Online Commerce Suite™ XML Integration Guide I

User Manual: Pdf

Open the PDF directly: View PDF ![]() .

.

Page Count: 128 [warning: Documents this large are best viewed by clicking the View PDF Link!]

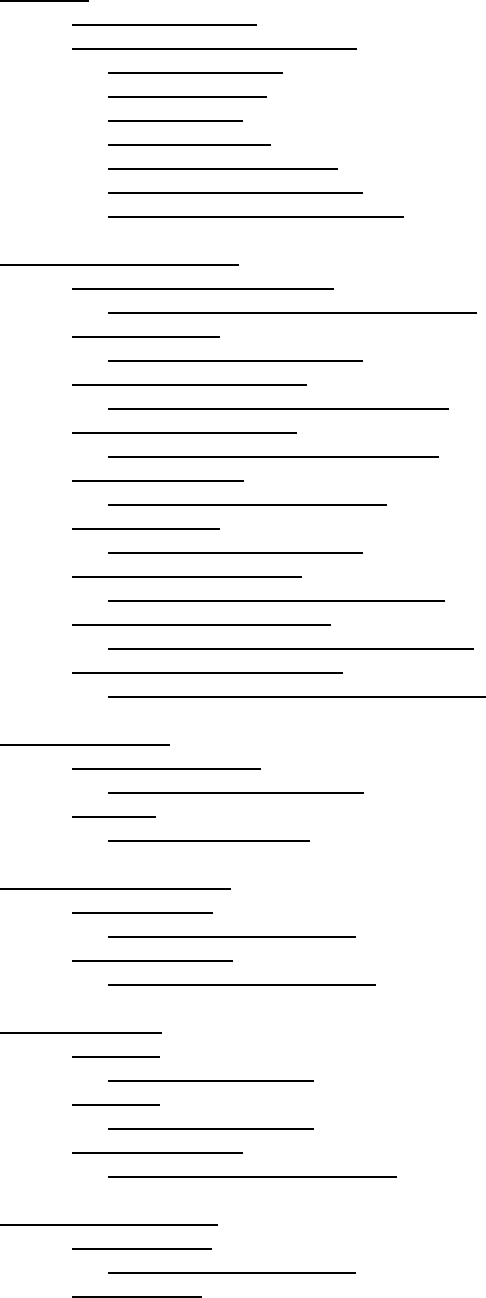

- Table of Contents

- Overview

- Credit Card Transactions

- EBT Transactions

- Debit Card Transactions

- ACH Transaction

- Check 21 Transactions

- 3rd Party Check Processing Service Providers

- Transaction Retrieve

- Stored Profile

- Stored Value Transactions

- Batch Settlements

- Transaction Results

- Appendix A: Transaction Authorization Specification.

- Appendix B: AVS Response Codes

- Appendix C: CVV2/CVC2 Response Codes

- Appendix D: Country and Currency Code

- Appendix E: LineItems

- Appendix F: P2P Encrypted Device Format

Online Commerce Suite™

XML Integration Guide

Release 2.10

July 2016

Merchant Partners

11121 Willows Rd NE

Suite 120

Redmond, WA 98052

© 2016 Merchant Partners. All Rights Reserved.

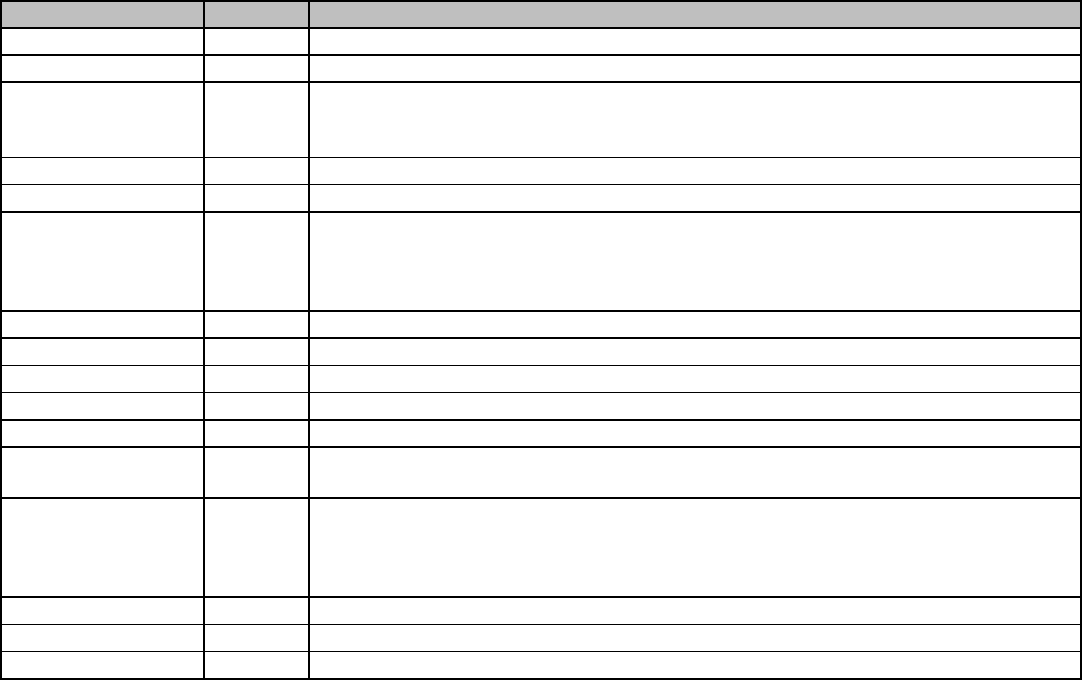

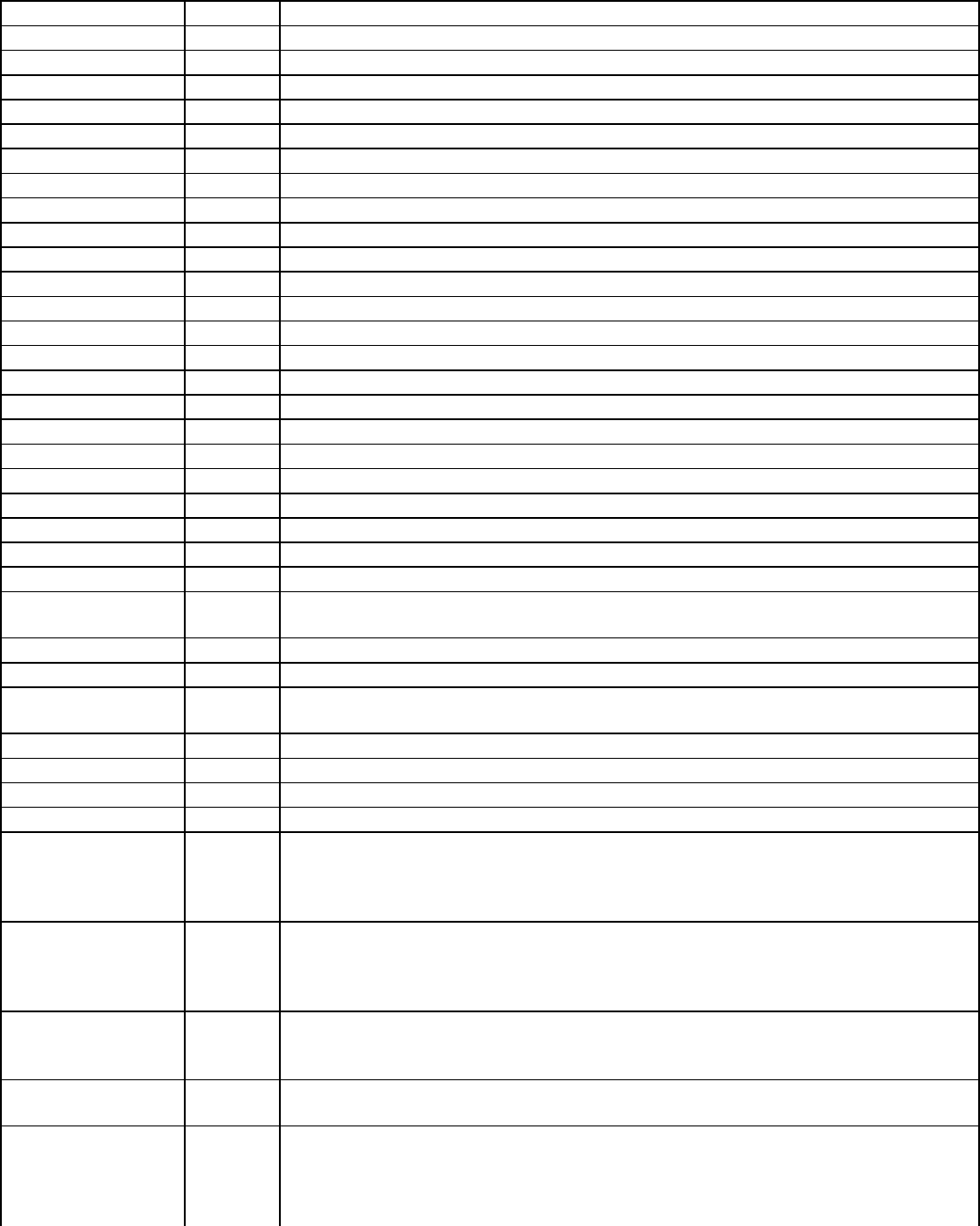

Table of Contents

Overview......................................................................................................................................................................Page 1

What's In This Guide........................................................................................................................................Page 1

How to Comment on This Guide......................................................................................................................Page 1

Contact Information....................................................................................................................................Page 1

Customer Service......................................................................................................................................Page 1

Documentation...........................................................................................................................................Page 1

Certified Networks......................................................................................................................................Page 1

Hardware Compatible List..........................................................................................................................Page 1

Transaction Processing URL.....................................................................................................................Page 1

Transaction Types (XML Actions)..............................................................................................................Page 2

Credit Card Transactions...........................................................................................................................................Page 4

Credit Card Pre-Authorization..........................................................................................................................Page 4

Credit Card Pre-Authorization Sample 1.1.................................................................................................Page 8

Credit Card Sale...............................................................................................................................................Page 9

Credit Card Sale Sample 2.1...................................................................................................................Page 14

Credit Card Authentication.............................................................................................................................Page 15

Credit Card Authentication Sample 2.2....................................................................................................Page 20

Credit Card Post Capture...............................................................................................................................Page 21

Credit Card Post Capture Sample 3.1.....................................................................................................Page 22

Credit Card Refund........................................................................................................................................Page 23

Credit Card Refund Sample 4.1...............................................................................................................Page 23

Credit Card Void.............................................................................................................................................Page 24

Credit Card Void Sample 5.1...................................................................................................................Page 24

Standalone Credit/Refund..............................................................................................................................Page 26

Standalone Credit/Refund Sample 6.1....................................................................................................Page 27

Credit Card Incremental Auth.........................................................................................................................Page 28

Credit Card Incremental Auth Sample 7.1...............................................................................................Page 30

Credit Card Pre-Auth Reversal.......................................................................................................................Page 31

Credit Card Pre-Auth Reversal Sample 8.1.............................................................................................Page 33

EBT Transactions......................................................................................................................................................Page 35

EBT Supported fields.....................................................................................................................................Page 35

EBT Transaction Sample 9.0...................................................................................................................Page 37

EBT Void........................................................................................................................................................Page 38

EBT Void Sample 9.0a.............................................................................................................................Page 39

Debit Card Transactions...........................................................................................................................................Page 41

Debit Card Sale..............................................................................................................................................Page 41

Debit Card Sale Sample 9.1....................................................................................................................Page 44

Debit Card Return..........................................................................................................................................Page 46

Debit Card Return Sample 9.2.................................................................................................................Page 48

ACH Transaction.......................................................................................................................................................Page 50

ACH Sale........................................................................................................................................................Page 50

ACH Sale Sample 11.1............................................................................................................................Page 52

ACH Void........................................................................................................................................................Page 53

ACH Void Sample 12.1............................................................................................................................Page 53

ACH Credit/Refund.........................................................................................................................................Page 54

ACH Credit/Refund Sample 13.1.............................................................................................................Page 55

Check 21 Transactions.............................................................................................................................................Page 56

Check 21 Sales..............................................................................................................................................Page 56

Check 21 Sale Sample 14.1....................................................................................................................Page 57

Check 21 Void................................................................................................................................................Page 59

Online Commerce Suite™ XML Integration Guide

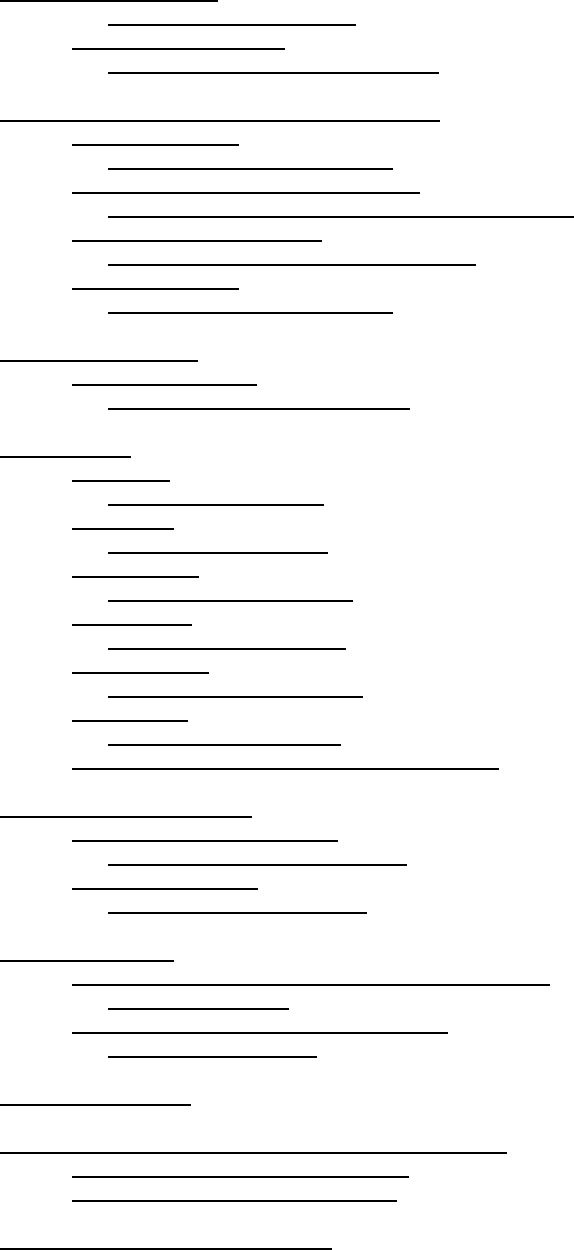

Table of Contents

Check 21 Transactions

Check 21 Void Sample 15.1....................................................................................................................Page 59

Check 21 Credit/Refund.................................................................................................................................Page 60

Check 21 Credit/Refund Sample 16.1.....................................................................................................Page 60

3rd Party Check Processing Service Providers.....................................................................................................Page 62

External ACH Sale.........................................................................................................................................Page 62

External ACH Sale Sample 17.1..............................................................................................................Page 63

External ACH Consumer Disbursement.........................................................................................................Page 65

External ACH Consumer Disbursement Sample 18.1.............................................................................Page 66

External ACH Credit/Refund..........................................................................................................................Page 68

External ACH Credit/Refund Sample 19.1...............................................................................................Page 68

External ACH Void.........................................................................................................................................Page 69

External ACH Void Sample 20.1..............................................................................................................Page 69

Transaction Retrieve.................................................................................................................................................Page 71

Transaction Retrieve......................................................................................................................................Page 71

Transaction Retrieve Sample 21.1...........................................................................................................Page 71

Stored Profile.............................................................................................................................................................Page 73

Profile Add......................................................................................................................................................Page 73

Profile Add Sample 22.1..........................................................................................................................Page 75

Profile Sale.....................................................................................................................................................Page 77

Profile Sale Sample 23.1.........................................................................................................................Page 79

Profile Update.................................................................................................................................................Page 80

Profile Update Sample 24.1.....................................................................................................................Page 82

Profile Delete..................................................................................................................................................Page 84

Profile Delete Sample 25.1......................................................................................................................Page 84

Profile Retrieve...............................................................................................................................................Page 86

Profile Retrieve Sample 26.1...................................................................................................................Page 87

Profile Credit...................................................................................................................................................Page 88

Profile Credit Sample 27.1.......................................................................................................................Page 90

Profile Import (Deprecated. Refer to Profile Add)...........................................................................................Page 91

Stored Value Transactions.......................................................................................................................................Page 92

Stored Value Supported fields........................................................................................................................Page 92

Stored Value Transaction Sample...........................................................................................................Page 94

Stored Value Refund......................................................................................................................................Page 95

Stored Value Refund Sample..................................................................................................................Page 96

Batch Settlements.....................................................................................................................................................Page 97

Batch Settlement (Settlement a Single Batch Number).................................................................................Page 97

Batch Settle Sample................................................................................................................................Page 97

Batch Settle All (Settles All Open Batches)....................................................................................................Page 98

Batch Settle All Sample...........................................................................................................................Page 98

Transaction Results................................................................................................................................................Page 100

Appendix A: Transaction Authorization Specification........................................................................................Page 101

Credit Card Approval response format.........................................................................................................Page 101

Credit Card Decline response format...........................................................................................................Page 102

Appendix B: AVS Response Codes......................................................................................................................Page 103

Online Commerce Suite™ XML Integration Guide

Table of Contents

Appendix C: CVV2/CVC2 Response Codes..........................................................................................................Page 104

Appendix D: Country and Currency Code............................................................................................................Page 105

Appendix E: LineItems...........................................................................................................................................Page 112

Appendix E-1: Product Codes......................................................................................................................Page 112

Appendix E-3: Service Codes................................................................................................................Page 119

Appendix E-4: Measurement Codes......................................................................................................Page 120

Appendix E-5: Default Dispenser Card Reader Pre-Auth Amounts and Cutoff Amounts......................Page 120

Appendix E-6: Fleet Card Partial Authorization and VoicePost Support................................................Page 120

Appendix F: P2P Encrypted Device Format.........................................................................................................Page 122

MAGTEK......................................................................................................................................................Page 122

MAGTEK iPAD.............................................................................................................................................Page 123

ID TECH.......................................................................................................................................................Page 123

INGENICO....................................................................................................................................................Page 124

Online Commerce Suite™ XML Integration Guide

Overview

Online Commerce Suite is a Web-based payment gateway that allows you to process secure credit card and electronic

check payments for goods and services over the Internet. Using the Online Merchant Center™ web-based administrative

user interface, you can configure your Online Commerce Suite account, add users, and manage your e-business. Online

Commerce Suite provides a comprehensive set of online and downloadable transaction management and accounting

reports.

What's In This Guide

The Online Commerce Suite XML Integration Guide is designed to assist you with the steps required to process credit

card and electronic check transactions via the XML API. XML is just one of many transaction processing methods

available in the Online Commerce Suite. For an overview of the integration methods available, please refer to the

Integration Guide.

How to Comment on This Guide

Every effort has been made to produce an accurate and easy to understand the XML Integration Guide.

Contact Information

For more information about Online Commerce Suite, refer to the following:

Customer Service

If you have problems with this document, or find that the instructions are incorrect, incomplete, or inadequate, please let

us know.

Send your comments to support@merchantpartners.com

Phone: (866) 242-9933

Documentation

Web Site URL: https://www.onlinemerchantcenter.com/mpartners/html/user_manuals.html

