Security 2009 Annual Report 10K Vicon Industries Inc And User Manual

2009 Annual Report-10K 2009_Annual_Report-10K 2009_Annual_Report-10K Financials English-US s Collateral

2017-08-09

User Manual: Security 2009 Annual Report-10K 2009_Annual_Report-10K uploads wp-content

Open the PDF directly: View PDF ![]() .

.

Page Count: 52

- Letter To Our Shareholders

- PART I

- PART II

- ITEM 5 - MARKET FOR THE REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

- ITEM 6 - SELECTED FINANCIAL DATA

- ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

- ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

- ITEM 8 - FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

- ITEM 9A – CONTROLS AND PROCEDURES

- ITEM 9B – OTHER INFORMATION

- PART III

- PART IV

- ITEM 15 – EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

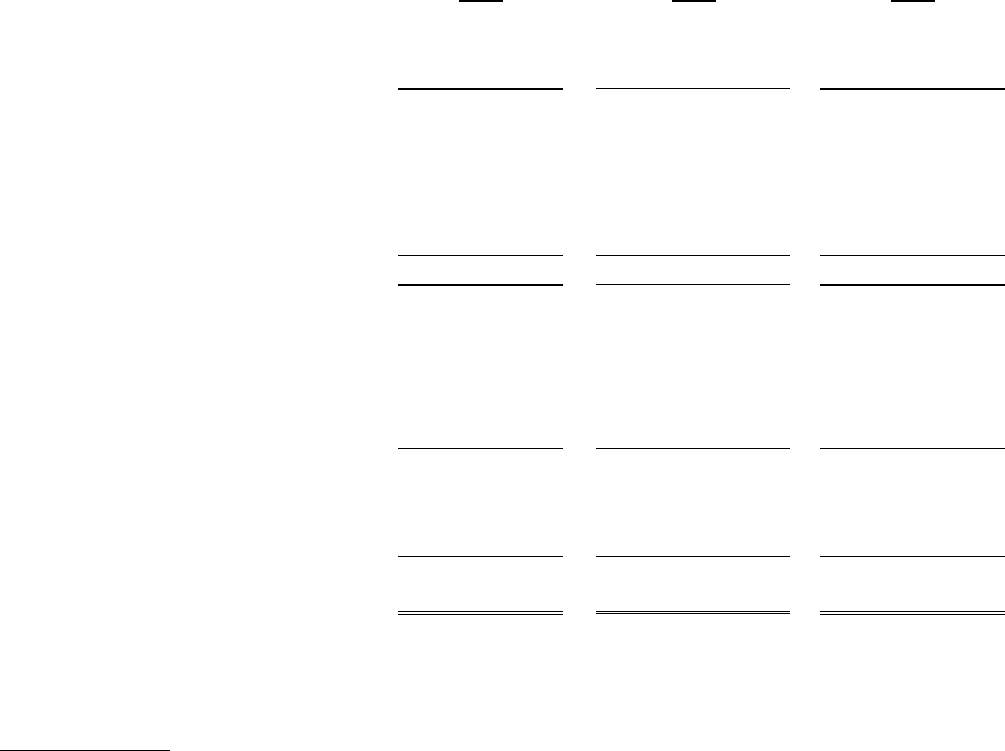

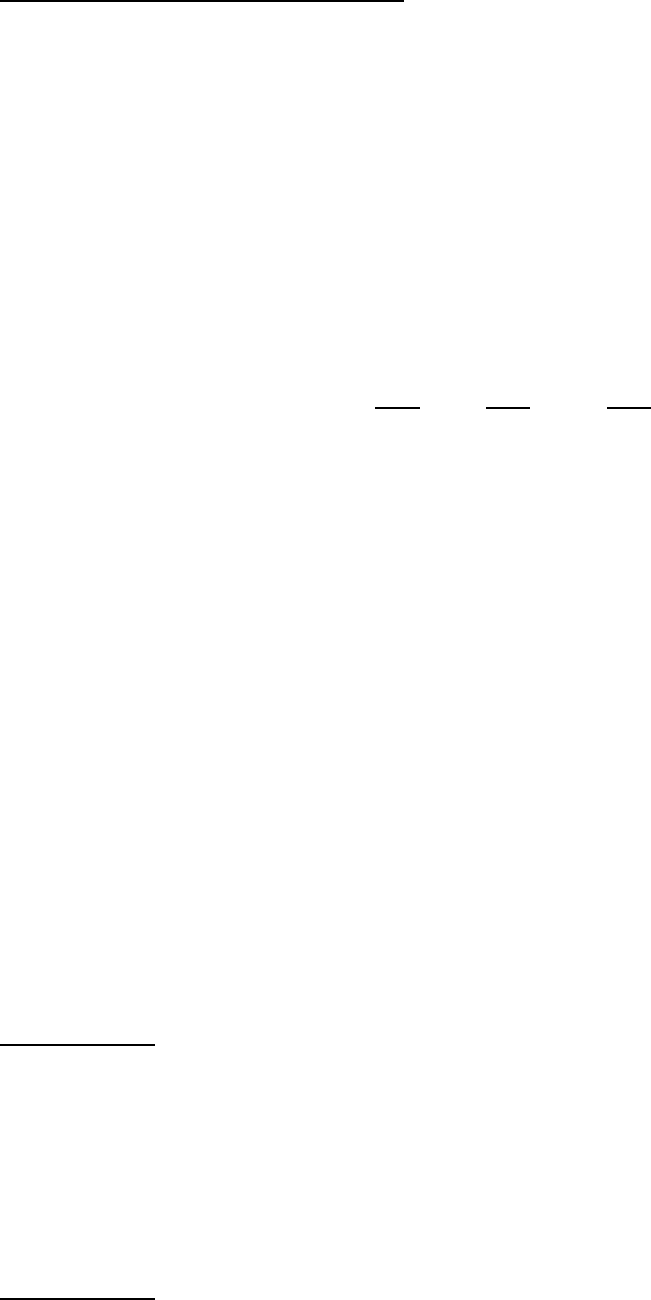

- VICON INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Fiscal Years Ended September 30, 2009, 2008 and 2007

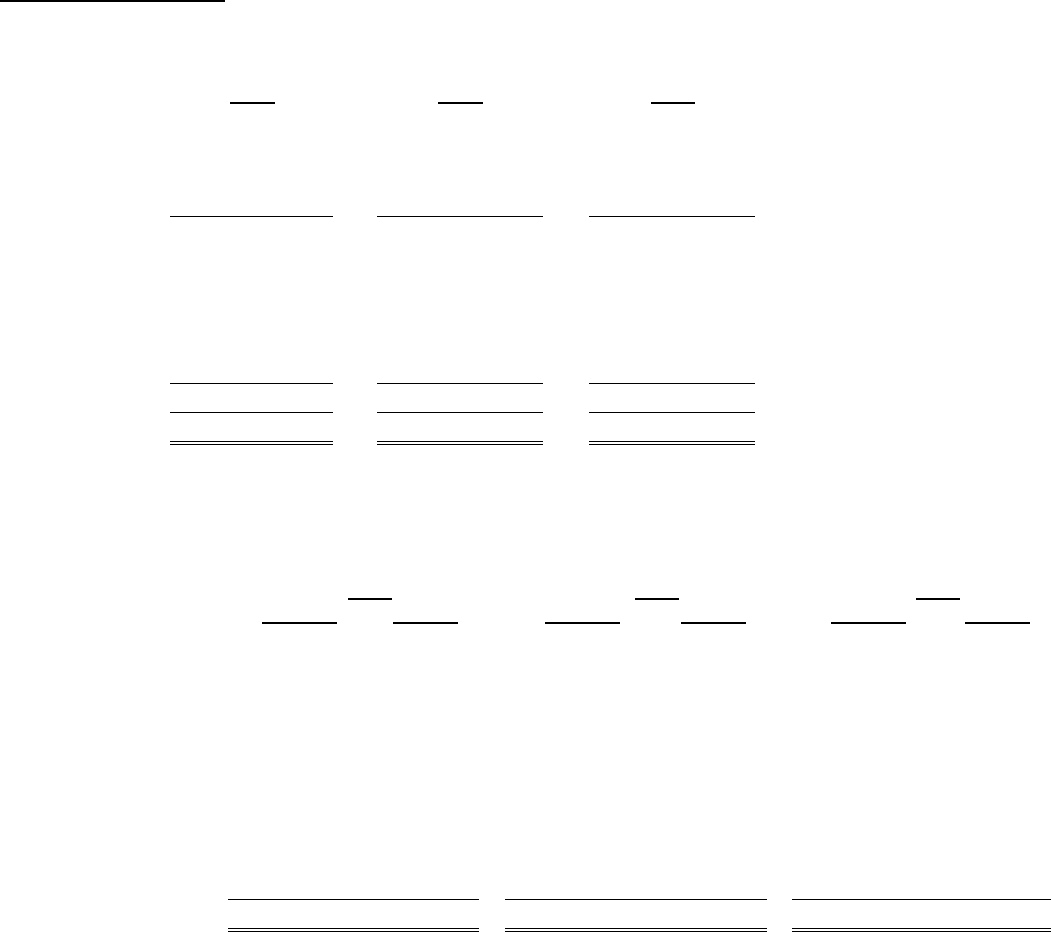

- VICON INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS September 30, 2009 and 2008

