NonBOA_ee_packet_2007 Payroll Forms

Payroll Forms 1 Payroll_Forms_1 Payroll_Forms_1 4 2013 pdf 258413772373414384

2013-04-16

: Pdf Payroll Forms Payroll_Forms 4 2013 pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 8

Gathering Employee Information

To help you set up payroll, have each employee complete Form W-4 (attached). Use the

completed form to record the employee’s filing status and allowances for federal income tax

withholding.

Also, have each employee complete an I-9 (attached). This federal form verifies the employee’s

eligibility to work in the U.S. Required: keep the completed form on file (you do not need to

enter any information from the form in your payroll account).

Your state might require each employee to complete additional forms. For more information, click

Taxes & Forms in the navigation bar at the top of the page, then click Employee Setup.

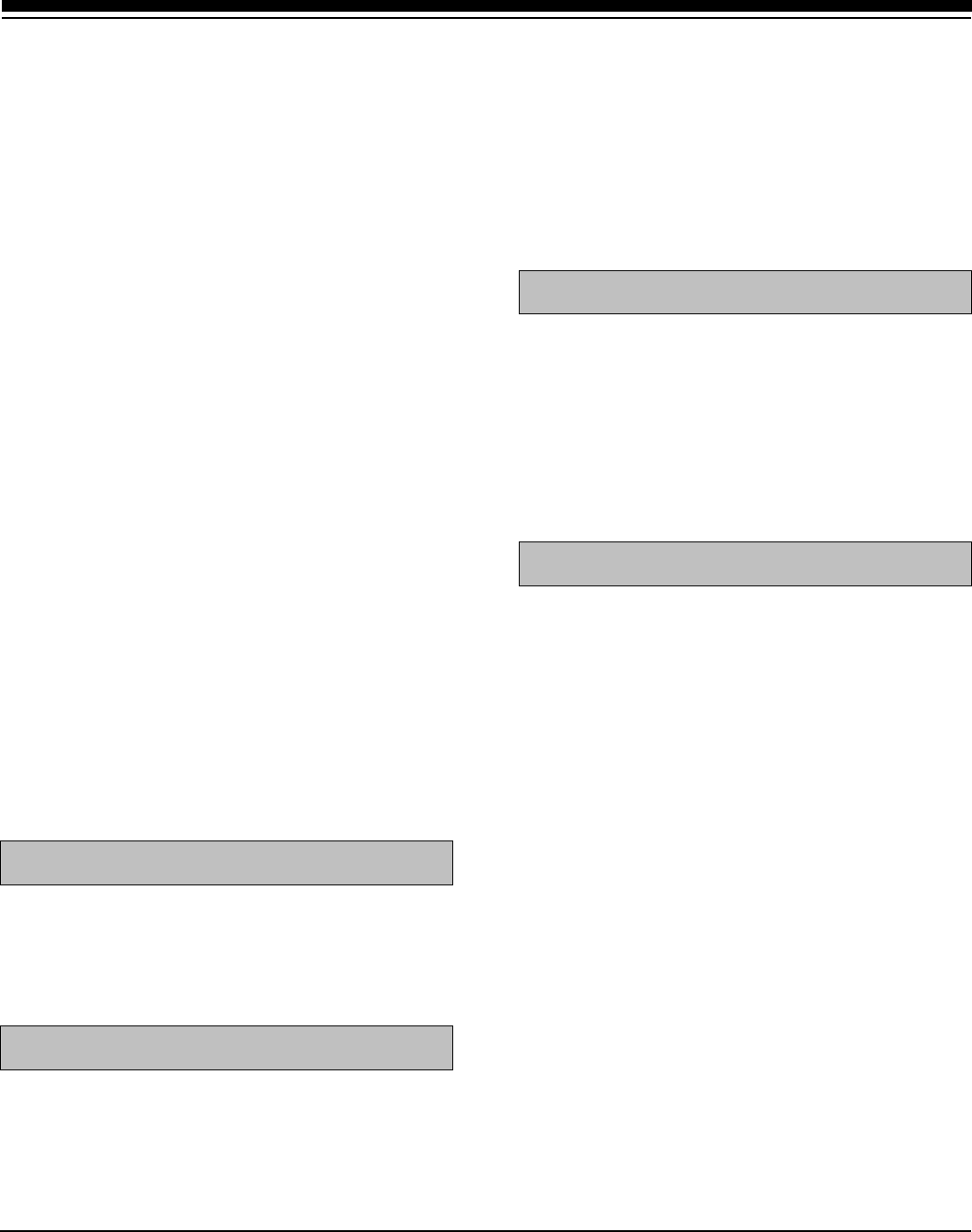

Form W-4 (2013)

Purpose. Complete Form W-4 so that your

employer can withhold the correct federal income

tax from your pay. Consider completing a new Form

W-4 each year and when your personal or financial

situation changes.

Exemption from withholding. If you are exempt,

complete only lines 1, 2, 3, 4, and 7 and sign the

form to validate it. Your exemption for 2013 expires

February 17, 2014. See Pub. 505, Tax Withholding

and Estimated Tax.

Note. If another person can claim you as a

dependent on his or her tax return, you cannot claim

exemption from withholding if your income exceeds

$1,000 and includes more than $350 of unearned

income (for example, interest and dividends).

Basic instructions. If you are not exempt, complete

the Personal Allowances Worksheet below. The

worksheets on page 2 further adjust your

withholding allowances based on itemized

deductions, certain credits, adjustments to income,

or two-earners/multiple jobs situations.

