BMI Agent Quick Reference Guide

User Manual:

Open the PDF directly: View PDF ![]() .

.

Page Count: 29

ABOUT US COMPLETE

COVERAGE

POLICYHOLDER

SERVICES

BILLING AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

AGENT QUICK REFERENCE GUIDE

2019

VERSION TWO

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US

ABOUT US

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ALL THAT OUR

CUSTOMERS

DO IS ALL THAT

WE DO, TOO.

Builders Mutual values its responsibility to protect residential,

commercial, and trade contractors and offers unparalleled

service and relationships. Headquartered in North Carolina,

Builders Mutual provides insurance coverage exclusively to

the construction industry throughout the Mid-Atlantic and

Southeast. It’s not just our specialty. It’s all we do. We have

a history with the North Carolina Home Builders Association

and maintain strong partnerships with various industry

associations. From the groundbreaking to the ribbon cutting,

we stand by our customers, helping them avoid risks and

ensuring they enjoy a job well done.

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

The following coverage options are available for contractors in Florida:

*Builders Mutual’s focus in Florida is Workers’ Compensation. GL, Inland Marine, and Umbrella are reserved

for best-in-class risks with exceptional historical performance. Contact your Underwriter or Territory Manager

to discuss consideration on specifi c accounts.

• Workers’ Compensation

• General Liability*

• Inland Marine*

• Umbrella*

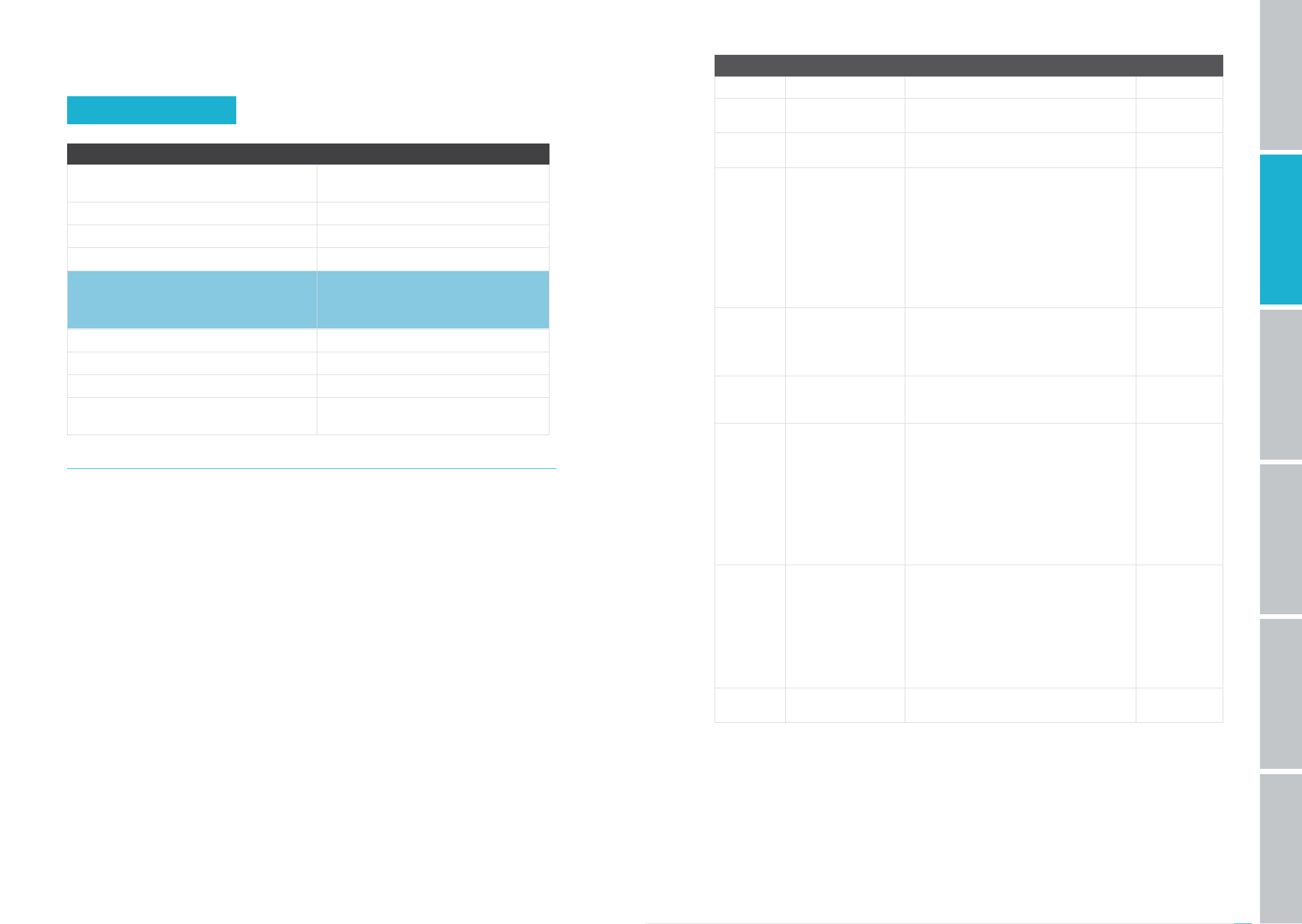

COMPLETE COVERAGE FOR CONTRACTORS

Builders Mutual provides a complete range of coverage options for residential,

commercial, and trade contractors, including:

MARKET FOOTPRINT

Builders Mutual partners with more than 700 independent agencies spread across Florida,

Maryland, Mississippi, North Carolina, South Carolina, Tennessee, and Virginia. We can also

provide coverage in Georgia and Washington, D.C.

• Workers’ Compensation

• Commercial Package Policy

• General Liability

• Property

• Inland Marine

• Crime

• Auto

• Builders Risk

• Umbrella

Florida-domiciled operations must be written by Florida resident agents.

For Georgia risks, please contact your Underwriter.

NOTE

ABOUT US

4

INDUSTRY PARTNERSHIPS

Builders Mutual maintains sponsorships with several builder and trade associations to show our

dedication to the industry we serve. Since many of our employees are highly involved in these

organizations and often serve on boards and special committees, these sponsorships represent

more than a fi nancial commitment; they’re also chances to get involved.

Sponsorships

Offi cial Safety Sponsor of National Association of Home Builders

Diamond Sponsor of North Carolina Home Builders Association

Premier Partner of Home Builders Association of Virginia

Premier Partner of Home Builders Association of South Carolina

Premier Partner of Home Builders Association of Tennessee

Bronze Sponsor of Maryland Building Industry Association

Corporate Sponsor of Hispanic Contractors Association of the Carolinas

Corporate Sponsor of Associated Builders and Contractors, Carolinas Chapter

Strategic Partner of Appalachian State University Brantley Risk & Insurance Center

ABOUT US

5

Builders Mutual is focused on the longevity of our company and

our ability to serve our customers now and in the years to come.

A (Excellent) rating by A.M. Best Company

JOB-SITE SAFETY INSTITUTE

The Job-Site Safety Institute (JSI) is a nonprofi t organization that was founded

and initially funded by Builders Mutual as a research and educational organization

dedicated to eliminating job-site-related injury and death in the construction

industry. The JSI vision is to provide practical safety solutions that save lives.

Incorporated in 2014, JSI brings together educational institutions and industry

leaders to help increase awareness of construction site dangers. The research

conducted by JSI will produce studies that guide safety practices, set new

standards, and infl uence worker behavior on job-sites.

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US

For more than 30 years, Builders Mutual has returned dividends to eligible

Workers’ Compensation policyholders who put safety fi rst. The total has

surpassed $55 million. We continue to provide fi nancial stability to our

policyholders and show steady, controlled growth as a company. This dividend

return is one way to recognize the strong results of both our policyholders

and our company.

Since 1984

Physical Address

Builders Mutual Insurance Company

5580 Centerview Drive

Raleigh, NC 27606

Main Mailing Address

Builders Mutual Insurance Company

PO Box 150005

Raleigh, NC 27624-0005

KEY CONTACTS

Builders Mutual understands that insurance is a business built on relationships. We believe

in taking a collaborative approach to writing new business, renewing accounts, and servicing

policies. Contact us today! We are ready to provide support and help you grow your business.

Claims Mailing Address

Builders Mutual Insurance Company

PO Box 150006

Raleigh, NC 27624-0006

For individual employee contact information, log in to buildersmutual.com

and click on Your Support Team.

Territory Manager

Your Territory Manager is the primary

liaison between your agency and

Builders Mutual and will serve as a

trusted advisor to help you meet

your sales goals.

Mid-Market Underwriter (UW)

Large Account Underwriter (UW)

Your Mid-Market UW will work with you

on accounts over $400,000 in payroll and

over $4 million in subcontracted costs.

For construction accounts over $250,000

in premium, your Large Account UW

will work with you to deliver the same

great coverage options and competitive

rating that you are accustomed to with

your mid-market accounts, bundled with

tailored services to support the unique

needs of large contractors.

Express Account Underwriter (UW)

Your Express Account UW will work

with you on accounts up to $400,000

in payroll and up to $4 million in

subcontracted costs.

SALES & UNDERWRITING

6

Agency Service Rep (ASR)

Your ASR will process quotes and issue new

business, endorsements, and renewals.

Your ASR works closely with your assigned

Express Account and Mid-Market UWs to

provide fast, accurate service.

ABOUT US

7

CUSTOMER CONTACT CENTER

800-809-4859

Available Monday through Friday, 8 a.m. to 6 p.m. EST.

IMPORTANT EMAILS

To ensure faster processing and response times, use the following email addresses:

newbusiness@bmico.com

endorsements@bmico.com

lossruns@bmico.com

audits@bmico.com

RISK MANAGEMENT

Visit buildersmutual.com/RM for specifi c Risk Management contact information.

AUDIT

Call the Customer Contact Center at 800-809-4859

Email us at audits@bmico.com

Visit buildersmutual.com/audit and click on Find an Auditor for contact information

for Builders Mutual auditors in your area.

CLAIMS

To Report a Claim

Call 800-809-4862 to be connected with a representative.

Email noticeofl oss@bmico.com

Fax 919-227-0204

Visit the Builders Mutual Claims Center at buildersmutual.com/claims

to report a claim online.

State-specifi c claims forms are also available in the Claims Center.

