Chp 7 ERB 3225 X Chp7Problems

User Manual: ERB 3225 X

Open the PDF directly: View PDF ![]() .

.

Page Count: 6

144 Chapter 7 Payroll

Unit 7.1 Gross pay: Wages and incentive plans

1. The Fair Labor Standards Act applies to all employees. (T or F) False; Some employees are exempt, including many

managers and seasonal workers.

2. Some employers provide overtime pay that is superior to what the Fair Labor Standards Act requires. (T or F) True

3. The employees of Sunshine Outdoor Products are paid time and a half after 40 hours per week. Compute each

employee’s gross pay.

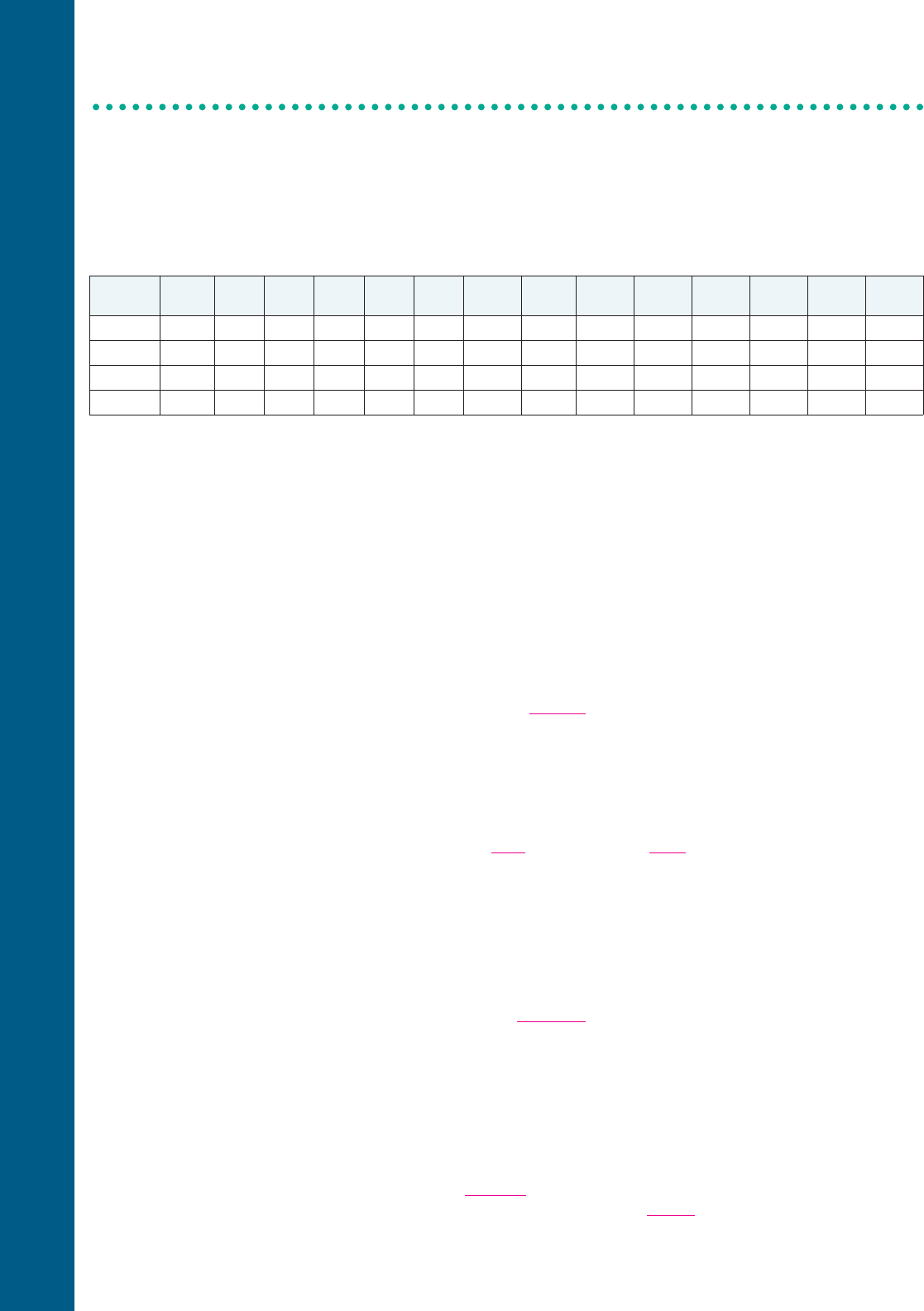

Total Regular Overtime Reg. rate Overtime Regular Overtime Gross

Name M T W Th F S hours hours hours per hour rate pay pay pay

Don Day 8 8 8 10 8 4.5 46.5 40 6.5 8.00 12.00 320.00 78.00 398.00

Joy Erb 8 8 8 8 8 8 48 40 8 8.25 12.375 330.00 99.00 429.00

Bo Hart 8 8 8 8 8 0 40 40 0 7.25 10.875 290.00 0.00 290.00

Thu Ho 8 8 8 10 4 0 38 38 0 8.25 12.375 313.50 0.00 313.50

4. You and three classmates work for different companies. Your gross pay is $1,295 a month. Betty earns $640 semi-

monthly, Brad earns $310 a week, and Meg earns $600 biweekly. Who has the greatest gross pay?

You: $1,295 12 $15,540.00

Betty: $640 24 $15,360.00

Brad: $310 52.14 weeks $16,163.40

Meg: $600 26.07 biweekly periods $15,642.00

5. Jay Hirschi sold eight new cars during the week. If he earns $150 per sale, what is his gross pay for the week?

