Medicare Form10 Instructions

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 291 [warning: Documents this large are best viewed by clicking the View PDF Link!]

- R1P240_1.pdf

- NOTE: This form is not used by freestanding skilled nursing facilities.

- NOTE: Follow this sequence of numbering for subscripting lines throughout the cost report.

- 1. Round to 2 decimal places:

- 3. Round to 4 decimal places:

- 4. Round to 5 decimal places:

- Line 2, Column 2--Enter the 5 position Contractor Number.

- FROM__________

- FROM__________

- 4004.1 Part I - Hospital and Hospital Health Care Complex Identification Data.-- The information required on this worksheet is needed to properly identify the provider. The responses to all lines are Yes or No unless otherwise indicated by the type o...

- Line Descriptions

- Line 21--Indicate the type of control or auspices under which the hospital is conducted as indicated:

- Line 27--For the Standard Geographic classification (not wage), what is your status at the end of the cost reporting period. Enter “1” for urban or “2” for rural.

- Lines 28 - 34--Reserved for future use.

- Lines 39 - 44--Reserved for future use.

- Lines 48 - 54--Reserved for future use.

- Lines 63 - 69--Reserved for future use.

- covers the beginning of the fourth academic year of the first new teaching program’s existence, enter the number “4” in column 3. If the current cost reporting period covers the beginning of the fifth or subsequent academic years of the first new teac...

- Lines 72 - 74--Reserved for future use.

- Lines 77 - 79--Reserved for future use.

- Lines 81-84--Reserved for future use.

- Line 85--Is this a new hospital under 42 CFR 413.40(f)(1)(i) (TEFRA)? Enter “Y” for yes or “N” for no in column 1.

- Line 87 - 89--Reserved for future use.

- Line 95--If line 94 of the corresponding column is “Y” for yes, enter the percentage by which capital costs are reduced.

- Line 96--Does title V and/or XIX reduce operating costs? Enter “Y” for yes or “N” for no in the applicable column.

- Line 97--If line 96 of the corresponding column is “Y” for yes, enter the percentage by which operating costs are reduced.

- Lines 98 - 104--Reserved for future use.

- Lines 110 - 114--Reserved for future use.

- Line 116--Are you classified as a referral center? Enter “Y” for yes or “N” for no. See 42 CFR 412.96.

- Lines 121 - 124--Reserved for future use.

- Line 125--Does your facility operate a transplant center? Enter “Y” for yes or “N” for no in column 1. If yes, enter the certification dates below.

- Line 134--If this is an organ procurement organization (OPO), enter the OPO number in column 1 and termination date, if applicable, in column 3.

- Line 147--Was there a change in the statistical basis? Enter “Y” for yes or “N” for no.

- Line 148--Was there a change in the order of allocation? Enter “Y” for yes or “N” for no.

- Lines 150 - 154--Reserved for future use.

- Lines 162 - 164--Reserved for future use.

- Column Descriptions

- Line Descriptions

- Line 2--Enter title XVIII M+C and XIX HMO days (columns 6 and 7) and other Medicaid eligible days not included on line 1, columns 6 and 7, respectively.

- Line 3--Enter title XVIII M+C and XIX HMO days (columns 6 and 7) for IPF subproviders days not included on line 1, columns 6 and 7, respectively.

- Line 4--Enter title XVIII M+C and XIX HMO days (columns 6 and 7) for IRF subproviders days not included on line 1, columns 6 and 7, respectively.

- Line 5--Enter the Medicare covered swing bed days (which are considered synonymous with SNF swing bed days) for all Title XVIII programs where applicable. See 42 CFR 413.53(a)(2). Exclude all M+C days from column 6, include the M+C days in column 8.

- Line 6--Enter the non-Medicare covered swing bed days (which are considered synonymous with NF swing bed days) for all programs where applicable. See 42 CFR 413.53(a)(2).

- Line 7--Enter the sum of lines 1, 5 and 6.

- Lines 8 through 13--Enter the appropriate statistic applicable to each discipline for all programs.

- Line 21--If you have more than one hospital-based other long term care facility, subscript this line.

- Line 22--If you have more than one hospital-based HHA, subscript this line.

- Line 23--Enter data for an ASC. If you have more than one ASC, subscript this line.

- Line 24--Enter days applicable to hospice patients in a distinct part hospice.

- Line 30--Enter in column 8 the employee discount days if applicable. These days are used on Worksheet E, Part A, line 31 in the calculation of the DSH adjustment and Worksheet E-3, Part III, line 3 in the calculation of the LIP adjustment.

- Line 31--Enter in column 8 the employee discount days, if applicable, for IRF subproviders.

- For the purposes of reporting on this line, labor and delivery days are defined as days during which a maternity patient is in the labor/delivery room ancillary area at midnight at the time of census taking, and is not included in the census of the in...

- Line 33--See instructions for “Columns 5 through 7 of this worksheet.

- 4005.2 Part II - Hospital Wage Index Information.--This worksheet provides for the collection of hospital wage data which is needed to update the hospital wage index applied to the labor-related portion of the national average standardized amounts of ...

- NOTE: Any line reference for Worksheets A and A-6 includes all subscripts of that line.

- Column 2

- Line 1--Enter from Worksheet A, column 1, line 200, the wages and salaries paid to hospital employees increased by amounts paid for vacation, holiday, sick, other paid-time-off (PTO), severance, and bonus pay if not reported in column 1.

- Column 4--Enter on each line the result of column 2 plus or minus column 3.

- Enter the number of hours in your normal work week in the space provided.

- Report in column 2 the FTE contracted and consultant staff of the outpatient rehabilitation provider.

- Column Descriptions for Lines 3 Through 200

- Column 1--The case mix resource utilization group (RUGs) designations are already entered in this column.

- Column 3--Enter the number of days associated with the swing beds. All swingbed SNF payment data will be reported as a total amount paid under the RUG PPS payment system on Worksheet E-2, line 1 and will be generated from the PS&R or your records.

- Column 4--Enter the sum total of columns 2 and 3.

- Line 201--Enter in column 1, the CBSA code in effect at the beginning of the cost reporting period. Enter in column 2, the CBSA code in effect on or after October 1 of the current cost reporting period, if applicable.

- R1P240_2.pdf

- Lines 1 and 2--Enter the full address of the RHC/FQHC.

- Line 14--Identify provider’s name and CCN number filing the consolidated cost report.

- Lines 24 - 29--Reserved for future use.

- Lines 36 - 39--Reserved for future use.

- Lines 47-49--Reserved for future use.

- Lines 77 - 87--Reserved for future use.

- Line 91--Enter the costs of the emergency room cost center.

- Lines 96 and 97--Use these lines to report durable medical equipment rented or sold, respectively. Enter the direct expenses incurred in renting or selling durable medical equipment (DME) items to patients. Also, include all direct expenses incurred...

- Column Descriptions

- Line 7--Enter the standard travel expense rate applicable. (See CMS Pub. 15-1, chapter 14.)

- Line 9--Enter in the appropriate columns the total number of hours worked for each category.

- NOTE: There is no travel allowance for aides employed by outside suppliers.

- When you furnish therapy services from outside suppliers to health care program patients but simply arrange for such services for non health care program patients and do not pay the non health care program portion of such services, your books reflect ...

- R1P240_3.pdf

- NOTE: Do not transfer negative numbers.

- Column Descriptions

- Since capital-related cost, non-physician anesthetists, and approved education programs are not included in the operating cost per discharge, columns 19 through 23, lines 30 through 194 are shaded on Worksheet B, Part II, for all lines except 19 throu...

- Line Descriptions

- Column Descriptions

- Inpatient routine service cost centers

- Inpatient ancillary

- Other Reimbursable

- Special Purpose

- Column 3--Enter on each cost center line the sum of columns 1 and 2.

- Ratios

- Hospital, subprovider, SNF, NF, swing

- Column Descriptions

- Column 3--For each line, subtract column 2 from column 1, and enter the result.

- Column 4--Multiply column 2 by the appropriate capital reduction percentage, and enter the result.

- Column 6--Subtract columns 4 and 5 from column 1, and enter the result.

- Column 7--Enter the total charges from Worksheet C, Part I, column 8.

- Column 8--Divide column 6 by column 7, and enter the result.

- Column 5--Enter the sum of columns 1 through 3 (including subscripts) minus column 4.

- Exclude charges for which costs were excluded on Worksheet A-8. For example, CRNA costs reimbursed on a fee schedule are excluded from total cost on Worksheet A-8. For titles V and XIX, enter the appropriate outpatient service charges.

- For title XVIII, complete a separate Worksheet D, Part V, for each provider component as applicable. Enter the applicable component number in addition to the hospital provider number. Make no entries in columns 5 through 7 of this worksheet for any c...

- Column 4--Cost Reimbursed Services Not Subject to Deductibles and Coinsurance--Vaccine Cost Apportionment--This column provides for the apportionment of costs which are not subject to deductible and coinsurance i.e., Pneumococcal, Influenza, Hepatitis...