Certified Networks

Web Site URL: https://www.onlinemerchantcenter.com/mpartners/html/networks.html

Hardware Compatible List

Web Site URL: https://www.onlinemerchantcenter.com/mpartners/html/equipment.html

Transaction Processing URL

URL: https://trans.merchantpartners.com/cgi-bin/ProcessXML.cgi/

Page 1

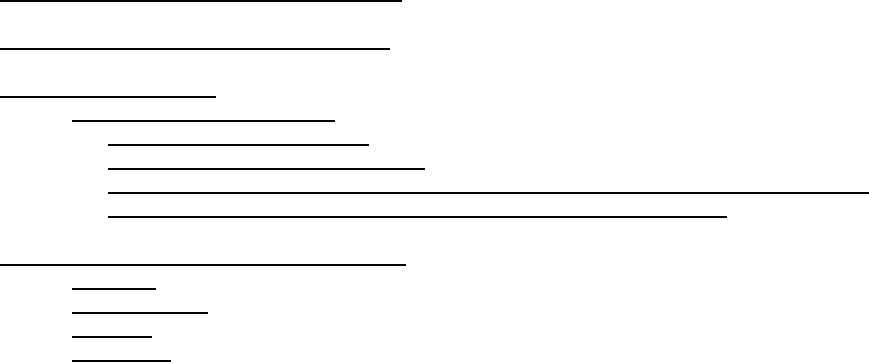

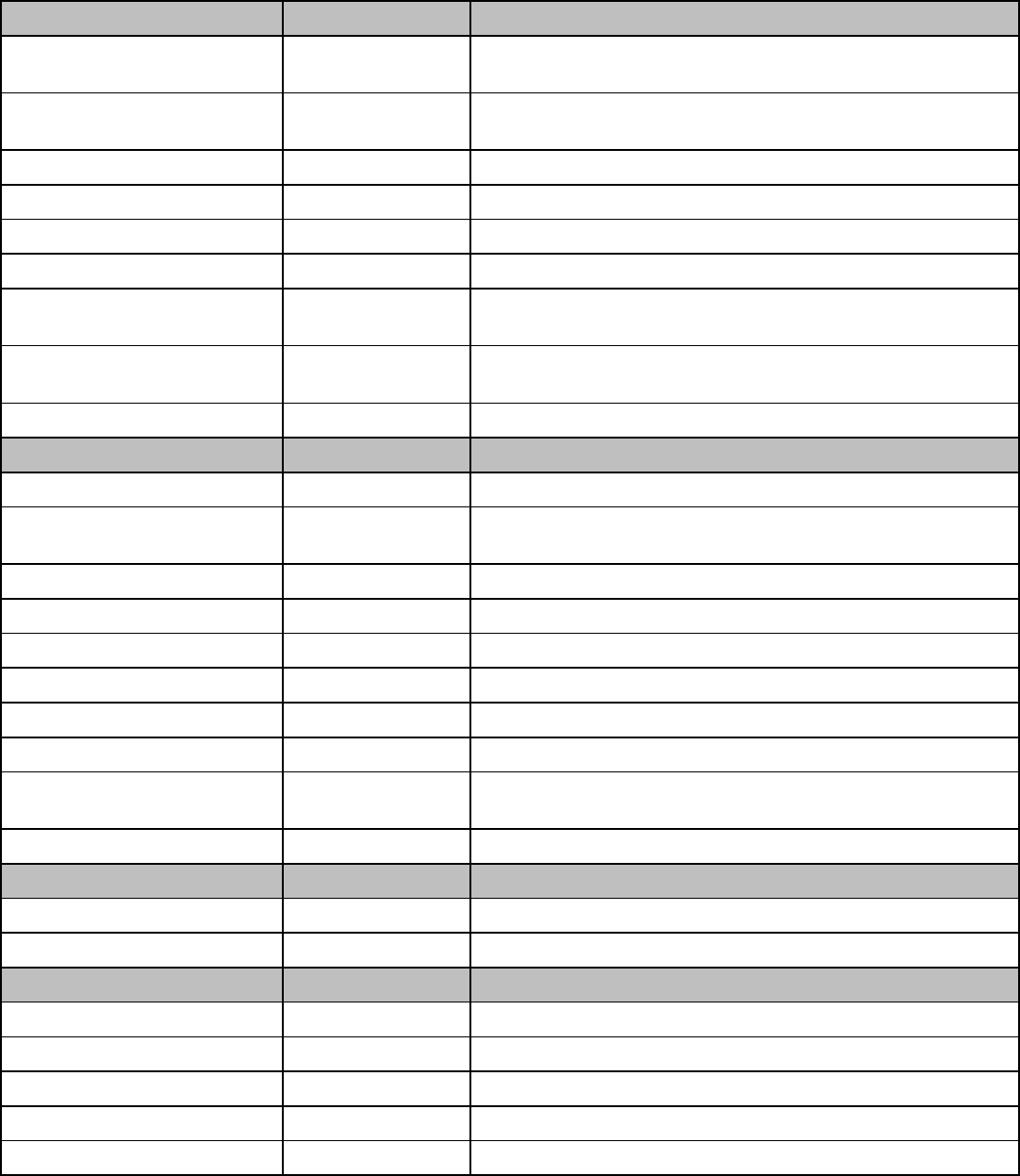

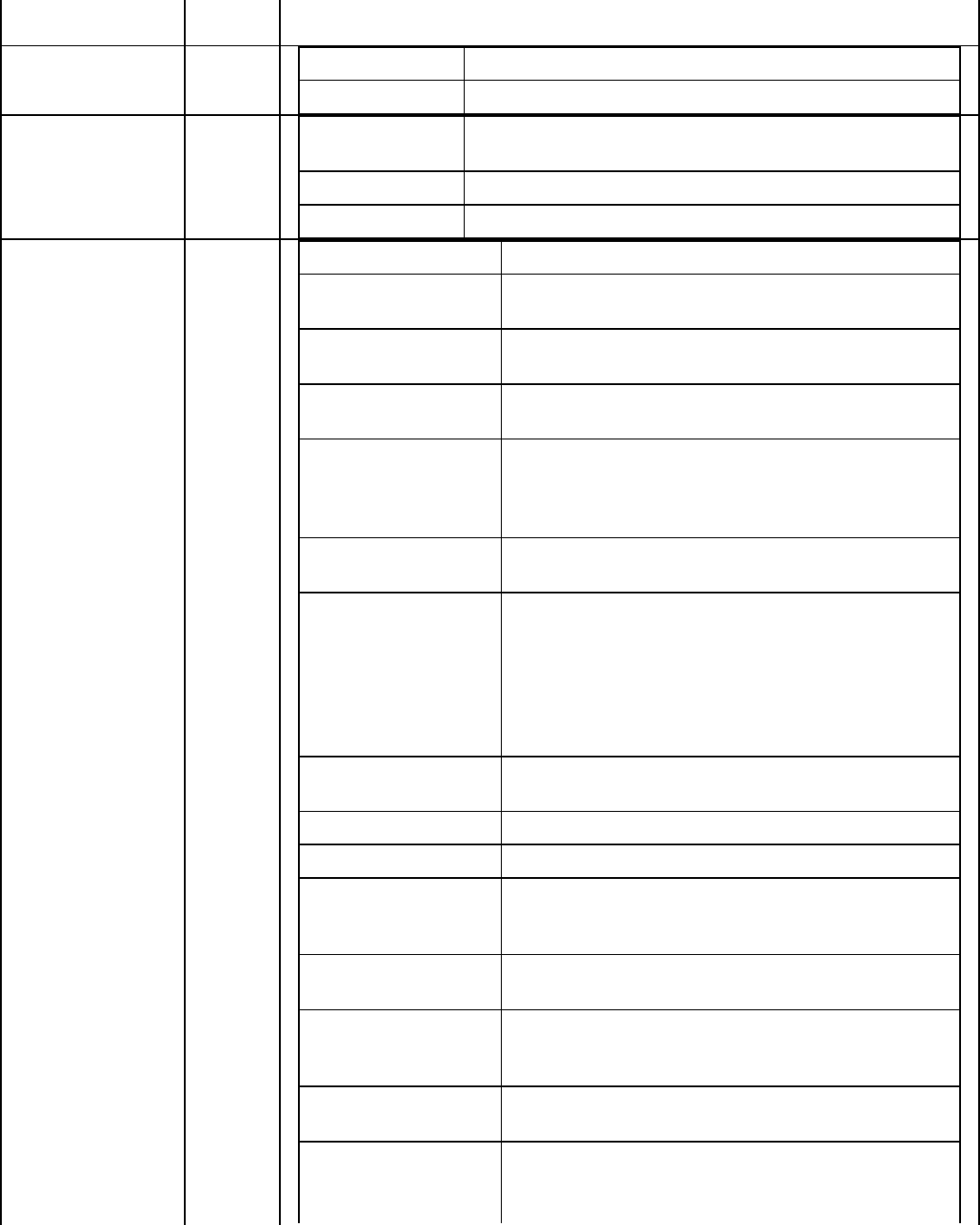

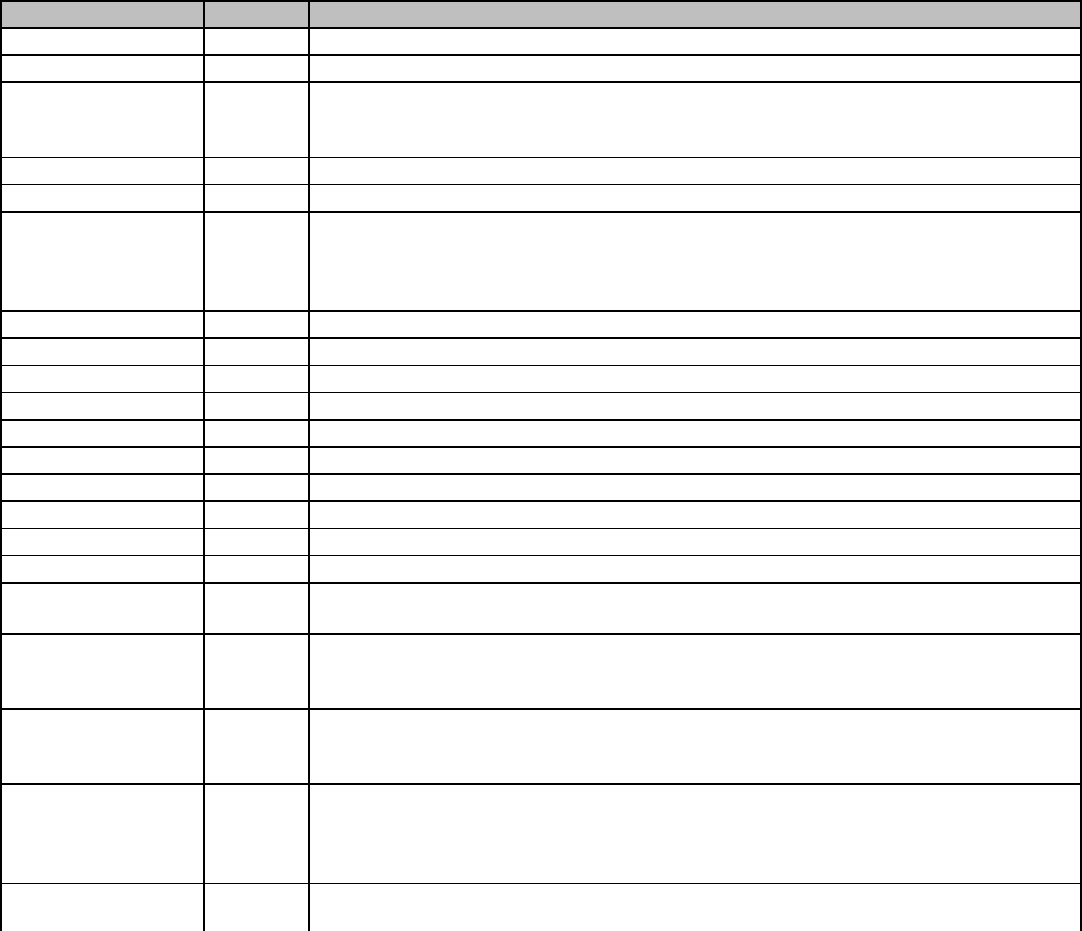

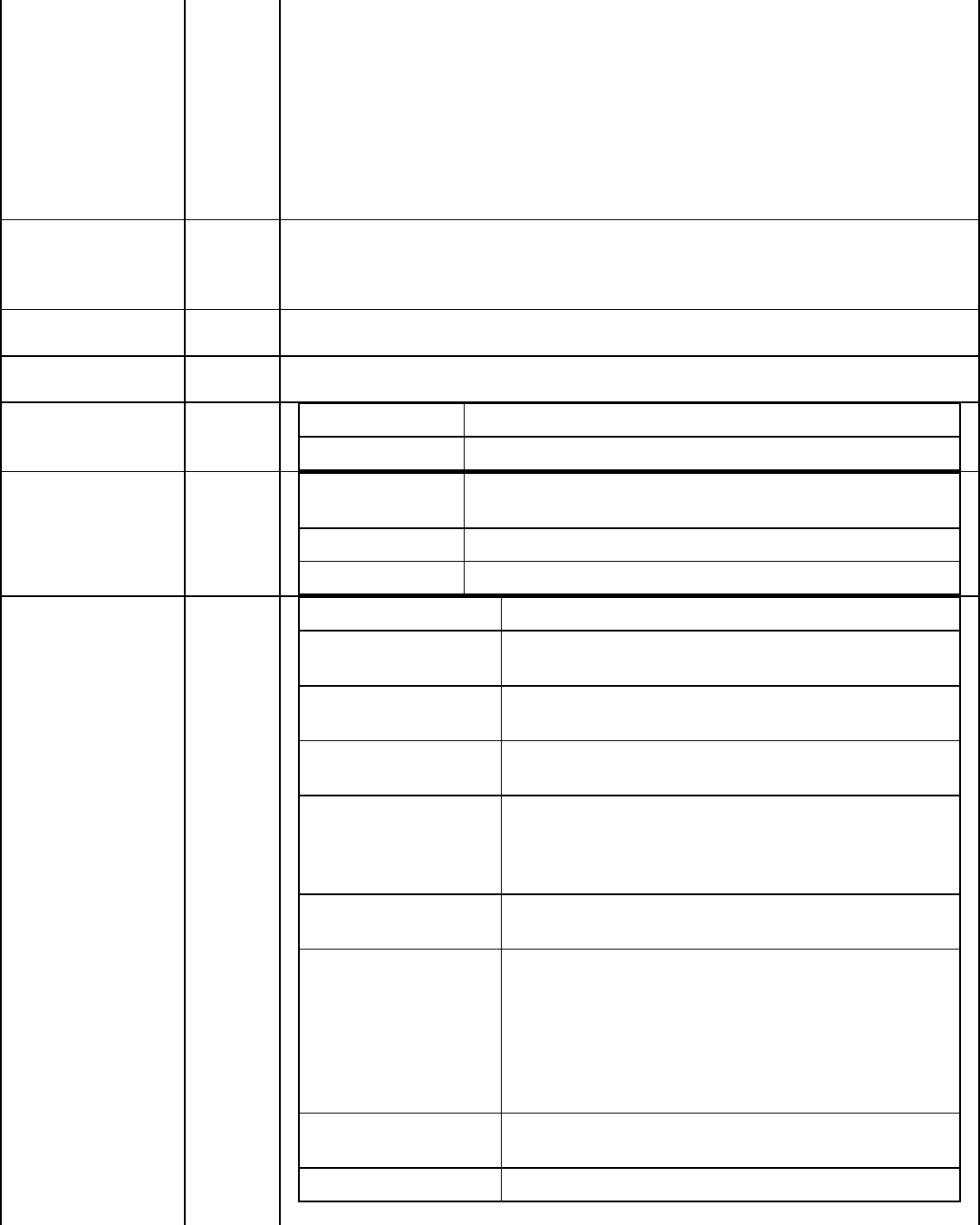

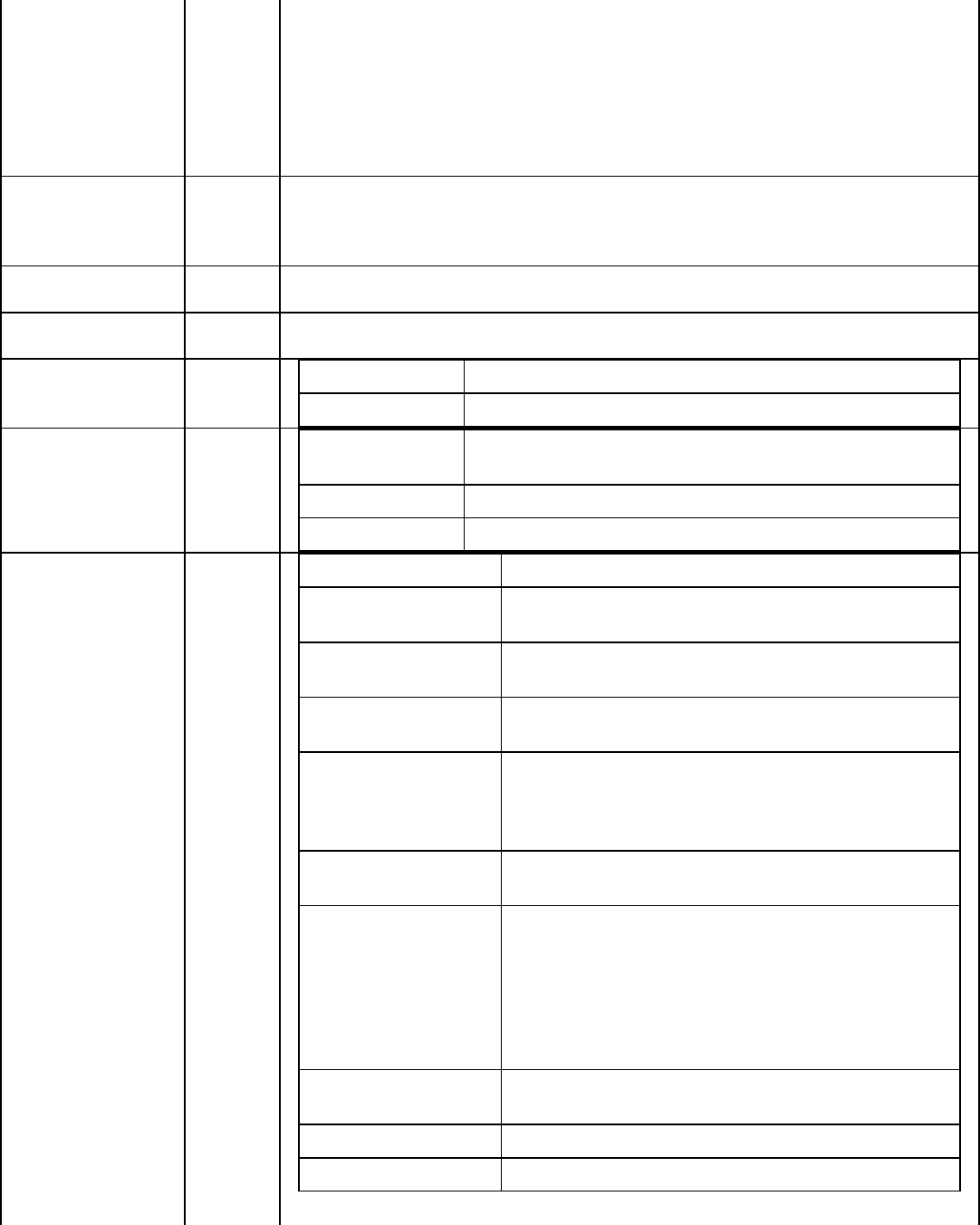

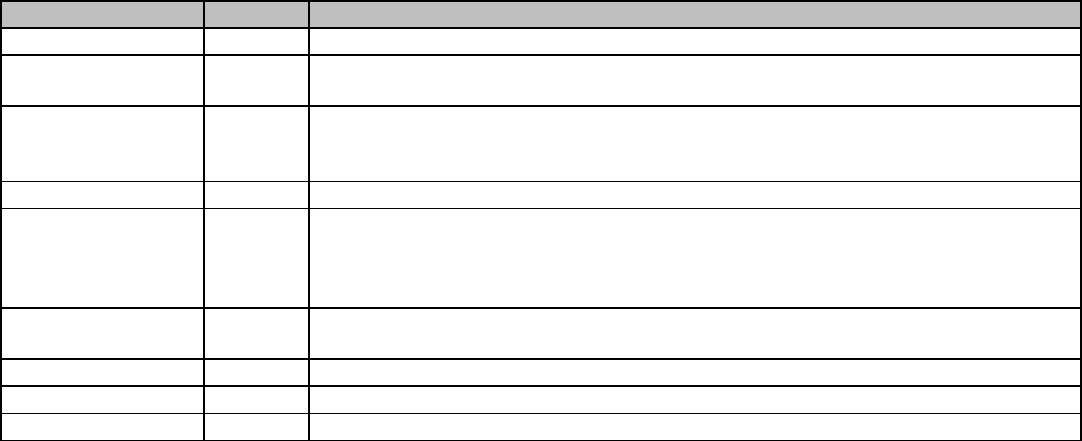

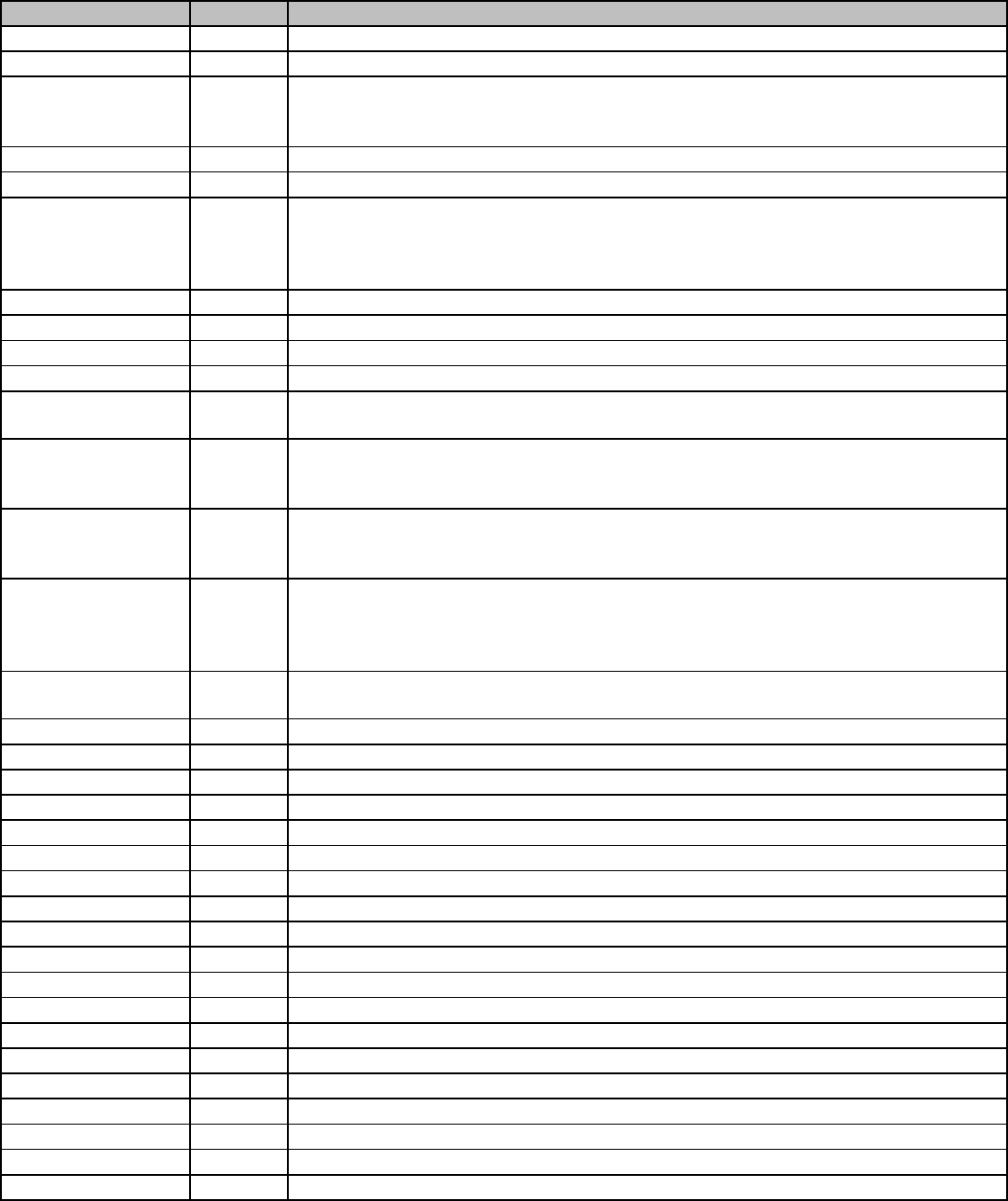

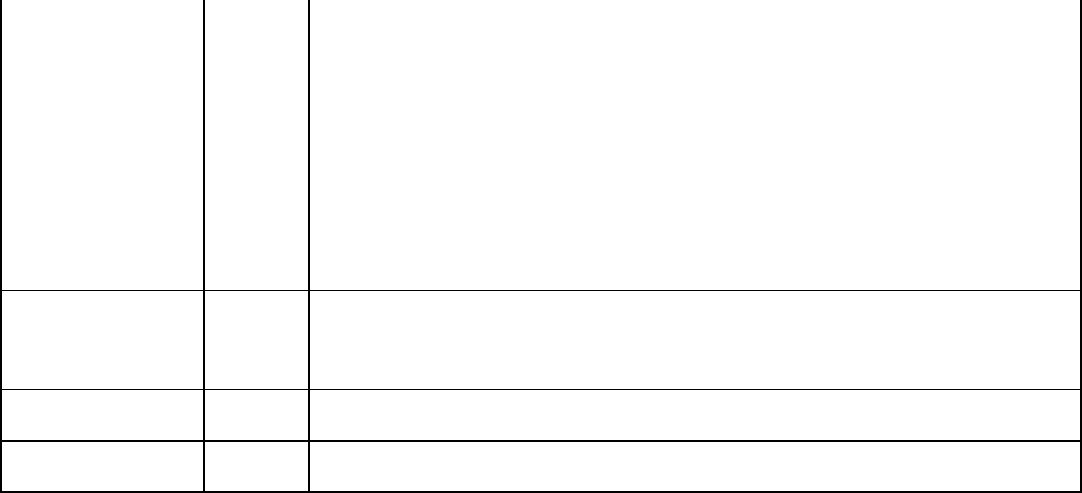

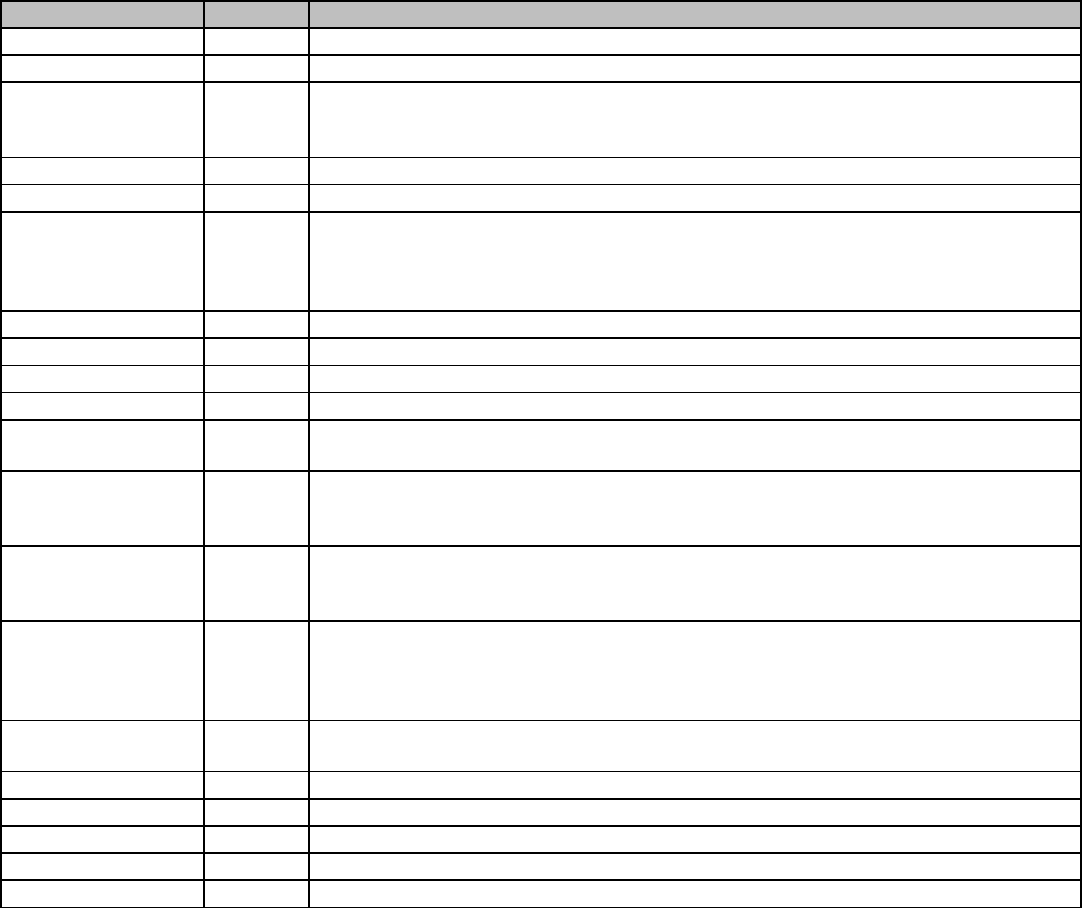

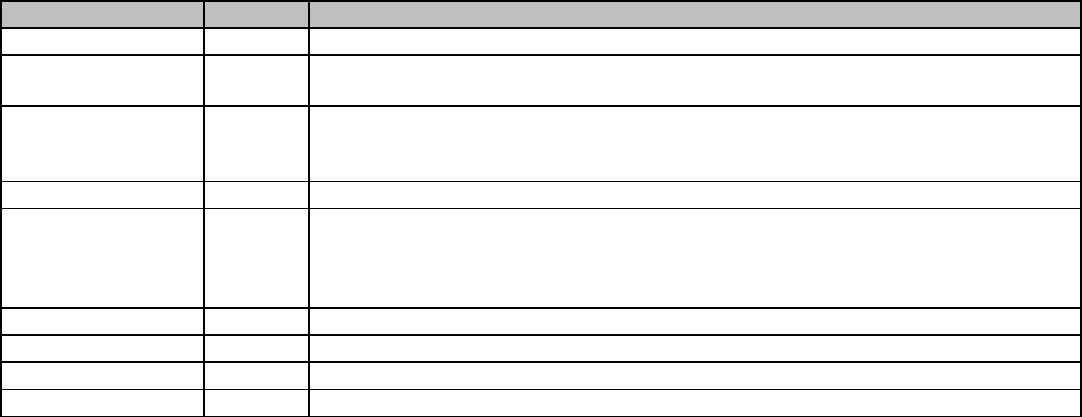

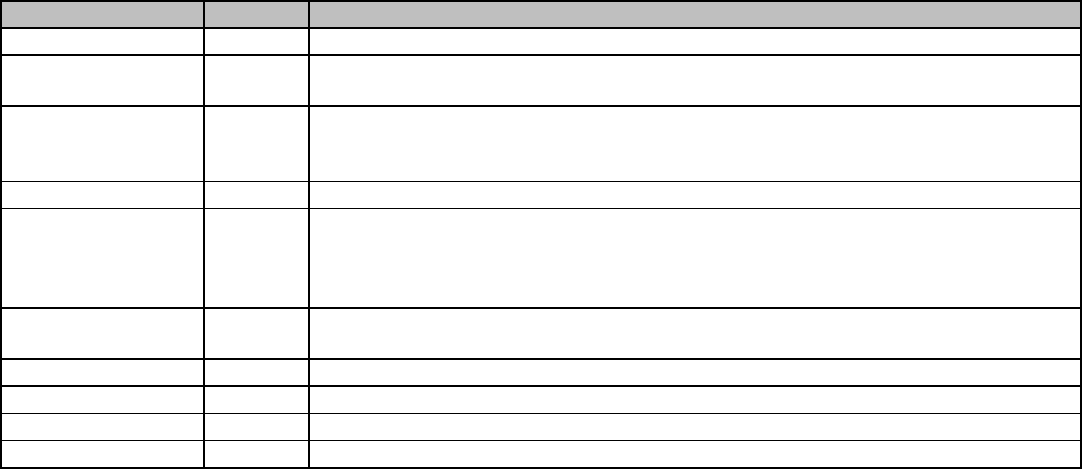

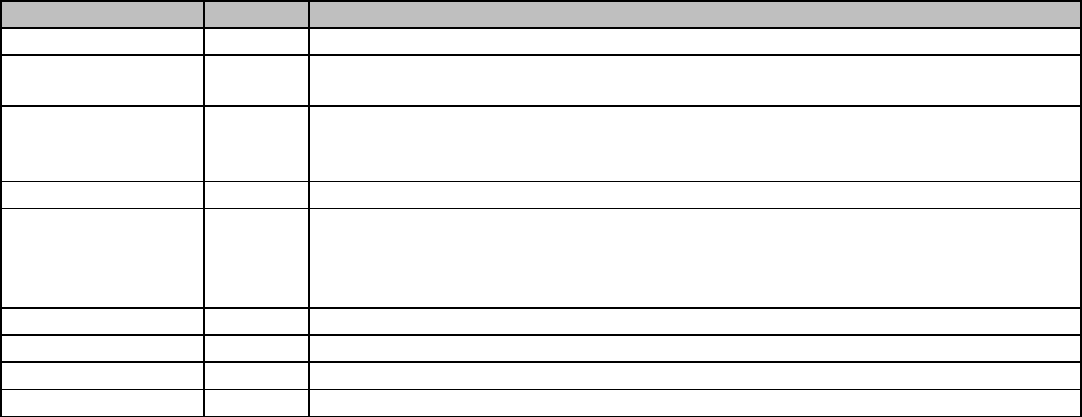

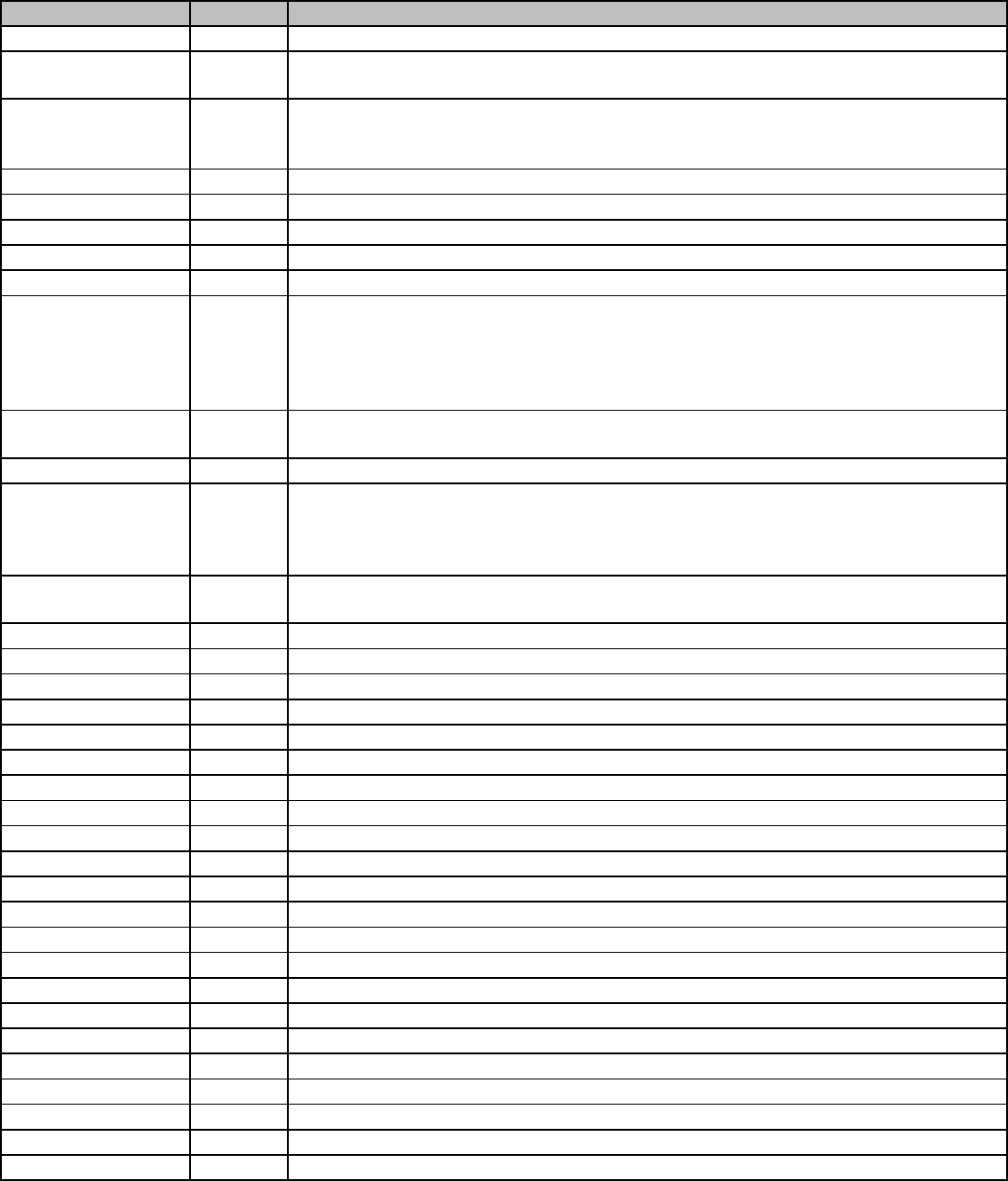

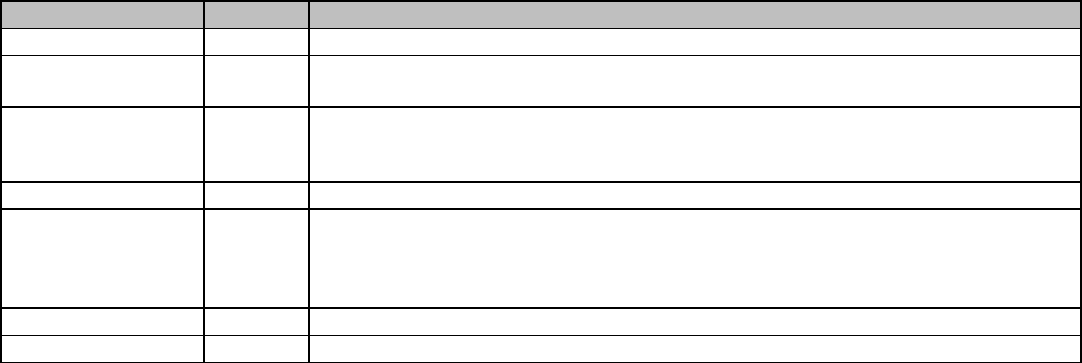

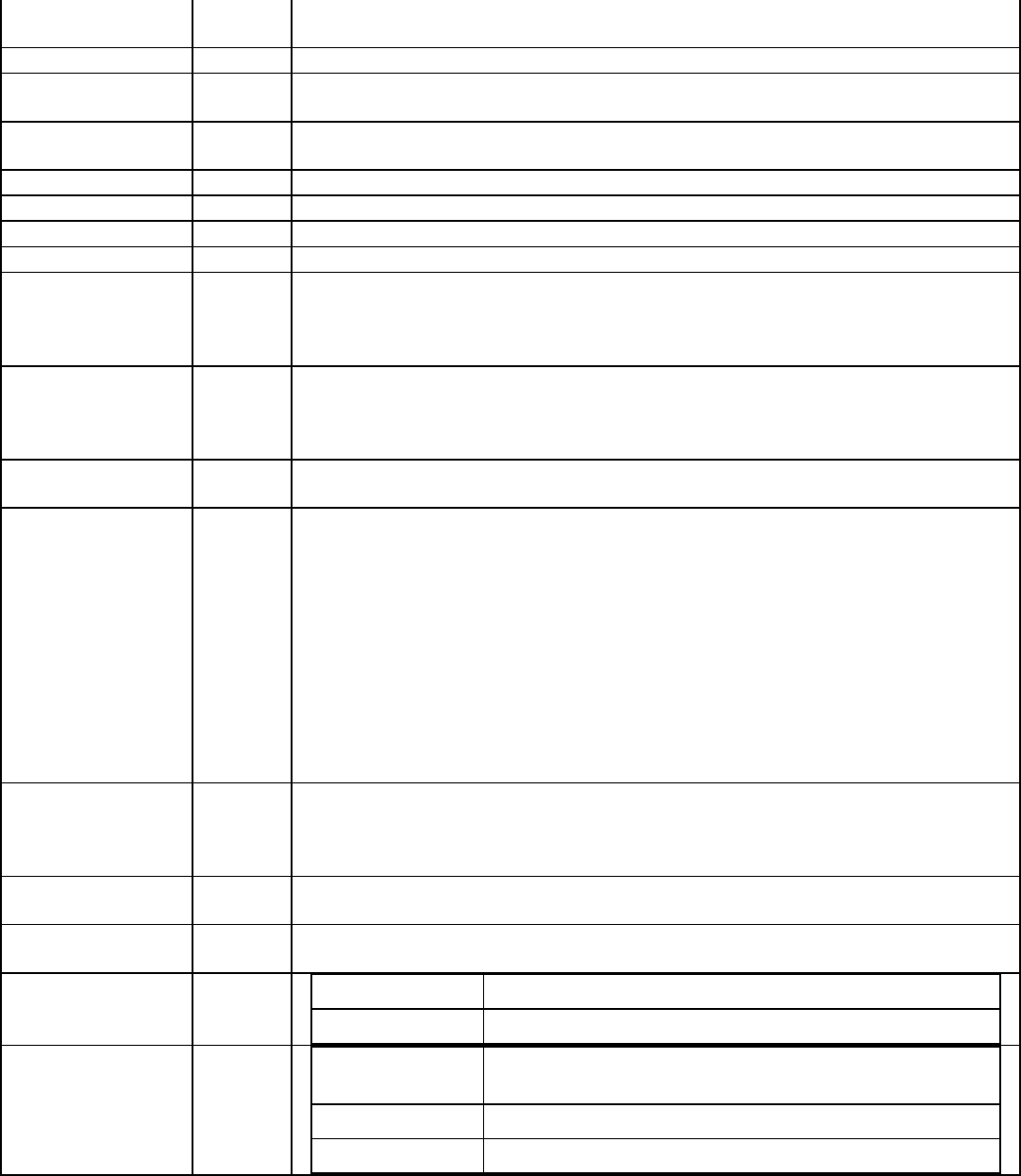

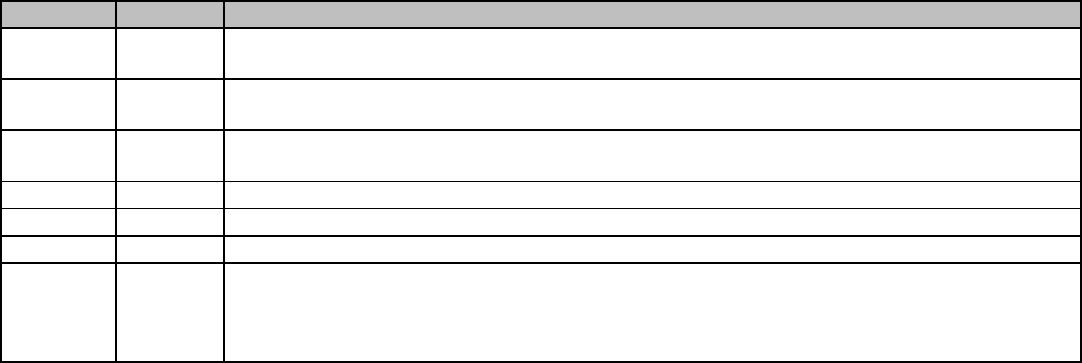

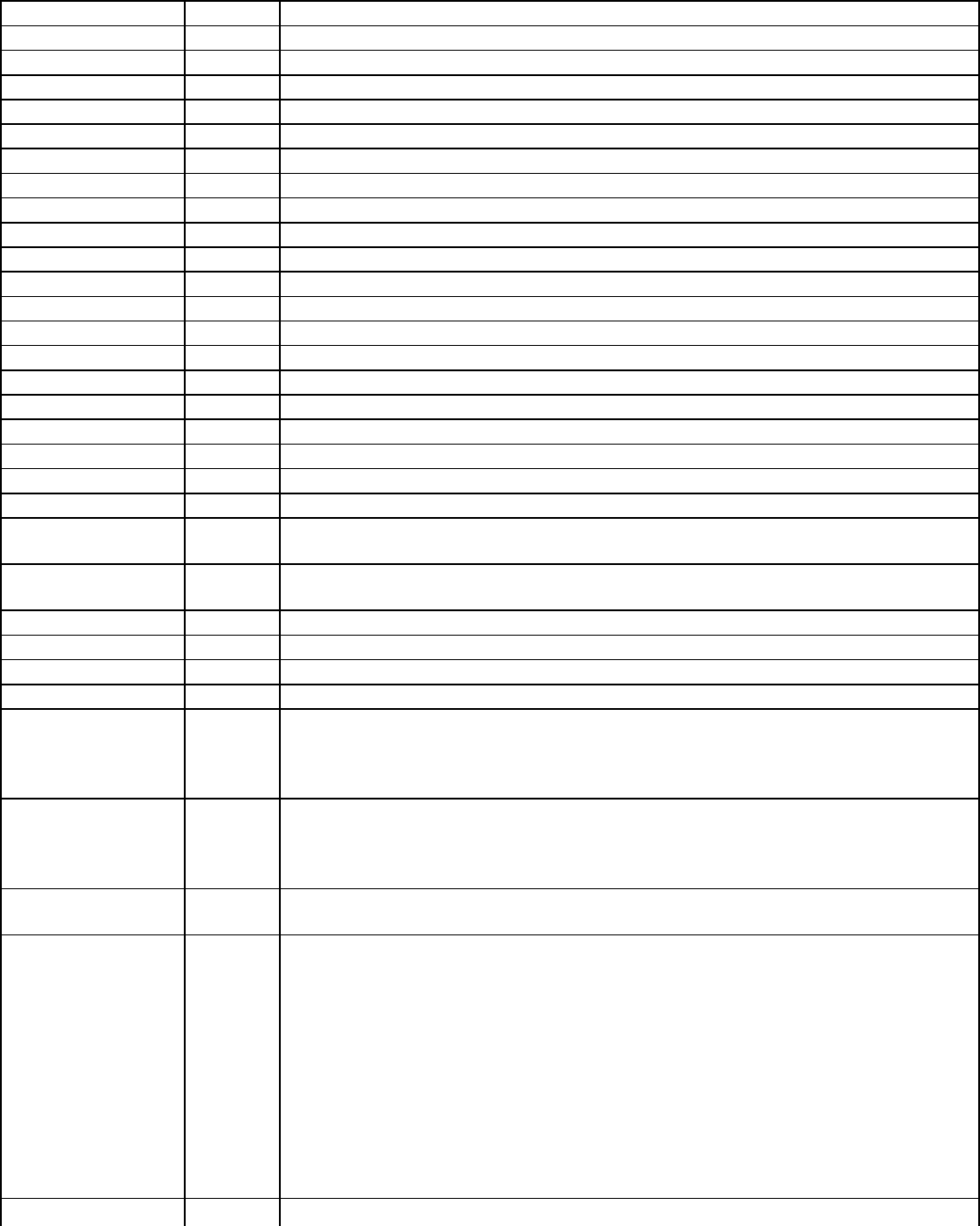

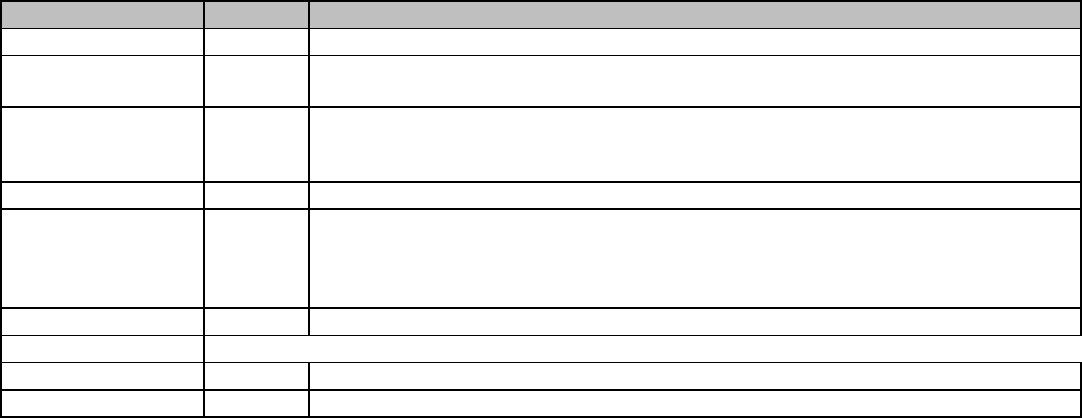

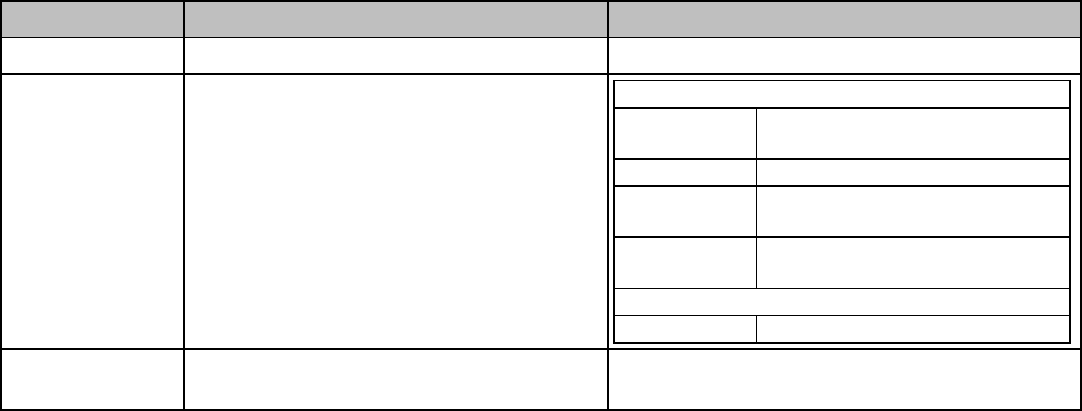

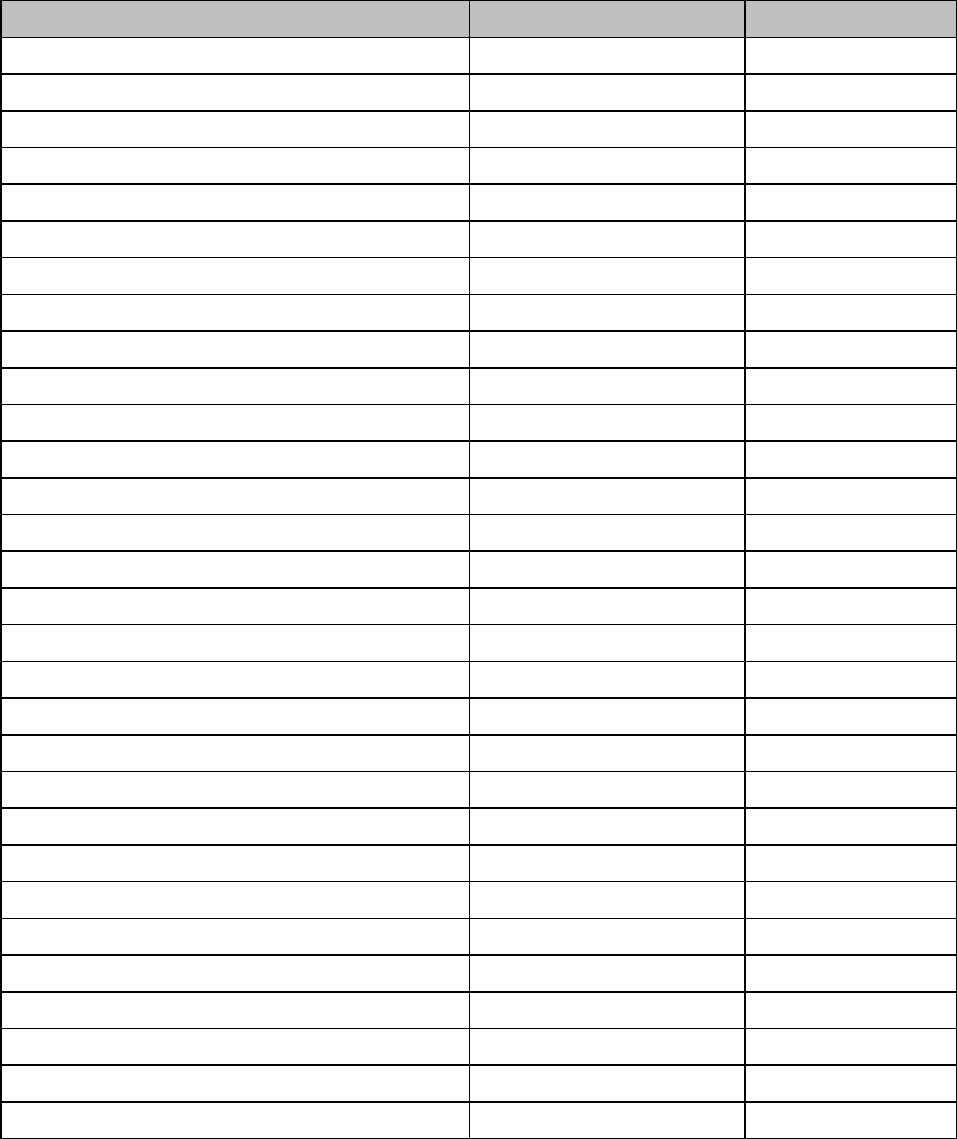

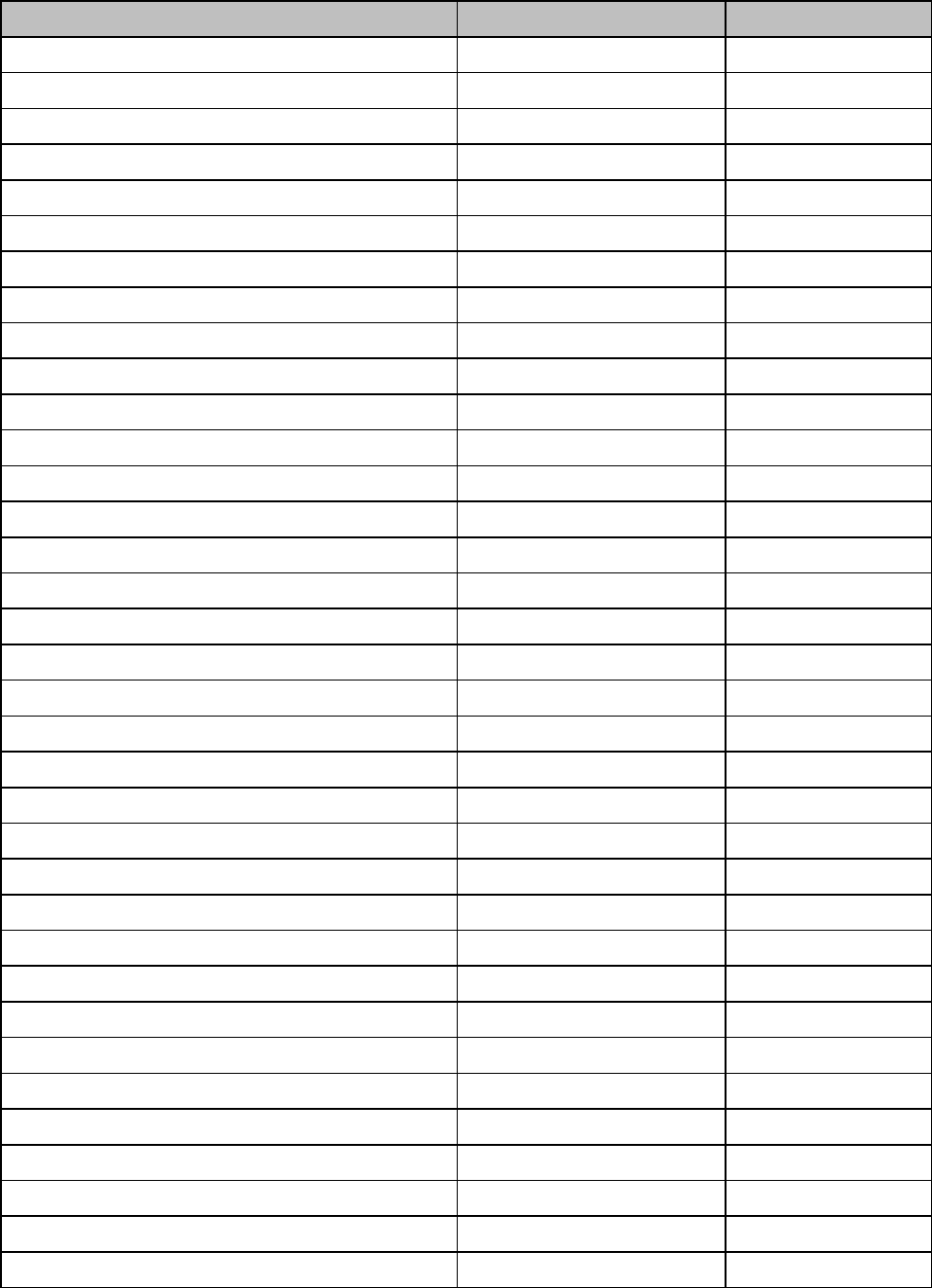

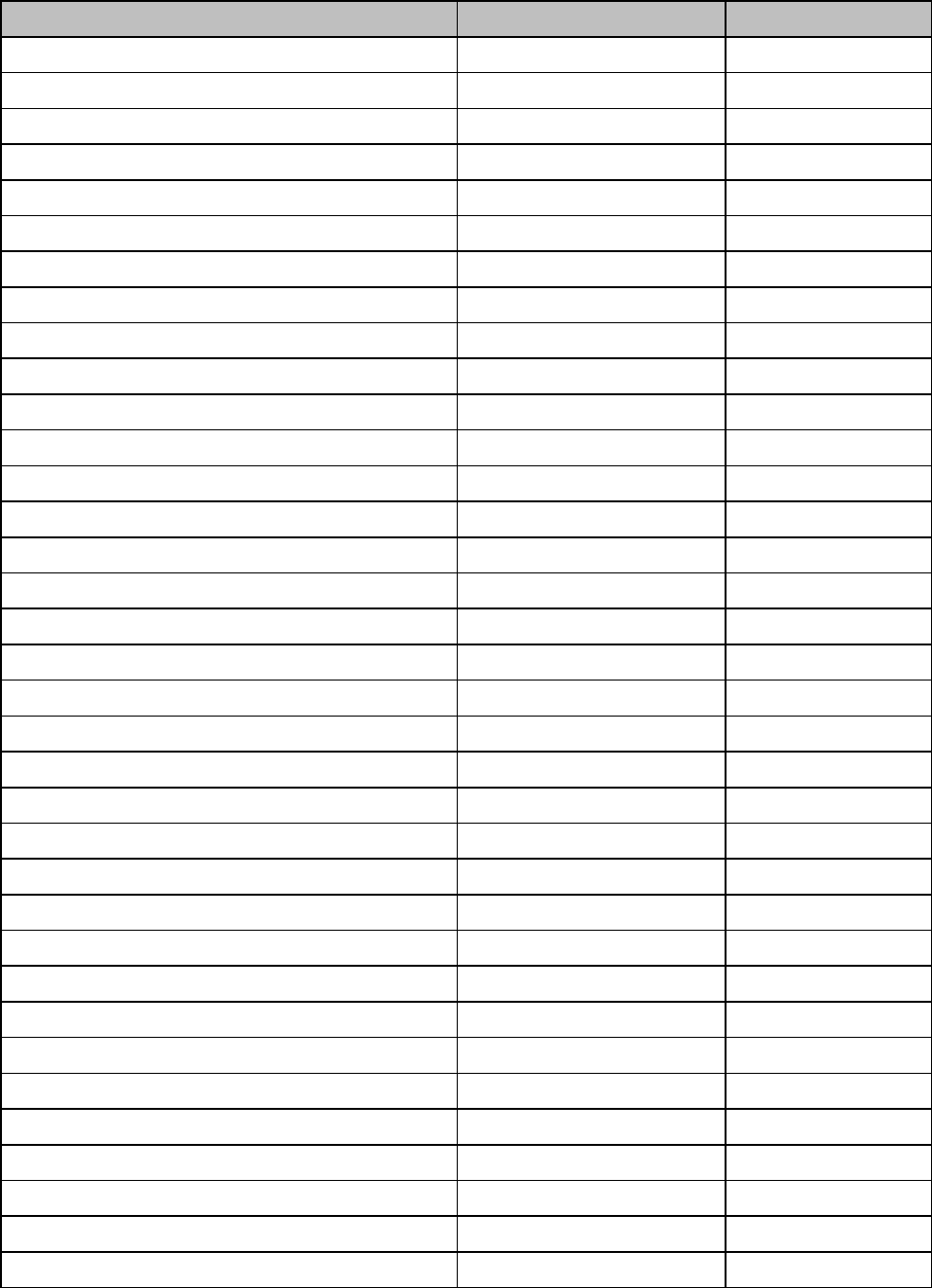

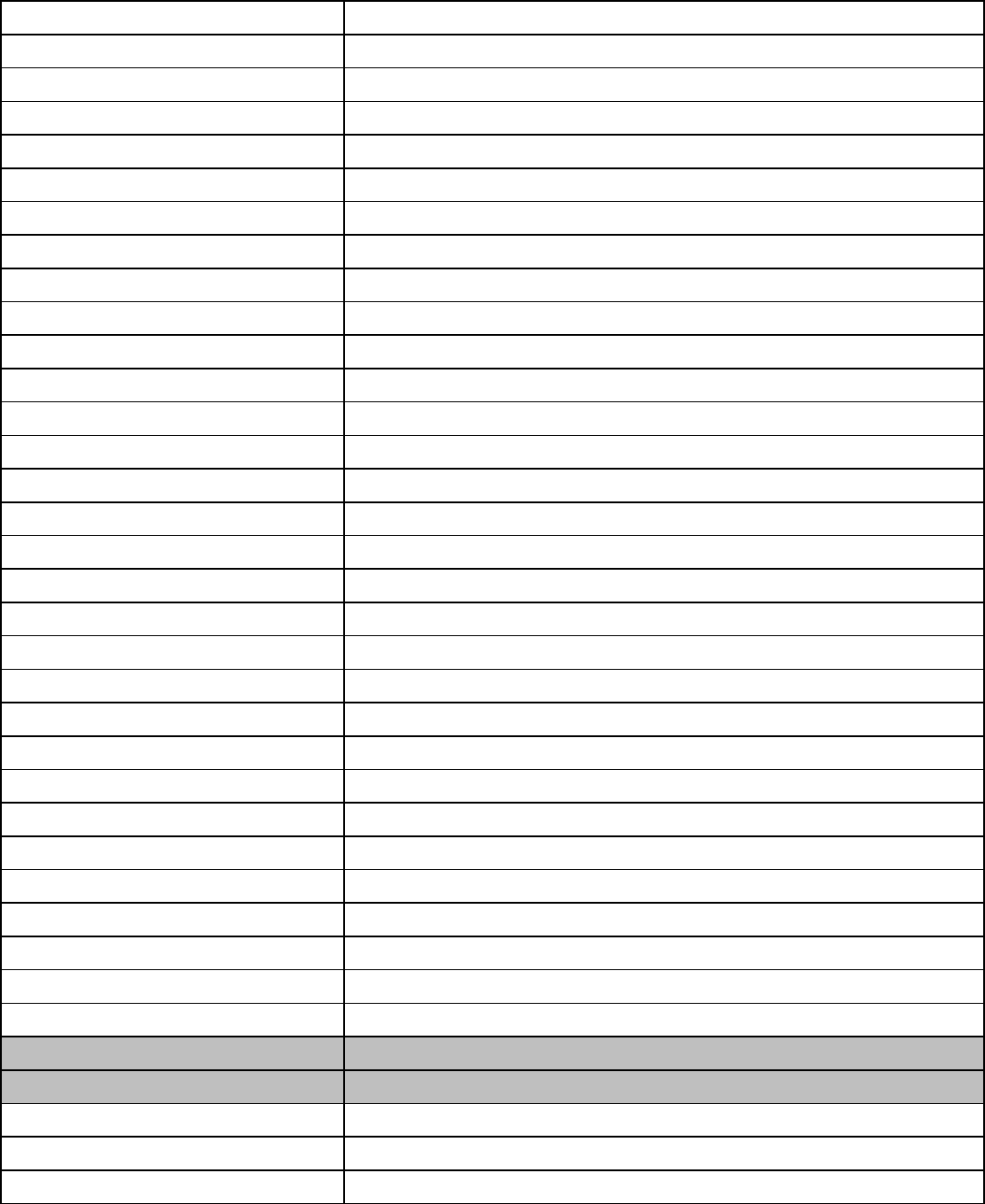

Transaction Types (XML Actions)

The following transaction types are available:

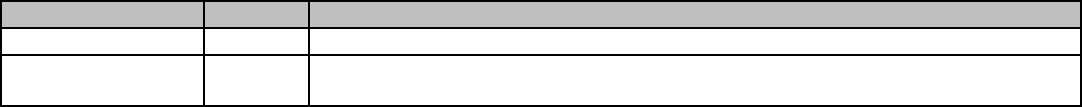

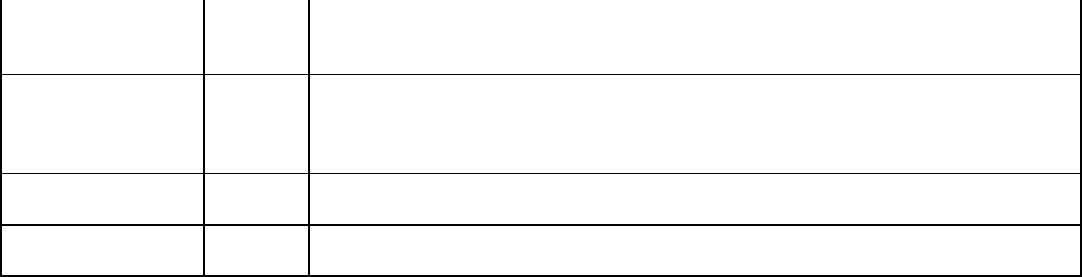

Credit Card Transaction Service Number Description

Credit Card Pre-Auth 1 A purchase amount is reserved at a card and authorization is

needed to withdraw money and finish a payment.

Credit Card Sales 2 A single-step transaction without pre-authorization. Money are

just withdrawn from a card.

Credit Card Post Capture 3 The reserved amount was withdrawn after authorization.

Credit Card Refund 4 Issue Credit for the CC (previous transaction required).

Credit Card Void 5 Void a Credit Card Auth or Sale (previous transaction required).

Standalone Credit/Refund 6 Process a Standalone Credit Card Credit.

Credit Card Incremental

Authorization 20 This transaction types processes an incremental transaction

which only applies to credit card transactions.

Credit Card Pre-Auth Reversal 21 This transaction types processes an authorized reversal which

only applies to credit card.

Credit Card Authentication 30 This transaction types processes an credit card authentication.

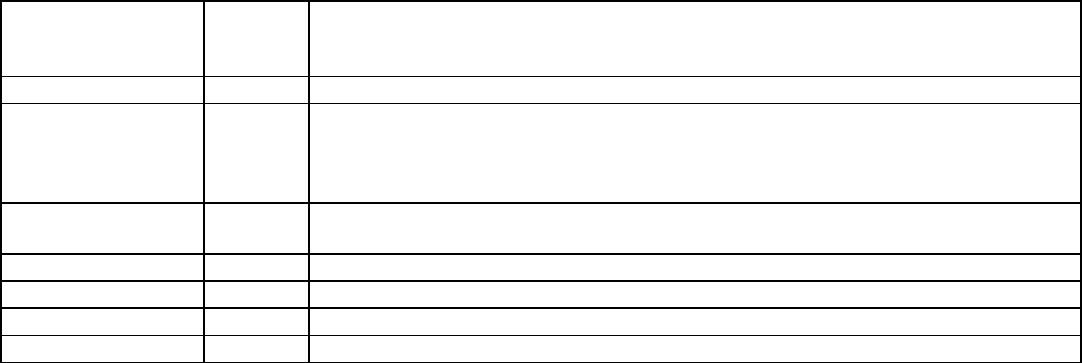

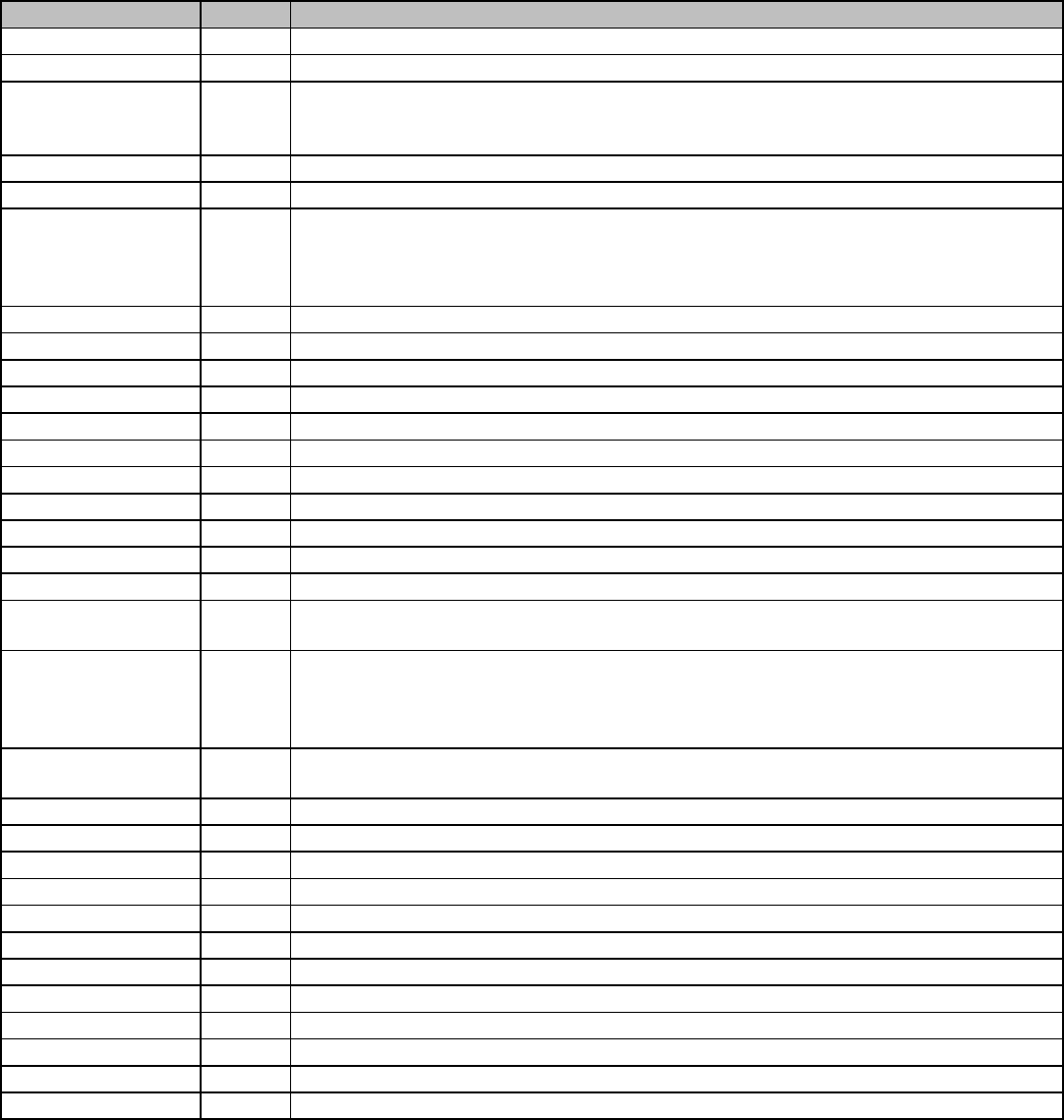

EBT Transaction Service Number Description

EBT Balance Inquiry 32 Process a EBT Balance Inquiry

