28075 M28075

User Manual: 28075

Open the PDF directly: View PDF ![]() .

.

Page Count: 64

Disability Income insurance underwritten by:

Mutual of Omaha Insurance Company

Mutual of Omaha Plaza

Omaha, NE 68175

mutualofomaha.com

TM

Disability Income ChoiceSM

Portfolio

Mutual of Omaha Insurance Company

M27879

AGENT &

UNDERWRITING

GUIDE

when choices mat tersm

M28075

DI Choice

DI Choice at Work

For producer use only. Not for use with general public.

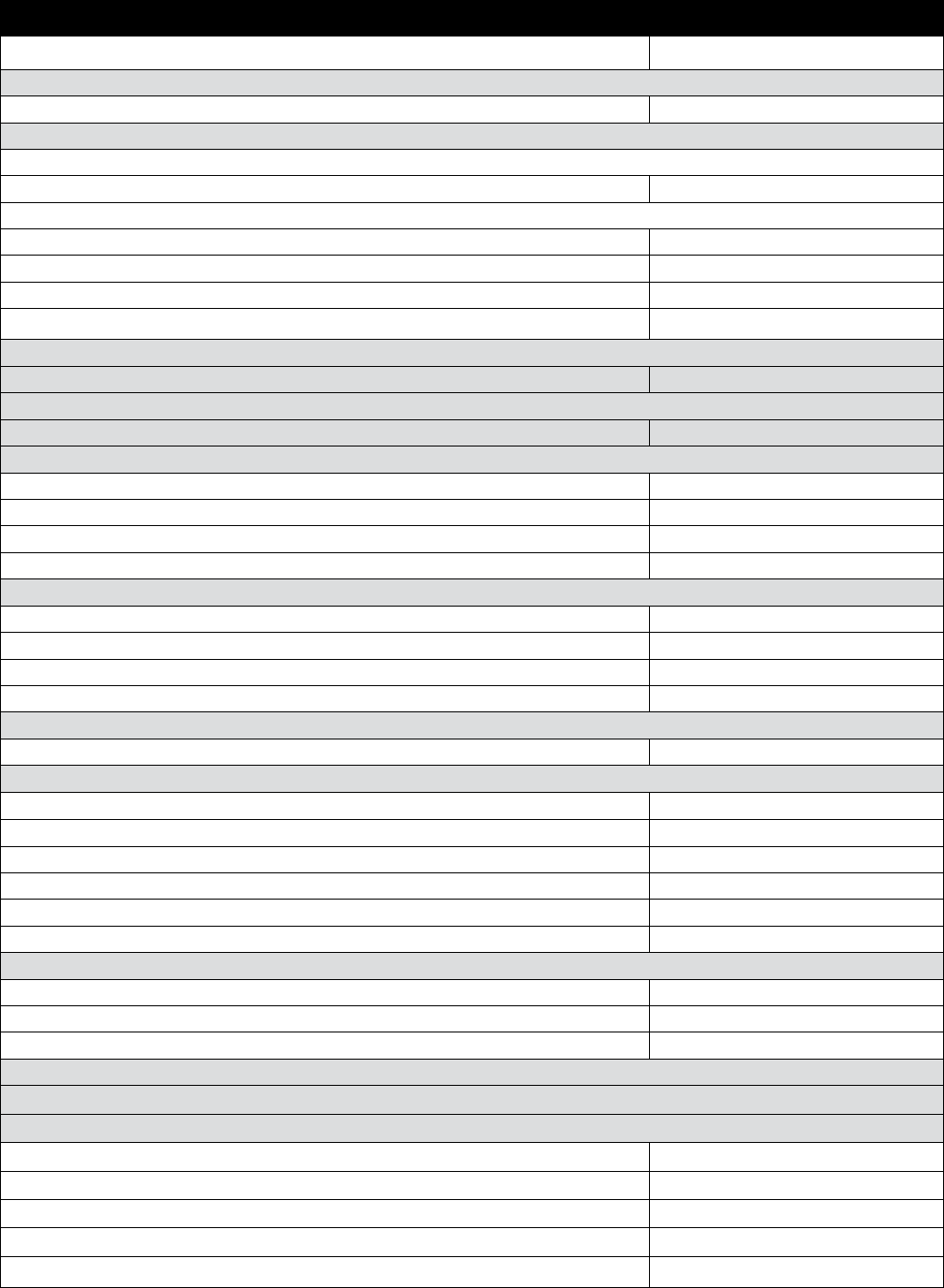

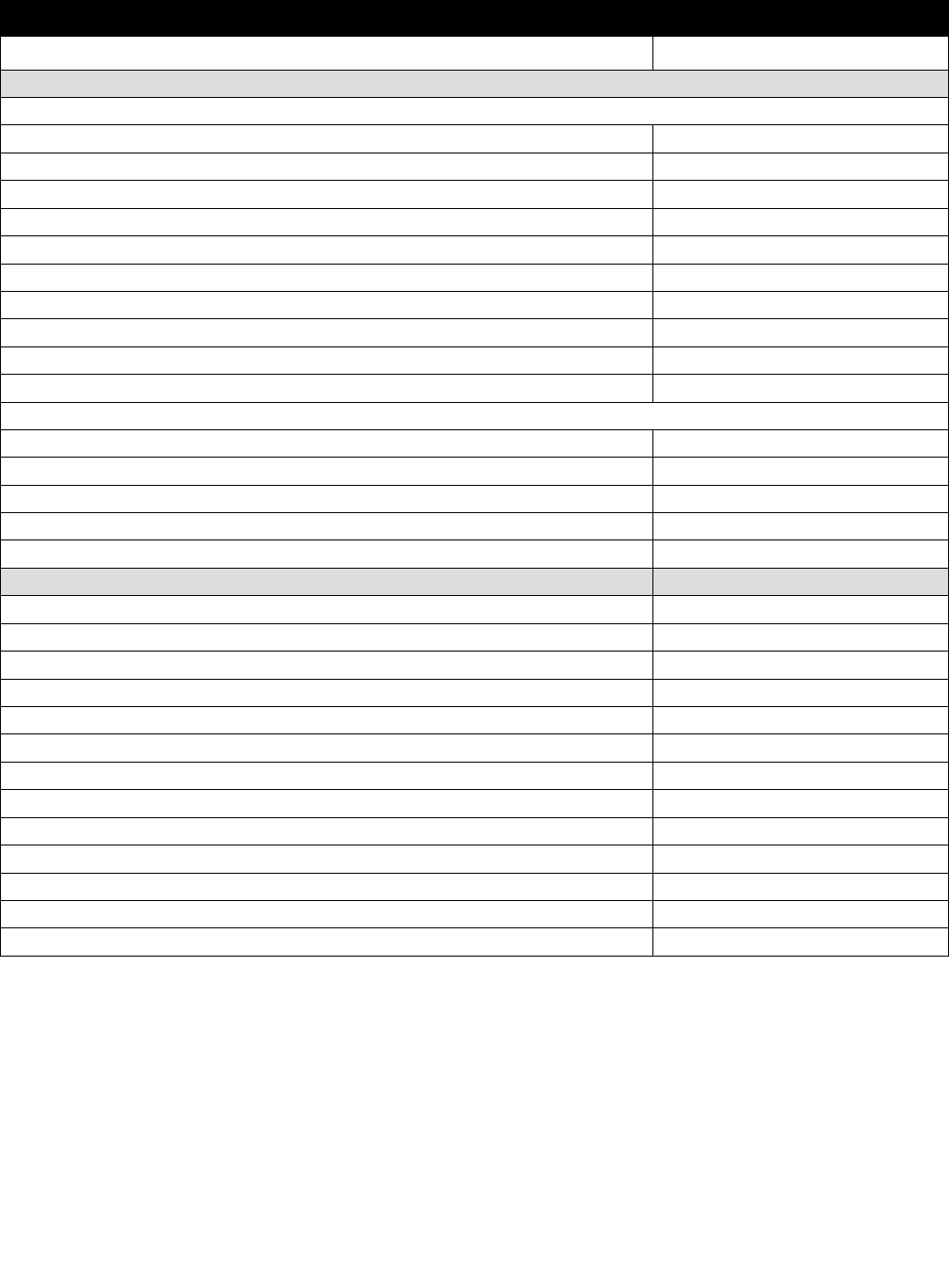

Table of Contents

Contact Information...........................................................Section 1

Product Guidelines/Description . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 2

Accident Only Disability

n Benefits and Riders

Short-Term Disability

n Benefits and Riders

Long-Term Disability

n Benefits and Riders

Business Overhead Expense

n Examples of Qualified Applicants

Underwriting Programs .......................................................Section 3

n Program Overview

n Individual Eligibility Requirements

n Disability Choice at Work Eligibility Requirements

n Business Submission Process

Associate Marketing ..........................................................Section 4

n Program Overview

n Association Marketing Guidelines

n Getting Started

General Underwriting Guidelines.............................................Section 5

n Minimum Benefit Amounts

n Social Security Number

n Foreign Travel

n Non-English Speaking Applicants

n Preferential Rates

n State Sponsored Compulsory Disability Insurance

n Tobacco Use

n Hazardous Avocations

Medical Underwriting Guidelines.............................................Section 6

n Possible Underwriting Outcomes

n Pre-Existing Medical Conditions

n Scheduling

n Paramedical Facilities

n Blood Profile, Urinalysis and HIV Consent

n Client Interview (PHI)

n Attending Physician’s Statements (APS)

n Notice of Underwriting Action (Pending Report)

n Body Build Chart

M28075

Financial Underwriting Guidelines ...........................................Section 7

n Definitions

n Salary

n Earned Income

n Unearned Income

n Overtime Income

n Self-Employed

n Net Worth

n Bankruptcy

n Depreciation

n Future Insurability Option

n Income Documentation

n Income Qualification Table

Occupational Underwriting ...................................................Section 8

n General Description of Occupational Classes

n Multiple Occupations

n Maximum Benefit Amounts

n Benefit and Elimination Periods

n Special Restrictions

n Home-Based Occupations

n Premium Savings

n Business Owner Upgrades

n Uninsurable Occupations

n Occupational Classification Manual

For producer use only. Not for use with general public.

For producer use only. Not for use with general public.

Contact Information

Application Submission

Records/Mailing Processing Center

9330 State Hwy. 133

Blair, NE 68008-6179

Fax: 402-997-1804

Policy Delivery Requirements

Fax: 402-997-1905

Pending Application Requirements

Fax: 402-997-1805

Mutual of Omaha

Licensing

Phone: 800-867-6873

Hours: 8 a.m. to 4:30 p.m. Central time Monday – Friday

Fax: 402-997-1830

Email: contractsandappointments@mutualofomaha.com

Sales Support

Phone: 877-617-5589 or 800-693-6083

Hours: 7:30 a.m. to 4:30 p.m. Central time Monday – Friday

Email: sales.support@mutualofomaha.com

n Appointments

n Contracting & Licensing

n Proposals

n Sales/Product Support

DI Service Office

Claims

Phone: 800-268-6443

Hours: 7 a.m. to 5 p.m. Central time Monday – Friday

Multi-Life Underwriting Coordinator

Phone: 877-778-0838

Fax: 402-997-1893

Hours: 8 a.m. to 4:30 p.m. Central time Monday – Friday

Email: multilife@mutualofomaha.com

n Case Quoting

n Group Approval

n Multi-Life Inquiries

1

Section 1

Product Guidelines

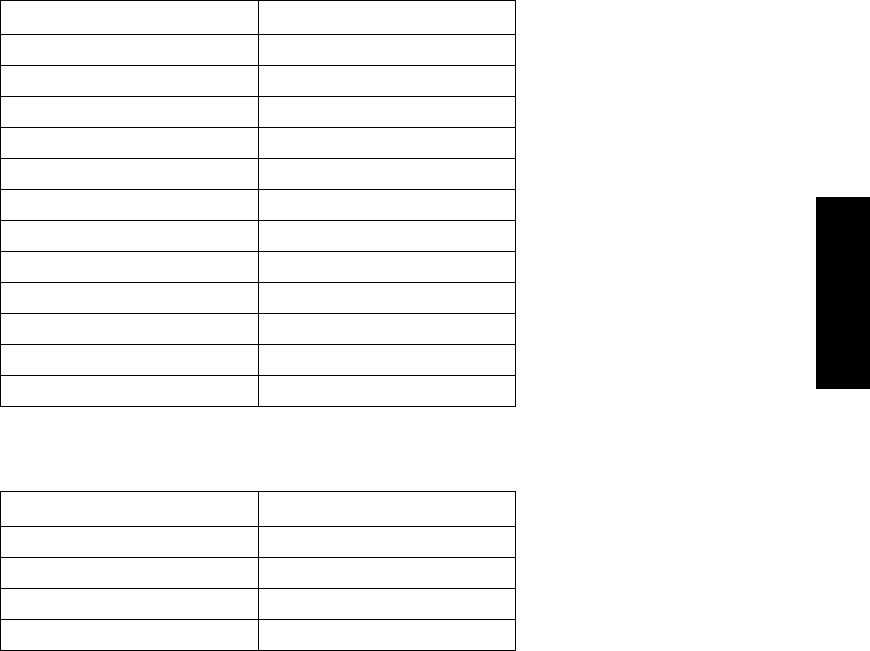

Accident Only Disability

Benefit Period

(Months)

Elimination Period

(Days) Issue Ages Occupational Classes

3, 6, 12, 24 0, 7, 14, 30, 60, 90 18-61 6A, 5A, 4A, 3A, 2A, 1A, S

Premium Structure

n Individual – unisex

n DI Choice at Work – unisex

Premium Savings

If your client is a member of a qualifying association or is self-employed, they may qualify for a premium savings.

Renewability

This product guarantees the right to continue the coverage until age 67. During that time, we cannot cancel the policy as long

as the required premiums are paid when due.

Maximum Benefit Amounts

The maximum monthly benefit amount available is $5,000.

Total Disability Income Benefit

If an injury prevents your client from performing the material and substantial duties of their regular occupation, and they

aren’t gainfully employed in another occupation, we will pay a monthly benefit once the elimination period has been met.

Partial Disability Benefit

If an injury prevents your client from performing the material and substantial duties of their regular occupation for more

than 50 percent of the time usually spent in the daily performance of such duties, we will pay 50 percent of the total disability

monthly benefit. These benefits commence after the elimination period has been satisfied and are payable for up to six

months.

Survivor Benefit

If your client dies while they are disabled, we will pay their beneficiaries a lump sum amount equal to three times the total

disability monthly benefit payable at the time of their death.

Recurrent Disability

If a related disability occurs within six months of returning to full-time employment, we will consider it a recurrent disability.

A new elimination period will not need to be satisfied and the same benefit period will continue.

Presumptive Total Disability

We will presume your client to be totally and permanently disabled if an injury results in their complete and irrecoverable

loss of hearing, speech, sight or use of both hands, both feet or one hand and one foot. We will pay your client total disability

benefits for the full length of the benefit period even if they return to work in another occupation. We also will waive the

elimination period.

Waiver of Premium

We will waive premium for the coverage and all optional riders after your client is disabled for 90 days. We also will refund any

premiums paid during this 90-day period.

