PENNSYLVANIA BASIC MANUAL December 1, 2009 !! Pa 12 1 09

Preview ! pa_basic_manual_12-1-09 Alliance Laundry Systems Lawn Mower Manuals - Lawn Mower Manuals – The Best Lawn Mower Manuals Collection

User Manual: !! Alliance Laundry Systems Lawn Mower Manuals - Lawn Mower Manuals – The Best Lawn Mower Manuals Collection

Open the PDF directly: View PDF ![]() .

.

Page Count: 449 [warning: Documents this large are best viewed by clicking the View PDF Link!]

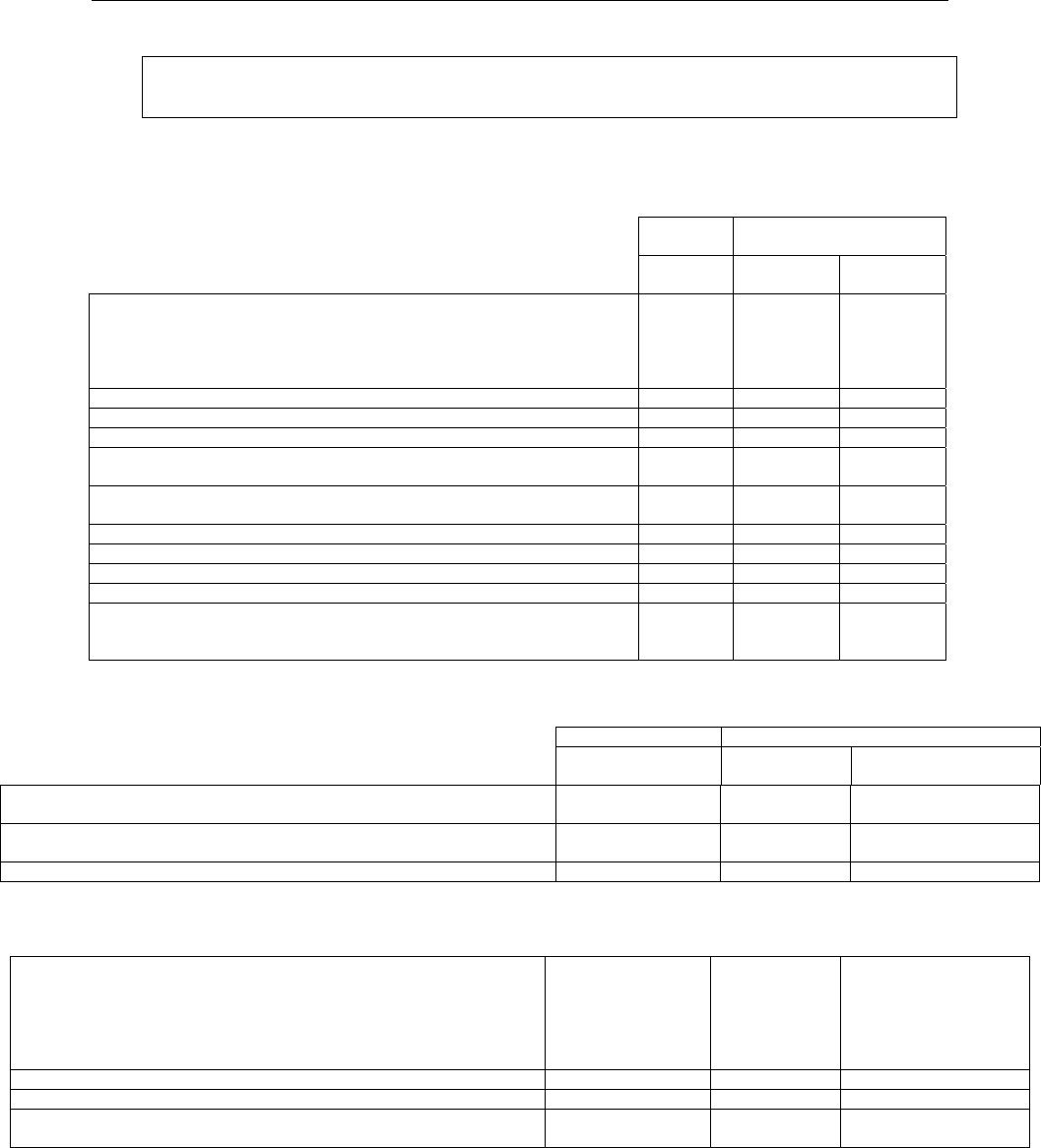

- Information Page

- Preface

- Bureau Membership

- Section 1 - Underwriting Rules

- Section 1 - Premium Algorithm

- Section 1 - Executive Officer Minimum/Maximum

- Section 1 - PCCPAP Program

- Section 1 - Appeals Procedure

- Section 2 - Rating Values

- Section 2 - Definitions

- Section 2 - Classifications

- Section 2 - General Auditing & Classification Information

- Section 2 - Underwriting Guide Alphabetic

- Section 3 - Endorsements

- Section 4 - Retrospective Rating Plans

- Section 5 - Experience Rating Plan

- Section 5 - Table B

- Section 6 - Merit Rating Plan

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

PENNSYLVANIA WORKERS COMPENSATION

MANUAL

Of

RULES, CLASSIFICATIONS AND

RATING VALUES

FOR

WORKERS COMPENSATION AND

FOR EMPLOYERS LIABILITY

INSURANCE

Effective DECEMBER 1, 2009

PENNSYLVANIA COMPENSATION RATING BUREAU

PENNSYLVANIA COMPENSATION RATING BUREAU

Manual Information Page

December 1, 2009 Manual

Section 1

Effective December 1, 2009

º Rule IV revision to definition of Salesperson – Outside

º Rule V revision to Per Diem Guidelines

Section 2

Effective December 1, 2009

º Revise Definitions

º Revise class descriptions and Underwriting Guide entries for Codes 855 and 935

º Underwriting Guide additions to Code 607

º Revise class description for Code 028

º Revise class title for Codes 606 and 617 and add Operations Not Included sections

º Revise class description of Code 607

º Revisions to class descriptions and Underwriting Guide entries for Codes 818 and 819

º Clarify class language for 21 classes

º Addition of two General Auditing & Classification Information entries

º Revision to General Auditing & Classification Information part of Wholesale/Retail Mail Order House

or Internet Sales – Definitions

º Addition of 14 and revision of six Underwriting Guide entries

º Addition of Per Diems section in General Auditing & Classification Information section

Section 3

Effective December 1, 2009

º Revision to WC 37 03 10 C

Any questions, suggestions or comments about this Manual should be directed to Bruce Decker at bdecker@pcrb.com

PENNSYLVANIA WORKERS COMPENSATION MANUAL

EFFECTIVE: DECEMBER 1, 2009 PREFACE

Page 1

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

PREFACE

A. In accordance with Section 654 of The Insurance Company Law of May 17, 1921, P.L. 682 and Act 44 of 1993, Act 57 of

1996, as amended, the Insurance Commissioner has approved this Manual of risk classes, underwriting rules, bureau rating

values and rating plans, to become effective 12:01 A.M. December 1, 2009, with respect to all policies, the effective date of

which is December 1, 2009 or thereafter, subject to the following express conditions, for the State Workers’ Insurance Fund

and for the insurance companies, corporations, associations and exchanges enumerated in the attached list and for no other

insurance company, corporation, association or exchange.

B. Organization of Manual

This Manual has six sections:

Section 1 – Underwriting Rules

Section 2 – Rating Values and Classifications/General Auditing and Classification Information

Section 3 – Endorsements

Section 4 – Retrospective Rating Plans

Section 5 – Experience Rating Plan

Section 6 – Merit Rating Plan

C. Definitions

The following words are referenced in Act 44 of 1993 or have been used in this Manual with meanings intended to be

consistent with the requirements of that Act. For purposes of improving the understanding of the Manual, definitions of these

words as used elsewhere in this Manual are set forth below.

1. Bureau Data Card – Bureau Data Cards are issued by the Pennsylvania Compensation Rating Bureau. These data

cards provide the risk name, location, Bureau file number, authorized classification(s) and if applicable the risk’s

experience modification for a minimum of one year.