8 cars $150 = $1,200

6. Tom Judkins sews sleeping bags. He is paid $5.50 per hour plus $1.50 per sleeping bag. During the week, Tom worked

40 hours and sewed 32 sleeping bags. What is Tom’s gross pay for the week?

Base salary: 40 hours $5.50 $220.00

Piecework: 32 sleeping bags $1.50 + 48.00

Gross pay $268.00

7. Brock Snyder assembles chairs. During the pay period, Brock assembled 344 chairs. Determine his gross pay, based

upon these piecework rates:

The first 100: $1.75 per chair 100 $1.75 $175

The next 100: $2.00 per chair 100 $2.00 200

Thereafter: $2.25 per chair +144 $2.25 + 324

344 $699

8. Blanche Baker is a salesperson in a computer store and receives a $1,200 semimonthly draw. Blanche is paid a 3% com-

mission on net sales. During October, Blanche sold $125,800 of merchandise; her share of sales returns was $2,592.

Calculate Blanche’s commission payment for October.

Net sales: $125,800 - $2,592 returns = $123,208

Commission: $123,208 3% $3,696.24

Less draw: 2 draws $1,200 - 2,400.00

Commission still due $1,296.24

9. Alfonso Gallegos is a salesperson for a furniture store. He is paid a semimonthly salary of $800 plus 3% of monthly net

sales over $80,000. Alfonso’s sales during November were $128,300. His share of returns were $3,400. Determine his

gross pay for November.

Salary: 2 $800 $1,600

Commission:

Net sales: $128,300 - $3,400 $124,900

Base amount - 80,000

Overage $ 44,900 3% +1,347

Total earnings $2,947

Chapter Review Problems

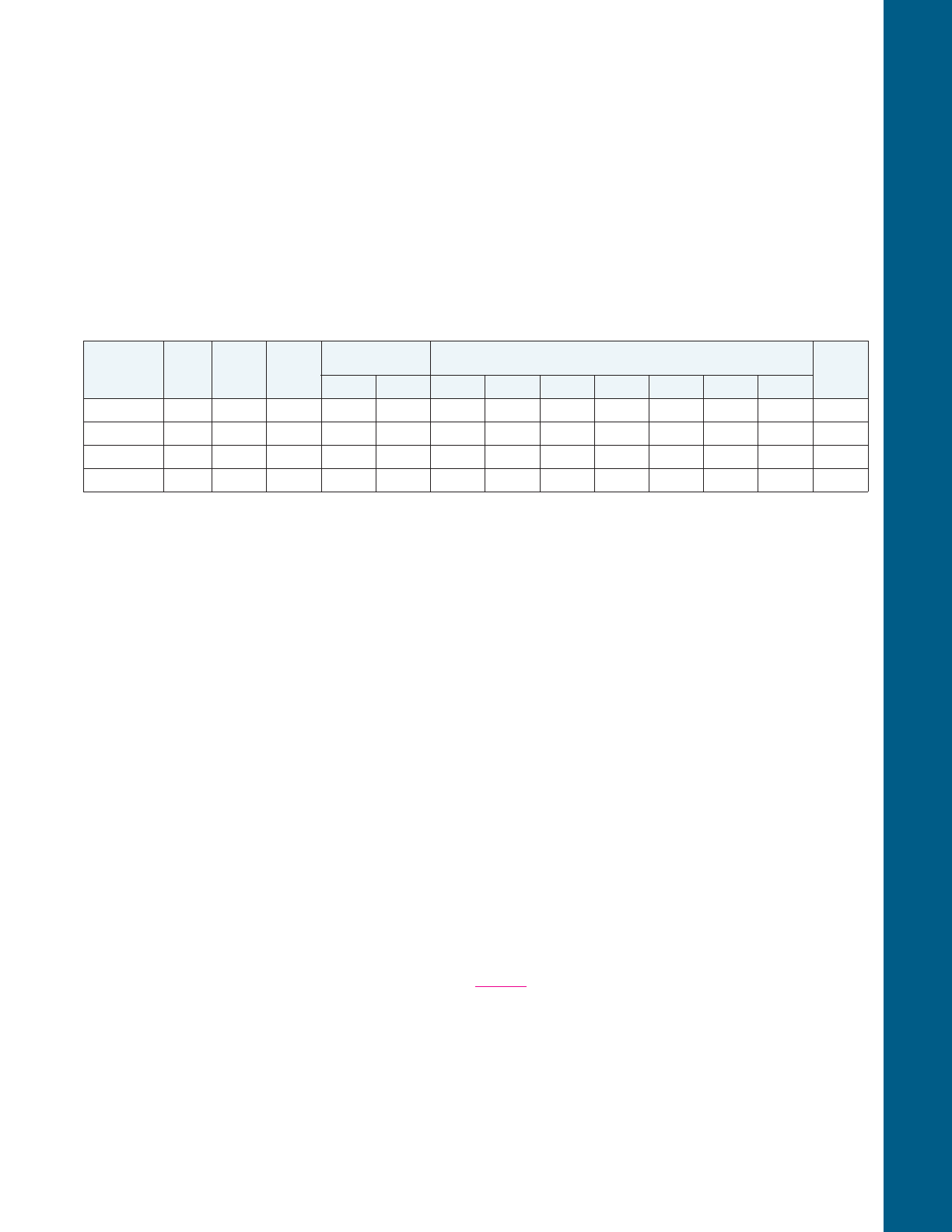

AMERICAN PHARMACY

Payroll Register

December 15, 2001

Dan Bevan M-1 63,750 1,275 1,275 1,275 79.05 18.49 198.00 63.75 50.00 Savings 409.29 865.71

Ashlie Dobbs S-1 14,580 810 810 810 50.22 11.75 133.00 40.50 XX235.47 574.53

Ian Rice M-3 6,500 1,140 1,140 1,140 70.68 16.53 130.00 57.00 XX274.21 865.79

Totals X 84,830 3,225 3,225 3,225 199.95 46.77 461.00 161.25 50.00 X918.97 2,306.03

Unit 7.2 Payroll deductions for employees

10. Which statement is true?

a. Social Security consists of (1) FICA and (2) Medicare.

b. FICA consists of (1) Social Security and (2) Medicare. (b) is true.

c. Medicare consists of (1) FICA and (2) Social Security.

