DM 13.1 Financial Statement With Instructions _ON Only_. May 3 2013 (ON Only) . 6

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 33

FLR 13 (February 1, 2010)

www.DIVORCEmate.com

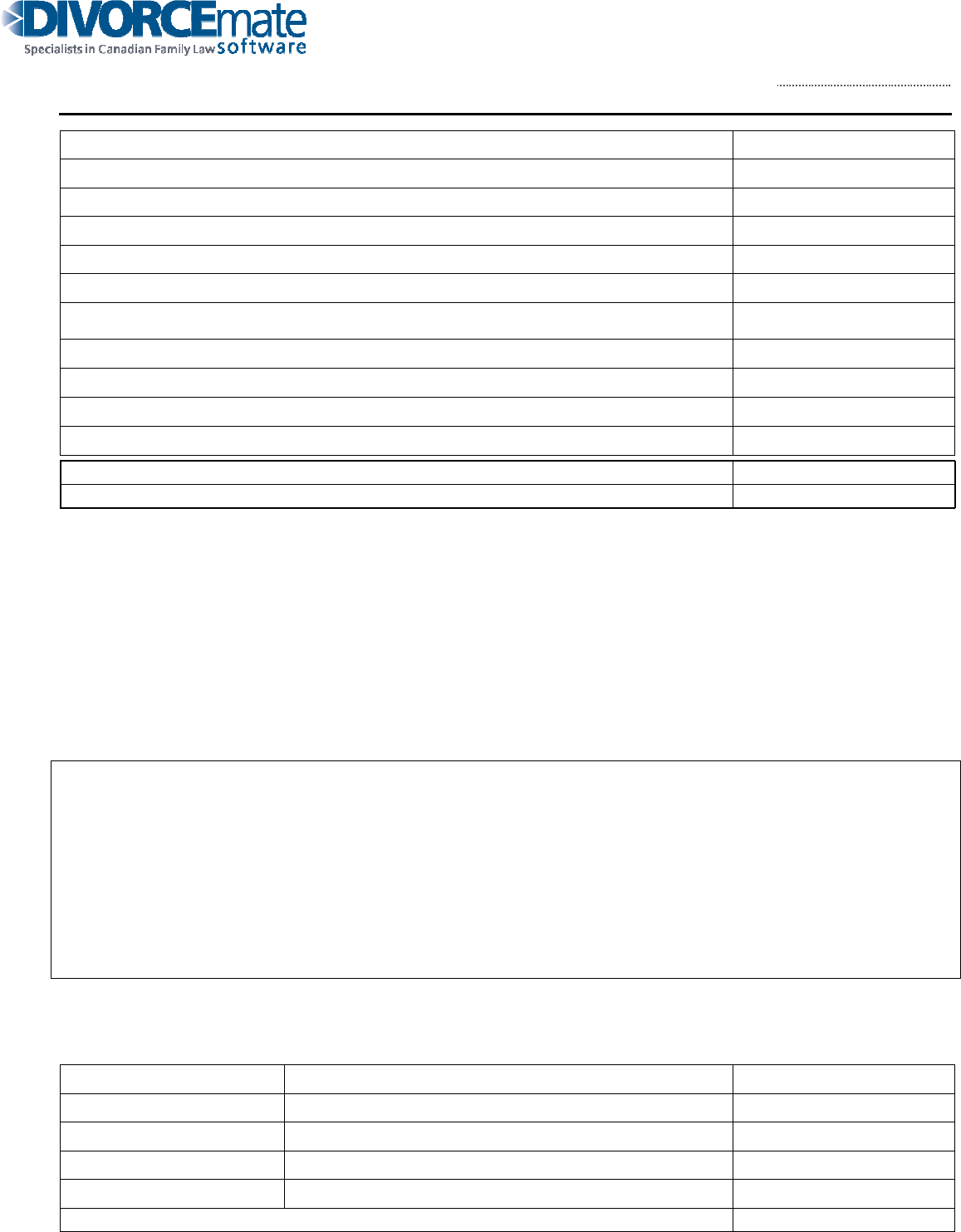

ONTARIO Court File Number

(Name of court)

at

Form 13.1: Financial

Statement (Property and

Support Claims)

sworn/affirmed

(Court office address)

Instructions for completing this Form 13.1 Financial Statement

FYI: Instructions regarding completion of this form are in Times Roman 11

font. The official form is in a

different font, Arial font and/or varying Arial font sizes and styles.

We suggest that you make a photocopy of this

form, then do your rough work in pencil, and transfer fin

al numbers to your good copy. Please print neatly and

clearly in dark pen on your good copy; complete all applicable checkboxes.

There is no need to do any

mathematics.

Complete financial disclosure is a prerequisite to the settlement of any family law case. The Family Law Act

,

and its interpretation by our Courts, leaves no uncertainty in this respect. Any agreement can be set aside if a

party has failed to truthfully and accurately disclose his or her financial position.

To this end, the rules of the

Court require completion of the Financial Statement, either Form 13.1 (support and

property claims) or Form 13 (support claims only). This form must show information th

at is complete, correct,

and up-to-date. It is important to remember that the Financial Statement is a sworn

document, just like an

affidavit. When you sign this completed document, you are giving evidence in the same manner as if you were

in Court. An incorrect, incomplete or misleading Financial Statement, in addition to affecting the v

alidity of

any agreement, can adversely affect your credibility in the eyes of the other side in reaching a settlement, and in

the eyes of the Court in rendering a decision.

IMPORTANT: If any significant information or numbers change, you must advise us i

mmediately. The

Family Law Rules provide that information in any Financial Statement that is more than 30 days old must be

updated at least 7 days (4 days if you are the responding party) before any case conference, settlement

conference, motion or trial.

The Financial Statement Form 13.1 (or Form 13)

forms the basis for the determination of each party's present

income position and income potential, present and proposed standards of living, and net family property.

All information contained in your Financ

ial Statement must be substantiated by other documentation, or at the

very least, you must be able to explain how the figures were determined. You should retain, gather and

organize all receipts, utilities bills, cancelled cheques, bank account statements

, credit card statements, RRSP

statements, investment account statements, line of credit statements, property or business valuations, estimates,

and all other substantiating documentation, and provide copies to us at our request.

Applicant(s)

Full legal name & address for service — street & number, municipality,

postal code, telephone & fax numbers and e-mail address (if any).

Lawyer’s name & address — street & number, municipality, postal code,

telephone & fax numbers and e-mail address (if any).

Form 13.1: Financial Statement (Property and (page 2) Court File Number:

Support Claims)

Respondent(s)

Full legal name & address for service — street & number, municipality,

postal code, telephone & fax numbers and e-mail address (if any).

Lawyer’s name & address — street & number, municipality, postal code,

telephone & fax numbers and e-mail address (if any).

INSTRUCTIONS

1. USE THIS FORM IF:

• you are making or responding to a claim for property or exclusive possession of the matrimonial home and its contents; or

• you are making or responding to a claim for property or exclusive possession of the matrimonial home and its contents

together with other claims for relief.

2. USE FORM 13 INSTEAD OF THIS FORM IF:

• you are making or responding to a claim for support but NOT making or responding to a claim for property or exclusive

possession of the matrimonial home and its contents.

3. If you have income that is not shown in Part I of the financial statement (for example, partnership income, dividends, rental

income, capital gains or RRSP income), you must also complete Schedule A.

4. If you or the other party has sought a contribution towards special or extraordinary expenses for the child(ren), you must also

complete Schedule B.

NOTE: You must fully and truthfully complete this financial statement, including any applicable schedules. Failure to do so may

result in serious consequences.

1.

My name is

(full legal name)

I live in

(municipality & province)

and I swear/affirm that the following is true:

PART I: INCOME

2. I am currently

employed by (name and address of employer)

self-employed, carrying on business under the name of (name and address of business)

unemployed since (date when last employed)

Form 13.1: Financial Statement (Property and (page 3) Court File Number:

Support Claims)

3.

I attach proof of my year-to-date income from all sources, including my most recent (attach all that are applicable):

pay cheque stub

social assistance stub

pension stub

worker

s’ compensation stub

employment insurance stub and last Record of Employment

statement of income and expenses/ professional activities (for self-employed individuals)

other (e.g. a letter from your employer confirming all income received to date this year)

4.

Last year, my gross income from all sources was $

(do not subtract any taxes that have been

deducted from this income).

5.

I am attaching the following required documents to this financial statement as proof of my income

over the past three years, if they have not already been provided:

• a copy of my personal income tax returns for each of the p

ast three taxation years, including any

materials that were filed with the returns.

(Income tax returns must be served but should NOT be filed in the

continuing record, unless they are filed with a motion to refrain a driver’s license suspension.)

• a copy o

f my notices of assessment and any notices of reassessment for each of the past three

taxation years;

•

where my notices of assessment and reassessment are unavailable for any of the past three taxation

years, an Income and Deductions printout from the Canad

a Revenue Agency for each of those years,

whether or not I filed an income tax return.

Note: An Income and Deductions printout is available from Canada Revenue Agency. Please call customer

service at 1-800-959-8281.

OR

I am an Indian within the meaning of the Indian Act (Canada) and I have chosen not to file income

tax returns for the past three years. I am attaching the following proof of income for the last three years (list

documents you have provided):

Notes, Above Information:

Form 13.1: Financial Statement (Property and (page 4) Court File Number:

Support Claims)

All Income and Money Received, Monthly

Income is intended to be current income (whether taxable or not). In other words, the preferred way to disclose

income is to list income for the next twelve-month period based on what you are currently receiving and any

anticipated changes to your income. Unfortunately, it may be difficult to determine current income,

particularly if you are non-salaried, and your income fluctuates from year to year. Therefore, depending on the

sources and the time of year the statement is prepared, it may be only be possible to use last year’s numbers.

All income from any source must be included, including gifts, capital gains, income from employment, interest

or dividends from shares or investment certificates, voluntary or indirect support from other members of your

family or from friends or a common law partner, Canada Child Tax Benefits received, Universal Child Care

Benefits received, GST/HST credits received, support payments actually received and any estimated Income

Tax Refund, if applicable.

Note that Canada Child Tax Benefit (“CCTB”) amounts may change once the Canada Revenue Agency

(“CRA”) is notified of the divorce or separation. Usually, the CCTB amount increases because the family

income is reduced.

Please make sure that you are inputting monthly amounts only. If you are paid weekly, please multiply by

4.33 to get a monthly equivalent. Alternatively, ensure that you indicate if a payment is made other than

monthly, so that we will know to do the necessary conversion to a monthly figure. Do NOT add or total this

or any other section.

If you earn overtime income, but only on a sporadic basis, you should still include the overtime income but you

should estimate the overtime income for the upcoming year. Bonuses and commissions should also be handled

in this manner.

For any item that is an estimate and not an accurate and/or fixed figure, please write "(estimate)" beside the

item and explain why the item can only be estimated.

IMPORTANT: Copies of your Income Tax Returns and all attachments for the last three taxation years,

and any Notices of Assessment or Reassessment for the last three taxation years must be provided to us

with this completed draft Financial Statement. If you do not have Notices of Assessment and

Reassessment for these three years, you must obtain an Income and Deductions printout (even if you did

not file) from the Canada Revenue Agency by calling 1-800-959-8281.