Risks approved for the Pennsylvania Construction Classification Premium Adjustment Program and any other

applicable credit programs will be shown on these data cards.

2. Bureau Loss Costs – Dollar amounts per unit of exposure attributable to the payment of losses under workers

compensation and employers liability coverages, filed by the Bureau based on the aggregate experience of all Bureau

members and approved by the Insurance Commissioner.

3. Bureau Rating Values – All parameters filed by the Bureau and approved by the Insurance Commissioner, and which

are used either mandatorily or by option of carriers for purposes of pricing workers compensation and employers liability

coverages. Such Bureau rating values include Bureau Loss Costs, experience rating plan values such as Expected

Loss Cost Factors, Credibility, Maximum Value of One Accident, and Credibility Weighted Maximum Value Charge,

retrospective rating plan values such as the Table of Expected Loss Ranges, Excess Loss Pure Premium Factors,

Retrospective Pure Premium Development Factors, and expense parameters applicable to U.S.L.&H.W. coverages

such as Premium Discounts, Expected Loss Ratio, Expense Ratios, Tax Multipliers and Loss Conversion Factors.

4. Carrier Rate – The amount per unit of exposure which an insurance carrier charges for workers compensation and

employers liability insurance.

5. Carrier Rating Values – All parameters used by carriers for purposes of pricing workers compensation and employers

liability insurance coverages. Such parameters may be either Bureau Rating Values adopted by a carrier for its own use

or values independently determined by a carrier.

6. Loss Cost – Dollar amounts per unit of exposure attributable to the payment of losses under workers compensation

and employers liability coverages. Loss Costs may be developed either by the Bureau based on the aggregate

experience of all Bureau members or may be established by individual carriers based on their own supporting

information.

7. Provision for Claim Payment – Historical aggregate losses projected through development to their ultimate value and

through trending to a future point in time, but excluding all loss adjustment or claim management expenses, other

operating expenses, assessments, taxes and profit or contingency allowances. In this Manual the term "Loss Cost" is

synonymous with Provision for Claim Payment.

8. Rating Value – A parameter or number used in pricing workers compensation or employers liability insurance

coverages. Rating Values may be established by the Bureau or by individual carriers. Where individual carriers have

established Rating Values different from those of the Bureau, the carrier's values supersede those of the Bureau for

purposes of that insurer's policies.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

EFFECTIVE: DECEMBER 1, 2009 PREFACE

Page 2

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

D. Pennsylvania Compensation Rating Bureau Membership List

ACADIA Insurance Company.

Accident Fund Insurance Company of America.

Accident Fund General Insurance Company.

Accident Fund National Insurance Company.

ACE American Insurance Company.

ACE Fire Underwriters Insurance Company.

ACE Indemnity Insurance Company.

ACE Property & Casualty Insurance Company.

ACIG Insurance Company.

ACUITY, A Mutual Insurance Company.

Advantage Workers Compensation Insurance Company.

Agent Alliance Insurance Company.

AIG Centennial Insurance Company.

A.I.U. Insurance Company.

Alea North America Insurance Company.

Alliance National Insurance Company.

Allianz Global Risks US Insurance Company.

Allied Eastern Indemnity Company.

Allied Property and Casualty Insurance Company.

Allmerica Financial Benefit Insurance Company.

Allstate Indemnity Company.

Allstate Insurance Company.

AMCO Insurance Company.

American Alternative Insurance Corporation.

American Automobile Insurance Company.

American Business & Personal Insurance Mutual, Inc.

American Casualty Company of Reading.

American Compensation Insurance Company.

American Country Insurance Company.

American Economy Insurance Company.

American European Insurance Company.

American Fire and Casualty Company.

American Guarantee and Liability Insurance Company.

American Hardware Mutual Insurance Company.

American Home Assurance Company.

American Insurance Company, The.

American International Insurance Company.

American Interstate Insurance Company.

American Manufacturers' Mutual Insurance Company.

American Mining Insurance Company.

American Motorists Insurance Company.

American Safety Casualty Insurance Company.

American Select Insurance Company.

American States Insurance Company.

American States Insurance Company of Texas.

American Zurich Insurance Company.

AmeriHealth Casualty Insurance Company.

Amerisure Mutual Insurance Company.

Amguard Insurance Company.

Arch Insurance Company.

Argonaut Great Central Insurance Company.

Argonaut Insurance Company.

Argonaut-Midwest Insurance Company.

Associated Indemnity Corporation.

Association Insurance Company.

Assurance Company of America.

Atlantic Specialty Insurance Company.

Atlantic States Insurance Company.

Auto-Owners Insurance Company.

Automobile Insurance Company of Hartford, Connecticut.

BancInsure, Inc.

Bankers Standard Fire and Marine Company.

Bankers Standard Insurance Company.

Benchmark Insurance Company.

Bituminous Casualty Corporation.

Bituminous Fire and Marine Insurance Company.

Brethren Mutual Insurance Company, The.

Brotherhood Mutual Insurance Company.

California Insurance Company.

Camden Fire Insurance Association, The.

Carolina Casualty Insurance Company.

Century Indemnity Company.

Charter Oak Fire Insurance Company.

Chartis Casualty Company.

Chartis Property Casualty Company.

Cherokee Insurance Company.

Chrysler Insurance Company.

Chubb Indemnity Insurance Company.

Church Mutual Insurance Company.

Cincinnati Casualty Company.

Cincinnati Indemnity Company.

Cincinnati Insurance Company, The.

Citizens Insurance Company of America.

Clarendon National Insurance Company.

Colony Specialty Insurance Company.

Commerce and Industry Insurance Company.

Companion Commercial Insurance Company.

Companion Property & Casualty Insurance Company.

Continental Casualty Company.

Continental Indemnity Company.

Continental Insurance Company, The.

Continental Western Insurance Company.

Cornhusker Casualty Company.

Crum & Forster Indemnity Company.

Cumberland Insurance Company, Inc.

Cumis Insurance Society, Inc.

Dallas National Insurance Company.

Deerfield Insurance Company.

Delos Insurance Company.

Depositors Insurance Company.

Discover Property & Casualty Insurance Company.

Donegal Mutual Insurance Company.

Eastern Advantage Assurance Company.

Eastern Alliance Insurance Company.

Eastguard Insurance Company.

Electric Insurance Company.

Emcasco Insurance Company.

Employers Compensation Insurance Company.

Employers’ Fire Insurance Company.

Employers’ Insurance Company of Wausau.

Employers’ Mutual Casualty Company.

Employers Preferred Insurance Company.

Erie Insurance Company.

Erie Insurance Company of New York.

Erie Insurance Exchange.

Erie Insurance Property & Casualty Company.

Essentia Insurance Company.

Everest National Insurance Company.

Everett Cash Mutual Insurance Company.

Excelsior Insurance Company.

Explorer Insurance Company.

Fairfield Insurance Company.

Fairmont Premier Insurance Company.

Fairmont Specialty Insurance Company.

Farmington Casualty Company.

Farmland Mutual Insurance Company.

Federal Insurance Company.

Federated Mutual Insurance Company.

Federated Rural Electric Insurance Exchange.

Federated Service Insurance Company.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

EFFECTIVE: DECEMBER 1, 2009 PREFACE

Page 3

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

Fidelity and Deposit Company of Maryland.

Fidelity and Guaranty Insurance Company.

Fidelity and Guaranty Insurance Underwriters, Inc.

Fireman's Fund Insurance Company.

Firemen's Insurance Company of Washington, D.C.

First Liberty Insurance Corporation.

First National Insurance Company of America.

First Nonprofit Insurance Company.

FirstComp Insurance Company.

Firstline National Insurance Company.

Flagship City Insurance Company.

Florists’ Insurance Company.

Florists’ Mutual Insurance Company.

Freedom Advantage Insurance Company.

Frontier Insurance Company.

Gateway Insurance Company.

General Casualty Company of Wisconsin.

General Casualty Insurance Company.

General Insurance Company of America.

Genesis Insurance Company.

Grange Mutual Casualty Company.

Granite State Insurance Company.

Graphic Arts Mutual Insurance Company.

Great American Alliance Insurance Company.

Great American Assurance Company.

Great American Insurance Company.

Great American Insurance Company of New York.

Great Divide Insurance Company.

Great Northern Insurance Company.

