Vantiv EProtect Integration Guide Enterprise E Protect V2.7

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 150 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- eProtect™ Integration Guide - Enterprise

- About This Guide

- 1 Introduction

- 1.1 eProtect Overview

- 1.2 How eProtect Works

- 1.3 Getting Started with eProtect

- 1.3.1 Migrating From Previous Versions of the eProtect API

- 1.3.2 Browser and Mobile Operating System Compatibility

- 1.3.3 eProtect Support for Apple Pay™ / Apple Pay on the Web

- 1.3.4 eProtect Support for Android Pay™

- 1.3.5 eProtect Support for Pay with Google™

- 1.3.6 eProtect Support for Visa Checkout™

- 1.3.7 jQuery Version

- 1.3.8 Certification and Testing Environment

- 1.3.9 Transitioning from Certification to Production

- 1.3.10 eProtect-Specific Response Codes

- 1.3.11 eProtect Registration ID Duplicate Detection

- 1.4 Creating a Customized CSS for iFrame

- 2 Integration and Testing

- 2.1 Integrating Customer Browser JavaScript API Into Your Checkout Page

- 2.1.1 Integration Steps

- 2.1.2 Loading the eProtect API and jQuery

- 2.1.3 Specifying the eProtect API Request Fields

- 2.1.4 Specifying the eProtect API Response Fields

- 2.1.5 Handling the Mouse Click

- 2.1.6 Intercepting the Checkout Form Submission

- 2.1.7 Handling Callbacks for Success, Failure, and Timeout

- 2.1.8 Detecting the Availability of the eProtect API

- 2.1.9 Using the Customer Browser JavaScript API for Apple Pay on the Web

- 2.1.10 Using the Customer Browser JavaScript API for Visa Checkout

- 2.1.11 Adding Visa Checkout to the eProtect Customer Browser JavaScript API

- 2.2 Integrating iFrame into your Checkout Page

- 2.3 Integrating eProtect Into Your Mobile Application

- 2.4 Collecting Diagnostic Information

- 2.5 Transaction Examples When Using ISO 8583, 610, HHMI, and PWS

- 2.6 Transaction Examples When Using cnpAPI

- 2.7 Testing and Certification

- 2.1 Integrating Customer Browser JavaScript API Into Your Checkout Page

- A Code Samples and Other Information

- B CSS Properties for iFrame API

- C Sample eProtect Integration Checklist

- Index

eProtect™ Integration Guide - Enterprise

January 2018

cnpAPI Release V12.0

eProtect API V3.0

Document Version: 2.7

Vantiv eProtect™ Integration Guide Document Version: 2.7

All information whether text or graphics, contained in this manual is confidential and proprietary information of Vantiv, LLC and is

provided to you solely for the purpose of assisting you in using a Vantiv, LLC product. All such information is protected by copyright laws

and international treaties. No part of this manual may be reproduced or transmitted in any form or by any means, electronic, mechanical or

otherwise for any purpose without the express written permission of Vantiv, LLC. The possession, viewing, or use of the information

contained in this manual does not transfer any intellectual property rights or grant a license to use this information or any software

application referred to herein for any purpose other than that for which it was provided. Information in this manual is presented "as is" and

neither Vantiv, LLC or any other party assumes responsibility for typographical errors, technical errors, or other inaccuracies contained in

this document. This manual is subject to change without notice and does not represent a commitment on the part Vantiv, LLC or any other

party. Vantiv, LLC does not warrant that the information contained herein is accurate or complete.

All trademarks are the property of their respective owners and all parties herein have consented to their trademarks appearing in this

manual. Any use by you of the trademarks included herein must have express written permission of the respective owner.

Copyright © 2003-2018, Vantiv, LLC - ALL RIGHTS RESERVED.

Document Version: 2.7 — cnpAPI Release: 12.0 iii

CONTENTS

© 2018 Worldpay, Inc. - All Rights Reserved.

About This Guide

Intended Audience .............................................................................................................v

Revision History .................................................................................................................v

Document Structure ..........................................................................................................xi

Documentation Set ...........................................................................................................xi

Typographical Conventions ............................................................................................. xii

Contact Information.......................................................................................................... xii

Chapter 1 Introduction

eProtect Overview............................................................................................................. 2

How eProtect Works ......................................................................................................... 4

Getting Started with eProtect ............................................................................................ 6

Migrating From Previous Versions of the eProtect API............................................... 6

From eProtect with jQuery 1.4.2 ........................................................................... 6

From JavaScript Browser API to iFrame............................................................... 7

Browser and Mobile Operating System Compatibility................................................. 8

Communication Protocol Requirement ................................................................. 8

eProtect Support for Apple Pay™ / Apple Pay on the Web ........................................ 8

eProtect Support for Android Pay™............................................................................ 9

eProtect Support for Pay with Google™ ................................................................... 10

eProtect Support for Visa Checkout™ ...................................................................... 10

Getting Started with Visa Checkout .................................................................... 10

Requirements for Using Visa Checkout .............................................................. 11

jQuery Version .......................................................................................................... 12

Certification and Testing Environment ...................................................................... 12

Pre-Live Environment Limitations and Maintenance Schedule........................... 13

Transitioning from Certification to Production ........................................................... 14

eProtect-Specific Response Codes .......................................................................... 14

eProtect Registration ID Duplicate Detection............................................................ 15

Creating a Customized CSS for iFrame.......................................................................... 16

CSS iFrame Validation and Customization Features................................................ 16

Using Web Developer Tools ..................................................................................... 20

Reviewing your CSS with Vantiv............................................................................... 20

Chapter 2 Integration and Testing

Integrating Customer Browser JavaScript API Into Your Checkout Page ...................... 24

Integration Steps....................................................................................................... 24

Loading the eProtect API and jQuery........................................................................ 25

eProtect™ Integration Guide - Enterprise Contents

iv Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

Specifying the eProtect API Request Fields ............................................................. 26

Specifying the eProtect API Response Fields........................................................... 27

Handling the Mouse Click ......................................................................................... 27

Intercepting the Checkout Form Submission ............................................................ 29

Handling Callbacks for Success, Failure, and Timeout............................................. 30

Success Callbacks .............................................................................................. 30

Failure Callbacks................................................................................................. 31

Timeout Callbacks............................................................................................... 32

Detecting the Availability of the eProtect API............................................................ 32

Using the Customer Browser JavaScript API for Apple Pay on the Web.................. 33

Using the Customer Browser JavaScript API for Visa Checkout .............................. 35

Adding Visa Checkout to the eProtect Customer Browser JavaScript API ............... 36

Requesting and Configuring the API Key and externalClientId........................... 36

Sending Vantiv the Required Fields.................................................................... 37

Integrating iFrame into your Checkout Page .................................................................. 38

Integration Steps....................................................................................................... 38

Loading the iFrame ................................................................................................... 38

Configuring the iFrame.............................................................................................. 39

Calling the iFrame for the Registration ID ................................................................. 41

Calling the iFrame for the Checkout ID..................................................................... 42

Notes on the PCI Non-Sensitive Value Feature.................................................. 43

Handling Callbacks ................................................................................................... 43

Handling Errors ................................................................................................... 44

Integrating eProtect Into Your Mobile Application........................................................... 46

Creating the POST Request ..................................................................................... 46

Sample Request.................................................................................................. 47

Sample Response............................................................................................... 48

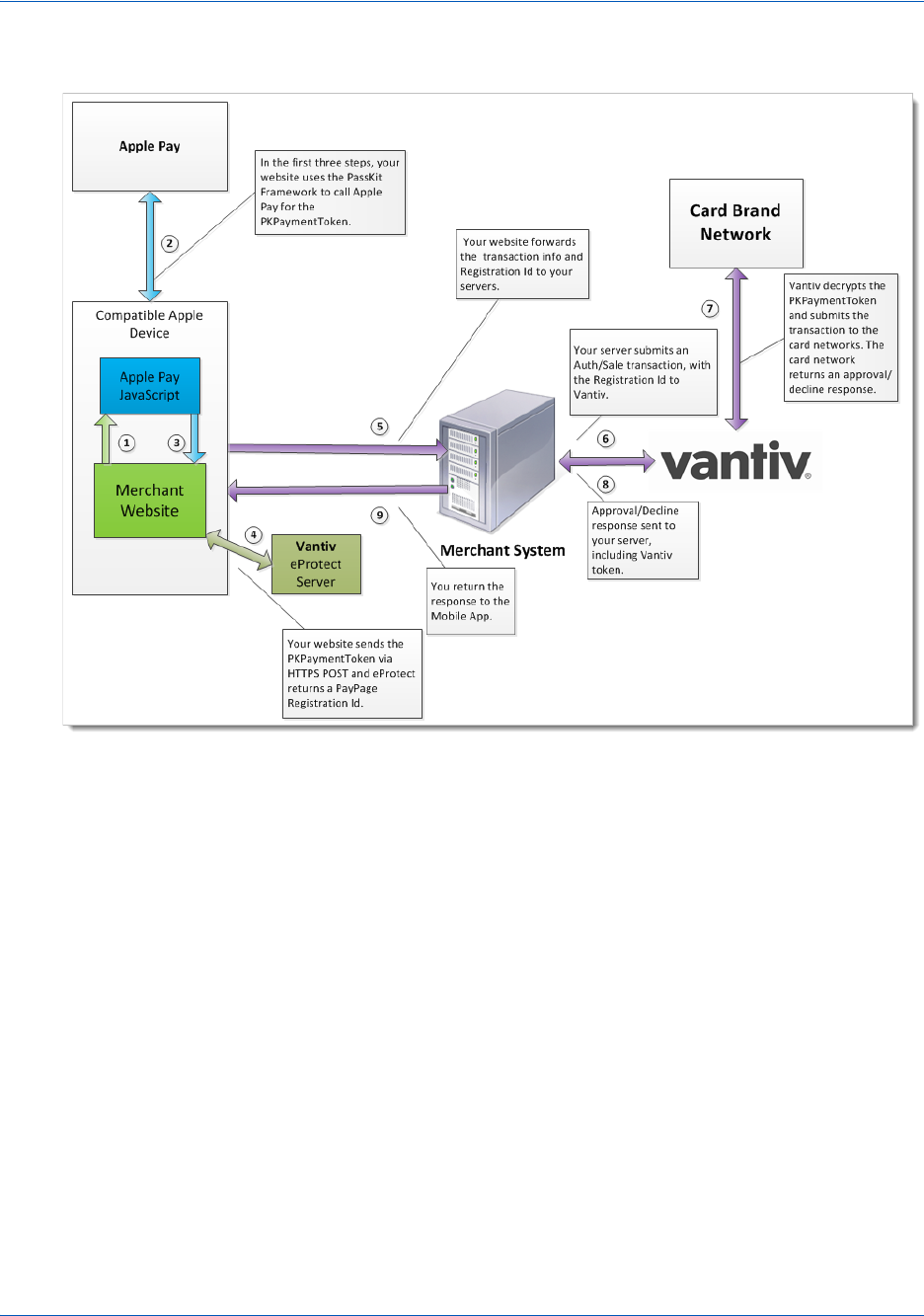

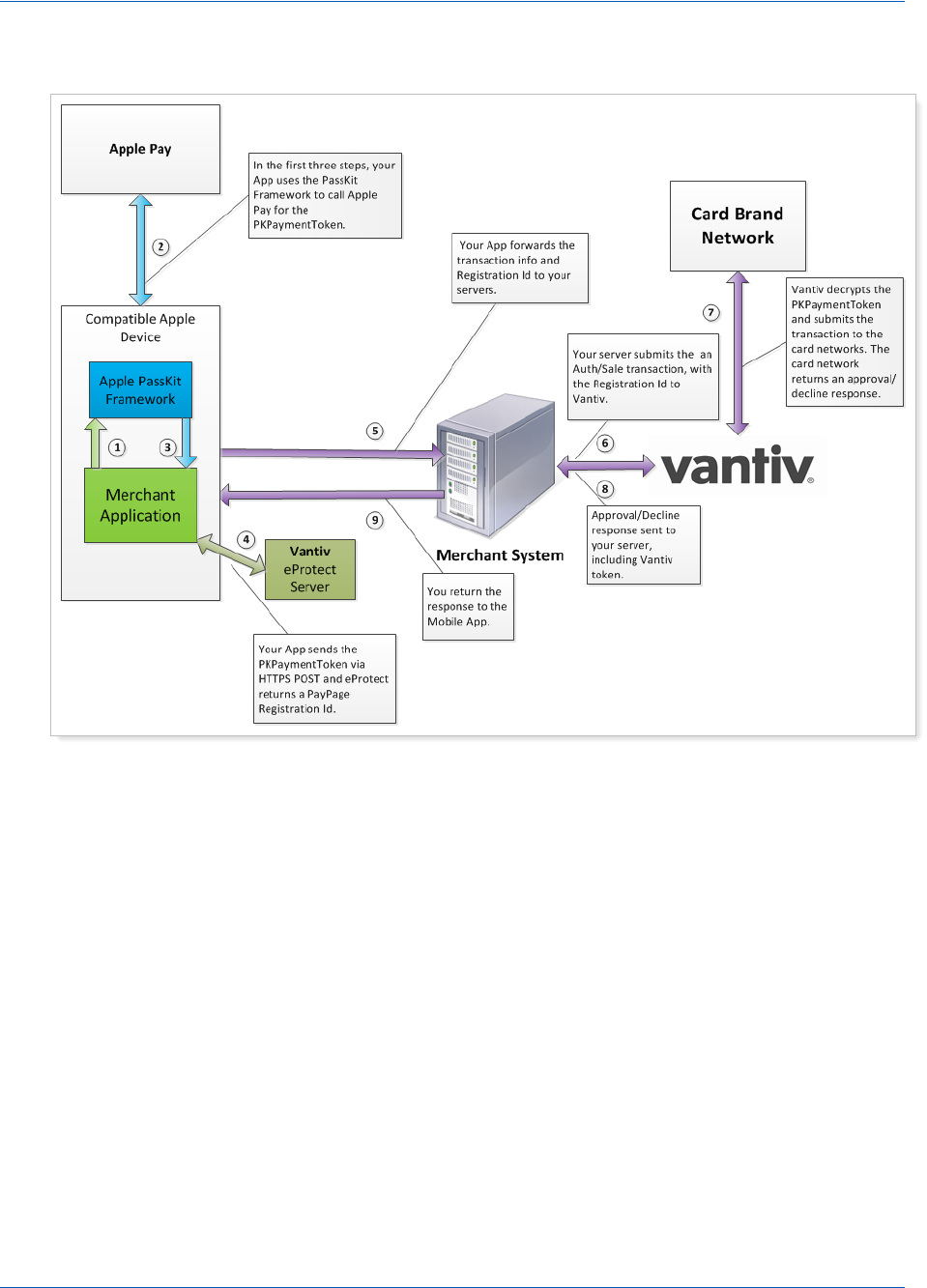

Using the Vantiv Mobile API for Apple Pay ............................................................... 48

Creating a POST Request for an Apple Pay Transaction ................................... 51

Sample Apple Pay POST Request ..................................................................... 52

Sample Apple Pay POST Response................................................................... 53

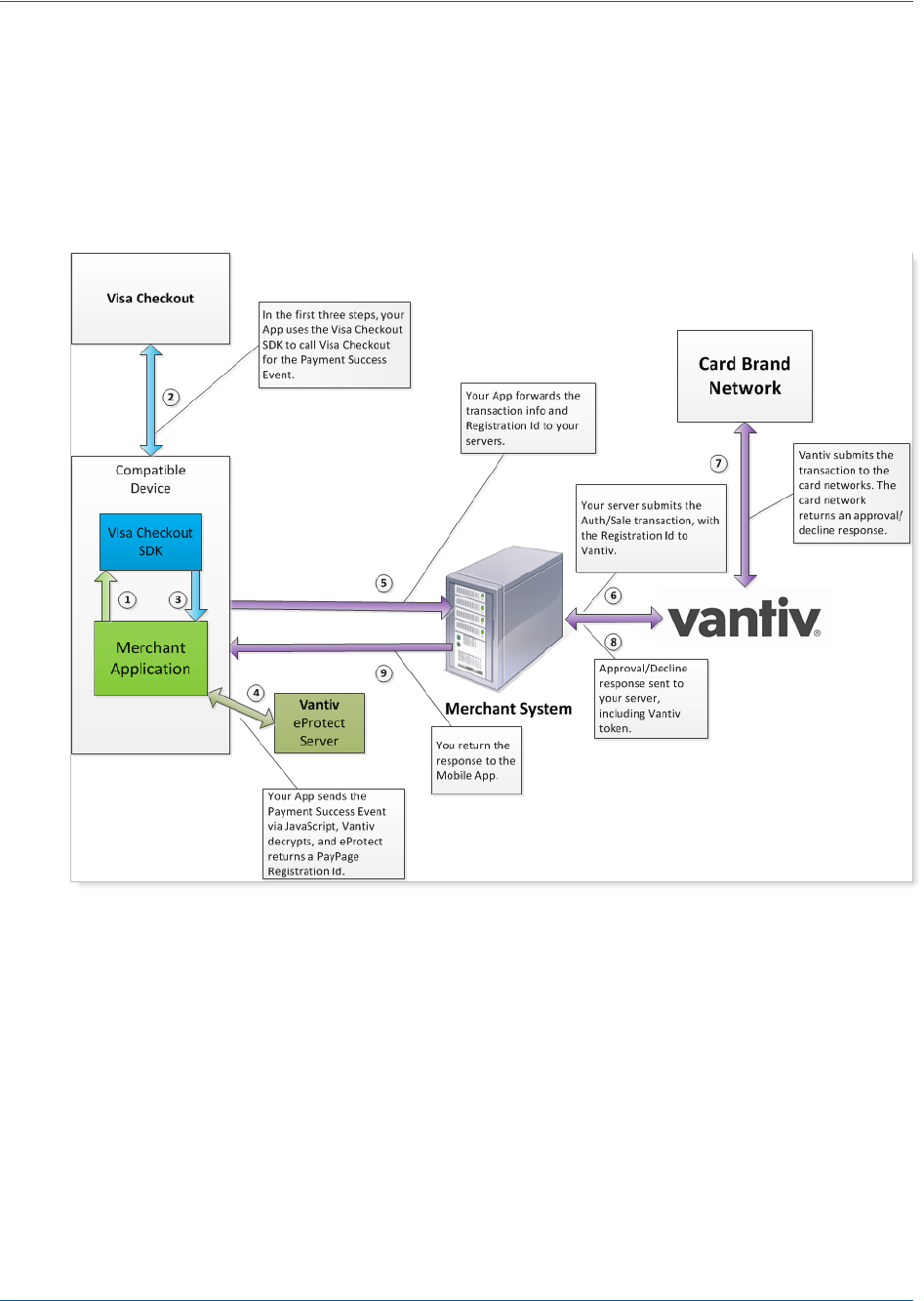

Using the Vantiv Mobile API for Visa Checkout ........................................................ 53

Sending Vantiv the Required Fields.................................................................... 55

Sample Visa Checkout POST Request............................................................... 55

Sample Visa Checkout POST Response............................................................ 56

Using the Vantiv Mobile API for Android Pay............................................................ 56

Using the Vantiv Mobile API for Pay with Google ..................................................... 59

Collecting Diagnostic Information ................................................................................... 62

Transaction Examples When Using ISO 8583, 610, HHMI, and PWS ........................... 63

Vantiv Online Systems - Acquirer ISO 8583 Message Format ................................. 64

Vantiv Online Systems - 610 Message Format......................................................... 67

eProtect™ Integration Guide - Enterprise Contents

Document Version: 2.7 — cnpAPI Release: 12.0 v

© 2018 Worldpay, Inc. - All Rights Reserved.

