Financial Engeering Quant Net Guide

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 89

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 1

International Guide to

Programs in Financial

Engineering

QUANTNET INC.

1133 Broadway, Suite 708

New York, NY 10010

www.quantnet.com

PUBLISHER

Andy Nguyen

andy@quantnet.com

EDITOR

Katie Petito

katie@katiepetito.com

ART DIRECTOR

Nancy Ruzow

nancy@ruzowgraphics.com

ADVERTISING SALES

AND TO ORDER PRINT

COPIES OF THIS GUIDE

quantnet.com/advertise

Copyright 2013-2014

by QUANTNET INC.

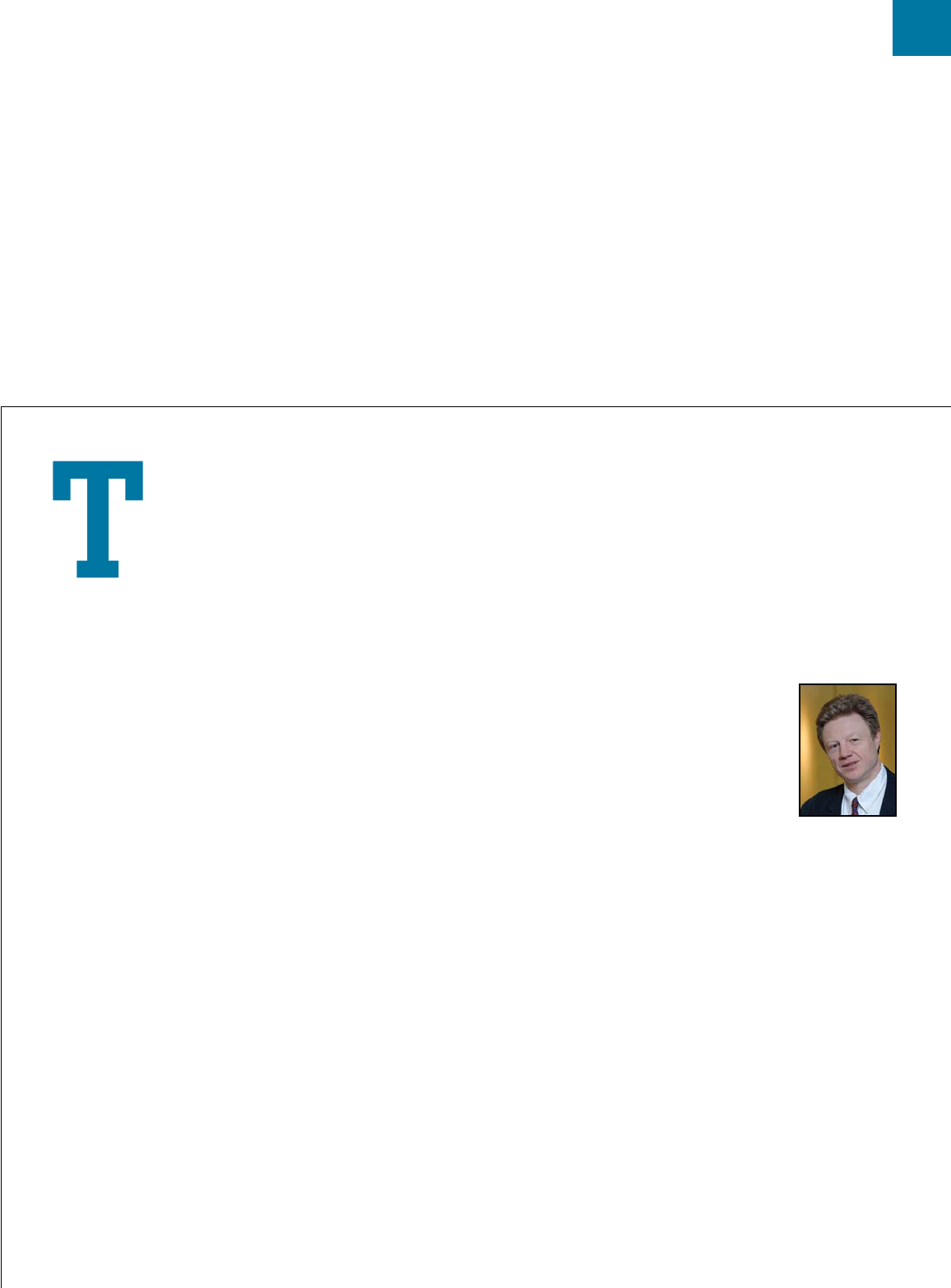

Welcome

Welcome to the 2013-14 edition of the QuantNet International Guide

to Programs in Financial Engineering.

Our inaugural edition has been an extremely useful companion

guide to the eld of nancial engineering for many students. It has

been downloaded thousands of times since its debut one year ago.

Quantitative nance is ever-evolving due to unprecedented

changes in technology, markets, and political forces. The biggest

changes occurring in the last few years have been the diversity of

employers who hire graduates from quant programs as well as the

emergence of the Big Data movement.

Candidates with strong technical skills will be in high demand

for the foreseeable future, but the required skills and domain

knowledge arerapidly changing, especially so for the nance

industry in the post-Dodd-Frank regulatory reform era.

The aim of this guide is to provide the information you need

toprepare for your immediate goal, be it as a stronger applicant

to thetop graduate programs, a better job applicant, or a more

successfulprofessional.

Today, as the top website for quant education and career

resources, we have served 2.5 million unique visitors since 2010.

Our audience is made up entirelyof MFE applicants, quantitative

nance professionals, academics, andemployers.

We hope that, having reading this guide, you’ll learn more

about the industry and make better-informed decisions on your

educationand career choices. Be sure to visit and join us on

QuantNetto take advantage of our special tools and a community

that helps you connect with employers and network with other

professionals inthe eld.

With best wishes for your career,

Andy Nguyen

andy@quantnet.com

QUANTNET | 2013-2014 GUIDE | quantnet.com2

Contents

A Welcome Message from QuantNet

by Andy Nguyen ........................................................ 1

About Financial Engineering

Big Data in Finance

by Andrew Sheppard .................................................5

What Do Financial Engineers Do?

by Aaron Brown.......................................................12

QuantNet Services Overview ..............................14

So You Want to Be a Financial Engineer?

