Product Detail Manual

127810-Catalog 127810-Catalog 127810-Catalog 662050 Batch5 unilog cesco-content 3:

145573-Attachment 145573-Attachment 145573-Attachment 662050 Batch5 unilog cesco-content 3:

145573-Attachment 145573-Attachment 145573-Attachment 037103 Batch5 unilog cesco-content 3:

101002-Attachment 101002-Attachment 101002-Attachment 043168 Batch7 unilog cesco-content 3:

2014-09-08

: Pdf 145573-Attachment 145573-Attachment 662051 Batch5 unilog

Open the PDF directly: View PDF ![]() .

.

Page Count: 146 [warning: Documents this large are best viewed by clicking the View PDF Link!]

General Electric Company

Fairfi eld, Connecticut 06828

www.ge.com

GE 2011 Annual Report

2011 Annual Report

GE Works

3.EPC055148101A.102

150

154

180

170

147

133

139

163

155 142

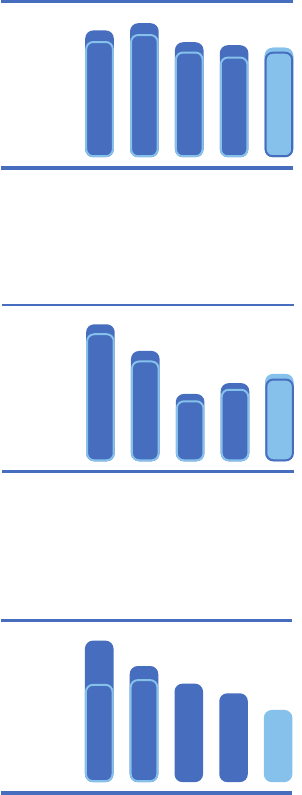

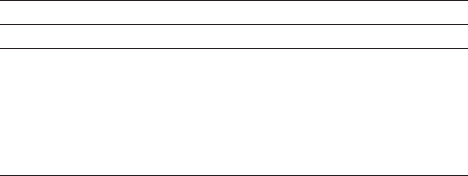

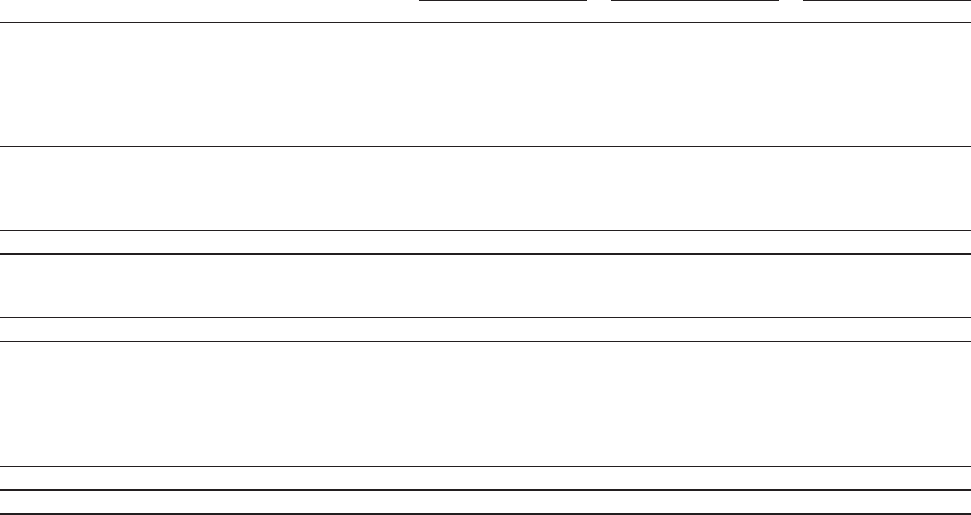

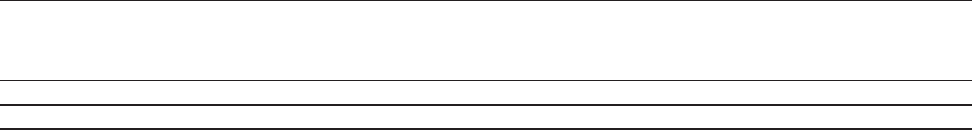

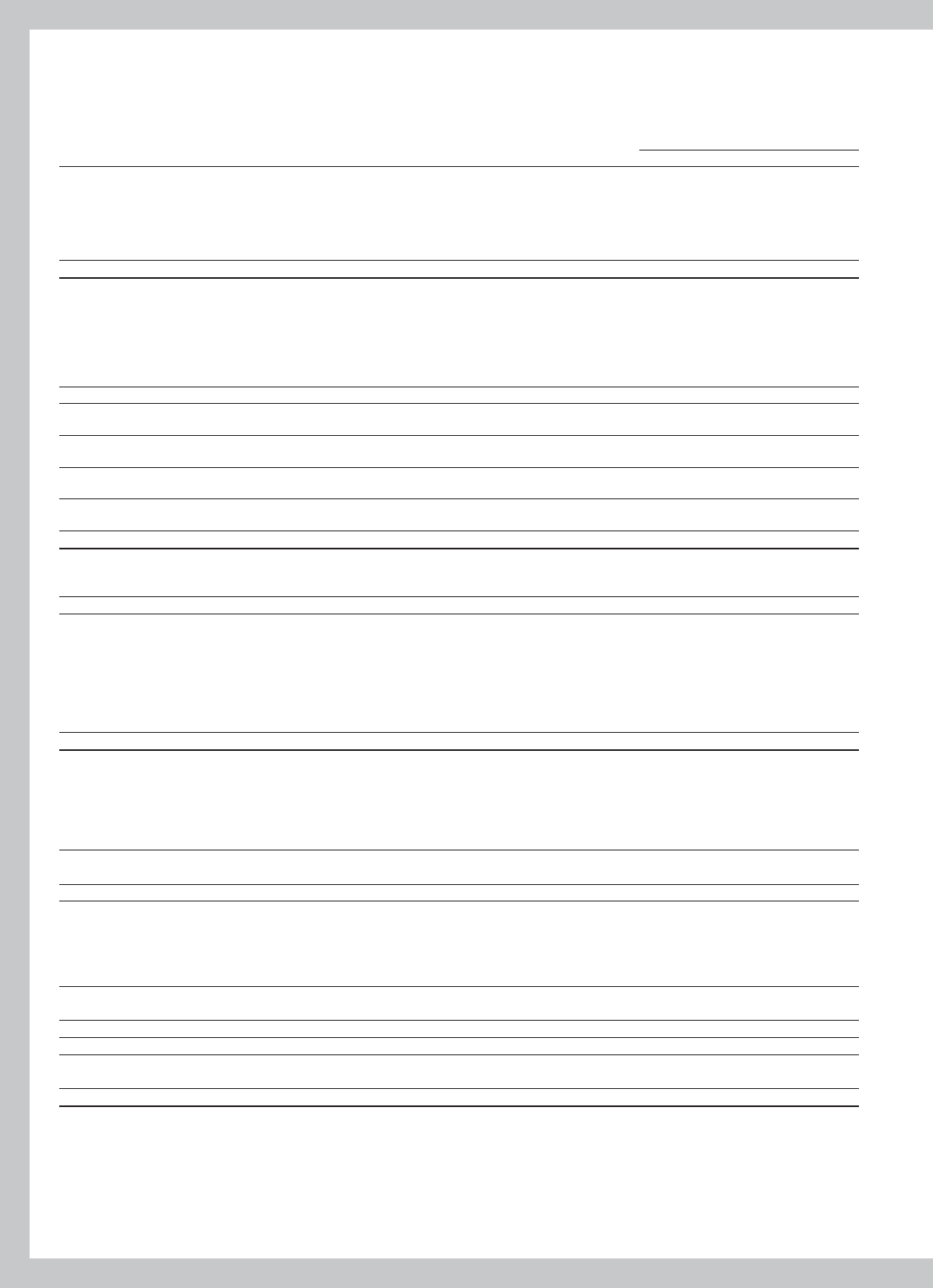

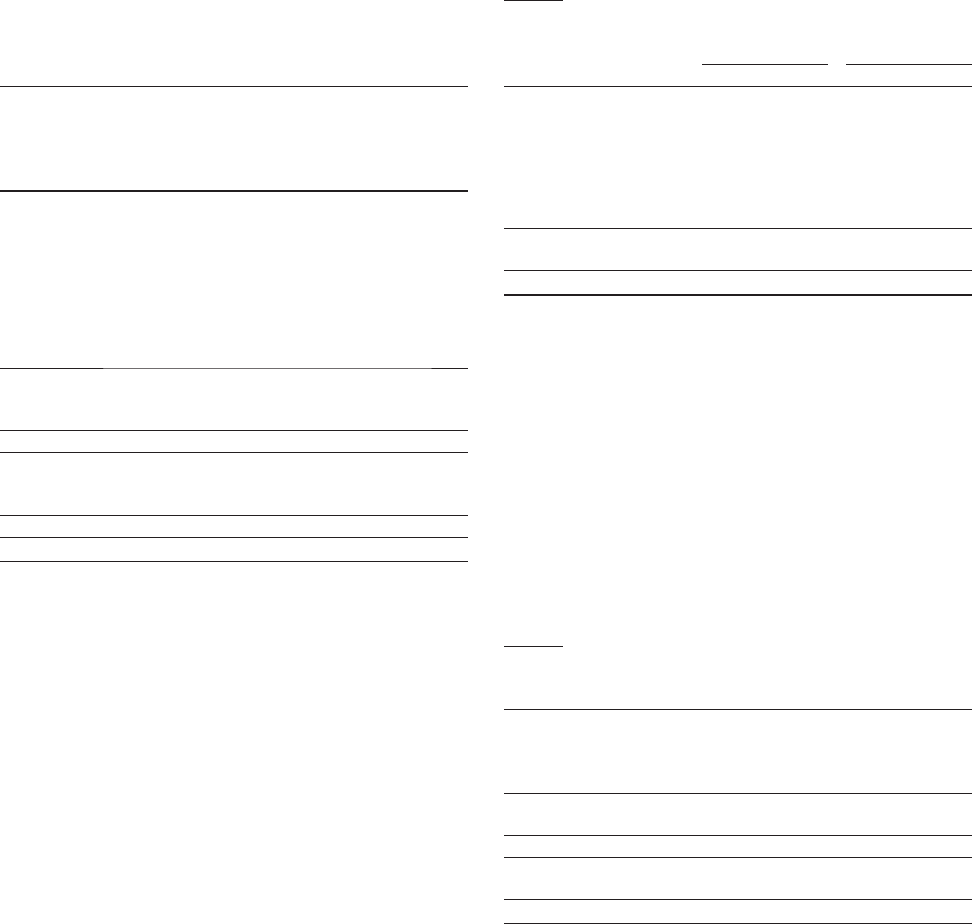

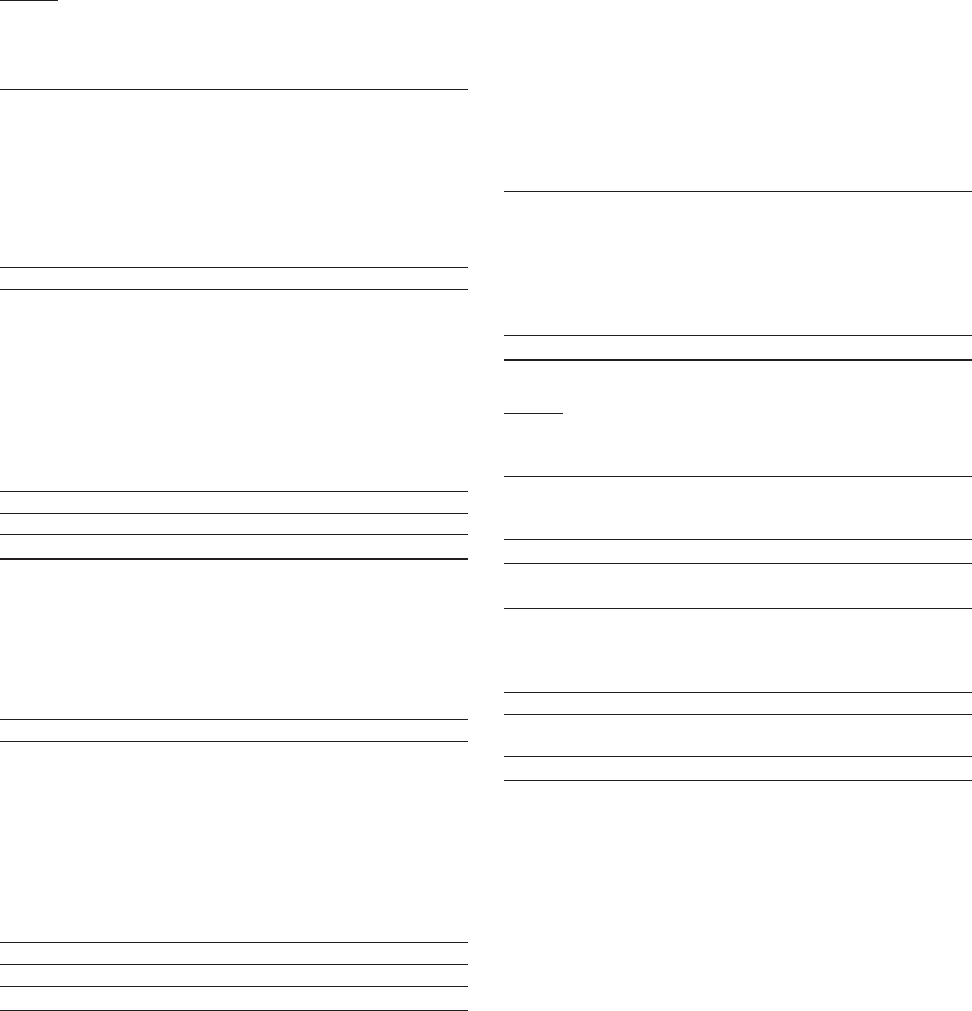

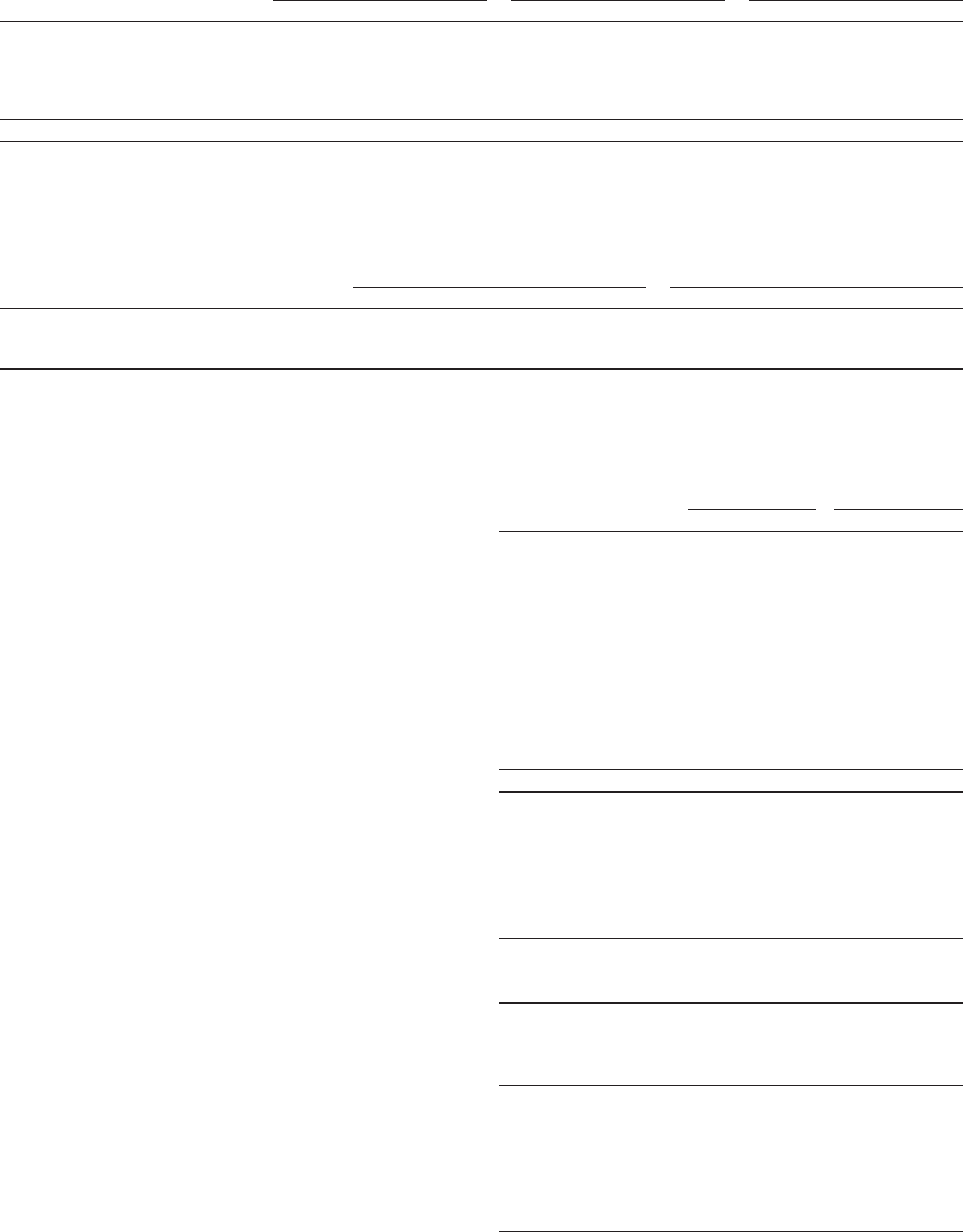

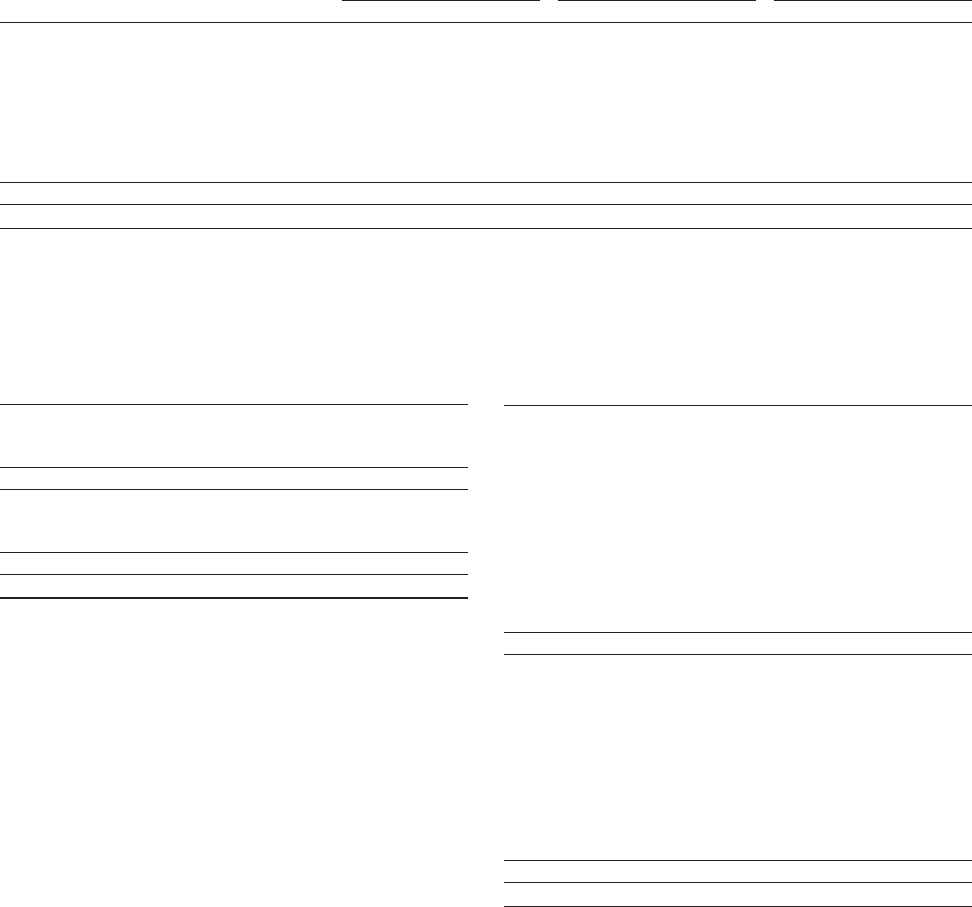

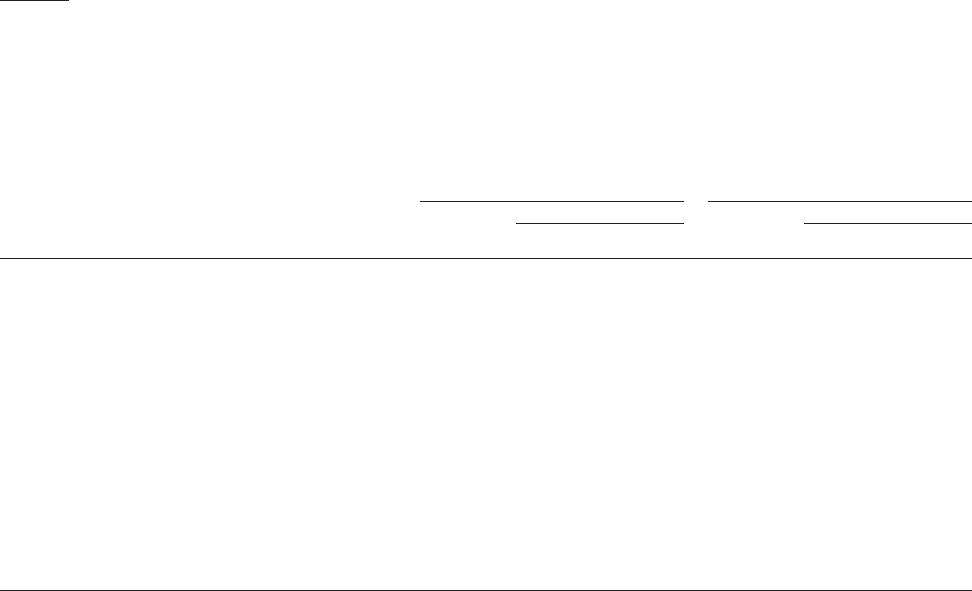

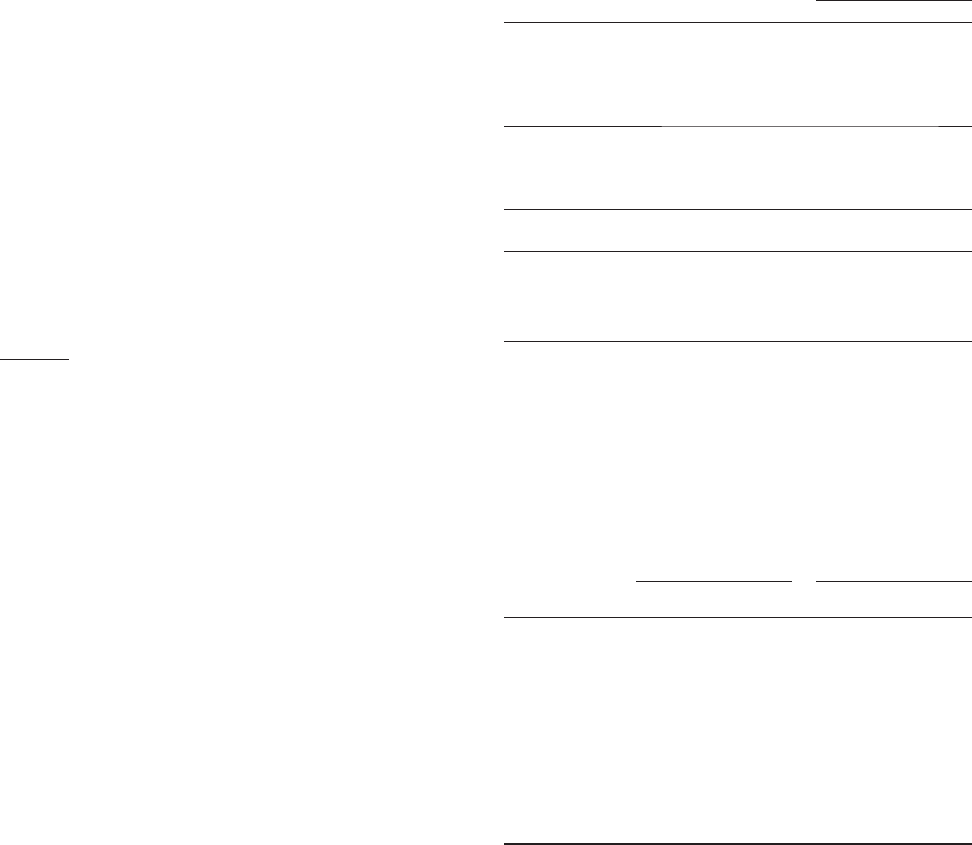

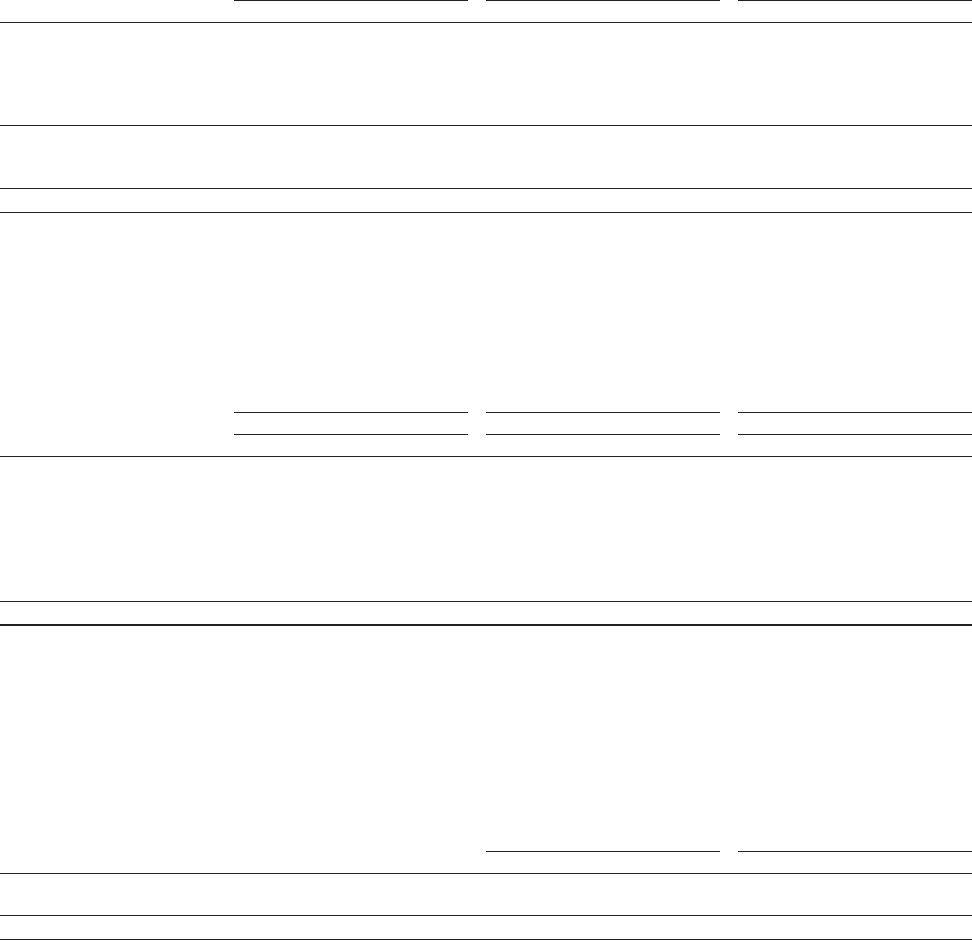

20082007 2009 2010 2011

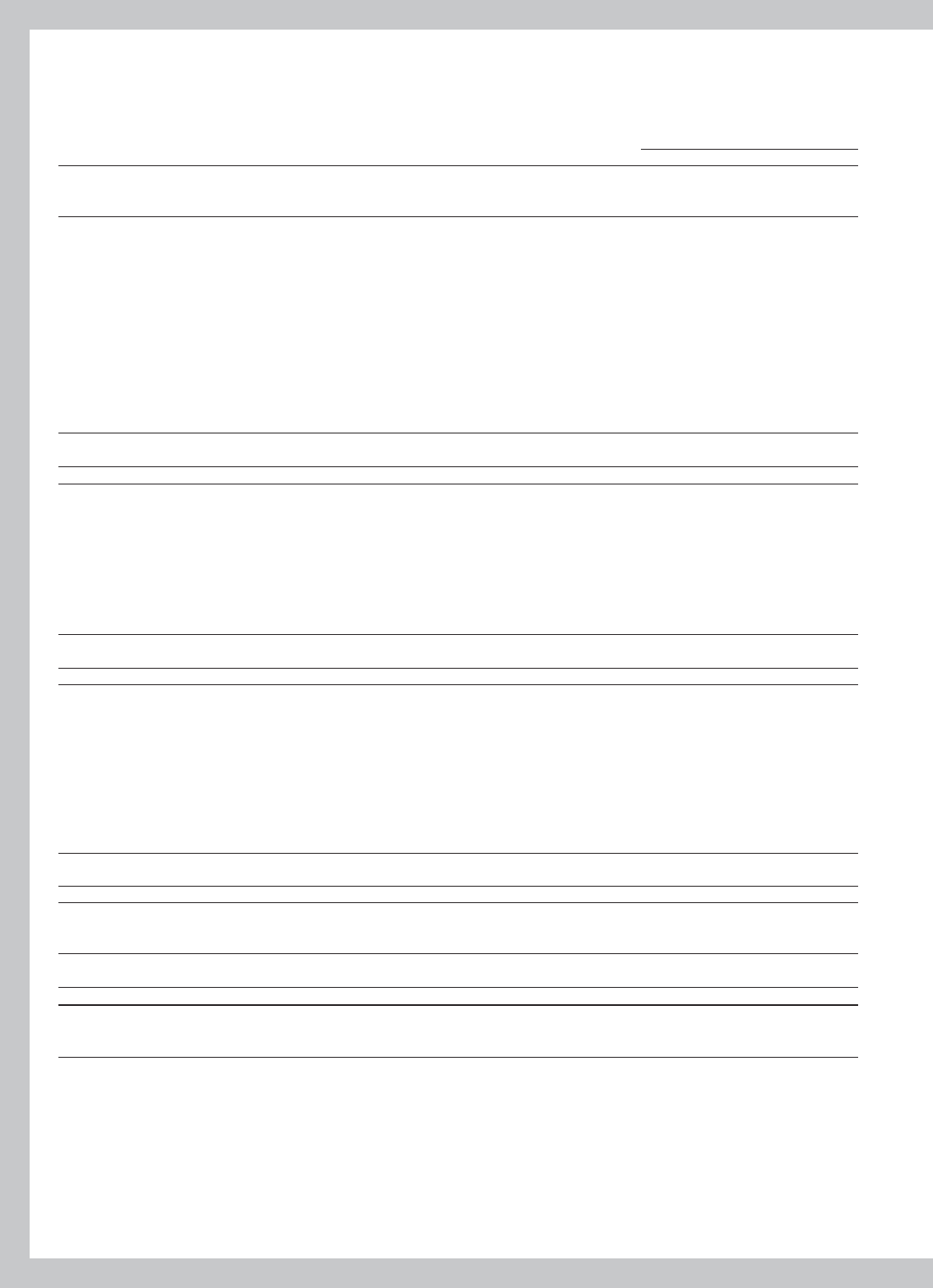

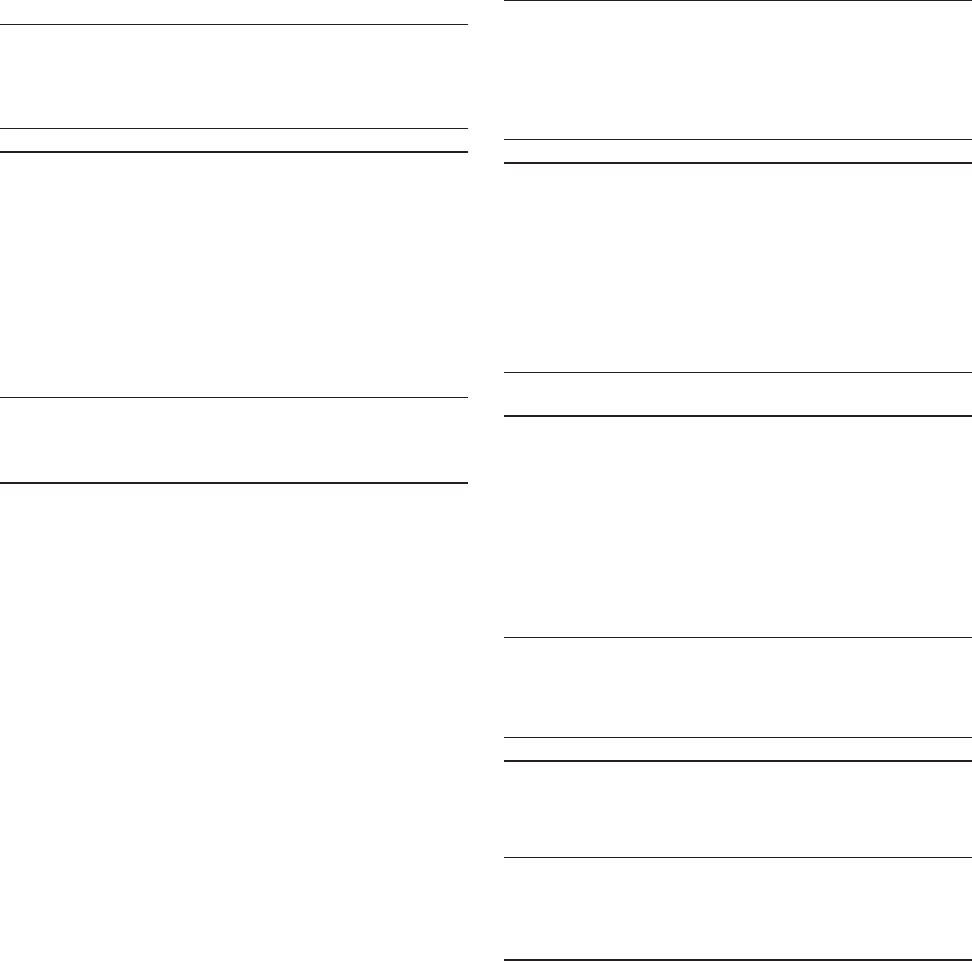

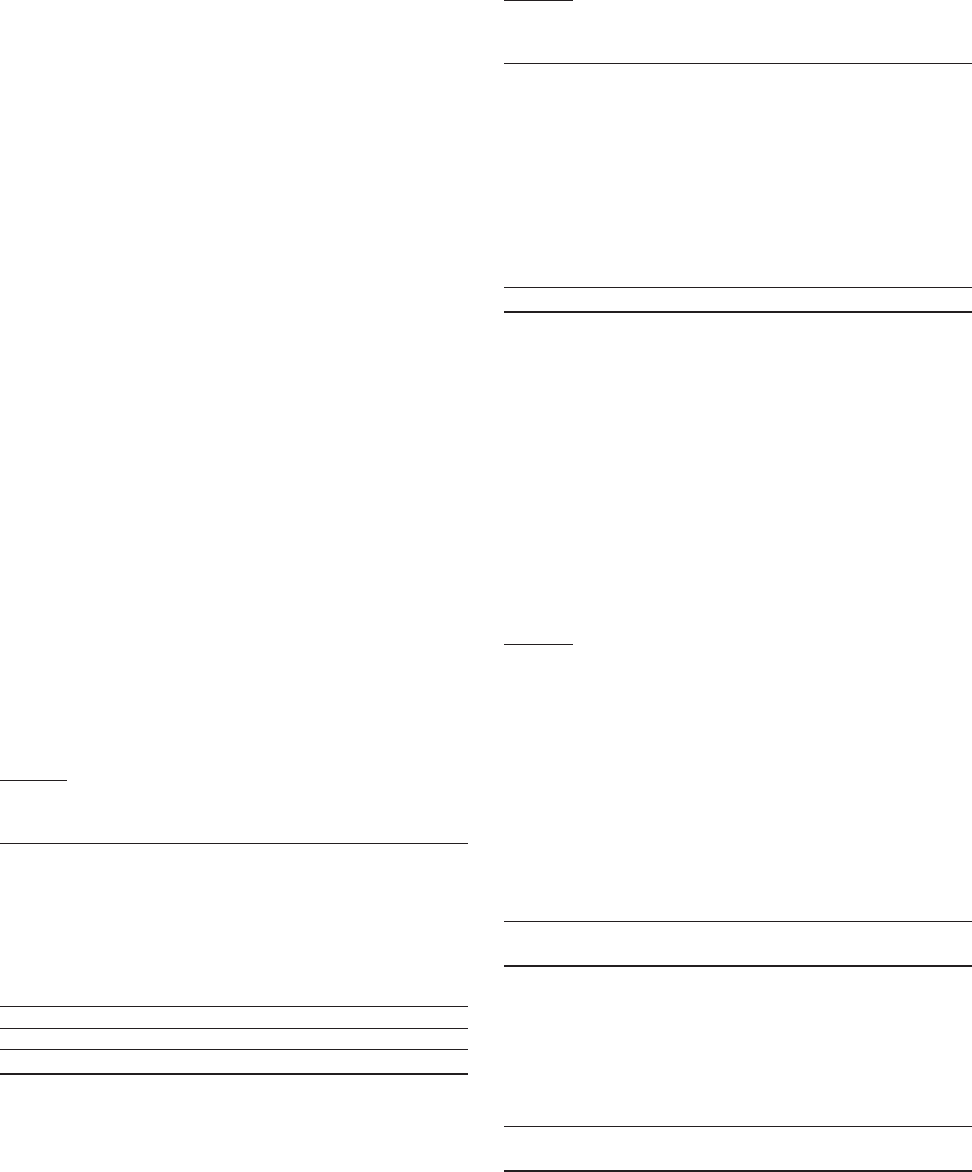

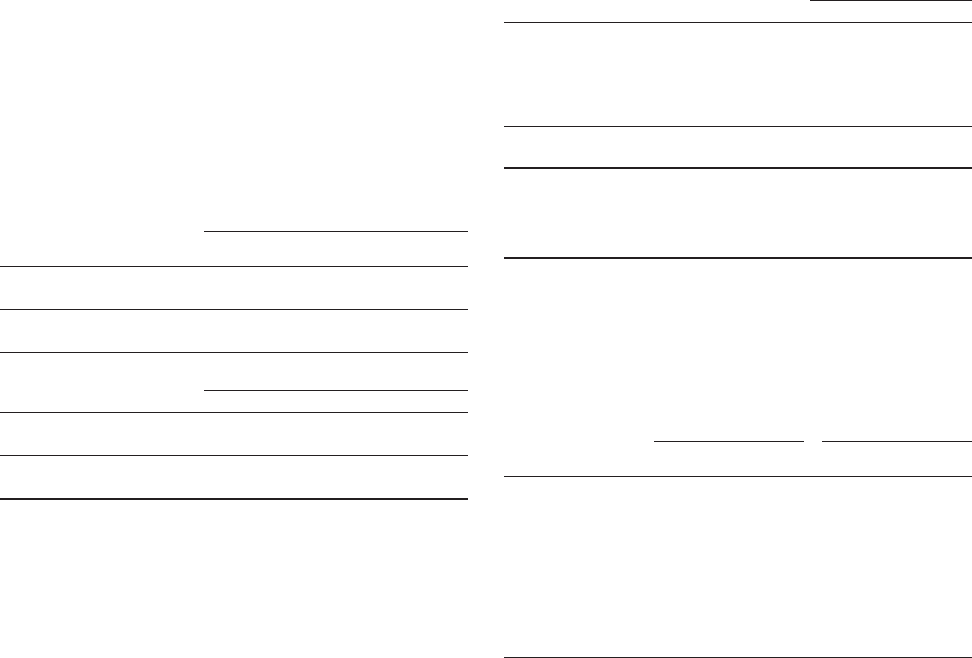

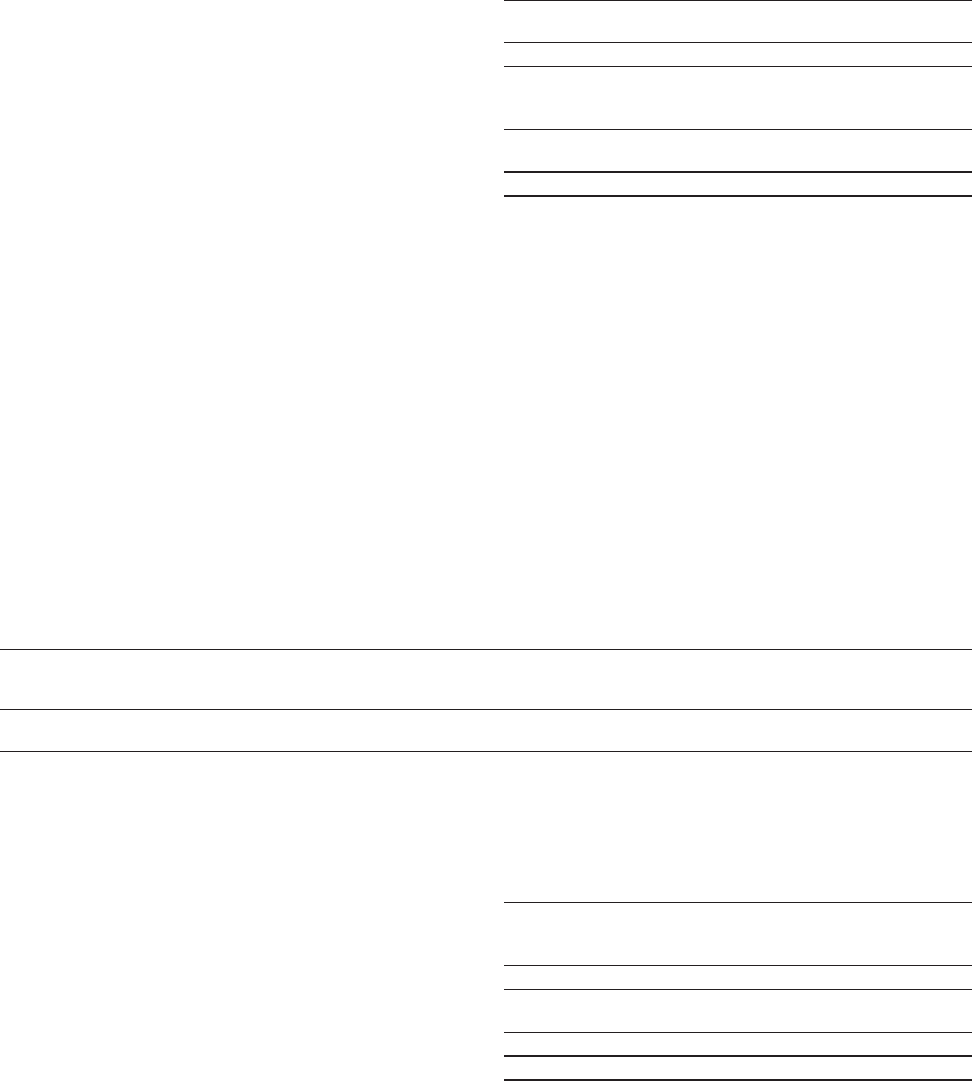

CONSOLIDATED REVENUES

(In $ billions)

NBCU

GE

ex NBCU

16.8

16.0

20082007

GECS

Dividend

Industrial

CFOA

2009 2010 2011

19.1

23.3

16.4 14.7

12.1

CASH FLOW FROM OPERATING

ACTIVITIES (CFOA)

(In $ billions)

10.8

17.8

22.3

12.5 14.1

9.5

15.9

20.4

11.3 13.0

20082007 2009 2010 2011

EARNINGS ATTRIBUTABLE TO GE

(In $ billions)

NBCU

GE

ex NBCU

22%

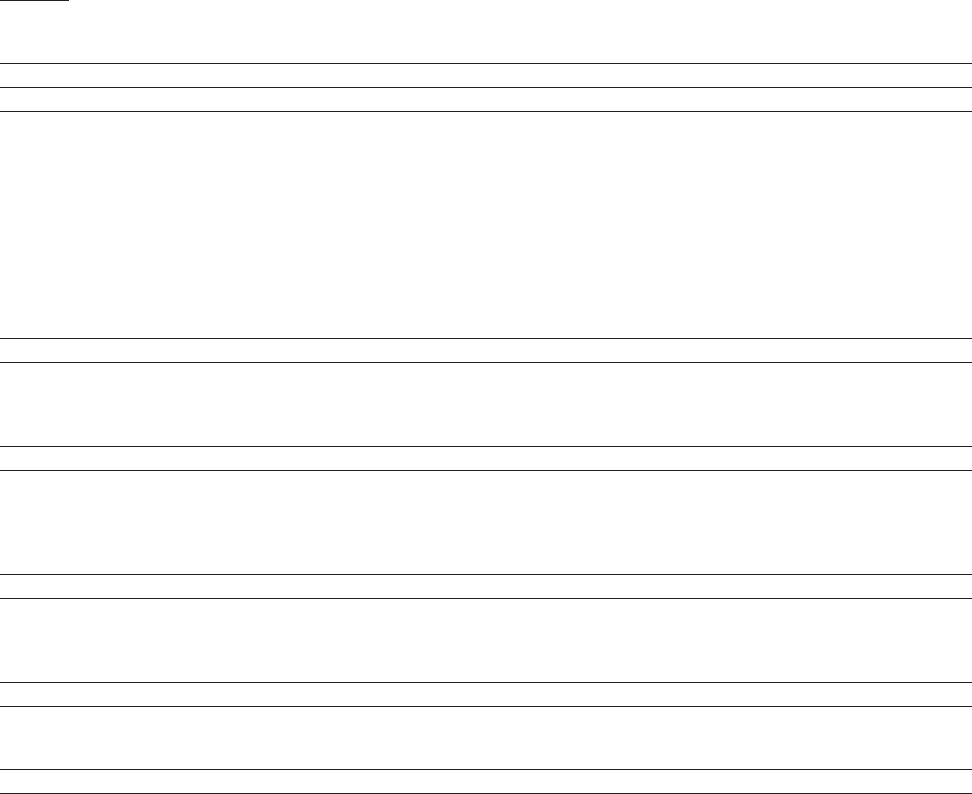

GROWTH CONTINUES

22% increase in Operating

EPS excluding impact

of the preferred stock

redemption, and 20% rise

