TM 00116 AFC Saa S Pro Telecom Developer Manual

TM_00116_AFC%20SaaS%20pro%20Telecom%20Developer%20Manual

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 114 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- 1. Introduction

- 1.1 Getting Started

- 1.2 AFC Transaction and Service Types

- 1.3 Client Information

- 1.4 Transaction Date

- 1.5 Tax Types

- 1.6 Bundles

- 1.7 Overrides

- 1.8 Exclusions

- 1.9 Exemptions

- 1.10 Compliance Files

- 1.11 Live vs. Test Transactions

- 1.12 Compliance Month

- 1.13 Tax Adjustments

- 1.14 Interstate/Intrastate Determination

- 1.15 Private Line

- 1.16 Proration

- 1.17 Tax Grouping

- 1.18 Specifying a Unique Identifier

- 1.19 Commit/Uncommit

- 1.20 Application of Tax Brackets and Limits

- 1.21 Use of Client IDs in the REST Interface

- 2. Specifying a Tax Jurisdiction

- 3. Invoice Mode

- 4. Generating Custom Reports

- 5. Bridge Conferencing

- 6. Optional Fields

- 7. Zip Lookup Requests

- 8. Safe Harbor Overrides for Traffic Studies

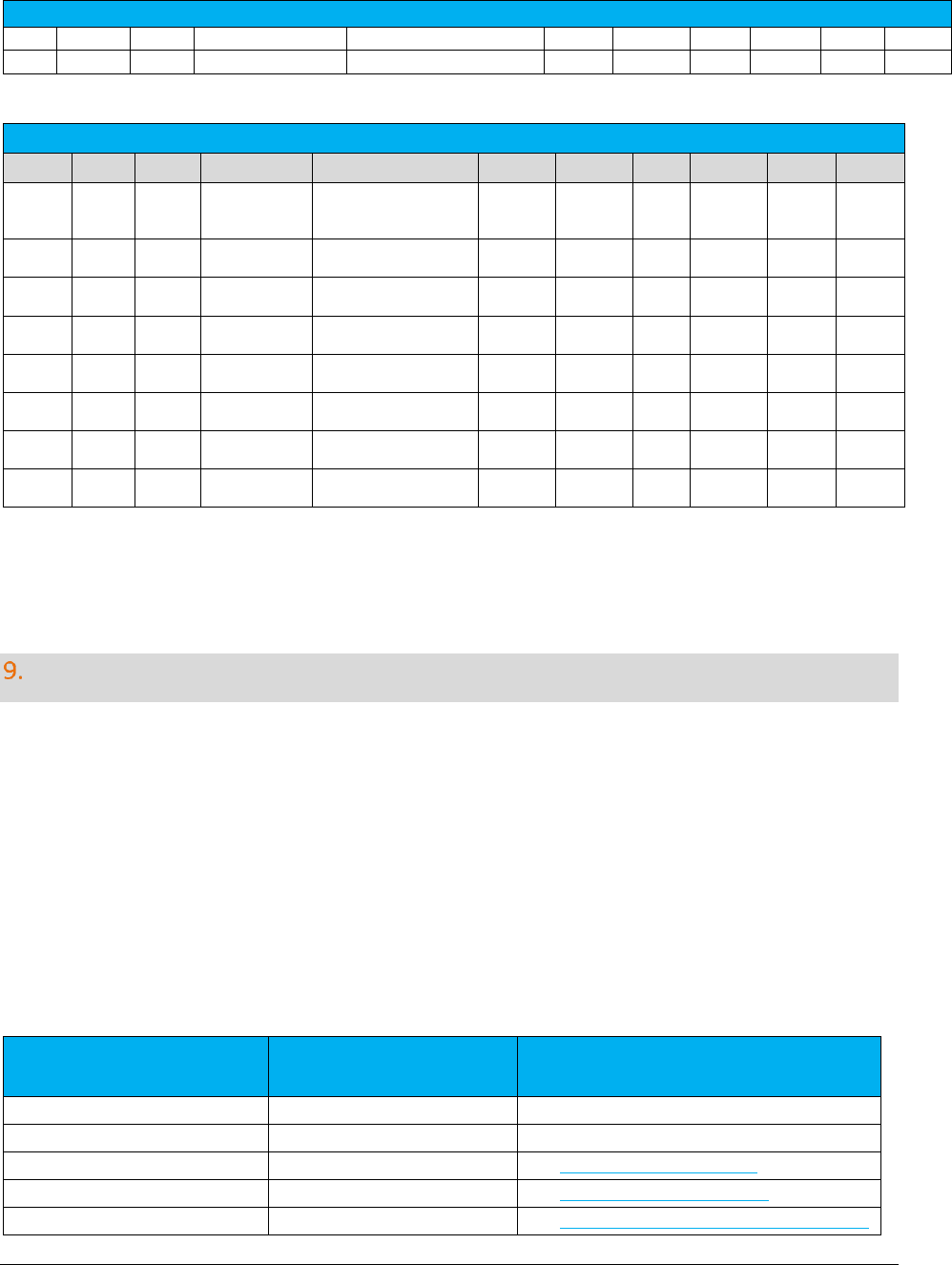

- 9. AFC SaaS Pro Telecom Web Service Programmer Reference

- 10. SOAP Telecom Web Methods

- 10.1 CalcTaxesWithPCode

- 10.2 CalcTaxesWithNpaNxx

- 10.3 CalcTaxesWithZipAddress

- 10.4 CalcTaxesWithFipsCode

- 10.5 CalcAdjWithPCode

- 10.6 CalcAdjWithNpaNxx

- 10.7 CalcAdjWithZipAddress

- 10.8 CalcAdjWithFipsCode

- 10.9 CalcReverseTaxesWithPCode

- 10.10 CalcReverseTaxesWithFipsCode

- 10.11 CalcReverseTaxesWithZipAddress

- 10.12 CalcReverseTaxesWithNpaNxx

- 10.13 CalcReverseAdjWithPCode

- 10.14 CalcReverseAdjWithFipsCode

- 10.15 CalcReverseAdjWithZipAddress

- 10.16 CalcReverseAdjWithNpaNxx

- 10.17 CalcTaxInclusiveTaxesWithPCode

- 10.18 CalcTaxInclusiveTaxesWithFipsCode

- 10.19 CalcTaxInclusiveTaxesWithZipAddress

- 10.20 CalcTaxInclusiveTaxesWithNpaNxx

- 10.21 CalcTaxInclusiveAdjWithPCode

- 10.22 CalcTaxInclusiveAdjWithFipsCode

- 10.23 CalcTaxInclusiveAdjWithZipAddress

- 10.24 CalcTaxInclusiveAdjWithNpaNxx

- 10.25 BeginCustomerBatch

- 10.26 CalcCustTaxes

- 10.27 CalcCustAdj

- 10.28 ProcessCustomerBatch

- 10.29 ProcessCustomerBatchV2

- 10.30 CalcTaxesInCustMode

- 10.31 CalcTaxesInCustModeV2

- 10.32 CalcProRatedTaxes

- 10.33 CalcProRatedAdj

- 10.34 CalcJurisdiction

- 10.35 CalcTaxesWithOverrides

- 10.36 CalcAdjWithOverrides

- 10.37 CalcBridgeConferenceTaxes

- 10.38 CalcAdjBridgeConferenceTaxes

- 10.39 CommitTransactions

- 10.40 Error Messages Common to all Calculation Methods

- 11. SOAP Utility Web Methods

- 11.1 GetAddress

- 11.2 GetTaxCategory

- 11.3 GetTaxDescription

- 11.4 GetTaxRates

- 11.5 FipsToPCode

- 11.6 PCodeToFips

- 11.7 ZipToPCode

- 11.8 NpaNxxToPCode

- 11.9 GetServerTime

- 11.10 GetVersion

- 11.11 GetEZtaxVersion

- 11.12 GetEZtaxDbVersion

- 11.13 CreateReport

- 11.14 GetOptionalFieldKeyDesc

- 11.15 UpdateOptionalFieldKeyDesc

- 11.16 ZipLookup

- 12. REST Interface APIs

- 13. Web Service Data Definitions

- 14. Web Service Enumeration Definitions

- 14.1 Specifying Tax Level

- 14.2 Specifying Calculation Type

- 14.3 Specifying Adjustment Method

- 14.4 Specifying Customer Type

- 14.5 Specifying Business Class

- 14.6 Specifying Service Class

- 14.7 Specifying Discount Type

- 14.8 Specifying Exemption Type

- 14.9 Specifying Lines

- 14.10 Specifying Sale Type

- 14.11 Specifying Incorporated

- 15. Monthly Update

AvaTax for Communications

SaaS Pro Telecom Developer Manual

Release: 9.18.1712.1

Document: TM_00116_0042

Date: 11/22/2017

All trade names referenced herein are either trademarks or registered trademarks of their respective companies.

© Avalara, Inc. 2017. CONFIDENTIAL

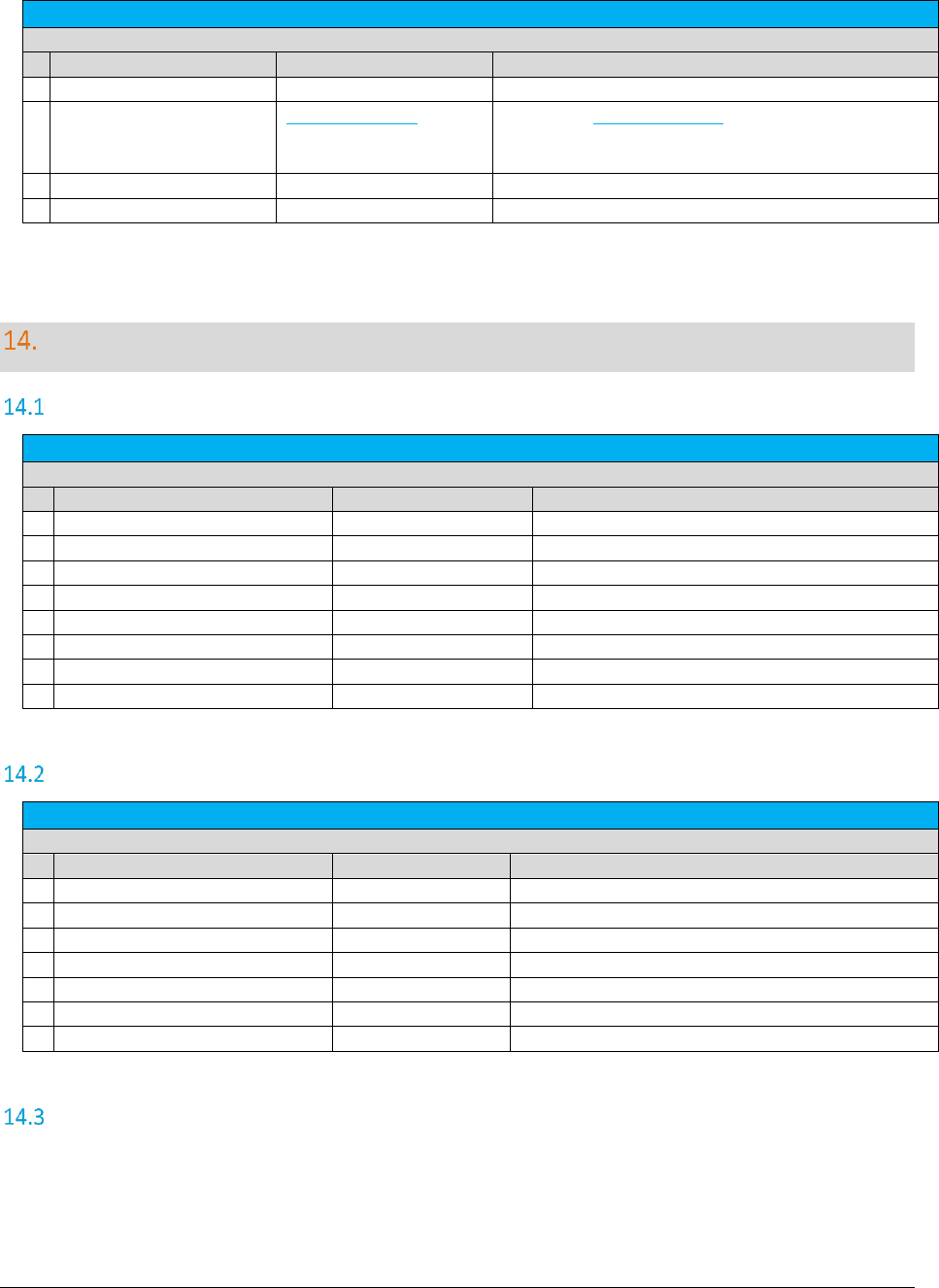

Avalara for Communications - Contact Information

Address

Avalara, Inc.

513 South Mangum Street, Suite 100

Durham, North Carolina, 27701

Toll Free

800-525-8175

Corporate Site

http://communications.avalara.com/

Comms Platform Site

https://communications.avalara.net

Email

communicationsupport@avalara.com

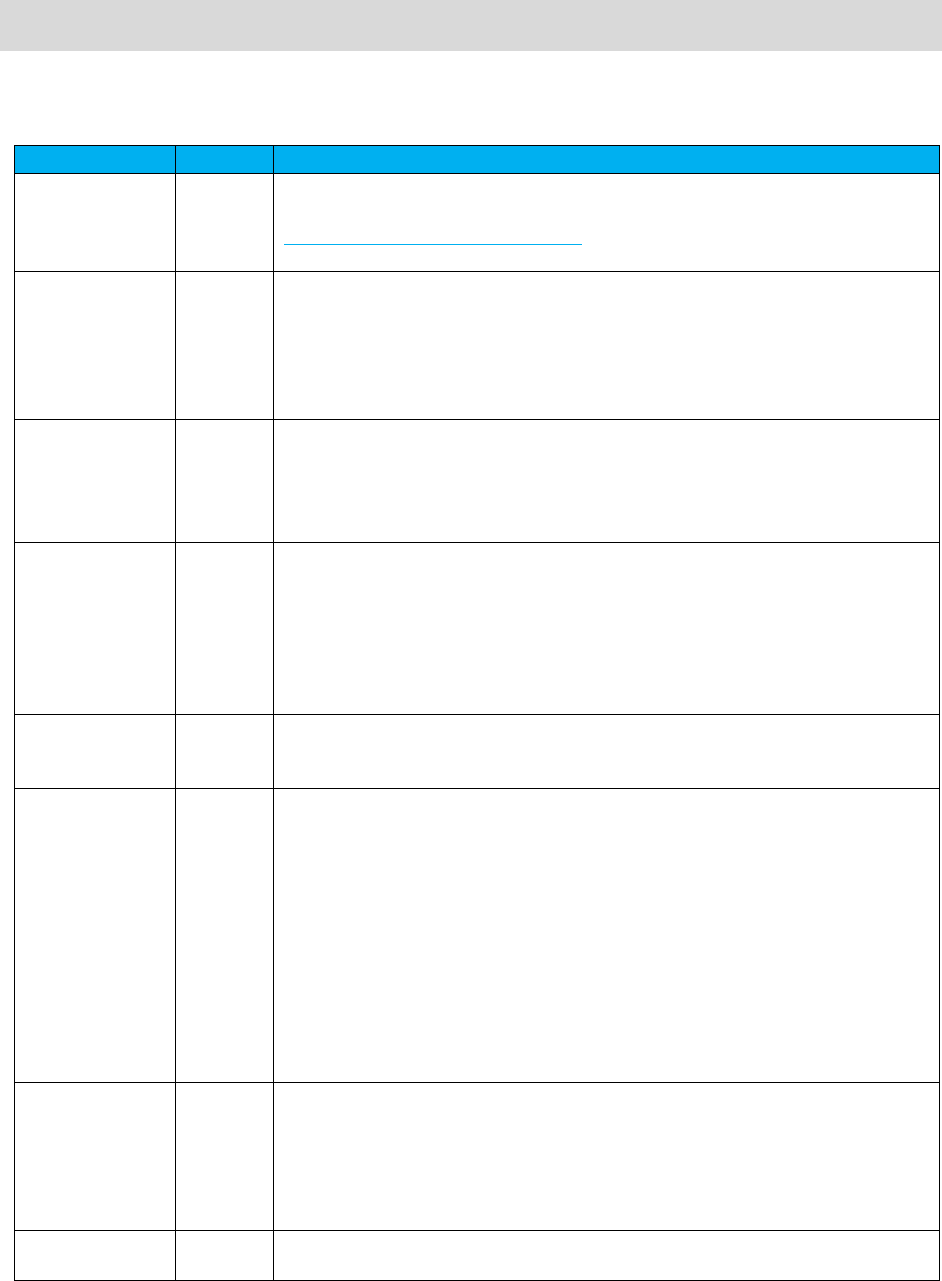

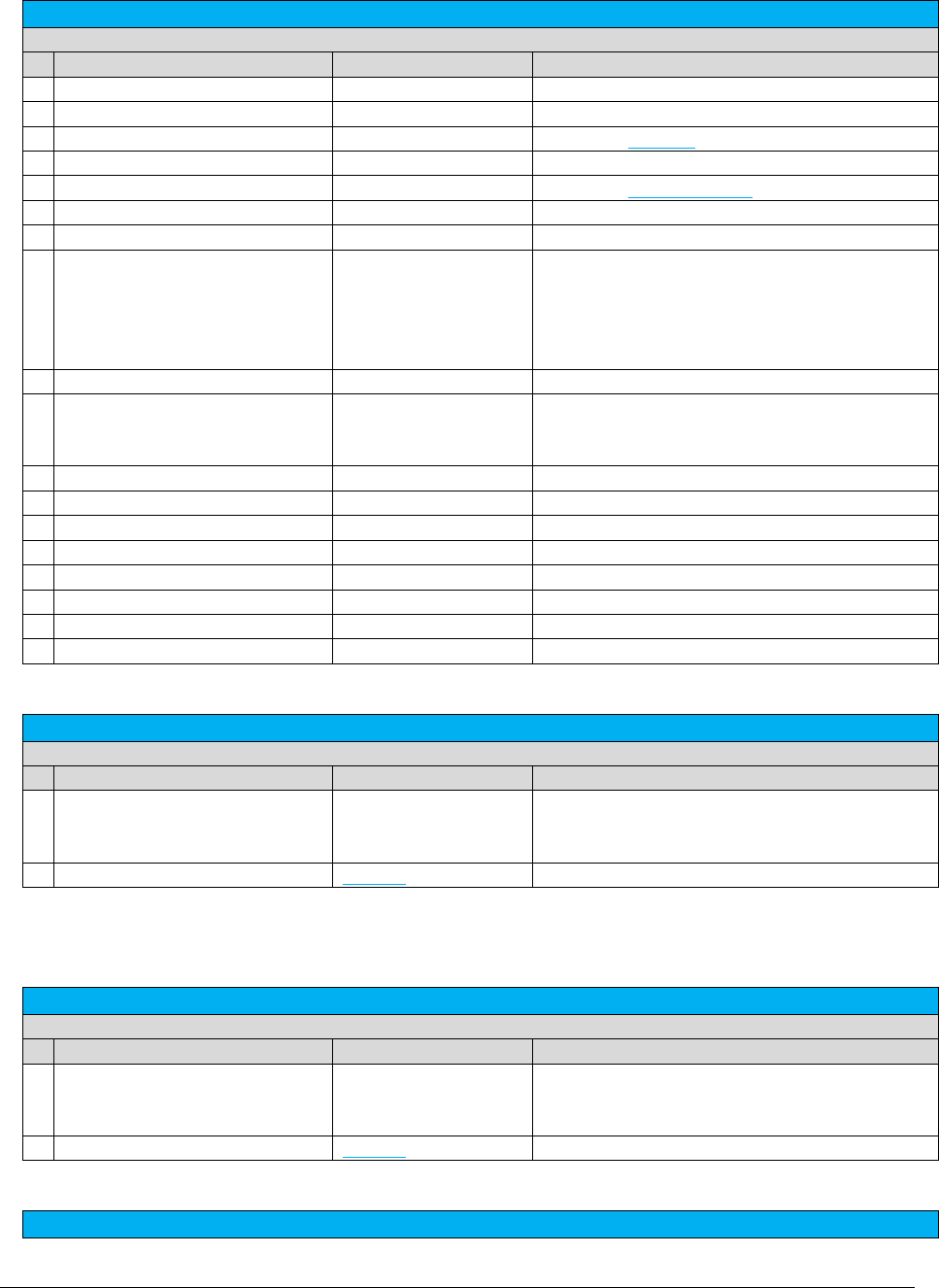

Document Revision History

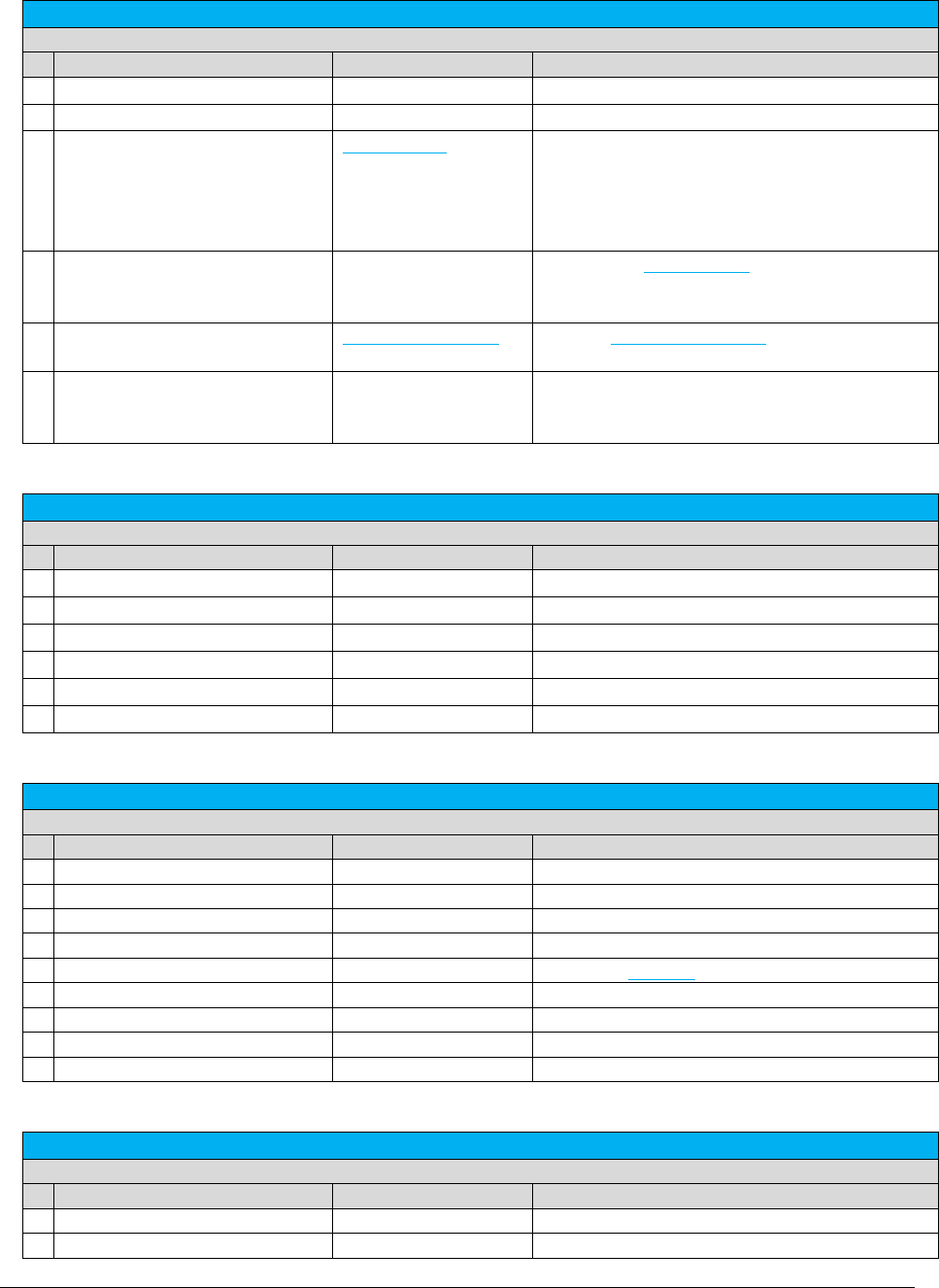

The Revision History log lists the date and description of the most recent revisions or versions of the

document.

