No Job Name FAS 124 GAAP Fin St Disclosures Man Ch 18

User Manual: FAS-124

Open the PDF directly: View PDF ![]() .

.

Page Count: 39

CCH brings you...

CHAPTER 18 ASC TOPIC 320:

INVESTMENTS—DEBT AND EQUITY SECURITIES

from the

Special Edition GAAP Financial Statement

Disclosures Manual

Visit CCHGroup.com/AASolutions for an overview of our complete set of Accounting and Auditing solutions.

©2009 CCH. All Rights Reserved.

To learn more about this book, or to make a purchase, visit CCHGroup.com

Vist CCHGroup.com/Books to browse the CCH online bookstore.

CHAPTER 18

ASC TOPIC 320: INVESTMENTS—DEBT

AND EQUITY SECURITIES

CONTENTS

Executive Summary 18.02

Debt and Equity Securities 18.02

Accounting Literature 18.03

Disclosure and Key Presentation Requirements 18.04

Applicable Guidance in ASC Topic 320 After FSP FAS

115-2 and FAS 124-2, Recognition and Presentation of

Other-Than-Temporary Impairments 18.04

Overall 18.05

Impairment of Securities 18.09

Applicable Guidance in ASC Topic 320 Before FSP FAS

115-2 and FAS 124-2, Recognition and Presentation of

Other-Than-Temporary Impairments 18.12

Overall 18.12

Impairment of Securities 18.17

Examples of Financial Statement Disclosures 18.18

Example 1: Accounting Policy Note Explains

Classification of Marketable Securities as Held to

Maturity, Trading, and Available for Sale 18.18

Example 2: Available-for-Sale Securities Are Classified

as Debt and Equity Securities 18.19

Example 3: Available-for-Sale Securities Are Classified

as Current and Noncurrent Assets 18.21

Example 4: Trading Securities 18.23

Example 5: Held-to-Maturity Securities 18.24

Example 6: Estimated Fair Value of Held-to-Maturity

Securities Approximates Cost 18.25

Example 7: Decline in Market Value Is Considered

Other Than Temporary 18.26

18.01

Example 8: Transfer of Held-to-Maturity Investments to

Available-for-Sale Category 18.27

Example 9: Pledged Investments 18.27

Example 10: Impaired Securities—ASC Topic 320 Based

on Guidance in FSP FAS 115-1 and FAS 124-1 18.27

Example 11: Impaired Securities—ASC Topic 320 Based

on Guidance in FSP FAS 115-2 and FAS 124-2 18.31

Other-Than-Temporary Impairments for Debt Securities 18.35

Example 12: Auction Rate Securities Classified as

Available-for-Sale Investments 18.36

Example 13: Auction Rate Securities Classified as

Noncurrent Assets Due to Failed Auctions 18.36

EXECUTIVE SUMMARY

Debt and Equity Securities

The topic of this chapter applies to both current and noncurrent

investments in debt and equity securities. The primary issue in

accounting and reporting for debt and equity investments is the

appropriate use of fair value. Generally accepted accounting

principles (GAAP) require that investments in equity securities that

have readily determinable fair values and all investments in debt

securities be classified in three categories (held to maturity, trading

securities, and available for sale) and be given specific accounting

treatments, as follows:

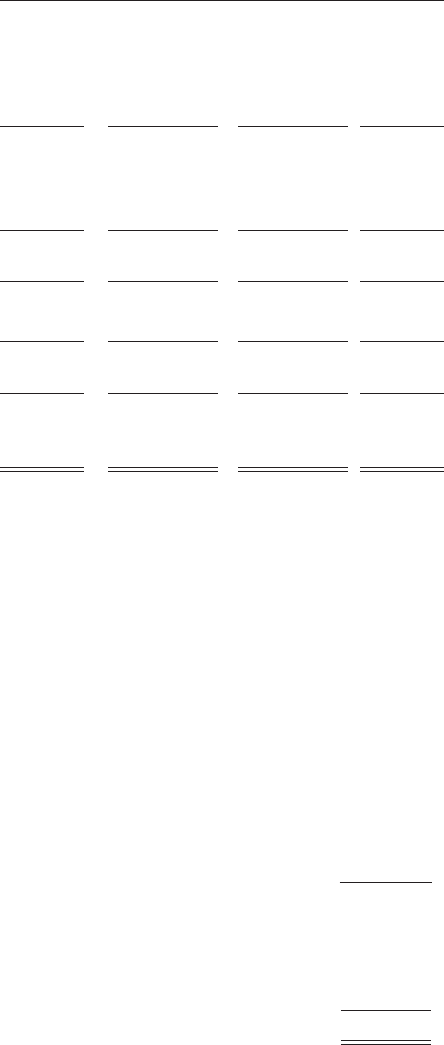

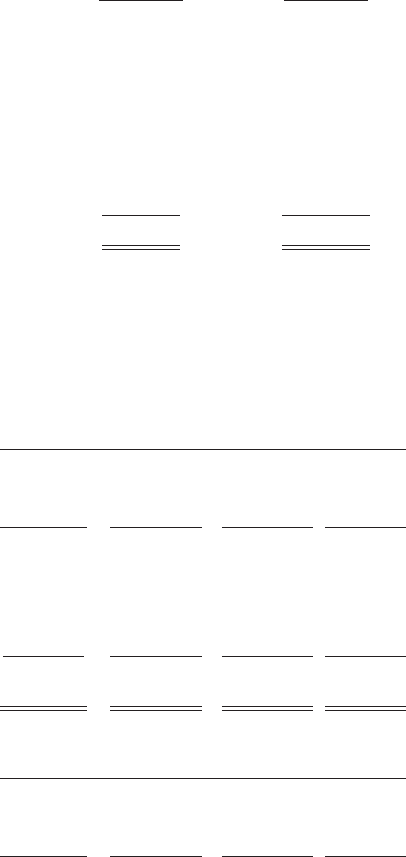

Classification Accounting Treatment

1. Available for sale—Debt and

equity securities that do not

meet the criteria to be

classified as held to maturity

or trading.

Fair value, with unrealized

holding gains and losses

reported in other

comprehensive income.

Nontemporary losses should

be charged to earnings.

2. Held to maturity—Debt

securities that the entity has

the positive intent and

ability to hold to maturity.

Amortized cost, reduced for

nontemporary losses that are

charged to earnings. Other

unrealized gains or losses

should not be recognized.

18.02 ASC Topic 320: Investments—Debt and Equity Securities

Classification Accounting Treatment

3. Trading securities—Debt and

equity securities bought and

held primarily for sale in the

near term (e.g., the entity’s

normal operating cycle).

Fair value, with unrealized

holding gains and losses

included in earnings.

The following are examples of debt and equity securities:

Debt Securities Equity Securities

U.S. Treasury securities Common stock

U.S. government agency securities Preferred stock

Municipal securities Warrants

Corporate bonds Rights

Convertible debt Call options

Commercial paper Put options

Collateralized mortgage obligations

Preferred stock that must be redeemed

Real estate mortgage investment conduits

Interest-only and principal-only strips

Generally, held-to-maturity securities are classified as noncurrent

assets until they are within one year of maturity; at that time, they

are classified as current assets. Trading securities are classified as

current assets. Available-for-sale securities are classified as current

or noncurrent, as appropriate.

