CERAMICORP INC 2015 2014 IFRS 1 31 15

2016-05-25

: Pdf Ceramicorp 2014-2015 Ceramicorp 2014-2015 2014-2015 Informes financieros Reporte y Transparencia Gobierno Corporativo

Open the PDF directly: View PDF ![]() .

.

Page Count: 31

CERAMICORP, INC.

Perrysville, Ohio

CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

CERAMICORP, INC.

Perrysville, Ohio

CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

CONTENTS

INDEPENDENT AUDITOR’S REPORT ................................................................................................... 1

CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION ......................................................... 3

CONSOLIDATED STATEMENTS OF INCOME ............................................................................... 4

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME ................................................ 5

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY ......................................................... 6

CONSOLIDATED STATEMENTS OF CASH FLOWS ...................................................................... 7

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ............................................................. 8

(Continued)

1.

Crowe Horwath LLP

Independent Member Crowe Horwath International

INDEPENDENT AUDITOR’S REPORT

Stockholders

Ceramicorp, Inc.

Report on the Financial Statements

We have audited the accompanying consolidated financial statements of Ceramicorp, Inc., which

comprise the consolidated statements of financial position as of December 31, 2015 and 2014, and the

consolidated statements of income, comprehensive income, changes in equity, and cash flows for the

years then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial

statements in accordance with International Financial Reporting Standards; this includes the design,

implementation, and maintenance of internal control relevant to the preparation and fair presentation of

consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our

audits. We conducted our audits in accordance with International Standards on Auditing. Those

standards require that we comply with ethical requirements and plan and perform the audit to obtain

reasonable assurance about whether the consolidated financial statements are free from material

misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the consolidated financial statements. The procedures selected depend on the auditor’s judgment,

including the assessment of the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error. In making those risk assessments, the auditor considers internal control

relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order

to design audit procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no

such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the

reasonableness of accounting estimates made by management, as well as evaluating the overall

presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

our audit opinion.

2.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of Ceramicorp, Inc. as of December 31, 2015 and 2014, and the result of

its operations and its cash flows for the years then ended in accordance with International Financial

Reporting Standards.