EBT Cash Benefit Balance

Inquiry 33 Process a EBT Cash Benefit Balance Inquiry

EBT Cash Benefit Return 34 Process a EBT Cash Benefit Return

EBT Cash Benefit Withdrawal 35 Process a EBT Cash Benefit Withdrawal

EBT Cash Benefit Sale 36 Process a EBT Cash Benefit Sale

EBT FoodStamp Voucher Sale 37 Process a EBT FoodStamp Voucher Sale

EBT FoodStamp Return 38 Process a EBT FoodStamp Return

EBT FoodStamp Sale 39 Process a EBT FoodStamp Sale

EBT FoodStamp Balance

Inquiry 40 Process a EBT FoodStamp Balance Inquiry

EBT Void 41 Process a EBT Void

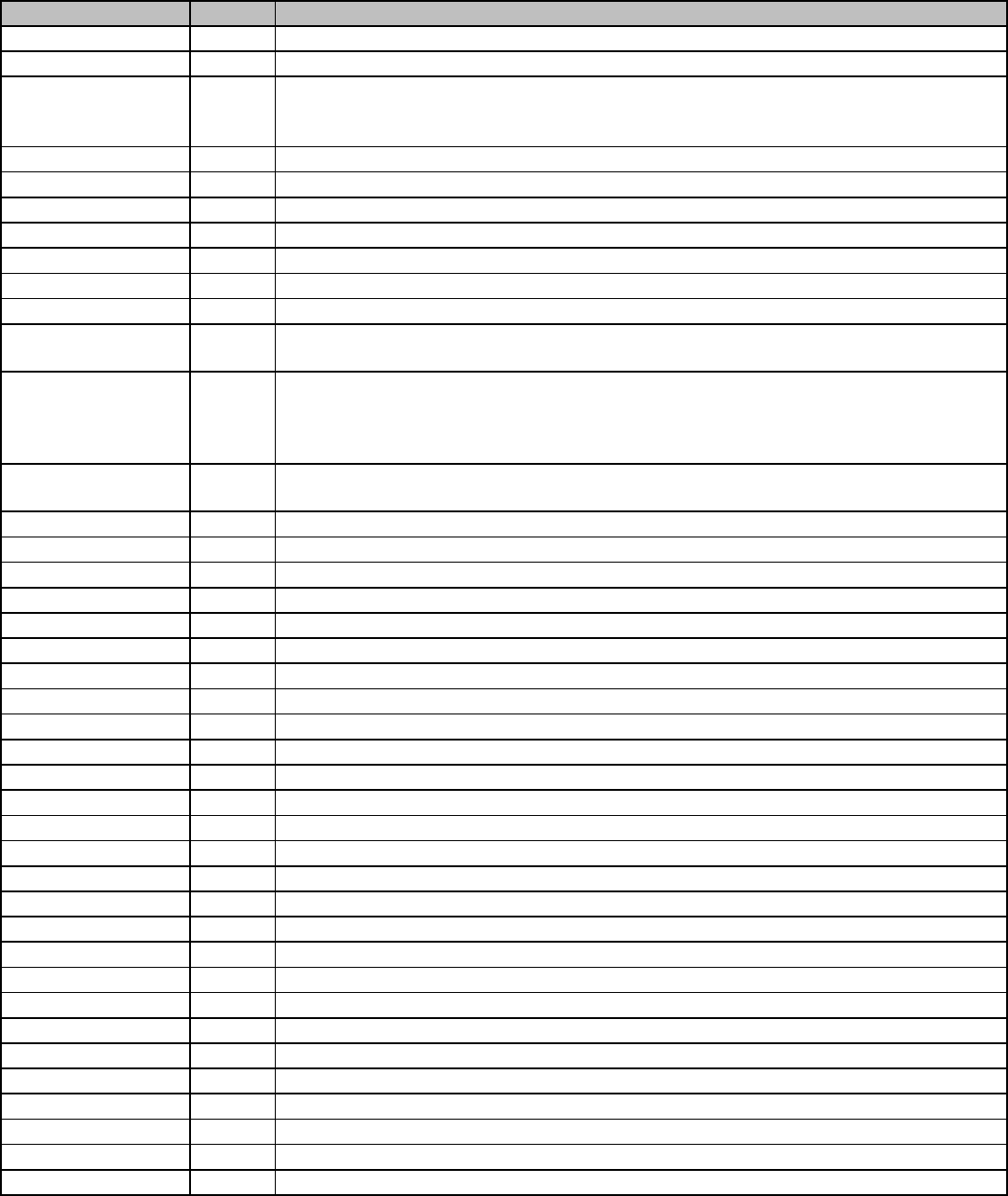

Debit Card Transaction Service Number Description

Debit Card 11 Process PIN-Debit Transaction.

Debit Card Return 26 Issue PIN-Debit Return.

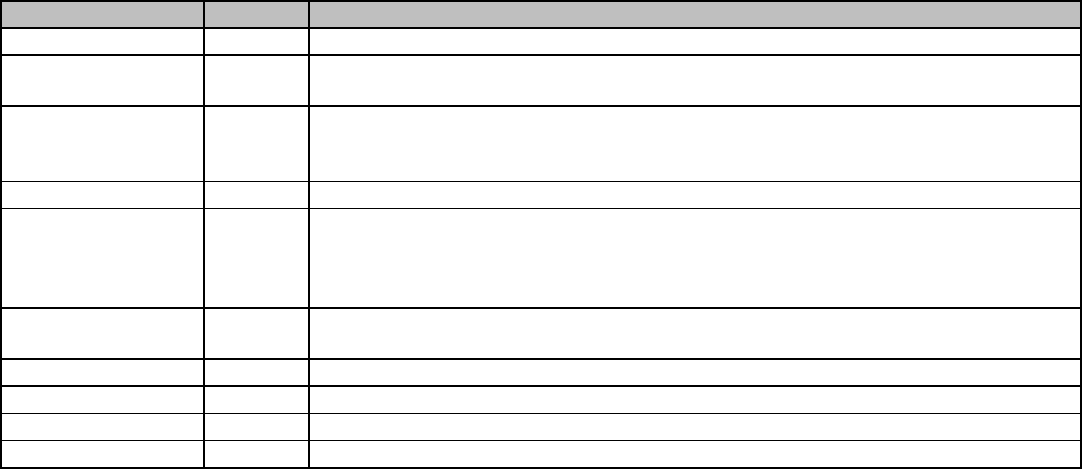

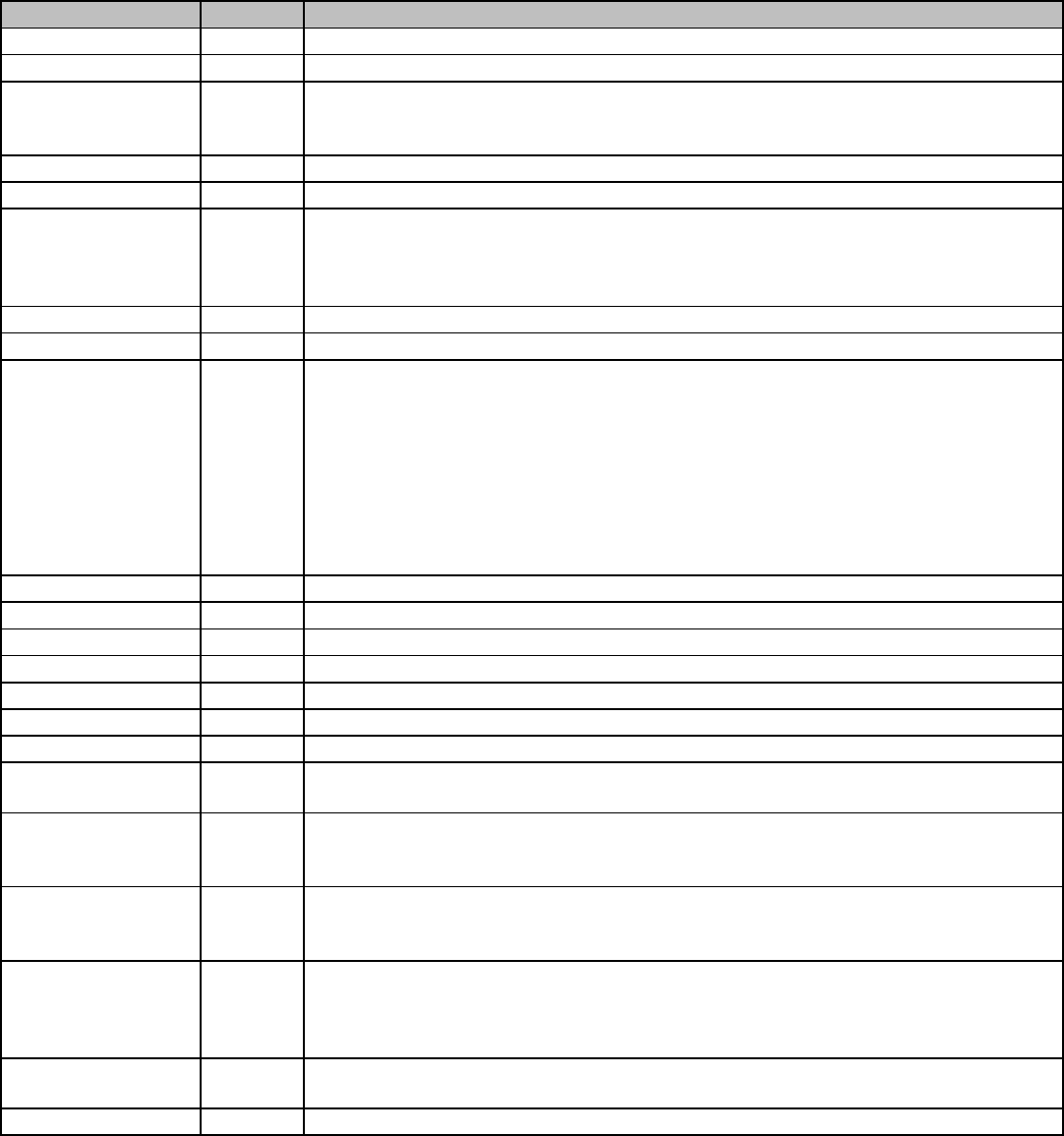

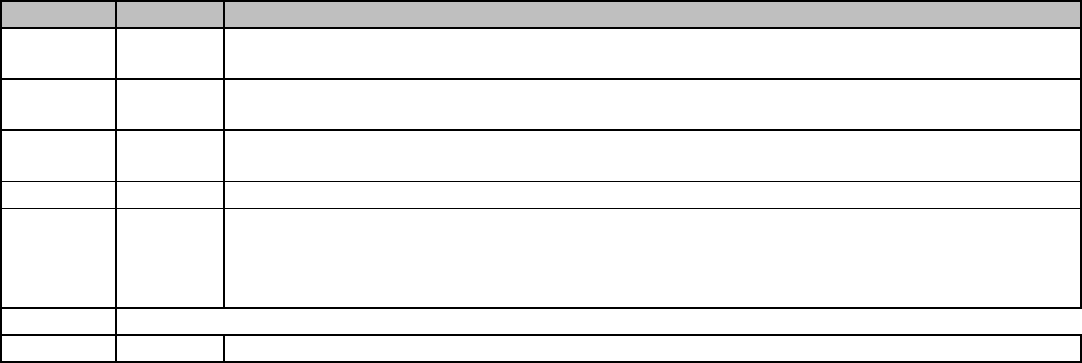

Stored Value Cards Service Number Description

Sale 42 Process Stored Value Card: Sale

Add Value 43 Process Stored Value: Add Value

Issue 44 Process Stored Value: Issue

Deactivate 45 Process Stored Value: Deactivate

Balance Inquiry 46 Process Stored Value: Balance Inquiry

Online Commerce Suite™ XML Integration Guide

Page 2

Refund 47 Process Stored Value: Refund

Credit Card Batch Settlement Service Number Description

Batch Settlement 24 Process Settlement for a single Batch.

Batch Settlement All 25 Process Settlement for ALL Open Batches.

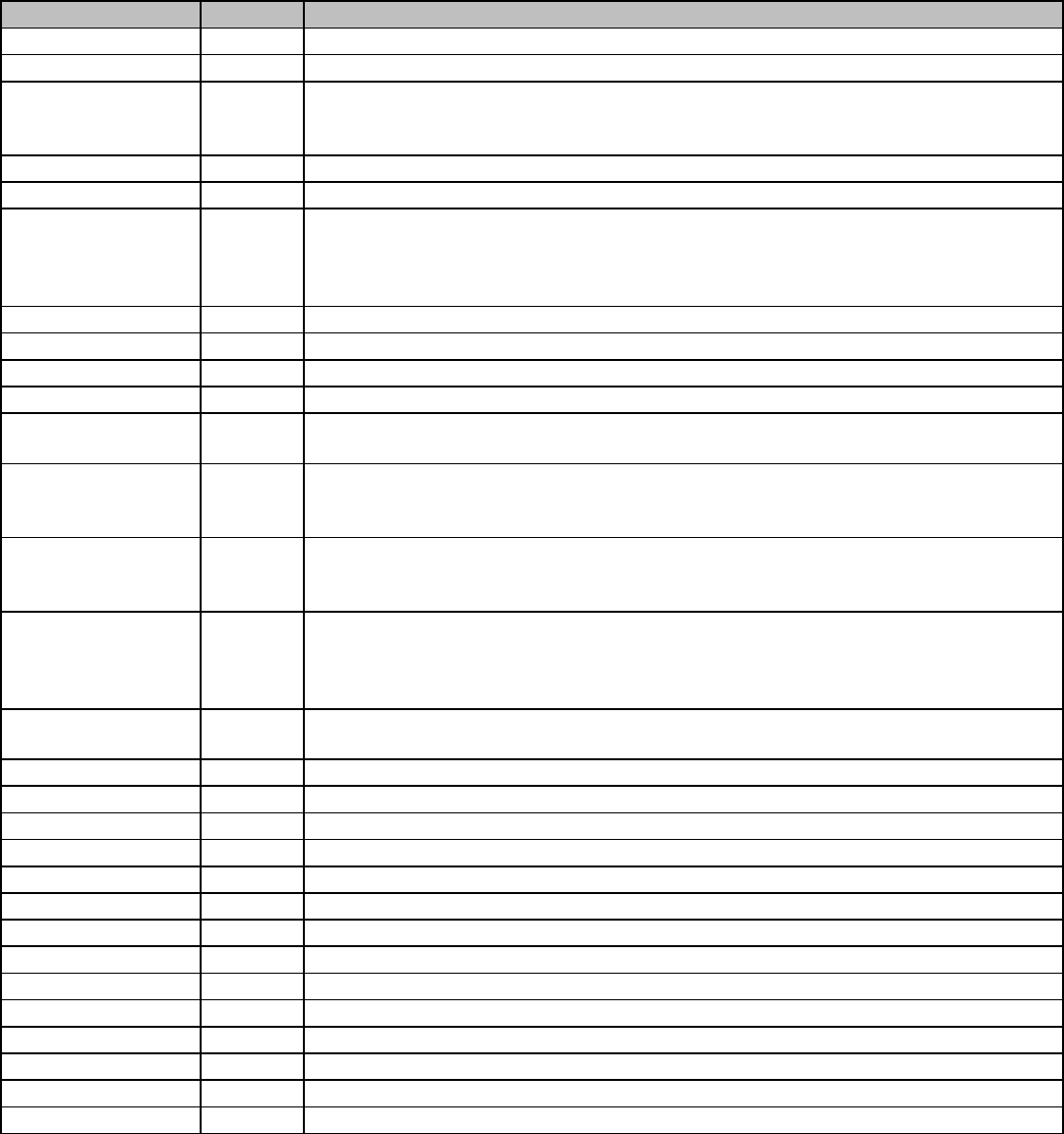

ACH Transaction Service Number Description

ACH Sale 2 Process a ACH sale.

ACH Credit/Refund 4 Issue Credit for the ACH Sale (previous transaction required).

ACH Void 5 Void a ACH Sale (previous transaction required).

ACH Standalone Credit 6 Process a Standalone ACH Credit.

Check 21 Transaction Service Number Description

Check 21 Sale 27 Process a Check21 Sale.

Check 21 Void 28 Process a Check21 Void (previous transaction required).

Check 21 Credit/Refund 29 Process a Check21 Credit (previous transaction required).

3rd Party Check Processing

Service Providers Service Number Description

Extended ACH Sale 14 Process a Extended ACH Sale.

Extended ACH Consumer

Disbursement 15 Process a Standalone Extended ACH Consumer Disbursement.

Extended ACH Credit 16 Process a Extended ACH Credit (previous transaction required).

Extended ACH Void 17 Process a Ext ACH Void (previous transaction required).

Extended ACH ProfileAdd 31 Process a Ext ACH Profile Add.

Transaction Retrieve Service Number Description

Transaction Retrieve 19 Retrieves the transaction results of the last transaction which

applies to all transaction types.