- Line Descriptions

- Line 200--Enter the sum of lines 50 through 98.

- Transfer References

- Definitions

- The following definitions apply to days used on this worksheet.

- Lines 1 through 16--Inpatient days reported, unless specifically stated, exclude days applicable to newborn and intensive care type patient stays. Report separately the required statistics for the hospital, each subprovider, hospital-based SNF, hospi...

- Column 5--Multiply the average cost per diem in column 3 by the program days in column 4.

- Line 52--Enter the sum of lines 50 and 51.

- 4025.3 Part III - Skilled Nursing Facility, Other Nursing Facility, and Intermediate Care Facility/Mental Retardation Only--This part provides for the apportionment of inpatient operating costs to titles V, XVIII, and XIX. Hospital-based SNFs comple...

- Line Descriptions

- Line 70--Enter the hospital-based SNF or other nursing facility routine service cost from Part I, line 37.

- Line 78--Calculate the inpatient routine service cost by subtracting line 77 from line 74.

- Line 79--Enter the aggregate charges to beneficiaries for excess costs obtained from your records.

- Line 84-- Enter the program ancillary service amount from Worksheet D-3, column 3, line 200.

- Line 88--Calculate the result of general inpatient routine cost on line 27 divided by line 2.

- Line 74--Enter the sum of lines 70 through 73.

- Line 83--Enter in columns 1 and 2 the applicable number of unusable organs.

- NOTE: CAHs do not complete this worksheet.

- Line Descriptions

- R1P240_4.pdf

- Part A - Inpatient Hospital Services Under PPS

- 4030.1 Part A - Inpatient Hospital Services Under IPPS--

- Line Descriptions

- NOTE: Reduce the bed days available by swing bed days (Worksheet S-3, Part I, column 8, sum of lines 5 and 6), and the number of observation days (Worksheet S-3, Part I, column 8, line 28).

- Calculation of the adjusted cap in accordance with 42 CFR 412.105(f):

- Calculation of the allowable current year FTEs:

- from the rolling average has expired (see 42 CFR 412.105(f)(1)(v)), enter on this line the allowable FTE count from line 12 plus the count of previously new FTE residents in that specific program that were added to line 15 of the prior year’s cost rep...

- Line 19--Enter the current year resident to bed ratio. Line 15 divided by line 4.

- Disproportionate Share Adjustment--Section 1886(d)(5)(F) of the Act, as implemented by 42 CFR 412.106, requires additional Medicare payments to hospitals with a disproportionate share of low income patients. Calculate the amount of the Medicare dispr...

- Line 30--Enter the percentage of SSI recipient patient days to Medicare Part A patient days. (Obtain the percentage from your contractor.)

- Line 32--Add lines 30 and 31 to equal the hospital’s DSH patient percentage.

- Lines 35-39--Reserved for future use.

- Line 46--Enter the ESRD payment adjustment (line 44, column 1 times line 45, column 1 times line 41, column 1 plus, if applicable, line 44, column 1 times line 45, column 2 times line 41, column 2).

- Line 55--Enter the net organ acquisition cost from Worksheet(s) D-4, Part III, column 1, line 69.

- Line 56--Enter the cost of teaching physicians from Worksheet D-5, Part II, column 3, line 20.

- Line 58--Enter the ancillary service other pass through costs from Worksheet D, Part IV, column 11, line 200.

- deductible and coinsurance obligation.

- Line 61--Enter the result of line 59 minus line 60.

- Line 62--Enter from the PS&R or your records the deductibles billed to program patients.

- Line 63--Enter from the PS&R or your records the coinsurance billed to program patients.

- Line 64--Enter the program allowable bad debts, reduced by the bad debt recoveries. If recoveries exceed the current year’s bad debts, line 64 and 65 will be negative.

- Line 66--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. These amounts must also be reported on line 64.

- Line 70--Enter any other adjustments. For example, enter an adjustment resulting from changing the recording of vacation pay from cash basis to accrual basis. (See Pub. 15-1, §2146.4.) Specify the adjustment in the space provided.

- Effective for discharges occurring during Federal fiscal years 2011 and 2012, enter on lines 70.97 through 70.99 the additional payment in accordance with ACA of 2010, §§3125 and 10314 which amends §1886(d)(12) of the Act (as implemented by 42 CFR 4...

- Line 74--Enter line 71 minus the sum of lines 72 and 73. Transfer to Worksheet S, Part III.

- NOTE: If a cost report is reopened more than one time, subscript lines 90 through 96, respectively, one time for each time the cost report is reopened.

- 4030.2 Part B - Medical and Other Health Services--Use Worksheet E, Part B, to calculate reimbursement settlement for hospitals, subproviders, and SNFs.

- Line Descriptions

- Line 3--Enter the gross PPS payments received including payment for drugs and device pass through payments.

- Line 5--Enter the hospital specific payment to cost ratio provided by your contractor. If a new provider does not file a full cost report for a cost reporting period that ends prior to January 1, 2001, the provider is not eligible for transitional co...

- Line 6--Enter the result of line 2 times line 5.

- If the sum of lines 3 and 4 is < line 6 complete lines 7 and 8, otherwise do not complete lines 7 and 8.

- Line 7--Enter the result of the sum of lines 3 and 4 divided by line 6.

- Line Descriptions

- Line 21--Enter the amount from line 11, less any amount on reported on line 20 for hospital/services subject to LCC.

- For hospital/services that are not subject to LCC in accordance with 42 CFR 413.13 (e.g., CAHs or nominal charge public or private hospitals identified on Worksheet S-2, lines 155-161), enter the reasonable costs from line 11.

- For CAHs enter on this line 101 percent of line 11.

- Line 22--Enter the cost of services rendered by interns and residents as follows from Worksheet D-2.

- Line 23--For hospitals or subproviders that have elected to be reimbursed for the services of teaching physicians on the basis of cost (see 42 CFR 415.160 and CMS Pub. 15-1, §2148), enter the amount from Worksheet D-5, Part II, column 3, line 21.

- 4030.2 (Cont.) FORM CMS-2552-10 12-10

- Line 27--Subtract lines 25 and 26 from lines 21 and 24 respectively. Add to that result the sum of lines 22 and 23.

- For critical access hospitals (CAHs), enter the lesser of (line 21 minus the sum of lines 25 and 26) or 80 percent times the result of (line 21 minus line 25 minus 101% of lab cost (Worksheet D, Part V, column 6, lines 60, 61, and subscripts) minus 10...

- Line 32--Enter line 30 minus line 31.

- Line 36--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 34.

- Line 37--Enter the sum of lines 32, 33 and 34 or 35 (hospitals and subproviders only).

- 4030.2 (Cont.) FORM CMS-2552-10 12-10

- 4031.1 Part I - Analysis of Payments to Providers for Services Rendered--

- Columns 1 and 2 - Inpatient Part A

- Line Descriptions

- 4031.2 Part II - Calculation of Reimbursement Settlement for Health Information Technology--

- Line Descriptions

- Line 4--Enter the sum of lines 1, 2 and 3.

- Line 6--Enter line 4 minus line 5.

- Line 7--Enter the Part A deductibles.

- Line 8--Enter line 6 less line 7.

- Line 10--Enter the result of subtracting line 9 from line 8.

- Line 13--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 11.

- Line 15--Enter the amount from Worksheet E-4, line 49 for the hospital component only.

- Line 16--Enter the routine service other pass through costs from Worksheet D, Part III, column 9, line 30 for a freestanding facility or lines 40 through 42, as applicable, for the corresponding subproviders. Add to this amount the ancillary service ...

- Line Descriptions

- Line 16--Enter the sum of lines 12, 13, 14 and 15.

- Line 18--Enter line 16 minus line 17.

- Line 19--Enter the Part A deductibles.

- Line 20--Enter line 18 minus line 19.

- Line 22--Enter the result of subtracting line 21 from line 20.

- Line 25--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 23.

- Line 27--Enter the amount from Worksheet E-4, line 49 for the hospital component only.

- Line 28--Enter the routine service other pass through costs from Worksheet D, Part III, column 9, line 30 for a freestanding facility or line 40 for the IPF subprovider. Add to this amount the ancillary service other pass through costs from Worksheet...

- Line Descriptions

- Line 17--Enter the sum of lines 13, 14, 15 and 16.

- Line 19--Enter line 17 minus line 18.

- Line 20--Enter the Part A deductibles.

- Line 21--Enter line 19 less line 20.

- Line 23--Enter the result of subtracting line 22 from line 21.

- Line 26--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 24.

- Line 28--Enter the amount from Worksheet E-4, line 49 for the hospital component only.

- Line 29--Enter the routine service other pass through costs from Worksheet D, Part III, column 9, line 30 for a freestanding facility or line 41 for IRF the subproviders. Add to this amount the ancillary service other pass through costs from Workshee...

- Line Descriptions

- Line 7--Enter the sum of lines 3, 4, 5 and 6.

