Business Guide GPP Mass Payments DD

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 76

- 1 Introduction

- 2 Processing

- 2.1 Credit Transfer Process

- 2.1.1 Incoming File Handling

- 2.1.1.1 File Processing Workflow

- 2.1.1.2 File Parsing/Validations

- 2.1.1.3 Create Batch (Payment Information) Summary

- 2.1.1.4 File Department Selection

- 2.1.1.5 File Priority

- 2.1.1.6 File Duplicate Check

- 2.1.1.7 Validate Initiating Party

- 2.1.1.8 Incoming File Filter Rules

- 2.1.1.9 Split File to Processing Group (Chunks)

- 2.1.1.10 Business Flow Selection

- 2.1.2 Preprocessing Transactions

- 2.1.3 Payment Grouping (Sub Batch) Generation

- 2.1.3.1 Sub Batch Generation (S) Workflow

- 2.1.3.2 Debit Authorization

- 2.1.3.3 Rate Usage for Debit Side Conversion

- 2.1.3.4 Value Date

- 2.1.3.5 Debit Transaction Code

- 2.1.3.6 Credit Transaction Code

- 2.1.3.7 Fees (Sub Batch)

- 2.1.3.8 Debit Hold Until Time

- 2.1.3.9 Interface Selection

- 2.1.3.10 Stop Flag

- 2.1.3.11 Compliance Check

- 2.1.3.12 External FX (Lump Sum)

- 2.1.3.13 Posting Consolidation (First Leg)

- 2.1.3.14 Flow Management

- 2.1.4 Execution

- 2.1.5 Execute Individual

- 2.1.6 Execute Bulk Destination

- 2.1.7 Acknowledgment Reporting

- 2.1.8 Mass Payments Accounting

- 2.1.1 Incoming File Handling

- 2.2 Direct Debit Process

- 2.2.1 Incoming File Handling

- 2.2.1.1 File Processing Workflow

- 2.2.1.2 File Parsing/Validations

- 2.2.1.3 Create Batch (Payment Information) Summary

- 2.2.1.4 File Department Selection

- 2.2.1.5 File Priority

- 2.2.1.6 File Duplicate Check

- 2.2.1.7 Validate Initiating Party

- 2.2.1.8 Incoming File Filter Rules

- 2.2.1.9 Split File to Processing Group (Chunks)

- 2.2.1.10 Business Flow Selection

- 2.2.2 Preprocessing Transactions

- 2.2.3 Payment Grouping (Sub Batch) Generation

- 2.2.3.1 Sub Batch Generation (S) Workflow

- 2.2.3.2 Rate Usage for Debit Side Conversion

- 2.2.3.3 Value Date

- 2.2.3.4 Debit Transaction Code

- 2.2.3.5 Credit Transaction Code

- 2.2.3.6 Fees (Sub Batch)

- 2.2.3.7 Debit Hold Until Time

- 2.2.3.8 Interface Selection

- 2.2.3.9 Stop Flag

- 2.2.3.10 Compliance Check

- 2.2.3.11 External FX (Lump Sum)

- 2.2.3.12 Posting Consolidation (Credit Side)

- 2.2.3.13 Flow Management

- 2.2.4 Execution

- 2.2.5 Execute Individual

- 2.2.6 Execute Bulk Destination

- 2.2.7 Acknowledgment Reporting

- 2.2.8 Compensation Calculation

- 2.2.9 Mandate Management, Validation & Enrichment

- 2.2.1 Incoming File Handling

- 2.1 Credit Transfer Process

- 3 Manual Handling

- 4 Business Setup

- 4.1 Profiles

- 4.2 Rules

- 4.2.1 Advising Type Selection Rules

- 4.2.2 Batch Validation

- 4.2.3 Bulking Sending Time Rules

- 4.2.4 File Department Rule

- 4.2.5 File Priority Rules

- 4.2.6 Incoming File Filter Rules

- 4.2.7 Parties Bulking Profile Selections Rules

- 4.2.8 Sub-Batch Filter Rules

- 4.2.9 Fee Type Selection Rule/Fee Formula Selection Rule

- 4.2.10 Mandate Validation Rules

- Appendix A: Mass Payment File Header

- Appendix B: STP Validation Error Statuses

- Appendix C: Flow Legend

- Appendix D: Glossary

Global PAYplus Version 4.6.3

Mass Payments

Business Guide

Copyright

© 2009-2016 D+H Global Transaction Banking Solutions. All rights reserved. D+H is a trademark of D+H Limited

Partnership.

PROPRIETARY AND CONFIDENTIAL - This document contains information, which contains Confidential and

Know How property of D+H. Disclosure to or use by persons who are not expressly authorized in writing by D+H

is strictly prohibited.

D+H reserves the right to alter the specifications and descriptions in this publication without prior notice. No part

of this publication shall be deemed to be part of any contract or warranty unless specifically incorporated by

reference into such contract or warranty.

All brand or product names are the trademarks or registered trademarks of their respective holders.

The information contained herein is merely descriptive in nature, and does not constitute a binding offer for the

license of the product described herein.

Catalog ID: GPP4.6-00-B23-03-201606

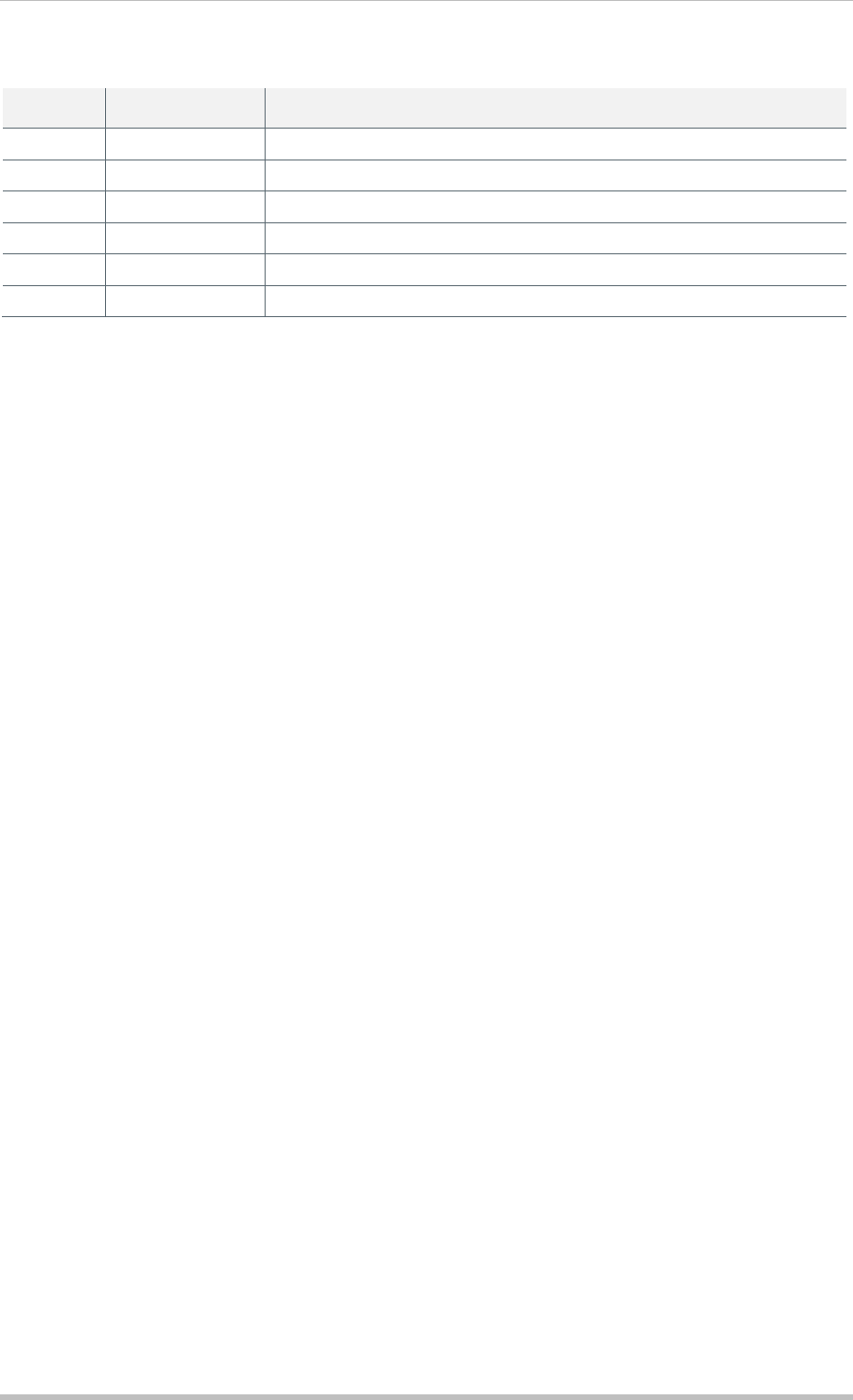

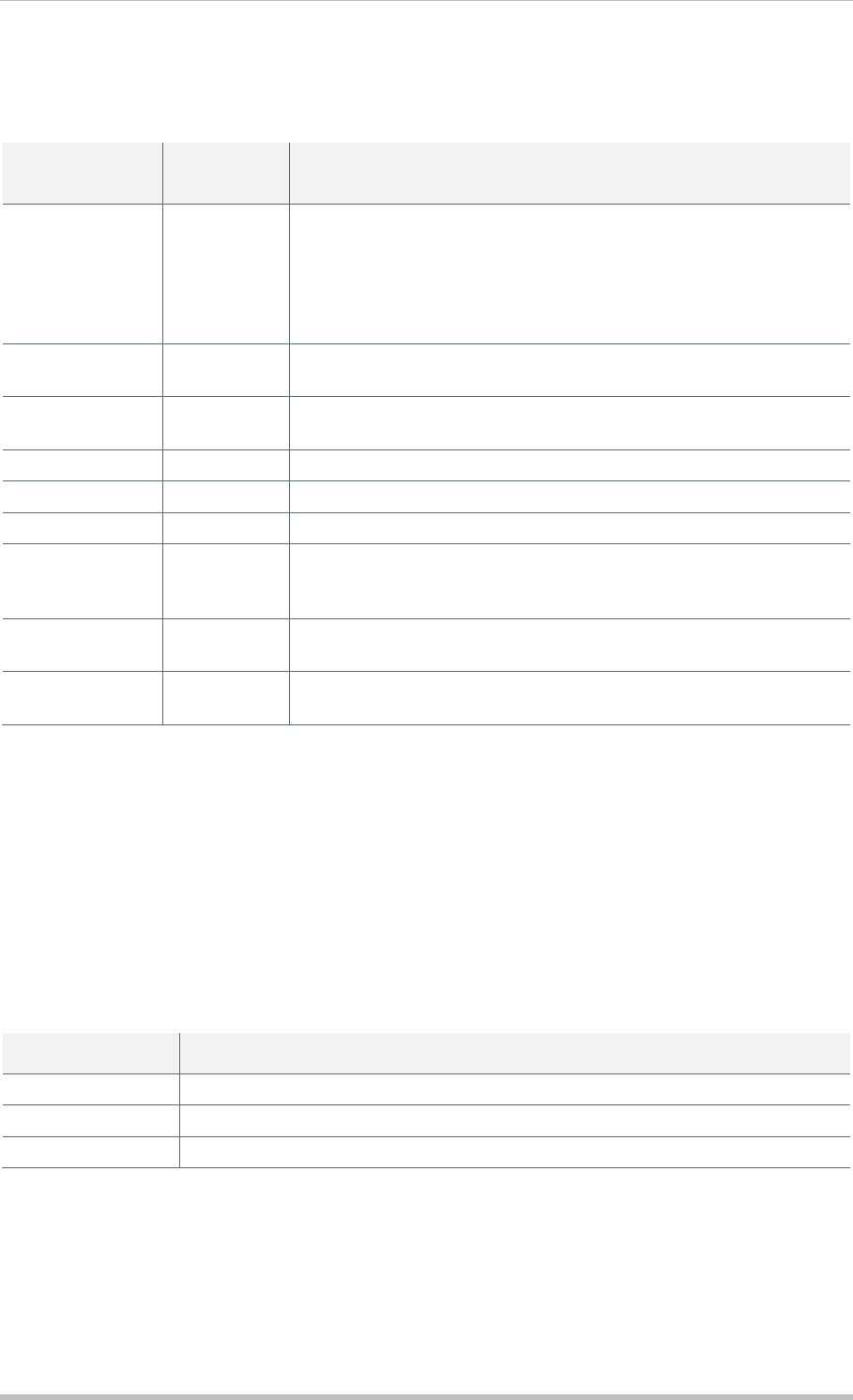

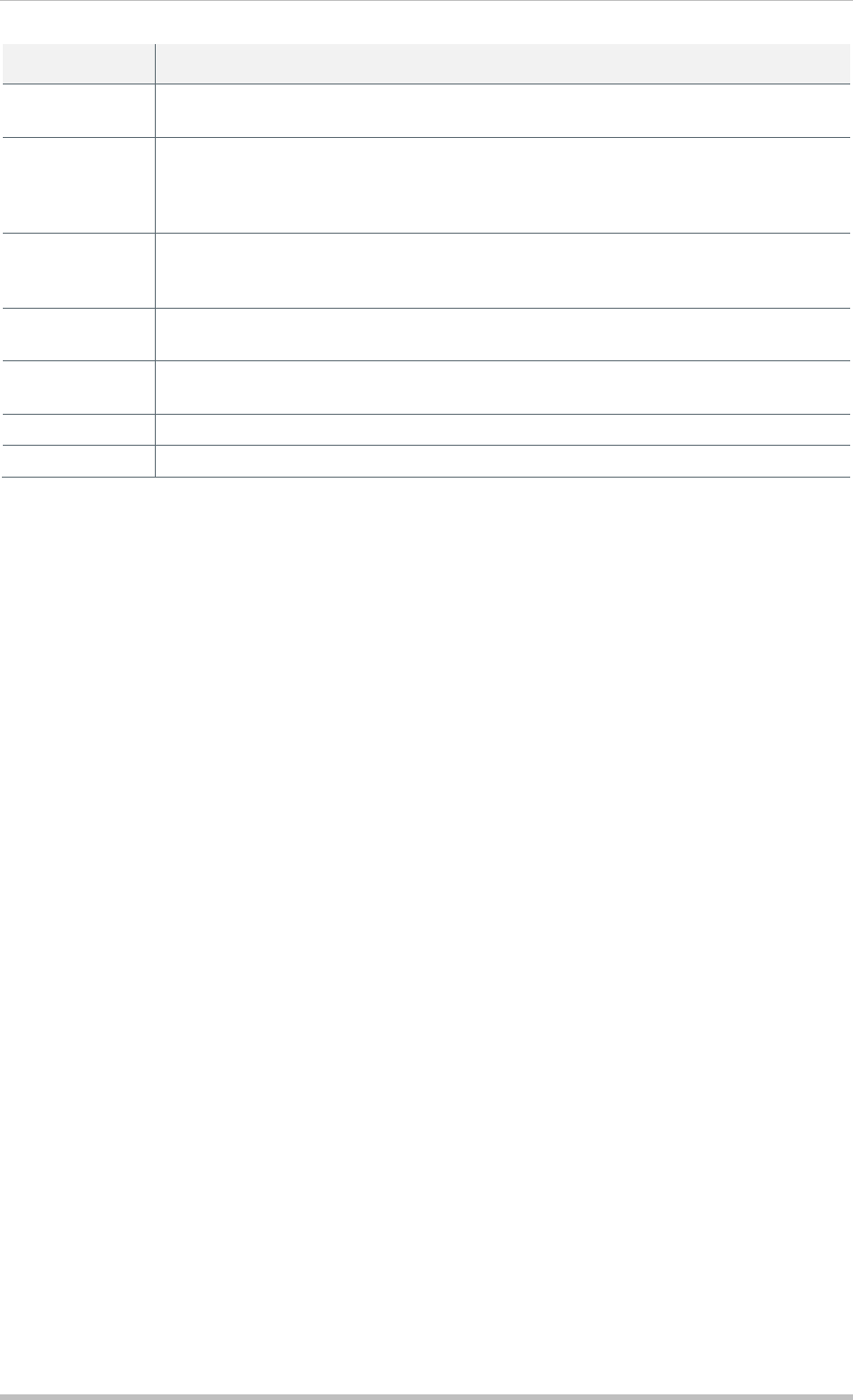

Mass Payments Version Control

Global PAYplus Business Guide Page 3

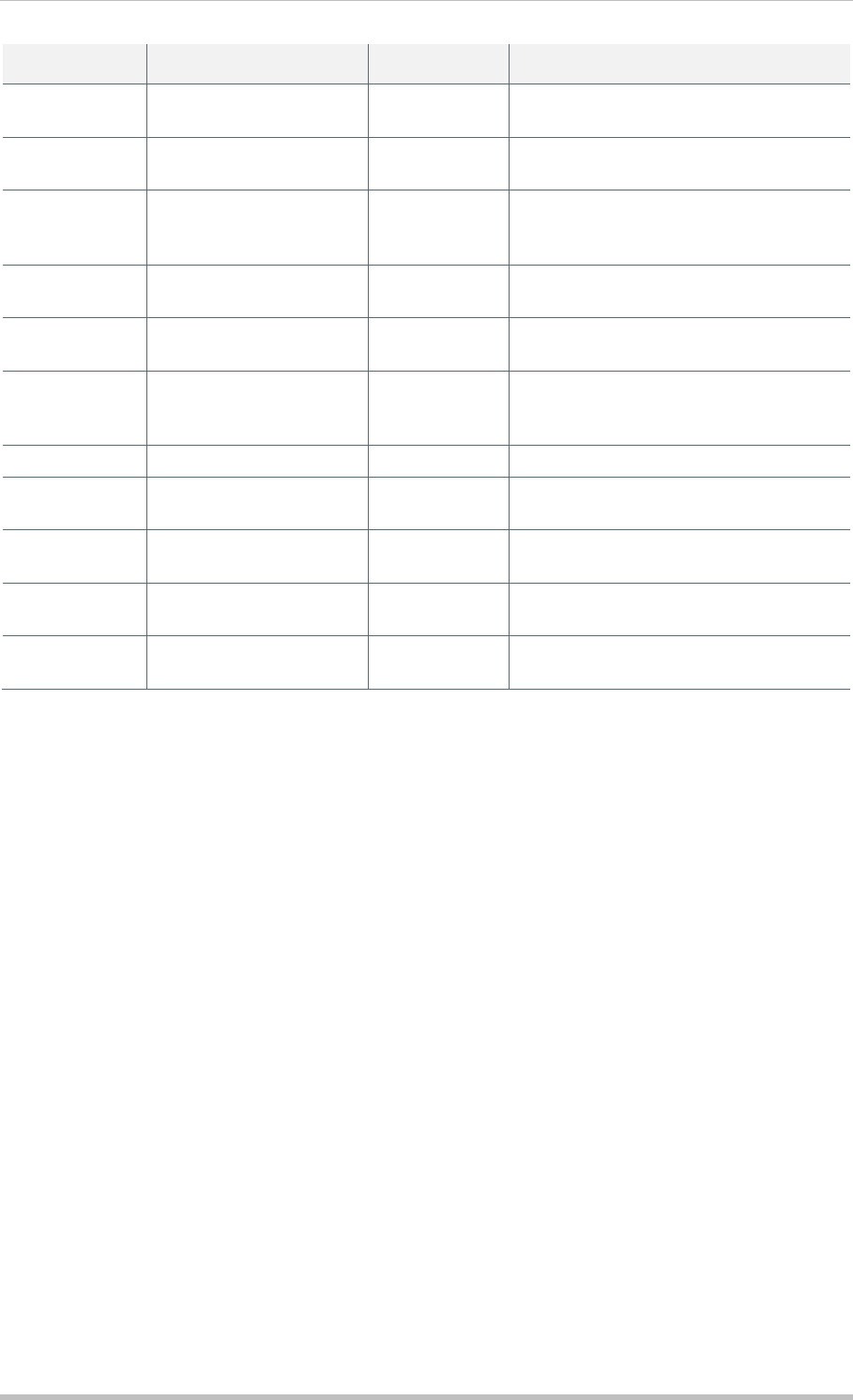

Version Control

Version

Date

Summary of Changes

1.0

Document Created

2.0

August 2015

New structure and amended contents

3.0

November 2015

Updated for rebranding

Mass Payments Table of Contents

Global PAYplus Business Guide Page 4

Table of Contents

1 INTRODUCTION .......................................................................................................................... 6

1.1 Overview ............................................................................................................................... 6

1.2 Mass Payments File Levels .................................................................................................. 6

1.3 Message Types ..................................................................................................................... 7

1.3.1 Payment Initiation .............................................................................................................. 7

1.3.2 Payment Clearing and Settlement .................................................................................... 7

1.3.3 Exceptions and Investigations ........................................................................................... 8

1.3.4 Bank to Customer Cash Management .............................................................................. 8

1.3.5 Credit Transfer R Messages ............................................................................................. 8

1.3.6 Direct Debit R Messages ................................................................................................... 9

1.3.7 Mixed Files ........................................................................................................................ 9

1.4 GPP Message Types Terminology ....................................................................................... 9

2 PROCESSING ........................................................................................................................... 11

2.1 Credit Transfer Process ...................................................................................................... 11