Preparing for a Career in the Field

by Todd Fahey ..........................................................18

Efcient Ways to Set Up a Successful Career

by Dan Stefanica .....................................................23

READING LIST: Books about Financial

Engineering ...........................................................25

Finding a Master of Financial

Engineering Program

How to Identify a Master in Finance Program

Worth Attending

by Anthony DeAngelis .............................................28

How to Pick an MFE Program by Aaron Brown ..31

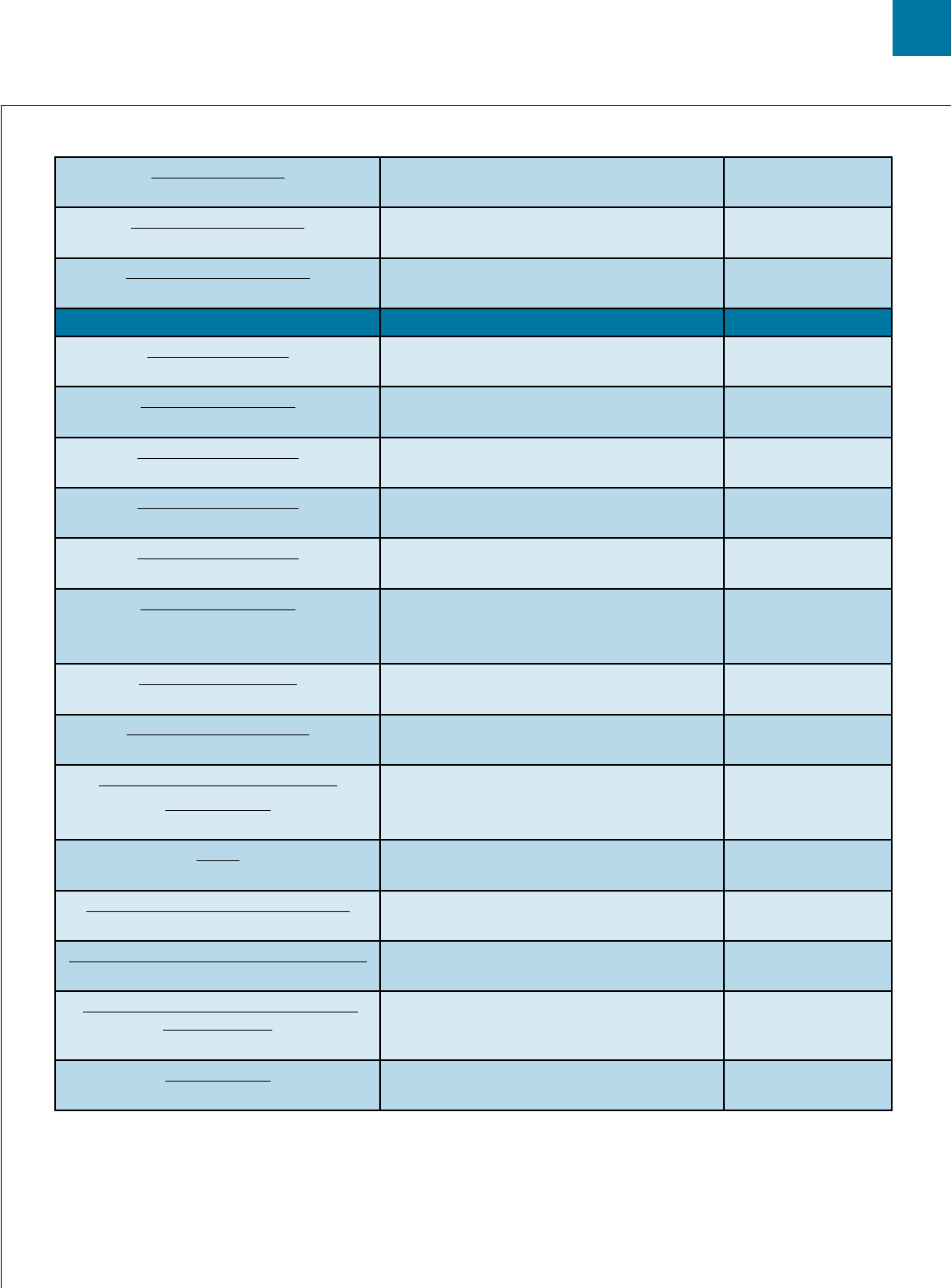

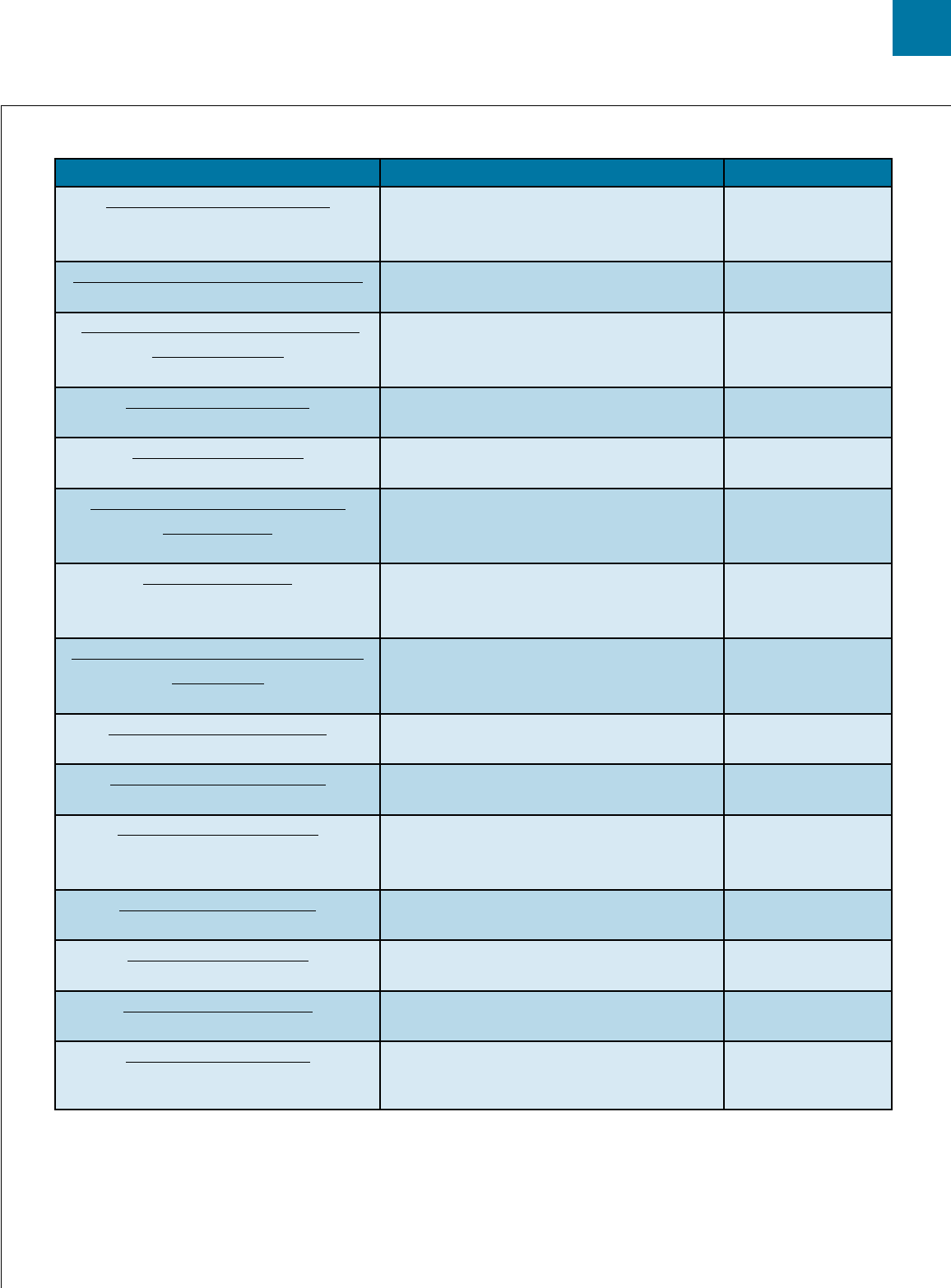

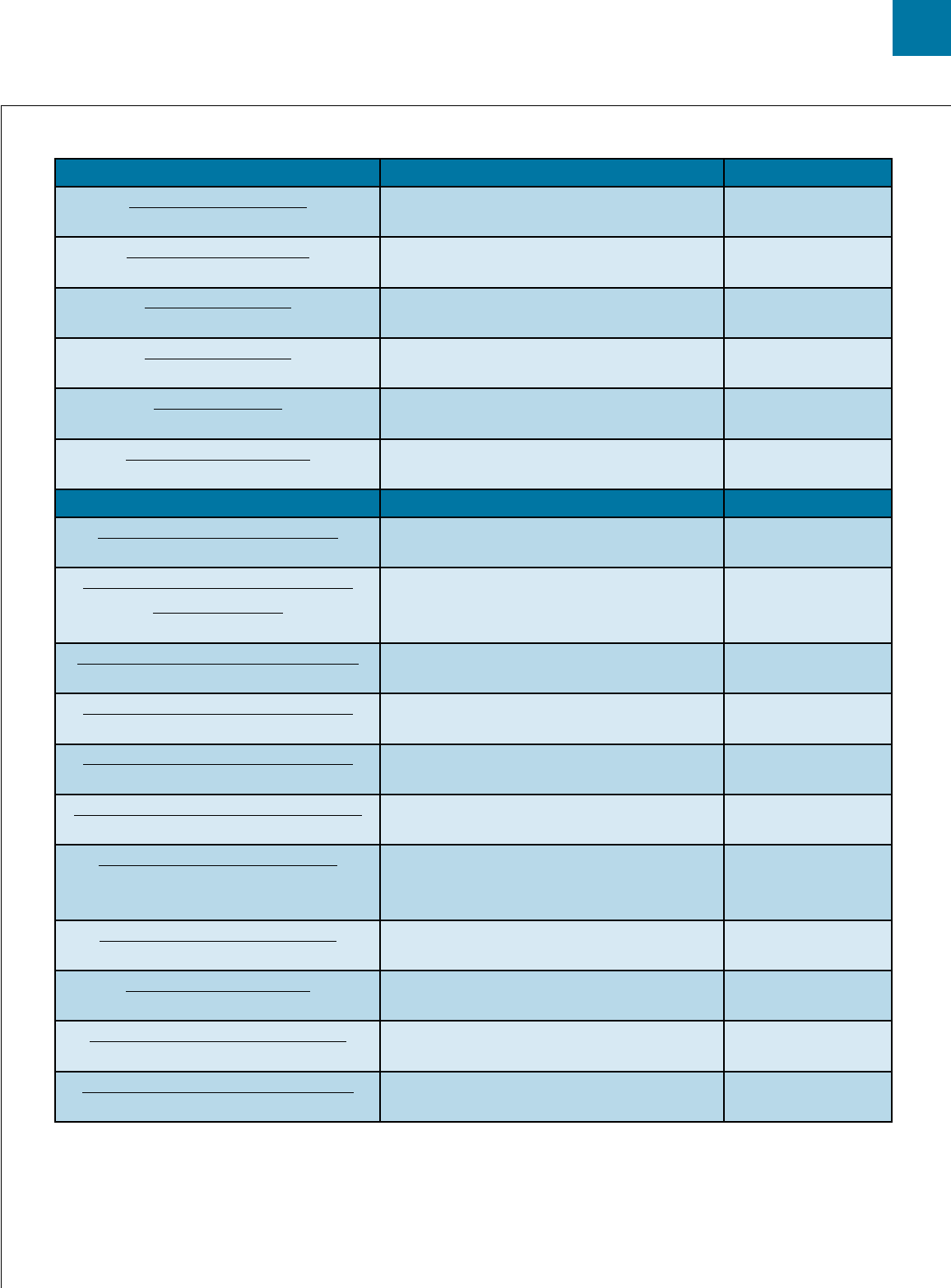

2013-14 QuantNet Ranking of Master of

Financial Engineering Programs....................... 34

International List of Education Programs

in Financial Engineering and Quantitative

Finance ...............................................................36

Quant’s Next Top Model

by Rachael Horsewood .............................................43

Understanding the Quantitative Finance

Industry in Asia

by Chyng Wen Tee and Christopher Ting ................49

Word-Class

Excellence

èOne-on-one alumni mentoring for every current student

èLifetime career services for alumni

Student Outcomes & Success

Competition Highlights

Dedicated, Tight-Knit Alumni Community

7%95%

96%113K

27

Admission Rate

Fall 2013

Students

Class of 2012

Job Placement

Class of 2012

Internship Placement

Summer 2013

Average Starting Salary

Class of 2012

TOP EMPLOYERS: Barclays Capital, Goldman Sachs,

ITG, JPMorgan, Morgan Stanley, State Street,

Autonomy Capital, Promontory Financial Group

èRotman International Trading Competition:

1st (2012); 3rd (2013, 2011)

èIAFE Student Competition: 2nd (2013)

èMetaquotes Automated Trading Championship:

2nd (2012)

baruch.cuny.edu/mfe

Two teams of Baruch College MFE students take first and fourth

places in the 2012 Rotman International Trading Competition in Toronto

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 3

Making Sure Your MFE Application Stands Out

by Bill Stanley ..........................................................53

QuantNet MFE Application Tracker ..................55

C++ Programming for Financial Engineering

Online Certicate ...............................................58

Graduate Schools Want Thoughtful,

Well-Rounded Students

by Gwen Stanczak ................................................... 59

READING LIST: Books for Applicants and

Students of Financial Engineering Programs....63

Getting a Job

Job Search Strategies & Interview Techniques:

Questions and Answers by Ellen Reeves ............. 65

Finance Industry Dictates Changes to Job

Market by Ken Abbott ............................................75

QuantNet Salary Survey ................................... 77

Questions Asked at Quant Interviews..............78

Firms that Employ Quants with

MFE Degrees ...................................................... 79

Why Join a Professional Organization?

by Peg DiOrio ...........................................................81

READING LIST: Books to Help Prepare for

Quant Interviews ...............................................83

Appendix

Excel 2007/2010 Shortcuts ................................85

Advertisers Index ........................................87

• Top-Ranked Department

of Applied Mathematics

National Research Council 2010

•Flexible Degree and Certificates

Master of Science in CF&RM

Computational Finance Certificate

Actuarial Science Certificate

• 94%JobPlacementofFirst

Graduating Class

Testimonials available on website

•MultipleAffordable Degree

Concentrations

computational-finance.uw.edu

Seattle Campus and

Worldwide Online

Ideal Blend of Theory and

Applications Curriculum

Top UW and finance industry faculty

Extensive use of R and R Finance Packages

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 5

Big Data in Finance

By Andrew

Sheppard

echnology has

always been a driver

in nance. That was

true when Nathan

Rothschild (the

eponymous founder of

Rothschild Bank) used carrier

pigeons to relay the news of

Napoleon’s defeat at Waterloo

to London in 1815, something

that was obviously going to

move the London markets, and

an innovation that, at the time,

shortened the transmission

of the outcome of the battle

from days to hours. Technology

as a driver in nance is also

true today, perhaps even more

so. And what’s really driving

nance today, from a technology

perspective, is Big Data (and Big

Compute and Machine Learning

and Data Mining and the Cloud,

as these oftentimes go hand-in-

hand with Big Data).