Any working copy of your income tax return would also be helpful.

If you are preparing a new personal income tax return before this matter is over, please forward it to us as well.

You must also provide proof of your current income, to be attached to this Financial Statement. Please

provide us with your most recent pay cheque stub(s), employment insurance stub, worker’s

compensation stub, pension stub, or any other proof of income. If you are self-employed, please provide

a copy of your financial statements for the past three years.

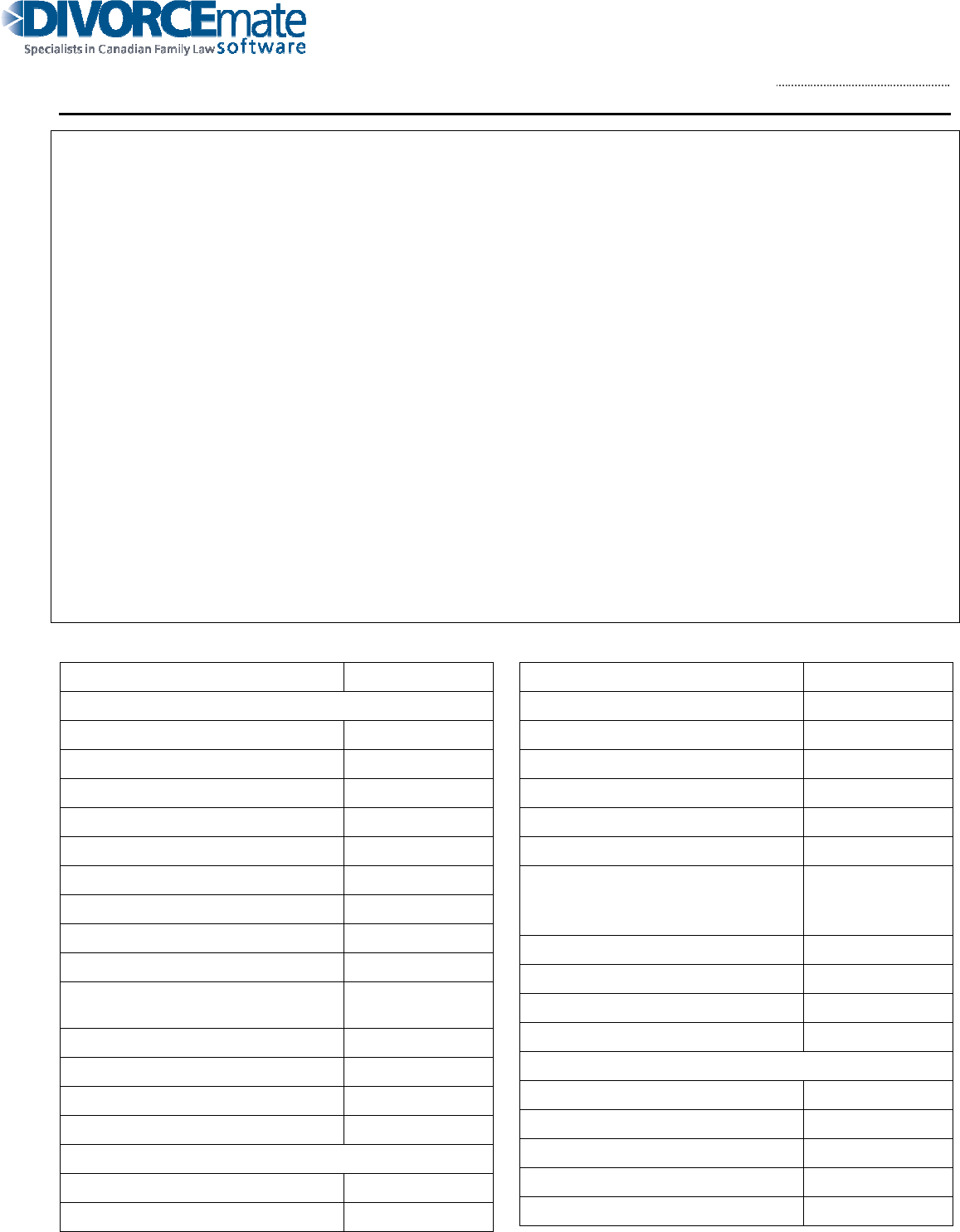

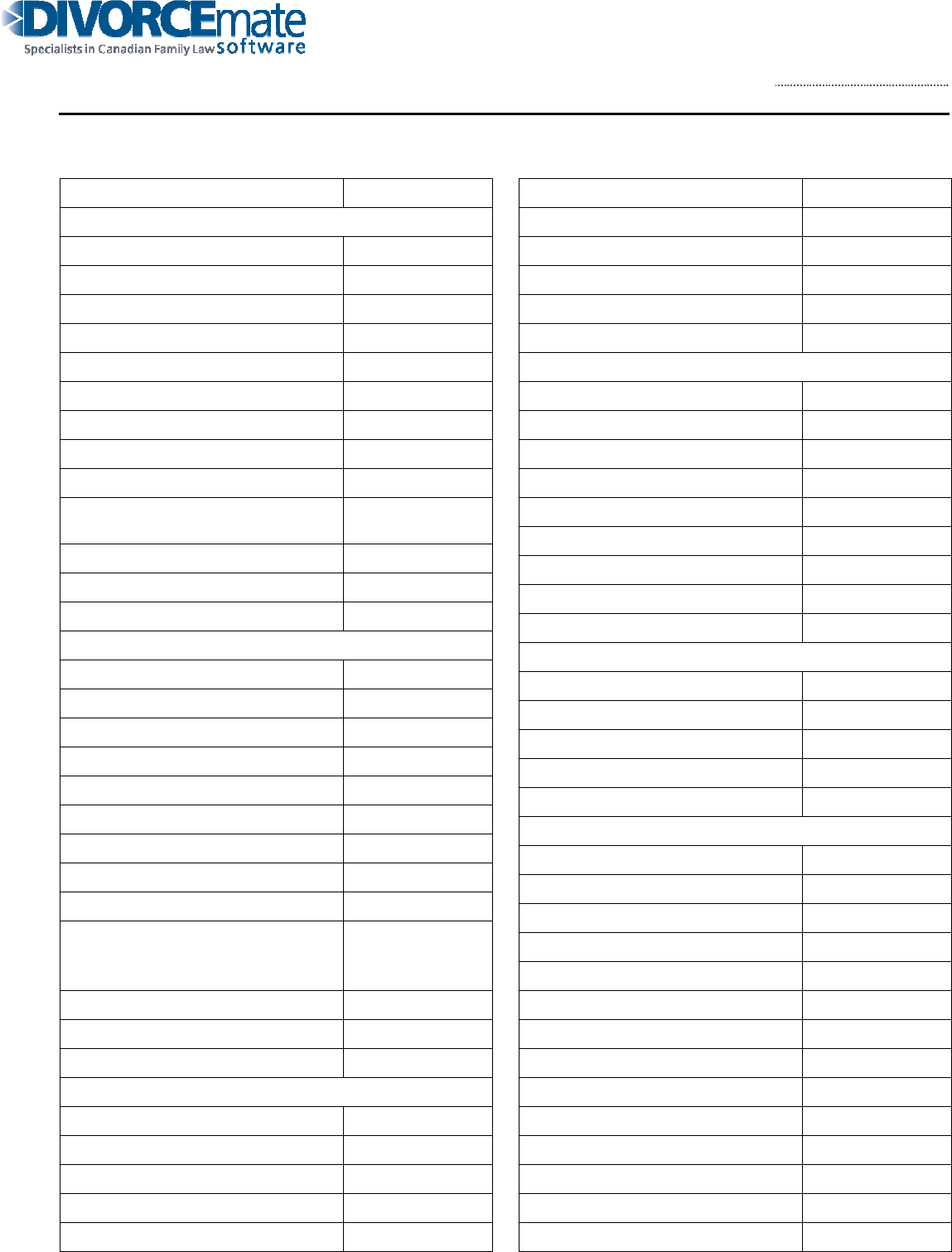

(In this table you must show all of the income that you are currently receiving.)

Income Source

Amount Received/Month

1.

Employment income (before deductions)

2.

Commissions, tips and bonuses

3.

Self-employment income (Monthly amount before expenses: $ )

4.

Employment Insurance benefits

Form 13.1: Financial Statement (Property and (page 5) Court File Number:

Support Claims)

5

.

Workers’ compensation benefits

6.

Social assistance income (including ODSP payments)

7.

Interest and investment income

8.

Pension income (including CPP and OAS)

9.

Spousal support received from a former spouse/partner

10.

Child Tax Benefits or Tax Rebates (e.g. GST) (including CCTB and UCCB)

11.

Other sources of income (e.g. RRSP withdrawals, capital gains) (*attach Schedule A

and divide annual amount by 12)

12. Total monthly income from all sources: $0.00

13. Total monthly income X 12 = Total annual income: $0.00

Notes, Income Source:

Other Benefits, Yearly

The column, "Yearly Market Value", sets out those benefits that you have NOT had to pay for yourself (ie.

non-cash benefits). These might include the use of a company car, free room and board, dental, life insurance,

vision, drug and/or extended health care plans, a sports club membership, a company loan at low or no interest,

a meal allowance, a cell phone, a blackberry, a parking pass, stock options etc.

Most benefits are taxable and their value can be obtained from last year's T4 slip or your payslip. A reasonable

estimate of the value should be made for non-taxable benefits.

You should provide the annual value of these benefits.

14.

Other Benefits

Provide details of any non-

cash benefits that your employer provides to you or are paid for by your business such as medical insurance

coverage, the use of a company car, or room and board.

Item

Details

Yearly Market Value

Total $0.00

Form 13.1: Financial Statement (Property and (page 6) Court File Number:

Support Claims)

Notes, Other Benefits:

Total Expenses, Monthly

"Expenses" represents your current expenses (or your best estimate of your expenses where you cannot

ascertain the actual amounts) over the most current twelve-month period. Note that there is no “right” or

“wrong” and do not be concerned about how your expenses “look”. Do be accurate and truthful.

If you have separated relatively recently, these expenses should be based on your standard of living at the time

of separation. If the separation was some time ago, these expenses are based on your present standard of

living.

Reviewing previous bills, receipts, cheque registers, credit card statements, etc. should assist you in figuring

out what your expenses are. If the children are living with you, please include their expenses in with yours, as

appropriate.

If you have an expense that does not fall into a category, please be sure to list it under the appropriate heading.

If you do not include this expense, you may not get credit for it as an expense when your amount of support

received or support paid is determined.

If your spouse is paying or paid for certain expenses, put this expense into your financial statement but place an

" * " (asterisk), or "(paid by spouse)" or an "H" (Husband) or "W" (Wife) beside those expenses under

“Expense”, or if any expenses are shared, use “shared equally”, or “Wife pays 75%”, or as applicable.

If you are living in new accommodation at the time you are completing this Financial Statement, then we

suggest that you show the new accommodation expenses, as well as all other expenses that you have continued

to incur, with appropriate explanations.

Some expenses do not occur regularly. Car repairs and clothing expenses are such expenses. Please make

your best possible estimate and insert it in the appropriate column. For example, you might take your last six

months’ bills and average them out on a monthly basis.