- Line 9--Enter line 7 minus line 8.

- Line 10--Enter the Part A deductibles.

- Line 11--Enter line 9 less line 10.

- Line 13--Enter the result of subtracting line 12 from line 11.

- Line 16--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 14.

- Line 18--Enter the amount from Worksheet E-4, line 49 for the hospital component only.

- Line 19--Enter the routine service other pass through costs from Worksheet D, Part III, column 9, line 30 for a freestanding facility. Add to this amount the ancillary service other pass through costs from Worksheet D, Part IV, column 11, line 200.

- Line 10--Enter the sum of lines 7 through 9.

- Line 15--Enter the excess of the customary charges on line 14 over the reasonable cost on line 6.

- Computation of Reimbursement Settlement

- Line 19--Enter the sum of lines 6, 17 and 18.

- Line 20--Enter the Part A deductibles billed to Medicare beneficiaries.

- Line 22--Enter line 19 less the sum of lines 20 and 21.

- Line 23--Enter from PS&R or your records the coinsurance billed to Medicare beneficiaries.

- Line 24--Enter line 22 minus line 23.

- Line 27--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 25.

- Line 30--Enter line 28, plus or minus line 29.

- Line Descriptions

- Prospective Payment Amount

- Line 6--Enter any deductible amounts imposed.

- Line 9--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 8.

- Line 10--DRA 2005 SNF Bad Debt--Calculate this line as follows: [((line 8 - line 9) *.7) + line 9]. This is the adjusted SNF reimbursable bad debt in accordance with DRA 2005, section 5004.

- Line Descriptions

- Line 1--Enter the appropriate inpatient operating costs.

- Line 12--Enter the sum of the amounts recorded on lines 8 through 11.

- Prospective Payment Amount

- Line 25--Enter the result of Worksheet L, Part III, line 13 less Worksheet L, Part III, line 17. If this amount is negative, enter zero on this line.

- Line 27--Enter the sum of lines 22 through 26.

- Line 28--For titles V and XIX only, enter the customary charges for PPS.

- Computation of Reimbursement Settlement

- Line 33--Enter any coinsurance amounts imposed.

- Line 38--Enter the result of line 36 plus or minus line 37.

- Line 40--Enter the sum of lines 38 and 39.

- Line 5--Enter the sum of lines 1, 3, and 4, less line 2, to determine the FTE adjusted cap. However, if the resulting cap is less than zero, enter zero on this line.

- Line 7--Enter the lesser of lines 5 or 6.

- Line 10--Enter in column 2 the weighted dental and podiatric resident FTE count for the current year.

- Line 11--Enter in column 1, the amount from column 1, line 9. Enter in column 2, the sum of the amounts in column 2, lines 9 and 10.

- Line 20--Section 422 Direct GME FTE Cap--Enter the number of unweighted allopathic and osteopathic direct GME FTE resident cap slots the hospital received under 42 CFR §413.79(c)(4).

- Line Descriptions

- Line 28--In each column, divide line 26 by line 27 and enter the result (expressed as a decimal).

- Line 42--Enter the Part B Medicare reasonable cost. Enter the sum of the amounts on each title XVIII Worksheet E, Part B, columns 1 and 1.01, sum of lines 1, 2, 9,10, 22, and 23; Worksheet E-2, column 2, line 8; Worksheet H-4, Part I, sum of columns ...

- R1P240_5.pdf

- Line Descriptions

- Line 28--Enter the gross allowable bad debts for dual eligible beneficiaries. This amount is reported for statistical purposes only. This amount must also be reported on line 27.

- Line 29--Enter the result of line 26 plus 27.

- Column Descriptions

- Column 2--This column lists the statistical bases for allocating costs on Worksheet I-3.

- Column 3--Enter paid hours per type of staff listed on lines 1 through 6.

- Column 4--Enter full time equivalents by dividing column 3 by 2080 hours.

- Line Descriptions

- R1P240_6.pdf

- Column 2--Enter the charges for each cost center. Obtain the charges from your records.

- Line 20--Enter the totals of lines 1 through 19 in columns 1, 2, and 4 through 9.

- Line 28--Enter the totals for columns 4 through 9.

- Line 5--Title XVIII CMHCs enter the result obtained by subtracting line 4 from the sum of lines 2 and 3. Titles V and XIX providers not reimbursed under PPS enter the total reasonable costs by subtracting line 4 from line 1.

- Line 18--CMHCs enter 0 (zero) as these services are reimbursed under PPS. For titles V and XIX, enter 100 percent less the applicable coinsurance.

- Line 19--Enter the actual coinsurance billed to program patients (from your records).

- Line 20--For title XVIII, enter the difference of line 17 minus line 19. For titles V and XIX, enter the difference of line 18 minus line 19.

- Line 28--For contractor final settlement, report on this line the amount from Worksheet J-4, line 5.99.

- Line Descriptions

- Line 3--Enter the amount of each retroactive lump sum adjustment and the applicable date.

- Line 4--Transfer the total interim payments to the title XVIII Worksheet J-3, line 27.

- COMPLETE ONLY PART I, II, OR III.

- Line Descriptions

- Lines 3 - 6

- Line 6--Multiply line 5 by the sum of lines 1 and 2.

- Lines 7 - 11

- Enter the amount of the Federal rate portion of the additional capital payment amounts relating to the disproportionate share adjustment. Complete these lines if you answered yes to line 45 on Worksheet S-2. (See 42 CFR 412.312(b)(3).) For hospital...

- Line 9--Add lines 7 and 8, and enter the result.

- Column descriptions

- On lines 5 through 7 and 9, enter the actual number of visits for each type of position.

- Line descriptions

- Line 8--Enter the total of lines 4 through 7.

- Line 10--Enter the cost of health care services from Worksheet M-1, column 7, line 22.

- Line 11--Enter the total nonreimbursable costs from Worksheet M-1, column 7, line 28.

- Line 12--Enter the sum of lines 10 and 11 for the cost of all services (excluding overhead).

- Line 14--Enter the total facility overhead costs incurred from Worksheet M-1, column 7, line 31.

- Line 18--Subtract the amount on line 17 from line 16 and enter the result.

- Line descriptions

- Line 1--Enter the total allowable cost from Worksheet M-2, line 20.

- Line 2--Report vaccine costs on this line from Worksheet M-4.

- Line 3--Subtract the amount on line 2 from the amount on line 1 and enter the result.

- Line 6--Enter the total adjusted visits (sum of lines 4 and 5).

- Line descriptions

- Line 17--Enter the primary payer amounts from your records.

- Line 20--For title XVIII, enter 80 percent of the amount on line 19.

- Line 21--Enter the amount from Worksheet M-4, line 16.

- Line 5--Enter the sum of lines 3 and 4.

- Line Descriptions

- Line 3--Enter the amount of each retroactive lump sum adjustment and the applicable date.

- Line 4--Transfer the total interim payments to the title XVIII Worksheet M-3, line 27.

Medicare

Department of Health and

Human Services (DHHS)

Provider Reimbursement Manual

Part 2, Provider Cost Reporting Forms and

Instructions, Chapter 40, Form CMS 2552-10

Centers for Medicare and

Medicaid Services (CMS)