Which raises the question: What

should a modern day quant

know about Big Data?

In many ways, this is related to

the changing role of the quant.

From my own experience of

having been a quant for 20+

years, you have to reinvent

yourself every three to ve

years or die. These days, the

best quants I see are not just

good at the quantitative stuff

(math and the technical side

of nance), but are also ace

programmers, because the best

and most useful type of quants

build useful tools that can be

used to make more money

while better understanding

and (we hope) managing risk.

Now added to the mix is the

role of Data Scientist. For a

modern-day quant it’s going to

be difcult to avoid nancial Big

Data. Or, turning that statement

around, if you are a modern-

day quant and you aren’t really

rather good with Big Data, you

are handicapping yourself. (I’d

like to say “shooting yourself in

the foot,” but that may be a bit

harsh, but not by much). Adapt

and prosper, or die; it’s your

choice. Has life ever been any

different for a quant?

So, what should the modern-day

quant know about Big Data? I’ll

answer that by picking out the

“peaks” of the Big Data

landscape that are particularly

relevant from a quant nance

point of view.

However, before I do that, I

would like to dene what Big

Data is and describe some

characteristics of Big Data,

which I hope will leave us in the

position of knowing what we’re

talking about. Or, at the very

least, for me to know what I am

talking about!

I’m going to give not one, but

two, denitions of Big Data in

nance. The rst is from an end-

user perspective and leverages

Microsoft Excel’s role as the de

facto, front-end-of-choice for

trading desks, risk departments,

and pretty much every layer of

the nancial organization from

front-to-back ofce. If end users

continued on page 7

“If end users have data that doesn’t fit in Excel,

or requires hours for Excel to process,

you typically have a Big Data problem.”

U.S. NEWS

RANKED

RMI.GSU.EDU

Since 1953, the Department of Risk Management and Insurance at Georgia State University

has been innovating on the cutting edge of research and education in risk and its management.

Innovation and Leadership

in Financial Risk Management

Risk Management at Georgia State University: Unmatched Recognition

A top ve ranking in U.S. News & World Report (undergraduate program)

Designation as a Center of Actuarial Excellence by the Society of Actuaries

Our Mathematical Risk Management program has been named an Accredited University Risk Program by PRMIA –

Professional Risk Managers’ International Association – one of only two programs in North America with this designation

Master of Science in Mathematical Risk Management

The quantitatively rigorous program prepares students for analytical and technical positions in nancial

institutions, risk management advisory organizations, energy companies and the treasury departments

of non- nancial corporations. The program draws expertise from mathematical nance, actuarial

science, and corporate risk management.

More than 90% of students who graduated

from Georgia State University’s MS in

Mathematical Risk Management

program between 2009 and 2012

had a job prior to or within

three months of graduation.

Visit rmi.gsu.edu for

more information.

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 7

have data that doesn’t t in

Excel, or requires hours for Excel

to process, you typically have a

Big Data problem.

The other perspective on Big

Data is from an IT department’s

point of view, and it basically

says that if you are looking at a

data set and the rst thing that

comes to mind is “gosh, this

belongs in Hadoop,” then you

have a Big Data problem. Note

that in the second denition,

it is only necessary to initially

think the data belongs in

Hadoop, not that it really does

actually belong in Hadoop (and

much nancial doesn’t, but more

on that later); it’s the sentiment

that is at the core of the second

denition. These are simple and

practical working denitions

for Big Data, and strangely

enough, in more than a few

years of working in nancial Big

Data, I’ve yet to hear someone

disagree with them as useful

working denitions.

Now that we know—or at least

can broadly agree—on what Big

Data is, it’s time to explore the

nature, or character, of data.

Data, generally speaking, is

characterized along four axes:

volume, velocity, variety, and

veracity—also known as the

four V’s for obvious reasons.

Volume is the quantity of data.

Velocity is the rate at which

data is arriving. Variety is how

structured or unstructured the

data is (which, in short, is data

complexity). And Veracity is the

quality and reliability of the data.

(Guess what, data that is clean

and easily and unambiguously

interpreted is better!) Data that

is considered “Big” along any

of these axes is, by denition,

Big Data. This is our third, and

perhaps, most generic denition

of Big Data.

There is also a characteristic

of nancial data that sets

it apart from data in many

other industries, and this is its

relatively short “half-life.” The

half-life of data is the time it

takes for the economic value

of the data to halve in value.

To illustrate with a somewhat

fatuous example, I’m going

to give you the choice of two

prices: 1) IBM’s stock price for

yesterday or 2) IBM’s stock price

for tomorrow. Any takers for

yesterday’s stock price? No,

I thought not. And a show of

hands for tomorrow’s price? Yes,

that’s more like it! Clearly, stock

prices, generally speaking, have

a rather short half-life. What this

means from a practical point of

view is that for much nancial

data, if you can’t use it within

a small multiple of its half-life,

you may as well throw it away.

Its value can decay that quickly.

There may be other reasons

for storing the data, such as

regulatory mandates, but you

should always be mindful of the

economic value of the data you

are dealing with and deal with it

accordingly.

What’s driving Big Data?

Financial markets across

all times and all places are

governed by two simple

impulses: greed and fear. Or,

opportunity and risk, to be more

polite. The opportunity to make

a dollar, and the chance to not

continued on page 8

Big Data in Finance continued from page 5

“Financial markets across all times and all places

are governed by two simple impulses: greed and

fear. Or, opportunity and risk, to be more polite.”

“There is also a characteristic of financial data that

sets it apart from data in many other industries,

and this is its relatively short ‘half-life’.”

QUANTNET | 2013-2014 GUIDE | quantnet.com8

lose a dollar. Companies in

nance see great value in Big

Data, otherwise they would stop

using the stuff in a heartbeat.

They also see the chance to

better manage their risks using

more data. And, as mentioned

before, the regulators are hard at

work with new and far-reaching

mandates that generate, and

require the storage of, vast

amounts of new data. What also

drives data growth is technical

capability, such as the price of

disk storage; because if we could

not store and process Big Data

economically, again, we’d stop

doing it.

Also, I’ll give a piece of advice

to budding and existing quants.

And it is this: build a portfolio

of tools that people love to

use. Not only will this endear

you—beyond measure—to

your existing employer and

users, it will also prove to be

an invaluable resource when

it comes to nding your next

employer and next group of

users. If you are a budding quant

without an employer, then build

some demo tools or contribute

to open-source projects in the

nance space. There is a world

of difference, a gulf that is

tremendously wide, between

just talking about something

versus saying, “hey, look, if I can

just ip open my laptop for a

moment I can show you a real-

time simulator I built for bank-

wide CVA calculations that uses

GPUs for compute acceleration”

(or some other tool or technique

that knocks their socks off).

It’s good advice, because I have

successfully used it many times

myself.

Now, back to the “peaks” of the

Big Data landscape.

The perspective I want to give

is a combination of techniques

and tools that a practicing

quant should ideally have at

their ngertips. You don’t have

to be an expert in each, but you

should know enough to know

what techniques and tools to

use in a given situation and

to become expert when the

need arises. In the case where

you need to become expert in

something very quickly, in the

words of a former head trader I

worked for: “You have a week!”

On the trading desk I don’t think

it has ever been otherwise.

In terms of techniques, there

are a number of areas of

importance. Data gathering,

cleaning (also called

“scrubbing”), normalizing

(putting everything on the

same apples-to-apples basis),

storing and management; all

of which I will group together

under “Data Programming”.

And “Data Insights” are ways

of understanding the nature

and character of the data you

are dealing with; you need to

understand your data before you

can intelligently attack it with

analysis. This “insights” step is

often overlooked. “Fools rush in”

is the expression that comes to

mind when people do this.“Data

Analysis” is extracting

meaningful and actionable

information from the data.

This is the way I think when

tackling Big Data problems; if

you don’t nd it useful, feel free

to create your own. But one way

or another, design and build a

Big Data tool chain that works

for you, because an ad hoc set of

tools that you throw together for

each project will leave you in a

world of pain.

Data Programming

In many ways, this is the

plumbing that supports

everything else you want to

do with data. Like real-world

plumbing, you want this to

be tight, clean, and have the

right capacity. No one wants

to be dealing with an ugly

mess on the oor, or have to

metaphorically put their hand in

ontinued on page 9

Big Data in Finance continued from page 7

“In the case where you need to become expert in something very quickly,

in the words of a former head trader I worked for:

‘You have a week!’”

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 9

Big Data in Finance continued from page 8

the toilet bowl to unblock

things! This is something you

just have to get right, otherwise

you won’t get to the insights

and analysis for your data. Also,

something that is very often

overlooked is that few (if any)

data sets are static; data is a

dynamic and living thing, so

an automated mechanism for

updating your data set is a must,

and this mechanism must also

be robust and scale as your data

set gets bigger.

In terms of gathering, cleaning,

and normalizing your data,

scripting languages are very

useful. Languages such as

Python have a rich set of

libraries that make data

manipulation, if not simple,

then at least easier. And don’t be

afraid to use older but still very

useful and powerful tools such

as Awk. You can use traditional

languages such as C++, but

that will be really productive

only after you have built a data

toolbox or developed a DSL

(Domain Specic Language) for

the purpose, in which case you

have effectively created your

own scripting language anyway.

So why not just use something

like Python and save yourself

the effort?

Also, since I’ve now mentioned

DSLs, I would like to say a few

more things about them. DSLs

for Big Data are incredibly

powerful. They are a way of

getting things done very quickly

and succinctly and at a level of

abstraction that end users can

understand; this way you can

provide Big Data tools for end

users to use. This is true not

just for the data programming

part of the data tool chain, but

anywhere in the chain of tools

you use for data insights and

analysis. Start building DSLs for

Big Data and make your life, and

the lives of your users, easier.

People will love you for it!

For data storage and

management, there are plenty

of good databases and tools.

You should build your own only

if doing so is a real competitive

advantage (emphasis on “real”

here). There are plenty of in-

memory databases and NoSQL

databases and relational

databases (yes, some Big Data

really does belong under the

relational model!) that you

should nd one where your

data ts well. Just make sure

that your choice here makes

downstream activities—insights

and analysis—simple and not

hard.

In the area of data storage and

management, one tool that I

must mention specically is

Hadoop, which I will introduce

through a story.

Some years ago I was working

on Big Data on Wall Street and

I would often ask “Have you

looked at Hadoop?” to which

the response was nearly always

“What’s Hadoop?” Fast-forward

from that point by six months,

and I would ask people “Are you

working on Big Data?”—often to

the same people as before—and

the answer would be “Yes, we

have a Hadoop project!” In six

months people had gone from

not knowing what Hadoop is to

Hadoop being synonymous with

Big Data! Gosh, things move fast

in nance.

Hadoop is not just a tool for

storing and managing Big Data,

it is in reality an ecosystem of

tools that includes such things

as machine learning (Mahout).

Hadoop is simply a must-have

skill for a quant these days; start

learning it today.

continued on page 10

“. . . there are plenty of good databases and tools.

You should build your own only if doing so is a real

competitive advantage (emphasis on ‘real’ here).”

QUANTNET | 2013-2014 GUIDE | quantnet.com10

Data Insights

Know your data.

That seems a sensible idea,

but it’s amazing how many

people jump into analysis

without even the most basic

knowledge of what they are

dealing with. Before doing

analysis on your data, and

certainly before you start

making important decisions

with your data, you should have

an intimate knowledge of all

aspects and characteristics of

your data. Think of it like this:

if you were going to attack an

enemy on a hilltop over open

ground, wouldn’t you want to

do some reconnaissance rst?

Datareconnaissance, if we can

call it that, will give you a good

picture of the battleeld before

you advance.

Tools I nd useful here are,

again, the scripting languages

and tools used for data

programming. In addition,

data visualization is a very

powerful technique for having

a sense of what your data is

about. Whereas a large data set

presented as a table of numbers

is largely incomprehensible to a

human, the same data

creatively displayed as a

graphic—ideally one that is

interactive and which allows

the user to zoom in and out,

ip, and rotate—can convey

meaning at all scales, large and

small. Tools that are useful for

this type of exploratory work

include MATLAB, Mathematica,

and R, the latter being free and

open-source. These same tools

are very good at extracting

statistical and other summary

measures from your data. You

should also keep an eye out for

new and useful tools that may

make you more productive;

this is general advice for the

whole data tool chain. The data

language Julia is one such tool

that comes to mind and is worth

keeping an eye on.

I’ll close the discussion on data

insights with a word of caution.

Data sets are so large these days

that there is a danger of seeing

patterns in the data that

simply aren’t there. The term

for this isapophenia.

If you have ever looked at

a cloud and seen a ship, a

car, or a face that looks like

your grandmother, you have

experienced apophenia. The

cloud has so many countless

water particles that almost

any pattern can be tted to

them just by altering your

point of view. Make sure this

doesn’t happen with you

and your nancial data.

Apophenia in nancial data

is particularly prevalent

when looking for protable

strategies from the data.

Data Analysis

This, frankly, is the purpose of

Big Data. Data programming and

data insights were just a way

to get you here in an orderly

fashion. Now it’s time to extract

continued on page 11

“ . . . if you build tools that give easy access to Big Data to your end users

(eliminating you as the bottleneck at each stage of the data tool chain),

people will love you for it.”

Big Data in Finance continued from page 9

“You should also keep an eye out

for new and useful tools that may make you

more productive; this is general advice

for the whole data tool chain.”

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 11

Big Data in Finance continued from page 10

value from the data. The data

tool chain all the way up to this

point has been expense, now it’s

time for prot!

When you chose how to store

and manage your Big Data (the

data programming step), you will

have chosen a tool that makes

the analysis easier. Here’s where

the ecosystem of tools around

something such as Hadoop pays

big dividends. Not only does

Hadoop provide good out-of-

the-box tools for analysis, it also

provides tools to build your own

analysis tools.

Hadoop is particularly strong in

this area, but other NoSQL and

relational tools are coming along

very nicely too and denitely

worth looking at.

It’s also the case that Excel and

R have become rather good

front-ends to Big Data; Excel

in particular is a comfortable

and easy-to-use front-end for

end users. And I will repeat a

common theme throughout this

article: if you build tools that

give easy access to Big Data to

your end users (eliminating you

as the bottleneck at each stage

of the data tool chain), people

will love you for it.

Lastly, and this is again

something all too often

overlooked, analysis is also a

source of Big Data. Data feeds

on data, and more Big Data is

often the byproduct of Big Data.

Indeed, sometimes your analysis

may generate data sets that are

larger than your original Big

Data. Just make sure that extra

size is reected in the added

value they bring.

So, where are we today? Big

Data is now a reality in nance

and pervades every nook and

cranny of nancial institutions.

IBM has determined that 90%

of the world’s data was created

in the past two years alone, and

there seems no end in sight to

data growth. From this quant’s

perspective, you had better get

your Big Data skills up to snuff—

and quickly.

To echo again the words of my

former head trader boss, “You

have a week!”, so you’d better

get started soon.

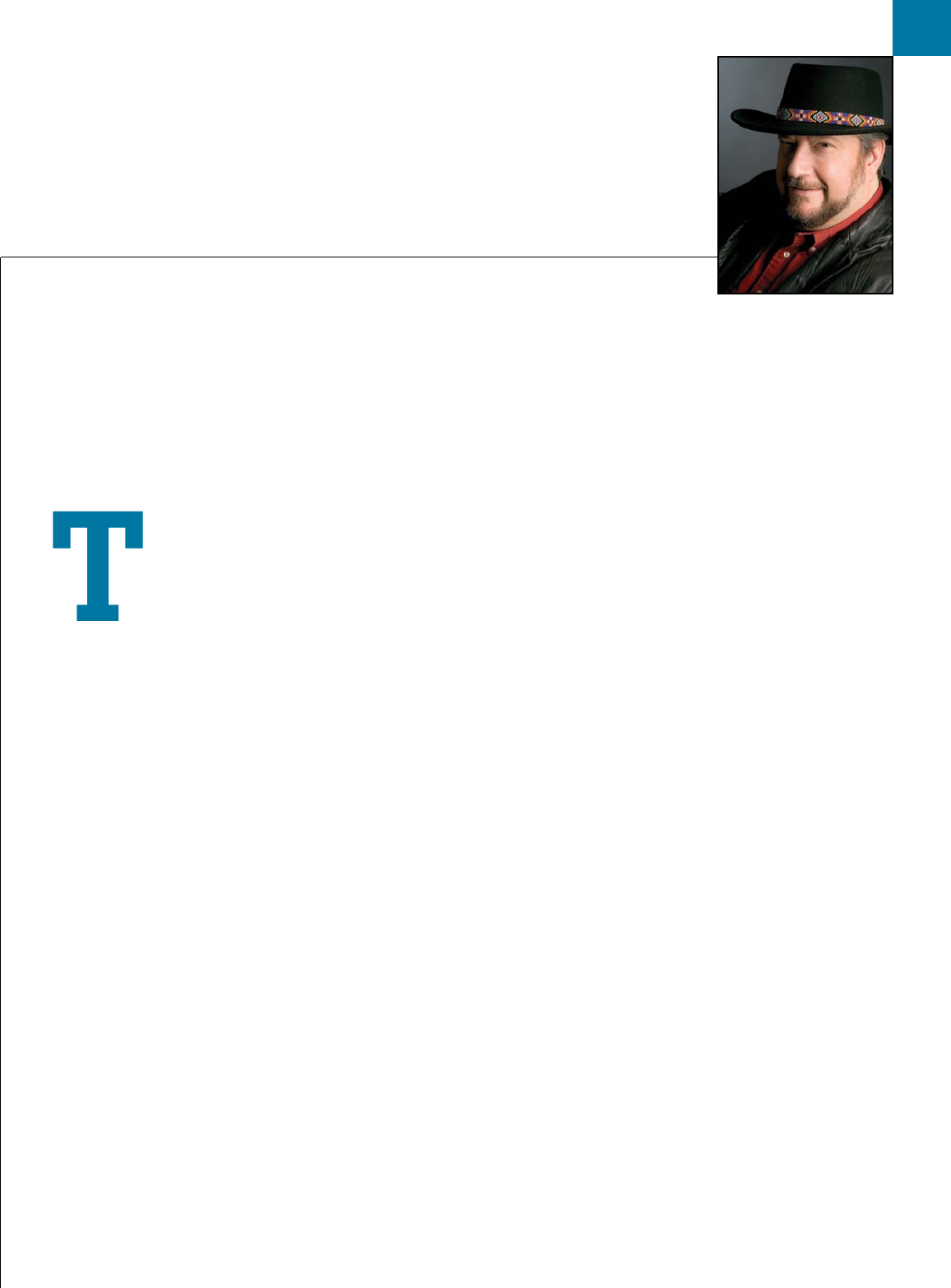

Andrew Sheppard started his career in nance as a quant at Bankers Trust working in

London, then Tokyo, and nally in New York. Andrew has since worked as a consultant,

chief quant, and CTO at various European and U.S. banks and a multi-billion dollar

hedge fund. Since 2010 he has worked as a consultant exclusively in the areas of Big

Data and Big Compute in nance and insurance.

QUANTNET | 2013-2014 GUIDE | quantnet.com12

he function of

nance is to connect

providers of capital

with users of capital.

This can be a simple

process. For example, a venture

capitalist might nd wealthy

individuals to fund start-up

companies. This venture

capitalist might make use of

tools such as a spreadsheet

and quantitative theory such as

discounted cash ow valuation,

but has little need for a

specialized nancial engineer.

Most nance is done in more

complicated ways, using

intermediate institutions such

as banks, exchanges, and special

purpose entities. Many people

with technical skills are needed

to keep this system running. I

do not consider them nancial

engineers, however. They work

in nance and have quantitative

skills, but they are doing niche

jobs for which the eld of

application doesn’t matter

much. Designing databases or

solving equations for a bank is

not essentially different from

doing the same tasks for, say,

a parcel delivery service or an

aircraft manufacturer.

I dene a nancial engineer as

someone using technical skills

in the nance industry whose

work is informed by the end-to-end,

capital provider to capital user,

effects of what he does. It is not

necessarily a better or more

honorable profession than

the specialists who make up

most of the nancial technical

workforce. It does require

different attitudes and skills,

and it presents different

challenges and offers different

rewards.

There are three characteristics

any engineer must have. First,

she must accept reality. She does

not spend effort worrying about

how things might have been

different, or complaining to the

universe or agitating for other

people to change their ways. She

is not concerned with opinions,

untestable propositions, or

abstractions that do not affect

decisions. Second, she must

have a vision for how things

could be better. It need not be an

individual vision, many engineers

function best on group projects,

but random tinkering is not

engineering. Third, she must

have the drive and skills to

accomplish her vision through

her own efforts. She can fail at

the third step and be a failed

engineer. But if she fails at either

of the rst two steps, she’s

something other than an

engineer. The engineer’s prayer

is, “Thank you ____ (ll in what-

ever you feel gratitude toward

for existence) for the universe

and for my eyes, my hands, my

brain. I’ll take it from here.”

continued on page 13

What Do Financial

Engineers Do?

Engineering is not merely knowing and being knowledgeable, like a walking

encyclopedia; engineering is not merely analysis; engineering is not merely the

possession of the capacity to get elegant solutions to nonexistent engineering

problems; engineering is practicing the art of the organized forcing of technological

change. Engineers operate at the interface between science and society.

—Gordon Brown

By Aaron Brown

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 13

What Do Financial Engineers Do? continued from page 12

This denition generates two

questions. Do you need a

nancial engineering degree in

order to be a nancial engineer?

The answer is “no”; some of the

greatest engineers in history

were self-educated. However,

a good nancial engineering

program is the most efcient

way to pick up the necessary

knowledge. You would have to

work for many years, in many

areas of nance, to become

familiar with the nancial

system end-to-end through

direct experience. You can learn

most of the technical skills from

books and the Internet, but not

the practical details that are

essential to sound engineering.

Thirty years ago, a quant with

a good general education, a

curious mind, and a diverse

set of industry contacts could

teach himself. Today it would be

extremely difcult.

The second question is whether

there is any reason to enter a

nancial engineering program

if you do not want to be a

nancial engineer. This one is

tricky. The reason employers

hire people from nancial

engineering programs is they

need employees with a breadth

of technical nancial knowledge.

Only a few employers want

engineers of any stripe;

engineers can be disruptive.

Employers are more likely to be

looking for technical specialists

who can move to different areas

as needed, and who might avoid

some tunnel vision mistakes

of a quant without general

nancial training. So you might

be tempted to get a nancial

engineering degree in order to

have a better chance of getting a

job as a technical specialist.

That can work, but I think it’s

rarely a good idea. The trouble

is people like that usually have

short careers in nance. When

you amortize the cost of the

program along with the lost

employment time while in the

program, you might well end up

making more money in a lower-

salaried, less volatile career.

More important, that lower-

salaried career can progress

naturally. You won’t face a mid-

career transition after being

laid off from a high-paying job,

having to start over in some

other eld. Another point is

there are probably cheaper and

easier things you can do to

improve your chances of landing

a technical specialist job in

nance than get an MFE.

What is it like to be a nancial

engineer? I have to start with a

caveat. The world is changing

fast, and the nancial world

is changing faster. It’s easier

to predict functions than

institutional roles. For example,

I’m pretty condent nancial

engineers will be describing the

possible evolution of derivative

prices for many years, and

probably using some kind of

generalized Monte

Carlo to do it. But

I have much less

condence that

they will be doing

it on anything like

a modern dealer

trading desk. Over

my career, I have seen

species of nancial businesses

spring up, evolve, and die out.

Nevertheless, to prevent this

from getting too abstract, I’m

going to use current institutional

terms. Just remember to focus

on the functions of the job,

not how it is embedded in a

nancial business.

Let’s begin with front ofce jobs,

jobs in groups that generate

direct revenue. These are the

most exciting jobs with the best

pay, also the most volatile and

the ones where luck plays

continued on page 15

“What’s it like to be a financial engineer? I have to start with caveat.

The world is changing fast, and the financial world is changing faster.

It’s easier to predict functions than institutional roles.”

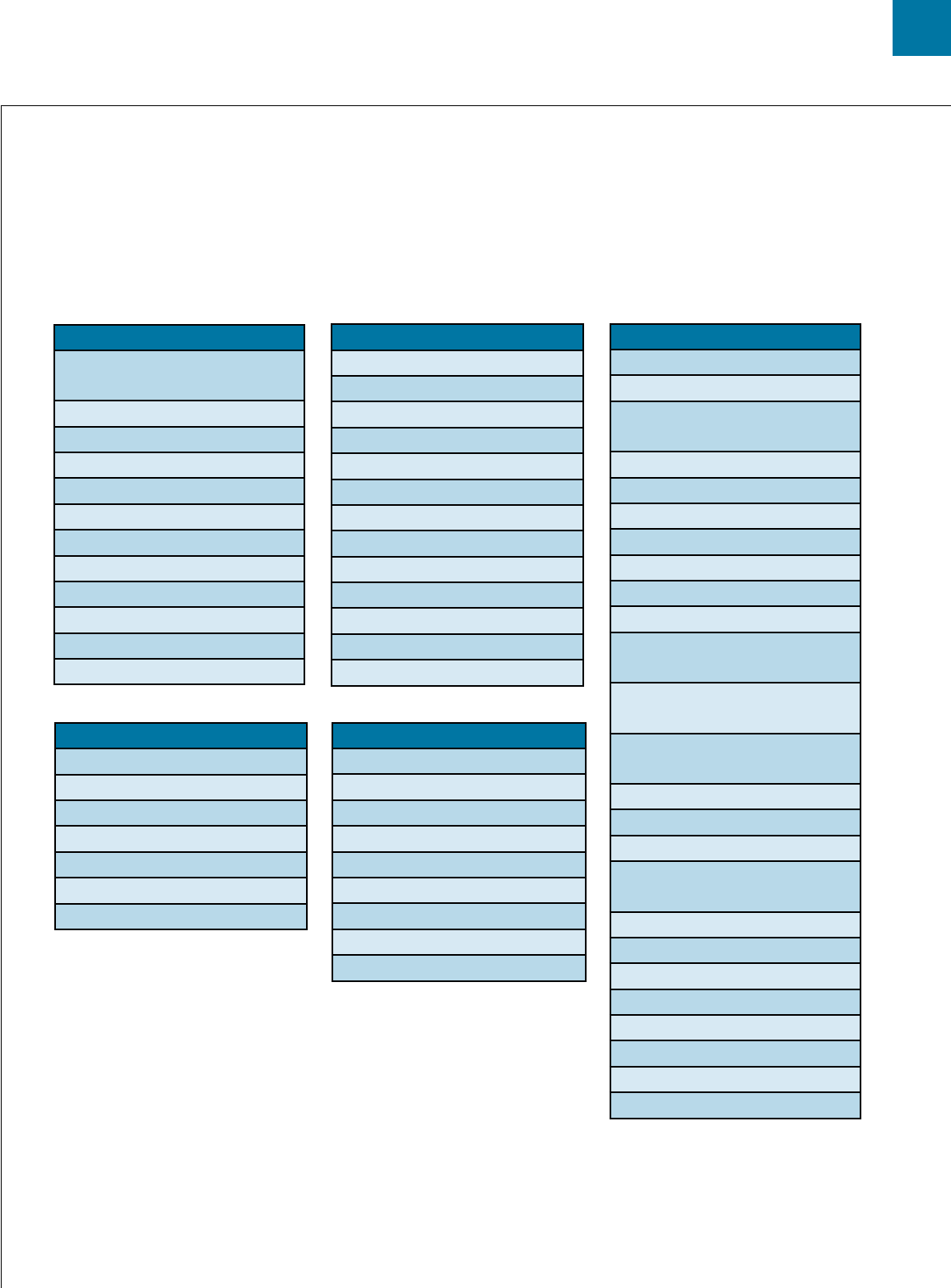

Since its beginning in 2003, QuantNet has grown from a small

discussion board for MFE students to a global comprehensive

resource dedicated to nancial engineering. Whether you are

thinking of a graduate degree or certicate, looking to upgrade your

programming skills, or comparing your salary data, we have the

right tools for you.

C++ ONLINE CERTIFICATE

This certicate is designed for people interested in pursuing graduate studies in

nancial engineering and covers essential C++ topics with applications to nance.

Approximately half of the students who successfully completed the seminar prior

to July 2013 are now enrolled in nancial engineering graduate programs.

COMMUNITY

QuantNet is the largest community of MFE applicants and graduates. Every month,

QuantNet.com is frequented by thousands of visitors looking for information

about graduate programs or careers in the eld of quantitative nance.

QUANT PROGRAMS RESOURCES

QuantNet Resources are the website’s latest tool that provides applicants with in-

depth student reviews, placement and admission statistics, and other important

data on nancial engineering (MFE) and other quant master programs.

APPLICATION TRACKER

The Application Tracker is used by hundreds of MFE applicants every year to

evaluate their chance of admission to the top programs. It now allows direct

prole comparison against the database of applicants admitted worldwide to 68

master’s programs in nancial engineering and quantitative nance.

SALARY DATABASE

Ever wonder howyour compensationis compared with other professionals with

a similar education, job type, and experience prole? Our database contains

hundreds of salary submissions by our members who hold an MFE degree and

work in various quantitative nance positions around the world.

MFE PROGRAMS RANKING

The 2013-2014 QuantNet ranking is the most comprehensive ranking to date of

master programs in Financial Engineering (MFE), Mathematical Finance in North

America.

QuantNet surveyed program administrators, hiring managers and quantitative

nance professionals from nancial institutions around the world for statistics

reecting student selectivity and graduate employment.

SERVICES OVERVIEW

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 15

What Do Financial Engineers Do? continued from page 13

the greatest role in career

success. They reward aggressive,

condent nancial engineers,

and may require subordinating

personal lives. On the other

hand, they allow the most

professional freedom. Front-

ofce nancial engineers can

choose to work in a wide variety

of circumstances from one-

person start-ups to the largest

companies. A disadvantage

is front-ofce skills are

not transferrable to other

professions. If your professional

rewards and satisfaction are the

biggest things in your life, and if

you are sure nance is for you,

the front ofce may be the best

place to work.

The two forms of revenue in

nance are trading prots and

many avors of fees. Financial

engineers are needed to design

and support trading strategies,

create and manage structured

products, develop software to

be used in pricing or hedging,

and other tasks that combine

aspects of all three functions.

The reason you should have

a nancial engineer for these

tasks is all the revenue is

extracted from a highly complex

and fast-changing nancial

system. It’s not enough to write

good code or solve equations

properly; front-ofce quants

need to build systems that

can thrive in a chaotic and

competitive environment.

Next come back-ofce jobs.

There are a lot more of them

than front ofce jobs, and they

afford better work-life balance.

Success will depend on ability

more than on luck and politics.

Careers will be more predictable

and if you do decide to leave

nance, your acquired back-

ofce skills will have some

value. Your achievements are

likely to have longer useful lives.

Pay and excitement are lower

than in the front ofce. Financial

engineers can play important

roles in back-ofce areas such

as nancial control, especially

risk control, and systems

development.

Back ofce is sometimes

referred to as the “plumbing”

of the nancial system. Like

plumbing, everyone ignores

it when it works, but when it

doesn’t work, life can be very

unpleasant. Also like plumbing,

it’s a lot more complicated than

most people imagine.

Finally there is the middle ofce.

A century ago, there were literal

physical front and back ofces in

brokerage rms, the front ofce

for clients and the back ofce

for clerks. There never was a

real middle ofce. The term was

invented in the 1980s to describe

risk management, because

risk managers used front-

ofce skills, and sometimes

got injected into front-ofce

decisions, but did not generate

revenue directly.

There’s no generally

agreed denition

of the term; some

people include

departments

such as treasury,

information

technology, legal, and

compliance. Financial engineers

are most often found in risk

management and, if you include

them in middle ofce, front-

ofce IT and risk IT.

In some respects—pay, glamour,

and career volatility—middle

ofce is (as you might expect)

midway between front ofce and

back ofce. In another respect,

however, it differs from both

front and back ofce. Middle

ofce requires nancial

engineers. However specialized

a nancial task or institution, it

can be affected by the end-to-end

continued on page 16

“It’s not enough to write good code or solve equations

properly; front-office quants need to build systems that can thrive

in a chaotic and competitive environment.”

QUANTNET | 2013-2014 GUIDE | quantnet.com16

What Do Financial Engineers Do? continued from page 15

chain of capital in which it is

embedded.

The great British engineer Henry

Royce dened the simple ethos

of the profession: “Strive for

perfection in everything you do.

Take the best that exists and

make it better. When it does not

exist, design it.” This is a proud

and noble undertaking, for those

with the talent and energy to

attempt it. And today, nance

is one of the most exciting

and useful places to practice

engineering. You take it from

here.

Aaron Brown is risk manager at AQR Capital Management and the current

Global Association of Risk Professionals Risk Manager of the Year. He is the

author of Red-Blooded Risk (Wiley, 2012), The Poker Face of Wall Street (Wiley,

2006, selected one of the 10 best books of 2006 by Business Week) and

A World of Chance (with Reuven and Gabrielle Brenner, Cambridge University

Press, 2008). In his 31-year Wall Street career he has been a trader, portfolio

manager, head of mortgage securities, and risk manager for institutions

including Citigroup and Morgan Stanley. He also served a stint as a nance

professor and was one of the top professional poker players in the world during the

1970s and 80s. He holds degrees in Applied Mathematics from Harvard and Finance and

Statistics from the University of Chicago.

Join the Conversation QuantNet’s more than 20,000 members meet in the Forums to

trade information about everything from general education and

career topics to detailed conversations on day-to-day financial

engineering topics to answers for specific questions asked

during the interview process.

Everyone from well-known

quant professionals to

students new to the industry

can get together to talk about

the latest trends in quantitative finance.

The forums are searchable and allow

you to see which topics are the

most recently updated.

Here’s a sample of the forums

generating chatter now:

Ellen Reeves’ column

“Ask Ellen—Job

Hunting and Career

Development Advice”

“Q/A with Todd Fahey” oers

the opportunity to chat with

Todd Fahey, a headhunter for

Sheield Haworth, Inc.

“C++ Online Certiicate”

contains multiple threads for

anyone interested in learning

more about the course to

enrolled students seeking

help from their peers.

QUANTNET | 2013-2014 GUIDE | quantnet.com18

So You Want to Be a

Financial Engineer?

Preparing for a Career in the Field By Todd Fahey

hen

preparing

for a career

in Financial

Engineering,

it’s helpful to know what you

need to know in order to be

considered a good candidate

for a job, as well as how to be

successful in that role once you

are hired.

First, you should know that the

general utilization of an MFE

degree tends to be oriented

toward quantitative roles on

the desk (i.e., working on the

trading desk and delivering

the models, risk calculators,

etc., directly to the traders

who utilize their products), or

in risk management, model

validation, library control, CVA,

or quantitative development

and programming.

I’ve been a recruiter for more

than 14 years, and have worked

exclusively in quantitative

nance for the last 12 years.

My coverage spans global

investment banks, hedge funds,

proprietary trading companies,

and asset management rms,

focusing on the front-ofce

quant and trading and tech-

nology professionals. The vast

majority of roles that I cover

are automated/systematic/

algorithmic quants and traders

through quantitative software

and systems/platform developers

and quantitative analytics and

modeling on the desk. I will

discuss in more detail how

to prepare yourself for these

roles, and help you focus on the

subjects you need your degree

program to teach you.

While the job market is very soft

for new MFEs hitting the market

to be desk quants, as well as

those in exotics and structured

nance, there is a signicant

need within the CVA, risk, and

quant developer/programming

elds right now. I anticipate this

need will only grow stronger

over time as there is signicant

emphasis on risk and credit

at the moment—and the

foreseeable future—specically

as it relates to the current

regulatory environments both

here and abroad.

The other area that is bright

at the moment is within the

world of automated, algorithmic,

systematic, and quantitative

trading. These roles are highly

competitive for entry-level

professionals. Further, they all

require programming skills in

core languages, along with a

solid knowledge of statistical,

neural network and/or articial

intelligence methods. If this is a

route you are looking to pursue,

you need to know that you will

be facing some ridiculously stiff

competition, and you may be

best served by being open to

relocation outside of the U.S.—

Asia in particular. Also, work

hard on getting solid skills and

experience with C++, Python,

Java, and/or Scala, as these

tend to be the most utilized

programming languages in the

eld.

My personal recommendation if

you’re looking for a job now, in

terms of target companies would

be, in order: hedge funds, asset

management rms, proprietary

trading companies and, nally,

nally, banks. The reasoning

behind this is that banks are in

regulatory hell right now;

proprietary trading companies

could very well have some

continued on page 19

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 19

So You Want to Be a Financial Engineer? continued from page 18

issues with the pending

regulations in the U.S. and the

UK, and there is still a lot of

money waiting for deployment

across the global spectrum right

now. Asset management rms

and hedge funds appear to be

the beneciaries of what we

anticipate over the next 5-10

year stretch.

But how do you prepare for

these jobs? First, it’s helpful to

know what to prepare for in

terms of education, based upon

your interests. For example, if

you desire to pursue a path in

high frequency futures trading,

you should be aware that the

vast majority of these people

do not have PhDs, and some

employers in this eld actually

believe them to be detrimental.

A strong background in

electrical and/or computer

engineering (with a master’s

degree, preferably), very strong

programming skills (C++, Java,

C#, Scala, Python, etc.) and

comfort with very large data

sets is key.

If you are more interested in

the mathematical side, a PhD

is the preference, although

not a necessity (MFEs typically

work in this arena, as well).

Typical coursework for

these careers is Operations

Research, Applied Mathematics,

Mathematics, Theoretical

Physics (not experimental—

not a desirable math track),

Electrical Engineering, Computer

Science or Engineering, and

Mechanical Engineering. If you

decide that this is the path to

pursue, understand that strong

programming is a requirement

and will be done every day. It is

no longer optional. And, if you

can only program in MATLAB,

SAS, S+ or another RAD or

statistical package, you will be

at a disadvantage compared

with those who can program in

advanced languages mentioned

above.

What do you need to know to

make yourself competitive in

the market wherever you choose

to work in the world? Let’s face

it—this is probably the most

competitive eld of employment

outside of professional sports.

As such, talent alone might not

get you in the door. There are

things that you should do in

order to make yourself stand

out from the crowd. Including

some things that may make you

uncomfortable and push you

in directions you may not have

considered prior to pursuing this

career path. I will highlight the

things I believe that will best

start you on the path to success:

Personality and

Communication Skills

Believe it or not, you are not

quite as unique as you might

think you are. Everybody in

this eld is “smart”. The ones

who get jobs—and then

progress upward through the

continued on page 20

“. . . there is still a lot of money waiting

for deployment across the global spectrum right

now. Asset management firms and

hedge funds appear to be the beneficiaries

of what we anticipate over the next

5-10 year stretch.”

“There are things that you should do

in order to make yourself stand out from

the crowd. Including some things that

may make you uncomfortable and push

you in directions you may not have

considered . . .“

QUANTNET | 2013-2014 GUIDE | quantnet.com20

So You Want to Be a Financial Engineer? continued from page 19

ranks—have one commonality:

people (at least someone) like

them. You need to be articulate

and outgoing. Inquisitive, yet

thoughtful.

One way to help your

personality show through would

be to join Toastmasters or a

similar organization. While you

may not ever be in sales or a

rened public speaker, it will

only serve to help differentiate

yourself from being like

everyone else.

Probably the most overlooked

need beyond the technical

skills required in this eld is

the need for communication,

specically, communication in

the English language. English

is the universal language of

nance—the same as if you were

an international airline pilot.

If you are not a native speaker,

it would be extremely helpful

to take communications

courses to help with your

grammar, presentation, and

writing abilities. Even if this is

not part of your curriculum,

outside tutoring would not hurt

you. After all, you may be the

smartest mathematician in the

world, but if you can’t articulate

it so that people understand

you, or if your writing skills are

so atrocious (author included

here . . . ) that it is impossible to

follow in a linear fashion, you’re

severely disadvantaged.

