Sierra Leone Investors Guide

sierra-leone-investors-guide

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 56

Sierra Leone:

An Investor’s Guide

A Private Sector Perspective on the Investment Landscape

Publication Date, July 2015

In October 2014, the UK Foreign and Commonwealth Office held a briefing for the business

community on its actions to support the Government of Sierra Leone during the Ebola crisis.

Following that briefing, a group of financial and professional services firms based in the UK came

together to provide pro bono support for the UK Government as it assisted the Government of Sierra

Leone in the fight against Ebola. The group of firms, known informally as the “City Ebola Taskforce”,

has drafted this Investor Guide to address “aversion behaviour” on the part of investors by presenting

a private sector voice on the opportunities for investment in Sierra Leone.

The contents of this publication are, to the best of our knowledge, current at the date of publication,

and are for reference purposes only. They do not constitute legal or investment advice and should

not be relied upon as such. Specific professional advice about your specific circumstances should

always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills LLP 2015

01

Forewords .......................................................................................................................................................................................................................................................... 03

Introduction ...................................................................................................................................................................................................................................................06

Executive Summary ............................................................................................................................................................................................................................ 06

Part I: Investing in Sierra Leone.............................................................................................................................................................................. 11

Sierra Leone at a Glance ......................................................................................................................................................................................... 11

Country Facts .............................................................................................................................................................................................................................. 11

Governance.....................................................................................................................................................................................................................................12

Rule of Law ...................................................................................................................................................................................................................................... 12

Business and Human Rights..............................................................................................................................................................................13

Dispute Resolution..............................................................................................................................................................................................................14

Finance and Banking .......................................................................................................................................................................................................15

Investing in Sierra Leone ..........................................................................................................................................................................................16

Policy and the Legislative Framework ................................................................................................................................................. 19

Introduction to the Legal Landscape ...................................................................................................................................................19

Entry and Establishment ............................................................................................................................................................................................19

Treatment and Protection of Foreign Investments .........................................................................................................20

Key Legislation Affecting Businesses in Sierra Leone ........................................................................................... 21

Part II: Overview of key sectors ...............................................................................................................................................................................26

Energy.......................................................................................................................................................................................................................................................26

Natural Resources: Mining and Petroleum ............................................................................................................................... 30

Infrastructure: Water, Roads, Rail, Ports, Airports, Telecoms and Tourism ...................... 34

Agriculture and Fisheries ........................................................................................................................................................................................ 38

Part III: Post-Ebola Investment Climate ..................................................................................................................................................42

Introduction to the Post-Ebola Investment Climate ......................................................................................................42

The Post-Ebola Recovery Strategy..........................................................................................................................................................42

Rebound in Economic Activity ....................................................................................................................................................................... 43

Investment Opportunities: Health, Education and Social Services ................................................ 43

Renewed Focus on Traditional Growth Sectors.............................................................................................................. 44

Looking to the Future .................................................................................................................................................................................................................. 45

List of Abbreviations ......................................................................................................................................................................................................................... 46

References........................................................................................................................................................................................................................................................ 48

Contents

02

03

Sierra Leone Investment and

Export Promotion Agency

Towerhill, O.A.U. Drive

Freetown, Sierra Leone

+232 78 233 712

+232 77 439 355

www.investsierraleone.biz

Since my election as President of the

Republic of Sierra Leone in 2007, my

focus has been to rekindle that pioneering

spirit, to motivate and develop the private

sector to drive Sierra Leone’s economic

development. That is why my Government

has in the last seven years prioritised

improving the enabling environment so that

the private sector can thrive and provide

much-needed growth, opportunities and

resources for our country.

As I write, we are fighting the last cases

of Ebola in the country. It has been a long,

unprecedented struggle, but with the

dedication and heroism of our Ebola

response workers, with the strength,

expertise and, too often, sacrifice of our

doctors, nurses and other health workers,

and with support from our international

partners, we are winning the fight for our

humanity and our nation.

Before we were struck by Ebola, we were

one of the fastest growing economies

in the world. Our ambition is to return

to this trajectory of prosperity. From my

first term’s “Agenda for Change”, which

focused on private sector-led growth, to

the “Agenda for Prosperity”, our country’s

vision to become a middle-income country,

we as a nation are pursuing an inclusive

economy with reduced poverty and greater

opportunities for all people. We recognise

that this is only possible in partnership with

the private sector.

The private sector has therefore been

placed at the heart of our recovery plan

through which we hope to expedite

socio-economic recovery and reclaim the

path to sustainable development set out

in the “Agenda for Prosperity”. Our

long-term strategy and short-term

Recovery and Transition Plan set out to

restore and strengthen trade and private

sector activities. This Investor Guide is one

step in that direction.

This Guide represents an independent

private sector voice on Sierra Leone’s

investment landscape. I am grateful to

the firms that came together to draft the

Guide and would encourage potential

investors looking for a comprehensive,

independent and objective reflection of the

potential of the Republic of Sierra Leone

for future investment to read about the

numerous opportunities outlined in the

pages that follow.

I look forward to you visiting our great

country, to experience first-hand, the

beauty, the graciousness and the resilience

of Sierra Leoneans and our remarkable

investment potential.

A very warm welcome, and God bless

Sierra Leone.

H.E. Dr. Ernest Bai Koroma

President of the Republic of Sierra Leone

I look forward to you visiting

ourgreat country, to experience

rst‑hand, the beauty, the

graciousness and the resilience

ofSierra Leoneans and our

remarkable investment potential.

Sierra Leone has a wonderful heritage and history of achieving

many rsts in Africa – from being pioneers in printing

newspapers and delivering national radio to establishing

Fourah Bay College, the rst university in sub‑Saharan Africa.

Foreword by

President Ernest Bai Koroma

04

Africa’s story in the twenty-first century is

one of entrepreneurialism, advancing

technology and rising opportunity. Sierra

Leone was very much a part of this story

prior to the 2014-2015 Ebola epidemic

and was one of the fastest-growing

economies in the world. Investments in

infrastructure and energy were

accelerating, efforts to strengthen

government institutions and capacity

were under way, and the Sierra Leone

Government was working on policies and

reforms conducive to good governance

and private sector growth. As a result,

Sierra Leone was presenting attractive

international investment opportunities

in energy, including in hydropower and

solar generation; infrastructure; natural

resources such as bauxite, diamonds,

gold, rutile, coltan, iron ore and potentially

offshore oil. Lastly, there were largely

untapped opportunities in agriculture and

fisheries, with fish stocks estimated at

more than US$100 million per annum.

Apart from the terrible human cost, the

Ebola outbreak has set Sierra Leone back

economically. It took the heroic efforts of

the Sierra Leonean people and their

government and an unprecedented crisis

response from the United Kingdom,

non-governmental organisations and wider

international community to turn the tide of

the epidemic. At the time of publication,

the UK remains focused on supporting the

government and people of Sierra Leone to

get to zero new cases of Ebola as quickly

as possible, but it is right that we are also

looking to the future. That future should be

one with a revitalised economy; a growing

and flourishing private sector will be key

to this crucial pillar of a sustainable

recovery effort.

Now is the time for the private sector to

truly come into its own in the long-term

recovery effort, identifying and driving the

business opportunities that Sierra

Leoneans and leading businesses stand

ready to grasp. This is not just a matter of

corporate responsibility. If Sierra Leone’s

potential can be harnessed to create

sustainable long-term growth on behalf

of all its people, it could become a real

economic force and a major market in

which to do business. There is huge

potential in sectors such as energy (where

a ten-fold increase in generation is planned

over the coming years), mining, petroleum,

agriculture and infrastructure.

The Government of Sierra Leone, with UK

and international community support, is

working to diversify its economy, improve

transparency, broaden its tax base, develop

and improve its infrastructure and create

jobs for the people of Sierra Leone. Private

sector involvement and investment will be

central to unlocking this potential – to

everyone’s benefit. We hope that this

Investor Guide will be a tool to support the

widening and strengthening of these

partnerships so critical for our shared

prosperity. The way the world acts now will

define Sierra Leone’s future, and the

region’s future, for years to come.

The Rt Hon Justine Greening

UK Secretary of State for International

Development

James Duddridge MP

UK Minister for Africa, Caribbean, and the

Overseas Territories in the Foreign and

Commonwealth Office

Foreword by the UK Secretary

of State for International

Development and UK Minister

for Africa

05

Acknowledgements

Herbert Smith Freehills LLP, Standard

Chartered Bank and Prudential are very

grateful for the assistance provided in the

compilation of this Investor Guide by the

Government of Sierra Leone including the

Sierra Leone Investment and Export

Promotion Agency, the Africa Governance

Initiative, the UK Department for

International Development, the UK Foreign

and Commonwealth Office, Friends

Provident, Addax Bioenergy, Solon Capital

Partners, TCQ Power, Copperbelt Energy

Corporation, ManoCap, Lion Mountains

and Phoenix Africa Development Company,

the UK Sierra Leone Pro Bono Network,

Eversheds LLP, BMT Law Chambers,

Francis Taylor Building, Agiterra Group,

and Planting Promise.