Transmittal 1

Date: December 2010

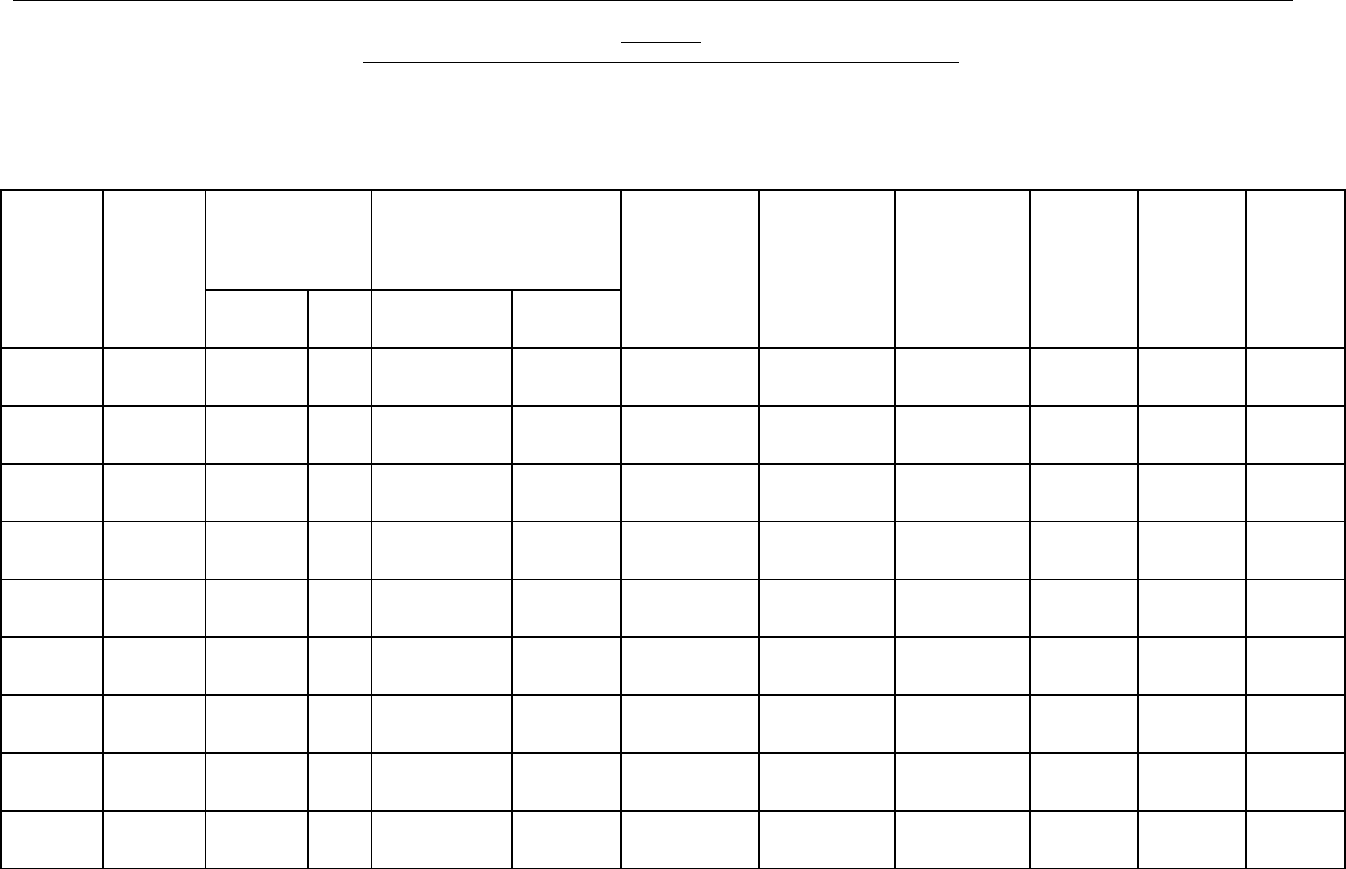

HEADER SECTION NUMBERS

PAGES TO INSERT

PAGES TO DELETE

Table of Contents

Chapter 40

40-1 - 40-6 (6 pp.) -----

4000 - 4070

40-7 - 40-287 (281 pp.)

-----

4090

40-501 - 40-663 (163 pp.)

-----

4095

40-701 - 40-811 (111 pp.)

-----

NEW/REVISED MATERIAL--EFFECTIVE DATE: Cost Reporting Periods Beginning on

or After May 1, 2010.

This transmittal introduces Chapter 40, Hospital and Hospital Health Care Complex Cost Report,

Form CMS-2552-10, which contains instructions for the completion of the new cost report forms

to be filed by hospitals and hospital health care complexes.

The following is a summary of the major revisions to the cost reporting forms:

Form CMS Form CMS

2552-96 Wkst. 2552-10 Wkst. Summary of Changes

S S, Parts I, II &III Added Part I for cost report status, Part II is

now the certification and Part III is now the

settlement summary.

S-2 S-2, Part I Expanded the questions that will generate

other worksheets on the cost report.

S-2, Part II Included the Hospital Cost Report

Questionnaire CMS Form 339 into

CMS-2552-10.

S-3, Part I S-3, Part I Re-designated the subscripted lines and

columns into whole number lines and

columns.

S-3, Part II & III S-3, Part II & III Re-designated the subscripted lines and

columns into whole number lines and

columns.

S-3, Part IV New worksheet to capture wage related cost

that was formerly on the hospital cost

report questionnaire CMS Form 339.

S-3, Part V New worksheet to capture contract

labor and benefit cost.

Pub. 15-2-40

Form CMS Form CMS

2552-96 Wkst. 2552-10 Wkst. Summary of Changes

S-4 S-4 Re-designated the subscripted lines and

columns into whole number lines and

columns.

S-5 S-5 Re-designated the subscripted lines and

into whole number lines.

S-6 S-6 Minor changes.

S-7 S-7 This redesigned worksheet captures all

of the statistics for hospital based skilled

nursing facility (SNFs).

S-8 S-8 Minor changes.

S-9 S-9 No change.

S-10 S-10 Redesigned the entire worksheet.

A A Eliminated “Old Capital,” “New

Capital” designation. Re-designated

the subscripted lines and columns

into whole number lines and columns.

A-6 A-6 No change.

A-7 A-7 Minor changes to conform to

Worksheet A.

A-8 A-8 Minor changes to conform to

Worksheet A.

A-8-1 A-8-1 Minor changes to conform to

Worksheet A.

A-8-2 A-8-2 No change.

A-8-3 A-8-3 Designated the worksheet for cost

reimbursed providers.

A-8-4 Eliminated.

Form CMS Form CMS

2552-96 Wkst. 2552-10 Wkst. Summary of Changes

B, Part I B, Part I Eliminated “Old Capital” and “New Capital”

designation. Re-designated the subscripted

lines and columns into whole number lines

and columns.

B, Part II Eliminated since Old Capital no longer applies.

B, Part III B, Part II Re-designated New Capital to Capital Related

Costs. Re-designated the subscripted lines and

columns into whole number lines and columns.

B-1 B-1 Changes to conform to Worksheet A and B.

C, Parts I - II C, Parts I - II Changes to conform to Worksheet A and B.

C, Parts III - IV Eliminated.

D, Parts I - V D, Parts I - V Minor changes.

D, Part VI Eliminated.

D-1 D-1 Minor changes.

D-2 D-2 Minor changes.

D-4 D-3 Renamed D-4 to D-3 and made minor

changes.

D-6 D-4 Renamed D-6 to D-4 and made minor

changes.

D-9 D-5 Renamed D-9 to D-5 and made minor

changes.

E, Part A E, Part A Re-designated the worksheet to eliminate

obsolete lines and convert subscripted

lines into whole number lines.

E, Part B E, Part B Re-designated the worksheet to eliminate

obsolete lines and convert subscripted lines

into whole number lines.

E, Part C Eliminated.

E, Part D Eliminated.

E, Part E Eliminated.

E-1 E-1, Part I Renamed worksheet with minor changes.

E-1, Part II New section to accommodate the collection of

data necessary to calculate the Health

Information Technology (HIT) payment.

Form CMS Form CMS

2552-96 Wkst. 2552-10 Wkst. Summary of Changes

E-2 Minor changes.

E-3, Part I E-3, Part I Redesigned the worksheet to be used

exclusively by TEFRA reimbursed providers.

E-3, Part II New worksheet to be used exclusively by

Inpatient Psychiatric providers.

E-3, Part III New worksheet to be used exclusively by

Inpatient Rehabilitation providers.

E-3, Part IV New worksheet to be used exclusively by

Long Term Care providers.

E-3, Part II E-3, Part V Redesigned the worksheet to be used

exclusively by cost reimbursed providers.

E-3, Part III E-3, Part VI Redesigned the worksheet now to be used

exclusively for title XVIII SNF

reimbursement.

E-3, Part VII New worksheet for titles V & XIX SNF

reimbursement.

E-3, Part IV E-4 New worksheet to calculate Direct Graduate

Medical Education and ESRD Direct

Graduate Medical Education.

G, G-1, G-2, and G-3 G, G-1, G-2, and G-3 Minor changes. Re-designated the subscripted

lines and into whole number lines.

H H No Change.

H-1 Eliminated data included on Worksheet H.

H-2 Eliminated data included on Worksheet H.

H-3 Eliminated data included on Worksheet H.

H-4, Parts I & II H-1, Parts I & II Renamed the worksheet and eliminated

“Old Capital” and “New Capital” designations.

Re-designated the subscripted lines and

columns into whole number lines and

columns.

H-5, Parts I & II H-2, Parts I & II Renamed the worksheet and eliminated

“Old Capital” and “New Capital” designations.

Re-designated the subscripted lines and

columns into whole number lines and

columns.

Form CMS Form CMS

2552-96 Wkst. 2552-10 Wkst. Summary of Changes

H-6 H-3 Renamed and redesigned the worksheet

to eliminate obsolete data requirements.

H-7 H-4 Eliminated obsolete lines and re-designated

subscripted lines to whole number lines.

H-8 H-5 Renamed the worksheet with some minor

changes.

I-1, I-2, I-3, I-4, & I-5 I-1, I-2, I-3, I-4, & I-5 Eliminated “Old Capital” and “New Capital”

designations. Re-designated the subscripted

lines and columns into whole number

lines and columns.

J-1, J-2, J-3, & J-4 J-1, J-2, J-3, & J-4 Eliminated “Old Capital” and “New Capital”

designations. Re-designated the subscripted

lines and columns into whole number

lines and columns. These worksheets

are now to be used exclusively by CMHC.