Crowe Horwath LLP

South Bend, Indiana

February 4, 2016

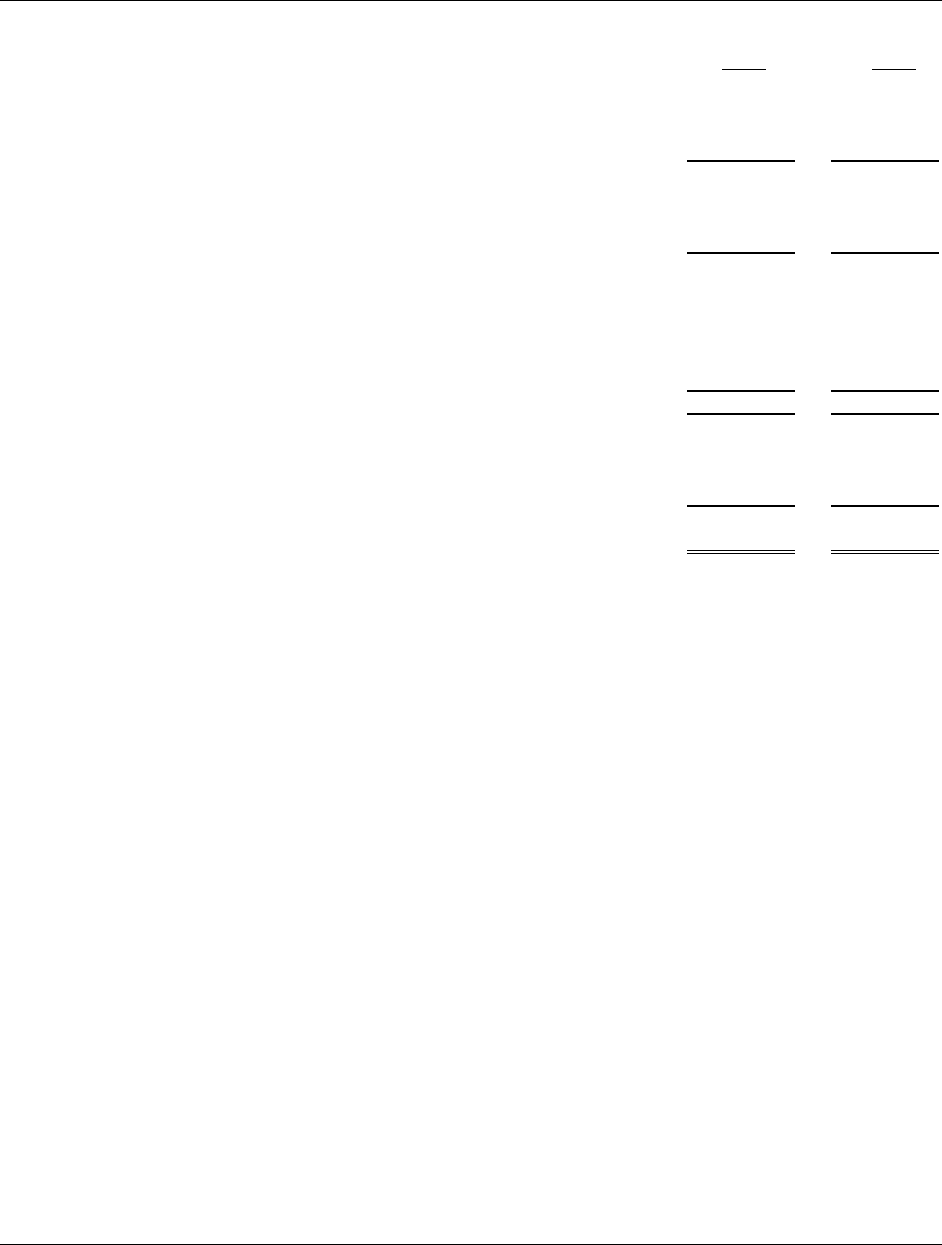

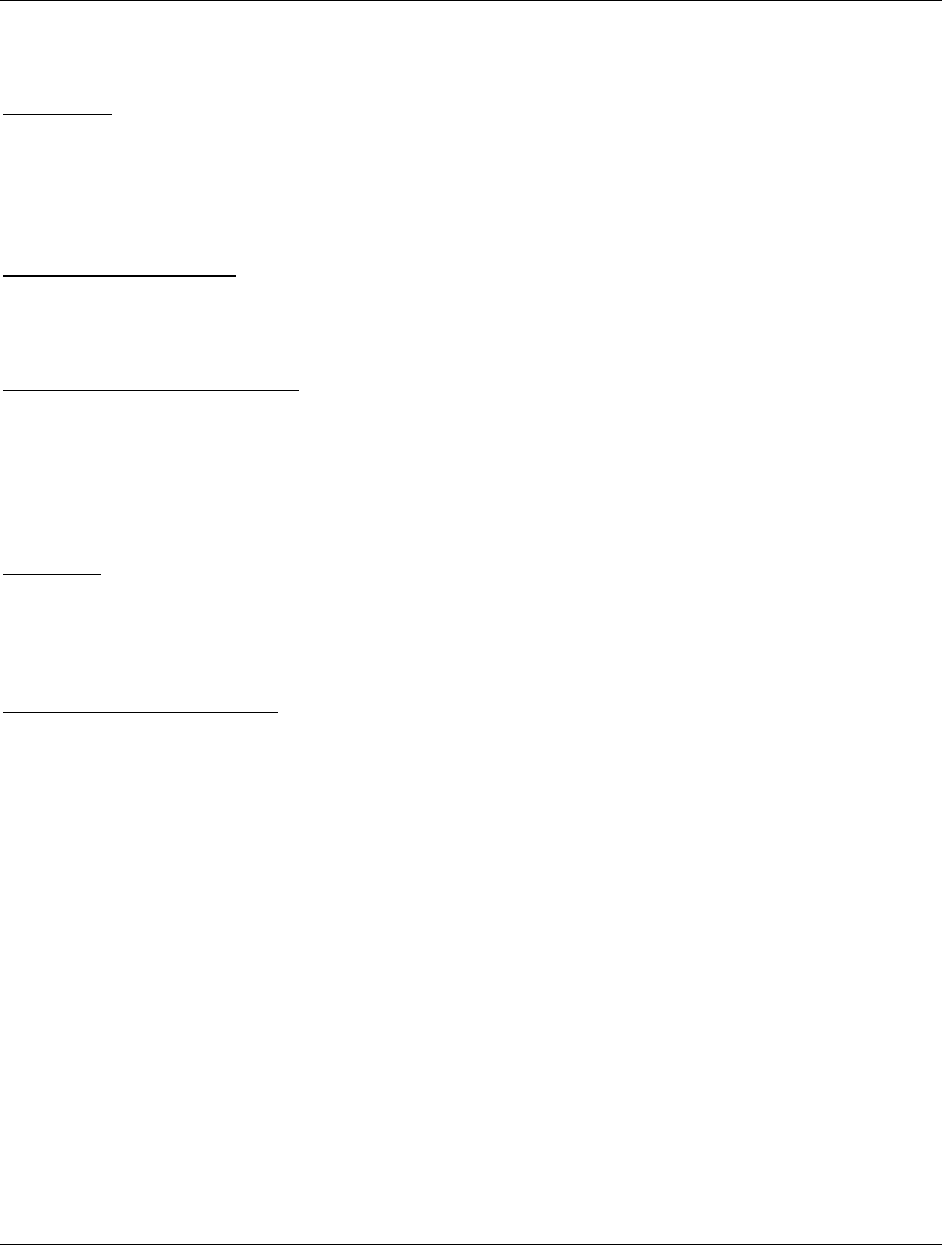

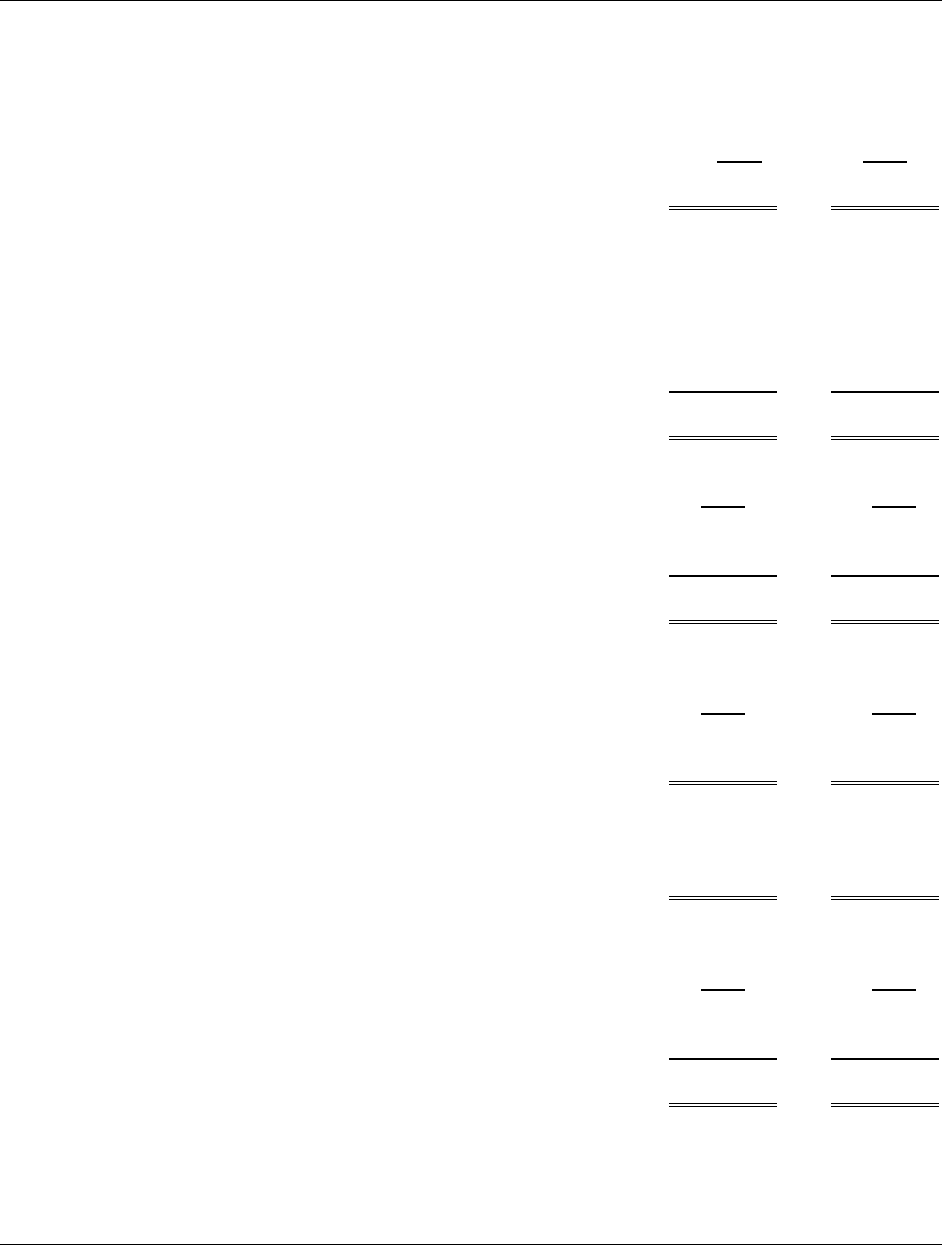

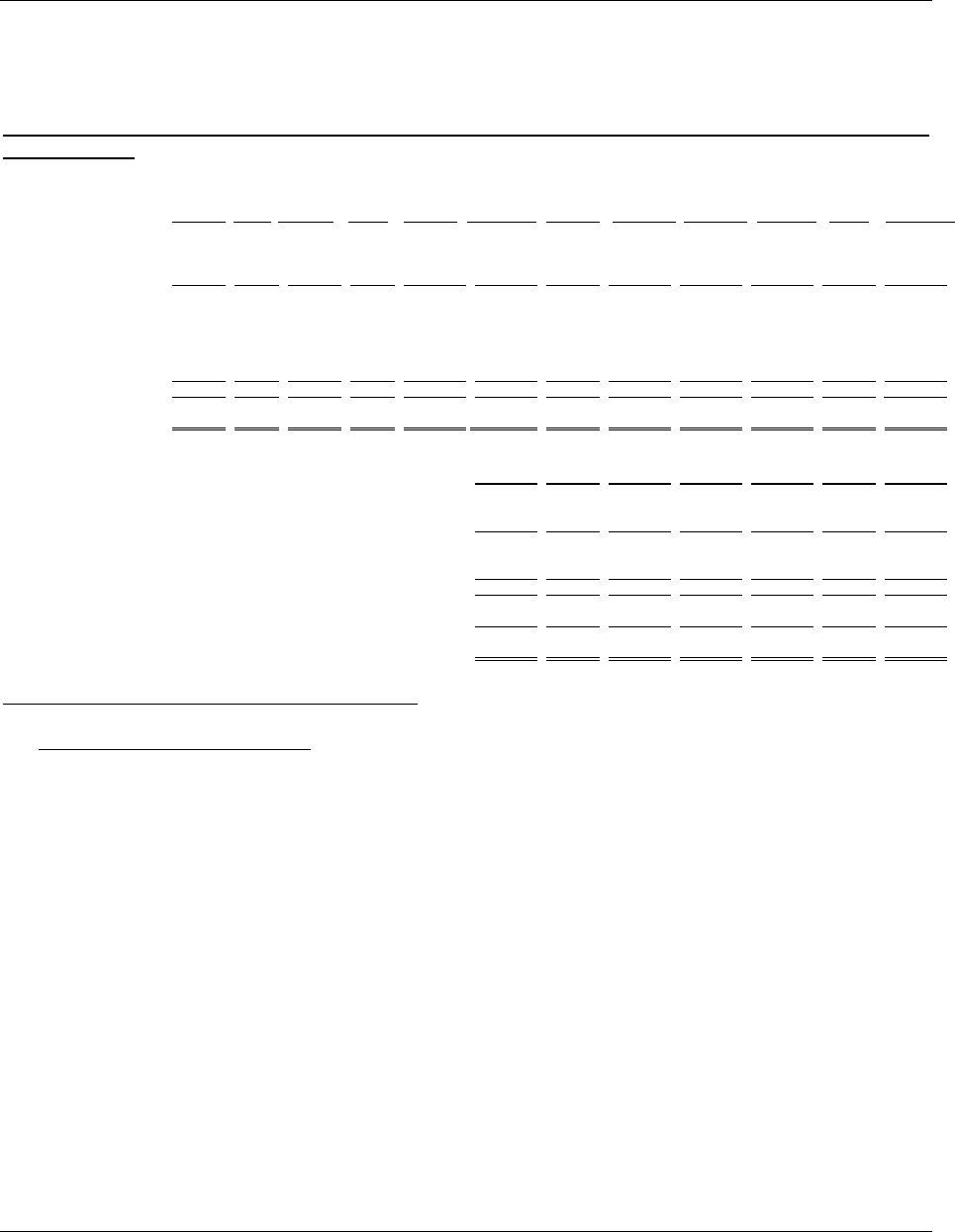

CERAMICORP, INC.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

December 31, 2015 and 2014

(Dollars in Thousands)

See accompanying notes to consolidated financial statements.

3.

2015 2014

ASSETS

Current assets

Cash $ 502 $ 473

Receivables, net 8,161 9,174

Inventories, net 13,209 12,939

Other current assets 673 223

Total current assets 22,545 22,809

Deferred taxes 6,096 9,129

Property, plant and equipment, net 19,399 18,394

Other assets

Goodwill 33,328 33,328

Intangible asset 8,500 8,500

41,828 41,828

$ 89,868 $ 92,160

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities

Revolving credit loan, net $ 2,361 $ 1,560

Current portion of long-term debt 400 400

Accounts payable and accrued liabilities 10,536 13,983

Total current liabilities 13,297 15,943

Long-term debt, net of current portion 200 600

Accrued employee benefit obligations 5,728 5,402

Total liabilities 19,225 21,945

Stockholders’ equity

Common stock, $0.01 par value, 1000 shares authorized, 438 shares

issued and outstanding - -

Additional paid in capital 77,058 77,058

Accumulated other comprehensive loss (7,944) (8,228)