- VICON INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Fiscal Years Ended September 30, 2009, 2008, and 2007

- VICON INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Years Ended September 30, 2009, 2008 and 2007

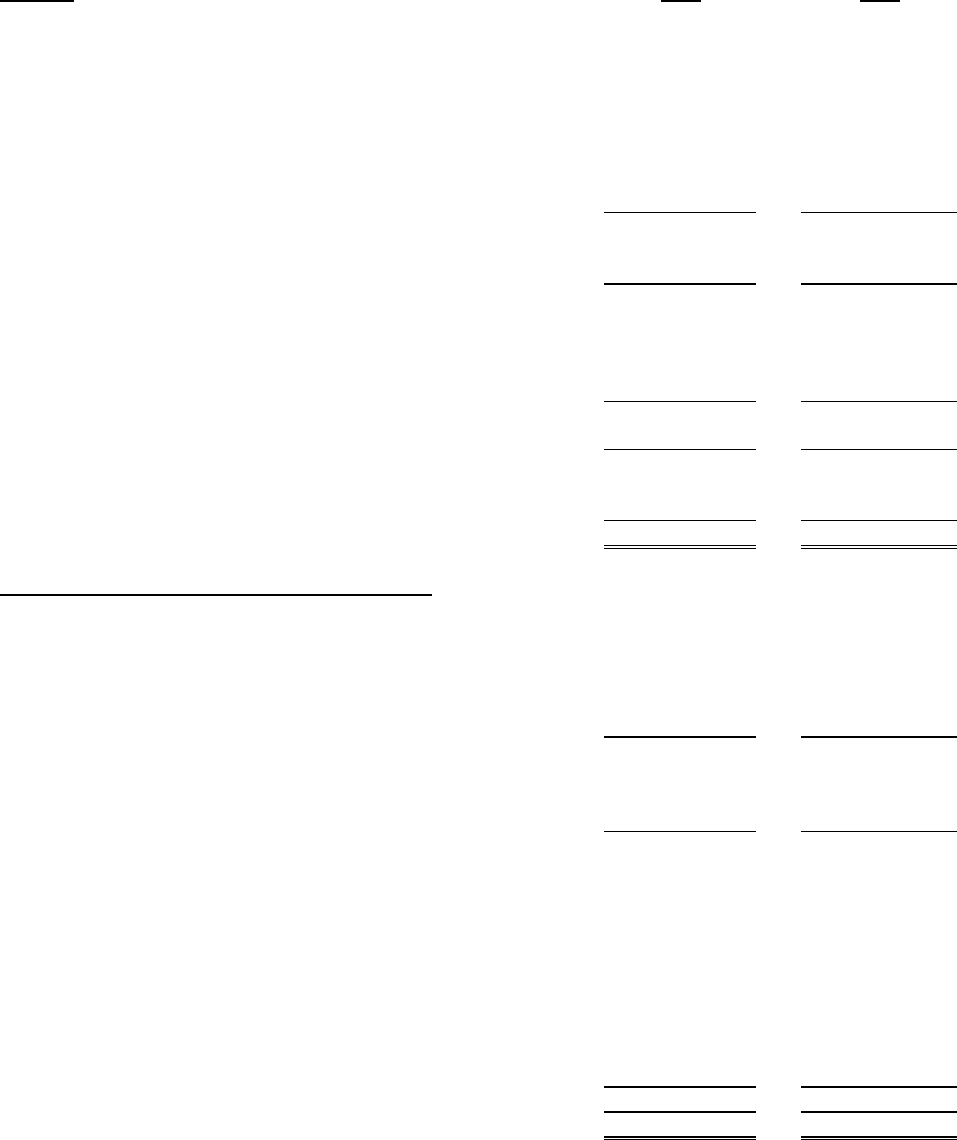

- VICON INDUSTRIES, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Fiscal Years ended September 30, 2009, 2008, and 2007

- NOTE 1. Summary of Significant Accounting Policies

- NOTE 2. Income Taxes

- NOTE 3. Other Comprehensive Income (Loss)

- NOTE 4. Segment and Geographic Information

- NOTE 5. Stock Option Plans

- NOTE 6. Shareholder Rights Plan

- NOTE 7. Earnings Per Share

- NOTE 8. Commitments and Contingencies

- NOTE 9. Litigation

- NOTE 10. Related Party Transactions

- NOTE 11: Recent Accounting Pronouncements

- NOTE 12. Quarterly Financial Data (unaudited)

- SIGNATURES

2009 Annual Report

Vicon Industries, Inc.

ii

Letter To Our Shareholders

The 2009 fiscal year, which ended on

September 30, 2009, was a challenging year by any

measure. Throughout 2009, the Company experienced

consistent weakness worldwide in new orders as a result

of the global recession. Capital expenditures for new

construction and other projects incorporating electronic

security systems slowed considerably. The negative

impact of the recession was felt throughout the entire

security industry. Most of the business the Company

competed for in 2009 was in the public sector, funded

by government or associated agencies, while private

sector projects virtually dried up. This condition has

persisted into fiscal year 2010. Past experience has

shown that the nature of our business trails economic

downturns and correspondingly trails the recovery.

Consequently, we anticipate capital expenditure

funding, particularly in the private sector, to remain

tight with intense competition for funded projects.

With the foregoing as a backdrop, the

Company nevertheless achieved $60.4 million in sales

in fiscal 2009 while producing net income of $2.0

million. While the operating results were off from the

prior fiscal year, they were nonetheless respectable in a

very tough economic environment. The strengthening

of the U.S. dollar in fiscal 2009 hurt foreign results as

the flight to the dollar as a safe haven currency reduced

by nearly $3.0 million the value of reported sales and

new orders compared with the figures for fiscal 2008.

To some extent, the 2009 financial performance was

attained as a result of a fairly robust backlog of

unfilled orders as the Company headed into calendar

2009. New orders were off 11% in fiscal 2009 at $59.3

million versus $67.0 million for the prior year. Also

noteworthy in fiscal 2009, was the generation of over

$7 million in free cash flow which increased the

Company’s cash position to $16.7 million.

Believing its shares to be significantly

undervalued, the Company in fiscal 2009 purchased

226,119 shares of its common stock in open market

transactions at an average price of $5.22 per share. Our

belief is supported by the fact that the common shares at

December 31, 2009 had a net tangible book value of

$7.56 per outstanding share of which $3.21 was

represented by cash. Further, common stock

repurchases have been and will continue to be made in

fiscal 2010.

In previous letters, I have discussed the

emergence of IP video. The security industry transition

to IP or network video greatly accelerated in 2009. In

fact, almost all of the projects we now compete for

employ network video to some extent. The quicker than

anticipated market acceptance of IP video has

accelerated camera technology and related user

situational management applications. The focus of

iii

Vicon’s engineering effort is now exclusively in these

two areas.

Market and competitive forces continue to

strain our engineering resources, particularly in the area

of software development. Anticipating the future of

electronic security, it is apparent that software

development will be a significant hurdle for the

Company. In spite of the weak economy and its

negative effect on our recent operating results, we have

not diminished our development efforts. The reality is

that additional resources may be required to achieve our

ambitious development plans. While not always

accomplished, one of our goals is to have a major

software release annually to our physical security

information management platform branded ViconNet®.

ViconNet V6, which has been in development for over a

year, is now scheduled for June release. V6 supports the

latest video compression technology, expands the

capabilities of our virtual matrix, and adds browser

functionality among other enhancements. Since January

2009, our engineers have been designing Vicon’s first

all digital megapixel remote-positioning dome camera.

We expect to be in production by this time next year.

Once complete, the dome camera will become the

foundation from which a full range of fixed-position

megapixel cameras will follow.

As the security industry inexorably moves to

software solutions from a predominately hardware

orientation, the challenge of revenue growth becomes

more acute. Today Vicon’s business model, as with

most competitors, is largely dependent upon hardware

sales to absorb the increasing cost of embedded and

application software. Our current model will require

modification as software and cameras evolve into the

principal elements of practically every video security

and surveillance system.

Traditionally, Vicon has sought growth by

geographic or channel expansion and/or through

additional product offerings. This strategy, however,

has not been enough to see meaningful stepped growth.

Given today’s user preference for IP based systems,

Vicon’s future growth potential may be limited as a

video only company. Clearly the trend of IP system

design engineers is toward integration of various

security filters, such as, video, access, intrusion, and

biometrics. Accordingly, we have begun the process of

evaluating acquisition opportunities. Specifically, we

are interested in companies that would expand our

product offerings in the integrated solutions sector

and/or expand our customer channel.

To meet the rapid technology shifts discussed

and related engineering demands, the Company’s

executive ranks have been reinforced. In January 2010,

Mark Provinsal joined the Company as Vice President,

Marketing and Product Management. Mark, who has

over 10 years of executive industry experience, will

guide the Company’s product strategy and marketing

programs. Also, in February 2010, Frank Jacovino

joined us as Vice President of Technology and

Development in charge of all product development.

Frank’s expertise in software development management

will be instrumental in taking our product offerings to

the next level.