Programming

If you’re not good at it, get good

at it. In almost every role in

quantitative nance you will be

required to program. The better

you are, the easier it will be for

you to land a job in the eld.

Languages to concentrate on

are: C++, Perl, Python, Java,

continued on page 21

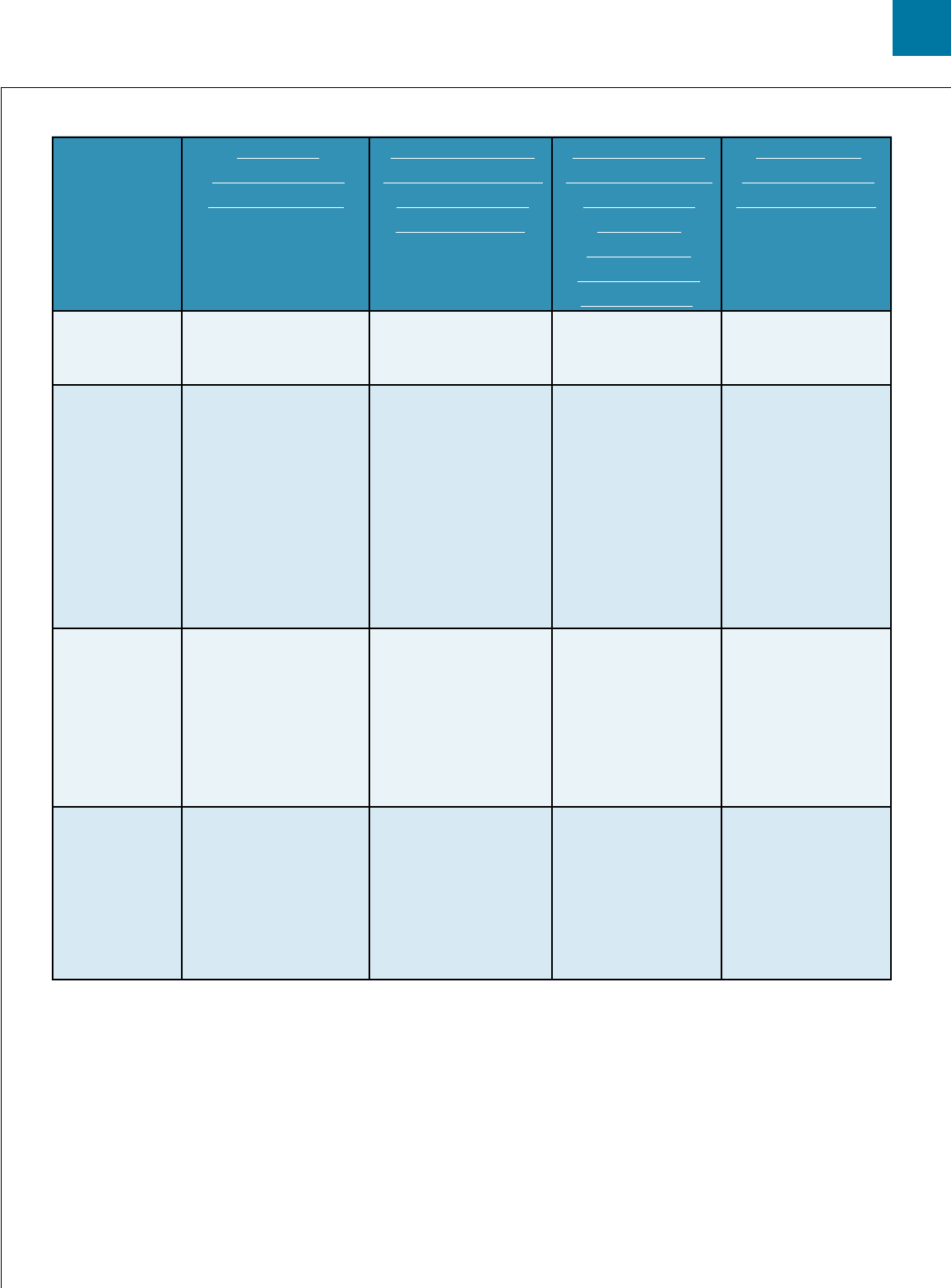

RESULTS FROM OTHER MFE/MATH FINANCIAL PROGRAMS

12. University of Chicago (Math Finance)

20. MIT

29. Boston University (Math Finance)

32. Rutgers University (Math Finance)

35. NYU (Math Finance)

37. Boston University (Math Finance)

38. UC Berkeley (Financial Engineering)

41. University of Chicago (Math Finance)

2013 Rotman International

Trading Competition Result

THE 2013 COMPETITION WAS ATTENDED BY MANY TOP MFE PROGRAMS

FROM OVER 40 UNIVERSITIES WORLDWIDE.

THE TOP 5 TEAMS THIS YEAR ARE

1. Laval University (Quebec)

2. Chulalongkorn University (Thailand)

3. Baruch College (Financial Engineering)

3. University of Toronto

5. BI Norwegian Business School

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 21

So You Want to Be a Financial Engineer? continued from page 20

C# / .NET, Scala, Hadoop,

MATLAB (not a substitute for

C++!) and other functional

programming languages.

Economics and Finance

In the world of quantitative

trading, economics and nance

classes are not important—other

than for being a well-rounded

professional at a macro level.

Within the world of quantitative

strategists, there is a chasm.

Most banks and hedge funds

look for those who have a

rigorous math background.

However, there are a number

of hedge funds and asset

managers who look to avoid

those backgrounds. They want

classically trained economists

with PhDs from the major Ivy

League schools. If you don’t have

a PhD from one of those schools

and a top undergrad from the

same level institution—don’t

waste your time. This eld

is ercely competitive and

you need to up your game to

even have an opportunity to

interview.

Math

There are a lot of different areas

within math, but there is one

thing for certain: if you’re going

to be a derivatives quant, you

had best be good at stochastic

calculus. Other areas of note are

linear algebra, spatial geometry,

and familiarity with partial

differential equations and

ordinary differential equations.

Internships

The ability to secure an

internship should be a priority

from the moment you walk

in the door as a freshman in

college. You get to learn about

what these people do on a daily

basis, and you may have an

opportunity for a rotation.

You get to be on the Human

Resource department’s radar—

a big thing once you are ready to

enter the job market.

The best way to nd a job is

to have one in hand as you

get ready to graduate because

you’ve interned at the company

and they feel they need to have

you on their team because you

impressed them so greatly as

an intern. Most

importantly, you

begin to network

with other

professionals in the

eld. People move

often and it is 99.99%

likely that you will

leave your rst job

within ve years. The

saying “It’s not what you

know, it’s who you know,” carries

a lot of weight in the hiring

world. Get to know as many

people as you can and actively

engage with your network often.

continued on page 22

“The best way to find a job is to have one in hand as you get ready

to graduate because you’ve interned at the company and

they feel they need to have you on their team because you

impressed them so greatly as an intern. Most importantly, you

begin to network with other professionals in the field.”

“There are many different quantitative

networking groups, conferences, and

symposiums in every financial center to keep

you engaged in the latest trends and ideas,

and also—and I cannot stress the importance

of this enough—the ability to network not only

with your peers, but the level of successful

professional that you all strive to be.”

QUANTNET | 2013-2014 GUIDE | quantnet.com22

So You Want to Be a Financial Engineer? continued from page 21

Continuing Education

If there were ever a time to

recommend staying the distance

if you have your sights on a PhD,

now is the time. Entering the

market later with a PhD may put

you at the top of the candidate

list, as well as position you to job

search in a better market.

Not interested in a PhD?

Not a problem. There are

many different quantitative

networking groups, conferences,

and symposiums in every

nancial center to keep you

engaged in the latest trends and

ideas, and also—and I cannot

stress the importance of this

enough—the ability to network

not only with your peers, but the

level of successful professional

that you all strive to be.

One other thing that you need

to do is read. Voraciously. I’m

not speaking about books,

articles, and literature dedicated

to your eld of endeavor.

I’m speaking of information

ow that is real-time and/or

relevant to recent events. If you

don’t know what is going on

around you, it is hard to have

an opinion about what is going

on around you. Read The Wall

Street Journal, Financial Times, and

other newspapers. Subscribe to

e-zines such as Fierce Finance or

FINAlternatives. Join specic web

communities such as QuantNet,

Wilmott, or Nuclear Phynance.

Read books by Michael Lewis or

other topical books relevant to

nance (I’m personally a huge

fan of Roger Lowenstein’s When

Genius Failed: The Rise and Fall of

Long-Term Capital Management.

Become a well-rounded quant

and you will start to move away

from the pack.

The purpose of this article is to

give you a general overview of

the market, the trends, and what

skills I believe you should have

based upon what positive and

negative stresses I see in the

market now and in the next few

years.

Ultimately, I hope that you

remember the ultimate

lesson here: each of your own

situations and experiences is

unique to you. Clarity of your

path is the most important thing

to you. Keep the goal in mind

as you make your decisions

and, with a bit of luck and good

timing, you will arrive at the

point you’re aiming for.

Todd Fahey is Executive Director, Global Head – Quantitative Strategies Practice, at

Shefeld Haworth, Inc. He has trained quantitative and technical recruiters; published

articles, blogs, and e-zines; and presented at various business schools. He can be

reached at fahey@shefeldhaworth.com. Todd also has a Q&A column on QuantNet

where you can ask him questions about the quant job market.

A note from Todd Fahey: I am an executive search consultant, and my value to companies

is to nd experienced personnel. In order for me to maximize my time and efciency,

I need to look at what is the cost/benet of my time usage. Simply, the majority of my

clients are looking for me to nd them the people that they are willing to pay for my

services and that they would have difculty nding on their own. That means that I

more than tend to look at people who are currently actively working in the industry,

have a minimum of three years of work experience, and carry a numerate degree from

a top university globally. Beyond these criteria, it is a stretch to say that I am willing to

work with an individual who don’t meet the bar. I am always willing to offer advice and

suggestions, but that doesn’t mean that I can necessarily help any one individual.

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 23

Financial Engineering Education as a

Gateway for a Quantitative Finance Career

Efficient Ways to Set Up

a Successful Career By Dan Stefanica

graduate degree

in nancial

engineering is

primarily a way to

start, or advance,

a career in quantitative nance.