Stored Profile Service Number Description

Profile Add 7 Issue Credit Card or ACH Sale using the Stored Profile.

Profile Sale 8 Issue Credit Card or ACH Sale using the Stored Profile.

Profile Update 9 Updates the Stored Profile (ie, card number, expiration dates,

etc.).

Profile Delete 10 Deletes the Stored Profile (ie, card number, expiration dates,

etc.).

Profile Retrieve 12 Retrieves the account number, address and billing info.

Profile Credit 13 Issue Credit using the Stored Profile.

Profile Import 18 The Online Commerce Suite to Import the Profile. A PreAuth

(creditcard) will not be performed.

Online Commerce Suite™ XML Integration Guide

Page 3

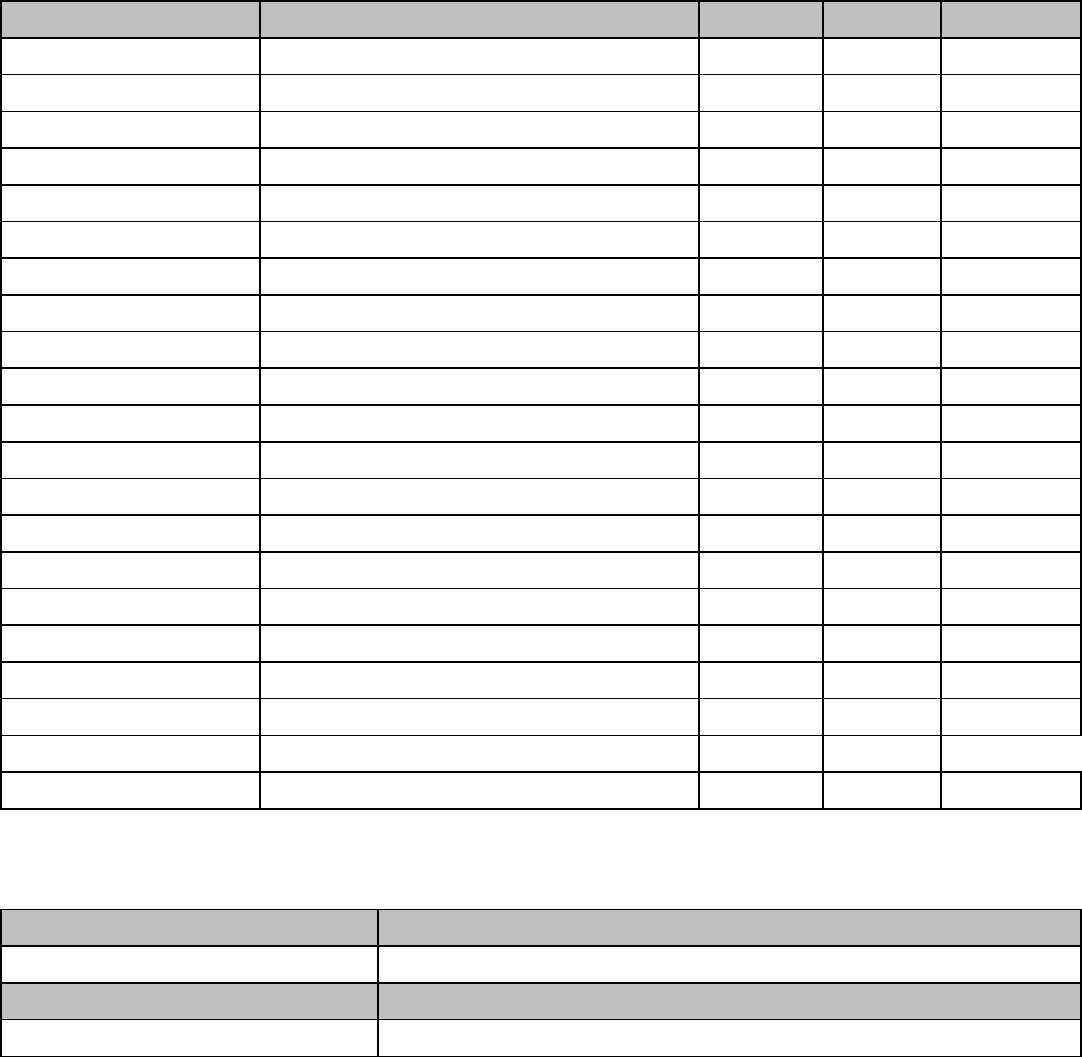

Credit Card Transactions

The following tables describe required and optional data elements that can be sent to the Merchant Partners gateway to

complete a transaction.