Complete all worksheets that apply. However, you

may claim fewer (or zero) allowances. For regular

wages, withholding must be based on allowances

you claimed and may not be a flat amount or

percentage of wages.

Head of household. Generally, you can claim head

of household filing status on your tax return only if

you are unmarried and pay more than 50% of the

costs of keeping up a home for yourself and your

dependent(s) or other qualifying individuals. See

Pub. 501, Exemptions, Standard Deduction, and

Filing Information, for information.

Tax credits. You can take projected tax credits into

account in figuring your allowable number of

withholding allowances. Credits for child or

dependent care expenses and the child tax credit

may be claimed using the Personal Allowances

Worksheet below. See Pub. 505 for information on

converting your other credits into withholding

allowances.

Nonwage income. If you have a large amount of

nonwage income, such as interest or dividends,

consider making estimated tax payments using Form

1040-ES, Estimated Tax for Individuals. Otherwise, you

may owe additional tax. If you have pension or annuity

income, see Pub. 505 to find out if you should adjust

your withholding on Form W-4 or W-4P.

Two earners or multiple jobs. If you have a

working spouse or more than one job, figure the

total number of allowances you are entitled to claim

on all jobs using worksheets from only one Form

W-4. Your withholding usually will be most accurate

when all allowances are claimed on the Form W-4

for the highest paying job and zero allowances are

claimed on the others. See Pub. 505 for details.

Nonresident alien. If you are a nonresident alien,

see Notice 1392, Supplemental Form W-4

Instructions for Nonresident Aliens, before

completing this form.

Check your withholding. After your Form W-4 takes

effect, use Pub. 505 to see how the amount you are

having withheld compares to your projected total tax

for 2013. See Pub. 505, especially if your earnings

exceed $130,000 (Single) or $180,000 (Married).

Future developments. Information about any future

developments affecting Form W-4 (such as

legislation enacted after we release it) will be posted

at www.irs.gov/w4.

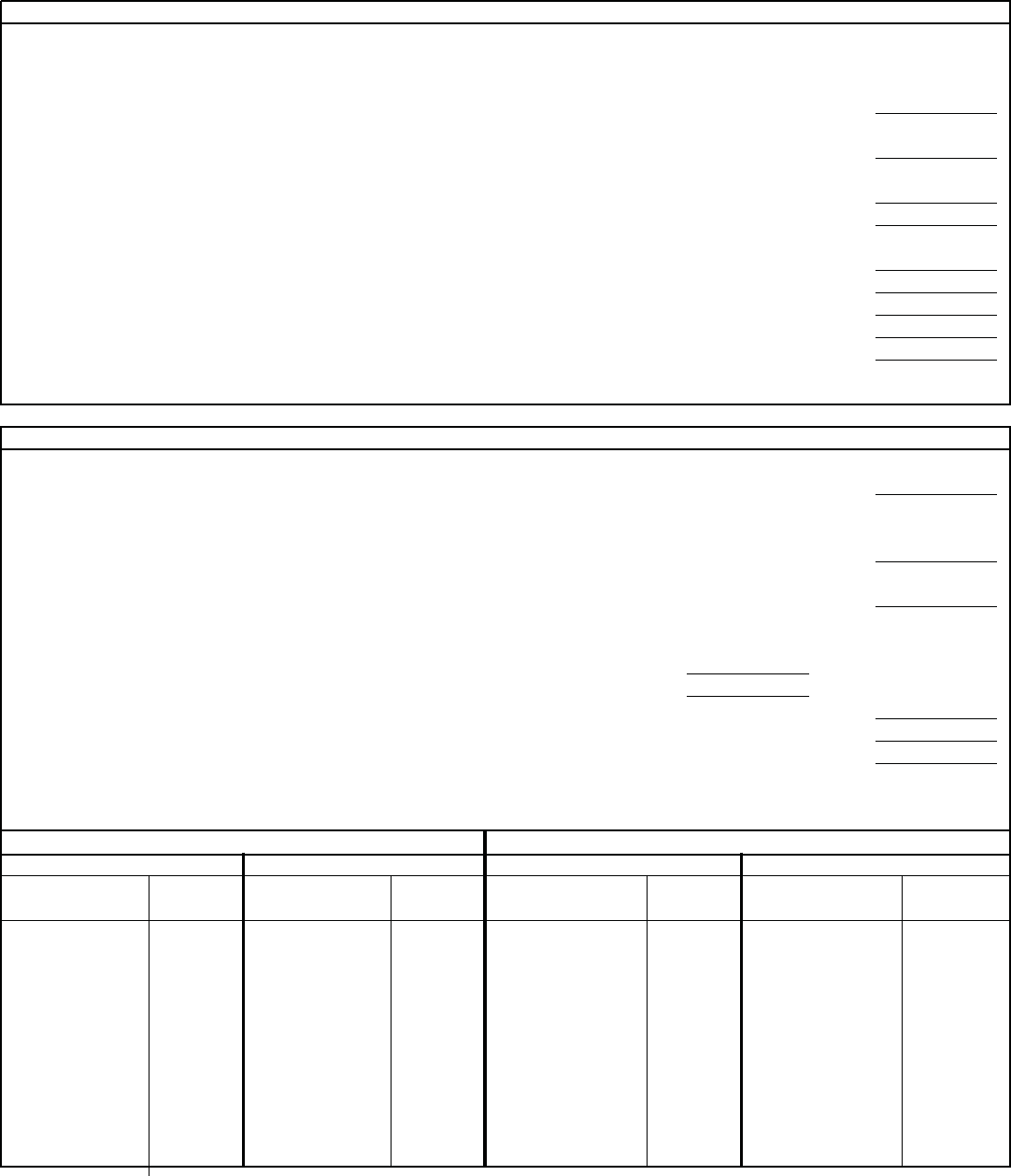

Personal Allowances Worksheet (Keep for your records.)