It is important to keep an accurate record from now on and to keep receipts that are collected for all expenses.

We may need to provide these to your spouse's solicitor on cross-examination or at trial in order to verify your

expenses.

If you are estimating the amount of a particular expense, or if you have calculated a global figure for a

particular expense, and have made a list in order to come up with the estimated or global figure, please keep

this working list in order that you will be able to explain, if necessary, how you calculated the amounts. We

may also want to include the breakdown of a particular expense in notes to be attached to the Financial

Statement.

NEVER inflate your expenses; please keep them accurate. Once the form is completed, please review your

expenses carefully to determine whether in fact they are correct. Always keep in mind that your spouse's

solicitor may cross-examine you in the future and if it turns out you have exaggerated your expenses, the Court

may wonder whether you exaggerate all the time and begin to doubt you in other areas of your testimony.

According to the Child Support Guidelines, proper budgets may be required under certain special situations.

Form 13.1: Financial Statement (Property and (page 7) Court File Number:

Support Claims)

If necessary, we will request that you complete a “Proposed Budget”. If required, the Proposed Budget may be

found at the end of this form. A Proposed Budget may also be required if your current budget does NOT

accurately reflect your accustomed standard of living or your expenses are going to be changing in the future

(ie. you propose to move to another residence after your final settlement). The Proposed Budget must also

avoid exaggeration. It is very helpful to include notes indicating the reasons for any changes from the amounts

reflected under current expenses that are not self-evident. These notes should contain all necessary details.

Please note that if you are not going to change your residence, your fixed expenses should remain the same.

However, your expenses for food, toiletries, sundries, etc. will change, as you will not be including expenses

for your spouse and/or children (if they are not living with you).

If you are self-employed, similarly ensure that expenses are not double counted. Expenses put through your

business (and thereby already reflected in your net income from self-employment) should not be reflected

again on the Financial Statement unless they are in fact personal expenses charged back to you by the business.

Some expenses that may risk being double counted include some housing expenses if a portion of your home is

used for business, “Cell phone”, “Meals outside the home”, “Car Loan or Lease Payments”, “Gas and oil”,

“Parking”, “Entertainment/recreation” and “Gifts”.

If necessary, we may also request that you complete a “Children’s Budget”. If required, the Children’s Budget

may be found at the end of this form. A Children’s Budget should be completed if you are proposing a shared

custody situation, a child is 18 years or over, if one parent stands in loco parentis (in the place of), if undue

hardship is claimed, if the payor’s income is greater than $150,000, or if you are claiming more than the Table

amount or believe you should pay less than the Table amount specified in the Child Support Guidelines.

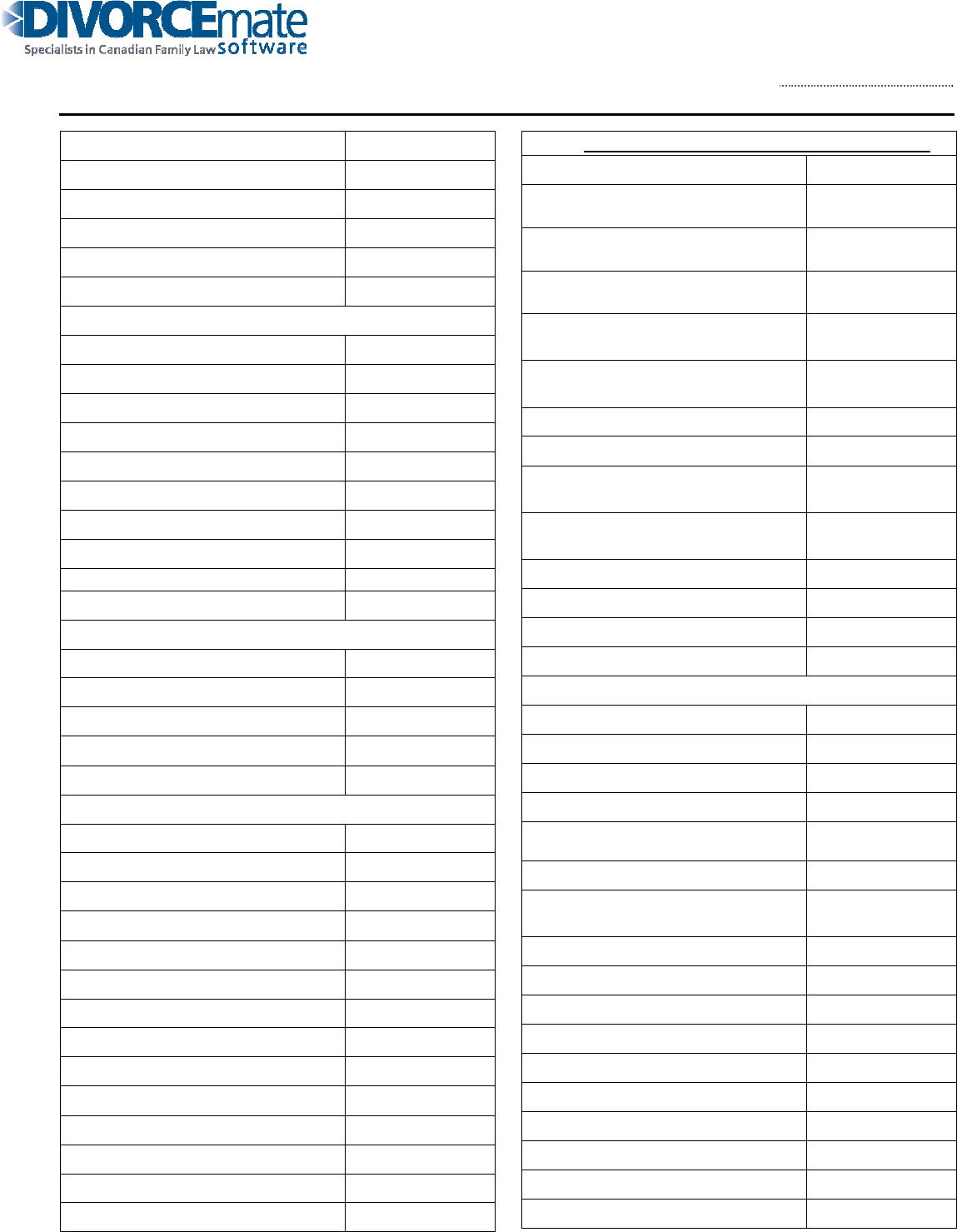

PART 2: EXPENSES

EXPENSE

Monthly Amount

Automatic Deductions

CPP contributions

EI premiums

Income taxes

Employee pension contributions

Union dues

Other pension plans

Group insurance

Canada Savings Bonds deductions

RRSP payroll deductions

Child or spousal support

deductions

Other (provide details)

$0.00

Housing

Rent or mortgage

Property taxes

Property insurance

Condominium fees

Repairs and maintenance

Gardening

Pool maintenance

Snow removal

Alarm and security

Recreational property expenses

(timeshare, cottage, chalet,

snowbird property, etc.)

Other (provide details)

$0.00

Utilities

Water

Heat

Electricity

Telephone

Cell phone (smart phone)

Form 13.1: Financial Statement (Property and (page 8) Court File Number:

Support Claims)

Cable

Internet

Other (provide details)

$0.00

Household Expenses

Groceries

Household supplies

Meals outside the home

Pet care

Laundry and Dry Cleaning

Housekeeper/Cleaning service

Other (provide details)

$0.00

Childcare Costs

Daycare expense

Babysitting costs

Other (provide details)

SUBTOTAL $0.00

Transportation

Public transit, taxis

Gas and oil

Car insurance and license

Repairs and maintenance

Parking

Car Loan or Lease Payments

Boat

Other recreational vehicle(s)

Motor league membership

Access transportation costs

Other (provide details)

$0.00

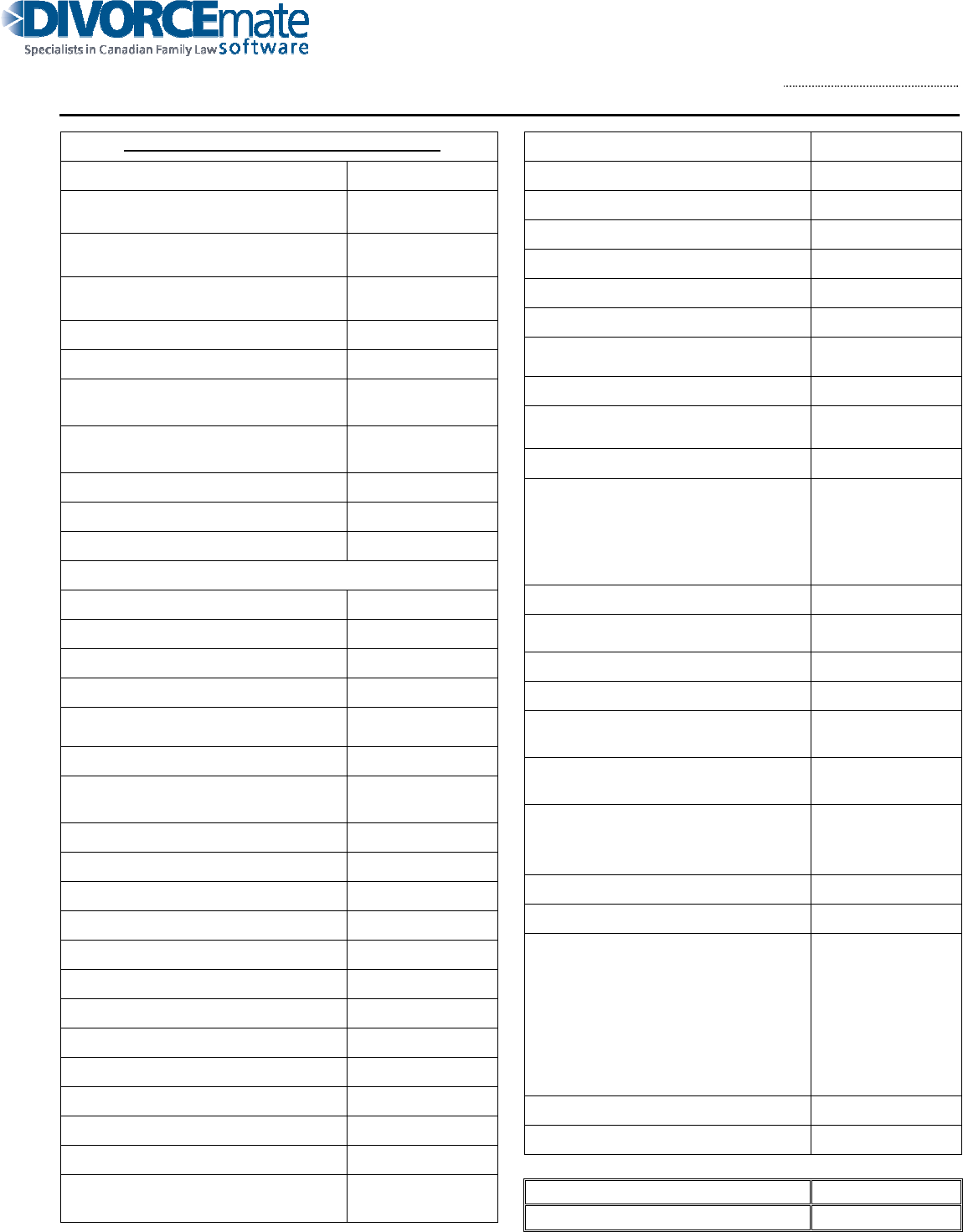

Health (break down children’s expenses separately)

Health insurance premiums

Dental expenses (regular care – not

covered by health plan)

Medicine and drugs (prescription –

not covered by health plan)

Eye care (glasses, exam, contacts –

not covered by health plan)

Orthodontic expenses (not

covered by health plan)

Special dental care (not covered

by health plan)

Non-prescription drugs

Vitamins

Health care aids (not covered by

health plan)

Counselling (not covered by

health plan)

Other (provide details)

$0.00

Personal

Clothing

Hair care and beauty

Alcohol and tobacco

Education (specify)

Entertainment/recreation (including

children)

Gifts

Magazine/newspaper

subscriptions

Gym membership/personal trainer

Private club memberships

Charities

Professional dues

Safety deposit box

Bank and credit card fees

Lawyer’s fees

Accountant’s fees

Other professional fees

Personal tax arrears

Form 13.1: Financial Statement (Property and (page 9) Court File Number:

Support Claims)

Home office supplies

Photographs

Delivered in-home content

(movies, etc.)