in Operating earnings.

$200B

RECORD INDUSTRIAL

BACKLOG

Record equipment and service

orders drove the backlog to a

record of $200 billion.

$85B

FINANCIAL FLEXIBILITY

GE had $85 billion of cash and

equivalents at year-end 2011.

70%

DIVIDEND INCREASES

GE announced two dividend

increases in 2011 following

two increases in 2010: a total

70% increase over the two years.

18%

INTERNATIONAL GROWTH

GE’s global growth initiative

helped drive 18% growth in

industrial international revenue.

$18B

U.S. EXPORTS

International sales of American-

made products totaled $18 billion

in 2011, a $1 billion increase

from 2010.

6%

R&D SPEND

GE continued its strong research

and development investment

with total spending at 6% of

industrial revenue.

13,000

U.S. JOBS

GE has announced the creation

of 13,000 jobs in the United States

since 2009.

2011 SUMMARY fi nancial and strategic highlights

Note: Financial results from continuing operations unless otherwise noted.

CONTENTS

2 Letter to Shareowners

10 Business Overview

29 Board of Directors

31 Financial Section

142 Corporate Information

ON THE COVER

Wellington Pereira dos Santos

Operator II

GE’s Wellstream facility in Niterói, Brazil,

is a leading producer of high-quality

fl exible pipe equipment for the Brazilian

offshore drilling market, part of a

$500 million expansion of operations

in the country.

GE Works

At GE, we put our ideas to work. Taking them off the paper, out

of the lab and into the world. Engineers, scientists, teachers,

leaders and doers, all sharing a belief that things can be made

to work better. It’s why we come to work every day. To build,

power, move and cure the world. We are at work making the

world work better.

Jeffrey R. Immelt

Chairman of the Board and

Chief Executive Offi cer

John Krenicki, Jr.

Vice Chairman, GE and

President & Chief Executive

Offi cer, Energy Infrastructure

Keith S. Sherin

Vice Chairman, GE and

Chief Financial Offi cer

Michael A. Neal

Vice Chairman, GE

and Chairman &

Chief Executive Offi cer,

GE Capital Corp.