AEnter “1” for yourself if no one else can claim you as a dependent .................. A

BEnter “1” if:

{

• You are single and have only one job; or

• You are married, have only one job, and your spouse does not work; or . . .

•

Your wages from a second job or your spouse’s wages (or the total of both) are $1,500 or less.

}

B

CEnter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more

than one job. (Entering “-0-” may help you avoid having too little tax withheld.) . ............. C

DEnter number of dependents (other than your spouse or yourself) you will claim on your tax return ........ D

EEnter “1” if you will file as head of household on your tax return (see conditions under Head of household above) . . E

FEnter “1” if you have at least $1,900 of child or dependent care expenses for which you plan to claim a credit . . . F

(Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.)

G Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $65,000 ($95,000 if married), enter “2” for each eligible child; then less “1” if you

have three to six eligible children or less “2” if you have seven or more eligible children.

• If your total income will be between $65,000 and $84,000 ($95,000 and $119,000 if married), enter “1” for each eligible child ...

G

H

Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.)

aH

For accuracy,

complete all

worksheets

that apply.

{

• If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions

and Adjustments Worksheet on page 2.

• If you are single and have more than one job or are married and you and your spouse both work and the combined

earnings from all jobs exceed

$40,000 ($10,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to

avoid having too little tax withheld.

• If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Separate here and give Form W-4 to your employer. Keep the top part for your records.

Form W-4

Department of the Treasury

Internal Revenue Service

Employee's Withholding Allowance Certificate

a Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

OMB No. 1545-0074

2013

1 Your first name and middle initial Last name

Home address (number and street or rural route)

City or town, state, and ZIP code

2 Your social security number

3Single Married Married, but withhold at higher Single rate.

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

4If your last name differs from that shown on your social security card,

check here. You must call 1-800-772-1213 for a replacement card.

a

5Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2) 5

6Additional amount, if any, you want withheld from each paycheck .............. 6$

7I claim exemption from withholding for 2013, and I certify that I meet both of the following conditions for exemption.

• Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and

• This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write “Exempt” here . . .............

a7

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

(This form is not valid unless you sign it.) aDate a

8 Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.)

9 Office code (optional)

10 Employer identification number (EIN)

For Privacy Act and Paperwork Reduction Act Notice, see page 2. Cat. No. 10220Q Form W-4 (2013)