3

Section 2

For producer use only. Not for use with general public.

Workers’ Compensation

If your client is disabled by an injury or illness that is covered by state or federal workers’ compensation, employer’s liability

or occupational disease law, we will pay 50 percent of the benefit for which your client is eligible.

OPTIONAL RIDERS (Available only at issue)

Accident Hospital Confinement Indemnity Benefits Rider

This optional rider pays a daily room benefit of $125, $250, $350, or $500 (x2 ICU) for each day of hospital confinement due

to an accident. Benefits are payable for a maximum of 45 days for any period of confinement.

n Underwriting of the rider will be subject to the Underwriting Rules for the Policy Form, Health Manual and

Occupational Guide

n Issue ages 18-61

n Only one Accident Hospital Confinement Indemnity Benefits rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n Neither the Association Group premium savings nor the Self-Employed premium savings applies to this rider

Accident Medical Expense Benefits Rider

This optional rider reimburses your client for $1,000, $2,000, $3,000 and $5,000 in medical-related expenses incurred per

accident. Only services and supplies received within 26 weeks from the date of the Injury are covered, excluding dental care

or treatment.

n Total benefits payable for any one Injury are limited to the Maximum Benefit

n Total lifetime benefits payable under this rider are limited to ten times the Maximum Benefit

n The rider terminates on whichever of the following occurs first:

n The date the policy terminates

n The date total lifetime benefits paid under this rider equal ten times the Maximum Benefit

n The date your client reaches age 67

* Features and riders may not be available with all policies or approved in all states.

4

For producer use only. Not for use with general public.

Short-Term Disability

Benefit Period

(Months)

Elimination Period

(Days)

Issue

Ages Occupational Classes

3, 6, 12, 24 0/7, 7, 0/14,

14, 30, 60, 90

18-61 Individual

18-70 DI Choice at Work

6A, 5A, 4A, 3A, 2A, 1A, S

Premium Structure

n Individual – sex distinct

n DI Choice at Work – unisex

Premium Savings

If your client is a member of a qualifying association, or self-employed, they may qualify for a premium savings.

Renewability

This product guarantees the right to continue coverage until age 67. During that time, we cannot cancel the policy as long

as the required premiums are paid when due. After age 67, coverage may continue to age 75 if working full time and the

necessary premiums are paid when due.

n For DI Choice at Work coverage, after age 67, coverage may be continued for life if working full time and the necessary

premiums are paid when due

Maximum Monthly Benefit Amounts

The maximum monthly benefit amount available is $5,000.

Total Disability Benefits

If your client is unable to perform the material and substantial duties of their regular occupation due to injury or illness and is

not gainfully employed in another occupation, we will pay a monthly benefit once the elimination period has been met.

Partial Disability Benefit

If your client is able to perform the material and substantial duties of their regular occupation due to injury or illness for no more

than 50 percent of the time usually spent in the daily performance of such duties, we will pay 50 percent of the total disability

monthly benefit. These benefits commence after the elimination period has been satisfied and are payable for up to six months.

Survivor Benefit

If your client dies while they are disabled, we will pay their beneficiaries a lump sum amount equal to three times the total

disability monthly benefit payable at the time of their death.

Terminal Illness Benefit

Your client has the option to accelerate up to 12 months of disability benefits if diagnosed with a terminal illness.

Recurrent Disability

If a related disability occurs within six months of returning to full-time employment, we will consider it a recurrent disability.

A new elimination period will not need to be satisfied and the same benefit period will continue.

Presumptive Total Disability

We will presume your client to be totally and permanently disabled if sickness or injury results in their complete and

irrecoverable loss of hearing, speech, sight, or use of both hands, both feet or one hand and one foot. We will pay total

disability benefits for the full length of the benefit period even if they return to work in another occupation. We also will waive

the elimination period.

5For producer use only. Not for use with general public.

Section 2

Waiver of Premium

We will waive premium for the coverage and all optional riders after your client is disabled for 90 days. We also will refund any

premiums paid during this 90-day period.

Transplant Donor Benefits

We will pay benefits on the same basis as any other sickness if your client becomes disabled as the result of a transplant of part

of their body to the body of another person.

Rehabilitation Benefit

If your client is disabled and receiving disability benefits, they may be eligible to receive vocational rehabilitation services at

our expense.

Workers’ Compensation

If your client is disabled by an injury or illness that is covered by state or federal workers’ compensation, employer’s liability or

occupational disease law, we will pay 50 percent of the short-term disability benefit for which your client is eligible.

OPTIONAL RIDERS (Available only at issue)

Hospital Confinement Indemnity Benefits Rider

This optional rider pays a daily room benefit of $125, $250, $350, or $500 (x2 ICU) for each day of hospital confinement due

to an accident or sickness, subject to a one-day elimination period. Benefits are payable for a maximum of 45 days for any

period of confinement.

n Underwriting of the rider will be subject to the Underwriting Rules for the Policy Form, Health Manual and Occupational

Guide

n Issue ages 18-61

n Only one Hospital Confinement Indemnity Benefits rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n Neither the Association Group premium savings nor the Self-Employed premium savings applies to this rider

Accident Medical Expense Benefits Rider

This optional rider reimburses your client for $1,000, $2,000, $3,000 and $5,000 in medical-related expenses incurred per

accident. Only services and supplies received within 26 weeks from the date of the Injury are covered, excluding dental care or

treatment.

n Reimbursable amounts must be in excess of the Deductible Amount

n Total benefits payable for any one Injury are limited to the Maximum Benefit

n Total lifetime benefits payable under this rider are limited to ten times the Maximum Benefit

n The rider terminates on whichever of the following occurs first:

n The date the policy terminates

n The date total lifetime benefits paid under this rider equal ten times the Maximum Benefit

n The date your client reaches age 67

Critical Illness Benefits Rider

This optional rider pays a lump-sum benefit of $5,000, $10,000, $15,000 or $25,000 upon diagnosis of certain specified

diseases.

n Underwriting of the rider will be subject to the Underwriting Rules for the Policy Form, Health Manual and Occupational

Guide

n Adverse family history may affect rider availability

n Issue ages 18-61

n Only one Critical Illness Benefits rider may be attached to a given policy

6

For producer use only. Not for use with general public.

n The rider will terminate on the earliest of the following:

n When the Critical Illness Benefit is paid;

n The date the policy terminates;

n The renewal date following Age 67; or

n The date we receive a written request to cancel this rider (in which case, the grace period will not apply).

n Neither the Association Group premium savings nor the Self-Employed premium savings applies to this rider

Critical Illness Insured Conditions

n Alzheimer’s Disease

n Blindness

n Deafness

n Heart Attack (Myocardial Infarction)

n Life-Threatening Cancer (when first symptoms appear and first Diagnosis occurs more than 30 days after the Rider Date

or rider reinstatement date)

n Major Organ Transplant

n Paralysis

n Renal Failure or

n Stroke

Return of Premium Rider

This optional rider provides for the return of a specified percentage of premiums paid (80 percent or 50 percent)

less any claims paid at the end of each term period (usually 10 years). Premium and claims for the Critical Illness Benefits

rider, Hospital Confinement Indemnity Benefits rider, and Accident Hospital Confinement Indemnity Benefits rider are

excluded from the return of premium calculation.

n The underwriting for this rider is the same as the policy to which it is attached

n Issue ages 18-57

n Elimination Periods of 30, 60 and 90 days only

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider

n Not available with the DI Choice at Work products

* Features and riders may not be available with all policies or approved in all states.

7

For producer use only. Not for use with general public.

Section 2

Long-Term Disability

Benefit Period

(Years)

Elimination Period

(Days) Issue Ages Occupational Classes

2 60, 90, 180, 365

18-61 Individual

18-70 DI Choice at Work

6A, 5A, 4A, 3A, 2A, 1A

5 60, 90, 180, 365 18-61 6A, 5A, 4A, 3A, 2A, 1A

10 60, 90, 180, 365 18-56

6A, 5A, 4A, 3A, 2A

To Age 67 60, 90, 180, 365 18-61 6A, 5A, 4A, 3A

Premium Structure

n Individual – sex distinct

n DI Choice at Work – unisex

Note: Annual Policy Fee $50

Premium Savings

If your client is a member of a qualifying association, or self-employed, they may qualify for a premium savings.

n Not available with the DI Choice at Work products

Renewability

This product is guaranteed renewable until age 67. During that time, the policy cannot be cancelled as long as required

premiums are paid when due. After Age 67 coverage may be continued to age 75 if working full time and the necessary

premiums are paid when due.

n For DI Choice at Work coverage, after age 67, coverage may be continued for life if working full time and the necessary

premiums are paid when due

Maximum Monthly Benefit Amounts

The maximum monthly base benefit amount available is $10,000, or $12,300 if the Social Insurance Supplement Benefits

Rider is added. This amount may vary according to income and occupation.

Total Disability Benefits

If an injury or illness prevents your client from performing the material and substantial duties of their regular occupation,

and they are not gainfully employed in another occupation, we will pay a monthly benefit once the elimination period has

been met. After the first 24 months following the elimination period, if the maximum benefit period has not been met, we will

continue to pay a monthly benefit as long as they are unable to perform the material and substantial duties of any occupation

for which they are reasonably suited because of education, training or experience.

Proportionate Disability Benefit

If an injury or illness prevents your client from performing one or more of the material and substantial duties of their regular

occupation, or is unable to perform such duties for as much time as it would normally take to do them, and the loss of

monthly income is at least 20 percent, we will pay a percentage of the total disability monthly benefit that is proportionate to

their loss of income once the elimination period has been met. These benefits are payable for up to 24 months.

Survivor Benefit

If your client dies while disabled, we will pay their beneficiaries a lump sum amount equal to three times the total disability

monthly benefit payable at the time of their death.

Terminal Illness Benefit

Your client has the option to accelerate up to 12 months of disability benefits if diagnosed with a terminal illness.

Recurrent Disability

If a related disability occurs within six months of a return to full-time employment, we will consider it a recurrent disability. A

new elimination period won’t need to be satisfied and the same benefit period will continue.

8

For producer use only. Not for use with general public.

Presumptive Total Disability

We will presume your client to be totally and permanently disabled if sickness or injury results in their complete and

irrecoverable loss of hearing, speech, sight, or use of both hands, both feet or one hand and one foot. We will pay total

disability benefits for the full length of the benefit period even if they return to work in another occupation. We also will waive

the elimination period.

Waiver of Premium

We will waive premium for the coverage and all optional riders after your client is disabled for 90 days. We also will refund any

premiums paid during this 90-day period.

Transplant Donor Benefits

We will pay your client benefits on the same basis as any other sickness if your client becomes disabled as the result of a

transplant of part of their body to the body of another person.

Rehabilitation Benefit

If your client is disabled and receiving disability benefits, they may be eligible to receive vocational rehabilitation services at

our expense.

OPTIONAL RIDERS (Available only at issue)

Hospital Confinement Indemnity Benefits Rider

This optional rider pays a daily room benefit of $125, $250, $350, or $500 (x2 ICU) for each day of hospital confinement due

to an accident or sickness, subject to a one-day elimination period. Benefits are payable for a maximum of 45 days for any

period of confinement.

n Underwriting of the rider will be subject to the Underwriting Rules for the Policy Form, Health Manual and Occupational

Guide

n Issue ages 18-61

n Only one Hospital Confinement Indemnity Benefits rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n Neither the Association Group premium savings nor the Self-Employed premium savings applies

Accident Medical Expense Benefits Rider

This optional rider reimburses your client for $1,000, $2,000, $3,000 and $5,000 in medical-related expenses incurred per accident.

Only services and supplies received within 26 weeks from the date of the Injury are covered, excluding dental care or treatment.

n Reimbursable amounts must be in excess of the Deductible Amount

n Total benefits payable for any one Injury are limited to the Maximum Benefit

n Total lifetime benefits payable under this rider are limited to ten times the Maximum Benefit

n The rider terminates on whichever of the following occurs first:

n The date the policy terminates

n The date total lifetime benefits paid under this rider equal ten times the Maximum Benefit

n The date your client reaches age 67

Critical Illness Benefits Rider

This optional rider pays a lump-sum benefit of $5,000, $10,000, $15,000 or $25,000 upon diagnosis of certain specified

diseases.

n Underwriting of the rider will be subject to the Underwriting Rules for the Policy Form, Health Manual and Occupational

Guide

n Adverse family history may affect rider availability

n Issue ages 18-61

9

For producer use only. Not for use with general public.

Section 2

10

n Only one Critical Illness Benefits rider may be attached to a given policy

n The rider will terminate on the earliest of the following:

n When the Critical Illness Benefit is paid;

n The date the policy terminates;

n The renewal date following Age 67; or

n The date we receive a written request to cancel this rider (in which case, the grace period will not apply).

n Neither the Association Group Discount nor the Self-Employed Discount applies to this rider

Critical Illness Insured Conditions

n Alzheimer’s Disease

n Blindness

n Deafness

n Heart Attack (Myocardial Infarction)

n Life-Threatening Cancer (when first symptoms appear and first Diagnosis occurs more than 30 days after the Rider Date

or rider reinstatement date)

n Major Organ Transplant

n Paralysis

n Renal Failure or

n Stroke

Return of Premium Rider

This optional rider provides for the return of a specified percentage of premiums paid (80 percent or 50 percent)

less any benefits paid at the end of each term period (usually 10 years). Premium and claims for the Critical Illness Benefits

rider, Hospital Confinement Indemnity Benefits rider, and Accident Hospital Confinement Indemnity Benefits rider are

excluded from the return of premium calculation.

n The underwriting for this rider is the same as the policy to which it is attached

n Issue ages 18-57

n Elimination Periods of 60, 90, 180 and 365 days only

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider

n Not available with DI Choice at Work products

Social Insurance Supplement Rider

This optional rider offers disability income insurance at more affordable premiums than base coverage since disability benefits

payable under this rider are offset dollar-for-dollar by other forms of social insurance.

n Underwriting rules for the rider will be subject to the underwriting rules for the Policy Form, Health Section,

Occupational Section and Income Qualification Table

n The same Benefit Period/Elimination Period options and Issue Age/Occupational restrictions that apply to the base

coverage also apply to the Social Insurance Supplement rider

n The Elimination Period and the Benefit Period must be the same for the base plan and the SIS rider

n Only one Social Insurance Supplement rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider

Note: New York and New Jersey SIS Riders: SIS (Social Insurance Substitute) Benefits riders provide total or proportionate

disability coverage in addition to the base policy’s benefits. However, these riders’ benefits will no longer be paid should

Social Insurance benefits pay for the loss being claimed.