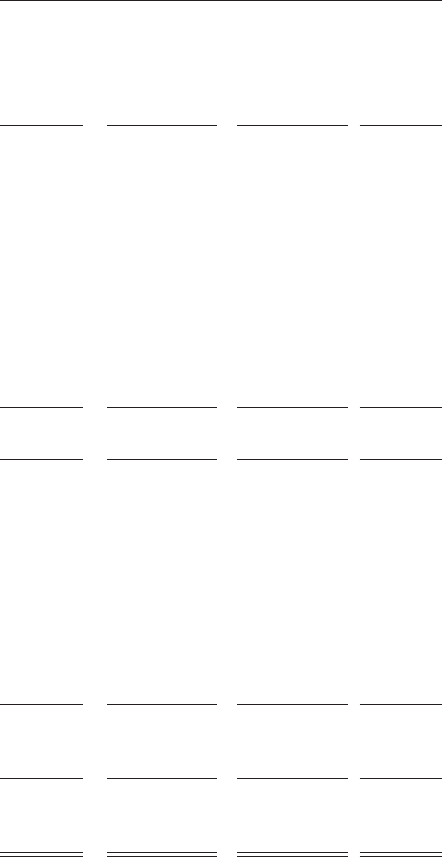

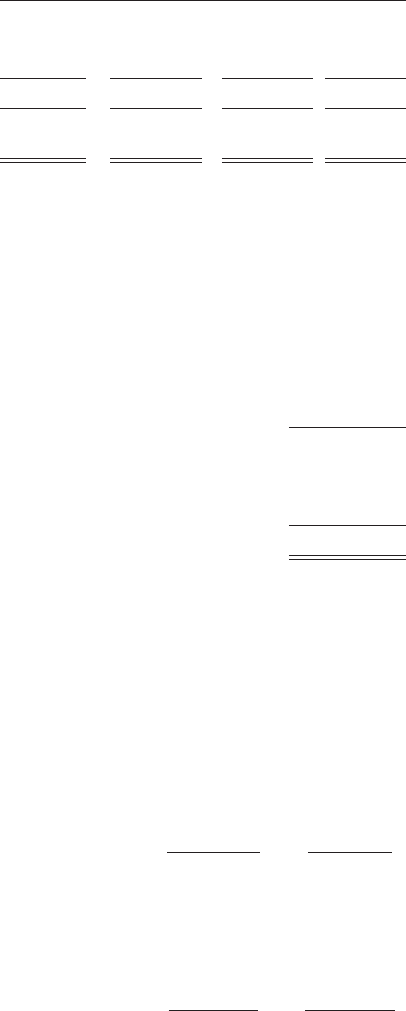

Accounting Literature

FASB Accounting Standards

Codification Topic

Pre-Codification Accounting

Literature

320, Investments—Debt and Equity

Securities

FAS-115, Accounting for

Certain Investments in Debt

and Equity Securities

FSP FAS 115-1 and FAS

124-1, The Meaning of Other-

Than-Temporary Impairment

and Its Application to Certain

Investments

ASC Topic 320: Investments—Debt and Equity Securities 18.03

FASB Accounting Standards

Codification Topic

Pre-Codification Accounting

Literature

FSP FAS 115-2 and FAS 124-

2, Recognition and

Presentation of Other-Than-

Temporary Impairments

EITF 86-40, Investments in

Open-End Mutual Funds

That Invest in U.S.

Government Securities

FASB Implementation

Guidance (Q&A), A Guide

to Implementation of

Statement 115 on Accounting

for Certain Investments in

Debt and Equity Securities:

Questions and Answers

DISCLOSURE AND KEY PRESENTATION

REQUIREMENTS

Applicable Guidance in ASC Topic 320 After FSP FAS

115-2 and FAS 124-2, Recognition and Presentation of

Other-Than-Temporary Impairments

Note: The disclosure and key presentation requirements in this

section are prescribed by ASC Topic 320, Investments—Debt

and Equity Securities, based on FSP FAS 115-2 and FAS 124-2,

Recognition and Presentation of Other-Than-Temporary

Impairments, which is effective for interim and annual reporting

periods ending after June 15, 2009. Early adoption is permitted

for periods ending after March 15, 2009, provided the pending

content that links to ASC paragraph 820-10-65-4 (based on FSP

FAS 157-4, Determining Fair Value When the Volume and

Level of Activity for the Asset or Liability Have Significantly

Decreased and Identifying Transactions That Are Not Orderly)

is also adopted. In addition, if either the pending content in ASC

paragraph 820-10-65-4 (based on FSP FAS 157-4) or in ASC

paragraph 825-10-65-1 (based on FSP FAS 107-1 and APB

28-1, Interim Disclosures about Fair Value of Financial Instru-

ments) is adopted early, the presentation and disclosure

requirements in this section must also be adopted early. The

presentation and disclosure requirements in this section are not

required for earlier periods presented for comparative purposes

at initial adoption. In periods after initial adoption, comparative

disclosures are required only for periods ending after initial

adoption.

18.04 ASC Topic 320: Investments—Debt and Equity Securities

Overall

1. Investments in available-for-sale securities and trading secu-

rities should be reported separately from similar assets that

are subsequently measured using another measurement

attribute on the face of the balance sheet by presenting either

of the following (ASC 320-10-45-1) (FAS-115, par. 17):

a. The aggregate of those fair value and non-fair-value

amounts in the same line item and parenthetically dis-

closing the amount of fair value included in the aggre-

gate amount.

b. Two separate line items displaying the fair value and

non-fair-value carrying amounts.

2. Held-to-maturity securities, available-for-sale securities, and

trading securities should be reported on a classified balance

sheet as either current or noncurrent. (ASC 320-10-45-2)

(FAS-115, par. 17) (Note: ASC Section 210-10-45, Balance

Sheet−Overall−Other Presentation Matters [ARB-43, Ch. 3A,

Current Assets and Current Liabilities], provides further guid-

ance on the required presentation of current and noncurrent

assets in the balance sheet.) See Chapter 3, “ASC Topic 210:

Balance Sheet.”

3. For deferred tax assets that have been recognized relating to

net unrealized losses on available-for-sale securities, the fol-

lowing presentation matters should be followed:

a. If the entity recognizes a valuation allowance at the same

time that it establishes the deferred tax asset (or in a later

interim period of the same fiscal year in which the de-

ferred tax asset is recognized), the offsetting entry to the

valuation allowance should be reported in the component

of other comprehensive income classified as unrealized

gains and losses on certain investments in debt and equity

securities. (ASC 320-10-45-3) (Q&A-115, par. 54)

b. If the entity initially decided that no valuation allowance

was required at the time it established the deferred tax

asset but, in a subsequent fiscal year, decides to recognize

a valuation allowance, the offsetting entry to the valua-

tion allowance should be included as an item in deter-

mining income from continuing operations (i.e., not in

other comprehensive income). (ASC 320-10-45-4) (Q&A-

115, par. 56)

c. If, subsequent to the year the deferred tax asset and

related valuation allowance were recognized, an entity

makes a change in judgment about the level of future

years’ taxable income such that all or a portion of that

ASC Topic 320: Investments—Debt and Equity Securities 18.05

valuation allowance is no longer warranted, any rever-

sals in the valuation allowance due to such change

should be included as an item in determining income

from continuing operations. (ASC 320-10-45-5) (Q&A-

115, par. 57)

d. If, subsequent to the year the deferred tax asset and re-

lated valuation allowance were recognized, an entity gen-

erates taxable income in the current year that can use the

benefit of the deferred tax asset, the elimination or reduc-

tion of the valuation allowance should be allocated to that

taxable income. (ASC 320-10-45-5) (Q&A-115, par. 57)

e. If in the current year the entity recognizes a valuation

allowance at the same time that it establishes the

deferred tax asset:

(1) The entity should determine the extent to which the

valuation allowance is directly related to the unre-

alized loss and the other previously recognized

deductible temporary differences (e.g., an accrual

for other postemployment benefits). (ASC 320-10-45-

6) (Q&A-115, par. 55)

(2) The offsetting entry to the valuation allowance

should be reported in the component of other

comprehensive income classified as unrealized

gains and losses on available-for-sale securities only

to the extent the valuation allowance is directly

related to the unrealized loss on the available-for-

sale securities that arose in the current year. (ASC

320-10-45-6) (Q&A-115, par. 55)

4. Gains and losses that have accumulated before transfers

involving trading securities should be classified consistently

with realized gains and losses for the category from which

the security is being transferred (not the category into which

the security is being transferred). (ASC 320-10-45-7) (Q&A-

115, par. 44)

5. All or a portion of the unrealized holding gain and loss of an

available-for-sale security that is designated as being hedged

in a fair value hedge should be recognized in earnings dur-

ing the period of the hedge, pursuant to ASC paragraphs 815-

25-35-1 through 35-4 (FAS-133, par. 22). (ASC 320-10-45-8)

(FAS-115, par. 13)

6. Subsequent increases in the fair value of available-for-sale

securities should be included in other comprehensive

income. (ASC 320-10-45-9) (FAS-115, par. 16)

7. Subsequent decreases in the fair value of available-for-sale

securities (if not an other-than-temporary impairment)

18.06 ASC Topic 320: Investments—Debt and Equity Securities

should be included in other comprehensive income. (ASC

320-10-45-9) (FAS-115, par. 16)

8. Cash flows from purchases, sales, and maturities of

available-for-sale securities and held-to-maturity securi-

ties should be classified as cash flows from investing

activities and reported gross for each security classification

in the statement of cash flows. (ASC 320-10-45-11) (FAS-115,

par. 18)

9. Cash flows from purchases, sales, and maturities of trading

securities should be classified in the statement of cash flows

based on the nature and purpose for which the securities

were acquired. (ASC 320-10-45-11) (FAS-115, par. 18)

10. If individual amounts for the three categories of invest-

ments (i.e., held-to-maturity, available-for-sale, or trading)

are not presented on the face of the balance sheet, they

should be disclosed in the notes. (ASC 320-10-45-13) (FAS-

115, par. 117)

11. If the entity reports certain investments in debt securities as

cash equivalents, the notes should reconcile the reporting

classifications used in the balance sheet. (ASC 320-10-45-13)

(FAS-115, par. 117)

12. For securities classified as available for sale, the following

disclosures should be made for interim and annual periods,

by major security type, as of each date for which a balance

sheet is presented (ASC 320-10-50-2 through 50-4) (FAS-115,

pars. 19 and 20; EITF 86-40) (Note: Major security types

should be based on the nature and risks of the security. An

entity should consider the (shared) activity or business

sector, vintage, geographic concentration, credit quality, or

economic characteristic in determining whether disclosure

for a particular security type is necessary and whether it is

necessary to further separate a particular security type into

greater detail.):

a. The amortized cost basis.

b. The aggregate fair value.

c. The total other-than-temporary impairment recognized

in accumulated other comprehensive income.

d. Total gains for securities with net gains in accumulated

other comprehensive income.

e. Total losses for securities with net losses in accumulated

other comprehensive income.

f. Information about the contractual maturities of those

securities as of the date of the most recent balance sheet

ASC Topic 320: Investments—Debt and Equity Securities 18.07

presented. (Note: Maturity information may be com-

bined in appropriate groupings. Securities that are not

due at a single maturity date, such as mortgage-backed

securities, may be disclosed separately rather than allo-

cated over several maturity groupings; however, if allo-

cated, the basis for the allocation should also be

disclosed.)

