Business Guide GPP Method Of Payment

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 32

- 1 Overview

- 2 Processing

- 3 Manual Handling

- 4 System Configuration and Business Setup

- 5 Message Data

- Appendix A: Glossary

Global PAYplus Version 4.6.6

Method of Payment

Business Guide

Copyright

© 2009-2017 D+H Global Transaction Banking Solutions. All rights reserved. D+H is a trademark of D+H Limited

Partnership.

PROPRIETARY AND CONFIDENTIAL - This document contains information, which contains Confidential and

Know How property of D+H. Disclosure to or use by persons who are not expressly authorized in writing by D+H

is strictly prohibited.

D+H reserves the right to alter the specifications and descriptions in this publication without prior notice. No part

of this publication shall be deemed to be part of any contract or warranty unless specifically incorporated by

reference into such contract or warranty.

All brand or product names are the trademarks or registered trademarks of their respective holders.

The information contained herein is merely descriptive in nature, and does not constitute a binding offer for the

license of the product described herein.

Catalog ID: GPP4.6-00-B03-06-201706

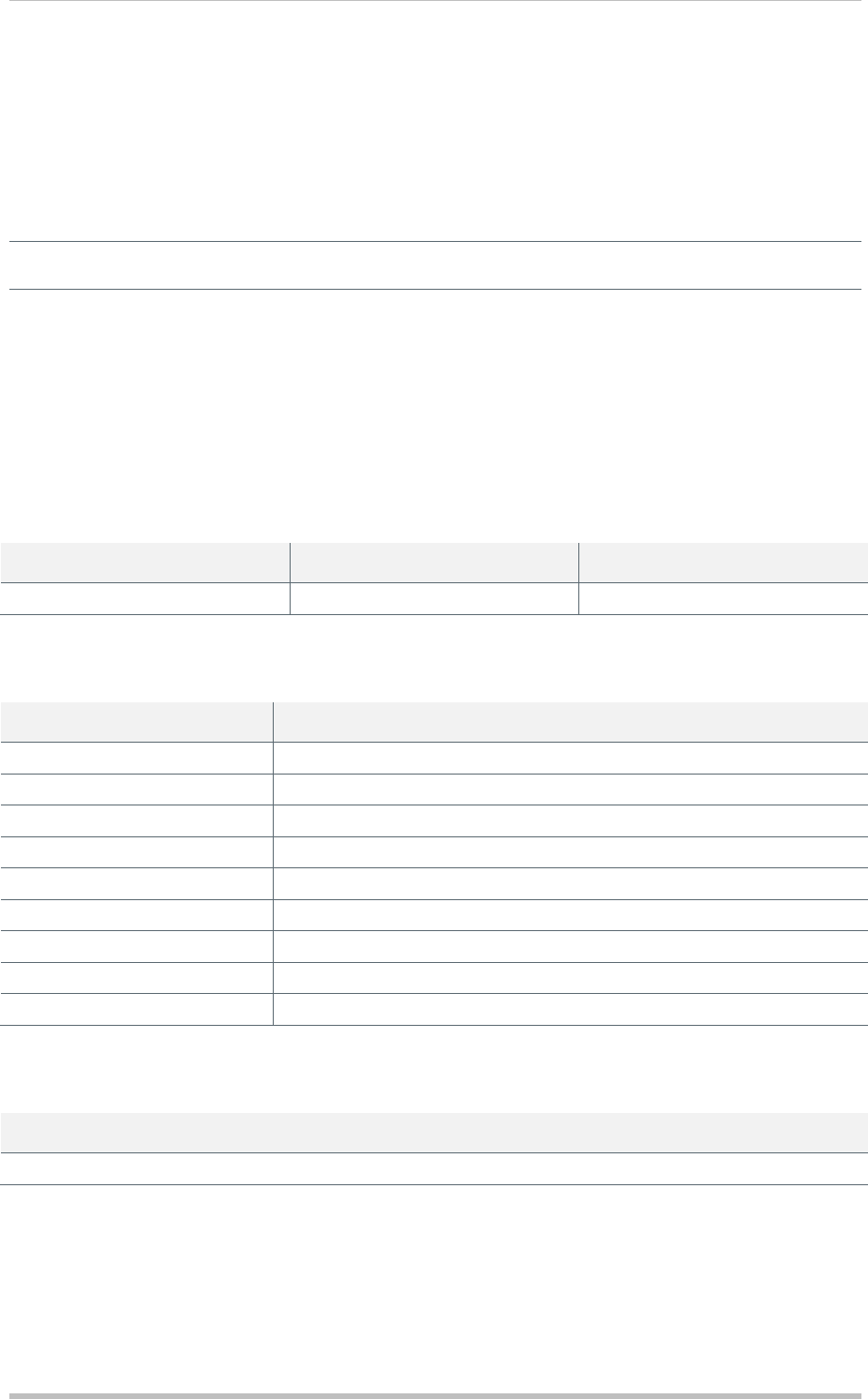

Method of Payment Version Control

Global PAYplus Business Guide Page 3

Version Control

Version Date Summary of Changes

1.0 Document created

2.0 Updated section Memberships with RTGS BIC checkbox, Method

of Payment and Membership Validation with membership check

level Metro/Country, Parties with enhances graphical use interface

image.

3.0 Updated Method of Payments profile

4.0 Document restructured

5.0 Nov 2015 Document updated for rebranding

6.0 July 2016 Updated descriptions of Earliest Value Date, Latest Value Date,

and Value Date Extension

Method of Payment Table of Contents

Global PAYplus Business Guide Page 4

Table of Contents

1 OVERVIEW ..................................................................................................................................... 5

1.1 Introduction .............................................................................................................................. 5

1.2 High Level Schema .................................................................................................................. 5

1.3 Target Audience ....................................................................................................................... 6

2 PROCESSING ................................................................................................................................ 6

2.1 MOP Selection ......................................................................................................................... 7

2.2 Message Type Selection per MOP .......................................................................................... 7

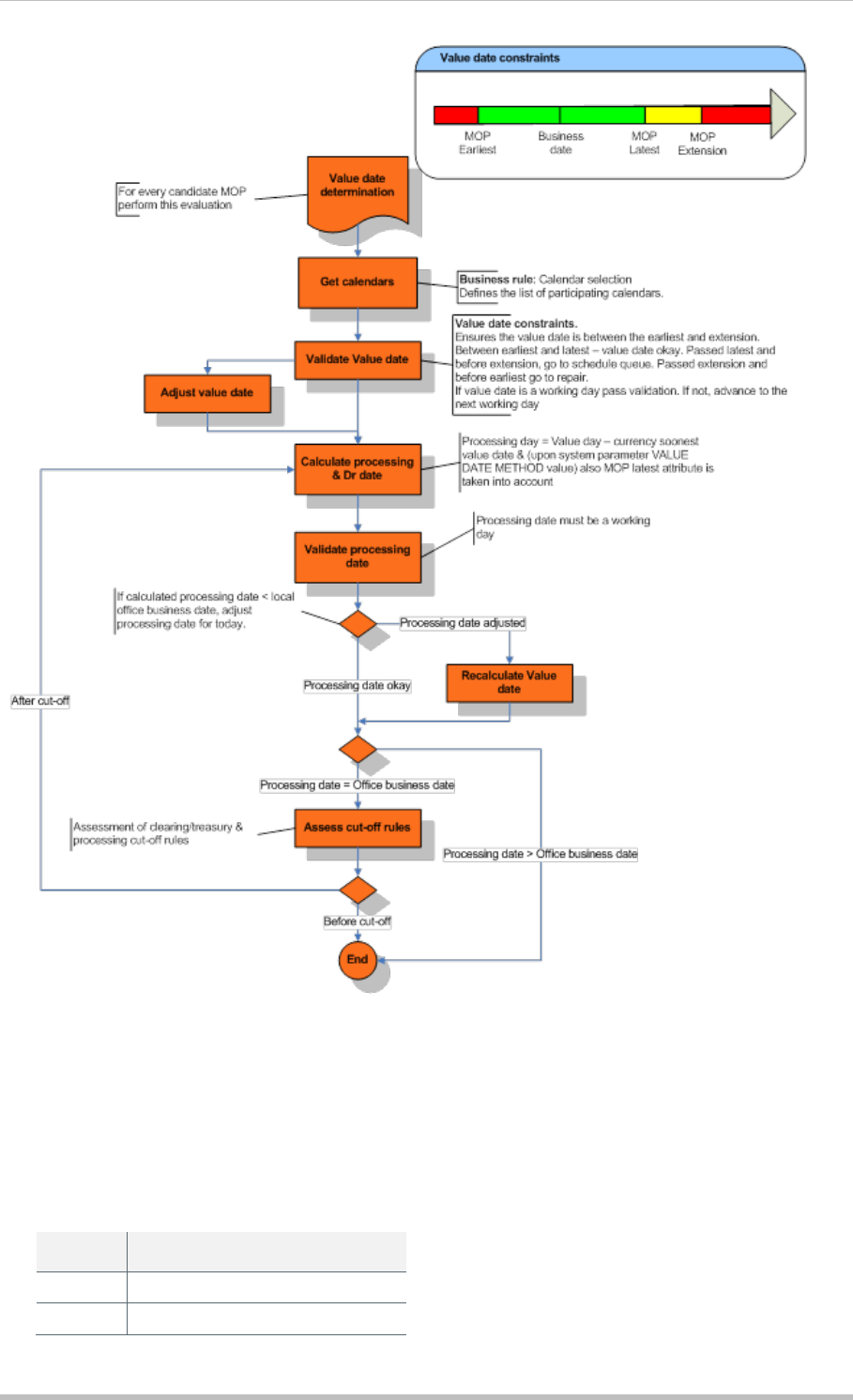

2.3 Value Date Determination ........................................................................................................ 8