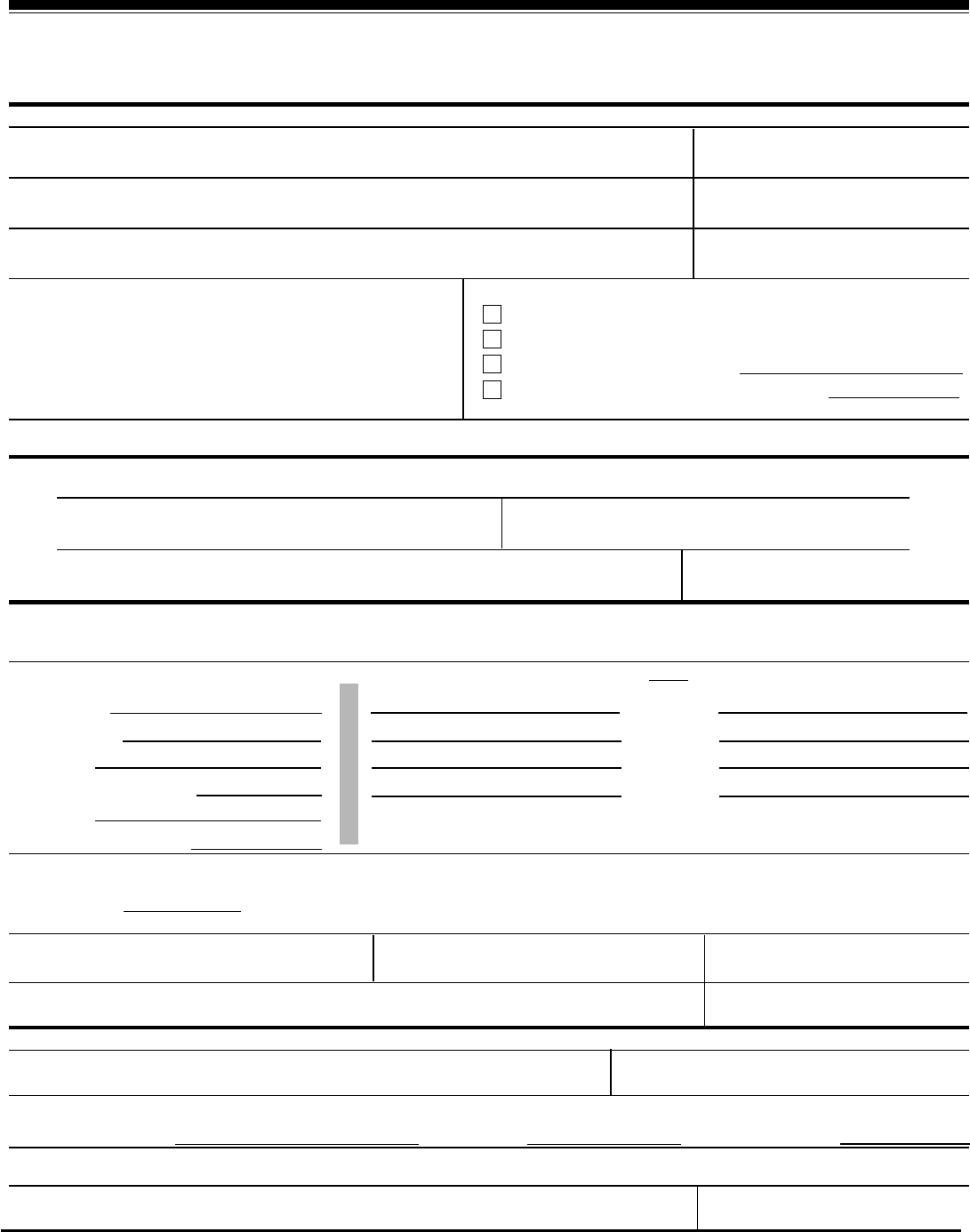

Form W-4 (2013) Page 2

Deductions and Adjustments Worksheet

Note. Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to income.

1Enter an estimate of your 2013 itemized deductions. These include qualifying home mortgage interest,

charitable contributions, state and local taxes, medical expenses in excess of 7.5% of your income, and

miscellaneous deductions ......................... 1$

2Enter:

{

$12,200 if married filing jointly or surviving spouse

$8,950 if head of household ...........

$6,100 if single or married filing separately

}

2$

3 Subtract line 2 from line 1. If zero or less, enter “-0-” . ............... 3$

4

Enter an estimate of your 2013 adjustments to income and any additional standard deduction (see Pub. 505)

4$

5Add lines 3 and 4 and enter the total. (Include any amount for credits from the Converting Credits to

Withholding Allowances for 2013 Form W-4 worksheet in Pub. 505.) . ........... 5$

6Enter an estimate of your 2013 nonwage income (such as dividends or interest) . ....... 6$

7 Subtract line 6 from line 5. If zero or less, enter “-0-” . ............... 7$

8 Divide the amount on line 7 by $3,900 and enter the result here. Drop any fraction ....... 8

9Enter the number from the Personal Allowances Worksheet, line H, page 1 . . ....... 9

10 Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earners/Multiple Jobs Worksheet,

also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, page 1 10

Two-Earners/Multiple Jobs Worksheet (See Two earners or multiple jobs on page 1.)

Note. Use this worksheet only if the instructions under line H on page 1 direct you here.

1

Enter the number from line H, page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet)

1

2Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if

you are married filing jointly and wages from the highest paying job are $65,000 or less, do not enter more

than “3” .............................. 2

3If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter

“-0-”) and on Form W-4, line 5, page 1. Do not use the rest of this worksheet ......... 3

Note. If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. Complete lines 4 through 9 below to

figure the additional withholding amount necessary to avoid a year-end tax bill.

4Enter the number from line 2 of this worksheet .......... 4

5Enter the number from line 1 of this worksheet .......... 5

6 Subtract line 5 from line 4 ......................... 6

7Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here .... 7$

8 Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed . . 8$

9

Divide line 8 by the number of pay periods remaining in 2013. For example, divide by 25 if you are paid every two

weeks and you complete this form on a date in January when there are 25 pay periods remaining in 2013. Enter

the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheld from each paycheck

9$

Table 1

Married Filing Jointly

If wages from LOWEST

paying job are—

Enter on

line 2 above

$0 - $5,000 0

5,001 - 13,000 1

13,001 - 24,000 2

24,001 - 26,000 3

26,001 - 30,000 4

30,001 - 42,000 5

42,001 - 48,000 6

48,001 - 55,000 7

55,001 - 65,000 8

65,001 - 75,000 9

75,001 - 85,000 10

85,001 - 97,000 11

97,001 - 110,000 12

110,001 - 120,000 13

120,001 - 135,000 14

135,001 and over 15

All Others

If wages from LOWEST

paying job are—

Enter on

line 2 above

$0 - $8,000 0

8,001 - 16,000 1

16,001 - 25,000 2

25,001 - 30,000 3

30,001 - 40,000 4

40,001 - 50,000 5

50,001 - 70,000 6

70,001 - 80,000 7

80,001 - 95,000 8

95,001 - 120,000 9

120,001 and over 10

Table 2

Married Filing Jointly

If wages from HIGHEST

paying job are—

Enter on

line 7 above

$0 - $72,000 $590

72,001 - 130,000 980

130,001 - 200,000 1,090

200,001 - 345,000 1,290

345,001 - 385,000 1,370

385,001 and over 1,540

All Others

If wages from HIGHEST

paying job are—

Enter on

line 7 above

$0 - $37,000 $590

37,001 - 80,000 980

80,001 - 175,000 1,090

175,001 - 385,000 1,290

385,001 and over 1,540

Privacy Act and Paperwork Reduction Act Notice.

We ask for the information on this

form to carry out the Internal Revenue laws of the United States. Internal Revenue Code

sections 3402(f)(2) and 6109 and their regulations require you to provide this information; your

employer uses it to determine your federal income tax withholding. Failure to provide a

properly completed form will result in your being treated as a single person who claims no

withholding allowances; providing fraudulent information may subject you to penalties. Routine

uses of this information include giving it to the Department of Justice for civil and criminal

litigation; to cities, states, the District of Columbia, and U.S. commonwealths and possessions

for use in administering their tax laws; and to the Department of Health and Human Services

for use in the National Directory of New Hires. We may also disclose this information to other

countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal

laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is subject to the

Paperwork Reduction Act unless the form displays a valid OMB control number. Books or

records relating to a form or its instructions must be retained as long as their contents may

become material in the administration of any Internal Revenue law. Generally, tax returns and

return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending

on individual circumstances. For estimated averages, see the instructions for your income tax

return.