With the underpinnings of a sound financial

position, we move forward with confidence to meet the

challenges ahead. I am particularly grateful to our

customers and stockholders for their support in these

difficult times. Also, thanks and gratitude go to the

Vicon employees and business partners worldwide for

their dedication and commitment to the Company and

its mission. They are the backbone and reason for

Vicon’s 43 years of proud and successful history.

Kenneth M. Darby

Chairman & CEO

iv

1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: September 30, 2009

Commission File No. 1-7939

VICON INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

NEW YORK 11-2160665

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer identification No.)

89 Arkay Drive, Hauppauge, New York 11788

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (631) 952-2288

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $.01 NYSE Amex

(Title of class) (Name of each exchange on which registered)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X_ _

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No X__

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No __

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any,

every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and

post such files) Yes No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein,

and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ____

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a

smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act. (Check one)

Large Accelerated Filer Accelerated Filer Non-Accelerated Filer Smaller reporting company X_

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange

Act of 1934) Yes No X_ _

The aggregate market value of voting and non-voting Common Stock held by non-affiliates of the registrant based upon

the closing price of $5.32 per share as of March 31, 2009 was approximately $10,902,000.

The number of shares outstanding of the registrant's Common Stock as of December 15, 2009 was 4,575,456.

2

PART I

ITEM 1 - BUSINESS

General

Vicon Industries, Inc. (“the Company”), incorporated in 1967, designs, manufactures, assembles and

markets a wide range of video systems and system components used for security, surveillance, safety and

control purposes by a broad group of end users. A video system is typically a private network that can

transmit and receive video, audio and data signals in accordance with the operational needs of the user. The

Company's primary business focus is the design of network video systems that it produces and sells

worldwide, primarily to installing dealers, system integrators, government entities and security products

distributors.

The Company operates within the electronic protection segment of the security industry which includes,

among others: fire and burglar alarm systems, access control, biometric and video systems and asset

protection. The U.S. security industry consists of thousands of individuals and businesses (exclusive of

public sector law enforcement) that provide products and services for the protection and monitoring of

people, property and information. The security industry includes fire and detection systems, access control,

video systems, asset protection, guard services and equipment, locks, safes, armored vehicles, security

fencing, private investigations, biometric systems and others. The Company’s products are typically used

for crime deterrence, visual documentation, observation of inaccessible or hazardous areas, enhancing safety,

mitigating liability, obtaining cost savings (such as lower insurance premiums), managing control systems

and improving the efficiency and effectiveness of personnel. The Company’s products are used in, among

others, office buildings, manufacturing plants, apartment complexes, retail stores, government facilities,

airports, transportation operations, prisons, casinos, hotels, sports arenas, health care facilities and financial

institutions.

Products

The Company’s product line consists of various elements of a video system, beginning with a physical

security information management application (PSIM), which manages all network devices including

cameras. The Company also produces video system edge devices such as video encoders, decoders,

network/digital/hybrid video recorders, analog and IP fixed position or robotic cameras, megapixel digital

cameras, matrix video switchers and system controls. The Company provides a comprehensive line of

products due to the many varied climatic and operational environments in which the products are

expected to perform. In addition to selling from a standard catalog line, the Company at times produces to

specification or will modify an existing product to meet customer requirements. Recently, the Company

entered into an OEM agreement with an access control producer to supply such products on an integrated

basis with its video systems.

The Company’s products range from a simple camera mounting bracket to a large digital control,

transmission, recording, storage and video matrix switching system. The Company’s sales are

concentrated principally among its network video products (ViconNet and Kollector) and dome camera

(Surveyor) product lines.

Marketing

The Company’s marketing emphasizes engineered video system solutions, which includes system design,

project management, technical training and pre and post sales support. The Company promotes and

markets its products through industry trade shows worldwide, product brochures and catalogues, direct

marketing and electronic mailings to existing and prospective customers, webinars, training seminars for

system designers, customers and end users, road shows that preview new systems and system

components, and advertising through trade and end user magazines and the Company's website

(www.vicon-cctv.com).

3

The Company’s products are sold principally to independent dealers, system integrators and security

products distributors. Sales are effectuated principally by field sales engineers and inside customer service

representatives. The Company’s sales effort is supported by in-house customer service coordinators and

technical support groups which provide product information, application engineering, design detail, field

project management, and hardware and software technical support.

The Company’s products are utilized in video system installations by: (1) commercial and industrial

users, such as office buildings, manufacturing plants, warehouses, apartment complexes, shopping malls

and retail stores; (2) federal, state, and local governments for national security purposes, agency

facilities, prisons, and military installations; (3) financial institutions, such as banks, clearing houses,

brokerage firms and depositories, for security purposes; (4) transportation departments for highway traffic

control, bridge and tunnel monitoring, and airport, subway, bus and seaport security and surveillance; (5)

gaming casinos, where video surveillance is often mandated by regulatory authorities; (6) health care

facilities, such as hospitals; and (7) institutions of education, such as schools and universities.

The Company’s principal sales offices are located in Hauppauge, New York; Fareham, England;

Zaventem, Belgium; and Neumunster, Germany.

International Sales

The Company sells its products in the U.K., Europe, Scandinavia and the Middle East through its European

based subsidiaries and elsewhere outside the U.S. principally by direct export from its U.S. headquarters.

The Company has a few territorial exclusivity agreements with customers but primarily uses a wide range of

installation companies and security products distributors in international markets.

Export sales and sales from the Company’s foreign subsidiaries amounted to $28.4 million, $32.0 million

and $32.0 million or 47%, 48% and 46% of consolidated net sales in fiscal years 2009, 2008, and 2007,

respectively. The Company’s principal foreign markets are the U.K., Europe, Middle East and the Pacific

Rim, which together accounted for approximately 83% of international sales in fiscal 2009.

Competition

The Company operates in a highly competitive marketplace both domestically and internationally. The

Company competes by providing high-end video systems and system components that incorporate broad

capability together with high levels of customer service and technical support. Generally, the Company does

not compete based on price alone.

The Company’s principal video systems competitors include the following companies or their affiliates:

Matsushita Electric Corp. (Panasonic), Sony Corporation, Pelco Sales Company (a division of Schneider

Electric), Bosch Security Systems, Inc., Sensormatic Electronics Corp. (a division of Tyco International),

GE Security Systems, United Technologies, AXIS Communications, On-Net Surveillance Systems, Inc. and

Honeywell Security Systems. Many additional companies, both domestic and international, produce

products that compete against one or more of the Company’s product lines. Many of the Company’s

principal competitors are larger companies whose financial resources and scope of operations are

substantially greater than the Company’s.

Engineering and Development

The Company’s engineering and development is directed principally on new and improved video systems and

system components. In recent years, the trend of product development and demand within the video security and

surveillance market has been toward enhanced software applications involving the compression, analysis,

transmission, storage, manipulation, imaging and display of digital video over IP networks. As the demands of the

Company’s target market segment require the Company to keep pace with changes in technology, the Company

has focused its engineering effort in these developing areas. Development projects are chosen and prioritized

based on customer feedback, the Company's analysis as to the needs of the marketplace, anticipated technological

advances and market research.

At September 30, 2009, the Company employed a total of 36 engineers in the following areas: software

4

development, mechanical design, manufacturing/testing and electrical and circuit design. Engineering and

development expense amounted to approximately 9%, 8% and 7% of net sales in fiscal years 2009, 2008 and

2007, respectively.

Source and Availability of Raw Materials

The Company relies upon independent manufacturers and suppliers to manufacture and assemble most of its

proprietary products and expects to continue to rely on such entities in the future. The Company’s

relationships with certain of its independent manufacturers, assemblers and suppliers are not covered by

formal contractual agreements.

Raw materials and components purchased by the Company and its suppliers are generally readily available

in the market, subject to market lead times at the time of order. The Company is generally not dependent

upon any single source for a significant amount of its raw materials or components.

Intellectual Property

The Company owns a limited number of design and utility patents expiring at various times. The

Company owns certain trademarks and several other trademark applications are pending both in the

United States and in Europe. Most of the Company’s key products utilize proprietary software which is

protected by copyright. The Company considers its software to be unique and is a principal element in the

differentiation of the Company’s products from its competition. However, the laws of certain foreign

countries do not protect intellectual property rights to the same extent or in the same manner as the laws

of the U.S. The Company has no significant licenses, franchises or concessions with respect to any of its

products or business dealings. In addition, the Company does not believe its limited number of patents or

its lack of licenses, franchises and concessions to be of substantial significance. The Company is a

defendant in a patent infringement suit as discussed in “Item 3 - Legal Proceedings”, the outcome of

which could possibly have a material effect on the Company’s business.

Inventories

The Company generally maintains sufficient finished goods inventory levels to respond to customer

demand, since most sales are to installing dealers and system integrators who normally do not carry any

significant inventory. The Company principally builds inventory to known or anticipated customer

demand. In addition to normal safety stock levels, certain additional inventory levels may be maintained

for products with long purchase and manufacturing lead times. The Company believes that it is important

to carry adequate inventory levels of parts, components and products to avoid production and delivery

delays that may detract from the sales effort.