2.3.1 Define Participating Calendars ............................................................................................. 9

2.3.2 Validate Payment Value Date ............................................................................................ 10

2.3.3 Calculate Processing Date & Dr Value Date ...................................................................... 10

2.3.4 Validate Processing Date ................................................................................................... 11

2.3.5 Cut-off Assessment ............................................................................................................ 12

2.4 MOP Validation ...................................................................................................................... 12

2.4.1 MT/MOP Validity................................................................................................................. 12

2.4.2 MOP Validation System Rule Assessment ........................................................................ 12

2.4.3 Relationship Management Application (RMA) Validation................................................... 15

2.4.4 Membership Validation ....................................................................................................... 15

3 MANUAL HANDLING ................................................................................................................... 17

3.1 Automated Error Handling ..................................................................................................... 17

3.2 Pre define the Preferred MOP ............................................................................................... 17

3.3 Interim Cut-off Time Handling ................................................................................................ 17

4 SYSTEM CONFIGURATION AND BUSINESS SETUP............................................................... 17

4.1 Business Setup ...................................................................................................................... 18

4.1.1 System Parameters ............................................................................................................ 18

4.1.2 Profiles ................................................................................................................................ 18

4.1.3 Business Rules ................................................................................................................... 27

4.1.4 Statuses .............................................................................................................................. 29

4.1.5 Entitlements ........................................................................................................................ 29

4.2 System Configuration ............................................................................................................. 30

4.2.1 System Rules ..................................................................................................................... 30

5 MESSAGE DATA ......................................................................................................................... 31

5.1 Message Attributes ................................................................................................................ 31

5.1.1 MOP Related ...................................................................................................................... 31

5.1.2 Value Date Related ............................................................................................................ 31

APPENDIX A: GLOSSARY ..................................................................................................................... 32

Method of Payment Overview

Global PAYplus Business Guide Page 5

1 Overview

1.1 Introduction

Method of Payment defines the means via which a payment is executed / delivered (for example,

Book Transfer, SWIFT, via the RTGS/Clearing House).

The method of payment determines many aspects of the processing such as:

• Clearing Settlement account (when using RTGS such as TARGET).

• Value date determination (by taking into account the cut-off restrictions & the relevant calendars

to be used)

• Formats and message types to be used

• Whether membership validation is required (e.g. EBA membership)

• Whether exchange of bilateral keys or RMA required

• Whether routing through correspondents is allowed or not

Global PAYplus (GPP) supports both automatic and manual method of payment selection:

• The initiator (manual or electronic) may determine the method of payment, in which case GPP

validates the requested method of payment against various validation parameters.

• Alternatively, the initiator of the payment may leave the method of payment selection to be

executed by GPP. The automatic method of payment selection is done using the bank-defined

Method of Payment Selection rules. GPP scans all the Method of Payment Selection rules in

order of priority and selects the first one (i.e. the rule with the highest priority) that is valid both

against the payment at hand and against the method of payment itself that gives the earliest valid

value date to the message. This allows the bank to determine its own preferences in usage of the

various alternative methods of payments while maintaining integrity of usage.

This business guide describes in detail:

• MOPs

• Memberships

• Relationship management application (RMA)

• SWIFT Standard Settlement Instructions (SSI) or Bank routing as it is described in GPP

• Value date determination

• Calendars selection

• Cut-off assessment

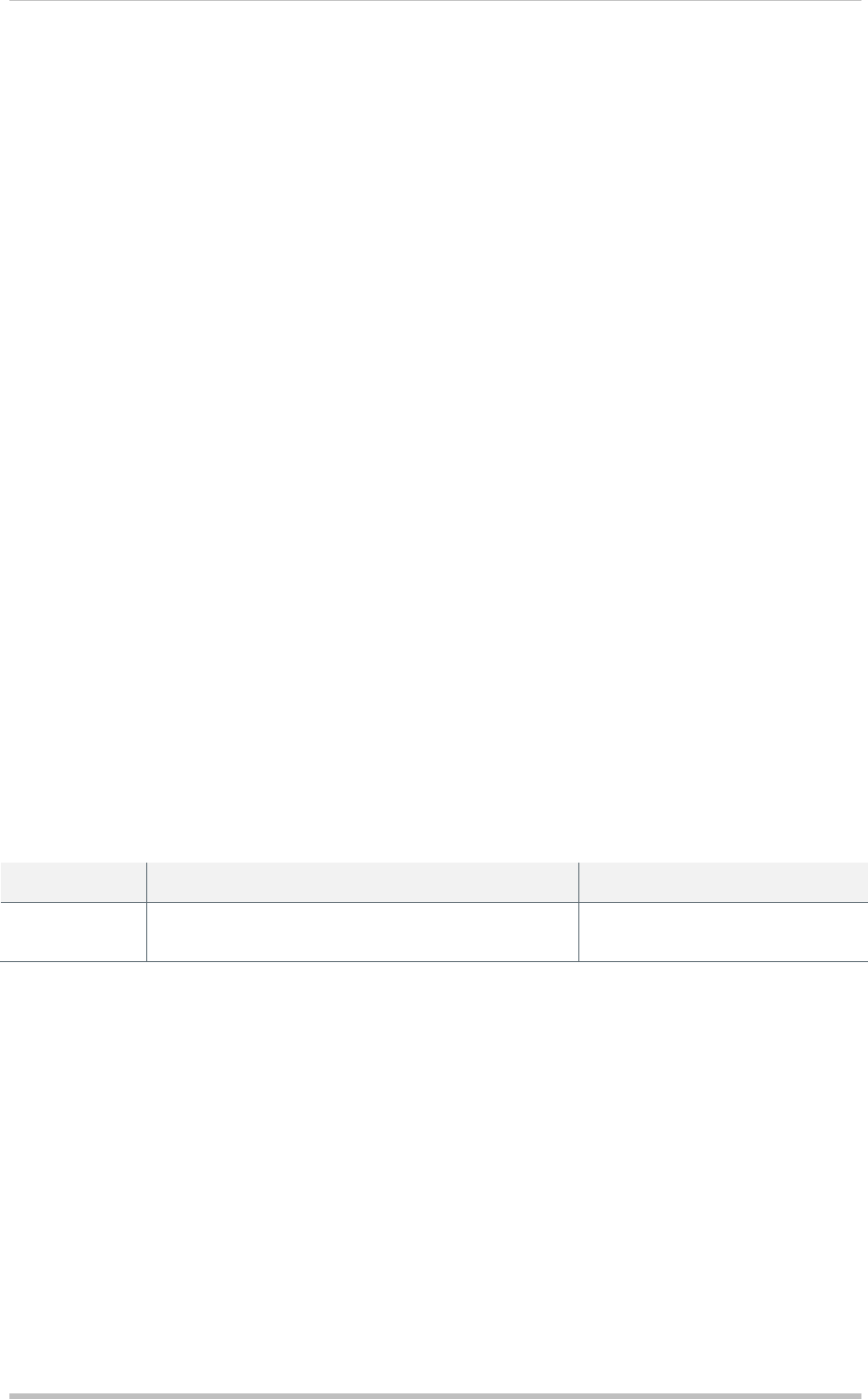

1.2 High Level Schema

Method of Payment Processing

Global PAYplus Business Guide Page 6

1.3 Target Audience

This document describes the MOP workflow. It is designed for business analysts and system

administrators who need to set up and configure this feature. It is also of value to anyone who wants

to know more about how this feature is implemented.

2 Processing

This section details how GPP processes Method of Payment (MOP) selection.

The MOP Selection service determines the best method/channel to transfer funds. It is performed in

seven steps:

1. MOP selection: Selecting all applicable MOPs as determined by payment attributes. This step is

performed first at the specific customer level and then at the default (Office) level.

2. Message type selection per MOP: Temporary setup of Message Type (MT) per the examined

MOP.

3. Value date determination: Calculate MOP Value Date for each of the candidate MOPs found in

previous step. This step includes an assessment of all types of Cut-offs that are set in the system

4. MOP validation: Additional validations that are performed on the selected MOPs from previous

step, or performed on a specific MOP that was input manually.