K, K-1, K-2, K-3, K, K-1, K-2, K-3,

K-4, Parts I&II K-4, Parts I&II

K-5, Parts I-III, K-5, Parts I-III,

& K-6 & K-6 Eliminated “Old Capital” and “New Capital”

designations. Re-designated the subscripted

lines and columns into whole number

lines and columns.

L L Re-designated the subscripted lines to whole

lines and eliminated the hold harmless

section.

L-1, Parts I-III L-2, Part I-III Eliminated “Old Capital” “New

Capital” designations. Re-designated

the subscripted lines and columns

into whole number lines and

columns.

Paper Reduction Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a

collection of information unless it displays a valid OMB control number. The valid OMB

control number for this information collection is 0938-0050. The time required to complete this

information collection is estimated 673 hours per response, including the time to review

instructions, search existing resources, gather the data needed, and complete and review the

information collection. If you have any comments concerning the accuracy of the time

estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security

Boulevard, Attn: PRA Report Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland

21244-1850.

CHAPTER 40

HOSPITAL AND HOSPITAL

HEALTH CARE COMPLEX COST REPORT

FORM CMS-2552-10

Section

General ............................................................................................................................... 4000

Rounding Standards for Fractional Computations...................... .............................. 4000.1

Acronyms and Abbreviations................................................................ .................... 4000.2

Recommended Sequence for Completing Form CMS-2552-10..................................... ... 4001

Sequence of Assembly...................................................................................................... . 4002

Sequence of Assembly for Non-Proprietary Hospital Participating in Medicare

and Subject to Prospective Payment System ........................................................ 4002.1

Sequence of Assembly for Proprietary Health Care Complex Participating

in Titles V, XVIII, and XIX .................................................................................... 4002.2

Worksheet S - Hospital and Hospital Health Care Complex Cost Report Certification

and Settlement Summary....................................................... ......................................... 4003

Part I - Cost Report Status ........................................................................................ 4003.1

Part II - Certification by Officer or Administrator of Provider(s) ............................. 4003.2

Part III - Settlement Summary...................................................................................4003.3

Worksheet S-2 .................................................................................................................... 4004

Part I - Hospital and Hospital Health Care Complex Identification Data ................. 4004.1

Part II - Hospital and Hospital Heath Care Complex Questionnaire ........................ 4004.2

Worksheet S-3 - Hospital and Hospital Health Care Complex Statistical Data and

Hospital Wage Index Information ................................................................................... 4005

Part I - Hospital and Hospital Health Care Complex Statistical Data ...................... 4005.1

Part II - Hospital Wage Index Information.......................................... ..................... 4005.2

Part III - Hospital Wage Index Summary......................................... ......................... 4005.3

Part IV - Hospital Wage Related Cost ...................................................................... 4005.4

Part V - Hospital and Health Care Complex Contract Labor and Benefit Cost ........ 4005.5

Worksheet S-4 - Hospital-Based Home Health Agency Statistical Data ........................... 4006

Worksheet S-5 - Hospital Renal Dialysis Department Statistical Data ............................. 4007

Worksheet S-6 - Hospital-Based Outpatient Rehabilitation Provider Data......... .............. 4008

Worksheet S-7 - Statistical Data and Prospective Payment for Skilled Nursing

Facilities .................................................... ................................................................... 4009

Worksheet S-8 - Provider-Based Rural Health Clinic/Federally Qualified

Health Center Provider Statistical Data ....................................... ............................... 4010

Worksheet S-9 - Hospice Identification Data .................................................................... 4011

Part I - Enrollment Days Based on Level of Care ..................................................... 4011.1

Part II - Census Data ................................................................................................. 4011.2

Worksheet S-10 - Hospital Uncompensated Care Data ..................................................... 4012

Rev. 1 40-1

CHAPTER 40

Section

Worksheet A - Reclassification and Adjustment of Trial Balance of Expenses ................ 4013

Worksheet A-6 - Reclassifications................................................................................... .. 4014

Worksheet A-7 - Analysis of Capital Assets..................................................................... 4015

Part I - Analysis of Changes in Capital Asset Balances ........................................... 4015.1

Part II - Reconciliation of Capital Cost Centers........................................................ 4015.2

Part III - Reconciliation of Amounts from Worksheet A, Column 2,

Lines 1 thru 2........................................................................................ ................. 4015.3

Worksheet A-8 - Adjustments to Expenses....................................................................... 4016

Worksheet A-8-1 - Statement of Costs of Services from Related Organizations and

Home Office Costs..................................................... ..................................................... 4017

Worksheet A-8-2 - Provider-Based Physician Adjustments.................................. ............ 4018

Worksheet A-8-3 - Reasonable Cost Determination for Therapy Services

Furnished by Outside Suppliers for Cost Based Providers ............................................. 4019

Part I - General Information................................................ ...................................... 4019.1

Part II - Salary Equivalency Computation......................................... ....................... 4019.2

Part III - Standard Travel Allowance and Standard Travel Expense Computation

Provider Site.......................................................................................................... 4019.3

Part IV - Standard Travel Allowance and Standard Travel Expense -

Off Site Services...................................................... .............................................. 4019.4

Part V - Overtime Computation........................................................... ..................... 4019.5

Part VI - Computation of Therapy Limitation and Excess Cost Adjustment ........... 4019.6

Worksheet B, Part I - Cost Allocation - General Service Cost and

Worksheet B-1 - Cost Allocation - Statistical Basis........................................... ............... 4020

Worksheet B, Part II - Allocation of Capital-Related Costs and Worksheet B ................. 4021

Worksheet B-2 - Post Stepdown Adjustments............................................ ....................... 4022

Worksheet C - Computation of Ratio of Cost to Charges and Outpatient

Capital Reduction............................................................................................................ 4023

Part I - Computation of Ratio of Costs to Charges ................................................... 4023.1

Part II - Computation of Ratio of Outpatient Service

Cost to Charge Ratios Net of reductions ................................................................ 4023.2

Worksheet D - Cost Apportionment................................................................................. . 4024

Part I - Apportionment of Inpatient Routine Service Capital Costs........................... 4024.1

Part II - Apportionment of Inpatient Ancillary Service Capital Costs ....................... 4024.2

Part III - Apportionment of Inpatient Routine Service Other Pass

Through Costs........................................................................... .............................. 4024.3

Part IV - Apportionment of Inpatient Ancillary Service Other Pass Through

Costs........................................................................... ............................................. 4024.4

Part V - Apportionment of Medical and Other Health Services Costs ...................... 4024.5

40-2 Rev. 1

CHAPTER 40

Section

Worksheet D-1 - Computation of Inpatient Operating Cost .............................................. 4025

Part I - All Provider Components ................................................................................ 4025.1

Part II - Hospital and Subproviders Only ..................................................................... 4025.2

Part III - Skilled Nursing Facility and Other Nursing Facility Only ............................ 4025.3

Part IV - Computation of Observation Bed Cost ......................................................... 4025.4

Worksheet D-2 - Apportionment of Cost of Services Rendered by Interns and Residents 4026

Part I - Not in Approved Teaching Program ................................................................ 4026.1

Part II - In Approved Teaching Program (Title XVIII, Part B Inpatient Routine

Costs Only) ............................................................................................................... 4026.2

Part III - Summary for Title XVIII ............................................................................... 4026.3

Worksheet D-3 - Inpatient Ancillary Service Cost Apportionment ................................... 4027

Worksheet D-4 - Computation of Organ Acquisition Costs and Charges for Hospitals

Which Are Certified Transplant Centers ........................................................................ 4028

Part I - Computation of Organ Acquisition Costs (Inpatient Routine and

Ancillary Services) .................................................................................................... 4028.1

Part II - Computation of Organ Acquisition Costs (Other Than Inpatients Routine

and Ancillary Service Costs) ..................................................................................... 4028.2

Part III - Summary of Costs and Charges ..................................................................... 4028.3

Part IV - Statistics ........................................................................................................ 4028.4

Worksheet D-5 - Apportionment of Cost for Services of Teaching Physicians ................ 4029

Part I - Reasonable Compensation Equivalent Computation ....................................... 4029.1

Part II - Apportionment of Cost for Services of Teaching Physicians ......................... 4029.2

Worksheet E - Calculation of Reimbursement Settlement ................................................ 4030

Part A - Inpatient Hospital Services Under PPS .......................................................... 4030.1

Part B - Medical and Other Health Services ................................................................ 4030.2

Worksheet E-1 - Analysis of Payments to Providers for Services Rendered ..................... 4031

Part I - Analysis of Payments to Providers for Services Rendered .............................. 4031.1

Part II - Calculation of reimbursement Settlement for Health

Information Technology ............................................................................................ 4031.2

Worksheet E-2 - Calculation of Reimbursement Settlement - Swing Beds ...................... 4032

Worksheet E-3 - Calculation of Reimbursement Settlement ............................................. 4033

Part I - Calculation of Medicare Reimbursement Settlement Under TEFRA .............. 4033.1