Great West Casualty Company.

Greater New York Mutual Insurance Company.

Greenwich Insurance Company.

Guarantee Insurance Company.

GuideOne Mutual Insurance Company.

Hanover Insurance Company, The.

Harco National Insurance Company.

Harford Mutual Insurance Company.

Harleysville Insurance Company.

Harleysville Insurance Company of New Jersey.

Harleysville Mutual Insurance Company.

Harleysville Preferred Insurance Company.

Harleysville Worcester Insurance Company.

Hartford Accident and Indemnity Company.

Hartford Casualty Insurance Company.

Hartford Fire Insurance Company.

Hartford Insurance Company of the Midwest.

Hartford Insurance Company of the Southeast.

Hartford Underwriters Insurance Company.

Highlands Insurance Company.

Highmark Casualty Insurance Company.

HM Casualty Insurance Company.

Housing and Redevelopment Insurance Exchange.

Illinois National Insurance Company.

Imperial Casualty and Indemnity Company.

Indemnity Insurance Company of North America.

Indiana Lumbermen's Mutual Insurance Company.

Insurance Company of Greater New York.

Insurance Company of North America.

Insurance Company of the State of Pennsylvania, The.

Insurance Company of the West.

Lackawanna American Insurance Company.

Lackawanna Casualty Company.

Lackawanna National Insurance Company.

Lancer Insurance Company.

Laundry Owners’ Mutual Liability Insurance Association.

Laurier Indemnity Company.

Leading Insurance Group Insurance Company, Ltd

Lebanon Mutual Insurance Company.

Liberty Insurance Corporation.

Liberty Insurance Underwriters, Inc.

Liberty Mutual Fire Insurance Company.

Liberty Mutual Insurance Company.

Liberty Mutual Mid-Atlantic Insurance Company.

Lincoln General Insurance Company.

LM Insurance Corporation.

Lumbermen's Mutual Casualty Company.

Lumbermen's Underwriting Alliance.

Manufacturers Alliance Insurance Company.

Markel Insurance Company.

Maryland Casualty Company.

Massachusetts Bay Insurance Company.

Medmarc Casualty Insurance Company.

MEMIC Indemnity Company.

Mercer Insurance Company.

Merchants Mutual Insurance Company.

Merchants Preferred Insurance Company.

Meridian Security Insurance Company.

Mid-Century Insurance Company.

Middlesex Insurance Company.

Midwest Employers Casualty Company.

Millers Capital Insurance Company.

Mitsui Sumitomo Insurance Company of America.

Mitsui Sumitomo Insurance USA Inc.

Montgomery Mutual Insurance Company.

Motorists’ Mutual Insurance Company.

Mutual Benefit Insurance Company.

National American Insurance Company.

National Fire Insurance Company of Hartford.

National Interstate Insurance Company.

National Surety Corporation.

National Union Fire Insurance Company of Pittsburgh, Pa.

Nationwide Agribusiness Insurance Company.

Nationwide Mutual Fire Insurance Company.

Nationwide Mutual Insurance Company.

Nationwide Property and Casualty Insurance Company.

Netherlands Insurance Company.

New Hampshire Insurance Company.

New Jersey Manufacturers' Insurance Company.

NGM Insurance Company.

NIPPONKOA Insurance Company, Ltd. US Branch.

Norguard Insurance Company.

North American Elite Insurance Company.

North American Specialty Insurance Company.

North River Insurance Company, The.

Northbrook Indemnity Company.

Northern Assurance Company of America, The.

Northern Insurance Company of New York.

NOVA Casualty Company.

Ohio Casualty Insurance Company.

Ohio Security Insurance Company.

Old Republic General Insurance Corporation.

Old Republic Insurance Company.

OneBeacon America Insurance Company.

OneBeacon Insurance Company.

Oriska Insurance Company.

Owners Insurance Company.

Pacific Employers' Insurance Company.

Pacific Indemnity Company.

Paramount Insurance Company.

Patriot General Insurance Company.

Peerless Indemnity Insurance Company.

Peerless Insurance Company.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

EFFECTIVE: DECEMBER 1, 2009 PREFACE

Page 4

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

Peninsula Indemnity Company.

Penn Millers Insurance Company.

Penn National Security Insurance Company.

PennCommonwealth Casualty of America Corporation.

Pennsylvania Casualty Company.

Pennsylvania General Insurance Company.

Pennsylvania Lumbermens Mutual Insurance Company.

Pennsylvania Manufacturers' Association Insurance

Company.

Pennsylvania Manufacturers Indemnity Company.

Pennsylvania National Mutual Casualty Insurance

Company.

Pennsylvania Surface Coal Mining Insurance Exchange.

Pharmacists Mutual Insurance Company.

Phoenix Insurance Company, The.

Potomac Insurance Company.

Praetorian Insurance Company.

Preferred Professional Insurance Company.

Princeton Insurance Company.

Property and Casualty Insurance Company of Hartford.

Protective Insurance Company.

Public Service Mutual Insurance Company.

QBE Insurance Corporation.

Redland Insurance Company.

Regent Insurance Company.

Republic-Franklin Insurance Company.

Rockwood Casualty Insurance Company.

SAFECO Insurance Company of America.

Safety First Insurance Company.

Safety National Casualty Corp.

School Boards Insurance Company of Pennsylvania, Inc.

SeaBright Insurance Company.

SECURA Insurance, A Mutual Company.

Select Risk Insurance Company.

Selective Insurance Company of America.

Selective Insurance Company of New York.

Selective Insurance Company of South Carolina.

Selective Insurance Company of the Southeast.

Selective Way Insurance Company.

Seneca Insurance Company, Inc.

Sentinel Insurance Company, Ltd.

Sentry Casualty Company.

Sentry Insurance, A Mutual Company.

Sentry Select Insurance Company.

Somerset Casualty Insurance Company.

Sompo Japan Insurance Company of America.

Southern Insurance Company.

Southern Insurance Company of Virginia.

Southern States Insurance Exchange.

SPARTA Insurance Company.

St. Paul Fire and Marine Insurance Company.

St. Paul Guardian Insurance Company.

St. Paul Mercury Insurance Company.

St. Paul Protective Insurance Company.

Standard Fire Insurance Company, The.

Star Insurance Company.

StarNet Insurance Company.

State Auto Property & Casualty Insurance Company.

State Automobile Mutual Insurance Company.

State Farm Fire and Casualty Company.

State National Insurance Company, Inc.

State Workers’ Insurance Fund.

Statesman Insurance Company.

Strathmore Insurance Company.

SUA Insurance Company.

Synergy Comp Insurance Company.

Technology Insurance Company.

T.H.E. Insurance Company.

TIG Indemnity Company.

TIG Insurance Company.

Tokio Marine & Nichido Fire Insurance Company, Ltd.

Tower Insurance Company of New York.

Tower National Insurance Company.

Trans Pacific Insurance Company.

Transguard Insurance Company of America, Inc.

Transportation Insurance Company.

Travelers Casualty and Surety Company.

Travelers Casualty and Surety Company of America.

Travelers Casualty Company of Connecticut.

Travelers Casualty Insurance Company of America.

Travelers Commercial Insurance Company.

Travelers Indemnity Company, The.

Travelers Indemnity Company of America.

Travelers Indemnity Company of Connecticut, The.

Travelers Property Casualty Company of America.

Truck Insurance Exchange.

Trumbull Insurance Company.

Trustgard Insurance Company.

Twin City Fire Insurance Company.

U.S. Specialty Insurance Company.

Ullico Casualty Company.

Union Insurance Company.

United National Insurance Company.

United States Fidelity and Guaranty Company.

United States Fire Insurance Company.

United Wisconsin Insurance Company.

Universal Underwriters' Insurance Company.

Utica Mutual Insurance Company.

Valley Forge Insurance Company.

Vanliner Insurance Company.

Vigilant Insurance Company.

Vinings Insurance Company.

Wausau Business Insurance Company.

Wausau Underwriters' Insurance Company.

Wesco Insurance Company.

West American Insurance Company.

Westchester Fire Insurance Company.

Westfield Insurance Company.

Westfield National Insurance Company.

WestGUARD Insurance Company.

Westport Insurance Corporation.

Williamsburg National Insurance Company.