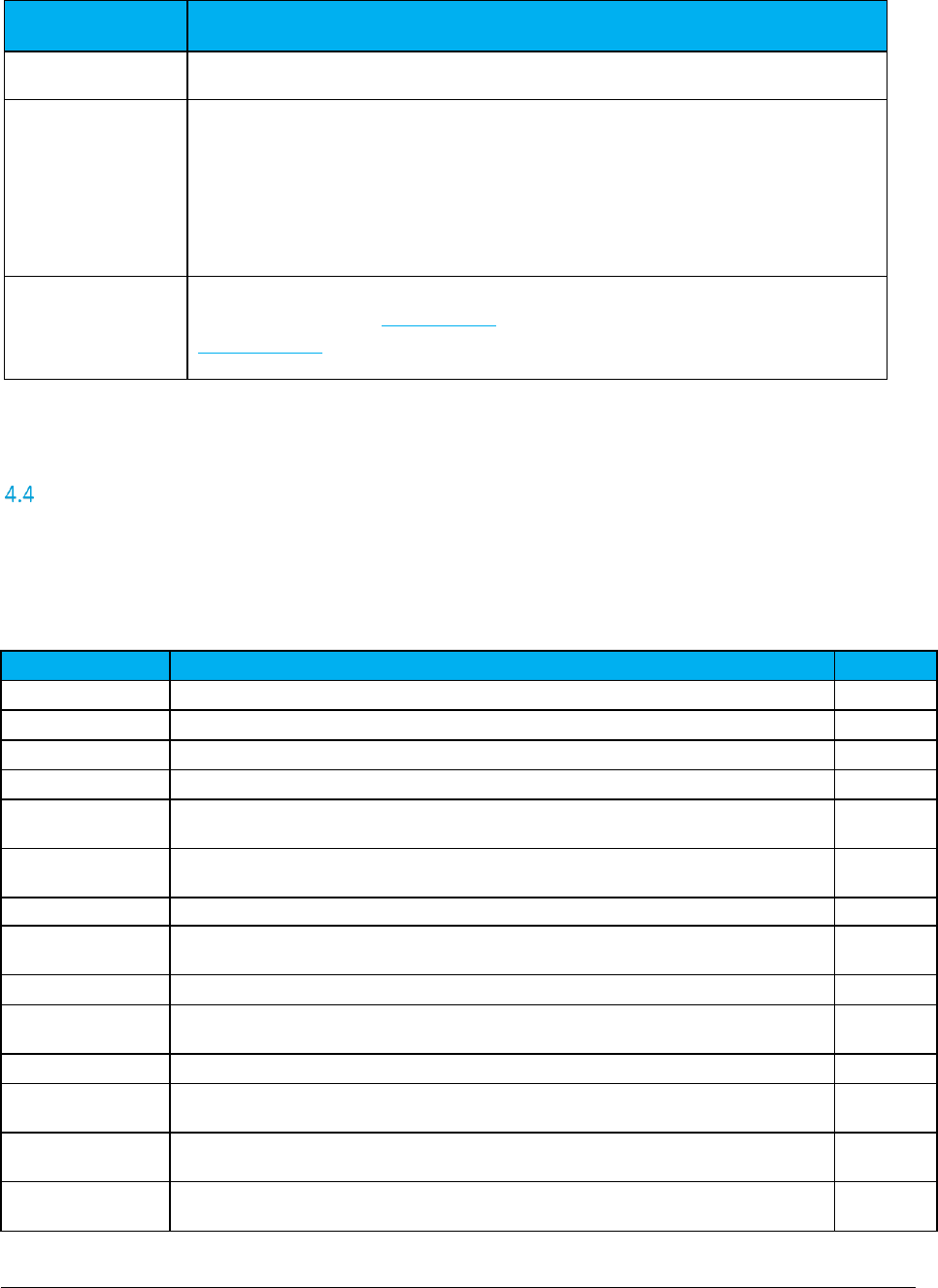

Date

Version

Description

02/19/2016

0026

Avalara branding updates to reflect the transition to the new company and

product names have been incorporated into this document. Please see

Appendix A – Avalara Product Names for specific changes in product references

and descriptions.

05/18/2016

0027

Updates to support Custom Log and Category Exemptions include: Addition of

new Section 1.8 Exemptions, updates to Section 1.15 Proration; updates to

Section 3 Customer Mode, added new Section 4 Generating Reports, updates to

Section 7 Utility Web Methods (CreateReport) and updates to Section 8 Web

Service Data Definitions (ReportOptions, CustomLogField and

CategoryExemption tables)

06/17/2016

0028

Added new Section 1.16 Tax Grouping, Section 3.6 Supported APIs for Customer

Mode, Section 5 Bridge Conferencing, and new tables added to Section 9 Web

Service Data Definitions to support bridge conferencing. Added note to Section

7.24 CalcJurisdiction and updated Section 2 with details for entry of Canadian

postal codes.

08/02/2016

0029

Added note in Section 1.7 Exclusions regarding excluded tax jurisdictions

appearing as unknown or not appearing on TSRs. Added new Section 6

Optional Fields to describe default and extended optional fields. Updated

Section 8 Utility Web Methods with new APIs, GetOptionalFieldKeyDesc and

UpdateOptionalFieldKeyDesc to support additional alphanumeric field for AFC

SaaS Pro. OptionalField added to Transaction table and an OptionalField and

OptionalKey table added in Section 9 Web Service Data Definitions.

09/26/2016

0030

Updated Section 4.4 Custom Log Report Columns to include columns for the

Extended Optional fields. Added new Section 12 Monthly Update Procedures for

downloading documentation.

11/15/2016

0031

Updated description in Section 1.9.2 Level Exemptions. Updated single

transaction maximum from 3,000 to 50,000 in Section 3 Customer Mode.

Added new Section 3.7 Tax Inclusive Transactions to indicate how to process tax

inclusive calculations in customer mode. Added new Section 7 Zip Lookup

Requests and 11.16 Zip Lookup to provide an overview of zip lookup

functionality and use of the API. Added new Section 10.21

ProcessCustomerBatchV2 API and Section 10.23 CalcTaxesInCustModeV2 API.

Added new Section 12 REST Interface APIs. Updated Section 13 Web Data

Definitions includes updated data structure tables for Transaction, and new

ones for TaxDataV2, CustomerResultsV2, ZipLookup, ZipLookupResults and

LocationData. Also, updated the BridgeConferenceParticipantResult table in

Section 13 to show the updated value for the errorcode field.

12/05/2016

0032

Updated Section 3 Customer Mode with note providing recommendation on

appropriate duration of a transaction in Invoice Mode. Updated Section 4.6.1

Accessing the FTP Site to reflect utilization of a secure file-transfer protocol

(SFTP) in addition to FTP. Updated remarks in Section 11.7 ZipToPCode. Added

Section 8 Safe Harbor Overrides for Traffic Studies and updated Section 13 Web

Data Definitions with the new SafeHarborOverride data structure table.

01/11/2017

0033

Updated Section 1.14 Private Line to reflect support of additional APIs. Also

updated copyright year on document.

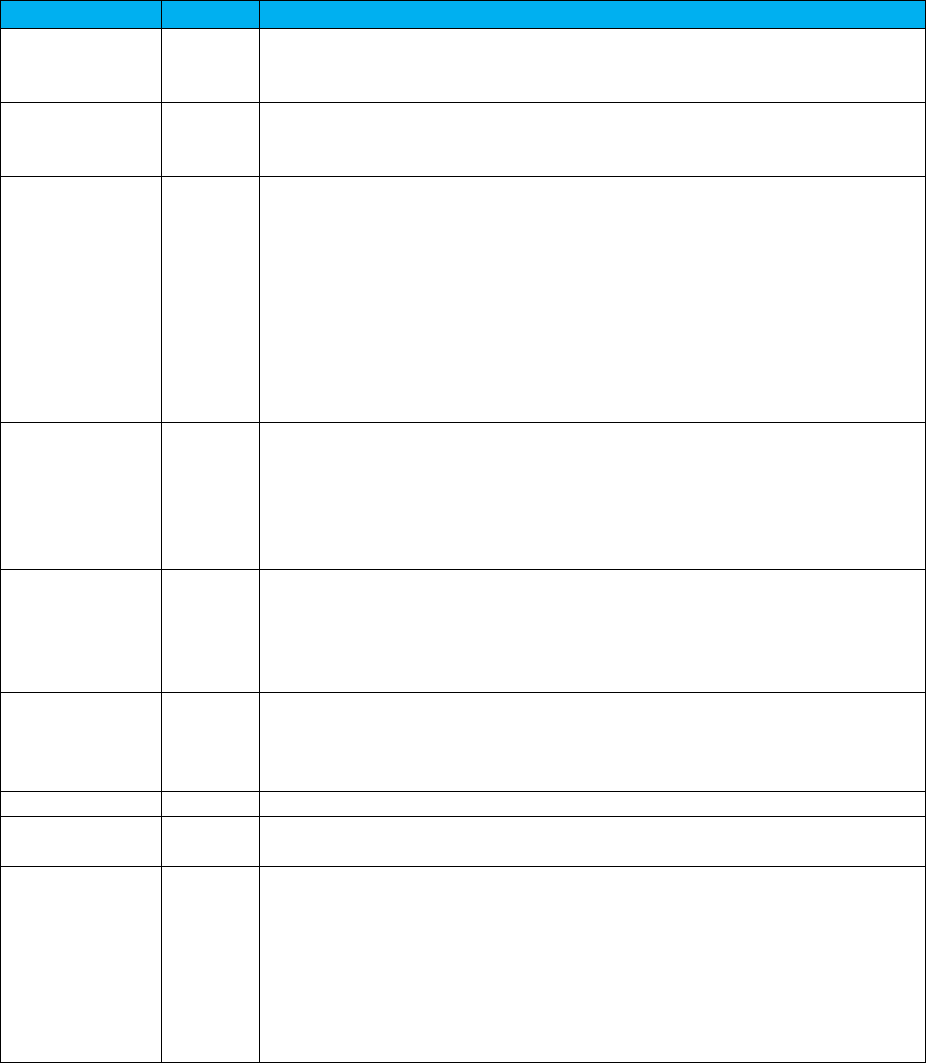

Date

Version

Description

01/18/2017

0034

Added notes to Section 1.13 Interstate/Intrastate Determination and Section

1.14 Private Line. Also updated tables in Section 3.6 Supported and Non-

Supported Features (under Customer Mode).

02/13/2017

0035

Added new Section 1.1 Getting Started which includes requirements for

integration and key inputs. Updated Section 1.4 Transaction Date with

additional details for date format.

03/13/2017

0036

All references to ‘reverse’ tax calculations in AFC SaaS Pro have been updated

and renamed to reflect the current naming convention which is ‘tax inclusive’

calculations. As a result, 8 APIs in Section 10 SOAP Telecom Web Methods have

been updated and renamed. The table in Section 12 in REST Interface APIs has

also been updated. Updated Section 1.9.3 Tax type exemptions with note

regarding availability of wildcard character for tax types. Release number and

version updates. Updated Section 1.15 Private Line to include expanded

support of the feature with adjustment APIs. Added new Section 1.18 Specifying

a Unique Identifier. Updated description in Discount Table in Section 14 Web

Service Enumeration Definitions.

04/14/2017

0037

Added new Section 1.19 Commit/Uncommit and Section 1.20 Application of Tax

Brackets and Limits. All references to ‘Customer Mode’ in AFC SaaS Pro have

been updated and renamed to reflect the current naming convention which is

‘Invoice Mode.’ As a result, Section 3 has been updated and renamed Invoice

Mode. Added new error message to Section 10 Error Messages Common to all

Calculation Methods.

05/25/2017

0038

Updated Section 1.3 Client Information. Added Section 10.39 for

CommitTransactions API. Added CommitTransactions to the table in Section 10

SOAP Telecom Web Methods and to the table in Section 12 REST Interface APIs.

Added CommitData data structure table to Section 13 Web Service Data

Definitions.

06/27/2017

0039

Updated links in Section 1.1 Getting Started. Updated Section 1.14

Interstate/Intrastate and Section 1.15 Private Line to include Invoice Mode APIs.

Added Section 1.21 Use of Client IDs in the REST Interface. Updates throughout

Section 12 REST Interface APIs and Section 15 Monthly Update.

07/07/2017

0040

Miscellaneous updates in Section 3 Invoice Mode.

10/25/2017

0041

Updated Avalara contact information (address and support site). Removed

Appendix A – Avalara Product Names.

11/22/2017

0042

Added note related to timestamp/invoice date passed in Section 1.4 Transaction

Date. Updated Section 2 Specifying a Tax Jurisdiction with a note and table

providing overview of alternate formats for US zip code plus 4 digits. Updated

Section 10.31 CalcTaxesInCustModeV2 to include SafeHarborOverride as a

parameter. Added private line fields to the Transaction table in Section 13 Web

Service Data Definitions. Added new REST APIs to the table in Section 12 REST

Interface APIs. Updated Section 14 Web Service Enumeration Definitions with an

ExemptionType table which provides values and descriptions.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | i

Copyright 2017 Avalara, Inc.

Table of Contents

Introduction ....................................................................................................................................... 1

Getting Started ............................................................................................................................ 2

Integration Requirements ..................................................................................................... 2

Key Input Requirements ........................................................................................................ 2

AFC Transaction and Service Types ............................................................................................. 3

Client Information ....................................................................................................................... 3

Transaction Date ......................................................................................................................... 3

Tax Types..................................................................................................................................... 4

Bundles ....................................................................................................................................... 5

Overrides ..................................................................................................................................... 5

Exclusions .................................................................................................................................... 5

Exemptions ................................................................................................................................. 6

Category Exemptions ............................................................................................................. 6

Level Exemptions ................................................................................................................... 7

Tax Type Exemptions ............................................................................................................. 7

Compliance Files ......................................................................................................................... 7

Live vs. Test Transactions ............................................................................................................ 9

Compliance Month .................................................................................................................... 10

Tax Adjustments ........................................................................................................................ 10

Interstate/Intrastate Determination ......................................................................................... 10

Private Line ............................................................................................................................... 12

Proration ................................................................................................................................... 12

Tax Grouping ............................................................................................................................. 13

Specifying a Unique Identifier ................................................................................................... 15

Commit/Uncommit ................................................................................................................... 15

Application of Tax Brackets and Limits ...................................................................................... 16

Tax Brackets ........................................................................................................................ 16

Tax Limits ............................................................................................................................. 16

Use of Client IDs in the REST Interface ...................................................................................... 16

Definition of Terms .............................................................................................................. 17

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | ii

Copyright 2017 Avalara, Inc.

Specifying a Tax Jurisdiction ............................................................................................................. 17

Getting the Right Tax Jurisdiction for Local Taxation ................................................................ 20

Invoice Mode ................................................................................................................................... 21

Overview ................................................................................................................................... 21

Batch Transaction Submission................................................................................................... 21

Single Transaction Submission .................................................................................................. 21

Taxing Jurisdiction Specification ................................................................................................ 22

API Results ................................................................................................................................. 22

Supported and Non-Supported Features .................................................................................. 23

Tax Inclusive Transactions ......................................................................................................... 23

Tax Inclusive - Batch Transaction Submission ...................................................................... 23

Tax Inclusive - Single Transaction Submission ..................................................................... 24

Generating Custom Reports ............................................................................................................. 24

Report Process Overview .......................................................................................................... 24

Setting up ReportOptions.......................................................................................................... 25

BaseReport .......................................................................................................................... 25

CreateNbaFile ...................................................................................................................... 25

CreateNcaFile ...................................................................................................................... 25

CustomLogFields ................................................................................................................. 25

EmailAddress ....................................................................................................................... 26

FileExtension ....................................................................................................................... 26

FileName ............................................................................................................................. 26

IncludeHeaders.................................................................................................................... 27

Precision .............................................................................................................................. 27

ReportType .......................................................................................................................... 27

StartDate, EndDate, and TimeSpan ..................................................................................... 28

Report Types ............................................................................................................................. 28

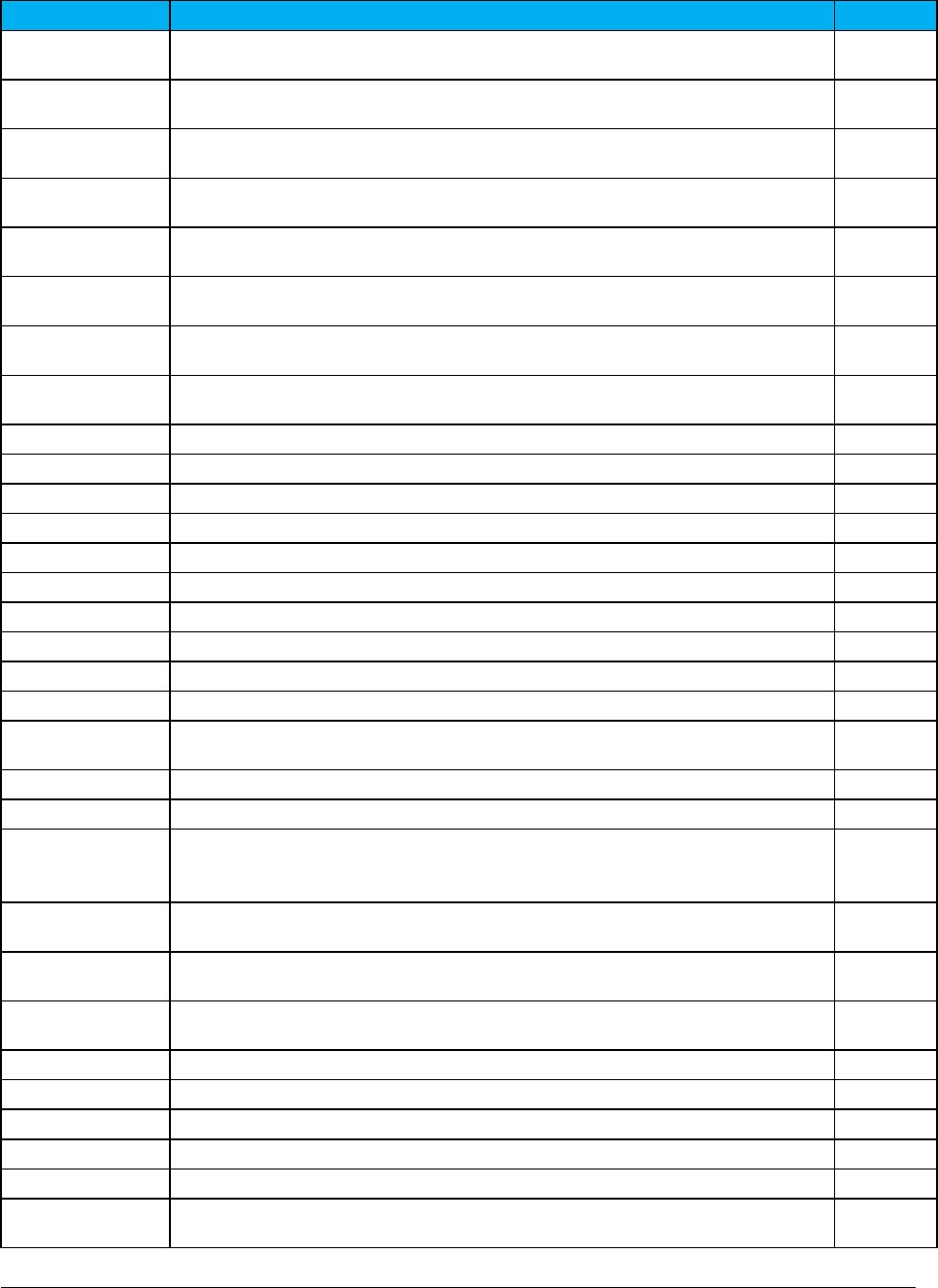

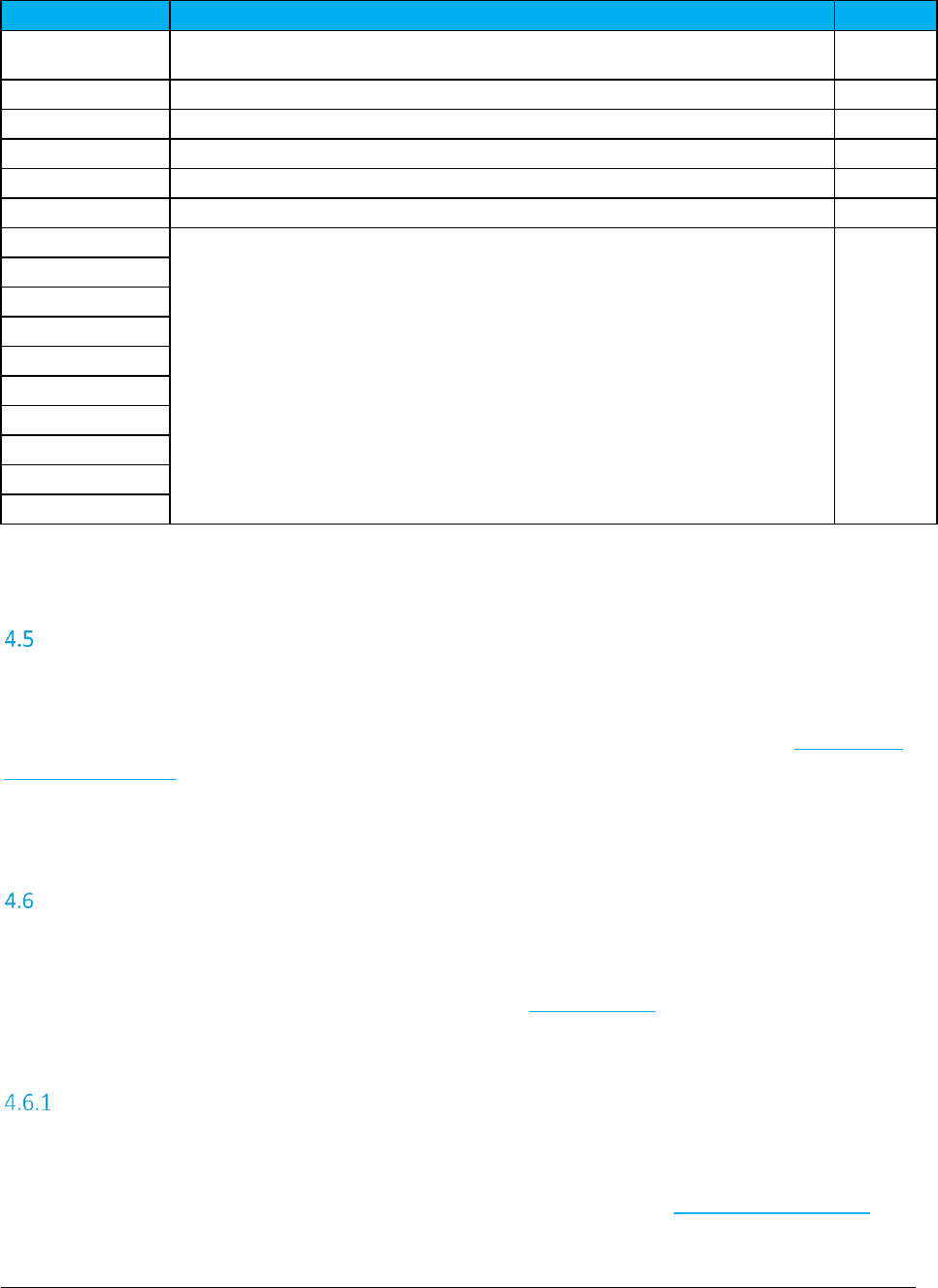

Custom Log Report Columns ..................................................................................................... 29

Aggregation ............................................................................................................................... 31

Output Files ............................................................................................................................... 31

Accessing the FTP Site ......................................................................................................... 31

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | iii

Copyright 2017 Avalara, Inc.