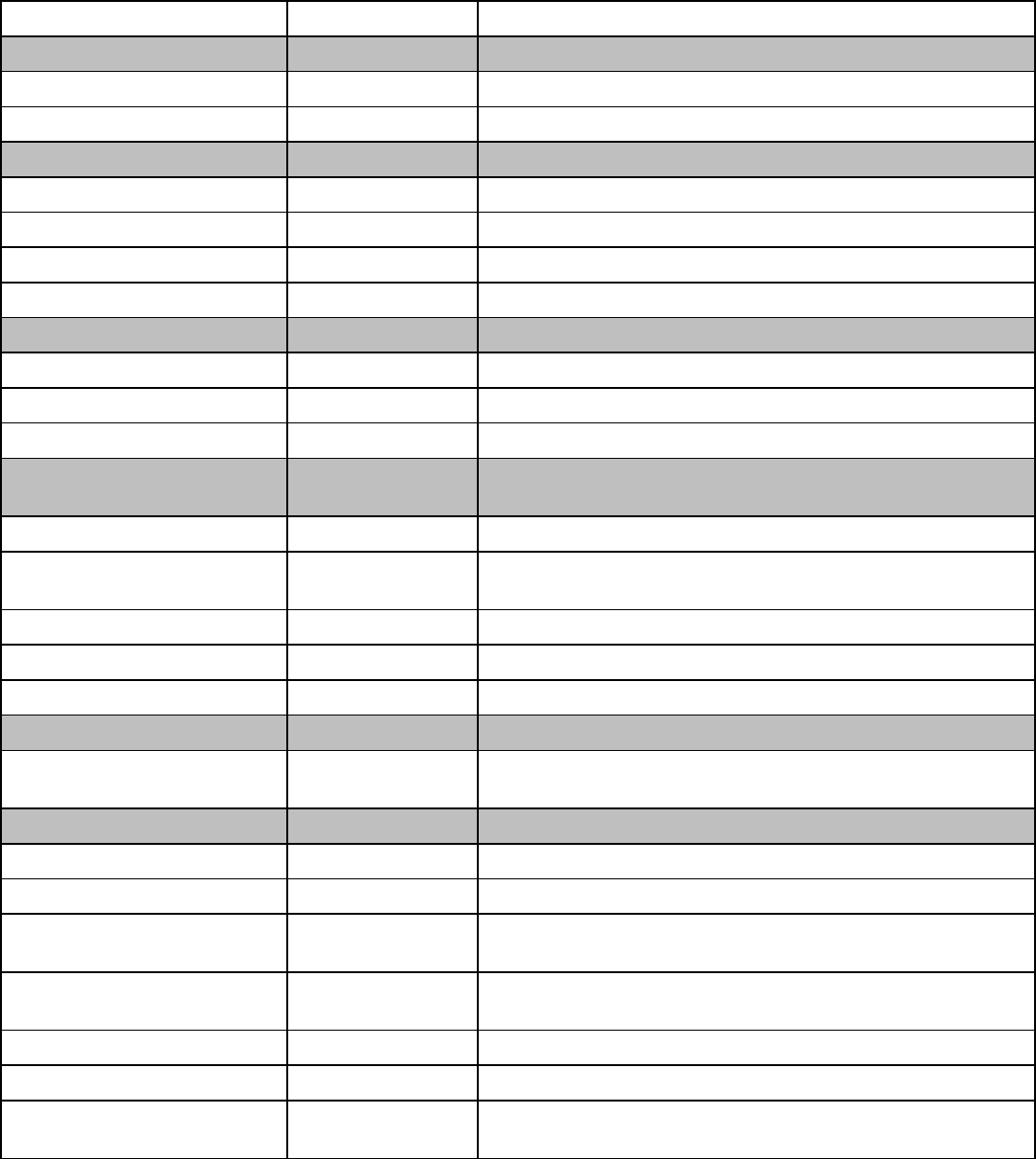

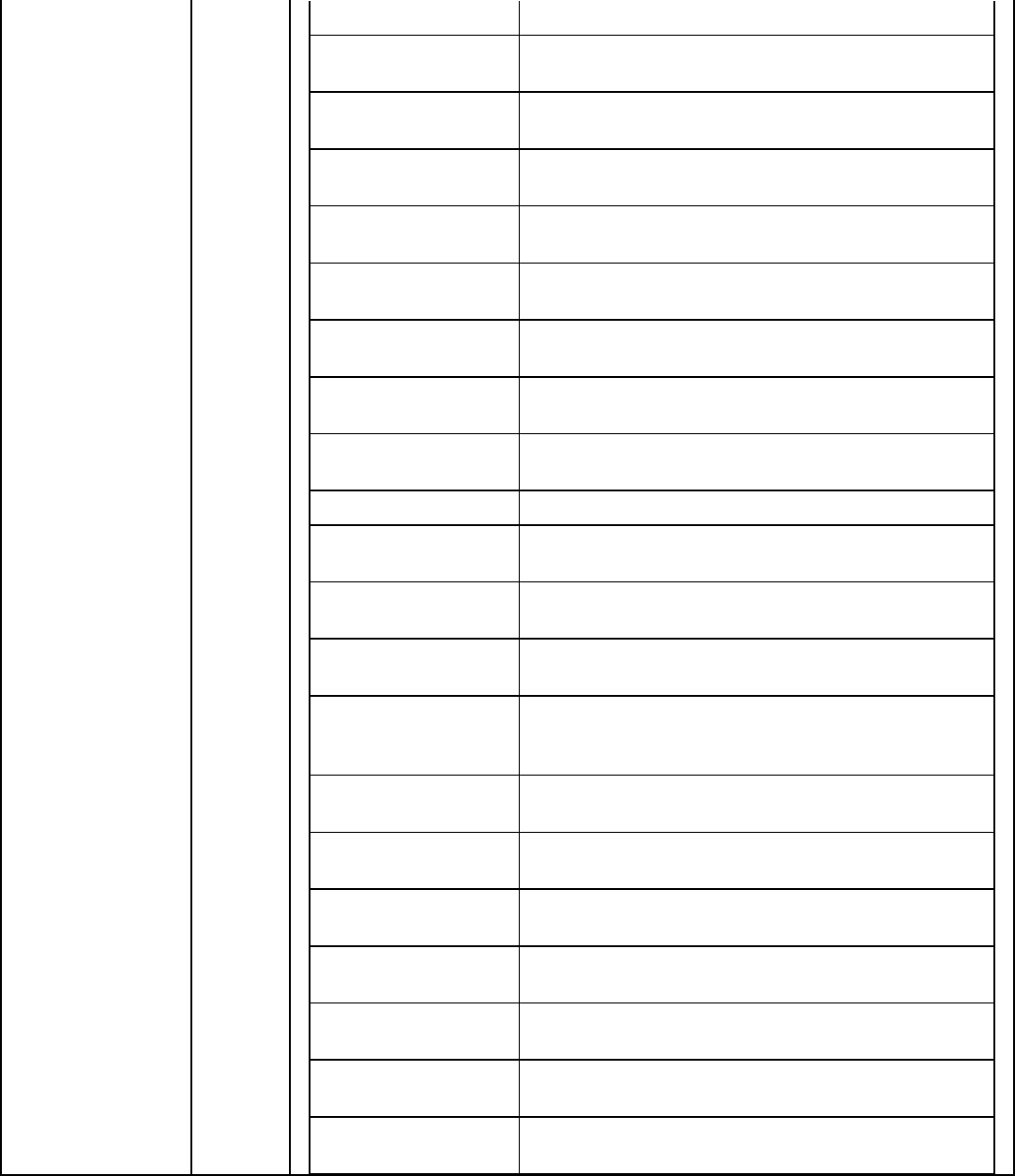

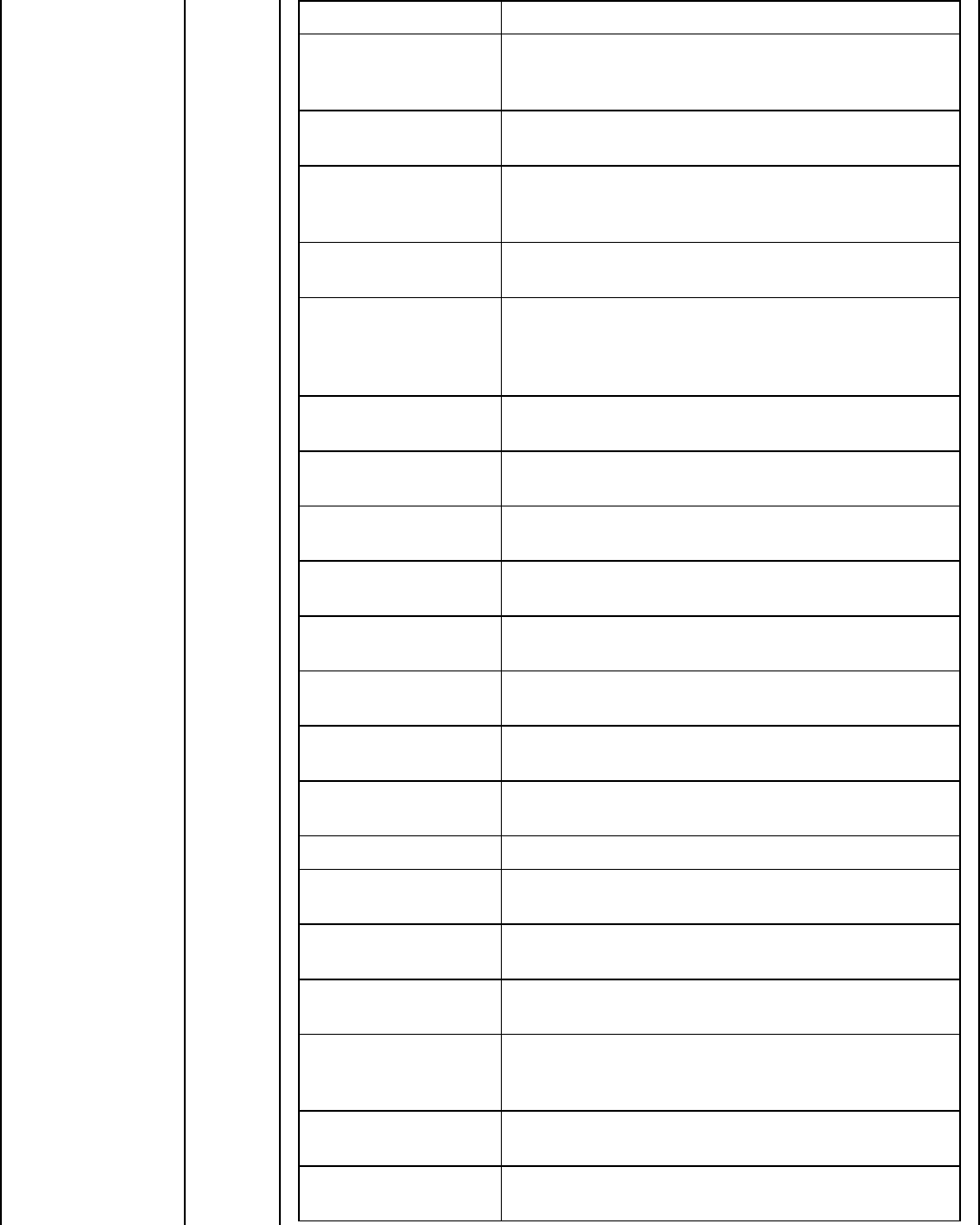

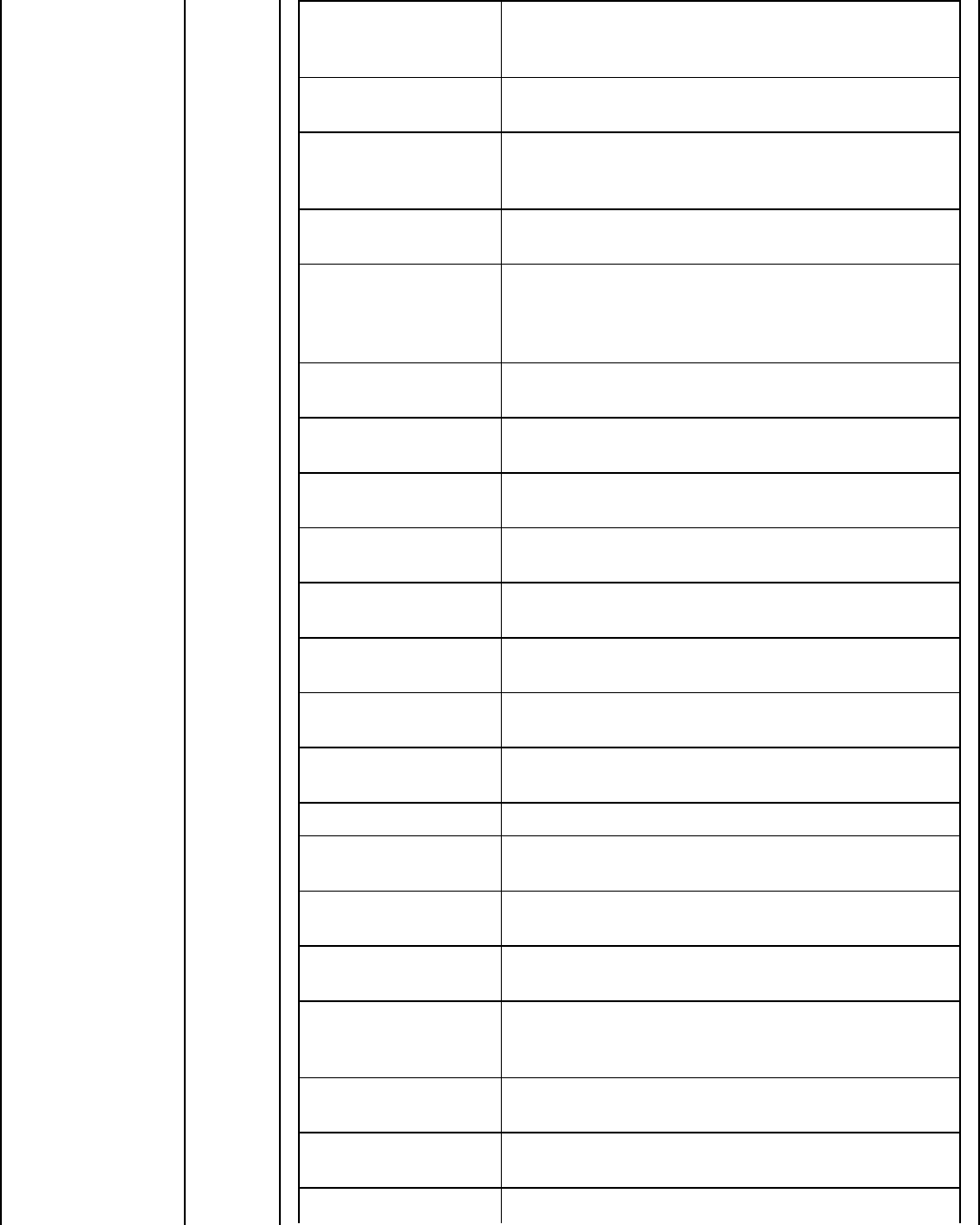

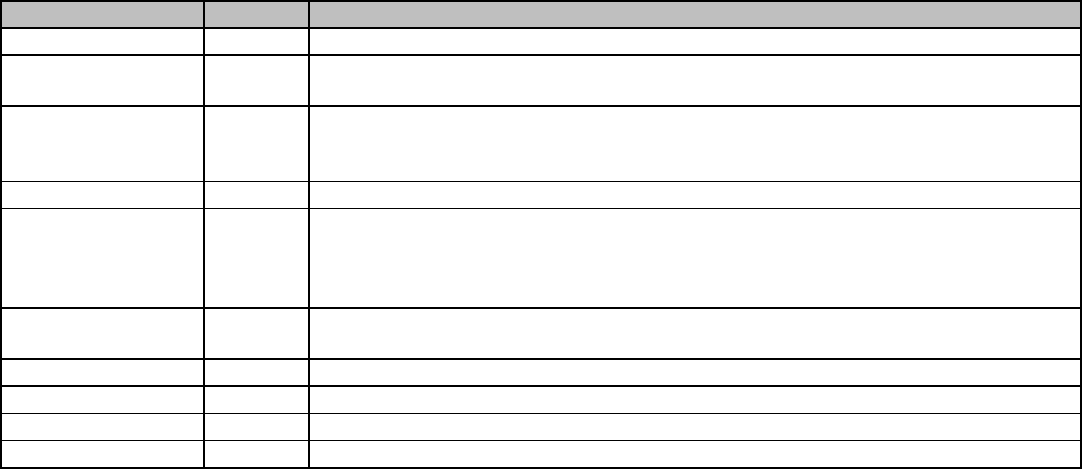

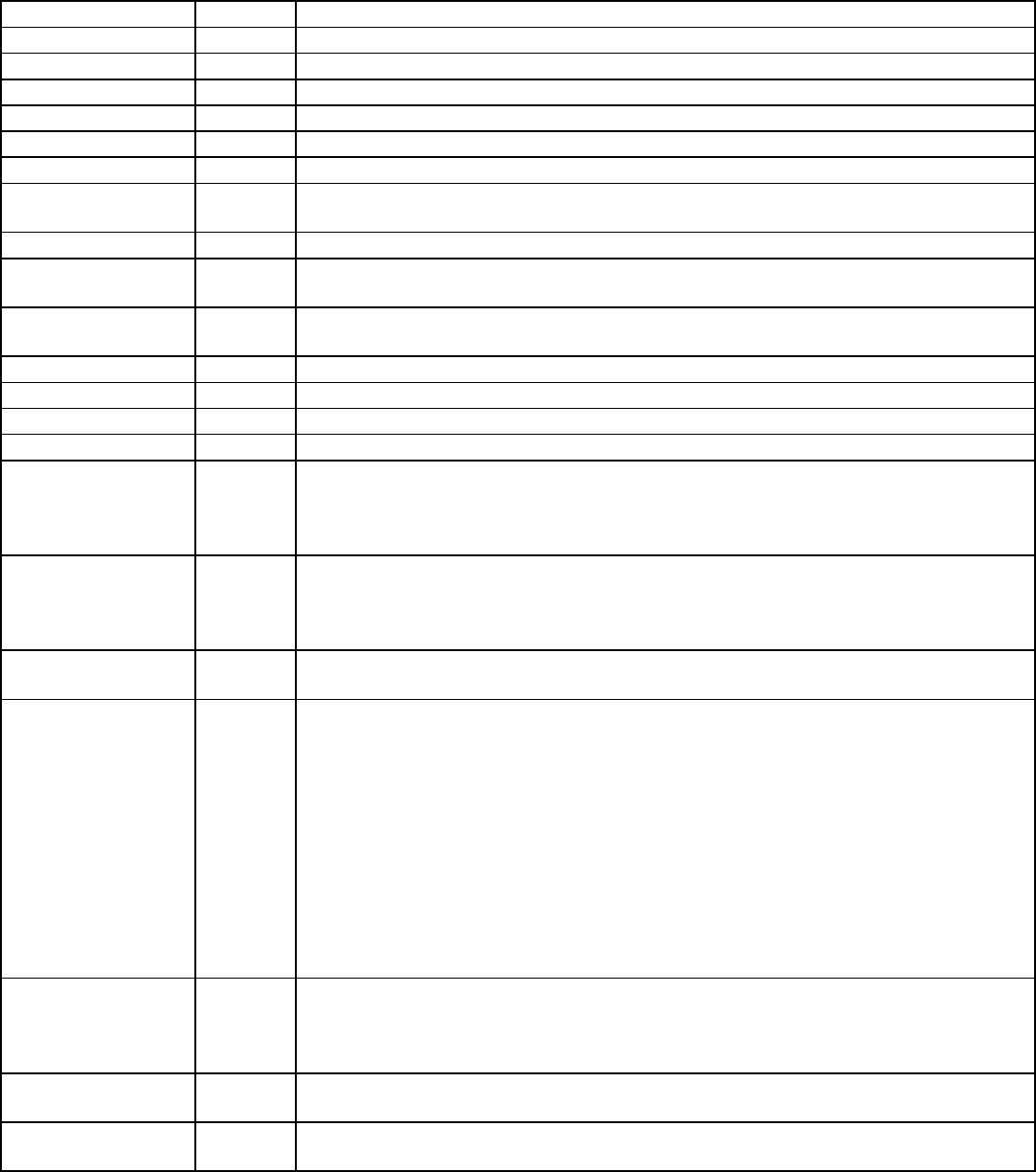

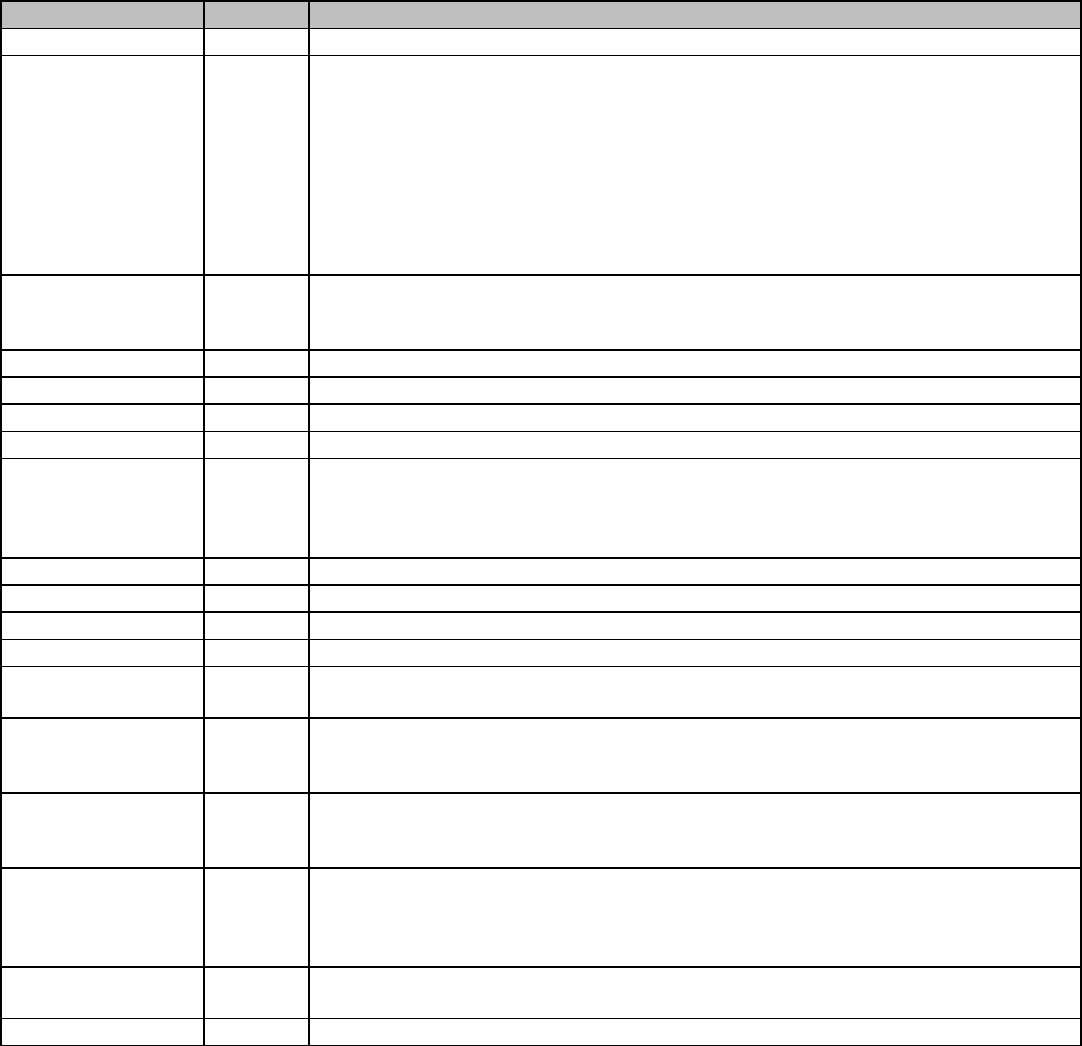

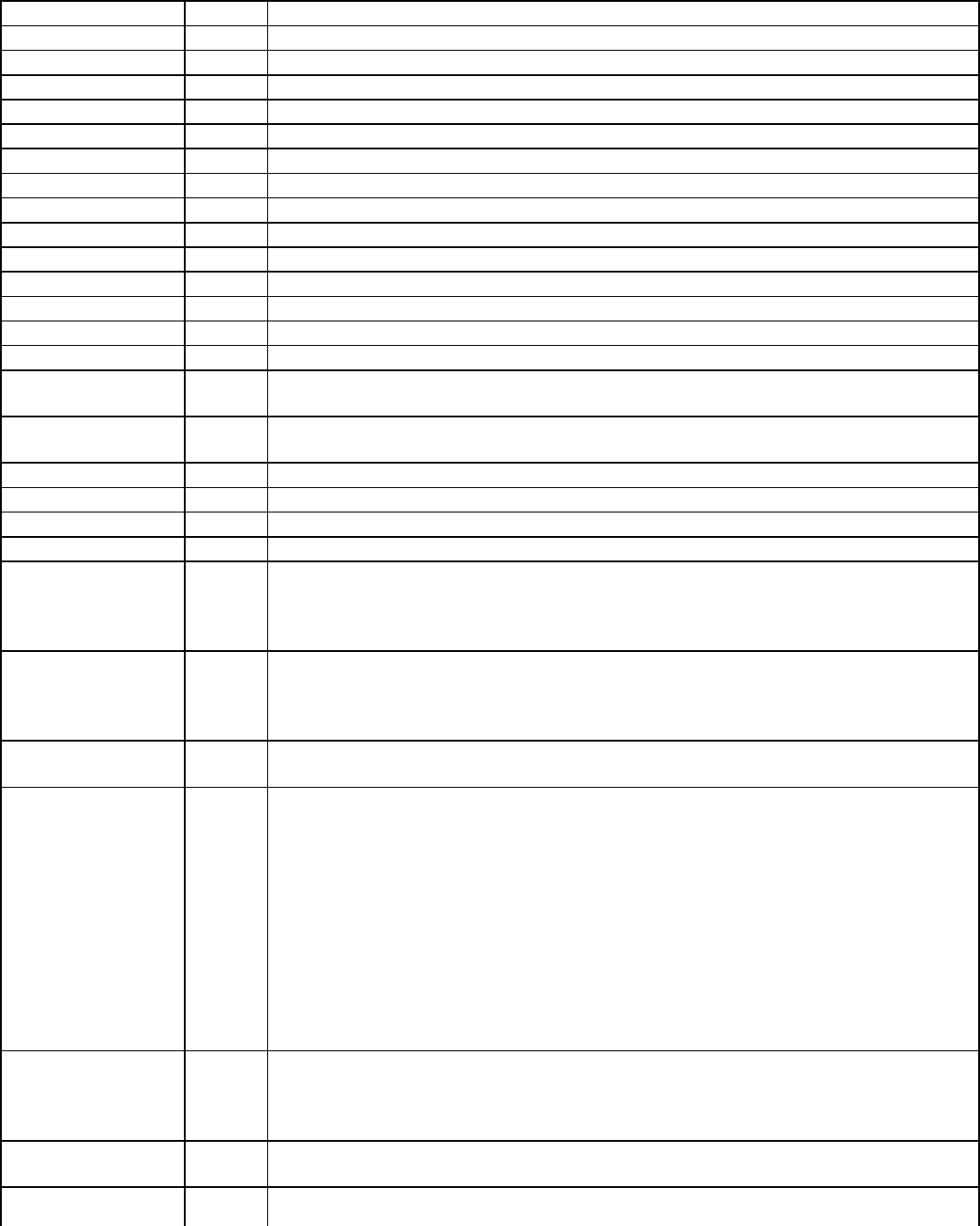

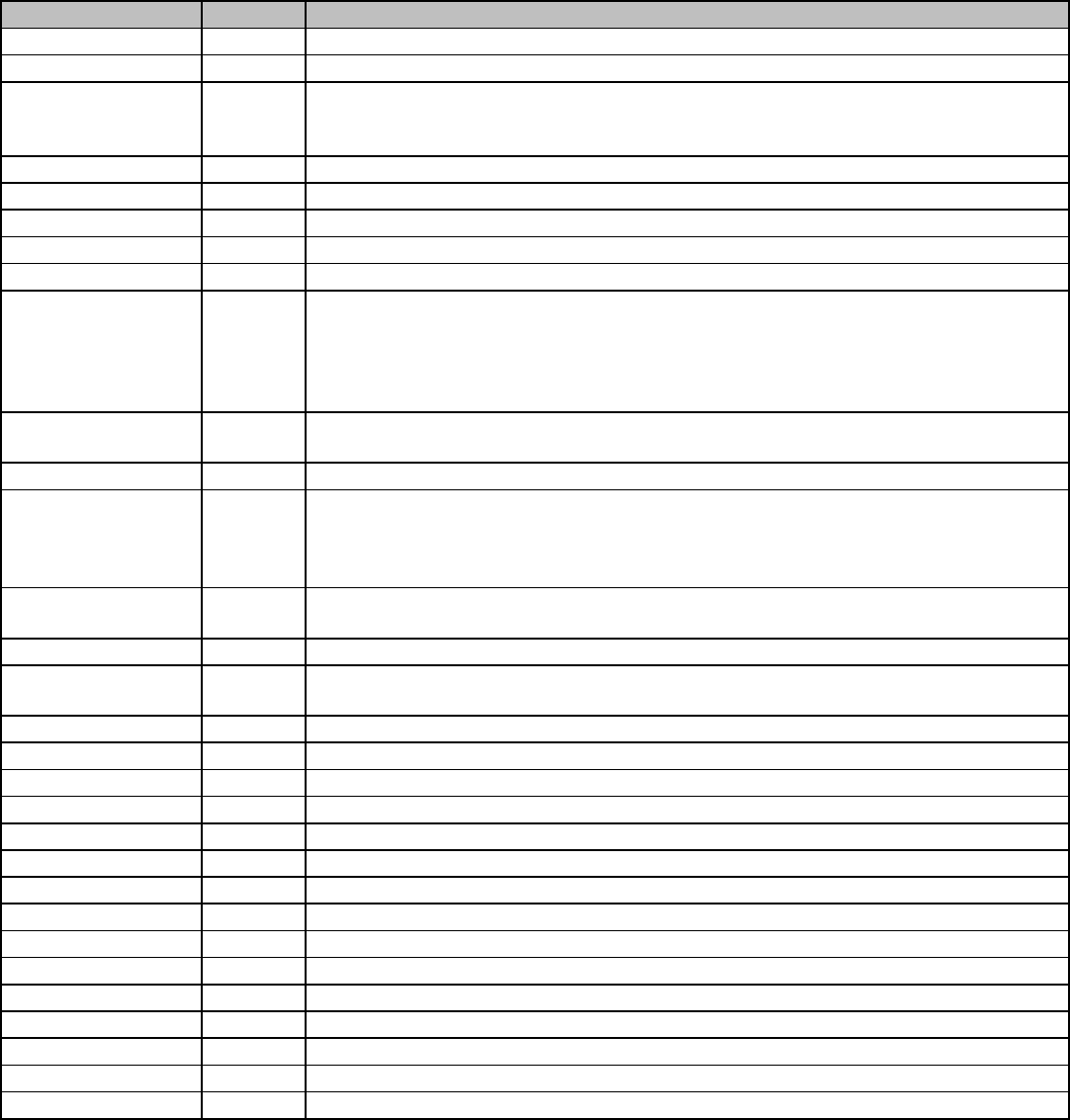

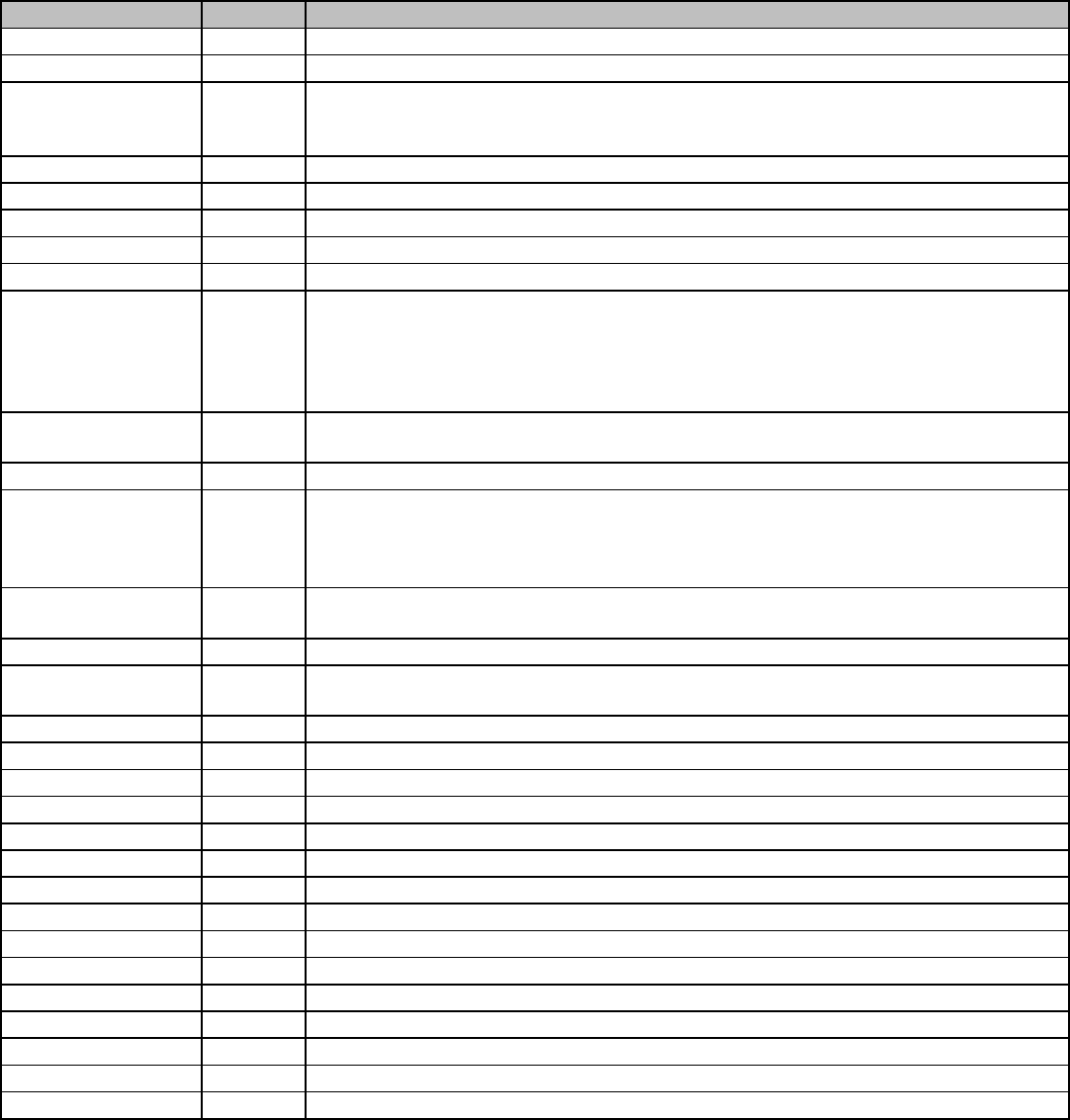

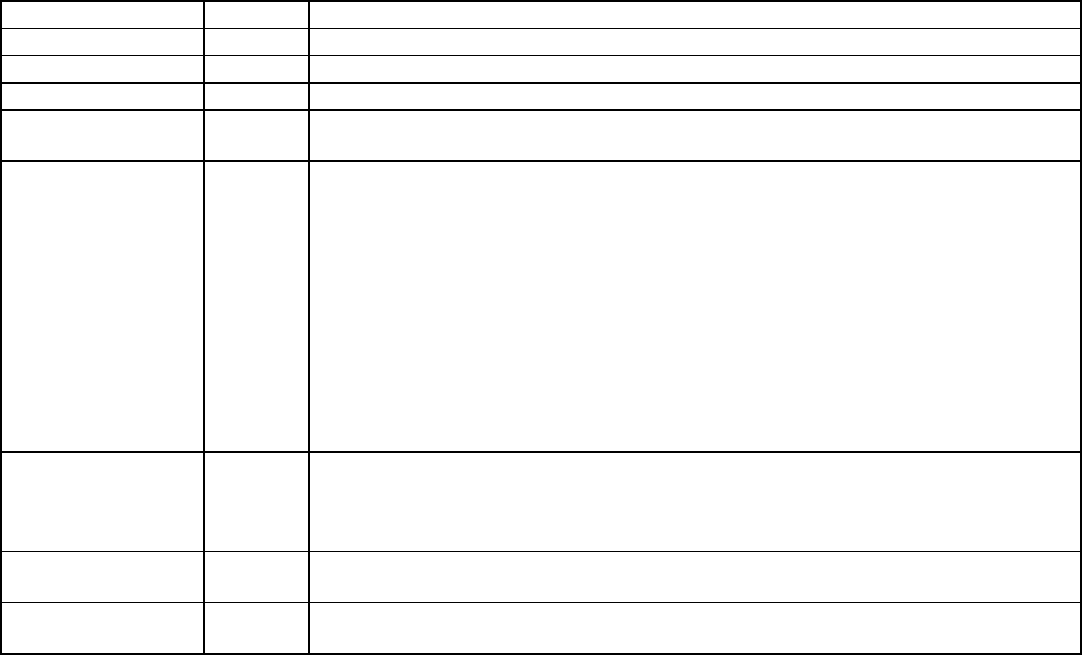

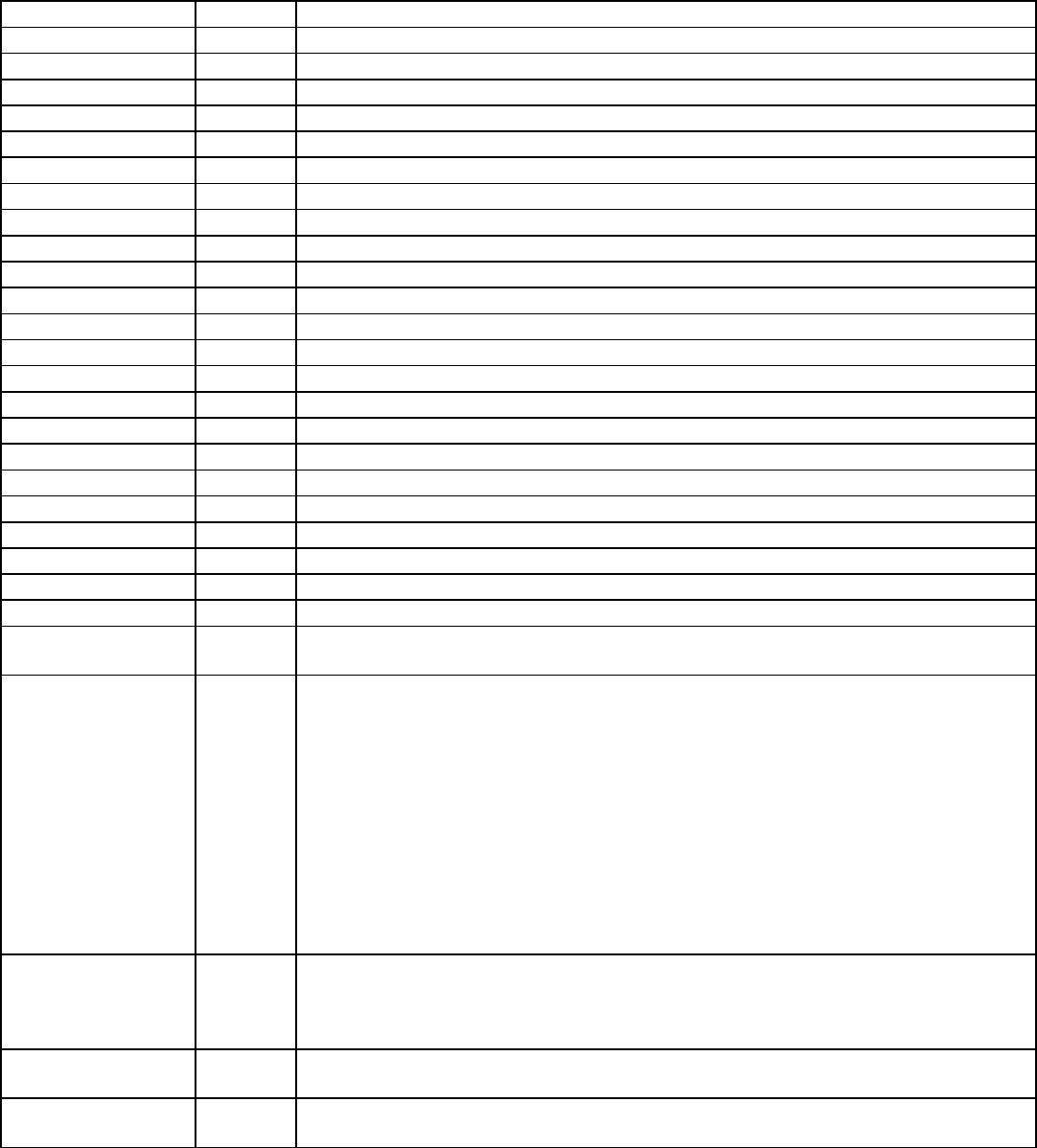

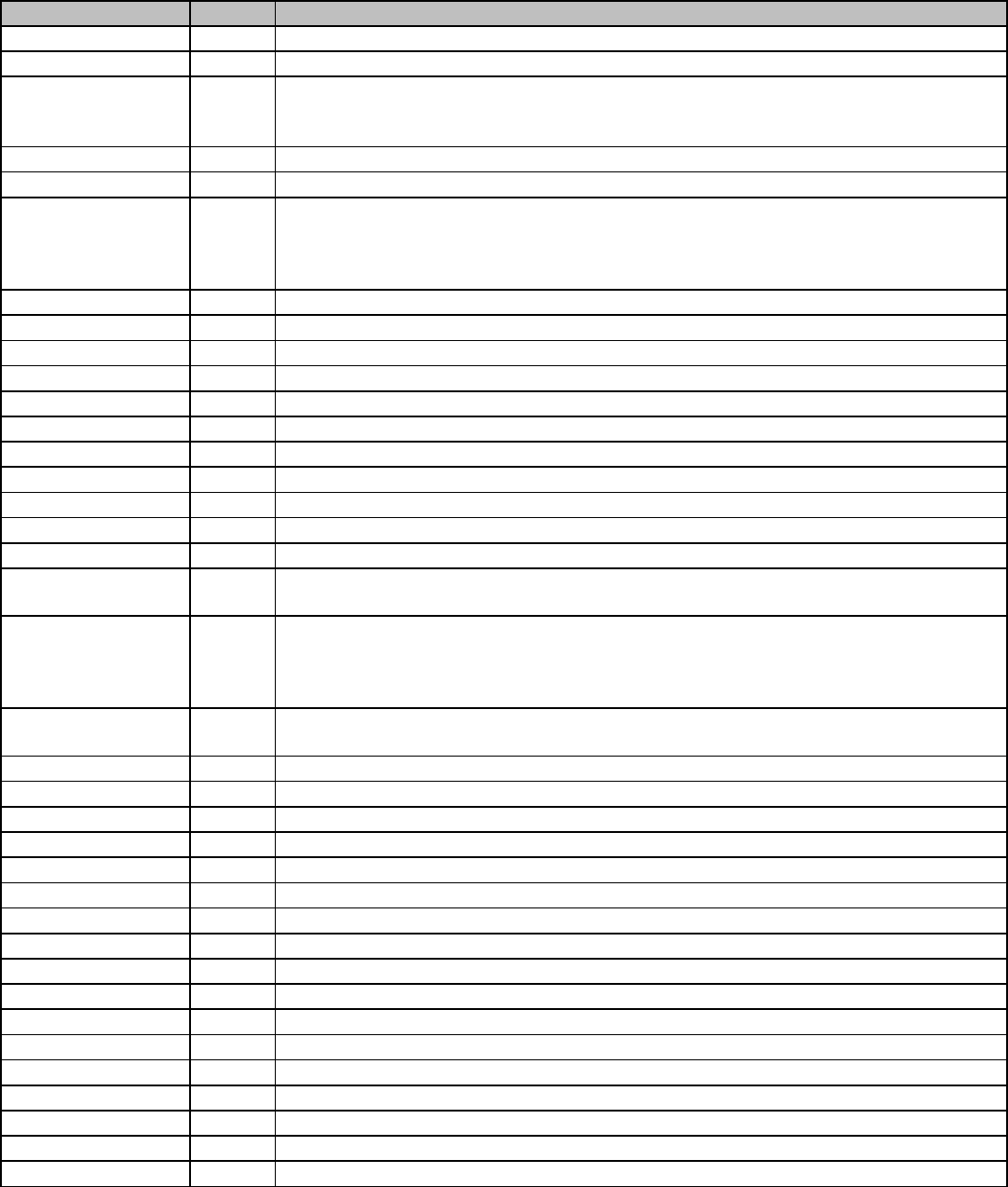

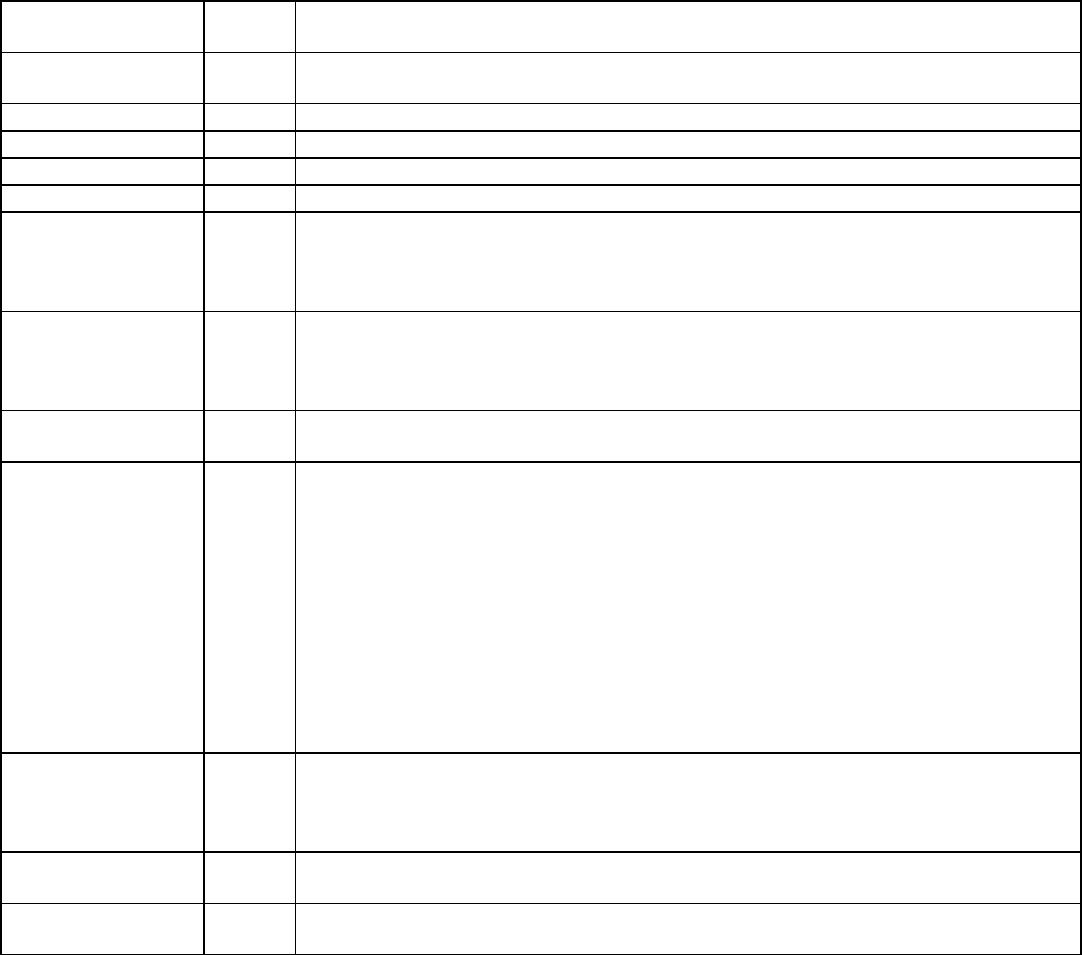

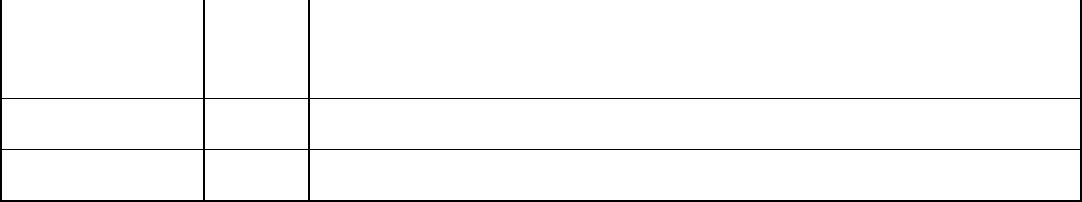

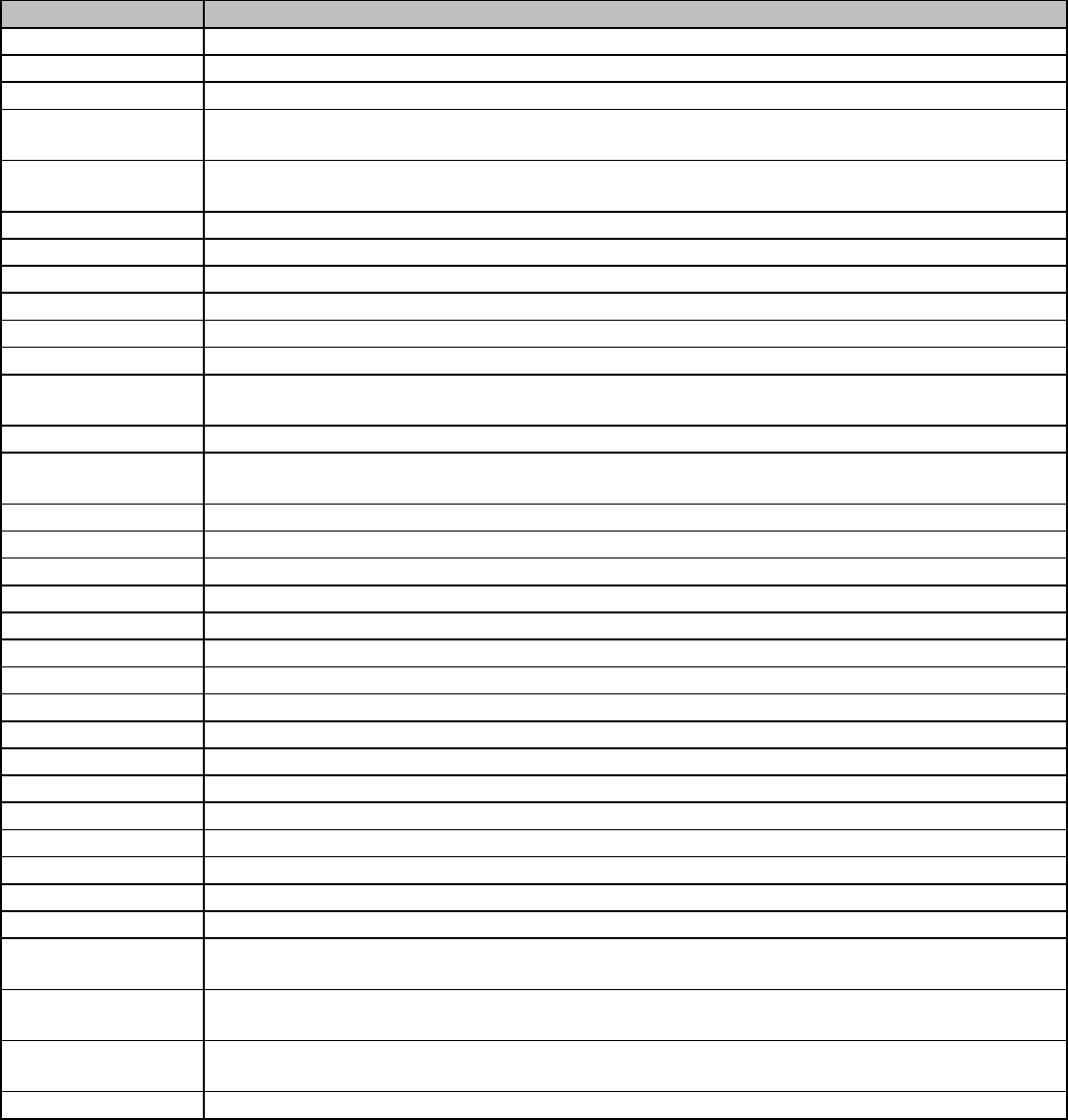

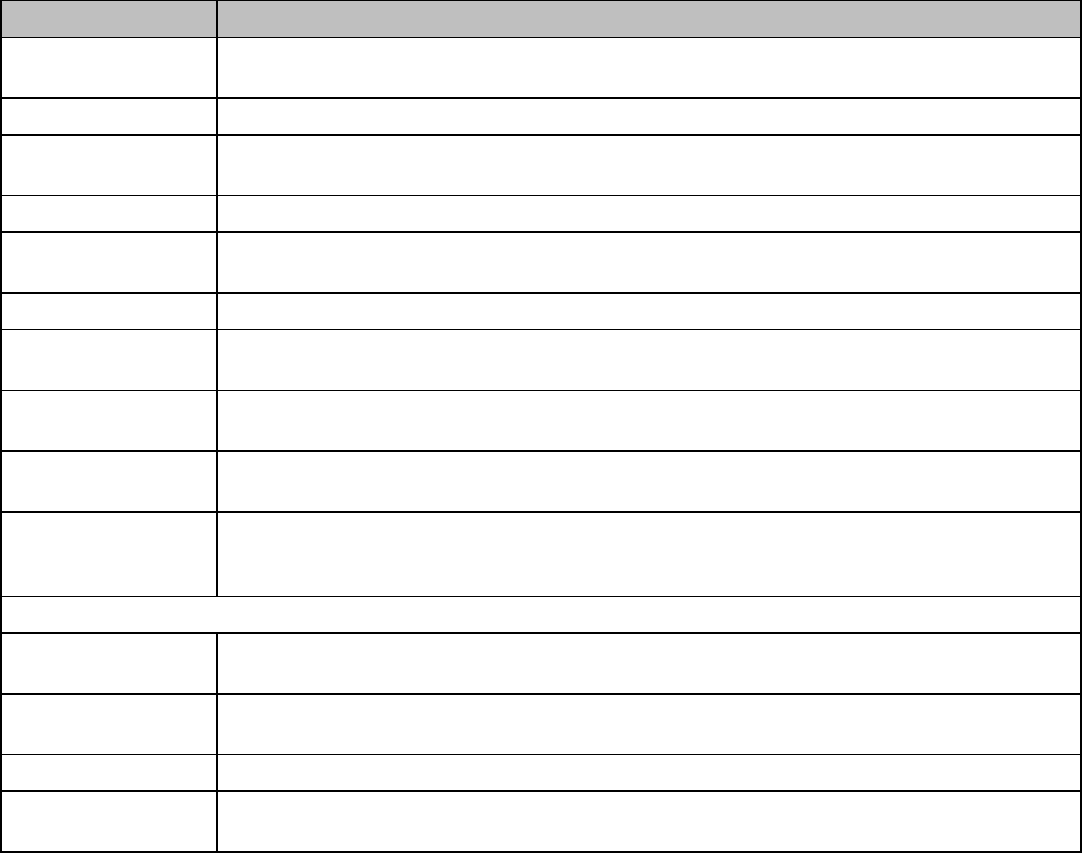

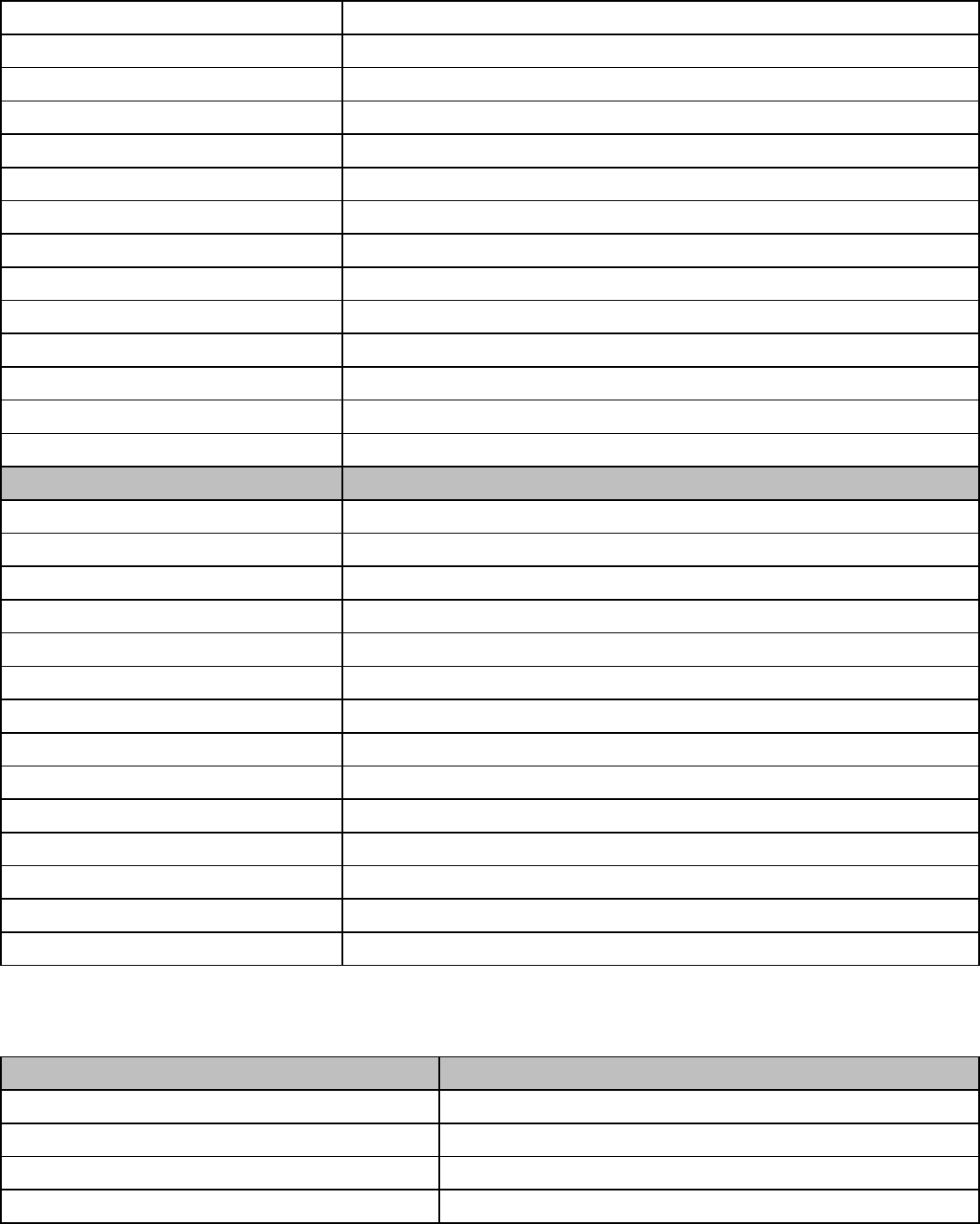

Credit Card Pre-Authorization

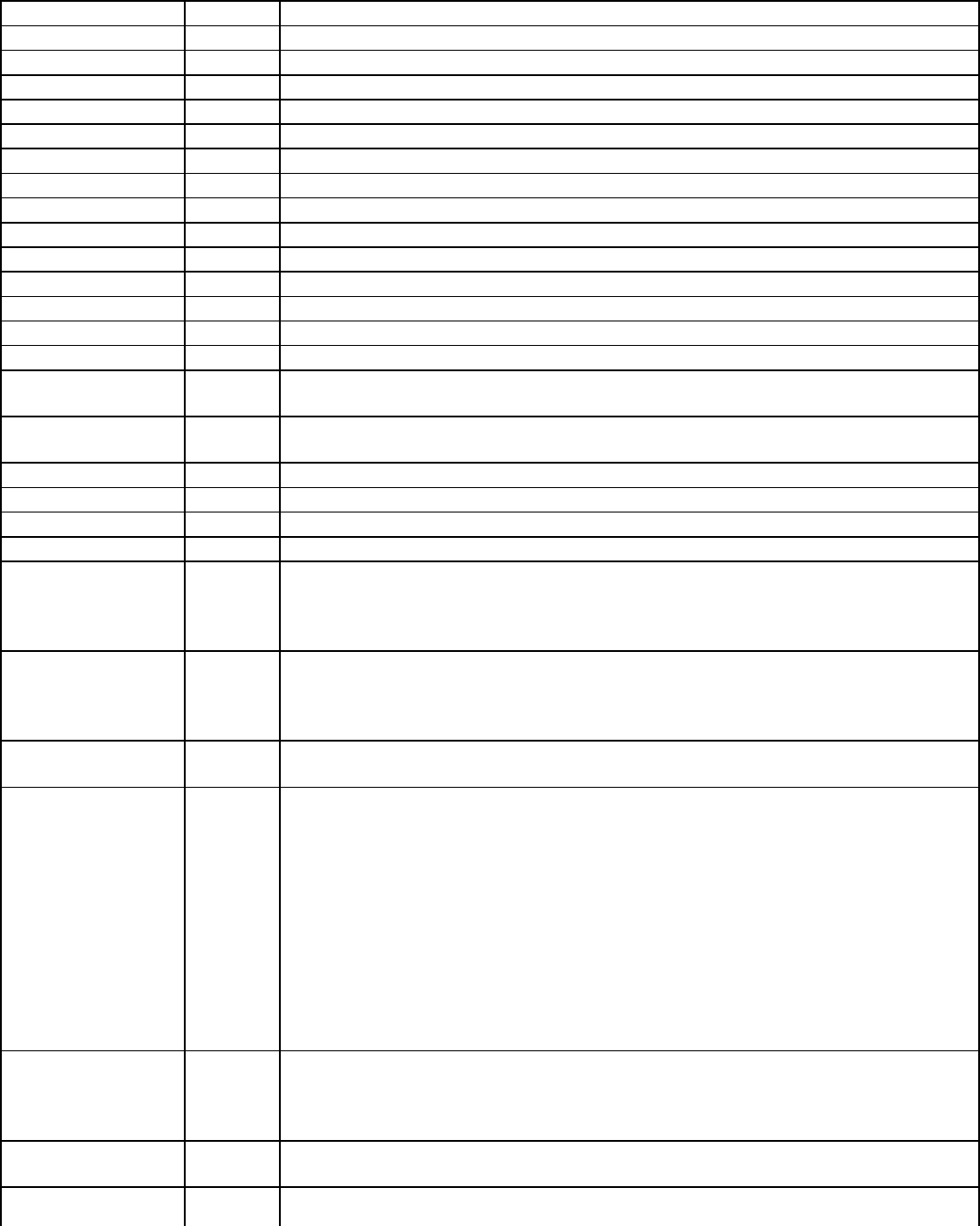

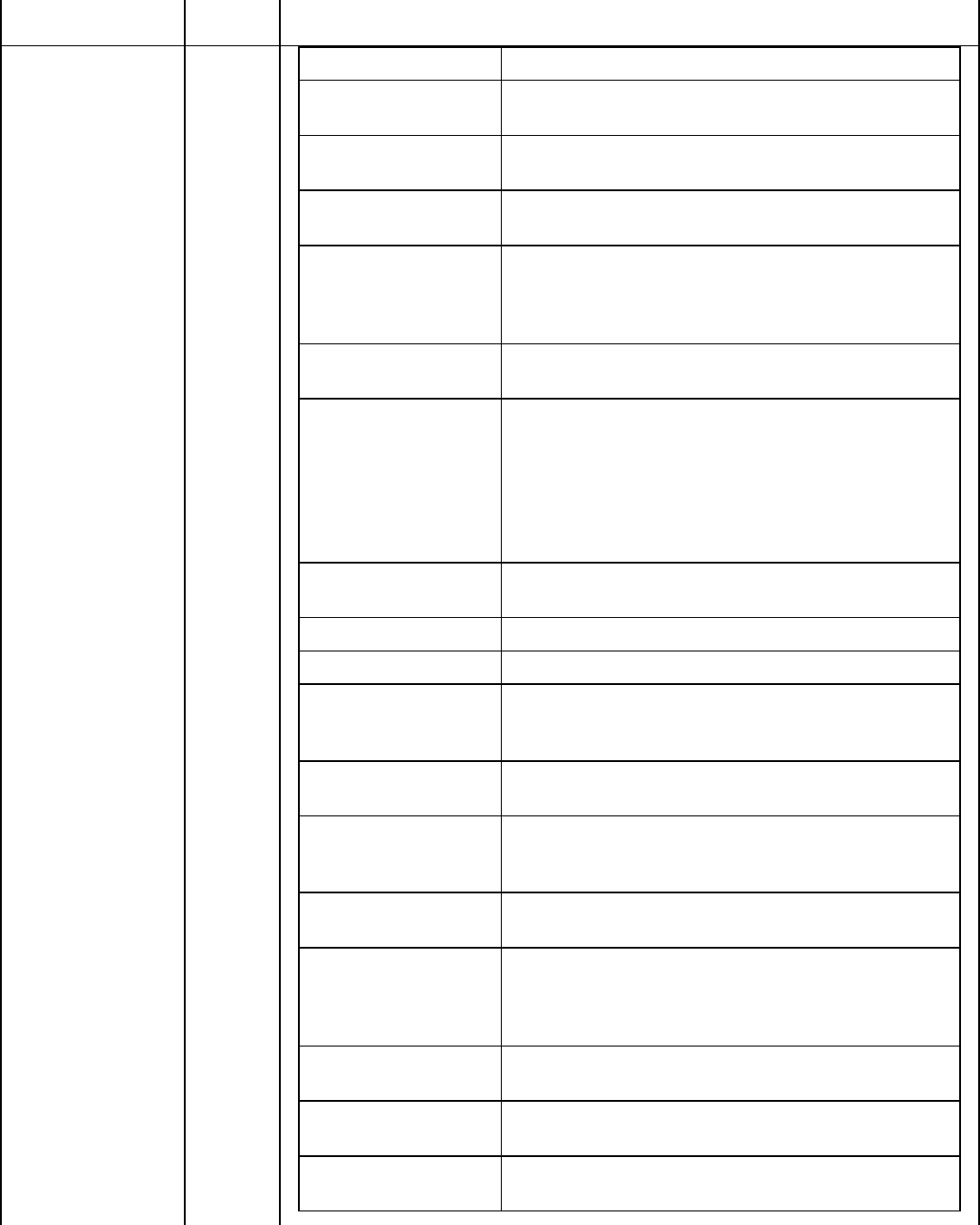

Fields Required Description

transaction name X Credit card only

service X The 1 instructs Online Commerce Suite to process an AUTH.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

ccname X Consumer name as it appears on the credit card.

ccnum X Consumers credit card number. Do not include spaces. If the 3DES encryption option

has been enabled on the account, this value must be encrypted using the 3DES key

assigned to the Account ID. Use the FRISK Configuration Options menu in the Online

Merchant Center to view and configure the 3DES encryption option.

expmon X Expiration month (12) of the consumer credit card.

expyear X Expiration year of the consumers credit card in yyyy format

cvv2 Credit card cvv2/cvc2 code

currencycode Three-letter ISO4217 (refer to Appendix D)

swipedata The swipe data from the magnetic strip on the back of a credit or debit card. Used for

card-present transactions.

encryptedswipedata The encrypted swipe data from the magnetic strip on the back of a credit or debit card.