We are delighted to have worked

together to produce this Investor Guide

for Sierra Leone.

As global businesses with a long-standing

commitment to Africa in general – and

Sierra Leone in particular – we are

passionate about helping Sierra Leone

recover and emerge stronger from the

Ebola crisis. While challenges remain, the

country offers tremendous potential, with

strong underlying growth and investment

opportunities. We are absolutely

committed to working with the Government

of Sierra Leone and international partners

and investors to help the country reach its

full potential, for the benefit of all.

This Investor Guide outlines the opportunities

the country offers, provides context for

potential investors and outlines resources

that potential investors can draw on.

Each of our organisations has responded

to the Ebola crisis, deploying our

resources, networks and expertise to help

where we can. We have also recognised

that we are stronger when we work

together, which is why we joined forces to

form the City Ebola Taskforce. There is no

doubt that the financial and professional

services sector has an important role to

play in supporting the rebuilding of

stronger banking, insurance and legal

frameworks in Sierra Leone.

The work in regenerating Sierra Leone will

stretch well beyond the immediate aftermath

of the crisis and will require commitment,

skill and imagination over the coming

months and years. We hope that this

Investor Guide will grow and develop, and

will serve as a useful resource for all those

with an interest in helping Sierra Leone on

its path towards economic recovery.

Stéphane Brabant

Partner, Africa Practice Group Chairman

Herbert Smith Freehills

Diana Layfield

CEO, Africa Region

Standard Chartered

Matt Lilley

CEO Africa

Prudential plc

Joint Letter from

Herbert Smith Freehills,

Standard Chartered

and Prudential plc

06

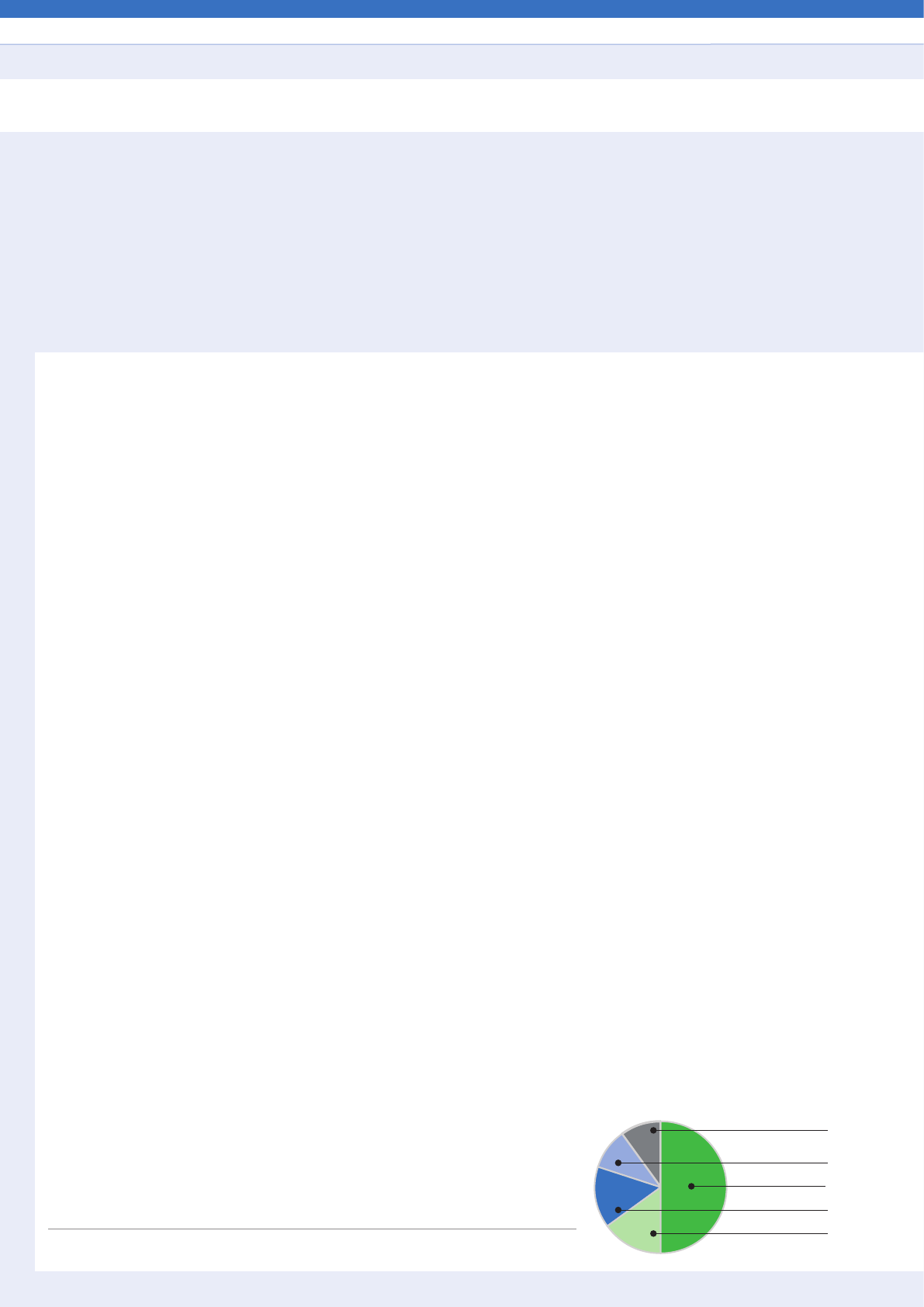

2005 2006 2007 2008 2009 2010 2011

0

5

15

25

10

20

4.5325.240

4.241

8.042

3.1965.962

2012 2013

15.204

20.127

Sierra Leone GDP growth, constant 2010 USD %

e Government of Sierra Leone

(GoSL) has placed private sector‑led

growth at the heart of its Post‑Ebola

Recovery Strategy (published in

2015), acknowledging the need to

assure investors that Sierra Leone

isan environment conducive to

foreign direct investment.

The Ebola outbreak not only resulted in a

devastating humanitarian crisis but also

“aversion behaviour” on the part of

numerous investors, which adversely

affected this pre-crisis growth.

The Government of Sierra Leone (GoSL)

has placed private sector-led growth at the

heart of its Post-Ebola Recovery Strategy

(published in 2015), acknowledging the

need to assure investors that Sierra Leone

is an environment conducive to foreign

direct investment (FDI). Although

challenges to doing business in Sierra

Leone remain, several of these challenges

themselves also give rise to promising

opportunities for investment.

The purpose of this Investor Guide is to

identify and describe areas of opportunity

for investment in Sierra Leone in the run-up

to reaching zero new cases of Ebola and in

the immediate post-crisis period.

This Investor Guide considers key features of

the Sierra Leonean economy and its principal

industry sectors and provides an outline of the

applicable legislative framework. It features

case studies from current international

investors in Sierra Leone and demonstrates

the progress that has been made in recent

years in creating an attractive environment for

foreign investment, as well as the key

challenges that are being, and remain to be,

addressed at the time of publication.