Backlog

The backlog of orders believed to be firm as of September 30, 2009 and 2008 was approximately $2.8

million and $3.9 million, respectively. Orders are generally cancelable without penalty at the option of the

customer. The Company prefers that its backlog of orders not exceed its ability to fulfill such orders on a

timely basis, since experience shows that long delivery schedules only encourage the Company’s

customers to look elsewhere for product availability.

Employees

At September 30, 2009, the Company employed 192 full-time employees, of whom 7 are officers, 41 are

in administration, 79 are in sales and technical service capacities, 36 are in engineering and 29 are

production employees. At September 30, 2008, the Company employed 199 persons. There are no

collective bargaining agreements with any of the Company’s employees and the Company considers its

relations with its employees to be good.

5

ITEM 1A – RISK FACTORS

The Company designs, manufactures and markets a wide range of video systems and components

worldwide and is subject to all business risks that similar technology companies and all other companies

encounter in their operations. Market risks that pertain particularly to the Company are discussed

elsewhere in this Form 10-K under Item 1 – Business; Item 3 – Legal Proceedings; Item 7 –

Management’s Discussion and Analysis of Financial Condition and Results of Operations; and Item 7A –

Quantitative and Qualitative Disclosures about Market Risk.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

ITEM 2 - PROPERTIES

The Company principally operates from an 80,000 square-foot facility located at 89 Arkay Drive,

Hauppauge, New York, which it owns. The Company also owns a 14,000 square-foot sales, service and

warehouse facility in southern England which services the U.K., Europe and the Middle East. In addition,

the Company operates under leases from offices in Yavne, Israel; Neumunster, Germany; and various local

sales offices throughout Europe. The Company believes that its facilities are adequate to meet its current and

foreseeable operating needs.

ITEM 3 - LEGAL PROCEEDINGS

The Company is one of several defendants in a patent infringement suit commenced by Lectrolarm

Custom Systems, Inc. in May 2003 in the United States District Court for the Western District of

Tennessee. The alleged infringement by the Company relates to its camera dome systems and other

products that represent significant sales to the Company. Among other things, the suit seeks past and

enhanced damages, injunctive relief and attorney’s fees. In January 2006, the Company received the

plaintiff’s claim for past damages through December 31, 2005 that approximated $11.7 million plus pre-

judgment interest. The Company and its outside patent counsel believe that the complaint against the

Company is without merit. The Company is vigorously defending itself and is a party to a joint defense

with certain other named defendants.

In January 2005, the Company petitioned the U.S. Patent and Trademark Office (USPTO) to reexamine

the plaintiff’s patent, believing it to be invalid. In April 2006, the USPTO issued a non-final office action

rejecting all of the plaintiff’s patent claims asserted against the Company citing the existence of prior art

of the Company and another defendant. On June 30, 2006, the Federal District Court granted the

defendants’ motion for continuance (delay) of the trial, pending the outcome of the USPTO’s

reexamination proceedings. In February 2007, the USPTO issued a Final Rejection of the six claims in

the plaintiff’s patent asserted against the Company, which was reaffirmed in June 2007 after the plaintiff

filed a response with the USPTO requesting reconsideration of its Final Rejection. The plaintiff has

appealed the examiner’s decision to the USPTO Board of Patent Appeals and Interferences and has an

additional appeal available to it thereafter in the Court of Appeals for the Federal Circuit.

The Company is unable to reasonably estimate a range of possible loss, if any, at this time. Although the

Company has received favorable rulings from the USPTO with respect to the reexamination proceedings,

there is always the possibility that the plaintiff’s patent claims could be upheld in appeal and the matter

would proceed to trial. Should this occur and the Company receives an unfavorable outcome at trial, it

could result in a liability that is material to the Company’s results of operations and financial position.

ITEM 4 - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

6

PART II

ITEM 5 - MARKET FOR THE REGISTRANT'S COMMON STOCK, RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

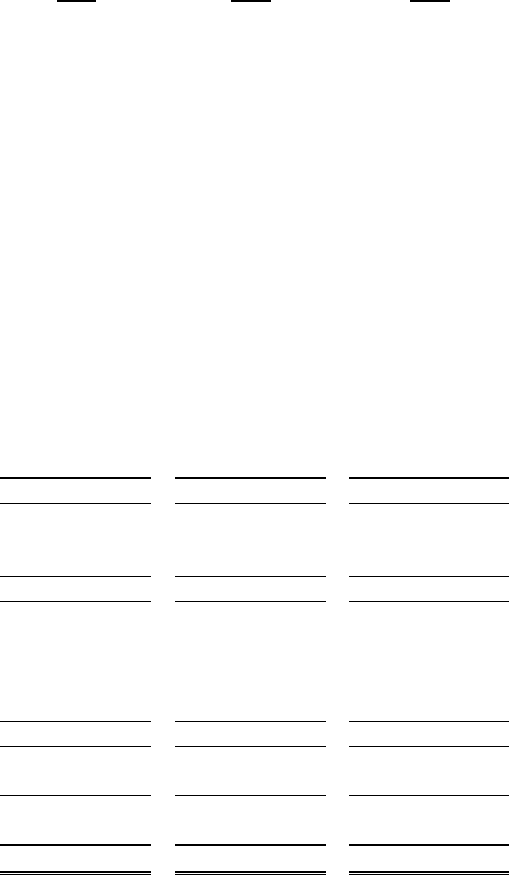

The Company’s stock is traded on the NYSE Amex under the symbol (VII). The following table sets

forth for the periods indicated, the range of high and low prices for the Company's Common Stock:

Quarter Ended High Low

Fiscal 2009

December 6.00 3.54

March 6.45 4.40

June 6.07 4.52

September 6.76 5.11

Fiscal 2008

December 12.23 7.61

March 9.95 4.53

June 5.75 4.64

September 5.85 4.27

The last sale price of the Company’s Common Stock on December 15, 2009 as reported on the NYSE

Amex was $5.92 per share. As of December 15, 2009, there were approximately 150 shareholders of

record.

The Company has never declared or paid cash dividends on its Common Stock and anticipates that any

earnings in the foreseeable future will be retained to finance the growth and development of its business.

In May 2008, the Company’s Board of Directors authorized the purchase of up to $1 million worth of

shares of the Company’s outstanding common stock. In December 2008, the Board of Directors

authorized the purchase of an additional $1 million worth of shares of the Company’s outstanding

common stock. The following table summarizes repurchases of common stock for the three month period

ended September 30, 2009:

Total

Number Average Approximate Dollar Value

of Shares Price Paid Of Shares that May Yet Be

Period Purchased (1) Per Share Purchased Under the Programs

07/01/09-07/31/09 14,627 $ 5.96 $ 794,885

08/01/09-08/31/09 13,390 $ 5.69 $ 718,716

09/01/09-09/30/09 12,787 $ 5.83 $ 644,121

Total 40,804 $ 5.83

(1) All repurchases were executed in open market transactions.

On December 3, 2009, the Company’s Board of Directors authorized the repurchase of an additional $1.5

million of shares of the Company’s common stock.

7

ITEM 6 - SELECTED FINANCIAL DATA

(in thousands, except per share data)

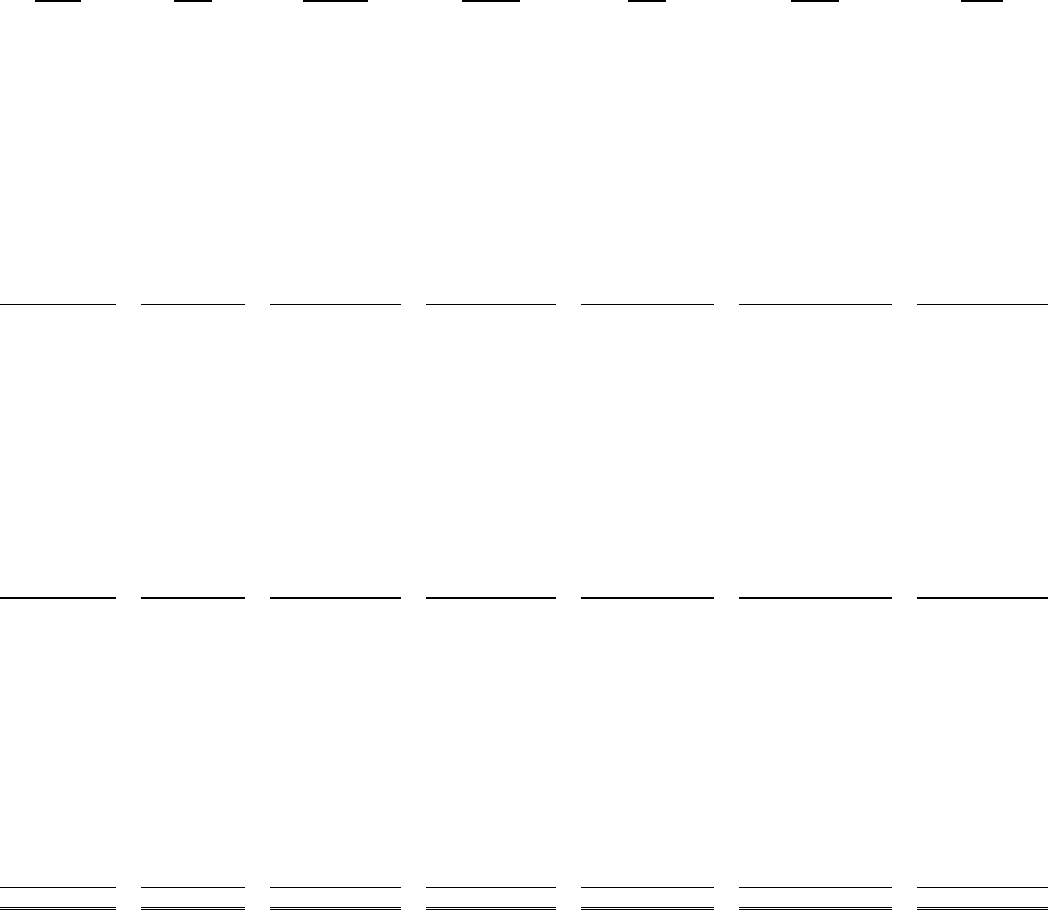

FISCAL YEAR 2009 2008 2007 2006 2005

Net sales $ 60,445 $ 66,911 $ 69,073 $ 56,279 $ 56,056

Gross profit 27,293 30,422 29,386 22,094 20,996

Operating income (loss) 3,031 4,389 4,682 (367) (2,931)