5. RMA check: Re-check bilateral key dates (if needed).

6. Message type selection: Restore original MT (after all applicable MOPs are examined)

7. MOP determination: Selecting the ‘Best MOP’ out of the MOPs found at previous step.

The service can run in two modes:

• Full MOP Selection – includes steps 1-7

• MOP Validation – includes steps 4-7

In cases where the first-in-credit chain cannot be reached either directly (when accounting

relationship exists) or via a clearing house (usually when sending foreign currency to the first in credit

chain) the Bank routing profile is assessed to find the first-in-credit chain correspondent and MOP

selection is performed again.

See GPP Business Guide Building Correspondent Chain for more details.

Method of Payment Processing

Global PAYplus Business Guide Page 7

2.1 MOP Selection

1. Assess MOP Selection business rules that are attached to the receiving party and the Office.

2. Collect all applicable MOPs.

3. If MOP exists, then continue to MOP Validation.

MOP Selection Rules are used to determine and assign a MOP for each payment.

• The list of available actions for MOP Selection rules consists of all the active MOPs in the system

• The rule can be attached to Party and Office

If a STOP action is defined, the service stops evaluating the MOP selection rules from this point

onward (both at Customer and Office level).

The outcome of the evaluation process is a list of applicable MOPs that are further validated in the

next step.

Note: It is possible that the same MOP is found valid after the MOP selection phase is complete. In

this case, the list of applicable MOPs is distinct (i.e. use only one MOP, where more than one

applicable MOP is found).

2.2 Message Type Selection per MOP

Note: The Message Type may be received with the message, or manually defined by the operator.

System table MSG_TYPE_MOP defines the applicable message types for every MOP.

For example, Target 2 supports SWIFT 103 and 202, and not pain or pacs (ISO based payment

types). Since it is possible for GPP to receive the ISO-based message types, a temporary conversion

Method of Payment Processing

Global PAYplus Business Guide Page 8

is required just to ensure that the message type is supported for the MOP. The validation itself is

performed during the MOP validation step.

The system rule Message Type selection is evaluated and converts the original message type to a

different one depending on the candidate MOP (which is the sub-rule type in this system rule).

The message type is temporarily set in the payment information and it is restored back to the original

message type information when all applicable MOPs have been examined.

Note: Each time a MOP is examined, the relevant Message Type – if found by the process –

becomes the temporary Message Type, overriding the previous one. The original Message Type is

restored before selecting the best MOP.

2.3 Value Date Determination

For every candidate MOP, a value date calculation is performed.

To be able to conclude, the processing date, which is an internal attribute, should be determined. This

is the date the payment needs to be processed by before posting. It comprises the following steps:

• Define Participating Calendars

• Validate Payment Value Date

• Calculate Processing Date & Dr Value Date

• Validate Processing Date

• Cut-off Assessment

Method of Payment Processing

Global PAYplus Business Guide Page 9

2.3.1 Define Participating Calendars

• Assess Calendar Selection business rule to allow a selection of the relevant participating

calendars.

• The system default selection is the list of all participating calendars. The business rule action

allows an exclusion or inclusion of specific (or some) calendars from the list. In this rule, all

matching rules are selected.

• Calendar list:

# Calendar Name

1. Local office

2. MOP

Method of Payment Processing

Global PAYplus Business Guide Page 10

# Calendar Name

3. Debit currency

4. Credit currency

5. Country (of receiver)

6. Customer (receiver)

• The list of actions (calendar inclusion/exclusion):

Rule Action Name

Exclude Country Calendar

Exclude Credit Currency Calendar

Exclude Credit Customer Calendar

Exclude Debit Currency Calendar

Exclude Mop Calendar

Exclude Office Calendar

Include Country Calendar

Include Credit Currency Calendar

Include Credit Customer Calendar

Include Debit Currency Calendar

Include Mop Calendar

Include Office Calendar

The system concatenates all defined calendars into one virtual calendar. This calendar takes effect in

the business date calculation.

2.3.2 Validate Payment Value Date

1. If the payment value date >= local office business date:

a. If the payment value date < MOP attribute extension, ensure the payment value date is a

business date for the concatenated calendar. If the payment value date is a non-working day,

advance the payment value date to the next working day.

b. If the payment value date > MOP attribute extension, stop evaluation and set the payment to

repair.

2. If the payment value date < local office business date:

a. If the payment value date < MOP attribute earliest, set the payment value date to the earliest

value date.

b. If the payment value date > MOP attribute earliest, ensure the payment value date is a

working day. If it is a non-working day, adjust it to the next working day.

2.3.3 Calculate Processing Date & Dr Value Date

1. Set Soonest value date (Soonest std vd) attribute. Soonest value date = the value of the

participating customer overrides soonest value date (D_STANDARD_VD). If not empty, then

soonest value date is known and should be taken into account as received. This skips the

derivation phase below. If received empty, then value should be derived. Continue to next step.

a. If there is no currency conversion involved, set soonest value date = 0 and exit service.

Method of Payment Processing

Global PAYplus Business Guide Page 11

b. If there is currency conversion in payment or where there is no conversion but system

parameter ALWAYS_INCL_CCY_SOONEST is set to Yes, derive the soonest value date as

follows:

i. Define the relevant participating customer in conversion (i.e. either debit or credit

customer) and check whether the customer is set up for expedited soonest value date

(CUSTOMRS.FX_EXPEDITE = 1).

ii. Find a matching soonest value date profile from:

- Exchange rate info for the specific payment currency pairs

- Currency preferences (referring to the “other” currency with base currency)

2. Calculate processing date:

a. VALUE_DATE_METHOD set to LATEST:

b. With system parameter VALUE_DATE_METHOD set to LATEST the debit value date is

defined by the soonest value date (working days) before the instruction value date and the

processing date is the same as the debit value date.

Processing date = value date –soonest value

date

Dr date = Processing date

c. VALUE_DATE_METHOD set to EARLIEST_PD

i. With system parameter set to EARLIEST_PD, the debit value date is defined by the

soonest value date (working days) before the instruction value date and the processing

date is defined by the MOP latest value date (this may cause situations where a message

is sent out of the bank with future debit and credit value date).

Processing date = value date – Maximum

of (MOP latest & soonest value date)

Dr date = value date –soonest value date

d. VALUE_DATE_METHOD set to EARLIEST_DR :

i. With system parameter set to EARLIEST_DR, the debit value date is defined by the

soonest value date (working days) before the instruction value date and may be changed

if the MOP latest value date enables sending the message in advance. In this case, the

debit value date is adjusted to the MOP latest MOP value date (no earlier than TODAY).

The processing date is defined by the MOP latest value date as well.

Processing date = value date – Maximum

of (MOP latest & soonest value date)

Dr date = Processing date

2.3.4 Validate Processing Date

Processing date must be greater than or equal to the office business date.

1. If < TODAY, then set the processing date for TODAY and recalculate the new credit value date.

2. Must be a working day:

a. If a holiday then move forward to the next working day.

b. Reevaluate value date if processing date was adjusted.

Method of Payment Processing

Global PAYplus Business Guide Page 12

2.3.5 Cut-off Assessment

1. Processing date is performed for TODAY processing date only.

2. If passed Cut-off time, advance processing date (for processing Cut-off) or credit value date (for

clearing and treasury Cut-off) & recalculate the value date.

3. If processing date > business date, the Cut-off rules are not assessed and the payment is

warehoused in the Scheduled queue

4. The following logic applies for all Cut-off assessments:

a. Assess the relevant Cut-off business rule to retrieve a Cut-off profile.

i. Cut-off profile includes interim Cut-off time and final Cut-off time.

ii. It is also possible to define different times per specific dates.

b. If rule is not found, take the default rule that is defined in the Static Data as follows:

i. Default processing Cut-off rule over the local office profile.

ii. Default clearing Cut-off rule over the MOP profile.

iii. Default treasury Cut-off rule over the currency profile.

c. If a rule is found (or if taken from the default profile) check server local office time with the

interim and final Cut-off time.

i. If before interim Cut-off time, then set the relevant cut-off status to ‘Before’.

ii. If after interim and before final, set the relevant cut-off time to ‘XXX’ and assess the

missed Cut-off business rules.

- If a matching rule is found, set payment status to Repair and prompt the user (would

you like to override). User action may be:

Override (allow processing) – set cut-off status to ‘XXX’

Not override – set Cut-off status to ‘XXX’

- If a matching rule not found, the interim cut-off is considered as passed Cut-off and

will be set to ‘XXX’.

iii. If after final Cut-off, set the Cut-off status to ‘After’.

Note: System parameter REPAIR_AFTER_CUTOFF specifies whether the system can move the

value date when Cut-off time is passed. This is done when the payment was captured via a feeding

system and the bank/FI is obligated for the feeding value date and considers the passed Cut-off time

a bank/FI issue.

2.4 MOP Validation

2.4.1 MT/MOP Validity

The MT/MOP combination validity is checked by accessing the MSG_TYPE_MOP table with the

payment’s MT and candidate MOP. If the combination is found, the service continues with the

evaluation of the MOP validation rules. Otherwise, the service stops the evaluation of the current

MOP and continues to the next MOP. An error describing the reason for failure of the current MOP

needs to be defined.

2.4.2 MOP Validation System Rule Assessment

The MOP profile includes attributes that help in specifying the MOP. Some attributes are used for

validation, for example, the MOP maximum allowed amount is specified in the MOP profile and is

validated to be within the MOP boundaries for every payment.