Used for card-present transactions. Format of this data depends on the device. Refer

to Appendix E for string format.

encryptedreadertype The value of this field depends on the encrypted swipe device used. This field has to

be used if encryptedswipedata is used. 1 = Magtek (Most Magtek devices), 2 = Magtek

IPAD, 3 = IDTECH, 4 = Ingenico iSC250,350 / iPP250,350.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X Transaction dollar amount in US dollars in the form of 1.00. For CC it will default to $1

if not provided.

billaddr1 The consumers billing address.

billaddr2 The consumers billing address.

billcity The consumers billing city.

billstate The consumers billing state.

billcity The consumers billing city.

billzip The consumers billing zip.

billcountry The consumers billing country.

shipaddr1 The consumers shipping address.

shipaddr2 The consumers shipping address.

shipcity The consumers shipping city.

shipstate The consumers shipping state.

shipzip The consumers shipping city.

shipcountry The consumers shipping zip.

custom1 32 char alphanumeric string for data storage (included in reports)

Page 4

custom2 32 char alphanumeric string for data storage (included in reports)

custom3 32 char alphanumeric string for data storage (included in reports)

custom4 32 char alphanumeric string for data storage (included in reports)

custom5 32 char alphanumeric string for data storage (included in reports)

custom6 32 char alphanumeric string for data storage (included in reports)

email Consumer email address

memo Comments associated to this profile

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

dlnum Driver License Number

ssnum Social Security Number

cardpresent 1 indicates the card was present

dynamicdescriptor This field will be passed all the way to the Consumers Credit Card statement. This is

only available for TSYS.

cardpresentreader 1 indicates a card reader was present

industrycode * Industry Code One character value: "H": Hotel / "F": food(restaurants) / "R": Retail

(*Only required for TCMP)

chargetypeamx Code indicating whether the primary charge is Lodging, Restaurant, or Gift Shop. One

character value: 1 Hotel, 2 Restaurant, 3 Gift Shop

roomrateamt Room rate dollar amount in US dollars in the form of 0.00.

checkindate The date (yymmdd) that the guest checked in to the hotel

checkoutdate The date (yymmdd) that the guest checked out of the hotel

purchaseid Hotel Folio number (25 characters alphanumeric)

property Prestigious property indicatory. Used by participants in Visa Prestigious Lodging

Program. A transaction amount of $1 should be entered in the amount field if the

merchant wishes the transaction to participate in the program. Number value: 500,

1000, or 1500

extracharges Extra charges 6 1-digit codes, each a partial or complete explanation of why charged

amount differs from receipt cardholder received at checkout. Digit values: 0: no extra,

2: Restaurant, 3: Gift Shop, 4: Mini-bar, 5: Telephone, 6: Other, 7: Laundry. Example:

"240000" indicates restaurant and mini-bar charges.

recur_create Creates a recurring billing record for a consumer. Set recur_create=1 to create a

recurring billing record.

recur_billingcycle 0 = No Recurring Billing Cycle

1 = Weekly Recurring Billing Cycle

2 = Monthly Recurring Billing Cycle

3 = Quarterly Recurring Billing Cycle

4 = Semi-Annual Recurring Billing Cycle

5 = Annual Recurring Billing Cycle

6 = Bi-Weekly Recurring Billing Cycle

7 = Bi-Annual Recurring Billing Cycle

8 = Quad Weekly (28 day) Recurring Billing Cycle

9 = One Time Recurring Billing Cycle

10 = Daily Recurring Billing Cycle

11 = Bi-Monthly Recurring Billing Cycle

recur_billingmax Maximum number of times a consumers account is debited through recurring billing.

For example, setting recur_billingmax =6 bills the consumer 6 times.

-1 = Unlimited number of times

0 = No Recurring Billing

recur_start Number of days after an initial payment where the consumer is debited on a recurring

cycle.

recur_amount

Online Commerce Suite™ XML Integration Guide

Page 5

Amount the consumer is to be re-debited on the recurring cycle. Do not use a dollar

sign.

fsa health care flag 0 is off 1 is on

rxamount Qualified amount.

purchasecardlevel2 pocustmerrefid Cardholders Customer ID or Reference Number for the

Purchase Card.

taxamount Total tax charged for the transaction.

taxexempt 1 = a tax exempt purchase. 0 = a taxable purchase.

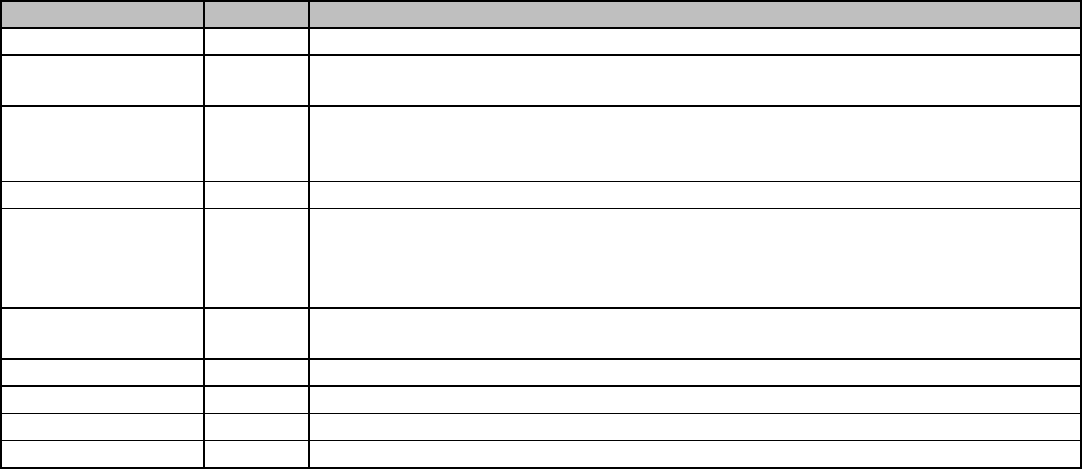

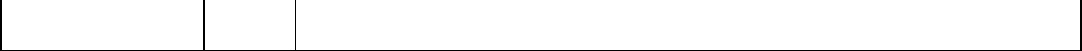

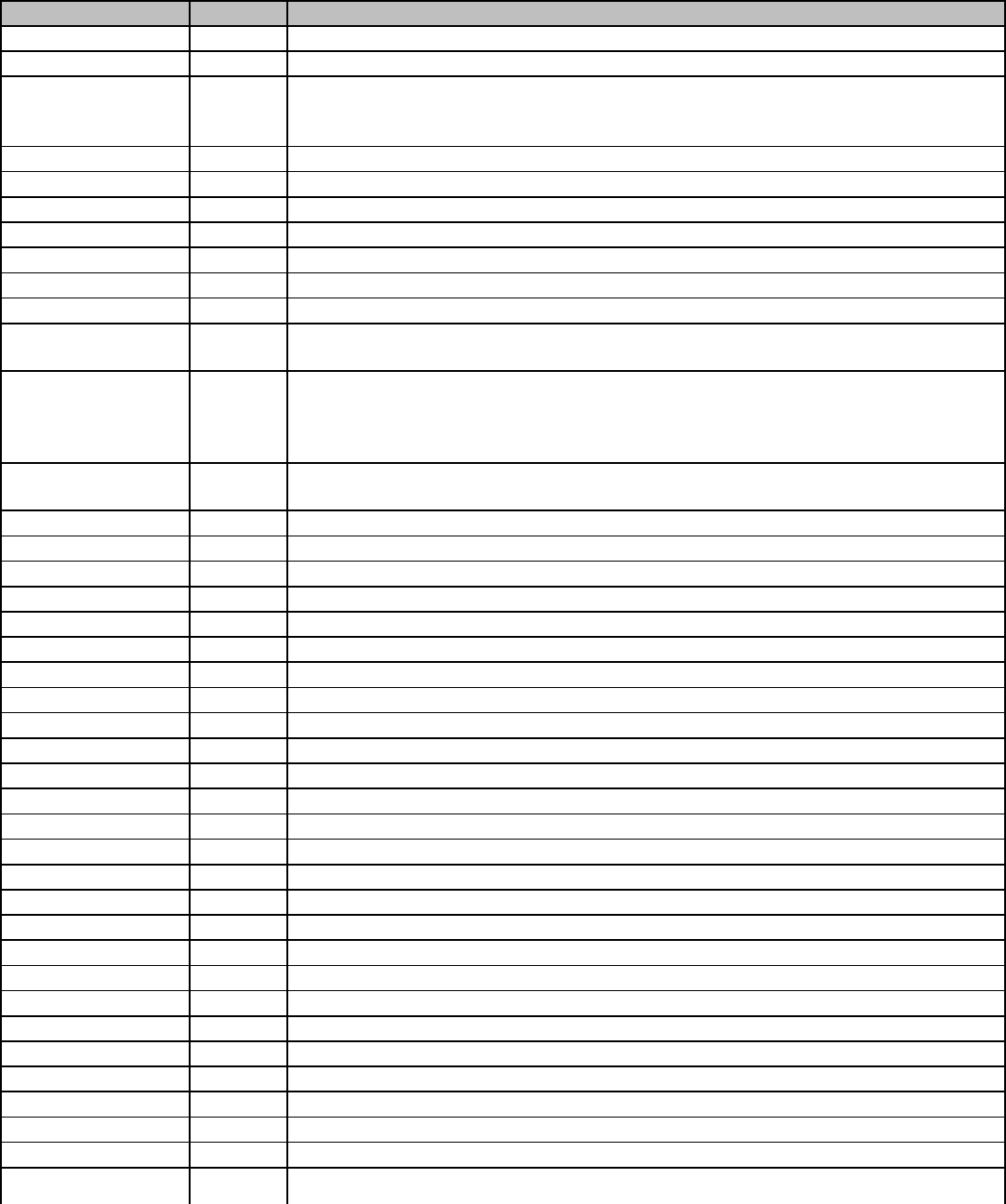

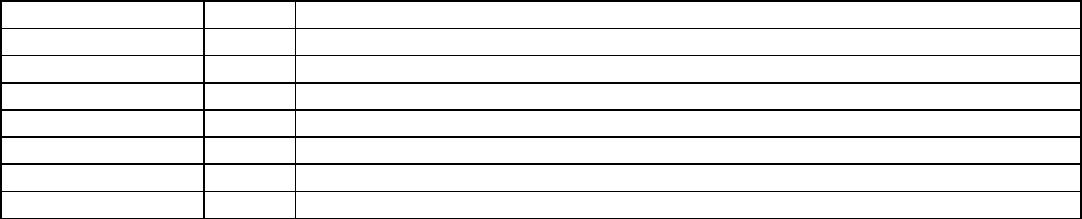

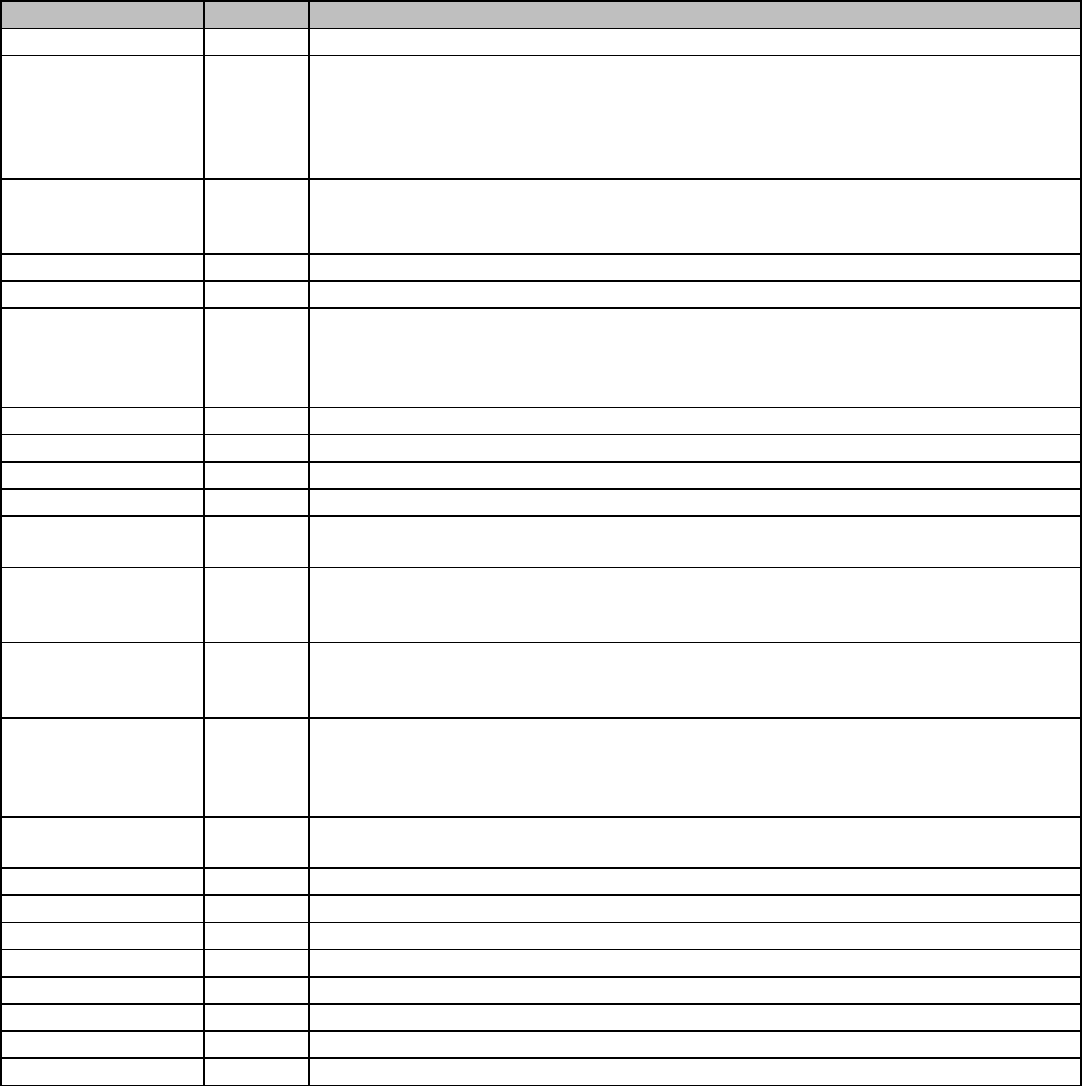

emvdata emvflag Must be set to 1 for an EMV transaction

interchangeprofile 82 - Indicates the capabilities of the card to support

specific functions in the application

dedicatedfilename 84 - Identifies the name of the DF as described in

ISO/IEC 7816-4

termverresults 95 - Status of the different functions as seen from the

terminal

secondarypinblock 0C0B - Discover also allows the cardholder to change

pins at the terminal so LISO needs to allow for the

secondary PIN Block. This is the encrypted PIN Block

sent from the terminal.

applicationid 4F - Identifies the application as described in ISO/IEC

7816-5

languagepreference 5F2D - 1-4 languages stored in order of preference,

each represented by 2 alphabetical characters

according to ISO 639 Note: EMVCo strongly

recommends that cards be personalised with data

element '5F2D' coded in lowercase, but that terminals

accept the data element whether it is coded in upper or

lower case.

panseqnumber 5F34 - Identifies and differentiates cards with the same

PAN

terminaltransdate 9A - Local date that the transaction was authorised

transactionstatus 9B - Indicates the functions performed in a transaction

cryptotranstype 9C - Indicates the type of financial transaction,

represented by the first two digits of ISO 8583:1987

Processing Code

aidterminal 9F06 - Identifies the application as described in

ISO/IEC 7816-5

appusagecontrol 9F07 - Indicates issuerÕs specified restrictions on the

geographic usage and services allowed for the

application

terminalversionno 9F09 - Version number assigned by the payment

system for the application

issueractiondefault 9F0D - Specifies the issuer's conditions that cause a

transaction to be rejected if it might have been

approved online, but the terminal is unable to process

Online Commerce Suite™ XML Integration Guide

Page 6

the transaction online

issueractiondenial 9F0E - Specifies the issuer's conditions that cause the

denial of a transaction without attempt to go online

issueractiononline 9F0F - Specifies the issuer's conditions that cause a

transaction to be transmitted online

issuerdata 9F10 - Contains proprietary application data for

transmission to the issuer in an online transaction

terminalcountrycode 9F1A - Indicates the country of the terminal,

represented according to ISO 3166

terminalserialnum 9F1E - Unique and permanent serial number assigned

to the IFD by the manufacturer

cryptogram 9F26 - Cryptogram returned by the ICC in response of

the GENERATE AC command

cryptoid 9F27 - Indicates the type of cryptogram and the actions

to be performed by the terminal

terminalcapprofile 9F33 - Indicates the card data input, CVM, and security

capabilities of the terminal

cvresults 9F34 - Indicates the results of the last CVM performed

terminaltype 9F35 - Indicates the environment of the terminal, its

communications capability, and its operational control

transcounter 9F36 - Counter maintained by the application in the ICC

(incrementing the ATC is managed by the ICC)

randomnumber 9F37 - Value to provide variability and uniqueness to

the generation of a cryptogram

transrefcurrencycode 9F3C - Code defining the common currency used by

the terminal in case the Transaction Currency Code is

different from the Application Currency Code

additionaltermcapability 9F40 - Indicates the data input and output capabilities

of the terminal

transseqcounter 9F41 - Counter maintained by the terminal that is

incremented by one for each transaction

iccdynamicnumber 9F4C - Time-variant number generated by the ICC, to

be captured by the terminal

transcatcode 9F53 - Indicates the type of transaction being

processed

issuerscriptresult 9F5B - Present if scripts were sent by Issuer in original

response

formfactorindicator 9F6E - Indicates the form factor of the consumer

payment device

customerexcdata 9F7C - In US contactless transactions, issuer

proprietary info

Online Commerce Suite™ XML Integration Guide

Page 7

Credit Card Pre-Authorization Sample 1.1

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>1</service>

<acctid>TEST0</acctid>

<subid></subid>

<consumername></consumername>

<merchantpin></merchantpin>

<ccname></ccname>

<ccnum></ccnum>

<expmon></expmon>

<expyear></expyear>

<swipedata></swipedata>

<billaddr1>1111 main st</billaddr1>

<billaddr2></billaddr2>

<billcity></billcity>

<billstate></billstate>

<billzip></billzip>

<billcountry></billcountry>

<shipaddr1></shipaddr1>

<shipaddr2></shipaddr2>

<currencycode></currencycode>

<shipcity></shipcity>

<shipstate></shipstate>

<shipzip></shipzip>

<shipcountry></shipcountry>

<cardpresent></cardpresent>

<cardpresentreader></cardpresentreader>

<industrycode></industrycode>

<chargetypeamx></chargetypeamx>

<roomrateamx></roomrateamx>

<checkindate></checkindate>

<checkoutdate></checkoutdate>

<purchaseid></purchaseid>

<property></property>

<extracharges></extracharges>

<ipaddress></ipaddress>

<email></email>

<phone></phone>

<memo></memo>

<recur_create></recur_create>

<recur_billingcycle></recur_billingcycle>

<recur_billingmax></recur_billingmax>

<recur_start></recur_start>

<recur_amount></recur_amount>

<merchantpin></merchantpin>

<amount>9.95</amount>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

</transaction>

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0" encoding="UTF-8"?>

<interface_driver>

<trans_catalog>

<transaction>

Online Commerce Suite™ XML Integration Guide

Page 8

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>AUTH:TEST:::126476380:::</result>