Work First Casualty Company.

XL Insurance America, Inc.

XL Specialty Insurance Company.

Zenith Insurance Company.

ZNAT Insurance Company.

Zurich American Insurance Company.

Zurich American Insurance Company of Illinois.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 1

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

TABLE OF CONTENTS

SECTION 1 – UNDERWRITING RULES

RULE I – GENERAL

A. Workers Compensation

B. Standard Policy

C. Endorsement Forms

D. Endorsement Forms Section

E. Application of Manual Rules

F. Effective Date

1. Manual

2. Changes

G. Anniversary Rating Date

1. Definition

2. Rewritten Policies

3. Long Term Policies

H. Filing Requirements

1. Policy

2. Policy Writing Procedures

3. Endorsements

4. Standard Endorsement Filing Procedure

5. Binders

I. Policy Corrections

J. Medical Contracts

RULE II – EXPLANATION OF COVERAGES AND METHODS OF INSURING

A. Part One – Workers Compensation Insurance

1. Description of Coverage A

2. Pennsylvania Coverage

3. Longshore Coverage

4. Deductible Coverage

B. Coverage Requirements

C. Part Two – Employers Liability Insurance

1. Description of Coverage B

2. Employers Liability for Diseases

3. Admiralty Law or Federal Employers’ Liability Act

4. Employers Liability Insurance with Workers Compensation Insurance

5. Employers Liability Insurance without Workers Compensation Insurance

D. Voluntary Compensation Insurance

1. Description of Voluntary Compensation Insurance

2. How Provided

E. Part Three – Other States Insurance

1. Description of Other States Coverage

2. States where not Available

3. Restriction on Use

4. Premium

F. Deductible Coverage

G. Group Deductible or Retrospective Rating Plan Coverage

RULE III – POLICY PREPARATION – INSURED, POLICY PERIOD AND STATE OF OPERATIONS

A. Explanations of Terms

1. Employer/Entity

2. Insured

3. Majority Interest

4. Risk

B. Name, Address and Other Work-Places of Insured

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 2

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

1. Combination of Legal Entities

2. Name of Insured

3. Pennsylvania Locations

C. Policy Period

1. Normal Policy Period

2. Policy for One Year

3. Policy Longer than One Year

4. Renewal Certificates/Agreements

5. Three Year Fixed Carrier Rating Value Policy Option

6. Annual Rating Endorsements

D. State Laws Designated in the Policy

1. Listing of Pennsylvania

2. Longshore Act

3. Additional States

RULE IV – CLASSIFICATIONS

A. General Explanation

1. Objective

B. Classifications

1. Basic Classifications

2. Standard Exception Classification

a. Clerical Office Employees

b. Drafting Employees

c. Salespersons, Collectors, or Messengers, Outside

3. General Inclusions

4. General Exclusions

C. Assignment of Classifications

1. Object of Classification Procedure

2. Assignment of a Classification

3. Assignment of Additional Classifications

4. Assignment of Analogy

5. Payroll Assignment – Multiple Classifications Interchange of Labor

6. Construction or Erection Operations

7. NOC Definition

8. Changing Classifications

9. Classification Appeal

10. Mercantile Business/Stores

D. Show the Classifications in Item 4 of the Information Page

RULE V – PREMIUM BASIS

A. Basis of Premium – Total Remuneration

B. Remuneration – Payroll

1. Definition

2. Inclusions

3. Exclusions

4. Payroll

5. Employee Savings Plans

C. Estimated Payrolls

1. Estimated Payrolls by Classification

2. Determination of Estimated Payrolls

3. Approval of Estimated Payrolls

D. Whole Dollars – Payrolls

E. Payroll Limitation

1. How Payroll Limitation Applies

2. Partial Week

F. Basis of Premium Additional Information

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 3

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

1 Employee Expense Reimbursements

2 Salary Reduction Plans

3 Strike Periods (Wages Paid)

4 Traveling Time Periods

5 Wages Paid for Idle Time

6 Religious Exclusions

7 Members of Religious Orders

8 Subcontractors

9 Outworkers/Homeworkers

RULE VI – RATING VALUES AND PREMIUM DETERMINATION

A. Bureau Rating Values

1. Bureau Loss Cost

2. Disease or Radiation Loading

3. Premium Adjustment Factor

4. Experience Rating Factor

5. Terrorism

6. Catastrophe (other than Certified Acts of Terrorism)

7. Employer Assessment Pursuant to Act 57 of 1997

B. Carrier Rating Values

C. Premium

D. Whole Dollars - Premium

E. Premium Modification – Experience Rating Plan

F. Premium Determination for Federal and Maritime Insurance

G. Premium Algorithm

RULE VII – PREMIUM DISCOUNT

A. Premium Discount

B. Combination of Policies

1. Combination Permitted

2. Combination Procedure

C. Wrap-Up Construction Projects

RULE VIII – LIMITS OF LIABILITY

A. Workers Compensation and Employers Liability Policy

1. Part One – Workers Compensation

2. Part Two – Employers Liability

a. Standard Limits

b. Increased Limits

c. Accident Limit

d. Disease Limit

e. Show Limit on the Information Page

B. Voluntary Compensation Insurance

1. Standard Limits

2. Increased Limits

3. Premium Determination

4. Payroll Records

RULE IX – SPECIAL CONDITIONS OR OPERATIONS AFFECTING COVERAGE AND PREMIUM

A. Executive Officers

1. Definition

2. Law and Status

3. Executive Officer Exclusion Procedure

4. Executive Officers- Multiple Corporate Enterprises

5. Executive Officer Remuneration – Treatment of:

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 4

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

6. Premium Determination

7. Assignment of Payroll

8. Flight Duties

B. Real Estate Sales Person/Broker Licensed Insurance Agent – Exception

C. Professional and Semi-Professional Athletes – Class Code 970

D. Sole Proprietors and Partnerships

E. Subcontractors

1. Law on Contractors and Subcontractors

2. Coverage

3. Premium for Uninsured Subcontractors

4. Drivers, Chauffeurs and Helpers Under Contract

F. Ex-Medical Coverage

G. Truckers - Interstate

H. Pennsylvania Construction Classification Premium Adjustment Program

I. Certified Safety Committee Credit Program

RULE X – CANCELLATION

A. Who May Cancel

B. Premium Determination – Cancellation by the Insurance Carrier

1. Carrier Rating Values and Payroll

2. Experience Rating

C. Premium Determination - Cancellation by the Insured when Retiring from Business

D. Premium Determination – Cancellation by the Insured, Except when Retiring from

Business

1. Actual Payroll

2. Extended Payroll and Number of Days

3. Carrier Rate

4. Experience Rating

5. Short Rate Percentage

6. Example of Short Rate Cancellation

E. Short Rate Cancellation Tables for Term of One Year, Pro Rate Cancellation Tables –

One Year

RULE XI – THREE YEAR FIXED RATE POLICY OPTION

RULE XII – U.S. LONGSHORE AND HARBOR WORKERS’ COMPENSATION ACT

A. General Explanation

B. Workers Compensation Insurance – Part One

C. Employers Liability Insurance – Part Two

D. Classifications and Rates

1. Classifications

2. Rates for Federal “F” Classifications

3. Rates for Non-Federal “Non-F” Classifications

E. Extensions of the U.S.L. & H.W. Act

1. Defense Bases Act

2. Civilian Employees of Nonappropriated Fund Instrumentalities Act

3. Premium Determination

4. Outer Continental Shelf Lands Act

F. Pennsylvania Workers Compensation Voluntary Pool

RULE XIII – THE ADMIRALTY LAW AND THE FEDERAL EMPLOYERS LIABILITY ACT

A. General Explanation

1. Admiralty Law

2. Federal Employers Liability Act (F.E.L.A.)

B. Description of Coverage Programs

1. Program I

2. Program II

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 5

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

C. Coverage

1. Admiralty Law Endorsements

2. Admiralty Law Coverage Options

3. F.E.L.A. Endorsements

4. U.S.L. & H.W. Act

D. Limits of Liability

1. Standard Limits

2. Increased Limits

3. Minimum Premium

E. Classifications

F. Waters not under Admiralty Jurisdictions

1. Coverage

2. Premium Determination

3. Admiralty Law or U.S.L. & H.W. Act Liability

RULE XIV – AGRICULTURAL, DOMESTIC WORKERS - RESIDENCES

A. Definitions

1. Inside Domestic Workers

2. Outside Domestic Workers

3. Occasional Domestic Workers

B. Coverage

1. Workers Compensation and Employers Liability Insurance

2. Voluntary Compensation Insurance

C. Name of Insured

D. Classifications

1. Domestic Workers

2. Maintenance, Repair or Construction Operations

E. Bureau Rating Values and Premium

1. Bureau Rating Values

2. Records Required

3. Full Time Domestic Workers

4. Occasional Domestic Workers

RULE XV – FINAL EARNED PREMIUM DETERMINATION

A. Actual Payroll

B. Premium Determination

C. Audit Rights to Carrier

D. Authorized Classifications

RULE XVI – APPEALS FROM APPLICATION OF THE RATING SYSTEM PROCEDURE

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 6

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

RULE I – GENERAL

A. WORKERS COMPENSATION

Workers Compensation as used in this Manual means workers compensation and occupational

disease law of Pennsylvania.