Other (provide details)

$0.00

Other expenses

Life insurance premiums

RRSP/RESP withdrawals

Vacations

School fees and supplies (for

children)

Clothing for children

Children’s activities (break down

individually)

Summer camp expenses

Debt payments (interest only on

credit cards, personal loans, lines

of credit, etc. as principal expense

should already be reflected in

other items)

Support paid for other children

Other expenses not shown above

(specify)

Children’s allowance(s)

Children’s school lunches

Children’s school activities (field

trips etc.)

Children’s particular education

needs (private tutoring etc.)

Children’s post-secondary

education fees, tuition, books,

living expenses etc.

Support paid to other spouse

Income tax instalments

Income taxes and CPP (not

deducted from pay) (eg. tax

arising out of capital gains,

dividends, RRSP withdrawals,

accrued income from bonds,

attributed income from mutual

funds, self-employed income etc.)

$0.00

Total Amount of Monthly Expenses $0.00

Total Amount of Yearly Expenses $0.00

The preceding income and expenses information should establish or come close to establishing your need for

support or ability to pay support as the case may be.

If, when totaled by us, you show a surplus or a deficit of more than $100, please be prepared to explain.

For example, if you are running a deficit, you will be required to explain how this is being financed. There are

a number of ways to explain a deficit:

1. You are borrowing money to finance your living expenses;

2. You are spending your savings;

3. There is income which has not been listed in this Financial Statement, perhaps money given to you by your

family or a close friend;

4. You have exaggerated or the figures are not accurate; and/or

5. You have experienced a recent loss of income (or are very recently separated) and have not yet been

required to pay certain annual expenses such as insurance or realty taxes, that usually require a loan (or that

were formerly paid by your spouse).

Form 13.1: Financial Statement (Property and (page 10) Court File Number:

Support Claims)

Notes, Expenses:

Other Income Earners in the Home

You are required to disclose the income of anyone else living with you in the home, including a roommate, tenant or

new partner, whether or not you have remarried.

PART 3: OTHER INCOME EARNERS IN THE HOME

Complete this part only if you are making or responding to a claim for undue hardship or spousal support. Check and complete all

sections that apply to your circumstances.

1.

I live alone.

2.

I am living with (full legal name of person you are married to or cohabiting with)

3.

I/we live with the following other adult(s):

4. I/we have (give number) of child(ren) who live(s) in the home.

5.

My spouse/partner

works at

(place of work or business)

does not work outside the home.

6.

My spouse/partner

earns (give amount) $

per .

does not earn any income.

7.

My spouse/partner or other adult residing in the home contributes about $

per towards the household expenses.

Notes, Other Income Earners in the Home:

Form 13.1: Financial Statement (Property and (page 11) Court File Number:

Support Claims)

Assets In and Out of Ontario

Under the terms of the Family Law Act, the Court must make an Order to equalize the "Net Family Property"

(“NFP”) of the husband and wife unless exceptional circumstances exist.

The following Assets and Liabilities section sets out the information required by the Court in order to

determine your NFP.

Your NFP is the total of assets owned on the Valuation Date ("Valuation Date" refers to the date of separation

unless you are informed otherwise by our office) less your total liabilities on valuation date and the value of

certain property that the Family Law Act further allows you to deduct or exclude (if applicable). Therefore,

your NFP = your Total Assets on Valuation Date – your Total Liabilities on Valuation Date – deductions as of

the date of marriage – exclusions as of Valuation Date. Please note that your NFP cannot be less than zero.

It is the market value of assets that should be listed, not the purchase price or replacement value. If you

have an asset for which there is no market or if you are asserting a trust claim (or beneficial interest) in

property that is not in your name, please provide us with full details so that we can analyse the matter further

and determine how best to reflect it in your Financial Statement.

Please keep in mind that this is YOUR statement. You should therefore include only those items that you

personally own, or have an interest in, such as joint ownership of real estate where you own a defined

percentage. For example, if you jointly own your home with your spouse, show your 50% share of market

value.

If you have nothing to declare of value in any of the following Asset and Liabilities sections, please enter

"NIL".

“On date of marriage” refers to the Date of Marriage for this action. Please be sure to list all Assets that you

brought into the marriage under the appropriate headings. For example, you may have brought an engagement

ring, home, car, bank account, or furnishings of some value into the marriage.

“On Valuation Date” refers to the date you were separated from the other party in this action. The Valuation

Date is a very important date in the calculation of your NFP.

"Today" refers to the current value or fair market value at the present date (i.e. the date you swear the Financial

Statement). If you still have an interest in any asset or debt listed in the previous column, or have acquired an

asset or debt since separation, put its present day value in the “today” column as well. It is possible for one

asset or debt to have three different values in three different columns.

All values must be realistic and truthful as you may be asked to substantiate any of these values. Please

provide any document of proof that will help establish value, ownership and timing. Please enclose any copies

of deeds, leases or appraisal documents that you may have in your possession.

Even if you feel you will be entitled to an exclusion or deduction for a particular asset (for example, it was

inherited or gifted to you), you must include it in the appropriate category. Later in the form, you will be

entitled to exclude it or deduct it and it will therefore not be calculated in your Net Family Property.

Please note that all entries throughout the form should be converted to Canadian dollars at the prevailing

exchange rate at the relevant time. Current and historic exchange rates are available from the Bank of Canada

website.

Form 13.1: Financial Statement (Property and (page 12) Court File Number:

Support Claims)

PART 4: ASSETS IN AND OUT OF ONTARIO

Please insert your Date of Marriage and Valuation Date (Date of Separation) below. If you are not sure of the exact date,

please discuss this date with us prior to completing this form.

If any sections of Parts 4 to 9 do not apply, do not leave blank, print “NONE” in the section.

The date of marriage is: (give date)

The valuation date is: (give date)

The date of commencement of cohabitation is (if different from date of marriage): (give date)

Notes, Dates:

Land

Please list below the value of YOUR interest in all land (i.e. real estate) that you own or owned on the

applicable dates. An interest in land includes an interest in the matrimonial home, any leasehold interests, or

any mortgages you own (ie. you are the mortgagee). Indicate whether that property was held by you alone or

together with another person or persons. If you have a registered interest, please state your percentage

ownership. Reflect only YOUR share of the market value on the applicable date, without deduction for

encumbrances such as mortgages, or costs of disposition, such as real estate commissions. For example, if you

are a joint owner of the matrimonial home with your spouse, put down one-half of the estimated market value.

Please also list the full value of the property in brackets under the address of the property.

Do NOT deduct the mortgage here. It will be deducted elsewhere.

Do NOT deduct the costs of sale here. They will be deducted elsewhere.

If you owned a property on the Date of Marriage, please include its market value at that time in the first

column under “on date of marriage”. It is possible for one piece of land to have three different values in three

different columns.

Finally, if you have acquired an interest in land since the Valuation Date, it must be listed as well. You will

obviously only have to provide one value for that particular asset and enter it under the “today” column.

An executed Agreement of Purchase and Sale should be reflected as a contingent interest. A deposit should

also be reflected as an asset.

Please provide us with all appraisals for any of the properties listed.

Form 13.1: Financial Statement (Property and (page 13) Court File Number:

Support Claims)

PART 4(a): LAND

Include any interest in land owned on the dates in each of the columns below, including leasehold interests and mortgages. Show

estimated market value of your interest, but do not deduct encumbrances or costs of disposition; these encumbrances and costs

should be shown under Part 5 “Debts and Other Liabilities”.

Nature & Type of

Ownership

(Give your percentage

interest where relevant.)

Address of Property

Estimated Market value of YOUR interest

on date of

marriage

on valuation

date today

Matrimonial Home

Matrimonial Home means the dwelling

you ordinarily occupied as a family

residence on valuation date (ie. date of

separation). You can have more than one

matrimonial home.

15. TOTAL VALUE OF LAND

$0.00

$0.00

$0.00

Form 13.1: Financial Statement (Property and (page 14) Court File Number:

Support Claims)

Notes, Land:

IMPORTANT: The same procedure is applicable for your other assets listed on the following pages. Estimate

as best you can the market value of the asset on the Valuation Date. If that asset existed on the Date of

Marriage, estimate its market value at that time under the “on date of marriage” column. If it still exists, give it

a value as of the “today” date as well.

If you acquired property after the Valuation Date, you must disclose it in the Financial Statement as well and a

value must be ascribed to it, in the “today” column.

General Household Items and Vehicles

Under “Household goods & furniture”, please estimate the value of your share of the furniture and appliances,

etc. It is not necessary to provide a listing of all household items etc.; a summary of the major items or

categories of items and their respective values should be sufficient. However, in estimating the value of the

items, it may be helpful for you to list all items, which list could be attached for added information.

It is IMPORTANT to note that all items are estimated at their market value for that particular date (ie.

how much could you reasonably expect to get if you were to sell the item at an open auction). Do NOT

use the replacement cost or the insured value of these items. Unfortunately, items such as furniture,

appliances and electronics do not tend to retain their value and are likely not worth nearly as much as their

original purchase price.

If you believe that you and your spouse owned an item together, put in one-half of its value. (Please indicate

the full value of the item in brackets under Description). If you believe the item was yours alone, put in the

total value.

Vehicles can be valued through professional automotive books, known as the “black book” or “red book”.

Alternatively, vehicle and boat values may be obtained by looking in the newspaper want ads or local buy/sell

magazines or on a Canadian buy/sell website.

Please enter the estimated value of jewellery, works of art, and other special items (including wine collections,

stamp collections, instrument collections, antiques, Royal Doulton figurines, etc.) to the best of your ability. If

you are unsure of these estimates, please mark "estimate" beside the entry’s description. You may be required

to obtain appropriate professional appraisals for the value of expensive jewellery, works of art or antiques at

some time in the future.

Please attach copies of any appraisals or your valuation notes, if available and applicable.