2.1.1 Incoming File Handling .................................................................................................... 11

2.1.2 Preprocessing Transactions ............................................................................................ 14

2.1.3 Payment Grouping (Sub Batch) Generation ................................................................... 21

2.1.4 Execution ......................................................................................................................... 25

2.1.5 Execute Individual ........................................................................................................... 26

2.1.6 Execute Bulk Destination ................................................................................................ 27

2.1.7 Acknowledgment Reporting ............................................................................................ 29

2.1.8 Mass Payments Accounting ............................................................................................ 30

2.2 Direct Debit Process ........................................................................................................... 31

2.2.1 Incoming File Handling .................................................................................................... 31

2.2.2 Preprocessing Transactions ............................................................................................ 35

2.2.3 Payment Grouping (Sub Batch) Generation ................................................................... 45

2.2.4 Execution ......................................................................................................................... 48

2.2.5 Execute Individual ........................................................................................................... 50

2.2.6 Execute Bulk Destination ................................................................................................ 51

2.2.7 Acknowledgment Reporting ............................................................................................ 53

2.2.8 Compensation Calculation .............................................................................................. 53

2.2.9 Mandate Management, Validation & Enrichment ............................................................ 55

3 MANUAL HANDLING ................................................................................................................ 58

3.1 Manual Repair ..................................................................................................................... 58

3.2 Manual Repair Accounting .................................................................................................. 58

3.3 Manual Cancellation ........................................................................................................... 58

3.3.1 Incoming File Cancellation .............................................................................................. 58

3.3.2 Incoming Batch Cancellation ........................................................................................... 59

3.3.3 Incoming Transaction Cancellation and Reversal ........................................................... 60

3.4 GPP Mass Payments User Interface .................................................................................. 61

3.4.1 File Summary .................................................................................................................. 61

3.4.2 Batch Summary ............................................................................................................... 62

3.4.3 Pending Outgoing Files Summary................................................................................... 63

3.4.4 Pending Outgoing File ..................................................................................................... 63

3.4.5 Transaction Data ............................................................................................................. 63

Mass Payments Table of Contents

Global PAYplus Business Guide Page 5

4 BUSINESS SETUP .................................................................................................................... 64

4.1 Profiles ................................................................................................................................ 64

4.1.1 Accounts Profile............................................................................................................... 64

4.1.2 Batch Control Profile ....................................................................................................... 64

4.1.3 Bulking Profile.................................................................................................................. 64

4.1.4 Direct Debits .................................................................................................................... 65

4.1.5 Override STP Profiles ...................................................................................................... 66

4.1.6 Interest Rates Profile ....................................................................................................... 66

4.1.7 Interest Types Profile ...................................................................................................... 67

4.1.8 Method of Payment Profile .............................................................................................. 67

4.1.9 Parties Profile .................................................................................................................. 67

4.2 Rules ................................................................................................................................... 68

4.2.1 Advising Type Selection Rules ........................................................................................ 68

4.2.2 Batch Validation............................................................................................................... 68

4.2.3 Bulking Sending Time Rules ........................................................................................... 68

4.2.4 File Department Rule ...................................................................................................... 68

4.2.5 File Priority Rules ............................................................................................................ 68

4.2.6 Incoming File Filter Rules ................................................................................................ 69

4.2.7 Parties Bulking Profile Selections Rules ......................................................................... 69

4.2.8 Sub-Batch Filter Rules .................................................................................................... 70

4.2.9 Fee Type Selection Rule/Fee Formula Selection Rule ................................................... 70

4.2.10 Mandate Validation Rules ............................................................................................... 70

APPENDIX A: MASS PAYMENT FILE HEADER ................................................................................ 71

APPENDIX B: STP VALIDATION ERROR STATUSES ..................................................................... 73

APPENDIX C: FLOW LEGEND ........................................................................................................... 74

APPENDIX D: GLOSSARY .................................................................................................................. 75

Mass Payments Introduction

Global PAYplus Business Guide Page 6

1 Introduction

Note: This Business Guide is currently being certified for GPP V4.5; therefore, there may be

amendments in the future. For more information, please contact your D+H Project Manager.

1.1 Overview

Global PAYplus (GPP) Mass Payments enables Financial Institutions (FI) to receive, process, and

send files that contain multiple payment, collection, and related transactions.

The GPP Mass Payments functionality:

Receives files that contain multiple transactions from clients, clearing partners/partner banks and

clearing systems

Distributes transactions into chunks (manageable groups) and handles the chunks simultaneously

using parallel processing

Generates single or consolidated postings

Generates outgoing files

GPP supports the following Mass Payment Instruments:

Credit Transfer: An initiating party (debtor) sends payment instructions to the bank ordering the

transfer of funds from a debtor account to a creditor account. In a mass payment scenario, the FI

receives a file containing multiple credit transactions. The transactions instruct the FI to transfer

funds from a single debtor account to multiple creditor accounts held at clearing participant FIs.

For example, a company pays employee salaries using monthly mass payment credit transfers.

After processing to completion, the company’s account is debited for the total amount of all

transactions and each employee’s bank account is credited for the amount specified in the

relevant individual transaction at the relevant bank.

Direct Debit: An initiating party (creditor) sends collection instructions to the bank requesting the

transfer of funds from a debtor account to a creditor account. In a mass payment scenario, the

initiating party, such as a FI customer or clearing partner, sends a file containing multiple direct

debit transactions. The transactions instruct the FI to collect funds from multiple debtor accounts,

held at clearing participant banks, and credit a single creditor account.

For example, a utility company, bills its customers using a monthly mass payment direct debit.

After processing to completion, the company’s account is credited for the total amount of all

transactions and each customer bank account is debited for the amount specified in the relevant

individual transaction.

To process a direct debit, a valid mandate must exist between a debtor and creditor. Authorized

GPP users can create and manage mandates using Mandate profiles in the GPP GUI. For

information about mandates, see Direct Debit Mandate Management.

Upon receipt of a direct debit, GPP verifies that a valid mandate exists by implementing the Direct

Debit Mandate Validation processing. For information about the service, see Mandate Validation.

R Messages: GPP supports all R messages including Reject, Return, and Recall. For more

information, see Credit Transfer R Messages and Direct Debit R Messages.

1.2 Mass Payments File Levels

GPP supports the following file levels:

Bulk: GPP processes one bulk (one group header) per file and stores it in the File Summary.

Payment Information (Batch): Each bulk can have one or multi payment information (PaymentInf)

Mass Payments Introduction

Global PAYplus Business Guide Page 7

Individual: Each payment information contains one or multi individual transactions.

Bulk, payment information and individual transactions are visible in the GPP User Interface (UI).

1.3 Message Types

GPP Mass Payments supports both credit transfers and direct debits. Both message types, based on

ISO20022 standards, can be exchanged between the following parties:

Initiating Party and Financial Institution (FI): Messages exchanged between an initiating party

(usually a bank customer) and a financial institution (a bank) are usually in Payment Initiation

(pain) format. A pain message can be either a credit transfer (pain.001) or direct debit (pain.008).

Financial Institutions (FI): Messages exchanged between two financial institutions (a bank and

a CSM) are usually in Payment Clearing and Settlement (pacs) format.

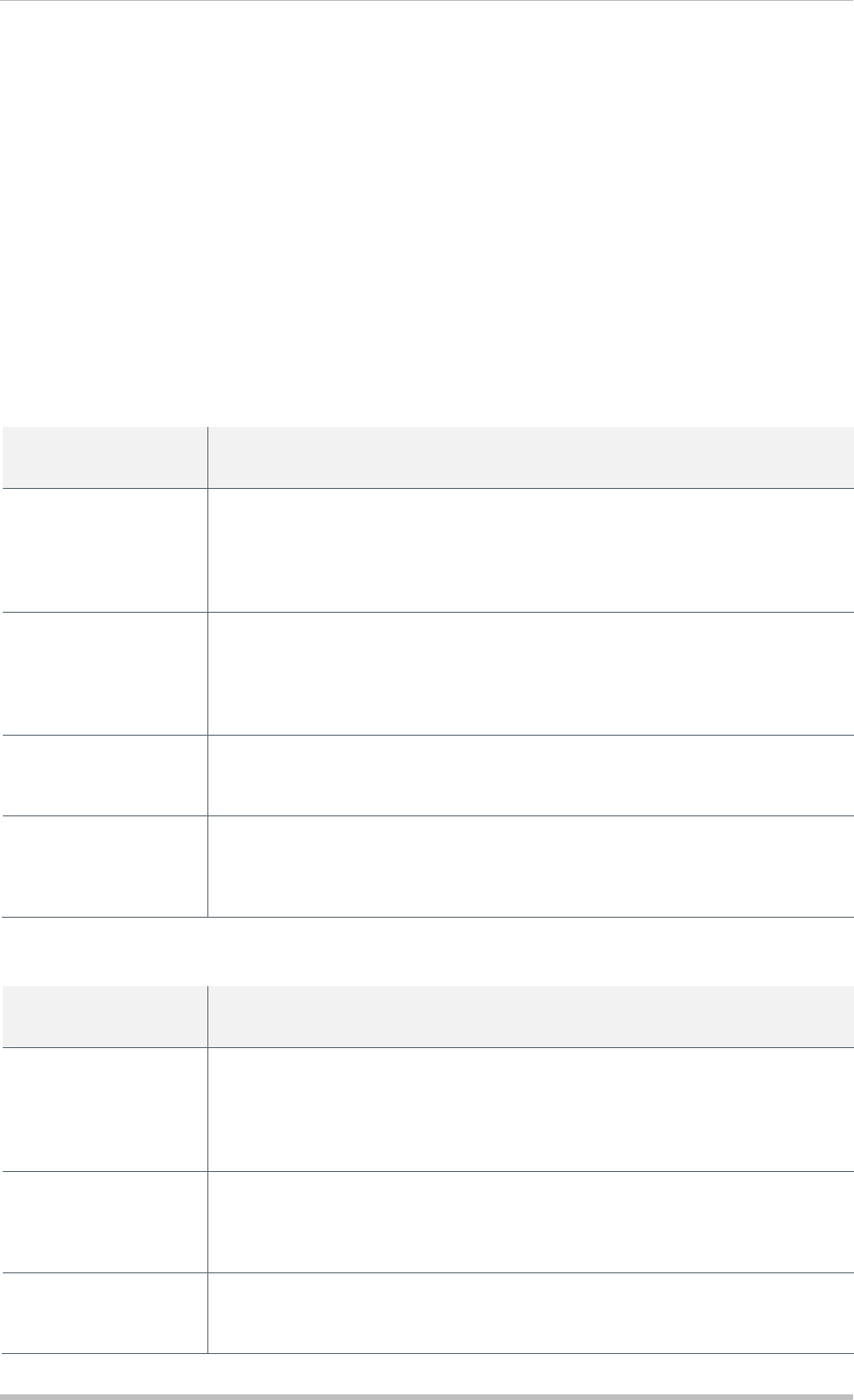

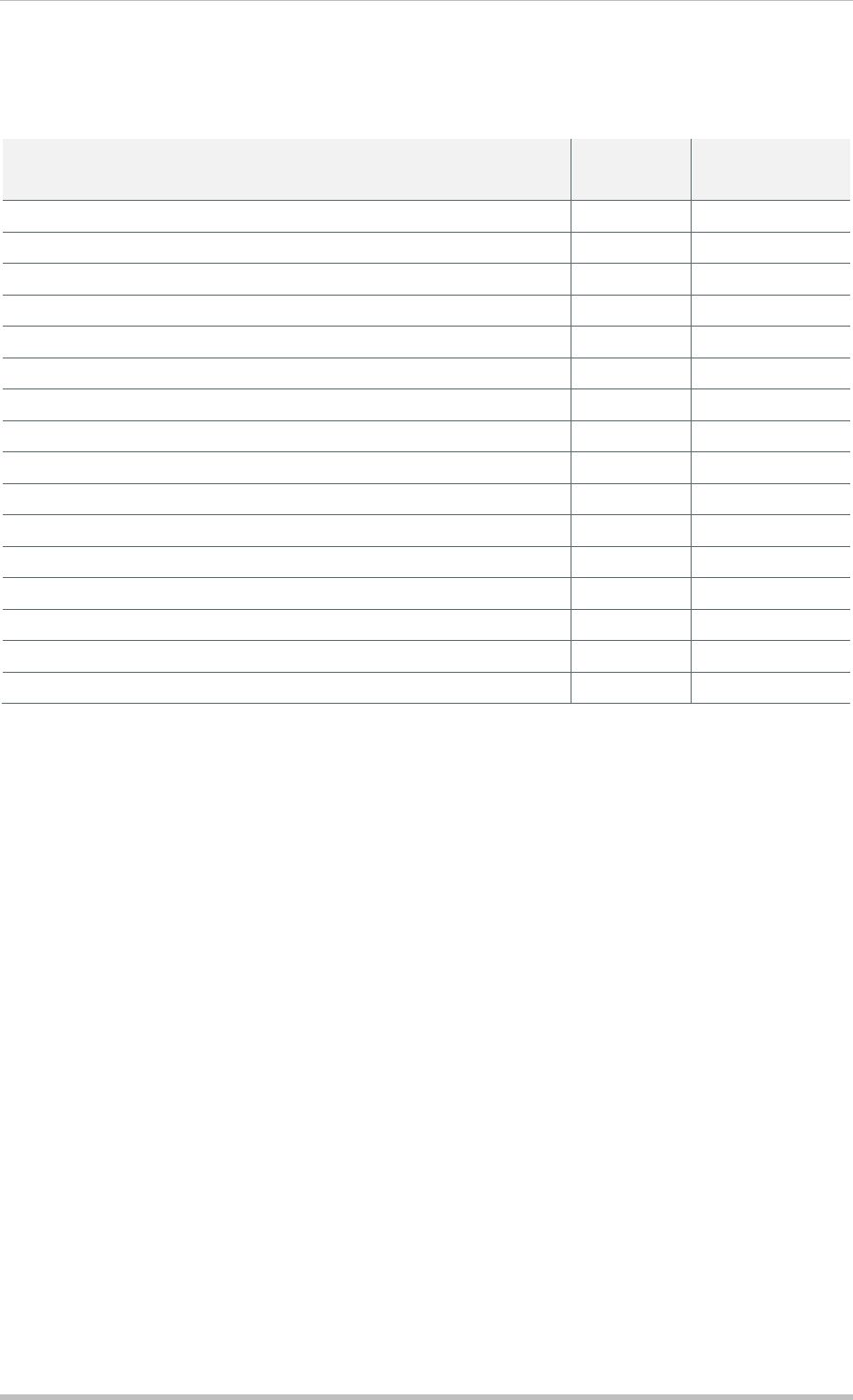

1.3.1 Payment Initiation

Message

Type

Description

pain.001

Customer Credit Transfer Initiation

This message is sent by the initiating party to the forwarding agent or

debtor agent. It is used to request movement of funds from the debtor

account to a creditor. It can contain one or more customer credit transfer

instructions.

pain.002

Customer Payment Status Report

This message is sent by an instructed agent to the previous party in the

payment chain. It is used to inform this party about the positive or negative

status of an instruction (either single or file). It is also used to report on a

pending instruction.

pain.007

Customer Payment Reversal

This message is sent by the initiating party to the next party in the payment

chain. It is used to reverse a payment previously executed.

pain.008

Customer Direct Debit Initiation

This message is sent by the initiating party to the forwarding agent or

creditor agent. It is used to request single or bulk collection(s) of funds from

one or various debtor's account(s) for a creditor.

1.3.2 Payment Clearing and Settlement

Message

Type

Description

pacs.002

FI To FI Payment Status Report

This message is sent by an instructed agent to the previous party in the

payment chain. It is used to inform this party about the positive or negative

status of an instruction (either single or file). It is also used to report on a

pending instruction.

pacs.003

FI To FI Customer Direct Debit

This message is sent by the creditor agent to the debtor agent, directly or

through other agents and/or a payment clearing and settlement system. It

is used to collect funds from a debtor account for a creditor.

pacs.004

Payment Return

This message is sent by an agent to the previous agent in the payment

chain to undo a payment previously settled.

Mass Payments Introduction

Global PAYplus Business Guide Page 8

Message

Type

Description

pacs.007

FI To FI Payment Reversal

This message is sent by an agent to the next party in the payment chain. It

is used to reverse a payment previously executed.

pacs.008

FI To FI Customer Credit Transfer

This message is sent by the debtor agent to the creditor agent, directly or

through other agents and/or a payment clearing and settlement system. It

is used to move funds from a debtor account to a creditor.

1.3.3 Exceptions and Investigations

Message

Type

Description

camt.029

Resolution Of Investigation

This message is sent by a case assignee to a case creator/case assigner.

It is used to inform of the resolution of a case, and optionally provides

details about:

the corrective action undertaken by the case assignee

information on the return where applicable

camt.056

FI To FI Payment Cancellation Request

This message is sent by a case creator/case assigner to a case assignee.

It is used to request the cancellation of an original payment instruction. It is

exchanged between the instructing agent and the instructed agent to

request the cancellation of an interbank payment previously sent.

1.3.4 Bank to Customer Cash Management

Message

Type

Description

camt.054

Bank To Customer Debit Credit Notification

This message is sent by the account servicer to an account owner or to a

party authorized by the account owner to receive the message. It can be

used to inform the account owner, or authorized party, of single or multiple

debit and/or credit entries reported to the account.

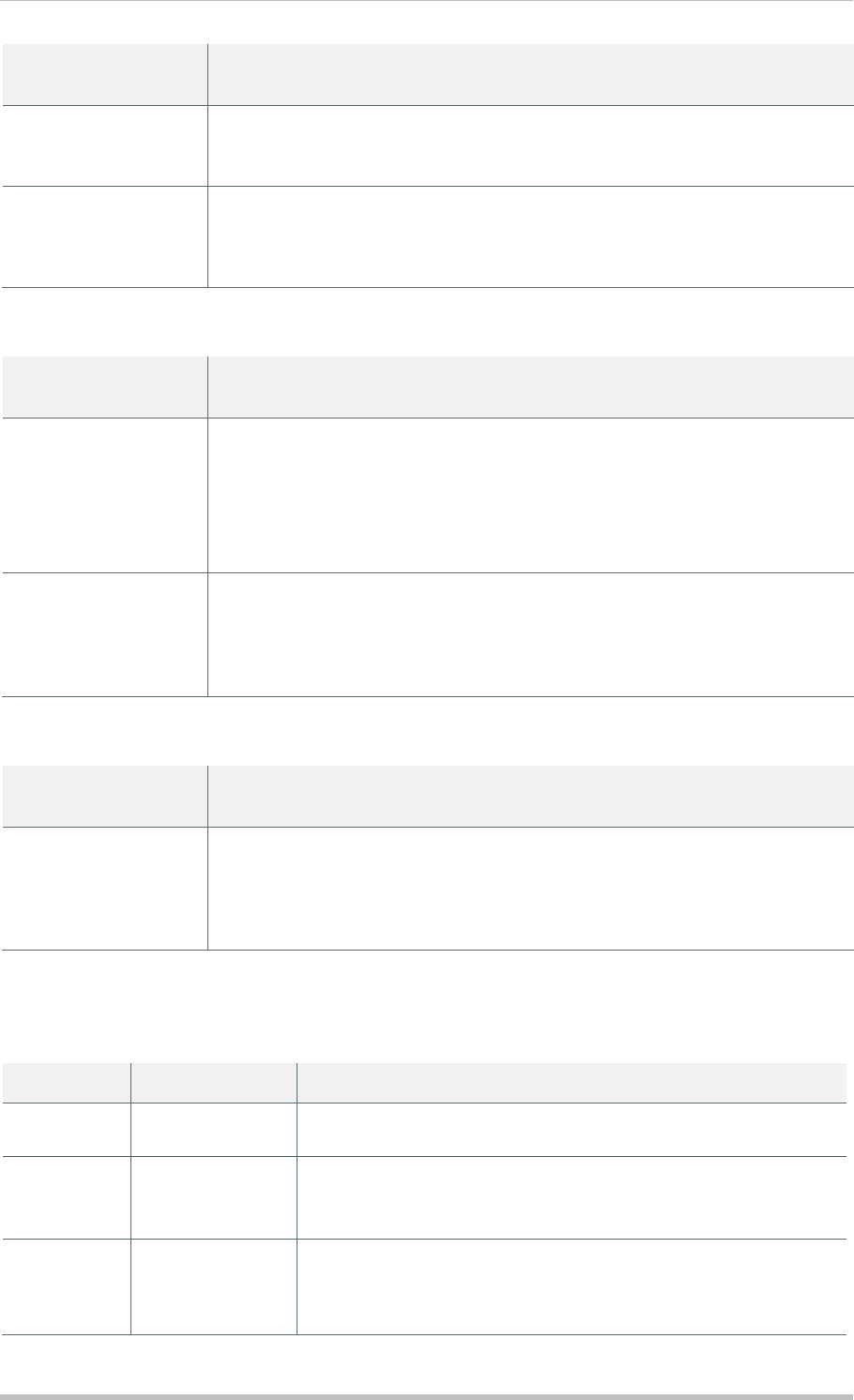

1.3.5 Credit Transfer R Messages

GPP supports these Credit Transfer R messages.