<authcode>TEST</authcode>

<historyid>126476381</historyid>

<orderid>98452813</orderid>

<refcode>126476380</refcode>

<total>9.95</total>

<merchantordernumber />

<avsresult />

<cvv2result />

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

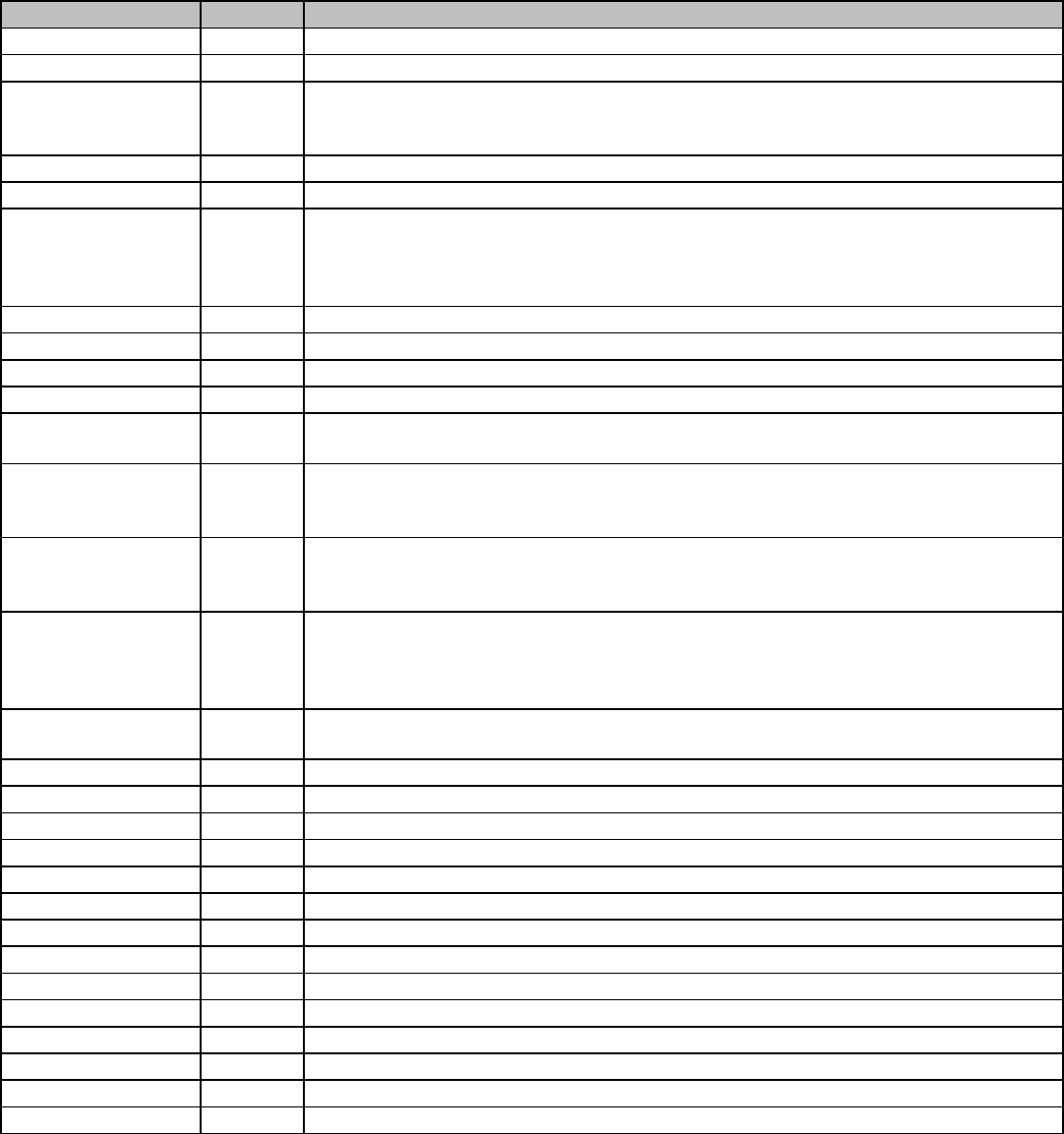

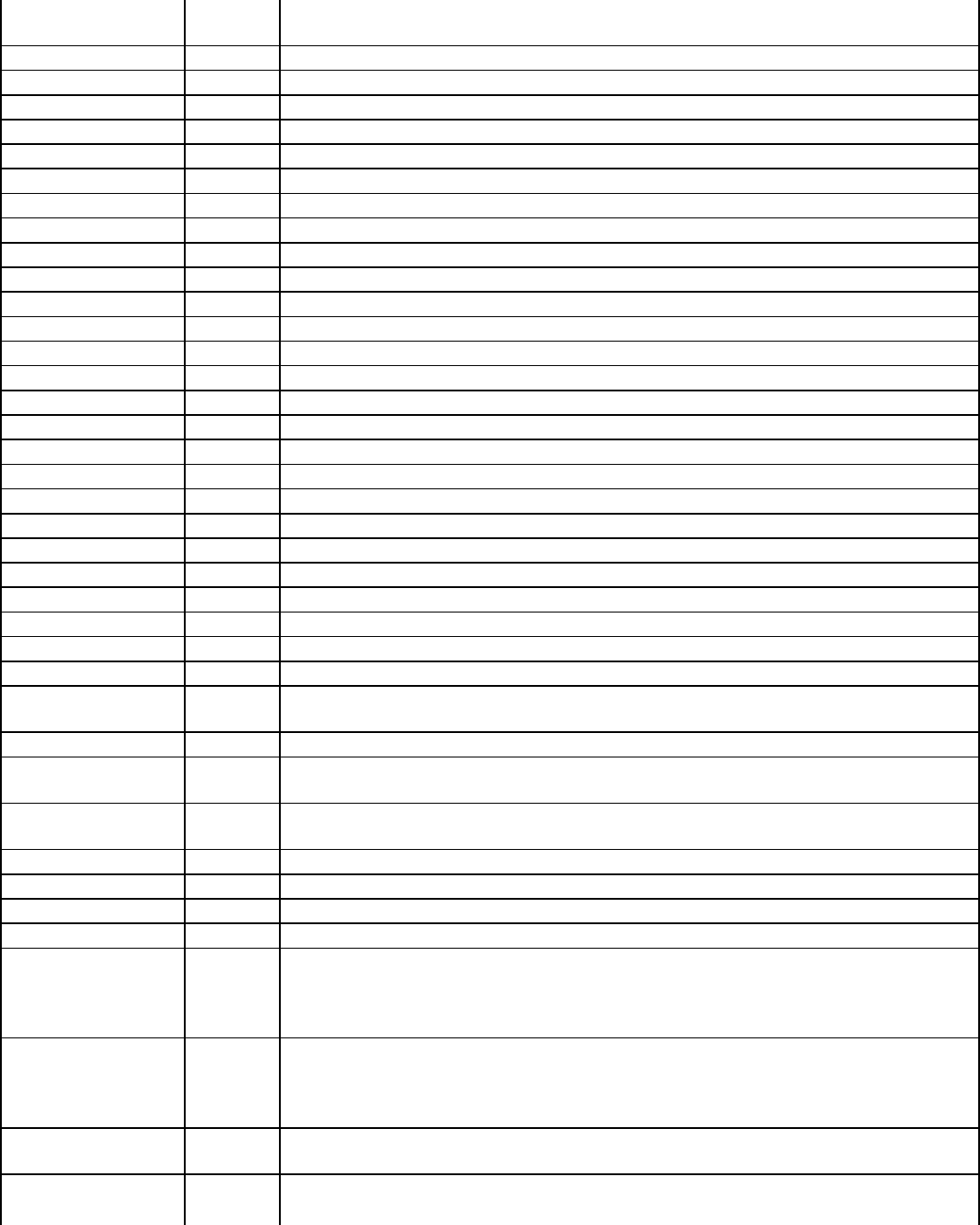

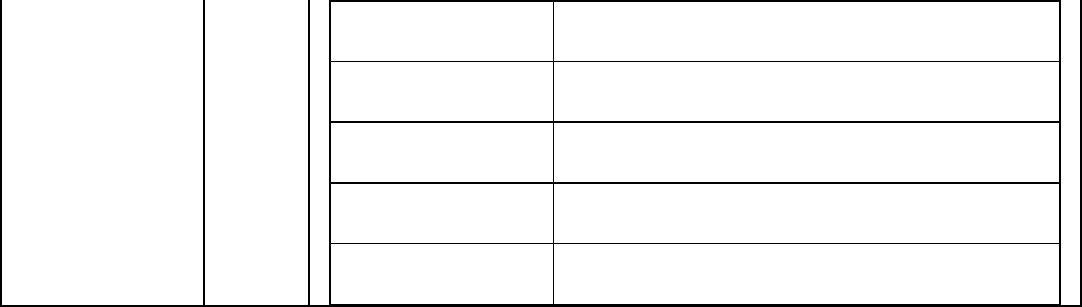

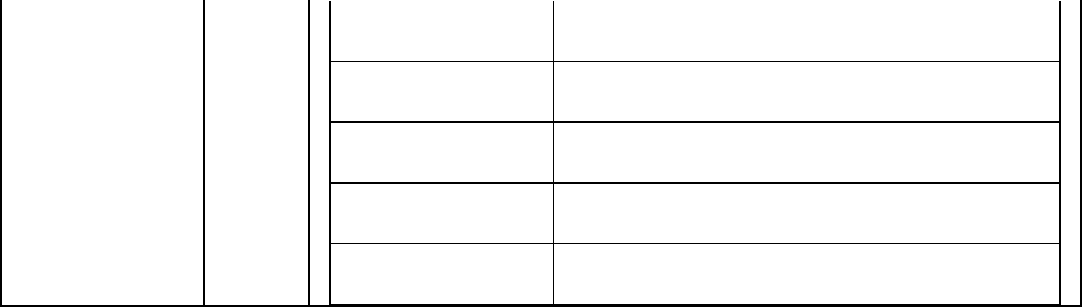

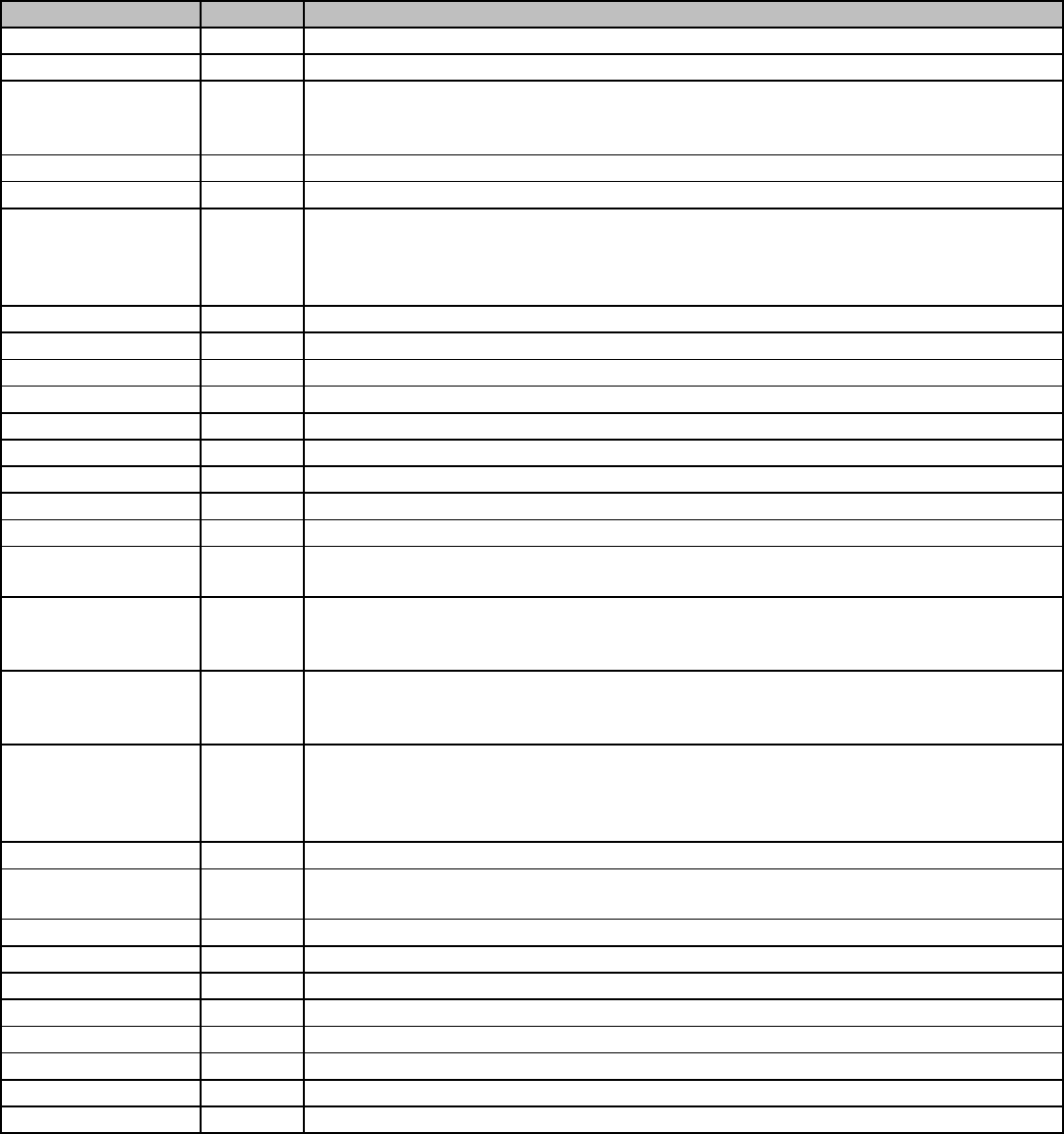

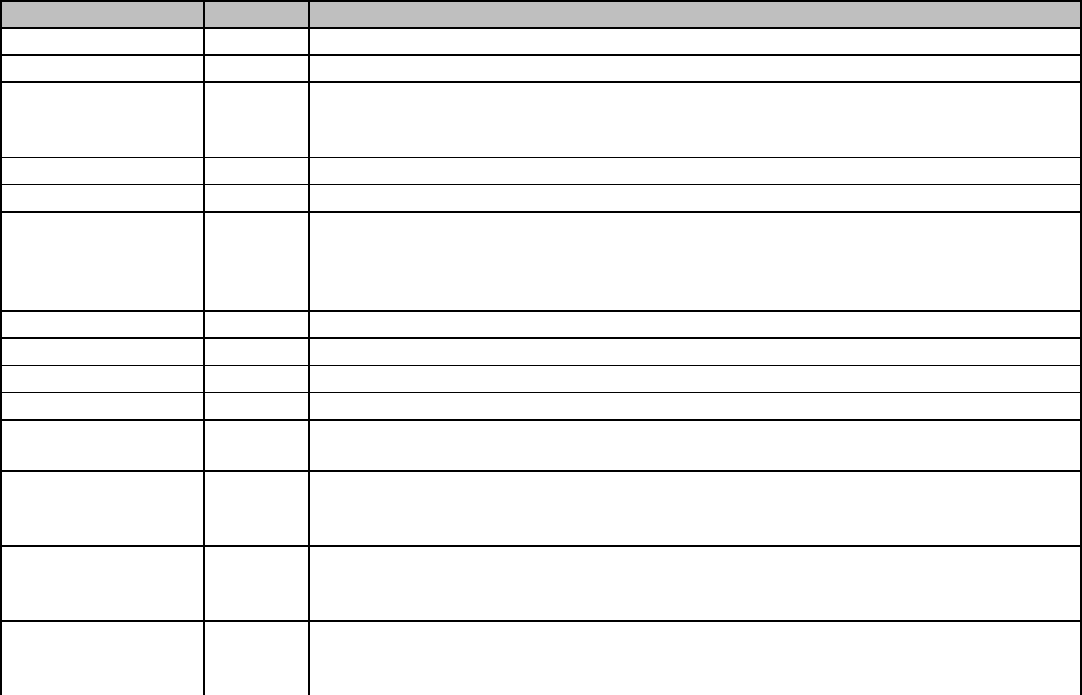

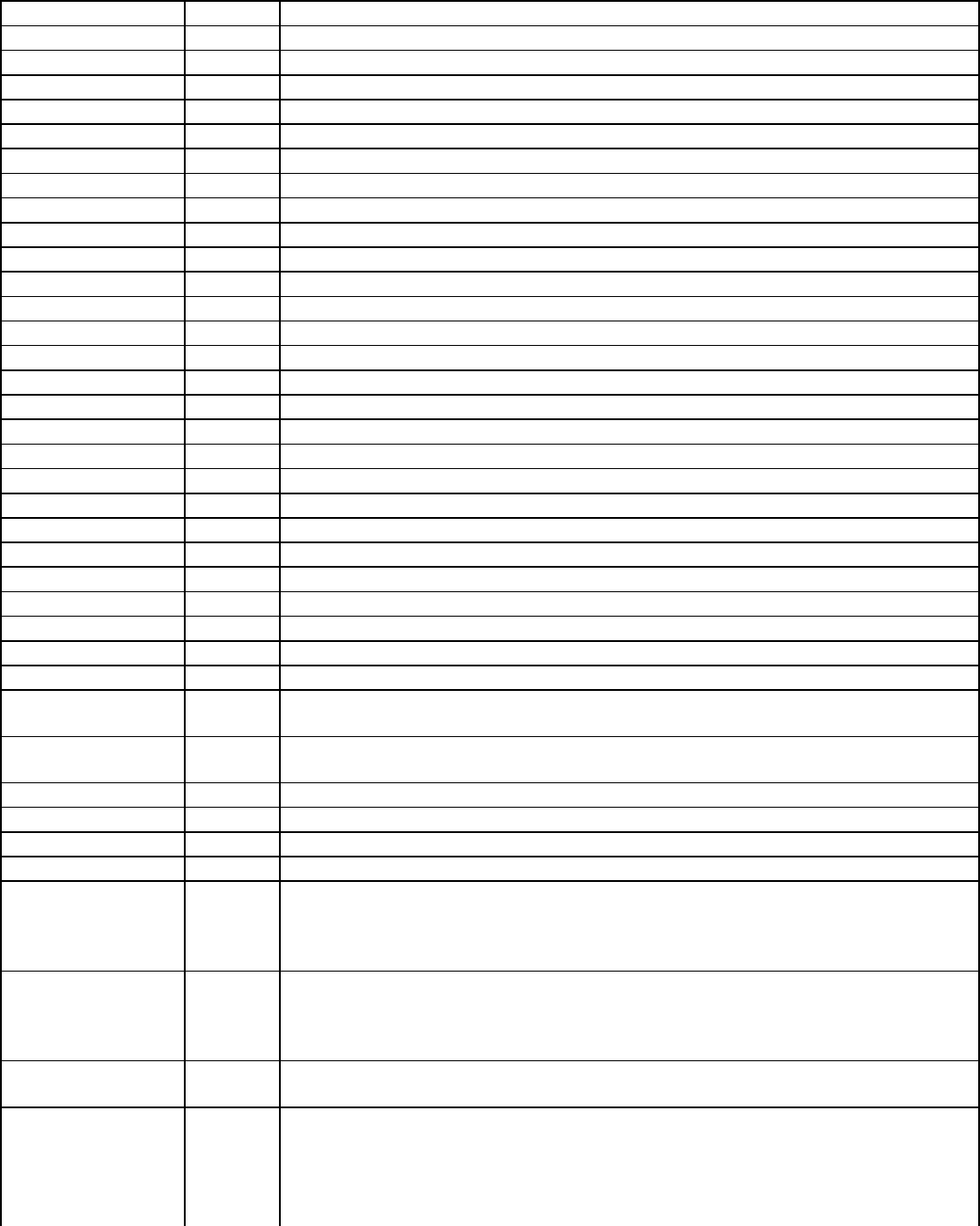

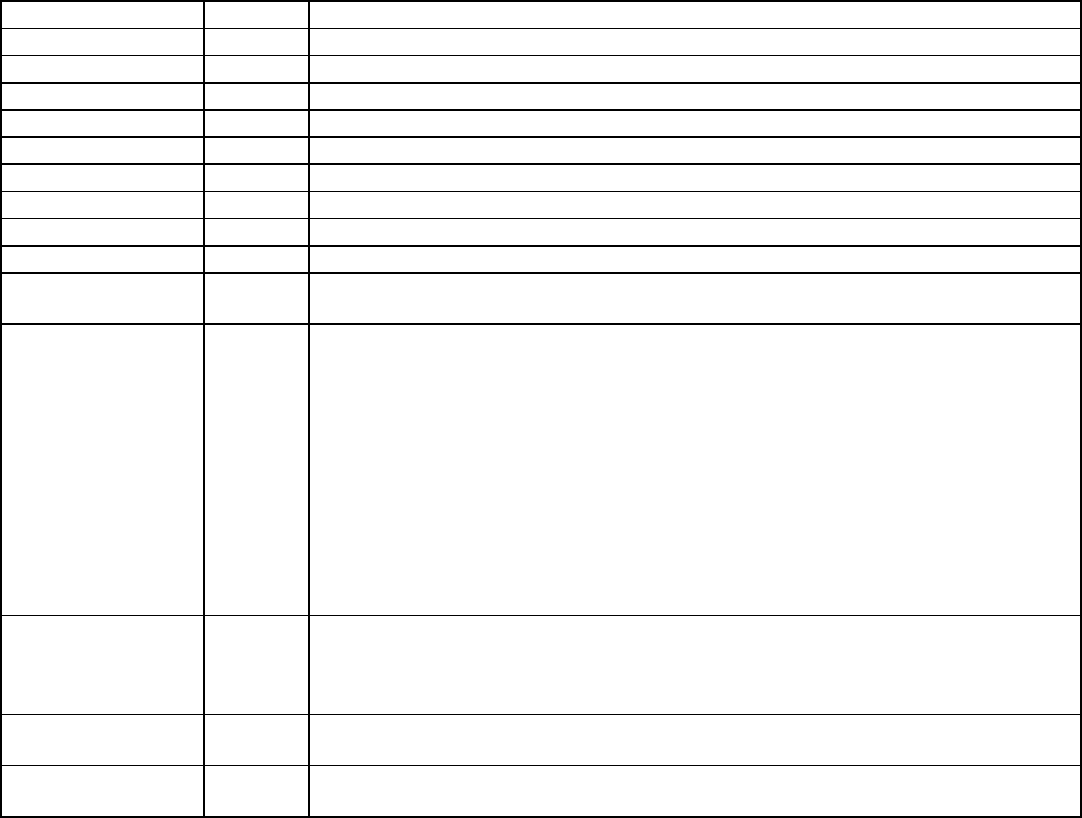

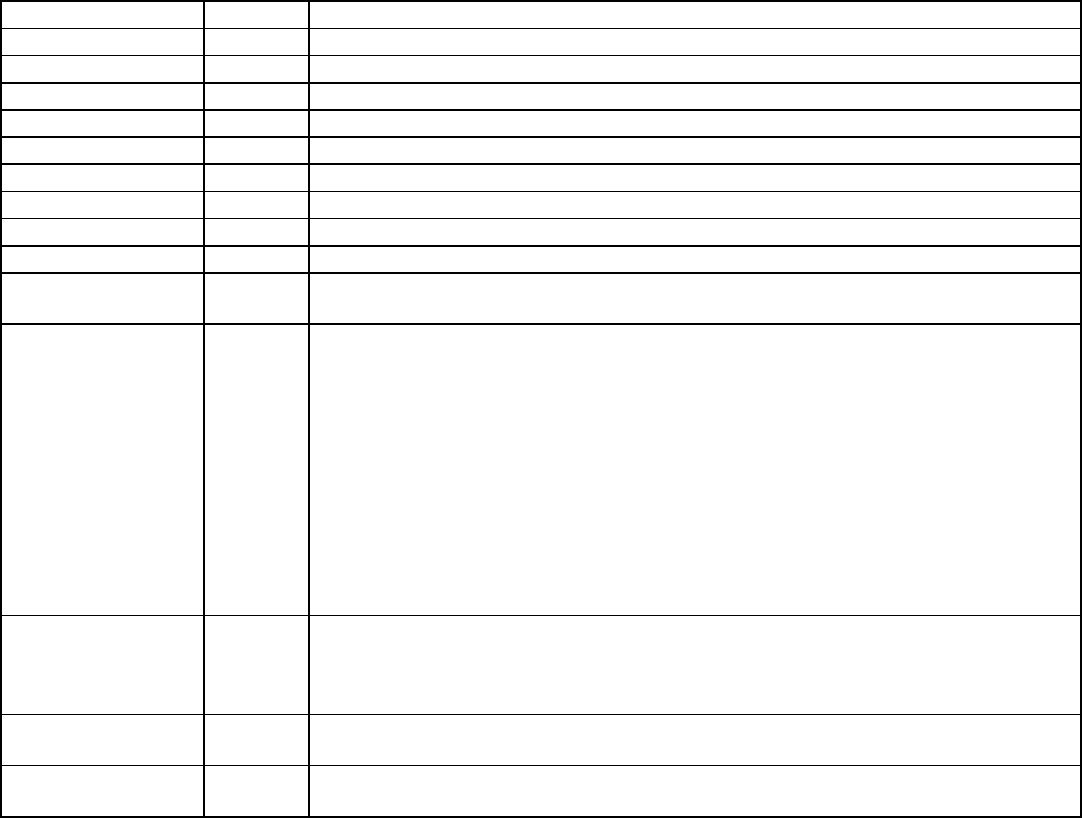

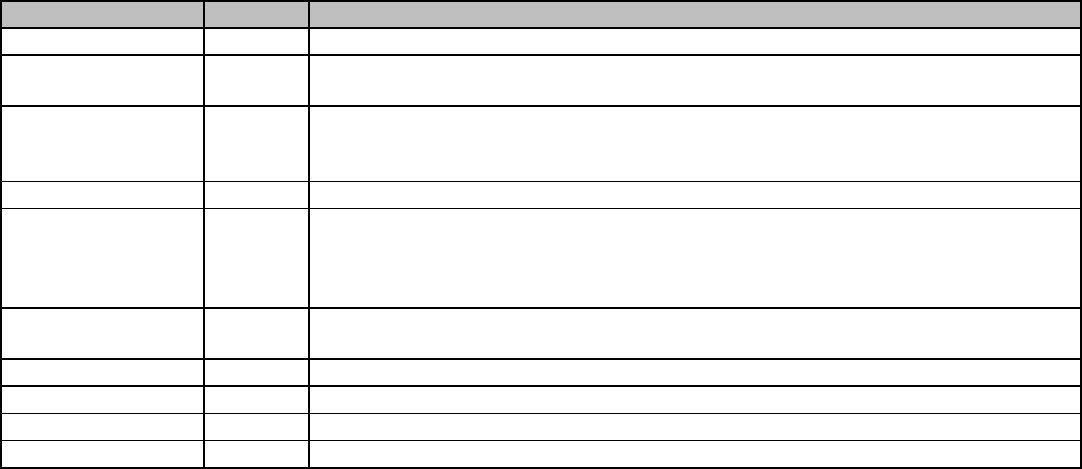

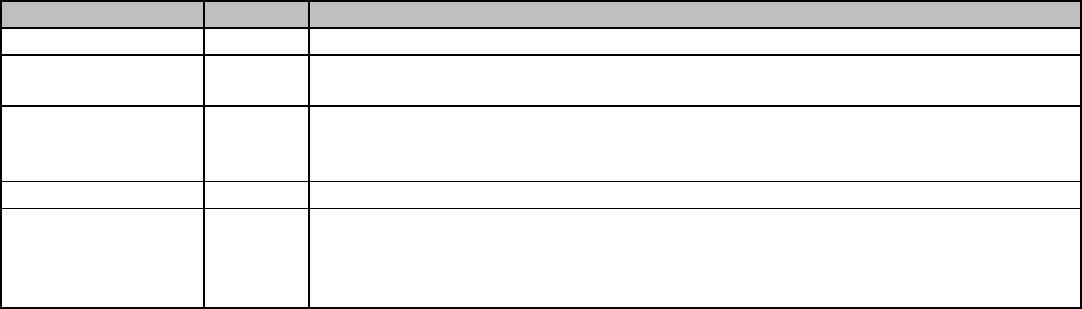

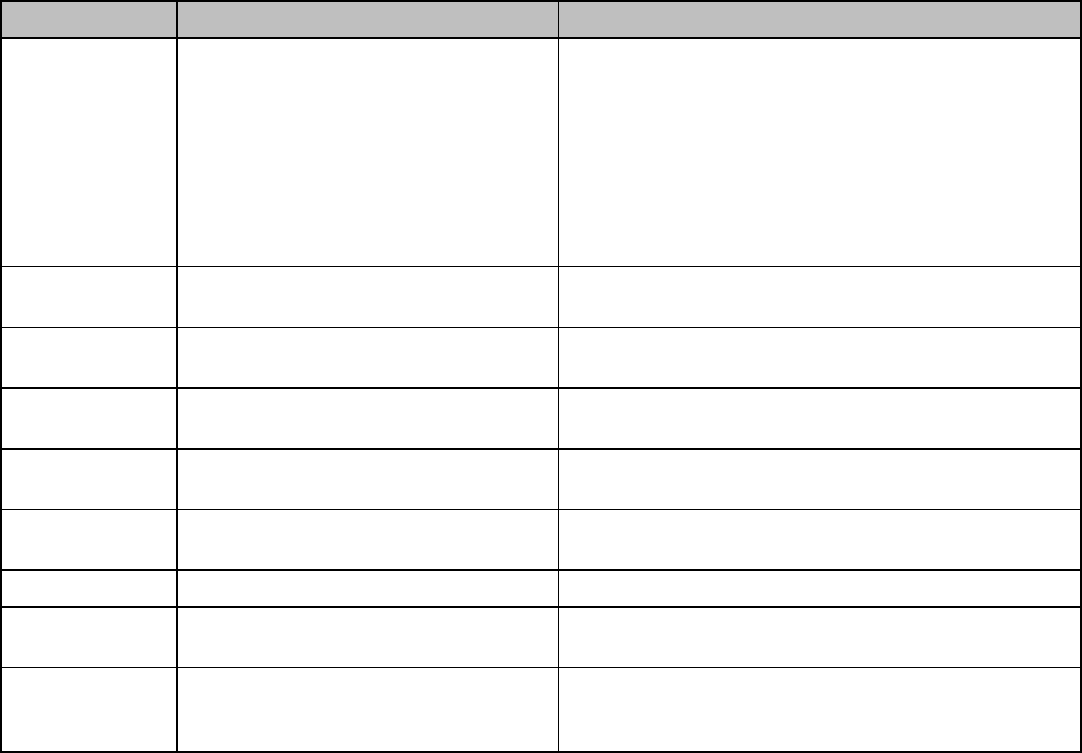

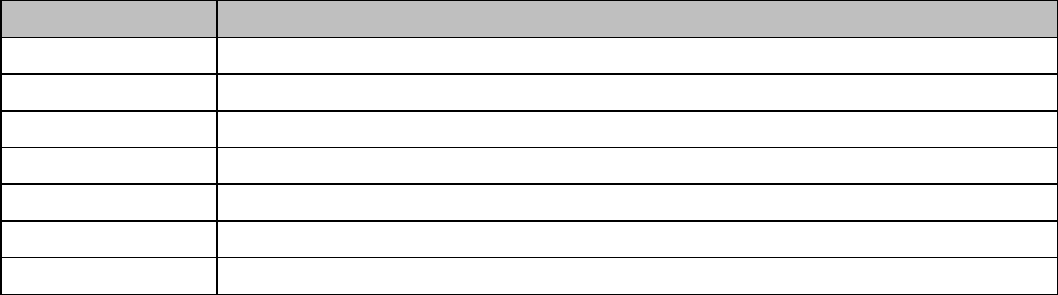

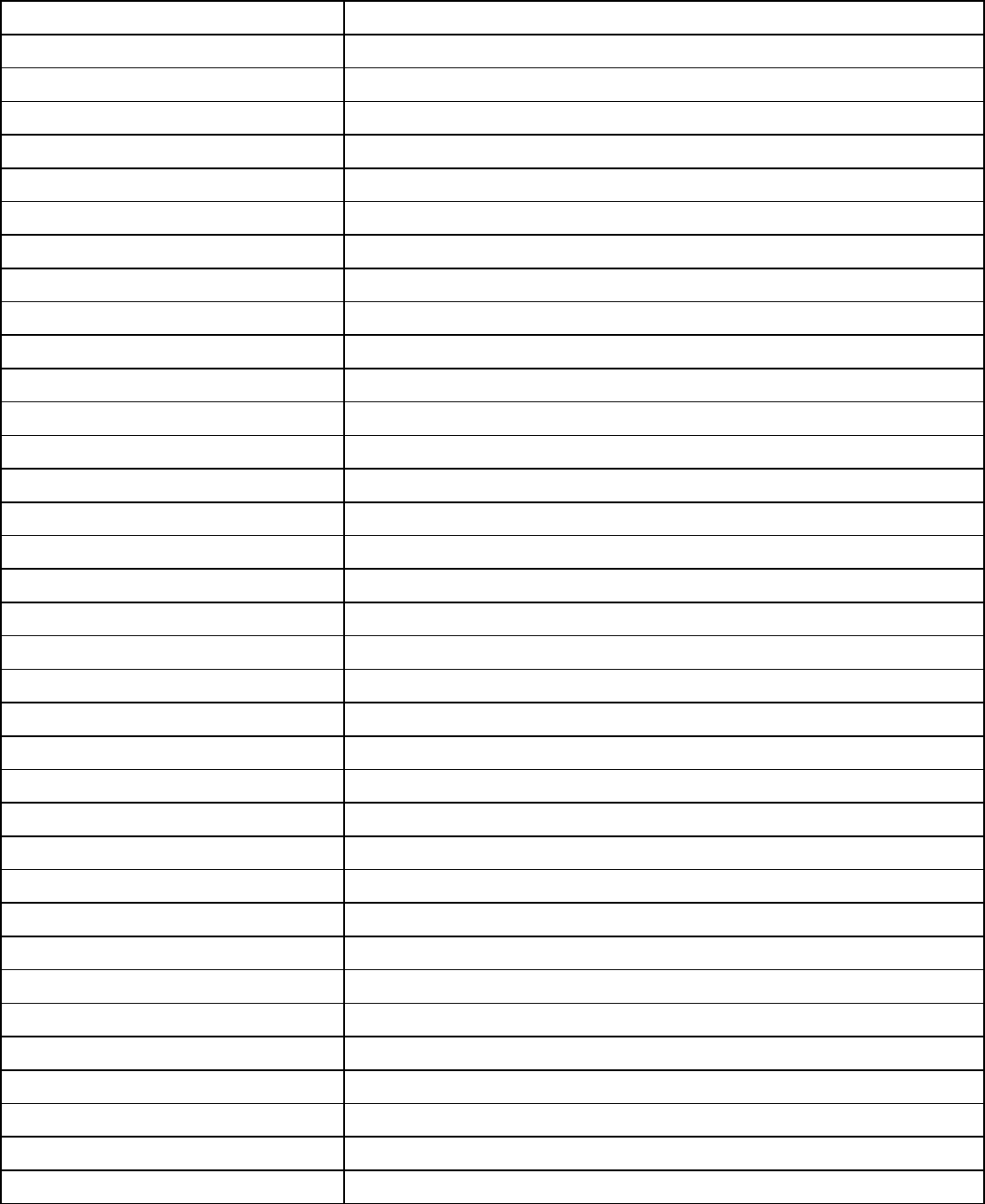

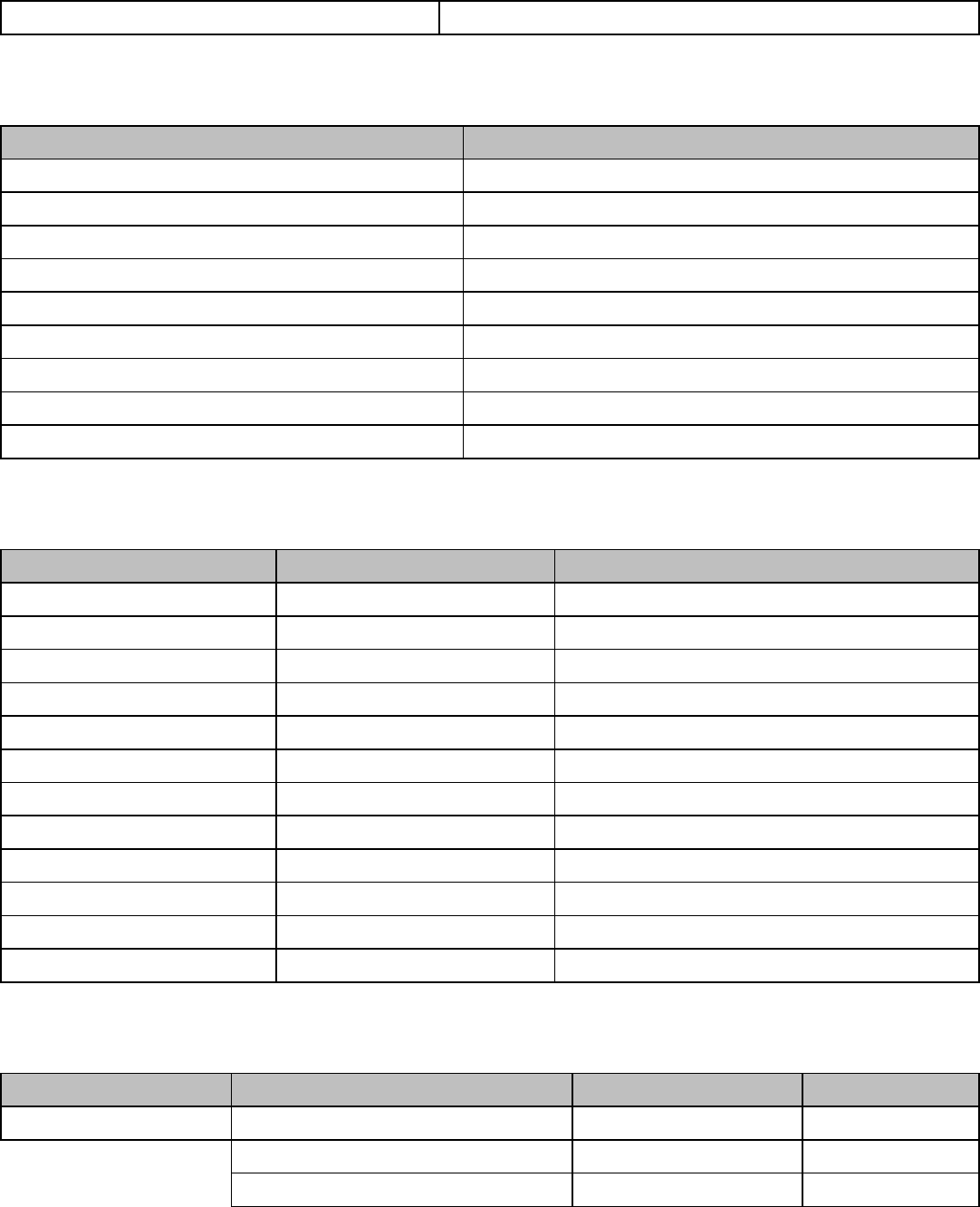

Credit Card Sale

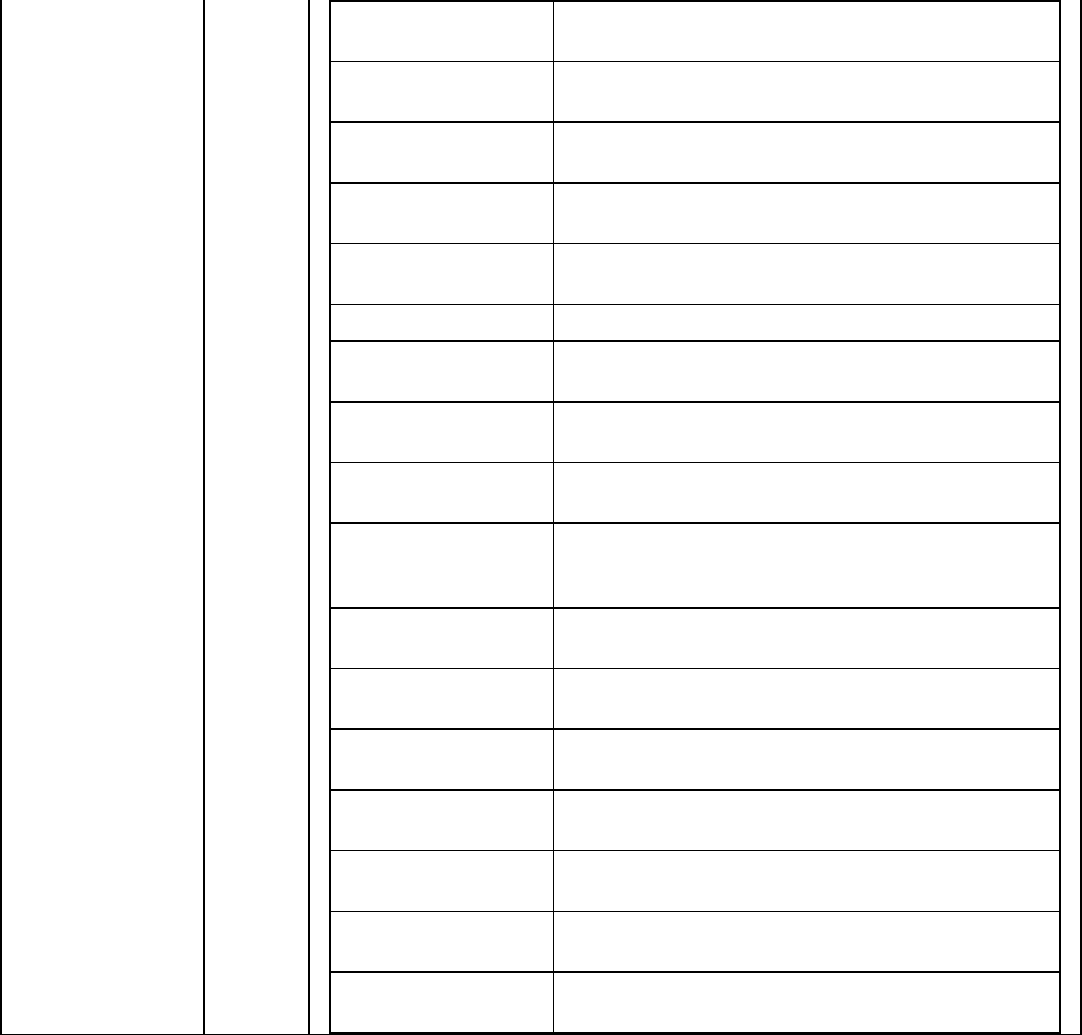

Fields Required Description

transaction name X credit card and ach (if ach, check name, check ABA, check account is required)

service X The 2 instructs Online Commerce Suite to process an SALE.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

ccname X Consumer name as it appears on the credit card.

ccnum X Consumers credit card number. Do not include spaces. If the 3DES encryption option

has been enabled on the account, this value must be encrypted using the 3DES key

assigned to the Account ID. Use the FRISK Configuration Options menu in the Online

Merchant Center to view and configure the 3DES encryption option.

expmon X Expiration month (12) of the consumer credit card.

expyear X Expiration year of the consumers credit card in yyyy format

ckname First and Last Name

ckaba Routing number

ckacct Account number

ckno Check number

cktype SEC code for transaction (WEB, POP, ARC, PPD, ICL, RCK, BOC, TEL)

cvv2 Credit card cvv2/cvc2 code

voiceauth Authorization code for Voice Authorization

currencycode Three-letter ISO4217 (refer to Appendix D)

swipedata The swipe data from the magnetic strip on the back of a credit or debit card. Used for

card-present transactions.

encryptedswipedata The encrypted swipe data from the magnetic strip on the back of a credit or debit card.

Used for card-present transactions. Format of this data depends on the device. Refer

to Appendix E for string format.

encryptedreadertype The value of this field depends on the encrypted swipe device used. This field has to

be used if encryptedswipedata is used. 1 = Magtek (Most Magtek devices), 2 = Magtek

IPAD, 3 = IDTECH, 4 = Ingenico iSC250,350 / iPP250,350.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X

Online Commerce Suite™ XML Integration Guide

Page 9

Transaction dollar amount in US dollars in the form of 1.00. For CC it will default to $1

if not provided.

billaddr1 The consumers billing address.

billaddr2 The consumers billing address.

billcity The consumers billing city.

billstate The consumers billing state.

billcity The consumers billing city.

billzip The consumers billing zip.

billcountry The consumers billing country.

shipaddr1 The consumers shipping address.

shipaddr2 The consumers shipping address.

shipcity The consumers shipping city.

shipstate The consumers shipping state.

shipzip The consumers shipping city.

shipcountry The consumers shipping zip.

custom1 32 char alphanumeric string for data storage (included in reports)

custom2 32 char alphanumeric string for data storage (included in reports)

custom3 32 char alphanumeric string for data storage (included in reports)

custom4 32 char alphanumeric string for data storage (included in reports)

custom5 32 char alphanumeric string for data storage (included in reports)

custom6 32 char alphanumeric string for data storage (included in reports)

email Consumer email address

memo Comments associated to this profile

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

dlnum Driver License Number

ssnum Social Security Number

cardpresent 1 indicates the card was present

dynamicdescriptor This field will be passed all the way to the Consumers Credit Card statement. This is

only available for TSYS.

cardpresentreader 1 indicates a card reader was present

industrycode * Industry Code One character value: "H": Hotel / "F": food(restaurants) / "R": Retail

(*Only required for TCMP)

chargetypeamx Code indicating whether the primary charge is Lodging, Restaurant, or Gift Shop. One

character value: 1 Hotel, 2 Restaurant, 3 Gift Shop

roomrateamt Room rate dollar amount in US dollars in the form of 0.00.

checkindate The date (yymmdd) that the guest checked in to the hotel

checkoutdate The date (yymmdd) that the guest checked out of the hotel

purchaseid Hotel Folio number (25 characters alphanumeric)

property Prestigious property indicatory. Used by participants in Visa Prestigious Lodging

Program. A transaction amount of $1 should be entered in the amount field if the

merchant wishes the transaction to participate in the program. Number value: 500,

1000, or 1500

extracharges Extra charges 6 1-digit codes, each a partial or complete explanation of why charged

amount differs from receipt cardholder received at checkout. Digit values: 0: no extra,

2: Restaurant, 3: Gift Shop, 4: Mini-bar, 5: Telephone, 6: Other, 7: Laundry. Example:

"240000" indicates restaurant and mini-bar charges.

recur_create Creates a recurring billing record for a consumer. Set recur_create=1 to create a

recurring billing record.

recur_billingcycle 0 = No Recurring Billing Cycle

1 = Weekly Recurring Billing Cycle

Online Commerce Suite™ XML Integration Guide

Page 10

2 = Monthly Recurring Billing Cycle

3 = Quarterly Recurring Billing Cycle

4 = Semi-Annual Recurring Billing Cycle

5 = Annual Recurring Billing Cycle

6 = Bi-Weekly Recurring Billing Cycle

7 = Bi-Annual Recurring Billing Cycle

8 = Quad Weekly (28 day) Recurring Billing Cycle

9 = One Time Recurring Billing Cycle

10 = Daily Recurring Billing Cycle

11 = Bi-Monthly Recurring Billing Cycle

recur_billingmax Maximum number of times a consumers account is debited through recurring billing.

For example, setting recur_billingmax =6 bills the consumer 6 times.

-1 = Unlimited number of times

0 = No Recurring Billing

recur_start Number of days after an initial payment where the consumer is debited on a recurring

cycle.

recur_amount Amount the consumer is to be re-debited on the recurring cycle. Do not use a dollar

sign.

fsa health care flag 0 is off 1 is on

rxamount Qualified amount.

purchasecardlevel2 pocustmerrefid Cardholders Customer ID or Reference Number for the

Purchase Card.

taxamount Total tax charged for the transaction.

taxexempt 1 = a tax exempt purchase. 0 = a taxable purchase.

emvdata emvflag Must be set to 1 for an EMV transaction

interchangeprofile 82 - Indicates the capabilities of the card to support

specific functions in the application

dedicatedfilename 84 - Identifies the name of the DF as described in

ISO/IEC 7816-4

termverresults 95 - Status of the different functions as seen from the

terminal

secondarypinblock 0C0B - Discover also allows the cardholder to change

pins at the terminal so LISO needs to allow for the

secondary PIN Block. This is the encrypted PIN Block

sent from the terminal.

applicationid 4F - Identifies the application as described in ISO/IEC

7816-5

languagepreference 5F2D - 1-4 languages stored in order of preference,

each represented by 2 alphabetical characters

according to ISO 639 Note: EMVCo strongly

recommends that cards be personalised with data

element '5F2D' coded in lowercase, but that terminals

accept the data element whether it is coded in upper or

lower case.

panseqnumber 5F34 - Identifies and differentiates cards with the same

PAN

terminaltransdate 9A - Local date that the transaction was authorised

Online Commerce Suite™ XML Integration Guide

Page 11

transactionstatus 9B - Indicates the functions performed in a transaction

cryptotranstype 9C - Indicates the type of financial transaction,

represented by the first two digits of ISO 8583:1987

Processing Code

aidterminal 9F06 - Identifies the application as described in

ISO/IEC 7816-5

appusagecontrol 9F07 - Indicates issuerÕs specified restrictions on the

geographic usage and services allowed for the

application

terminalversionno 9F09 - Version number assigned by the payment

system for the application

issueractiondefault 9F0D - Specifies the issuer's conditions that cause a

transaction to be rejected if it might have been

approved online, but the terminal is unable to process

the transaction online

issueractiondenial 9F0E - Specifies the issuer's conditions that cause the

denial of a transaction without attempt to go online

issueractiononline 9F0F - Specifies the issuer's conditions that cause a

transaction to be transmitted online

issuerdata 9F10 - Contains proprietary application data for

transmission to the issuer in an online transaction

terminalcountrycode 9F1A - Indicates the country of the terminal,

represented according to ISO 3166

terminalserialnum 9F1E - Unique and permanent serial number assigned

to the IFD by the manufacturer

cryptogram 9F26 - Cryptogram returned by the ICC in response of

the GENERATE AC command

cryptoid 9F27 - Indicates the type of cryptogram and the actions

to be performed by the terminal

terminalcapprofile 9F33 - Indicates the card data input, CVM, and security

capabilities of the terminal

cvresults 9F34 - Indicates the results of the last CVM performed

terminaltype 9F35 - Indicates the environment of the terminal, its

communications capability, and its operational control

transcounter 9F36 - Counter maintained by the application in the ICC

(incrementing the ATC is managed by the ICC)

randomnumber 9F37 - Value to provide variability and uniqueness to

the generation of a cryptogram

transrefcurrencycode 9F3C - Code defining the common currency used by

the terminal in case the Transaction Currency Code is

different from the Application Currency Code

additionaltermcapability 9F40 - Indicates the data input and output capabilities

of the terminal

transseqcounter 9F41 - Counter maintained by the terminal that is

incremented by one for each transaction

Online Commerce Suite™ XML Integration Guide

Page 12

iccdynamicnumber 9F4C - Time-variant number generated by the ICC, to

be captured by the terminal

transcatcode 9F53 - Indicates the type of transaction being

processed

issuerscriptresult 9F5B - Present if scripts were sent by Issuer in original

response

formfactorindicator 9F6E - Indicates the form factor of the consumer

payment device

customerexcdata 9F7C - In US contactless transactions, issuer

proprietary info

Online Commerce Suite™ XML Integration Guide

Page 13

Credit Card Sale Sample 2.1

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>2</service>

<acctid>TEST0</acctid>

<subid></subid>

<consumername></consumername>

<merchantpin></merchantpin>

<ccname></ccname>

<ccnum></ccnum>

<expmon></expmon>

<expyear></expyear>

<swipedata></swipedata>

<billaddr1>1111 main st</billaddr1>

<billaddr2></billaddr2>

<billcity></billcity>

<billstate></billstate>

<billzip></billzip>

<billcountry></billcountry>

<shipaddr1></shipaddr1>

<shipaddr2></shipaddr2>

<shipcity></shipcity>

<curencycode></currencycode>

<shipstate></shipstate>

<shipzip></shipzip>

<shipcountry></shipcountry>

<cardpresent></cardpresent>

<cardpresentreader></cardpresentreader>

<industrycode></industrycode>

<chargetypeamx></chargetypeamx>

<roomrateamx></roomrateamx>

<checkindate></checkindate>

<checkoutdate></checkoutdate>

<purchaseid></purchaseid>

<property></property>

<extracharges></extracharges>

<ipaddress></ipaddress>

<email></email>

<phone></phone>

<memo></memo>

<recur_create></recur_create>

<recur_billingcycle></recur_billingcycle>

<recur_billingmax></recur_billingmax>

<recur_start></recur_start>

<recur_amount></recur_amount>

<merchantpin></merchantpin>

<amount>9.95</amount>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

</transaction>

Online Commerce Suite™ XML Integration Guide

Page 14

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0"?><interface_driver>

<trans_catalog>

<transaction>

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>AUTH:TEST:::126476380:::</result>