John G. Rice

Vice Chairman, GE and

President & Chief Executive

Offi cer, Global Growth &

Operations

Pictured, left to right:

GE 2011 ANNUAL REPORT 1

We look at

what the

world needs

A belief

in a better

way

A relentless

drive to invent

and build things

that matter

A world

that works

better

X+=

THE GE WORKS EQUATION

Culture is the foundation for any

successful enterprise, and ours

inspires our people to improve

every day. It is why GE Works.

It starts by being “mission-based.” We have a relentless

drive to invent things that matter: innovations that

build, power, move and help cure the world. We make

things that very few in the world can, but that everyone

needs. This is a source of pride. To our employees and

customers, it defi nes GE.

We build on this mission with a belief

in a better way. We are constantly

learning and driving best practices. We

invest to train our people and develop

leaders. We learn from customers,

competitors, peers and each other.

Because we know we can get better,

we are never afraid. Competition is in

our blood.

GE is a “We Company,” not a “Me

Company.” We want people who listen

more than they talk. We want leaders

who build teams. Bob Santamoor

represents labor; he is the Chairman of

the IUE-CWA GE Aerospace Conference

Board. We have worked together for

years. We don’t agree on everything,

but we respect each other. When we

meet, we talk about jobs. We need

each other to be successful.

We made the decision to invest $1 billion

in our Appliance business, modernizing

our factories in the U.S. Our fi rst two

new products will be introduced early

in 2012, with other major launches

throughout the next two years. Most of

LETTER TO SHAREOWNERS

2 GE 2011 ANNUAL REPORT

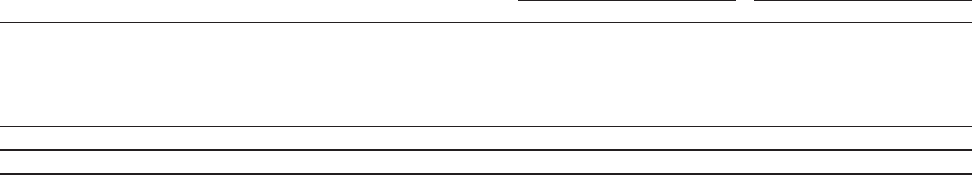

THE ECONOMY IN 2012

Four things we’re watching

Infl ation is the

“wild card”

Prepare for

high infl ation

Prices have

moderated in

recent quarters

INFLATION

Will it derail the

recovery?

Do not believe

European

governments

will allow for a

“catastrophic

event”

Plan for a

recession

Committed for the

long term to an

important region

EUROPE

What’s the

outlook?

U.S. economy

strengthening

each day

Could be a

pleasant surprise

UNITED STATES

Will politics hurt

the consumer?

Transitioning to a

consumer-driven

economy

Government

investing in

growth

The economic

engine for most

of the emerging

markets

CHINA

Will it grow?

our appliance product manufacturing

will move back from China and Mexico

to the U.S. We think we can make

more money and serve our customers

better. We also think this will make us

a better manufacturing company in

every corner of the world. But it is only

possible because our designers, factory

workers, managers and marketers

work together. GE is a “We Company.”

We are solving problems, tough prob-

lems. We are in the seventh year of a

clean energy business strategy called

ecomagination. Clean energy goes in

and out of focus for governments and

consumers. But, at GE, we are steadfast

in our investing. In 2011, we had $21 bil-

lion of clean energy revenue, growing

twice as fast as the Company average.

Ecomagination drives growth because

we are solving problems for our custom-

ers. At coal mines, from Pennsylvania

to Peru, our water solutions allow

custom ers to operate productively

while achieving high environmental

standards. We demonstrate every day

that, through innovation, we can meet

societal needs and do it profi tably.

We deliver results. That is the ultimate

output of a strong culture. Over the

next few years, our performance will

accelerate. We aim to reward investors

by delivering a more valuable company

and returning cash. We want to earn

your trust.

We believe that culture and resiliency

count in a company. At GE we have a

quiet confi dence in our willingness to

work hard, to learn and, ultimately,

to prevail. This is how we work and how

we earn your trust. It is how we com-

pete and win. GE Works.

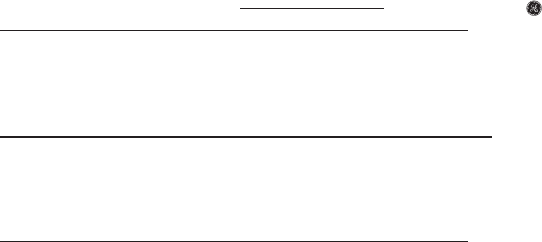

A POSITION OF STRENGTH

GE’s Operating EPS growth was 22%

last year. We bought back preferred

shares of stock we issued during the

fi nancial crisis and increased our

dividend twice. Our stock price fi nished

about fl at, in line with the broader

S&P 500 Index. We outperformed the

S&P Financial and Industrial sectors—

the “GE neighborhood”—which declined

by 18% and 3%, respectively, in 2011.

Despite our growth, it was tough for GE

to break away from investor concerns

about macroeconomic risk. Investor

anxiety is understandable. Europe took

center stage as a source of instability.

Daily headlines about Greece, Italy and

the volatility of the European banks

frayed nerves. And, U.S. politics and

defi cit concerns worried investors in

the second half of 2011.

I have been CEO for ten years. In that

time, we have experienced the 9/11

tragedy, Hurricane Katrina, the 2002

recession, the 2008 fi nancial crisis, the

Gulf oil spill, “Arab Spring,” the Japan

tsunami, and now the European crisis—

quite a bit.

Today, we live in what most business

commentators call a volatile world.

I would argue that when the environ-

ment is continuously unstable, it is no

longer volatile. Rather, we have entered

a new economic era. The emerging

economies grow, while the developed

world slows. Some of the world’s largest

economies face massive fi scal defi cits

and must deleverage. Interest rates are

likely to stay low for extended periods.

Material prices are moving higher. There

is broad-based social unrest. And, it

could remain this way for a long time.

I have learned that nothing is certain

except for the need to have strong risk

management, a lot of cash, the willing-

ness to invest even when the future is

unclear, and great people.

We have great fi nancial strength.

Between GE Capital and GE Parent, we

have $85 billion of cash. And we sur-

rounded the Company with a strong

enterprise risk model that has been

GE 2011 ANNUAL REPORT 3

tested. We are restructuring our

European operations to sustain our

profi tability at lower levels of growth.

We accelerated global and technical

investments, ahead of competition,

during the downturn to ensure growth

in a choppy environment. We redeployed

capital from NBCU to support $11 billion

of Energy acquisitions, which should

provide an earnings boost in 2012. We

fi nished 2011 with $200 billion of product

and service backlog, more than at any

time in our history.

We also have a talented and committed

team. In December, I had dinner with

our Aviation supply chain leaders from

around the world. I do this regularly

with different operating teams. It allows

me to “go deep” and understand chal-

lenges through their eyes. My dinner

partners are the ones who have to

meet record engine demand with high

quality and low cost. They are also the

leaders of our fi ne frontline workforce,

the best in the world. They understand

technology, globalization, innovation

and lean manufacturing. Their tough-

minded, competitive attitude inspires

me. I know that with our team, we will

succeed in this environment.

GE Works for investors, and you should

benefi t from our people and our prep-

aration. As business leaders, we cannot

create the environment, but we can

shape our own destiny. Today, GE has

a stronger portfolio, large-scale

competitive advantage, product and

technology leadership, and strength in

the growth markets. We are ready

to compete. We are positioned to win

right now.

WE HAVE BUILT A

STRONGER PORTFOLIO

We have our strongest portfolio in

recent history. This year, we expect to

have organic growth of 5 to 10% with

expanding margins. GE Capital is

smaller and focused on specialty

fi nance, particularly in mid-market

segments. We expect GE Capital’s

earnings rebound to continue in 2012.

Together, this portfolio is built to grow

earnings and return cash to investors.

Our top strategic priority has been to

build a strong, competitively advan-

taged infrastructure business that

grows ahead of our peers and faster

than the global GDP. Over the last

decade, we have refashioned GE from

an “industrial conglomerate” to an

“infrastructure leader.” This has been

disruptive at times, but it has several

advantages. Infrastructure businesses

use GE’s core strengths in technology,

globalization and services. Infra struc-

ture is also positioned to benefi t from

several long-term tailwinds, especially

growth in emerging markets. Infra-

structure requires scale and fi nancial

strength. Deep customer relationships,

built on long-term thinking, really count.

We have diversifi ed and strengthened

our core businesses, like Energy.

Historically, this business was based

largely on selling one product—heavy

duty gas turbines—in one market—the

U.S. That kind of concentration creates

volatility as markets rise and fall.

Today, we have a broad Energy portfolio,

including a range of gas power

generation products, oil and gas tech-

nology, renewables, smart grid

services, energy management tech-

nologies and controls; these products

and services are sold around the world.

As an energy leader, our earnings are

more diversifi ed, less volatile and

should grow through the cycles. This is

the same model we are using in the

rest of our businesses.

We have boosted the growth rate

of our infrastructure portfolio by

investing in adjacencies, promising

opportunities that are outside of, but

closely related to, our core businesses.