13. For securities classified as held to maturity, the following

disclosures should be made for interim and annual periods,

by major security type, as of each date for which a balance

sheet is presented (ASC 320-10-50-5) (FAS-115, par. 19)

(Note: Major security types should be based on the nature

and risks of the security. An entity should consider the

(shared) activity or business sector, vintage, geographic con-

centration, credit quality, or economic characteristic in

determining whether disclosure for a particular security

type is necessary and whether it is necessary to further

separate a particular security type into greater detail.):

a. The amortized cost basis.

b. The aggregate fair value.

c. Gross unrecognized holding gains.

d. Gross unrecognized holding losses.

e. Net carrying amount.

f. The total other-than-temporary impairment recognized

in accumulated other comprehensive income.

g. Gross gains and losses in accumulated other compre-

hensive income for any derivatives that hedged the

forecasted acquisition of the held-to-maturity securities.

h. Information about the contractual maturities of those

securities as of the date of the most recent balance sheet

presented. (Note: Maturity information may be com-

bined in appropriate groupings. Securities that are not

due at a single maturity date, such as mortgage-backed

securities, may be disclosed separately rather than allo-

cated over several maturity groupings; however, if allo-

cated, the basis for the allocation should also be

disclosed.)

14. The following disclosures should be made for each annual

or interim period for which an income statement is pre-

sented (ASC 320-10-50-9) (FAS-115, par. 21):

a. The proceeds from sales of available-for-sale securities

and the gross realized gains and gross realized losses on

those sales that have been included in earnings.

18.08 ASC Topic 320: Investments—Debt and Equity Securities

b. The method used to determine the cost of a security

sold or the amount reclassified out of accumulated

other comprehensive income into earnings (i.e., specific

identification, average cost, or other method used).

c. The gross gains and gross losses included in earnings

from transfers of securities from the available-for-sale

category into the trading category.

d. The amount of the net unrealized holding gain or loss

on available-for-sale securities that has been included in

accumulated other comprehensive income for the

period.

e. The amount of gains and losses reclassified out of accu-

mulated other comprehensive income into earnings for

the period.

f. The portion of trading gains and losses for the period

that relates to trading securities still held at the balance

sheet date.

15. For any sales of or transfers from securities classified as

held-to-maturity, the following disclosures should be made

in the notes to the financial statements for each annual or

interim period for which an income statement is presented

(ASC 320-10-50-10) (FAS-115, par. 22):

a. The net carrying amount of the sold or transferred secu-

rity.

b. The net gain or loss in accumulated other comprehen-

sive income for any derivative that hedged the fore-

casted acquisition of the held-to-maturity security.

c. The related realized or unrealized gain or loss.

d. The circumstances leading to the decision to sell or

transfer the security. (Note: Such sales or transfers

should be rare, except for sales and transfers due to the

changes in circumstances identified in ASC paragraphs

320-10-25-6(a) through (f) [FAS-115, par. 8].)

Impairment of Securities

1. In periods in which an entity determines that a security’s

decline in fair value below its amortized cost basis is other

than temporary, the entity should present the total other-

than-temporary impairment in the income statement with an

offset for the amount of the total other-than-temporary

impairment that is recognized in other comprehensive

income, if any. (ASC 320-10-45-8A) (FSP FAS 115-1 and FAS

124-1, par. 16B)

ASC Topic 320: Investments—Debt and Equity Securities 18.09

2. The financial statement in which the components of

accumulated other comprehensive income are reported

should separately present amounts recognized therein

related to held-to-maturity and available-for-sale debt secu-

rities for which a portion of an other-than-temporary

impairment has been recognized in earnings. (ASC

320-10-45-9A) (FSP FAS 115-1 and FAS 124-1, par. 16C)

3. For all investments in an unrealized loss position for which

other-than-temporary impairments have not been recog-

nized in earnings (including investments for which a portion

of an other-than-temporary impairment has been recognized

in other comprehensive income), the following disclosures

should be made in the entity’s annual and interim financial

statements (ASC 320-10-50-6 through 50-8) (FSP FAS 115-1

and FAS 124-1, par. 17):

a. As of each date for which a balance sheet is presented,

the following quantitative information, in tabular form,

should be aggregated by category of investment—each

major security type that the entity disclosed in accor-

dance with ASC Subtopic 320-10, (FSP FAS 115-1 and FAS

124-1), and cost-method investments—and segregated

by those investments that have been in a continuous

unrealized loss position for less than 12 months and

those that have been in a continuous unrealized loss

position for 12 months or longer:

(1) The aggregate amount of unrealized losses (i.e., the

amount by which amortized cost basis exceeds fair

value).

(2) The aggregate related fair value of investments with

unrealized losses.

b. As of the date of the most recent balance sheet, the fol-

lowing qualitative information, in narrative form, that

provides sufficient information to allow the financial

statement users to understand the quantitative disclo-

sures and the information that the entity considered

(both positive and negative) in reaching the conclusion

that the impairments are not other-than-temporary (Note:

The disclosures required may be aggregated by invest-

ment categories, but individually significant unrealized

losses generally should not be aggregated.):

(1) The nature of the investment.

(2) The cause of the impairment.

(3) The number of investment positions that are in an

unrealized loss position.

(4) The severity and duration of the impairment.

18.10 ASC Topic 320: Investments—Debt and Equity Securities

(5) Other evidence considered by the entity in reaching

its conclusions that the investment is not other-than-

temporarily impaired, including, for example,

performance indicators of the underlying assets in

the security (including default rates, delinquency

rates and percentage of nonperforming assets), loan

to collateral value ratios, third-party guarantees,

current levels of subordination, vintage, geographic

concentration, industry analyst reports, sector credit

ratings, volatility of the security’s fair value, and/

or any other information that the entity considers

relevant.

4. The following disclosures should be made, by major security

type, for annual and interim periods in which an other-than-

temporary impairment of a debt security is recognized and

only the amount related to a credit loss was recognized in

earnings (ASC 320-10-50-8A) (FSP FAS 115-1 and FAS 124-1,

par. 18A):

a. The methodology used to measure the amount related to

credit loss.

b. The significant inputs used to measure the amount

related to credit loss. (Examples of significant inputs

include, but are not limited to, performance indicators of

the underlying assets in the security (including default

rates, delinquency rates, and percentage of nonperform-

ing assets), loan to collateral value ratios, third-party

guarantees, current levels of subordination, vintage, geo-

graphic concentration, and credit ratings.)

5. A tabular rollforward should be disclosed of the amount

related to credit losses recognized in earnings, for each

interim and annual reporting period presented, that includes

(ASC 320-10-50-8B) (FSP FAS 115-1 and FAS 124-1, par. 18B):

a. The beginning balance of the amount related to credit

losses on debt securities held by the entity at the begin-

ning of the period for which a portion of an other-than-

temporary impairment was recognized in other

comprehensive income.

b. Additions for the amount related to the credit loss for

which an other-than-temporary impairment was not

previously recognized.

c. Reductions for securities sold during the period

(realized).

d. Reductions for securities for which the amount previ-

ously recognized in other comprehensive income was rec-

ognized in earnings because the entity intends to sell the

ASC Topic 320: Investments—Debt and Equity Securities 18.11

security or more likely than not will be required to sell the

security before recovery of its amortized cost basis.

e. Additional increases to the amount related to the credit

loss for which an other-than-temporary impairment was

previously recognized when the investor does not intend

to sell the security and it is not more likely than not that

the entity will be required to sell the security before

recovery of its amortized cost basis.

f. Reductions for increases in cash flows expected to be col-

lected that are recognized over the remaining life of the

security.

g. The ending balance of the amount related to credit losses

on debt securities held by the entity at the end of the

period for which a portion of an other-than-temporary

impairment was recognized in other comprehensive

income.