Response ............................................................................................................ 68

(HHMI) Host-to-Host Format ..................................................................................... 70

Payment Web Services (PWS) External Payments .................................................. 71

Transaction Examples When Using cnpAPI ................................................................... 75

Transaction Types and Examples............................................................................. 75

Authorization Transactions........................................................................................ 76

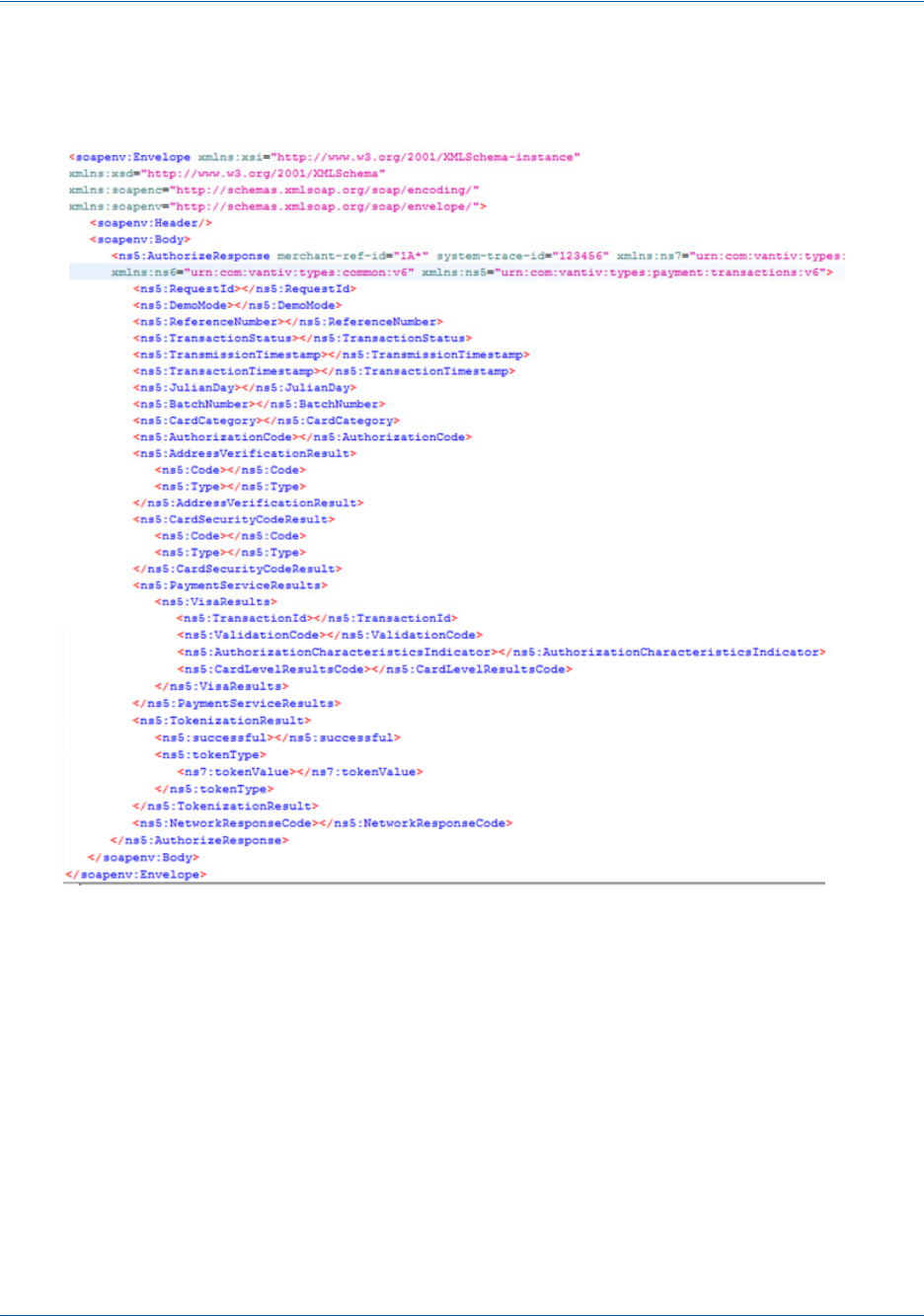

Authorization Request Structure ......................................................................... 76

Authorization Response Structure ...................................................................... 77

Sale Transactions ..................................................................................................... 79

Sale Request Structure ....................................................................................... 79

Sale Response Structure .................................................................................... 80

Register Token Transactions .................................................................................... 82

Register Token Request ..................................................................................... 82

Register Token Response................................................................................... 83

Force Capture Transactions...................................................................................... 84

Force Capture Request....................................................................................... 84

Force Capture Response .................................................................................... 85

Capture Given Auth Transactions............................................................................. 86

Capture Given Auth Request .............................................................................. 86

Capture Given Auth Response ........................................................................... 88

Credit Transactions ................................................................................................... 89

Credit Request Transaction ................................................................................ 89

Credit Response ................................................................................................. 90

Testing and Certification ................................................................................................. 92

Testing eProtect Transactions .................................................................................. 93

Appendix A Code Samples and Other Information

HTML Checkout Page Examples.................................................................................... 98

HTML Example for Non-eProtect Checkout Page .................................................... 98

HTML Example for JavaScript API-Integrated Checkout Page................................. 99

HTML Example for Hosted iFrame-Integrated Checkout Page............................... 102

Information Sent to Order Processing Systems............................................................ 106

Information Sent Without Integrating eProtect ........................................................ 106

Information Sent with Browser-Based eProtect Integration .................................... 106

Information Sent with Mobile API-Based Application Integration ............................ 107

cnpAPI Elements for eProtect....................................................................................... 108

cardValidationNum.................................................................................................. 109

checkoutId............................................................................................................... 110

expDate................................................................................................................... 111

paypage .................................................................................................................. 112

paypageRegistrationId ............................................................................................ 113

eProtect™ Integration Guide - Enterprise Contents

vi Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

registerTokenRequest............................................................................................. 114

registerTokenResponse .......................................................................................... 115

token ....................................................................................................................... 116

Appendix B CSS Properties for iFrame API

CSS Property Groups ................................................................................................... 118

Properties Excluded From White List............................................................................ 132

Appendix C Sample eProtect Integration Checklist

Index

Document Version: 2.7 — cnpAPI Release: 12.0 v

© 2018 Worldpay, Inc. - All Rights Reserved.

ABOUT THIS GUIDE

This guide provides information on integrating eProtect, which, when used together with

Omnitoken, will reduce your exposure to sensitive cardholder data and significantly reduce your

risk of payment data theft. It also explains how to perform eProtect transaction testing and

certification with Vantiv.

Intended Audience

This document is intended for technical personnel who will be setting up and maintaining

payment processing.

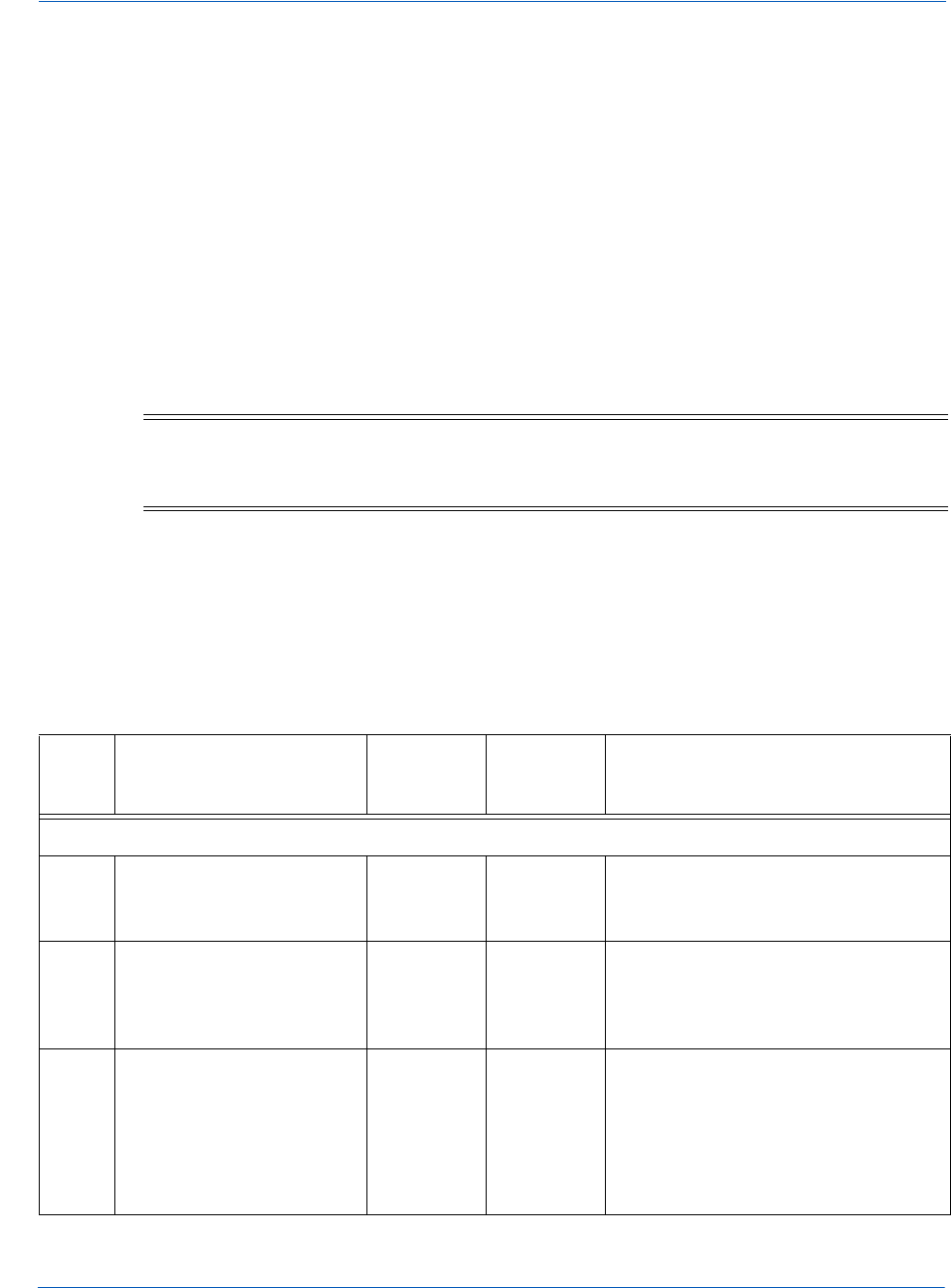

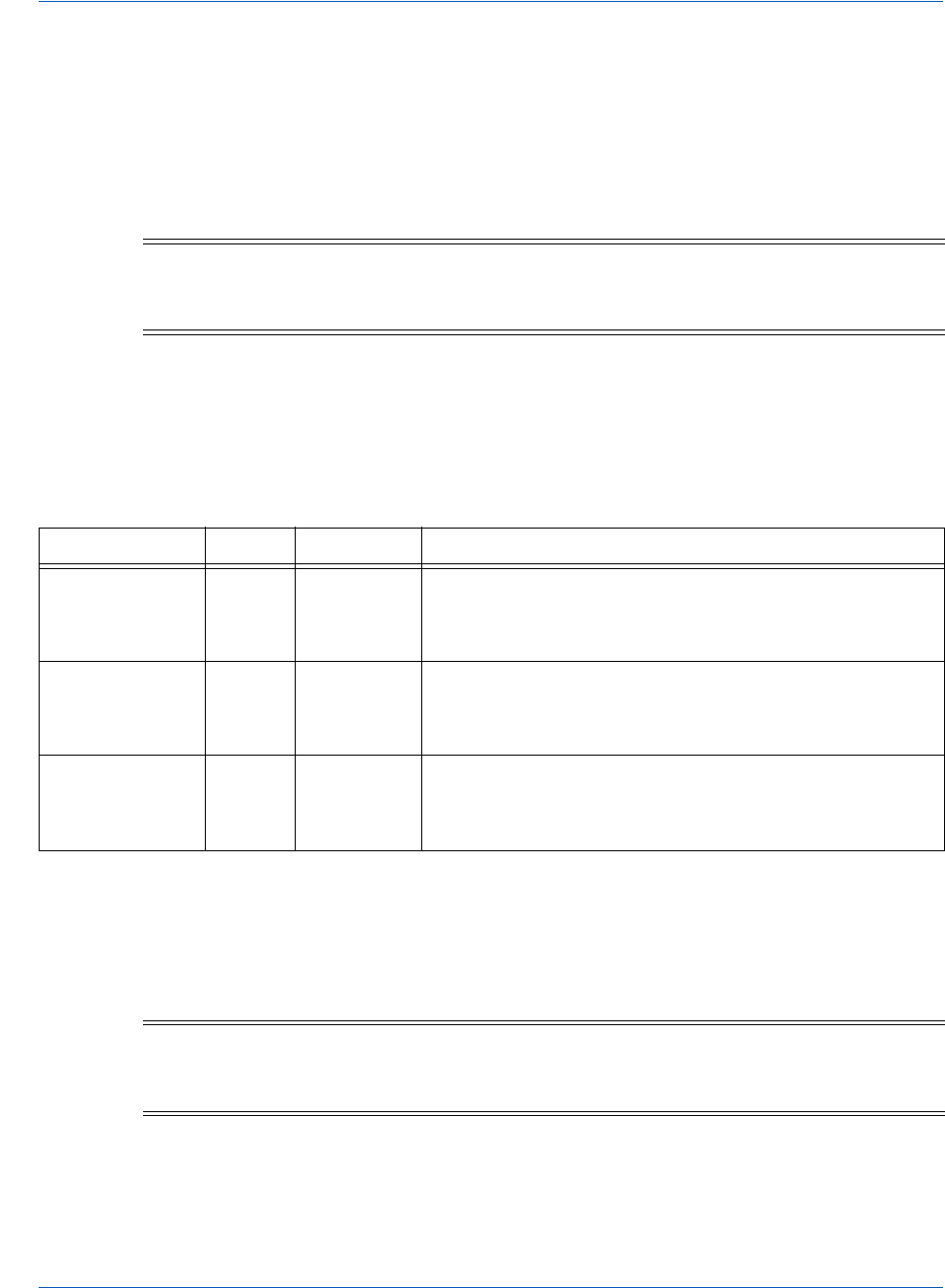

Revision History

This document has been revised as follows:

NOTE:The PayPage product is now known as Vantiv eProtect. The term

‘PayPage’ however, is still used in this guide in certain text descriptions,

along with many data elements, JS code, and URLs. Use of these data

elements, etc., with the PayPage name is still valid with this release, but

will transition to ‘eProtect’ in a future release.

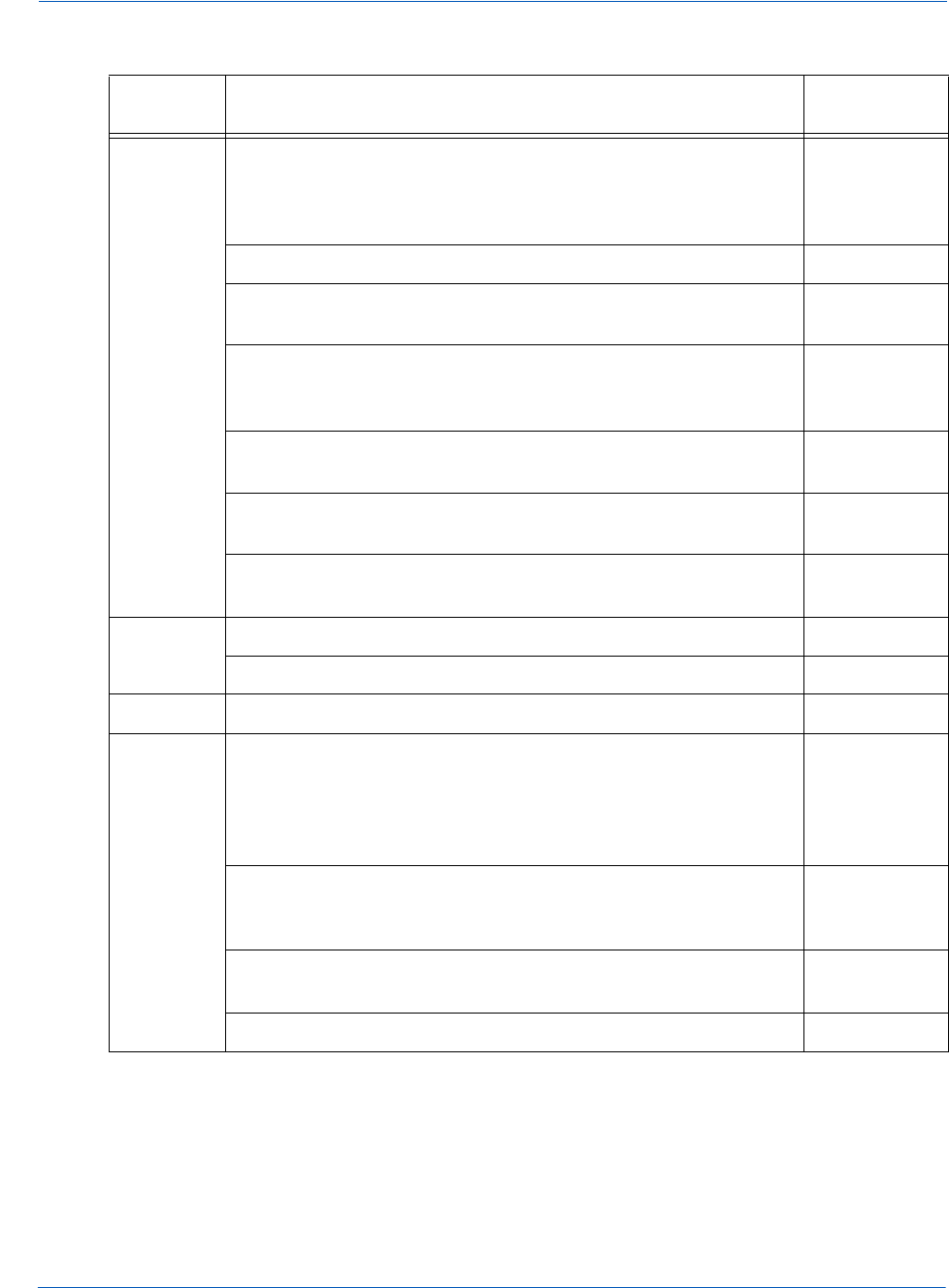

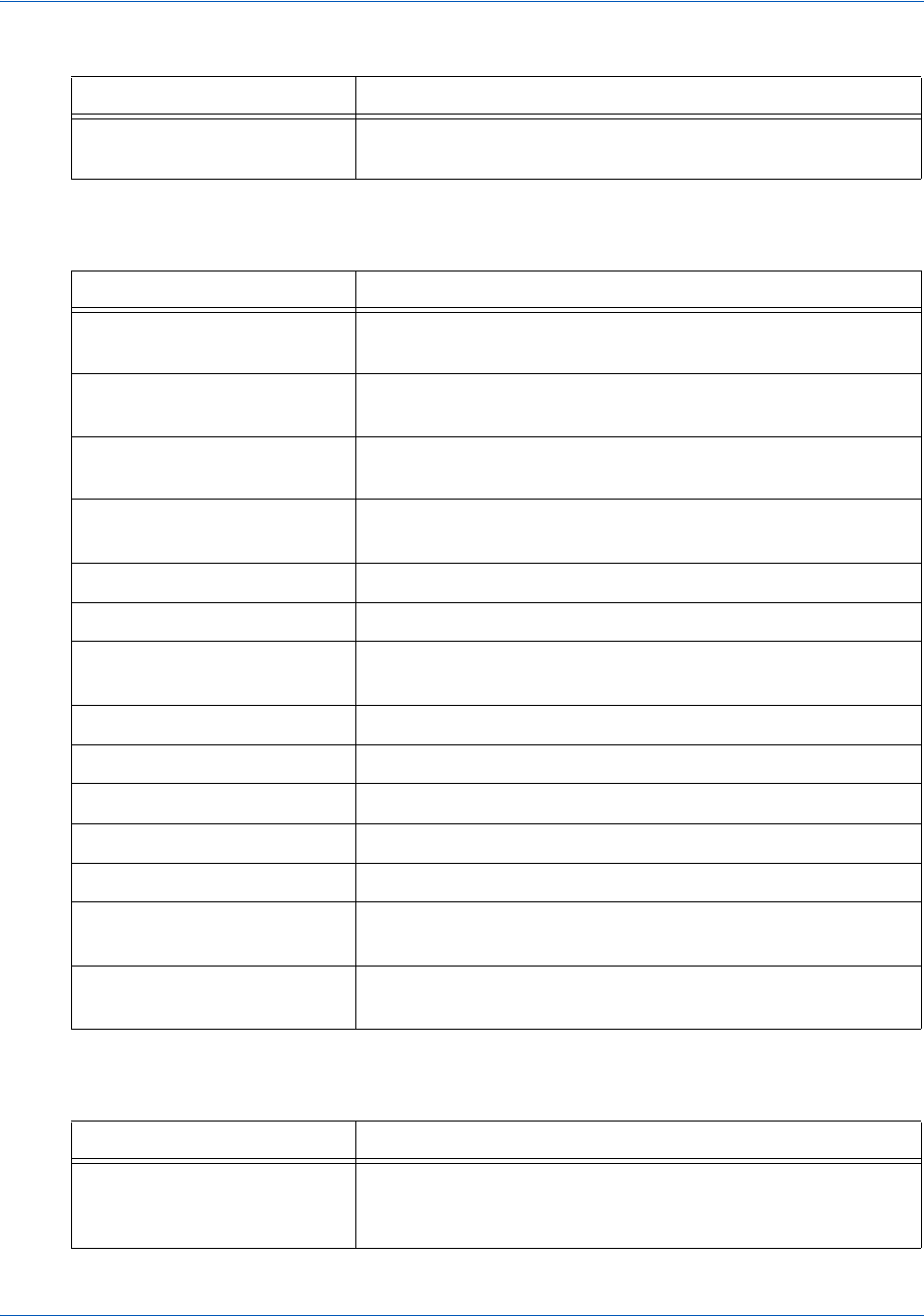

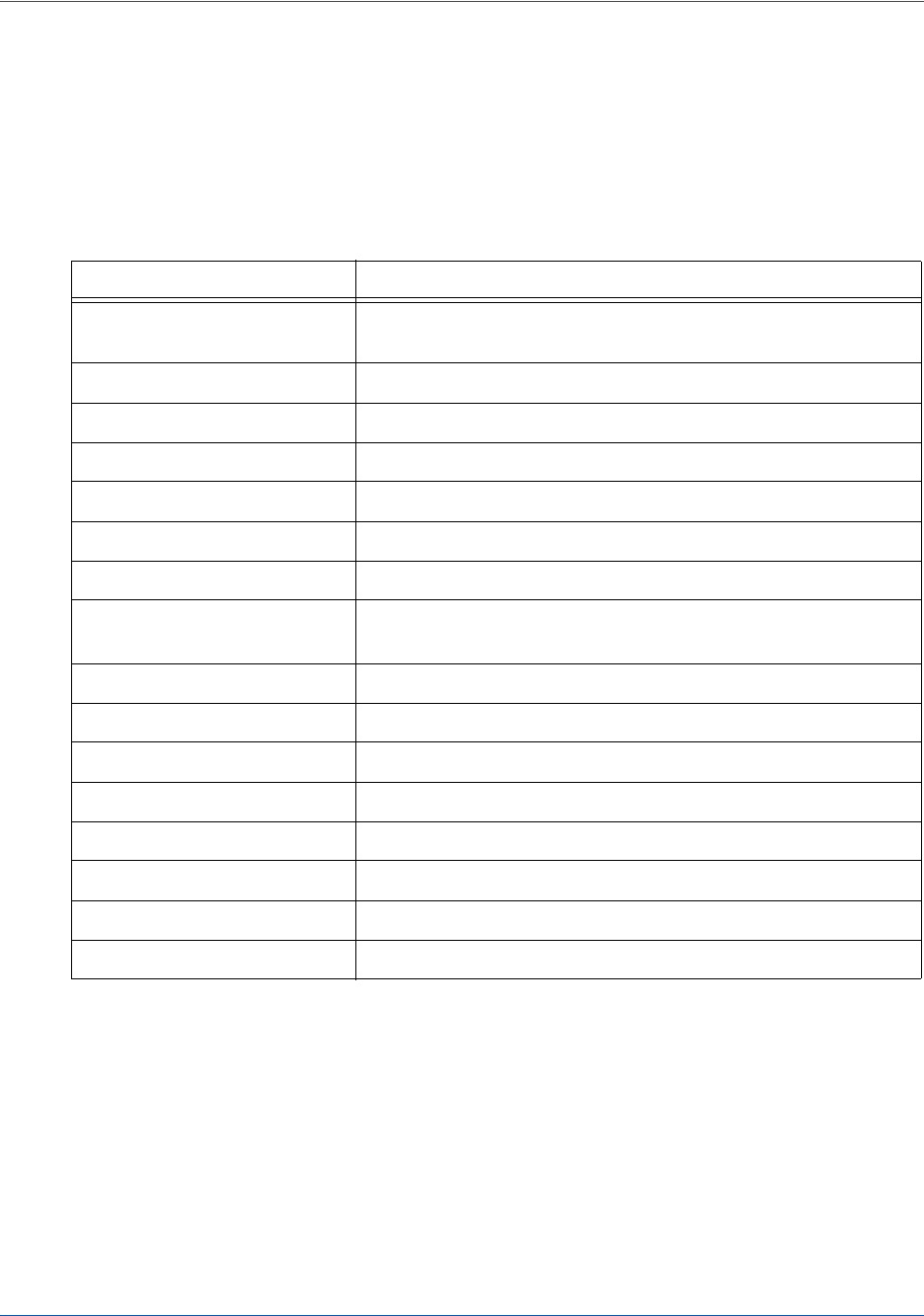

TABLE 1 Document Revision History

Doc.