Sample Code ............................................................................................................................. 34

Bridge Conferencing......................................................................................................................... 35

Optional Fields ................................................................................................................................. 35

Overview ................................................................................................................................... 35

Default Optional Fields .............................................................................................................. 35

Extended Optional Fields .......................................................................................................... 35

Setting Up an Extended Optional Field in a Transaction...................................................... 36

UpdateOptionalFieldKeyDesc .............................................................................................. 36

GetOptionalFieldKeyDesc .................................................................................................... 37

Zip Lookup Requests ........................................................................................................................ 37

Overview ................................................................................................................................... 37

Setting up a Request .................................................................................................................. 37

Best Match .......................................................................................................................... 37

Location Data ...................................................................................................................... 38

Limit Results ........................................................................................................................ 38

Results ....................................................................................................................................... 38

Examples ................................................................................................................................... 38

Safe Harbor Overrides for Traffic Studies ......................................................................................... 40

AFC SaaS Pro Telecom Web Service Programmer Reference ............................................................ 41

TaxService Endpoint .................................................................................................................. 42

SOAP Telecom Web Methods .......................................................................................................... 43

CalcTaxesWithPCode ................................................................................................................. 45

CalcTaxesWithNpaNxx .............................................................................................................. 45

CalcTaxesWithZipAddress ......................................................................................................... 46

CalcTaxesWithFipsCode ............................................................................................................ 46

CalcAdjWithPCode .................................................................................................................... 47

CalcAdjWithNpaNxx .................................................................................................................. 48

CalcAdjWithZipAddress ............................................................................................................. 48

CalcAdjWithFipsCode ................................................................................................................ 49

CalcReverseTaxesWithPCode .................................................................................................... 50

CalcReverseTaxesWithFipsCode ................................................................................................ 50

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | iv

Copyright 2017 Avalara, Inc.

CalcReverseTaxesWithZipAddress............................................................................................. 51

CalcReverseTaxesWithNpaNxx .................................................................................................. 52

CalcReverseAdjWithPCode ........................................................................................................ 52

CalcReverseAdjWithFipsCode ................................................................................................... 53

CalcReverseAdjWithZipAddress ................................................................................................ 54

CalcReverseAdjWithNpaNxx...................................................................................................... 55

CalcTaxInclusiveTaxesWithPCode ............................................................................................. 55

CalcTaxInclusiveTaxesWithFipsCode ......................................................................................... 56

CalcTaxInclusiveTaxesWithZipAddress ...................................................................................... 57

CalcTaxInclusiveTaxesWithNpaNxx ........................................................................................... 57

CalcTaxInclusiveAdjWithPCode ................................................................................................. 58

CalcTaxInclusiveAdjWithFipsCode ............................................................................................. 59

CalcTaxInclusiveAdjWithZipAddress .......................................................................................... 59

CalcTaxInclusiveAdjWithNpaNxx ............................................................................................... 60

BeginCustomerBatch................................................................................................................. 61

CalcCustTaxes ............................................................................................................................ 61

CalcCustAdj ............................................................................................................................... 62

ProcessCustomerBatch ............................................................................................................. 62

ProcessCustomerBatchV2 ......................................................................................................... 63

CalcTaxesInCustMode ............................................................................................................... 63

CalcTaxesInCustModeV2 ........................................................................................................... 64

CalcProRatedTaxes .................................................................................................................... 65

CalcProRatedAdj........................................................................................................................ 66

CalcJurisdiction ......................................................................................................................... 66

CalcTaxesWithOverrides ........................................................................................................... 67

CalcAdjWithOverrides ............................................................................................................... 68

CalcBridgeConferenceTaxes ...................................................................................................... 68

CalcAdjBridgeConferenceTaxes ................................................................................................. 69

CommitTransactions ................................................................................................................. 70

Error Messages Common to all Calculation Methods ............................................................... 71

SOAP Utility Web Methods .............................................................................................................. 72

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | v

Copyright 2017 Avalara, Inc.

GetAddress ................................................................................................................................ 73

GetTaxCategory ......................................................................................................................... 74

GetTaxDescription ..................................................................................................................... 74

GetTaxRates .............................................................................................................................. 75

FipsToPCode .............................................................................................................................. 75

PCodeToFips .............................................................................................................................. 76

ZipToPCode ............................................................................................................................... 76

NpaNxxToPCode........................................................................................................................ 77

GetServerTime .......................................................................................................................... 77

GetVersion ................................................................................................................................ 78

GetEZtaxVersion ........................................................................................................................ 78

GetEZtaxDbVersion ................................................................................................................... 79

CreateReport ............................................................................................................................. 79

GetOptionalFieldKeyDesc .......................................................................................................... 80

UpdateOptionalFieldKeyDesc .................................................................................................... 80

ZipLookup .................................................................................................................................. 81

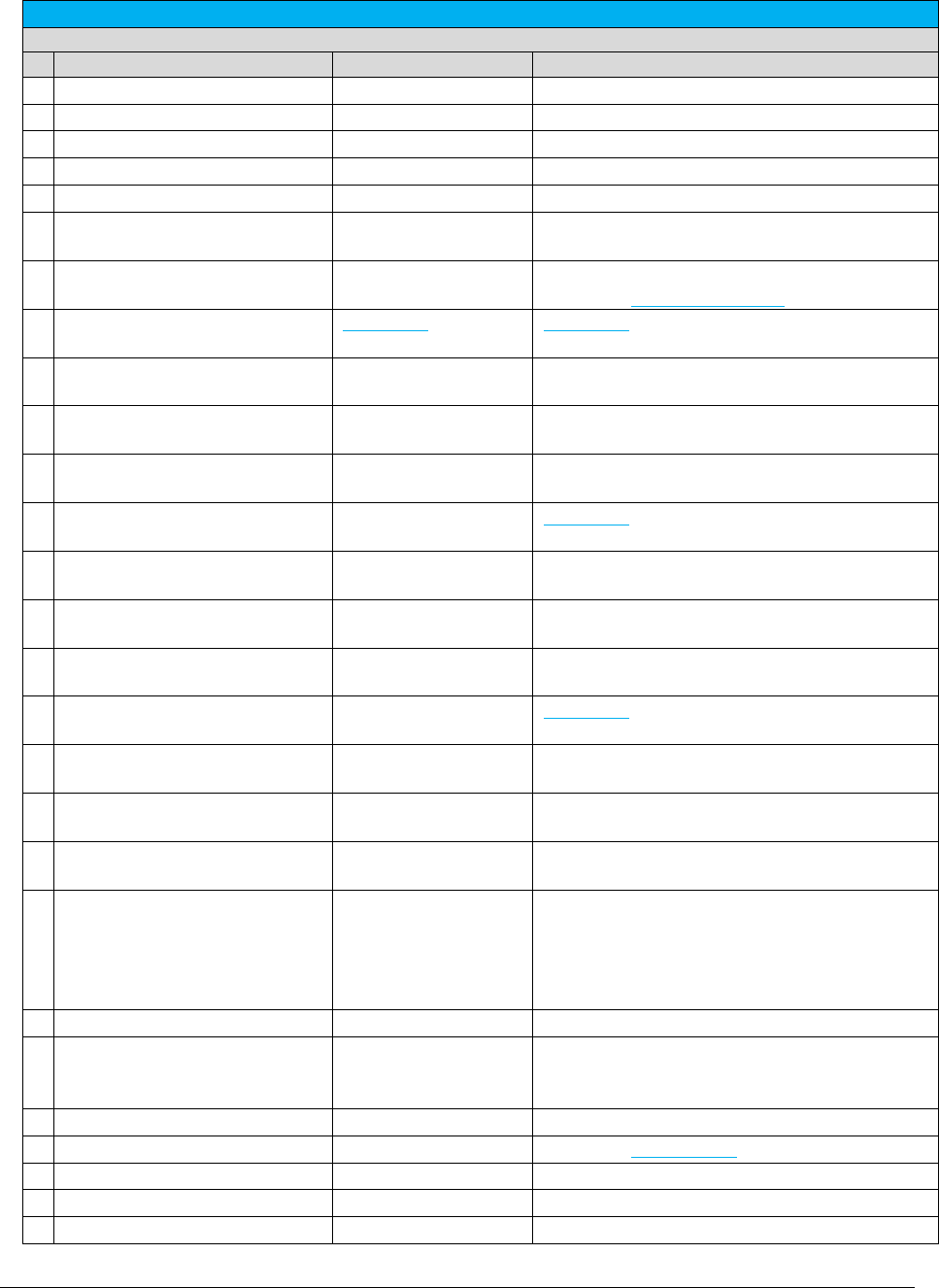

REST Interface APIs .......................................................................................................................... 81

Web Service Data Definitions ........................................................................................................... 84

AddressData ......................................................................................................................................... 86

Nexus ................................................................................................................................................... 86

Exclusion .............................................................................................................................................. 87

TaxExemption ...................................................................................................................................... 87

TaxData ................................................................................................................................................ 87

TaxDataV2 ............................................................................................................................................ 88

CustomerResults .................................................................................................................................. 89

CustomerResultsV2 .............................................................................................................................. 89

CustomerTaxData ................................................................................................................................ 90

ReverseTaxResults ............................................................................................................................... 90

TaxInclusiveTaxResults ......................................................................................................................... 90

TaxRateInfo .......................................................................................................................................... 90

TaxRateHistory ..................................................................................................................................... 91

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | vi

Copyright 2017 Avalara, Inc.

ReportOptions ..................................................................................................................................... 91

CustomLogField ................................................................................................................................... 92

TaxRateOverrideInfo ............................................................................................................................ 92

CategoryExemption .............................................................................................................................. 92

TaxLogDataV914 .................................................................................................................................. 92

OptionalField ....................................................................................................................................... 93

OptionalKey ......................................................................................................................................... 94

ZipLookup ............................................................................................................................................ 94

ZipLookupResult ................................................................................................................................... 94

LocationData ........................................................................................................................................ 94

SafeHarborOverride ............................................................................................................................. 94

CommitData ......................................................................................................................................... 95

BridgeConferenceParticipant ............................................................................................................... 97

BridgeConferenceResults ..................................................................................................................... 97

BridgeConferenceParticipantResult ..................................................................................................... 97

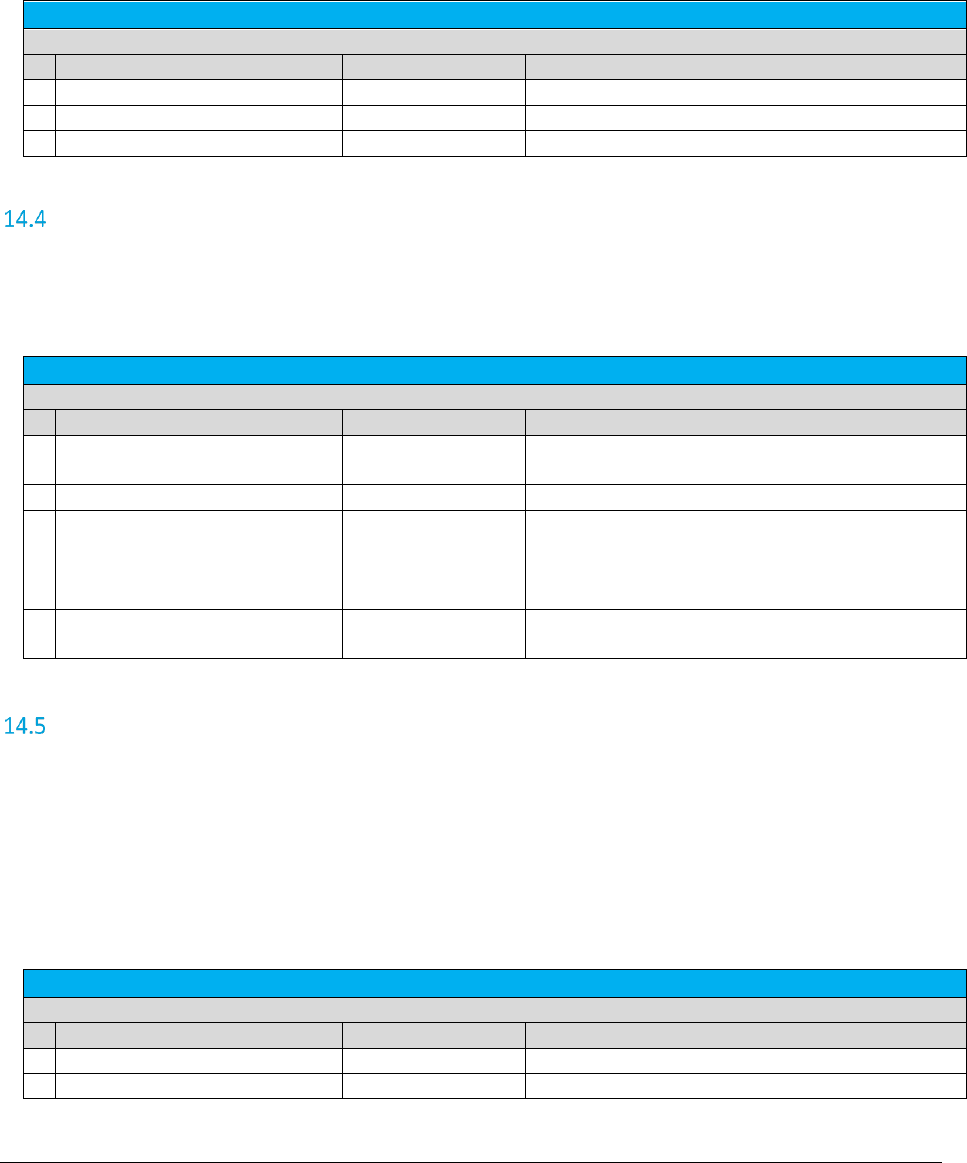

Web Service Enumeration Definitions .............................................................................................. 98

Specifying Tax Level .................................................................................................................. 98

TaxLevel ............................................................................................................................................... 98

Specifying Calculation Type ....................................................................................................... 98

CalculationType ................................................................................................................................... 98

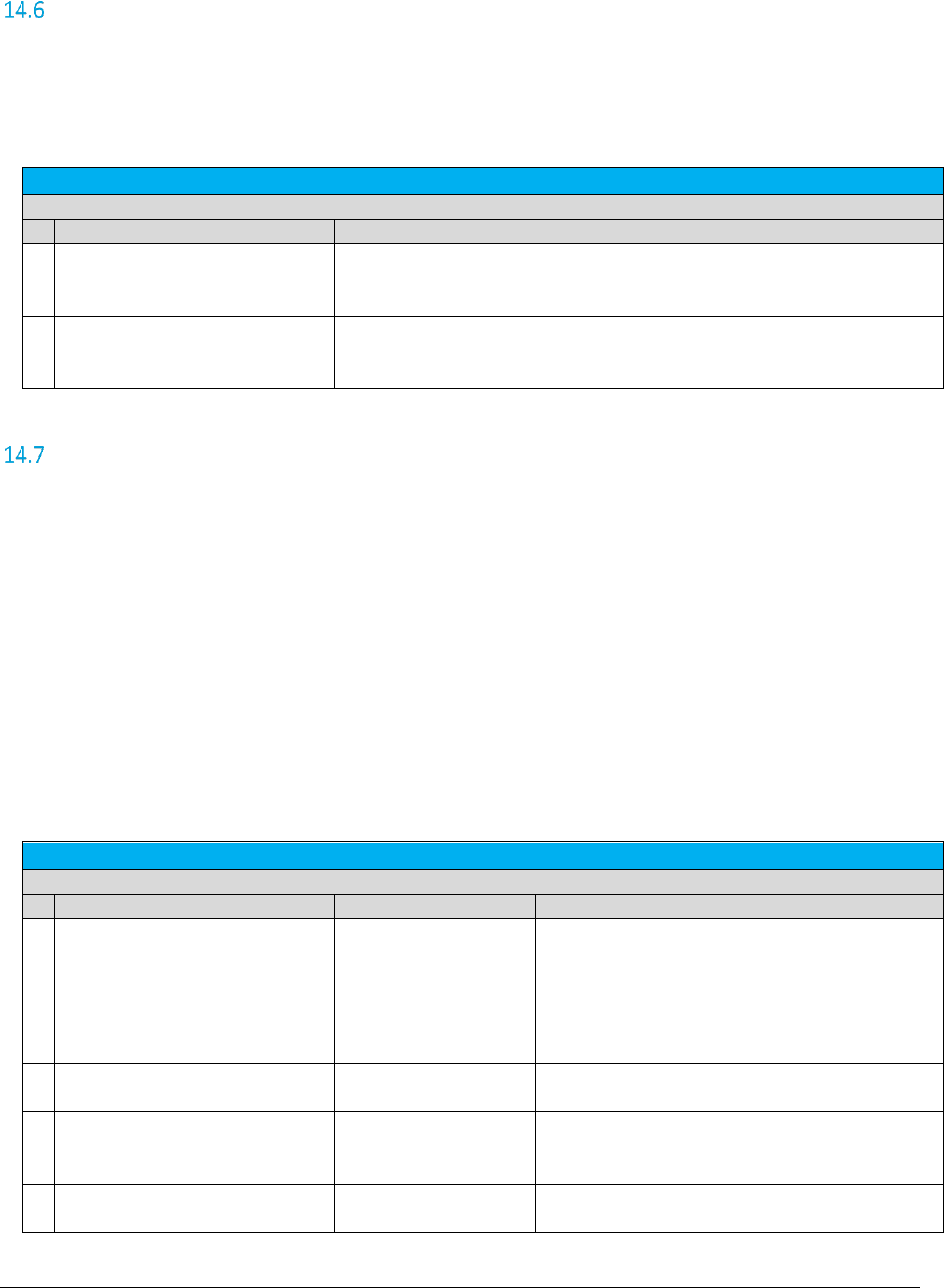

Specifying Adjustment Method ................................................................................................. 98

AdjustmentMethod.............................................................................................................................. 99

Specifying Customer Type ......................................................................................................... 99

CustomerType ...................................................................................................................................... 99

Specifying Business Class .......................................................................................................... 99

BusinessClass ....................................................................................................................................... 99

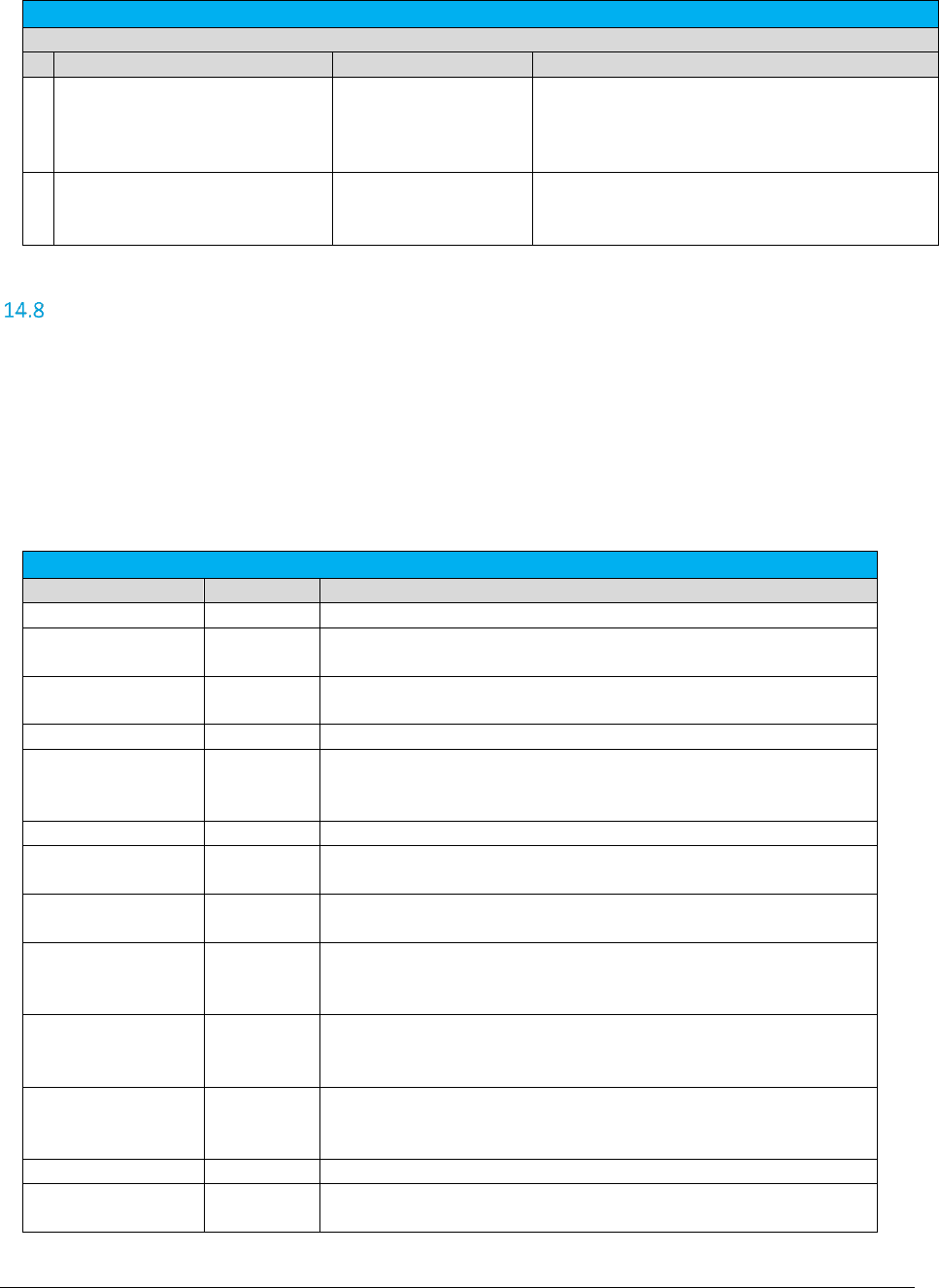

Specifying Service Class ........................................................................................................... 100

ServiceClass ....................................................................................................................................... 100

Specifying Discount Type ........................................................................................................ 100

DiscountType ..................................................................................................................................... 100

Specifying Exemption Type ..................................................................................................... 101

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | vii

Copyright 2017 Avalara, Inc.