B. STANDARD POLICY

Standard Policy means the Standard Provisions Workers Compensation and Employers Liability

Policy and the Information Page approved by the Pennsylvania Insurance Department.

C. ENDORSEMENT FORMS

Endorsement forms mean standard endorsements contained in the Endorsement Forms Section. A

standard endorsement must be used in the form prescribed in Section 3.

D. ENDORSEMENT FORMS SECTION (SECTION 3)

Refer to the Endorsement Forms Section for complete description of coverages and instructions on

use of the endorsement forms.

E. APPLICATION OF MANUAL RULES

Rules apply separately to each policy, except as allowed by Rule VII – PREMIUM DISCOUNT.

F. EFFECTIVE DATE

1. Manual

This Manual applies only from the anniversary rating date which occurs on or after the effective

date of this Manual.

2. Changes

The effective date of a change in any rule, classification or Bureau rating value is 12:01 a.m. on

the date specified on the manual page. Any change will be highlighted and linked to the

appropriate Bureau circular announcing the change. Unless specified otherwise, each change

applies only from the anniversary rating date which occurs on or after the effective date of the

change.

G. ANNIVERSARY RATING DATE

1. Definition

The anniversary rating date is the effective month and day of the policy in effect and each

annual anniversary thereafter unless a different date has been established by the Pennsylvania

Compensation Rating Bureau.

2. Rewritten Policies

If a policy is canceled and rewritten by the same or another carrier, all rules, classifications and

carrier rating values of the rewriting carrier which were in effect as of the anniversary rating

date shall apply to the rewritten policy until the next anniversary date as established by the

Pennsylvania Compensation Rating Bureau.

Use the Anniversary Rating Date Endorsement.

No policy may be canceled, rewritten or extended for any period to avoid or take advantage of

any changes in the rules or Bureau rating values of the Manual.

3. Long Term Policies

For application of anniversary rating dates on policies issued for a term in excess of one year,

refer to Rule III - C.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 7

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

H. FILING REQUIREMENTS

1. Policy

An exact copy of every Workers Compensation Policy showing the state of Pennsylvania on

the Information Page shall be filed with the Pennsylvania Compensation Rating Bureau within

thirty days after the effective date of the policy.

2. Policy Writing Procedures

a. Policy Numbers

The policy number designated by the carrier at policy issuance must remain constant and

must be used on all endorsements and other documents related to that policy. If a portion

of the policy number is designated at inception as the "key" policy number, such

designation must be clearly identified on the policy information page and the "key" number

must be used on all endorsements and other documents related to that policy.

b. Renewal Policy Numbers

The information page of each renewal policy shall identify the policy number of the policy

which it renews, in accordance with a. above. This procedure also applies to rewritten

policies. The word "same" should be used to indicate that the same policy number has

been used on renewal. The word "new" should be used to indicate a newly issued policy.

3. Endorsements

An exact copy of all endorsements or agreements attached to the policy at its inception date or

issued subsequent to the inception date of the policy must be filed with the Bureau within thirty

days after the date of issue of such endorsement or agreement.

4. Standard Endorsement Filing Procedure

a. Any endorsement filed with the Insurance Department on behalf of Bureau members by

the Bureau must be filed for approval with the Bureau. For filing procedure details refer to

Section 3.

b. Non Standard Endorsements filing procedure, refer to Section 3.

5. Binders

a. A copy of the binder must be filed with the Bureau on an approved form with all required

endorsements attached no later than thirty days after its date of inception.

b. The binder must contain the classification codes and Carrier Rating Values applicable to

the employer in accordance with the assignment issued by the Bureau or in accordance

with the Classification Rules of this Manual if no specific Bureau assignment has been

made.

c. A binder must be replaced with a short-term policy covering the amount of time the binder

was in effect or replaced with a full-term policy including the time period the binder was in

effect.

I. POLICY CORRECTION

If the Bureau finds that a policy requires correction to conform to Manual rules or

classifications, the carrier shall be notified by letter. Such policy shall be corrected and a copy

of the correcting endorsement shall be submitted to the Bureau no later than thirty (30) days

after notification.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 8

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

J. MEDICAL CONTRACTS

1. Medical contracts and agreements between insurance carriers and insured employers where

medical service or supplies are furnished by the employer in consideration of a reduced

premium or other consideration cannot be made.

2. Insurance carriers may not furnish medical equipment or hospital supplies to the insured’s

employer.

RULE II – EXPLANATION OF COVERAGES AND METHODS OF INSURING

A. PART ONE – WORKERS COMPENSATION INSURANCE

1. Description of Coverage A

Workers compensation insurance provides coverage for the statutory obligation of an employer

to provide benefits for employees as required by:

a. Workers compensation law or occupational disease law of any state or territory of the

United States, including the District of Columbia, and

b. United States Longshore and Harbor Workers' Compensation Act.

2. Pennsylvania workers compensation insurance may be provided only by the Standard Policy.

3. Longshore Coverage

U.S. Longshore and Harbor Workers' Compensation Act insurance may be provided only by

attaching the Longshore and Harbor Workers' Compensation Act Coverage Endorsement (WC

00 01 06A) to the Standard Policy. Refer to Rule XII.

B. COVERAGE REQUIREMENTS

1. Compulsory as to all employments

Exceptions:

a. Individual proprietors

b. Partners of a partnership (including members of a Limited Liability Company (LLC).

c. Elected officers of the Commonwealth or any of its political subdivisions.

d. An executive officer of a for profit corporation or an executive officer of a nonprofit

corporation who serves voluntarily and without remuneration may, however, elect not to be

an “employee” of the corporation. For the purposes of this exclusion, an executive officer

of a for-profit corporation is an individual who has either an ownership interest in a

Subchapter S corporation as defined by the Act of March 4, 1971 (P.L. 6, No. 2) known as

the “Tax Reform Code of 1971,” or an interest of at least five percent in a Subchapter C

corporation as defined by the Tax Reform Code of 1971.

e. Any person who is a licensed real estate salesperson or an associate real estate broker

affiliated with a licensed real estate broker or a licensed insurance agent affiliated with a

licensed insurance agency, under a written agreement, remunerated on a commission only

basis and who qualifies as an independent contractor for State tax purposes or for Federal

tax purposes under the Internal Revenue Code of 1986 (Public Law 99-514, 26 U.S.C. § 1

Et Seq.).

f. Domestic or casual labor.

g. Outworker (a person to whom articles are given for cleaning, repair, etc. at home).

h. Farmer with one employee who works less than 30 days a year or earns less than $1,200

a year. A spouse or a child of the farmer employer under eighteen years of age shall not

be deemed an employee unless the services of such spouse or child are engaged by the

farmer employer under an express written contract of hire which is filed with the

Pennsylvania Department of Labor and Industry.

i. Elective for members of certain religious sects whose tenets prohibit benefits from

insurance, provided the sect makes provisions for its members.

2. No insurance carrier is permitted to issue policies which would create duplicate coverage for an

employer. Policies of different insurance carriers cannot be written for separate parts of a single

risk.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 9

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

3. When an employer proposes to insure both his accident and occupational disease

compensation liability, such liability must be covered by a single policy of one insurance carrier.

C. PART TWO – EMPLOYERS LIABILITY INSURANCE

1. Description of Coverage B

Employers liability insurance provides coverage for the legal obligation of an employer to pay

damages because of bodily injury by accident or disease, including resulting death, sustained

by an employee. Employers liability coverage applies only if the injury or death of an employee

arises out of and in the course of employment and is sustained:

a. In the United States of America, its territories or possessions, or Canada, or

b. While temporarily outside the United States of America, its territories or possessions, or

Canada, if the injured employee is a citizen or resident of the United States or Canada; but

suits for damages and actions on judgments must be in or from a court of the United

States, its territories or possessions or Canada.

Unless specifically excluded, coverage for the liability of an employer under admiralty law

and the Federal Employers Liability Act is provided by employers liability insurance.

2. Employers Liability for Diseases

Employers liability insurance for diseases not covered by a workers compensation law or an

occupational disease law is provided by the Standard Policy.

3. Admiralty Law or Federal Employers Liability Act

Employers liability insurance for liability of an employer under admiralty law or Federal

Employers Liability Act is not provided by the Standard Policy. Refer to Rule XII for rules and

endorsements to cover or limit this exposure.

4. Employers Liability Insurance With Workers Compensation Insurance

Employers liability insurance written with workers compensation insurance is provided

by the Standard Policy.

5. Employers Liability Insurance Without Workers Compensation Insurance

Employers liability insurance without workers compensation insurance is prohibited in the state

of Pennsylvania.

D. VOLUNTARY COMPENSATION INSURANCE

1. Description of Voluntary Compensation Coverage

Voluntary compensation insurance does not provide workers compensation coverage and is

not available for employments subject to a workers' compensation law. This insurance affords

the benefits of a designated compensation law as if the affected employees were subject to

that law, even though the law does not require payment of benefits to such employees.

Voluntary compensation insurance shall not provide compensation, medical or other benefits in

excess of the statutory requirements in the workers compensation law designated in the

standard Voluntary Compensation and Employers Liability Coverage Endorsement.

2. How Provided

Voluntary Compensation insurance is provided by attaching the Standard Voluntary

Compensation and Employers Liability Coverage Endorsement (WC 00 03 11A) to the

Standard Policy. Refer to Rule VIII for rules and carrier rating values.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 10

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

E. PART THREE – OTHER STATES INSURANCE

1. Description of Other States Coverage

a. Employers liability insurance and, where permitted by law, workers compensation

insurance are provided in other states not listed in Item 3-A of the Information Page by

listing states where coverage is to be provided in Item 3-C of the Information Page.

b. If workers compensation insurance does not apply because the insured or carrier is unable

to take the necessary action to bring the insured under a workers compensation law, the

carrier will reimburse the insured for all compensation and other benefits required of the

insured under such law.

c. Part Three – Other States Insurance does not provide U.S. Longshore and Harbor

Workers' Compensation Act coverage. It may be afforded only in accordance with Rule

XII.

2. States Where Not Available

Other states coverage is not available in states:

a. With a monopolistic state fund, or

b. Where the carrier elects not to write this coverage.

3. Restriction on Use

Coverage for operations known or expected to be performed in a state not listed in Item 3-A of

the Information Page shall not be provided under Part Three – Other States Insurance.

4. Premium

Premium developed for operations covered under Part Three – Other States Insurance shall be

based on workers compensation rules and carrier rating values.

F. DEDUCTIBLE COVERAGE

Act 44 of 1993 requires an insurer issuing a workers compensation policy to offer a deductible

program upon a policyholder's request.

1. Deductible coverage shall be made part of the policy if requested by the policyholder.

Underwriting criteria for deductible coverage are to be established by individual carriers.

2. The claimants' benefits will be paid by the insurance carrier without regard to any deductible.

3. The policyholder must agree to reimburse the carrier for the deductible amount for any benefits

paid to claimants.

4. Failure of the policyholder to reimburse the carrier for any deductible amount shall be treated

as non-payment of premium under the policy.

5. The loss elimination ratio is determined by the hazard group (found in Section 2 of this Manual)

of the policy's governing classification. Codes 951, Salesmen and 953, office, cannot be

governing classifications unless they are the only classifications on the policy.

6. The premium adjustment for the deductible provisions of the policy shall be reported as a credit

which shall be applied prior to experience modification or other carrier premium modifications.

7. If the policy is issued with a deductible provision, the Deductible Endorsement (WC 37 04 03)

shall be issued and made part of the policy.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 11

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

8. The Pennsylvania Insurance Department has promulgated three deductible coverage levels of

$1,000 per claim, $5,000 per claim and $10,000 per claim respectively. Individual carriers can

offer different deductible levels and/or premium credits upon approval of the Pennsylvania

Insurance Department.

G. GROUP DEDUCTIBLE OR RETROSPECTIVE RATING PLAN COVERAGE

Act 57 of 1996 permits an insurer issuing a workers compensation policy to offer an endorsement for

deductible or retrospective rating plans for groups of five or more employers, subject to approval by

the Insurance Commissioner and subject to the individual insurer's underwriting criteria for deductible

coverage (see F. 1. above).

1. The insurer will issue an individual workers compensation policy for each member of the group.

2. Each group member will be held jointly and severally liable for the payment of premiums or

deductible amounts with regard to benefits paid for compensable claims of the group as a

whole.

RULE III – POLICY PREPARATION – INSURED, POLICY PERIOD AND STATE OF OPERATIONS

Item 1, 2 and 3-A of the Information Page

A. EXPLANATION OF TERMS

1. Employer/Entity

Employer may be an individual, partnership, joint venture, corporation, association, or a

fiduciary such as a trustee, receiver or executor, or other entity.

2. Insured

Insured means the employer designated in Item 1 of the Information Page. If the insured is a

professional association use the Professional Association Act Endorsement in Section 3 of this

Manual.

3. Majority Interest

Majority Interest as defined in the Experience Rating Plan Section applies. The term majority

shall mean more than 50%.

a. Majority of voting stock, or

b. Majority of members or directors if there is no voting stock, or

c. Majority participation of general partners in profits of a partnership.

4. Risk

Risk means a single legal entity or two or more legal entities which qualify for combination in

the state of Pennsylvania.

B. NAME, ADDRESS, AND OTHER WORKPLACES OF INSURED – ITEM 1

1. Name of Insured

In addition to providing the complete legal name of the insured, carriers shall designate each

fictitious name shown on the Information Page by the symbol D.B.A. (doing business as). In

addition, if a fictitious name is shown on an endorsement the same designation, D.B.A., shall

be shown. A fictitious name is a business name which is not the legal name of the insured.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 12

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

The effective date of any change, addition or deletion in the name of the insured shall be

shown on the endorsement.

Name and address changes should be effected on a separate endorsement and not in

conjunction with other policy amendments.

2. Combination of Legal Entities

Separate legal entities may be insured in one policy only if the same person, or group of

persons, owns the majority interest in such entities.

3. Pennsylvania Locations

All locations and operations of the employer in Pennsylvania shall be insured in one policy.

Exception: Long Term Construction Projects (Wrap-up). See Rule IX-D.

C. POLICY PERIOD – ITEM 2

1. Normal Policy Period

The normal policy period is one year. A policy may be issued for any period but not longer than

3 years.

2. Policy for One Year

a. The manual rules are based on a policy period of one year.

b. A policy issued for a period not longer than one year and 16 days is treated as a one year

policy.

3. Policy Longer Than One Year

A policy issued for a period longer than one year and 16 days, other than a 3-year fixed carrier

rating value policy, is treated as follows:

a. The policy period is divided into consecutive 12-month units.

b. If the policy period is not a multiple of 12 months, use the Standard Policy Period

Endorsement (WC 00 04 05) to specify the first or last unit of less than 12 months as a

short-term policy.

c. All manual rules and procedures apply to each such unit as if a separate policy had been

issued for each unit.

4. Renewal Certificates, Agreements and Continuing Form Policies, should be handled as

policies longer than one year.

5. Three-Year Fixed Carrier Rating Value Policy Option

A policy may be issued for a period of 3 years at fixed carrier rating values. Such a policy shall

not be issued if the risk is subject to the Experience Rating Plan on the effective date of the

policy.

A policy issued under this option shall be known as a Three-Year Fixed Carrier Rating Value

Policy and shall be so designated on the Information Page. Refer to Rule XI.

6. Annual Rating Endorsements

An "Annual Rating Endorsement" shall be submitted annually for each continuing form policy

or policy written for a period in excess of one year but not more than three years to be effective

on the anniversary date set by such policy. It shall be submitted to the Bureau not later than

thirty days subsequent to its inception.

Each annual rating endorsement shall be clearly identified by printing in large boldface type at

the top of the endorsement the words "ANNUAL RATING ENDORSEMENT."

Annual rating endorsements shall also:

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 13

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

a. Show the name of the carrier providing the insurance. If the names of affiliated

carriers are printed on endorsement forms, the particular carrier providing coverage shall

be clearly indicated.

b. Show the policy number, including all printed and typed prefixes to facilitate the

identification of the policy to which the Annual Rating Endorsement is related.

c. If the annual rating endorsement being filed replaces an annual rating

endorsement covering the same period, indicate that it is a rewrite.

d. Show the date of its inception and expiration.

e. Show the code number(s) and carrier rate(s) applicable. If the carrier rate(s) or

experience modification is not effective as of inception date of the endorsement, also

show the effective date of such carrier rate(s) or modification.

f. Show the premium adjustment period, deposit premium and estimated annual

premium for the period covered by the Annual Rating Endorsement.

Annual Rating Endorsements shall be used only for the purpose of showing the carrier rates,

experience modifications, premium adjustment period, deposit premium and estimated annual

premium for each one-year period. They cannot be used to make any other changes in the

policy such as, but not restricted to, modifying the name of the insured, adding or eliminating

classifications, adding or eliminating locations.

D. STATE LAWS DESIGNATED IN THE POLICY – Item 3-A

1. Listing of Pennsylvania

Insurance for operations conducted in Pennsylvania is provided by listing the state in Item 3-A

of the Information Page.

2. Longshore Act

The U.S. Longshore and Harbor Workers Compensation Act shall not be entered in Item 3-A of

the Information Page. Refer to Rule XII.

3. Additional States

A state may be added after the effective date of the policy. For the additional state operations,

apply:

a. Carrier rating values in effect on the anniversary rating date of the policy to which the state

has been added.

b. Any change in carrier rating values which applies to outstanding policies for the state

being added.

c. When adding the State of Pennsylvania, the Information Page and attached endorsements

shall be prepared so that the Pennsylvania coverage can be clearly determined.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 14

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

RULE IV – CLASSIFICATIONS

Item 4 of the Information Page

A. GENERAL EXPLANATION

1. Objective

The object of the classification system is to group insureds into classifications so that the rating

value for each classification reflects the exposures common to such distinct business

enterprise (See Rule IV, C. 2. & C. 3.). Subject to certain exceptions described later in this rule,

it is the business of the insured within Pennsylvania that is classified, not the separate

employments, occupations or operations within the business.

B. CLASSIFICATIONS

1. Basic Classifications

All classifications in the Manual are basic classifications, other than the standard exception

classifications. Basic classifications describe the business of an insured such as:

Business

Classification

Manufacture of a Product Furniture Manufacturing

A Process Printing

Construction or Erection Carpentry

A General Type or Character of Business Hardware Store

A Service Beauty Parlor

Classifications are listed in Section Two of the Manual. Notes following a classification are part

of that classification. Also, see Section Two of this Manual for classifications by group

arrangement which is essentially a numeric listing.

2. Standard Exception Classification

Some occupations are common to so many businesses that special classifications have been

established for them. They are called standard exception classifications. Employees within the

definition of a standard exception classification are not included in a basic classification unless

the basic classification specifically includes those employees. The standard exception

classifications are defined below:

a. CLERICAL OFFICE EMPLOYEES – Code 953 – are employees exclusively engaged in

keeping the books or records of the insured or conducting correspondence or who are

engaged wholly in office work where such books or records are kept or such

correspondence is conducted.

This classification shall be applied only to employees herein described who work

exclusively in separate buildings or on separate floors or in departments on such floors

which are separated from all other workplaces of the employer by floor to ceiling partitions

except for retail stores where a partition at least five feet high is required and within which

no work is performed other than clerical office duties as defined in this rule.

If any clerical office employee has any other regular duty, the entire payroll of that

employee shall be assigned in accordance with the class to which the business is

assigned.

(1) The clerk, such as a counter, front desk, lobby, mall kiosk, time, stock or tally clerk

or librarian, whose work is necessary, incidental or part of any operation of the

business other than clerical office, shall not be considered a clerical office

employee. Such clerk should be assigned to the basic classification of the

business.

The cashier also shall not be considered a clerical office employee. A cashier is

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 15

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

(2) responsible for accepting payment for merchandise or services rendered. The

cashier's physical location may include but is not necessarily limited to: a booth,

behind a counter or on a sales floor. The cashier or any employee whose regular

and frequent duty is accepting payment for merchandise or services should be

assigned to the basic classification of the business regardless of the physical work

location.

(3) Office employees shall be separately classified except in connection with those

classes which specifically include Office Employees.

b. DRAFTING EMPLOYEES, Code 953, are employees engaged exclusively in drafting and

confined to office work. The entire payroll of any such employees engaged in any other

operations shall be assigned to the highest Bureau loss cost classification of operations to

which they are exposed.

c. SALESPERSONS – OUTSIDE, Code 951 – are employees either exclusively engaged in

sales or collection work away from the employer's premises or who regularly and frequently

are engaged in --- sales or collection work away from their employer’s premises and devote

the balance of their time in clerical office duties.

This classification is inapplicable to employees delivering merchandise or products. Even

though they may also collect or solicit, such employees shall be assigned in accordance

with the classification appropriate to the business of the employer for which delivery is being

made.

Also not included are floor and/or counter salespersons. Such employees shall be assigned

in accordance with the class appropriate to the business at the location.

Employees who sell or solicit exclusively by telephone shall be assigned to Code 953,

Clerical Office Employees.

Salespersons, Collectors or Messengers shall be separately classified except in connection

with those classes which specifically include all employees or all employees except office.

--- Mobile, self-propelled factory, farm or construction equipment Salespersons – Code 819

are employees engaged in --- selling such equipment, or auctioning automobiles or

instructing persons how to drive an automobile or truck on and away from the insured’s

premises. The separate Code 819 shall be treated as Salespersons – Outside, Code 951,

for the purposes of this rule ---.

3. General Inclusions

a. Some operations appear to be separate businesses, but they are included within the

scope of all classifications other than the standard exception classifications. These

operations are called general inclusions and are:

(1) Commissaries or restaurants operated for an insured's employees except in

connection with construction, erection, lumbering, mining or the recovery of

petroleum and/or natural gas.

(2) Manufacturing of containers such as bags, barrels, bottles, boxes, cans, cartons

or packing cases (and the incident printing thereon) to be used by the employer in

the packaging of its products.

(3) Medical facilities operated by the insured for its employees.

(4) Maintenance or repair and/or cleaning of an insured's buildings, or vehicles or

equipment when performed by employees of an insured.

(5) Printing or lithographing by an insured on its products.

(6) Stamping or Welding – when an integral technique that is a part of an overall

manufacturing process.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 16

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

(7) Drilling or Blasting – when conducted by the employees of a surface or

underground non-coal mine operator to facilitate mineral extraction. Drilling,

redrilling or deepening conducted by an entity whose field of business is the

recovery of petroleum and/or natural gas shall be separately classified.

(8) Quality control of an insured's products or research laboratories engaged in

developing and/or improving products manufactured by an insured.

(9) Drivers, chauffeurs and their helpers including all employees whose principal

duties are the operation and/or the repair of vehicles.

(10) If vehicles, including drivers, chauffeurs and helpers are employed under contract

and if the owner of such vehicles has not insured his compensation obligation and

furnished evidence of such insurance, the actual payroll of the drivers, chauffeurs

and helpers shall be included in the payroll of the insured employer at the proper

carrier rating value(s) for the operations in which they are engaged. If such payroll

cannot be obtained, one-third (1/3) of the total amount paid for the hire of such

vehicles under contract shall be considered as payroll of the drivers, chauffeurs

and helpers.

