Terminal Technical Manual AEIPS V4.3 Apr 2015

AEIPS%20Terminal%20Technical%20Manual%20-%20v4.3%20-%20Apr%202015

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 94

AEIPS

Terminal Technical Manual

(AEIPS 4.3)

April 2015

American Express

Page 2 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

Confidential and Trade Secret Materials

This

document

contains

sensitive,

confidential

and

trade

secret

information and

may

not

be

disclosed

to

third

parties

without

the

prior

written

consent

of

American

Express

Travel

Related

Services

Company,

Inc.

The

policies,

procedures,

and

rules

in

this

manual

are

subject

to

change from

time

to

time

by

American

Express

Global

Network

Services.

©

2015

American

Express

Travel

Related

Services

Co.,

Inc.

All

Rights

Reserved

Page 3 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

Table of Contents

1 SUMMARY OF CHANGES ..................................................................................................................... 10

2 INTRODUCTION ..................................................................................................................................... 11

2.1 Scope ................................................................................................................................................... 11

2.2 Audience ............................................................................................................................................. 11

2.3 Reference Materials ........................................................................................................................... 11

2.3.1 ISO ................................................................................................................................................ 11

2.3.2 EMV .............................................................................................................................................. 12

2.3.3 American Express ......................................................................................................................... 12

2.4 Use of Terms ...................................................................................................................................... 12

2.4.1 Optional, Mandatory or Conditional .............................................................................................. 12

2.4.2 Use of the Term “Chip Card” ........................................................................................................ 12

2.4.3 Cardholder or Cardmember? ........................................................................................................ 12

2.5 Document Structure ........................................................................................................................... 13

2.6 Notation ............................................................................................................................................... 13

3 TRANSACTION OVERVIEW .................................................................................................................. 14

3.1 Functional Overview .......................................................................................................................... 14

3.2 Dual Interface Support ....................................................................................................................... 15

3.3 Mandatory and Optional Functionality Summary ........................................................................... 15

3.3.1 Functions ...................................................................................................................................... 15

3.3.2 Commands .................................................................................................................................... 16

3.3.3 AEIPS Command Non-Specific Status Words ............................................................................. 17

4 APPLICATION SELECTION ................................................................................................................... 18

4.1 Overview ............................................................................................................................................. 18

4.2 Commands .......................................................................................................................................... 18

4.3 Processing Requirements ................................................................................................................. 19

4.3.1 Chip Card Insertion and Power Up Sequence .............................................................................. 19

4.3.2 Answer to Reset ............................................................................................................................ 19

4.3.3 Application Selection – Building the Candidate List ..................................................................... 19

4.3.4 Application Selection – Choosing the Required Application ......................................................... 20

5 INITIATE APPLICATION PROCESSING ............................................................................................... 21

5.1 Overview ............................................................................................................................................. 21

5.2 Commands .......................................................................................................................................... 21

5.3 Processing Requirements ................................................................................................................. 21

Page 4 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

6 READ APPLICATION DATA .................................................................................................................. 23

6.1 Overview ............................................................................................................................................. 23

6.2 Commands .......................................................................................................................................... 23

6.3 Processing Requirements ................................................................................................................. 23

7 OFFLINE DATA AUTHENTICATION ..................................................................................................... 25

7.1 Overview ............................................................................................................................................. 25

7.1.1 Static Data Authentication (SDA) .................................................................................................. 26

7.1.2 Dynamic Data Authentication (DDA) ............................................................................................ 27

7.1.3 Combined DDA / Application Cryptogram Generation (CDA) ...................................................... 27

7.2 Commands .......................................................................................................................................... 27

7.3 Processing Requirements ................................................................................................................. 28

7.3.1 American Express Scheme CA Keys ........................................................................................... 28

7.3.2 Static Data Authentication (SDA) .................................................................................................. 28

7.3.3 Dynamic Data Authentication (DDA) ............................................................................................ 29

7.3.4 Combined DDA/AC Generation (CDA) ......................................................................................... 29

8 PROCESSING RESTRICTIONS ............................................................................................................. 30

8.1 Overview ............................................................................................................................................. 30

8.2 Processing Requirements ................................................................................................................. 30

9 CARDHOLDER VERIFICATION ............................................................................................................. 32

9.1 Overview ............................................................................................................................................. 32

9.2 Commands .......................................................................................................................................... 32

9.3 Processing Requirements ................................................................................................................. 33

9.3.1 Online PIN ..................................................................................................................................... 34

9.3.2 Offline PIN ..................................................................................................................................... 34

9.3.3 Other CVM .................................................................................................................................... 36

9.4 PIN Pad Requirements ....................................................................................................................... 36

10 TERMINAL RISK MANAGEMENT ...................................................................................................... 37

10.1 Overview .......................................................................................................................................... 37

10.2 Commands ...................................................................................................................................... 37

10.3 Processing Requirements ............................................................................................................. 37

11 1ST TERMINAL ACTION ANALYSIS .................................................................................................. 39

11.1 Overview .......................................................................................................................................... 39

Page 5 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

11.2 Processing Requirements ............................................................................................................. 39

11.2.1 Offline Processing Results ............................................................................................................ 40

11.2.2 Request Application Cryptogram in 1st GENERATE AC ............................................................. 41

12 1ST CARD ACTION ANALYSIS ........................................................................................................... 42

12.1 Overview .......................................................................................................................................... 42

12.2 Commands ...................................................................................................................................... 43

12.3 Processing Requirements ............................................................................................................. 43

13 ONLINE PROCESSING ....................................................................................................................... 44

13.1 Overview .......................................................................................................................................... 44

13.2 Processing Requirements ............................................................................................................. 44

14 ISSUER AUTHENTICATION ............................................................................................................... 46

14.1 Overview .......................................................................................................................................... 46

14.2 Commands ...................................................................................................................................... 46

14.3 Processing Requirements ............................................................................................................. 46

15 2ND TERMINAL ACTION ANALYSIS .................................................................................................. 48

15.1 Overview .......................................................................................................................................... 48

15.2 Processing Requirements ............................................................................................................. 48

15.2.1 Advice Messages .......................................................................................................................... 49

15.2.2 Voice Referrals ............................................................................................................................. 49

16 2ND CARD ACTION ANALYSIS .......................................................................................................... 50

16.1 Overview .......................................................................................................................................... 50

16.2 Commands ...................................................................................................................................... 50

16.3 Processing Requirements ............................................................................................................. 51

17 ISSUER SCRIPT PROCESSING ........................................................................................................ 52

17.1 Overview .......................................................................................................................................... 52

17.2 Commands ...................................................................................................................................... 52

17.3 Processing Requirements ............................................................................................................. 53

17.4 Processing a Blocked Application ............................................................................................... 53

18 TRANSACTION COMPLETION .......................................................................................................... 54

Page 6 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

18.1 Overview .......................................................................................................................................... 54

18.2 Processing Requirements ............................................................................................................. 54

18.2.1 Voice referrals ............................................................................................................................... 54

19 PERFORMANCE REQUIREMENTS ................................................................................................... 55

20 CRYPTOGRAPHIC REQUIREMENTS ............................................................................................... 56

20.1 Unpredictable Number Generation ............................................................................................... 56

20.2 Offline Data Authentication ........................................................................................................... 56

20.3 Offline PIN Encipherment .............................................................................................................. 56

20.4 PIN Entry Device ............................................................................................................................. 56

21 ADDITIONAL PRODUCT SPECIFICS ................................................................................................ 57

21.1 Membership-Related Data Processing ......................................................................................... 57

21.1.1 Overview ....................................................................................................................................... 57

21.1.2 Data............................................................................................................................................... 57

21.1.3 Processing Requirements ............................................................................................................. 57

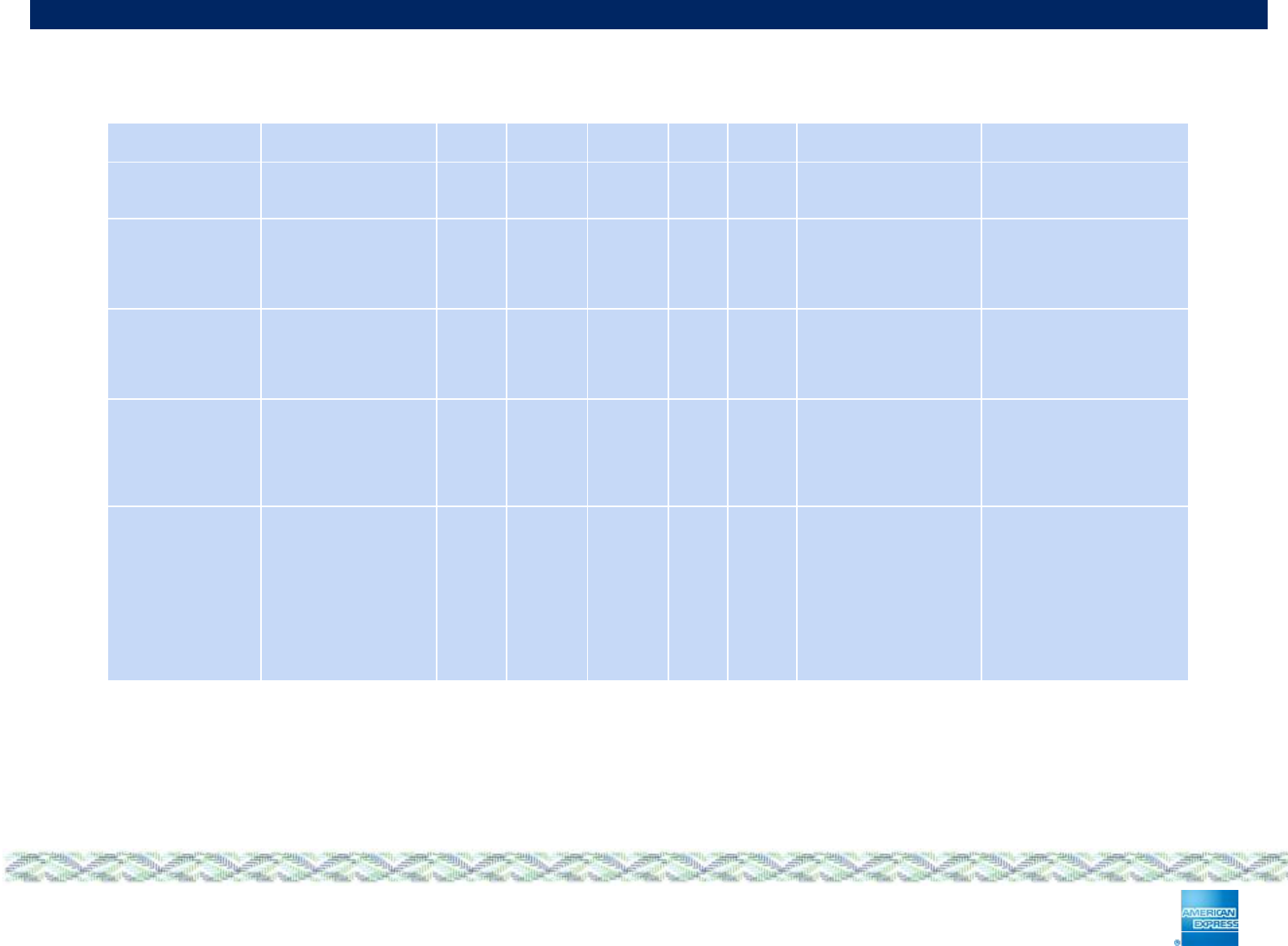

22 DATA ELEMENTS ............................................................................................................................... 58

22.1 Data Overview ................................................................................................................................. 58

22.2 Payment Systems Environment .................................................................................................... 58

22.2.1 PSE Select Response Data .......................................................................................................... 58

22.2.2 PSE Directory Level Data ............................................................................................................. 59

22.3 Payment Application Data ............................................................................................................. 59

22.3.1 Select Response Data .................................................................................................................. 59

22.3.2 Initiate Application Processing Data ............................................................................................. 61

22.3.3 Read Record Data ........................................................................................................................ 62

22.3.4 SDA Data ...................................................................................................................................... 67

22.3.5 DDA / CDA Data ........................................................................................................................... 68

22.3.6 Chip Card PIN Encipherment Data ............................................................................................... 69

22.3.7 Terminal Risk Management Data ................................................................................................. 70

22.4 Data Elements Table ...................................................................................................................... 72

23 GLOSSARY ......................................................................................................................................... 91

24 INDEX .................................................................................................................................................. 94

Page 7 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

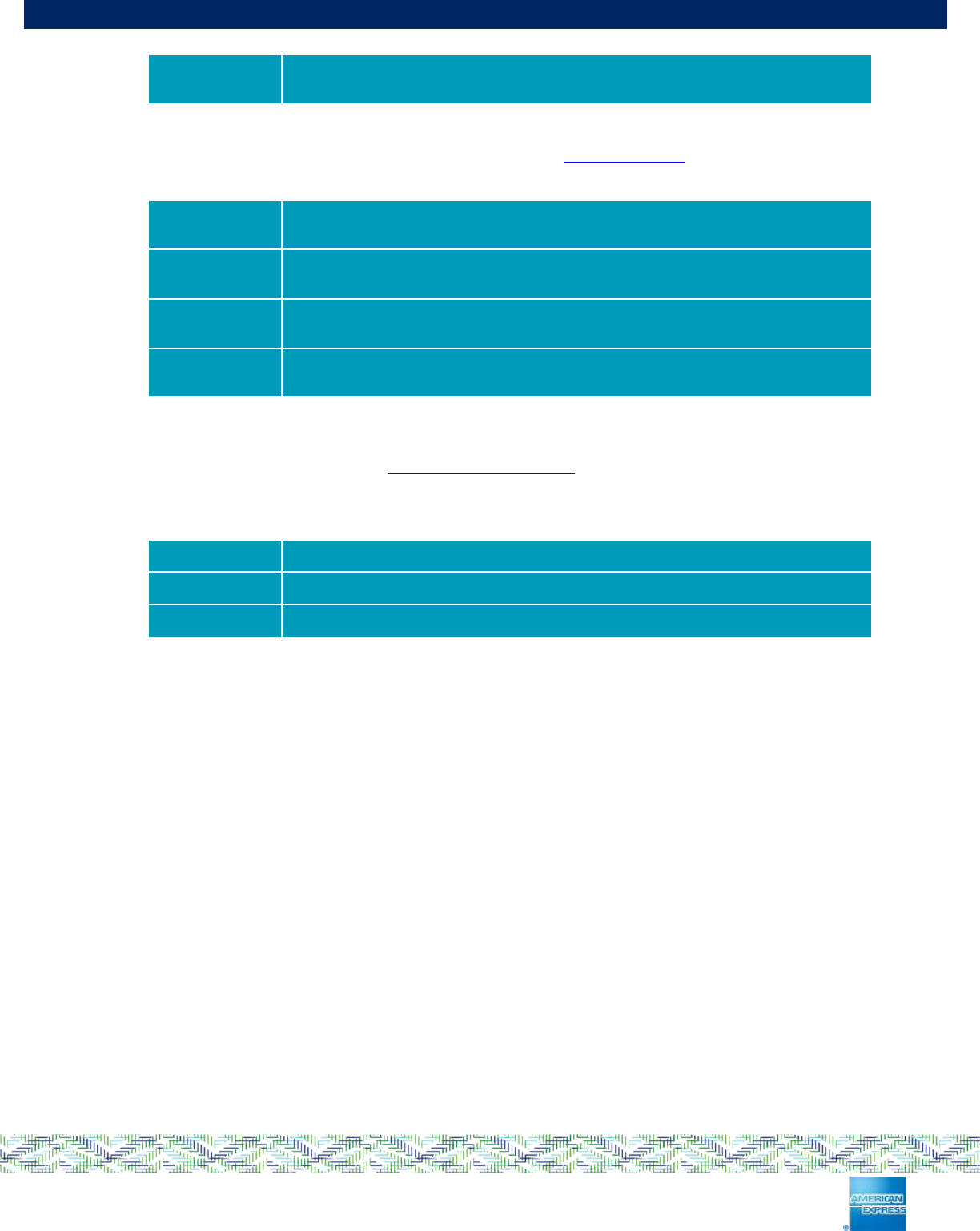

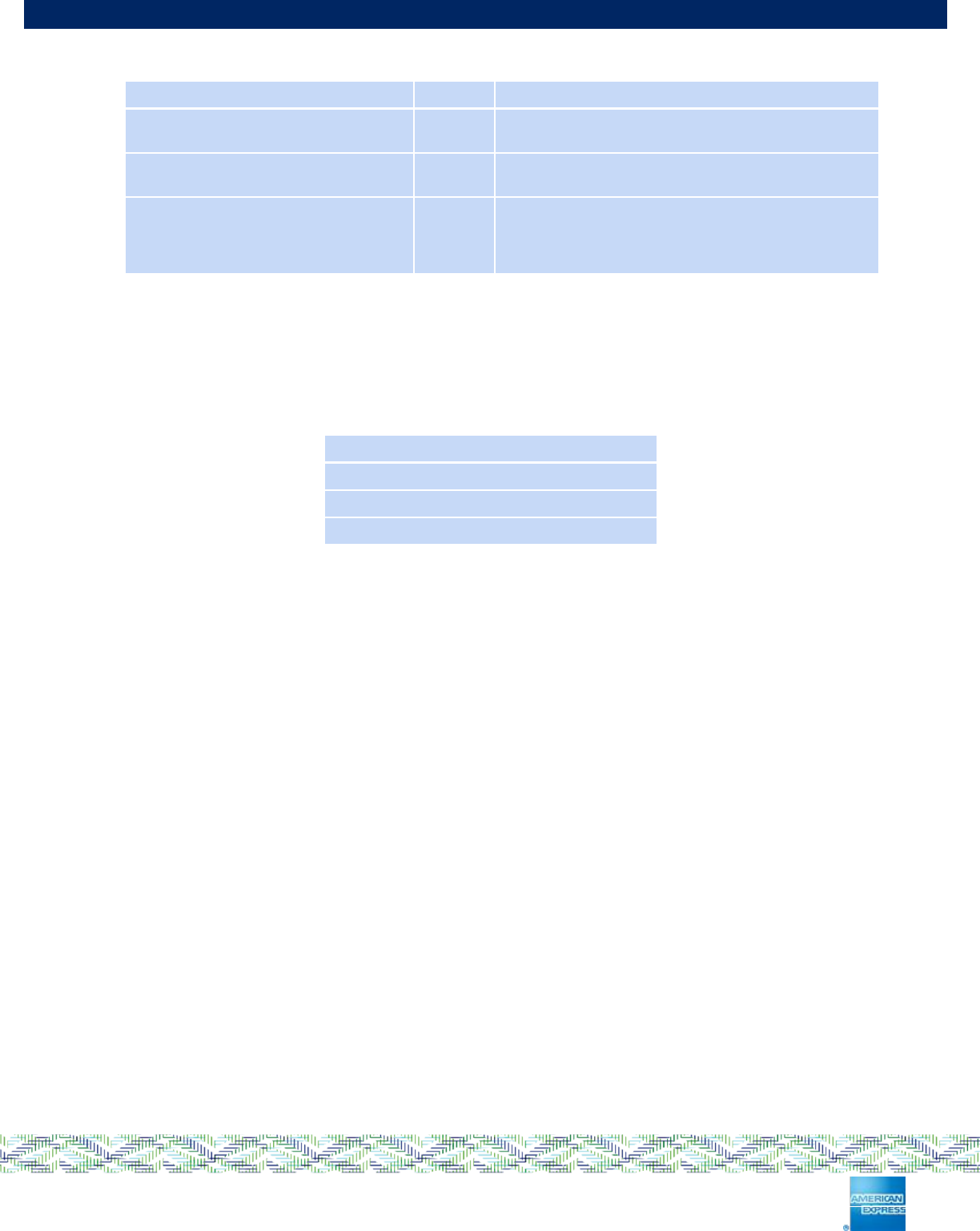

List of Figures

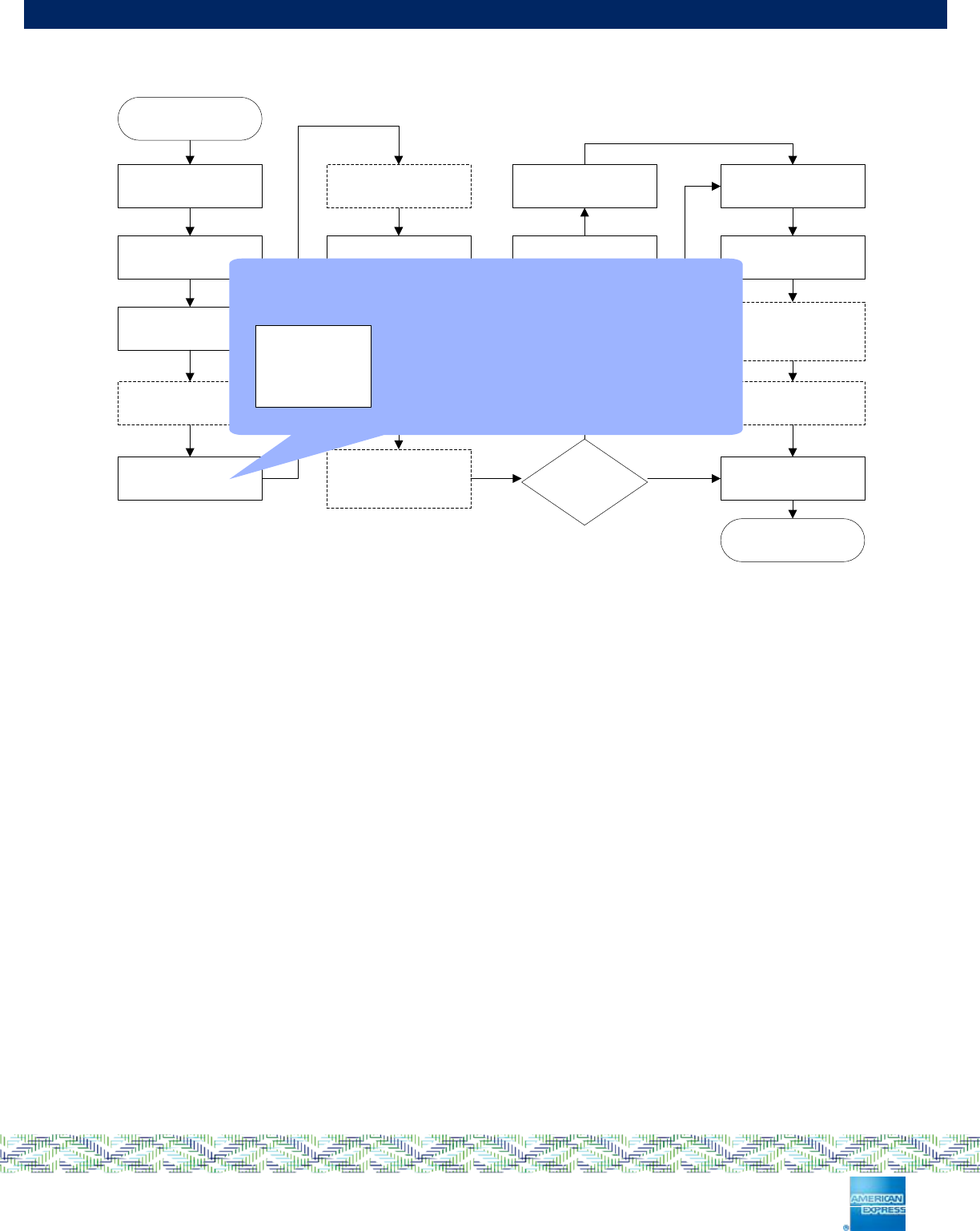

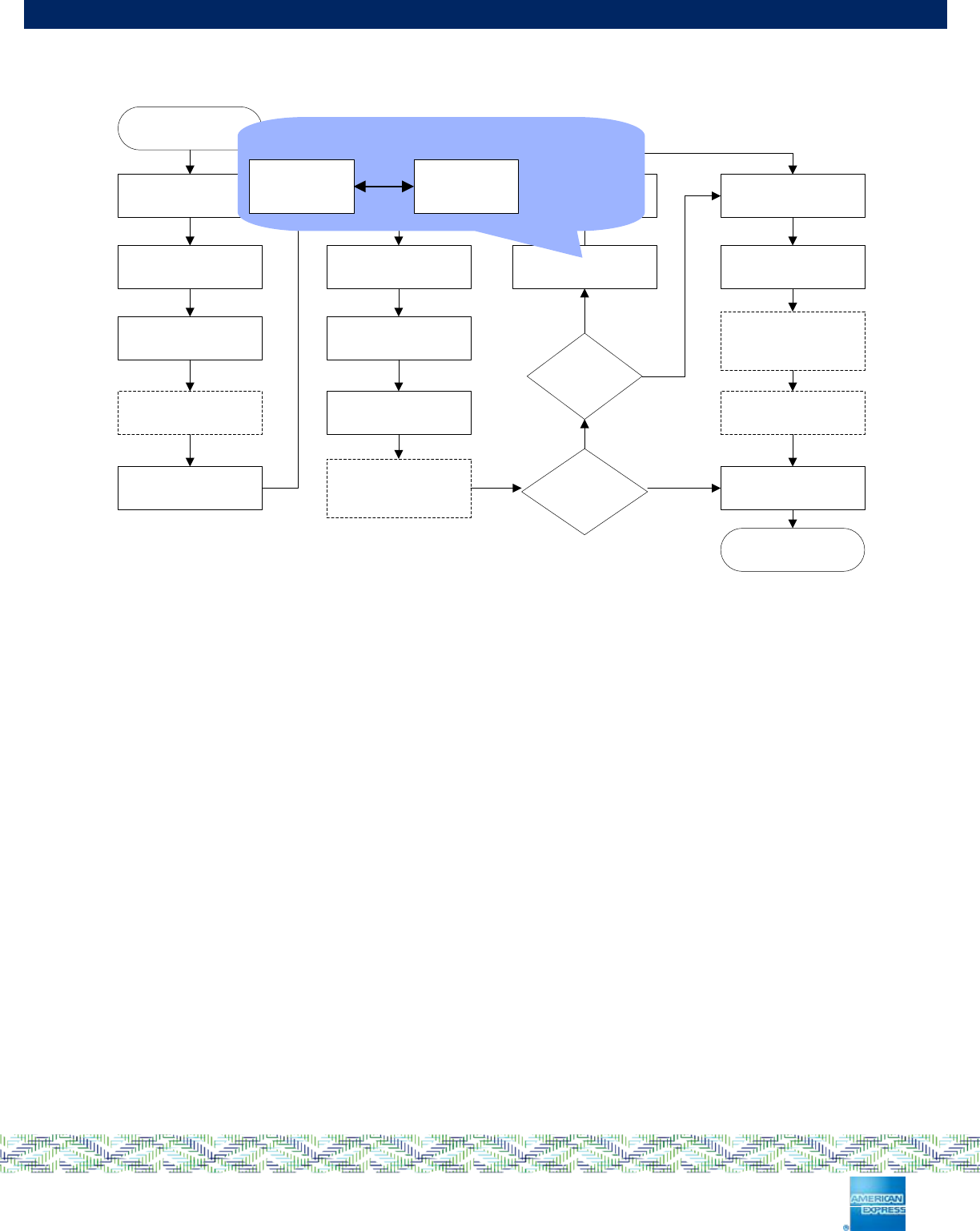

Figure 3-1: AEIPS Transaction Flow ............................................................................................ 14