To Manage Claims

Call Claims Support 800-809-4861

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

* *

**

**

*

**

**

*

**

**

*

**

**

*

**

**

*

N/A

N/A

N/A

N/A

N/A

N/A

N/A

ABOUT US

*

PPPPP

*

P*

P*

P*

P*

P

PPPPP

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P P

P

P

P

CCCCC

CCCCC

CCCCC

PPPPP

**

**

*

**

**

*

**

**

*

**

**

*

CCCC

CCCC

CCCC

CCCC

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

C

C

U

U U UU

N/A CCCC

ABOUT US

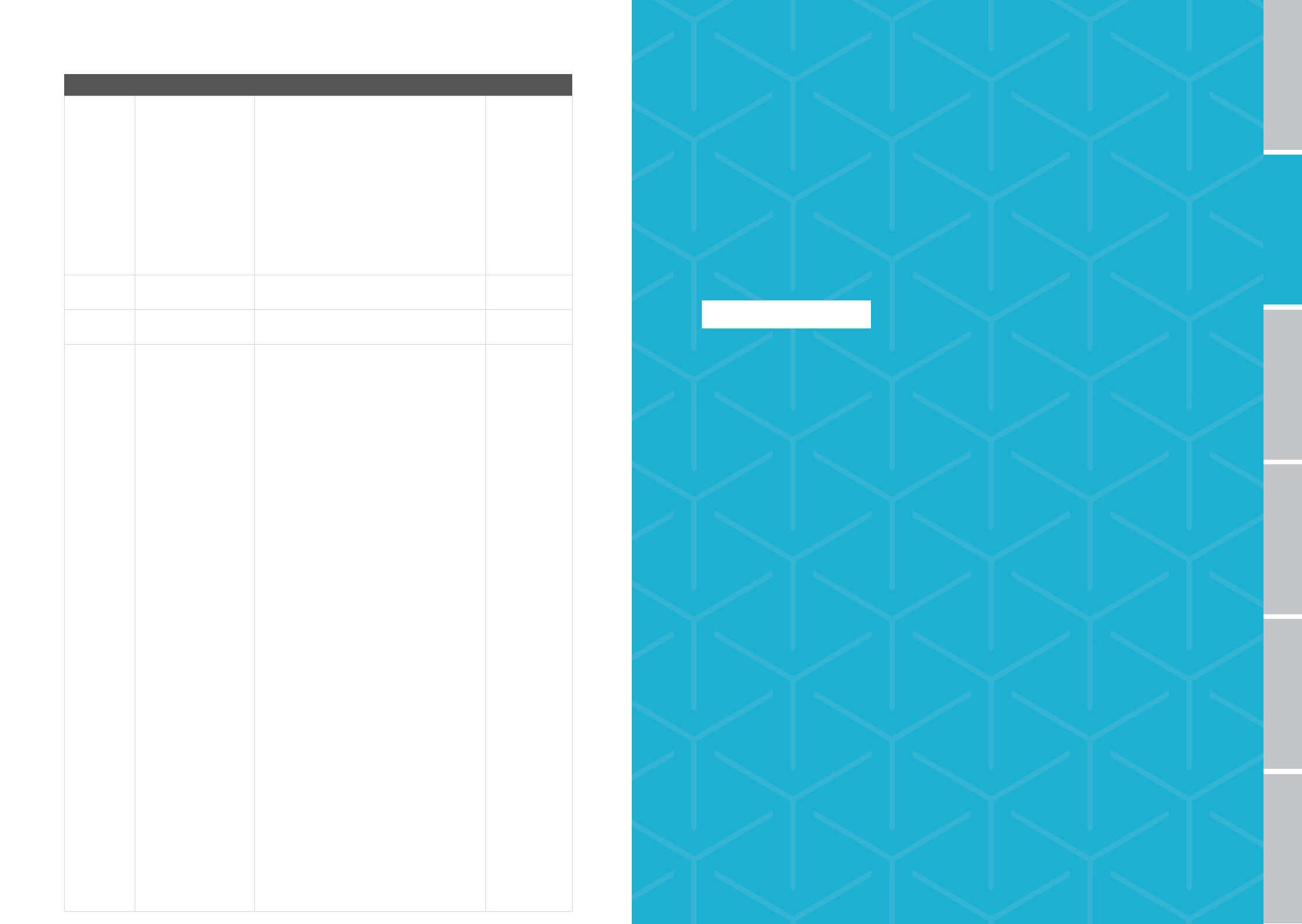

CLASSIFICATION

Trade

Contractor Workers’

Comp. General

Liability

Comm.

Auto Property

Carpentry – Framing (No new ventures)

Carpentry – Modular Housing, Not Mobile Homes

(For Trade, contact your Underwriter)

Carpentry – Remodeler – No Fire or Water Restoration or

Major Renovation; Limited Scope

Carpentry – Residential; includes new construction

(single-family dwellings 3 stories or less), additions, decks,

porch/patio enclosures and remodelers (For Trade,

contact your Underwriter)

Carpentry – Siding

Carpentry Installation of Cabinet Work or Interior Trim;

Countertop and Cabinet Installation; hardwood fl oor

fi nishing and installation

Carpentry Multi-Family Dwellings 3 Stories or Less

(For Trade, carpentry not involving building structures.

Contact your Underwriter.) (Applies in DC, FL, and VA

only for Workers’ Comp.)

Carpentry NOC (For Trade, carpentry not involving

building structures)

Carpentry Shop Only & Drivers

Carpet/Floor Covering Installation – (WC binding authorized

only if no unins. subs used)

Carpet, Rug, Furniture Upholstery Cleaning –

On Customer’s Premises

Ceiling Installation Suspended Acoustical – other than metal

Ceiling Installation Suspended Acoustical – metal

Central Vacuum Systems – Residential

Concrete – Floors, Driveways, or Sidewalks

Concrete Construction NOC – 3 stories or less

Concrete Construction Residential – footings and

foundations; no foundation repair

Concrete Power Washing – no height exposure

Conduit Construction Including Drivers

Debris Removal – in connection with construction operations

only, no building demolition work

Door Installation

Drywall/Sheetrock Contractor

Electrical Apparatus Installation – within buildings;

no work above 480 volts and/or no industrial work.

Electrical Contractor – no work above 480 volts and/or

no industrial work.

Excavating Contractor – Commercial or Multi-Occupancy

Structures, no logging/tree removal or demolition

Excavating Contractor – Single Family Dwellings,

no logging/tree removal or demolition

Executive Supervisors Construction Manager Construction

Superintendent (Single Family Dwellings)

Fence Installation and Repair

Garage Doors – Wood

Gas Construction

Glazier Away From Shops & Drivers

9

BUILDERS MUTUAL APPETITE GUIDE

N/A

N/A

N/A

N/A

N/A

P C U

CCCCC

PPPPP

UUUU

PPPP

PPPP

UUUU

P P PU

**

C

**

C U C

**

C**

C

**

C**

C

N/A

N/A

N/A

N/A

*

C*

C

*

C*

C

*

C

*

C

*

C

*

C

*

C

*

C

*

C

*

C

*

C

CCCCC

Air Conditioning Systems or Equipment – Dealers or

Distributors and Installation, Servicing or Repair

Appliances and Accessories Installation, Servicing or Repair

– Commercial (Contact your Underwriter)

Appliance Installation, Servicing Or Repair - Household

Architectural or Engineering Firm (as a governing class)

Associations – HBA (No Habitat for Humanity)

Automatic Sprinkler Installation & Drivers – Fire Suppression

Building Material Dealer – no repairs, no sales of used items

Burglar Alarm/Security System Installation or Repair

& Drivers – No Monitoring

Cabinet Works w/Power Driven Machinery

Cabinets/Vanities – No Power Woodworking

Cable TV & Telephone Service Connection (customer’s

premises only) – WC considered only if no overhead

work – including no pole climbing and no work from

ladder or bucket truck

Cable TV & Telephone Service Connection (line construction

work) – WC considered only if no overhead work – including

no pole climbing and no work from ladder or bucket truck

Cable/Phone/Intercom Installation (Communication

Equipment Installation) – Limited height exposure;

no pole to pole, limited work from ladder or bucket truck,

no line contractors – TV & Telephone Service Connection

(Contact your Underwriter)