The following attributes take part in the MOP validation:

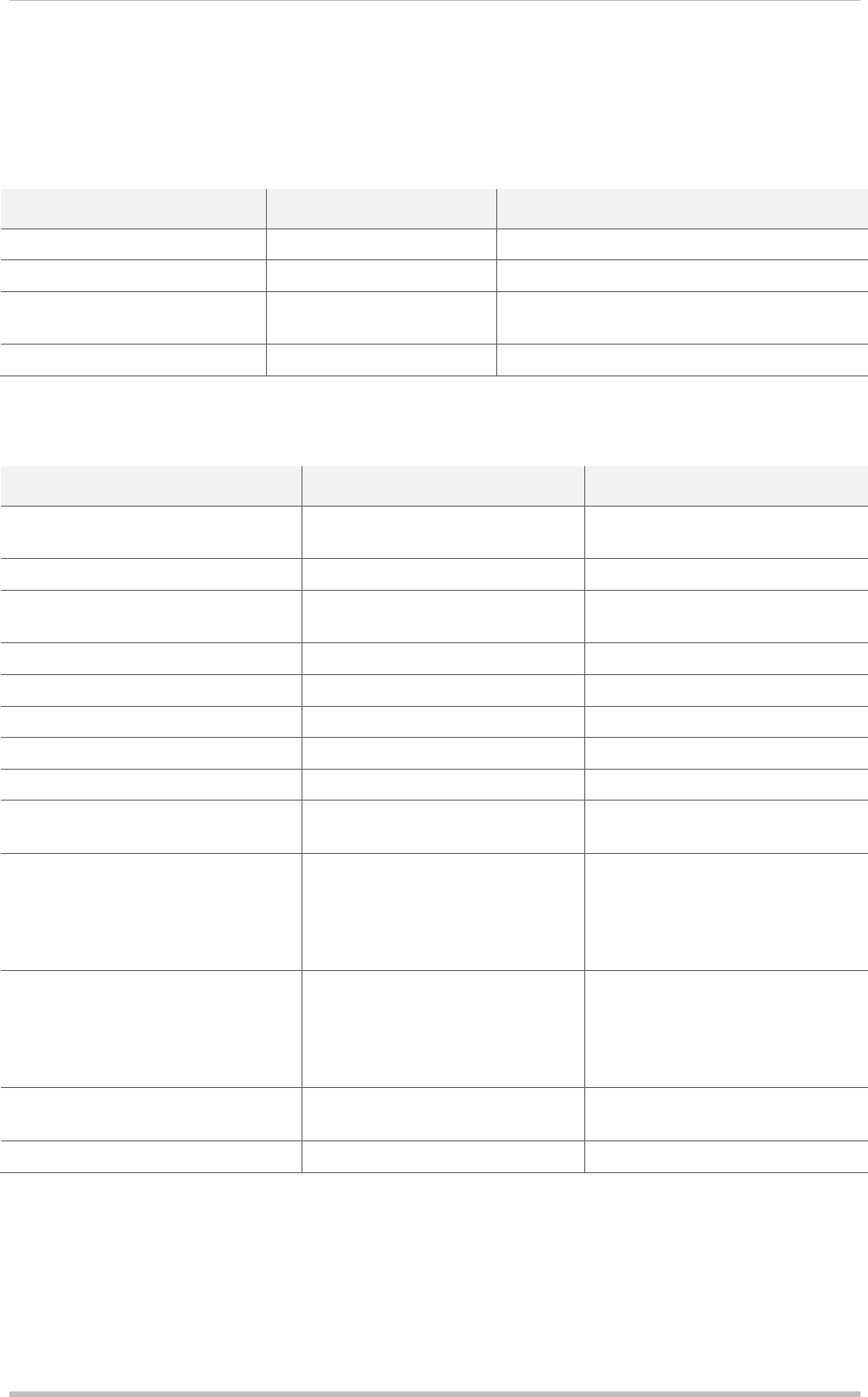

Method of Payment Processing

Global PAYplus Business Guide Page 13

Field/Flag Description Comments

MOP down This option is used to indicate that the

MOP is not available for selection. In exceptional cases, where the MOP

is not applicable, it is easier to amend

the MOP down flag so that all

payments fail the MOP down

validation, rather than change the rule

attachment.

Currency MOP currency (where applicable).

Min. amount The minimum amount (in base currency)

of a payment that this MOP will accept. The minimum and maximum amounts

are validated for every payment.

Max. amount The maximum amount (in base

currency) of a payment that this MOP

will accept.

See above

Allowed for non-

accounting

messages

Indicates that the MOP can be selected

for non-accounting messages.

Sender/Receiver

Type Specifies the identification code type

used for the Sender and Receiver of the

message, for example, BICs for SWIFT,

ABAs for FED messages, etc.

Membership

required Indicates that membership validations

are required for the MOP.

Draft currency Validates that the payment currency is a

Draft Currency as set up in the Currency

profile.

The MOP Validation system rule specifies extra validations that should be performed on the candidate

MOP. The table describes a pre-defined set of rules that cover the current validations:

Rule Name Rule Description Conditions

MOPDOWN If the MOP down check box is

selected, the MOP is not

available for use.

[Cdt MOP Down] is TRUE (MOP Down flag =

Cdt MOP Down refers to MOP.MOPDOWN

MOPCURR If MOP currency is not defined,

then all currencies are valid.

If MOP currency is defined (not

empty), check that the

Instruction Currency is equal to

MOP Currency or if MOP

Currency = EUR and Instruction

Currency is flagged to ‘In Euro’

If not equal or not flagged then

the MOP is not valid.

[Cdt MOP Ccy] Is Not EMPTY AND

(

([Cdt MOP Ccy] <> EUR AND [Cdt MOP Ccy]

<> [Sttlm Ccy])

OR

([Cdt MOP Ccy] = EUR AND [Instr ccy euro] <>

IN AND [Orgnl sttlm ccy] <> [Cdt MOP Ccy])

)

* Instr ccy euro [F_INSTR_CCY_EURO] is the

reference to the currency profile euro IN indicator.

Method of Payment Processing

Global PAYplus Business Guide Page 14

Rule Name Rule Description Conditions

MOPDRAFT If Draft currency in MOP profile

is un-checked – Skip validation

If checked, validate that the

payment currency is allowed as

a Draft Currency (specified in

the currency preferences profile

for the settlement currency)

[Cdt MOP Chk Draft Ccy] Is TRUE AND [Instr ccy

draft] Is Not TRUE

Cdt MOP chk draft refers to

MOP.CHK_DRAFT_CURRENCY

Instr ccy draft ccy refers to

CURRENCY_BU.DRAFT_CURRENCY

MOPMINMAX

A If Min/Max Amounts are not

defined – Skip the validation.

If instruction is below the Min

amount, then the MOP is not

valid.

If Instruction amount is over the

Max amount, then check the

‘MOP split over amount’ flag.

If the flag is not checked, then

the MOP is not valid.

If the flag is checked, then the

MOP is valid.

([Cdt MOP Min Amt] Is Not EMPTY AND

[Sttlm amt] < [Cdt MOP Min Amt])

OR

([Cdt MOP Max Amt] Is Not EMPTY AND [Sttlm

amt] > [Cdt MOP Max Amt] AND [Cdt MOP Split

Over Max] Is FALSE)

Cdt MOP Split Over Max refers to

MOP.SPLIT_OVER_MAX

Cdt MOP Min Amt refers to MOP.MINAMOUNT

Cdt MOP Max Amt refers to MOP.MAXAMOUNT

MOPIDETIFY Checks the Sender/Receiver

identified in MOP when the

MOP is specified as a MOP

that sends out payments

(MOP.SENDOUTMSG)

If checked, validates that the

Sender and Receiver are

identified in the MOP – Sender

(SEND_ABA) and Receiver

(REC_ABA) can be identified

by the type defined in the

‘Sender/Receiver Type’ field.

For example:

‘Sender/Receiver Type’ = SA,

Sender and Receiver should be

identified by a BIC

‘Sender/Receiver Type’ = FW,

Sender and Receiver should be

identified by an ABA

If Sender ID is defined in the

MOP, then there is no need to

validate the Sender.

If Sender and Receiver cannot

be identified, then MOP is

invalid.