Applicable Guidance in ASC Topic 320 Before FSP FAS

115-2 and FAS 124-2, Recognition and Presentation of

Other-Than-Temporary Impairments

Note: The disclosure and key presentation requirements in this

section are prescribed by ASC Topic 320, Investments—Debt

and Equity Securities, prior to the adoption of the guidance

based on FSP FAS 115-2 and FAS 124-2, Recognition and Pre-

sentation of Other-Than-Temporary Impairments, which is

effective for interim and annual reporting periods ending after

June 15, 2009.

Overall

1. Investments in available-for-sale securities and trading secu-

rities should be reported separately from similar assets that

are subsequently measured using another measurement

attribute on the face of the balance sheet by presenting either

of the following (ASC 320-10-45-1) (FAS-115, par. 17):

a. The aggregate of those fair value and non-fair-value

amounts in the same line item and parenthetically dis-

closing the amount of fair value included in the aggre-

gate amount.

b. Two separate line items displaying the fair value and

non-fair-value carrying amounts.

2. Held-to-maturity securities, available-for-sale securities, and

trading securities should be reported on a classified balance

sheet as either current or noncurrent. (ASC 320-10-45-2)

18.12 ASC Topic 320: Investments—Debt and Equity Securities

(FAS-115, par. 17) (Note: ASC Section 210-10-45, Balance

Sheet−Overall−Other Presentation Matters, [ARB-43, Ch. 3A,

Current Assets and Current Liabilities], provides further guid-

ance on the required presentation of current and noncurrent

assets in the balance sheet.)

3. For deferred tax assets that have been recognized relating to

net unrealized losses on available-for-sale securities, the fol-

lowing presentation matters should be followed:

a. If the entity recognizes a valuation allowance at the same

time that it establishes the deferred tax asset (or in a later

interim period of the same fiscal year in which the de-

ferred tax assert is recognized), the offsetting entry to the

valuation allowance should be reported in the component

of other comprehensive income classified as unrealized

gains and losses on certain investments in debt and equity

securities. (ASC 320-10-45-3) (Q&A-115, par. 54)

b. If the entity initially decided that no valuation allowance

was required at the time it established the deferred tax

asset but, in a subsequent fiscal year, decides to recognize

a valuation allowance, the offsetting entry to the valua-

tion allowance should be included as an item in deter-

mining income from continuing operations (i.e., not in

other comprehensive income). (ASC 320-10-45-4) (Q&A-

115, par. 56)

c. If, subsequent to the year the deferred tax asset and

related valuation allowance were recognized, an entity

makes a change in judgment about the level of future

years’ taxable income such that all or a portion of that

valuation allowance is no longer warranted, any rever-

sals in the valuation allowance due to such change

should be included as an item in determining income

from continuing operations. (ASC 320-10-45-5) (Q&A-

115, par. 57)

d. If, subsequent to the year the deferred tax asset and re-

lated valuation allowance were recognized, an entity gen-

erates taxable income in the current year that can use the

benefit of the deferred tax asset, the elimination or reduc-

tion of the valuation allowance should be allocated to that

taxable income. (ASC 320-10-45-5) (Q&A-115, par. 57)

e. If in the current year the entity recognizes a valuation

allowance at the same time that it establishes the

deferred tax asset:

(1) The entity should determine the extent to which the

valuation allowance is directly related to the unre-

alized loss and the other previously recognized

ASC Topic 320: Investments—Debt and Equity Securities 18.13

deductible temporary differences (e.g., an accrual

for other postemployment benefits). (ASC 320-10-

45-6) (Q&A-115, par. 55)

(2) The offsetting entry to the valuation allowance

should be reported in the component of other com-

prehensive income classified as unrealized gains

and losses on available-for-sale securities only to the

extent the valuation allowance is directly related to

the unrealized loss on the available-for-sale securi-

ties that arose in the current year. (ASC 320-10-45-6)

(Q&A-115, par. 55)

4. Gains and losses that have accumulated before transfers

involving trading securities should be classified consis-

tently with realized gains and losses for the category from

which the security is being transferred (not the category into

which the security is being transferred). (ASC 320-10-45-7)

(Q&A-115, par. 44)

5. All or a portion of the unrealized holding gain and loss of

an available-for-sale security that is designated as being

hedged in a fair value hedge should be recognized in earn-

ings during the period of the hedge, pursuant to ASC para-

graphs 815-25-35-1 through 35-4, (FAS-133, par. 22). (ASC

320-10-45-8) (FAS-115, par. 13)

6. Subsequent increases in the fair value of available-for-sale

securities should be included in other comprehensive

income. (ASC 320-10-45-9) (FAS-115, par. 16)

7. Subsequent decreases in the fair value of available-for-sale

securities (if not an other-than-temporary impairment)

should be included in other comprehensive income. (ASC

320-10-45-9) (FAS-115, par. 16)

8. Cash flows from purchases, sales, and maturities of

available-for-sale securities and held-to-maturity securities

should be classified as cash flows from investing activities

and reported gross for each security classification in

the statement of cash flows. (ASC 320-10-45-11) (FAS-115,

par. 18)

9. Cash flows from purchases, sales, and maturities of trading

securities should be classified in the statement of cash flows

based on the nature and purpose for which the securities

were acquired. (ASC 320-10-45-11) (FAS-115, par. 18)

10. If individual amounts for the three categories of invest-

ments (i.e., held-to-maturity, available-for-sale, or trading)

are not presented on the face of the balance sheet, they

18.14 ASC Topic 320: Investments—Debt and Equity Securities

should be disclosed in the notes. (ASC 320-10-45-13) (FAS-

115, par. 117)

11. If the entity reports certain investments in debt securities as

cash equivalents, the notes should reconcile the reporting

classifications used in the balance sheet. (ASC 320-10-45-13)

(FAS-115, par. 117)

12. For securities classified as available for sale, the following

disclosures should be made, by major security type, as of

each date for which a balance sheet is presented (ASC 320-

10-50-2 through 50-4) (FAS-115, pars. 19 and 20; EITF 86-40):

a. The aggregate fair value.

b. Total gains for securities with net gains in accumulated

other comprehensive income.

c. Total losses for securities with net losses in accumulated

other comprehensive income.

d. Information about the contractual maturities of those

securities as of the date of the most recent balance sheet

presented. (Note: Maturity information may be com-

bined in appropriate groupings. Securities that are not

due at a single maturity date, such as mortgage-backed

securities, may be disclosed separately rather than allo-

cated over several maturity groupings; however, if allo-

cated, the basis for the allocation should also be

disclosed.)

13. For securities classified as held to maturity, the following

disclosures should be made, by major security type, as of

each date for which a balance sheet is presented (ASC 320-

10-50-5) (FAS-115, par. 19):

a. The aggregate fair value.

b. Gross unrecognized holding gains.

c. Gross unrecognized holding losses.

d. Net carrying amount.

e. Gross gains and losses in accumulated other compre-

hensive income for any derivatives that hedged the

forecasted acquisition of the held-to-maturity securities.

f. Information about the contractual maturities of those

securities as of the date of the most recent balance sheet

presented. (Note: Maturity information may be com-

bined in appropriate groupings. Securities that are not

due at a single maturity date, such as mortgage-backed

securities, may be disclosed separately rather than

allocated over several maturity groupings; however, if

ASC Topic 320: Investments—Debt and Equity Securities 18.15

allocated, the basis for the allocation should also be dis-

closed.)

14. The following disclosures should be made for each period

for which an income statement is presented (ASC 320-10-

50-9) (FAS-115, par. 21):

a. The proceeds from sales of available-for-sale securities

and the gross realized gains and gross realized losses on

those sales that have been included in earnings.

b. The method used to determine the cost of a security

sold or the amount reclassified out of accumulated

other comprehensive income into earnings (i.e., specific

identification, average cost, or other method used).

c. The gross gains and gross losses included in earnings

from transfers of securities from the available-for-sale

category into the trading category.

d. The amount of the net unrealized holding gain or loss

on available-for-sale securities that has been included in

accumulated other comprehensive income for the

period.

e. The amount of gains and losses reclassified out of accu-

mulated other comprehensive income into earnings for

the period.

f. The portion of trading gains and losses for the period

that relates to trading securities still held at the balance

sheet date.

15. For any sales of or transfers from securities classified as

held-to-maturity, the following disclosures should be made

in the notes to the financial statements for each period for

which an income statement is presented (ASC 320-10-50-10)

(FAS-115, par. 22):

a. The net carrying amount of the sold or transferred secu-

rity.

b. The net gain or loss in accumulated other comprehen-

sive income for any derivative that hedged the fore-

casted acquisition of the held-to-maturity security.

c. The related realized or unrealized gain or loss.

d. The circumstances leading to the decision to sell or

transfer the security. (Note: Such sales or transfers

should be rare, except for sales and transfers due to the

changes in circumstances identified in ASC paragraphs

320-10-25-6(a) through (f) [FAS-115, par. 8].)