Executive Summary

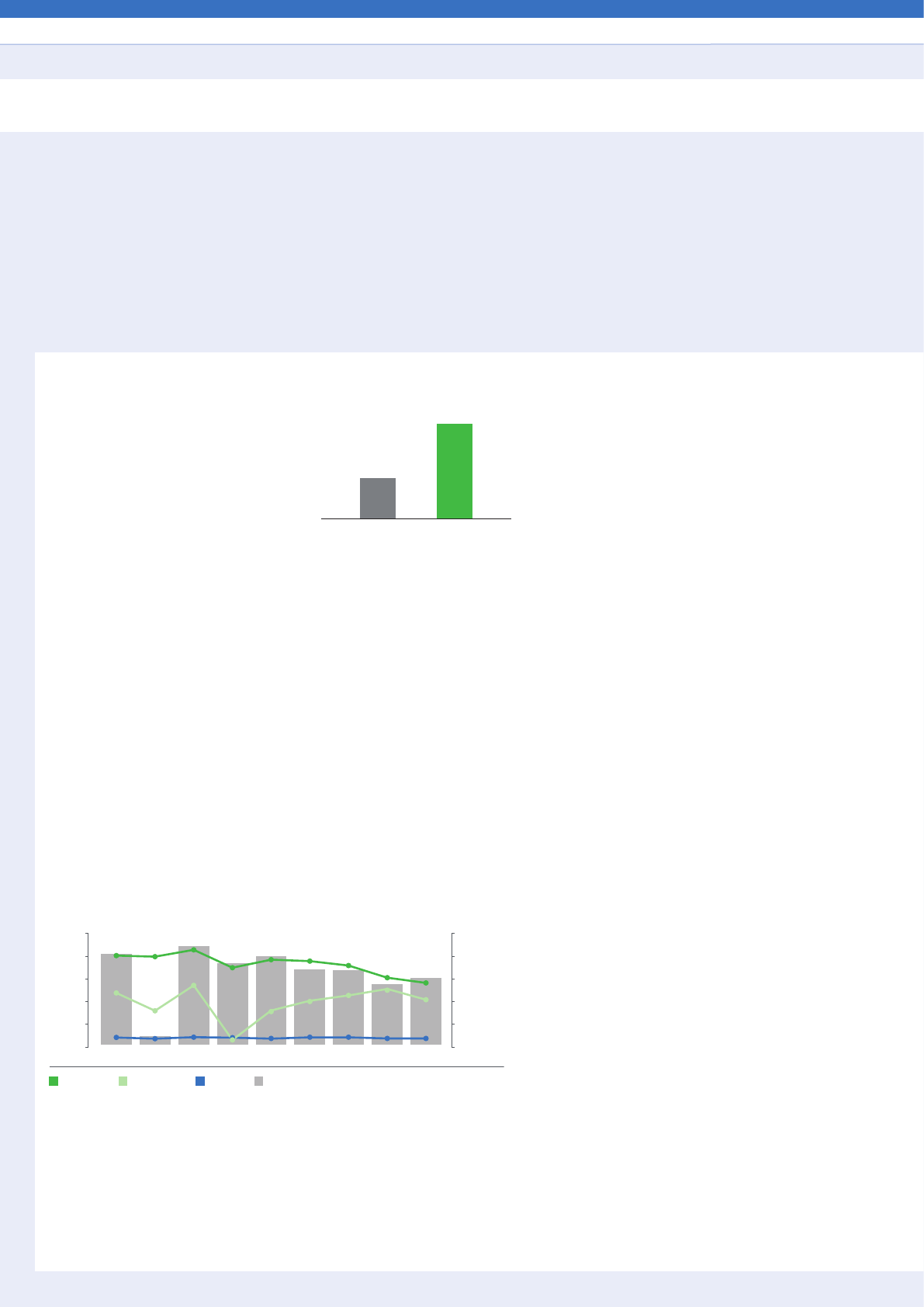

Economic Context

Sierra Leone’s economic fundamentals

present an attractive investment

proposition. In 2013, Sierra Leone’s real

GDP growth was approximately 20 per

cent. While this fell during the height of the

Ebola crisis, with estimates for 2014 and

forecasts for 2015 predicting negative

growth, Sierra Leone is projected to return

to solid growth as the country recovers

from the outbreak and coinciding drop in

commodity prices.

Forecasts for 2016 and 2017 place the

country’s estimated growth at 8.4 per cent.

in terms of real GDP, which is above other

sub-Saharan economies such as Kenya,

Nigeria and Ghana, and also above the

global developing country average of

approximately 5 per cent. Sierra Leone’s

currency, the Leone, has proved stable,

and inflation has fallen from double digit

levels at the start of the decade to a

projected 6.6 per cent. for 2015. It is

expected that growth will rebound to

double digits over the next three to

five years.

In the four years preceding the Ebola outbreak, Sierra Leone’s

economy outperformed both the West African and pan‑

African averages year‑on‑year, placing it among the world’s

top 20 economies by growth during that period.

Introduction

Introduction Part I Part II Part III Looking to the Future

07

2013 2014e2015f 2016f

0

5

15

25

10

20

20.1

6.0

-12.8

8.4

2017f

8.9

-15

-10

-5

Developing economies averageSierra LeoneNigeriaKenyaGhana

Real GDP growth %

FDI levels have been increasing since the

end of the civil war in 2002 and the latest

United Nations (UN) figures show

US$579.1 million of inward FDI flows for

2013. This is, in part, due to the GoSL

undertaking what the United Nations

Conference on Trade and Development

(UNCTAD) has called “one of West

Africa’s most ambitious reform agendas”.

Sierra Leone has made it a political priority

to create a highly competitive environment

for FDI. The country has recently been

called “one of the world’s top ten business

reformers”, and has climbed into the top

half of the sub-Saharan index for ease of

doing business, coming above its

neighbours Senegal, Guinea and Liberia in

the 2015 World Bank survey.

Steady economic progression has been

underpinned by political stability. Since

2002, there have been two peaceful

democratic elections, including a peaceful

transition of power between the two major

political parties. Sierra Leone is one of

Africa’s most religiously tolerant nations: as

The Economist has noted, “Sierra Leone

takes religious tolerance seriously…

relations between the two main religious

groups in the West African country are

cordial.” Continued stability will be

essential as the country aims to meet its

objective of achieving “middle income

status” (as defined by the World Bank)

by 2035.

To place the country back on its trajectory

to meet this objective, the GoSL’s Post-

Ebola Recovery Strategy includes a holistic

review of the GoSL’s priorities, policies and

systems underpinning social betterment

and economic growth. The Strategy

indicates the GoSL’s willingness to reflect

on what could have been done differently

in the period preceding the Ebola outbreak

and reasserts its commitment to creating a

favourable investment climate in order to

boost private sector participation and bring

back the growth the country enjoyed

before the outbreak.

Overview of Investment

Opportunities

Sierra Leone benefits from a number of

enviable natural advantages. It has a

strategic location on the Atlantic seaboard

of West Africa, with one of the largest

natural harbours in the world. The country

has over 5.4 million hectares of fertile

agricultural land and forestry, almost

75 per cent. of which remains under-

cultivated. It is also seeking to improve the

exploitation of its significant fish stocks,

yields for which are, at the time of

publication, estimated at more than

US$100 million per annum.

Rich deposits of a variety of important

minerals lie beneath the ground, including

iron ore (Sierra Leone is home to one of the

world’s largest deposits containing an

estimated 12.8 billion tonnes of iron ore

reserves), bauxite (of which Sierra Leone

has significant reserves, including a reserve

at Port Loko of around 100 million tonnes)

and rutile (Sierra Leone produced an

estimated 120,000 tonnes of contained

titanium dioxide in 2014, which accounted

for roughly 14 per cent of total world

production). Between 2009 and 2012

the value of Sierra Leone’s natural

resource exports exceeded

US$1.2 billion, accounting for

approximately 70 per cent of the country’s

total exports. The GoSL recognises that the

effective exploitation of the country’s natural

resources represents its best prospect

of achieving its aims under the Agenda

for Prosperity (A4P).

Notwithstanding the natural attractions of

Sierra Leone as an investment destination,

foreign investors will nonetheless need to

overcome certain obstacles. The most

visible of these is the lack of adequate

social and physical infrastructure and

historic underfunding in education, health,

transport and telecommunications, coupled

with the diversion of scarce public

resources caused by the civil war of the

1990s. This Investor Guide sets out the

measures the GoSL is taking to address

these concerns, including infrastructure

08

rehabilitation and construction projects.

The GoSL is also tackling issues of

corruption through the development and

strengthening of anti-corruption

mechanisms outlined in further detail in

Part I below.

Sierra Leone is ranked 183 out of 187

countries on the United Nations

Development Programme (UNDP)’s

Human Development Index 2013 and is

currently seeking to rediscover the

momentum it had before the Ebola

outbreak. Patience, flexibility and

determination are essential for successful

investment in the country, and for

capitalising on the undoubted

opportunities that exist.

Opportunities for immediate investment

range from Sierra Leone’s traditional

strengths in mineral resources, to huge,

largely untapped opportunities in

agriculture and fisheries. There are also

opportunities in biofuels and hydro-

electricity along with serious potential in

offshore oil and gas.

For specific details on the opportunities

and challenges relating to the following

sectors summarised here, please refer to

Part II of this Investor Guide.

Energy

The GoSL is focused on increasing

generation capacity and improving the

transmission and distribution of power in

the country. This presents numerous

opportunities for investment in the sector.

To address Sierra Leone’s low levels of

installed power generation capacity, the

GoSL has identified up to 27 potential

hydropower sites, ranging from the

US$580 million Yiben project, to smaller

projects, including mini-hydro plants below

1 MW. In addition, the potential for solar

power is as great as 2200kWh/m,

according to the European Commission.

Hybrid solar-hydro plants are being

considered as a possible solution to

managing reduced water levels during

Sierra Leone’s dry season.