If MOP.NCC_TYPE not empty

and swift required and

CR_NCC_TYPE=MOP.NCC_T

YPE then valid

([Cdt MOP Send Out Msg] Is TRUE

AND [Cdt MOP Sndr BIC] Is EMPTY

AND (([Cdt MOP Send Rec ID Cd] = SA

AND ([Cdt pty BIC] Is EMPTY

OR [Instg pty BIC] Is EMPTY))

OR ([Cdt MOP Send Rec ID Cd] = FW

AND ([Cdt pty ABA] Is EMPTY

OR [Instg pty ABA] Is EMPTY))

OR ([Cdt MOP Send Rec ID Cd] = CP

AND ([Cdt pty alias] Is EMPTY

OR [Instg pty alias] Is EMPTY))))

OR ([Cdt MOP Send Out Msg] Is TRUE

AND [Cdt MOP Sndr BIC] Is Not EMPTY

AND (([Cdt MOP Send Rec ID Cd] = SA

AND [Cdt pty BIC] Is EMPTY)

OR ([Cdt MOP Send Rec ID Cd] = FW

AND [Cdt pty ABA] Is EMPTY)

OR ([Cdt MOP Send Rec ID Cd] = CP

AND [Cdt pty alias] Is EMPTY)))

Cdt MOP Send Out Msg refers to

MOP.SENDOUTMSG

Cdt MOP Sndr BIC refers to

Cdt pty BIC refers to CUSTOMRS.SWIFT_ID

Cdt MOP Send Rec ID Cd refers to

MOP.SEND_REC_IDCODE

Cdt pty ABA refers to CUSTOMRS.ABA

Cdt pty alias refers to CUSTOMRS.ALIAS

MOP.NCC_TYPE

CRACCNOTE

X Credit account does not exist

If credit account does not exist,

[Cdt MOP Sttlm acct exists] Is FALSE

Method of Payment Processing

Global PAYplus Business Guide Page 15

Rule Name Rule Description Conditions

then do not select a MOP that

does not have a clearing

account.

AND [Cdt acct nb] Is EMPTY

AND [Msg class] <> OPI

Cdt MOP Sttlm acct exists refers to

MOP.SETT_ACC_EXISTS

If the MOP is found to be invalid, i.e., a fitting rule is found, the service stops the evaluation of the

MOP validation rules and continues to the next MOP. If there is no other MOP to validate, then the

MOP Selection service finishes.

2.4.3 Relationship Management Application (RMA) Validation

If no fitting rule is found, meaning the MOP is valid, the service performs the RMA (former Bilateral

Keys) validation (where required to do so by candidate MOP profile)

If the RMA check required check box is not selected in the Method of Payment profile

(MOP.BILATERALKEYREQUIRED), then skip validation. If it is selected, then continue with the

validation.

If selected, validate that there is a relationship with the candidate receiving bank (can be either the

initial receiver or the full member that was mapped to receiver field) in Bilateral Key Profile.

Note: In the past, the validation of relationship was determined based on the existence of Bilateral

Key between 2 counterparties. As of 2008, SWIFT introduced a mechanism called RMA that replaces

the Bilateral Key mechanism and is now used for relationship validation.

If the MOP RMA check box is selected, access the SWIFT RMA profile with the following parameters:

• Correspondent – the candidate receiver, BIC8

• Sender – “own” BIC8

• Payment’s Value Date – if either the Start Date or the End Date of the RMA record is filled, the

payment’s processing date must be between those dates. The dates are expressed in

Coordinated Universal Time (UTC). However, since the payment’s processing date is only

calculated later in the process, the validation of the date will be checked only after the processing

date is determined, that is, after Step 4. If either the Start Date or the End Date of the RMA record

is filled, a flag will be set to indicate that Step 5 needs to be performed.

• Payment’s MT (Message Type) – first, the process will check if the MT requires authorization – an

attribute of the MT. If it requires, and the permission list in the RMA record is not empty, then the

process will further check if the payment’s MT exist in the include list of MTs for this particular

correspondent (or the payment’s MT is not included in the excluded MTs – depending on the

implementation).

The process only returns entries in active status. If no entry is found for the specific parameters, the

MOP is not valid.

2.4.4 Membership Validation

Membership is validated if the MOP validation business rule passes and the candidate MOP requires

membership check.

1. If the Membership required flag is not selected in the Method of Payment profile, then skip

validation.

2. If membership check is required, then

Method of Payment Processing

Global PAYplus Business Guide Page 16

d. Assess the type field to have an indication of the method of assessing the membership

profile. Where type (MOP.MEMBERSHIP_TYPE) =

iv. MOP – use the MOP name to assess membership profile.

v. Group – use the group name (defined in the next field- MOP.MOP_GROUP) to assess

the membership profile.

vi. MOPs in Group – Find all MOPs that are associated with the defined group name field

(i.e. get a list of MOPs in hand) and find membership to one of these MOPs in

membership profile.

3. The Country entry point check box in the Method of Payment profile is an additional check box

that also defines the Membership assessment method: If selected, it indicates the entry point

defined for the country of the receiver prior to membership validation. That is whether the receiver

country code profile (COUNTRY_CFG.STEP2_ENABLED= 1) is set for Step2 enabled. Relevant

for STEP2 XCT MOP

4. When assessing the membership profile, the following is assessed:

a. Select Member Type, Member ID, MOP and Processing Date.

b. The values of Member Type, Member ID and MOP may change as follows:

Member Type and Member ID (Receiver of the payment)

1) If the receiver is identified in the MOP:

Member Type = Sender/Receiver Type in MOP profile (SA, FW or CP)

Member ID = Receiver (SA – SWIFT_ID, FW – ABA, CP – ALIAS)

2) Or Member Type = MOP.NCC_TYPE (of the evaluated MOP)

Member ID = the value in CR_NCC

5. Analyzing the results:

a. If an entry found, validate that the Business Date is within the Valid from and Valid to dates. If

not, MOP is invalid.

b. If the entry found is marked as associate (MEMBERSHIP.MEMBERASSOCIATE=A), then

map the full member (MEMBERSHIP.MEMBERIFASSOCIATE) to be the new first-in-credit

chain (in most cases it becomes the message receiver).

c. If no entry is found and the Receiver is identified by a BIC (Member Type = SA) then perform

the check again:

i. If Check main BIC in membership check box (MOP.CHK_MAIN_BIC) is flagged, look for

an entry in the Memberships.

Set the Member check level

Metro (6 BIC digits, default)

Country (8 BIC digits)

d. If no entry is found, then MOP is invalid.

Method of Payment Manual Handling

Global PAYplus Business Guide Page 17

3 Manual Handling

3.1 Automated Error Handling

If GPP is not able to derive a MOP for the payment at hand, the payment is dropped to Repair for

manual handling. Error messages are displayed in the error pane of the message.

Following manual handling (either correcting the payment or static data setup), the user must submit

the payment for processing. GPP will then execute the MOP selection process again.

3.2 Pre define the Preferred MOP

When manually handling a payment, the user can either request that a specific MOP be assigned to a

payment or allow GPP to determine the MOP for the payment at hand by invoking the MOP selection

process.

If the user selects a specific MOP for the payment (selects the MOP from the drop-down list, where all

MOPs appearing is this list are the MOPs whose profile is checked for manual selection by a User)

then GPP only performs MOP validation. If validation fails then the payment is dropped to Repair with

an error message indicating the reason for validation failure. If validation is successful, processing

continues on the payment with the requested MOP.

3.3 Interim Cut-off Time Handling

When the missed cut-off rule found (i.e. passed interim cut-off time and before final cut-off time) the

payment is routed to repair queue and the operator has to define whether the payment can continue

processing (i.e. considered as if it is before final cut-off time) or actually passed cut-off.

4 System Configuration and Business Setup

The list of available MOPs is defined by D+H. If a new MOP is required, please contact D+H. All

provided MOPs are setup on the global level office (from which an office based MOP can be copied

and set).

The list of provided MOPs is:

MOP Description

BOOK In-house payments

DRAFT Draft

EBA Direct payment

EURO1 EBA EURO1

SWIFT SWIFT

STEP1 EBA STEP1

XCT EBA STEP2 XCT

SCT EBA STEP2 SCT

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 18

4.1 Business Setup

4.1.1 System Parameters

Specify whether the default global offices values are okay and if not specify a local office system

parameters entries.

Name Description

ALWAYS_INCL_CCY_SOONEST Refer to the currency soonest attribute even when no need for

currency conversion. Default is No

REPAIR_AFTER_CUTOFF If payment has passed Cut-off time, payment is sent to repair

rather than forwarding the value date so that the payment is sent

to SCHEDULE. This system parameter is different to standard

GPP functionality. Default is No

4.1.2 Profiles

These are the details of the required setup in GPP profiles for the Method of Payment.

Note: For a detailed description of all the fields in the profiles, see GPP Online Help.

4.1.2.1 Office

The Offices profile identifies the main bank and all subsidiary banks and branches within a GPP SP

installation. A single GPP SP installation can serve a number of institutions or branches.

These are the specific fields in the Offices profile that must be defined for MOP processing.

Field Name Description

Base currency Code for the base currency that this office uses. The list is derived from Profile

➔ Global ➔ Currencies Info. This attribute is used in the Statuses and Filters

tree to show the total message count and the corresponding base currency

amount.

Business date Business date of the office. Automatically populated based on the default

office business date. This date is updated automatically by End-of-Day tasks.

Next business date States the next calculated business date for the office.

Calendar National/regional holiday calendar to use at this office, selected from a drop-

down list. The list is derived from Profile ➜ Schedule ➜ Calendars.

Default Cut-off

name Processing cut-off time for the office. No payment for the office is processed

after this time. The list is derived from Profile ➜ Cut-off Times.