Specifying Lines ....................................................................................................................... 102

Specifying Sale Type ................................................................................................................ 102

Specifying Incorporated .......................................................................................................... 102

Monthly Update ............................................................................................................................. 103

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 1 of 103

Copyright 2016 Avalara, Inc.

Introduction

AvaTax for Communications (AFC) SaaS Pro is easily integrated into your application. Typically,

integration efforts are measured in days, instead of the months required of other products. Avalara

provides a complete sales and use taxation solution with its AFC SaaS Pro product. AFC SaaS Pro

performs transaction processing for numerous types of products and services, from alcohol to

prescription drugs, from general merchandise to software sales.

AFC SaaS Pro relieves or minimizes your organization of the following cost of doing business burdens:

1) Cost of research and maintenance of the continually changing tax data of approximately

70,000 communities capable of levying taxes in the United States as well as international

taxes.

2) Tax compliance reduces liability and exposure to tax audits.

3) Cost of tracking, maintenance, and implementation of tax systems based upon the whim of

federal, state, county, and/or local governments.

4) Cost of research and maintenance of nearly 400,000 tax rates and complex application rules

including, but not limited to the following:

Over 200 tax types.

Federal, state, county, district and local taxes.

Taxing for eighty other countries.

Applicability to sale and/or resale

Applicability to different customer types

Taxes that are included in base taxable amount of other taxes

Maximum tax bases

Excess tax rates

Transit Taxes

State and county taxes that are replaced by county and /or local taxes

Special state and county rates based upon county or local jurisdiction

Determination of 1 of 10 different jurisdiction determination rules per tax

Maintenance of address to tax jurisdiction cross reference data

Application of taxes based upon transaction type

Application of taxes based upon service type

Application of taxes based upon attribute type

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 2 of 103

Copyright 2016 Avalara, Inc.

Getting Started

Integration Requirements

Please reference the links provided below for the most current and detailed integration requirements.

Integration Checklist:

https://developer.avalara.com/certification/communications/

Certification Use Cases:

https://developer.avalara.com/certification/communications-certification/

Key Input Requirements

The following items are required as input for AFC SaaS Pro:

Transaction Date (Please reference Transaction Date for additional details).

Jurisdiction information details: (Please reference Specifying a Tax Jurisdiction for additional

details).

o Address

o Zip

o Zip+4

o FIPS Code

o PCode

o NPANXX

Product Information/ Transaction and Service Types (Please reference AFC Transaction and

Service Types for additional details.)

Sale Type details: (Please reference Transaction for additional details.)

o Retail

o Wholesale

Customer Type Info (of who is being billed) details: (Please reference CustomerType for

additional details.)

o Business

o Residential

o Industrial

o Senior Citizen

Business Class (of who is billing) details: (Please reference BusinessClass for additional

details.)

o CLEC

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 3 of 103

Copyright 2016 Avalara, Inc.

o ILEC

o Other

Service Class (of who is billing) details: (Please reference ServiceClass for additional details.)

o Primarily Long Distance

o Primarily Local

o Other

Other Company Info (of who is billing) details: (Please reference Transaction for additional

details.)

o Regulated: Y or N

o Franchise: Y or N

o Facilities: Y or N

*Certain Inputs can be set as defaults and do not have to be selectable options in the billing platform

being utilized. This represents a selection of data elements. Additional features/functions may require

additional elements.

AFC Transaction and Service Types

The AFC SaaS Pro software package provides a wide range of transaction and service types. The result is a

complete taxation package. When passing a transaction to AFC SaaS Pro, the user must indicate the

transaction and service type of the transaction. See TM_00505_AFC Telecom Mapping Guidelines.pdf for

more details about the transaction and service types supported by AFC SaaS Pro.

Client Information

Many taxing jurisdictions apply taxes differently to different types of customers. In addition, many

jurisdictions apply taxes differently depending upon the type of sale. For these reasons, it is necessary to

indicate to AFC SaaS Pro the type of client the transaction occurred with. The client type will be

“Business”, “Residential”, “Industrial” or “Senior Citizen”. Likewise, it is necessary to indicate the type of

sale, “sale” or “resale”. Transactions that are performed with the end user of that product or service are

“sale”. Products that are with a reseller (entity that intends to resell the product or service purchased)

are “resale”. To have exempt taxes available for reporting, exemption type 3 (Sales For Resale) should be

used in combination with Resale.

Transaction Date

AFC SaaS Pro maintains multiple tax rates for every tax contained in the system. One rate is the current

tax rate and the others are the previous tax rates. When transactions are passed to AFC SaaS Pro for tax

generation, the caller is required to specify a date. AFC SaaS Pro compares this date to the effective date

of each tax that applies to the transaction. If the date passed to AFC SaaS Pro is "equal to" or "greater

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 4 of 103

Copyright 2016 Avalara, Inc.

than" the effective tax date, the current tax rate is used. If the date passed to AFC SaaS Pro is prior to the

effective date, AFC SaaS Pro will select the previous tax rate for the tax based on the effective date of the

previous tax rate. If a transaction is passed to AFC SaaS Pro without a date (that is, the date is set to

zero), AFC SaaS Pro will set the date to the current date.

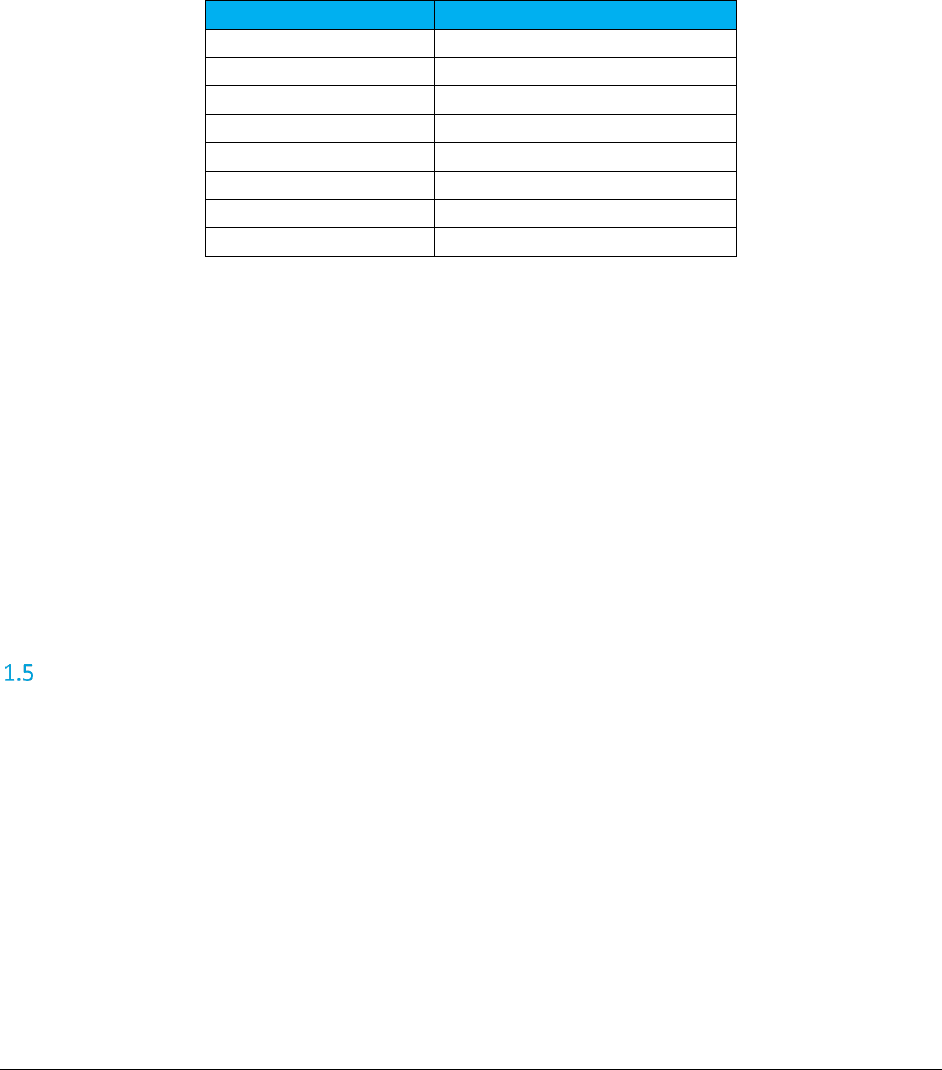

The Date field is normally populated with the bill date, invoice date or call date (as applicable) and may

appear in one of the following Standard Date and Time Format Strings for .NET Framework shown in the

table below.

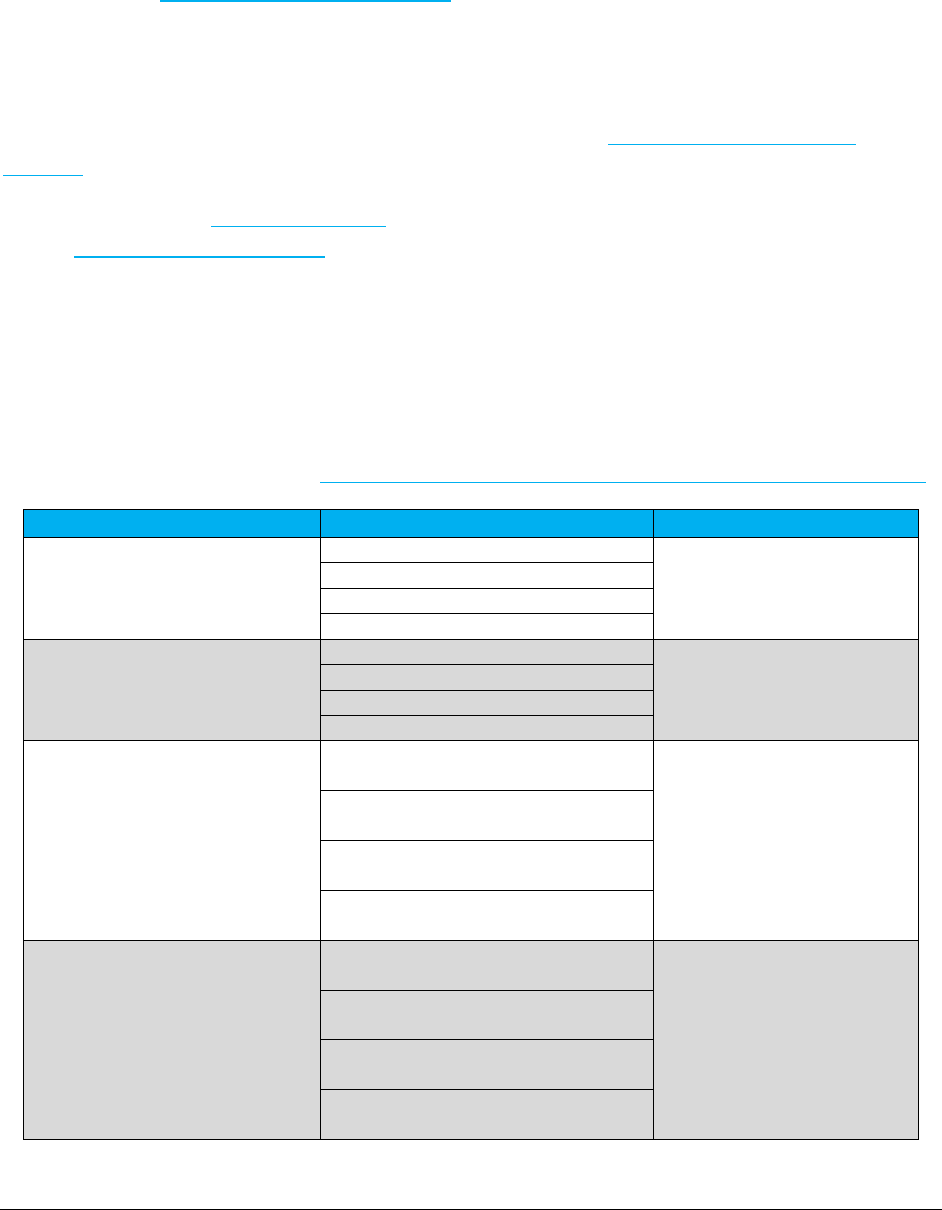

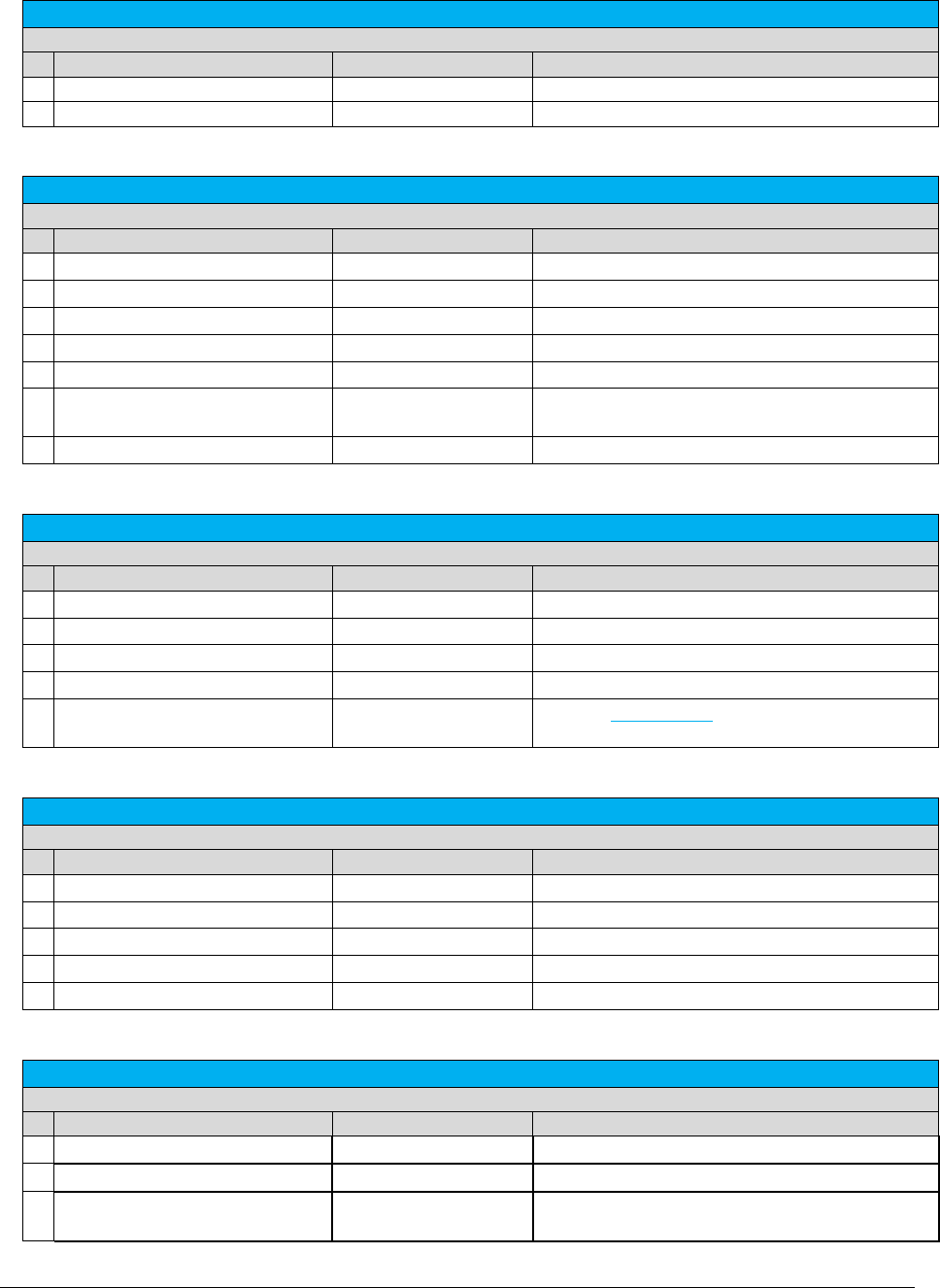

Date Format

Sample

mm/dd/yyyy

06/01/2016

m/d/yyyy

6/1/2016

mm-dd-yyyy

06-01-2016

m-d-yyyy

6-1-2016

yyyy-mm-dd

2016-06-01

yyyy-m-d

2016-6-1

yyyy-mm-ddThh:MM:ss

2016-06-01T13:45:30

yyyy-m-dThh:MM:ss

2016-6-1T13:45:30

A common question asked for some transactions is "What date should be used for taxing a transaction,

the date it occurred or the billing date?" Normally this should be the billing date. Generally accepted

accounting principles tell us we should record our liabilities when we record our revenues. In most cases

neither of these are recorded (or even known) until billing occurs. Large organizations may have a

different answer to this question. If you are running high volumes of transactions daily and record

revenue as it occurs, then the tax should be recorded on the same basis (i.e. the transaction date should

be used).

Note: The invoice date passed to the server in the transaction by default is preserved as is. It is

recommended that clients not use time zone modifiers on the invoice date.

Tax Types

The application of taxes varies from location to location as well as the particular transaction and service

provided. Different localities typically have different taxes and logic associated with the application of the

taxes. For example, one locality may apply tax to medical equipment paid for by Medicare but not to

equipment paid for by Medicaid. A neighboring locality may apply tax to both or neither. For the most

current list of Tax Types, see the TM_00505_AFC Telecom Mapping Guidelines.pdf file in the most current

Distribution/Update download. This document is under /support/docs.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 5 of 103

Copyright 2016 Avalara, Inc.

Bundles

The Bundling feature allows the user to define multiple AFC SaaS Pro transaction/service type pairs as one

unique “bundle” transaction/service pair type. AFC SaaS Pro processes all of the transaction/service type

pairs in the bundle and stores the results in the file EZtax.bdl, the formatted text bundle definition file.

This file must be created and edited by AFC Bundler, an optional utility program. The bundle (.bdl) file

must be installed on our web server to be implemented. Email your zipped bundle file to

communicationsupport@avalara.com for installation. We will contact you when it has been installed.

Overrides

Overrides allow the client to change the rate of a tax in the AFC Engine. Avalara markets the AFC

Override Utility (a Graphic User Interface based Windows program that is sold separately) to support this

activity. It steps the user through the process of creating an EZtax.ovr file.

WARNING

An override to exempt taxes OVERRIDES the tax information in

Avalara’s tax research database. This is not recommended for those that

do not possess a full understanding of the tax ramifications and liabilities

when doing so.

The override (.ovr) file must be installed on our web server to be implemented. Email your zipped

override file to communicationsupport@avalara.com for installation. We will contact you when it has

been installed.

Overrides on tax rates may also be performed for specific transactions.

Exclusions

The AFC SaaS Pro Telecom interface allows the client to specify the states where the client’s company

wants to exclude all taxes. There are two methods in which exclusions can be specified to AFC SaaS Pro:

(1) Users can provide an exclusion file to be installed on our web service. The format of the

exclusion file is either a state abbreviation or the country ISO code followed by a comma and the

state abbreviation, one per line. Example: “AZ” or “USA,AZ” are both valid for excluding taxes in

the state of Arizona. The exclusion file should be emailed to

communicationsupport@avalara.com for installation. We will contact you when it has been

installed.

(2) Users can provide an array of Exclusion objects with each tax method call to the telecom

interface. These exclusion objects modify the exclusion settings only for the current method call.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 6 of 103

Copyright 2016 Avalara, Inc.

If both methods are utilized, the exclusions passed in via the API call will be used and the exclusion file

will be ignored for that particular transaction.