18.16 ASC Topic 320: Investments—Debt and Equity Securities

Impairment of Securities

1. For all investments in an unrealized loss position for which

other-than-temporary impairments have not been recog-

nized, the following disclosures should be made in the enti-

ty’s annual financial statements (ASC 320-10-50-6 through

50-8) (FSP FAS 115-1 and FAS 124-1, par. 17):

a. As of each date for which a balance sheet is presented,

the following quantitative information, in tabular form,

should be aggregated by each category of investment

that the entity disclosed in accordance with ASC Sub-

topic 320-10 (FSP FAS 115-1 and FAS 124-1), and cost-

method investments, and segregated by those

investments that have been in a continuous unrealized

loss position for less than 12 months and those that have

been in a continuous unrealized loss position for 12

months or longer:

(1) The aggregate related fair value of investments with

unrealized losses.

(2) The aggregate amount of unrealized losses (i.e., the

amount by which cost exceeds fair value).

b. As of the date of the most recent balance sheet, addi-

tional qualitative information, in narrative form, that pro-

vides sufficient information to allow the financial

statement users to understand the quantitative disclo-

sures and the information that the entity considered

(both positive and negative) in reaching the conclusion

that the impairments are not other-than-temporary,

which could include:

(1) The nature of the investment.

(2) The cause of the impairment.

(3) The number of investment positions that are in an

unrealized loss position.

(4) The severity and duration of the impairment.

(5) Other evidence considered by the entity in reaching

its conclusions that the investment is not other-than-

temporarily impaired, including, for example,

industry analyst reports, sector credit ratings, vola-

tility of the security’s fair value, and/or any other

information that the entity considers relevant.

ASC Topic 320: Investments—Debt and Equity Securities 18.17

EXAMPLES OF FINANCIAL STATEMENT

DISCLOSURES

The following sample disclosures are available on the

accompanying disc.

Example 1: Accounting Policy Note Explains Classification of

Marketable Securities as Held to Maturity, Trading, and Available

for Sale

The Company determines the appropriate classification of its invest-

ments in debt and equity securities at the time of purchase and

reevaluates such determinations at each balance sheet date. Debt

securities are classified as held to maturity when the Company has

the positive intent and ability to hold the securities to maturity. Debt

securities for which the Company does not have the intent or ability

to hold to maturity are classified as available for sale. Held-to-

maturity securities are recorded as either short term or long term on

the Balance Sheet, based on contractual maturity date and are stated

at amortized cost. Marketable securities that are bought and held

principally for the purpose of selling them in the near term are

classified as trading securities and are reported at fair value, with

unrealized gains and losses recognized in earnings. Debt and mar-

ketable equity securities not classified as held to maturity or as trad-

ing, are classified as available for sale, and are carried at fair market

value, with the unrealized gains and losses, net of tax, included in

the determination of comprehensive income and reported in share-

holders’ equity.

The fair value of substantially all securities is determined by

quoted market prices. The estimated fair value of securities for

which there are no quoted market prices is based on similar types of

securities that are traded in the market.

18.18 ASC Topic 320: Investments—Debt and Equity Securities

Example 2: Available-for-Sale Securities Are Classified as Debt and

Equity Securities

Available-for-sale securities consist of the following:

December 31, 20X2

Amortized

Cost

Gains in

Accumulated

Other

Comprehensive

Income

Losses in

Accumulated

Other

Comprehensive

Income

Estimated

Fair

Value

U.S.

government

securities $1,412,000 $ -0- $ (6,000) $1,406,000

Commercial

paper 1,347,000 5,000 (2,000) 1,350,000

Corporate

bonds 1,153,000 51,000 (17,000) 1,187,000

Fixed rate notes 100,000 -0- -0- 100,000

Total debt

securities 4,012,000 56,000 (25,000) 4,043,000

Common stock 822,000 100,000 (56,000) 866,000

Preferred stock 140,000 5,000 -0- 145,000

Total equity

securities 962,000 105,000 (56,000) 1,011,000

Total available-

for-sale

securities $4,974,000 $161,000 $(81,000) $5,054,000

December 31, 20X1

Amortized

Cost

Gains in

Accumulated

Other

Comprehensive

Income

Losses in

Accumulated

Other

Comprehensive

Income

Estimated

Fair

Value

U.S.

government

securities $1,161,000 $ -0- $(4,000) $1,157,000

Commercial

paper 1,632,000 9,000 (6,000) 1,635,000

ASC Topic 320: Investments—Debt and Equity Securities 18.19

December 31, 20X1

Amortized

Cost

Gains in

Accumulated

Other

Comprehensive

Income

Losses in

Accumulated

Other

Comprehensive

Income

Estimated

Fair

Value

Corporate

bonds 1,788,000 12,000 (73,000) 1,727,000

Fixed rate

notes 150,000 -0- -0- 150,000

Total debt

securities 4,731,000 21,000 (83,000) 4,669,000

Common stock 615,000 37,000 (26,000) 626,000

Preferred stock 110,000 4,000 -0- 114,000

Total equity

securities 725,000 41,000 (26,000) 740,000

Total available-

for-sale

securities $5,456,000 $62,000 $(109,000) $5,409,000

During the years ended December 31, 20X2, and December 31,

20X1, available-for-sale securities were sold for total proceeds of

$823,000 and $617,000, respectively. The gross realized gains on

these sales totaled $127,000 and $104,000 in 20X2 and 20X1,

respectively. For purpose of determining gross realized gains, the

cost of securities sold is based on specific identification. Net

unrealized holding gains on available-for-sale securities in the

amount of $127,000 and $53,000 for the years ended December 31,

20X2, and December 31, 20X1, respectively, have been included

in accumulated other comprehensive income. Total other-than-

temporary impairment recognized in accumulated other compre-

hensive income amounted to $50,000 and $45,000 at December 31,

20X2, and December 31, 20X1, respectively.

Contractual maturities of available-for-sale debt securities at

December 31, 20X2, are as follows:

Estimated

Fair Value

Due in one year or less $2,388,000

Due in 1–2 years 1,161,000

Due in 2–5 years 273,000

Due after 5 years 221,000

Total investments in debt securities $4,043,000

18.20 ASC Topic 320: Investments—Debt and Equity Securities

Actual maturities may differ from contractual maturities because

some borrowers have the right to call or prepay obligations with or

without call or prepayment penalties.

Example 3: Available-for-Sale Securities Are Classified as Current and

Noncurrent Assets

Available-for-sale securities consist of the following:

December 31, 20X2

Amortized

Cost

Gains in

Accumulated

Other

Comprehensive

Income

Losses in

Accumulated

Other

Comprehensive

Income

Estimated

Fair

Value

Current:

Auction rate

securities $2,800,000 -0- -0- $2,800,000

Municipal

bonds and

notes 748,000 -0- (4,000) 744,000

Asset-backed

securities 302,000 6,000 (2,000) 306,000

U.S.

government

obligations 675,000 12,000 (7,000) 680,000

Total current

securities 4,525,000 18,000 (13,000) 4,530,000

Noncurrent:

Auction rate

securities 1,300,000 -0- -0- 1,300,000

Municipal

bonds 679,000 8,000 (6,000) 681,000

Corporate

bonds 274,000 -0- (9,000) 265,000

Common stock 413,000 47,000 (26,000) 434,000

Preferred stock 279,000 24,000 (13,000) 290,000

Total

noncurrent

securities 2,945,000 79,000 (54,000) 2,970,000

Total available-

for-sale

securities $7,470,000 $97,000 $(67,000) $7,500,000

ASC Topic 320: Investments—Debt and Equity Securities 18.21

December 31, 20X1

Amortized

Cost

Gains in

Accumulated

Other

Comprehensive

Income

Losses in

Accumulated

Other

Comprehensive

Income

Estimated

FairValue

Current:

Auction rate

securities $4,300,000 $ -0- $4,300,000$ -0-

Municipal

bonds and

notes 623,000 (3,000) 620,000-0-

Asset-backed

securities 291,000 (1,000) 294,0004,000

U.S.

government

obligations 600,000 (6,000) 604,00010,000

Total current

securities 5,814,000 (10,000) 5,818,00014,000

Noncurrent:

Auction rate

securities 1,450,000 -0- 1,450,000-0-

Municipal

bonds 610,000 (5,000) 612,0007,000

Corporate

bonds 296,000 (11,000) 285,000-0-

Common stock 471,000 (29,000) 485,00043,000

Preferred stock 342,000 (17,000) 353,00028,000

Total

noncurrent

securities 3,169,000 (62,000) 3,185,00078,000

Total available-

for-sale

securities $8,983,000 $(72,000) $9,003,000$92,000

Proceeds from the sales of available-for-sale securities were

$511,000 and $307,000 during 20X2 and 20X1, respectively. Gross

realized gains on those sales during 20X2 and 20X1 were $107,000

and $95,000, respectively. Gross realized losses on those sales

during 20X2 and 20X1 were $53,000 and $46,000, respectively. For

purpose of determining gross realized gains and losses, the cost of

securities sold is based on average cost. Net unrealized holding

18.22 ASC Topic 320: Investments—Debt and Equity Securities

gains on available-for-sale securities in the amount of $10,000

and $36,000 for the years ended December 31, 20X2, and December

31, 20X1, respectively, have been included in accumulated other

comprehensive income. Total other-than-temporary impairment

recognized in accumulated other comprehensive income amounted

to $160,000 and $130,000 at December 31, 20X2, and December 31,

20X1, respectively.