The GoSL is also raising capital to invest in

the creation of a national grid through the

2015 Electricity Medium-Term Bond.

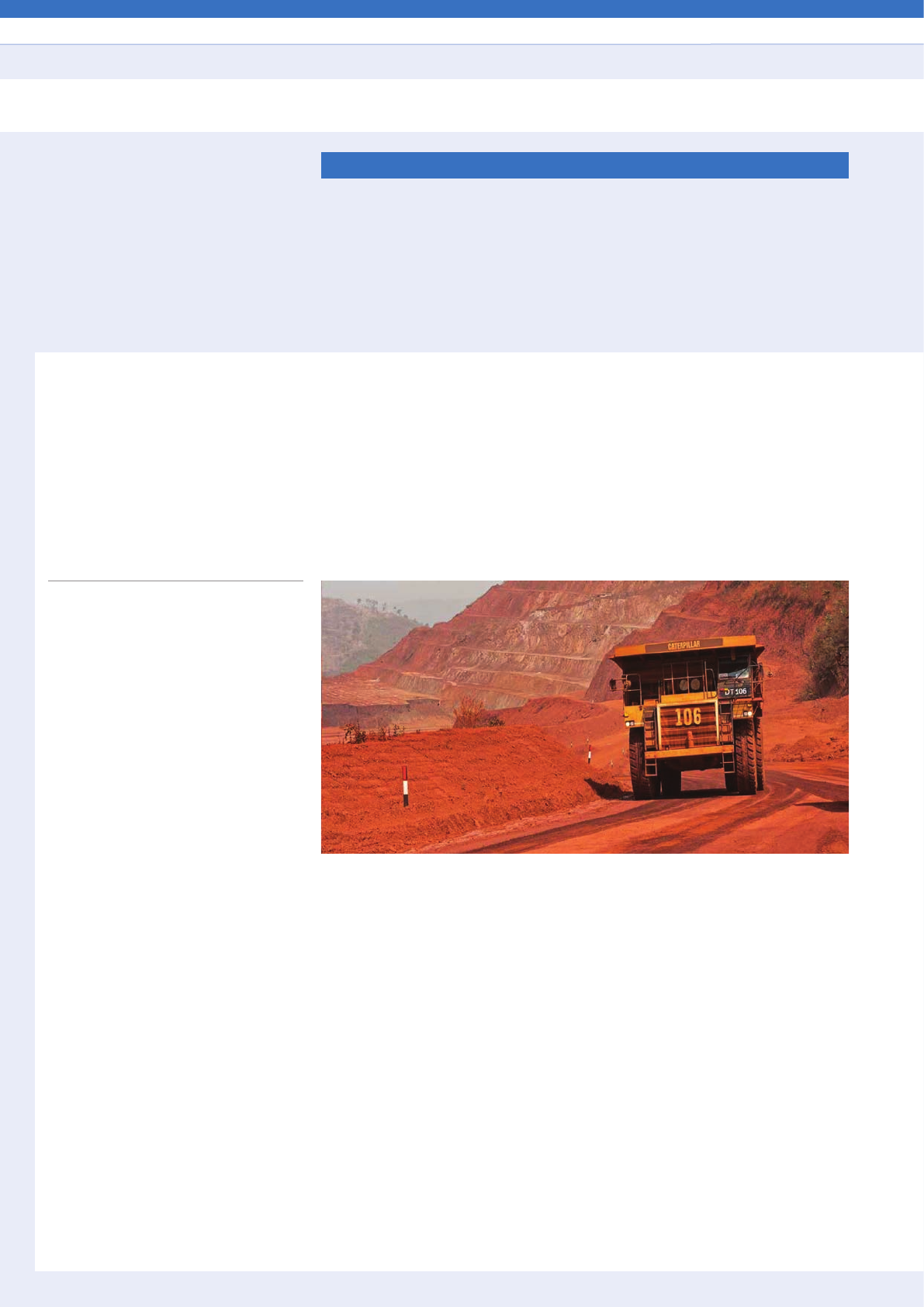

Natural Resources

Sierra Leone has rich mineral deposits and

significant reserves of gold and diamonds,

outlined further in Parts I and II of this

Investor Guide.

The extractives sector has been heavily

affected by the drop in iron ore prices

compounded by the Ebola outbreak.

Production remains below Sierra Leone’s

potential output and extensive reserves

remain under-exploited.

Sierra Leone has made significant efforts

to improve the integrity of its mining sector

to meet modern standards, complying with

the global standards of the Extractive

Industries Transparency Initiative.

Discoveries of offshore oil fields by African

Petroleum and Anadarko display significant

potential. The GoSL estimates that oil

production could start in 2017. Although

the size of oil resources and the financial

viability of extraction are not yet clear,

estimates range from 500 to 700

million barrels of oil, and preliminary

drilling indicates that the oil is of a

high quality.

Infrastructure

The GoSL has embarked on a vast

programme of works to improve the

country’s infrastructure, giving rise to many

opportunities for strategic partnerships.

Improvements to the country’s physical and

digital infrastructure will inevitably advance

growth in other sectors. This includes

Sierra Leone’s promising tourism sector,

which has significant potential for growth,

particularly following the opening of

Freetown’s five-star Radisson Blu Hotel in

2014 and the development of the Hilton’s

Cape Sierra Hotel, due to open in 2015.

Opportunities for immediate

investment range from Sierra Leone’s

traditional strengths in mineral

resources, to huge, largely untapped

opportunities in agriculture and

sheries. ere are also

opportunities in biofuels and

hydro‑electricity along with serious

potential in oshore oil and gas

Introduction Part I Part II Part III Looking to the Future

09

Sierra Leone’s principal transport hubs are

the Port of Freetown and Lungi

International Airport. Both sites have been

criticised in the past for being outdated.

The GoSL has taken steps to address this:

In November 2010, the National

Commission for Privatization awarded a 20

year concession of the Port of Freetown

terminal to Bolloré Africa Logistics,

resulting in changes that are expected to

increase the involvement of the private

sector in front-line and back-up cargo

handling and storage functions.

Lungi International Airport is also under

renovation, with US$8.9 million funding

from the World Bank and the

participation of a number of European

private enterprises. In addition, plans are

in place for the development of a new

airport at Mamamah.

In telecoms, the Africa Coast to Europe

(ACE) submarine cable, which extends

from France to South Africa, finally linked

to the Sierra Leone network in February

2013. The country will also benefit from

the ECOWAS fibre optic network

(ECOWAN) in due course. This is

addressed as a priority in the GoSL’s

Post-Ebola Recovery Strategy.

The post-Ebola landscape will give rise to

significant investment opportunities in

health and sanitation infrastructure. Ebola

has hit these sectors hard, with the loss of

many hospital staff and resources to the

disease. As has been noted,

“reconstructing the health system in the

post-Ebola period will require significant

investments in every aspect of the health

system.”

Agriculture and Fisheries

The agricultural sector has also been badly

affected by the Ebola epidemic. Despite

these difficulties, the extensive opportunities

for investment in this area are attractive.

Sierra Leone has around 5.4 million hectares

of fertile land and compares favourably

against its counterparts in other emerging

markets in terms of labour costs, leasing

costs and resource costs.

In addition, a number of tax incentives are

available to certain agribusinesses. The

GoSL is promoting investment in cash

crops such as cocoa, coffee and palm oil

and is also planning to establish (tax free)

export-processing zones in the country.

Fisheries and marine resources are one of

Sierra Leone’s lesser known sources of

untapped wealth, yet they have the

potential to become the country’s second

largest sector for exports after minerals.

Investment Climate

The GoSL’s A4P programme is aimed at

boosting the country’s investment climate

and capitalising on the current political

stability. The programme emphasises

private sector-led growth, with a particular

focus on diversifying the economy and

improving the enabling environment for

private sector-led growth through, for

instance, improvements in energy, water

and transport infrastructure. Further details

can be found in the sector-specific sections

under Part II of this Investor Guide.

The Investment Promotion Act 2004 (IPA),

which serves as the foundation of the

private investment regime in Sierra Leone,

has as its purpose the promotion and

attraction of private investment, both

domestic and foreign, “for the development

of value-adding opportunities, export

creation and investment opportunities.”

The IPA offers significant incentives to

foreign investors in Sierra Leone, including

the ability to repatriate profits and capital

without restriction, the ability for

companies to carry forward losses

indefinitely and customs exemptions for

expatriate workers and their families.

A variety of tax and non-tax incentives

for both local and foreign investors

have been designed to channel

investments to specific industries and

encourage engagement in eligible new

enterprises and expansion projects in

agriculture, agro-industries, manufacturing

and construction. Incentives include

income tax exemptions, deductions for

income tax purposes and import duty

exemptions. These are explored in greater

detail in Parts I of this Investor Guide.

The IPA supplements these incentives with

a framework for the settlement of disputes

in an international forum, providing for

United Nations Commission on

International Trade Law (UNCITRAL)

arbitration (or resolution under such other

international machinery as the parties may

agree) in the event of a dispute between

an investor and the GoSL with respect to

(a) an investment in a business enterprise,

or (b) investments that have been

obstructed or delayed by the GoSL.

Investors from the United Kingdom (UK)

and Germany investing in Sierra Leone

benefit from bilateral investment treaties

(BITs), which prohibit discriminatory

treatment, provide for most-favoured nation

(MFN) treatment, and refer investor-state

disputes to ICSID arbitration. A BIT with

China containing standard investment

protections has been signed but is not yet

in force.