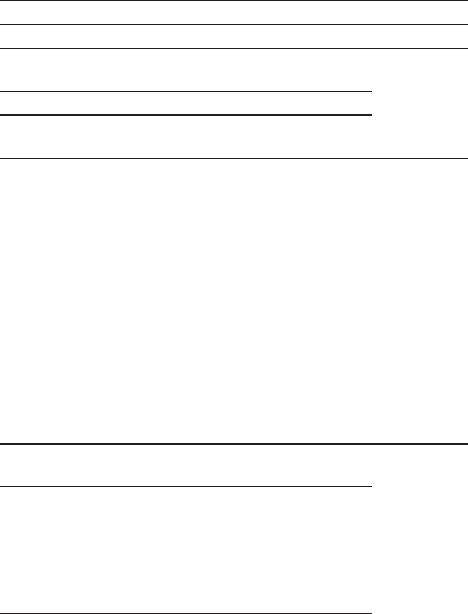

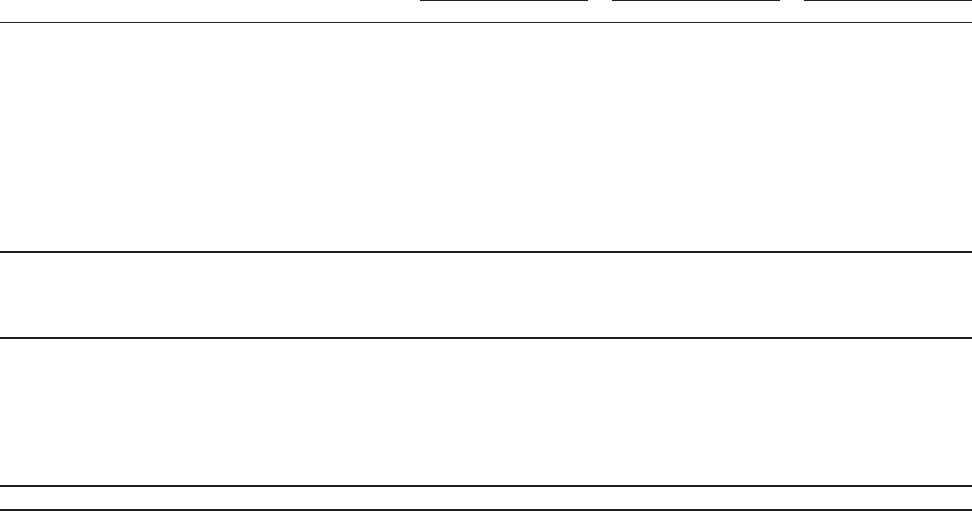

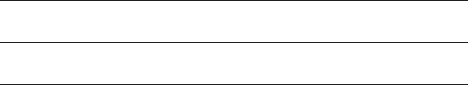

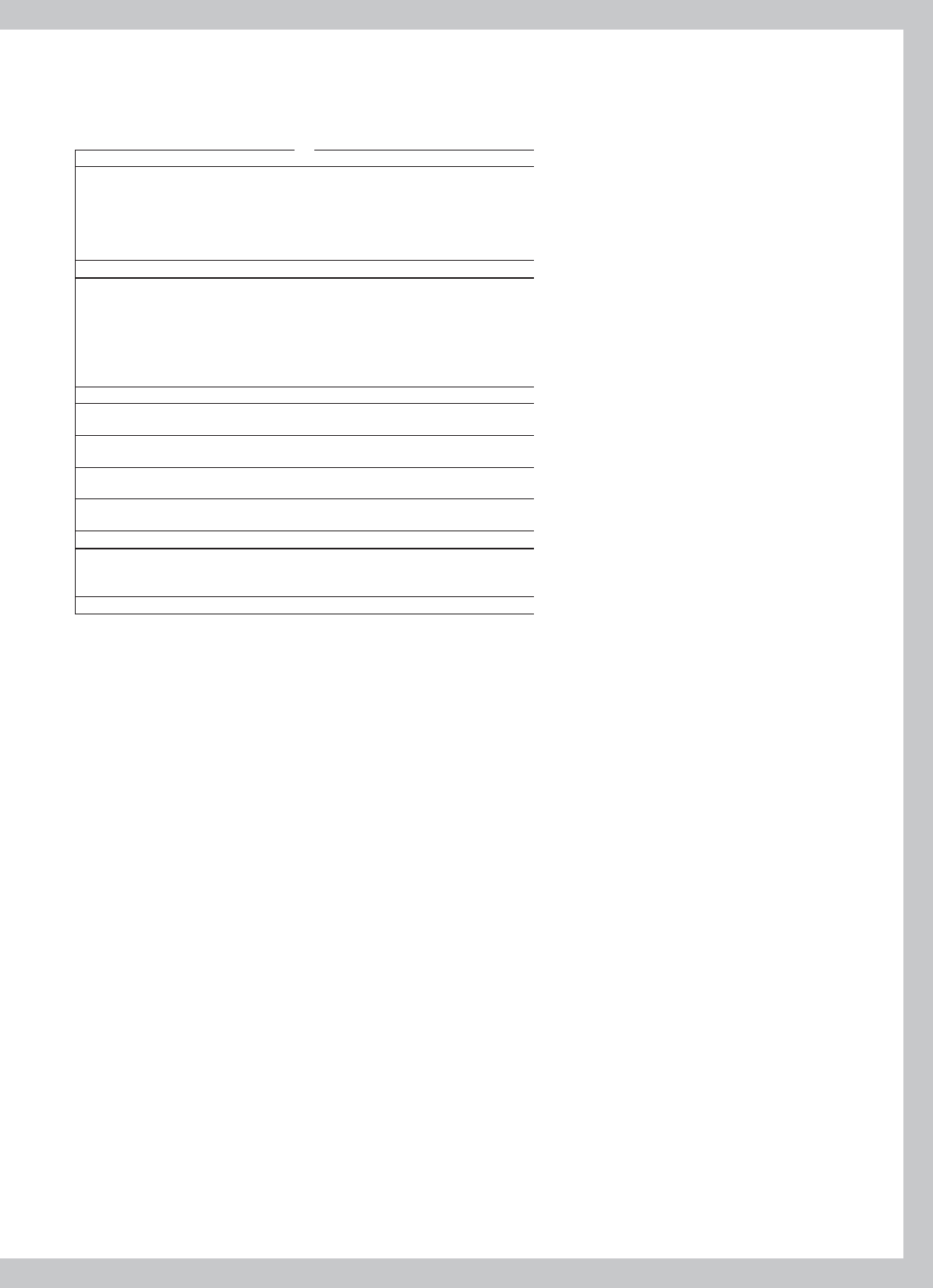

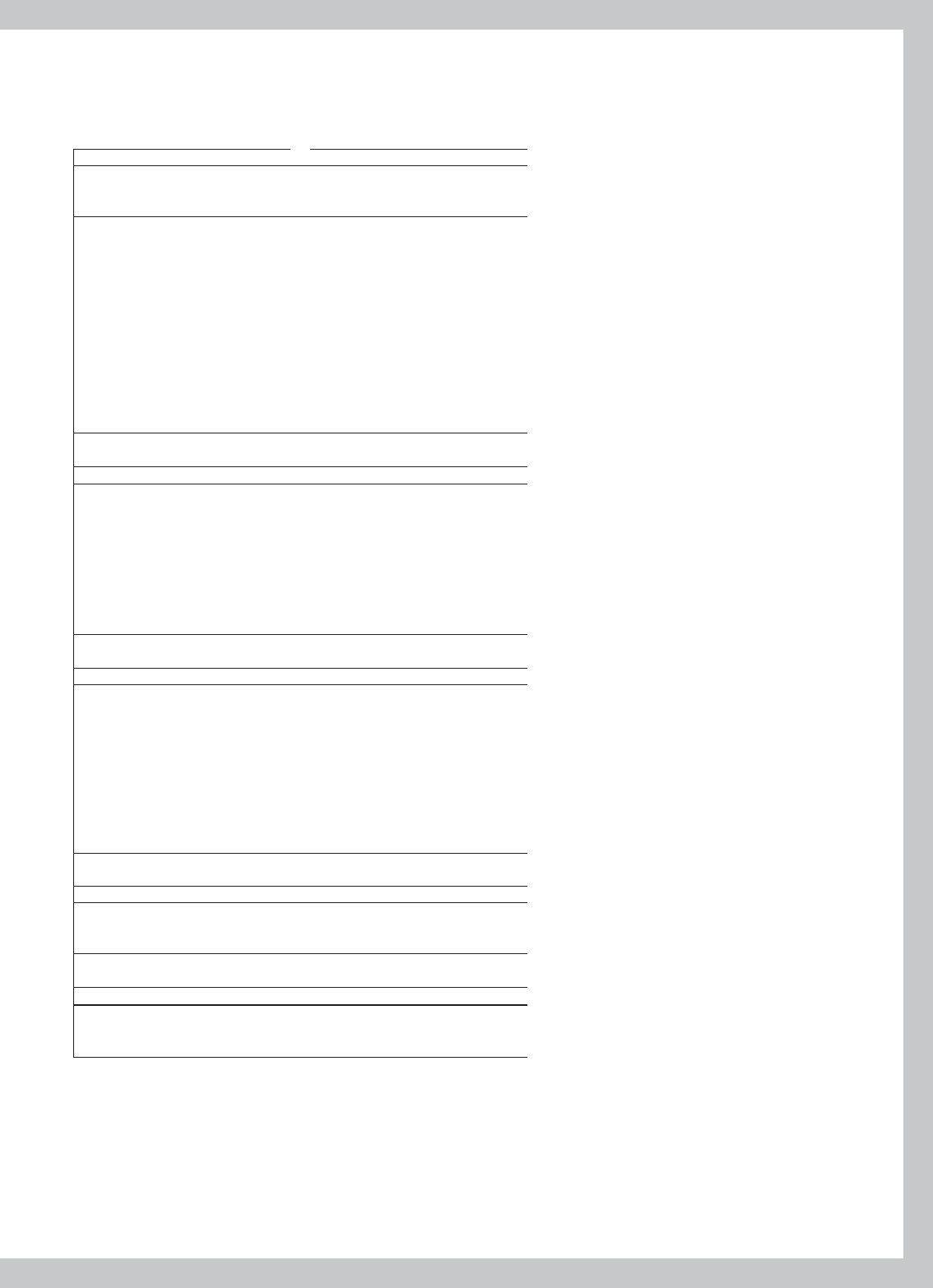

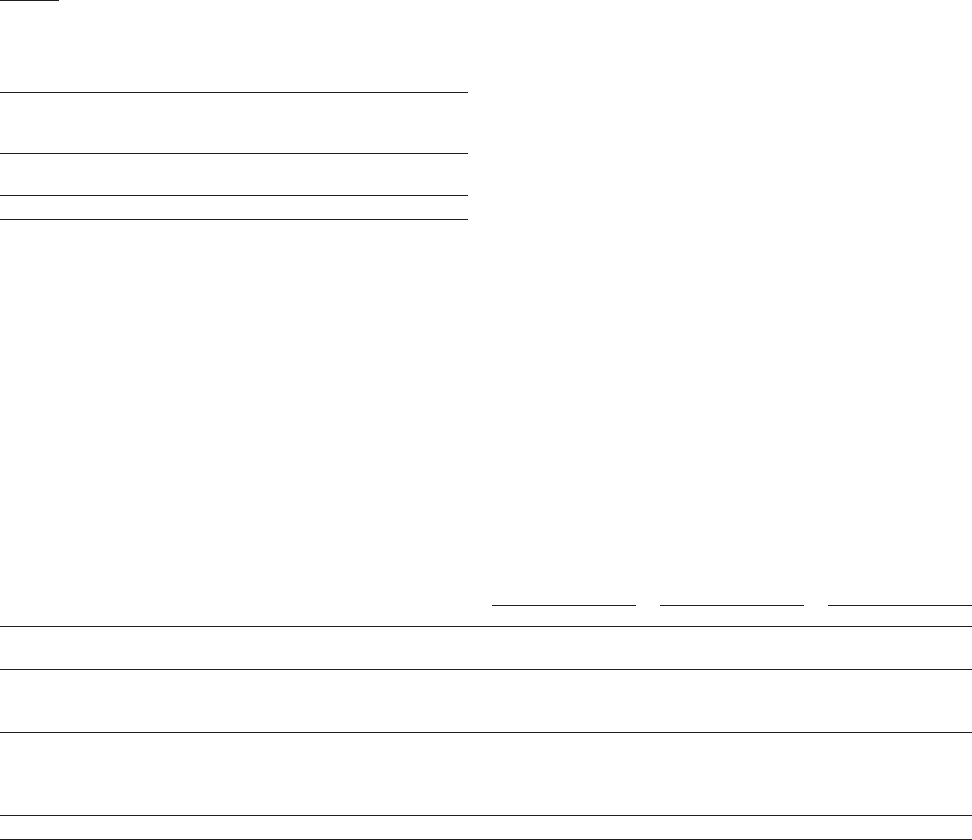

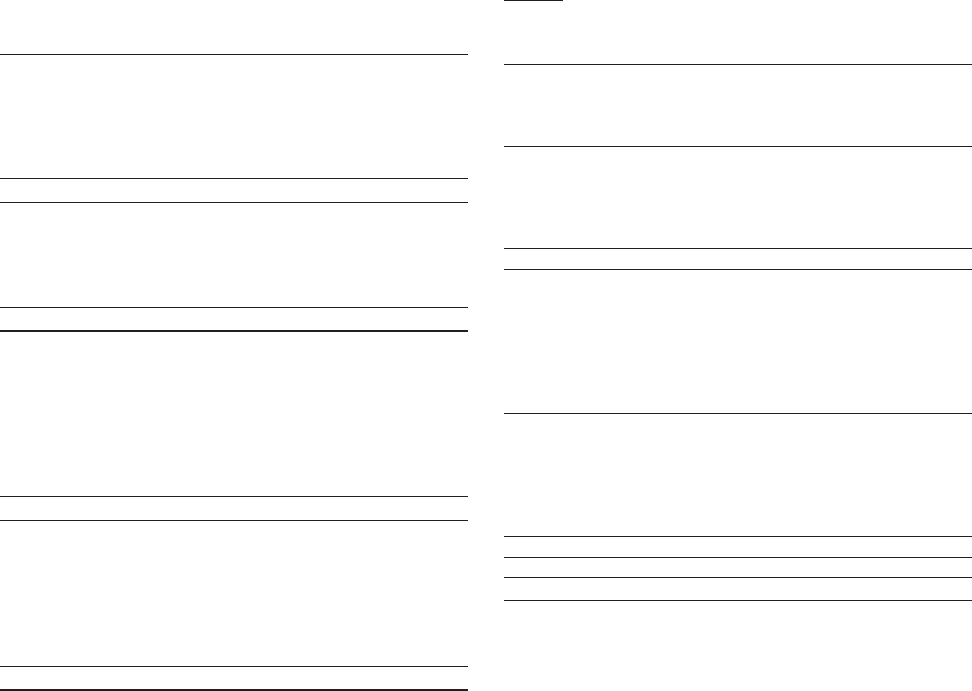

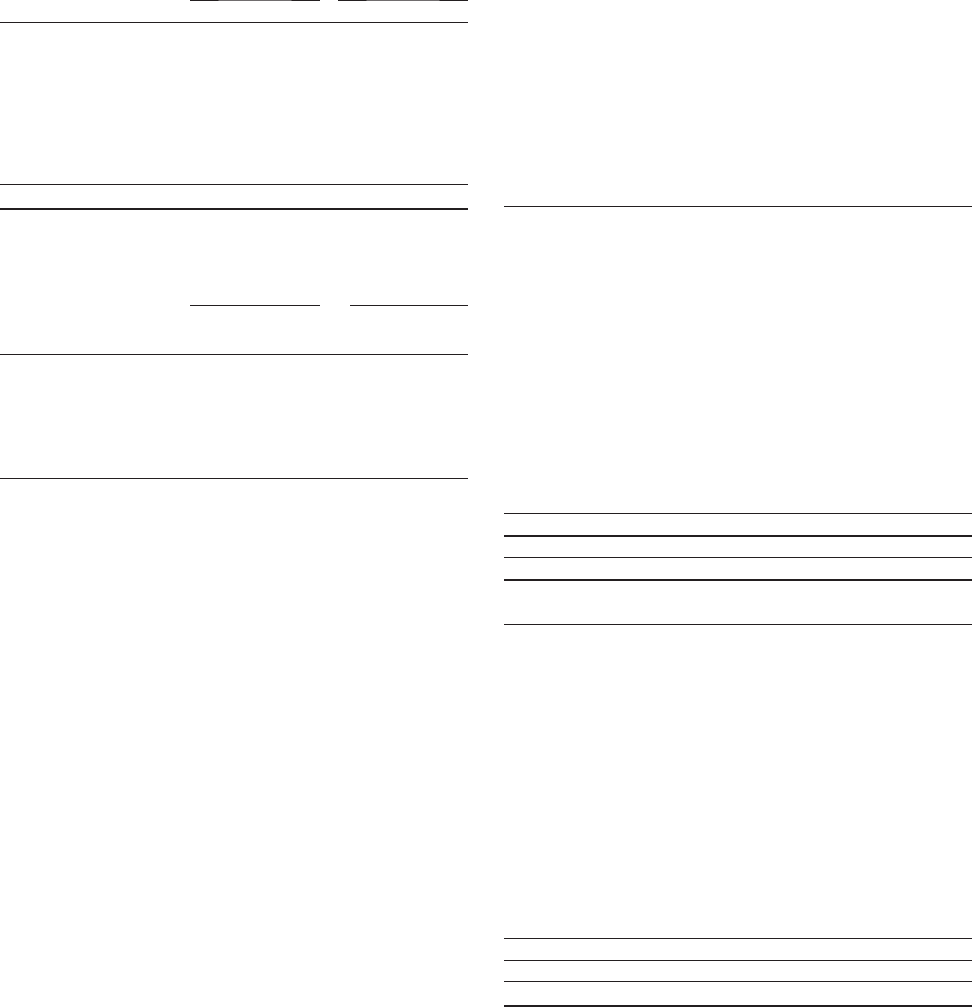

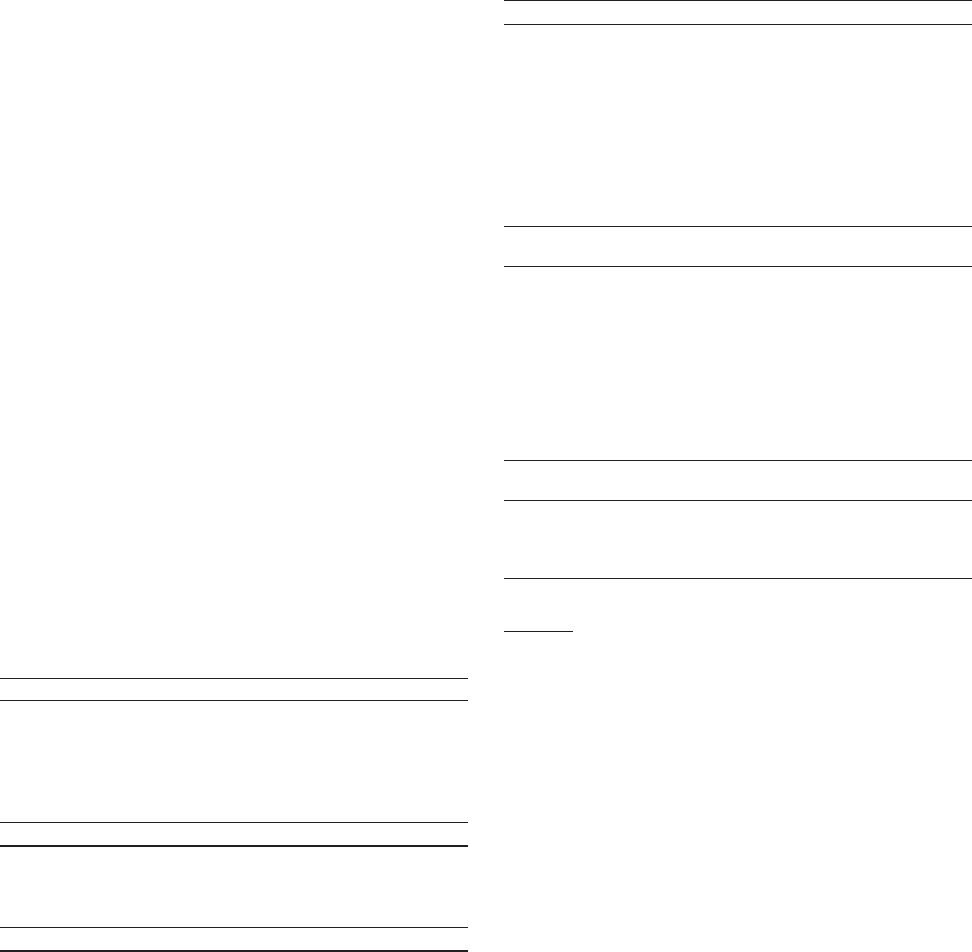

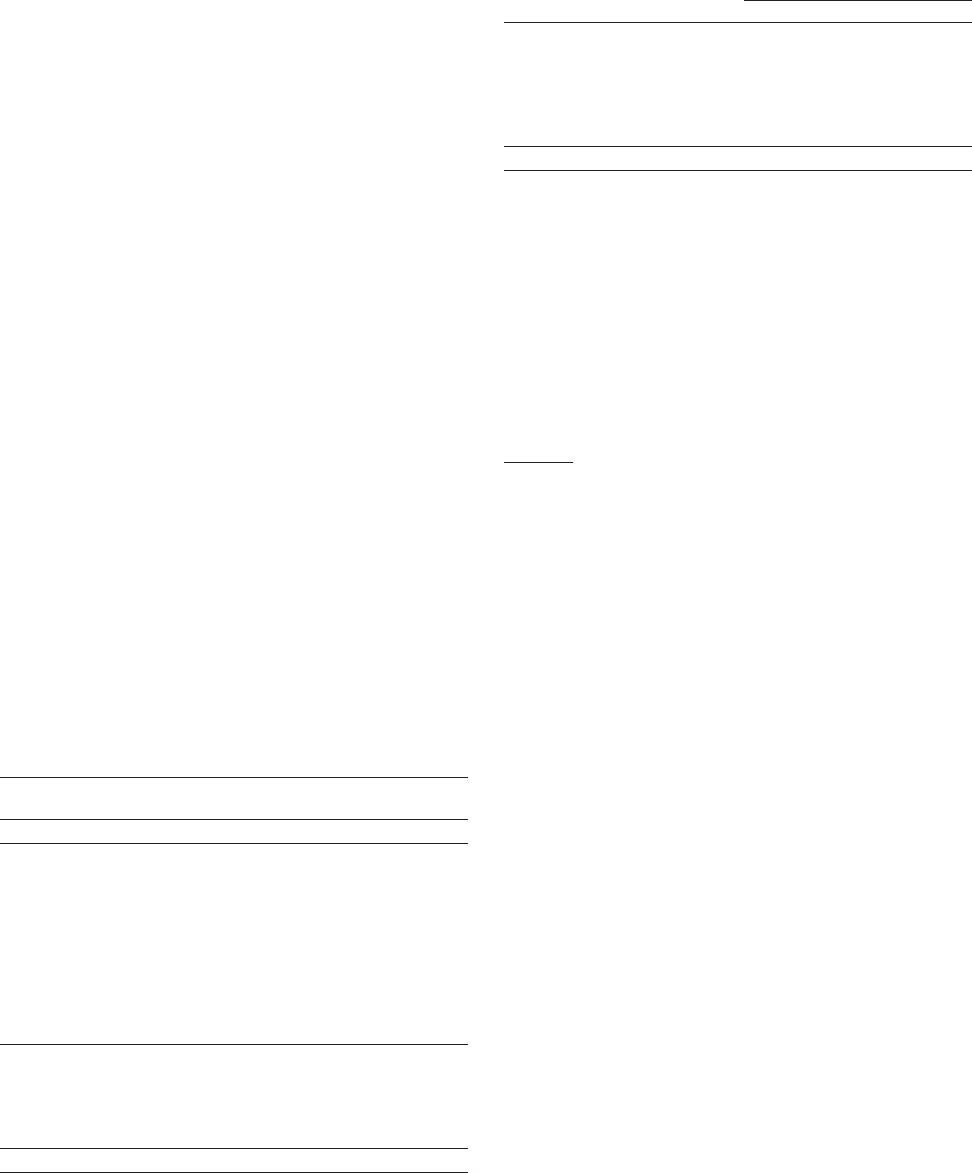

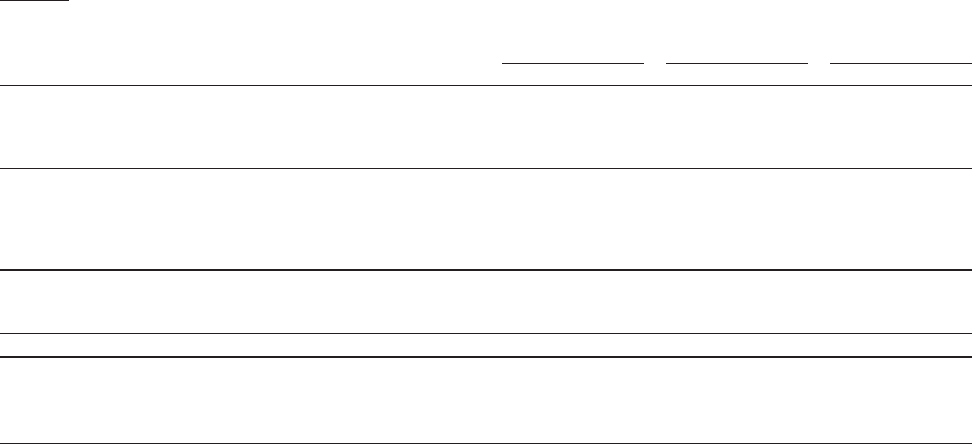

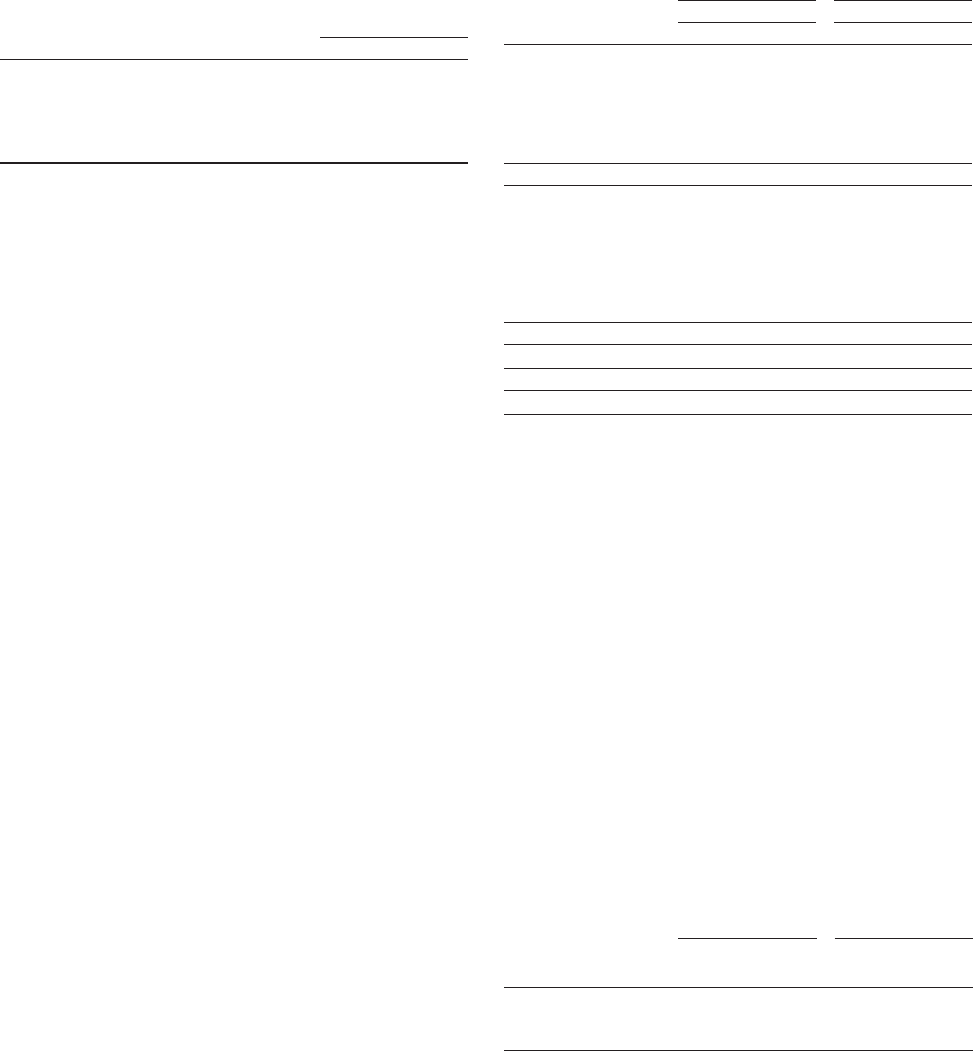

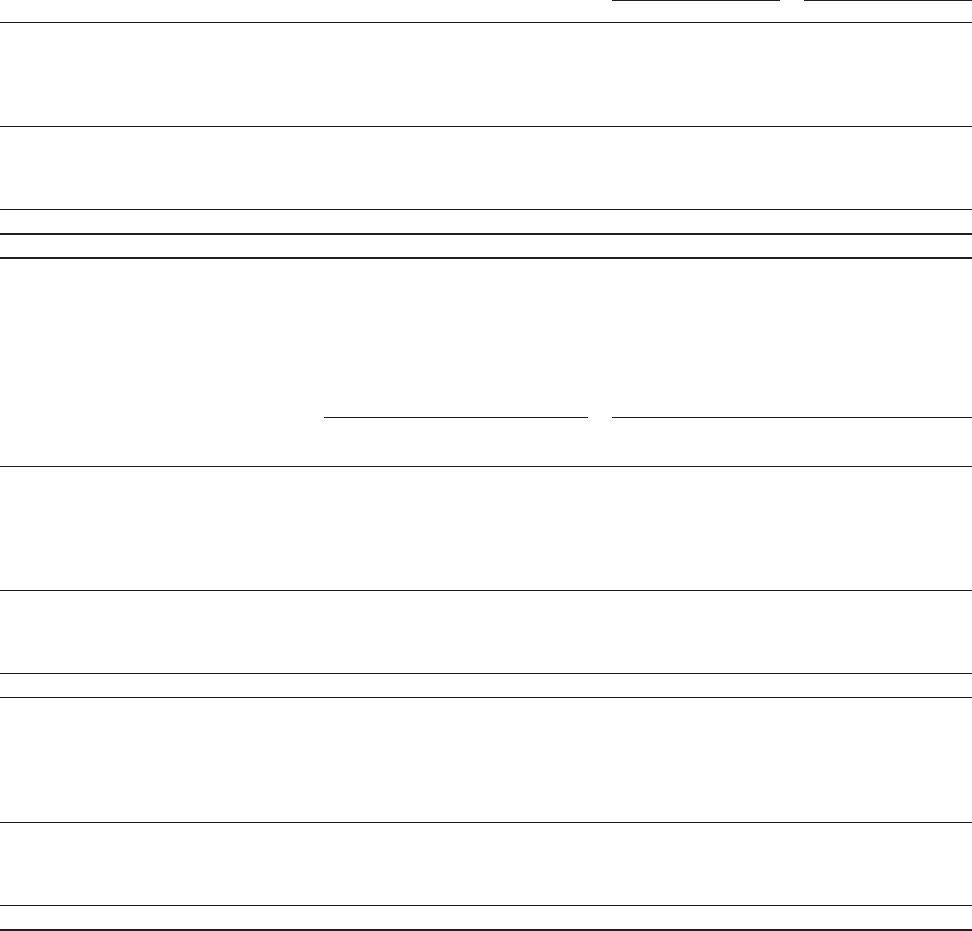

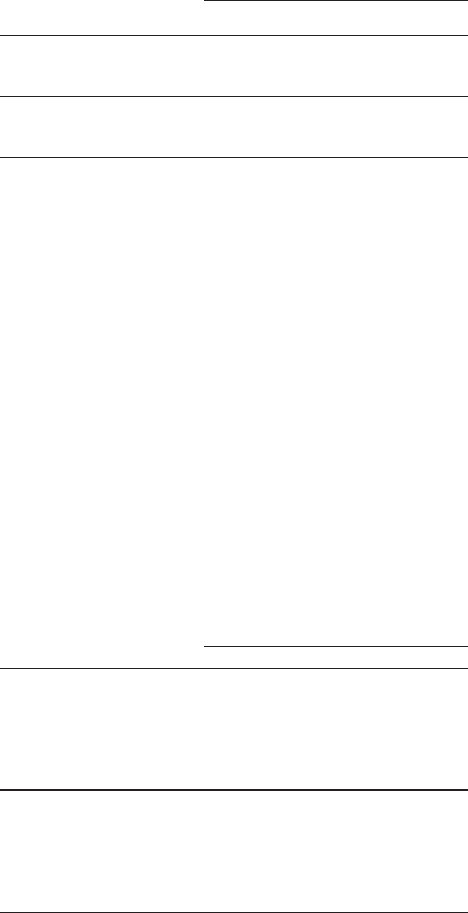

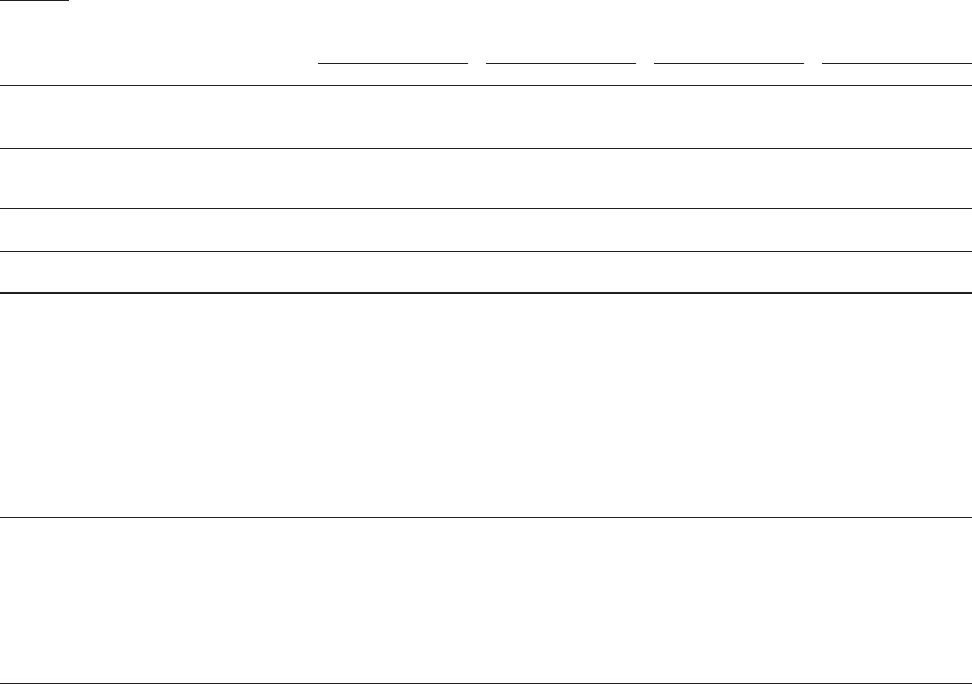

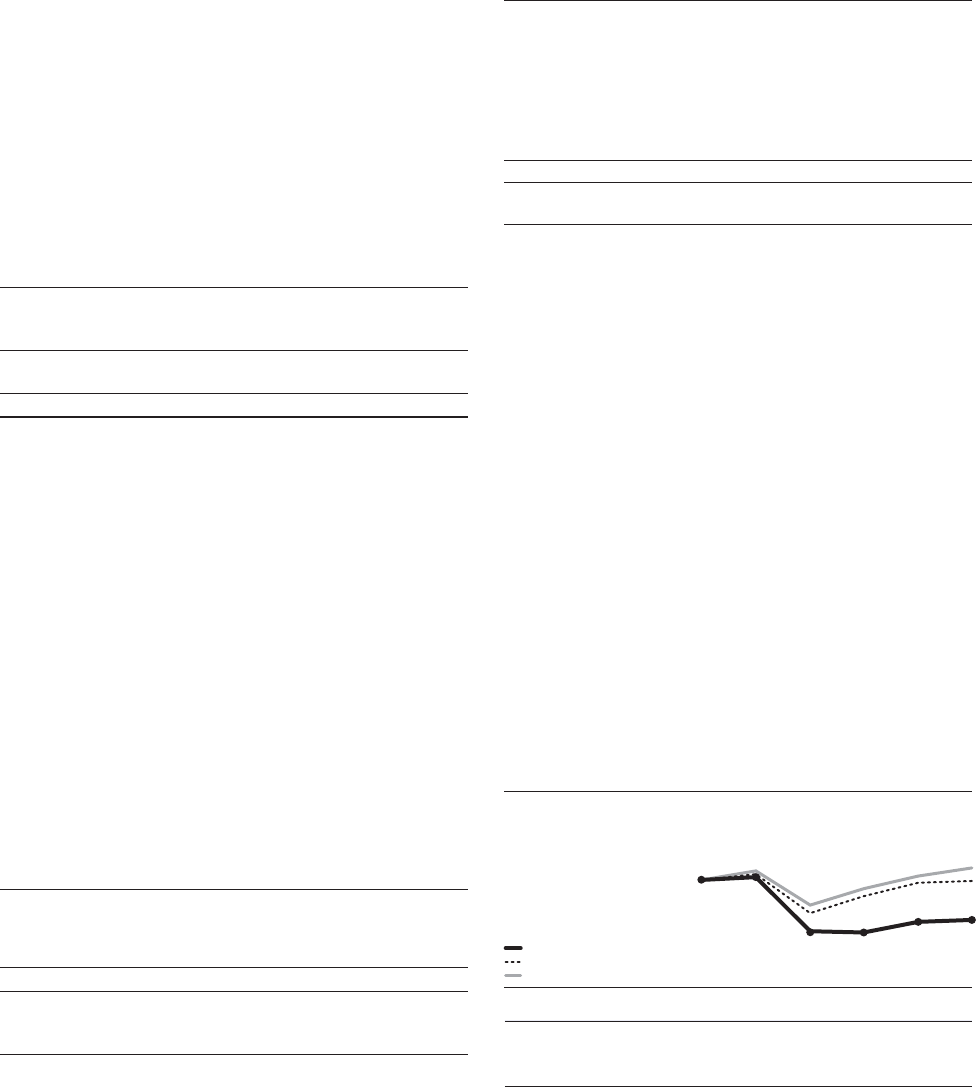

PORTFOLIO STRATEGY

Improved portfolio positioned for a variety of outcomes

Revenue ~$150B

+ $100B of cash: 2012–2016

+ Fund growth and reward investors

EARLY DECADE

Transformation

Begins

MID-DECADE

Reposition, Simplify

and Invest

GOING FORWARD

Growth and Value

Creation

GE Capital

24%

Insurance

15%

Plastics, Media

20%

Infrastructure

41%

36%

Focused Leader

Simple and Safe

64%

High Tech

Global Leader

High Margin/

Returns

15%

8%

43%

34%

4 GE 2011 ANNUAL REPORT

I have written in the past about “bets”

we have made in Aviation Systems,

Life Sciences and other industries.