R-Message

Initiating Party

Description

Recall

Debtor Bank

A debtor bank requests to cancel a previously transmitted

credit transfer.

Rejection

Creditor Bank

A creditor bank rejects a transaction received from an initiating

party, such as a bank customer. The rejection is sent to CSM

which in turn is sent back to the debtor bank.

Return

Creditor Bank

A creditor bank approves a recall message received from a

debtor bank, which results in the generation of a return

message. In addition, a creditor bank returns a received post-

settlement transaction that cannot be processed to completion.

Mass Payments Introduction

Global PAYplus Business Guide Page 9

R-Message

Initiating Party

Description

Recall

Rejection

Creditor Bank

A creditor bank rejects a recall message received from a debtor

bank, which results in the generation of a recall rejection

message. A debtor bank receives a recall rejection as a

negative response for a recall message.

1.3.6 Direct Debit R Messages

GPP supports the following categories of R messages:

Pre-Settlement: The R message is sent before the transaction is settled in the ACH.

Post-Settlement: The R message is sent after a transaction is settled in the ACH.

Settlement

Date

R Message

Initiating

Party

Description

Pre-Settlement

Cancellation

Creditor

Bank

A creditor bank requests to cancel a previously sent

direct debit message by sending a cancellation

message to the ACH.

Pre-Settlement

Rejection

Debtor

Bank

A debtor bank rejects a direct debit message

received from a creditor bank by sending a rejection

message to the ACH.

Pre-Settlement

Refusal

Debtor

Bank

A debtor bank refuses to honor a direct debit

message by sending a refusal message to the ACH.

A debtor bank can refuse to honor a direct debit for a

reason such as an invalid mandate.

Post-Settlement

Reversal

Creditor

Bank

A creditor bank generates a reversal after

determining that a payment was received due to an

invalid direct debit message.

Post-Settlement

Return

Debtor

Bank

A debtor bank returns a direct debit message to a

creditor bank for a reason such as insufficient funds

in the debtor account.

Post-Settlement

Refund

Debtor

Bank

A debtor bank requests a refund from a creditor after

transaction settlement when the debtor disagree to

the direct debit.

1.3.7 Mixed Files

GPP supports mixed file processing for both incoming and outgoing files. A mixed file is a file that

contains both credit transfers and direct debit messages (in addition to related transactions, such as

return messages) in a single file. A mixed file can contain either PAIN or PACS messages, but not

both.

1.4 GPP Message Types Terminology

During GPP mass payment processing, GPP generates the following messages for different purposes

like posting, advising, etc. These message types are used in GPP terminology and during the MP BG

descriptions.

Mass Payments Introduction

Global PAYplus Business Guide Page 10

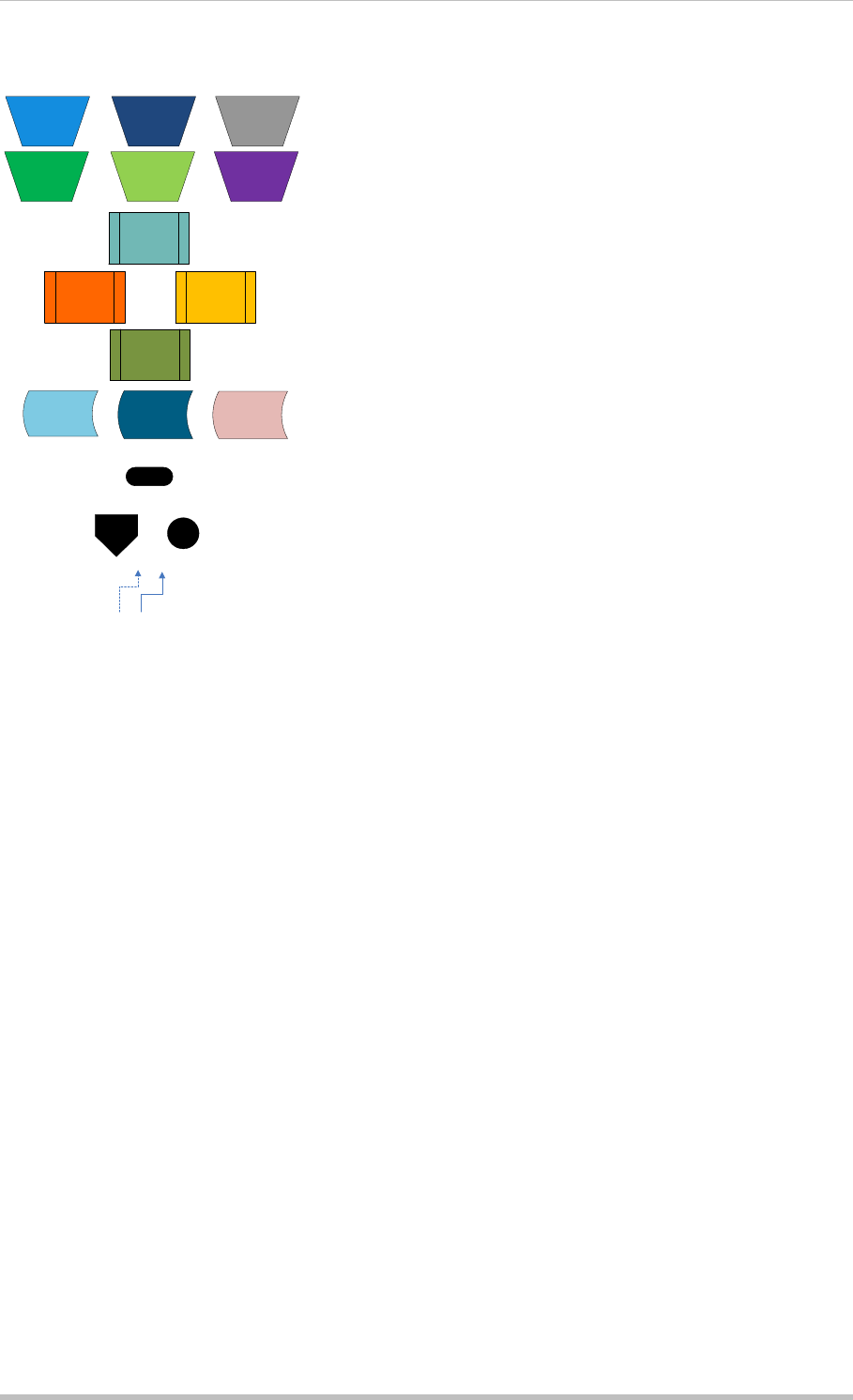

These messages can be one of the following types:

Type

Message

Details

I

Individual

GPP generates I payment for an individual transaction that was

received in a bulk.

S

Sub-Batch

GPP generates S payment for consolidated payments that share

common attributes like account, request date.

R

R-messages

GPP generates an Individual R payment for rejection, reversal,

recall, refund, return.

A

Aggregation

GPP generates an A payment for the consolidated payments sent

out in a file.

F

Funding

GPP generates an F payment for Inter-office transaction, when the

initiating office differs from the destination office, but both are in

GPP.

RF

Reverse Funding

GPP generates an RF message to reverse F message.

RS

Reverse Sub-Batch

GPP generates an RS message to reverse S message.

Mass Payments Processing

Global PAYplus Business Guide Page 11

2 Processing

This section provides details of the end to end GPP processes describing each step in the Mass

Payments flow. GPP processes incoming and outgoing credit and debit files and R messages.

Note: For a description of the legend used in all the workflows, see Appendix C: Flow Legend.

2.1 Credit Transfer Process

2.1.1 Incoming File Handling

GPP receives and processes incoming files that contain transaction messages.

Processing begins upon the receipt of a mass payment file, such as a file containing pain.001 or

pain.008 messages.