Retained earnings 1,529 1,385

Total stockholders’ equity 70,643 70,215

$ 89,868 $ 92,160

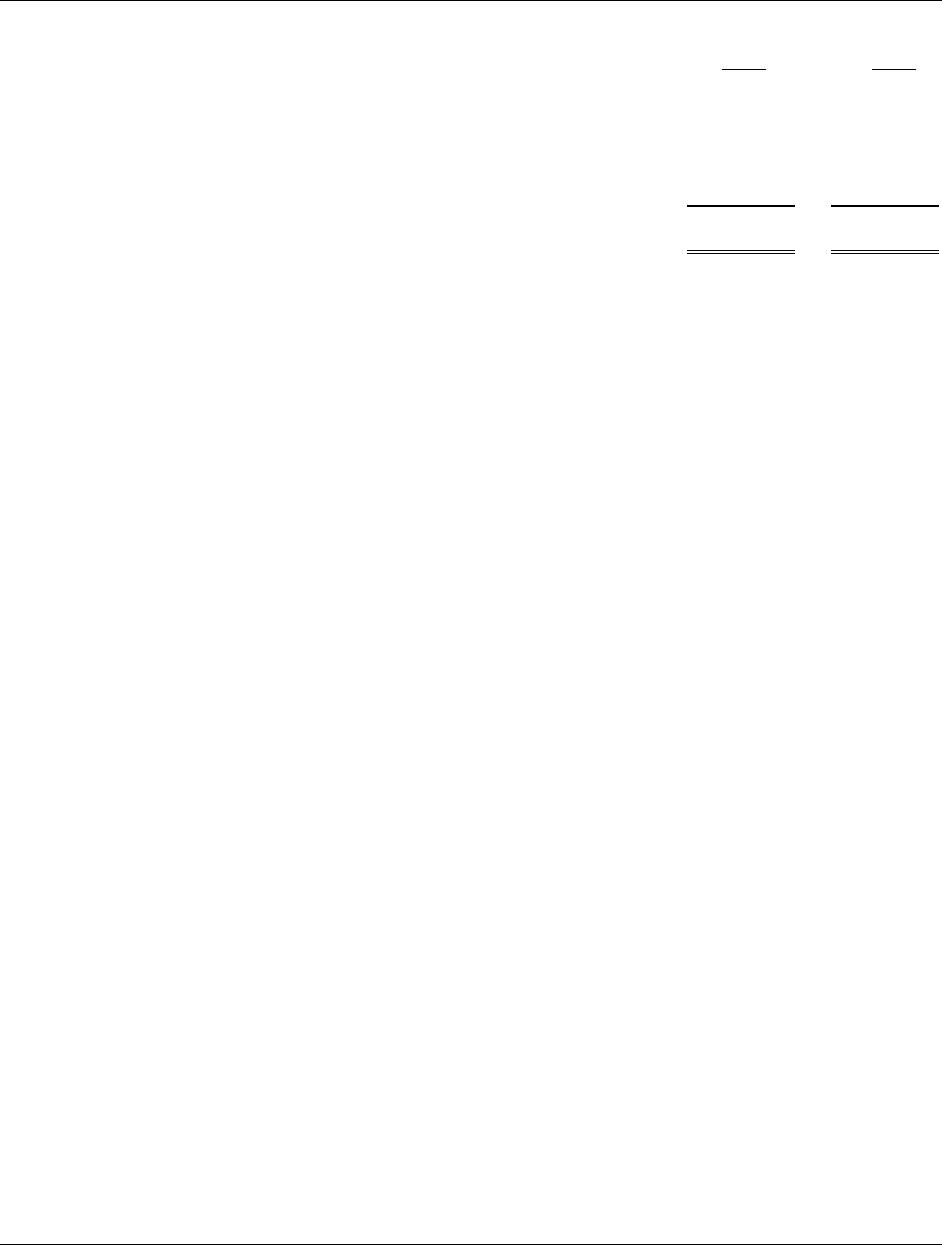

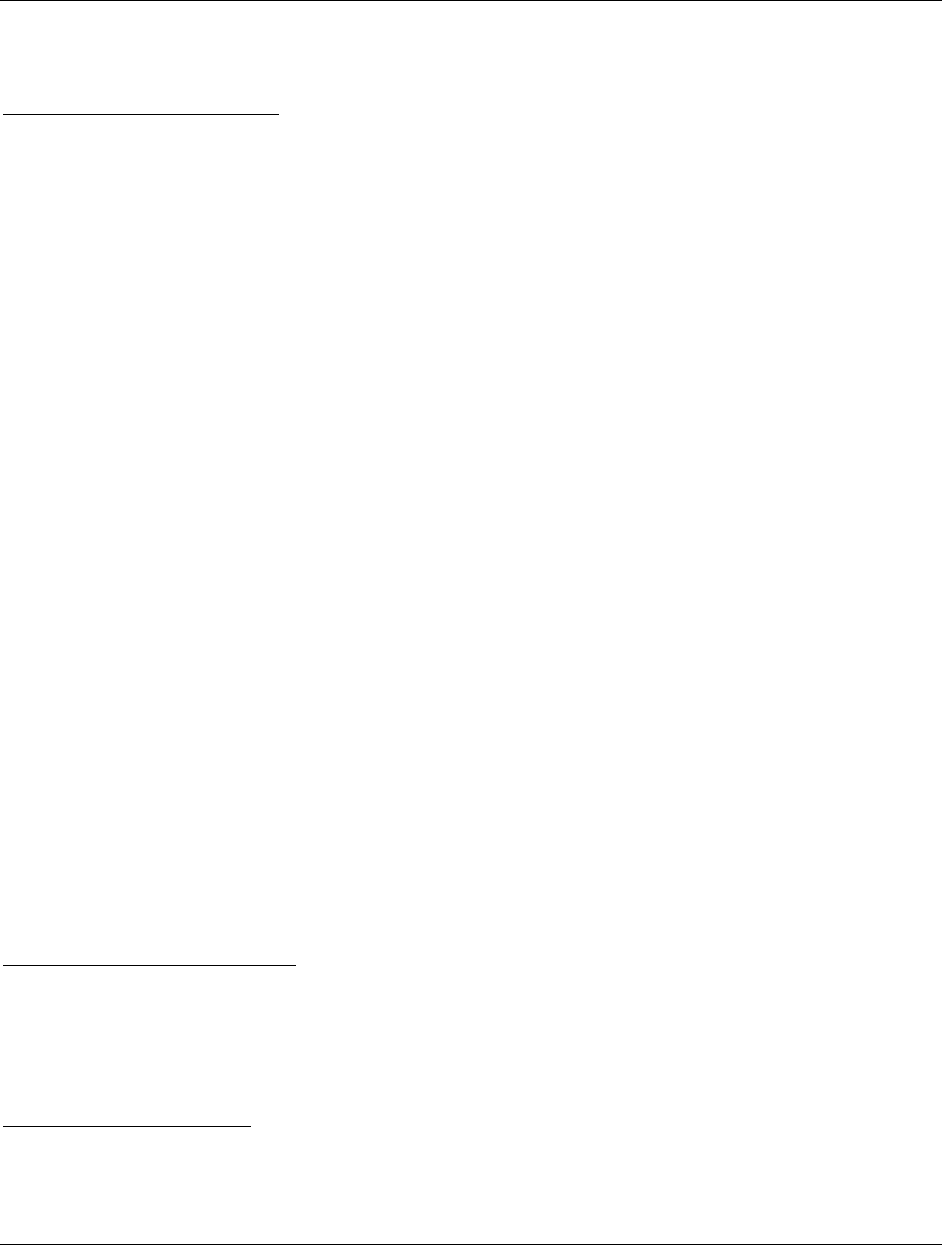

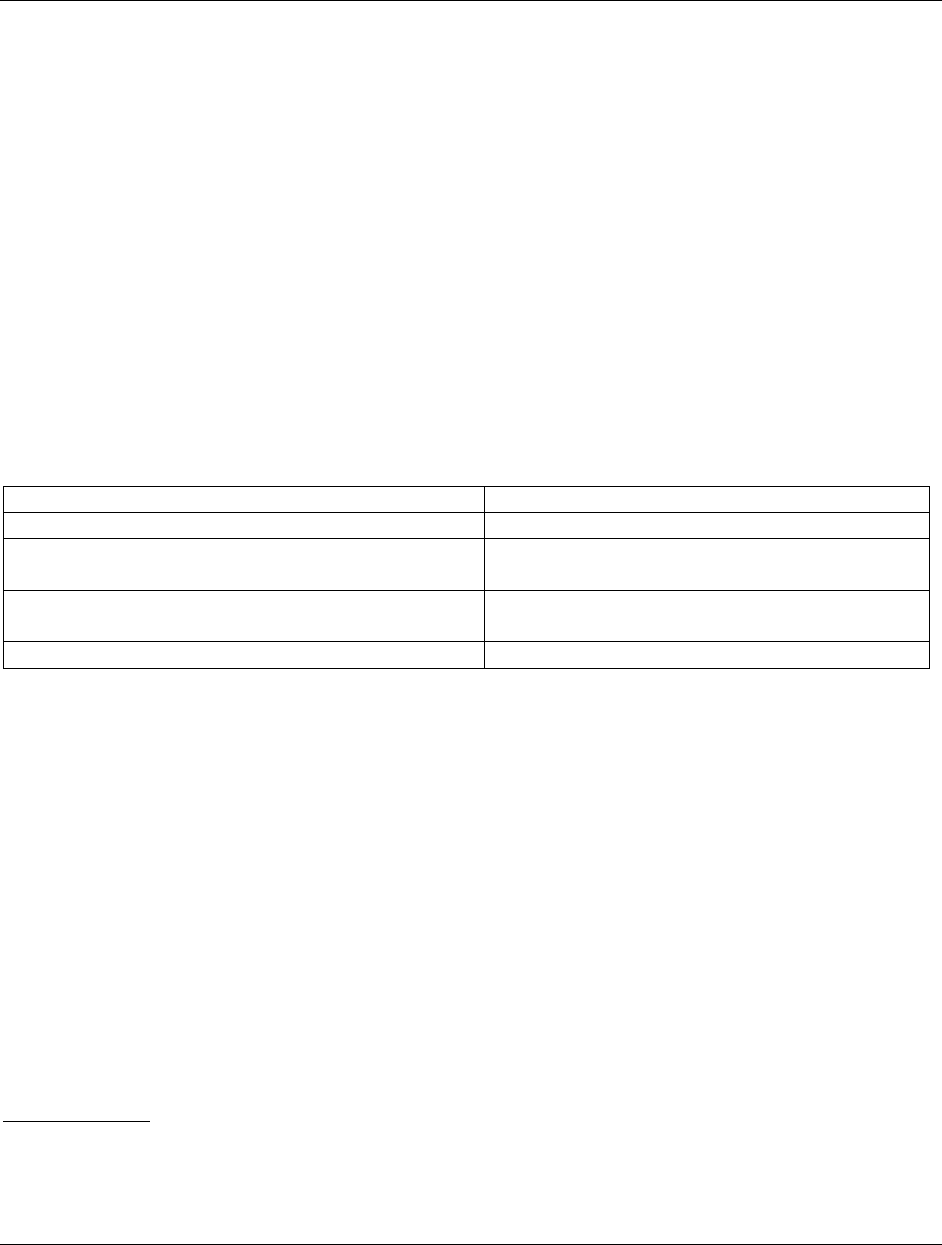

CERAMICORP, INC.

CONSOLIDATED STATEMENTS OF INCOME

Years ended December 31, 2015 and 2014

(Dollars in Thousands)

See accompanying notes to consolidated financial statements.

4.

2015 2014

Net sales $ 98,713 $ 100,520

Cost of sales 82,677 80,737

Gross profit 16,036 19,783

Selling, general and administrative expenses 11,765 12,994

Income before other expense 4,271 6,789

Other expense

Interest expense 120 285

Other expense 16 6

136 291

Income before income taxes 4,135 6,498

Income tax expense 1,667 1,858

Net income $ 2,468 $ 4,640

CERAMICORP, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Years ended December 31, 2015 and 2014

(Dollars in Thousands)

See accompanying notes to consolidated financial statements.

5.

2015 2014

Net income $ 2,468 $ 4,640

Other comprehensive income (loss):

Actuarial losses on defined benefit plans, net of tax (359) (3,173)

Comprehensive income $ 2,109 $ 1,467

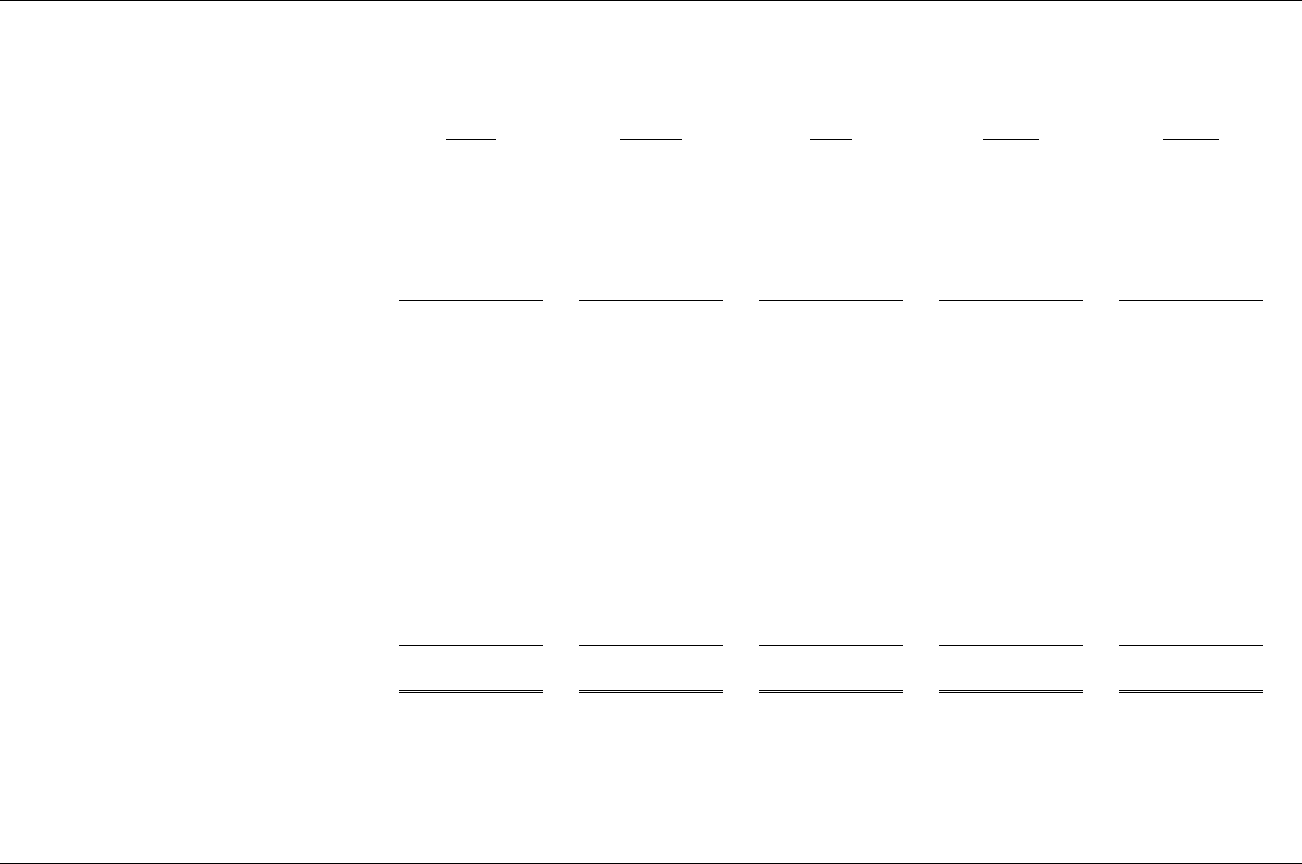

CERAMICORP, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Years ended December 31, 2015 and 2014

(Dollars in Thousands)

See accompanying notes to consolidated financial statements.

6.

Accumulated

Additional Other Total

Common Paid-In Comprehensive Accumulated Stockholders’

Stock Capital Loss Deficit Equity

Balance at January 1, 2014 $ - $ 77,058 $ (5,055) $ (3,255) $ 68,748

Net income - - - 4,640 4,640

Actuarial losses on defined benefit

plans, net of tax - - (3,173) - (3,173)

Balance at December 31, 2014 - 77,058 (8,228) 1,385 70,215

Net income - - - 2,468 2,468

Actuarial losses on defined benefit

plans, net of tax - - (359) - (359)

Reclassification of accumulated

other comprehensive loss of

terminated defined benefit plan - - 643 (1,003) (360)

Adjustment prior period related

to conversion to IFRS

(See Note 20) - - - (1,321) (1,321)

Balance at December 31, 2015 $ - $ 77,058 $ (7,944) $ 1,529 $ 70,643

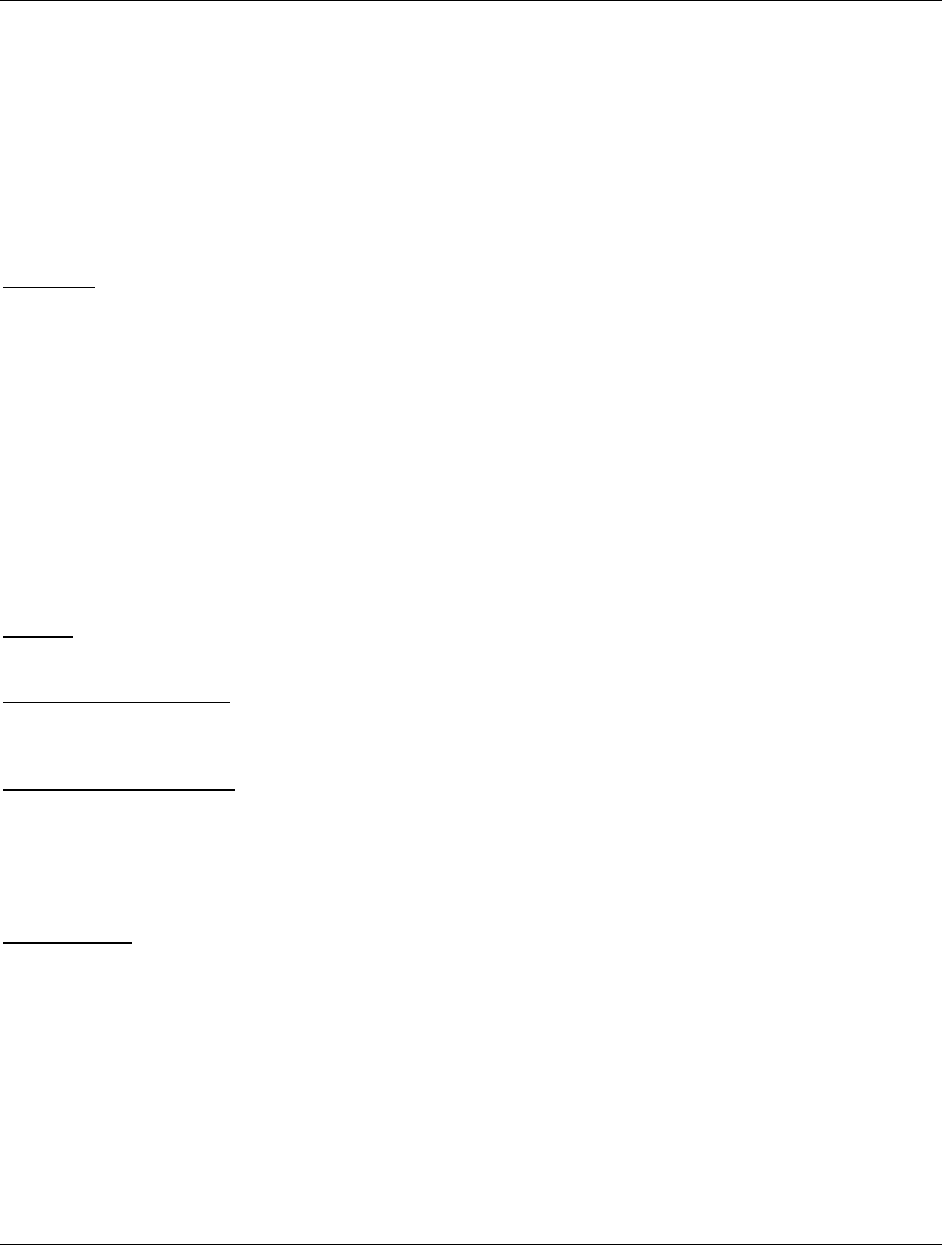

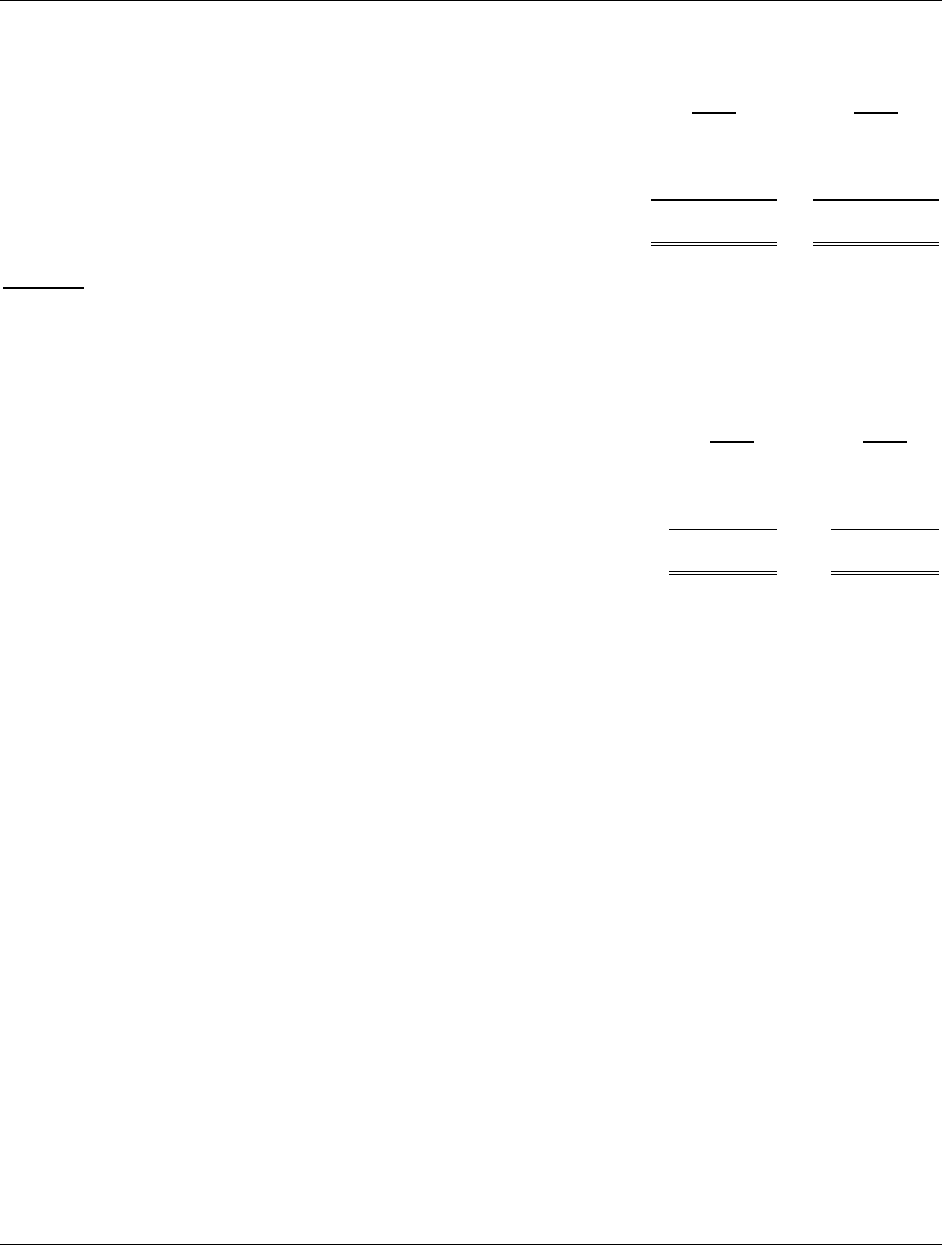

CERAMICORP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31, 2015 and 2014

(Dollars in Thousands)