Version Description Location(s)

1.0 Initial Release All

1.1 Updated with revised URL for sample POST. 2.2

About This Guide Revision History

vi Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.2 Updated to include Vantiv-Hosted PayPage iFrame solution

(many changes and re-arrangement of sections). Also includes

addition of Appendix B, and new HTML and JavaScript samples

in Appendix A, PayPage iFrame Solution (many changes and

re-arrangement of sections).

All

‘Migrating From Previous Versions of the PayPage API.’

‘PayPage Certification, Testing, and Production URLs for mobile

POST.'

Example for credit response code mappings for ISO 8583.

1.3 Support for PCI Non-Sensitive values through PayPage. Sections

2.1.5, 2.2.4,

2.2.5, 2.3.1,

2.3.1.1

Updating Handling Callbacks section for handling errors

differently depending on whether they are user error

(recoverable) and non-user error (non-recoverable).

1.4 Added link for iFrame CSS demo site. Sections

1.3.6, 1.3.7,

2.2.3, 2.2.5,

2.3.1

Added PayPage iFrame-Specific Response Codes.

Added new optional Common Property parameters for

configuring iFrame.

Updated code to reflect revisions.

Updated information on testing URLs and User Agent examples.

1.5 Added new Native Applications on Mobile Operating Systems. Sections

1.3.2, 1.3.1.2

Added step for JavaScript Browser API to Vantiv-Hosted iFrame

on creating cascade style sheet.

1.6 Updated product name in applicable areas throughout the guide

from PayPage to eProtect (Phase 1). Updated many instances

of PayFrame to iFrame.

ALL, Sections

1.1, 1.3.4,

Documen-

tation Set,

Chapter 2

Updated the eProtect workflow diagrams and steps.

Change term to iFrame from Vantiv-Hosted.

Update with applicable support & contact information.

1.3.4 - Corrected iFrame link in Certification and Testing

Environments.

Added Online Developer Platform (ODP).

TABLE 1 Document Revision History (Continued)

Doc.

Version Description Location(s)

Revision History About This Guide

Document Version: 2.7 — cnpAPI Release: 12.0 vii

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.7 Added information on obtaining CSS sample files from Vantiv. Chapter 1,

Appendix B

Increased recommended transaction timeout value to 15000 (15

seconds) from 5000 (five seconds).

Chapter 2,

Appendix A

and C

'CC Num - Token Generated' field has '1' value replaced with

'&#' to avoid PCI sensitive values within document.

Appendix A,

Section 1.3

1.8 Updated the paypageRegistrationId value to

‘1111222233330001.’

Section

2.3.1.2

Added information on using the pciNonSensitive value in the

iFrame and POST requests.

Sections

2.2.4 and

2.3.1

1.9 Added information on maximum length and data type for

orderId and id parameters.

Sections

2.1.3, 2.2.4,

and 2.3.1

1.10 Added additional information on the PCI non-sensitive value. Section 2.2.4.

1.11 Re-arranged the example section and added a note related to

eProtect and PWS (only available to existing PWS customers).

Section 2.6

Removed the sample JavaScripts in Appendix A. Sample scripts

are available at the pre-live, post-live, and production eProtect

URLs.

Section 1.3.4,

Appendix A.3

1.12 Added information on LitleXML elements, example transactions,

response codes used for eProtect.

Section 1.3,

2.6, 2.7,

Appendix A

Added notes to LitleXML transaction examples related to

expiration dates (required for eProtect transactions).

Section 2.7

1.13 Added information on loading the JavaScript API (must be

loaded daily to your checkout page).

Chapter 2

1.14 Added notes to recommend eProtect testing using different

devices and all browsers.

Chapter 1

and 2

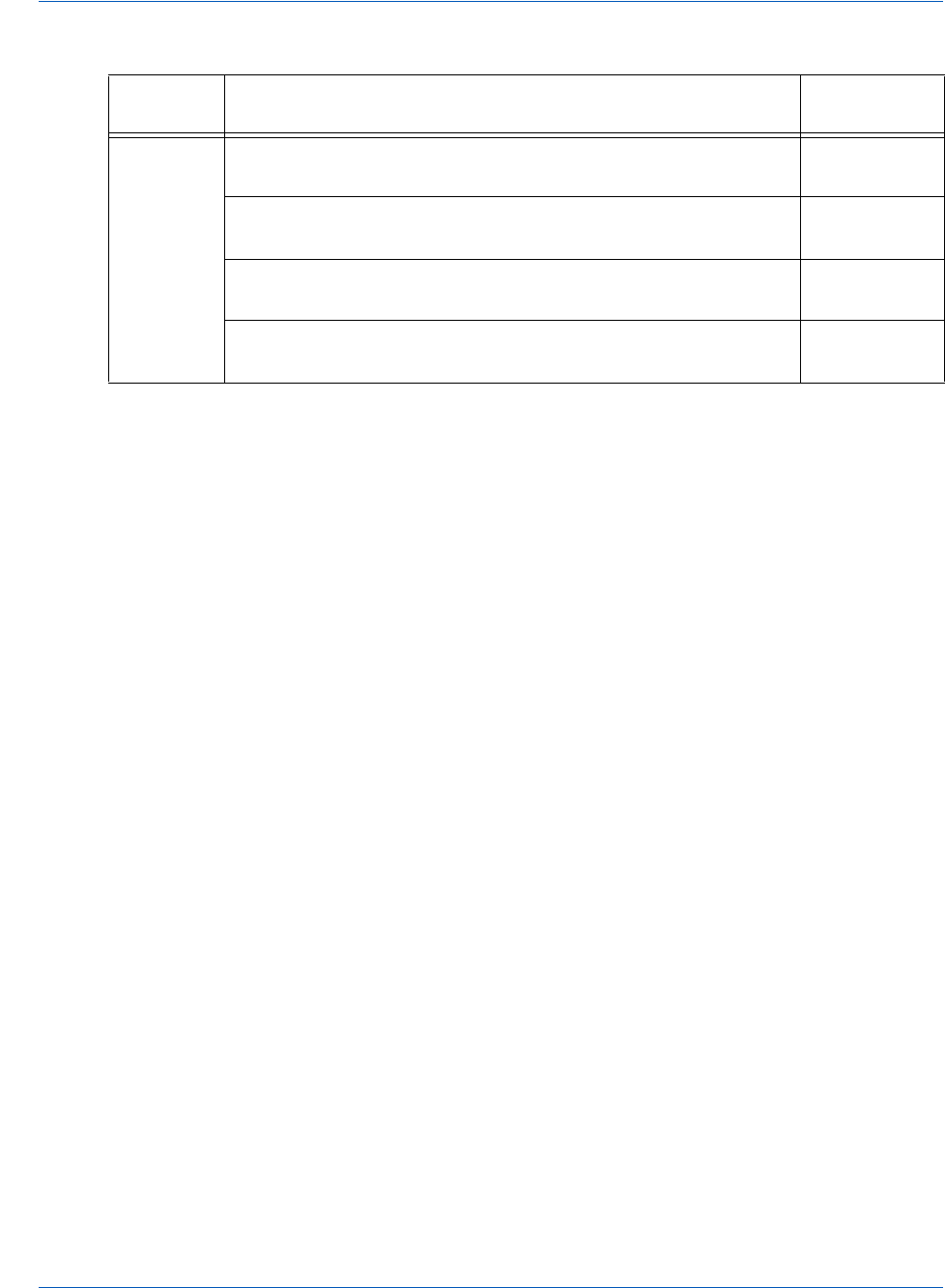

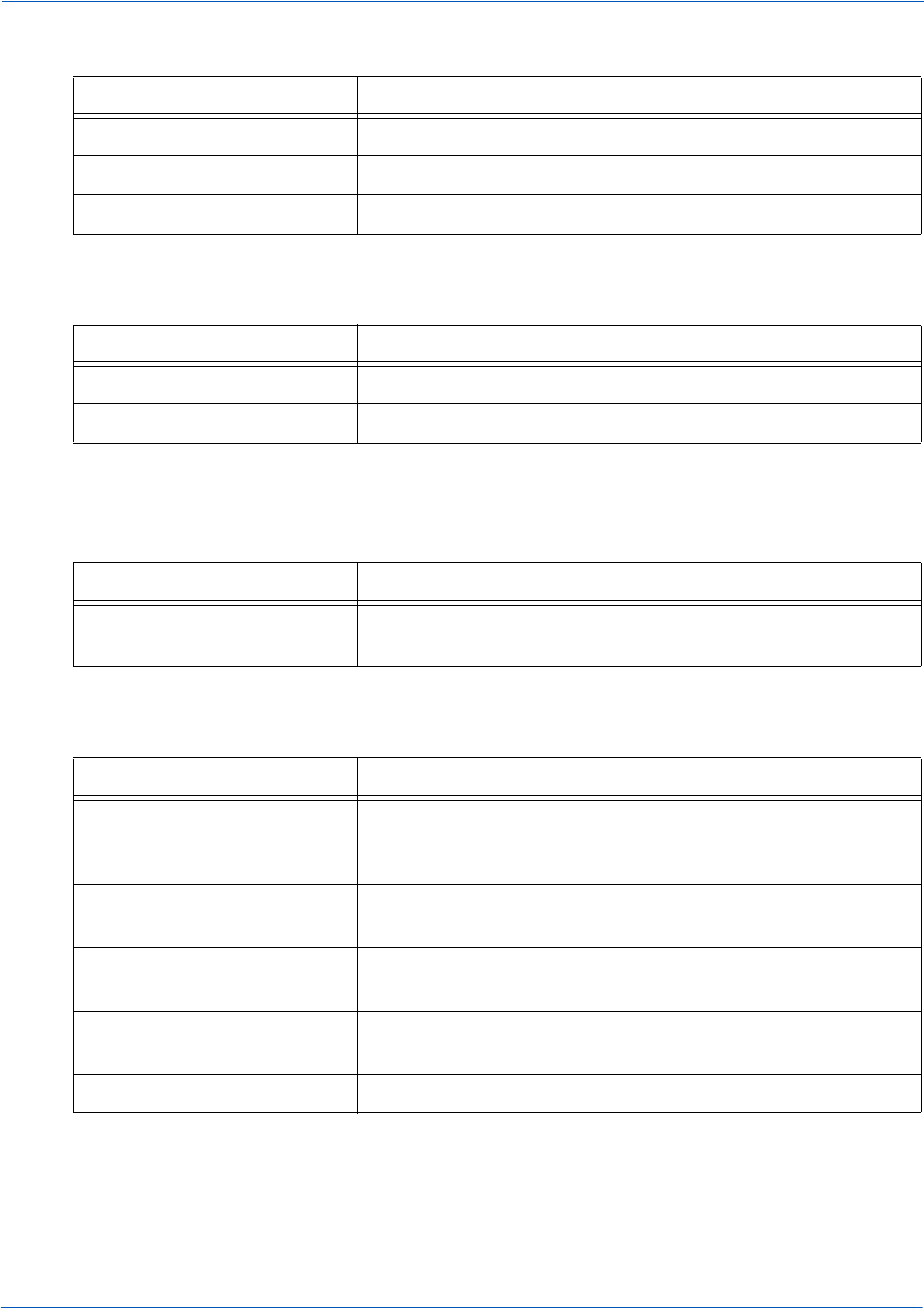

TABLE 1 Document Revision History (Continued)

Doc.

Version Description Location(s)

About This Guide Revision History

viii Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.15 Added information on API V3 JavaScript (updated URLs and

code examples); updated the XML examples to reference

LitleXML 11.0.

Chapter 1

and 2

Updated testing information with card numbers; added

information on testing on multiple devices and browsers.

Chapter 2

Updated the descriptions of id and orderId fields/elements. Chapter 2

Added a table of TPS Response Codes to the example section

for the 610 messaging format.

Chapter 2

Added recommendation on avoiding ‘Flash of Un-styled Content’

(FOUC) issues.

Chapter 2

1.16 Added information on new support for Apple Pay and Android

Pay.

Chapter 1

and 2

2.0 Updated all URLs (JavaScript library request, submission

request, etc.) due to retirement of Litle domain.

Chapter 1

and 2

Added note on informing customer of JavaScript requirement. Chapter 2

Added additional information on using the eCommerce option in

610 messages.

Chapter 2

Updated most instances of ‘PayFrame’ with ‘iFrame.’ All

Updated numerous function and object names (due to

retirement of Litle name) with Vaniv, Vantivcnp or eProtect, etc.;

also changed instances of ‘LitleXML’ to ‘’ due to change in

product name.

All

Updated cnpAPI version to 11.1. Chapter 2

2.1 Added information on new enhancements to iFrame for greater

iFrame and CSS customizations, including in-line field

validations, tool tip additions and customizations, etc.

Chapter 1

and Chapter

2

Added information on support for Visa Checkout™. Note: the

new sections are for information purposes only, as Visa

Checkout is not generally available with this release.

Chapter 1

and Chapter

2

2.2 Updated the testlitle.com sample page URLs to

testvantivcnp.com. Added further information on which sample

page URL to view when using the new enhanced iFrame

features.

Chapter 1

TABLE 1 Document Revision History (Continued)

Doc.

Version Description Location(s)

Revision History About This Guide

Document Version: 2.7 — cnpAPI Release: 12.0 ix

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

2.3 Added information on the new CVV low-value token

(checkoutId) feature for iFrame and JS Customer Browser API,

including new response codes, checkoutIdMode and the

getCheckoutId function.

Chapter 1

and 2

Added information on the new cnpAPI element, <checkoutId>. Appendix A

Removed information and the URL for post-live regression

testing as it is not applicable to Enterprise merchants.

Chapter 1

Corrected the Request Submission URL in Table 1-2 from

https://request-eprotect.vantivprelive.com to

https://request.eprotect.vantivprelive.com.

Chapter 1

Added information on Pre-Live Certification Environment

maintenance and limitations.

Chapter 1

Removed notes on non-general availability for Visa Checkout; it

is now generally available to all merchants.

Chapter 1

and 2

Added information on eProtect Registration ID Duplicate

Detection.

Chapter 1

2.4 Added information on required communication protocol. Chapter 1

Corrected some instances of ‘eProtect’ in code samples. Appendix A

2.5 Minor correction to code examples in section A.1.3. Appendix A

2.6 Updated all cnpAPI element names to replace Litle with cnp. For

example, litleToken is now cnpToken, litleOnlineRequest is now

cnpOnlineRequest, etc. This includes the namespace:

http://www.litle.com/schema is now

http://www.vantivcnp.com/schema.

Chapter 2

Corrected various eProtect element spelling errors, cleaned up

miscellaneous coding in the HTML examples.

Chapter 2

and Appendix

A

Re-worked Section 1.3.9, Creating a Customized CSS for

iFrame for better clarification.

Chapter 1

Added information on new CSS-allowed Appearance properties. Appendix B

TABLE 1 Document Revision History (Continued)

Doc.

Version Description Location(s)

About This Guide Revision History

xDocument Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

2.7 Re-arranged and relocated the Creating a Customized CSS for

iFrame section for better understanding.

Chapter 1

Added information on including a ‘Trust Icon’ on your payment

page when customizing iFrame CSS files.

Chapter 1

Removed workaround information for Flash of Unstyled Content

(FOUC) as this issue has been corrected.

Chapter 2

Added information on Pay With Google. Chapter 1

and 2

TABLE 1 Document Revision History (Continued)

Doc.

Version Description Location(s)

Document Structure About This Guide

Document Version: 2.7 — cnpAPI Release: 12.0 xi

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

Document Structure

This manual contains the following sections:

Chapter 1, "Introduction"

This chapter provides an overview of the eProtect feature, and the initial steps required to get

started with eProtect.

Chapter 2, "Integration and Testing"

This chapter describes the steps required to integrate the eProtect feature as part of your checkout

page, transaction examples, and information on eProtect Testing and Certification.

Appendix A, "Code Samples and Other Information"

This appendix provides code examples and reference material related to integrating the eProtect

feature.

Appendix B, "CSS Properties for iFrame API"

This appendix provides a list of CSS Properties for use with the iFrame implementation of

eProtect.

Appendix C, "Sample eProtect Integration Checklist"

This appendix provides a sample of the eProtect Integration Checklist for use during your

Implementation process.

Documentation Set

For additional information, see the following Vantiv documentation:

•Acquirer ISO 8583 Message Format (Effective 02.15.2017)

•Vantiv Online Systems 610 Interface Reference Guide (Effective 02.15.2017)

•HHMI: Host-To-Host Format Specification (Effective Date 02.15.2017)

""

•Payment Web Services (PWS) External Payments Developers' Guide (V6.1.2)

–Payment Web Services (PWS) Release Notes v6.1.2 and higher

–Payment Web Services (PWS) Frequently Asked Questions

•Vantiv cnpAPI Reference Guide

NOTE:Using eProtect in combination with PWS is available to existing PWS

customers only.