If you have suggestions for making this form simpler, we would be happy to hear from you.

See the instructions for your income tax return.

Department of Homeland Security

U.S. Citizenship and Immigration Services

Form I-9, Employment

Eligibility Verification

Anti-Discrimination Notice. It is illegal to discriminate against

any individual (other than an alien not authorized to work in the

United States) in hiring, discharging, or recruiting or referring for a

fee because of that individual's national origin or citizenship status.

It is illegal to discriminate against work-authorized individuals.

Employers CANNOT specify which document(s) they will accept

from an employee. The refusal to hire an individual because the

documents presented have a future expiration date may also

constitute illegal discrimination. For more information, call the

Office of Special Counsel for Immigration Related Unfair

Employment Practices at 1-800-255-8155.

All employees (citizens and noncitizens) hired after November

6, 1986, and working in the United States must complete

Form I-9.

OMB No. 1615-0047; Expires 08/31/12

The Preparer/Translator Certification must be completed if

Section 1 is prepared by a person other than the employee. A

preparer/translator may be used only when the employee is

unable to complete Section 1 on his or her own. However, the

employee must still sign Section 1 personally.

Form I-9 (Rev. 08/07/09) Y

Read all instructions carefully before completing this form.

Instructions

When Should Form I-9 Be Used?

What Is the Purpose of This Form?

The purpose of this form is to document that each new

employee (both citizen and noncitizen) hired after November

6, 1986, is authorized to work in the United States.

For the purpose of completing this form, the term "employer"

means all employers including those recruiters and referrers

for a fee who are agricultural associations, agricultural

employers, or farm labor contractors. Employers must

complete Section 2 by examining evidence of identity and

employment authorization within three business days of the

date employment begins. However, if an employer hires an

individual for less than three business days, Section 2 must be

completed at the time employment begins. Employers cannot

specify which document(s) listed on the last page of Form I-9

employees present to establish identity and employment

authorization. Employees may present any List A document

OR a combination of a List B and a List C document.

Filling Out Form I-9

This part of the form must be completed no later than the time

of hire, which is the actual beginning of employment.

Providing the Social Security Number is voluntary, except for

employees hired by employers participating in the USCIS

Electronic Employment Eligibility Verification Program (E-

Verify). The employer is responsible for ensuring that

Section 1 is timely and properly completed.

1. Document title;

2. Issuing authority;

3. Document number;

4. Expiration date, if any; and

5. The date employment begins.

Employers must sign and date the certification in Section 2.

Employees must present original documents. Employers may,

but are not required to, photocopy the document(s) presented.

If photocopies are made, they must be made for all new hires.

Photocopies may only be used for the verification process and

must be retained with Form I-9. Employers are still

responsible for completing and retaining Form I-9.

Noncitizen nationals of the United States are persons born in

American Samoa, certain former citizens of the former Trust

Territory of the Pacific Islands, and certain children of

noncitizen nationals born abroad.

Employers should note the work authorization expiration

date (if any) shown in Section 1. For employees who indicate

an employment authorization expiration date in Section 1,

employers are required to reverify employment authorization

for employment on or before the date shown. Note that some

employees may leave the expiration date blank if they are

aliens whose work authorization does not expire (e.g., asylees,

refugees, certain citizens of the Federated States of Micronesia

or the Republic of the Marshall Islands). For such employees,

reverification does not apply unless they choose to present

If an employee is unable to present a required document (or

documents), the employee must present an acceptable receipt

in lieu of a document listed on the last page of this form.

Receipts showing that a person has applied for an initial grant

of employment authorization, or for renewal of employment

authorization, are not acceptable. Employees must present

receipts within three business days of the date employment

begins and must present valid replacement documents within

90 days or other specified time.

Employers must record in Section 2:

Preparer/Translator Certification

Section 2, Employer

Section 1, Employee

in Section 2 evidence of employment authorization that

contains an expiration date (e.g., Employment Authorization

Document (Form I-766)).

EMPLOYERS MUST RETAIN COMPLETED FORM I-9

DO NOT MAIL COMPLETED FORM I-9 TO ICE OR USCIS

To order USCIS forms, you can download them from our

website at www.uscis.gov/forms or call our toll-free number at

1-800-870-3676. You can obtain information about Form I-9

from our website at www.uscis.gov or by calling

1-888-464-4218.

USCIS Forms and Information

What Is the Filing Fee?

There is no associated filing fee for completing Form I-9. This

form is not filed with USCIS or any government agency. Form

I-9 must be retained by the employer and made available for

inspection by U.S. Government officials as specified in the

Privacy Act Notice below.

The authority for collecting this information is the

Immigration Reform and Control Act of 1986, Pub. L. 99-603

(8 USC 1324a).

Privacy Act Notice

This information is for employers to verify the eligibility of

individuals for employment to preclude the unlawful hiring, or

recruiting or referring for a fee, of aliens who are not

authorized to work in the United States.

A blank Form I-9 may be reproduced, provided both sides are

copied. The Instructions must be available to all employees

completing this form. Employers must retain completed Form

I-9s for three years after the date of hire or one year after the

date employment ends, whichever is later.