11. The number of allowances claimed on Form W-4 must match the number of exemptions claimed on the federal income

tax return. (T or F) False

12. American Pharmacy has three employees. Complete American’s weekly payroll register. Use: (a) 2001 FICA tax rates, (b)

the wage-bracket method shown in Illustrations 7-2 and 7-3, and (c) a 5% rate for withholding state income tax.

13. Refer to Problem 12. What amount of federal income tax would be withheld for Dan Bevan if American used the

percentage method?

Step 1 Using Illustration 7-4, locate the weekly amount for 1 withholding allowance. Multiply by the number of

allowances: $55.77 1 allowance = $55.77

Step 2 Subtract the result of Step 1 from Dan’s gross pay: $1,275.00 - $55.77 = $1,219.23

Step 3 Using Illustration 7-5, for married persons, find the range that includes the result of Step 2 ($1,219.23). Use the

range labeled “over $960 but not over $2,023.” The amount to be withheld is $125.40 plus 28% of the excess over

$960:

Amount = $125.40 + 28%($1,219.23 - $960.00)

= $125.40 + 28%($259.23)

= $125.40 + $72.58

= $197.98

↑

Notice that this is 2¢ less than the $198

found in Problem 12, using the wage-bracket method.

14. FICA tax and federal income tax are the same thing. (T or F) False

15. Cliff Garton works for West Engineering Company. His gross pay for week 45 is $1,800. Prior year-to-date earnings are

$79,200. Using 2001 FICA tax rates, determine how much Social Security tax and Medicare tax should be withheld from

Cliff’s pay.

Social Security:

Limit $80,400

Prior earnings - 79,200

Amount subject to Social Security tax $ 1,200 6.2% = $74.40

Medicare: $1,800 1.45% = $26.10

Gross pay this

period subject to: Deductions from employee’s pay

Chapter Review Problems 145

Employee

W-4

form

Prior

YTD

earnings

Gross

pay this

period SS MED SS MED FIT SIT Other Explain Total Net pay

Unit 7.3 Employer taxes and settling up with the IRS

16. Employers withhold FICA tax from employees’ pay. Employers must pay matching amounts. (T or F) True

17. FUT and SUT are withheld from employees’ pay. (T or F) False. Unemployment tax is an expense of employers.

For Problems 18–21, refer to Problem 12.

18. Determine American Pharmacy’s share of Social Security tax. $199.95. American must pay a matching amount;

because $199.95 was withheld from employee’s pay, American must pay an additional $199.95 for Social Security.

19. Determine American’s share of Medicare tax. $46.77. American must pay a matching amount.

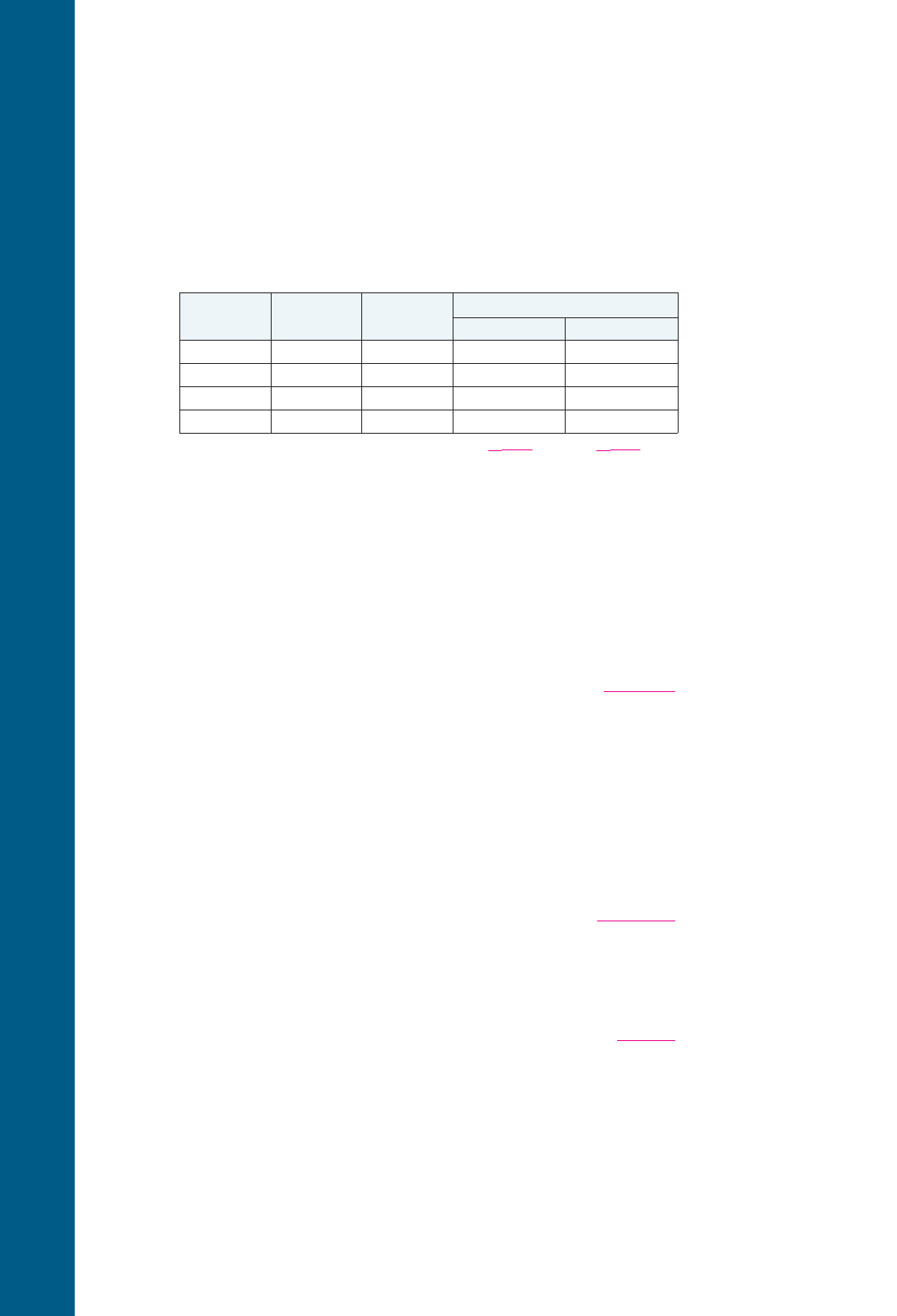

20. Calculate American’s FUT and SUT. Assume a SUT rate of 2.5% on the first $15,000 paid each employee each year.

21. American incurs these additional payroll expenses: (a) health insurance of $100 per employee and (b) a contribu-

tion to employees’ retirement plans at 8% of gross pay. What is American’s total payroll expense for this pay period

(including wages)?

Gross pay (from Problem 12) $3,225.00

Employer’s share of Social Security tax (from Problem 18) 199.95

Employer’s share of Medicare tax (from Problem 19) 46.77

FUT (from Problem 20) 4.00

SUT (from Problem 20) 39.00

Health insurance premiums: 3 employees $100 300.00

Contribution to employees’ retirement plans: $3,225 8% + 258.00

Total payroll expenses $4,072.72

22. To avoid an underpayment penalty on federal income tax, a taxpayer can make estimated payments of sufficient

amount. (T or F) True

23. Estimated payments are a guess, based on projected income and deductions. (T or F) True

For Problems 24–26, consider the tax situation of Lee Albert, a self-employed artist. Lee’s 2001 net income is $94,300.

24. Calculate Lee’s self-employment FICA tax, to the nearest dollar.

Step 1 $94,300 92.35% = $87,086 (rounded)

Step 2 FICA tax on first $80,400: $80,400 15.3% $12,301.20

FICA tax on remainder: 2.9%($87,086 - $80,400) + 193.89

Total, rounded $12,495.00

25. When Lee prepares his 2001 federal income tax return, his federal income tax is figured at $17,211 (not including

self-employment FICA tax). What is Lee’s total tax liability?