About This Guide Typographical Conventions

xii Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

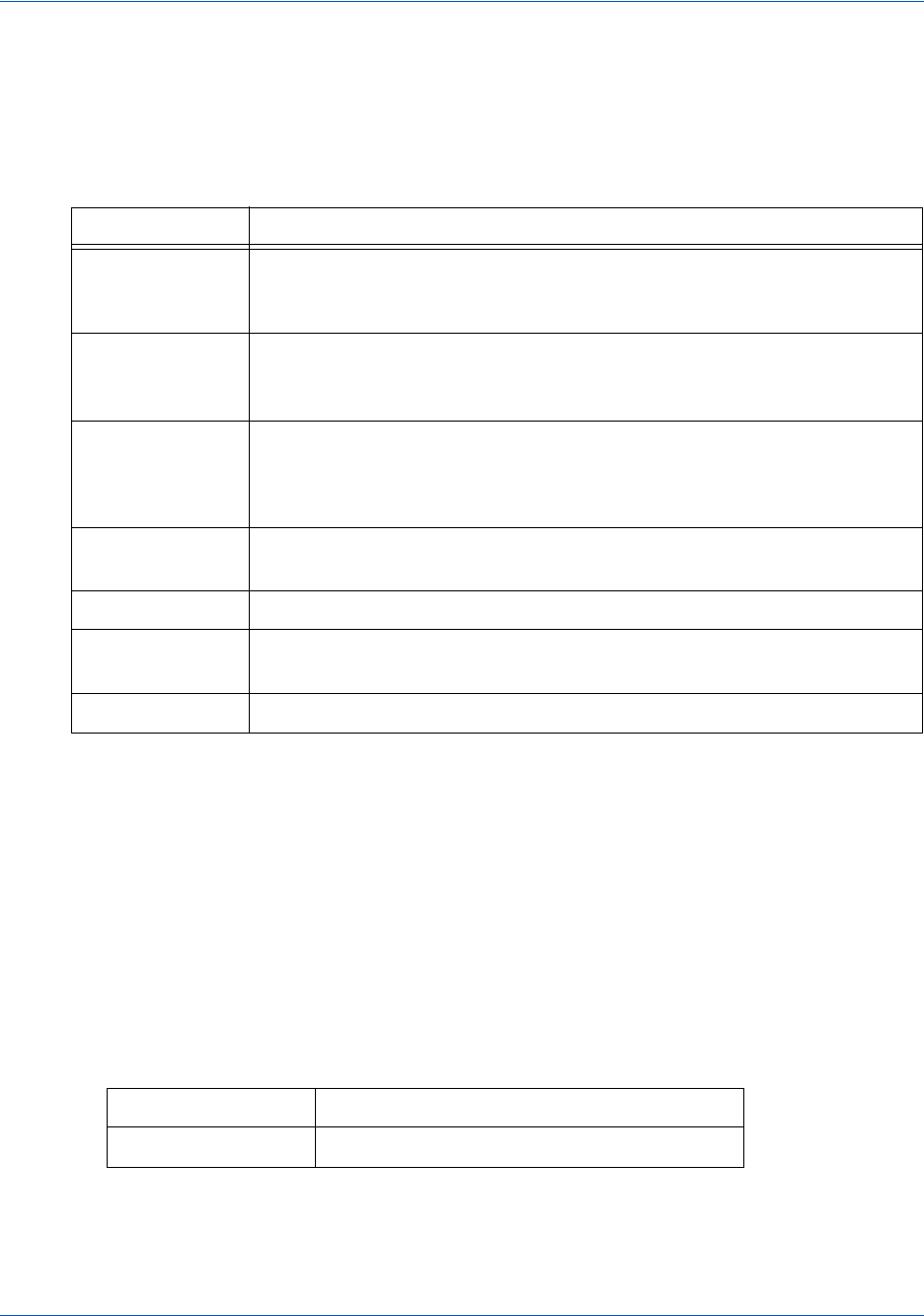

Typographical Conventions

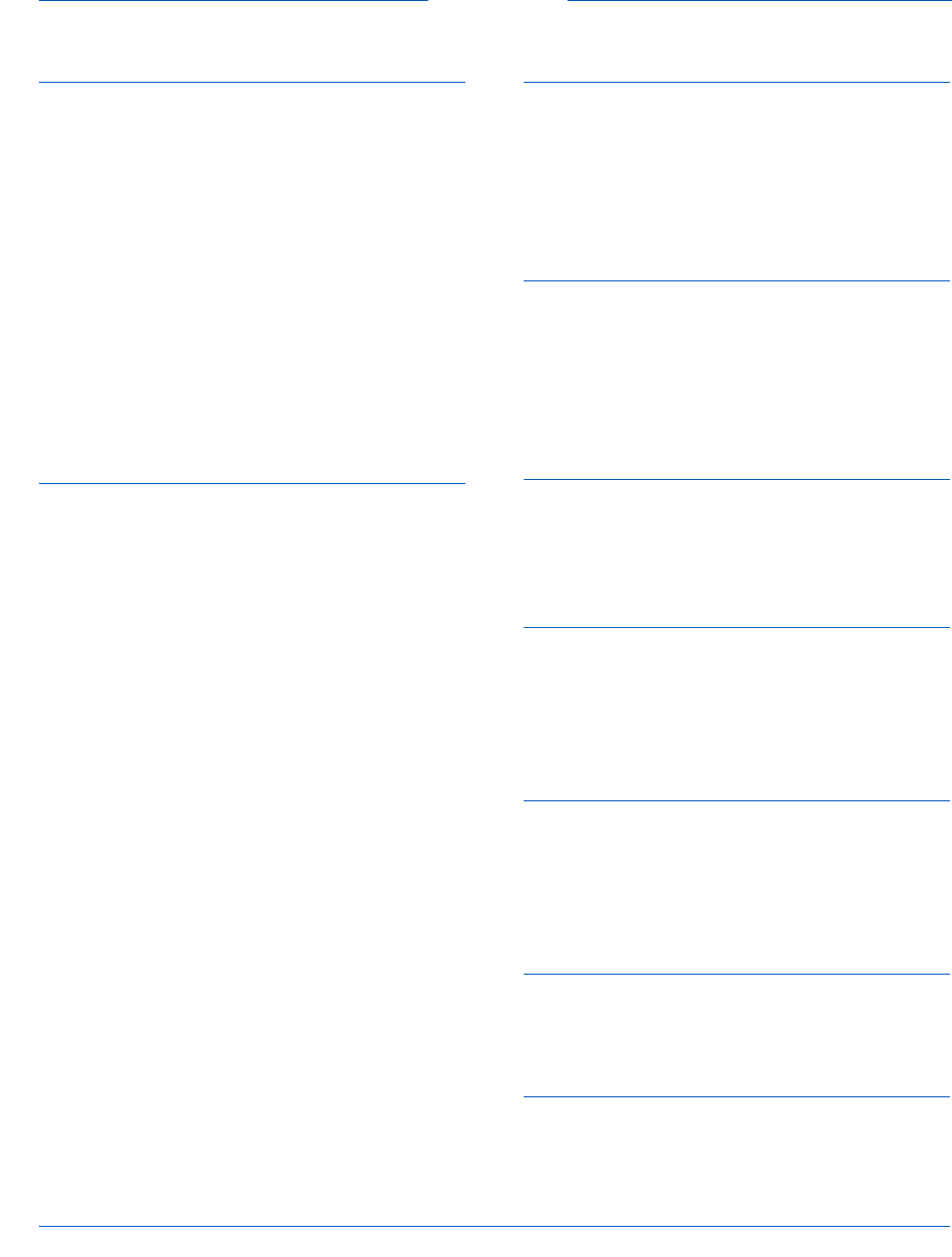

Table 2 describes the conventions used in this guide.

Contact Information

This section provides contact information for organizations within Vantiv.

Implementation - For technical assistance related to eProtect issues encountered during the

testing and certification process, please contact your assigned Vantiv Conversion Manager or

eProtect Implementation Consultant. If you do not have an assigned Implementation Consultant,

please contact your Relationship Manager.

Vantiv Contact Center - For technical issues related to eProtect in production.

Relationship Management- For non-technical issues, please contact your Vantiv Relationship

Manager.

TABLE 2 Typographical Conventions

Convention Meaning

.

.

.

Vertical ellipsis points in an example mean that information not directly

related to the example has been omitted.

. . . Horizontal ellipsis points in statements or commands mean that parts of

the statement or command not directly related to the example have been

omitted.

< > Angle brackets are used in the following situations:

•user-supplied values (variables)

•XML elements

[ ] Brackets enclose optional clauses from which you can choose one or

more option.

bold text Bold text indicates emphasis.

Italicized text Italic type in text indicates a term defined in the text, the glossary, or in

both locations.

blue text Blue text indicates a hypertext link.

Contact 1-866-622-2390

Hours Available 24/7 (seven days a week, 24 hours a day)

Document Version: 2.7 — cnpAPI Release: 12.0 1

© 2018 Worldpay, Inc. - All Rights Reserved.

1

INTRODUCTION

This chapter provides an introduction and an overview of Vantiv eProtect™. The topics discussed

in this chapter are:

•eProtect Overview

•How eProtect Works

•Getting Started with eProtect

•Migrating From Previous Versions of the eProtect API

•eProtect Support for Apple Pay™ / Apple Pay on the Web

•eProtect Support for Android Pay™

•eProtect Support for Pay with Google™

•eProtect Support for Visa Checkout™

•Creating a Customized CSS for iFrame

NOTE:The PayPage product is now known as Vantiv eProtect™. The term

‘PayPage’ however, is still used in this guide in certain text descriptions,

along with many data elements, JS code, and URLs. Use of these data

elements, etc., with the PayPage name is still valid with this release, but

will transition to ‘eProtect’ in a future release.

Introduction eProtect Overview

2Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.1 eProtect Overview

Vantiv's eProtect and OmniToken solutions help solve your card-not-present challenges by

virtually eliminating payment data from your order handling systems, transferring the ownership

to Vantiv and reducing PCI applicable controls.

The eProtect feature controls the fields on your checkout page that hold sensitive card data. When

the cardholder submits their account information, your checkout page calls the eProtect

JavaScript to register the provided credit card for a token. The JavaScript API validates, encrypts,

and passes the account number to our system as the first step in the form submission. The return

message includes the Registration ID in place of the account number. No card data is actually

transmitted via your web server.

Vantiv ensures high service availability for eProtect by implementing primary and secondary

endpoints (i.e., routing to a secondary site if the primary site is unavailable). High availability is

supported when using the eProtect JavaScript API V.3; it is not available for the Mobile API

option.

Vantiv provides three integration options for eProtect:

• iFrame API - this solution builds on the same architecture of risk- and PCI scope-reducing

technologies of eProtect by fully hosting fields with PCI-sensitive values. Payment card

fields, such as primary account number (PAN), expiration date, and CVV2 values are hosted

from our PCI-Compliance environment, rather than embedded as code into your checkout

page within your environment.

• JavaScript Customer Browser API - controls the fields on your checkout page that hold

sensitive card data. When the cardholder submits his/her account information, your checkout

page calls the eProtect JavaScript to register the provided credit card for a token. The

JavaScript validates, encrypts, and passes the account number to our system as the first step

in the form submission. The return message includes the Registration ID in place of the

account number. No card data is actually transmitted via your web server.

• Mobile API - eProtect Mobile Native Application allows you to use the eProtect solution to

handle payments without interacting with the eProtect JavaScript in a browser. With Mobile

Native Application, you POST an account number to our system and receive a Registration

ID in response. You can use it in native mobile applications--where the cross-domain

limitations of a browser don't apply--to replace payment card data from your web servers.

For more information on PCI compliance and the Vantiv eProtect product, see the Vantiv eProtect

iFrame Technical Assessment Paper, prepared by Coalfire IT Audit and Compliance.

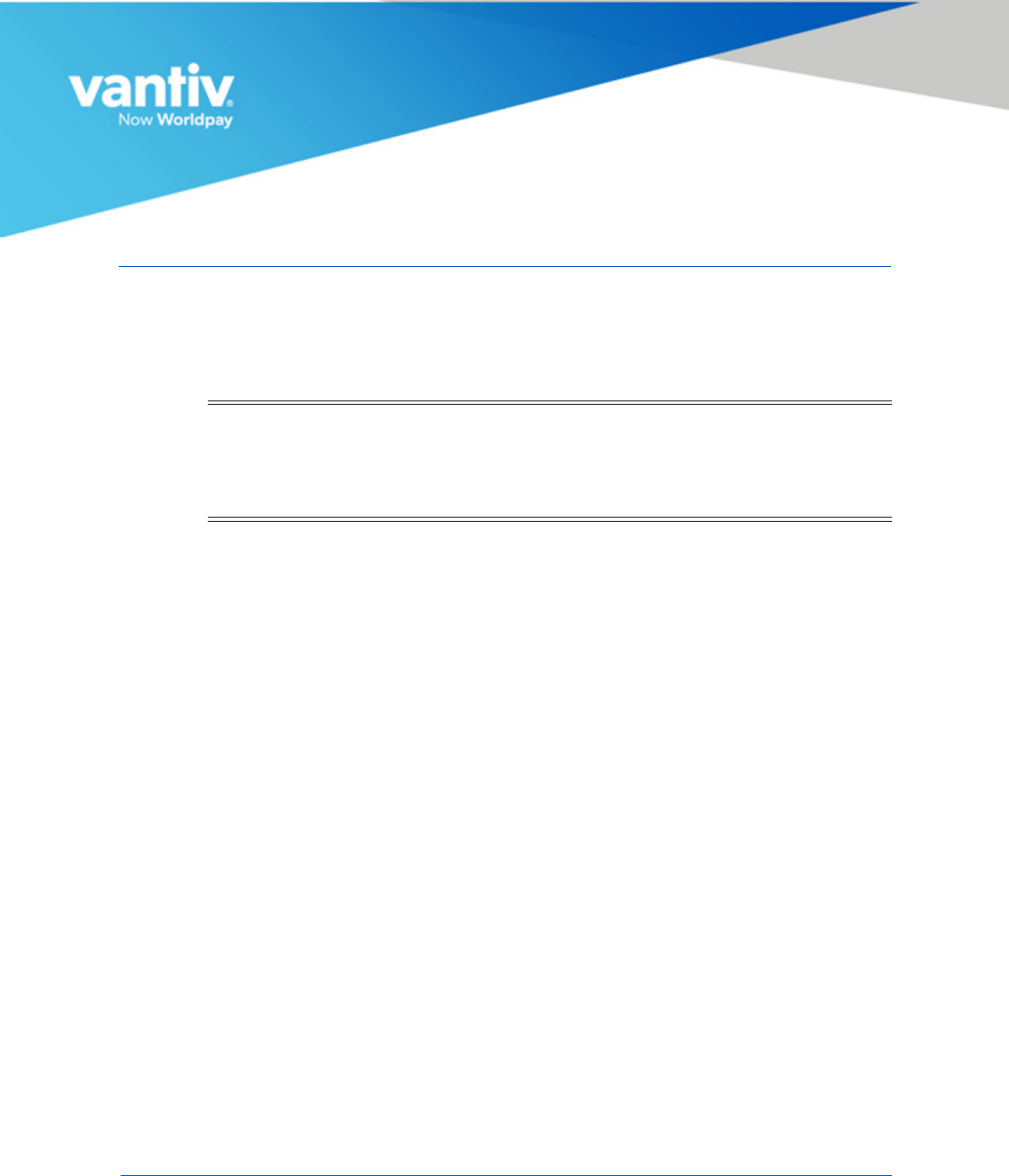

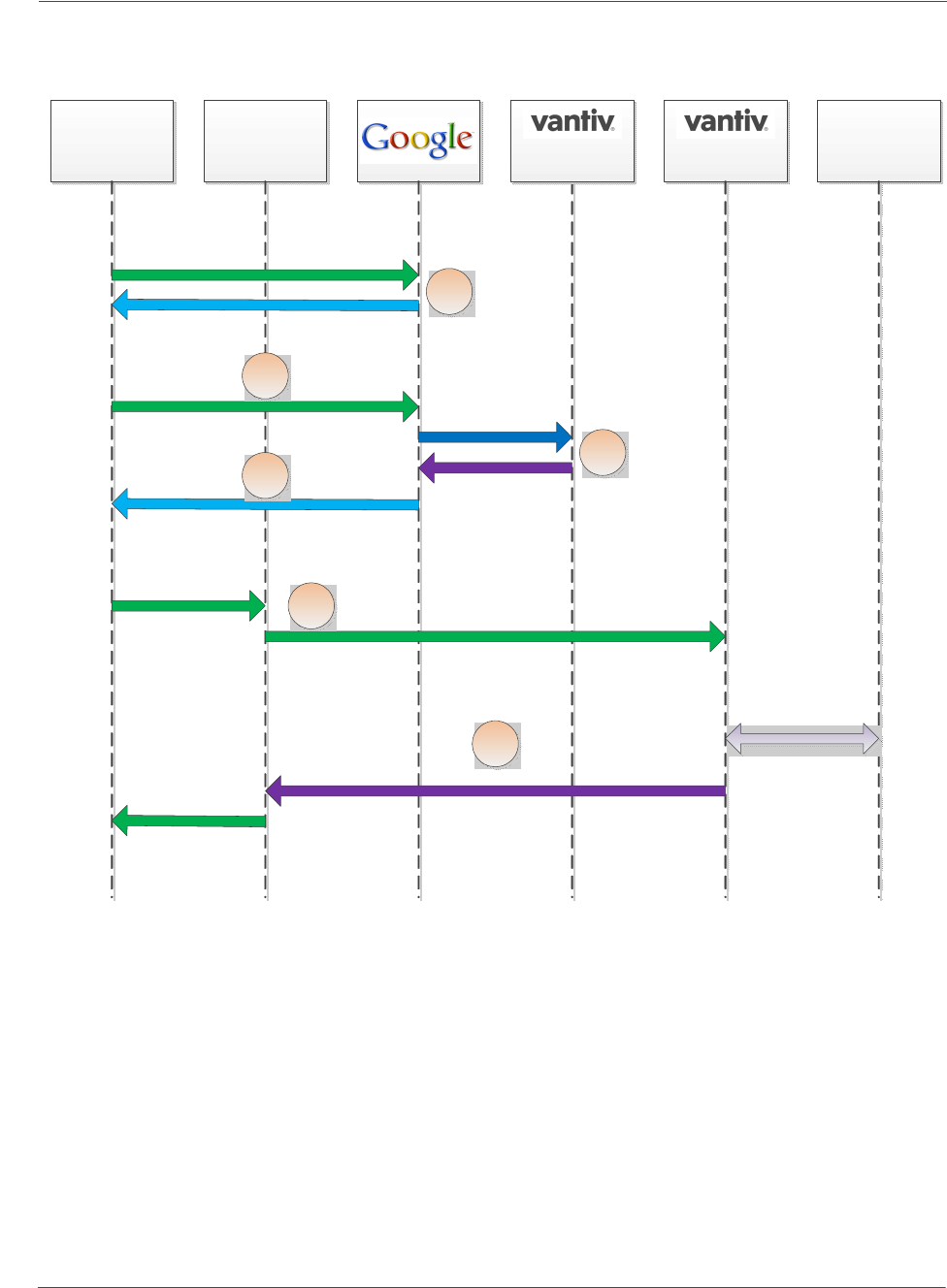

Figure 1-1 illustrates eProtect with Omnitoken. See the section, How eProtect Works on page 4

for additional details.

NOTE:In order to optimally use the eProtect feature for risk reduction, this

feature must be used at all times, without exception.

eProtect Overview Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 3

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

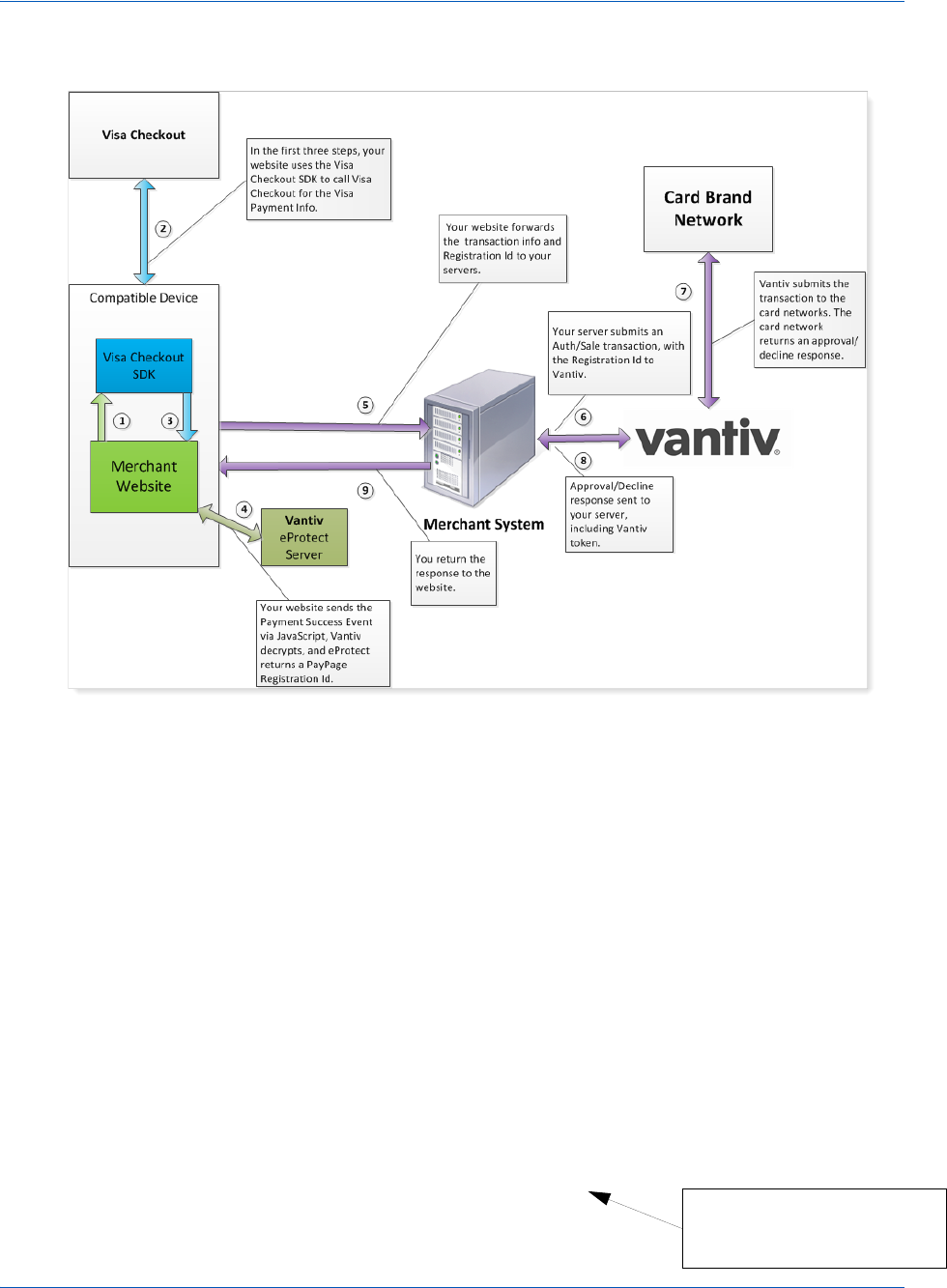

FIGURE 1-1 eProtect

Introduction How eProtect Works

4Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.2 How eProtect Works

This section illustrates the eProtect process.

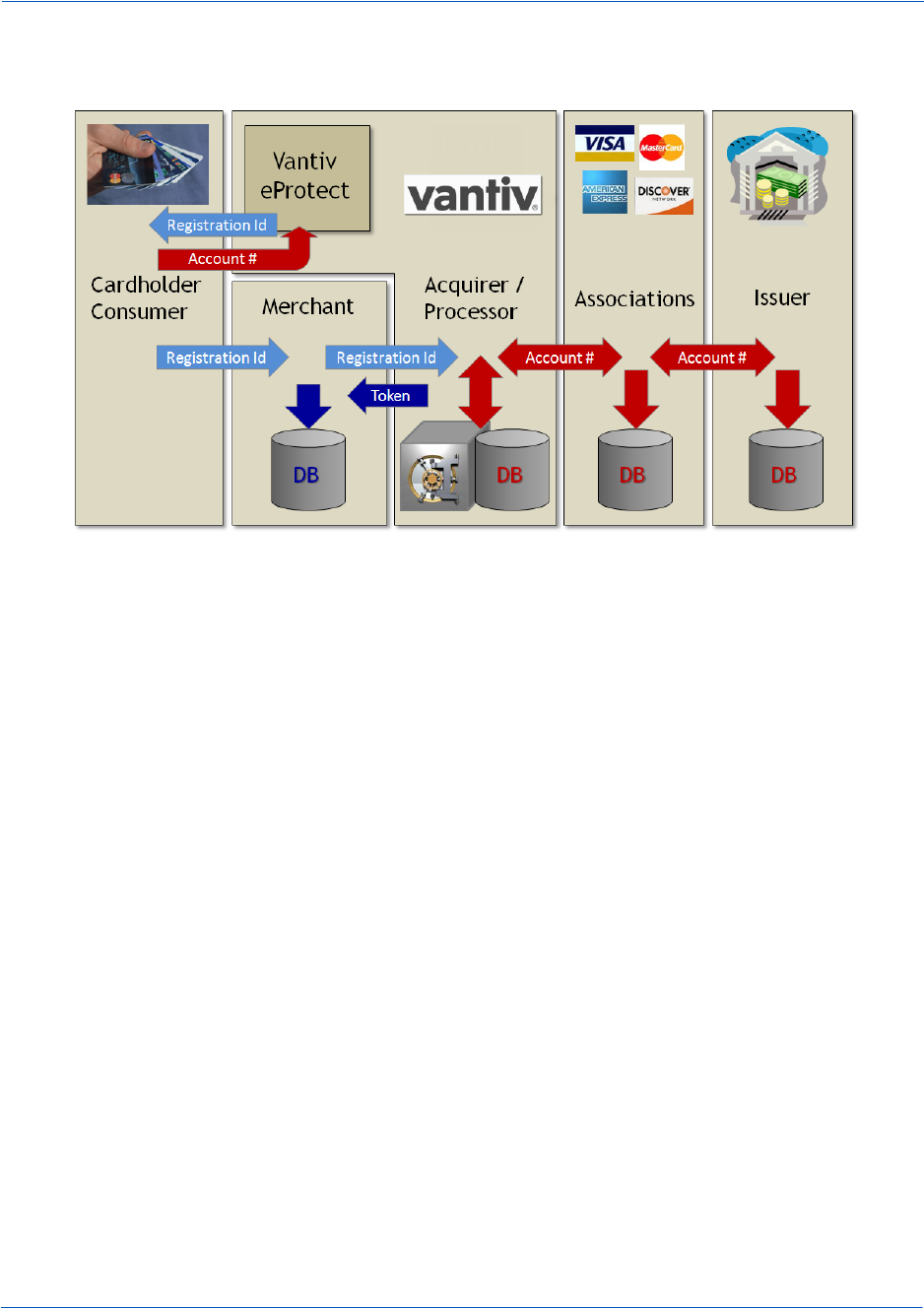

1. When your customer is ready to finalize a purchase from your website or mobile application,

your web server delivers your Checkout form to the customer’s web browser or mobile

device.