Photocopying and Retaining Form I-9

Form I-9 may be signed and retained electronically, as

authorized in Department of Homeland Security regulations

at 8 CFR 274a.2.

C. If an employee is rehired within three years of the date

this form was originally completed and the employee's

work authorization has expired or if a current

employee's work authorization is about to expire

(reverification), complete Block B; and:

1. Examine any document that reflects the employee

is authorized to work in the United States (see List

A or C);

2. Record the document title, document number, and

expiration date (if any) in Block C; and

3. Complete the signature block.

A. If an employee's name has changed at the time this form

is being updated/reverified, complete Block A.

B. If an employee is rehired within three years of the date

this form was originally completed and the employee is

still authorized to be employed on the same basis as

previously indicated on this form (updating), complete

Block B and the signature block.

Employers must complete Section 3 when updating and/or

reverifying Form I-9. Employers must reverify employment

authorization of their employees on or before the work

authorization expiration date recorded in Section 1 (if any).

Employers CANNOT specify which document(s) they will

accept from an employee.

For more detailed information, you may refer to the

USCIS Handbook for Employers (Form M-274). You may

obtain the handbook using the contact information found

under the header "USCIS Forms and Information."

Note that for reverification purposes, employers have the

option of completing a new Form I-9 instead of completing

Section 3.

Information about E-Verify, a free and voluntary program that

allows participating employers to electronically verify the

employment eligibility of their newly hired employees, can be

obtained from our website at www.uscis.gov/e-verify or by

calling 1-888-464-4218.

General information on immigration laws, regulations, and

procedures can be obtained by telephoning our National

Customer Service Center at 1-800-375-5283 or visiting our

Internet website at www.uscis.gov.

This information will be used by employers as a record of

their basis for determining eligibility of an employee to work

in the United States. The form will be kept by the employer

and made available for inspection by authorized officials of

the Department of Homeland Security, Department of Labor,

and Office of Special Counsel for Immigration-Related Unfair

Employment Practices.

Submission of the information required in this form is

voluntary. However, an individual may not begin employment

unless this form is completed, since employers are subject to

civil or criminal penalties if they do not comply with the

Immigration Reform and Control Act of 1986.

Section 3, Updating and Reverification

Form I-9 (Rev. 08/07/09) Y Page 2

Paperwork Reduction Act

An agency may not conduct or sponsor an information

collection and a person is not required to respond to a

collection of information unless it displays a currently valid

OMB control number. The public reporting burden for this

collection of information is estimated at 12 minutes per

response, including the time for reviewing instructions and

completing and submitting the form. Send comments

regarding this burden estimate or any other aspect of this

collection of information, including suggestions for reducing

this burden, to: U.S. Citizenship and Immigration Services,

Regulatory Management Division, 111 Massachusetts

Avenue, N.W., 3rd Floor, Suite 3008, Washington, DC

20529-2210. OMB No. 1615-0047. Do not mail your

completed Form I-9 to this address.