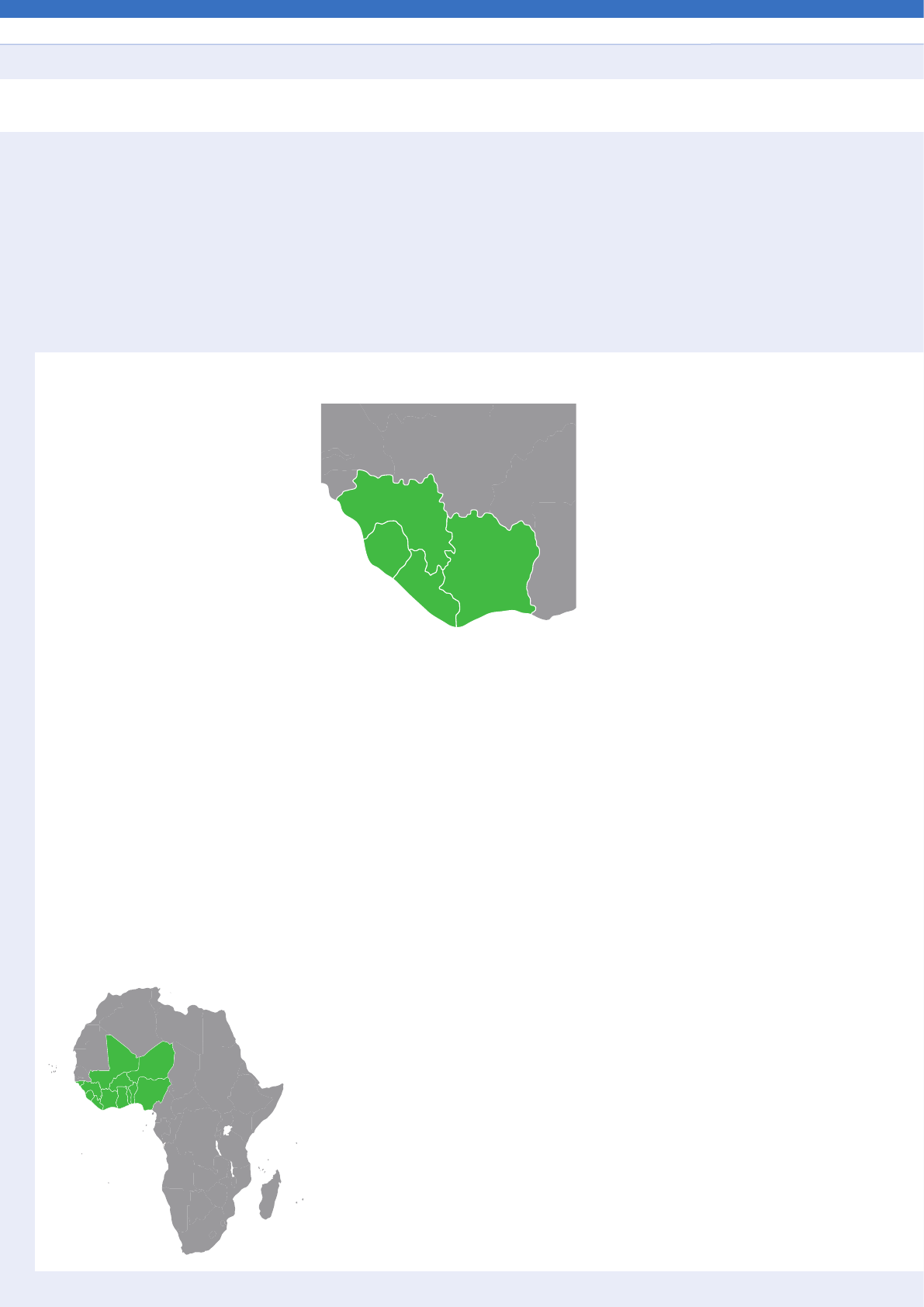

At a regional level, Sierra Leone is a

member of the Economic Community of

West African States (ECOWAS), a

15-member regional group and, more

locally, the Mano River Union (MRU), a

smaller regional group consisting of Côte

d’Ivoire, Guinea, Liberia and Sierra Leone.

Both groups exist to develop intra-African

trade by promoting economic co-operation

and the removal or harmonisation of tariffs

and other barriers.

10

In the context of an increasing focus on

human rights within businesses around

the world, the GoSL has taken steps to

enhance human rights protection. These

are explored in Part I of this Investor

Guide. The country has seen a steady

improvement in this area since the end of

the civil war in 2002. This includes the

establishment of the Sierra Leone Human

Rights Commission in 2004, which has

a mandate to protect and promote human

rights across the country, and the National

Commission for Social Action, which has

been active in disability rights and has

provided rehabilitation grants to over

one thousand conflict victims, including

amputees. Legislative reforms include the

Persons with Disability Act 2011, which

transposed the Convention on the Rights

of Persons with Disabilities into domestic

law, gender justice laws and the Child

Rights Act 2007.

Key GoSL Contacts for Investors

Sierra Leone has developed a political

framework for the promotion and

facilitation of inbound investment. The

Sierra Leone Investment and Export

Promotion Agency (SLIEPA) was

established in 2007, which provides

existing and potential investors with

information and support relating to

investment in Sierra Leone. Potential

investors may find it helpful to make

contact with SLIEPA early in the

investment process.

Alongside SLIEPA, the Public Private

Partnership Act 2010 (PPP Act 2010)

established the Public Private Partnership

Unit (PPP Unit) as an agency of the

GoSL’s executive arm. The PPP Unit

sources, develops, supports and conducts

due diligence in respect of public-private

investments in Sierra Leone, with particular

regard to investments in infrastructure and

other long-term projects.

ere are considerable opportunities

for immediate investment in Sierra

Leone. ese will benet from the

GoSL’s increased focus on improving

the investment climate in the

post‑Ebola period. In this context,

we invite investors to consider

afreshSierra Leone as a desirable

destination for investment.

Introduction Part I Part II Part III Looking to the Future

11

Population

6.32m

Area

7 1,740km2

GDP

US$4.4bn

Sierra Leone at a Glance

Country Facts1

Population: 6.32m (April 2015 estimate);

4.98 million at last census (2004). The

next census, which was postponed due to

the Ebola outbreak, is now planned for

December 2015. Around 38 per cent. of

the population live in urban areas.

Geography: Situated in West Africa.

Bordered to the west by the Atlantic

Ocean, to the north and northeast by

Guinea and to the south and southeast

by Liberia.

Area: 71,740km2

GDP: US$4.4 billion falling by 12.8 per

cent. from the 2014 figure, though

currently predicted to rebound to 8.4 per

cent. growth in 2016 if iron ore production

returns to its previous levels (April 2015

estimate). Over the past ten years (until

2014), GDP has been continually (and

increasingly) on the rise. In 2013, before

Ebola hit the country, Sierra Leone’s

real GDP growth rate was more than

20 per cent.

Currency: Leone (Le)

Official language: English

Core industries: agriculture (key crops,

such as rice, sugar, oil palm and cocoa, as

well as agribusiness functions relating to

trading and/or processing); diamonds

(over 600,000 carats exported in 2013),

iron ore (one of the world’s largest iron ore

deposits at African Minerals’ Tonkolili mine

contains an estimated 12.8 billion

tonnes), rutile (the world’s largest

reserves, producing an estimated 120,000

tonnes of contained titanium dioxide in

2014), gold (producing approximately 141

kg worth of gold in terms of mine output in

2012 and 193 kg in 2014) and bauxite

mining (including the country’s Port Loko

deposit, which contains 100 million tonnes

of bauxite reserves). Tourism is another

key sector in the country, with potential

to tap into sub-Saharan Africa’s

US$66 billion tourism industry.

Part I of the Investor Guide sets out Sierra Leone’s investment

climate, key opportunities and challenges for investors in the

country, an overview of the market and thelegal framework

for FDI.

Part I

Investing in Sierra Leone

1 Unless indicated otherwise, figures have been

sourced from the IMF.

12

Key exports and imports: as detailed

further in Part II of this Investor Guide,

Sierra Leone’s main exports are in the

mining and agriculture sectors. Until 2012,

diamonds were the main export in Sierra

Leone. Iron ore has since taken its place,

accounting for 55.7 per cent. of total

exports in 2013. The mining sector

accounts for roughly 90 per cent. of annual

export revenues. At the time of publication,

Sierra Leone’s exports are worth

approximately US$765 million, of which

mineral resources account for

approximately 75 per cent., followed

closely by cocoa (8.5 per cent.) and coffee.

Sierra Leone’s main imports are machinery

and transport equipment (largely relating to

mining and oil investment projects and

accounting for approximately 50 per cent

of total imports) and fuel (10 per cent). The

Bank of Sierra Leone expects exports to

decrease in the short term and level out in

the medium term, and for imports to

increase.