Contractual maturities of available-for-sale debt securities at

December 31, 20X2, are as follows:

Estimated

Fair Value

Within one year $4,530,000

After 1-5 years 2,050,000

After 5-10 years 196,000

$6,776,000

Actual maturities may differ from contractual maturities because

some borrowers have the right to call or prepay obligations with or

without call or prepayment penalties.

Example 4: Trading Securities

The Company’s short-term investments comprise equity and debt

securities, all of which are classified as trading securities and are car-

ried at their fair value based on the quoted market prices of the secu-

rities at December 31, 20X2, and December 31, 20X1. Net realized

and unrealized gains and losses on trading securities are included

in net earnings. For purpose of determining realized gains and

losses, the cost of securities sold is based on specific identification.

The composition of trading securities, classified as current assets,

is as follows at December 31, 20X2, and December 31, 20X1:

December 31, 20X2 December 31, 20X1

Cost Fair Value Cost Fair Value

Treasury bills $2,796,000 $2,796,000 $2,515,000 $2,515,000

Mutual funds 883,000 765,000 691,000 653,000

Common stock 617,000 501,000 574,000 452,000

Preferred stock 311,000 294,000 282,000 258,000

Total trading

securities $4,607,000 $4,356,000 $4,062,000 $3,878,000

ASC Topic 320: Investments—Debt and Equity Securities 18.23

Investment income for the years ended December 31, 20X2, and

December 31, 20X1, consists of the following:

20X2 20X1

Gross realized gains from

sale of trading securities $ 162,000 $ 129,000

Gross realized losses from

sale of trading securities (71,000) (46,000)

Dividend and interest

income 194,000 123,000

Net unrealized holding

losses (67,000) (134,000)

Net investment income $ 218,000 $ 72,000

Example 5: Held-to-Maturity Securities

At December 31, 20X2, and December 31, 20X1, the Company held

investments in marketable securities that were classified as held to

maturity and consisted of the following:

December 31, 20X2

Amortized

Cost

Unrecognized

Holding

Gains

Unrecognized

Holding

Losses

Estimated

Fair Value

U.S. government

securities $4,997,000 $ 8,000 $ (3,000) $5,002,000

States and

municipalities 1,170,000 75,000 (10,000) 1,235,000

Corporate bonds 1,219,000 67,000 (11,000) 1,275,000

Total held-to-

maturity securities $7,386,000 $150,000 $(24,000) $7,512,000

December 31, 20X1

Amortized

Cost

Unrecognized

Holding

Gains

Unrecognized

Holding

Losses

Estimated

Fair Value

U.S. government

securities $3,624,000 $ 9,000 $ (2,000) $3,631,000

States and

municipalities 1,641,000 95,000 (16,000) 1,720,000

18.24 ASC Topic 320: Investments—Debt and Equity Securities

December 31, 20X1

Amortized

Cost

Unrecognized

Holding

Gains

Unrecognized

Holding

Losses

Estimated

Fair Value

Corporate bonds 1,023,000 61,000 (13,000) 1,071,000

Total held-to-

maturity securities $6,288,000 $165,000 $(31,000) $6,422,000

During the years ended December 31, 20X2, and December 31,

20X1, held-to-maturity securities were sold for total proceeds of

$917,000 and $733,000, respectively. The gross realized gains on

these sales totaled $58,000 and $64,000 in 20X2 and 20X1, respec-

tively. For purpose of determining gross realized gains, the cost of

securities sold is based on specific identification.

Contractual maturities of held-to-maturity securities at December

31, 20X2, are as follows:

Net Carrying

Amount

Due in one year or less $1,380,000

Due in 2-5 years 5,481,000

Due in 6-10 years 525,000

Total investments in held-to-maturity securities $7,386,000

Actual maturities may differ from contractual maturities because

some borrowers have the right to call or prepay obligations with or

without call or prepayment penalties.

Example 6: Estimated Fair Value of Held-to-Maturity Securities

Approximates Cost

At December 31, 20X2, and December 31, 20X1, the Company had

marketable debt securities that were classified as held to maturity

and carried at amortized cost. Held-to-maturity securities consisted

of the following:

20X2 20X1

Current:

U.S. government securities $1,714,000 $ -0-

Commercial paper 1,975,000 1,810,000

Certificates of deposit 1,315,000 600,000

Corporate notes 2,417,000 1,976,000

ASC Topic 320: Investments—Debt and Equity Securities 18.25

20X2 20X1

Total current held-to-maturity

securities 7,421,000 4,386,000

Noncurrent:

U.S. government securities 3,411,000 3,100,000

Corporate notes 3,719,000 2,418,000

Total noncurrent held-to-maturity

securities 7,130,000 5,518,000

Total held-to-maturity securities $14,551,000 $9,904,000

At December 31, 20X2, maturities for noncurrent held-to-

maturity securities were between one and two years. At December

31, 20X2, and December 31, 20X1, the estimated fair value of each

investment approximated its amortized cost and, therefore, there

were no significant unrecognized holding gains or losses.

Example 7: Decline in Market Value Is Considered Other Than

Temporary

The Company invests in debt and equity securities of technology

companies for business and strategic purposes. Investments in

public companies are classified as “available for sale” and are

carried at fair value based on quoted market prices. The Company

reviews its marketable equity holdings in publicly traded compa-

nies on a regular basis to determine if any security has experienced

an other-than-temporary decline in fair value. The Company

considers the investee company’s cash position, earnings and

revenue outlook, stock price performance, liquidity and manage-

ment ownership, among other factors, in its review. If it is

determined that an other-than-temporary decline exists in a

marketable equity security, the Company writes down the invest-

ment to its market value and records the related write-down as an

investment loss in its Statement of Operations.

At December 31, 20X2, the Company wrote down to fair market

value certain equity security investments. The write-down

amounted to $157,000 and was due to a decline in the fair value of

the equity security which, in the opinion of management, was con-

sidered to be other than temporary. The write-down is included in

general and administrative expenses in the accompanying State-

ment of Operations for 20X2.

18.26 ASC Topic 320: Investments—Debt and Equity Securities

Example 8: Transfer of Held-to-Maturity Investments to Available-for-

Sale Category

In March 20X2, the Company transferred all of its held-to-maturity

investments to the available-for-sale category. Management deter-

mined that it no longer had the positive intent to hold its investment

in securities classified as held-to-maturity for an indefinite period of

time because of management’s desire to have more flexibility in man-

aging the investment portfolio. The securities transferred had a total

amortized cost of $3,770,000, fair value of $3,862,000 and unrealized

gross gains of $218,000 and unrealized gross losses of $126,000 at the

time of the transfer. The net unrealized gain of $92,000 was recorded

as other comprehensive income at the time of transfer.

Example 9: Pledged Investments

The Company has pledged certain held-to-maturity investments as

collateral for payments due under operating leases and for a

standby letter of credit related to an operating lease. Total amount

of securities pledged at December 31, 20X2, was approximately

$736,000, of which $400,000 is classified as a restricted investment.

The operating leases expire at various dates through December 31,

20X5. The standby letter of credit expires on March 31, 20X3, but is

automatically renewable through the underlying lease expiration

date of March 31, 20X5.

Example 10: Impaired Securities—ASC Topic 320 Based on Guidance in

FSP FAS 115-1 and FAS 124-1

Note: To facilitate the illustration of narrative disclosures and

for simplicity, this example presents only the quantitative infor-

mation as of the date of the latest balance sheet. However,

GAAP requires the quantitative information to be presented as

of each date for which a balance sheet is presented.