Income (loss) before income taxes 3,219 4,589 4,921 (397) (3,069)

Net income (loss) 2,017 2,839 7,886 (547) (2,885)

Net income (loss) per share:

Basic .44 .59 1.67 (.12) (.63)

Diluted .43 .57 1.59 (.12) (.63)

Total assets 47,316 46,964 45,841 35,955 34,192

Long-term debt - - - 1,740 2,062

Working capital 30,845 29,181 26,041 20,181 19,713

Property, plant and equipment (net) 5,018 5,301 5,762 6,229 6,616

8

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

General

Management's Discussion and Analysis of Financial Condition and Results of Operations discusses our

consolidated financial statements for the periods indicated, which have been prepared in accordance with

accounting principles generally accepted in the United States of America. The preparation of these

financial statements requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. On

an on-going basis, management evaluates its estimates and judgments, including those related to revenue

recognition, bad debts, product warranties, inventories, long lived assets, income taxes and contingencies

and litigation. Management bases its estimates and judgments on historical experience and on various

other factors including general market conditions that are believed to be reasonable under the

circumstances. Actual results may differ from these estimates under different assumptions or conditions.

Results for the periods reported herein are not necessarily indicative of results that may be expected in

future periods.

Overview

The Company designs, manufactures, assembles and markets a wide range of video systems and system

components used for security, surveillance, safety and communication purposes by a broad group of end

users worldwide. The Company’s product line consists of various elements of a video system, including

digital video and network video recorders, video encoders, decoders, servers and related physical security

information management software, analog, megapixel and IP fixed and robotic cameras, matrix video

switches, video displays and system peripherals.

The Company sells high-end video systems and system components in a highly competitive worldwide

marketplace principally to authorized security dealers and system integrators. Such dealers and integrators

typically resell the Company’s products directly to end users, among other services. The Company’s sales

are principally project based and are largely dependent upon winning projects, construction activities and

the timing of funding. Sales will vary from period to period depending upon many factors including

seasonal and geographic trends in construction activities and the timing of deliveries due to changes in

project schedules and funding. The Company does not maintain a sizable backlog as its customer orders

are typically deliverable within three months or often upon receipt of order. The Company’s operating

cost structure is principally fixed and therefore profitability is largely dependent upon sales levels. In

fiscal 2009, the Company’s sales levels were impacted by the worldwide economic downturn as capital

expenditure projects were cancelled and funding for new construction and renovation projects weakened.

Thus far in fiscal 2010, the Company is experiencing continued weak market conditions which have

significantly reduced its sales levels. The impact of such sales decline and continued lower incoming

order levels will have a material adverse impact on the Company’s near term financial results.

The Company competes in a market of rapid technology shifts which influence the performance

capability of security systems. As a result, the Company spends a significant amount on new product

development. In fiscal 2009 and 2008, the Company incurred $5.4 million and $5.6 million of

engineering and development expense or 9% and 8% of net sales, respectively. The Company’s

expenditures for product development are substantially less than its larger competitors. In recent years,

the rapid pace of technology changes has placed increased burden on the Company’s development

resources which may necessitate an increase in annual expense for product development. Further, the

Company’s sales effort requires a high level of customer service and technical support for its products.

Customer support levels were maintained during fiscal 2009 despite a reduction in sales and such

expenditure levels are expected to continue in fiscal 2010. The Company will also consider any strategic

initiative that may augment or supplement its present product offerings and technology platforms, among

other benefits.

The Company has a foreign sales and distribution subsidiary in Europe that conducts business in British

pounds and Euros that represented approximately 36% of the Company’s consolidated sales for fiscal

9

2009. It also has an Israel based engineering and development subsidiary that incurs a majority of its

operating expenses in shekels that represented approximately 15% of the Company’s operating expenses

for fiscal 2009. During fiscal 2009, there were material changes in exchange rates between world

currencies that affected the Company’s financial statements. In 2009, U.S. dollar gained on average 21%

against the British pound, 10% against the Euro and 8% against the shekel compared with 2008. This

served to reduce the Company’s consolidated reported sales and costs in these currencies on a translation

basis, increase the cost of European subsidiaries U.S. dollar based sourced product costs and incur

company-wide negative result impacts on the settlements of transactional balances between companies.

The Company has also historically secured selected forward currency exchange contracts to help stabilize

the impact of changing exchange rates and will continue to do so in fiscal 2010. Such contract settlements

have served to further impact currency transactions in fiscal 2009. The aggregate net negative impacts of

such complex currency exchange transactions on the fiscal year’s results were not reasonably

quantifiable.

RESULTS OF OPERATIONS

Fiscal Year 2009 Compared with 2008

Net sales for 2009 decreased $6.5 million (10%) to $60.4 million compared with $66.9 million in 2008.

Domestic sales decreased $2.9 million (8%) to $32.0 million compared with $34.9 million in 2008 while

international sales decreased $3.6 million (11%) to $28.4 million compared with $32.0 million in 2008.

Approximately $2.8 million of the decrease in international sales was due to negative currency exchange

rate changes in the current year as European currencies significantly weakened against the U.S. dollar.

The remaining sales decreases across all business segments was due to weakening worldwide economic

conditions as funding for new construction and renovation projects slowed during 2009. Order intake for

2009 decreased $7.7 million to $59.3 million compared with $67.0 million in 2008 and was similarly

impacted by negative exchange rate changes in the current year. The backlog of unfilled orders was $2.8

million at September 30, 2009 compared with $3.9 million at September 30, 2008.

Gross profit margins for 2009 decreased slightly to 45.2% compared with 45.5% in 2008. The decrease

included reduced European margins caused by weakening European currencies during 2009. The

Company’s Europe based subsidiaries experienced increased costs on U.S. dollar denominated product

purchases as a result of unfavorable currency exchange rate changes.

Operating expenses for 2009 decreased to $24.3 million or 40.1% of net sales compared with $26.0

million or 38.9% of net sales in 2008. Selling, general and administrative expenses decreased $1.5

million to $18.9 million for 2009 compared with $20.4 million in 2008. The decrease included a $1.1

million reduction in European subsidiary operating costs due principally to currency translation. In

addition, the Company continued to invest in new product development, incurring $5.4 million of

engineering and development expenses in 2009 compared with $5.6 million in 2008. Lower expenses

were incurred by the Company’s Israel based engineering and development operation as a result of a

stronger U.S. dollar in 2009.

The Company generated operating income of $3.0 million for fiscal 2009 compared with $4.4 million for

2008.

Interest expense decreased to $2,000 for 2009 compared with $45,000 in 2008 principally as a result of

the repayment of bank borrowings in January 2008. Interest and other income decreased to $190,000 for

2009 compared with $244,000 in 2008. Although the Company generated $7.1 million of cash in 2009, its

interest income decreased as a result of reduced yields on investments.

Income tax expense for 2009 decreased to $1.2 million compared with $1.8 million in 2008 as a result of

decreased taxable income. The current year tax expense includes a $1.1 million provision for U.S.

income taxes compared with a $1.2 million provision in 2008. The balance of tax expense for the years

presented represents foreign taxes on profits reported by the Company’s U.K. subsidiary.

As a result of the foregoing, the Company generated net income of $2.0 million in 2009 compared with

$2.8 million in 2008.

10

RESULTS OF OPERATIONS

Fiscal Year 2008 Compared with 2007

Net sales for 2008 decreased 3% to $66.9 million compared with $69.1 million in 2007. Domestic sales

decreased 6% to $34.9 million compared with $37.0 million in 2007 while international sales decreased

slightly to $32.0 million compared with $32.1 million in 2007. The sales decreases in these segments

were due in part to weakening economic conditions in certain of the Company’s markets during 2008.

However, order intake for 2008 increased to $67.0 million compared with $65.7 million in 2007. The

backlog of unfilled orders was $3.9 million at September 30, 2008 compared with $3.8 million at

September 30, 2007.