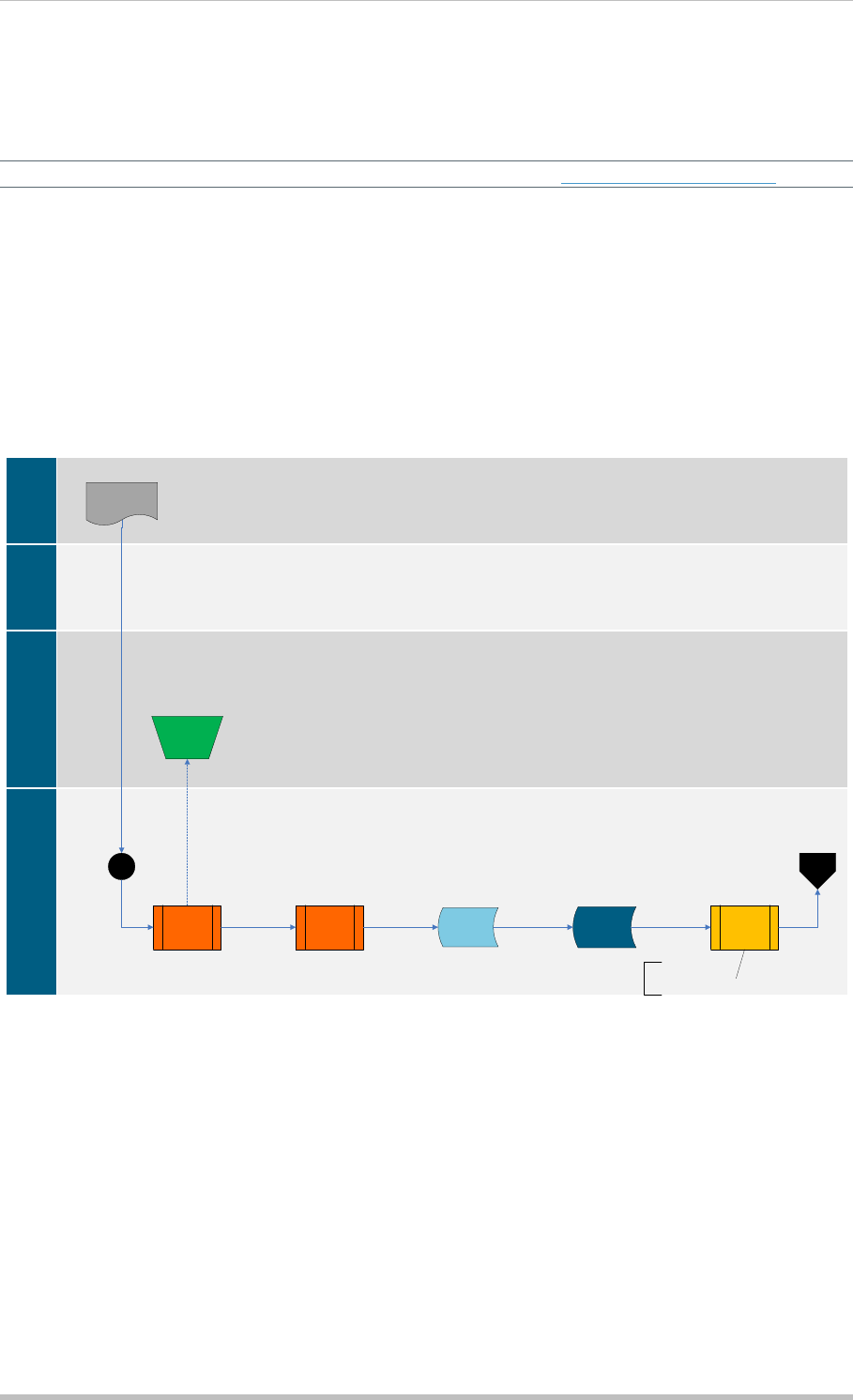

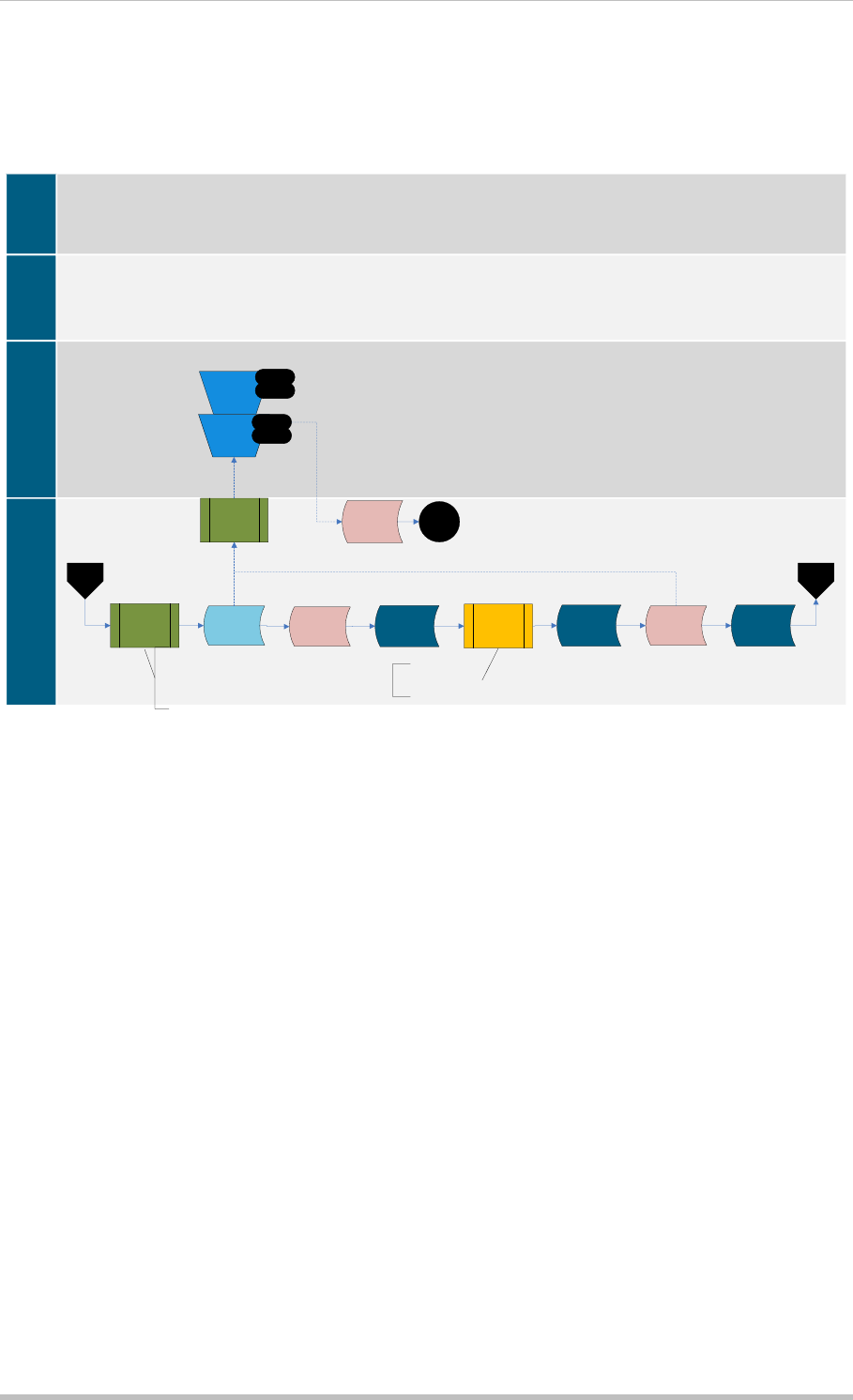

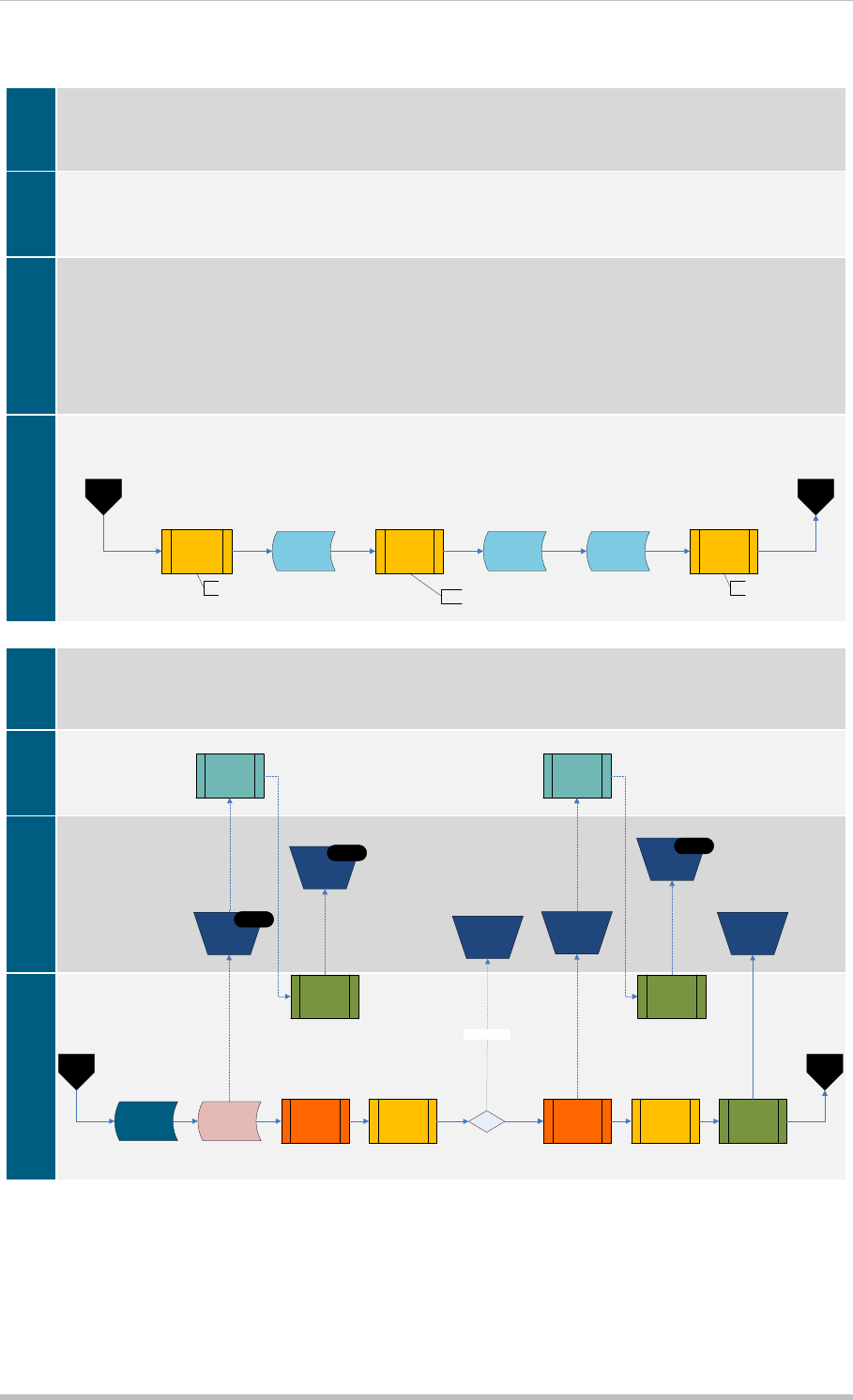

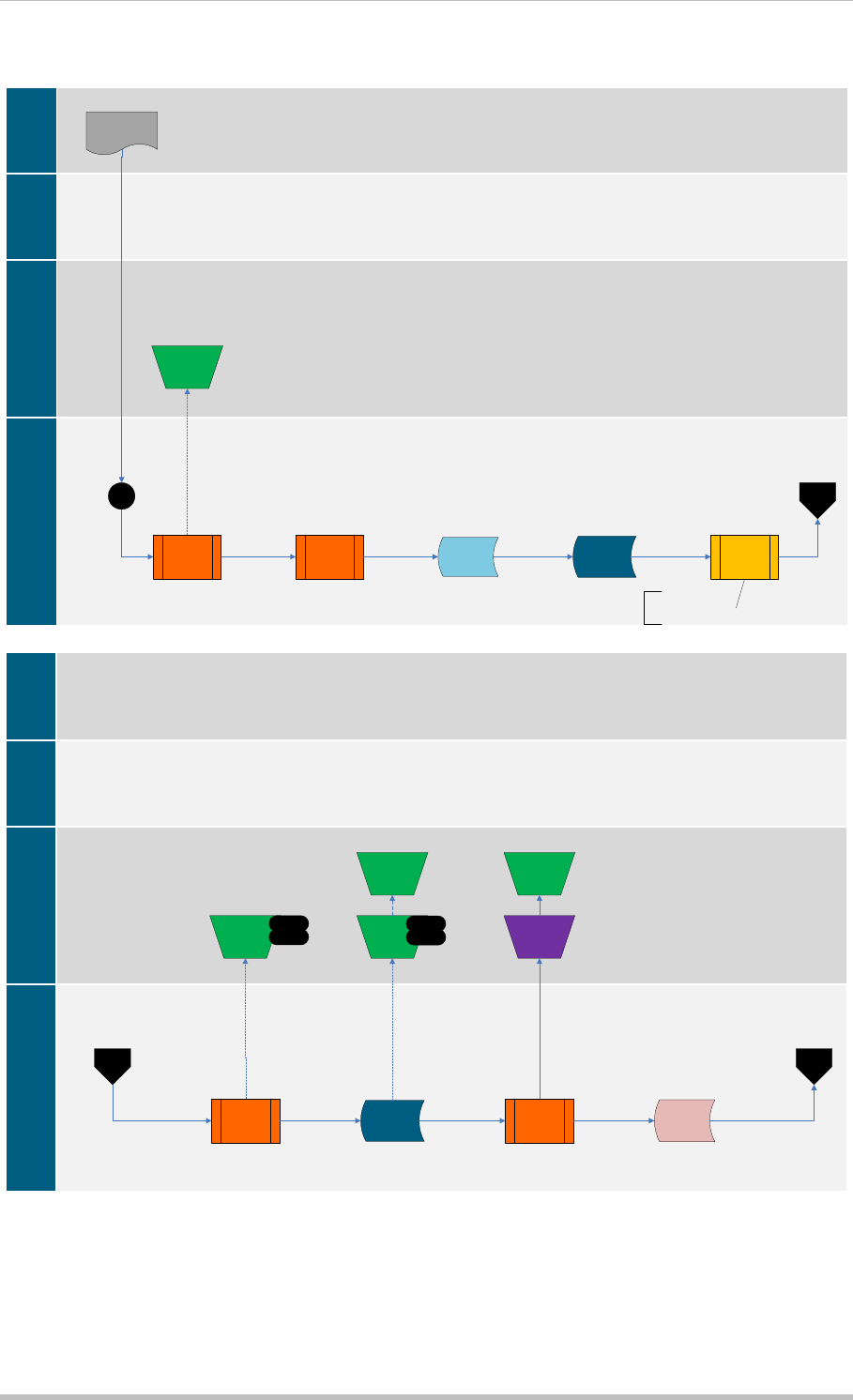

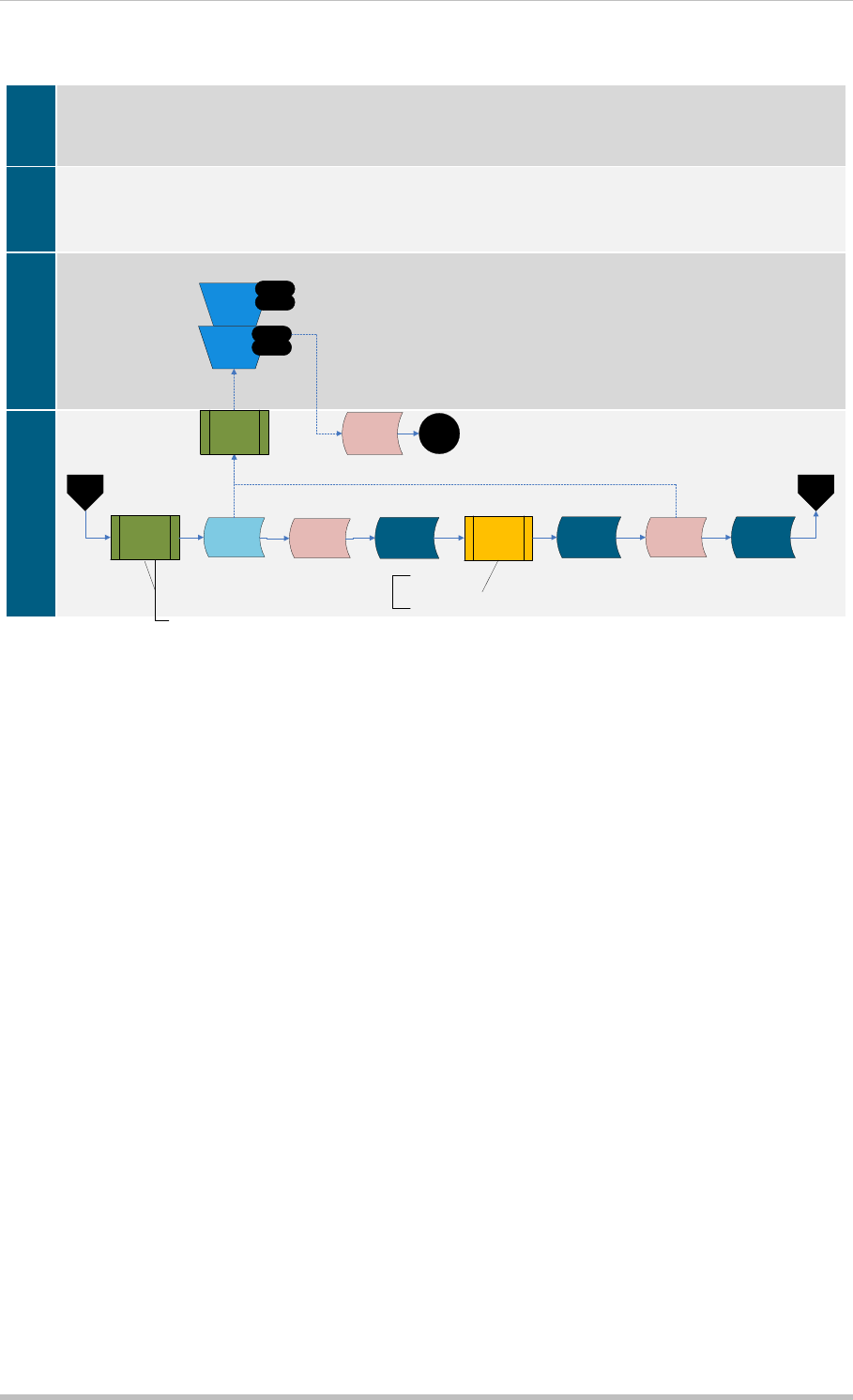

2.1.1.1 File Processing Workflow

File Processing

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 3 of 35

Start

File

File Parsing/

Validations

Rejected

File Priority File

Duplicate

Check

MatchingCheckService

Sub Type = Orig

File^Duplicate

File

Department

Selection

Create

Batch

Summary

Cont

Mass Payments Processing

Global PAYplus Business Guide Page 12

2.1.1.2 File Parsing/Validations

When GPP receives a mass payments file, GPP:

Parses the file to bulks and validates the format and contents of the file.

o If parsing fails, GPP rejects the file

o If parsing is successful, GPP continues to process the file

Assigns a unique file ID to each received file and registers the file in the File Summary.

Checks that the initiating party (the party who sent the mass payment file) is a customer of the FI.

GPP continues processing a mass payment file only if all file validations succeed.

If an incoming file does not pass file validation, GPP generates a file-level error and does not continue

processing the file. GPP can also generate a payment status report file and send it to the initiating

party to indicate that the file was rejected. The report file includes a reason for the file rejection. For

more information, see Acknowledgment Reporting

2.1.1.3 Create Batch (Payment Information) Summary

Each incoming file received from a customer can contain multiple batches. GPP delimit the batches

by specific parameters, for example:

Debtor Account ID (for credit transfer files)

Execution Date/Due Date

GPP determines specific batch processing preferences using the following:

Batch Control Profile: Enables a bank to define specific file processing preferences for each

batch in an incoming file. For more information, see Batch Control Profile.

Incoming File: Can contain specific batch processing instructions such as batch booking

indicator.

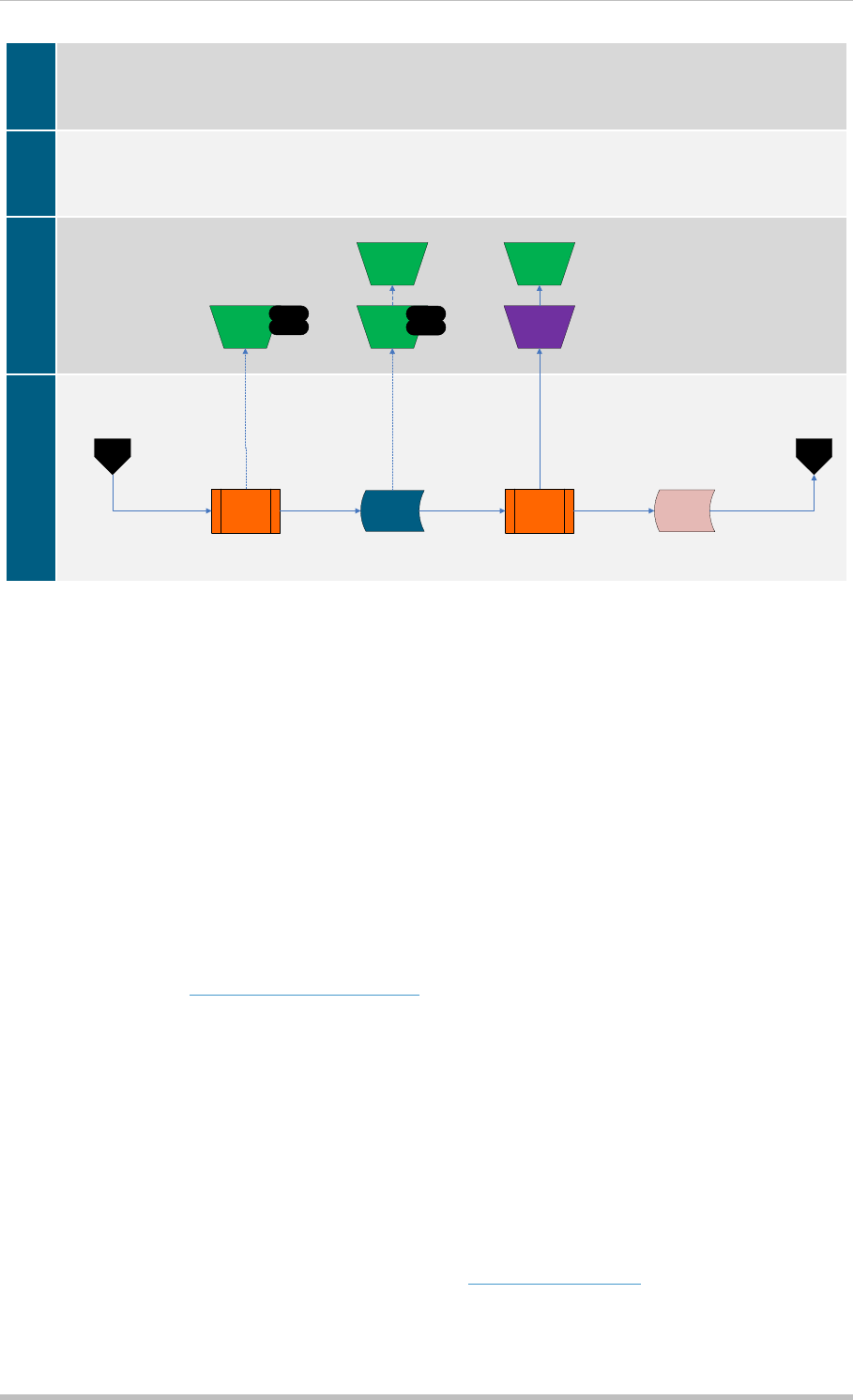

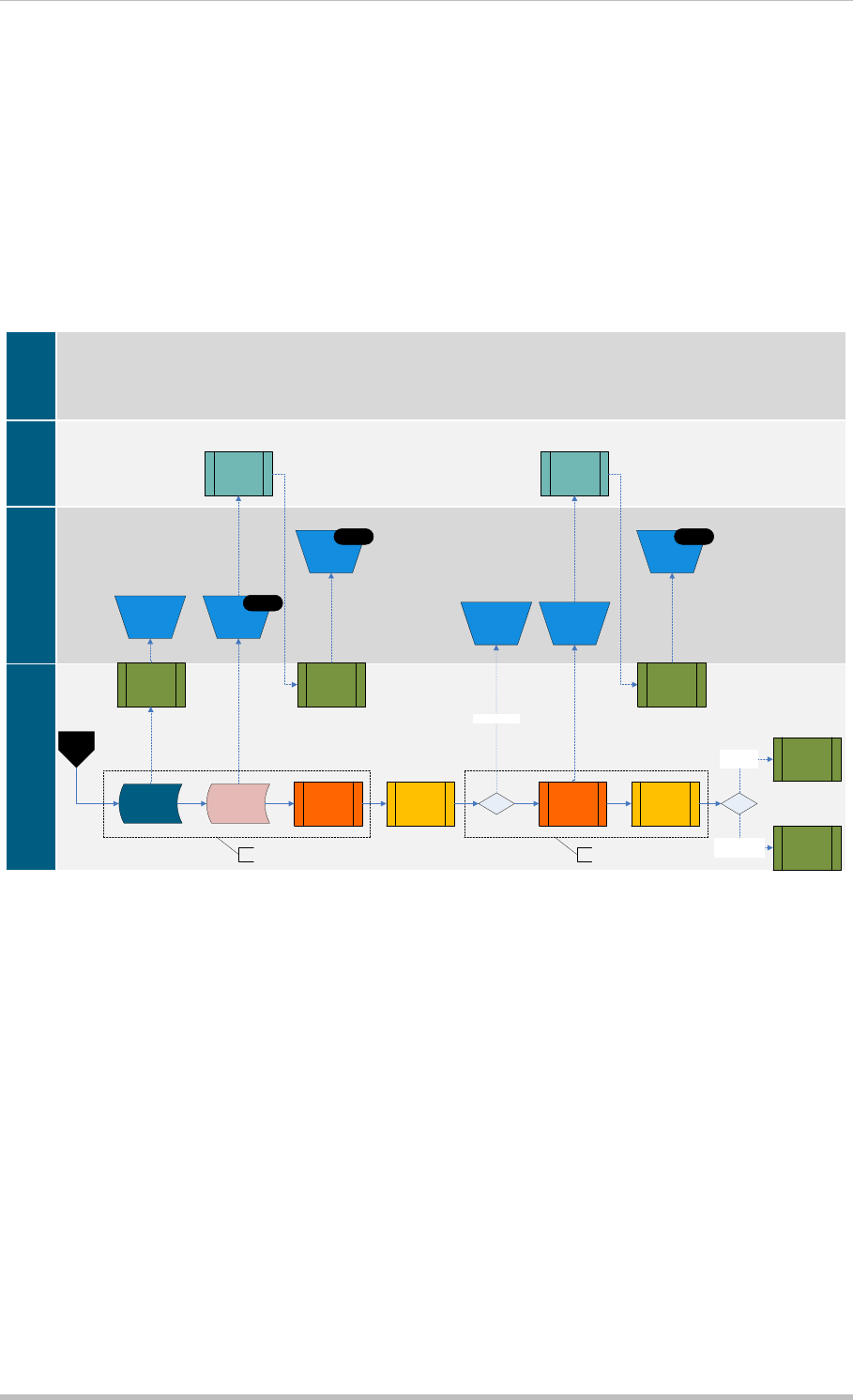

File Processing II

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 4 of 35

Validate

Initiating

Party

Not Valid

InitgPty

Incoming

File Filter

Rules

Rejected

Hold

Split file to

processing

group

(chunks)

Cont

Distributed

Release

Distributed

Business

Flow

Selection

Cancelled

Release

Rejected

Back

Mass Payments Processing

Global PAYplus Business Guide Page 13

Parties Profile: Enables a bank to define specific processing preferences in the Acknowledgment

Preferences section. For more information, see Parties Profile.

GPP users can view information about the batches in a file received from a customer. For more

information, see Batch Summary.

2.1.1.4 File Department Selection

GPP derives and identifies payment attributes (for example, office, department, creation date) during

the initial process in the business flow.

Once the Office is selected, the Department Selection rules for this Office, are evaluated to select the

relevant Department. A default department is selected when there are no specific rules setup.

2.1.1.5 File Priority

The order in which GPP processes each file can be prioritized using the File Priority rules. Each File

Priority rule is attached to a specific office.

After validating an incoming file, when two or more files are waiting for processing, GPP invokes the

File Priority rules to assign a priority to the incoming file. GPP first processes the file with the highest

priority and continues processing subsequent files according to the priority of each, as determined by

the rule. For example, high priority can be assigned to files received from a specific customer.

Each payment in an incoming file inherits its file-level priority.

If a file-level priority is not assigned to an incoming file, GPP determines the payment-level priority for

each payment in the file using Prioritization rules. These rules enable a bank to assign a priority to an

individual payment.

When viewing payments in a manual queue, an authorized GPP user can sort messages by the

assigned priority to assist in handling higher priority payments first.

For File priority Codes, see File Priority Rules.

2.1.1.6 File Duplicate Check

GPP checks whether the incoming file is duplicated and has already been received and processed.

This check is based on parameters which are configurable in GPP (system configuration).

If a duplicate file is found, GPP routes the file to the Duplicate queue for manual handling. A user

can perform one of these actions:

o Release the file to continue processing

o Cancel the file

If a duplicate file is not found; GPP continues to process the payment.

2.1.1.7 Validate Initiating Party

GPP checks that the initiating party is registered for submitting files.

If the Initiating Party is not valid, GPP changes the status of the file to Not Valid Integrity. The user

can perform one of these actions:

o Release the file for continued system processing

o Reject the file

If the Initiating Party is valid; GPP continues to process the payment.

Mass Payments Processing

Global PAYplus Business Guide Page 14

2.1.1.8 Incoming File Filter Rules

GPP invokes Incoming File Filter rules to enable a bank to prevent STP processing of an incoming

file. The Incoming File Filter rules are attached to an initiating party.

If GPP determines that an incoming file meets the conditions defined in an Incoming File Filter rule,

GPP stops processing the file and performs an action defined in the rule. A rule can have one of the

following actions:

Hold: GPP routes the incoming file to a queue for manual handling.

Reject: GPP rejects the incoming file.

Example: A rule is defined that holds all files received from a specific bank customer and routes them

to a queue for manual handling.

In addition to an action definition, each Incoming File Filter rule has an optional usage definition that

enables a bank to define an error code for each incoming file that meets the conditions of the rule.

GPP generates a file-level NAK to the initiating party, which contains error message details as

specified in the business rule.

2.1.1.9 Split File to Processing Group (Chunks)

GPP distributes transactions received in files into manageable group of transactions to increase

system performance and maximize system resource utilization.

After initial validation that includes duplicate checking, GPP distributes the transactions into physical

groups. A system parameter defines the number of individual transactions that GPP includes in each

group.

The GPP mass payment functionality can handle incoming files that contain multiple message types.

A GPP mechanism ensures that all groups are processed in the correct order based on message

type. This prevents illogical processing situations, such as processing a message recall before the

corresponding payment received in the same file.

After distributing incoming transactions into groups, GPP processes each group of transactions using

parallel processing to increase TPS (Transactions per seconds).

The number of running parallel processes is directly related to specific system configuration.

2.1.1.10 Business Flow Selection

For Customers processing Mass Payments, the business flow selection is defaulted to Mass

Payments per customer specific requirements.

2.1.2 Preprocessing Transactions

Once the Payment Information (PaymentInf) is validated successfully, GPP generates the individual

transactions related to the validated Payment Information. Any changes to PaymentInf level

information, as a result of processing within GPP is applied to the related individual transactions (for

example, changes to the initiating party account).

During the pre-processing flow, GPP generates a Unique Grouping ID (UGID) to identify and group

individual transactions that share common attributes. GPP uses the UGID when generating an S

message as part of the mass payment functionality.

Individual transactions that generate errors, such as duplicate transactions, are routed to the Rejected

Duplicate queue.

Mass Payments Processing

Global PAYplus Business Guide Page 15

2.1.2.1 Payment Initiation

For a detailed description of the Payment Initiation, see Payment Initiation Business Guide.

2.1.2.1.1 Payment Initiation Workflow

2.1.2.1.2 Map Payment Information

GPP derives and identifies fundamental payment attributes, for example, Department, and Message

Class, during the initial process in the business flow.

2.1.2.1.3 Rate Usage - Base Conversion

GPP converts all transactions to a base currency equivalent, which enables security checks,

threshold limit checks, and other validations.

2.1.2.1.4 Repair and Enrichment

GPP utilizes the Repair and Enrichment Rules and Repair and Enrichment Selection Rules to

automatically repair messages, which increases STP rates. GPP also enriches specific message

fields by deriving required information.

Transactions can be automatically repaired and enriched using the Repair and Enrichment rules,

which can derive missing information that was not included in the original payment message.

GPP can use these rules to do the following:

Set values of missing transaction attributes

Remove values from transaction attributes

Update transaction statuses

GPP determines the relevant rule by invoking Repair and Enrichment Selection rules for specific

transactions.

Pre Processing - Payment Initiation I (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 5 of 35

Map

Payment

Info

Sets...

MID

Msg Class

Office

Department

Product code etc..

Repair

Submit

Cancel

Rate usage-

base

conversion

Source MOP

STP

Validation

Repair And

Enrichment

Message

Duplicate

Check

MatchingCheckService

Sub Type = OrigInal

Payment^Duplicated

Cont

Party Detail

Enrichment

Bacl

Office SLACrisis Check

Business

Flow

Selection

Flow

Management

Single

Message

Flow

Wait Rate

Submit

Repair

Mass Payments Processing

Global PAYplus Business Guide Page 16

At a determined point in the workflow, GPP invokes a Repair and Enrichment Selection rule that

checks for specific conditions, such as a specific payment message type. If a transaction matches the

defined conditions, GPP invokes the relevant Repair and Enrichment rule, which can perform an

action such as setting a message attribute with a specific value.

For example, GPP can invoke a Repair and Enrichment Selection rule for all pacs.008 payment

messages. The invoked Repair and Enrichment rule can be defined to perform an action such as

removing the values in the creditor agent message attributes.

2.1.2.1.5 Party Detail Enrichment

GPP identifies and loads relevant account information for the first in chain party.

For incoming files received from a customer or from ACH, GPP identifies and loads the first in chain

debit or credit account. GPP applies derived party attributes to all transactions in the batch (ISO

Payment Information block).