ABOUT US

APPETITE GUIDE

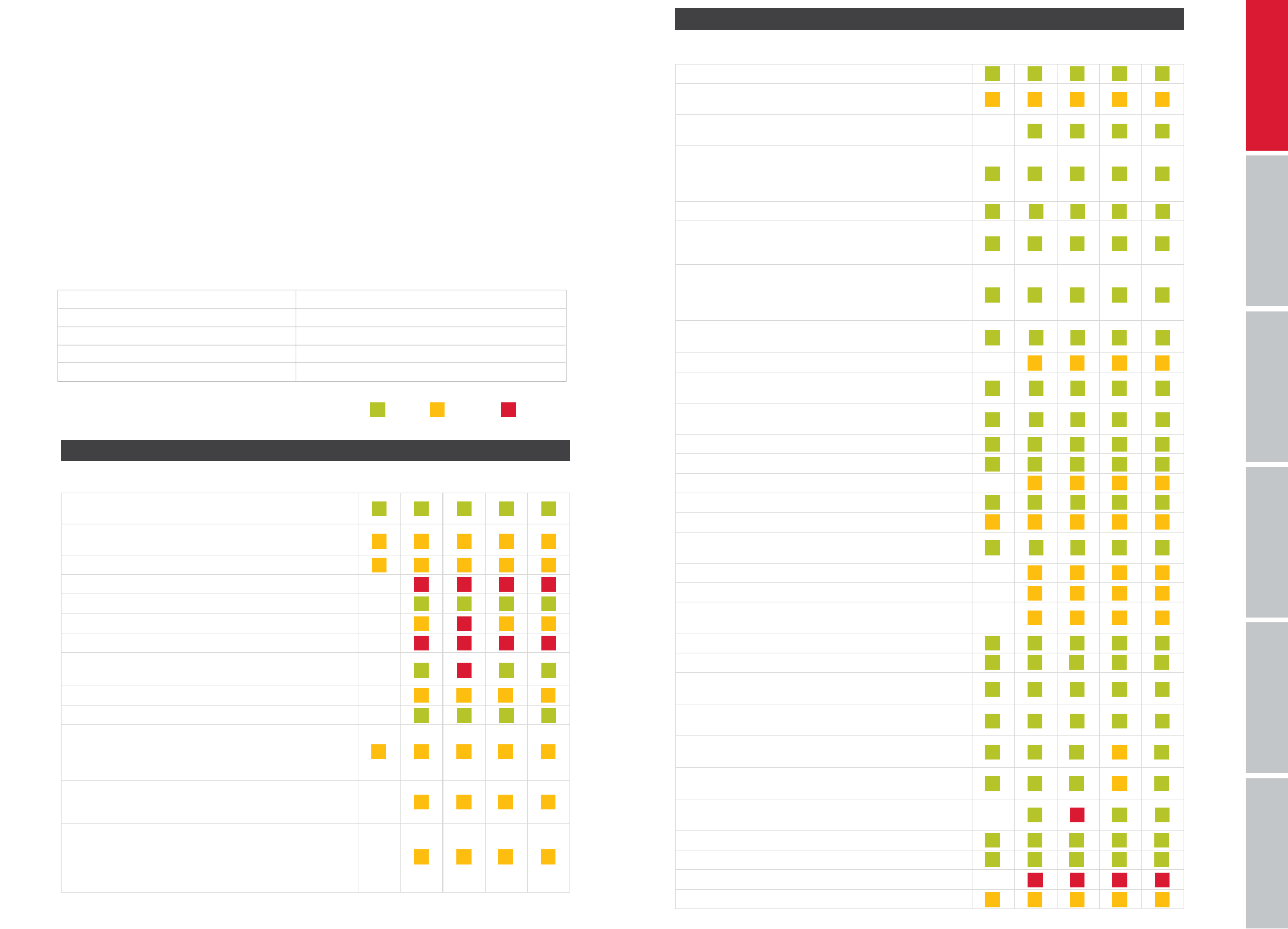

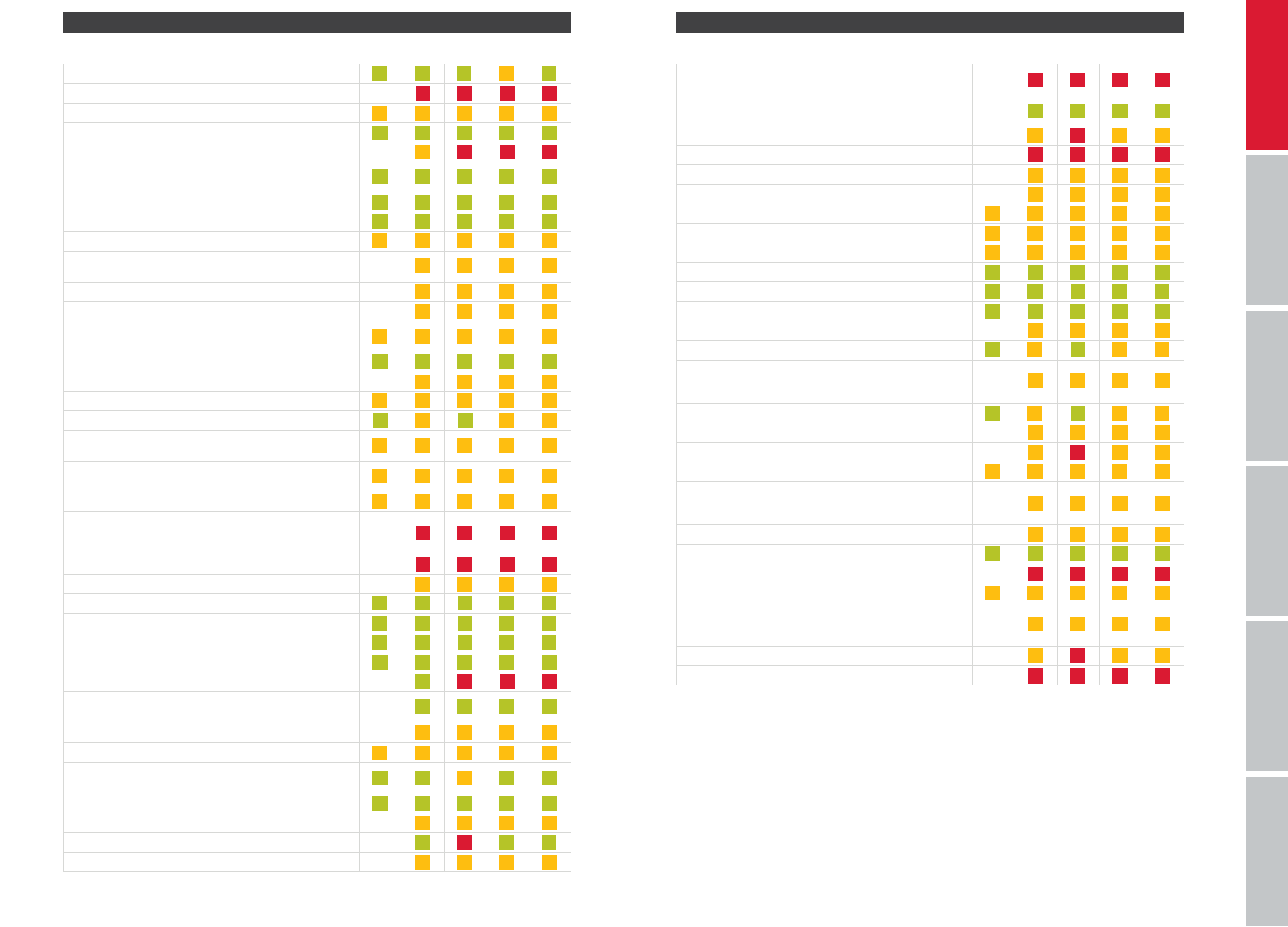

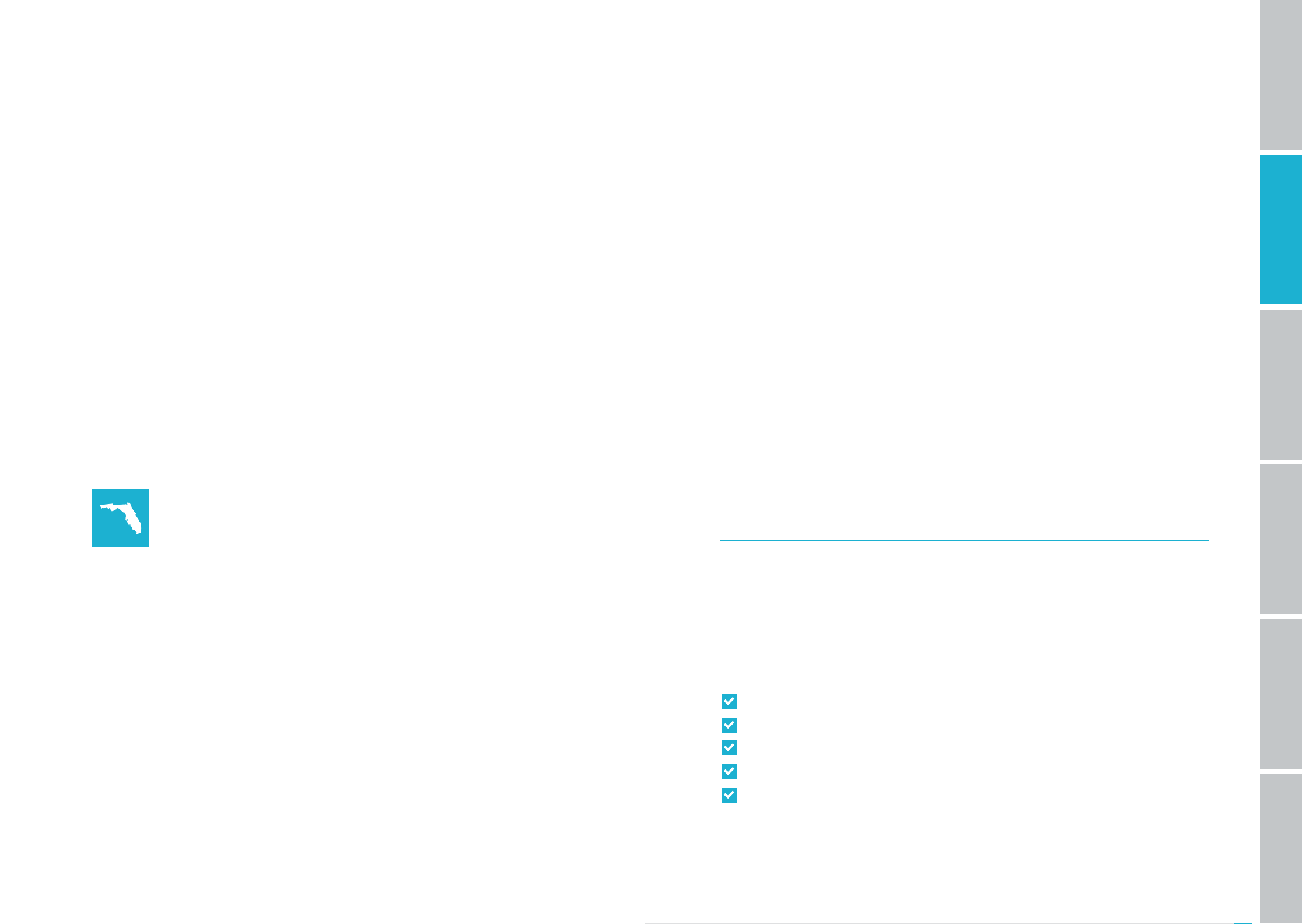

As a niche carrier dedicated to the construction industry, our target market includes

construction and construction-related classes. The ratings in our Appetite Guide should be used

as a general reference. When in doubt about a particular risk, consult your Underwriter prior to

binding coverage. Any classifi cation not listed should be considered as Undesirable.

For incidental employee exposures outside our footprint (DC, FL, GA, MD, MS, NC, SC, TN,

and VA), coverage is available. Please speak with your Underwriter for details.

The following 10 Workers’ Compensation classes continue to represent the top-performing

trades and have a proven history of solid performance with Builders Mutual.

5403 Carpentry - NOC Commercial

5437 Carpentry - Interior Trim

5645 Carpentry - Residential

5102 Door/Sash Erection

5190 Electrical Wiring

6217 Excavation

5478 Floor Covering

5479 Insulation

5474 Painting or Paperhanging

5551 Roofi ng

Best Performing Workers’ Compensation Classes

Preferred Considered Undesirable

Trade

Contractor Workers’

Comp. General

Liability

Comm.

Auto Property

CLASSIFICATION BUILDERS MUTUAL APPETITE GUIDE

8

*post-survey at Underwriter’s discretion **pre-survey required

In Florida, pre-surveys are required on framing, roofing, siding,

drywall, masonry, concrete and other high-hazard classes.

*post-survey at Underwriter’s discretion **pre-survey required

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

CCCCC

CCCCC

CCCCC

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

C

**

**

**

**

*

**

**

**

**

**

**

**

**

**

**

*

**

**

**

**

**

**

**

**

**

*

**

**

**

**

**

*

**

**

**

**

*

**

**

**

**

**

*

**

**

**

**

*

CCCCC

CCCCC

CCCCC

CCCCC

CCCCC

CCCC

CCCC

CCCC

CCCC

C

C

C C

C

C

C

CCCC

CCCC

CCCC

*

P*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P

*

P**

P

P

P

*

P

C

*

P

*

P*

P*

P*

PC

ABOUT US

CLASSIFICATION

Grading Contractor – no logging/tree removal or demolition

Gutter Installation

Handyperson (Contact your Underwriter)

Home Furnishings Installation

Home Inspectors

HVAC Equipment Dealers or Distributors & Installation,

Servicing or Repair

Insulation (Organic or Plastic in Solid State; Includes Foam)

Interior Designers (For Trade, contact your Underwriter)

Iron or Steel Erection Construction of Dwellings 2 Stories

Iron or Steel Fabrication Shop – Railings, balconies, fi re

escapes, staircases

Iron Works Fabrication – Ornamental

Irrigation/Drainage System

Janitorial Services – Construction-related (No residential

or offi ce janitorial services)

Landscaping Gardening & Drivers (No DOT work)

Lathing & Drivers

Lawn Maintenance

Masonry Contractor – less than 3 stories

Metal Erection Decorative or Artistic, Door, Door Frame

or Sash Erection

Metal Erection in the construction of dwellings

not exceeding 2 stories

Metal Erection – Non-Structural

Millwright Work NOC & Drivers Including HVAC – No industrial

machinery or repair; any crane operation conducted by insured

must be through insured subcontractors

Nursery – Plants

Ornamental Metal Works (for Trade, Decorative or Artistic)

Painting – Exterior – less than 3 stories

Painting – Shop Only

Painting/Paper Hanging – Interior

Paper Hanging & Drivers – No Painting

Pest Control

Phone/Cable/Intercom/Wireless – Residential Installation;

No height exposure

Pile Driving

Plastering NOC & Drivers

Plumbing Contractor – No Sprinkler Installation (Commercial

– No boiler work)

Plumbing Contractor – No Sprinkler Installation (Residential)

Power Washing – Decks and Houses

Project or Construction Manager

Property Management

Trade

Contractor Workers’

Comp General

Liability

Comm.

Auto Property

10

BUILDERS MUTUAL APPETITE GUIDE

ABOUT US

N/A

N/A

N/A

N/A

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

U

N/A P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

P

N/A C C CU

N/A ** ** **

C C C C

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

*

*

*

*

**

**

*

**

**

*

*

*

**

**

**

*

*

*

**

**

*

*

*

*

*

**

**

*

C C C C

C C C C

C C C C

C C C C

C C C C

C C C C

C C C C

C C C

C C C

C C C C C

**

*

**

**

**

*

**

**

**

*

**

**

*

*

**

**

**

*

**

**

C C C C C

C C C C C

C C C C C

C C C C C

*

P*

P*

P*

P*

P

**

**

**

**

**

**

C

C

C

C

C

C

*

P

*

P

*

P

*

P

P

Real Estate Agent; only undesirable as a governing class and

not in conjunction with a carpentry or construction code

Remodeler – No Fire or Water Restoration or Major

Renovation; Limited Scope

Real Estate Appraiser

Retail Dealers

Roofi ng Contractor – consult Underwriting Guidelines

Septic Tanks

Septic Tank Cleaning

Septic Tank Installation/Service & Repair

Sewer Construction All Operations & Drivers

Sheet Metal Works – Outside (Sheet Metal Shop/Install)

Siding

Spa/Whirlpool Installation

Stone Cutting/Polishing

Stone/Brick/Masonry Contractor

Street/Road Construction: Paving or Repaving and Drivers –

Residential-related; No Freeways, Highways or Major Metro

Areas; no bridge/tunneling work

Stucco Contractor – No Application of Waterproof Sealants

Surveying/Land Planning Contractor

Swimming Pool Construction – Above Ground

Swimming Pool Servicing (No Construction)

Telephone Cable Installation – (WC considered only if

no overhead work including no pole climbing and no work

from ladder or bucket truck)

Telephone or Fire Alarm Line Construction & Drivers

Tile, Stone, Mosaic or Terrazzo Work Interior Construct Only

Tree Removal

Water Main Construction – Residential Only; no gas construction

Waterproofi ng Contractor – Commercial (WC considered

only if no work at height, such as from ladders, scaffolds,

harnesses, boom/bucket lifts, etc.)

Welding or Cutting NOC & Drivers

Wholesale Dealer/Distributor – Construction-Related Only

CLASSIFICATION

ABOUT US

Trade

Contractor Workers’

Comp General

Liability

Comm.

Auto Property

11

BUILDERS MUTUAL APPETITE GUIDE

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE

COVERAGE

COMPLETE COVERAGE

COMPLETE

COVERAGE

ABOUT US BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE COVERAGE

WORKERS’ COMPENSATION

For residential, commercial, and trade contractors, a Builders Mutual Workers’ Compensation

insurance policy protects a company’s most valuable asset – its employees. Accidents happen,

and when they do, you want an insurance company focused on getting injured workers the

medical care and rehabilitation they need to get back on the job-site.

SAFETY PAYS

Builders Mutual consistently returns dividends to eligible policyholders who put safety fi rst.

The dividend distribution is based on the fi nancial results of each year, and while a dividend

distribution is not guaranteed, traditional eligibility criteria are listed below:

• The Workers’ Compensation policy must be active on January 1 of the distribution year

• The policy must have maintained 24 months of consecutive coverage

• The policyholder’s loss experience must be less than 50%

With underwriting approval, we offer fl at and variable dividend plans for

eligible policyholders.

Flat Dividend Plan

Any dividend for which the account may be eligible according to the plan

selected at policy inception. See agency manual for fl at dividend table.

FLORIDA-SPECIFIC DIVIDEND OPTIONS

Variable Dividend Plan

Any dividend for which the account may be eligible shall vary according to

the premium size and actual loss experience during the subject policy period.

For examples, see agency manual and variable dividend table.

14

GENERAL LIABILITY

Builders Mutual offers two General Liability (GL) products: our Trade Contractor Program

and our Standard General Liability policy. Both of these GL products include the General

Liability Enhancement Endorsement. The common coverages needed to issue a Certifi cate

of Insurance, and to comply with most construction contractual insurance requirements, are

included in every GL policy we issue – at no additional charge.