Extended Own Occupation Disability Definition Amendment Rider

This optional rider extends the own occupation definition of disability applicable to the base and SIS rider past two years, to

the duration of the Benefit Period.

n The underwriting for this rider is the same as the policy to which it is attached

n Issue ages 18-61

For producer use only. Not for use with general public.

n Benefit Periods 5-Year, 10-Year, and To Age 67

n Occupational Classes 6A, 5A, 4A, 3A and 2A

n Only one Extended Own Occupation Disability Definition Amendment rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider

Future Insurability Option Rider (FIO)

This optional rider allows the policyholder to increase their base monthly benefit, at the policy’s annual renewal date, subject only

to proof of financial insurability. The maximum increase amount is up to two times the base benefit, but the total base plus FIO

monthly benefit may never exceed the maximum base monthly benefit for the policyholder’s occupational class. The maximum

allowable increase on any given notice date is 25 percent of the total disability monthly benefit (base only) at policy issue.

n The underwriting for this rider is the same as the policy to which it is attached

n Issue ages 18-51

n Benefit Periods 2, 5, and 10-Year and To Age 67

n Occupational Classes 6A, 5A, 4A, 3A, and 2A (government employees are not eligible)

n Health Risk Classes Standard, Standard with Exclusion, “L” or “7” and “M” or “8” (see Medical Underwriting Guidelines,

Section 6)

n Only one Future Insurability Option rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 57

n The date benefits have been increased to the maximum allowable

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider

Extended Proportionate Disability Benefits Rider

This optional rider extends the maximum duration Proportionate Disability benefits can be received past 24 months, to the

duration of the Benefit Period.

n The underwriting for this rider is the same as the policy to which it is attached

n Issue ages 18-61

n Benefit Periods 5-Year, 10-Year, and To Age 67

n Only one Extended Proportionate Disability Benefits rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider.

Cost-of-Living Adjustment Rider

This optional rider increases the disability benefits payable under the base policy and SIS rider by the lesser of:

n The CPI-U (Consumer Price Index – All Urban Consumers)

n 5.0 percent compounded annually

n The underwriting for this rider is the same as the policy to which it is attached

n Issue ages 18-61

n Benefit Periods 2, 5, and 10-Year and To Age 67

n Only one Cost-of-Living Adjustment rider may be attached to a given policy

n The rider terminates on whichever of the following occurs first:

n The first renewal date following age 67

n The date the policy terminates

n The Association Group premium savings and Self-Employed premium savings apply to this rider

* Features and riders may not be available with all policies or approved in all states.

11

For producer use only. Not for use with general public.

Section 2

12

For producer use only. Not for use with general public.

Business Overhead Expense

Benefit Period

(Months)

Elimination Period

(Days) Issue Ages Occupational Classes

12, 18 30, 60, 90, 180 and 365 20-59 6A, 5A, 4A, 3A, 2A, 1A

Premium Structure

n Individual – sex distinct

Renewability

This product guarantees the right to continue the coverage until your client retires, sells their business or otherwise

discontinues their business or profession until age 65. During that time, we cannot cancel the policy as long as the required

premiums are paid when due.

Total Loss of Time Benefit

If your client is completely unable to engage in their occupation and is not gainfully employed in another occupation, we will

pay benefits for operating expenses incurred during this total loss of time.

Recurrent Total Loss of Time Benefit

If further loss of time results from injury or sickness for which benefits have already been paid, the maximum operating

expense benefit and deductible period will be restored after return to full-time work for a period of six consecutive months.

Waiver of Premium

Premiums will be waived for the coverage after total loss of time benefits have been paid continuously for 90 days.

Monthly Benefit Limits

n Minimum: $500

n Maximum: Occupation Class 6A, 5A, 4A $15,000

Occupation Class 3A $12,000

Occupation Class 2A $ 6,000

Occupation Class 1A $ 5,000

n The Maximum monthly benefit may not exceed the average monthly operating expenses for the 12-month period

proceeding the date of the application

For producer use only. Not for use with the general public. 13

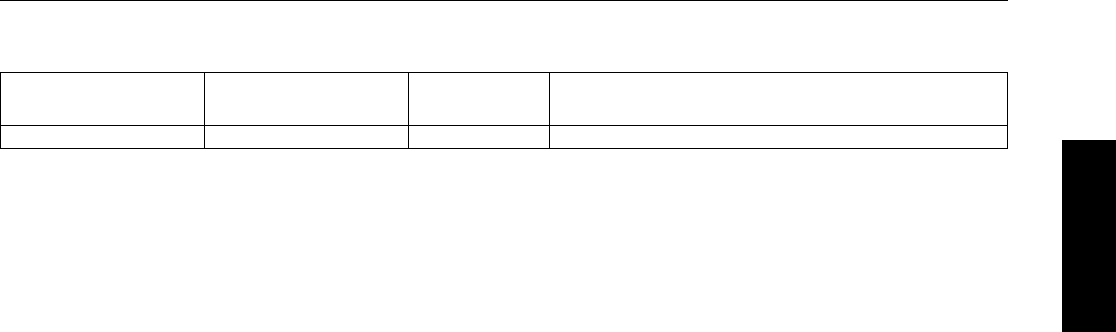

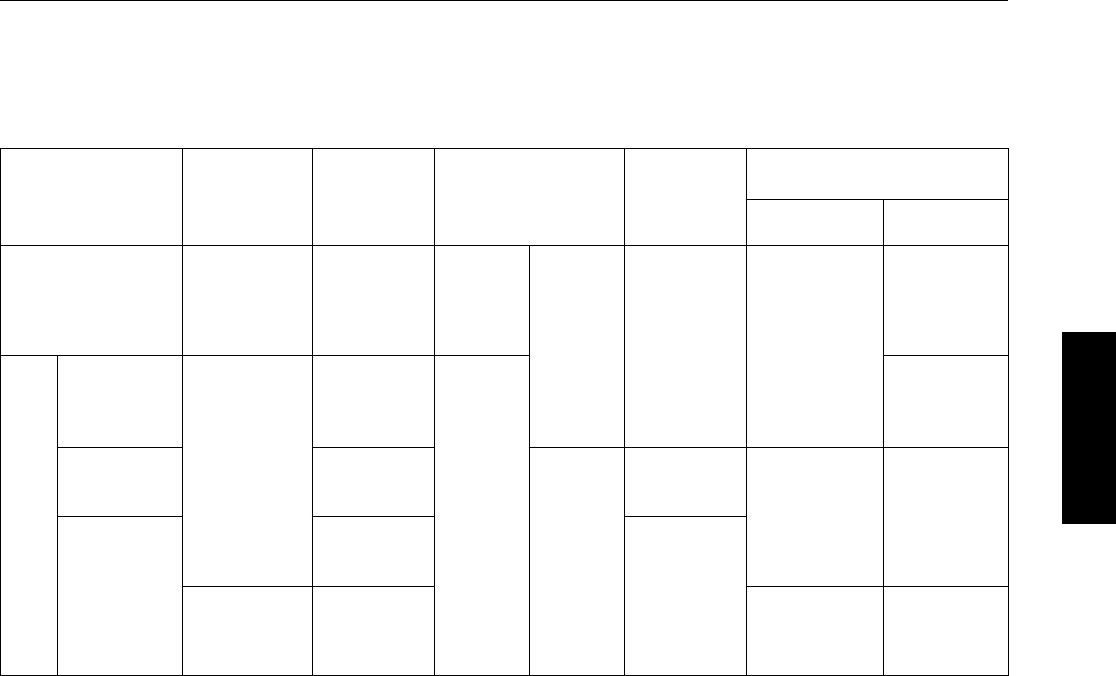

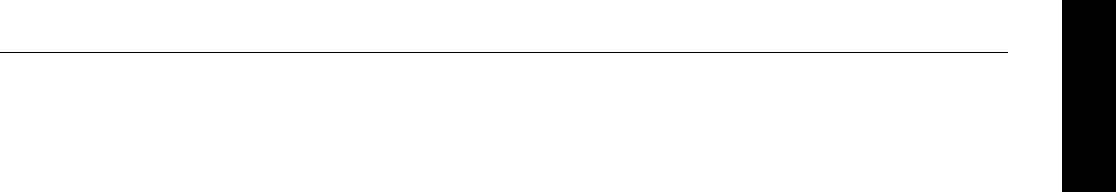

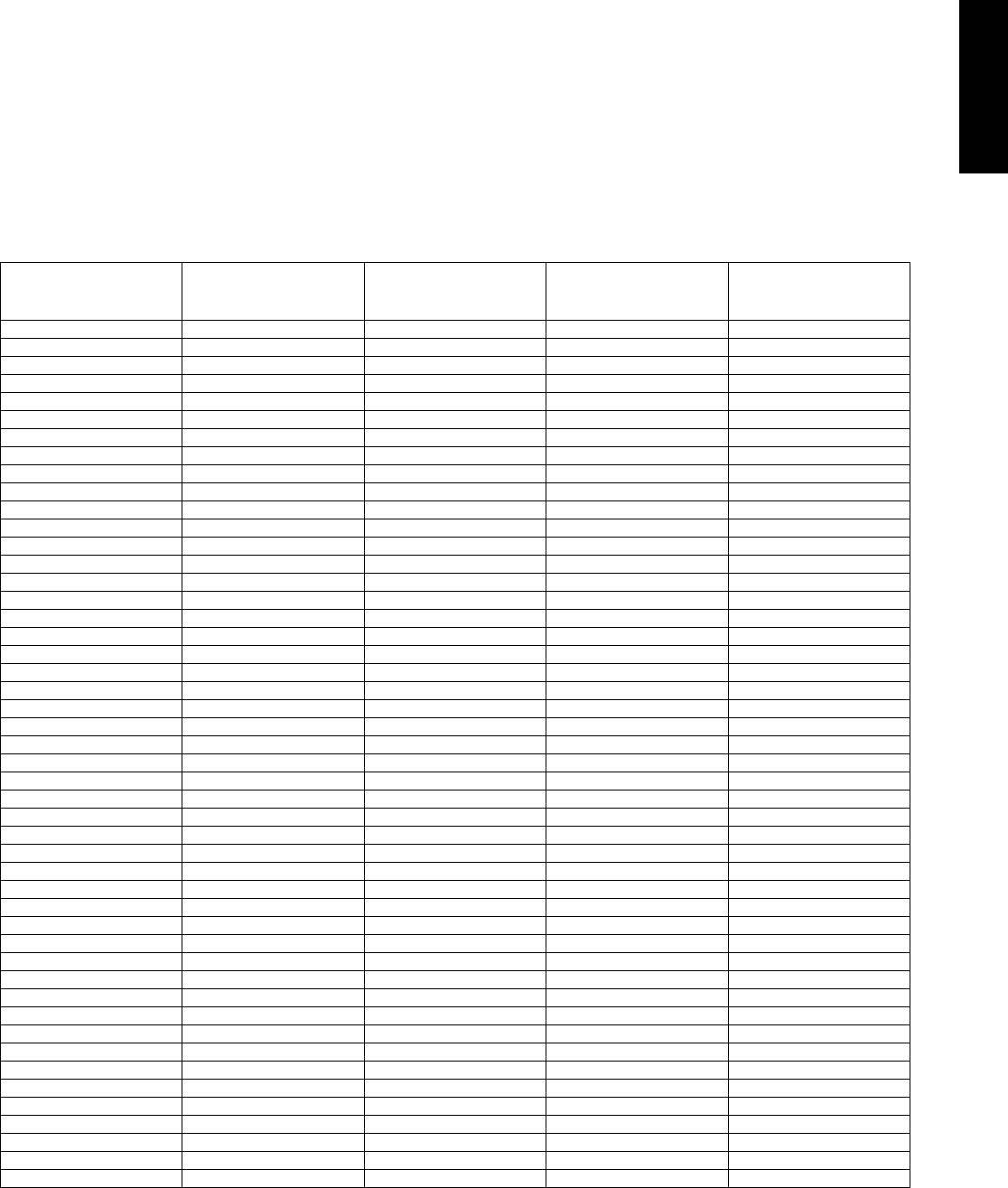

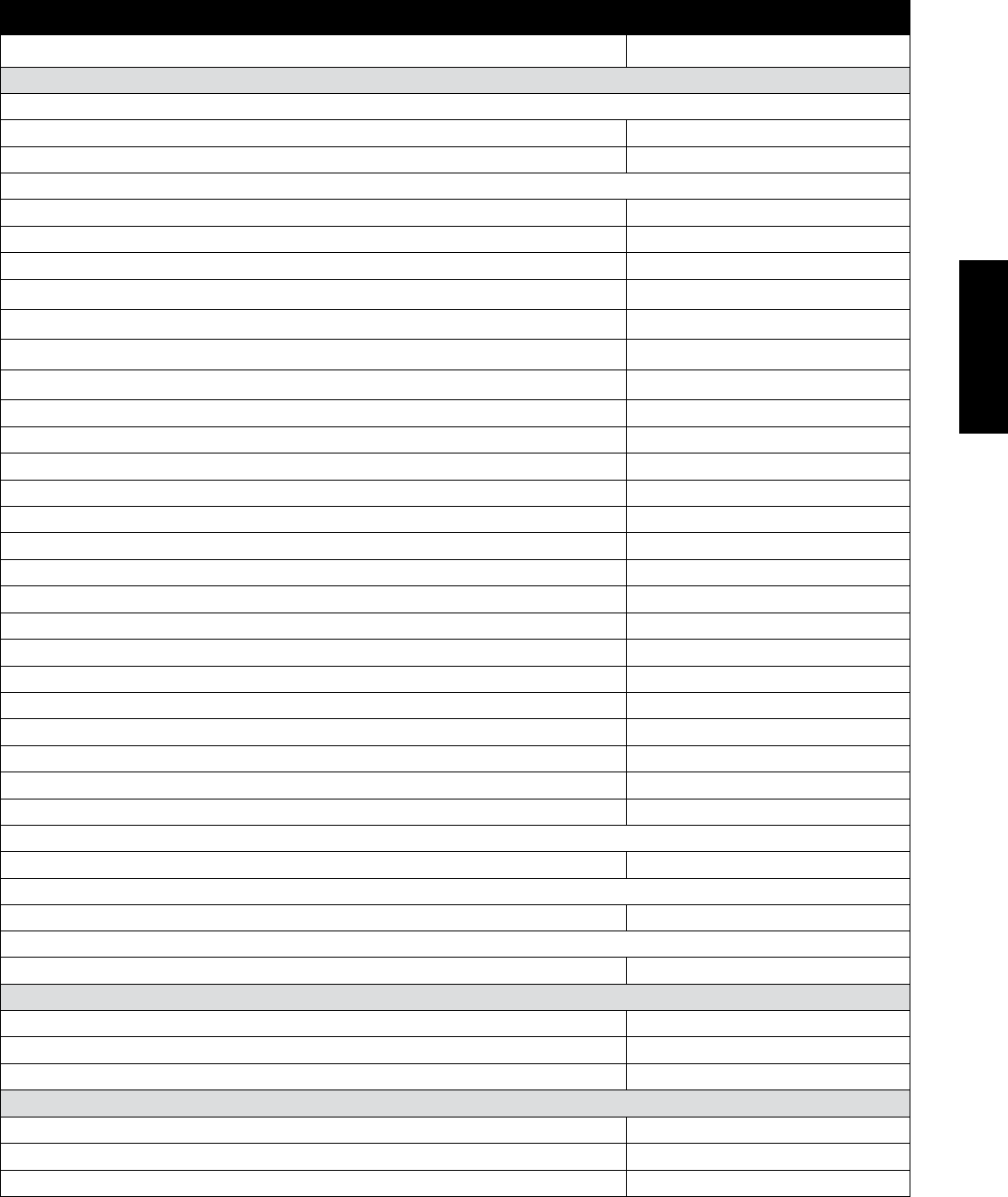

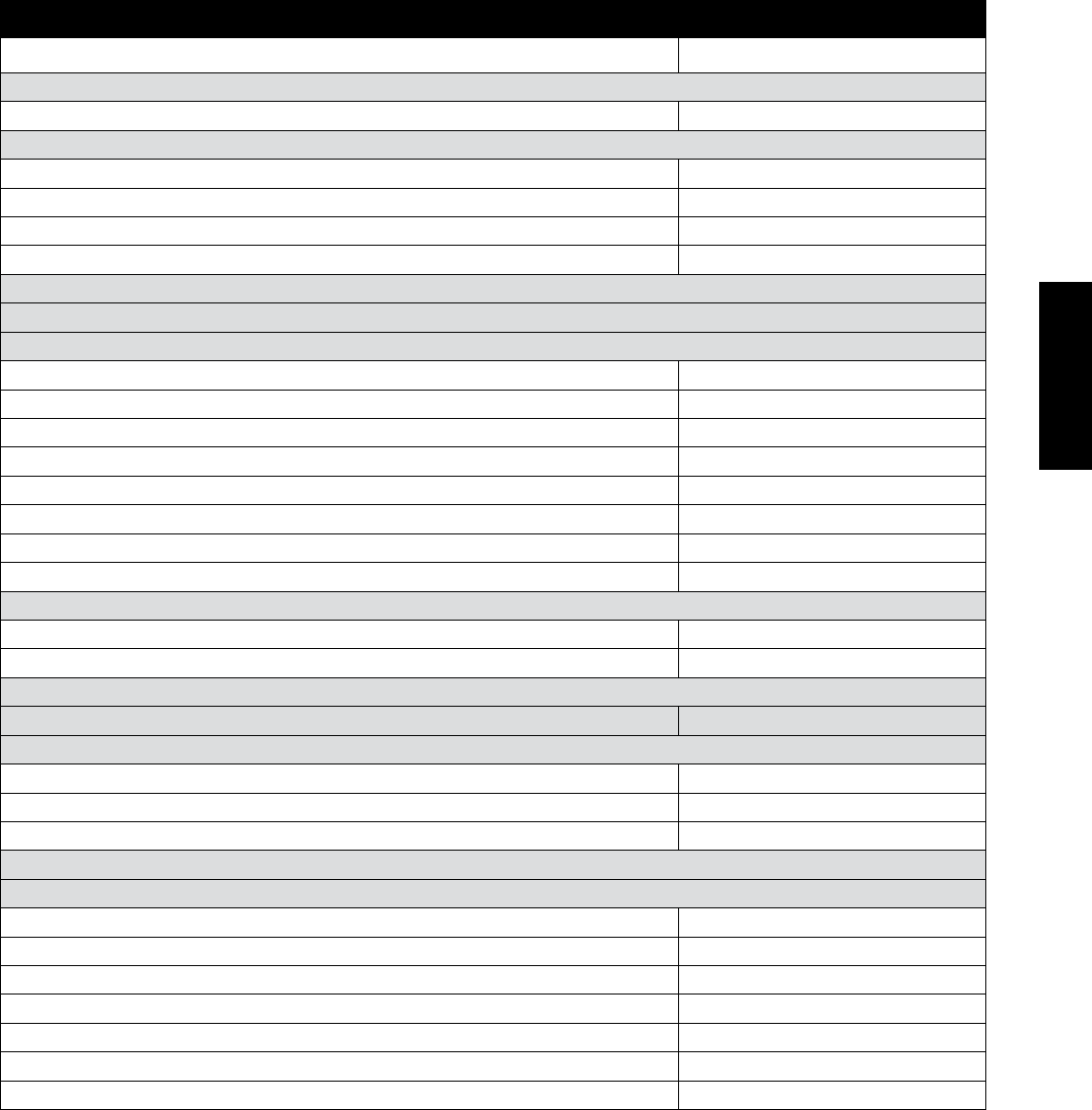

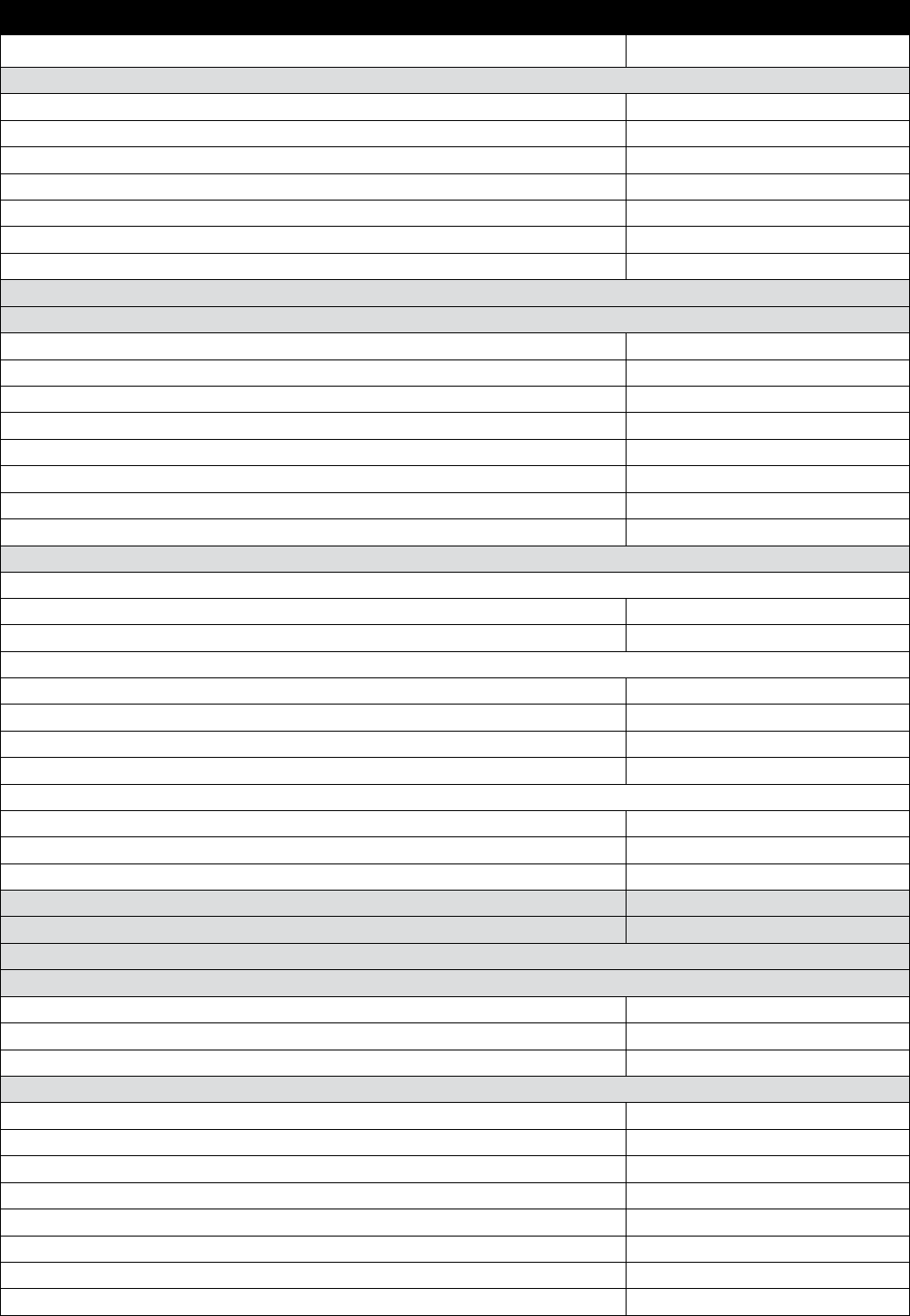

Underwriting Programs

Program Overview

Mutual of Omaha Disability Income Choice portfolio provides products that fit producers that sell in the individual market or

the employer sponsored market. Below is a brief overview of the various products and programs to use as a quick reference to

select the best program to meet your client’s needs.

Disability Income

Choice Program

Options

Who Pays the

Premium

Minimum

Group

Size and

Participation

Eligibility Underwriting

Discounts and

Maximum Benefits

Maximum Benefit Discount

Individual

(sex-distinct) Individual N/A

30 hours

plus per

week

Ages 18-61 3 months

of service

Full

Underwriting

Based on Product

and Income

Guidelines

AODI/

STD $5,000

LTD $12,300

BOE $15,000

Association

Group – 15%

Self-

Employed –

15%

DI Choice at Work

(unisex)

Fully

Underwritten

Employee Paid

(voluntary

participation)

3 or more

Ages 18-70

(18-61 for

AODI)

20%

Express

Standard Issue

Greater of 5

lives or 10%

participation

6 months

of service

1 GSI question

+ 6 knock out

questions Up to $5,000 10% – 20%

Guaranteed

Standard Issue

Minimum of

10 lives or 30%

participation 1 underwriting

question

Employer Paid

(mandatory

participation)

Minimum

of 10 lives

and 100%

participation

Up to $8,000 15% – 25%

DI Choice – Individual

Features four customizable disability products. All are offered with various premium allowance and program features that will

meet the needs of any of your individual clients.

Eligibility

n Working at least 30 hours per week in Occupation Classes 6A, 5A, 4A, 3A, 2A, or 1A (Class S, for Accident Only Disability

and Short-Term Disability products only)

n Age 18-61

n Annual income of at least $15,000

n Maximum Benefit

❍ Accident Only Disability – $5,000

❍ Short-Term Disability – $5,000

❍ Long-Term Disability – $12,300

❍ Business Overhead Expense – $15,000

n Maximum Benefit based on Occupation

n Premium Savings

❍ Association Groups – 15 percent

❍ Self-Employed – 15 percent

n Employees who have been with their current employer less than three months, the following will be required:

❍ Letter from current employer or human resources department verifying employee disability programs and current

payment stub

Section 3

For producer use only. Not for use with the general public. 14

n Citizenship/Residency Requirements

❍ United States citizens permanently residing within the United States or its territories, or

❍ Foreign Nationals who have a Permanent Resident Visa and have lived continuously in the United States or its

territories for at least three (3) years

n Proof of status will be required by submitting a copy of the permanent resident visa card and completing the

Foreign National/Travel Questionnaire

❍ Non-Resident Foreign Nationals or those persons anticipating residence in a foreign country, even temporarily, are

ineligible for disability income insurance

❍ Client traveling more than 90 days outside the U.S. or in areas with political unrest, poor economic conditions, lack

of modern living standards, or modern medical facilities are ineligible for coverage

n Self-employed requirements

❍ Engaged in the same occupation as they were prior to becoming self-employed for at least 6 months, or

❍ Newly working or engaged in a different occupation than they were prior to becoming self-employed at least

12 months

n Fully Underwritten Issue Requirements

❍ An individual’s medical history, financial information and occupation are all considered when being fully

underwritten. This may include a client interview, ordering Attending Physicians Statement (APS), Paramed or a

Blood & Urine profile. In addition, financial underwriting would include providing financial statements and records

depending on the type and level of coverage being applied for. Finally, your client’s occupation determines the

premium rate and amount of coverage available

❍ Streamlined Underwriting is available through Simplified Underwriting. Underwriting decision within 48 hours of

initial underwriting review provided the following conditions are met:

n Applicant is in occupation class 6A, 5A, 4A, 3A, or 2A

n For Accident Only Disability coverage: Applicant is age 55 or younger and medically standard

n For Short-Term and Long-Term Disability coverage: Applicant is nontobacco, age 45 or younger, and medically

standard

n No adverse information from the Medical Information Bureau

n All application questions have been clearly and completely answered and required forms and financial

documents have been submitted with the application

n Business Overhead Expense (BOE) Requirements

❍ May be issued to qualified professional and business persons working at least 30 hours per week in Occupation

Classes 6A, 5A, 4A, 3A, 2A, or 1A who incur operating expenses covered by this policy and have been in business for a

minimum of two years

❍ Age 20-59

❍ Persons operating businesses out of their own home are not eligible for this coverage

n Examples of qualified applicants are:

n Individuals, joint occupants, and members of a partnership

n In the case of joint occupants and partners, the monthly benefit may not exceed the applicant’s share of

monthly operating expenses

n Professional individuals who have incorporated solely for tax purposes and who, except for incorporation,

would also qualify as stated above

n Officers of C corporations with not more than five employees including corporation officers, subject to the

following:

n Each officer insured must be an active full-time, salaried employee of the corporation

n The maximum monthly benefit may not include salaries paid to officers or stockholders of the

corporation

n Coverage issued to any one officer may not exceed a share of expenses proportionate to that officer’s

share of outstanding stock

n Citizenship/Residency Requirements:

n United States citizens permanently residing within the United States or its territories, or

n Foreign Nationals who have a Permanent Resident Visa and have lived continuously in the United States

or its territories for at least three (3) years

n Proof of status will be required by submitting a copy of the permanent resident visa card, and

completing the Foreign National/Travel Questionnaire

n Non-Resident Foreign National or those persons anticipating residence in a foreign country, even

temporarily, are ineligible to disability income insurance

n Client traveling more than 90 days outside the U.S. or in areas with political unrest, poor economic

conditions, lack of modern living standards, or modern medical facilities are ineligible for coverage

For producer use only. Not for use with the general public. 15

Disability Choice at Work

Features the advantages of three underwriting programs on three customizable disability products. All are offered with

various allowances and program features that will meet the needs of any of your business clients. Targeting the small to mid-

sized business market, DI Choice at Work builds on the success of the individually sold DI Choice to offer a product that is

competitive and unique in the employer sponsored market.

How do the DI Choice at Work programs work?

Employers decide who participates in the program – all employees or a select group of employees (i.e., all managers). They

also determine how they would like to fund the program.

n Employer-paid (mandatory participation) – the employer pays the entire cost of the program – either for all employees or

a select group of employees

n Employee-paid (voluntary participation) – the employer makes the coverage available to employees on a voluntary basis,

with each employee paying his or her own premiums, or the employer can contribute for a portion of the premium with

the remaining being paid by the employee

What are preferred target market characteristics?

Look for small to mid-sized businesses with the following characteristics:

n Sole proprietorship, Partnership, LLC, S Corporation, C Corporation

n Limited geographic locations

n Past success with voluntary insurance programs

n Diverse distribution of age, gender, and occupation

Also, look for businesses with a desire to create employee loyalty and retain valued employees. They also should be:

n committed to supporting the program

n agreeable to on-site employee meetings and enrollment during company time

n businesses that are looking to set themselves apart from their competitors by offering a more robust benefits package

What circumstances could affect the group offer?