2.1.2.1.6 Message Duplicate Check

Duplicate checking is executed on payments that are either received by GPP from external networks

(ACH) or internal applications or are manually entered or handled by a user. Based on the selected

algorithm (key message fields such as message type, currency, amount and beneficiary) GPP

examines every payment for possible duplication.

GPP determines whether a payment is a duplicate using the Automatic Matching Algorithm rule.

If a payment is a duplicate, GPP routes the payment to the Dupex queue for manual handling. A

user can perform one of these actions:

o Accept to continue processing

o Cancel the payment

If a duplicate payment is not found; GPP continues to process the payment.

2.1.2.1.7 Crisis Check

Crisis Check processing is required to hold transactions, which are in process but due to

extraordinary circumstances need to be stopped from processing further. It is intended as a temporary

measure and more permanent parameters should be set to deal with longer term scenarios, for

example, posting restrictions, static data changes, and non-STP rules.

The Crisis Hold rule is applied to all individual transactions, transactions received via bulk files and

across offices. Any transactions meeting filter conditions are stopped from processing further until a

decision is made to continue processing or cancel.

When a Crisis Hold rule that is attached to an object is changed or detached from an object, the

Release Crisis Filter activity will be triggered and payments will be released.

2.1.2.1.8 Source MOP STP Validation

Source MOP selection identifies the debit MOP. For more information, see GPP Payment Initiation

Business Guide.

The Source MOP can be:

Book for files received from Channels

Low Value clearing

GPP perform MOP STP validation for a specific MOP to increase its STP and to adhere to the MOP

and/or clearing rules, for example, SEPA EPC rulebook regulations.

Mass Payments Processing

Global PAYplus Business Guide Page 17

2.1.2.1.9 Office SLA

Ensures as early as possible in the payment processing flow whether the payment may be associated

with a specific SLA profile. For example, not processing the credit transfer file before a certain time of

the day when cross border credits are usually received.

For more information, see GPP Payment Initiation Business Guide.

2.1.2.2 Credit Transfer (Individual) Processing

2.1.2.2.1 Debit Party Workflow

2.1.2.2.1.1 Incoming Return/Reject Matching

GPP automatically attempts to match the incoming R message to its related message using system

configurable criteria as defined in a Matching Check profile. Once matched, authorized users can

view all related messages in the GPP user interface.

For more information, see GPP R-Messages Business Guide.

2.1.2.2.1.2 Find First in Chain

GPP identifies the transaction destination (from where the payment is being sent) for the first party in

the debit chain. When the First in Chain party cannot be identified, the transaction is sent to Repair for

manual handling.

For more information, see GPP Parties Identification Business Guide.

2.1.2.2.1.3 Load Party

GPP identifies and loads relevant account information for the first in debit chain party. If there is an

issue with identifying the party, the transaction is routed to the Repair queue for manual handling.

For more information, see GPP Parties Identification Business Guide.

Pre Processing - Debit Party Processing (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 6 of 35

Back Cont

Find 1st in

Chain Load Party

Repair

Account

Derivation Debit

Authorization SLA- Debit

party

Rate usage

for debit side

conversion

Batch Booking=’False’

Submit

Cancel

Flow

Management

Incoming

Return/

Reject

Matching

Mass Payments Processing

Global PAYplus Business Guide Page 18

2.1.2.2.1.4 Account Derivation

GPP derives relevant accounts (debit account of a credit transfer) and performs currency conversions

(if required) when the payment currency is different to account currency.

If there is an issue with identifying the account, the payment is routed to the Repair queue for manual

handling.

For more information, see GPP Parties Identification Business Guide.

2.1.2.2.1.5 Debit Authorization

Credit Transfer Debit Authorization verifies that the FI is authorized to debit the debtor account. This

is performed on the individual transaction only when posting is performed for each individual

transaction.

For more information, see GPP Parties Identification Business Guide.

2.1.2.2.1.6 SLA Debit Party

Ensures whether the payment is associated with a specific SLA Debit Party profile. For example, not

processing the credit transfer file before a certain time of the day when cross border credits are

usually received.

2.1.2.2.1.7 Rate Usage for Debit Side Conversion

If a currency conversion is required GPP invokes Rate Usage rules to determine the relevant foreign

currency exchange rate for each transaction.

Based on the type of conversion, the following types of Rate Usage Conversion rules may be invoked:

Base Amount Conversion: Determines the base amount foreign currency conversion rate for

transactions.

Debit Side Conversion: Determines the debit-side foreign currency conversion rate for payments.

For more information, see GPP Currency Conversion Business Guide.

2.1.2.2.2 Credit Side Workflow

Pre Processing - Credit Side Processing (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 7 of 35

Start

Credit Party

Processing

Repair

Dest MOP

STP

Validation

Submit

Cancel

Cont

Party Detail

Enrichment

Multi Office

– Re invoke

Destination

Party

Flow

Management

Transfer

method

identification

Applicable for bank routing

Mass Payments Processing

Global PAYplus Business Guide Page 19

2.1.2.2.2.1 Credit Party Processing

During the credit party processing, GPP identifies the first in the credit chain, loads the party and the

credit account.

For more information, see GPP Parties Identification Business Guide.

2.1.2.2.2.2 Party Detail Enrichment

GPP identifies and loads relevant account information for the first party in the chain - credit side of a

credit transfer.

GPP invokes Credit Account Enrichment rules to determine the credit account number and usage

instructions for that account for Credit Transfer. These rules enable a FI to define the relevant credit

account for a payment.

2.1.2.2.2.3 Destination MOP Selection and MOP STP Validation

GPP uses Method of Payment (MOP) selection rules defined in GPP, to determine the best route for

the payment to be delivered, for example, via clearing, SWIFT. The MOP parameters are also used to

determine whether the transaction continues processing as a single message or should be sent out in

a file.

For more information, see GPP Method of Payment Business Guide.

2.1.2.2.2.4 Transfer Method Identification

This step is relevant for transactions received in a file and executed via High Value/Individual

processing. During this process, GPP indicates if the transaction’s transfer method is Serial or Cover.

For more information, see GPP Building Correspondent Chain Business Guide.

2.1.2.2.2.5 Multi Office - Re Invoke Destination Party

In a multi office scenario where the creditor is located in a different office than the debtor, the credit

side is re-processed and re-evaluates all the rules in the destination office.

Mass Payments Processing

Global PAYplus Business Guide Page 20

2.1.2.3 Post MOP

2.1.2.3.1 Post MOP Workflow

2.1.2.3.2 Debit Transaction Code

In this process GPP selects a debit code per transaction. This code can be exposed for external

systems in a structured way. Examples of the code are type of transaction, type of customer, and

fees.

2.1.2.3.3 Credit Transaction Code

In this process GPP selects a credit code per transaction. This code can be exposed for external

systems in a structured way. Examples of the code are type of transaction, type of customer, and

fees.

2.1.2.3.4 Prevent STP

GPP uses Override STP profiles to prevent Straight-Through Processing (STP) of specific payments.

The Override STP profile can be defined for the following:

Special Instruction: Prevent STP processing of a payment with specific characteristics, such as a

settlement amount greater than a defined value.

Validation: Prevent STP processing of a payment that is invalid as defined by the specific

conditions, such as a missing product code.

For a list of error statuses, see Appendix B: STP Validation Error Statuses.

For more information, see GPP Special Instructions Business Guide.

2.1.2.3.5 Fees (Itemized)

The relevant fees are determined for each party in the transaction. This is performed when posting is

required on the transaction level (Batch Booking is false).

Pre Processing - Post MOP (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 8 of 35

Compliance

Validation

Cont

Debit

Transaction

code

Credit

Transaction

code Prevent STP Generate Sub

Batch

Wait Sub-

Batch

Wait

Sched Sub

Batch

Processing

date

Cancel

Start

Accumulate transaction

according to grouping ID

Batch compliance request

Compliance

request - file

buffer

Fees

(itemized)

Batch Booking=’False’

Flow

Management

Future

Date

Mass Payments Processing

Global PAYplus Business Guide Page 21

For more information, see GPP Fees - Core Processing Business Guide

2.1.2.3.6 Compliance Validation

GPP invokes Compliance Validation rules to determine whether to send a specific payment for

compliance to verify that a payment complies with various anti-money laundering regulations.

GPP enables the following types of Compliance Validation rules:

Submit: If a payment meets the conditions defined in the rule, GPP sends the transaction for

compliance verification.

Bypass: If a payment does not meet the conditions defined in the rule, GPP does not send the

transaction for compliance verification.

2.1.2.3.7 Generate Grouped Transaction (Sub Batch)

As part of this processing GPP groups number of payments which have similar parameters in order to

allow single posting on the account or perform single currency conversion for the entire S message.

When GPP completes preprocessing for all individual transactions, additional file validations are

invoked as follows:

Number of Transactions: Validates that the total number of transactions counted in an incoming

file matches the declared number of transactions in the file.

Control Sum: Validates that the total amount of all transactions contained in the incoming file is

equal to the amount defined in the file header. GPP includes all payment amounts when checking

the control sum, regardless of the defined currency for an individual transaction.

Rejected Transactions: Validates that the total number of transactions (expressed as a

percentage) in an incoming file that are rejected by GPP does not exceed a threshold set by the

bank.

Transactions that successfully complete these file validations continue to be processed in the Sub-

Batch Generation.

If the additional validations are not successful, GPP stops processing the transactions, and might hold

the file for manual handling or reject it.

2.1.3 Payment Grouping (Sub Batch) Generation

Sub-Batch generation accumulates transactions that are sent out in files and completes processing

on individual transactions.

GPP collects and group transactions originated in a file into groups based on definable criteria in

order to apply actions on the entire group for example, posting, fees, and foreign exchange.