During quoting in Builders Online Business, a short series of questions will be asked that will

determine whether the risk qualifi es for the Standard GL or Trade Contractor Program.

TRADE CONTRACTOR PROGRAM

With our Trade Contractor Program, policyholders enjoy a lower composite rate with no

maximum payroll limitation. The policy does not include the exclusion for damage to work

performed by subcontractors on your behalf (CG2294). The corresponding Commercial

Umbrella policy does not include the same exclusion (CU2264).

Trade Contractor Eligibility

Three years of prior experience desired

Minimum annual payroll, per individual, owner, partner, or offi cer, varies by state

Exterior operations must be three stories or less

Subcontract less than 25% of work

Subject to underwriting eligibility criteria

COMPLETE COVERAGE

MULTI-LINING ACCOUNTS

At Builders Mutual, we are here to help you provide the best products to your customers.

Our full suite of coverages is designed specifi cally for the construction industry.

Our enhancement endorsements add coverages that make COI issuance a breeze. We are

pleased to offer these enhanced coverages for General Liability, Property, and Auto policies.

Multi-lining accounts isn’t just a good idea. It is shown to be more effective for retaining

accounts and measuring loss ratio. We compared results from the last four operating years and

discovered that multi-line accounts perform 5.6% better in retention and 6.1% better in loss

ratio than mono-line accounts. Would you like to grow your book of business? Multi-lining with

Builders Mutual is something to consider.

Review your Agency Snapshot report and work with your Territory Manager to multi-line your

existing customers’ accounts with Builders Mutual.

15

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE COVERAGE

COVERAGE ENHANCEMENTS

As we work with you to multi-line accounts and grow your book of business, we are pleased to

offer these enhancement endorsements for General Liability, Property, Auto and Hired Auto,

and Non-Owned Liability policies.

GENERAL LIABILITY ENHANCEMENT ENDORSEMENT

This form is automatically added to all General Liability

and Trade Contractor policies at no charge.

The most common coverages needed to issue a Certifi cate of Insurance for contractors are

included with our enhancement endorsement, as shown in the highlights below.

AVAILABLE IN ALL STATES

GENERAL LIABILITY COVERAGE

Bodily Injury – Mental Anguish Included

Off-Premises Care, Custody, or

Control Coverage

$25,000

Incidental Medical Malpractice Included

Amendment of Insured Contract Defi nition Included

Liberalization Clause Included

Unintentional Failure to Disclose Hazards Included

Lost Keys of Others $500 Occurrence/$1,500 Aggregate

Medical Payments $15,000

Broadened Mobile Equipment* Included

Newly Formed or Acquired Organizations Included

Non-Owned Aircraft Included

Watercraft Coverage Enhancement Included

Aggregate Limits Per Project Included

Personal and Advertising Injury –

Electronic Publication

Included

Property Damage Liability –

Borrowed Equipment

$25,000

Supplementary Payments (Bail Bonds)

Enhancement

$5,000

Damage to Premises Rented to You Limit $500,000

Knowledge of an Occurrence, Claim, or Suit Included

Voluntary Property Damage Coverage $5,000 Occurrence/$10,000 Aggregate

Waiver of Transfer of Rights of

Recovery Against Others

Included

16

*NOTE In VA, street cleaning is considered an auto, not mobile equipment.

AUTO ENHANCEMENT ENDORSEMENT

This form is automatically added to all

Auto policies at no charge.

Issuing certifi cates of insurance is made easy with automatically included Blanket Additional

Insureds and Waiver of Subrogation. Primary non-contributary is built into the Auto enhancement

form. Additional coverages designed specifi cally for the contractor are highlighted below.

NOT AVAILABLE IN FLORIDA

COMPLETE COVERAGE

GENERAL LIABILITY COVERAGE Continued

Duties in the Event of Occurrence,

Offense, Claim, or Suit

Included

Primary and Non-Contributory –

Other Insurance Condition

Included

The Blanket Additional Insured – Ongoing and Blanket Additional Insured –

Completed Ops/Products are also automatically attached to all GL policies,

making COI issuance easier than ever!

Blanket Additional Insureds Included

Employee Hired Auto:

• Liability

• Physical Damage

Included

Included

Limited Liability Company as an Insured Included

Newly Acquired or Formed Entities Included

Supplementary Payments:

• Bail Bonds

• Reasonable Expenses Due to Our Request

$3,000

$500 Per Day

Hired Autos Physical Damage:

• Loss of Use

Lesser of $50,000 or ACV*

$75 Per Day/$750 Per Loss

AUTO ENHANCEMENT ENDORSEMENT COVERAGE

Towing and Labor

Private Passenger Types/“Light Trucks”

$75 Per Disablement/$300

Other than Private

Passenger Types/“Light Trucks”

$150 Per Disablement/$300

Personal Effects $500

Transportation Expenses –

All Vehicle Types

• Temporary Transportation

• Return of Stolen Auto

$75 Per Occurrence/$750 Total

$5,000

Rental Reimbursement:

• Private Passenger Types/“Light Trucks” $75 Per Day/$750 Per Occurrence

*NOTE VA $20/day, $600 max.

17

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE COVERAGE

Electronic Equipment Included

Loan/Lease Gap Coverage Included

Glass Repair* Comprehensive Deductible Waived

Waiver of Subrogation Included

Unintentional Omissions** Included

AUTO ENHANCEMENT COVERAGE Continued

OPTIONAL CGL HIRED AUTO AND NON-OWNED

AUTO LIABILITY ENDORSEMENT

This form can be added to a Standard or Trade Contractor

General Liability policy for a fl at fee of $200.

• As long as the insured has no existing Commercial Auto policy, simply add this

form to the existing General Liability policy.

• Make your contractor happy with just one policy and one bill.

AVAILABLE IN ALL STATES

*NOTE Not included in SC enhancement, as SC is a zero deductible state for glass claims.

**NOTE Not included in VA enhancement; this is automatically included in policy.

PROPERTY ENHANCEMENT

With Business Income and Extra Expense

This form is automatically added to all

Property policies at no charge.

Business Income and Extra Expense is now included on a 12-month actual loss sustained (ALS)

basis. At Underwriter’s discretion for certain class codes, ALS may not be available. Additional

coverages designed specifi cally for contractors are highlighted below.

NOT AVAILABLE IN FLORIDA

PROPERTY ENHANCEMENT COVERAGE

Arson, Theft, and Vandalism Reimbursement $10,000

Brands and Labels $25,000

Business Income and Extra Expense –

Actual Loss Sustained

Valuation:

• Fabricator’s/Manufacturer’s Selling

Price Valuation

• Replacement Cost Valuation for

Personal Property of Others

Included

$10,000

Fire Extinguisher Recharge Expense $5,000

Fire Department Service Charge $5,000

Newly Acquired or Constructed Property:

• Building

• Personal Property

$1,000,000

$500,000

18

Newly Acquired Location – Business Income

and Extra Expense

$250,000

Valuable Papers and Records –

Cost of Research

$30,000

Property Off Premises $20,000

Non-Owned Detached Trailers $10,000

Outdoor Fences $10,000

Outdoor Signs $10,000

Outdoor Trees, Shrubs, and Plants

(Subject to a $1,000 Per Item Limitation)

$10,000

Radio and Television Receiving Equipment $10,000

Refrigerated Property $10,000

Ordinance or Law Coverage:

• Loss to the Undamaged Portion

of the Building

• Demolition Costs

• Increased Cost of Construction

Included

$50,000

$50,000

Pollutant Cleanup and Removal $25,000

Property In Transit $25,000

Backup of Sewers and Drains $25,000

Contractors’ Tools and Equipment

and Equipment of Others

• Tools in a Locked Vehicle

$5,000

$1,000

Accounts Receivable $25,000

Claim Data Expense $25,000

Computers and Media $25,000

Fine Arts $25,000

Installation Property $25,000

Employee Theft (Including Forgery

or Alteration)

$25,000

Computer Fraud $25,000

Lock Replacement $5,000

Money, Securities, and Stamps (Inside/Outside) $5,000

Electronic Data* $2,500

PROPERTY ENHANCEMENT COVERAGE Continued

COMPLETE COVERAGE

19

*NOTE Not included in VA enhancement; this is automatically included in policy.

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

Valuable Papers and Records –

Cost of Research $50,000

Property Off Premises $50,000

Property in Transit $50,000

Backup of Sewers and Drains $50,000

Contractors’ Tools and Equipment and

Equipment of Others:

• Tools in a Locked Vehicle

$10,000

$5,000

Accounts Receivable $50,000

Installation Property $50,000

Lock Replacement $10,000

Money, Securities, and Stamps

(Inside/Outside) $10,000

PROPERTY ENHANCEMENT PLUS

With Business Income and Extra Expense

This form can be added to Property policies to

upgrade coverage for a $250 charge.

NOT AVAILABLE IN FLORIDA

COMPLETE COVERAGE

UMBRELLA PRODUCT ENHANCEMENT HIGHLIGHTS

Our new umbrella rating is not available online. Please note these important underwriting

guidelines when submitting an application:

• The Umbrella policy limit can be written up to $10 million.

• The minimum retained limit is $10,000.

• The General Liability policy must be written with Builders Mutual with minimum limits of

$1,000,000 per occurrence and $2,000,000 aggregate.

• Underlying coverage minimum requirements include $1,000,000 Commercial Auto

Combined Single Limit and 500/500/500 for Employer’s Liability.

• Commercial Auto and Employer’s Liability may be written by an AM Best A (Excellent) rated

company with a fi nancial rank of VII as long as the policy is written on an ISO form.

• Concurrent policy expiration dates are mandatory for the Umbrella and General Liability

policies. Concurrency in Workers’ Compensation, Employer’s Liability, and Commercial Auto

policies is preferred.

• An Umbrella Policy Minimum Premium Chart is included online in Rule 39 of the Umbrella

Additional Rules sections.

UPGRADED COVERAGE HIGHLIGHTS

20

MOST COMMONLY USED FORMS

WC Waiver of Subrogation Add using form WC 000313. No Charge

WC Blanket Waiver of

Subrogation

Add using form WC 9801.

NC and FL add using form WC 000313.

No Charge

WC Notice of Cancellation Add using form WC 3206 in NC.

WC 9900 10 01 for all other states.

No Charge

GL Enhancement Automatically added form CG 7051.

VA – CG 7055

Provides coverage for:

• Aggregate Limits Per Project

• Primary Non-Contributory

• Waiver of Subrogation

Please review enhancements for

further coverages and limits.

No Charge

GL Hired Auto and

Non-Owned Liability

Add using form CA 7049.

• Paired with the GL policy when no

commercial auto policy exists. Will

eliminate a bill and streamline coverage.

$200

GL Waiver of Subrogation Add the certifi cate holder specifi cally if the

blanket version in the the enhancement listed

above is not acceptable.

$250

GL Named Additional

Insured

Ongoing Operations

Add a certifi cate holder with form CG 2010.

Products-Completed Operations

Add a certifi cate holder with Builders Mutual

form CG 7026.

CG 2037 is also available.

Builders Mutual only charges on the fi rst fi ve

CG 2010 and CG 2037 forms per policy.

$50

$25

$250

GL Blanket Additional

Insured

Both automatically included with

Enhancement CG 7051.

Ongoing Operations

Automatically added to every policy using

form CG 7034 (CG 2010 equivalent).

Products-Completed Operations

Automatically added to every policy using

form CG 7024 (CG 2037 equivalent).

No Charge

No Charge

GL 30-Day Notice of

Cancellation

Can be added to policies with good

payment history using form IL 6006.

No Charge

COMPLETE COVERAGE

21

COMPLETE

COVERAGE

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

Auto Enhancement Automatically added form CA30 00

(CA 30000714sc for SC).

SC – CA 30000714sc

VA – CA 30 00 07 14VA

Provides coverage for:

• Blanket Additional Insured/

Primary – Non-Contributory

• Glass Repair

• Waiver of Subrogation (Blanket)

Please review enhancements for further

coverages and limits.

No Charge

Auto 30-Day Notice of

Cancellation

Can be added to policies with good payment

history using form IL 6006.

No Charge

Auto Named Additional

Insured

Can add using form CA 2048. No Charge

Property Property

Enhancement

Standard

Property

Enhancement

PLUS

Property Enhancement with Business Income

and Extra Expense. Automatically attached.

SC, TN – IL1601

NC – IL6014

MD – IL6022

DC, GA, MS – IL6018

VA – IL6025, IL6027

Provides the following:

• Business income and extra expense –

12-month ALS

• Installation property

• Contractors’ tools and equipment of others

• Backup of sewers and drains

• Property in transit

Enhancement Plus with Business Income and

Extra Expense.

SC, TN – IL6011

NC – IL6015

MD – IL6023

DC, GA, MS – IL6019

VA – IL6026, IL6028

Provides higher limits on 10 additional

coverages beyond those offered in the

standard enhancement including:

• Valuable Papers and Records

(Cost of Search)

• Property Off Premises – Property in Transit

• Accounts Receivable – Installation Property

• Backup of Sewer and Water

• Contractors’ Tools and Equipment and

Equipment of Others

• Money, Securities, and Stamps

(Inside/Outside)

• Lock Replacement

Please review enhancements for further

coverages and limits.

No Charge

$250

MOST COMMONLY USED FORMS Continued

COMPLETE COVERAGE

22

Builders Risk provides fl exible, comprehensive coverage during the course of construction.

Coverage includes property, scaffolding and temporary structures, and theft of materials, and

it can include profi t. Builders Risk also features coverage that extends beyond the dwelling or

structure, such as debris removal, pollution cleanup and removal, and fences, trees, and outdoor

property. Coverage is also available for remodelers, unsold dwellings, model homes, and

contents.

We offer both reporting form and One-Shot options.

Builders Mutual targets Residential, Commercial, Model Homes, and Remodeling with

our Enhanced Builders Risk One-Shot. We will write up to $5 million residential and

$15 million commercial.

Looking for a fast response? Complete an EBR One-Shot policy today. The EBR One-Shot is

written online via BOB, and when criteria are met for straight-through processing, the agent can

immediately print a Certifi cate of Insurance with the policy number.

Risks that meet the criteria listed below will go straight through. No paper applications must be

submitted. However, signed applications must be kept in the agent’s offi ce.

• Less than $3 million

• Protected classes 1-8

• No wind exposure

• New construction

• No Builders Risk losses

• No earthquake coverage requested

• No more than one building per location

When special circumstances apply, the homeowner can be listed as the fi rst named insured.

Contact your Underwriter for more details.

WHY DO YOU NEED BUILDERS RISK?

ENHANCED BUILDERS RISK ONE-SHOT

Builders Risk reporting forms are currently available for residential builders with more than

10 starts a year. We offer monthly reporting with a monthly rate or an annual rate. For a builder

with an average project completion of four months or less, the monthly rate is the best option.

Each month, the insured reports the existing homes still under construction, the homes that

have been completed, and any new locations. Coverage begins and continues according to the

monthly report. Since reporting form ratings are not available online, please contact

your Underwriter for a quote.

NOT AVAILABLE IN FLORIDA

MONTHLY REPORTING

COMPLETE COVERAGE

23

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

Need more coverage?

Higher limits are available for additional premium. No deductible applies to these

Supplemental Coverages. The following Supplemental Coverages are offered in package form.

ENHANCED BUILDERS RISK ONE-SHOT

COMPLETE COVERAGE

Pro Rata Cancellation

We will provide pro rata return on the fi rst year, once the minimum premium ($350) is met.

We will provide a full pro rata return in the second year and beyond for residential construction.

There is no minimum premium requirement in order to prorate a commercial risk.

Renewal

EBR One-Shot coverage will automatically end 12 months from the inception date unless the policy is

renewed and additional premium paid. To renew policies for a second term, the agent can send a request

to endorsements@bmico.com containing the EBR One-Shot policy number(s) the insured would like to

renew prior to the expiration date.

24

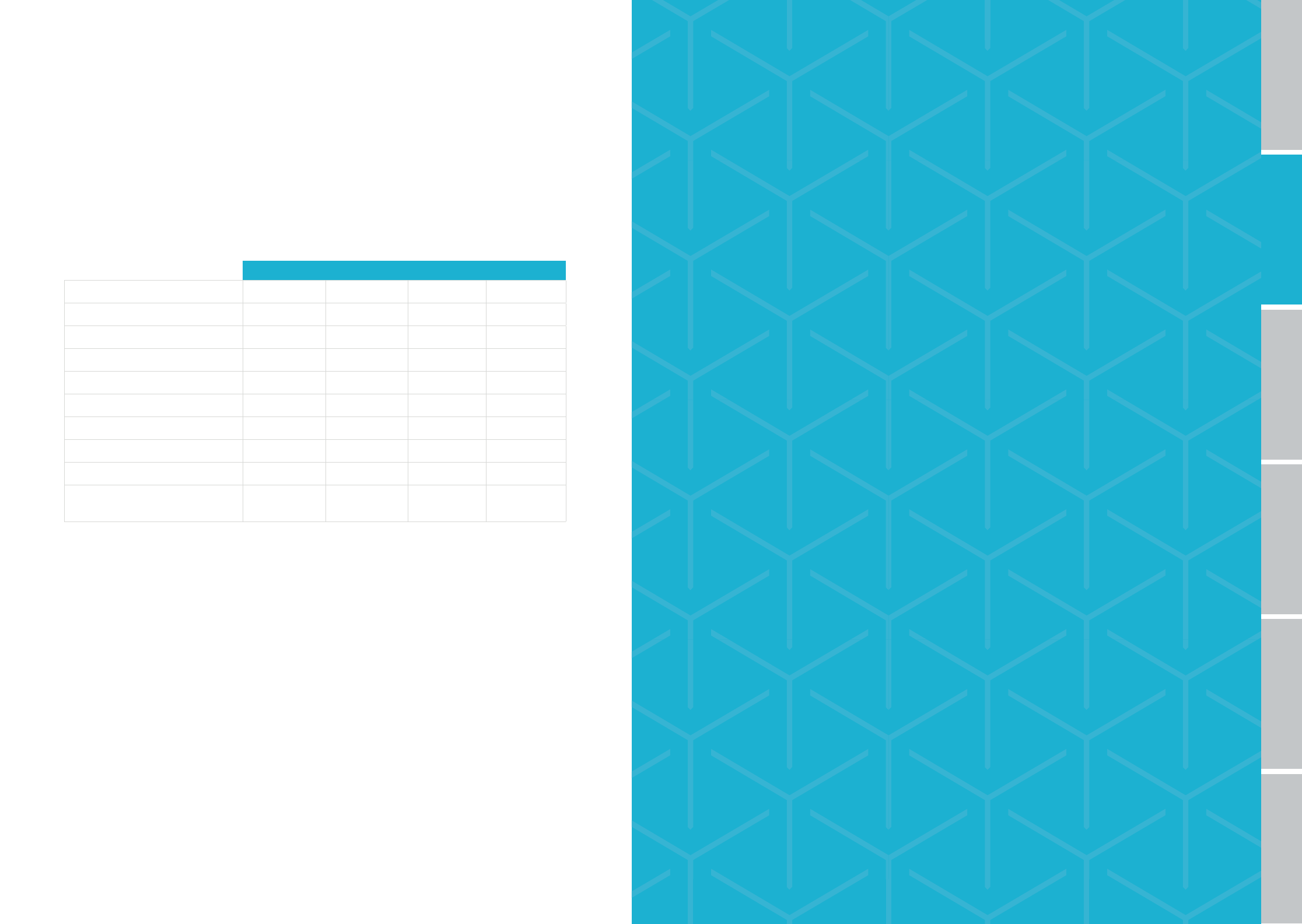

Scaffolding $5,000 $25,000 $50,000 $100,000

Debris Removal $10,000 $25,000 $50,000 $100,000

Backup of Sewers or Drains $5,000 $25,000 $50,000 $100,000

Fire Department Service Charge $10,000 $25,000 $50,000 $100,000

Valuable Papers $10,000 $25,000 $50,000 $100,000

Pollutant Cleanup and Removal $15,000 $15,000 $15,000 $15,000

Reward $10,000 $25,000 $50,000 $100,000

Property at Temporary Storage $25,000 $75,000 $150,000 $250,000

Property in Transit $10,000 $25,000 $50,000 $100,000

PREMIUM CHARGE ADDED

TO BASE RATE INCLUDED $125 $250 $500

PACKAGE A PACKAGE B PACKAGE C PACKAGE D

COMPLETE COVERAGE

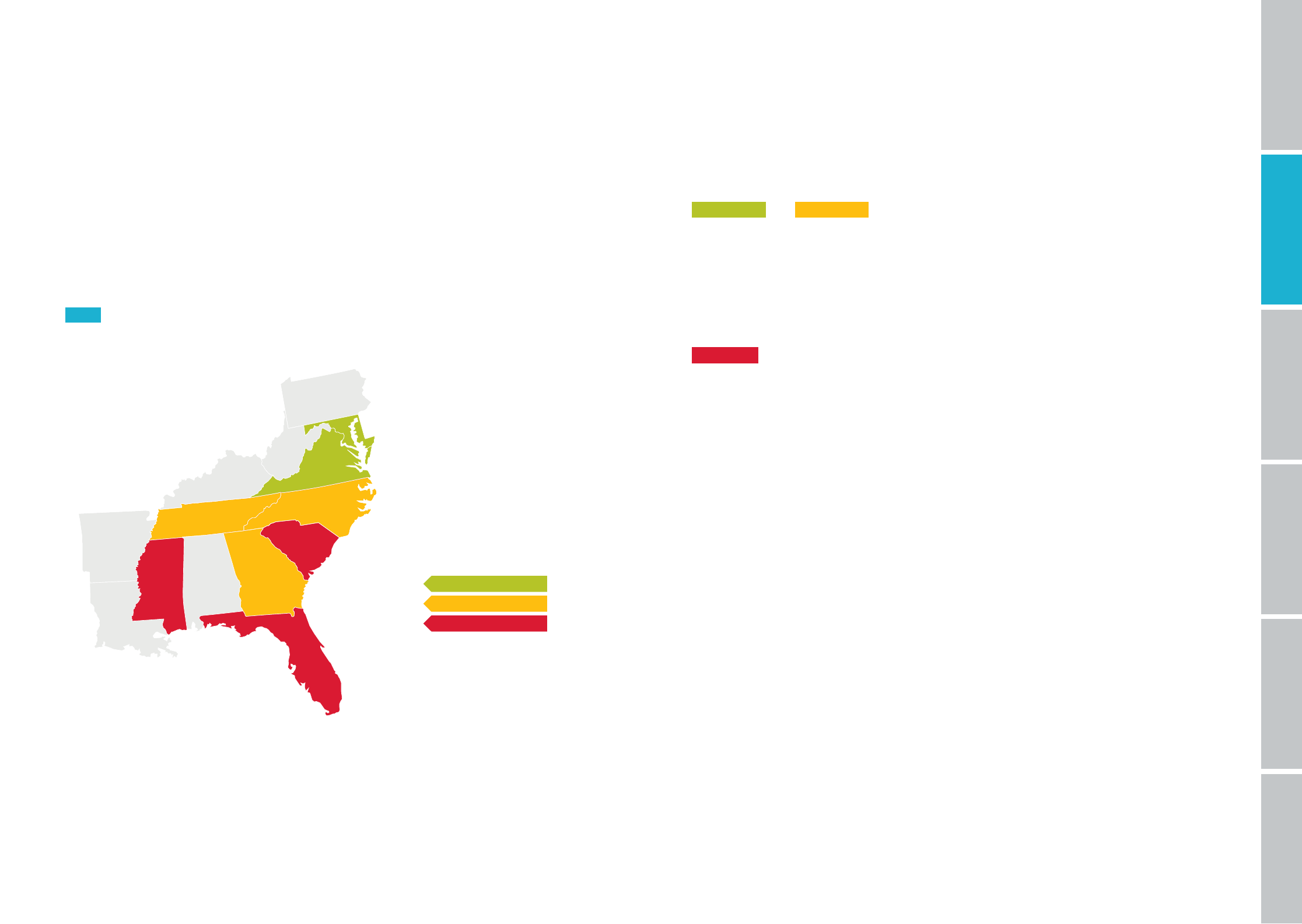

CLARIFYING OUR POSITION

As we work with you to write multi-line accounts, we believe

it’s important to clarify our position on important topics like

Construction Defect and Windstorm Guidelines. The following

reference tools were created to help you better understand our

position and include criteria we use to evaluate exposures.

25

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE COVERAGE

CONSTRUCTION DEFECT

CG2294 Removal Consideration Criteria

As experts in construction insurance, we have a strong understanding of construction

defect issues. When considering removal of the CG2294, we vary our approach based

on location and risk type.

Our Trade Contractor Program does not include the exclusion for damage to work

performed by subcontractors on your behalf (GC2294). The corresponding Commercial

Umbrella policy does not include the same exclusion (CU2264).