A variety of factors may affect the Guaranteed Standard Issue and Express Standard Issue offer including:

n existing coverage

n participation

n age distribution

n gender diversity

n occupation classes

n business stability

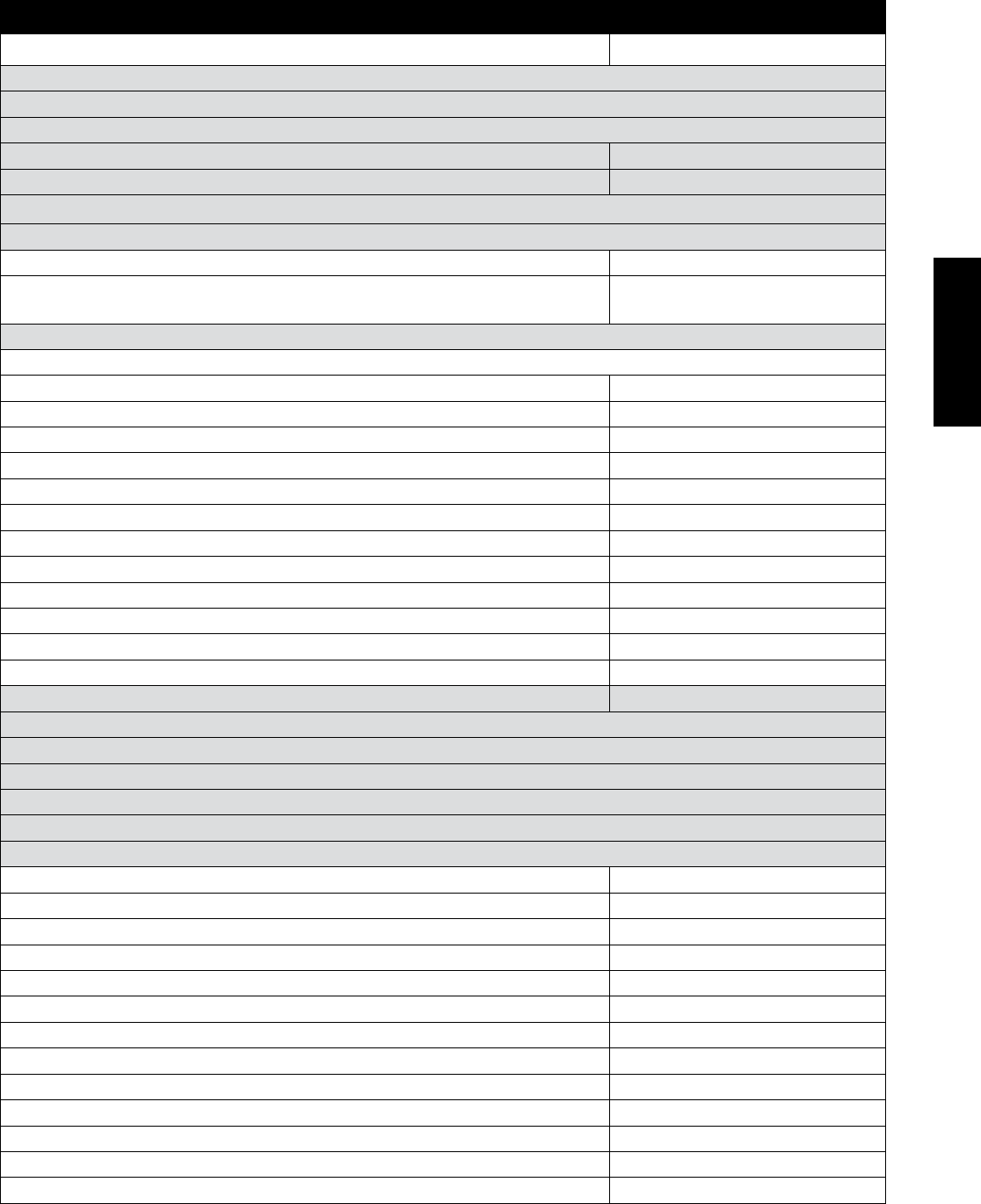

What are the benefits of offering income protection at work?

Benefits to Employer Benefits to Employees

Helps attract and retain quality employees by setting the

company apart from competitors by offering a more robust

benefits package

Helps protect the loss of income after an accident or sickness

Enhances a company’s reputation as a place people want

to work

Provides the ease of purchasing insurance at work and

paying through payroll deduction

Builds morale and develops a workforce of loyal employees Allows them to take their policy with them, even if they leave

the company

Section 3

For producer use only. Not for use with the general public. 16

Eligibility

n Full-time employee working at least 30 hours per week in Occupation Classes 6A, 5A, 4A, 3A, 2A, or 1A (Class S, for

Accident Only Disability and Short-Term Disability products only)

n Age 18-70

n Age 18-61; Accident Only Disability

n Annual income of at least $15,000

n Maximum Benefit

❍ Accident Only Disability – $5,000

❍ Short-Term Disability – $5,000

❍ Long-Term Disability – $12,300

n W-2 employee with continuous employment for the previous three months

n United States citizen permanently residing within the United States or its territories for at least 3 years

n Foreign Nationals who have a Permanent Resident Visa and have lived continuously in the United States or its territories

for at least three (3) years

❍ Proof of status will be required by submitting a copy of the permanent resident visa card and completing the Foreign

National/Travel Questionnaire

n Non-Resident Foreign Nationals or those persons anticipating residence in a foreign country, even temporarily, are

ineligible for disability income insurance

Fully Underwritten Issue

n This program is voluntary and available to all eligible full-time employees working 30+ hours per week. The underwriting

program allows the employee to customize coverage using the three associated disability products and optional riders.

The maximum benefit available is based on the employee’s occupation class and the Income Qualification Table

n Three Eligible Employees – 20 percent premium savings

n Ages 18-70 (age 61 for Accident Only Disability)

n Group size for preapproval is limited to 3-250 eligible employees

n W-2 employees who have been employed with the company for the previous three months

n Individual Underwriting Guidelines Apply

Express Standard Issue

This program is voluntary participation for full-time eligible employees working 30+ hours per week that the employer deems

eligible. The program is available for those employers who still want to promote and support an income protection program

featuring Express Standard Issue underwriting and allowances for their employees, but not bear the expense of the associated

premiums

n The minimum group size for this program is the greater of 5 lives or 10 percent participation

n Employed with company for the previous six months

n Available for annual open enrollment

n The available premium allowances1 based on the group size are:

n 5-24 Eligible Employees – 10 percent

n 25-49 Eligible Employees – 15 percent

n 50+ Eligible Employees – 20 percent

n The available maximum benefit based on the group characteristics are as follows:

n 5-24 Eligible Employees – up to $3,000

n 25-49 Eligible Employees – up to $4,000

n 50+ Eligible Employees – up to $5,000

Guaranteed Standard Issue

The Guaranteed Standard Issue (GSI) underwriting program is available to employers on both an employer-paid (mandatory)

and employee-paid (voluntary) basis. This underwriting program is designed to allow employers to select the employees who

are eligible to receive the coverage and the benefit configurations and riders available to them. The GSI program features only

one underwriting questions on a simple-to-complete application.

n Employer-paid (mandatory participation): This program is provided by the employer to full-time employees working

30+ hours per week that the employer determines as eligible. The employer must pay 100 percent of the eligible

employees’ premiums

n The minimum group size for this program is 10 eligible employees and 100 percent of these eligible employees must

receive the coverage

1

Allowances assume a 12/12 pre-existing condition provision. A pre-existing condition is a condition for which medical advice, diagnosis,

care or treatment was recommended by or received from a Physician within the 12 months prior to effective date. We will not pay benefits

for loss resulting from a pre-existing condition, unless such loss occurs after 12 months has expired.

For producer use only. Not for use with the general public. 17

n Employed with company for the previous six months

n The available premium allowances1 based on the group size are:

n 10-24 Eligible Employees – 15 percent

n 25-49 Eligible Employees – 20 percent

n 50+ Eligible Employees – 25 percent

n The available maximum benefit based on the group characteristics are:

n 10-24 Eligible Employees – up to $3,000

n 25-49 Eligible Employees – up to $5,000

n 50+ Eligible Employees – up to $8,000

n At the discretion of the underwriter, an Annual Benefit Increase (ABI) may be offered to the group:

n Provisions of the option include:

❍ Annual Benefit Increase allows for existing participants and new eligible employees to increase their monthly

benefit on the anniversary date of the program provided their income has increased

❍ This option is available for mandatory employer paid cases only

❍ Premiums will be based on the applicant’s current attained age

❍ Updated census must be provided to support increase

Requirements and information regarding a group’s ABI program will be outlined in the Offer Letter.

n Employee-paid (voluntary participation): This program is voluntary participation for full-time eligible employees

working 30+ hours per week that the employer deems eligible. The program is available for those employers who still

want to promote and support an income protection program featuring Guaranteed Standard Issue underwriting and

allowances for their employees, but not bear the expense of the associated premiums

n The minimum group size for this program is 10 eligible employees with the greater of 10 employees or 30 percent of

the eligible employees accepting coverage

n Employed with company for the previous six months

n The available premium allowances2 based on the group size are:

n 10-24 Eligible Employees – 10 percent

n 25-49 Eligible Employees – 15 percent

n 50+ Eligible Employees – 20 percent

n The available maximum benefit based on the group characteristics are as follows:

n 10-24 Eligible Employees – up to $3,000

n 25-49 Eligible Employees – up to $4,000

n 50+ Eligible Employees – up to $5,000

Additional Details

n If an employee wants to buy coverage outside of the limits of the Guaranteed Standard Issue or Express Standard Issue

coverage the employee will complete an additional Fully Underwritten Issue application for any of the additional benefits

n Eligible new hires are allowed to purchase after completing six months of continuous, full-time employment. Dependent

upon the selection of the employer, enrollment may be available during the 60 days following the six months of employment

or during the annual enrollment period

n If an employee is terminated or leaves the business, the coverage is completely portable and may be taken with them as

they leave. When porting employer-paid cases, the employee can elect to be billed directly without any coverage change

1

Allowances assume a 3/12 pre-existing condition provision. A pre-existing condition is a condition for which medical advice, diagnosis, care

or treatment was recommended by or received from a Physician within the 3 months prior to effective date. We will not pay benefits for loss

resulting from a pre-existing condition, unless such loss occurs after 12 months has expired.

2

Allowances assume a 12/12 pre-existing condition provision. A pre-existing condition is a condition for which medical advice, diagnosis,

care or treatment was recommended by or received from a Physician within the 12 months prior to effective date. We will not pay benefits

for loss resulting from a pre-existing condition, unless such loss occurs after 12 months has expired.

Section 3

Business Submission Process

Individual

Mutual of Omaha provides a disability income insurance application

that agents will find easy to use. All applications and required

forms can be found on our Sales Professional Access (SPA) website.

Trial Inquiries

n Although we do not accept trial applications, fax or mail all available information to the Underwriting Department with

appropriate authorization where necessary, for a preliminary opinion based on the information provided

n Underwriting has the final approval authority and any offer is subject to full underwriting, including confirmation and clarification

of the information provided

n Inquiries can also be made using the underwriting template in Sales Professional Access (SPA)

n Trial Inquiries can be emailed to the following: underwriter.health@mutualofomaha.com

Complete and accurate information is critical in providing timely service and underwriting decisions. When completing the

medical portion of the application, provide details of medical history.

Application Submission

Brokerage applications should be submitted to the following address or fax number:

Application Submission

Mutual of Omaha

Records/Mailing Processing Center

9330 State Hwy 133

Blair, NE 68008-6179

Fax (402) 997-1804

Agency Applications should be submitted through the Division Office

Application Processing

Incomplete Applications

If we are unable to complete our underwriting requirements with 45 days of the application date, we must close the file as

incomplete and return premiums paid. A letter of explanation is sent to the agent and the applicant to inform them that

insurance is not in force as a result of an incomplete application.

When outstanding underwriting requirements are received, we outline our preliminary offer in writing to the agent, subject to

a new application.

Time Service

Our goal is to make underwriting decisions on the majority of applications within 15 days of receipt of the application.

Simplified Underwriting should be complete in 48 hours.

Applications issued other than applied for

If we need to adjust the benefits, add a premium increase or an exclusion rider or make other adjustments to the policy, we

will notify you of our handling prior to issue to confirm that the policy can be placed as offered.

Declined Applications

When an application is denied, a letter with a refund check in the amount of any premiums paid is sent to the applicant.

Application Completion Requirements

n Applications must be completed in ink. Typewritten applications bearing the applicant’s handwritten signature will be accepted

n While in the presence of the applicant, agents must ask all of the application questions of the applicant and complete

the application with full, explicit and accurate answers. “N/A” is not an acceptable application answer; where applicable,

please use “no” or “none” instead

n Any corrections or alterations to the application must be made in the presence of, or initiated by the applicant, not the

agent. Changes made with corrective tape or fluids will not be accepted

n No application will be accepted that has been altered or corrected with regard to the signature of the proposed insured,

the date signed, or the licensed agent’s signature

For producer use only. Not for use with the general public. 18

n Backdating on the application will not be accepted

n The applicant’s home and business phone numbers must be completed on the application to expedite the personal history

interview that may be necessary

n The PHI can be initiated before the application is submitted

n Applications must be completed based upon the applicants resident state unless otherwise stipulated

n The Agent must be licensed in the signing state

HIPAA Compliance

The health information authorization form must be completed at the time of application as required by the Health Insurance

Portability and Accountability Act of 1996. The authorization form is included in the application packet.

Replacements

n Replacement of present insurance must conform to the replacement regulations for the applicant’s state of residence

n You should advise the proposed insured to continue premium payments on any present insurance until underwriting is

completed and a policy is issued

n Make sure the proper forms are fully completed, paying special attention to the replacement questions, agent certification,

the existing policy number and issuing company

n Replacement forms can be obtained from Sales Professional Access (SPA)

Premium Processing

Initial Premiums

Initial premiums should be collected at the time the application is taken and should accompany the application to the home

office. If money is collected, give the Conditional Receipt to the applicant and advise them that coverage is effective subject to

the terms of the receipt.

Mutual of Omaha does not accept individually billed monthly business. If an application is submitted on a quarterly, semi-

annual or annual basis without money or without the full first premium, the application is underwritten and, when the policy

is issued, premium is to be paid within 30 days.

When the full premium on C.O.D. cases, or the balance of the premium on a partial pay case, is not received in the home office

within 30 days from the date of issue, the policy is void and the applicant is notified by letter.

Bank Service Plan (BSP)

It’s easy and convenient to use the Bank Service Plan to pay premiums on new and existing policies. Have your client complete

the authorization in the application. Send a voided check with the application. For in-force policies, send the form listing the

policies already in force and a voided check. If your client has more than one policy, we will establish a convenient combined

payment plan for all the policies to keep them in force with one monthly authorized payment.

We will establish contact with the bank. The withdrawal will then appear on the client’s bank statement.

Direct Bill BSP Modal Factors

Annual 1.0000

Semiannual 0.5150

Quarterly 0.2600

Monthly (BSP) 0.0875

For producer use only. Not for use with the general public. 19

Section 3

For producer use only. Not for use with the general public. 20

Policy Issue and Delivery

Delivering the policy

Delivering the policy in person is important to building relationships with your clients. It also ensures that they receive their

policies in a prompt and reliable manner. We ask all of our agents to deliver policies in person.

If any change in health occurs after the application date, communicate this information to the Underwriting department

immediately. You must not deliver a policy when a change in health has occurred. Please contact Underwriting for further

instructions.

Policies Issued as Other Than Applied For

A policy is conditionally issued as a counteroffer of insurance when the policy cannot be issued as applied for and coverage

is rated modified and/or conditions are excluded. Polices issued other than as applied for may require an amendment rider

which will be sent with the policy package.

Delivering a Policy Issued Other Than Applied For

n The requested form must be signed and the first full premium paid for the policy to become effective

n Any exclusion riders or benefit-limitation riders will be shown on the policy schedule

n Witness and secure the signature of the applicant

n Delivery and acceptance of the conditionally issued policies should be completed promptly. Contact Underwriting if

special circumstances require an extension of delivery time

n The policy will be rescinded if the signed amendment rider is not received in the home office within 30 days

n Any rescissions will be explained by letter to the applicant and any premiums paid refunded. A copy of this letter will be

sent to you. The policy and unsigned forms should be returned to the home office

Fully Underwritten Issue

n No group approval required for eligible groups

n No census required

n Three eligible employees required

n Group size for preapproval is limited to 3-250 eligible employees

n W-2 employees who have been employed with the company for the previous three months

n Requires employers endorsement of program (Acknowledgement Form)

Step 1: Create a Proposal

Complete a case quote using Mutual of Omaha’s WinFlex Multi-Life Proposal Software.

Step 2: Submit applications and appropriate forms

n Submit one signed copy of Employer Acknowledgement form with initial DI Choice at Work applications

n Complete Payroll Deduction and List Bill Group section if applicable

n Submit your multi-life applications using your normal channel

Mail to: Records/Mailing Processing Center

9330 State Hwy. 133

Blair, NE 68008-6179

Fax: 402-997-1804

21

For producer use only. Not for use with general public.

Disability Choice at Work

Guaranteed Standard Issue and Express Standard Issue

Mutual of Omaha provides a disability income insurance application that agents will find easy to use. All applications and required

forms can be found on our Sales Professional Access (SPA) website.

Getting Started

Step 1: Request a Preliminary Proposal

n Submit your request for a proposal by completing required sections on the Group Request Form. A complete census

must accompany the request

n Send an email to multilife@mutualofomaha.com

n Fax 402-997-1893

n Call 877-778-0838

Census Requirements

An employee census in an excel format must be submitted along with the Group Request Form. A complete census

(M27573) requires the following information for all Eligible Employees:

n Employee name or ID

n Date of birth/Age

n Annual salary

n Annual bonuses (Previous 2 years, if available)

n Commissions (Previous 2 years, if available)

n Job title/Duties

n Gender

n Employment start date

Step 2: Submit the Group for Approval

If not already complete, submit the Multi-Life Group Approval Request Form (M27546) along with an updated complete

census (M27573) to Mutual of Omaha’s Multi-Life Department for review:

Mail to: Mutual of Omaha Insurance Company

Multi-Life Underwriting – 6th Floor

Mutual of Omaha Plaza

Omaha, NE 68175

Fax: 402-997-1893

Email: multilife@mutualofomaha.com

Step 3: Group Approval

Within one to two business days, the Multi-Life Underwriting Coordinator will review the Group Approval Request Form and

respond with an approval, decline, or request additional information. If the group is approved, an Offer Letter containing the

details of the program will be sent to you and your marketer or division office.

Step 4: Deliver the Offer Letter

The offer letter should be delivered immediately to the employer. If necessary an updated proposal should accompany the

offer letter. Review the letter and proposal with the business and return the signed Offer Letter along with any other required

documents to the Multi-Life Underwriting Coordinator within 30 days.

If the group is utilizing List Bill/Payroll Deduction, please complete the New Employer Questionnaire (M27566) and return

the completed form to the Multi-Life Underwriting Coordinator.

The group cannot be activated until the signed Offer Letter is returned to the Multi-Life Underwriting Coordinator.

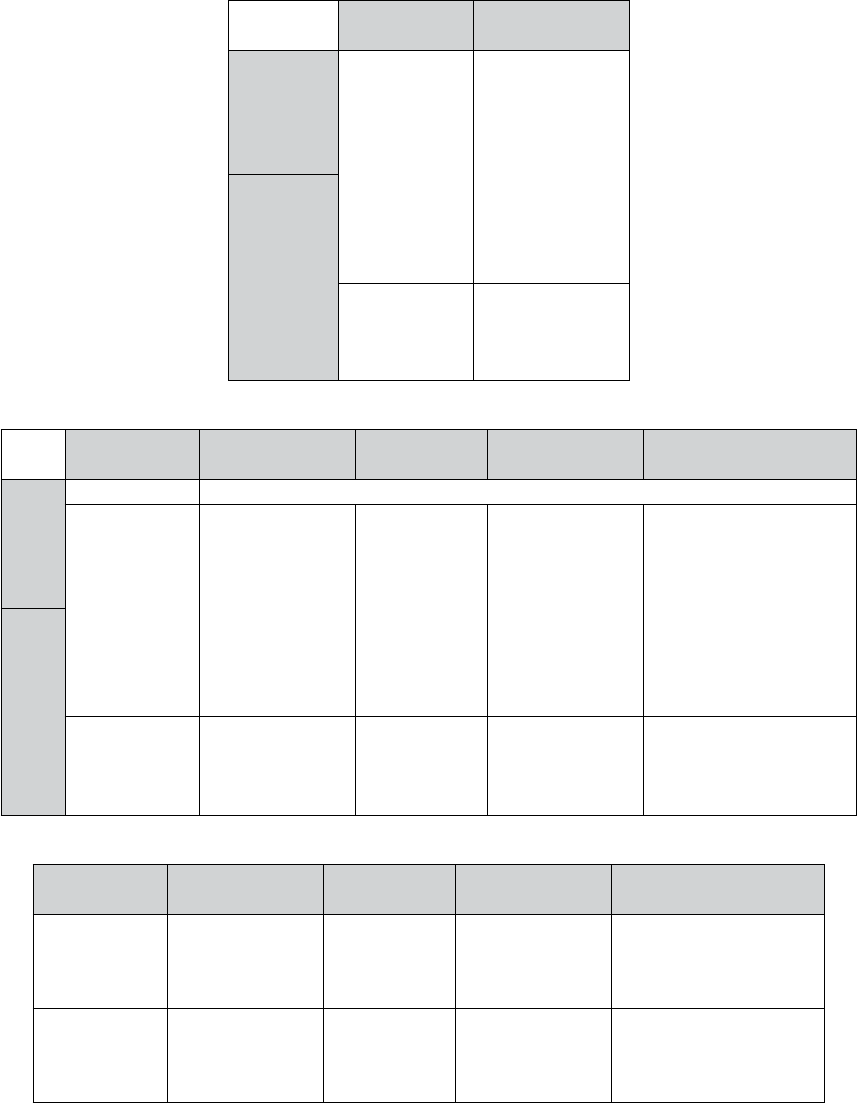

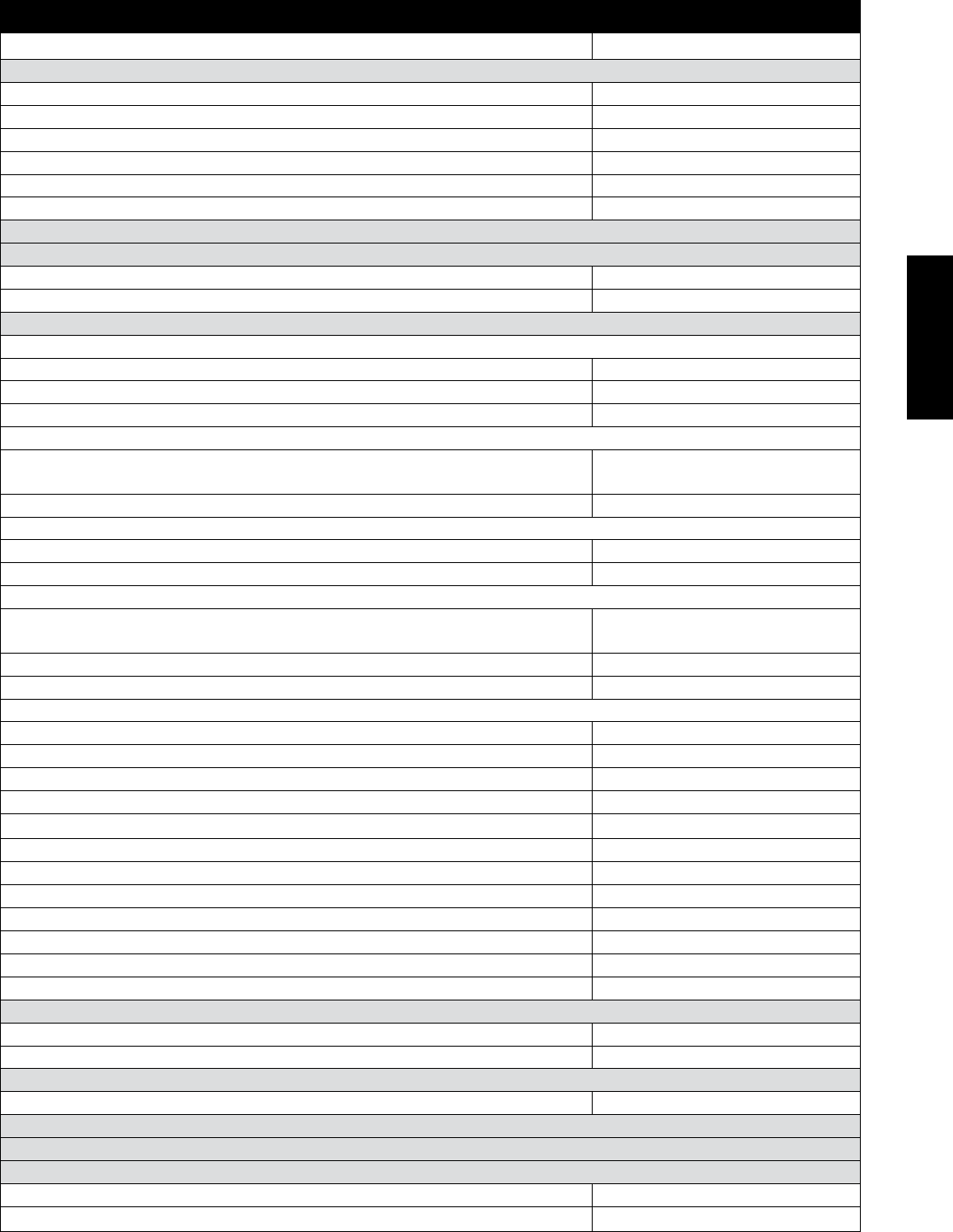

Step 1 Step 2 Step 3 Step 4 Step 5 Step 6 Submit

Applications

to Mutual of

Omaha

Request a

Preliminary

Proposal

Complete

the Group

Approval

Process

Group

Approval

Deliver

Offer

Letter

Implemen-

tation

Call

Enrollment

➤➤➤➤➤➤

Section 3

22

For producer use only. Not for use with general public.

Step 5: The Implementation Call

Upon receipt of the signed Offer Letter, the Multi-Life Underwriting Coordinator will issue an invitation for an

Implementation Call. The call may include:

n The Multi-Life Underwriting Coordinator

n The agent and/or marketer/division office

n The organization’s benefits administrator

During the call, the implementation process will be discussed, including billing set-up, enrollment period, common effective

date, and application requirements. Following the call, the Multi-Life Underwriting Coordinator will assign a group number

and send an Implementation Memo to you or your marketer/division office via email. The Implementation Memo will

contain the details of the program.

Step 6: Enrollment

Once you complete the Implementation Call, you can begin taking applications on the date selected for enrollment to begin.

n Applications can be solicited during the 60-day enrollment period specified during the Implementation Call

n All policies issued prior to the pre-determined common effective date will receive the same effective date. Any application

approved after the common effective date will receive an effective date coinciding with the next billing cycle

n Hold applications until you reach participation percentage required

n Submit your multi-life applications using your normal channel

Mail to: Records/Mailing Processing Center

9330 State Hwy. 133

Blair, NE 68008-6179

Fax: 402-997-1804

Administrative Information

Application Completion Requirements

n Applications must be completed based upon the applicant’s resident state unless otherwise stipulated in the Offer Letter

n The agent must be licensed in the signing state

n Applications must be received in our home office within the 30 days following the end of the open enrollment period. All

applications must be signed within the open enrollment period. No applications will be taken after the enrollment period

has expired except in the previously explained circumstances involving eligible new hires and new entrants into eligible

employee groups

Billing Information

Billing Options

The agent/marketer/division office and the Multi-Life Underwriting Coordinator will work together to set up a billing plan to

meet the needs of the multi-life group.

n List Bill/Payroll Deduction – Available for all eligible employees. A minimum of three participants and a completed

Employer Questionnaire (M27566) including an updated census (M27573) are required to set up a list bill/payroll

deduction case. All employees using list bill/payroll deduction must elect the same premium mode. The following

premium modes are available for list bill/payroll deduction:

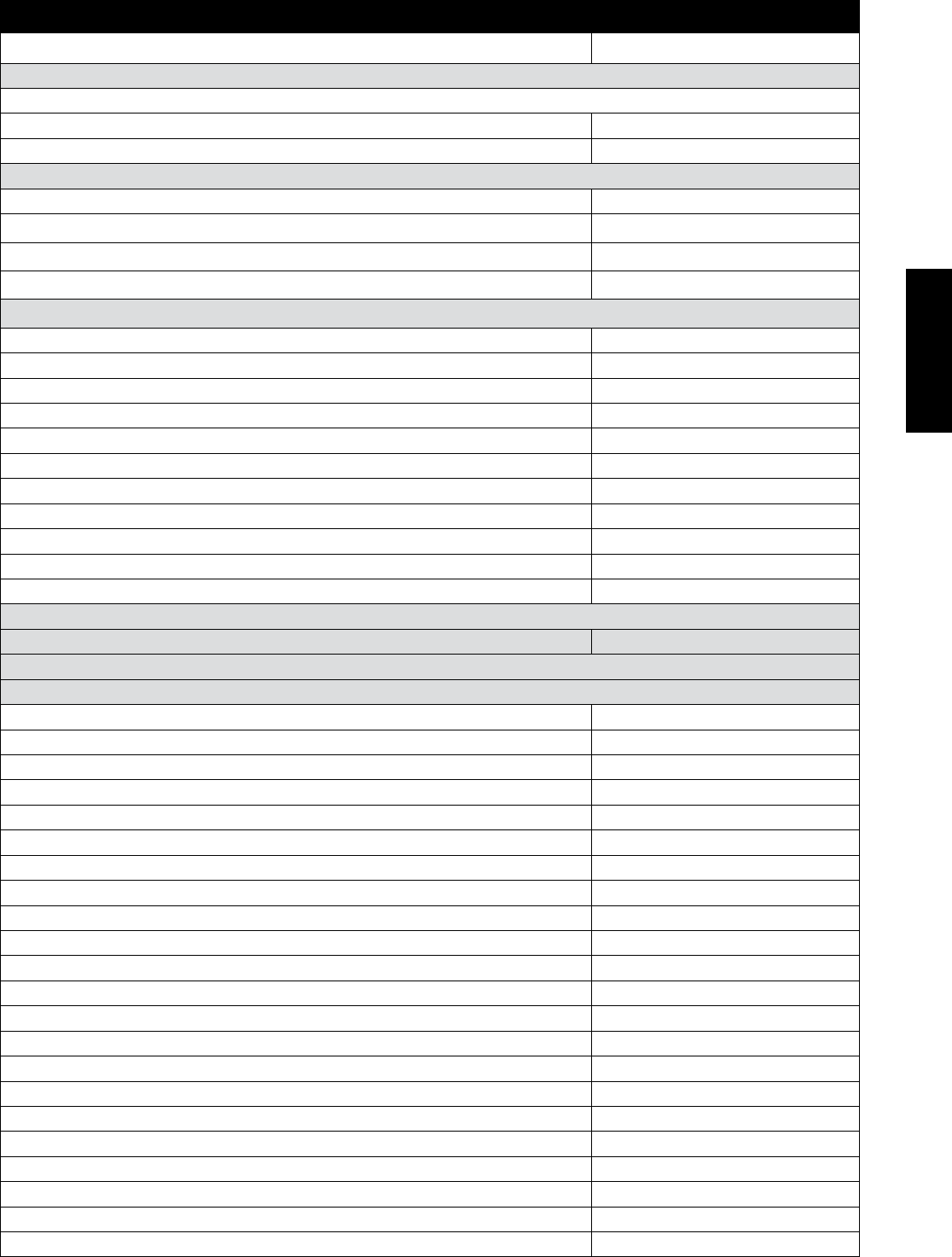

PRD Modes Modal Factors

9-Pay 0.1167

10-Pay 0.1.050

11-Pay 0.0955

18-Pay 0.0583

19-Pay 0.0553

20-Pay 0.0525

21-Pay 0.0500

22-Pay 0.0477

23-Pay 0.0457

24-Pay 0.0438

25-Pay 0.0420

26-Pay 0.0404

n Direct Bill – Available to all participants on a monthly, quarterly, semiannual or annual basis. Monthly billing must be set

up through automatic checking account deduction

Premium Modes Modal Factors

Annual 1.0000

Semiannual 0.5150

Quarterly 0.2600

Monthly (BSP) 0.0875

Premium Collection

Premium should not be collected with the multi-life application. This applies to all direct bill and list bill/payroll deduction

cases. As no premium is collected with the application, conditional coverage is not available for DI Choice at Work cases.

Split Billing

Cases may exist where the employer will only be paying a portion of the employee’s premium. For example, the employer may

choose to pay for the basic benefit level and the employee may choose to voluntarily buy-up additional coverage. To determine

the additional premium, two separate illustrations will need to be run and the difference can be calculated. A bill will be sent

to the employer for the entire premium.

23

For producer use only. Not for use with general public.

Section 3

25

For producer use only. Not for use with general public.

Association Marketing

Program Overview

Association Marketing is a cost-effective and efficient way to target groups of individuals with a common occupation or

interest – allowing you to build your business through the power of third-party endorsements. More than 600 associations

nationwide endorse Mutual of Omaha.

An Association must have bylaws and dues-paying members to qualify. A 15 percent premium allowance is available if the

insured or eligible spouse is a member of a qualifying association.

Association Marketing Guidelines

Membership Requirements

n Local associations must have at least 150 members

n State associations must have at least 250 members

n Multi-state or national associations must have at least 1,000 members

Membership Qualifications

To qualify as an association, an organization must:

n Have been in existence for at least two years

n Have bylaws and officers

n Have annual dues-paying members who vote on officers and matters of policy

Desirable Characteristics

Associations with the following concerns or attributes will not be eligible for preferential rates and/or no-cost benefit

enhancements:

n Has no affinity

n Lack reliable membership records

n Formed for the purpose of obtaining insurance

n Formed to promote political views

n Formed for purely social purposes

n Formed for commercial venture

n Primarily consists of members with hazardous occupations

n Credit unions/banks

Section 4

For producer use only. Not for use with general public. 26

Getting Started

Association Approval Process

Step 1 Step 2 Step 3

Submit electronic

(or paper) proposal

request and

association bylaws to

home office for review

➞

Agent approaches

association and

makes presentation

to association

representatives

➞

Agent develops

marketing plan and

association director signs

Affiliation Agreement

(M18100_0911) and

marketing plan

Allow five to seven

business days for review

and notification of initial

approval or rejection

Association agrees to

proceed

Step 4 Step 5

Signed Affiliation

Agreement and

Marketing Plan

submitted to home

office for review

➞

Final approval

and Association

Marketing number

provided in five

business days

The home office reserves the right to final approval or disapproval of all association group requests

based on product, underwriting and marketing assessment of each group’s fit for our program.

Additional Details on Approved Associations

1. All applications are individually underwritten according to the specific product’s underwriting guidelines.

2. An individual applicant must be a member of the association for at least three months before applying for coverage to be

eligible for any discount or benefit enhancement.

n The Association Marketing verification form (M27646) must be submitted with the application to qualify for the

preferential rate or no-cost benefit enhancement

n Agents should not encourage individuals to enroll in an association for the purpose of receiving a discount or

enhancement

3. Due to employer-benefit laws, employees of members are not eligible for coverage using Association Marketing discounts

or benefit enhancements (although they may be eligible for coverage through individual or DI Choice at Work).

4. To keep the group open and eligible for preferential rates and/or no-cost benefit enhancements, the agent must issue

the number of applications agreed to in the marketing plan within the agreed timeframe. If the required number of

applications is not issued within that period, the group will be evaluated for closure to new business. After the initial

evaluation period, there must be five issued applications every six months to keep the group open.

5. All approved marketing materials that may be used to communicate with the association and its members can be found

on SPA.

6. The agent is responsible for any promotional expenses incurred in working with the association.

If you have additional questions on this program or need further assistance, please email Association Marketing at

association.marketing@mutualofomaha.com or call (800) 624-5554.

General Underwriting Guidelines

This section is designed to provide you with comprehensive information regarding our eligibility and employment

requirements and medical guidelines.

For specific product information, please see the associated product section. In addition, you can talk directly to the

underwriting staff. Contact your DI underwriting team for underwriting questions or pending case status at 1-800-715-4376.

Minimum Benefit Amounts

The minimum monthly benefit amounts required are shown in the table below. These minimums may be satisfied with a

combination of base and SIS coverage.

Minimum Monthly Benefit

Amounts/Increments

Accident Only

Disability

Short-Term

Disability

Long-Term

Disability

Business Operating

Expense

Minimum Benefit $300 $300 $300 $500

Minimum Increment $100 $100 $100 $50

Social Security Number

Applicants are considered for insurance by providing a valid Social Security number issued by the United States Social

Security Administration.

Foreign Travel

Applicants who travel to foreign countries frequently, for more than 90 days annually, and/or those who travel to areas with

political unrest, poor economic conditions, lack of modern living standards or modern medical facilities, are ineligible for

disability income insurance coverage.

Applicants who are working outside of the United States are also ineligible for disability income insurance coverage.

Non-English Speaking Applicants

Applicants who do not speak the English language are considered for insurance provided the Agent serves as a 3rd-Party

translator and completes Form MLU25947, Agent’s Certification for Non-English Speaking Applicants. Reasonable efforts

will be made to assist non-English speaking applicants in completing the telephone interview and other underwriting

requirements.

Product Combinations

Applicants may not apply for combinations of Elimination Periods and Benefit Periods using multiple accident and sickness

policies with the intent to create total benefits where the Elimination Period is less than the minimum allowed for a particular

Benefit Period. Example:

n Applying for a 30-day Elimination Period with a 1-year Benefit Period on one application and applying for a 365-day

Elimination Period with a To Age 67 Benefit Period on another application

n If applying for Accident Only plan and a Sickness/Accident plan, the elimination period for the Accident only plan

must be 14 days or less

State Sponsored Compulsory Disability Insurance

In some states residents are eligible for compulsory disability insurance programs with benefit periods ranging from 26 to

52 weeks. The benefits vary by state and will be considered when determining benefit amount eligibility.

27

Section 5

For producer use only. Not for use with general public.

Tobacco Use (Short-Term Disability and Long-Term Disability only)

Individuals who have used tobacco products within 12 months of application completion or those with positive nicotine

(cotinine) urinalysis test results require tobacco user rates. Tobacco products include cigarettes, cigars, pipes, chewing tobacco,

and nicotine gum and patches. Tobacco user rates are 25 percent higher than nontobacco rates. Tobacco users who stop using

tobacco products for 12 consecutive months will qualify for a rate reduction. A nontobacco questionnaire and urinalysis will

need to be completed.

Hazardous Avocations

Persons who engage in hazardous avocations on an amateur basis may still be eligible for disability income coverage.

Avocations such as

n automobile/motorcycle/boat racing,

n hang gliding,

n skydiving/parachuting,

n scuba diving,

n rock climbing,

Similar activities should be identified during the application process and an Avocation Questionnaire (included in the

application kit) must be completed. Typically, an amendment rider excluding the avocation will be attached to the policy if the

application is approved.

28

For producer use only. Not for use with general public.

