Owners Manual

owners_manual

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 41

Version 0.967 (Last Updated 04.17.2018)

Notes:

(1) This draft Owner’s Manual is a work in progress and describes the design and structure of Metronome, a

new type of cryptocurrency. Metronome and its underlying technology is still in development and this

Owner’s Manual will be updated throughout this process to reflect changes throughout the development

cycle. While every measure has been taken to ensure the accuracy of the material, Metronome authors and

their partners do not guarantee the accuracy or completeness of the material found in this Owner’s Manual.

(2) Potential purchasers of Metronome and participants in the Metronome ecosystem should read this

Owner’s Manual, including the acknowledgements and disclaimers in Appendix [A], and should carefully

consider any risks before making a purchase.

0

Owner’s Manual License

© 2018 Autonomous Software. All rights not expressly granted by Licensor are hereby reserved.

AUTONOMOUS SOFTWARE (“LICENSOR”) OWNS AND RETAINS EXCLUSIVE OWNERSHIP OF, AND ALL

RIGHT, TITLE AND INTEREST IN AND TO, ALL COPYRIGHTS AND OTHER INTELLECTUAL PROPERTY

RIGHTS IN AND TO THIS METRONOME OWNER’S MANUAL (THE “OWNER’S MANUAL”) AND THE

GENERICIZED VERSION (DEFINED BELOW). THE OWNER’S MANUAL AND GENERICIZED VERSION ARE

COLLECTIVELY REFERRED TO HEREIN AS THE “WORK.”

“METRONOME,” “MET,” AND THE METRONOME LOGO (COLLECTIVELY, THE “METRONOME MARKS”) ARE

TRADEMARKS OF LICENSOR AND MAY BE USED ONLY WITH LICENSOR’S EXPRESS WRITTEN

PERMISSION. YOU MAY NOT USE THE METRONOME MARKS OR ANY CONFUSINGLY SIMILAR MARK ON

OR IN CONNECTION WITH ANY PRODUCT OR SERVICE, OR IN ANY OTHER MANNER THAT MIGHT CAUSE

CONFUSION IN THE MARKETPLACE, INCLUDING IN ADVERTISING, OR ON SOFTWARE OR HARDWARE.

1. License Grant and Restrictions. Subject to the terms and conditions of this License, Licensor

hereby grants you a worldwide, royalty-free, non-exclusive, perpetual license to copy, display and distribute the

Owner’s Manual in whole (but not in part) without modification, modify or create a derivative work of the

Genericized Version (defined below), and copy, display and distribute such work; provided that none of the

foregoing creates any implication that you are, or that your work or the cryptocurrency, smart contract or technology

described therein is, in any way associated with or endorsed by Licensor or its affiliates. The above rights may be

exercised in all media and formats whether now known or hereafter devised. The above rights include the right to

make such modifications as are technically necessary to exercise the rights in other media and formats. Each time

you distribute or publicly perform the Work, the Licensor grants to the recipient a license to the Work on the same

terms and conditions as the license granted to you under this License. “Genericized Version” means a version of

the Owner’s Manual which does not include or contain any reference to Licensor, to Licensor’s affiliates or to the

words Metronome, MET, or any Metronome Marks.

2. Proposed Modifications to Owner’s Manual. By submitting any proposed modification to the

Owner’s Manual, you hereby assign to Licensor all copyrights without restriction in and to such proposed

modification. As such, Licensor may choose in its sole discretion, to include or not to include any such proposed

modification in the Owner’s Manual (in whole or in part, and in modified or unmodified form).

3. Disclaimer of Representations and Warranties. THE OWNER’S MANUAL IS PROVIDED AS-IS

WITH NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS, IMPLIED, STATUTORY OR

OTHERWISE, INCLUDING, WITHOUT LIMITATION, WARRANTIES OF TITLE, MERCHANTABILITY, FITNESS

FOR A PARTICULAR PURPOSE, NON-INFRINGEMENT, ACCURACY, OR THE PRESENCE OR ABSENCE OF

ERRORS. SOME JURISDICTIONS DO NOT ALLOW THE EXCLUSION OF IMPLIED WARRANTIES, SO SUCH

EXCLUSION MAY NOT APPLY TO YOU.

4. Enforceability. If any provision of this License is invalid or unenforceable under applicable law, it

shall not affect the validity or enforceability of the remainder of the terms of this License, and without further action

by the parties to this agreement, such provision shall be reformed to the minimum extent necessary to make such

provision valid and enforceable. No term or provision of this License shall be deemed waived and no breach

consented to unless such waiver or consent shall be in writing and signed by the party to be charged with such

waiver or consent.

5. Treaty Rights. The rights granted under, and the subject matter referenced, in this License were

drafted utilizing the terminology of the Berne Convention for the Protection of Literary and Artistic Works (as

amended on September 28, 1979), the Rome Convention of 1961, the WIPO Copyright Treaty of 1996, the WIPO

Performances and Phonograms Treaty of 1996 and the Universal Copyright Convention (as revised on July 24,

1971). These rights and subject matter take effect in the relevant jurisdiction in which the License terms are sought

to be enforced according to the corresponding provisions of the implementation of those treaty provisions in the

1

applicable national law. If the standard suite of rights granted under applicable copyright law includes additional

rights not granted under this License, such additional rights are deemed to be included in the License; this License

is not intended to restrict the license of any rights under applicable law.