Federal income tax $17,211

Self-employment FICA tax (from Problem 24) + 12,495

Total tax liability $29,706

26. If Lee made quarterly estimated tax payments of $8,000 per payment, calculate the dollar amount of refund or

balance due.

Total tax liability (from Problem 25) $29,706

Amounts already paid to IRS: 4 $8,000 $32,000

Lee has paid too much to the IRS; he will get a refund of $2,294 ($32,000 - $29,706).

146 Chapter 7 Payroll

Gross pay this pay period subject to

Prior YTD Gross pay this

Employee Earnings period FUT SUT

Dan Bevan 63,750 1,275 00

Tom Hess 14,580 810 0420

Amy Salk 6,500 1,140 500 1,140

Total X 3,225 500 1,560

Tax rates 0.8% 2.5%

Tax $4.00 $39.00

Chapter Review Problems 147

Challenge problems

For Problems 27 and 28, consider the situation of Janele Stratton. Janele assembles tents. She is paid $8.50 per hour plus $2.50

per tent.

27. During the week, Janele worked 40 hours and completed 48 tents. What is her gross pay for the week?

Base salary: 40 hours $8.50 $340.00

Piecework: 48 tents $2.50 + 120.00

Gross pay $460.00

28. Calculate Janele’s average hourly wage for the week.

$460 gross pay 40 hours = $11.50 per hour

For Problems 29–31, consider the paycheck of Taryn Olds, who works for National Technologies. Taryn earns $1,225 each week.

Her prior year-to-date earnings are $6,125. She is married and claims 2 withholding allowances.

29. Calculate Taryn’s payroll deductions for this pay period: (a) Social Security tax; (b) Medicare tax; (c) federal

income tax (using the wage-bracket method); and (d) state income tax (figured as 6.5% of gross pay).

Social Security tax: $1,225 6.2% = $75.95

Medicare tax: $1,225 1.45% = $17.76

Federal income tax: $168 (Illustration 7-3, “at least $1,220 but less than $1,230,” 2 withholding allowances)

State income tax: $1,225 6.5% = $79.63

30. Taryn has National withhold $75 each week for a savings plan. What is the amount of Taryn’s paycheck?

Gross pay $1,225.00

Less deductions:

Social Security tax $ 75.95

Medicare tax 17.76

Federal income tax 168.00

State income tax 79.63

Savings plan deduction + 75.00

Total deductions - 416.34

Net pay $808.66

31. Determine National’s payroll expenses, as a result of Taryn’s wages: (a) Social Security tax; (b) Medicare tax; (c) FUT;

and (d) SUT (assume that National pays 2% on the first $10,000).

Social security tax: Matching amount from Problem 29 $75.95

Medicare tax: Matching amount from Problem 29 $17.76

FUT:

Limit: $7,000

Prior year-to-date earnings - 6,125

Amount subject to FUT $ 875 0.8% $7.00

SUT: $1,225 2% $24.50

32. Galey and Connie Colosimo filed their 2001 income tax return in April 2002. They listed Galey’s wages of $38,000,

Connie’s business net income of $53,000, and exemptions and deductions they were entitled to. Their federal

income tax liability came to $16,378 and Connie’s self-employment FICA tax was $7,489. Galey’s employer with-

held $2,356 for Social Security; $551 for Medicare; $4,940 for federal income tax; and $2,100 for state income tax.

Galey and Connie paid quarterly estimates of $4,500 per payment. Calculate their overpayment or underpayment.

Amounts owed to IRS Amounts already paid to IRS

Income tax liability $16,378 Federal income tax w/h Galey’s pay $ 4,940

Connie’s self-employment tax + 7,489 Estimated payments: 4 $4,500 +18,000

Total tax liability $23,867 Total already paid to IRS $22,940

Galey and Connie have not paid enough. They owe an additional $927 ($23,867 - $22,940).

148 Chapter 7 Payroll

1. Tan Ho is paid weekly at a rate of $9.75 per hour. Calculate Tan’s gross pay for the week, assuming he worked 44

hours and receives time and a half after the first 40 hours.