Mass Payments Processing

Global PAYplus Business Guide Page 22

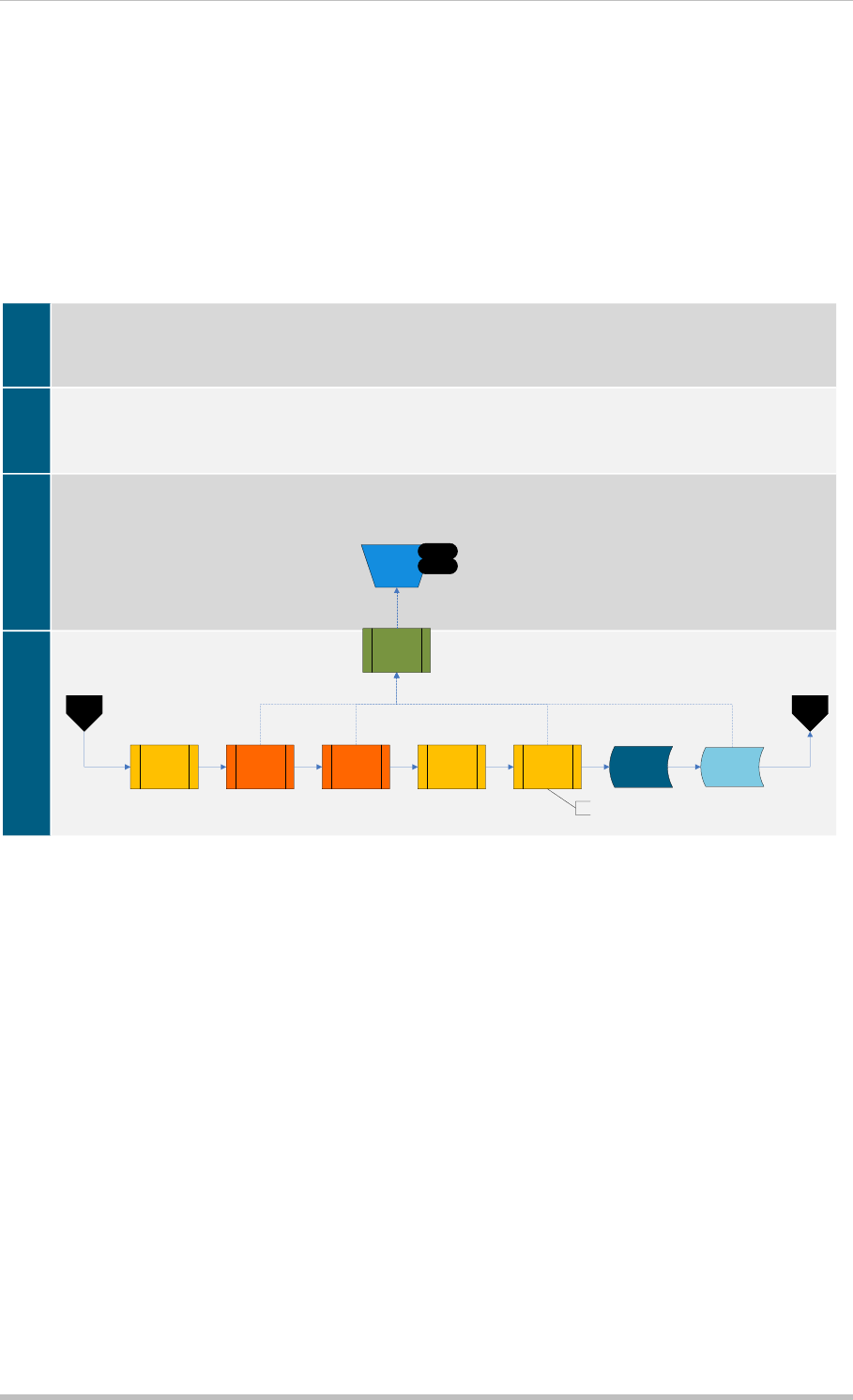

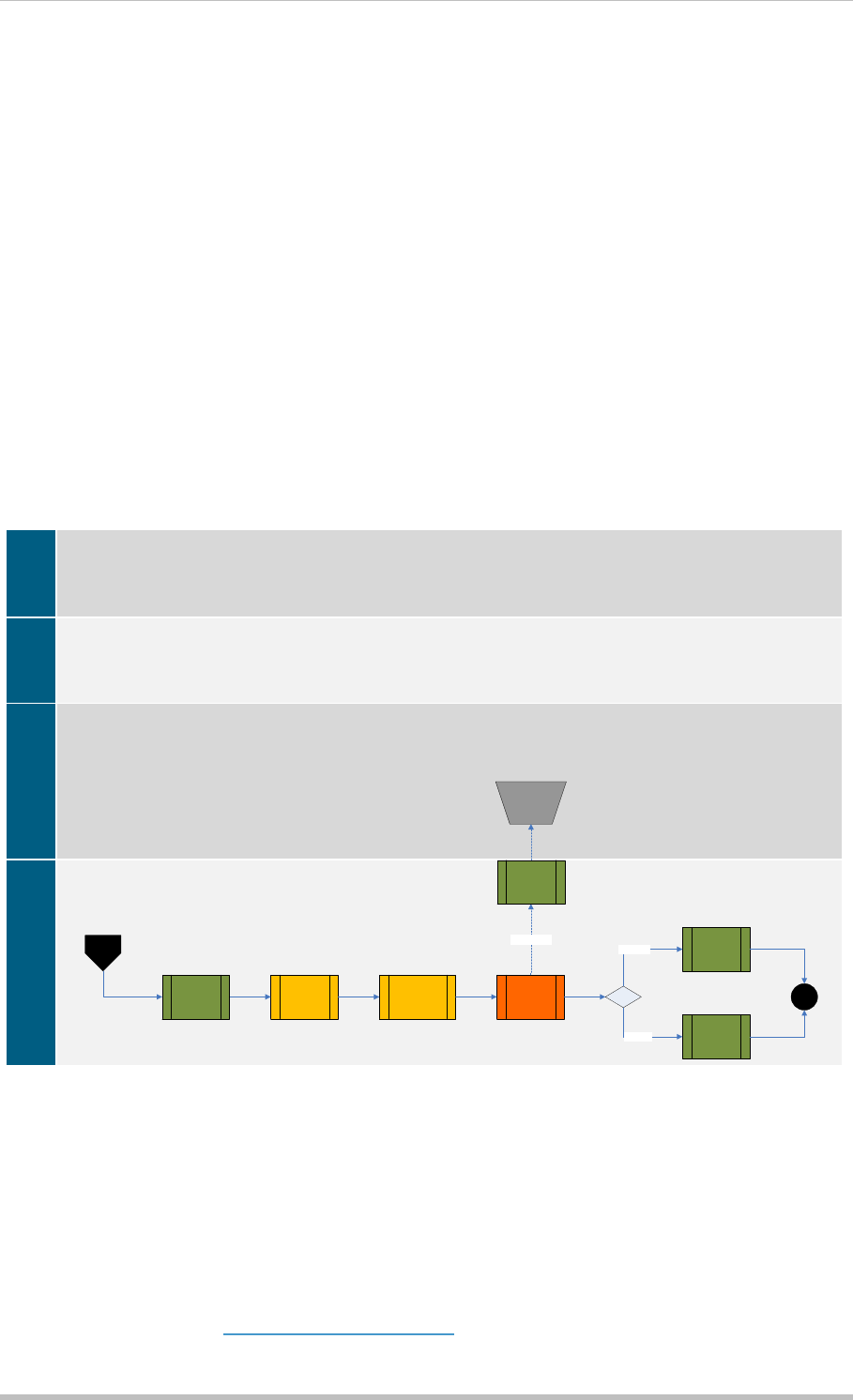

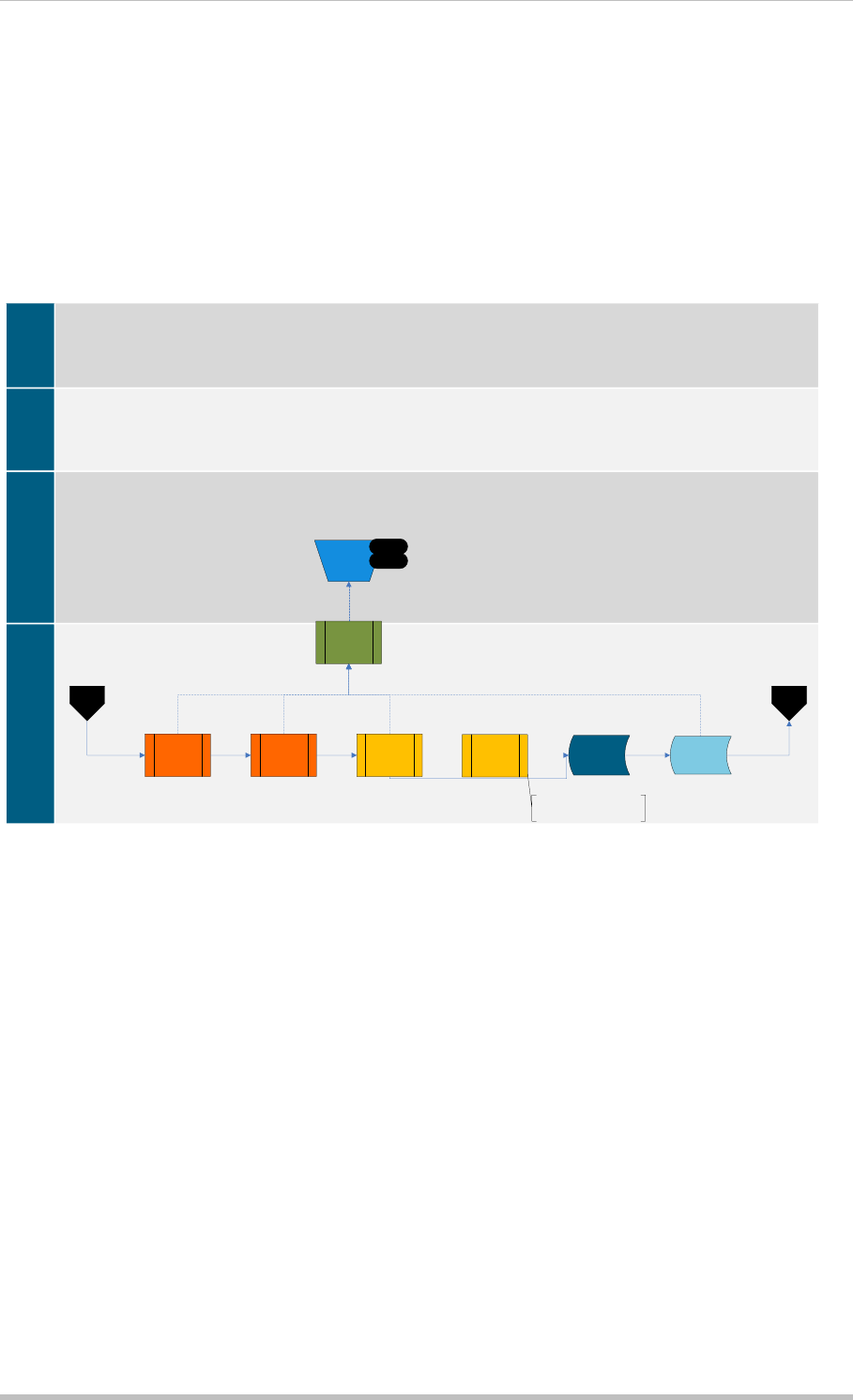

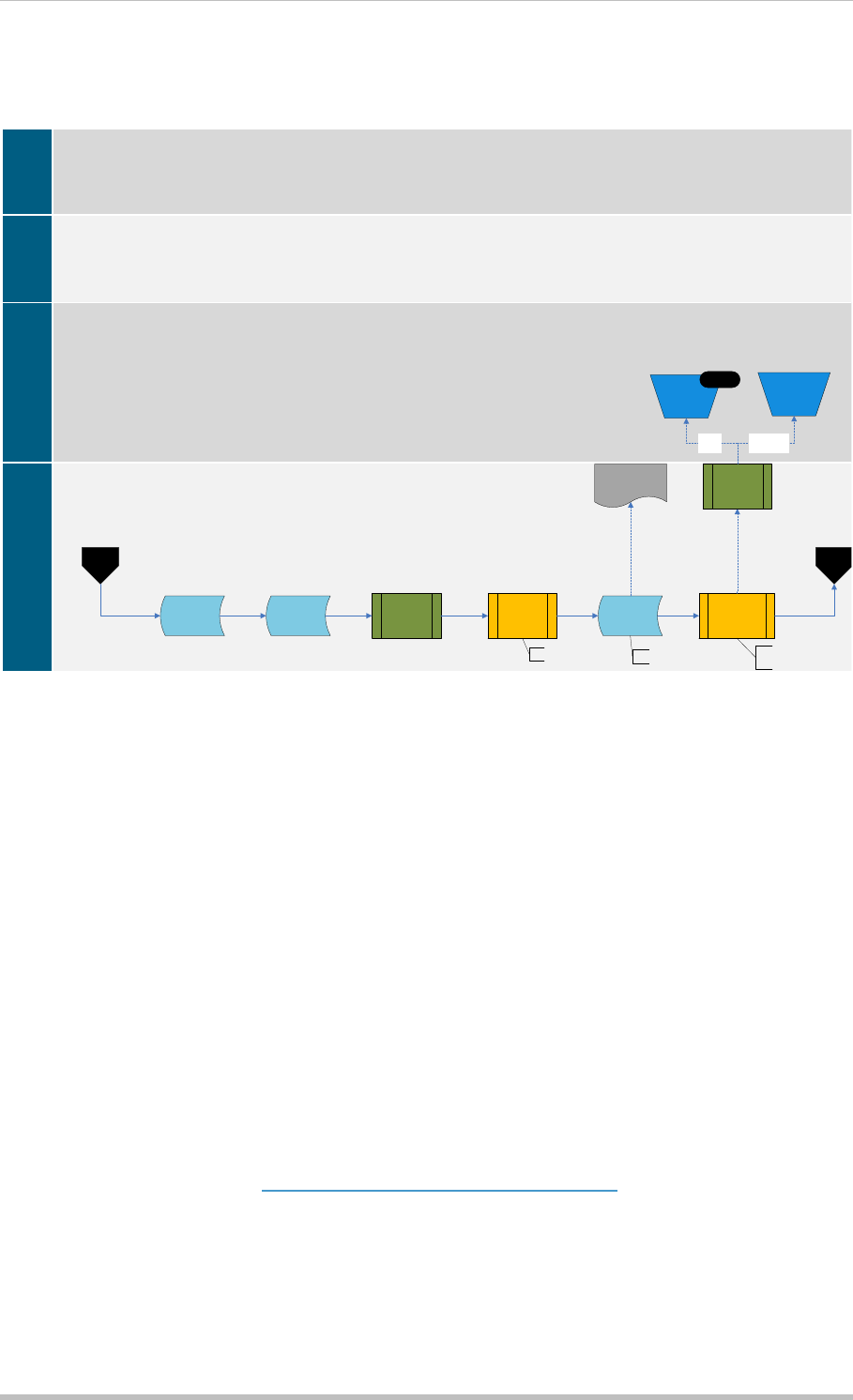

2.1.3.1 Sub Batch Generation (S) Workflow

Sub Batch Generation (S)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 9 of 35

Debit

Authorization

Rate usage

for debit side

conversion

Debit

Transaction

Codes

Fees

(Sub-Batch)

Credit

Transaction

code

Value Date

Start Cont

Recalculate Value Date

Batch Booking=’True’ Batch Booking=’True’

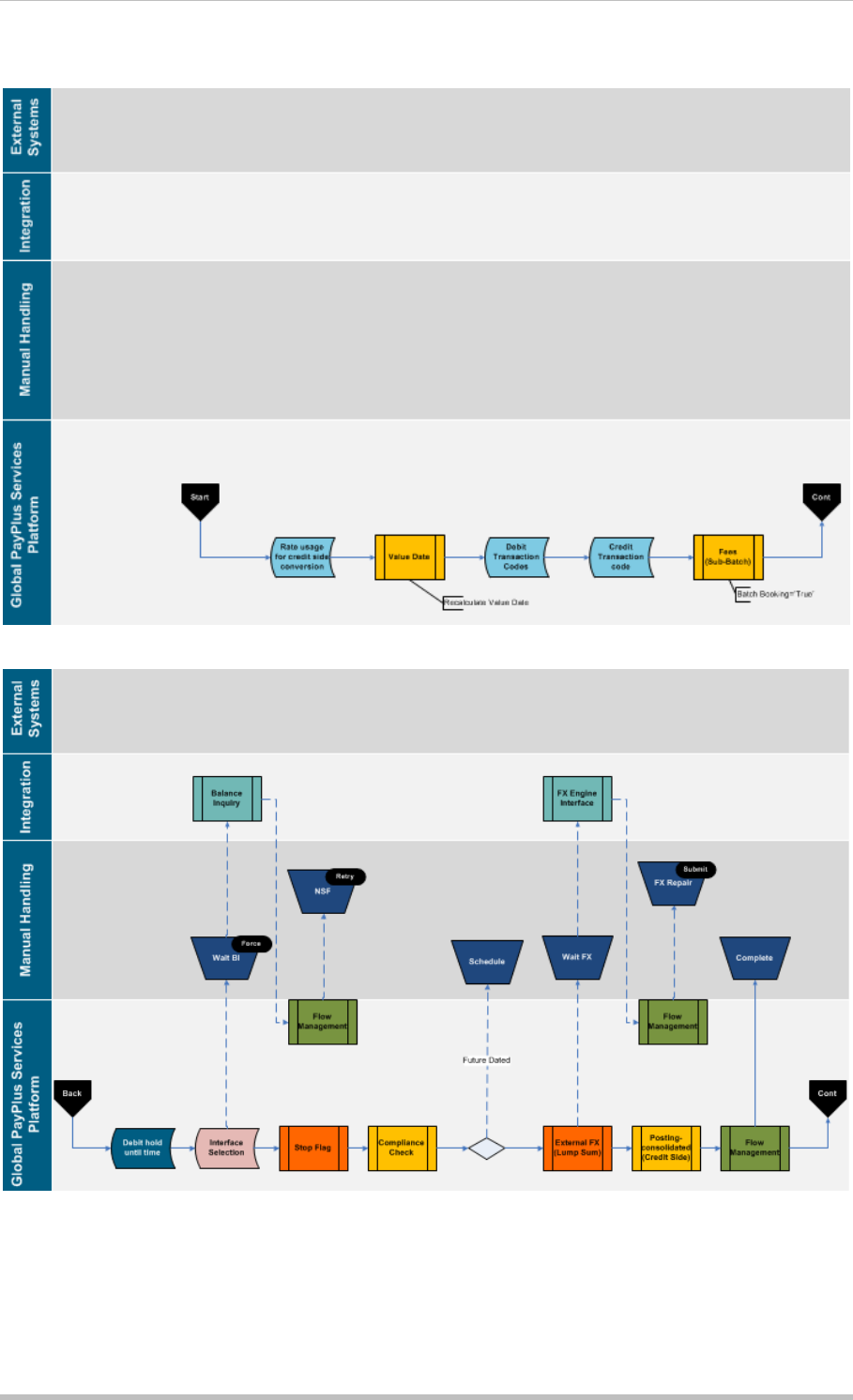

Sub Batch Generation II (S)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 10 of 35

Posting-

consolidated

(first leg)

Flow

Management

Complete

Debit hold

until time

Back Cont

Schedule

Stop Flag

Interface

Selection

Balance

Inquiry

Wait BI

Force

NSF

Retry

External FX

(Lump Sum)

FX Engine

Interface

Compliance

Check

Future Dated

Wait FX

FX Repair

Submit

Flow

Management

Flow

Management

Mass Payments Processing

Global PAYplus Business Guide Page 23

2.1.3.2 Debit Authorization

Debit Authorization verifies that the FI is authorized to debit the debtor account. This is performed on

the S message only when posting is required to be performed for the S message (Batch Booking flag

is true).

For more information, see GPP Parties Identification Business Guide.

2.1.3.3 Rate Usage for Debit Side Conversion

GPP uses Rate Usage rules to determine the relevant foreign currency exchange rate for each

transaction, if a currency conversion is required.

The Debit Side Conversion determines the debit-side foreign currency conversion rate for

transactions.

2.1.3.4 Value Date

GPP recalculates the Value Date for the S message.

For more information, see Value Date and Cutoff Business Guide.

2.1.3.5 Debit Transaction Code

In this process GPP selects a debit code per transaction. This code can be exposed for external

systems in a structured way. Examples of the code are type of transaction, type of customer, fees.

2.1.3.6 Credit Transaction Code

In this process GPP selects a credit code per transaction. This code can be exposed for external

systems in a structured way. Examples of the code are type of transaction, type of customer, fees.

2.1.3.7 Fees (Sub Batch)

The relevant fees are determined for each party in the S message. This is performed if posting is

done on the S message (Batch Booking flag is true).

For more information, see Fees – Core Processing Business Guide.

2.1.3.8 Debit Hold Until Time

GPP provides a mechanism of stopping S message processing up until a pre-defined time. This is

performed using the Hold Until Time rule. When a rule is selected to a sub batch, based on specific

attribute, the sub batch is held until a pre-defined time (and as a result, all of the transactions related

to the Sub batch are held until its completion). On the selected time, Sub batch is released back to

processing.

2.1.3.9 Interface Selection

GPP uses Interface Selection rules to interact with external interfaces at specific stages during the

payment processing. At this stage the Balance Inquiry Interface can be selected.

If GPP determines that a payment matches the defined rule conditions, the defined action of the rule

is executed, which can be one of the following:

Bulk Interface Request: Message attributes are accumulated and stored, which GPP later uses

to generate a bulk request to an external interface.

Individual Interface Request: Individual message attributes are stored and GPP generates a

single request to an external interface.

Mass Payments Processing

Global PAYplus Business Guide Page 24

The action for an Interface Selection rule implements an Interface profile that includes definitions for

interface requests and responses such as:

Protocol: The protocol used by GPP to communicate with the external interface.

Format Type: The format of the incoming response or outgoing request.

Connection Point: The location of the request that is sent or of the response that is received.

2.1.3.10 Stop Flag

Account stop flag check is performed on the S message account. The stop flag is either received from

Balance Inquiry response or setup in the account profile.

2.1.3.11 Compliance Check

A GPP Compliance service ensures compliance with various anti-money laundering regulations and

foreign asset controls. GPP verifies that all incoming and outgoing payments in the S message

comply with the latest regulations, such as embargoes and anti-terrorist financing regulations.

GPP performs the compliance check in a two-step process:

1. Initial Response: GPP sends an initial request to the compliance interface, for all transactions in

the bulk as a single request. The interface returns one of the following types of Initial Responses:

o No Hit: The interface determines that the payment complies with all relevant regulations. GPP

continues processing the payment.

o Possible Hit: The interface determines that the payment might not comply with all relevant

regulations. GPP does not continue processing the payment. It is pending receipt of a Final

Response.

2. Final Response: The interface returns one of the following types of Final Responses:

o Passed: The interface determines that the payment complies with all relevant regulations.

GPP continues processing the payment.

o Rejected: The interface determines that the payment does not comply with all relevant

regulations and returns a rejected indicator. GPP rejects the payment by setting the payment

status to Rejected and routing the message to the Rejected queue. GPP does not continue

processing the message.

o Seized: The interface determines that the payment does not comply with all relevant

regulations and returns a seized indicator. GPP implements a process to seize the payment

by setting the payment status to Seized and routing the message to the Seized queue. This is

a final status and GPP does not continue processing the message.

2.1.3.12 External FX (Lump Sum)

GPP Performs currency conversion for the lump sum amount when the payment currency is different

to the account currency. .

GPP calculate conversions using an FX rate obtained from GPP or using a rate from an external

system.

2.1.3.13 Posting Consolidation (First Leg)

GPP triggers the relevant interface to perform required posting.

In a credit transfer, debits the debtor or clearing participant and credits the relevant suspense

account.

Mass Payments Processing

Global PAYplus Business Guide Page 25

2.1.3.14 Flow Management

As part of the flow management the S message is routed to Complete after posting and GPP

continues the execution processing on the individual transactions.

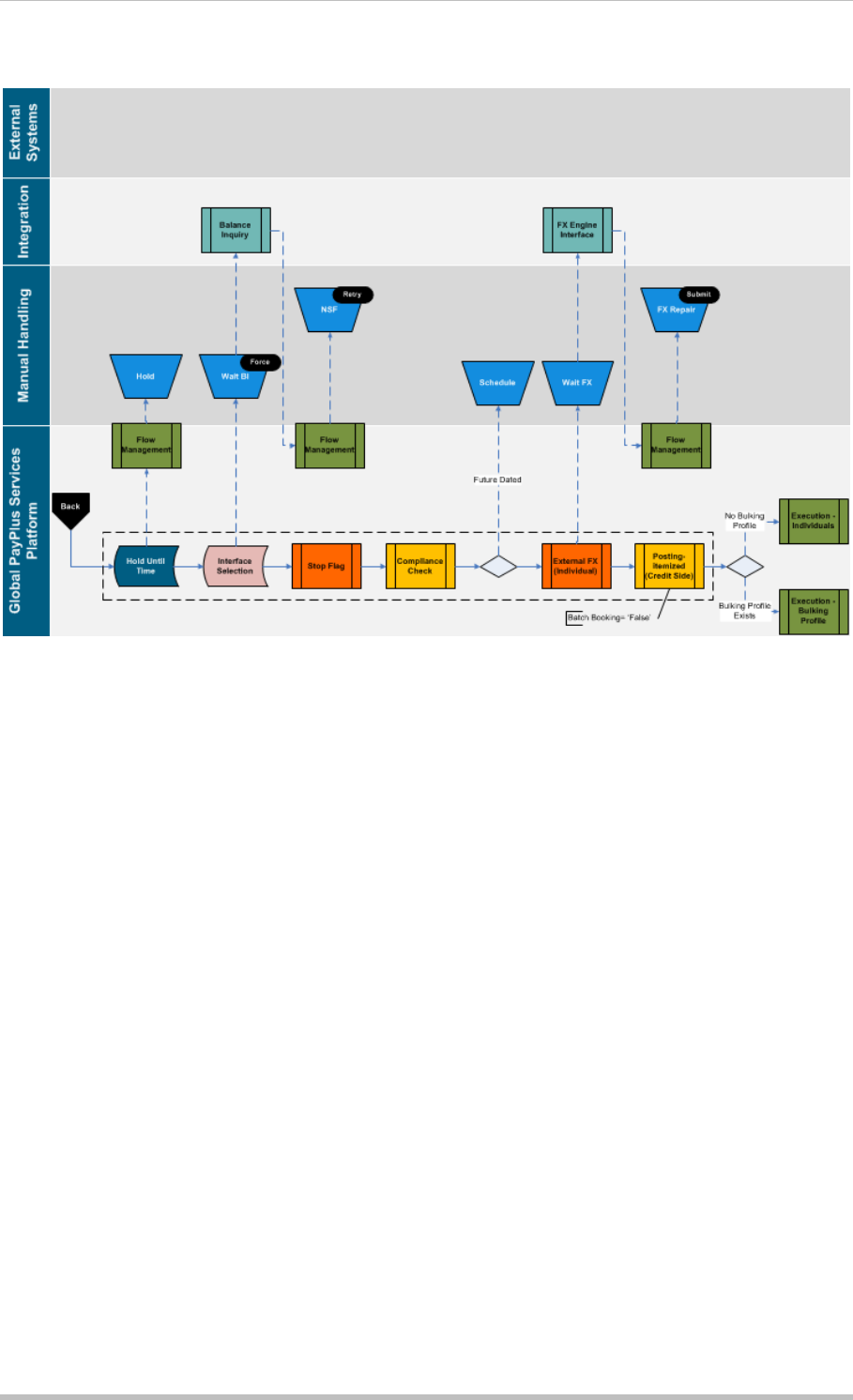

2.1.4 Execution

GPP generates posting and processes the outgoing file during the execution stage. GPP performs a

few generic steps and then based on bulking profile existence, GPP process individual executions

and bulk executions.

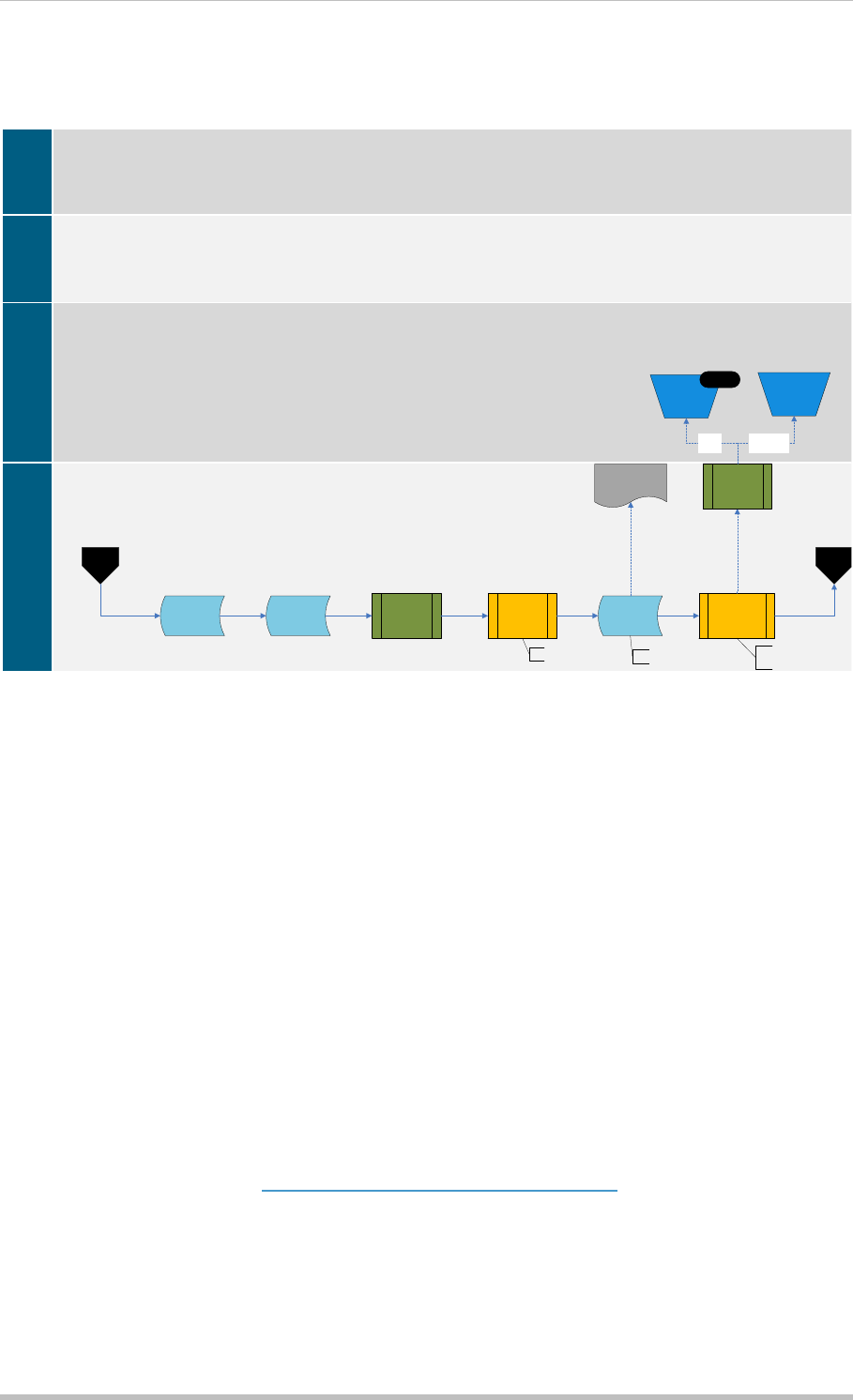

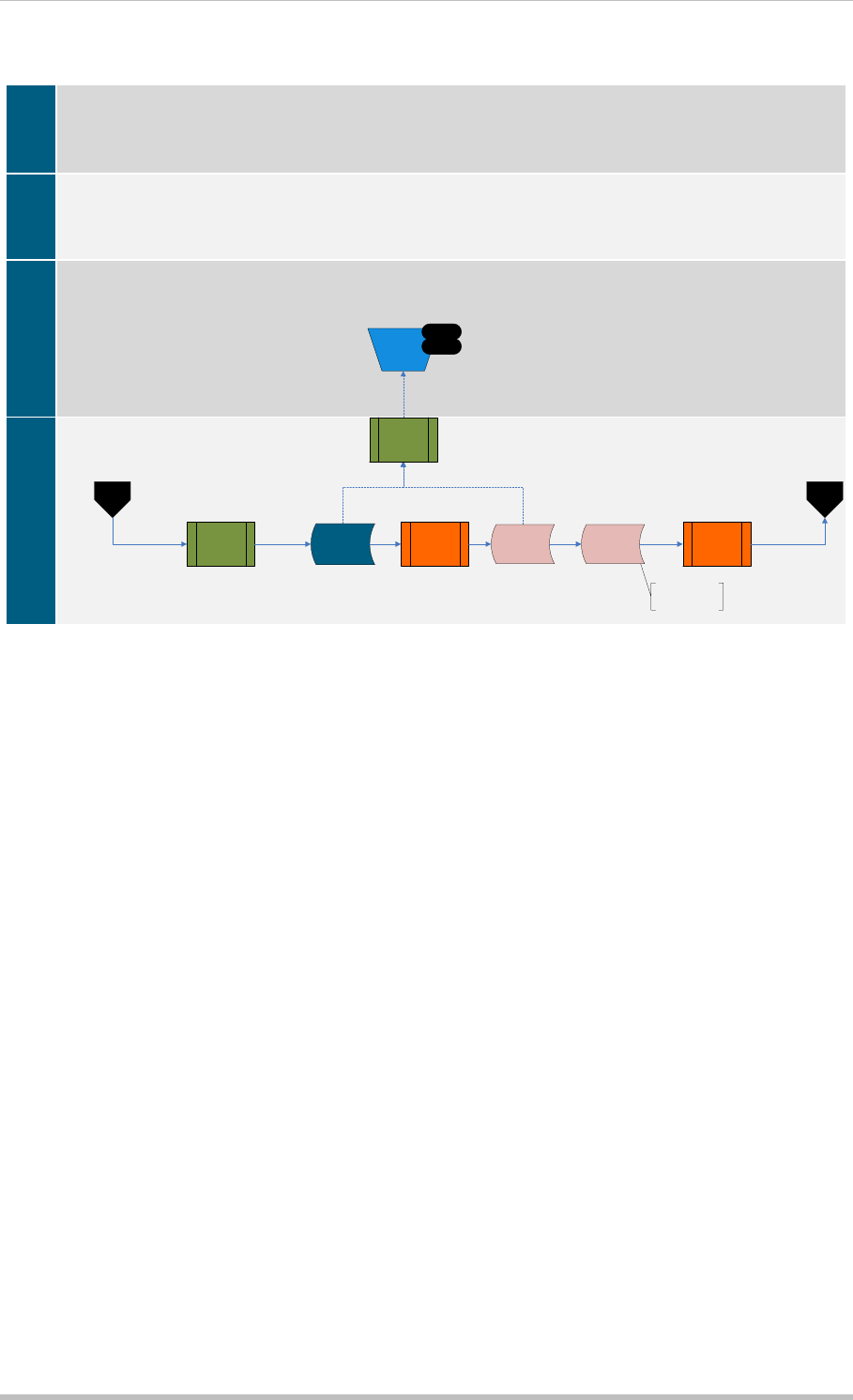

2.1.4.1 Execution Workflow

2.1.4.2 Hold Until Time

GPP provides a mechanism of stopping selected transaction processing up until a pre-defined time.