Adjacencies have allowed us to grow

$35 billion of incremental revenue in a

decade, with more to come. We believe

in a long-term approach to entering

these fast growth segments. For

instance, we have about a $4 billion

position in Life Sciences that could

double in the next few years. We are

building strength in drug discovery,

molecular medicine, bioprocess

manufacturing and digital pathology.

All of these segments will grow at two to

three times global GDP.

GE Capital’s earnings grew more than

100% in 2011. It is stronger and safer.

Our Capital team has executed on

every commitment it made during the

fi nancial crisis. We have reduced

leverage, improved liquidity and shed

assets, while growing at high margins.

Commercial Real Estate, previously a

major investor concern, is positioned

for solid earnings growth in the future.

From 2008 to 2011, GE Capital’s fi nancial

performance compares favorably to

most other fi nancial services fi rms in

the world.

Financial services have been deeply

out of favor with investors.

Nonethe less, there are large segments

where GE Capital will lead and build

upon GE’s strengths. These include

mid-market lending and leasing,

fi nancing in GE domains and a few

other specialty fi nance segments.

Here, we have a clear advantage over

banks and can grow profi tably.

GE Capital has strengthened its balance

sheet immensely. Our Tier One Common

Ratio is about 10%, well in excess of the

levels set by fi nancial regulators. Now,

because of our fi nancial strength and

earnings power, and subject to Federal

Reserve review, we expect GE Capital

to resume paying a dividend this year

to GE. Ultimately, the size of GE Capital

depends on several factors: returns,

competitive advantage, dividend

capability and regulatory burdens. In

the near term, GE Capital should see

sustained earnings growth with good

margins and lower risk.

Our goal is to have GE Capital make

sense for GE investors. First and

foremost, we have more liquidity and

a safer profi le. We believe that having

the Federal Reserve as a regulator is

a positive. We are winning in the mar-

ketplace. The one area that we cannot

control is external “headline risk.” The

fi nancial services industry is still going

through transitions, and we are part

of that change. Regulators, governments

and rating agencies will have their say.

But that doesn’t change our fundamental

strength. We have successfully navigated

through this volatility, and we aim

to create value through GE Capital.

We have the world’s best infrastructure

company, positioned for multi-year

growth. We have a valuable specialty

fi nance company that is safer and

stronger than ever. Together we build,

power, move and help cure the world.

INITIATIVES DRIVE PERFORMANCE

We aspire to drive organic growth

faster than our peers, with expanding

margins. We drive company-wide

initiatives to achieve technical superiority,

growth market leadership, service

expansion based on profi table cus-

tomer relationships, and operational

action to achieve margin growth.

For each initiative we have bold

aspirations, and we utilize the

GE enterprise to achieve results.

We have a full pipeline of great new

products. Technical superiority is the

most sustainable form of competitive

advantage. We will invest $16 billion

in R&D from 2010 to 2012, more than

double our historical average and about

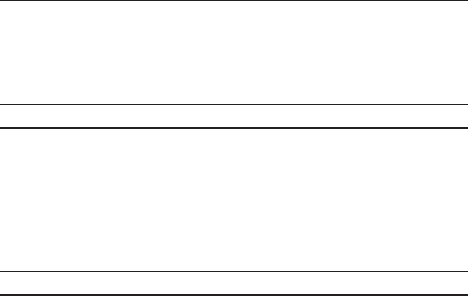

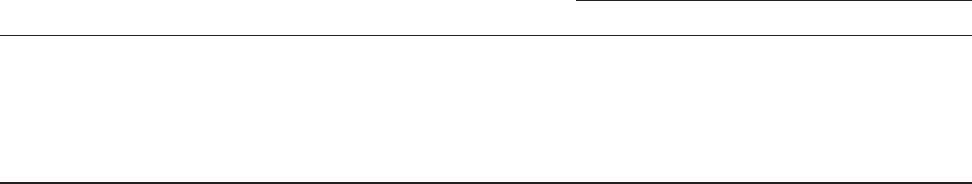

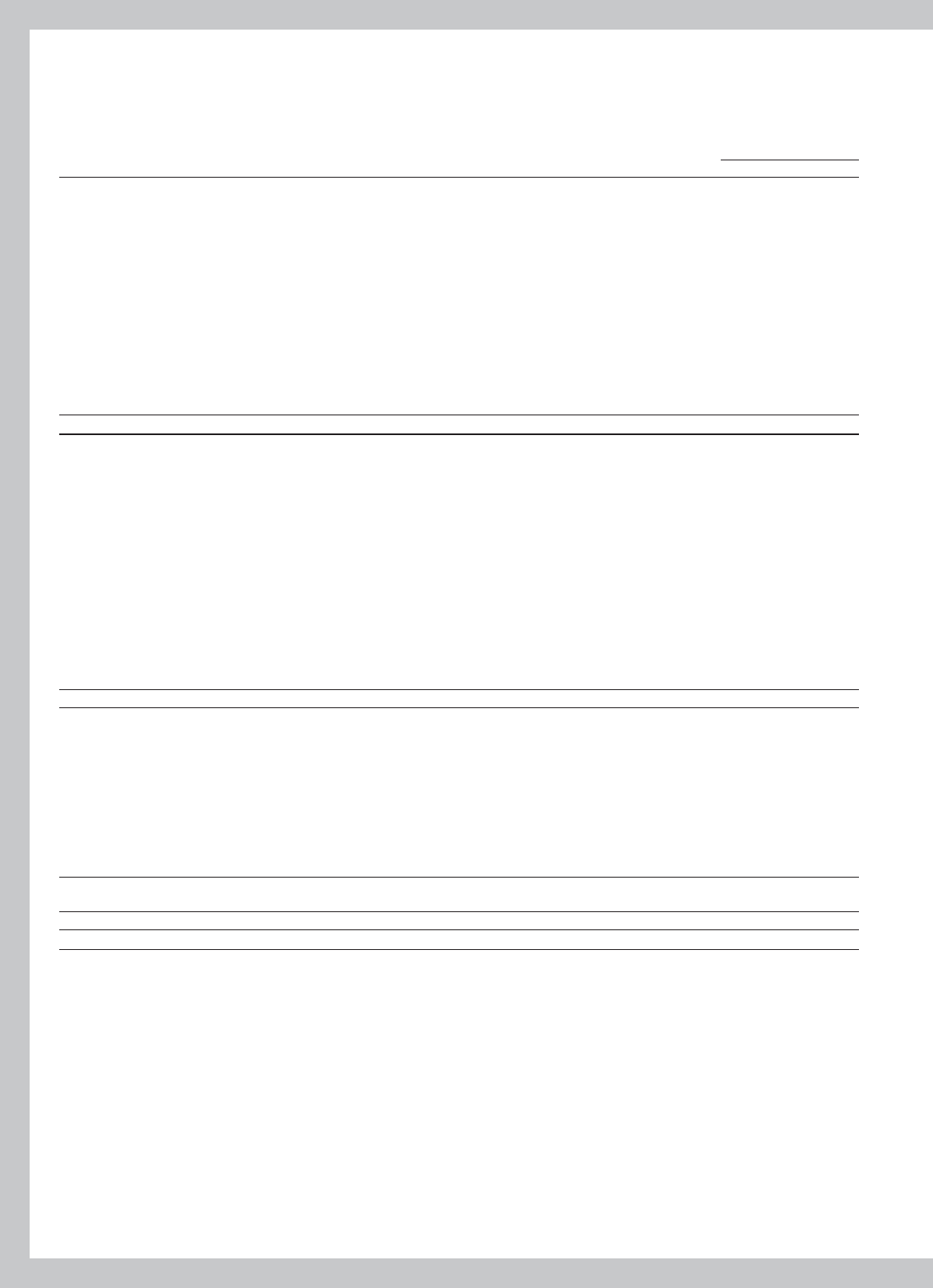

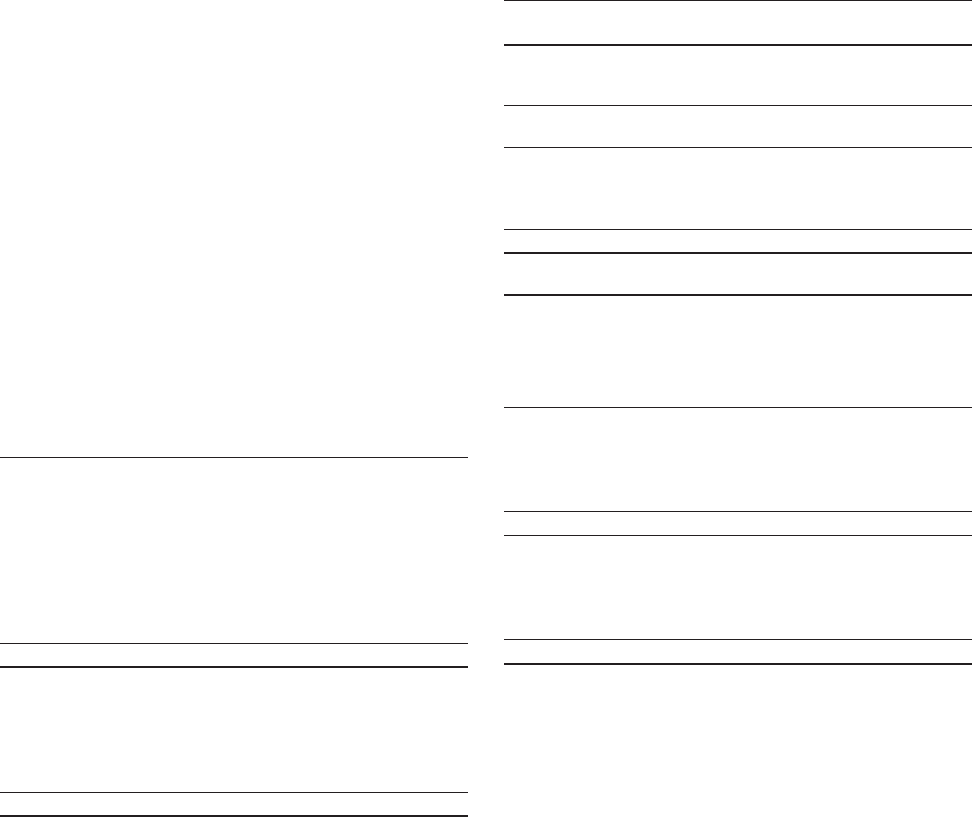

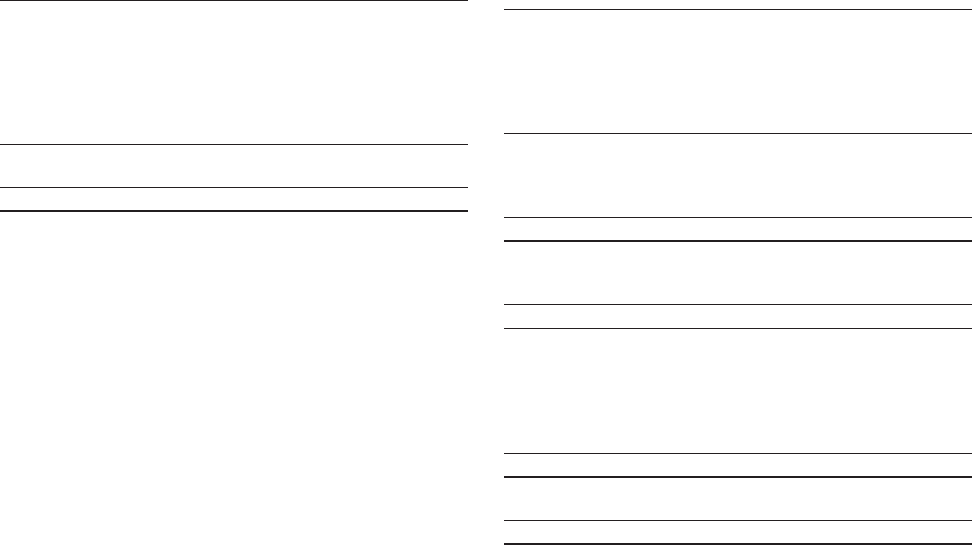

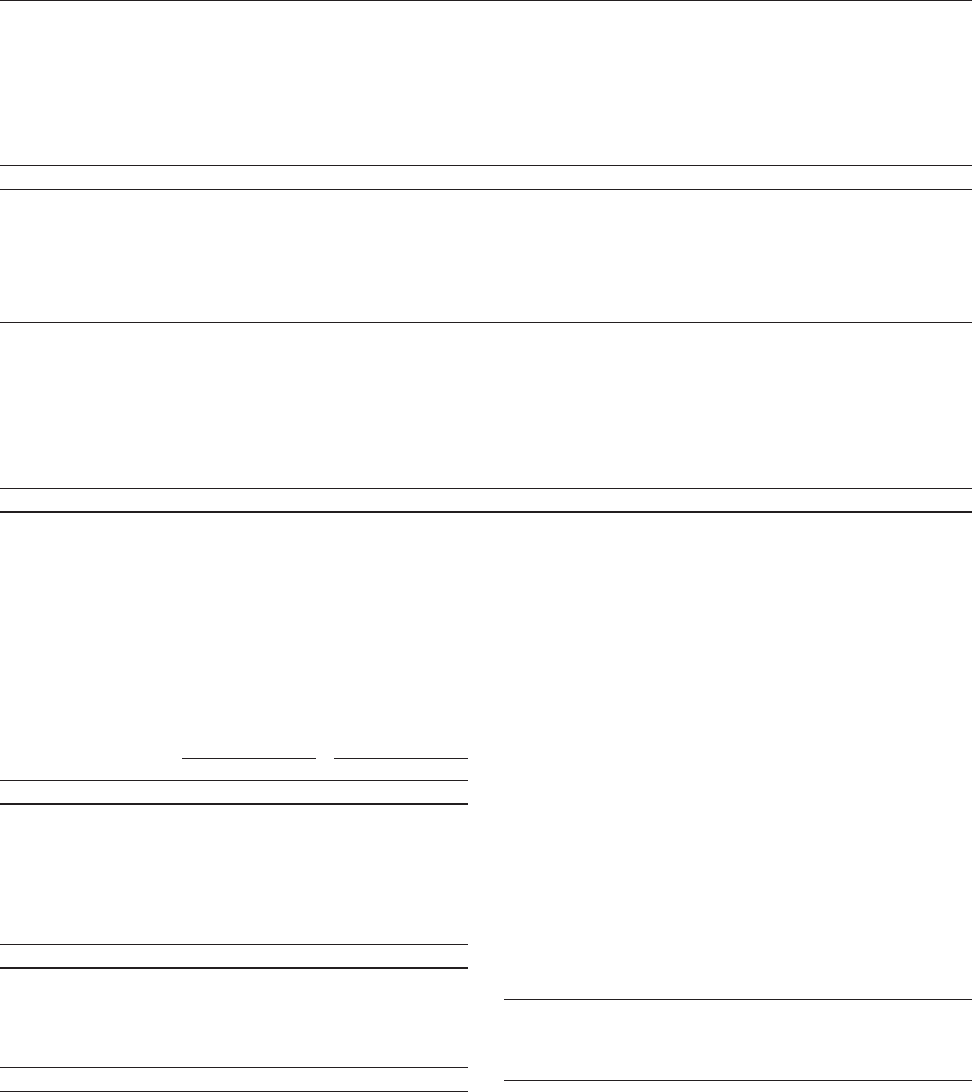

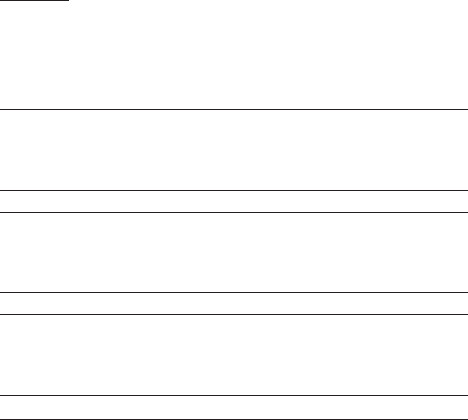

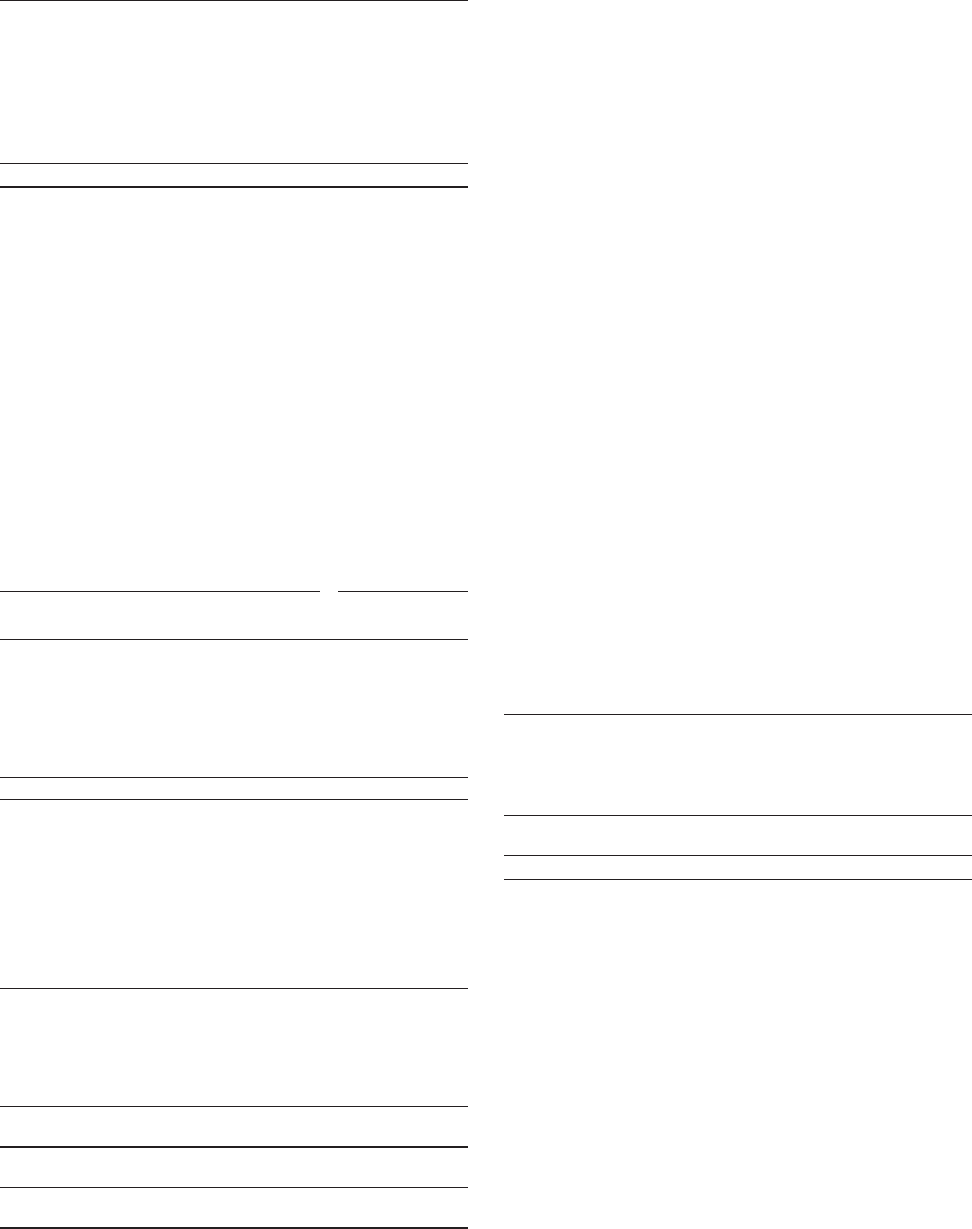

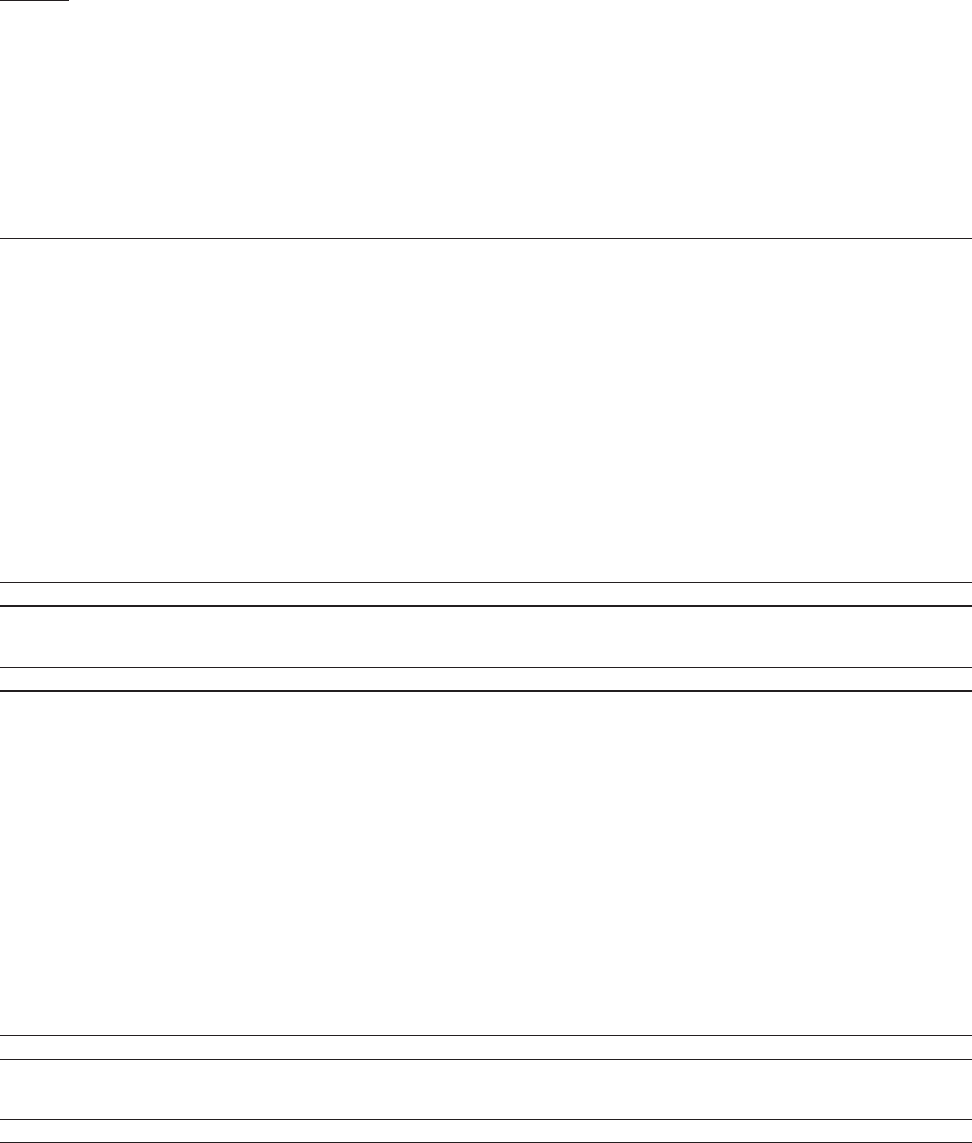

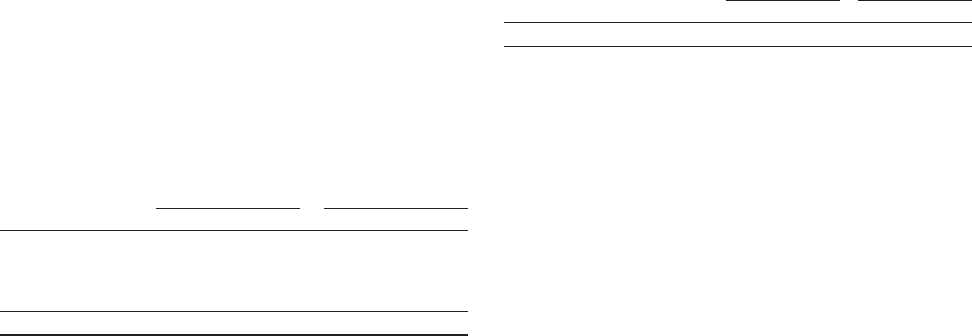

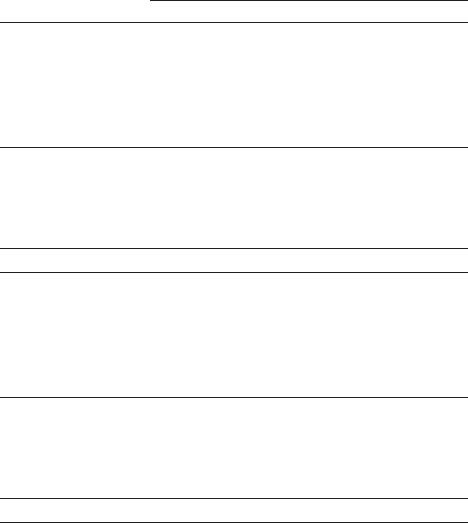

GE CAPITAL

TRANSFORMATION

Pre-Crisis 2011

TIER ONE

COMMON RATIO 4% 10%

LEVERAGE 8:1 4:1

CP COVERAGE 74% 292%

DEBT RATING AAA AA

GROWTH ADJACENCIES

Promising opportunities for expansion, such as in Oil & Gas

and Life Sciences, are closely related to our core businesses

and have helped fuel GE’s growth over the last decade.