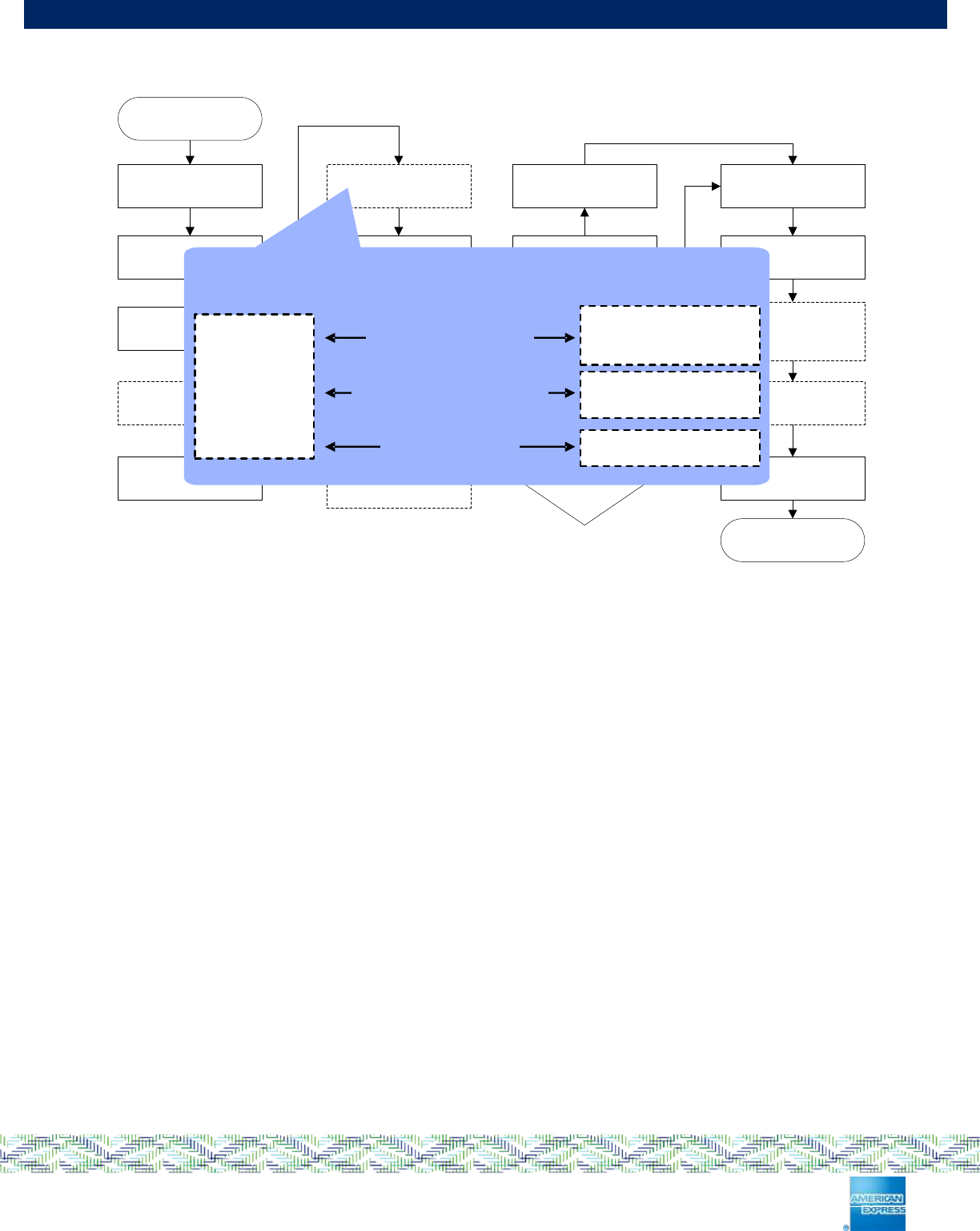

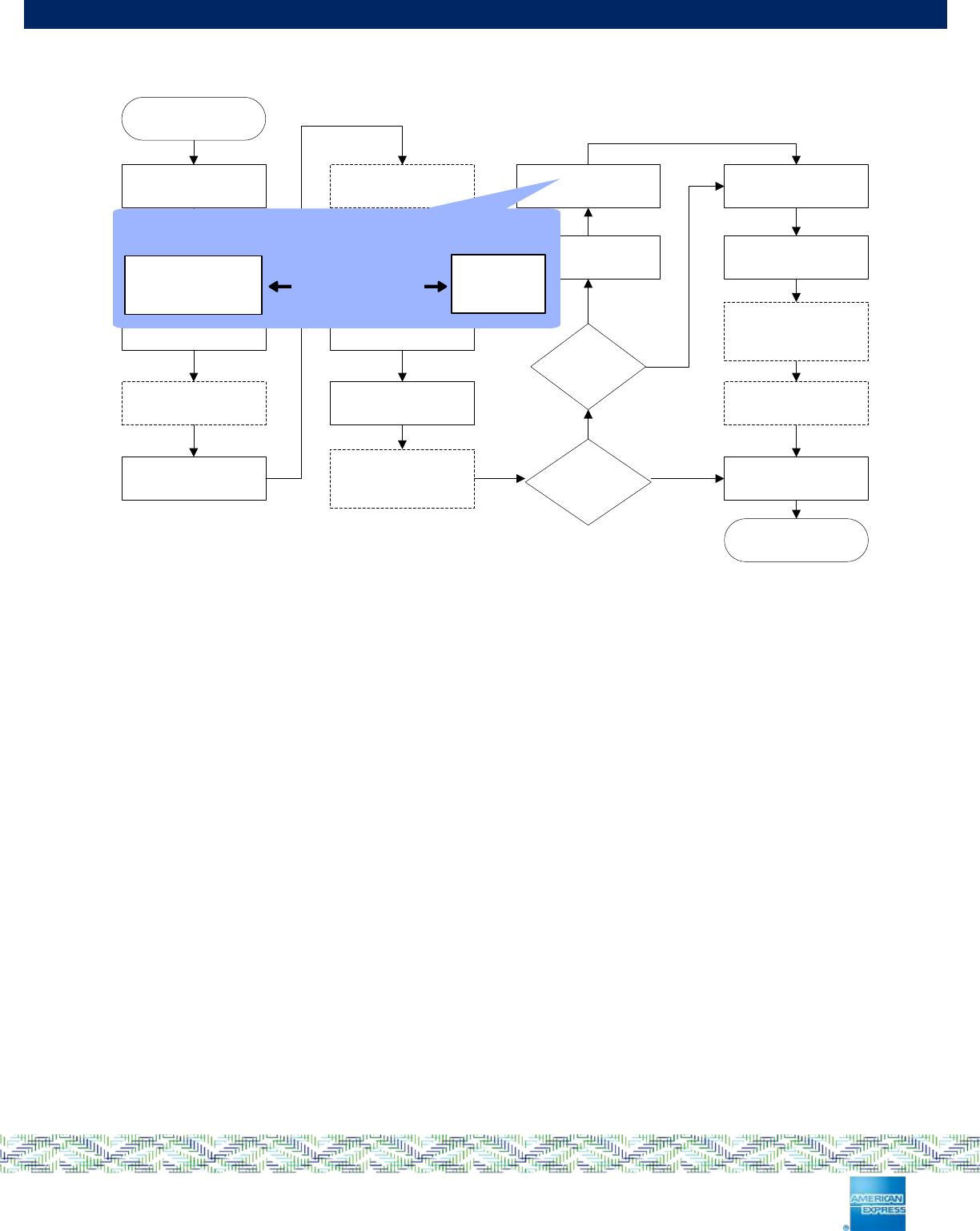

Figure 4-1: Application Selection Detail ....................................................................................... 18

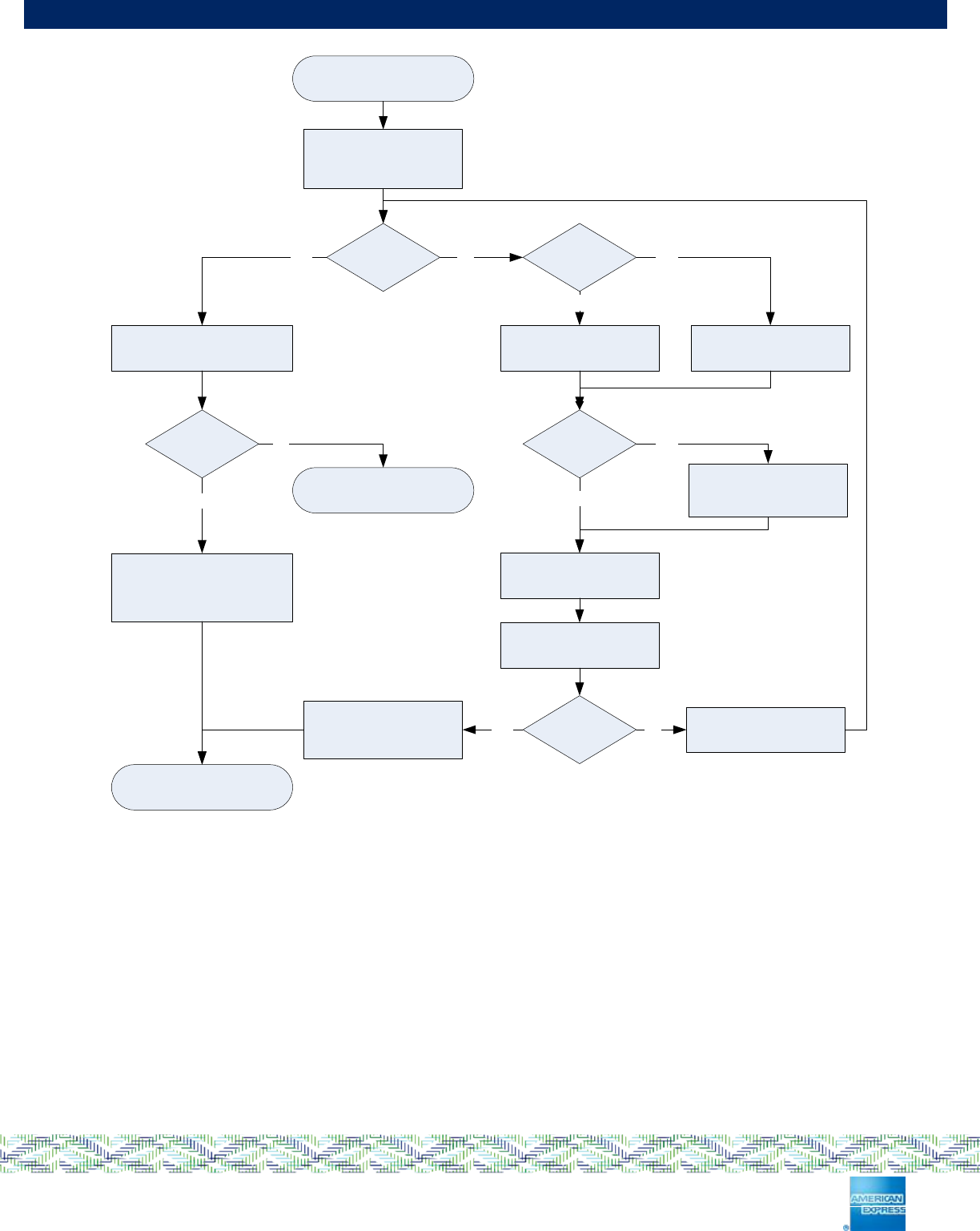

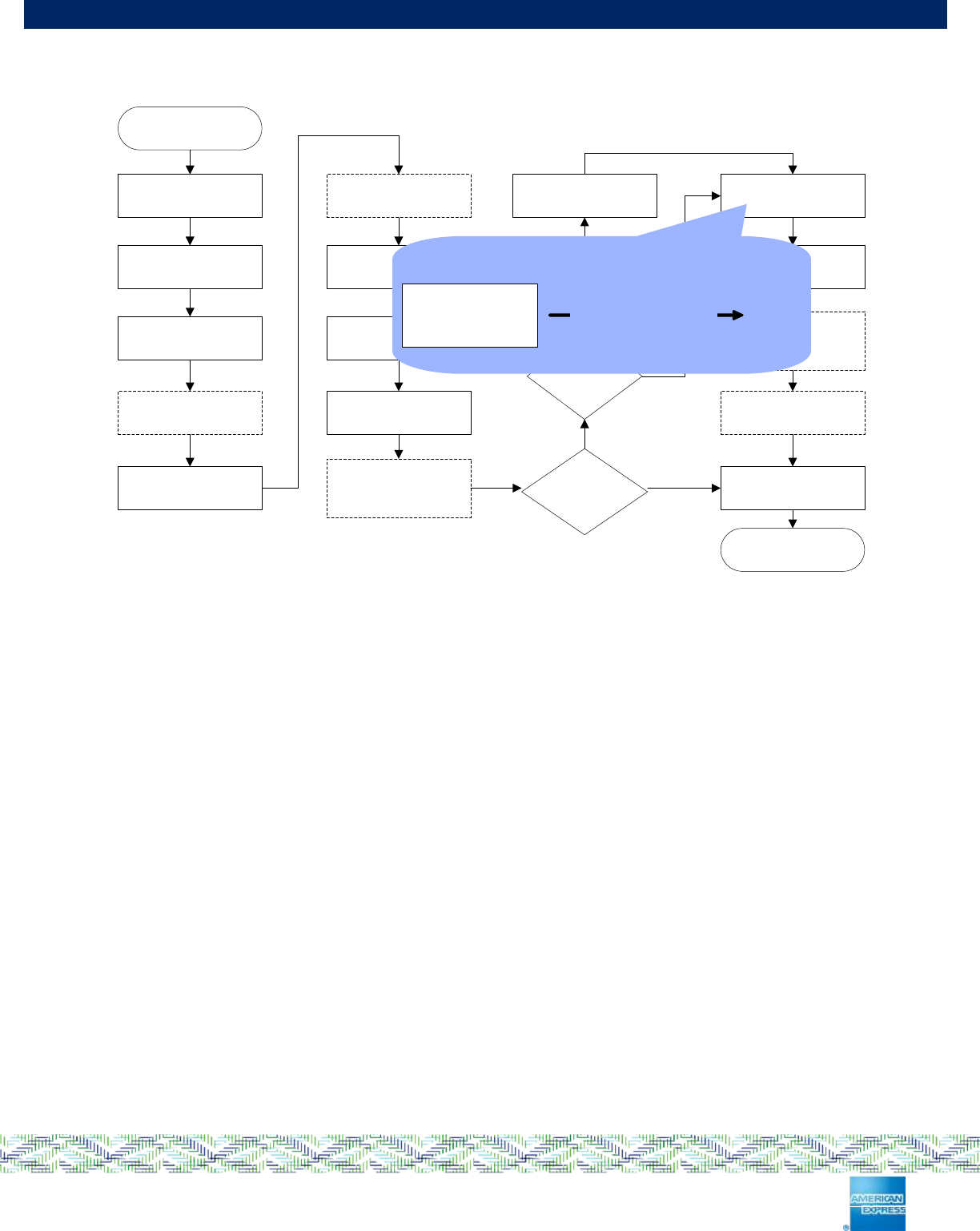

Figure 5-1: Initiate Application Processing Detail ......................................................................... 21

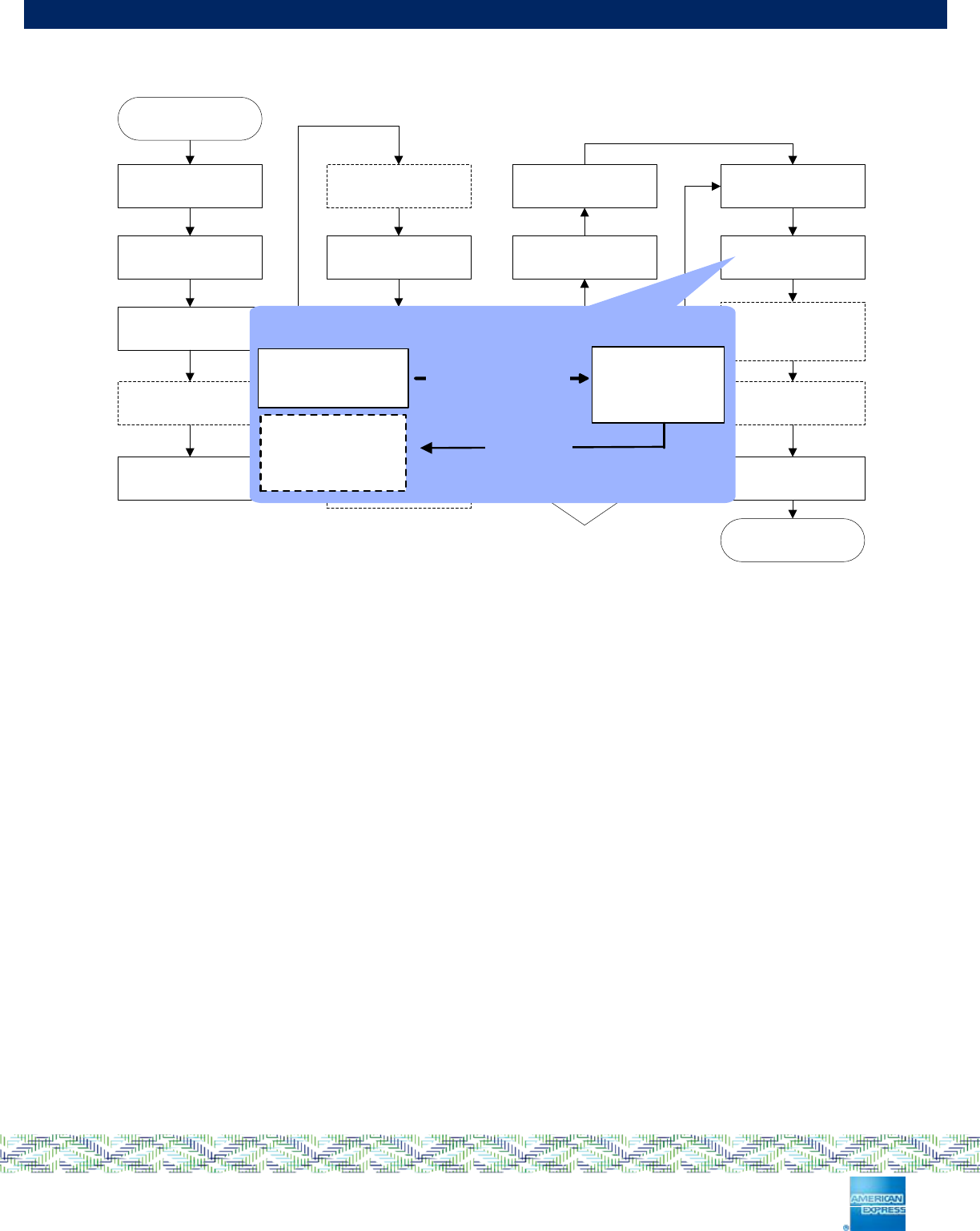

Figure 6-1: Read Application Data Detail ..................................................................................... 23

Figure 7-1: Offline Data Authentication Detail .............................................................................. 25

Figure 7-2: Key Hierarchy ............................................................................................................ 26

Figure 8-1: Processing Restrictions Detail ................................................................................... 30

Figure 9-1: Cardholder Verification Detail .................................................................................... 32

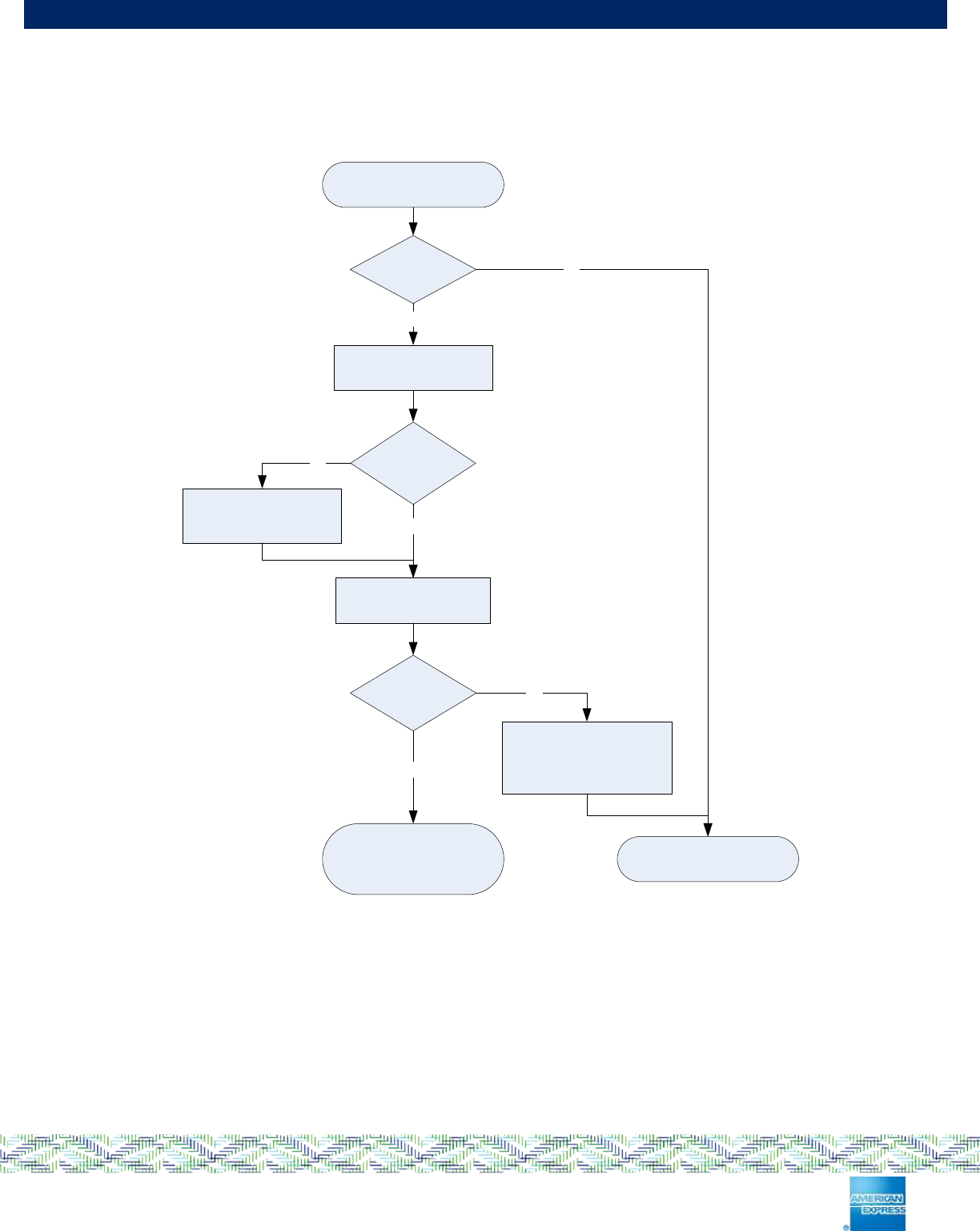

Figure 9-2: Cardholder Verification Terminal Process Flow ......................................................... 33