2

Table of contents

Table of contents 3

List of Tables and Figures 4

Motivations 5

Taking cryptocurrency to the next level… literally 7

Executive Summary 8

Background 10

Blockchain technology 10

Cryptocurrency 10

Descending price auctions 11

Introducing Metronome 12

How Metronome Works 12

Cross-Blockchain Portability 15

Distributed, voluntary consensus governance 15

Cryptocurrency market context to date 17

The landscape 17

Metronome contracts and technical aspects 22

Metronome Proceeds and Autonomous Converter Contracts 22

Token Supply Economics 26

Theory 26

Supply schedule 26

Metronome Core 27

Token API 27

Auction API 30

Metronome Proceeds Contract 31

Proceeds Contract API 31

3

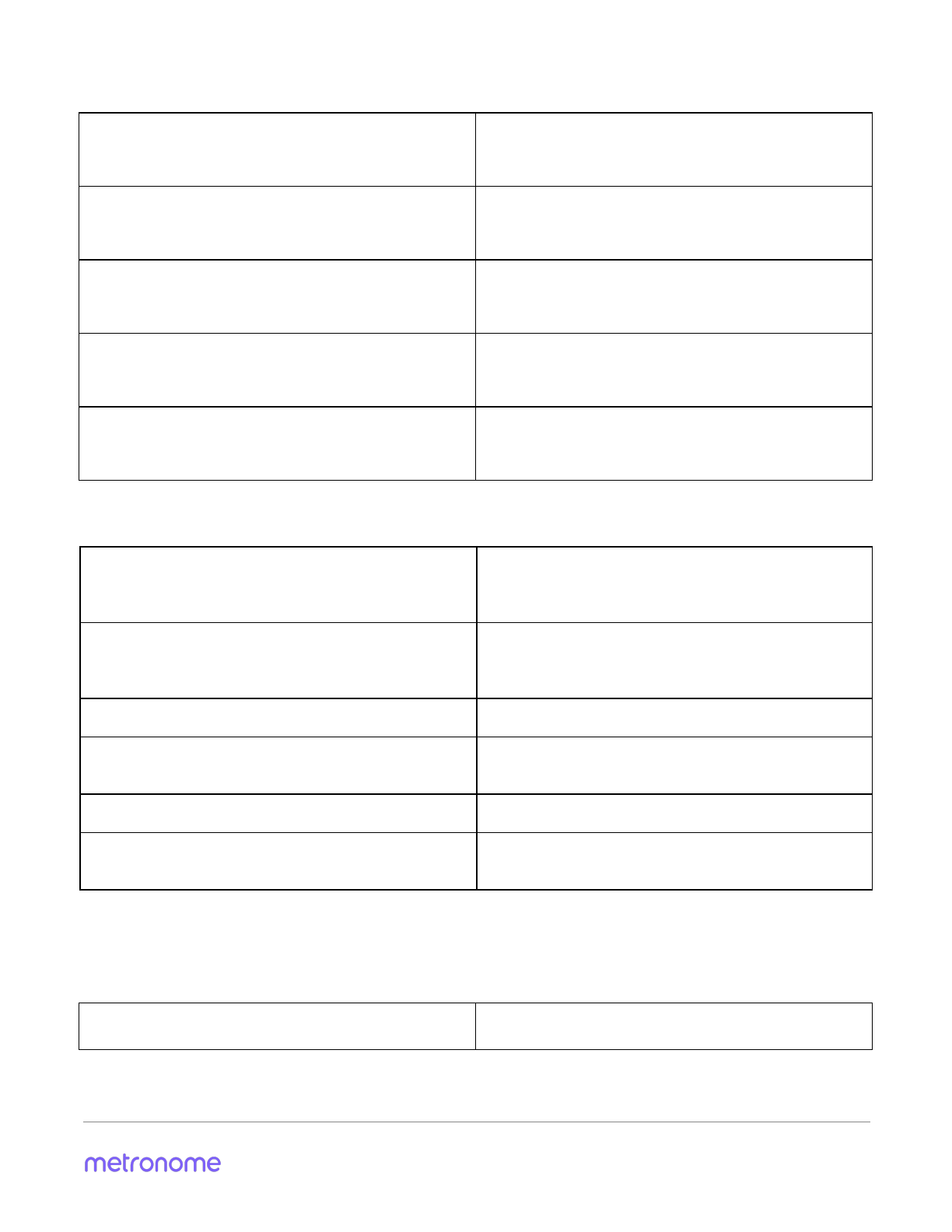

Metronome Autonomous Converter Contract 32

Autonomous Converter Contract API 32

TokenLocker 33

TokenLocker API 33

TokenPorter 33

TokenPorter API 33

Glossary of Contract Terms 35

APPENDIX A 36

List of Tables and Figures

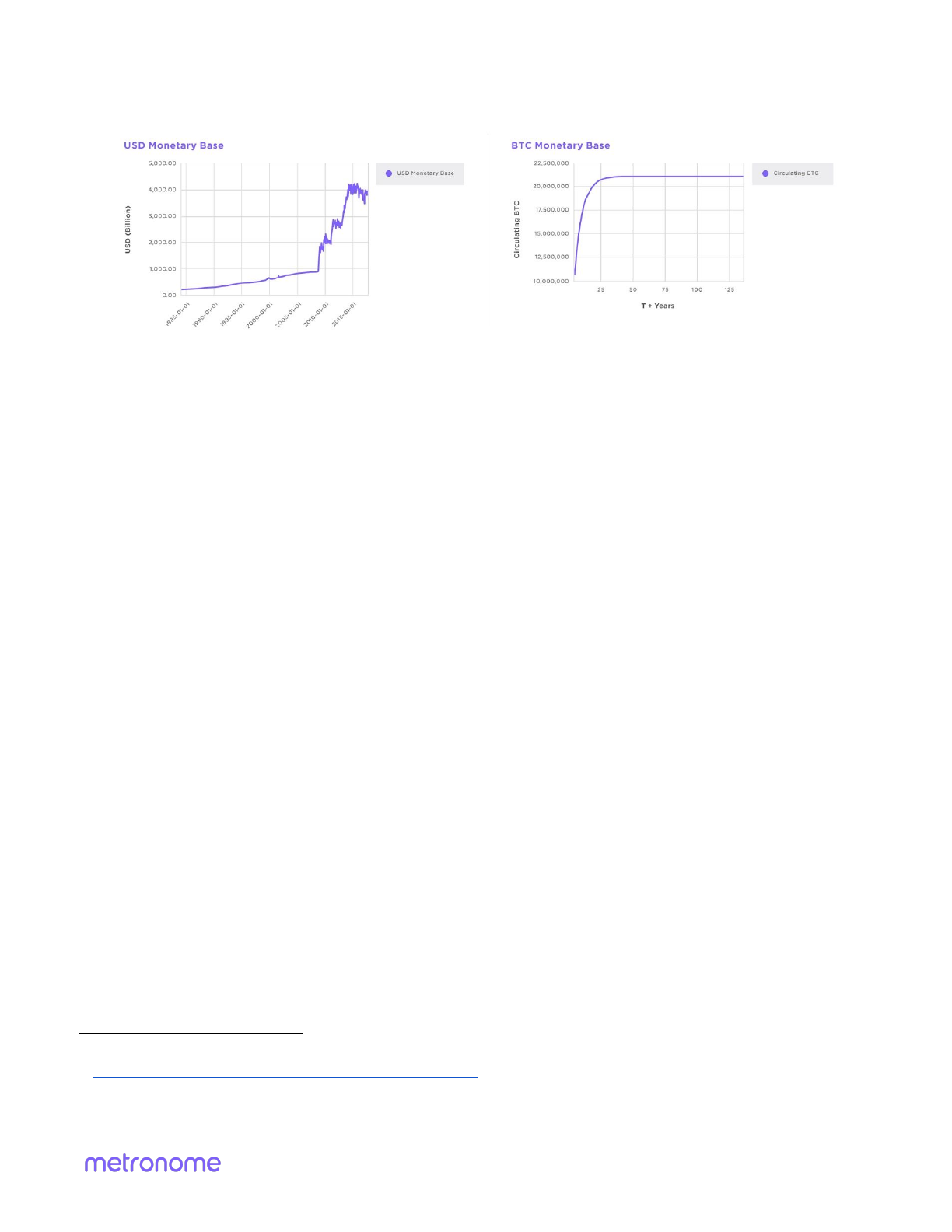

Figure 1: USD and BTC monetary base comparison 11

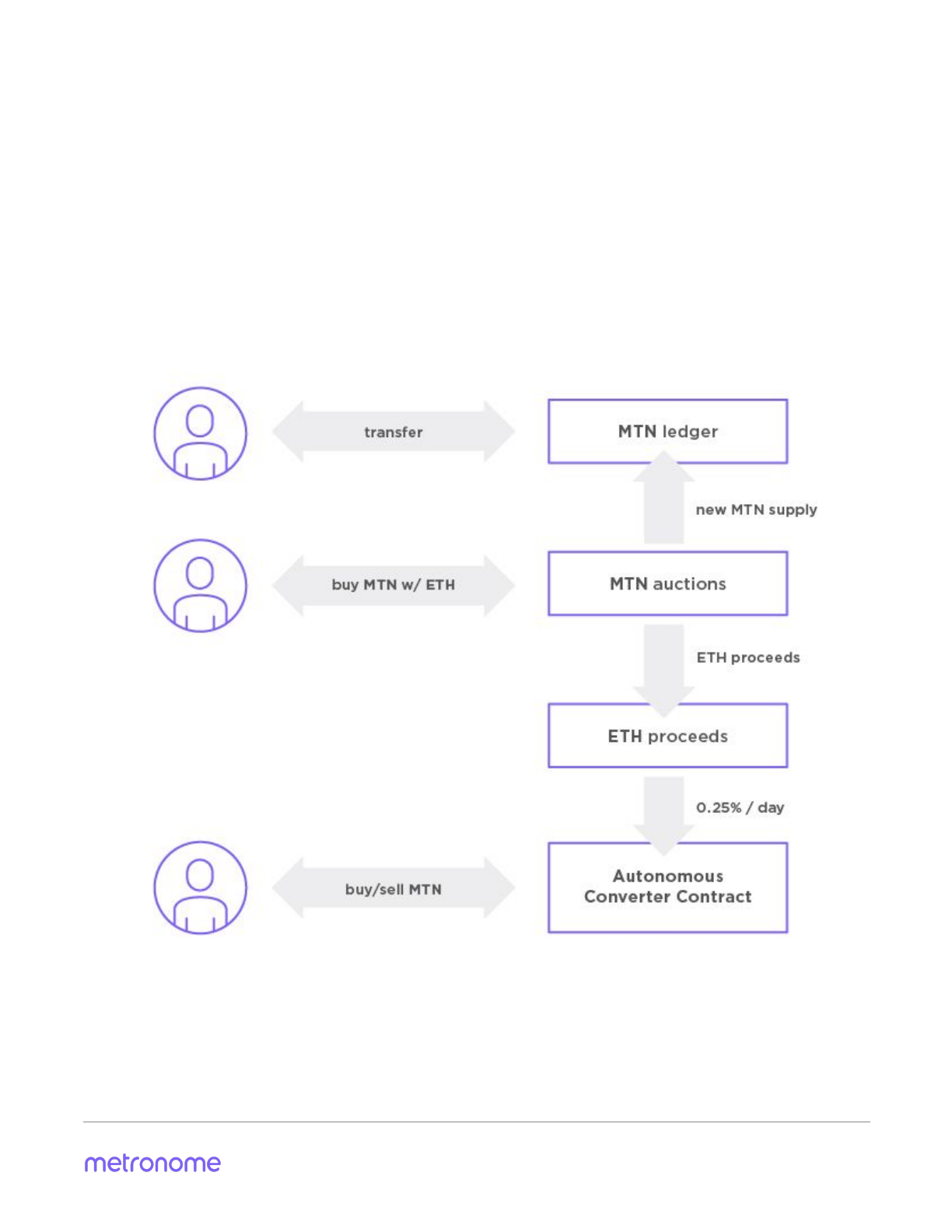

Figure 2: The flow of and interaction between Metronome contracts 12

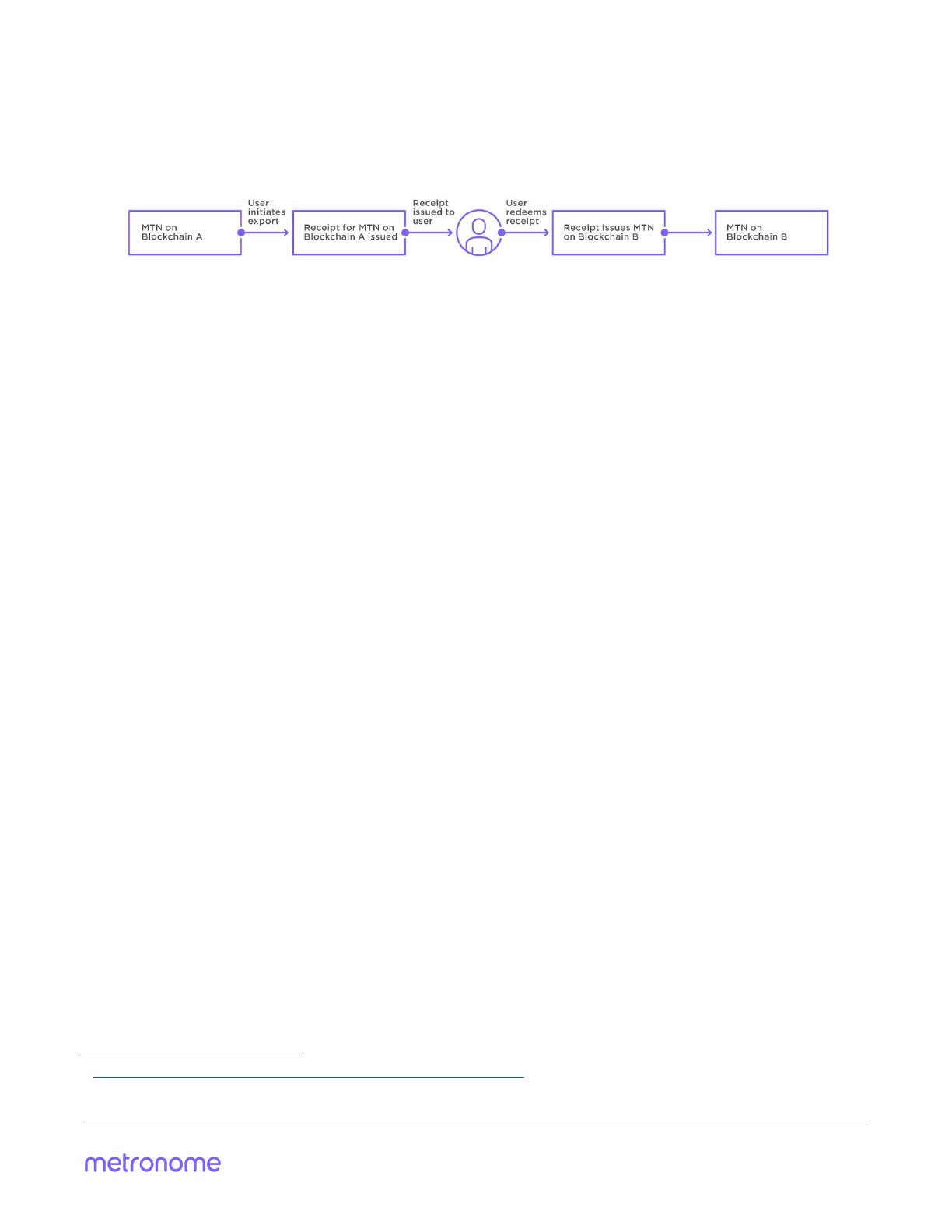

Figure 3: Demonstration of cross-blockchain portability 15

Figure 4: Popular cryptocurrency mintage 17

Figure 5: Comparison of Bitcoin and Metronome mintage and supply 18

Figure 6: Comparison between ZEC and MTN author’s retention 19

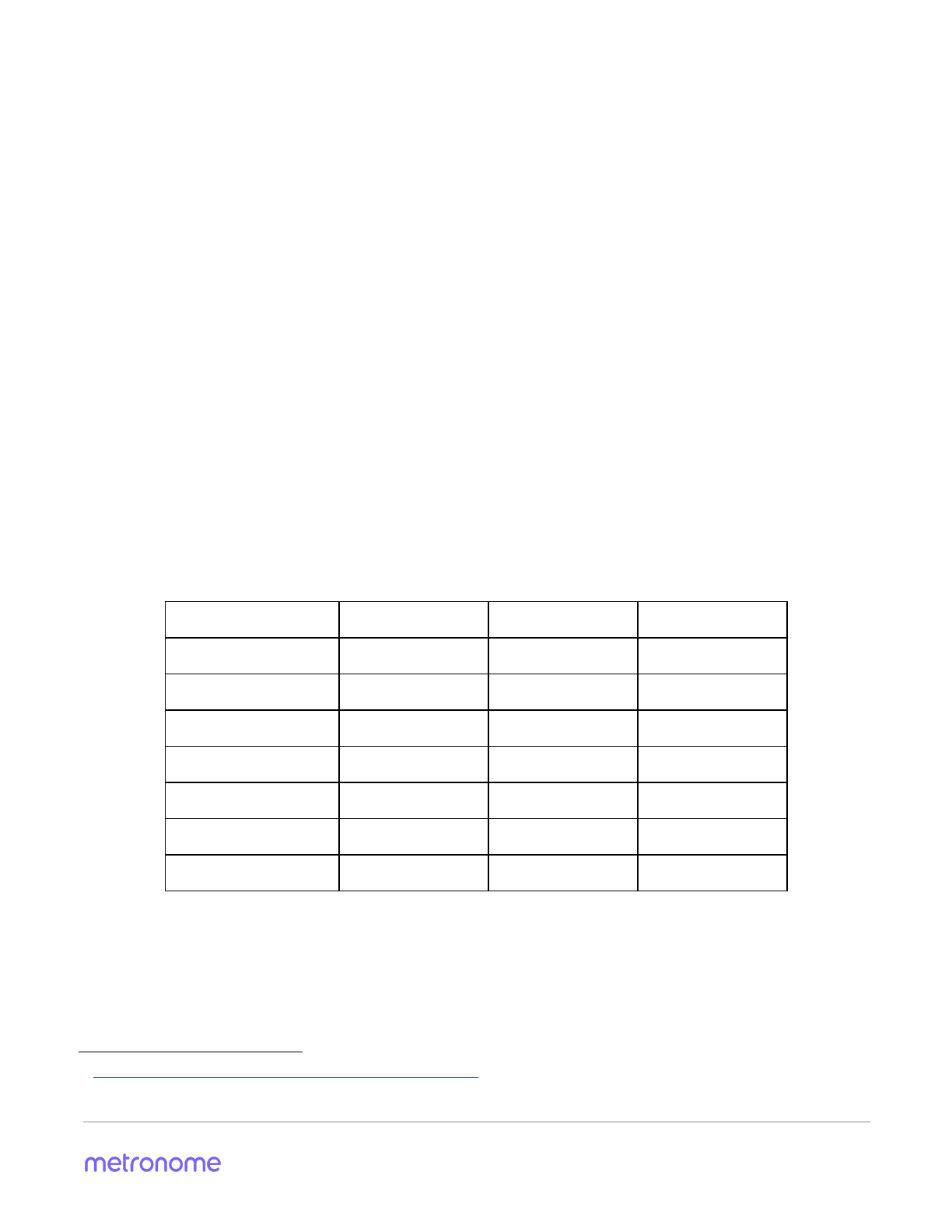

Table 1: Comparison of important attributes between today’s cryptocurrencies 20

Figure 7: How the Autonomous Converter Contract works 23

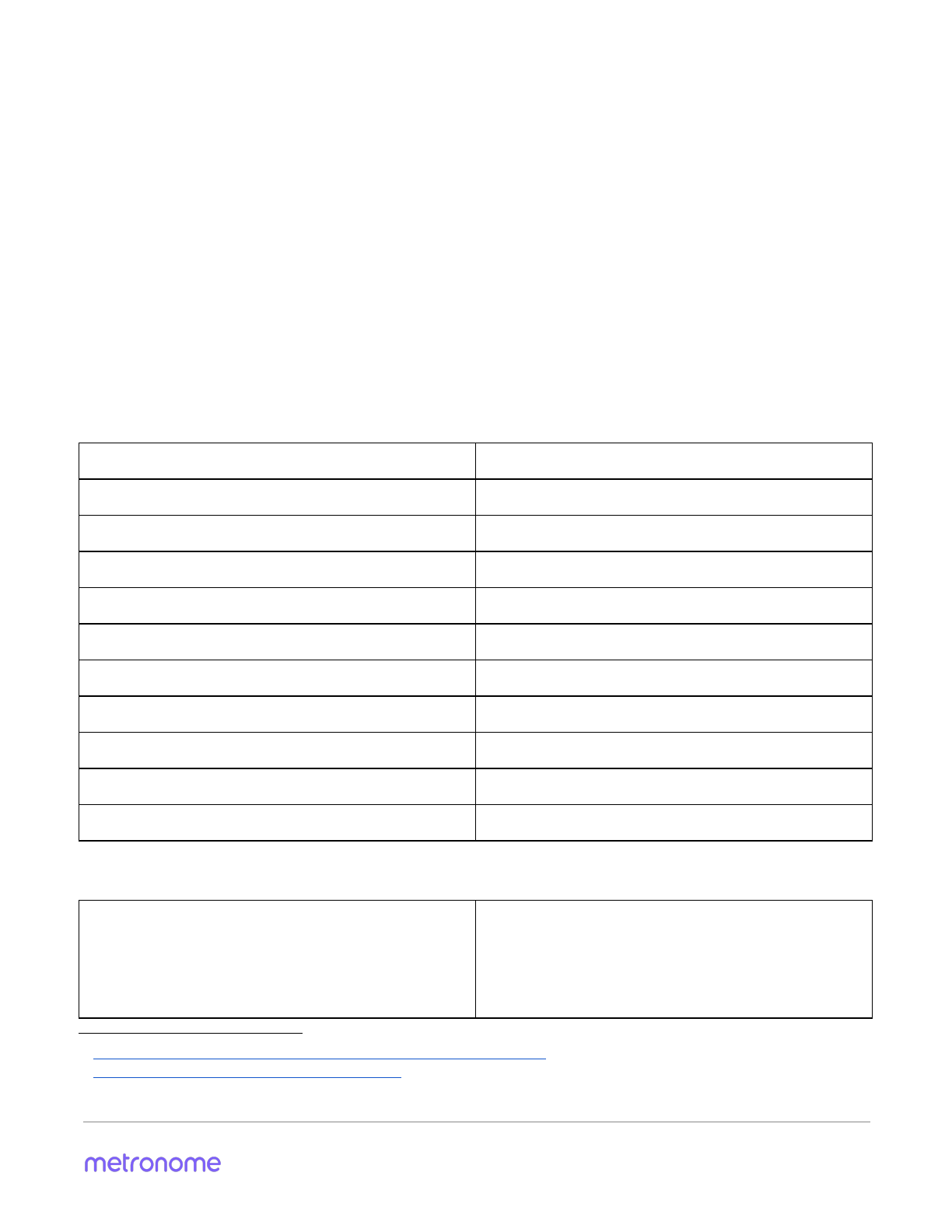

Table 2: Supply Schedule 26

4

Motivations

In the development of Metronome, the Metronome authors aspire to take the lessons learned from previous

cryptocurrencies and build one whose sole purpose is to be a long-term monetary system. With this in mind,

the Metronome authors saw a novel opportunity in:

●Economically engineering something to last

●Bootstrapping decentralized financial products

●Ensuring equal access to token distribution

●Ensuring autonomous, self-governing contracts

●Taking cryptocurrency to the next level... literally

Economically engineering something to last

Some cryptocurrencies' mintage is either static or goes to zero over time – like Bitcoin ,and Litecoin – raising

1 2 3

questions with economists about their long term viability. , , Other cryptocurrencies’ token supply is

4 5

hand-stitched together in pre-ICO deals that award certain parties a vast amount of supply, resulting in those

parties controlling the majority of tokens. Some cryptocurrencies sell out to certain parties in a pre-sale or

private sale, leaving very little to the general public. Metronome attempts to fix those problems with daily

auctions that provide an on-going token supply mintage, ad infinitum. An on-going token supply mintage is

theorized to provide sustainability versus other cryptocurrencies whose mintage either is or goes to zero. ,

6 7

The Metronome team expects that this will also encourage MTN holders to use the many payment features of

Metronome. Utilizing those use cases, actually using it as a currency, may help solidify its endurance. The

Metronome team also believes that an ongoing mintage also dilutes any potential disproportionate amounts

purchased at a given time. Through Metronome, the team believes it is engineering something that is

built-to-last. Longevity is Metronome’s main goal.

Bootstrapping decentralized financial products

Bootstrapping decentralized systems into self-sustainability is a new thing, more art than science. Metronome

is attempting to break new ground here. All proceeds from Metronome’s auctions are sent to two separate

smart contracts, which are designed –among other things– to provide liquidity to MTN owners that may want

8

to sell.