FOCUS:

Life Sciences, Aviation Systems, Oil & Gas, Mining, Distributed Energy and Pathology,

among others

(Revenues)

2011 $39B

2001 $4B

GE 2011 ANNUAL REPORT 5

6% of our revenue. This has impacted

our margins in the short term, but the

bet is paying off.

Technology allows us to win in the

market. GE Aviation and its partners

are the world’s largest producers of

jet engines, and last year received

$23 billion of orders, our biggest year

in history. Together, we will launch

12 new jet engines this decade. This

will result in signifi cant future growth.

Technical strength drives growth.

Based on our industry-leading technol-

ogy, we will install about 40% of the

wind turbines in the U.S. this year. At

Healthcare, we are launching 100 new

products that lower cost, improve

quality and expand access. Over the

next fi ve years, GE will be dedicating

$1 billion to the development of new

cancer solutions. In Transportation, we

are building six new rail platforms that

capitalize on global growth. We have

launched new businesses in solar

energy and power management.

Technology adds value to our acquisi-

tions. In 2007, we acquired Smith’s

Aerospace Group to give us a small

position in aircraft avionics and energy

management. Then our researchers

went to work. We are building solutions

for integrated power management,

distributed engine control and onboard

advanced computing. These technolo-

gies will help our engines be even

more fuel-effi cient, and allow us to

develop more content on the plane. We

are building novel solutions for our

customers and should be in the top tier

of the avionics industry by the end of

the decade.

We have scale advantage in technol-

ogy. We have the fi nancial strength to

make big bets. Our Global Research

Center spreads ideas and lowers risks.

Our technical teams execute complex

projects better than anyone.

We win in growth markets. In 2012,

our growth market revenues will near

$40 billion, expanding by about 15%.

We are a reliable, high-integrity

partner and are actively investing in

our leadership, capability, coverage

and the supply chain.

Operating around the world is not

without its challenges. There is

volatility and risk. But there is also

great opportunity. In the emerging

markets, we’ve added about 1,000

infrastructure salespeople every year

for the last four years. Since 2005,

we have increased our senior leaders

outside the United States by 50%.

We are committed to serve our global

customers better and faster.

Our geographic footprint is diversifi ed.

Latin America will approach $10 billion

in revenue in 2012, and could double

again in a few years. In Russia, we are

building ventures in two important

growth markets: gas power generation

and diagnostic imaging equipment.

In Nigeria, we are building out a com-

prehensive “Company-to-Country”

approach to address infrastructure

challenges; Nigeria should be our next

billion-dollar country. In Saudi Arabia,

we will invest to localize capability,

better serve our customers and help

the government address healthcare

needs for its citizens. We are playing to

win in every corner of the world.

The best global companies are devel-

oping new business models tailored

for growth markets. For instance, in the

next 25 years, 1.5 billion people will

gain access to power, much of it “off”

the electricity grid. This will result in a

$16 trillion power opportunity. Today

we have $5 billion of revenue in distrib-

uted energy, and our revenue should

almost double in the next three years.

Similarly, there are 50,000 locomotives

around the world that are more than

25 years old. Replacing or retrofi tting

those locomotives to be more fuel-

effi cient is a $15 billion opportunity.

GE has deep relationships and operating

advantages in growth markets.

John Rice, our vice chairman, leads the

initiative to win globally. I consider the

development of growth markets to

be the most profound economic change

for this generation of GE leaders. This is

a transition where GE must win.

BUILDING COMPETITIVE

ADVANTAGE

Superior technology

Leadership in growth markets

Services & customer relationships

Margin expansion

Smart capital allocation

6 GE 2011 ANNUAL REPORT

We are building mutually profi table

relationships with our customers. Our

service business has a $147 billion

backlog and will generate $45 billion in

revenue in 2012. Service is a strength

for GE because we understand our

products and the ways in which

they are used. When we do well, our

customers benefi t. And we’re continuing

to do everything we can to increase

their productivity and help them

optimize their assets. That is why last

year we invested so heavily in

analytics, controls, monitoring and

diagnostics integration. And we are

building a new software center of

excellence in California.

I don’t see GE as a software company.

However, we will lead in the productivity

of our installed products and their

ecosystems. This will require leadership

of the “Industrial Internet,” making

infrastructure systems more intelligent.

This will show up in more profi table

Contractual Service Agreements (CSAs)

and a software business that could

double to $5 billion in the next few years.

Here is how it could work. The GE90 is

the world’s most powerful engine; it

powers the Boeing 777. Each engine has

17 sensors. These sensors constantly

take complete performance data from

the engine. From this data, we can

build sophisticated analytics that can

avoid unplanned outages, provide

repair data in real time, increase fuel

performance and optimize fl eet

performance. This analytical capability,

applied with domain expertise across

our large fl eet of engines, could save

billions for our customers.

Relationships are also a critical part of

what differentiates the smaller, more

focused GE Capital. We decided from a

strategic standpoint that we should

concentrate on the industries and

sectors where we have a strong com-

petitive advantage versus banks.

That’s the way we think about the

portfolio. Last year we helped launch a

center at The Ohio State University that

is dedicated to the middle market, the

segment that consists of companies

ranging in revenues from $10 million to

$1 billion, including almost 200,000

businesses in the U.S. We have great

origination capability, industry domain

expertise and relationships in that

segment, all of which will fuel GE Capital’s

recovery and growth.

Deep relationships are a competitive

advantage at GE. They are long-term,

and they start at the top. Our leaders

spend a lot of time in the market with

our customers. I chair our Service and

Commercial Councils so that I can

relate to our leaders, follow the metrics

and understand competition. We must

execute for our customers.

We aim to grow margins. Our margins

were about 15% in 2011; we expect

to drive them up by 50 basis points

next year. We are near the top of all

industrial companies, but we can get

even better.

It begins with the way we think about

our cost structure. In the last generation,

GE and our industrial peers began a

long-term trend to outsource our supply

==

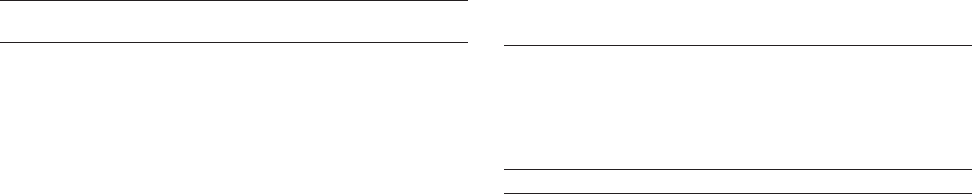

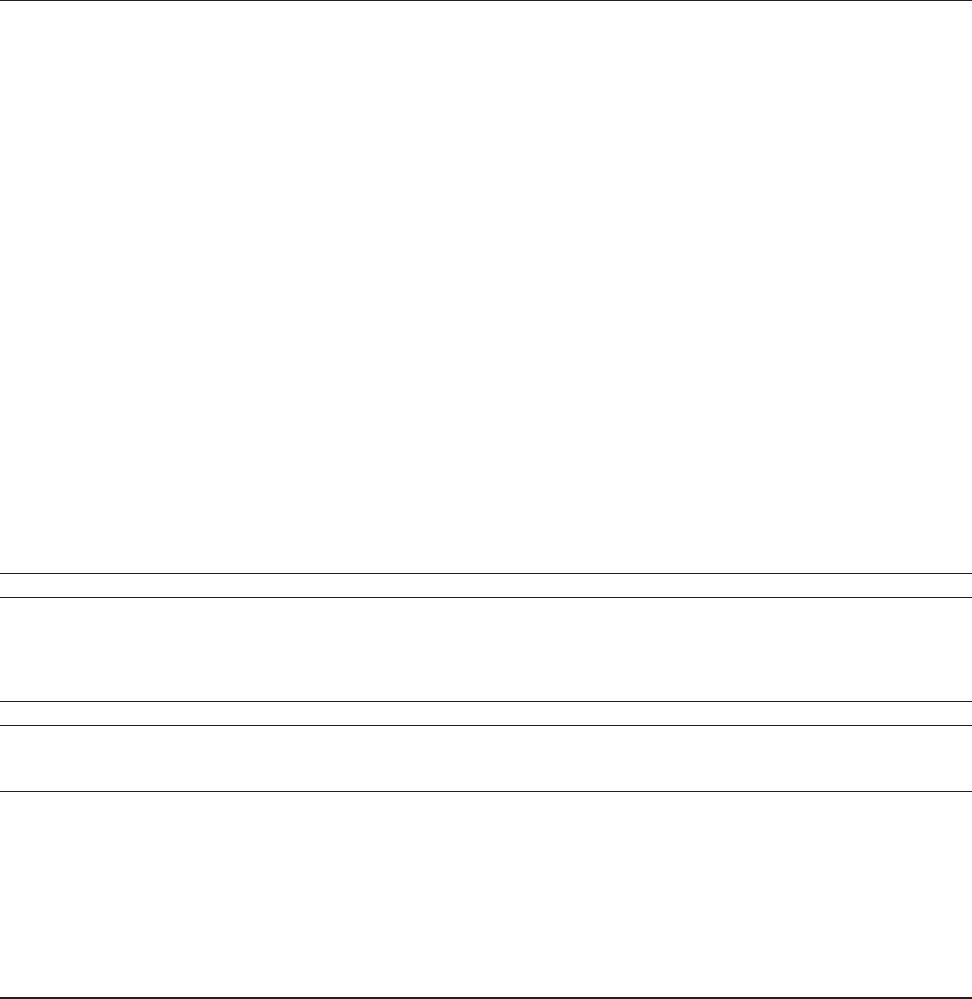

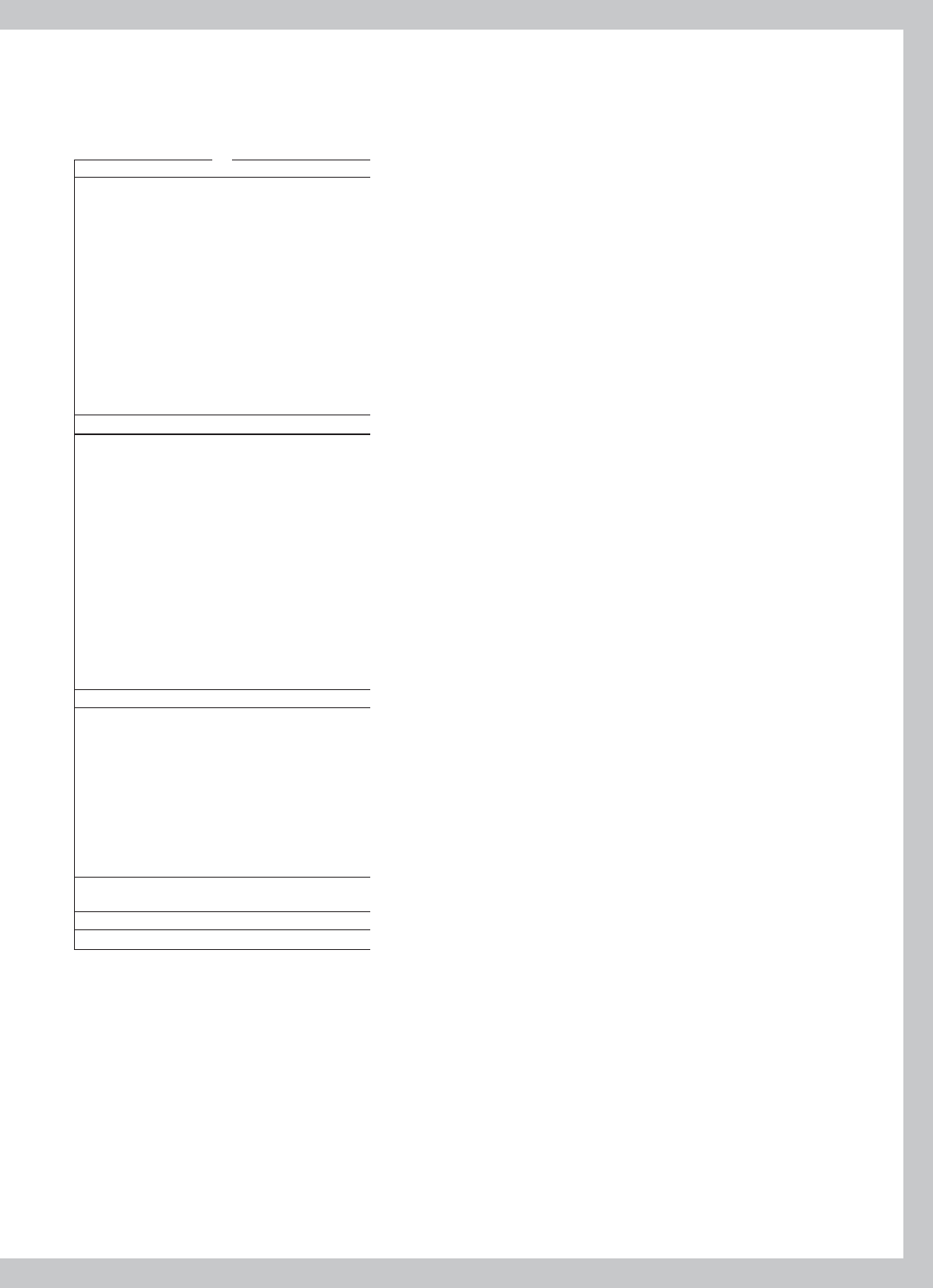

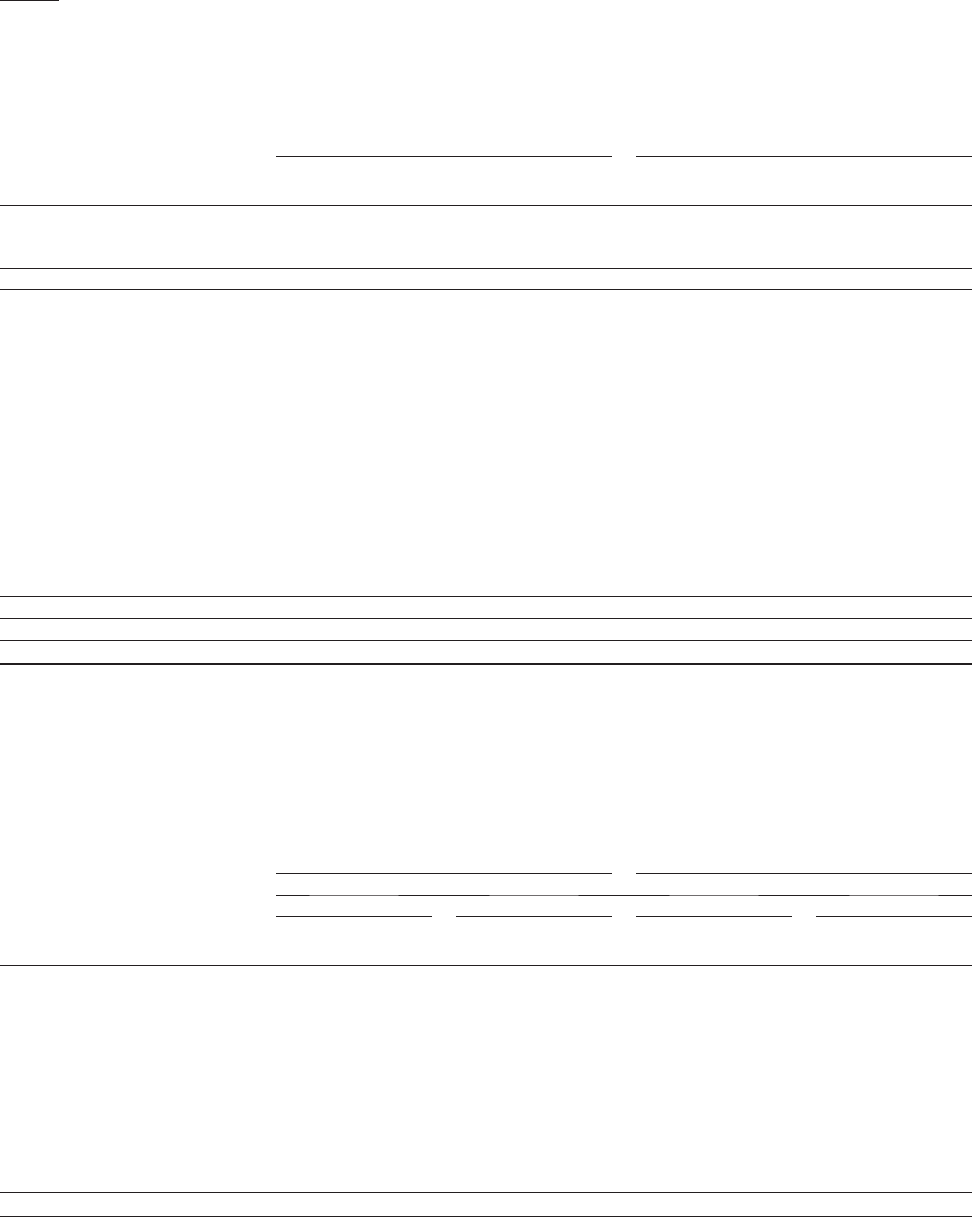

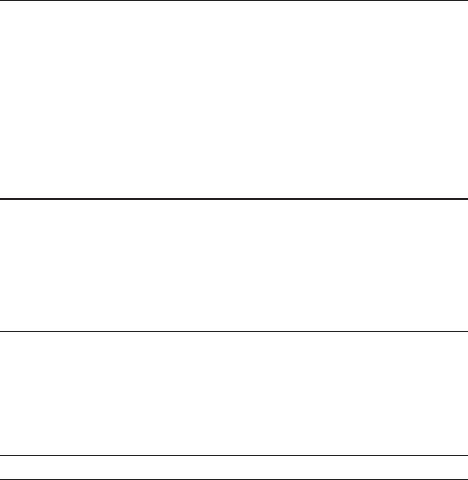

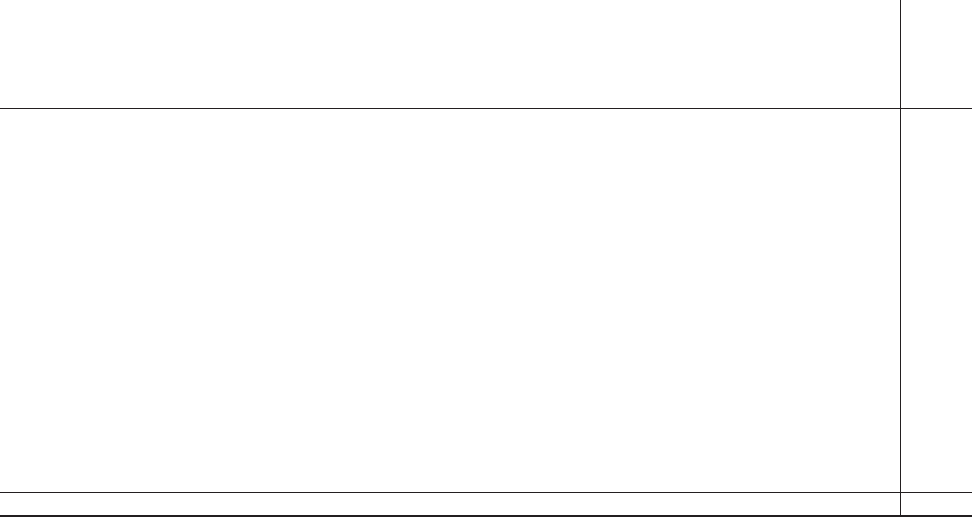

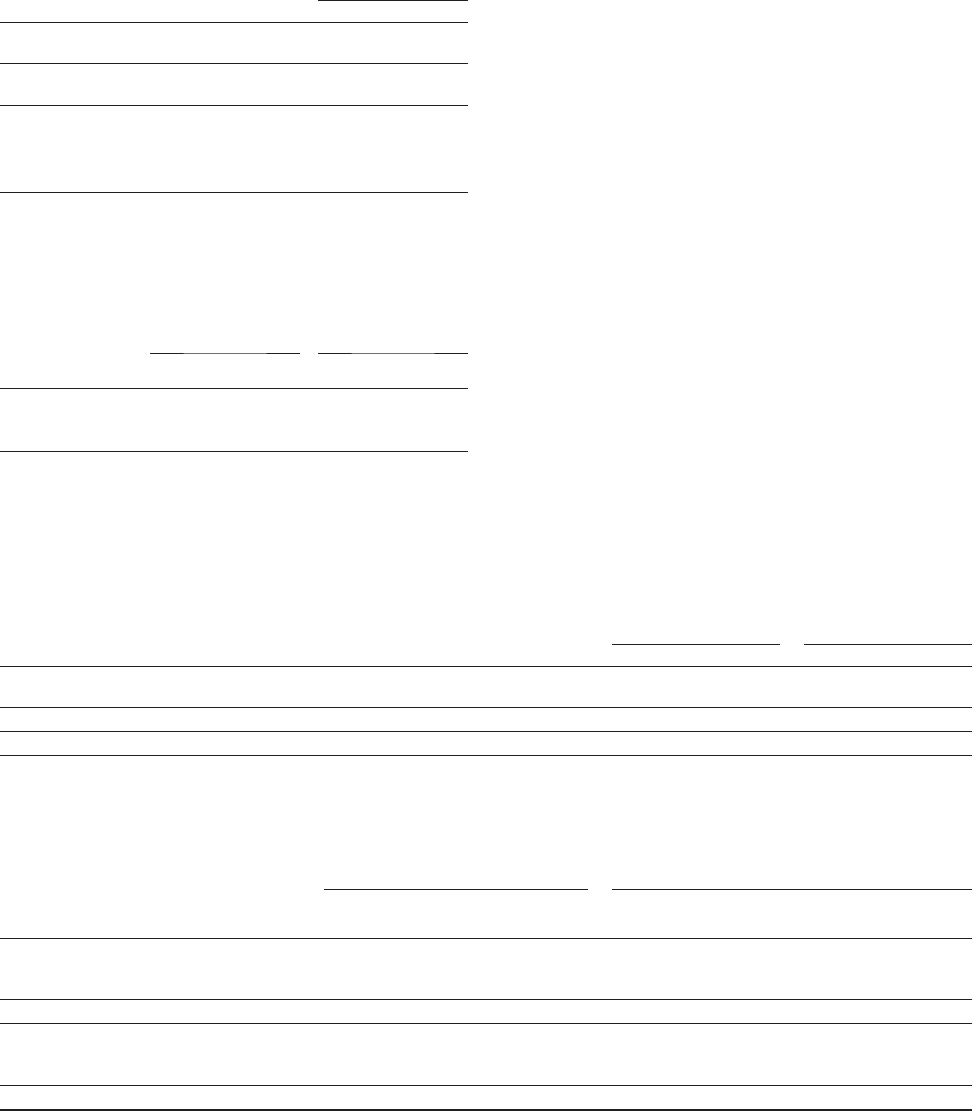

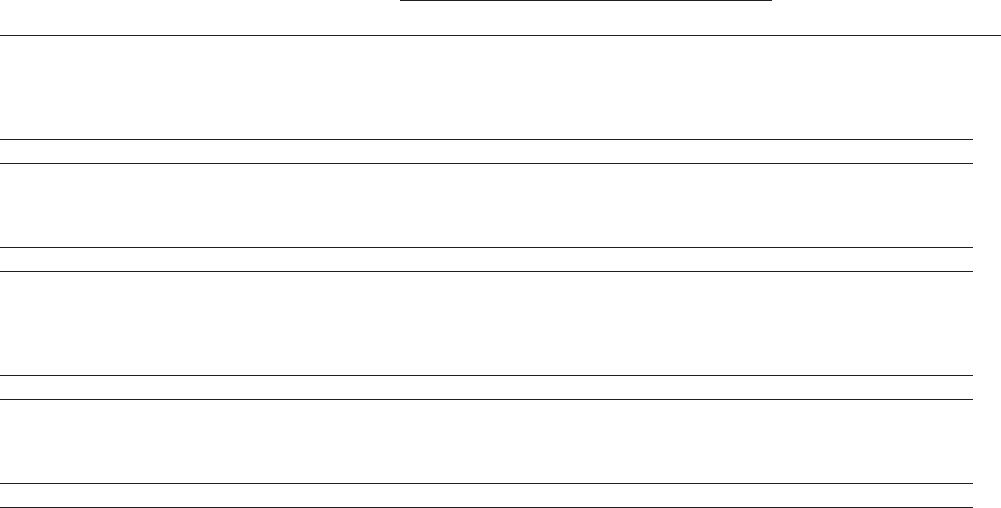

GE90 ANALYTICS BENEFIT

90,000

fl ight records analyzed

~200

parameters per

fl ight record

~18MM

parameters per

month

Enhances asset utilization

Increases system performance

Drives strong alignment with

customers

Facilitates securing of long-term

service agreements

Provides additional revenue

streams

THE POWER OF THE INDUSTRIAL INTERNET

Advanced Analytics drives strong alignment with customers

GE 2011 ANNUAL REPORT 7

chain to other companies. This made

sense in an era when labor was expen-

sive and material was cheap. Today, our

material costs are more important. So

we have to control our supply chain to

achieve long-term productivity.