Form 13.1: Financial Statement (Property and (page 15) Court File Number:

Support Claims)

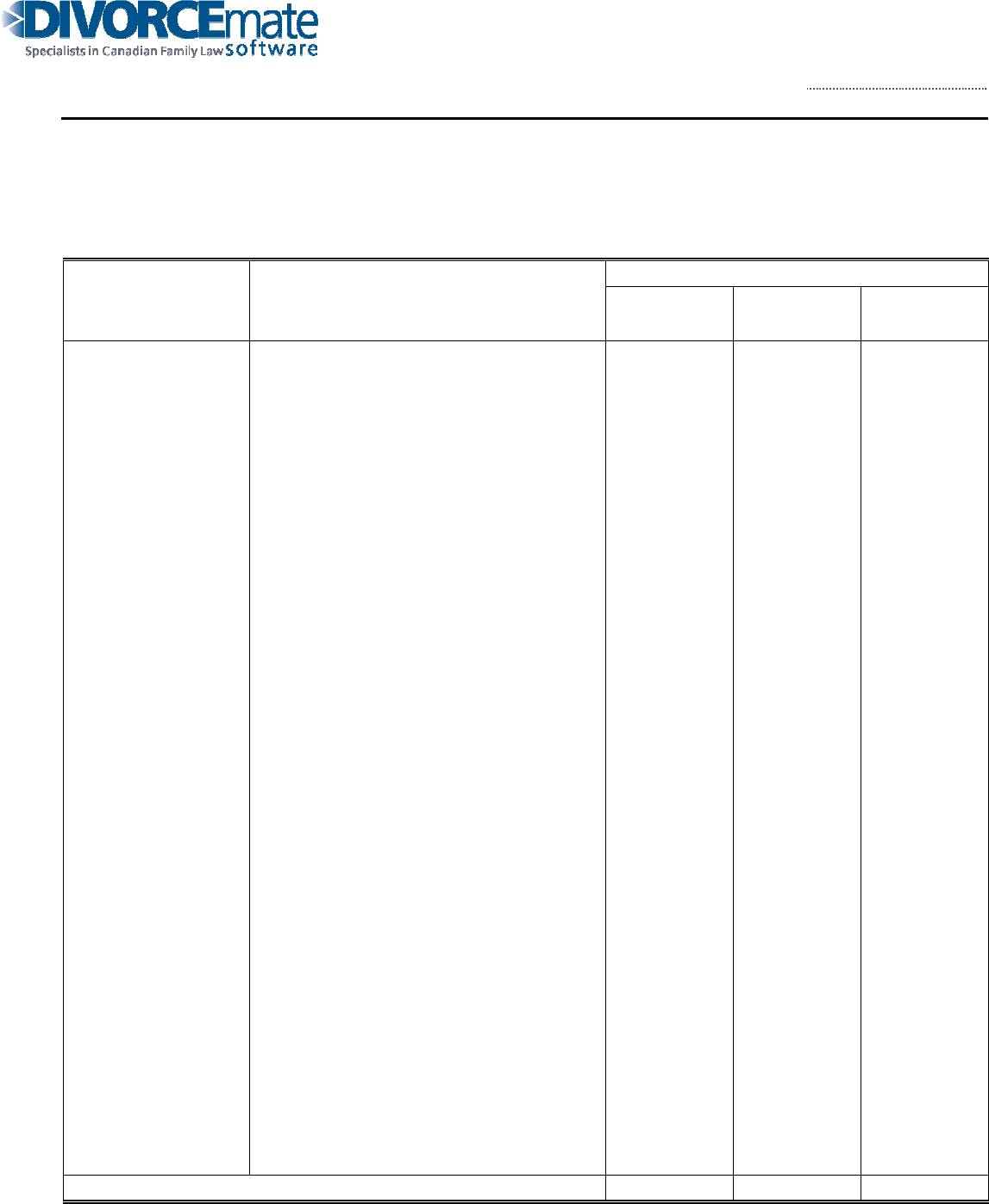

PART 4(b): GENERAL HOUSEHOLD ITEMS AND VEHICLES

Show estimated market value, not the cost of replacement for these items owned on the dates in each of the columns below. Do not

deduct encumbrances or costs of disposition; these encumbrances and costs should be shown under Part 5, “Debts and Other

Liabilities”.

Item Description

Indicate if

NOT in

your

posses-

sion

Estimated Market value of YOUR interest

on date of

marriage

on valuation

date today

Household goods

& furniture

Cars, boats,

vehicles

Jewellery, art,

electronics, tools,

sports & hobby,

equipment

Other special

items

16. TOTAL VALUE OF GENERAL HOUSEHOLD ITEMS AND VEHICLES

$0.00

$0.00

$0.00

Form 13.1: Financial Statement (Property and (page 16) Court File Number:

Support Claims)

Notes, General Household Items and Vehicles:

Bank Accounts, Savings, Securities and Pensions

Please include ALL of your bank accounts, RRSPs (registered retirement savings plans) and similar savings

plans, RRIFs (registered retirement income funds), RPPs (registered pension plans), and LIRAs (locked in

retirement accounts), treasury bills, Canada Savings Bonds, term deposits, guaranteed investment certificates,

mutual funds and any other investments.

With respect to bank accounts, list ALL accounts even if you are not actively using them, even if there is a

minimal or nominal amount in the account, and even if they no longer exist but did at one of the relevant dates

(e.g. date of marriage). Under "Category", state whether an account is a chequing or savings account, and

whether it is a joint account. Obtain bank statements for all accounts listed on the relevant dates (ie. on date of

marriage, on valuation date and today). If you do not have old account records, you should obtain copies from

your bank. While most banks charge a fee for these records, it is important that you have all documentation

necessary to support the figures disclosed in your Financial Statement. However, at this time please show the

account in your statement and we will discuss it further with you. If you have opened bank accounts etc. since

the separation, these must be accurately filled in as well, in the “today” column.

If you have used all of the money in the joint account since the separation, attribute all of the money to

yourself. If the money is still in the joint account, attribute one-half of it to yourself (and list the full amount of

the account in brackets under “Description”).

Please show the value of shares in private or public corporations, stocks, bonds, debt instruments and any other

investment not listed above. Remember, the book value is rarely the value of those shares. The full, pre-tax,

fair market value must be disclosed. The estimated fair market value of your securities is what they would sell

for on the open market. If the value is unknown or indeterminable, or if you have shares in your spouse's

business and have no idea of the value, please indicate this and we will retain an accountant to assist in the

valuation.

All stock options should be disclosed, even if unvested. It will likely be necessary to retain an accountant to

assist in the valuation.

The value of an RRSP or RRIF is indicated on the bank or broker statement. If you have a self-administered

RRSP, you should obtain the current market value by checking with your broker.

The value of an RPP or a private pension is generally the present value of an expected future stream of income,

as determined by a qualified actuary. Please note that the value of the pension may well be more than the

contributions of the employer and employee. Recent legislation requires pension administrators to provide

valuations of private pension plans in accordance with the procedure to be set out in regulations. In some

cases, however, we may still want to obtain a professional valuation.

Please provide us with the appropriate pension booklet and any other documentation pertaining to your pension

benefit plan, to assist us in obtaining the pension valuation.

Do NOT deduct taxes here. They will be deducted elsewhere. Pensions are the only exception to this rule as

most valuations provide a lump sum value net of tax.

Form 13.1: Financial Statement (Property and (page 17) Court File Number:

Support Claims)

PART 4(c): BANK ACCOUNTS, SAVINGS, SECURITIES AND PENSIONS

Show the items owned on the dates in each of the columns below by category, for example, cash, accounts in financial institutions,

pensions, registered retirement or other savings plans, deposit receipts, any other savings, bonds, warrants, options, notes and other

securities. Give your best estimate of the market value of the securities if the items were to be sold on the open market.

Category INSTITUTION (including location)/

DESCRIPTION (including issuer and date)

Account

number

Amount / Estimated Market Value

on date of

marriage

on valuation

date today

17. TOTAL VALUE OF ACCOUNTS, SAVINGS, SECURITIES AND

PENSIONS

$0.00

$0.00

$0.00

Notes, Bank Accounts, Savings, Securities and Pensions:

Form 13.1: Financial Statement (Property and (page 18) Court File Number:

Support Claims)

Life & Disability Insurance

List and provide details of all of the policies owned by you, whether term or whole life. Do NOT list policies

that your spouse owns. The information you require should be listed in your policy.

If your policy is whole life, please indicate the cash surrender value, which can be found on the most recent

statement from your insurer. Any loans against the policy will reduce its cash surrender value. If you do not

know the cash surrender value, your life insurance agent may assist you.

If your policy is a term policy, it will not have any cash surrender value. It is important that you also indicate

the face value of the policy.

You should also include group insurance policies owned by you privately or through your employer.

You should also disclose and provide details of all disability and/or critical illness insurance policies.

Even though the policy may have no cash surrender value for the purpose of calculating your Net Family

Property, you must still list it and provide details for the purposes of full disclosure.

PART 4(d): LIFE & DISABILITY INSURANCE

List all policies in existence on the dates in each of the columns below.

Company, Type &

Policy No. Owner Beneficiary

Face

Amount

Cash Surrender Value

on date of

marriage

on valuation

date today

18. TOTAL CASH SURRENDER VALUE OF INSURANCE POLICIES

$0.00

$0.00

$0.00

Notes, Life & Disability Insurance:

Form 13.1: Financial Statement (Property and (page 19) Court File Number:

Support Claims)

Business Interests

List any company or firm, either incorporated or unincorporated, in which you have a business interest.

“Business interests” include sole proprietorships, partnerships (limited or otherwise), joint ventures and all

types and classes of corporate shares (not already listed under “Securities” above).

Remember the value of your interest is the price you would obtain if you were to sell your interest on the open

market. If you are unable to ascertain the value of your interest, for the purposes of this form, please show the

"book value" if known, and attach copies of the financial statements for your business for the last three years.

Please note, establishing the market value of a business will likely require a professional business valuation

and/or other evidence. Valuation discounts should be reflected in the business valuation.

PART 4(e): BUSINESS INTERESTS

Show any interest in an unincorporated business owned on the dates in each of the columns below. An interest in an incorporated

business may be shown here or under “BANK ACCOUNTS, SAVINGS, SECURITIES AND PENSIONS” in Part 4(c). Give your best

estimate of market value of your interest.

Name of Firm or

Company Interest

Estimated Market value of YOUR interest

on date of

marriage

on valuation

date today

19. TOTAL VALUE OF BUSINESS INTERESTS

$0.00

$0.00

$0.00

Notes, Business Interests:

Form 13.1: Financial Statement (Property and (page 20) Court File Number:

Support Claims)

Money Owed to You

List all monies owed to you, either personally or from a business. For example, if someone has borrowed

$500.00 from you and still owes you the $500.00, list it here.

Include any accrued income tax refunds from the Canada Revenue Agency, any accrued commissions or

bonuses from your employer/business, any royalties owing to you, any shareholder loans payable to you, and

any other receivables owing to you from corporate (or unincorporated) entities.

For pensions in pay, include the capitalized value of future payments.

If applicable, please list any security with value held by you to secure listed accounts receivable.

PART 4(f): MONEY OWED TO YOU

Give details of all money that other persons owe to you on the dates in each of the columns below, whether because of business or

from personal dealings. Include any court judgments in your favour, any estate money and any income tax refunds owed to you.

