customize

page. These customizations apply mostly to Layouts A and B. Layout C is embedded on a

page you host in an iFrame. So for Layout C, you already control the appearance of the page.

NOTE:These customizations are not applied to the mobile version of the hosted checkout

pages.

-Header (Applicable to Layouts A and B) - You can change the following:

– Header height (Applicable to Layouts A and B)

– Header background color (Applicable to Layout B only)

– Header font type, size (Applicable to Layouts A and B)

– Header font color (Applicable to Layout B only)

– Swap between displaying the business name or the business logo image

– Edit business name in the header (Applicable to Layouts A and B)

– Position of the business name or the logo within the header (left, centered, right)

(Applicable to Layouts A and B)

Gateway Developer Guide and Reference 07 February 2013 41

Configuring Hosted Checkout Pages

Using a Secure Token to Pass Hosted Pages Customization Parameters 3

-Page Background (Applicable to Layout B only) - You can change the following:

– Background color