4.1.2.2 Parties

The Parties profile maintains the customer data. Customers can be financial institutions with which

the office has a relationship or a private (non-financial) customer of the bank. The Parties profile

defines bank information within the SWIFT or similar payment network. In this context, a Party

includes any financial institution in the payment network, including your own financial institution.

These are the specific fields in the Main panel of the Parties profile that must be defined for MOP

processing.

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 19

Field Name Description

Party Name Name of the party

BIC/BEI ISO 9362 (also known as BIC code or SWIFT code) is a standard format of Bank

Identifier Codes approved by the International Organization for Standardization. It

is the unique identification code of a particular bank.

ABA The American Bankers Association (ABA) is a free-trade and professional

association that promotes and advocates issues important to the banking industry

in the United States.

ABA codes are assigned to American banks

Clearing

Participant ID Additional optional identification code for the clearing house.

Registration code that identifies a financial institution that is engaged in trading

securities.

Calendar Enables a calendar to be assigned to a party for payment value date calculations

when the party is the payment receiver. Clicking opens a list of

national/regional holiday calendars. The list is derived from Profiles ➔ Schedule ➔

Calendars.

Base currency Specifies the party base currency.

Memberships

Button Opens the Memberships profile Data Search window for accessing the relevant

party’s membership information.

Bank Routing

Button Opens the Bank Routing profile Data Search window for accessing the relevant

party’s Bank routing information.

These are the specific fields in the Processing panel of the Parties profile that must be defined for

MOP processing.

Field Name Description

Override serial

payments with

direct/cover

If selected, overrides the Transfer Method profile default settings. Setting this flag

always sends both direct and cover, rather than serial.

Serial payments may still be sent if the Beneficiary Band does not have

SWIFT RMA keys.

Expedited FX

settlement If selected, overrides the currency profile Soonest Value Date attribute with Next

Day Value. For example: if AUD is a spot currency for a U.S. office and the

customer has the Expedited FX Settlement selected (checked), then for that

customer the currency attribute is Next Day Value.

Prohibit Rolled

VALUE DATE

forward

Determines whether or not the maturity date (settlement date) on collections

received from a Creditor or Indirect Participant, should be rolled forward to the

earliest available settlement date.

• If the check box is unchecked then the settlement date will be rolled forward to

the next available working day.

• If the check box is checked then the settlement date will not be rolled forward

and the payment will be rejected with the following error.

4.1.2.3 Bank Routing

Bank Routing Profiles are also known as Standard settlement instructions (SSI). It is a directory that

sets up, for each bank/FI, a list of agents that holds its foreign currency accounts. The bank route is

associated with a party in the system (i.e. BIC11 level).

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 20

The business practice may define a higher level of bank routing that applies for all the

banks/branches below that level. For example, it is possible to have a bank route for bank

BANKGB22 (region level) and to state that all branches below it (example: BANKGB22ABC and

BANKGB22DEF) share the same configuration.

Ensure the SSI information is setup under this profile. You may use profile update task to perform this

task by a service.

These are the specific fields in the Bank Routing profile that must be defined for MOP processing.

Field Name Description

Destination

Bank The destination bank code for the message.

Name Name of the bank. Populated automatically based on the Destination Bank

selection.

Currency

Code Select the required currency code. If not selected, routing operates for all

currencies.

Route Level Banks should setup all bank routes and specify the route levels as follows: Metro

for BIC 8 setup, Country for BIC 6 setup, Full for BIC 11 setup.

BIC The Bank BIC. Populated automatically based on the Destination Bank selection.

Message Type Select an option to associate a message type with an agent.

Agent The agent of the destination bank.

Agent Name The name of the agent. Populated automatically based on the Agent selection

Transfer

Method Select from three options:

Serial: Direct message/transfer funds via a third bank

Cover: Direct cover message transfer from bank to bank, with funds transfer via a

third bank

Transfer method profile: Sending serial payments or direct and cover messages to

chosen countries for a given currency, as specified in Transfer method profile

4.1.2.4 Memberships

Most clearing houses require the payment receiver and sender to be a member. The Membership

profile defines whether the MOP requires membership and a list of parties that are members for a

certain clearing house.

Define all the required memberships.

These are the specific fields in the Membership profile that must be defined for MOP processing.

Field Name Description

MOP MOP in which membership is being registered.

Member Type Allows linking an associate member bank against a settlement bank with ID of

type Sort Codes.

Note: When the MOP Sender/Receiver type is BIC and the NCC type is SC, then

Member IDs may either be Sort Codes or BICs, but the Member if-Associate (in

other words, the Member ID of the Member via which as associate is a member)

must always be a BIC.

Member ID Member ID for the MOP selected from the Parties Data Search window. After

selection, value of BIC/BEI, ABA or CP ID, is shown based on the Member Type.

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 21

Field Name Description

Main BIC If selected, indicates that when membership check using BIC-11 fails, the system

executes the check again, looking for an entry where the first 8 characters of the

BIC are the same and the entry is flagged as a Main BIC entry.

Type of

Membership Three types of membership:

• Full member: Indicates full membership in the MOP, and Member field is

disabled

• Associate: Indicates associate membership in the MOP, that is, the member

via which this bank is a member of the MOP. When selected, Member drop-

down list is enabled

• RTGS BIC: For future use

Member/City Member/City selected from the Parties Data Search window. This field is disabled

if Full Member is selected from Type of Membership.

Valid from/to Effective start and expiry date of membership.

RTGS BIC Indicates that the party is a member of RTGS

4.1.2.5 Method of Payment

The Method of Payment profile is provided to support the wide variety of payment methods. A MOP

profile is defined for each method of payment.

The profile includes several parameters that allow the MOP to be configured to conform to the

characteristics of the payment channel, and how the bank utilizes the specific channel, for example,

whether membership is required, minimum and maximum transfer amounts, whether to check Cut-off

times, or the acceptable greatest prior or future value date allowable.

Every payment is assigned a “debit” (“original” or “incoming”) MOP to indicate how the payment was

received. Additionally, every payment within GPP SP is assigned a “credit” (“current” or “outgoing”)

MOP which identifies how the payment will be affected.

Note: A new MOP cannot be created. It is possible to save an existing MOP as a new office-based

MOP when the MOP SWIFT is provided and each bank sets the MOP profile for SWIFT per its local

office.

Create local office MOPs.

These are the specific fields in the General panel of the MOP profile that must be defined for MOP

processing.

Field Name Description

MOP The name of the MOP. In GPP, creation of new MOP name is not allowed. The

user can save an existing MOP per office and set it accordingly.

Description A short description of the MOP.

MOP Down If selected, this flag indicates to GPP that the MOP is not available.

If selected, this MOP will not be selected or validated.

If cleared, GPP will resume using the MOP.

Calendar If the MOP operates under a specific calendar, select a calendar from the list and

assign it to the MOP.

If no calendar is assigned, the default calendar for the office is used.

The calendars are displayed from the Profiles Schedule Calendars menu.

MOP Business The current business day for the MOP.

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 22

Field Name Description

Date

The business date can be changed manually or by an end-of-day task that

advances the MOP business date to the next valid business date for the MOP.

Advance to

day after

holiday

If selected, advances the MOP Business Date if it falls on a holiday.

Roll forward at

start of day If selected, rolls the MOP Business Date at SOD task.

Default cut-off

name Specifies the default cut-off time for the MOP. A list of all the default clearing cut-off

times is shown from Profiles Cut-off Times.

Earliest value

date Defines the number of days that the transaction can be sent in advance to the

clearing for the settlement date.

Note: Only positive numbers are allowed. This number is deducted from the value

date for value date range validation.

Latest value

date Defines the number of days that the transaction has to be sent in advance to the

clearing in order to meet the settlement date.

Note: Only positive numbers are allowed. This number is deducted from the value

date for value date range validation.

Value date

extension MOP Extension is an attribute which determines the limit for the future dated

transactions that are acceptable for the MOP.

Defines the number of days relative to the Latest value date that defines a value

date extension (max. 10 characters).

Payments with value dates between the latest value date and the value date

extension are validated for the particular MOP and sent to the Schedule queue.

Possible values:

• 0 - Today

• 1 - Next business date, and so on

Currency When the MOP is for a specific currency, select the 3-character code for the

currency. If left blank, all currencies are valid for the MOP.

Min. amount The minimum amount (in base currency) of a payment that this MOP will accept.

Max. amount The maximum amount (base currency) of a payment that this MOP will accept.

Settlement

account exists If selected, indicates that a settlement account has been defined for the MOP.

Initially, the field is disabled. Once the operator defines a settlement account for the

MOP via the Identifiers Profile, the ‘Settlement account exists’ flag (of that MOP)

will be checked without enabling it.

Allowed for

non-

accounting

messages

If selected, indicates that the MOP can be selected for non-accounting messages.

Membership

required If selected, indicates that membership validations are required for the MOP.

Country entry

point If selected, requires MOP STEP2 XCT where set up of a country base

representative is enough to confirm the required membership.

Check main

BIC in

membership

Required for the TARGET2 MOP. Checks the main BIC only for a valid

membership

RMA check

Required The system checks if the payment’s Processing Date is within the range of the

Start Date or the End Date of the RMA record. If it falls within the range, the MOP

is valid. If it doesn’t, the MOP is invalid.

Membership

Defines the membership check either on Metropolitan (BIC-8) or country (BIC-6)

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 23

Field Name Description

check level

level.

Type Select from the possible options:

• MOP - The intended receiver is set up as a member or associate of the MOP.

• Group - The intended receiver is set up as a member or associate of the Group.

This checks membership in a group of MOPs

• MOPs in Group - The intended receiver is set up as a member or associate of

any MOP that belongs to the Group

Note: Mandatory if Membership Required is selected.

Group Allows a MOP to be added to a logic group. For example, each FED district is a

distinct MOP, but a single group named FED is used as the Group.

Note: Mandatory if the ‘Group’ or ‘MOPs in Group’ option is selected in the Type

drop-down list.

MOP can be

selected by

operator

If selected, the Method of Payment can be selected when the message is in the

Repair or Create Status.

Send outgoing

messages If selected, indicates that an outgoing payment is required for this MOP.

Additional

member type An additional party identifier type that should be allowed for the Member type in the

Membership profile. The drop-down provided includes NCC_TYPE_ISO of all

entries in the COUNTRY_NCC table.

Allow force

from

scheduled

queue

If selected, indicates that payments with this MOP can be forced from the

Scheduled queue.

Draft currency If selected, GPP SP will validate that the payment currency is a Draft Currency as

set up in the currency profile. If the payment currency is not a Draft Currency then

this MOP is not selected or validated for the message. When unchecked, no

checking of Draft Currency occurs.

Identifiers

Button Opens the Identifiers profile Data Search window.

Party ID

Enrichment

Button

Opens the Party ID Enrichment profile Data Search window.

Allowed

Backdate VD

to Retain

If initial Value date < Business dt (back date value payments)

• If initial Value date < value stated in the “Allowed Back date value date” over the

original MOP Set msg status to Repair

• If initial Value date >= value stated in the “Allowed Back dated value date to

advance” over the original MOP advance the initial Value date to the original

MOP ‘Allowed backdated VD to retain’ time.

If initial Value date > Business dt continue processing

Allowed

Backdated VD

to Advance

These are the specific fields in the Processing panel of the MOP profile that must be defined for MOP

processing.

Field Name Description

General Section

Outgoing only If selected, this MOP may only be used for outgoing messages.

Inter-office If selected, defines a MOP that moves funds between offices (i.e. message is

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 24

Field Name Description

not sent out).

Supports priority

payments If selected, indicates that the MOP supports EUR priority payments, that is, a

SWIFT based scheme that supports the tag23B SPRI codeword.

When the check box is not selected & codeword sent in payment = SPRI, then

the codeword on the outgoing payment is changed to CRED.

Value date

override allowed Relevant when payment value date is greater than MOP value date extension.

If selected, the payment is sent to Repair. The operator can override (value

date remains unchanged) and the payment is sent to ‘Release Q’.

If clear, the payment is sent to Repair and the operator must amend the value

date.

Generate

References If selected, indicates whether a unique reference should be generated for the

MOP

Algorithm Indicates the algorithm to be used for the UTR generation. Mandatory if

‘Generate Reference’ field is checked and disabled if unchecked. Dropdown list

of algorithm names, Possible values:

UTR – 16 characters reference based on System ID, date and sequence

number.

UTR_S – 9 digits reference based on a unique sequence number

Validate reference

in confirmation If selected, GPP verifies that the UTR in the response matches the UTR in the

payment. If the UTR does not match the payment will be routed to the Rejected

queue.

Enrich party

identifier If selected, indicates that the identifier in hand for the first credit chain, if not of

the type specified in the Sender/receiver type field, should be used to derive

the correct identifier of type specified in the Sender/receiver type field. The

derivation process will use the Party Identifier Enrichment profile.

Split payment over

max If selected, indicates that GPP SP should split payments above the maximum

amount, rather than invalidating the MOP or selecting a different MOP.

Eligible for virtual

account

processing

If selected, indicates if this MOP is eligible for virtual account processing.

The check box is not selected by default.

Bulking profile Where MOP requires the messages to be sent in a bulk (group). This field

enables to define a bulking profile attributes by pointing to a bulking profile ID.

Where applicable, the same bulking profile can be associated to multiple

MOPs.

Outward return

days Specifies the number of days allowed for an outward/outgoing return message.

Direct/Cover

Release Determines whether the Direct should be processed dependently or

independently from the Cover and the point in the flow where Direct payment

generation takes place.

Messaging Section

FIN copy service If the MOP is a SWIFT FIN-copy based system, this field identifies the FIN

service code. The code maps to block 3, field 103 of a SWIFT message.

Sender/Receiver

Type Specifies the identification code type used for the Sender and Receiver of the

message, for example, BICs for SWIFT, ABAs for FED messages, etc.

Sender ID The ID of the sender institution. Used if the MOP requires the institution to use

a different ID than the regular one. For example, in the Australian RTGS, banks

use different BICs than the ones they use for international payments.

Receiver ID The ID of the Receiver of messages using this MOP. Used in MOPs like

TARGET, where the receiver is always the BIC that the central bank has set-up

for the purpose of TARGET messaging.

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 25

Field Name Description

Communication

preferences Specifies whether the outgoing payment should be waiting for SWIFT

acknowledgement (ACK) and whether the payment should wait for confirmation

(012) before continue processing. Where the following possibilities are covered:

None (default selection) – Do not wait for ACK or confirmation and continue

processing (if a NAK or Rejection is received the system acts accordingly)

Wait for ACK – payments wait for ACK in a wait ACK queue before continue

processing

Wait for confirmation – payments wait for Confirmation in a wait confirmation

queue before continue processing

Accounting Section

Clearing suspense

account: Office The clearing suspense office account details:

Account office

Account number

Account currency: Auto-populated for the account selected

Account owner: Specifies the following values concatenated for the party which

account belongs to. Read Only.

Return of funds

account: Office The return of funds account office details:

Account office

Account number

Account currency: Auto-populated for the account selected

Account owner: Specifies the following values concatenated for the party which

account belongs to. Read Only.

Settlement

accounting

Outgoing/Incoming

4.1.2.6 SWIFT RMA

The Relationship Management Application (RMA) is used for establishing a relationship between the

parties exchanging traffic over the SWIFT network. It replaces the Bilateral Key Exchange (BKE)

model used by SWIFT.

The RMA in GPP ensures that the Office, as one of the SWIFT operators, can maintain its business

relationships with other SWIFT operators by providing full and/or selective control over the traffic it

receives from them.

When defining an RMA profile in GPP:

• GPP derives the Correspondent from the relevant Office.

• The GPP user selects the Issuer from a list of options.

GPP maintains only those relationship requests issued by an Office to a Correspondent.

Define the office RMA entries

These are the specific fields on the SWIFT RMA profile that must be defined for MOP processing.

Field Name Description

Correspondent The BIC-8 of the defined Office and populated automatically based on the

Office.

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 26

Field Name Description

Issuer The BIC-8 of the counterparty as selected from a list.

Start Date Start date of the relationship between issuer and correspondent.

End Date End date of the relationship between issuer and correspondent.

Include message

categories Select to include specific message categories.

Include message

types Select to include message type to RMA based on categories selected.

Exclude message

types Select message type to RMA based on categories selected.

4.1.2.7 Identifiers

MOP Identifiers are used to set up and view the party identifiers and settlement account information

for a MOP (e.g., EBA settlement account). One or more identifier can be set up per MOP. In the case

of clearing-type MOPs, the settlement account at the clearing is defined as an attribute of the MOP.

For example:

• For MOP SWIFT: There will be an entry for each of the BICs that the Office uses on the SWIFT

network. The identifiers for SWIFT will not have a settlement account.

• For MOP EBA: There will be an entry for each of the BICs that the Office uses to identify itself at

EBA. Each of these entries will have a settlement account.

Set up office identifiers for every MOP.

These are the specific fields in the Identifiers profile that must be defined for MOP Processing.

Field Name Description

MOP The MOP of the MOP profile for which an identifier is defined.

Identifier Opens the Parties profile from which to select the appropriate identifier for the

local bank in the MOP.

Note: Enabled after selection of MOP.

Default ID for

MOP/Office If selected, indicates that this identifier should automatically populate the local

bank field in manually created transactions for this office.

Default Office for

ID If selected, ensures that if the same identifier is used across multiple offices, an

incoming message destined to this identifier should be associated with the office

of this entry.

Settlement Account Section

Office Office associated with the Settlement Account.

Account Select the Settlement Account that the local bank uses at the MOP for payments

exchanged with this MOP.

Currency Populated automatically based on Account selection

Account owner

info Populated automatically based on Account selection

MOP Button Selects all MOP associated identifiers

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 27

4.1.2.8 Cut-off Times

The Cut-off Times profile defines the latest time for transactions to be processed for various MOPs

and currencies for the office. It allows value date adjustments for transactions that are processed in

other time zones.