Details

Amount Owed to You

on date of

marriage

on valuation

date today

20. TOTAL OF MONEY OWED TO YOU

$0.00

$0.00

$0.00

Notes, Money Owed to You:

Form 13.1: Financial Statement (Property and (page 21) Court File Number:

Support Claims)

Other Property

List any other property you can think of which is not listed in any other asset category, such as silver or gold

bars, intellectual property (e.g. patents, trademarks, copyrights), collectibles or collections (not already

included above), air miles, other credit card reward points, horses and other valuable animals, musical

instruments, etc.

PART 4(g): OTHER PROPERTY

Show other property or assets owned on the dates in each of the columns below. Include property of any kind not listed above. Give

your best estimate of market value.

Category Details

Estimated Market Value of YOUR interest

on date of

marriage

on valuation

date today

21. TOTAL OF OTHER PROPERTY

$0.00

$0.00

$0.00

22. VALUE OF ALL PROPERTY OWNED ON THE VALUATION DATE

(Add items [15] to [21].)

$0.00

$0.00

$0.00

Notes, Other Property:

Form 13.1: Financial Statement (Property and (page 22) Court File Number:

Support Claims)

Debts and Other Liabilities

Please list all of your debts under the three relevant columns below. These should include mortgages, loans,

lines of credit, income and other taxes payable, overdrafts, outstanding legal and other professional fees, and

credit card balances.

The “on valuation date” column should show all of your debts, or your share of any debts, at the date you and

your spouse separated. For instance, if a property is owned jointly and you and your spouse are jointly liable

for the mortgage, include only YOUR share of the mortgage, indicating the full amount of the mortgage in

brackets under “Details”. However, if the entire mortgage, loan, etc. is in your name only, include the full

amount.

Credit card balances should only be reflected if you are the principal cardholder or a joint cardholder (in which

case you would reflect your one-half share of the outstanding balance). If you are just a supplementary

cardholder with no personal liability, you should not disclose the balance on your Financial Statement.

Debts to parents, other relatives and friends should be included, but note that they will be closely examined to

determine whether they are loans or gifts. If no promissory note or other written document exists, no payments

or demand for payment has ever been made; a court is likely to treat these as gifts.

You should include amounts for any unpaid legal or professional bills as a result of this case.

Please indicate here any contingent tax and costs of disposition (eg. income tax owing in respect of income

already earned, where income tax has not be deducted at source or already paid in advance by way of an

installment to CRA; real estate commissions payable on any assets disposed of or to be disposed of prior to or

after trial). You should also include any other contingent liabilities such as guarantees, for which you may be

liable in the future, and please indicate that they are "contingent".

Please provide us with all documentation you have to verify all debts and other liabilities, including loan and

credit card statements, tax assessment notices, etc.

PART 5: DEBTS AND OTHER LIABILITIES

Show your debts and other liabilities on the dates in each of the columns below. List them by category such as mortgages, charges,

liens, notes, credit cards, and accounts payable. Don’t forget to include:

• any money owed to the Canada Revenue Agency;

• contingent liabilities such as guarantees or warranties given by you (but indicate that they are contingent); and

• any unpaid legal or professional bills as result of this case.

Category Details

Amount owing

on date of

marriage

on valuation

date today

Matrimonial Home

Matrimonial Home means the dwelling

you ordinarily occupied as a family

residence on valuation date (ie. date of

separation). You can have more than

one matrimonial home.

Form 13.1: Financial Statement (Property and (page 23) Court File Number:

Support Claims)

23. TOTAL OF DEBTS AND OTHER LIABILITIES

$0.00

$0.00

$0.00

Notes, Debts and Other Liabilities:

Form 13.1: Financial Statement (Property and (page 24) Court File Number:

Support Claims)

Property, Debts and Other Liabilities on Date of Marriage

IMPORTANT: It is NOT necessary to complete this section, as you have already supplied the

information that will go in this section by completing the “on date of marriage” columns in the sections

above. Please ensure that you have included all property and debts and other liabilities as of the “date of

marriage” in the preceding sections, even if they were not applicable or in existence on the “valuation

date”.

The purpose of this section is to determine your net worth on the day you were married in the calculation of

your Net Family Property. To arrive at this figure, we take your assets as of the date of marriage, and subtract

your liabilities as of the date of marriage. A matrimonial home brought into the marriage, however, cannot be

deducted if it still exists at the Valuation Date, pursuant to the Family Law Act. Therefore, the value of a

matrimonial home owned on the date of marriage (that still exists on the date of separation) and any associated

mortgage, will not be included in this section as a date of marriage asset.

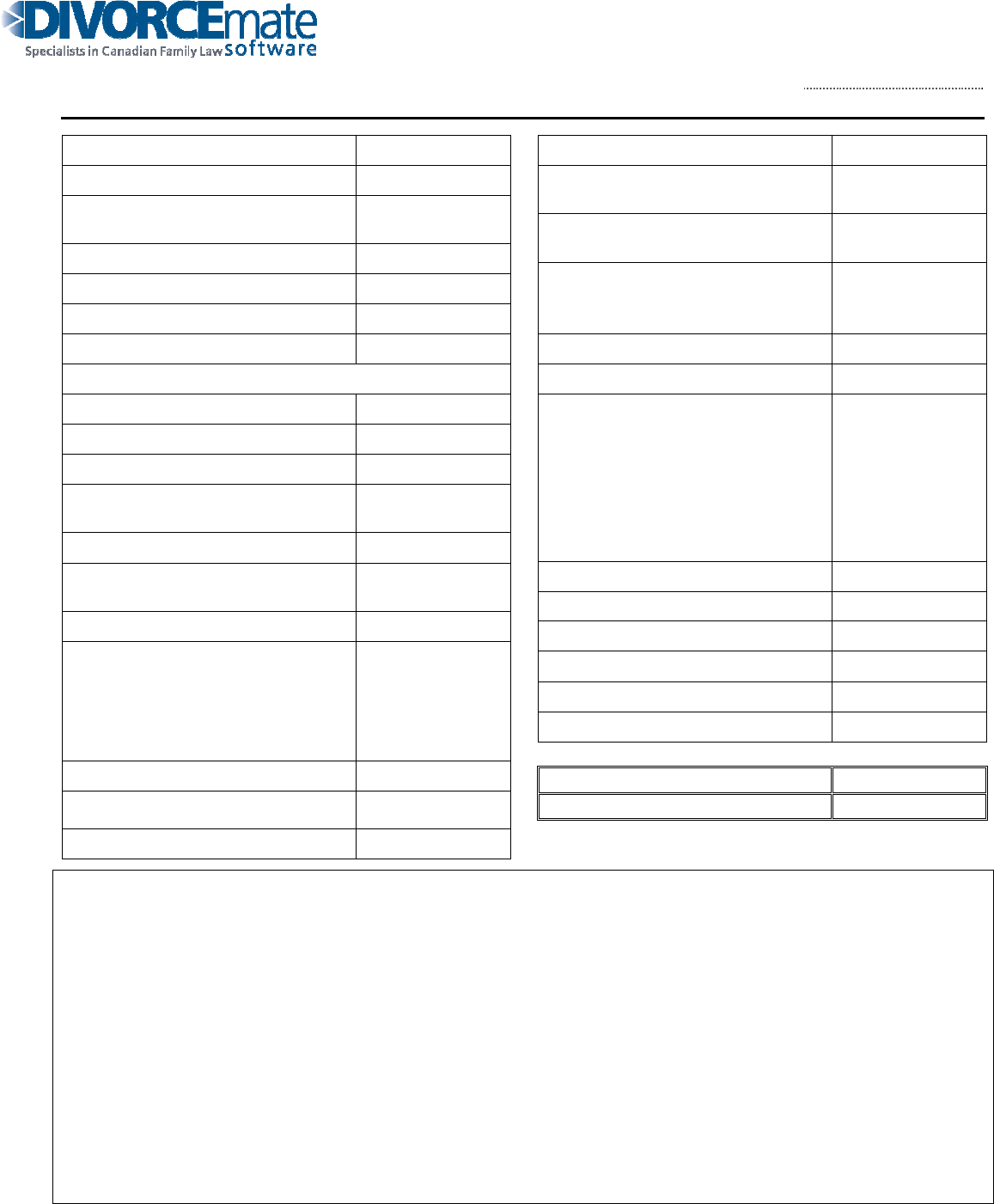

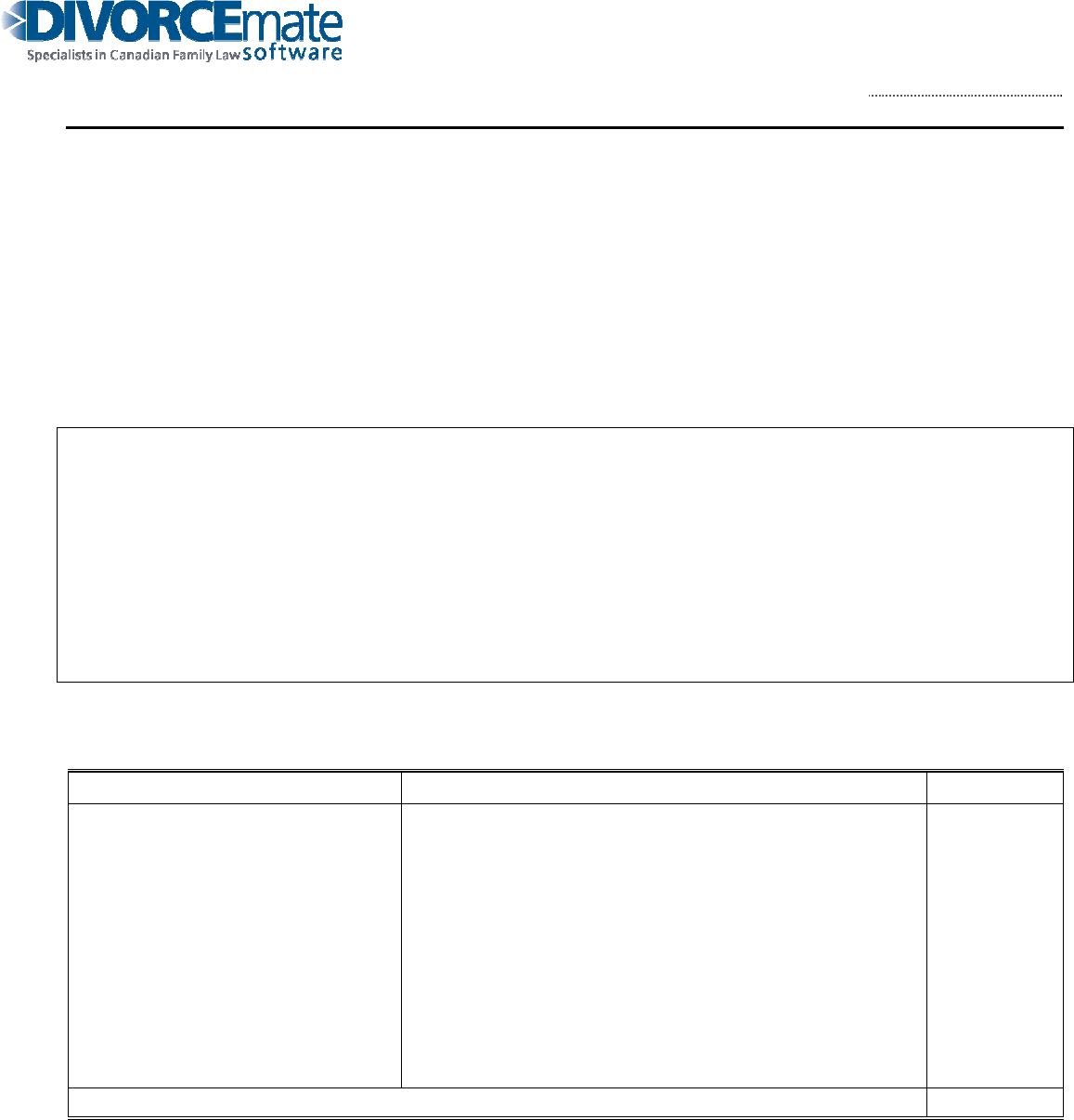

PART 6: PROPERTY, DEBTS AND OTHER LIABILITIES ON DATE OF MARRIAGE

Show by category the value of your property, debts and other liabilities, calculated as of the date of your marriage. (In this part, do not

include the value of a matrimonial home or debts or other liabilities directly related to its purchase or significant improvement, if you

and your spouse ordinarily occupied this property as your family residence at the time of separation.)