NOTE

DC, MD, VA Most favorable

GA, NC, TN Favorable

FL, MS, SC Least favorable

26

COMPLETE COVERAGE

CONSTRUCTION DEFECT

We will partner with you to review each risk according to the guidelines below.

DC, MD, VA and GA, NC, TN

• Commercial Trade Contractors (TC) whose subcontracted work is <50%

• Commercial General Contractors (GC) using 100% insured subs

- Prior or current habitational or residential work NOT eligible

• Residential TC whose subcontracted work is <50%

• Residential GC specialized in custom building

- Coastal counties NOT eligible

- Tract builders NOT eligible

FL, MS, SC

• Commercial TC whose subcontracted work is <50%

• Commercial GC using 100% insured subs

- Prior or current habitational or residential work NOT eligible

- Residential TC whose subcontracted work is <50%

• NOTE: Residential GCs are not eligible for consideration

The risk must also meet the following criteria:

• Minimum three years of prior insurance coverage and implemented subcontractor

agreements for at least three years

• Provide project list with description of the construction type

- DC, MD, VA three-year project list

- GA, NC, TN fi ve-year residential or three-year commercial

- FL, MS, SC seven-year project list

• No prior construction defect claims (for any type of residential construction)

• Quality control program with daily inspections and punch list signoff

• Risk transfers maintained

- Additional insured endorsements CG 2010 07 04 and CG 2037 07 04 or equivalent

- Limits equal to our insured’s GL limits of $1M/$2M

- 30-day notifi cation of coverage, reduction, or cancellation

- Waiver of Subrogation

- Retain coverage for at least three years

• General Liability loss ratio not to exceed 50%

• Good fi nancial standing

27

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE COVERAGE

WINDSTORM GUIDELINES

Managing property exposure in coastal regions is critical. The windstorm

maps included apply for both PROPERTY and BUILDERS RISK policies.

28

COMPLETE COVERAGE

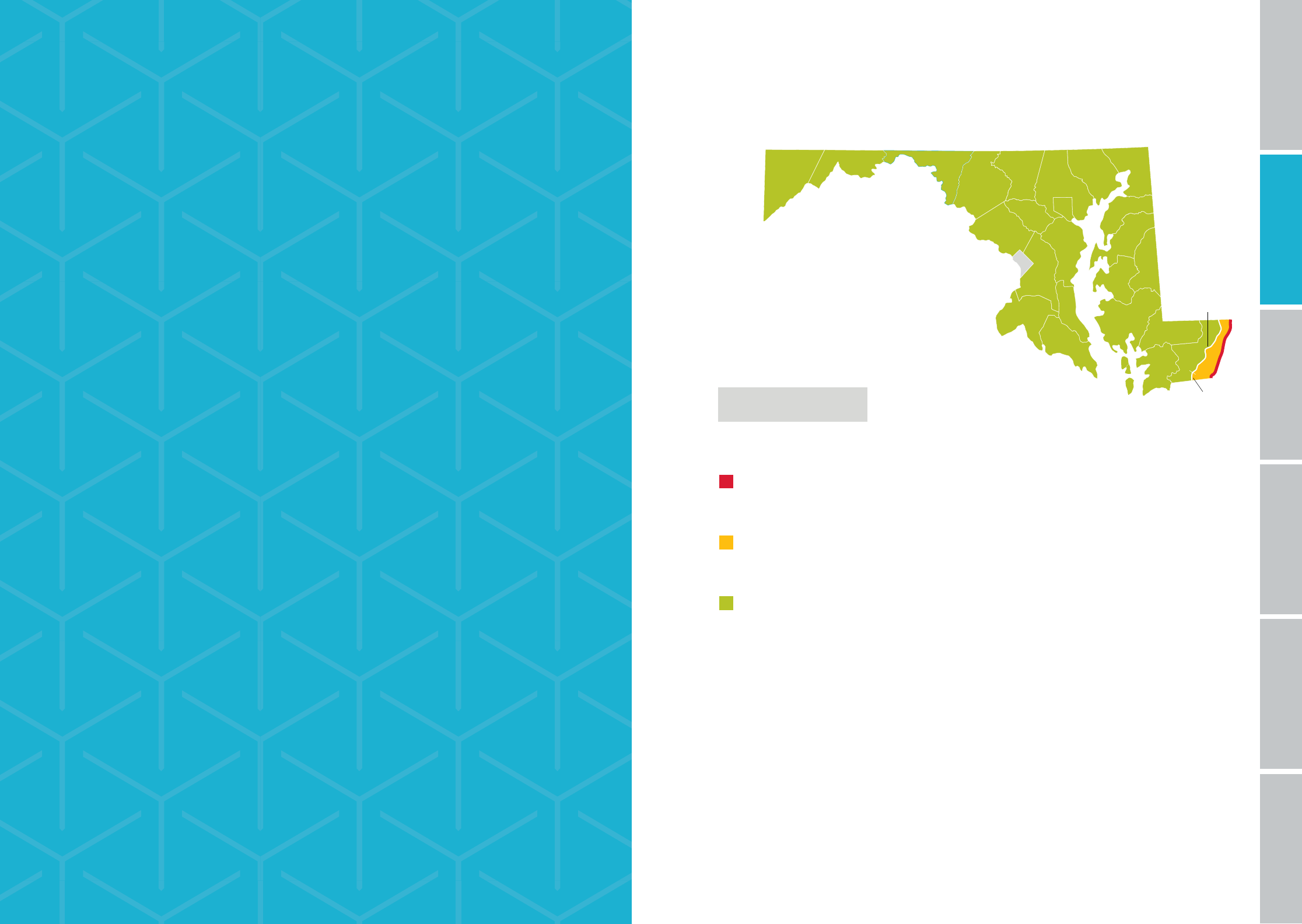

HWY 113

HWY 13

MARYLAND

Beach Area Not eligible for property coverage.

• Assateague Island

• Ocean City

Coastal Plain Standard 2% wind deductible.

• East of HWY 113 or 13

(Whichever is nearest the coast)

Inland No wind restrictions.

• Remainder of the state

NOTE Coastal restrictions do not apply to risks with business personal

property only valued at $25,000 or less. All submissions subject to UW

guidelines and approval.

29

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

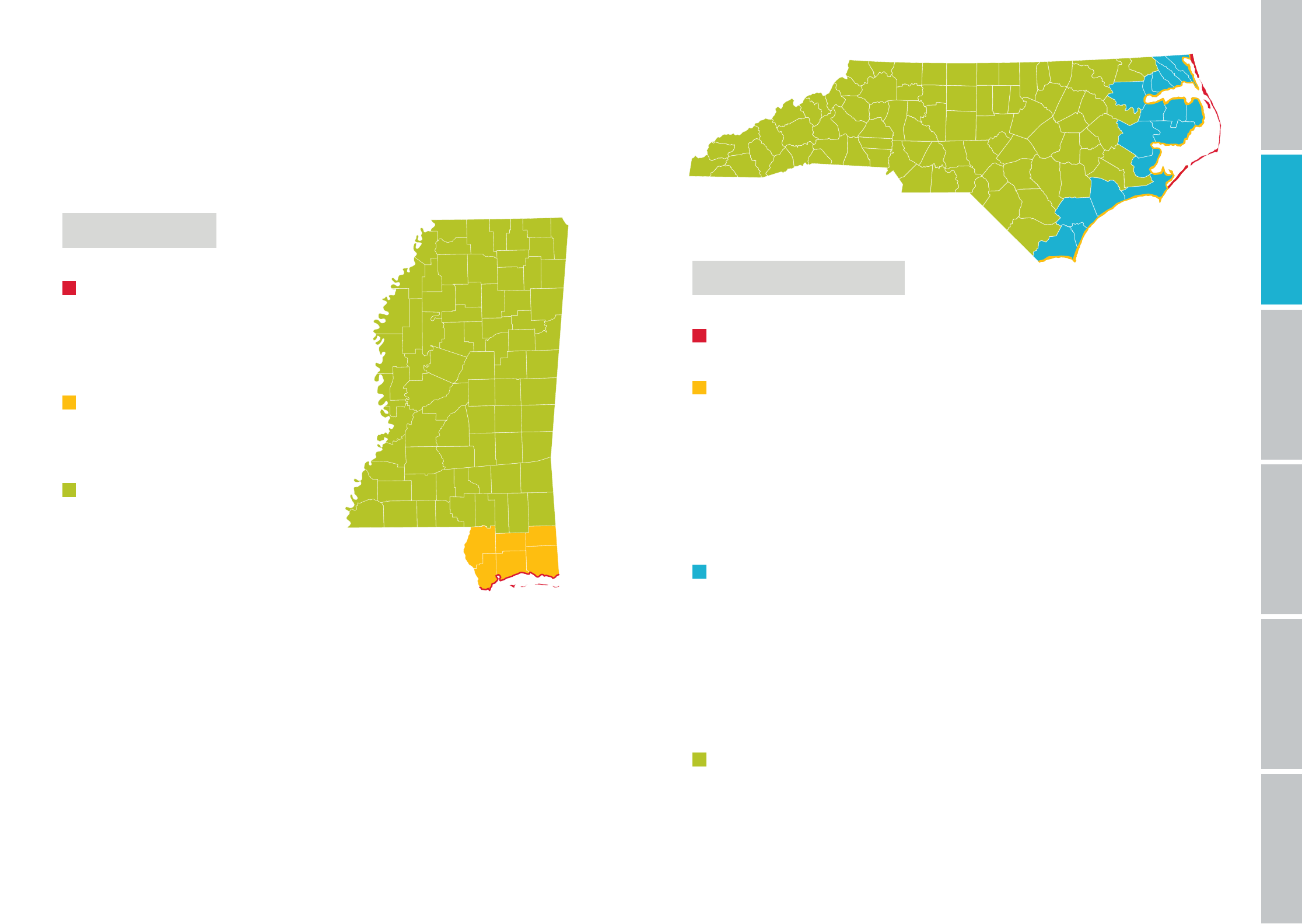

COMPLETE COVERAGE

Beach Area Not eligible for property coverage.

Less than 1,000 feet from the coast in the

following counties:

• Hancock

• Harrison

• Jackson

Coastal Plain Not eligible for wind coverage.

• Hancock

• Harrison

• Jackson

• George

• Pearl River

• Stone

Inland No wind restrictions.

NOTE Coastal restrictions do not apply to risks with business personal

property only valued at $25,000 or less. All submissions subject to UW

guidelines and approval.

• Remainder of the state

MISSISSIPPI

30

NOTE Coastal restrictions do not apply to risks with

business personal property only valued at $25,000 or less.

All submissions subject to UW guidelines and approval.

Beach Area Not eligible for property coverage.

• Outer Banks

Coastal Plain Not eligible for wind coverage.

Inland East Standard 2% wind deductible.

Inland West No wind restrictions.

• Remainder of the state

• Beaufort

• Brunswick

• Camden

• Carteret

• Chowan

• Currituck

• Beaufort

• Brunswick

• Camden

• Carteret

• Chowan

• Currituck

• Dare

• Hyde

• New Hanover

• Onslow

• Pamlico

• Pasquotank

• Dare

• Hyde

• New Hanover

• Onslow

• Pamlico

• Pasquotank

• Pender

• Perquimans

• Tyrrell

• Washington

• Pender

• Perquimans

• Tyrrell

• Washington

Less than 1 mile from the coast in the

following counties:

Greater than 1 mile from the coast in the following

zip codes:

COMPLETE COVERAGE

31

NORTH CAROLINA

ABOUT US COMPLETE

COVERAGE BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

COMPLETE COVERAGE

Coastal Plain and Inland East zip

codes detailed below.