Gross profit margins for 2008 increased to 45.5% compared with 42.5% in 2007 as the Company

experienced higher margins on certain project business. The margin increase also included the benefit of

favorable exchange rate changes in Europe and reduced product component costs.

Operating expenses for 2008 increased to $26.0 million or 38.9% of net sales compared with $24.7

million or 35.8% of net sales in 2007. Selling, general and administrative expenses increased to $20.4

million for 2008 compared with $19.5 million in 2007 as the Company made certain investments in sales

organization infrastructure. In addition, the Company continued to invest in new product development,

incurring $5.6 million of engineering and development expenses in 2008 compared with $5.2 million in

2007. Increased expenses were incurred by the Company’s Israeli based engineering and development

operation as a result of a weaker U.S. dollar in 2008.

The Company generated operating income of $4.4 million for fiscal 2008 compared with $4.7 million for

2007.

Interest expense decreased to $45,000 for 2008 compared with $142,000 in 2007 principally as a result of

the paydown of bank borrowings. Interest and other income decreased to $244,000 for 2008 compared

with $380,000 in 2007. The prior year included $168,000 of gains from life insurance proceeds and

policies on the death of a retired executive. Excluding the effect of these gains, interest and other income

increased $32,000 principally as a result of increased cash balances during the current year period.

The Company recorded income tax expense of $1.8 million for 2008 compared with a benefit of $3.0

million for 2007. The current year tax expense includes a $1.2 million provision for U.S. income taxes as

compared with a $3.4 million tax benefit for 2007. The Company did not recognize income tax expense

on its U.S. pre-tax income of $3.9 million for 2007 as it utilized available net operating loss

carryforwards in the amount of $1.5 million (tax effected). In the fourth quarter of 2007, the Company

recorded a $3.4 million tax benefit relating to the recognition of remaining unrecognized U.S. net

deferred income tax assets. The deferred income tax asset recognition was made as a result of an updated

assessment of their realization. The 2008 income tax expense also included a $525,000 provision for

foreign taxes compared with $399,000 for 2007 relating primarily to profits recorded by the Company’s

U.K. subsidiary.

As a result of the foregoing, the Company generated net income of $2.8 million in 2008 compared with $7.9

million in 2007. Net income for 2007 would have been $3.1 million had income tax expense been provided

at an assumed effective tax rate.

LIQUIDITY AND CAPITAL RESOURCES

Net cash provided by operating activities was $8.4 million for 2009, which included $2.0 million of net

income, $2.0 million of non-cash charges for the year and a $4.2 million reduction of accounts receivable

due to the decrease in 2009 sales levels. Net cash used in investing activities was $573,000 in 2009

consisting of general capital expenditures. Net cash used in financing activities was $865,000 in 2009,

which included $1.3 million of common stock repurchases offset in part by $397,000 of proceeds

received from the exercise of stock options. As a result of the foregoing, cash increased by $7.1 million in

11

2009 after the effect of exchange rate changes on the cash position of the Company.

The Company believes that it has sufficient cash to meet its anticipated operating costs and capital expenditure

requirements for at least the next twelve months.

The Company does not have any off-balance sheet transactions, arrangements or obligations (including

contingent obligations) that have, or are reasonably likely to have, a material effect on the Company’s

financial condition, results of operations, liquidity, capital expenditures or capital resources.

The Company is one of several defendants in a patent infringement suit commenced by Lectrolarm

Custom Systems, Inc. in May 2003 in the United States District Court for the Western District of

Tennessee. The alleged infringement by the Company relates to its camera dome systems and other

products that represent significant sales to the Company. Among other things, the suit seeks past and

enhanced damages, injunctive relief and attorney’s fees. In January 2006, the Company received the

plaintiff’s claim for past damages through December 31, 2005 that approximated $11.7 million plus pre-

judgment interest. The Company and its outside patent counsel believe that the complaint against the

Company is without merit. The Company is vigorously defending itself and is a party to a joint defense

with certain other named defendants.

In January 2005, the Company petitioned the U.S. Patent and Trademark Office (USPTO) to reexamine

the plaintiff’s patent, believing it to be invalid. In April 2006, the USPTO issued a non-final office action

rejecting all of the plaintiff’s patent claims asserted against the Company citing the existence of prior art

of the Company and another defendant. On June 30, 2006, the Federal District Court granted the

defendants’ motion for continuance (delay) of the trial, pending the outcome of the USPTO’s

reexamination proceedings. In February 2007, the USPTO issued a Final Rejection of the six claims in

the plaintiff’s patent asserted against the Company, which was reaffirmed in June 2007 after the plaintiff

filed a response with the USPTO requesting reconsideration of its Final Rejection. The plaintiff has

appealed the examiner’s decision to the USPTO Board of Patent Appeals and Interferences and has an

additional appeal available to it thereafter in the Court of Appeals for the Federal Circuit.

The Company is unable to reasonably estimate a range of possible loss, if any, at this time. Although the

Company has received favorable rulings from the USPTO with respect to the reexamination proceedings,

there is always the possibility that the plaintiff’s patent claims could be upheld in appeal and the matter

would proceed to trial. Should this occur and the Company receives an unfavorable outcome at trial, it

could result in a liability that is material to the Company’s results of operations and financial position.

Critical Accounting Policies

The Company’s significant accounting policies are fully described in Note 1 to the consolidated financial

statements included in Part IV. Management believes the following critical accounting policies, among

others, affect its more significant judgments and estimates used in the preparation of its consolidated

financial statements.

The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has

occurred or services have been rendered, the selling price is fixed or determinable, and collectability of

the resulting receivable is reasonably assured. As it relates to product sales, revenue is generally

recognized when products are sold and title is passed to the customer. Shipping and handling costs are

included in cost of sales. Advance service billings under a national supply contract with one customer are

deferred and recognized as revenues on a pro rata basis over the term of the service agreement.

Pursuant to the adoption of Financial Accounting Standards Board (FASB) Accounting Standards

Codification (ASC) 605-25-05 (EITF Issue No. 00-21, “Revenue Arrangements with Multiple

Deliverables”), the Company evaluates multiple-element revenue arrangements for separate units of

accounting, and follows appropriate revenue recognition policies for each separate unit. Elements are

considered separate units of accounting provided that (i) the delivered item has stand-alone value to the

customer; (ii) there is objective and reliable evidence of the fair value of the undelivered item; and (iii) if

a general right of return exists relative to the delivered item, delivery or performance of the undelivered

item is considered probable and substantially within the control of the Company. As applied to the

12

Company, under arrangements involving the sale of product and the provision of services, product sales

are recognized as revenue when the products are sold and title is passed to the customer, and service

revenue is recognized as services are performed. For products that include more than incidental software,

and for separate licenses of the Company’s software products, the Company recognizes revenue in

accordance with the provisions of ASC 985-605 (Statement of Position 97-2, “Software Revenue

Recognition”), as amended.

The Company maintains allowances for doubtful accounts for estimated losses resulting from the inability

of its customers to make required payments. If the financial condition of its customers were to deteriorate,

resulting in an impairment of their ability to make payments, additional allowances may be required.

The Company provides for the estimated cost of product warranties at the time revenue is recognized.

While the Company engages in product quality programs and processes, including monitoring and

evaluating the quality of its component suppliers, its warranty obligation is affected by product failure

rates, material usage and service delivery costs incurred in correcting a product failure. Should actual

product failure rates, material usage or service delivery costs differ from its estimates, revisions to the

estimated warranty liability may be required.

The Company writes down its inventory for estimated obsolescence and slow moving inventory equal to

the difference between the carrying cost of inventory and the estimated net realizable market value based

upon assumptions about future demand and market conditions. Technology changes and market

conditions may render some of the Company’s products obsolete and additional inventory write-downs

may be required. If actual future demand or market conditions are less favorable than those projected by

management, additional inventory write-downs may be required.

The Company assesses the recoverability of the carrying value of its long-lived assets, including

identifiable intangible assets with finite useful lives, whenever events or changes in circumstances

indicate that the carrying amount of the assets may not be recoverable. The Company evaluates the

recoverability of such assets based upon the expectations of undiscounted cash flows from such assets. If

the sum of the expected future undiscounted cash flows were less than the carrying amount of the asset, a

loss would be recognized for the difference between the fair value and the carrying amount.

The Company’s ability to recover the reported amounts of deferred income tax assets is dependent upon

its ability to generate sufficient taxable income during the periods over which net temporary tax

differences become deductible.

The Company is subject to proceedings, lawsuits and other claims related to labor, product and other

matters. The Company assesses the likelihood of an adverse judgment or outcomes for these matters, as

well as the range of potential losses. A determination of the reserves required, if any, is made after

careful analysis. The required reserves may change in the future due to new developments.

Recent Accounting Pronouncements

In September 2006, the FASB issued ASC 820 (Statement of Financial Accounting Standards (SFAS)

No. 157, “Fair Value Measurement”), which defines fair value, establishes a framework for measuring

fair value and expands disclosures regarding assets and liabilities measured at fair value, which was

amended in February 2008. The adoption of the provisions related to financial assets and financial

liabilities were effective for the Company’s first quarter of fiscal 2009 and did not have a material impact

on its consolidated financial position, results of operations or cash flows. The Company does not expect

that the adoption of the remaining provisions of ASC 820 will have a material impact on its consolidated

financial position, results of operations or cash flows.