History & politics: Sierra Leone gained

independence from Britain in 1961. From

1961 to 1998 the political system shifted

between multi-party democracy, military

rule and one-party rule. Sierra Leone has

remained a multi-party democracy since

1998. The country emerged from a

decade-long civil war in 2002.

The Constitution recognises three

branches of government: legislative,

executive and judicial. Parliamentary terms

last for five years and the President may

not serve for more than two terms, whether

or not those terms are consecutive.

The current President, Ernest Bai Koroma

of the All People’s Congress Party, is

serving his second term, having been

re-elected in 2012 (winning 58.7 per cent.

of votes). His party also holds 67 of the

112 nationally-elected seats. 12 additional

seats are filled in separate elections by

paramount chiefs. A total of ten parties

took part in the 2012 elections, which were

peaceful and transparent. The next

elections are due to be held in early 2018.

The Constitution, as currently drafted, does

not allow an incumbent to stand for a third

term. A peaceful, credible and stable

transition of power would increase investor

confidence by providing a reduced risk of

shock and greater predictability.

Foreign aid: The country remains largely

dependent on foreign aid. The current

account deficit was estimated to be

US$511.8 million in 2013 and US$466.9

million in 2014. The deficit is projected to

be US$582 million for 2015.

Sierra Leone benefits from the support of

various international agencies, including

the United Nations Development

Programme (UNDP), the World Bank, and

the UK Department for International

Development (DFID).

Governance

The GoSL is led by a President elected

directly by the people and who is also the

Head of State and Commander-in-Chief of

the armed forces.

Within the GoSL, the Ministry of Trade and

Industry has oversight of policies relating

to domestic and international trade.

SLIEPA is responsible for policies to

improve the investment climate, promote

local and export trade and encourage the

development of small-to-medium-sized

businesses. SLIEPA has thus far focused

on FDI in key economic sectors including

agriculture, marine resources, mining,

energy and tourism sectors.

A system of local government was

established by the Local Government Act

2004. It comprises 19 councils: five city

councils, one municipal council and 13

district councils. The Decentralization

Secretariat was established under the

World Bank’s Institutional Reform and

Capacity Building Project to promote

decentralisation.

Rule of law

Constitution

Sierra Leone’s Constitution contains

certain investment protections, such as the

right not to be deprived of one’s property,

described further below. There are

numerous provisions that uphold the

separation of powers between the

legislative, executive and judicial branches

of government.

The Supreme Court has power to rule on

all matters relating to the interpretation of

the Constitution and in relation to any

question concerning whether Parliament,

or any other authority, has exceeded its

powers. Parliamentary Committees also

have a duty to investigate the activities and

administration of the executive Ministries.

Transparency and Accountability

Sierra Leone is a party to the UN

Convention Against Corruption.

Domestically, the Anti-Corruption

Commission (ACC), established under the

Anti-Corruption Act of 2000, as amended

in 2008, is the body responsible for

investigating allegations of, and educating

the public on, corruption.

Sierra Leone scored 3.0 out of 6.0 for

transparency, accountability, and corruption

in the public sector ratings (where 1.0

indicates low transparency levels and 6.0

high transparency levels) on the World

Bank’s 2014 Country Policy and

International Assessment. In the same

year, Sierra Leone ranked 119 out of 175

in Transparency International’s Corruption

Perceptions Index (CPI), with a score of

31/100.

Introduction Part I Part II Part III Looking to the Future

13

While there is still work to be done,

Sierra Leone is heading in the right

direction, with a key outcome in the

GoSL’s Justice Sector Reform Strategy

and Investment Policy (JSRSIP III) for

2015-2018 being the strengthening of

anti-corruption institutions and

mechanisms. It is encouraging that Sierra

Leone has seen a consistent improvement

in its CPI ranking over the past six years.

The 2014 Index put Sierra Leone ahead of

21 other sub-Saharan African countries,

including common investment destinations

such as Nigeria and Kenya. On a global

level, Sierra Leone’s ranking surpasses

many other emerging investment markets.

Sierra Leone has made significant efforts

to regulate the procurement process to

ensure transparency and accountability in

public procurement. The National Public

Procurement Authority (NPPA), which was

established under the Public Procurement

Act of 2004, is mandated with the task of

overseeing and monitoring procurement

across MDAs and local councils, building

capacity and assisting with policy

formulation. The NPPA has made

significant reforms to the public

procurement system, creating regulations

to support the implementation of the

Public Procurement Act, developing

user-friendly manuals for compliance with

the regulations, and producing standard

bidding documents and requests for

proposals. The NPPA does not have

enforcement powers however it can refer

any cases of non-compliance with

procurement laws to the ACC.

Sierra Leone’s Audit Service, established

in 1998, works to ensure greater

accountability, efficiency and effectiveness

in the distribution and use of public funds.

In 2014, the Audit Service had its mandate

to audit and report on all public accounts

extended. Its remit covers all public bodies

including central and local government and

the judiciary. The Audit Service has the

power to disallow unlawful expenditure and

recover monies due through litigation. The

success of its independent operations is

reflected in the real-time audit it conducted

during the Ebola crisis.

In 2013, the Right to Access Information

Act was implemented providing access to

information held by public bodies. The

GoSL has built on this, announcing the

launch of an Open Data Portal in May

2015. The Portal will make available

information on economic recovery and

public services as well as open contracting

data, budget data and data on

development assistance.

A medium-term Public Finance

Management Reform Strategy has

been developed for the period 2015-

2017 to improve the credibility and

transparency of fiscal and budget

management under the new Public

Financial Management Improvement

and Consolidation Project, funded by

the GoSL and the Multi-Donor Budget

Support Partnership (made up of the

World Bank, European Union (EU),

DFID and the African Development

Bank (AfDB)).

Business and Human Rights

Sierra Leone is party to numerous

international and regional human rights

treaties which may be relevant in a

commercial context, including the

International Covenant on Civil and Political

Rights, the International Covenant on

Economic, Social and Cultural Rights, the

Convention Against Torture and Other

Cruel, Inhuman and Degrading Treatment

or Punishment, the Convention on the

Elimination of All Forms of Discrimination

against Women, and the African Charter

on Human and Peoples’ Rights. Chapter III

of the Constitution concerns the

“Recognition and Protection of

Fundamental Human Rights and Freedoms

of the Individual.”

Human rights concerns have been identified

in a number of areas, including in relation to

gender equality and rights relating to sexual

orientation, labour rights and land

acquisition, along with sector-specific

concerns such as mining conditions.

However steps have been taken to enhance

human rights protection, with steady

improvement being seen since the civil war

ended in 2002, including through the

establishment of the Sierra Leone Human

Rights Commission (the HR Commission)

in 2004 with a mandate to protect and

promote human rights across the country.

The Commission is accredited by the UN’s

Office of the High Commissioner for

Human Rights and has been active in

investigating human rights concerns. The

HR Commission advises the GoSL on draft

legislation which may have an impact on

human rights. It has also played an active

role in the constitutional review process

launched in July 2013. Individuals may

report concerns of human rights violations

directly to the HR Commission.

In 2013, following a public inquiry into

human rights concerns, the HR

Commission partnered with human rights

institutions in Denmark and Ireland to

develop Guidelines for Monitoring Human

Rights and Business in Sierra Leone.

The Guidelines are intended to be used by

the GoSL, district human rights

commissions and civil society to promote

respect for human rights in business

activities. The HR Commission is preparing

the country’s report to the UN Human

Rights Council’s Universal Periodic Review,

which is due to be submitted in October

2015.

14

In addition, the National Commission for

Social Action has been active in promoting

the rights of those with disabilities in Sierra

Leone, providing rehabilitation grants to

over one thousand conflict victims,

including amputees. Legislative reforms

include the Persons with Disability Act

2011, which transposed the Convention on

the Rights of Persons with Disabilities into

domestic law, gender justice laws and the

Child Rights Act 2007.

Dispute Resolution

Law and Courts

Sierra Leone has a two-tiered legal system

based on the English common law model.

Outside of Freetown and the Western

Area, local customary law also applies. The

court system comprises of two levels, the

Superior Courts (High Court, Court of

Appeal and Supreme Court) and the Lower

Courts Magistrates Court and Local

Courts. The High Court houses a number

of different divisions, including the Fast

Track Commercial Court (FTCC). The

Court of Appeal deals with appeals from

the High Court. The Supreme Court is the

country’s final appeal court.

Civil proceedings are normally commenced

by a writ of summons or originating

summons filed together with a statement

of claim at the High Court or District

Registry. The length of time between

issuance of a writ of summons and the

start of a trial can take up to three months

and the length of time from trial to final

judgment can extend to over a year.

Proceedings often advance at a slow pace

due to frequent adjournments and

procedural issues. The Ebola outbreak has

caused further delays within the machinery

of justice, leading to an increase in the

already substantial backlog of cases.