Note: Excluded tax jurisdictions will either appear as unknown or will not be included in any Transaction

Service Reports (TSRs) produced.

Exemptions

There are three types of exemptions allowed in AFC SaaS Pro.

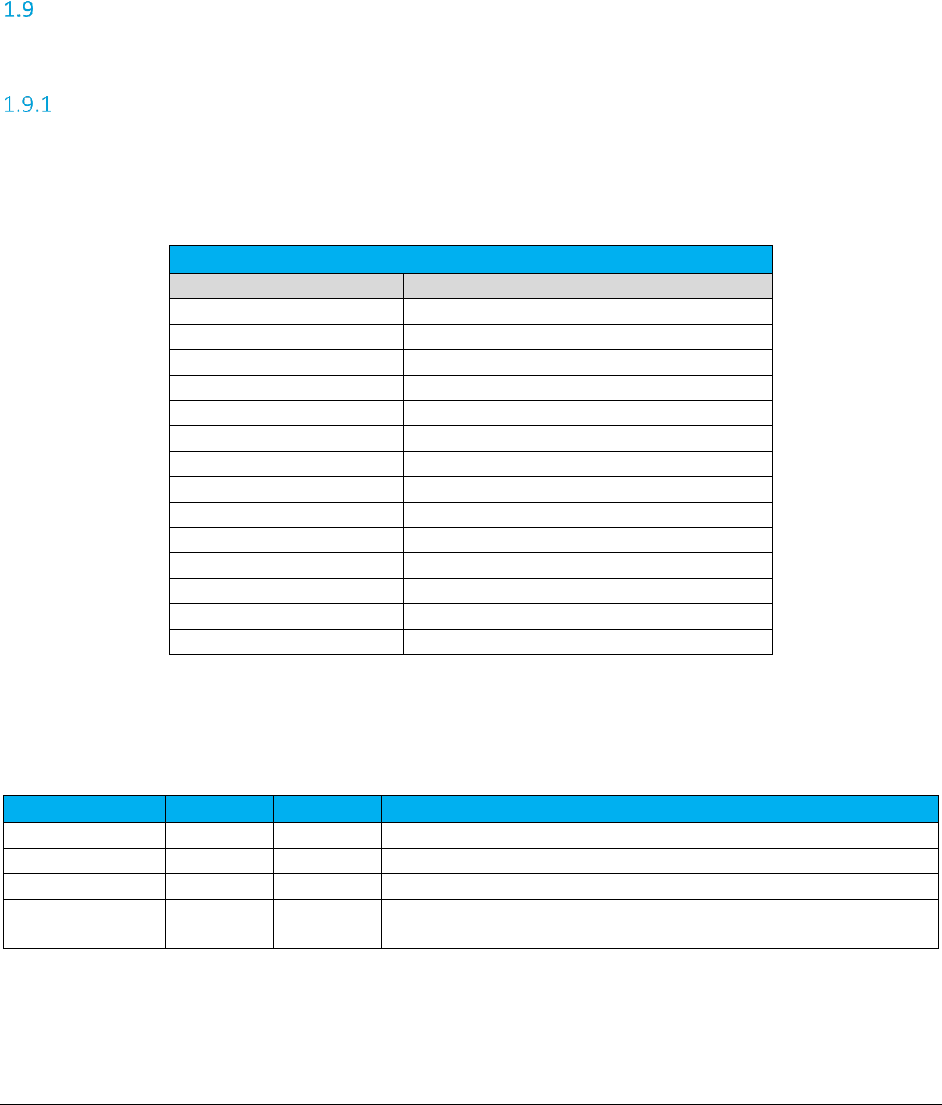

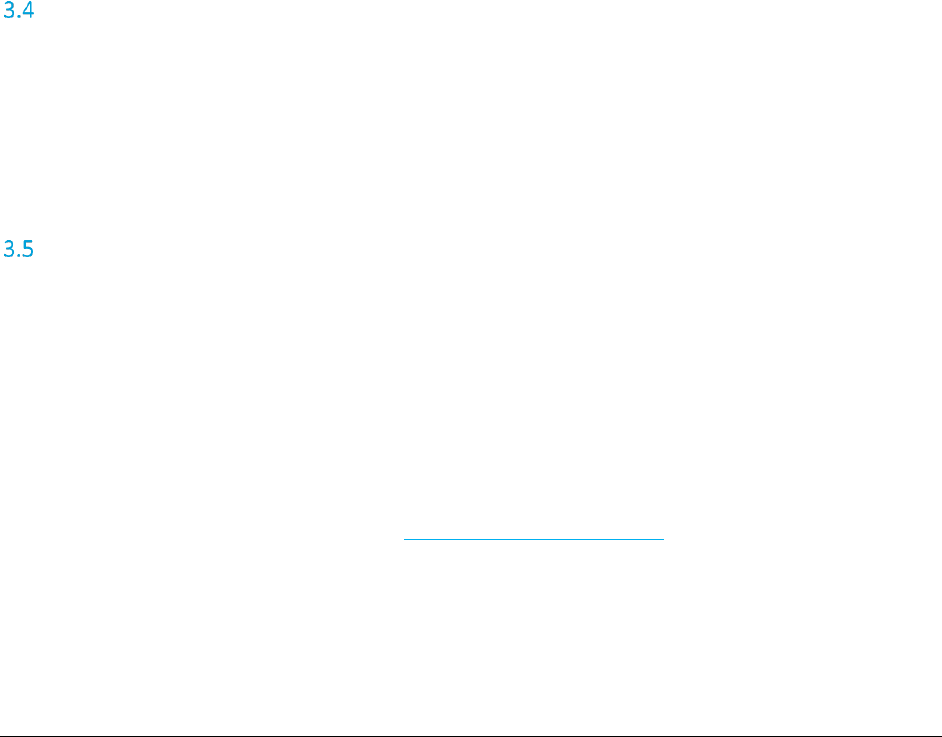

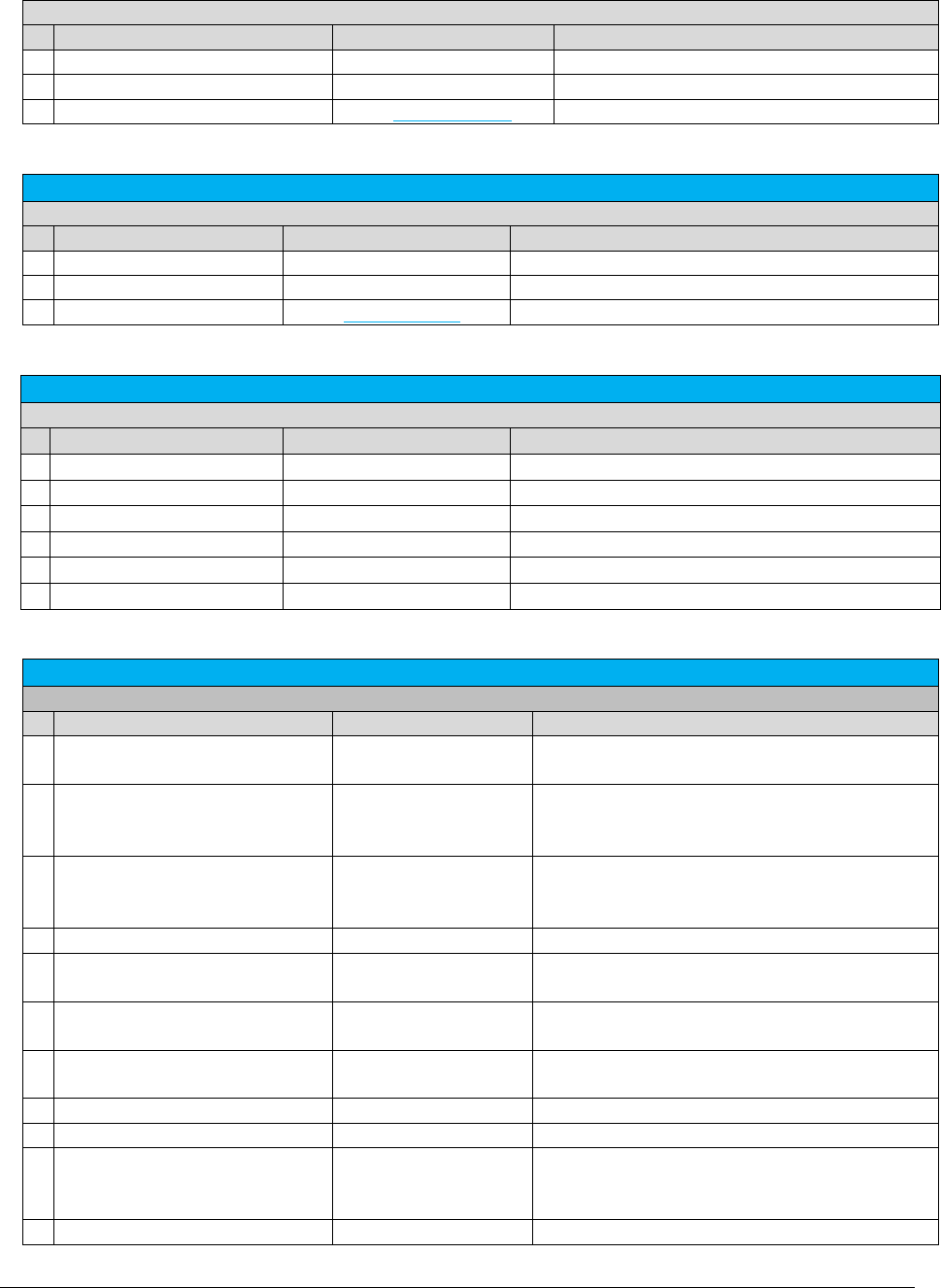

Category Exemptions

Category Exemptions are exemptions applied by tax category. (Please reference the table below to view

the current listing of tax categories. Users may also reference Section 6 Category Definitions in the AFC

Telecom Mapping Guidelines document for a detailed overview of tax type assignment per tax category.)

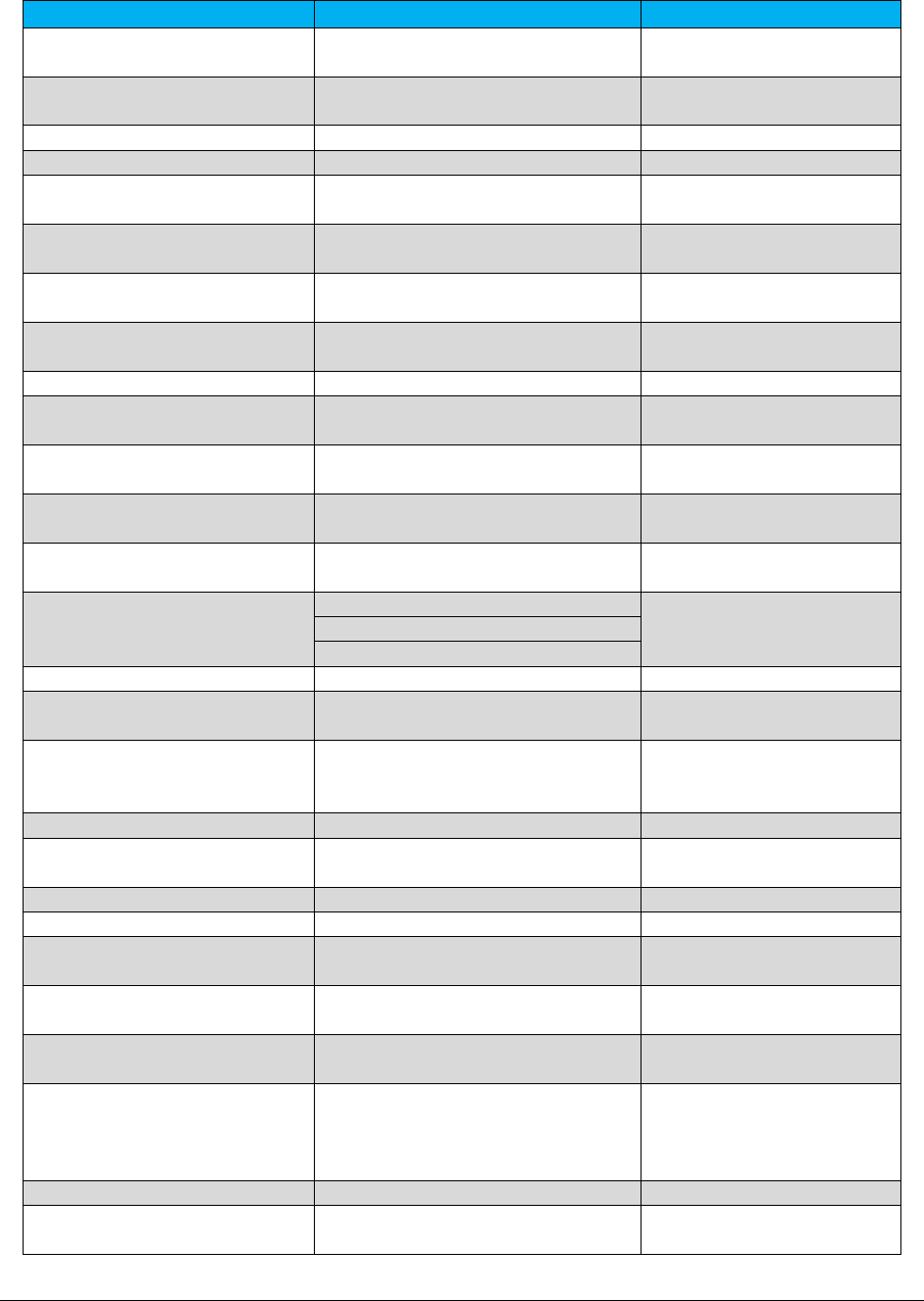

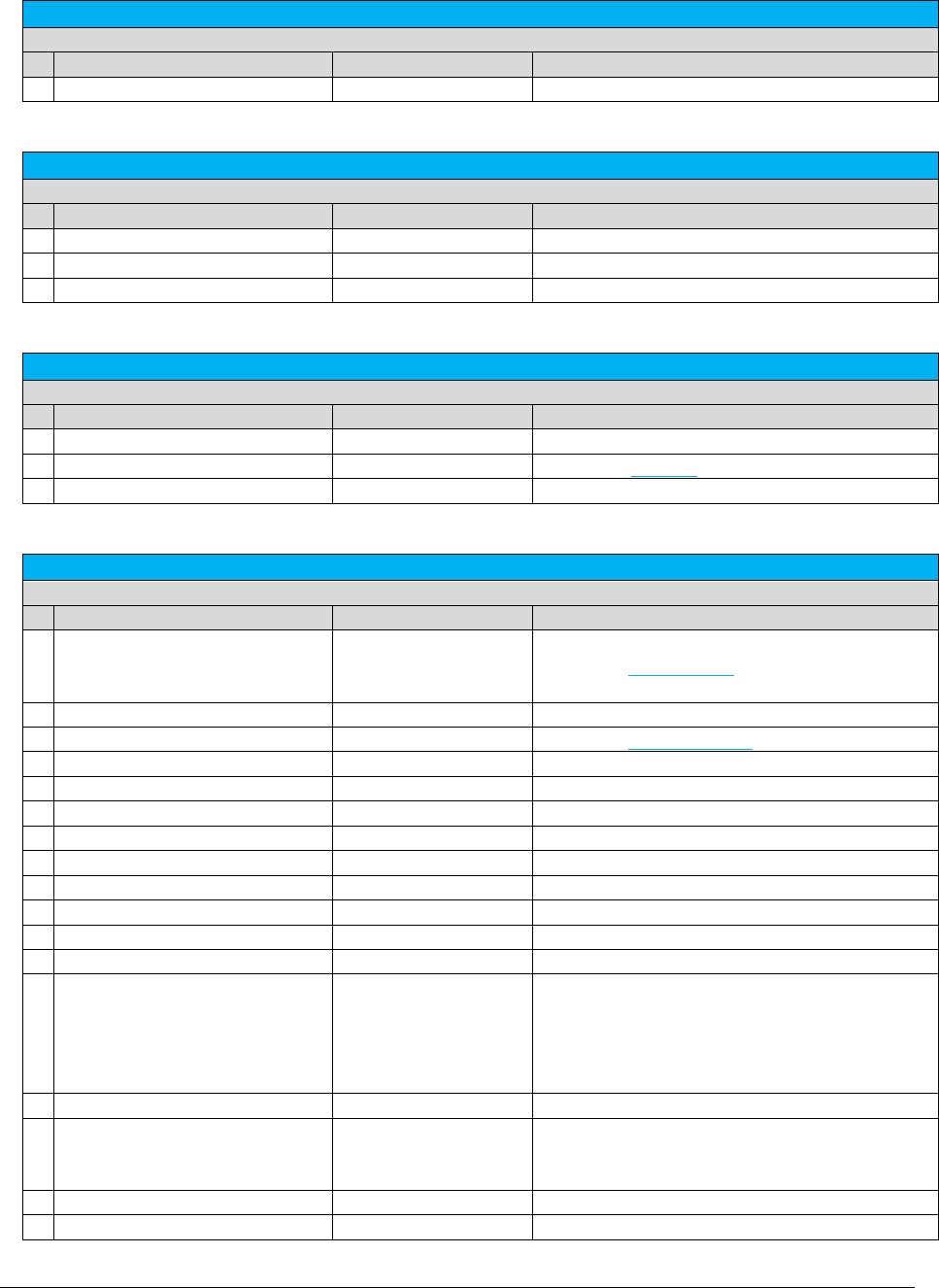

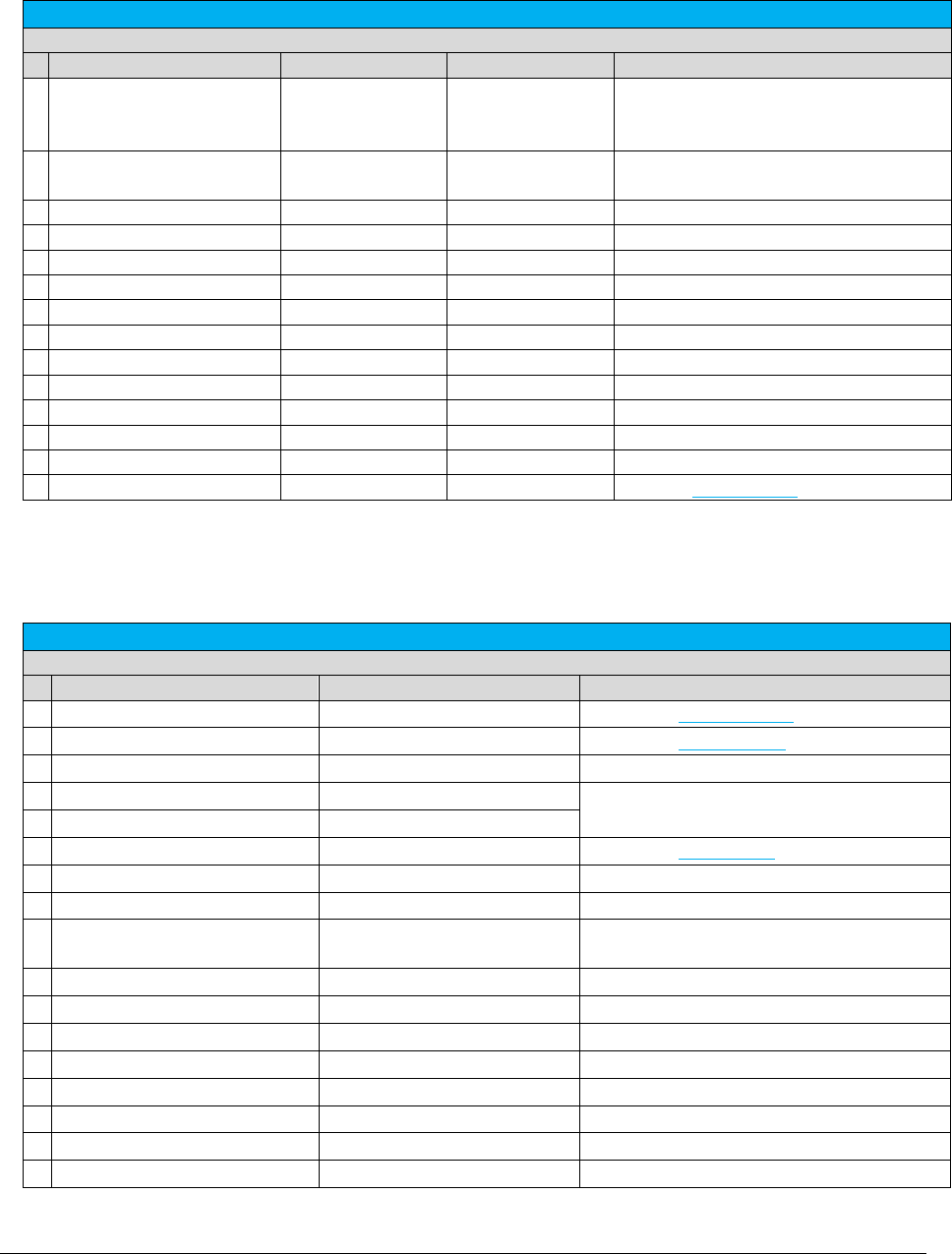

Tax Categories

Category ID

Name

0

No Category Description

1

Sales and Use Taxes

2

Business Taxes

3

Gross Receipts Taxes

4

Excise Taxes

5

Connectivity Charges

6

Regulatory Charges

7

E-911 Charges

8

Utility User Taxes

9

Right of Way Fees

10

Communications Services Tax

11

Cable Regulatory Fees

12

Reserved

13

Value Added Taxes

The Category ID number must be passed in order for exemptions to be applied appropriately. In addition

to this, the Country Code or State Abbreviation or both values for the category exemption must be

provided as well. Please reference the example provided using the following scenario.

Category

Country

State

Comments

1 – 13

USA

Provided categories will be exempted in all US jurisdictions.

USA

Error message will be generated as Category is required field.

1 – 13

USA

KS

Provided categories will be exempted in all Kansas jurisdictions.

1 – 13

KS

Provided categories will be exempted in all Kansas jurisdictions by

assuming “USA” as country.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 7 of 103

Copyright 2016 Avalara, Inc.

Level Exemptions

The exemption level is the jurisdictional level of the taxing authority that defines the tax. It is used to

exempt taxes at specific federal, state, county and/or local level taxes.

Note: Most Federal taxes are only exempted when selling to a reseller who is registered, reporting, and

remitting to the regulating agency. For this reason, a wholesale exemption or a tax type exemption must

be used to exempt taxes at the Federal level.