NOTE

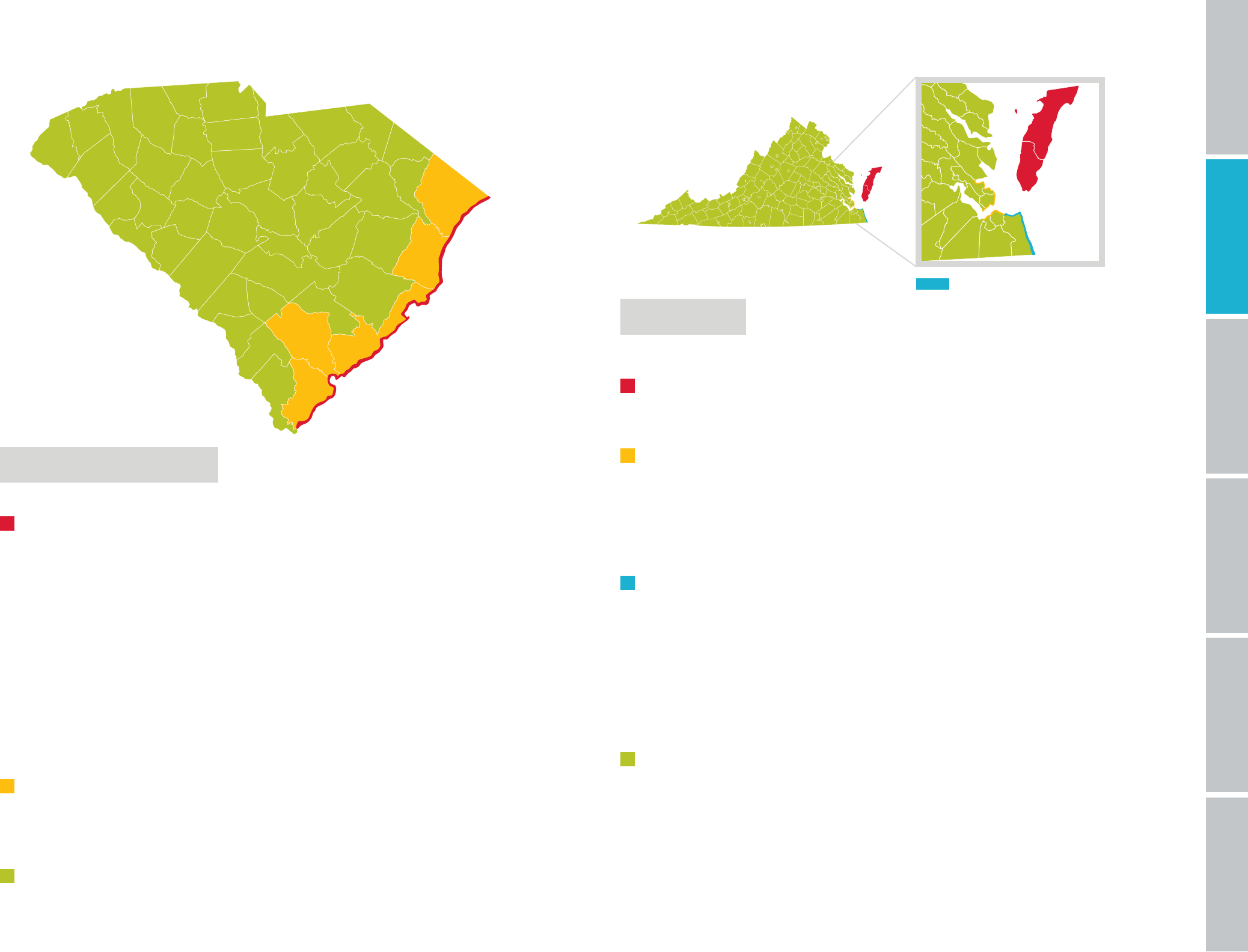

VIRGINIA

Beach Area Not eligible for property coverage.

• Accomack

• Northampton

Coastal Plain Not eligible for property coverage.

Inland East Not eligible for property coverage.

Inland West No wind restrictions.

• Remainder of the state

• 23451

• 23456

• 23457

• 23455

• 23503

• 23511

• 23518

• 23607

• 23459

• 23461

• 23651

• 23661

• 23662

• 23663

• 23664

• 23669

• 23692

• 23696

• 23703

Less than 2 miles from the coast in the

following zip codes:

Less than 2,000 feet from the coast in the

following zip codes:

NOTE Coastal restrictions do not apply to risks with

business personal property only valued at $25,000 or less.

All submissions subject to UW guidelines and approval.

33

COMPLETE COVERAGE

SOUTH CAROLINA

32

Beach Area Not eligible for wind coverage.

Rule: These are eligible for the wind pool and as a result are not eligible

for Wind coverage with BMIC. Visit www.scwind.com/EligibilityCheck.asp

to verify eligibility.

• Horry

- East of HWY 17 business or bypass (whichever is further west)

Coastal Plain Standard 2% wind deductible.

• Horry

• Georgetown

• Charleston

• Colleton

• Beaufort

NOTE Coastal restrictions do not apply to risks with

business personal property only valued at $25,000 or less.

All submissions subject to UW guidelines and approval.

• Colleton

• Georgetown

• Beaufort

• Charleston

- East of the Intracoastal Waterway from the northern border of the City

of Charleston to the Georgetown County border

- Edisto Island, Edingsville Beach, Kiawah Island, Botany Bay,

Folly Island, Seabrook Island, Morris Island

- East of the Intracoastal Waterway

Inland No wind restrictions.

• Remainder of the state

BILLING

COMPLETE

COVERAGE

ABOUT US POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

BILLING

BILLING

BILLINGABOUT US COMPLETE

COVERAGE

POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

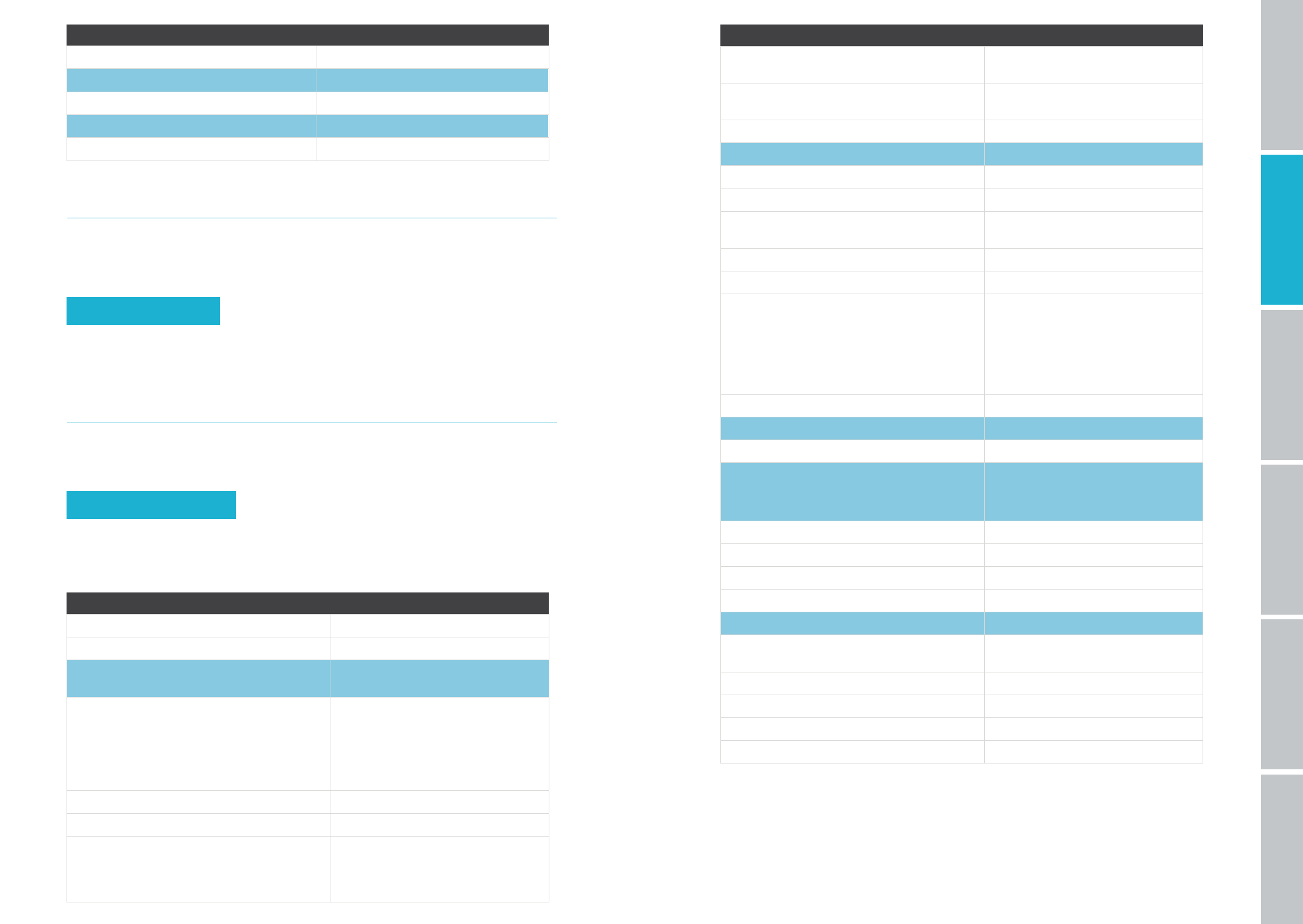

Builders Mutual does not charge installment fees

on our 2-Pay, 4-Pay, or 10-Pay payment plans.

20% of total (premium + expense constant*) is due at application,

and customer is billed the remainder over nine installments.

*The expense constant applies to Workers’ Compensation policies only.

25% of total (premium + expense constant*) is due at application,

and customer is billed the remainder over three installments.

50% of total (premium + expense constant*) is due at application,

and customer is billed the remainder in the fi fth month, with payment

due the sixth month.

100% due at application.This is required when the estimated annual

premium is $1,000 or less.

PAYMENT PLANS

Builders Mutual offers a variety of fl exible payment plans, including:

BILLING

36

10-PAY

4 - PAY

2- PAY

ANNUAL

MONTHLY SELF-REPORTING FOR WORKERS’ COMPENSATION

With our convenient system of monthly reporting, a customer’s monthly premium is based

on actual payroll from the previous month. Premiums are in proportion to the actual amount

of work in progress, eliminating large unexpected audits.

Here’s how it works:

• Customers pay the 15% deposit* plus the expense constant when submitting their application.

• Each month, customers log in to buildersmutual.com and enter their payroll. Premium due is

automatically calculated, ensuring payment of the exact amount owed.

• If paper is preferred, customers manually calculate their payroll and mail their report. Payments

can be accepted via check, through our Customer Contact Center (800-809-4859), or online.

*The 15% deposit is adjusted when policy estimates are adjusted and is retained only to apply toward premium in the event

of termination. Once policyholders complete their second year with us, we no longer require a deposit. Money classifi ed as

“deposit” will be applied as “premium” at renewal in the fi rst month of the third year.

BILLING

Builders Online Business makes billing easy. Your policyholders can register to use our

online platform by visiting buildersmutual.com/policyholders. After creating a user ID

and password, they can:

• Pay bills

• Register for Auto-draft

• Enter workers’ comp monthly payroll

• View policy documents

• Enroll to Go Paperless

NOTE Policyholders may ONLY change payment plans at policy renewal.

37

ONLINE TOOLS

POLICYHOLDER

SERVICES

ABOUT US COMPLETE

COVERAGE BILLING AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

POLICYHOLDER

SERVICES

POLICYHOLDER

SERVICES

POLICYHOLDER

SERVICES

ABOUT US COMPLETE

COVERAGE BILLING AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

CLAIMS

To Report a Claim

Call 800-809-4862 to be connected with a representative.

Email noticeofl oss@bmico.com

Fax 919-227-0204

Visit the Builders Mutual Claims Center at buildersmutual.com/claims

to report a claim online.

State-specifi c claims forms are also available in the Claims Center.

To Manage Claims

Call Claims Support 800-809-4861

SERVICES

CUSTOMER CONTACT CENTER

Builders Mutual’s Customer Contact Center is available Monday through Friday,

8 a.m. to 6 p.m. EST. When you call 800-809-4859, a trained Customer Service

Representative will serve as a central point of contact for all your basic agency and

customer inquiries, including:

We now have an express payment line for policyholders and agents who want to

quickly make payments by phone.

• Audit information

• Billing inquiries

• Commissions

• Dividends

• HBA membership requirements

• Payments

• Policy documents

• Status of policy changes

RISK MANAGEMENT

Customers can depend on Builders Mutual Risk Management experts to:

• Discuss their operations during a job-site safety visit and help them identify

possible risks and exposures

• Recommend straightforward, easy-to-implement solutions to minimize

losses and promote OSHA compliance

• Demonstrate proper usage of safety equipment

• Partner with customers to develop a safety or education program tailored

to their company’s needs

Risk Management Consultants are assigned according to the county in which the policy

is written and can be located using the “Find a Risk Management Consultant” tool on

buildersmutual.com.

40

SERVICES

Risk Management Online Resources

Builders Mutual maintains a robust collection of online resources to help customers develop

a culture of safety. Customers can visit buildersmutual.com/RM to access:

WORKSAFE

Statistically, new employees, especially those who have been on the job for less than six

months, have a greater chance of being exposed to a serious injury or fatal accident. This is

why it is essential that employers provide workers with basic safety training before they ever

step foot on a job-site.