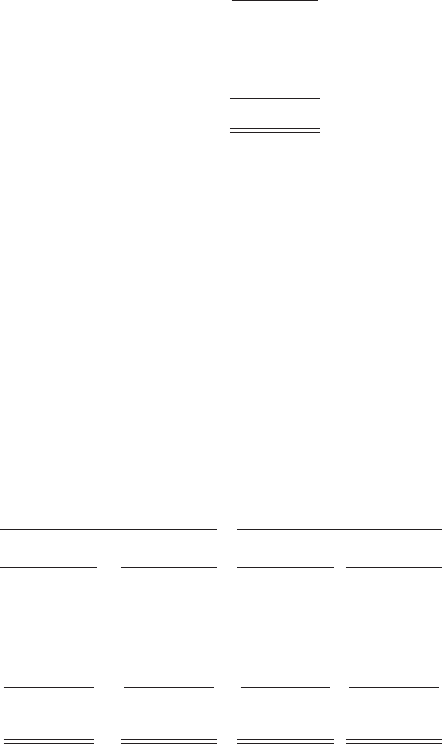

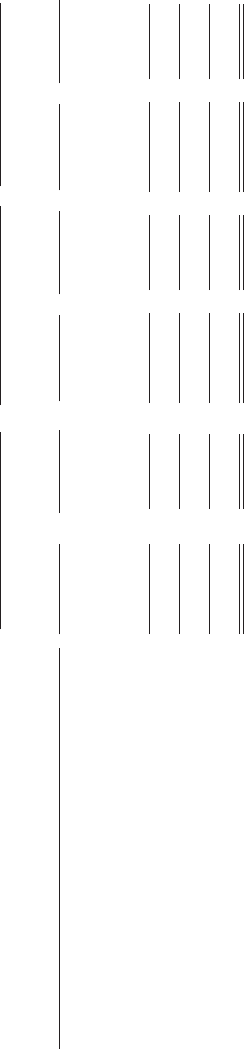

The following table shows the Company’s investments’ gross unre-

alized losses and fair value, aggregated by investment category and

length of time that individual securities have been in a continuous

unrealized loss position, at December 31, 20X2:

ASC Topic 320: Investments—Debt and Equity Securities 18.27

Less than 12 Months 12 Months or More Total

Description of Securities Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

U.S. Treasury obligations $1,000,000 $ 15,000 $1,100,000 $ 20,000 $2,100,000 $ 35,000

Federal agency mortgage-backed securities 750,000 18,000 800,000 14,000 1,550,000 32,000

Corporate bonds 1,540,000 60,000 1,300,000 85,000 2,840,000 145,000

Total debt securities 3,290,000 93,000 3,200,000 119,000 6,490,000 212,000

Common stock 860,000 55,000 920,000 150,000 1,780,000 205,000

Total $4,150,000 $148,000 $4,120,000 $269,000 $8,270,000 $417,000

18.28 ASC Topic 320: Investments—Debt and Equity Securities

The Company has determined that the unrealized losses are deemed

to be temporary impairments as of December 31, 20X2. The Com-

pany believes that the unrealized losses generally are caused by

liquidity discounts and increases in the risk premiums required by

market participants rather than an adverse change in cash flows or

a fundamental weakness in the credit quality of the issuer or under-

lying assets.

U.S. Treasury Obligations. The unrealized losses on the Company’s in-

vestments in U.S. Treasury obligations were caused by interest rate

increases. The contractual terms of those investments do not permit

the issuer to settle the securities at a price less than the amortized cost

of the investment. Because the Company has the ability and intent to

hold those investments until a recovery of fair value, which may be

maturity, the Company does not consider those investments to be

other-than-temporarily impaired at December 31, 20X2.

Federal Agency Mortgage-Backed Securities. The unrealized losses on

the Company’s investment in federal agency mortgage-backed secu-

rities were caused by interest rate increases. The Company pur-

chased those investments at a discount relative to their face amount,

and the contractual cash flows of those investments are guaranteed

by an agency of the U.S. government. Accordingly, it is expected that

the securities would not be settled at a price less than the amortized

cost of the Company’s investment. Because the decline in market

value is attributable to changes in interest rates and not credit qual-

ity, and because the Company has the ability and intent to hold

those investments until a recovery of fair value, which may be matu-

rity, the Company does not consider those investments to be other-

than-temporarily impaired at December 31, 20X2.

Corporate Bonds. The Company’s unrealized losses on investments in

corporate bonds relate to a $1,540,000 investment in ABC Company’s

Series B Debentures and a $1,300,000 investment in XYZ Company’s

Series C Debentures. The unrealized losses were primarily caused by

(a) a recent decrease in profitability and near-term profit forecasts by

industry analysts resulting from intense competitive pricing pressure

in the manufacturing industry and (b) a recent sector downgrade by

several industry analysts. The contractual terms of those investments

do not permit ABC Company and XYZ Company to settle the

security at a price less than the amortized cost of the investment.

While the credit ratings of ABC Company and XYZ Company have

decreased from A to BBB (S&P), the Company currently does not be-

lieve it is probable that it will be unable to collect all amounts due ac-

cording to the contractual terms of the investments. Therefore, it is

expected that the debentures would not be settled at a price less than

the amortized cost of the investments. Because the Company has the

ability and intent to hold these investments until a recovery of fair

ASC Topic 320: Investments—Debt and Equity Securities 18.29

value, which may be maturity, it does not consider the investment in

the debentures of ABC Company and XYZ Company to be other-

than-temporarily impaired at December 31, 20X2.

Common Stock. The Company’s investments consist primarily of

investments in common stock of companies in the consumer tools

and appliances industry ($1,100,000 of the total fair value and

$155,000 of the total unrealized losses in common stock investments)

and the air courier industry ($680,000 of the total fair value and

$50,000 of the total unrealized losses in common stock investments).

Within the Company’s portfolio of common stocks in the consumer

tools and appliances industry (all of which are in an unrealized loss

position) approximately 35% of the total fair value and 30% of the

Company’s total unrealized losses are in ABC Company. The

remaining fair value and unrealized losses are distributed in four

companies. The severity and duration of the impairment correlate

with the weak sales experienced recently within the consumer tools

and appliance industry. The Company evaluated the near-term

prospects of the issuer in relation to the severity and duration of the

impairment. Based on that evaluation and the Company’s ability

and intent to hold those investments for a reasonable period of time

sufficient for a forecasted recovery of fair value, the Company does

not consider those investments to be other-than-temporarily

impaired at December 31, 20X2.

The Company’s portfolio of common stocks in the air courier

industry consists of investments in 6 companies, 4 of which (or

approximately 80% of the total fair value of the investments in the

air courier industry) are in an unrealized loss position. The air

courier industry and the Company’s investees are susceptible to

changes in the U.S. economy and the industries of their customers.

A substantial number of their principal customers are in the

automotive, personal computer, electronics, telecommunications,

and related industries, and their businesses have been adversely

affected by the slowdown of the U.S. economy, particularly during

the first half of 20X2 when the Company’s investments became

impaired. In addition, the credit ratings of nearly all companies in

the portfolio have decreased from A to BBB (S&P or equivalent

designation). The severity of the impairments in relation to the

carrying amounts of the individual investments is consistent with

those market developments. The Company evaluated the near-term

prospects of the issuers in relation to the severity and duration of

the impairment. Based on that evaluation and the Company’s

ability and intent to hold those investments for a reasonable period

of time sufficient for a forecasted recovery of fair value, the

Company does not consider those investments to be other-than-

temporarily impaired at December 31, 20X2.

18.30 ASC Topic 320: Investments—Debt and Equity Securities

Example 11: Impaired Securities—ASC Topic 320 Based on Guidance in

FSP FAS 115-2 and FAS 124-2

Note: To facilitate the illustration of narrative disclosures and

for simplicity, this example presents only the quantitative infor-

mation as of the date of the latest balance sheet. However,

GAAP requires the quantitative information to be presented as

of each date for which a balance sheet is presented.

The following table shows the Company’s investments’ gross unre-

alized losses and fair value, aggregated by investment category and

length of time that individual securities have been in a continuous

unrealized loss position, at December 31, 20X2:

ASC Topic 320: Investments—Debt and Equity Securities 18.31

Less than 12 Months 12 Months or More Total

Description of Securities Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

U.S. Treasury obligations $1,000,000 $ 15,000 $1,100,000 $ 20,000 $2,100,000 $ 35,000

Federal agency mortgage-backed securities 750,000 18,000 800,000 14,000 1,550,000 32,000

Corporate bonds 1,540,000 60,000 1,300,000 85,000 2,840,000 145,000

Total debt securities 3,290,000 93,000 3,200,000 119,000 6,490,000 212,000

Common stock 860,000 55,000 920,000 150,000 1,780,000 205,000

Total $4,150,000 $148,000 $4,120,000 $269,000 $8,270,000 $417,000

18.32 ASC Topic 320: Investments—Debt and Equity Securities

The Company has determined that the unrealized losses are deemed

to be temporary impairments as of December 31, 20X2. The Com-

pany believes that the unrealized losses generally are caused by

liquidity discounts and increases in the risk premiums required by

market participants rather than an adverse change in cash flows or

a fundamental weakness in the credit quality of the issuer or under-

lying assets.

U.S. Treasury Obligations. The unrealized losses on the Company’s

investments in U.S. Treasury obligations were caused by interest

rate increases. The contractual terms of those investments do not

permit the issuer to settle the securities at a price less than the amor-

tized cost of the investment. Because the Company does not intend

to sell the investments and it is not more likely than not that the

Company will be required to sell the investments before recovery of

their amortized cost bases, which may be maturity, the Company

does not consider those investments to be other-than-temporarily

impaired at December 31, 20X2.