Tax Type Exemptions

Tax Type exemptions are used to specify a specific Tax Type at a specific Tax Level to be exempted for the

current transaction. The exemption jurisdiction code specifies the jurisdiction for the tax exemption. If

the jurisdiction code is not specified (i.e. set to zero), then all taxes of the Tax Type and Tax Level

specified are considered exempt regardless of the jurisdiction they are calculated for. Typically the PCode

should be specified as tax type exemptions are normally only effective for specific jurisdictions.

Another option allows the tax type to be set to zero, to indicate that all taxes of a specific tax level are

exempt in the specific jurisdiction.

Note: To exempt a county or city for all taxes, apply a specified exemption for the county and/or city by

entering the tax type as 0. This is the wildcard character for tax type when applying exemptions in AFC

SaaS Pro.

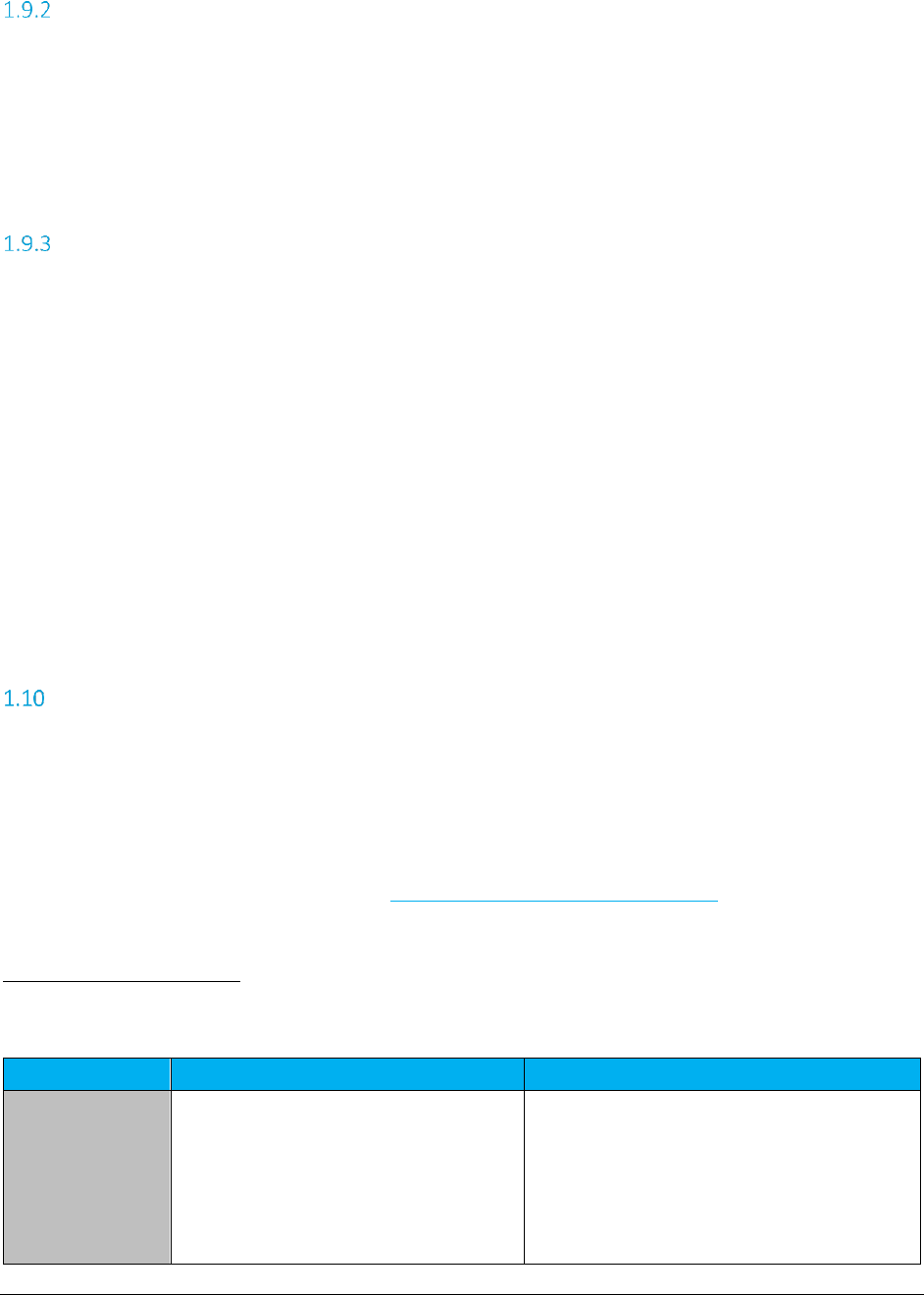

Compliance Files

The web service automatically generate compliance files at the end of the month for the clients

contracted for compliance services. These files contain a summary of the tax data generated for all

transactions processed throughout the month. The format of the compliance files may be that of any of

the available AFC SaaS Pro sorting and reporting utilities. The compliance files may be placed in an FTP

site where they can be downloaded or they may be automatically emailed to a specific email account.

AFC SaaS Pro Clients are required to contact communicationsupport@avalara.com in order to set up

these preferences.

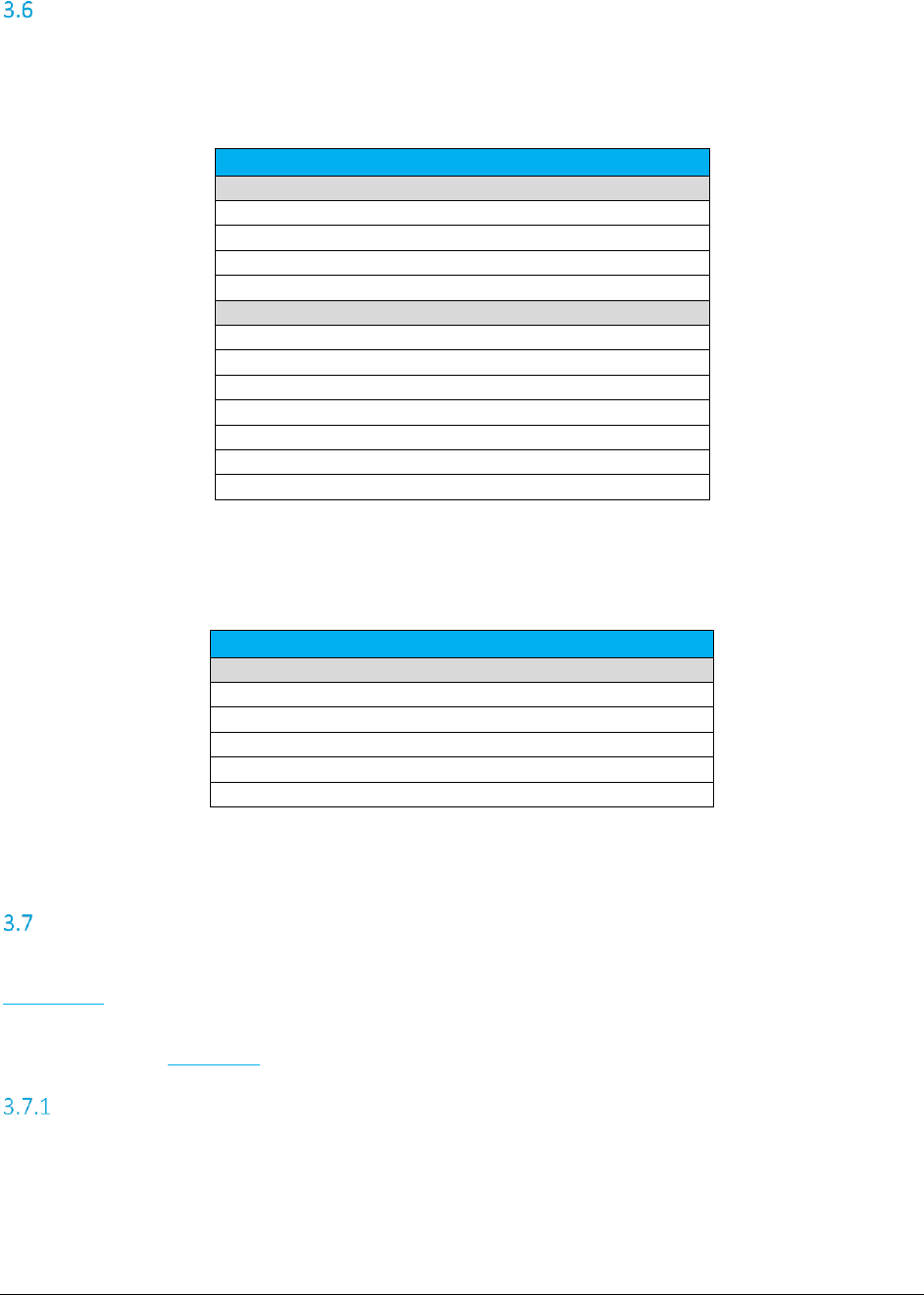

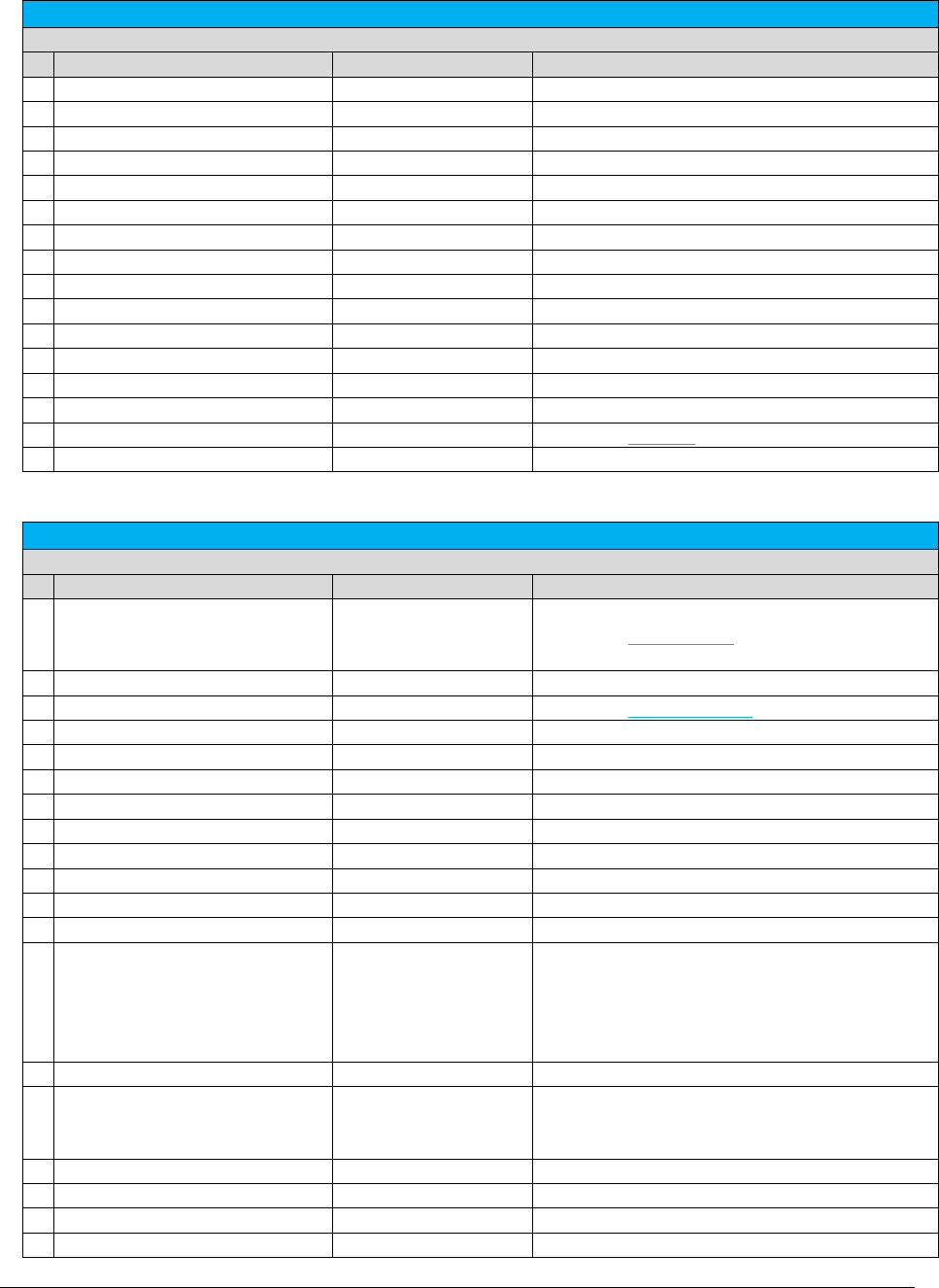

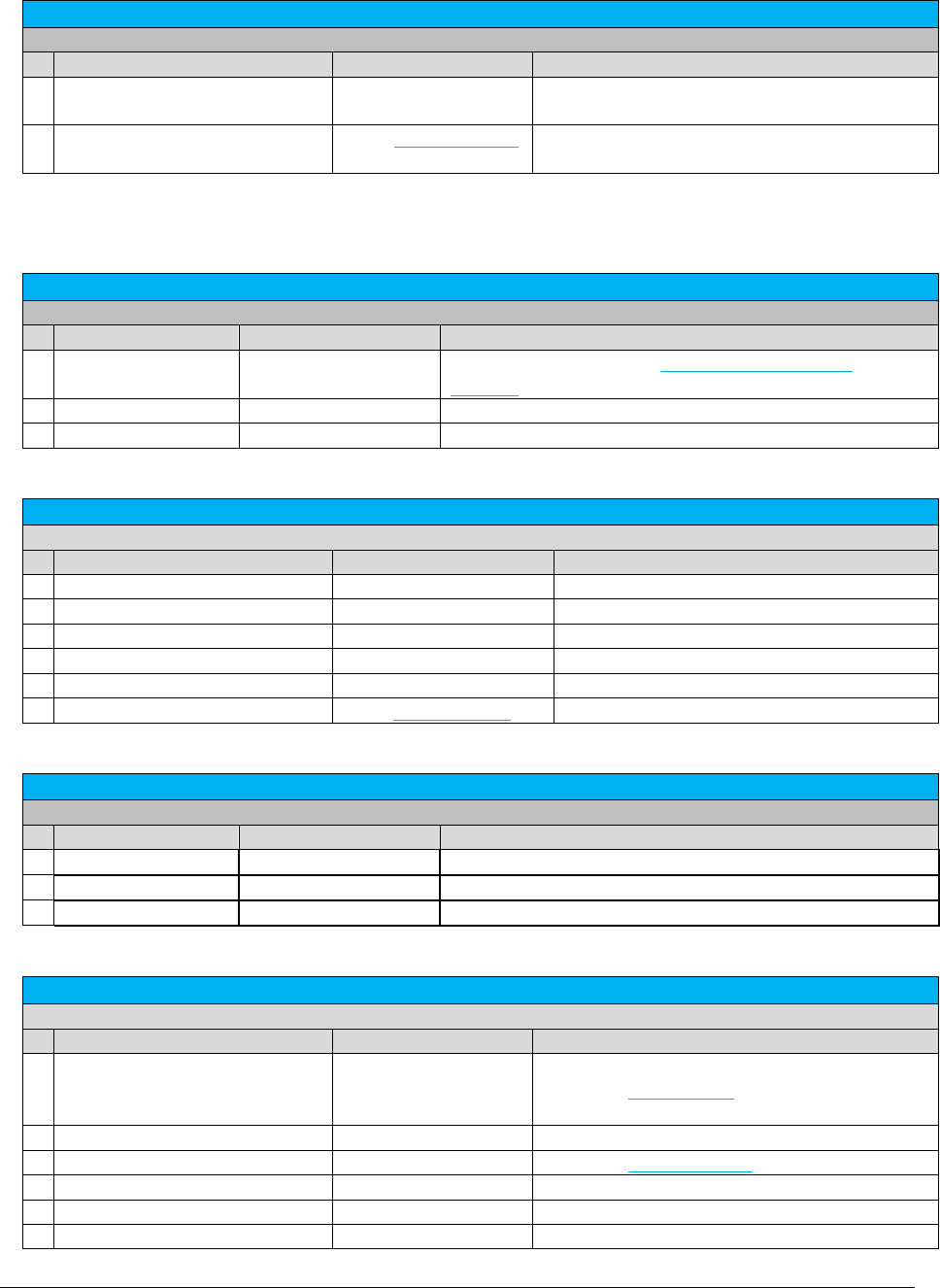

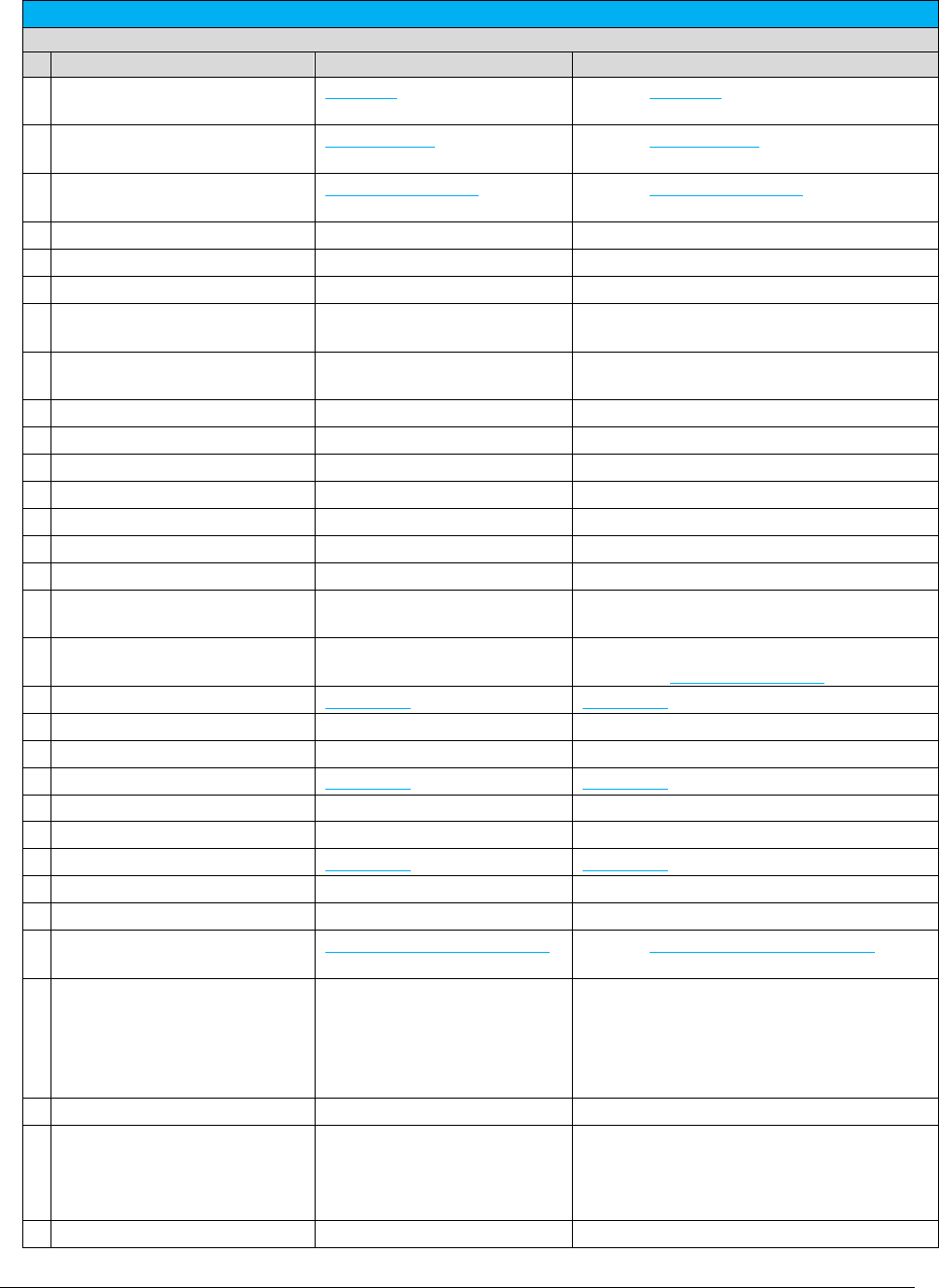

Sorting & Reporting Utilities

Method

Description

Example

Date Method 0

This method gathers all transactions that were

sent to our server during the previous month

by looking at start time field for each

transaction and generate the compliance files

from that data on the first of every month or

requested date. AFC SaaS Pro uses date

method 0 to generate compliance reports,

unless specified by client.

Reporting Scenario 1: Throughout the month of

January 2013, you submit several transactions

to the web service for taxation at the time each

sale occurs. The system will generate the

January 2013 compliance reports on February

1st, 2013 for all the transactions received in

January, irrespective of invoice date.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 8 of 103

Copyright 2016 Avalara, Inc.

Method

Description

Example

Date Method 1

This method processes data based on invoice

date. We gather all transactions that have an

invoice date of the previous month and

generate the compliance files from that data

on the first day of every month.

Reporting Scenario 2: Throughout the month of

January 2013, you submit several transactions

to the web service for taxation with an invoice

date of January 2013. On February 1st, 2013,

the system will gather all transactions with an

invoice date of January 1st through January

31st 2013 and generate the compliance data.

Reporting Scenario 3: You send a transaction

with an invoice date of January 15th past

February 1st when AFC SaaS Pro runs your

compliance reports, this transaction will never

show up on any report. You will need to submit

a request to our network services to rerun your

data for January in order to capture January

data sent past February. Additional charges

apply to rerun, or provide subsequent

compliance reports for the month.

Alternatively, you may request your compliance

reports to be generated on a specific day of the

month in order to give you enough time to

complete processing tax calculations for your

billing cycle. Please contact

communicationsupport@avalara.com in order

to set up these preferences.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 9 of 103

Copyright 2016 Avalara, Inc.

Method

Description

Example

Date Method 2

This method processes data based on an

optional10 field. The client will fill in the

optional10 field with the year and month

(YYYYMM format) that they want the

transaction to show up in their compliance

files. When AFC SaaS Pro runs the compliance

reports, it only includes transactions from the

previous month, based upon optional10 field.