Overtime hours: 44 total hours - 40 regular hours = 4 overtime hours

Overtime rate: $9.75 regular rate 1.5 = $14.625

Pay for regular hours: 40 hours $9.75 $390.00

Pay for overtime: 4 hours $14.625 + 58.50

Gross pay for week $448.50

2. You have two job offers: $3,500 a month, and $820 weekly. Which offer results in the greatest gross pay?

Monthly: $3,500 12 $42,000.00

Weekly: $820 52.14 $42,754.80

3. Geraldine Upton sews coats. She is paid $7.50 per hour plus $2.50 per coat. During the week, she worked 40

hours and sewed 63 coats. What is Geraldine’s gross pay for the week?

Base salary: 40 hours $7.50 $300.00

Piecework: 63 coats $2.50 + 157.50

Gross pay $457.50

4. Gilbert Wilcox works for Gardner Engineering Company. Gilbert earns $2,000 a week during 2001 and has prior

year-to-date earnings of $80,000. Using 2001 rates, what amount should Gardner withhold for FICA tax?

Social Security tax:

Limit $80,400

Prior earnings - 80,000

Amount subject to Social Security tax $ 400 6.2% $24.80

Medicare tax: $2,000 1.45% + 29.00

Total FICA tax $53.80

5. Irving Fox works for Green Landscaping Company. Irving’s weekly gross pay during 2001 is $800. Irving is single

and claims 1 exemption. What amount of federal income tax should Green withhold, assuming Green uses the per-

centage method?

Step 1 Using Illustration 7-4, locate the weekly amount for 1 withholding allowance. Multiply by the number of

allowances: $55.77 1 allowance = $55.77

Step 2 Subtract the result of step 1 from Irving’s gross pay: $800.00 - 55.77 = $744.23

Step 3 Using Illustration 7-5, for single persons, find the range that includes the result of Step 2 ($744.23). Use the

range labeled “over $552 but not over $1,196.” The amount to be withheld is $75.15 plus 28% of the excess

over $552:

Amount = $75.15 + 28%($744.23 - $552.00)

= $75.15 + 28%($192.23)

= $75.15 + $53.82

= $128.97

6. Employers pay no FICA tax; they simply withhold FICA tax from employees’ pay. (T or F) False

7. Mindy Lowe works for Founders Hospital. She is paid $1,600 for the month of May 2001. Her prior year-to-date

earnings are $6,400. Calculate Founder’s FUT on Mindy’s pay.

Limit: $7,000

Prior earnings - 6,400

Amount subject to FUT $ 600 0.8% = $4.80

Practice Test

Practice Test 149

8. Clint Perry is a self-employed accountant. Clint’s net income during 2001 was $105,200. Calculate Clint’s 2001

self-employment FICA tax.

Step 1 $105,200 92.35% = $97,152 (rounded)

Step 2 FICA tax on first $80,400: $80,400 15.3% $12,301.20

FICA tax on remainder: 2.9%($97,152 - $80,400) + 485.81

Total, rounded $12,787.00

9. Terry and Margie Anderson filed their 2001 income tax return in March 2002. They listed Margie’s wages, Terry’s

business net income, and exemptions and deductions they were entitled to. Their federal income tax liability came

to $13,280, and Terry’s self-employment FICA tax was $4,192. Margie’s employer withheld $1,860 for Social

Security, $435 for Medicare, $7,970 for federal income tax, and $1,625 for state income tax. Terry and Margie made

quarterly estimates of $2,500 per payment. Calculate their overpayment or underpayment.

Amounts owed to IRS Amounts already paid to IRS

Income tax liability $13,280 Federal income tax w/h Margie’s pay $ 7,970

Terry’s self-employment tax + 4,192 Estimated payments: 4 $2,500 +10,000

Total tax liability $17,472 Total already paid to IRS $17,970

Terry and Margie have paid too much. They will get a refund of $498 ($17,970 - $17,472).