When the contract price does not include the cost of fuel, maintenance, or other

services provided to the owner or owner-operator of a vehicle under contract, the

value of such goods and services shall be added to the contract price before

determining the one-third (1/3) amount.

If the owner of the vehicle is also a driver, and if in the event of an injury would be

entitled to workers compensation benefits from the insured, (see Section 2 Owner-

Operator Owner/Driver for more detail), use actual payroll or if unavailable, use

one-third (1/3) of the contract price for that vehicle which shall be included in the

payroll of the insured employer.

(11) Tools, dies, molds or fixtures made and/or repaired by an insured that are used in

the insured's product manufacturing operations.

(12) Aircraft travel by employees, other than members of the flying crew, including

employees whose payroll is assigned to the Standard Exception Classifications.

(13) Child day care services operated by the employer for his employees.

(14) Warehousing by an employer of its merchandise, products and/or raw materials.

(15) Security guards protecting their employer’s premises and property.

(16) Heat treating by an insured on its products.

(17) Counter personnel

(18) Cashiers

b. Any operation described by a General Inclusion shall be separately classified only if:

1. Such operation constitutes a separate and distinct business of the insured as

provided in Rule IV - C. below or

2. It is specifically excluded by the classification wording, or

3. The principal business is described by a standard exception classification.

4. General Exclusions

Some operations in a business are so unusual that they are excluded from basic

classifications. They are classified separately unless specifically included in the basic

classification wording. These operations are called general exclusions and are:

(1) Aircraft operation – all operations of the flying and ground crews.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 17

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

(2) New construction or structural alterations by the insured's employees.

(3) Sawmill Operations – sawing logs into lumber by equipment such as circular

carriage or band carriage saws, including operations incidental to the sawmill.

(4) Stevedoring, including tallying and checking incidental to stevedoring.

(5) Mining and Quarrying, Clay, Gravel or Sand Excavation and Dredging.

C. ASSIGNMENT OF CLASSIFICATIONS

1. Object of the Classification Procedure

a. The object of the classification procedure is to assign the one basic classification which

best describes each distinct business enterprise of the insured within Pennsylvania.

Subject to certain exceptions described in this Rule, each classification includes all the

various types of labor found in a distinct enterprise. It is the business which is classified,

not the individual employments, occupations or operations within a business. Additional

classifications shall be assigned as provided below.

b. Act 44 of 1993 permits an insurer to develop subclassifications to the Bureau's

classification system as approved by the Insurance Commissioner. Any such

subclassification shall be filed by the developing insurer with the Bureau and the Insurance

Commissioner thirty (30) days prior to its use. The insurer's filing shall demonstrate that

payroll and loss data produced under such subclassification can be reported to the Bureau

consistent with the Bureau's classification system and statistical plan. Otherwise, the

Insurance Commissioner shall disapprove the subclassification filing.

2. Assignment of a Classification

a. The policy shall contain only classifications approved by the Pennsylvania Compensation

Rating Bureau and in accordance with this Manual.

Each classification is presumed to describe an entire business enterprise. Any policy

which contains more than a single classification cannot contain any classifications

representing a payroll less than that of one full-time employee, but this rule will not apply in

classifications involved in Construction, Erection, Stevedoring, Part-Time Aircraft

Operations or if the business’ basic and major operations are described by the Standard

Exception Classifications and there are employees whose job duties are not assignable to

the Standard Exceptions except as specified in classification phraseology.

Act 44 of 1993 permits an insurer to develop subclassifications to the Bureau's

classification system as approved by the Insurance Commissioner. Any such

subclassification shall be filed by the developing insurer with the Bureau and the Insurance

Commissioner thirty (30) days prior to its use. The insurer's filing shall demonstrate that

payroll and loss data produced under such subclassification can be reported to the Bureau

consistent with the Bureau's classification system and statistical plan. Otherwise, the

Insurance Commissioner shall disapprove the subclassification filing.

b. Single Enterprise. If a risk consists of a single operation or a number of separate

operations which normally occur in the business described by a single manual

classification, or separate operations which are an integral part of or incidental to the main

business, that single classification which most accurately describes the entire enterprise

shall be applied. The separate operations so covered may not be assigned to another

classification even though such operation may be specifically described by some other

classification or may be conducted at a separate location.

Division of payroll shall be made as provided in respect to General Exclusions, Standard

Exceptions or Special Class Wording. For construction or erection work, see special

procedure set forth in Rule IV, C. 5.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 18

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

EXCEPTION

Where a retail outlet is located at the same or contiguous premises as a business'

manufacturing facility, the applicable retail store classification shall apply to the payroll of

the retail outlet provided that such outlet is operated in an area physically separate from

other operations by a floor to ceiling partition and it is separately staffed.

c. Authorized Classifications. When the classification of any insured has been established

by the Rating Bureau, no policy shall be issued or endorsed nor adjustment of premium

made under any other or conflicting classification.

In any instance where the established classification does not describe the current

operations of the insured, the insuring carrier or insured shall draw the matter to the

attention of the Rating Bureau in writing with full particulars prior to the application of any

other classifications. The reclassification shall not take place until the Bureau Staff has

received and reviewed such documentation and has replied in writing to the insured or

insuring carrier agreeing with their position or otherwise advising on which class(es) to

assign.

The insuring carrier is not relieved of the obligation to apply the class authorized for an

insured because of lack of knowledge that the Bureau has established an authorized

classification for that insured.

3. Assignment of Additional Classifications

a. Multiple Classifications/Multiple Enterprises (Not construction or erection operations –

see paragraph 6.)

Additional classifications may be used only when valid evidence supports their

authorization or in conformity with the rules stated under "Standard Exceptions" and

"Exclusions." Additional classes may not be added without Bureau authorization when

their use is in violation of Manual Rules or an existing bureau data card.

Additional classifications shall be assigned to an insured only if the following conditions

exist:

1. If the classification wording requires the assignment of an additional

classification for specified employees or operations.

2. If there are distinct enterprises (meaning thereby businesses, which are

specifically classified in this Manual, but not operations that normally occur

in the business described by the assigned classifications, nor operations

described by any of the General Inclusions), conducted in a given plant by

the same insured and the entire work in each enterprise is conducted either

in a separate building or on a separate floor or floors of a building, or on the

same floor in separate departments divided by floor to ceiling partitions

without interchange of labor and the insured conducts each of such

enterprises as a separate undertaking with separate records of payroll,

then such separate undertakings shall each be separately classified, (and

the proper carrier rating value applied to each).

3. See Governing Classification rules for assignment of incidental operations

that support more than one distinct enterprise.

b. Governing Classification

The governing classification is that classification other than the standard exception

classifications (which may never be the governing class) which carries the largest amount

of payroll exclusive of payroll of miscellaneous employees as defined below.

PENNSYLVANIA WORKERS COMPENSATION MANUAL

SECTION 1 UNDERWRITING RULES

EFFECTIVE DATE: DECEMBER 1, 2009

Page 19

© 2009 PENNSYLVANIA COMPENSATION RATING BUREAU

(1) This concept shall be utilized not in the initial classification assignment process but

to determine how to classify miscellaneous employees when an insured is

assigned two or more classifications.

Miscellaneous employees are employees that either supervise or support all the

various undertakings of the insured. The functions performed by miscellaneous

employees may include but are not necessarily limited to: maintenance, mailroom,

shipping and receiving, yard operations, security, power plant operations, lobby or

front desk personnel, elevator operators, porters, foremen, superintendents or

timekeepers.

(2) The entire remuneration of miscellaneous employees is assignable to the

governing classification.

(3) The governing classification in the case of construction or erection operations shall

be determined on a job basis within each policy period if payrolls are kept

separately by job within the policy period; otherwise on the basis of the entire policy

period.

(4) If the basic and major operations are described by classifications defined as

Standard Exceptions, the payroll of all employees not specifically included in the

definition for such Standard Exceptions shall be separately classified to Code 971.

4. Assignment By Analogy

Any enterprise which is not described by a classification in this Manual shall be assigned to the

classification or classifications most analogous from the standpoint of process and hazard. The

limitations and conditions of the classification or classifications so assigned and all Manual

rules pertaining to the classification shall be applicable.

5. Payroll Assignment – Multiple Classifications - Interchange of Labor