Category and details Value on date of marriage

Assets Liabilities

Land $0.00

General household items & vehicles $0.00

Bank accounts, savings, securities, pensions $0.00

Life & disability insurance $0.00

Business interests $0.00

Money owed to you $0.00

Other property (Specify.) $0.00

Debts and other liabilities (Specify.) $0.00

TOTALS

$0.00

$0.00

24. NET VALUE OF PROPERTY OWNED ON DATE OF MARRIAGE

(From the total of the “Assets” column, subtract the total of the “Liabilities” column.)

$0.00

25. VALUE OF ALL DEDUCTIONS (Add items [23] and [24].)

$0.00

Notes, Property, Debts and Other Liabilities on Date of Marriage:

Form 13.1: Financial Statement (Property and (page 25) Court File Number:

Support Claims)

Excluded Property

Excluded property is property that is not required to be included in the calculation of your Net Family Property

pursuant to the Family Law Act (see list below). Excluded property will already have been shown in the

previous sections of the Financial Statement, and will be effectively “cancelled out” in this section.

List all excluded property (land, business interests, investments, cash, possessions, etc.) according to the

following guidelines:

a) property, other than a matrimonial home, that was acquired by gift or inheritance from a third person after

the date of marriage,

b) income from property that was acquired by gift or inheritance, other than a matrimonial home, if the donor

or testator expressly stated that it was to be excluded from your Net Family Property,

c) damages received by you, or to which you may be entitled, in connection with a personal injury lawsuit,

d) proceeds or a right to proceeds of a life insurance policy as defined by the Insurance Act,

e) property, other than a matrimonial home, which can be traced back to funds received as a result of any of

the above, and

f) property which you and your spouse have agreed by domestic contract (marriage contract/cohabitation

agreement) is not to be included in your Net Family Property.

For example, if you own a painting on the Valuation Date, but you purchased that painting with money that

you inherited from your mother after the date of marriage, you are entitled to exclude the value of the painting

on the Valuation Date. More specifically, if you inherited $1,000 during the marriage and bought the painting

for $1,000 during the marriage, but the painting is worth $5,000 on the Valuation Date, you are entitled to an

exclusion of $5,000 and that is the amount that you enter in the “Value on valuation date” column with respect

to that painting. You should already have listed the painting as art under the “General Household Items and

Vehicles” section and disclosed a value of $5,000 for it on the valuation date. By including it again in this

section as excluded property, you are effectively “canceling out” the prior listing, so that it will not be included

in the calculation of your Net Family Property.

You will be required to prove and trace the excluded property into property owned on the Valuation Date.

Therefore, please provide us with all corroborative documentation with respect to any property you are

claiming as excluded property. For instance, in the above example, you could provide a copy of the cancelled

$1,000 cheque from your mother’s estate, a bank statement showing that the funds were deposited to your bank

account, and then a copy of the cancelled cheque used to purchase the painting.

Please note that a matrimonial home that was gifted to or inherited by you cannot be excluded from your Net

Family Property unless excluded by way of a domestic contract (marriage contract/cohabitation agreement).

PART 7: EXCLUDED PROPERTY

Show by category the value of property owned on the valuation date that is excluded from the definition of “net family property” (such

as gifts or inheritances received after marriage).

Category Details Value on

valuation date

Gift or inheritance from third person

Income from property expressly excluded by

donor/testator

Damages and settlements for personal injuries, etc.

Life insurance proceeds

Traced property

Excluded property by spousal agreement

Other Excluded Property

26. TOTAL VALUE OF EXCLUDED PROPERTY

$0.00

Form 13.1: Financial Statement (Property and (page 26) Court File Number:

Support Claims)

Notes, Excluded Property:

Disposed-Of Property

If your marriage was shorter than two years, show by category the value of any property that you disposed of

during that period of time.

If your marriage was longer than two years, show by category the value of any property that you disposed of in

the two years immediately preceding the date you are completing this form.

One of the purposes of this disclosure is to determine whether or not assets have been sold or disposed of under

circumstances in which the value received was not appropriate.

The value of Disposed Property does NOT affect the calculation of your Net Family Property.

PART 8: DISPOSED-OF PROPERTY

Show by category the value of all property that you disposed of during the two years immediately preceding the making of this

statement, or during the marriage, whichever period is shorter.

Category Details Value

27. TOTAL VALUE OF DISPOSED-OF PROPERTY

$0.00

Notes, Disposed-of Property:

Form 13.1: Financial Statement (Property and (page 27) Court File Number:

Support Claims)

Calculation of Net Family Property

IMPORTANT: It is NOT necessary to complete this section, as you have already supplied the

information that will go in this section by completing the sections above. Please ensure that you have

included all property and debts and other liabilities in the preceding sections.

PART 9: CALCULATION OF NET FAMILY PROPERTY

Deductions BALANCE

Value of all property owned on valuation date (from item [22] above) $0.00

Subtract value of all deductions (from item [25] above) $0.00

$0.00

Subtract total value of all excluded property (from item [26] above) $0.00

$0.00

28. NET FAMILY PROPERTY

$0.00

NOTE: This financial statement must be updated no more than 30 days before any court event by either completing and filing:

• a new financial statement with updated information, or

• an affidavit in Form 14A setting out the details of any minor changes or confirming that the information contained in this statement

remains correct.

Additional Information Required

Income Tax Return - Please provide us with a copy of your most recent personal income tax return, as well as

the previous three years’ income tax returns, together with all Notices of Assessment or Reassessment and all

attachments.

Proof of Income – Please provide us with your most recent pay stub, employment insurance stub, worker’s

compensation stub, pension stub, etc.

In addition to the above information, if applicable, please be prepared to provide the following "most current

information" required under the Child Support Guidelines:

1. The most recent statement of earnings paid in the year to date, including overtime. Alternatively, a letter

from your employer setting out your annual salary or remuneration;

2. If you are self-employed, the three most recent annual financial statements of your business or professional

practice, other than a partnership, and a statement showing a breakdown of all salaries, wages, management

fees or other payments or benefits paid to, or on behalf of, persons or corporations with whom you do not

deal at arm's length;

3. If you are a partner in a partnership, confirmation of your income and draw from, and capital in, the

partnership for its three most recent taxation years;

4. Where you control a corporation, the three most recent financial statements of the corporation and its

subsidiaries, and a statement showing a breakdown of all salaries, wages, management fees or other

payments or benefits paid to, or on behalf of, persons or corporations with whom the corporation, and every

related corporation, does not deal at arm's length;

5. Where you are a beneficiary under a trust, a copy of the trust settlement agreement and copies of the trust’s

three most recent financial statements; and

6. If you receive income from employment insurance, social assistance, a pension, workers’ compensation,

disability payments or any other source, the most recent statement of income indicating the total amount of

income from the applicable source during the current year, or if such a statement is not provided, a letter

from the appropriate authority setting out the required information.

7. Any other pertinent information that could affect personal income taxes and CSG calculation.

Form 13.1: Financial Statement (Property and (page 28) Court File Number:

Support Claims)

It would also be helpful if you could provide your Child Tax Benefit Notice from Canada Revenue Agency,

and all other supporting/corroborating documentation requested elsewhere in the Financial Statement.

Notes, General:

Sworn/Affirmed before me at

(municipality)

in

(province, state or country)

on Signature

(This form to be signed in front of a lawyer,

justice of the peace, notary public or

commissioner for taking affidavits.)

(date)

Commissioner for taking affidavits

(Type or print name below if signature is illegible.)

Form 13.1: Financial Statement (Property and (page 29) Court File Number:

Support Claims)

PART 2: EXPENSES

PROPOSED BUDGET

EXPENSE

Monthly Amount

Automatic Deductions

CPP contributions

EI premiums

Income taxes

Employee pension contributions

Union dues

Other pension plans

Group insurance

Canada Savings Bonds deductions

RRSP payroll deductions

Child or spousal support

deductions

Other (provide details)

$0.00

Housing

Rent or mortgage

Property taxes

Property insurance

Condominium fees

Repairs and maintenance

Gardening

Pool maintenance

Snow removal

Alarm and security

Recreational property expenses

(timeshare, cottage, chalet,

snowbird property, etc)

Other (provide details)

$0.00

Utilities

Water

Heat

Electricity

Telephone

Cell phone (smart phone)

Cable

Internet

Other (provide details)

$0.00

Household Expenses

Groceries

Household supplies

Meals outside the home

Pet care

Laundry and Dry Cleaning

Housekeeper/Cleaning service

Other (provide details)

$0.00

Childcare Costs

Daycare expense

Babysitting costs

Other (provide details)

SUBTOTAL $0.00

Transportation

Public transit, taxis

Gas and oil

Car insurance and license

Repairs and maintenance

Parking

Car Loan or Lease Payments

Boat

Other recreational vehicle(s)

Motor league membership

Access transportation costs

Other (provide details)

$0.00

Form 13.1: Financial Statement (Property and (page 30) Court File Number:

Support Claims)

Health (break down children’s expenses separately)

Health insurance premiums

Dental expenses (regular care – not

covered by health plan)

Medicine and drugs (prescription –

not covered by health plan)

Eye care (glasses, exam, contacts –

not covered by health plan)

Non-prescription drugs

Vitamins

Health care aids

(not covered by

health plan)

Counselling

(not covered by

health plan)

Other (provide details)

$0.00

Personal

Clothing

Hair care and beauty

Alcohol and tobacco

Education (specify)

Entertainment/recreation (including

children)

Gifts

Magazine/newspaper

subscriptions

Gym membership/personal trainer

Private club memberships

Charities

Professional dues

Safety deposit box

Bank and credit card fees

Lawyer’s fees

Accountant’s fees

Other professional fees

Personal tax arrears

Home office supplies

Photographs

Delivered in-home content

(movies, etc.)