Figure 9-3: Offline PIN Terminal Process Flow ............................................................................ 35

Figure 10-1: Terminal Risk Management Detail ........................................................................... 37

Figure 11-1: Terminal Action Analysis Detail................................................................................ 39

Figure 12-1: 1st Card Action Analysis Detail ................................................................................ 42

Figure 13-1: Online Processing Detail ......................................................................................... 44

Figure 14-1: Issuer Authentication Detail ..................................................................................... 46

Figure 15-1: 2nd Terminal Action Analysis Detail ......................................................................... 48

Figure 16-1: 2nd Card Action Analysis Detail ............................................................................... 50

Figure 17-1: Issuer Script Processing Detail ................................................................................ 52

Figure 18-1: Transaction Completion Detail ................................................................................. 54

Figure 22-1: AEIPS Data ............................................................................................................. 58

Page 8 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

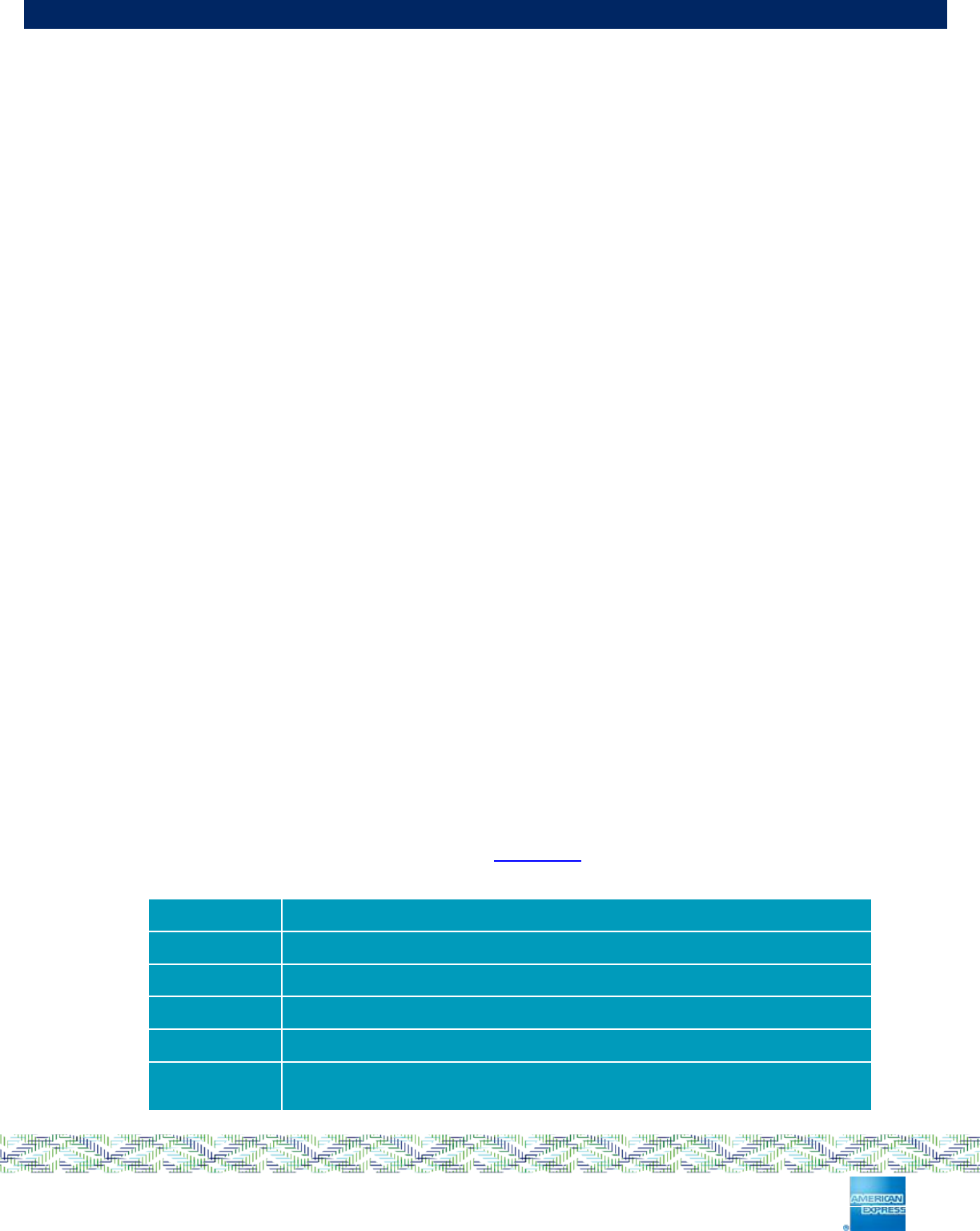

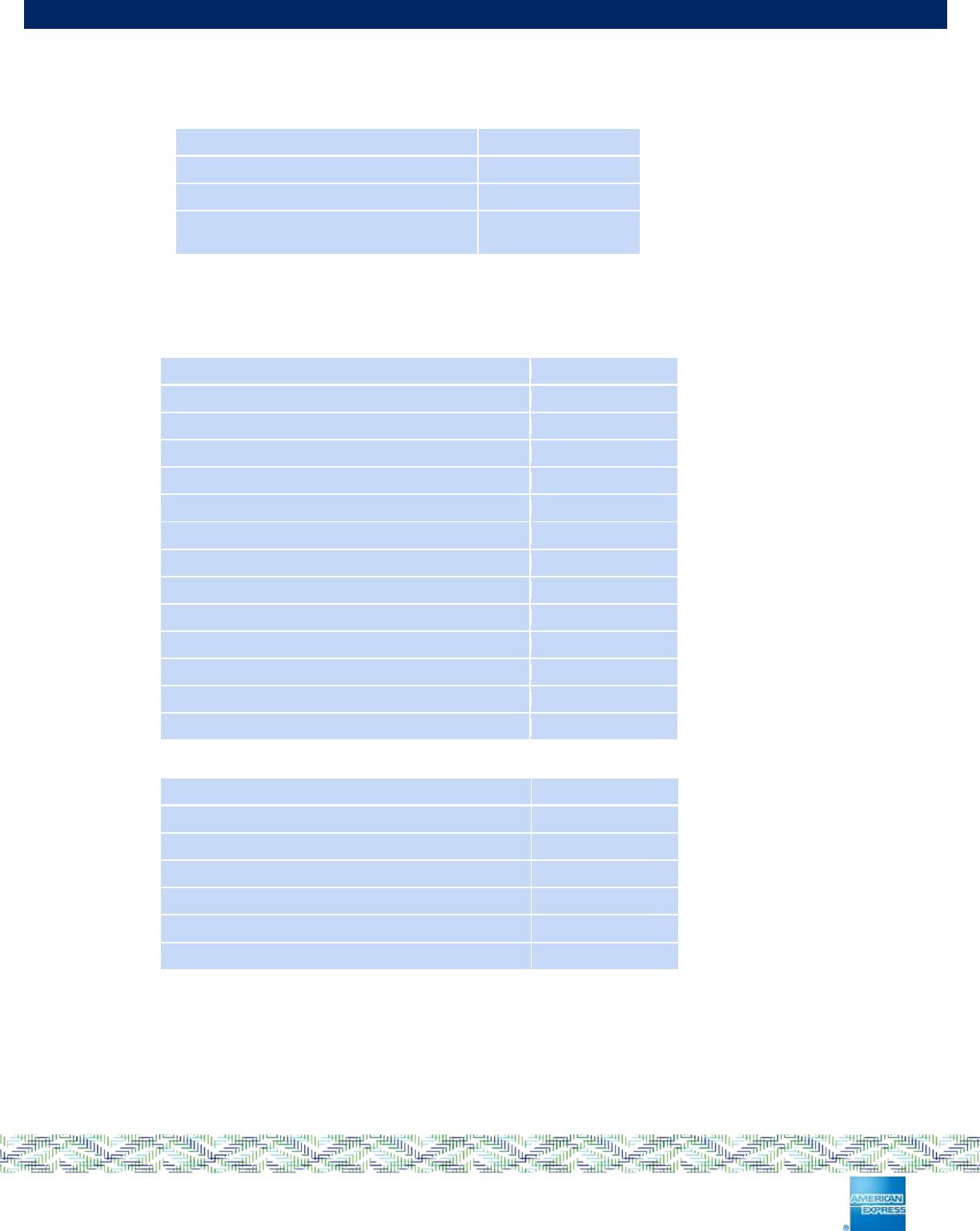

List of Tables

Table 2-1: ISO Publications ......................................................................................................... 11

Table 2-2: EMV Publications ........................................................................................................ 12

Table 2-3: American Express Publications ................................................................................... 12

Table 3-1: AEIPS Terminal Functionality Requirements .............................................................. 15

Table 3-2: AEIPS Command Terminal Support Requirements ..................................................... 16

Table 3-3: AEIPS Command Non-Specific Status Words ............................................................ 17

Table 11-1: Issuer Action Codes and corresponding Terminal Action Codes ............................... 40

Table 22-1: PSE Response Data ................................................................................................. 59

Table 22-2: PSE Directory Level Data ......................................................................................... 59

Table 22-3: Select Response Data .............................................................................................. 60

Table 22-4: Application Priority Indicator (API) ............................................................................. 61

Table 22-5: Data Retrievable by Get Processing Options Command (GPO) ................................ 61

Table 22-6: Application Interchange Profile (AIP) ........................................................................ 62

Table 22-7: Read Record Data Objects ....................................................................................... 63

Table 22-8: Application Usage Control (AUC) .............................................................................. 64

Table 22-9: CDOL1 Data Objects ................................................................................................ 64

Table 22-10: CDOL2 Data Objects .............................................................................................. 65

Table 22-11: Authorization Response Code Values (Tag ‘8A’) .................................................... 65

Table 22-12: Cardholder Verification Methods List ...................................................................... 66

Table 22-13: Optional Data Objects ............................................................................................. 67

Table 22-14: Data used in Static Data Authentication .................................................................. 67

Table 22-15: Data Objects for Signing ......................................................................................... 68

Table 22-16: Mandatory Data for Dynamic Data Authentication ................................................... 68

Table 22-17: Public key modulus lengths for which support is mandatory .................................... 69

Table 22-18: Static Data to be Authenticated ............................................................................... 69

Table 22-19: DDOL Data Objects ................................................................................................ 69

Page 9 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

Table 22-20: Mandatory Data for Chip Card PIN Encipherment ................................................... 70

Table 22-21: Data Retrievable by GET DATA Command ............................................................ 70

Table 22-22: Terminal Verification Results (TVR) Settings .......................................................... 71

Table 22-23: AEIPS Data Elements Table (DET) ......................................................................... 73

Table 23-1: Acronyms and Abbreviations .................................................................................... 91

Page 10 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

1 Summary of Changes

Summary of changes from AEIPS 4.2 Specification:

Document structure changes

All section numbers 1-17 incremented by 1 to 2-18

Summary of Changes now section 1

Data Elements moved from section 18 to 23

Table 11-1 added.

Table 11-1 renamed as Table 11-2

Cryptographic Requirements moved from section 19 to 20

Addition of sections: 19 Performance Requirements; 21 Additional Product Specifics; 24

Index

All Tables; Figures & internal links updated to match new structure

Document functional changes – updates

Updates for EMV Bulletin No. 137

o Use of CDA for both 1st & 2nd GENERATE AC is now recommended.

o Mandatory check for presence of CA Public Key required for CDA, no CDA

processing if not present.

Updates for EMV Bulleting No. 113

o Table 22-22 updated to include Byte 1 bit 2 “SDA Selected”.

o Additionally, in 7.3.2 set SDA Selected bit in TVR is SDA is performed.

Updates for EMV 4.2 to 4.3:

o Despite EMV removing support for DDF entries to the PSE DDF directory,

Terminals need to continue to support them for compatibility with existing cards

o Introduction of CDA Mode to define CDA processing

o Terminal Risk Management is always performed regardless of the AIP setting

o DDA support in mandated in Terminals. This document also mandates CDA

Document functional changes – new features

Added Membership related data processing in section 21.1, with new optional data

elements (‘9F5A’ & ‘9F5B’)

Introduction of PUT DATA command for contactless CVM list update via contact interface

with tag (“9F6F”)

Document functional changes – clarifications

Process overviews included within individual sections instead of separate section.

Duplication removed.

Processing for APPLICATION UNBLOCK described

Handling online PIN

CDA processing options fully described

Setting TVR bits

Page 11 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

2 Introduction

This version of the American Express AEIPS Terminal Technical Manual fully conforms to EMV v4.3

[EMV4.3i - iv]. There are two volumes within AEIPS:

AEIPS Chip Card Specification

AEIPS Terminal Manual (this document).

2.1 Scope

The purpose of this document is to outline the terminal functionality required to process American Express

Chip Card transactions. All American Express Acquirers and Third Party Processors must ensure that the

terminal performs American Express Chip Card transactions as defined in this manual.

Any functionality beyond that defined in this document must comply with [EMV4.3i – iv] (See section 2.3.2

for additional information).

This document only specifies requirements for Terminal interaction with American Express payment

applications over a contact interface. Requirements for Terminals supporting contactless payments can be

found in the American Express Expresspay Terminal Specification [XP-TERM].

This document is primarily a technical manual but the business requirements that the technical solutions

address are also outlined.

Any terminal application intended to process an American Express Chip Card shall be certified against the

requirements in this manual. Note that EMV certification is conditional but not sufficient in meeting this

requirement.

2.2 Audience

This document is intended for American Express personnel involved with the implementation of payment

products on Integrated Circuits or “chip”, American Express Global Network Services Partners, Chip Card

application developers, Systems developers, Chip Card and Terminal vendors seeking a technical

understanding of the functionality of Chip Cards and Terminals supporting AEIPS.

2.3 Reference Materials

Reference citations in this manual are shown as labels within square brackets (e.g., [ISO3166]). Full details

of the references are given in this section.

Users of the information contained in these materials are solely responsible for identifying and obtaining any

and all patent or other intellectual property licenses that may be needed for products or services developed

in connection with these materials.

2.3.1 ISO

ISO standards may be ordered via the ISO Website at www.iso.org.

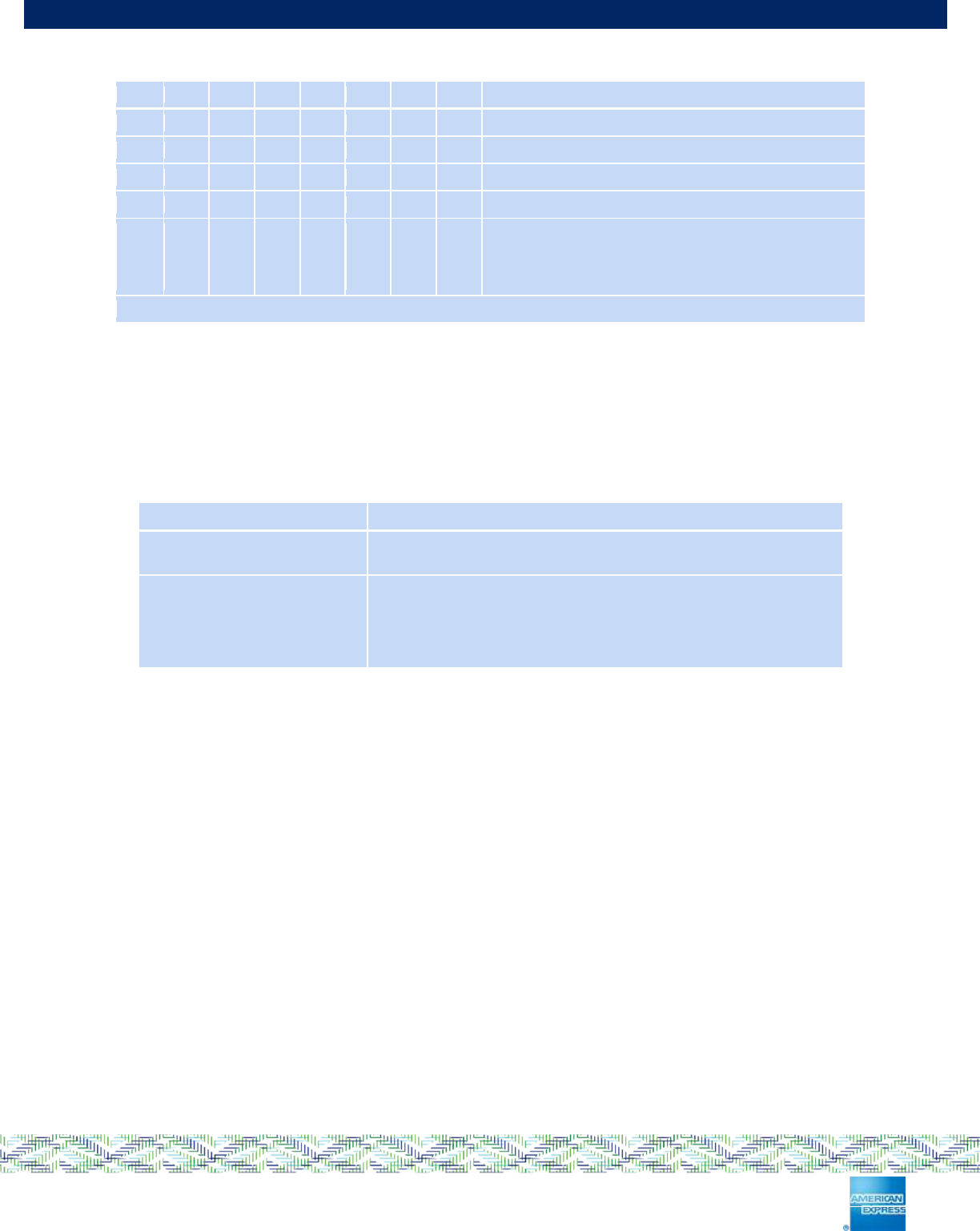

Table 2-1: ISO Publications

[ISO3166]

Codes for the representation of names and countries

[ISO4217]

Codes for the representation of currencies and funds

[ISO639]

Codes for the representation of names and languages

[ISO8583]

Financial Transaction Card Originated Messages - Interchange message specifications

[ISO7813]

Identification Cards - Financial transaction Cards

[ISO7816-4]

Identification Cards - Integrated circuit(s) Cards with contacts - Part 4: Inter-industry

commands for interchange

Page 12 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

[ISO7816-5]

Identification Cards - Integrated circuit(s) Cards with contacts -Part 5: Numbering system

and registration procedure for application identifiers

2.3.2 EMV

EMV publications may be ordered from the EMV Co. Website at www.emvco.com.

Table 2-2: EMV Publications

[EMV4.3i]

EMV ICC Specification for Payment Systems, Book 1 – Application independent ICC to

terminal interface requirements, version 4.3, November 2011

[EMV4.3ii]

EMV ICC Specification for Payment Systems, Book 2 – Security and key management,

4.3, November 2011

[EMV4.3iii]

EMV ICC Specification for Payment Systems, Book 3 – Application specification, version

4.3, November 2011

[EMV4.3iv]

EMV ICC Specification for Payment Systems, Book 4 – Cardholder, attendant and acquirer

interface requirements, version 4.3, November 2011

2.3.3 American Express

There are a number of American Express documents that are relevant to AEIPS card Issuers and Acquirers,

which can be obtained from GNSWEB, americanexpress.com/gns.

All American Express’ AEIPS manuals operate within the boundaries defined in [EMV4.3i – iv].

Table 2-3: American Express Publications

[AG]

Acquirer Chip Card Implementation Guide

[ATG]

AEIPS Terminal Guide

[XP-TERM]

Expresspay Terminal Specification (ExpressPay 3.1)

2.4 Use of Terms

2.4.1 Optional, Mandatory or Conditional

American Express’ philosophy is to facilitate market requirements while ensuring global interoperability. To

this end, AEIPS’ minimum requirements reflect the EMV mandatory items in addition to specific

requirements for American Express.

American Express’ minimum requirements are designated using the term “mandatory”, “required”, or

“must”. Participants wishing to implement parts of EMV beyond this may do so only if this manual does not

state that those parts are not supported under AEIPS.

Markets can customize their programs beyond the minimum requirements through adoption of the optional

functions and through proprietary processing. Proprietary processing, however, must not compromise

global interoperability.

If a requirement is conditional, it must meet the condition as defined in the value restrictions.

2.4.2 Use of the Term “Chip Card”

In general, the term “Chip Card” is used to represent the entity which performs the AEIPS Chip Card

application functions. This acknowledges the possibility of the chip supporting multiple applications.

2.4.3 Cardholder or Cardmember?

The words Cardholder and Cardmember refer to “A person who has entered into an agreement and

established a Card Account with an Issuer, or whose name is embossed on a Card”.

Page 13 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

2.5 Document Structure

This document is structured to guide the reader through the steps required to implement the AEIPS

Terminal requirements.

It is assumed that technical readers are familiar with the EMV specifications [EMV4.3i – iv] and that all

readers have a basic understanding of the technology. Each part of this document starts with a descriptive

section. This is the suggested minimum reading for a business understanding of the document. Subsequent

sections indicate the technical detail associated with the business function or requirement.

Section 3 provides an overview of a terminal transaction.

Sections 4 to 18 describe each of the transaction processing steps in detail, providing: an overview; list of

commands; set of processing requirements.

Section 19 describes the performance requirements.

Section 20 describes the cryptographic requirements.

Section 21 describes the additional product functionality Terminals use to support additional American

Express services.

Section 22 summarizes the Data Elements.

Section 23 contains a glossary of terms used in this document.

Section 24 is the index.

2.6 Notation

Throughout this document, the data elements that are defined in the Data Dictionary, Table 22-23, are

marked in italics, e.g., Card Verification Results.

In the transaction flow diagrams that are used throughout this document, dashed lines around boxes are

used to indicate the presence of optional functionality.

Hexadecimal numbers are represented within single quotes, e.g., ‘6A83’.

Page 14 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

3 Transaction Overview

This section provides a general non-technical overview of the complete AEIPS transaction. It is important to

understand this, since the rest of this document is structured around the transaction steps as defined in this

section.

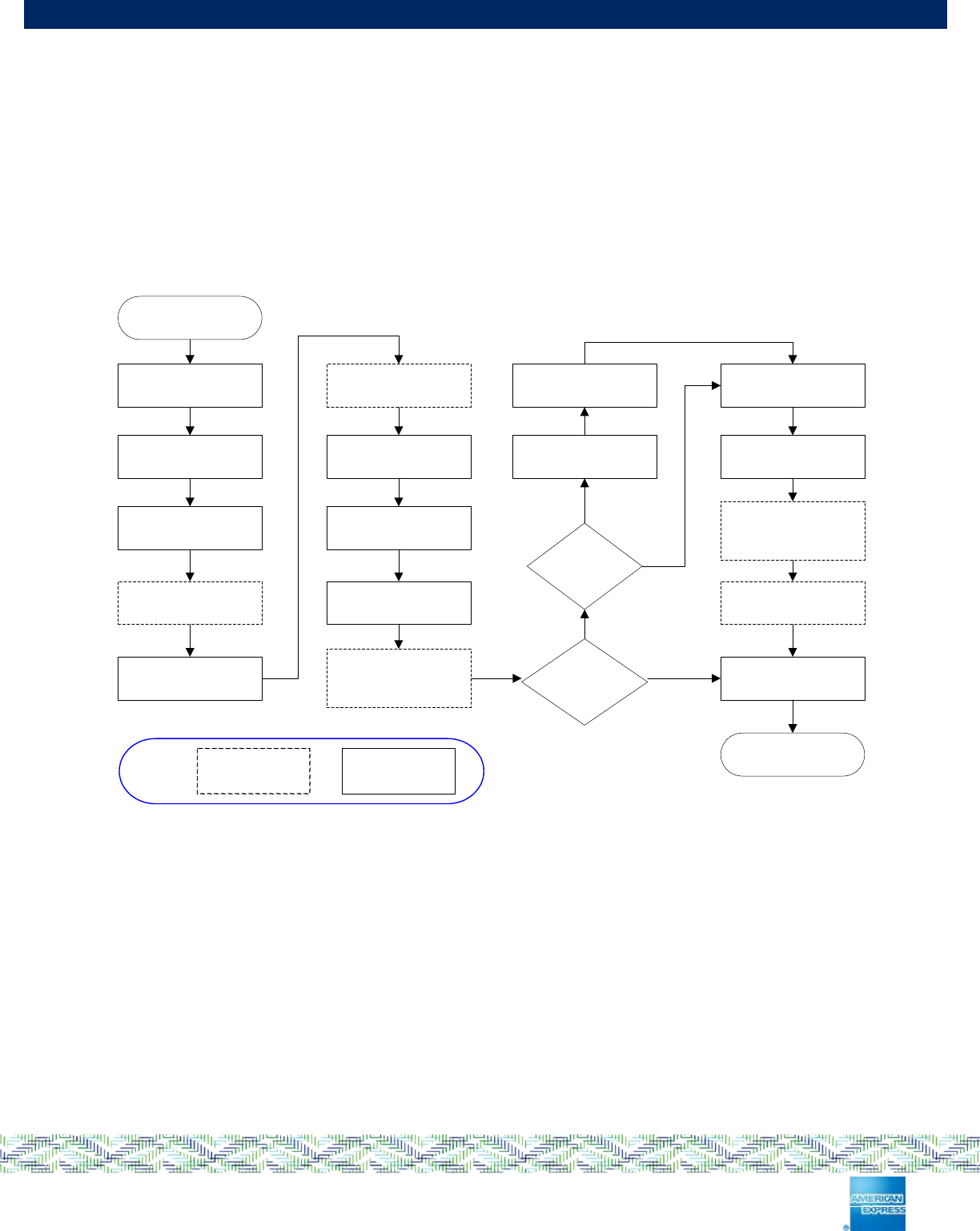

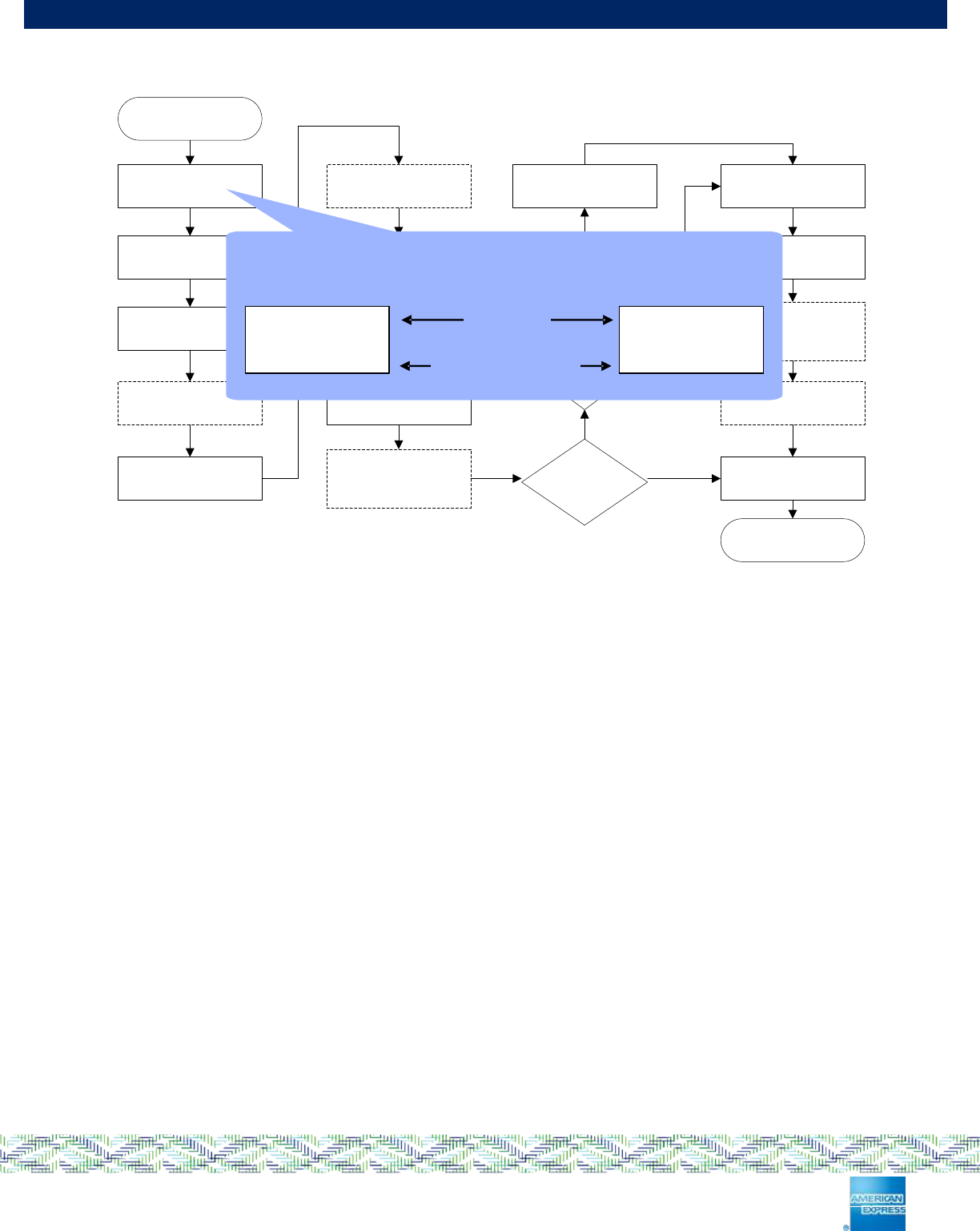

3.1 Functional Overview

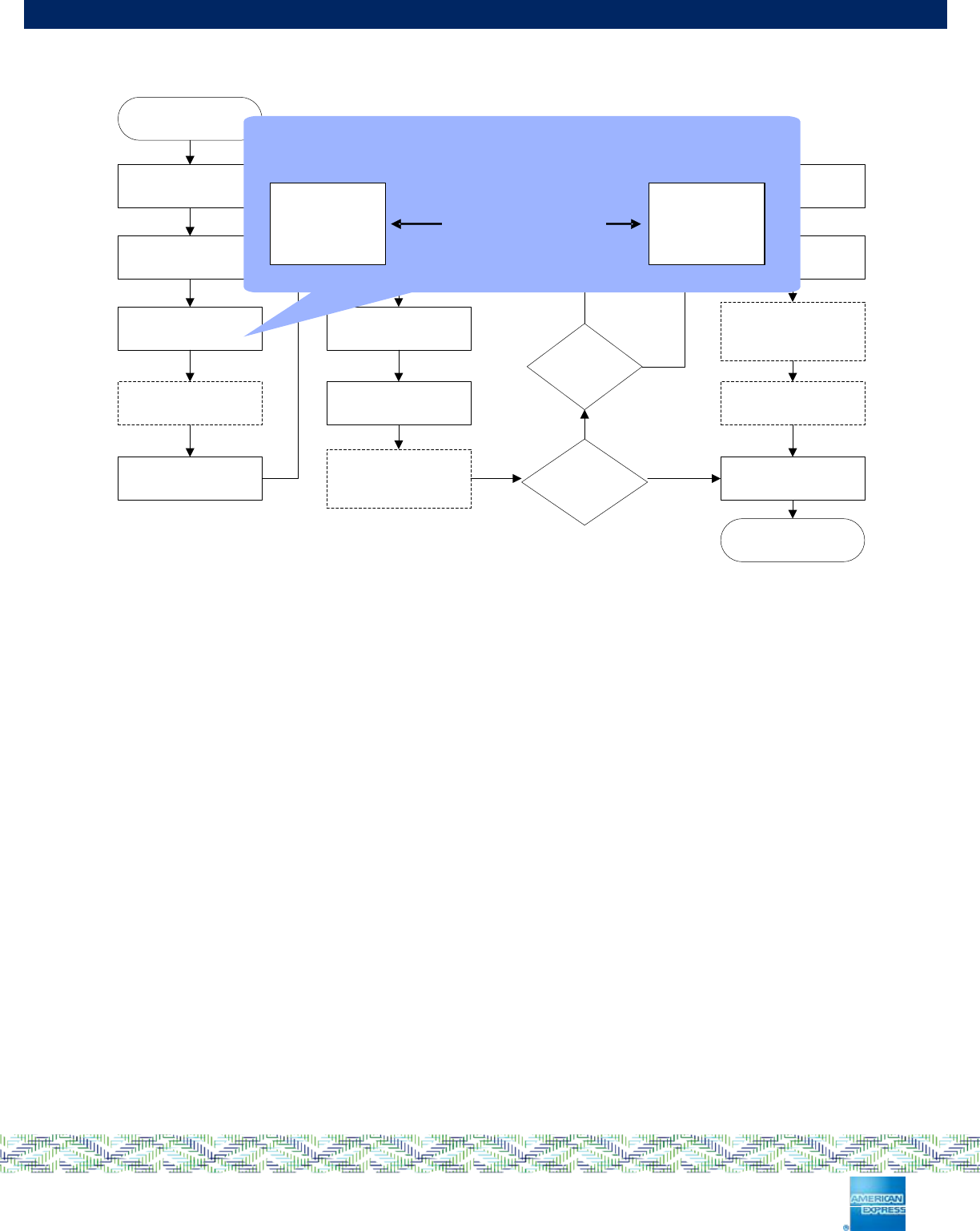

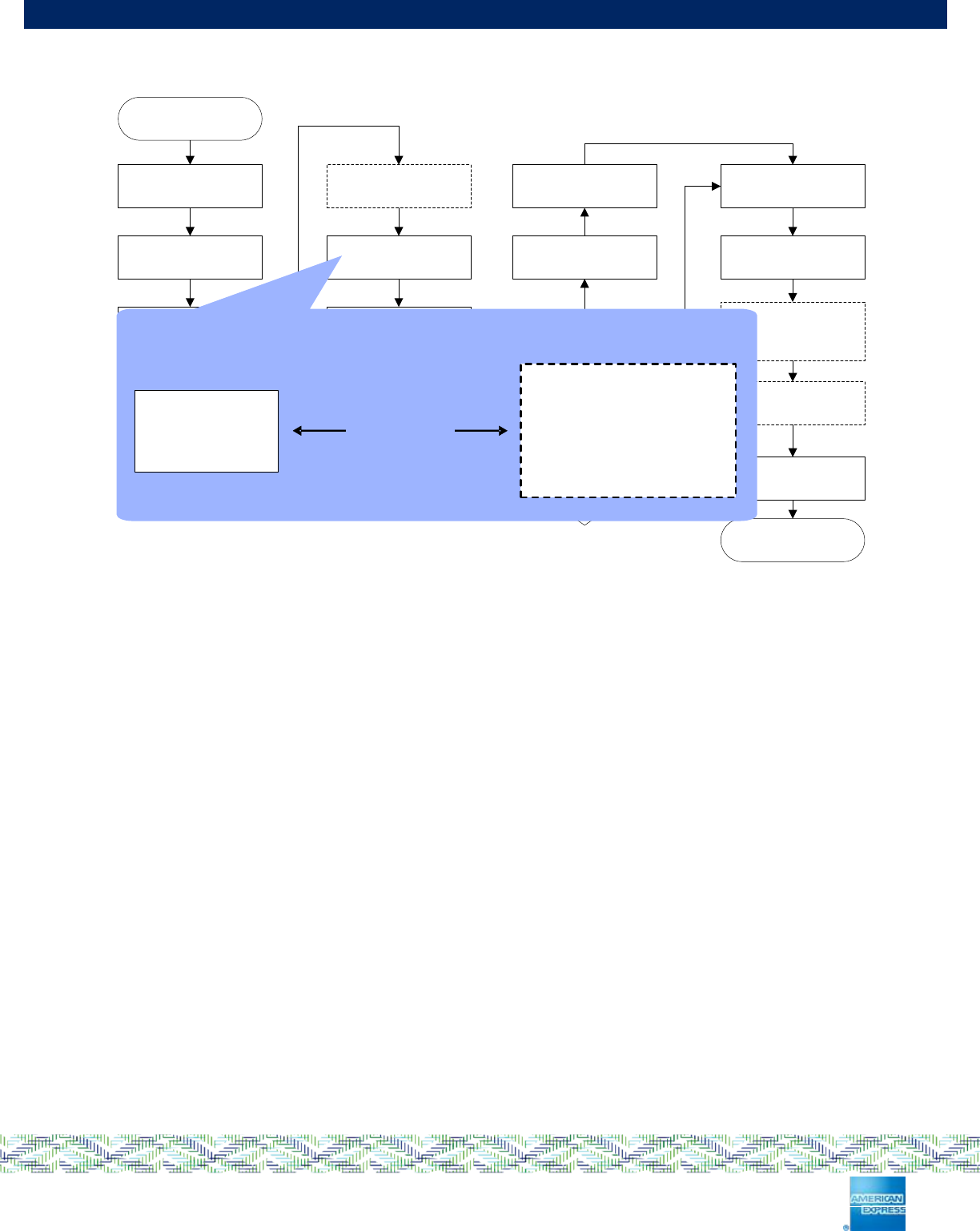

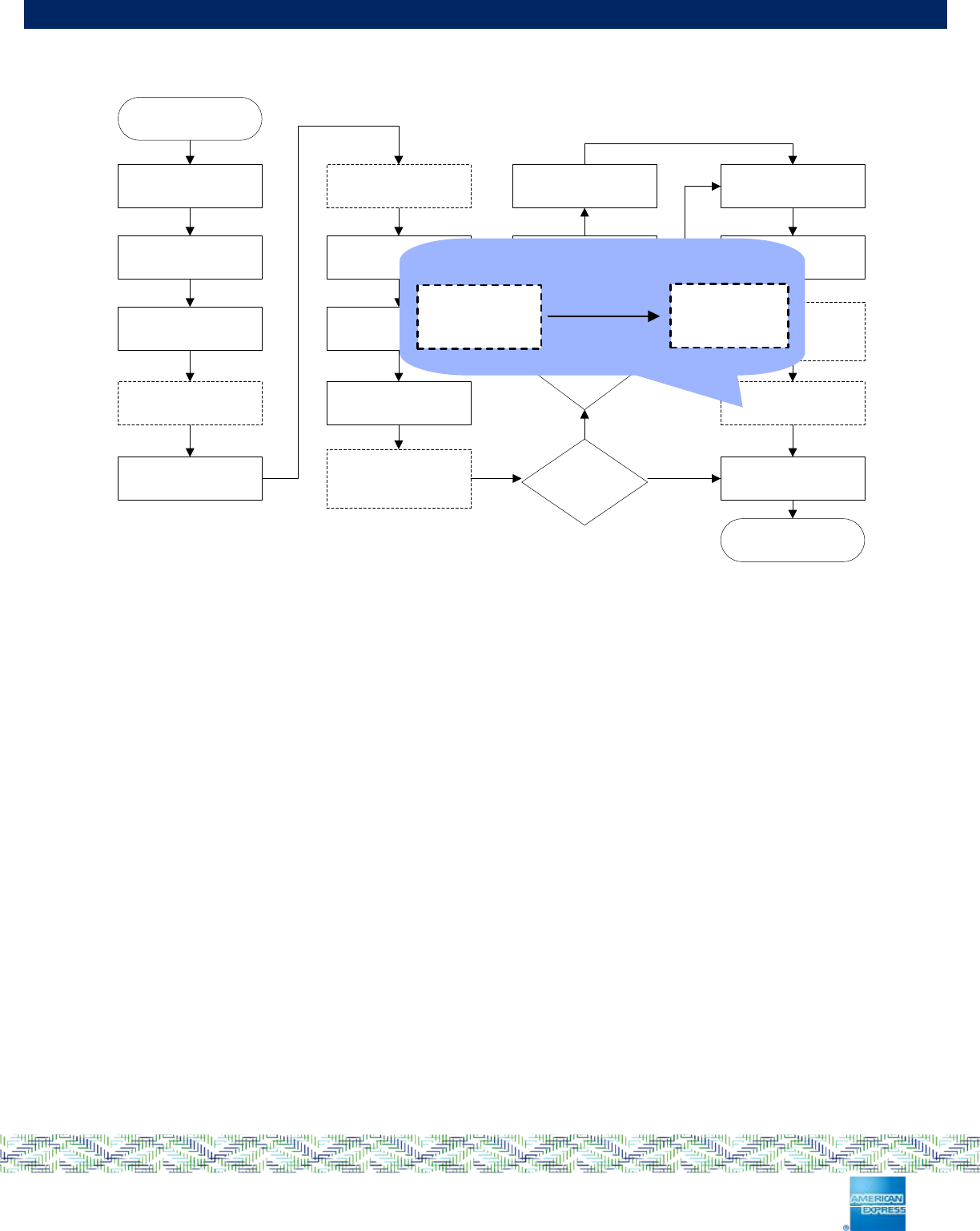

All functions mentioned in this manual are performed as described in the EMV [EMV4.3i – iv]. Figure 3-1

shows the AEIPS transaction flow from the point at which a Chip Card is inserted into a Terminal to the point

at which it is removed. Functions shown as dashed boxes are optional.

This diagram is used throughout this manual where more detail of each function is provided.

Figure 3-1: AEIPS Transaction Flow

As shown in Figure 3-1, a transaction consists of a number of processing steps which assure the AEIPS

transaction. These steps are described in detail in sections 4 to 18 below.

In summary, the AEIPS transaction flow provides the means to:

Authorize payment

Authenticate the card

Authenticate the transaction at the time of the transaction and for audit purposes

Verify the Cardholder.

Insert card

Application

selection

Init application

processing

Read application

data

Processing

restrictions

Cardholder

verification

Terminal risk

management

1st terminal action

analysis

1st card action

analysis

Online

transaction

2nd terminal action

analysis

2nd card action

analysis

Issuer script

processing

Transaction

completion

Online processing

Issuer

authentication

Remove card

Y

N

Y

Offline data

authentication

CDA sig check

Offline data

authentication

Unable to

go online

N

Offline data

authentication

CDA sig check

Optional /

Conditional Step Mandatory

Step

Legend

Page 15 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

3.2 Dual Interface Support

A dual interface card is one that is capable of transacting over both a contact and contactless interface. The

functionality required of an American Express payment application over a contact interface is defined in this

manual. The functionality required of an American Express payment application over a contactless interface

is defined in the Expresspay Terminal Specification [XP-TERM].

Terminal and card behavior over the contactless interface is beyond the scope of the AEIPS manuals.

However, Terminals meeting this manual will successfully process dual interface cards when used on the

contact interface.

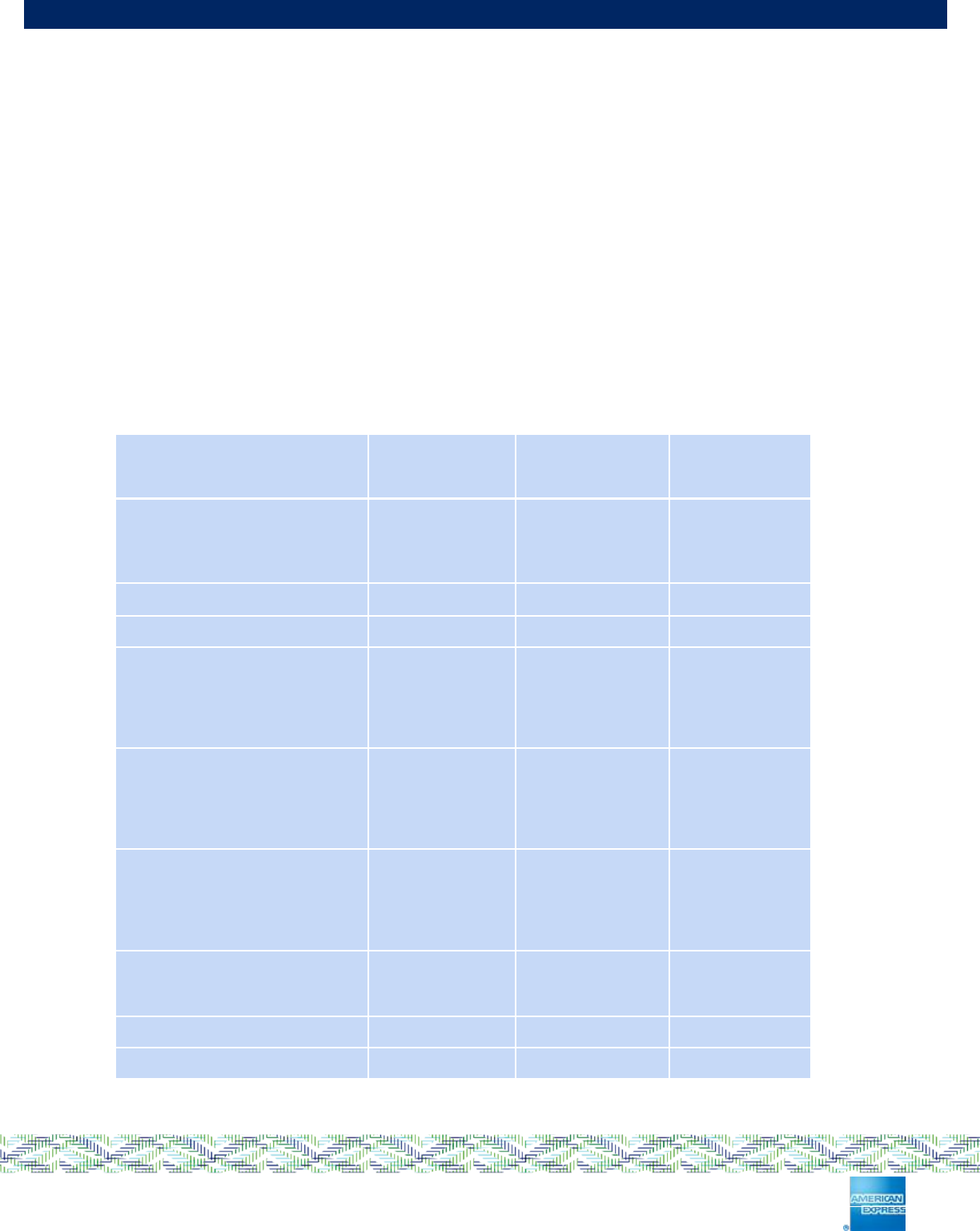

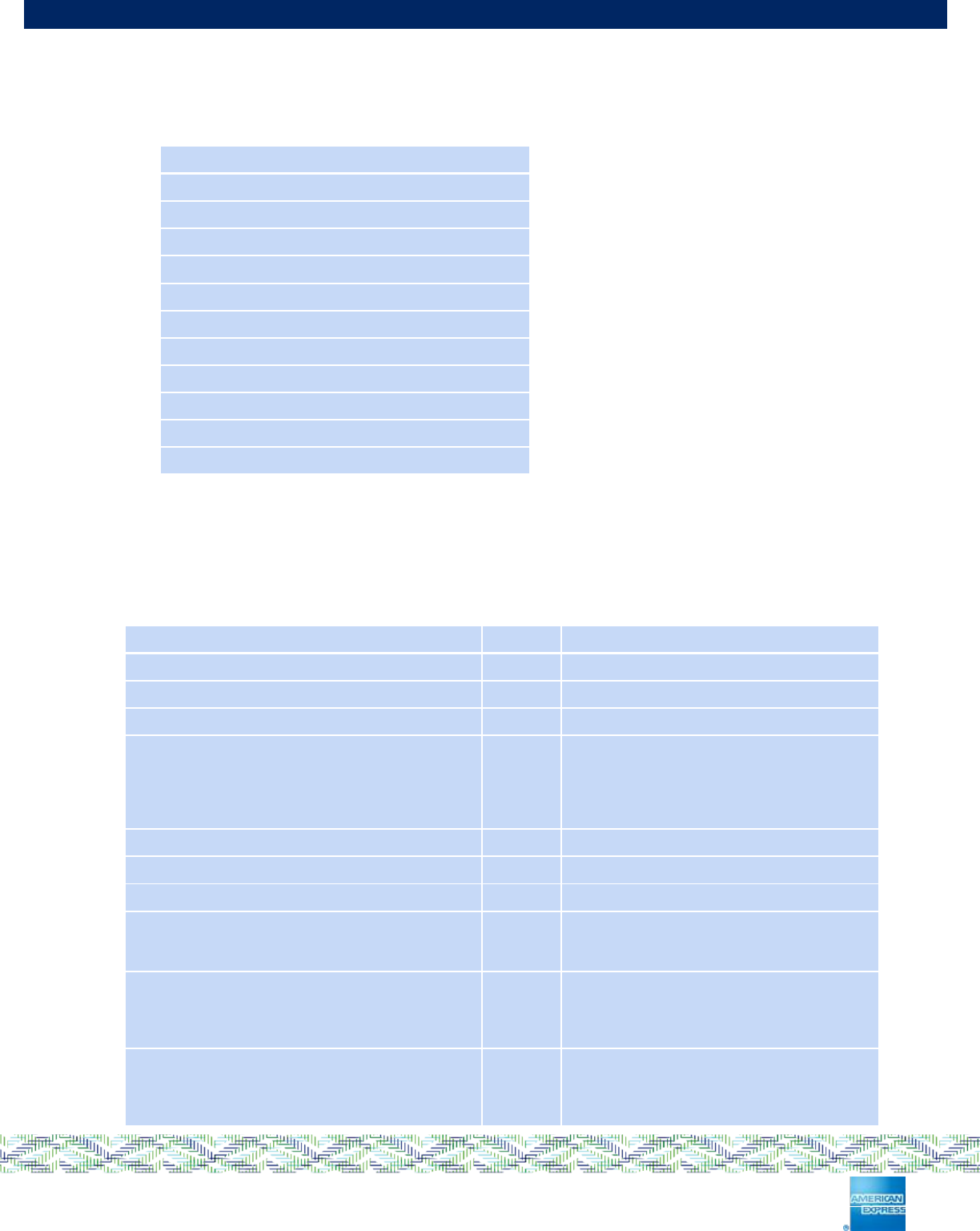

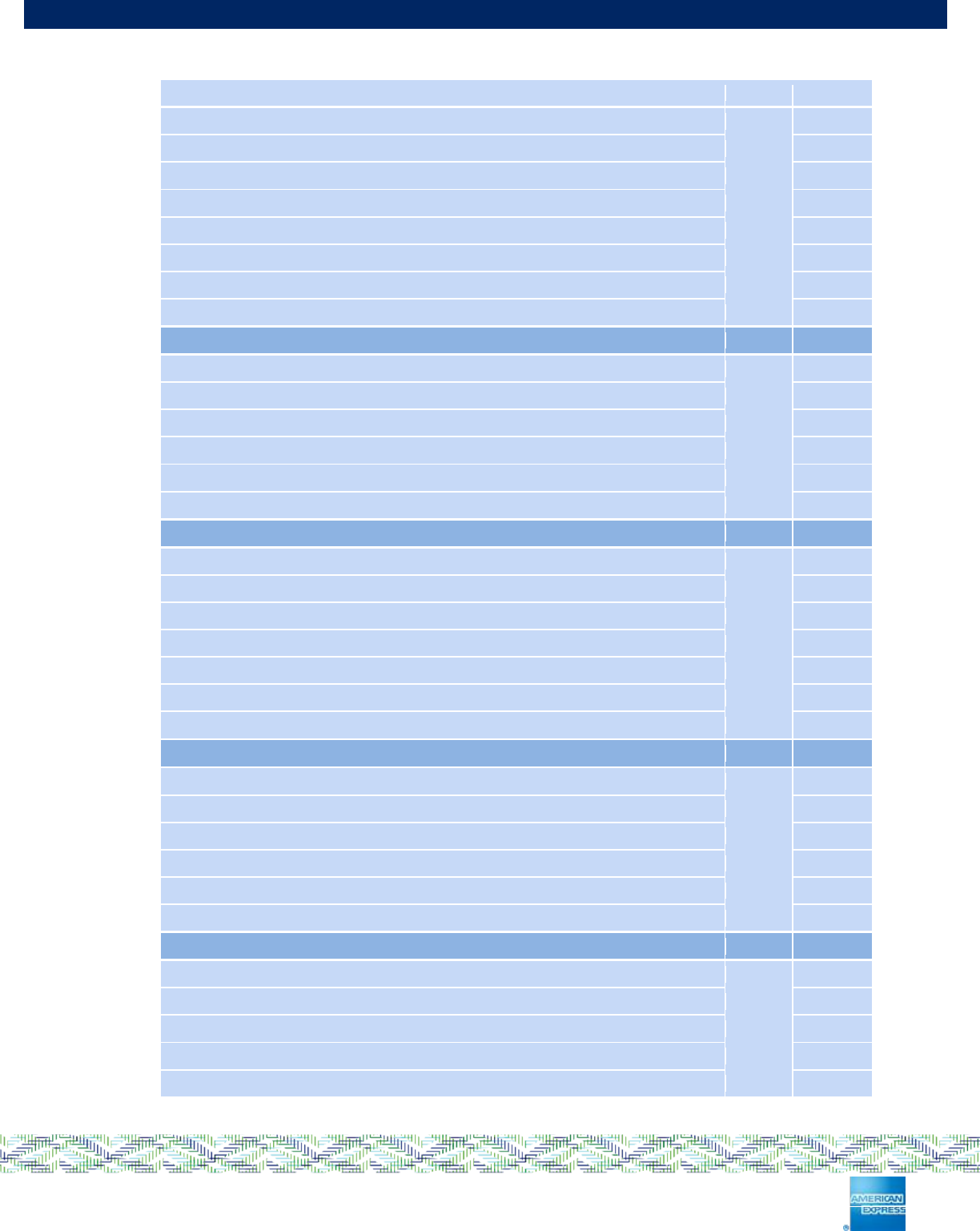

3.3 Mandatory and Optional Functionality Summary

3.3.1 Functions

AEIPS Terminals must support the mandatory functions listed in Table 3-1 below. An Acquirer can then

decide whether to make use of these functions or not. Unless noted, it should be assumed that mandatory

parts of EMV are mandatory under AEIPS. Where AIEPS requirements differ from EMV on the presence of

these functions, then this is highlighted in bold in Table 3-1. Optional functions may be supported at the

Acquirer’s discretion. Conditional functions must be supported if the associated condition is true.

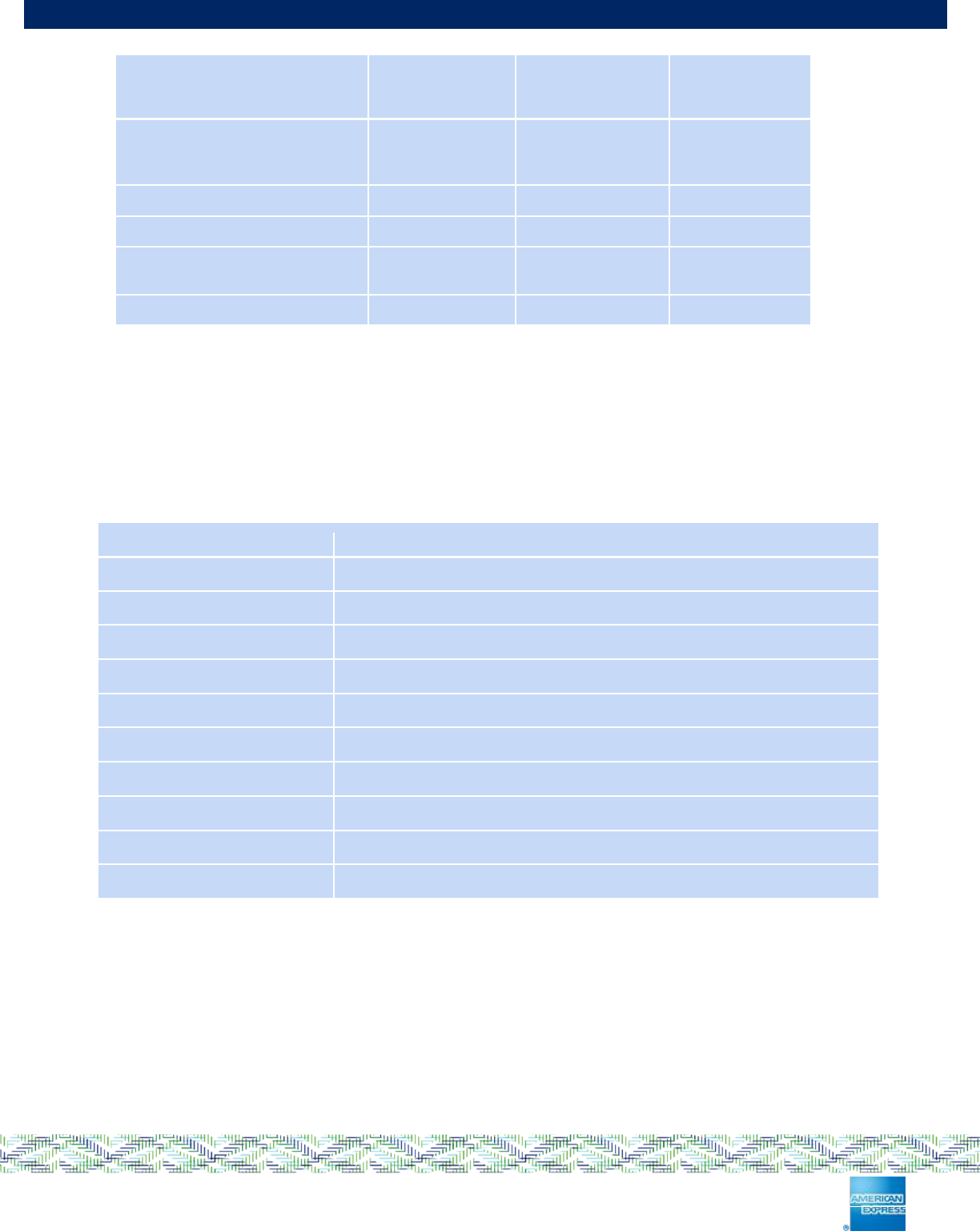

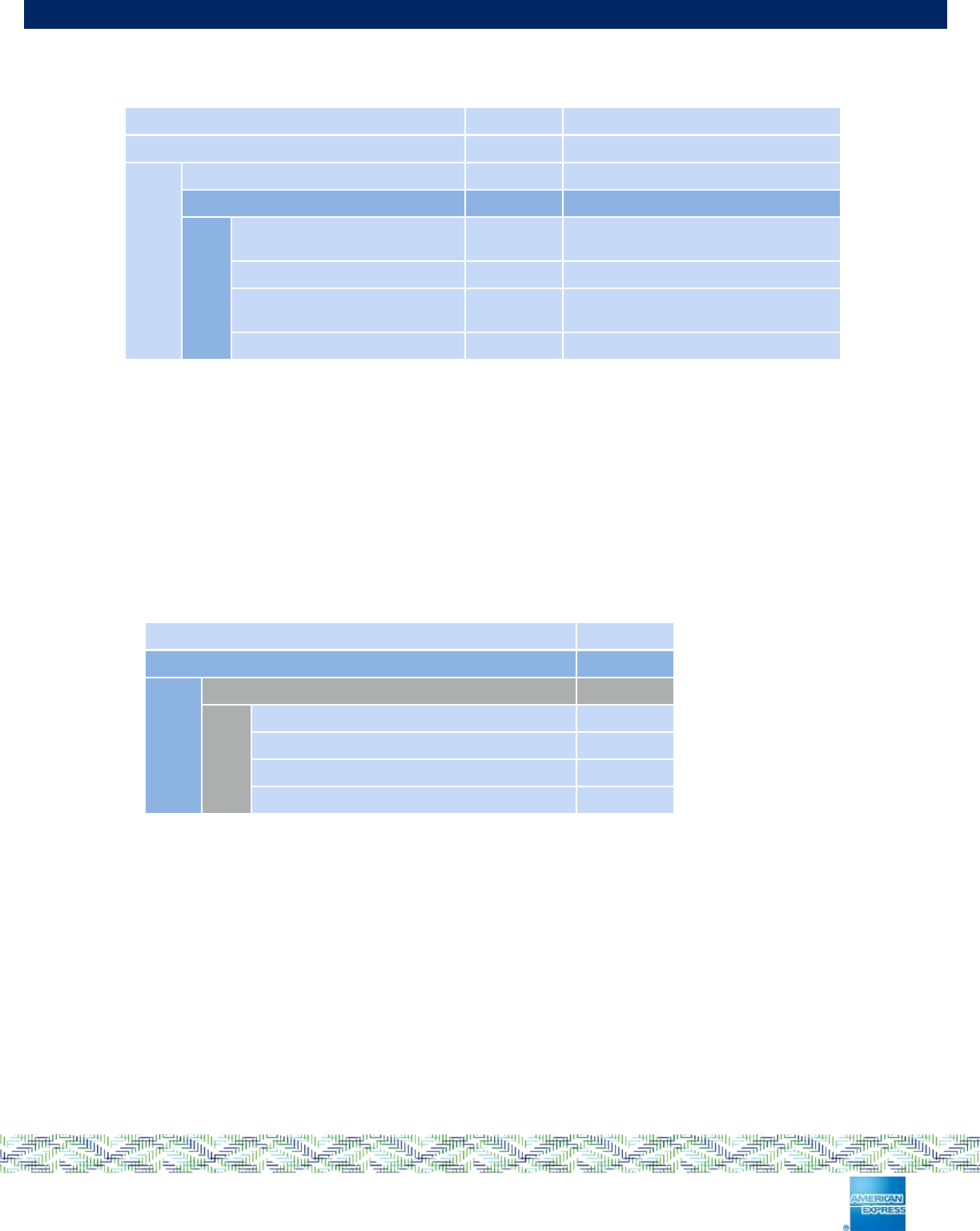

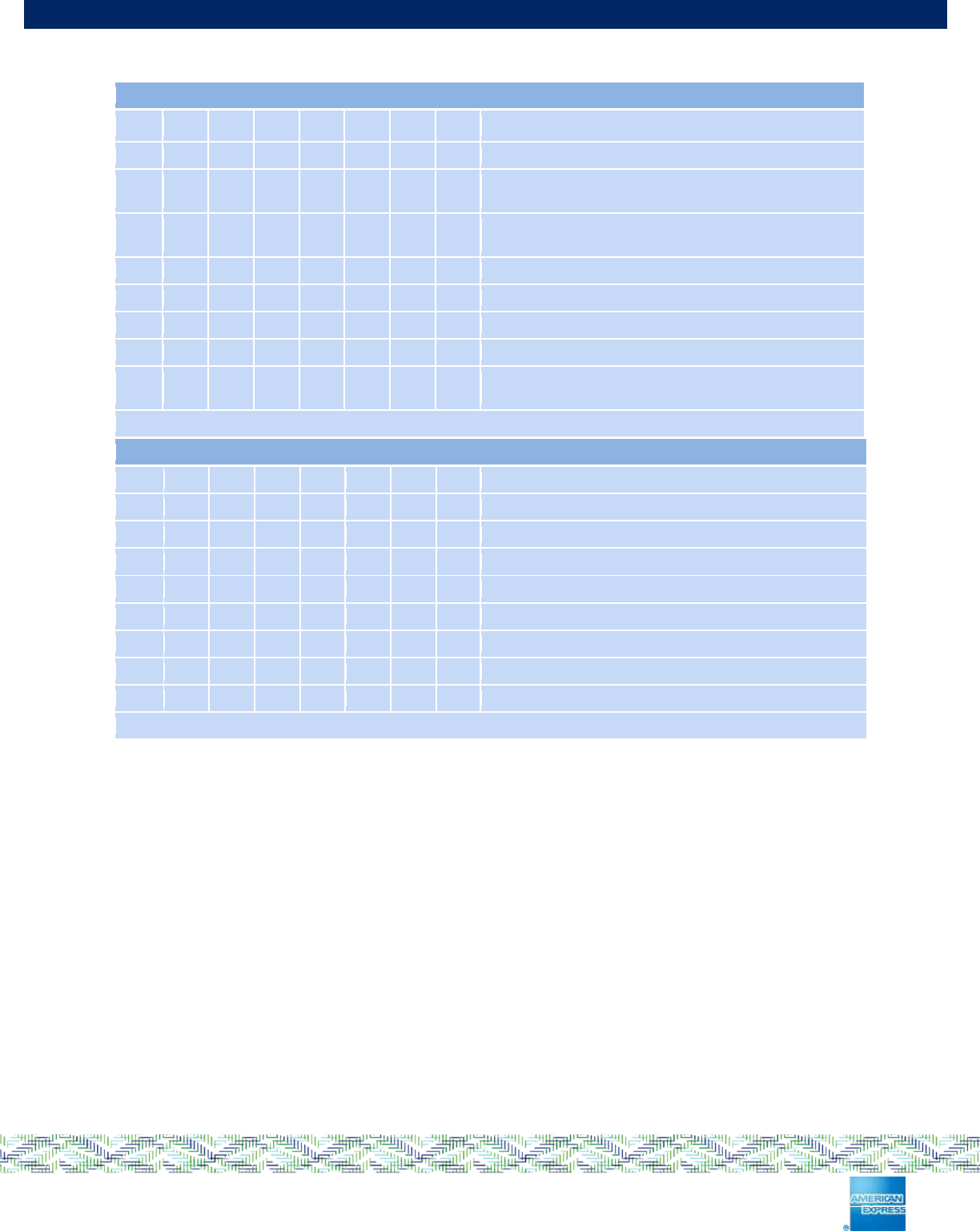

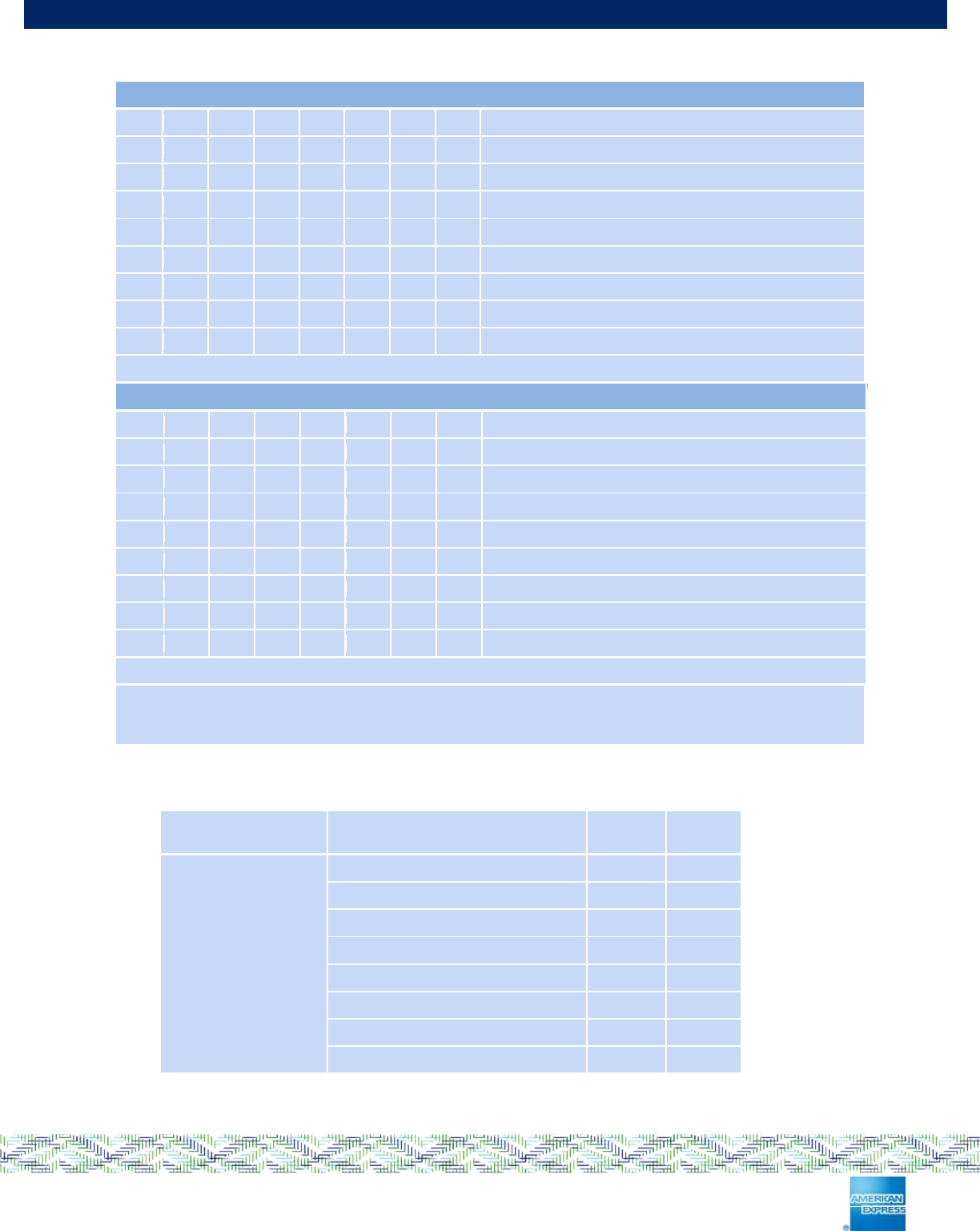

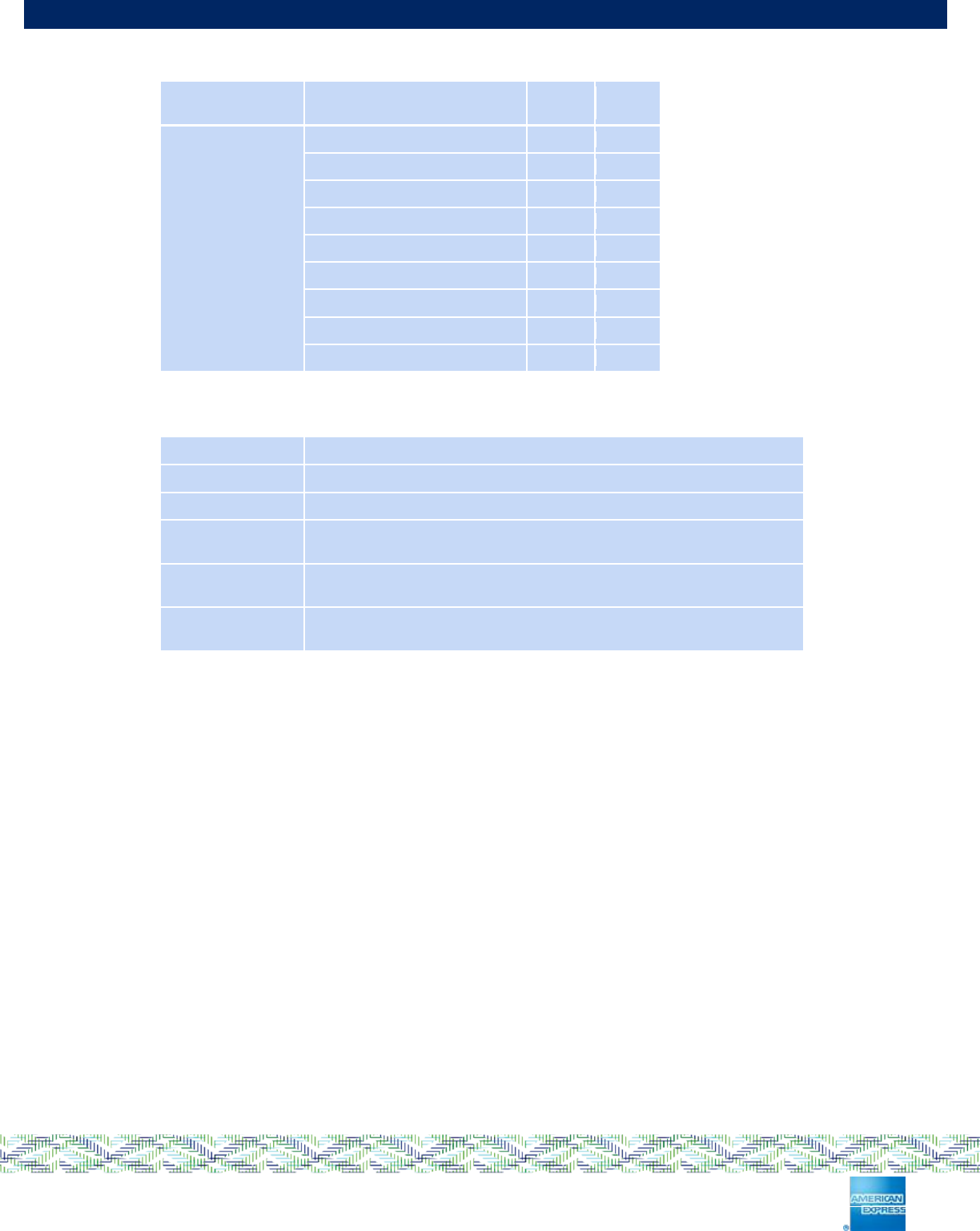

Table 3-1: AEIPS Terminal Functionality Requirements

Function

Online Capable

Terminals

Online Only

Terminals

(e.g. ATMs)

Offline Only

Terminals

Application Selection

Directory Method

Explicit Selection Method

Partial Name Selection Enabled

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Initiate Application Processing

Mandatory

Mandatory

Mandatory

Read Application Data

Mandatory

Mandatory

Mandatory

Offline Data Authentication

SDA

Standard DDA

Combined DDA/AC Generation

CRL checking of Issuer PKC

Mandatory

Mandatory

Mandatory

Mandatory

N/S

Optional

Optional

Optional

Optional

N/S

Mandatory

Mandatory

Mandatory

Mandatory

N/S

Processing Restrictions

Application Version Number

Application Usage Control

Effective Date Check

Expiration Date Check

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Cardholder Verification

Signature

Online PIN

Offline PIN

No CVM

Mandatory

Mandatory

Conditional*

Optional

Conditional**

Mandatory

Mandatory

Conditional*

Optional

Conditional**

Mandatory

Mandatory

N/S

Optional

Conditional**

Terminal Risk Management

Velocity Checking

New Card Check

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

1st Terminal Action Analysis

TACs Mandatory***

TACs Mandatory***

TACs Mandatory***

1st Card Action Analysis

N/A

N/A

N/A

Page 16 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

Function

Online Capable

Terminals

Online Only

Terminals

(e.g. ATMs)

Offline Only

Terminals

Online Processing

Online Capability

Issuer Authentication

Mandatory

Mandatory

N/S

2nd Terminal Action Analysis

Mandatory

Mandatory

Mandatory

2nd Card Action Analysis

N/A

N/A

N/A

Issuer Script Processing

Secure Messaging

Mandatory

Mandatory

N/S

Transaction Completion

Mandatory

Mandatory

Mandatory

* Online PIN is mandatory for cash advance transactions.

** No CVM is mandatory for CATs

*** It is mandatory that TACs are present.

3.3.2 Commands

The table below indicates the command requirements for an AEIPS-compliant Terminal to support the Chip

Card commands defined in [EMV4.3iii].

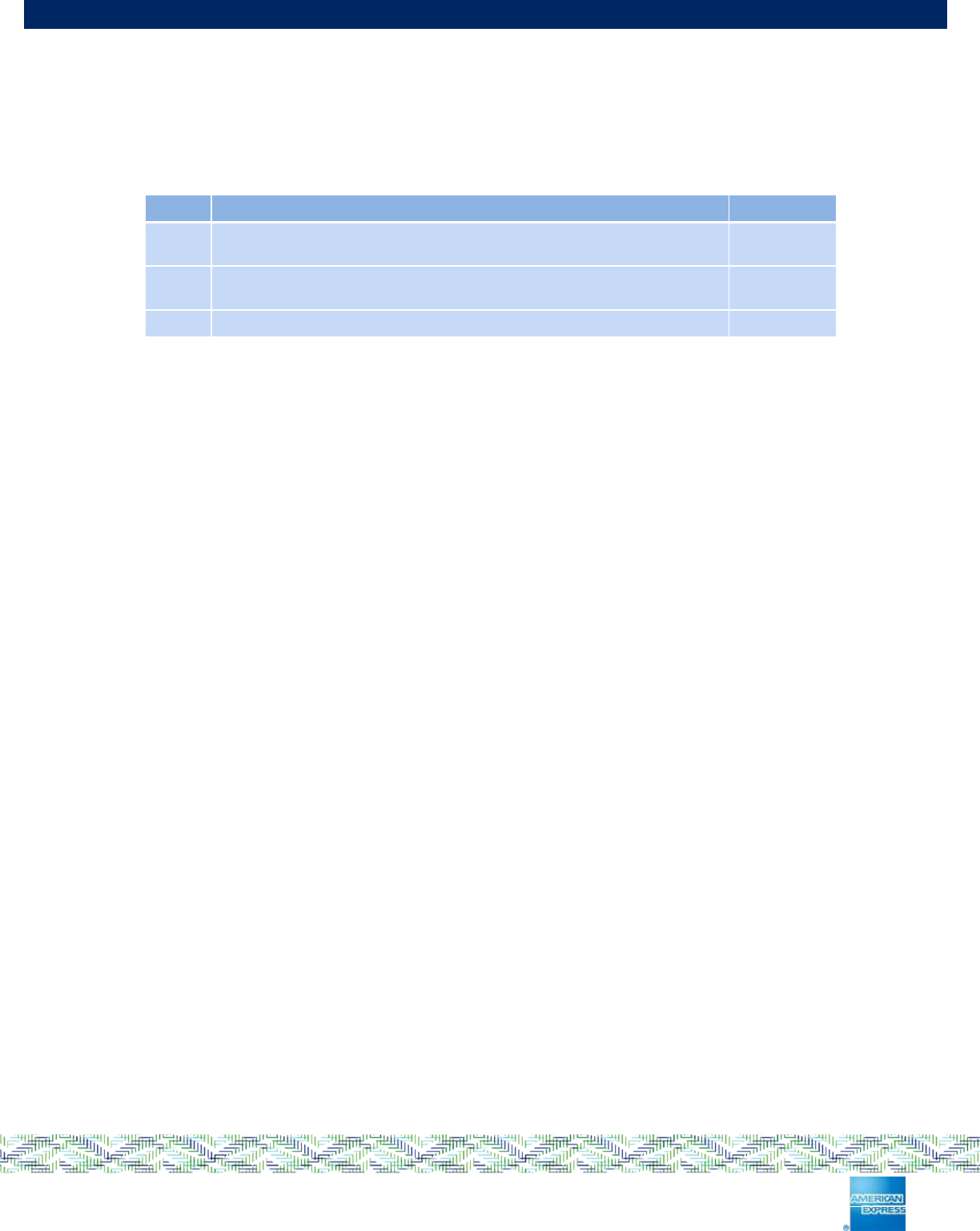

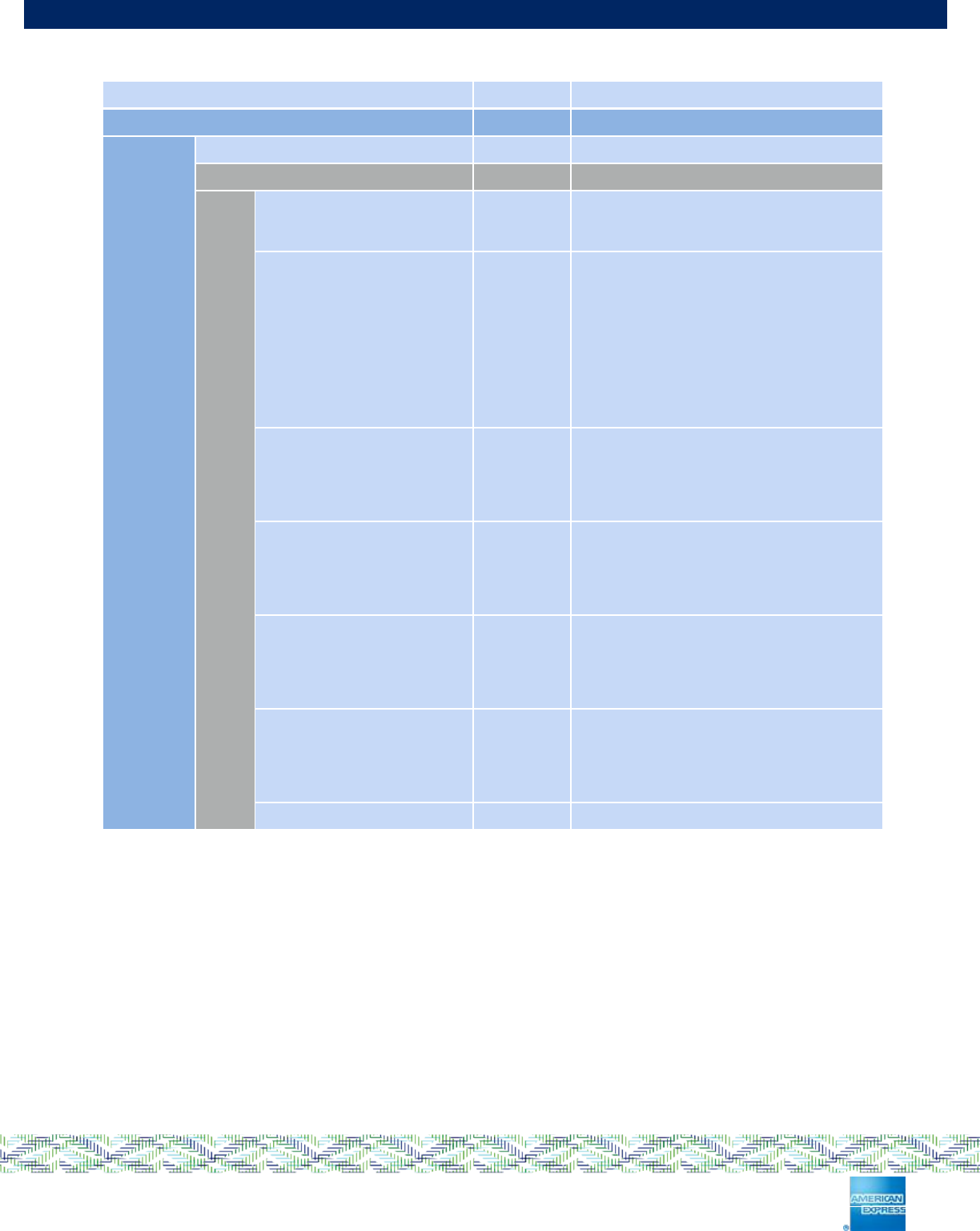

Table 3-2: AEIPS Command Terminal Support Requirements

Command

AEIPS Terminal Support

EXTERNAL AUTHENTICATE

Mandatory

GENERATE AC

Mandatory

GET CHALLENGE

Mandatory

GET DATA

Mandatory

GET PROCESSING OPTIONS

Mandatory

GET RESPONSE

Mandatory

INTERNAL AUTHENTICATE

Mandatory

READ RECORD

Mandatory

SELECT

Mandatory

VERIFY

Mandatory

Page 17 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

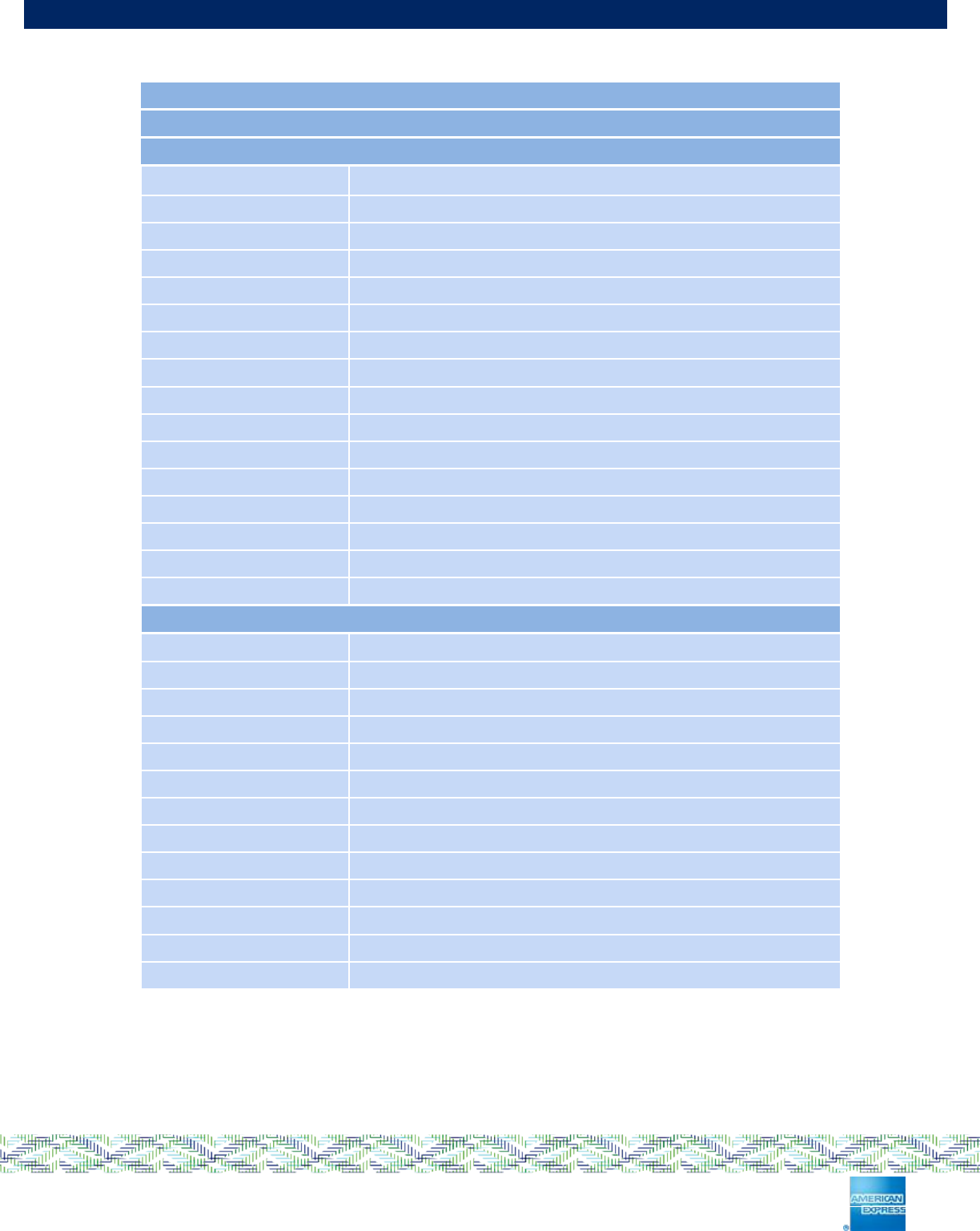

3.3.3 AEIPS Command Non-Specific Status Words

The table below indicates the status word responses that an AEIPS-compliant card may generate in

response to errors processing commands. Additional status words representing particular errors specific to a

command can be found in the appropriate section of the document. The order column indicates the order in

which error checking will be performed by the card.

Table 3-3: AEIPS Command Non-Specific Status Words

Order

Error Condition

Status Word

1

When any command is attempted with an CLA byte not equal to one of ‘00’,

‘04’, ‘80’, ‘84’.

6E00

2

When a command is attempted with an INS byte not equal to one of:

‘A4’, ‘A8’, ‘B2’, ‘CA’, ‘20’, ‘88’, ‘AE’, ‘82’, ‘1E’, ‘24’, ‘DA’, ‘18’.

6D00

3

When a supported card command completes processing without error

9000

Page 18 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

4 Application Selection

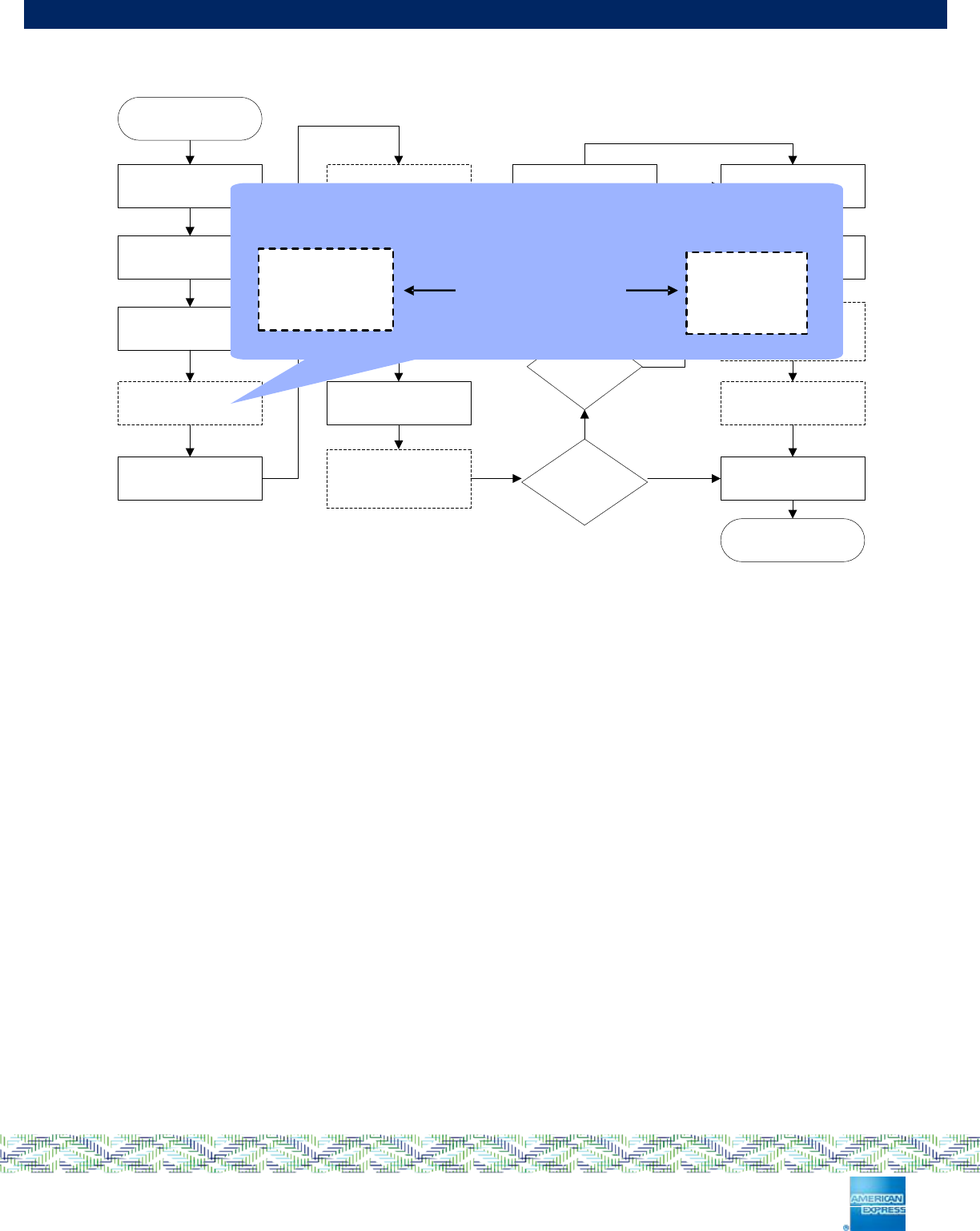

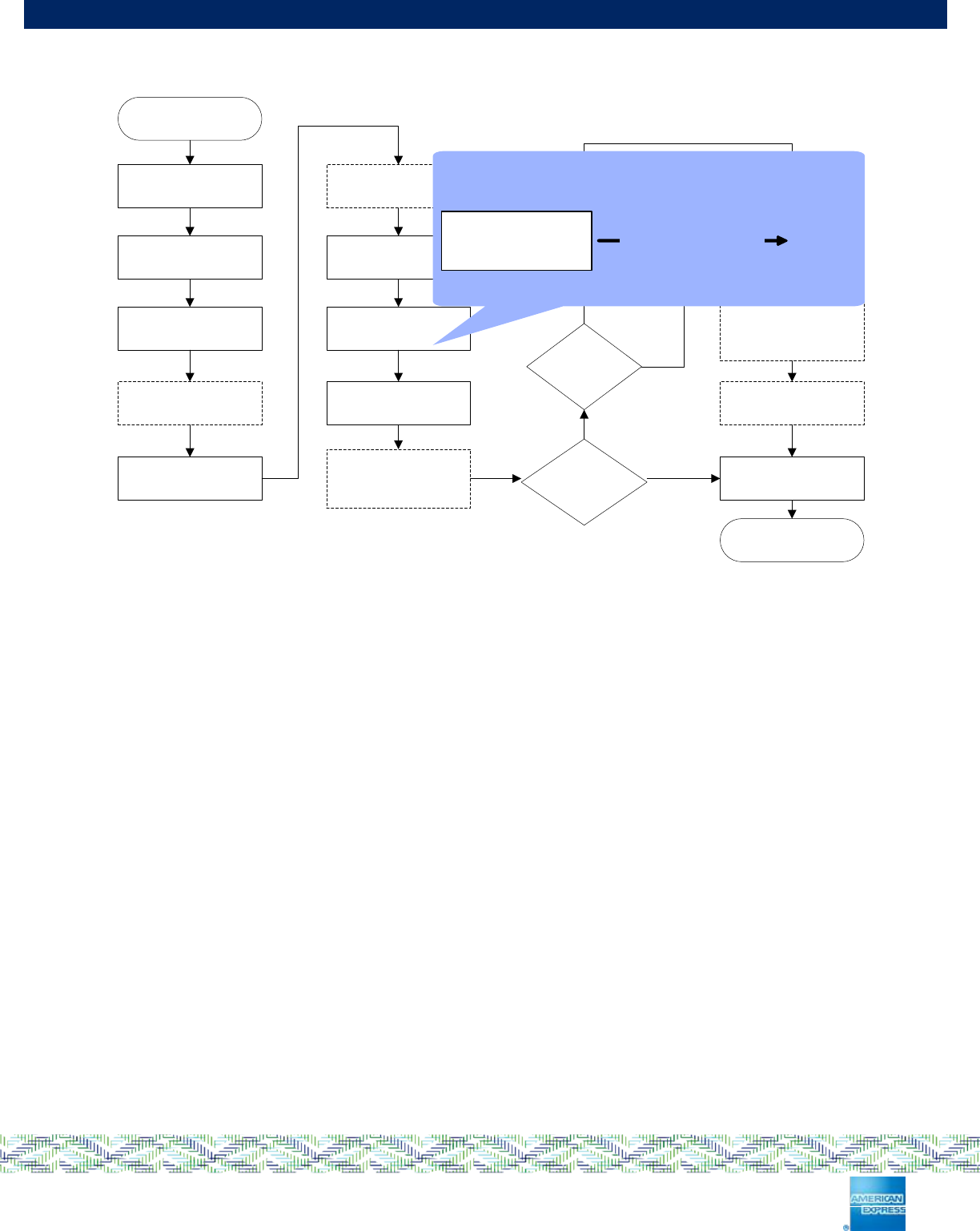

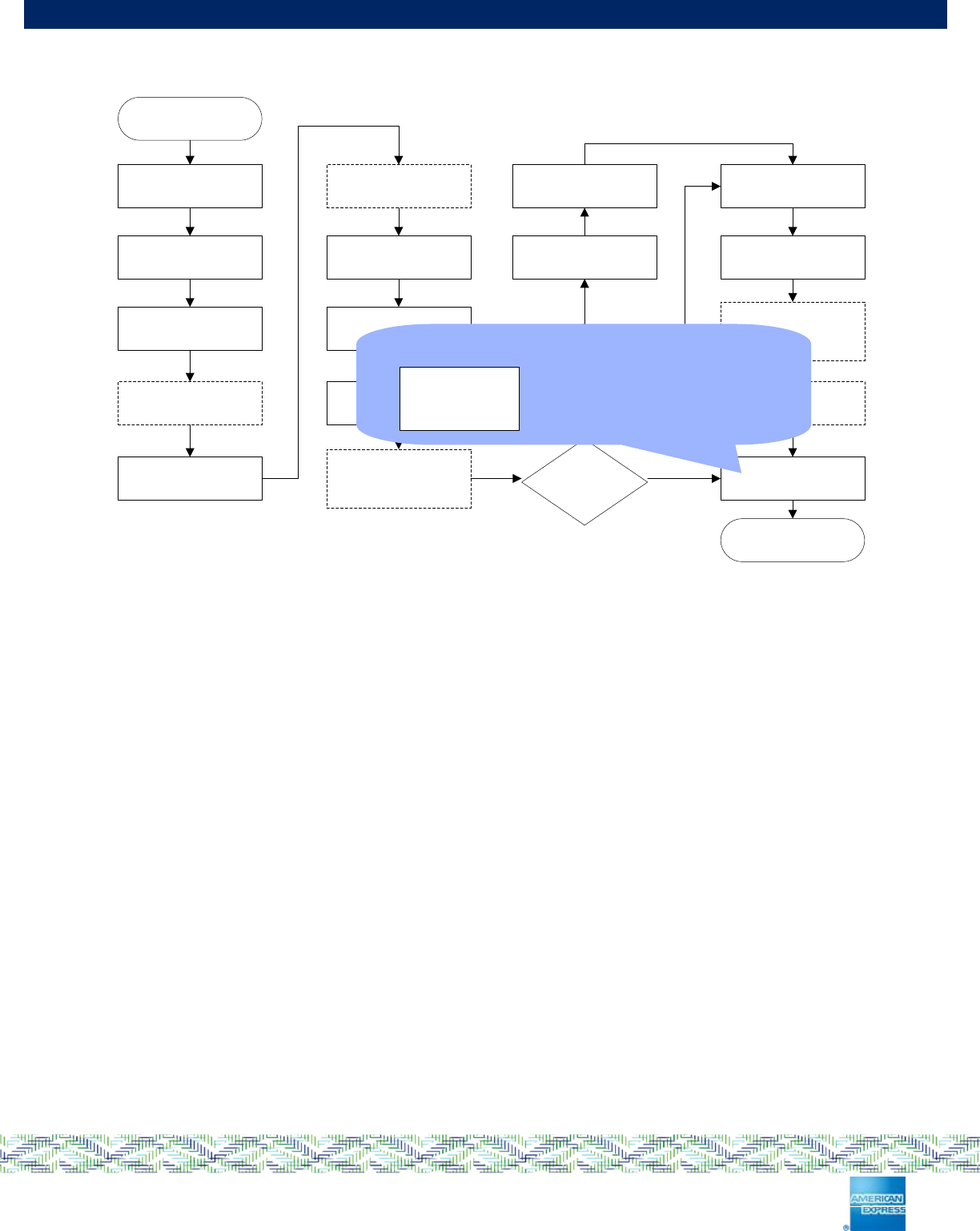

Figure 4-1: Application Selection Detail

4.1 Overview

When an AEIPS Chip Card is presented to a Terminal, the Terminal determines, and optionally displays, a

list of applications supported by both Chip Card and Terminal. In the case where the list is displayed, the

Cardholder selects the desired application from the available list.

When the Terminal does not support Cardholder selection the terminal selects the application according its

priority.

During Application Selection, the Chip Card and Terminal determine which of the applications that are

supported by both will be used to conduct the transaction. Two steps are performed:

Build the candidate list: The Terminal builds a list of mutually supported applications.

Application selection: A single application from the candidate list is identified and selected for the

following transaction.

4.2 Commands

SELECT

READ RECORD

To support Application Selection as described in [EMV4.3i] Sections 11.2 and 11.3, the Terminal must

support the READ RECORD and the SELECT commands.

Insert card

Application

selection

Init application

processing

Read application

data

Processing

restrictions

Cardholder

verification

Terminal risk

management

1st terminal action

analysis

1st card action

analysis

Online

transaction

2nd terminal action

analysis

2nd card action

analysis

Issuer script

processing

Transaction

completion

Online processing

Issuer

authentication

Remove card

Y

N

Y

Offline data

authentication

CDA sig check

Offline data

authentication

Unable to

go online

N

Offline data

authentication

CDA sig check

List supported

applications

Card

SELECT

READ RECORD

Application

selection

Terminal

Page 19 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

4.3 Processing Requirements

Card Application selection consists of a number of stages:

Card Insertion and Power Up Sequence

Answer to Reset

Application Selection – Building the Candidate List

Application Selection – Choosing the Required Application.

4.3.1 Chip Card Insertion and Power Up Sequence

Terminals must be fully compliant to the requirements detailed in [EMV4.3i] Part I – Electromechanical

Characteristics and Logical Interface and Transmission Protocols.

4.3.2 Answer to Reset

The Chip Card reader must be fully compliant with the requirements of [EMV4.3i] Part II –

Electromechanical Characteristics and Logical Interface and Transmission Protocols. This details the

electromechanical characteristics and transmission protocols to be used for communication between Chip

Card and Terminal.

4.3.2.1 Protocol Support

Two transmission protocols are defined in the EMV Specifications:

T = 0 – Character-oriented asynchronous half-duplex transmission protocol

T = 1 – Block-oriented asynchronous half-duplex transmission protocol.

The Terminal must be capable of supporting both protocols.

If a Chip Card does not support a protocol which is supported by the Terminal, i.e., other than T=0 or T=1,

fallback to magnetic stripe must apply.

4.3.3 Application Selection – Building the Candidate List

Applications are identified by Application Identifiers (AIDs). AIDs are intended to identify a Chip Card

product or service provider, i.e., American Express Charge Card, American Express Credit Card, etc.

The following EMV documents detail the Terminal requirements for the support of the EMV Application

Selection process:

[EMV4.3i] Section 12

[EMV4.3iv] Section 11.3.

Note that EMV4.3 removes other DDF entries from the PSE DDF directory. However, terminals must

continue to process application selection of PSE with DDF entries in accordance with previous versions of

EMV and as detailed in [ISO7816-4] until the cards are replaced.

EMV specifies two methods for identifying the candidate list of applications for selection:

Using a Terminal held list of supported AIDs, as described in [EMV4.3i] Section 12.3.3

Using the Payment Systems Environment (PSE), as described in [EMV4.3i] Section 12.3.2.

Terminals compliant with this manual must support both methods. If the PSE is present on the card then

the PSE selection method must be attempted first.

If either the card does not have a PSE, or PSE processing does not identify a suitable application, the

Terminal must use a list of AIDs it supports to build the candidate list.

Additionally, all AEIPS compliant terminals must support the use of partial name selection, as described in

[EMV4.3i] Section 11.3.5.

If there are no applications supported by both the Chip Card and Terminal, the transaction must be

terminated.

Page 20 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

The Registered Application Provider Identifier (RID) assigned to American Express is ‘A000000025’.

4.3.4 Application Selection – Choosing the Required Application

There are three scenarios depending on the display capabilities and environment of the terminal:

Terminal supports Cardholder selection - if the Terminal supports Cardholder selection, the

Cardholder must be presented with an application list in priority order. If the Cardholder does not

select an application, the transaction must be terminated.

Terminal supports Cardholder confirmation - if the Terminal supports Cardholder confirmation,

then it will select the highest priority application and must ask for Cardholder confirmation. If the

Cardholder confirms, the application must be selected. Otherwise the Terminal must select the

next highest priority application, until the Cardholder confirms, or no further applications exist. If the

Cardholder does not select an application, the transaction must be terminated.

Terminal does not support Cardholder selection or confirmation - if the Terminal does not

support application selection or confirmation by the Cardholder, the Terminal must select the

highest priority application that does not require Cardholder confirmation.

The application priority is indicated by the value of the Application Priority Indicator read from the Chip Card.

The Application Priority Indicator also defines whether a particular application requires specific Cardholder

confirmation before use in a transaction. Operational design and Terminal location should take this into

account if a Terminal is going to support such applications.

If as a result of application selection a list is presented to the Cardholder, it must be in priority sequence,

with the highest priority application listed first.

If there is no priority sequence specified in the card, the list should be in the order in which the applications

were encountered in the card, unless the terminal has its own preferred order. The same applies where

duplicate priorities are assigned to multiple applications or individual entries are missing the Application

Priority Indicator i.e. the terminal may use its own preferred order or display the duplicate priority or non-

prioritized applications in the order encountered in the card.

If there is only one AEIPS application supported by both the Chip Card and Terminal, the Terminal may

select it automatically without involving the Cardholder if the payment application does not require

cardholder confirmation

If there is only one AEIPS application supported by both the Chip Card and Terminal which requires

cardholder confirmation, then explicit Cardholder selection must ensue.

Once the Terminal has identified the application to be used for the transaction, it must be selected by the

Terminal using the SELECT command, as defined in [EMV4.3i] Section 11.3 SELECT Command-Response

APDUs.

Page 21 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

5 Initiate Application Processing

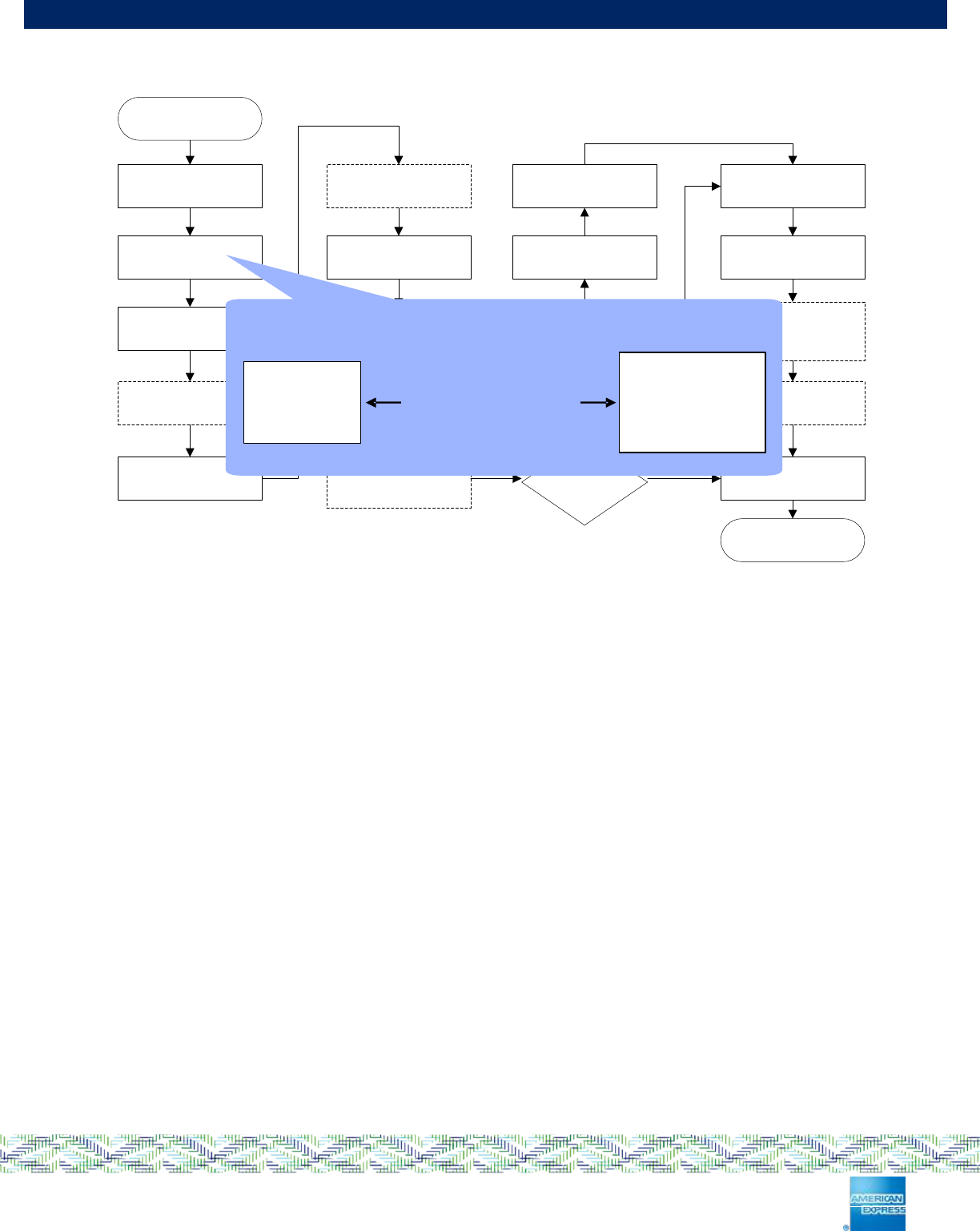

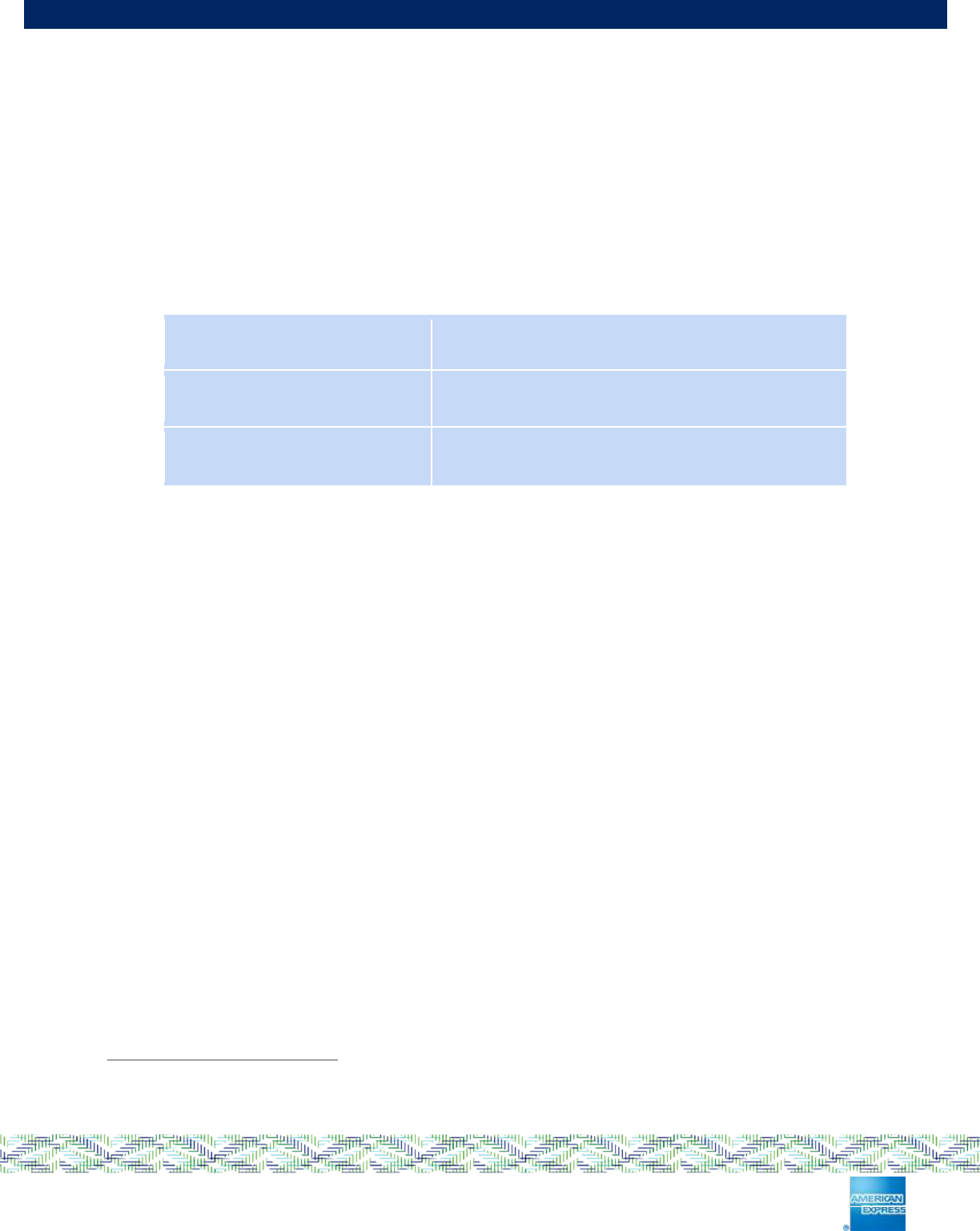

Figure 5-1: Initiate Application Processing Detail

5.1 Overview

If an AEIPS application is selected, the Terminal requests that the Chip Card presents the location of the

data to be used for the current transaction and the functions supported.

The GET PROCESSING OPTIONS command signals the Chip Card to return the Application File Locator

(AFL) and Application Interchange Profile (AIP).

The AFL is a list of parameters identifying the files and records to be read from the Chip Card used in

processing the transaction. The AIP indicates the capabilities of the Chip Card to support specific functions

of the application to be taken into consideration by the Terminal when determining how to process the

transaction.

5.2 Commands

GET PROCESSING OPTIONS

To support Initiate Application Processing, the Terminal must support the GET PROCESSING OPTIONS

command as defined in [EMV4.3iii] Section 6.5.8.

5.3 Processing Requirements

The Terminal must determine whether the optional Processing Data Object List (PDOL) was supplied by

the Chip Card application in response to the application selection.

If the PDOL is used, the Terminal must format the GET PROCESSING OPTIONS command to include any

data elements requested in the PDOL to be sent to the Chip Card with this command.

If the PDOL is not present, the Terminal must format the GET PROCESSING OPTIONS command with the

command data field of ‘8300’.

Insert card

Application

selection

Init application

processing

Read application

data

Processing

restrictions

Cardholder

verification

Terminal risk

management

1st terminal action

analysis

1st card action

analysis

Online

transaction

2nd terminal action

analysis

2nd card action

analysis

Issuer script

processing

Transaction

completion

Online processing

Issuer

authentication

Remove card

Y

N

Y

Offline data

authentication

CDA sig check

Offline data

authentication

Unable to

go online

N

Offline data

authentication

CDA sig check

CardTerminal

Initiate

application

processing

GET PROCESSING

OPTIONS

Supported

functions &

pointers to

application data

Page 22 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

The Terminal must format the GET PROCESSING OPTIONS command according to [EMV4.3iii] Section

6.5.8.

During Application Initiation, the Terminal signals the Chip Card that processing of the transaction is

beginning. Initiate Application Processing must be performed as described in [EMV4.3iii] Section 10.1, and

[EMV4.3iv] Section 6.3.1 and store the AFL and AIP returned from the Chip Card.

If the response from the Chip Card returns SW1 SW2 = ‘6985’ indicating that ‘Conditions of use are not

satisfied’, the Terminal must remove the current application from the list of mutually supported applications

(the candidate list) and return to Application Selection (See Section 4).

If the response from the Chip Card does not contain both the AFL and AIP then the Terminal must remove

the current application from the list of mutually supported applications (the candidate list) and return to

Application Selection (See Section 4).

If the response from the Chip Card returns the AFL and AIP, the Terminal must proceed to Read

Application Data (See Section 6).

Page 23 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

6 Read Application Data

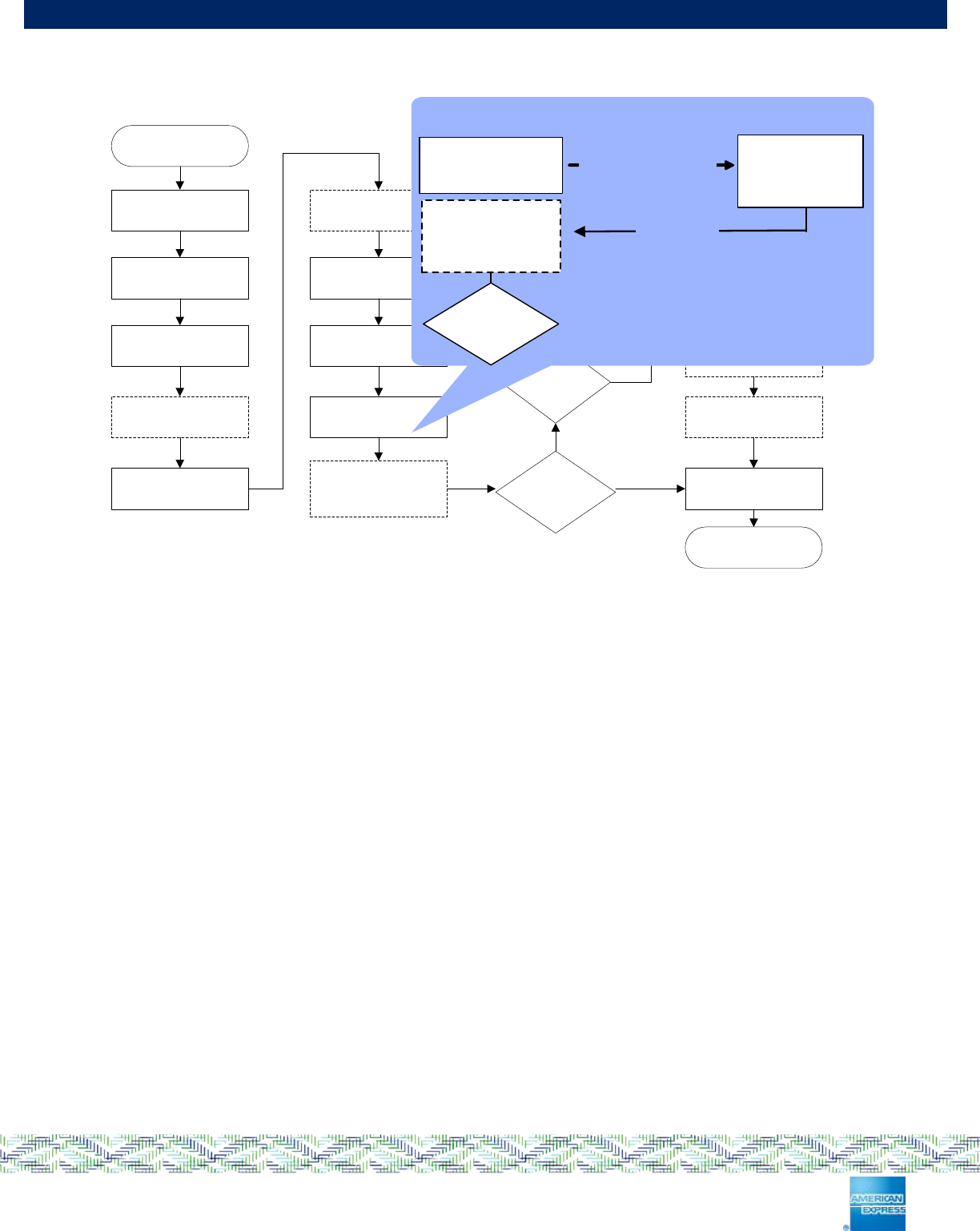

Figure 6-1: Read Application Data Detail

6.1 Overview

The Terminal reads the data from the location presented by the Chip Card AFL.

The Terminal reads any Chip Card data necessary for completing the transaction using the READ RECORD

command. The AFL is a list identifying the files and records that must be used in the processing of a

transaction. The files that are read may be used for application purposes or as authentication data used

during Offline Data Authentication (See Section 7).

6.2 Commands

READ RECORD

AEIPS compliant Terminals must support the READ RECORD command as described in [EMV4.3iii]

Section 6.5.11.

6.3 Processing Requirements

The Terminal must read all data records specified in the AFL.

It is mandatory that the READ RECORD command be performed as defined in [EMV4.3i] Section 11.2.

All data read successfully from the Chip Card must be stored by the Terminal and used when required

during the transaction. If a processing error occurs during this read record phase, the transaction must be

aborted.

It is not the Terminal’s responsibility to ensure the integrity of the data read from the Chip Card unless it is a

specific requirement of the EMV specifications. As long as the data retrieved within a read record command

correctly breaks down into valid Tag/Length/Value (TLV) data elements, the Terminal can assume it is valid,

and the integrity of the data element placed in a Chip Card is the responsibility of the Issuer.

Insert card

Application

selection

Init application

processing

Read application

data

Processing

restrictions

Cardholder

verification

Terminal risk

management

1st terminal action

analysis

1st card action

analysis

Online

transaction

2nd terminal action

analysis

2nd card action

analysis

Issuer script

processing

Transaction

completion

Online processing

Issuer

authentication

Remove card

Y

N

Y

Offline data

authentication

CDA sig check

Offline data

authentication

Unable to

go online

N

Offline data

authentication

CDA sig check

Provide

application

records

Card

READ RECORD

Read

application

data

Terminal

Page 24 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

Terminal vendors must ensure that an invalid data element value does not cause the Terminal to become

unusable or lock up.

Data validation (missing or erroneous data on the Chip Card) is detailed in [EMV4.3iii] Section 7.5, in

particular the Terminal Verification Results (TVR) byte 1, bit 6 must be set according to [EMV4.3iii] Table

31.

Page 25 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

7 Offline Data Authentication

Figure 7-1: Offline Data Authentication Detail

7.1 Overview

Offline Data Authentication is a mechanism intended to prove that certain significant card data elements

have not been altered after the Chip Card was issued. “Static” data authentication proves that data is not

counterfeit and “dynamic” data authentication proves that the data is not cloned. The three forms of data

authentication are:

Static Data Authentication (SDA)

Dynamic Data Authentication (DDA)

Combined DDA/Application Cryptogram Generation (CDA).

The Terminal determines whether it should authenticate the Chip Card offline using either static or dynamic

data authentication based upon the Chip Card support for these methods.

Offline Data Authentication results are used when the Chip Card and Terminal decide whether to approve

the transaction offline, go online for approval or to decline the transaction.

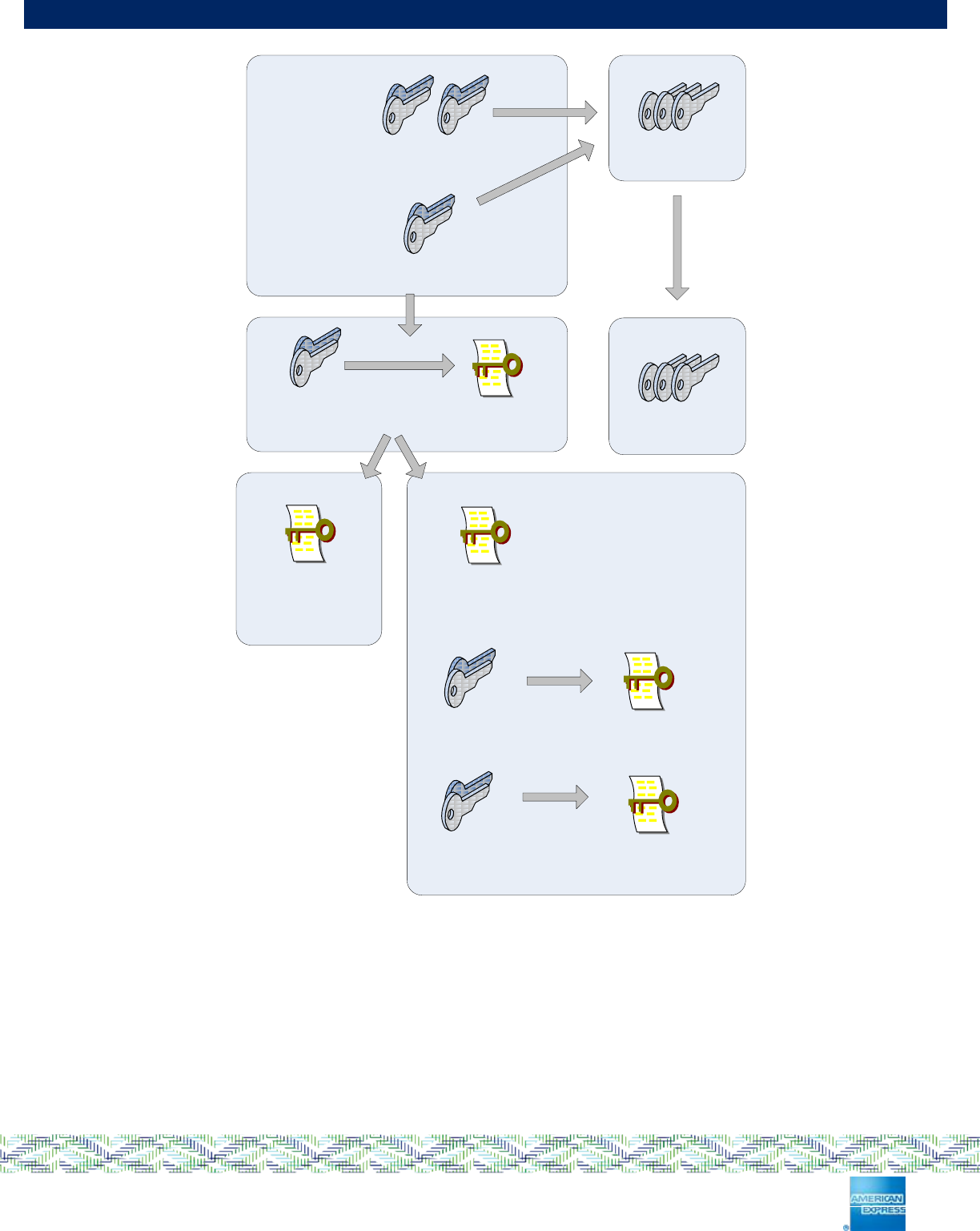

Offline Data Authentication uses Public Key Cryptography. Figure 7-2 shows the one-to-one and the one-to-

many relationships in the American Express Public Key Scheme. At the top of the trust tree there is the

American Express EMV Certificate Authority (CA). Directly under this, each issuing Participant has a CA and

each issues many Chip Cards. Each AEIPS-compliant Chip Card holds the Issuer’s Public Key Certificate

which is signed by an American Express EMV CA private key. Each payment application on an AEIPS-

compliant Chip Card may hold an Application DDA Private Key and Public Key Certificate which is signed by

an Issuer CA Private Key. For the cryptographic scheme to work, each Terminal need only hold the set of

American Express EMV CA Public Keys.

Insert card

Application

selection

Init application

processing

Read application

data

Processing

restrictions

Cardholder

verification

Terminal risk

management

1st terminal action

analysis

1st card action

analysis

Online

transaction

2nd terminal action

analysis

2nd card action

analysis

Issuer script

processing

Transaction

completion

Online processing

Issuer

authentication

Remove card

Y

N

Y

Offline data

authentication

CDA sig check

Offline data

authentication

Unable to

go online

N

Offline data

authentication

CDA sig check

Card

Generate

dynamic

cryptogram

Card

Terminal

Offline data

authentication

part 1

INTERNAL

AUTHENTICATE

(only if DDA)

Page 26 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

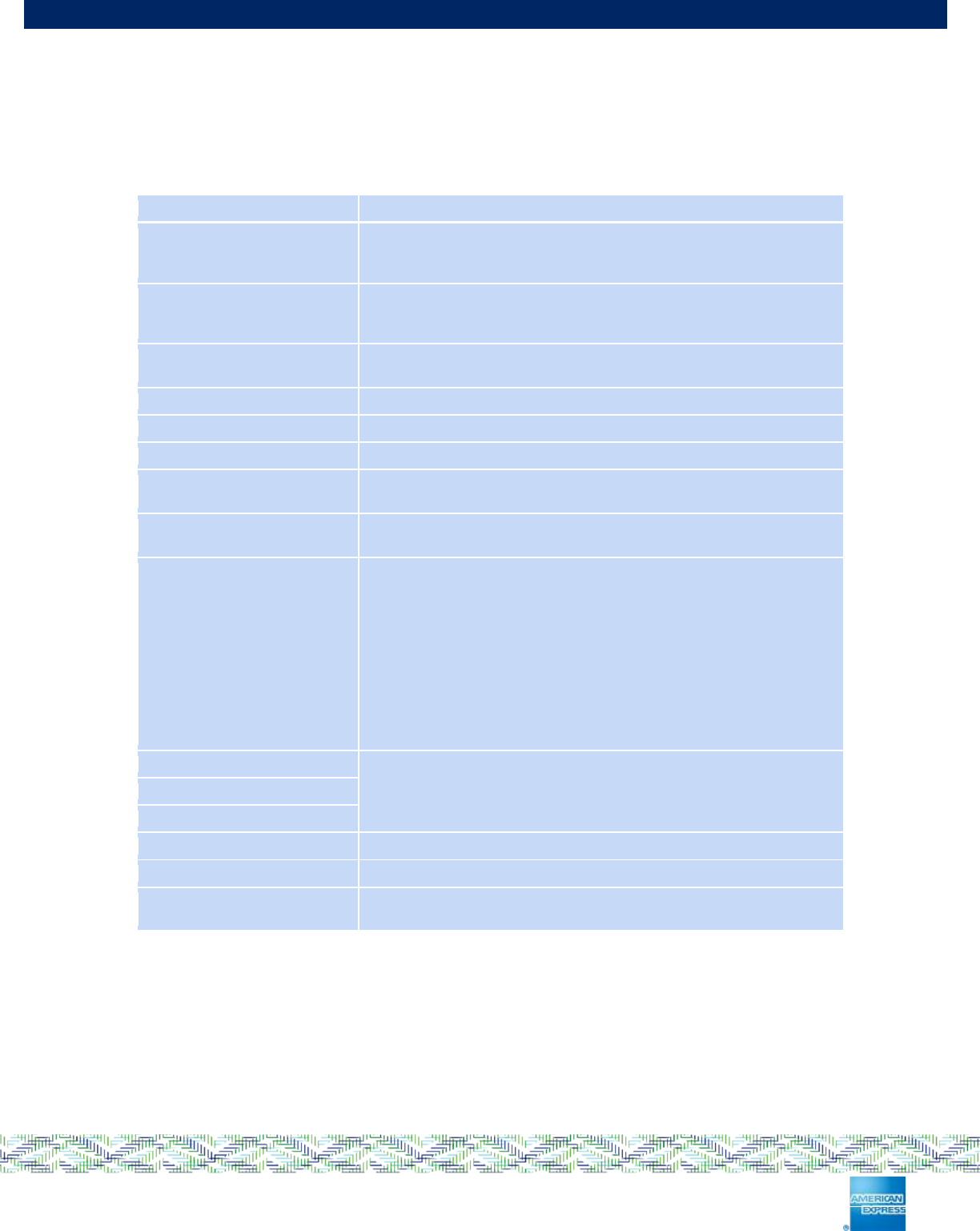

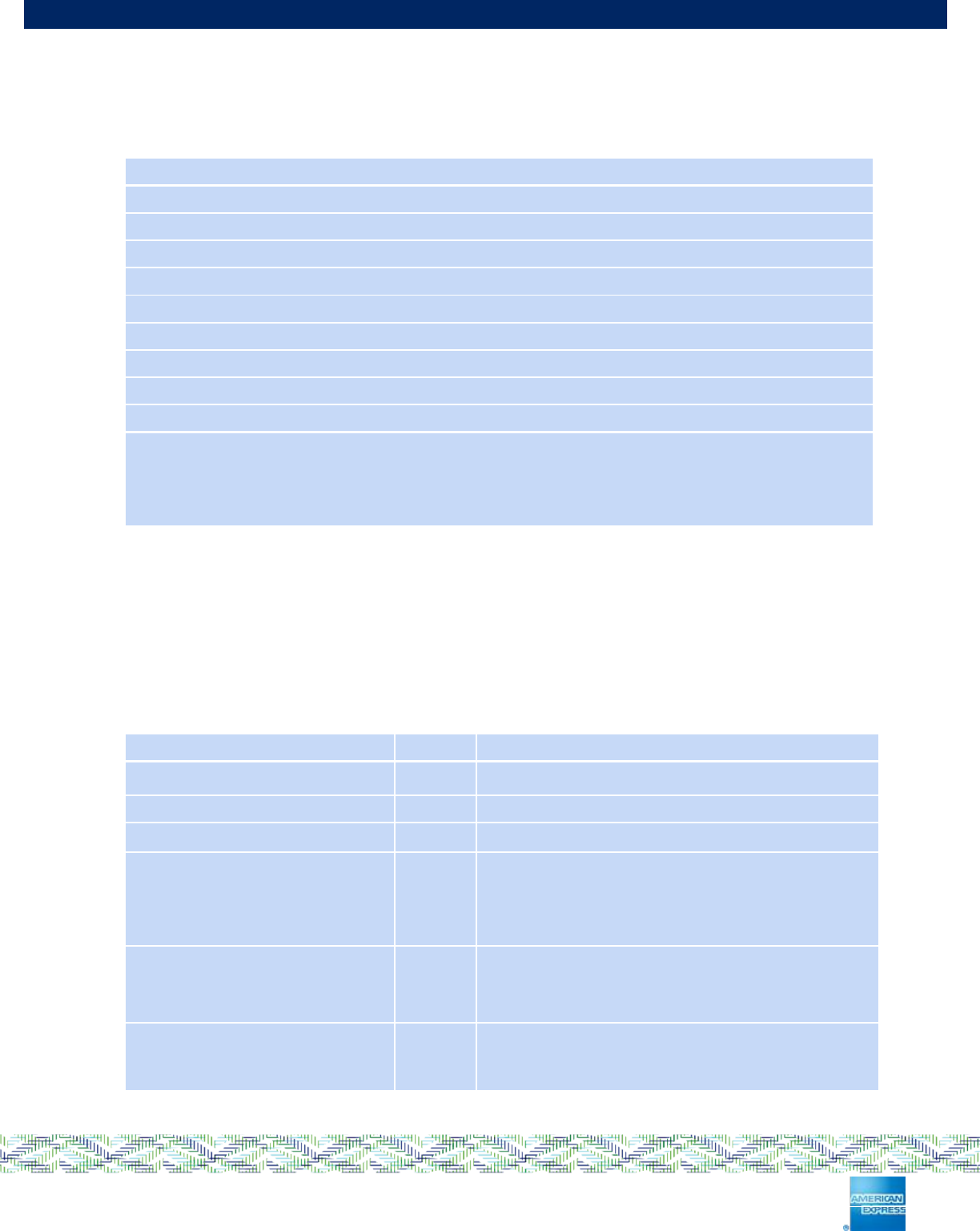

Figure 7-2: Key Hierarchy

Note: The Application DDA keys may also be used for offline PIN encipherment during cardholder

verification. Alternatively, a payment application may include a separate Application PIN encipherment

Public and Private Key if this function is supported, and is shown in the figure. Section 9 describes

cardholder verification.

7.1.1 Static Data Authentication (SDA)

SDA validates a fixed cryptographic signature over data elements held within the Chip Card to assure that

this data has not been altered since Chip Card personalization. The Terminal uses the Issuer Public Key

retrieved from the Chip Card to decrypt the data from the Chip Card and make sure that the hash obtained

Current American

Express CA key pair

Previous American

Express CA key

pairs, still in use

Issuer Key Pair (one

per BIN Range) Issuer Public Key Certificate

(Signed with American Express

CA Private Key)

Issuer Public Key Certificate

(Signed with American

Express CA Private Key)

Application DDA Key Pair

(one per card application,

can also be used for PIN

Encipherment)

Issuer Public Key Certificate

(Signed with American

Express CA Private Key)

Application PIN

Encipherment Key

Pair (one per card

application, optional)

Application DDA Public Key Certificate

(Signed with the Issuer Private Key)

AMERICAN EXPRESS

ISSUER

ACQUIRER

Live American

Express CA Public

Keys

ALL TERMINALS

Live American

Express CA Public

Keys

SDA Cards DDA / CDA Cards

Application PIN Encipherment Public

Key Certificate (Signed with the Issuer

Private Key)

Page 27 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

in this way matches a hash of the actual data objects retrieved from the Chip Card. If these hashes do not

match, then offline SDA fails.

During SDA, the Chip Card is passive and the Terminal is active. The Chip Card provides the data to be

validated but the terminal carries out all the computation.

7.1.2 Dynamic Data Authentication (DDA)

DDA is an offline authentication technique in which the Chip Card and the Terminal are both active and

capable of executing a Public/Private Key algorithm. DDA validates not only that the Chip Card data has not

been altered but also that the data is being read from a genuine card and is not a copy.

As part of DDA processing the Terminal verifies the Chip Card static data has not been altered in a similar

manner to SDA. In addition, the Terminal validates that the card is genuine in a separate process by

requesting that the Chip Card generates a cryptogram using dynamic (transaction unique) data from the

Chip Card and Terminal and a Chip Card Application DDA Private Key. The Terminal decrypts this dynamic

signature using the Chip Card Application DDA Public Key recovered from Chip Card data. A match of the

decrypted data to a hash of the original data verifies that the Chip Card is not a counterfeit.

7.1.3 Combined DDA / Application Cryptogram Generation (CDA)

CDA was introduced to EMV to enable transactions to be performed more efficiently and securely by directly

linking the Application Cryptogram used in authorization and settlement with the offline authentication

process. CDA is an offline authentication mechanism that uses a similar technique to DDA, but combines

the generation of the offline authentication signature with the generation of the Application Cryptogram. This

means that the Terminal does not perform offline data authentication processing as a separate process but

as part of the processing of the Application Cryptogram produced by the card as a result of Card Action

Analysis (Sections 12 and 16).

7.2 Commands

READ RECORD

INTERNAL AUTHENTICATE (DDA Only)

The data elements used for Offline Data Authentication are read from the Chip Card by the Terminal using

the READ RECORD command during the “Read Application Data” phase of the transaction. If supported,

the INTERNAL AUTHENTICATE command must be performed as specified in [EMV4.3iii] Section 6.5.9

INTERNAL AUTHENTICATE Command-Response APDUs.

Only one INTERNAL AUTHENTICATE command must be supported per transaction.

Page 28 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

7.3 Processing Requirements

AEIPS requires that all Terminals are capable of performing Offline Data Authentication except Terminals

operating in certain ‘online only’ environments, for example ATMs.

Offline Data Authentication can take three forms as described in the EMV 4.3 specifications. AEIPS-

compliant Terminals must support:

Static Data Authentication (SDA)

Dynamic Data Authentication (DDA)

Combined DDA/Application Cryptogram Generation (CDA).

Offline Data Authentication must be performed as described in [EMV4.3ii] Sections 5 and 6, and [EMV4.3iii]

Section 10.3. TVR bits affected include byte 1, bits 8, 7, 4 and 3. If Offline Data Authentication is not

performed, then TVR byte 1, bit 8 must be set to “1”.

The Terminal must determine Chip Card authentication using SDA, DDA or CDA based on the Chip Card

support for these methods as indicated in the AIP of the Chip Card.

When Offline Data Authentication is to be performed, CDA has the highest priority and if the Chip Card

supports it, then CDA must be performed. If the card only supports DDA and/or SDA then DDA must be

attempted. If the Chip Card does not support either type of dynamic data authentication, but does support

Static Data Authentication (SDA), then SDA must be performed.

Any Terminal that has the ability to complete a transaction offline (i.e., without positive online authorization

from the Issuer of the Chip Card) must support and perform Offline Data Authentication (subject to the Chip

Card indicating Offline Data Authentication is supported in the AIP).

EMV optionally supports the use of a Certificate Revocation List (CRL) to enable the listing of Issuer Public

Key Certificates that a Payment Scheme has revoked. American Express does not support the use of

CRLs for this purpose at this time.

7.3.1 American Express Scheme CA Keys

In order that Offline Data Authentication can be performed by a Terminal, the Terminal must be configured

with the necessary American Express Certificate Authority (CA) Public Keys.

American Express will distribute the American Express CA Public Keys (CAPKs) to Acquirers of American

Express Chip Card transactions. The Acquirers are responsible for the distribution of the American Express

CAPKs to all Terminals that support Offline Data Authentication.

Terminals must be able to store and use a minimum of six American Express CAPKs and associated data,

permitting all keys to be available for use during the processing of a Chip Card transaction.

The CAPKs, their related data elements that a Terminal must hold along with details of the format in which

the CAPKs are distributed by American Express are shown in the American Express Terminal Guide [ATG].

7.3.2 Static Data Authentication (SDA)

If Static Data Authentication is to be performed, then the Terminal must:

Check that the CAPK identified by the Card is configured.

If the CAPK is not present or is invalid, then SDA fails and the Terminal must set the TVR

byte 1 bit 7 to “1” (SDA Failed).

If Static Data Authentication is to be performed then this must be performed as described in

[EMV4.3ii] Sections 5 and 6, and [EMV4.3iii] Section 10.3.

The Terminal must set the TVR byte 1 bit 2 “SDA selected” to “1”.

During SDA the Terminal will validate the Signed Static Application Data read from the Chip Card. If

SDA fails, the Terminal must set the TVR byte 1, bit 7 “SDA Failed” bit to ”1”.

Page 29 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

7.3.3 Dynamic Data Authentication (DDA)

If Standard Dynamic Data Authentication, as described in [EMV4.3ii] Section 6.5, is to be performed, the

INTERNAL AUTHENTICATE command must be issued to the Chip Card as described in [EMV4.3iii]

Section 6.5.9 Command-Response APDUs.

The INTERNAL AUTHENTICATE Command must include a concatenation of the data elements identified in

the Dynamic Authentication Data Object List (DDOL) read from the Chip Card, or in the event that the DDOL

is not present in the Chip Card the Terminal must use the Default DDOL (tag ‘9F37’) present in the

Terminal. In all cases the DDOL must contain the Unpredictable Number (tag ‘9F37’) otherwise DDA is

considered by the Terminal to have failed.

If DDA is to be performed, then the Terminal must check that the CAPK identified by the Card is configured.

If the CAPK is not present or is invalid, then DDA fails and the Terminal must set the TVR byte 1 bit

4 to “1” (DDA Failed).

During DDA the Terminal must validate the Signed Dynamic Application Data returned by the card in the

response to the INTERNAL AUTHENTICATE Command.

If DDA fails the Terminal must set the TVR byte 1, bit 4 “DDA Failed” to ”1”.

7.3.4 Combined DDA/AC Generation (CDA)

If CDA is to be performed, the INTERNAL AUTHENTICATE Command is not issued to the Chip Card.

Instead, CDA can be requested by a Terminal in the following circumstances:

When requesting a TC as part of 1st GENERATE AC

When requesting an ARQC as part of 1st GENERATE AC

When requesting a TC as part of 2nd GENERATE AC.

Terminals supporting Offline Data Authentication have 4 operating modes for when requesting an online

cryptogram from the Chip Card and processing an approved online authorization:

CDA to be requested on 1st and 2nd GENERATE AC

CDA to be requested on 1st but not the 2nd GENERATE AC

CDA is not requested on 1st or 2nd GENERATE AC

CDA to be requested only on the 2nd GENERATE AC.

Terminals can be configured to support any one of the modes for AEIPS transactions. American Express

recommends that terminals request CDA on both the 1st and 2nd GENERATE AC, which corresponds to

CDA Mode 1 in [EMV4.3ii] Table 30.

If requested, CDA processing is performed following Card Action Analysis and is described in Sections 12

and 16.

If CDA is to be performed, either following the 1st and / or 2nd GENERATE AC, the Terminal must check that

the CAPK identified by the card is configured.

If the CAPK is not present then CDA shall be considered to have failed, CDA must not be

requested in the GENAC and the Terminal must set the TVR byte 1, bit 3 “CDA Failed” to “1”.

Page 30 of 94

April 2015 © 2015 American Express. All Rights Reserved

AMERICAN EXPRESS AEIPS TERMINAL TECHNICAL MANUAL

8 Processing Restrictions

Figure 8-1: Processing Restrictions Detail

8.1 Overview

The Terminal performs a number of checks to see whether the transaction should be allowed. Parameters

that can effect this decision include the effective and expiration date for the Chip Card, whether the

application versions of the Chip Card and Terminal match, and whether any Application Usage Control

restrictions are in effect. An Issuer may use Application Usage Controls to restrict a Chip Card’s use for

cash, goods or services.

The Terminal uses the data gathered from the Chip Card during Read Application Data (See Section 6) to

ascertain the particular restrictions under which this transaction can be carried out.

8.2 Processing Requirements

The Terminal must perform Processing Restrictions, as defined in [EMV4.3iii] Section 10.4 and [EMV4.3iv]

Sections 6.3.3, to see whether the transaction should be allowed.

Processing Restrictions cover the following mandatory checks to be performed by the Terminal:

Comparison of the Chip Card Application Version Number, if present in the Chip Card, to a

Terminal-resident Application Version Number. The Terminal must store an Application Version

Number for each Application Identifier (AID) supported by the Terminal. If the Chip Card Application

Version Number and Terminal-resident Application Version Number are not the same, then the

Terminal must set the TVR byte 2 bit 8 to “1” as described in [EMV4.3iii] Section 10.4.1.

Application Usage Control - This is used to determine if any geographical or transaction type

restrictions have been imposed on the Chip Card product, e.g., it may be used to restrict a Chip

Card’s use for domestic or international cash, or goods and services:

Domestic Usage Check - If the Issuer Country Code read from the Chip Card is equal to the

Terminal Country Code, the transaction is defined as ‘Domestic’. The Terminal checks that

the transaction type (e.g., Cash, Goods or Services) for the transaction being processed is

Insert card

Application

selection

Init application

processing

Read application

data

Processing

restrictions

Cardholder

verification

Terminal risk

management

1

st

terminal action

analysis

1

st

card action

analysis

Online

transaction

2

nd

terminal action

analysis

2

nd

card action

analysis

Issuer script

processing

Transaction

completion

Online processing

Issuer

authentication

Remove card

Y

N

Y

Offline data

authentication

CDA sig check

Offline data

authentication

Unable to

go online

N

Offline data

authentication

CDA sig check

Card

Processing

restrictions

Terminal

Page 31 of 94

April 2015 © 2015 American Express. All Rights Reserved