This is performed using the Timed Hold rule. When a rule is selected to a sub batch, based on

specific attribute, the sub batch is held until a pre-defined time (and as a result, all of the transactions

related to the Sub batch are held until its completion). On the selected time, Sub batch is released

back to processing.

2.1.4.3 Interface Selection (Balance Inquiry)

GPP uses the interface selection rules to generate an external balance inquiry request. For Balance

Inquiry standard interface information, see GPP Technical Guide Balance Inquiry Interface.

2.1.4.4 Stop Flag

Account stop flag check is performed on the individual account. The stop flag is either received from a

Balance Inquiry response or setup in the account profile.

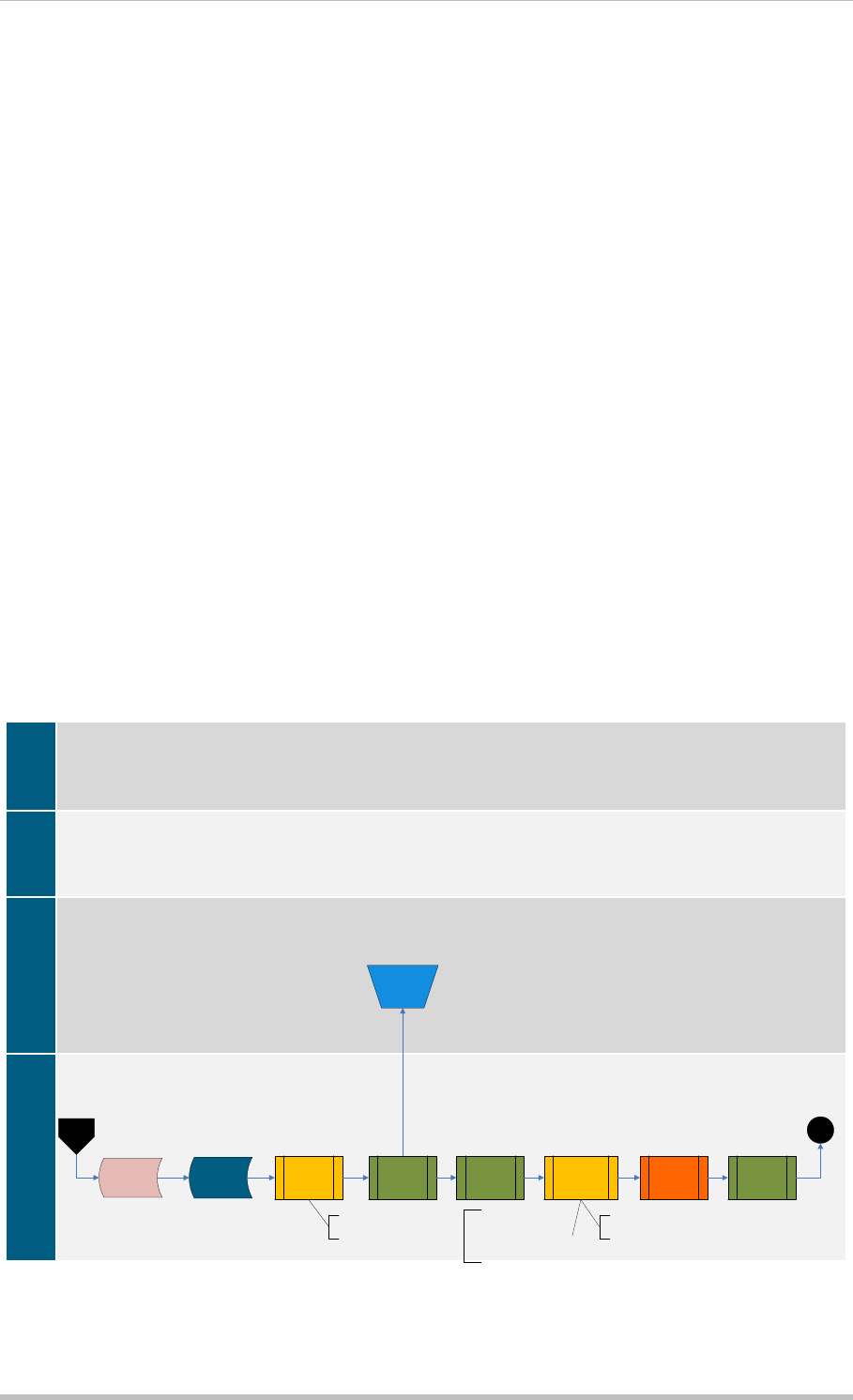

Execution (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 11 of 35

Posting-

itemized

(customer

leg)

Stop Flag

Batch Booking= ‘False’

Bulking Profile

Exists

Back

Hold Until

Time

Execution -

Individuals

Execution -

Bulking

Profile

Interface

Selection

Balance

Inquiry

Wait BI

Force

NSF

Retry

Schedule

External FX

(Individual)

FX Engine

Interface

Compliance

Check

Future Dated

Wait FX

FX Repair

Submit

No Bulking

Profile

Flow

Management

Flow

Management

Hold

Flow

Management

Batch Booking= ‘False’

Mass Payments Processing

Global PAYplus Business Guide Page 26

2.1.4.5 Compliance Check

GPP performs a compliance request on the individual payment.

2.1.4.6 External FX (Individual)

GPP generates an external FX request for individual payments, when posting indicator refers to

individual payments.

2.1.4.7 Posting Itemized (Customer Leg)

GPP triggers the relevant interface to perform required posting. For example for CTO GPP perform

the debit posting per transaction.

For more information, see Mass Payments Accounting

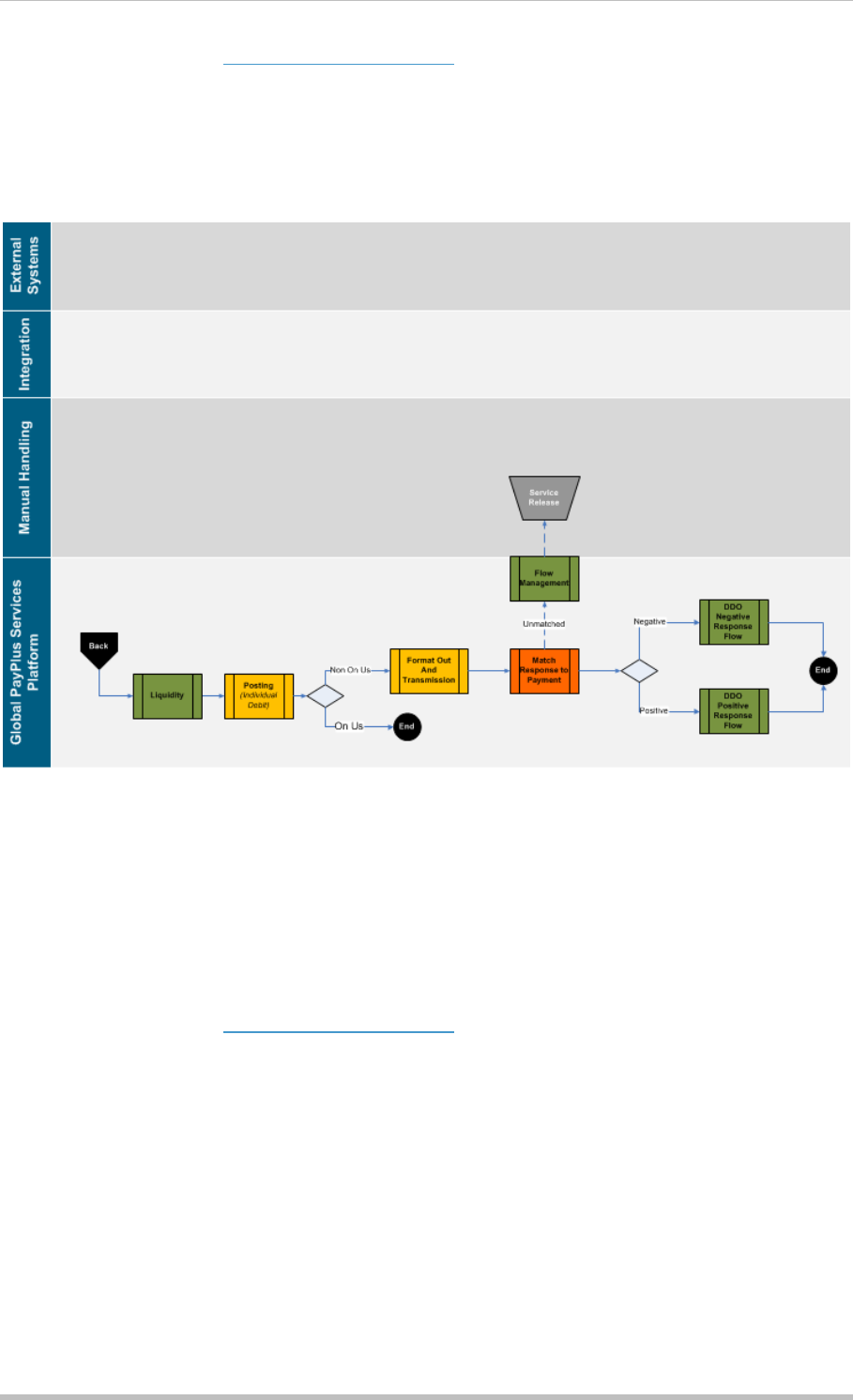

2.1.5 Execute Individual

During this process, GPP process individual executions.

2.1.5.1 Execute Individual Files Workflow

2.1.5.2 Liquidity

In this step, GPP checks the liquidity status for clearing the settlement account.

For more information, see GPP Liquidity & Risk Management Business Guide

2.1.5.3 Posting (Individual Credit)

GPP triggers the relevant interface to perform the required posting.

For more information, see Mass Payments Accounting

Execution - Destination Single (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 12 of 35

Posting

(Individual

Credit)

Format Out

And

Transmission End

CTO

Negative

Response

Flow

CTO

Positive

Response

Flow

Positive

Match

Response to

Payment

Service

Release

Unmatched

Flow

Management

Liquidity

Back Negative

Mass Payments Processing

Global PAYplus Business Guide Page 27

2.1.5.4 Format Out and Transmission

GPP generates the out payment.

2.1.5.5 Match Response to Payment

GPP matches the response to the individual payment

2.1.5.6 Response Handling

2.1.5.6.1 CTO Negative Response

Upon receipt of a negative response, the CTO is routed to the Rejected queue.

2.1.5.6.2 CTO Positive Response

Upon receipt of a positive response, the CTO remains in the Complete queue.

2.1.6 Execute Bulk Destination

GPP collects and organizes transactions destined for a file-based clearing system into bulks based on

definable criteria. An outgoing file can contain multiple message types. For example, a single

outgoing file can contain credit transfers, recall requests, and recall returns. An outgoing file can also

contain transactions that were received individually and transactions that were received in files.

GPP uses the specific bulking parameters for each Method of Payment (MOP) that handles

transaction bulking. These parameters are defined in the Bulking profile that is associated with the

MOP.

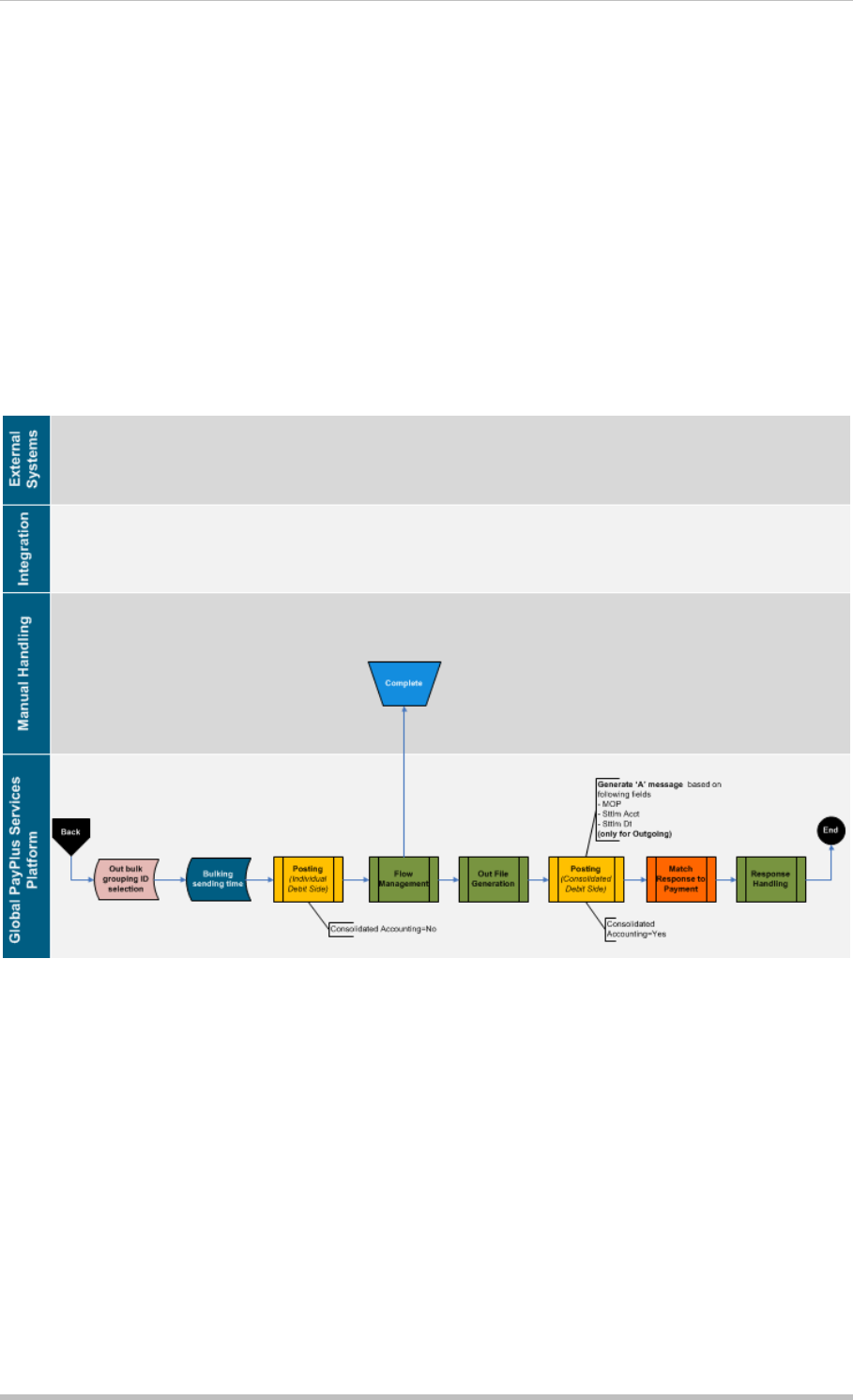

2.1.6.1 Execute Bulk Workflow

Execution - Destination Bulk (I)

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 13 of 35

Out bulk

grouping ID

selection

Bulking

sending time

Posting

(Individual

Credit)

Consolidated

Accounting=No

Out File

Generation

Complete

Generate ‘A’ message

based on following fields

- MOP

- Sttlm Acct

- Sttlm Dt

Back

Posting

(Consolidated

Credit)

Consolidated

Accounting=Yes

Flow

Management Response

Handling

Match

Response to

Payment

End

Mass Payments Processing

Global PAYplus Business Guide Page 28

2.1.6.2 Out Bulk Grouping ID Selection

GPP invokes Out Bulk Grouping ID Selection rules to determine the Group ID - Out data manipulation

rule that GPP uses to build the OFID, and OGID.

The OFID (outgoing file ID) is used to place transactions into the relevant outgoing file.

The OGID (outgoing group ID) is used to place transactions with common attributes into relevant

groups in the outgoing file.

When generating an outgoing customer file (pain.001 and pain.008), GPP determines:

1. The relevant file into which the transaction should be placed using the OFID. The OFID

determines, for example, if a file must only contain transactions of a single message type or value

date.

2. The relevant Group Header within the outgoing file into which the transaction should be placed

using the OGID.

2.1.6.3 Bulking Sending Time

GPP invokes Bulking Sending Time rules to determine the appropriate time to generate and send

outgoing files of payment messages. Each sending time defined in the Bulking profile must have a

corresponding Bulking Sending Time rule.

This rule also enables authorized GPP users to define a last sending time for a specific message

type.

Bulking profile can be configured to send out the relevant transaction upon incoming file processing.

In this case, Bulking sending time rules are not evaluated and Out file generation is triggered once

incoming file processing is completed (i.e. all transactions received in the incoming file are

processed).

2.1.6.4 Posting (individual Credit)

GPP triggers the relevant interface to perform required posting.

For more information, see Mass Payments Accounting.

2.1.6.5 Flow Management

GPP routes all individual transactions to the Complete queue and creates the A message for file

generation.

2.1.6.6 Out File Generation

GPP invokes Bulking Sending Time rules to determine the time to generate and send outgoing files of

payments. Each sending time defined in the Bulking profile must have a corresponding Bulking

Sending Time rule.

This rule also enables authorized GPP users to define a last sending time for a specific message

type.

For more information about Bulking profiles and sending times, see Bulking Profile.

GPP also enables authorized users to generate outgoing files containing groups of transactions that

have successfully completed processing and send them to a CSM, regardless of the defined sending

time. For more information, see Pending Outgoing File.

Mass Payments Processing

Global PAYplus Business Guide Page 29

2.1.6.7 Posting (Consolidated Credit)

GPP triggers the relevant interface to perform required posting.

For more information, see Mass Payments Accounting

2.1.6.8 Match Response to Payment

GPP matches the response to the file level.

2.1.6.9 Response Handling

2.1.6.9.1 CTO Negative Response

Upon receipt of a negative response, the CTO is routed to the Rejected queue.

2.1.6.9.2 CTO Positive Response

Upon receipt of a positive response, the CTO remains in the Complete queue.

2.1.7 Acknowledgment Reporting

GPP can generate file status reports for FI customers that enable the customers to track file and

transaction processing. GPP can generate these reports at different stages of the processing

workflow using Advising Type Selection rules. For more information about the rule, see Advising Type

Selection Rules.

GPP enables a bank to generate a Customer Acknowledgment report for a customer. The report is a

file that contains details of all accepted and rejected transactions for a customer that a bank receives

in a single file. GPP generates a Customer Acknowledgment upon completion of individual

transaction validation during the specific payment processing workflows and stores it in a specific

location, after which an external interface sends it to the initiating party (bank customer).