9

1 https://medium.com/@jgarzik/bitcoin-is-being-hot-wired-for-settlement-a5beb1df223a

2 https://bitcoin.org/bitcoin.pdf

3 https://bitcointalk.org/index.php?topic=47417.0

4 https://www.economist.com/blogs/freeexchange/2014/04/money

5 https://econjwatch.org/file_download/139/2007-01-hummel-com.pdf?mimetype=pdf

6 https://econjwatch.org/file_download/139/2007-01-hummel-com.pdf?mimetype=pdf

7 Tsiang, S.C., Journal of Money, Credit and Banking, I(1969), pp. 266–80 "A Critical Note on the Optimum Supply

of Money"

8 https://medium.com/@MetronomeToken/on-metronome-author-retention-and-contract-behavior-73dad8f16494

9 https://medium.com/@MetronomeToken/proceeds-for-the-community-not-the-authors-d41874d4d41f

5

By having all auction proceeds stay within the Metronome ecosystem, the Metronome team anticipates that it

will thrive. Further, the team expects that others will study Metronome’s model for their projects and

products.

Ensuring equal access to token distribution

Cryptocurrency should be more egalitarian. More than just the 1% should have access to the world's next

cryptocurrency. Distributing access to the cryptocurrency widely to the public reduces the number of

stakeholders with large percentage stakes compared to the entire Metronome economy.

The descending price auction aims to distribute the token at a price purchasers deem fair. Other ICOs' token

10

distribution is hand-engineered and often most is gone in pre-sales and private sales before the public ever

gets access.

11

Metronome employs a descending price auction for both its Initial Supply Auction and Daily Supply Lots, with

public access to all auction opportunities. There is no presale, whitelist, or any bonus. Everyone participating

12

in any Metronome auction will need to operate within the same rules as everyone else: purchase at a given

price or wait for the price to descend. No one is excluded from or privileged in these public auctions.

13

The Metronome team believes conducting the Initial Supply Auction this way may discourage whales and

other large players within the space from dominating the supply of MTN –as access to disproportionate

amounts of MTN would potentially require purchasing above discovered market price–, and the team believes

it will encourage a fairer distribution among the community of purchasers. Metronome is not looking for a

quick pop for short term speculators, rather, every aspect of the initial supply auction attempts to provide

fairer access to and fairer distribution of MTN.

Autonomous, self-governing contracts

Humans are fallible. Software and math are more predictable decades and further into the future. An

algorithm is apolitical, and will not hyper-inflate or manipulate the currency at the discretion of humans. With

autonomous, self-governing contracts there are no humans to affect the value of cryptocurrency at the

14

human’s discretion. To this end, the Metronome smart contracts’ ownership functions will be locked down,

such that following launch no one can take ownership of them. Metronome will be fully autonomous.

Metronome was engineered to be self-adjusting and self-governing. To that end, Metronome’s contracts are

fully autonomous and we believe will behave predictably, without intervention of the authors.

10 http://onlinelibrary.wiley.com/doi/10.3982/TE502/pdf

11

http://markets.businessinsider.com/news/stocks/Etherparty-Pre-sale-Sells-Out-Receives-Over-25MPublic-ICO-sale-

launches-Oct-1-1002374859

12 https://medium.com/@MetronomeToken/what-is-a-descending-price-auction-8c0770bb6a71

13 https://medium.com/@MetronomeToken/fairness-as-a-first-order-variable-8012a5c22ed1

14 https://medium.com/@MetronomeToken/self-governance-as-a-design-goal-fc06afd61dd5

6

Taking cryptocurrency to the next level… literally

Every other cryptocurrency is tied to one blockchain network. LTC is only recorded on the Litecoin blockchain.

BTC is only recorded on the Bitcoin blockchain. There are risks in being tied to just one railroad: management

discord, supply uncertainty, etc. The market does not know that cross-blockchain are even possible, much

less a need.

Metronome is the first cryptocurrency that is not tied to one blockchain forevermore. It is the first

cryptocurrency that has the potential to be secured by the best blockchain networks, without permanent

commitment to any one blockchain. This is a completely new concept, even in the innovative cryptocurrency

space.

7

Executive Summary

Metronome (“Metronome” or “MTN”) is a new cryptocurrency, engineered for institutional-level endurance.

Metronome incorporates lessons learned from other cryptocurrencies like Bitcoin and Ethereum and is

designed to be used for the next 100 years and beyond.

Metronome will be launched to the public with equal opportunity for access. Metronome will have zero

founder privileges after launch and features a highly-predictable and reliable token supply.

The Metronome token supply:

●10,000,000 initial MTN supply

○8,000,000 distributed via public descending price auction, as described in more detail below

○2,000,000 distributed to founders as founder retention (20%)

■Minted to special TokenLocker contract (see API section)

●25% available for use by authors at end of Initial Supply Auction

●The remaining 75% becomes available in 12 equal amounts over 12 calendar

quarters

●Only Metronome Authors can withdraw from their TokenLocker contract, and

only at the specific times above

●New MTN minted daily

○Daily minted MTN distributed via public descending price auction

○Daily minted volume at (i) 2,880 MTN per day, or (ii) an annual rate equal to 2.0000% of the

then-outstanding MTN supply per year

The three core design principles of Metronome are self-governance, reliability, and portability. They make

Metronome unique and enduring.

●Self-Governance

○No undue founder influence after launch – autonomously governed by smart contracts

○Resistant to individual or community discord, disagreement or misinterpretation

○Public access to all sale opportunities

○100% on-chain, decentralized, auditable

○Pricing via descending price auction

●Reliability

○Predictable token supply

○New MTN minted daily ad infinitum, at the greater of (i) 2,880 MTN per day, or (ii) an annual

rate equal to 2.0000% of the then-outstanding MTN supply per year

○Stable, predictable minting of new token supply ad infinitum

○Architected for predictable pricing

●Portability

○Cross-blockchain portability allows provable export to, and import from, different contracts or

different chains

■Further protects the cryptocurrency from governance issues and instability

○Community development of new chain export and import functionalities

○Enables a migration path to future blockchains as the ledger technology platform matures

●Additional features

8

○Initial payments expected to be settled in 15 to 30 seconds – Settlement times are based on

underlying blockchain

○Mass pay – allowing multiple payments to be sent in one batch

○Subscriptions – allowing for recurring payments between users

○ERC20- and ERC827-compliant

15

■The ERC827 extension is the latest standard with enhanced decentralization transfer

and security features

In this document, we propose Metronome as a new cryptocurrency that uniquely satisfies the above criteria

as the world’s first self-governing, cross-blockchain cryptocurrency. We anticipate that the cryptocurrency and

other token communities will devise their own uses for it.

To that end, and in the interest of self-governance, the Metronome authors will have no privileged interest in

the Metronome token after the initial auction. Metronome will use a descending price auction for both its

initial auction and Daily Supply Lot to give purchasers the opportunity to purchase at the price that they feel is

fair.

15 https://github.com/ethereum/EIPs/issues/827

9

Background

Blockchain technology

Blockchain is a new type of cryptographically-secure record-keeping technology, that has major implications

in the finance sector. It is a distributed and—usually—decentralized ledger accounting for all units in its entire

ecosystem. Public and complete ledgers across the entire network need to sync and agree with one another.

These are called nodes. Nodes prevent “double spending” of the blockchain units and also validate

transactions in blocks on the network.

Blocks are packaged transactional data, the hash of the previous block, a targeted hash, and a number called

a nonce. Where nodes validate these blocks, miners write them to the blockchain by attempting to discover a

nonce that makes a hash of all the data in the block meet its targeted hash. For their efforts and

computational power, they are rewarded with newly-minted units of cryptocurrency.

The “chain” in blockchain refers to the unbroken line of mined blocks that miners write to the decentralized

public ledger. Miners must incorporate the data from previous blocks to successfully discover new blocks,

making a traceable history to the very beginning of the cryptocurrency.

Cryptocurrency

A cryptocurrency is a digital currency that uses cryptographic techniques to regulate the addition of new

currency supply into the market. Often, its new issuance is a reward for successfully discovering blocks in the

above-described mining process. The cryptography also verifies the validity of funds changing hands. Only the

private keys held by the transacting users authorizes the transfer of funds between their wallets. Since these

transactions are visible on the blockchain (see above) and the use of cryptographic keys ensures that the user

intends to send funds and has sufficient funds for a transaction, the need for a third party to transfer and

validate the transfer of funds between accounts is reduced. Encryption techniques replace the roles of

clearinghouses and other intermediaries. Therefore, cryptocurrencies have the potential to provide greater

predictability for monetary supply and issuance over fiat currencies.

Where the fiat currency issuance and supply can be managed extensively by their issuing authorities,

cryptocurrencies can only behave as they are engineered to behave. This is why one can predict the monetary

supply and mintage rate of a cryptocurrency with greater ease than predicting the monetary supply rate of a

fiat currency.

10

Figure 1: Comparison between USD monetary base and the popular cryptocurrency’s, (bitcoin’s) token base

16

Since Bitcoin, other cryptocurrencies—both similar and dissimilar—have been created. These

cryptocurrencies collectively make up an active and dynamic market.

Descending price auctions

Currently, most new cryptocurrencies offer their initial disbursements with traditional sales. These sales may

include bonuses, early purchaser pricing, and other incentives to encourage purchasers to buy all of their

supply. While these incentives can help, they do not guarantee a sell-out and can tend toward asymmetrical

public access. This model does not work for a cryptocurrency with longevity as its main goal. The Metronome

team chose to use a different method, aiming to avoid this pattern.

The Metronome team decided to employ a descending price auction as its model for its Initial Supply Auction

and Daily Supply Lots, which may provide interesting opportunities and a fairer distribution of MTN. With a

descending price auction, the price begins at a high initial price. As the auction proceeds, the price is reduced

until all units are sold, or a pre-set price floor is reached, or the auction time limit is reached and the auction

ends. We believe market price discovery is rapid and fair, as each purchaser pays what it thinks is fair at the

time of purchase. Should a purchaser deem a given price too high or unfair, they can wait for the price to

17

descend to a level they agree with and purchase then – provided there is supply left.

The Metronome team chose this mechanism in an effort to mitigate against whales from controlling a

disproportionate amount of the MTN supply, grant equal access to auction opportunities, and approach a

fairer distribution of MTN.

16 Sources: coinmarketcap, coinbase, blockchain.info, Federal Reserve Bank of St Louis

17 http://onlinelibrary.wiley.com/doi/10.3982/TE502/pdf

11

Introducing Metronome

Metronome is a new cryptocurrency, engineered for self-governance and longevity, long term-reliability, and

maximum portability. Designed for institution-level endurance, Metronome incorporates lessons learned

from other cryptocurrencies that came before it, and is designed to be used for the next 100 years and

beyond. We believe Metronome is the 1,000 year cryptocurrency.

How Metronome Works

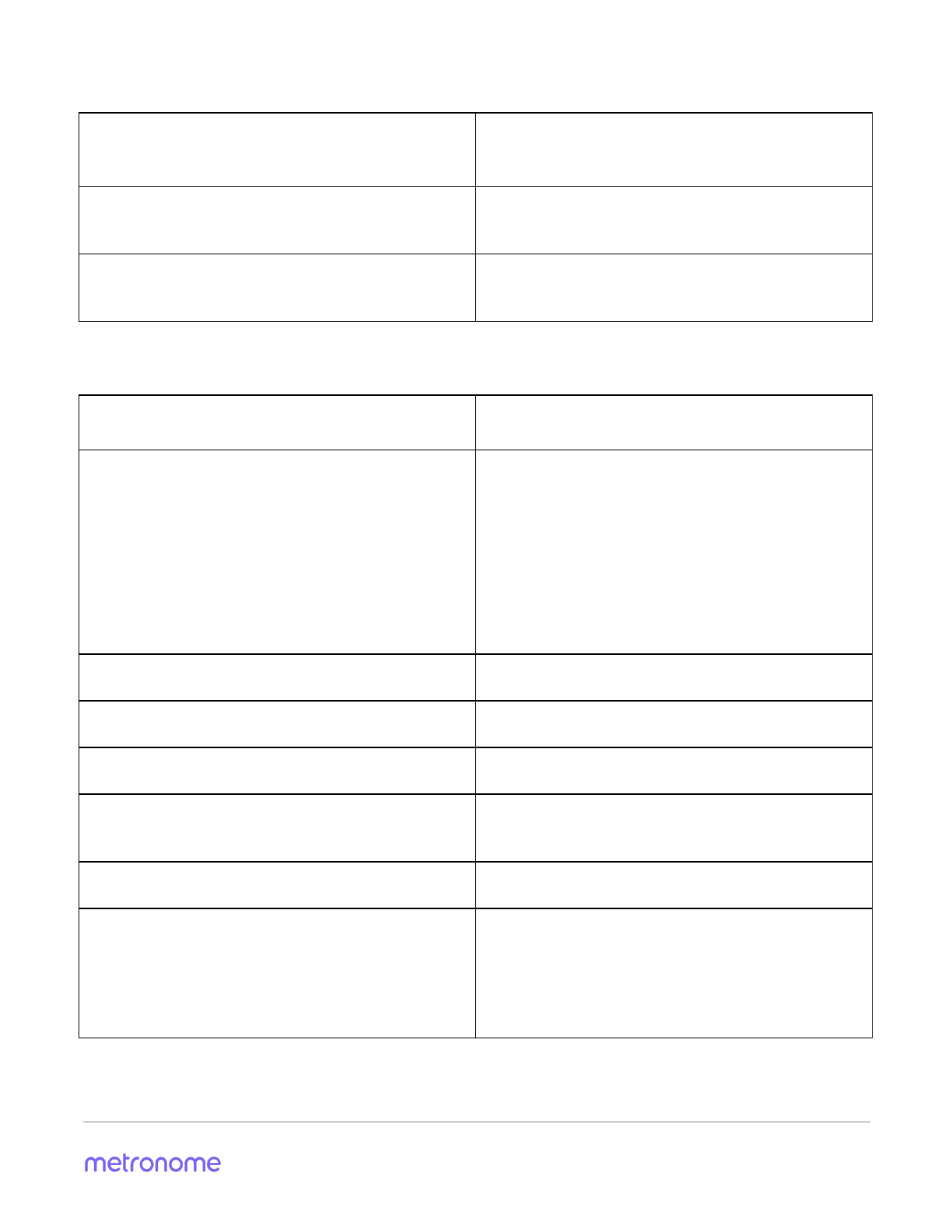

Figure 2: The flow of and interaction between Metronome contracts on the Ethereum blockchain

12

Launch

As part of the Metronome team’s goal of providing fairer, more equal access to auction opportunities and

MTN supply, Metronome’s Initial Supply Auction and Daily Supply Lot will utilize a descending price auction

(DPA). This model is different than traditional auctions, and deserves some explanation. In a descending price

auction, the price per token starts at a maximum price. The price slowly decreases until all offered supply is

purchased or until the auction time limit is reached and the auction ends. Metronome employs DPAs in an

effort to establish transparent and predictable pricing.

18

The starting price in the Initial Supply Auction will be 2 ETH per MTN. As long as the auction is open and there

are still MTN available for purchase, the price descends by 0.0001984320568 ETH every 60 seconds, toward its

floor price of 0.0000033 ETH.

Purchasers purchase Metronome cryptocurrency in real time and will receive their Metronome almost

immediately after purchase. Metronome purchased during the Initial Supply Auction will not be transferable

until the close of the Initial Supply Auction, while Metronome purchased during the Daily Supply Lots will be

transferable immediately upon receipt.

The Metronome team believes conducting the auction this way provides purchasers with the opportunity to

purchase MTN at the price they see as fair, provided there are MTN available for purchase at that price. The

Metronome team believes that a descending price auction will also provide more accurate market price

discovery than a pure dutch “everyone gets final price” auction, simply because if purchasers are willing to

pay above that price, then the final price is inherently undervalued.

This method also may reduce the chance of whales and other large players in the auction from soaking up

massive amounts of MTN, since purchasing a disproportionately large amount of MTN would potentially be

more expensive than the emergent market price. A pure dutch auction would still disproportionately

distribute MTN to early purchasers.

Although many supply purchase scenarios are possible, one is worth highlighting: a slow trickle followed by a

sudden waterfall. In this scenario, purchasers purchase a small quantity of supply at higher prices. Once the

pricing falls below some threshold, the remaining supply might be consumed rapidly.

Phase 1: Initial Supply Auction

●An initial token supply of 10,000,000 tokens is allocated.

●20% of the initial token supply is retained by founders.

○Minted to special TokenLocker contract (see API section)

■25% available for use by authors at end of Initial Supply Auction.

■The remaining 75% becomes available in 12 equal amounts over 12 calendar quarters

■Only Metronome Authors can withdraw from their TokenLocker contract, and only at

the specific times above

18 Mishra, Debasis, and David C. Parkes. “Multi-Item Vickrey-Dutch Auctions.” Games and Economic Behavior,

vol. 66, no. 1, 2009, pp. 326–347., doi:10.1016/j.geb.2008.04.007.

13

●Descending price auction of 8,000,000 tokens (representing the total initial token supply of 10 million

MTN, less the 20% token supply retained by the founders).

●Initial supply auction will last up to 7 days.

●Initial supply auction price is set at 2 ETH per MTN, with a floor price set at 0.0000033 ETH.

●In the initial supply auction, every 60 seconds, MTN auction price decreases by 0.0001984320568 ETH,

linearly.

●The auction continues until the entire 8,000,000 token inventory is sold or until the auction ends after

7 full days (10,080 minutes).

●100% from initial auction proceeds are stored in the Proceeds Contract

Phase 2: Operational currency

●Every 24 hours, new tokens are added to the Daily Supply Lot following the previous auction’s close ad

infinitum, at the rate that is the greater of (i) 2,880 MTN per day, or (ii) an annual rate equal to

2.0000% of the then-outstanding supply per year.

●Every 24 hours, an auction is initiated, lasting no more than 24 hours ( to avoid auction overlap).

○Descending price auction of all tokens in the Daily Supply Lot begins at a maximum price of

twice the previous auction closing price (i.e., the price of the last token sold if the auction sold

out, or the price when the auction timed out).

○In the event that zero (0) Metronome are sold in a given Daily Supply Lot, the price of the

following day’s Daily Supply Lot will begin at 1/100th of the last price at which Metronome was

purchased in a Daily Supply Lot auction.

●Every 60 seconds, auction price decreases to 99% of previous price.

●Auction continues until (i) the entire Daily Supply Lot inventory is sold, or (ii) the end of the

twenty-four hour period of the auction, whichever is earlier.

○If the Daily Supply Lot inventory does not sell out entirely, any remaining MTN will be added to

the next day’s Daily Supply Lot

●The absolute floor price in any Daily Supply Lot auction is 1 Wei

●100% of Daily Supply Lot proceeds goes to the Proceeds Contract.

●Every 24 hours, 0.25% of the total accumulated balance of the Proceeds Contract is sent to the

Autonomous Converter Contract (described below), providing additional options for MTN owners to

sell their MTN, if they so desire.

14

Cross-Blockchain Portability

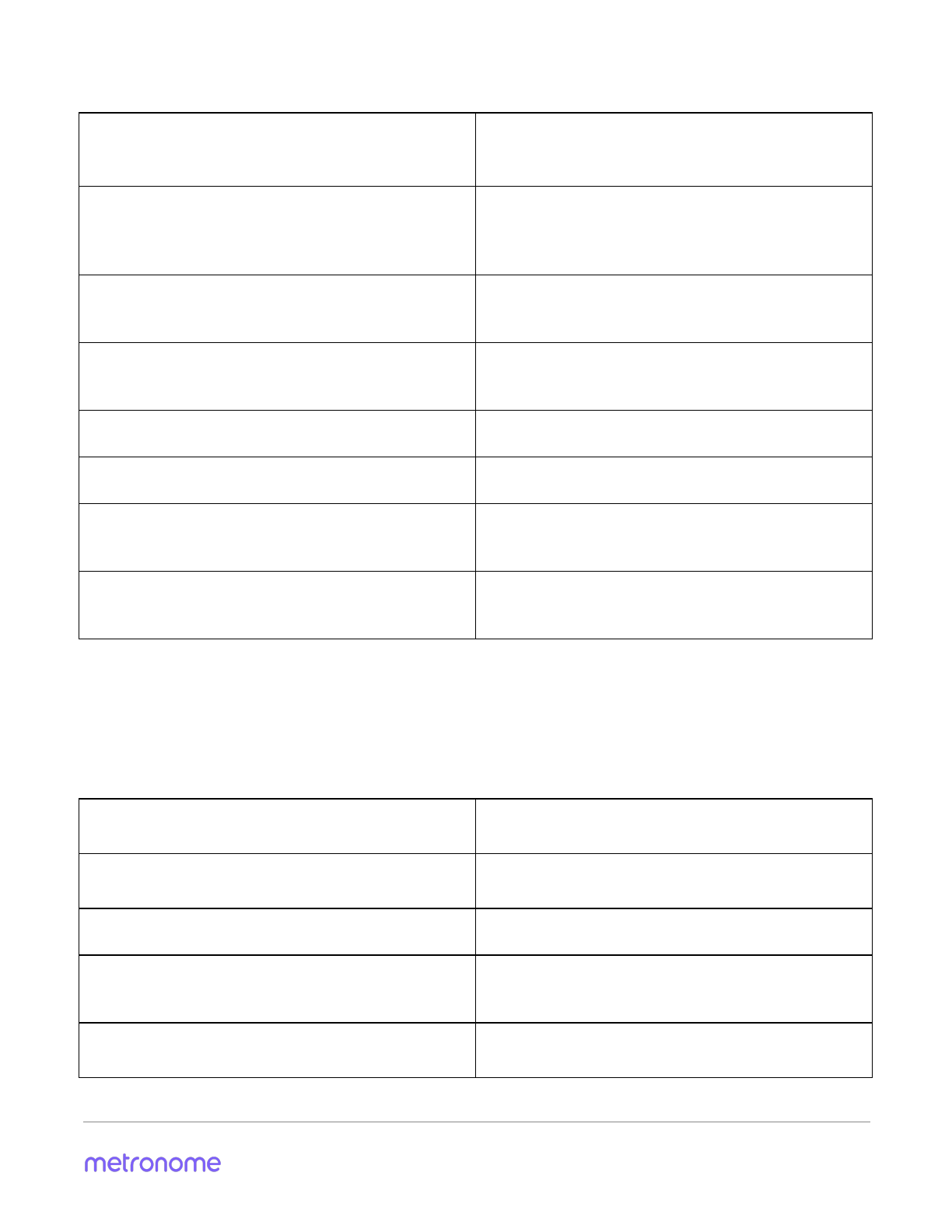

Figure 3: Demonstration of cross-blockchain portability

One of Metronome’s unique features is its cross-chain portability, which will allow users to move their MTN

from one blockchain to another blockchain for any reason. If a user decides to move their MTN, the user must

commit to a target blockchain, the destination that will receive the MTN. The user removes their MTN from

the token supply on source blockchain A, receiving a “proof of exit” merkle receipt. Then user then provides

19

this receipt to the Metronome contracts on target blockchain B.

In this scenario, the token supply of MTN on blockchain A is reduced, and the token supply on blockchain B is

increased through this export/import process. The autonomous Daily Supply Lot is adjusted on a pro-rata

basis on both blockchain A and blockchain B, to reflect the new distribution of MTN across blockchains A and

B. For example, if 50% of all MTN exist on the blockchain A and 50% of all MTN exist on blockchain B, then the

daily auctions on chain A shall mint 1,440 tokens/day, and the daily auctions on chain B shall mint 1,440

tokens/day.

Distributed, voluntary consensus governance

The ability to export Metronome from the initial ‘genesis’ chain launched by its authors, and import to

follow-on upgrades released – by its authors or other parties – based on the voluntary consensus of the MTN

holder community provides an opportunity for both immutable contracts, and a fair distributed mechanism

to upgrade those contracts as the market matures.

If, for example, the market demand greatly exceeds supply, and the real-world price of the original MTN rises

beyond what is practical for merchants, some could agree to fork the MTN supply with a new MTN contract

on the same or different chains, by exporting funds they control to the new fork. These dynamics have the

potential to remove risk from a- priori design of the token supply curves, as new immutable MTN contracts

can have upgraded token supply curves for greater commercial use.

Similarly, if market supply starts to exceed demand for a sustained period of time and the price is falling,

holders on different MTN forks may agree to “merge” from multiple export sources to a single import

destination. By reducing the total economically active supply of MTN through this voluntary consensus

mechanism, the token supply is reduced in the event of reduced demand, maintaining stable prices.

19 https://en.bitcoin.it/wiki/Protocol_documentation#Merkle_Trees

15

How forks and movement to new chains impact the MTN token supply curve and issuance is an open

question to the Metronome community. We invite you to participate in defining, implementing, forking, and

merging new MTN target contracts of your own, import MTN to new contracts, and see what happens.

16

Cryptocurrency market context to date

To better understand how Metronome fits into the cryptocurrency world, we need to take a high-level look at

the overall landscape.

The landscape

Let’s examine several well-known cryptocurrencies, the token supply allocation, issuance schedule, economic

resilience and mutability resistance of that schedule.

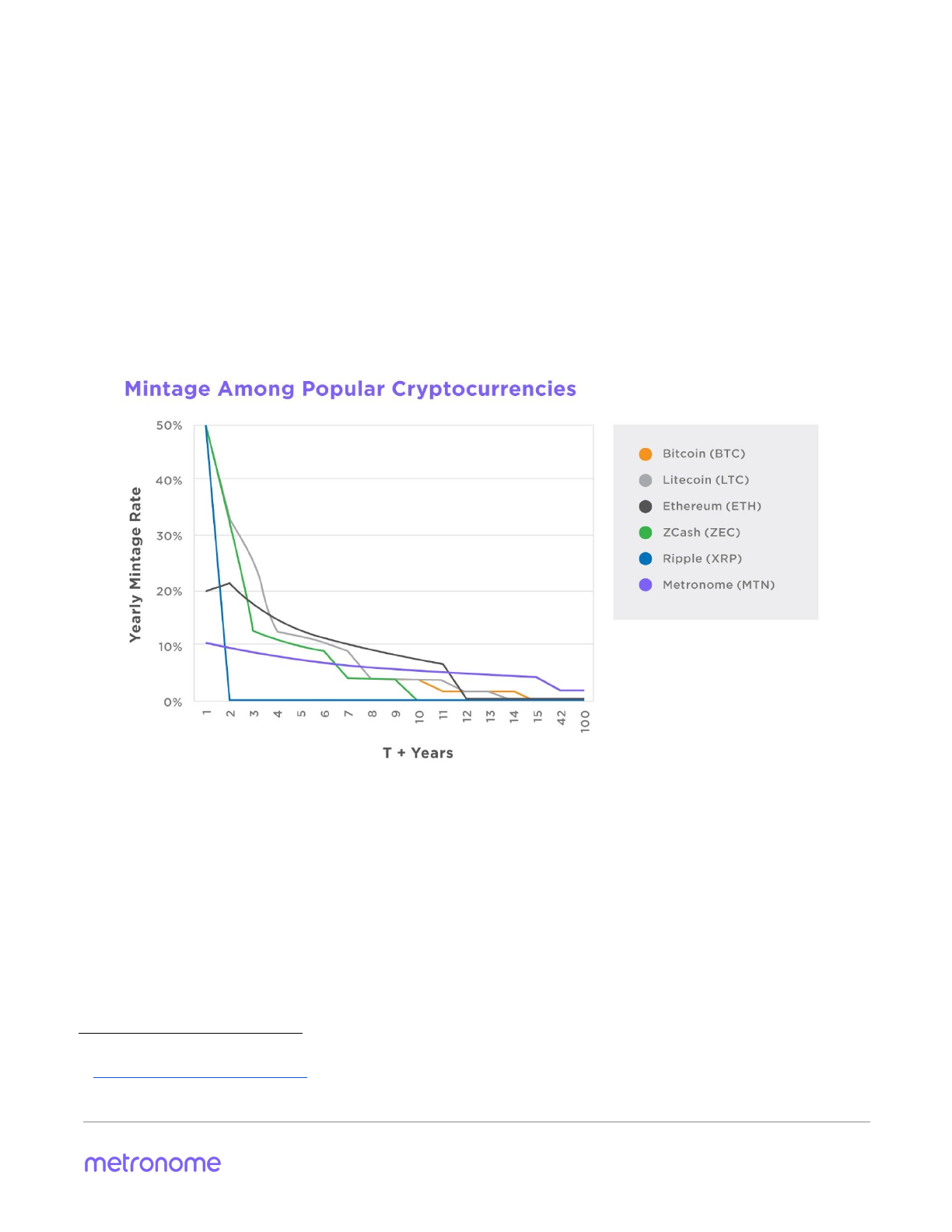

Figure 4: Mintage of popular cryptocurrencies today, note: ETH is a prediction

20

Bitcoin (“Bitcoin” or “BTC”) began on Jan 5, 2009, with public equal access to mining and participation in the

ecosystem. New currency supply is added with every block. Block period is targeted at 10 minutes/block

21

every 2,016 blocks. Supply minted is 50 BTC per block, reduced by one-half every four years.

The Bitcoin community ethos places high value on the immutability of Bitcoin’s 21 million currency supply

limit, and the immutability of the issuance schedule. Once that limit is reached, mining for new BTC stops and

transaction fees will, hopefully, provide incentive for miners. It is widely debated within the Bitcoin

community whether transaction fees will suffice to keep Bitcoin funded and secure, when supply issuance

20 Sources: coinmarketcap.com, coinbase, blockchain.info

21 https://bitcoin.org/bitcoin.pdf

17

declines to these negligible levels. If Bitcoin were restarted from-scratch today, would its current, absolute

22 23

deflationary nature be replaced by an enduring mild inflation feature to incent miners to secure the network

indefinitely into the future? Perhaps. Low levels of inflation are desirable since it discourages hoarding of

resources, encouraging investment and – in cryptocurrencies – continuing to secure the blockchain through

mining.

24

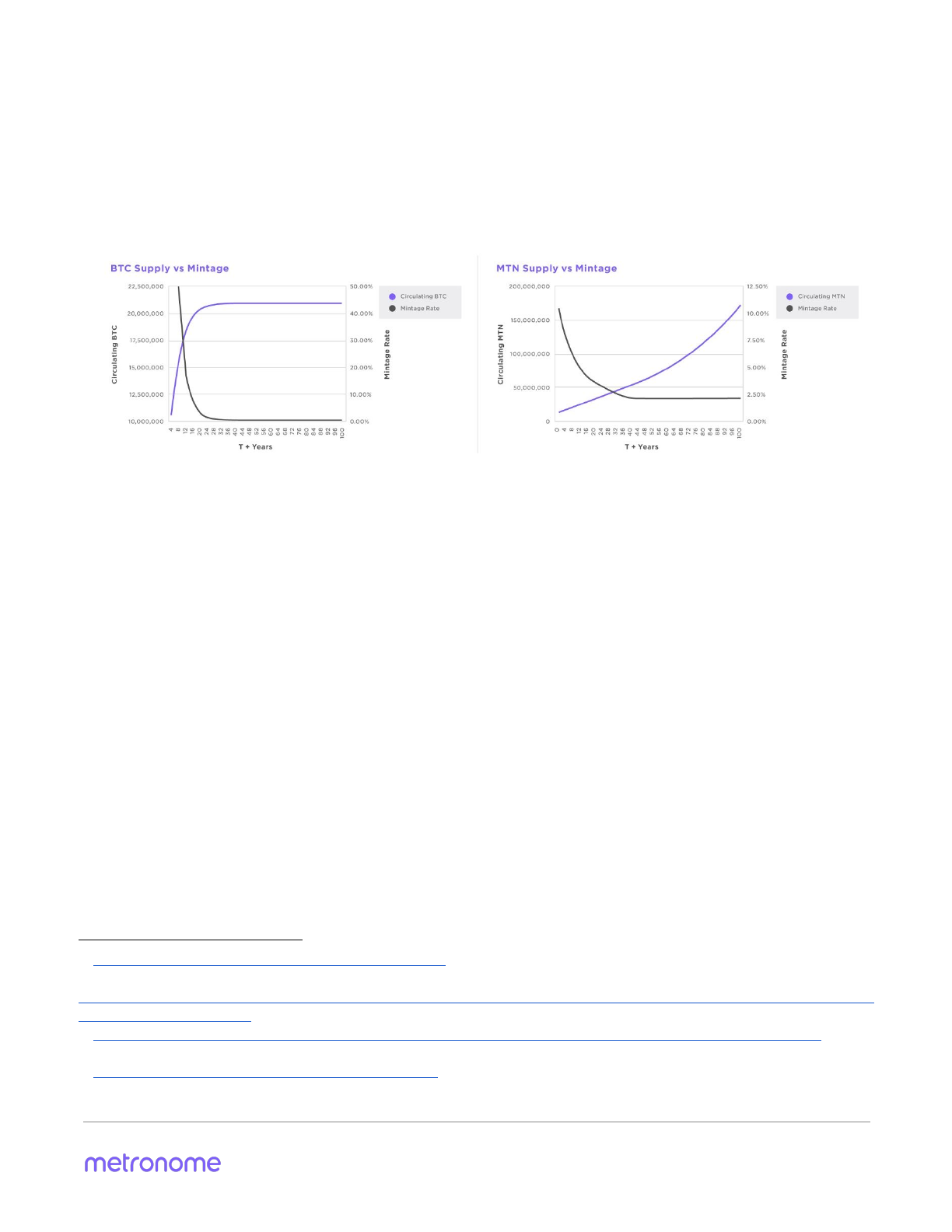

Figure 5: Comparison of Bitcoin and Metronome mintage and circulating supply

25

The predictability and immutability of the issuance schedule is what users rely on today. Predictability gives

market users the ability to plan years, possibly decades into the future. Immutability ensures that the

currency supply will not be subject to the whims and frailties of humans. However, Bitcoin has various groups

interested in influencing network governance, embroiling the community in contentious forks, uncertainty,

and spectacle.

Litecoin (“Litecoin” or “LTC”) is patterned after Bitcoin. Blocks are targeted at 2.5 minutes/block. Supply

26

minted is 50 LTC per block, reduced by one-half every four years. Litecoin is largely a photocopy of Bitcoin,

from a currency issuances perspective: The issuance schedule is presumed immutable by most of the

community. The new supply issuance declines over time, similar to Bitcoin. Litecoin’s governance is similar to

Bitcoin, but has some customary deference to the icons in its ecosystem.

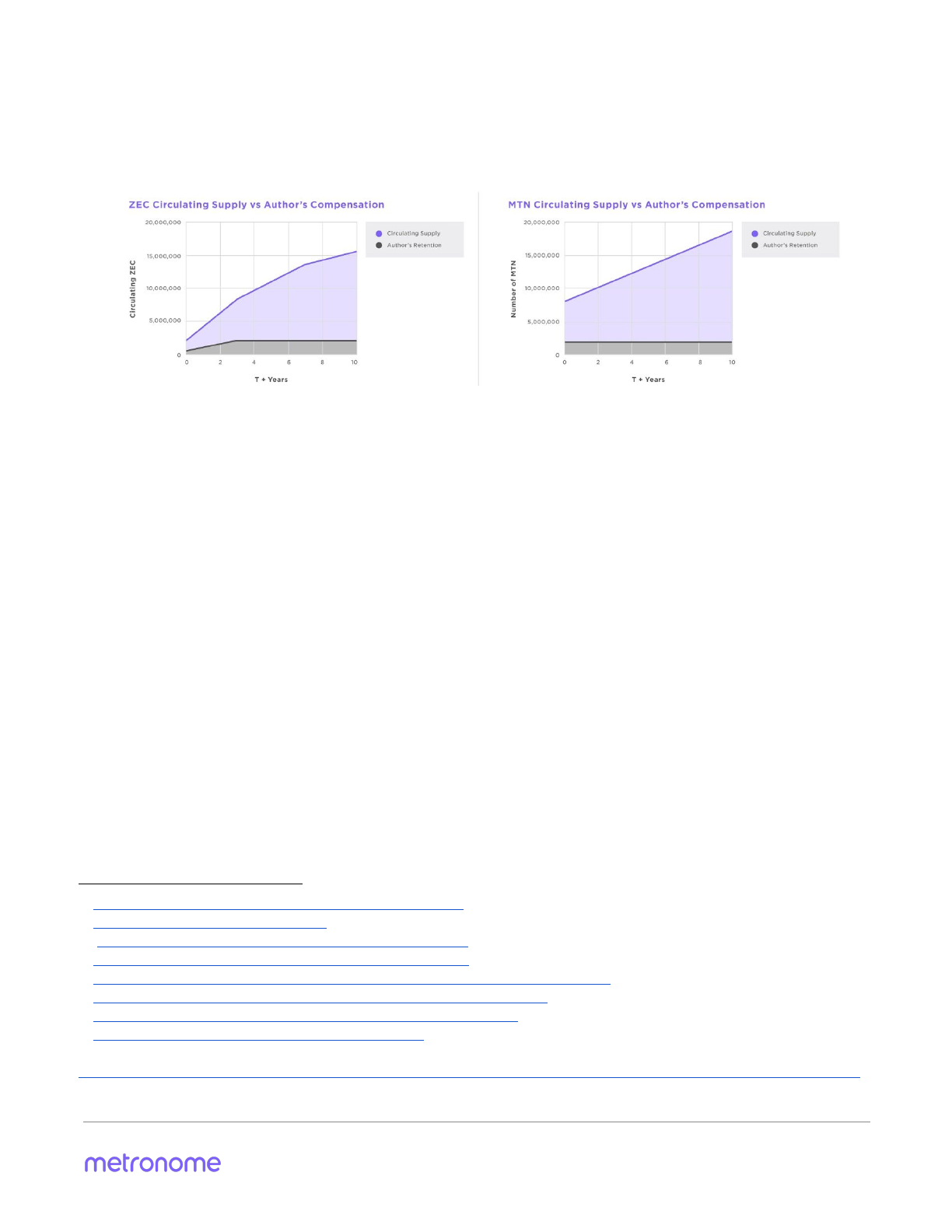

Zcash (“Zcash” or “ZEC”) behaves similarly. Proof-of-work mining is open to all. Block period is targeted at 2.5

minutes per block. Supply minted is 12.5 ZEC per block, reduced by one-half every four years. As a special

case, the first 20,000 blocks have slow-start ramp-up to full 12.5 ZEC emission rate. Instead of a one-time

compensation, the development team and support protocol development receive a 10% Founders’ Reward of

token supply is applied for all blocks up until the first halving, four years from its launch. After that point,

22 https://bitcointalk.org/index.php?topic=108964.0

23 Kroll, Joshua A, et al. “The Economics of Bitcoin Mining or, Bitcoin in the Presence of Adversaries.”

http://www.thebitcoin.fr/wp-content/uploads/2014/01/The-Economics-of-Bitcoin-Mining-or-Bitcoin-in-the-Pres

ence-of-Adversaries.pdf

24 https://www.brightscope.com/financial-planning/advice/article/8491/Asked-Answered-Zero-Inflation/

25 Sources: coinmarketcap.com, coinbase, blockchain.info

26 https://bitcointalk.org/index.php?topic=47417.0

18

100% of the minted token supply goes to miners. The Zcash Foundation is intended to be the natural locus

27

of voluntary governance of the ecosystem.

28

Figure 6: Comparison between ZEC and MTN author’s retention vs circulating supply

29

The Ethereum (“Ethereum” or “ETH”) pre-sale raised over 60,000,000 ETH, which were pre-mined into the

genesis block. New currency supply – 5 ETH – is added with every block. The new currency supply T+1Y

30 31

increased 19.8%. T+2Y, 21.2%. T+3Y, 17.4%. Supply increase declines from there. The Ethereum currency

issuance schedule is widely communicated to be in flux, and may change as the system evolves. Ethereum is

32

slated to change to proof of stake, which will change its issuance. The issuance is therefore mutable, with

33

the goal of resilience and sustainability. While any changes must be supported by the community and miners,

there is still a lot of customary deference to and reliance upon a small founding team.

Ripple (“Ripple” or “XRP”) has an available supply of 38 billion XRP. The managing company, Ripple, Inc., has a

34

further 61 billion XRP, of which Ripple Inc has placed 55 billion XRP in escrow. This is centrally managed, with

35

Ripple, Inc. controlling a large portion of the cryptocurrency’s ecosystem. Ripple Inc. directly manages the

issuance of supply into the market, and XRP is therefore highly mutable. Ripple Inc retains disproportionate

governing power.

Metronome takes the lessons learned from these digital currencies and the result is a cryptocurrency

designed for institutional-level endurance with issuance, governance, and reliability as the leading principles

in its architecture. It is 100% autonomous with no undue influence from authors to further the design goal of

self-governance. Metronome is predictable and mints new MTN at a predictable rate, which makes it stable. It

27 https://z.cash/blog/founders-reward-transfers.html

28 https://z.cash/blog/funding.html

29 https://z.cash/blog/founders-reward-transfers.html

30 https://github.com/ethereum/wiki/wiki/White-Paper

31 https://blog.ethereum.org/2014/08/08/ether-sale-a-statistical-overview/

32 https://twitter.com/VitalikButerin/status/879675471532654595

33 https://github.com/ethereum/wiki/wiki/Proof-of-Stake-FAQ

34 https://coinmarketcap.com/currencies/ripple/

35

https://ripple.com/insights/ripple-to-place-55-billion-xrp-in-escrow-to-ensure-certainty-into-total-xrp-supply/

19

is also able to be imported and exported between blockchains for whatever reason the user sees fit, making it

portable.

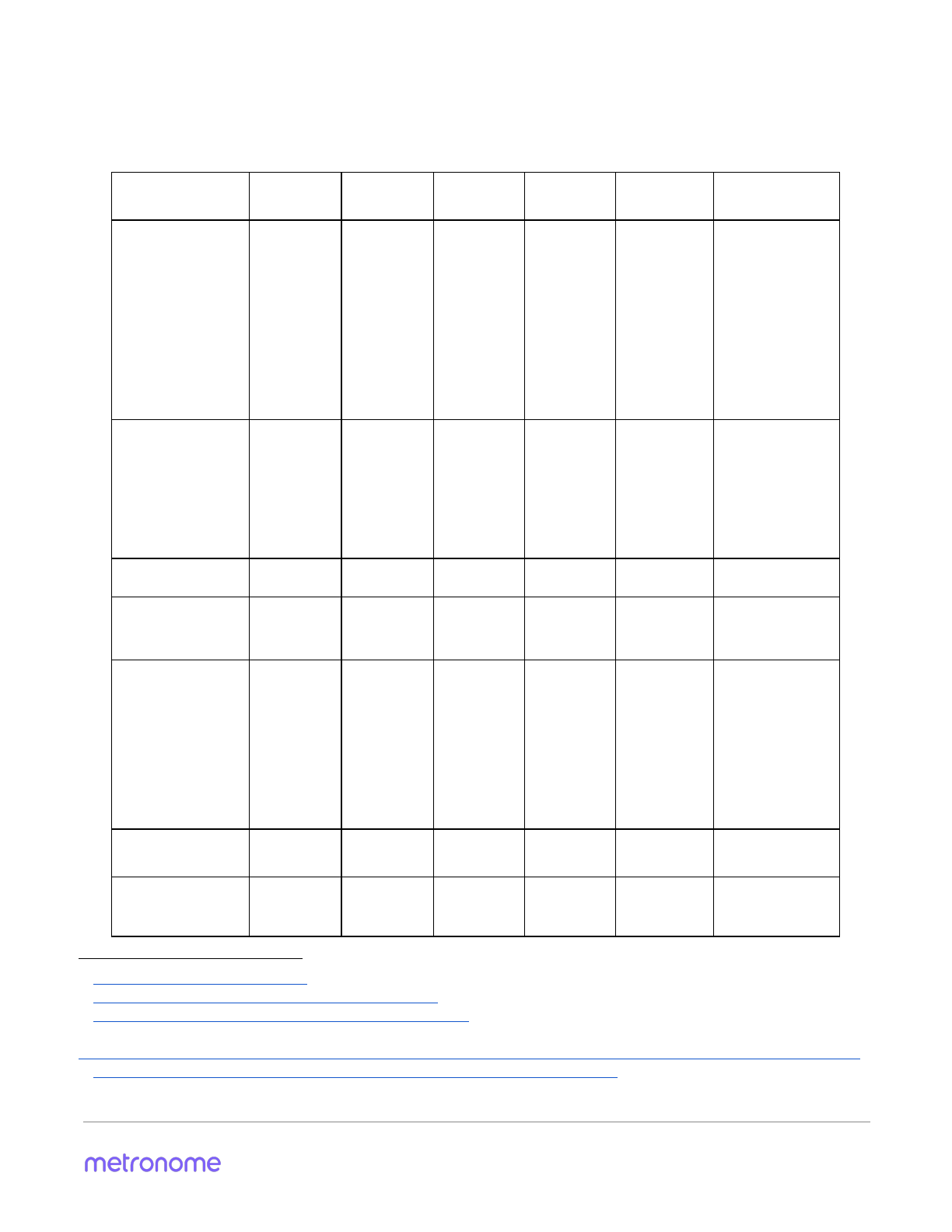

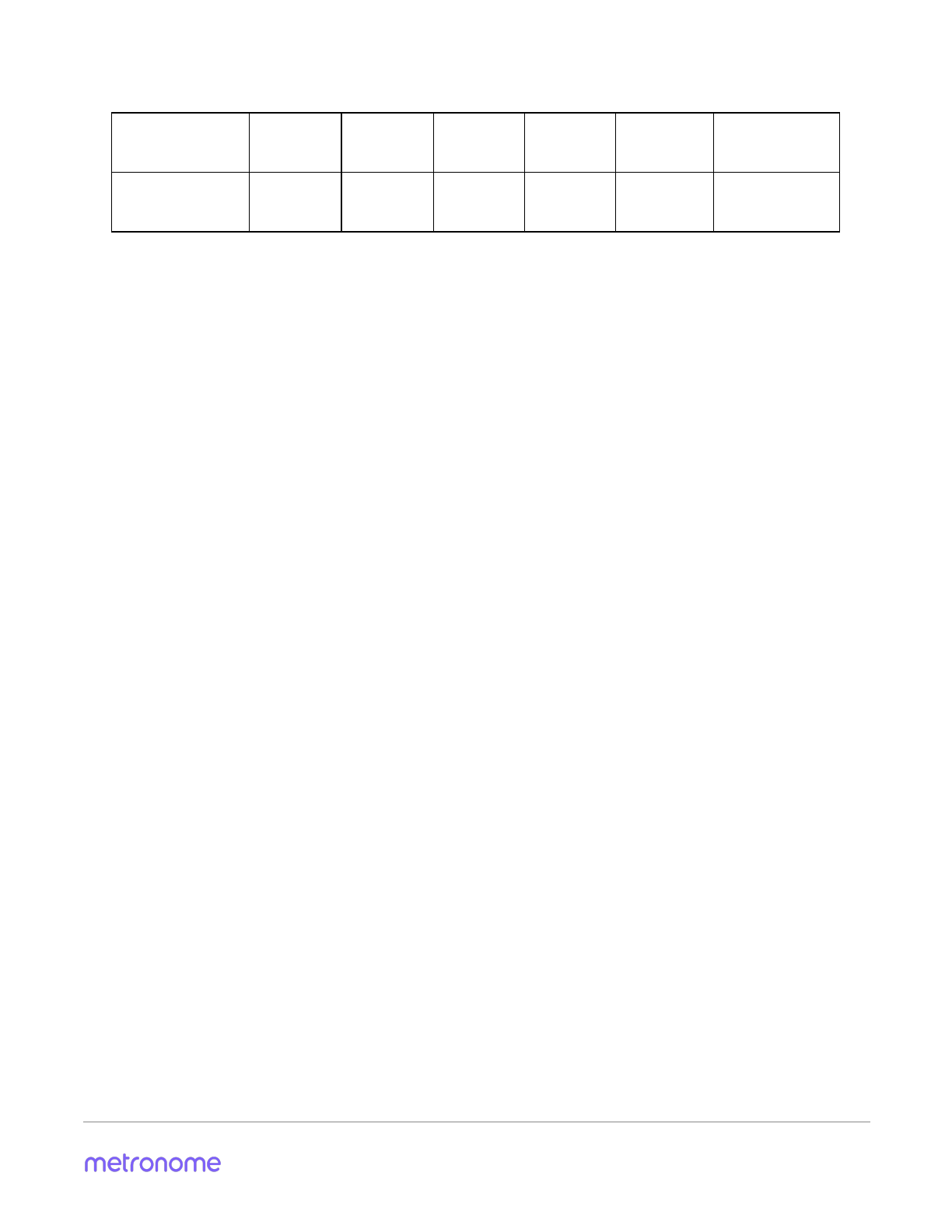

BTC

36

LTC

37

ETH

38

XRP

39

ZEC

40

MTN

Reliability

BTC is

famous for

its

contentious

forks and

deflationary

nature.

Token

supply and

issuance is

stable, but

finite.

Like BTC,

LTC’s

issuance and

token supply

is subject to

a hard cap,

which may

threaten

chain

stability

ETH’s

issuance

and token

supply

model is in

flux. It has

forked in the

past.

XRP has a

stable

supply. It is

fully

governed by

Ripple Inc.

Similar to

BTC, ZEC is

subject to a

hard cap

which may

call into

question the

security of

the chain in

the future.

MTN issuance

and supply will

remain

predictable ad

infinitum as

defined by its

contracts. There

is no uncertainty

about supply or

issuance.

Self-

Governance

BTC is self

governed,

but has

many

groups

looking to

exert undue

influence.

LTC is self

governed,

but

customary

deference to

its icons.

Changes to

ETH need

community

support, but

much

reliance

upon a small

team.

XRP is not

self

governing.

Ripple Inc

retains sole

power of

governance

over XRP.

The Zcash

Foundation is

natural locus

of voluntary

governance.

MTN is entirely

self governed

through

autonomous

contracts.

Portability

no

no

no

no

no

yes

Immutability

strong

strong

Mutable;

Will change

with PoS

weak

strong

strong

Issuance

Model

50 BTC per

10 minutes.

Decreases

by ½ every 4

years.

50 LTC per

2.5 minutes.

Decreases

by ½ every 4

years.

5 ETH per 15

seconds.

Issued once,

by Ripple Inc

12.5 per 2.5

minutes.

Decreases by

½ every 4

years.

Daily MTN

auction sales at

greater of (i)

2,880 MTN per

day, or (ii) an

annual rate

equal to 2.0000%

of the

then-outstanding

supply per year

Supply limit

21 million

84 million

unknown

100 billion

21 million

See Issuance

Model above

Settlement

time

10 minutes

2.5 minutes

15 seconds

5 seconds

2.5 minutes

15 seconds

36 https://bitcoin.org/bitcoin.pdf

37 https://bitcointalk.org/index.php?topic=47417.0

38 https://github.com/ethereum/wiki/wiki/White-Paper

39

https://ripple.com/insights/ripple-to-place-55-billion-xrp-in-escrow-to-ensure-certainty-into-total-xrp-supply/

40 http://zerocash-project.org/media/pdf/zerocash-extended-20140518.pdf

20

Mass Pay

feature

yes

yes

no

no

yes

yes

Subscription

feature

no

no

no

no

no

yes

Table 1: Comparison of important attributes between today’s cryptocurrencies

21

Metronome contracts and technical aspects

Four autonomous smart contracts comprise Metronome. The general flow is:

1. The first contract is the MTN token and ledger, interacting directly with the blockchain. This is how

users settle peer-to- peer transactions, and it can be used as a distributed store of wealth. This is the

familiar ERC20 token standard with ERC827 functionality for improved security and transfer.

2. The token contract is followed by the Auctions contract. A user purchases MTN through the Auctions

contract. When a user makes a purchase from the Auctions contract, the contract mints the MTN for

the user.

3. The Auctions contract then sends the proceeds to the third contract, the Proceeds Contract. 100% of

the proceeds from the Initial Supply Auction and each Daily Supply Lot are sent from the Auctions

contract to the Proceeds contract.

4. Every 24 hours, the Proceeds Contract sends 0.25% of its contents to the fourth contract – the

Autonomous Converter Contract – providing it with available ETH. When a user sends ETH or MTN to

the Autonomous Converter Contract, the contract returns MTN or ETH, respectively at the rate

determined by the contract. Since the ratio of tokens in the Autonomous Converter Contract

determines their relative value, we expect arbitrage to keep pricing approximately accurate. If the

contract has too few MTN (or ETH), that makes it expensive compared to its corresponding pair. A

user who believes his or her MTN (or ETH) are not worth that much will tender his or her tokens in

exchange for the other token. This can balance the contract’s contents, correcting the relative price

imbalance.

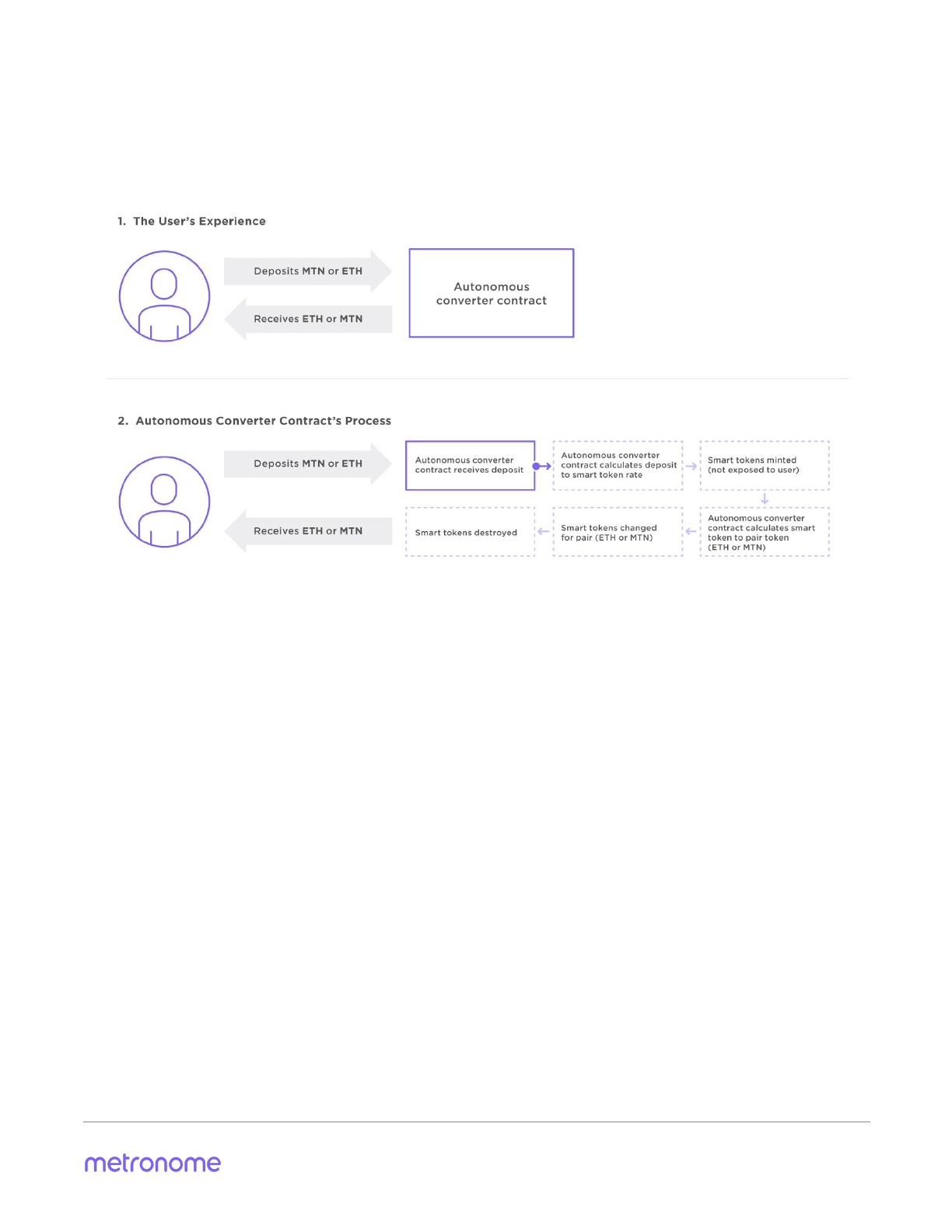

Metronome Proceeds and Autonomous Converter Contracts

All proceeds from all auctions stay in the Metronome ecosystem, with the intent to build an enduring

ecosystem for Metronome and its users. By ensuring all proceeds from the auctions stay on-chain in

contracts — and outside of the control of any group — we believe Metronome may enjoy greater and more

autonomous longevity.

This flow starts with the Auctions contract, which is the contract purchasers interact with when purchasing

MTN from an auction. Then, the Proceeds Contract receives the proceeds from the Auctions contract and

exports a portion to the Autonomous Converter Contract, providing the Autonomous Converter Contract with

ETH supply for purchase and sale. One MTN will be in the Autonomous Converter Contract at the time it is

initialized.

In the Initial Supply Auction and every subsequent Daily Supply Lot, 100% of the proceeds will go to the

Proceeds Contract. None of the proceeds are ever distributed to Metronome authors. Each day, the Proceeds

Contract will forward 0.25% of its total accumulated proceeds to the Autonomous Converter Contract. It is our

expectation that this may smooth out the variance in daily auction volume, compared to just placing receipts

in the Autonomous Converter Contract directly.

When selling ETH to the Autonomous Converter Contract, the amount of MTN obtainable for a particular

amount of ETH in the contract rises. If someone sells MTN to buy ETH, they will get more ETH back, and if

someone wants to use the Autonomous Converter Contract to buy MTN, they will have to pay more ETH for it.

To the extent that the daily ETH selling in the Autonomous Converter Contract raises MTN value above what

22

the market can support, we believe that arbitrage will capture the excess ETH. However, given that the

predictability of Metronome is measured in decades-long timescales, we also expect the market to predict

and price in the flow of ETH availability into the Autonomous Converter Contract.

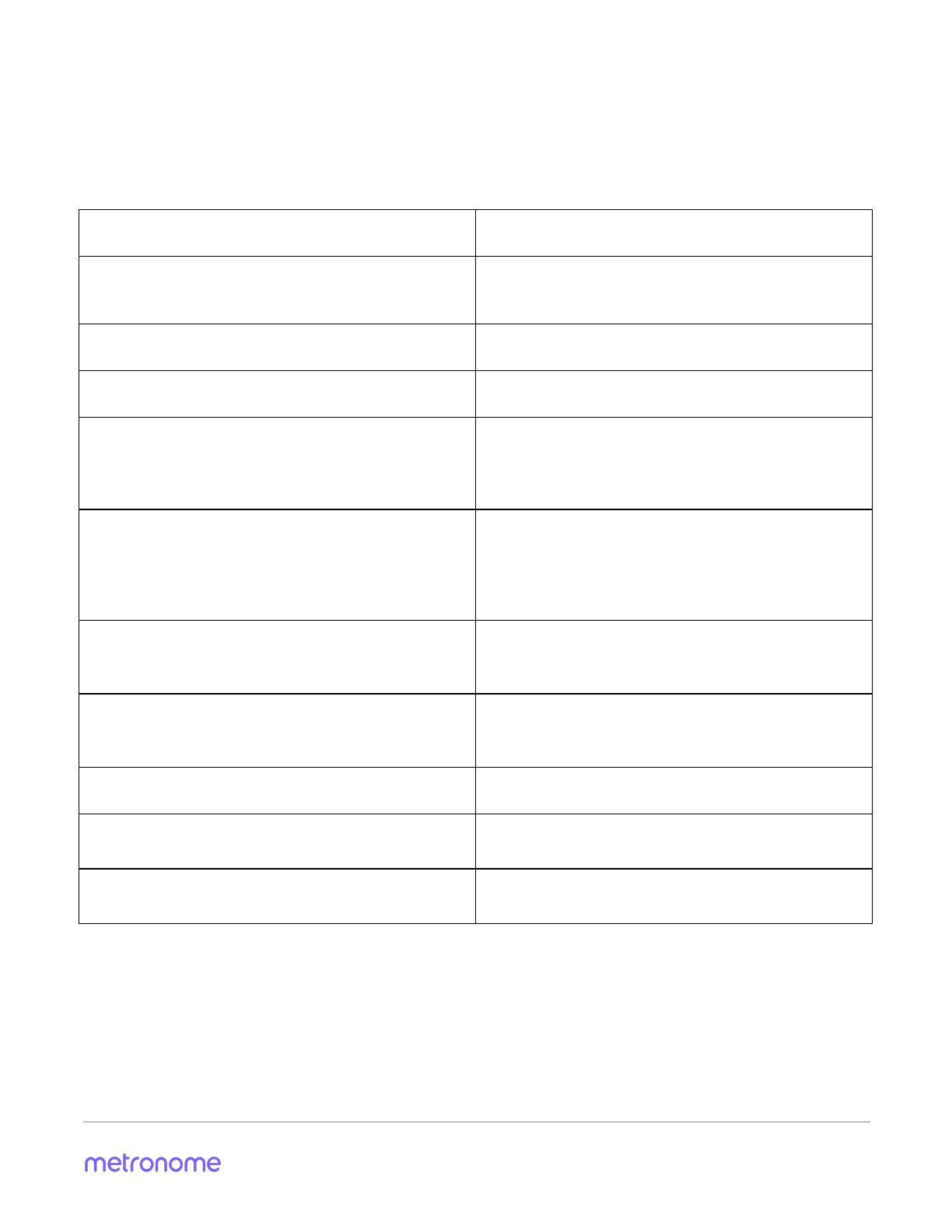

Figure 7: The user’s experience interacting with the Autonomous Converter Contract and the Autonomous

Converter Contract’s back-end process

Economic prediction

While the Autonomous Converter Contract seeks to approach a market-determined price, the auction

contract has a fixed pricing schedule each day. Consequently:

●When an auction’s token price is higher than the Autonomous Converter Contract’s, purchasers would

be expected to be less likely to purchase tokens from the auction. They would be better off buying the

cheaper tokens from the Autonomous Converter Contract.

●When the auction’s token price is lower than the Autonomous Converter Contract’s, anyone can make

arbitrage profits by buying at auction and selling the tokens to the Autonomous Converter Contract.

This would arbitrage out any ETH imbalance in the Autonomous Converter Contract. However, since

everyone wants to do this, the auction would be expected to sell out before the price discrepancy

becomes significant.

In sum, purchasers in an auction would be expected to attempt to purchase tokens at auction at a price very

close to the current price in the Autonomous Converter Contract, and each day’s later purchasers will be able

to profit from its earlier purchasers, essentially getting paid for the risk that they will not be able to buy at all

in the auction.

Once a Daily Supply Lotsells out, excess demand could be met by selling to the Autonomous Converter

23

Contract, possibly increasing the token price. We expect that each auction would sell out, because the

descending price will eventually decay below market price.

The math

When the user transacts with the Autonomous Converter Contract, there is always price slippage, since users

are throwing off the ratio between token supplies. Formulas determine all the prices, such that whether the

user makes lots of tiny purchases or one big purchase, everything comes out the same.

41

There are two formulas: one calculates how many smart tokens a user gets for MTN or ETH, the other

determines how much MTN or ETH a user gets for smart tokens. Smart tokens are never exposed to the user.

Building accurate and efficient “elementary functions” is a serious engineering task. New implementations are

necessary since Ethereum has only 256-bit integers.

By restricting the Autonomous Converter Contract to two cryptocurrencies – MTN and ETH – at reserve ratio

0.5, the math is simplified and only a square root is needed, which is simple to implement and reasonably

efficient to run.

The math is as follows:

R = Reserve Token Balance

S = Smart Token Supply

F = Constant Reserve Ratio

T = Smart tokens received in exchange for reserve tokens E

E = Reserve tokens received in exchange for smart tokens T

The original formulas are:

42

T = S((1 + ) )

R

E F− 1

E = R(1 - (1 - ) )

S

T 1

F

In our case, because F is set to 0.5, the formula can make do with fixed-point multiplication, division, and

square root:

T = S( ) - 1)

√1 + R

E

E = R(1 - (1 - ) )

S

T 2

A worked example

Let’s say the Autonomous Converter Contract has 1000 ETH and 2000 MTN, and there are 10000 smart

tokens. The Autonomous Converter Contract’s price for MTN is 0.50 ETH. A user believes this is on the high

side and wishes to trade 100 MTN for ETH. At the current nominal price this would return 50 ETH, but actually

41 https://drive.google.com/file/d/0B3HPNP-GDn7aRkVaV3dkVl9NS2M/view

42 https://www.bancor.network/static/bancor_protocol_whitepaper_en.pdf

24

the user will get less due to price slippage.

Step one: Trade 100 MTN for smart tokens.

T = S( ) - 1)

√1 + R

E

T = 10000( ) - 1) = 10000( - 1) = 10000(1.0247 - 1) = 10000(0.0247) = 247

√1 + 100

2000 √1.05

The user receives 247 newly-minted smart tokens. The total supply of smart tokens is now 10247. The total

supply of MTN held in the Autonomous Converter Contract is now 2100.

Step two: Convert 247 smart tokens for ETH, this is fulfilled automatically by the contract, the user is never

exposed to the smart tokens.

Assume that 1000 ETH so is the reserve supply for the formula:

E = R(1 - (1 - ) )

S

T 2

E= 1000(1 - (1 - ) ) = 1000(1 - (1 - 0.0241) ) = 1000(1 - .976 ) = 1000(1 - 0.953) = 1000(0.047) = 247

10247 2 2 2

47

The user receives 47 ETH for their 100 MTN.

The contract now contains 953 ETH and 2100 MTN, or 0.45 ETH per MTN. By selling some MTN, the user has

lowered the price of MTN in the Autonomous Converter Contract compared to ETH. He or she receives ETH

approximately midway between the initial price and final price.

The 247 smart tokens are destroyed when they are traded in, lowering the smart token supply back to 10000.

Transaction ordering mitigation

The user can predict the outcome of his or her trade, provided no other transactions are executed ahead of

the user’s. There is no way to guarantee this; in fact, other parties could see his or her transaction in transit,

and issue their own transaction ordering. Miners in particular could do this very effectively.

To mitigate against transaction ordering, we require the user to specify a minimum return. If he or she does

not get at least that much back from their trade, his or her transaction rolls back; he or she pays only a small

transaction fee to cover the computational cost of executing the transaction.

25

Token Supply Economics

Theory

●Predictability of supply enables market participants to accurately gauge supply 12 months, 5 years, 50

years into the future

●Pricing is determined via descending price auction

Supply

●Initial supply: 10,000,000 tokens, via descending price auction

●Supply after initial supply: an annual supply that is the greater of (i) 2,880 MTN per day, or (ii) 2.0000%

of the then-outstanding supply per year

●Auction settles in near-real-time

○Some economists suggest this discovers the best price for the auction, since everyone pays

their price limit

43

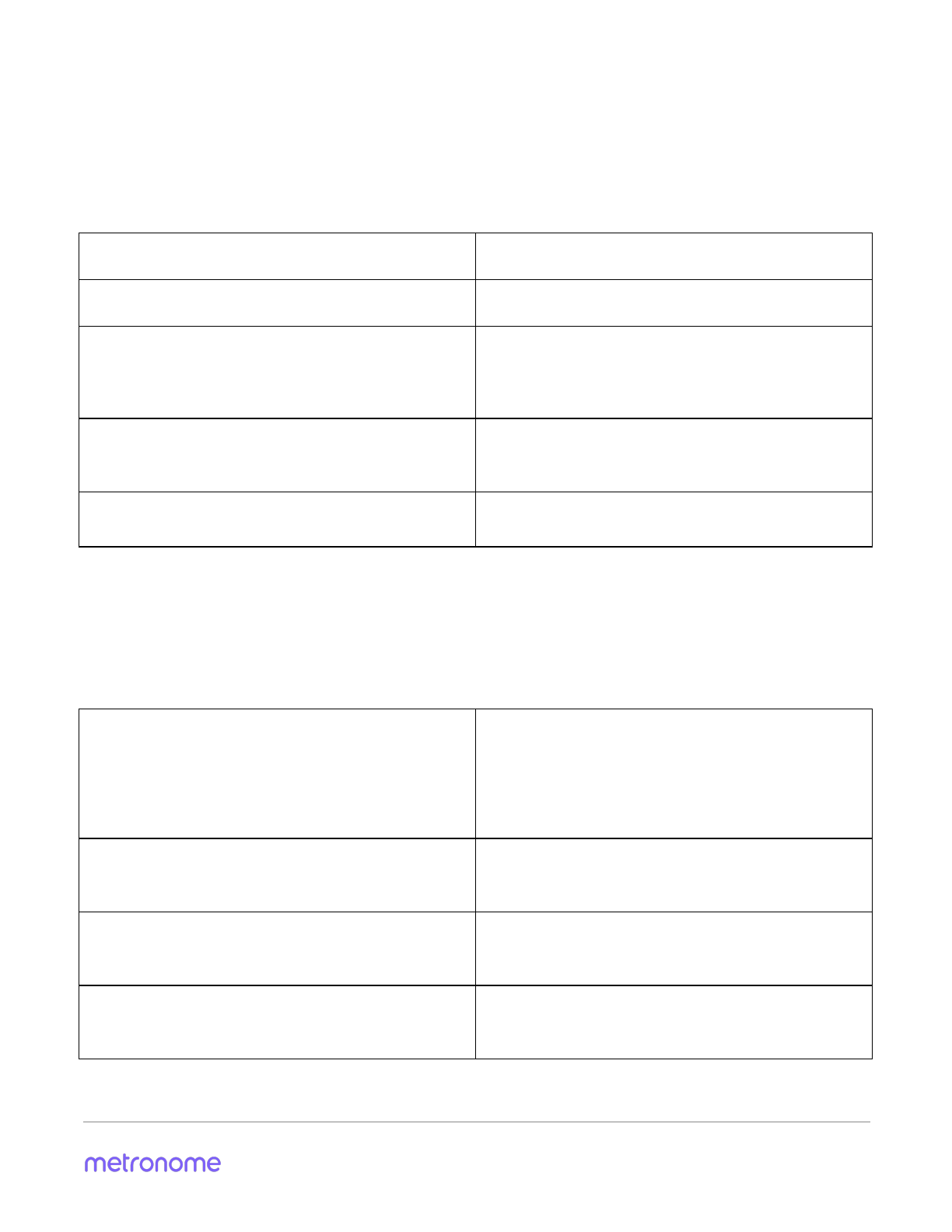

Supply schedule

Time

Circulating MTN

Mintage Rate

Daily Mintage

T + 1 year

11,051,200

10.512%

2,880

T + 2 years

12,102,400

9.512%

2,880

T + 3 years

13,153,600

8.686%

2,880

T + 5 years

15,258,880

7.399%

2,880

T + 10 years

20,517,760

5.400%

2,880

T + 50 years

63,499,700

2.000%

3,411

T + 70 years

94,382,561

2.000%

5,070

Table 2: Supply Schedule

43 http://onlinelibrary.wiley.com/doi/10.3982/TE502/pdf

26

API Reference

Metronome Core

Token API

The token API used to query and transfer MTN tokens is the familiar ERC20 token standard. Metronome also

44

aligns itself with the current best practice of using ERC827. ERC827 is the newer superset of ERC20, and is the

45

latest standard with enhanced decentralized transfer and security. The improvement also makes it easy for

the transfer to call any function on the receiving contract. ERC827 allows for data to be transferred as well as

value, something that the ERC20 token standard cannot do alone. Metronome is proud to use the most

cutting-edge technology available.

Standard ERC20

const name

Metronome

const symbol

MTN

const decimals

18

function totalSupply

ERC20-compliant; refer to ERC20 standard.

function balanceOf

ERC20-compliant; refer to ERC20 standard.

function transfer

ERC20-compliant; refer to ERC20 standard.

function transferFrom

ERC20-compliant; refer to ERC20 standard.

function approve

ERC20-compliant; refer to ERC20 standard.

function allowance

ERC20-compliant; refer to ERC20 standard.

event Transfer

ERC20-compliant; refer to ERC20 standard.

event Approval

ERC20-compliant; refer to ERC20 standard.

Custom ERC827-related functions

function approveMore(address _spender, uint256 _value)

public returns (bool)

function approveLess(address _spender, uint256 _value)

public returns (bool)

These are safer versions of approve. They are not

standard, but can be used by users who want to

avoid the chance of a well-known race attack against

the standard version when updating values.

44 https://theethereum.wiki/w/index.php/ERC20_Token_Standard

45 https://github.com/ethereum/EIPs/issues/827

27

function transfer(address _to, uint256 _value, bytes _data)

public returns (bool);

Extension of ERC20, which accepts extra data for

function call.

function transferFrom(address _from, address _to, uint256

_value, bytes _data) public returns (bool);

Extension of ERC20, which accepts extra data for

function call.

function approve(address _spender, uint256 _value, bytes

_data) public returns (bool);

Extension of ERC20, which accepts extra data for

function call.

event Transfer(address indexed _from, address indexed _to,

uint256 _value, bytes _data);

Extension of ERC20, which accepts extra data for

event call.

event Approval(address indexed _owner, address indexed

_spender, uint256 _value, bytes _data);

Extension of ERC20, which accepts extra data for

event call.

Custom Token Function

Function multiTransfer(uint[] bits) Allows multiple

Transfers in a single transaction.

Each uint in the bits array represents a transfer; the

leftmost 160 bits are the address, and 96 bits to the

right are the amount.

function setTokenPorter(address _tokenPorter) public

onlyOwner returns (bool)

Sets contract for TokenPorter, responsible for

export

features, this can only be run by owner

function mint(address _to, uint _value) public returns (bool)

Mint will only be allowed by minter and tokenporter

function destroy(address _from, uint _value) public returns

(bool)

Destroy will only be allowed by minter and

tokenporter

function enableMTNTransfers() public returns (bool)

This function will enable MTN transfer and it can be

called successfully only after initial auction end.

function export(bytes8 _destChain, address

_destMetronomeAddr, address _destRecipAddr, uint

_amount, bytes _extraData) public returns (bool)

Export MTN to another metronome supported

chain.

Merkles

These functions are not intended for manual use, but there is some thought that they could be the

foundation for interesting UI features.

Function setRoot(bytes32 root)

Sets the merkle root associated with msg.sender

28

Function rootsMatch(address a, address b) constant returns

(bool)

Returns true if the two addresses have matching

roots.

function getRoot(address addr) public view returns (bytes32)

Gets the merkle root associated with the address

Subscriptions

These functions are part of a unique Metronome feature: subscriptions on the blockchain. Users are able to

facilitate relationships and recurring payments between other users and institutions via subscriptions. The

user subscribes by authorizing them to withdraw a weekly payment. The authorized group or individual then

is able to move the payment from the user’s account to any account they see fit. The user is able to cancel

subscriptions if and when necessary.

This addresses an issue that other cryptocurrencies have struggled with in the past. Paying for subscription

based material is either not possible or onerous with many popular cryptocurrencies. The Metronome

subscription feature fixes that.

function subscribe(uint _startTime, uint _payPerWeek,

address _recipient) public returns (bool)

Subscribe to someone, i.e. authorize them to

withdraw weekly payment

_startTime is when the subscription will start

_payPerWeek is the tokens payable per week

including decimals _recipient is who gets to

withdraw the tokens

function cancelSubscription(address _recipient) public

returns (bool)

Cancel the subscription

_recipient is who are you unsubscribing from

function getSubscription(address _owner, address

_recipient) public constant returns (uint startTime, uint

payPerWeek, uint lastWithdrawTime)

Get subscription info

_owner pays, _recipient is receiver of subscription

Return the following information,

startTime is when the subscription started

payPerWeek is how much can recipient withdraw

each week

lastWithdrawTime is when the recipient

last withdrew

function subWithdraw(address _owner) public transferable

returns (bool)

Withdraw funds from someone who has subscribed

to you, returns success

_owner is your subscriber

function multiSubWithdraw(address[] _owners) public

returns (uint)

Withdraw funds from a bunch of subscribers

(_owners) at once. Returns number of successful

withdraw.