To control our product cost, we leverage

both human and technical innovation.

Human innovation comes in the form of

lean manufacturing. At Appliance Park,

in Louisville, Kentucky, we have torn

down functional silos and replaced them

with a “one team” mentality. We know

that one key to success is driving down

manufacturing hours per unit. In some

factories it takes nine hours to build a

refrigerator. Our employees in Louisville

are working to cut that to three hours.

By revamping what was a 25-year-old

dishwasher line, the Appliance Park

team has reduced the time to produce

by up to 68%, and the space required by

more than 80%.

Our Aviation business and its sophisti-

cation—in advanced manufacturing,

computer modeling, and material

sciences and composites—is a great

example of technical innovation. For

instance, the use of different qualities

of carbon fi ber and resins enabled us

to create unique fan blades, fan cases

and components that sharply reduce

engine weight compared to traditional

all-metal versions. Impact-resistant

properties make these fan blades

extremely durable. This allows us to

substantially lower engine cost and

accelerate “speed to market.”

In 2010, we launched an enterprise

initiative called “GE Advantage”

to drive operating results. We have

30 industrial projects under way,

utilizing ideas from thousands of

employees and targeting $2 billion of

margin improvements. Our team is

using classic GE tools like lean, work

out and Six Sigma. Projects have

big payoffs.

In our Oil & Gas business, our goal is to

give customers a new business quote in

a day, have a project be operational

in a year, and have our equipment

always available for customers’ use.

This would result in several hundred

million dollars of benefi t for our

customers and GE. Our Aviation supply

chain team is trying to compress the

learning curve on new engines, again

with a huge payoff in margins and

cash, with improved customer quality.

This is the GE team, fi nding a better

way. This is how we will become leaner

and more productive. This is how we

will sustain improvements in margins.

We will reward investors through

smart allocation of capital. Our busi-

ness model generates a lot of cash.

Over the next few years, thanks to

NBCU monetization, dividends from GE

Capital and solid growth, we expect to

have about $30 billion in available cash.

This will provide us with an opportunity

to reward investors while protecting us

against a volatile economy.

One of our top priorities is to grow

dividends. We’ve increased the

dividend four times in the last two

years, and we have a dedicated

focus on increasing the GE dividend

in line with future earnings. We have

found that focusing on acquisitions

between $1 billion and $3 billion in

industries we know improves our

chance for success. Don’t look for

any big deals in 2012. Ultimately, if

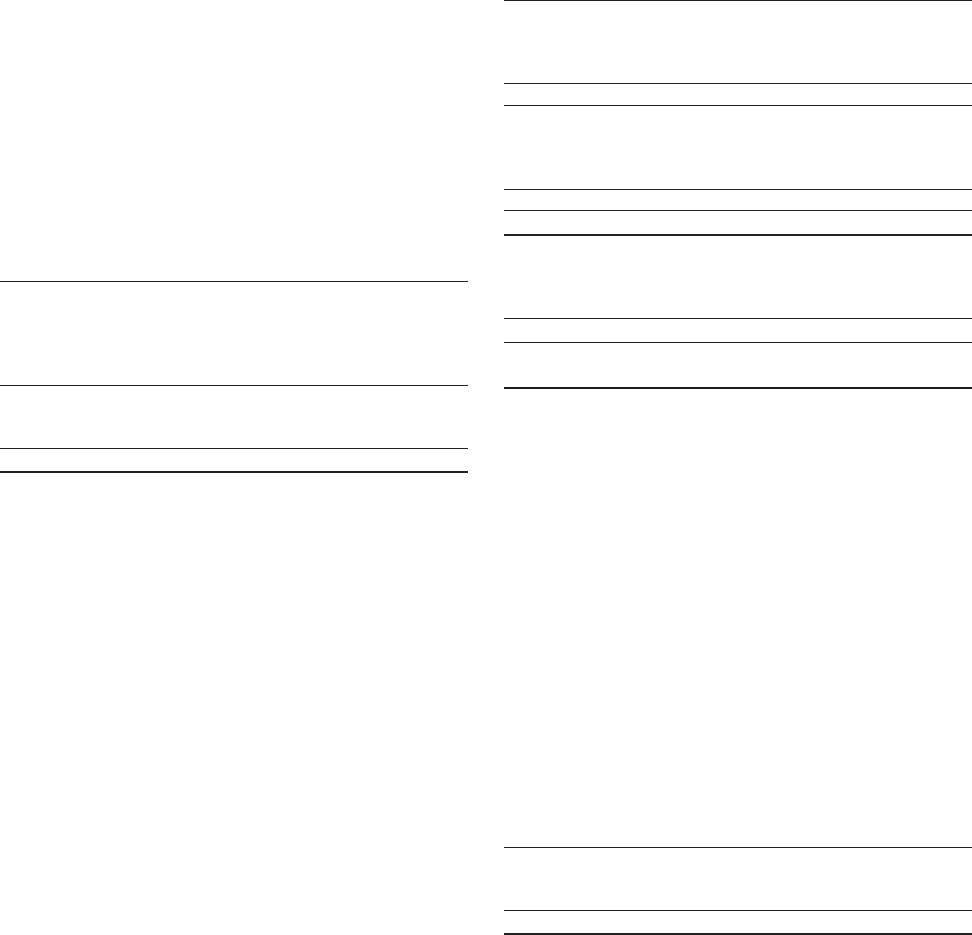

GE ADVANTAGE

Our rejuvenated focus on process excellence and process improvement is already delivering big returns.

Nearly 40 GE-wide projects currently under way will yield billions in margins over the next three years.

New product

introduction

Commercial

excellence

Service and Contractual

Service Agreement

excellence

Acquisition

integration

Order to

remittance

Inquiry

to order

GE Capital

deal conversion

Speed/

Bureaucracy

8 GE 2011 ANNUAL REPORT

2012: FOCUS FOR INVESTORS

you view GE as a safe growth company,

with an attractive dividend yield

that can invest and achieve returns

well above our cost of capital, we are

in a good place for investors.

Competitive advantage is about

outperforming our peers, building an

attractive fi nancial profi le and

rewarding investors. In our chosen

industries, we are ahead today. Our

fi nancial results should exceed the

S&P 500, with a more valuable profi le.

THE VALUE OF COMPETITIVENESS

We live in a tough era in which the

public discourse, in general, is negative.

I worry that the mood of the times

prevents us from moving forward.

American companies, particularly

big companies, are vilifi ed. There is

social unrest in many corners of the

world. This should not be a surprise.

Our problems are diffi cult; when

economic progress is uneven and

unemployment is high, we need to

work together to fi nd a better way.

In these times, it is diffi cult to explain

the benefi ts of globalization. GE is an

infrastructure company. The U.S. is

not investing much in infrastructure,

but most other countries are. We will

sell 140 heavy duty gas turbines in

2012; fewer than fi ve will go to the U.S.

So, we must sell in 120 countries;

we must build global capability; we

must export. In the last decade our

exports have more than doubled,

creating thousands of high-paying

American jobs. We are consistently

among America’s top exporters. Are

we “un-American” because we sell

around the world? No. Our company,

because of our great people, can win.

And, that is the American spirit.

Last year, I told you that I was asked to

lead the President’s Council on Jobs and

Competitiveness. When the President

asked, and given the state of the coun-

try, I felt that saying “yes” was the right

thing to do. I was honored to do so.

In January, we gave our year-end

report to the President. We had three

key messages: the country has lost

ground in relative global capability; we

have multiple ways to create more

jobs, but they require leadership and

teamwork; and our long-term success

must be built on a foundation of com-

petitiveness. The Council delivered

more than 80 specifi c recommenda-

tions to the President, half of which are

being implemented. I know that the

U.S. can and will do better in the future.

In the process of leading the Council,

I learned a few things. Competitiveness

comes fi rst. As a country, we must

love to compete again. As a nation,

we must love to win. We simply must

create more competitive structures

in this country, improving areas like

education, infrastructure and regulation.

If we focus again on competition and

innovation, I know we will win and

create jobs.

Words and actions count. People in this

country can work together, but only

if they are properly led. It starts by

solving tough problems together, like

the defi cit. We need to be a country of

action, not just words. We need to be

a country where we engage everyone,

the entire team.

At GE, we like working together. We see

the future as interesting, exciting and

fi lled with opportunity. We have a

better portfolio, we have invested in

competitive advantage, and we have

the culture of GE Works.

GE will compete. And we will win in

every corner of the world. We are

optimistic and ready for the future. We

are proud of our company.

GE Works. For investors, this means

solid earnings growth and a solid

dividend foundation. For employees,

it means a belief in a better way,

a relentless drive to invent and build

things that matter. For customers,

it means more profi table solutions.

And for society, GE will help create a

world that works better.

Jeffrey R. Immelt

Chairman of the Board

and Chief Executive Offi cer

February 24, 2012

1

INDUSTRIAL

GROWS 10%+

AND

RETURN CASH

FROM

GE CAPITAL

2

BUILD

SOFTWARE

AND

ANALYTICS

CAPABILITY

3

INVEST IN

GLOBAL

GROWTH

AND BUILD

SUSTAINABLE

PROCESSES

4

BEST-IN-

CLASS

OPERATING

PERFORMANCE:

GROW

MARGINS

5

CAPITAL

ALLOCATION:

ATTRACTIVE

DIVIDEND

GE 2011 ANNUAL REPORT 9

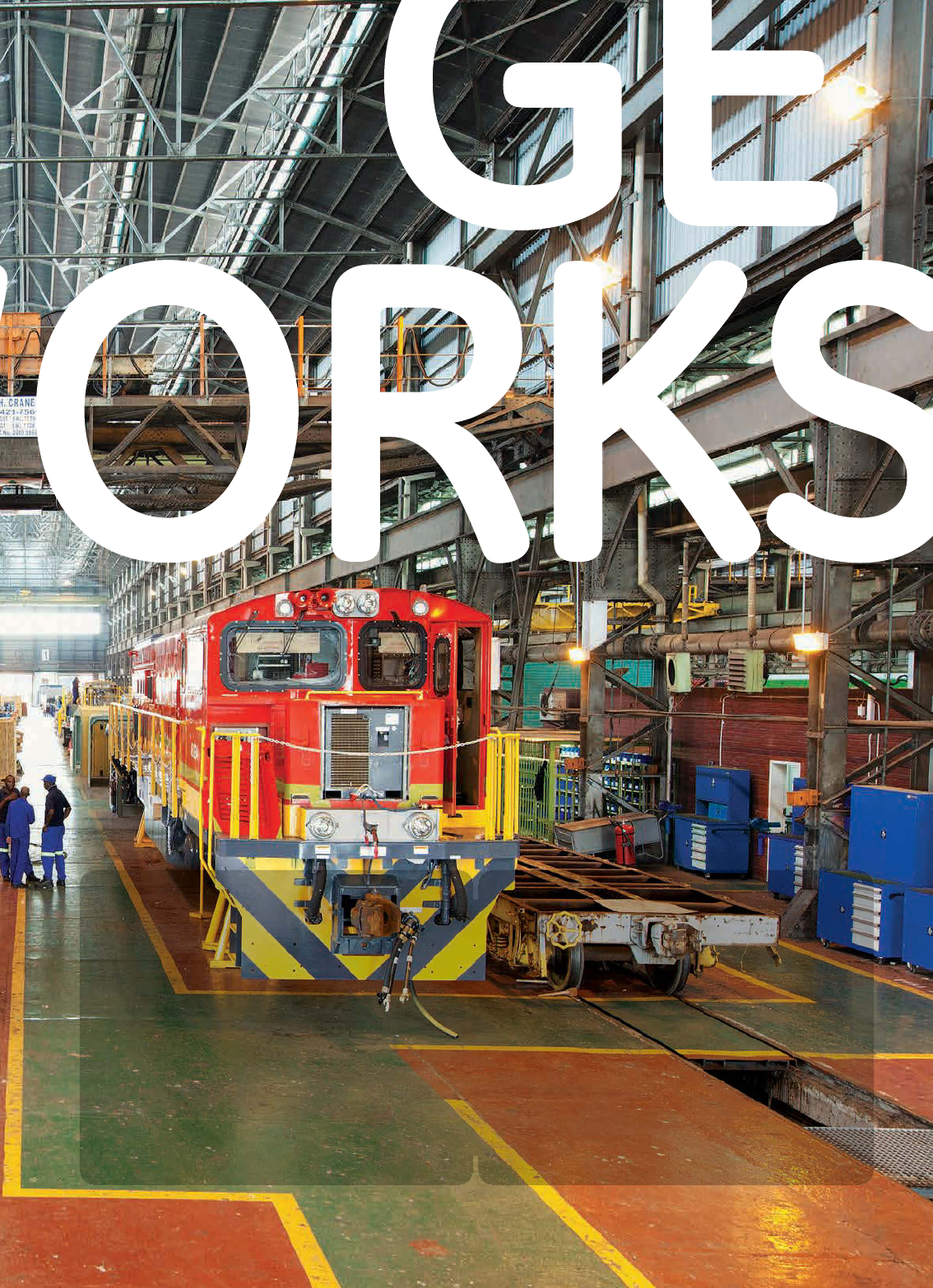

GE Model C30ACi Locomotive Assembly

Transnet Freight Rail

Pretoria, South Africa

GE works on things that matter. The best

people and the best technologies taking on the

toughest challenges. Finding solutions in energy,

health and home, transportation and fi nance.

Building, powering, moving and curing the world.

Not just imagining. Doing. GE works.

ge 2011 annual report 11

BUILDING

GE Builds the World

GE builds the world by providing capital, expertise and infrastructure for a global

economy. In the past year, GE Capital provided billions in financing so businesses

could build and grow their operations and consumers could build their financial futures.

We build appliances, lighting, power systems and other products that help millions

of homes, offices, factories and retail facilities around the world work better. We aren’t

afraid of the future. We build it.

BUILDING

GE GeoSpring™ Hybrid

Water Heater Assembly

GE Appliances

Louisville, Kentucky

Left to right:

Travis Saylor

Final Assembly Operator

Randy Barger

Replacement Operator

Kevin Moore

Final Assembly Operator

Middle market businesses lead the way in the U.S. in creating jobs and

pumping life into the economy. They can’t do it without funding, expertise

and solid business-building advice. GE Capital is a major source of funding

for the middle market, committing $122 billion in the U.S. in the past

year. For example, we helped snack manufacturer Shearer’s Foods, Inc.

with financing. Shearer’s Foods updated and expanded operations, added

359 new jobs and grew revenue to $405 million in 2011. GE works for

customers—helping them build businesses, and build them better.

Photo above and right: Shearer’s Foods, Millennium Manufacturing Facility, Massillon, Ohio

Dan Henson (third from left),

President & CEO, GE Capital, Americas,

pictured with (from left to right):

Bob Shearer, Lee Cooper, Scott W.

Smith, Sharon Garavel, Tom Quindlen

and Fritz Kohmann.

Leading from

the Middle

14 GE 2011 ANNUAL REPORT

REBUILDING

EXCELLENCE America needs investment to stay

competitive, create jobs and drive economic

opportunity. GE is investing more than $1 billion to

transform the appliances we make, leading to

the creation of 1,300 U.S. jobs. By combining

design and production in one site and using lean

manufacturing, we’re able to bring better products to

market faster and more cost-effectively, reflecting

the world-class competitiveness of our U.S. facilities. ACCESSING

GE’S EXPERTISE Through Access GE,

GE Capital brings a broad range of tools,

resources and expertise to help customers

solve their most pressing challenges and find

new ways to grow. When electronic security

provider ADT was looking to upgrade its fleet

of full-size service vans, GE Capital helped

determine the most cost-effective and fuel-

efficient replacement. The deployment of the

new vehicles will help ADT save more than

$6 million a year and reduce CO2 emissions 40%.

This year, GE Capital will launch the Access GE

online portal, a new way to deliver crucial

knowledge and expertise to our customers.

GE 2011 ANNUAL REPORT 15

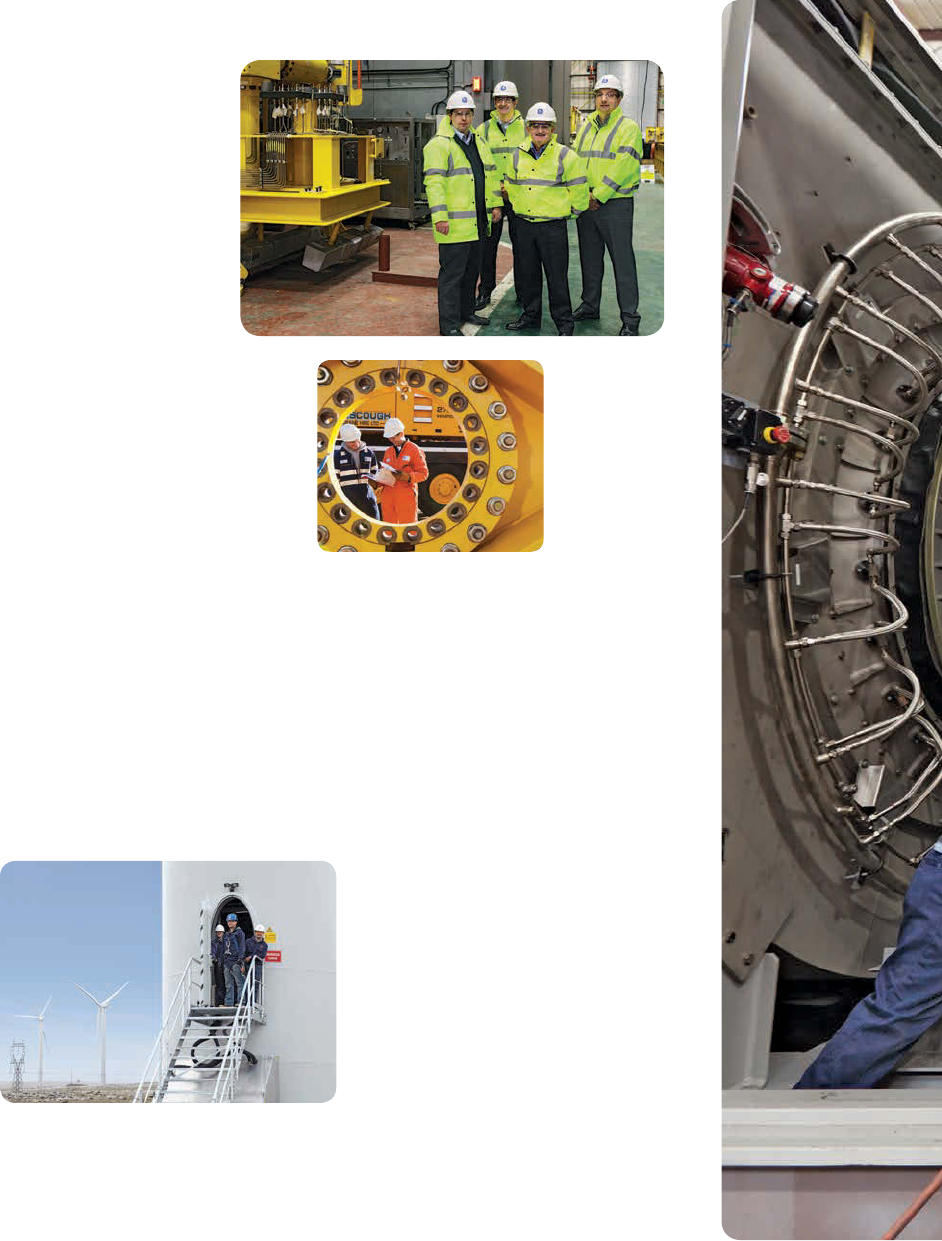

Stephen Fitzgibbon

Mechanical Fitter I

Gorgon Tree

Subsea Control Systems

GE Oil & Gas

Aberdeen, Scotland

GE Powers the World

GE’s advanced technologies and energy solutions provide a powerful advantage for

millions of people. Our technology helps to deliver a quarter of the world’s electricity.

We are one of the largest clean energy companies in the world. We deliver innovation

that the world needs: from an integrated wind, solar and natural gas project, to smart

grids that help utilities manage electricity demand, to gas engines that run on organic

waste, to more accessible charging stations for electric vehicles. We don’t just imagine

a cleaner and more productive world. We power it.

PIPELINE OF

INNOVATION Competitive and

environmental challenges in the oil and gas

industry are driving energy producers to seek

better efficiency, reliability and environmental

protection. Tackling these complex challenges

takes leadership, teamwork and innovation.

The GE Oil & Gas team in Aberdeen, Scotland,

is leading many of our technology and service

solutions for the sector.

Innovations in recent years have included

next-generation valves with improved nano-

coatings for increased safety and reliability;

pipe inspection technology; and other

advances that enable oil and gas companies

to produce the energy the world needs more

safely, reliably and cost-effectively.

Rod Christie (second from left),

VP & GM, GE Advanced Subsea

Power & Processing Systems,

pictured with (from left to right):

Balazs Somogyi, Gerry McCue

and Neil Saunders.

LEADERSHIP IN

WIND POWER The world needs

clean, renewable energy, and wind power

is a big part of the answer. GE wind

turbines, among the most widely used

in the world, will soon power the largest

wind farm in the U.S. The Shepherds

Flat project in Oregon, developed by

Caithness Energy, will get its power from

338 advanced GE 2.5xl ecomagination-

qualified wind turbines, which deliver

greater efficiency, reliability and grid

connectivity. The Shepherds Flat turbines

will produce enough clean energy

to power about 235,000 households.

18 ge 2011 annual report

To integrate more renewable resources into the power grid, the world

needs a better way to obtain power when the sun isn’t shining or the wind

blowing. The ecomagination-qualified Flex family of products helps meet

this need. The FlexEfficiency 50 Heavy Duty Gas Turbine and the FlexAero

LM6000-PH Aeroderivative Gas Turbine allow for flexible, efficient and

environmentally friendly power generation day or night. The FlexAero is

the world’s most efficient combined-cycle gas turbine in its class and will

save 26 million gallons of water annually with its innovative eco-friendly

technology. The first FlexEfficiency 50 plant will go online in 2015.

Fast, Flexible

Power

Anytime

FlexAero LM6000-PH

Aeroderivative Gas Turbine,

being built in Houston, Texas.

ge 2011 annual report 19

GE Moves the World

When the world needs a better way to get there faster, we work to make the trip safer

and more cost-effective, with lower carbon emissions, too. We make the world’s largest

jet engine—and among the world’s most efficient. We build locomotives that reduce

emissions. And we provide advanced air traffic and rail freight management systems.

We don’t just dream of a world where people and goods travel more safely, quickly and

efficiently around the globe. We move it.

GE90 Aircraft Engine Testing

GE Aviation

Peebles, Ohio

Airlines are demanding record numbers of advanced aircraft

engines, including the GEnx and LEAP, to power their next-

generation fleets. Our aviation supply chain team is meeting the

challenge. New manufacturing facilities in Ellisville, Mississippi,

and Auburn, Alabama, will add capacity and create jobs. We

are also integrating suppliers into new programs and driving

big improvements in quality and delivery through a team-based

culture and lean manufacturing techniques. We do all this so

we can deliver a record number of aircraft engine orders with

maximum cost-efficiency, productivity and quality.