Form I-9 (Rev. 08/07/09) Y Page 3

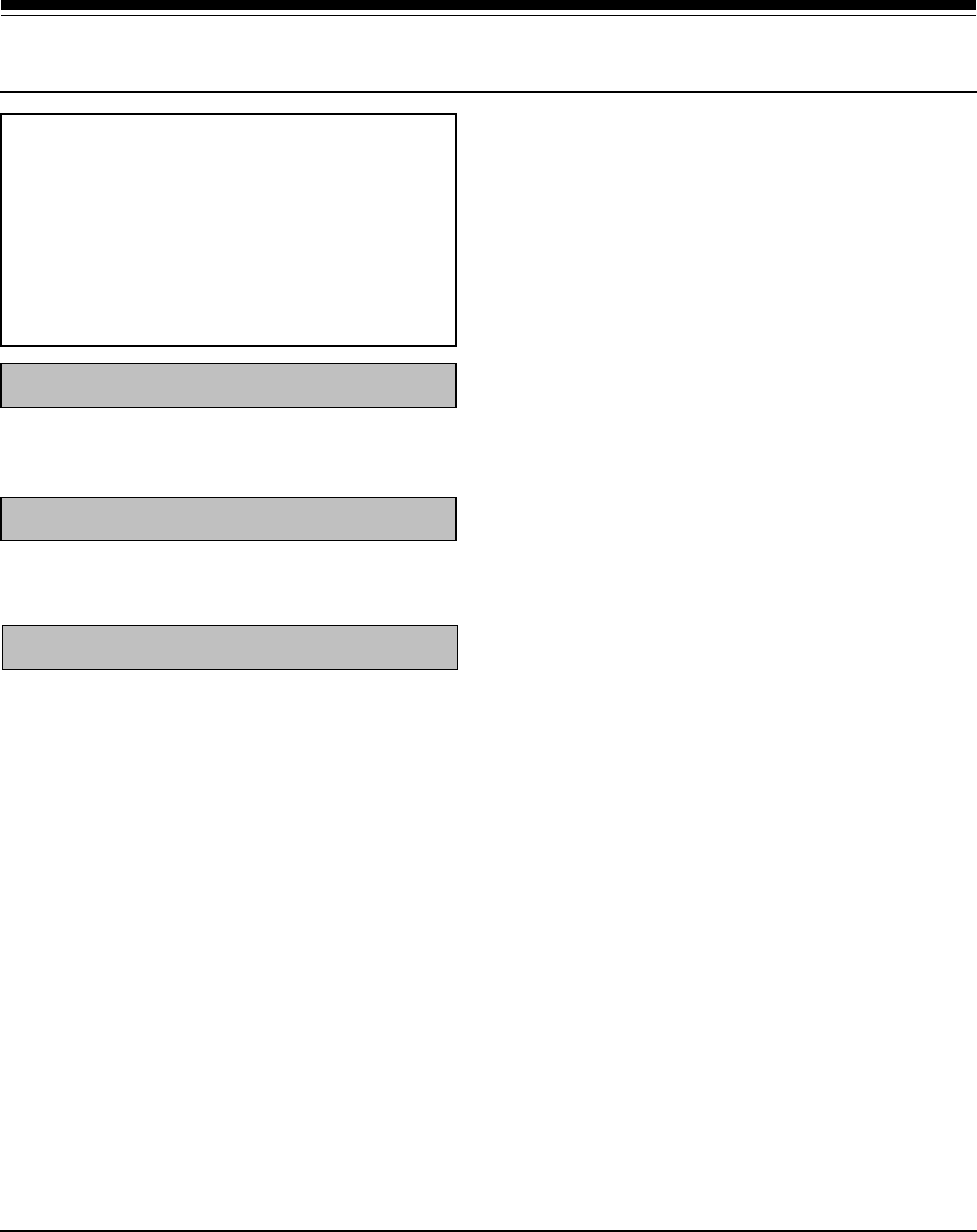

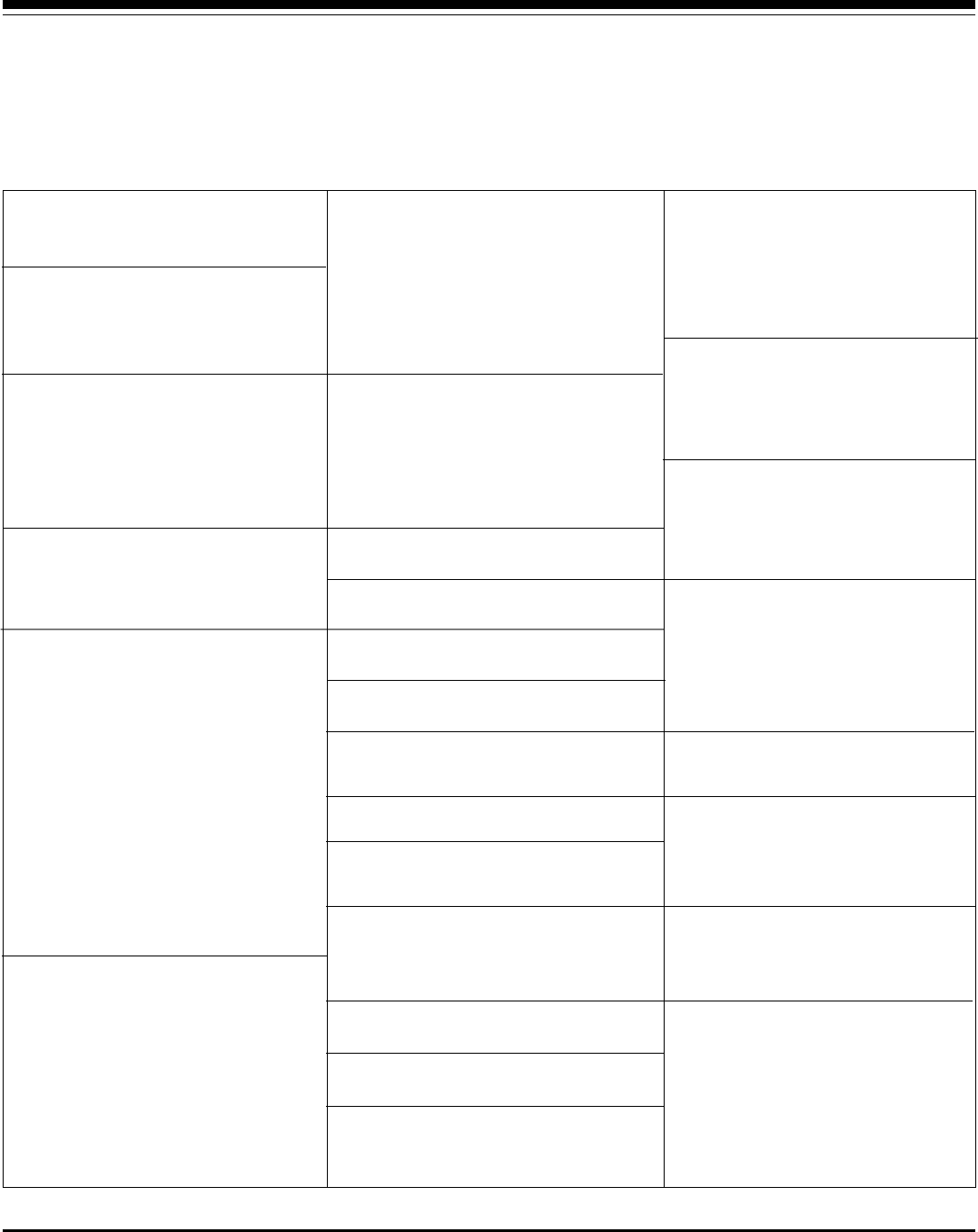

Department of Homeland Security

U.S. Citizenship and Immigration Services

Form I-9, Employment

Eligibility Verification

OMB No. 1615-0047; Expires 08/31/12

Read instructions carefully before completing this form. The instructions must be available during completion of this form.