Part II - Calculation of Reimbursement Settlement for Medicare Part A Services

- IPF PPS ................................................................................................................... 4033.2

Part III - Calculation of Reimbursement Settlement All Other Health Services

- IRF PPS .................................................................................................................. 4033.3

Part IV - Calculation of Reimbursement Settlement All Other Health Services

- LTCH PPS ............................................................................................................. 4033.4

Part V - Calculation of Reimbursement Settlement for Cost Providers ...................... 4033.5

Part VI - Calculation of Reimbursement Settlement for SNF PPS .............................. 4033.6

Part VII - Calculation of Reimbursement Settlement for Title V & XIX .................... 4033.7

Worksheet E-4 - Direct Graduate Medical Education and ESRD

Outpatient Direct Medical Education Costs ......................................................... 4034

Rev. 1 40-3

CHAPTER 40

Section

Financial Statements Worksheets ...................................................................................... 4040

Worksheet G ................................................................................................................ 4040.1

Worksheet G-1 ............................................................................................................. 4040.2

Worksheet G-2 ............................................................................................................. 4040.3

Worksheet G-3 ............................................................................................................. 4040.4

Worksheet H - Analysis of Provider-Based Home Health Agency Costs ......................... 4041

Worksheet H-1 - Cost Allocation HHA Statistical Basis .................................................. 4042

Worksheet H-2 - Allocation of General Service Costs to HHA Cost Centers ................... 4043

Part I - Allocation of General Service Costs to HHA Cost Centers............................. 4043.1

Part II - Allocation of General Service Cost to HHA Cost Centers - Statistical Basis 4043.2

Worksheet H-3 - Apportionment of Patient Service Costs ................................................ 4044

Part I - Computation of Lesser of Aggregate Medicare Cost Aggregate Medicare

Limitation Cost, or Per Beneficiary Cost Limitation ............................................... 4044.1

Part II - Apportionment of Cost of HHA Services Furnished by Shared Hospital

Departments .............................................................................................................. 4044.2

Worksheet H-4 - Calculation of HHA Reimbursement Settlement ................................... 4045

Part I - Computation of Lesser of Reasonable Cost or Customary Charges ................ 4045.1

Part II - Computation of HHA Reimbursement Settlement ......................................... 4045.2

Worksheet H-5 - Analysis of Payments to Provider-Based HHAs

for Services Rendered to Program Beneficiaries ............................................................ 4046

Worksheet I - Analysis of Renal Dialysis Department Costs ............................................ 4047

Worksheet I-1 - Analysis of Renal Cost ............................................................................ 4048

Worksheet I-2 - Allocation of Renal Department Costs to Treatment Modalities ............ 4049

Worksheet I-3 - Direct and Indirect Renal Dialysis Cost Allocation - Statistical Basis .... 4050

Worksheet I-4 - Computation of Average Cost Per Treatment for Outpatient

Renal Dialysis ................................................................................................................. 4051

Worksheet I-5 - Calculation of Reimbursable Bad Debts - Title XVIII, Part B ................ 4052

40-4 Rev. 1

CHAPTER 40

Section

Worksheet J-1 - Allocation of General Service Costs to CMHC Cost Centers ................ 4053

Part I - Allocation of General Service Costs to CMHC Cost Centers ......................... 4053.1

Part II - Allocation of General Service Costs to CMHC

Cost Centers -Statistical Basis ............................................................................... 4053.2

Worksheet J-2 - Computation of CMHC Provider Costs .................................................. 4054

Part I - Apportionment of CMHC Cost Centers ....................................................... 4054.1

Part II - Apportionment of Cost of CMHC Provider Services Furnished

by Shared Hospital Departments.................... ...................................................... 4054.2

Worksheet J-3 - Calculation of Reimbursement Settlement -

CMHC Provider Services .................................................................................... 4055

Worksheet J-4 - Analysis of Payments to Hospital-Based CMHC

for Services Rendered to Program Beneficiaries ................................................ 4056

Worksheet K - Analysis of Provider-Based Hospice Costs ............................................... 4057

Worksheet K-1 - Compensation Analysis - Salaries and Wage ......................................... 4058

Worksheet K-2 - Compensation Analysis - Employee Benefits (Payroll Related) ............ 4059

Worksheet K-3 - Compensation Analysis - Contracted Services/Purchased Services ...... 4060

Worksheet K-4 - Part I - Cost Allocation - General Service Costs and

Part II - Cost Allocation - Statistical Basis .......................................................... 4061

Worksheet K-5 - Allocation of General Service Costs to Hospice Cost Centers .............. 4062

Part I - Allocation of General Service Costs to Hospice Cost Centers ..................... 4062.1

Part II - Allocation of General Service Costs to Hospice

Cost Centers - Statistical Basis ............................................................................ 4062.2

Part III - Computation of the Total Hospice Shared Costs ....................................... 4062.3

Worksheet K-6 - Calculation of Per Diem Cost ................................................................ 4063

Rev. 1 40-5

CHAPTER 40

Section

Worksheet L - Calculation of Capital Payment.................................................................. 4064

Part I - Fully Prospective Method............................................................................... 4064.1

Part II – Payment Under Reasonable Cost ................................................................. 4064.2

Part III - Computation of Exception Payments........................................................... 4064.3

Worksheet L-1.................................................................................................................... 4065

Part I - Allocation of Allowable Capital Costs for Extraordinary Circumstances ..... 4065.1

Part II - Computation of Program Inpatient Ancillary Service Capital Costs for

Extraordinary Circumstances ................................................................................... 4065.2

Part II - Computation of Program Inpatient Routine Service Capital Costs for

Extraordinary Circumstances..................................................................... ............. 4065.3

Worksheet M-1 - Analysis of Provider Based Rural Health Clinic Federally

Qualified Health Center Costs.................................................................... .................... 4066

Worksheet M-2 - Allocation of Overhead to RHC/FQHC Services....................................4067

Worksheet M-3 - Calculation of Reimbursement Settlement for RHC/FQHC Services ... 4068

Worksheet M-4 - Computation of Pneumococcal and Influenza Vaccine Cost ................ 4069

Worksheet M-5 - Analysis of Payments to Hospital-Based RHC/FQHC

Services Rendered to Program Beneficiaries ........................................................... 4070

Exhibit 1 - Form CMS-2552-10 Worksheets...................................................... ............... 4090

Exhibit 2 - Electronic Reporting Specifications for Form CMS-2552-10 ......................... 4095

40-6 Rev. 1

12-10 FORM CMS-2552-10 4000

4000. GENERAL

The Paperwork Reduction Act of 1995 requires that you be informed why information is collected

and what the information is used for by the government. Section 1886(f)(1) of the Social Security

Act (the Act) requires the Secretary to maintain a system of cost reporting for Prospective Payment

System (PPS) hospitals, which includes a standardized electronic format. In accordance with

§§1815(a), 1833(e), and 1861(v)(1)(A) of the Act, providers of service participating in the Medicare

program are required to submit annual information to achieve settlement of costs for health care

services rendered to Medicare beneficiaries. Also, 42 CFR 413.20(b) requires cost reports on an

annual basis. In accordance with these provisions, all hospital and health care complexes to

determine program payment must complete Form-CMS-2552-10 with a valid Office of Management

and Budget (OMB) control number. In addition to determining program payment, the data submitted

on the cost report support management of the Federal programs, e.g., data extraction in developing

cost limits, data extraction in developing and updating various prospective payment systems. The

information reported on Form CMS-2552-10 must conform to the requirements and principles set

forth in 42 CFR, Part 412, 42 CFR, Part 413, and in the Provider Reimbursement Manual, Part I.

The filing of the cost report is mandatory, and failure to do so results in all payments to be deemed

overpayment and a withhold up to 100 percent until the cost report is received. (See Pub. 15-2,

§100.) Except for the compensation information, the cost report information is considered public

record under the freedom of information act 45 CFR Part 5. The instructions contained in this

chapter are effective for hospitals and hospital health care complexes with cost reporting periods

beginning on or after May 1, 2010.

NOTE: This form is not used by freestanding skilled nursing facilities.

Worksheets are provided on an as needed basis dependent on the needs of the hospital. Not all

worksheets are needed by all hospitals. The following are a few examples of conditions for which

worksheets are needed:

• Reimbursement is claimed for hospital swing beds;

• Reimbursement is claimed for a hospital-based inpatient rehabilitation facility (IRF) or

inpatient psychiatric facility (IPF);

• Reimbursement is claimed for a hospital-based community mental health center (CMHC);

• The hospital has physical therapy services furnished by outside suppliers (applicable for

cost reimbursement and Tax Equity and Fiscal responsibility Act of 1982 (PL97248)

(TEFRA providers, not PPS); or

• The hospital is a certified transplant center (CTC).