29

function multiSubWithdrawFor(address[] _owners, address[]

_recipients) public returns (uint)

Withdraw funds from given subscribers(_owners) to

their respective _recipients. Returns number of

successful withdraw.

event LogSubscription(address indexed subscriber, address

indexed subscribesTo)

Emitted for new user subscriptions

event LogCancelSubscription(address indexed subscriber,

address indexed subscribesTo)

Emitted when user cancels subscription

Auction API

Function () payable

Standard fallback function; send ETH, receive MTN

tokens immediately

function whatWouldPurchaseDo(uint _wei, uint

_timestamp) public constant returns (uint weiPerToken, uint

tokens, uint refund)

Tells the user what the results would be, of a

purchase at time _timestamp

_wei is the amount of ETH in wei to be sent,

_timestamp is the timestamp of the prospective

auction purchase.

weiPerToken is the resulting price,

tokens are the number of tokens that would be

returned,

refund is the ETH in wei refund the user would get

(if auction sold out in this purchase)

function isRunning() public constant returns (bool)

True if auction system has started

function currentTick() public view returns(uint)

Calls whichTick for current block timestamp

function currentAuction() public view returns(uint)

Calls whichAuction(currentTick())

function whichTick(uint t) public view returns(uint)

Returns the auction tick for given timestamp, t,

since genesis time

function whichAuction(uint t) public view returns(uint)

Returns the auction instance for given auction tick, t

function heartbeat() public view returns (bytes8

chain,address auctionAddr,address convertAddr,address

tokenAddr,uint minting,uint totalMTN,uint proceedsBal,uint

currTick, uint currAuction,uint nextAuctionGMT,uint

genesisGMT,uint currentAuctionPrice,uint

dailyMintable,uint _lastPurchasePrice)

Returns statistics on the current auction

30

function mintInitialSupply(uint[] _founders, address _token,

address _proceeds, address _autonomousConverter) public

onlyOwner returns (bool)

Called during initial deployment to mint the initial

supply for founders. This is an owner-only function.

function initAuctions(uint _startTime, uint _minimumPrice,

uint _startingPrice, uint _timeScale) public onlyOwner

returns (bool)

Called during initial deployment sets the auction

start time parameters. This is an owner-only

function.

function stopEverything() public onlyOwner

Owner only function that pauses the current

auction.

function isInitialAuctionEnded() public view returns (bool)

True, if 7 days have passed or all tokens have been

sold in initial auction

function globalMtnSupply() public view returns (uint)

Total available supply as of the current auction

function globalDailySupply() public view returns (uint)

Total available MTN Token for current daily auction

function currentPrice() public constant returns (uint

weiPerToken)

Current price in daily auction

event LogAuctionFundsIn(uint amount)

Emitted when funds are received by Auctions

contract

Metronome Proceeds Contract

Proceeds Contract API

event LogProceedsIn(address indexed from, uint value)

Emitted when funds are received by Proceeds

contract

event LogClosedAuction(address indexed from, uint value)

Emitted when Proceeds pushes funds into

AutonomousConverter

function () public payable

Handles incoming funds for Proceeds

function initProceeds(address _autonomousConverter,

address _auction) public onlyOwner

Called during initial deployment. This is an

owner-only function.

function closeAuction() public

Sends funds to AutonomousConverter at the end of

the auction

31

Metronome Autonomous Converter Contract

Autonomous Converter Contract API

function () public payable

Handles incoming funds for AutonomousConverter

function init(address _reserveToken, address _smartToken,

address _proceeds, address _auctions) public payable

Called during initial deployment. This is an

owner-only function.

function getMtnBalance() public view returns (uint)

Shows MTN balance in contract

function getEthBalance() public view returns (uint)

Shows ETH balance in contract

function convertEthToMtn(uint _mintReturn) public payable

returns (uint returnedMtn)

Change ETH to MTN. Throw if the returned MTN

would be less than minReturn. Return the amount

of

MTN.

function convertMtnToEth(uint _amount, uint _mintReturn)

public returns (uint returnedEth)

Change MTN to ETH. Throw if the returned ETH

would be less than minReturn. Return the amount

of ETH. Caller will first need to Approve AC to make

a

transfer.

function getMtnForEthResult(uint _depositAmount) public

view returns (uint256)

Return how much MTN the user would get for the

given _depositAmount which is in ETH.

function getEthForMtnResult(uint _depositAmount) public

view returns (uint256)

Return how much ETH the user would get for the

given _depositAmount which is in MTN

event LogFundsIn(address indexed from, uint value)

Emitted when AutonomousConvert receives Funds

event ConvertEthToMtn(address indexed from, uint eth, uint

met)

Emitted when conversion from ETH to MTN

happens.

event ConvertMtnToEth(address indexed from, uint eth, uint

met)

Emitted when conversion from MTN to ETH

happens.

32

TokenLocker

TokenLocker API

event Withdrawn(address indexed who, uint amount)

Emitted for all withdraws

event Deposited(address indexed who, uint amount)

Emitted for all deposits

function lockTokenLocker() public onlyAuction

Lock the tokenLocker. Calling this function will

results in postLock phase of tokenLocker. No more

deposits are allowed. Token withdraw is allowed

during this phase. This is Auction only function.

function deposit (address beneficiary, uint amount) public

onlyAuction preLock

Deposit the fund in locker. Depositing funds are

only allowed during preLock phase.

function withdraw() public onlyOwner postLock

Withdraw funds are only allowed during postLock

phase. This is owner only function.

TokenPorter

TokenPorter API

event ExportReceiptLog(bytes8 destinationChain, address

indexed destinationMetronomeAddr, address indexed

destinationRecipientAddr, uint amountToBurn, bytes

extraData, uint currentTick, uint indexed burnSequence,

bytes32 currentBurnHash, bytes32 prevBurnHash, uint

dailyMintable, uint[] supplyOnAllChains, uint genesisTime)

Emitted during export requests

function addDestinationChain(bytes8 _chainName, address

_contractAddress) public onlyOwner returns (bool)

Add chain as approved chain for metronome export.

This is owner only function.

function removeDestinationChain(bytes8 _chainName)

public onlyOwner returns (bool)

Remove chain from approved chain for metronome

export. This is owner only function.

function claimReceivables(address[] recipients) public

returns (uint)

This function will be called by destination contract

who is performing import of metronome to record

metronome mint in destination contract.

33

function export(bytes8 _destChain, address

_destMetronomeAddr, address _destRecipAddr, uint

_amount, bytes _extraData) public returns (bool)

Exports users account to be imported into another

chain

34

Glossary of Contract Terms

●Autonomous Converter Contract The smart contract, allowing people to trade MTN with ETH or ETH

to MTN.

●Autonomous Proceeds Provider The Metronome Proceeds Contract and Autonomous Converter

Contract.

●Constants Holds a few common constants like DECIMALS.

●Daily Supply Lot The descending price auction that adds newly minted MTN into the ecosystem daily.

●EVM Stands for Ethereum Virtual Machine.

46

●Fixed_Math Implements fixed-point arithmetic, including add, subtract, multiply, divide, square,

square root. Will include overflow protections. For binary functions it assumes that both inputs have

the same number of decimal places.

●Formula Implements the core Bancor-style formula, using the fixed math functions. Formula is

stateless, all the variables are passed in as parameters.

●Metronome The main auctions contract.

●Migrations Part of Truffle’s migrations capability.

●ReserveToken Implements MTN. Gives the Autonomous Converter Contract the right to move tokens

around (in response to trading events).

●Proceeds Contract Accepts ETH from Metronome, forwards 0.25% of its balance to the Autonomous

Converter Contract every 24 hours.

●Smart Token The token issued by Autonomous Converter Contract that acts as an intermediary

when changing between MTN and ETH (and vice versa) via the Autonomous Converter Contract. This

process is automated and is not exposed to the user.

●Token The MTN token purchased by purchasers.

46 http://ethdocs.org/en/latest/introduction/what-is-ethereum.html

35

APPENDIX A

ACKNOWLEDGMENTS AND DISCLAIMERS

BY PURCHASING, OWNING, AND/OR USING METRONOME TOKENS YOU EXPRESSLY

ACKNOWLEDGE AND ASSUME THE FOLLOWING RISKS.

1. Purchaser Acknowledgments. As a purchaser (“Purchaser” or “you”) of Metronome

tokens (“MTN”), you acknowledge as follows:

(a) MTN are not structured or sold as securities or any other form of investment

product. MTN have not been registered with the United States Securities and Exchange Commission

under the Securities Act of 1933, as amended, or under any State securities act, or under any similar laws

in any other jurisdiction, nor do they function in reliance upon exemptions under those laws.

Accordingly, none of the information presented in the Owner’s Manual is intended to form the basis for

any investment decision, and no specific recommendations are intended. The use, sale, or other

disposition of MTN is restricted as stated in the Owner’s Manual. By acquiring MTN, Purchaser

represents that it will comply with all requirements of the Owner’s Manual and any laws promulgated by

any jurisdiction including U.S. federal, state, or local laws. The creators of MTN expressly disclaim any

and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising

directly or indirectly from: (i) reliance on any information contained in the Owner’s Manual or any other

documentation, (ii) any error, omission or inaccuracy in any such information, or (iii) any action resulting

from such information;

(b) This document has not been registered and will not be registered as a prospectus

with the Monetary Authority of Singapore, and is not a prospectus as defined in the Securities and Futures

Act (Cap. 289 of Singapore) (the “SFA”). Accordingly, statutory liability under the SFA in relation to the

content of prospectuses would not apply;

(c) You will not use MTN or Metronome to create a product regulated by the U.S.

Commodity Futures Trading Commission, including creating futures contracts, swaps, or retail

commodity transactions. You also acknowledge that the purchase of MTN is not intended to be, and is

not marketed as, any form of option or swap transaction;

(d) You understand the technical and business matters relating to cryptographic tokens,

token storage mechanisms (such as token wallets), and blockchain technology to understand MTN and to

appreciate the risks and implications of using, purchasing and/or disposing of MTN;

(e) You have obtained sufficient information about MTN to make an informed

decision to purchase MTN and are not relying on any information other than that provided in the Owner’s

Manual in making the decision to purchase MTN;

36

(f) You understand that MTN confers only the right to use MTN as contemplated in

the Owner’s Manual. MTN confers no other rights of any form, including, but not limited to, any entity

ownership, distribution, redemption, liquidation, proprietary (including any form of intellectual property),

or financial or legal rights;

(g) You are purchasing MTN solely for the purpose of using MTN as contemplated in

the Owner’s Manual, being aware of the commercial risks associated with MTN. You are not purchasing

MTN for any other purposes, including, but not limited to, any investment, speculative, or financial

purpose;

(h) Your purchase of MTN complies with applicable laws and regulations in your

jurisdiction, including, but not limited to, (i) legal capacity and any requirement or restriction on the

purchase of MTN, (ii) any foreign exchange or regulatory restrictions applicable to such purchase, and

(iii) any governmental or other consents that may need to be obtained;

(i) You are solely responsible for any applicable tax obligations arising from your

purchase or use of MTN;

(j) If you are purchasing MTN on behalf of an entity, you are authorized to agree to

these Acknowledgments and Disclaimers on such entity’s behalf;

(k) You are not (i) a citizen or resident of a geographic area in which the acceptance of

delivery of MTN is prohibited by applicable law, decree, regulation, treaty, or administrative act, (ii) a

citizen or resident of, or located in, a geographic area that is subject to U.S. or other sovereign country

sanctions or embargoes, or (iii) an individual, or an individual employed by or associated with an entity,

identified on the U.S. Department of Commerce’s Denied Persons or Entity List, the U.S. Department of

Treasury’s Specially Designated Nationals or Blocked Persons Lists, the U.S. Department of State’s

Debarred Parties List, any similar restricted persons regulation or list of any other applicable sovereign

country, or any successor regulations or restrictions to any of the foregoing. You agree that if your

country of residence or other circumstances change such that the above acknowledgments are no longer

accurate, you will immediately cease using MTN;

(l) The value of MTN will depend on whether it is accepted as a cryptocurrency and

the extent it is utilized for the payment of goods and services. Inadequate demand may make it difficult to

utilize MTN for the payment of goods and services, which would tend to diminish the value of MTN.

Likewise, if MTN is not adopted generally the value could also diminish. Moreover, in the near term

there remains a substantial regulatory risk related to oversight of cryptocurrencies and token sales that

could significantly reduce the value of MTN;

(m) The value of MTN should depend primarily on the prevailing value of using MTN

as a cryptocurrency for the payment of goods and services;

(n) The price of MTN should fluctuate in response to competitive and market

conditions affecting the general supply of and demand for MTN as a cryptocurrency. These conditions

37

are beyond the control of any particular party or of MTN holders. The value of MTN when it is used or

exchanged may be lower than the price at which it was purchased;

(o) The release of new MTN on a regular automated and independent basis is intended

to help stabilize the price of MTN around its intrinsic value for services in the Metronome ecosystem, but

there can be no assurance that such release of MTN will succeed in doing so. The Metronome authors do

not intend to take any actions to support or limit the price of MTN, and may purchase and sell MTN for

their own account at any price;

(p) The sale of MTN does not limit in any respect the power of any Metronome author

to participate in other projects, operate other networks or issue other tokens that may compete with MTN;

(q) No promises of future performance or value are or will be made with respect to

MTN, including no promise of inherent value, no promise of continuing payments, and no guarantee that

MTN will hold any particular value; and

(r) There are no conditions as to how the Metronome authors may use proceeds from

the sale of their own MTN.

2. Acknowledgment of Certain Risks. You acknowledge that the following risks exist with

respect to MTN and agree that you are expressly assuming these risks:

(a) Autonomous Nature of MTN

. MTN operates autonomously, without any ability of

any party to influence or control the operation of MTN. The autonomous nature of MTN may create risks

in the future, including risks that were not foreseeable at the time of launch of MTN or your purchase.

(b) Risk of Losing Access to MTN Due to Loss of Private Key(s), Custodial Error or

Purchaser Error.

A private key, or a combination of private keys, is necessary to control and dispose of

MTN stored in your digital wallet or vault. Accordingly, loss of requisite private key(s) associated with

the digital wallet or vault storing MTN will result in loss of such MTN. Moreover, any third party that

gains access to such private key(s), including by gaining access to login credentials of a hosted wallet

service you use, may be able to misappropriate MTN. Any errors or malfunctions caused by or otherwise

related to the digital wallet or vault you choose to receive and store MTN, including your own failure to

properly maintain or use such digital wallet or vault, may also result in the loss of MTN. Additionally,

your failure to follow precisely the procedures set forth for buying and receiving MTN, including, for

instance, if you provide the wrong address, may result in the loss of MTN.

(c) Risks Associated with the Blockchain Protocols.

Any malfunction, breakdown or

abandonment of the blockchain protocols on which MTN operates may have a material adverse effect on

MTN. Moreover, advances in cryptography, or technical advances, could present risks to MTN, by

rendering ineffective the cryptographic consensus mechanism that underpins the blockchain protocols.

(d) Risk of Mining Attacks.

MTN is susceptible to attacks by miners in the course of