See accompanying notes to consolidated financial statements.

7.

2015 2014

Cash flows from operating activities

Net income $ 2,468 $ 4,640

Adjustments to reconcile net income to net cash provided

From operating activities:

Depreciation 2,217 2,083

Amortization of deferred financing fees 34 49

Deferred income taxes 1,552 1,992

Changes in operating assets and liabilities

Receivables 1,013 (1,324)

Inventories (270) (45)

Other assets (450) (53)

Accounts payable (2,054) 1,872

Accrued liabilities and accrued employee benefit

obligations (1,626) (1,223)

Net cash provided by operating activities 2,884 7,991

Cash flows from investing activities

Capital expenditures (3,222) (1,805)

Net cash used in investing activities (3,222) (1,805)

Cash flows from financing activities

Proceeds from revolving credit loans 100,014 95,848

Payments on revolving credit loans (99,239) (98,669)

Payment of deferred financing fees (8) -

Payments on long-term debt (400) (3,400)

Member contributions - -

Member distributions - -

Net cash provided by (used in) financing activities 367 (6,221)

Net change in cash 29 (35)

Cash at beginning of year 473 508

Cash at end of year $ 502 $ 473

Supplemental disclosures of cash flow information

Cash paid for interest $ 87 $ 276

Cash paid (refunds received) for income taxes, net 169 (96)

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

8.

NOTE 1 – GENERAL INFORMATION

The consolidated financial statements include the accounts of Ceramicorp, Inc. (the “Company”) and its

wholly owned subsidiary Mansfield Plumbing Products, LLC (“Mansfield”). All intercompany balances and

transactions have been eliminated in consolidation.

The Company was incorporated on January 12, 2004 as a corporation under the laws of the state of

Delaware.

Mansfield is a manufacturer of high quality vitreous china toilets, lavatories and urinals, plastic plumbing

fittings, acrylic whirlpool tubs and shower bases. The Company’s products are sold throughout North

America. Mansfield is a limited liability company organized under the laws of Delaware, incorporated on

April 20, 2000.

NOTE 2 - BASIS OF PRESENTATION

The consolidated financial statements have been prepared in accordance with International Financial

Reporting Standards, International Accounting Standards and interpretations (collectively IFRSs) issued

by the International Accounting Standards Board (IASB).

The consolidated financial statements were approved and authorized for issue on February 4, 2016.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash: The Company maintains deposit accounts in financial institutions. The Company considers short-

term cash investments with a maturity of 90 days or less to be cash equivalents. The Company had no

restricted cash representing compensating balances as of December 31, 2015 and 2014.

Revenue recognition: Revenue is measured at the fair value of the consideration received or receivable.

Sales are recorded net of returns, price concessions and other discounts.

Sales are recognized when the goods are delivered and titles have passed, at which time all the following

conditions are satisfied:

The Company has transferred to the buyer the significant risks and rewards of ownership of the

goods;

The Company retains neither continuing managerial involvement to the degree usually

associated with ownership nor effective control over the goods sold;

The amount of revenue can be measured reliably;

It is probable that the economic benefits associated with the transaction will flow to the Company;

and

The costs incurred or to be incurred in respect of the transaction can be measured reliably.

All of the Company’s revenue for the years ended December 31, 2015 and 2014 was derived from the

sale of goods.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

9.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Receivables: The Company accounts for trade receivables based on amounts billed to customers. Past

due receivables are determined based on contractual terms. The Company does not accrue interest on

any of its trade receivables. The majority of the Company’s accounts receivable is due from companies in

the construction and distribution industries. Credit is extended based on evaluation of a customers’

financial condition, and generally, collateral is not required. Accounts receivable are generally due within

45 days and are stated at amounts due from customers net of an allowance for doubtful accounts.

Significant Concentrations: Sales to the Company’s largest customer amounted to $19,353 and $18,233

and comprised approximately 19% and 18% of net sales for the years ended December 31, 2015 and

2014, respectively. Accounts receivable from the same customer was approximately 21% and 24% of net

receivables at December 31, 2015 and 2014, respectively.

Allowance for Doubtful Accounts: The allowance for doubtful accounts is determined by management

based on the Company’s historical losses, specific customer circumstances and general economic

conditions. Periodically, management reviews accounts receivable and records an allowance for specific

customers based on current circumstances and charges off the receivable against the allowance when all

attempts to collect the receivable have failed. The Company additionally determines a general provision

based on historical experience of bad debt as a percentage of receivables. The general provision is

reviewed on an annual basis for any material change in trend.

Inventories: Inventories are stated at the lower of cost and net realizable value. Net realizable value

represents the estimated selling price less estimated cost of completion and selling cost. Cost includes

raw materials, labor and manufacturing overhead. The Company uses the first-in, first-out method of

accounting for inventory. Management establishes a reserve for excess and obsolete inventories based

on past sales, usage and current customer demand.

Property, Plant and Equipment: Property, plant and equipment acquired after the date of the Company’s

first-time adoption of IFRS are carried at cost, less accumulated depreciation. Cost includes borrowing

costs capitalized, when applicable. Property, plant and equipment owned by the Company at January 1,

2014 are carried at deemed cost based on appraised values as of that date that approximate fair value.

Related cost and accumulated depreciation for an item of property, plant and equipment are removed

from the accounts upon disposal or when no future economic benefits are expected to arise from the

continued use of the asset. Any gain or loss arising on the disposal or retirement of an item of property,

plant and equipment is determined as the difference between the sales proceeds and the carrying

amount of the asset and is recognized in profit or loss. Major renewals and betterments are capitalized.

Maintenance, repairs and minor renewals are expensed as incurred.

The Company provides for depreciation of property, plant and equipment principally by straight-line

methods over the expected useful lives of the assets.

Buildings 39 years

Machinery and equipment 10 years

Kiln 15 years

Computers 3 years

Office equipment and miscellaneous 5 years

Autos and trucks 7 years

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

10.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Goodwill and Intangible Asset: Goodwill represents the excess purchase price over the fair value of

assets acquired through acquisition. Goodwill has been allocated for impairment testing purposes to

Mansfield Plumbing Products, LLC as the cash-generating unit. Goodwill is assessed at least annually for

impairment and any such impairment will be recognized in the period identified. Based on this

assessment, management has determined there is no impairment of goodwill at December 31, 2015 and

2014.

The Company’s intangible asset consists of a business trademark acquired through acquisition.

Management performs an annual impairment review of its indefinite lived business trademark. Based

upon this review, management has determined that no impairment of its business trademark exists at

December 31, 2015 and 2014.

The recoverable amount of the cash generating unit is determined based on a value in use calculation

utilizing five year management projections of future debt-free distributable cash flows and a three percent

long-term assumed annual growth rate of distributable cash flows for periods after the five-year forecast.

A weighted average cost of capital, incorporating information from external valuation specialists, is utilized

to discount the future estimated distributable cash flows. An appropriate cash flow structure for purposes

of determining the weighted average cost of capital incorporates capital structure information for public

company industry participants. The reasonableness of the cash generating unit’s determined fair value is

annually assessed against multiples of enterprise value to both sales and EBITDA for public company

industry participants.

A fifteen percent decrease in the estimated fair value of the cash generating unit would not have resulted

in an impairment of goodwill at December 31, 2015.

The recoverable amount of the Company’s indefinite lived trademark is determined annually utilizing the

Relief-From-Royalty Method. The applicable sales base for valuing the trademark is equal to the total

sales of the cash generating unit, all of which incorporate the Company’s brands. A royalty rate,

consistently applied, has been determined with the assistance of external valuation specialists. The

required rate of return utilized to capitalize projected royalty income is a weighted average cost of capital

determined for the cash generating unit utilizing an assumption, based on input from external valuation

specialists, that the strength of the Company’s trademark would permit the Company to modestly borrow

against the intangible asset.

A fourteen percent decrease in the estimated fair value of the trademark would not have resulted in an

impairment of the trademark at December 31, 2015.

Impairment of Long-Lived Assets: The Company continually evaluates whether events and circumstances

have occurred that indicate the remaining estimated useful life of long-lived assets may warrant revision.

In evaluating whether these long-lived assets are recoverable, the Company estimates the sum of the

expected future cash flows, undiscounted and without interest charges derived from such assets over

their remaining useful life. The Company has determined that no impairment of long-lived assets exists at

December 31, 2015 and 2014.

Environmental Remediation: The Company records liabilities when environmental assessments indicate

that remedial efforts are probable and that costs can be reasonably estimated. Costs of future

expenditures do not reflect any claims for recoveries. At December 31, 2015 and 2014, the Company

had no recorded liability for environmental assessments.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

11.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

During 2003, the Company signed a Findings and Orders Agreement with the Ohio Environmental

Protection Agency (OEPA) requiring the Company to establish and fund a trust to be used for future

environmental remediation of an existing Company landfill, and to monitor this landfill for a period of 30

years subsequent to closure. Such trust, in the form of an escrow account, was fully funded by the

Company in accordance with the agreement. At December 31, 2015 and 2014, the escrow account had

a balance of $647 and $943, respectively, as required by the OEPA. The above mentioned escrow

account is not reflected in the statements of financial position of the Company.

Provisions: Provisions are recognized when the Company has a present obligation (legal or constructive)

as a result of a past event, it is probable that the Company will be required to settle the obligation, and a

reliable estimate can be made of the amount of the obligation.

Product liability claims for damages associated to product failure are generally recognized upon receipt if

such claims are appropriate. An accrual is established based on historical experience of similar claims.

The Company periodically assesses the adequacy of the accrual. When an identifiable cause issue

establishes a basis for estimate of probable future exposure, a separate accrual is established to monitor

these claims incorporating an accrual for future claims.

In addition to this liability, the Company expenses a portion of sales to the majority of its wholesale

customers as a defective allowance in lieu of a warranty. For those wholesale and retail customer sales

not subject to a defective allowance, the Company accrues a warranty liability for estimated costs in

satisfaction of warranty obligations. The Company’s estimate of costs to service warranty obligations is

based upon historical experience and expectations of future conditions.

Leasing: Operating lease payments are recognized as an expense on a straight-line basis over the lease

term.

Deferred Financing Fees: Deferred financing fees are amortized over the term of the related debt, or

applicable period of such debt term and recorded at amortized cost using a method that approximates the

effective interest method. Debt presented net of deferred financing fees under IFRS.

Retirement Benefit Costs: The employee benefit obligation recognized in the statement of financial

position represents the present value of the defined benefit obligation as adjusted for unrecognized

actuarial gains and losses and unrecognized past service cost, and as reduced by the fair value of plan

assets. Obligations for defined benefit pension plans are recorded based on actuarial techniques.

Changes in funded status, based on actuarial estimates, are recorded in other comprehensive income

and net periodic benefit costs are recorded through earnings.

Income Taxes: The Company accounts for income taxes under the asset and liability method, which

requires the recognition of deferred tax assets and liabilities for the expected future consequences of

events that have been included in the financial statements. Under this method, deferred tax assets and

liabilities are determined based on the differences between the financial statements and tax basis of

assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to

reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income

in the period that includes the enactment date.

The Company recognizes interest and penalties, if any, related to unrecognized tax benefits as income

tax expense in the consolidated statements of income. The Company is no longer subject to income tax

examinations by U.S. federal, state, or Canadian tax authorities for years ended December 31, 2010 and

prior due to the expiration of the statute of limitations. The Company does not expect the total amount of

unrecognized tax benefits, of which there were none at December 31, 2015 and 2014, to significantly

change in the next 12 months.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

12.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

A tax position is recognized as a benefit only if it is more-likely-than-not that the tax position would be

sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized

is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For

tax positions not meeting the more-likely-than-not test, no tax benefit is recorded.