The FTCC was established in 2010 with

the aim of reducing the time taken to

resolve commercial disputes. The

efficiency of the new Court has also been

impeded by the Ebola crisis. The first

full-time FTCC judge was appointed in

April 2015 and the process is under way to

appoint a second. Judges from other

divisions of the High Court and Court of

Appeal split their time between those

courts and the FTCC.

Foreign investors can access the court

system, although it has also been criticised

as potentially subject to financial and

political influence. The GoSL’s JSRSIP III

sets out various planned system reforms to

increase the efficiency of the court system.

The EU, UNDP, Ireland, Japan and the UK

are also supporting judicial reform projects

in Sierra Leone with a similar objective.

The judiciary is headed by the Chief

Justice, who, along with other judges of

the Superior Courts, is appointed by the

President on the advice of the Judicial and

Legal Services Commission. Each

appointment is subject to Parliamentary

approval. Before appointment, judges must

have been entitled to practise as counsel

in Sierra Leone (or a country with an

analogous legal system) for 10, 15 or

20 years for the High Court, Court of

Appeal and Supreme Court respectively.

Foreign Judgments and

Foreign Law

The Sierra Leonean courts recognise

foreign judgments emanating from a

jurisdiction which shares a bilateral or

reciprocal enforcement treaty with Sierra

Leone. UK judgments benefit from such an

agreement for instance. In order to enforce

a foreign judgment in Sierra Leone, a party

must apply (with supporting evidence) to

the High Court for registration of the

judgment. Judgment debtors are entitled to

apply to set aside the registration.

Sierra Leone has a dualist system and as

such international law is not directly

applicable domestically. It must first be

translated into national legislation before it

can be applied by the national courts.

Arbitration

Express contract terms providing for the

final settlement of disputes through

arbitration will be enforceable. The High

Court will generally stay proceedings

where there is a valid arbitration

agreement. In practice, this is only done

where the clause does not (explicitly or

implicitly) exclude the jurisdiction of the

Sierra Leonean High Court.

Sierra Leone is currently not a party to the

New York Convention on the Recognition

and Enforcement of Foreign Arbitral

Awards (the New York Convention).

However, acceding to the New York

convention has been identified as a

national priority under the JSRSIP III. It is

thought this will be implemented in the

near future.

Although Sierra Leone is not party to the

New York Convention, under the national

legislative framework awards in arbitrations

situated outside of Sierra Leone can be

registered with the High Court and may

then be enforced as if they were

judgments of the High Court of Sierra

Leone, subject to the permission of the

court. Investors should note that the Court

may refuse to register arbitral awards in

limited circumstances such as fraud,

insufficient notice, or where enforcement

would be contrary to public policy.

Introduction Part I Part II Part III Looking to the Future

15

Finance and Banking

Banking Facilities

Sierra Leone’s banking system is overseen

by its central bank, the Bank of Sierra

Leone. Thirteen commercial banks operate

in the country, including one regional and

one domestic bank as well as seven

Nigerian, two pan-African and two

State-owned banks. The two largest

commercial banks in terms of customers

and assets are the Sierra Leone

Commercial Bank and Rokel Commercial

Bank.

All commercial banks are headquartered in

Freetown. Accounts can be held in foreign

and domestic currencies. Automated teller

machines (ATMs) are available. Credit

cards are not widely used owing to poor

connectivity. Transfers of over US$10,000

in value must be sent through the banking

system with the objective of ensuring

transparency.

Banks cannot lend in foreign currencies,

which is a limitation on local business

expansion. This can in turn impact the

supply chains of large foreign-run

businesses.

Foreign Exchange

Currency can be freely converted in Sierra

Leone, subject to its availability. The Leone

is not pegged to a foreign currency and

has a floating exchange rate. Exchange

rates were fairly flat in Q1 2014, trading at

an average of USD/SLL 4360, but started

rising in Q2 2014 largely due to the impact

of Ebola and challenges in the mining

sector. The depreciation peaked in

November with an average rate of USD/

SLL 5050, representing almost 16 per

cent. year-on-year depreciation. Since then

marginal appreciation has been seen, with

trading at an average rate of around 4870

at end May 2015.

The Bank of Sierra Leone conducts weekly

foreign exchange auctions but limits the

amount a single bidder can purchase to

US$100,000 (US$ is currently the only

currency offered at these auctions). Only

commercial banks operating in the country

are entitled to take part and foreign

currency purchased through the auction

must be used for imports of goods.

Access to Credit

The World Bank’s 2015 Global Report on

Doing Business ranked Sierra Leone at

151 out of 189 economies for “getting

credit”. The regional average for the rest of

sub-Saharan Africa was 122. The category

was assessed by reference to (a) movable

collateral laws (that is the strength of legal

rights of borrowers and lenders in secured

transactions) and (b) credit information

systems (the sharing of credit information).

In terms of specific scores on the strength

of legal rights, Sierra Leone ranked above

regional comparators such as the Gambia

and Liberia, but sat below Nigeria, Kenya

and Rwanda among others. Higher scores

on strength of legal rights indicate that

collateral and bankruptcy laws are better

designed to facilitate access to credit.

Along with 33 other countries, Sierra

Leone’s score for access to credit

information is zero. Although the Credit

Reference Act 2011 (CRA) does provide

the legislative framework for the Bank of

Sierra Leone to operate an interim Credit

Reference Bureau Unit, where such units

are not operational or cover less than 5 per

cent. of the adult population on the depth

of credit information, the World Bank

Report scores the country at zero for this

category. The World Bank report does not

cover access to credit more generally.

Interest rates for commercial loans are

relatively high. In November 2014, the

GoSL enacted the Borrowers and Lenders

Act, which applies to security interests in

movable property, establishing the

framework for lenders to register charges

on the borrowers’ moveable assets. The

legislation provides for priority by date of

registration and contains provisions in

relation to the enforcement of such

collateral. It should be noted that the Act’s

scope appears to be limited to “lenders”,

which are defined as commercial banks or

other financial institutions licensed by the

Bank of Sierra Leone. The framework

established by the Act brings structure to

an area which to date has been unclear. It

is hoped the Act will improve access to

finance and provide lenders with the

confidence that their collateral over

movables has a solid legal framework

supporting it.

To support small and medium enterprises

(SMEs) in Sierra Leone, the Ministry of

Trade and Industry has introduced an SME

Policy, which facilitates access to credit

and provides subsidies and incentives

(such as a special interest rate) for SMEs.

Taking Security

Security by way of fixed or floating charge

can be taken over any class of assets,

including land, receivables, cash and

shares. The charge and instrument must

be registered with the Corporate Affairs

Commission within 21 days of the date of

its creation. There are few restrictions on

the timing and value of enforcement of

security. However, there is no guarantee

that secured creditors will be paid first, and

a creditor cannot enforce against an

insolvent debtor without the court’s

permission. Insolvency proceedings can be

resolved expeditiously through the FTCC.

16

Following amendments to the Companies

Act in 2014, there are also generally few

restrictions on foreign companies (i.e.

those not registered to do business in

Sierra Leone) to prevent them from

enforcing contractual obligations in the

courts of Sierra Leone, for example in

terms of foreclosure.

The GoSL continues to enact reforms to

strengthen the market for security, expanding

permissible security to include both future

assets and replacements for already secured

assets, and establishing a public credit

registry to facilitate lenders’ credit checks.

Anti-Money Laundering

Sierra Leone is not on the Financial Action

Taskforce list of countries suffering from

strategic deficiencies in Anti-Money

Laundering (AML) provisions, but was

identified as a jurisdiction of concern in the

United States (US) Department of State

2014 International Narcotics Control

Strategy Report due to a combination of its

position as a strategic sea port and a lack

of restrictive border controls.

The GoSL enacted the Anti-Money

Laundering and Combating of Financing of

Terrorism Act in 2012, criminalising terrorist

financing (and the failure to report such

financing), introducing AML compliance

requirements such as “Know Your

Customer” and other verification checks,

and imposing record-keeping requirements.

The Act also establishes the Financial

Intelligence Unit (FIU), which has wide

investigatory powers in respect of money

laundering and suspicious transactions.

The Regulation on Terrorism Prevention

(Freezing of International Terrorists’ Funds

and other Related Measures), which deals

with the freezing of funds in accordance

with UN Security Council Resolutions

1267 and 1373 awaits parliamentary

approval at the time of publication of this

Investor Guide. Revised guidelines on

preventing money laundering and terrorist

financing for both financial and non-

financial institutions have been issued by

the FIU and Bank of Sierra Leone.

The Intergovernmental Action Group

Against Money Laundering in West Africa,

established by ECOWAS in 2000, which

works towards the development of AML

strategies in the region, last reported on

Sierra Leone in 2013 (the 9th follow-up to

the 2006 Mutual Evaluation). Its report

highlighted the progress made by the

enactment of the Anti-Money Laundering

and Combating of Financing of Terrorism

Act 2012 and increased domestic

cooperation in investigating transnational

organised crime, including money

laundering. The Report also identified

challenges that still remain in terms of

supervision of AML compliance and the

resourcing of the FIU.