<authcode>TEST</authcode>

<historyid>126476381</historyid>

<orderid>98452813</orderid>

<refcode>126476380</refcode>

<total>9.95</total>

<merchantordernumber></merchantordernumber>

<avsresult></avsresult>

<cvv2result></cvv2result>

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

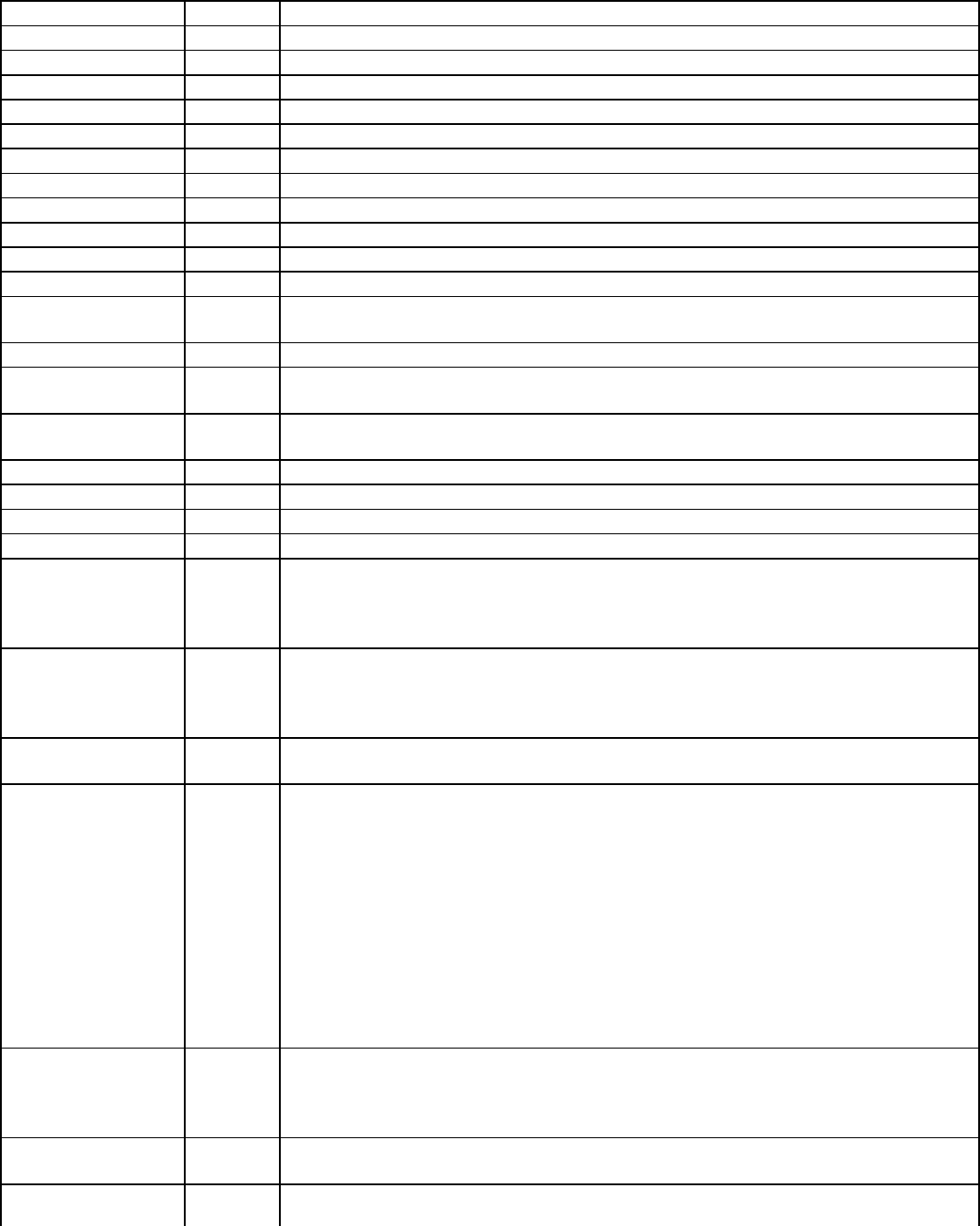

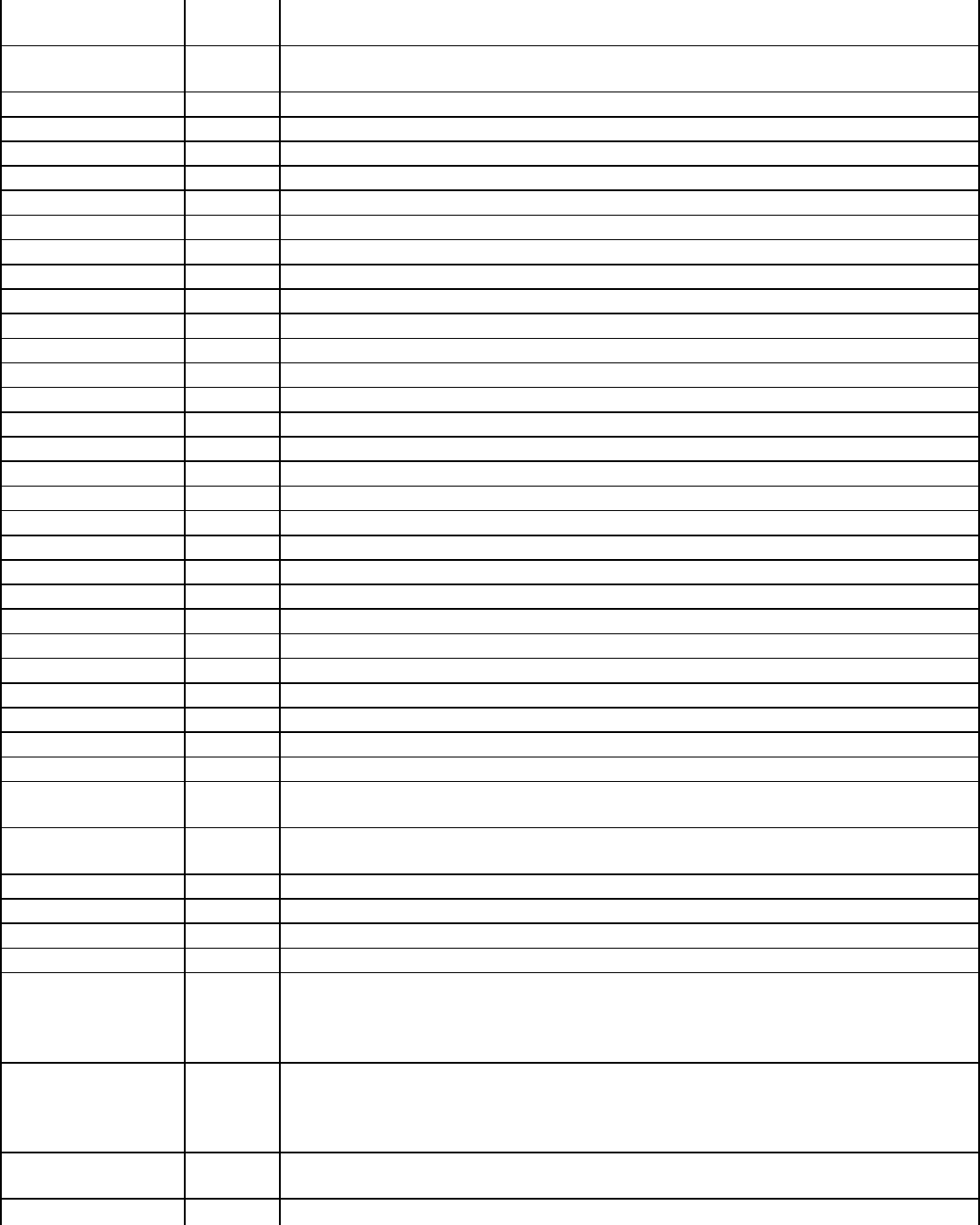

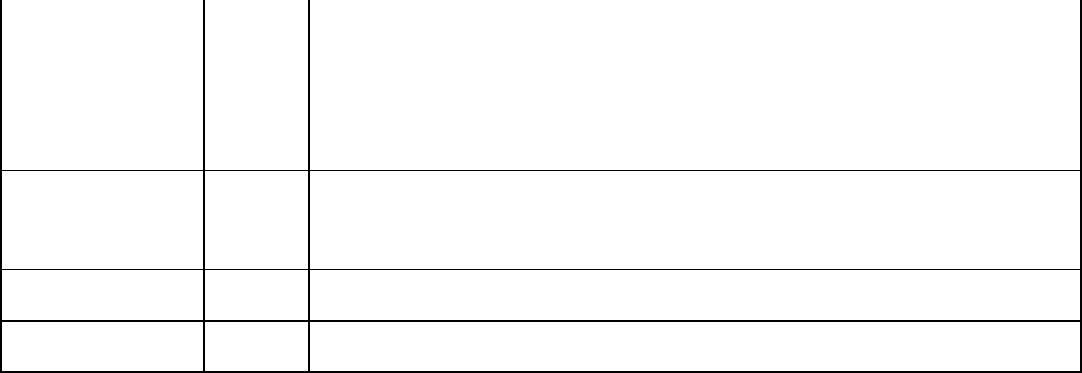

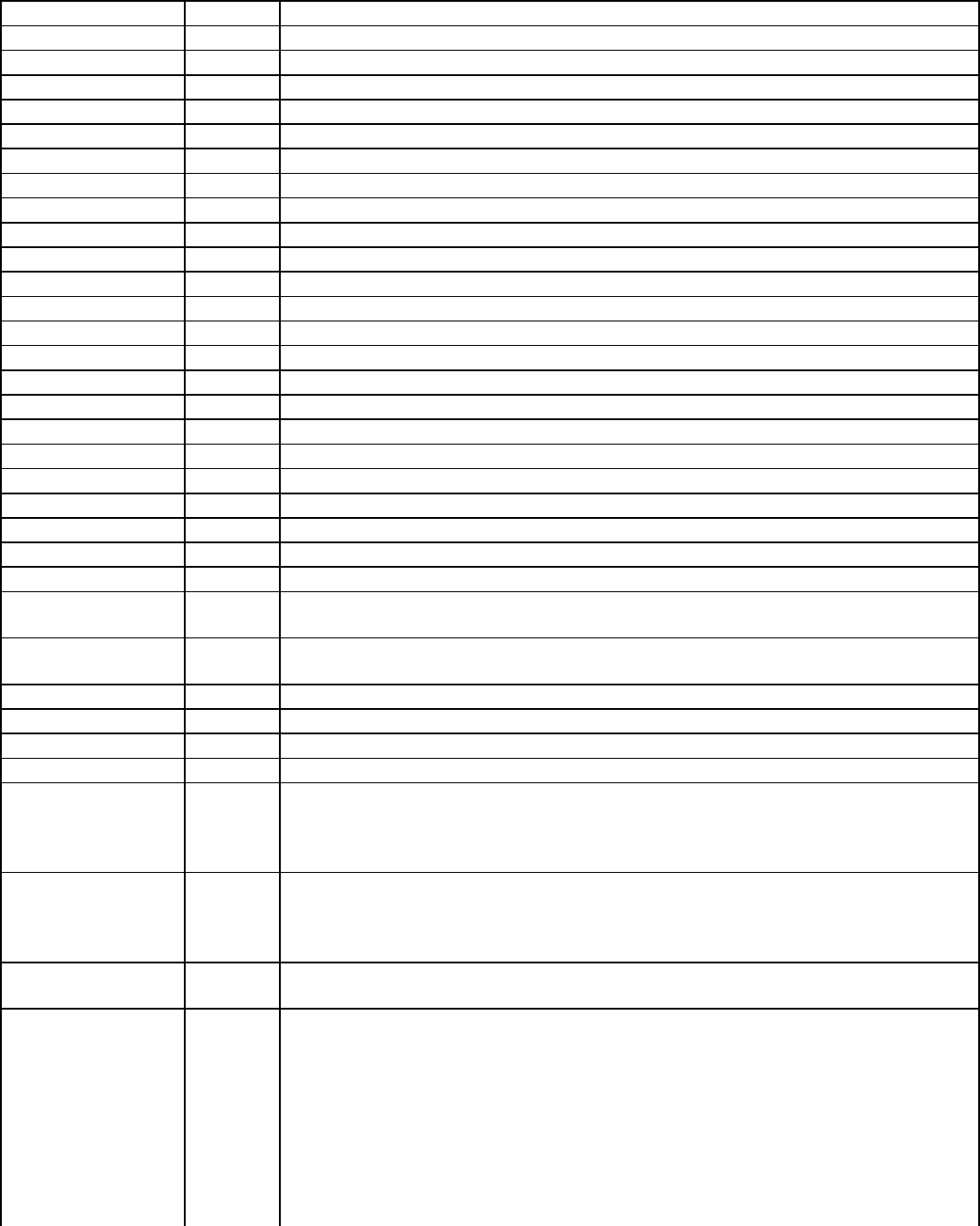

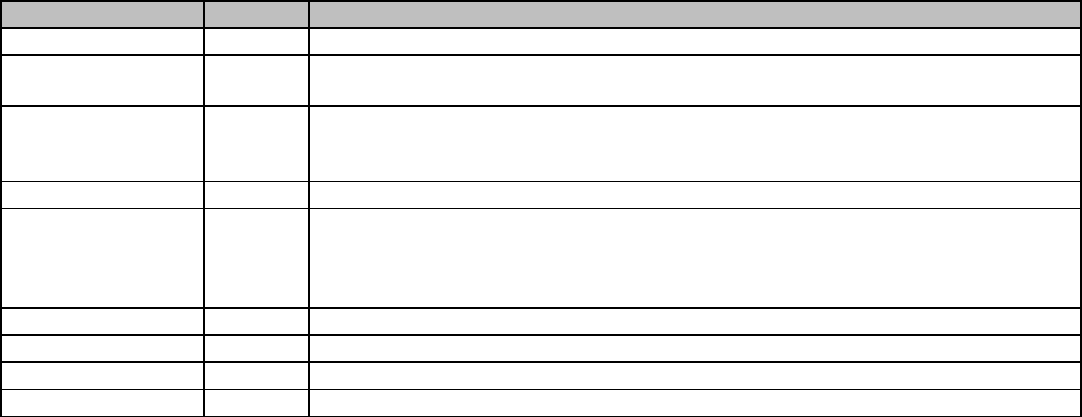

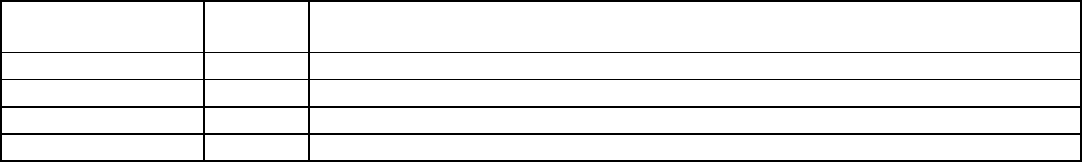

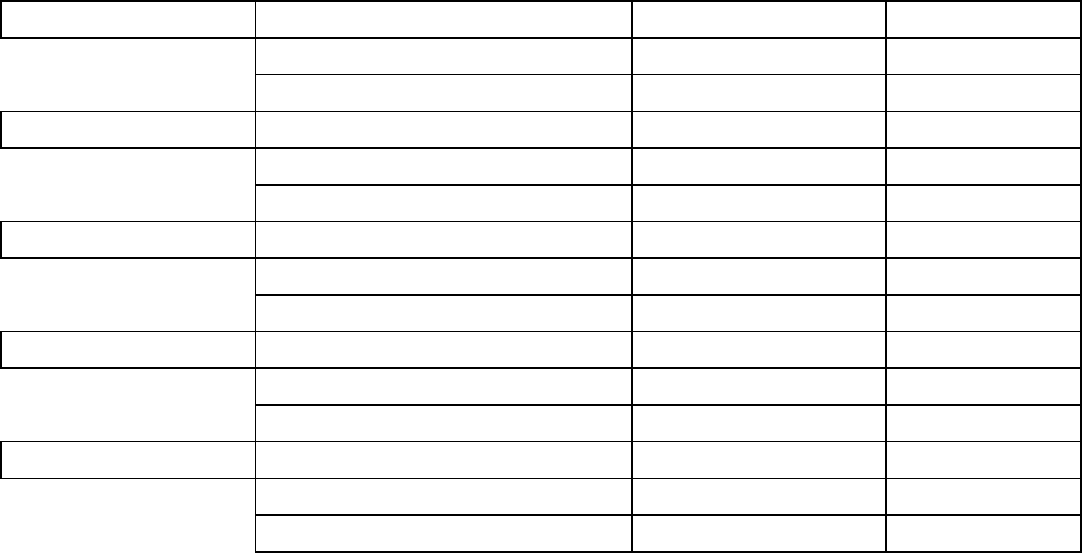

Credit Card Authentication

Fields Required Description

transaction name X creditcard

service X The "30" instructs Online Commerce Suite to process an Authentication.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

ccname X Consumer name as it appears on the credit card.

ccnum X Consumers credit card number. Do not include spaces. If the 3DES encryption option

has been enabled on the account, this value must be encrypted using the 3DES key

assigned to the Account ID. Use the FRISK Configuration Options menu in the Online

Merchant Center to view and configure the 3DES encryption option.

expmon X Expiration month (12) of the consumer credit card.

expyear X Expiration year of the consumers credit card in yyyy format

cvv2 Credit card cvv2/cvc2 code

voiceauth Authorization code for Voice Authorization

currencycode Three-letter ISO4217 (refer to Appendix D)

swipedata The swipe data from the magnetic strip on the back of a credit or debit card. Used for

card-present transactions.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X Transaction dollar amount in US dollars in the form of 0.00.

billaddr1 The consumers billing address.

billaddr2 The consumers billing address.

Online Commerce Suite™ XML Integration Guide

Page 15

billcity The consumers billing city.

billstate The consumers billing state.

billcity The consumers billing city.

billzip The consumers billing zip.

billcountry The consumers billing country.

shipaddr1 The consumers shipping address.

shipaddr2 The consumers shipping address.

shipcity The consumers shipping city.

shipstate The consumers shipping state.

shipzip The consumers shipping city.

shipcountry The consumers shipping zip.

custom1 32 char alphanumeric string for data storage (included in reports)

custom2 32 char alphanumeric string for data storage (included in reports)

custom3 32 char alphanumeric string for data storage (included in reports)

custom4 32 char alphanumeric string for data storage (included in reports)

custom5 32 char alphanumeric string for data storage (included in reports)

custom6 32 char alphanumeric string for data storage (included in reports)

email Consumer email address

memo Comments associated to this profile

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

dlnum Driver License Number

ssnum Social Security Number

cardpresent 1 indicates the card was present

dynamicdescriptor This field will be passed all the way to the Consumers Credit Card statement. This is

only available for TSYS.

cardpresentreader 1 indicates a card reader was present

industrycode Industry Code One character value: "H": Hotel

chargetypeamx Code indicating whether the primary charge is Lodging, Restaurant, or Gift Shop. One

character value: 1 Hotel, 2 Restaurant, 3 Gift Shop

roomrateamt Room rate dollar amount in US dollars in the form of 0.00.

checkindate The date (yymmdd) that the guest checked in to the hotel

checkoutdate The date (yymmdd) that the guest checked out of the hotel

purchaseid Hotel Folio number (25 characters alphanumeric)

property Prestigious property indicatory. Used by participants in Visa Prestigious Lodging

Program. A transaction amount of $1 should be entered in the amount field if the

merchant wishes the transaction to participate in the program. Number value: 500,

1000, or 1500

extracharges Extra charges 6 1-digit codes, each a partial or complete explanation of why charged

amount differs from receipt cardholder received at checkout. Digit values: 0: no extra,

2: Restaurant, 3: Gift Shop, 4: Mini-bar, 5: Telephone, 6: Other, 7: Laundry. Example:

"240000" indicates restaurant and mini-bar charges.

deviceid Used by the acquired to identify the lane, pump, or device where the transaction

occurs in a multilane environment. ID should start at 0001 and go up to 9999 and is

mandatory for MasterCard.

recur_create Creates a recurring billing record for a consumer. Set recur_create=1 to create a

recurring billing record.

recur_billingcycle 0 = No Recurring Billing Cycle

1 = Weekly Recurring Billing Cycle

2 = Monthly Recurring Billing Cycle

3 = Quarterly Recurring Billing Cycle

Online Commerce Suite™ XML Integration Guide

Page 16

4 = Semi-Annual Recurring Billing Cycle

5 = Annual Recurring Billing Cycle

6 = Bi-Weekly Recurring Billing Cycle

7 = Bi-Annual Recurring Billing Cycle

8 = Quad Weekly (28 day) Recurring Billing Cycle

9 = One Time Recurring Billing Cycle

10 = Daily Recurring Billing Cycle

11 = Bi-Monthly Recurring Billing Cycle

recur_billingmax Maximum number of times a consumers account is debited through recurring billing.

For example, setting recur_billingmax =6 bills the consumer 6 times.

-1 = Unlimited number of times

0 = No Recurring Billing

recur_start Number of days after an initial payment where the consumer is debited on a recurring

cycle.

recur_amount Amount the consumer is to be re-debited on the recurring cycle. Do not use a dollar

sign.

fsa health care flag 0 is off 1 is on

rxamount Qualified amount.

purchasecardlevel2 pocustmerrefid Cardholders Customer ID or Reference Number for the

Purchase Card.

taxamount Total tax charged for the transaction.

taxexempt 1 = a tax exempt purchase. 0 = a taxable purchase.

emvdata emvflag Must be set to 1 for an EMV transaction

interchangeprofile 82 - Indicates the capabilities of the card to support

specific functions in the application

dedicatedfilename 84 - Identifies the name of the DF as described in

ISO/IEC 7816-4

termverresults 95 - Status of the different functions as seen from the

terminal

secondarypinblock 0C0B - Discover also allows the cardholder to change

pins at the terminal so LISO needs to allow for the

secondary PIN Block. This is the encrypted PIN Block

sent from the terminal.

applicationid 4F - Identifies the application as described in ISO/IEC

7816-5

languagepreference 5F2D - 1-4 languages stored in order of preference,

each represented by 2 alphabetical characters

according to ISO 639 Note: EMVCo strongly

recommends that cards be personalised with data

element '5F2D' coded in lowercase, but that terminals

accept the data element whether it is coded in upper or

lower case.

panseqnumber 5F34 - Identifies and differentiates cards with the same

PAN

terminaltransdate 9A - Local date that the transaction was authorised

transactionstatus 9B - Indicates the functions performed in a transaction

Online Commerce Suite™ XML Integration Guide

Page 17

cryptotranstype 9C - Indicates the type of financial transaction,

represented by the first two digits of ISO 8583:1987

Processing Code

aidterminal 9F06 - Identifies the application as described in

ISO/IEC 7816-5

appusagecontrol 9F07 - Indicates issuerÕs specified restrictions on the

geographic usage and services allowed for the

application

terminalversionno 9F09 - Version number assigned by the payment

system for the application

issueractiondefault 9F0D - Specifies the issuer's conditions that cause a

transaction to be rejected if it might have been

approved online, but the terminal is unable to process

the transaction online

issueractiondenial 9F0E - Specifies the issuer's conditions that cause the

denial of a transaction without attempt to go online

issueractiononline 9F0F - Specifies the issuer's conditions that cause a

transaction to be transmitted online

issuerdata 9F10 - Contains proprietary application data for

transmission to the issuer in an online transaction

terminalcountrycode 9F1A - Indicates the country of the terminal,

represented according to ISO 3166

terminalserialnum 9F1E - Unique and permanent serial number assigned

to the IFD by the manufacturer

cryptogram 9F26 - Cryptogram returned by the ICC in response of

the GENERATE AC command

cryptoid 9F27 - Indicates the type of cryptogram and the actions

to be performed by the terminal

terminalcapprofile 9F33 - Indicates the card data input, CVM, and security

capabilities of the terminal

cvresults 9F34 - Indicates the results of the last CVM performed

terminaltype 9F35 - Indicates the environment of the terminal, its

communications capability, and its operational control

transcounter 9F36 - Counter maintained by the application in the ICC

(incrementing the ATC is managed by the ICC)

randomnumber 9F37 - Value to provide variability and uniqueness to

the generation of a cryptogram

transrefcurrencycode 9F3C - Code defining the common currency used by

the terminal in case the Transaction Currency Code is

different from the Application Currency Code

additionaltermcapability 9F40 - Indicates the data input and output capabilities

of the terminal

transseqcounter 9F41 - Counter maintained by the terminal that is

incremented by one for each transaction

iccdynamicnumber

Online Commerce Suite™ XML Integration Guide

Page 18

9F4C - Time-variant number generated by the ICC, to

be captured by the terminal

transcatcode 9F53 - Indicates the type of transaction being

processed

issuerscriptresult 9F5B - Present if scripts were sent by Issuer in original

response

formfactorindicator 9F6E - Indicates the form factor of the consumer

payment device

customerexcdata 9F7C - In US contactless transactions, issuer

proprietary info

Online Commerce Suite™ XML Integration Guide

Page 19

Credit Card Authentication Sample 2.2

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>2</service>

<acctid>TEST0</acctid>

<subid></subid>

<amount>0.00</amount>

<consumername></consumername>

<merchantpin></merchantpin>

<ccname></ccname>

<ccnum></ccnum>

<expmon></expmon>

<expyear></expyear>

<swipedata></swipedata>

<billaddr1>1111 main st</billaddr1>

<billaddr2></billaddr2>

<billcity></billcity>

<billstate></billstate>

<billzip></billzip>

<billcountry></billcountry>

<shipaddr1></shipaddr1>

<shipaddr2></shipaddr2>

<shipcity></shipcity>

<curencycode></currencycode>

<shipstate></shipstate>

<shipzip></shipzip>

<shipcountry></shipcountry>

<cardpresent></cardpresent>

<cardpresentreader></cardpresentreader>

<industrycode></industrycode>

<chargetypeamx></chargetypeamx>

<roomrateamx></roomrateamx>

<checkindate></checkindate>

<checkoutdate></checkoutdate>

<purchaseid></purchaseid>

<property></property>

<extracharges></extracharges>

<ipaddress></ipaddress>

<email></email>

<phone></phone>

<memo></memo>

<recur_create></recur_create>

<recur_billingcycle></recur_billingcycle>

<recur_billingmax></recur_billingmax>

<recur_start></recur_start>

<recur_amount></recur_amount>

<merchantpin></merchantpin>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

</transaction>

Online Commerce Suite™ XML Integration Guide

Page 20

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0"?><interface_driver>

<trans_catalog>

<transaction>

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>AUTHENTICATE:TEST:::532311090:N::U</result>

<authcode>TEST</authcode>

<historyid>532311090</historyid>

<orderid>396487140</orderid>

<refcode>532311090</refcode>

<total>0.00</total>

<merchantordernumber></merchantordernumber>

<avsresult></avsresult>

<cvv2result></cvv2result>

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

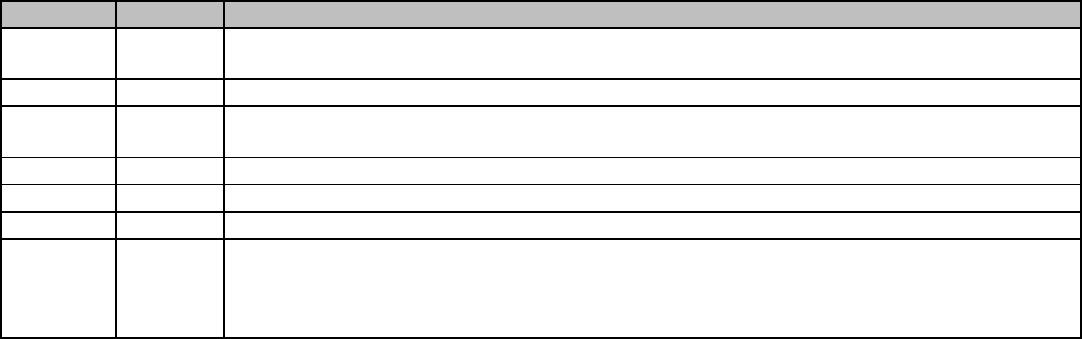

Credit Card Post Capture

Fields Required Description

transaction name X Credit card only

service X The 3 instructs Online Commerce Suite to process a POST or Capture a previous

AUTH transaction.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X Transaction dollar amount in US dollars in the form of 1.00. It will default to original

AUTH amount if its not defined.

historykeyid X The history ID of the AUTH transaction.

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

Online Commerce Suite™ XML Integration Guide

Page 21

Credit Card Post Capture Sample 3.1

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>3</service>

<acctid>TEST0</acctid>

<subid></subid>

<merchantpin></merchantpin>

<historykeyid></historykeyid>

<ipaddress></ipaddress>

<amount></amount>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

</transaction>

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0"?><interface_driver>

<trans_catalog>

<transaction>

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>POST:TEST:::126476380:::</result>

<authcode>TEST</authcode>

<historyid>126476381</historyid>

<orderid>98452813</orderid>

<refcode>126476380</refcode>

<total>9.95</total>

<merchantordernumber></merchantordernumber>

<avsresult></avsresult>

<cvv2result></cvv2result>

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

Online Commerce Suite™ XML Integration Guide

Page 22

Credit Card Refund

Fields Required Description

transaction name X Credit card or ach

service X The 4 instructs Online Commerce Suite to process a Credit / Refund of a previous

Sale transaction.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X Transaction dollar amount in US dollars in the form of 1.00. It will default to original

Sale amount if its not defined.

historykeyid X The history ID of the Sale transaction.

orderkeyid X The order id of the Sale transaction.

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

Credit Card Refund Sample 4.1

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>4</service>

<acctid>TEST0</acctid>

<subid></subid>

<merchantpin></merchantpin>

<orderkeyid></orderkeyid>

<historykeyid></historykeyid>

<ipaddress></ipaddress>

<amount></amount>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

</transaction>

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0"?><interface_driver>

<trans_catalog>

<transaction>

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>CREDIT:TEST:::126476380:::</result>

<authcode>TEST</authcode>

Online Commerce Suite™ XML Integration Guide

Page 23

<historyid>126476381</historyid>

<orderid>98452813</orderid>

<refcode>126476380</refcode>

<total>9.95</total>

<merchantordernumber></merchantordernumber>

<avsresult></avsresult>

<cvv2result></cvv2result>

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

Credit Card Void

Fields Required Description

transaction name X Credit card or ach

service X The 5 instructs Online Commerce Suite to process a VOID on a previous Sale

transaction.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X Transaction dollar amount in US dollars in the form of 1.00. It will default to original

Sale amount if its not defined.

historykeyid X The history ID of the Sale transaction.

orderkeyid X The order id of the Sale transaction.

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

Credit Card Void Sample 5.1

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>5</service>

<acctid>TEST0</acctid>

<subid></subid>

<merchantpin></merchantpin>

<orderkeyid></orderkeyid>

<historykeyid></historykeyid>

<ipaddress></ipaddress>

<amount></amount>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

Online Commerce Suite™ XML Integration Guide

Page 24

</transaction>

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0"?><interface_driver>

<trans_catalog>

<transaction>

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>VOID:TEST:::126476380:::</result>

<authcode>TEST</authcode>

<historyid>126476381</historyid>

<orderid>98452813</orderid>

<refcode>126476380</refcode>

<total>9.95</total>

<merchantordernumber></merchantordernumber>

<avsresult></avsresult>

<cvv2result></cvv2result>

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

Online Commerce Suite™ XML Integration Guide

Page 25

Standalone Credit/Refund

Fields Required Description

transaction name X Credit card and ach (if ach, check name, check ABA, checking account is required)

service X The 6 instructs Online Commerce Suite to process any Standalone Credit/Refund.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

ccname X Consumer name as it appears on the credit card.

ccnum X Consumers credit card number. Do not include spaces. If the 3DES encryption option

has been enabled on the account, this value must be encrypted using the 3DES key

assigned to the Account ID. Use the FRISK Configuration Options menu in the Online

Merchant Center to view and configure the 3DES encryption option.

expmon X Expiration month (12) of the consumer credit card.

expyear X Expiration year of the consumers credit card in yyyy format

ckname First and Last Name

ckaba Routing number

ckacct Account number

ckno Check number

cktype SEC code for transaction (WEB, POP, ARC, PPD, ICL, RCK, BOC, TEL)

cvv2 Credit card cvv2/cvc2 code

currencycode Three-letter ISO4217 (refer to Appendix D)

swipedata The swipe data from the magnetic strip on the back of a credit or debit card. Used for

card-present transactions.

encryptedswipedata The encrypted swipe data from the magnetic strip on the back of a credit or debit card.

Used for card-present transactions. Format of this data depends on the device. Refer

to Appendix E for string format.

encryptedreadertype The value of this field depends on the encrypted swipe device used. This field has to

be used if encryptedswipedata is used. 1 = Magtek (Most Magtek devices), 2 = Magtek

IPAD, 3 = IDTECH, 4 = Ingenico iSC250,350 / iPP250,350.

merchantpin The 32 character Merchant PIN code generated from the Online Merchant Center.

When the Merchant PIN option has been enabled in the Online Merchant Center,

transactions without a valid Merchant PIN will be declined with a decline response of

DECLINED:1101150001:DECLINED

amount X Transaction dollar amount in US dollars in the form of 1.00.

dynamicdescriptor This field will be passed all the way to the Consumers Credit Card statement. This is

only available for TSYS.

custom1 32 char alphanumeric string for data storage (included in reports)

custom2 32 char alphanumeric string for data storage (included in reports)

custom3 32 char alphanumeric string for data storage (included in reports)

custom4 32 char alphanumeric string for data storage (included in reports)

custom5 32 char alphanumeric string for data storage (included in reports)

custom6 32 char alphanumeric string for data storage (included in reports)

ipaddress Consumers IP address

merchantordernumber Customers unique alpha-numeric number

Online Commerce Suite™ XML Integration Guide

Page 26

Standalone Credit/Refund Sample 6.1

[INPUT]

<?xml version="1.0"?>

<interface_driver>

<trans_catalog>

<transaction name="creditcard">

<inputs>

<service>6</service>

<acctid>TEST0</acctid>

<subid></subid>

<merchantpin></merchantpin>

<ccname></ccname>

<ccnum></ccnum>

<expmon></expmon>

<expyear></expyear>

<swipedata></swipedata>

<curencycode></currencycode>

<ipaddress></ipaddress>

<email></email>

<memo></memo>

<merchantpin></merchantpin>

<amount>9.95</amount>

<custom1></custom1>

<custom2></custom2>

<custom3></custom3>

<custom4></custom4>

<custom5></custom5>

<custom6></custom6>

<merchantordernumber></merchantordernumber>

<server_host>TestHost</server_host>

</inputs>

</transaction>

</trans_catalog>

</interface_driver>

[OUTPUT]

<?xml version="1.0"?><interface_driver>

<trans_catalog>

<transaction>

<outputs>

<status>Approved</status>

<accountname>John Doe</accountname>

<result>CREDIT:TEST:::126476380:::</result>

<authcode>TEST</authcode>

<historyid>126476381</historyid>

<orderid>98452813</orderid>

<refcode>126476380</refcode>

<total>9.95</total>

<merchantordernumber></merchantordernumber>

<avsresult></avsresult>

<cvv2result></cvv2result>

<duplicate>0</duplicate>

</outputs>

</transaction>

</trans_catalog>

</interface_driver>

Online Commerce Suite™ XML Integration Guide

Page 27

Credit Card Incremental Auth

Fields Required Description

transaction name X Incremental Auth only

service X The 20 instructs Online Commerce Suite to process an AUTH.

acctid X Five character alphanumeric Account ID assigned to the merchant. Use TEST0 for

testing if you do not have an Account ID. Change to your Account ID for live

transaction processing.

subid Merchant Sub ID. If unsure whether you have one, leave blank.

ccname X Consumer name as it appears on the credit card.

ccnum X Consumers credit card number. Do not include spaces. If the 3DES encryption option

has been enabled on the account, this value must be encrypted using the 3DES key

assigned to the Account ID. Use the FRISK Configuration Options menu in the Online

Merchant Center to view and configure the 3DES encryption option.

expmon X Expiration month (12) of the consumer credit card.

expyear X Expiration year of the consumers credit card in yyyy format

cvv2 Credit card cvv2/cvc2 code

currencycode Three-letter ISO4217 (refer to Appendix D)

swipedata The swipe data from the magnetic strip on the back of a credit or debit card. Used for

card-present transactions.

encryptedswipedata The encrypted swipe data from the magnetic strip on the back of a credit or debit card.

Used for card-present transactions. Format of this data depends on the device. Refer

to Appendix E for string format.

encryptedreadertype The value of this field depends on the encrypted swipe device used. This field has to