Deferred Taxes: Deferred tax assets and liabilities are recognized in the applicable reporting period for

differences in consolidated financial statement and tax basis at rates in effect for the year in which the

differences are expected to reverse. Deferred tax assets are recognized for all deductible temporary

differences for which it is probable that a benefit will be realized.

Financial Instruments: Fair value is the price that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants at the measurement date. Fair value

measurements are to be considered from the perspective of a market participant that holds the asset or

owed the liability.

The fair value hierarchy requires an entity to maximize the use of observable inputs and minimize the use

of unobservable inputs when measuring fair value. Three levels of inputs may be used to measure fair

value:

Level 1: Quoted prices in active markets for identical or similar assets and liabilities.

Level 2: Quoted prices for identical or similar assets and liabilities in markets that are not active or

observable inputs other than quoted prices in active markets for identical or similar assets

and liabilities.

Level 3: Unobservable inputs that are supported by little or no market activity and that are significant

to the fair value of the assets and liabilities.

NOTE 4 – CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY

The preparation of these consolidated financial statements in compliance with IFRS requires

management to make judgments and estimates and form assumptions that affect the reported amounts of

assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period.

Judgment is commonly used in determining whether a balance or transaction should be recognized in the

financial statements and estimates and assumptions are more commonly used in determining the

measurement of recognized transactions and balances. However, judgment and estimates are often

interrelated.

On an ongoing basis, management evaluates its judgments and estimates in relation to assets, liabilities,

revenue and expenses. Management uses historical experience and various other factors it believes to

be reasonable under the given circumstances as the basis for its judgments and estimates. Actual

outcomes may differ from these estimates under different assumptions and conditions.

Information about critical judgments in applying accounting policies that have the most significant effect

on amounts recognized in the financial statements and estimates is included in the following areas:

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

13.

NOTE 4 – CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY (Continued)

Pension benefits: The cost of defined benefit pension plans and other post-employment medical benefits

and the present value of the pension obligation are determined using actuarial valuation. The actuarial

valuation involves making various assumptions which may differ from actual developments in the future.

These include the determination of the discount rate, mortality rates and future pension increases. Due to

the complexity of the valuation, the underlying assumptions and its long-term nature, a defined benefit

obligation is highly sensitive to changes in the assumptions. All assumptions are reviewed at each

reporting date.

In determining the appropriate discount rate, management considers the interest rate of corporate bonds

with at least AA rating. The mortality rate is based on publicly available mortality tables.

Reserve for obsolete and slow-moving inventories: Inventory provisions include shrinkage, obsolescence

and write-downs which take into account historical information related to sales trends and stock counts

and represent the expected write-down between the estimated net realizable value and the original cost.

Allowance for doubtful accounts: The Company monitors its exposure for credit losses on its customer

receivable balances and the credit worthiness of its customers on an ongoing basis and records related

allowances for doubtful accounts. Allowances are estimated based upon specific customer balances,

where a risk of default has been identified. A general provision is made for non-customer specific

defaults.

Product liability reserves: The Company provides for expenses associated with product liability claims

received. Additionally, when an identifiable cause issues establishes a basis for estimate of probable

future exposure, a separate accrual is established to monitor these claims incorporating an accrual for

future claims. Product liability reserves are subject to adjustment as new information develops or

circumstances change that would affect the estimated liability. Management’s reserves for product

liability claims are based on past and current claims, the timing of amounts of related payments, the

status of any ongoing litigation and the potential impact of defense and settlement initiatives. There are

inherent uncertainties involved in estimating the value of claims, settlement costs and the effectiveness of

the Company’s defense and settlement initiatives.

Deferred Tax Assets: The Company records net deferred tax assets to the extent management believes

realization of these assets is probable. In making such a determination, the Company considers all

available positive and negative evidence, including future reversals of existing temporary differences,

projected taxable income, tax-planning strategies, and results of recent operations.

The amount of the deferred tax assets considered realizable may be adjusted if estimates of future

taxable income are reduced or increased, or if negative evidence is no longer present and additional

weight may be given to subjective evidence such as the Company’s projections for growth.

NOTE 5 - RECEIVABLES

2015 2014

Receivables

Trade receivables $ 8,242 $ 9,313

Allowance for doubtful accounts (81) (139)

Total receivables, net $ 8,161 $ 9,174

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

14.

NOTE 6 – PROPERTY, PLANT AND EQUIPMENT

Total

Machinery Construction Property

and in and

Land Buildings Equipment Process Equipment

Cost

Balance at January 1, 2014 $ 210 $ 3,442 $ 11,974 $ 3,046 $ 18,672

Additions/ reclassifications - 41 2,795 (1,031) 1,805

Balance at December 31, 2014 210 3,483 14,769 2,015 20,477

Additions/ reclassifications - 155 1,551 1,516 3,222

Balance at December 31, 2015 $ 210 $ 3,638 $ 16,320 $ 3,531 $ 23,699

Accumulated depreciation

Depreciation $ - $ 244 $ 1,839 $ - $ 2,083

Balance at December 31, 2014 - 244 1,839 - 2,083

Depreciation - 256 1,961 - 2,217

Balance at December 31, 2015 $ - $ 500 $ 3,800 $ - $ 4,300

Net book value

As of December 31, 2014 $ 210 $ 3,239 $ 12,930 $ 2,015 $ 18,394

As of December 31, 2015 210 3,138 12,520 3,531 19,399

NOTE 7 – OTHER ASSETS

2015 2014

Other current assets

Prepayments $ 275 $ 188

Other receivables 398 35

Total other current assets $ 673 $ 223

NOTE 8 - INVENTORIES

2015 2014

Inventories

Raw materials and supplies $ 2,658 $ 2,553

Work in process 1,178 929

Finished goods 9,973 9,903

13,809 13,385

Reserve for obsolete and slow-moving inventories (600) (446)

$ 13,209 $ 12,939

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

15.

NOTE 9 - INCOME TAXES

Income tax expense is reconciled to income before income taxes as follows:

2015 2014

Income before income taxes $ 4,135 $ 6,498

Theoretical tax at 34% federal tax rate $ 1,406 $ 2,209

Increase (decreases) from effects of:

State and foreign tax rate differences 141 3

Non-deductible permanent differences 18 34

Other, primarily tax return to provision true-up 102 (57)

Change in tax rate to value deferred

tax balances from 37% to 36% - (331)

$ 1,667 $ 1,858

The components of income tax expense are as follows:

2015 2014

Current – federal, state and foreign $ 115 $ (134)

Deferred – federal and state 1,552 1,992

$ 1,667 $ 1,858

Income tax expense recognized directly in equity:

2015 2014

Deferred tax

Reclassification of accumulated other comprehensive loss

of terminated defined benefit plan $ 360 $ -

Income tax benefit recognized in other comprehensive income:

Deferred tax

Tax effect on actuarial losses on defined benefit plans $ (200) $ (1,658)

Deferred tax assets (liabilities) have been recognized for the following:

2015 2014

Deferred tax assets $ 22,422 $ 22,832

Deferred tax liabilities (16,326) (13,703)

$ 6,096 $ 9,129

Deferred taxes related primarily to net operating loss carry forwards, pension and post-retirement benefit

obligations, goodwill and intangible asset amortization, depreciation, inventory, receivables and other

assets and liabilities.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

16.

NOTE 9 - INCOME TAXES (Continued)

At December 31, 2015 and 2014, the Company had $54,996 and $55,095, respectively, of federal NOL

carryforwards that expire at various dates from 2022 to 2031. The deferred tax assets related to a portion

of these federal NOL carryforwards are not recognized because management does not believe realization

of such NOLs is probable. The deferred tax assets related to these NOLs will be recognized when

management determines, based on available information from projections of future profitability, that

realization of the deferred tax assets is probable.

NOTE 10 - DEBT

Debt consists of the following at December 31, 2015 and 2014:

2015 2014

Revolving credit loans $ 2,423 $ 1,649

Deferred financing fees (62) (89)

PNC Term Loan 600 1,000

Total outstanding borrowings 2,961 2,560

Revolving credit loans classified as current, net of deferred financing fees 2,361 1,560

Current portion of long-term debt 400 400

Long-term debt, net of current portion $ 200 $ 600

On October 22, 2010, the Company entered into a $21,000 promissory note with Banco de Bogota, which

was guaranteed by ColCeramica S.A. (“ColCeramica”), an affiliated entity, and required no principal

payments until maturity on October 22, 2013. This agreement provided for interest at the variable rate of

3.00% above the six month floating LIBOR rate and interest was first payable on April 22, 2011 and each

180 days thereafter.

On June 22, 2012, the Company entered into a $15,000 Promissory Note with Banco de Bogota (the

“Bank of Bogota Term Loan”) in replacement of the $21,000 promissory note agreement. The Bank of

Bogota Term Loan was guaranteed by ColCeramica and required no principal payments until maturity on

October 22, 2016. This agreement provided for interest at the variable rate of 3.00% above the six month

floating LIBOR rate from June 22, 2012 to April 22, 2013 and at the variable rate of 3.25% above the six

month floating LIBOR rate from April 23, 2013 to October 22, 2016. Interest on the Bank of Bogota Term

Loan was first payable on October 22, 2012 and each 180 days thereafter.

The Company repaid the remaining principal outstanding of $3,000 to Bank of Bogota on November 5,

2014. There was no prepayment penalty. The final interest payment of $4 was paid to Bank of Bogota

on November 5, 2014.

The Company and PNC Bank, National Association are party to a Revolving Credit, Term Loan and

Security Agreement, as most recently amended on July 9, 2015 (the “Agreement”). The Agreement

provides for $15,000 of revolving credit loans (the “Revolver”) and a term loan in the amount of $2,000

(“PNC Term Loan”), with a maturity date of the Agreement of July 9, 2020.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

17.

NOTE 10 – DEBT (Continued)

The Revolver allows for the Company to borrow up to $15,000 subject to certain restrictions based upon

the level of secured assets, as defined in the Agreement, less any outstanding letters of credit not to

exceed $1,500. At December 31, 2015, the Company had $9,120 of available borrowings under the

Revolver; $9,165 based upon the level of secured assets as defined in the Agreement less $45 in

outstanding letters of credit.

The Agreement contains both a subjective acceleration clause and a requirement that the Company

maintain a lockbox arrangement whereby collections are forwarded to the lender for repayment of

revolving credit loans. Accordingly, at December 31, 2015 and 2014, borrowings outstanding on the

Revolver are classified as current in the accompanying statements of financial position.

The PNC Term Loan requires monthly principal payments of approximately $33.

Interest for both the Revolver and the PNC Term Loan is based upon a LIBOR rate plus an applicable

margin corresponding to the leverage ratio for the trailing four quarter period ending on the last day of the

most recently completed fiscal quarter as follows:

LEVERAGE RATIO Applicable Margin

Less than or equal to 0.50 to 1.00 1.25%

Greater than 0.50 to 1.00 but less than or

equal to 1.50 to 1.00 1.50%

Greater than 1.50 to 1.00 but less than or

equal to 2.50 to 1.00 1.75%

Greater than 2.50 to 1.00 2.00%

At December 31, 2015, the Company’s effective interest rate for outstanding borrowings under the

Revolver and PNC Term Loan was 1.68%. At December 31, 2014 the Company’s effective interest rate

was 2.53% for outstanding borrowings under the Revolver and 2.50% for amounts due under the PNC

Term Loan. Interest on the Revolver and PNC Term Loan is payable in arrears on the first day of each

month.

The Agreement requires the Company to comply with various financial, affirmative and restrictive

covenants, including a minimum fixed charge coverage ratio. At December 31, 2015 and 2014, the

company was in compliance with these covenants.

Approximate aggregate maturities of debt are as follows:

2015 $ 400

2016 2,623

NOTE 11 – PROVISIONS

Product Liability: The Company has a deductible of $150 per occurrence under its product liability

insurance, which covers product liability claims up to $1,000 per occurrence. The Company also has

excess insurance to cover product liability losses beyond the $150 deductible and the $1,000 coverage

per occurrence.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

18.

NOTE 11 – PROVISIONS (Continued)

2015 2014

Liability at beginning of year $ 1,916 $ 1,782

Provision 780 1,145

Claims paid (1,380) (1,011)

Liability at end of year $ 1,316 $ 1,916

Warranty: The Company’s accrued warranty liability was $363 and $185 at December 31, 2015 and 2014,

respectively.

NOTE 12 – ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

Accounts payable and accrued liabilities 2015 2014

Trade payables $ 5,301 $ 7,355

Accrued compensation and benefits 1,538 1,703

Other accrued liabilities 3,697 4,925

$ 10,536 $ 13,983

NOTE 13 - EMPLOYEE RETIREMENT BENEFIT PLANS

The Mansfield Plumbing Products, LLC Cash Balance Pension Plan (“Cash Balance Pension Plan”)

covers eligible salaried employees and eligible non-bargaining hourly employees of the Company.

Benefits for this plan are provided based on defined contributions, a stated amount for each year of

service. Effective July 31, 2007, the Company elected to freeze the Mansfield Plumbing Products, LLC

Cash Balance Pension Plan. As of December 31, 2015, IRS and the Pension Benefit Guaranty

Corporation (PBGC) approval was granted for termination of the plan and remaining liabilities have been

transferred to an annuity provider.

The Mansfield Plumbing Products, LLC Retirement Plan for Hourly Employees (“Hourly Pension Plan”)

covers eligible hourly employees of the Company. Benefits for this plan are provided based on a stated

amount for each year of service. Effective July 31, 2008, the Company elected to freeze the Mansfield

Plumbing Products, LLC Retirement Plan for Hourly Employees.