NOTE: Public reporting burden for this collection of information is estimated to average 108

hours per response, and record keeping burden is estimated to average 565 hours per

response. This includes time for reviewing instructions, searching existing data sources,

gathering and maintaining data needed, and completing and reviewing the collection of

information. Send comments regarding this burden estimate or any other aspect of this

collection of information, including suggestions for reducing the burden, to:

o Center for Medicare and Medicaid Services

7500 Security Boulevard

Mail Stop C5-03-03

Baltimore, MD 21244-1855

o The Office of Information and Regulatory Affairs

Office of Management and Budget

Washington, DC 20503

Rev. 1 40-7

4000 (Cont.) FORM CMS-2552-10 12-10

Section 4007(b) of the omnibus reconciliation Act (OBRA 1987) states that effective with cost

reporting periods beginning on or after October 1, 1989, you are required to submit your cost report

electronically unless you receive an exemption from CMS. The legislation allows CMS to delay or

waiver implementation if the electronic submission results in financial hardship (in particular for

providers with only a small percentage of Medicare volume). Exemptions are granted on a case-by-

case basis. (See Pub. 15-2, §130.3 for electronically prepared cost reports and requirements.)

In addition to Medicare reimbursement, these forms also provide for the computation of

reimbursement applicable to titles V and XIX to the extent required by individual State programs.

Generally, the worksheets and portions of worksheets applicable to titles V and XIX are completed

only to the extent these forms are required by the State program. However, Worksheets S-3 and D-1

must always be completed with title XIX data.

Each electronic system provides for the step down method of cost finding. This method provides for

allocating the cost of services rendered by each general service cost center to other cost centers,

which utilize the services. Once the costs of a general service cost center have been allocated, that

cost center is considered closed. Once closed, it does not receive any of the costs subsequently

allocated from the remaining general service cost centers. After all costs of the general service cost

centers have been allocated to the remaining cost centers, the total costs of these remaining cost

centers are further distributed to the departmental classification to which they pertain, e.g., hospital

general inpatient routine, subprovider.

The cost report is designed to accommodate a health care complex with multiple entities. If a health

care complex has more than one entity reporting (except skilled nursing facilities and nursing

facilities which cannot exceed more than one hospital-based facility), add additional lines for each

entity by subscripting the line designation. For example, subprovider, line 4, Worksheet S, Part III is

subscripted 4.00 for subprovider I and 4.01 for subprovider II.

NOTE: Follow this sequence of numbering for subscripting lines throughout the cost report.

Similarly, add lines 42.00 and 42.01 to Worksheets A; B, Parts I and II; B-1; C; D, Parts I and III;

and Worksheet L-1, Parts I and II. For multiple use worksheets such as Worksheet D-1, add

subprovider II to the existing designations in the headings and the corresponding component number.

In completing the worksheets, show reductions in expenses in parentheses ( ) unless otherwise

indicated.

4000.1 Rounding Standards for Fractional Computations.--Throughout the Medicare cost report,

required computations result in fractions. The following rounding standards must be employed for

such computations. When performing multiple calculations, round after each calculation. However,

1. Round to 2 decimal places:

a. Percentages

b. Averages, standard work week, payment rates, and cost limits

c. Full time equivalent employees

d. Per diems, hourly rates

2. Round to 3 decimal places:

a. Payment to cost ratio

40-8 Rev. 1

12-10 FORM CMS-2552-10 4000.2

3. Round to 4 decimal places:

a. Wage adjustment factor

b. Medicare SSI ratio

4. Round to 5 decimal places:

a. Payment reduction (e.g., capital reduction, outpatient cost reduction)

5. Round to 6 decimal places:

a. Ratios (e.g., unit cost multipliers, cost/charge ratios, days to days)

Where a difference exists within a column as a result of computing costs using a fraction or decimal,

and therefore the sum of the parts do not equal the whole, the highest amount in that column must

either be increased or decreased by the difference. If it happens that there are two high numbers

equaling the same amount, adjust the first high number from the top of the worksheet for which it

applies.

4000.2 Acronyms and Abbreviations.--Throughout the Medicare cost report and instructions, a

number of acronyms and abbreviations are used. For your convenience, commonly used acronyms

and abbreviations are summarized below.

ACA - Patient Protection and Affordable Care Act

A&G - Administrative and General

AHSEA - Adjusted Hourly Salary Equivalency Amount

ARRA - American Recovery and Reinvestment Act of 2009

ASC - Ambulatory Surgical Center

BBA - Balanced Budget Act

BBRA - Balanced Budget Reform Act

BIPA - Benefits Improvement and Protection Act

CAH - Critical Access Hospitals

CAPD - Continuous Ambulatory Peritoneal Dialysis

CAP-REL - Capital-Related

CBSA - Core Based Statistical Areas

CCN - CMS Certification Number (formerly known as a provider number)

CCPD - Continuous Cycling Peritoneal Dialysis

CCU - Coronary Care Unit

CFR - Code of Federal Regulations

CMHC - Community Mental Health Center

CMS - Center for Medicare and Medicaid Services

COL - Column

CORF - Comprehensive Outpatient Rehabilitation Facility

CRNA - Certified Registered Nurse Anesthetist

CT - Computer Tomography

CTC - Certified Transplant Center

DEFRA - Deficit Reduction Act of 1984

DPP - Disproportionate Patient Percentage

DRA - Deficit Reduction Act of 2005

DRG - Diagnostic Related Group

DSH - Disproportionate Share

EACH - Essential Access Community Hospital

ECR - Electronic Cost Report

EHR - Electronic Health Records

ESRD - End Stage Renal Disease

FQHC - Federally Qualified Health Center

Rev. 1 40-9

4000.3 FORM CMS-2552-10 12-10

FR - Federal Register

FTE - Full Time Equivalent

HCERA - Health Care and Education Reconciliation Act of 2010

HCRIS - Healthcare Cost Report Information System

GME - Graduate Medical Education

HHA - Home Health Agency

HIT - Health Information Technology

HMO - Health Maintenance Organization

HSR - Hospital Specific Rate

I & Rs - Interns and Residents

ICF/MR - Intermediate Care Facility for the Mentally Retarded

ICU - Intensive Care Unit

IME - Indirect Medical Education

INPT - Inpatient

IOM - Internet Only Manual

IPF - Inpatient Psychiatric Facility

IPPS - Inpatient Prospective Payment System

IRF - Inpatient Rehabilitation Facility

LDP - Labor, Delivery and Postpartum

LIP - Low Income Patient

LOS - Length of Stay

LCC - Lesser of Reasonable Cost or Customary Charges

LTCH - Long Term Care Hospital

MA - Medicare Advantage (previously known as M+C)

M+C - Medicare + Choice (also known as Medicare Part C, Medicare Advantage

and Medicare HMO)

MCP - Monthly Capitation Payment

MDH - Medicare Dependent Hospital

MED-ED - Medical Education

MIPPA - Medicare Improvements for Patients and Providers Act of 2008

MMA - Medicare Prescription Drug Improvement and Modernization Act of 2003

MRI - Magnetic Resonance Imaging

MS-DRG - Medicare Severity Diagnosis-Related Group

MSP - Medicare Secondary Payer

NF - Nursing Facility

NPI - National Provider Identifier

NPR - Notice of Program Reimbursement

OBRA - Omnibus Budget Reconciliation Act

OLTC - Other Long Term Care

OOT - Outpatient Occupational Therapy

OPD - Outpatient Department

OPO - Organ Procurement Organization

OPPS - Outpatient Prospective Payment System

OPT - Outpatient Physical Therapy

OSP - Outpatient Speech Pathology

ORF - Outpatient Rehabilitation Facility

PBP - Provider-Based Physician

PPS - Prospective Payment System

PRM - Provider Reimbursement Manual

PRO - Professional Review Organization

PRA - Per Resident Amount

PS&R - Provider Statistical and Reimbursement Report (or System)

PT - Physical Therapy

PTO - Paid Time Off

RCE - Reasonable Compensation Equivalent

RHC - Rural Health Clinic

40-14 Rev. 1

12-10 FORM CMS-2552-10 4001

RPCH - Rural Primary Care Hospitals

RT - Respiratory Therapy

RUG - Resource Utilization Group

SCH - Sole Community Hospitals

SCHIP - State Children’s Health Insurance Program

SNF - Skilled Nursing Facility

SSI - Supplemental Security Income

TEFRA - Tax Equity and Fiscal Responsibility Act of 1982

TOPPS - Transitional Corridor Payment for Outpatient Prospective Payment System

UPIN - Unique Physician Identification Number

WKST - Worksheet

NOTE: In this chapter, TEFRA refers to §1886(b) of the Act and not to the entire Tax Equity

and Fiscal Responsibility Act.

4000.3 Instructional, Regulatory and Statutory Effective Dates.--Throughout the Medicare cost

report instructions, various effective dates implementing instructions, regulations and/or statutes are

utilized.