Other (provide details)

Other expenses

Life insurance premiums

RRSP/RESP withdrawals

Vacations

School fees and supplies (for

children)

Clothing for children

Children’s activities (break down

individually)

Summer camp expenses

Debt payments (interest only on

credit cards, personal loans, lines of

credit, etc., as principal expense

should already be reflected in other

items)

Support paid for other children

Other expenses not shown above

(specify)

Children’s allowance(s)

Children’s school lunches

Children’s school activities (field

trips etc.)

Children’s particular education

needs (private tutoring etc.)

Children’s post-secondary

education fees, tuition, books,

living expenses etc.

Support paid to other spouse

Income tax instalments

Income taxes and CPP (not

deducted from pay) (eg. tax

arising out of capital gains,

dividends, RRSP withdrawals,

accrued income from bonds,

attributed income from mutual

funds, self-employed income etc.)

$0.00

Total Amount of Monthly Expenses $0.00

Total Amount of Yearly Expenses $0.00

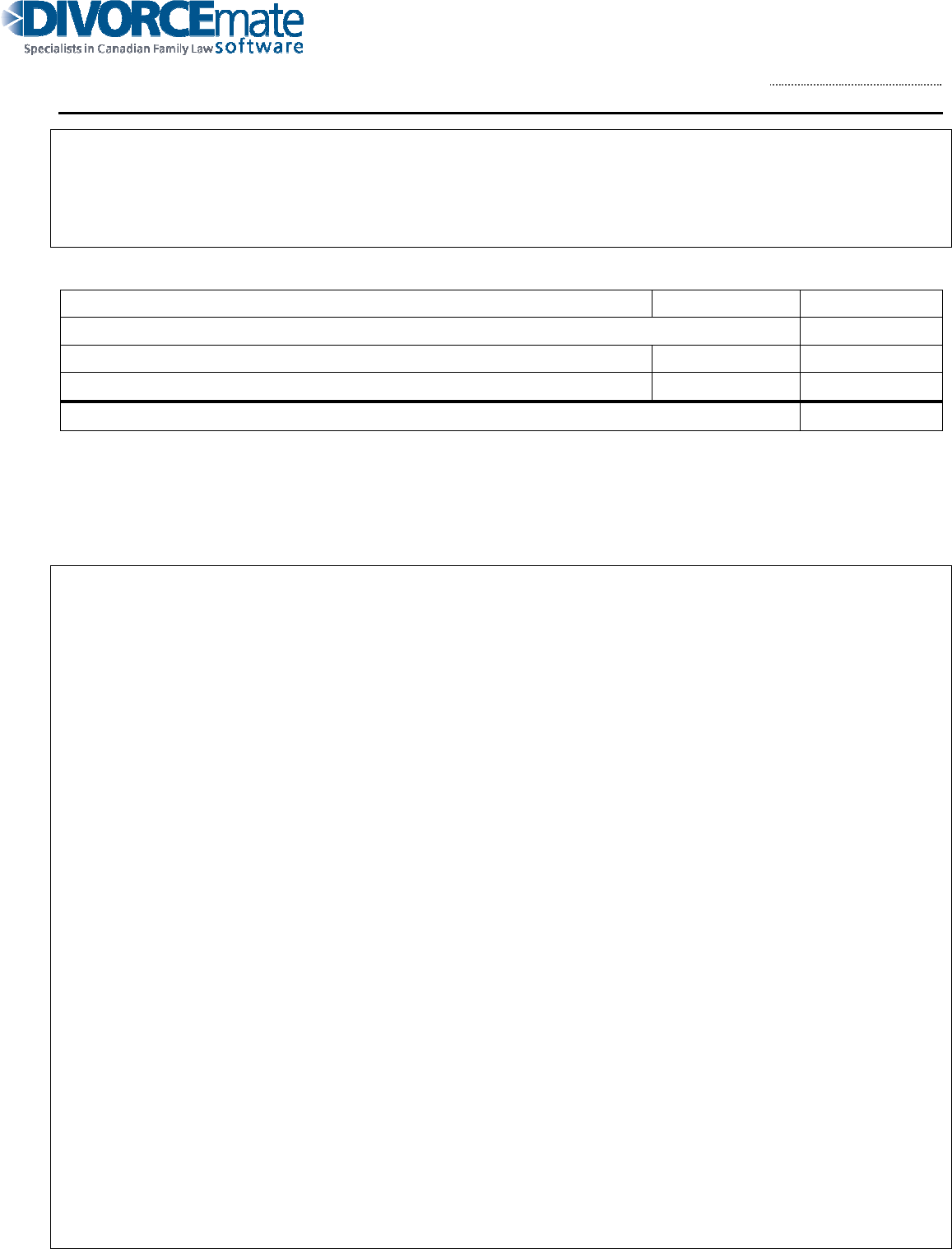

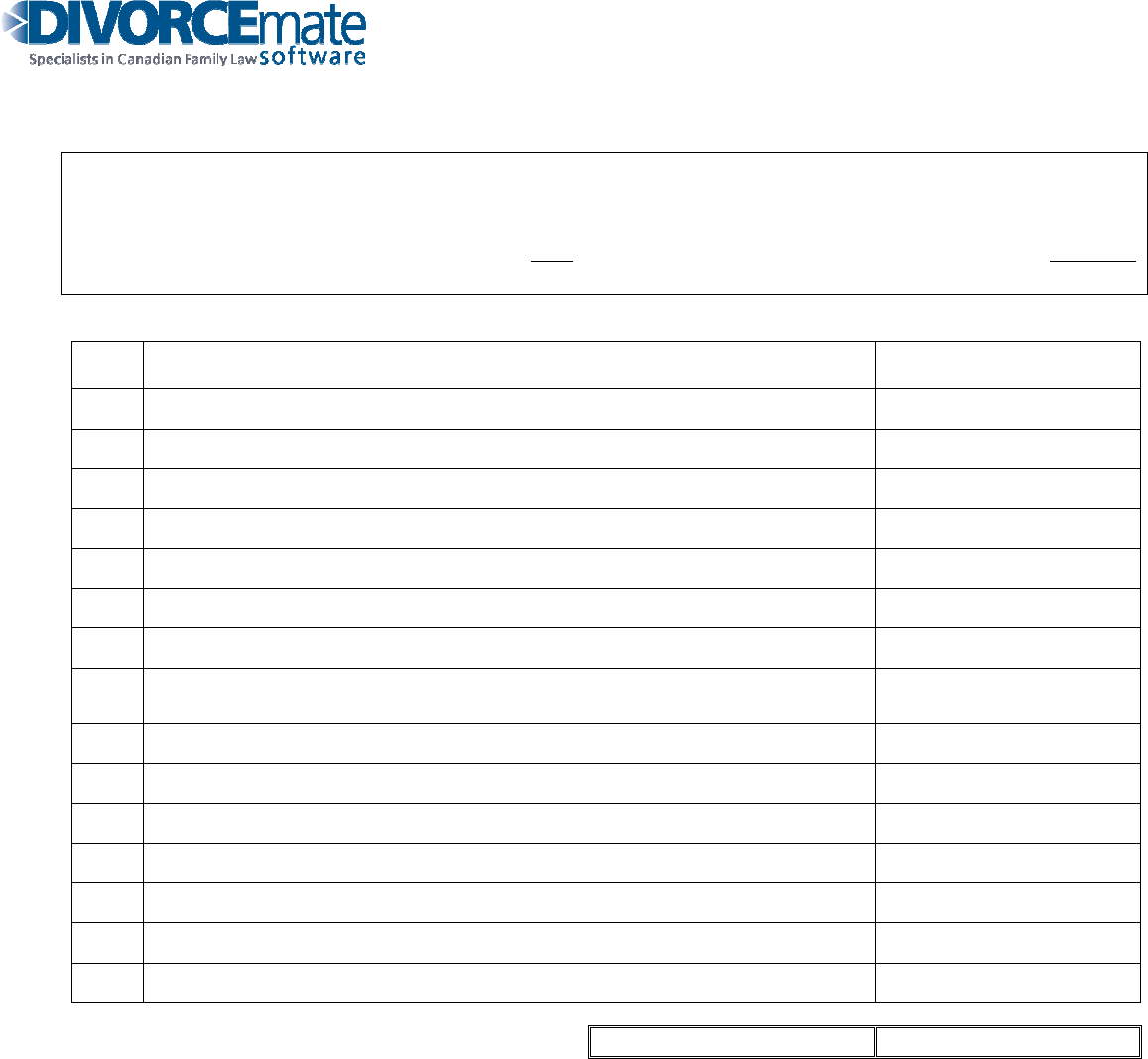

Schedule A

Additional Sources of Income

Include in Schedule “A”, any additional sources of income, not already broken down in the “Income Source”

section of Part I. The subtotal of these additional sources of income is to be included as a monthly amount (ie.

divided by 12) on Line 11 of the “Income Source” section of Part I. As indicated previously, the preferred way

to disclose income is to list income for the next twelve-month period based on what you are currently

receiving and any anticipated changes to your income.

Line Income Source Annual Amount

1.

Net partnership income

2.

Net rental income (Gross annual rental income of $ )

3.

Total amount of dividends received from taxable Canadian corporations

4.

Total capital gains ($ ) less capital losses ($ )

5.

Registered retirement savings plan withdrawals

6.

Any other income (specify source)

Gifts

Voluntary or indirect support from other members of your family or from

friends or a common law partner

Income tax refund

Support payments received from other party in this Financial Statement

Subtotal $0.00

Notes, Schedule A:

Schedule B

Special or Extraordinary Expenses for the Child(ren)

Include in Schedule “B”, any special or extraordinary expenses for the children. Under the Child Support

Guidelines, the following expenses related to the children qualify as special or extraordinary:

• Necessary childcare (ie. daycare and babysitting) expenses;

• Medical insurance premiums and certain health-related expenses for the child that cost more than $100

annually;

• Extraordinary expenses for the child’s education (eg. tutoring, private school costs etc.);

• Post-secondary school expenses; and

• Extraordinary expenses for extracurricular activities.

Many of these special expenses have associated tax deductions or credits which apply to reduce the actual net

cost of the expense to you. The Child Support Guidelines provide that it is the net cost of the special expenses

that is to be shared by you and your spouse in proportion to your respective incomes after deducting any

contributions from the child or third parties.

You should include the full value of each special expense for the children, and note the value of any tax

deduction or credit claimed in relation to each expense. We will then determine the effect of the tax deductions

or credits on the expenses and determine the net amount of those expenses.

You must also include proof of all expenses (eg. invoices, receipts etc.).

Child’s Name Expense Amount/yr.

Available Tax

Credits or

Deductions*

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Total Net Annual Amount $0.00

Total Net Monthly Amount $0.00

* Some of these expenses can be claimed in a parent’s income tax return in relation to a tax credit or deduction

(for example childcare costs). These credits or deductions must be shown in the above chart.

I attach proof of the above expenses.

I earn $

per year which should be used to determine my share of the above expenses.

NOTE:

Pursuant to the Child Support Guidelines, a court can order that the parents of a child share the costs of the following

expenses for the child:

• Necessary childcare expenses;

• Medical insurance premiums and certain health-related expenses for the child that cost more than $100

annually;

• Extraordinary expenses for the child’s education;

• Post-secondary school expenses; and,

• Extraordinary expenses for extracurricular activities.

Notes, Schedule B: