American Express Global Credit Authorization Guide April 2016 Apr

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 300 [warning: Documents this large are best viewed by clicking the View PDF Link!]

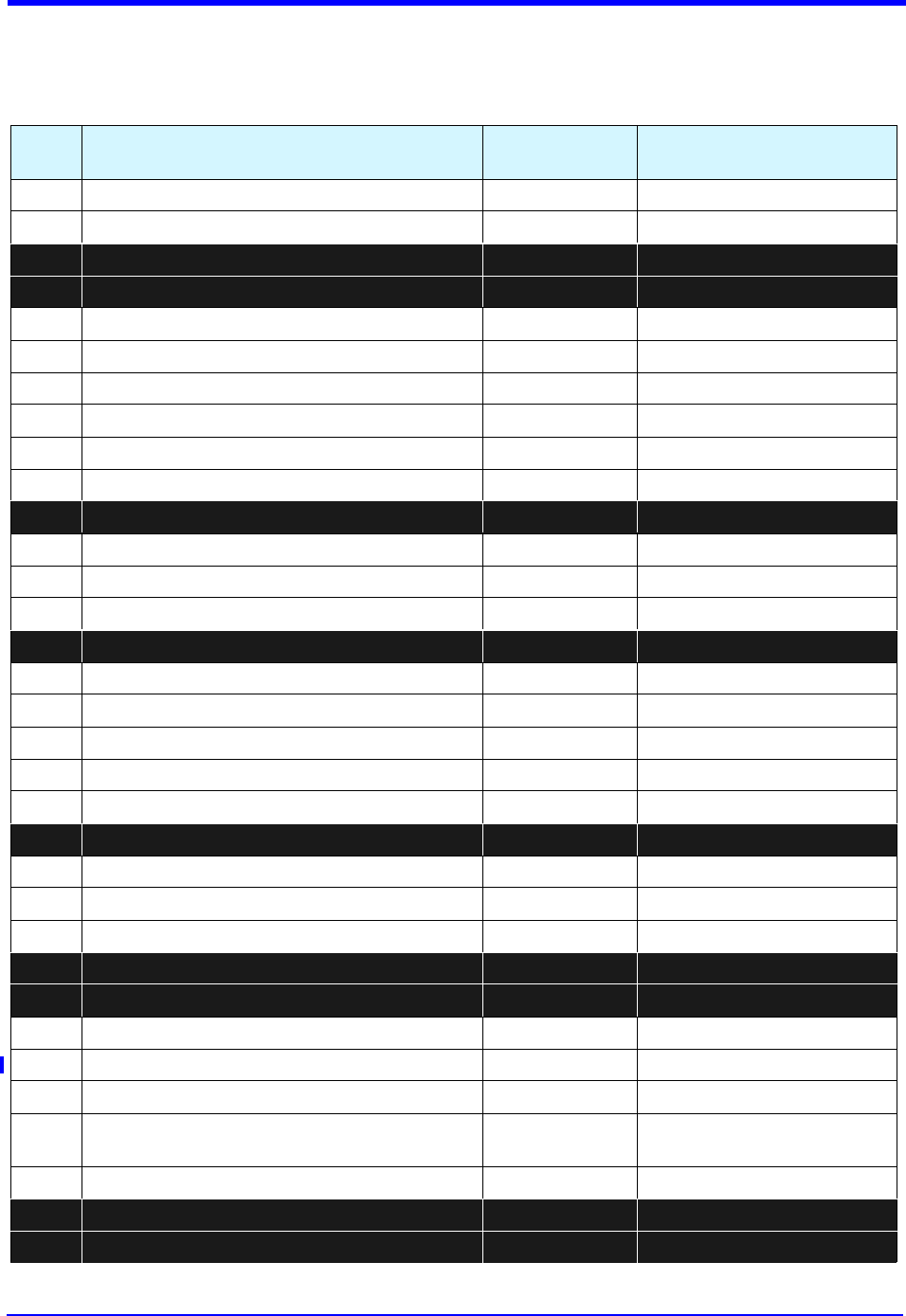

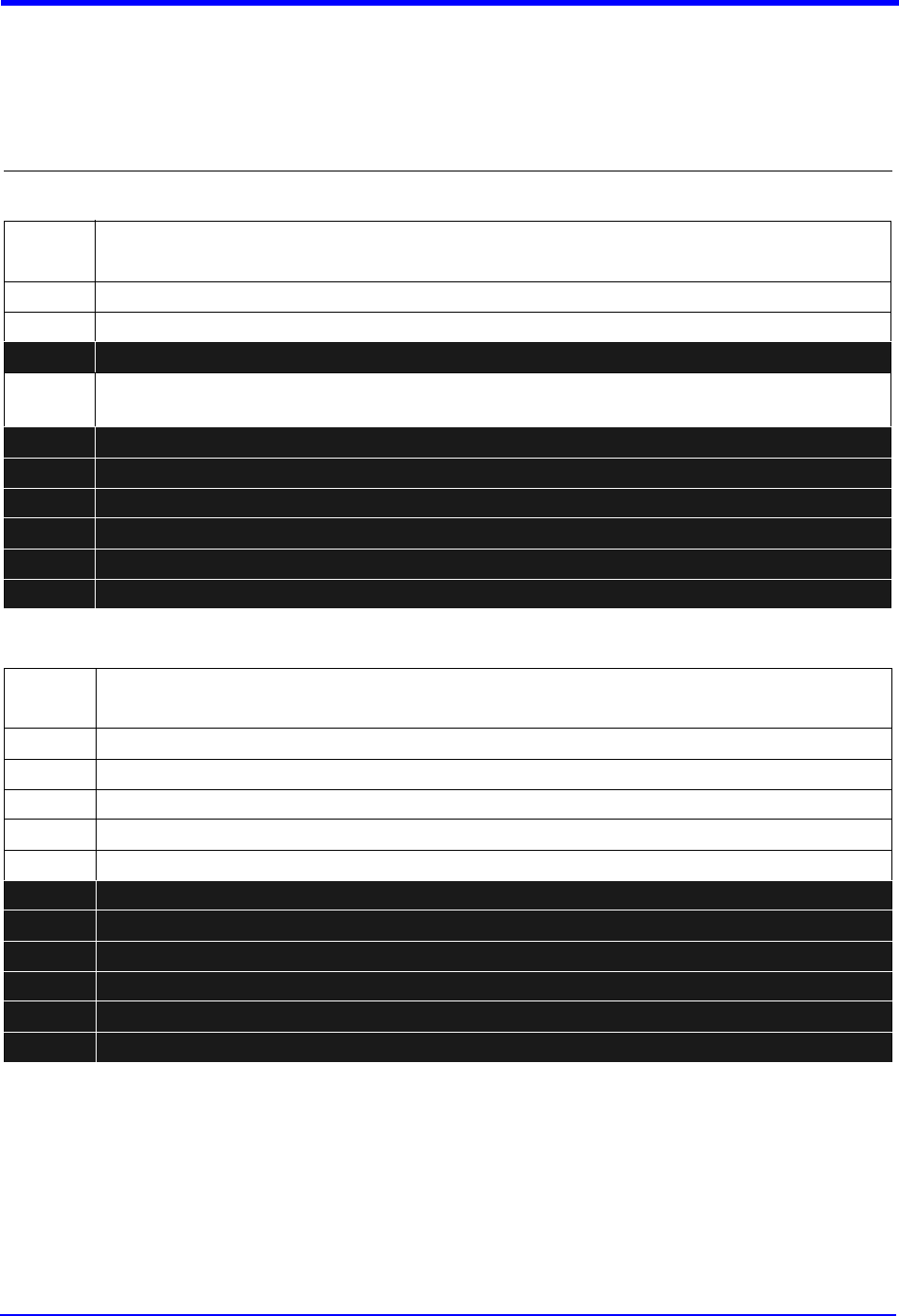

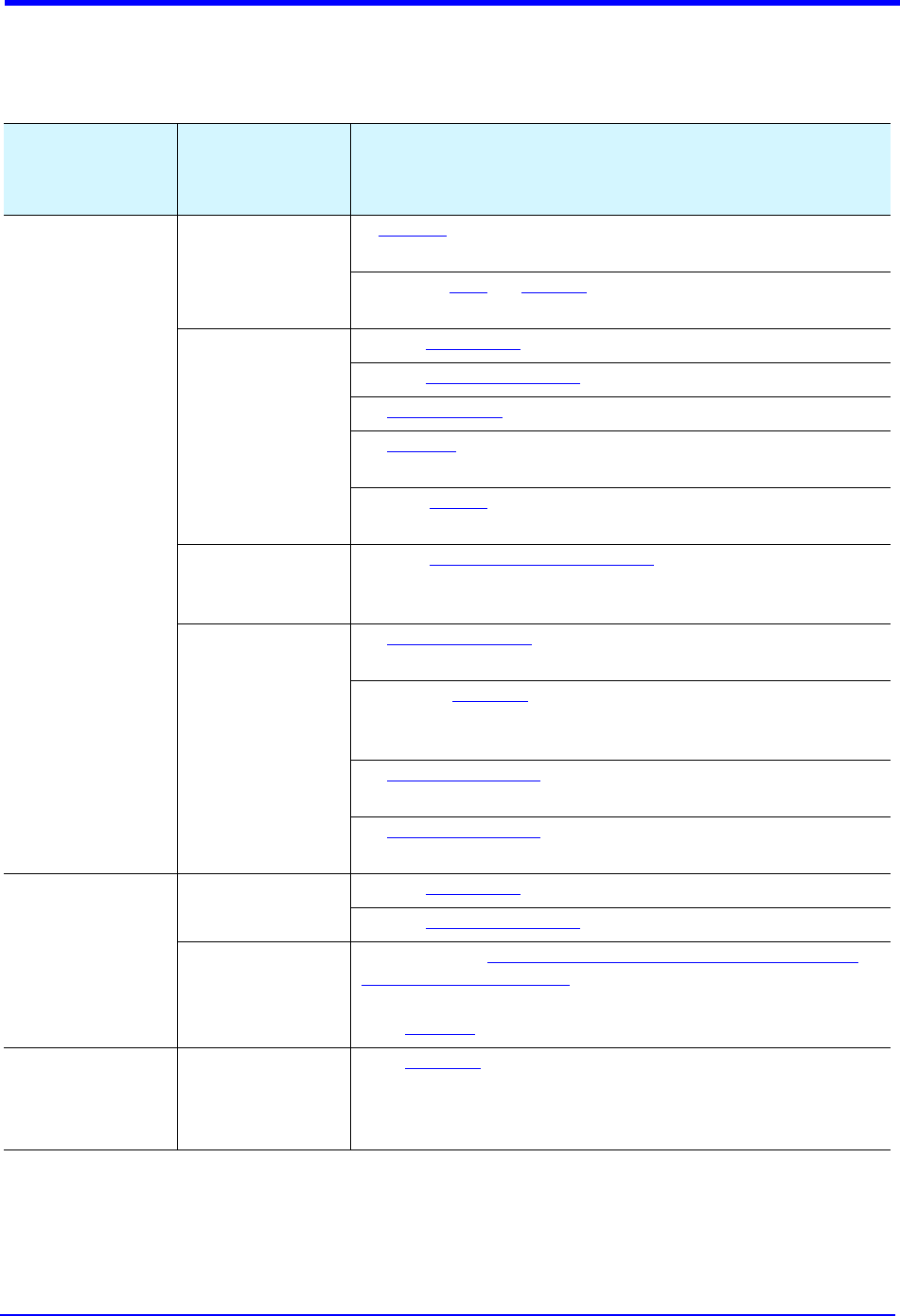

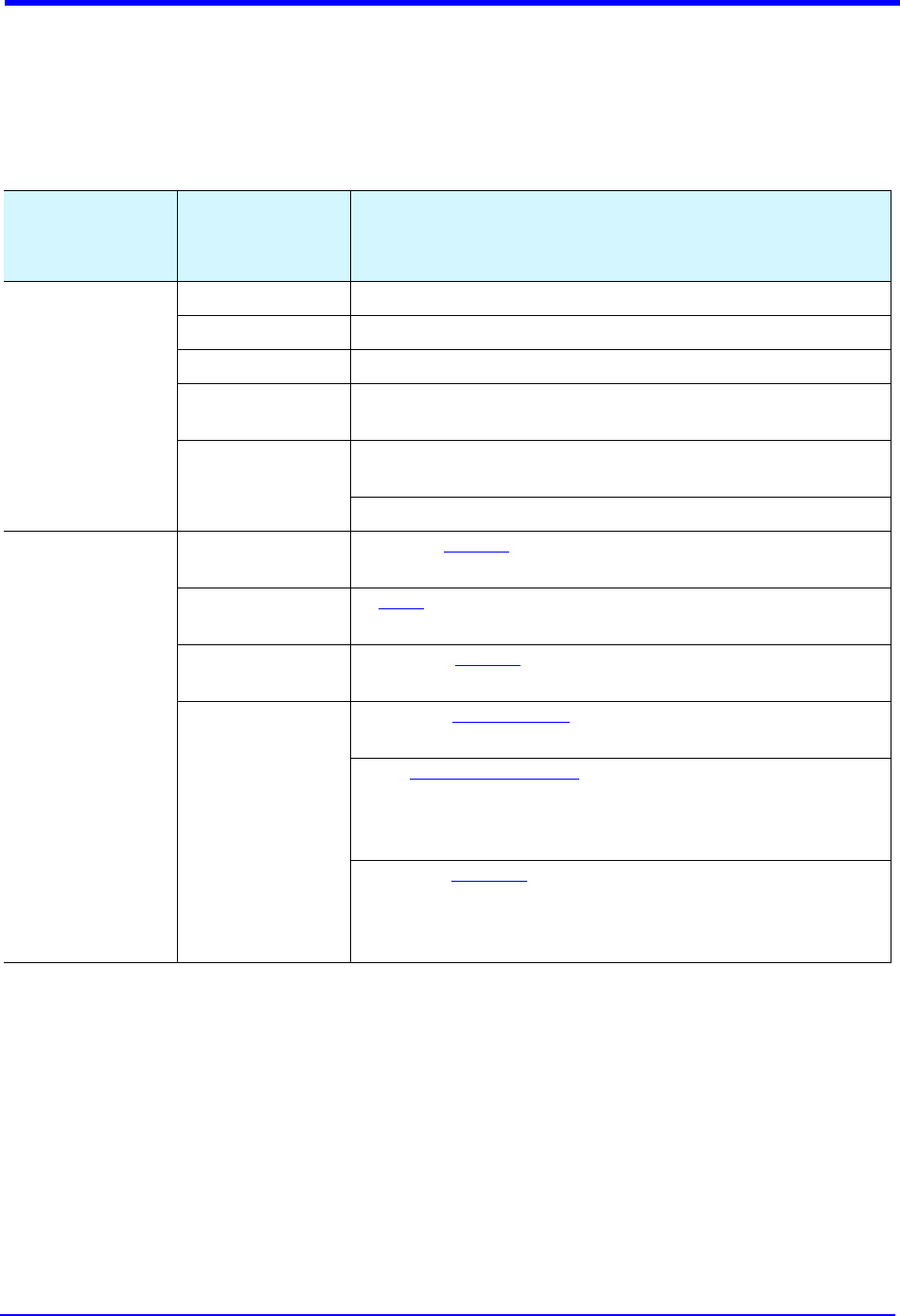

- Summary of Changes Table

- Table of Contents

- 1.0 About the Global Credit Authorization Guide

- 2.0 Implementation Planning

- 3.0 Card Acceptance Guidelines

- 4.0 Guidelines for Using the GCAG ISO 8583 Message Formats

- 5.0 Card Acceptance Supported Services

- 6.0 Fraud Prevention Services

- 7.0 ISO 8583 Message Bit Map Table

- 8.0 ISO 8583 Authorization Request/Response Message Formats

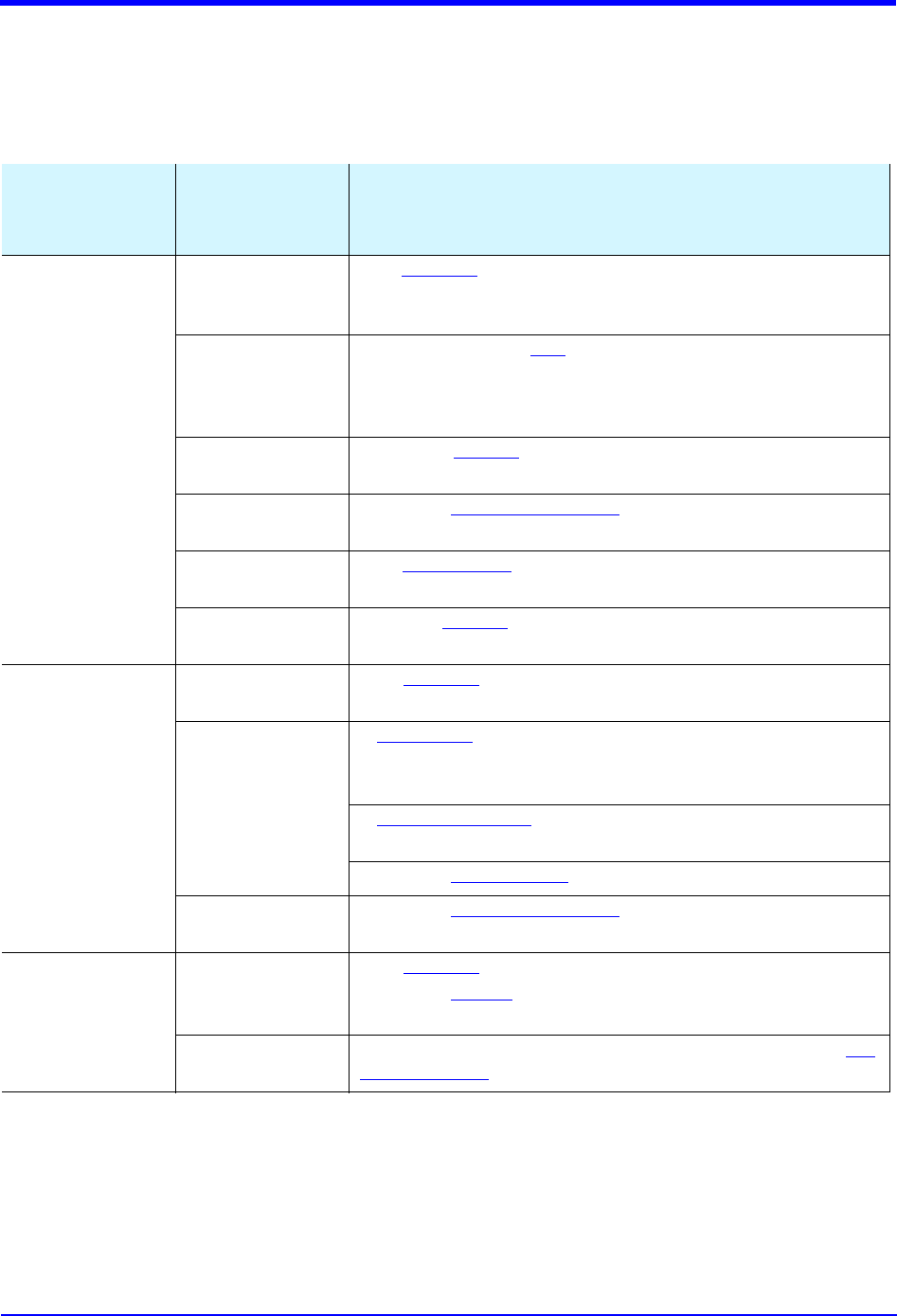

- 8.1 1100 Authorization Request

- MESSAGE TYPE IDENTIFIER

- BIT MAP - PRIMARY

- BIT MAP - SECONDARY

- PRIMARY ACCOUNT NUMBER (PAN)

- PROCESSING CODE

- AMOUNT, TRANSACTION

- DATE AND TIME, TRANSMISSION

- SYSTEMS TRACE AUDIT NUMBER

- DATE AND TIME, LOCAL TRANSACTION

- DATE, EFFECTIVE

- DATE, EXPIRATION

- DATE, SETTLEMENT

- MERCHANT TYPE

- COUNTRY CODE, ACQUIRING INSTITUTION

- POINT OF SERVICE DATA CODE

- FUNCTION CODE

- MESSAGE REASON CODE

- CARD ACCEPTOR BUSINESS CODE

- APPROVAL CODE LENGTH

- ACQUIRER REFERENCE DATA

- ACQUIRING INSTITUTION IDENTIFICATION CODE

- FORWARDING INSTITUTION IDENTIFICATION CODE

- TRACK 2 DATA

- RETRIEVAL REFERENCE NUMBER

- CARD ACCEPTOR TERMINAL IDENTIFICATION

- CARD ACCEPTOR IDENTIFICATION CODE

- CARD ACCEPTOR NAME/LOCATION

- TRACK 1 DATA

- ADDITIONAL DATA - NATIONAL

- ADDITIONAL DATA - PRIVATE

- CURRENCY CODE, TRANSACTION

- PERSONAL IDENTIFICATION NUMBER (PIN) DATA

- SECURITY RELATED CONTROL INFORMATION

- INTEGRATED CIRCUIT CARD SYSTEM RELATED DATA

- NATIONAL USE DATA

- NATIONAL USE DATA

- PRIVATE USE DATA

- PRIVATE USE DATA

- KEY MANAGEMENT DATA

- MESSAGE AUTHENTICATION CODE FIELD

- 8.2 1110 Authorization Response

- MESSAGE TYPE IDENTIFIER

- BIT MAP - PRIMARY

- PRIMARY ACCOUNT NUMBER (PAN)

- PROCESSING CODE

- AMOUNT, TRANSACTION

- DATE AND TIME, TRANSMISSION

- SYSTEMS TRACE AUDIT NUMBER

- DATE AND TIME, LOCAL TRANSACTION

- DATE, SETTLEMENT

- AMOUNTS, ORIGINAL

- ACQUIRER REFERENCE DATA

- ACQUIRING INSTITUTION IDENTIFICATION CODE

- PRIMARY ACCOUNT NUMBER, EXTENDED

- PRIMARY ACCOUNT NUMBER, EXTENDED (continued)

- RETRIEVAL REFERENCE NUMBER

- APPROVAL CODE

- ACTION CODE

- CARD ACCEPTOR TERMINAL IDENTIFICATION

- CARD ACCEPTOR IDENTIFICATION CODE

- ADDITIONAL RESPONSE DATA

- CURRENCY CODE, TRANSACTION

- AMOUNTS, ADDITIONAL

- INTEGRATED CIRCUIT CARD SYSTEM RELATED DATA

- NATIONAL USE DATA

- NATIONAL USE DATA

- PRIVATE USE DATA

- PRIVATE USE DATA

- MESSAGE AUTHENTICATION CODE FIELD

- 8.1 1100 Authorization Request

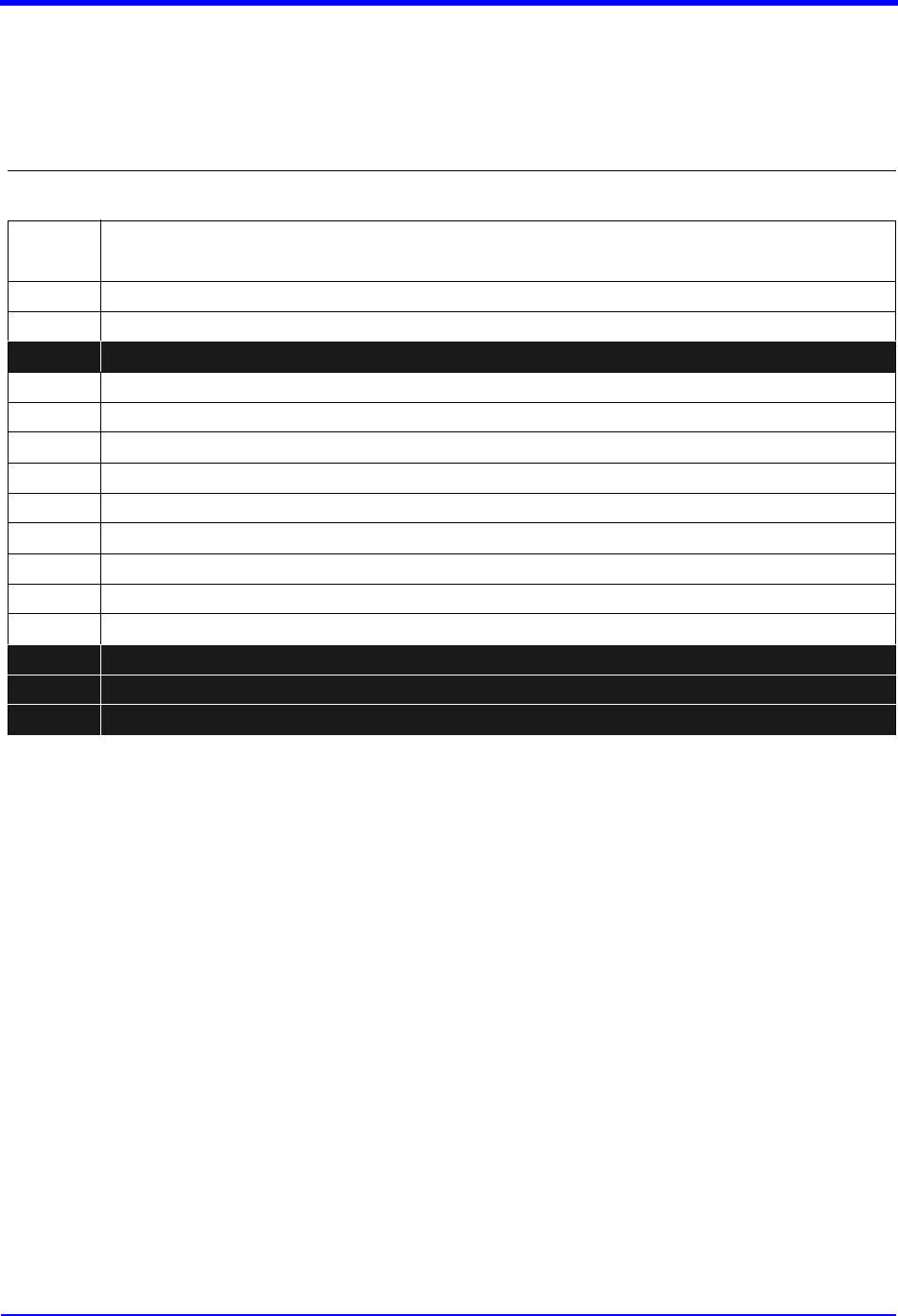

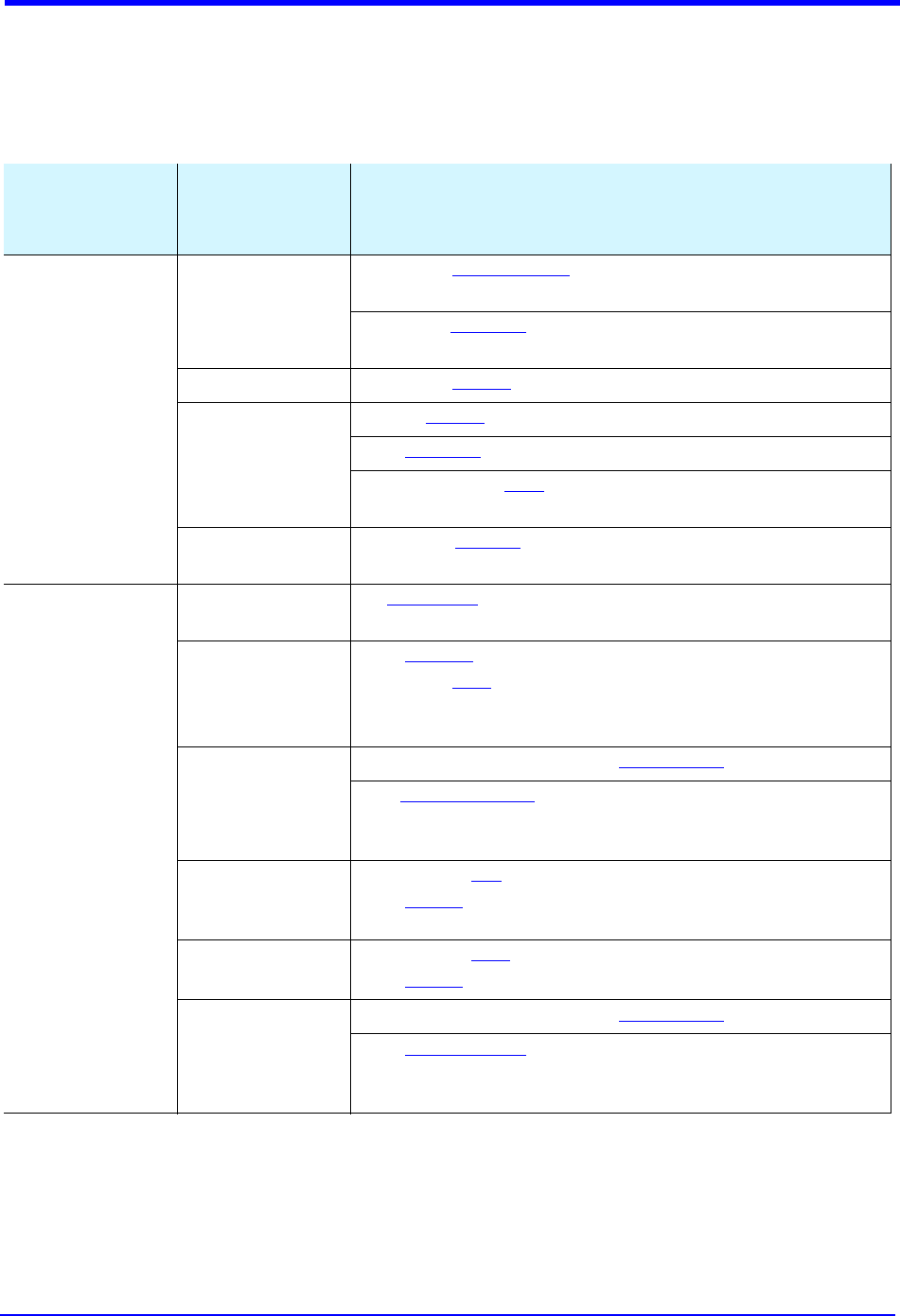

- 9.0 ISO 8583 Reversal Advice Request/Response Message Formats

- 9.1 1420 Reversal Advice Request

- MESSAGE TYPE IDENTIFIER

- BIT MAP - PRIMARY

- PRIMARY ACCOUNT NUMBER (PAN)

- PROCESSING CODE

- AMOUNT, TRANSACTION

- SYSTEMS TRACE AUDIT NUMBER

- DATE AND TIME, LOCAL TRANSACTION

- DATE, EXPIRATION

- COUNTRY CODE, ACQUIRING INSTITUTION

- POINT OF SERVICE DATA CODE

- MESSAGE REASON CODE

- CARD ACCEPTOR BUSINESS CODE

- ACQUIRER REFERENCE DATA

- ACQUIRING INSTITUTION IDENTIFICATION CODE

- FORWARDING INSTITUTION IDENTIFICATION CODE

- RETRIEVAL REFERENCE NUMBER

- CARD ACCEPTOR TERMINAL IDENTIFICATION

- CARD ACCEPTOR IDENTIFICATION CODE

- CURRENCY CODE, TRANSACTION

- ORIGINAL DATA ELEMENTS

- PRIVATE USE DATA

- MESSAGE AUTHENTICATION CODE FIELD

- 9.2 1430 Reversal Advice Response

- MESSAGE TYPE IDENTIFIER

- BIT MAP - PRIMARY

- PRIMARY ACCOUNT NUMBER (PAN)

- PROCESSING CODE

- AMOUNT, TRANSACTION

- SYSTEMS TRACE AUDIT NUMBER

- DATE AND TIME, LOCAL TRANSACTION

- ACQUIRER REFERENCE DATA

- ACQUIRING INSTITUTION IDENTIFICATION CODE

- RETRIEVAL REFERENCE NUMBER

- ACTION CODE

- CARD ACCEPTOR TERMINAL IDENTIFICATION

- CARD ACCEPTOR IDENTIFICATION CODE

- CURRENCY CODE, TRANSACTION

- MESSAGE AUTHENTICATION CODE FIELD

- 9.1 1420 Reversal Advice Request

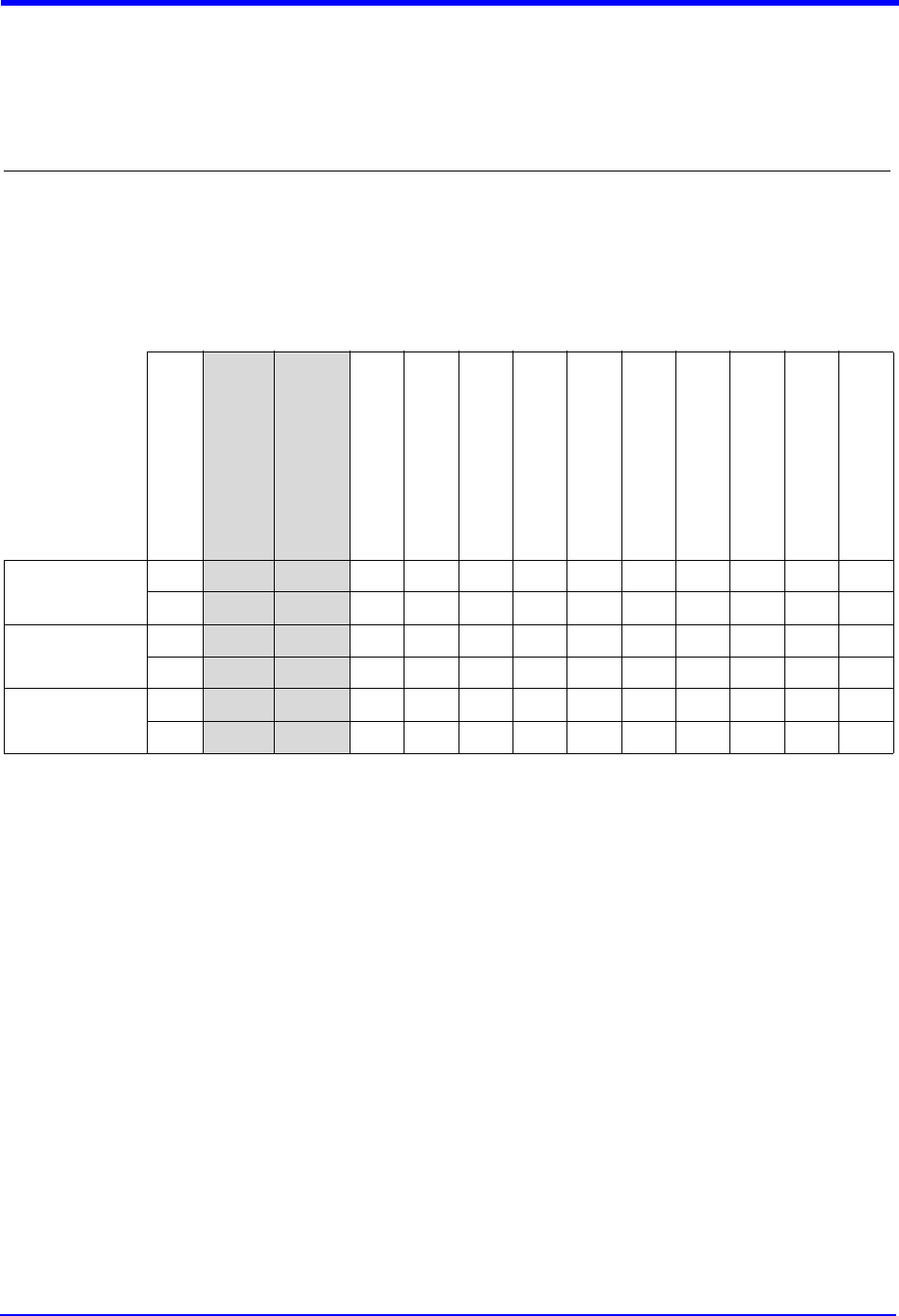

- 10.0 ISO 8583 Network Management Request/Response Message Formats

- 10.1 1804 Network Management Request

- MESSAGE TYPE IDENTIFIER

- BIT MAP - PRIMARY

- BIT MAP - SECONDARY

- PROCESSING CODE

- SYSTEMS TRACE AUDIT NUMBER

- DATE AND TIME, LOCAL TRANSACTION

- FUNCTION CODE

- MESSAGE REASON CODE

- FORWARDING INSTITUTION IDENTIFICATION CODE

- TRANSACTION DESTINATION INSTITUTION IDENTIFICATION CODE

- TRANSACTION ORIGINATOR INSTITUTION IDENTIFICATION CODE

- KEY MANAGEMENT DATA

- RECEIVING INSTITUTION IDENTIFICATION CODE

- MESSAGE AUTHENTICATION CODE FIELD

- 10.2 1814 Network Management Response

- MESSAGE TYPE IDENTIFIER

- BIT MAP - PRIMARY

- BIT MAP - SECONDARY

- PROCESSING CODE

- SYSTEMS TRACE AUDIT NUMBER

- DATE AND TIME, LOCAL TRANSACTION

- FUNCTION CODE

- FORWARDING INSTITUTION IDENTIFICATION CODE

- ACTION CODE

- TRANSACTION DESTINATION INSTITUTION IDENTIFICATION CODE

- TRANSACTION ORIGINATOR INSTITUTION IDENTIFICATION CODE

- KEY MANAGEMENT DATA

- RECEIVING INSTITUTION IDENTIFICATION CODE

- MESSAGE AUTHENTICATION CODE FIELD

- 10.1 1804 Network Management Request

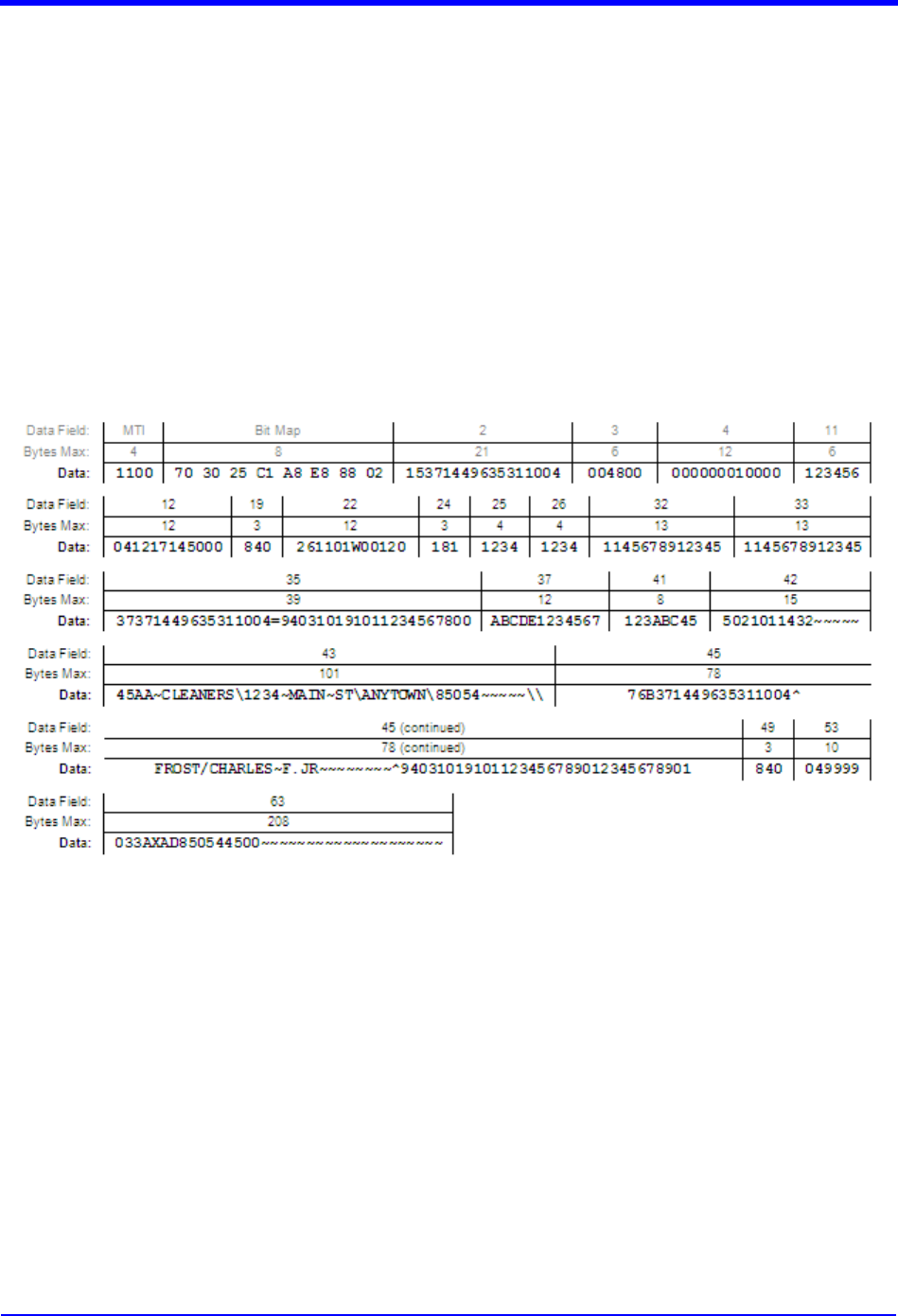

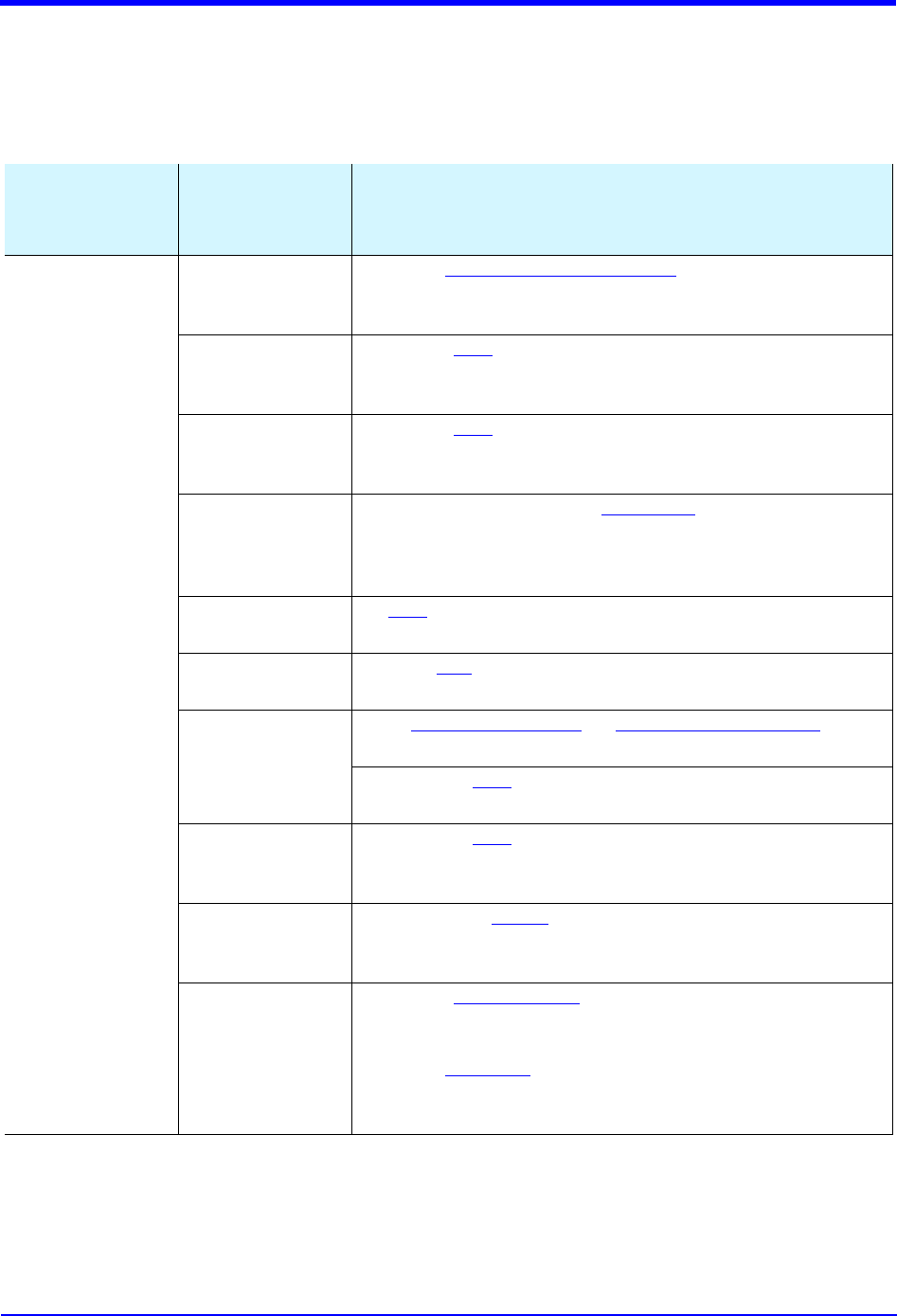

- 11.0 Examples of Typical Message Formats

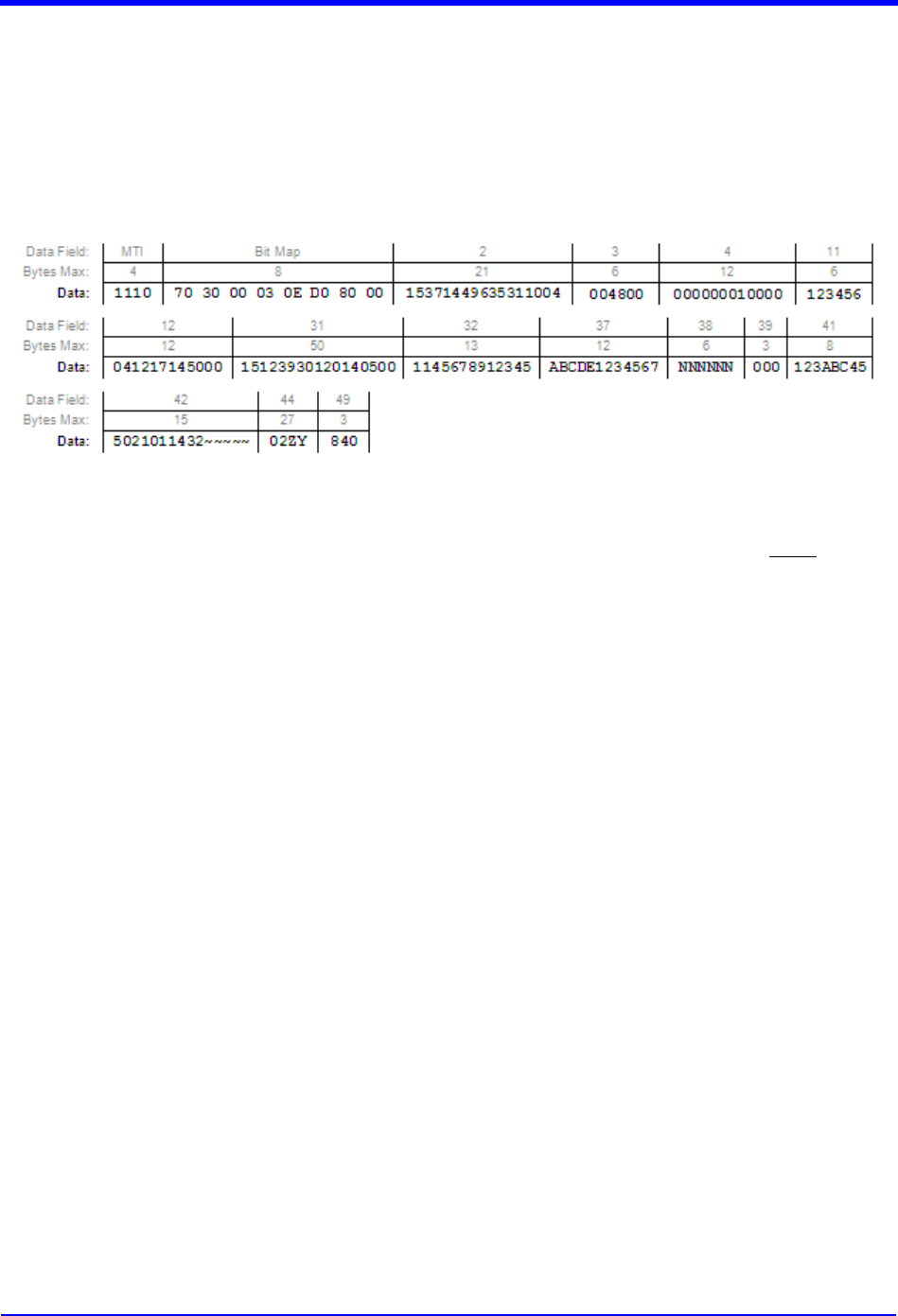

- 11.1 1100 Authorization Request Message — Card Present Transaction with AAV & CID/4DBC/4CSC — American Express

- 11.2 1100 Authorization Request Message — Card Not Present Transaction with AAV & CID/4DBC/4CSC — American Express

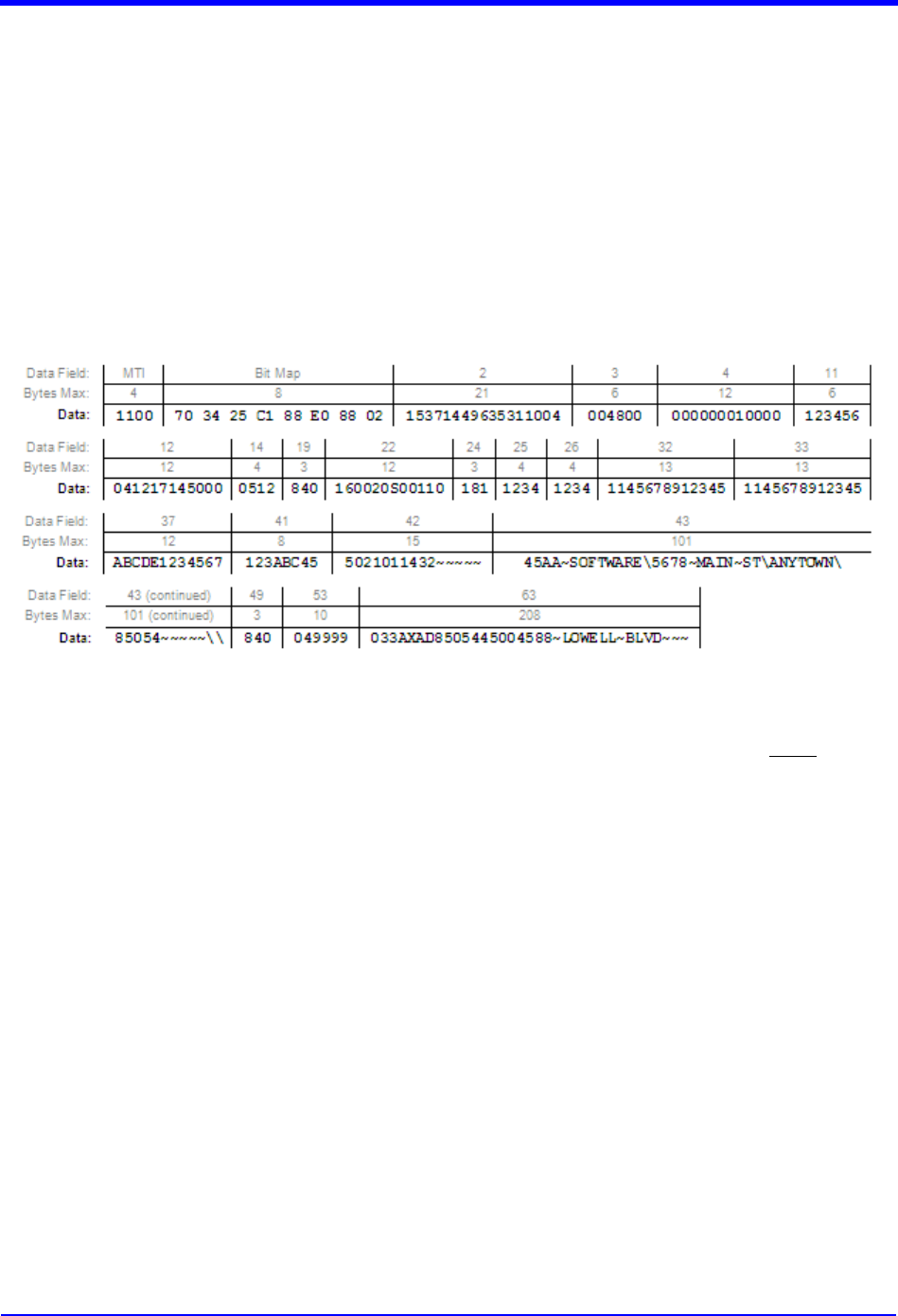

- 11.3 1110 Authorization Response Message — American Express

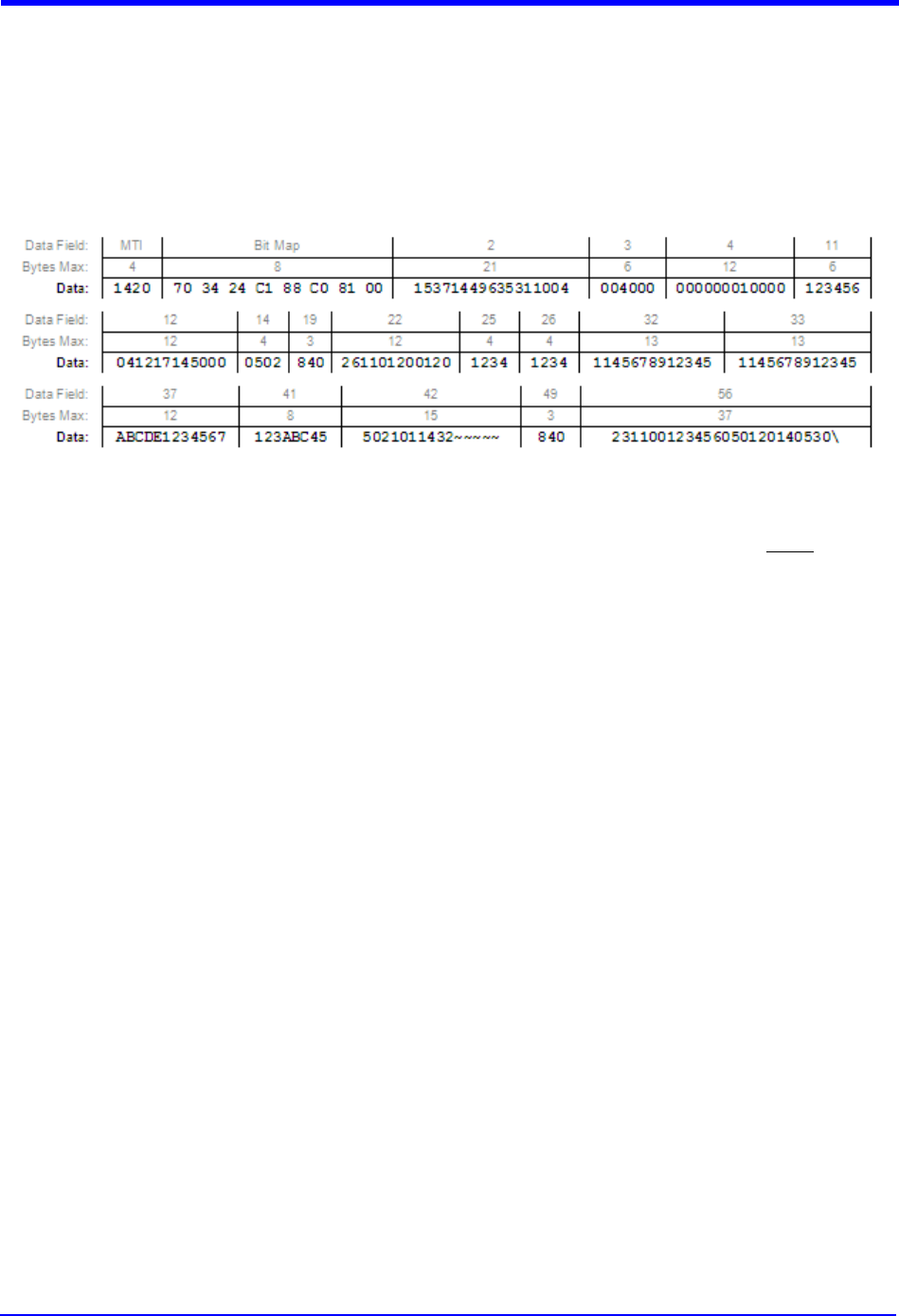

- 11.4 1420 Reversal Advice Request Message

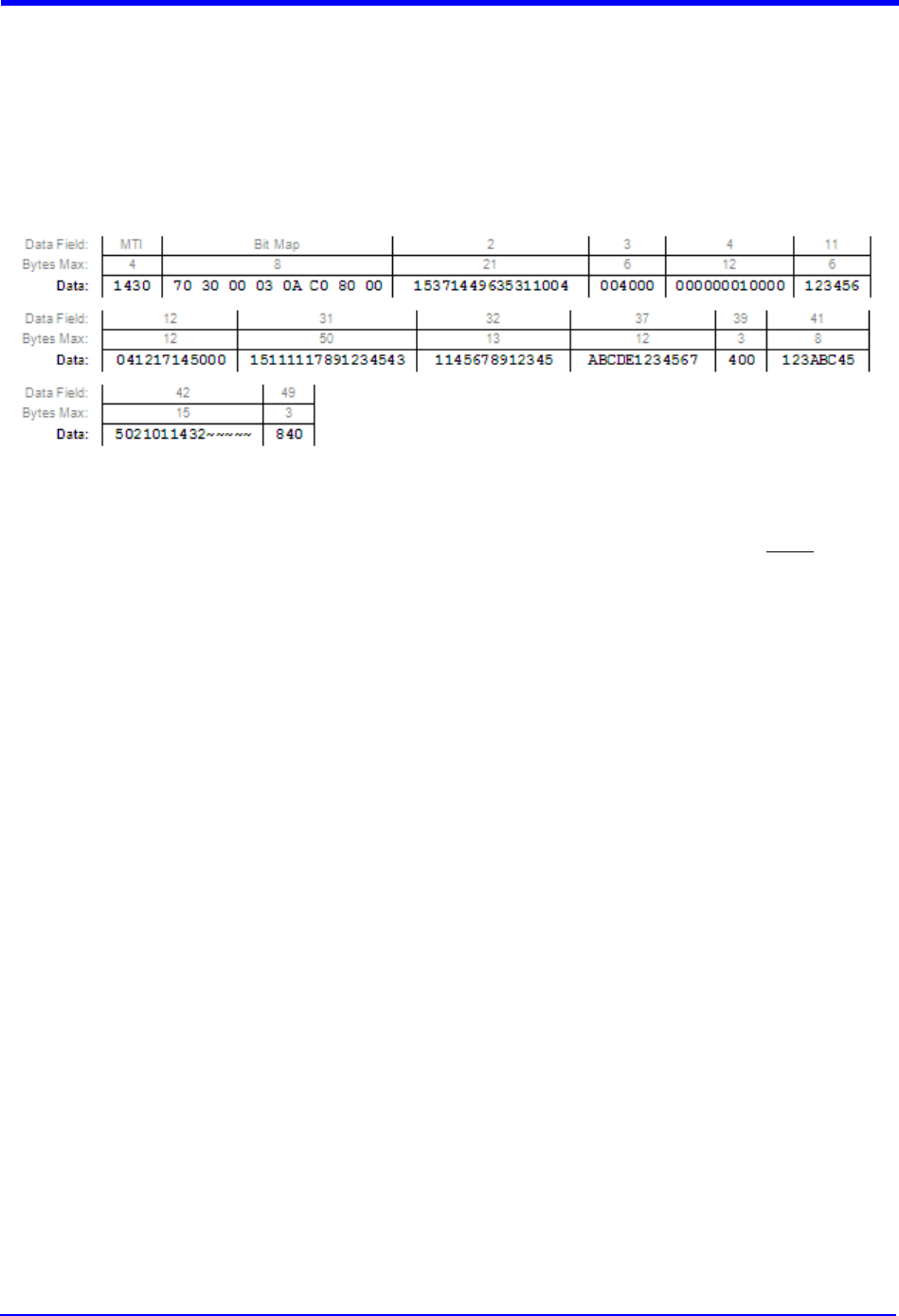

- 11.5 1430 Reversal Advice Response Message

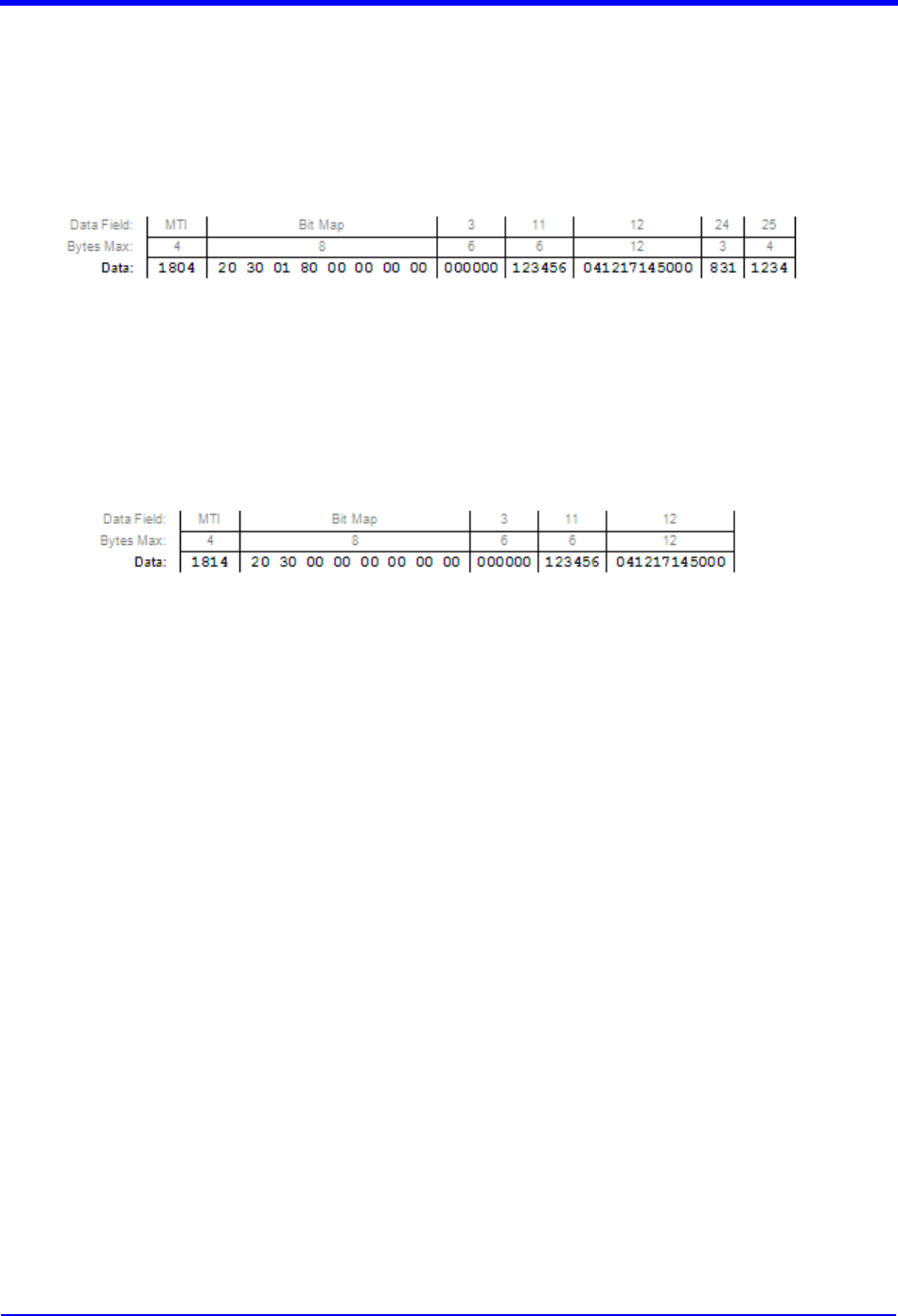

- 11.6 1804 Network Management Request Message

- 11.7 1814 Network Management Response Message

- 12.0 Revision Log

AMERICAN EXPRESS

GLOBAL CREDIT AUTHORIZATION GUIDE

ISO 8583:1993 (VERSION 1)

APRIL 2016

GLOBAL MERCHANT SERVICES

table of contents

Copyright © 2004-2016 American Express Travel Related Services Company, Inc. All rights reserved. This

document contains sensitive, confidential and trade secret information; and no part of it shall be disclosed to

third parties or reproduced in any form or by any electronic or mechanical means, including without limitation

information storage and retrieval systems, without the express prior written consent of American Express

Travel Related Services Company, Inc.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 i

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

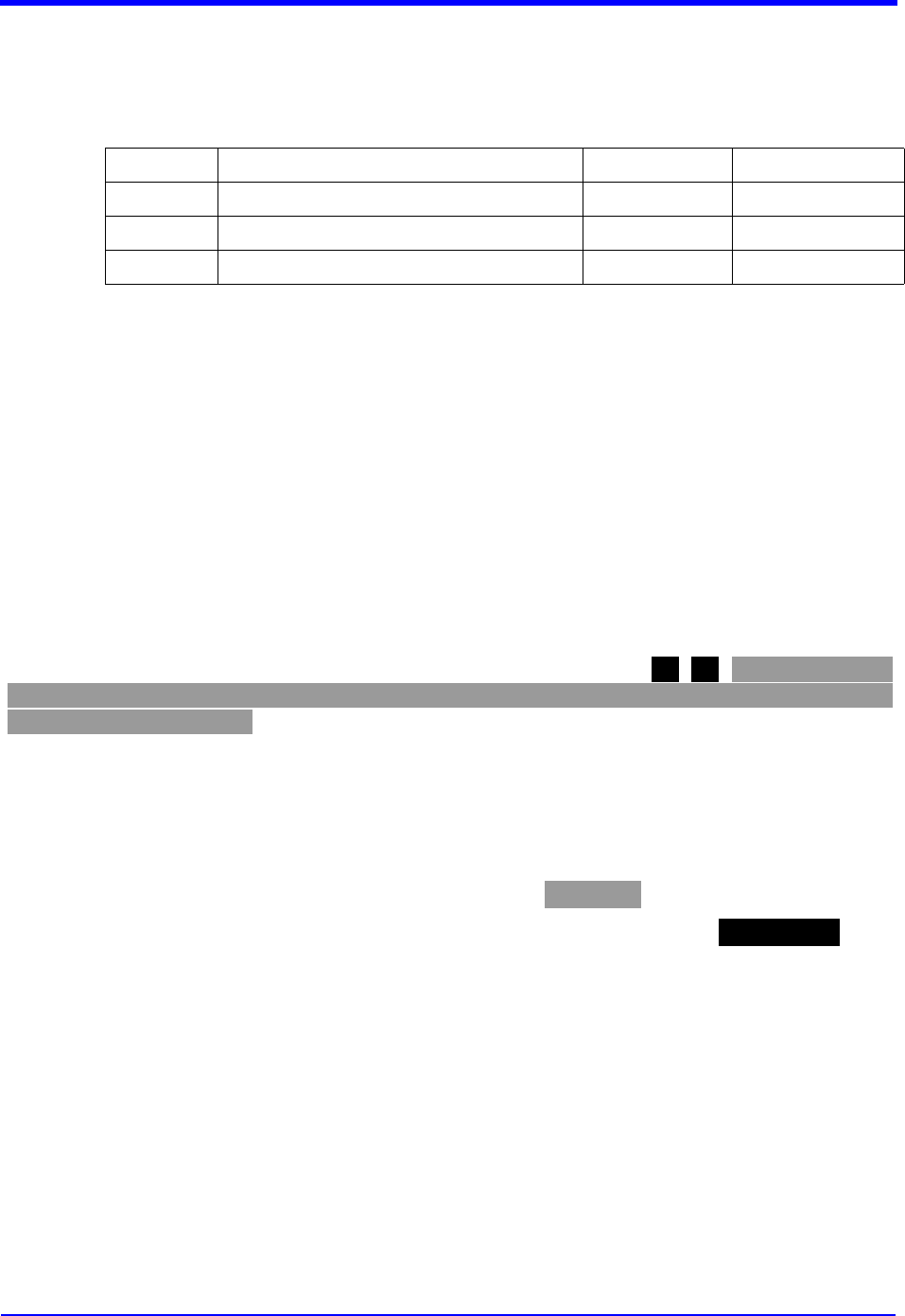

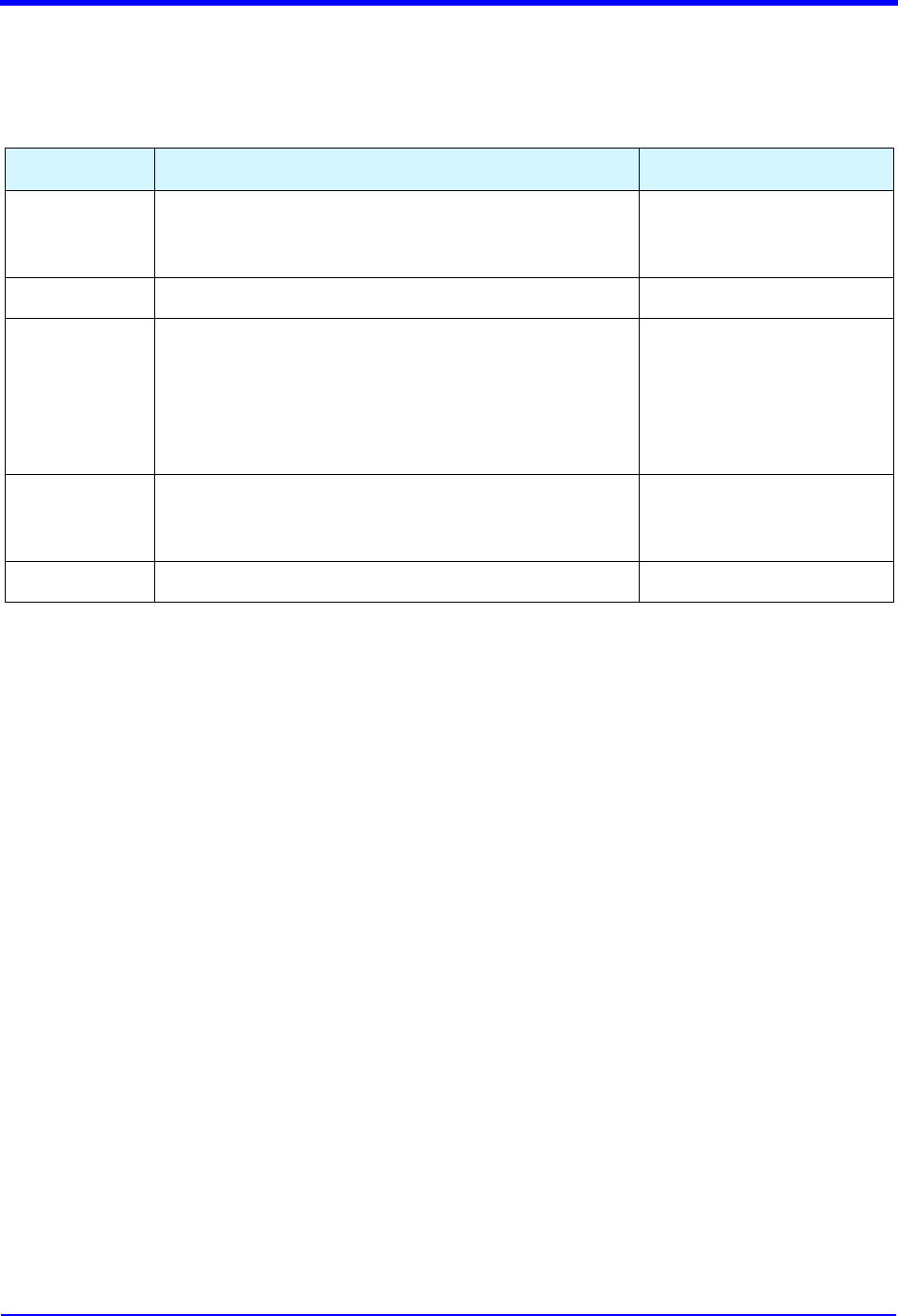

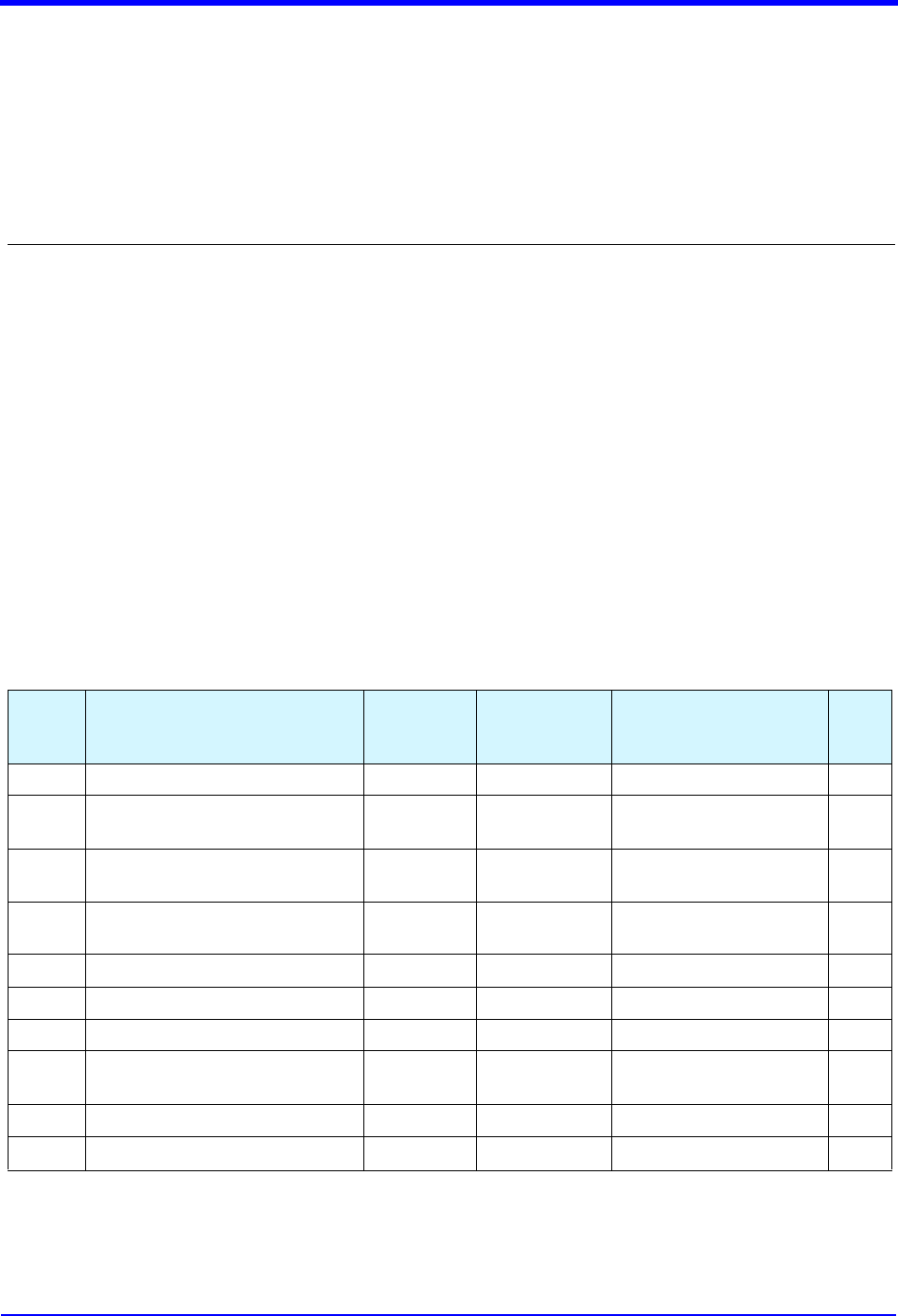

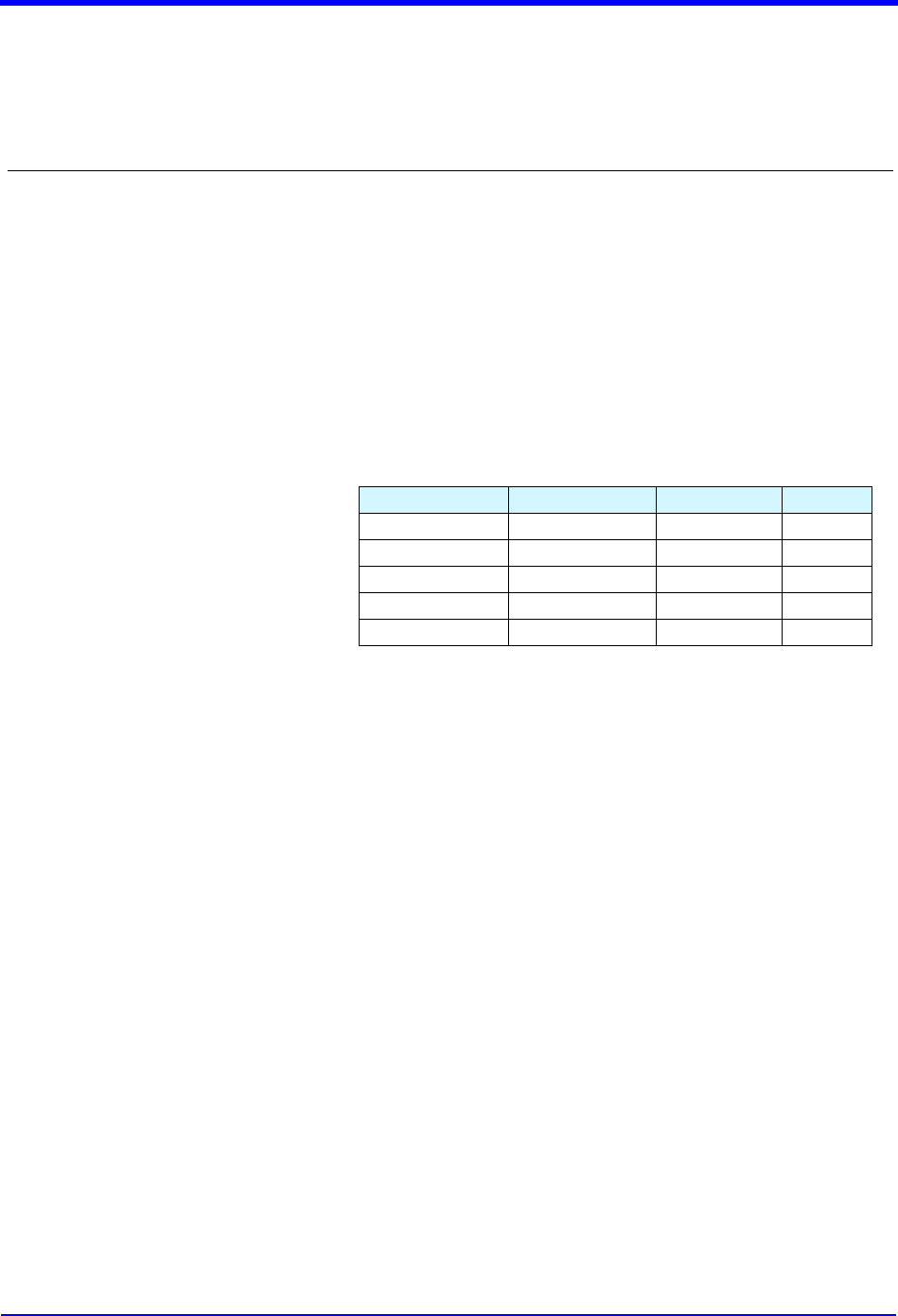

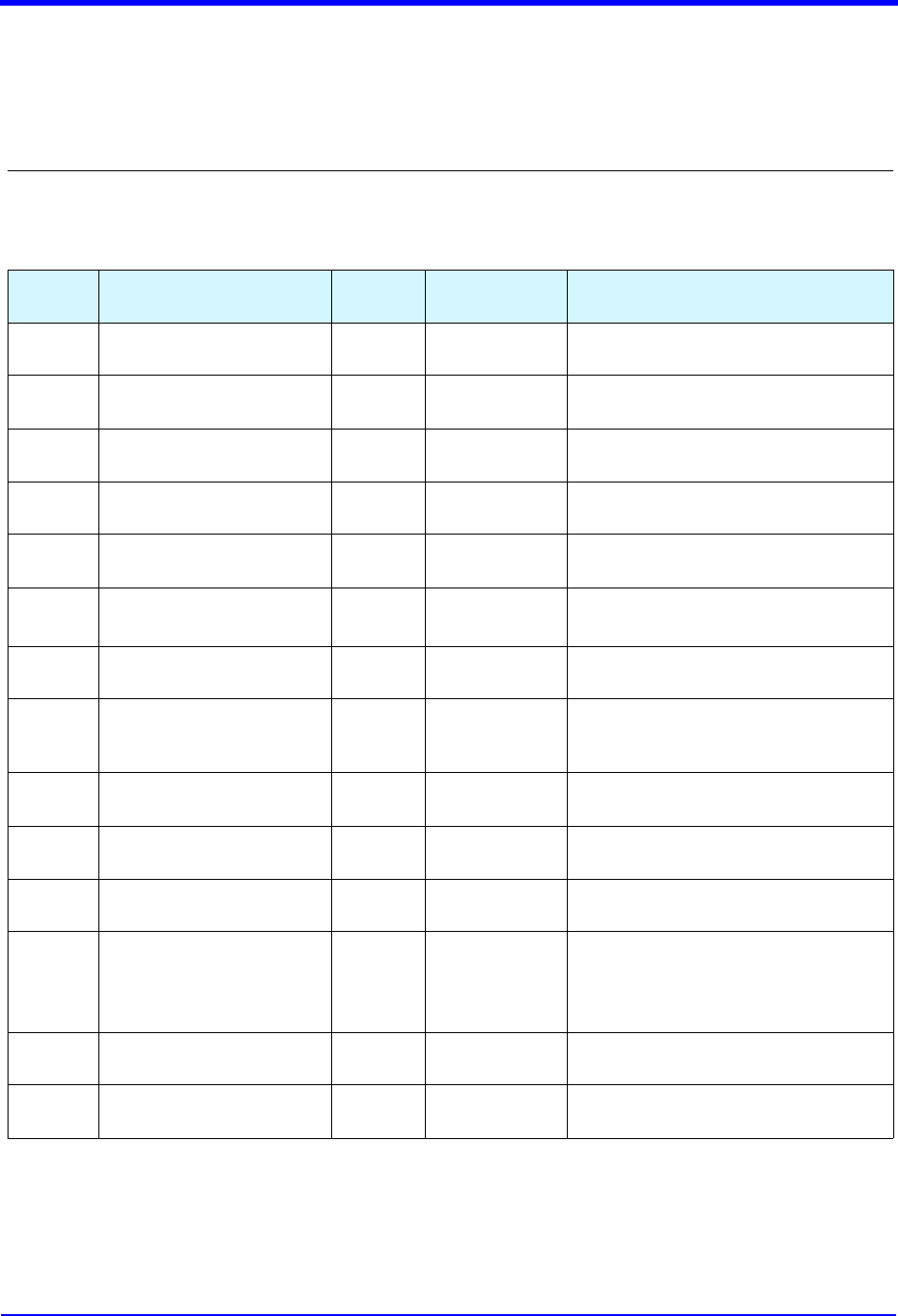

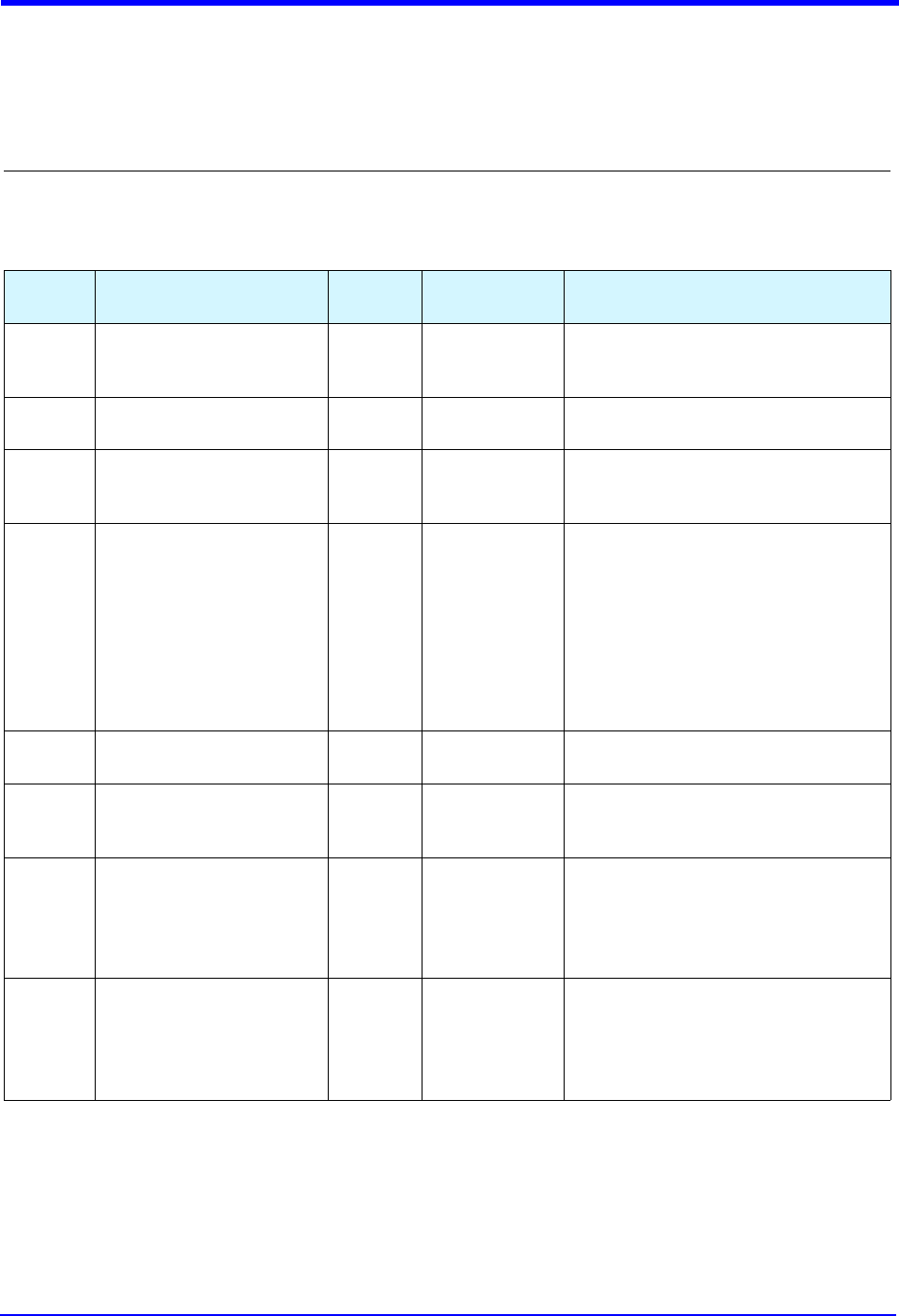

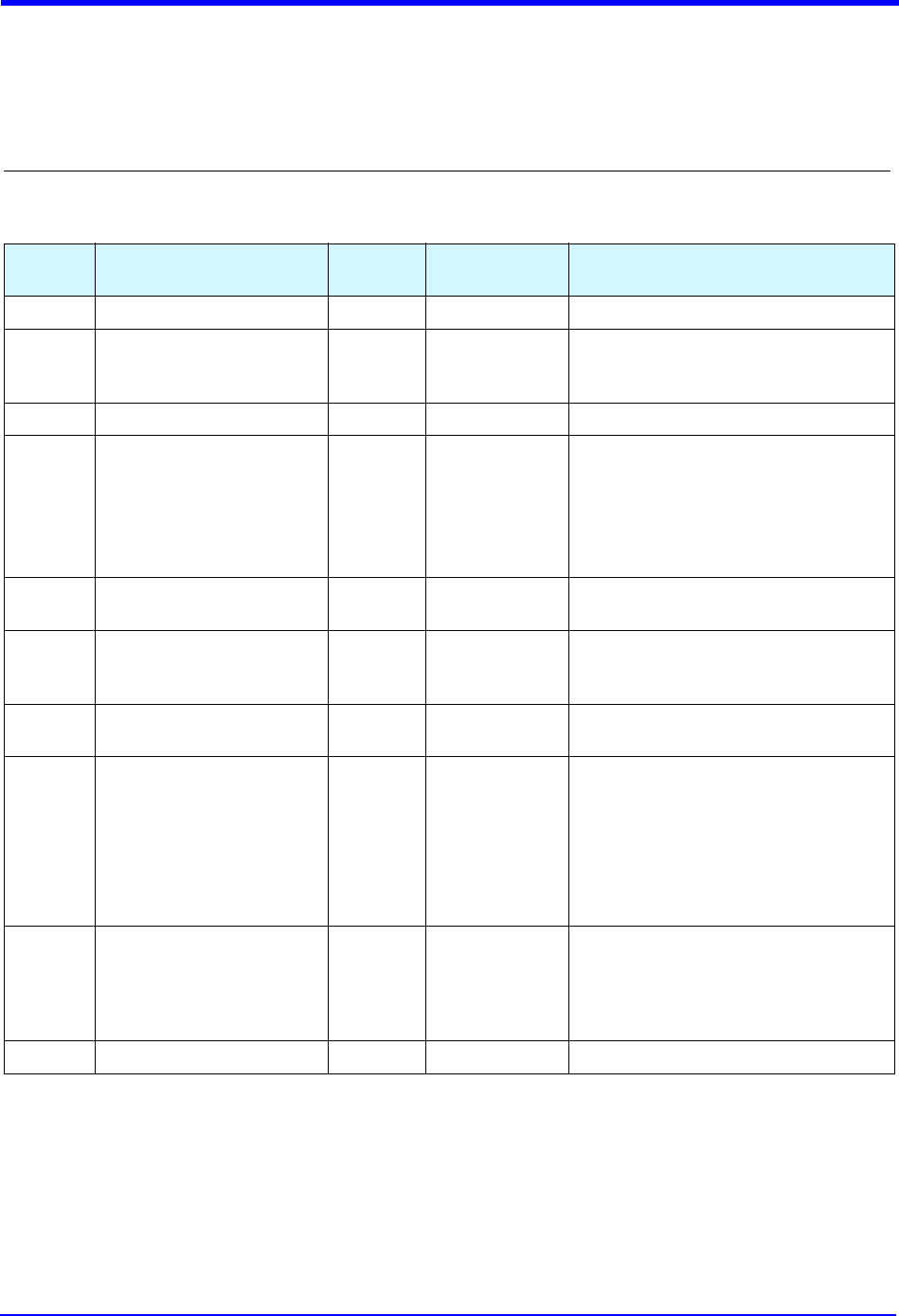

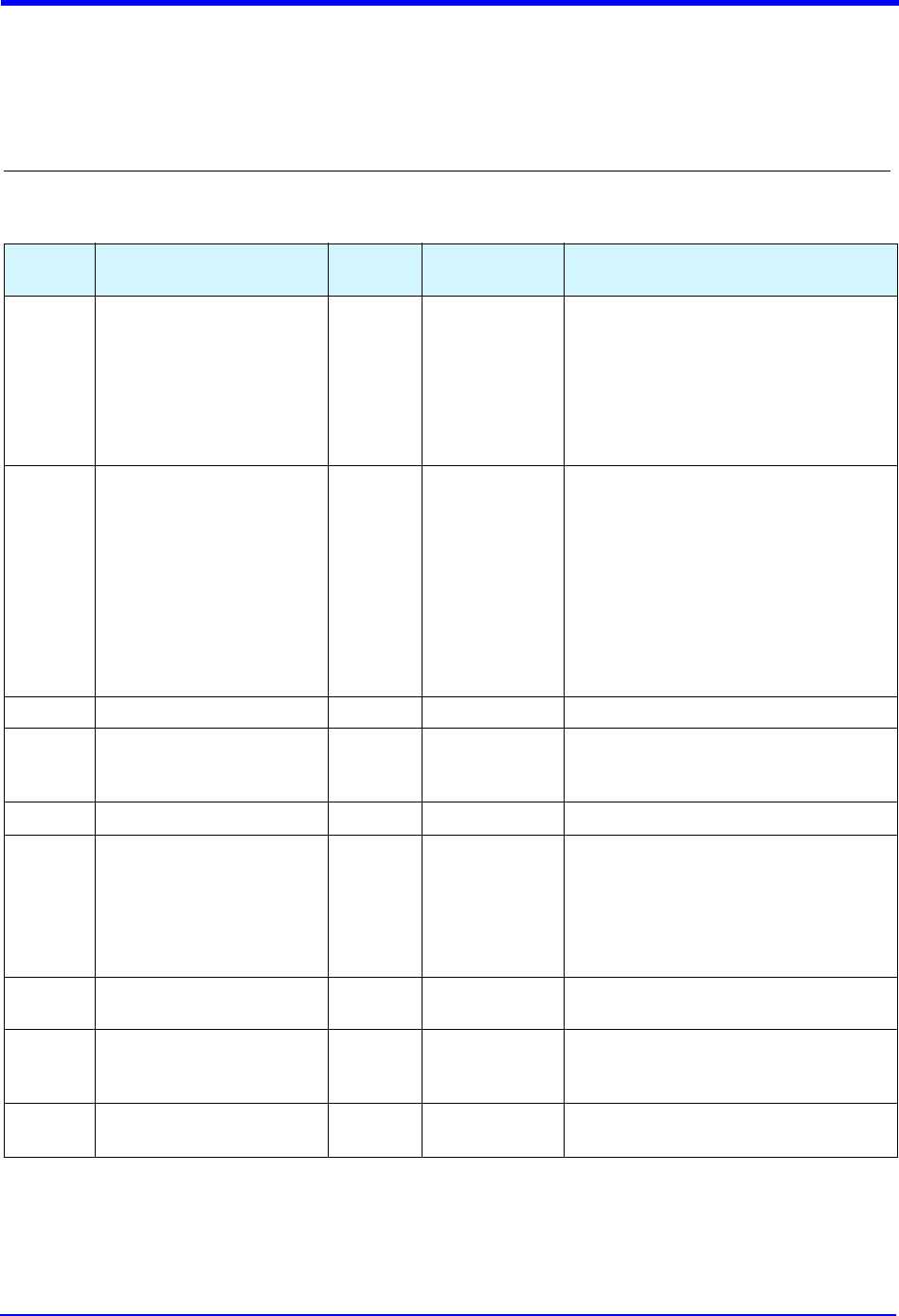

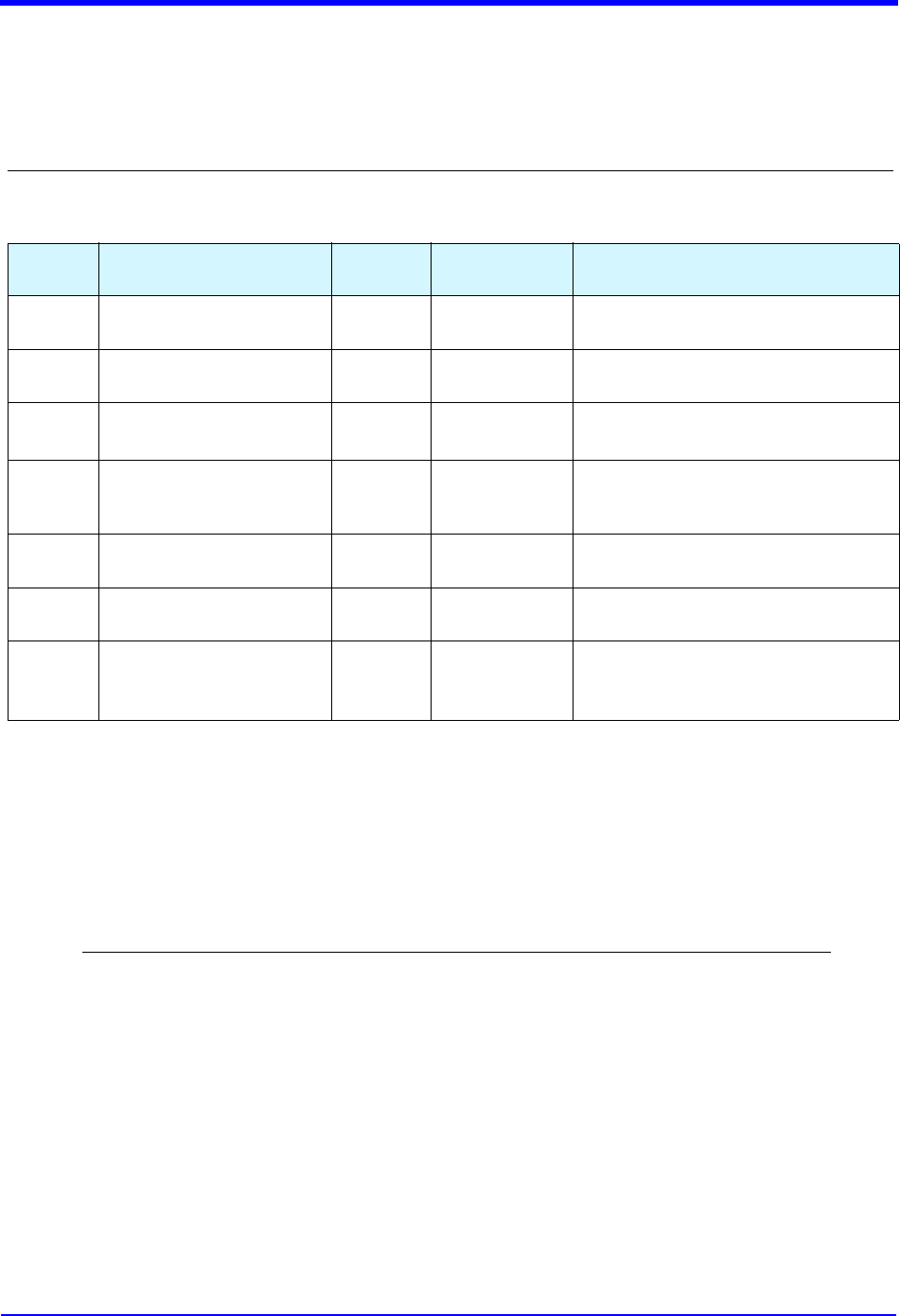

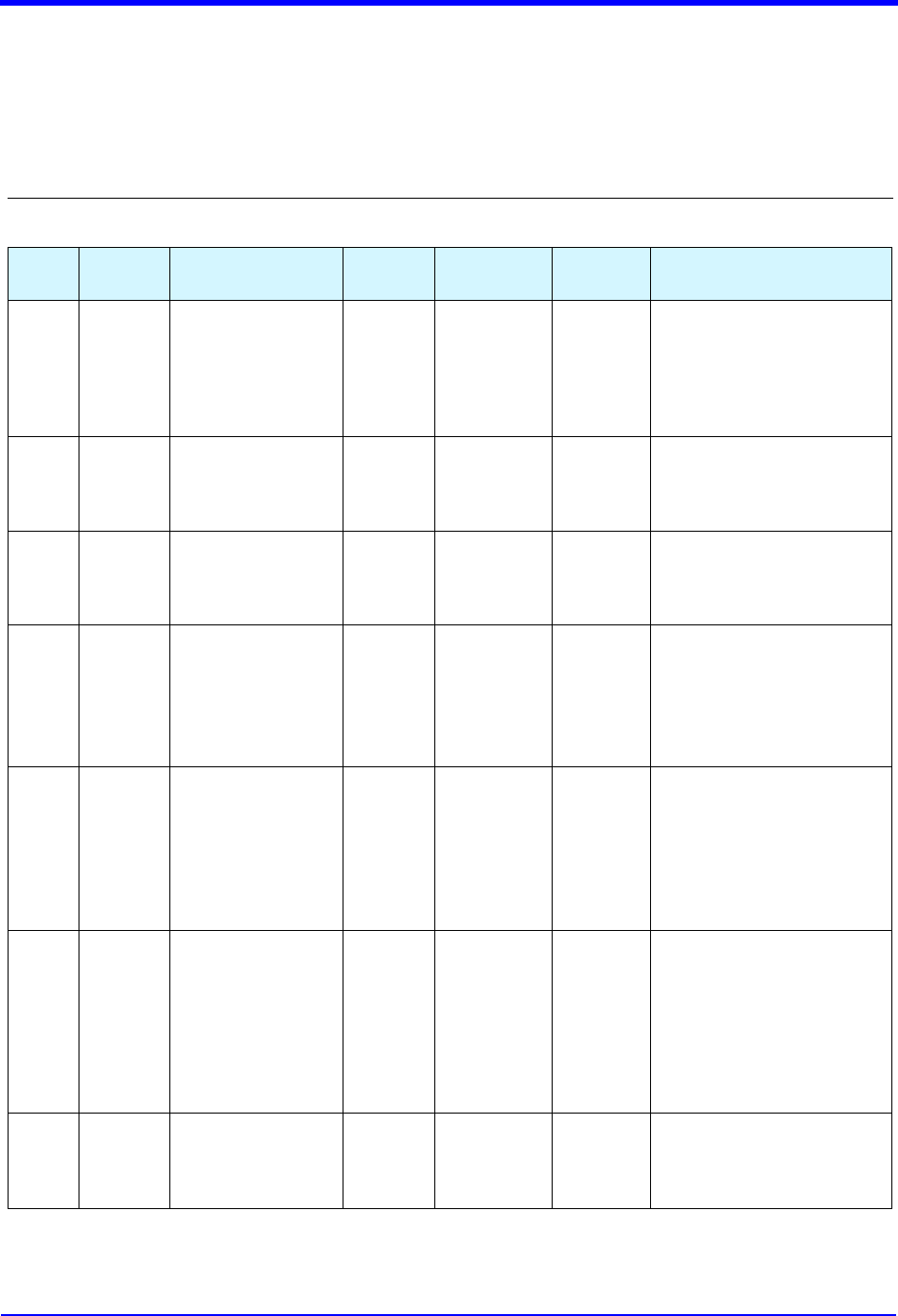

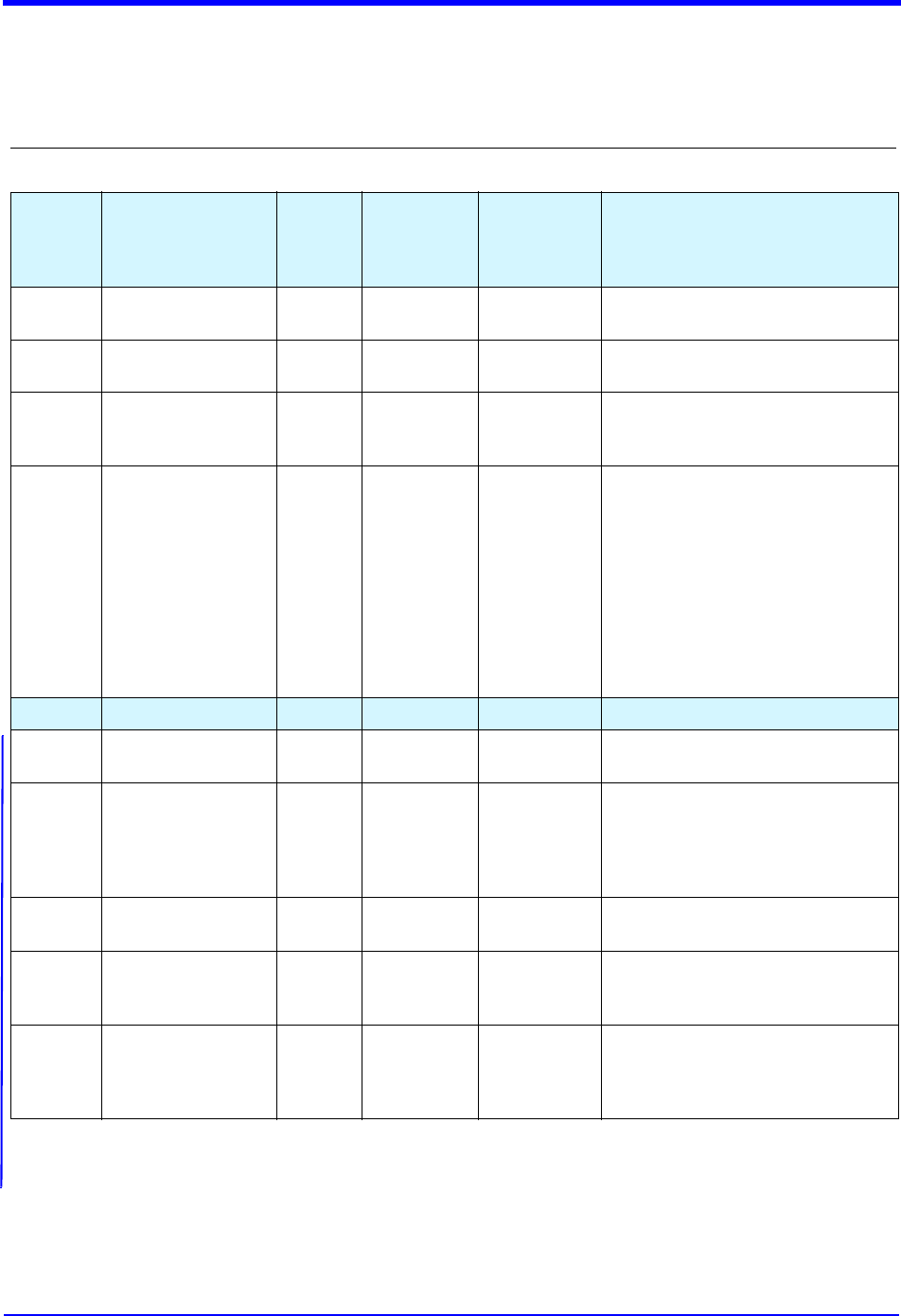

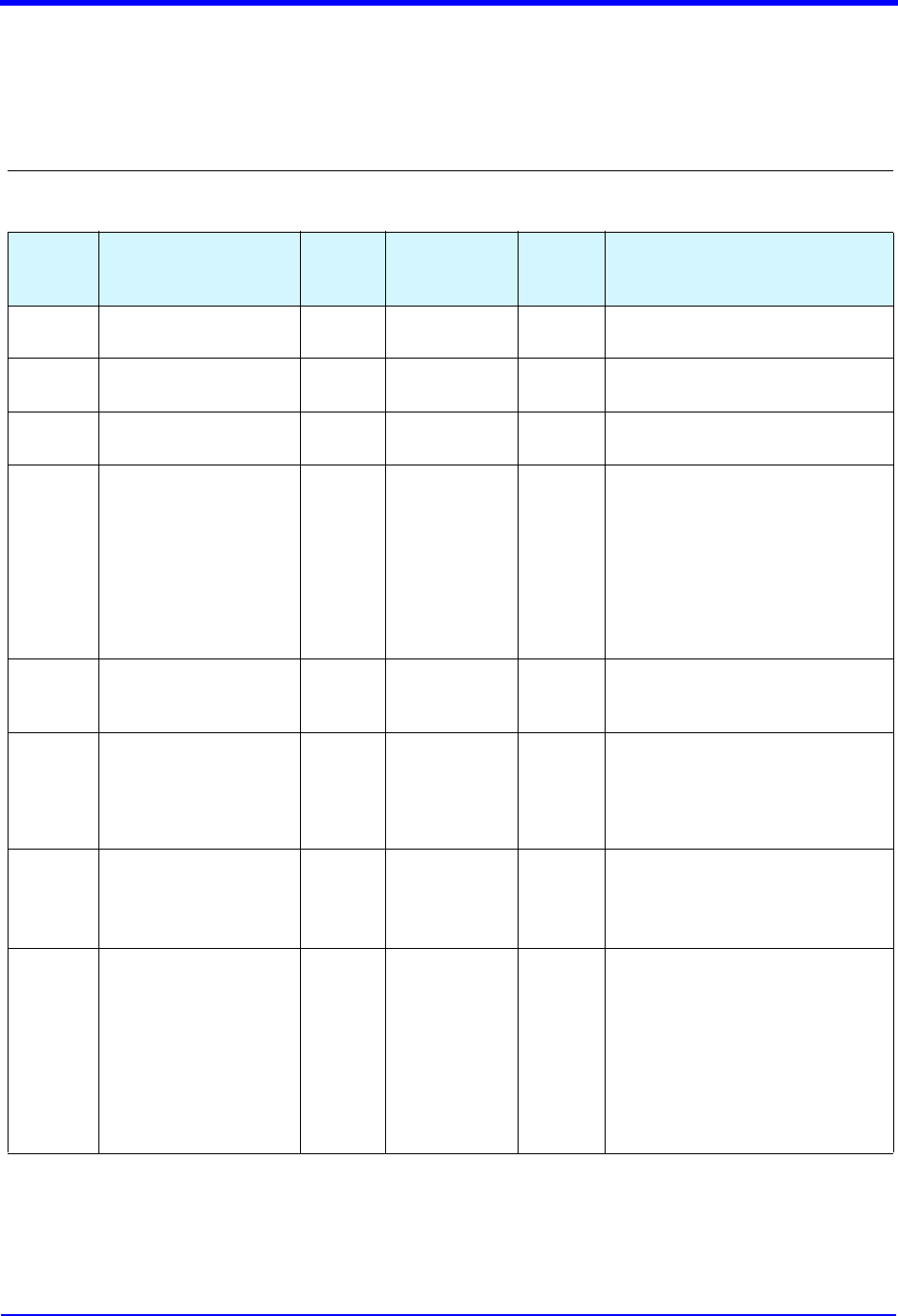

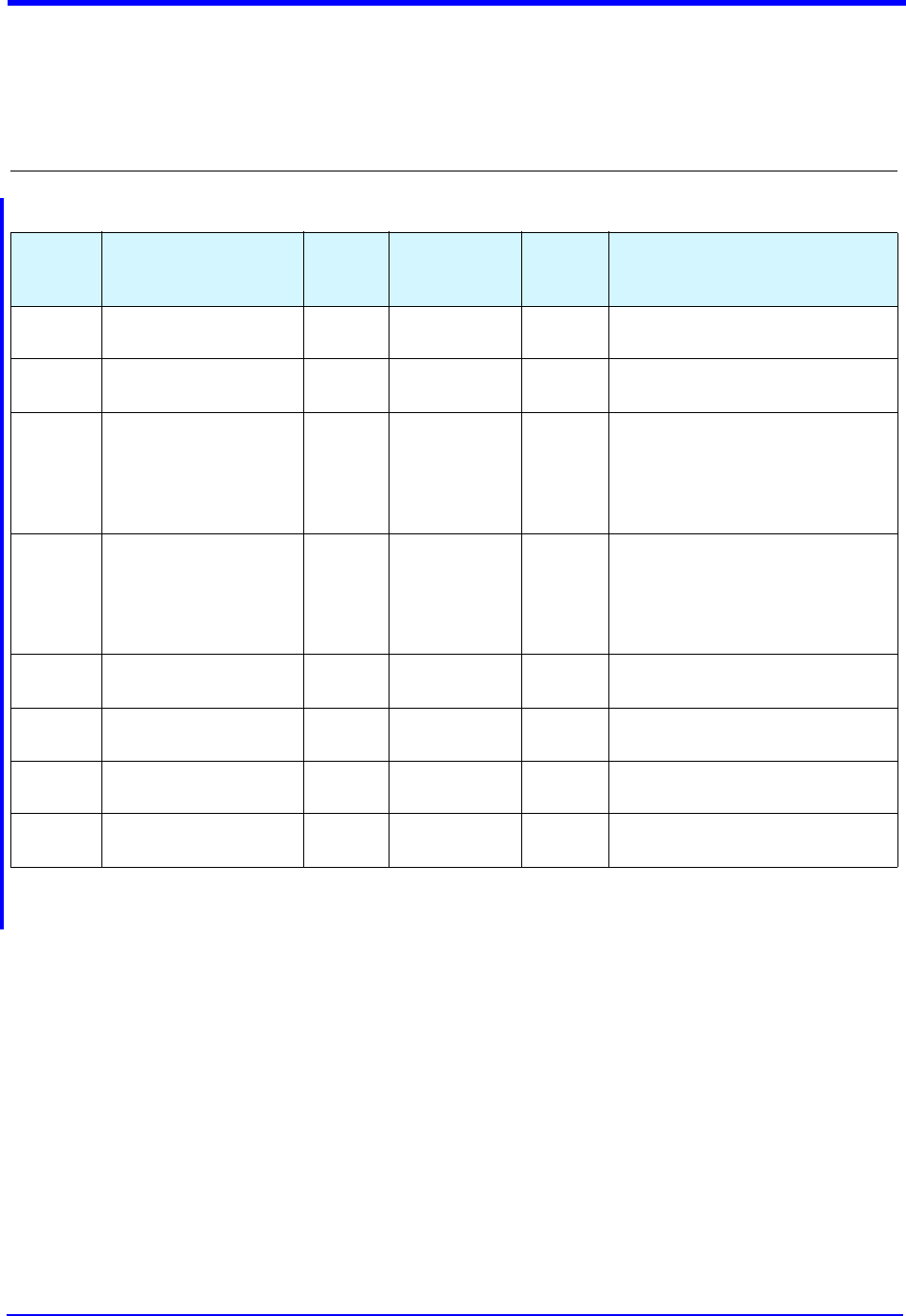

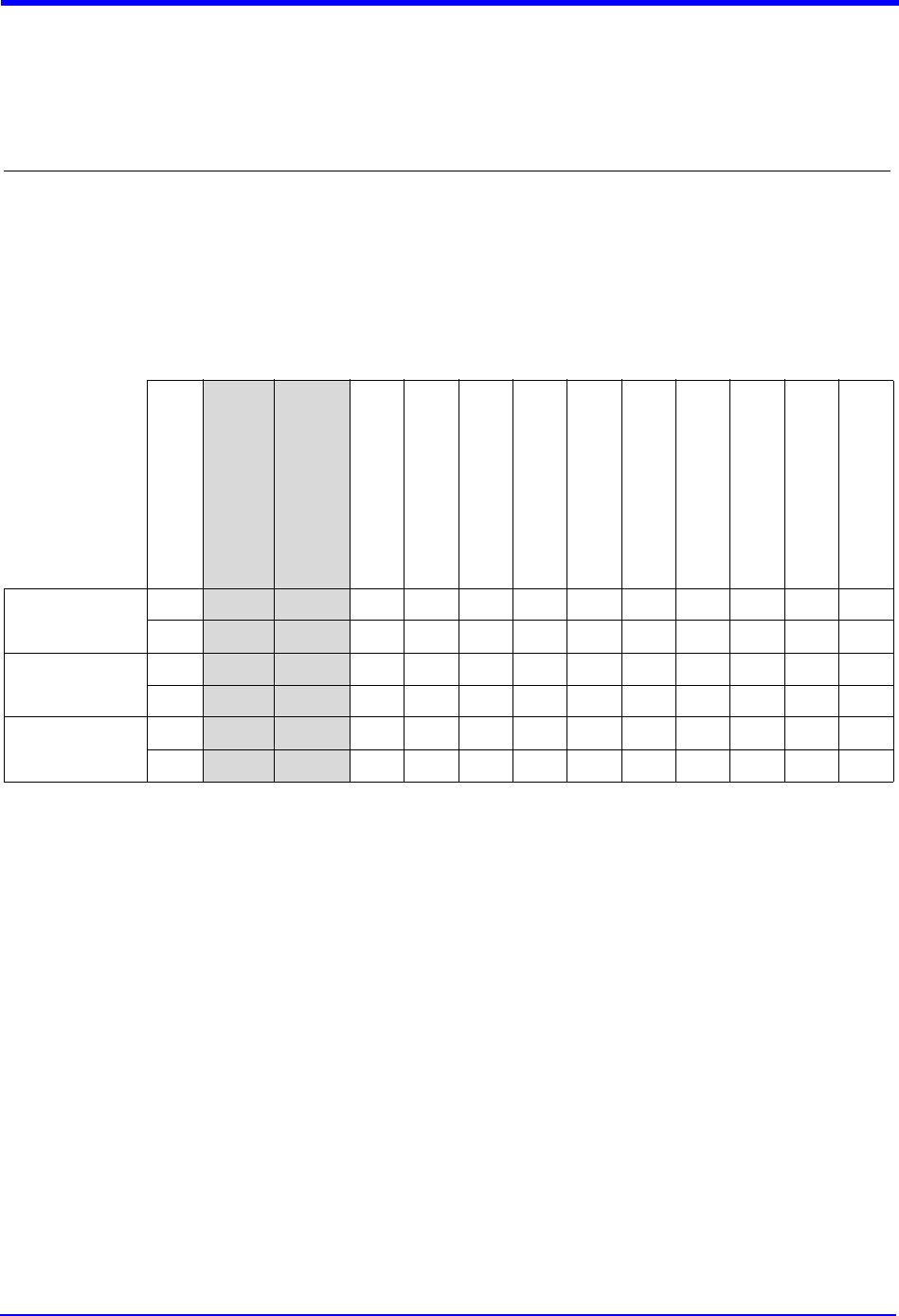

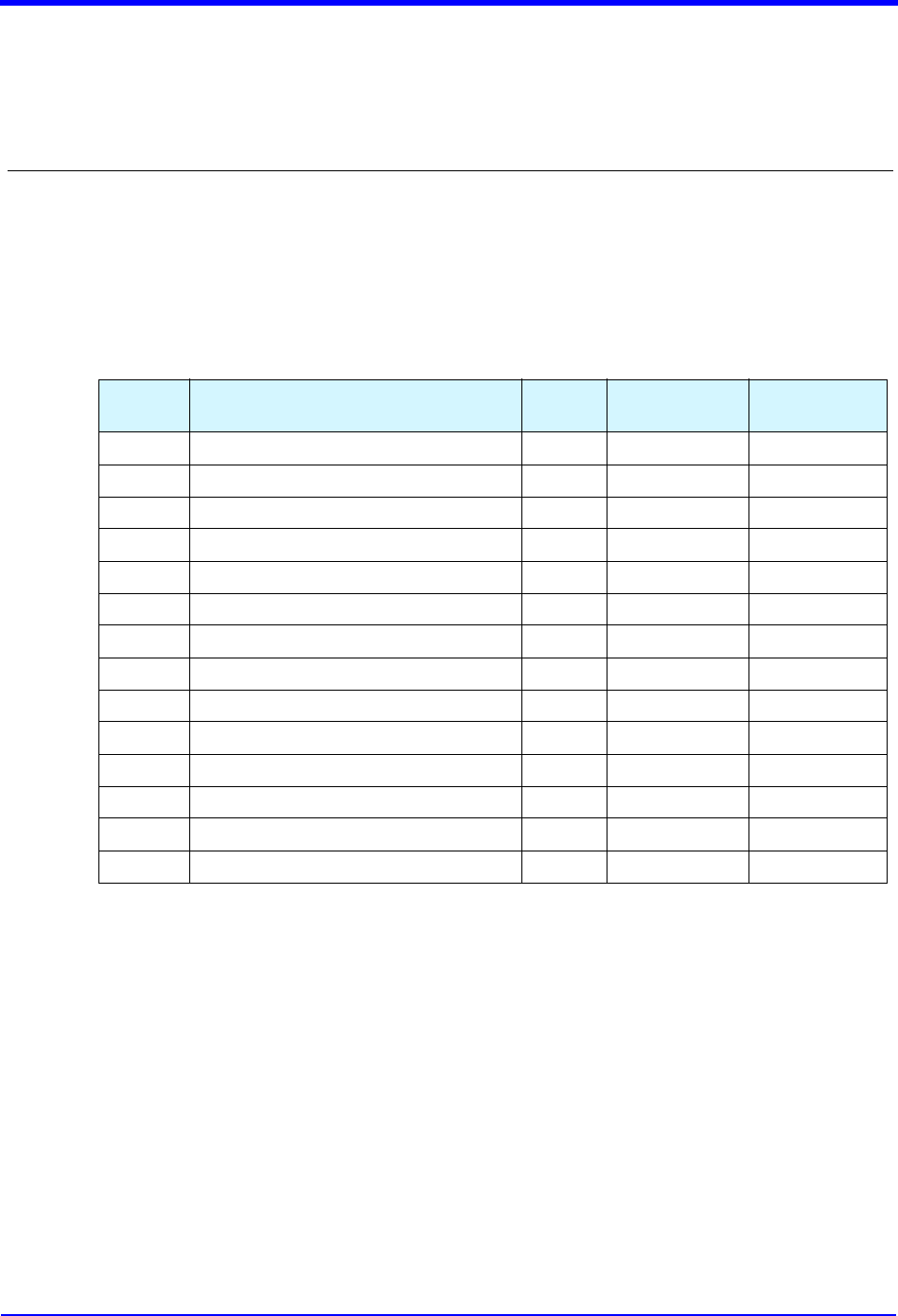

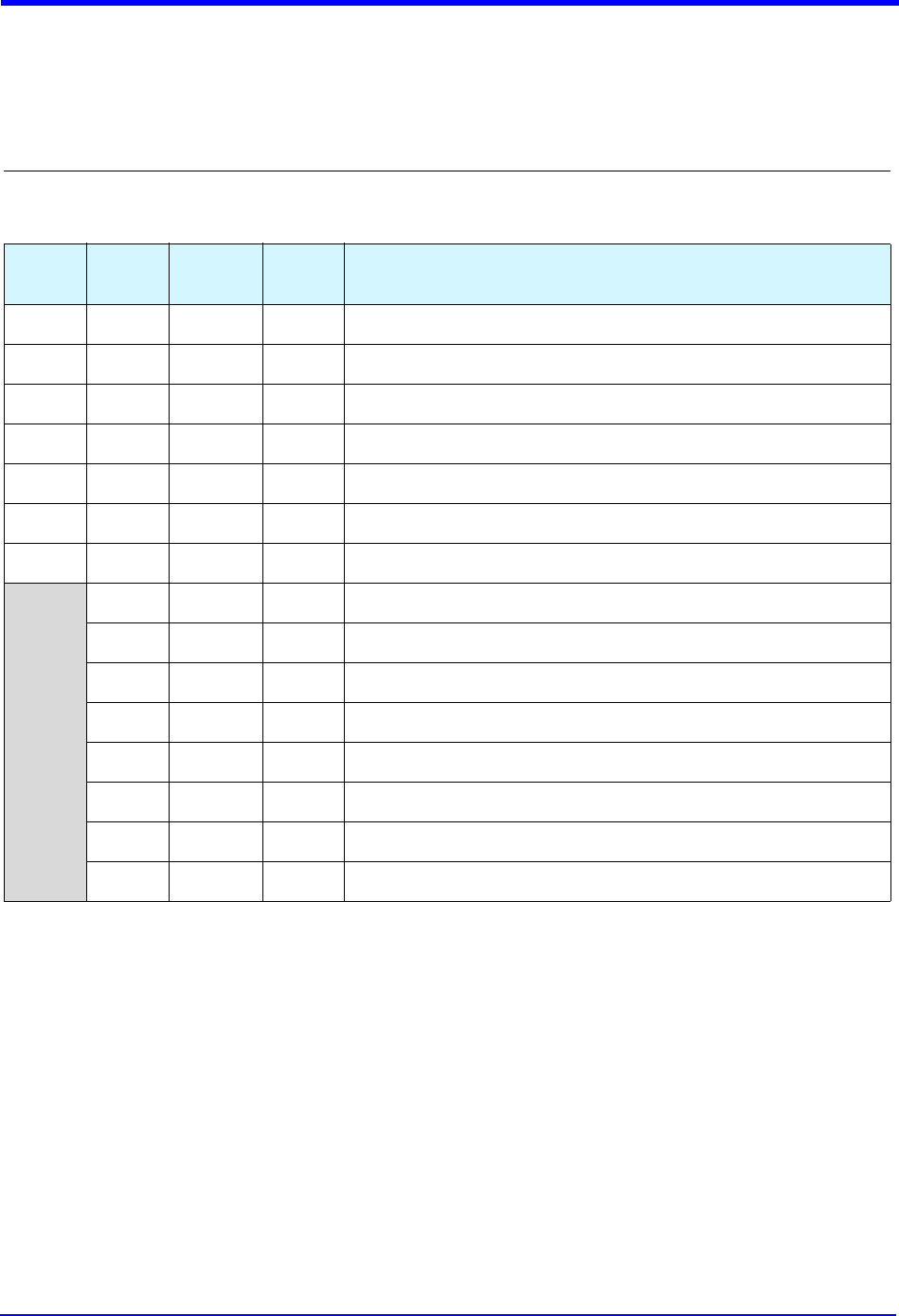

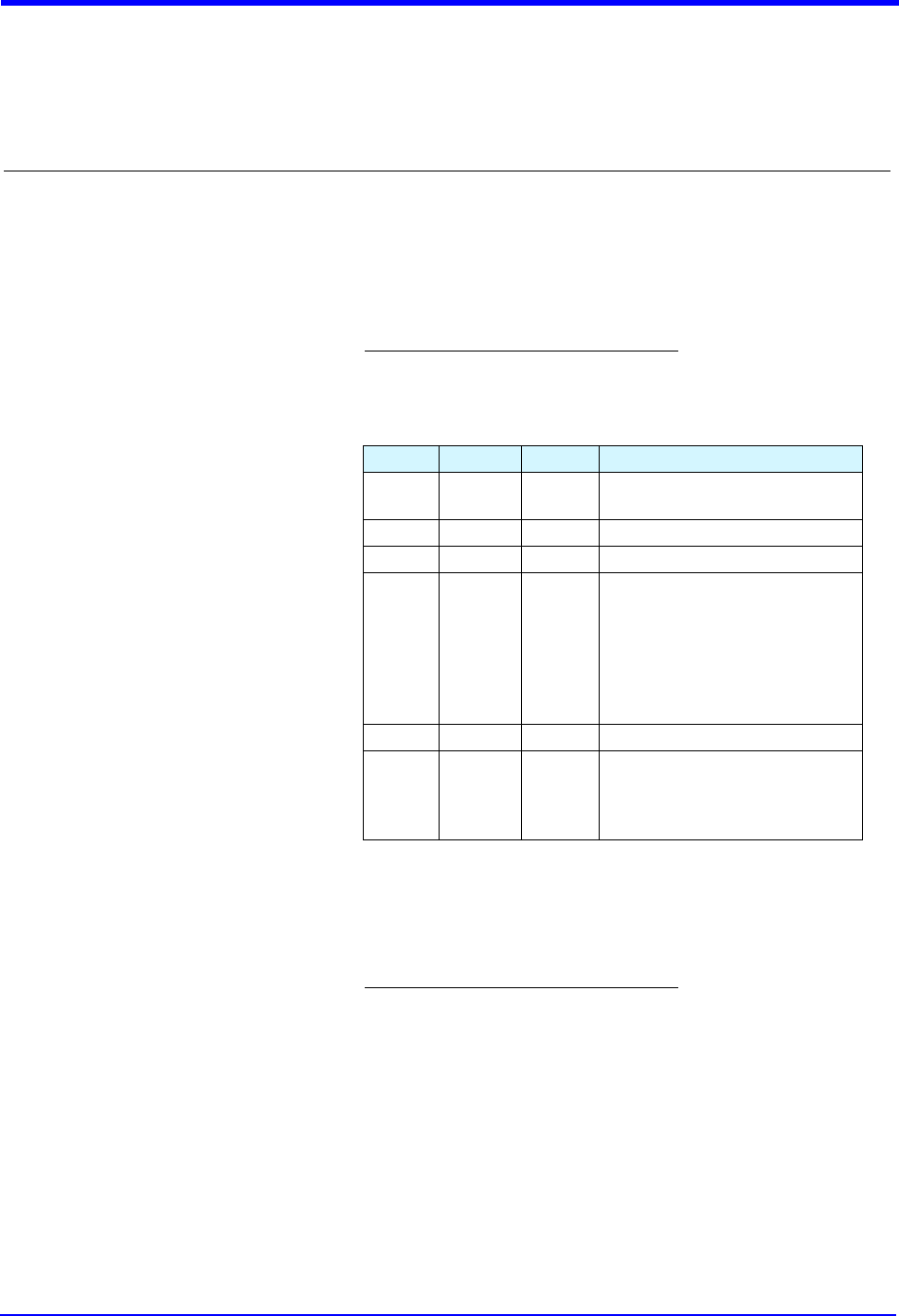

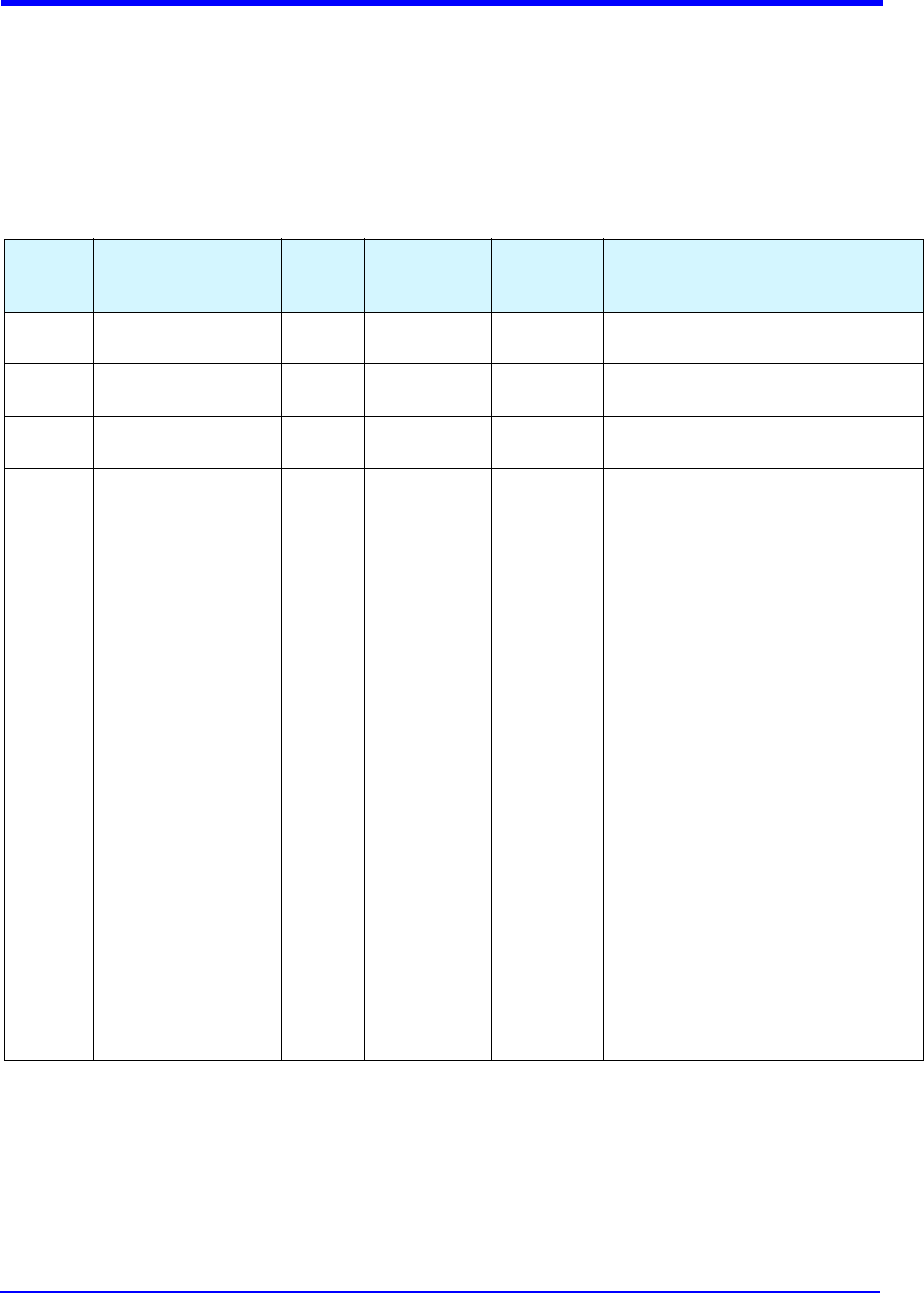

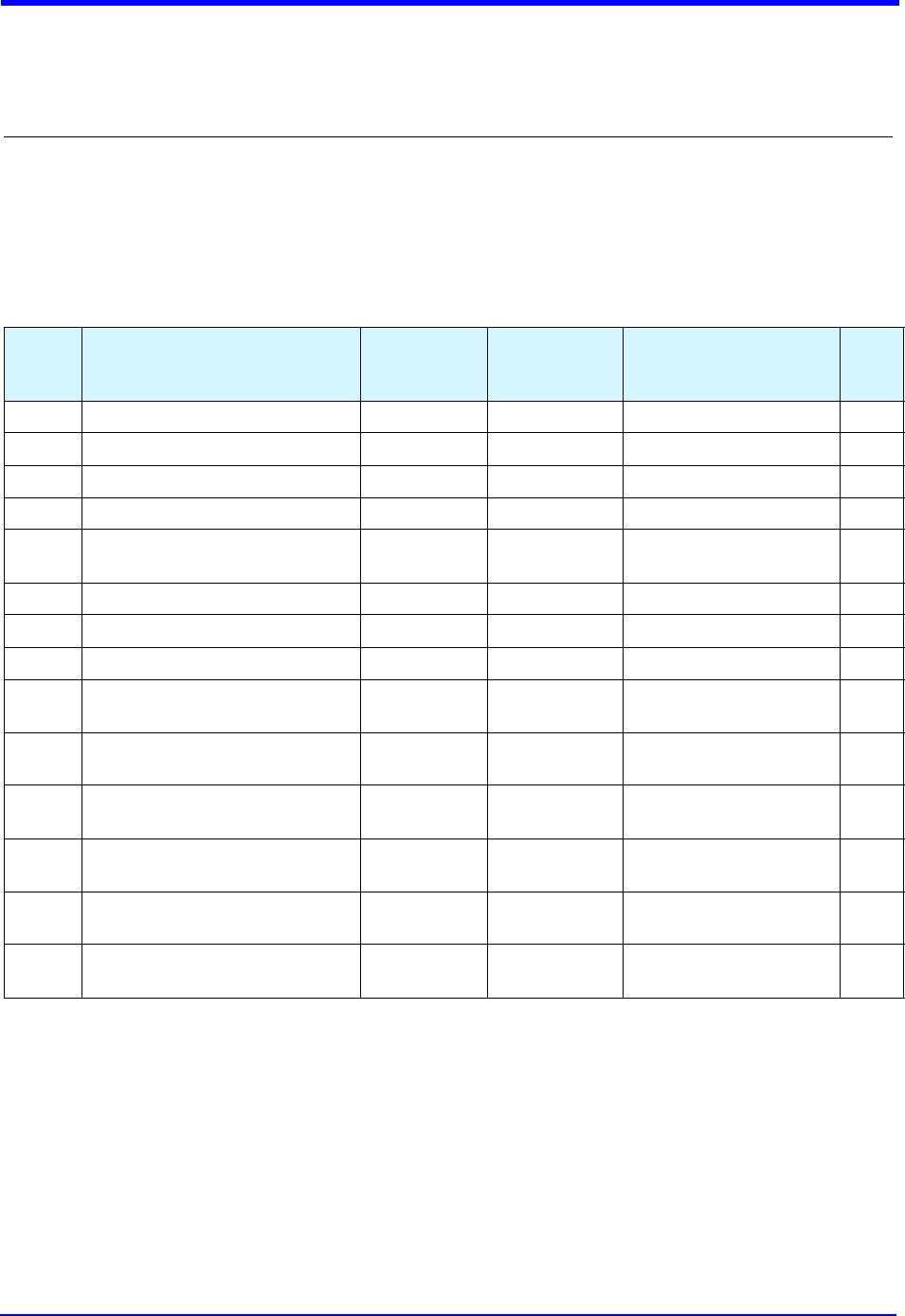

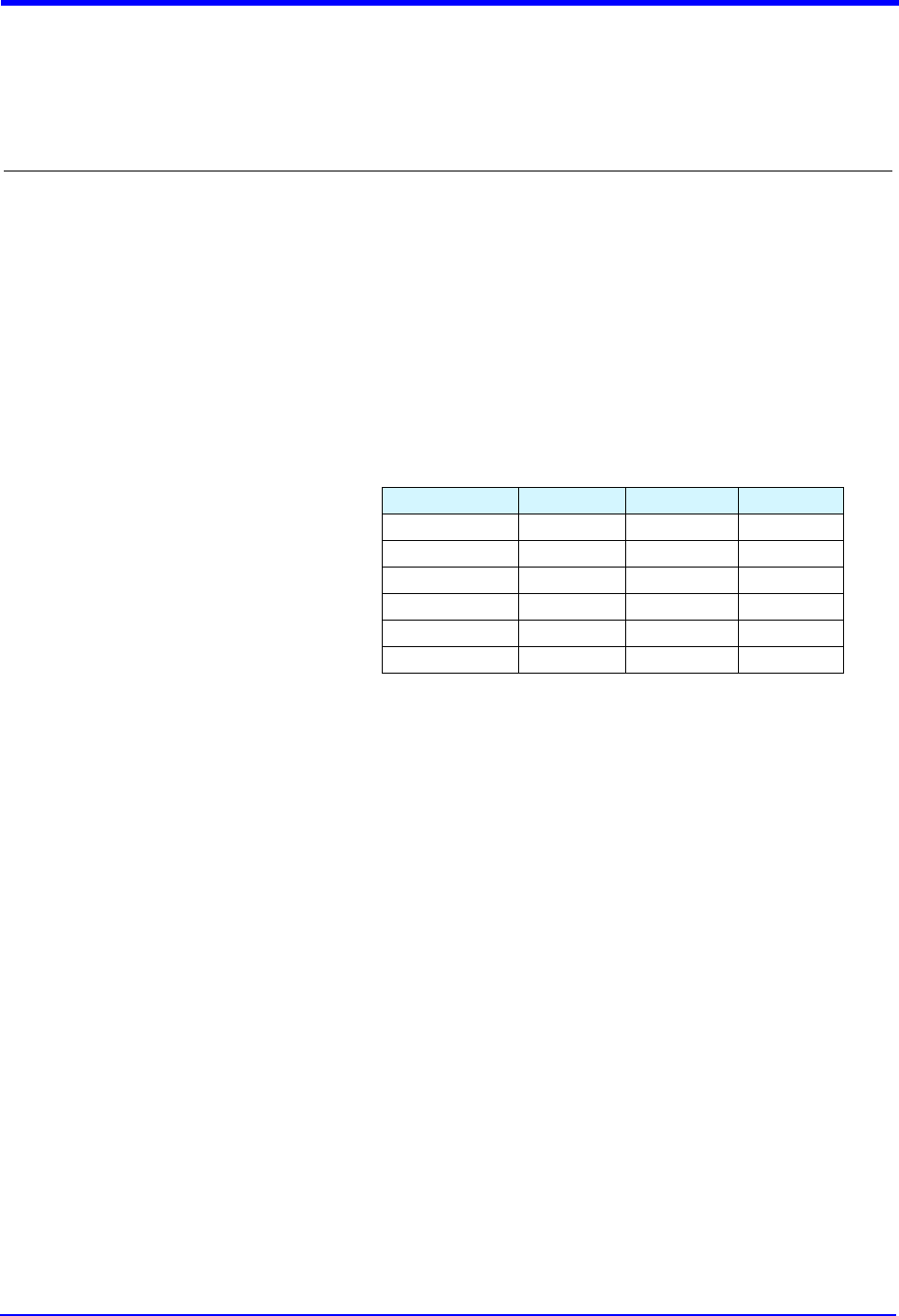

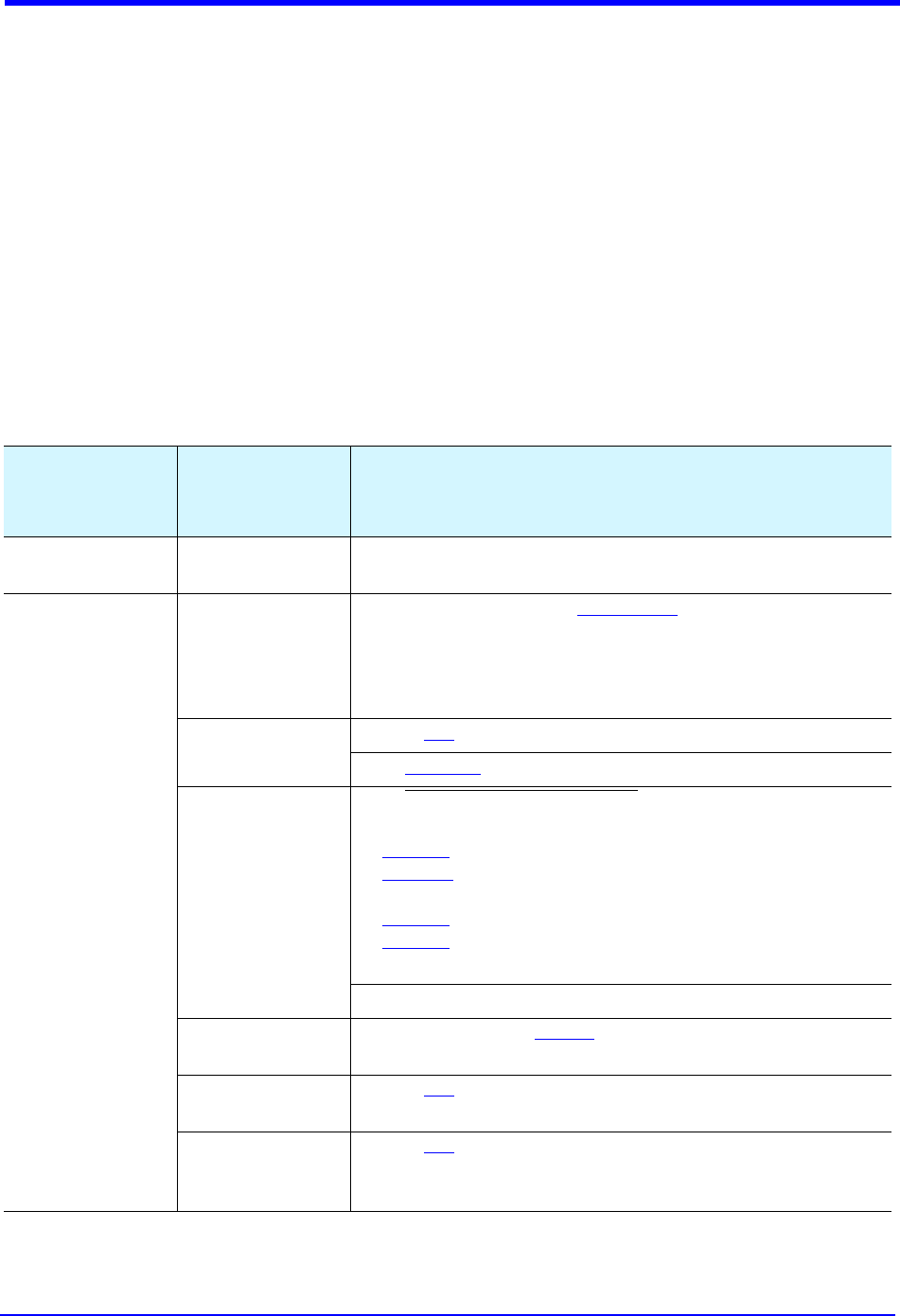

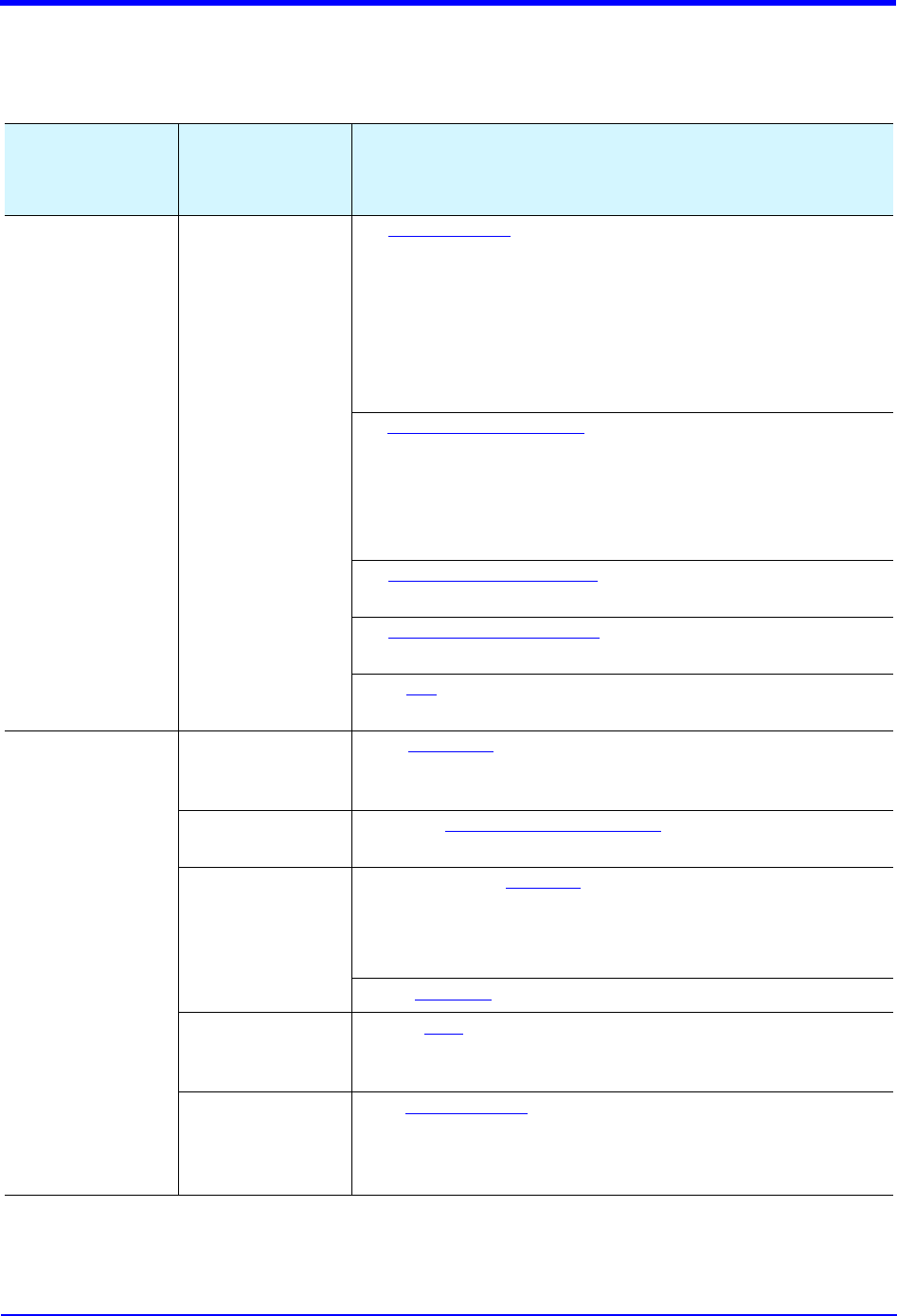

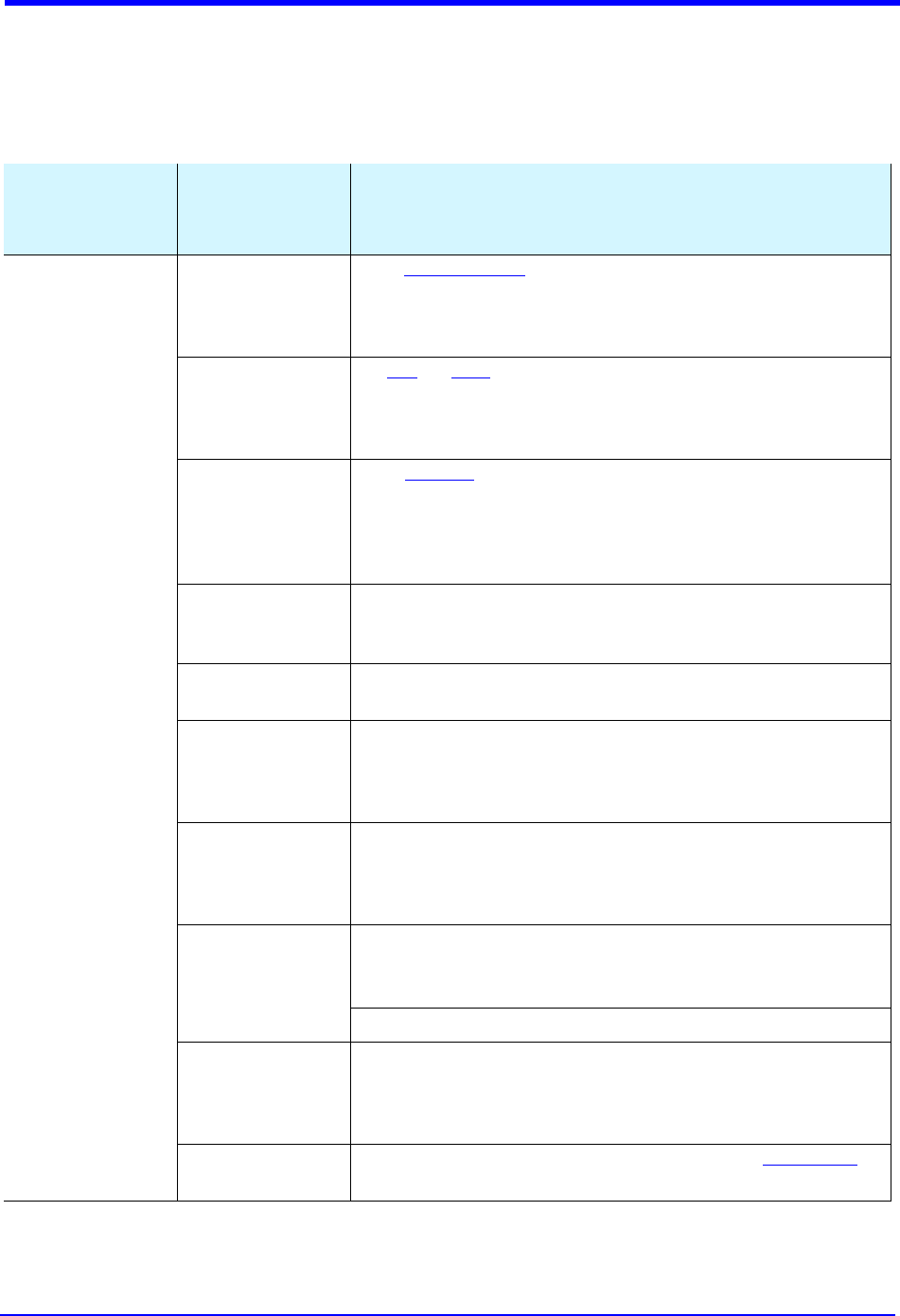

Summary of Changes Table

The Summary of Changes is a broad overview of technical changes made to the specification since its last

publication. This information may affect the way a Merchant, Third Party Processor or Vendor processes

American Express Card transactions. Other changes, including but not limited to, clarification and

consistency updates are included in the Revision Log located at the back of this guide.

Data Element or

Section Number Description of Change

GENERAL CHANGES

Added verbiage for Payment Token and/or Digital Wallet functionality to the following:

• 1100 message: DF 2, DF 14, DF 22, DF 24, DF 60, DF 61

• 1110 message: DF 34, DF 60

• Section 1.5: Related Documents

• Section 5.0 Card Acceptance Supported Services

• Section 5.4.2.1 Expresspay Transit Transactions at Transit Access Terminals

• Section 5.8 Digital Wallet Payments

• Section 6.1 Payment Token Transactions

Added verbiage for Derived Unique Key Per Transaction (DUKPT) functionality to the following:

• 1100 message: DF 53

• Section 6.5.2 Derived Unique Key Per Transaction (DUKPT)

1100 AUTHORIZATION REQUEST MESSAGE

DF 22: Point of Service Data

Code

In the Point of Service Data Code tables, made the following changes and updates to include

Payment Token functionality:

•Position 1, removed value ‘X’ as a valid value.

•Position 5, value 4, at the end of the description, added ‘delayed shipment, split bill

transactions’.

•Position 6, added value ‘Z’ to identify Digital Wallet transactions.

•Position 7, removed values ‘X’ and ‘Y’ as valid values. For value 5, added verbiage for

Digital Wallet and Payment Token functionality.

Removed references to magnetic stripe signature.

DF 24: Function Code In the description, added verbiage to the function code table for ‘196=Expresspay Translation

(PAN & Expiration Date Request)’.

DF 43: Card Acceptor

Name/Location

Updated field for clarity around formatting for Payment Service Providers (Aggregators) and

OptBlue Participants.

DF 62: Private Use Data Removed references to magnetic stripe signature.

ii April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

this page intentionally left blank

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 iii

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

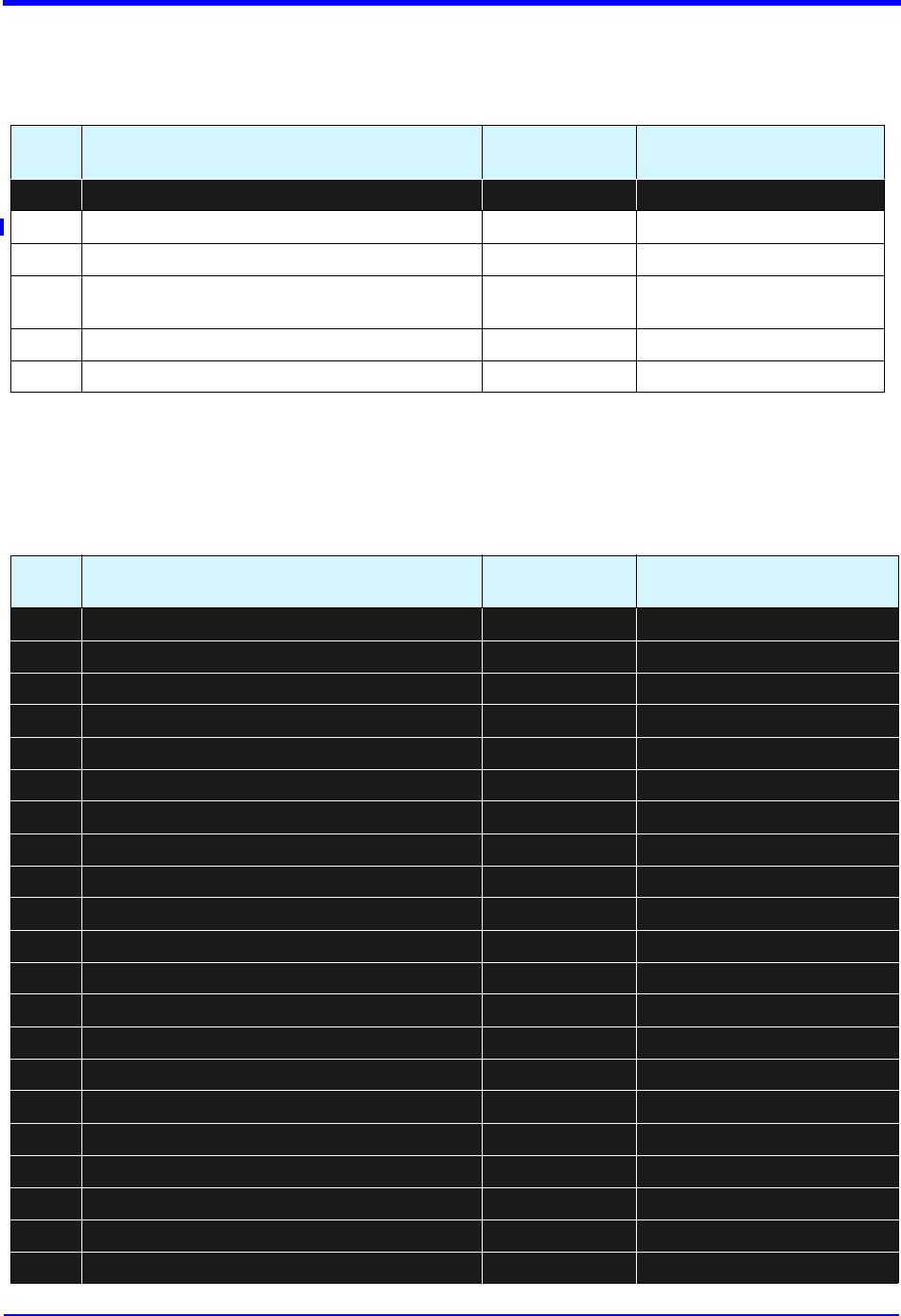

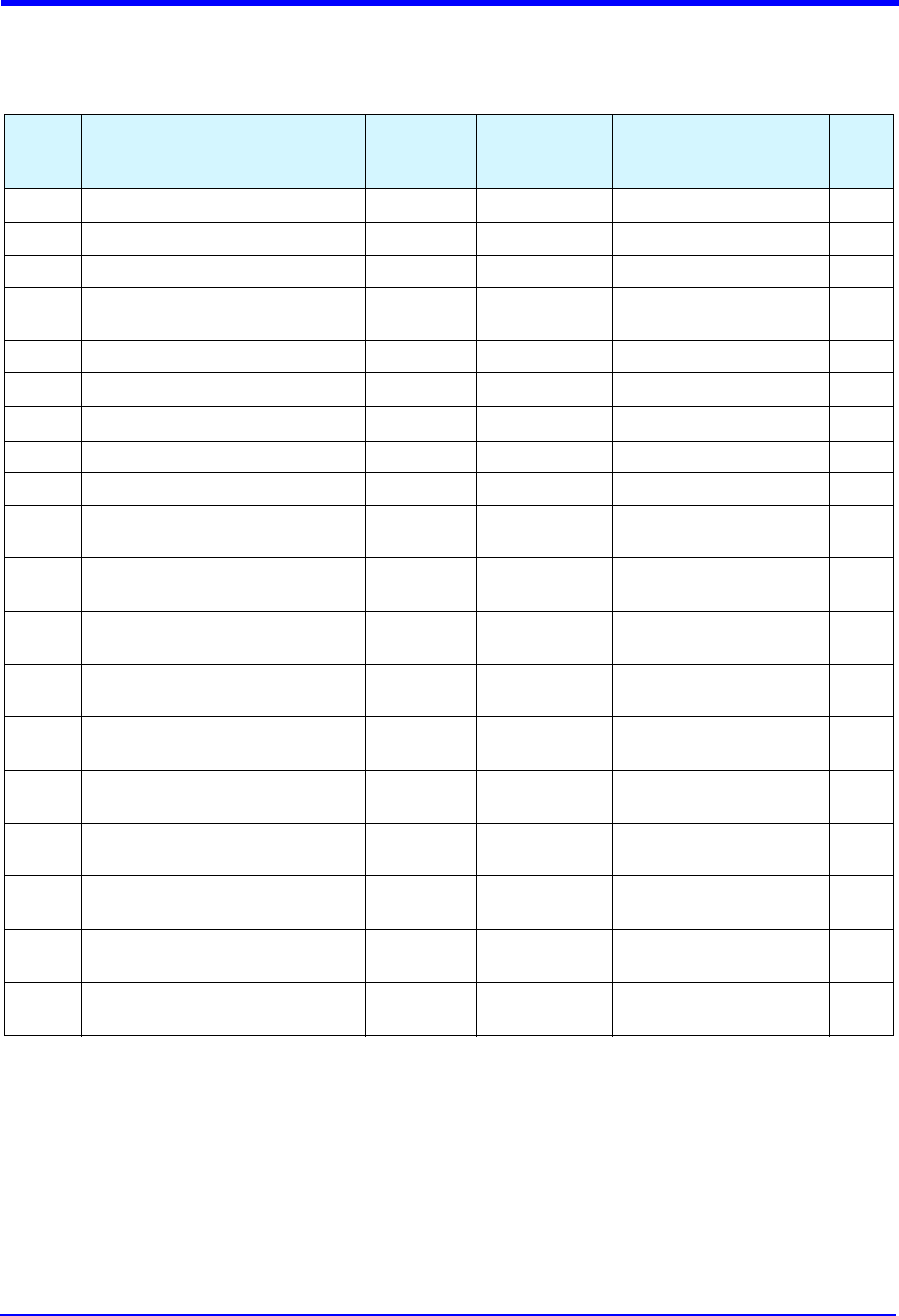

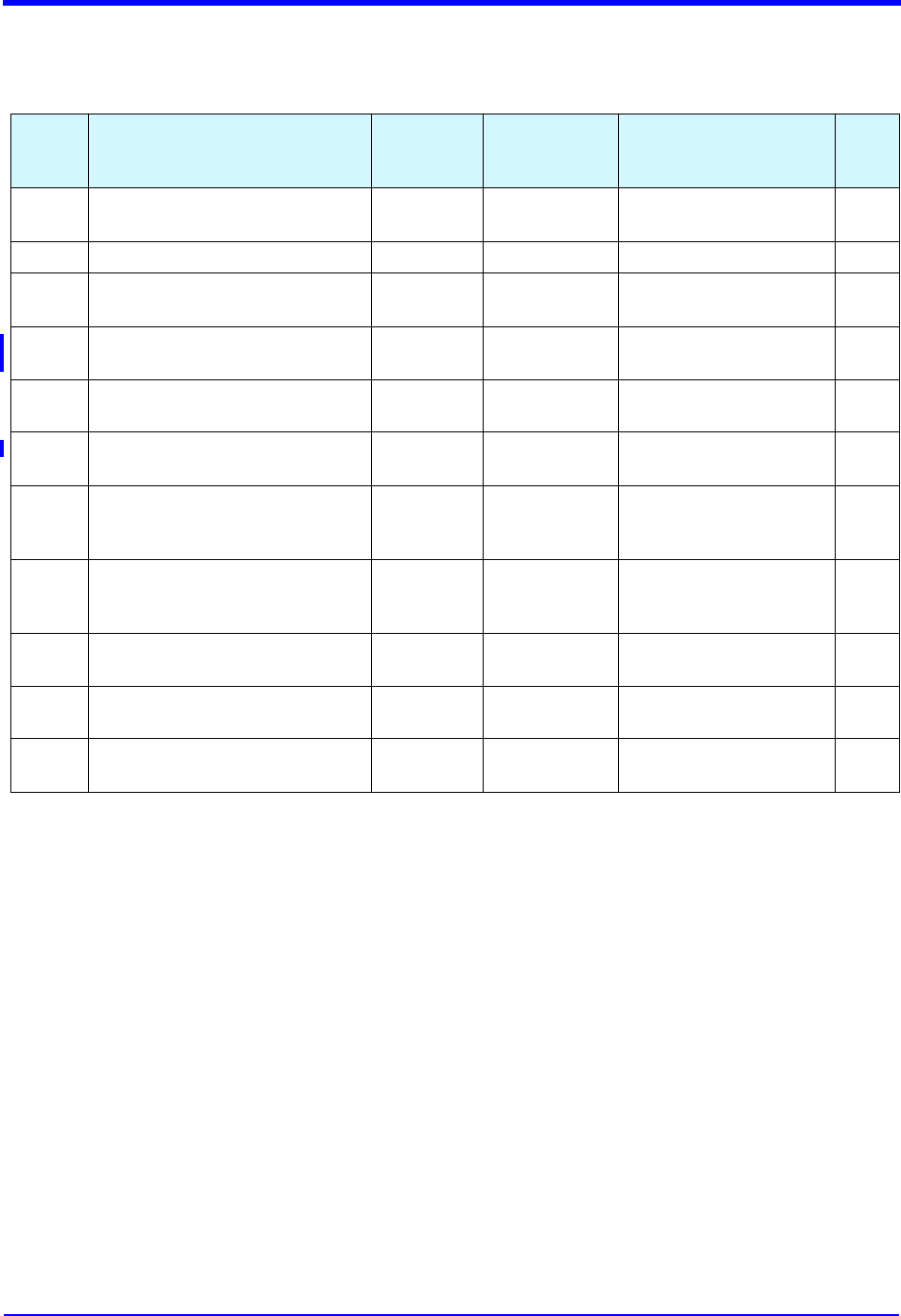

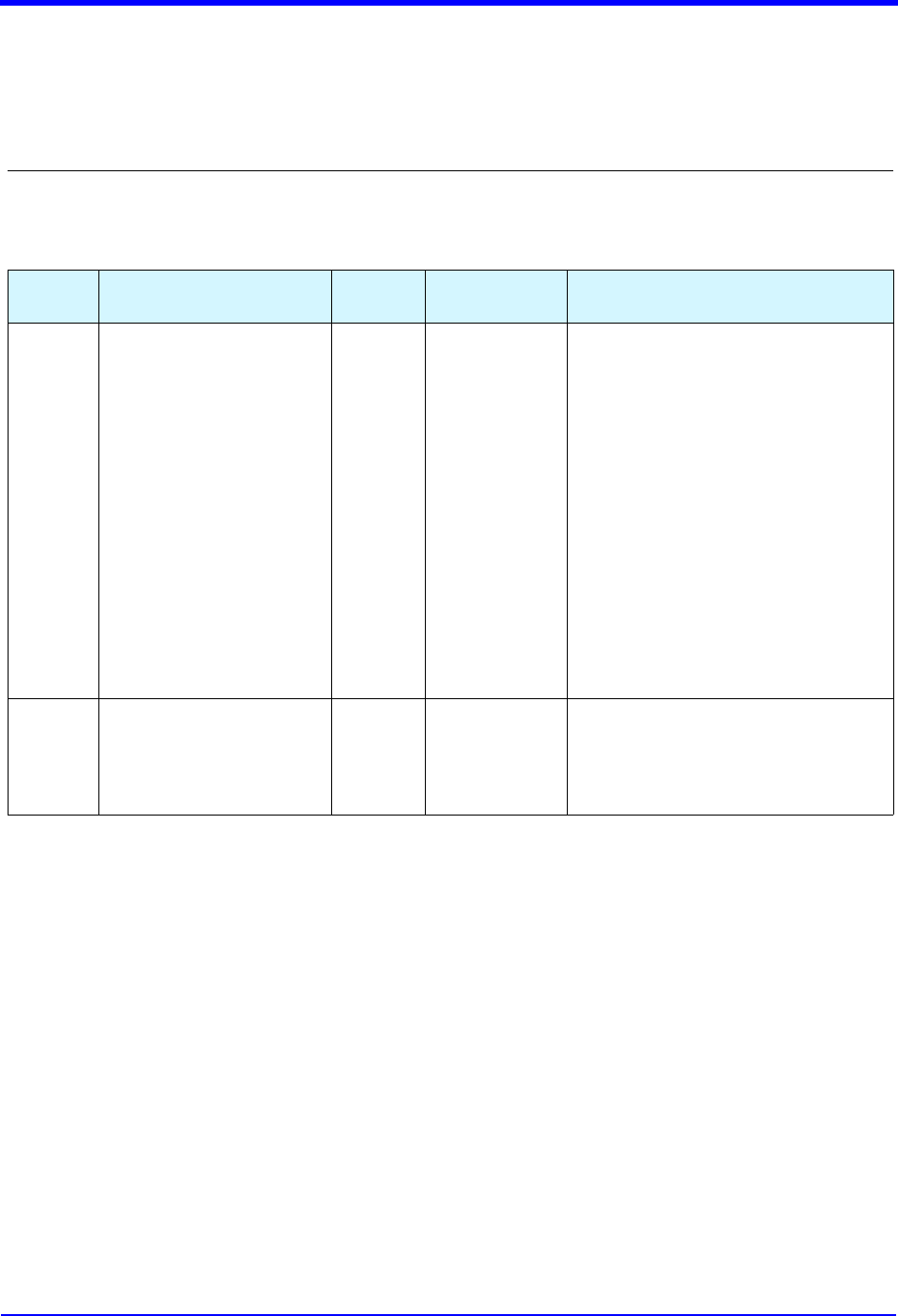

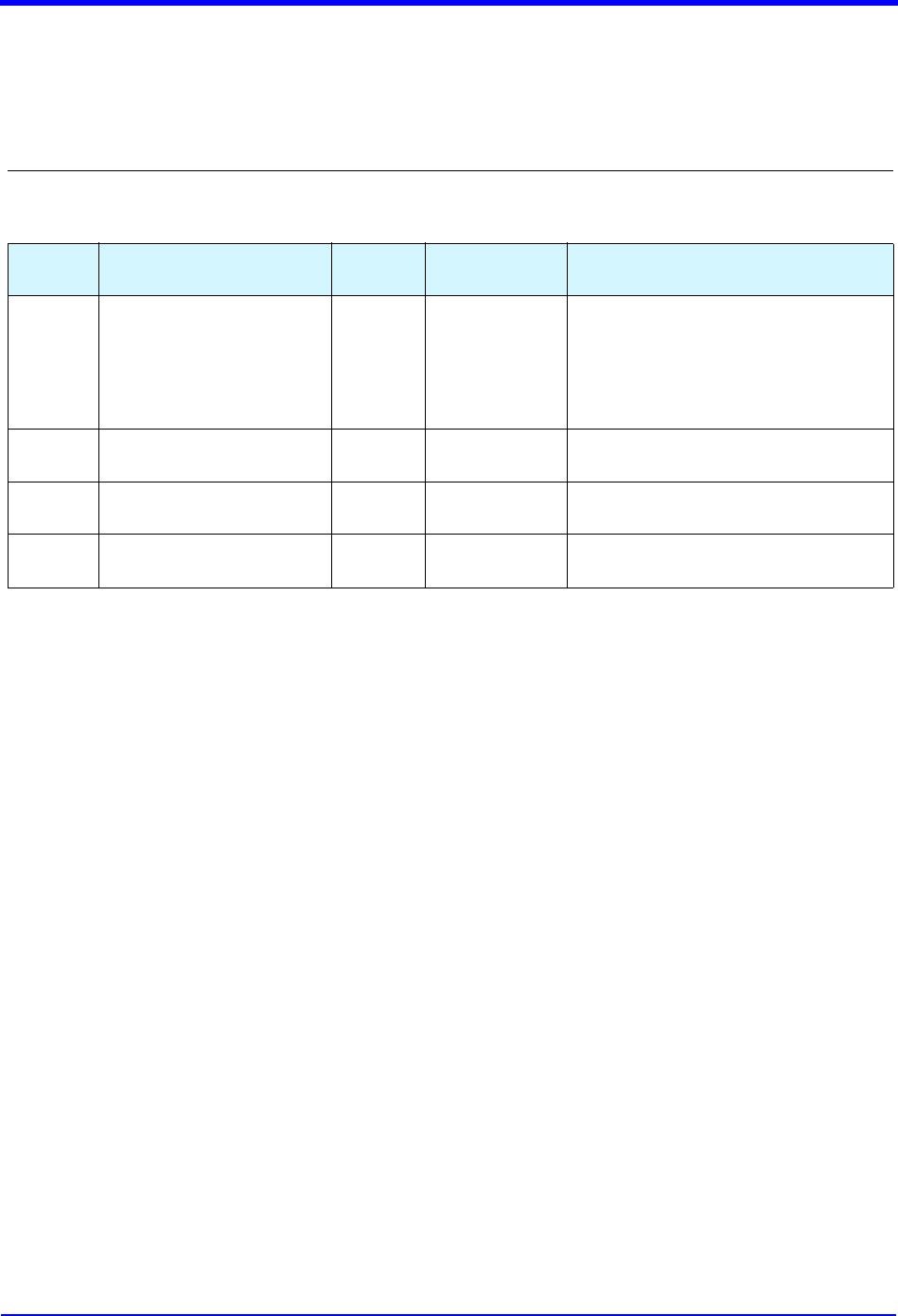

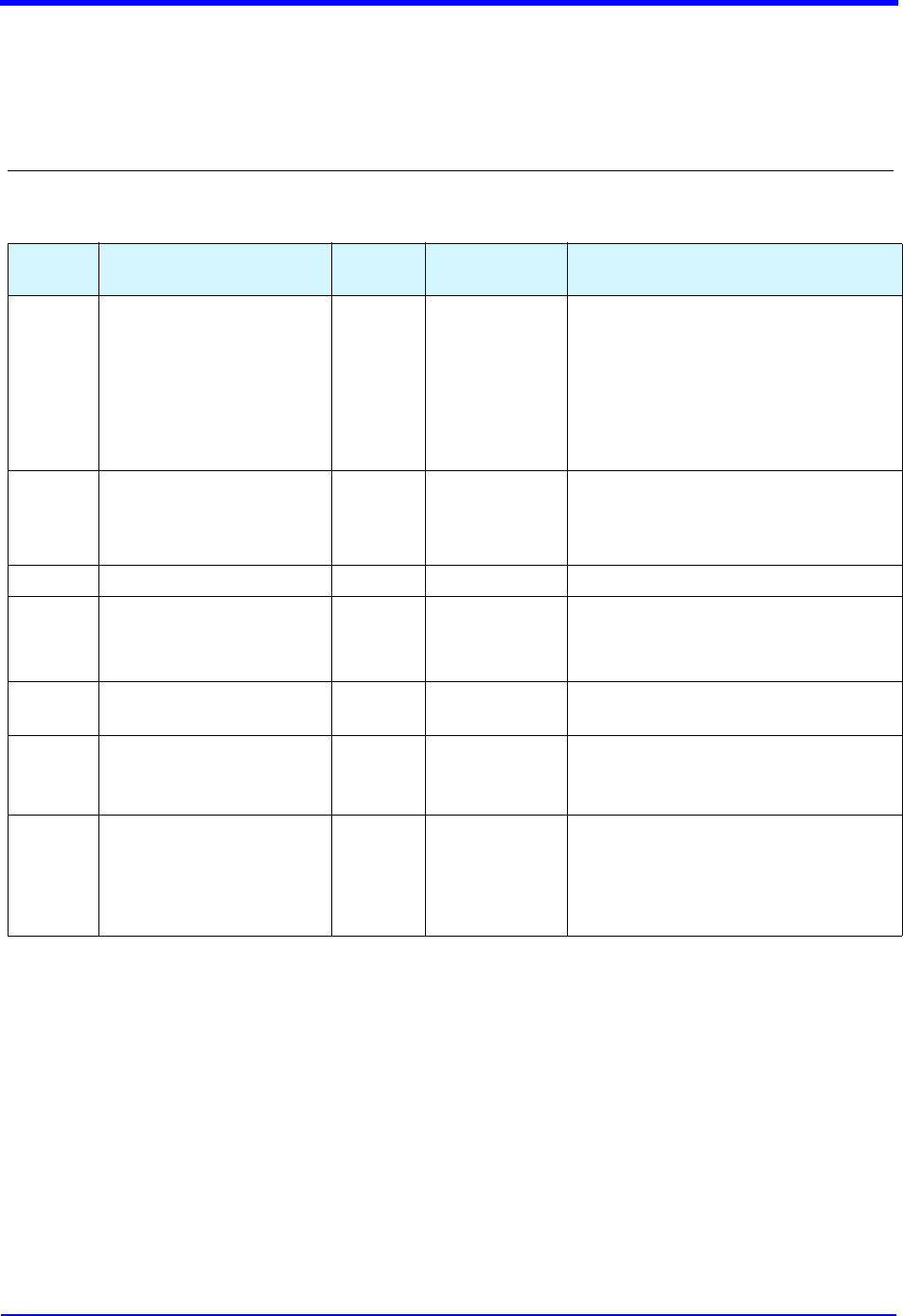

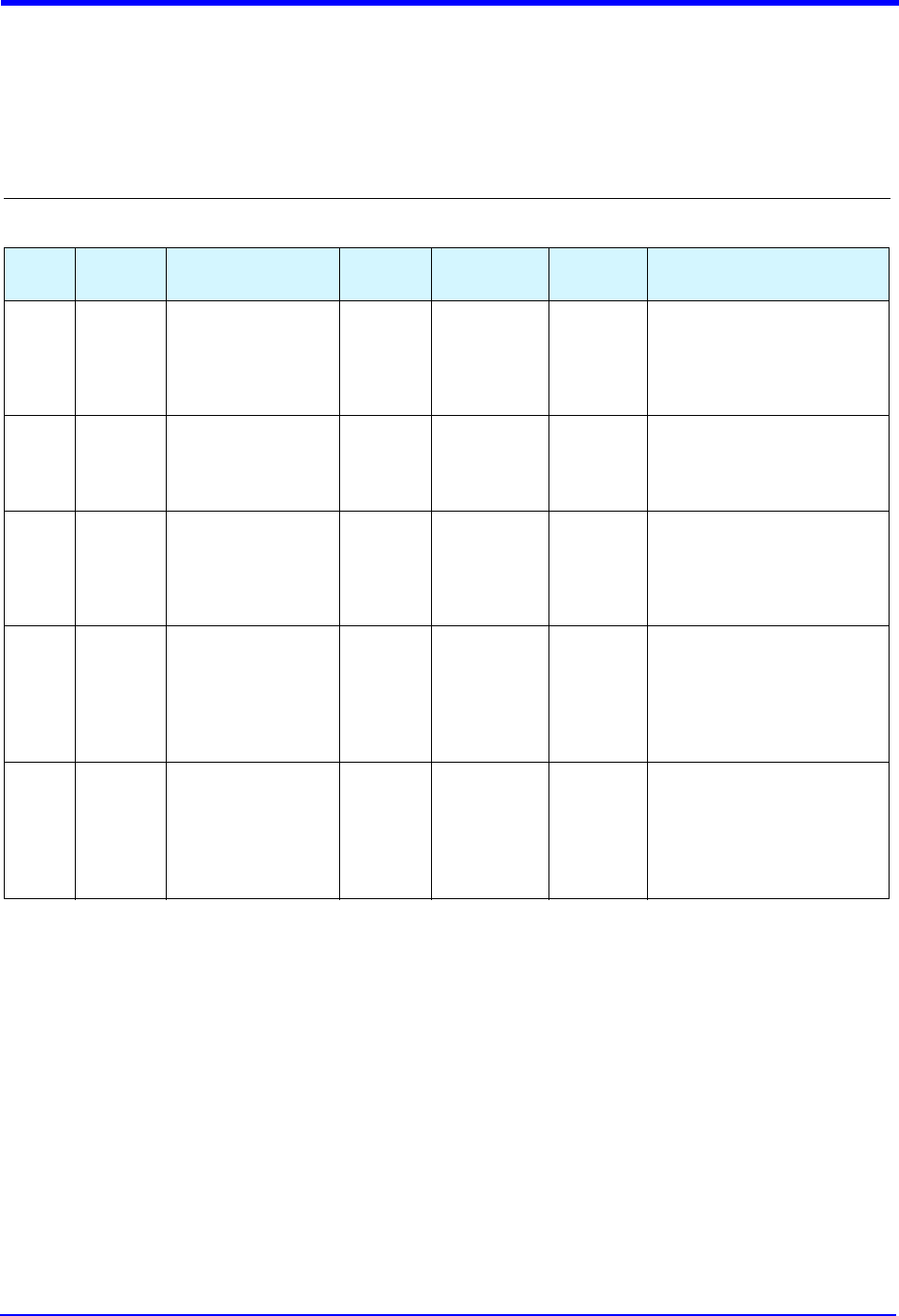

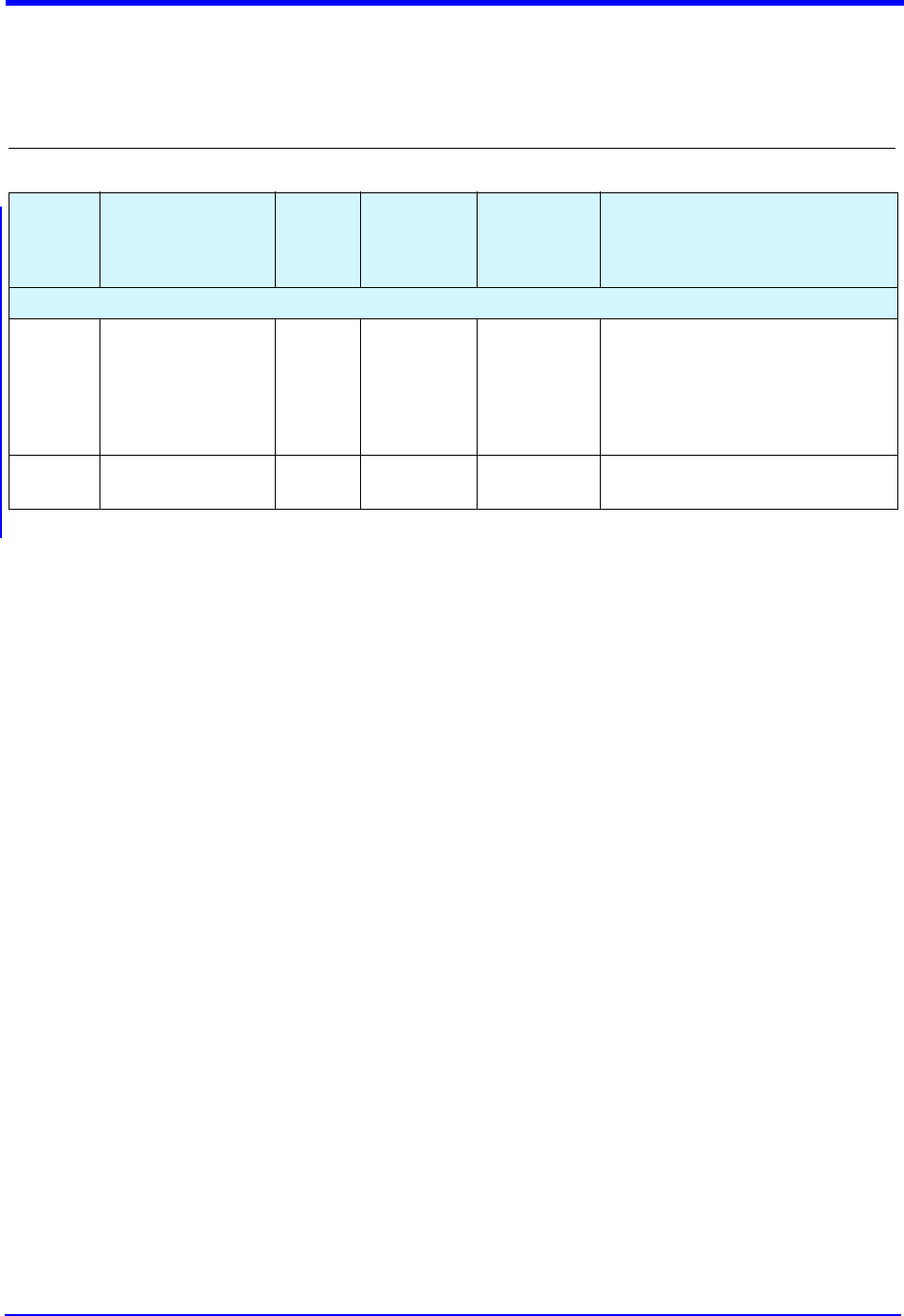

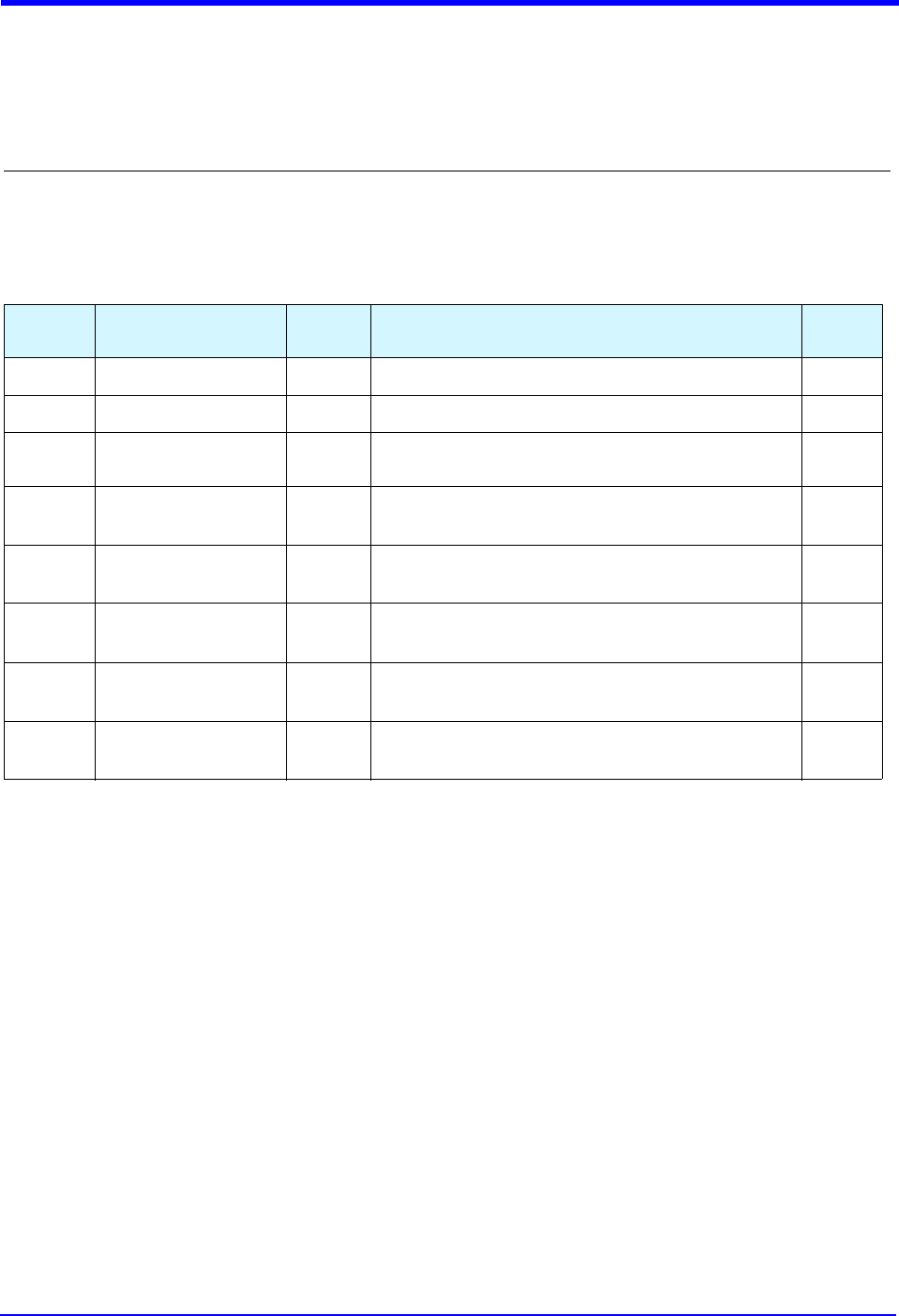

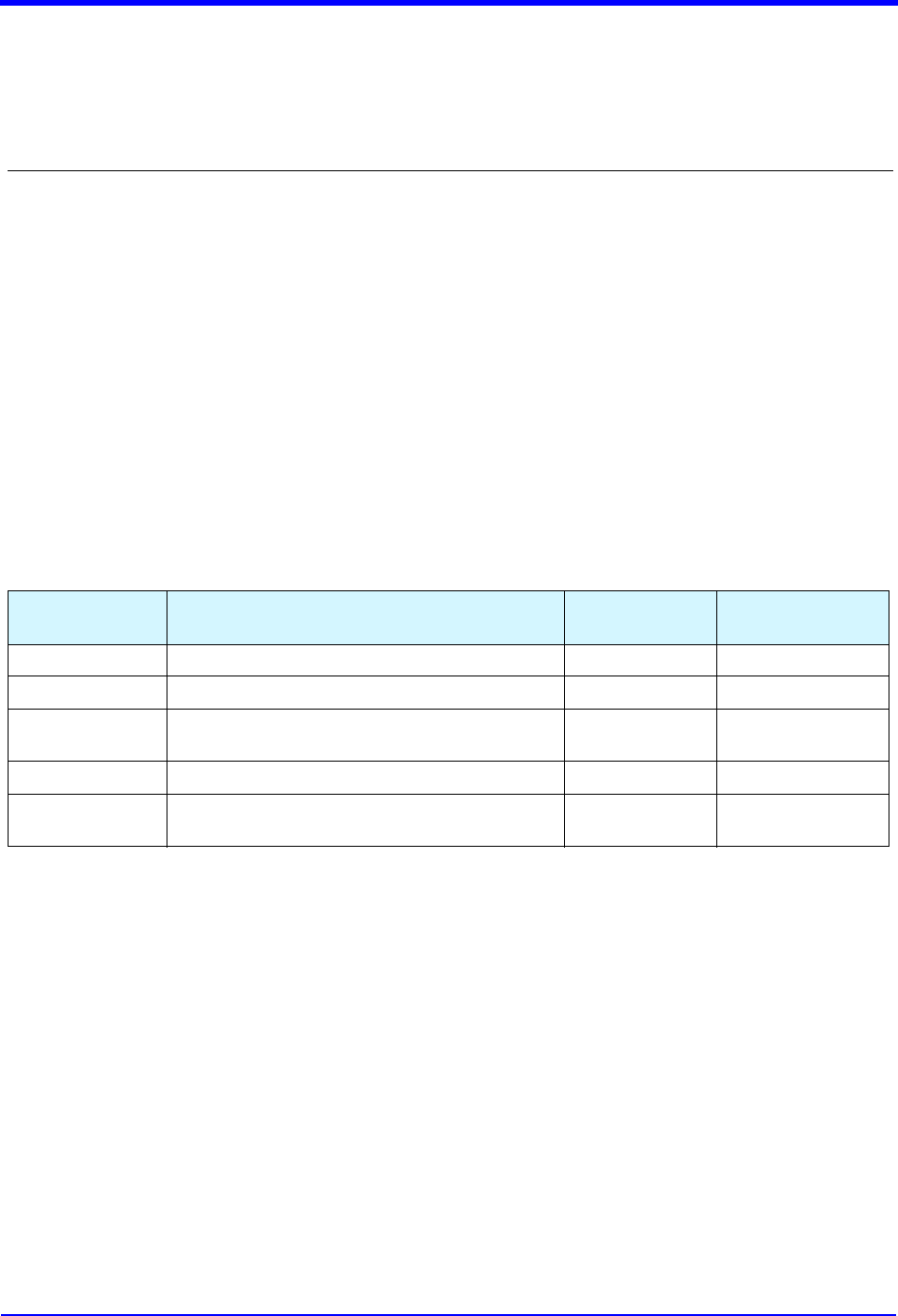

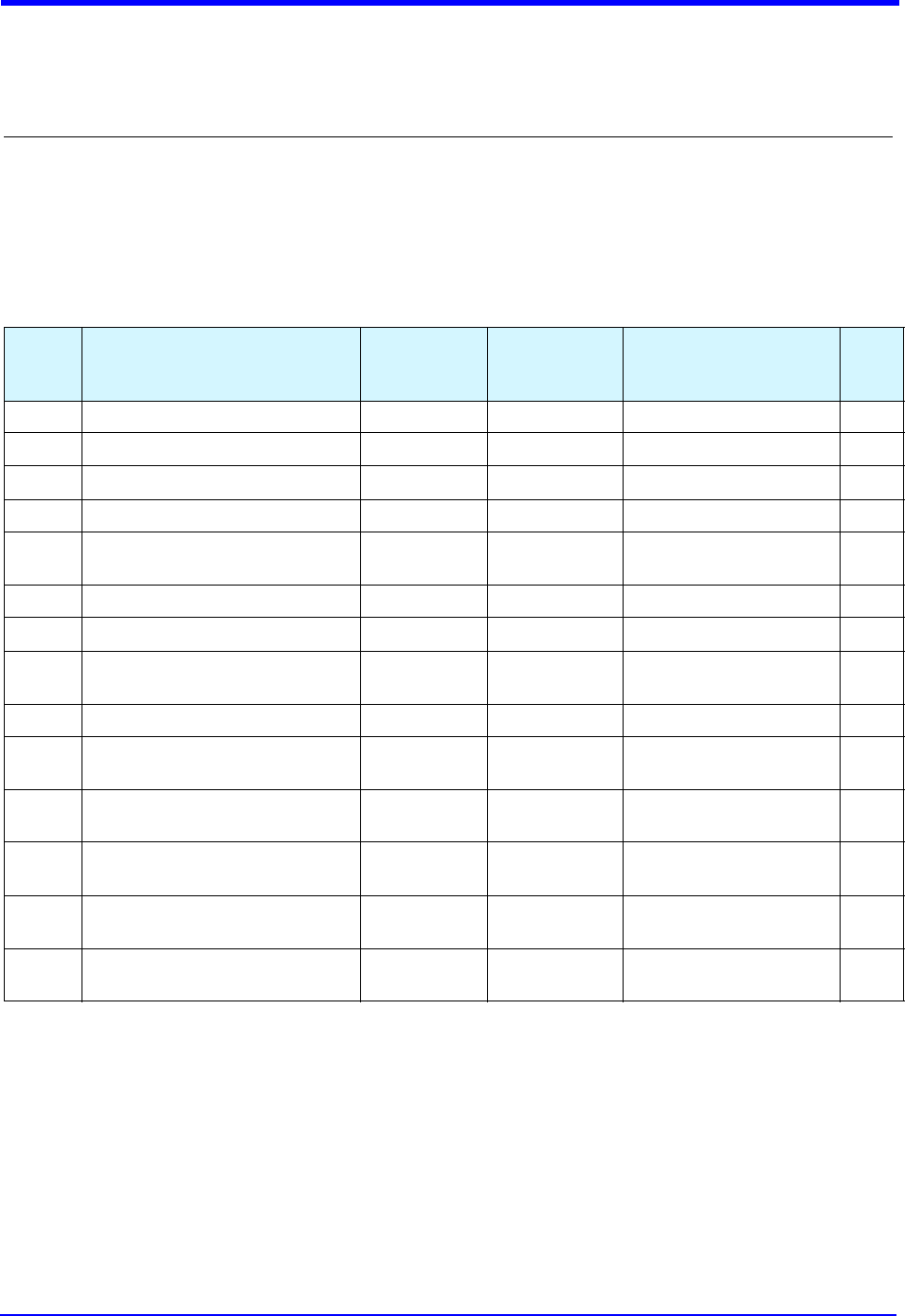

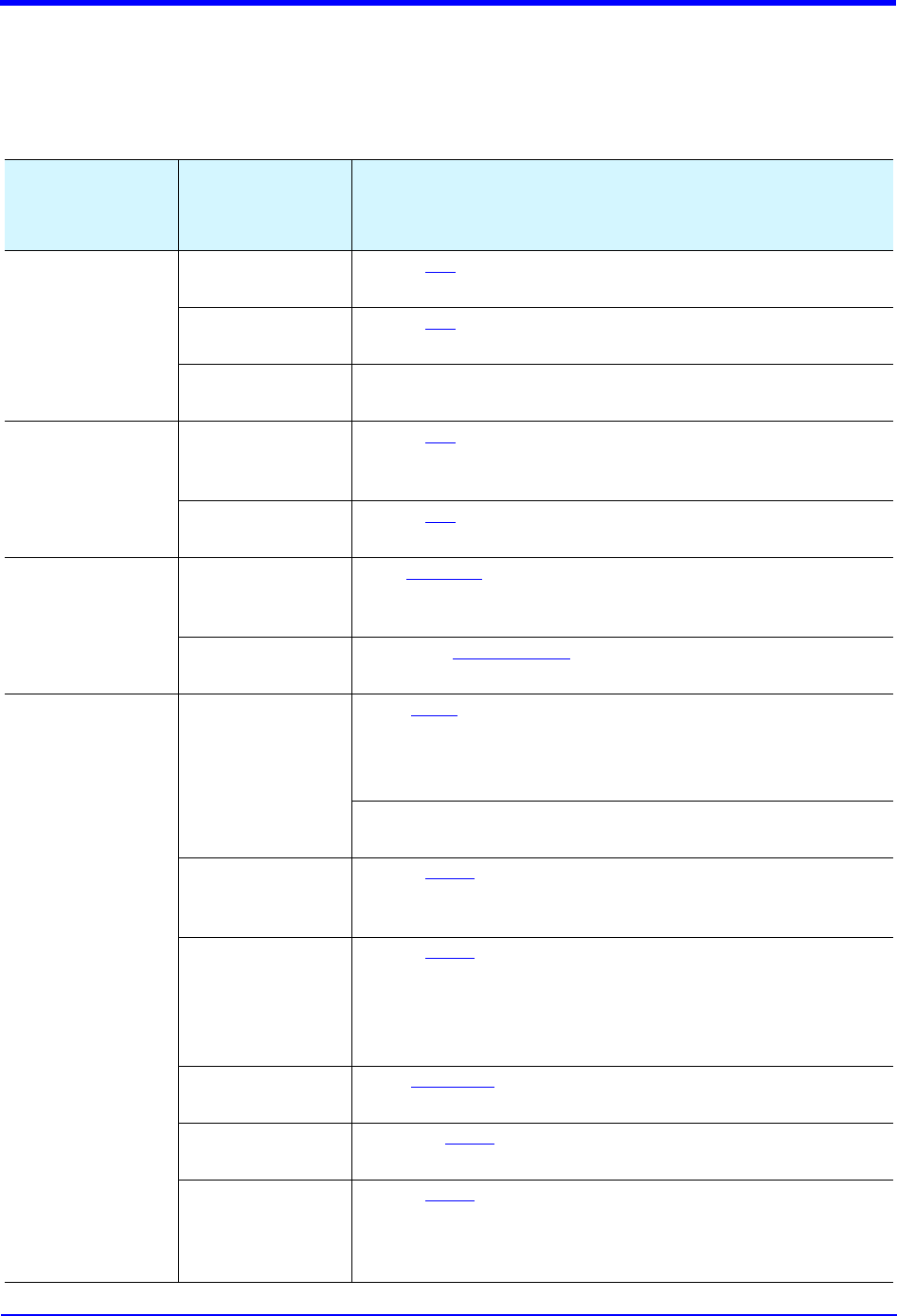

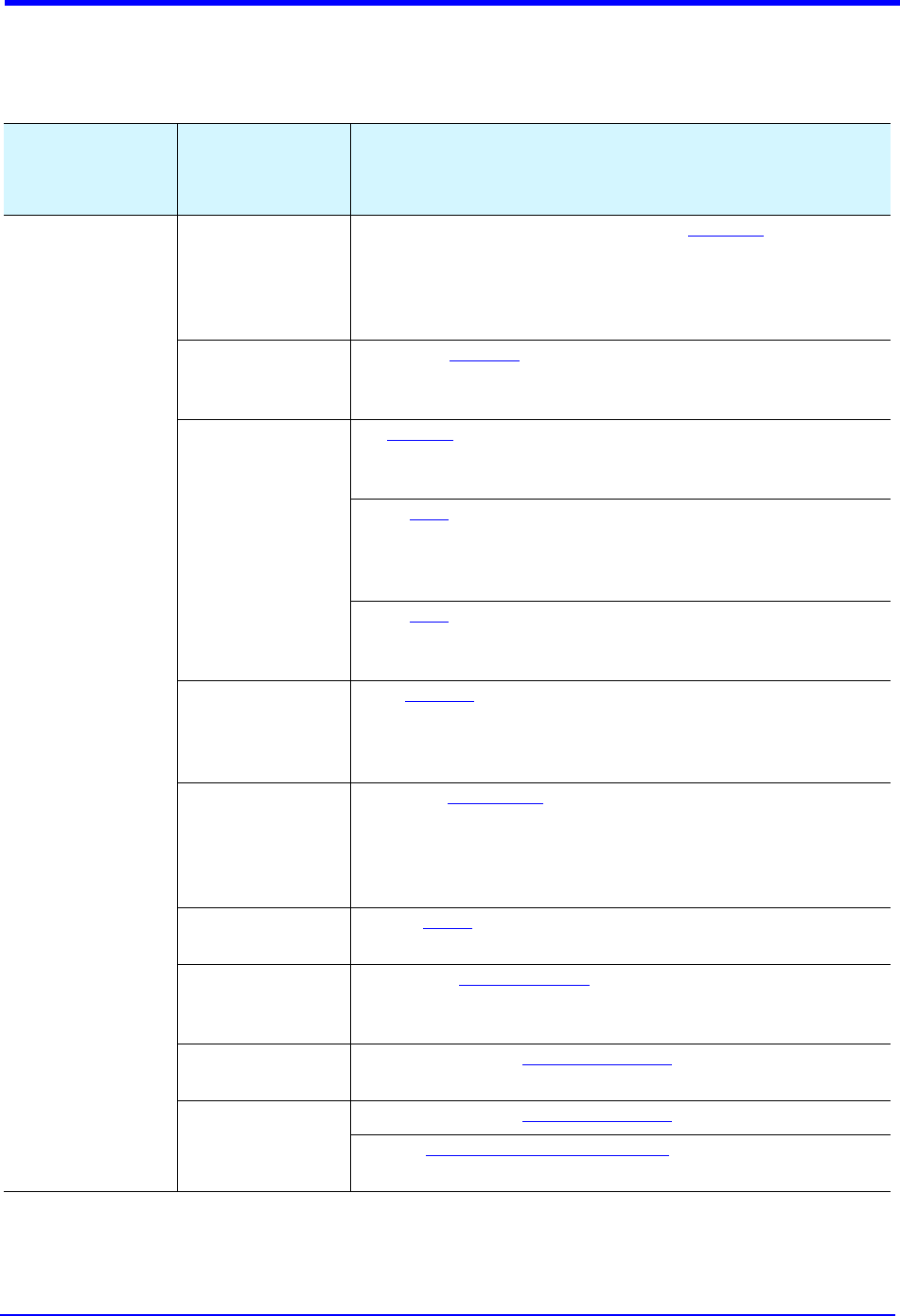

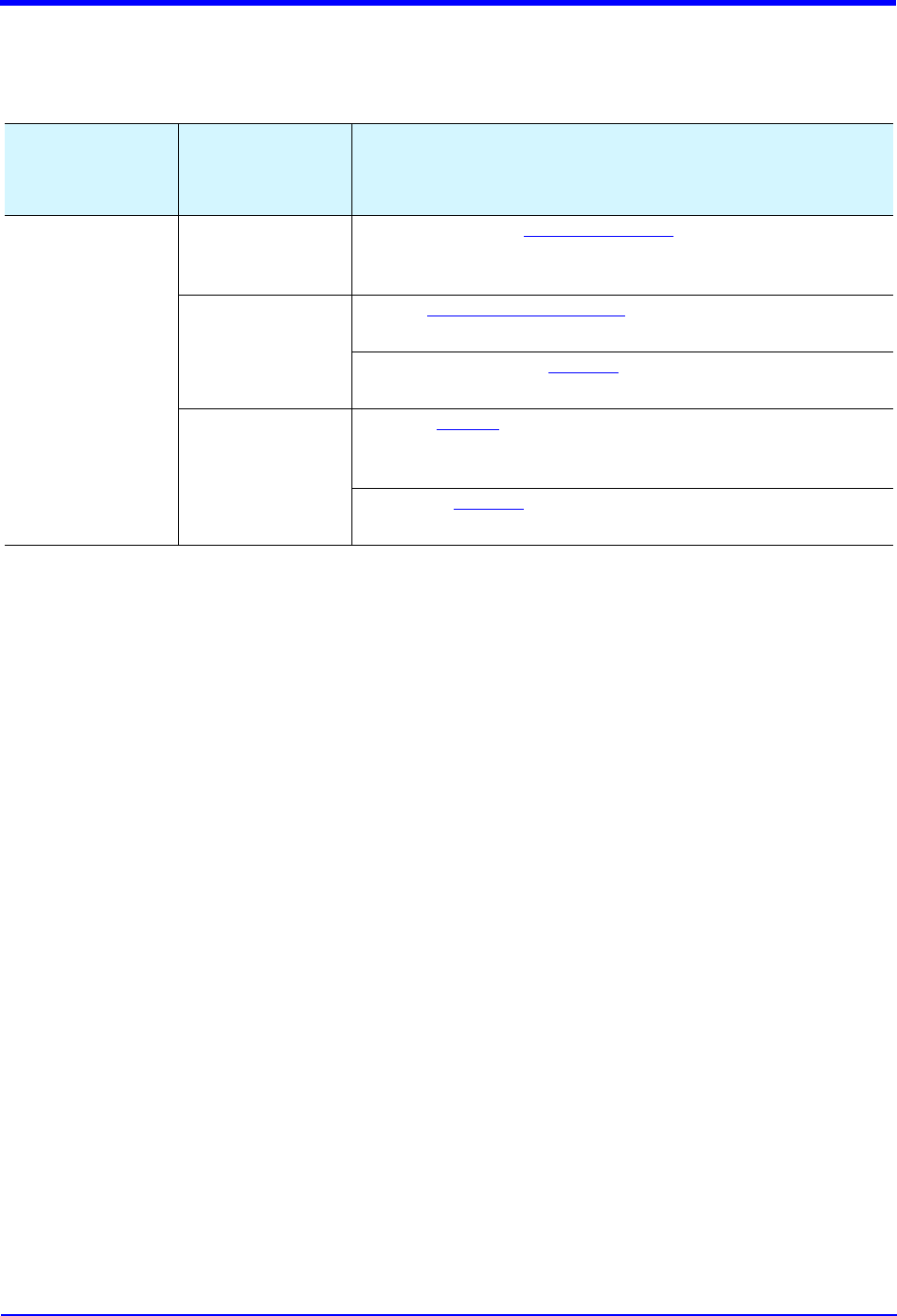

Table of Contents

Summary of Changes Table................................................................................................ i

1.0 About the Global Credit Authorization Guide......................................................1

1.1 Who Should Use the GCAG ISO .............................................................................................. 1

1.2 Document Changes.................................................................................................................. 1

1.3 Communication Process........................................................................................................... 2

1.3.1 Semi-Annual Publication Process............................................................................... 2

1.3.2 Notice of Specification Changes ................................................................................ 2

1.3.3 Technical Bulletins...................................................................................................... 2

1.4 Contact Information ................................................................................................................. 2

1.5 Related Documents.................................................................................................................. 3

2.0 Implementation Planning........................................................................................5

2.1 Overview of Implementation Planning .................................................................................... 5

2.2 Development Responsibilities .................................................................................................6

2.3 Development Steps.................................................................................................................. 7

2.4 Hardware Requirements.......................................................................................................... 7

2.5 Communications Options......................................................................................................... 7

2.6 Leased Lines............................................................................................................................. 7

3.0 Card Acceptance Guidelines .................................................................................9

4.0 Guidelines for Using the GCAG ISO 8583 Message Formats ..........................11

4.1 Variations in Messaging........................................................................................................ 14

4.2 ISO 8583 Message Formats................................................................................................... 14

4.2.1 Authorization Request/Response ............................................................................. 14

4.2.2 Reversal Advice Request/Response......................................................................... 15

4.2.3 Network Management Request/Response.............................................................. 16

5.0 Card Acceptance Supported Services ...............................................................17

5.1 Online Authorizations ............................................................................................................ 18

5.1.1 Non-Referral Link...................................................................................................... 18

5.1.2 Referral Queue.......................................................................................................... 20

5.1.3 Referral Queue — Referral Mode............................................................................ 22

5.2 American Express OptBlue® Program.................................................................................... 23

5.3 Prepaid Card Authorizations ..................................................................................................24

5.3.1 Partial Authorization ................................................................................................. 24

5.3.2 Authorization with Balance Return .......................................................................... 25

5.4 Chip Card Authorizations ....................................................................................................... 26

5.4.1 AEIPS......................................................................................................................... 26

5.4.2 Expresspay................................................................................................................ 28

5.5 Recurring Billing and Standing Authorization ....................................................................... 30

5.6 Batch Authorizations.............................................................................................................. 31

5.6.1 Message Separation................................................................................................. 32

5.6.2 Supported File Layouts ............................................................................................. 33

5.7 Authorization Amount Adjustment ........................................................................................ 39

table of contents

of changes

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

iv April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

Table of Contents

5.8 Digital Wallet Payments ........................................................................................................ 39

5.8.1 In-Store Digital Wallet Transactions........................................................................ 39

5.8.2 In-App Transactions.................................................................................................. 40

5.9 Other Authorization Services .................................................................................................41

5.9.1 American Express Travelers Cheque Verifications................................................... 41

5.9.2 Non-American Express Card Authorizations ............................................................ 41

6.0 Fraud Prevention Services....................................................................................43

6.1 Payment Token Transactions ................................................................................................. 43

6.2 Verification Services .............................................................................................................. 44

6.2.1 Enhanced Authorization............................................................................................ 44

6.3 Electronic Verification Services .............................................................................................46

6.3.1 Card Identifier (CID) Verification............................................................................... 46

6.3.2 Automated Address Verification (AAV) .................................................................... 47

6.3.3 ZIP Code Verification ................................................................................................ 47

6.3.4 Telephone Number Verification................................................................................ 48

6.3.5 Email Address Verification ....................................................................................... 49

6.4 American Express SafeKeySM................................................................................................. 50

6.5 Online PIN .............................................................................................................................. 51

6.5.1 Master/Session Key Management Methodology .................................................... 51

6.5.2 Derived Unique Key Per Transaction (DUKPT).......................................................... 52

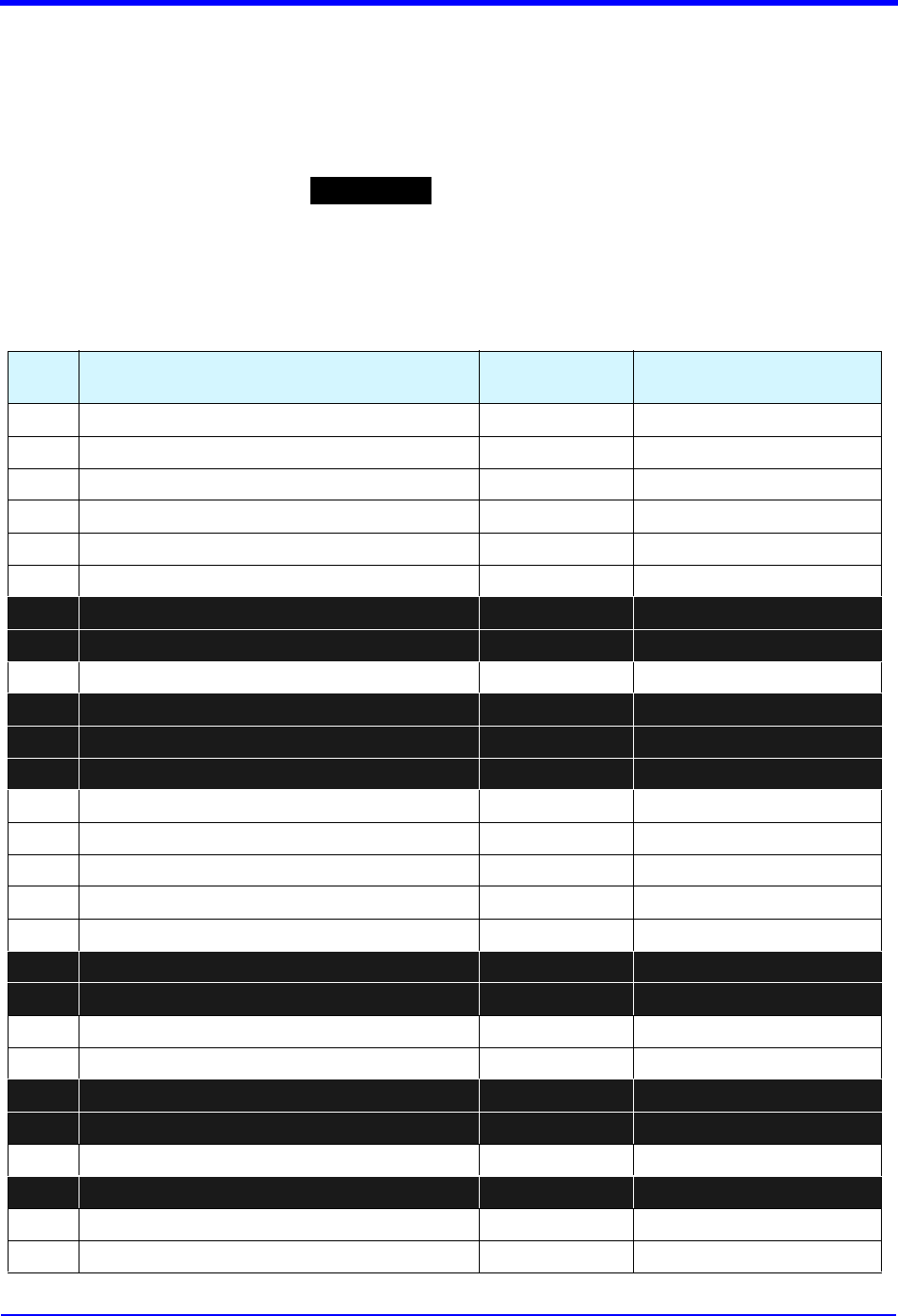

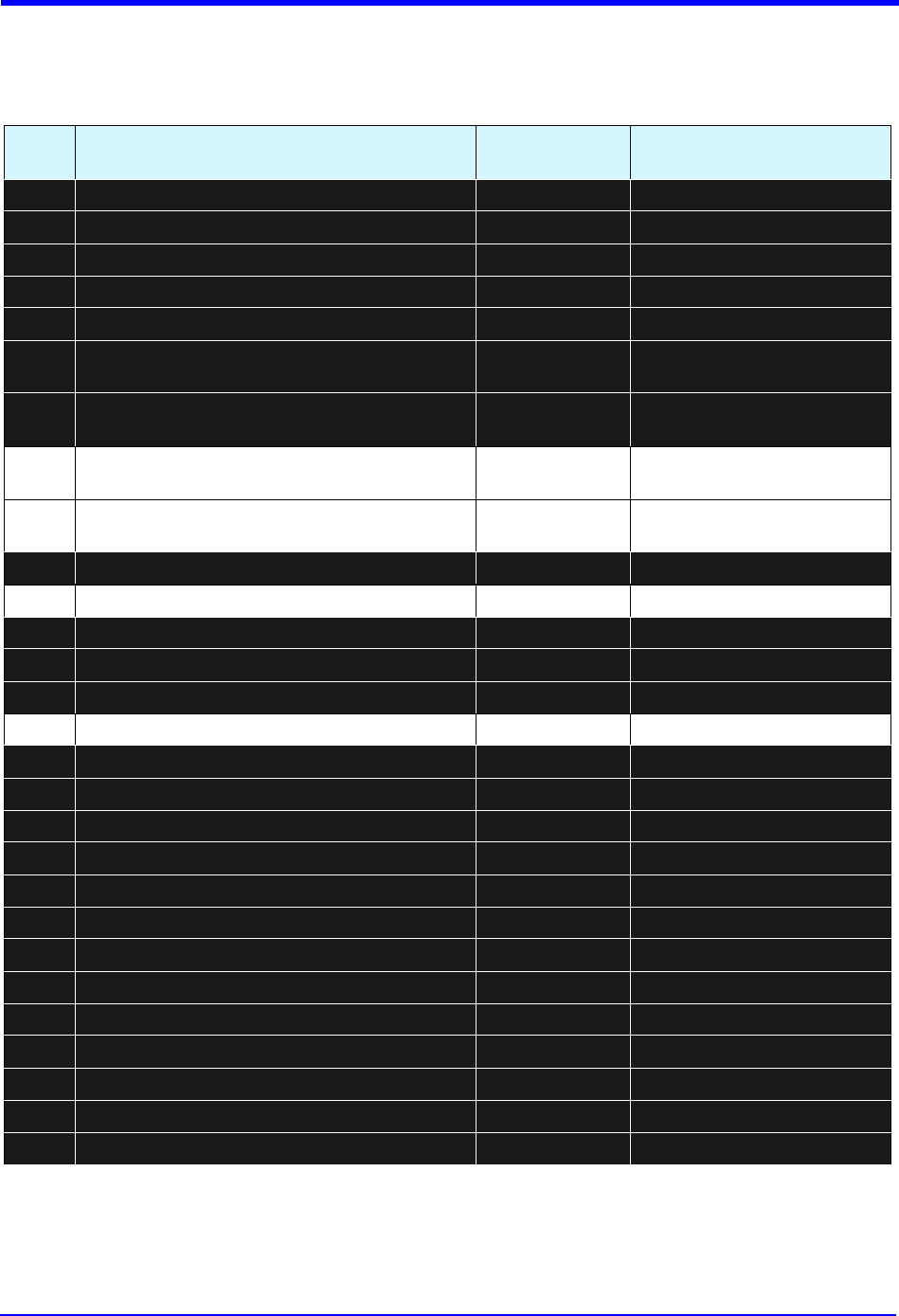

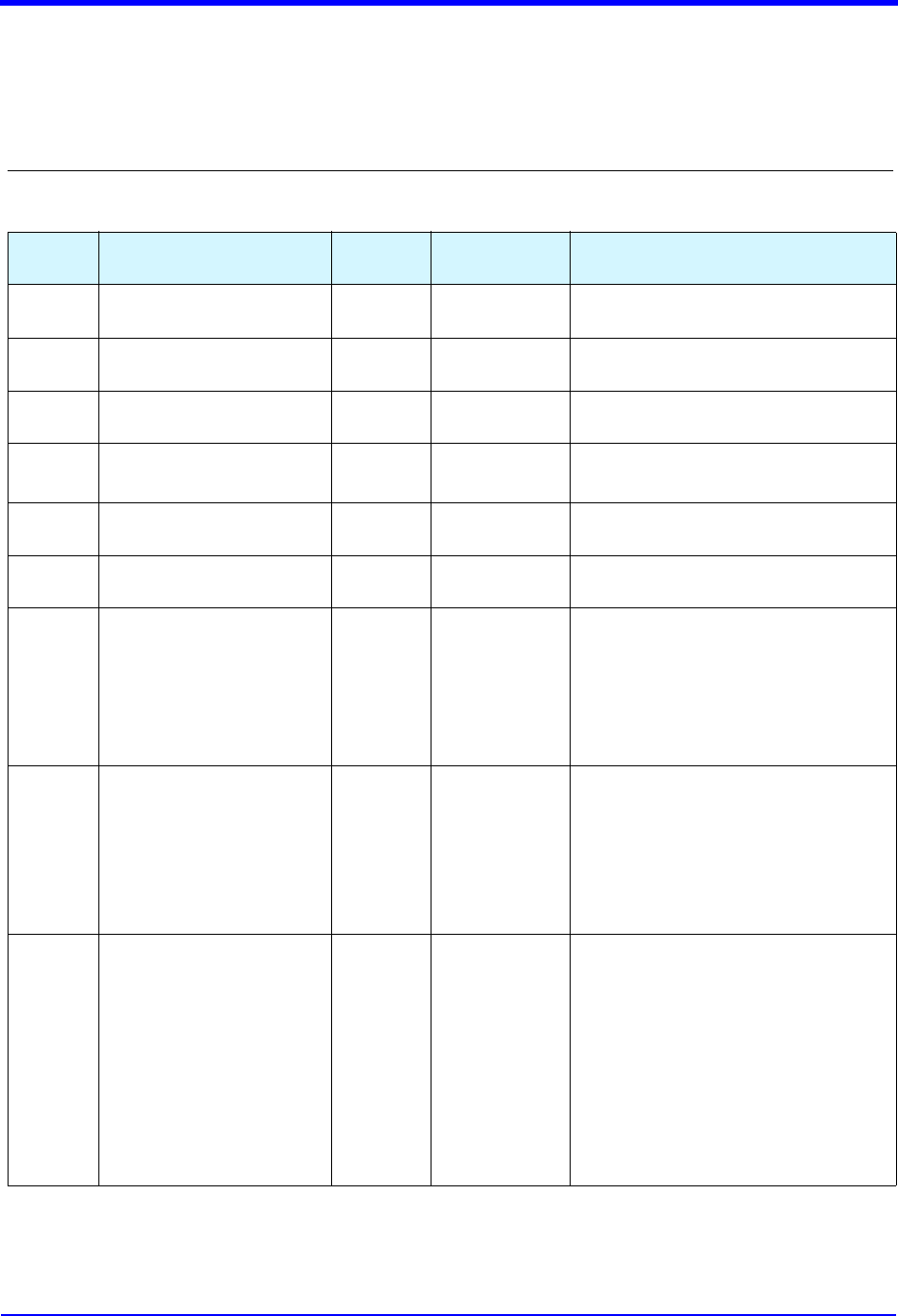

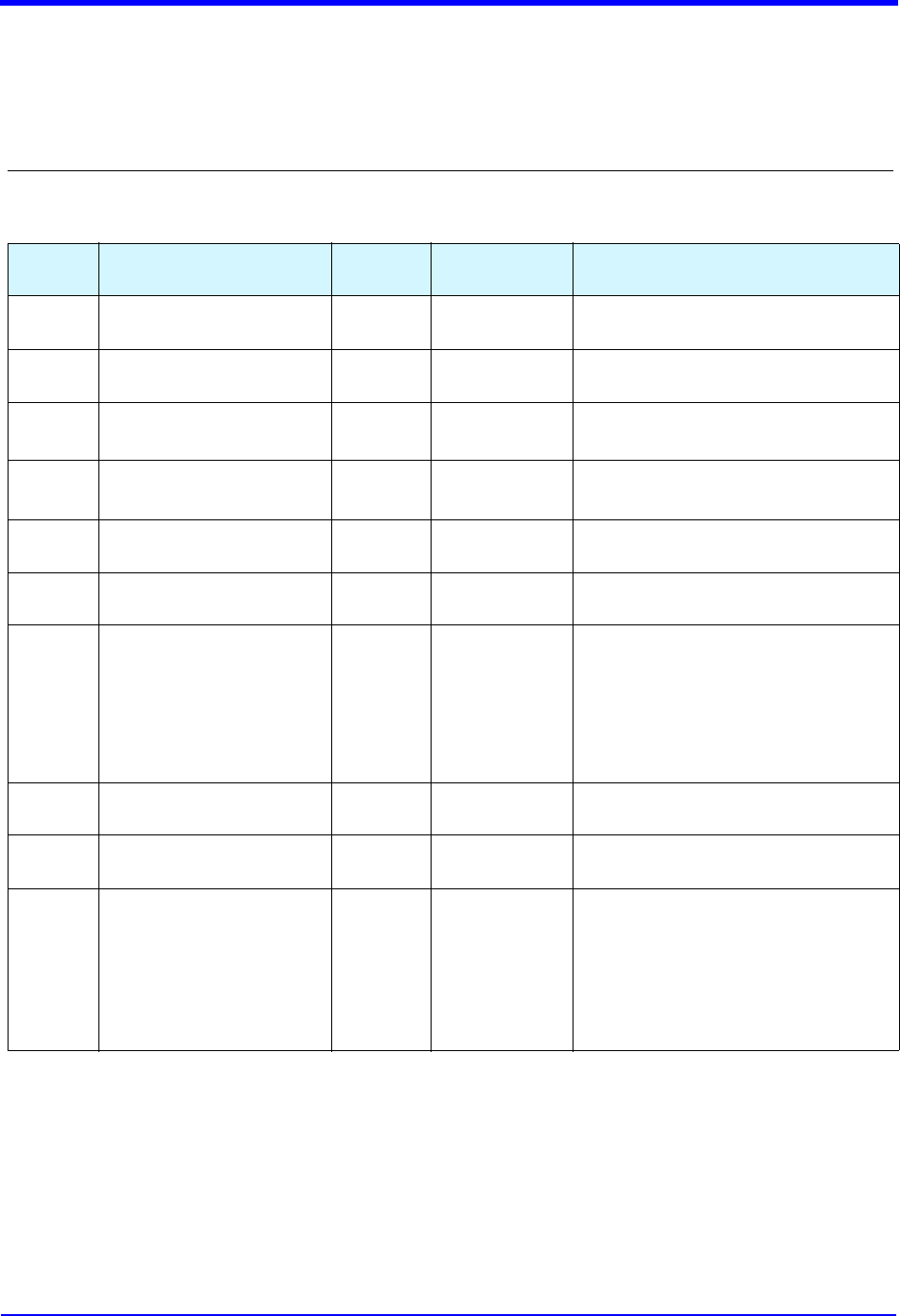

7.0 ISO 8583 Message Bit Map Table........................................................................53

7.1 Primary Bit Map ..................................................................................................................... 53

7.2 Secondary Bit Map................................................................................................................. 55

8.0 ISO 8583 Authorization Request/Response Message Formats.......................59

8.1 1100 Authorization Request ..................................................................................................59

8.2 1110 Authorization Response .............................................................................................. 179

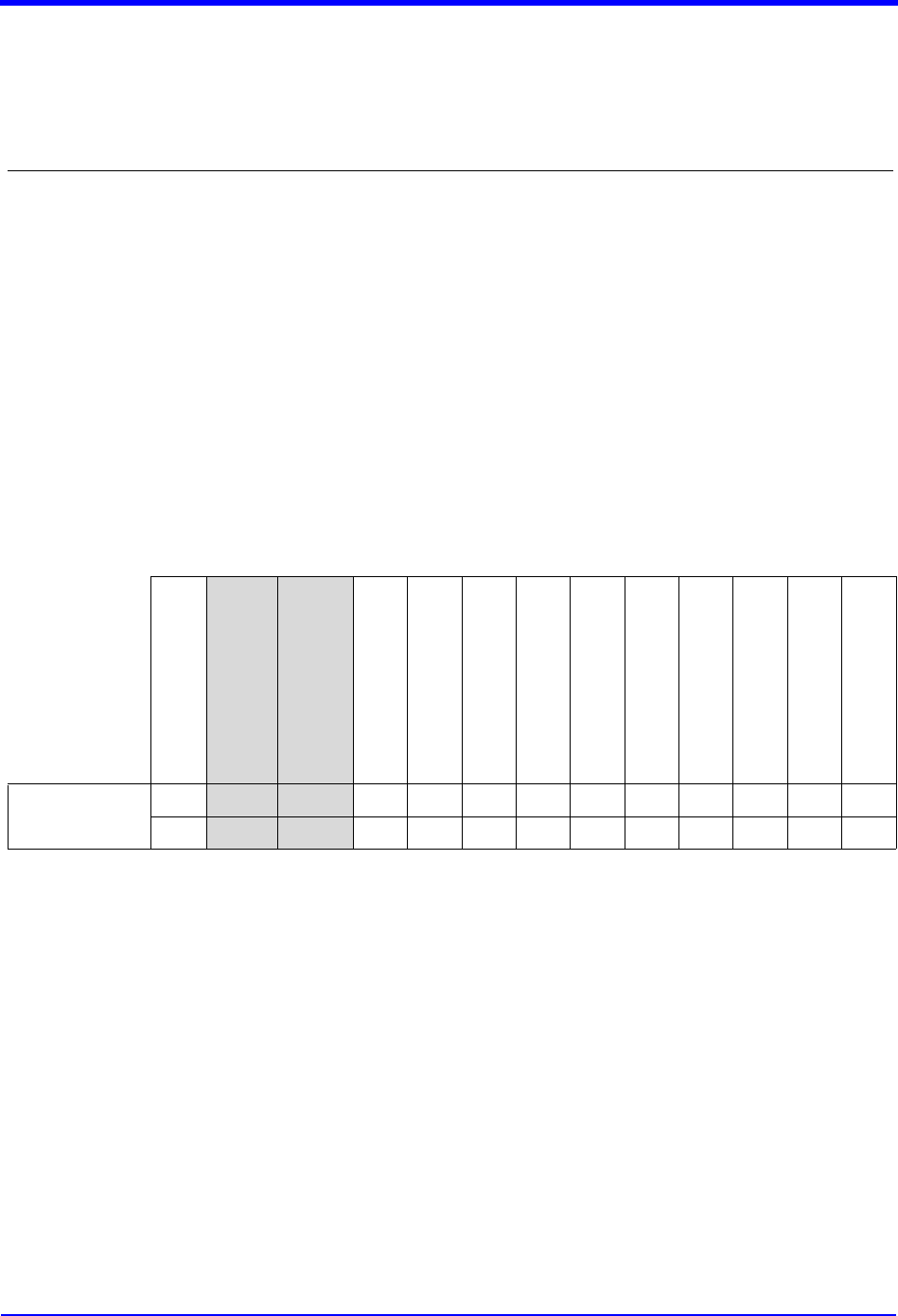

9.0 ISO 8583 Reversal Advice Request/Response Message Formats ...............219

9.1 1420 Reversal Advice Request ............................................................................................ 220

9.2 1430 Reversal Advice Response.......................................................................................... 237

10.0 ISO 8583 Network Management Request/Response Message Formats ....247

10.1 1804 Network Management Request.................................................................................. 248

10.2 1814 Network Management Response ............................................................................... 258

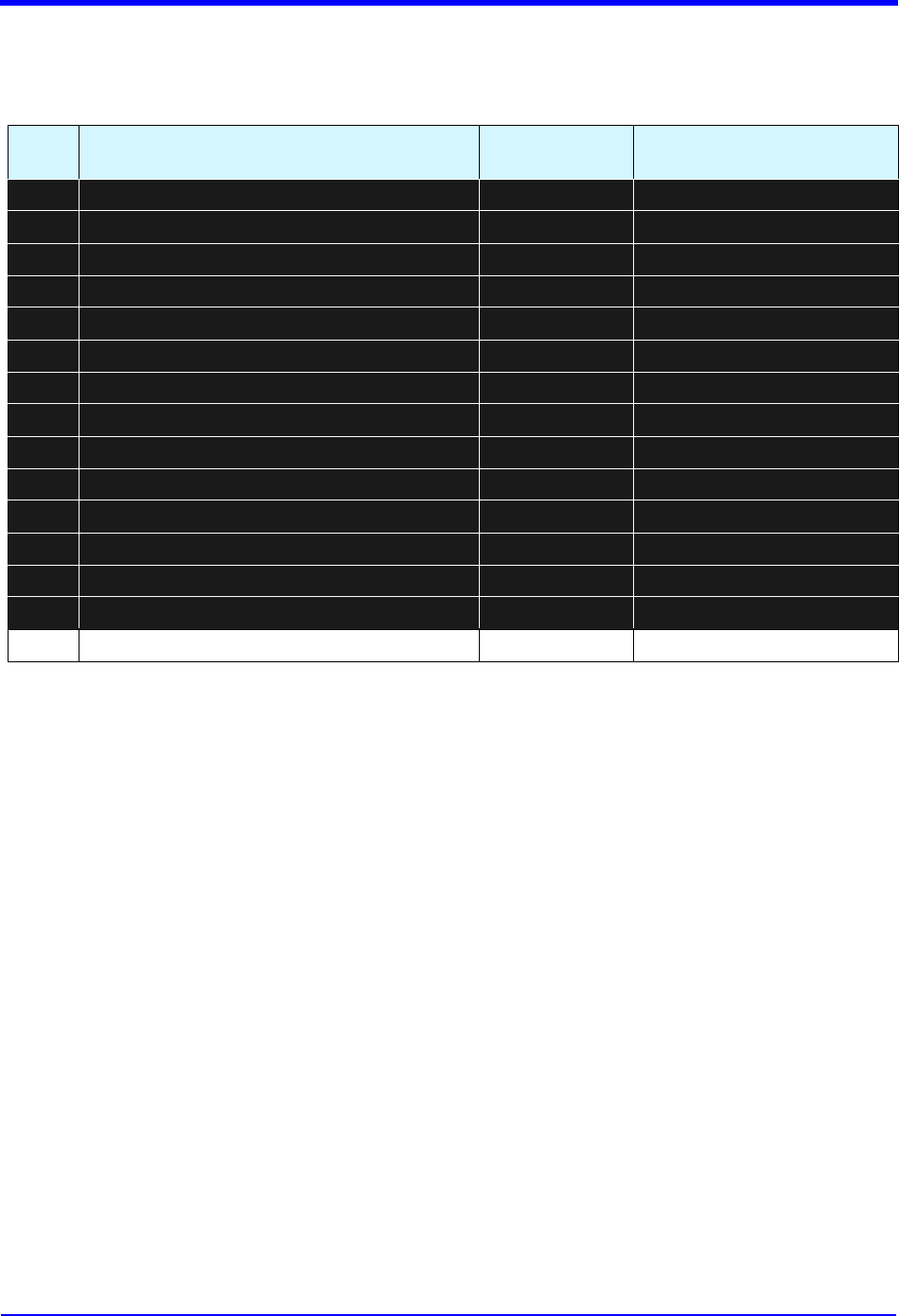

11.0 Examples of Typical Message Formats............................................................269

11.1 1100 Authorization Request Message — Card Present Transaction with

AAV & CID/4DBC/4CSC — American Express ................................................................... 269

11.2 1100 Authorization Request Message — Card Not Present Transaction with

AAV & CID/4DBC/4CSC — American Express ................................................................... 271

11.3 1110 Authorization Response Message — American Express........................................... 273

11.4 1420 Reversal Advice Request Message ............................................................................ 274

11.5 1430 Reversal Advice Response Message.......................................................................... 276

11.6 1804 Network Management Request Message.................................................................. 277

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 v

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

Table of Contents

11.7 1814 Network Management Response Message............................................................... 277

12.0 Revision Log ..........................................................................................................279

table of contents

of changes

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

vi April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

Table of Contents

this page intentionally left blank

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 1

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

1.0 About the Global Credit Authorization Guide

The American Express Global Credit Authorization Guide (GCAG) ISO contains software

development instructions for use of the American Express Authorization System. These instructions

enable programmers to code software in accordance with American Express requirements.

American Express will allow users that conform to this specification and pass our certification tests

to access the American Express Global Network to obtain authorizations for financial transactions.

Use of this specification prior to certification is prohibited.

1.1 Who Should Use the GCAG ISO

The GCAG ISO is written for Merchants, authorized Third Party Processors, OptBlue

Participants, Payment Service Providers (Aggregators) and Vendors.

In this guide, the terms Merchant, Seller, Service Establishment or SE, and Card Acceptor

are used interchangeably to refer to businesses that are approved to accept American

Express and/or American Express Partners' Cards as payment for goods and/or services.

The GCAG ISO is based on International Standard ISO 8583:1993, Financial Transaction

Card Originated Interchange Message Specifications.

1.2 Document Changes

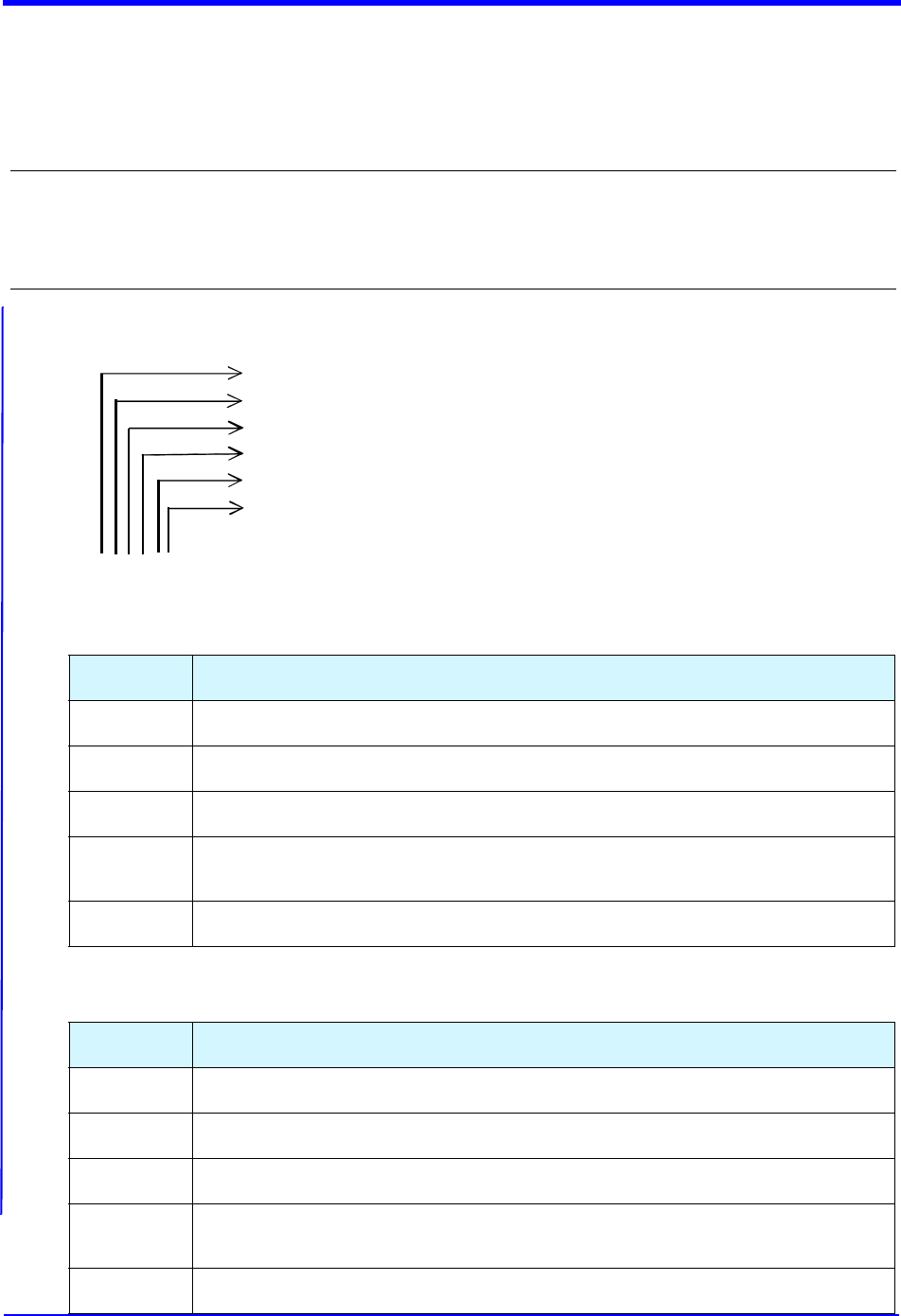

Changes to the GCAG ISO are identified in various ways.

Summary of Changes Table — The GCAG ISO begins with a Summary of Changes table

that provides a broad overview of technical and/or data field changes since the last

publication. The summary includes the following:

• The data field or section where revision occurred

• A brief description of the revision

Revision Mark — Throughout this document, revised areas that may affect the way a

Merchant, Third Party Processor or Vendor processes transactions are indicated with a

revision mark. This mark appears in the page margin, next to where a change was made.

See example of a revision mark at left. Removed text will not have a revision mark.

Changes may or may not be indicated with a revision mark.

Revision Log — The Revision Log is the last section in this document, and it contains a

condensed overview of changes made in the last three publications.

2 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

1.3 Communication Process

This section outlines how changes to American Express Technical Specifications are

communicated.

1.3.1 Semi-Annual Publication Process

The American Express Network publishes Technical Specifications twice each

year, in April and October. Specification changes, which will require technical

changes to implement or support, as well as any certification requirements

and/or compliance dates, will be communicated six months prior to publication

in a Notice of Specification Changes (NOSC).

1.3.2 Notice of Specification Changes

Notice of Specification Changes (NOSC) are also published twice each year, in

April and October. In each edition, changes to existing, or the introduction of

new features and functionality will be announced. These changes will be

incorporated into the next editions of the Technical Specifications.

• Changes published in the April NOSC will be incorporated into the October

editions of the Technical Specifications.

• Changes published in the October NOSC will be incorporated into the April

editions of the Technical Specifications.

1.3.3 Technical Bulletins

American Express will publish any changes occurring outside of the April and

October publication schedule in Technical Bulletins. Technical Bulletins will

generally contain the same level of detail found in the NOSC, including a

description of the change, and the business and technical impacts of the change

to customers.

Technical Bulletins may also communicate changes, corrections, and

clarifications announced in previous Technical Specifications. Information

communicated in Technical Bulletins will be incorporated into the next editions

of the Technical Specifications.

1.4 Contact Information

To notify us when content clarifications are required, send an email to

SpecQuestions@aexp.com. You may also send a copy of the document page in question.

You will receive confirmation of your request in 3-5 business days. Changes, corrections,

and clarifications will be published in the next release.

For questions on modifications to existing functionality, contact your American Express

representative.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 3

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

1.5 Related Documents

•American Express Global Financial Submission Guide (GFSG)

• American Express Global Codes & Information Guide

• American Express Online PIN Processing Implementation Guide for Merchants

or Third Party Processors

• American Express Global Credit Authorization Guide ISO 8583:1993 (Version 1)

Authorization Adjustment Addendum (AAA)

• American Express Network Communications Guide (MPLS & VPN)*

• American Express ICC Payment (AEIPS) Chip Card Specification

• American Express ICC Payment (AEIPS) Terminal Specification

• American Express Merchant Regulations - U.S.

• American Express SafeKey SM Acquirer — Merchant Implementation Guide

• Acquirer Chip Card Implementation Guide

• Implementing American Express EMV Acceptance on a Terminal

• Expresspay Terminal Specification

• Expresspay Card Specification

• Expresspay Card Specification Dual Interface Addenda

• Expresspay Communication Layer

• International Standard ISO 8583:1993, Financial Transaction Card Originated

Interchange Messages — Interchange Message Specifications

• International Standard ISO/IEC 7813, Identification Cards — Financial Transaction

Cards (Track I and Track II Specifications)

• American National Standards Institute ANSI X4.16, Financial Transaction Cards —

Magnetic Stripe Encoding

• American National Standards Institute ANSI X9.24, Asymmetric Techniques for the

Distribution of Symmetric Keys

• EMVCo Payment Tokenization Specification - Technical Framework

_____________________

*USA and Canada only. For information on connectivity solutions in other global regions, contact your American Express

representative.

4 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

this page intentionally left blank

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 5

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

2.0 Implementation Planning

This section addresses the requirements and procedures needed for implementing authorization

software. This section includes the following:

2.1 Overview of Implementation Planning

2.2 Development Responsibilities

2.3 Development Steps

2.4 Hardware Requirements

2.5 Communications Options

2.6 Leased Lines

2.1 Overview of Implementation Planning

Merchants and authorized Third Party Processors who are interested in developing an

interface to American Express must first contact an American Express representative. The

American Express representative will discuss the business and basic technical issues

involved with authorization, and if necessary, financial submission.

Once the business issues and decisions have been resolved, an American Express

representative calls the Merchant and acts as the primary American Express contact

during all phases of development until the software is approved for production use.

The American Express representative arranges for a technical conference call that

includes members of the Merchant's technical staff and representatives of American

Express. Prior to the first call, Merchants should become familiar with the contents of this

document, as well as the following American Express documents:

• American Express Global Codes & Information Guide

•American Express Global Financial Submission Guide (if implementing both

authorization and submission)

•American Express Network Communications Guide (MPLS & VPN)*

_____________________

* USA and Canada only. For information on connectivity solutions in other global regions, contact your American Express

representative.

6 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

2.1 Overview of Implementation Planning (continued)

During the technical conference call, Merchants may ask the American Express staff

detailed questions about hardware, communications protocol, and authorization service

options. The American Express technical staff and American Express representative will

provide detailed descriptions of processing options and message formats. The conference

concludes when the Merchant and American Express agree on the authorization service

options and interface requirements.

Following the initial conference calls, the American Express representative will arrange a

technical conference call to review, in detail, the authorization message format selected

by the Merchant.

2.2 Development Responsibilities

The following lists outline the basic installation responsibilities for both American Express

and the Merchant.

American Express provides the following services:

• Allows scheduled access to American Express testing facilities.

• Allows 24-hour access to the American Express Consolidated Data Network (CDN)

after the Merchant is approved for production activities.

• Installs and maintains circuit modems for a leased line authorization link, for

qualified Merchants only. For more information, contact your American Express

representative.

The Merchant provides the following:

• Develops or purchases credit authorization application and communications protocol

software.

• Dedicates staff and computer resources to credit authorization software development

within the project schedule agreed upon by American Express and the Merchant.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 7

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

2.3 Development Steps

Most Merchants develop and implement their authorization software in these steps:

1. Participate in the technical conference call with American Express.

2. Receive and review the Business Requirements Document and Application Test Plan.

3. Develop authorization application and communications protocol software.

4. Test communications protocol with American Express. After protocol approval, test

the authorization application software as stated in the Application Test Plan.

5. Receive American Express approval for production processing.

2.4 Hardware Requirements

The requirements for the hardware used by the Merchant are dependent on the types of

products and services to be supported by the Merchant. For this reason, hardware

requirements are established during conversations with the American Express

representative.

2.5 Communications Options

For details, refer to the American Express Network Communications Guide (MPLS & VPN)*

2.6 Leased Lines

Merchants who wish to use a leased line must qualify by transaction volume. This

qualification is negotiated between the Merchant and the American Express

representative. Qualified Merchants who choose a leased line may either use online or

batch services.

The costs associated with using a leased line are contractually established between the

Merchant and American Express. Merchants using their leased line to obtain MasterCard

and VISA authorizations through the American Express authorizations system are assessed

a small fee per transaction.

_____________________

* USA and Canada only. For information on connectivity solutions in other global regions, contact your American Express

representative.

8 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

this page intentionally left blank

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 9

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

3.0 Card Acceptance Guidelines

American Express enables Merchants and Third Party Processors to obtain financial transaction

authorizations for the following:

• American Express Cards

• American Express-supported Network Cards

• American Express Prepaid Cards

• American Express Travelers Cheques

The Merchant or Third Party Processor must develop authorization software to enable the Merchant

to collect Point of Sale (POS) information in any manner chosen by the Merchant's development

team and also to submit that data to American Express in a format prescribed by this document.

American Express requires all Merchants and service providers, as part of their Card Acceptance or

servicing agreements, to adhere to the American Express Data Security Operating Policy (DSOP).

The policy requires Merchants to comply with the Payment Card Industry Security Standard to

process, store or transmit Cardmember payment information. More information on the American

Express DSOP and the PCI Data Security Standard can be found at

www.americanexpress.com/datasecurity.

Users of this specification are often classified by regions which allow data field requirements and

certification requirements to be applied to a specific region. When no country or region is listed for

a requirement it is assumed to be a global requirement for all regions otherwise, the requirement

applies to the countries and/or regions listed. The following acronyms are the recognized regional

definitions:

• APA — Asia Pacific and Australia

• Canada — Canada

• EMEA — Europe, Middle East and Africa

• LA/C — Latin America and Caribbean

• USA — United States

For a complete list of regions and applicable countries, refer to the American Express Global Codes

& Information Guide.

10 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

3.0 Card Acceptance Guidelines (continued)

Data from the following data fields in approved Authorization Request (1100) and Authorization

Response (1110) messages should be retained by the Merchant since this information is required

for financial submission:

Note: Other data may also be required. For more information on data requirements for financial

submission, refer to the American Express Global Financial Submission Guide (GFSG).

• Primary Account Number (PAN) • Approval Code

• Amount, Transaction • Acquirer Reference Data (Transaction Identifier/TID)

• Date and Time, Local Transaction

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 11

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

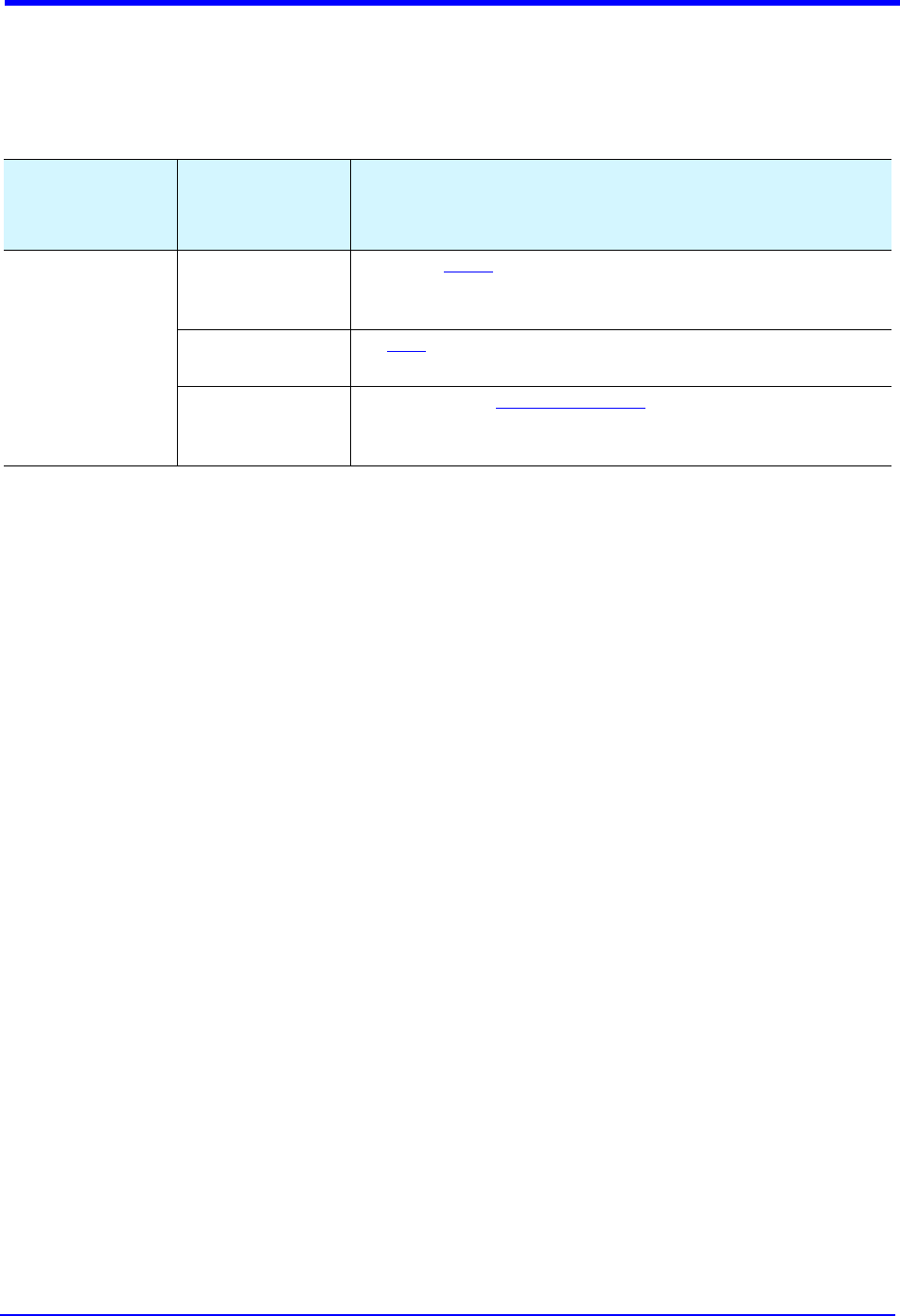

4.0 Guidelines for Using the GCAG ISO 8583 Message Formats

ISO 8583 standard provides for variable length messages that are bit map driven. A bit map

consists of a 64-bit string contained within an eight-byte data field. The data content of a message

is determined by the value (1) or (0) in a bit map data field. Each bit is associated with a unique data

field. If the data content for a data field is available, the bitmap position should be set to one (1)

and the respective data field should be sent. If the data content for a data field is not available, the

bitmap position should be set to zero (0) and the respective data field should not be sent.

Data fields can be either fixed-length or variable-length. The Variable Length Indicator (VLI)

indicates how many bytes of data will follow it. A length subfield or Variable Length Indicator (VLI)

precedes the variable length data subfields. The length of the VLI will be encoded in either two or

three character bytes. The length of the VLI is not included in the length of the variable data

subfield it describes.

For example:

LLVAR — When present with a variable length data field specification, this indicates that the data

field contains two subfields:

• “LL” indicates the number of positions in the VLI, and the value in the VLI shows the length

of the variable-length data subfield that follows. The length may be 01 to 99 unless

otherwise restricted.

• “VAR” is the variable length data subfield.

Example: A 27-byte data field with LLVAR indicates a VLI of 2 bytes with a maximum length of 25

bytes of variable data.

LLLVAR — When present with a variable length specification, this indicates that the data field

contains two subfields:

• “LLL” indicates the number of positions in the variable-length data subfield that follows.

Length may be 001 to 999, unless otherwise restricted.

• “VAR” is the variable length data subfield.

Example: A 503-byte data field with LLLVAR indicates a VLI of 3 bytes with a maximum length of

500 bytes of variable data.

12 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

4.0 Guidelines for Using the GCAG ISO 8583 Message Formats (continued)

• Unless otherwise specified, all fixed-length numeric data fields should be right justified and

zero filled. Fixed-length alphanumeric data fields should be left justified and character

space filled. Binary data fields should be in eight-bit blocks that are left justified and zero

filled.

• The message content must be configured in the EBCDIC character set unless otherwise

noted in the data field details.

• The communications protocol must support Transparency, due to the presence of binary

data (e.g., bitmaps) that may be mistaken for communications control information.

• Some data fields are not supported in this version of the American Express ISO 8583

interface. However, to allow all processes to consistently and accurately deal with all data

fields, all the attributes of all 64 data fields in the primary bit map are supplied beginning

on page 53 and must be allowed while developing the interface. This allows a message to

be sent even when it contains unsupported data. The data will not be processed by the

recipient nor returned to the sender, but the definitions allow each system to step past

unsupported data fields.

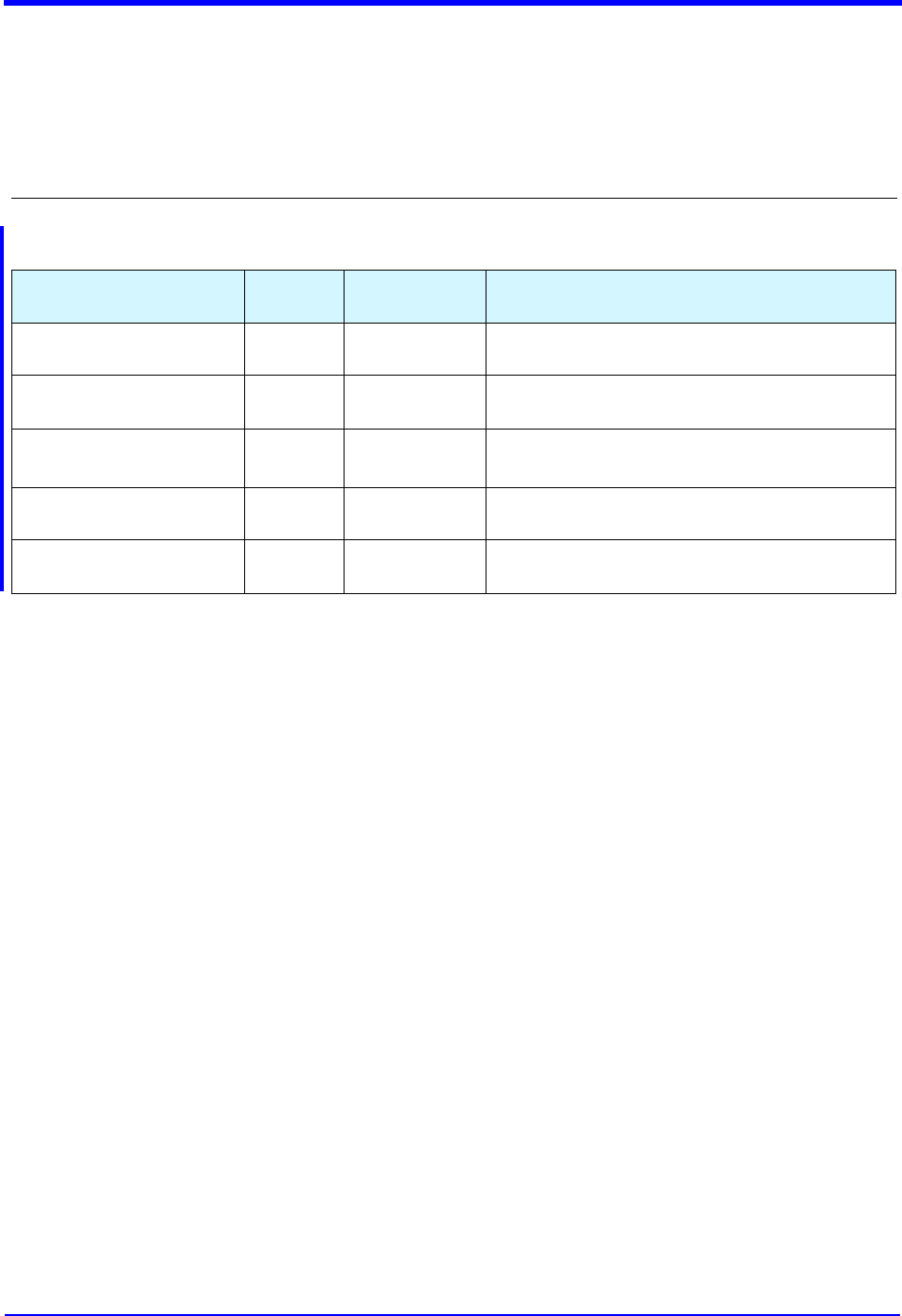

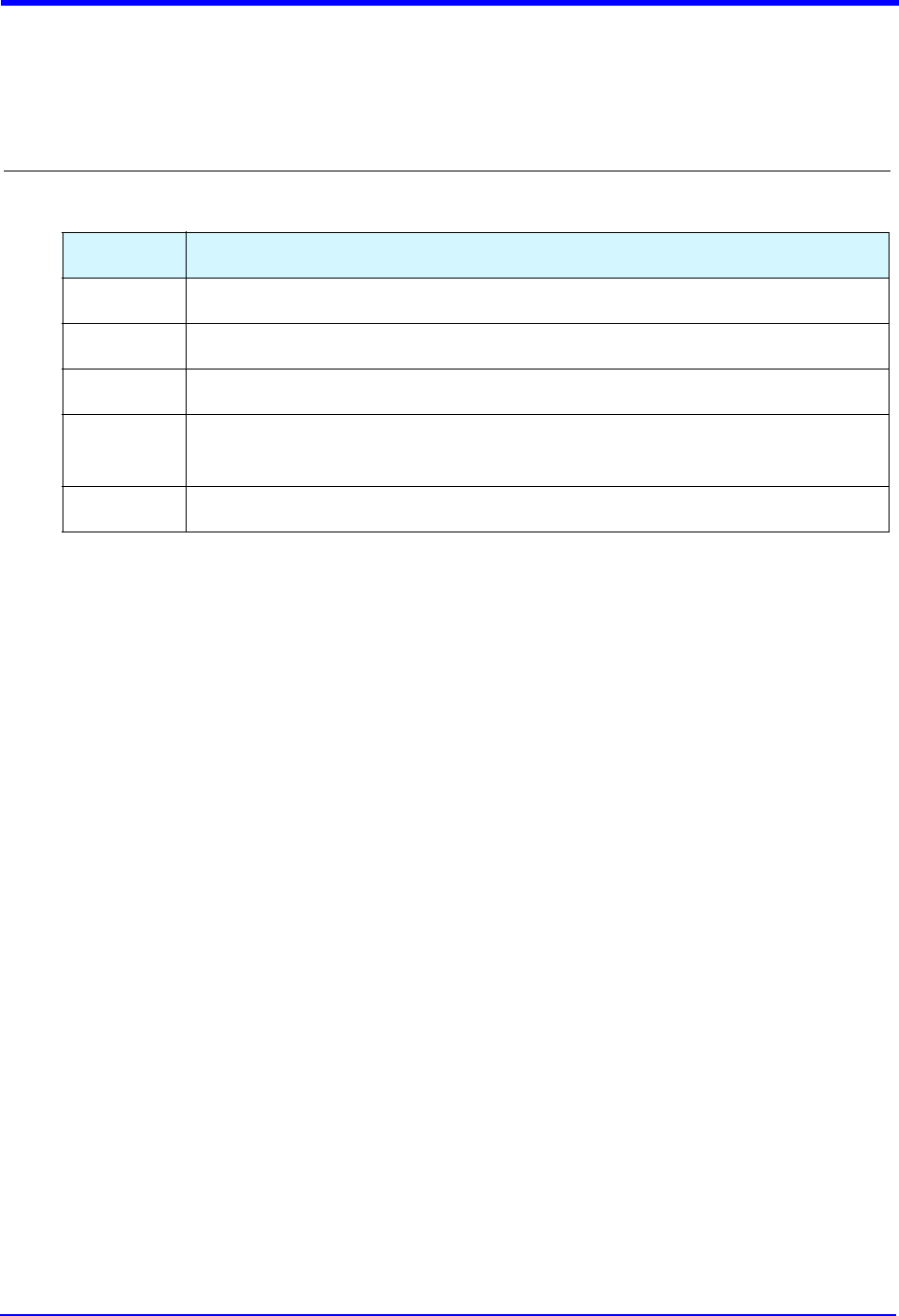

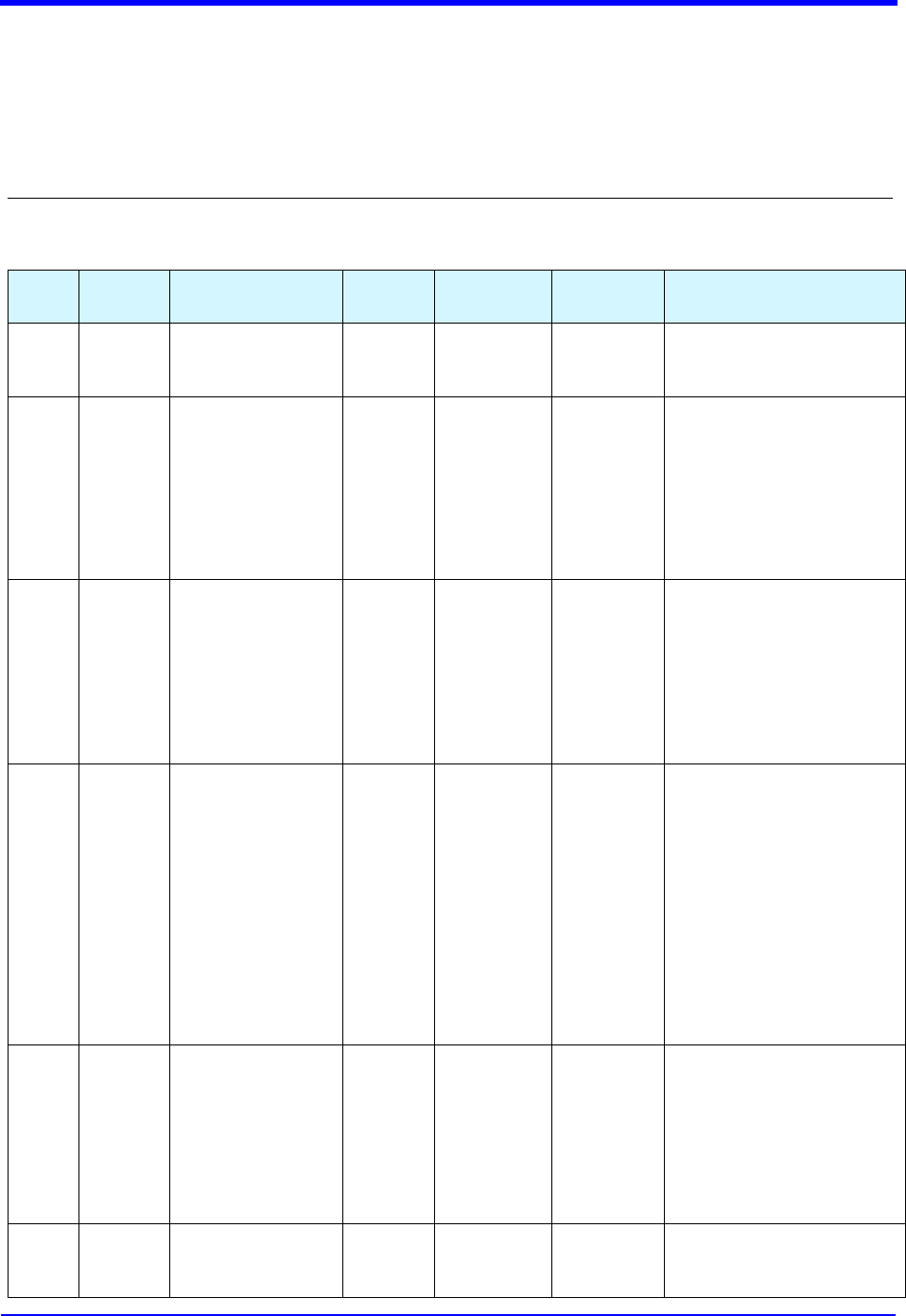

• Some data fields of the message are required to process the message while others are not

required to process the message. Some data fields may be required in the response when

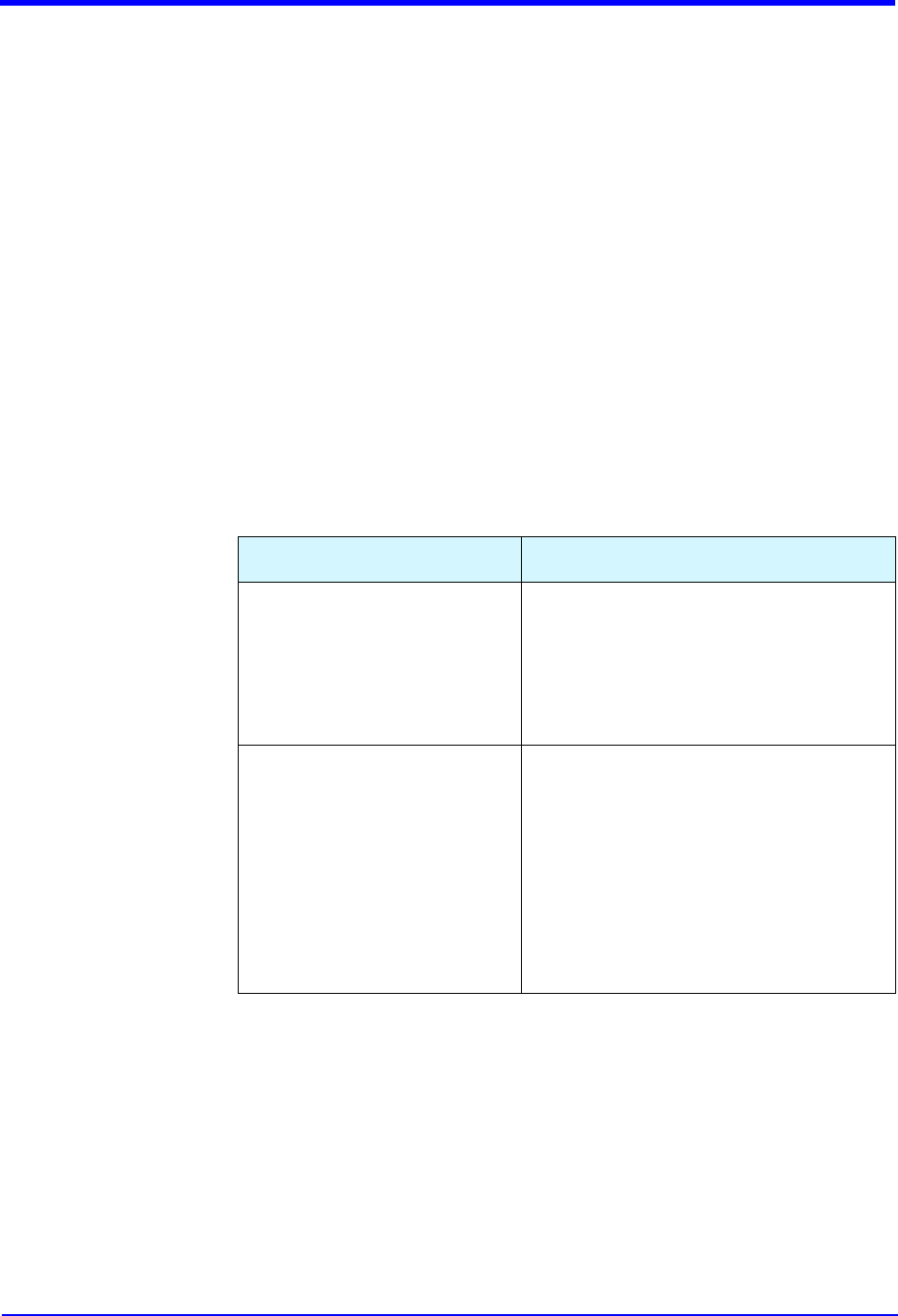

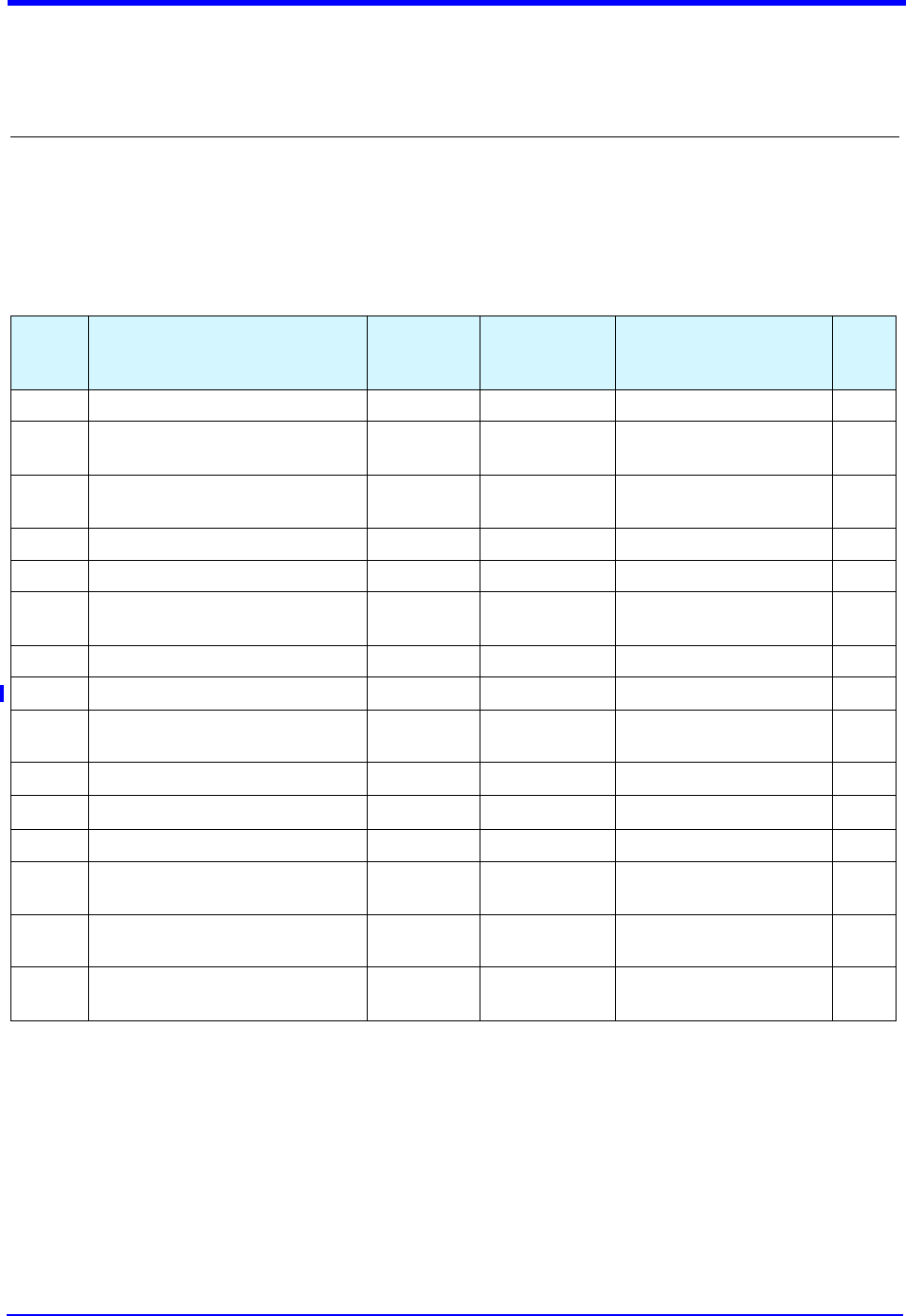

present in the request. Data field requirements are as follows:

Mandatory Data field and contents are required to process this message. Data field

must contain the appropriate text or numeric information as indicated.

Mandatory - Echo returned Data field is mandatory for processing this message; and whenever

included in an originating request message, it will be preserved and

returned in the response message without alteration.

Optional Data field and contents are not mandatory for processing the message, but

should be provided if available.

Optional - Echo returned Data field is optional for processing this message; and whenever included

in an originating request message, it will be preserved and returned in the

response message without alteration.

Conditional A data field may be conditional if it is only used in certain circumstances.

See Data Field Descriptions for specific details.

Conditional - Echo returned Data field is conditional for processing this message; and whenever

included in an originating request message, it will be preserved and

returned in the response message without alteration.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 13

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

4.0 Guidelines for Using the GCAG ISO 8583 Message Formats (continued)

When Track 1 and/or Track 2 data is read from a magnetic stripe, the Merchant, their devices,

systems, software, Vendors and Third Party Processors should capture all characters between the

start and end sentinels, strip off the sentinels and LRC, and forward the remainder to American

Express in the appropriate ISO 8583 Track 1 and/or Track 2 data field without regard to the specific

lengths referenced in these sections. For more information, refer to the American Express

Magnetic Stripe Formats in the American Express Global Codes & Information Guide.

Both Track 1 and Track 2 must be converted from ASCII to EBCDIC, and character spaces must not

be stripped. In addition, data must not be padded to standardize track lengths, and it must be

transmitted as read.

The Authorization Request (1100) message contains a data field that describes point-of-service

processing capabilities (Data Field 22). Merchants and Third Party Processors must ensure that

authorization data in Data Field 22 is accurate. Specifically, accuracy of Card Present, Cardholder

Present and Track Data Indicators can significantly affect message processing, decrease POS

disruptions and maximize customer satisfaction.

For more information, contact your American Express representative.

14 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

4.1 Variations in Messaging

No individual data field should exceed 290 bytes, except where specifically noted.

Messages transmitted to American Express must not exceed 900 bytes in total length.

For assistance in selecting optional data fields and determining the appropriate formats

and variable data field lengths to use, contact your American Express representative.

American Express reserves the right to modify data field parameters (e.g., changing Data

Field Type from numeric to alphanumeric, or vice-versa) to meet specific business and/or

internal data and system requirements.

American Express Card creation standards for magnetic stripe layouts may include

additional data undefined in currently published American Express implementations of

ANSI X4.16 and ISO 7813 formats. Magnetic stripe data fields in current use will not be

moved; however, discretionary or unused data fields may be redefined for use with future

American Express Card products. Therefore, the data field definitions referenced in the

American Express Magnetic Stripe and Expresspay Pseudo-Magnetic Stripe Formats are

for reference only and may not reflect all American Express Card variations that may be

encountered.

For additional information, refer to American Express Magnetic Stripe and Expresspay

Pseudo-Magnetic Stripe Formats in the American Express Global Codes & Information

Guide.

4.2 ISO 8583 Message Formats

American Express supports the International Organization for Standardization ISO 8583

format to exchange messages for authorizations.

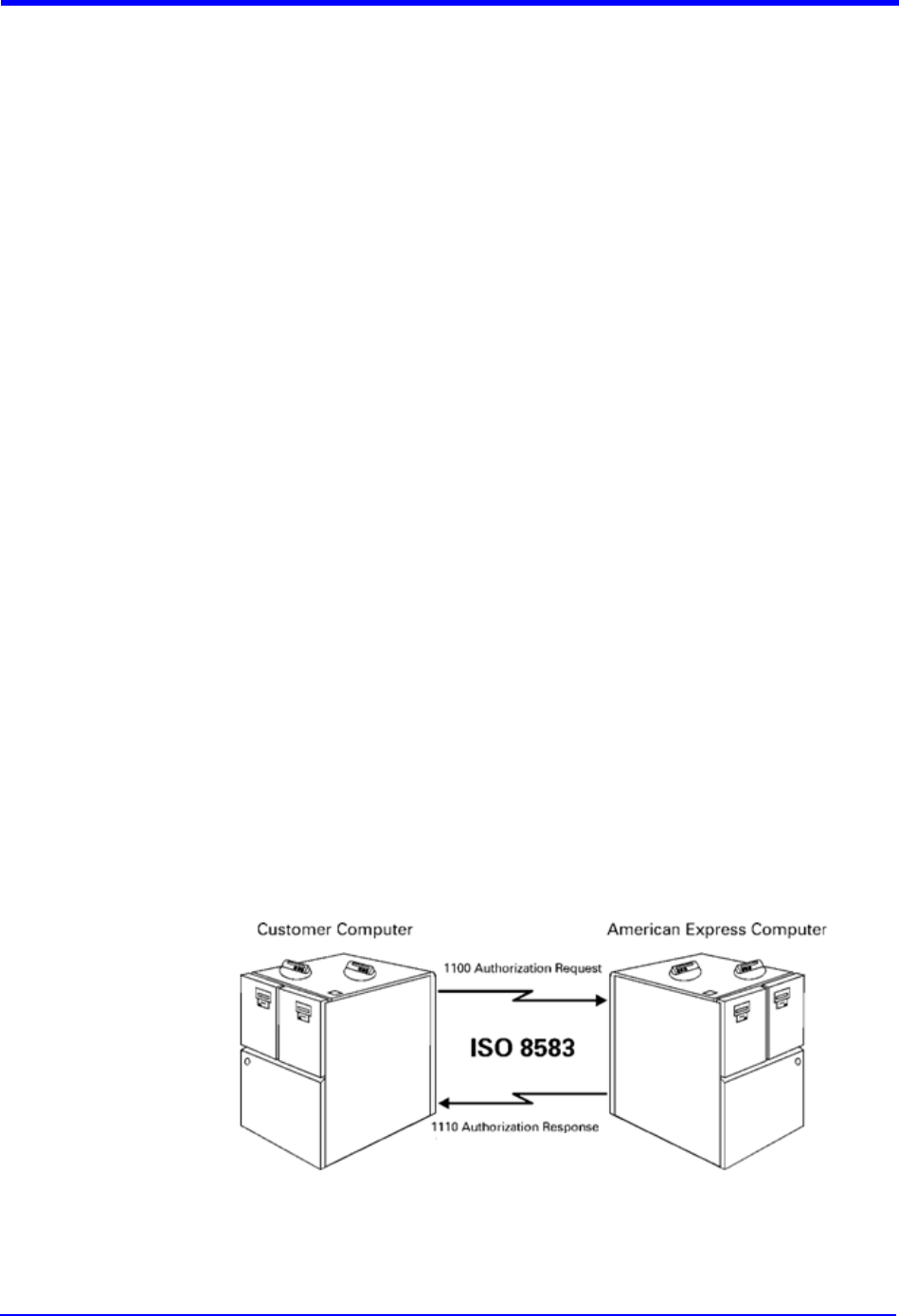

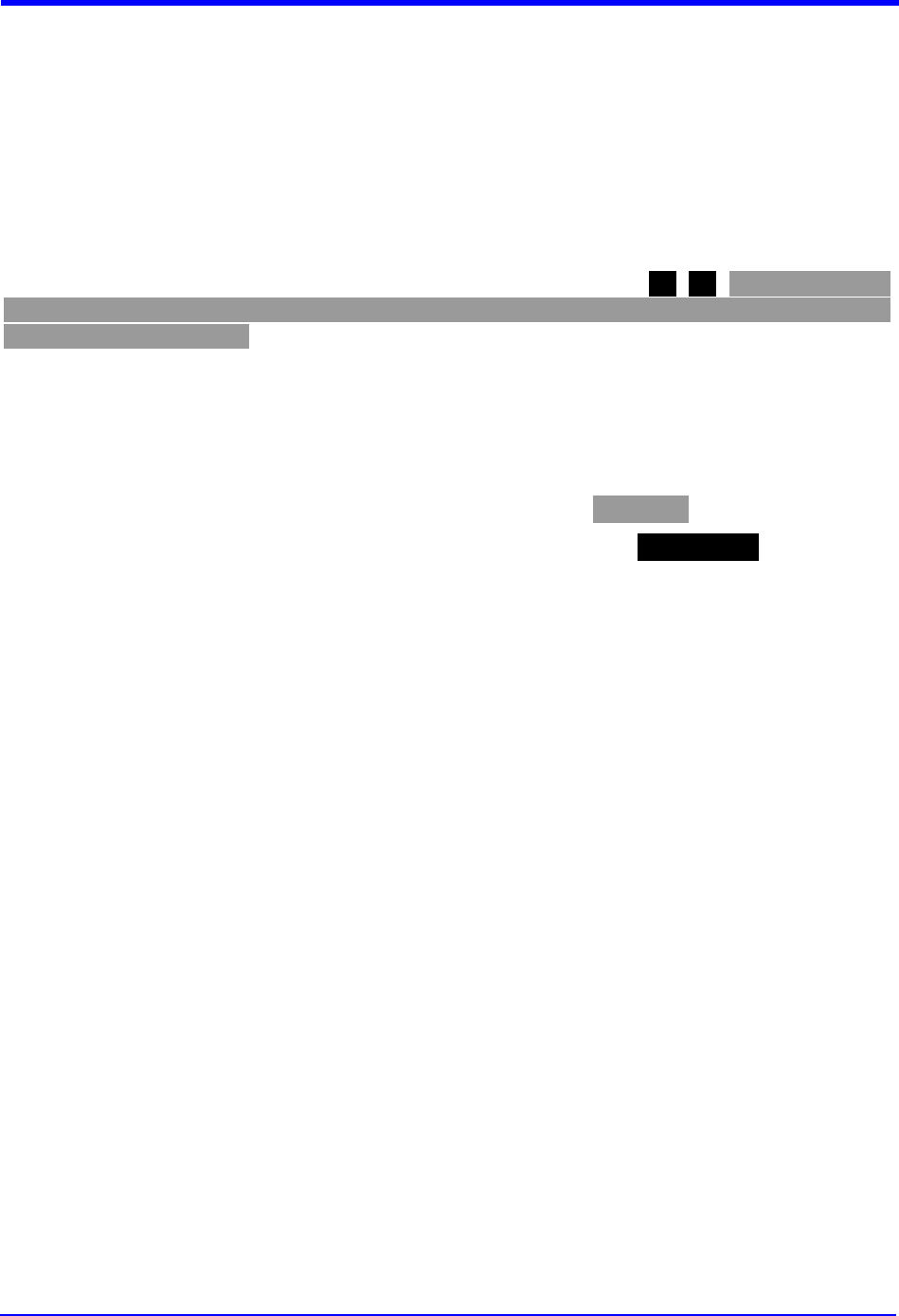

4.2.1 Authorization Request/Response

• 1100 Message is used for Authorization Request messages

• 1110 Message is used for Authorization Response messages

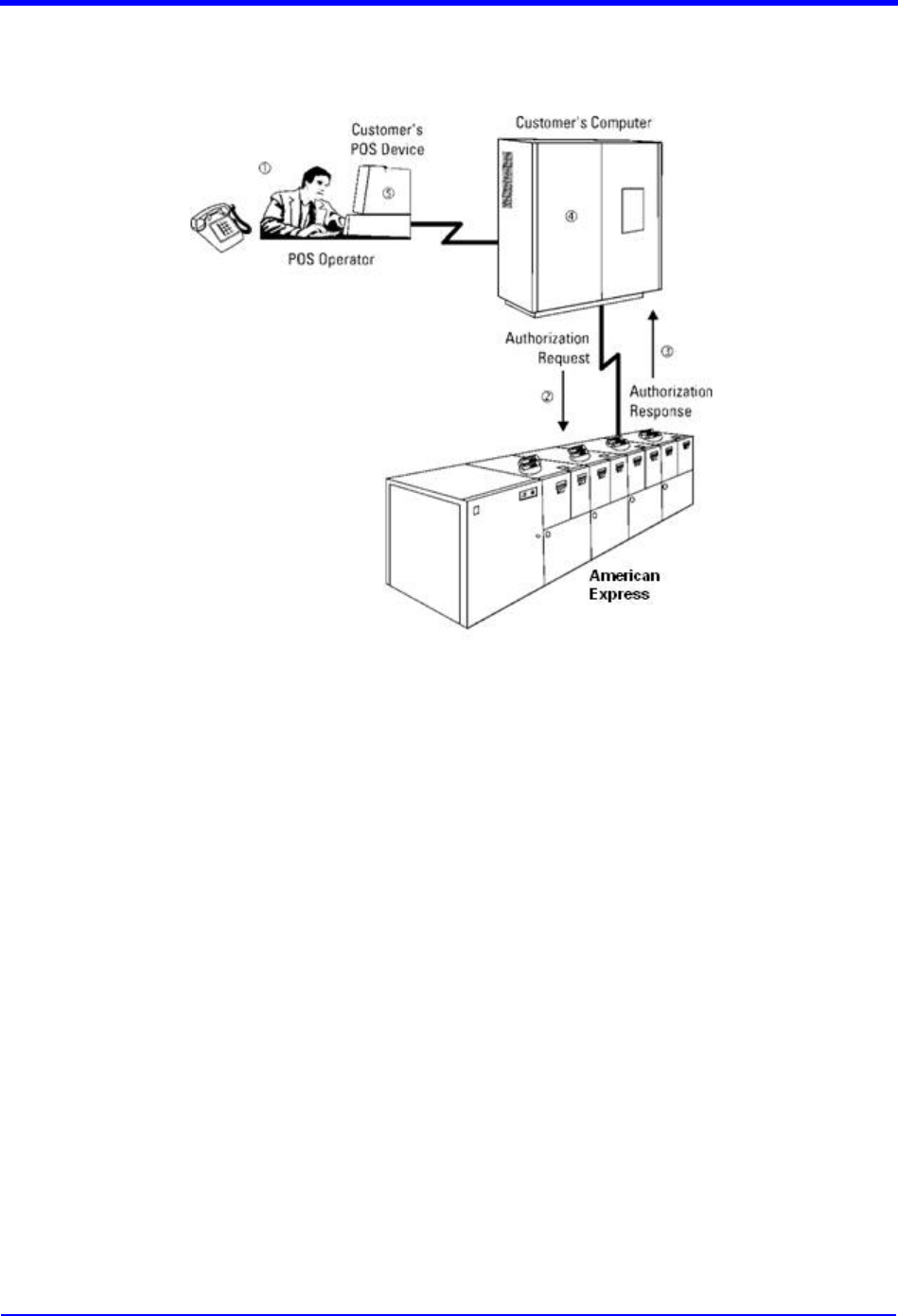

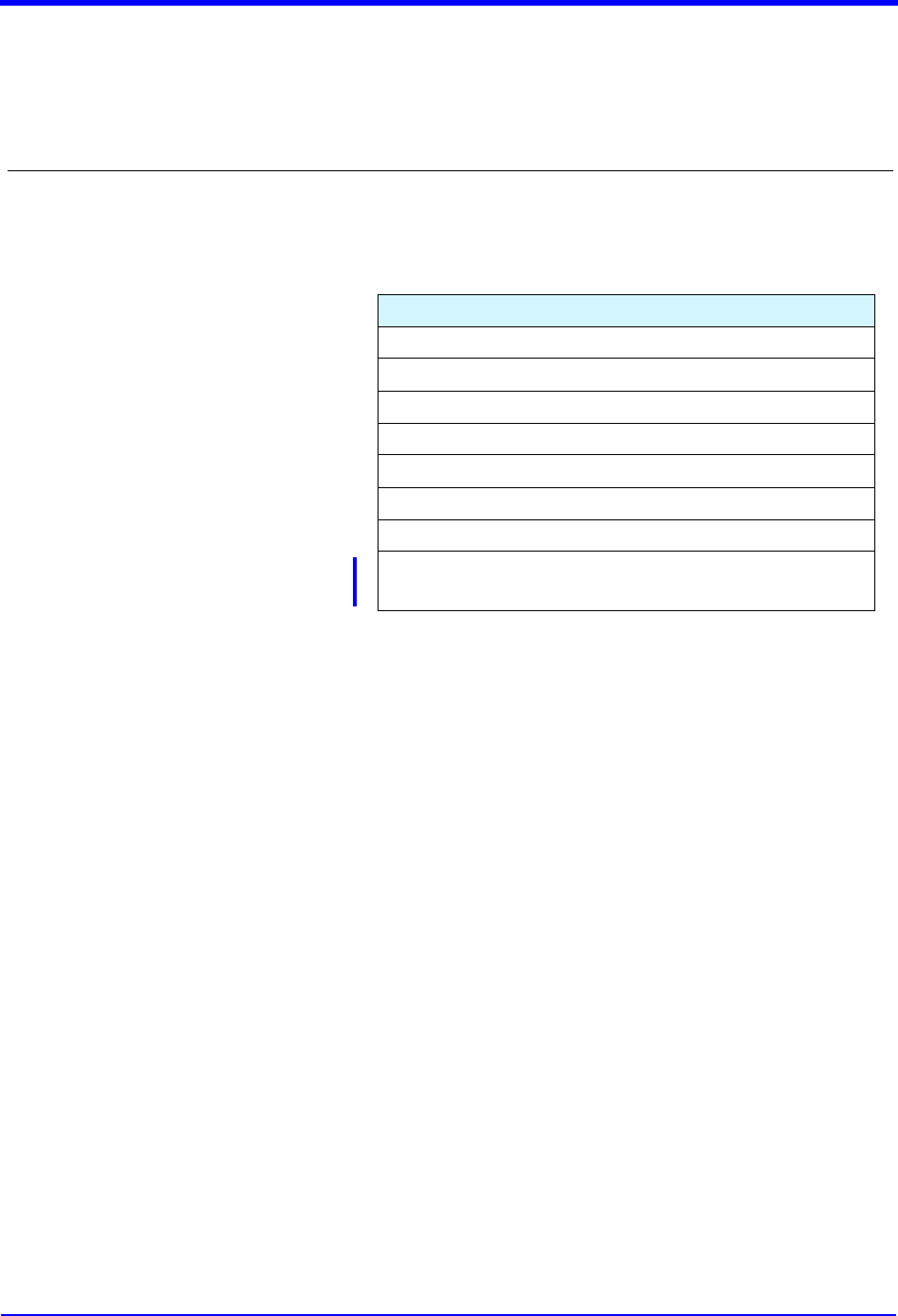

Figure 1-1. ISO 8583 Authorization Message Exchange

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 15

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

4.2.1 Authorization Request/Response (continued)

Merchants use the Authorization Request (1100) message to transmit credit

authorization and/or Automated Address Verification (AAV) request messages

to American Express. American Express uses the Authorization Response (1110)

message to respond to a Merchant's Authorization Request (1100) message.

American Express places the credit analysis results for the request in the

Authorization Response (1110) message.

Merchant time-out values are determined during the technical conference call.

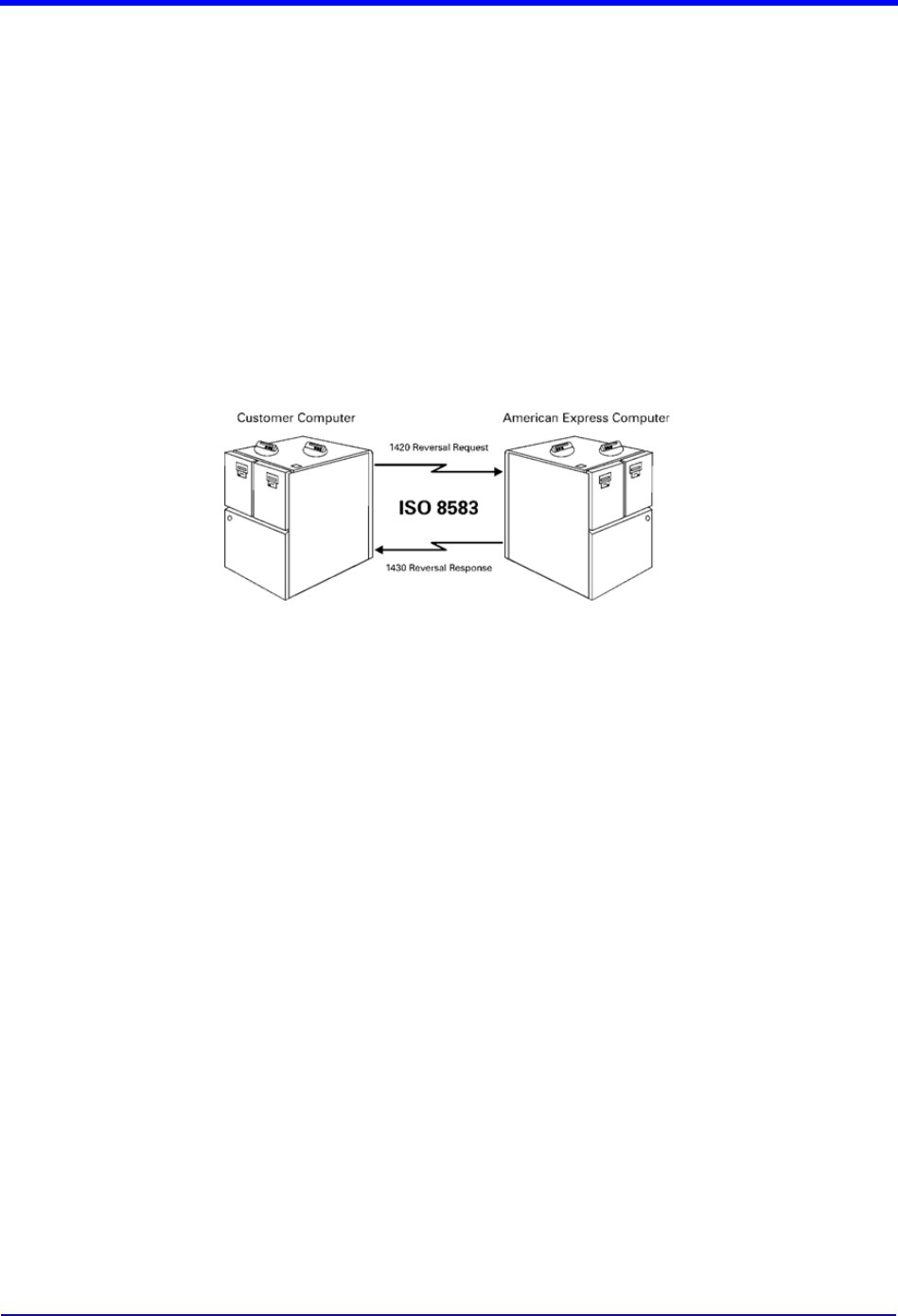

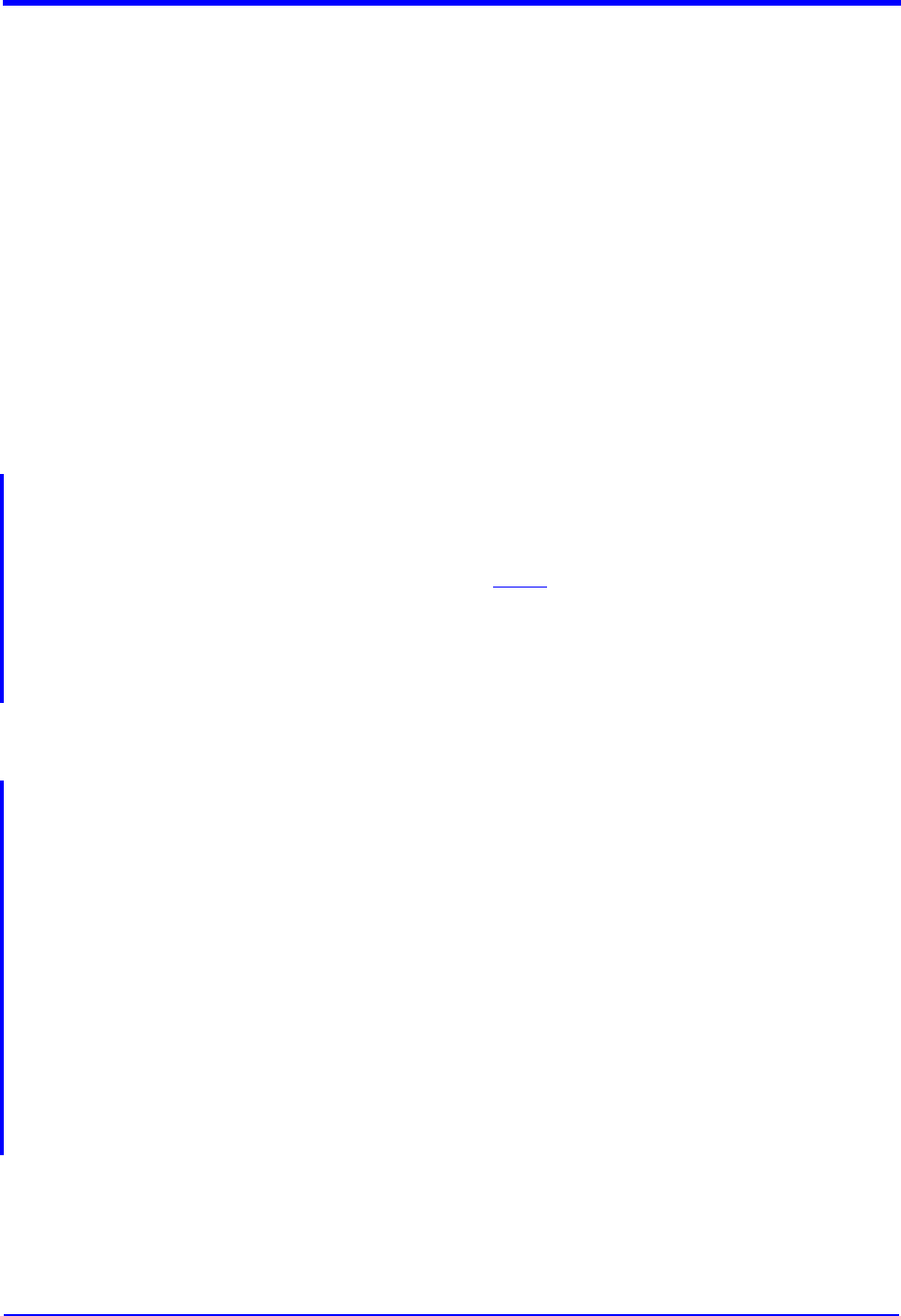

4.2.2 Reversal Advice Request/Response

• 1420 Message is used for Reversal Advice Request messages

• 1430 Message is used for Reversal Advice Response messages

Figure 1-2. ISO 8583 Reversal Advice Message Exchange

These messages are constructed as specified in the ISO 8583-1993 standard. If

your system supports a different version of ISO 8583, notify your American

Express representative.

The Reversal Advice Request (1420) message allows the acquiring source to

cancel the effects of a previous authorization transaction, completely. For more

information, see page 219.

16 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

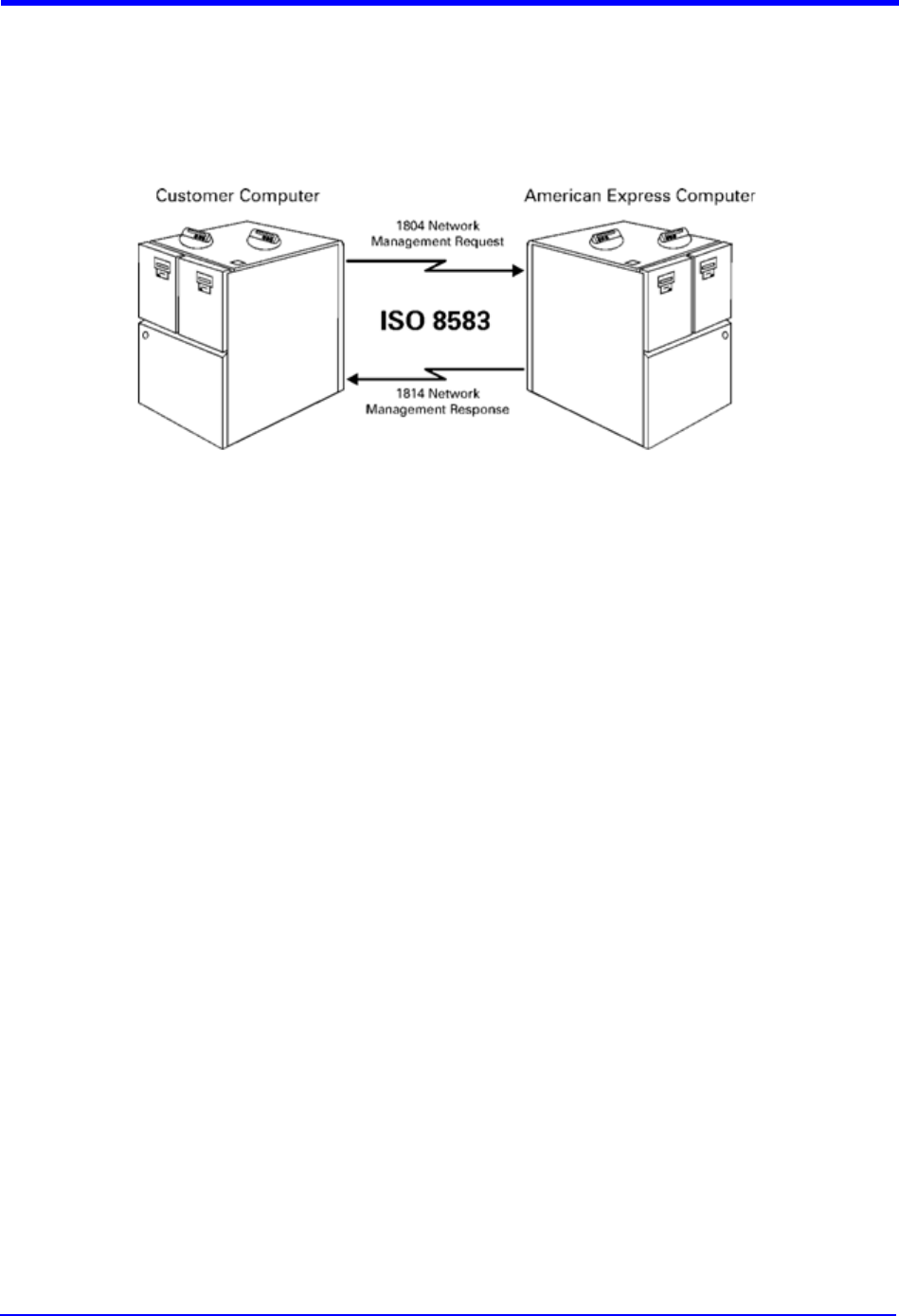

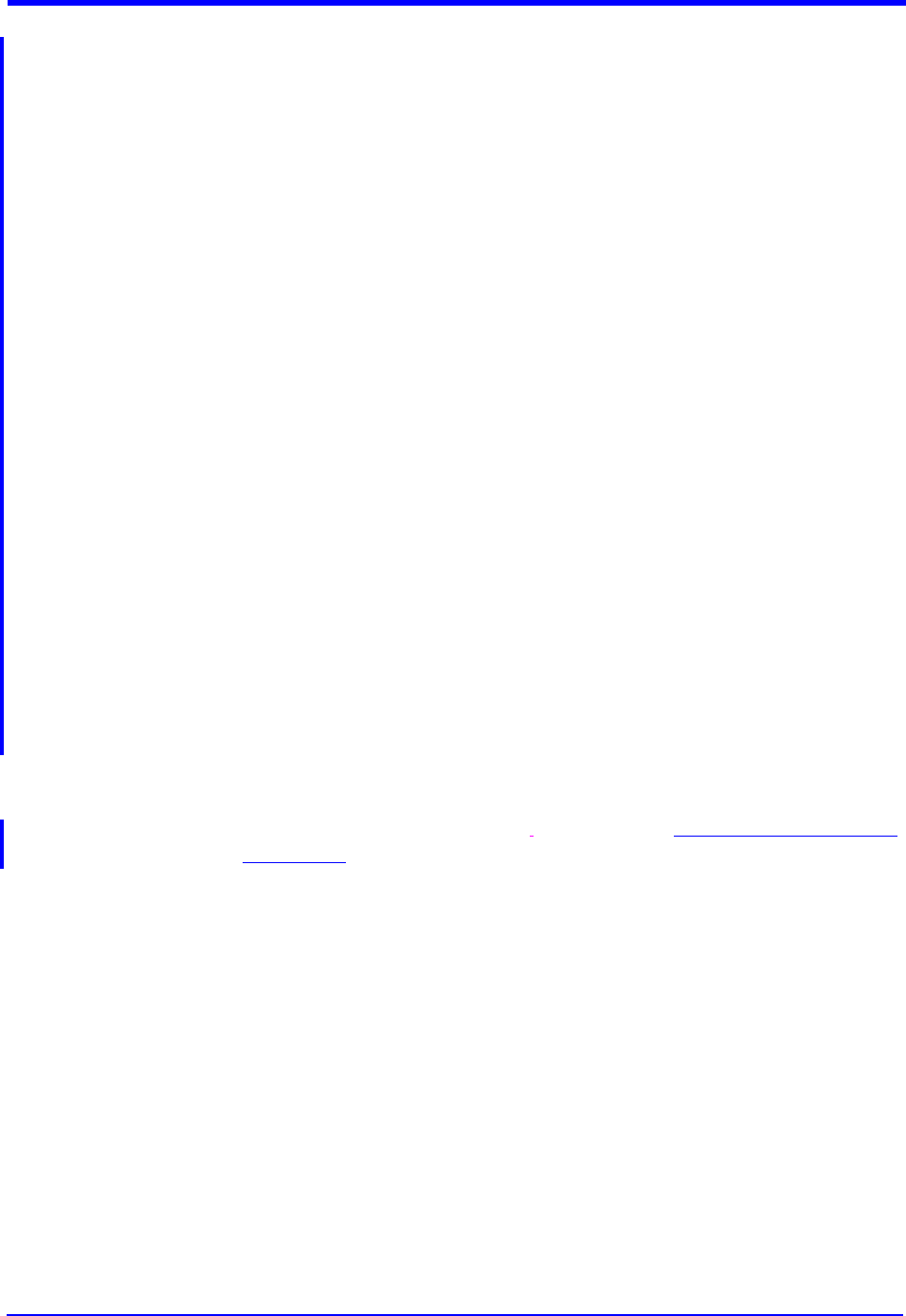

4.2.3 Network Management Request/Response

• 1804 Message is used for Network Management Request messages

• 1814 Message is used for Network Management Response messages

Figure 1-3. ISO 8583 Administration/Network Message Exchange

Network management messages are used to control the system security and

operating condition of the interchange network and may be initiated by any

interchanging party.

The Network Management Request (1804) message allows for either dynamic

key exchange, an echo test or a signon/signoff request. When the Network

Management Request (1804) message is received, it should be responded to by

transmitting a Network Management Response (1814) message.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 17

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.0 Card Acceptance Supported Services

American Express offers the following services for the products it supports:

•Online Authorizations — A Merchant who uses the online authorization service can

transmit an authorization request and receive an authorization response, all in one

individual session.

•American Express OptBlue Program— The American Express OptBlue Program is a program

designed to increase acceptance of Cards among small Merchants by offering an integrated

service and pricing through certain eligible third party Acquirers and payment processing

companies.

•Prepaid Card Authorizations — This service allows a Merchant to accept and process an

authorization request for American Express Prepaid Cards.

•Chip Card Authorizations (ICC) — American Express issues cards that in addition to a

magnetic stripe, also contain an integrated chip that conforms to the industry EMV

specifications.

•Recurring Billing and Standing Authorization — Recurring Billing transactions include

periodic billings for regularly scheduled charges while Standing Authorization allows a

Merchant to automatically charge a Cardmember’s American Express Card.

•Batch Authorizations — A Merchant who uses the batch authorization service can

transmit authorization request files containing multiple authorization request

transactions periodically during a day or at the end of the business day. All

authorization response transactions are batched into files and returned.

•Authorization Amount Adjustment — The Authorization Amount Adjustment can be used by

any Merchant, Third Party Processor or Vendors that supports Automated Fuel Dispensers.

This functionality allows for the release of held funds due to the actual sale amount being

less than the original authorized amount.

•Digital Wallet Payments — This service allows Merchants to accept Digital Wallet

transactions which provide Cardmembers a quick and flexible way to pay in store and within

Mobile Applications (App) via various devices that Cardmembers frequently use.

•Other Authorization Services — A Merchant may process other financial transaction cards,

as well as American Express Travelers Cheque authorizations.

18 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

5.1 Online Authorizations

The American Express online authorization process begins when a Cardmember uses the

American Express Card to purchase goods or services from a Merchant. The purchase could

occur at the physical location of the Merchant or remotely (e.g., a purchase through the

internet, by mail-order or by telephone-order).

If the purchase occurs at the Merchant's location, the card is either swiped so that the Point

of Sale terminal can read the magnetic stripe, inserted into a Chip Card capable terminal so

the card data can be read from the embedded chip, tapped against the contactless

interface, or manually keyed. If the purchase is made remotely, the Cardmember is required

to provide their Card data to the Merchant to obtain authorization.

Once the information is complete, the data is transmitted to American Express. There are

two services offered to Merchants who use online authorization:

• Non-Referral Link

• Referral Queue

5.1.1 Non-Referral Link

Non-Referral Link is the primary processing method used by most Merchants

that accept the American Express Card and transmit authorization requests to

American Express. Non-Referral Link allows an authorization to be processed

without electronically referring the request to an American Express-employee

Authorizer. When the electronic authorization request is transmitted to

American Express via a non-referral link, American Express evaluates various

information, which may include the Cardmember's spending, payment and

credit history and risk criteria associated with the transaction. If the request

passes this evaluation, the American Express authorization system approves the

request, and returns an “APPROVED” message and approval code to the

Merchant's system.

If the authorization request is not automatically approved, a message equivalent

to “DENY” or “PLEASE CALL” is returned to the Merchant's system. When a

Merchant receives a “PLEASE CALL” message, the POS Device Operator at the

establishment must call American Express and speak to an Authorizer, who will

verbally approve or deny the authorization request.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 19

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.1.1 Non-Referral Link (continued)

Figure 1-1. Non-Referral Link Processing

1. A POS Device Operator enters a transaction at the Merchant's system.

2. The Merchant's computer processes the transaction data and transmits an

authorization request message to American Express.

3. American Express receives and processes the request then sends a

response message to the Merchant's computer.

4. The Merchant's computer receives and processes the response message,

then displays the response on the Merchant's system.

5. If American Express approves the request, an “APPROVED” message and

an approval code are displayed at the Merchant's system.

If American Express declines the request, a message equivalent to “DENY”

is displayed at the Merchant's system.

If American Express cannot make a decision, a “PLEASE CALL” message is

displayed at the Merchant's system, and the POS Device Operator must

then call an American Express Authorizer, who will analyze the transaction

and verbally approve or deny the request.

20 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

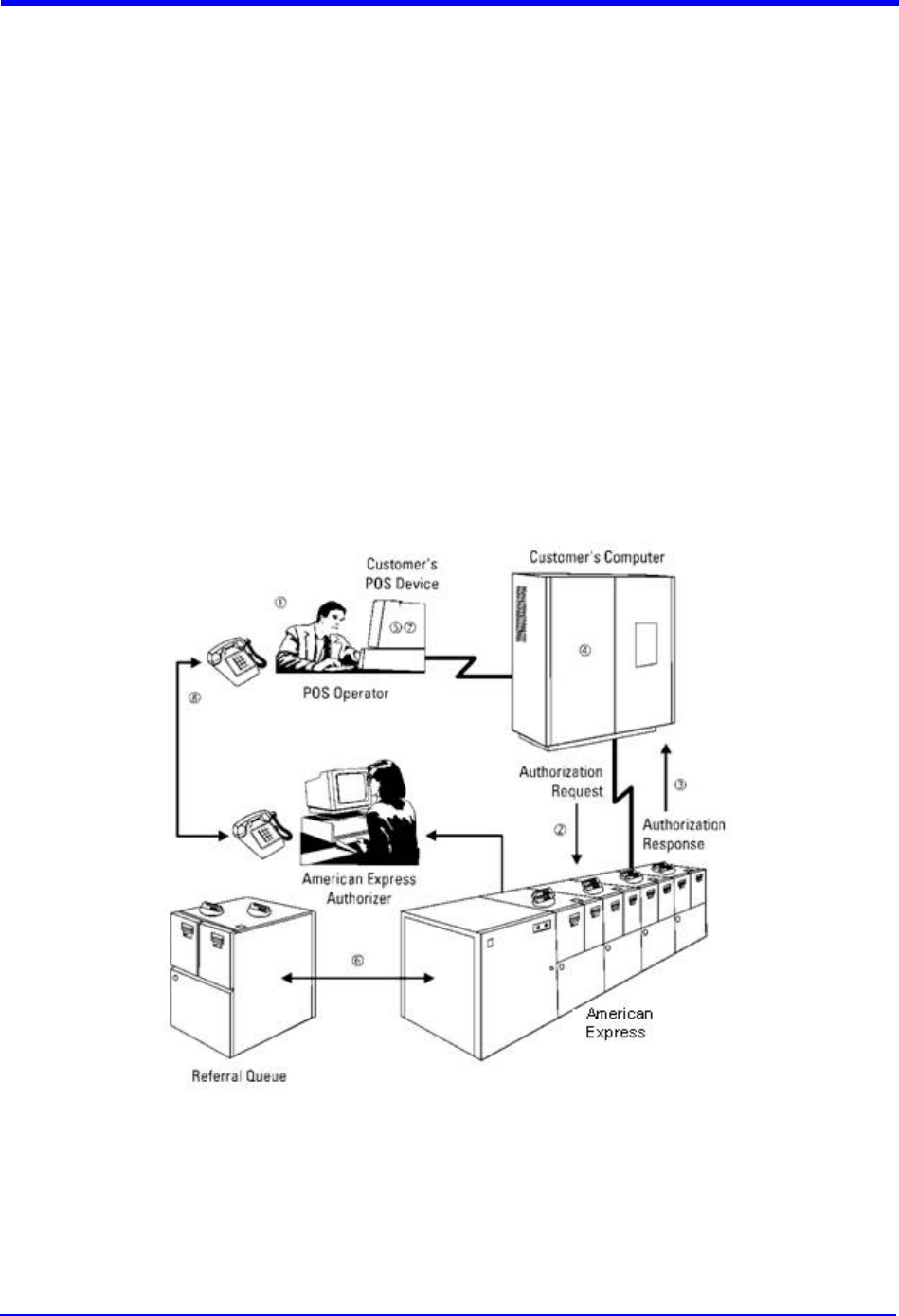

5.1.2 Referral Queue

The referral queue option is available for both referral and non-referral

processing links. The referral queue system assigns a four-digit referral number

to each request that receives a “PLEASE CALL” authorization response, and

places the request in a queue. The referral queue number is then included in the

“PLEASE CALL” response message transmitted to the Merchant's system.

The POS Device Operator calls American Express and provides the referral

queue number. Based on the referral queue number, the call is transferred to the

assigned Authorizer, who reviews the information and either approves or denies

the transaction. This procedure eliminates the re-entry of transaction data

during the authorization call.

Illustrations of referral queue processing for non-referral links are shown on the

next few pages.

5.1.2.1 Referral Queue — Non-Referral Mode

Figure 1-2. Referral Queue for Non-Referral Mode

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 21

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.1.2.1 Referral Queue — Non-Referral Mode (continued)

1. A POS Device Operator enters a transaction at the Merchant's

system.

2. The Merchant's computer processes the transaction data and

transmits an authorization request message to American

Express.

3. American Express receives and processes the request then

sends a response message to the Merchant's computer.

4. The Merchant's computer receives and processes the response

message, then displays the response on the Merchant's system.

5. If American Express approves the request, an “APPROVED”

message and an approval code are displayed at the Merchant's

system.

6. If American Express declines the request, a message equivalent

to “DENY” is displayed at the Merchant’s system.

7. If American Express cannot make a decision, a “PLEASE CALL”

message is displayed at the Merchant’s system, and the POS

Device Operator must then call an American Express Authorizer,

who will analyze the transaction and verbally approve or deny

the request.

8. The POS Device Operator calls American Express and provides

the referral number. That number provides access to an

American Express Authorizer.

22 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

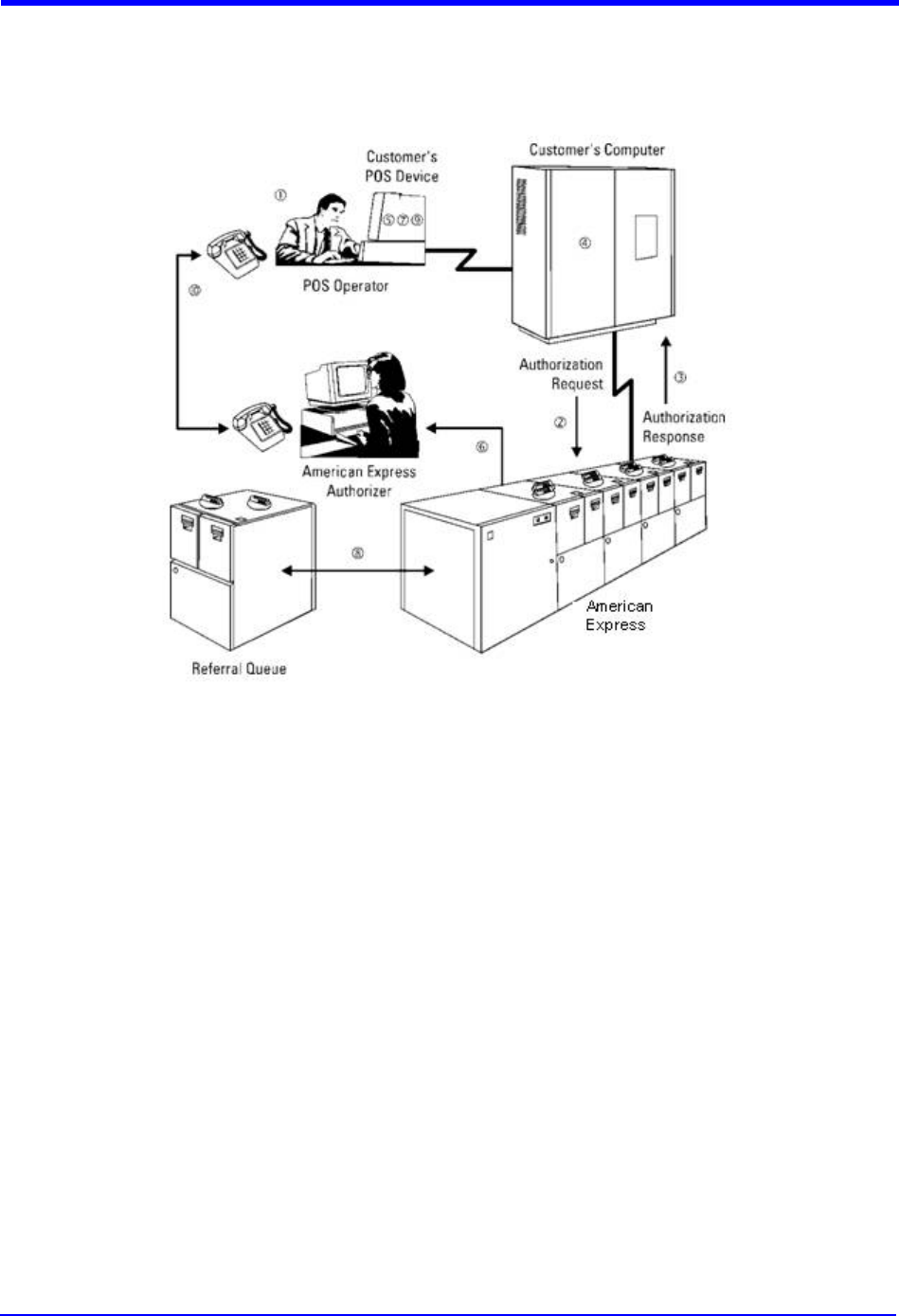

5.1.3 Referral Queue — Referral Mode

Figure 1-3. Referral Queue for Referral Mode

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 23

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.1.3 Referral Queue — Referral Mode (continued)

1. A POS Device Operator enters a transaction at the Merchant's system.

2. The Merchant's computer processes the transaction data and transmits an

authorization request message to American Express.

3. American Express receives and processes the request then sends a

response message to the Merchant's computer.

4. The Merchant's computer receives and processes the response message,

then displays the response on the Merchant's system.

5. If American Express approves the request, an “APPROVED” message and

an approval code are displayed at the Merchant's system.

6. If the Authorizer approves the request, an “APPROVED” response and an

approval code are transmitted to the Merchant's computer. That computer

processes the American Express response and sends the message to the

Merchant's system.

7. If the Authorizer does not approve the request automatically, a referral

number is assigned to the “PLEASE CALL” response message. The request

is placed in the referral queue for easy access by American Express

Authorizers.

8. The “PLEASE CALL” response message (with the referral number) is

transmitted to the Merchant's computer, and both “PLEASE CALL” and the

referral number are displayed on the Merchant's system.

9. The POS Device Operator calls American Express and provides the referral

number. That number provides access to an American Express Authorizer.

10. After examining the request, spending history and payment history of the

Cardmember, the Authorizer will verbally approve or deny the request.

5.2 American Express OptBlue® Program

The American Express OptBlue Program is designed to increase acceptance of Cards

among small Merchants by offering integrated service and pricing through certain eligible

third party Acquirers and payment processing companies. Program participants will be

eligible to provide a full one-stop servicing solution for American Express Card acceptance

to eligible small Merchants, including the flexibility to provide Merchants the benefit of a

single statement, one settlement process, and one contact for all the major Card brands.

For information on how to participate in the OptBlue program, contact your American

Express representative.

24 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

5.3 Prepaid Card Authorizations

The Prepaid Card Partial Authorization and Authorization with Balance Return features are

designed to help Merchants provide Card balance information to American Express Prepaid

Cardholders at the point of sale. The Authorization Request/Response messages are

exchanged to determine available funds to help the Merchant successfully complete

Prepaid Card transactions in a timely manner.

Partial Authorization and Authorization with Balance Return features only apply to Prepaid

Cards. Merchants who participate are not required to know which American Express

products are prepaid. American Express will return the specified information for

transactions that qualify otherwise, the responses will be the same as those they receive

today.

5.3.1 Partial Authorization

American Express strongly recommends Partial Authorization, because it

approves a request for the remaining balance rather than declining it when

there are insufficient funds to cover the original amount.

The Partial Authorization feature allows American Express to authorize a

transaction for an amount less than the original Merchant requested amount.

Partial Authorization is used in circumstances where the Prepaid Card has

insufficient funds to cover the original amount of the request. Rather than

receiving a denial message, the transaction will be approved for the remaining

balance of the Card. The Cardholder can then pay the Merchant the outstanding

amount of the transaction via another form of payment.

Data Field 24 (Function Code) of the Authorization Request (1100) message is

used to identify a Merchant that accepts partial authorizations. The approved

amount is returned in Data Field 4 (Amount, Transaction) of the Authorization

Response (1110) message. The original requested authorization amount is

returned in Data Field 30 (Amounts, Original); and the available amount

remaining on the Card (including a zero balance) may be returned in Data Field

54 (Amounts, Additional).

Merchants should develop internal instructions for using the Prepaid Card

Partial Authorization or Authorization with Balance Return features at their

point of sale. American Express will allow authorized Merchants that conform to

this specification and pass our certification tests to access the American

Express network to acquire Partial Authorization or Authorization with Balance

Return.

Third Party Processors must develop support for both Partial Authorization and

Authorization with Balance Return functionalities in order to provide the ability

for their Merchants to utilize either feature. Additional information may be

obtained from your American Express representative.

Balances may not be returned for some Prepaid Cards.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 25

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.3.2 Authorization with Balance Return

In addition, American Express offers the Authorization with Balance Return

feature.

The Authorization with Balance Return feature allows Merchants that choose

not to use the Partial Authorization feature to receive the Prepaid Card balance

on the Authorization Response (1110) message. Systems that do not support

split tender capability which is required for Partial Authorizations can receive a

response message containing the remaining balance (Authorization with

Balance Return), This enables the customer to submit a new request for an

amount less than or equal to the funds available or they can choose an alternate

form of payment for the transaction.

Data Field 24 (Function Code) of the Authorization Request (1100) message is

used to identify an Authorization with Balance Return request. The available

balance may be returned to the Merchant in Data Field 54 (Amounts, Additional)

in the Authorization Response (1110) message, even if the transaction is denied.

Transactions that are denied for insufficient funds can be resubmitted for an

amount equal to or less than the remaining balance provided in the

Authorization Response (1110) message.

Prepaid Card Balance Inquiry may also be performed utilizing either the Partial

Authorization or the Authorization with Balance Return feature. This can be

done by simply entering an amount of zero in the Data Field 4 (Amount,

Transaction). The transaction will be approved, and the available balance is

returned in Data Field 54 (Amounts, Additional). A new authorization request

can then be created for an amount equal to or less than the remaining balance.

Balances may not be returned for some Prepaid Cards.

26 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

5.4 Chip Card Authorizations

Two types of Chip Cards are issued by American Express, Contact (AEIPS) and Contactless

(Expresspay):

• AEIPS — A Contact Chip Card is physically inserted into a Card Reader to enable it

to communicate with the Terminal. The American Express contact solution is called

AEIPS (American Express ICC Payment Specifications).

• Expresspay — A Contactless Chip Card uses radio frequency technology to

communicate with the Terminal, and the card does not need to be inserted into a

reader. Contactless transactions are typically faster than Contact transactions. The

American Express contactless solution is called Expresspay.

In order to submit transactions from American Express Chip Cards for authorization and

submission, the Merchant, authorized Third Party Processor or Vendor must submit data to

American Express in the formats prescribed by the GCAG ISO and the American Express

Global Financial Submission Guide.

Note: American Express requires chip card accepting devices to be approved by EMVCo.

EMVCo approval can be obtained at an EMVCo approved laboratory. Further details can be

obtained from the EMVCo website (www.emvco.com) or from your local American Express

representative.

5.4.1 AEIPS

In an AEIPS transaction, the Card is inserted into the Card Reader in the

terminal; and the Card data is read directly from the chip. Transaction data is

created and populated in Data Field 55 (Integrated Circuit Card System Related

Data) - special certification is required. For more information on the breakdown

of Data Field 55, see page 138.

American Express mandates that in addition to populating Data Field 55, AEIPS

transactions must include Data Field 35 (Track 2 Data).

For terminals that are EMV-enabled but not yet certified or for terminals that are

EMV-enabled for other payment brands but not yet for American Express

(AEIPS), transactions must be processed using any of the other non-EMV

methods.

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 27

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.4.1 AEIPS (continued)

When submitting AEIPS transactions, Data Field 22 (Point of Service Data Code)

must be populated based on acquiring method and adhere to the following

guidelines:

• Position 1: Card Data Input Capability - Transactions must not be

processed using value 5 (Integrated Circuit Card - ICC) unless the terminal

and link are certified by American Express for EMV processing.

• Position 7: Card Data Input Mode -

o Transactions must not be processed using value 5 (Integrated

Circuit Card - ICC) unless the terminal and link are certified by

American Express for EMV processing.

o Transactions must not be processed using value 9 (Technical

Fallback) unless the terminal and link are certified by American

Express for EMV processing and used to indicate a fallback

transaction.

• Position 9: Cardmember Authentication Entity- Transactions must not be

processed using value 1 (Integrated Circuit Card - ICC) unless the terminal

and link are certified by American Express for EMV processing.

• Position: 10: Card Data Output Capability - Transactions must not be

processed using value 3 (Integrated Circuit Card - ICC) unless the terminal

and link are certified by American Express for EMV processing.

28 April 2016 This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

table of contents

Global Credit Authorization Guide ISO Format American Express Proprietary & Confidential

5.4.2 Expresspay

In an Expresspay transaction, the data is passed between the chip and the

terminal using Radio Frequency (RF) technology. Expresspay has two different

modes in which the Card and Terminal can operate:

• Expresspay EMV Mode - This mode of operation is designed for those

Issuers and Acquirers that support EMV data in the authorization

messages. EMV capable terminals support both EMV and Magstripe

Modes.

• Expresspay Magstripe Mode- This mode of operation is designed for both

Issuers who can accept EMV data as well as Issuers and Acquirers who

have not implemented EMV acceptance. Magstripe capable terminals only

support Magstripe Mode.

If supporting Expresspay, Merchants, authorized Third Party Processors and

Vendors must support EMV and Magstripe Mode including the Expresspay

Pseudo-Magnetic Stripe Format. It is mandatory for all Third Party Processors

and Vendors to certify they can pass Expresspay data. Refer to Expresspay

Pseudo-Magnetic Stripe Formats in the American Express Global Codes &

Information Guide.

In order to submit transactions from Expresspay Cards for authorization and

submission, the Merchant, authorized Third Party Processor or Vendors must

submit data to American Express in the formats prescribed by the GCAG ISO and

the American Express Global Financial Submission Guide.

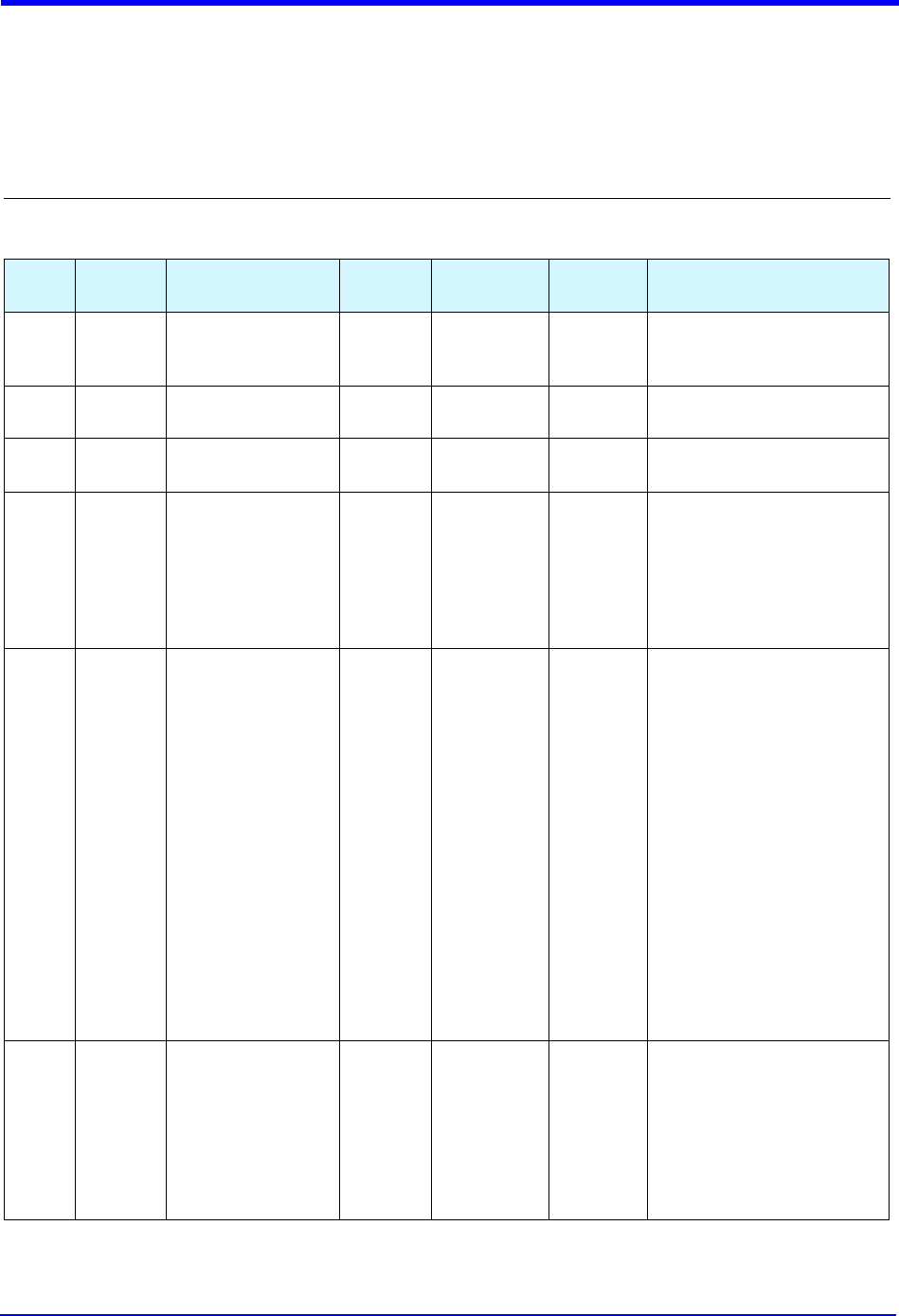

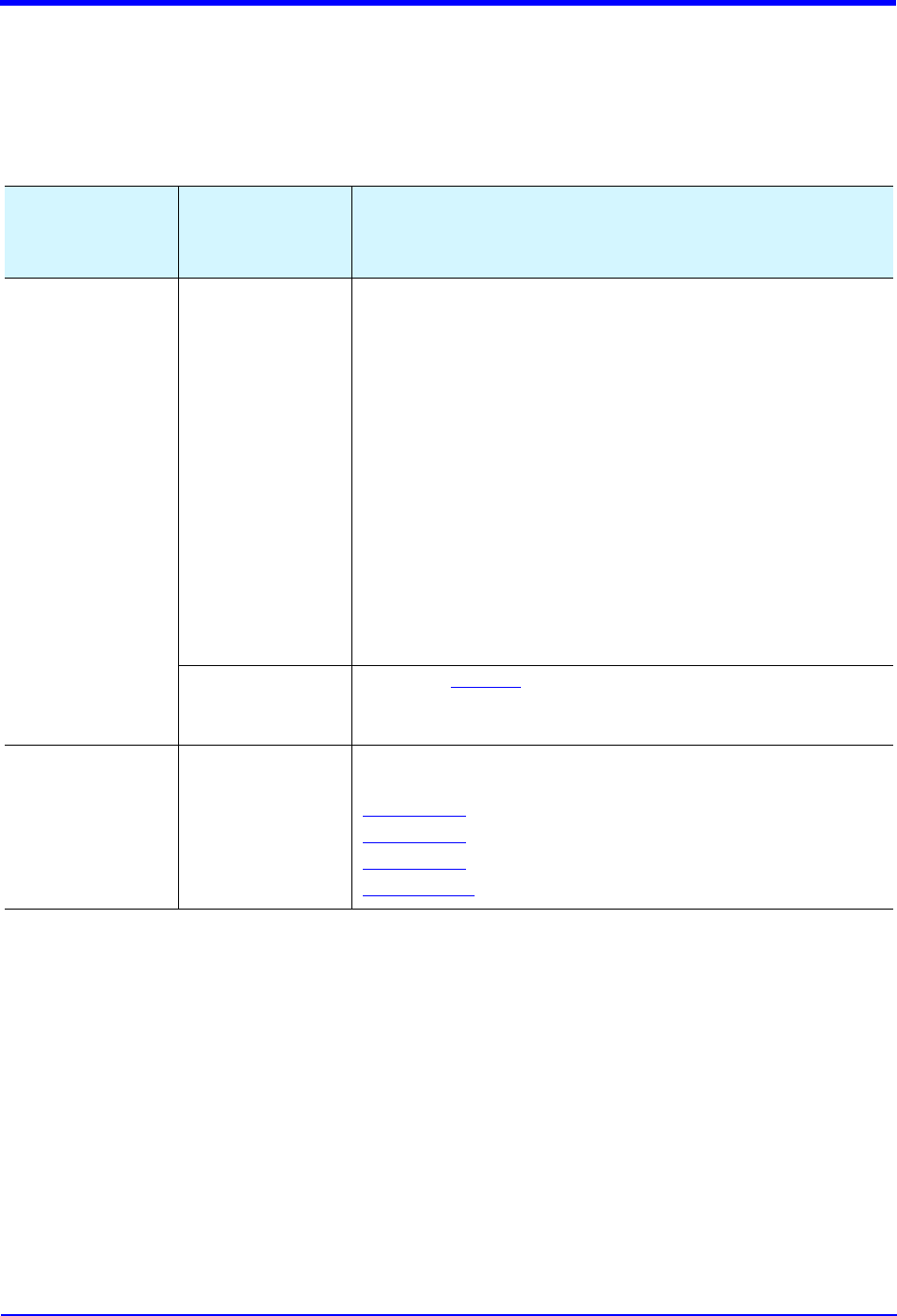

Expresspay Requirements

Notes:

1. Expresspay transactions must originate at a contactless reader and cannot be manually keyed.

2. It is important to note that pseudo-magnetic stripe data from a chip card contactless reader differs

slightly from track data obtained from a magnetic stripe read. For this reason, when Magstripe-Capable

Terminals, Track 1 and/or Track 2 pseudo-magnetic stripe data is supplied intact, the start and end

sentinels should be stripped off; and all remaining characters between the sentinels (including the

Interchange Designator and Service Code) should be forwarded to American Express without

alteration, in the appropriate ISO 8583 Track 1 and/or Track 2 data field (Data Fields 45 and/or 35,

respectively). For complete lists of allowable Interchange Designator/Service Code combinations, refer

to the American Express Global Codes & Information Guide.

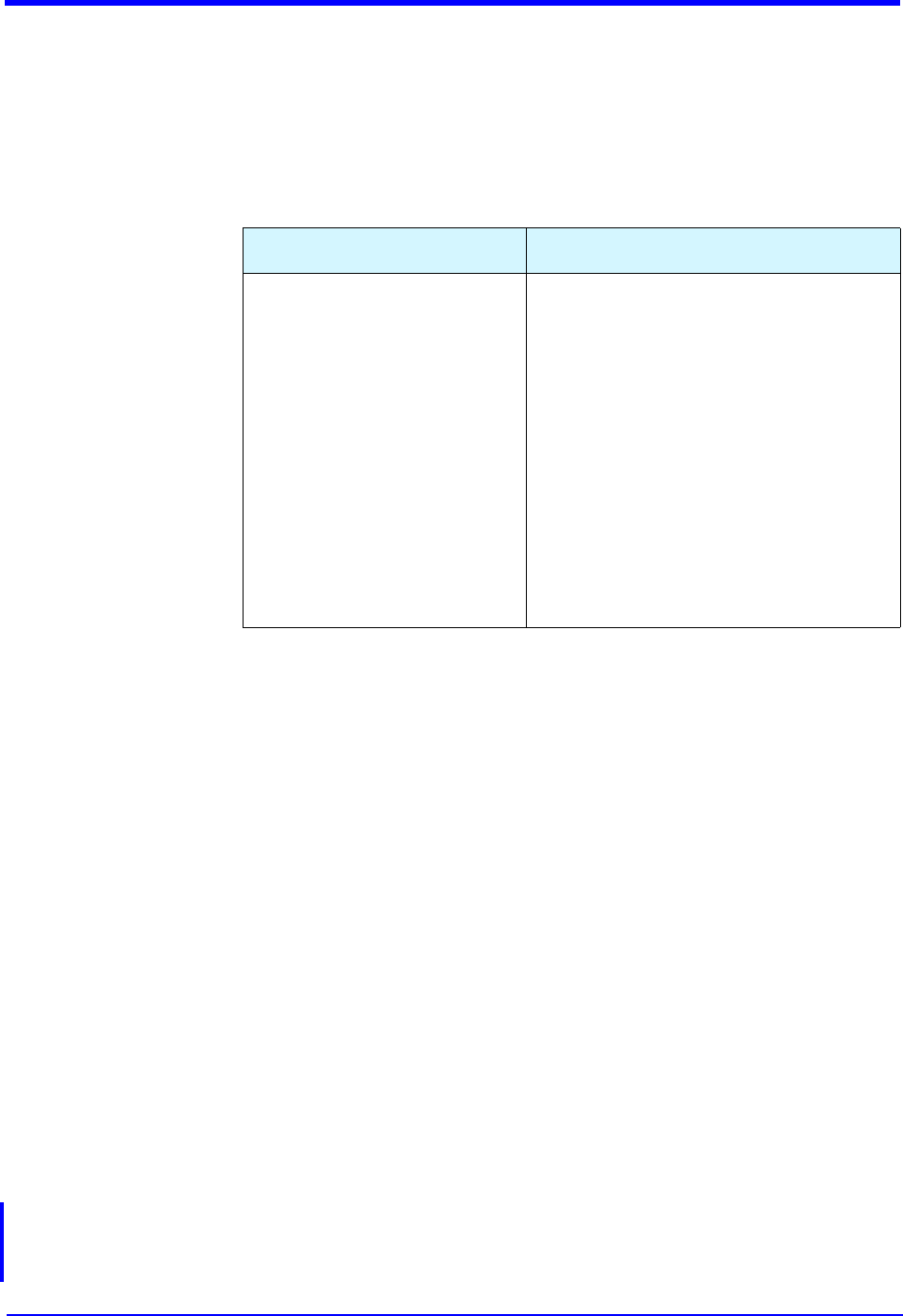

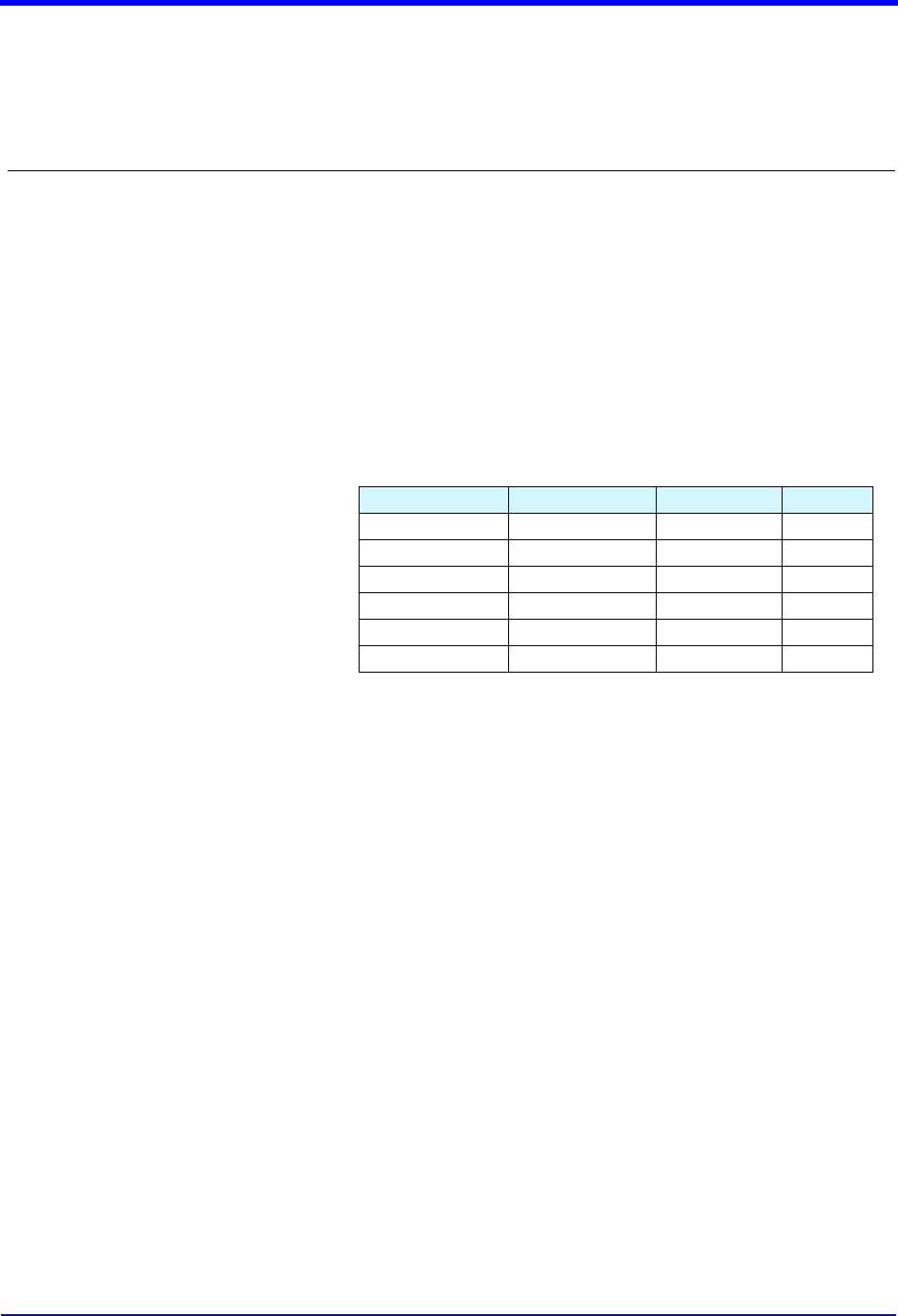

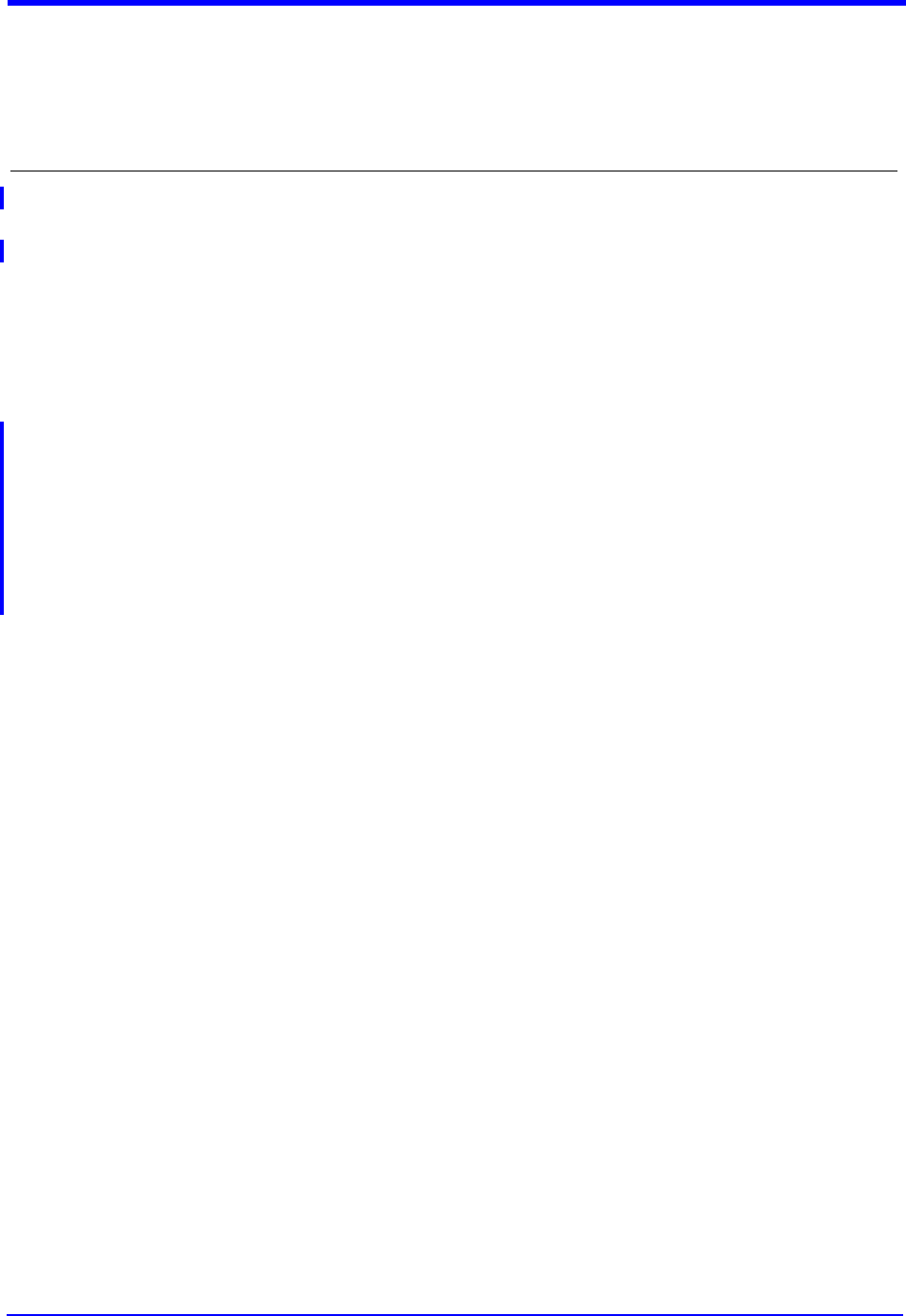

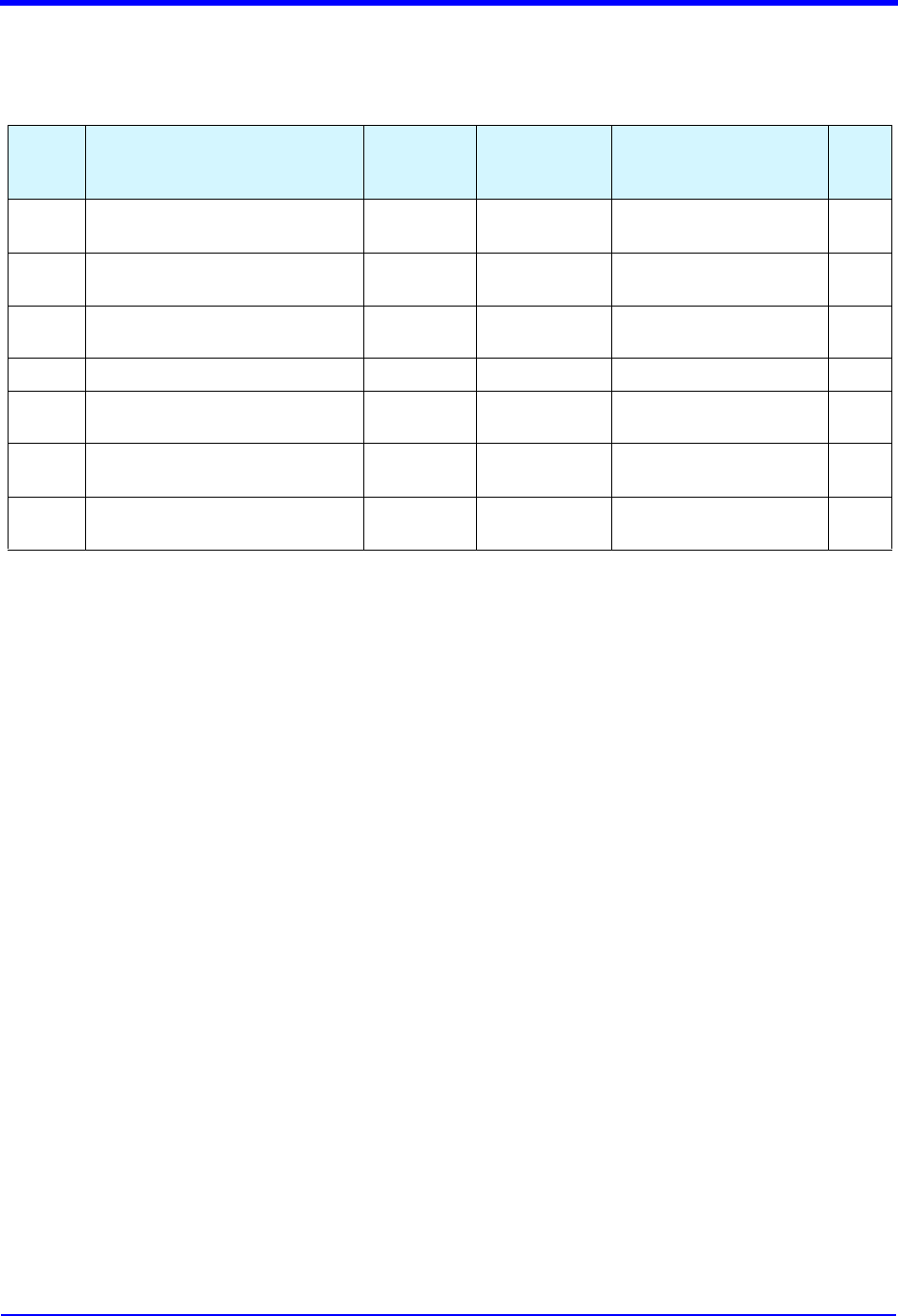

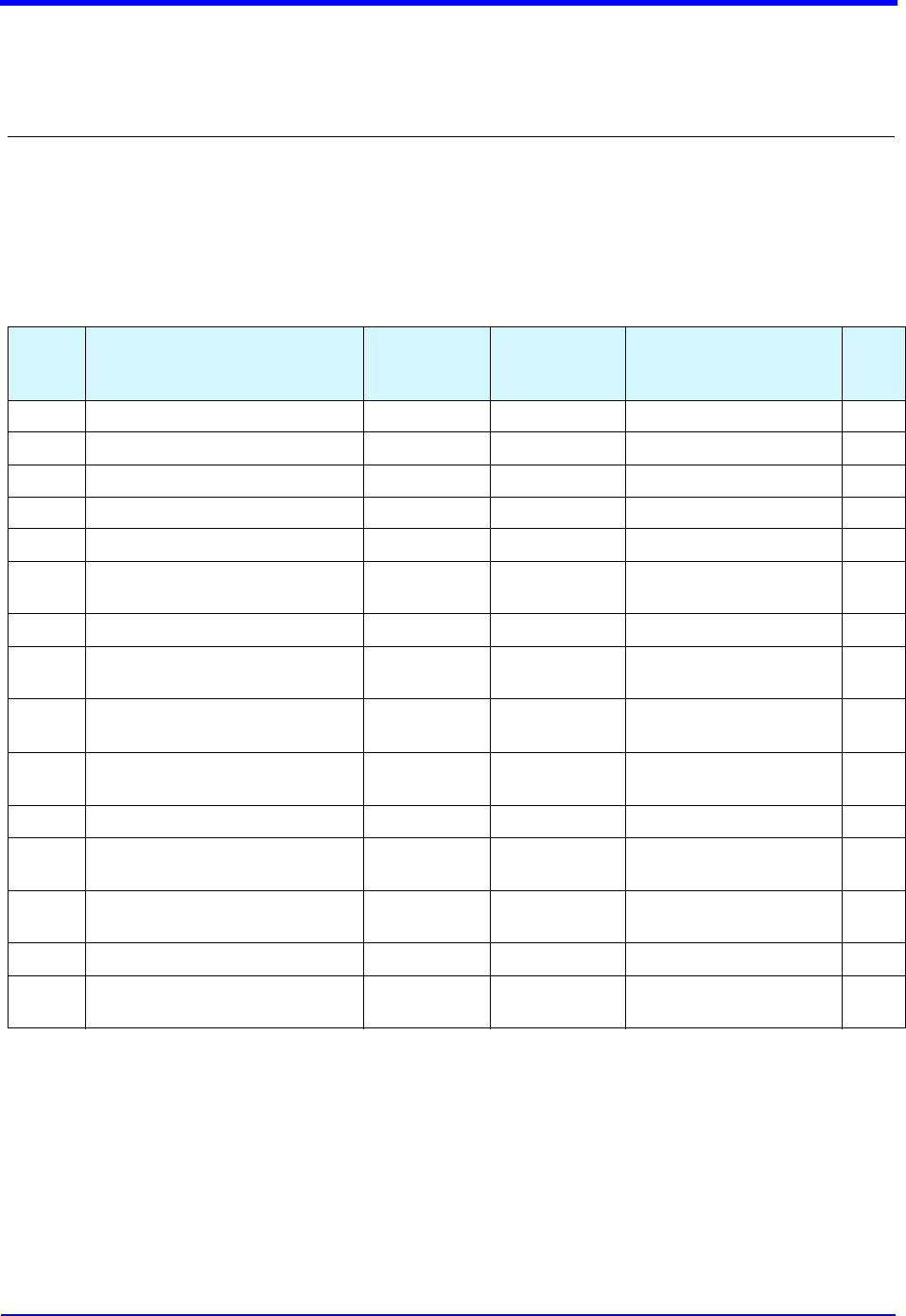

Magstripe Capable Terminals EMV Capable Terminals

• Track 1 (Data Field 45) and/or Track 2 (Data

Field 35) must be present. For information on

Expresspay Pseudo-Magnetic Stripe Formats,

refer to the American Express Global Codes

& Information Guide.

• ICC System Related Data (Data Field 55) must

be present.

• Track 2 Data (Data Field 35)

• POS Data Code (Data Field 22)

o Position 6 = “X”

(Contactless transactions,

including American Express

Expresspay)

o Position 7= “2” (Magnetic

stripe read; Track 1 and/or

Track 2) or “W” (Swiped

transaction with keyed

CID/4DBC/4CSC)

• POS Data Code (Data Field 22)

o Position 6 = “X” (Contactless transactions,

including American Express Expresspay)

o Position 7 = “5” (Integrated Circuit Card

[ICC]; EMV and Track 2 data captured from

chip)

This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third April 2016 29

parties without the express prior written consent of American Express Travel Related Services Company, Inc.

American Express Proprietary & Confidential Global Credit Authorization Guide ISO Format

5.4.2.1 Expresspay Transit Transactions at Transit Access

Terminals

The American Express Expresspay Transit solution will supplement

existing American Express Network functionality to meet the transit

industry's need for high speed, low risk transactions. The resulting

service enables the customer to experience American Express