It is not only useful academically,

but practically as well by learning

about various career paths and

deciding which best suits your

interests and background, and

by creating opportunities to

compete for the right openings

at the right time.

Based on a long experience

fostering careers of both young

and mid-career students and

alumni, I will briey share

pointers on how to put a master

of nancial engineering (MFE)

graduate degree in the larger

perspective of a successful

career in quantitative nance,

from deciding whether to pursue

an MFE, to shaping your career

path once you graduate.

Make sure you learn about

possible career paths before

deciding to apply for an MFE

program. The comprehensive

QuantNet Quant Internship and

Graduate Recruitment Firms

Listing includes an extensive

list of career options from buy-

side and sell-side employers.

The book The Complete Guide to

Capital Markets for Quantitative

Professionals by Alex Kuznetsov

and Mark Joshi’s On Becoming

a Quant guide are also good

sources of information.

Once the decision to pursue an

MFE is made, a three-pronged

process begins: deciding where

to apply, putting together a

competitive application, and

preparing for graduate studies.

Approach this from a career

goals perspective: nd the

program that best suits and

services your career needs and

then use the time you have before

you start the program to strengthen

and update your background. By

doing so, you will set yourself up

for a successful graduate studies

experience, and for better career

options upon graduation.

There should be no doubt

that programming will be an

important part of your future

work and studies. Improve your

C++ and VBA skills, which will

be valuable both in a highly

quantitative role and in a

business-oriented role.

Brush up on your math skills

d Calculus— My book A Primer

for the Mathematics of Financial

Engineering was written with this

goal in mind.

d Linear algebra—Gil Strang’s

Introduction to Linear Algebra has

a strong numerical avor.

d Probability—A Natural

Introduction to Probability Theory

by Ronald Meester is both

intuitive and rigorous.

Learn about financial

instruments in a

quantitative framework

d Salih Neftci’s An Introduction

to the Mathematics of Financial

Derivatives is good background

reading.

continued on page 24

QUANTNET | 2013-2014 GUIDE | quantnet.com24

Efficient Ways to Set Up a Successful Career continued from page 23

d Principles of Financial

Engineering, also by Neftci, gives

an excellent practical view

of quant nance for trading

applications.

I cannot overemphasize the

importance of preparing for

graduate studies from the

moment you decide you want

to pursue them. A strong

and current knowledge of

programming, mathematics,

and fundamentals of nance

when entering the program

is, in my experience, a great

attribute of highly successful

graduates, which translates

into signicantly better career

opportunities.

Once you accept an admission

offer, you have several more

months to prepare for your

studies. It is then time to contact

the program and ask for specic

instructions on how to best use

that time given your particular

set of strengths and background

knowledge.

During your studies, remember

at all times that you are doing

an MFE as a step toward a

quantitative career.

Use the program resources—

networking with graduating

students, talking to industry

professionals teaching in the

program, and consulting with

career advisors—to identify the

areas you would like to work in

by the end of the rst semester

of studies. Find out what skills

are most valued by employers in

those areas, and use this

knowledge to decide which

courses you choose subsequently,

as well as what you need to

emphasize in your studies.

Put your job search in a longer-

term perspective. The goal

should not be just to get a job

upon graduation, but to nd the

right position that will allow

your career to grow over time.

This could mean a rst job

where you will further learn and

grow your set of skills, or taking

a position that could be used

as an apprenticeship toward,

why not, starting your own rm

when the time is right several

years down the road.

And it may all start the moment

you begin preparing for your

MFE graduate studies. You have

more time between when you

decide to pursue an MFE and

when you start the degree, than

between the beginning of your

studies and when you start

interviewing for internships.

That time is precious and, if

used efciently, could make a

big difference.

Good luck!

Dan Stefanica has been the Director of the Masters Program in Financial Engineering

at Baruch College, City University of New York, since its inception in 2002. He teaches

graduate courses on numerical methods for nancial engineering, as well as pre-

program courses on advanced calculus and numerical linear algebra with nancial

applications. He is also the author of A Primer for the Mathematics of Financial Engineering,

QuantNet’s #1 best-selling book three years in a row: 2010, 2011, and 2012.

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 25

On Becoming a Quant

AUTHOR: Mark Joshi

PAGES: 20

FORMAT: Online PDF le

WHY YOU SHOULD READ IT: Mark Joshi’s short

guide advises students who want to become a

quant. He covers the types of quant jobs and

expected salaries, the areas of derivatives quants

work in, the types of employers who hire quants,

what a quant needs to learn, the current job

market, and how to look for a job and what to

expect during the interview.

The Complete Guide to Capital Markets for

Quantitative Professionals

AUTHOR: Alex Kuznetsov

PAGES: 600

FORMAT: Hardcover, Kindle

WHY YOU SHOULD READ IT: This book is a must-

read for those with a background in science and

technology who are thinking of transferring

their skills to the nancial industry. Kuznetsov

details how the nancial industry works, as well

as how different rms make their money. Then

he describes how professional with different

technical backgrounds t into roles within the

industry. A section on technology discusses how

nancial models are created and used.

My Life as a Quant: Reflections on

Physics and Finance

AUTHOR: Emanuel Derman

PAGES: 308

FORMATS: Hardcover, Paperback, Kindle

WHY YOU SHOULD READ IT: This is the book that

introduces “quant” as a profession for generations

of students. Emanuel Derman discusses his

journey as one of the rst high-energy particle

physicists to migrate to Wall Street, and along the

way he analyzes the incompatible personas of

traders and quants. Derman also notes the

dissimilar nature of knowledge in physics and

nance, while offering his thoughts on how to

apply the principles of physics to nancial markets.

The Big Short: Inside the Doomsday Machine

AUTHOR: Michael Lewis

PAGES: 266

FORMAT: Hardcover, Paperback, Kindle, Audio, CD

WHY YOU SHOULD READ IT: Michael Lewis’ #1

best-selling book tells the story of the 2007-2008

nancial crisis and how Wall Street missed the bad

securities being issued backed by the subprime

mortgage-backed securities (MBS) that destroyed

more than $1 trillion in wealth.

Financial Engineering: The Evolution

of a Profession

AUTHOR: Tanya S. Beder

PAGES: 616

FORMAT: Hardcover, Kindle

WHY YOU SHOULD READ IT: Part of the Robert

W. Kolb Series in Finance, Tanya S. Beder has put

together a collection of articles by practitioners

and academics with a dedicated section on the

Financial Engineering degree. This book details

the different participants, developments, and

products of various markets—from xed income,

equity, and derivatives to foreign exchange. Case

studies from companies in different segments of

the industry, a glossary, and a companion website

offer additional information and support for those

interested in nancial engineering.

See more recommended reading at

QUANTNET MASTER READING

LIST FOR QUANTS.

READING LIST: Books about Financial Engineering

apply now: www.poly.edu/Fe2

+ M.S. in Financial Engineering

Diversied program spanning

four industry-focused tracks in:

Risk Finance; Computational Finance;

Technology and Algorithmic Finance;

Financial Markets and Corporate Finance.

Inquire about NYU-Poly’s one-year full-time program,

part-time programs or certicate programs.

Master of science

financial engineering

in a technology-intensive environMent

We give you a solid theoretical foundation. Then we show you how

to put it to practice. Our rigorous, top-tier master’s program will

teach you to solve the most complex problems facing nancial

engineers today and train you to be a leader in global nance.

+ Graduates gain careers as portfolio managers, traders and

quants in global rms like Goldman Sachs and the World Bank.

+ Ranked #8 by Social Science Research Network for

research downloads.

+ International exchanges available with leading universities

in Africa, Europe and Asia.

+ Campus in the heart of New York City’s nancial district.

+ Career services support from the NYU Wasserman Center

for Career Development.

+ International conferences and workshops held regularly.

+ Research Internship Grant Fund, dedicated to raising one million

dollars annually,allows deserving students to pursue research

projects for six months after graduation.

+ Key nancial technologies available to students including 12

Bloomberg terminalsas well as a FINCAD grant worth seven

milliondollars.

+ The rst curriculum to be certied by the International

Association of Financial Engineers.

+ The NYU-Poly M.S. in Financial Engineering was initiated

with the generous support of the Alfred P. Sloan Foundation

and was the second program of its kind, anywhere.

Bridge theory & Practice · gloBal outreach · excellence in research

QUANTNET | 2013-2014 GUIDE | quantnet.com28

How to Identify a Master

in Finance Program

Worth Attending

By Anthony

DeAngelis

ith the

increased

popularity of

specialized

graduate

degrees in nance (Finance

and Financial Engineering), I

have received countless emails,

all with the question “Is this

program worth attending?”

This is an important question

considering the cost, both in

time and money, that going back

to school entails. With the ever-

increasing number of programs

out there, potential applicants

should take into consideration

the following before making

their decision. These apply to

both domestic and international

students, but I will talk toward

the end about specic things to

look out for as an international

student.

1) What are your goals?

If your goal is to use the MSF/

MFE degree as your second

chance at breaking into

investment banking or trading,

then you have to pick a program

that has strong on-campus

recruiting and a history of

placement in this area. These

programs tend to have highly

ranked undergraduate business

programs and are located near

major metro areas. You can

gure out if a program is for

you by looking at their past

placement stats and seeing if

investment banks and other

trading shops come on campus

for recruiting.

If your goal is to study nance

and break into the nancial

industry, regardless of the

position, then you have a lot

more exibility. Look for schools

that are known in their region

or city, those with a wide range

of recruiting and alumni (front

ofce nance roles), or those

that allow you to work while

attending school. This will

give you the opportunity to

keep gaining experience while

increasing your knowledge and

skill set so that you can move up

in your career or laterally into

that nancial position you are

seeking.

2) Cohort program or

flexible class load?

A few universities offer a lock-

step cohort program. Everyone

takes the same classes at the

same time. Other programs

allow students to specialize

and customize their program. It

is important for you to decide

what kind of educational

experience you want.

A cohort program is the most

simple and direct way to go

about a master’s degree, and it

ensures everyone is qualied

and eligible for the widest

variety of nance roles. You also

build close friendships and a

connection with the campus

and university. The downside

is that you lose the exibility to

continued on page 29

QuantNet’s 2013-2014 International Guide to Programs in Financial Engineering | quantnet.com 29