The Company’s funding policy for its plans is to make no less than the minimum annual contributions

required by applicable governmental regulations.

Other benefits consist of post-retirement life and health-care benefits provided by the Company to certain

of its former employees. The Company has two plans that provide these benefits to retirees. Benefits

are determined on varying formulas based on age at retirement and years of active service. Health care

benefits are contributory and the life insurance plans are noncontributory. The Company has not funded

any of the post-retirement health care benefit liabilities. Contributions to the post-retirement health care

plans are made by the Company as claims are incurred.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

19.

NOTE 13 - EMPLOYEE RETIREMENT BENEFIT PLANS (Continued)

The Company recognizes the overfunded or underfunded status of its defined benefit post-retirement

plans as an asset or liability in its statement of financial position and recognizes changes in the funded

status in the year in which the changes occur as other comprehensive income (loss). The Company is

required to measure defined benefit plan assets and obligations as of December 31, the date of the

Company’s fiscal year-end.

Termination of Cash Balance Pension Plan: On March 26, 2015 the PBGC accepted the Company’s

Form 500 Filing for a Standard Plan Termination for the Mansfield Plumbing Products, LLC Cash Balance

Pension Plan. In accordance with 29 Code of Federal Regulations (CFR) § 4041.26, the PBGC’s 60-day

review period ended on May 25, 2015 and in accordance with 29 CFR § 4041.28, distribution of plan

assets through either lump sum payments or annuity purchases occurred by 180 days after the end of the

PBGC review period. On November 5, 2015 a Sales Agreement between Mansfield Plumbing Products

LLC and United of Omaha was signed and the transfer of the liability occurred on November 16, 2015.

Hourly Pension Plan Partial Settlement: In June 2014, the Company announced a special election

window to offer voluntary lump sum payments to terminated vested participants of the Hourly Pension

Plan who were not currently receiving benefits. The special election window was from August 1, 2014 to

October 31, 2014 and provided participants with a one-time election within this period to receive a lump

sum settlement of their pension benefits or not make the election and continue to be entitled to their

pension benefits upon retirement. Participants with an aggregate pension benefit obligation of $2,151

elected to receive a lump sum settlement and payments of this amount were made from existing plan

assets during the fourth quarter of 2014.

Obligations and Funded Status:

2015 2014

Pension Other Pension Other

Benefits Benefits Benefits Benefits

Change in benefit obligation

Benefit obligation at beginning of year $ 32,994 $ 213 $ 30,445 $ 177

Interest cost 1,231 6 1,364 6

Expected expenses 496 - 235 -

Settlement gain (loss) 10 - (627) -

Participant contributions - 1 - 1

Actuarial (gain) loss (1,467) (19) 5,079 43

Settlement payments (2,911) - (2,151) -

Benefits paid (1,388) (6) (1,351) (14)

Benefit obligation at end of year 28,965 195 32,994 213

Change in plan assets

Fair value of plan assets at beginning of year 27,780 - 28,974 -

Actual gain on plan assets (1,031) - 1,609 -

Company contribution 956 5 698 13

Participant contributions - 1 - 1

Settlement payments (2,911) - (2,151) -

Change in benefit obligation

Benefits paid (1,388) (6) (1,351) (14)

Fair value of plan assets at end of year 23,406 - 27,779 -

Funded status at end of year $ (5,559) $ (195) $ (5,215) $ (213)

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

20.

NOTE 13 - EMPLOYEE RETIREMENT BENEFIT PLANS (Continued)

Amounts recognized in the statements of financial position consist of:

2015 2014

Pension Other Pension Other

Benefits Benefits Benefits Benefits

Current liabilities $ - $ 26 $ - $ 26

Noncurrent liabilities 5,559 169 5,215 187

$ 5,559 $ 195 $ 5,215 $ 213

Components of net periodic benefit cost for the years ended December 31, 2015 and 2014 are as follows:

2015 2014

Pension Other Pension Other

Benefits Benefits Benefits Benefits

Interest cost $ 1,231 $ 6 $ 1,364 $ 6

Expected expenses 496 - 235 -

Expected return on plan assets (1,016) - (1,316) -

Pension settlement gain (loss) 10 - (627) -

Net periodic benefit cost $ 721 $ 6 $ (344) $ 6

Amounts that have not been recognized as components of net periodic benefit cost and are included in

accumulated other comprehensive loss at December 31, 2015 and 2014 consist of:

2015 2014

Net actuarial loss $ (12,411) $ (12,855)

Tax effect 4,467 4,627

Net actuarial loss, net of tax $ (7,944) $ (8,228)

Assumptions: The weighted-average assumptions used at December 31 are as follows:

2015 2014

Pension Other Pension Other

Benefits Benefits Benefits Benefits

Discount rate 2.90% and 4.10% 3.00% 3.45% and 3.80% 2.85%

Health care cost trend rate - * - **

* 7.0% for 2015, decreasing to 5.0% for 2019

** 7.5% for 2014, decreasing to 5.0% for 2019

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

21.

NOTE 13 - EMPLOYEE RETIREMENT BENEFIT PLANS (Continued)

As of December 31, 2015 and 2014, the accumulated benefit obligation for the Company’s pension plans

was $28,965 and $32,994 respectively. As of December 31, 2015 and 2014, both of the Company’s

pension plans had accumulated benefit obligations in excess of plan assets. The projected benefit

obligation, accumulated benefit obligation and fair value of plan assets for these pension plans were

$28,965, $28,965, and $23,406, respectively, as of December 31, 2015.

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for these

pension plans were $32,994, $32,994, and $27,779, respectively, as of December 31, 2014. A one-

percentage-point change in the assumed health care cost trend rate would have the following effects.

2015 2014

Increase Decrease Increase Decrease

Effect on total of service

and interest cost components $ - $ - $ - $ -

Effect on post-retirement benefit obligation 11 (10) 13 (12)

Plan Assets: The fair value of the Company’s pension plan assets at December 31 by asset category are

as follows:

Quoted Prices in Active Markets for Identical Assets

Level 1 2015 2014

Domestic Equity Large Value $ 893 $ 1,190

Domestic Equity Small / Mid Growth 713 1,117

Domestic Equity Small / Mid Value 733 1,150

Mutual Funds

Money Market 437 704

Domestic Equity Large Growth 942 1,404

Domestic Equity Large Value - 30

Domestic Equity Small / Mid Growth - 30

Domestic Equity Small / Mid Value - 30

Domestic Fixed Income - 1,467

International Growth 857 671

International Fixed Income - 361

Global Equity 373 -

Blended Mid Growth - 727

Long / Short - 52

Tactical Allocation - 119

Exchange Traded Funds

Domestic Equity Fund Large Core 1,851 2,471

International Equity Core 1,359 1,402

Emerging Markets 959 1,831

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

22.

NOTE 13 - EMPLOYEE RETIREMENT BENEFIT PLANS (Continued)

Significant Other Observable Inputs

Level 2 2015 2014

Fixed Income

Corporate $ 7,233 $ 7,197

Governmental 2,697 1,004

International 282 257

Hedge Funds of Funds 3,946 4,445

Cash 131 120

Total $ 23,406 $ 27,779

Level 1 asset consist of the plans’ investments in common equity, mutual funds, and exchange traded

funds. Fair values for these securities are based on unadjusted, quoted prices for identical assets in an

active market.

Level 2 assets consist of the plans’ investments in fixed income securities and hedge funds of funds. Fair

value of corporate, governmental, and international fixed income securities is based on most recent bid

prices in the principal market in which such securities are traded, or are valued based on information

provided by a pricing service. Fair value of shares of hedge funds of funds is based on the net asset

values of the shares as reported by the fund managers at year end.

The investment objectives of the hedge funds of funds include capital appreciation through the use of

leverage and short positions, as well broad diversification with positions in global currency, financial and

commodity markets. A portion of the plans’ investment in hedge funds of funds allow for quarterly

redemptions, with 65 days advance notice. Otherwise, there are no restrictions on redemptions or

advance notice requirements.

The Company, or its agents, exercise reasonable skill and caution in making investment decisions. A

number of factors are evaluated in determining if an investment strategy will be employed by the

Company’s master pension trusts. These factors include, but are not limited to, investment style,

investment risk, investment manager performance and costs.

The primary investment objective of the Company’s master pension trust for the Hourly Pension Plan is to

maximize the value of plan assets focusing on capital preservation, current income and long-term growth

of capital and income. The plans’ assets are typically invested in a broad range of equities, debt, hedge

funds and cash instruments. The Company’s investment strategies for the Hourly Pension Plan resulted

in a targeted investment allocation of 1% short term investments, 44% debt securities, 38% equity

securities, and 17% non-traditional investments, principally hedge funds.

Contributions: The Company expects to contribute $26 to its other post-retirement benefit plan and $964

to its Hourly Pension Plan in 2016.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

23.

NOTE 13 - EMPLOYEE RETIREMENT BENEFIT PLANS (Continued)

Estimated Future Benefit Payments: The following benefit payments are expected to be paid:

Pension Other

Benefits Benefits

2016 $ 1,369 $ 26

2017 1,407 24

2018 1,460 22

2019 1,500 20

Years 2020-2024 9,777 69

Other: The Company also has two defined contribution plans for eligible employees, the Mansfield

Plumbing Products LLC Employee Savings Plan for Ohio Hourly Employees and the Ceramicorp, Inc.

Employee Savings Plan. Contributions to these plans by the Company are determined based on a

percentage of the contributions made by the employee. Company contributions to these plans were

$247 and $223 for the years ended December 31, 2015 and 2014, respectively.

NOTE 14 – DEFERRED COMPENSATION

On November 28, 2012, the Company entered into deferred compensation arrangements with certain key

employees. Employees have the opportunity to earn phantom shares for each of the years ended

December 31, 2013 through 2017, contingent upon the Company achieving share price goals as defined

in the agreements. Earned phantom shares cumulatively vest over five years, with 33% of then

outstanding shares vested at December 31, 2015, 67% of then outstanding shares vested at

December 31, 2016 and 100% of then outstanding shares vested at December 31, 2017. Vested

phantom shares outstanding are exercisable each year at the share price as defined in the agreements

and are paid in cash.

For the years ended December 31, 2015 and 2014, phantom shares earned totaled -0- and 6,174,

respectively. Total earned phantom shares outstanding were 11,565 and 13,717 at December 31, 2015

and 2014, respectively.

A participant in the plan transferred services to an affiliated entity on January 1, 2015. In accordance with

the plan agreement, the participant’s 2,152 earned shares as of December 31, 2014 became immediately

vested as of January 1, 2015. Payment of the value of these earned shares in the amount of $111 was

made as of December 31, 2015. No other phantom shares were exercised, expired or forfeited.

Remaining phantom shares vested were 3,855 and -0- as of December 31, 2015 and 2014.

The Company recognized expense of $56 and $304 in 2015 and 2014, respectively, based on the

phantom shares earned, the applicable vesting period for the earned shares for continuing participants,

the provision recognized in 2014 for the transferring employee and the December 31, 2015 and 2014

share prices as defined. Corresponding liabilities of $325 and $381 at December 31, 2014 and 2013,

respectively, are included in accounts payable and accrued liabilities on the statement of financial

position. Unrecognized expense is recorded over the remaining years of the phantom share program in

accordance with the defined vesting period of the earned phantom shares. Total unrecognized expense

related to all phantom shares earned and valued at the December 31, 2015 and 2014 share prices are

approximately $105 and $330, respectively.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

24.

NOTE 15 – CAPITAL MANAGEMENT

The Company manages its capital to ensure that the Company will be able to continue as a going

concern while maximizing the return to stakeholders through the optimization of the Company’s capital

structure.

The capital structure of the Company consists of net debt (borrowings as detailed in Note 10 offset by

cash balances) and equity of the Company.

The Company is subject to external borrowing restrictions.

2015 2014

Outstanding borrowings $ 2,961 $ 2,560

Cash balances (378) (360)

Net debt 2,583 2,200

Equity 70,643 70,215

Net debt to equity ratio 3.66% 3.13%

NOTE 16 - RELATED PARTY TRANSACTIONS

The Company purchased approximately $4,461 and $4,904 of finished goods from ColCeramica, a 100%

owner of Ceramicorp, during the years ended December 31, 2015 and 2014, respectively. At

December 31, 2015 and 2014, the Company had accounts payable to ColCeramica related to these

purchases of $1,853 and $1,369, respectively, which is included in accounts payable and accrued

liabilities on the accompanying statements of financial position. Additionally, at December 31, 2015 and

2014, the Company had in-transit purchases from ColCeramica of $212 and $188, respectively, which is

also included in accounts payable and accrued liabilities on the accompanying statements of financial

position.

In November of 2014, the Company purchased a bowl casting machine from ColCeramica for $463.

The Company is party to an Intercorporate Service Agreement with Ceramicorp (the “Management

Agreement”). The Management Agreement calls for the Company to pay Ceramicorp a $50 monthly fee

for executive, management, financial, tax, legal, risk management, technical, consulting, administrative

and other services described in the Management Agreement. Effective January 1, 2009, Ceramicorp

ceased charging the Company the $50 monthly fee, although the Company continues to receive these

services. Accordingly, the Company did not recognize any management fee expense during the years

ended December 31, 2015 and 2014.

NOTE 17 – COMPENSATION OF KEY MANAGEMENT PERSONNEL

The Company’s key management personnel are members of the executive team of the Company.

Wages, salaries and other employee benefits for key management personnel are included in expense for

their respective functions. Variable compensation for key management personnel is included in general

and administrative expenses.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

25.