• Create clearing, treasury and processing cut-off

• Assign a default processing cut-off to the local office

• Assign default treasury cut-off to the currency preferences profile

• Assign default clearing cut-off to the relevant clearinghouse MOPs

These are the specific fields in the Cut-off Times profile that must be defined for MOP processing.

Field Name Description

Cut-off name Cut-off name

Cut-off type Available types:

Clearing – Clearing House

Treasury – Bank Treasury

Processing – Bank Processing

Description Description of the Cut-off Times profile

Default time Disabled and selected by default. Uses times defined in the Times section of Cut-

off Times profiles.

Disabled and cleared if an exception is defined for the Cut-off time so that different

dates and times can be specified.

Time zone Time zone for aligning cut-off times

Dates Section

Exclude

message types Select message type to RMA based on categories selected.

Times Section

Interim cut-off

time Interim cut-off time (in the time zone specified in the profile)

Final cut-off

time Final cut-off time (in the time zone specified in the profile)

Exception

Button Enables the creation of a Cut-off exception for a specific Cut-off time. This button

is enabled only when updating a Cut-off Time profile that is flagged as ‘Default

time’.

4.1.3 Business Rules

GPP uses these Business Rules in MOP Processing.

4.1.3.1 MOP Selection

MOP Selection Rules are used to determine and assign a MOP for each payment.

The list of available actions for MOP Selection rules consists of all the active MOPs in the system.

The rule can be attached to Party and Office.

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 28

The service evaluates the MOP Selection Rules attached to the Receiver and the Office. All rules will

be evaluated.

If a STOP action is defined, the service will stop evaluating the MOP selection rules from this point

onward (both Customer and Office level).

The outcome of the evaluation process is a list of applicable MOPs that will be further validated in the

next step.

Note: The MOP list may include the same MOP more than once. The list should be filtered to hold

only one appearance per MOP. The MOP with the lower priority is removed.

Setup and attach MOPs as follows:

1. Create local office MOPs

2. Create MOP selection business rules to select the specified MOPs

3. Attach (pay attention to the attachment order) the list of MOP selection rules

Example of MOP selection rule attachment list

Rule Type Object Object Name

MOP Selection FD1SAFNDTUS2LXXX D+H

Rule Attachment Selection List

Rule Name Description

BOOK203TST test 203 that parsed to 202 that will

SCT For MOP selection service

RT_TARGT2 When RT comes in first in Cdt chain

EBA For MOP Selection

SWIFT MOP Selection for office FD1

TARGT2 MOP Selection office FD1

XCT XCT MOP

BOOKFORBKPMT BOOK for bank payment

BOOKFORCUSTPMT MOP BOOK for customer paymento

Text of the Selected Rule

Text

[Cdtr BIC] = MELNGB2XXXX

4.1.3.2 Cut-off Business Rules

Define all required cut-off selection and missed cut-off business rules (6 of them).

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 29

4.1.3.2.1 Cut-off Selection

There are three types of Cut-off Selection Rules:

• Processing (for Low value payments)

• Clearing (MOP)

• Treasury (Currency)

The Cut-off rules are attached to Office.

The action of the Cut-off Selection rule is a Cut-off Time Profile (entry which is marked as default).

Rule action: The first valid rule found is used.

4.1.3.2.2 Missed Cut-off

There are three types of Missed Cut-off Rules:

• Missed Treasury Cut-off

• Missed Clearing Cut-off

• Missed Processing Cut-off

The rules determine whether to send a payment that missed the cut-off times for manual override,

allowing the user to process the payment on the same day. The rules are attached to the Office.

Rule action – Manual override. First valid rule is used.

4.1.3.3 Calendar Selection

The business rule defines the list of calendars that need to be taken into account when calculating the

business dates in value date phase.

4.1.4 Statuses

4.1.4.1 Schedule

ID Action Available Action Buttons

SCHEDULE Messages with future processing dates waiting to

be released on matured processing date Send to Repair

Cancel

4.1.4.2 Repair

Here the operator is able to:

• Amend the payment & submit. The system reevaluates the payment details

• Cancel the payment

4.1.5 Entitlements

Ensure that entitlements are given and set for the relevant system users to access the relevant

queues and profiles.

4.1.5.1 Access Class Profiles

• Global: Country Preferences, Currency Preferences

Method of Payment System Configuration and Business Setup

Global PAYplus Business Guide Page 30

• Routing: Bank Routing, Identifiers, Membership, Method of Payment, Party Identifier Enrichment,

SWIFT RMA Cut-off Times

4.1.5.2 Rule Type Level Profiles

• MOP Selection

• MOP Validation

• Processing Cut-off

• Missed Processing Cut-off

4.2 System Configuration

4.2.1 System Rules

4.2.1.1 Message Type Selection Rule

This rule specifies the conditions in which the original MT is temporary set to a new MT (the rule’s

action).

• The rule requires a subtype to be chosen.

• The subtype list for this rule will be taken from MOP profile (Distinct list)

• The available rule action is a list of Message Types. This list is derived by joining between

MSG_TYPES and MSG_TYPE_MOP tables, retrieving MT records for the MOP chosen as

subtype.

• The rules will be attached to the Office

Rule action: First valid rule is returned

4.2.1.2 MOP Validation

This rule specifies the conditions under which the MOP fails the validation. The MOP Validation rule is

a system rule. The rules will be attached to the Office. All rules are evaluated. If a fitting rule is found,

the evaluated MOP fails the validation and becomes invalid.

Rule action – Invalid MOP (system action)

Method of Payment Message Data

Global PAYplus Business Guide Page 31

5 Message Data

5.1 Message Attributes

5.1.1 MOP Related

Field ID Name Description

D_AVAILABLE_MOPS Available MOPs Available method of payments

MF_MOP_SELECTION_STS MOP selection sts MOP selection status

MU_SET_CDT_MOP User set cdt MOP sts A monitor for user interaction to set the

credit MOP

P_CDT_MOP Cdt MOP Credit method of payment (MOP)

5.1.2 Value Date Related

Field ID Name Description

P_ORG_INITG_PTY_CUST_CD Orgnl initiating party cust cd Original initiating party party

code

P_OFFICE Pmt office Office

X_STTLM_CCY Sttlm Ccy Settlement (SWIFT tag 32A)-

Currency

P_CDT_ACCT_CCY Cdt acct ccy Credit account currency

P_DBT_ACCT_CCY Dbt acct ccy Total debit account currency

F_CDT_CUST_COUNTRYCODE Cdt pty ctry cd Credit party country code

F_DBT_CUST_COUNTRYCODE Dbt pty country cd Debit party country code

MF_USED_EXPEDITE_VD Used expedite value dt Used expedite value date

MU_FORCE_STANDARD_VD User force std value dt User monitor. Forces standard

soonest value date calculation

D_PD_MONTH_CALENDAR Process dt month cal Calendar days’ availability. 0 -

unavailable, 1-available.

Always set to 31 char. Long.

First character is the first day of

month

D_VD_MONTH_CALENDAR Value dt month cal Calendar days’ availability. 0 -

unavailable, 1-available.

Always set to 31 char. Long.

First character is the first day of

month

D_STANDARD_VD Soonest std vd Soonest standard value date.

Calculated value date

D_MOP_VALID Is MOP valid Is MOP valid

Method of Payment Appendix A: Glossary

Global PAYplus Business Guide Page 32

Appendix A: Glossary

Term Description

Candidate

MOP An interim situation where the MOP (or list of MOPs) are examined (post MOP

selection phase and prior to the final decision making point)

Clearing Cut

Off Time Is the cut off time set by the bank where they no longer accept to process

messages from external sources i.e. SWIFT and FEEDER for the current business

day. In general messages received after this cut off should have their processing

date advanced to the next business day and then held for processing until this

date.

Instruction Date The date contained in field 32 of any incoming SWIFT messages or in any

messages sent in from the feeder systems

MOP Method of payment

MOP Earliest

value date The number of days before MOP business date that payments may be set.

MOP Extension The number of days from MOP business date and forward that allows payment

processing. Any value date that is great than Latest and below Extension will be

processed and stored in the schedule queue. Any payment exceeding the

extension will be sent to repair queue.

MOP latest

value date The number of days after MOP business date that payments may be set

MT Message Type abbreviation

Processing

Cut-off Time An internal cut-off time that may be defined to ensure latest time of day to process

the payment.

Processing

Date An internal attribute (i.e. not going out with the payment details) that indicates the

time the payment needs to be processed (up until posting phase) so that the

payment value date will be fulfilled. When, for example, the payment includes FX

transaction for currency with soonest value date greater than zero the processing

date would be before the value date

Soonest Value

Date (of

Currency)

The number of business days required to process a currency.

O/N Overnight - Same day value (0 days)

T/N Tomorrow/Next day value (1 day)

SPOT – Two business days’ value (2 days)

Treasury Cut

Off Time Treasury cut-off times are applied to Incoming, outgoing and internal messages.

The function “treasury cut off time “refers to the cut off time that should be applied

to transactions being paid in a currency that the branch does not have direct

access to via a clearing system. The treasury cut off time is the time at which the

treasury department closes their position in a currency.

SSI Standard Settlement Instruction