In December 2007, the FASB issued ASC 805 (SFAS 141 and SFAS 141R , “Business Combinations”).

ASC 805 will significantly change the accounting for business combinations in a number of areas

including the treatment of contingent consideration, contingencies, acquisition costs, IPR&D and

restructuring costs. In addition, under ASC 805, changes in deferred tax asset valuation allowances and

acquired income tax uncertainties in a business combination after the measurement period will impact

13

income tax expense. ASC 805 is effective for fiscal years beginning after December 15, 2008. The

Company has not yet evaluated the impact, if any, of adopting this pronouncement.

In December 2007, the FASB issued ASC 810 (SFAS 160, “Noncontrolling Interests in Consolidated

Financial Statements, an amendment of ARB No. 51” (“SFAS 160”)). ASC 810 will change the

accounting and reporting for minority interests, which will be recharacterized as noncontrolling interests

(NCI) and classified as a component of equity. This new consolidation method will significantly change

the accounting for transactions with minority interest holders. ASC 810 is effective for fiscal years

beginning after December 15, 2008. The Company has not yet evaluated the impact, if any, of adopting

this pronouncement.

In October 2009, the FASB amended ASC 985-605 (Statement of Position 97-2, “Software Revenue

Recognition”) to provide new guidance on accounting for revenue arrangements that include tangible

products containing software and non-software components that function together to deliver the product’s

essential functionality. These amendments become effective on a prospective basis for fiscal years

beginning after June 15, 2010, although early adoption is permitted. The Company has not yet evaluated

the impact, if any, of adopting this pronouncement.

Foreign Currency Activity

The Company’s foreign exchange exposure is principally limited to the relationship of the U.S. dollar to

the British pound sterling, the Euro and the Israeli shekel.

Sales by the Company’s U.K. and German based subsidiaries to customers in Europe are made in British

pounds sterling or Eurodollars. In fiscal 2009, approximately $4.5 million of products were sold by the

Company to its U.K. based subsidiary for resale. The Company has also entered into certain engineering

cost sharing agreements with its U.K. based subsidiary that are denominated in U.S. dollars. The

Company attempts to minimize its currency exposure on these intercompany transactions through the

purchase of forward exchange contracts.

The Company’s Israeli based subsidiary incurs shekel based operating expenses which are funded by the

Company in U.S. dollars. In fiscal 2009, the Company purchased forward exchange contracts to hedge its

currency exposure on certain of these expenses.

As of September 30, 2009, the Company had forward exchange contracts outstanding with notional amounts

aggregating $2.0 million. The Company also attempts to reduce the impact of an unfavorable exchange rate

condition through cost reductions from its suppliers and shifting product sourcing to suppliers transacting in

more stable and favorable currencies.

In general, the Company seeks lower costs from suppliers and enters into forward exchange contracts to

mitigate short-term exchange rate exposures. However, there can be no assurance that such steps will be

effective in limiting long-term foreign currency exposure.

14

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market Risk Factors

The Company is exposed to various market risks, including changes in foreign currency exchange rates

and interest rates. The Company has a policy that prohibits the use of currency derivatives or other

financial instruments for trading or speculative purposes.

The Company enters into forward exchange contracts to hedge certain foreign currency exposures and

minimize the effect of such fluctuations on reported earnings and cash flow (see “Foreign Currency

Activity”, Note 1 “Derivative Instruments” and “Fair Value of Financial Instruments” to the

accompanying financial statements). At September 30, 2009, the Company’s foreign currency exchange

risks included an aggregate $2.6 million of intercompany account balances between the Company and its

subsidiaries, which are short term and will be settled in fiscal 2010.

Related Party Transactions

Refer to Item 13 and “Note 10. Related Party Transactions” to the accompanying financial statements.

Inflation

Inflation has increased the Company’s operating costs in recent years. To offset the effects of inflation,

the Company seeks to increase sales and lower its costs where possible.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

Statements in this Report on Form 10-K and other statements made by the Company or its representatives

that are not strictly historical facts including, without limitation, statements included herein under the

Management’s Discussion and Analysis captions “Overview”, “Results of Operations” and “Liquidity and

Capital Resources” are “forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995 that should be considered as subject to the many risks and uncertainties

that exist in the Company's operations and business environment. The forward-looking statements are

based on current expectations and involve a number of known and unknown risks and uncertainties that

could cause the actual results, performance and/or achievements of the Company to differ materially from

any future results, performance or achievements, express or implied, by the forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, and that in light

of the significant uncertainties inherent in forward-looking statements, the inclusion of such statements

should not be regarded as a representation by the Company or any other person that the objectives or

plans of the Company will be achieved. The Company also assumes no obligation to publicly update or

revise its forward-looking statements or to advise of changes in the assumptions and factors on which

they are based.

ITEM 8 - FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See Part IV, Item 15, for an index to consolidated financial statements and financial statement schedules.

15

ITEM 9A – CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

The Company’s management, with the participation of its Chief Executive Officer and Chief Financial

Officer, conducted an evaluation of the effectiveness of the design and operation of the Company’s

disclosure controls and procedures, as required by Exchange Act Rule 13a-15. Based on that evaluation,

the Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of the period

covered by this report, the Company’s disclosure controls and procedures were effective to ensure that

information required to be disclosed by the Company in the reports that it files or submits under the

Exchange Act is recorded, processed, summarized and reported within the time periods specified by the

Securities and Exchange Commission’s rules and forms and such information is accumulated and

communicated to management as appropriate to allow timely decisions regarding required disclosures.

Management's Report on Internal Control over Financial Reporting

The Company's management is responsible for establishing and maintaining adequate internal control

over financial reporting. The Company's internal control over financial reporting is a process designed

under the supervision of its Chief Executive Officer and Chief Financial Officer to provide reasonable

assurance regarding the reliability of financial reporting and the preparation of the Company's financial

statements for external reporting in accordance with accounting principles generally accepted in the

United States of America. Management evaluates the effectiveness of the Company's internal control over

financial reporting using the criteria set forth by the Committee of Sponsoring Organizations of the

Treadway Commission (COSO) in Internal Control—Integrated Framework. Management, under the

supervision and with the participation of the Company's Chief Executive Officer and Chief Financial

Officer, assessed the effectiveness of the Company's internal control over financial reporting as of

September 30, 2009 and concluded that it is effective.

This annual report does not include an attestation report of the Company's registered public accounting

firm regarding internal control over financial reporting. Management’s report was not subject to

attestation by the Company’s registered public accounting firm pursuant to temporary rules of the

Securities and Exchange Commission that permit the Company to provide only management’s report in

this annual report.

Changes in Internal Controls

There were no changes in the Company's internal control over financial reporting identified in connection

with the evaluation referred to above that occurred during the fourth quarter of the fiscal year ended

September 30, 2009 that have materially affected, or are reasonably likely to materially affect, the

registrant's internal control over financial reporting.

Limitations on the Effectiveness of Controls

The Company believes that a control system, no matter how well designed and operated, cannot provide

absolute assurance that the objectives of the control system are met, and no evaluation of controls can

provide absolute assurance that all controls issues and instances of fraud, if any, within a Company have

been detected. The Company's disclosure controls and procedures are designed to provide reasonable

assurance of achieving their objectives and the Company's Chief Executive Officer and Chief Financial

Officer have concluded that such controls and procedures are effective at the "reasonable assurance"

level.

ITEM 9B – OTHER INFORMATION

None.

16

PART III

ITEM 10 - DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

The Executive Officers and Directors of the Company are as follows:

Name Age Position

Kenneth M. Darby 63 Chairman of the Board, President and

Chief Executive Officer

John M. Badke 50 Senior Vice President, Finance and

Chief Financial Officer

Peter A. Horn 54 Vice President, Operations

Bret M. McGowan 44 Vice President, U.S. Sales and Marketing

Yacov A. Pshtissky 58 Vice President, Technology and Development

Christopher J. Wall 56 Managing Director, Vicon Industries Ltd.

Yigal Abiri 60 General Manager, Vicon Systems Ltd.

Peter F. Neumann 75 Director

Bernard F. Reynolds 67 Director

W. Gregory Robertson 66 Director

Arthur D. Roche 71 Director

The business experience, principal occupations and employment, as well as period of service, of each of the

officers and directors of the Company during at least the last five years are set forth below.

Kenneth M. Darby - Chairman of the Board, President and Chief Executive Officer. Mr. Darby has

served as Chairman of the Board since April 1999, as Chief Executive Officer since April 1992 and as

President since October 1991. He has served as a director since 1987. Mr. Darby also served as Chief

Operating Officer and as Executive Vice President, Vice President, Finance and Treasurer of the Company.

He joined the Company in 1978 as Controller after more than nine years at Peat Marwick Mitchell & Co., a

public accounting firm. Mr. Darby's current term on the Board ends in May 2011.

John M. Badke – Senior Vice President, Finance and Chief Financial Officer. Mr. Badke has been

Senior Vice President, Finance since May 2004 and Chief Financial Officer since December 1999.

Previously, he was Vice President, Finance since October 1998 and served as Controller since joining the

Company in 1992. Prior to joining the Company, Mr. Badke was Controller for NEK Cable, Inc. and an

audit manager with the international accounting firms of Arthur Andersen & Co. and Peat Marwick Main &

Co.