2. If using the iFrame API, the browser loads the iFrame URL hosted by the eProtect server. If

using the JavaScript API, the browser loads the eProtect Client code (JavaScript) from the

eProtect server. The API validates credit cards, submits account numbers to the eProtect

Service, encrypts account numbers, and adds the Registration IDs to the form. It also contains

Vantiv' s public encryption key.

(continued on next page)

Step 1

Step 2

How eProtect Works Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 5

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

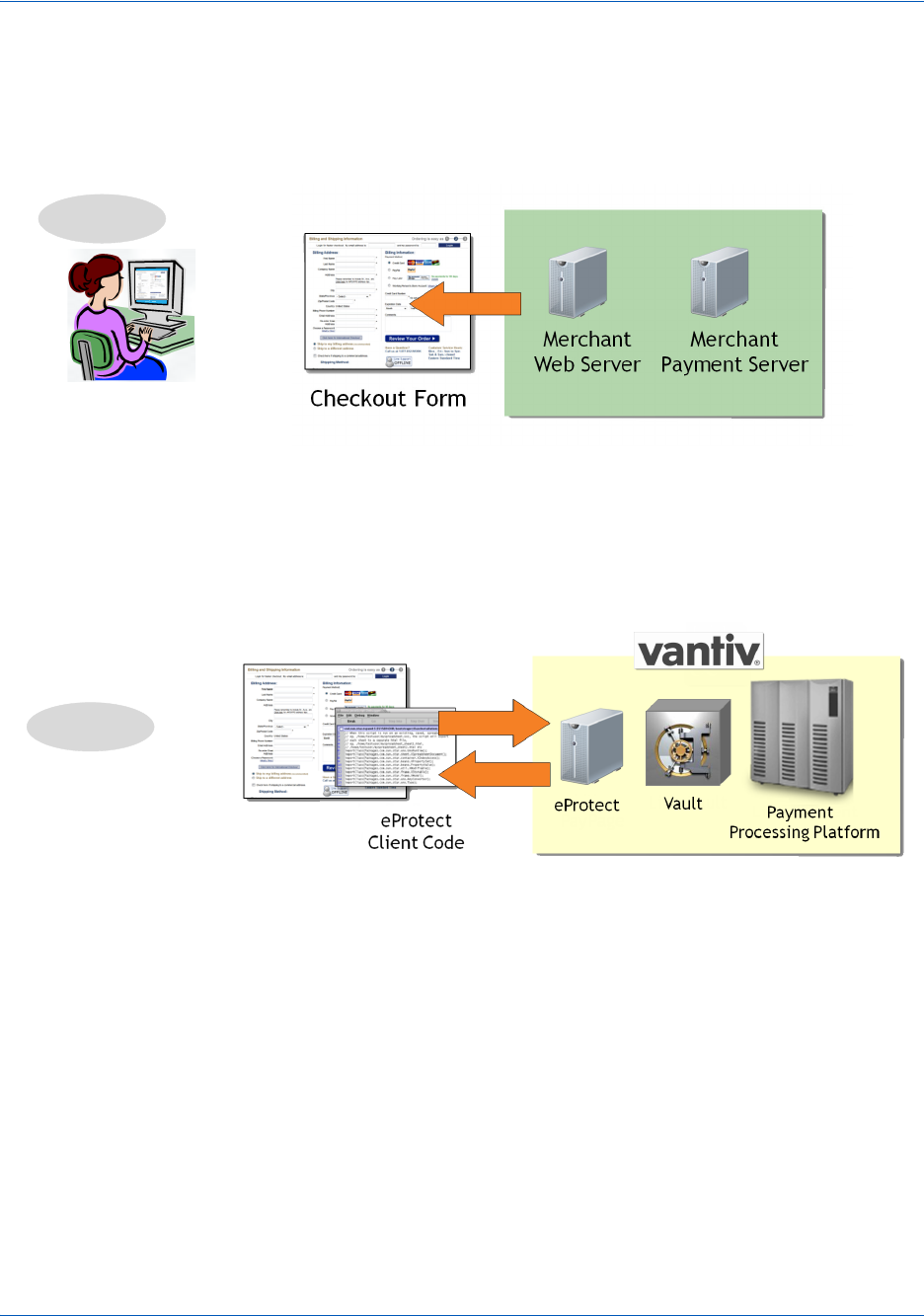

3. After the customer enters their card number and clicks or taps the submit button, the eProtect

APIs sends the card number data to our eProtect service which calls our Security Services

vault or submits a cnpAPI transaction to register an OmniToken for the card number

provided. The token is securely stored in Enterprise Security Services for processing (when

your payment processing system submits an authorization or sale transaction). A Registration

ID is generated and returned to the customer's browser as a hidden field for web processing,

or to their mobile device as a POST response.

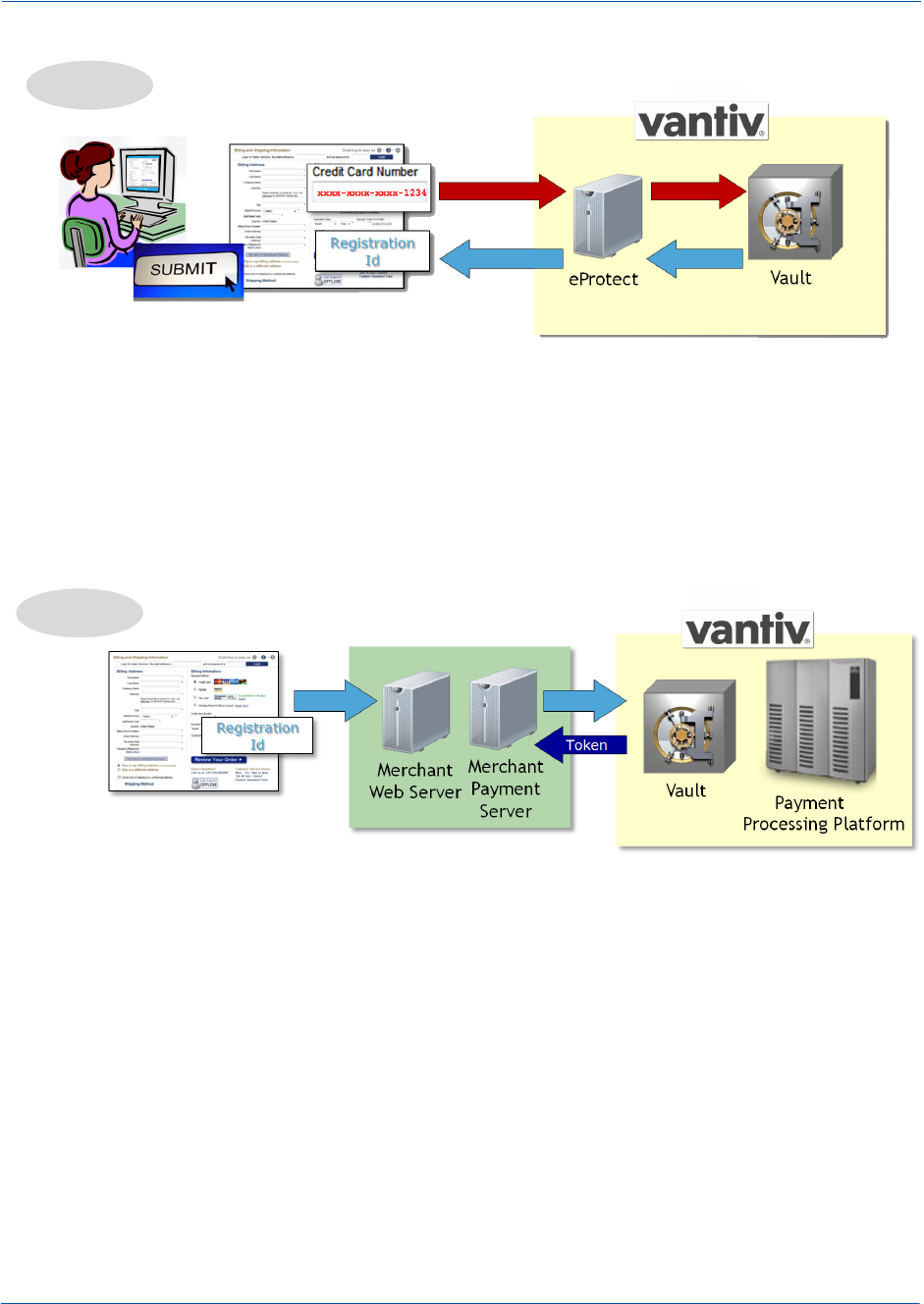

4. All of the customer-provided information is then delivered to your web server along with the

Registration ID. Your payment processing system sends the payment with the Registration

ID, and Enterprise Security Services vault maps the Registration ID to the OmniToken and

card number, processing the payment as usual. The response message from the applicable

Vantiv front end contains the OmniToken value, which you store as you would a credit card.

Step 3

Step 4

Introduction Getting Started with eProtect

6Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.3 Getting Started with eProtect

Before you start using the eProtect feature, you must complete the following:

•Ensure that your organization is enabled and certified to process OmniTokens, using the

OmniToken solution.

•Complete and return the eProtect Integration Checklist provided by your Implementation

Consultant and return to Implementation. See Appendix C, "Sample eProtect Integration

Checklist".

•Obtain a PayPage ID from your eProtect Implementation Consultant.

•If you are implementing the iFrame solution, create a Cascading Style Sheet (CSS) to

customize the look and feel of the iFrame to match your checkout page, then submit the Style

Sheet to Vantiv for verification. See Creating a Customized CSS for iFrame on page 16 for

more information.

•Modify your checkout page or mobile native application--and any other page that receives

credit card data from your customers--to integrate the eProtect feature (execute an API call or

POST to our system). See one of the following sections, depending on your application:

•Integrating Customer Browser JavaScript API Into Your Checkout Page on page 24

•Integrating iFrame into your Checkout Page on page 38

•Integrating eProtect Into Your Mobile Application on page 46 for more information.

•Modify your system to accept the response codes listed in Table 1-3, eProtect-Specific

Response Codes Received in Browsers or Mobile Devices and Table 1-4, eProtect Response

Codes Received in cnpAPI Responses.

•Test and certify your checkout process. See Transaction Examples When Using ISO 8583,

610, HHMI, and PWS on page 63 for more information.

1.3.1 Migrating From Previous Versions of the eProtect API

1.3.1.1 From eProtect with jQuery 1.4.2

Previous versions of the eProtect API included jQuery 1.4.2 (browser-based use only). Depending

on the implementation of your checkout page and your use of other versions of jQuery, this may

result in unexpected behavior. This document describes version 2 of the eProtect API, which

requires you to use your own version of jQuery, as described within.

If you are migrating, you must:

•Include a script tag to download jQuery before loading the eProtect API.

•Construct a new eProtect API module when calling sendToEprotect.

Getting Started with eProtect Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 7

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.3.1.2 From JavaScript Browser API to iFrame

When migrating from the JavaScript Customer Browser API eProtect solution to the iFrame

solution, complete the following steps. For a full HTML code example a iFrame eProtect

implementation, see the HTML Example for Hosted iFrame-Integrated Checkout Page on page

102.

1. Remove the script that was downloading eProtect-api3.js.

2. Add a script tag to download eprotect-iframe-client3.min.js.

3. On your form, remove the inputs for account number, cvv, and expiration date. Put an empty

div in its place.

4. Consolidate the three callbacks (submitAfterEprotect, onErrorAfterEprotect and

onTimeoutAfterEprotect in our examples) into one callback that accepts a single

argument. In our example, this is called eProtectiframeClientCallback.

5. To determine success or failure, inspect response.response in your callback. If

successful, the response is ‘870.’ Check for time-outs by inspecting the

response.timeout; if it is defined, a timeout has occurred.

6. In your callback, add code to retrieve the paypageRegistrationId, bin, expMonth and

expYear. Previously, paypageRegistrationId and bin were placed directly into your

form by our API, and we did not handle expMonth and expYear (we’ve included these

inside our form to make styling and layout simpler).

7. Create a Cascading Style Sheet (CSS) to customize the look and feel of the iFrame to match

your checkout page, then submit the Style Sheet to Vantiv for verification. See Creating a

Customized CSS for iFrame on page 16 and Configuring the iFrame on page 39 for more

information.

8. See Calling the iFrame for the Registration ID on page 41 to retrieve the

paypageRegistrationId.

Introduction Getting Started with eProtect

8Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.3.2 Browser and Mobile Operating System Compatibility

The eProtect feature is compatible with the following (see Table 1-1, "Apple Pay on the Web

Compatible Devices" for information on Apple Pay web):

Browsers (when JavaScript is enabled):

•Mozilla Firefox 3 and later

•Internet Explorer 8 and later

•Safari 4 and later

•Opera 10.1 and later

•Chrome 1 and later

Native Applications on Mobile Operating Systems:

•Chrome Android 40 and later

•Android 2.3 and later

•Apple iOS 3.2 and later

•Windows Phone 10 and later

•Blackberry 7, 10 and later

•Other mobile OS

1.3.2.1 Communication Protocol Requirement

If you are using an MPLS network, Vantiv requires that you use TLS 1.2 encryption.

1.3.3 eProtect Support for Apple Pay™ / Apple Pay on the Web

Vantiv supports Apple Pay for in-app and in-store purchases initiated on compatible versions of

iPhone and iPad, as well as purchases from your desktop or mobile website initiated from

compatible versions of iPhone, iPad, Apple Watch, MacBook and iMac (Apple Pay on the Web).

If you wish to allow Apple Pay transactions from your native iOS mobile applications, you must

build the capability to make secure purchases using Apple Pay into your mobile application. The

operation of Apple Pay on the iPhone and iPad is relatively simple: either the development of a

new native iOS application or modification of your existing application that includes the use of

IMPORTANT:Because browsers differ in their handling of eProtect transactions,

Vantiv recommends testing eProtect on various devices (including

smart phones and tablets) and all browsers, including Internet

Explorer/Edge, Google Chrome, Apple Safari, and Mozilla Firefox.

Getting Started with eProtect Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 9

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

the Apple PassKit Framework, and the handling of the encrypted data returned to your application

by Apple Pay. See Using the Vantiv Mobile API for Apple Pay on page 42 for more information.

For Apple Pay on the Web, integration requires that the <applepay> field be included in the

sendToEprotect call when constructing your checkout page with the JavaScript Customer

Browser API. See Integrating Customer Browser JavaScript API Into Your Checkout Page on

page 22 and Using the Customer Browser JavaScript API for Apple Pay on the Web on page 30

for more information on the complete process. Also, see Table 1-1, Apple Pay on the Web

Compatible Devices for further information on supported Apple devices.

1.3.4 eProtect Support for Android Pay™

Android Pay is an in-store and in-app (mobile or web) payment method, providing a secure

process for consumers to purchase goods and services. In-store purchases are done by using Near

Field Communication (NFC) technology built into the Android Smart phone with any

NFC-enabled terminal at the retail POS. For in-app purchases, the consumer need only select

Android Pay as the payment method in your application. You will need to modify your

application to use Android Pay as a payment method.

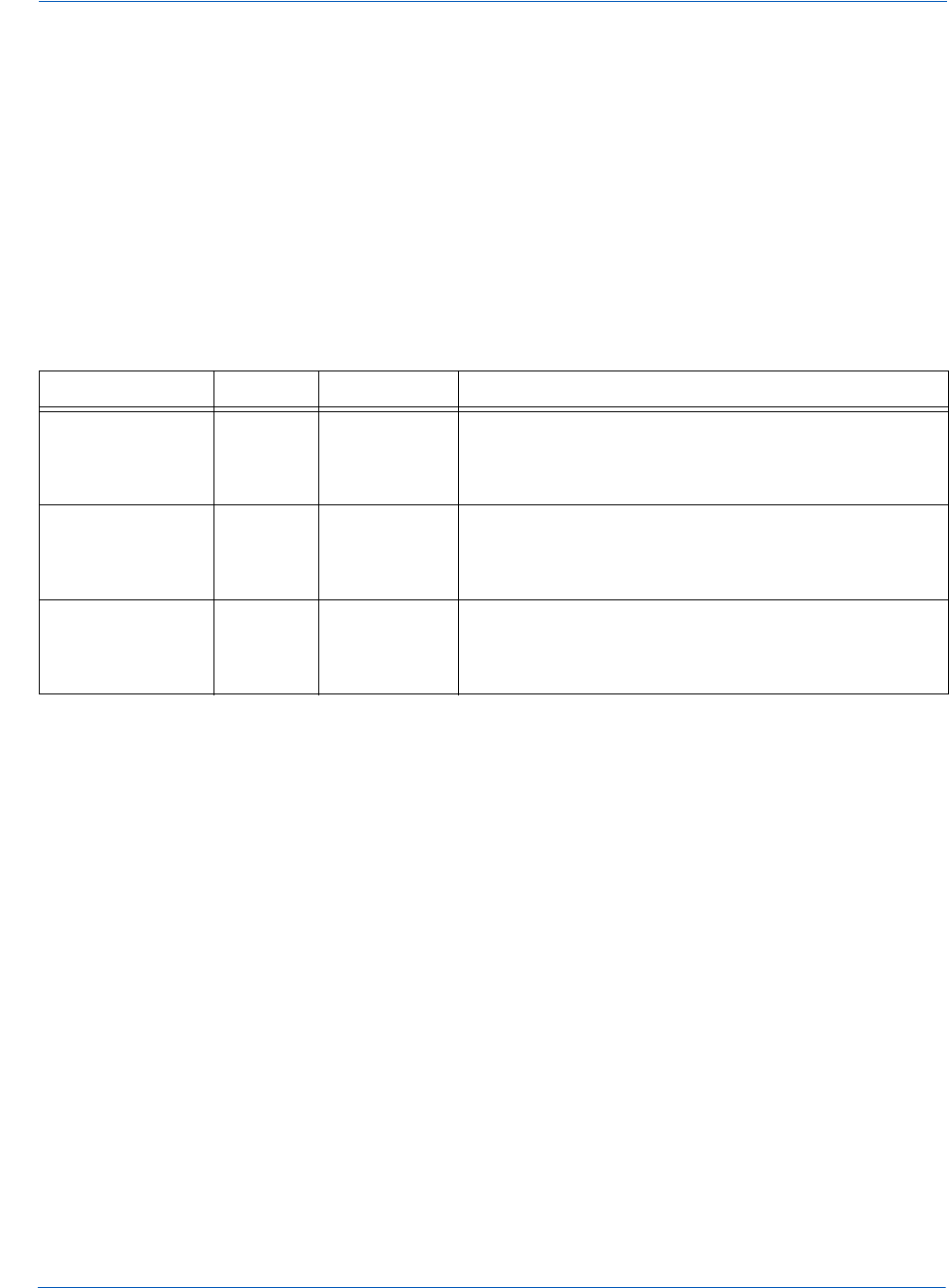

NOTE:Table 1-1 represents data available at the time of publication, and is

subject to change. See the latest Apple documentation for current

information.