Photo: GE Aviation’s Evendale, Ohio, world headquarters

Strong Supply

Chain Links

Colleen Athans (third from left),

VP & GM, GE Aviation Supply Chain,

pictured with (from left to right):

Bob Briggs, Joe Allen,

Melissa Twiningdavis and

Denice Biocca.

22 ge 2011 annual report

ON TRACK FOR EXPANSION

Transnet Freight Rail (TFR), one of South

Africa’s largest rail freight operators,

is striving to meet the growing needs

of a rapidly developing region. The GE

locomotive is delivering the solution. Three

of our locomotives can do the work of

four older models, with lower costs, better

fuel efficiency and reduced emissions.

Producing the 143 locomotives ordered by

TFR will be a global effort: locomotive

components manufactured at GE plants

in the U.S. will be fully assembled in South

Africa. This will create jobs in both countries

and help TFR meet the demand for reliable

freight transportation.

A LEAP FORWARD IN AIRCRAFT

ENGINES Airlines are purchasing new

planes to update and expand their fleet

while balancing high fuel costs and new

international environmental standards.

GE and its CFM International 50/50 joint

venture partner Snecma, created the

LEAP engine to meet this demand.

Ecomagination-qualified LEAP engines use

the latest-generation materials and design

processes to reduce weight, improve

performance and lower maintenance.

This means planes are more likely to

take off and land on time and spend less

time in the shop and more time moving

passengers and cargo around the world.

ge 2011 annual report 23

William Hunn

CT Gantry Assembly Production Associate

Optima 580 CT System

GE Healthcare

Waukesha, Wisconsin

GE Helps Cure the World

GE Healthcare technology is helping doctors and caregivers save nearly 3,000 lives

every day and address the world’s biggest healthcare challenges. GE is at work providing

advanced diagnostic tools as well as systems that help researchers discover lifesaving

solutions, and patient record systems that help lower costs and enhance patient care. Our

technology is designed to help medical professionals detect disease earlier and treat it

better. And, we’re investing to create new solutions to develop groundbreaking products

and processes. We see a world where cost, quality and lack of access prevent too many

people from getting the healthcare they need. We’re helping to cure it.

A CLEAR PICTURE

OF HEALTH To help physicians provide patients

with accurate diagnoses and targeted treatments,

healthcare organizations need advanced imaging

technology. GE entered into a strategic alliance with

OhioHealth, a nationally recognized, not-for-profit

healthcare system, to bring cutting-edge computed

tomography (CT) and magnetic resonance (MR)

imaging systems to patients across central Ohio.

The GE Healthcare team listened to OhioHealth’s

needs and delivered a better way—including our

Optima CT660, Optima MR450w and Discovery

MR750w systems—that provide real-time, high-

resolution imaging.

SOLUTIONS FOR THE

PHARMA INDUSTRY Advanced medicines

create new challenges for pharmaceutical

companies. GE technology is used to manufacture

many of these medicines, which gives us the

experience to help these companies tackle key

issues such as safe and cost-effective delivery

and reducing time to market. Our innovative

ReadyToProcessTM single-use platform enables

flexible manufacturing, faster process design and

quicker changeover between production campaigns,

without compromising quality or safety. Single-use

technologies: an affordable solution that drives

medical progress and helps save lives.

HIGH DEFINITION,

LOW-DOSE SCANS Computed

tomography is widely used to help

physicians detect cancers, other

diseases and injuries. GE continues

to work to produce CT systems that

provide high image clarity for physicians

and reduced patient exposure to

radiation. Our Veo image reconstruction

technology uses modeling and complex

data analysis to enhance clinical images

even at lowered doses. GE not only

makes tools to help doctors, we also

provide entire healthcare systems with

services and technology to meet the

needs of their patients.

26 GE 2011 ANNUAL REPORT

Taking

the Fight

to Cancer

Yousef Alohali (second from

right), Director, Clinical

Education, GE Healthcare Saudi

Arabia, pictured with (from left

to right): Victor Delos Santos,

Noor Hanifa Palala (Saudi

Ministry of Health), Majed Nasser

and Golnar Kamalvand.

Cancer is among the world’s leading causes of death, and GE is committed

to helping cure it. GE’s global fight against cancer is backed by a five-

year, $1 billion commitment to improve screening and diagnosis to help

doctors fight cancer more effectively. In 2011, as part of this commitment

and in partnership with prominent venture capitalists, GE launched a

$100 million healthymagination open innovation Challenge to find the

next generation of cancer diagnostic tools and treatments, starting with

breast cancer. Innovations now in the pipeline include a mobile mammography

device and molecular diagnostics to enable patient-specific cancer

therapies. We’re also bringing new weapons to the fight against breast cancer

by increasing access to mammography screenings in underserved areas,

like Wyoming, Saudi Arabia and China.

Photo left and above: Riyadh, Saudi Arabia

GE 2011 ANNUAL REPORT 27

At GE, we aren’t afraid of the future,

we’re building it. We’re growing

global leaders, investing in new

technologies, developing advanced

manufacturing skills, applying

intelligent software to make things

work smarter, and partnering with

customers and communities around

the globe. GE works by delivering

economic growth, shareholder value

and, most of all, solutions that make

the world work better.

Board members focus on the areas that are important to

shareowners—strategy, risk management, leadership development

and regulatory and compliance matters. In 2011, they received

briefi ngs on a variety of issues, including capital allocation and

business development, risk management, technology excellence,

regulatory trends, social cost, capital market trends, service

contract performance, political contributions and lobbying

activities, and GE’s branding, marketing and operating initiatives.

At the end of the year, the Board and each of its committees

conducted a thorough self-evaluation.

The GE Board held 15 meetings during

2011, including three meetings of the

non-management directors of the Board.

Each outside Board member is expected to

visit at least two GE businesses without the

involvement of corporate management

in order to develop his or her own feel for

the Company.

Directors (left to right)

Rochelle B. Lazarus

3,4

Chairman of the Board and former

Chief Executive Offi cer, Ogilvy & Mather

Worldwide, global marketing

communications company,

New York, New York. Director since 2000.

Robert W. Lane

1,2

Former Chairman of the Board and

Chief Executive Offi cer, Deere & Company,

agricultural, construction and forestry

equipment, Moline, Illinois.

Director since 2005.

Alan G. (A.G.) Lafl ey

3,5

Former Chairman of the Board and

Chief Executive Offi cer, Procter & Gamble

Company, personal and household

products, Cincinnati, Ohio.

Director since 2002.

Roger S. Penske

4

Chairman of the Board, Penske Corporation,

diversifi ed transportation company,

and Penske Truck Leasing Corporation,

Chairman of the Board and Chief Executive

Offi cer, Penske Automotive Group, Inc.,

automotive retailer, Detroit, Michigan.

Director since 1994.

Sam Nunn

2,4

Co-Chairman and Chief Executive Offi cer,

Nuclear Threat Initiative, Washington, D.C.

Director since 1997.

Andrea Jung

2,3

Chairman of the Board and

Chief Executive Offi cer, Avon Products, Inc.,

beauty products, New York, New York.

Director since 1998.

Ann M. Fudge

4

Former Chairman of the Board and

Chief Executive Offi cer, Young & Rubicam

Brands, global marketing communications

network, New York, New York.

Director since 1999.

Ralph S. Larsen

2,3,6

Former Chairman of the Board and Chief

Executive Offi cer, Johnson & Johnson,

pharmaceutical, medical and consumer

products, New Brunswick, New Jersey.

Director since 2002.

W. Geoffrey Beattie

1,5

President, The Woodbridge Company

Limited, Toronto, Canada.

Director since 2009.

James S. Tisch

5

President and Chief Executive Offi cer,

Loews Corporation, diversifi ed holding

company, New York, New York.

Director since 2010.

Susan Hockfi eld

3,4

President, Massachusetts Institute

of Technology, Cambridge, Massachusetts.

Director since 2006.

James J. Mulva

1,4

Chairman of the Board and Chief Executive

Offi cer, ConocoPhillips, international,

integrated energy company,

Houston, Texas. Director since 2008.

Douglas A. Warner III

1,2,3

Former Chairman of the Board, J.P. Morgan

Chase & Co., The Chase Manhattan Bank,

and Morgan Guaranty Trust Company,

investment banking, New York, New York.

Director since 1992.

Robert J. Swieringa

1

Professor of Accounting and former

Anne and Elmer Lindseth Dean, Johnson

Graduate School of Management,

Cornell University, Ithaca, New York.

Director since 2002.

James I. Cash, Jr.

1,2,4

Emeritus James E. Robison

Professor of Business Administration,

Harvard Graduate School of Business,

Boston, Massachusetts.

Director since 1997.

Jeffrey R. Immelt

4

Chairman of the Board and Chief

Executive Offi cer, General Electric

Company, Fairfi eld, Connecticut.

Director since 2000.

(pictured on page 1)

1 Audit Committee

2 Management Development and

Compensation Committee

3 Nominating and Corporate

Governance Committee

4 Public Responsibilities Committee

5 Risk Committee

6 Presiding Director

GE 2011 ANNUAL REPORT 29

At its heart,

the Board believes

GE Works is about GE’s

most valuable asset:

its people.

long- and short-term incentives, we reward our

executives’ discipline in consistently making

smart decisions over the course of their careers

at GE. We particularly value those individuals

who have the good judgment and ability to

balance risk and return and deliver long-term

results for shareowners.

At the same time, we do not ignore annual

performance, because we understand that if we

don’t turn in good short-term performance,

there won’t be a long term. We evaluate annual

performance both in terms of executing on long-

term strategies and in meeting specifi c annual

objectives. What is critical to note, however, is

that because we take the long view, good years

do not result in outsized payouts.

Similarly, in off years, compensation appropriately

considers the current year’s performance, but also

aligns it in the context of long-term performance.

Furthermore, we measure executives’ contribu-

tions to the Company’s overall performance rather

than focusing only on their individual business

or function. We reward sustained fi nancial

and operating performance and leadership

excellence. In short, we use a balanced approach,

one that enables us to attract and retain the best

people for the Company’s long-term success.

All our investors should know that the directors of

GE remain committed to working on your behalf.

And we will continue to take seriously our role in

ensuring that GE has the right strategies and the

right people to help make the world work better.

Sincerely,

Ralph S. Larsen

Presiding Director

February 24, 2012

As Presiding Director and Chair of the Management

Development and Compensation Committee of

GE’s Board of Directors, I write each year to

share our perspective on how GE measures

performance, how we motivate and reward our

executives, and how we work to align both

performance measurement and compensation

with the interests of our shareowners. This year,

I will focus on three areas: fi rst, how the theme

of our annual report, GE Works, fi ts with our

governing philosophy and why we believe it

provides an important business-building

advantage; second, our commitment to developing

leaders; and fi nally, executive compensation.

At its heart, the Board believes GE Works is about

GE’s most valuable asset: its people. It provides a

valuable platform for the Company to talk about

its defi ning culture and to tell the story of the

impact our people make around the world.

Furthermore, it serves as a powerful reminder

that GE works to deliver shareholder value

by offering real and sustainable solutions to the

world’s toughest problems.

It is a fi tting way to talk about the Company,

because GE has always taken a long-term view.

Through its more than 130-year history, the

Company has successfully weathered many

economic cycles. GE has done this over and over

again by fostering innovation, making smart

investments, and, of course, hiring and training

disciplined leaders who focus on achieving our

long-term strategies.

Developing leaders has always been a hallmark of

the Company, refl ecting a commitment to

meritocracy and a belief that when one person

grows and improves, all may grow and improve—

that together, we all rise. The collaborative,

evolutionary nature of GE’s leadership culture

inspires many of our top executives to spend most

or all of their careers here. This provides the

Company with unparalleled domain expertise; it

also creates an environment of loyalty where our

leaders are deeply invested in and committed to

the Company. Today, GE’s senior management,

under the exceptional leadership of Jeff Immelt, is

a proven team that we believe is among the best

in the world.

Our compensation programs are designed and

operate to support our leadership culture and

long-term emphasis. They are not formula-driven,

nor do we reward our executives for taking

outsized risks that produce short-term gains.

Instead, with a mix of cash and equity and

TO OUR SHAREOWNERS

30 GE 2011 ANNUAL REPORT

GE 2011 ANNUAL REPORT 31

financial section

Contents

32 Management’s Discussion of Financial Responsibility ............................ We begin with a letter from our Chief Executive and Financial Offi cers

discussing our unyielding commitment to rigorous oversight, control-

lership, informative disclosure and visibility to investors.

32 Management’s Annual Report on Internal Control

Over Financial Reporting ...................................................................................... In this report our Chief Executive and Financial Offi cers provide

their assessment of the effectiveness of our internal control over

fi nancial reporting.

33 Report of Independent Registered Public Accounting Firm .................. Our independent auditors, KPMG LLP, express their opinions on our

fi nancial statements and our internal control over fi nancial reporting.

34 Management’s Discussion and Analysis (MD&A)

34 Operations ........................................................................................................... We begin the Operations section of MD&A with an overview of our

earnings, including a perspective on how the global economic

environment has affected our businesses over the last three years.

We then discuss various key operating results for GE industrial (GE)

and fi nancial services (GECS). Because of the fundamental differences

in these businesses, reviewing certain information separately for

GE and GECS offers a more meaningful analysis. Next we provide a

description of our global risk management process. Our discussion

of segment results includes quantitative and qualitative disclosure

about the factors affecting segment revenues and profi ts, and the

effects of recent acquisitions, dispositions and signifi cant trans-

actions. We conclude the Operations section with an overview of

our operations from a geographic perspective and a discussion

of environmental matters.

49 Financial Resources and Liquidity .......................................................... In the Financial Resources and Liquidity section of MD&A, we provide

an overview of the major factors that affected our consolidated

fi nancial position and insight into the liquidity and cash fl ow activities

of GE and GECS.

64 Critical Accounting Estimates .................................................................. Critical Accounting Estimates are necessary for us to prepare

our fi nancial statements. In this section, we discuss what these

estimates are, why they are important, how they are developed

and uncertainties to which they are subject.

68 Other Information .......................................................................................... We conclude MD&A with a brief discussion of new accounting

standards that will become effective for us beginning in 2012.

69 Selected Financial Data ............................................................................... Selected Financial Data provides fi ve years of fi nancial information

for GE and GECS. This table includes commonly used metrics that

facilitate comparison with other companies.

70 Audited Financial Statements and Notes

70 Statement of Earnings

70 Consolidated Statement of Changes in Shareowners’ Equity

72 Statement of Financial Position

74 Statement of Cash Flows

76 Notes to Consolidated Financial Statements

137 Supplemental Information ................................................................................... We provide Supplemental Information to reconcile certain “non-GAAP

fi nancial measures” referred to in our report to the most closely

associated GAAP fi nancial measures. We also provide information

about our stock performance over the last fi ve years.

140 Glossary ....................................................................................................................... For your convenience, we also provide a Glossary of key terms used in

our fi nancial statements.

We also present our fi nancial information electronically at

www.ge.com/investor.

32 GE 2011 ANNUAL REPORT

Management’s Discussion of Financial Responsibility

We believe that great companies are built on a foundation of

reliable fi nancial information and compliance with the spirit and

letter of the law. For General Electric Company, that foundation

includes rigorous management oversight of, and an unyielding

dedication to, controllership. The fi nancial disclosures in this

report are one product of our commitment to high-quality

fi nancial reporting. In addition, we make every effort to adopt

appropriate accounting policies, we devote our full resources

to ensuring that those policies are applied properly and consis-

tently and we do our best to fairly present our fi nancial results in a

manner that is complete and understandable.

Members of our corporate leadership team review each of our

businesses routinely on matters that range from overall strategy

and fi nancial performance to staffi ng and compliance. Our busi-

ness leaders monitor fi nancial and operating systems, enabling us

to identify potential opportunities and concerns at an early stage

and positioning us to respond rapidly. Our Board of Directors over-

sees management’s business conduct, and our Audit Committee,

which consists entirely of independent directors, oversees our

internal control over fi nancial reporting. We continually examine

our governance practices in an effort to enhance investor trust

and improve the Board’s overall effectiveness. The Board and

its committees annually conduct a performance self-evaluation

and recommend improvements. Our Presiding Director led three

meetings of non-management directors this year, helping us

sharpen our full Board meetings to better cover signifi cant top-

ics. Compensation policies for our executives are aligned with the

long-term interests of GE investors.

We strive to maintain a dynamic system of internal controls

and procedures—including internal control over fi nancial

reporting—designed to ensure reliable fi nancial recordkeeping,

transparent fi nancial reporting and disclosure, and protection of

physical and intellectual property. We recruit, develop and retain

a world-class fi nancial team. Our internal audit function, includ-

ing members of our Corporate Audit Staff, conducts thousands

of fi nancial, compliance and process improvement audits each

year. Our Audit Committee oversees the scope and evaluates the

overall results of these audits, and members of that Committee

regularly attend GE Capital Board of Directors, Corporate Audit

Staff and Controllership Council meetings. Our global integrity

policies—“The Spirit & The Letter”—require compliance with law

and policy, and pertain to such vital issues as upholding fi nan-

cial integrity and avoiding confl icts of interest. These integrity

policies are available in 31 languages, and are provided to all of

our employees, holding each of them accountable for compli-

ance. Our strong compliance culture reinforces these efforts by

requiring employees to raise any compliance concerns and by

prohibiting retribution for doing so. To facilitate open and candid

communication, we have designated ombudspersons through-

out the Company to act as independent resources for reporting

integrity or compliance concerns. We hold our directors, con-

sultants, agents and independent contractors to the same

integrity standards.

We are keenly aware of the importance of full and open

presentation of our fi nancial position and operating results, and

rely for this purpose on our disclosure controls and procedures,

including our Disclosure Committee, which comprises senior

executives with detailed knowledge of our businesses and the

related needs of our investors. We ask this committee to review

our compliance with accounting and disclosure requirements,

to evaluate the fairness of our fi nancial and non-fi nancial dis-

closures, and to report their fi ndings to us. We further ensure

strong disclosure by holding approximately 300 analyst and

investor meetings annually.

We welcome the strong oversight of our fi nancial reporting

activities by our independent registered public accounting

fi rm, KPMG LLP, engaged by and reporting directly to the Audit

Committee. U.S. legislation requires management to report on

internal control over fi nancial reporting and for auditors to

render an opinion on such controls. Our report follows and the

KPMG LLP report for 2011 appears on the following page.

Management’s Annual Report on Internal Control

Over Financial Reporting

Management is responsible for establishing and maintaining

adequate internal control over fi nancial reporting for the

Company. With our participation, an evaluation of the effective-

ness of our internal control over fi nancial reporting was

conducted as of December 31, 2011, based on the framework

and criteria established in Internal Control—Integrated Framework,

issued by the Committee of Sponsoring Organizations of the

Treadway Commission.

Based on this evaluation, our management has concluded

that our internal control over fi nancial reporting was effective as

of December 31, 2011.

Our independent registered public accounting fi rm has issued

an audit report on our internal control over fi nancial reporting.

Their report follows.

JEFFREY R. IMMELT KEITH S. SHERIN

Chairman of the Board and Vice Chairman and

Chief Executive Offi cer Chief Financial Offi cer

February 24, 2012

GE 2011 ANNUAL REPORT 33

Report of Independent Registered

Public Accounting Firm

To Shareowners and Board of Directors

of General Electric Company:

We have audited the accompanying statement of fi nancial

position of General Electric Company and consolidated affi liates

(“GE”) as of December 31, 2011 and 2010, and the related state-

ments of earnings, changes in shareowners’ equity and cash

fl ows for each of the years in the three-year period ended

December 31, 2011. We also have audited GE’s internal control

over fi nancial reporting as of December 31, 2011, based on

criteria established in Internal Control—Integrated Framework

issued by the Committee of Sponsoring Organizations of the

Treadway Commission (“COSO”). GE management is responsible

for these consolidated fi nancial statements, for maintaining

effective internal control over fi nancial reporting, and for its

assessment of the effectiveness of internal control over fi nancial

reporting. Our responsibility is to express an opinion on these

consolidated fi nancial statements and an opinion on GE’s internal

control over fi nancial reporting based on our audits.

We conducted our audits in accordance with the standards of

the Public Company Accounting Oversight Board (United States).

Those standards require that we plan and perform the audits to

obtain reasonable assurance about whether the fi nancial state-

ments are free of material misstatement and whether effective

internal control over fi nancial reporting was maintained in all

material respects. Our audits of the consolidated fi nancial state-

ments included examining, on a test basis, evidence supporting

the amounts and disclosures in the fi nancial statements, assess-

ing the accounting principles used and signifi cant estimates

made by management, and evaluating the overall fi nancial state-

ment presentation. Our audit of internal control over fi nancial

reporting included obtaining an understanding of internal control

over fi nancial reporting, assessing the risk that a material weak-

ness exists, and testing and evaluating the design and operating

effectiveness of internal control based on the assessed risk. Our

audits also included performing such other procedures as we

considered necessary in the circumstances. We believe that our

audits provide a reasonable basis for our opinions.

A company’s internal control over fi nancial reporting is a pro-

cess designed to provide reasonable assurance regarding the

reliability of fi nancial reporting and the preparation of fi nancial

statements for external purposes in accordance with generally

accepted accounting principles. A company’s internal control

over fi nancial reporting includes those policies and procedures

that (1) pertain to the maintenance of records that, in reason-

able detail, accurately and fairly refl ect the transactions and

dispositions of the assets of the company; (2) provide reasonable

assurance that transactions are recorded as necessary to permit

preparation of fi nancial statements in accordance with generally

accepted accounting principles, and that receipts and expendi-

tures of the company are being made only in accordance with

authorizations of management and directors of the company;

and (3) provide reasonable assurance regarding prevention or

timely detection of unauthorized acquisition, use, or disposition

of the company’s assets that could have a material effect on the

fi nancial statements.

Because of its inherent limitations, internal control over

fi nancial reporting may not prevent or detect misstatements.

Also, projections of any evaluation of effectiveness to future

periods are subject to the risk that controls may become inad-

equate because of changes in conditions, or that the degree of

compliance with the policies or procedures may deteriorate.

In our opinion, the consolidated fi nancial statements appear-

ing on pages 70, 72, 74, 76–136 and the Summary of Operating

Segments table on page 42 present fairly, in all material

respects, the fi nancial position of GE as of December 31, 2011

and 2010, and the results of its operations and its cash fl ows for

each of the years in the three-year period ended December 31,

2011, in conformity with U.S. generally accepted accounting

principles. Also, in our opinion, GE maintained, in all material

respects, effective internal control over fi nancial reporting as

of December 31, 2011, based on criteria established in Internal

Control—Integrated Framework issued by COSO.

As discussed in Note 1 to the consolidated fi nancial state-

ments, GE, in 2010, changed its method of accounting for

consolidation of variable interest entities; and, in 2009, changed

its method of accounting for impairment of debt securities, busi-

ness combinations and noncontrolling interests.

Our audits of GE’s consolidated fi nancial statements were

made for the purpose of forming an opinion on the consoli-

dated fi nancial statements taken as a whole. The accompanying

consolidating information appearing on pages 71, 73 and 75

is presented for purposes of additional analysis of the consoli-

dated fi nancial statements rather than to present the fi nancial

position, results of operations and cash fl ows of the individual

entities. The consolidating information has been subjected to

the auditing procedures applied in the audits of the consoli-

dated fi nancial statements and, in our opinion, is fairly stated

in all material respects in relation to the consolidated fi nancial

statements taken as a whole.

KPMG LLP

Stamford, Connecticut

February 24, 2012

34 GE 2011 ANNUAL REPORT

management’s discussion and analysis

Operations

The consolidated fi nancial statements of General Electric

Company (the Company) combine the industrial manufacturing

and services businesses of General Electric Company (GE) with

the fi nancial services businesses of General Electric Capital

Services, Inc. (GECS or fi nancial services). Unless otherwise indi-

cated by the context, we use the terms “GE,” “GECS” and “GECC”

on the basis of consolidation described in Note 1 to the consoli-

dated fi nancial statements.

In the accompanying analysis of fi nancial information, we

sometimes use information derived from consolidated fi nan-

cial information but not presented in our fi nancial statements