GPP generates the following types of acknowledgments (both in pain.002 format):

ACK: A positive acknowledgment message

NAK: A negative acknowledgment message

The Parties profile enables a bank to define the types and XSD versions of acknowledgment

messages that GPP generates for each customer. For more information, see Parties Profile.

GPP invokes Advising Type Selection rules to determine whether an advice message must be

generated at a specific point in the workflow. For example, this rule type is used to generate file-level

acknowledgments or message acknowledgments in response to a file received file from a corporate

customer.

Predefined rules are included to generate a pain.002 acknowledgment message to an initiating party

that sent a mass payment file and is defined to receive a Customer Acknowledgment (see Parties

Profile) when the following occur:

File Rejected by User: If a file does not pass validation (see File Parsing/Validations), GPP can

hold it for manual handling. If an authorized GPP user chooses to reject the file, GPP generates

an advice message file with an RJCT file rejection code. Individual transactions are not included

in the file.

Preprocessing: During Preprocessing (see Preprocessing Transactions), GPP accumulates

information for the following:

Mass Payments Processing

Global PAYplus Business Guide Page 30

o Positive Acknowledgments: Generated for successfully processed transactions

o Negative Acknowledgments: Generated for transactions that failed processing, each advice

message includes a reason for the failure

Additional File Validation and Request File Generation: During the process, GPP performs

additional file validations, which can result in the following:

o Complete or Partial File Acceptance: If a file passes additional file validations, completely or

partially, GPP generates an acknowledgment file in pain.002 format. The file contains

accumulated information for each individual transaction with an ACTC reason code for each

accepted transaction and an RJCT reason code for each rejected transaction.

o File Rejection: If a file does not pass additional file validations, GPP rejects the entire file, sets

the file rejection code to RJCT, and generates a file-level rejection. The file does not contain

individual transactions.

Sub-Batch: During the Sub-Batch flow, GPP invokes Advising Type Selection rules to generate

an individual pain.002 NAK for each transaction that received a negative compliance response.

For more information about the GPP Compliance Service, see Compliance Check.

The Advising Type Selection rules can also be used to set up event notifications when the information

provided in each event is by a predetermined structure, such as a configurable XML tag or value.

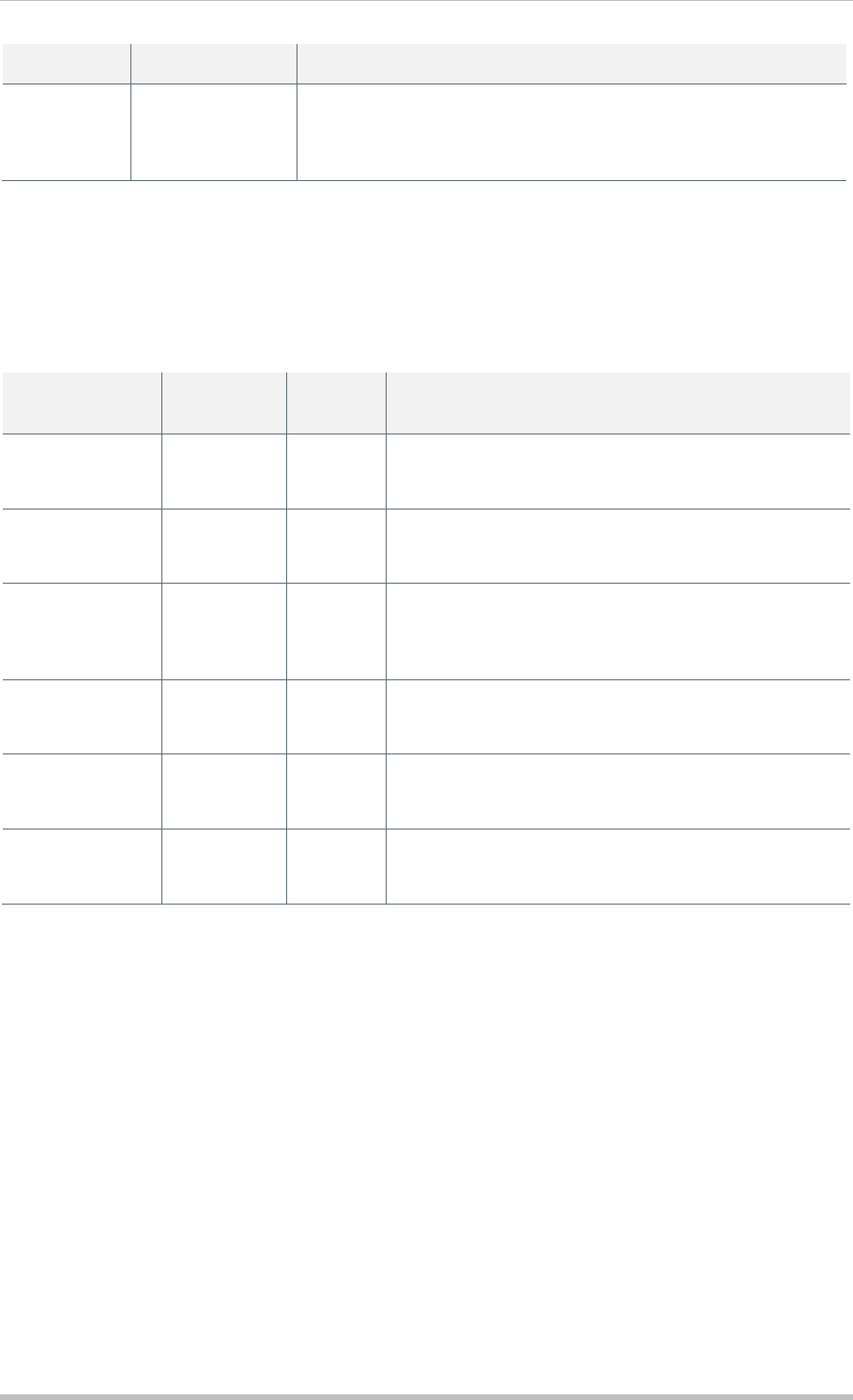

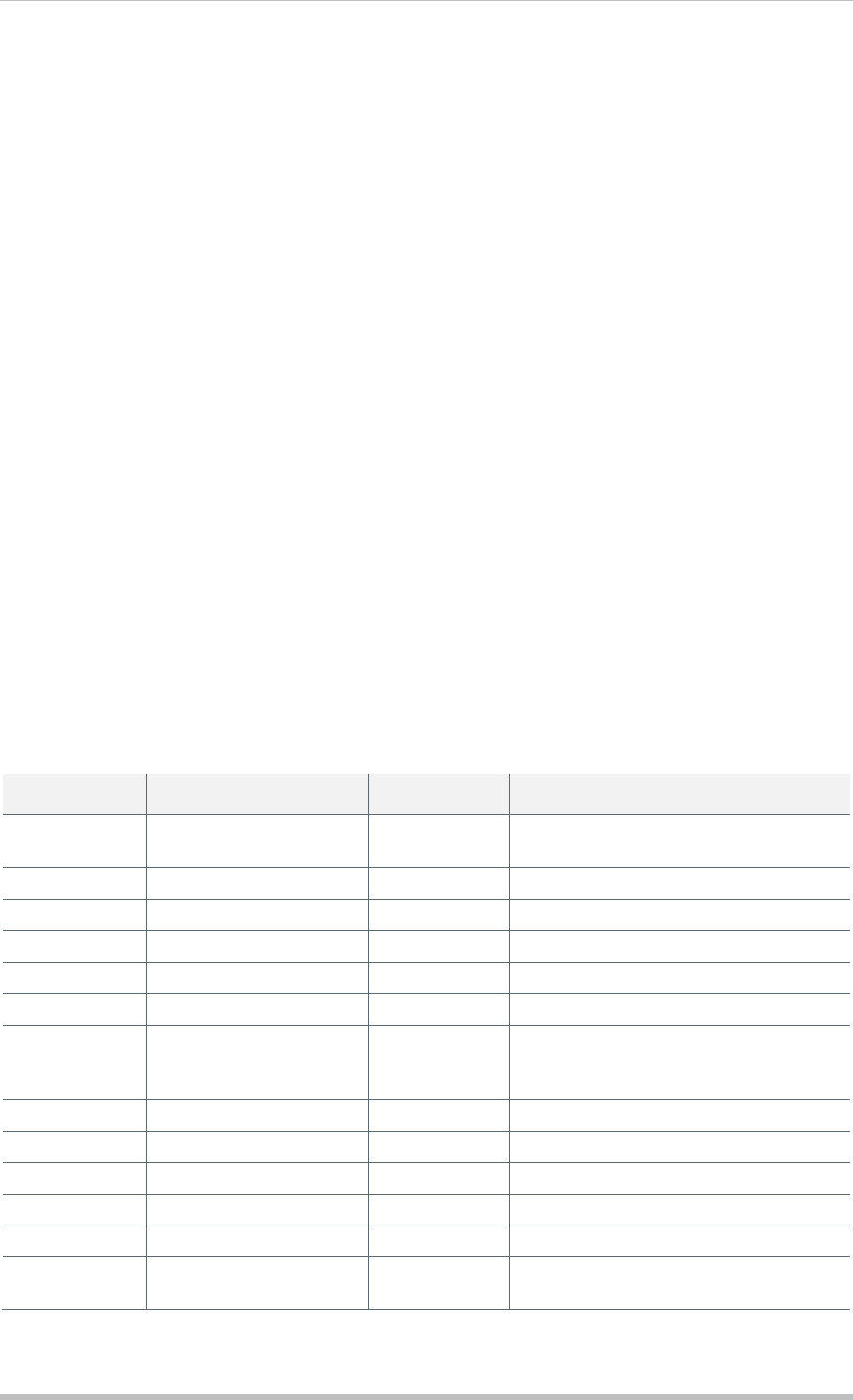

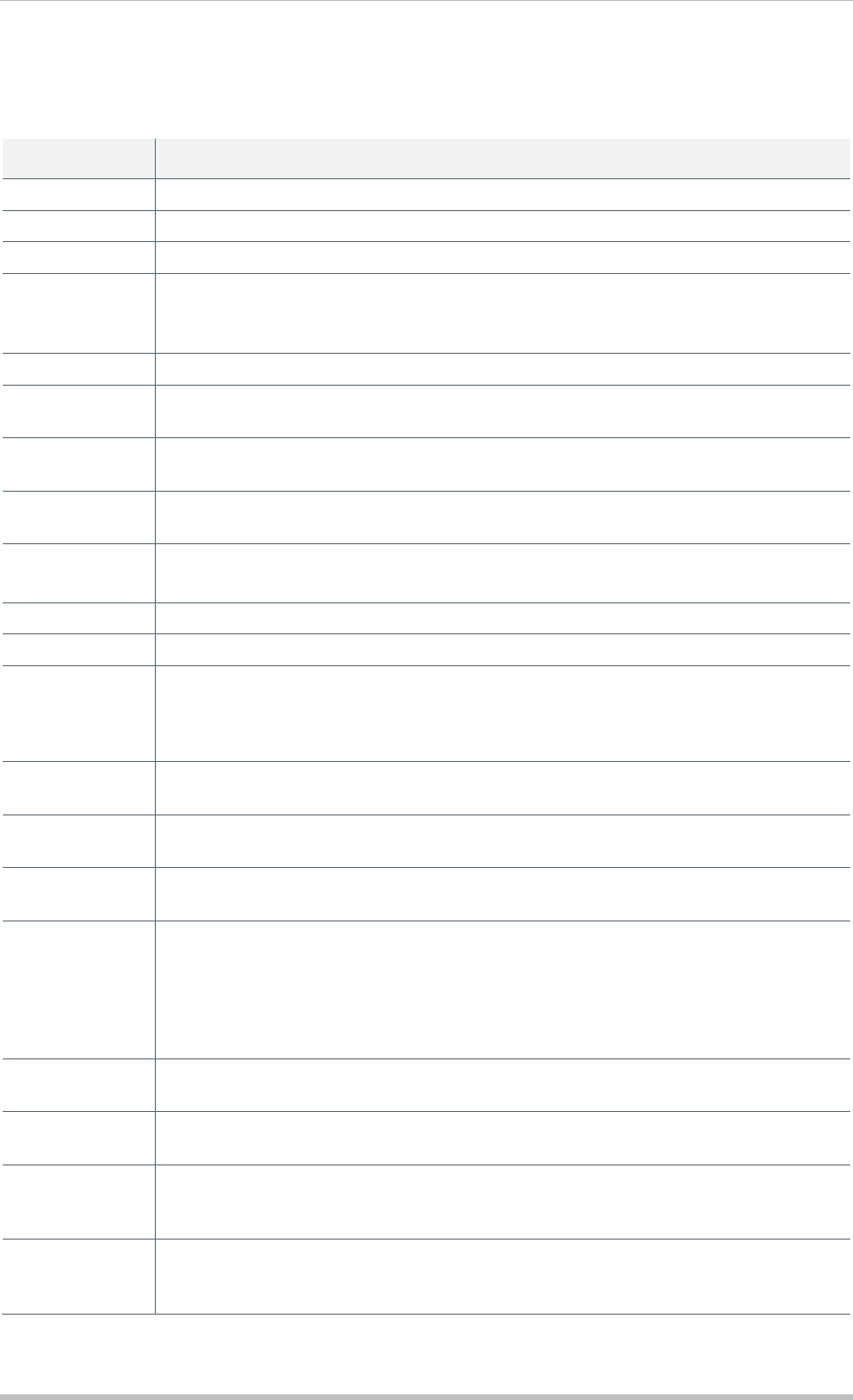

2.1.8 Mass Payments Accounting

2.1.8.1 Outward Credit Transfer Accounting Models

GPP generates a single or consolidated posting.

When a file of credit transfers is received from a corporate customer, GPP can perform a consolidated

debit to the debtor’s account. Consolidated postings, are offset against a suspense account. When

the transactions are sent out, for example, to clearing, GPP debits the same suspense account

previously credited and credits a clearing account.

Accounting Model

Description

Exceptions Scenarios

Customer Leg

(Debit

Customer)

Itemized

For each transaction within a

file, individual posting entries

and accounting requests will

be generated.

Any payments

rejected/cancelled at a

later stage perform

reverse accounting

Consolidated Net

Accounting

Performs lump sum

accounting (debit customer)

for processed transactions

only (for example,

transactions which

successfully completed pre-

processing)

Posting is not performed for

rejected or canceled

transactions.

Payments included in the

lump sum posting, and

rejected/cancelled at a

later stage are posted

separately as offsets to

the account (reverse

accounting)

Consolidated

Gross Accounting

Performs Lump sum

accounting which debits

customer for all transactions

which were not rejected

during pre-processing.

For example, transactions

which completed pre-

processing/in repair/

sanctions hold.

Any payments

rejected/cancelled after

posting are posted

separately as offsets to

the account (reverse

accounting).

Mass Payments Processing

Global PAYplus Business Guide Page 31

Accounting Model

Description

Exceptions Scenarios

Clearing

Leg/Book

(Credit

Settlement

account)

Itemized

For each transaction,

individual posting entries and

accounting requests are

generated to credit the

settlement account /

customer.

Rejected/cancelled

payments perform

reverse accounting.

Consolidated

Credit - Gross

GPP performs consolidated

credit-side posting, in which

posting debits the relevant

suspense account and

credits the clearing account

associated with the MOP.

Any payments rejected

by the scheme are

posted separately as

offsets to the account

(reverse accounting).

2.1.8.2 Inward Credit Transfer Accounting Models

Accounting Model

Description

Exceptions Scenarios

Clearing Leg

(Debit

Settlement

account)

Itemized

Any payment

rejected/cancelled at a later

stage performs reverse

accounting.

Any payments

rejected/cancelled at a

later stage perform

reverse accounting.

Consolidated

Gross Accounting

Lump sum accounting debits

settlement account for lump

sum amount of all

transactions received from

the clearing.

Any payments rejected at

a later stage are posted

separately as offsets to

the account (reverse

accounting).

Customer Leg

(Credit

Customer)

Itemized

For each transaction within a

file, individual posting entries

and accounting requests are

generated to credit the

customers.

Consolidated

Credit - Gross

GPP performs consolidated

credit-side posting, in which

posting debits the relevant

suspense account and

credits the clearing account

associated with the MOP.

Any payments rejected

by the scheme are

posted separately as

offsets to the account

(reverse accounting).

2.2 Direct Debit Process

2.2.1 Incoming File Handling

GPP receives and processes incoming files that contain transaction messages.

Processing begins upon the receipt of a mass payment file, such as a file containing pain.001 or

pain.008 messages.

Mass Payments Processing

Global PAYplus Business Guide Page 32

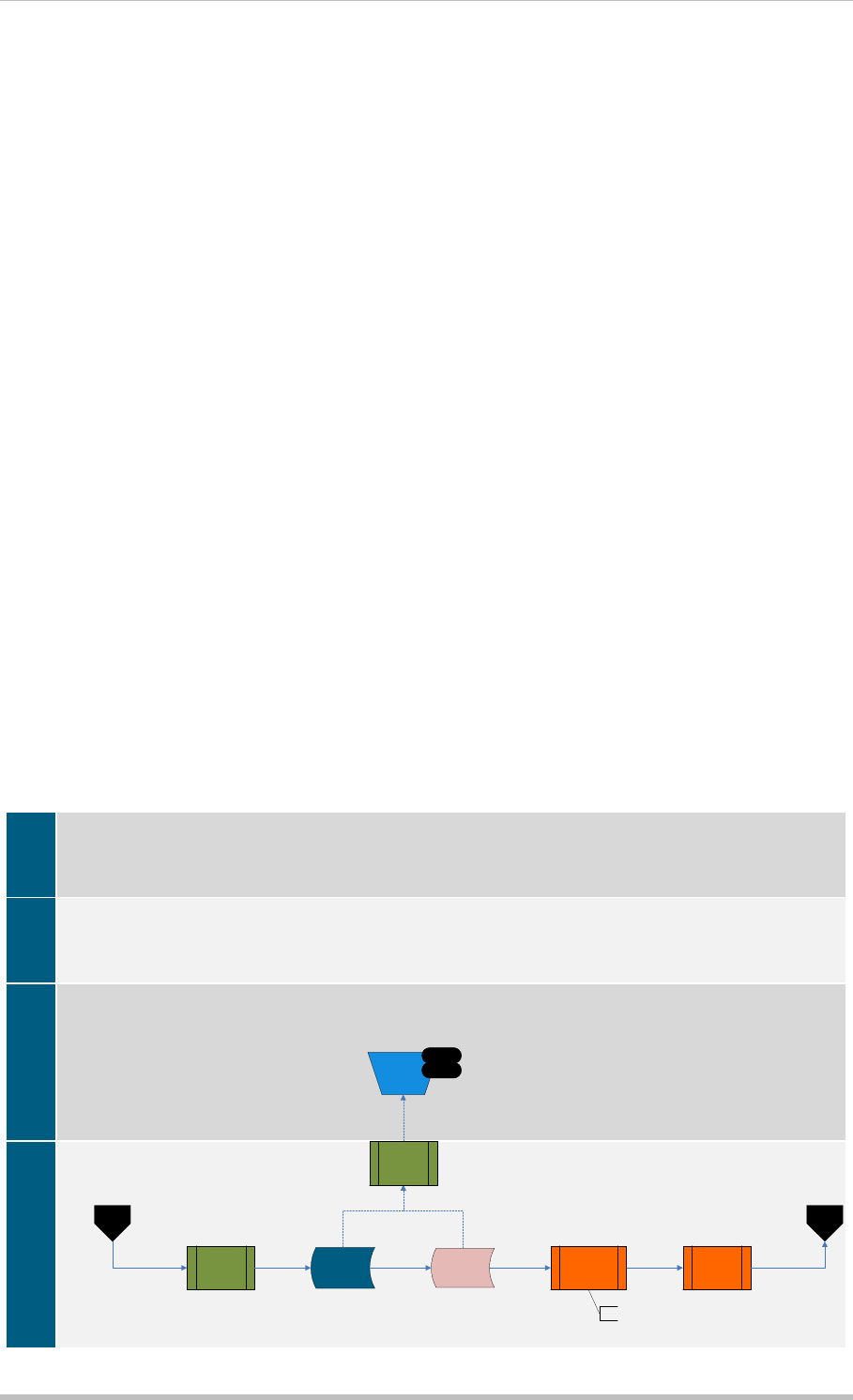

2.2.1.1 File Processing Workflow

File Processing

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 3 of 35

Start

File

File Parsing/

Validations

Rejected

File Priority File

Duplicate

Check

MatchingCheckService

Sub Type = Orig

File^Duplicate

File

Department

Selection

Create

Batch

Summary

Cont

File Processing II

External

Systems

IntegrationManual Handling

Global PayPlus Services

Platform

Page 4 of 35

Validate

Initiating

Party

Not Valid

InitgPty

Incoming

File Filter

Rules

Rejected

Hold

Split file to

processing

group

(chunks)

Cont

Distributed

Release

Distributed

Business

Flow

Selection

Cancelled

Release

Rejected

Back

Mass Payments Processing

Global PAYplus Business Guide Page 33

2.2.1.2 File Parsing/Validations