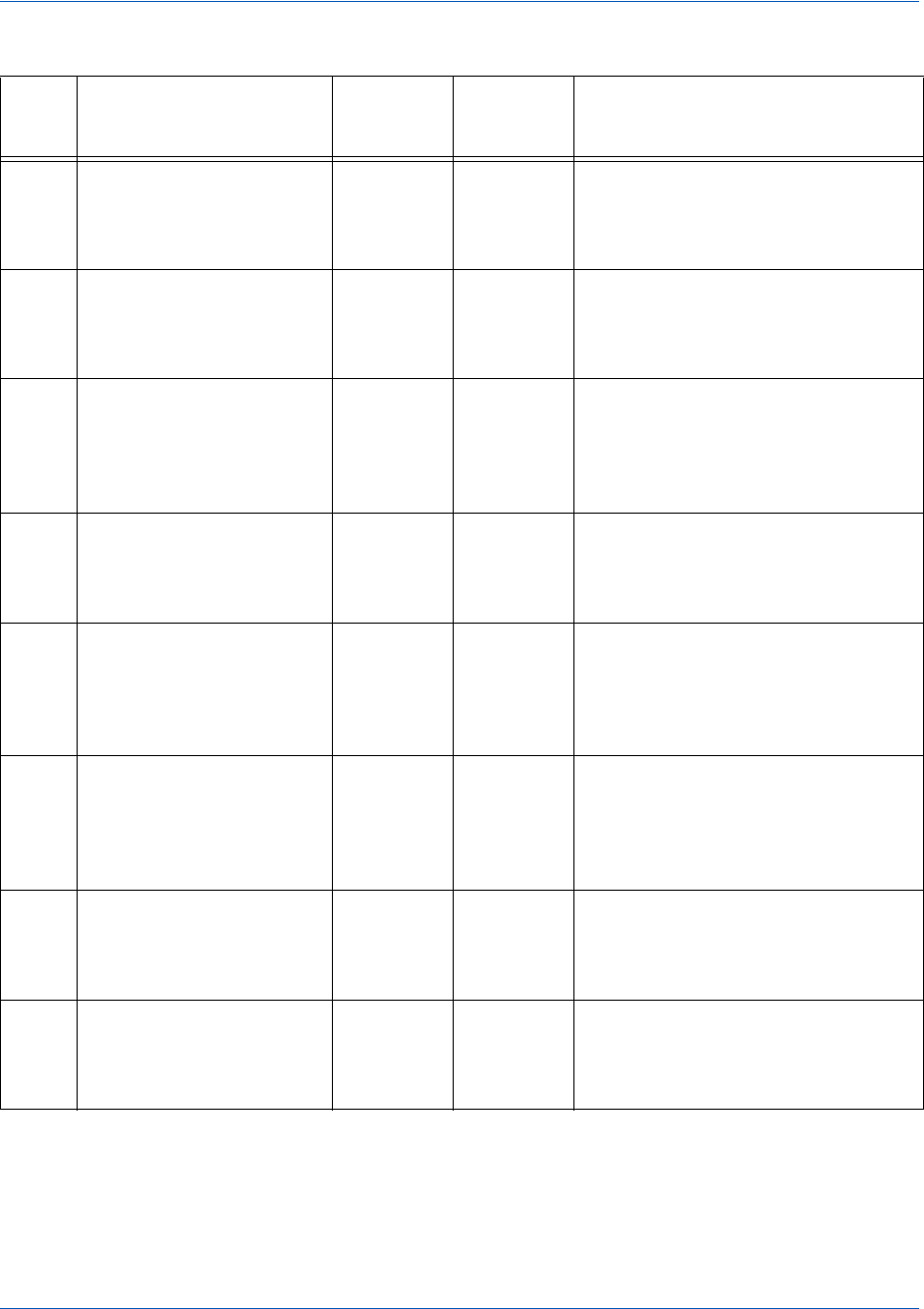

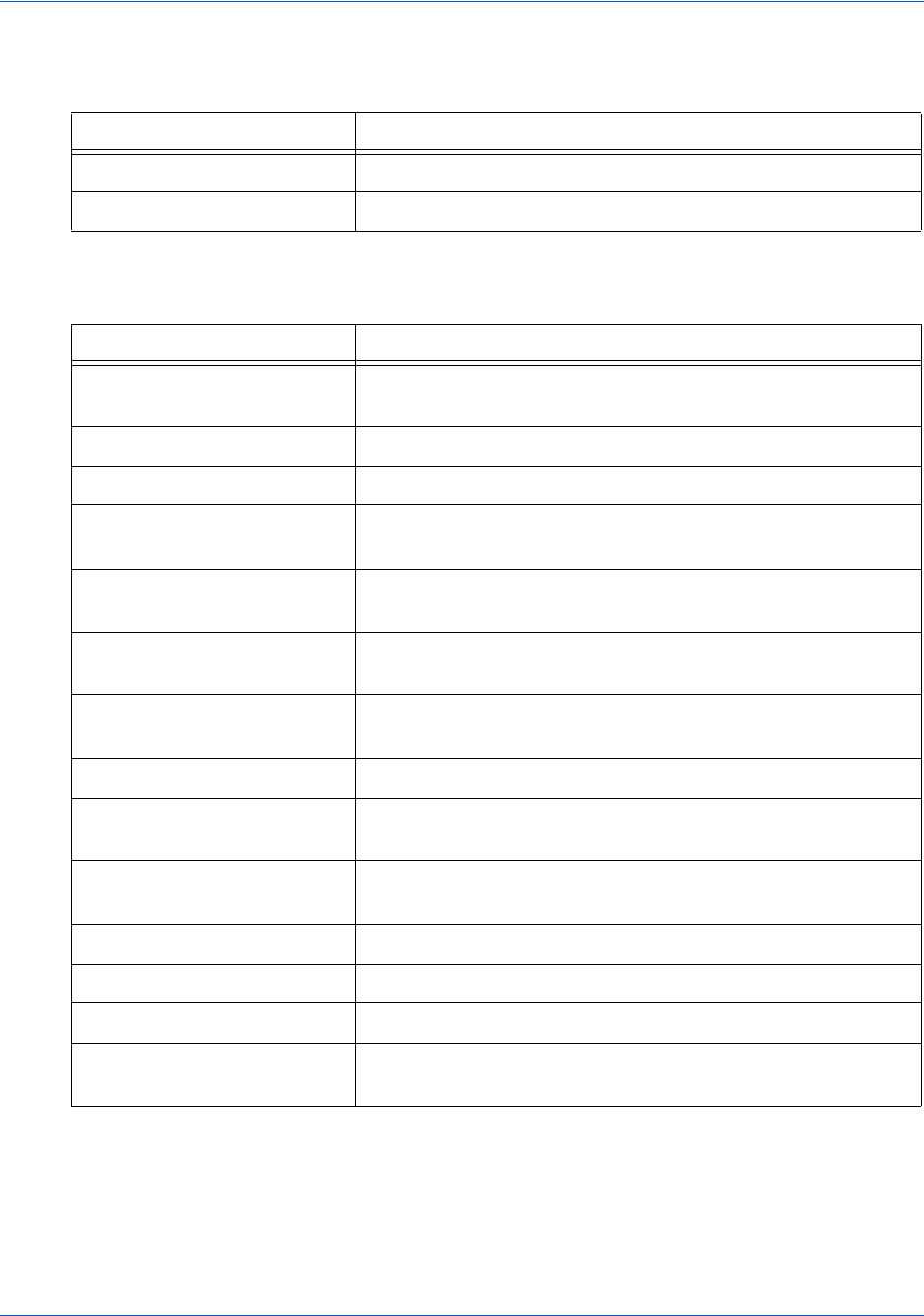

TABLE 1-1 Apple Pay on the Web Compatible Devices

Apple Device Operating System Browser

iPhone 6 and later

iPhone SE

iOS 10 and later

Safari only

iPad Pro

iPad Air 2 and later

iPad Mini 3 and later

iOS 10 and later

Apple Watch

Paired with iPhone 6 and later

Watch OS 3 and later

iMac

Paired with any of the above mobile

devices with ID Touch for

authentication

macOS Sierra and later

MacBook

Paired with any of the above mobile

devices with ID Touch for

authentication

macOS Sierra and later

Introduction Getting Started with eProtect

10 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

Vantiv supports two methods for merchants to submit Android Pay transactions from Web/Mobile

applications to the eCommerce platform. The preferred method involves you sending certain

Vantiv specific parameters to Google®. The response from Google includes a Vantiv

paypageRegistrationId, which you use in you payment transaction submission to Vantiv.

With the alternate method, you receive encrypted information from Google, decrypt it on your

servers, and submit the information to Vantiv in a payment transaction. See Using the Vantiv

Mobile API for Android Pay on page 56 for more information.

1.3.5 eProtect Support for Pay with Google™

Pay With Google is an on-line payment method that lets your customers use the cards they've

saved to their Google Account to pay quickly and easily in your apps. and on your websites. By

clicking the Pay with Google button, customers can choose a payment method saved in their

Google Account and finish checkout in a few, simple steps.

You can use the Google Payment API to simplify payments for customers who make purchases in

Android apps or on Chrome with a mobile device.

Vantiv supports two methods for merchants to submit Pay with Google transactions from Mobile

applications to the eCommerce platform. The preferred method involves you sending certain

Vantiv-specific parameters to Google. The response from Google includes a Vantiv

paypageRegistrationId, which you use normally in your payment transaction submission to

Vantiv. With the alternate method, you receive encrypted information from Google, decrypt it on

your servers, and submit the information to Vantiv in a payment transaction. See Using the Vantiv

Mobile API for Pay with Google on page 59 for more information.

1.3.6 eProtect Support for Visa Checkout™

Visa Checkout™ is a digital payment service in which consumers can store card information for

Visa, MasterCard, Discover, and American Express cards. Visa Checkout provides quick

integration for merchants that want to accept payments from these card holders. Visa Checkout is

flexible and imposes only a few requirements for its use, leveraging your existing

environments--web site and mobile applications--where you add Visa Checkout buttons to

existing pages and implement business and event logic using programming languages, tools, and

techniques in the same way you currently do. Vantiv supports Visa Checkout purchases from your

website or mobile app. initiated from compatible devices.

1.3.6.1 Getting Started with Visa Checkout

NOTE:Parts of this section are excerpts from Visa Checkout documentation and

represents data available at the time of publication of this document, and

is therefore subject to change. See the latest Visa documentation

(https://developer.visa.com/products/visa_checkout/reference) for current

information.

Getting Started with eProtect Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 11

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

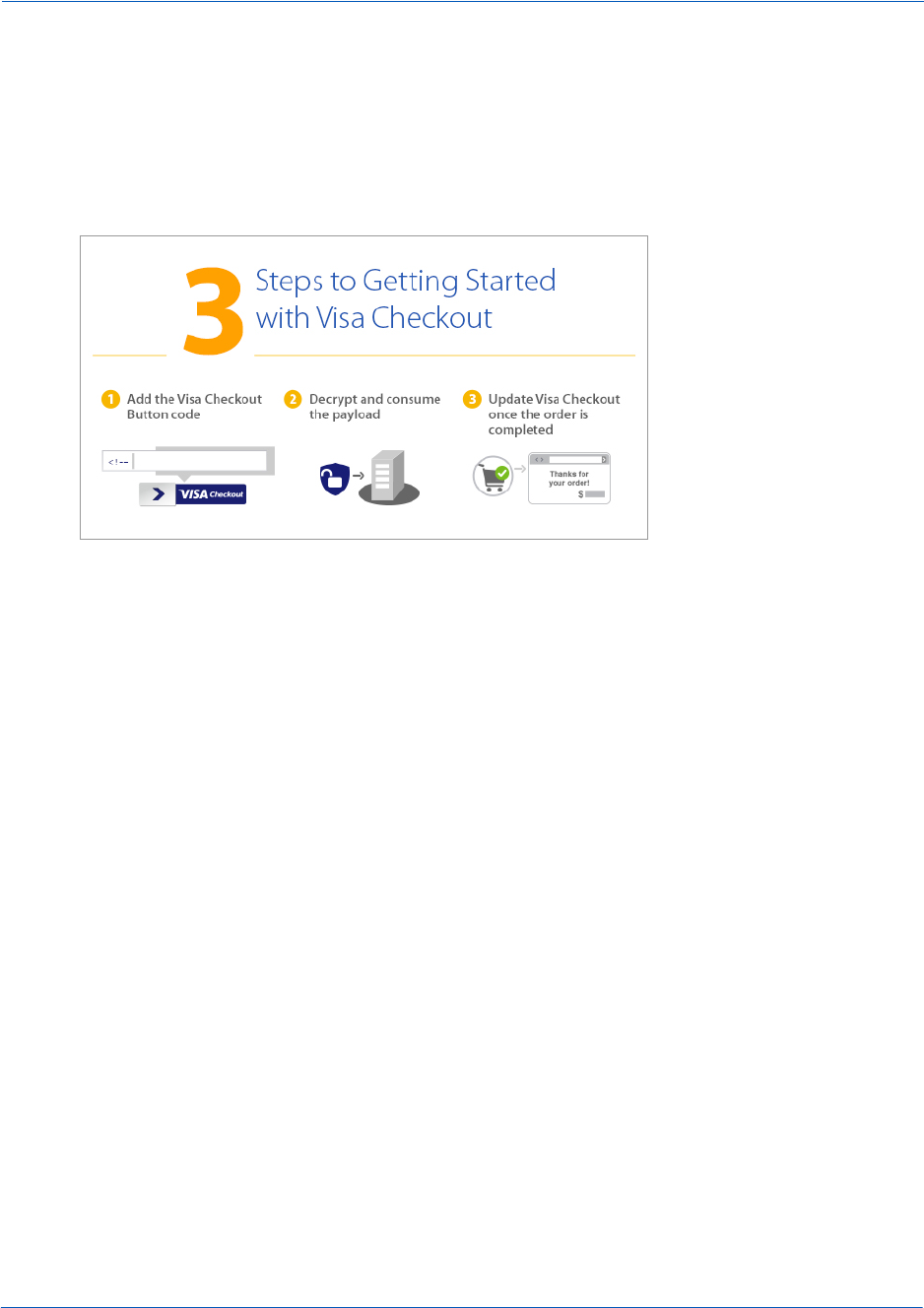

The simplest approach to integrating Visa Checkout takes three steps and can be done entirely

from your web page (with the exception of decrypting the consumer information payload on a

secure server). Figure 1-2 illustrates the main steps for getting started with Visa Checkout.

FIGURE 1-2 Getting Started with Visa Checkout

1. Place a Visa Checkout button on your web page and include the necessary JavaScript to

handle events associated with the button.

2. Handle the payment event returned by Visa Checkout by decrypting the consumer

information payload.

3. Update Visa Checkout with the final payment information after the payment has been

processed.

All integration options require that you perform step 1. Sections in this document describes the

method using Vantiv eProtect.

1.3.6.2 Requirements for Using Visa Checkout

This section describes the various requirements for using Visa Checkout.

• Usage and Placement of Visa Checkout Buttons: You are required to implement the Visa

Checkout branding requirements on all pages where the consumer is presented payment

method options, such as Visa Checkout or another payment method. Common examples

include shopping cart page, login page, product page, and payment page. Your actual

implementation depends on your specific flow.

You can use Visa Checkout on any web page or in any flow on your site or native mobile

application where a consumer is asked to type in their billing and payment information.

Common examples include cart pages (both full and mini) pages, payment pages, card-on-file

management pages, or immediately before a flow where a consumer is prompted for personal

information, which may be available, at least partially, within Visa Checkout.

Introduction Getting Started with eProtect

12 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

See the latest Visa Checkout Integration Guide for more information and to learn how placing

Visa Checkout buttons on the shopping cart page and your login page might work.

• Clickjacking Prevention Steps: To prevent clickjacking of your pages, each page must

contain JavaScript to verify that there are no transparent layers, such as might be the case if

your page was loaded as an iFrame of a page containing malicious code, and that only your

site can load your pages.

See the latest Visa Checkout Integration Guide for more information on preventing

clickjacking.

• Obtaining the externalClientId from Vantiv: During the on-boarding process, Vantiv

Implementation assigns an externalClientId to denote the relationship between Vantiv,

your organization and Visa.

• Updating Visa Checkout with the Payment Information: After you finish making a

payment (and perhaps using the information from the payload), you must update the payment

information in Visa Checkout. To update Visa Checkout from a Thank You page (next page to

load after making the payment), you add a one-pixel image to the page.

For more information about the Update Payment Info pixel image, see the latest Visa

Checkout Integration Guide.

See additional information on Using the Customer Browser JavaScript API for Visa Checkout on

page 35 and Using the Vantiv Mobile API for Visa Checkout on page 53.

1.3.7 jQuery Version

If you are implementing a browser-based solution, you must load a jQuery library before loading

the eProtect API. We recommend using jQuery 1.4.2 or higher. Refer to http://jquery.com for

more information on jQuery.

1.3.8 Certification and Testing Environment

For certification and testing of Vantiv feature functionality, Vantiv uses the Pre-Live testing

environment. This environment should be used by both newly on-boarding Vantiv merchants, and

existing merchants seeking to incorporate additional features or functionalities (for example,

eProtect) into their current integrations.

Use the URLs listed in Table 1-2 when testing and submitting eProtect transactions. Sample

JavaScripts are available at pre-live and production eProtect URLs. The following sample scripts

are available:

•eProtect JavaScript (eProtect-api3.js)

•iFrame Client (eprotect-iframe-client3.js)

•iFrame JavaScript (eProtect-iframe.js)

Getting Started with eProtect Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 13

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.3.8.1 Pre-Live Environment Limitations and Maintenance Schedule

When using the pre-live environment for testing, please keep in mind the following limitations

and maintenance schedules:

•The number of merchants configured per organization is limited to the number necessary to

perform the required certification testing.

•Data retention is limited to a maximum of 30 days.

•Merchant profile and data is deleted after seven (7) consecutive days with no activity.

•Maintenance window - every other Thursday from 10:00 PM to 6:00 AM ET.

•Daily limit of 1,000 Online transactions.

•Daily limit of 10,000 Batch transactions.

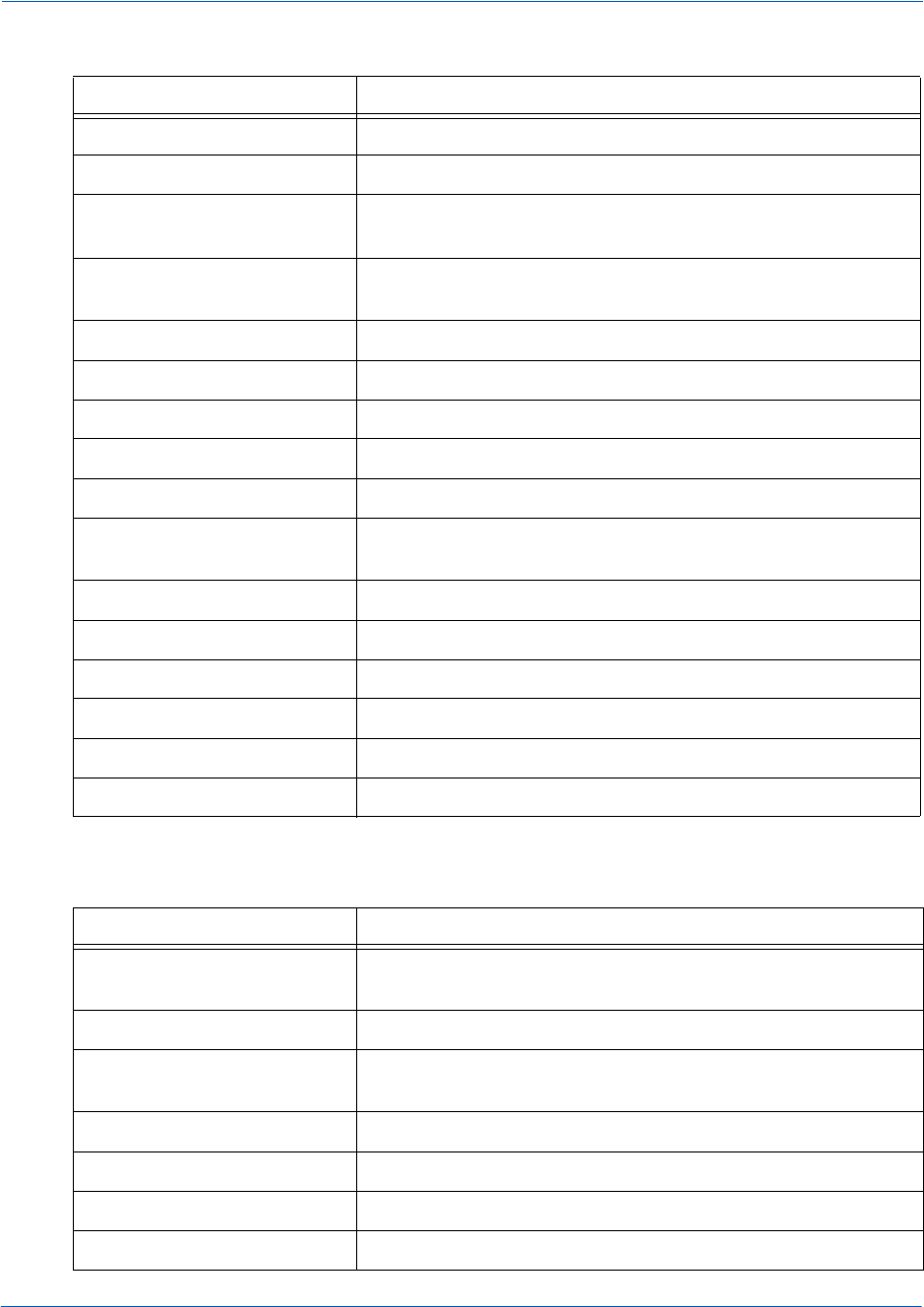

TABLE 1-2 eProtect Certification, Testing, and Production URLs

Environment URL Purpose URL

Pre-Live

(Testing and

Certification)

JavaScript Library https://request.eprotect.vantivprelive.com/eProtect/eProtect-

api3.js

Request

Submission

(excluding POST)

https://request.eprotect.vantivprelive.com

iFrame https://request.eprotect.vantivprelive.com/eProtect/js/eProtect-

iframe-client3.min.js

POST Request

Submission (for

Mobile API)

https://request.eprotect.vantivprelive.com/eProtect/paypage

API Key Request

(Visa Checkout

only)

https://request.eprotect.vantivprelive.com/eProtect/keys.json

Live

Production

Production Contact your Implementation Consultant for the eProtect

Production URL.

NOTE:Depending upon overall system capacity and/or system maintenance

requirements, data purges may occur frequently. Whenever possible, we will

provide advanced notification.

NOTE:Due to the planned maintenance windows, you should not use this

environment for continuous regression testing.

Introduction Getting Started with eProtect

14 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.3.9 Transitioning from Certification to Production

Before using your checkout form with eProtect in a production environment, replace all instances

of the Testing and Certification URLs listed in Table 1-2 with the production URL. Contact

Implementation for the appropriate production URL. The URLs in the above table and in the

sample scripts throughout this guide should only be used in the certification and testing

environment.