Where applicable, at the end of select paragraphs and/or sentences the effective date (s) is indicated

in parentheses ( ) for cost reporting periods ending on or after that date, i.e., (12/31/2010). Dates

followed by a “b” are effective for cost reporting periods beginning on or after the specified date, i.e.,

(9/30/2010b). Dates followed by an “s” are effective for services rendered on or after the specified

date, i.e., (4/1/2010s). Instructions not followed by an effective date are effective retroactive back to

cost reporting periods beginning on or after 5/1/2010 (transmittal 1).

Rev. 1 40-11

4001 (Cont.) FORM CMS-2552-10 12-10

4001. RECOMMENDED SEQUENCE FOR COMPLETING FORM CMS-2552-10

Part I - Statistics, Departmental Cost Adjustments and Cost Allocations

Step Worksheet Instructions

1 S-2, Parts I & II Read §4004.1 - 4004.2. Complete entire

worksheet.

2 S-3, Parts I - V Read §4005 - 4005.5. Complete entire

worksheets.

3 S-4 Read §4006. Complete entire worksheet, if

applicable.

4 S-5 Read §4007. Complete entire worksheet, if

applicable.

5 S-6 Read §4008. Complete entire worksheet, if

applicable.

6 S-7 Read §4009. Complete entire worksheet, if

applicable.

7 S-8 Read §4010. Complete entire worksheet, if

applicable.

8 S-9, Parts I & II Read §4011. Complete entire worksheet, if

applicable.

9 A Read §4013. Complete columns 1-3, lines

1-200.

10 A-6 Read §4014. Complete, if applicable.

11 A Read §4013. Complete columns 4 and 5,

lines 1-200.

12 A-7, Parts I - III Read §4015. Complete entire worksheet.

13 A-8-1 Read §4017. Complete Parts A and B.

14 A-8-2 Read §4018. Complete, if applicable.

15 A-8-3, Parts I - VI Read §§4019 - 4019.6. Complete, if

applicable.

40-12 Rev. 1

12-10 FORM CMS-2552-10 4001 (Cont.)

Step Worksheet Instructions

16 A-8 Read §4016. Complete entire worksheet.

17 A Read §4013. Complete columns 6 and 7,

lines 1-200.

18 B, Part I & B-1 Read §4020. Complete all columns through

column 26.

19 B, Part II Read §4021. Complete entire worksheet.

20 B-2 Read §4022. Complete, if applicable.

21 L-1, Part I Read §§4065 and 4065.1. Complete, if

applicable.

Rev. 1 40-13

4001 (Cont.) FORM CMS-2552-10 12-10

Part II - Departmental Cost Distribution and Cost Apportionment

Step Worksheet Instructions

1 C Read §4023 - 4023.1. Complete entire

worksheet.

2 D, Part I Read §§4024 and 4024.1. Complete entire

worksheet.

3 D, Part III Read §§4024 and 4021.3. Complete entire

worksheet.

4 L-1, Part II Read §4065.2. Complete, if applicable.

5 D-1, Parts I & IV Read §§4025, 4025.1 and 4025.4.

Complete both parts.

6 D, Part II Read §§4024 and 4024.2. Complete entire

worksheet. A separate worksheet must be

completed for each applicable healthcare

program for each hospital and subprovider

subject to PPS or TEFRA provisions.

7 D, Part IV Read §§4024 and 4024.4. Complete entire

worksheet. A separate worksheet must be

completed for each applicable health care

program for each hospital and subprovider

subject to PPS or TEFRA provisions.

8 L-1, Part III Read §4065.3. Complete, if applicable.

9 D, Part V Read §§4024 and 4024.5. Complete entire

worksheet. A separate worksheet must be

completed for each applicable health care

program for each applicable provider

component.

10 D-3 Read §4027. Complete entire worksheet.

A separate copy of this worksheet must be

completed for each applicable health care

program for each applicable provider

component.

11 D-1, Parts I & II Read §§4025, 4025.1 and 4025.2. All

providers must complete Part I. The

hospital and subprovider(s) must complete

Part II, lines 38-39 and lines 64-69.

40-14 Rev. 1

12-10

FORM CMS-2552-10

4001 (Cont.)

Step Worksheet Instructions

12 D-1, Parts III & IV Read §§4025, 4025.3 and 4025.4. Only the

hospital-based SNF and hospital-based NF

must complete Part III, lines 70-86. All

providers must complete Part IV.

13 D-2, Parts I - III Read §§4026 - 4026.3. Complete only

those parts that are applicable. Do not

complete Part III unless both Parts I and II

are completed.

14 L, Parts I - III Read §4064. Complete applicable parts.

15 D-5, Parts I & II Read §§4029 - 4029.2. Complete entire

worksheet, if applicable.

16 D-4, Parts I - IV Read §§4028 - 4028.4. Complete only if

hospital is a certified transplant center.

17 E-4 Read §§4034. Complete entire worksheet,

if applicable.

Rev. 1

40-15

4001 (Cont.) FORM CMS-2552-10 12-10

Part III - Calculation and Apportionment of Hospital-Based Facilities

A. Title XVIII - For SNF Only Reimbursed Under PPS.--

Step Worksheet Instructions

1 E-3, Part VI Read §4033.6. If applicable, complete lines

1-15 for title XVIII SNF PPS services.

2 E-1, Part I Read §4031.1. Complete this worksheet for

title XVIII services corresponding to

Worksheet E-3, Part VI.

3 E-3, Part VI Complete the remainder of this worksheet,

lines 16-19.

B. Titles V and XIX - For Hospital, Subprovider(s), NF and ICF/MRs.--

Step Worksheet Instructions

4 E-3, Part VII Read §4033.7. If applicable, complete

entire worksheet for titles V and XIX

services. Use a separate worksheet for

each title.

C. Title XVIII - For Swing Bed-SNF and Titles V and XIX - For Swing Bed-NF.--

Step Worksheet Instructions

5 E-2 Read §4032. Complete a separate copy of

this worksheet (lines 1-19) for each

applicable health care program for each

applicable provider component. Only

entries applicable to title XVIII are made

in column 2. Complete lines 9, 13, and 17

of column 1 for titles V and XIX and

columns 1 and 2 for title XVIII.

6 E-1, Part I Read §4031.1. Complete this worksheet

for title XVIII services corresponding to

Worksheet E-2 title XVIII swing bed-SNF

only.

7 E-2 Complete the remainder of this worksheet,

lines 20-23.

40-16

Rev. 1

12-10 FORM CMS-2552-10 4001 (Cont.)

D. Title XVIII Only - For Home Health Agency.--

Step Worksheet Instructions

8 H Read §4041. Complete entire worksheet,

if applicable.

9 H-1, Parts I and II Read §4042. Complete entire worksheet, if

applicable.

10 H-2, Parts I and II Read §§4043 - 4043.2. Complete entire

worksheet, if applicable.

11 H-3, Parts I and II Read §§4044 - 4044.2. Complete entire

worksheet, if applicable.

12 H-4, Parts I and II Read §§4045 - 4045.2. Complete entire

worksheet, if applicable.

13 H-5 Read §4046. Complete entire worksheet, if

applicable.

E. Title XVIII- For ESRD.--

14 I-1 Read §§4047 - 4048. Complete a separate

worksheet for renal dialysis department(s)

and a separate worksheet for home program

dialysis department(s), if applicable.

15 I-2 Read §4049. Complete a separate

worksheet for renal dialysis department(s)

and a separate worksheet for home program

dialysis department(s), if applicable.

16 I-3 Read §4050. Complete a separate

worksheet for renal dialysis department(s)

and a separate worksheet for home program

dialysis department(s), if applicable.

17 I-4 Read §4051. Complete a separate

worksheet for renal dialysis department(s)

and a separate worksheet for home program

dialysis department(s), if applicable.

18 I-5 Read §4052. Complete only one worksheet

combining all renal dialysis departments

and home program dialysis departments, if

applicable.

Rev. 1

40-17

40-17

4001(Cont.) FORM CMS-2552-10 12-10

F. Title XVIII - For CMHC.--

Step Worksheet Instructions

19 J-1, Parts I and II Read §§4053 - 4053.2. Complete entire

worksheet, if applicable.

20 J-2, Part I Read §§4054 - 4054.1. Complete entire

worksheet, if applicable.

21 J-2, Part II Read §4054.2. Complete entire worksheet,

if applicable.

22 J-3 Read §4055. Complete entire worksheet,

if applicable.

23 J-4 Read §4056. Complete lines 1-4 for title

XVIII only.

G. Titles XVIII and XIX - For Provider Based-Hospice.--

24 K-1 Read §4058. Complete entire worksheet,

if applicable.

25 K-2 Read §4059. Complete entire worksheet,

if applicable.

26 K-3 Read §4060. Complete entire worksheet,

if applicable.

27 K Read §4057. Complete entire worksheet,

if applicable.

28 K-4, Parts I and II Read §4061. Complete both worksheets,

if applicable.

29 K-5, Parts I, II & III Read §§4062 - 4062.3. Complete all

worksheets, if applicable.

30 K-6 Read §4063. Complete entire worksheet,

if applicable.

40-18 Rev. 1