ANTI-DISCRIMINATION NOTICE: It is illegal to discriminate against work-authorized individuals. Employers CANNOT

specify which document(s) they will accept from an employee. The refusal to hire an individual because the documents have a

future expiration date may also constitute illegal discrimination.

Section 1. Employee Information and Verification (To be completed and signed by employee at the time employment begins.)

Print Name: Last First Middle Initial Maiden Name

Address (Street Name and Number) Apt. # Date of Birth (month/day/year)

StateCity Zip Code Social Security #

I am aware that federal law provides for

imprisonment and/or fines for false statements or

use of false documents in connection with the

completion of this form.

Employee's Signature Date (month/day/year)

Preparer and/or Translator Certification (To be completed and signed if Section 1 is prepared by a person other than the employee.) I attest, under

penalty of perjury, that I have assisted in the completion of this form and that to the best of my knowledge the information is true and correct.

Address (Street Name and Number, City, State, Zip Code)

Print NamePreparer's/Translator's Signature

Date (month/day/year)

Section 2. Employer Review and Verification (To be completed and signed by employer. Examine one document from List A OR

examine one document from List B and one from List C, as listed on the reverse of this form, and record the title, number, and

expiration date, if any, of the document(s).)

ANDList B List CORList A

Document title:

Issuing authority:

Document #:

Expiration Date (if any):

Document #:

Expiration Date (if any):

and that to the best of my knowledge the employee is authorized to work in the United States. (State

(month/day/year)

employment agencies may omit the date the employee began employment.)

CERTIFICATION: I attest, under penalty of perjury, that I have examined the document(s) presented by the above-named employee, that

the above-listed document(s) appear to be genuine and to relate to the employee named, that the employee began employment on

Print Name TitleSignature of Employer or Authorized Representative

Date (month/day/year)Business or Organization Name and Address (Street Name and Number, City, State, Zip Code)

B. Date of Rehire (month/day/year) (if applicable)A. New Name (if applicable)

C. If employee's previous grant of work authorization has expired, provide the information below for the document that establishes current employment authorization.

Document #: Expiration Date (if any):Document Title:

Section 3. Updating and Reverification (To be completed and signed by employer.)

l attest, under penalty of perjury, that to the best of my knowledge, this employee is authorized to work in the United States, and if the employee presented

document(s), the document(s) l have examined appear to be genuine and to relate to the individual.

Date (month/day/year)Signature of Employer or Authorized Representative

I attest, under penalty of perjury, that I am (check one of the following):

A lawful permanent resident (Alien #)

A citizen of the United States

An alien authorized to work (Alien # or Admission #)

A noncitizen national of the United States (see instructions)

until (expiration date, if applicable - month/day/year)

Form I-9 (Rev. 08/07/09) Y Page 4

For persons under age 18 who

are unable to present a

document listed above:

LISTS OF ACCEPTABLE DOCUMENTS

LIST A LIST B LIST C

2. Permanent Resident Card or Alien

Registration Receipt Card (Form

I-551)

8. Employment authorization

document issued by the

Department of Homeland Security

1. Driver's license or ID card issued by

a State or outlying possession of the

United States provided it contains a

photograph or information such as

name, date of birth, gender, height,

eye color, and address

1. Social Security Account Number

card other than one that specifies

on the face that the issuance of the

card does not authorize

employment in the United States

9. Driver's license issued by a Canadian

government authority

1. U.S. Passport or U.S. Passport Card

2. Certification of Birth Abroad

issued by the Department of State

(Form FS-545)

3. Foreign passport that contains a

temporary I-551 stamp or temporary

I-551 printed notation on a machine-

readable immigrant visa

4. Employment Authorization Document

that contains a photograph (Form

I-766)

3. Certification of Report of Birth

issued by the Department of State

(Form DS-1350)

3. School ID card with a photograph

5. In the case of a nonimmigrant alien

authorized to work for a specific

employer incident to status, a foreign

passport with Form I-94 or Form

I-94A bearing the same name as the

passport and containing an

endorsement of the alien's

nonimmigrant status, as long as the

period of endorsement has not yet

expired and the proposed

employment is not in conflict with

any restrictions or limitations

identified on the form

6. Military dependent's ID card

4. Original or certified copy of birth

certificate issued by a State,

county, municipal authority, or

territory of the United States

bearing an official seal

7. U.S. Coast Guard Merchant Mariner

Card 5. Native American tribal document

8. Native American tribal document

7. Identification Card for Use of

Resident Citizen in the United

States (Form I-179)

10. School record or report card

11. Clinic, doctor, or hospital record

12. Day-care or nursery school record

Illustrations of many of these documents appear in Part 8 of the Handbook for Employers (M-274)

2. ID card issued by federal, state or

local government agencies or

entities, provided it contains a

photograph or information such as

name, date of birth, gender, height,

eye color, and address

4. Voter's registration card

5. U.S. Military card or draft record

Documents that Establish Both

Identity and Employment

Authorization

Documents that Establish

Identity

Documents that Establish

Employment Authorization

OR AND

All documents must be unexpired

6. Passport from the Federated States of

Micronesia (FSM) or the Republic of

the Marshall Islands (RMI) with

Form I-94 or Form I-94A indicating

nonimmigrant admission under the

Compact of Free Association

Between the United States and the

FSM or RMI

6. U.S. Citizen ID Card (Form I-197)

Form I-9 (Rev. 08/07/09) Y Page 5