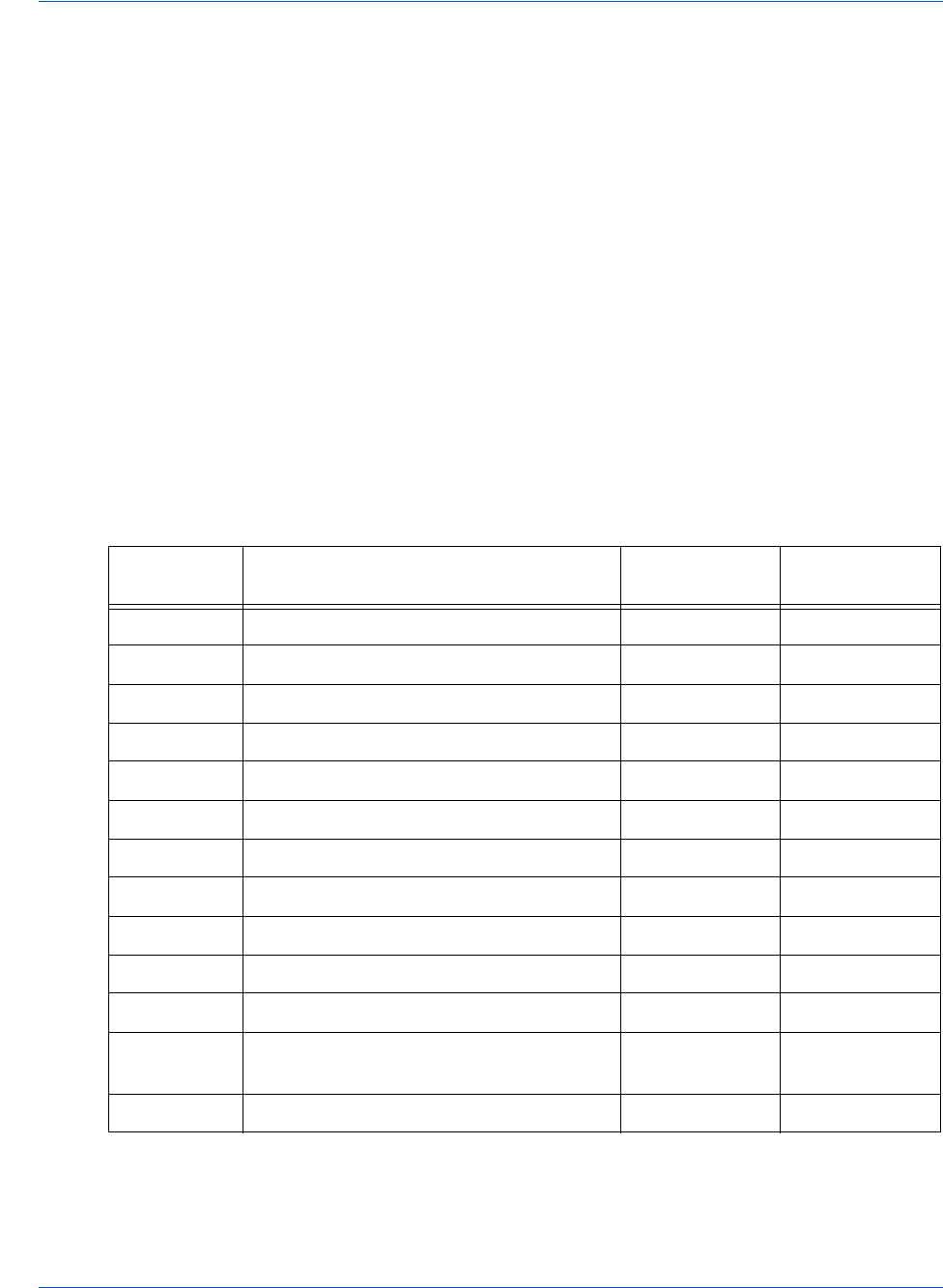

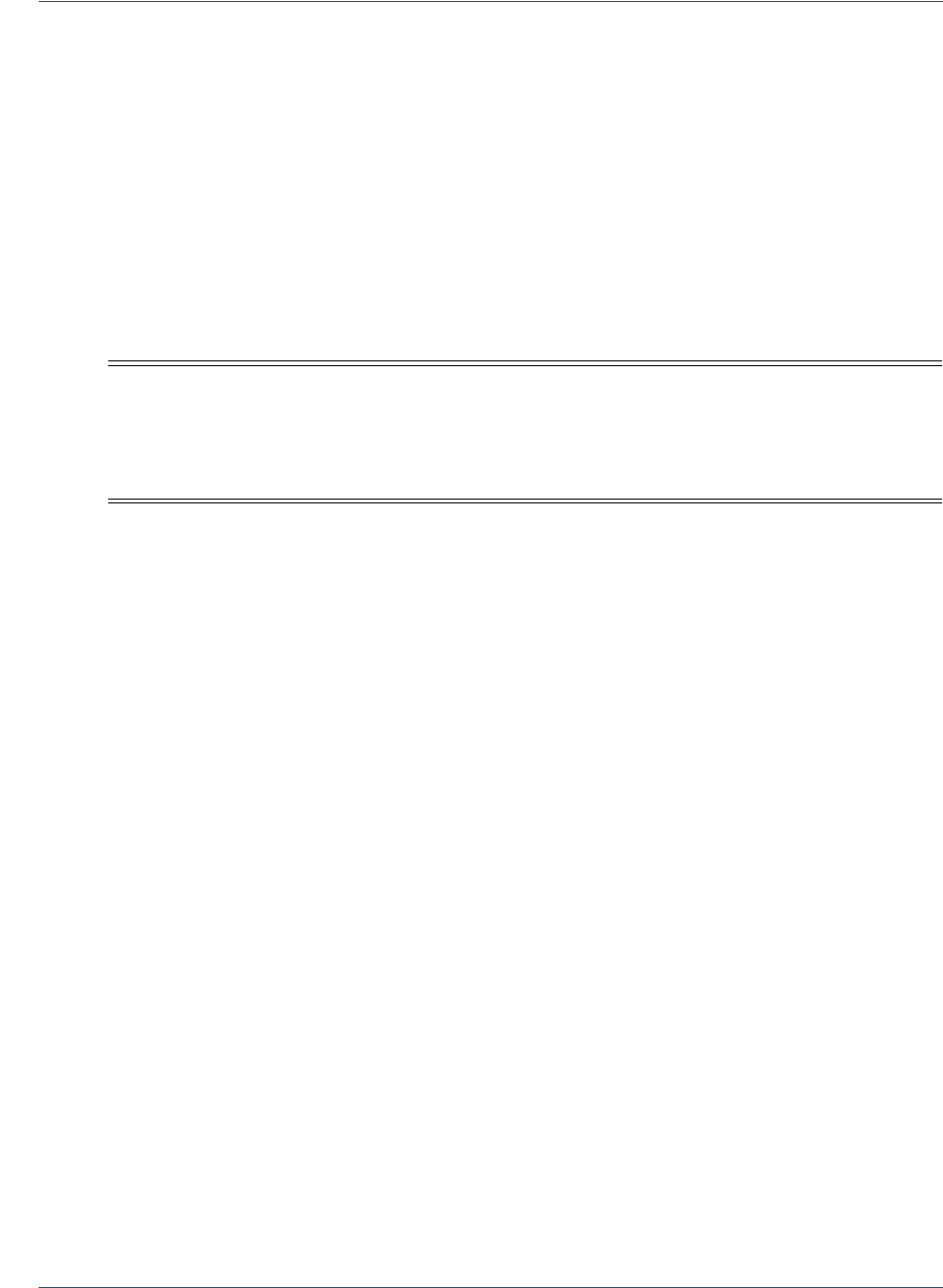

1.3.10 eProtect-Specific Response Codes

Table 1-3 lists response codes specific to the eProtect feature, received in the browser or mobile

device, and those received via the applicable Vantiv message specification responses. Table 1-4

lists those received via a cnpAPI Response. For further information on response codes specific to

token transactions, see the publications listed in Documentation Set on page xi.

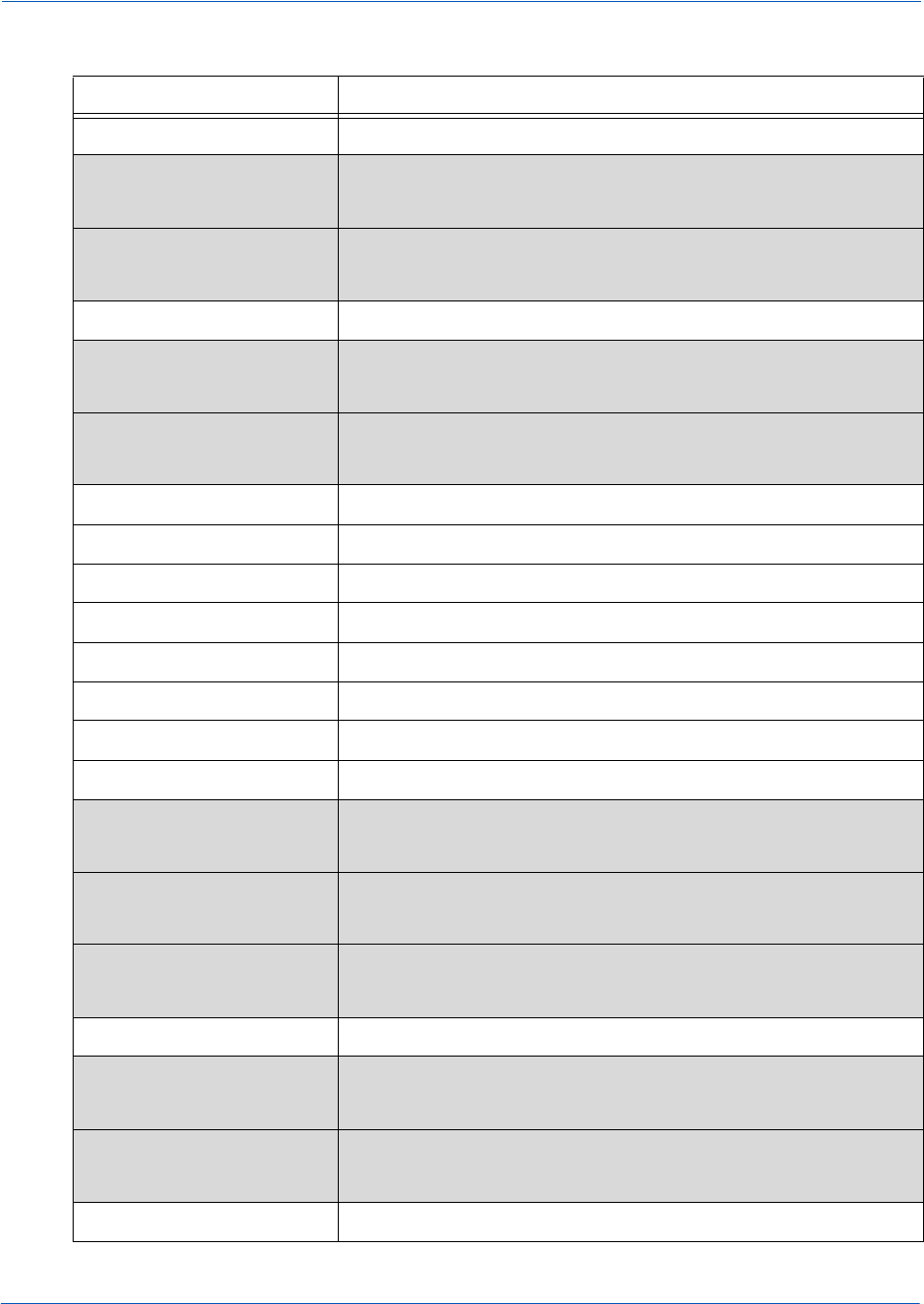

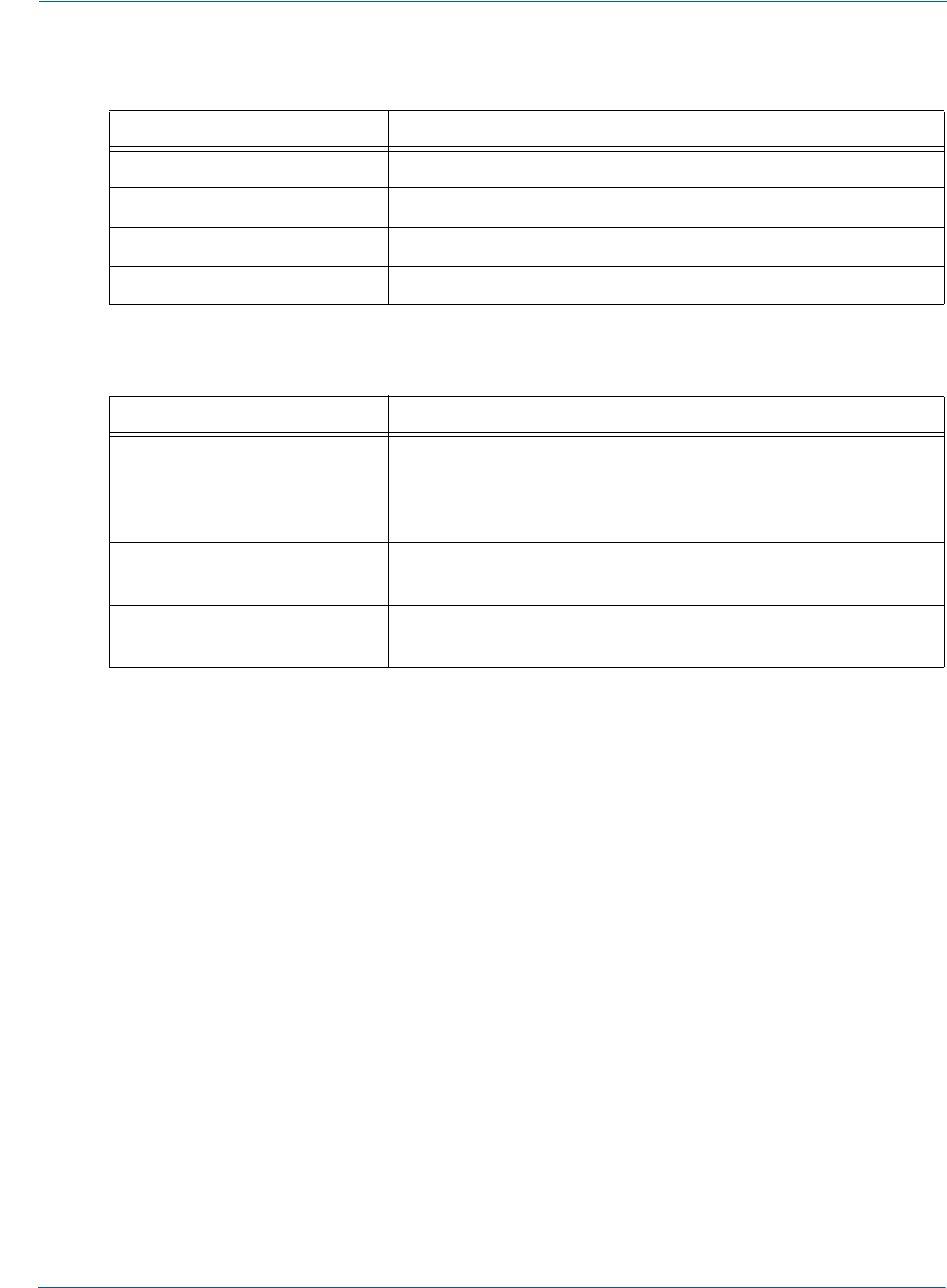

TABLE 1-3 eProtect-Specific Response Codes Received in Browsers or Mobile Devices

Response

Code Description Error Type Error Source

870 Success -- --

871 Account Number not Mod10 Validation User

872 Account Number too short Validation User

873 Account Number too long Validation User

874 Account Number not numeric Validation User

875 Unable to encrypt field System JavaScript

876 Account number invalid Validation User

881 Card Validation number not numeric Validation User

882 Card Validation number too short Validation User

883 Card Validation number too long Validation User

884 eProtect iFrame HTML failed to load System Vantiv eComm

885 eProtect iFrame CSS failed load -

<number>

System Vantiv eComm

889 Failure System Vantiv eComm

Getting Started with eProtect Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 15

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.3.11 eProtect Registration ID Duplicate Detection

Vantiv performs duplicate detection reviews on all form fields such as the card number, CVV,

order ID, and Transaction ID. In the event that multiple eProtect registrations are submitted

within a five-minute period containing identical form fields, subsequent requests are flagged as

duplicates, and processed by returning the originating callback response and Registration ID

value.

With this, false positives may occur if your organization has not implemented a policy that

provides a unique Order ID and Transaction ID for every request. If not implemented, you could

potentially receive an incorrect CVV value, which could be disruptive to chargeback processing.

Vantiv strongly recommends that the order ID and transaction ID data elements be unique for

every registration request.

NOTE:For information on response codes specific to OmniToken transactions,

see the applicable Vantiv message interface specification.

TABLE 1-4 eProtect Response Codes Received in cnpAPI Responses

Response

Code Response Message

Response

Type Description

826 Checkout ID was

invalid

Soft

Decline

An eProtect response indicating that the

Checkout ID submitted was too long, too

short, non-numeric, etc.

827 Checkout ID was not

found

Soft

Decline

An eProtect response indicating that the

Checkout ID submitted was expired, or

valid but not found.

828 Generic Checkout ID

error

Soft

Decline

There is an unspecified Checkout ID

error; contact your Relationship

Manager.

877 Invalid PayPage

Registration ID

Hard

Decline

An eProtect response indicating that the

Registration ID submitted is invalid.

878 Expired PayPage

Registration ID

Hard

Decline

An eProtect response indicating that the

Registration ID has expired (Registration

IDs expire 24 hours after being issued).

879 Merchant is not

authorized for

PayPage

Hard

Decline

A response indicating that your

organization is not enabled for the

eProtect feature.

Introduction Creating a Customized CSS for iFrame

16 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.4 Creating a Customized CSS for iFrame

Before you begin using the iFrame solution, you must create a Cascading Style Sheet (CSS) to

customize the look and feel of the iFrame to match your checkout page. After creating and

customizing your style sheet, you then submit the style sheet to Vantiv, where it will be tested

before it is deployed into production. This section describes the various tools and customizations

available for creating your CSS for iFrame and submitting your CSS for review:

•CSS iFrame Validation and Customization Features

•Using Web Developer Tools

•Reviewing your CSS with Vantiv

1.4.1 CSS iFrame Validation and Customization Features

Vantiv offers a set of iFrame validation and customization features to reduce cart abandonment,

increase conversions, and help simplify the payment experience for your customers. See

Configuring the iFrame on page 33 for further information on placement of these properties in

your checkout page.

These features include:

Real-Time In-line Field Validations - while traditional web forms use submit-and-refresh rules

that respond once you click the Submit button, real-time in-line validations can help your

customers fill out web forms faster and with fewer errors. By guiding them with real-time

feedback that instantly confirms whether the values they input are valid, transactions can be more

successful and less error-prone, and customers are more satisfied with their checkout experience.

Payment Form Behaviors - customizable behaviors include:

•Empty Input - if your customer clicks back after leaving a payment form (for example, if they

want to edit their payment information or in the case of a timeout, etc.), eProtect detects

whether your customer has attempted to enter new form data.

If they have not entered any new values, you can use the original token for the transaction. If

your customer attempts to enter new values, eProtect clears the form—instead of leaving the

previous entries in place—eliminating the need to erase the old values before re-entering new

values.

•Disallowed Characters - allows only numeric values to be entered for the Account Number

and CVC fields (no alpha or special characters are permitted).

•Auto-Formatting of account numbers based on the type of card.

NOTE:If you are evaluating your styling options and/or having trouble creating

your own style sheet, Vantiv can provide sample CSS files. Please contact

your assigned Implementation Consultant for sample CSS files.

Creating a Customized CSS for iFrame Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 17

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

Client Driven Behaviors - additional capabilities include:

•Tooltips - you can add a tool tip for any field (not just security code) activated by hovering, or

when clicking 'What's This?’

•Font Library and Icons - Vantiv hosts SVG Icons (Font Awesome, v4.7.0) font library on our

servers for you to leverage in your CSS, using an industry standard icon library for all icons.

•Trust Badge - you can add a ‘trust’ badge (e.g., a padlock or shield icon) on the payment form

to reassure your customers that your site is legitimate and that all their personal data is

collected securely through trusted third-party service providers. Note that the trust badge can

be displayed in place of the card graphic; your page cannot display both.

Table 1-5, "iFrame Checkout Page Customizations - In-Line Field Validations" and Table 1-6,

"Style Sheet and iFrame Customizations" show samples of these CSS iFrame customizations and

describes the implementation of each.

When you set the optional enhancedUxFeatures.inlineFieldValidations property to

true when configuring your iFrame, the behaviors listed in Table 1-5 are all included.