Investing in Sierra Leone

In its Post-Ebola Recovery Strategy, the

GoSL sets out its objectives for restoring

and strengthening trade and private sector

activities. These are to: (i) increase the

capacity of the professional wing of the

Ministry of Trade and Industry and its role

in coordinating all trade and business

matters across the economy; (ii) make

SLIEPA more functional and proactive in

the promotion of investment and export

opportunities; (iii) reduce interest rates to

promote agriculture and small-scale

business operations and the general

development of the private sector; and (iv)

promote public private partnerships (PPPs)

in the provision of public services.

Lack of Restrictions

In 2015 the country ranked 140 out of

189 countries in the World Bank’s

“ease of doing business” review. The

review places Sierra Leone above the

average ranking for sub-Saharan

Africa, coming below only Ghana and

Kenya in terms of regulatory practice to

best performance, and ranking above

neighbouring Senegal, Guinea and Liberia.

Much higher than its overall ranking

were Sierra Leone’s rankings in the

categories of “starting a business” (91),

where it ranked above Ghana (96), Nigeria

(129) and Indonesia (155); and

“protecting minority investors” (62),

where it was ranked above many

developing country markets in sub-

Saharan Africa as well as other emerging

investment markets outside of the region,

such as China and Russia. Lower rankings

included infrastructure-related criteria,

such as “getting electricity” (172) and

“registering property” (158).

At the domestic level, there are few

specific restrictions, controls, fees or taxes

on foreign ownership of companies in

Sierra Leone. Foreign companies can own

Sierra Leonean companies (including

outright) subject to certain registration

formalities being completed.

An exception to this general rule applies to

investments in mining of less than

US$500,000, which require a Sierra

Leonean holding of 25 per cent. Foreign

and domestic investors are treated the

same under the law regulating this area.

Investors can also use foreign technical

and unskilled workers in their businesses

situated in Sierra Leone.

As mentioned above, SLIEPA provides

investors with information on how to

register their businesses and assists with

obtaining relevant licenses and permits. To

this end, the GoSL has established a “one

stop shop” at the Office of the

Administrator and Registrar General

(OARG).

Investors should note that some practical

restrictions are reported to exist in relation

to registering transfers of shares.

Difficulties with this process have been

expressed by foreign investors in the past,

however the changes brought in by the

2014 amendment to the Companies Act

have now clarified the authority of the

Corporate Affairs Commission to register

share transfers.

Introduction Part I Part II Part III Looking to the Future

17

Insurance

Two World Bank affiliated risk insurance

agencies operate in Sierra Leone: the

African Trade Insurance Agency and the

Multilateral Investment Guarantee Agency.

Both agencies provide various kinds of

insurance (including against political risk)

to investors, suppliers and lenders.

Land Ownership

Foreign investors cannot own land outright

in Sierra Leone but can take leases for

terms of up to 99 years. Further details on

the land regime can be found in Part I of

this Investor Guide.

Repatriation of Profits

After the payment of taxes, profits earned

by foreign investors may be freely

transferred abroad. This includes dividends

paid to a parent company incorporated

outside Sierra Leone. Investors are also

able freely to repatriate funds received

from the liquidation of a business and

awards from the settlement of disputes.

Transfers of repayments of principal and

interest on arm’s length third party loans

contracted outside Sierra Leone and

registered with the Bank of Sierra Leone

are also allowed without restriction, subject

to the payment of any withholding tax due.

Expropriation

There is no history of expropriation of

property belonging to foreign investors in

Sierra Leone and the law provides

protection against it taking place (see

Part I for further details).

Technology Transfer

There are no technology transfer

requirements applicable to foreign

investments in Sierra Leone. Investors are

not required to invest in manufacturing,

research and development, or service

facilities in Sierra Leone in order to secure

approval for major procurements.

Investment Context

Taxation

2015 Tax rates:

Corporation tax Resident companies Non-resident companies

Basic rate 30 per cent 30 per cent

Mining companies 30 per cent 30 per cent

Capital gains 30 per cent

(Subject to a minimum

chargeable threshold of

Le3.6 million (US$829) per

annum or per transaction)

30 per cent

(Subject to a minimum

chargeable threshold of

Le3.6 million (US$829) per

annum or per transaction)

Goods and

Services Tax

15 per cent

(Subject to exemptions for

exports of goods (excluding

minerals) stores on vessels and

aircraft leaving Sierra Leone

and various exempt supplies2;

and for businesses with an

annual turnover of less than

Le350 million (US$82,000))

15 per cent

(Subject to exemptions for

exports of goods (excluding

minerals) stores on vessels

and aircraft leaving Sierra

Leone and various exempt

supplies; and for businesses

with an annual turnover of

less than Le350 million

(US$82,000))

Rental income 10 per cent

(Subject to an allowance of

20 per cent for repairs and

maintenance and a tax free

threshold of Le3.6 million

(US$829)

25 per cent

(Final tax for non-resident

companies)

Dividends 0 per cent

(Dividends received by a

resident company from another

resident company are exempt

from tax)

10 per cent

(Final tax for non-resident

companies)

Interest 15 per cent

(Interest on government

development stocks is exempt

from tax)

15 per cent

(Final tax for non-resident

companies)

Royalties 25 per cent 25 per cent

(Final tax for non-resident

companies)

Natural resource

payments

25 per cent 25 per cent

Payments to

contractors

5 per cent 10 per cent

2 Exempt supplies include fertilisers, water, books and newspapers, education, pharmaceuticals, some

passenger transport, crude oil and hydrocarbon products, land, buildings, public works and machinery.

18

Visas

Visa requirements applicable to foreign

citizens vary depending on the purpose of

their travel. A “Landing Visa” is required for

entry into Sierra Leone unless the individual

concerned is a citizen of a country which is

a member of the ECOWAS. Members

include Benin, Burkina Faso, Cape Verde,

Côte d’ Ivoire, The Gambia, Ghana, Guinea,

Guinea Bissau, Liberia, Mali, Niger, Nigeria,

Sierra Leone, Senegal and Togo.

A work permit is required for foreign

individuals who wish to work in Sierra

Leone. Visas and work permits may be

obtained from Sierra Leonean diplomatic

missions abroad. Visas can also be

purchased at Lungi International Airport on

arrival, however it is advisable to obtain the

relevant visa before travelling.

GoSL Approach

A standardised approach to FDI has not

yet been developed throughout GoSL.

Currently, foreign investors may find

themselves dealing primarily or exclusively

with a single ministry, which can present

challenges for investors carrying out due

diligence and cause delays where other

ministries or stakeholders become involved

at a later stage. The GoSL, through

SLIEPA, is addressing these concerns by

establishing an Investment Management

Framework to evaluate and provide

oversight of investment in the country.

Dialogue between the GoSL and foreign

investors is encouraged. SLIEPA provides

“investor aftercare” to support established

investments and build long-term

relationships with foreign investors in

Sierra Leone.

With the support of the EU, AfDB and the

World Bank, SLIEPA held its first public-

private investor aftercare roundtable in

June 2014. In his keynote speech,

President Koroma described the

roundtable as a “platform for networking

and exchanging views on business and

investment relations” to allow “local and

international private sector players to

advise government on how to improve the

investment climate together”. President

Koroma acknowledged the role and power

of the private sector in the “sustainable

transformation of the country.”

Interaction with Local Communities

Investors in large-scale and potentially

disruptive investment projects should be

aware of the impact their investment may

have on local communities in the areas

affected. Foreign investors must be

sensitive to the tension that can arise in

cases where the effect of the investment

on the local community involves, for

example, relocation, forced evacuation,

land degradation, and lack of community

benefit and community participation.

Consultation and engagement with local

communities during the entire investment

process (including before and after

implementation) in cases of large-scale

investment is therefore key to building a

successful long-term investment and

avoiding tensions.

Workforce

Many of Sierra Leone’s professional classes

left the country during or as a consequence

of the civil war. However, a wide range of

organisations are working on developing

Sierra Leone’s human resources.

In 2008, President Koroma established the

Office of Diaspora Affairs (ODA) to

respond to the need to build capacity

within the GoSL Ministries, Departments

and Agencies (MDAs). Although the Ebola

crisis has affected the return of talented

members of the diaspora to the country,

such movement is likely to resume and

gain pace in the medium term.

Ebola-related Restrictions

Although some countries have relaxed

travel restrictions introduced in response to

the Ebola outbreak, many remain in place.

At the time of publication, a number of

airlines are revisiting such restrictions with

a view to reinstating their pre-Ebola flight

schedules. Restrictions and modifications

are reported to be increasingly relaxed as

the virus subsides.

Introduction Part I Part II Part III Looking to the Future

19

Policy and the Legislative

Framework

Introduction to the Legal

Landscape

The GoSL’s poverty reduction strategy, the