NOTE 17 – COMPENSATION OF KEY MANAGEMENT PERSONNEL (Continued)

Compensation awarded to key management personnel is comprised of the following:

2015 2014

Wages, salaries and other employee benefits $ 1,436 $ 1,342

Short term and long term variable compensation 56 692

Total $ 1,492 $ 2,034

NOTE 18 – LEASING ARRAGEMENTS

The Company is obligated under operating leases for certain warehouse space, manufacturing

equipment, computers and office equipment. Future minimum lease obligations under non-cancelable

operating leases (with initial or remaining lease terms in excess of one year) at December 31, 2015 are

as follows:

2016 $ 483

2017 203

2018 7

2019 2

2020 2

$ 697

Lease expense amounted to approximately $659 and $699 during the years ended December 31, 2015

and 2014, respectively.

NOTE 19 - EXPENSE BY NATURE

2015 2014

Changes in inventories of finish goods and work in process $ 31,319 $ 26,559

Raw materials 23,096 25,879

Salaries and benefits 16,656 17,320

Freight 5,223 5,406

Commissions 4,196 4,250

Product liability and warranty 4,026 3,965

Warehouse and other 2,350 2,457

Depreciation and amortization 2,251 2,133

Advertising 1,914 1,834

Income tax 1,667 1,858

Other 1,043 1,114

Consulting expenses 658 779

Insurance 520 583

Contract services 515 436

Travel 411 482

Licenses 144 559

Bank fees 134 128

Maintenance 122 138

$ 96,578 $ 95,880

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

26.

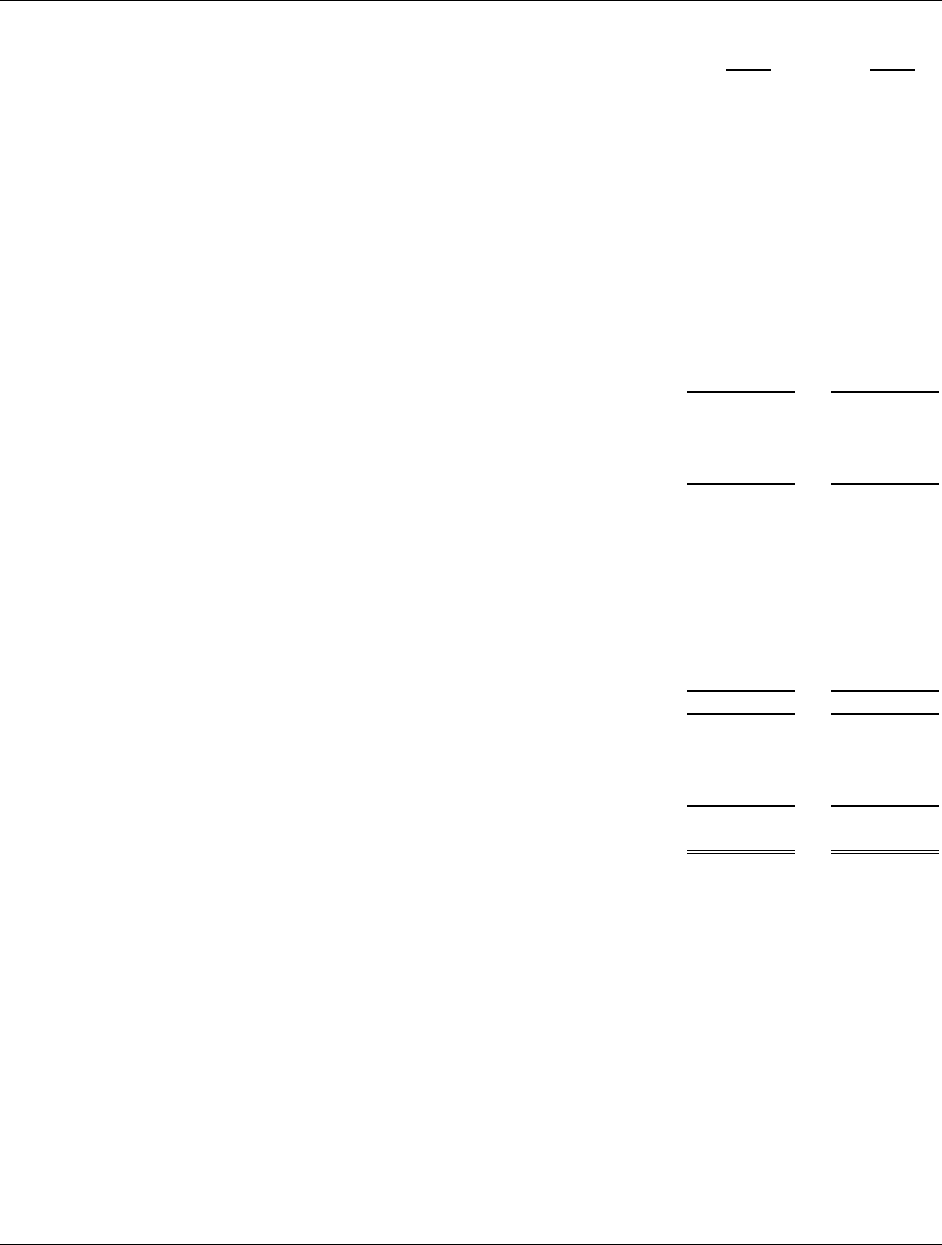

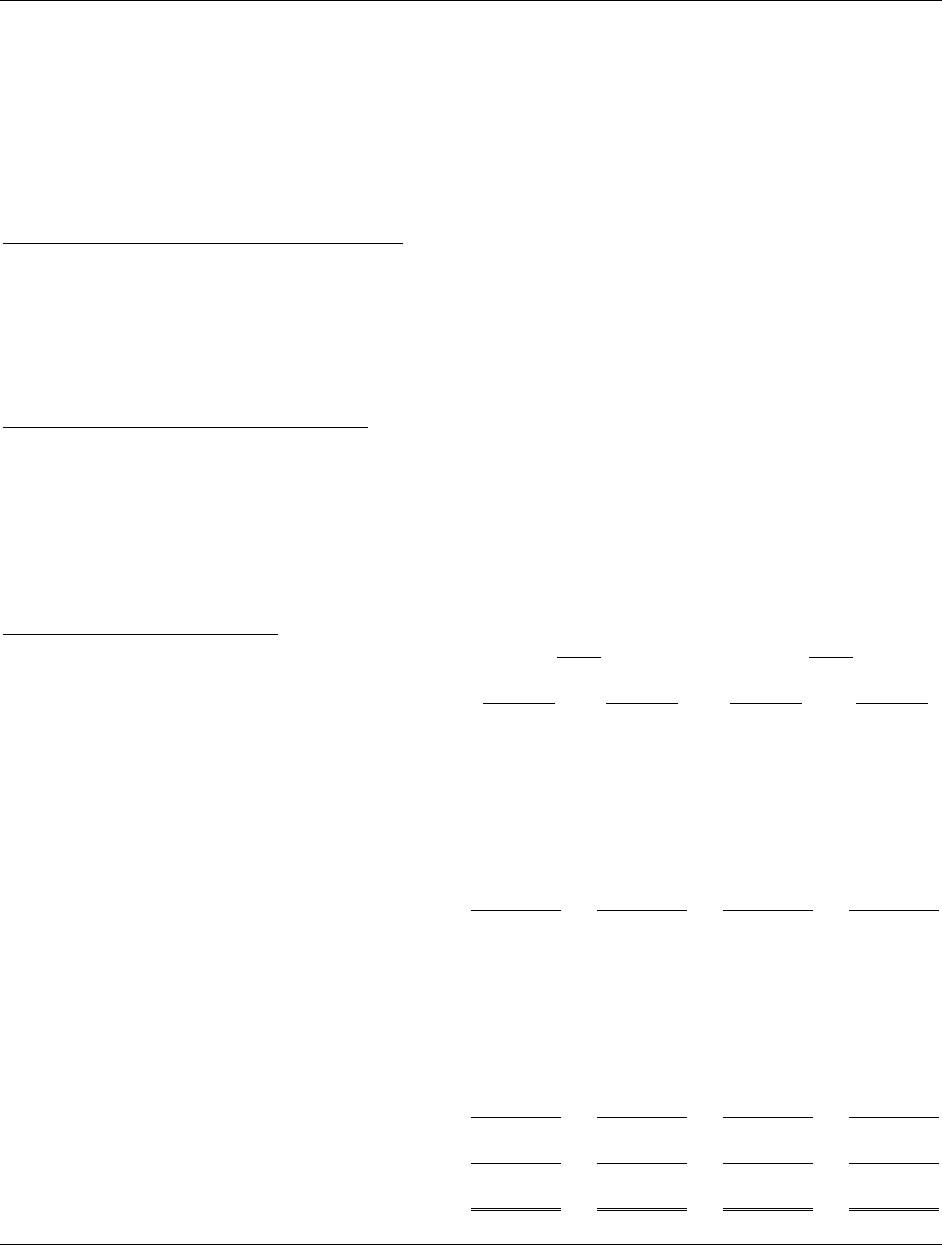

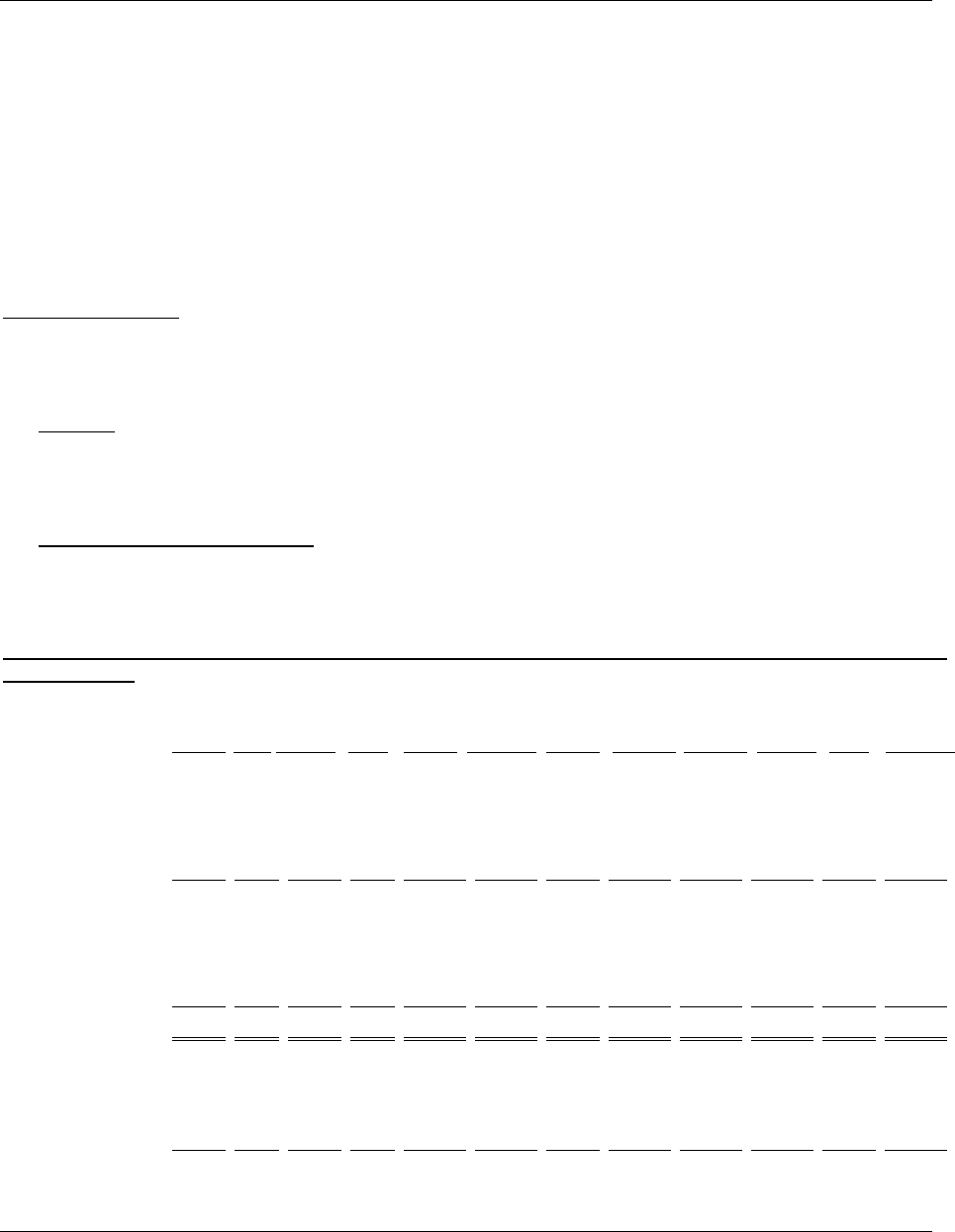

NOTE 20 – TRANSITION TO INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)

These consolidated financial statements for the years ended December 31, 2015 and December 31, 2014

are the first that the Company has prepared in accordance with IFRS. The Company’s consolidated

financial statements were previously prepared in accordance with United States generally accepted

accounting principles (US GAAP). Adjustments have been made by the Company to restate consolidated

financial information as previously presented in accordance with US GAAP to an IFRS basis as of

January 1, 2014 and December 31, 2014. The accounting policies set out in Note 3 and the application of

IFRS 1 have been applied in preparing the consolidated financial statements for the years ended

December 31, 2015 and 2014.

Exemptions applied: IFRS 1 First-Time adoption of International Financial Reporting Standards allows

first-time adopters certain exceptions from the retrospective application of certain IFRS.

The Company has applied the following exemptions:

Goodwill: No adjustment resulted from the conversion to IFRS. The Company has elected an

exemption from the application of IFRS related to business combinations prior to January 1, 2014.