To promote a culture of safety, Builders Mutual developed WorkSafe, a compact but critical

introduction to best practices on the job-site. Whether customers have one new employee

or a small group of workers starting, training materials are available to educate, review, and

sign off on the eight key topics that every employee should know BEFORE stepping on the

job-site. Download these materials at buildersmutual.com/worksafe.

Short safety talks that can be discussed in regularly

scheduled safety meetings

A series of safety videos available to watch from the

convenience of a mobile device, tablet, or larger monitor

Includes Accident Report and Investigation Forms,

Job-site Inspection Forms, Drug and Alcohol Policy

Forms, and sample Subcontractor Agreements

Links to industry safety resources, including the

National Safety Council and Occupational Safety

and Health Administration (OSHA)

Sample safety modules available to help customers develop a

detailed Safety Program that addresses specifi c work-related

hazards, as well as hazards that could result from a change in

practice or conditions on the job-site

TOOLBOX TALKS

TOOLBOX

VIDEO TALKS

SAFETY POLICY

SAFETY LINKS

SAFETY

PROGRAM

41

POLICYHOLDER

SERVICES

ABOUT US COMPLETE

COVERAGE BILLING AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

PREMIUM AUDIT

Each year, Workers’ Compensation and General Liability account(s) are audited. With a little

advanced planning and Builders Mutual by your side, premium audits can be simple. As part

of our dedication to providing our policyholders with the best service possible, we want them

to be prepared with the proper records and a thorough understanding of the process, making

their premium audit as effi cient as possible.

We have assembled all the tools our policyholders need to prepare for their audit.

Customers can visit buildersmutual.com/audit to access these resources:

TIP

Classifi cations are made based on job duties and exposures, not job title.

Remember, only the workers on the job-site can have their time broken out into

more than one classifi cation. For more helpful tips, review our Audit Prep kit at

buildersmutual.com/auditkit.

Call the Customer Contact Center at 800-809-4859

Email us at audits@bmico.com

Visit buildersmutual.com/audit and click on Find an Auditor for contact information

for Builders Mutual auditors in your area

SERVICES

43

At Builders Mutual, our industry experts are our most valuable asset. When you have an

Audit question, reach out to us for an answer:

A comprehensive tool to help policyholders learn what records to

provide, ideas on organizing records, retention guidelines for certain

records, insight into common audit questions on remuneration and

class codes, and tips on working with subcontractors.

Links to useful audit resources, including Workers’ Compensation

monthly self-reporting FAQ’s and worksheet instructions, state-

specifi c coverage verifi cation links, and Builders Mutual sample

subcontractor agreements.

AUDIT PREP KIT

PREMIUM AUDIT

LINKS

SERVICES

Builders Mutual created Builders University

®

to help strengthen our customers’

safety programs and address risks that impact their profi ts. We offer a variety

of standard courses as well as the knowledge and expertise to create custom

classes that meet our customers’ needs. Some of our core classes include:

• OSHA 10- and 30-hour Construction Industry Safety Courses

• Fall Protection

• WorkSafe 101: Best Practices for Hiring and Job-Site Safety Training

• Driver Safety

• Preparing for your Workers’ Comp and General Liability Audits

Visit buildersmutual.com/BU for details.

BUILDERS MUTUAL BLOG

The Builders Mutual blog was created as a resource to share our knowledge

and expertise with policyholders, agents and those in the construction

industry. We utilize our own employee industry experts to produce original

articles focused on current industry topics, safety and small business initiatives.

Article topics range from safety and cybersecurity to hiring and training

employees.

For the latest construction trends and industry news visit

blog.buildersmutual.com.

42

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

POLICYHOLDER

SERVICES

ABOUT US COMPLETE

COVERAGE BILLING

AGENT

SERVICES

AGENT SERVICES

POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US COMPLETE

COVERAGE BILLING

AGENT SERVICES

Builders Mutual values our

independent agency partners.

We are always looking for ways

to improve your experience

and provide tools to help you

manage your accounts and grow

your business.

46

AGENT SERVICES

Our online platform allows you to quote, sell, and service policies with ease.

There are several online tools available to help you better manage your overall

account with Builders Mutual.

Access to Builders Online Business is only available to agents actively appointed with

Builders Mutual. Visit buildersmutual.com/agents to register for access or to log in and get

started on these features:

Quote and Manage Policies

Rate, quote, issue, and service your policies. In this section, you can also:

• Upload Workers’ Compensation policies with AMS360, Sagitta, Applied, and

IVANS Transformation Station.

• Message with your Underwriter on specifi c quotes.

• Pay new business, installments, and renewals. When submitting payments,

remember to use these forms:

- New Business Premium Allocation form

- One-Time Payment Authorization form

• Service all of your policies in one place with policy, billing, and claims inquiry.

Most frequently accessed resources are available on the Agent Landing page:

Trade Contractor Program

Eligibility and state-specifi c rates

for our General Liability Trade

Contractor Program.

Appetite Guide

General list of our appetite for

business classes in workers’ comp,

GL (including trade), commercial

auto, and property.

Quick Reference Guide

Electronic version of Agent Quick

Reference Guide.

My Agency Snapshot

Review a detailed report of your agency’s book of business with prior-month or prior-year fi gures.

My Producer Listing

View your agency’s appointed producers and see resident and non-resident status.

My HBA Expressway (NC only)

Review membership status for NC policyholders.

My Commissions

Register for electronic funds transfer (EFT) of your monthly commission payment, and access

current and prior statements. Statements are only accessible by one login ID and require an

additional personal identifi cation number (PIN).

My Claims

Submit a claim, view claim history, or review the Claims Snapshot report, which provides

your agency with a complete overview of all claims.

Agency Manual

Review this online manual that includes each state’s rules, underwriting guidelines, rates,

and forms.

Marketing Materials

Review and request customized marketing materials to promote and grow your business.

47

Training

Easily access training information

for Builders Online Business by line

of business and topic.

Agency Alerts

Most recent rate, form and product

updates.

Your Support Team

Your agency’s assigned sales and

underwriting contacts.

POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US COMPLETE

COVERAGE BILLING

AGENT SERVICES

48

AGENT OF RECORD CHANGES

New Business

Agent of Record requests on new policies must be accompanied by the following:

• Completed applications (signed by a licensed agent and the policyholder due at binding)

• Completed contractor supplement

• Currently valued loss runs for the past three years

• Agent of Record letter signed by the policyholder (not subject to a rescission period)

Renewals

Agent of Record change requests on existing policies must be accompanied by the following:

• Completed applications (signed by a licensed agent and the policyholder specifying the

policy numbers to be transferred)

• Agent of Record letter signed by the policyholder (subject to 10-day rescission period)

• Requests should be submitted no sooner than 90 days prior to the renewal date and no

later than the effective date.

• No requests will be accepted midterm. All requests will be effective at the next renewal.

SPECIAL RECOGNITION PROGRAMS

Champions Club

Champions Club recognizes our profi table partner agencies with over $750,000 in

premium. This select agent group will have access to special recognition programs,

advertising opportunities, and unique service and sales support. Champions Club

agents are announced each January and are recognized for the entire calendar year.

Agents must qualify each year to earn and maintain Champions Club status.

Builders Reserve

Builders Reserve recognizes the top individual Builders Mutual agency partners across

our market footprint. These agencies represent Builders Mutual’s “Best of the Best”

and merit an additional level of recognition and support by Builders Mutual leadership

and staff. Builders Reserve agencies are announced each January and are recognized

for the entire calendar year. Agents must qualify each year to earn and maintain

Builders Reserve status.

NOTE In MD and VA, contact your Underwriter for state-specifi c AOR guidelines.

BUILDERS UNIVERSITY AGENT PROGRAM

In 2003, Builders Mutual developed Builders University as an educational tool to

provide agents with a solid foundation of insurance knowledge for the construction

industry. Classes are offered each year in several locations across our market footprint

to build our agents’ expertise.

Builders University classes provide detailed information on insurance exposures,

exclusions, and coverages. Course materials include practical examples, case law,

policy information, and risk management instruction specifi cally for the construction

industry. Every class is free and provides 3.5 hours of continuing education (CE).*

The Certifi ed Builders Insurance Agent (CBIA) Designation was created for agency

partners that want to distinguish themselves as experts in the construction insurance

industry. Complete the 6 classes within the CBIA program and pass the CBIA exam to

earn your designation.

Learn more about upcoming classes and Builders University locations at

buildersmutual.com/AgentBU.

* Approved for CE in FL, MD, MS, NC, SC, TN, and VA unless otherwise noted.

Class length may vary according to state requirements.

CO-OP ADVERTISING PROGRAM

As a valued agency partner, we encourage you to take advantage of our Co-op

Advertising Program to market your agency in the local community. From print

advertising to promotional giveaways and event sponsorships, Builders Mutual will

cover half the cost. Signing up is easy.

1. Visit buildersmutual.com/agents/marketing_materials and review the co-branded

Marketing Materials readily available.

2. Contact the Marketing Department or email kmariani@bmico.com to request co-op

support. Prior approval is required.

3. The agency will pay for the advertisement or sponsorship in full. Builders Mutual

will reimburse the agency 50% of the total advertising cost (up to a specifi c dollar

amount per calendar year).

Additional incentives are available for Builders Reserve and Champions Club agencies.

AGENT SERVICES

49

POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US COMPLETE

COVERAGE BILLING

32

HBA

MEMBERSHIP

HBA MEMBERSHIP

POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US COMPLETE

COVERAGE BILLING

HBA MEMBERSHIP (NC ONLY)

When North Carolina contractors choose to insure with Builders

Mutual, we require that they join and maintain a membership in a

local North Carolina HBA. This requirement stems back to our roots

and strong ties with the NCHBA, demonstrating our long-lasting

commitment to the construction industry.

In the early 1980s, builders in North Carolina had diffi culty accessing

affordable Workers’ Compensation insurance. For this reason, the

North Carolina Home Builders Association (NCHBA) established a self-

insured fund for its members. When it was created, HBA membership

was a key requirement for all policyholders. Nearly 15 years later, the

fund evolved into an independent mutual insurance company, and

Builders Mutual was born.

Over the years, we have expanded into additional states and

established partnerships with various industry associations. However,

we never lose sight of our roots. Builders Mutual remains exclusively

dedicated to the construction industry, and we understand the value

of an HBA membership. Builders Mutual is actively involved with the

HBA – from participating in legislative initiatives in our nation’s Capital,

to grassroots community outreach. We were founded by members,

and we’re here to insure eligible members.

Builders Mutual requires

HBA Membership for

North Carolina Policyholders

52

HBA MEMBERSHIP: IT’S NOT A CLUB.

IT’S A COMMITMENT TO YOUR INDUSTRY.

HBA Expressway

Builders Mutual tracks membership through an online system called My HBA Expressway.

The Expressway allows local HBAs across the state to log in and audit our NC policyholders.

Each NC agency has access to the Expressway as well. When you log in and click on My HBA

Expressway, you can:

• View your policyholder’s HBA payment status

• Chat with Builders Mutual and the HBA through a unique messaging system

How does it work?

1. The local HBA notifi es Builders Mutual when the policyholder’s membership status is

unpaid, as early as the day following inception. This occurs when the policyholder has not

paid renewal dues or fails to join as a new member once the new policy is active.

2. When the policyholder is marked unpaid, the producer assigned to the account receives

an email. This email alerts the producer that the policyholder has unpaid dues.

• After 14 days, if the dues remain unpaid, Builders Mutual will mail a courtesy letter to

the policyholder. This letter alerts the policyholders that they have 30 days to comply

before their policy is in jeopardy of cancellation. The producer receives a copy of the

courtesy letter via email.

• After 30 days, if the dues remain unpaid, Builders Mutual begins the process to

cancel the policy mid-term.

A complete list of North Carolina local HBA chapters and their contact info

is available on buildersmutual.com.

HBA MEMBERSHIP (NC ONLY)

53

From networking and leads, to a voice representing contractors in the industry, to

tangible savings and rebates, there is more to member benefi ts than just Builders Mutual.

Visit buildersmutual.com/partnerships to learn more.

It is extremely important that our agents communicate the HBA membership

requirement to NC policyholders to create a positive customer experience.

When our agents proactively explain the HBA requirement and sell the value of

the HBA membership, we mitigate policyholder frustration and ultimately avoid

policy cancellation for non-payment of HBA dues.

BILLING POLICYHOLDER

SERVICES

AGENT

SERVICES

HBA MEMBERSHIP

(NC ONLY)

ABOUT US COMPLETE

COVERAGE

PO Box 150005 Raleigh, NC 27624 | 800-809-4859 | buildersmutual.com STAY CONNECTED blog.buildersmutual.com