Reporting Scenario 4: Throughout the month of

January 2013, you submit several transactions

to the web service for taxation at the time each

sale occurs. Each transaction must include the

value 201301 in the Optional10 field. The

system will generate the January 2013

compliance reports on February 1st, 2013 and

include the taxes for all transactions with a

201301 value in the Optional10 field. It is

important to note that if you send transactions

with 201301 in the optional10 field, after the

compliance report is run on February 1, they

will be provided in any compliance reports. In

this case, you should record the transaction as

201302 or a future period for them to be

reported upon.

Reporting Scenario 5: On February 1st 2013,

you process a batch for all January 2013

transactions. Each transaction must have a

201301 value in the Optional10 field. You

should request your reports to be generated on

the 2nd day of the month beforehand. The

system will generate your January 2013

compliance reports on the 2nd day of the

month and include the taxes for all transactions

with a 201301 value in the Optional10 field.

Reporting Scenario 6: On February 15th, you

process an adjustment for a transaction that

took place on January 15th 2013. The Date field

of the transaction must have the date of the

original transaction (January 15th) in order to

get the appropriate tax adjustments back, but

the Optional10 field of the transaction must

have a value of 201302 since the adjustment

was handled during February. The tax

adjustment will be included in your February

2013 compliance reports.

In order to allow enough time to complete tax calculations for your billing cycle, Network Services will

assist in establishing the correct date method depending on your transaction method and the appropriate

date of the month for your compliance reports. Please contact communicationsupport@avalara.com in

order to set up or establish the appropriate preferences.

Live vs. Test Transactions

Each client is provided with a three-character company code when signing up for the AFC SaaS Pro

product. In order to run a live transaction, the client’s company code must be placed in the

CompanyIdentifier field of the Transaction to be processed using AFC SaaS Pro (see Transaction data

definition). Only taxes for transactions that contain this code in the CompanyIdentifier field will be

included in the monthly compliance files created by the AFC SaaS Pro Web Service. The

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 10 of 103

Copyright 2016 Avalara, Inc.

CompanyIdentifier field may be left blank or use a value other than the assigned company code in order

to process transactions where the taxes generated are to be excluded from the monthly compliance

reports such as test transactions or quotes.

Compliance Month

Optional10 field applies when Date Method 2 is used. The month for the billing cycle must be specified in

the Optional10 field of the transaction by entering the year and month in YYYYMM format. This will allow

the transaction and taxes to be reported in the appropriate compliance reports for the specified month.

Tax Adjustments

Tax adjustment functions are used for adjustment activities such as refunds, changing a customer’s bill or

writing off un-collectable accounts. Please apply the following general rules while passing tax adjustments

via Web Service.

1. To calculate adjustments accurately:

a. Provide the correct web adjustment method (Please refer to Telecom Web Methods for

more details).

b. Send positive values for charge, line, and locations.

c. Send the adjustment method (see Adjustment Method Table ).

d. Send the discount type (see Discount Type Table).

Interstate/Intrastate Determination

The Interstate or Intrastate feature provides clients with the ability to apply interstate or intrastate

charges appropriately when sending transaction messages to the AFC SaaS Pro service without specifying

either the transaction type or the service type. To use this functionality, set the transaction type to ‘-1’

and a valid service type listed in the below scenarios; conversely, set the transaction type to a valid

transaction type listed in the below scenarios and the service type to ‘-1’. The AFC SaaS Pro service will

determine the appropriate interstate or intrastate transaction or service and return the appropriate

taxes.

This feature is enabled for the following APIs:

CalcTaxesWithZipAddress

CalcTaxesWithFipsCode

CalcTaxesWithPCode

CalcTaxesWithNpaNxx

CalcProRatedTaxes

CalcAdjWithZipAddress

CalcAdjWithFipsCode

CalcAdjWithPCode

CalcAdjWithNpaNxx

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 11 of 103

Copyright 2016 Avalara, Inc.

CalcProRatedAdj

CalcTaxesInCustMode

CalcTaxesInCustModeV2

ProcessCustomerBatch

ProcessCustomerBatchV2

Note: This feature is only supported with use of the APIs listed above.

In addition, this feature is only applicable in each of the following scenarios:

A) Scenario A – One of the following service types listed in the table below has been identified, but

the transaction type needs to be determined. For example, a service type of ‘1’ is entered for a

toll service and ‘-1’ is entered for the unknown transaction type. The web service will determine

the correct transaction type and apply INTERSTATE (transaction type 1) or INTRASTATE

(transaction type 2) based on the termination and origination data.

Service Type

Service Type Description

1

TOLL

2

TOLL FREE

3

WATS

4

PRIVATE LINE

14

LATE CHARGE

16

900

27

DATA

54

DIRECTORY ASSISTANCE

635

TOLL FREE NUMBER

B) Scenario B – The following transaction type has been identified, but the service type is unknown.

For example, ‘61’ is entered for a VPN transaction and ‘-1’ is entered for the unknown service

type. The web service will determine if the service type is INTERSTATE MPLS (service type 585) or

INTRASTATE MPLS (service type 586) based on the termination and origination data.

Transaction Type

Transaction Type Description

61

VPN

C) Scenario C – One of the following transaction types listed in the table below has been identified,

but the service type is unknown. For example, ‘19’ is entered for a VOIP transaction and ‘-1’ is

entered for the unknown service type. The web service will determine if the service type is

INTERSTATE USAGE (service type 49) or INTRASTATE USAGE (service type 50) base d on the

termination and origination data.

Transaction Type

Transaction Type Description

19

VOIP

20

VOIPA

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 12 of 103

Copyright 2016 Avalara, Inc.

Transaction Type

Transaction Type Description

21

PAYPHONE

59

VOIP NOMADIC

Private Line

The Private Line feature provides clients with the ability to obtain taxes for a private line transaction.

Clients must call with one of the following APIs:

CalcTaxesWithPCode

CalcTaxesWithFipsCode

CalcTaxesWithNpaNxx

CalcTaxesWithZipAddress

CalcAdjWithPCode

CalcAdjWithFipsCode

CalcAdjWithNpaNxx

CalcAdjWithZipAddress

CalcTaxesInCustMode

CalcTaxesInCustModeV2

ProcessCustomerBatch

ProcessCustomerBatchV2

In addition, clients must specify that the transaction is for a private line and provide a number between 0

and 1 to indicate the percentage which applies to the origination point. Any remaining charges are then

applied to the termination point.

Note: This feature is only supported with use of the eight APIs referenced. It is not supported for use

with Tax Inclusive or Reverse APIs.

Proration

The Proration feature provides clients with the ability to calculate prorated taxes on a transaction that

represents a partial month of service through use of the CalcProRatedTaxes API or the CalcProRatedAdj

API. Percentage-based taxes are prorated by way of the charge amount passed. However, fixed and per

line taxes are subject to special pro-rating rules and procedures. Some tax authorities allow sellers to

pro-rate fixed and per line taxes for partial months, but many insist on receiving the full amount. AFC

SaaS Pro will apply these rules automatically if the pro-rating feature is used. . A number between 0 and

1 is passed to specify the percentage of the month the service was active. The pro-rating functionality

checks the logic of each tax in the appropriate jurisdiction to determine if prorating is allowed. If

prorating is not allowed, the full amount is taxed. If pro-rating is allowed, the fixed or per line tax

applicable to the service will be returned multiplied by the fraction supplied.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 13 of 103

Copyright 2016 Avalara, Inc.

If the proration is being used for an adjustment credit rather than a partial charge, the ratio of the

percentage applied should reflect the portion of the month in which the service was not active.

Tax Grouping

The following options determine how tax calculation results are returned after calling one of the tax

calculation API functions. By changing this option, the taxes returned by the tax calculation API function

may be grouped according to this setting.

NOTE: This option will not modify the way that tax calculation results are logged into the AFC log data.

Only the tax calculation results returned by either one of the tax calculation API will be group according to

the values set for this option.

Please contact communicationsupport@avalara.com in order to have tax grouping options set or

activated.

General Rules

The following rules apply when using any value for this option:

1. Federal taxes may not be grouped. Each Federal tax will be returned individually.

2. Non-billable taxes may not be grouped.

3. Only rate-based taxes may be grouped. Taxes with a different calculation type (for example,

fixed, per line, etc) will be returned individually.

4. Use taxes may be grouped with other use taxes only (for example, state and local use tax).

Use taxes will not be grouped with other tax types.

5. When grouping taxes for different tax levels (for example, state and local taxes) the

jurisdiction code for the lowest level jurisdiction will be returned.

6. Unincorporated taxes will be considered as County taxes when grouping taxes by tax level,

and will be grouped accordingly.

7. The tax rates for all taxes being grouped into a single record will be added together.

Default Option:

groupresults=default (default)

The default option indicates that the taxes returned in the tax table after processing a transaction

with AFC will not be grouped. Each tax will be returned in an individual tax record.

Tax Level Options:

groupsamelevel

This option will cause rate-based taxes at the same level to be grouped together. For example, if

AFC returns a Local Sales Tax and a Local District Tax, these taxes will be grouped together since

they have the same tax level (Local).

groupstate_groupcountyandlocal

This option will cause all state taxes to be grouped together into a single record, and all county

and local taxes to be grouped together into a separate record.

groupstatecountyandlocal

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 14 of 103

Copyright 2016 Avalara, Inc.

This option will cause all state, county, and local taxes to be grouped together into a single

record.

Sales Tax Options:

The following options may be used in combination with any of the tax level options specified above.

These options may be used to group sales taxes separately from other taxes. This option must be

appended to the EZTax.cfg file following the line for the tax level group option.

groupsales

This option will group Sales Taxes (tax type 1) and Use Taxes (tax type 49) taxes into a separate

record according to the tax level option being specified.

groupsalescategory

When using this option, AFC will group any items that are considered Sales Taxes together. In

addition to the Sales Tax (tax type 1) and Use Tax (tax type 49), some District and Transit taxes

are also in the sales tax category.

Examples

groupstatecountylocal

By entering the configuration option shown above into the EZTax.cfg file, all State, County, and

Local taxes will be grouped together into a single record.

groupstatecountylocal

groupsalescategory

By entering these two options in the configuration file, all State, County, and Local sales category taxes

will be grouped together into a single record. Any other State, County and Local taxes (if any) will be

grouped into a separate record.

Tax Return Table

When grouping taxes together, the fields in the tax return table will contain the following values:

1. Jurisdiction Code. Jurisdiction Code (PCode) for the lowest level jurisdiction. For example, if

Kansas state taxes and Overland Park local taxes were grouped together, the tax record will

contain the jurisdiction code for Overland Park.

2. Tax level. When grouping State, County and Local taxes together, the tax record will contain a

value of 6 in the tax level. When grouping only County and Local taxes together, the tax

record will contain a value of 7 in the tax record. Constants are provided for these values in

the appropriate file.

3. Tax type. When grouping different taxes together, the tax type in the tax record will contain a

value of 0. If only Sales Taxes (tax type 1) or Use Taxes (tax type 49) are being grouped

together, the tax record will contain the corresponding tax type.

4. Tax amount. This field will contain the sum of the tax amount for all taxes being grouped

together.

5. Tax rate. This field will contain the sum of the tax rates for all taxes being grouped together.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 15 of 103

Copyright 2016 Avalara, Inc.

NOTE: The remaining fields in the tax table will not contain any meaningful value. Grouping tax

calculation results may serve as a way to simplify the tax information for display purposes only. If further

detail is required for each tax being returned by AFC, this feature should not be used.

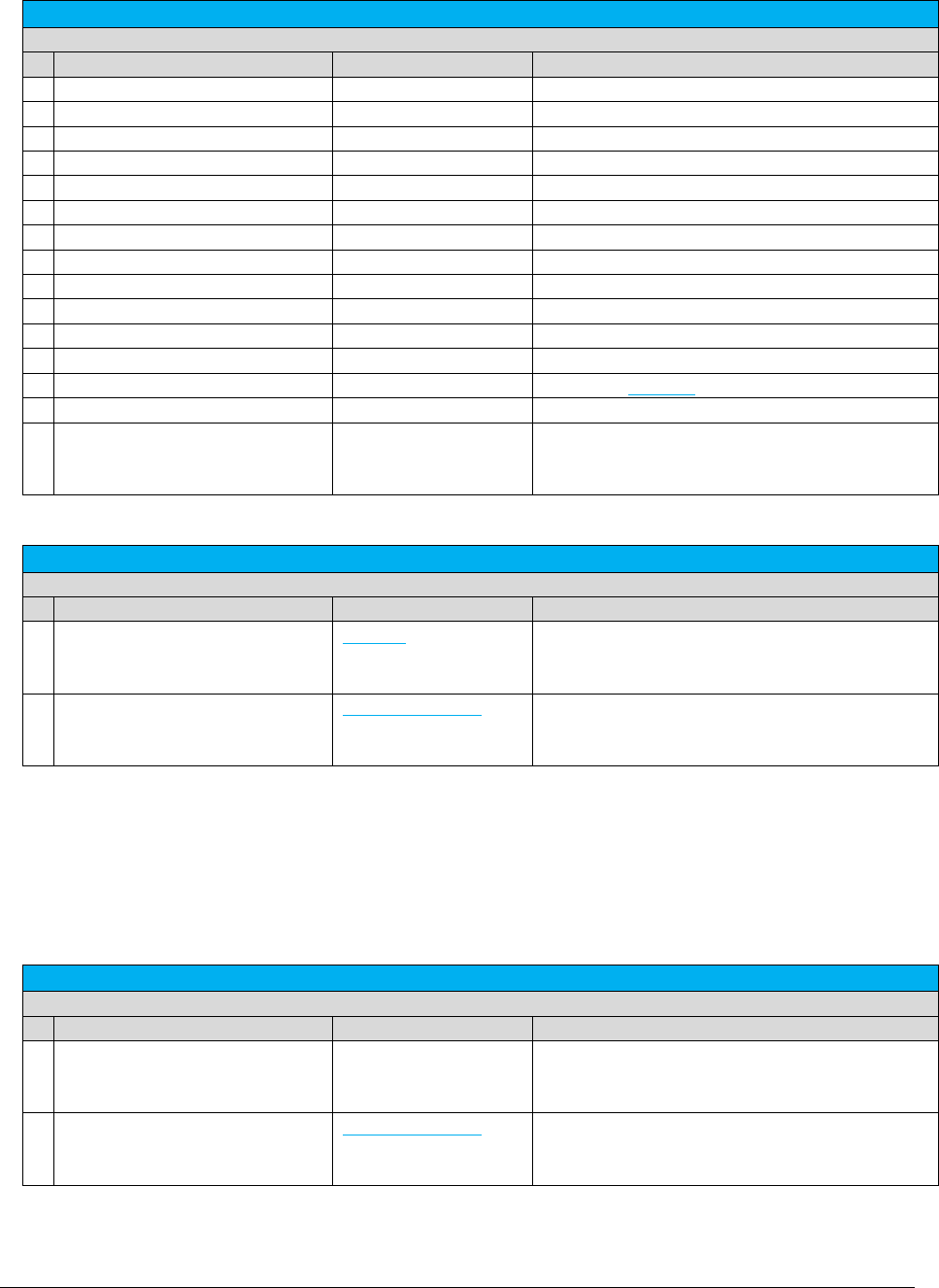

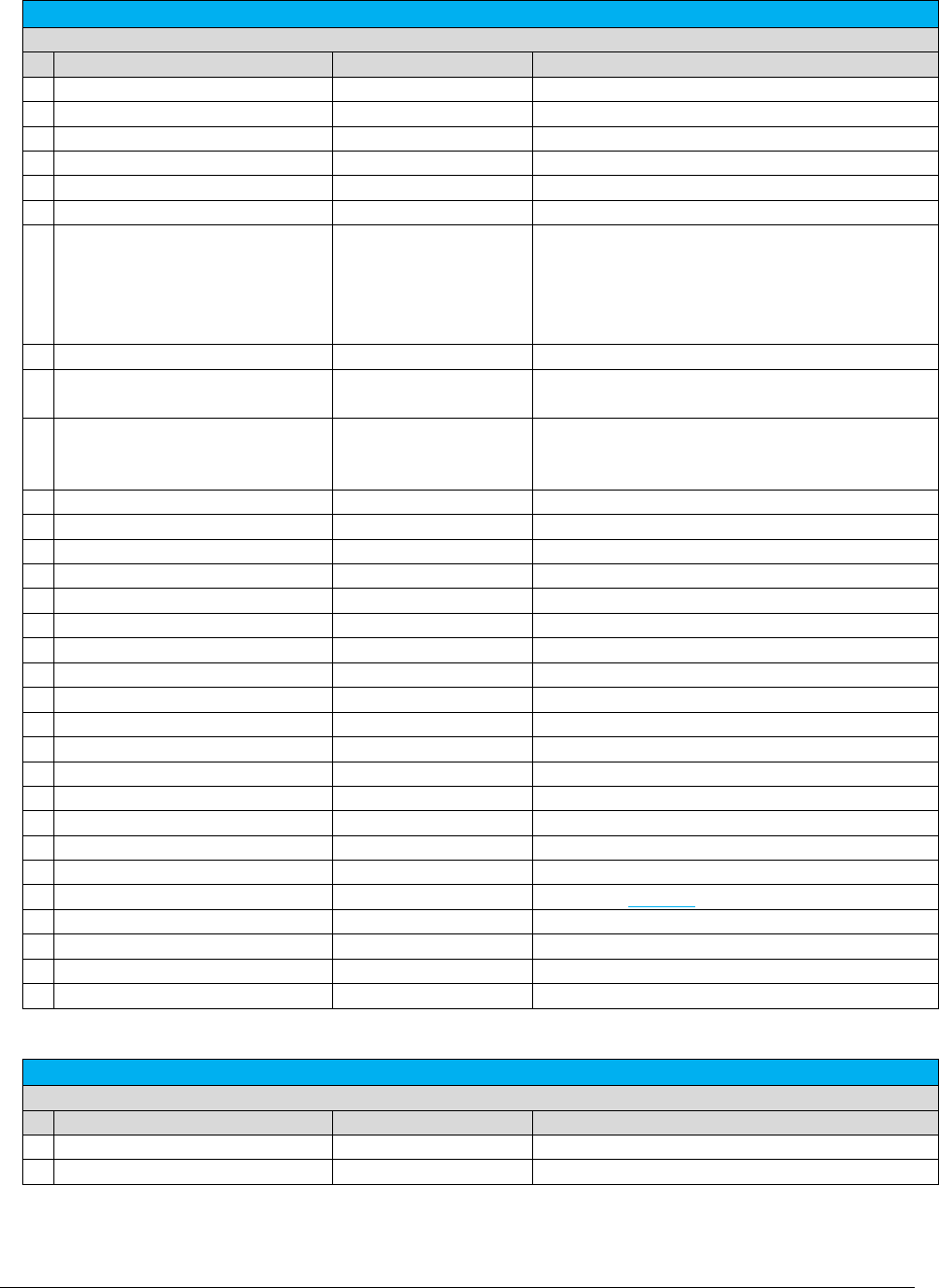

Specifying a Unique Identifier

AFC SaaS Pro does not provide in the response a unique identifier for a specific transaction. However,

there are numerous reporting fields which can be used for the requesting application to populate a

unique identifier. Reporting fields do not impact tax calculations. It is recommended that clients

generate or construct the unique identifier in a way that is meaningful to their billing application and then

proceed to provide that data to Avalara through one of the available reporting fields.

Reporting fields that can be used individually or in combination to represent a unique identifier are

shown in the table below.