Accordingly, IFRS 3 has not been retrospectively applied to business combinations that occurred

before January 1, 2014.

Property, plant and equipment: Fair value at the opening statement of financial position date was

used as deemed cost, with subsequent measurements under the cost model for all types of assets.

Depreciation is calculated using the straight line method, based on useful lives as estimated by the

appraiser.

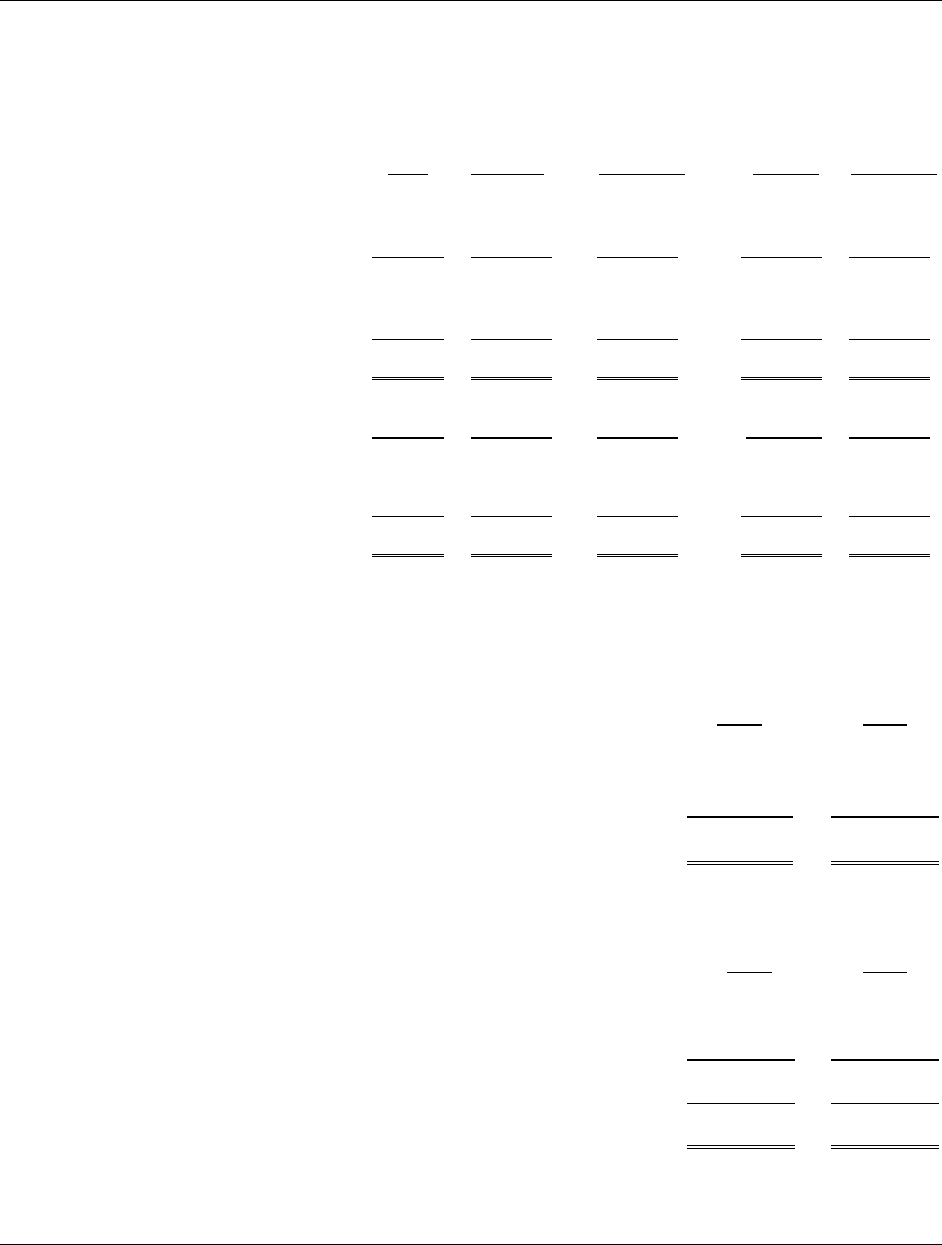

Reconciliation of Previously Reported Consolidated Statements of Financial Position under US

GAAP to IFRS

US GAAP IFRS US GAAP IFRS

Balance Deferred Deferred Balance Balance PP&E Depr Deferred Deferred Balance

1/1/2014 PP&E Fin. Fees Taxes 1/1/2014 12/31/2014 Pension (01/01/14) (12/31/14) Fin. Fees Taxes 12/31/2014

ASSETS

Current Assets

Cash $ 508 $ - $ - $ - $ 508 $ 473 $ - $ - $ - $ - $ - $ 473

Receivables 7,850 - - - 7,850 9,174 - - - - - 9,174

Inventories 12,894 - - - 12,894 12,939 - - - - - 12,939

Deferred tax assets 2,179 - - (2,179) - 1,757 - - - - (1,757) -

Other current assets 170 - - - 170 223 - - - - - 223

Total current assets 23,601 - - (2,179) 21,422 24,566 - - - - (1,757) 22,809

Property, plant and

equipment 15,000 3,672 - - 18,672 15,111 - 3,672 (389) - - 18,394

Goodwill 33,328 - - - 33,328 33,328 - - - - - 33,328

Intangible asset 8,500 - - - 8,500 8,500 - - - - - 8,500

Deferred financing fees 138 - (138) - - 89 - - - (89) - -

Deferred tax assets 7,284 - - 2,179 9,463 7,232 - - - - 1,897 9,129

$ 87,851 $ 3,672 $ (138) $ - $ 91,385 $ 88,826 $ - $ 3,672 $ (389) $ (89) $ 140 $ 92,160

LIABILITIES AND EQUITY

Current liabilities

Revolving credit loan $ 4,470 $ - $ (138) $ - $ 4,332 $ 1,649 $ - $ - $ - $ (89) $ - $ 1,560

Current portion of LTD 400 - - - 400 400 - - - - - 400

Accounts payable 5,483 - - - 5,483 7,355 - - - - - 7,355

Accrued liabilities 6,798 - - - 6,798 6,628 - - - - - 6,628

Total current liabilities 17,151 - (138) - 17,013 16,032 - - - (89) - 15,943

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

27.

NOTE 20 – TRANSITION TO INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)

(Continued)

Reconciliation of Previously Reported Consolidated Statements of Financial Position under US

GAAP to IFRS

US GAAP IFRS US GAAP IFRS

Balance Deferred Deferred Balance Balance PP&E Depr Deferred Deferred Balance

1/1/2014 PP&E Fin.Fees Taxes 1/1/2014 12/31/2014 Pension (01/01/14) (12/31/14) Fin. Fees Taxes 12/31/2014

LTD, net of current portion $ 4,000 $ - $ - $ - $ 4,000 $ 600 $ - $ - $ - $ - $ - $ 600

Accr. EE benefit obligations 1,624 - - - 1,624 5,402 - - - - - 5,402

Total liabilities 22,775 - (138) - 22,637 22,034 - - - (89) - 21,945

Stockholder’s equity

Common stock 77,058 - - - 77,058 77,058 - - - - - 77,058

Accum. Other comp.loss (5,055) - - - (5,055) (7,586) (1,002) - - - 360 (8,228)

Retained earnings (6,927) 3,672 - - (3,255) (2,680) 1,002 3,672 (389) - (220) 1,385

Total stockholder’s equity 65,076 3,672 - - 68,748 66,792 - 3,672 (389) - 140 70,215

$ 87,851 $ 3,672 $ (138) $ - $ 91,385 $ 88,826 $ - $ 3,672 $ (390) $ (89) $ 140 $ 92,160

Net sales $ 100,520 $ - $ - $ - $ - $ - $ 100,520

Cost of sales 80,568 (220) - 389 - - 80,737

Gross profit 19,952 (220) - (389) - - 19,783

Selling, general and adm. 12,994 - - - - - 12,994

Pension settlement cost 782 (782) - - - - -

Income before other expense 6,176 1,002 - (389) - - 6,789

Interest expense 285 - - - - - 285

Other expense 6 - - - - - 6

291 - - - - - 291

Income before income taxes 5,885 1,002 - (389) - - 6,498

Income tax expense 1,638 - - - - 220 1,858

Net income $ 4,247 $ 1,002 $ - $ (389) $ - $ (220) $ 4,640

Summary and Description of IFRS Adjustments

Property, plant and equipment: The fair value of property, plant and equipment at January 1, 2014

was determined by an appraiser to be $15,626. The recorded value under US GAAP at January 1,

2014 was $11,954. The fair value was elected as deemed cost and recognized at the date of

transition to IFRS with an increase to property, plant and equipment of $3,672 and a corresponding

increase to retained earnings for the same amount at January 1, 2014. Depreciation expense of $389

was recognized for the year ended December 31, 2014 related to the increased value of property,

plant and equipment that was recognized at January 1, 2014.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

(Continued)

28.

NOTE 20 – TRANSITION TO INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)

(Continued)

Pensions: There are no adjustments for pensions at January 1, 2014 as the reported amounts in

other comprehensive income and retained earnings at January 1, 2014 are the same under US

GAAP and IFRS in accordance with IAS 19, paragraphs 120 – 122. An adjustment of $1,002 to

reduce pension expense with a corresponding reduction to accumulated other comprehensive loss

was recognized for the year ended December 31, 2014. The adjustment includes a $1,409 reduction

to pension settlement costs. $782 was recorded to pension settlement expense in 2014 under US

GAAP for settlement of obligations under a lump sum window offered to participants in the Mansfield

Plumbing Products, LLC Retirement Plan for Hourly Employees. The expense reflected recognition

of unrecorded expense related to the settlement obligations under US GAAP settlement accounting.

A credit of $627 is reflected under IFRS reflecting the lesser value of the settlement amounts versus

the actuarially determined obligations.2014 pension expense, unrelated to settlement costs, is $407

greater under IFRS principally reflecting the explicit inclusion in pension expense of plan

administrative costs and the use of the same discount rate as used in the valuation of plan obligations

to determine the expected return on assets. Under US GAAP an expected long term return on assets

was used to determine the expected return on assets.

Deferred financing fees: Under IFRS, deferred financing fees are deducted from the carrying value of

the related liability and not recorded as a separate asset as allowed under US GAAP. The carrying

value of deferred financing fees of $138 at January 1, 2014 and $89 at December 31, 2014 have

been reclassified from a separate asset to an off-set of the recorded debt balance. There is no

adjustment to the recognized expense for the year ended December 31, 2014 as the expense

recognized under US GAAP approximated the effective interest method over the term of the debt as

required by IFRS.

Income Taxes: The tax effect of the above mentioned adjustments totaling $220 was recorded at the

estimated effective tax rate of 36%. Income tax benefit and a corresponding deferred tax asset of

$140 was recorded for the tax effect of the depreciation expense adjustment ($389 x 36% = $140).

Income tax expense and a corresponding decrease in accumulated other comprehensive loss of

$360 was recorded for the tax effect of the reduction in pension expense ($1,002 x 36% = $360).

Prior Period Correction of IFRS Adjustments: Subsequent to initial adjustments of the 2014 financial

statements to an IFRS basis, a necessary correction to the statement of financial position was

identified for the impact upon the Company’s net deferred tax asset for the revaluation of the

Company’s property, plant and equipment as of January 1, 2014. The adjustment is reflected as a

reduction to the Company’s net deferred tax asset of $1,321 and as a charge to retained earnings of

the same amount in the 2015 financial statements. The entry to correct the effect of initial IFRS

adjustments does not impact the net income for any period presented.

NOTE 21 - CONTINGENT LIABILITIES

Litigation: The Company is involved in several lawsuits arising in the ordinary course of business,

however, it is the opinion of the Company’s management that these lawsuits are either without merit, are

covered by insurance or are adequately reserved for in the accompanying statements of financial

position, and the ultimate disposition of pending litigation will not be material in relation to the Company’s

financial position or results of operations.

CERAMICORP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2015 and 2014

(Dollars in Thousands, Except Share Amounts)

29.

NOTE 21 - CONTINGENT LIABILITIES (Continued)

Self-Insurance: The Company is self-insured for workers’ compensation in Ohio and was self-insured for

workers’ compensation at its Kilgore, Texas facility. A liability of $121 and $166 was recorded at

December 31, 2015 and 2014, respectively, to estimate payment of claims pending on those dates.

The Company is also self-insured for employee health benefits. Self-insured losses are based on

management’s estimates of the aggregate liability for uninsured claims based on the Company’s historical

claims experience. The self-insured plan includes $175 specific stop loss insurance per individual per

year with an aggregate limit of $1,000. A liability of $616 and $485 was recorded at December 31, 2015

and 2014, respectively, to estimate payment of claims pending on those dates.

Indemnification and Hold Harmless Agreement: The Company is party to an indemnification and hold

harmless agreement with an insurer for one of the Company’s insurance programs. In exchange for the

return of $424 in escrow monies held by the insurer in excess of required loss reserves received

September 2014, the Company has agreed to indemnify the insurer for any costs incurred should a claim

be made for the monies by a third party. The Company warrants that it is the only insured entitled to the

return of the funds. At December 31, 2015 and 2014, no amount has been accrued for any estimated

cost under the obligation as it is the opinion of the Company’s management that such claims would be

unlikely to occur and would be without merit.

NOTE 22 – EVENTS AFTER THE REPORTING PERIOD

The Company has evaluated events and transactions occurring subsequent to the statement of financial

position date of December 31, 2015, for items that should be recognized or disclosed in these financial

statements. This evaluation was conducted through February 4, 2016, the date these consolidated

financial statements were available to be issued.