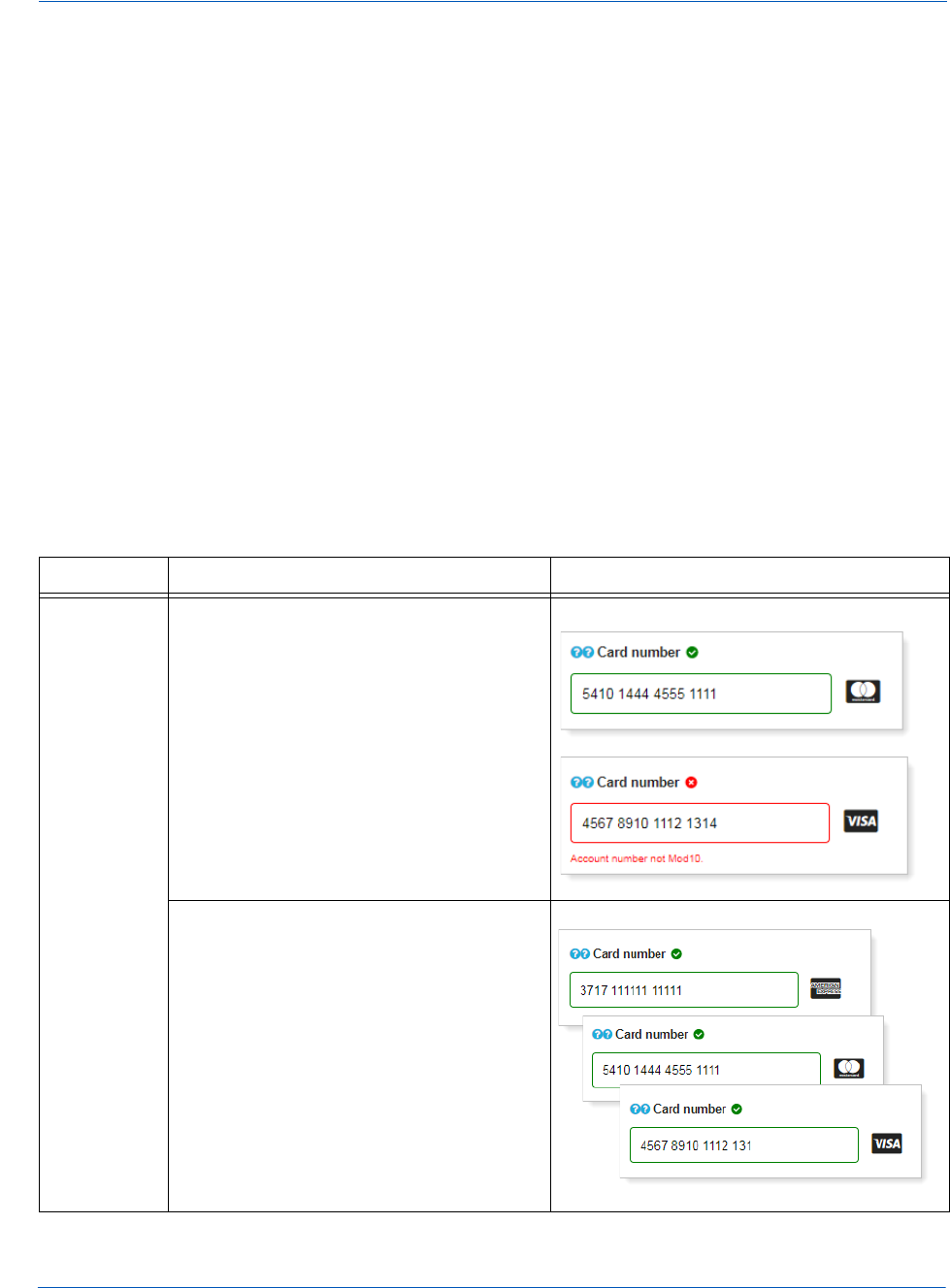

TABLE 1-5 iFrame Checkout Page Customizations - In-Line Field Validations

Field Validation Behavior Samples

Card

Number

The iFrame checks the card number for

correct size (too short or too long) and

against the Luhn/Mod10 algorithm.

In this example, if the consumer’s inputs

are valid, you can configure the iFrame to

display green field borders and include a

green check mark. Red borders and a

red ‘X’ can indicate invalid input.

The error messages and frame colors are

customizable in your style sheet.

The iFrame identifies the card type (Visa,

MasterCard, Amex, etc.) based on the

first few digits entered, and displays the

appropriate card graphic. If the card type

is unknown, the iFrame displays a

generic card graphic.

You can configure your style sheet to

hide the card graphic.

In addition, the iFrame auto-formats the

arrangement of the card digits based on

the initial entry.

Introduction Creating a Customized CSS for iFrame

18 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

The items listed in Table 1-6 are also available as optional features controlled by the your style

sheet and via iFrame function. By default, the Tool Tip features are active, but can be suppressed

with the CSS.

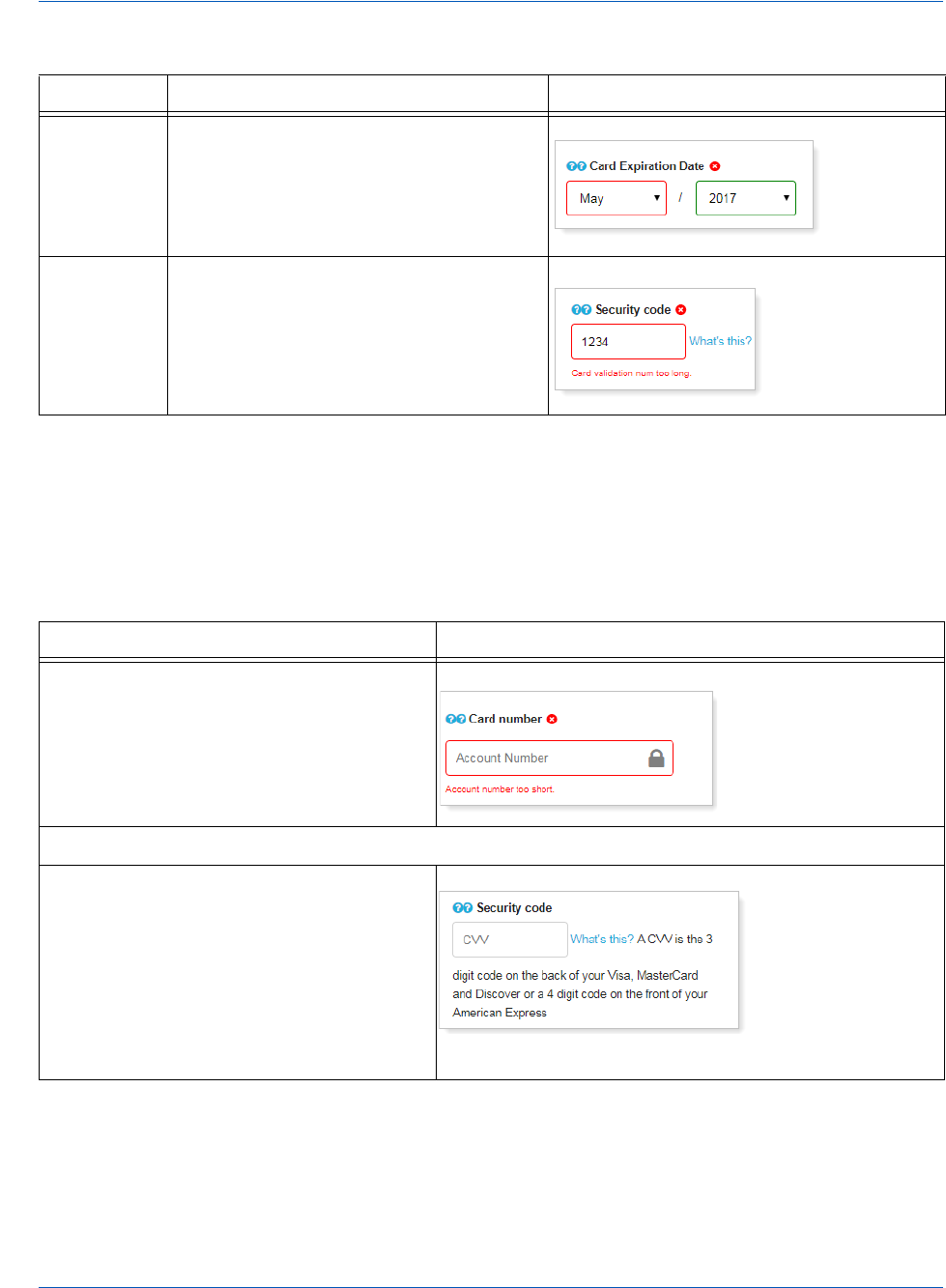

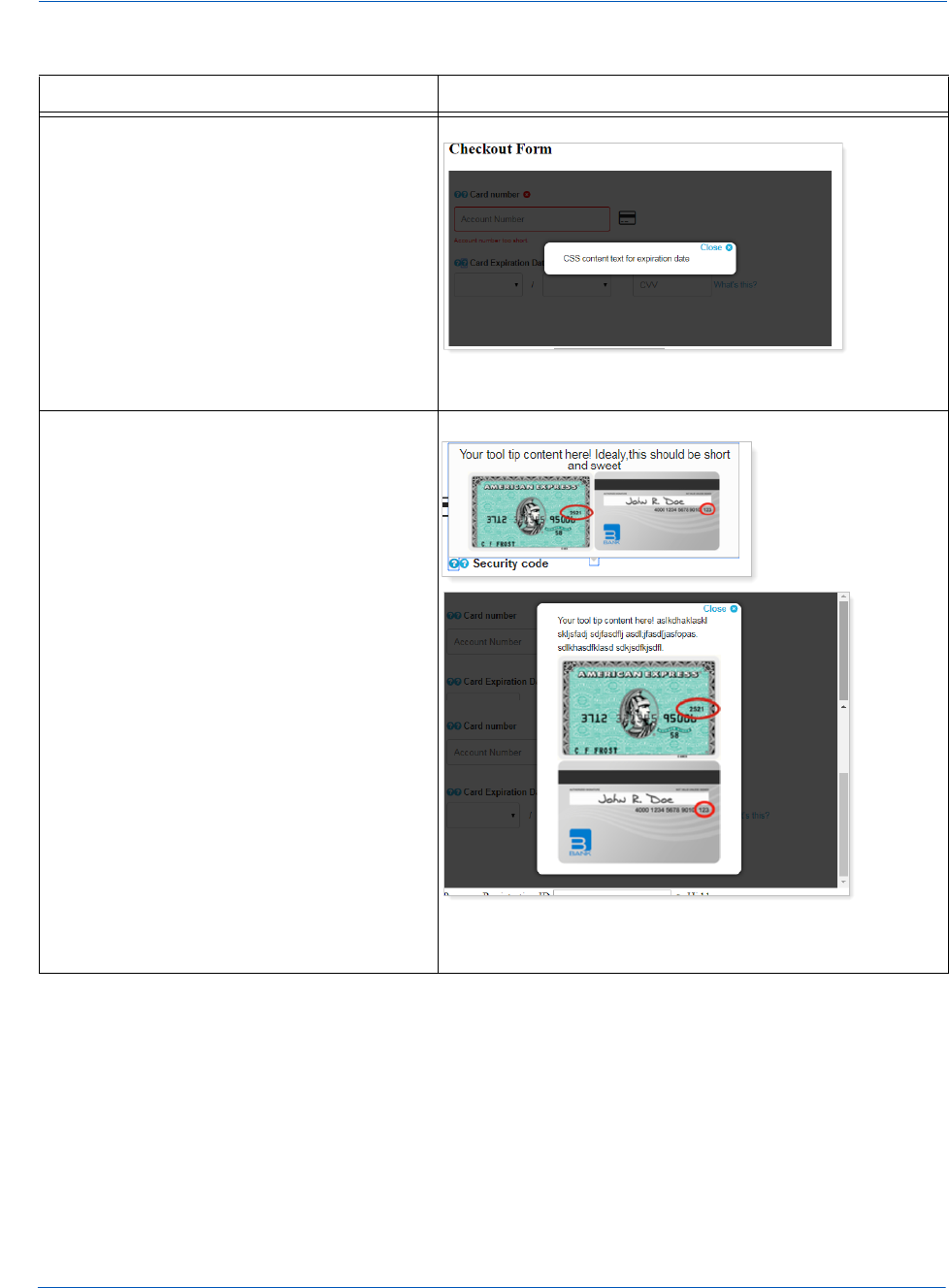

Expiration

Date

The iFrame checks the expiration month

to determine if the selected month is prior

to the current month.

Security

Code

The iFrame confirms the logic against the

account number type. For example, if the

card is an American Express card and

the consumer enters only three digits

(should be four digits), an error is

indicated.

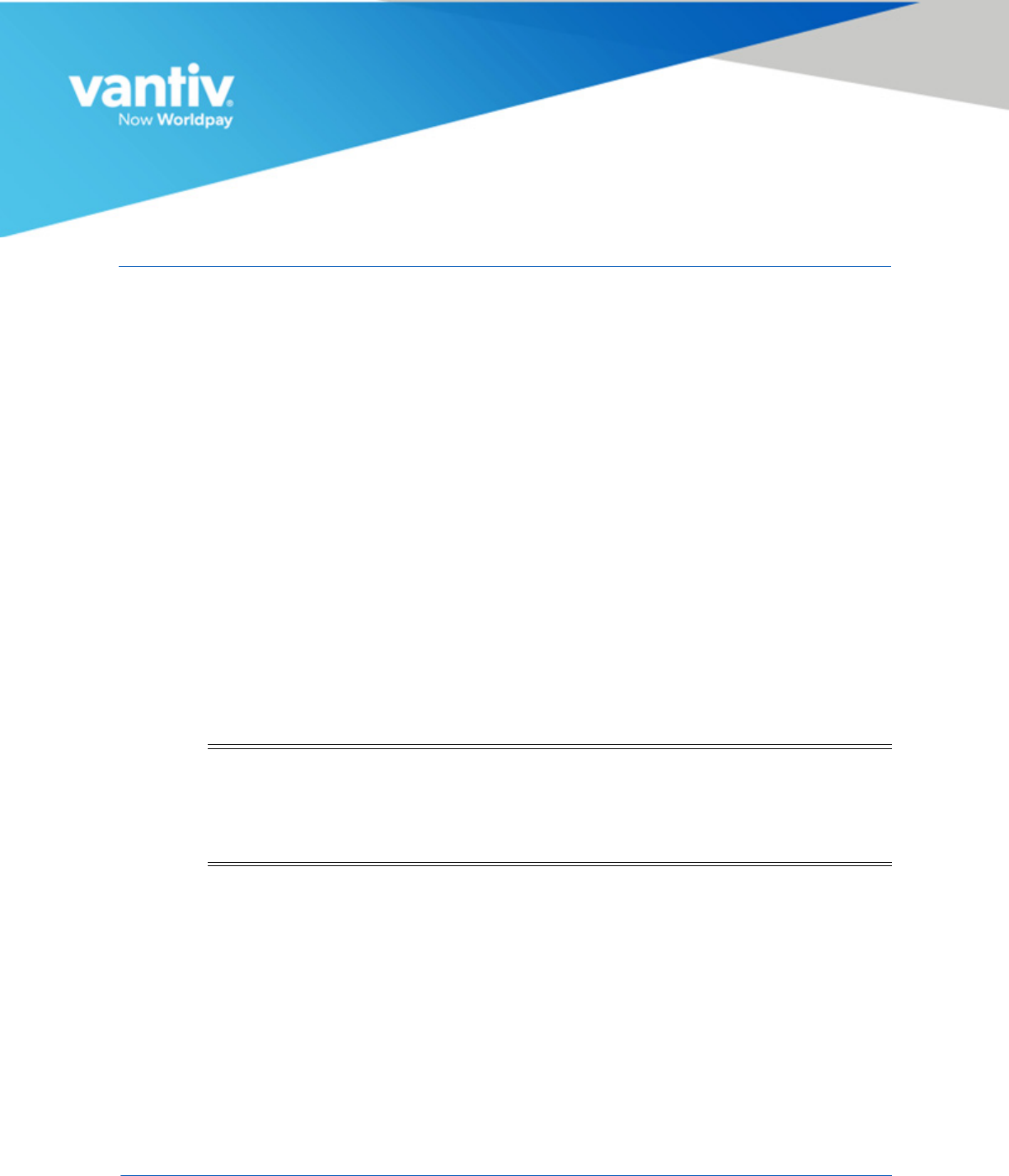

TABLE 1-6 Style Sheet and iFrame Customizations

Customization Samples

Trust Badge - You can add a ‘trust badge’

(e.g., a padlock or shield icon) to the

payment form, using the Font Awesome

(V4.7.0) icon library. Note that the trust

badge can be displayed in place of the card

graphic; your page cannot display both.

Tool Tips - you control the following tool tip behavior in your style sheet:

You can add a tool tip for any field (not just

security code) activated by hovering, or

when clicking 'What's This?’

Tool tip displayed after clicking ‘What’s This?’

TABLE 1-5 iFrame Checkout Page Customizations - In-Line Field Validations (Continued)

Field Validation Behavior Samples

Creating a Customized CSS for iFrame Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 19

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

You can configure your style sheet to

activate a tool tip by hovering over the ‘?’

icon (rather than clicking). This is useful for

short statements.

You can also configure a modal dialog to

activate on the click of the second ‘?’ icon

to display more lengthy CSS content.

Modal dialog displayed upon clicking second ‘?’ icon.

Tool Tips (continued)

You can configure your CSS to display a

Security code modal dialog where the tool

tip displays generic card art showing the

placement of CVC on cards. You can hide

this with the CSS, if you choose.

You can also remove the scrollbars, as well

as direct your CSS to auto-size the dialog

based on content.

Modal dialog displayed upon clicking first or second ‘?’

icon at the security code field.

TABLE 1-6 Style Sheet and iFrame Customizations (Continued)

Customization Samples

Introduction Creating a Customized CSS for iFrame

20 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

1.4.2 Using Web Developer Tools

By using standard browser-provided web developer tools, you can develop and customize your

CSS prior to sending it to Vantiv for boarding.

To access the developer tool and to customize your CSS:

1. Go to https://www.testvantivcnp.com/iframe/ to access the demo URL and review the

provided style sheet.

If you are using the enhanced iFrame features described in the previous section, CSS iFrame

Validation and Customization Features, use the following URL:

https://www.testvantivcnp.com/checkout/checkout-iframe-enhanced-demo.jsp

2. Right click the Account Number text field, then click Inspect or Inspect Element

(depending on your browser). The browser splits the window into two or more

browser-specific developer frames.

3. Locate the highlighted HTML section in the developer tool frame of the browser where it

shows <input type="text" id="accountNumber"...

4. Scroll up a few lines, and locate the HTML section, <head>…</head>. Expand the section

with the arrow icon (if it is not already expanded).

5. Locate the HTML section <style>…</style>, which is the last child of the <head/>

element, and expand it.

6. Double click the content, delete it, then paste in your new style sheet. To make the new CSS

style effective, simply click somewhere else to exit the editing mode.

7. Copy and paste the CSS file and send it to your Vantiv Implementation Consultant for review.

1.4.3 Reviewing your CSS with Vantiv

Vantiv reviews your CSS by an automatic process which has white-listed allowed CSS properties

and black-listed, ‘dangerous’ CSS values (such as URL, JavaScript, expression). Properties

identified as such have been removed from the white list, and if used, will fail verification of the

CSS. See Table B-24, "CSS Properties Excluded From the White List (not allowed)" for those

properties not allowed.

If an error is detected, Vantiv returns the CSS for correction. If the CSS review is successful, the

CSS is uploaded to the your eProtect configuration.

Note the following:

•If additional properties and/or values are introduced in future CSS versions, those properties

and values will be automatically black-listed until Vantiv can review and supplement the

white-listed properties and values.

•Certain properties allow unacceptable values, including URL, JavaScript, or expression. This

includes the content property, which allows you to enter ‘Exp Date’ instead of our provided

Creating a Customized CSS for iFrame Introduction

Document Version: 2.7 — cnpAPI Release: 12.0 21

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

‘Expiration Date’ label. If the property contains a URL, JavaScript, expression, or

attr(href), Vantiv will fail verification of the CSS.

•Any property in the white list also allows its browser’s extended values, where applicable.

See https://www.testvantivcnp.com/iframe/ to view a simple iFrame example.

To view an iFrame example checkout page using the enhanced features described in CSS iFrame

Validation and Customization Features on page 16, use the following URL:

https://www.testvantivcnp.com/checkout/checkout-iframe-enhanced-demo.jsp

Introduction Creating a Customized CSS for iFrame

22 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

Document Version: 2.7 — cnpAPI Release: 12.0 23

© 2018 Worldpay, Inc. - All Rights Reserved.

2

INTEGRATION AND TESTING

This chapter describes the steps required to integrate the eProtect™ feature as part of your

checkout page, transaction examples, and information on eProtect testing and certification. The

sections included are:

•Integrating Customer Browser JavaScript API Into Your Checkout Page

•Integrating iFrame into your Checkout Page

•Integrating eProtect Into Your Mobile Application

•Collecting Diagnostic Information

•Transaction Examples When Using ISO 8583, 610, HHMI, and PWS

•Transaction Examples When Using cnpAPI

•Testing and Certification

NOTE:The PayPage product is now known as Vantiv eProtect. The term

‘PayPage’ however, is still used in this guide in certain text descriptions,

along with many data elements, JS code, and URLs. Use of these data

elements, etc., with the PayPage name is still valid with this release, but

will transition to ‘eProtect’ in a future release.

Integration and Testing Integrating Customer Browser JavaScript API Into Your Checkout Page

24 Document Version: 2.7 — cnpAPI Release: 12.0

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

2.1 Integrating Customer Browser JavaScript API Into

Your Checkout Page

This section provides step-by-step instructions for integrating the Customer Browser JavaScript

API eProtect solution into your checkout page. This section also provides information on the

following payment methods:

•Using the Customer Browser JavaScript API for Apple Pay on the Web

•Using the Customer Browser JavaScript API for Visa Checkout

See Integrating eProtect Into Your Mobile Application on page 46 for more information on the

mobile solution.

See Integrating iFrame into your Checkout Page on page 38 for more information on the iFrame

solution.

2.1.1 Integration Steps

Integrating eProtect into your checkout page includes these steps, described in detail in the

sections to follow:

1. Loading the eProtect API and jQuery

2. Specifying the eProtect API Request Fields

3. Specifying the eProtect API Response Fields

4. Handling the Mouse Click

5. Intercepting the Checkout Form Submission

6. Handling Callbacks for Success, Failure, and Timeout

7. Detecting the Availability of the eProtect API

The above steps make up the components of the sendToEprotect call:

sendToEprotect(eProtectRequest, eProtectFormFields, successCallback, errorCallback,

timeoutCallback, timeout)

• eProtectRequest - captures the form fields that contain the request parameters (paypageId ,

url, etc.)

• eProtectFormFields - captures the form fields used to set various portions of the eProtect

registration response (Registration Id, Checkout Id, response reason code, response reason

message, etc.).

• successCallback - specifies the method used to handle a successful eProtect registration.

• errorCallback - specifies the method used to handle a failure event (if error code is

received).

Integrating Customer Browser JavaScript API Into Your Checkout Page Integration and Testing

Document Version: 2.7 — cnpAPI Release: 12.0 25

© 2018 Worldpay, Inc. - All Rights Reserved.

eProtect™ Integration Guide - Enterprise

• timeoutCallback - specifies the method used to handle a timeout event (if the

sendToEprotect

exceeds the timeout threshold).

•timeout - specifies the number of milliseconds before the timeoutCallback is invoked.

JavaScript code examples are included with each step. For a full HTML code example of the

eProtect implementation, see the HTML Checkout Page Examples on page 98.

2.1.2 Loading the eProtect API and jQuery