Peter A. Horn - Vice President, Operations. Mr. Horn has been Vice President, Operations since June

1999. From 1995 to 1999, he was Vice President, Compliance and Quality Assurance. Prior to that time, he

served as Vice President in various capacities since his promotion in May 1990.

Bret M. McGowan – Vice President, U.S. Sales and Marketing. Mr. McGowan has been Vice President,

U.S. Sales and Marketing since April 2005. From 2001 to 2005, he served as Vice President, Marketing.

Previously, he served as Director of Marketing since 1998 and as Marketing Manager since 1994. He joined

the Company in 1993 as a Marketing Specialist.

Yacov A. Pshtissky - Vice President, Technology and Development. Mr. Pshtissky has been Vice

President, Technology and Development since May 1990. Mr. Pshtissky was Director of Electrical Product

Development from March 1988 through April 1990.

17

Christopher J. Wall - Managing Director, Vicon Industries, Ltd. Mr. Wall has been Managing

Director, Vicon Industries Ltd. since February 1996. Previously he served as Financial Director, Vicon

Industries, Ltd. since joining the Company in 1989. Prior to joining the Company he held a variety of

senior financial positions within Westland plc, a UK aerospace company.

Yigal Abiri – General Manager, Vicon Systems Ltd. Mr. Abiri has been General Manager, Vicon

Systems Ltd. since joining the Company in August 1999. Previously, he served as President of QSR,

Ltd., a developer and manufacturer of remote video surveillance equipment.

Peter F. Neumann - Director. Mr. Neumann has been a director of the Company since 1987. He is the

retired President of Flynn-Neumann Agency, Inc., an insurance brokerage firm. Mr. Neumann's current term

on the Board ends in May 2012.

Bernard F. Reynolds - Director. Mr. Reynolds has been a director of the Company since May 2009. He has

been retired since 2004 and had previously served as the President of Aon Consulting’s Human Resources

Outsourcing Group. Prior to the merger of Aon Consulting Worldwide and ASI Solutions Incorporated in May

2001, Mr. Reynolds served as the Chairman and Chief Executive Officer of ASI, a company he founded in

1978. Mr. Reynolds’ current term on the Board ends in May 2012.

W. Gregory Robertson - Director. Mr. Robertson has been a director of the Company since 1991. He is

the Chairman of TM Capital Corporation, a financial services company which he founded in 1989. From

1985 to 1989, he was employed by Thomson McKinnon Securities, Inc. as head of investment banking and

public finance. Mr. Robertson’s current term on the Board ends in May 2010.

Arthur D. Roche - Director. Mr. Roche has been a director of the Company since 1992. He served as

Executive Vice President and co-participant in the Office of the President of the Company from

August 1993 until his retirement in November 1999. For the six months prior to that time, Mr. Roche

provided consulting services to the Company. In October 1991, Mr. Roche retired as a partner of Arthur

Andersen & Co., an international accounting firm which he joined in 1960. His current term on the Board

ends in May 2011.

There are no family relationships between any director, executive officer or person nominated or chosen by

the Company to become a director or officer.

Audit Committee Financial Expert

All named directors other than Mr. Darby are independent directors and members of the Audit

Committee. The Board of Directors has determined that Arthur D. Roche, Chairman of the Audit

Committee, qualifies as an “Audit Committee Financial Expert”, as defined by Securities and Exchange

Commission Rules, based on his education, experience and background. Mr. Roche is independent as

that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act.

Code of Ethics

The Company has adopted a Code of Ethics that applies to all its employees, including its chief executive

officer, chief financial and accounting officer, controller, and any persons performing similar functions. Such

Code of Ethics is published on the Company’s internet website (www.vicon-cctv.com).

Compliance with Section 16(a) of the Exchange Act

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to the Company during the

year ended September 30, 2009 and certain written representations that no Form 5 is required, no person who,

at any time during the year ended September 30, 2009 was a director, officer or beneficial owner of more than

10 percent of any class of equity securities of the Company registered pursuant to Section 12 of the Exchange

Act failed to file on a timely basis, as disclosed in the above forms, reports required by Section 16(a) of the

Exchange Act during the year ended September 30, 2009, except that Mr. Reynolds filed one late report on

Form 3, Mr. Neumann filed two late reports on Form 4, and Messrs. Maloney and Reynolds each filed one

late report on Form 4.

18

ITEM 11 - EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Philosophy and Objectives of Our Compensation Program

The Company’s compensation programs are intended to enable it to attract, motivate, reward and retain

the management talent required to achieve corporate objectives, and thereby increase stockholder value. It

is the Company’s policy to provide incentives to senior management to achieve both short-term and long-

term objectives and to reward exceptional performance and contributions to the development of the

business. To attain these objectives, the executive compensation program includes four key components:

Base Salary. Base salary for the Company’s executives is intended to provide competitive

remuneration for services provided to the Company over a one-year period. Base salaries are set at levels

designed to attract and retain the most appropriately qualified individuals for each of the key management

level positions within the Company.

Cash Incentive Bonuses. The Company's bonus programs are intended to reward executive

officers for the achievement of various annual performance goals approved by the Company’s Board of

Directors. For fiscal 2009, a performance based bonus plan was established for certain of the Company’s

executive officers, including among others Kenneth M. Darby, Chief Executive Officer and John M.

Badke, Chief Financial Officer, whereby the participants would share a specified pretax profit based

bonus pool of between seven percent (7%) and eleven percent (11%) upon the achievement of a certain

annual pretax profit targets ranging from $2.0 million to $4.5 million (and above), respectively. Under

such plan, Messrs. Darby and Badke earned bonuses of $176,000 and $88,000, respectively, based upon

the allocation of an aggregate bonus pool of ten percent (10%) of the Company’s consolidated pretax

profit for 2009, after certain adjustments. Mr. Darby’s and Mr. Badke’s bonus allocation represented

approximately 49% and 25%, respectively, of the available bonus pool.

In addition, a performance based bonus plan was established for Christopher J. Wall, the Company’s

European subsidiary Managing Director, for fiscal year 2009 whereby Mr. Wall would earn an amount

equal to between 2% and 6% (based on achievement levels) of the combined pretax operating profits of

the Company’s Europe based subsidiaries. Under such plan, Mr. Wall earned a bonus of $127,000

(82,083 Pounds Sterling) based upon the achievement of 5% of specified profits for fiscal 2009.

Equity-Based Compensation. Equity-based compensation is designed to provide incentives to the

Company’s executive officers to build shareholder value over the long term by aligning their interests

with the interest of shareholders. The Compensation Committee of the Board of Directors believes that

equity-based compensation provides an incentive that focuses the executive's attention on managing the

company from the perspective of an owner with an equity stake in the business. Among our executive

officers, the number of shares of stock awarded or common stock subject to options granted to each

individual generally depends upon the level of that officer's responsibility. The largest grants are

generally awarded to the most senior officers who, in the view of the Compensation Committee, have the

greatest potential impact on the Company’s profitability and growth. Previous grants of stock options or

stock grants are reviewed in determining the size of any executive's award in a particular year.

In March 2007, the Board of Directors adopted the Company’s 2007 Stock Incentive Plan, which was

approved by the Company’s stockholders at its Annual Meeting of Stockholders held on May 18, 2007.

Under such plan, a total of 500,000 shares of Common Stock were reserved for issuance and include the

grant of stock options, restricted stock and other stock awards as determined by the Compensation

Committee. The purpose of the Stock Incentive Plan is to attract and retain executive management by

providing them with appropriate equity-based incentives and rewards for superior performance and to

provide incentive to a broader range of employees. In fiscal 2009, the Compensation Committee awarded

a total of 43,000 stock options to named executive officers, including 25,000 to Mr. Darby, 8,000 to Mr.

Badke and 10,000 to Mr. Wall.

Retirement, Health and Welfare Benefits and Other Perquisites. The Company’s executive

officers are entitled to a specified retirement/severance benefit pursuant to employment agreements as

detailed below.

19

In addition, the executive officers are entitled to participate in all of the Company’s employee benefit

plans, including medical, dental, group life, disability, accidental death and dismemberment insurance and

the Company’s sponsored 401(k) and mandated foreign Retirement Plans. Further, Mr. Wall receives a

supplemental retirement benefit in the form of a defined contribution of five percent (5%) of his annual

salary. The Company also provides its Chief Executive Officer with a country club membership and

certain additional insurances not covered by primary insurance plans available to other employees and the

Company’s named executive officers are provided a leased car.

Employment Agreements

The Company has entered into employment agreements with its named executive officers that provide

certain benefits upon termination of employment or change in control of the Company without Board of

Director approval. Under Mr. Darby’s employment agreement, he is entitled to receive a lump sum

payment equal to the balance owing under his agreement in the event of a change in control of the

Company under any condition. All the other agreements provide the named executive officer with a

payment of three times their average annual compensation for the previous five year period if there is a

change in control of the Company without Board of Director approval, as defined. Such payment can be

taken in a present value lump sum or equal installments over a three year period. The agreements also

provide the named executive officers other than Mr. Darby with certain severance/retirement benefits