29

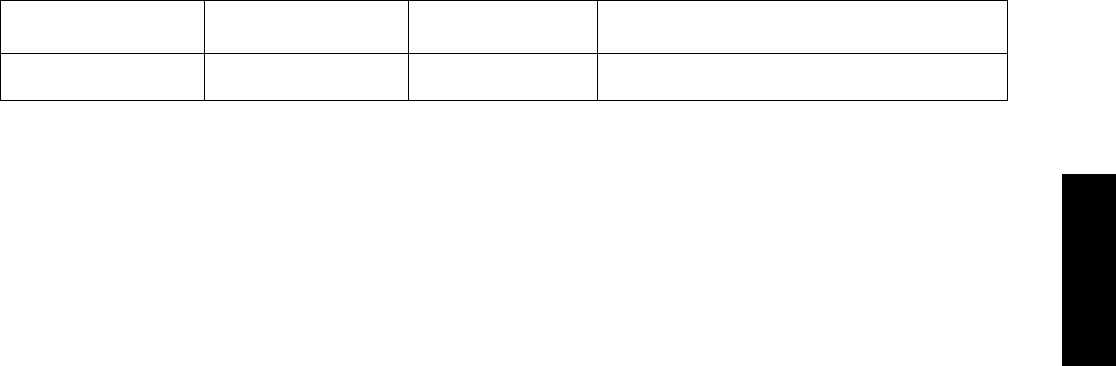

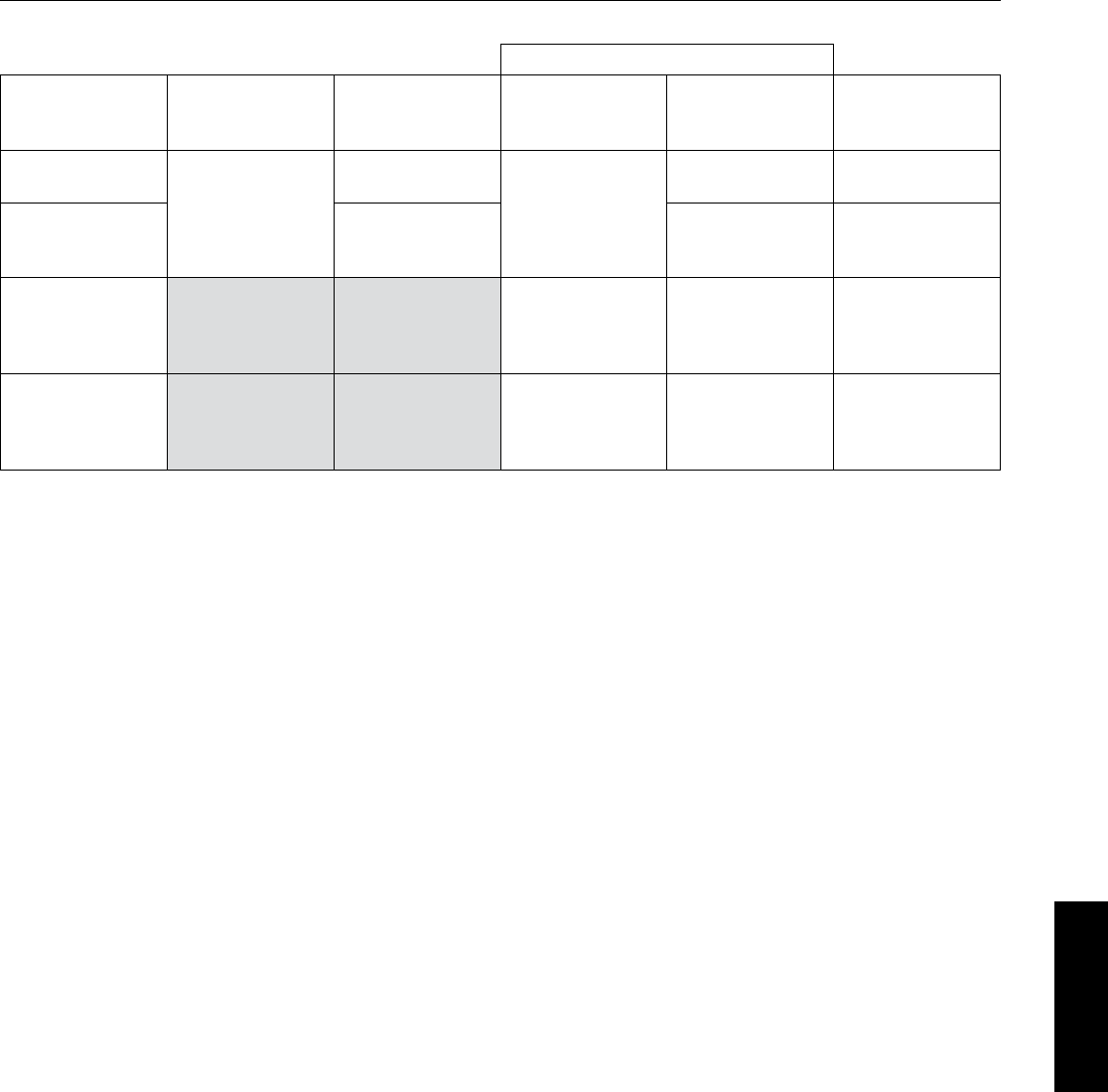

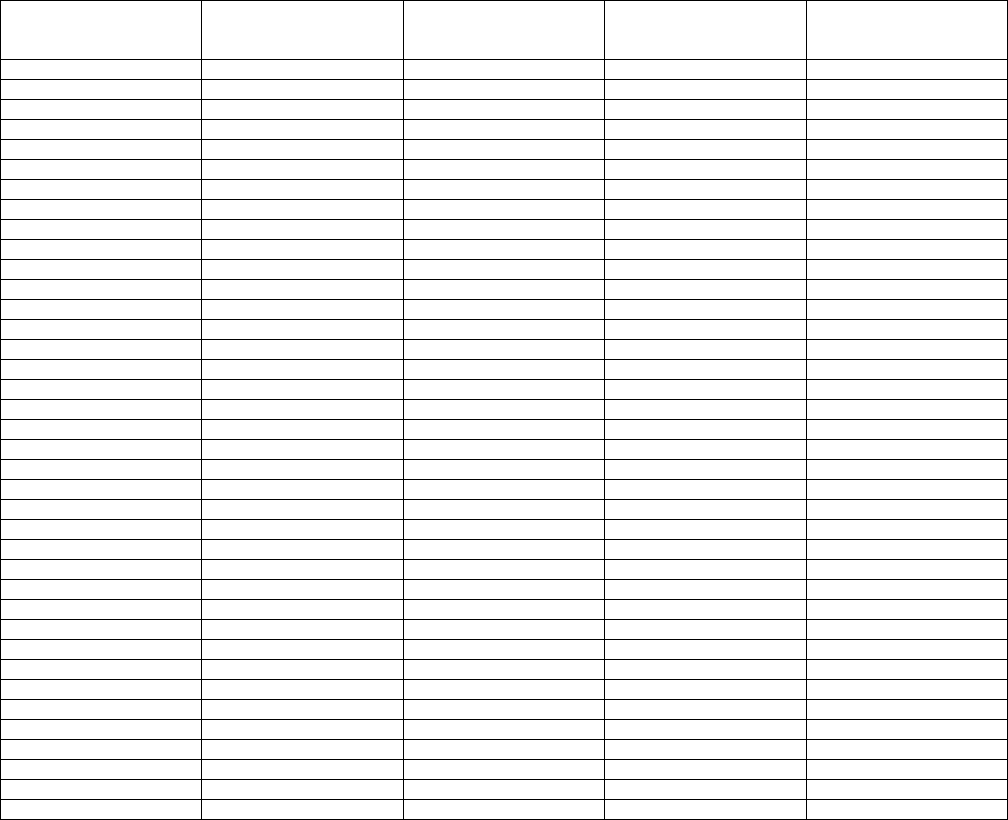

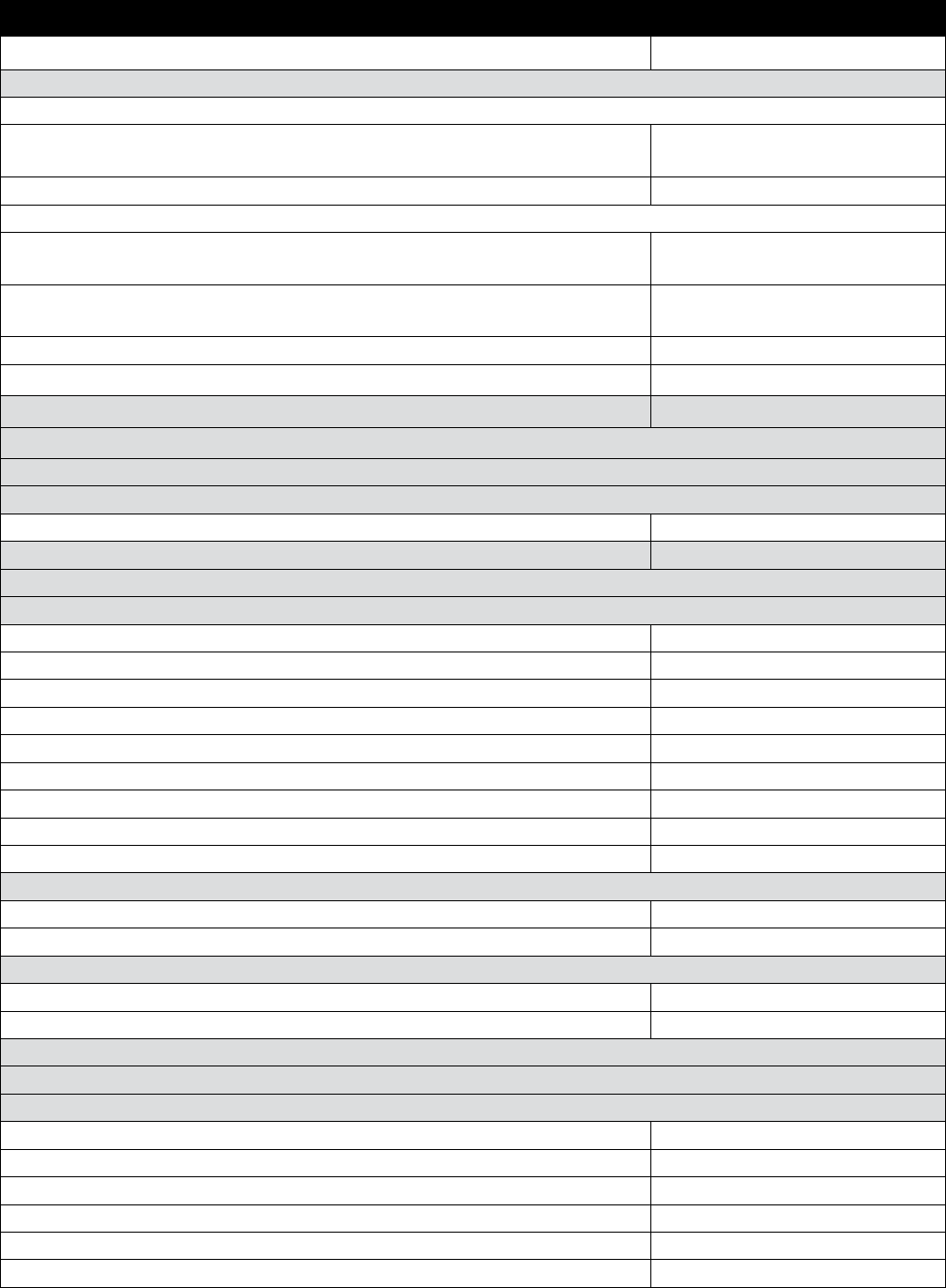

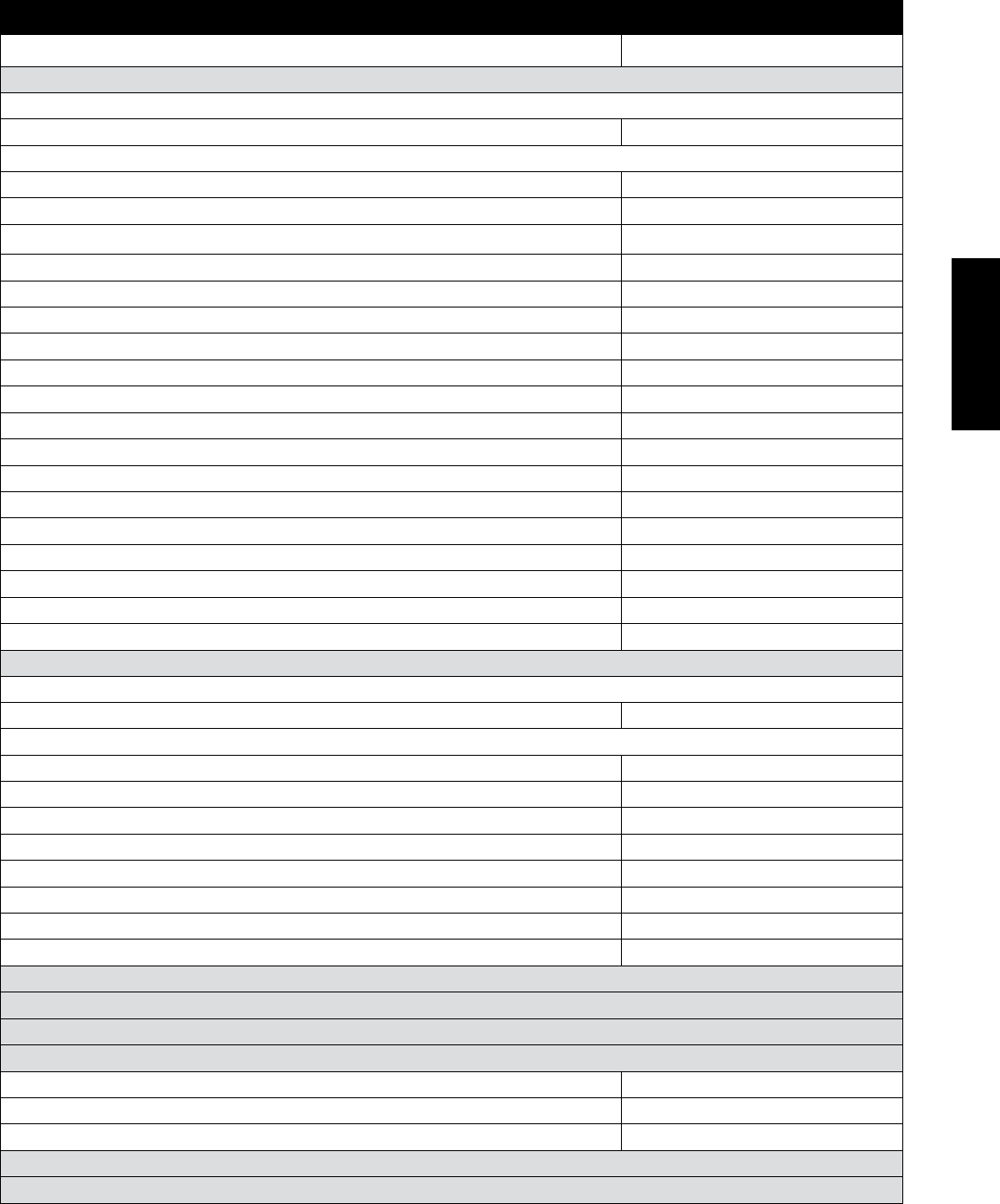

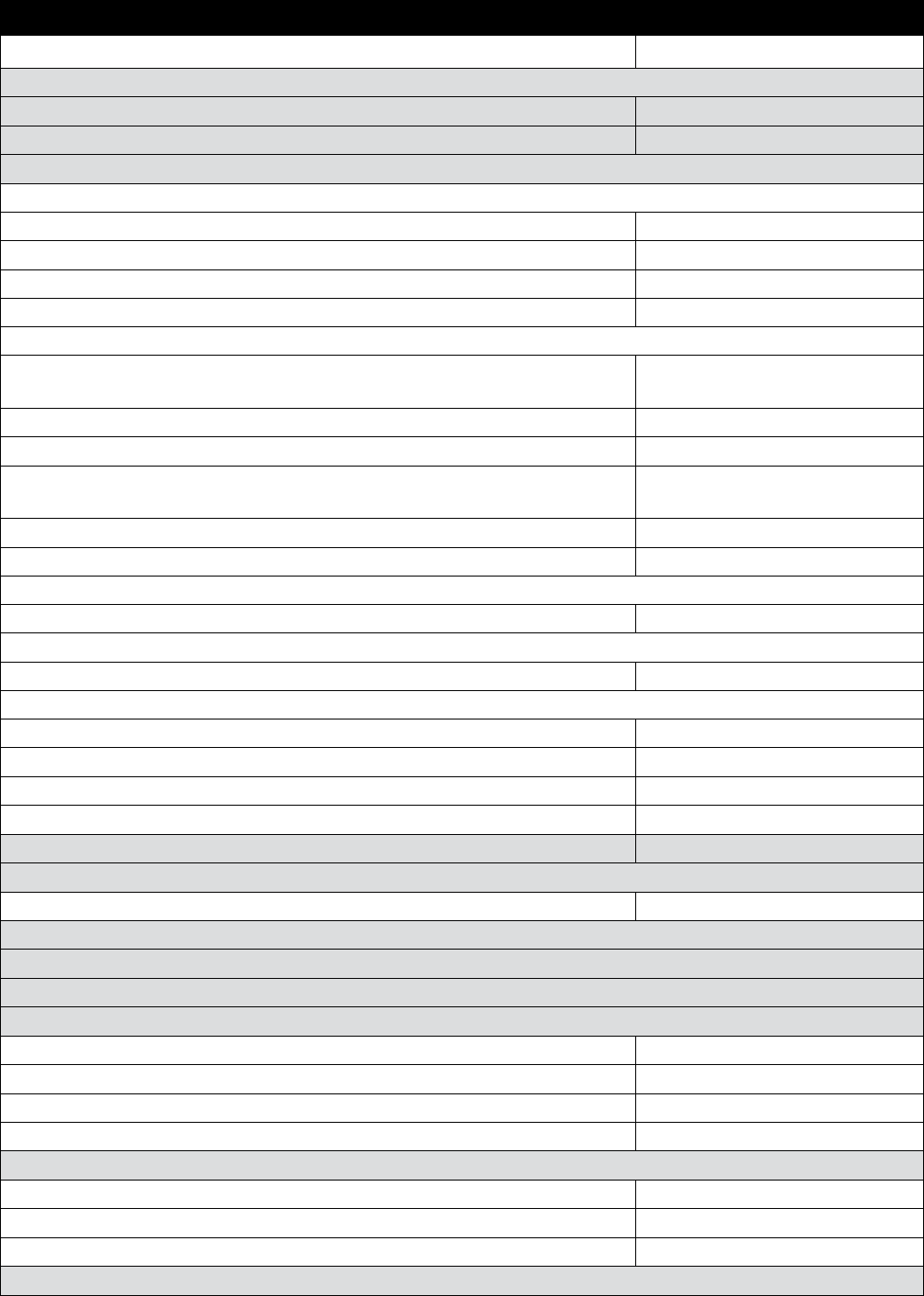

Medical Underwriting Guidelines

Long-Term Plan

Total Monthly

Benefit Amount

Accident Only

Disability

Short-Term

Disability

2-Year and 5-Year

Benefit Period

10-Year and To

Age 67

Benefit Period

Business

Overhead

Expense

$300-$3,000

Simplified

Underwriting¹

Simplified

Underwriting¹

Interview

Interview Simplified

Underwriting¹

$3,100-$5,000 Interview

Interview,

Physical Data,

Blood and Urine

Interview

$5,100-$8,000

Interview,

Physical Data,

Blood and Urine

Interview,

Long Form

Paramed, Blood

and Urine

Interview,

Physical Data,

Blood and Urine

$8,100 and Above

Interview,

Long Form

Paramed, Blood

and Urine, EKG²

Interview,

Long Form

Paramed, Blood

and Urine, EKG²

Interview,

Long Form

Paramed, Blood

and Urine, EKG²

¹Underwriting decisions within 48 hours of initial underwriting review provided the following conditions are met:

n Applicant is in occupation class 6A, 5A, 4A, 3A, or 2A

n For Accident Only Disability coverage: Applicant is age 55 or younger and medically standard

n For Short-Term and Long-Term Disability coverage: Applicant is nontobacco, age 45 or younger, and medically standard

n No adverse information from the Medical Information Bureau

n All application questions have been clearly and completely answered and required forms and financial documents have been

submitted with the application

²Age 45 and over only

Possible Underwriting Outcomes

n Standard

n Impairment Rate-Up of L (25 percent), M (50 percent),