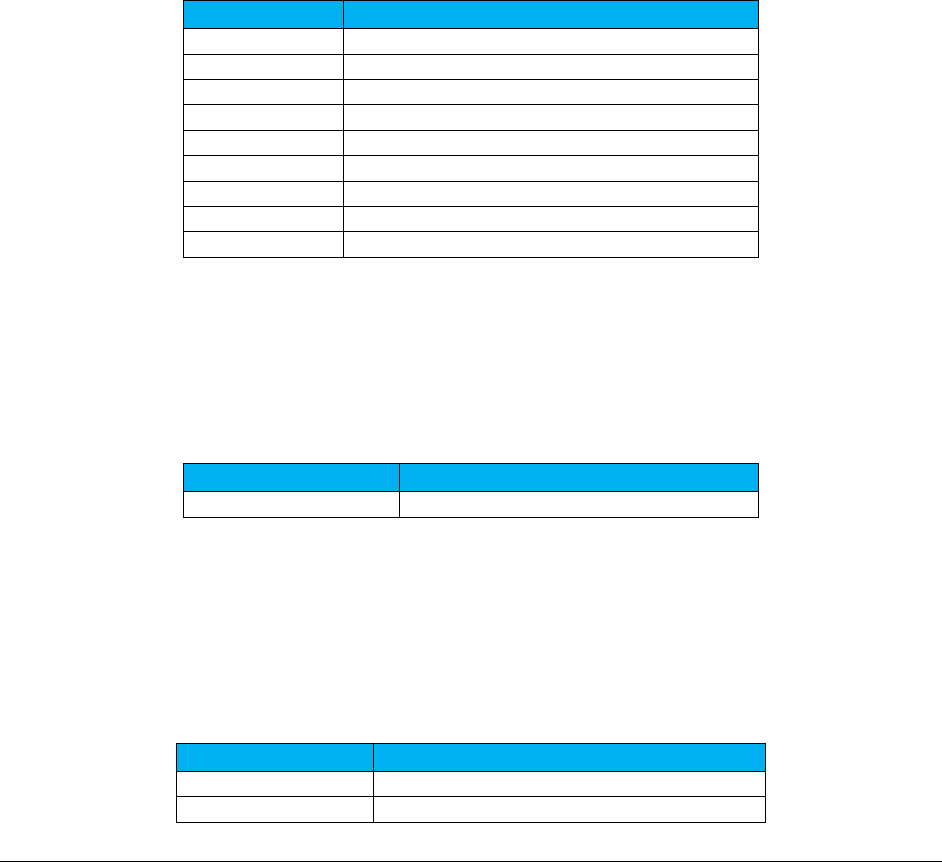

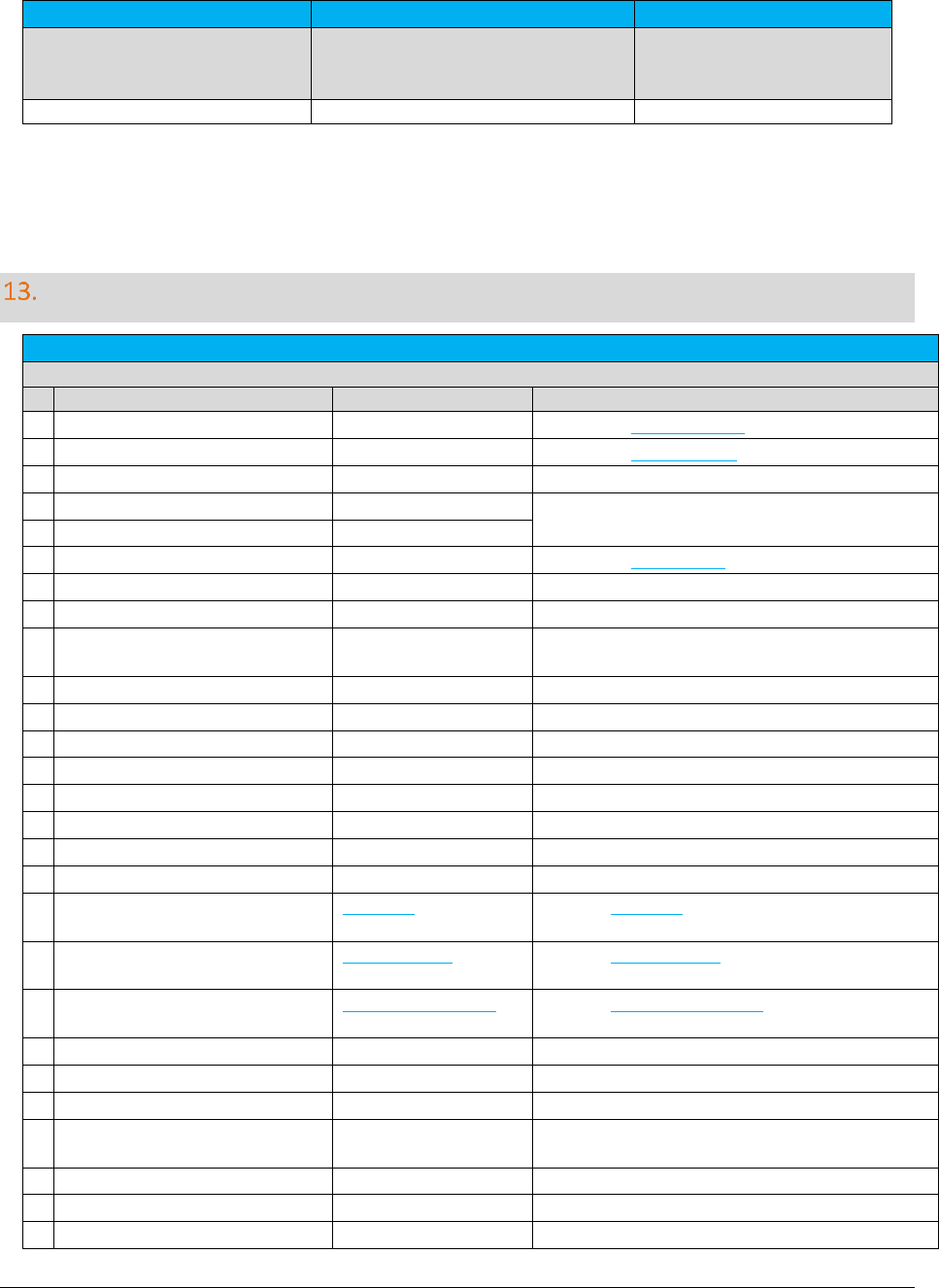

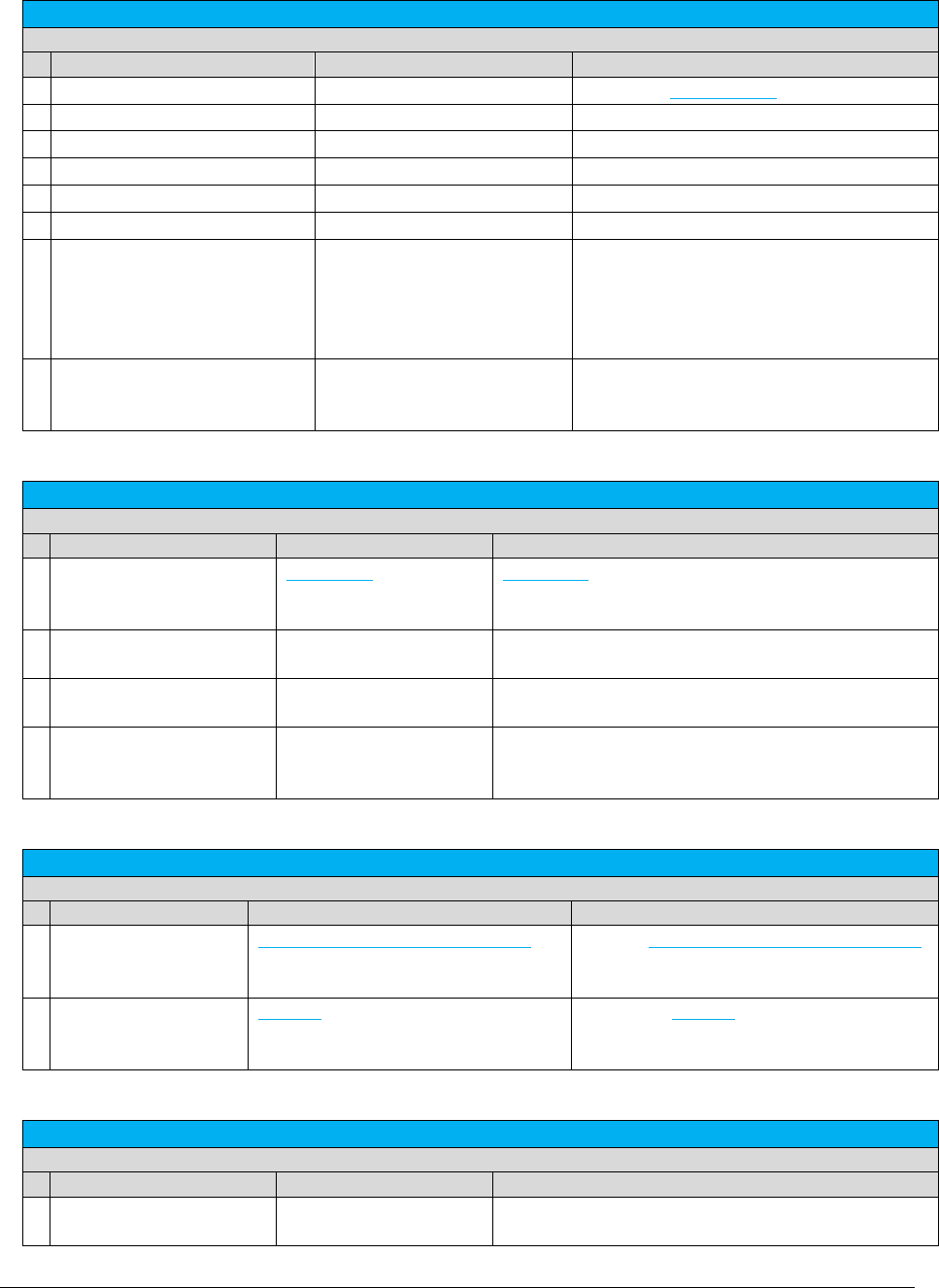

Reporting Fields

Column Name

Description

Optional

Optional4

Optional5

Optional6

Optional7

Optional8

Optional9

Optional10

InvoiceNumber

ServiceLevelNumber

Unsigned int. Should be >= 0. The max value is different for different

platforms, but in general supports values at least up to 4294967295 (232 -1).

OptionalAlpha1

CustomerNumber

Alpha-numeric field. Supports up to 20 bytes.

OptionalFields

Alpha-numeric field. Supports up to 10 fields and up to 150 bytes per field.

Commit/Uncommit

The process to commit documents is optional and used to identify documents that should be included in

the Compliance Reports for remittance to the Department of Revenue (DoR) for tax compliance

reporting. This process is often used when not all taxes being calculated are considered final for

compliance reporting. When a document is considered final, a commit can be sent to finalize the

document. This also allows users to commit an entire invoice by using the document code instead of

calculating the taxes again when the document is determined to be final.

Note: This feature is supported with the use of all tax calculations. Please reference the AvaTax for

Communications SaaS Pro Commit/Uncommit Process document for additional information and details.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 16 of 103

Copyright 2016 Avalara, Inc.

Application of Tax Brackets and Limits

Tax Brackets

Some jurisdictions will dictate a tax rate that changes as the taxable amount of the transaction increases.

These break points at which the changes occur define the brackets (or steps) and are most commonly

based on dollar amount ranges although other units of measure exist. The rate may increase or decrease

according to usage levels.

AFC SaaS Pro supports these transactions with an unlimited number of tax brackets. The Avalara Tax

Research department continually researches jurisdictions for specific tax practices, such as tax rate

brackets, updating the AFC Engine monthly. These updates occur automatically and the user is not

required to make changes to account for this.

As an example of applying tax brackets, if a jurisdiction has a general sales tax set at 2% for the first $500

of a single transaction and set at 1% for that which is over $500, the tax for a $1200 sale would result in

($500 x 2%) = $10 plus ($700 x 1%) = $7 which is a total tax of $17.00.

Tax Limits

Some jurisdictions have established tax rates that either take effect or cease to take effect at a specific

threshold, defined as a currency value. The point at which this occurs is referred to as a cap or limit. AFC

SaaS Pro supports these transactions and the user is not required to make changes to account for it.

As an example of applying tax limits, if a jurisdiction charges a 10% UTT on only the first $10 of an invoice,

the tax for a $20 invoice would “cap” at the $10 threshold, resulting in a ($10 x 10% =) $1 UTT fee.

As an example of the converse, if a jurisdiction does NOT tax the first $25 of Internet Access usage, a $35

charge would be reduced by the $25 threshold “limit,” resulting in a ($35-$25 = ) $10 taxed amount.

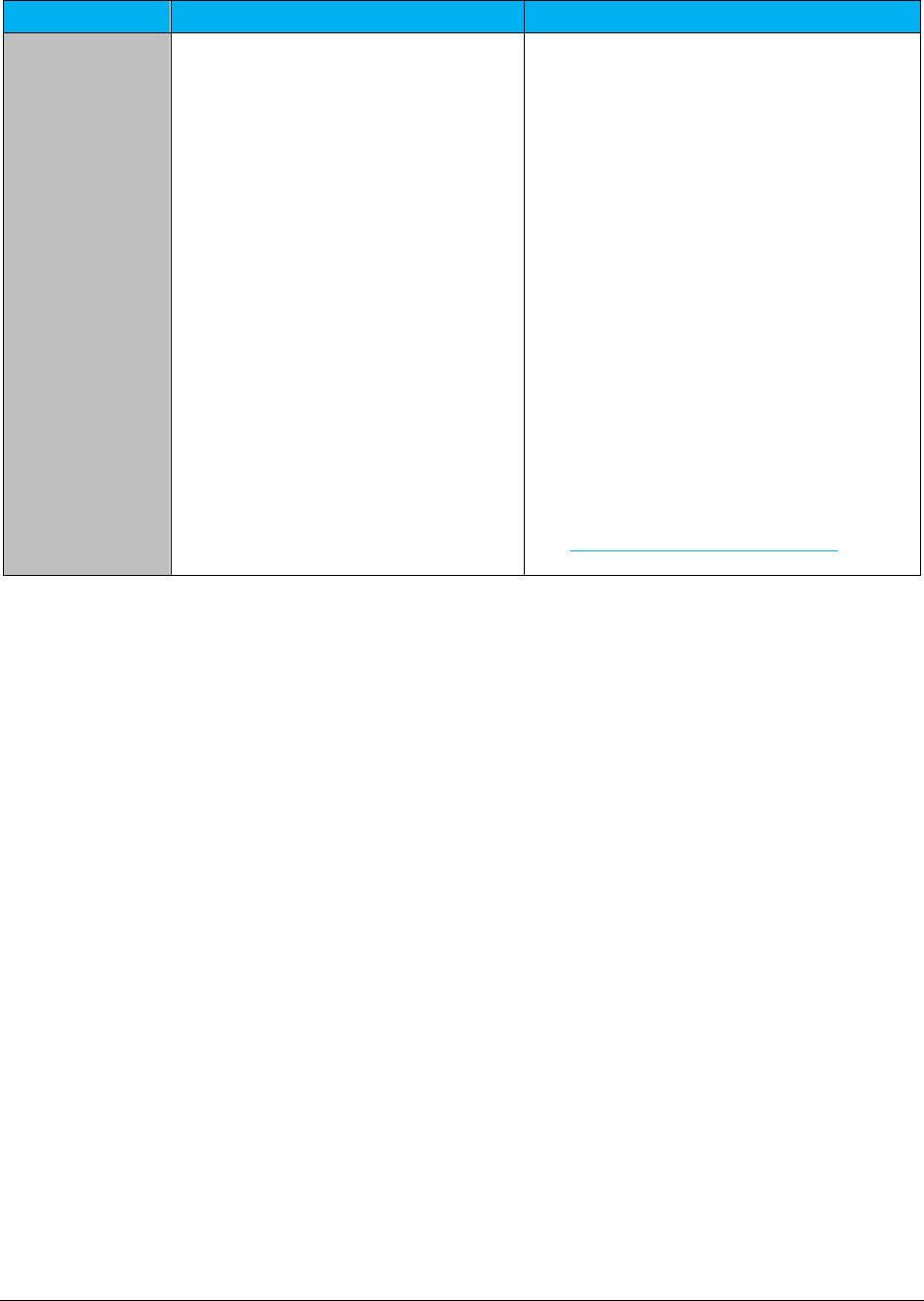

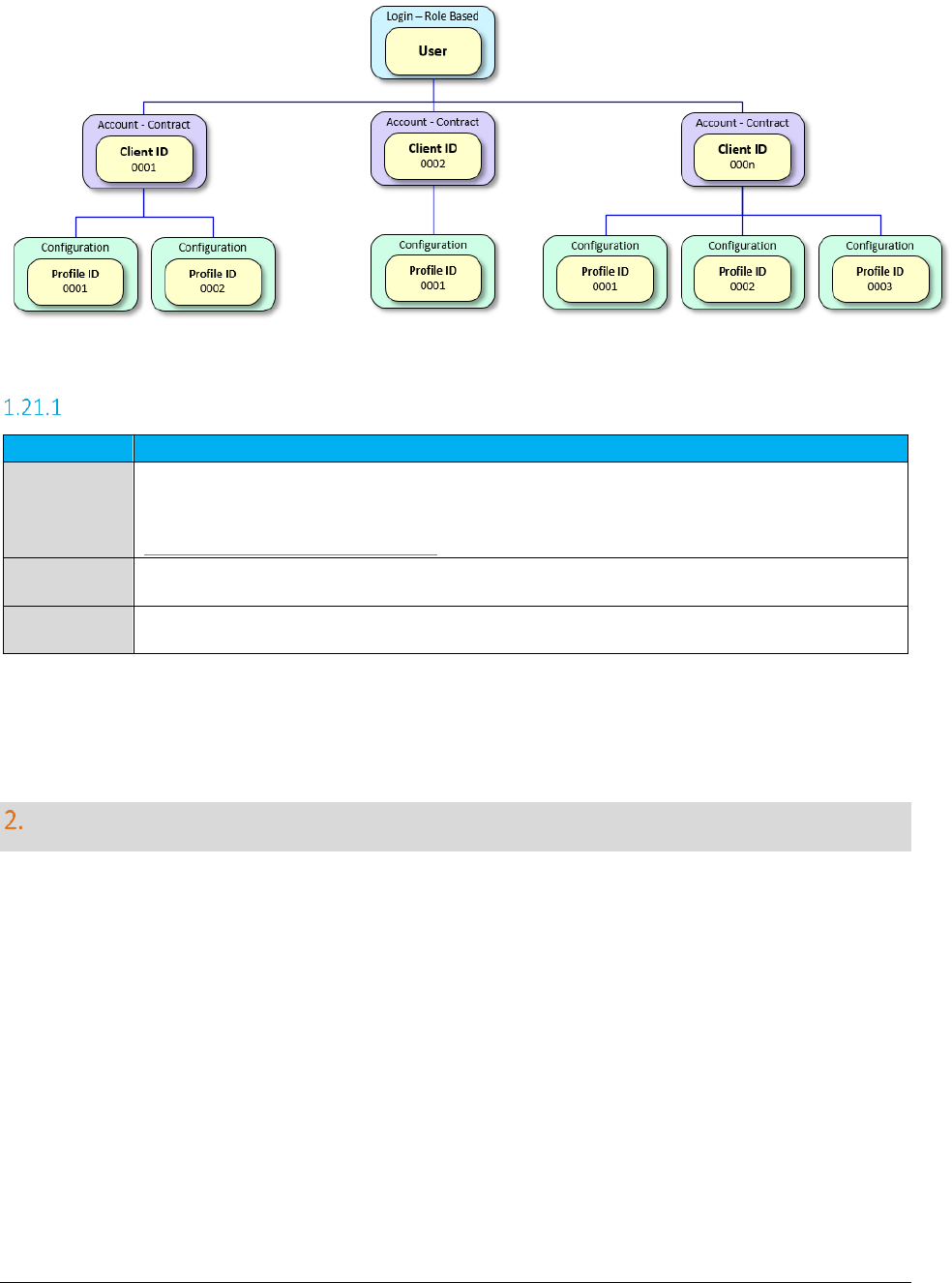

Use of Client IDs in the REST Interface

Users may obtain access to multiple client accounts which are referred to as Client IDs when using AFC

SaaS Pro. The Client ID is assigned and provided by Avalara. They are specific to each client account;

however, an individual user may utilize several Client IDs based on the number of client accounts to which

they have been assigned to manage.

Please reference the image below for further illustration of the relationship between individual users and

Client IDs.

A F C S a a S P r o T e l e c o m D e v e l o p e r M a n u a l | 17 of 103

Copyright 2016 Avalara, Inc.

Definition of Terms

Term

Definition

User

The username or email account login used to access the AFC Customer Portal. This includes

Reporting, Developer Content and Tax Determination access. The user account will have one to

many AFC client accounts associated with it. Please contact

communicationsupport@avalara.com to create or change a user account.

Client

An AFC entity with a valid contract. The client account will have one to many profiles. Please

contact your Avalara Customer Account Manager (CAM) to establish a new client.

Profile

The client’s customizations for the AFC tax engine. This includes overrides, bundles and

exclusions.

Specifying a Tax Jurisdiction

For AFC SaaS Pro to calculate taxes for transactions correctly, it must first determine the taxing

jurisdiction for the transaction in question. The tax laws of various jurisdictions complicate this. AFC SaaS

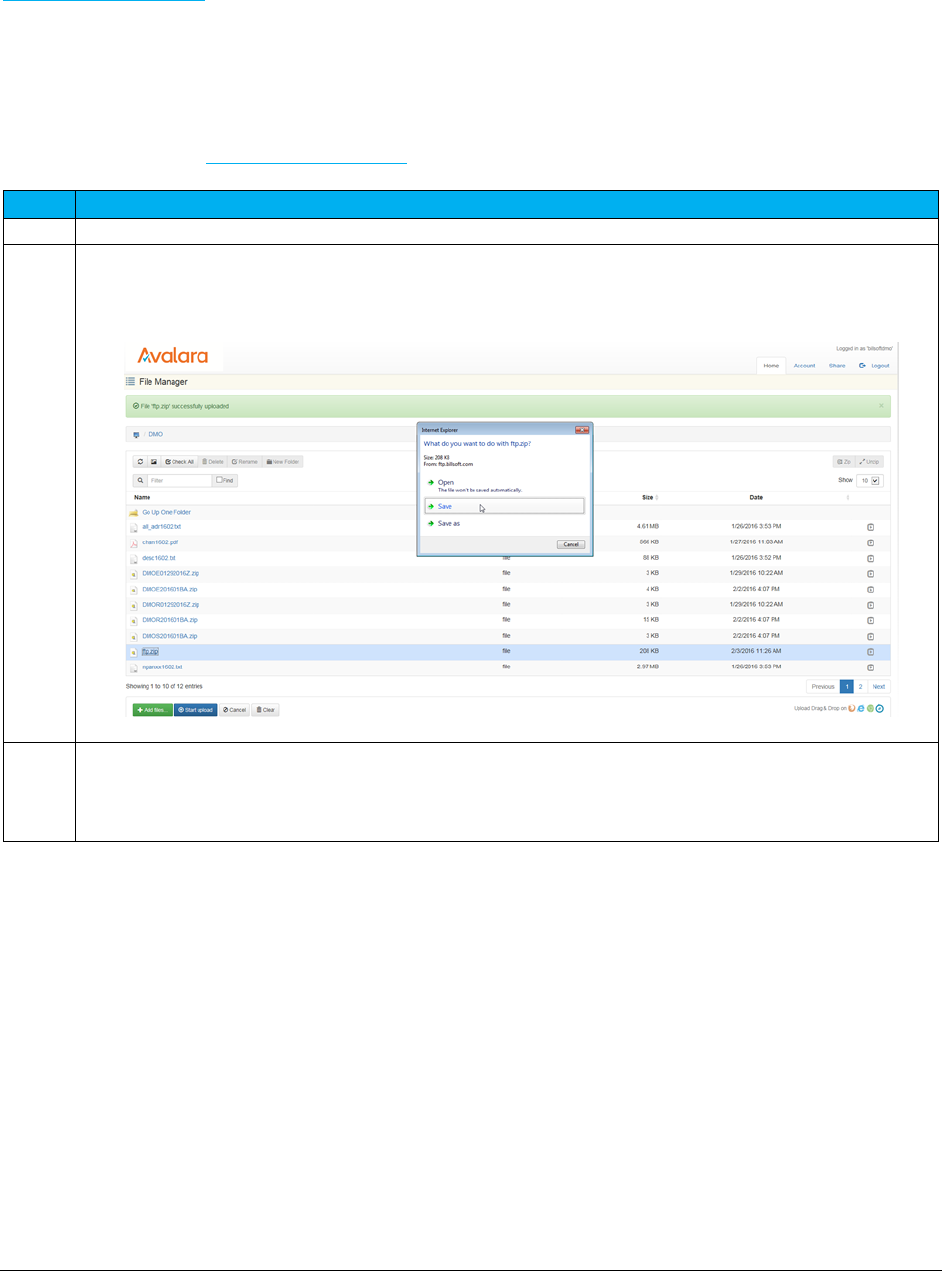

Pro currently supports multiple unique rules for determination of the correct tax jurisdiction. Jurisdiction