Federal Agency Mortgage-Backed Securities. The unrealized losses on

the Company’s investment in federal agency mortgage-backed secu-

rities were caused by interest rate increases. The Company pur-

chased those investments at a discount relative to their face amount,

and the contractual cash flows of those investments are guaranteed

by an agency of the U.S. government. Accordingly, it is expected that

the securities would not be settled at a price less than the amortized

cost bases of the Company’s investments. Because the decline in

market value is attributable to changes in interest rates and not

credit quality, and because the Company does not intend to sell the

investments and it is not more likely than not that the Company will

be required to sell the investments before recovery of their amor-

tized cost bases, which may be maturity, the Company does not con-

sider those investments to be other-than-temporarily impaired at

December 31, 20X2.

Corporate Bonds. The Company’s unrealized losses on investments

in corporate bonds relate to a $1,540,000 investment in ABC

Company’s Series B Debentures and a $1,300,000 investment in

XYZ Company’s Series C Debentures. The unrealized losses were

primarily caused by (a) a recent decrease in profitability and

near-term profit forecasts by industry analysts resulting from

intense competitive pricing pressure in the manufacturing industry

and (b) a recent sector downgrade by several industry analysts. The

contractual terms of those investments do not permit ABC

Company and XYZ Company to settle the security at a price less

than the amortized cost basis of the investment. While the credit

ratings of ABC Company and XYZ Company have decreased from

A to BBB (S&P), the Company currently does not expect ABC

ASC Topic 320: Investments—Debt and Equity Securities 18.33

Company and XYZ Company to settle the debentures at a price less

than the amortized cost basis of the investments (i.e., the Company

expects to recover the entire amortized cost basis of the security).

Because the Company does not intend to sell the investment and it

is not more likely than not that the Company will be required to sell

the investment before recovery of its amortized cost basis, which

may be maturity, it does not consider the investment in the

debentures of ABC Company and XYZ Company to be other-than-

temporarily impaired at December 31, 20X2.

Common Stock. The Company’s investments consist primarily of

investments in common stock of companies in the consumer tools

and appliances industry ($1,100,000 of the total fair value and

$155,000 of the total unrealized losses in common stock investments)

and the air courier industry ($680,000 of the total fair value and

$50,000 of the total unrealized losses in common stock investments).

Within the Company’s portfolio of common stocks in the consumer

tools and appliances industry (all of which are in an unrealized loss

position), approximately 35% of the total fair value and 30% of the

Company’s total unrealized losses are in ABC Company. The

remaining fair value and unrealized losses are distributed in four

companies. The severity and duration of the impairment correlate

with the weak sales experienced recently within the consumer tools

and appliance industry. The Company evaluated the near-term

prospects of the issuer in relation to the severity and duration of the

impairment. Based on that evaluation and the Company’s ability

and intent to hold those investments for a reasonable period of time

sufficient for a forecasted recovery of fair value, the Company does

not consider those investments to be other-than-temporarily

impaired at December 31, 20X2.

The Company’s portfolio of common stocks in the air courier

industry consists of investments in six companies, four of which (or

approximately 80% of the total fair value of the investments in the

air courier industry) are in an unrealized loss position. The air cou-

rier industry and the Company’s investees are susceptible to

changes in the U.S. economy and the industries of their customers.

A substantial number of their principal customers are in the auto-

motive, personal computer, electronics, telecommunications, and

related industries, and their businesses have been adversely affected

by the slowdown of the U.S. economy, particularly during the first

half of 20X2 when the Company’s investments became impaired. In

addition, the credit ratings of nearly all companies in the portfolio

have decreased from A to BBB (S&P or equivalent designation). The

severity of the impairments in relation to the carrying amounts of

the individual investments is consistent with those market develop-

ments. The Company evaluated the near-term prospects of the issu-

ers in relation to the severity and duration of the impairment. Based

on that evaluation and the Company’s ability and intent to hold

18.34 ASC Topic 320: Investments—Debt and Equity Securities

those investments for a reasonable period of time sufficient for a

forecasted recovery of fair value, the Company does not consider

those investments to be other-than-temporarily impaired at Decem-

ber 31, 20X2.

Other-Than-Temporary Impairments for Debt Securities

The Company recognizes other-than-temporary impairments

(OTTI) for debt securities classified as available for sale in accor-

dance with ASC 320 (based on FSP FAS 115-2 and FAS 124-2).

Accordingly, the Company assesses whether it intends to sell or it is

more likely than not that it will be required to sell a security before

recovery of its amortized cost basis less any current-period credit

losses. For debt securities that are considered other-than-

temporarily impaired and that the Company does not intend to sell

and will not be required to sell prior to recovery of the amortized

cost basis, the Company separates the amount of the impairment

into the amount that is credit related (credit loss component) and the

amount due to all other factors. The credit loss component is recog-

nized in earnings and is the difference between the security’s amor-

tized cost basis and the present value of its expected future cash

flows discounted at the security’s effective yield. The remaining dif-

ference between the security’s fair value and the present value of

future expected cash flows is due to factors that are not credit related

and, therefore, is not required to be recognized as losses in the

income statement, but is recognized in other comprehensive income.

Management believes that the Company will fully collect the carry-

ing value of securities on which it has recorded a non-credit-related

impairment in other comprehensive income.

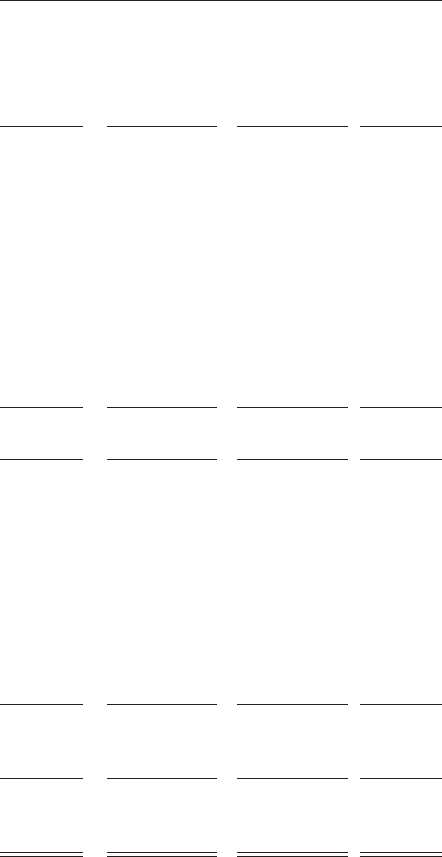

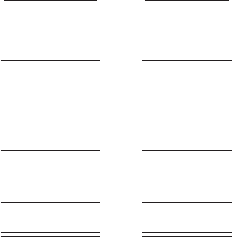

The table below presents a roll-forward of the credit loss compo-

nent recognized in earnings (referred to as “credit-impaired” debt

securities). The credit loss component of the amortized cost repre-

sents the difference between the present value of expected future

cash flows and the amortized cost basis of the security prior to con-

sidering credit losses. The beginning balance represents the credit

loss component for debt securities for which OTTI occurred prior to

January 1, 20X2. OTTI recognized in earnings in 20X2 for credit-

impaired debt securities is presented as additions in two compo-

nents based upon whether the current period is the first time the

debt security was credit-impaired (initial credit impairment) or is

not the first time the debt security was credit impaired (subsequent

credit impairments). The credit loss component is reduced if the

Company sells, intends to sell or believes it will be required to sell

previously credit-impaired debt securities. Additionally, the credit

loss component is reduced if the Company receives or expects to

receive cash flows in excess of what the Company previously

expected to receive over the remaining life of the credit-impaired

ASC Topic 320: Investments—Debt and Equity Securities 18.35

debt security, or if the security matures or is fully written down.

Changes in the credit loss component of credit-impaired debt secu-

rities were as follows for the year ended December 31, 20X2:

Balance, January 1, 20X2 $ 250,000

Additions:

Initial credit impairments 180,000

Subsequent credit impairments 50,000

Reductions:

For securities sold (25,000)

Due to change in intent to sell or require-

ment to sell

(10,000)

For increases in expected cash flows (5,000)

Balance, December 31, 20X2 $ 440,000

Example 12: Auction Rate Securities Classified as Available-for-Sale

Investments

At December 31, 20X2, and 20X1, the Company held $2,800,000 and

$4,300,000, respectively, of auction rate securities, which are shown

as a separately stated current asset in the accompanying financial

statements. Also, at December 31, 20X2, and 20X1, the Company

held $1,300,000 and $1,450,000, respectively, of auction rate securi-

ties related to the Company’s standby letters of credit, which collat-

eralize the leases for its Irvine and San Diego offices and are

classified as other noncurrent assets. Auction rate securities are

variable-rate bonds tied to short-term interest rates with maturities

on the face of the securities in excess of 90 days. The Company’s

investments in these auction rate securities are classified as

available-for-sale securities. The securities are recorded at cost,

which approximates fair market value because of their variable

interest rates, which typically reset every 7 to 35 days. Despite the

long-term nature of their stated contractual maturities, the Com-

pany has the intent and ability to quickly liquidate these securities;

therefore, the Company had no cumulative gross unrealized hold-